Exhibit 99.2

Exhibit 99.2

Fiscal 2013 Second Quarter Update

May 2, 2013

Regarding Forward-Looking Statements

Certain statements contained in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also be identified by the use of forward-looking terminology such as “may,” “will,” “intend,” “expect,” “believe,” or “continue” or comparable terminology and are made based upon management’s current expectations and beliefs as of this date concerning future developments and their potential effect upon New Jersey Resources (NJR or the Company). There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on the Company will be those anticipated by management. NJR cautions persons reading or hearing this presentation that the assumptions that form the basis for forward-looking statements regarding NJR’s net financial earnings (NFE) for the remainder of fiscal 2013, forecasted contribution of business segments to fiscal 2013 NFE, long-term financial goals of NJR, expected contribution by new customers of New Jersey Natural Gas Company (NJNG) to utility gross margin, expected number of new customers of NJNG, the completion of NJRCEV’s planned solar projects in fiscal 2013, Solar Renewable Energy Certificate (SREC) prices, NJR’s effective tax rate, estimated capital expenditures in fiscal 2013, by NJNG and NJRCEV, expected dividend payout ratio, and the potential impact of post-tropical cyclone Sandy, (commonly referred to as “Superstorm” Sandy).

The factors that could cause actual results to differ materially from NJR’s expectations include, but are not limited to, weather and economic conditions; demographic changes in the NJNG service territory and their effect on NJNG’s customer growth; volatility of natural gas and other commodity prices andtheir impact on NJNG customer usage, NJNG’s Basic Gas Supply Service incentive programs, NJRES’ operations and on the Company’s risk management efforts; changes in rating agency requirements and/or credit ratings and their effect on availability and cost of capital to the Company; the impact of volatility in the credit markets; the ability to comply with debt covenants; the impact to the asset values and resulting higher costs and funding obligations of NJR’s pension and postemployment benefit plans as a result of downturns in the financial markets, a lower discount rate, and impacts associated with the Patient Protection and Affordable Care Act; accounting effects and other risks associated with hedging activities and use of derivatives contracts; commercial and wholesale credit risks, including the availability of creditworthy customers and counterparties and liquidity in the wholesale energy trading market; the ability to obtain governmental approvals and/or financing for the construction, development and operation of certain non-regulated energy investments; risks associated with the management of the Company’s joint ventures and partnerships; risks associated with our investments in renewable energy projects and our investment in an on-shore wind developer, including the availability of regulatory and tax incentives, logistical risks and potential delays related to construction, permitting, regulatory approvals and electric grid interconnection, the availability of viable projects and NJR’s eligibility for federal investment tax credits (ITC), the future market for SRECs and operational risks related to projects in service; timing of qualifying for ITCs due to delays or failures to complete planned solarenergy projects and the resulting effect on our effective tax rate and earnings; the level and rate at which NJNG’s costs and expenses (including those relatedto restoration efforts resulting from Superstorm Sandy) are incurred and the extent to which they are allowed to be recovered from customers through the regulatory process; access to adequate supplies of natural gas and dependence on third-party storage and transportation facilities for natural gas supply; operating risks incidental to handling, storing, transporting and providing customers with natural gas; risks related to our employee workforce, including a work stoppage; the regulatory and pricing policies of federal and state regulatory agencies; the possible expiration of the NJNG Conservation Incentive Program (CIP), the costs of compliance with the proposed regulatory framework for over-the-counter derivatives; the costs of compliance with present and future environmental laws, including potential climate change-related legislation; risks related to changes in accounting standards; the disallowance of recovery of environmental-related expenditures and other regulatory changes; environmental-related and other litigation and other uncertainties; risks related to cyber-attack of failure of information technology systems; and the impact of natural disasters, terrorist activities, and other extreme events on our operations and customers, including any impacts to utility gross margin, and restoration costs resulting from Superstorm Sandy. The aforementioned factors are detailed in the “Risk Factors” sections of our Annual Report on Form 10-K filed on November 28, 2012, as filed with the Securities and Exchange Commission (SEC) and our Quarterly Report on Form 10-Q, to be filed with the SEC on May 3, 2013, each of which is, or will be, available on the SEC’s website at sec.gov. NJR disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.

2

Disclaimer Regarding Non-GAAP Financial Measures

This presentation includes the non-GAAP measures net financial earnings (losses), financial margin and utility gross margin. As an indicator of the Company’s operating performance, these measures should not be considered an alternative to, or more meaningful than, GAAP measures such as cash flow, net income, operating income or earnings per share. Net financial earnings (losses) and financial margin exclude unrealized gains or losses on derivative instruments related to the Company’s unregulated subsidiaries and certain realized gains and losses on derivative instruments related to natural gas that has been placed into storage at NJRES. Volatility associated with the change in value of these financial and physical commodity contracts is reported in the income statement in the current period. In order to manage its business, NJR views its results without the impacts of the unrealized gains and losses, and certain realized gains and losses, caused by changes in value of these financial instruments and physical commodity contracts prior to the completion of the planned transaction because it shows changes in value currently as opposed to when the planned transaction ultimately is settled. NJNG’s utility gross margin represents the results of revenues less natural gas costs, sales and other taxes and regulatory rider expenses, which are key components of the Company’s operations that move inrelation to each other.

Management uses net financial earnings (NFE), financial margin and utility gross margin as supplemental measures to other GAAP results to provide a more complete understanding of the Company’s performance. Management believes these non-GAAP measures are more reflective of the Company’s business model, provide transparency to investors and enable period-to-period comparability of financial performance. For a full discussion of our non-GAAP financial measures, please see Item 7 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2012, filed on November 28, 2012.

