UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03343

Sit Large Cap Growth Fund, Inc.

(Exact name of registrant as specified in charter)

80 South Eighth Street

3300 IDS Center

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

80 South Eighth Street

3300 IDS Center

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 332-3223

Date of fiscal year end: June 30, 2021

Date of reporting period: December 31, 2021

Item 1: Reports to Stockholders

Semi-Annual Report

December 31, 2021

Balanced Fund

Dividend Growth Fund

Global Dividend Growth Fund

Large Cap Growth Fund

ESG Growth Fund

Mid Cap Growth Fund

Small Cap Dividend Growth Fund

Small Cap Growth Fund

International Growth Fund

Developing Markets Growth Fund

| | |

| | Sit Mutual Funds |

|

Sit Mutual Funds STOCK FUNDS SEMI-ANNUAL REPORT TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

February 4, 2022

Dear Fellow Shareholders:

Global economic growth was relatively resilient in 2021, despite the ongoing struggle to overcome both direct and indirect impacts of the Covid-19 pandemic. Corporate earnings have surprised on the upside over the last several quarters, and we believe the continuation of this trend will be critical in determining the market gains in the year ahead.

Economic Outlook

The approval of Covid-19 vaccines beginning in December 2020 and subsequent inoculations helped unleash pent-up demand and contributed to a sustained rebound in economic activity in 2021. As a result, the consensus real GDP growth forecast for 2021 is now +5.6%, up from +4.0% at the start of the year. U.S. household balance sheets are in excellent shape, at least at the consolidated level, leaving consumers well positioned to fuel the next leg of the expansion. Importantly, job growth has accelerated in recent months, and we expect this to continue as savings rates continue to come down due to the waning impact of government stimulus. A surge in both financial and tangible asset values drove household net worth to an all-time high of $145 trillion at the end of the third quarter. The associated wealth effect and accumulated excess savings of about $2.5 trillion should sustain robust spending. Even so, we project spending on goods (ex. autos) will normalize after housebound consumers, with federal aid in hand, pulled forward the equivalent of about three years’ worth of incremental demand at the prior trendline growth rate. Expenditures on services, a category 1.5 to 2.0 times bigger than goods, is up from an April 2020 low but remains well below its historical trendline. Omicron’s proliferation is knocking demand near term and will likely weigh heavily on first quarter 2022 economic growth. However, services are well-poised for renewed strength once the latest Covid-19 wave ebbs. Despite clear signs that the broad increase in consumer prices is curbing demand, we expect this impact to moderate as inflation decelerates in the year ahead.

We believe inflation will progressively lessen in 2022 against challenging year-over-year comparisons (i.e., “base effect”) but remain above the Federal Reserve’s targeted +2.0% entering 2023. Nonetheless, the global spike in Covid-19 infections has added considerable uncertainty to the supply-demand outlook and its effect on inflation near term. Ultimately, we anticipate easing supply constraints and subsiding demand growth to lead to goods disinflation/deflation, with continued services inflation, notably that driven by housing, a partial offset. Still, tightening U.S. labor conditions could trigger a wage-price spiral and persistent inflation, absent higher productivity. Due to higher inflation expectations, the Fed now intends to taper additional asset purchases to nil by March and to hike the federal funds rate at a much faster pace. Although

the Fed kept asset levels steady for three years after quantitative easing between 2012 and 2014, it is now supposedly considering allowing the balance sheet to wind down “naturally” as assets mature. Moreover, the Fed’s hawkish pivot occurred after a peak in market-based inflation expectations and as Covid headwinds were reaccelerating, increasing the possibility of a policy mistake. Nonetheless, we expect the Fed to remain responsive to shifting economic and financial market conditions.

Covid-19 impacts have also influenced economic trends outside the U.S. Even before Omicron became a household name, the Delta variant of Covid-19 was, once again, surging through continental Europe in a summer wave. In the U.K., new Covid-19 cases never truly receded from the summer levels but, instead, remained elevated through the fall and then burst higher in December. The services sector is bearing the brunt of record Omicron-led cases and renewed restrictions, while manufacturing has been resilient. Japan’s GDP growth disappointed in calendar 2021 amid a stop-start dynamic and pandemic-induced supply chain disruptions. Sluggish initial vaccination efforts and a greater dependence on disruption-prone goods exports, such as autos, rendered the economy vulnerable to setbacks. However, Japan’s economy appears better positioned for growth in 2022. China’s economy has slowed sharply in recent months, due largely to prior policy tightening, and may stay growth-challenged near term. We suspect the ongoing deleveraging of China’s property market will be a sizable drag on economic growth in 2022. Moreover, given the Omicron-led Covid-19 outbreak globally, China’s zero-Covid policy could remain in place beyond the February 2022 Winter Olympics and continue hindering the services sector recovery. Ahead of China’s 20th Party Congress in late 2022, top policymakers announced that economic growth stability would be the highest priority in 2022. The scale/scope of policy support should become clearer in the first half, with underutilized fiscal revenue and government bond issuance in 2021 offering capacity for spending to bolster economic growth.

Equity Strategy

Following three exceptional years, we expect moderating equity returns in 2022, as tightening monetary policy challenges equity valuations and corporate earnings growth begins to decelerate. In addition, there are numerous crosscurrents (e.g., Covid, interest rates, mid-term elections, geopolitics, etc.) to sustain the recent uptick in market volatility measures.

Better-than-expected corporate earnings triumphed over accumulating risks and uncertainties to drive U.S. equities higher in 2021. Following steady upward revisions throughout the year, consensus estimates now infer S&P 500® Index bottom-up earnings growth of +51.4% in 2021, up from the +23.2% forecast at the start

| | |

| | |

| 2 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

of the year. Thus, the S&P 500® Index returned +28.7% in 2021 on relatively stable valuations, bringing the three-year annualized return of +26.1% to its best level in over two decades. Market momentum has been boosted by fund flows, as investors poured into equities in 2021, prompted by abundant liquidity, rebounding economic activity, positive earnings revisions, the Covid-19 vaccine rollout, the “there-is-no-alternative” effect, a revival in day trading, and combinations thereof. Nearly $1 trillion flowed into global equity mutual funds and ETFs in 2021, more than the cumulative sum for the prior 20-year period. Global M&A deal volume surged to a record $4.1 trillion in 2021, nearly double the average annual amount over the prior ten years. While rising interest rates could dampen activity somewhat, 2022 looks poised for another solid year of dealmaking. Besides M&A, listed companies are increasing stock repurchase programs and dividend payments to bolster share prices. S&P 500® Index constituents bought back an estimated $730 billion in stock in 2021 (up over +40% year over year) and will pay out about $550 billion in dividends (+15%).

We anticipate the combination of decelerating corporate earnings growth and modestly lower valuations due to tighter monetary policy will result in lower overall equity returns in 2022. In addition, market volatility may increase, given the numerous crosscurrents (e.g., Covid-19 trends, interest rates, geopolitics). However, in our view, companies with pricing power will continue to prosper, even if inflation pressures begin to moderate in some areas. Together, these conditions point to an opportunity for stock picking, as company fundamentals become paramount, after the powerful liquidity backdrop that “lifted all boats” for most stocks over the past two years. Specifically, we expect earnings growth to be the key determinant of stock and sector performance in the year ahead.

We expect the technology, healthcare, and capital goods sectors to stand out as best positioned to deliver above-average earnings growth in 2022. The technology sector remains a favorite, as a cyclical pick-up in enterprise spending amplifies several secular growth drivers (e.g., cloud spending, artificial intelligence, digital transformation, etc.). Moreover, capital goods firms are rallying from depressed conditions (first triggered by trade disputes, then Covid-19). We favor firms exposed to accelerating spending in infrastructure, automation, and “electrification” in key end markets, such as autos and renewable energy. Lastly, the aging global population will continue to drive demand for healthcare products and services, with a rebound in key Covid-impacted areas, such as medical devices and hospitals, expected once the current surge in cases subsides and elective procedures advance. In terms of underweights, we have become more cautious on retailers, as stimulus spending is waning and cost pressures (e.g., wages, shipping) continue to squeeze margins.

Dividend-based investment strategies have lagged over the last several years, primarily due to a combination of the unprecedented outperformance in “long duration,” non-dividend-paying growth stocks and the lagging performance of the defensive names within the dividend-paying universe. We believe catalysts are emerging for improved performance of dividend payers over the near-to-intermediate term. First, the expected moderation in broad stock market returns will raise the appeal of incremental returns from dividends. Second, dividend increases have been accelerating for several quarters, and we suspect investors may view companies that are growing dividends as an attractive alternative to bonds if interest rates increase. Finally, we believe the relative price stability (i.e., lower betas) of dividend payers may attract investors as market volatility increases.

For international portfolios, we are overweight equities in China, South Korea, Singapore, and India. The worst of the Covid-19 lockdown is behind us, and the recent surge in Covid cases driven by the Omicron variant only temporarily delays the full reopening of economies. Immunization and restrictions should ultimately contain the spread of the virus and allow for an economic expansion. As a result, we are optimistic on emerging markets and expect stronger earnings growth in 2022. Although we are cautious on China near term, given lingering headwinds, such as still-negative earnings revisions, property market deleveraging, and elevated U.S.-China tensions, the positive policy shift to economic growth stability should lead to an expansion in price-to-earnings multiples. Notably, China’s valuation discounts to global equities are almost at all-time highs. We are maintaining our weight in currently out-of-favor internet stocks and prefer exposure to the reopening trade, mass consumption, capital market reform, and renewables themes as well. Our South Korea holdings are in technology, financials, e-commerce, and electric vehicle battery manufacturers. In Singapore, we favor financials, technology, gaming, and e-commerce sectors. India investments are in the industries of consumer, financials, energy, information services, and industrials.

Roger J. Sit

Chairman, President, CEO and Global CIO

OBJECTIVE & STRATEGY

The dual objectives of the Sit Balanced Fund are to seek long-term growth of capital consistent with the preservation of principal and to provide regular income. It pursues its objectives by investing in a diversified portfolio of stocks and bonds. The Fund may emphasize either equity securities or fixed-income securities, or hold equal amounts of each, dependent upon the Adviser’s analysis of market, financial and economic conditions.

The Fund’s permissible investment allocation is: 35-65% in equity securities and 35-65% in fixed-income securities. At all times at least 25% of the fixed-income assets will be invested in fixed-income senior securities.

Fund Performance

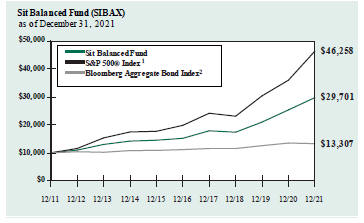

The Sit Balanced Fund’s return for the 6-month period ended December 31, 2021 was +6.95%. The S&P 500® Index return was +11.67% over the period, while the Bloomberg Aggregate Bond Index gained +0.06%.

