Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-03327

MFS SERIES TRUST XIII

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: February 28*

Date of reporting period: February 28, 2019

| * | This FormN-CSR pertains to the following series of the Registrant: MFS Diversified Income Fund, MFS Government Securities Fund and MFS New Discovery Value Fund. The remaining series of the Registrant has a fiscal year end other than February 28. |

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

Annual Report

February 28, 2019

MFS® Diversified Income Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the complete reports will be made available on the fund’s Web site (funds.mfs.com), and you will be notified by mail each time a report is posted and provided with a Web site link to access the report.

If you are already signed up to receive shareholder reports by email, you will not be affected by this change and you need not take any action. You may sign up to receive shareholder reports and other communications from the fund by email by contacting your financial intermediary (such as a broker-dealer or bank) or, if you hold your shares directly with the fund, by calling 1-800-225-2606 or by logging on to MFS Access at mfs.com.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you can call 1-800-225-2606 or send an email request to orderliterature@mfs.com to let the fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the MFS fund complex if you invest directly.

DIF-ANN

Table of Contents

MFS® Diversified Income Fund

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK GUARANTEE

Table of Contents

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Shareholders:

Markets experienced a bout of volatility in late 2018 as a result of higher interest rates, international trade friction and geopolitical uncertainty surrounding issues such as

Brexit. But concern over those issues dissipated in the early months of 2019 due to a more dovish posture by the U.S. Federal Reserve, progress toward a trade pact between the United States and China, and a consensus forming in the British Parliament against ano-deal Brexit. Over the past year, U.S. equities have outperformed their global peers due in part to fiscal stimulus undertaken in late 2017 and early 2019, which helped maintain healthy levels of U.S. economic output against a backdrop of slowing global growth, though returns, on average, have been modest.

Globally, inflation remains largely subdued thanks in part to stable

oil prices, though tight labor markets are keeping investors on the lookout for its potential reappearance. Rising incomes in many developed and emerging markets are supportive of gains in consumption, though a challenging backdrop for global trade has weighed on manufacturing in most regions. Should the U.S. and China reach a comprehensive trade agreement, sentiment could improve later this year.

As a global investment manager with nearly a century of expertise, MFS® firmly believes active risk management offers downside mitigation and may help improve investment outcomes. We built our active investment platform with this belief in mind. Our long-term perspective influences nearly every aspect of our business, ensuring that our investment decisions align with the investing time horizons of our clients.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

April 16, 2019

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

Table of Contents

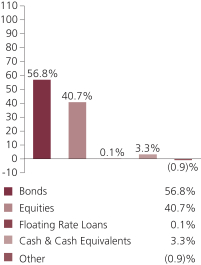

Portfolio structure (i)

| Top ten holdings (i) | ||||

| Simon Property Group, Inc., REIT | 2.3% | |||

| Fannie Mae, 3.5%, 30 Years | 2.1% | |||

| U.S. Treasury Notes, 1.75%, 11/30/2021 | 2.1% | |||

| Fannie Mae, 4%, 30 Years | 1.9% | |||

| Public Storage, Inc., REIT | 1.7% | |||

| Welltower, Inc., REIT | 1.3% | |||

| Fannie Mae, 4.5%, 30 Years | 1.3% | |||

| Medical Properties Trust, Inc., REIT | 1.3% | |||

| Brixmor Property Group Inc., REIT | 1.2% | |||

| Sun Communities, Inc., REIT | 1.1% |

| GICS equity sectors (i) | ||||

| Real Estate | 23.0% | |||

| Health Care | 3.4% | |||

| Consumer Staples | 3.0% | |||

| Financials | 2.2% | |||

| Energy | 1.7% | |||

| Information Technology | 1.6% | |||

| Utilities | 1.5% | |||

| Industrials | 1.5% | |||

| Consumer Discretionary | 1.2% | |||

| Communication Services | 1.2% | |||

| Materials | 0.4% | |||

| Fixed income sectors (i) | ||||

| Emerging Markets Bonds | 18.5% | |||

| High Yield Corporates | 15.4% | |||

| Mortgage-Backed Securities | 11.6% | |||

| U.S. Treasury Securities | 7.7% | |||

| U.S. Government Agencies | 1.2% | |||

| Investment Grade Corporates | 1.0% | |||

| Commercial Mortgage-Backed Securities | 0.5% | |||

| Collateralized Debt Obligations | 0.4% | |||

| Municipal Bonds | 0.3% | |||

| Floating Rate Loans | 0.1% | |||

| Asset-Backed Securities | 0.1% | |||

| Non-U.S. Government Bonds (o) | 0.0% | |||

2

Table of Contents

Portfolio Composition – continued

| Composition including fixed income credit quality (a)(i) |

| |||

| AAA | 1.0% | |||

| AA | 0.6% | |||

| A | 1.4% | |||

| BBB | 7.2% | |||

| BB | 12.9% | |||

| B | 11.5% | |||

| CCC | 1.6% | |||

| CC (o) | 0.0% | |||

| U.S. Government | 6.7% | |||

| Federal Agencies | 12.8% | |||

| Not Rated | 1.2% | |||

| Non-Fixed Income | 40.7% | |||

| Cash & Cash Equivalents | 3.3% | |||

| Other | (0.9)% | |||

| Issuer country weightings (i)(x) |

| |||

| United States | 67.4% | |||

| Canada | 2.4% | |||

| Switzerland | 2.2% | |||

| United Kingdom | 1.7% | |||

| France | 1.4% | |||

| Argentina | 1.2% | |||

| Japan | 1.1% | |||

| China | 1.0% | |||

| Chile | 1.0% | |||

| Other Countries | 20.6% | |||

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. Not Rated includes fixed income securities and fixed income derivatives, which have not been rated by any rating agency.Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (o) | Less than 0.1%. |

| (x) | Represents the portfolio’s exposure to issuer countries as a percentage of the portfolio’s net assets. For purposes of this presentation, United States includes Cash & Cash Equivalents and Other. |

3

Table of Contents

Portfolio Composition – continued

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

The fund invests a portion of its assets in the MFS High Yield Pooled Portfolio. Percentages include the indirect exposure to the underlying holdings, including investments in money market funds and Other, of the MFS High Yield Pooled Portfolio and not the direct exposure from investing in the MFS High Yield Pooled Portfolio itself.

Cash & Cash Equivalents includes any direct exposure to cash, direct and indirect exposure to investments in money market funds, cash equivalents, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s direct cash position and other assets and liabilities.

Other includes the direct and indirect equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS.

Percentages are based on net assets as of February 28, 2019.

The portfolio is actively managed and current holdings may be different.

4

Table of Contents

Summary of Results

The MFS Diversified Income Fund (“fund”) includes investments in high yield corporate bonds, U.S. government debt, emerging markets debt, real estate investment trusts (“REITs”) and global equity securities.

For the twelve months ended February 28, 2019, Class A shares of the fund provided a total return of 6.10%, at net asset value. This compares with a return of 4.68% for the fund’s benchmark, the Standard & Poor’s 500 Stock Index. The fund’s other benchmark, the MFS Diversified Income Fund Blended Index (“Blended Index”) generated a return of 6.46% over the reporting period. The Blended Index reflects the blended returns of various equity and fixed income market indices, with percentage allocations to each index designed to resemble the allocations of the fund. The market indices and related percentage allocations used to compile the Blended Index are set forth in the Performance Summary.

Market Environment

The global economy decelerated during the reporting period, led by weakness in China and Europe as business and investor sentiment was undermined by growing trade frictions. Slower growth, along with tighter financial conditions, contributed to an uptick in market volatility late in the period. Equity valuations fell and credit spreads widened, fueled in part by concerns that the US Federal Reserve was on course to further tighten monetary policy after it lifted rates for a fourth time during the period and indicated its intention to hike several more times while allowing its balance sheet to run off at its predetermined pace.

The market’s negative reaction to these policy signals prompted the Fed to reverse course at the end of the period and indicate that its policy was on hold as inflation pressures abated. The Fed also indicated that it will maintain a larger balance sheet than it had previously. These dovish shifts helped equity valuations rebound, reduced volatility and narrowed credit spreads. Central banks globally are tilting more dovish as well, with China lowering reserve requirements, The Bank of Canada and Bank of England holding rates steady and the European Central Bank acknowledging that it may not be able to hike rates in the fall of 2019 as it had earlier projected.

Emerging markets experienced considerable volatility during the period as tighter global financial conditions exposed structural weakness in some countries. Those pressures were somewhat relieved at the end of the period as the Fed adopted its more dovish posture. However, slowing global growth and ongoing trade frictions remained concerns.

From a geopolitical perspective, the lack of consensus in the United Kingdom on the best path toward a rapidly approaching Brexit, a fractious Eurosceptic Italian coalition government, large-scale protests in France over stagnant wages, and news that Germany’s Angela Merkel will not seek another term as chancellor were sources of uncertainty in Europe. In emerging markets, new Brazilian president Jair Bolsanaro took office, with markets generally encouraged by his market-friendly agenda. In contrast, markets were nervous about the less-market-friendly approach of Mexico’s new president Andres Manuel Lopez Obrador. For much of the period, the contentious

5

Table of Contents

Management Review – continued

US-China trading relationship was a drag on global sentiment, although tentative signs of progress toward resolution helped steady markets late in the period. Concerns persisted about slowing Chinese economic activity.

Factors Affecting Performance

During the reporting period, both security selection and an overweight position in the fund’s emerging markets debt sleeve were primary detractors from performance relative to the Bloomberg Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index, which is a component of the Blended Index. Additionally, an overweight allocation to the U.S. Government debt segment held back relative returns.

Conversely, security selection and, to a lesser extent, an overweight position in the fund’s REIT segment contributed to relative performance as this asset class outpaced its respective benchmark, the MSCI U.S. REIT Index, during the reporting period. An underweight position in the fund’s high yield corporate debt sleeve also aided relative results as high yield securities lagged the Blended Index.

Respectfully,

Portfolio Manager(s)

Robert Almeida, Ward Brown, David Cole, Rick Gable, Matt Ryan, Jonathan Sage, Geoffrey Schechter, and Michael Skatrud

Note to Shareholders: Effective March 1, 2018, Robert Almeida and Michael Skatrud became Portfolio Managers of the Fund. Effective September 1, 2018, William Adams is no longer a Portfolio Manager of the Fund. Effective December 31, 2018, Jim Swanson is no longer a Portfolio Manager of the Fund.

