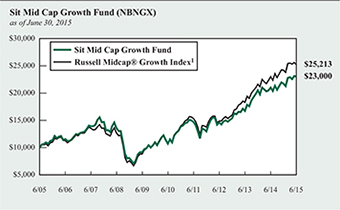

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

- - - - - - - - - - -

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03343

- - - - - - - - - - -

Sit Large Cap Growth Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 332-3223

Date of fiscal year end: June 30, 2015

Date of reporting period: June 30, 2015

Item 1: Reports to Stockholders

|

Sit Mutual Funds STOCK FUNDS ANNUAL REPORT TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER (Unaudited)

August 5, 2015

Dear Fellow Shareholders:

Global equity markets overcame some significant challenges and generally climbed higher over the past twelve months. While growth in the U.S. and other major developed markets remains on track, emerging markets have become a more significant source of risk to global growth.

Despite another weak first quarter in the U.S., with only modest growth in Gross Domestic Product (GDP), most current indicators point to a rebound in the second quarter of 2015. Specifically, consumer spending (which accounts for over two-thirds of GDP) appears to have moved higher from a soft first quarter, and nonfarm payrolls continue to grow at a healthy 200,000+ monthly clip. Job growth has been relatively resilient in light of the weak trends in energy, mining and manufacturing, which have been negatively impacted by weak commodity prices and the stronger U.S. dollar. Auto sales continue to be quite strong and, encouragingly, housing-related data have been particularly robust following a relatively tepid 2014. In summary, we continue to believe that the U.S. economy is growing at a moderate two to three percent pace.

U.S. inflation, as measured by the headline Consumer Price Index (CPI), remains well-controlled and in a tight range. The key factors suppressing inflation are still in place, and we do not anticipate a change in trend. Commodity prices continue to be quite low; the stronger dollar is dampening import prices; and there is little evidence that wage inflation is accelerating in a meaningful way. To be sure, all of these factors must be closely monitored, given the potential impact that an uptick in inflation will have on Federal Reserve policy. We believe that the Federal Reserve is likely to raise interest rates later this year or early next year, but a “traditional” tightening cycle (i.e., with multiple successive rate increases) is not likely, given moderate economic growth and a lack of inflationary pressure.

Outside the U.S., many European economies have improved in recent months due to the combined impact of a weaker currency, lower energy prices, and an accommodative monetary policy. Even beleaguered economies, such as Spain, have rebounded, despite very high unemployment. For the euro area overall, we have raised our economic projections based on improving employment trends, modest wage growth, increases in consumer spending, and some signs that bank lending is picking up.

While we remain cautious on the long-term prospects for Japan given structural headwinds (i.e. elevated government debt, aging population), the near-term picture looks relatively stable, as both consumption and investment spending are rising. Exports have helped, as well, due to the weak currency. However, exports to China represent a key risk to the country and for the global economy overall. Growth has been steadily decelerating and the recent significant stock market correction is an incremental cause for concern. Policymakers, how-

ever, have taken dramatic measures to stabilize the market and we expect continued easing of monetary policies, which should help stabilize growth. This bears watching, as growth is imperative given China’s elevated debt levels and the major impact an interruption in growth could have on the rest of the world, particularly other emerging markets.

Equity Strategy

While we believe equity prices can grind higher in the months ahead, numerous cross-currents are likely to result in increasing volatility as we proceed through the remainder of 2015.

Valuation and earnings trends will likely serve to constrain stock market upside. Valuations for the overall market are “fair” in our view, with price-to-earnings ratios at the upper end of historical ranges. That said, we believe elevated valuations are justified, given the low current inflation environment. We think that further market gains must be driven by increases in corporate profits. Earnings growth for the market overall (e.g., the S&P 500®) has come to a standstill, as the combination of a strong U.S. dollar and a dramatic decline in energy sector earnings has impacted results. The drag from these factors will likely be helped by easier comparisons in the months ahead. However, with corporate profit margins at peak levels, we believe a low- to mid-single earnings growth rate is a reasonable expectation.

All of this points to a challenging investment environment, but we clearly see opportunities. We continue to position our equity portfolios in diversified, high quality companies that are able to generate growth in a sluggish economic environment. In addition, we favor companies with strong balance sheets and cash flow generation and management teams that consistently return capital back to shareholders in the form of share repurchases and dividends. In terms of sectors, we have become more cautious on the energy and producer manufacturing sectors, given their dependence on emerging markets and vulnerability to a stronger U.S. dollar. We have incrementally increased exposure to the consumer discretionary sector, as solid labor markets, somewhat higher wages and falling energy costs provide a sound backdrop for U.S. consumers. Across all portfolios, healthcare remains a key area of focus for a number of reasons. First, the combination of steady employment gains and the Affordable Care Act has increased the insured population, leading to higher medical utilization in many areas. Second, we believe the pace of innovation and pipeline productivity has increased in recent years, given broad-based product introductions across therapeutic and device manufacturers. Third, the sector is being driven by the aging population all over the world.

In international and global portfolios, we remain overweight Europe, with an emphasis on exporting companies benefiting from the weak euro, and have added some exposure to

| | |

| | |

2 | | SIT MUTUAL FUNDS ANNUAL REPORT |

companies benefiting from improvements in consumer spending within the region. While the recent Greek debt negotiations have weighed on near-term performance, we believe that sentiment will shift more positively as the European Central Bank remains very accommodative, mainly through its quantitative easing program, for quite some time. While Japanese stocks have performed well in recent months, we are underweight the region given our longer term concerns over structural challenges facing the country. We continue to have significant exposure to China based on our long-term view that growth there is still quite strong relative to the rest of the world. Regardless of the economic region, we remain focused on well-managed, high quality growth companies.

With best wishes,

Roger J. Sit

Chairman, President, CEO and Global CIO

OBJECTIVE & STRATEGY

The dual objectives of the Sit Balanced Fund are to seek long-term growth of capital consistent with the preservation of principal and to provide regular income. It pursues its objectives by investing in a diversified portfolio of stocks and bonds. The Fund may emphasize either equity securities or fixed-income securities, or hold equal amounts of each, dependent upon the Adviser’s analysis of market, financial and economic conditions.

The Fund’s permissible investment allocation is: 35-65% in equity securities and 35-65% in fixed-income securities. At all times at least 25% of the fixed-income assets will be invested in fixed-income senior securities.

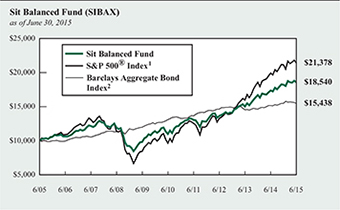

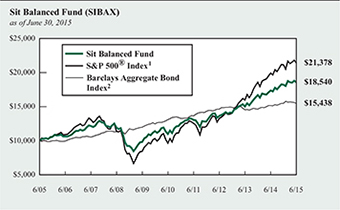

The Sit Balanced Fund’s twelve-month return was +6.86%. The S&P 500® Index return was +7.42% over the period, while the Barclays Aggregate Bond Index gained +1.86%. The Lipper Balanced Fund Index advanced +3.11% over the period.

Stocks and bonds moved modestly higher over the past twelve months, as investors continue to await a potential change in Federal Reserve policy. The equity portion outperformed the S&P 500® Index over the past twelve months, due to strong stock selection and an overweighted position in the outperforming health technology sector. In addition, the Fund benefitted from underweighting both the energy minerals and utilities sectors, which lagged over the period. Negative stock selection in the producer manufacturing and consumer non-durables detracted from results. Looking ahead, we continue to believe that high quality companies with stable earnings growth, strong cash flow generation, and minimal debt levels will outperform the overall stock market, as economic growth remains sluggish and investors seek firms with financial flexibility to return capital, through either share repurchases or increased dividends.

For the twelve months ending 6/30/15, the fixed income portion of the Fund considerably outperformed the Barclays Aggregate Bond Index, primarily due to its attractive income advantage. The Fund’s yield curve positioning also helped the return. Positions in longer duration U.S. Treasury securities contributed positively to performance, as longer maturity yields declined over the twelve-month period. Looking forward, we expect the yield curve to resume flattening as short yields rise in anticipation of the Fed raising its fed funds rate target later this year. We expect longer maturity yields to decline in the short- to medium-term as the market believes that the Fed’s actions will prevent inflation from becoming a problem. We continue to position the portfolio along the yield curve to take advantage of its expected flattening, while maintaining a significant yield advantage relative to the benchmark.

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the S&P 500® Index and the Barclays Aggregate Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the primary index for the equity portion of the Fund.

2 Barclays Aggregate Bond Index is an unmanaged market value-weighted index which measures the performance of investment grade debt securities with maturities of at least one year. This is the primary index for the fixed income portion of the Fund.

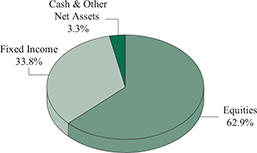

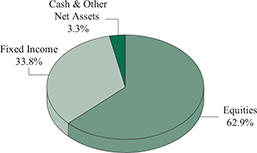

As of June 30th, the asset allocation of the Fund was 63% equities, 34% fixed income, and 3% cash and equivalents.

Roger J. Sit

Bryce A. Doty

John M. Bernstein

Portfolio Managers

| | |

Information on this page is unaudited. |

4 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2015

| | | | | | | | | | |

| | | Sit

Balanced

Fund | | | S&P 500®

Index 1 | | | Barclays

Aggregate

Bond

Index 2 |

One Year | | | 6.86 | % | | | 7.42 | % | | 1.86% |

Five Year | | | 11.03 | | | | 17.34 | | | 3.35 |

Ten Year | | | 6.37 | | | | 7.89 | | | 4.44 |

Since Inception (12/31/93) | | | 6.96 | | | | 9.26 | | | 5.61 |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index.