Factors that Influenced the Fund’s Performance

During the 6-months ended December 31, 2021, the fixed income portion of the Fund outperformed the Bloomberg Aggregate Bond Index, driven by an income advantage as well as strong performance from positions in U.S. Treasury Inflation Protected securities (TIPs). U.S. consumers, flush with cash from stimulus checks and months of curtailed spending, thanks to the Covid-19 pandemic, unleashed a tsunami-like wave of pent-up demand during the period, which businesses were ill-prepared to meet, due to the ongoing worker shortages and global supply chain issues. Late in the period, Federal Reserve members finally acknowledged the extent of the inflation problems and showed a willingness to stop their aggressive money printing policy. The U.S. Treasury yield curve flattened meaningfully in response. Our overweight in TIPs provided a significant amount of inflation protection, resulting in the Treasury sector being the best performing sector. Overweights in the Taxable Municipal and Corporate bond sectors also contributed positively to performance, as both see their prospects improving as the economy emerges from the pandemic. Conversely, Mortgage-related sectors did poorly, as Fed tapering of mortgage purchases lowered demand. The equity portion of the Fund, while producing strong absolute returns, slightly underperformed the market during the period. This was largely due to negative stock selection in the consumer durables and technology services sectors. Countering this, the Fund’s stock selection in the electronic technology sector added to returns.

Outlook and Positioning

The fixed income portion of the portfolio is positioned defensively against a rise in interest rates. We believe it is wishful thinking to expect inflation to come down immediately from Fed tightening. Workers need to go back to work and, until they do, inflation is likely to remain elevated, pressuring interest rates higher. We think workers will return in the second half of 2022, at which time we expect to increase the quality of the portfolio and to be slow to reinvest cash, as we foresee the Fed raising rates four times to 1.0% by year end. In the equity portion of the Fund, we have maintained a large overweight position in technology companies that should benefit from emerging secular trends, some of

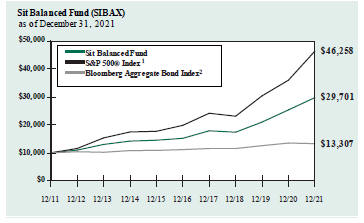

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the S&P 500® Index and the Bloomberg Aggregate Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the primary index for the equity portion of the Fund.

2 Bloomberg Aggregate Bond Index is an unmanaged market value weighted index which measures the performance of investment grade debt securities with maturities of at least one year. It is not possible to invest directly in an index. This is the primary index for the fixed income portion of the Fund.

which have been accelerated by the Covid-19 pandemic. Additionally, we are looking to selectively grow our exposure to early-stage cyclicals (e.g., transports, industrials), which should benefit more than the market, in general, from improving economic growth during 2022. While we expect consumer spending to remain strong in 2022, the Fund is underweight the consumer services sector, as services have seen outsized inflation pressure, driven largely by wage increases. The end of various federal aid programs may also affect spending.

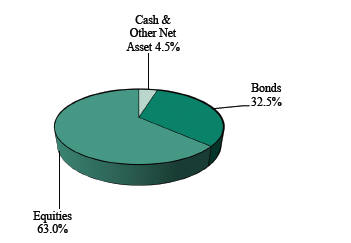

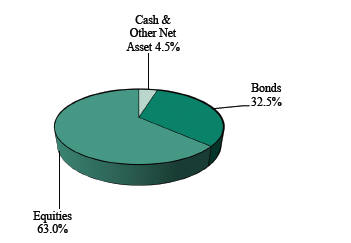

As of December 31, 2021, the asset allocation of the Fund was 63% equity, 32.5% fixed income, and 4.5% cash and equivalents.

Roger J. Sit

Bryce A. Doty

Portfolio Managers

| | |

| | |

| 4 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | | | | | |

COMPARATIVE RATES OF RETURNS | |

|

as of December 31, 2021 | |

| | | | Sit Balanced Fund | | |

| S&P 500

Index | ®

1 | |

| Bloomberg

Aggregate Bond Index |

|

| | | |

Six Months | | | 6.95% | | | | 11.67 | % | | | 0.06 | % |

| | | |

One Year | | | 17.15 | | | | 28.71 | | | | -1.54 | |

| | | |

Five Year | | | 14.35 | | | | 18.47 | | | | 3.57 | |

| | | |

Ten Years | | | 11.50 | | | | 16.55 | | | | 2.90 | |

| | | |

Since Inception (12/31/93) | | | 8.03 | | | | 10.77 | | | | 5.05 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index.

2 Bloomberg Aggregate Bond Index is an unmanaged market value weighted index which measures the performance of investment grade debt securities with maturities of at least one year.

| | | | |

PORTFOLIO SUMMARY | | | | |

| |

Net Asset Value 12/31/21: | | | $33.79 Per Share | |

| |

Net Asset Value 6/30/21: | | | $32.85 Per Share | |

| |

Total Net Assets: | | | $76.7 Million | |

Top Equity Holdings:

1. Apple, Inc.

2. Microsoft Corp.

3. Alphabet, Inc.

4. Amazon.com, Inc.

5. NVIDIA Corp.

Top Fixed Income Holdings:

1. United States Treasury Inflation Bonds, 0.13%, 1/15/23

2. United States Treasury Inflation Bonds, 0.63%, 1/15/24

3. U.S. Treasury Strip, 1.97%, 11/15/50

4. U.S. Treasury Bill, 0.01%, 1/25/22

5. U.S. Treasury Strip, 2.18%, 8/15/47

Based on total net assets as of December 31, 2021. Subject to change.

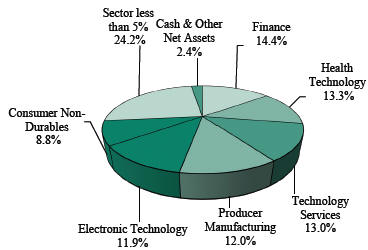

FUND DIVERSIFICATION

Based on total net assets as of December 31, 2021. Subject to change.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2021

Sit Balanced Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) |

| | |

Common Stocks - 63.0% | | | | | | | | |

| | |

Communications - 1.1% | | | | | | | | |

American Tower Corp. | | | 2,825 | | | | 826,312 | |

| | | | | | | | |

Consumer Durables - 1.4% | | | | | | | | |

Activision Blizzard, Inc. | | | 6,975 | | | | 464,047 | |

YETI Holdings, Inc. * | | | 7,300 | | | | 604,659 | |

| | | | | | | | |

| | |

| | | | | | | 1,068,706 | |

| | | | | | | | |

Consumer Non-Durables - 4.3% | | | | | | | | |

Conagra Brands, Inc. | | | 8,900 | | | | 303,935 | |

Constellation Brands, Inc. | | | 2,275 | | | | 570,957 | |

Estee Lauder Cos., Inc. - Class A | | | 2,275 | | | | 842,205 | |

Mondelez International, Inc. | | | 9,900 | | | | 656,469 | |

NIKE, Inc. | | | 2,950 | | | | 491,676 | |

PepsiCo, Inc. | | | 2,475 | | | | 429,932 | |

| | | | | | | | |

| | |

| | | | | | | 3,295,174 | |

| | | | | | | | |

Consumer Services - 2.6% | | | | | | | | |

Chegg, Inc. * | | | 3,325 | | | | 102,078 | |

McDonald’s Corp. | | | 2,300 | | | | 616,561 | |

Starbucks Corp. | | | 4,850 | | | | 567,305 | |

Visa, Inc. | | | 3,500 | | | | 758,485 | |

| | | | | | | | |

| | |

| | | | | | | 2,044,429 | |

| | | | | | | | |

Electronic Technology - 10.6% | | | | | | | | |

Apple, Inc. | | | 18,125 | | | | 3,218,456 | |

Applied Materials, Inc. | | | 7,825 | | | | 1,231,342 | |

Broadcom, Inc. | | | 1,865 | | | | 1,240,990 | |

Keysight Technologies, Inc. * | | | 2,950 | | | | 609,205 | |

NVIDIA Corp. | | | 5,140 | | | | 1,511,725 | |

Qualcomm, Inc. | | | 1,625 | | | | 297,164 | |

| | | | | | | | |

| | |

| | | | | | | 8,108,882 | |

| | | | | | | | |

Finance - 4.3% | | | | | | | | |

Ameriprise Financial, Inc. | | | 2,250 | | | | 678,735 | |

Chubb, Ltd. | | | 3,250 | | | | 628,258 | |

First Republic Bank | | | 1,750 | | | | 361,393 | |

Goldman Sachs Group, Inc. | | | 2,100 | | | | 803,355 | |

JPMorgan Chase & Co. | | | 3,425 | | | | 542,349 | |

T Rowe Price Group, Inc. | | | 1,550 | | | | 304,792 | |

| | | | | | | | |

| | |

| | | | | | | 3,318,882 | |

| | | | | | | | |

Health Services - 3.0% | | | | | | | | |

Centene Corp. * | | | 3,150 | | | | 259,560 | |

HCA Healthcare, Inc. | | | 2,625 | | | | 674,415 | |

UnitedHealth Group, Inc. | | | 2,825 | | | | 1,418,545 | |

| | | | | | | | |

| | |

| | | | | | | 2,352,520 | |

| | | | | | | | |

Health Technology - 5.8% | | | | | | | | |

Abbott Laboratories | | | 3,550 | | | | 499,627 | |

AbbVie, Inc. | | | 3,825 | | | | 517,905 | |

Baxter International, Inc. | | | 4,375 | | | | 375,550 | |

Dexcom, Inc. * | | | 1,465 | | | | 786,632 | |

Johnson & Johnson | | | 3,000 | | | | 513,210 | |

Medtronic, PLC | | | 6,950 | | | | 718,977 | |

Thermo Fisher Scientific, Inc. | | | 1,575 | | | | 1,050,903 | |

| | | | | | | | |

| | |

| | | | | | | 4,462,804 | |

| | | | | | | | |

Process Industries - 1.6% | | | | | | | | |

Darling Ingredients, Inc. * | | | 1,825 | | | | 126,454 | |

Linde, PLC | | | 1,225 | | | | 424,377 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) |

