UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 3329

Variable Insurance Products Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | June 30, 2004 |

Item 1. Reports to Stockholders

Fidelity® Variable Insurance Products

Service Class 2R

Contrafund® Portfolio

Equity-Income Portfolio

Growth Portfolio

Semiannual Report

June 30, 2004(2_fidelity_logos) (Registered_Trademark)

Contents

Contrafund Portfolio | 3 4 12 | Investment Summary- Investments Financial Statements |

Equity-Income Portfolio | 16 17 22 | Investment Summary Investments Financial Statements |

Growth Portfolio | 26 27 32 | Investment Summary Investments Financial Statements |

Notes | 36 | Notes to the Financial Statements |

For a free copy of the fund's proxy voting guidelines, call 1-800-221-5207, or visit the Securities and Exchange Commission (SEC)'s web site at www.sec.gov.

Fidelity Variable Insurance Products are separate account options which are purchased through a variable insurance contract.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

(Recycle graphic) This report is printed on recycled paper using soy-based inks.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not

authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Mutual fund shares are not deposits or obligations of, or guaranteed by, any depository institution. Shares are not insured by the FDIC,

Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested.

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Fidelity Variable Insurance Products: Contrafund Portfolio

Investment Summary

Top Five Stocks as of June 30, 2004 |

| % of fund's

net assets |

Avon Products, Inc. | 3.3 |

3M Co. | 3.2 |

Berkshire Hathaway, Inc. Class A | 2.8 |

EnCana Corp. | 1.9 |

Yahoo!, Inc. | 1.8 |

| 13.0 |

Top Five Market Sectors as of June 30, 2004 |

| % of fund's

net assets |

Health Care | 15.6 |

Information Technology | 13.1 |

Consumer Discretionary | 13.0 |

Financials | 12.5 |

Industrials | 10.7 |

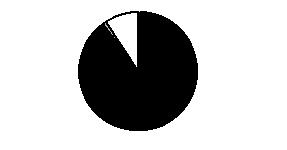

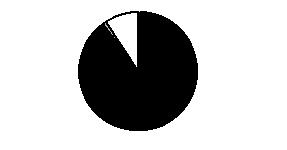

Asset Allocation as of June 30, 2004 |

% of fund's net assets* |

| Stocks and Equity Futures | 89.7% | |

| Bonds | 1.1% | |

| Short-Term Investments and Net Other Assets | 9.2% | |

* Foreign investments | 21.5% | |

Semiannual Report

Fidelity Variable Insurance Products: Contrafund Portfolio

Investments June 30, 2004 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 88.7% |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - 12.9% |

Auto Components - 0.2% |

Gentex Corp. | 590,400 | | $ 23,427,072 |

Automobiles - 0.5% |

Harley-Davidson, Inc. | 83,900 | | 5,196,766 |

Toyota Motor Corp. | 1,257,800 | | 51,330,819 |

| | 56,527,585 |

Hotels, Restaurants & Leisure - 2.6% |

Ameristar Casinos, Inc. | 18,600 | | 624,588 |

Boyd Gaming Corp. | 265,700 | | 7,059,649 |

Buffalo Wild Wings, Inc. | 70,400 | | 1,946,560 |

Friendly Ice Cream Corp. (a) | 204,600 | | 2,690,490 |

Gaylord Entertainment Co. (a) | 52,827 | | 1,658,240 |

GTECH Holdings Corp. | 202,600 | | 9,382,406 |

Hilton Group PLC | 1,522,398 | | 7,644,789 |

International Game Technology | 505,550 | | 19,514,230 |

Kerzner International Ltd. (a) | 130,800 | | 6,220,848 |

Krispy Kreme Doughnuts, Inc. (a) | 975,000 | | 18,612,750 |

Lakes Entertainment, Inc. (a) | 209,600 | | 2,429,264 |

Life Time Fitness, Inc. | 111,600 | | 2,343,600 |

McDonald's Corp. | 198,800 | | 5,168,800 |

Outback Steakhouse, Inc. | 266,700 | | 11,030,712 |

P.F. Chang's China Bistro, Inc. (a) | 300,600 | | 12,369,690 |

Panera Bread Co. Class A (a) | 809,596 | | 29,048,304 |

Penn National Gaming, Inc. (a) | 78,803 | | 2,616,260 |

Pinnacle Entertainment, Inc. (a) | 44,800 | | 564,928 |

Rank Group PLC | 403,940 | | 2,204,785 |

Red Robin Gourmet Burgers, Inc. (a) | 221,787 | | 6,070,310 |

Ryan's Restaurant Group, Inc. (a) | 282,750 | | 4,467,450 |

Shuffle Master, Inc. (a) | 257,634 | | 9,354,691 |

Stanley Leisure PLC | 651,898 | | 4,966,640 |

Starbucks Corp. (a) | 1,233,800 | | 53,645,624 |

Station Casinos, Inc. | 632,300 | | 30,603,320 |

The Cheesecake Factory, Inc. (a) | 374,424 | | 14,898,331 |

William Hill PLC | 3,106,053 | | 31,307,387 |

Wynn Resorts Ltd. (a) | 77,042 | | 2,976,132 |

| | 301,420,778 |

Household Durables - 1.3% |

Blyth, Inc. | 69,000 | | 2,379,810 |

D.R. Horton, Inc. | 1,277,477 | | 36,280,347 |

Fortune Brands, Inc. | 331,400 | | 24,997,502 |

Harman International Industries, Inc. | 641,600 | | 58,385,600 |

Leggett & Platt, Inc. | 90,100 | | 2,406,571 |

LG Electronics, Inc. | 115,080 | | 5,462,438 |

Pulte Homes, Inc. | 190,300 | | 9,901,309 |

Sharp Corp. | 316,000 | | 5,121,726 |

| | 144,935,303 |

Internet & Catalog Retail - 1.7% |

Blue Nile, Inc. | 83,416 | | 3,137,276 |

|

| Shares | | Value (Note 1) |

eBay, Inc. (a) | 1,394,000 | | $ 128,178,300 |

InterActiveCorp (a) | 1,957,867 | | 59,010,111 |

| | 190,325,687 |

Leisure Equipment & Products - 0.0% |

RC2 Corp. (a) | 58,813 | | 2,087,862 |

Media - 1.9% |

Citadel Broadcasting Corp. | 100,500 | | 1,464,285 |

E.W. Scripps Co. Class A | 250,900 | | 26,344,500 |

Fox Entertainment Group, Inc.

Class A (a) | 1,208,600 | | 32,269,620 |

Getty Images, Inc. (a) | 169,100 | | 10,146,000 |

McGraw-Hill Companies, Inc. | 70,100 | | 5,367,557 |

Meredith Corp. | 58,000 | | 3,187,680 |

News Corp. Ltd. ADR | 384,000 | | 13,601,280 |

Pixar (a) | 579,317 | | 40,268,325 |

SBS Broadcasting SA (a) | 220,700 | | 6,777,697 |

Sogecable SA (a) | 111,700 | | 4,516,002 |

The DIRECTV Group, Inc. (a) | 738,300 | | 12,624,930 |

Univision Communications, Inc.

Class A (a) | 183,000 | | 5,843,190 |

Viacom, Inc. Class B (non-vtg.) | 238,236 | | 8,509,790 |

Vivendi Universal SA sponsored ADR (a) | 188,400 | | 5,256,360 |

Washington Post Co. Class B | 29,200 | | 27,156,292 |

XM Satellite Radio Holdings, Inc.

Class A (a) | 406,620 | | 11,096,660 |

| | 214,430,168 |

Multiline Retail - 0.4% |

99 Cents Only Stores (a) | 1,384,466 | | 21,113,107 |

JCPenney Co., Inc. | 382,600 | | 14,446,976 |

Neiman Marcus Group, Inc. Class A | 120,900 | | 6,728,085 |

| | 42,288,168 |

Specialty Retail - 3.4% |

AC Moore Arts & Crafts, Inc. (a) | 197,700 | | 5,438,727 |

Advance Auto Parts, Inc. (a) | 736,300 | | 32,529,734 |

AnnTaylor Stores Corp. (a) | 1,460,850 | | 42,335,433 |

Bed Bath & Beyond, Inc. (a) | 1,352,200 | | 51,992,090 |

Best Buy Co., Inc. | 117,600 | | 5,967,024 |

Cabela's, Inc. Class A | 59,600 | | 1,606,220 |

Chico's FAS, Inc. (a) | 938,800 | | 42,396,208 |

Claire's Stores, Inc. | 108,800 | | 2,360,960 |

Dick's Sporting Goods, Inc. (a) | 199,300 | | 6,646,655 |

Guitar Center, Inc. (a) | 78,400 | | 3,486,448 |

Halfords Group PLC | 943,366 | | 4,634,172 |

Hot Topic, Inc. (a) | 112,400 | | 2,303,076 |

Lowe's Companies, Inc. | 230,400 | | 12,107,520 |

Pacific Sunwear of California, Inc. (a) | 1,301,072 | | 25,461,979 |

PETCO Animal Supplies, Inc. (a) | 612,200 | | 19,718,962 |

PETsMART, Inc. | 921,800 | | 29,912,410 |

Regis Corp. | 107,500 | | 4,793,425 |

Signet Group PLC | 2,348,926 | | 4,893,313 |

Staples, Inc. | 593,000 | | 17,380,830 |

The Pep Boys - Manny, Moe & Jack | 909,200 | | 23,048,220 |

TJX Companies, Inc. | 1,188,100 | | 28,680,734 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