2 Barclays Aggregate Bond Index is an unmanaged market value-weighted index which measures the performance of investment grade debt securities with maturities of at least one year.

PORTFOLIO SUMMARY

| | |

Net Asset Value 6/30/15: | | $ 21.54 Per Share |

Net Asset Value 6/30/14: | | $21.01 Per Share |

Total Net Assets: | | $23.0 Million |

TOP HOLDINGS

Top Equity Holdings:

1. Apple, Inc.

2. Medtronic, PLC

3. Visa, Inc.

4. CVS Health Corp.

5. PepsiCo, Inc.

Top Fixed Income Holdings:

1. U.S. Treasury Strips, 4.22%, 2/15/36

2. GNMA, 4.50%, 6/15/40

3. FNMA, 7.50%, 5/25/42

4. U.S. Treasury Strips, 4.56%, 2/15/26

5. FNMA, 7.00%, 5/25/31

Based on total net assets as of June 30, 2015. Subject to change.

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2015. Subject to change.

| | |

Information on this page is unaudited. | | |

JUNE 30, 2015 | | 5 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Balanced Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Common Stocks - 62.9% | | | | |

Commercial Services - 1.3% | | | | |

1,400 | | Equifax, Inc. | | | 135,926 | |

2,900 | | Robert Half International, Inc. | | | 160,950 | |

| | | | | | |

| | | | | 296,876 | |

| | | | | | |

Communications - 1.3% | | | | |

1,150 | | SBA Communications Corp. * | | | 132,216 | |

3,750 | | Verizon Communications, Inc. | | | 174,788 | |

| | | | | | |

| | | | | 307,004 | |

| | | | | | |

Consumer Durables - 1.2% | | | | |

1,025 | | Polaris Industries, Inc. | | | 151,813 | |

785 | | Whirlpool Corp. | | | 135,844 | |

| | | | | | |

| | | | | 287,657 | |

| | | | | | |

Consumer Non-Durables - 3.7% | | | | |

875 | | Michael Kors Holdings, Ltd. * | | | 36,829 | |

1,825 | | NIKE, Inc. | | | 197,136 | |

3,425 | | PepsiCo, Inc. | | | 319,690 | |

1,150 | | Philip Morris International, Inc. | | | 92,196 | |

2,500 | | Procter & Gamble Co. | | | 195,600 | |

| | | | | | |

| | | | | 841,451 | |

| | | | | | |

Consumer Services - 5.3% | | | | |

150 | | Chipotle Mexican Grill, Inc. * | | | 90,748 | |

4,750 | | H&R Block, Inc. | | | 140,838 | |

5,300 | | Starbucks Corp. | | | 284,160 | |

2,000 | | Time Warner, Inc. | | | 174,820 | |

4,300 | | Twenty-First Century Fox, Inc. | | | 139,944 | |

5,700 | | Visa, Inc. | | | 382,755 | |

| | | | | | |

| | | | | 1,213,265 | |

| | | | | | |

Electronic Technology - 6.1% | | | | |

3,575 | | Apple, Inc. | | | 448,394 | |

9,750 | | Applied Materials, Inc. | | | 187,395 | |

1,975 | | Avago Technologies, Ltd. | | | 262,537 | |

5,000 | | Ciena Corp. * | | | 118,400 | |

7,300 | | Intel Corp. | | | 222,030 | |

1,275 | | Skyworks Solutions, Inc. | | | 132,728 | |

700 | | Xilinx, Inc. | | | 30,911 | |

| | | | | | |

| | | | | 1,402,395 | |

| | | | | | |

Energy Minerals - 3.2% | | | | |

1,575 | | Chevron Corp. | | | 151,940 | |

2,250 | | Continental Resources, Inc. * | | | 95,378 | |

850 | | EOG Resources, Inc. | | | 74,418 | |

1,450 | | Gulfport Energy Corp. * | | | 58,362 | |

3,500 | | Marathon Petroleum Corp. | | | 183,085 | |

2,300 | | Occidental Petroleum Corp. | | | 178,871 | |

| | | | | | |

| | | | | 742,054 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Finance - 6.2% | | | | |

900 | | ACE, Ltd. | | | 91,512 | |

1,850 | | Ameriprise Financial, Inc. | | | 231,120 | |

2,175 | | Discover Financial Services | | | 125,324 | |

925 | | Goldman Sachs Group, Inc. | | | 193,131 | |

4,275 | | JPMorgan Chase & Co. | | | 289,674 | |

1,600 | | Marsh & McLennan Cos., Inc. | | | 90,720 | |

1,350 | | Prudential Financial, Inc. | | | 118,152 | |

2,350 | | US Bancorp | | | 101,990 | |

3,150 | | Wells Fargo & Co. | | | 177,156 | |

| | | | | | |

| | | | | 1,418,779 | |

| | | | | | |

Health Services - 2.8% | | | | |

1,305 | | Express Scripts Holding Co. * | | | 116,067 | |

400 | | Humana, Inc. | | | 76,512 | |

875 | | McKesson Corp. | | | 196,709 | |

2,025 | | UnitedHealth Group, Inc. | | | 247,050 | |

| | | | | | |

| | | | | 636,338 | |

| | | | | | |

Health Technology - 9.3% | | | | |

2,550 | | AbbVie, Inc. | | | 171,334 | |

425 | | Alexion Pharmaceuticals, Inc. * | | | 76,827 | |

750 | | Allergan, PLC * | | | 227,595 | |

1,750 | | Celgene Corp. * | | | 202,536 | |

2,700 | | Gilead Sciences, Inc. | | | 316,116 | |

1,650 | | Johnson & Johnson | | | 160,809 | |

5,899 | | Medtronic, PLC | | | 437,116 | |

1,050 | | Mylan NV * | | | 71,253 | |

125 | | Regeneron Pharmaceuticals, Inc. * | | | 63,766 | |

2,050 | | St. Jude Medical, Inc. | | | 149,794 | |

1,000 | | Thermo Fisher Scientific, Inc. | | | 129,760 | |

1,150 | | Zimmer Holdings, Inc. | | | 125,613 | |

| | | | | | |

| | | | | 2,132,519 | |

| | | | | | |

Industrial Services - 0.6% | | | | |

1,600 | | Schlumberger, Ltd. | | | 137,904 | |

| | | | | | |

Process Industries - 1.8% | | | | |

2,450 | | Ecolab, Inc. | | | 277,022 | |

1,225 | | International Paper Co. | | | 58,298 | |

600 | | Praxair, Inc. | | | 71,730 | |

| | | | | | |

| | | | | 407,050 | |

| | | | | | |

Producer Manufacturing - 4.8% | | | | |

675 | | 3M Co. | | | 104,152 | |

875 | | Caterpillar, Inc. | | | 74,218 | |

2,000 | | Danaher Corp. | | | 171,180 | |

1,250 | | Delphi Automotive, PLC | | | 106,362 | |

725 | | General Dynamics Corp. | | | 102,725 | |

2,150 | | Honeywell International, Inc. | | | 219,236 | |

950 | | Illinois Tool Works, Inc. | | | 87,200 | |

| | |

See accompanying notes to financial statements. | | |

6 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity /Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| | |