| | |

Sherwin-Williams Co. | | | 1,800 | | | | 633,888 | |

| | | | | | | | |

| | |

| | | | | | | 1,184,719 | |

| | | | | | | | |

Producer Manufacturing - 3.6% | | | | | | | | |

Honeywell International, Inc. | | | 2,275 | | | | 474,360 | |

Motorola Solutions, Inc. | | | 1,400 | | | | 380,380 | |

Northrop Grumman Corp. | | | 500 | | | | 193,535 | |

Parker-Hannifin Corp. | | | 1,600 | | | | 508,992 | |

Safran SA, ADR | | | 11,550 | | | | 353,314 | |

Siemens AG, ADR | | | 6,800 | | | | 588,880 | |

Trane Technologies, PLC | | | 1,200 | | | | 242,436 | |

| | | | | | | | |

| | |

| | | | | | | 2,741,897 | |

| | | | | | | | |

Retail Trade - 5.9% | | | | | | | | |

Amazon.com, Inc. * | | | 610 | | | | 2,033,947 | |

CVS Health Corp. | | | 5,800 | | | | 598,328 | |

Home Depot, Inc. | | | 2,050 | | | | 850,770 | |

Netflix, Inc. * | | | 500 | | | | 301,220 | |

TJX Cos., Inc. | | | 6,550 | | | | 497,276 | |

Ulta Beauty, Inc. * | | | 795 | | | | 327,810 | |

| | | | | | | | |

| | |

| | | | | | | 4,609,351 | |

| | | | | | | | |

Technology Services - 16.8% | | | | | | | | |

Accenture, PLC | | | 2,025 | | | | 839,464 | |

Adobe, Inc. * | | | 1,300 | | | | 737,178 | |

Alphabet, Inc. - Class A * | | | 620 | | | | 1,796,165 | |

Alphabet, Inc. - Class C * | | | 205 | | | | 593,186 | |

Atlassian Corp., PLC * | | | 2,150 | | | | 819,774 | |

Autodesk, Inc. * | | | 1,900 | | | | 534,261 | |

DocuSign, Inc. * | | | 2,025 | | | | 308,428 | |

Dynatrace, Inc. * | | | 5,975 | | | | 360,591 | |

EPAM Systems, Inc. * | | | 185 | | | | 123,663 | |

Intuit, Inc. | | | 1,200 | | | | 771,864 | |

Meta Platforms, Inc. * | | | 2,215 | | | | 745,015 | |

Microsoft Corp. | | | 7,800 | | | | 2,623,296 | |

Paycom Software, Inc. * | | | 600 | | | | 249,114 | |

PayPal Holdings, Inc. * | | | 3,300 | | | | 622,314 | |

RingCentral, Inc. * | | | 350 | | | | 65,573 | |

salesforce.com, Inc. * | | | 3,650 | | | | 927,575 | |

ServiceNow, Inc. * | | | 560 | | | | 363,502 | |

Splunk, Inc. * | | | 1,950 | | | | 225,654 | |

Twilio, Inc. * | | | 400 | | | | 105,336 | |

| | | | | | | | |

| | |

| | | | | | | 12,811,953 | |

| | | | | | | | |

Transportation - 1.5% | | | | | | | | |

FedEx Corp. | | | 2,350 | | | | 607,804 | |

Union Pacific Corp. | | | 2,050 | | | | 516,456 | |

| | | | | | | | |

| | |

| | | | | | | 1,124,260 | |

| | | | | | | | |

Utilities - 0.5% | �� | | | | | | | |

NextEra Energy, Inc. | | | 4,140 | | | | 386,510 | |

| | | | | | | | |

Total Common Stocks

(cost: $24,399,498) | | | | | | | 48,336,399 | |

| | | | | | | | |

See accompanying notes to financial statements.

| | |

| | |

| 6 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | | Fair Value ($) |

| | |

Bonds – 30.8% | | | | | | | | |

| | |

Asset-Backed Securities - 0.4% | | | | | | | | |

| | |

Bayview Opportunity Master Fund

2017-SPL1 A, 4.00%, 10/28/64 1, 4 | | | 32,720 | | | | 33,116 | |

| | |

New Century Home Equity Loan Trust

2005-A A4W, 4.71%, 8/25/35 14 | | | 343 | | | | 342 | |

| | |

OSCAR US Funding Trust VII, LLC

2017-2A A4, 2.76%, 12/10/24 4 | | | 25,952 | | | | 26,063 | |

| | |

Small Business Administration: | | | | | | | | |

2008-20A 1, 5.17%, 1/1/28 | | | 22,632 | | | | 24,287 | |

2007-20H 1, 5.78%, 8/1/27 | | | 20,899 | | | | 22,470 | |

| | |

Towd Point Mortgage Trust: | | | | | | | | |

2020-MH1 A1A, 2.18%,

2/25/60 1, 4 | | | 123,704 | | | | 123,606 | |

2019-MH1 A2, 3.00%,

11/25/58 1, 4 | | | 100,000 | | | | 101,827 | |

| | | | | | | | |

| | |

| | | | | | | 331,711 | |

| | | | | | | | |

Collateralized Mortgage Obligations - 4.0% | | | | | |

| | |

Fannie Mae: | | | | | | | | |

2017-84 JP, 2.75%, 10/25/47 | | | 24,659 | | | | 25,608 | |

2003-34 A1, 6.00%, 4/25/43 | | | 28,588 | | | | 31,892 | |

2004-T1 1A1, 6.00%, 1/25/44 | | | 17,780 | | | | 20,103 | |

1999-17 C, 6.35%, 4/25/29 | | | 7,436 | | | | 8,236 | |

2001-82 ZA, 6.50%, 1/25/32 | | | 11,211 | | | | 12,491 | |

2009-30 AG, 6.50%, 5/25/39 | | | 32,332 | | | | 37,424 | |

2013-28 WD, 6.50%, 5/25/42 | | | 33,129 | | | | 39,130 | |

2004-T1 1A2, 6.50%, 1/25/44 | | | 53,271 | | | | 60,975 | |

2004-W9 2A1, 6.50%, 2/25/44 | | | 31,076 | | | | 35,535 | |

2010-108 AP, 7.00%, 9/25/40 | | | 775 | | | | 892 | |

2004-T3 1A3, 7.00%, 2/25/44 | | | 5,833 | | | | 6,785 | |

1993-21 KA, 7.70%, 3/25/23 | | | 5,993 | | | | 6,152 | |

| | |

Freddie Mac: | | | | | | | | |

4293 BA, 5.28%, 10/15/47 1 | | | 11,286 | | | | 12,787 | |

2122 ZE, 6.00%, 2/15/29 | | | 42,079 | | | | 47,161 | |

2126 C, 6.00%, 2/15/29 | | | 24,756 | | | | 27,460 | |

2480 Z, 6.00%, 8/15/32 | | | 26,876 | | | | 30,190 | |

2485 WG, 6.00%, 8/15/32 | | | 26,964 | | | | 30,551 | |

2575 QE, 6.00%, 2/15/33 | | | 13,140 | | | | 14,805 | |

2980 QA, 6.00%, 5/15/35 | | | 13,012 | | | | 14,577 | |

2283 K, 6.50%, 12/15/23 | | | 1,813 | | | | 1,887 | |

2357 ZJ, 6.50%, 9/15/31 | | | 17,441 | | | | 19,497 | |

4520 HM, 6.50%, 8/15/45 | | | 16,449 | | | | 19,342 | |

3704 CT, 7.00%, 12/15/36 | | | 11,541 | | | | 13,684 | |

2238 PZ, 7.50%, 6/15/30 | | | 10,162 | | | | 11,837 | |

| | |

Government National Mortgage Association: | | | | | | | | |

2021-86 WB, 4.73%, 5/20/51 1 | | | 184,921 | | | | 208,902 | |

2021-27 CW, 5.00%, 2/20/51 1 | | | 156,637 | | | | 182,903 | |

2021-104 HT, 5.50%, 6/20/51 | | | 193,206 | | | | 222,379 | |

2021-27 AW, 5.85%, 2/20/51 1 | | | 223,860 | | | | 266,032 | |

2015-80 BA, 6.99%, 6/20/45 1 | | | 14,984 | | | | 17,032 | |

2018-147 AM, 7.00%, 10/20/48 | | | 42,761 | | | | 46,967 | |

2018-160 DA, 7.00%, 11/20/48 | | | 37,029 | | | | 41,471 | |

2014-69 W, 7.21%, 11/20/34 1 | | | 18,666 | | | | 21,421 | |

2013-133 KQ, 7.32%, 8/20/38 1 | | | 20,244 | | | | 23,504 | |

2005-74 HA, 7.50%, 9/16/35 | | | 3,575 | | | | 3,763 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | | Fair Value ($) |

| | |

JP Morgan Mortgage Trust: | | | | | | | | |

2021-13 A11, 0.90%, 4/25/52 1, 4 | | | 337,013 | | | | 336,598 | |

2021-3 A4, 2.50%, 7/1/51 1, 4 | | | 152,812 | | | | 154,155 | |

2021-6 A4, 2.50%, 10/25/51 1, 4 | | | 353,584 | | | | 356,691 | |

2021-13 A4, 2.50%, 4/25/52 1, 4 | | | 332,684 | | | | 334,776 | |

2019-HYB1 A5A, 3.00%,

10/25/49 1, 4 | | | 48,835 | | | | 48,829 | |

2020-8 A3, 3.00%, 3/25/51 1, 4 | | | 22,934 | | | | 23,242 | |

| | |

New Residential Mortgage Loan Trust: | | | | | | | | |

2018-3A A1, 4.50%, 5/25/58 1, 4 | | | 49,355 | | | | 52,552 | |

| | |

PMT Loan Trust: | | | | | | | | |

2013-J1 A11, 3.50%, 9/25/43 1, 4 | | | 34,087 | | | | 34,257 | |

| | |

Sequoia Mortgage Trust: | | | | | | | | |

2020-4 A5, 2.50%, 11/25/50 1, 4 | | | 57,983 | | | | 58,561 | |

2019-5 A4, 3.50%, 12/25/49 1, 4 | | | 2,955 | | | | 2,952 | |

| | |

Vendee Mortgage Trust: | | | | | | | | |

1994-2 2, 5.44%, 5/15/24 1 | | | 2,030 | | | | 2,031 | |

2008-1 B, 6.04%, 3/15/25 1 | | | 8,674 | | | | 9,740 | |

| Wells Fargo Mortgaged Backed Securities Trust: | | | | | | | | |

2020-5 A3, 2.50%, 9/25/50 1, 4 | | | 45,811 | | | | 45,970 | |

2020-2 A17, 3.00%, 12/25/49 1, 4 | | | 36,699 | | | | 36,993 | |

2020-2 A3, 3.00%, 12/25/49 1, 4 | | | 15,599 | | | | 15,644 | |

| | | | | | | | |

| | |

| | | | | | | 3,076,366 | |

| | | | | | | | |

Corporate Bonds - 8.3% | | | | | | | | |

American Equity Investment Life Holding Co., 5.00%, 6/15/27 | | | 75,000 | | | | 84,975 | |