CONSUMER DISCRETIONARY - continued |

Specialty Retail - continued |

United Auto Group, Inc. | 52,600 | | $ 1,612,190 |

Urban Outfitters, Inc. (a) | 305,600 | | 18,614,096 |

| | 387,920,426 |

Textiles Apparel & Luxury Goods - 0.9% |

Brown Shoe Co., Inc. | 56,100 | | 2,296,173 |

Burberry Ltd. | 2,831,173 | | 21,054,860 |

Carter's, Inc. | 76,000 | | 2,212,360 |

Coach, Inc. (a) | 1,204,324 | | 54,423,402 |

Delta Woodside Industries, Inc. (a) | 22,175 | | 24,836 |

Fossil, Inc. (a) | 222,500 | | 6,063,125 |

NIKE, Inc. Class B | 57,600 | | 4,363,200 |

Puma AG | 31,241 | | 7,958,265 |

Quiksilver, Inc. (a) | 86,200 | | 2,052,422 |

| | 100,448,643 |

TOTAL CONSUMER DISCRETIONARY | | 1,463,811,692 |

CONSUMER STAPLES - 8.6% |

Beverages - 0.5% |

Anheuser-Busch Companies, Inc. | 212,800 | | 11,491,200 |

Coca-Cola Hellenic Bottling Co. SA (Bearer) | 310,870 | | 7,279,431 |

Cott Corp. (a) | 445,200 | | 14,451,728 |

Cott Corp. (a)(c) | 220,500 | | 7,144,200 |

PepsiCo, Inc. | 205,910 | | 11,094,431 |

The Coca-Cola Co. | 86,900 | | 4,386,712 |

| | 55,847,702 |

Food & Staples Retailing - 1.7% |

Smart & Final, Inc. (a) | 31,000 | | 372,620 |

Sysco Corp. | 2,436,600 | | 87,400,842 |

Tesco PLC | 2,292,590 | | 11,105,656 |

The Pantry, Inc. (a) | 202,900 | | 4,423,220 |

United Natural Foods, Inc. (a) | 321,452 | | 9,293,177 |

Wal-Mart Stores, Inc. | 131,400 | | 6,932,664 |

Walgreen Co. | 67,000 | | 2,426,070 |

Whole Foods Market, Inc. | 416,407 | | 39,746,048 |

William Morrison Supermarkets PLC | 7,616,950 | | 32,116,561 |

| | 193,816,858 |

Food Products - 0.7% |

Dean Foods Co. (a) | 215,500 | | 8,040,305 |

Hershey Foods Corp. | 421,000 | | 19,479,670 |

Kellogg Co. | 459,600 | | 19,234,260 |

People's Food Holdings Ltd. | 877,000 | | 576,873 |

Saputo, Inc. | 129,990 | | 3,111,613 |

Smithfield Foods, Inc. (a) | 250,500 | | 7,364,700 |

SunOpta, Inc. (a) | 715,100 | | 6,132,951 |

Wm. Wrigley Jr. Co. | 271,500 | | 17,118,075 |

| | 81,058,447 |

|

| Shares | | Value (Note 1) |

Household Products - 1.5% |

Colgate-Palmolive Co. | 3,018,600 | | $ 176,437,170 |

Personal Products - 4.2% |

Avon Products, Inc. | 7,950,256 | | 366,824,807 |

Gillette Co. | 2,486,900 | | 105,444,560 |

NBTY, Inc. (a) | 20,700 | | 608,373 |

| | 472,877,740 |

TOTAL CONSUMER STAPLES | | 980,037,917 |

ENERGY - 6.9% |

Energy Equipment & Services - 0.8% |

BJ Services Co. (a) | 156,400 | | 7,169,376 |

Carbo Ceramics, Inc. | 113,000 | | 7,712,250 |

Schlumberger Ltd. (NY Shares) | 732,800 | | 46,540,128 |

Smith International, Inc. (a) | 456,575 | | 25,458,622 |

| | 86,880,376 |

Oil & Gas - 6.1% |

Apache Corp. | 576,680 | | 25,114,414 |

Blackrock Ventures, Inc. (a) | 869,100 | | 4,912,673 |

BP PLC sponsored ADR | 883,632 | | 47,336,166 |

Burlington Resources, Inc. | 782,980 | | 28,328,216 |

Cabot Oil & Gas Corp. Class A | 93,900 | | 3,971,970 |

Canadian Natural Resources Ltd. | 43,400 | | 1,303,074 |

Chesapeake Energy Corp. | 495,300 | | 7,290,816 |

China Petroleum & Chemical Corp. sponsored ADR | 516,640 | | 19,089,848 |

Comstock Resources, Inc. (a) | 89,600 | | 1,743,616 |

ConocoPhillips | 44,900 | | 3,425,421 |

Denbury Resources, Inc. (a) | 134,400 | | 2,815,680 |

Devon Energy Corp. | 33,600 | | 2,217,600 |

EnCana Corp. | 5,005,892 | | 216,237,722 |

Encore Acquisition Co. (a) | 236,000 | | 6,584,400 |

ENI Spa sponsored ADR | 66,200 | | 6,642,508 |

EOG Resources, Inc. | 142,500 | | 8,508,675 |

Evergreen Resources, Inc. (a) | 129,500 | | 5,231,800 |

Exxon Mobil Corp. | 759,900 | | 33,747,159 |

Houston Exploration Co. (a) | 314,500 | | 16,303,680 |

Magnum Hunter Resources, Inc. (a) | 125,600 | | 1,303,728 |

Murphy Oil Corp. | 900,500 | | 66,366,850 |

Newfield Exploration Co. (a) | 119,900 | | 6,683,226 |

Noble Energy, Inc. | 88,300 | | 4,503,300 |

Occidental Petroleum Corp. | 174,300 | | 8,437,863 |

Patina Oil & Gas Corp. | 218,600 | | 6,529,582 |

PetroChina Co. Ltd. sponsored ADR | 124,600 | | 5,768,980 |

PetroKazakhstan, Inc. Class A | 137,860 | | 3,744,409 |

Pioneer Natural Resources Co. | 491,400 | | 17,238,312 |

Pogo Producing Co. | 13,200 | | 652,080 |

Premcor, Inc. (a) | 1,449,600 | | 54,360,000 |

Prima Energy Corp. (a) | 31,600 | | 1,250,412 |

Quicksilver Resources, Inc. (a) | 185,000 | | 12,407,950 |

Talisman Energy, Inc. | 250,110 | | 5,456,332 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

ENERGY - continued |

Oil & Gas - continued |

Total SA sponsored ADR | 335,100 | | $ 32,196,408 |

Tsakos Energy Navigation Ltd. | 67,400 | | 2,288,904 |

Valero Energy Corp. | 64,600 | | 4,764,896 |

Vintage Petroleum, Inc. | 23,800 | | 403,886 |

XTO Energy, Inc. | 658,825 | | 19,626,397 |

| | 694,788,953 |

TOTAL ENERGY | | 781,669,329 |

FINANCIALS - 12.3% |

Capital Markets - 0.3% |

Goldman Sachs Group, Inc. | 47,200 | | 4,444,352 |

Lehman Brothers Holdings, Inc. | 192,700 | | 14,500,675 |

Merrill Lynch & Co., Inc. | 377,500 | | 20,377,450 |

| | 39,322,477 |

Commercial Banks - 1.4% |

Bank of Ireland | 1,140,160 | | 15,240,309 |

Bank One Corp. | 439,600 | | 22,419,600 |

Banknorth Group, Inc. | 166,400 | | 5,404,672 |

Commerce Bancorp, Inc., New Jersey | 302,817 | | 16,657,963 |

East West Bancorp, Inc. | 69,600 | | 2,136,720 |

Fifth Third Bancorp | 127,064 | | 6,833,502 |

M&T Bank Corp. | 292,900 | | 25,570,170 |

PrivateBancorp, Inc. | 26,204 | | 719,562 |

Royal Bank of Scotland Group PLC | 687,021 | | 19,849,460 |

SouthTrust Corp. | 540,300 | | 20,969,043 |

UCBH Holdings, Inc. | 165,930 | | 6,557,554 |

Wells Fargo & Co. | 78,800 | | 4,509,724 |

Westcorp | 165,720 | | 7,531,974 |

Wintrust Financial Corp. | 54,500 | | 2,752,795 |

| | 157,153,048 |

Consumer Finance - 1.0% |

MBNA Corp. | 697,800 | | 17,996,262 |

SLM Corp. | 2,259,400 | | 91,392,730 |

| | 109,388,992 |

Diversified Financial Services - 0.6% |

Brascan Corp. Class A (ltd. vtg.) | 198,000 | | 5,554,509 |

CapitalSource, Inc. | 44,400 | | 1,085,580 |

Citigroup, Inc. | 228,200 | | 10,611,300 |

Moody's Corp. | 719,200 | | 46,503,472 |

| | 63,754,861 |

Insurance - 7.5% |

ACE Ltd. | 409,200 | | 17,300,976 |

AFLAC, Inc. | 583,100 | | 23,796,311 |

Allstate Corp. | 542,900 | | 25,271,995 |

AMBAC Financial Group, Inc. | 27,600 | | 2,026,944 |

American International Group, Inc. | 1,855,814 | | 132,282,422 |

Arch Capital Group Ltd. (a) | 31,600 | | 1,260,208 |

Assurant, Inc. | 344,200 | | 9,079,996 |

Axis Capital Holdings Ltd. | 43,600 | | 1,220,800 |

|

| Shares | | Value (Note 1) |

Berkshire Hathaway, Inc. Class A (a) | 3,639 | | $ 323,689,050 |

Brit Insurance Holdings PLC (a) | 3,985,600 | | 6,018,663 |

Brown & Brown, Inc. | 44,600 | | 1,922,260 |

Cincinnati Financial Corp. | 3,255 | | 141,658 |

Endurance Specialty Holdings Ltd. | 538,000 | | 18,722,400 |

Everest Re Group Ltd. | 804,180 | | 64,623,905 |

Great-West Lifeco, Inc. | 67,000 | | 2,421,021 |

HCC Insurance Holdings, Inc. | 503,800 | | 16,831,958 |

Infinity Property & Casualty Corp. | 55,800 | | 1,841,400 |

IPC Holdings Ltd. | 160,300 | | 5,919,879 |

Markel Corp. (a) | 28,950 | | 8,033,625 |

Mercury General Corp. | 116,400 | | 5,779,260 |

MetLife, Inc. | 147,200 | | 5,277,120 |

Montpelier Re Holdings Ltd. | 1,449,200 | | 50,649,540 |

PartnerRe Ltd. | 368,300 | | 20,893,659 |

Penn-America Group, Inc. | 25,900 | | 362,600 |

Progressive Corp. | 90,800 | | 7,745,240 |

RenaissanceRe Holdings Ltd. | 683,965 | | 36,899,912 |

StanCorp Financial Group, Inc. | 66,800 | | 4,475,600 |

UICI (a) | 56,300 | | 1,340,503 |

USI Holdings Corp. (a) | 933,687 | | 14,752,255 |

W.R. Berkley Corp. | 300,950 | | 12,925,803 |

White Mountains Insurance Group Ltd. | 12,300 | | 6,273,000 |

Willis Group Holdings Ltd. | 771,400 | | 28,888,930 |

| | 858,668,893 |

Real Estate - 0.1% |

CBL & Associates Properties, Inc. | 108,200 | | 5,951,000 |

Simon Property Group, Inc. | 40,200 | | 2,067,084 |

The Rouse Co. | 44,720 | | 2,124,200 |

| | 10,142,284 |

Thrifts & Mortgage Finance - 1.4% |

Countrywide Financial Corp. | 207,860 | | 14,602,165 |

Doral Financial Corp. | 355,075 | | 12,250,088 |

Golden West Financial Corp., Delaware | 1,028,800 | | 109,412,880 |

New York Community Bancorp, Inc. | 917,090 | | 18,002,477 |

W Holding Co., Inc. | 155,389 | | 2,668,029 |

| | 156,935,639 |

TOTAL FINANCIALS | | 1,395,366,194 |

HEALTH CARE - 15.6% |

Biotechnology - 2.9% |

Affymetrix, Inc. (a) | 38,200 | | 1,250,286 |

Biogen Idec, Inc. (a) | 471,400 | | 29,816,050 |

Celgene Corp. (a) | 5,100 | | 292,026 |

ConjuChem, Inc. (a) | 539,930 | | 5,181,126 |

Dyax Corp. (a) | 177,600 | | 2,086,800 |

Gen-Probe, Inc. (a) | 405,100 | | 19,169,332 |

Genentech, Inc. (a) | 3,626,900 | | 203,831,780 |

Gilead Sciences, Inc. (a) | 83,200 | | 5,574,400 |

IDEXX Laboratories, Inc. (a) | 275,470 | | 17,338,082 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