1,500 | | Raytheon Co. | | | 143,520 | |

950 | | United Technologies Corp. | | | 105,383 | |

| | | | | | |

| | |

| | | | | 1,113,976 | |

| | | | | | |

Retail Trade - 5.2% | | | | |

3,200 | | CVS Health Corp. | | | 335,616 | |

1,700 | | Dick’s Sporting Goods, Inc. | | | 88,009 | |

2,800 | | Home Depot, Inc. | | | 311,164 | |

900 | | Macy’s, Inc. | | | 60,723 | |

1,200 | | Target Corp. | | | 97,956 | |

2,900 | | TJX Cos., Inc. | | | 191,893 | |

1,675 | | Wal-Mart Stores, Inc. | | | 118,808 | |

| | | | | | |

| | |

| | | | | 1,204,169 | |

| | | | | | |

Technology Services - 7.5% | | | | |

1,550 | | Accenture, PLC | | | 150,009 | |

3,300 | | Adobe Systems, Inc. * | | | 267,333 | |

1,250 | | ANSYS, Inc. * | | | 114,050 | |

2,500 | | Cognizant Technology Solutions Corp. * | | | 152,725 | |

1,875 | | Facebook, Inc. * | | | 160,809 | |

325 | | Google, Inc. - Class A* | | | 175,513 | |

255 | | Google, Inc. - Class C* | | | 132,730 | |

5,975 | | Microsoft Corp. | | | 263,796 | |

3,250 | | Oracle Corp. | | | 130,975 | |

155 | | priceline.com, Inc. * | | | 178,462 | |

| | | | | | |

| | |

| | | | | 1,726,402 | |

| | | | | | |

Transportation - 2.6% | | | | |

3,300 | | Delta Air Lines, Inc. | | | 135,564 | |

550 | | FedEx Corp. | | | 93,720 | |

1,050 | | Ryder System, Inc. | | | 91,738 | |

1,750 | | Union Pacific Corp. | | | 166,898 | |

1,050 | | United Parcel Service, Inc. | | | 101,755 | |

| | | | | | |

| | |

| | | | | 589,675 | |

| | | | | | |

Total Common Stocks (cost: $10,672,600) | | | 14,457,514 | |

| | | | | | |

Bonds - 31.5% | | | | |

Asset-Backed Securities - 2.0% | | | | |

5,989 | | Bayview Financial Acquisition Trust,

2006-D 1A2, 5.66%, 12/28/36 14 | | | 5,973 | |

41,527 | | Centex Home Equity,

2004-D AF4, 4.68%, 6/25/32 14 | | | 42,425 | |

16,529 | | Citifinancial Mortgage Securities, Inc.,

2004-1 AF3, 3.77%, 4/25/34 14 | | | 16,758 | |

32,105 | | Conseco Finance,

2001-D M1, 1.54%, 11/15/32 1 | | | 31,079 | |

74,989 | | Credit Suisse First Boston Mortgage Corp.,

2005-AGE1 M3, 0.83%, 2/25/32 1 | | | 72,410 | |

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| | |

27,280 | | Green Tree Financial Corp.,

1997-7 A6, 6.76%, 7/15/28 | | | 28,009 | |

45,566 | | HouseHold Home Equity Loan Trust,

2007-2 A4, 0.49%, 7/20/36 1 | | | 44,982 | |

10,204 | | Irwin Home Equity Corp.,

2005-1 M1, 5.42%, 6/25/35 14 | | | 10,307 | |

24,792 | | New Century Home Equity Loan Trust,

2005-A A4W, 4.82%, 8/25/35 14 | | | 25,720 | |

22,309 | | RAAC Series,

2005-SP2 1M1, 0.70%, 5/25/44 1 | | | 22,140 | |

26,312 | | Residential Asset Mortgage Products, Inc.,

2005-RZ3 A3, 0.58%, 9/25/35 1 | | | 26,183 | |

7,953 | | Residential Funding Mortgage Securities II, Inc.,

2003-HI2 A6, 5.26%, 7/25/28 14 | | | 8,036 | |

101,056 | | Vanderbilt Acquisition Loan Trust Series,

2002-1 B2, 8.47%, 5/7/32 1 | | | 113,652 | |

| | | | | | |

| | |

| | | | | 447,674 | |

| | | | | | |

Collateralized Mortgage Obligations - 5.4% | | | | |

| | Fannie Mae: | | | | |

61,023 | | 2004-T1 1A1, 6.00%, 1/25/44 | | | 69,086 | |

19,016 | | 2009-30 AG, 6.50%, 5/25/39 | | | 20,750 | |

8,977 | | 2013-28 WD, 6.50%, 5/25/42 | | | 10,259 | |

34,366 | | 2004-W9 2A1, 6.50%, 2/25/44 | | | 38,803 | |

133,840 | | 2012-68 GW, 7.00%, 5/25/31 | | | 161,748 | |

7,882 | | 2010-108 AP, 7.00%, 9/25/40 | | | 8,922 | |

15,772 | | 2004-T3, 1A3, 7.00%, 2/25/44 | | | 18,014 | |

149,613 | | 2013-28 WE, 7.50%, 5/25/42 | | | 175,479 | |

| | Freddie Mac: | | | | |

60,974 | | 4293 BA, 5.33%, 10/15/47 1 | | | 66,668 | |

54,662 | | 2122 ZE, 6.00%, 2/15/29 | | | 59,897 | |

39,520 | | 2283 K, 6.50%, 12/15/23 | | | 43,972 | |

39,392 | | T-59 1A1, 6.50%, 10/25/43 | | | 45,263 | |

17,319 | | 3946 KW, 7.00%, 11/15/29 | | | 18,771 | |

59,301 | | 3704 CT, 7.00%, 12/15/36 | | | 69,652 | |

35,585 | | 2238 PZ, 7.50%, 6/15/30 | | | 41,126 | |

| | Government National Mortgage Association: | | | | |

82,571 | | 2014-69 W, 7.28%, 11/20/34 1 | | | 98,285 | |

50,025 | | 2005-74 HA, 7.50%, 9/16/35 | | | 56,624 | |

113,116 | | RFMSI Series Trust, | | | | |

| | 2003-S12 M1, 5.98%, 12/25/32 1 | | | 119,786 | |

| | Sequoia Mortgage Trust: | | | | |

40,141 | | 2013-3 A2, 2.50%, 3/25/43 1 | | | 37,393 | |

25,414 | | 2012-4 A2, 3.00%, 9/25/42 1 | | | 24,652 | |

36,223 | | Vendee Mortgage Trust, | | | | |

| | 2008-1 B, 7.71%, 3/15/25 1 | | | 41,861 | |

| | | | | | |

| | |

| | | | | 1,227,011 | |

| | | | | | |

| | |

See accompanying notes to financial statements. | | |

JUNE 30, 2015 | | 7 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Balanced Fund (Continued)

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| |

Corporate Bonds - 10.7% | | | | |

37,072 | | Aircraft Certificate Owner Trust 2003, 7.00%, 9/20/22 4 | | | 39,667 | |

61,635 | | America West Airlines 2000-1 Trust, 8.06%, 7/2/20 | | | 69,340 | |

25,000 | | American Airlines 2015-1 Class A Trust, 3.38%, 5/1/27 | | | 24,688 | |

100,000 | | Assured Guaranty US Holdings, Inc., 7.00%, 6/1/34 | | | 109,139 | |

70,000 | | Boeing Co., 8.75%, 9/15/31 | | | 104,850 | |

100,000 | | Bottling Group, LLC, 5.13%, 1/15/19 | | | 110,839 | |

23,304 | | Burlington Northern and Santa Fe Railway Co. 2001-1 Trust, 6.73%, 7/15/22 | | | 26,527 | |

50,000 | | Caterpillar Financial Services Corp., 7.15%, 2/15/19 | | | 58,866 | |

50,000 | | CNA Financial Corp., 7.35%, 11/15/19 | | | 59,101 | |

25,000 | | Coca-Cola Femsa SAB de CV, 2.38%, 11/26/18 | | | 25,352 | |

25,000 | | ConocoPhillips, 5.90%, 10/15/32 | | | 28,864 | |

37,139 | | Continental Airlines 2000-1 Class A-1 Trust, 8.05%, 11/1/20 | | | 42,105 | |

50,000 | | Danaher Corp., 5.40%, 3/1/19 | | | 55,810 | |

45,384 | | Delta Air Lines 2007-1 Class A Trust, 6.82%, 8/10/22 | | | 52,078 | |

63,046 | | Doric Nimrod Air Alpha 2012-1 Class A Trust, 5.13%, 11/30/22 4 | | | 66,673 | |

60,768 | | Doric Nimrod Air Alpha 2013-1 Trust, 5.25%, 5/30/23 4 | | | 64,414 | |

50,000 | | DTE Gas, Co., 5.00%, 10/1/19 | | | 55,788 | |

50,000 | | Google, Inc., 3.63%, 5/19/21 | | | 53,570 | |

50,000 | | Hiland Partners LP / Hiland Partners Finance Corp., 5.50%, 5/15/22 4 | | | 51,999 | |

150,000 | | INVISTA Finance, LLC, 4.25%, 10/15/19 4 | | | 147,750 | |

50,000 | | Kansas City Power & Light Co.,

7.15%, 4/1/19 | | | 58,979 | |

25,000 | | Liberty Mutual Insurance Co.,

7.88%, 10/15/26 4 | | | 30,239 | |

50,000 | | LyondellBasell Industries NV,

4.63%, 2/26/55 | | | 44,032 | |

65,000 | | Manufacturers & Traders Trust Co. (Subordinated), 5.63%, 12/1/21 1 | | | 67,038 | |

100,000 | | Microsoft Corp., 5.20%, 6/1/39 | | | 112,017 | |

75,000 | | Moody’s Corp., 2.75%, 7/15/19 | | | 75,639 | |

40,000 | | Northern States Power Co.,

7.13%, 7/1/25 | | | 51,369 | |

25,000 | | Northern Trust Co. (Subordinated),

6.50%, 8/15/18 | | | 28,564 | |

52,984 | | Northwest Airlines 2007-1 A Trust,

7.03%, 11/1/19 | | | 59,475 | |

57,242 | | Procter & Gamble ESOP,

9.36%, 1/1/21 | | | 69,573 | |

50,000 | | Progressive Corp. (Subordinated),

6.70%, 6/15/37 1 | | | 52,125 | |

50,000 | | Security Benefit Life Insurance Co. (Subordinated), 7.45%, 10/1/33 4 | | | 60,974 | |

50,000 | | State Street Corp., 7.35%, 6/15/26 | | | 65,253 | |

50,000 | | Tosco Corp., 8.13%, 2/15/30 | | | 69,503 | |

50,000 | | United Parcel Service, Inc.,

2.45%, 10/1/22 | | | 48,249 | |

50,000 | | United Technologies Corp.,

6.13%, 2/1/19 | | | 57,128 | |

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| | |

41,915 | | US Airways 2001-1C Trust (Subordinated), 7.35%, 3/20/22 | | | 46,790 | |

