UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03343

Sit Large Cap Growth Fund, Inc.

(Exact name of Registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP

Sit Mutual Funds

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(612) 332-3223

Date of fiscal year end: June 30, 2024

Date of reporting period: June 30, 2024

| Item 1: | Reports to Stockholders. |

Sit Large Cap Growth Fund

Annual Shareholder Report

June 30, 2024

This annual shareholder report contains important information about Sit Large Cap Growth Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.sitfunds.com/documents. You can also request this information by contacting us at 1-800-332-5580.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Sit Large Cap Growth Fund | $115 | 1.00% |

How did the Fund perform in the past 12 months and what affected its performance?

For the 12-month period ended June 30, 2024, the Sit Large Cap Growth Fund returned +30.22%, underperforming the Russell 1000® Growth Index's return of +33.48%. During the period, stock selection in the health technology sector was the largest detractor from performance. In this sector, an underweight position in Eli Lilly (+94%), combined with overweight positions in DexCom (-12%) and Gilead Sciences (-11%), weighed on returns. Stock selection in the technology services sector also hurt performance, as the Fund was underweight Meta Platforms (+76%) and it owned positions in equities that declined during the period, such as Paycom Software (-55%) and Accenture (-0.2%). Augmenting returns during the period was strong stock selection and an overweight position in the electronic technology sector. Key contributors to performance here included positions in NVIDIA (+192%) and Broadcom (+88%). An underweight position, combined with positive stock selection in the consumer durables sector, also benefited performance.

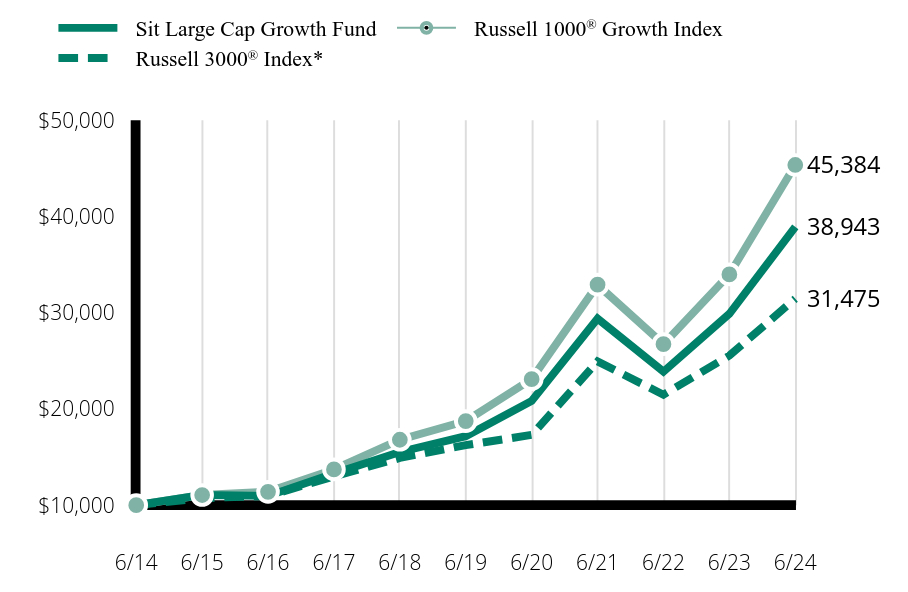

How did the Fund perform over the last 10 years?

Total Return Based on $10,000 Investment

| Sit Large Cap Growth Fund | Russell 3000® Index* | Russell 1000® Growth Index |

|---|

| 6/14 | $10,000 | $10,000 | $10,000 |

| 6/15 | 11,062 | 10,729 | 11,056 |

| 6/16 | 10,964 | 10,959 | 11,390 |

| 6/17 | 13,286 | 12,987 | 13,716 |

| 6/18 | 15,535 | 14,907 | 16,804 |

| 6/19 | 17,174 | 16,246 | 18,746 |

| 6/20 | 20,838 | 17,306 | 23,110 |

| 6/21 | 29,407 | 24,950 | 32,932 |

| 6/22 | 23,885 | 21,490 | 26,749 |

| 6/23 | 29,905 | 25,563 | 34,000 |

| 6/24 | 38,943 | 31,475 | 45,384 |

The line graph above shows the value of a hypothetical $10,000 investment in the Fund over the past 10 fiscal years (or since inception if shorter). The graph above and the table below are total returns, which assume the reinvestment of dividends and capital gains, if any. Neither the Fund’s returns nor the index returns reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s past performance is not a good predictor of the Fund’s Future performance. Updated performance information is available at www.sitfunds.com.

| Footnote | Description |

Footnote* | Effective with this report, and pursuant to new regulatory requirements, the Russell 3000® Index replaced the Russell 1000® Growth Index as the Fund's primary benchmark to represent a broad-based securities market index. The Fund continues to use the Russell 1000® Growth Index as an additional benchmark. |

Average Annual Total Returns (as of June 30, 2024)

| 1 Year | 5 Years | 10 Years |

|---|

| Sit Large Cap Growth Fund | 30.22% | 17.79% | 14.56% |

Russell 3000® IndexFootnote Reference* | 23.13% | 14.14% | 12.15% |

Russell 1000® Growth Index | 33.48% | 19.34% | 16.33% |

Fund Statistics (as of June 30, 2024)

| Total Net Assets | $214,112,417 |

| # of Portfolio Holdings | 63 |

| Portfolio Turnover Rate | 11.11% |

| Investment Advisory Fees Paid | $1,787,411 |

| Weighted average market cap | $1,398.8 Billion |

| Median market cap | 0 |

What did the Fund invest in?