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

6

Table of Contents

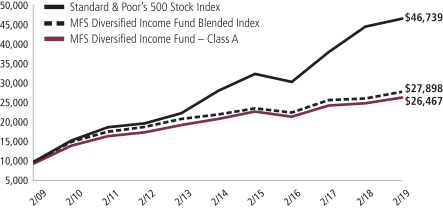

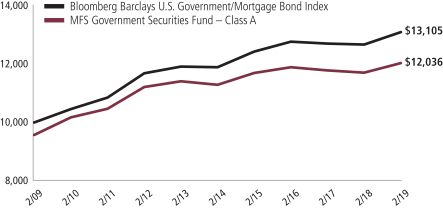

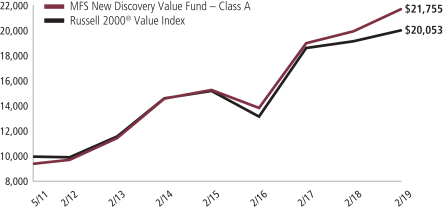

PERFORMANCE SUMMARYTHROUGH 2/28/19

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

7

Table of Contents

Performance Summary – continued

Total Returns through 2/28/19

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr | Life (t) | |||||||||

| A | 5/26/06 | 6.10% | 4.82% | 10.70% | N/A | |||||||||

| C | 5/26/06 | 5.40% | 4.06% | 9.88% | N/A | |||||||||

| I | 5/26/06 | 6.45% | 5.08% | 10.98% | N/A | |||||||||

| R1 | 7/01/08 | 5.40% | 4.04% | 9.89% | N/A | |||||||||

| R2 | 7/01/08 | 5.92% | 4.58% | 10.44% | N/A | |||||||||

| R3 | 7/01/08 | 6.18% | 4.84% | 10.71% | N/A | |||||||||

| R4 | 7/01/08 | 6.45% | 5.10% | 10.98% | N/A | |||||||||

| R6 | 7/02/12 | 6.46% | 5.18% | N/A | 6.39% | |||||||||

| Comparative benchmark(s) | ||||||||||||||

| Standard & Poor’s 500 Stock Index (f) | 4.68% | 10.67% | 16.67% | N/A | ||||||||||

| MFS Diversified Income Fund Blended Index (f)(w) | 6.46% | 4.79% | 10.80% | N/A | ||||||||||

| Bloomberg Barclays U.S. Government/Mortgage Bond Index (f) | 3.37% | 1.95% | 2.74% | N/A | ||||||||||

| Bloomberg Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index (f) | 4.31% | 4.54% | 11.41% | N/A | ||||||||||

| JPMorgan Emerging Markets Bond Index Global (f) | 2.43% | 4.76% | 8.36% | N/A | ||||||||||

| MSCI All Country World High Dividend Yield Index (net div) (f) | 1.54% | 4.71% | 12.54% | N/A | ||||||||||

| MSCI U.S. REIT Index (net div) (f) | 19.80% | 7.04% | 17.04% | N/A | ||||||||||

| Average annual with sales charge | ||||||||||||||

| A With Initial Sales Charge (4.25%) | 1.59% | 3.91% | 10.22% | N/A | ||||||||||

| C With CDSC (1% for 12 months) (v) | 4.40% | 4.06% | 9.88% | N/A | ||||||||||

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (v) | Assuming redemption at the end of the applicable period. |

| (w) | As of February 28, 2019, the MFS Diversified Income Fund Blended Index (a custom index) was comprised of 25% Bloomberg Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index, 20% Bloomberg Barclays U.S. Government/Mortgage Bond Index, 15% JPMorgan Emerging Markets Bond Index Global, 20% Morgan Stanley Capital International (MSCI) U.S. REIT Index (net div), and 20% Morgan Stanley Capital International (MSCI) All Country World (ACWI) High Dividend Yield Index (net div). |

8

Table of Contents

Performance Summary – continued

Benchmark Definition(s)

Bloomberg Barclays U.S. Government/Mortgage Bond Index – measures debt issued by the U.S. Government, and its agencies, as well as mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Bloomberg Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index – a component of the Bloomberg Barclays U.S. High-Yield Corporate Bond Index, which measures performance of non-investment grade, fixed rate debt. The index limits the maximum exposure to any one issuer to 2%.

JPMorgan Emerging Markets Bond Index Global – measures the performance of U.S. dollar-denominated debt instruments issued by emerging market sovereign andquasi-sovereign entities: Brady bonds, loans, Eurobonds.

MSCI All Country World High Dividend Yield Index (net div) – is designed to reflect the performance of developed and emerging markets equities with higher-than-average dividend income and quality characteristics.

MSCI U.S. REIT Index (net div) – a market capitalization-weighted index that is designed to measure equity market performance for real estate investment trusts (REITs) that generate a majority of their revenue and income from real estate rental and leasing operations.

Standard & Poor’s 500 Stock Index – a market capitalization-weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

9

Table of Contents

Fund expenses borne by the shareholders during the period, September 1, 2018 through February 28, 2019

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the MFS High Yield Pooled Portfolio, an underlying MFS Pooled Portfolio in which the fund invests. MFS Pooled Portfolios are mutual funds advised by MFS that do not pay management fees to MFS but do incur investment and operating costs. If these transactional and indirect costs were included, your costs would have been higher.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period September 1, 2018 through February 28, 2019.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10

Table of Contents

Expense Table – continued

| Share Class | Annualized Ratio | Beginning Account Value 9/01/18 | Ending Account Value | Expenses Paid During 9/01/18-2/28/19 | ||||||||||||||

| A | Actual | 0.97% | $1,000.00 | $1,023.02 | $4.87 | |||||||||||||

| Hypothetical (h) | 0.97% | $1,000.00 | $1,019.98 | $4.86 | ||||||||||||||

| C | Actual | 1.73% | $1,000.00 | $1,020.03 | $8.66 | |||||||||||||

| Hypothetical (h) | 1.73% | $1,000.00 | $1,016.22 | $8.65 | ||||||||||||||

| I | Actual | 0.72% | $1,000.00 | $1,025.11 | $3.62 | |||||||||||||

| Hypothetical (h) | 0.72% | $1,000.00 | $1,021.22 | $3.61 | ||||||||||||||

| R1 | Actual | 1.73% | $1,000.00 | $1,020.04 | $8.66 | |||||||||||||

| Hypothetical (h) | 1.73% | $1,000.00 | $1,016.22 | $8.65 | ||||||||||||||

| R2 | Actual | 1.23% | $1,000.00 | $1,022.57 | $6.17 | |||||||||||||

| Hypothetical (h) | 1.23% | $1,000.00 | $1,018.70 | $6.16 | ||||||||||||||

| R3 | Actual | 0.98% | $1,000.00 | $1,023.84 | $4.92 | |||||||||||||

| Hypothetical (h) | 0.98% | $1,000.00 | $1,019.93 | $4.91 | ||||||||||||||

| R4 | Actual | 0.73% | $1,000.00 | $1,025.11 | $3.67 | |||||||||||||

| Hypothetical (h) | 0.73% | $1,000.00 | $1,021.17 | $3.66 | ||||||||||||||

| R6 | Actual | 0.64% | $1,000.00 | $1,024.73 | $3.21 | |||||||||||||

| Hypothetical (h) | 0.64% | $1,000.00 | $1,021.62 | $3.21 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect theone-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

11

Table of Contents

2/28/19

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Common Stocks - 40.5% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Aerospace - 0.3% | ||||||||

| Boeing Co. | 21,381 | $ | 9,406,785 | |||||

| Airlines - 0.4% | ||||||||

| Aena S.A. | 21,687 | $ | 3,870,390 | |||||

| Air Canada (a) | 463,553 | 11,663,239 | ||||||

|

| |||||||

| $ | 15,533,629 | |||||||

| Alcoholic Beverages - 0.1% | ||||||||

| Molson Coors Brewing Co. | 72,709 | $ | 4,483,237 | |||||

| Automotive - 0.4% | ||||||||

| Magna International, Inc. | 244,363 | $ | 12,894,538 | |||||

| Biotechnology - 0.2% | ||||||||

| Biogen, Inc. (a) | 22,592 | $ | 7,410,402 | |||||

| Broadcasting - 0.2% | ||||||||

| Publicis Groupe | 103,245 | $ | 5,722,657 | |||||

| Brokerage & Asset Managers - 0.1% | ||||||||

| ASX Ltd. | 34,457 | $ | 1,705,323 | |||||

| Business Services - 1.2% | ||||||||

| DXC Technology Co. | 149,484 | $ | 9,845,016 | |||||

| Equinix, Inc., REIT | 76,181 | 32,262,654 | ||||||

|

| |||||||

| $ | 42,107,670 | |||||||

| Computer Software - 0.1% | ||||||||

| Adobe Systems, Inc. (a) | 19,560 | $ | 5,134,500 | |||||

| Computer Software - Systems - 0.2% | ||||||||

| Hitachi Ltd. | 186,700 | $ | 5,586,009 | |||||

| Construction - 0.2% | ||||||||

| Persimmon PLC | 140,086 | $ | 4,520,589 | |||||

| Toll Brothers, Inc. | 107,269 | 3,818,776 | ||||||

|

| |||||||

| $ | 8,339,365 | |||||||

| Consumer Products - 0.5% | ||||||||

| Kimberly-Clark Corp. | 161,490 | $ | 18,866,877 | |||||

12

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Electrical Equipment - 0.5% | ||||||||

| Schneider Electric S.A. | 224,923 | $ | 17,504,481 | |||||

| Electronics - 0.8% | ||||||||

| Samsung Electronics Co. Ltd. | 121,333 | $ | 4,865,402 | |||||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 562,477 | 21,964,727 | ||||||