3

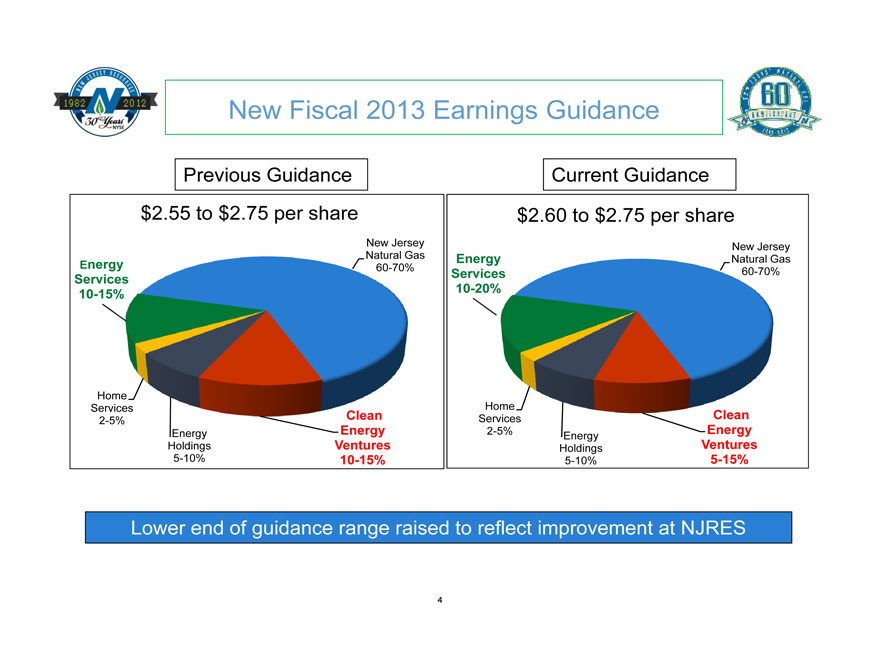

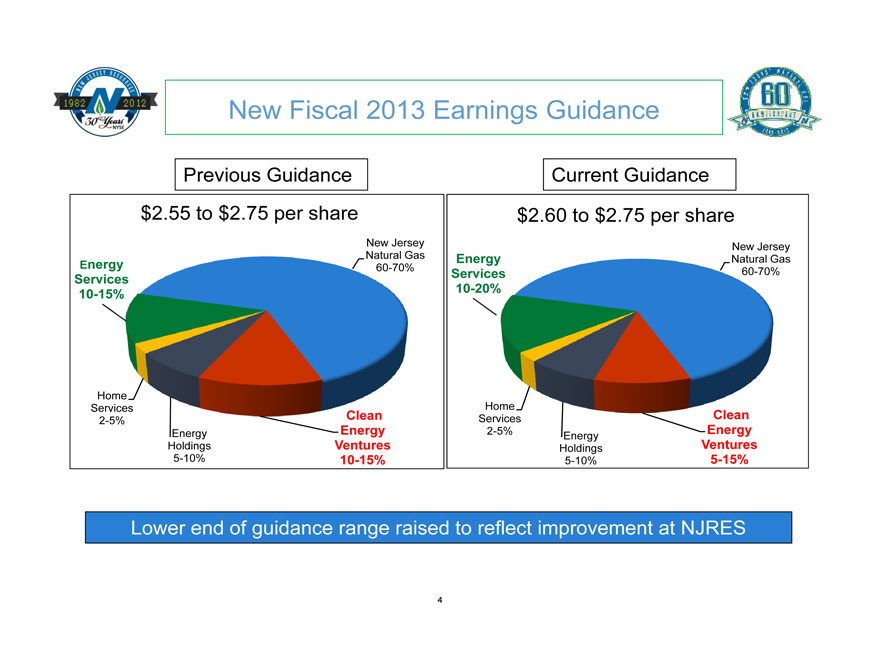

New Fiscal 2013 Earnings Guidance

Previous Guidance

$2.55 to $2.75 per share

Energy Services

10-15%

Home Services

2-5%

Energy Holdings

5-10%

Clean Energy Ventures

10-15%

New Jersey Natural Gas

60-70%

Current Guidance

$2.60 to $2.75 per share

Energy Services

10-20%

Home Services

2-5%

Energy Holdings

5-10%

Clean Energy Ventures 5-15%

New Jersey Natural Gas

60-70%

Lower end of guidance range raised to reflect improvement at NJRES

4

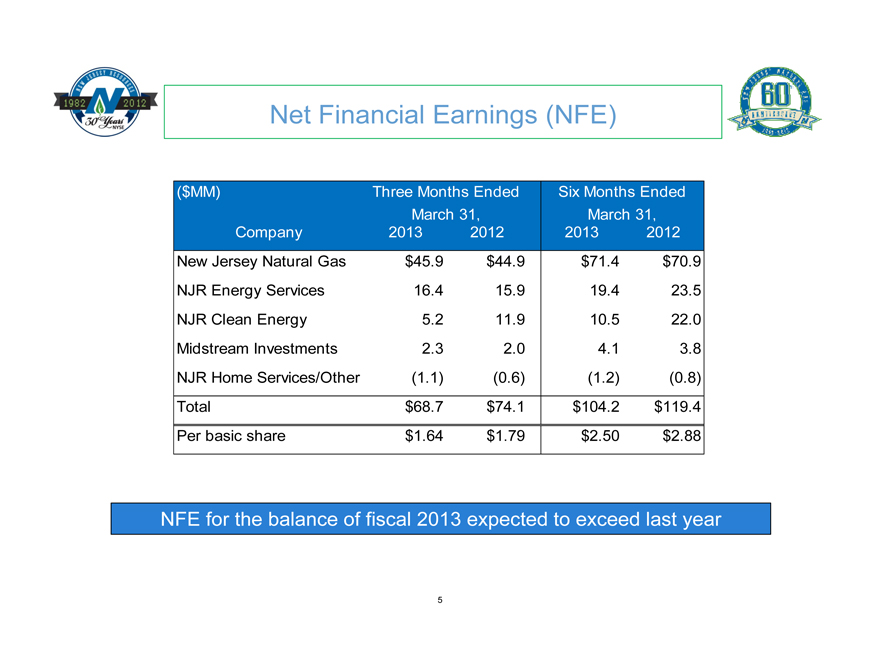

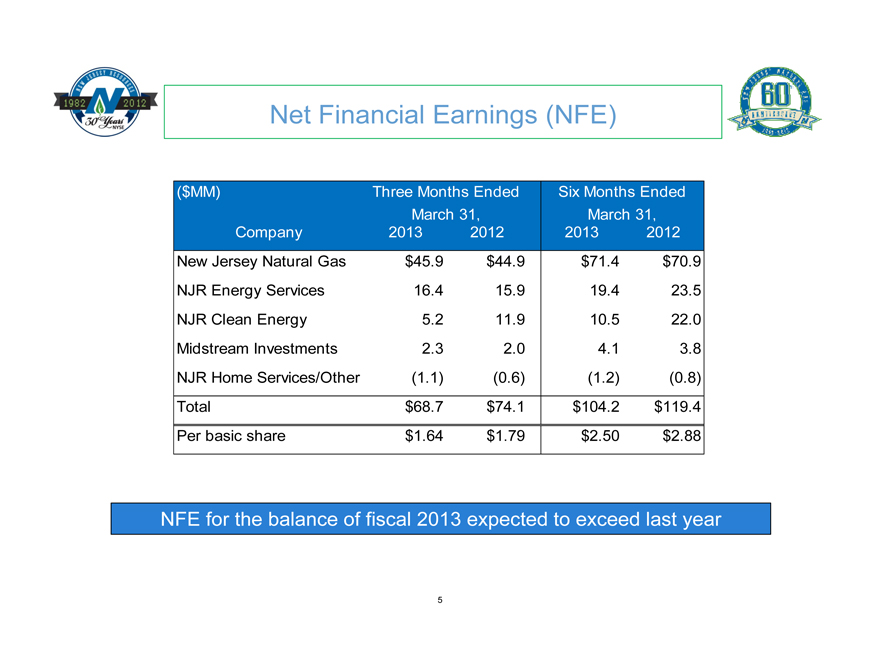

Net Financial Earnings (NFE)

($MM) Three Months Ended Six Months Ended

March 31, March 31,

Company 2013 2012 2013 2012

New Jersey Natural Gas $45.9 $44.9 $71.4 $70.9

NJR Energy Services 16.4 15.9 19.4 23.5

NJR Clean Energy 5.2 11.9 10.5 22.0

Midstream Investments 2.3 2.0 4.1 3.8

NJR Home Services/Other (1.1) (0.6) (1.2) (0.8)

Total $68.7 $74.1 $104.2 $119.4

Per basic share $1.64 $1.79 $2.50 $2.88

NFE for the balance of fiscal 2013 expected to exceed last year

5

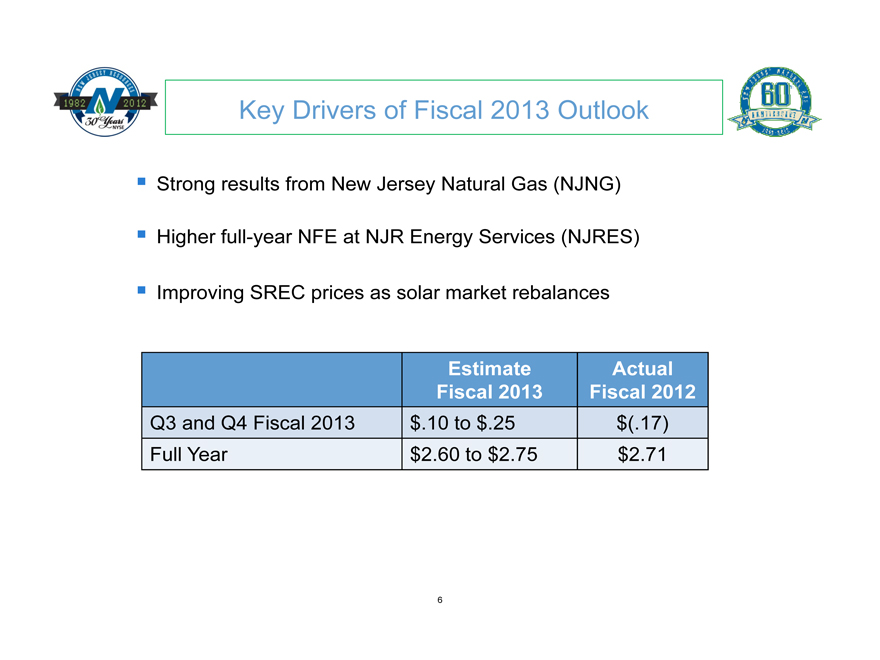

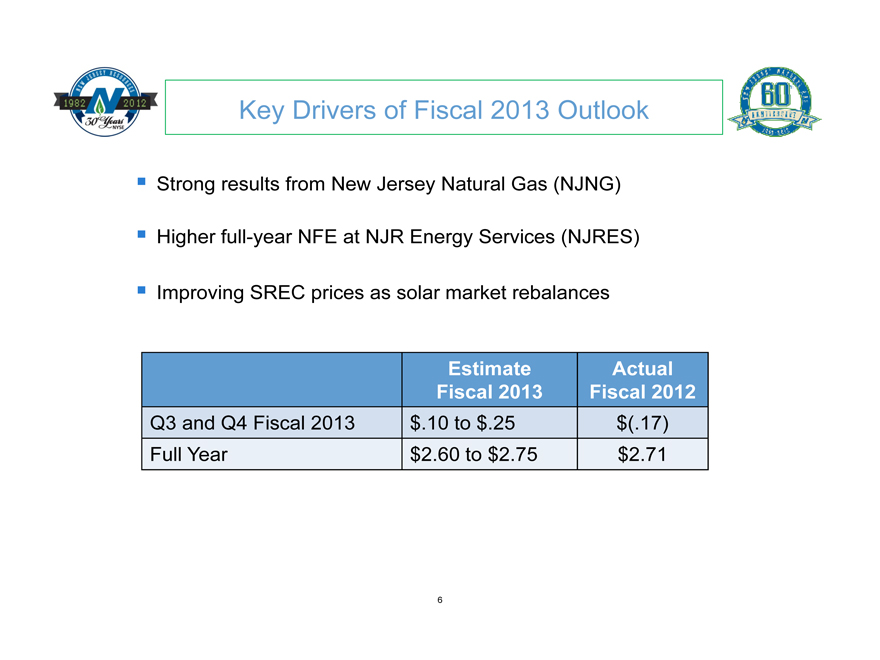

Key Drivers of Fiscal 2013 Outlook

Strong results from New Jersey Natural Gas (NJNG)

Higher full-year NFE at NJR Energy Services (NJRES)

Improving SREC prices as solar market rebalances

Estimate Actual

Fiscal 2013 Fiscal 2012

Q3 and Q4 Fiscal 2013 $.10 to $.25 $(.17)