The Fund predominantly invested in common stocks of domestic companies with capitalizations exceeding $5 billion. The tables below reflect the investment makeup of the Fund as of June 30, 2024. Portfolio holdings are subject to change.

Top 10 Equity (% of Net Assets)

| Microsoft Corp. | 11.5% |

| Apple, Inc. | 10.6 |

| NVIDIA Corp. | 10.0 |

| Alphabet, Inc. | 7.4 |

| Amazon.com, Inc. | 5.7 |

| Broadcom, Inc. | 3.9 |

| Applied Materials, Inc. | 2.5 |

| UnitedHealth Group, Inc. | 2.4 |

| Meta Platforms, Inc. | 2.3 |

| salesforce.com, Inc. | 1.8 |

Sector Allocation (% of Net Assets)

| Technology Services | 30.0% |

| Electronic Technology | 29.1 |

| Retail Trade | 9.8 |

| Health Technology | 6.4 |

| Producer Manufacturing | 5.0 |

| Health Services | 2.9 |

| Consumer Services | 2.5 |

| Consumer Non-Durables | 2.4 |

| Others | 9.4 |

| Cash and other net assets | 2.5 |

| Total | 100.0 |

There were no material changes to the Fund during the 12-month period ended June 30, 2024.

Additional Information is available on the Fund’s website at www.sitfunds.com, including its prospectus, financial information, holdings, and proxy voting information.

The SEC permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. The Sit Funds, or your financial intermediary, may household the mailing of your documents indefinitely unless you instruct the Sit Funds, or your financial intermediary, otherwise. If you would prefer that your Sit Fund documents not be householded, please contact the Sit Funds at 1-800-332-5580, or contact your financial intermediary. Your instructions that householding not apply to delivery Fund documents will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

Sit Large Cap Growth Fund

Annual Shareholder Report

June 30, 2024

Item 2: Code of Ethics.

The Registrant has adopted a Code of Ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Registrant has not made any amendment to its code of ethics during the period covered by this report which must be described herein pursuant to Item 2. The Registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the Registrant’s code of ethics is available without charge upon request by calling the Registrant at 612-332-3223 or 1-800-332-5580, or by mail at Sit Mutual Funds, 3300 IDS Center, 80 South Eighth Street, Minneapolis, MN 55402.

Item 3: Audit Committee Financial Expert.

The Registrant’s Board of Directors has determined that Mr. Edward M. Giles, Mr. Sidney L. Jones, Mr. Bruce C. Lueck, Mr. Donald W. Phillips, and Mr. Barry N. Winslow are audit committee financial experts serving on its audit committee. Mr. Giles, Mr. Jones, Mr. Lueck, Mr. Phillips, and Mr. Winslow are independent for purposes of this Item.

Item 4: Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed to the Registrant for the last two fiscal years for professional services rendered by the Registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Audit Fees (a) | | | Audit Related Fees (b) | | | Tax Fees (c) | | | All

Other Fees (d) | | | |

Fiscal year ended June 30, 2024 | | | $25,600 | | | | 0 | | | | $5,935 | | | | 0 | |

Fiscal year ended June 30, 2023 | | | $29,500 | | | | 0 | | | | $6,825 | | | | 0 | |

(e) (1) The Audit Committee is required to pre-approve audit and non-audit services performed for the Registrant by the independent auditor in order to assure that the provision of such services does not impair the auditor’s independence. The audit committee also is required to pre-approve certain non-audit services performed by the Registrant’s independent auditor for the Registrant’s investment adviser and certain of the adviser’s affiliates if the services relate directly to the operations and financial reporting of the Registrant. Services to be provided by the auditor must receive general pre-approval or specific pre-approval by the audit committee. Any proposed services exceeding pre-approved cost levels will require separate pre-approval by the audit committee.

The audit committee may delegate pre-approval authority to the audit committee chairman. The chairman shall report any pre-approval decisions to the audit committee at its next scheduled meeting. The audit committee does not delegate its responsibility to pre-approve services performed by the independent auditor to management.

(2) No services included in (b) – (d) were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the Registrant’s principal accountant for non-audit services rendered to the Registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant were $0 and $0, respectively.

(h) The Registrant’s audit committee has determined that the provision of non-audit services rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is considered compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5: Audit Committee of Listed Registrants.

Not applicable to open-end investment companies.

Item 6: Investments.