|

| |||||||

| $ | 26,830,129 | |||||||

| Energy - Independent - 0.7% | ||||||||

| Frontera Energy Corp. | 72,682 | $ | 692,604 | |||||

| Marathon Petroleum Corp. | 250,347 | 15,524,018 | ||||||

| Phillips 66 | 88,717 | 8,548,770 | ||||||

|

| |||||||

| $ | 24,765,392 | |||||||

| Energy - Integrated - 1.0% | ||||||||

| BP PLC | 790,758 | $ | 5,604,904 | |||||

| China Petroleum & Chemical Corp. | 10,280,000 | 8,879,060 | ||||||

| Eni S.p.A. | 155,953 | 2,690,278 | ||||||

| Exxon Mobil Corp. | 75,373 | 5,956,728 | ||||||

| Galp Energia SGPS S.A. | 389,249 | 6,388,901 | ||||||

| LUKOIL PJSC, ADR | 81,297 | 6,763,910 | ||||||

|

| |||||||

| $ | 36,283,781 | |||||||

| Food & Beverages - 0.6% | ||||||||

| General Mills, Inc. | 93,616 | $ | 4,412,122 | |||||

| J.M. Smucker Co. | 57,329 | 6,071,715 | ||||||

| Marine Harvest A.S.A. (l) | 164,559 | 3,796,339 | ||||||

| Tyson Foods, Inc., “A” | 100,049 | 6,169,021 | ||||||

|

| |||||||

| $ | 20,449,197 | |||||||

| Food & Drug Stores - 0.2% | ||||||||

| Wesfarmers Ltd. | 329,507 | $ | 7,755,353 | |||||

| Insurance - 1.2% | ||||||||

| AXA | 258,673 | $ | 6,559,804 | |||||

| MetLife, Inc. | 173,311 | 7,831,924 | ||||||

| Prudential Financial, Inc. | 65,927 | 6,319,103 | ||||||

| Samsung Fire & Marine Insurance Co. Ltd. | 3,655 | 979,801 | ||||||

| Zurich Insurance Group AG | 61,913 | 20,471,209 | ||||||

|

| |||||||

| $ | 42,161,841 | |||||||

| Machinery & Tools - 0.3% | ||||||||

| Eaton Corp. PLC | 112,500 | $ | 8,974,125 | |||||

13

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Major Banks - 0.7% | ||||||||

| ABSA Group Ltd. | 372,705 | $ | 4,775,913 | |||||

| China Construction Bank | 13,966,000 | 12,418,571 | ||||||

| National Australia Bank Ltd. | 90,368 | 1,610,897 | ||||||

| Royal Bank of Canada | 87,075 | 6,807,524 | ||||||

|

| |||||||

| $ | 25,612,905 | |||||||

| Medical & Health Technology & Services - 0.8% | ||||||||

| HCA Healthcare, Inc. | 100,990 | $ | 14,041,650 | |||||

| McKesson Corp. | 10,870 | 1,382,229 | ||||||

| Walgreens Boots Alliance, Inc. | 173,334 | 12,339,647 | ||||||

|

| |||||||

| $ | 27,763,526 | |||||||

| Metals & Mining - 0.1% | ||||||||

| POSCO | 9,260 | $ | 2,165,360 | |||||

| Natural Gas - Distribution - 0.2% | ||||||||

| ENGIE | 383,032 | $ | 5,772,756 | |||||

| Network & Telecom - 0.2% | ||||||||

| Cisco Systems, Inc. | 156,466 | $ | 8,100,245 | |||||

| Other Banks & Diversified Financials - 0.2% | ||||||||

| DBS Group Holdings Ltd. | 132,300 | $ | 2,430,719 | |||||

| Komercni Banka A.S. | 22,250 | 934,106 | ||||||

| ORIX Corp. | 157,200 | 2,273,417 | ||||||

| Sberbank of Russia, ADR | 155,350 | 1,982,266 | ||||||

|

| |||||||

| $ | 7,620,508 | |||||||

| Pharmaceuticals - 2.7% | ||||||||

| Bayer AG | 137,624 | $ | 11,001,660 | |||||

| Bristol-Myers Squibb Co. | 263,536 | 13,614,270 | ||||||

| Eli Lilly & Co. | 51,423 | 6,494,211 | ||||||

| Novartis AG | 292,128 | 26,647,295 | ||||||

| Pfizer, Inc. | 279,023 | 12,095,647 | ||||||

| Roche Holding AG | 94,283 | 26,195,758 | ||||||

|

| |||||||

| $ | 96,048,841 | |||||||

| Real Estate - 21.6% | ||||||||

| Alexandria Real Estate Equities, Inc., REIT | 313,055 | $ | 42,541,044 | |||||

| American Homes 4 Rent, “A”, REIT | 1,254,852 | 27,405,968 | ||||||

| AvalonBay Communities, Inc., REIT | 223,020 | 43,406,383 | ||||||

| Boardwalk, REIT | 676,685 | 21,170,350 | ||||||

| Boston Properties, Inc., REIT | 181,949 | 24,142,813 | ||||||

14

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Real Estate - continued | ||||||||

| Brixmor Property Group Inc., REIT | 2,169,381 | $ | 37,877,392 | |||||

| CK Asset Holdings Ltd. | 405,000 | 3,361,349 | ||||||

| Corporate Office Properties Trust, REIT | 332,213 | 8,634,216 | ||||||

| Equity Lifestyle Properties, Inc., REIT | 299,428 | 32,529,858 | ||||||

| Farmland Partners, Inc., REIT | 380,839 | 1,957,512 | ||||||

| Industrial Logistics Properties Trust, REIT | 262,393 | 5,473,518 | ||||||

| Medical Properties Trust, Inc., REIT | 2,583,797 | 47,102,619 | ||||||

| Mid-America Apartment Communities, Inc., REIT | 387,794 | 40,167,702 | ||||||

| Prologis, Inc., REIT | 407,875 | 28,575,722 | ||||||

| Public Storage, Inc., REIT | 294,571 | 62,298,821 | ||||||

| Rexford Industrial Realty, Inc., REIT | 443,041 | 15,187,445 | ||||||

| RPT Realty, REIT | 1,826,287 | 23,157,319 | ||||||

| Simon Property Group, Inc., REIT | 440,029 | 79,715,654 | ||||||

| STAG Industrial, Inc., REIT | 830,129 | 22,977,971 | ||||||

| STORE Capital Corp., REIT | 1,264,234 | 41,049,678 | ||||||

| Sun Communities, Inc., REIT | 273,506 | 31,062,076 | ||||||

| Unibail - Rodamco-Westfield, REIT | 27,032 | 4,366,152 | ||||||

| Urban Edge Properties, REIT | 1,552,967 | 30,158,619 | ||||||

| VICI Properties, Inc., REIT | 944,292 | 20,122,863 | ||||||

| W.P. Carey, Inc., REIT | 263,314 | 19,451,005 | ||||||

| Welltower, Inc., REIT | 573,107 | 42,587,581 | ||||||

|

| |||||||

| $ | 756,481,630 | |||||||

| Restaurants - 0.4% | ||||||||

| Greggs PLC | 210,195 | $ | 4,990,379 | |||||

| Starbucks Corp. | 135,672 | 9,532,315 | ||||||

|

| |||||||

| $ | 14,522,694 | |||||||

| Specialty Chemicals - 0.3% | ||||||||

| PTT Global Chemical PLC | 4,348,100 | $ | 9,934,572 | |||||

| Telecommunications - Wireless - 1.3% | ||||||||

| American Tower Corp., REIT | 91,729 | $ | 16,158,063 | |||||

| KDDI Corp. | 611,100 | 14,739,536 | ||||||

| SK Telecom Co. Ltd. | 17,379 | 4,025,277 | ||||||

| Vodafone Group PLC | 5,501,548 | 9,798,382 | ||||||

|

| |||||||

| $ | 44,721,258 | |||||||

| Telephone Services - 0.2% | ||||||||

| TELUS Corp. | 173,491 | $ | 6,301,812 | |||||

| TELUS Corp. | 61,009 | 2,215,847 | ||||||

|

| |||||||

| $ | 8,517,659 | |||||||

15

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Common Stocks - continued | ||||||||

| Tobacco - 1.4% | ||||||||

| Imperial Brands PLC | 237,121 | $ | 7,895,659 | |||||

| Japan Tobacco, Inc. | 690,100 | 17,539,616 | ||||||

| Philip Morris International, Inc. | 255,117 | 22,179,872 | ||||||

|

| |||||||

| $ | 47,615,147 | |||||||

| Utilities - Electric Power - 1.2% | ||||||||

| E.ON AG | 281,460 | $ | 3,100,621 | |||||

| Exelon Corp. | 353,085 | 17,156,400 | ||||||

| SSE PLC | 1,021,914 | 16,109,114 | ||||||

| Xcel Energy, Inc. | 102,612 | 5,629,294 | ||||||

|

| |||||||

| $ | 41,995,429 | |||||||

| Total Common Stocks (Identified Cost, $1,212,056,180) |

| $ | 1,418,787,821 | |||||

| Bonds - 39.4% | ||||||||

| Asset-Backed & Securitized - 1.1% | ||||||||

| A Voce CLO Ltd.,2014-1A, “A1R”, FLR, 3.947% (LIBOR -3mo. + 1.16%), 7/15/2026 (n) | $ | 2,969,991 | $ | 2,969,545 | ||||

| Chesapeake Funding II LLC,2018-1A, “A1”, 3.04%, 4/15/2030 (n) | 1,751,198 | 1,752,394 | ||||||

| Chesapeake Funding II LLC,2018-3A, “A1”, 3.39%, 1/15/2031 (n) | 2,800,000 | 2,818,955 | ||||||

| Citigroup Commercial Mortgage Trust, 2015-GC27, “A5”, 3.137%, 2/10/2048 | 2,850,000 | 2,833,335 | ||||||

| Commercial Mortgage Trust,2015-DC1, “A5”, 3.35%, 2/10/2048 | 2,574,000 | 2,571,338 | ||||||

| Commercial Mortgage Trust,2015-PC1, “A5”, 3.902%, 7/10/2050 | 1,800,000 | 1,852,155 | ||||||

| CSAIL Commercial Mortgage Trust,2015-C2, “A4”, 3.504%, 6/15/2057 | 58,835 | 59,316 | ||||||

| Dryden Senior Loan Fund,2018-55A, “A1”, CLO, FLR, 3.807% (LIBOR - 3mo. + 1.02%), 4/15/2031 (n) | 2,267,245 | 2,240,580 | ||||||

| GS Mortgage Securities Trust, 2015-GC30, “A4”, 3.382%, 5/10/2050 | 1,750,000 | 1,761,013 | ||||||

| JPMBB Commercial Mortgage Securities Trust,2014-C26, 3.494%, 1/15/2048 | 1,888,516 | 1,911,745 | ||||||

| Loomis, Sayles & Co., CLO, “A2”, FLR, 4.179% (LIBOR -3mo. + 1.4%), 4/15/2028 (n) | 2,261,785 | 2,229,322 | ||||||

| Madison Park Funding Ltd.,2014-13A, “BR2”, FLR, 4.261% (LIBOR - 3mo. + 1.5%), 4/19/2030 (n) | 2,390,920 | 2,358,129 | ||||||

| Morgan Stanley Bank of America Merrill Lynch Trust,2017-C34, “A4”, 3.536%, 11/15/2052 | 700,873 | 700,726 | ||||||

| Morgan Stanley Capital I Trust,2018-H4, “XA”, 0.869%, 12/15/2051 (i) | 10,114,320 | 652,910 | ||||||