Full Year $2.60 to $2.75 $2.71

6

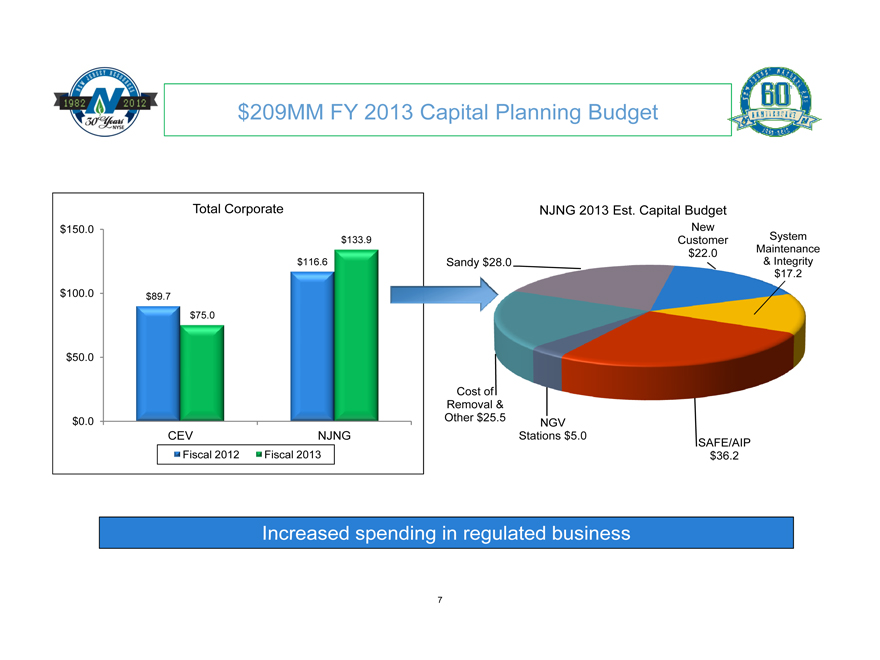

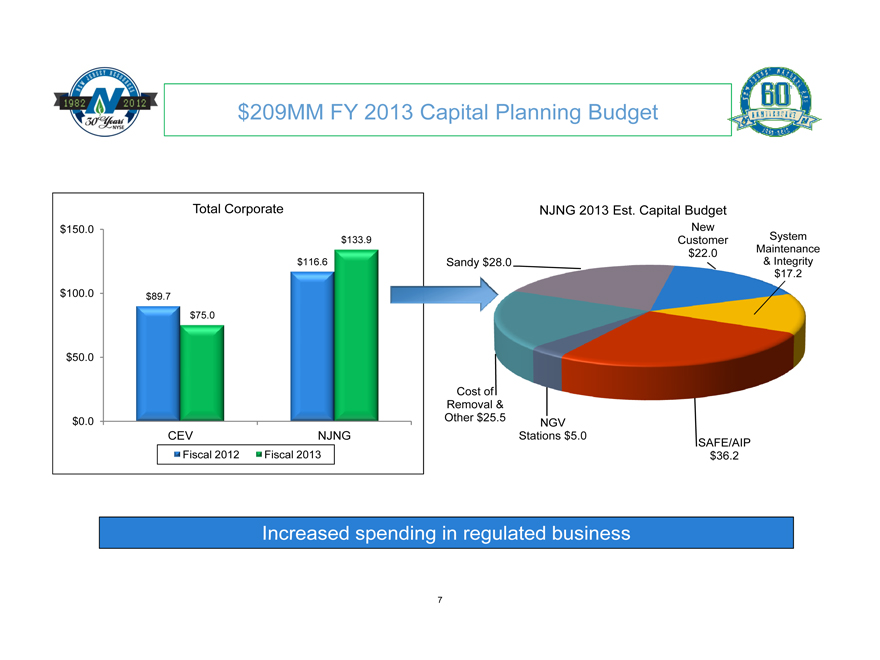

$209MM FY 2013 Capital Planning Budget

Total Corporate

$89.7 $75.0

$150.0 $100.0 $50.0 $0.0

$116.6

$133.9

CEV NJNG

Fiscal 2012

Fiscal 2013

NJNG 2013 Est. Capital Budget

Sandy $28.0

Cost of Removal & Other $25.5

NGV Stations $5.0

SAFE/AIP $36.2

System Maintenance

& Integrity $17.2

New Customer $22.0

Increased spending in regulated business

7

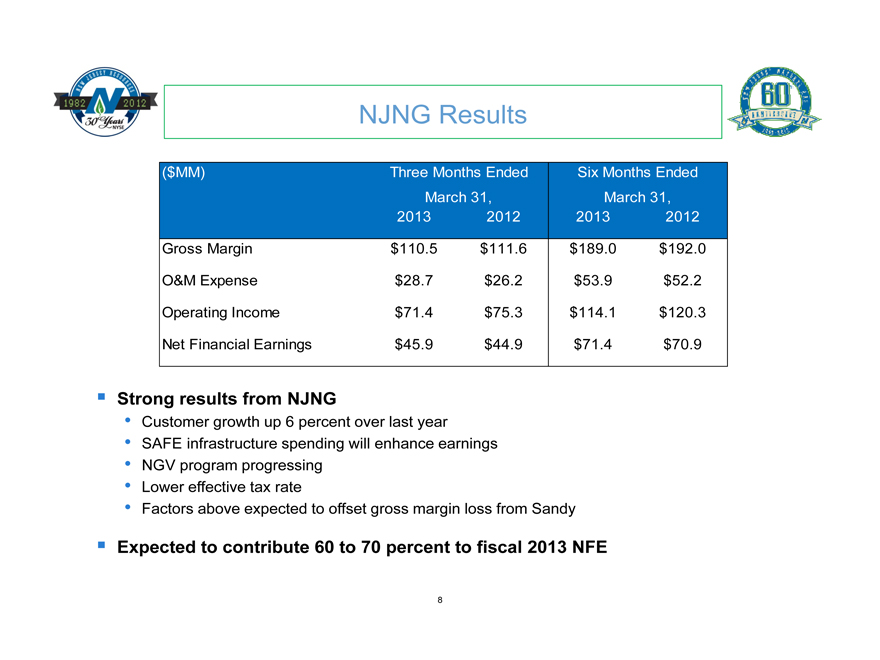

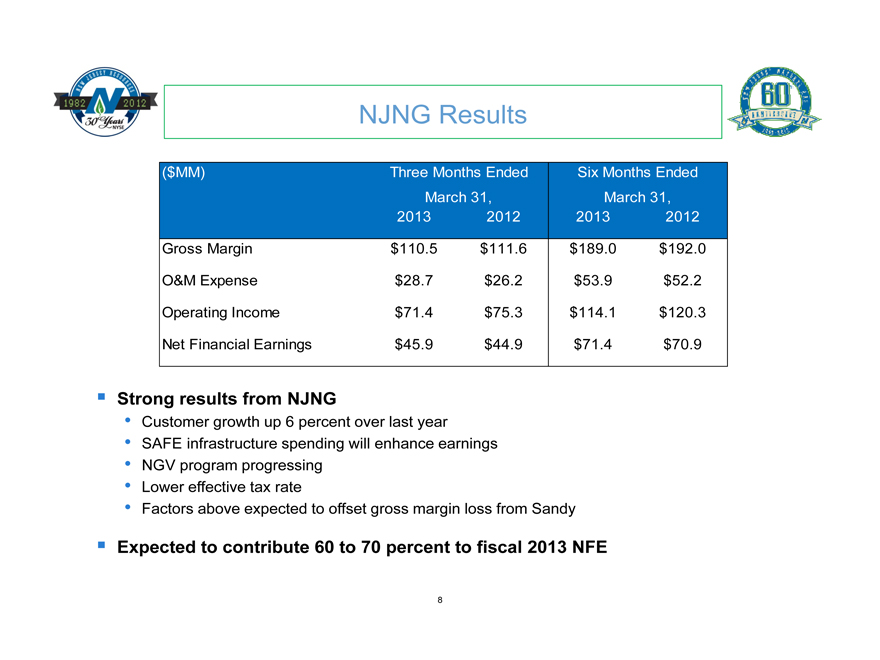

NJNG Results

($MM) Three Months Ended Six Months Ended March 31, March 31, 2013 2012 2013 2012

Gross Margin $110.5 $111.6 $189.0 $192.0 O&M Expense $28.7 $26.2 $53.9 $52.2 Operating Income $71.4 $75.3 $114.1 $120.3 Net Financial Earnings $45.9 $44.9 $71.4 $70.9

Strong results from NJNG

• Customer growth up 6 percent over last year

• SAFE infrastructure spending will enhance earnings

• NGV program progressing

• Lower effective tax rate

• Factors above expected to offset gross margin loss from Sandy

Expected to contribute 60 to 70 percent to fiscal 2013 NFE

8

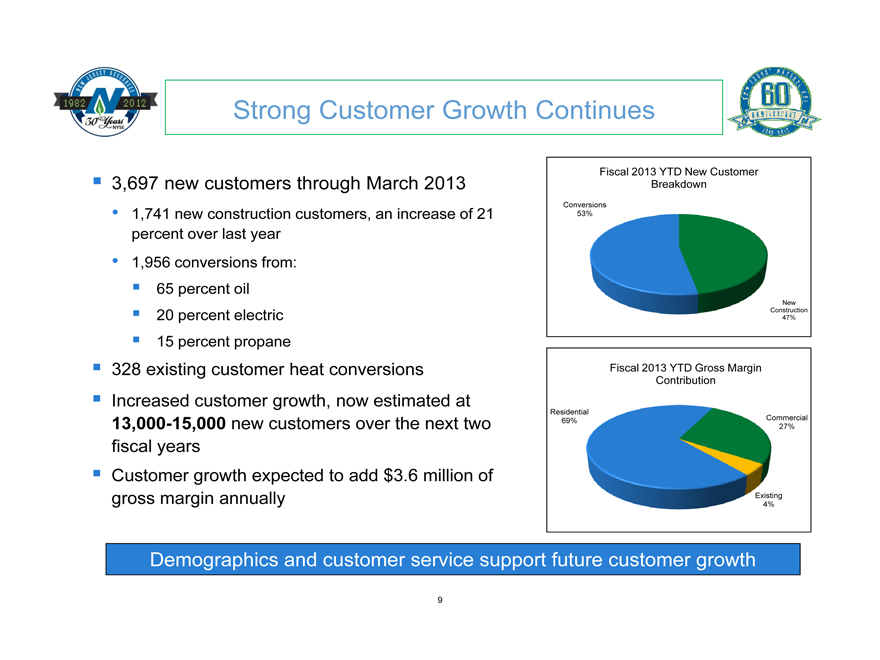

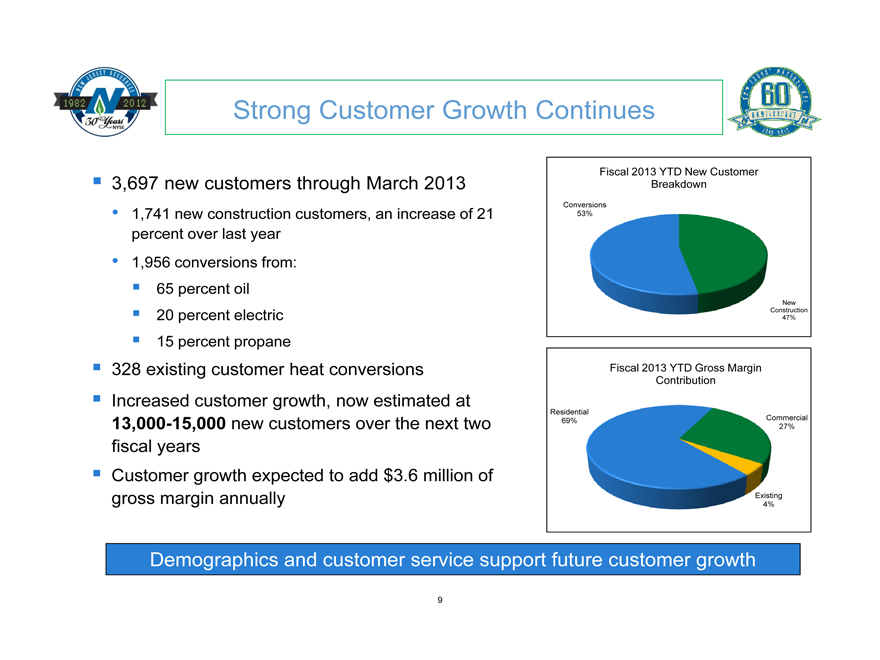

Strong Customer Growth Continues

3,697 new customers through March 2013

• 1,741 new construction customers, an increase of 21 percent over last year

• 1,956 conversions from:

65 percent oil

20 percent electric

15 percent propane

328 existing customer heat conversions

Increased customer growth, now estimated at 13,000-15,000 new customers over the next two fiscal years

Customer growth expected to add $3.6 million of gross margin annually

Fiscal 2013 YTD New Customer Breakdown

Conversions 53%

New Construction 47%

Fiscal 2013 YTD Gross Margin Contribution

Residential 69%

Commercial 27%

Existing 4%

Demographics and customer service support future customer growth

9

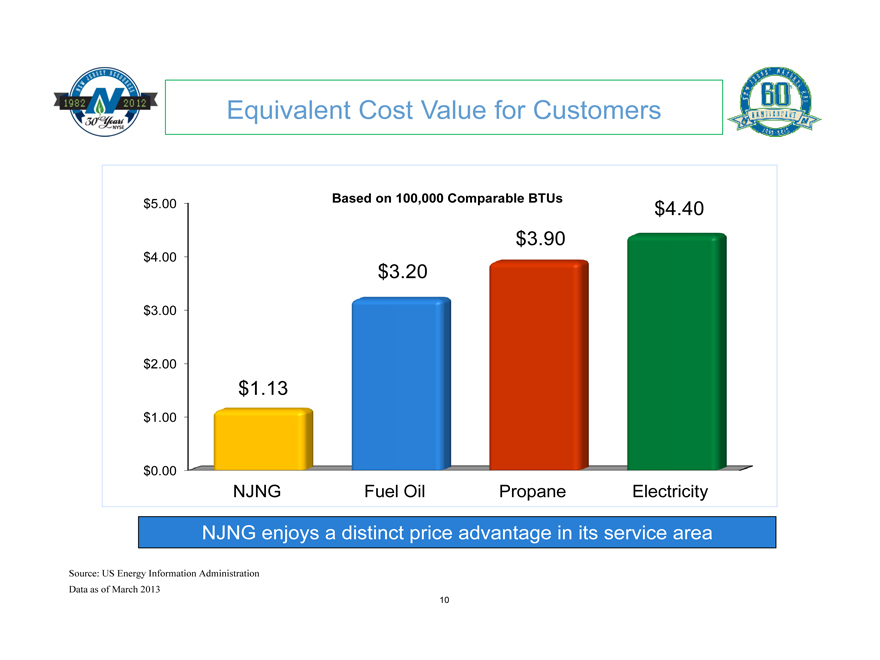

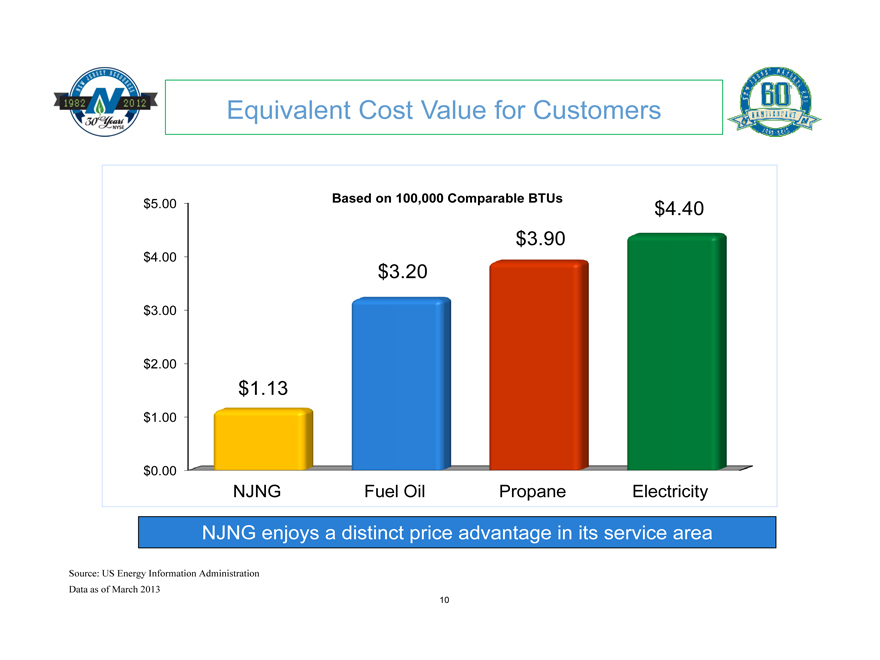

Equivalent Cost Value for Customers

$5.00 $4.00 $3.00 $2.00 $1.00 $0.00

Based on 100,000 Comparable BTUs

$1.13

$3.20

$3.90

$4.40

NJNG Fuel Oil Propane Electricity

NJNG enjoys a distinct price advantage in its service area

Source: US Energy Information Administration Data as of March 2013

10

Future Potential Customer Growth

New Construction

2013-2017 15,900

2018-Build Out 71,600

Conversions

Off Main 49,800

Non Heat

7,246

On Main 37,749

Near Main

29,192

With our new construction and conversion outlook, we see a total potential of over 204,000 new customers

Sources: Arthur D. Little, Harte Hanks and NJNG

11

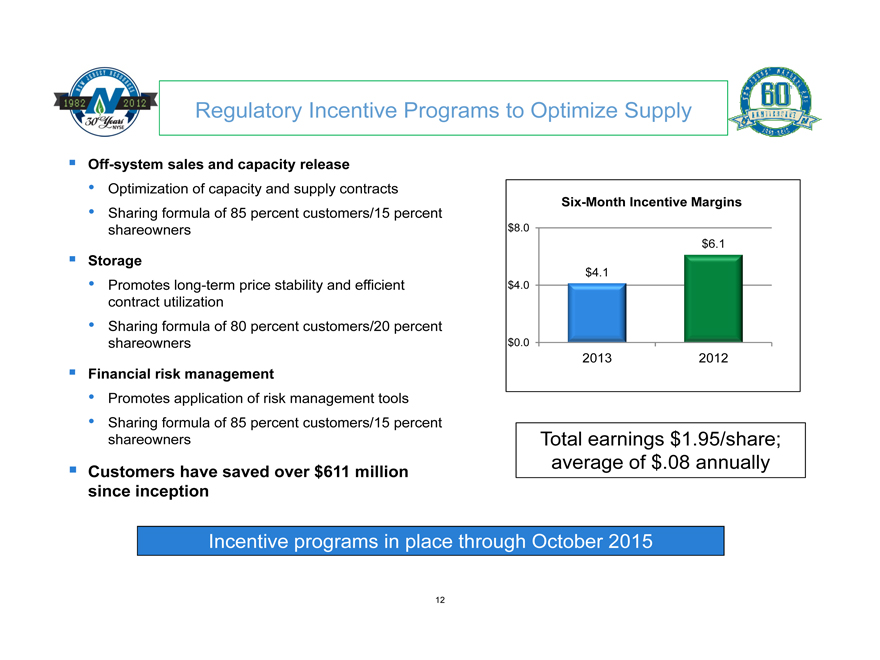

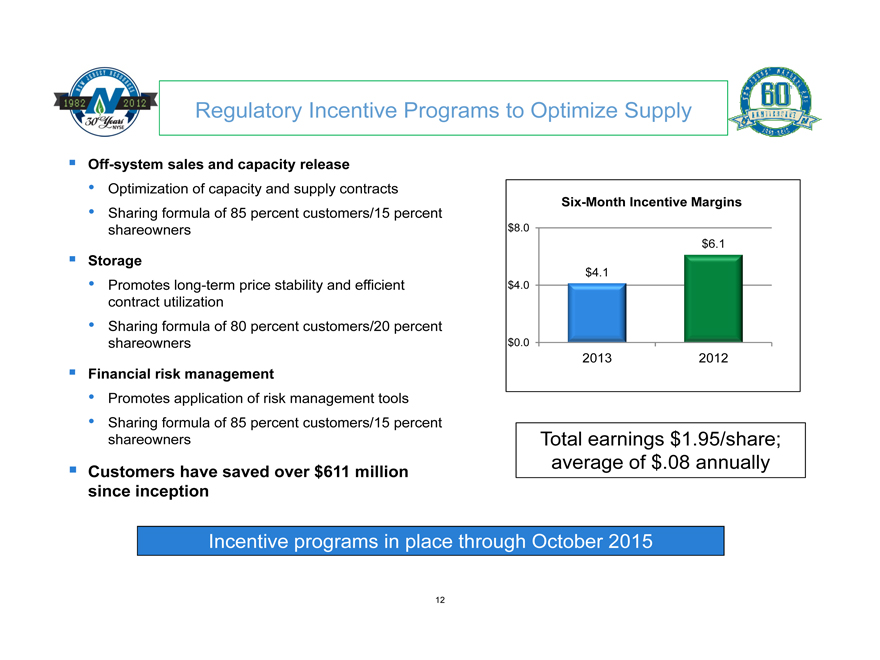

Regulatory Incentive Programs to Optimize Supply

Off-system sales and capacity release

• Optimization of capacity and supply contracts

• Sharing formula of 85 percent customers/15 percent shareowners

Storage

• Promotes long-term price stability and efficient contract utilization

• Sharing formula of 80 percent customers/20 percent shareowners

Financial risk management

• Promotes application of risk management tools

• Sharing formula of 85 percent customers/15 percent shareowners

Customers have saved over $611 million since inception

Six-Month Incentive Margins

$8.0 $4.0 $0.0

$4.1

$6.1

2013 2012

Total earnings $1.95/share; average of $.08 annually

Incentive programs in place through October 2015

12

Regulatory Collaboration Adds Value

Safety Acceleration and Facility Enhancement (SAFE) Program

Approved in October 2012; four-year, $130 million program

Conservation Incentive Program

In place through September 30, 2013; petition filed for extension on March 1, 2013