The schedule of investments is included as part of the material filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements and Other Information June 30, 2024 Balanced Fund Dividend Growth Fund Global Dividend Growth Fund Large Cap Growth Fund ESG Growth Fund Mid Cap Growth Fund Small Cap Dividend Growth Fund Small Cap Growth Fund International Growth Fund Developing Markets Growth Fund Sit Mutual Funds

|

Sit Stock Funds FINANCIAL STATEMENTS AND OTHER INFORMATION TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Balanced Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Common Stocks - 64.1% | | | | | | | | |

| | |

Consumer Non-Durables -1.7% | | | | | | | | |

Constellation Brands, Inc. | | | 2,250 | | | | 578,880 | |

Mondelez International, Inc. | | | 3,400 | | | | 222,496 | |

PepsiCo, Inc. | | | 1,825 | | | | 300,997 | |

| | | | | | | | |

| | |

| | | | | | | 1,102,373 | |

| | | | | | | | |

| | |

Consumer Services - 1.7% | | | | | | | | |

McDonald’s Corp. | | | 1,450 | | | | 369,518 | |

Visa, Inc. | | | 2,800 | | | | 734,916 | |

| | | | | | | | |

| | |

| | | | | | | 1,104,434 | |

| | | | | | | | |

| | |

Electronic Technology - 17.3% | | | | | | | | |

Apple, Inc. | | | 13,475 | | | | 2,838,104 | |

Applied Materials, Inc. | | | 2,600 | | | | 613,574 | |

Arista Networks, Inc. * | | | 765 | | | | 268,117 | |

Broadcom, Inc. | | | 1,235 | | | | 1,982,830 | |

NVIDIA Corp. | | | 38,400 | | | | 4,743,936 | |

Palo Alto Networks, Inc. * | | | 2,160 | | | | 732,262 | |

| | | | | | | | |

| | |

| | | | | | | 11,178,823 | |

| | | | | | | | |

| | |

Energy Minerals - 1.3% | | | | | | | | |

ConocoPhillips | | | 5,775 | | | | 660,544 | |

Shell, PLC, ADR | | | 2,400 | | | | 173,232 | |

| | | | | | | | |

| | |

| | | | | | | 833,776 | |

| | | | | | | | |

| | |

Finance - 3.4% | | | | | | | | |

Ameriprise Financial, Inc. | | | 1,150 | | | | 491,269 | |

Chubb, Ltd. | | | 1,400 | | | | 357,112 | |

Goldman Sachs Group, Inc. | | | 1,600 | | | | 723,712 | |

JPMorgan Chase & Co. | | | 2,925 | | | | 591,610 | |

| | | | | | | | |

| | |

| | | | | | | 2,163,703 | |

| | | | | | | | |

| | |

Health Services - 2.5% | | | | | | | | |

Centene Corp. * | | | 2,475 | | | | 164,093 | |

Quest Diagnostics, Inc. | | | 1,475 | | | | 201,898 | |

UnitedHealth Group, Inc. | | | 2,450 | | | | 1,247,687 | |

| | | | | | | | |

| | |

| | | | | | | 1,613,678 | |

| | | | | | | | |

| | |

Health Technology - 4.2% | | | | | | | | |

Abbott Laboratories | | | 3,550 | | | | 368,881 | |

AbbVie, Inc. | | | 600 | | | | 102,912 | |

Dexcom, Inc. * | | | 5,260 | | | | 596,379 | |

Eli Lilly & Co. | | | 260 | | | | 235,399 | |

Intuitive Surgical, Inc. * | | | 775 | | | | 344,759 | |

Johnson & Johnson | | | 1,250 | | | | 182,700 | |

Novo Nordisk A/S, ADR | | | 1,550 | | | | 221,247 | |

Thermo Fisher Scientific, Inc. | | | 1,040 | | | | 575,120 | |

Zimmer Biomet Holdings, Inc. | | | 650 | | | | 70,544 | |

| | | | | | | | |

| | |

| | | | | | | 2,697,941 | |

| | | | | | | | |

| | |

Industrial Services - 0.7% | | | | | | | | |

Cheniere Energy, Inc. | | | 2,750 | | | | 480,783 | |

| | | | | | | | |

| | |

Process Industries -1.3% | | | | | | | | |

Linde, PLC | | | 1,225 | | | | 537,542 | |

Sherwin-Williams Co. | | | 1,000 | | | | 298,430 | |

| | | | | | | | |

| | |

| | | | | | | 835,972 | |

| | | | | | | | |

| | |

Producer Manufacturing - 4.6% | | | | | | | | |

General Dynamics Corp. | | | 700 | | | | 203,098 | |

Honeywell International, Inc. | | | 1,450 | | | | 309,633 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Motorola Solutions, Inc. | | | 1,400 | | | | 540,470 | |