16

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Asset-Backed & Securitized - continued | ||||||||

| Symphony CLO Ltd.,2016-17A, “BR”, FLR, 3.987% (LIBOR - 3mo. + 1.2%), 4/15/2028 (n) | $ | 2,026,203 | $ | 1,994,029 | ||||

| TICP CLO Ltd., FLR, 3.601% (LIBOR - 3mo. + 0.8%), 4/20/2028 (n) | 3,317,451 | 3,290,059 | ||||||

| UBS Commercial Mortgage Trust,2017-C1, “A4”, 3.544%, 11/15/2050 | 1,505,000 | 1,493,924 | ||||||

| Wells Fargo Commercial Mortgage Trust,2015-C28, “A4”, 3.54%, 5/15/2048 | 1,516,848 | 1,533,887 | ||||||

| Wells Fargo Commercial Mortgage Trust, 2015-NXS1, “A5”, 3.148%, 5/15/2048 | 1,258,254 | 1,246,548 | ||||||

| Wells Fargo Commercial Mortgage Trust, 2016-LC25, “A4”, 3.64%, 12/15/2059 | 2,500,000 | 2,526,672 | ||||||

| Wells Fargo Commercial Mortgage Trust,2018-C48, “XA”, 0.958%, 1/15/2052 (i)(n) | 5,970,996 | 438,796 | ||||||

| West CLO Ltd.2013-1A, “A1AR”, FLR, 3.899% (LIBOR -3mo. + 1.16%), 11/07/2025 (n) | 328,834 | 328,693 | ||||||

|

| |||||||

| $ | 39,564,071 | |||||||

| Brokerage & Asset Managers - 0.0% | ||||||||

| Banco BTG Pactual S.A. (Cayman Islands), 7.75% to 2/15/2024, FLR (CMT - 5yr. + 5.257%) to 2/15/2029 (n) | $ | 1,643,000 | $ | 1,644,068 | ||||

| Cable TV - 0.1% | ||||||||

| VTR Finance B.V., 6.875%, 1/15/2024 (n) | $ | 3,818,000 | $ | 3,922,995 | ||||

| Chemicals - 0.2% | ||||||||

| Consolidated Energy Finance S.A., 6.875%, 6/15/2025 (n) | $ | 680,000 | $ | 663,000 | ||||

| Consolidated Energy Finance S.A., 6.875%, 6/15/2025 | 1,855,000 | 1,808,625 | ||||||

| Sasol Chemicals (USA) LLC, 5.875%, 3/27/2024 | 1,629,000 | 1,689,275 | ||||||

| Sasol Financing USA LLC, 6.5%, 9/27/2028 | 1,730,000 | 1,819,728 | ||||||

| Sherwin Williams Co., 2.75%, 6/01/2022 | 1,564,000 | 1,538,126 | ||||||

|

| |||||||

| $ | 7,518,754 | |||||||

| Computer Software - 0.0% | ||||||||

| Microsoft Corp., 3.125%, 11/03/2025 | $ | 476,000 | $ | 479,375 | ||||

| Computer Software - Systems - 0.0% | ||||||||

| Apple, Inc., 3.25%, 2/23/2026 | $ | 1,404,000 | $ | 1,403,526 | ||||

| Conglomerates - 0.2% | ||||||||

| Grupo KUO S.A.B. de C.V., 5.75%, 7/07/2027 (n) | $ | 5,300,000 | $ | 5,150,381 | ||||

| United Technologies Corp., 3.95%, 8/16/2025 | 1,000,000 | 1,019,953 | ||||||

|

| |||||||

| $ | 6,170,334 | |||||||

17

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Construction - 0.0% | ||||||||

| Empresas ICA S.A.B. de C.V., 8.375%, 7/24/2019 (a)(d)(n) | $ | 1,409,000 | $ | 228,963 | ||||

| Empresas ICA S.A.B. de C.V., 8.875%, 5/29/2024 (a)(d) | 2,102,000 | 320,555 | ||||||

| Empresas ICA S.A.B. de C.V., 8.875%, 5/29/2024 (a)(d)(n) | 3,072,000 | 468,480 | ||||||

|

| |||||||

| $ | 1,017,998 | |||||||

| Consumer Products - 0.1% | ||||||||

| Reckitt Benckiser Treasury Services PLC, 2.75%, 6/26/2024 (n) | $ | 1,734,000 | $ | 1,678,389 | ||||

| Consumer Services - 0.1% | ||||||||

| Alibaba Group Holding Ltd., 3.4%, 12/06/2027 | $ | 3,224,000 | $ | 3,086,633 | ||||

| Containers - 0.1% | ||||||||

| San Miguel Industrias PET S.A., 4.5%, 9/18/2022 (n) | $ | 2,724,000 | $ | 2,689,950 | ||||

| San Miguel Industrias PET S.A., 4.5%, 9/18/2022 | 1,606,000 | 1,585,925 | ||||||

|

| |||||||

| $ | 4,275,875 | |||||||

| Emerging Market Quasi-Sovereign - 4.0% | ||||||||

| Abu Dhabi Crude Oil Pipeline, 3.65%, 11/02/2029 (n) | $ | 802,000 | $ | 786,361 | ||||

| Abu Dhabi Crude Oil Pipeline, 4.6%, 11/02/2047 (n) | 3,245,000 | 3,287,425 | ||||||

| Aeropuerto Internacional de Tocumen S.A., 6%, 11/18/2048 (n) | 2,833,000 | 3,012,895 | ||||||

| Autoridad del Canal de Panama, 4.95%, 7/29/2035 (n) | 281,000 | 292,594 | ||||||

| Autoridad del Canal de Panama, 4.95%, 7/29/2035 | 1,220,000 | 1,270,337 | ||||||

| Banco do Brasil S.A. (Cayman Branch), 9.25%, 2/15/2029 | 433,000 | 478,036 | ||||||

| Banco do Brasil S.A. (Cayman Branch), 4.625%, 1/15/2025 | 2,728,000 | 2,699,356 | ||||||

| CEMIG Geracao e Transmissao S.A., 9.25%, 12/05/2024 (n) | 357,000 | 396,391 | ||||||

| Corporacion Nacional del Cobre de Chile, 4.375%, 2/05/2049 (n) | 2,000,000 | 1,951,800 | ||||||

| Empresa Nacional del Petroleo, 4.375%, 10/30/2024 (n) | 2,469,000 | 2,511,687 | ||||||

| Empresa Nacional del Petroleo, 5.25%, 11/06/2029 (n) | 1,233,000 | 1,303,198 | ||||||

| Equate Petrochemical B.V., 4.25%, 11/03/2026 | 1,500,000 | 1,497,633 | ||||||

| Eskom Holdings SOC Ltd., 6.35%, 8/10/2028 (n) | 2,885,000 | 2,955,302 | ||||||

| Eskom Holdings SOC Ltd., 8.45%, 8/10/2028 (n) | 1,043,000 | 1,106,734 | ||||||

| Export-Import Bank of India, 3.875%, 2/01/2028 (n) | 10,026,000 | 9,625,983 | ||||||

| JSC State Savings Bank of Ukraine, 9.625%, 3/20/2025 | 3,063,000 | 3,017,545 | ||||||

| Kazakhstan Temir Zholy Finance B.V., 4.85%, 11/17/2027 (n) | 6,560,000 | 6,658,400 | ||||||

| KazMunayGas National Co., JSC, 5.375%, 4/24/2030 (n) | 6,669,000 | 6,902,415 | ||||||

| KazMunayGas National Co., JSC, 5.375%, 4/24/2030 | 3,453,000 | 3,573,855 | ||||||

| KazMunayGas National Co., JSC, 6.375%, 10/24/2048 | 3,652,000 | 3,930,867 | ||||||

| Lima Metro Line 2 Finance Ltd., 5.875%, 7/05/2034 | 4,620,000 | 4,731,804 | ||||||

| Magyar Export-Import Bank PLC, 4%, 1/30/2020 | 2,518,000 | 2,529,311 | ||||||

18

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Emerging Market Quasi-Sovereign - continued | ||||||||

| NTPC Ltd., 7.375%, 8/10/2021 | INR | 120,000,000 | $ | 1,630,622 | ||||

| NTPC Ltd., 7.25%, 5/03/2022 | 90,000,000 | 1,217,146 | ||||||

| NTPC Ltd., 4.375%, 11/26/2024 | $ | 5,157,000 | 5,175,142 | |||||

| OCP S.A., 6.875%, 4/25/2044 | 2,448,000 | 2,663,424 | ||||||

| Office Cherifien des Phosphates, 4.5%, 10/22/2025 (n) | 2,898,000 | 2,869,484 | ||||||

| Office Cherifien des Phosphates, 6.875%, 4/25/2044 (n) | 2,519,000 | 2,740,672 | ||||||

| Petroamazonas, 4.625%, 11/06/2020 (n) | 302,000 | 291,430 | ||||||

| Petrobras Global Finance B.V., 8.75%, 5/23/2026 | 2,801,000 | 3,303,807 | ||||||

| Petrobras Global Finance B.V., 5.75%, 2/01/2029 | 2,057,000 | 2,050,520 | ||||||

| Petrobras International Finance Co., 6.75%, 1/27/2041 | 2,276,000 | 2,322,373 | ||||||

| Petroleos del Peru S.A., 4.75%, 6/19/2032 (n) | 4,117,000 | 4,055,245 | ||||||

| Petroleos del Peru S.A., 5.625%, 6/19/2047 (n) | 379,000 | 386,580 | ||||||

| Petroleos del Peru S.A., 5.625%, 6/19/2047 | 4,758,000 | 4,853,160 | ||||||

| Petroleos Mexicanos, 6.75%, 9/21/2047 | 5,319,000 | 4,622,477 | ||||||

| PT Indonesia Asahan Aluminium (Persero), 5.71%, 11/15/2023 (n) | 1,120,000 | 1,182,142 | ||||||

| PT Perusahaan Listrik Negara, 5.45%, 5/21/2028 (n) | 2,190,000 | 2,282,780 | ||||||

| PT Perusahaan Listrik Negara, 5.375%, 1/25/2029 (n) | 1,958,000 | 2,027,902 | ||||||

| PT Perusahaan Listrik Negara, 6.15%, 5/21/2048 (n) | 1,317,000 | 1,402,061 | ||||||

| Southern Gas Corridor CJSC, 6.875%, 3/24/2026 (n) | 8,595,000 | 9,568,367 | ||||||

| State Grid Overseas Investment (2016) Ltd., 3.5%, 5/04/2027 (n) | 3,774,000 | 3,665,872 | ||||||