NGV Program

Three agreements signed

Total investment of $6 to $8 million on Compressed Natural Gas infrastructure

NJNG earns a return of 7.1 percent/10.3 percent ROE

The SAVEGREEN Project®

Filing submitted to the NJ BPU; decision expected in June

Constructive regulatory environment and support of public policy objectives create growth opportunities for NJNG

13

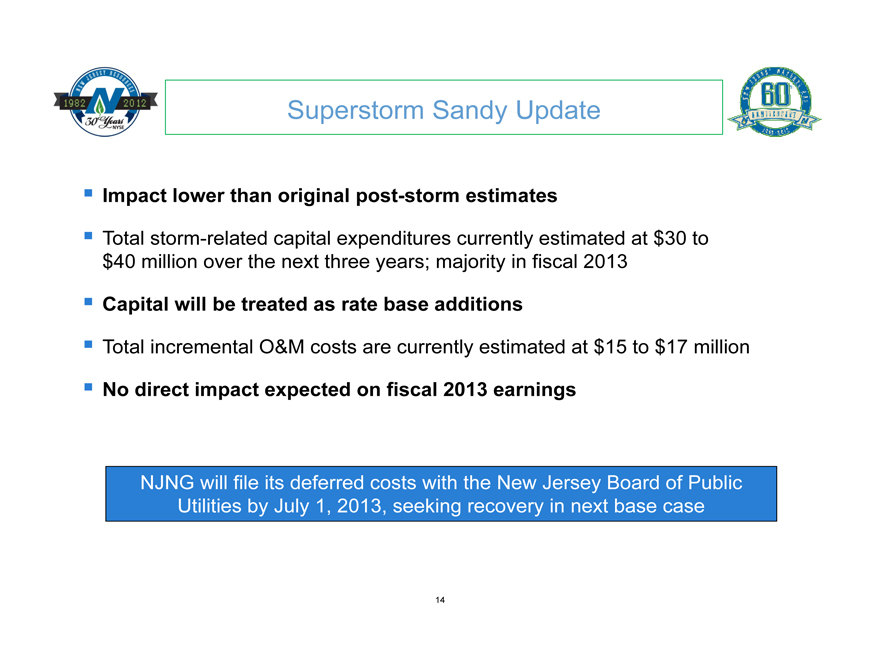

Superstorm Sandy Update

Impact lower than original post-storm estimates

Total storm-related capital expenditures currently estimated at $30 to $40 million over the next three years; majority in fiscal 2013

Capital will be treated as rate base additions

Total incremental O&M costs are currently estimated at $15 to $17 million

No direct impact expected on fiscal 2013 earnings

NJNG will file its deferred costs with the New Jersey Board of Public Utilities by July 1, 2013, seeking recovery in next base case

14

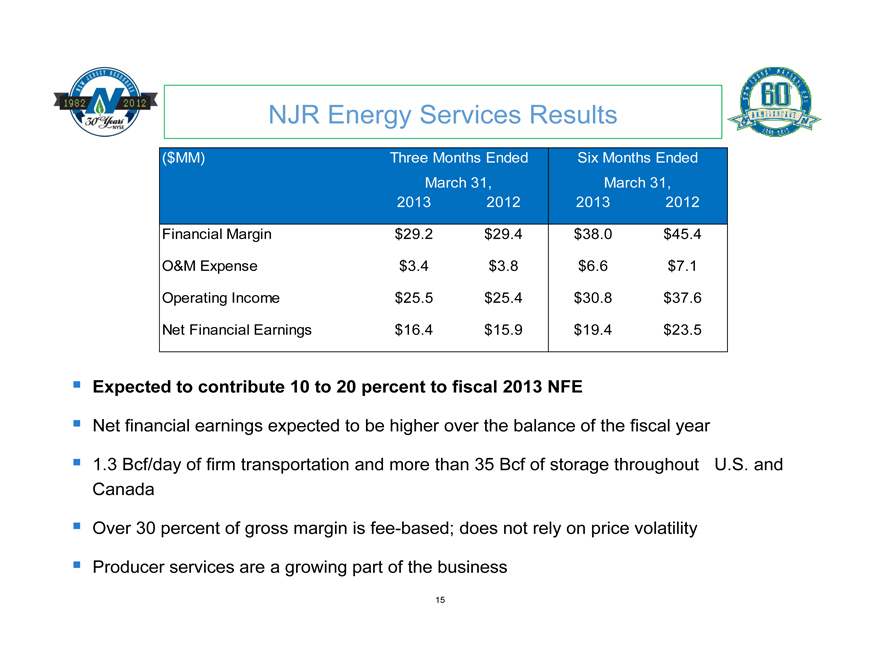

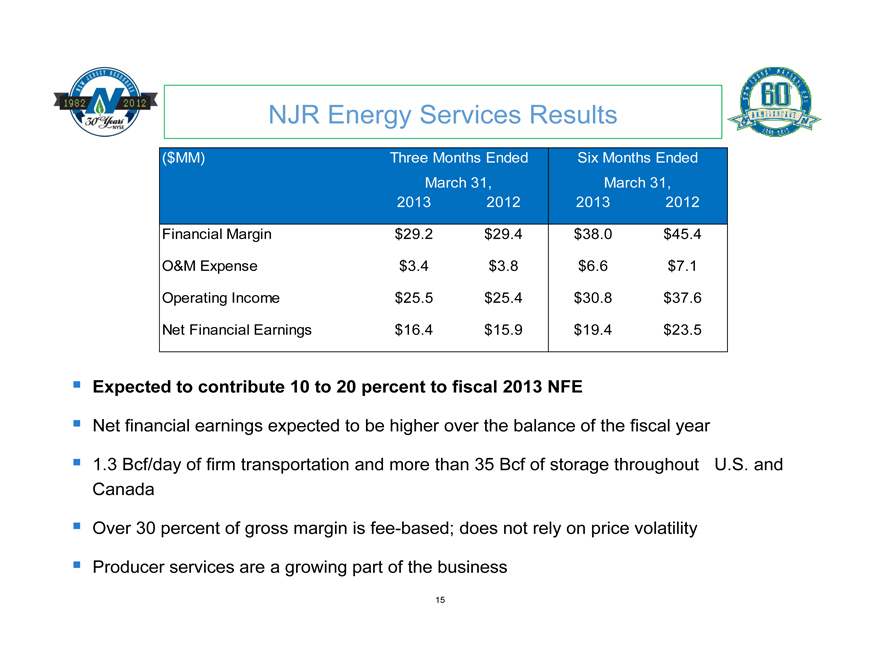

NJR Energy Services Results

($MM) Three Months Ended Six Months Ended March 31, March 31, 2013 2012 2013 2012

Financial Margin $29.2 $29.4 $38.0 $45.4 O&M Expense $3.4 $3.8 $6.6 $7.1 Operating Income $25.5 $25.4 $30.8 $37.6 Net Financial Earnings $16.4 $15.9 $19.4 $23.5

Expected to contribute 10 to 20 percent to fiscal 2013 NFE

Net financial earnings expected to be higher over the balance of the fiscal year

1.3 Bcf/day of firm transportation and more than 35 Bcf of storage throughout U.S. and Canada

Over 30 percent of gross margin is fee-based; does not rely on price volatility

Producer services are a growing part of the business

15

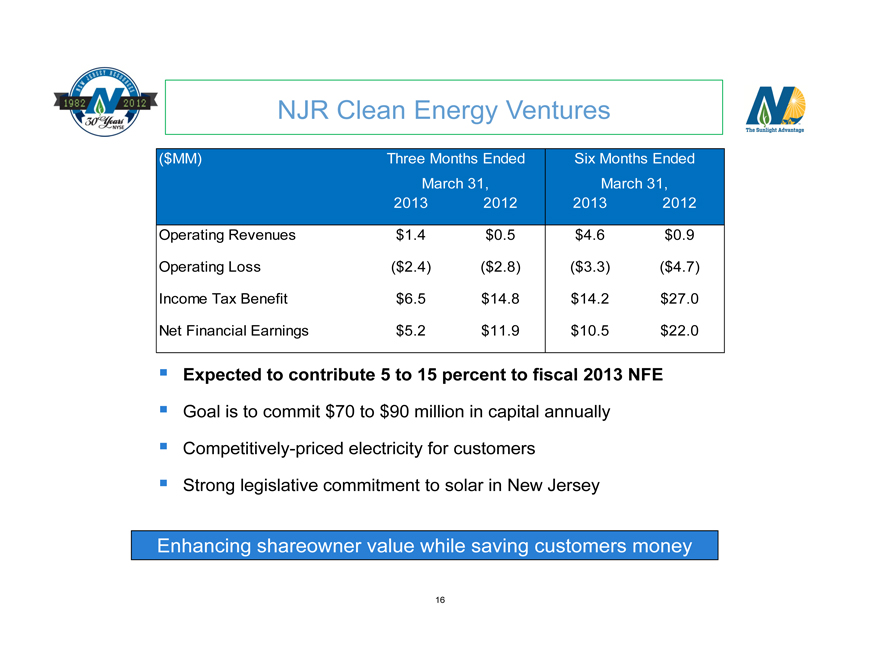

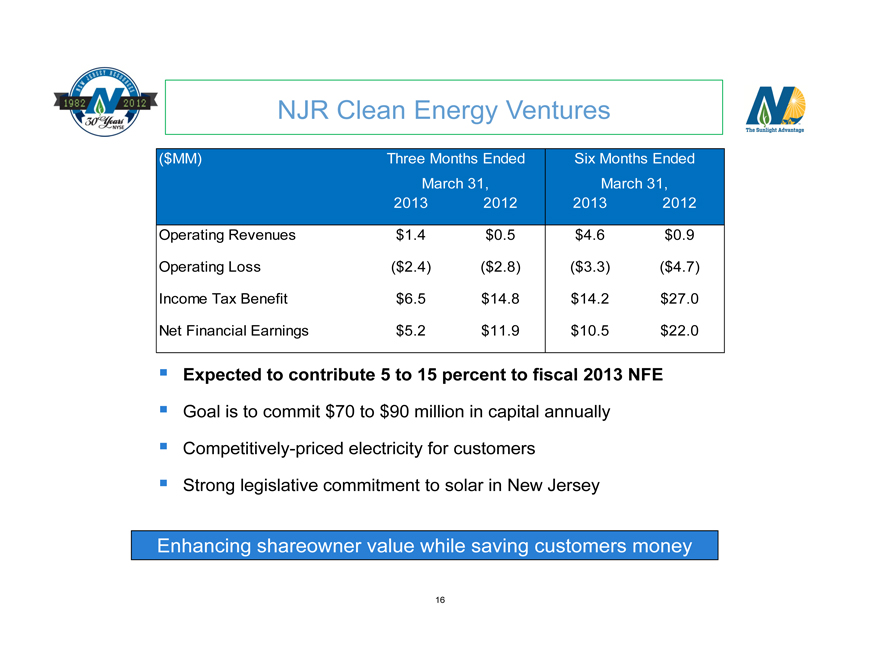

NJR Clean Energy Ventures

($MM) Three Months Ended Six Months Ended March 31, March 31, 2013 2012 2013 2012