HEALTH CARE - continued |

Biotechnology - continued |

Invitrogen Corp. (a) | 23,800 | | $ 1,713,362 |

Keryx Biopharmaceuticals, Inc. (a) | 44,600 | | 564,636 |

Ligand Pharmaceuticals, Inc. Class B (a) | 124,100 | | 2,156,858 |

Martek Biosciences (a) | 221,700 | | 12,452,889 |

Millennium Pharmaceuticals, Inc. (a) | 692,900 | | 9,562,020 |

ONYX Pharmaceuticals, Inc. (a) | 73,000 | | 3,092,280 |

Pharmion Corp. | 168,900 | | 8,262,588 |

Seattle Genetics, Inc. (a) | 712,300 | | 5,007,469 |

| | 327,351,984 |

Health Care Equipment & Supplies - 6.2% |

Advanced Medical Optics, Inc. (a) | 186,900 | | 7,956,333 |

Advanced Neuromodulation Systems, Inc. (a) | 383,050 | | 12,564,040 |

Alcon, Inc. | 1,126,000 | | 88,559,900 |

American Medical Systems Holdings, Inc. (a) | 169,300 | | 5,705,410 |

Animas Corp. | 3,000 | | 55,950 |

Apogent Technologies, Inc. (a) | 298,600 | | 9,555,200 |

Becton, Dickinson & Co. | 90,800 | | 4,703,440 |

Bio-Rad Laboratories, Inc. Class A (a) | 216,600 | | 12,749,076 |

Biomet, Inc. | 157,150 | | 6,983,746 |

Boston Scientific Corp. (a) | 856,100 | | 36,641,080 |

C.R. Bard, Inc. | 289,800 | | 16,417,170 |

Cooper Companies, Inc. | 146,060 | | 9,226,610 |

Cytyc Corp. (a) | 112,200 | | 2,846,514 |

DENTSPLY International, Inc. | 1,640,962 | | 85,494,120 |

Epix Medical, Inc. (a) | 218,800 | | 4,616,680 |

Fisher Scientific International, Inc. (a) | 183,031 | | 10,570,040 |

Given Imaging Ltd. (a) | 130,400 | | 4,617,464 |

INAMED Corp. (a) | 18,500 | | 1,162,725 |

Integra LifeSciences Holdings Corp. (a) | 262,200 | | 9,247,794 |

Kensey Nash Corp. (a) | 67,300 | | 2,321,850 |

Kinetic Concepts, Inc. | 46,600 | | 2,325,340 |

Kyphon, Inc. (a) | 68,400 | | 1,927,512 |

Medtronic, Inc. | 256,040 | | 12,474,269 |

Nobel Biocare Holding AG (Switzerland) | 33,299 | | 5,223,791 |

Phonak Holding AG | 82,475 | | 2,571,155 |

ResMed, Inc. (a) | 88,600 | | 4,515,056 |

Smith & Nephew PLC | 10,563,461 | | 116,768,497 |

St. Jude Medical, Inc. (a) | 367,576 | | 27,807,124 |

Stryker Corp. | 937,400 | | 51,557,000 |

Synthes, Inc. | 158,918 | | 18,157,151 |

Varian Medical Systems, Inc. (a) | 3,500 | | 277,725 |

Zimmer Holdings, Inc. (a) | 1,470,171 | | 129,669,082 |

| | 705,268,844 |

Health Care Providers & Services - 3.3% |

Aetna, Inc. | 833,700 | | 70,864,500 |

Anthem, Inc. (a) | 79,500 | | 7,120,020 |

Caremark Rx, Inc. (a) | 916,964 | | 30,204,794 |

DaVita, Inc. (a) | 49,800 | | 1,535,334 |

|

| Shares | | Value (Note 1) |

eResearchTechnology, Inc. (a) | 256,024 | | $ 7,168,672 |

Health Management Associates, Inc. Class A | 257,790 | | 5,779,652 |

ICON PLC sponsored ADR (a) | 20,300 | | 892,997 |

Inveresk Research Group, Inc. (a) | 340,500 | | 10,501,020 |

Molina Healthcare, Inc. | 11,000 | | 419,980 |

Omnicare, Inc. | 119,700 | | 5,124,357 |

Patterson Dental Co. (a) | 1,763,102 | | 134,859,672 |

PDI, Inc. (a) | 9,500 | | 288,135 |

Pediatrix Medical Group, Inc. (a) | 61,500 | | 4,295,775 |

ProxyMed, Inc. (a) | 8,100 | | 136,566 |

UnitedHealth Group, Inc. | 1,375,410 | | 85,619,273 |

VCA Antech, Inc. (a) | 4,500 | | 201,690 |

WebMD Corp. (a) | 119,300 | | 1,111,876 |

WellPoint Health Networks, Inc. (a) | 81,400 | | 9,117,614 |

| | 375,241,927 |

Pharmaceuticals - 3.2% |

Altana AG | 166,463 | | 10,035,193 |

AstraZeneca PLC sponsored ADR | 738,800 | | 33,718,832 |

Atherogenics, Inc. (a) | 312,300 | | 5,943,069 |

Cypress Bioscience, Inc. (a) | 304,500 | | 4,180,785 |

Elan Corp. PLC sponsored ADR (a) | 779,900 | | 19,294,726 |

Endo Pharmaceuticals Holdings, Inc. (a) | 5,400 | | 126,630 |

Eon Labs, Inc. (a) | 84,200 | | 3,446,306 |

IVAX Corp. (a) | 215,700 | | 5,174,643 |

Johnson & Johnson | 616,250 | | 34,325,125 |

Kos Pharmaceuticals, Inc. (a) | 211,300 | | 6,966,561 |

Merck & Co., Inc. | 38,200 | | 1,814,500 |

MGI Pharma, Inc. (a) | 116,600 | | 3,149,366 |

Nektar Therapeutics (a) | 61,600 | | 1,229,536 |

Novartis AG sponsored ADR | 681,400 | | 30,322,300 |

Novo Nordisk AS Series B | 1,186,974 | | 61,259,530 |

Pfizer, Inc. | 452,265 | | 15,503,644 |

Roche Holding AG (participation certificate) | 601,598 | | 59,707,181 |

Schering-Plough Corp. | 1,055,200 | | 19,500,096 |

Teva Pharmaceutical Industries Ltd. sponsored ADR | 739,600 | | 49,767,684 |

| | 365,465,707 |

TOTAL HEALTH CARE | | 1,773,328,462 |

INDUSTRIALS - 10.7% |

Aerospace & Defense - 1.1% |

Bombardier, Inc. Class B (sub. vtg.) | 1,207,400 | | 3,638,765 |

Lockheed Martin Corp. | 2,108,535 | | 109,812,503 |

Precision Castparts Corp. | 185,986 | | 10,171,574 |

| | 123,622,842 |

Air Freight & Logistics - 0.9% |

C.H. Robinson Worldwide, Inc. | 1,116,680 | | 51,188,611 |

Dynamex, Inc. (a) | 58,200 | | 809,562 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INDUSTRIALS - continued |