Baker Hughes a GE Co., LLC, 3.34%, 12/15/27 | | | 200,000 | | | | 213,321 | |

Bank of America Corp., 3 Mo. Libor + 1.04, 3.42%, 12/20/28 1 | | | 200,000 | | | | 213,685 | |

British Airways 2020-1 Class B Pass Through Trust, 8.38%, 11/15/28 4 | | | 53,981 | | | | 61,991 | |

Cabot Corp., 3.40%, 9/15/26 | | | 183,000 | | | | 191,859 | |

Canadian Pacific Railway Co., 7.13%, 10/15/31 | | | 100,000 | | | | 138,952 | |

Charles Stark Draper Laboratory, Inc., 4.39%, 9/1/48 | | | 100,000 | | | | 114,238 | |

CNO Financial Group, Inc., 5.25%, 5/30/29 | | | 100,000 | | | | 114,936 | |

Concho Resources, Inc., 2.40%, 2/15/31 | | | 200,000 | | | | 195,084 | |

ConocoPhillips Co., 6.95%, 4/15/29 | | | 125,000 | | | | 164,588 | |

CVS Pass-Through Trust, 7.51%,

1/10/32 4 | | | 127,988 | | | | 158,592 | |

Delta Air Lines 2015-1 Class A Pass Through Trust, 3.88%, 7/30/27 | | | 147,826 | | | | 154,670 | |

Delta Air Lines 2015-1 Class AA Pass Through Trust, 3.63%, 7/30/27 | | | 129,346 | | | | 135,949 | |

Duke Energy Florida, LLC: | | | | | | | | |

2.54%, 9/1/29 | | | 50,000 | | | | 51,495 | |

2.86%, 3/1/33 | | | 120,000 | | | | 124,961 | |

Entergy Louisiana, LLC, 4.95%, 1/15/45 | | | 150,000 | | | | 161,258 | |

Equifax, Inc., 6.90%, 7/1/28 | | | 150,000 | | | | 188,915 | |

Equinor ASA, 7.15%, 11/15/25 | | | 150,000 | | | | 180,754 | |

Fairfax Financial Holdings, Ltd., 7.75%, 7/15/37 | | | 150,000 | | | | 207,964 | |

Flex, Ltd., 4.88%, 5/12/30 | | | 200,000 | | | | 228,270 | |

ITT, LLC, 7.40%, 11/15/25 | | | 25,000 | | | | 28,912 | |

JetBlue Airways, 4.00%, 11/15/32 | | | 233,641 | | | | 252,066 | |

Johnson & Johnson, 3.55%, 3/1/36 | | | 150,000 | | | | 171,845 | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2021

Sit Balanced Fund (Continued)

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | | Fair Value ($) |

| | |

JPMorgan Chase & Co., 8.75%, 9/1/30 | | | 100,000 | | | | 151,077 | |

JPMorgan Chase & Co., 3 Mo. Libor + 0.95%, 3.51%, 1/23/29 1 | | | 50,000 | | | | 53,602 | |

Lincoln National Corp., 7.00%, 6/15/40 | | | 100,000 | | | | 152,819 | |

Motorola Solutions, Inc., 2.75%, 5/24/31 | | | 225,000 | | | | 225,655 | |

Northern Trust Corp. (Subordinated), 3 Mo. Libor + 1.13%, 3.38%,

5/8/32 1 | | | 250,000 | | | | 263,379 | |

PacifiCorp, 7.70%, 11/15/31 | | | 150,000 | | | | 214,379 | |

Polar Tankers, Inc., 5.95%, 5/10/37 4 | | | 100,000 | | | | 123,189 | |

Principal Financial Group, Inc., 3 Mo. Libor + 3.04%, 3.20%, 5/15/55 1 | | | 100,000 | | | | 99,123 | |

Royal Bank of Canada, 0.64%,

11/2/26 1 | | | 150,000 | | | | 149,641 | |

Security Benefit Life Insurance Co. (Subordinated), 7.45%, 10/1/33 4 | | | 100,000 | | | | 127,370 | |

Spirit Airlines, 4.10%, 4/1/28 | | | 115,466 | | | | 119,050 | |

Suncor Energy, Inc., 5.35%, 7/15/33 | | | 63,000 | | | | 76,432 | |

Tennessee Gas Pipeline Co., LLC, 7.00%, 10/15/28 | | | 213,000 | | | | 271,957 | |

Tyco Intl. Finance, 3.90%, 2/14/26 | | | 200,000 | | | | 209,569 | |

United Airlines 2018-1 Class AA Pass Through Trust, 3.50%, 3/1/30 | | | 300,538 | | | | 313,135 | |

United Airlines 2019-2 Class AA Pass Through Trust, 2.70%, 5/1/32 | | | 140,337 | | | | 139,209 | |

Unum Group, 7.25%, 3/15/28 | | | 25,000 | | | | 31,450 | |

WestRock MWV, LLC, 7.95%, 2/15/31 | | | 100,000 | | | | 141,122 | |

| | | | | | | | |

| | |

| | | | | | | 6,401,438 | |

| | | | | | | | |

Federal Home Loan Mortgage Corporation - 0.1% | | | | | |

7.50%, 7/1/29 | | | 74,791 | | | | 84,823 | |

8.00%, 2/1/34 | | | 7,160 | | | | 8,034 | |

8.50%, 9/1/24 | | | 321 | | | | 322 | |

| | | | | | | | |

| | |

| | | | | | | 93,179 | |

| | | | | | | | |

Federal National Mortgage Association - 1.0% | |

5.50%, 10/1/33 | | | 37,877 | | | | 41,560 | |

5.50%, 8/1/56 | | | 211,476 | | | | 242,748 | |

6.00%, 7/1/41 | | | 191,935 | | | | 221,387 | |

6.50%, 2/1/24 | | | 5,642 | | | | 5,791 | |

6.50%, 9/1/27 | | | 25,781 | | | | 28,443 | |

6.50%, 6/1/40 | | | 76,194 | | | | 86,277 | |

7.00%, 1/1/32 | | | 9,524 | | | | 10,266 | |

7.00%, 3/1/33 | | | 15,009 | | | | 16,558 | |

7.00%, 12/1/38 | | | 22,193 | | | | 24,255 | |

8.00%, 6/1/24 | | | 4,474 | | | | 4,701 | |

8.00%, 1/1/31 | | | 6,677 | | | | 6,734 | |

8.00%, 2/1/31 | | | 16,054 | | | | 19,182 | |

8.00%, 9/1/37 | | | 39,694 | | | | 45,672 | |

8.43%, 7/15/26 | | | 1,876 | | | | 1,903 | |

8.50%, 10/1/30 | | | 16,958 | | | | 19,247 | |

10.00%, 6/1/31 | | | 20,874 | | | | 22,892 | |

| | | | | | | | |

| | |

| | | | | | | 797,616 | |

| | | | | | | | |

Government National Mortgage Association - 0.2% | |

5.00%, 5/20/48 | | | 46,609 | | | | 50,534 | |

5.75%, 12/15/22 | | | 3,767 | | | | 3,756 | |

6.50%, 11/20/38 | | | 14,380 | | | | 15,998 | |

7.00%, 12/15/24 | | | 5,455 | | | | 5,725 | |

7.00%, 11/20/27 | | | 7,789 | | | | 8,573 | |

7.00%, 9/20/29 | | | 21,258 | | | | 23,735 | |

7.00%, 9/20/38 | | | 8,009 | | | | 9,482 | |

7.50%, 4/20/32 | | | 15,334 | | | | 16,898 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | | Fair Value ($) |

| | |

8.00%, 7/15/24 | | | 1,176 | | | | 1,188 | |

| | | | | | | | |

| | |

| | | | | | | 135,889 | |

| | | | | | | | |

Taxable Municipal Securities - 9.5% | | | | | | | | |

Chicago Park Dist., 2.53%, 1/1/34 | | | 235,000 | | | | 228,098 | |

Chino Public Fin. Auth., 1.99%, 9/1/27 | | | 150,000 | | | | 149,223 | |

City of Encinitas CA, 1.45%, 9/1/27 | | | 250,000 | | | | 244,250 | |

CO Health Facs. Auth., 3.13%, 5/15/27 | | | 250,000 | | | | 249,648 | |

Colorado Edu. & Cultural Fac. Auth., 3.97%, 3/1/56 | | | 205,000 | | | | 225,043 | |

Coventry Local Sch. Dist., 2.20%, 11/1/29 | | | 200,000 | | | | 200,162 | |

Essex Co. Impt. Auth., 3.97%, 8/1/30 4 | | | 200,000 | | | | 201,422 | |

GBG, LLC, 3.50%, 6/1/37 4, 9 | | | 150,000 | | | | 152,965 | |

Great Lakes Water Auth. Sewage Disposal System, 3.51%, 7/1/44 | | | 150,000 | | | | 158,172 | |

IN Finance Auth., 3.31%, 3/1/51 | | | 250,000 | | | | 253,970 | |

Kentucky Higher Edu. Student Loan Corp. (Subordinated), 5.27%, 6/1/36 | | | 100,000 | | | | 105,701 | |

KS Dev. Finance Auth. Rev., 2.77%, 5/1/51 | | | 250,000 | | | | 248,168 | |

LaGrange Co. Regional Utility Dist., 2.98%, 1/1/40 | | | 230,000 | | | | 224,229 | |

Louisiana State Trans. Auth., 1.45%, 2/15/27 | | | 300,000 | | | | 295,254 | |

Madison Co. Comm. Sch. Dist. No. 7, 1.90%, 12/1/30 | | | 150,000 | | | | 145,649 | |

Maricopa Co. Industrial Dev. Auth., 5.00%, 7/1/44 4 | | | 100,000 | | | | 99,899 | |

Massachusetts Edu. Auth.: | | | | | | | | |

4.41%, 7/1/34 | | | 30,000 | | | | 32,625 | |

4.00%, 1/1/32 | | | 50,000 | | | | 51,307 | |

MI State Hsg. Dev. Auth., 2.66%, 12/1/41 | | | 300,000 | | | | 296,823 | |

MN Hsg. Fin. Agy.: | | | | | | | | |

4.73%, 1/1/49 | | | 10,000 | | | | 10,277 | |

2.31%, 1/1/27 | | | 160,000 | | | | 159,586 | |

NJ Higher Edu. Student Assit. Auth., 3.50%, 12/1/39 8 | | | 100,000 | | | | 106,080 | |