Operating Revenues $1.4 $0.5 $4.6 $0.9 Operating Loss ($2.4) ($2.8) ($3.3) ($4.7) Income Tax Benefit $6.5 $14.8 $14.2 $27.0 Net Financial Earnings $5.2 $11.9 $10.5 $22.0

Expected to contribute 5 to 15 percent to fiscal 2013 NFE

Goal is to commit $70 to $90 million in capital annually Competitively-priced electricity for customers Strong legislative commitment to solar in New Jersey

Enhancing shareowner value while saving customers money

16

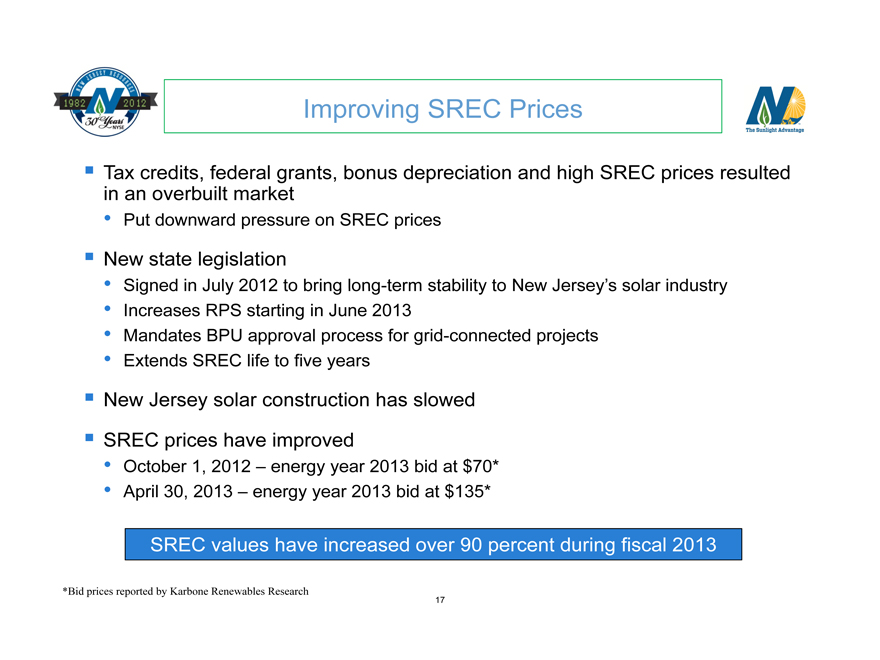

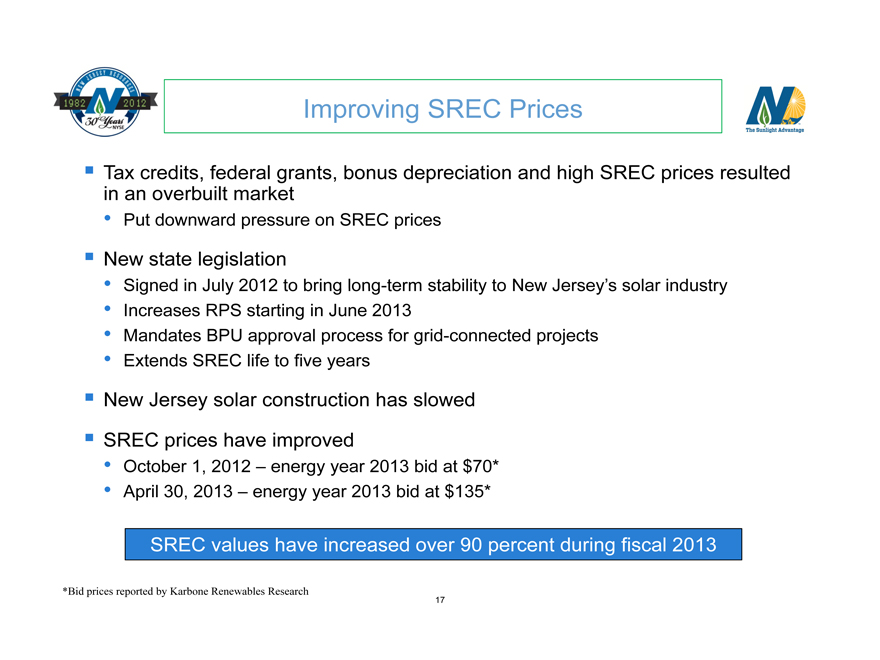

Improving SREC Prices

Tax credits, federal grants, bonus depreciation and high SREC prices resulted in an overbuilt market

Put downward pressure on SREC prices

New state legislation

Signed in July 2012 to bring long-term stability to New Jersey’s solar industry

Increases RPS starting in June 2013

Mandates BPU approval process for grid-connected projects

Extends SREC life to five years

New Jersey solar construction has slowed

SREC prices have improved

October 1, 2012 – energy year 2013 bid at $70*

April 30, 2013 – energy year 2013 bid at $135*

SREC values have increased over 90 percent during fiscal 2013

*Bid prices reported by Karbone Renewables Research

17

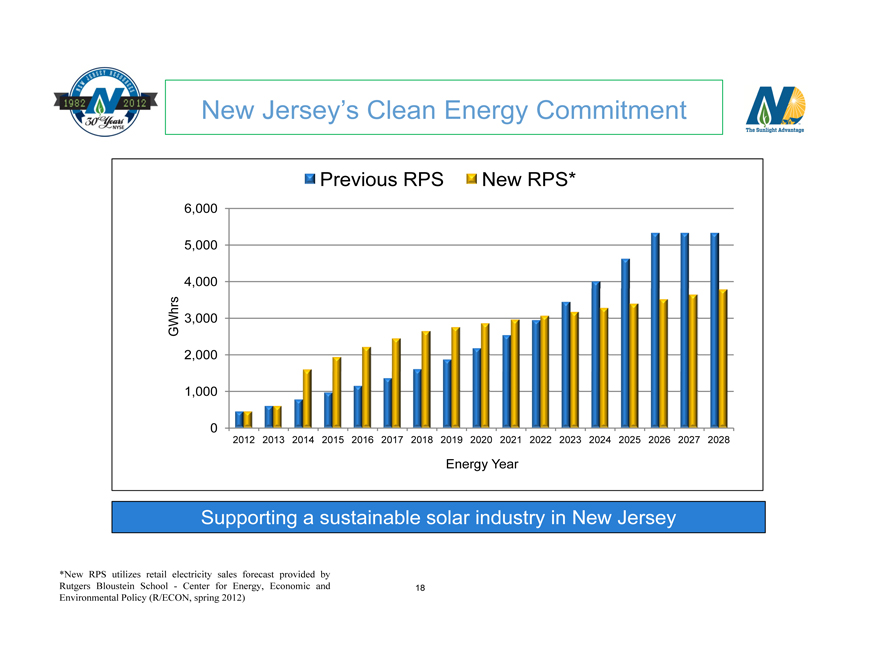

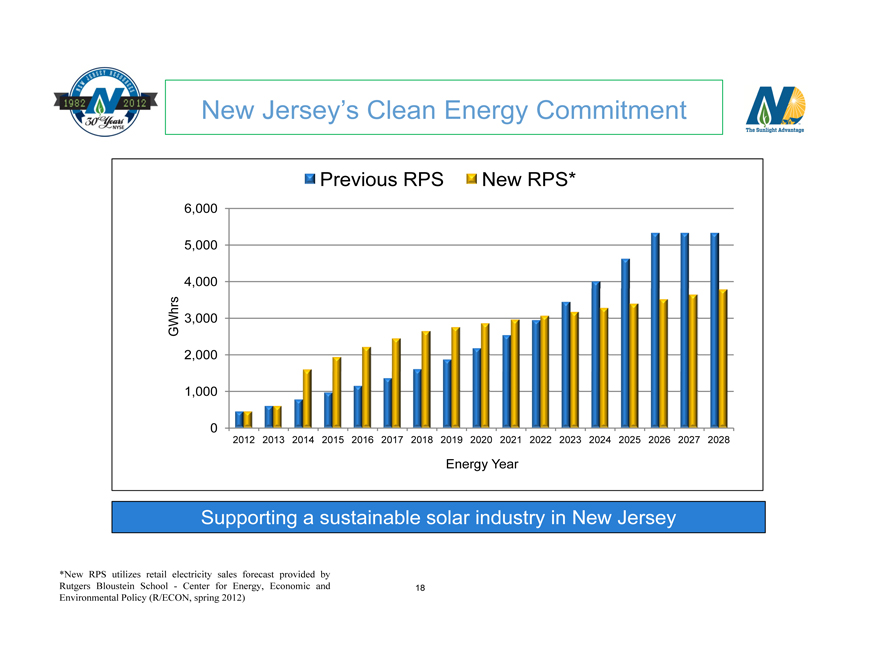

New Jersey’s Clean Energy Commitment

Previous RPS

New RPS*

6,000

5,000

4,000 GWhrs 3,000 2,000

1,000

0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Energy Year

Supporting a sustainable solar industry in New Jersey

*New RPS utilizes retail electricity sales forecast provided by Rutgers Bloustein School—Center for Energy, Economic and Environmental Policy (R/ECON, spring 2012)