2,000 | | Verizon Communications,

5.90%, 2/15/54 | | | 52,440 | |

41,130 | | Virgin Australia 2013-1A Trust,

5.00%, 10/23/23 4 | | | 42,878 | |

50,000 | | Wells Fargo & Co., 4.60%, 4/1/21 | | | 54,774 | |

50,000 | | XTO Energy, Inc., 6.75%, 8/1/37 | | | 69,724 | |

| | | | | | |

| | | | | 2,464,183 | |

| | | | | | |

| |

Federal Home Loan Mortgage Corporation - 2.0% | | | | |

48,877 | | 2.50%, 4/1/27 | | | 49,930 | |

27,647 | | 3.00%, 5/1/27 | | | 28,255 | |

13,176 | | 6.00%, 10/1/21 | | | 14,084 | |

74,310 | | 6.00%, 4/1/39 | | | 84,601 | |

73,137 | | 6.50%, 2/1/22 | | | 80,128 | |

73,031 | | 7.00%, 4/1/31 | | | 85,071 | |

34,278 | | 7.00%, 7/1/32 | | | 37,720 | |

6,806 | | 7.00%, 5/1/34 | | | 7,873 | |

30,696 | | 7.00%, 11/1/37 | | | 35,571 | |

8,400 | | 7.00%, 1/1/39 | | | 9,648 | |

16,785 | | 7.50%, 11/1/36 | | | 20,076 | |

391 | | 8.00%, 9/1/15 | | | 393 | |

6,187 | | 8.38%, 5/17/20 | | | 6,570 | |

| | | | | | |

| | | | | 459,920 | |

| | | | | | |

| |

Federal National Mortgage Association - 2.7% | | | | |

23,402 | | 5.50%, 2/1/18 | | | 24,407 | |

75,000 | | 6.17%, 11/1/43 | | | 85,699 | |

17,935 | | 6.50%, 5/1/36 | | | 20,597 | |

136,750 | | 6.50%, 8/1/37 | | | 158,629 | |

80,564 | | 6.50%, 3/1/40 | | | 92,520 | |

32,334 | | 7.00%, 1/1/32 | | | 37,370 | |

13,689 | | 7.00%, 12/1/32 | | | 16,403 | |

28,292 | | 7.00%, 3/1/33 | | | 33,124 | |

19,688 | | 7.00%, 12/1/36 | | | 23,953 | |

6,570 | | 7.00%, 11/1/38 | | | 7,648 | |

15,207 | | 7.50%, 4/1/33 | | | 18,974 | |

14,889 | | 7.50%, 11/1/33 | | | 17,652 | |

21,956 | | 7.50%, 1/1/34 | | | 26,872 | |

7,315 | | 7.50%, 4/1/38 | | | 8,936 | |

32,659 | | 8.00%, 2/1/31 | | | 40,007 | |

7,586 | | 8.45%, 7/15/26 | | | 8,757 | |

| | | | | | |

| | | | | 621,548 | |

| | | | | | |

| |

Government National Mortgage Association - 2.3% | | | | |

238,040 | | 4.50%, 6/15/40 | | | 261,485 | |

88,587 | | 6.00%, 4/15/29 | | | 102,004 | |

23,181 | | 7.00%, 12/15/24 | | | 25,802 | |

| | |

See accompanying notes to financial statements. | | |

8 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Principal

Amount ($) | | Name of Issuer | | Fair Value ($) | |

| | |

34,877 | | 7.00%, 9/20/38 | | | 40,746 | |

32,176 | | 8.00%, 7/15/24 | | | 36,394 | |

67,921 | | 8.38%, 3/15/31 | | | 70,795 | |

| | | | | | |

| | | | | 537,226 | |

| | | | | | |

Taxable Municipal Securities - 3.4% | | | | |

100,000 | | City of Austin, TX., Electric Utility Rev.,

2.08%, 11/15/19 | | | 99,792 | |

85,000 | | County of St. Clair IL, 5.40%, 12/30/28 | | | 89,373 | |

75,000 | | Denver Health & Hospital Authority,

2.95%, 12/1/18 | | | 75,746 | |

100,000 | | Glendale Community Dev. Authority,

2.40%, 10/1/19 | | | 100,239 | |

50,000 | | Macomb Interceptor Drain Drainage District, 5.50%, 5/1/30 | | | 51,361 | |

100,000 | | Mississippi Home Corp.,

3.05%, 12/1/34 | | | 100,061 | |

89,000 | | Multistate Liquidating Trust No.

1, 3.11%, 12/15/28 4,17 | | | 86,599 | |

40,000 | | New Hampshire Housing Finance Authority, 4.00%, 7/1/35 | | | 41,837 | |

50,000 | | State of Texas, 4.12%, 4/1/25 | | | 53,708 | |

75,000 | | Texas St. Pub. Fin. Auth. Charter Sch. Fin., 8.75%, 8/15/27 | | | 82,761 | |

| | | | | | |

| | | | | 781,477 | |

| | | | | | |

U.S. Government / Federal Agency Securities - 3.0% | | | | |

100,000 | | U.S. Treasury Note, 0.06%, 1/31/16 1 | | | 99,999 | |

| | U.S. Treasury Strips: | | | | |

200,000 | | 3.33%, 5/15/44 6 | | | 78,289 | |

625,000 | | 4.22%, 2/15/36 6 | | | 339,019 | |

225,000 | | 4.56%, 2/15/26 6 | | | 171,500 | |

| | | | | | |

| | | | | 688,807 | |

| | | | | | |

| |

Total Bonds

(cost: $7,228,959) | | | 7,227,846 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

|

Investment Companies - 2.3% | |

5,700 | | BlackRock Enhanced Government Fund | | | 77,121 | |

15,800 | | BlackRock Income Trust | | | 99,856 | |

8,400 | | Duff & Phelps Utility and Corporate Bond Trust | | | 78,708 | |

5,300 | | Federated Enhanced Treasury Income Fund | | | 70,013 | |

26,500 | | MFS Intermediate Income Trust | | | 122,430 | |

15,652 | | Putnam Premier Income Trust | | | 79,825 | |

| | | | | | |

Total Investment Companies

(cost: $546,126) | | | 527,953 | |

| | | | | | |

Total Investments in Securities - 96.7%

(cost: $18,447,685) | | | 22,213,313 | |

Other Assets and Liabilities, net - 3.3% | | | 756,397 | |

| | | | | | |

Total Net Assets - 100.0% | | | $22,969,710 | |

| | | | | | |

| * | Non-income producing security. |

| 1 | Variable rate security. Rate disclosed is as of June 30, 2015. |

| 4 | 144A Restricted Security. The total value of such securities as of June 30, 2015 was $591,193 and represented 2.6% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 6 | Zero coupon or convertible capital appreciation bond, for which the rate disclosed is either the effective yield on purchase date or the coupon rate to be paid upon conversion to coupon paying, respectively. |

| 14 | Step Coupon: A bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate disclosed is as of June 30, 2015. |

| 17 | Security that is either an absolute and unconditional obligation of the United States Government or is collateralized by securities, loans, or leases guaranteed by the U.S. Government or its agencies or instrumentalities. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

PLC — Public Limited Company

| | |

See accompanying notes to financial statements. | | |

JUNE 30, 2015 | | 9 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Balanced Fund (Continued)

A summary of the levels for the Fund’s investments as of June 30, 2015 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1

Quoted

Price ($) | | | Level 2

Other significant

observable inputs ($) | | | Level 3 Significant

unobservable inputs ($) | | Total ($) | |

Common Stocks ** | | | 14,457,514 | | | | — | | | — | | | 14,457,514 | |

Asset-Backed Securities | | | — | | | | 447,674 | | | — | | | 447,674 | |

Collateralized Mortgage Obligations | | | — | | | | 1,227,011 | | | — | | | 1,227,011 | |

Corporate Bonds | | | — | | | | 2,464,183 | | | — | | | 2,464,183 | |

Federal Home Loan Mortgage Corporation | | | — | | | | 459,920 | | | — | | | 459,920 | |

Federal National Mortgage Association | | | — | | | | 621,548 | | | — | | | 621,548 | |

Government National Mortgage Association | | | — | | | | 537,226 | | | — | | | 537,226 | |

Taxable Municipal Securities | | | — | | | | 781,477 | | | — | | | 781,477 | |

U.S. Government / Federal Agency Securities | | | — | | | | 688,807 | | | — | | | 688,807 | |

Investment Companies | | | 527,953 | | | | — | | | — | | | 527,953 | |

| | | | |

Total: | | | 14,985,467 | | | | 7,227,846 | | | — | | | 22,213,313 | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

For the reporting period, there were no transfers between levels 1, 2 and 3.

| | |

See accompanying notes to financial statements. | | |

10 | | SIT MUTUAL FUNDS ANNUAL REPORT |

[This page intentionally left blank.]

|

|

| |

Sit Dividend Growth Fund - Class I and Class S |

OBJECTIVE & STRATEGY

The objective of the Sit Dividend Growth Fund is to provide current income that exceeds the dividend yield of the S&P 500® Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

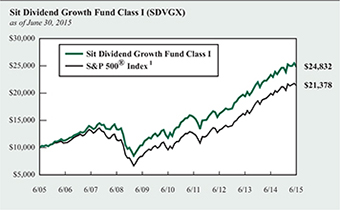

The Sit Dividend Growth Fund Class I posted a +6.39% return over the last twelve months, compared to the +7.42% return for the S&P 500® Index. The Fund’s gross dividend yield (before deduction of Fund expenses) is 2.50% compared to the 2.08% yield of the S&P 500® Index.

U.S. equities gained further ground over the past twelve months despite a decidedly clouded economic picture, both in the U.S. and in many regions around the world. While there has been some concern that dividend-paying stocks may lag the broader market if the Federal Reserve begins to finally raise rates, there are some important considerations to keep in mind. First, and foremost, we do not believe rates will rise significantly given the slow pace of economic growth and benign inflationary pressures, both here and abroad. Second, as we often point out, we expect all companies within the Fund to grow dividends on a consistent basis, providing a natural hedge if interest rates and inflation move higher over time. Third, any significant increase in interest rates could result in a sharp rise in volatility and a market correction. We note that the Fund has historically proven relatively defensive in periods of market turmoil.

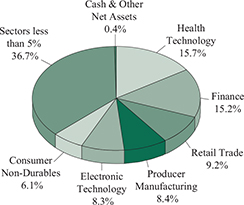

While the Fund remains well-diversified among sectors, there have been some significant changes in allocation compared to this time last year. Both the energy minerals and industrial services sectors have been reduced, reflecting our view that energy prices will take some time to recover. Conversely, the combination of low energy prices and steady job gains is good news for consumers, which has led us to increase the weighting in the retail trade sector.