Northrop Grumman Corp. | | | 375 | | | | 163,481 | |

Parker-Hannifin Corp. | | | 1,350 | | | | 682,843 | |

Safran SA, ADR | | | 11,550 | | | | 615,038 | |

Siemens AG, ADR | | | 5,175 | | | | 482,569 | |

| | | | | | | | |

| | |

| | | | | | | 2,997,132 | |

| | | | | | | | |

| | |

Retail Trade - 6.2% | | | | | | | | |

Amazon.com, Inc. * | | | 9,700 | | | | 1,874,525 | |

Home Depot, Inc. | | | 1,825 | | | | 628,238 | |

Lululemon Athletica, Inc. * | | | 885 | | | | 264,349 | |

Netflix, Inc. * | | | 460 | | | | 310,445 | |

TJX Cos., Inc. | | | 5,100 | | | | 561,510 | |

Ulta Beauty, Inc. * | | | 795 | | | | 306,767 | |

| | | | | | | | |

| | |

| | | | | | | 3,945,834 | |

| | | | | | | | |

| | |

Technology Services - 17.2% | | | | | | | | |

Accenture, PLC | | | 2,025 | | | | 614,405 | |

Adobe, Inc. * | | | 1,060 | | | | 588,872 | |

Alphabet, Inc. - Class A | | | 12,400 | | | | 2,258,660 | |

Alphabet, Inc. - Class C | | | 4,100 | | | | 752,022 | |

Autodesk, Inc. * | | | 1,275 | | | | 315,499 | |

Dynatrace, Inc. * | | | 4,250 | | | | 190,145 | |

Intuit, Inc. | | | 1,200 | | | | 788,652 | |

Meta Platforms, Inc. | | | 1,490 | | | | 751,288 | |

Microsoft Corp. | | | 7,475 | | | | 3,340,951 | |

Salesforce, Inc. | | | 3,650 | | | | 938,415 | |

ServiceNow, Inc. * | | | 560 | | | | 440,535 | |

| | | | | | | | |

| | |

| | | | | | | 10,979,444 | |

| | | | | | | | |

| | |

Transportation - 1.5% | | | | | | | | |

FedEx Corp. | | | 1,775 | | | | 532,216 | |

Union Pacific Corp. | | | 2,050 | | | | 463,833 | |

| | | | | | | | |

| | |

| | | | | | | 996,049 | |

| | | | | | | | |

| | |

Utilities - 0.5% | | | | | | | | |

NextEra Energy, Inc. | | | 4,140 | | | | 293,153 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $17,482,656) | | | | | | | 41,223,095 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | Fair Value ($) | |

| | |

Bonds – 28.1% | | | | | | | | |

| | |

Asset-Backed Securities - 0.1% | | | | | | | | |

| | |

Small Business Administration | | | | | | | | |

2008-20A 1, 5.17%, 1/1/28 | | | 8,845 | | | | 8,681 | |

| | |

Towd Point Mortgage Trust: | | | | | | | | |

2020-MH1 A1A, 2.18%, 2/25/60 1, 4 | | | 52,490 | | | | 50,180 | |

2019-MH1 A2, 3.00%, 11/25/58 1, 4 | | | 44,050 | | | | 43,767 | |

| | | | | | | | |

| | |

| | | | | | | 102,628 | |

| | | | | | | | |

| |

Collateralized Mortgage Obligations - 6.1% | | | | | |

| | |

Chase Home Lending Mortgage Trust: | | | | | | | | |

2023-1 A2, 6.00%, 6/25/54 1, 4 | | | 142,306 | | | | 142,782 | |

| | |

Chase Home Lending Mortgage Trust Series: | | | | | | | | |

2024-1 A8A, 6.00%, 1/25/55 1, 4 | | | 200,000 | | | | 196,764 | |

2024-2 A8A, 6.00%, 2/25/55 1, 4 | | | 200,000 | | | | 197,436 | |

See accompanying notes to financial statements.

| | |

| | |

| 2 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal Amount ($) | | Fair Value ($) | |