18

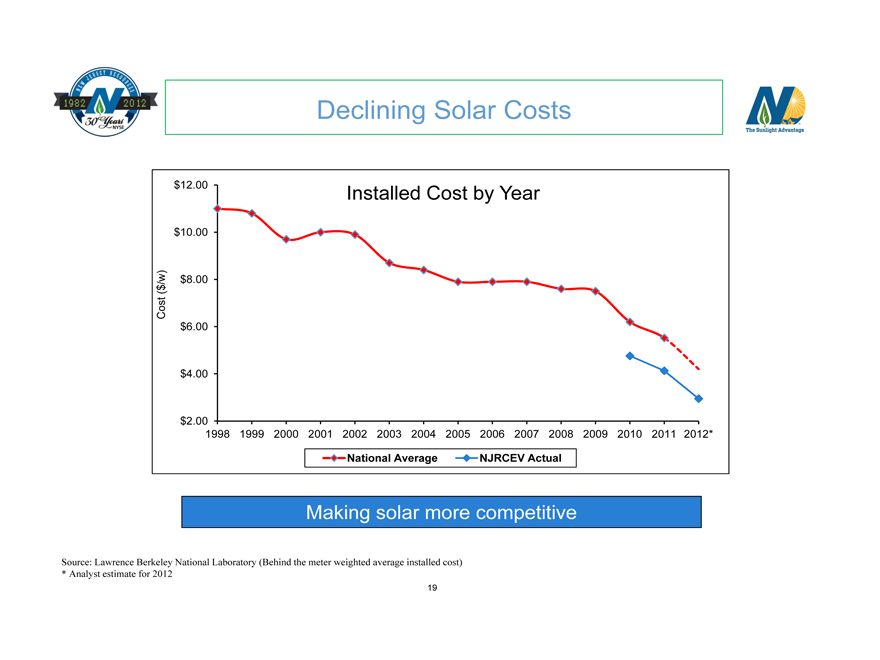

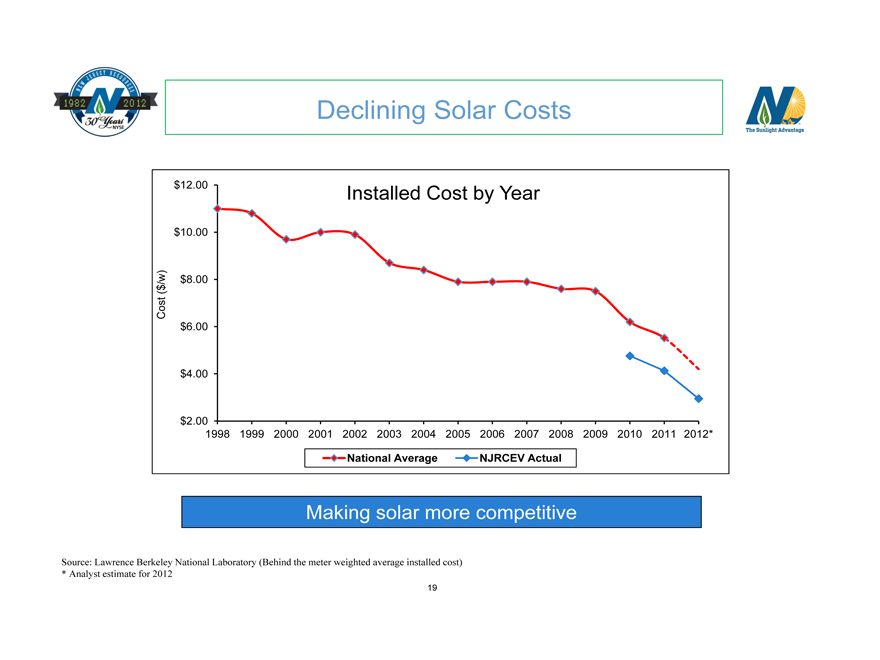

Declining Solar Costs

Installed Cost by Year

$12.00

$10.00

/w) $8.00 ( $ Cost $6.00

$4.00

$2.00

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012*

National Average

NJRCEV Actual

Making solar more competitive

Source: Lawrence Berkeley National Laboratory (Behind the meter weighted average installed cost)

* Analyst estimate for 2012

19

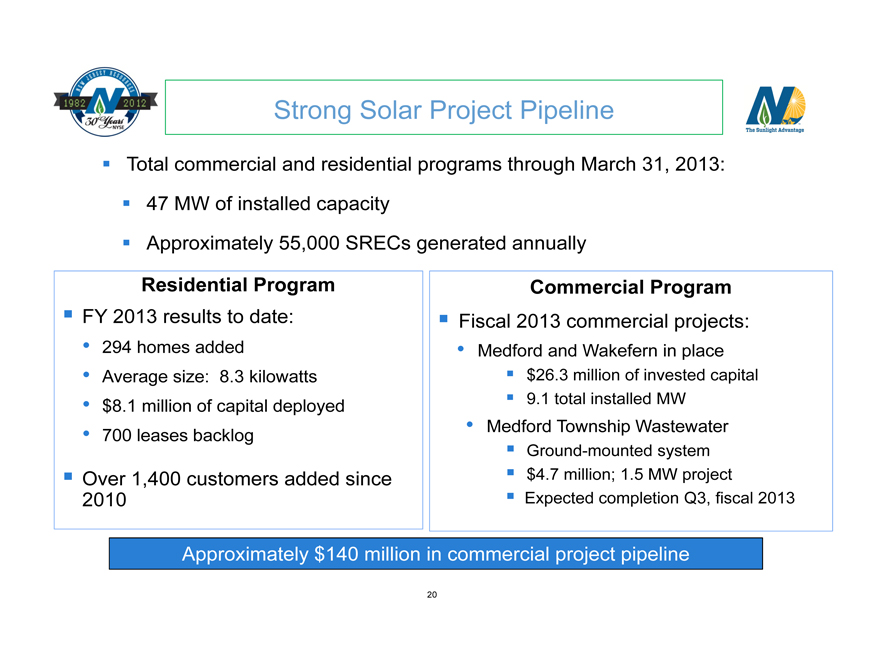

Strong Solar Project Pipeline

Total commercial and residential programs through March 31, 2013:

47 MW of installed capacity

Approximately 55,000 SRECs generated annually

Residential Program

FY 2013 results to date:

294 homes added

Average size: 8.3 kilowatts

$8.1 million of capital deployed

700 leases backlog

Over 1,400 customers added since 2010

Commercial Program

Fiscal 2013 commercial projects:

• Medford and Wakefern in place

$26.3 million of invested capital

9.1 total installed MW

• Medford Township Wastewater

Ground-mounted system

$4.7 million; 1.5 MW project

Expected completion Q3, fiscal 2013

Approximately $140 million in commercial project pipeline

20

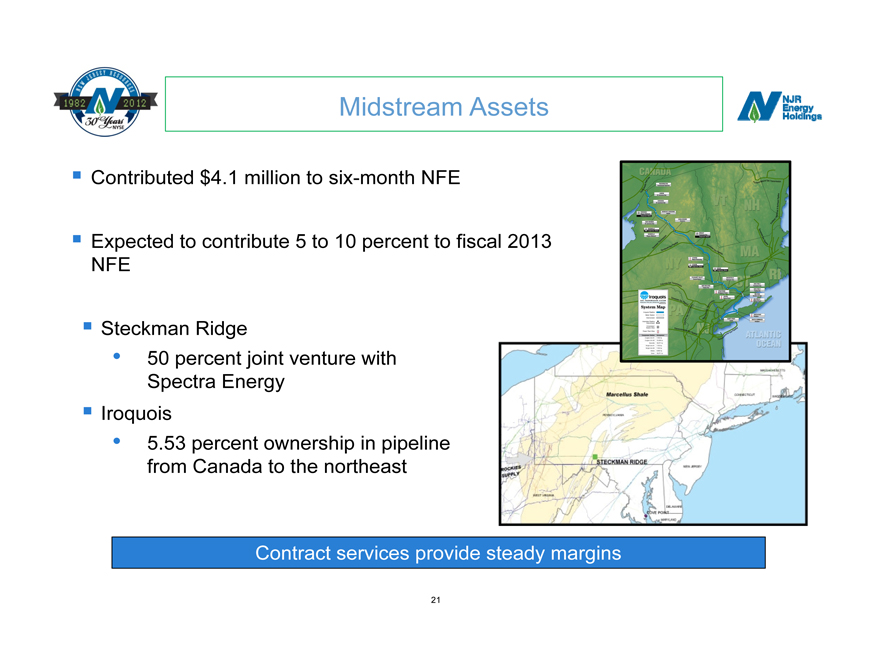

Midstream Assets

Contributed $4.1 million to six-month NFE

Expected to contribute 5 to 10 percent to fiscal 2013 NFE

Steckman Ridge

50 percent joint venture with Spectra Energy Iroquois

5.53 percent ownership in pipeline from Canada to the northeast

Contract services provide steady margins

21

NJR Home Services

Serves approximately 128,000 customers

Expected to contribute 2 to 5 percent to fiscal 2013 NFE

Expanded services now offered

Whole house electric and plumbing contracts

Standby generator contracts

Air conditioning

Generator sales and installation

Pursuing geographic expansion

Currently marketing in Sussex, Warren and Hunterdon counties

Home energy solutions for customer comfort

22

Financial Goals

Long-term NFE growth of 4 to 6 percent

Earnings from New Jersey Natural Gas of 60 to 70 percent Annual dividend growth of 5 percent Maintain a payout ratio at or lower than peer average