| State Grid Overseas Investment (2016) Ltd., 3.5%, 5/04/2027 | 7,145,000 | 6,940,290 | ||||||

| State Oil Company of the Azerbaijan Republic, 4.75%, 3/13/2023 | 3,933,000 | 3,975,162 | ||||||

| State Oil Company of the Azerbaijan Republic, 6.95%, 3/18/2030 | 1,463,000 | 1,618,444 | ||||||

| Trade & Development Bank of Mongolia LLC, 9.375%, 5/19/2020 | 4,312,000 | 4,497,821 | ||||||

|

| |||||||

| $ | 139,862,852 | |||||||

| Emerging Market Sovereign - 9.7% | ||||||||

| Arab Republic of Egypt, 6.125%, 1/31/2022 (n) | $ | 2,754,000 | $ | 2,795,304 | ||||

| Arab Republic of Egypt, 6.125%, 1/31/2022 | 8,324,000 | 8,448,843 | ||||||

| Arab Republic of Egypt, 5.577%, 2/21/2023 (n) | 3,045,000 | 3,029,775 | ||||||

| Arab Republic of Egypt, 5.875%, 6/11/2025 | 2,005,000 | 1,979,416 | ||||||

| Arab Republic of Egypt, 7.5%, 1/31/2027 | 1,900,000 | 1,964,315 | ||||||

| Arab Republic of Egypt, 6.588%, 2/21/2028 (n) | 4,360,000 | 4,245,768 | ||||||

| Arab Republic of Egypt, 7.6%, 3/01/2029 (n) | 4,598,000 | 4,710,651 | ||||||

| Arab Republic of Egypt, 8.5%, 1/31/2047 | 640,000 | 654,787 | ||||||

| Arab Republic of Egypt, 8.7%, 3/01/2049 (n) | 2,692,000 | 2,792,950 | ||||||

| Dominican Republic, 5.5%, 1/27/2025 (n) | 1,211,000 | 1,229,165 | ||||||

19

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Emerging Market Sovereign - continued | ||||||||

| Dominican Republic, 6.875%, 1/29/2026 | $ | 5,450,000 | $ | 5,906,437 | ||||

| Dominican Republic, 5.95%, 1/25/2027 | 3,057,000 | 3,168,581 | ||||||

| Dominican Republic, 6%, 7/19/2028 (n) | 5,087,000 | 5,265,045 | ||||||

| Dominican Republic, 6.5%, 2/15/2048 (n) | 4,694,000 | 4,705,735 | ||||||

| Emirate of Abu Dhabi, 3.125%, 10/11/2027 (n) | 443,000 | 431,380 | ||||||

| Emirate of Abu Dhabi, 4.125%, 10/11/2047 (n) | 590,000 | 584,849 | ||||||

| Federal Republic of Nigeria, 7.625%, 11/21/2025 (n) | 1,927,000 | 2,047,438 | ||||||

| Federal Republic of Nigeria, 6.5%, 11/28/2027 (n) | 2,571,000 | 2,526,110 | ||||||

| Federal Republic of Nigeria, 7.143%, 2/23/2030 (n) | 1,113,000 | 1,108,871 | ||||||

| Federal Republic of Nigeria, 7.696%, 2/23/2038 (n) | 1,425,000 | 1,406,903 | ||||||

| Federal Republic of Nigeria, 7.696%, 2/23/2038 | 4,078,000 | 4,026,209 | ||||||

| Federative Republic of Brazil, 5%, 1/27/2045 | 2,604,000 | 2,369,640 | ||||||

| Federative Republic of Brazil, 5.625%, 2/21/2047 | 1,678,000 | 1,646,974 | ||||||

| Government of Jamaica, 7.875%, 7/28/2045 | 432,000 | 513,000 | ||||||

| Government of Papua New Guinea, 8.375%, 10/04/2028 (n) | 1,069,000 | 1,135,813 | ||||||

| Government of Ukraine, 7.75%, 9/01/2022 | 4,009,000 | 3,898,753 | ||||||

| Government of Ukraine, 8.994%, 2/01/2024 (n) | 1,928,000 | 1,908,759 | ||||||

| Government of Ukraine, 7.75%, 9/01/2024 (n) | 2,600,000 | 2,449,980 | ||||||

| Government of Ukraine, 7.75%, 9/01/2024 | 2,000,000 | 1,884,600 | ||||||

| Government of Ukraine, 7.75%, 9/01/2025 (n) | 2,600,000 | 2,420,548 | ||||||

| Government of Ukraine, 7.75%, 9/01/2025 | 4,148,000 | 3,861,705 | ||||||

| Government of Ukraine, 7.75%, 9/01/2026 | 6,867,000 | 6,335,220 | ||||||

| Ivory Coast, 5.75%, 12/31/2032 | 2,578,345 | 2,440,197 | ||||||

| Kingdom of Morocco, 5.5%, 12/11/2042 | 2,188,000 | 2,297,400 | ||||||

| Kingdom of Saudi Arabia, 4.375%, 4/16/2029 (n) | 5,264,000 | 5,369,175 | ||||||

| Oriental Republic of Uruguay, 4.375%, 1/23/2031 | 1,415,000 | 1,442,593 | ||||||

| Oriental Republic of Uruguay, 4.125%, 11/20/2045 | 1,312,000 | 1,220,160 | ||||||

| Oriental Republic of Uruguay, 4.975%, 4/20/2055 | 3,778,000 | 3,798,817 | ||||||

| Republic of Angola, 8.25%, 5/09/2028 (n) | 4,896,000 | 5,097,421 | ||||||

| Republic of Argentina, 0%, 4/30/2019 | ARS | 52,941,000 | 1,637,072 | |||||

| Republic of Argentina, 6.875%, 4/22/2021 | $ | 4,987,000 | 4,730,219 | |||||

| Republic of Argentina, 4.625%, 1/11/2023 | 7,576,000 | 6,428,312 | ||||||

| Republic of Argentina, 7.5%, 4/22/2026 | 2,928,000 | 2,548,853 | ||||||

| Republic of Argentina, 6.875%, 1/26/2027 | 4,875,000 | 4,046,250 | ||||||

| Republic of Argentina, 5.875%, 1/11/2028 | 4,330,000 | 3,377,400 | ||||||

| Republic of Argentina, 2.5%, 12/31/2038 | 3,066,000 | 1,789,042 | ||||||

| Republic of Argentina, 7.625%, 4/22/2046 | 3,061,000 | 2,448,800 | ||||||

| Republic of Argentina, FLR,59.563% (Argentina Badlar -7 Day), 6/21/2020 | ARS | 88,124,000 | 2,439,634 | |||||

| Republic of Belarus, 7.625%, 6/29/2027 (n) | $ | 2,102,000 | 2,261,163 | |||||

| Republic of Belarus, 7.625%, 6/29/2027 | 609,000 | 655,113 | ||||||

| Republic of Chile, 4.7%, 9/01/2030 | CLP | 1,020,000,000 | 1,600,241 | |||||

| Republic of Colombia, 3.875%, 4/25/2027 | $ | 1,350,000 | 1,330,439 | |||||

20

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Emerging Market Sovereign - continued | ||||||||

| Republic of Colombia, 4.5%, 3/15/2029 | $ | 1,844,000 | $ | 1,884,568 | ||||

| Republic of Colombia, 6.125%, 1/18/2041 | 2,582,000 | 2,917,660 | ||||||

| Republic of Colombia, 5%, 6/15/2045 | 5,143,000 | 5,150,766 | ||||||

| Republic of Colombia, 5.2%, 5/15/2049 | 2,306,000 | 2,357,885 | ||||||

| Republic of Costa Rica, 7%, 4/04/2044 | 247,000 | 234,650 | ||||||

| Republic of Cote d’Ivoire, 5.25%, 3/22/2030 (n) | EUR | 2,432,000 | 2,632,667 | |||||

| Republic of Ecuador, 7.95%, 6/20/2024 | $ | 5,425,000 | 5,374,547 | |||||

| Republic of Ecuador, 9.625%, 6/02/2027 | 2,693,000 | 2,797,219 | ||||||

| Republic of Ecuador, 7.875%, 1/23/2028 (n) | 692,000 | 656,500 | ||||||

| Republic of Ecuador, 7.875%, 1/23/2028 | 8,394,000 | 7,963,388 | ||||||

| Republic of El Salvador, 5.875%, 1/30/2025 | 1,684,000 | 1,628,209 | ||||||

| Republic of El Salvador, 7.625%, 2/01/2041 | 4,133,000 | 4,201,194 | ||||||

| Republic of Gabon, 6.95%, 6/16/2025 | 3,072,000 | 2,968,934 | ||||||

| Republic of Hungary, 5.75%, 11/22/2023 | 5,468,000 | 5,987,460 | ||||||

| Republic of Hungary, 5.375%, 3/25/2024 | 11,712,000 | 12,720,403 | ||||||

| Republic of Indonesia, 4.75%, 1/08/2026 (n) | 4,918,000 | 5,093,917 | ||||||

| Republic of Indonesia, 4.35%, 1/08/2027 | 7,986,000 | 8,067,457 | ||||||

| Republic of Indonesia, 8.375%, 3/15/2034 | IDR | 22,091,000,000 | 1,604,029 | |||||

| Republic of Indonesia, 7.5%, 5/15/2038 | 52,848,000,000 | 3,487,235 | ||||||

| Republic of Kenya, 6.875%, 6/24/2024 | $ | 3,222,000 | 3,307,383 | |||||

| Republic of Kenya, 7.25%, 2/28/2028 (n) | 3,480,000 | 3,516,644 | ||||||

| Republic of Kenya, 8.25%, 2/28/2048 (n) | 1,974,000 | 1,987,226 | ||||||

| Republic of Mongolia, 5.625%, 5/01/2023 | 1,683,000 | 1,697,511 | ||||||

| Republic of Panama, 3.875%, 3/17/2028 | 2,654,000 | 2,699,118 | ||||||

| Republic of Panama, 4.5%, 4/16/2050 | 1,283,000 | 1,284,296 | ||||||

| Republic of Paraguay, 6.1%, 8/11/2044 | 4,048,000 | 4,440,575 | ||||||

| Republic of Paraguay, 5.6%, 3/13/2048 (n) | 1,194,000 | 1,240,411 | ||||||

| Republic of Paraguay, 5.6%, 3/13/2048 | 2,669,000 | 2,772,744 | ||||||

| Republic of Paraguay, 5.4%, 3/30/2050 (n) | 1,369,000 | 1,388,440 | ||||||

| Republic of Philippines, 8%, 7/19/2031 | PHP | 75,570,000 | 1,645,116 | |||||

| Republic of Rwanda, 6.625%, 5/02/2023 | $ | 1,257,000 | 1,285,534 | |||||

| Republic of Senegal, 4.75%, 3/13/2028 (n) | EUR | 1,883,000 | 2,087,630 | |||||