Air Freight & Logistics - continued |

Expeditors International of Washington, Inc. | 48,900 | | $ 2,416,149 |

United Parcel Service, Inc. Class B | 625,600 | | 47,026,352 |

| | 101,440,674 |

Airlines - 1.0% |

ExpressJet Holdings, Inc. Class A (a) | 131,021 | | 1,590,595 |

JetBlue Airways Corp. (a) | 1,366,154 | | 40,137,605 |

Ryanair Holdings PLC sponsored ADR (a) | 2,032,657 | | 66,630,496 |

Southwest Airlines Co. | 404,000 | | 6,775,080 |

| | 115,133,776 |

Building Products - 0.1% |

Lennox International, Inc. | 212,500 | | 3,846,250 |

Masco Corp. | 252,800 | | 7,882,304 |

| | 11,728,554 |

Commercial Services & Supplies - 1.4% |

Apollo Group, Inc. Class A (a) | 589,072 | | 52,009,167 |

Aramark Corp. Class B | 1,062,550 | | 30,558,938 |

Copart, Inc. (a) | 112,100 | | 2,993,070 |

Corporate Executive Board Co. | 4,100 | | 236,939 |

Education Management Corp. (a) | 377,200 | | 12,394,792 |

H&R Block, Inc. | 188,900 | | 9,006,752 |

R.R. Donnelley & Sons Co. | 212,400 | | 7,013,448 |

Resources Connection, Inc. (a) | 125,900 | | 4,923,949 |

Robert Half International, Inc. | 228,500 | | 6,802,445 |

Strayer Education, Inc. | 256,899 | | 28,662,221 |

Universal Technical Institute, Inc. | 78,600 | | 3,141,642 |

| | 157,743,363 |

Construction & Engineering - 0.1% |

Jacobs Engineering Group, Inc. (a) | 305,720 | | 12,039,254 |

Perini Corp. (a) | 305,400 | | 3,258,618 |

| | 15,297,872 |

Electrical Equipment - 0.4% |

Cooper Industries Ltd. Class A | 430,900 | | 25,599,769 |

Roper Industries, Inc. | 210,100 | | 11,954,690 |

Ultralife Batteries, Inc. (a) | 275,400 | | 5,331,744 |

| | 42,886,203 |

Industrial Conglomerates - 3.4% |

3M Co. | 4,028,520 | | 362,607,085 |

Carlisle Companies, Inc. | 21,900 | | 1,363,275 |

Hutchison Whampoa Ltd. | 1,004,000 | | 6,854,407 |

Tyco International Ltd. | 526,300 | | 17,441,582 |

| | 388,266,349 |

Machinery - 2.0% |

Briggs & Stratton Corp. | 102,500 | | 9,055,875 |

Danaher Corp. | 2,509,260 | | 130,105,131 |

Deere & Co. | 92,400 | | 6,480,936 |

IDEX Corp. | 124,500 | | 4,276,575 |

Illinois Tool Works, Inc. | 62,300 | | 5,973,947 |

|

| Shares | | Value (Note 1) |

Ingersoll-Rand Co. Ltd. Class A | 78,500 | | $ 5,362,335 |

Joy Global, Inc. | 367,000 | | 10,987,980 |

Oshkosh Truck Co. | 78,000 | | 4,470,180 |

PACCAR, Inc. | 795,044 | | 46,104,602 |

Volvo AB ADR | 143,100 | | 5,010,074 |

| | 227,827,635 |

Road & Rail - 0.2% |

Dollar Thrifty Automotive Group, Inc. (a) | 3,600 | | 98,784 |

Heartland Express, Inc. | 327,346 | | 8,956,187 |

Knight Transportation, Inc. (a) | 139,810 | | 4,016,741 |

Landstar System, Inc. (a) | 278,412 | | 14,719,642 |

| | 27,791,354 |

Trading Companies & Distributors - 0.1% |

Fastenal Co. | 107,512 | | 6,109,907 |

TOTAL INDUSTRIALS | | 1,217,848,529 |

INFORMATION TECHNOLOGY - 13.1% |

Communications Equipment - 2.5% |

Comverse Technology, Inc. (a) | 112,300 | | 2,239,262 |

Ditech Communications Corp. (a) | 159,900 | | 3,732,066 |

Harris Corp. | 459,000 | | 23,294,250 |

Juniper Networks, Inc. (a) | 649,005 | | 15,946,053 |

Motorola, Inc. | 1,917,100 | | 34,987,075 |

Plantronics, Inc. (a) | 67,300 | | 2,833,330 |

QUALCOMM, Inc. | 1,184,200 | | 86,422,916 |

Research in Motion Ltd. (a) | 695,800 | | 47,598,583 |

Scientific-Atlanta, Inc. | 523,700 | | 18,067,650 |

Telefonaktiebolaget LM Ericsson ADR (a) | 1,485,409 | | 44,443,437 |

| | 279,564,622 |

Computers & Peripherals - 0.4% |

Apple Computer, Inc. (a) | 310,200 | | 10,093,908 |

Dell, Inc. (a) | 838,600 | | 30,038,652 |

PalmOne, Inc. (a) | 98,700 | | 3,431,799 |

Seagate Technology | 21,964 | | 316,941 |

Synaptics, Inc. (a) | 347,569 | | 6,655,946 |

| | 50,537,246 |

Electronic Equipment & Instruments - 0.9% |

Amphenol Corp. Class A (a) | 348,600 | | 11,615,352 |

AU Optronics Corp. sponsored ADR | 24,445 | | 399,431 |

FARO Technologies, Inc. (a) | 65,532 | | 1,682,206 |

Flir Systems, Inc. (a) | 817,300 | | 44,869,770 |

Mettler-Toledo International, Inc. (a) | 15,300 | | 751,842 |

Molex, Inc. | 44,700 | | 1,433,976 |

National Instruments Corp. | 216,457 | | 6,634,407 |

Symbol Technologies, Inc. | 738,700 | | 10,888,438 |

Thermo Electron Corp. (a) | 142,000 | | 4,365,080 |

Waters Corp. (a) | 401,100 | | 19,164,558 |

| | 101,805,060 |

Internet Software & Services - 2.2% |

Akamai Technologies, Inc. (a) | 1,238,283 | | 22,227,180 |

Blue Coat Systems, Inc. (a) | 25,044 | | 838,724 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

INFORMATION TECHNOLOGY - continued |

Internet Software & Services - continued |

iVillage, Inc. (a) | 111,100 | | $ 705,485 |

Lastminute.com PLC (a) | 828,199 | | 2,719,820 |

Open Text Corp. (a) | 218,700 | | 7,000,892 |

Sina Corp. (a) | 185,400 | | 6,116,346 |

Websense, Inc. (a) | 101,442 | | 3,776,686 |

Yahoo!, Inc. (a) | 5,671,396 | | 206,041,817 |

| | 249,426,950 |

IT Services - 1.8% |

Accenture Ltd. Class A (a) | 67,400 | | 1,852,152 |

Alliance Data Systems Corp. (a) | 722,000 | | 30,504,500 |

Anteon International Corp. (a) | 786,600 | | 25,658,892 |

Cognizant Technology Solutions Corp. Class A (a) | 1,508,896 | | 38,341,047 |

CSG Systems International, Inc. (a) | 85,800 | | 1,776,060 |

First Data Corp. | 646,600 | | 28,786,632 |

Infosys Technologies Ltd. sponsored ADR | 400,000 | | 37,108,000 |

Iron Mountain, Inc. (a) | 271,200 | | 13,088,112 |

SRA International, Inc. Class A (a) | 392,900 | | 16,627,528 |

The BISYS Group, Inc. (a) | 623,100 | | 8,760,786 |

| | 202,503,709 |

Office Electronics - 0.1% |

Canon, Inc. | 88,500 | | 4,725,900 |

Zebra Technologies Corp. Class A (a) | 96,780 | | 8,419,860 |

| | 13,145,760 |

Semiconductors & Semiconductor Equipment - 4.0% |

Analog Devices, Inc. | 1,662,500 | | 78,270,500 |

ATI Technologies, Inc. (a) | 215,500 | | 4,064,757 |

Cree, Inc. (a) | 122,200 | | 2,844,816 |

Intel Corp. | 100,300 | | 2,768,280 |

International Rectifier Corp. (a) | 969,100 | | 40,140,122 |

Linear Technology Corp. | 252,500 | | 9,966,175 |

Marvell Technology Group Ltd. (a) | 3,421,200 | | 91,346,040 |

Microchip Technology, Inc. | 67,300 | | 2,122,642 |

National Semiconductor Corp. (a) | 379,200 | | 8,338,608 |

Pixelworks, Inc. (a) | 89,600 | | 1,372,672 |

Samsung Electronics Co. Ltd. | 351,340 | | 145,161,726 |

Sigmatel, Inc. | 171,988 | | 4,997,971 |

Silicon Laboratories, Inc. (a) | 1,287,646 | | 59,682,392 |

Tundra Semiconductor Corp. Ltd. (a)(c) | 35,300 | | 602,050 |

| | 451,678,751 |

Software - 1.2% |

Adobe Systems, Inc. | 442,289 | | 20,566,439 |

Altiris, Inc. (a) | 761,839 | | 21,034,375 |

Autodesk, Inc. | 356,500 | | 15,261,765 |

Electronic Arts, Inc. (a) | 107,900 | | 5,885,945 |

FileNET Corp. (a) | 132,468 | | 4,182,015 |

Kronos, Inc. (a) | 235,692 | | 9,710,510 |

Macrovision Corp. (a) | 32,400 | | 810,972 |

Magma Design Automation, Inc. (a) | 123,011 | | 2,365,502 |

Merge Technologies, Inc. (a) | 350,000 | | 5,120,500 |

|

| Shares | | Value (Note 1) |

Microsoft Corp. | 184,600 | | $ 5,272,176 |

Quality Systems, Inc. (a) | 26,391 | | 1,295,534 |

Red Hat, Inc. (a) | 228,067 | | 5,238,699 |

SAP AG sponsored ADR | 56,100 | | 2,345,541 |

Sonic Solutions, Inc. (a) | 561,999 | | 11,942,479 |

Symantec Corp. (a) | 639,303 | | 27,988,685 |

Ultimate Software Group, Inc. (a) | 3,225 | | 32,573 |

| | 139,053,710 |

TOTAL INFORMATION TECHNOLOGY | | 1,487,715,808 |

MATERIALS - 4.6% |

Chemicals - 0.8% |

Ecolab, Inc. | 1,673,700 | | 53,056,290 |

Methanex Corp. | 378,200 | | 5,018,472 |

Potash Corp. of Saskatchewan | 204,700 | | 19,704,236 |

Sinopec Shanghai Petrochemical Co. Ltd. sponsored ADR | 134,500 | | 4,464,055 |

The Scotts Co. Class A (a) | 94,000 | | 6,004,720 |

Valspar Corp. | 58,400 | | 2,942,776 |

| | 91,190,549 |

Construction Materials - 0.1% |

Eagle Materials, Inc. | 101,700 | | 7,222,734 |

Containers & Packaging - 0.0% |

Ball Corp. | 84,152 | | 6,063,152 |

Peak International Ltd. (a) | 200,000 | | 1,000,000 |

| | 7,063,152 |

Metals & Mining - 3.6% |

Aber Diamond Corp. (a) | 389,750 | | 11,585,267 |

Anglo American PLC ADR | 916,572 | | 19,128,858 |

Apex Silver Mines Ltd. (a) | 550,100 | | 9,379,205 |

Companhia Vale do Rio Doce sponsored ADR | 142,200 | | 6,761,610 |

Compania de Minas Buenaventura SA sponsored ADR | 1,374,300 | | 30,372,030 |

First Quantum Minerals Ltd. (a) | 279,500 | | 2,964,934 |

Freeport-McMoRan Copper & Gold, Inc. Class B | 1,584,234 | | 52,517,357 |

Gabriel Resources Ltd. (a) | 2,171,800 | | 2,100,324 |

Glamis Gold Ltd. (a) | 1,630,200 | | 28,658,962 |

Goldcorp, Inc. | 4,126,566 | | 48,167,503 |

International Steel Group, Inc. (a) | 156,100 | | 4,643,975 |

IPSCO, Inc. | 221,200 | | 4,988,152 |

Ivanhoe Mines Ltd. (a) | 734,200 | | 3,962,996 |

Ivanhoe Mines Ltd. warrants 12/19/05 (a) | 198,450 | | 148,774 |

Newcrest Mining Ltd. | 769,500 | | 7,411,463 |

Newmont Mining Corp. | 2,600,351 | | 100,789,605 |

Novagold Resources, Inc. (a) | 778,300 | | 3,600,053 |

Nucor Corp. | 155,800 | | 11,959,208 |

Peabody Energy Corp. | 44,900 | | 2,513,951 |

POSCO sponsored ADR | 67,200 | | 2,251,872 |

Common Stocks - continued |

| Shares | | Value (Note 1) |

MATERIALS - continued |

Metals & Mining - continued |

Rio Tinto PLC (Reg.) | 2,299,187 | | $ 56,358,821 |

SouthernEra Resources Ltd. (a) | 558,200 | | 1,527,423 |

| | 411,792,343 |

Paper & Forest Products - 0.1% |

Sappi Ltd. | 584,877 | | 9,002,495 |

TOTAL MATERIALS | | 526,271,273 |

TELECOMMUNICATION SERVICES - 3.8% |

Diversified Telecommunication Services - 0.1% |

PT Indosat Tbk | 3,790,000 | | 1,622,846 |

PT Indosat Tbk sponsored ADR | 126,600 | | 2,683,920 |

PT Telkomunikasi Indonesia Tbk sponsored ADR | 54,600 | | 849,030 |

| | 5,155,796 |

Wireless Telecommunication Services - 3.7% |

America Movil SA de CV sponsored ADR | 1,606,100 | | 58,413,857 |

KDDI Corp. | 1,548 | | 8,982,298 |

mmO2 PLC (a) | 2,313,919 | | 3,904,723 |

Mobile TeleSystems OJSC sponsored ADR | 107,500 | | 13,115,000 |

MTN Group Ltd. (a) | 447,300 | | 2,072,011 |

Nextel Communications, Inc. Class A (a) | 5,373,200 | | 143,249,512 |

Nextel Partners, Inc. Class A (a) | 2,217,700 | | 35,305,784 |

NII Holdings, Inc. (a) | 886,253 | | 29,857,864 |

Telesystem International Wireless, Inc. (a) | 1,197,700 | | 11,789,340 |

Vimpel Communications sponsored ADR (a) | 561,300 | | 54,137,385 |

Vodafone Group PLC sponsored ADR | 2,508,500 | | 55,437,850 |

Western Wireless Corp. Class A (a) | 299,500 | | 8,658,545 |

| | 424,924,169 |

TOTAL TELECOMMUNICATION SERVICES | | 430,079,965 |

UTILITIES - 0.2% |

Electric Utilities - 0.2% |

Entergy Corp. | 44,800 | | 2,509,248 |

Exelon Corp. | 78,500 | | 2,613,265 |

PG&E Corp. (a) | 326,800 | | 9,130,792 |

| | 14,253,305 |

|

| Shares | | Value (Note 1) |

Multi-Utilities & Unregulated Power - 0.0% |

AES Corp. (a) | 224,800 | | $ 2,232,264 |

TOTAL UTILITIES | | 16,485,569 |

TOTAL COMMON STOCKS (Cost $7,082,774,748) | 10,072,614,738 |

Convertible Preferred Stocks - 0.3% |

| | | |

FINANCIALS - 0.2% |

Diversified Financial Services - 0.2% |

Xerox Capital Trust II 7.50% (c) | 199,600 | | 16,250,434 |

UTILITIES - 0.1% |

Electric Utilities - 0.1% |

TXU Corp. 8.75% | 342,400 | | 16,221,200 |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $25,156,569) | 32,471,634 |