Relative to the Index, Fund performance was negatively impacted by stock selection in the health technology and finance sectors. Underperformers in the health technology sector included Johnson & Johnson and Merck, while closed-end funds Kayne Anderson and Tortoise Energy detracted from finance sector returns. On the positive side, strong stock selection in the energy minerals, utilities, commercial services and electronic technology sectors helped relative

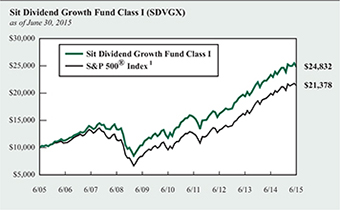

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the S&P 500® Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the Fund’s primary index.

returns. Top performers in these sectors included Marathon Petroleum, Kinder Morgan, WEC Energy Group, Equifax, Moody’s Corp. and Avago Technologies.

Our research effort remains on high quality companies that can deliver consistent earnings growth and return excess capital, primarily through dividends.

Roger J. Sit

Kent L. Johnson

Michael J. Stellmacher

Portfolio Managers

| | |

Information on this page is unaudited. |

12 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2015

| | | | | | | | | | | | |

| | | Sit Dividend

Growth Fund | | | | |

| | | Class I | | | Class S | | | S&P 500®

Index 1 | |

| | | |

One Year | | | 6.39% | | | | 6.13% | | | | 7.42% | |

Five Year | | | 16.08 | | | | 15.80 | | | | 17.34 | |

Ten Year | | | 9.52 | | | | n/a | | | | 7.89 | |

Since Inception - Class I (12/31/03) | | | 9.47 | | | | n/a | | | | 7.71 | |

Since Inception - Class S (3/31/06) | | | n/a | | | | 8.61 | | | | 7.42 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index.

PORTFOLIO SUMMARY

| | |

Class I: | | |

Net Asset Value 6/30/15: | | $17.40 Per Share |

Net Asset Value 6/30/14: | | $18.69 Per Share |

Total Net Assets: | | $955.5 Million |

Class S: | | |

Net Asset Value 6/30/15: | | $17.34 Per Share |

Net Asset Value 6/30/14: | | $18.63 Per Share |

Total Net Assets: | | $83.0 Million |

| |

Weighted Average Market Cap: | | $98.3 Billion |

TOP 10 HOLDINGS

1. Medtronic, PLC

2. Home Depot, Inc.

3. Microsoft Corp.

4. Apple, Inc.

5. Honeywell International, Inc.

6. JPMorgan Chase & Co.

7. PepsiCo, Inc.

8. Verizon Communications, Inc.

9. Intel Corp.

10. Becton Dickson and Co.

Based on total net assets as of June 30, 2015. Subject to change.

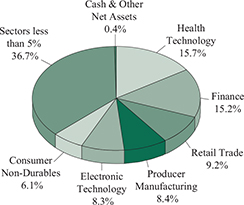

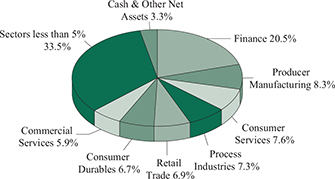

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2015. Subject to change.

| | |

Information on this page is unaudited. | | |

JUNE 30, 2015 | | 13 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Dividend Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Common Stocks - 98.5% | | | | |

Commercial Services - 1.9% | | | | |

51,425 | | Equifax, Inc. | | | 4,992,853 | |

67,375 | | Moody’s Corp. | | | 7,273,805 | |

160,525 | | Nielsen Holdings NV | | | 7,186,704 | |

| | | | | | |

| | | | | 19,453,362 | |

| | | | | | |

Communications - 2.8% | | | | |

205,450 | | BCE, Inc. | | | 8,731,625 | |

448,950 | | Verizon Communications, Inc. | | | 20,925,560 | |

| | | | | | |

| | | | | 29,657,185 | |

| | | | | | |

Consumer Durables - 2.7% | | | | |

66,425 | | Genuine Parts Co. | | | 5,947,030 | |

79,825 | | Snap-On, Inc. | | | 12,712,131 | |

54,650 | | Whirlpool Corp. | | | 9,457,182 | |

| | | | | | |

| | | | | 28,116,343 | |

| | | | | | |

Consumer Non-Durables - 6.1% | | | | |

80,225 | | JM Smucker Co./The | | | 8,697,192 | |

135,625 | | Kimberly-Clark Corp. | | | 14,372,181 | |

248,650 | | PepsiCo, Inc. | | | 23,208,991 | |

214,000 | | Procter & Gamble Co. | | | 16,743,360 | |

| | | | | | |

| | | | | 63,021,724 | |

| | | | | | |

Consumer Services - 4.2% | | | | |

364,200 | | H&R Block, Inc. | | | 10,798,530 | |

195,050 | | Starbucks Corp. | | | 10,457,606 | |

178,950 | | Time Warner, Inc. | | | 15,642,020 | |

96,800 | | Visa, Inc. | | | 6,500,120 | |

| | | | | | |

| | | | | 43,398,276 | |

| | | | | | |

Electronic Technology - 8.3% | | | | |

202,650 | | Apple, Inc. | | | 25,417,376 | |

759,375 | | Applied Materials, Inc. | | | 14,595,188 | |

130,200 | | Avago Technologies, Ltd. | | | 17,307,486 | |

626,400 | | Intel Corp. | | | 19,051,956 | |

43,500 | | Skyworks Solutions, Inc. | | | 4,528,350 | |

112,525 | | Xilinx, Inc. | | | 4,969,104 | |

| | | | | | |

| | | | | 85,869,460 | |

| | | | | | |

Energy Minerals - 3.8% | | | | |

188,775 | | Devon Energy Corp. | | | 11,230,225 | |

150,675 | | Marathon Petroleum Corp. | | | 7,881,809 | |

157,325 | | Occidental Petroleum Corp. | | | 12,235,165 | |

312,250 | | Suncor Energy, Inc. | | | 8,593,120 | |

| | | | | | |

| | | | | 39,940,319 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Finance - 15.2% | | | | |

50,975 | | ACE, Ltd. | | | 5,183,138 | |

106,975 | | Ameriprise Financial, Inc. | | | 13,364,387 | |

96,900 | | Arthur J Gallagher & Co. | | | 4,583,370 | |

47,500 | | Avalonbay Communities, Inc. | | | 7,593,825 | |

246,775 | | Brixmor Property Group, Inc. | | | 5,707,906 | |

134,625 | | Discover Financial Services | | | 7,757,092 | |

47,475 | | Goldman Sachs Group, Inc. | | | 9,912,305 | |

237,675 | | Hartford Financial Services Group, Inc. | | | 9,880,150 | |

311,225 | | Invesco, Ltd. | | | 11,667,825 | |

345,725 | | JPMorgan Chase & Co. | | | 23,426,326 | |

136,150 | | Macquarie Infrastructure Co., LLC | | | 11,250,074 | |

108,200 | | Marsh & McLennan Cos., Inc. | | | 6,134,940 | |

262,050 | | PacWest Bancorp | | | 12,253,458 | |

114,800 | | PNC Financial Services Group, Inc. | | | 10,980,620 | |

115,975 | | Prudential Financial, Inc. | | | 10,150,132 | |

41,275 | | T Rowe Price Group, Inc. | | | 3,208,307 | |

112,175 | | Validus Holdings, Ltd. | | | 4,934,578 | |

| | | | | | |

| | | | | 157,988,433 | |

| | | | | | |

Health Services - 3.1% | | | | |

181,600 | | Cardinal Health, Inc. | | | 15,190,840 | |

135,975 | | UnitedHealth Group, Inc. | | | 16,588,950 | |

| | | | | | |

| | | | | 31,779,790 | |

| | | | | | |

Health Technology - 15.7% | | | | |

235,825 | | Abbott Laboratories | | | 11,574,291 | |

209,750 | | AbbVie, Inc. | | | 14,093,102 | |

131,775 | | Becton Dickinson and Co. | | | 18,665,929 | |

103,175 | | Gilead Sciences, Inc. | | | 12,079,729 | |

180,600 | | Johnson & Johnson | | | 17,601,276 | |

439,375 | | Medtronic, PLC | | | 32,557,688 | |

222,275 | | Merck & Co., Inc. | | | 12,654,116 | |

554,400 | | Pfizer, Inc. | | | 18,589,032 | |

160,500 | | St. Jude Medical, Inc. | | | 11,727,735 | |

116,900 | | Teva Pharmaceutical Industries, Ltd., ADR | | | 6,908,790 | |

64,175 | | Zimmer Holdings, Inc. | | | 7,009,835 | |

| | | | | | |

| | | | | 163,461,523 | |

| | | | | | |

Process Industries - 3.9% | | | | |

77,350 | | Agrium, Inc. | | | 8,195,232 | |

151,900 | | Archer-Daniels-Midland Co. | | | 7,324,618 | |

247,125 | | International Paper Co. | | | 11,760,679 | |

61,200 | | LyondellBasell Industries NV | | | 6,335,424 | |

43,000 | | Praxair, Inc. | | | 5,140,650 | |

30,075 | | Scotts Miracle-Gro Co. | | | 1,780,741 | |

| | | | | | |

| | | | | 40,537,344 | |

| | | | | | |

| | |

See accompanying notes to financial statements. | | |

14 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Producer Manufacturing - 8.4% | | | | |