| Republic of Senegal, 4.75%, 3/13/2028 | 1,153,000 | 1,278,299 | ||||||

| Republic of Senegal, 6.75%, 3/13/2048 | $ | 1,061,000 | 966,147 | |||||

| Republic of South Africa, 4.875%, 4/14/2026 | 5,118,000 | 5,062,398 | ||||||

| Republic of South Africa, 4.85%, 9/27/2027 | 3,468,000 | 3,372,318 | ||||||

| Republic of South Africa, 5.875%, 6/22/2030 | 4,330,000 | 4,434,249 | ||||||

| Republic of Sri Lanka, 5.75%, 4/18/2023 (n) | 810,000 | 785,954 | ||||||

| Republic of Sri Lanka, 6.125%, 6/03/2025 | 9,785,000 | 9,348,931 | ||||||

| Republic of Turkey, 3.25%, 3/23/2023 | 2,486,000 | 2,270,712 | ||||||

| Republic of Turkey, 7.25%, 12/23/2023 | 1,967,000 | 2,050,420 | ||||||

| Republic of Turkey, 5.75%, 3/22/2024 | 5,759,000 | 5,650,040 | ||||||

| Republic of Turkey, 6%, 3/25/2027 | 13,331,000 | 12,754,834 | ||||||

21

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Emerging Market Sovereign - continued | ||||||||

| Republic of Turkey, 6.875%, 3/17/2036 | $ | 3,197,000 | $ | 3,069,120 | ||||

| Russian Federation, 4.75%, 5/27/2026 | 5,400,000 | 5,481,000 | ||||||

| Russian Federation, 4.25%, 6/23/2027 | 3,600,000 | 3,525,480 | ||||||

| Russian Federation, 4.375%, 3/21/2029 (n) | 7,800,000 | 7,611,521 | ||||||

| Russian Federation, 5.25%, 6/23/2047 | 2,400,000 | 2,379,418 | ||||||

| Socialist Republic of Vietnam, 4.8%, 11/19/2024 | 1,543,000 | 1,613,049 | ||||||

| State of Qatar, 5.103%, 4/23/2048 (n) | 5,813,000 | 6,270,774 | ||||||

| United Mexican States, 3.75%, 1/11/2028 | 2,895,000 | 2,771,963 | ||||||

| United Mexican States, 8.5%, 5/31/2029 | MXN | 88,240,000 | 4,658,715 | |||||

|

| |||||||

| $ | 340,848,483 | |||||||

| Energy - Independent - 0.2% | ||||||||

| Afren PLC, 11.5%, 2/01/2020 (a)(d)(z) | $ | 200,000 | $ | 164 | ||||

| Hunt Oil Co. of Peru LLC, 6.375%, 6/01/2028 (n) | 1,986,000 | 2,097,712 | ||||||

| Hunt Oil Co. of Peru LLC, 6.375%, 6/01/2028 | 1,526,000 | 1,611,838 | ||||||

| Tengizchevroil Finance Co. International Ltd., 4%, 8/15/2026 (n) | 2,119,000 | 2,040,699 | ||||||

|

| |||||||

| $ | 5,750,413 | |||||||

| Energy - Integrated - 0.0% | ||||||||

| Inkia Energy Ltd., 5.875%, 11/09/2027 (n) | $ | 901,000 | $ | 869,474 | ||||

| Food & Beverages - 0.2% | ||||||||

| Central American Bottling Corp., 5.75%, 1/31/2027 (n) | $ | 800,000 | $ | 812,000 | ||||

| Corporacion Lindley S.A., 6.75%, 11/23/2021 (n) | 1,145,000 | 1,209,406 | ||||||

| Corporacion Lindley S.A., 6.75%, 11/23/2021 | 1,010,000 | 1,066,812 | ||||||

| Marb Bondco PLC, 7%, 3/15/2024 (n) | 1,648,000 | 1,622,786 | ||||||

| MHP Lux S.A., 6.95%, 4/03/2026 (n) | 3,200,000 | 2,935,232 | ||||||

|

| |||||||

| $ | 7,646,236 | |||||||

| Forest & Paper Products - 0.1% | ||||||||

| Suzano Austria GmbH, 6%, 1/15/2029 (n) | $ | 1,631,000 | $ | 1,727,637 | ||||

| Gaming & Lodging - 0.1% | ||||||||

| Sands China Ltd., 5.4%, 8/08/2028 | $ | 2,871,000 | $ | 2,915,483 | ||||

| Industrial - 0.0% | ||||||||

| Indika Energy Capital II Pte. Ltd., 5.875%, 11/09/2024 (n) | $ | 1,412,000 | $ | 1,321,511 | ||||

| International Market Sovereign - 0.1% | ||||||||

| Government of Bermuda, 4.75%, 2/15/2029 (n) | $ | 1,582,000 | $ | 1,649,235 | ||||

| Local Authorities - 0.3% | ||||||||

| Buenos Aires Province, 7.5%, 6/01/2027 (n) | $ | 1,989,000 | $ | 1,829,900 | ||||

| Province of Santa Fe, 6.9%, 11/01/2027 | 2,012,000 | 1,569,360 | ||||||

22

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Local Authorities - continued | ||||||||

| Provincia de Cordoba, 7.125%, 6/10/2021 | $ | 7,306,000 | $ | 6,696,022 | ||||

|

| |||||||

| $ | 10,095,282 | |||||||

| Major Banks - 0.1% | ||||||||

| Bank of America Corp., 3.124% to 1/20/2022, FLR (LIBOR - 3mo. + 1.16%) to 1/20/2023 | $ | 2,175,000 | $ | 2,164,698 | ||||

| UBS Group Funding (Switzerland) AG, 3.491%, 5/23/2023 (n) | 829,000 | 826,795 | ||||||

|

| |||||||

| $ | 2,991,493 | |||||||

| Medical & Health Technology & Services - 0.1% | ||||||||

| Montefiore Obligated Group, 5.246%, 11/01/2048 | $ | 3,192,000 | $ | 3,334,625 | ||||

| Metals & Mining - 0.2% | ||||||||

| First Quantum Minerals Ltd., 7.25%, 4/01/2023 | $ | 683,000 | $ | 671,048 | ||||

| First Quantum Minerals Ltd., 6.5%, 3/01/2024 | 1,072,000 | 1,015,720 | ||||||

| Petra Diamonds U.S. Treasury PLC, 7.25%, 5/01/2022 (n) | 682,000 | 634,260 | ||||||

| Petra Diamonds U.S. Treasury PLC, 7.25%, 5/01/2022 | 2,699,000 | 2,510,070 | ||||||

| Vale S.A., 6.25%, 8/10/2026 | 1,555,000 | 1,649,855 | ||||||

|

| |||||||

| $ | 6,480,953 | |||||||

| Mortgage-Backed - 11.6% | ||||||||

| Fannie Mae, 4.5%, 6/01/2019 - 8/01/2046 | $ | 26,888,655 | $ | 28,205,506 | ||||

| Fannie Mae, 5.5%, 7/01/2019 - 4/01/2040 | 5,270,654 | 5,731,363 | ||||||

| Fannie Mae, 4.785%, 8/01/2019 | 47,133 | 47,365 | ||||||

| Fannie Mae, 5.05%, 8/01/2019 | 21,509 | 21,640 | ||||||

| Fannie Mae, 4.6%, 9/01/2019 | 117,273 | 118,105 | ||||||

| Fannie Mae, 4.67%, 9/01/2019 | 26,355 | 26,566 | ||||||

| Fannie Mae, 5%, 9/01/2019 - 3/01/2042 | 6,820,778 | 7,297,833 | ||||||

| Fannie Mae, 4.14%, 8/01/2020 | 38,033 | 38,709 | ||||||

| Fannie Mae, 5.19%, 9/01/2020 | 82,303 | 83,549 | ||||||

| Fannie Mae, 3.416%, 10/01/2020 | 282,412 | 284,973 | ||||||

| Fannie Mae, 4.58%, 1/01/2021 | 395,678 | 401,587 | ||||||

| Fannie Mae, 3.99%, 7/01/2021 | 361,653 | 370,811 | ||||||

| Fannie Mae, 6%, 7/01/2021 - 6/01/2038 | 345,588 | 377,978 | ||||||

| Fannie Mae, 2.152%, 1/25/2023 | 1,298,000 | 1,269,355 | ||||||

| Fannie Mae, 2.41%, 5/01/2023 | 225,283 | 222,712 | ||||||

| Fannie Mae, 2.55%, 5/01/2023 | 194,310 | 193,122 | ||||||

| Fannie Mae, 2.62%, 5/01/2023 | 267,077 | 266,151 | ||||||

| Fannie Mae, 3.65%, 9/01/2023 | 787,337 | 809,434 | ||||||

| Fannie Mae, 3.78%, 10/01/2023 | 462,356 | 480,967 | ||||||

| Fannie Mae, 3.92%, 10/01/2023 | 987,000 | 1,029,032 | ||||||

| Fannie Mae, 3.5%, 5/25/2025 - 8/01/2047 | 67,054,468 | 67,410,982 | ||||||

| Fannie Mae, 2.7%, 7/01/2025 | 680,000 | 668,943 | ||||||

23

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Mortgage-Backed - continued | ||||||||