Convertible Bonds - 0.2% |

| Principal Amount | | |

CONSUMER DISCRETIONARY - 0.1% |

Leisure Equipment & Products - 0.1% |

Eastman Kodak Co. 3.375% 10/15/33 | | $ 8,080,000 | | 8,913,533 |

FINANCIALS - 0.0% |

Diversified Financial Services - 0.0% |

Tyco International Group SA yankee 3.125% 1/15/23 | | 3,140,000 | | 5,077,694 |

INFORMATION TECHNOLOGY - 0.0% |

Software - 0.0% |

Red Hat, Inc. 0.5% 1/15/24 (c) | | 2,890,000 | | 3,262,232 |

TELECOMMUNICATION SERVICES - 0.1% |

Wireless Telecommunication Services - 0.1% |

Nextel Communications, Inc. 5.25% 1/15/10 | | 9,860,000 | | 9,564,200 |

UTILITIES - 0.0% |

Multi-Utilities & Unregulated Power - 0.0% |

AES Corp. 4.5% 8/15/05 | | 2,280,000 | | 2,258,842 |

TOTAL CONVERTIBLE BONDS (Cost $24,942,361) | 29,076,501 |

U.S. Treasury Obligations - 0.9% |

|

U.S. Treasury Bills, yield at date of purchase 1.03% to 1.25% 8/5/04 to 9/9/04 (d) | | 4,450,000 | | 4,443,066 |

U.S. Treasury Notes: | | | | |

4.25% 8/15/13 | | 45,275,000 | | 44,196,187 |

U.S. Treasury Obligations - continued |

| Principal Amount | | Value

(Note 1) |

U.S. Treasury Notes: - continued | | | | |

4.25% 11/15/13 | | $ 44,850,000 | | $ 43,653,402 |

4.75% 5/15/14 | | 11,100,000 | | 11,215,773 |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $103,084,440) | 103,508,428 |

Money Market Funds - 11.1% |

| Shares | | |

Fidelity Cash Central Fund, 1.16% (b) | 1,084,006,645 | | 1,084,006,645 |

Fidelity Securities Lending Cash Central Fund, 1.18% (b) | 174,634,350 | | 174,634,350 |

TOTAL MONEY MARKET FUNDS (Cost $1,258,640,995) | 1,258,640,995 |

TOTAL INVESTMENT

PORTFOLIO - 101.2% (Cost $8,494,599,113) | | 11,496,312,296 |

NET OTHER ASSETS - (1.2)% | | (138,669,954) |

NET ASSETS - 100% | $ 11,357,642,342 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value | | Unrealized Appreciation/(Depreciation) |

Purchased |

Equity Index Contracts |

290 S&P 500 Index Contracts | Sept. 2004 | | $ 82,679,000 | | $ 509,261 |

|

The face value of futures purchased as a percentage of net assets - 0.7% |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent fiscal year end is available upon request. |

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $27,258,916 or 0.2% of net assets. |

(d) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At the period end, the value of securities pledged amounted to $4,443,066. |

Other Information |

Purchases and sales of securities, other than short-term securities, aggregated $3,388,126,570 and $3,703,885,524, respectively, of which long-term U.S. government and government agency obligations aggregated $94,595,435 and $0, respectively. |

The fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $186,808 for the period. |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 78.5% |

United Kingdom | 4.2% |

Canada | 3.8% |

Bermuda | 3.4% |

Switzerland | 1.7% |

Korea (South) | 1.4% |

Others (individually less than 1%) | 7.0% |

| 100.0% |

Income Tax Information |

At December 31, 2003, the fund had a capital loss carryforward of approximately $1,251,202,000 of which $587,643,000 and $663,559,000 will expire on December 31, 2009 and 2010, respectively. |

See accompanying notes which are an integral part of the financial statements.

Contrafund Portfolio

Fidelity Variable Insurance Products: Contrafund Portfolio

Financial Statements

Statement of Assets and Liabilities

| June 30, 2004 (Unaudited) |

Assets | | |

Investment in securities, at value (including securities loaned of $171,231,021) (cost $8,494,599,113) - See accompanying schedule | | $ 11,496,312,296 |

Foreign currency held at value (cost $2,384,676) | | 2,374,071 |

Receivable for investments sold | | 110,123,678 |

Receivable for fund shares sold | | 6,516,476 |

Dividends receivable | | 6,453,628 |

Interest receivable | | 2,421,925 |

Receivable for daily variation on futures contracts | | 327,320 |

Prepaid expenses | | 21,567 |

Other affiliated receivables | | 10,079 |

Other receivables | | 663,045 |

Total assets | | 11,625,224,085 |

Liabilities | | |

Payable to custodian bank | $ 6,650,608 | |

Payable for investments purchased | 74,208,981 | |

Payable for fund shares redeemed | 5,346,533 | |

Accrued management fee | 5,331,005 | |

Distribution fees payable | 399,193 | |

Other affiliated payables | 807,147 | |

Other payables and accrued expenses | 203,926 | |

Collateral on securities loaned, at value | 174,634,350 | |

Total liabilities | | 267,581,743 |

| | |

Net Assets | | $ 11,357,642,342 |

Net Assets consist of: | | |

Paid in capital | | $ 9,290,135,986 |

Undistributed net investment income | | 9,942,995 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (944,694,491) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 3,002,257,852 |

Net Assets | | $ 11,357,642,342 |

Initial Class:

Net Asset Value, offering price and redemption price per share ($8,252,118,332 ÷ 336,708,072 shares) | | $ 24.51 |

Service Class:

Net Asset Value, offering price and redemption price per share ($1,876,991,551 ÷ 76,796,299 shares) | | $ 24.44 |

Service Class 2:

Net Asset Value, offering price and redemption price per share ($1,223,702,743 ÷ 50,377,642 shares) | | $ 24.29 |

Service Class 2R:

Net Asset Value, offering price and redemption price per share ($4,829,716 ÷ 199,254 shares) | | $ 24.24 |

Statement of Operations

| Six months ended June 30, 2004 (Unaudited) |

Investment Income | | |

Dividends | | $ 44,902,493 |

Interest | | 4,989,511 |

Security lending | | 915,268 |

Total income | | 50,807,272 |

| | |

Expenses | | |

Management fee | $ 30,992,384 | |

Transfer agent fees | 3,565,511 | |

Distribution fees | 2,216,864 | |

Accounting and security lending fees | 720,177 | |

Non-interested trustees' compensation | 25,194 | |

Appreciation in deferred trustee compensation account | 5,580 | |

Custodian fees and expenses | 399,749 | |

Registration fees | 18,266 | |

Audit | 47,825 | |

Legal | 9,583 | |

Miscellaneous | 257,075 | |

Total expenses before reductions | 38,258,208 | |

Expense reductions | (1,235,006) | 37,023,202 |

Net investment income (loss) | | 13,784,070 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities | 327,273,824 | |

Foreign currency transactions | 65,660 | |

Futures contracts | 3,772,229 | |

Total net realized gain (loss) | | 331,111,713 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 312,539,377 | |

Assets and liabilities in foreign currencies | (419,241) | |

Futures contracts | (229,874) | |

Total change in net unrealized appreciation (depreciation) | | 311,890,262 |

Net gain (loss) | | 643,001,975 |

Net increase (decrease) in net assets resulting from operations | | $ 656,786,045 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Variable Insurance Products: Contrafund Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended

June 30, 2004

(Unaudited) | Year ended

December 31,

2003 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 13,784,070 | $ 25,801,059 |

Net realized gain (loss) | 331,111,713 | 98,601,973 |

Change in net unrealized appreciation (depreciation) | 311,890,262 | 2,069,862,306 |

Net increase (decrease) in net assets resulting from operations | 656,786,045 | 2,194,265,338 |

Distributions to shareholders from net investment income | (33,283,266) | (35,507,037) |

Share transactions - net increase (decrease) | 460,202,304 | 535,497,703 |

Redemption fees | 269 | 3,718 |

Total increase (decrease) in net assets | 1,083,705,352 | 2,694,259,722 |

| | |

Net Assets | | |

Beginning of period | 10,273,936,990 | 7,579,677,268 |

End of period (including undistributed net investment income of $9,942,995 and undistributed net investment income of $23,673,410, respectively) | $ 11,357,642,342 | $ 10,273,936,990 |

Other Information: | | | | |

Share Transactions | Six months ended June 30, 2004 (Unaudited) |

| Initial Class | Service Class | Service Class 2 | Service Class 2R |

Shares Sold | 20,375,470 | 7,094,717 | 13,297,245 | 106,622 |

Reinvested | 1,123,479 | 189,967 | 89,389 | 356 |

Redeemed | (16,161,030) | (4,007,536) | (2,714,165) | (25,836) |

Net increase (decrease) | 5,337,919 | 3,277,148 | 10,672,469 | 81,142 |

Dollars Sold | $ 483,651,274 | $ 168,039,230 | $ 313,208,333 | $ 2,505,134 |

Reinvested | 26,671,383 | 4,498,414 | 2,105,112 | 8,357 |

Redeemed | (382,126,790) | (94,109,992) | (63,640,792) | (607,359) |

Net increase (decrease) | $ 128,195,867 | $ 78,427,652 | $ 251,672,653 | $ 1,906,132 |

Share Transactions | Year ended December 31, 2003 |

| Initial Class | Service Class | Service Class 2 | Service Class 2R |

Shares Sold | 43,575,507 | 16,391,007 | 21,425,743 | 119,703 |

Reinvested | 1,718,846 | 269,021 | 92,062 | 161 |

Redeemed | (43,003,502) | (8,751,544) | (6,273,261) | (46,848) |

Net increase (decrease) | 2,290,851 | 7,908,484 | 15,244,544 | 73,016 |

Dollars Sold | $ 877,441,120 | $ 326,586,457 | $ 422,566,799 | $ 2,529,458 |

Reinvested | 29,357,892 | 4,584,117 | 1,562,295 | 2,733 |

Redeemed | (837,322,380) | (169,383,155) | (121,521,459) | (906,174) |

Net increase (decrease) | $ 69,476,632 | $ 161,787,419 | $ 302,607,635 | $ 1,626,017 |

Distributions | Six months ended June 30, 2004 (Unaudited) |

| Initial Class | Service Class | Service Class 2 | Service Class 2R |

From net investment income | $ 26,671,383 | $ 4,498,414 | $ 2,105,112 | $ 8,357 |

| Year ended December 31, 2003 |

| Initial Class | Service Class | Service Class 2 | Service Class 2R |

From net investment income | $ 29,357,892 | $ 4,584,117 | $ 1,562,295 | $ 2,733 |

See accompanying notes which are an integral part of the financial statements.