61,400 | | 3M Co. | | | 9,474,020 | |

91,525 | | Delphi Automotive, PLC | | | 7,787,862 | |

74,000 | | General Dynamics Corp. | | | 10,485,060 | |

235,800 | | Honeywell International, Inc. | | | 24,044,526 | |

86,375 | | Illinois Tool Works, Inc. | | | 7,928,361 | |

57,950 | | Lockheed Martin Corp. | | | 10,772,905 | |

100,400 | | Raytheon Co. | | | 9,606,272 | |

200,625 | | Tyco International, PLC | | | 7,720,050 | |

| | | | | | |

| | | | | 87,819,056 | |

| | | | | | |

| |

Retail Trade - 9.2% | | | | |

167,100 | | CVS Health Corp. | | | 17,525,448 | |

242,725 | | Home Depot, Inc. | | | 26,974,029 | |

191,196 | | Macy’s, Inc. | | | 12,899,994 | |

180,025 | | Target Corp. | | | 14,695,441 | |

159,575 | | TJX Cos., Inc. | | | 10,559,078 | |

175,300 | | Wal-Mart Stores, Inc. | | | 12,434,029 | |

| | | | | | |

| | | | | 95,088,019 | |

| | | | | | |

| |

Technology Services - 4.9% | | | | |

79,875 | | Accenture, PLC | | | 7,730,302 | |

89,450 | | Automatic Data Processing, Inc. | | | 7,176,574 | |

576,175 | | Microsoft Corp. | | | 25,438,126 | |

255,025 | | Oracle Corp. | | | 10,277,508 | |

| | | | | | |

| | | | | 50,622,510 | |

| | | | | | |

| |

Transportation - 3.7% | | | | |

128,950 | | Delta Air Lines, Inc. | | | 5,297,266 | |

149,200 | | Ryder System, Inc. | | | 13,035,604 | |

81,575 | | Union Pacific Corp. | | | 7,779,808 | |

123,750 | | United Parcel Service, Inc. | | | 11,992,612 | |

| | | | | | |

| | | | | 38,105,290 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Utilities - 4.6% | | | | |

470,400 | | CenterPoint Energy, Inc. | | | 8,951,712 | |

200,825 | | Kinder Morgan, Inc. | | | 7,709,672 | |

191,048 | | Laclede Group, Inc. | | | 9,945,960 | |

141,675 | | NextEra Energy, Inc. | | | 13,888,400 | |

157,500 | | WEC Energy Group, Inc. | | | 7,082,775 | |

| | | | | | |

| | | | | 47,578,519 | |

| | | | | | |

| |

Total Common Stocks

(cost: $873,543,175) | | | 1,022,437,153 | |

| | | | | | |

| |

Investment Companies - 1.1% | | | | |

147,800 | | Kayne Anderson MLP Investment Co. | | | 4,535,982 | |

200,400 | | Tortoise Energy Infrastructure Corp. | | | 7,396,764 | |

| | | | | | |

| |

Total Investment Companies

(cost: $13,151,597) | | | 11,932,746 | |

| | | | | | |

| |

Total Investments in Securities - 99.6%

(cost: $886,694,772) | | | 1,034,369,899 | |

| |

Other Assets and Liabilities, net - 0.4% | | | 4,049,301 | |

| | | | | | |

| |

Total Net Assets - 100.0% | | $ | 1,038,419,200 | |

| | | | | | |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

ADR — American Depositary Receipt

LLC — Limited Liability Company

MLP — Master Limited Partnership

PLC — Public Limited Company

A summary of the levels for the Fund’s investments as of June 30, 2015 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1

Quoted Price ($) | | | Level 2

Other significant

observable inputs ($) | | Level 3 Significant

unobservable inputs ($) | | Total ($) | |

Common Stocks ** | | | 1,022,437,153 | | | — | | — | | | 1,022,437,153 | |

Investment Companies | | | 11,932,746 | | | — | | — | | | 11,932,746 | |

| | | | |

Total: | | | 1,034,369,899 | | | — | | — | | | 1,034,369,899 | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

For the reporting period, there were no transfers between levels 1, 2 and 3.

| | |

See accompanying notes to financial statements. | | |

JUNE 30, 2015 | | 15 |

|

|

| |

Sit Global Dividend Growth Fund - Class I and Class S |

OBJECTIVE & STRATEGY

The objective of the Sit Global Dividend Growth Fund is to provide current income that exceeds the dividend yield of the MSCI World Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks issued by U.S. and foreign companies. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

Global equity markets delivered modest returns over the twelve month period ended June 30, 2015. The U.S. equity markets appreciated in the mid-single digits while international markets were down in the mid-single digits. The Sit Global Dividend Growth Fund Class I appreciated +2.19% outperforming the MSCI World Index, which appreciated +1.43%. The Fund’s gross dividend yield (before deduction of Fund expenses) is 2.80% compared to the 2.38% yield of the MSCI World Index. Within the Index, the information technology, health care and consumer discretionary sectors had the strongest returns while the energy and material sectors were down double digits. Regionally, North America was the sole country with positive performance. The weakest region was Europe.

Contributing most favorably to relative performance in the last twelve months were the Fund’s holdings in the energy sector. The underweight position, positive currency effect and good stock selection all contributed. The materials and consumer discretionary sectors also contributed nicely due to good stock selection and currency effect. Conversely, the Fund was negatively impacted by the holdings in the industrial, health care, and utilities sectors.

Geographically, the United Kingdom and Singapore were the top contributing countries due to strong stock selection. France had the largest negative impact due to stock selection followed by Switzerland due to negative stock selection and the overweight position.

Global equities gained further ground over the past twelve months despite a decidedly clouded economic picture, both in the U.S. and in many regions around the world. Fears of a Greek debt default or potential exit from the Euro Area weighed heavily on returns across Europe in June. While Greece will remain a headline risk we believe a highly accommodative monetary policy, solid export demand driven by continued currency weakness, and ongoing upward earnings revisions driven by improving demand, operating leverage, and deployment of excess cash for acquisitions and share repurchases will support stock prices. We remain overweight Europe, with holdings weighted towards companies that have exposure outside of Europe and are beneficiaries of the weak euro; possess secular or niche growth drivers; and/or address domestic markets where there is meaningful pent-up demand. Given the European overweight, the Fund is modestly underweight in the U.S. and meaningfully underweight in Japan as we remain skeptical of the durability of the current recovery.

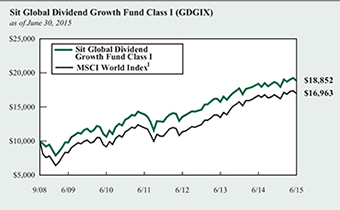

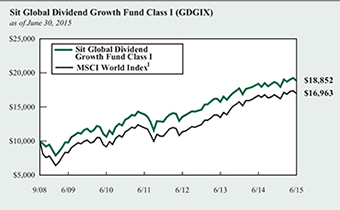

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the MSCI World Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. It is not possible to invest directly in an index. This is the Fund’s primary index.

While there has been some concern that dividend paying stocks may lag the broader market if the U.S. Federal Reserve begins to finally raise rates, there are some important considerations to keep in mind. First, and foremost, we do not believe rates will rise significantly given the pace of economic growth and benign inflationary pressures, both in the U.S. and abroad. Second, as we often point out, we expect all companies within the Fund to grow dividends on a consistent basis, providing a natural hedge if interest rates and inflation move higher over time. Third, any significant increase in interest rates could result in a sharp rise in volatility and a market correction. We note that the Fund has historically proven relatively defensive in periods of market turmoil.

Roger J. Sit Raymond E. Sit Tasha M. Murdoff

Kent L. Johnson Michael J. Stellmacher

Portfolio Managers

| | |

Information on this page is unaudited. |

16 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2015

| | | | | | | | | | | | |

| | | Sit Global Dividend Growth Fund | | | MSCI

World Index 1 | |

| | Class I | | | Class S | | |

One Year | | | 2.19% | | | | 2.00% | | | | 1.43% | |

Five Year | | | 12.08 | | | | 11.81 | | | | 13.10 | |

Since Inception (9/30/08) | | | 9.84 | | | | 9.57 | | | | 8.14 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. It is not possible to invest directly in an index.

PORTFOLIO SUMMARY

| | |

| Class I: | | |

Net Asset Value 6/30/15: | | $ 14.80 Per Share |

Net Asset Value 6/30/14: | | $ 15.74 Per Share |

Total Net Assets: | | $ 21.4 Million |

| Class S: | | |

Net Asset Value 6/30/15: | | $ 14.78 Per Share |

Net Asset Value 6/30/14: | | $ 15.72 Per Share |

Total Net Assets: | | $ 3.5 Million |

| |

Weighted Average Market Cap: | | $ 108.7 Billion |

TOP 10 HOLDINGS

1. Medtronic, PLC

2. Roche Holding AG

3. Seven & I Holdings Co., Ltd.

4. BCE, Inc.

5. Apple, Inc.

6. Nestle SA

7. Verizon Communications, Inc.

8. Barclays, PLC

9. Diageo, PLC, ADR

10. Cardinal Health, Inc.

Based on total net assets as of June 30, 2015. Subject to change.

