|

| NJR CONTACTS: | |

| ROBERTOBEL, VICEPRESIDENT, TREASURER& INVESTORRELATIONS | 732-938-1049 |

| DENNISPUMA, DIRECTOR, INVESTORRELATIONS | 732-938-1229 |

| MARKAYDIN, MANAGER, INVESTORRELATIONS | 732-938-1228 |

September 5, 2019

NJR MIDSTREAM ANNOUNCES ACQUISITION OF LEAF RIVER

ENERGY CENTER

| ■ | Strategically located and reliable salt dome natural gas storage facility in the Gulf Coast region |

| ■ | Strong contract profile with an average life of 4.9 years and a creditworthy and diversified customer base |

| ■ | Complements NJR’s existing gas midstream business and supports long-term NFE growth rate of 6% - 8% |

Transaction Overview

NJR Midstream, a business of New Jersey Resources (NYSE: NJR), has entered into an agreement to purchase Leaf River Energy Center (Leaf River) in Taylorsville, Mississippi for $367.5 million.

Background

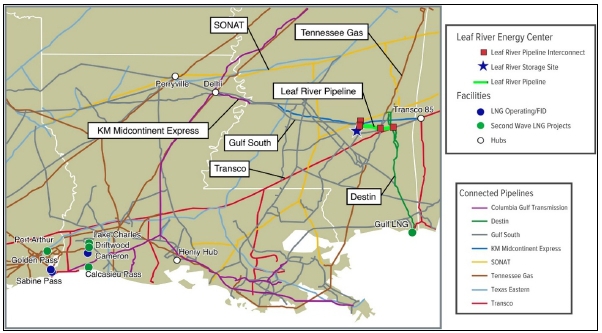

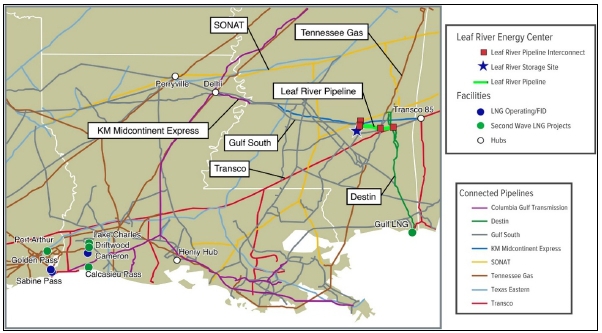

Leaf River owns and operates a salt dome natural gas facility, strategically located in southeastern Mississippi with connections to six major interstate pipelines. The facility employs 18 full-time employees including a well-seasoned executive management team and personnel that operates and maintains the facility.

Leaf River is a 32.2 million dekatherm (MMDth) salt dome natural gas storage facility providing storage solutions in the Gulf Coast region. The facility, comprising three salt domes, went into service in stages between 2011 and 2014, making it one of the newest natural gas storage facilities in North America. Leaf River’s pipeline connections form a critical intersection for abundant shale supply and growing Gulf Coast demand.

With the acquisition of the Leaf River asset, NJR will have ownership interests in natural gas storage facilities in the Gulf Coast and Marcellus Shale regions with working gas storage capacity of more than 44 MMDth.

Investment Rationale

1. Market Dynamics

The Gulf Coast is the fastest growing market for natural gas in the United States, driven by increased gas supply from Marcellus/Utica, Haynesville and Mid-Continent shale production. In addition, demand in the Gulf Coast has continued to grow due to LNG exports, gas-fired power generation and industrial expansions. Natural gas salt cavern storage facilities are helping to meet the supply/demand needs of the region.

LNG Exports

Since 2017, natural gas demand from LNG facilities has grown over 200% from 1.4 billion cubic feet (Bcf) per day to 4.2 Bcf per day. Global LNG demand has increased by 11.4% from 2016 – 2017, driven by the Asian and European markets. Global demand is expected to grow at a 6.5% CAGR through 2025. To accommodate the growing demand, three new export terminals are expected to begin operations in mid-2020, increasing export capacity to 9.2 Bcf per day. By 2025, the export capacity is expected to grow to 14.7 Bcf per day.

Natural Gas Fired Generation

Demand for natural gas in the Gulf Coast region has increased due to coal-to-gas fired generation plants and the retirement of coal and nuclear generation plants. Since 2013, there have been 11 gigawatts (GWs) of coal plant retirements and one GW of nuclear plant retirements. To compensate, over 32 GWs of planned natural gas-fired generation has been announced for the region.