| Fannie Mae, 3.59%, 9/01/2026 | $ | 363,356 | $ | 375,832 | ||||

| Fannie Mae, 2.597%, 12/25/2026 | 3,827,000 | 3,680,572 | ||||||

| Fannie Mae, 3.043%, 3/25/2028 | 2,027,000 | 1,996,210 | ||||||

| Fannie Mae, 3.23%, 1/01/2029 | 4,065,094 | 4,046,811 | ||||||

| Fannie Mae, 4.01%, 1/01/2029 | 692,705 | 725,472 | ||||||

| Fannie Mae, 4.96%, 6/01/2030 | 1,104,591 | 1,227,215 | ||||||

| Fannie Mae, 3%, 12/01/2031 - 11/01/2046 | 26,069,236 | 25,810,661 | ||||||

| Fannie Mae, 6.5%, 1/01/2033 - 10/01/2037 | 99,996 | 111,323 | ||||||

| Fannie Mae, 4%, 9/01/2040 - 9/01/2047 | 61,990,753 | 63,715,673 | ||||||

| Fannie Mae, 2%, 5/25/2044 - 4/25/2046 | 2,410,190 | 2,313,995 | ||||||

| Fannie Mae, TBA, 2.5%, 3/01/2034 - 4/01/2034 | 1,375,000 | 1,348,198 | ||||||

| Freddie Mac, 2.086%, 3/25/2019 | 27,858 | 27,804 | ||||||

| Freddie Mac, 1.883%, 5/25/2019 | 543,753 | 542,474 | ||||||

| Freddie Mac, 2.456%, 8/25/2019 | 1,033,631 | 1,031,109 | ||||||

| Freddie Mac, 4.186%, 8/25/2019 | 1,484,668 | 1,487,845 | ||||||

| Freddie Mac, 4.251%, 1/25/2020 | 400,000 | 403,230 | ||||||

| Freddie Mac, 4.224%, 3/25/2020 | 309,204 | 312,096 | ||||||

| Freddie Mac, 5%, 5/01/2020 - 6/01/2040 | 162,418 | 169,831 | ||||||

| Freddie Mac, 3.808%, 8/25/2020 | 806,000 | 814,434 | ||||||

| Freddie Mac, 3.034%, 10/25/2020 | 499,961 | 500,637 | ||||||

| Freddie Mac, 2.856%, 1/25/2021 | 1,424,597 | 1,423,769 | ||||||

| Freddie Mac, 6%, 5/01/2021 - 10/01/2038 | 410,579 | 450,346 | ||||||

| Freddie Mac, 2.791%, 1/25/2022 | 2,010,000 | 2,006,874 | ||||||

| Freddie Mac, 2.455%, 3/25/2022 | 1,416,866 | 1,407,569 | ||||||

| Freddie Mac, 2.716%, 6/25/2022 | 1,295,920 | 1,291,140 | ||||||

| Freddie Mac, 2.51%, 11/25/2022 | 2,731,000 | 2,703,473 | ||||||

| Freddie Mac, 2.637%, 1/25/2023 | 1,000,000 | 994,140 | ||||||

| Freddie Mac, 3.32%, 2/25/2023 | 1,277,000 | 1,301,033 | ||||||

| Freddie Mac, 3.25%, 4/25/2023 | 1,700,000 | 1,728,211 | ||||||

| Freddie Mac, 3.3%, 4/25/2023 - 10/25/2026 | 4,285,940 | 4,350,573 | ||||||

| Freddie Mac, 3.06%, 7/25/2023 | 886,000 | 892,705 | ||||||

| Freddie Mac, 3.458%, 8/25/2023 | 675,000 | 690,715 | ||||||

| Freddie Mac, 0.882%, 4/25/2024 (i) | 21,342,224 | 780,095 | ||||||

| Freddie Mac, 0.608%, 7/25/2024 (i) | 24,686,461 | 682,265 | ||||||

| Freddie Mac, 3.303%, 7/25/2024 | 5,037,000 | 5,128,252 | ||||||

| Freddie Mac, 3.064%, 8/25/2024 | 2,626,852 | 2,641,810 | ||||||

| Freddie Mac, 4.5%, 9/01/2024 - 5/01/2042 | 2,601,209 | 2,735,754 | ||||||

| Freddie Mac, 2.67%, 12/25/2024 | 2,555,000 | 2,516,103 | ||||||

| Freddie Mac, 2.811%, 1/25/2025 | 2,125,000 | 2,105,266 | ||||||

| Freddie Mac, 3.023%, 1/25/2025 | 1,000,000 | 1,001,885 | ||||||

| Freddie Mac, 3.329%, 5/25/2025 | 5,166,000 | 5,259,196 | ||||||

| Freddie Mac, 3.284%, 6/25/2025 | 5,000,000 | 5,083,459 | ||||||

| Freddie Mac, 4%, 7/01/2025 - 4/01/2044 | 2,878,752 | 2,955,001 | ||||||

24

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Mortgage-Backed - continued | ||||||||

| Freddie Mac, 3.01%, 7/25/2025 | $ | 1,775,000 | $ | 1,774,240 | ||||

| Freddie Mac, 2.745%, 1/25/2026 | 3,263,000 | 3,200,797 | ||||||

| Freddie Mac, 2.673%, 3/25/2026 | 2,368,000 | 2,310,357 | ||||||

| Freddie Mac, 3.224%, 3/25/2027 | 3,227,000 | 3,240,484 | ||||||

| Freddie Mac, 3.243%, 4/25/2027 | 3,546,000 | 3,562,034 | ||||||

| Freddie Mac, 3.117%, 6/25/2027 | 2,090,000 | 2,081,692 | ||||||

| Freddie Mac, 0.578%, 7/25/2027 (i) | 45,753,161 | 1,929,736 | ||||||

| Freddie Mac, 3.194%, 7/25/2027 | 3,516,000 | 3,514,934 | ||||||

| Freddie Mac, 0.436%, 8/25/2027 (i) | 35,124,572 | 1,121,833 | ||||||

| Freddie Mac, 3.187%, 9/25/2027 | 2,414,000 | 2,412,589 | ||||||

| Freddie Mac, 3.286%, 11/25/2027 | 3,301,000 | 3,317,508 | ||||||

| Freddie Mac, 3.444%, 12/25/2027 | 1,076,000 | 1,094,116 | ||||||

| Freddie Mac, 0.291%, 1/25/2028 (i) | 64,189,735 | 1,601,733 | ||||||

| Freddie Mac, 0.303%, 1/25/2028 (i) | 26,457,732 | 675,709 | ||||||

| Freddie Mac, 0.134%, 2/25/2028 (i) | 79,160,600 | 1,047,588 | ||||||

| Freddie Mac, 0.12%, 4/25/2028 (i) | 50,775,583 | 630,059 | ||||||

| Freddie Mac, 3.85%, 5/25/2028 | 2,253,000 | 2,358,360 | ||||||

| Freddie Mac, 5.5%, 6/01/2030 - 6/01/2041 | 714,322 | 775,077 | ||||||

| Freddie Mac, 6.5%, 5/01/2037 | 15,389 | 16,960 | ||||||

| Freddie Mac, 3.5%, 11/01/2037 - 1/01/2047 | 26,758,173 | 26,914,901 | ||||||

| Freddie Mac, 3%, 1/01/2038 - 3/01/2047 | 28,498,977 | 27,985,058 | ||||||

| Ginnie Mae, 2.5%, 7/20/2032 - 6/20/2042 | 1,045,000 | 965,158 | ||||||

| Ginnie Mae, 5.5%, 5/15/2033 - 1/20/2042 | 300,959 | 328,038 | ||||||

| Ginnie Mae, 4.5%, 7/20/2033 - 9/20/2041 | 4,877,495 | 5,118,184 | ||||||

| Ginnie Mae, 4%, 10/15/2039 - 4/20/2041 | 242,611 | 250,741 | ||||||

| Ginnie Mae, 3.5%, 12/15/2041 - 10/20/2048 | 10,660,388 | 10,796,951 | ||||||

| Ginnie Mae, 3%, 11/20/2047 - 10/20/2048 | 17,806,590 | 17,591,930 | ||||||

| Ginnie Mae, 6.158%, 4/20/2058 | 3,506 | 3,667 | ||||||

| Ginnie Mae, 0.66%, 2/16/2059 (i) | 3,105,578 | 183,029 | ||||||

| Ginnie Mae, TBA, 5%, 3/01/2049 | 1,900,000 | 1,979,275 | ||||||

|

| |||||||

| $ | 404,910,477 | |||||||

| Municipals - 0.3% | ||||||||

| New Jersey Economic Development Authority State Pension Funding Rev., Capital Appreciation, “B”, AGM, 0%, 2/15/2023 | $ | 6,363,000 | $ | 5,477,143 | ||||

| Philadelphia, PA, School District Rev., “A”, AGM, 5.995%, 9/01/2030 | 1,210,000 | 1,423,045 | ||||||

| State of California (Build America Bonds), 7.6%, 11/01/2040 | 2,320,000 | 3,466,451 | ||||||

| University of California Rev. (Build America Bonds), 5.77%, 5/15/2043 | 60,000 | 73,405 | ||||||

|

| |||||||

| $ | 10,440,044 | |||||||

25

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Natural Gas - Distribution - 0.2% | ||||||||

| GNL Quintero S.A., 4.634%, 7/31/2029 (n) | $ | 4,778,000 | $ | 4,831,752 | ||||

| Infraestructura Energética Nova S.A.B. de C.V, 4.875%, 1/14/2048 (n) | 4,200,000 | 3,364,494 | ||||||

|

| |||||||

| $ | 8,196,246 | |||||||

| Natural Gas - Pipeline - 0.2% | ||||||||

| Peru LNG, 5.375%, 3/22/2030 (n) | $ | 3,644,000 | $ | 3,727,994 | ||||

| Peru LNG, 5.375%, 3/22/2030 | 1,542,000 | 1,577,543 | ||||||

|

| |||||||

| $ | 5,305,537 | |||||||

| Network & Telecom - 0.4% | ||||||||

| C&W Senior Financing Designated Activity, 7.5%, 10/15/2026 (n) | $ | 1,212,000 | $ | 1,236,240 | ||||

| Empresa Nacional de Telecomunicaciones S.A., 4.75%, 8/01/2026 | 5,020,000 | 4,976,403 | ||||||

| Telefonica Celular del Paraguay S.A., 6.75%, 12/13/2022 (n) | 3,437,000 | 3,505,740 | ||||||

| WTT Investment Ltd., 5.5%, 11/21/2022 (n) | 3,800,000 | 3,743,916 | ||||||

|

| |||||||

| $ | 13,462,299 | |||||||

| Oil Services - 0.0% | ||||||||

| Shelf Drill Holdings Ltd., 8.25%, 2/15/2025 (n) | $ | 624,000 | $ | 595,920 | ||||

| Oils - 0.1% | ||||||||

| Thaioil Treasury Center Co. Ltd., 5.375%, 11/20/2048 (n) | $ | 1,550,000 | $ | 1,646,661 | ||||

| Other Banks & Diversified Financials - 0.4% | ||||||||

| Bangkok Bank (Hong Kong), 4.05%, 3/19/2024 (n) | $ | 4,000,000 | $ | 4,050,785 | ||||

| Banque Federative du Credit Mutuel S.A., 2.5%, 4/13/2021 (n) | 1,152,000 | 1,135,340 | ||||||