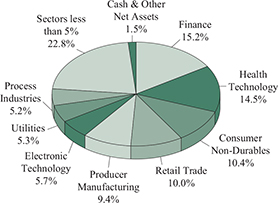

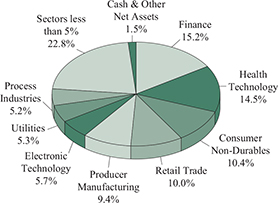

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2015. Subject to change.

| | |

Information on this page is unaudited. | | |

JUNE 30, 2015 | | 17 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Global Dividend Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Common Stocks - 97.6% | | | | |

Africa/Middle East - 1.0% | | | | |

Israel - 1.0% | | | | |

4,300 | | Teva Pharmaceutical Industries, Ltd., ADR | | | 254,130 | |

| | | | | | |

Asia - 5.3% | | | | |

China/Hong Kong - 1.1% | | | | |

5,950 | | HSBC Holdings, PLC, ADR | | | 266,620 | |

| | | | | | |

Japan - 2.7% | | | | |

15,700 | | Seven & I Holdings Co., Ltd. | | | 673,932 | |

| | | | | | |

Singapore - 1.5% | | | | |

2,800 | | Avago Technologies, Ltd. | | | 372,204 | |

| | | | | | |

Europe - 34.2% | | | | |

Belgium - 1.8% | | | | |

3,600 | | Anheuser-Busch InBev NV, ADR | | | 434,412 | |

| | | | | | |

France - 4.8% | | | | |

3,915 | | BNP Paribas SA | | | 237,573 | |

25,700 | | GDF Suez | | | 478,493 | |

2,750 | | Schlumberger, Ltd. | | | 237,022 | |

3,500 | | Schneider Electric SE | | | 242,337 | |

| | | | | | |

| | | | | 1,195,425 | |

| | | | | | |

Germany - 1.8% | | | | |

4,300 | | Siemens AG | | | 435,039 | |

| | | | | | |

Ireland - 4.4% | | | | |

2,575 | | Accenture, PLC | | | 249,208 | |

11,524 | | Medtronic, PLC | | | 853,928 | |

| | | | | | |

| | | | | 1,103,136 | |

| | | | | | |

Italy - 0.7% | | | | |

6,050 | | Azimut Holding SpA | | | 177,096 | |

| | | | | | |

Netherlands - 2.6% | | | | |

18,650 | | ING Groep NV, ADR | | | 309,217 | |

3,125 | | LyondellBasell Industries NV | | | 323,500 | |

| | | | | | |

| | | | | 632,717 | |

| | | | | | |

Spain - 1.2% | | | | |

45,200 | | Iberdrola SA | | | 305,171 | |

| | | | | | |

Switzerland - 9.2% | | | | |

2,500 | | ACE, Ltd. | | | 254,200 | |

3,945 | | Adecco SA | | | 320,166 | |

7,550 | | Nestle SA | | | 544,737 | |

2,885 | | Roche Holding AG | | | 808,929 | |

1,200 | | Zurich Insurance Group AG | | | 365,316 | |

| | | | | | |

| | | | | 2,293,348 | |

| | | | | | |

United Kingdom - 7.7% | | | | |

123,975 | | Barclays, PLC | | | 508,128 | |

7,875 | | Burberry Group, PLC | | | 194,279 | |

3,650 | | Delphi Automotive, PLC | | | 310,578 | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| | |

4,250 | | Diageo, PLC, ADR | | | 493,170 | |

68,065 | | DS Smith, PLC | | | 412,756 | |

| | | | | | |

| | | | | 1,918,911 | |

| | | | | | |

North America - 57.1% | | | | |

Bermuda - 0.6% | | | | |

4,000 | | Invesco, Ltd. | �� | | 149,960 | |

| | | | | | |

Canada - 5.0% | | | | |

3,600 | | Agrium, Inc. | | | 381,420 | |

14,375 | | BCE, Inc. | | | 610,938 | |

8,900 | | Suncor Energy, Inc. | | | 244,928 | |

| | | | | | |

| | | | | 1,237,286 | |

| | | | | | |

United States - 51.5% | | | | |

1,550 | | 3M Co. | | | 239,165 | |

6,300 | | AbbVie, Inc. | | | 423,297 | |

1,425 | | Ameriprise Financial, Inc. | | | 178,025 | |

4,400 | | Apple, Inc. | | | 551,870 | |

9,400 | | Applied Materials, Inc. | | | 180,668 | |

5,300 | | Arthur J Gallagher & Co. | | | 250,690 | |

2,150 | | Automatic Data Processing, Inc. | | | 172,494 | |

5,850 | | Cardinal Health, Inc. | | | 489,352 | |

16,200 | | CenterPoint Energy, Inc. | | | 308,286 | |

2,600 | | Chevron Corp. | | | 250,822 | |

2,550 | | CVS Health Corp. | | | 267,444 | |

4,375 | | Discover Financial Services | | | 252,088 | |

1,775 | | General Dynamics Corp. | | | 251,500 | |

2,225 | | Gilead Sciences, Inc. | | | 260,503 | |

3,925 | | Home Depot, Inc. | | | 436,185 | |

4,300 | | Honeywell International, Inc. | | | 438,471 | |

10,200 | | Intel Corp. | | | 310,233 | |

3,600 | | International Paper Co. | | | 171,324 | |

3,250 | | Johnson & Johnson | | | 316,745 | |

6,650 | | JPMorgan Chase & Co. | | | 450,604 | |

3,125 | | Kimberly-Clark Corp. | | | 331,156 | |

6,050 | | Kinder Morgan, Inc. | | | 232,260 | |

2,275 | | Lockheed Martin Corp. | | | 422,922 | |

5,350 | | Macy’s, Inc. | | | 360,964 | |

3,550 | | Marathon Petroleum Corp. | | | 185,700 | |

10,950 | | Microsoft Corp. | | | 483,442 | |

4,975 | | Occidental Petroleum Corp. | | | 386,906 | |

4,700 | | PepsiCo, Inc. | | | 438,698 | |

12,875 | | Pfizer, Inc. | | | 431,699 | |

4,250 | | Procter & Gamble Co. | | | 332,520 | |

4,125 | | Prudential Financial, Inc. | | | 361,020 | |

1,125 | | Snap-On, Inc. | | | 179,156 | |

3,400 | | St. Jude Medical, Inc. | | | 248,438 | |

4,800 | | Starbucks Corp. | | | 257,352 | |

2,400 | | Time Warner, Inc. | | | 209,784 | |

2,950 | | TJX Cos., Inc. | | | 195,202 | |

3,800 | | Union Pacific Corp. | | | 362,406 | |

| | |

See accompanying notes to financial statements. | | |

18 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| | |

3,200 | | United Parcel Service, Inc. | | | 310,112 | |

11,200 | | Verizon Communications, Inc. | | | 522,032 | |

5,250 | | Wal-Mart Stores, Inc. | | | 372,382 | |

| | | | | | |

| | | | | 12,823,917 | |

| | | | | | |

Total Common Stocks

(cost: $22,755,366) | | | 24,273,304 | |

| | | | | | |

Investment Companies - 0.9% | | | | |

7,775 | | Kayne Anderson MLP Investment Co. | | | 238,615 | |

| | | | | | |

(cost: $254,808) | | | | |

| |

Total Investments in Securities - 98.5% | | | | |

(cost: $23,010,174) | | | 24,511,919 | |

| |

Other Assets and Liabilities, net - 1.5% | | | 363,615 | |

| | | | | | |

| |

Total Net Assets - 100.0% | | | $24,875,534 | |

| | | | | | |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments

ADR — American Depositary Receipt

MLP — Master Limited Partnership

PLC — Public Limited Company

| | |

See accompanying notes to financial statements. | | |

JUNE 30, 2015 | | 19 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Global Dividend Growth Fund (Continued)

A summary of the levels for the Fund’s investments as of June 30, 2015 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 Quoted Price ($) | | | Level 2

Other significant

observable inputs ($) | | | Level 3 Significant

unobservable inputs ($) | | Total ($) | |

Common Stocks | | | | | | | | | | | | | | |

Belgium | | | 434,412 | | | | — | | | — | | | 434,412 | |

Bermuda | | | 149,960 | | | | — | | | — | | | 149,960 | |

Canada | | | 1,237,286 | | | | — | | | — | | | 1,237,286 | |

China/Hong Kong | | | 266,620 | | | | — | | | — | | | 266,620 | |

France | | | 237,022 | | | | 958,403 | | | — | | | 1,195,425 | |

Germany | | | — | | | | 435,039 | | | — | | | 435,039 | |

Ireland | | | 1,103,136 | | | | — | | | — | | | 1,103,136 | |

Israel | | | 254,130 | | | | — | | | — | | | 254,130 | |

Italy | | | — | | | | 177,096 | | | — | | | 177,096 | |

Japan | | | — | | | | 673,932 | | | — | | | 673,932 | |

Netherlands | | | 632,717 | | | | — | | | — | | | 632,717 | |

Singapore | | | 372,204 | | | | — | | | — | | | 372,204 | |

Spain | | | — | | | | 305,171 | | | — | | | 305,171 | |

Switzerland | | | 254,200 | | | | 2,039,148 | | | — | | | 2,293,348 | |

United Kingdom | | | 803,748 | | | | 1,115,163 | | | — | | | 1,918,911 | |

United States | | | 12,823,917 | | | | — | | | — | | | 12,823,917 | |

Investment Companies | | | 238,615 | | | | — | | | — | | | 238,615 | |

| | | | |

Total: | | | 18,807,967 | | | | 5,703,952 | | | — | | | 24,511,919 | |

The Fund adjusts the closing price of foreign equity securities by applying a systematic process for events occurring after the close of the foreign exchanges. At each reporting period, this process is applied for all foreign securities and therefore all foreign securities are classified as level 2. There are no transfers between level 1 and level 2 between reporting periods as a result of applying this process. Level 1 securities of foreign issuers are primarily American Depositary Receipts (ADRs), Public Limited Companies (PLCs) or Global Depositary Receipts (GDRs). There were no transfers into or out of level 3 during the reporting period.

| | |

See accompanying notes to financial statements. | | |

20 | | SIT MUTUAL FUNDS ANNUAL REPORT |

[This page intentionally left blank.]

|

|

| |

Sit Large Cap Growth Fund |

OBJECTIVE & STRATEGY

The objective of the Sit Large Cap Growth Fund is to maximize long-term capital appreciation. The Fund pursues this objective by investing at least 80% of its net assets in the common stocks of domestic growth companies with capitalizations of $5 billion or more at the time of purchase.