| | |

2024-3 A8, 6.00%, 2/25/55 1, 4 | | | 100,000 | | | | 99,583 | |

2024-4 A8, 6.00%, 3/25/55 1, 4 | | | 200,000 | | | | 200,137 | |

|

Fannie Mae: | |

2017-84 JP, 2.75%, 10/25/47 | | | 16,275 | | | | 14,042 | |

2003-34 A1, 6.00%, 4/25/43 | | | 21,419 | | | | 21,303 | |

2004-T1 1A1, 6.00%, 1/25/44 | | | 12,644 | | | | 12,800 | |

1999-17 C, 6.35%, 4/25/29 | | | 3,430 | | | | 3,420 | |

2001-82 ZA, 6.50%, 1/25/32 | | | 5,730 | | | | 5,734 | |

2009-30 AG, 6.50%, 5/25/39 | | | 21,956 | | | | 22,919 | |

2013-28 WD, 6.50%, 5/25/42 | | | 20,086 | | | | 20,881 | |

2004-T1 1A2, 6.50%, 1/25/44 | | | 32,141 | | | | 32,396 | |

2004-W9 2A1, 6.50%, 2/25/44 | | | 22,176 | | | | 22,264 | |

2004-T3 1A3, 7.00%, 2/25/44 | | | 4,540 | | | | 4,633 | |

|

Freddie Mac: | |

5280 A, 3.50%, 1/25/50 | | | 143,505 | | | | 131,340 | |

4812 CZ, 4.00%, 5/15/48 | | | 151,137 | | | | 138,631 | |

4293 BA, 5.28%, 10/15/47 1 | | | 6,477 | | | | 6,483 | |

2122 ZE, 6.00%, 2/15/29 | | | 18,294 | | | | 18,327 | |

2126 C, 6.00%, 2/15/29 | | | 12,305 | | | | 12,288 | |

2480 Z, 6.00%, 8/15/32 | | | 15,821 | | | | 16,111 | |

2485 WG, 6.00%, 8/15/32 | | | 16,645 | | | | 17,021 | |

2575 QE, 6.00%, 2/15/33 | | | 6,407 | | | | 6,551 | |

2980 QA, 6.00%, 5/15/35 | | | 7,762 | | | | 8,000 | |

5354 AB, 6.00%, 5/25/49 | | | 170,061 | | | | 171,328 | |

2357 ZJ, 6.50%, 9/15/31 | | | 13,498 | | | | 13,739 | |

4520 HM, 6.50%, 8/15/45 | | | 11,400 | | | | 12,259 | |

3704 CT, 7.00%, 12/15/36 | | | 7,134 | | | | 7,442 | |

|

Government National Mortgage Association: | |

2021-86 WB, 4.77%, 5/20/51 1 | | | 128,525 | | | | 123,506 | |

2021-104 HT, 5.50%, 6/20/51 | | | 164,204 | | | | 162,979 | |

2021-27 AW, 5.86%, 2/20/51 1 | | | 177,523 | | | | 181,119 | |

2015-80 BA, 7.00%, 6/20/45 1 | | | 5,580 | | | | 5,807 | |

2018-147 AM, 7.00%, 10/20/48 | | | 19,927 | | | | 20,539 | |

2018-160 DA, 7.00%, 11/20/48 | | | 19,467 | | | | 20,027 | |

2014-69 W, 7.20%, 11/20/34 1 | | | 8,809 | | | | 9,169 | |

2013-133 KQ, 7.31%, 8/20/38 1 | | | 10,863 | | | | 11,332 | |

2005-74 HA, 7.50%, 9/16/35 | | | 139 | | | | 141 | |

|

JP Morgan Mortgage Trust: | |

2021-6 A4, 2.50%, 10/25/51 1, 4 | | | 274,451 | | | | 237,104 | |

2021-13 A4, 2.50%, 4/25/52 1, 4 | | | 260,927 | | | | 225,491 | |

2021-6 A12, 5.00%, 10/25/51 1, 4 | | | 267,609 | | | | 254,684 | |

2023-6 A2, 6.00%, 12/26/53 1, 4 | | | 130,270 | | | | 129,476 | |

2023-10 A8, 6.00%, 5/25/54 1, 4 | | | 150,000 | | | | 149,646 | |

2024-1 A8, 6.00%, 6/25/54 1, 4 | | | 200,000 | | | | 195,739 | |

2024-2 A8A, 6.00%, 8/25/54 1, 4 | | | 125,000 | | | | 123,996 | |

2024-4 A8A, 6.00%, 10/25/54 1, 4 | | | 200,000 | | | | 200,628 | |

2024-5 A8, 6.00%, 11/25/54 1, 4 | | | 200,000 | | | | 198,929 | |

|

New Residential Mortgage Loan Trust: | |

2018-3A A1, 4.50%, 5/25/58 1, 4 | | | 30,386 | | | | 29,143 | |

|

Sequoia Mortgage Trust: | |

2020-4 A5, 2.50%, 11/25/50 1, 4 | | | 37,824 | | | | 33,913 | |

|

Vendee Mortgage Trust: | |

2008-1 B, 5.85%, 3/15/25 1 | | | 5,149 | | | | 5,174 | |

| | |

Wells Fargo Mortgaged Backed Securities Trust: | | | | | | | | |

2020-5 A3, 2.50%, 9/25/50 1, 4 | | | 31,450 | | | | 28,056 | |

| | | | | | | | |

| |

| | | | 3,903,212 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal Amount ($) | | Fair Value ($) | |

| | |

Corporate Bonds - 5.6% | | | | | | | | |

American Tower Trust, 5.49%, 3/15/28 4 | | | 150,000 | | | | 150,635 | |

Bank of New York Mellon Corp., 6.47%, 10/25/34 1 | | | 175,000 | | | | 189,097 | |

Charles Stark Draper Lab., Inc., 4.39%, 9/1/48 | | | 100,000 | | | | 85,109 | |

CVS Pass-Through Trust, 7.51%, 1/10/32 4 | | | 129,839 | | | | 135,142 | |

Delta Air Lines 2015-1 Class AA Pass Through Trust, 3.63%, 7/30/27 | | | 110,170 | | | | 105,127 | |

Duke Energy Florida, LLC, 2.86%, 3/1/33 | | | 120,000 | | | | 103,213 | |

Duke Energy Progress SC Storm Funding, LLC, 5.40%, 3/1/44 | | | 75,000 | | | | 76,519 | |

Entergy Louisiana, LLC, 4.95%, 1/15/45 | | | 200,000 | | | | 176,199 | |

Evergy Kansas Central, Inc., 5.90%, 11/15/33 | | | 175,000 | | | | 180,303 | |

Evergy Missouri West Storm Funding I, LLC, 5.10%, 12/1/38 | | | 100,000 | | | | 99,671 | |