Maintain a strong financial profile with a minimum equity ratio of 50 percent

23

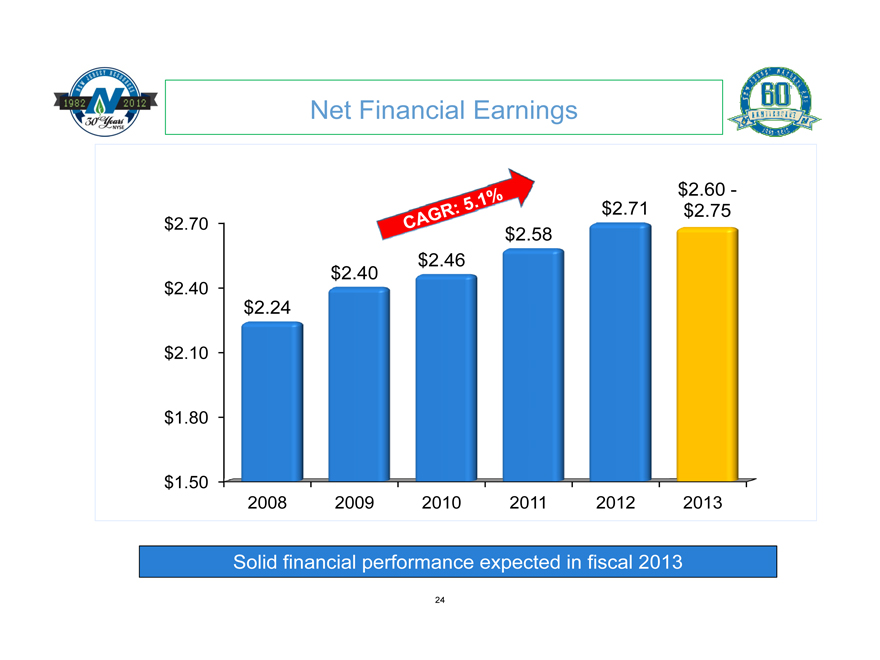

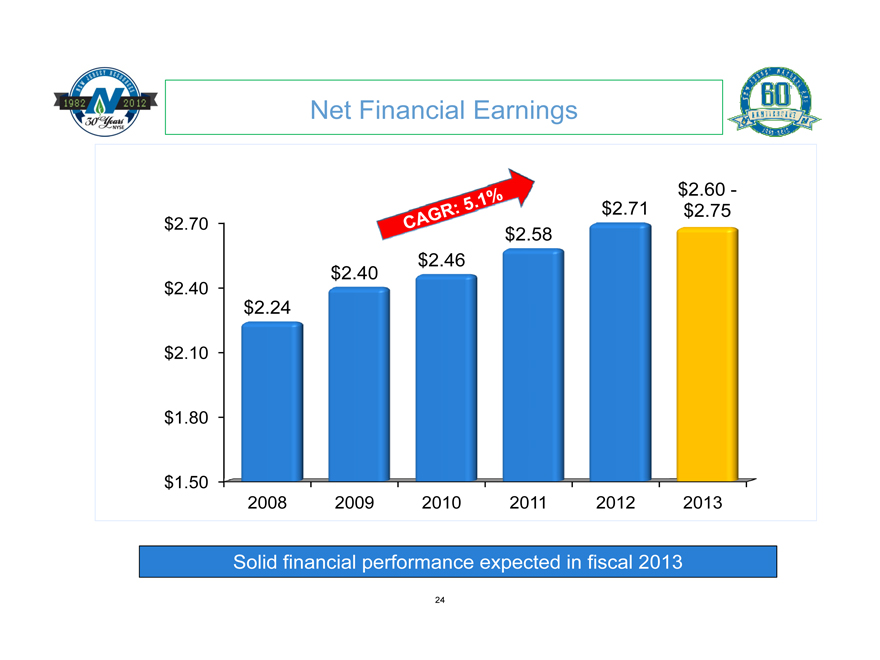

Net Financial Earnings

$2.70 $2.40 $2.10 $1.80 $1.50

2008 2009 2010 2011 2012 2013

Solid financial performance expected in fiscal 2013

$2.24

$2.40

$2.46

$2.58

$2.71

$2.60 -$2.75

24

Growing Dividends

$1.70 $1.60 $1.50 $1.40 $1.30 $1.20 $1.10 $1.00

2008 2009 2010 2011 2012 2013*

$1.12

$1.24

$1.36

$1.44

$1.54

$1.60

19 dividend increases in 17 years

* Current annual rate

25

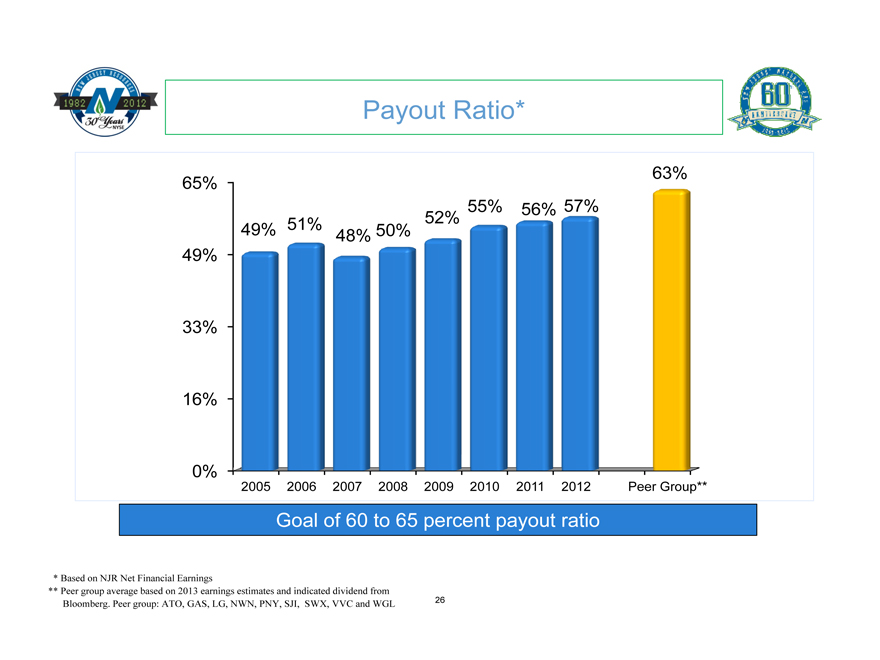

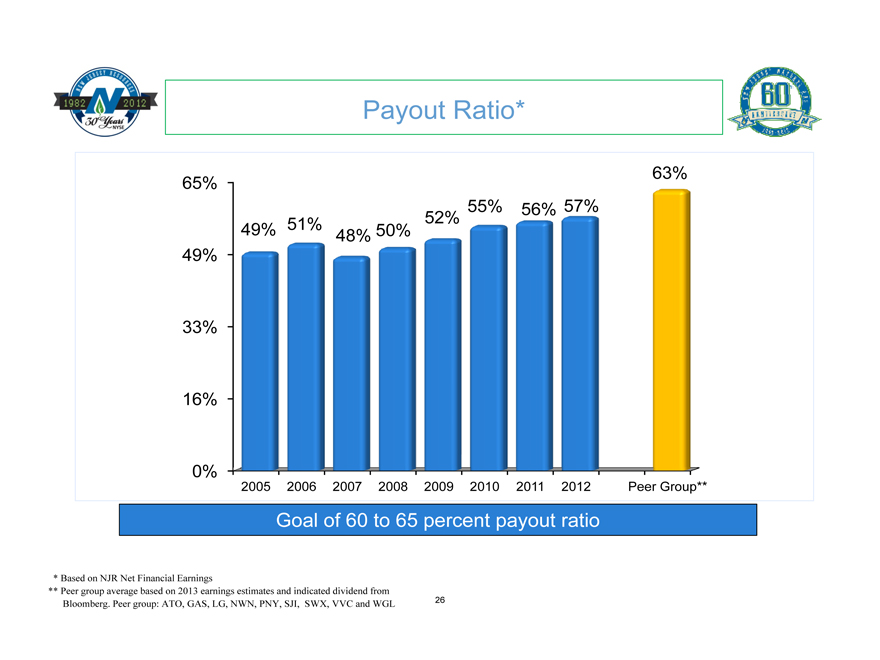

Payout Ratio*

65% 49% 33% 16% 0%

63% 55% 56% 57% 51% 52% 49% 48% 50%

2005 2006 2007 2008 2009 2010 2011 2012 Peer Group**

Goal of 60 to 65 percent payout ratio

* Based on NJR Net Financial Earnings

** Peer group average based on 2013 earnings estimates and indicated dividend from Bloomberg. Peer group: ATO, GAS, LG, NWN, PNY, SJI, SWX, VVC and WGL

26

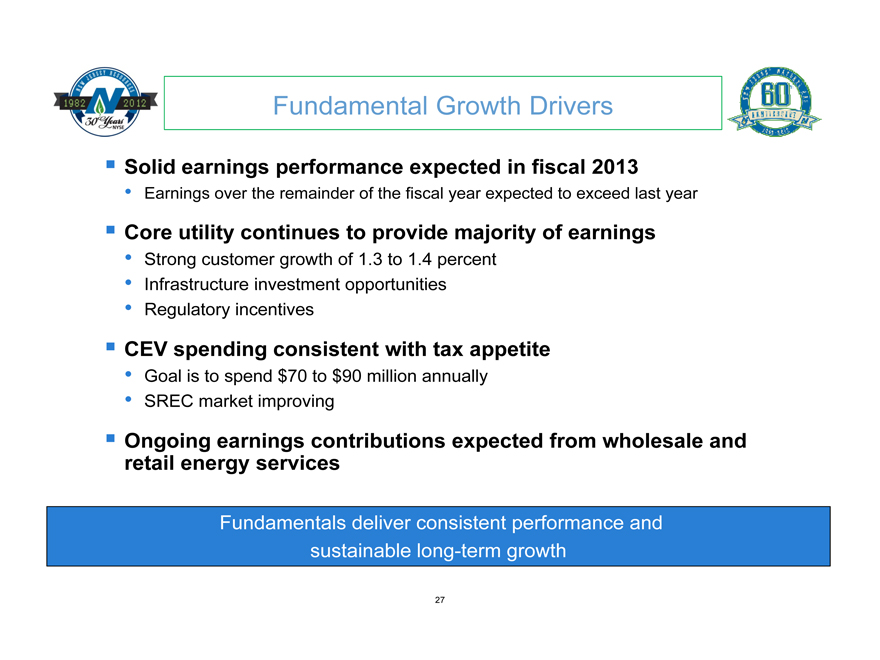

Fundamental Growth Drivers

Solid earnings performance expected in fiscal 2013

Earnings over the remainder of the fiscal year expected to exceed last year

Core utility continues to provide majority of earnings

Strong customer growth of 1.3 to 1.4 percent

Infrastructure investment opportunities

Regulatory incentives

CEV spending consistent with tax appetite

Goal is to spend $70 to $90 million annually

SREC market improving

Ongoing earnings contributions expected from wholesale and retail energy services

Fundamentals deliver consistent performance and sustainable long-term growth

27

Fiscal 2013 Second Quarter Update

May 2, 2013