The Sit Large Cap Growth Fund’s one-year return was +10.62%, compared to the +10.56% return for the Russell 1000® Growth Index. The S&P 500® Index return for the period was +7.42%.

U.S. stocks overcame some significant headwinds, including a stall in corporate earnings growth and signs of a less accommodative Federal Reserve, to post solid gains over the past year. While we believe stock prices can grind higher from here, investors must be prepared for an increase in volatility over the next several quarters as fears over higher interest rates in the U.S. and concerns over economic growth in emerging markets have potential to rattle global markets. We strongly believe, however, that the environment for high quality, large capitalization growth companies is very attractive on a relative basis. From a sector standpoint, we continue to believe that the two most heavily weighted sectors within the Fund, technology services and health technology, are particularly attractive, as valuations are reasonable given the secular growth in these areas. Conversely, the portfolio has minimal exposure to commodities (including energy) and other highly cyclical industries that are overly dependent on robust economic activity to drive earnings growth.

Relative to the Russell 1000® Growth Index, performance over the past year was positively impacted by stock selection in the consumer services, finance and health services sectors, as well as by an overweight position in the health technology sector, which performed very strongly during the period. Key contributors in these sectors included Starbucks Corp., Visa, Goldman Sachs, JPMorgan Chase, UnitedHealth Group, HCA Holdings, Gilead Sciences, Allergan and Regeneron Pharmaceuticals. Conversely, negative stock selection and overweighted positions in the underperforming producer manufacturing and technology services sector detracted from performance over the past twelve months. Laggards in these sectors included Trinity Industries, Eaton Corp., Google and Priceline Group.

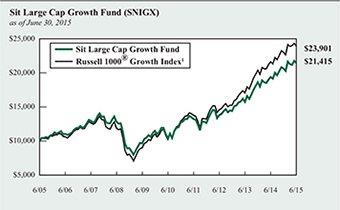

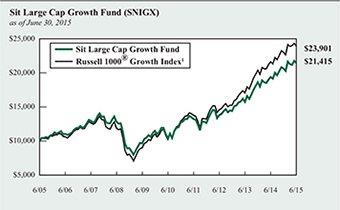

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the Russell 1000® Growth Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index. This is the Fund’s primary index.

We continue to be optimistic on the outlook for companies held in the Fund, and appreciate shareholders’ continued interest.

Roger J. Sit

Ronald D. Sit

Michael J. Stellmacher

Portfolio Managers

| | |

Information on this page is unaudited. |

22 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of June 30, 2015

| | | | | | | | | | | | |

| | | Sit Large

Cap Growth

Fund | | | Russell

1000®

Growth

Index 1 | | | Russell

1000®

Index 2 | |

| | | |

One Year | | | 10.62 | % | | | 10.56 | % | | | 7.37 | % |

Five Year | | | 15.56 | | | | 18.59 | | | | 17.58 | |

Ten Year | | | 7.91 | | | | 9.10 | | | | 8.13 | |

Since Inception 3 | | | 10.04 | | | | 11.11 | | | | 11.86 | |

(9/2/82) | | | | | | | | | | | | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 Russell 1000® Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index.

2 Russell 1000® Index is an unmanaged index that measures the performance of approximately 1,000 of the largest U.S. companies by market capitalization.

3 On 6/6/93, the Fund’s investment objective changed to allow for a portfolio of 100% stocks. Prior to that time, the portfolio was required to contain no more than 80% stocks.

PORTFOLIO SUMMARY

| | |

Net Asset Value 6/30/15: | | $ 47.21 Per Share |

Net Asset Value 6/30/14: | | $ 52.51 Per Share |

Total Net Assets: | | $ 144.8 Million |

Weighted Average Market Cap: | | $ 129.8 Billion |

TOP 10 HOLDINGS

1. Apple, Inc.

2. Google, Inc.

3. Medtronic, PLC

4. Gilead Sciences, Inc.

5. Visa, Inc.

6. Home Depot

7. CVS Health Corp.

8. Microsoft Corp.

9. PepsiCo, Inc.

10. Allergan, PLC

Based on total net assets as of June 30, 2015. Subject to change.

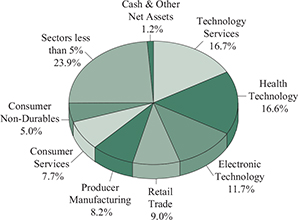

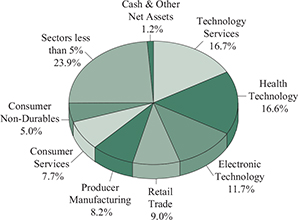

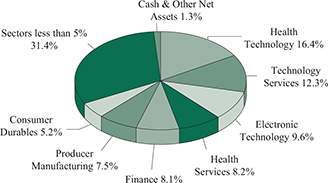

FUND DIVERSIFICATION

Based on total net assets as of June 30, 2015. Subject to change.

| | |

Information on this page is unaudited. | | |

JUNE 30, 2015 | | 23 |

SCHEDULE OF INVESTMENTS

June 30, 2015

Sit Large Cap Growth Fund

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Common Stocks - 98.8% | | | | |

Commercial Services - 2.2% | | | | |

16,800 | | Equifax, Inc. | | | 1,631,112 | |

26,600 | | Robert Half International, Inc. | | | 1,476,300 | |

| | | | | | |

| | | | | 3,107,412 | |

| | | | | | |

Communications - 2.6% | | | | |

11,500 | | SBA Communications Corp. * | | | 1,322,155 | |

53,400 | | Verizon Communications, Inc. | | | 2,488,974 | |

| | | | | | |

| | | | | 3,811,129 | |

| | | | | | |

Consumer Durables - 1.5% | | | | |

8,500 | | Polaris Industries, Inc. | | | 1,258,935 | |

5,500 | | Whirlpool Corp. | | | 951,775 | |

| | | | | | |

| | | | | 2,210,710 | |

| | | | | | |

Consumer Non-Durables - 5.0% | | | | |

19,800 | | NIKE, Inc. | | | 2,138,796 | |

33,600 | | PepsiCo, Inc. | | | 3,136,224 | |

24,800 | | Procter & Gamble Co. | | | 1,940,352 | |

| | | | | | |

| | | | | 7,215,372 | |

| | | | | | |

Consumer Services - 7.7% | | | | |

1,050 | | Chipotle Mexican Grill, Inc. * | | | 635,240 | |

34,500 | | H&R Block, Inc. | | | 1,022,925 | |

53,000 | | Starbucks Corp. | | | 2,841,595 | |

19,075 | | Time Warner, Inc. | | | 1,667,346 | |

41,700 | | Twenty-First Century Fox, Inc. | | | 1,357,126 | |

53,700 | | Visa, Inc. | | | 3,605,955 | |

| | | | | | |

| | | | | 11,130,187 | |

| | | | | | |

Electronic Technology - 11.7% | | | | |

63,975 | | Apple, Inc. | | | 8,024,064 | |

91,900 | | Applied Materials, Inc. | | | 1,766,318 | |

19,600 | | Avago Technologies, Ltd. | | | 2,605,428 | |

57,500 | | Ciena Corp. * | | | 1,361,600 | |

59,300 | | Intel Corp. | | | 1,803,610 | |

7,900 | | Skyworks Solutions, Inc. | | | 822,390 | |

10,900 | | Xilinx, Inc. | | | 481,344 | |

| | | | | | |

| | | | | 16,864,754 | |

| | | | | | |

Energy Minerals - 2.7% | | | | |

16,500 | | Continental Resources, Inc. * | | | 699,435 | |

8,100 | | EOG Resources, Inc. | | | 709,155 | |

12,000 | | Gulfport Energy Corp. * | | | 483,000 | |

22,860 | | Marathon Petroleum Corp. | | | 1,195,807 | |

11,200 | | Occidental Petroleum Corp. | | | 871,024 | |

| | | | | | |

| | | | | 3,958,421 | |

| | | | | | |

| | | | | | |

Quantity | | Name of Issuer | | Fair Value ($) | |

| |

Finance - 3.2% | | | | |

6,700 | | Goldman Sachs Group, Inc. | | | 1,398,893 | |

25,300 | | JPMorgan Chase & Co. | | | 1,714,328 | |

11,300 | | Marsh & McLennan Cos., Inc. | | | 640,710 | |

10,400 | | T Rowe Price Group, Inc. | | | 808,392 | |

| | | | | | |

| | | | | 4,562,323 | |

| | | | | | |

Health Services - 4.2% | | | | |

15,100 | | Express Scripts Holding Co. * | | | 1,342,994 | |

3,800 | | Humana, Inc. | | | 726,864 | |

9,600 | | McKesson Corp. | | | 2,158,176 | |

15,100 | | UnitedHealth Group, Inc. | | | 1,842,200 | |

| | | | | | |

| | | | | 6,070,234 | |

| | | | | | |

Health Technology - 16.6% | | | | |

25,900 | | AbbVie, Inc. | | | 1,740,221 | |

7,400 | | Alexion Pharmaceuticals, Inc. * | | | 1,337,698 | |

9,600 | | Allergan, PLC * | | | 2,913,313 | |

19,050 | | Celgene Corp. * | | | 2,204,752 | |