2. Location

Leaf River is located in southeastern Mississippi with connections to six major interstate pipelines. The strategic location of the assets also provides geographic and contractual advantages due to the proximity to markets on Transco and SONAT, as well as providing additional supply from the Tennessee Gas Pipeline.

2

3. Expandability

Leaf River has potential growth opportunities through facilities expansion and new pipeline interconnects. The facility is designed with the capability to economically install an additional storage cavern when market conditions support the additional capacity. An additional cavern would add approximately 13.1 MMDth of storage capacity.

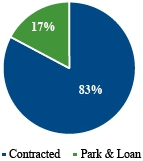

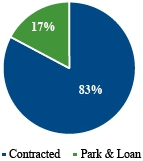

Contract Profile

The majority of Leaf River is highly contracted with high-quality, creditworthy counterparties and its diversified customer base has an average contract duration of 4.9 years.

| Contracted Volumes (MMDth) | | Contracted Volumes by Customer |

| |  |

Regulatory Considerations and Expected Closing Date

The transaction does not require approval from the Federal Energy Regulatory Commission and is expected to close in 2019.

Earnings Impact

The acquisition is expected to be nominally accretive to NFE in fiscal 2020 and support the long-term NFE growth rate of 6% - 8%.

Financial Considerations

NJR intends to finance the transaction with a new $350 million term loan and additional borrowings under the existing credit facility. The long-term financing plan will include long-term debt and equity that will maintain a strong balance sheet at NJR.

Forward-Looking Statements

Certain statements contained in this fact sheet are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. NJR cautions readers that the assumptions forming the basis for forward-looking statements include many factors that are beyond NJR’s ability to control or estimate precisely, such as estimates of future market conditions and the behavior of other market participants. Words such as “anticipates,” “estimates,” “expects,” “projects,” “may,” “will,” “intends,” “plans,” “believes,” “should” and similar expressions may identify forward-looking statements and such forward-looking statements are made based upon management’s current expectations, assumptions and beliefs as of this date concerning future developments and their potential effect upon NJR. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on NJR will be those anticipated by management. Forward-looking statements in this news release include, but are not limited to, certain statements regarding the closing of the purchase of Leaf River, future earnings of Leaf River and future investments by NJR in Leaf River.

3

Additional information and factors that could cause actual results to differ materially from NJR’s expectations are contained in NJR’s filings with the U.S. Securities and Exchange Commission (SEC), including NJR’s Annual Reports on Form 10-K and subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site, http:.//www.sec.gov. Information included in this news release is representative as of today only and while NJR periodically reassesses material trends and uncertainties affecting NJR's results of operations and financial condition in connection with its preparation of management's discussion and analysis of results of operations and financial condition contained in its Quarterly and Annual Reports filed with the SEC, NJR does not, by including this statement, assume any obligation to review or revise any particular forward-looking statement referenced herein in light of future events.

About New Jersey Resources

New Jersey Resources (NYSE: NJR)is a Fortune 1000 company that, through its subsidiaries, provides safe and reliable natural gas and clean energy services, including transportation, distribution, asset management and home services. NJR is composed of five primary businesses:

| ● | New Jersey Natural Gas, NJR’s principal subsidiary, operates and maintains over 7,500 miles of natural gas transportation and distribution infrastructure to serve over half a million customers in New Jersey’s Monmouth, Ocean, Morris, Middlesex and Burlington counties.

|

| ● | NJR Clean Energy Venturesinvests in, owns and operates solar projects with a total capacity of 250 megawatts, providing residential and commercial customers with low-carbon solutions.

|

| ● | NJR Energy Servicesmanages a diversified portfolio of natural gas transportation and storage assets and provides physical natural gas services and customized energy solutions to its customers across North America.

|

| ● | NJR Midstreamserves customers from local distributors and producers to electric generators and wholesale marketers through its 50 percent equity ownership in the Steckman Ridge natural gas storage facility, as well as its 20 percent equity interest in the PennEast Pipeline Project.

|

| ● | NJR Home Servicesprovides service contracts as well as heating, central air conditioning, water heaters, standby generators, solar and other indoor and outdoor comfort products to residential homes throughout New Jersey. |

NJR and its more than 1,000 employees are committed to helping customers save energy and money by promoting conservation and encouraging efficiency through Conserve to Preserve® and initiatives such as The SAVEGREEN Project® and The Sunlight Advantage®.

4