Contrafund Portfolio

Financial Highlights - Initial Class

| Six months ended

June 30, 2004 | Years ended December 31, |

| (Unaudited) | 2003 | 2002 | 2001 | 2000 | 1999 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 23.13 | $ 18.10 | $ 20.13 | $ 23.75 | $ 29.15 | $ 24.44 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .04 | .07 | .10 | .16 | .17 | .12 |

Net realized and unrealized gain (loss) | 1.42 | 5.05 | (1.97) | (3.01) | (1.84) | 5.59 |

Total from investment operations | 1.46 | 5.12 | (1.87) | (2.85) | (1.67) | 5.71 |

Distributions from net investment income | (.08) | (.09) | (.16) | (.17) | (.11) | (.12) |

Distributions from net realized gain | - | - | - | (.60) | (3.62) | (.88) |

Total distributions | (.08) | (.09) | (.16) | (.77) | (3.73) | (1.00) |

Redemption fees added to paid in capital E, G | - | - | - | - | - | - |

Net asset value, end of period | $ 24.51 | $ 23.13 | $ 18.10 | $ 20.13 | $ 23.75 | $ 29.15 |

Total Return B, C, D | 6.32% | 28.46% | (9.35)% | (12.28)% | (6.58)% | 24.25% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | .67% A | .67% | .68% | .68% | .66% | .67% |

Expenses net of voluntary waivers, if any | .67% A | .67% | .68% | .68% | .66% | .67% |

Expenses net of all reductions | .65% A | .65% | .64% | .64% | .63% | .65% |

Net investment income (loss) | .30% A | .34% | .50% | .77% | .69% | .48% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 8,252,118 | $ 7,665,424 | $ 5,956,028 | $ 6,972,615 | $ 8,516,464 | $ 9,005,129 |

Portfolio turnover rate | 67% A | 66% | 84% | 140% | 177% | 172% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share.

Financial Highlights - Service Class

| Six months ended

June 30, 2004 | Years ended December 31, |

| (Unaudited) | 2003 | 2002 | 2001 | 2000 | 1999 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 23.06 | $ 18.04 | $ 20.06 | $ 23.67 | $ 29.10 | $ 24.42 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .02 | .05 | .08 | .14 | .15 | .10 |

Net realized and unrealized gain (loss) | 1.42 | 5.04 | (1.96) | (3.00) | (1.85) | 5.58 |

Total from investment operations | 1.44 | 5.09 | (1.88) | (2.86) | (1.70) | 5.68 |

Distributions from net investment income | (.06) | (.07) | (.14) | (.15) | (.11) | (.12) |

Distributions from net realized gain | - | - | - | (.60) | (3.62) | (.88) |

Total distributions | (.06) | (.07) | (.14) | (.75) | (3.73) | (1.00) |

Redemption fees added to paid in capital E, G | - | - | - | - | - | - |

Net asset value, end of period | $ 24.44 | $ 23.06 | $ 18.04 | $ 20.06 | $ 23.67 | $ 29.10 |

Total Return B, C, D | 6.25% | 28.35% | (9.42)% | (12.36)% | (6.71)% | 24.15% |

Ratios to Average Net Assets F | | | | | | |

Expenses before expense reductions | .77% A | .77% | .78% | .78% | .76% | .78% |

Expenses net of voluntary waivers, if any | .77% A | .77% | .78% | .78% | .76% | .78% |

Expenses net of all reductions | .75% A | .75% | .74% | .74% | .74% | .75% |

Net investment income (loss) | .20% A | .24% | .39% | .67% | .59% | .37% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 1,876,992 | $ 1,695,467 | $ 1,183,683 | $ 1,201,105 | $ 1,245,222 | $ 775,216 |

Portfolio turnover rate | 67% A | 66% | 84% | 140% | 177% | 172% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Service Class 2

| Six months ended

June 30, 2004 | Years ended December 31, |

| (Unaudited) | 2003 | 2002 | 2001 | 2000 F |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 22.93 | $ 17.95 | $ 20.00 | $ 23.64 | $ 28.20 |

Income from Investment Operations | | | | | |

Net investment income (loss) E | .01 | .02 | .05 | .10 | .10 |

Net realized and unrealized gain (loss) | 1.40 | 5.02 | (1.96) | (2.98) | (.93) |

Total from investment operations | 1.41 | 5.04 | (1.91) | (2.88) | (.83) |

Distributions from net investment income | (.05) | (.06) | (.14) | (.16) | (.11) |

Distributions from net realized gain | - | - | - | (.60) | (3.62) |

Total distributions | (.05) | (.06) | (.14) | (.76) | (3.73) |

Redemption fees added to paid in capital E, H | - | - | - | - | - |

Net asset value, end of period | $ 24.29 | $ 22.93 | $ 17.95 | $ 20.00 | $ 23.64 |

Total Return B, C, D | 6.16% | 28.20% | (9.60)% | (12.47)% | (3.86)% |

Ratios to Average Net Assets G | | | | | |

Expenses before expense reductions | .92% A | .93% | .93% | .94% | .92% A |

Expenses net of voluntary waivers, if any | .92% A | .93% | .93% | .94% | .92% A |

Expenses net of all reductions | .90% A | .90% | .90% | .90% | .90% A |

Net investment income (loss) | .04% A | .09% | .24% | .52% | .43% A |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,223,703 | $ 910,341 | $ 439,157 | $ 231,686 | $ 81,950 |

Portfolio turnover rate | 67% A | 66% | 84% | 140% | 177% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F For the period January 12, 2000 (commencement of sale of shares) to December 31, 2000. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share.

Financial Highlights - Service Class 2R

| Six months ended

June 30, 2004 | Years ended December 31, |

| (Unaudited) | 2003 | 2002 F |

Selected Per-Share Data | | | |

Net asset value, beginning of period | $ 22.90 | $ 17.95 | $ 20.49 |

Income from Investment Operations | | | |

Net investment income (loss) E | .01 | .02 | .03 |

Net realized and unrealized gain (loss) | 1.40 | 5.01 | (2.57) |

Total from investment operations | 1.41 | 5.03 | (2.54) |

Distributions from net investment income | (.07) | (.08) | - |

Redemption fees added to paid in capital E, H | - | - | - |

Net asset value, end of period | $ 24.24 | $ 22.90 | $ 17.95 |

Total Return B, C, D | 6.17% | 28.18% | (12.40)% |

Ratios to Average Net Assets G | | | |

Expenses before expense reductions | .92% A | .93% | .96% A |

Expenses net of voluntary waivers, if any | .92% A | .93% | .96% A |

Expenses net of all reductions | .90% A | .90% | .92% A |

Net investment income (loss) | .05% A | .08% | .23% A |

Supplemental Data | | | |

Net assets, end of period (000 omitted) | $ 4,830 | $ 2,705 | $ 810 |

Portfolio turnover rate | 67% A | 66% | 84% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns do not reflect charges attributable to your insurance company's separate account. Inclusion of these charges would reduce the total returns shown. D Total returns would have been lower had certain expenses not been reduced during the periods shown. E Calculated based on average shares outstanding during the period. F For the period April 24, 2002 (commencement of sale of shares) to December 31, 2002. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Contrafund Portfolio

Fidelity Variable Insurance Products: Equity-Income Portfolio

Investment Summary

Top Five Stocks as of June 30, 2004 |

| % of fund's net assets |

Bank of America Corp. | 3.0 |

Exxon Mobil Corp. | 2.9 |

Citigroup, Inc. | 2.7 |

American International Group, Inc. | 2.6 |

Fannie Mae | 1.9 |

| 13.1 |

Top Five Market Sectors as of June 30, 2004 |

| % of fund's net assets |

Financials | 30.2 |

Industrials | 12.6 |

Consumer Discretionary | 10.9 |

Energy | 10.9 |

Health Care | 8.0 |

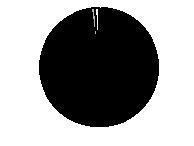

Asset Allocation as of June 30, 2004 |

% of fund's net assets* |

| Stocks | 99.2% | |

| Bonds | 0.6% | |

| Short-Term

Investments and

Net Other Assets | 0.2% | |

* Foreign investments | 12.0% | |

Semiannual Report

Fidelity Variable Insurance Products: Equity-Income Portfolio

Investments June 30, 2004 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 97.9% |

| Shares | | Value

(Note 1) |

CONSUMER DISCRETIONARY - 10.3% |

Auto Components - 0.1% |

TRW Automotive Holdings Corp. | 611,370 | | $ 11,524,325 |

Automobiles - 0.5% |

DaimlerChrysler AG | 385,800 | | 18,159,606 |

Toyota Motor Corp. ADR | 475,900 | | 38,842,958 |

| | 57,002,564 |

Hotels, Restaurants & Leisure - 1.3% |

Caesars Entertainment, Inc. (a) | 2,730,500 | | 40,957,500 |

McDonald's Corp. | 2,561,300 | | 66,593,800 |

MGM MIRAGE (a) | 446,670 | | 20,966,690 |

Six Flags, Inc. (a) | 1,408,356 | | 10,224,665 |

| | 138,742,655 |

Household Durables - 1.0% |

LG Electronics, Inc. | 237,410 | | 11,269,009 |

Maytag Corp. | 687,020 | | 16,838,860 |

Newell Rubbermaid, Inc. | 1,763,100 | | 41,432,850 |

Sony Corp. sponsored ADR | 587,200 | | 22,342,960 |

Whirlpool Corp. | 128,200 | | 8,794,520 |

| | 100,678,199 |

Media - 5.3% |

Clear Channel Communications, Inc. | 2,650,100 | | 97,921,195 |

Comcast Corp. Class A (a) | 2,852,091 | | 79,944,111 |

Liberty Media Corp. Class A (a) | 3,755,576 | | 33,762,628 |

Liberty Media International, Inc.