NJ Turnpike Auth., 1.71%, 1/1/29 | | | 200,000 | | | | 194,286 | |

No. Dakota Hsg. Fin. Auth., 3.70%, 7/1/33 | | | 100,000 | | | | 104,701 | |

NY City Hsg. Dev. Corp.: | | | | | | | | |

2.65%, 11/1/36 | | | 100,000 | | | | 101,005 | |

2.74%, 11/1/36 | | | 250,000 | | | | 252,997 | |

NY Mortgage Agency, 2.98%, 10/1/40 | | | 150,000 | | | | 149,515 | |

NY State Dormitory Auth., 2.69%, 7/1/35 | | | 200,000 | | | | 198,874 | |

Oregon State Fac. Auth.: | | | | | | | | |

2.68%, 7/1/31 | | | 350,000 | | | | 349,118 | |

3.29%, 10/1/40 | | | 100,000 | | | | 100,828 | |

Public Fin. Auth., 4.23%, 7/1/32 | | | 105,000 | | | | 121,704 | |

South Carolina Student Loan Corp., 2.92%, 12/1/28 | | | 200,000 | | | | 199,530 | |

State of Ohio, 2.17%, 12/1/31 | | | 250,000 | | | | 250,313 | |

Texas Children’s Hospital, 3.37%, 10/1/29 17 | | | 115,000 | | | | 125,669 | |

Texas Trans. Comm. State Highway, 5.18%, 4/1/30 | | | 150,000 | | | | 180,074 | |

Utah Charter Sch. Fin. Auth., 2.40%, 10/15/27 | | | 205,000 | | | | 206,406 | |

VA Hsg. Dev. Auth., 2.13%, 7/25/51 | | | 244,193 | | | | 244,608 | |

WA State Hsg. Fin. Comm., 3.50%, 7/1/24 4 | | | 250,000 | | | | 248,275 | |

Warren Consol. Schools, 1.85%, 5/1/31 | | | 250,000 | | | | 245,542 | |

Wichita Falls, 1.65%, 9/1/28 | | | 145,000 | | | | 142,171 | |

| | | | | | | | |

| | |

| | | | | | | 7,254,167 | |

| | | | | | | | |

See accompanying notes to financial statements.

| | |

| | |

| 8 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | | Fair Value ($) |

| |

U.S. Treasury / Federal Agency Securities - 7.3% | | | | | |

U.S. Treasury Bill 0.01%, 1/25/22 6 | | | 500,000 | | | | 499,994 | |

U.S. Treasury Strip 1.97%, 11/15/50 6 | | | 1,800,000 | | | | 1,034,452 | |

U.S. Treasury Strip 2.18%, 8/15/47 6 | | | 650,000 | | | | 396,185 | |

| | |

United States Treasury Inflation Bonds: | | | | | | | | |

0.13%, 1/15/23 | | | 1,827,377 | | | | 1,887,195 | |

0.13%, 1/15/30 | | | 107,504 | | | | 119,363 | |

0.13%, 7/15/30 | | | 107,878 | | | | 120,743 | |

0.63%, 1/15/24 | | | 1,422,480 | | | | 1,513,886 | |

| | | | | | | | |

| | |

| | | | | | | 5,571,818 | |

| | | | | | | | |

| | |

Total Bonds

(cost $23,548,525) | | | | | | | 23,662,184 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) |

| | |

Investment Companies 1.7% | | | | | | | | |

BlackRock Enhanced Government Fund | | | 4,886 | | | | 61,417 | |

BlackRock Income Trust | | | 19,400 | | | | 109,610 | |

DoubleLine Opportunistic Credit Fund | | | 10,411 | | | | 199,579 | |

Eaton Vance Short Duration Div. Inc. Fund | | | 6,641 | | | | 88,126 | |

Franklin, Ltd. Duration, Income Trust | | | 1,300 | | | | 11,817 | |

Nuveen Multi-Market Income Fund, Inc. | | | 3,953 | | | | 29,964 | |

Putnam Master Intermediate Income Trust | | | 61,000 | | | | 240,950 | |

Putnam Premier Income Trust | | | 81,475 | | | | 347,898 | |

WA Inflation-Linked Opp. & Inc. Fund | | | 4,709 | | | | 63,948 | |

WA Inflation-Linked Sec. & Inc. Fund | | | 10,953 | | | | 145,127 | |

| | | | | | | | |

| | |

Total Investment Companies

(cost: $1,315,178) | | | | | | | 1,298,436 | |

| | | | | | | | |

| | |

Short-Term Securities - 5.3% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt.

Fund, 0.01%

(cost $4,034,722) | | | 4,034,722 | | | | 4,034,722 | |

| | | | | | | | |

| |

Total Investments in Securities - 100.8%

(cost $53,297,923) | | | | 77,331,741 | |

| |

Other Assets and Liabilities, net - (0.8)% | | | | (597,253) | |

| | | | | | | | |

| | |

Total Net Assets - 100.0% | | | | | | $ | 76,734,488 | |

| | | | | | | | |

| * | Non-income producing security. |

| 1 | Variable rate security. Rate disclosed is as of December 31, 2021. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| 4 | 144A Restricted Security. The total value of such securities as of December 31, 2021 was $2,959,535 and represented 3.9% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 6 | Zero coupon or convertible capital appreciation bond, for which the rate disclosed is either the effective yield on purchase date or the coupon rate to be paid upon conversion to coupon paying. |

| 8 | Securities the income from which is treated as a tax preference that is included in alternative minimum taxable income for purposes of computing federal alternative minimum tax (AMT). At December 31, 2021, 0.1% of net assets in the Fund was invested in such securities. |

| 9 | Municipal Lease Security. The total value of such securities as of December 31, 2021 was $152,965 and represented 0.2% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 14 | Step Coupon: A bond that pays a coupon rate that increases on a specified date(s). Rate disclosed is as of December 31, 2021. |

| 17 | Security that is either an absolute and unconditional obligation of the United States Government or is collateralized by securities, loans, or leases guaranteed by the U.S. Government or its agencies or instrumentalities. |

| | ADR — American Depositary Receipt |

| | LLC — Limited Liability Company |

| | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2021

Sit Balanced Fund (Continued)

A summary of the levels for the Fund’s investments as of December 31, 2021 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted | | | Other significant | | | Significant | | | | |

| | | Prices ($) | | | observable inputs ($) | | | unobservable inputs ($) | | | Total ($) | |

Common Stocks** | | | 48,336,399 | | | | — | | | | — | | | | 48,336,399 | |

Asset-Backed Securities | | | — | | | | 331,711 | | | | — | | | | 331,711 | |

Collateralized Mortgage Obligations | | | — | | | | 3,076,366 | | | | — | | | | 3,076,366 | |

Corporate Bonds | | | — | | | | 6,401,438 | | | | — | | | | 6,401,438 | |

Federal Home Loan Mortgage Corporation | | | — | | | | 93,179 | | | | — | | | | 93,179 | |

Federal National Mortgage Association | | | — | | | | 797,616 | | | | — | | | | 797,616 | |

Government National Mortgage Association | | | — | | | | 135,889 | | | | — | | | | 135,889 | |

Taxable Municipal Securities | | | — | | | | 7,254,167 | | | | — | | | | 7,254,167 | |

U.S. Treasury / Federal Agency Securities | | | — | | | | 5,571,818 | | | | — | | | | 5,571,818 | |

Investment Companies | | | 1,298,436 | | | | — | | | | — | | | | 1,298,436 | |

Short-Term Securities | | | 4,034,722 | | | | — | | | | — | | | | 4,034,722 | |

Total: | | | 53,669,557 | | | | 23,662,184 | | | | — | | | | 77,331,741 | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

| | |

| | |

| 10 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

[This page is intentionally left blank.]

|

|

Sit Dividend Growth Fund - Class I and Class S |

OBJECTIVE & STRATEGY

The objective of the Sit Dividend Growth Fund is to provide current income that exceeds the dividend yield of the S&P 500® Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation.

The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

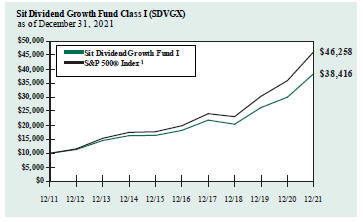

Fund Performance

The Sit Dividend Growth Fund Class I posted an +11.79% return during the 6-month period ended December 31, 2021, compared to the +11.67% return for the S&P 500® Index. The Fund’s gross dividend yield (before deducting Fund expenses) was 1.74% as of 12/31/21, compared to 1.30% for the S&P 500® Index.

Factors that Influenced the Fund’s Performance

The Fund posted strong absolute and relative returns over the final six months of 2021. A key contributor to the Fund’s performance during the period was stock selection within the technology services sector, particularly ownership of Accenture, PLC (+41%), which saw increased demand for digital transformation projects lead to an acceleration in growth. Additionally, the Fund did not own PayPal Holdings (-35%), where concerns over increasing competition led to stock price depreciation, and it underweighted Meta Platforms, which was affected by reputational issues, although the company’s financial performance has remained strong. Performance was also bolstered by stock selection in the producer manufacturing sector. Here, security selection was focused on companies that avoided supply chain disruptions and could capture pricing in an inflationary environment, such as Carlisle Cos. (+30%). Two main factors detracted from performance during the period. First, stock selection in the health technology sector, where holdings such as Medtronic, PLC, were negatively affected by a deferral of elective procedures. Second, an underweight position in the consumer durables sector, where many companies benefitted from economic reopening (particularly Tesla).

Outlook and Positioning

Dividend-based investment strategies have lagged over the last several years, primarily due to a combination of the unprecedented outperformance in “long duration,” non-dividend-paying growth stocks and the lagging performance of the defensive cohort within the dividend-paying universe. We believe catalysts are emerging for improved performance of dividend payers over the near-to-intermediate term. First, the expected moderation in broad stock market returns will raise the appeal of incremental returns from dividends. Second, dividend increases have been accelerating for several quarters, and we suspect investors may view companies that are growing dividends as an attractive alternative

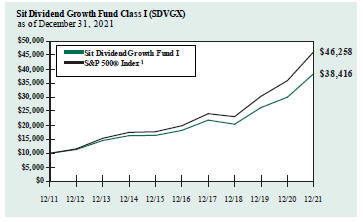

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years as compared to the performance of the S&P 500® Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index. This is the Fund’s primary index.

to bonds if interest rates increase. Finally, we believe the relative price stability (i.e., lower betas) of dividend payers may attract investors as market volatility increases. Within this market environment, the Fund is overweight financials, with a focus on companies with the most interest rate sensitivity, which should benefit from an expected rise in interest rates and also offer attractive dividend yields. Additionally, the Fund retains an overweight position in the electronic technology sector, where companies should see above-market growth rates, driven by secular trends. Finally, the Fund maintains an overweight position in the health technology sector. Companies here should retain stable growth rates due to a lack of economic sensitivity, and we also think investors are likely to gravitate towards this sector due an expected increase in market volatility during 2022.

Roger J. Sit

Kent L. Jonhnson

Portfolio Managers

| | |

| | |

| 12 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of December 31, 2021

| | | | | | | | | | | | | | | |

| | | Sit Dividend

Growth Fund | | |

| | | Class I | | Class S | | S&P 500®

Index1 |

| | | |

Six Month | | | | 11.79 | % | | | | 11.64 | % | | | | 11.67 | % |

| | | |

One Year | | | | 27.98 | | | | | 27.67 | | | | | 28.71 | |

| | | |

Five Year | | | | 16.17 | | | | | 15.88 | | | | | 18.47 | |

| | | |

Ten Year | | | | 14.41 | | | | | 14.12 | | | | | 16.55 | |

| | | |

Since Inception-Class I | | | | 11.06 | | | | | n/a | | | | | 10.61 | |

(12/31/03) | | | | | | | | | | | | | | | |

Since Inception-Class S | | | | n/a | | | | | 10.66 | | | | | 10.85 | |

(3/31/06) | | | | | | | | | | | | | | | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 S&P 500® Index is an unmanaged capitalization-weighted index that measures the performance of 500 widely held common stocks of large-cap companies. It is not possible to invest directly in an index.

PORTFOLIO SUMMARY

| | |

Class I: | | |

Net Asset Value 12/31/21: | | $17.28 Per Share |

Net Asset Value 6/30/21: | | $17.37 Per Share |

Total Net Assets: | | $228.4 Million |

| |

Class S: | | |

Net Asset Value 12/31/21: | | $17.18 Per Share |

Net Asset Value 6/30/21: | | $17.27 Per Share |

Total Net Assets: | | $28.5 Million |

| |

Weighted Average Market Cap: | | $500.9 Billion |

TOP 10 HOLDINGS

| | | | |

| | 1. | | | Microsoft Corp. |

| |

| | 2. | | | Apple, Inc. |

| |

| | 3. | | | Broadcom, Inc. |

| |

| | 4. | | | Johnson & Johnson |

| |

| | 5. | | | Alphabet, Inc. - Class A |

| |

| | 6. | | | Applied Materials, Inc. |

| |

| | 7. | | | Truist Financial Corp. |

| |

| | 8. | | | Medtronic, PLC |

| |

| | 9. | | | American Tower Corp. |

| |

| | 10. | | | JPMorgan Chase & Co. |

Based on total net assets as of December 31, 2021. Subject to change.

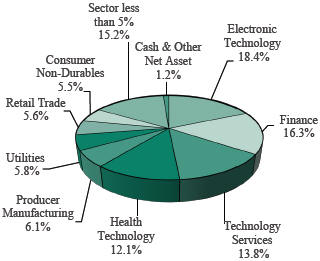

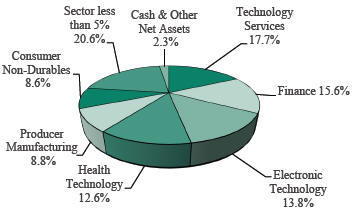

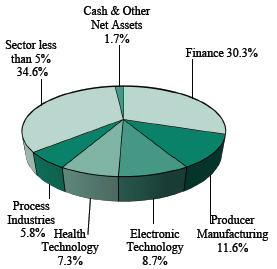

SECTOR ALLOCATION

Based on total net assets as of December 31 2021. Subject to change.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2021

Sit Dividend Growth Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| | |

Common Stocks - 98.8% | | | | | | | | |

| | |

Commercial Services - 0.6% | | | | | | | | |

Equifax, Inc. | | | 5,625 | | | | 1,646,944 | |

| | | | | | | | |

| | |

Communications - 1.8% | | | | | | | | |

American Tower Corp. | | | 15,750 | | | | 4,606,875 | |

| | | | | | | | |

| | |

Consumer Durables - 0.6% | | | | | | | | |

Activision Blizzard, Inc. | | | 22,875 | | | | 1,521,874 | |

| | | | | | | | |

| | |

Consumer Non-Durables - 5.5% | | | | | | | | |

Mondelez International, Inc. | | | 49,400 | | | | 3,275,714 | |

NIKE, Inc. | | | 12,725 | | | | 2,120,876 | |

PepsiCo, Inc. | | | 25,575 | | | | 4,442,633 | |

Procter & Gamble Co. | | | 25,800 | | | | 4,220,364 | |

| | | | | | | | |

| | |

| | | | | | | 14,059,587 | |

| | | | | | | | |

Consumer Services - 2.6% | | | | | | | | |

McDonald’s Corp. | | | 13,175 | | | | 3,531,822 | |

Visa, Inc. | | | 15,115 | | | | 3,275,572 | |

| | | | | | | | |

| | |

| | | | | | | 6,807,394 | |

| | | | | | | | |

Electronic Technology - 18.4% | | | | | | | | |

Analog Devices, Inc. | | | 25,075 | | | | 4,407,433 | |

Apple, Inc. | | | 85,050 | | | | 15,102,328 | |

Applied Materials, Inc. | | | 33,100 | | | | 5,208,616 | |

Broadcom, Inc. | | | 10,835 | | | | 7,209,717 | |

Marvell Technology, Inc. | | | 37,525 | | | | 3,283,062 | |

NVIDIA Corp. | | | 6,525 | | | | 1,919,068 | |

Qualcomm, Inc. | | | 13,950 | | | | 2,551,037 | |

Skyworks Solutions, Inc. | | | 22,350 | | | | 3,467,379 | |

TE Connectivity, Ltd. | | | 26,000 | | | | 4,194,840 | |

| | | | | | | | |

| | |

| | | | | | | 47,343,480 | |

| | | | | | | | |

Energy Minerals - 1.2% | | | | | | | | |

ConocoPhillips | | | 42,025 | | | | 3,033,364 | |

| | | | | | | | |

| | |

Finance - 16.3% | | | | | | | | |

Air Lease Corp. | | | 34,650 | | | | 1,532,569 | |

American Financial Group, Inc. | | | 12,050 | | | | 1,654,706 | |

American International Group, Inc. | | | 53,000 | | | | 3,013,580 | |

Ameriprise Financial, Inc. | | | 13,325 | | | | 4,019,620 | |

Chubb, Ltd. | | | 17,875 | | | | 3,455,416 | |

Everest Re Group, Ltd. | | | 13,400 | | | | 3,670,528 | |

Goldman Sachs Group, Inc. | | | 450 | | | | 172,147 | |

JPMorgan Chase & Co. | | | 29,025 | | | | 4,596,109 | |

MetLife, Inc. | | | 43,425 | | | | 2,713,628 | |

Morgan Stanley | | | 45,475 | | | | 4,463,826 | |

Realty Income Corp. | | | 52,475 | | | | 3,756,685 | |

STORE Capital Corp. | | | 103,700 | | | | 3,567,280 | |

Truist Financial Corp. | | | 88,450 | | | | 5,178,748 | |

| | | | | | | | |

| | |

| | | | | | | 41,794,842 | |

| | | | | | | | |

Health Services - 1.8% | | | | | | | | |

UnitedHealth Group, Inc. | | | 9,100 | | | | 4,569,474 | |

| | | | | | | | |

| | |

Health Technology - 12.1% | | | | | | | | |

Abbott Laboratories | | | 18,650 | | | | 2,624,801 | |

AbbVie, Inc. | | | 25,525 | | | | 3,456,085 | |

Agilent Technologies, Inc. | | | 16,775 | | | | 2,678,129 | |

AstraZeneca, PLC, ADR | | | 63,175 | | | | 3,679,944 | |

Baxter International, Inc. | | | 52,375 | | | | 4,495,870 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| | |

Johnson & Johnson | | | 40,500 | | | | 6,928,335 | |

Medtronic, PLC | | | 47,975 | | | | 4,963,013 | |

Thermo Fisher Scientific, Inc. | | | 3,575 | | | | 2,385,383 | |

| | | | | | | | |

| | |

| | | | | | | 31,211,560 | |

| | | | | | | | |

Industrial Services - 1.0% | | | | | | | | |

Jacobs Engineering Group, Inc. | | | 19,125 | | | | 2,662,774 | |

| | | | | | | | |

| | |

Non-Energy Minerals - 0.9% | | | | | | | | |

BHP Group, Ltd., ADR | | | 37,400 | | | | 2,257,090 | |

| | | | | | | | |

| | |

Process Industries - 2.6% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 12,525 | | | | 3,810,857 | |

DuPont de Nemours, Inc. | | | 34,400 | | | | 2,778,832 | |

| | | | | | | | |

| | |

| | | | | | | 6,589,689 | |

| | | | | | | | |

Producer Manufacturing - 6.1% | | | | | | | | |

Carlisle Cos, Inc. | | | 10,880 | | | | 2,699,546 | |

Dover Corp. | | | 14,325 | | | | 2,601,420 | |

Eaton Corp., PLC | | | 20,475 | | | | 3,538,489 | |

Parker-Hannifin Corp. | | | 10,900 | | | | 3,467,508 | |

Siemens AG, ADR | | | 40,000 | | | | 3,464,000 | |

| | | | | | | | |

| | |

| | | | | | | 15,770,963 | |

| | | | | | | | |

Retail Trade - 5.6% | | | | | | | | |

CVS Health Corp. | | | 33,900 | | | | 3,497,124 | |

Home Depot, Inc. | | | 9,625 | | | | 3,994,471 | |

Target Corp. | | | 15,450 | | | | 3,575,748 | |

TJX Cos., Inc. | | | 42,500 | | | | 3,226,600 | |

| | | | | | | | |

| | |

| | | | | | | 14,293,943 | |

| | | | | | | | |

Technology Services - 13.8% | | | | | | | | |

Accenture, PLC | | | 10,100 | | | | 4,186,955 | |

Alphabet, Inc. - Class A * | | | 1,835 | | | | 5,316,068 | |

Genpact, Ltd. | | | 53,250 | | | | 2,826,510 | |

Meta Platforms, Inc. * | | | 5,650 | | | | 1,900,378 | |

Microsoft Corp. | | | 51,500 | | | | 17,320,480 | |

Oracle Corp. | | | 43,575 | | | | 3,800,176 | |

| | | | | | | | |

| | |

| | | | | | | 35,350,567 | |

| | | | | | | | |

Transportation - 2.1% | | | | | | | | |

FedEx Corp. | | | 8,825 | | | | 2,282,498 | |

Union Pacific Corp. | | | 11,975 | | | | 3,016,862 | |

| | | | | | | | |

| | |

| | | | | | | 5,299,360 | |

| | | | | | | | |

Utilities - 5.8% | | | | | | | | |

AES Corp. | | | 100,900 | | | | 2,451,870 | |

Alliant Energy Corp. | | | 58,975 | | | | 3,625,193 | |

Entergy Corp. | | | 29,675 | | | | 3,342,889 | |

NextEra Energy, Inc. | | | 42,425 | | | | 3,960,798 | |

Xcel Energy, Inc. | | | 23,700 | | | | 1,604,490 | |

| | | | | | | | |

| | |

| | | | | | | 14,985,240 | |

| | | | | | | | |

Total Common Stocks

(cost: $170,472,111) | | | | | | | 253,805,020 | |

| | | | | | | | |

See accompanying notes to financial statements.

| | |

| | |

| 14 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| | |

Short-Term Securities - 1.1% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 0.01%

(cost $2,911,284) | | | 2,911,284 | | | | 2,911,284 | |

| | | | | | | | |

| | |

Total Investments in Securities - 99.9%

(cost $173,383,395) | | | | | | | 256,716,304 | |

| | |

Other Assets and Liabilities, net - 0.1% | | | | | | | 225,933 | |

| | | | | | | | |

| | |

Total Net Assets - 100.0% | | | | | | | $256,942,237 | |

| | | | | | | | |

| * | Non-income producing security. |

| | ADR — American Depositary Receipt |

| | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

A summary of the levels for the Fund’s investments as of December 31, 2021 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted | | | Other significant | | | Significant | | | | |

| | | Prices ($) | | | observable inputs ($) | | | unobservable inputs ($) | | | Total ($) | |

Common Stocks** | | | 253,805,020 | | | | — | | | | — | | | | 253,805,020 | |

Short-Term Securities | | | 2,911,284 | | | | — | | | | — | | | | 2,911,284 | |

Total: | | | 256,716,304 | | | | — | | | | — | | | | 256,716,304 | |

| ** | For equity securities categorized in a single level, refer to the Schedule of Investments for further breakdown. |

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

|

|

Sit Global Dividend Growth Fund - Class I and Class S |

OBJECTIVE & STRATEGY

The objective of the Sit Global Dividend Growth Fund is to provide current income that exceeds the dividend yield of the MSCI World Index and that grows over a period of years. Secondarily, the Fund seeks long-term capital appreciation. The Fund seeks to achieve its objectives by investing, under normal market conditions, at least 80% of its net assets in dividend-paying common stocks issued by U.S. and foreign companies. The Fund may invest the balance of its assets in preferred stocks, convertible bonds, and U.S. Treasury securities.

Fund Performance

Sit Global Dividend Growth Class I shares provided a return of +10.78% during the 6-month period ended December 31, 2021, compared to the return of the MSCI World Index of +7.76%. The Fund’s gross dividend yield (before deducting Fund expenses) was 1.66%, compared to a 1.63% dividend yield for the MSCI World Index.

Factors that Influenced the Fund’s Performance

Contributing favorably to performance during the 6-month period were the Fund’s holdings in the software & services, retailing, media & entertainment, and food beverage & tobacco sectors. Specific stock selections within software and services that helped returns included owning Atlassian Corp., PLC, Accenture, PLC, and Microsoft Corp., and not holding PayPal Holdings and Meta Platforms, while, in retailing, owning Home Depot and not owning Amazon.com benefitted performance. Conversely, the Fund’s holdings in the technology hardware & equipment (Logitech International SA), automobiles & components (not owning Tesla), and diversified financials (London Stock Exchange Group) sectors detracted from performance.

Geographically, the Fund’s exposure to North America and Asia Pacific ex-Japan positively impacted performance, while holdings in Non-Euroland and the United Kingdom negatively impacted performance.

Outlook and Positioning

S&P 500® Index earnings are projected to rise about +8.0% in 2022, on par with the prior 20-year average. However, year-over-year comparisons are especially difficult in the first half, and forward estimates extrapolate record S&P 500® Index profit margins. In addition, falling excess liquidity growth and rising bond yields may put downward pressure on stock valuations. Given an already-full S&P 500® Index valuation, we believe overall stock market gains will, at best, track earnings growth in 2022. Therefore, picking stocks of quality growth companies well positioned to exceed expectations will be crucial to outperformance.

Domestically, the technology, capital goods, and healthcare sectors stand out as best positioned to deliver above-average earnings growth in 2022. The technology sector remains a favorite, as a cyclical pick-up in enterprise spending amplifies several secular growth drivers (e.g., cloud spending, artificial intelligence, digital transformation, etc.). Moreover, capital goods companies are rallying from depressed conditions (first triggered by trade disputes, then Covid-19). We favor firms exposed to

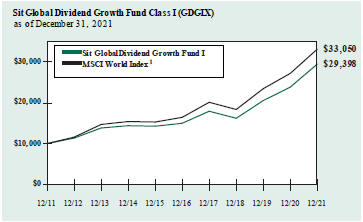

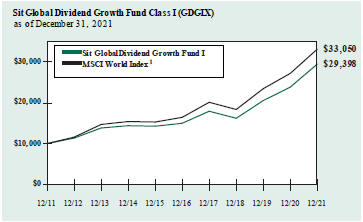

HYPOTHETICAL GROWTH OF $10,000

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the MSCI World Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. It is not possible to invest directly in an index. This is the Fund’s primary index.

accelerating spending on infrastructure, automation, and“ electrification” in key end markets, such as autos and renewable energy. Finally, the aging global population will continue to drive demand for healthcare products and services, with a rebound in key Covid-19-impacted areas, such as medical devices and hospitals, expected once the current surge in Covid cases subsides. Regarding underweights, we have become more cautious on retailers, as stimulus spending is waning and cost pressures (e.g., wages, shipping) continue to pressure margins.

Internationally, we are overweight equities in China, South Korea, Singapore, and India. The worst of the Covid-19 lockdown is behind us, and the recent surge in Covid cases driven by the Omicron variant only temporarily delays the full reopening of economies. Immunization and restrictions should ultimately contain the spread of the virus and allow for an economic recovery. As a result, we are optimistic on emerging markets and expect stronger earnings growth in 2022.

Roger J. Sit Raymond E. Sit

Kent L. Johnson

Portfolio Managers

| | |

| | |

| 16 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

as of December 31, 2021

| | | | | | | | | | | | |

| | | Sit Global Dividend | | | | |

| | | Growth Fund | | | MSCI World | |

| | | Class I | | | Class S | | | Index 1 | |

Six Month | | | 10.78 | % | | | 10.65 | % | | | 7.76 | % |

One Year | | | 23.59 | | | | 23.26 | | | | 21.82 | |

Five Year | | | 14.47 | | | | 14.20 | | | | 15.03 | |

Ten Year | | | 11.39 | | | | 11.11 | | | | 12.70 | |

| | | |

Since Inception (9/30/08) | | | 10.53 | | | | 10.26 | | | | 10.02 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains. Returns do not reflect the deduction of the 2% redemption fee imposed if shares are redeemed or exchanged within 30 calendar days from their date of purchase. If imposed, the fee would reduce the performance quoted. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. It is not possible to invest directly in an index.

PORTFOLIO SUMMARY

| | | | |

Class I: | | | | |

Net Asset Value 12/31/21: | | | $24.74 Per Share | |

Net Asset Value 6/30/21: | | | $22.47 Per Share | |

Total Net Assets: | | | $46.1 Million | |

Class S: | | | | |

Net Asset Value 12/31/21: | | | $24.73 Per Share | |

Net Asset Value 6/30/21: | | | $22.45 Per Share | |

Total Net Assets: | | | $4.4 Million | |

| |

Weighted Average Market Cap: | | | $539.3 Billion | |

TOP 10 HOLDINGS

| | | | |

| | 1. | | | Microsoft Corp. |

| | 2. | | | Apple, Inc. |

| | 3. | | | Accenture, PLC |

| | 4. | | | Atlassian Corp., PLC |

| | 5. | | | Alphabet, Inc. - Class A |

| | 6. | | | Applied Materials, Inc. |

| | 7. | | | Broadcom, Inc. |

| | 8. | | | Partners Group Holding AG |

| | 9. | | | Johnson & Johnson |

| | 10. | | | JPMorgan Chase & Co. |

Based on total net assets as of December 31, 2021. Subject to change.

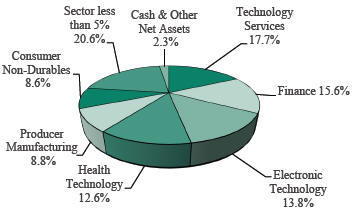

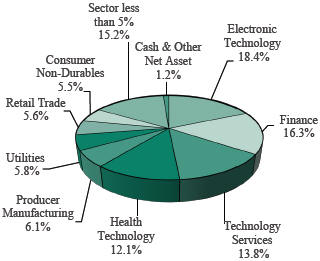

SECTOR ALLOCATION

Based on total net assets as of December 31 2021. Subject to change.

SCHEDULE OF INVESTMENTS (Unaudited)

December 31, 2021

Sit Global Dividend Growth Fund

Investments are grouped by geographic region

| | | | | | | | |

| |

| | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| |

| | |

Common Stocks - 97.7% | | | | | | | | |

| | |

Asia - 7.7% | | | | | | | | |

| | |

Australia - 4.5% | | | | | | | | |

Atlassian Corp., PLC * | | | 3,525 | | | | 1,344,047 | |

BHP Group, Ltd. ADR | | | 6,150 | | | | 371,153 | |

Macquarie Group, Ltd. | | | 3,900 | | | | 582,811 | |

| | | | | | | | |

| | |

| | | | | | | 2,298,011 | |

| | | | | | | | |

Japan - 2.3% | | | | | | | | |

Astellas Pharma, Inc. | | | 29,900 | | | | 486,203 | |

Recruit Holdings Co., Ltd. | | | 10,800 | | | | 654,591 | |

| | | | | | | | |

| | |

| | | | | | | 1,140,794 | |

| | | | | | | | |

Singapore - 0.9% | | | | | | | | |

Singapore Technologies Engineering, Ltd. | | | 158,600 | | | | 442,517 | |

| | | | | | | | |

| | |

Europe - 29.4% | | | | | | | | |

| | |

France - 1.3% | | | | | | | | |

Faurecia SE | | | 9,175 | | | | 436,945 | |

Safran SA, ADR | | | 7,700 | | | | 235,543 | |

| | | | | | | | |

| | |

| | | | | | | 672,488 | |

| | | | | | | | |

Germany - 4.4% | | | | | | | | |

adidas AG | | | 1,385 | | | | 399,251 | |

Allianz SE, ADR | | | 35,000 | | | | 826,350 | |

Muenchener Rueckversicherungs AG | | | 650 | | | | 192,777 | |

Siemens AG | | | 4,350 | | | | 756,144 | |

Siemens Energy AG * | | | 1,600 | | | | 40,968 | |

| | | | | | | | |

| | |

| | | | | | | 2,215,490 | |

| | | | | | | | |

Ireland - 5.6% | | | | | | | | |

Accenture, PLC | | | 3,675 | | | | 1,523,471 | |

Linde, PLC | | | 700 | | | | 242,501 | |

Medtronic, PLC | | | 6,200 | | | | 641,390 | |

Trane Technologies, PLC | | | 2,175 | | | | 439,415 | |

| | | | | | | | |

| | |

| | | | | | | 2,846,777 | |

| | | | | | | | |

Spain - 1.4% | | | | | | | | |

Iberdrola SA | | | 60,400 | | | | 715,848 | |

| | | | | | | | |

| | |

Sweden - 0.6% | | | | | | | | |

Telefonaktiebolaget LM Ericsson, ADR | | | 26,975 | | | | 293,218 | |

| | | | | | | | |

| | |

Switzerland - 8.2% | | | | | | | | |

Chubb, Ltd. | | | 2,650 | | | | 512,271 | |

Logitech International SA | | | 9,625 | | | | 793,870 | |

Lonza Group AG * | | | 950 | | | | 794,030 | |

Nestle SA | | | 6,075 | | | | 849,647 | |

Partners Group Holding AG | | | 725 | | | | 1,203,427 | |

| | | | | | | | |

| | |

| | | | | | | 4,153,245 | |

| | | | | | | | |

United Kingdom - 7.9% | | | | | | | | |

AstraZeneca, PLC, ADR | | | 15,400 | | | | 897,050 | |

BAE Systems, PLC | | | 74,675 | | | | 555,718 | |

Diageo, PLC, ADR | | | 4,225 | | | | 930,091 | |

HomeServe, PLC | | | 33,725 | | | | 399,196 | |

London Stock Exchange Group, PLC | | | 6,875 | | | | 644,882 | |

RELX, PLC | | | 17,550 | | | | 569,849 | |

| | | | | | | | |

| | |

| | | | | | | 3,996,786 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| |

| | |

North America - 60.6% | | | | | | | | |

| | |

United States - 60.6% | | | | | | | | |

Abbott Laboratories | | | 7,400 | | | | 1,041,476 | |

AbbVie, Inc. | | | 3,975 | | | | 538,215 | |

AES Corp. | | | 5,100 | | | | 123,930 | |

Alphabet, Inc. - Class A * | | | 450 | | | | 1,303,668 | |

Apple, Inc. | | | 19,200 | | | | 3,409,344 | |

Applied Materials, Inc. | | | 8,175 | | | | 1,286,418 | |

Arthur J Gallagher & Co. | | | 3,775 | | | | 640,504 | |

Bank of America Corp. | | | 16,300 | | | | 725,187 | |

Broadcom, Inc. | | | 1,825 | | | | 1,214,373 | |

Constellation Brands, Inc. | | | 2,750 | | | | 690,168 | |

CVS Health Corp. | | | 6,625 | | | | 683,435 | |

Euronet Worldwide, Inc. * | | | 2,800 | | | | 333,676 | |

FedEx Corp. | | | 1,950 | | | | 504,348 | |

Goldman Sachs Group, Inc. | | | 1,400 | | | | 535,570 | |

Home Depot, Inc. | | | 2,550 | | | | 1,058,276 | |

Honeywell International, Inc. | | | 3,200 | | | | 667,232 | |

Johnson & Johnson | | | 6,925 | | | | 1,184,660 | |

JPMorgan Chase & Co. | | | 7,350 | | | | 1,163,872 | |

Lockheed Martin Corp. | | | 1,565 | | | | 556,217 | |

McDonald’s Corp. | | | 1,860 | | | | 498,610 | |

Microsoft Corp. | | | 10,725 | | | | 3,607,032 | |

Mondelez International, Inc. | | | 7,100 | | | | 470,801 | |

Otis Worldwide Corp. | | | 3,875 | | | | 337,396 | |

PepsiCo, Inc. | | | 5,775 | | | | 1,003,175 | |

salesforce.com, Inc. * | | | 725 | | | | 184,244 | |

Scotts Miracle-Gro Co. | | | 2,675 | | | | 430,675 | |

Sherwin-Williams Co. | | | 2,400 | | | | 845,184 | |

Starbucks Corp. | | | 6,000 | | | | 701,820 | |

T Rowe Price Group, Inc. | | | 4,250 | | | | 835,720 | |

Thermo Fisher Scientific, Inc. | | | 1,175 | | | | 784,007 | |

Union Pacific Corp. | | | 4,050 | | | | 1,020,317 | |

UnitedHealth Group, Inc. | | | 1,625 | | | | 815,978 | |

Waste Management, Inc. | | | 5,100 | | | | 851,190 | |

WEC Energy Group, Inc. | | | 6,150 | | | | 596,980 | |

| | | | | | | | |

| | |

| | | | | | | 30,643,698 | |

| | | | | | | | |

Total Common Stocks

(cost: $24,809,357) | | | | | | | 49,418,872 | |

| | | | | | | | |

| | |

Short-Term Securities - 2.2% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 0.01%

(cost $1,092,770) | | | 1,092,770 | | | | 1,092,770 | |

| | | | | | | | |

| | |

Total Investments in Securities - 99.9%

(cost $25,902,127) | | | | | | | 50,511,642 | |

| | |

Other Assets and Liabilities, net - 0.1% | | | | | | | 31,609 | |

| | | | | | | | |

| | |

Total Net Assets - 100.0% | | | | | | | $50,543,251 | |

| | | | | | | | |

| * | Non-income producing security. |

| | ADR — American Depositary Receipt |

| | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

See accompanying notes to financial statements.

| | |

| | |

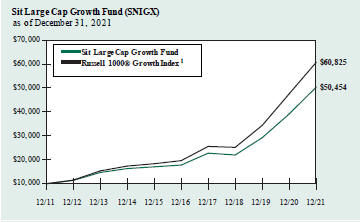

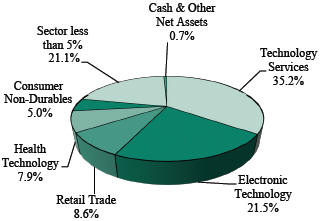

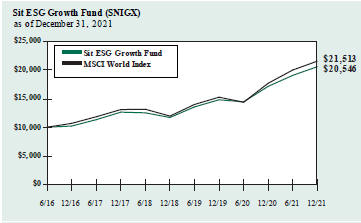

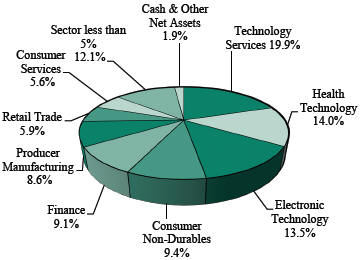

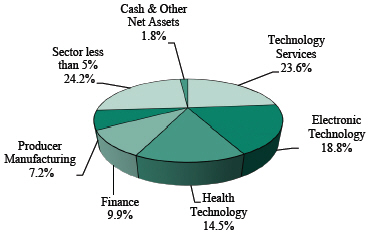

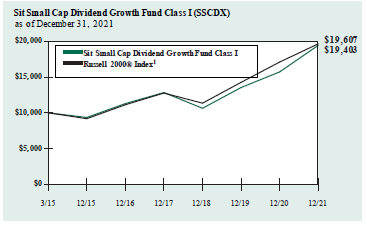

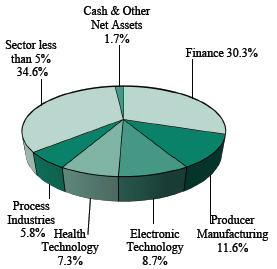

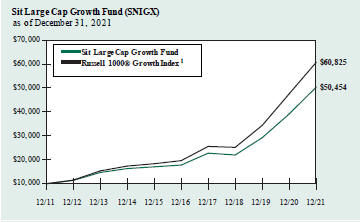

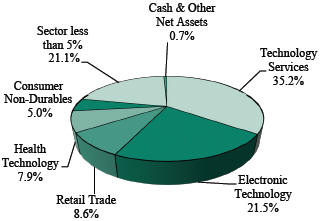

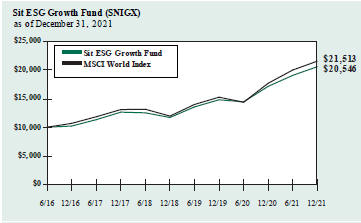

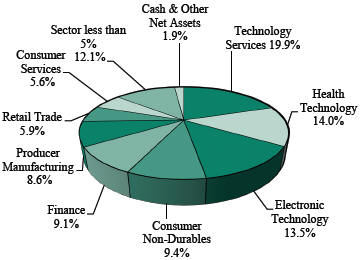

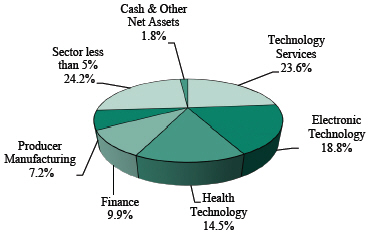

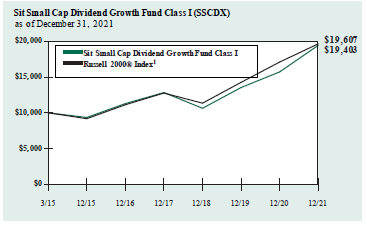

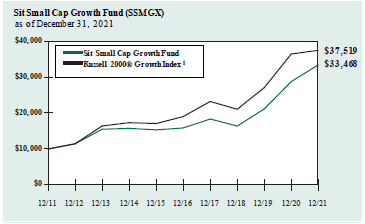

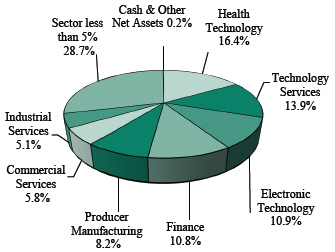

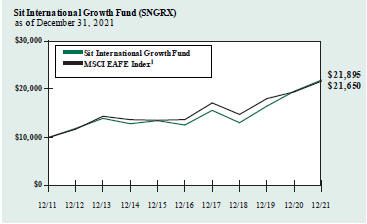

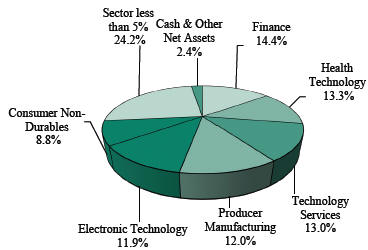

| 18 | | SIT MUTUAL FUNDS SEMI-ANNUAL REPORT |