Fairfax Financial Holdings, 7.75%, 7/15/37 | | | 150,000 | | | | 167,011 | |

First-Citizens Bank & Trust Co. | | | | | | | | |

(Subordinated), 4.13%, 11/13/29 1 | | | 175,000 | | | | 168,704 | |

GATX Corp., 6.90%, 5/1/34 | | | 175,000 | | | | 190,913 | |

Halliburton Co., 7.60%, 8/15/96 4 | | | 75,000 | | | | 84,675 | |

JPMorgan Chase & Co., 4.59%, 4/26/33 1 | | | 50,000 | | | | 47,772 | |

KeyCorp, 2.55%, 10/1/29 | | | 250,000 | | | | 212,031 | |

Leidos, Inc., 7.13%, 7/1/32 | | | 50,000 | | | | 54,276 | |

Louisville Gas & Electric Co., 5.45%,

4/15/33 | | | 50,000 | | | | 50,328 | |

Nationwide Mutual Insurance Co. (Subordinated), 3 Mo. Libor + 2.29%, 7.89%, 12/15/24 1, 4 | | | 195,000 | | | | 195,166 | |

Northern Trust Corp. (Subordinated), 3.38%, 5/8/32 1 | | | 250,000 | | | | 236,269 | |

Polar Tankers, Inc., 5.95%, 5/10/37 4 | | | 91,175 | | | | 92,655 | |

SBA Tower Trust, 6.60%, 1/15/28 4 | | | 145,000 | | | | 148,017 | |

Security Benefit Life Insurance Co. (Subordinated), 7.45%, 10/1/33 4 | | | 100,000 | | | | 95,877 | |

State Street Corp., 5.16%, 5/18/34 1 | | | 175,000 | | | | 173,280 | |

Truist Financial Corp., 7.16%, 10/30/29 1 | | | 175,000 | | | | 185,909 | |

Union Electric Co., 4.00%, 4/1/48 | | | 100,000 | | | | 78,041 | |

United Airlines 2019-2 Class AA Pass Through Trust, 2.70%, 5/1/32 | | | 121,192 | | | | 104,926 | |

| | | | | | | | |

| | |

| | | | | | | 3,586,865 | |

| | | | | | | | |

| |

Federal Home Loan Mortgage Corporation - 0.2% | | | | | |

7.50%, 10/1/38 | | | 92,371 | | | | 97,836 | |

8.50%, 5/1/31 | | | 36,675 | | | | 37,610 | |

| | | | | | | | |

| | |

| | | | | | | 135,446 | |

| | | | | | | | |

|

Federal National Mortgage Association - 2.4% | |

4.50%, 7/1/52 | | | 307,519 | | | | 290,822 | |

4.50%, 9/1/52 | | | 312,257 | | | | 295,118 | |

5.00%, 1/1/30 | | | 123,364 | | | | 122,553 | |

5.50%, 8/1/56 | | | 146,840 | | | | 149,371 | |

6.00%, 7/1/41 | | | 119,216 | | | | 122,558 | |

6.00%, 9/1/53 | | | 162,540 | | | | 163,200 | |

6.00%, 10/1/53 | | | 331,646 | | | | 333,777 | |

6.50%, 9/1/27 | | | 11,497 | | | | 11,712 | |

7.00%, 1/1/32 | | | 4,055 | | | | 4,047 | |

7.00%, 3/1/33 | | | 6,402 | | | | 6,533 | |

7.00%, 12/1/38 | | | 5,120 | | | | 5,176 | |

8.31%, 7/15/26 | | | 264 | | | | 263 | |

| | | | | | | | |

| | |

| | | | | | | 1,505,130 | |

| | | | | | | | |

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Balanced Fund (Continued)

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | Fair Value ($) | |

| |

Government National Mortgage Association - 1.4% | | | | | |

3.50%, 2/20/52 | | | 251,915 | | | | 226,687 | |

4.00%, 9/20/52 | | | 228,986 | | | | 208,081 | |

5.00%, 5/20/48 | | | 20,508 | | | | 20,211 | |

5.50%, 9/20/52 | | | 85,468 | | | | 83,859 | |

5.50%, 8/20/62 | | | 184,674 | | | | 182,426 | |

6.00%, 9/20/53 | | | 164,802 | | | | 164,536 | |

6.50%, 11/20/38 | | | 8,561 | | | | 8,734 | |

7.00%, 12/15/24 | | | 180 | | | | 180 | |

7.00%, 11/20/27 | | | 2,924 | | | | 2,978 | |

7.00%, 9/20/29 | | | 10,150 | | | | 10,342 | |

7.00%, 9/20/38 | | | 5,310 | | | | 5,439 | |

7.50%, 4/20/32 | | | 6,886 | | | | 6,938 | |

| | | | | | | | |

| | |

| | | | | | | 920,411 | |

| | | | | | | | |

| | |

Taxable Municipal Securities - 6.2% | | | | | | | | |

Benton & Polk Sch. Dist. No. 17J G.O., 5.47%, 6/15/27 | | | 150,000 | | | | 152,010 | |

City of Aurora G.O., 5.01%, 12/30/30 | | | 300,000 | | | | 301,071 | |

City of Dallas G.O., 5.61%, 2/15/30 | | | 250,000 | | | | 255,197 | |

City of Modesto CA Wastewater Rev., 1.20%, 11/1/26 | | | 240,000 | | | | 220,128 | |