| ING Groep N.V., 3.15%, 3/29/2022 | 1,585,000 | 1,574,847 | ||||||

| Kazkommertsbank JSC, 5.5%, 12/21/2022 | 8,000,000 | 7,968,000 | ||||||

|

| |||||||

| $ | 14,728,972 | |||||||

| Pollution Control - 0.0% | ||||||||

| Aegea Finance S.à r.l., 5.75%, 10/10/2024 (n) | $ | 1,617,000 | $ | 1,591,144 | ||||

| Restaurants - 0.1% | ||||||||

| Starbucks Corp., 3.8%, 8/15/2025 | $ | 2,396,000 | $ | 2,431,415 | ||||

| Supermarkets - 0.1% | ||||||||

| Eurotorg LLC Via Bonitron DAC, 8.75%, 10/30/2022 | $ | 1,552,000 | $ | 1,575,901 | ||||

| Eurotorg LLC Via Bonitron DAC, 8.75%, 10/30/2022 (n) | 1,028,000 | 1,043,831 | ||||||

|

| |||||||

| $ | 2,619,732 | |||||||

26

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| Supranational - 0.0% | ||||||||

| Inter-American Development Bank, 4.375%, 1/24/2044 | $ | 511,000 | $ | 593,575 | ||||

| Tobacco - 0.0% | ||||||||

| B.A.T Capital Corp., 2.764%, 8/15/2022 | $ | 1,508,000 | $ | 1,468,635 | ||||

| Transportation - Services - 0.2% | ||||||||

| Aeropuertos Dominicanos Siglo XXI S.A., 6.75%, 3/30/2029 | $ | 1,200,000 | $ | 1,209,000 | ||||

| JSL Europe S.A., 7.75%, 7/26/2024 (n) | 1,777,000 | 1,794,770 | ||||||

| Rumo Luxembourg S.à r.l., 7.375%, 2/09/2024 | 2,508,000 | 2,691,836 | ||||||

| Rumo Luxembourg S.à r.l., 5.875%, 1/18/2025 (n) | 1,231,000 | 1,258,697 | ||||||

| Rumo Luxembourg S.à r.l., “A”, 7.375%, 2/09/2024 (n) | 632,000 | 678,326 | ||||||

| Topaz Marine S.A., 9.125%, 7/26/2022 | 670,000 | 669,652 | ||||||

|

| |||||||

| $ | 8,302,281 | |||||||

| U.S. Government Agencies and Equivalents - 1.2% |

| |||||||

| AID-Tunisia, 2.452%, 7/24/2021 | $ | 728,000 | $ | 724,885 | ||||

| AID-Ukraine, 1.844%, 5/16/2019 | 3,674,000 | 3,669,338 | ||||||

| AID-Ukraine, 1.847%, 5/29/2020 | 8,820,000 | 8,750,348 | ||||||

| Fannie Mae, 1.75%, 11/26/2019 | 4,750,000 | 4,722,920 | ||||||

| Fannie Mae, 1.625%, 1/21/2020 | 7,500,000 | 7,439,925 | ||||||

| Freddie Mac, 1.5%, 10/21/2019 | 9,000,000 | 8,939,385 | ||||||

| Hashemite Kingdom of Jordan, 1.945%, 6/23/2019 | 987,000 | 985,325 | ||||||

| Hashemite Kingdom of Jordan, 2.503%, 10/30/2020 | 1,108,000 | 1,105,471 | ||||||

| Private Export Funding Corp., 2.25%, 3/15/2020 | 419,000 | 417,553 | ||||||

| Private Export Funding Corp., 2.3%, 9/15/2020 | 2,000,000 | 1,985,632 | ||||||

| Small Business Administration, 6.34%, 5/01/2021 | 11,443 | 11,658 | ||||||

| Small Business Administration, 6.07%, 3/01/2022 | 10,622 | 10,880 | ||||||

| Small Business Administration, 5.16%, 2/01/2028 | 52,351 | 55,028 | ||||||

| Small Business Administration, 2.21%, 2/01/2033 | 228,412 | 219,927 | ||||||

| Small Business Administration, 2.22%, 3/01/2033 | 402,038 | 388,461 | ||||||

| Small Business Administration, 3.15%, 7/01/2033 | 475,808 | 476,811 | ||||||

| Small Business Administration, 3.16%, 8/01/2033 | 529,738 | 530,502 | ||||||

| Small Business Administration, 3.62%, 9/01/2033 | 449,974 | 460,919 | ||||||

|

| |||||||

| $ | 40,894,968 | |||||||

| U.S. Treasury Obligations - 6.7% | ||||||||

| U.S. Treasury Bonds, 6.375%, 8/15/2027 | $ | 106,000 | $ | 135,502 | ||||

| U.S. Treasury Bonds, 5.25%, 2/15/2029 | 2,965,000 | 3,613,941 | ||||||

| U.S. Treasury Bonds, 4.375%, 2/15/2038 | 1,349,000 | 1,642,671 | ||||||

| U.S. Treasury Bonds, 4.5%, 8/15/2039 | 401,000 | 496,253 | ||||||

| U.S. Treasury Bonds, 3.125%, 2/15/2043 | 9,137,900 | 9,222,140 | ||||||

| U.S. Treasury Bonds, 2.875%, 5/15/2043 | 17,378,300 | 16,773,454 | ||||||

| U.S. Treasury Bonds, 2.5%, 2/15/2045 (f) | 33,851,000 | 30,296,645 | ||||||

27

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Bonds - continued | ||||||||

| U.S. Treasury Obligations - continued | ||||||||

| U.S. Treasury Bonds, 2.875%, 11/15/2046 | $ | 11,828,000 | $ | 11,369,203 | ||||

| U.S. Treasury Bonds, TIPS, 0.375%, 1/15/2027 | 8,177,913 | 7,954,298 | ||||||

| U.S. Treasury Notes, 2%, 11/30/2020 | 18,444,000 | 18,271,808 | ||||||

| U.S. Treasury Notes, 3.125%, 5/15/2021 | 3,748,000 | 3,796,607 | ||||||

| U.S. Treasury Notes, 1.75%, 11/30/2021 | 75,932,000 | 74,434,123 | ||||||

| U.S. Treasury Notes, 1.75%, 5/15/2022 | 3,949,000 | 3,858,297 | ||||||

| U.S. Treasury Notes, 2.5%, 8/15/2023 | 29,025,000 | 29,003,458 | ||||||

| U.S. Treasury Notes, 2.75%, 2/15/2024 | 7,855,000 | 7,936,618 | ||||||

| U.S. Treasury Notes, 2.5%, 5/15/2024 | 4,680,000 | 4,669,945 | ||||||

| U.S. Treasury Notes, 2.875%, 7/31/2025 | 1,948,000 | 1,979,807 | ||||||

| U.S. Treasury Notes, 2.25%, 8/15/2027 | 8,936,000 | 8,648,373 | ||||||

|

| |||||||

| $ | 234,103,143 | |||||||

| Utilities - Electric Power - 0.9% | ||||||||

| Azure Power Energy Ltd., 5.5%, 11/03/2022 (n) | $ | 3,114,000 | $ | 3,041,693 | ||||

| Cerro del Aguila S.A., 4.125%, 8/16/2027 (n) | 1,409,000 | 1,356,867 | ||||||

| Enel Finance International N.V., 2.875%, 5/25/2022 (n) | 2,073,000 | 2,013,614 | ||||||

| Energuate Trust, 5.875%, 5/03/2027 (n) | 762,000 | 727,718 | ||||||

| Engie Energia Chile S.A., 5.625%, 1/15/2021 | 2,177,000 | 2,252,694 | ||||||

| Engie Energia Chile S.A., 4.5%, 1/29/2025 (n) | 2,824,000 | 2,888,984 | ||||||

| Genneia S.A., 8.75%, 1/20/2022 (n) | 1,250,000 | 1,159,000 | ||||||

| Greenko Dutch B.V., 5.25%, 7/24/2024 (n) | 7,661,000 | 7,186,018 | ||||||

| LLPL Capital Pte. Ltd., 6.875%, 2/04/2039 (n) | 1,160,000 | 1,192,957 | ||||||

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | 1,536,000 | 1,478,400 | ||||||

| Transelec S.A., 4.25%, 1/14/2025 (n) | 2,631,000 | 2,621,160 | ||||||

| Transelec S.A., 4.25%, 1/14/2025 | 1,953,000 | 1,945,696 | ||||||

| Transelec S.A., 3.875%, 1/12/2029 (n) | 3,854,000 | 3,651,703 | ||||||

| Virginia Electric & Power Co., 3.5%, 3/15/2027 | 813,000 | 808,843 | ||||||

|

| |||||||

| $ | 32,325,347 | |||||||

| Utilities - Gas - 0.0% | ||||||||

| Gas Natural de Lima y Callao S.A., 4.375%, 4/01/2023 | $ | 1,259,000 | $ | 1,270,016 | ||||

| Total Bonds (Identified Cost, $1,406,015,324) | $ | 1,381,142,107 | ||||||

| Convertible Preferred Stocks - 0.2% | ||||||||

| Conglomerates - 0.0% | ||||||||

| Danaher Corp., 4.75% (a) | 857 | $ | 877,315 | |||||

| Utilities - Electric Power - 0.2% | ||||||||

| CenterPoint Energy, Inc., 7% | 67,302 | $ | 3,517,203 | |||||

| NextEra Energy, Inc., 6.123% | 27,684 | 1,683,741 | ||||||

|

| |||||||

| $ | 5,200,944 | |||||||

| Total Convertible Preferred Stocks (Identified Cost, $5,872,254) | $ | 6,078,259 | ||||||

28

Table of Contents

Portfolio of Investments – continued

| Investment Companies (h) - 18.5% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Bond Funds - 16.8% | ||||||||

| MFS High Yield Pooled Portfolio (v) | 65,172,602 | $ | 588,508,593 | |||||

| Money Market Funds - 1.7% | ||||||||

| MFS Institutional Money Market Portfolio, 2.49% (v) | 58,220,414 | $ | 58,220,415 | |||||

| Total Investment Companies (Identified Cost, $644,110,158) | $ | 646,729,008 | ||||||

| Collateral for Securities Loaned - 0.2% | ||||||||

| JPMorgan U.S. Government Money Market Fund, 2.31% (j) (Identified Cost, $8,740,224) | 8,740,224 | $ | 8,740,224 | |||||

| Other Assets, Less Liabilities - 1.2% | 43,641,614 | |||||||

| Net Assets - 100.0% | $ | 3,505,119,033 | ||||||

| (a) | Non-income producing security. |

| (d) | In default. |

| (f) | All or a portion of the security has been segregated as collateral for open futures contracts. |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $646,729,008 and $2,814,748,411, respectively. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |