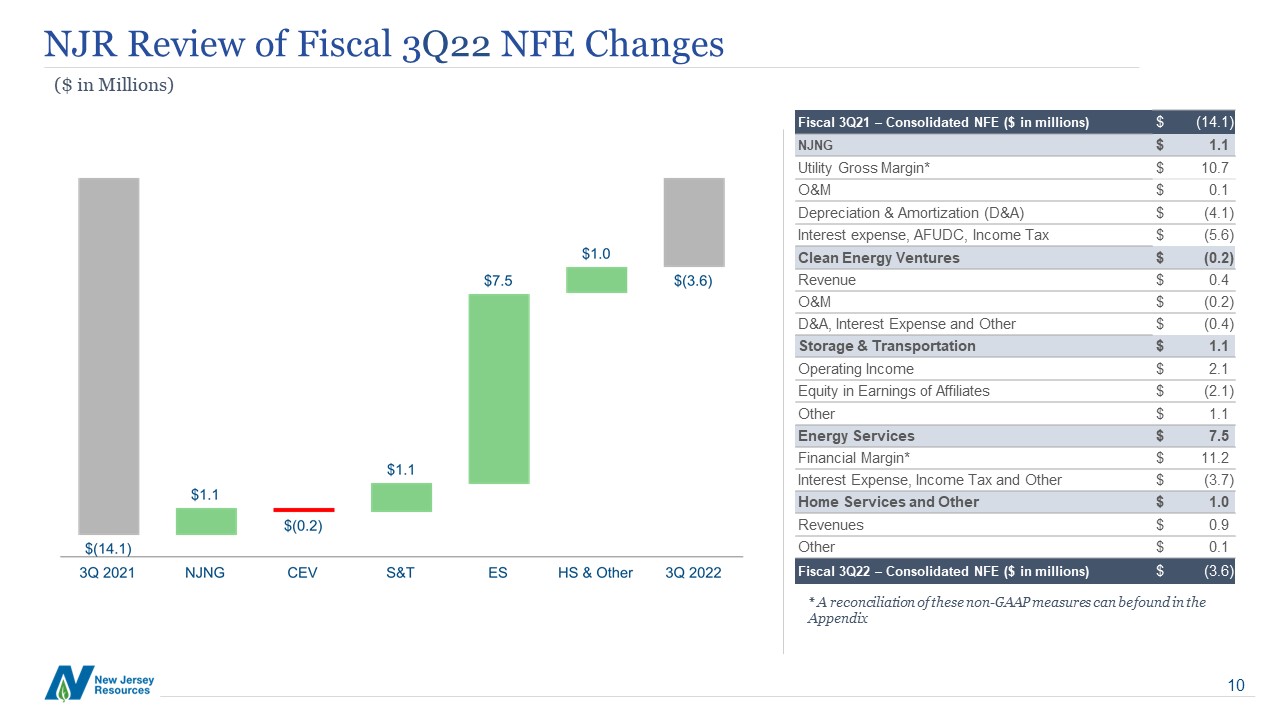

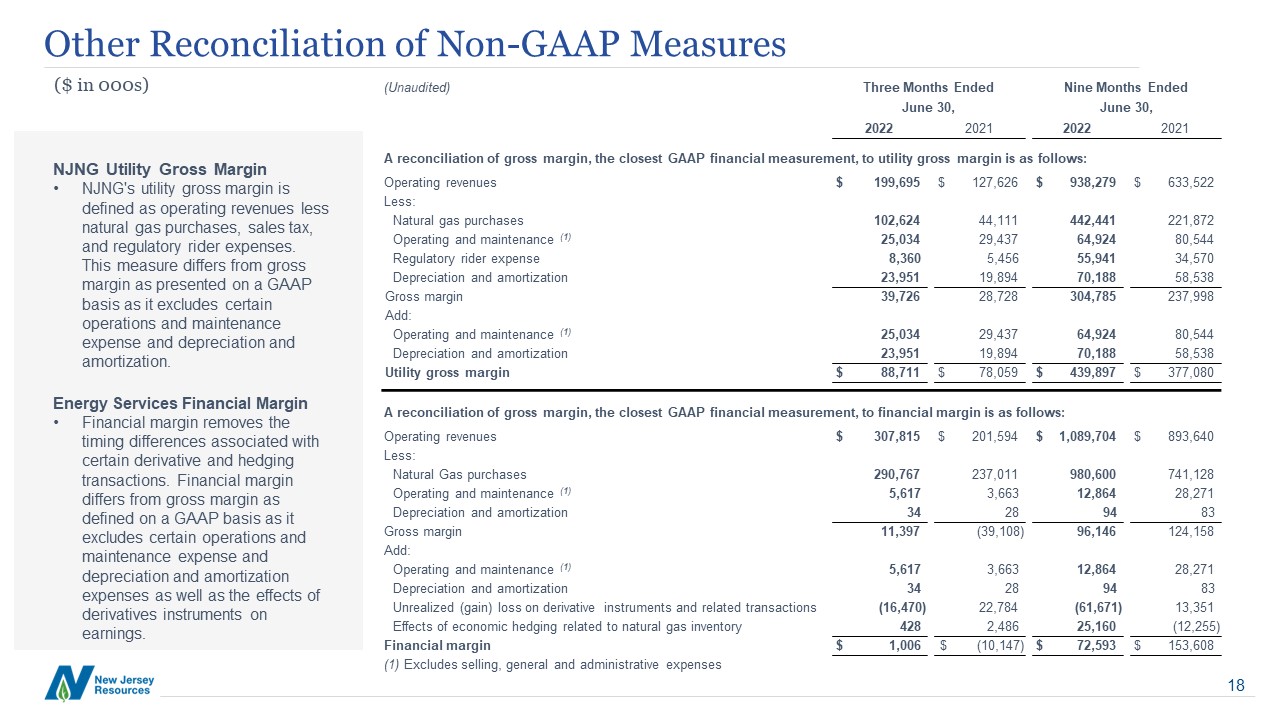

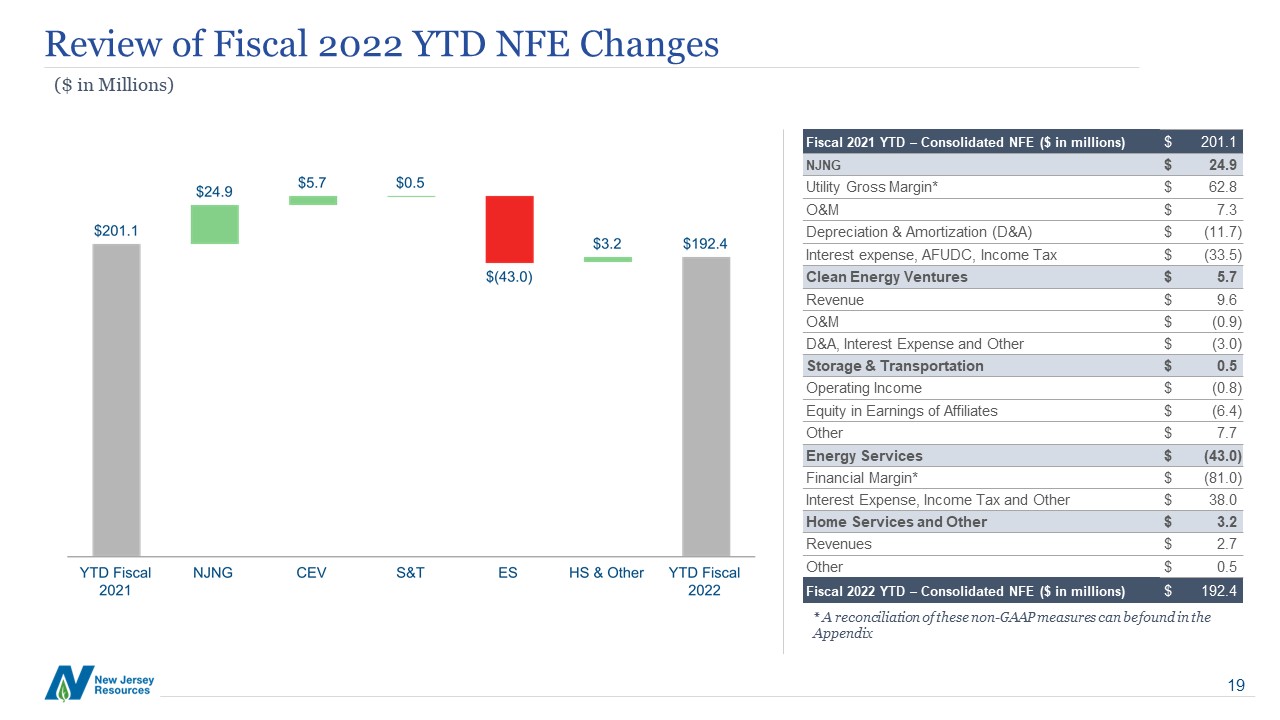

Other Reconciliation of Non-GAAP Measures ($ in 000s) (Unaudited) Three Months Ended Nine Months Ended June 30, June 30, 2022 2021 2022 2021 NJNG Utility Gross Margin A reconciliation of gross margin, the closest GAAP financial measurement, to utility gross margin is as follows: NJNG's utility gross margin is Operating revenues $ 199,695 $ 127,626 $ 938,279 $ 633,522 defined as operating revenues less Less: natural gas purchases, sales tax, Natural gas purchases 102,624 44,111 442,441 221,872 and regulatory rider expenses. Operating and maintenance (1) 25,034 29,437 64,924 80,544 This measure differs from gross Regulatory rider expense 8,360 5,456 55,941 34,570 margin as presented on a GAAP Depreciation and amortization 23,951 19,894 70,188 58,538 basis as it excludes certain Gross margin 39,726 28,728 304,785 237,998 operations and maintenance Add: expense and depreciation and Operating and maintenance (1) 25,034 29,437 64,924 80,544 amortization. Depreciation and amortization 23,951 19,894 70,188 58,538 Utility gross margin $ 88,711 $ 78,059 $ 439,897 $ 377,080 Energy Services Financial Margin Financial margin removes the A reconciliation of gross margin, the closest GAAP financial measurement, to financial margin is as follows: timing differences associated with Operating revenues $ 307,815 $ 201,594 $ 1,089,704 $ 893,640 certain derivative and hedging Less: transactions. Financial margin Natural Gas purchases 290,767 237,011 980,600 741,128 differs from gross margin as Operating and maintenance (1) 5,617 3,663 12,864 28,271 defined on a GAAP basis as it Depreciation and amortization 34 28 94 83 excludes certain operations and Gross margin 11,397 (39,108) 96,146 124,158 maintenance expense and Add: depreciation and amortization Operating and maintenance (1) 5,617 3,663 12,864 28,271 expenses as well as the effects of Depreciation and amortization 34 28 94 83 derivatives instruments on Unrealized (gain) loss on derivative instruments and related transactions (16,470) 22,784 (61,671) 13,351 earnings. Effects of economic hedging related to natural gas inventory 428 2,486 25,160 (12,255) Financial margin $ 1,006 $ (10,147) $ 72,593 $ 153,608 (1) Excludes selling, general and administrative expenses 18