Class A (a) | 187,778 | | 6,966,564 |

The Reader's Digest Association, Inc. (non-vtg.) | 1,243,903 | | 19,890,009 |

Time Warner, Inc. (a) | 7,114,850 | | 125,079,063 |

Viacom, Inc. Class B (non-vtg.) | 3,377,818 | | 120,655,659 |

Vivendi Universal SA sponsored ADR (a) | 1,039,500 | | 29,002,050 |

Walt Disney Co. | 1,993,500 | | 50,814,315 |

| | 564,035,594 |

Multiline Retail - 0.3% |

Big Lots, Inc. (a) | 1,141,556 | | 16,506,903 |

Sears, Roebuck & Co. | 452,700 | | 17,093,952 |

| | 33,600,855 |

Specialty Retail - 1.6% |

Abercrombie & Fitch Co. Class A | 979,400 | | 37,951,750 |

American Eagle Outfitters, Inc. (a) | 626,000 | | 18,097,660 |

Gap, Inc. | 1,541,200 | | 37,374,100 |

Limited Brands, Inc. | 2,197,300 | | 41,089,510 |

Office Depot, Inc. (a) | 813,000 | | 14,560,830 |

Toys 'R' Us, Inc. (a) | 1,295,900 | | 20,643,687 |

| | 169,717,537 |

Textiles Apparel & Luxury Goods - 0.2% |

Liz Claiborne, Inc. | 632,940 | | 22,773,181 |

TOTAL CONSUMER DISCRETIONARY | | 1,098,074,910 |

|

| Shares | | Value

(Note 1) |

CONSUMER STAPLES - 6.1% |

Beverages - 0.4% |

Anheuser-Busch Companies, Inc. | 844,800 | | $ 45,619,200 |

Food & Staples Retailing - 0.7% |

Albertsons, Inc. | 442,100 | | 11,733,334 |

CVS Corp. | 1,469,900 | | 61,765,198 |

| | 73,498,532 |

Food Products - 1.2% |

Campbell Soup Co. | 612,900 | | 16,474,752 |

Fresh Del Monte Produce, Inc. | 242,988 | | 6,140,307 |

H.J. Heinz Co. | 281,120 | | 11,019,904 |

Hormel Foods Corp. | 186,000 | | 5,784,600 |

Interstate Bakeries Corp. | 563,995 | | 6,119,346 |

Kellogg Co. | 194,900 | | 8,156,565 |

Kraft Foods, Inc. Class A | 943,100 | | 29,877,408 |

Unilever PLC sponsored ADR | 1,307,000 | | 51,979,390 |

| | 135,552,272 |

Household Products - 2.1% |

Colgate-Palmolive Co. | 1,705,300 | | 99,674,785 |

Kimberly-Clark Corp. | 1,273,400 | | 83,891,592 |

Procter & Gamble Co. | 710,400 | | 38,674,176 |

| | 222,240,553 |

Personal Products - 0.9% |

Gillette Co. | 2,332,620 | | 98,903,088 |

Tobacco - 0.8% |

Altria Group, Inc. | 1,562,800 | | 78,218,140 |

Loews Corp. - Carolina Group | 171,550 | | 4,211,553 |

| | 82,429,693 |

TOTAL CONSUMER STAPLES | | 658,243,338 |

ENERGY - 10.9% |

Energy Equipment & Services - 2.5% |

Baker Hughes, Inc. | 1,538,300 | | 57,916,995 |

BJ Services Co. (a) | 570,145 | | 26,135,447 |

Halliburton Co. | 583,400 | | 17,653,684 |

Noble Corp. (a) | 930,100 | | 35,241,489 |

Schlumberger Ltd. (NY Shares) | 1,996,600 | | 126,804,066 |

| | 263,751,681 |

Oil & Gas - 8.4% |

Apache Corp. | 647,780 | | 28,210,819 |

BP PLC sponsored ADR | 2,491,842 | | 133,487,976 |

ChevronTexaco Corp. | 1,270,071 | | 119,526,382 |

Exxon Mobil Corp. | 7,103,336 | | 315,459,152 |

Royal Dutch Petroleum Co.