CO Health Facs. Auth., 3.13%, 5/15/27 | | | 250,000 | | | | 226,127 | |

Colorado Edu. & Cultural Fac. Auth., 3.97%, 3/1/56 | | | 205,000 | | | | 159,441 | |

Coventry Local Sch. Dist., 2.20%, 11/1/29 | | | 200,000 | | | | 175,028 | |

LaGrange Co. Regional Utility Dist., 2.98%, 1/1/40 | | | 230,000 | | | | 182,533 | |

MA Bay Trans. Auth., 5.77%, 7/1/31 | | | 185,000 | | | | 187,216 | |

MA Hsg. Fin. Agy., 5.11%, 6/1/30 | | | 250,000 | | | | 250,598 | |

Maricopa Co. Industrial Dev. Auth., 3.50%, 7/1/44 4 | | | 100,000 | | | | 82,344 | |

| | |

Massachusetts Edu. Auth.: | | | | | | | | |

4.41%, 7/1/34 | | | 15,000 | | | | 14,470 | |

4.95%, 7/1/38 | | | 195,000 | | | | 186,757 | |

5.95%, 7/1/44 | | | 150,000 | | | | 145,866 | |

MN Hsg. Fin. Agy., 2.31%, 1/1/27 | | | 135,000 | | | | 126,650 | |

Public Fin. Auth., 4.23%, 7/1/32 | | | 105,000 | | | | 99,682 | |

State of Connecticut G.O., 5.09%, 10/1/30 | | | 100,000 | | | | 98,975 | |

Texas Children’s Hospital, 3.37%, 10/1/29 17 | | | 115,000 | | | | 108,779 | |

Utah Charter Sch. Fin. Auth., 2.40%, 10/15/27 | | | 205,000 | | | | 188,067 | |

VA Hsg. Dev. Auth., 2.21%, 11/1/30 | | | 250,000 | | | | 214,710 | |

VT Hsg. Fin. Agy., 6.25%, 11/1/54 | | | 200,000 | | | | 205,288 | |

WA State Hsg. Fin. Comm., 3.50%, 7/1/24 4 | | | 20,000 | | | | 20,000 | |

Wichita Falls, 1.65%, 9/1/28 | | | 145,000 | | | | 128,026 | |

WV Hsg. Dev. Fund Rev., 5.45%, 5/1/34 | | | 250,000 | | | | 251,148 | |

| | | | | | | | |

| | |

| | | | | | | 3,980,111 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Principal

Amount ($) | | Fair Value ($) | |

| |

U.S. Treasury / Federal Agency Securities - 6.1% | | | | | |

| | |

U.S. Treasury - 6.1% | | | | | | | | |

| | |

U.S. Treasury Bonds: | | | | | | | | |

3.63%, 2/15/53 | | | 275,000 | | | | 235,437 | |

4.25%, 2/15/54 | | | 200,000 | | | | 191,625 | |

4.63%, 5/15/54 | | | 225,000 | | | | 229,500 | |

4.75%, 11/15/53 | | | 1,200,000 | | | | 1,248,187 | |

| | |

U.S. Treasury Notes: | | | | | | | | |

4.00%, 1/31/29 | | | 1,325,000 | | | | 1,305,384 | |

4.25%, 3/31/29 | | | 300,000 | | | | 297,117 | |

4.38%, 5/15/34 | | | 225,000 | | | | 225,563 | |

4.50%, 11/15/33 | | | 200,000 | | | | 202,281 | |

| | | | | | | | |

| | |

| | | | | | | 3,935,094 | |

| | | | | | | | |

| | |

Total Bonds

(cost $18,861,870) | | | | | | | 18,068,897 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Investment Companies 4.8% | | | | | | | | |