(NY Shares) | 1,143,000 | | 59,058,810 |

Common Stocks - continued |

| Shares | | Value

(Note 1) |

ENERGY - continued |

Oil & Gas - continued |

Total SA: | | | |

Series B | 391,400 | | $ 75,211,424 |

sponsored ADR | 1,697,996 | | 163,143,456 |

YUKOS Corp. sponsored ADR | 248,400 | | 7,899,120 |

| | 901,997,139 |

TOTAL ENERGY | | 1,165,748,820 |

FINANCIALS - 29.5% |

Capital Markets - 6.0% |

Bank of New York Co., Inc. | 3,223,100 | | 95,016,988 |

Charles Schwab Corp. | 6,391,400 | | 61,421,354 |

Credit Suisse Group sponsored ADR | 735,200 | | 26,327,512 |

J.P. Morgan Chase & Co. | 3,654,550 | | 141,686,904 |

Janus Capital Group, Inc. | 2,332,400 | | 38,461,276 |

LaBranche & Co., Inc. | 517,900 | | 4,360,718 |

Mellon Financial Corp. | 1,716,500 | | 50,344,945 |

Merrill Lynch & Co., Inc. | 1,674,300 | | 90,378,714 |

Morgan Stanley | 2,066,900 | | 109,070,313 |

Nomura Holdings, Inc. | 1,853,000 | | 27,702,350 |

| | 644,771,074 |

Commercial Banks - 8.6% |

Bank of America Corp. | 3,827,984 | | 323,923,982 |

Bank One Corp. | 2,714,138 | | 138,421,038 |

Banknorth Group, Inc. | 339,400 | | 11,023,712 |

Comerica, Inc. | 730,200 | | 40,073,376 |

Huntington Bancshares, Inc. | 387,200 | | 8,866,880 |

Lloyds TSB Group PLC | 2,282,400 | | 17,928,844 |

PNC Financial Services Group, Inc. | 226,500 | | 12,022,620 |

Royal Bank of Scotland Group PLC | 325,447 | | 9,402,838 |

State Bank of India | 463,175 | | 4,544,908 |

Sumitomo Mitsui Financial Group, Inc. | 5,917 | | 41,156,180 |

U.S. Bancorp, Delaware | 2,754,538 | | 75,915,067 |

Wachovia Corp. | 2,359,675 | | 105,005,538 |

Wells Fargo & Co. | 2,243,800 | | 128,412,674 |

| | 916,697,657 |

Consumer Finance - 1.2% |

American Express Co. | 1,687,496 | | 86,703,544 |

MBNA Corp. | 1,456,400 | | 37,560,556 |

| | 124,264,100 |

Diversified Financial Services - 3.1% |

CIT Group, Inc. | 1,191,400 | | 45,618,706 |

Citigroup, Inc. | 6,273,619 | | 291,723,284 |

| | 337,341,990 |

Insurance - 7.7% |

ACE Ltd. | 2,113,415 | | 89,355,186 |

Allianz AG sponsored ADR | 567,200 | | 6,210,840 |

Allstate Corp. | 2,488,000 | | 115,816,400 |

American International Group, Inc. | 3,964,650 | | 282,600,252 |

|

| Shares | | Value

(Note 1) |

Assurant, Inc. | 274,700 | | $ 7,246,586 |

Conseco, Inc. (a) | 672,100 | | 13,374,790 |

Fondiaria-Sai Spa | 541,144 | | 12,088,179 |

Genworth Financial, Inc. Class A | 1,295,800 | | 29,738,610 |

Hartford Financial Services Group, Inc. | 1,334,400 | | 91,726,656 |

Marsh & McLennan Companies, Inc. | 368,000 | | 16,699,840 |

Muenchener Rueckversicherungs-Gesellschaft AG (Reg.) | 123,914 | | 13,465,283 |

Old Republic International Corp. | 530,996 | | 12,595,225 |

St. Paul Travelers Companies, Inc. | 2,029,026 | | 82,256,714 |

The Chubb Corp. | 634,000 | | 43,226,120 |

UnumProvident Corp. | 680,100 | | 10,813,590 |

| | 827,214,271 |

Real Estate - 0.1% |

CarrAmerica Realty Corp. | 193,740 | | 5,856,760 |

Thrifts & Mortgage Finance - 2.8% |

Fannie Mae | 2,926,100 | | 208,806,496 |

Freddie Mac | 717,900 | | 45,443,070 |

Housing Development Finance Corp. Ltd. | 1,133,500 | | 12,748,947 |

MGIC Investment Corp. | 218,200 | | 16,552,652 |

Sovereign Bancorp, Inc. | 864,250 | | 19,099,925 |

| | 302,651,090 |

TOTAL FINANCIALS | | 3,158,796,942 |

HEALTH CARE - 7.9% |

Health Care Equipment & Supplies - 1.1% |

Baxter International, Inc. | 3,196,100 | | 110,297,411 |

Hospira, Inc. (a) | 85,700 | | 2,365,320 |

| | 112,662,731 |

Health Care Providers & Services - 1.2% |

Cardinal Health, Inc. | 463,900 | | 32,496,195 |

Community Health Systems, Inc. (a) | 254,100 | | 6,802,257 |

HCA, Inc. | 204,800 | | 8,517,632 |

IMS Health, Inc. | 102,999 | | 2,414,297 |

McKesson Corp. | 1,062,800 | | 36,485,924 |

Tenet Healthcare Corp. (a) | 2,188,900 | | 29,353,149 |

UnitedHealth Group, Inc. | 247,800 | | 15,425,550 |

Wellcare Group, Inc. | 6,800 | | 115,600 |

| | 131,610,604 |

Pharmaceuticals - 5.6% |

Abbott Laboratories | 857,000 | | 34,931,320 |

Bristol-Myers Squibb Co. | 2,517,500 | | 61,678,750 |

GlaxoSmithKline PLC sponsored ADR | 467,000 | | 19,361,820 |

Johnson & Johnson | 2,187,200 | | 121,827,040 |

Merck & Co., Inc. | 2,851,900 | | 135,465,250 |

Pfizer, Inc. | 2,939,200 | | 100,755,776 |

Roche Holding AG (participation certificate) | 53,880 | | 5,347,463 |

Common Stocks - continued |

| Shares | | Value

(Note 1) |

HEALTH CARE - continued |

Pharmaceuticals - continued |

Schering-Plough Corp. | 3,803,630 | | $ 70,291,082 |

Wyeth | 1,436,600 | | 51,947,456 |

| | 601,605,957 |

TOTAL HEALTH CARE | | 845,879,292 |

INDUSTRIALS - 12.6% |

Aerospace & Defense - 4.0% |

Bombardier, Inc. Class B (sub. vtg.) | 4,147,900 | | 12,500,606 |

EADS NV | 1,540,015 | | 42,973,268 |

Honeywell International, Inc. | 3,094,325 | | 113,345,125 |

Lockheed Martin Corp. | 1,439,400 | | 74,963,952 |

Northrop Grumman Corp. | 903,000 | | 48,491,100 |

Raytheon Co. | 1,286,678 | | 46,024,472 |

The Boeing Co. | 997,800 | | 50,977,602 |

United Technologies Corp. | 379,520 | | 34,718,490 |

| | 423,994,615 |

Air Freight & Logistics - 0.1% |

Ryder System, Inc. | 204,900 | | 8,210,343 |

Airlines - 0.2% |

Southwest Airlines Co. | 968,800 | | 16,246,776 |

Building Products - 0.0% |

Masco Corp. | 162,300 | | 5,060,514 |

Commercial Services & Supplies - 0.6% |

Viad Corp. | 1,061,700 | | 28,676,517 |

Waste Management, Inc. | 1,286,100 | | 39,418,965 |

| | 68,095,482 |

Construction & Engineering - 0.2% |

Fluor Corp. | 368,900 | | 17,585,463 |

Electrical Equipment - 0.3% |

Emerson Electric Co. | 550,200 | | 34,965,210 |

Industrial Conglomerates - 3.5% |

3M Co. | 342,400 | | 30,819,424 |

General Electric Co. | 3,503,340 | | 113,508,216 |

Hutchison Whampoa Ltd. | 2,602,000 | | 17,764,109 |

Siemens AG sponsored ADR | 248,700 | | 18,035,724 |

Textron, Inc. | 879,800 | | 52,216,130 |

Tyco International Ltd. | 4,230,746 | | 140,206,922 |

| | 372,550,525 |

Machinery - 2.8% |

Caterpillar, Inc. | 575,500 | | 45,717,720 |

Deere & Co. | 394,050 | | 27,638,667 |

Dover Corp. | 410,600 | | 17,286,260 |

Eaton Corp. | 497,400 | | 32,201,676 |

Illinois Tool Works, Inc. | 210,000 | | 20,136,900 |

Ingersoll-Rand Co. Ltd. Class A | 1,114,344 | | 76,120,839 |

Navistar International Corp. (a) | 373,600 | | 14,480,736 |

Parker Hannifin Corp. | 289,700 | | 17,225,562 |

|

| Shares | | Value

(Note 1) |

SPX Corp. | 851,600 | | $ 39,548,304 |

Timken Co. | 452,600 | | 11,989,374 |

| | 302,346,038 |

Road & Rail - 0.9% |

Burlington Northern Santa Fe Corp. | 1,504,600 | | 52,766,322 |

Union Pacific Corp. | 807,900 | | 48,029,655 |

| | 100,795,977 |

TOTAL INDUSTRIALS | | 1,349,850,943 |

INFORMATION TECHNOLOGY - 6.3% |

Communications Equipment - 0.7% |

Lucent Technologies, Inc. (a) | 4,816,600 | | 18,206,748 |

Motorola, Inc. | 2,422,900 | | 44,217,925 |

Nokia Corp. sponsored ADR | 1,077,800 | | 15,671,212 |

| | 78,095,885 |

Computers & Peripherals - 1.7% |

Hewlett-Packard Co. | 4,681,211 | | 98,773,552 |

International Business Machines Corp. | 640,900 | | 56,495,335 |

Storage Technology Corp. (a) | 380,210 | | 11,026,090 |

Sun Microsystems, Inc. (a) | 3,998,675 | | 17,354,250 |

| | 183,649,227 |

Electronic Equipment & Instruments - 1.2% |

Arrow Electronics, Inc. (a) | 729,200 | | 19,557,144 |

Avnet, Inc. (a) | 1,328,830 | | 30,164,441 |

PerkinElmer, Inc. | 591,300 | | 11,849,652 |

Solectron Corp. (a) | 5,152,100 | | 33,334,087 |

Thermo Electron Corp. (a) | 1,155,100 | | 35,507,774 |

| | 130,413,098 |

IT Services - 0.2% |

Ceridian Corp. (a) | 780,800 | | 17,568,000 |

Office Electronics - 0.3% |

Xerox Corp. (a) | 1,881,900 | | 27,287,550 |

Semiconductors & Semiconductor Equipment - 1.2% |

Intel Corp. | 2,085,300 | | 57,554,280 |

Micron Technology, Inc. (a) | 1,866,200 | | 28,571,522 |

Rohm Co. Ltd. | 148,300 | | 18,010,104 |

Samsung Electronics Co. Ltd. | 65,630 | | 27,116,081 |

| | 131,251,987 |

Software - 1.0% |

Microsoft Corp. | 3,821,200 | | 109,133,472 |

TOTAL INFORMATION TECHNOLOGY | | 677,399,219 |

MATERIALS - 6.8% |

Chemicals - 2.8% |

Arch Chemicals, Inc. | 475,400 | | 13,701,028 |

Dow Chemical Co. | 2,294,100 | | 93,369,870 |

Eastman Chemical Co. | 476,800 | | 22,042,464 |

Ferro Corp. | 519,200 | | 13,852,256 |

Great Lakes Chemical Corp. | 650,500 | | 17,602,530 |

Common Stocks - continued |

| Shares | | Value

(Note 1) |

MATERIALS - continued |

Chemicals - continued |

Hercules Trust II unit | 15,700 | | $ 12,497,985 |

Lyondell Chemical Co. | 1,389,900 | | 24,170,361 |

Millennium Chemicals, Inc. | 929,150 | | 16,092,878 |

Olin Corp. | 828,000 | | 14,589,360 |

PolyOne Corp. (a) | 1,239,100 | | 9,218,904 |

PPG Industries, Inc. | 390,300 | | 24,389,847 |

Praxair, Inc. | 1,023,124 | | 40,832,879 |

| | 302,360,362 |

Containers & Packaging - 0.5% |

Smurfit-Stone Container Corp. (a) | 2,375,253 | | 47,386,297 |

Metals & Mining - 2.0% |

Alcan, Inc. | 955,100 | | 39,524,342 |

Alcoa, Inc. | 2,921,916 | | 96,510,885 |

Freeport-McMoRan Copper & Gold, Inc. Class B | 820,704 | | 27,206,338 |

Phelps Dodge Corp. | 702,200 | | 54,427,522 |

| | 217,669,087 |

Paper & Forest Products - 1.5% |

Bowater, Inc. | 391,300 | | 16,274,167 |

Georgia-Pacific Corp. | 1,562,701 | | 57,788,683 |

International Paper Co. | 645,400 | | 28,849,380 |

Weyerhaeuser Co. | 876,100 | | 55,299,432 |

| | 158,211,662 |

TOTAL MATERIALS | | 725,627,408 |

TELECOMMUNICATION SERVICES - 4.5% |

Diversified Telecommunication Services - 4.3% |

BellSouth Corp. | 5,200,199 | | 136,349,218 |

Qwest Communications International, Inc. (a) | 2,296,400 | | 8,244,076 |

SBC Communications, Inc. | 6,680,993 | | 162,014,080 |

Verizon Communications, Inc. | 4,242,902 | | 153,550,623 |

| | 460,157,997 |

Wireless Telecommunication Services - 0.2% |

KDDI Corp. | 3,028 | | 17,570,024 |

TOTAL TELECOMMUNICATION SERVICES | | 477,728,021 |

UTILITIES - 3.0% |

Electric Utilities - 1.8% |

Entergy Corp. | 796,700 | | 44,623,167 |

FirstEnergy Corp. | 1,127,400 | | 42,176,034 |

PG&E Corp. (a) | 403,800 | | 11,282,172 |

TXU Corp. | 1,234,820 | | 50,022,558 |

Wisconsin Energy Corp. | 1,293,700 | | 42,187,557 |

| | 190,291,488 |

Gas Utilities - 0.1% |

NiSource, Inc. | 568,729 | | 11,727,192 |

|

| Shares | | Value

(Note 1) |

Multi-Utilities & Unregulated Power - 1.1% |

Dominion Resources, Inc. | 1,174,600 | | $ 74,093,768 |

Public Service Enterprise Group, Inc. | 594,000 | | 23,777,820 |

SCANA Corp. | 617,300 | | 22,451,201 |

| | 120,322,789 |

TOTAL UTILITIES | | 322,341,469 |

TOTAL COMMON STOCKS (Cost $8,302,170,555) | 10,479,690,362 |

Convertible Preferred Stocks - 1.3% |

| | | |

CONSUMER DISCRETIONARY - 0.2% |

Automobiles - 0.1% |

General Motors Corp.: | | | |

Series B, 5.25% | 412,200 | | 10,090,656 |

Series C, 6.25% | 253,100 | | 7,314,590 |

| | 17,405,246 |

Hotels, Restaurants & Leisure - 0.1% |

Six Flags, Inc. 7.25% PIERS | 388,400 | | 8,641,900 |

TOTAL CONSUMER DISCRETIONARY | | 26,047,146 |

FINANCIALS - 0.5% |

Capital Markets - 0.0% |

State Street Corp. 6.75% | 24,900 | | 5,688,305 |

Consumer Finance - 0.2% |

Ford Motor Co. Capital Trust II 6.50% | 461,500 | | 25,206,207 |

Insurance - 0.3% |

Conseco, Inc. Series B, 5.50% | 143,400 | | 3,857,460 |

The Chubb Corp.: | | | |

7.00% | 167,700 | | 4,623,992 |

Series B, 7.00% | 120,100 | | 3,355,594 |

Travelers Property Casualty Corp. 4.50% | 240,200 | | 5,670,401 |

XL Capital Ltd. 6.50% | 401,800 | | 10,151,879 |

| | 27,659,326 |

TOTAL FINANCIALS | | 58,553,838 |

HEALTH CARE - 0.1% |

Health Care Equipment & Supplies - 0.1% |

Baxter International, Inc. 7.00% | 156,900 | | 8,935,455 |

INFORMATION TECHNOLOGY - 0.4% |

Communications Equipment - 0.2% |

Motorola, Inc. 7.00% | 399,700 | | 19,685,225 |

Office Electronics - 0.2% |

Xerox Corp. Series C, 6.25% | 145,650 | | 19,166,666 |

TOTAL INFORMATION TECHNOLOGY | | 38,851,891 |

Convertible Preferred Stocks - continued |

| Shares | | Value

(Note 1) |

UTILITIES - 0.1% |

Electric Utilities - 0.1% |

TXU Corp. 8.75% | 226,400 | | $ 10,725,700 |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $137,257,376) | 143,114,030 |

Corporate Bonds - 0.6% |

| Principal

Amount | | |

Convertible Bonds - 0.6% |

CONSUMER DISCRETIONARY - 0.4% |

Hotels, Restaurants & Leisure - 0.1% |

Royal Caribbean Cruises Ltd. liquid yield option note 0% 2/2/21 | $ 11,239,000 | | 6,019,946 |

Media - 0.2% |