Angel Oak Financial Strategies Income Trust | | | 8,400 | | | | 103,908 | |

BlackRock California Municipal Income Trust | | | 1,700 | | | | 20,349 | |

BlackRock Credit Allocation Income Trust | | | 11,350 | | | | 121,559 | |

BlackRock Enhanced Government Fund | | | 4,174 | | | | 38,985 | |

BlackRock Municipal Income Fund, Inc. | | | 12,800 | | | | 157,952 | |

BlackRock MuniHoldings NY Quality Fund | | | 600 | | | | 6,456 | |

BlackRock MuniYield NY Quality Fund, Inc. | | | 2,600 | | | | 27,222 | |

BlackRock New York Municipal Income Trust | | | 500 | | | | 5,355 | |

BlackRock Taxable Municipal Bond Trust | | | 10,671 | | | | 174,471 | |

BNY Mellon Municipal Income, Inc. | | | 1,900 | | | | 13,661 | |

DWS Municipal Income Trust | | | 12,900 | | | | 122,163 | |

Eaton Vance California Municipal Bond Fund | | | 2,000 | | | | 19,020 | |

Eaton Vance Municipal Bond Fund | | | 13,400 | | | | 141,772 | |

Eaton Vance New York Municipal Bond Fund | | | 1,100 | | | | 10,846 | |

First Trust Mortgage Income Fund | | | 3,800 | | | | 45,334 | |

Invesco Municipal Opportunity Trust | | | 21,395 | | | | 215,662 | |

Invesco Municipal Trust | | | 5,900 | | | | 58,764 | |

Invesco PA Value Municipal Income Trust | | | 4,900 | | | | 53,214 | |

Invesco Trust for Investment Grade Municipals | | | 8,700 | | | | 89,349 | |

Invesco Trust for Investment Grade NY Munis | | | 5,500 | | | | 61,820 | |

MFS Intermediate Income Trust | | | 62,200 | | | | 165,452 | |

Nuveen AMT-Free Muni Credit Income Fund | | | 5,134 | | | | 63,970 | |

Nuveen AMT-Free Quality Muni Income Fund | | | 19,500 | | | | 223,470 | |

Nuveen Multi-Market Income Fund | | | 17,353 | | | | 103,597 | |

Nuveen NJ Quality Muni Income Fund | | | 8,800 | | | | 107,448 | |

Nuveen NY AMT-Free Quality Muni Fund | | | 8,800 | | | | 97,592 | |

Nuveen PA Quality Muni Income Fund | | | 8,600 | | | | 104,920 | |

Nuveen Quality Municipal Income Fund | | | 14,400 | | | | 169,056 | |

Nuveen Taxable Municipal Income Fund | | | 7,067 | | | | 109,609 | |

Putnam Master Intermediate Income Trust | | | 61,000 | | | | 196,725 | |

Putnam Premier Income Trust | | | 45,692 | | | | 163,577 | |

TCW Strategic Income Fund, Inc. | | | 18,000 | | | | 85,320 | |

Western Asset Intermediate Muni Fund, Inc. | | | 1,800 | | | | 14,148 | |

| | | | | | | | |

| | |

Total Investment Companies

(cost: $3,143,882) | | | | | | | 3,092,746 | |

| | | | | | | | |

See accompanying notes to financial statements.

| | |

| | |

| 4 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Short-Term Securities - 2.7% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $1,765,021) | | | 1,765,021 | | | | 1,765,021 | |

| | | | | | | | |

| | |

Total Investments in Securities - 99.7%

(cost $41,253,429) | | | | | | | 64,149,759 | |

| | |

Other Assets and Liabilities, net - 0.3% | | | | | | | 185,532 | |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $64,335,291 | |

| | | | | | | | |

| * | Non-income producing security. |

| 1 | Variable rate security. Rate disclosed is as of June 30, 2024. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or, for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| 4 | 144A Restricted Security. The total value of such securities as of June 30, 2024 was $3,741,965 and represented 5.8% of net assets. These securities have been determined to be liquid by the Adviser in accordance with guidelines established by the Board of Directors. |

| 17 | Security that is either an absolute and unconditional obligation of the United States Government or is collateralized by securities, loans, or leases guaranteed by the U.S. Government or its agencies or instrumentalities. |

ADR — American Depositary Receipt

LLC — Limited Liability Company

PLC — Public Limited Company

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | | |

| | | Level 1 Quoted Prices ($) | | | Level 2

Other significant

observable inputs ($) | | Level 3 Significant

unobservable inputs ($) | | Total ($) | |

| | | | |

Common Stocks** | | | 41,223,095 | | | | — | | | | — | | | | 41,223,095 | |

Asset-Backed Securities | | | — | | | | 102,628 | | | | — | | | | 102,628 | |

Collateralized Mortgage Obligations | | | — | | | | 3,903,212 | | | | — | | | | 3,903,212 | |

Corporate Bonds | | | — | | | | 3,586,865 | | | | — | | | | 3,586,865 | |

Federal Home Loan Mortgage Corporation | | | — | | | | 135,446 | | | | — | | | | 135,446 | |

Federal National Mortgage Association | | | — | | | | 1,505,130 | | | | — | | | | 1,505,130 | |

Government National Mortgage Association | | | — | | | | 920,411 | | | | — | | | | 920,411 | |

Taxable Municipal Securities | | | — | | | | 3,980,111 | | | | — | | | | 3,980,111 | |

U.S. Treasury / Federal Agency Securities | | | — | | | | 3,935,094 | | | | — | | | | 3,935,094 | |

Investment Companies | | | 3,092,746 | | | | — | | | | — | | | | 3,092,746 | |

Short-Term Securities | | | 1,765,021 | | | | — | | | | — | | | | 1,765,021 | |

| | | | |

Total: | | | 46,080,862 | | | | 18,068,897 | | | | — | | | | 64,149,759 | |

| | | | |

| ** | For equity securities categorized in a single level, refer to the detail above for further breakdown. |

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Dividend Growth Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Common Stocks - 99.3% | | | | | | | | |

| | |

Commercial Services - 2.0% | | | | | | | | |

Booz Allen Hamilton Holding Corp. | | | 13,825 | | | | 2,127,668 | |

S&P Global, Inc. | | | 6,125 | | | | 2,731,750 | |

| | | | | | | | |

| | |

| | | | | | | 4,859,418 | |

| | | | | | | | |

| | |

Communications - 1.2% | | | | | | | | |

Verizon Communications, Inc. | | | 72,950 | | | | 3,008,458 | |

| | | | | | | | |

| | |

Consumer Non-Durables - 4.1% | | | | | | | | |

Mondelez International, Inc. | | | 18,575 | | | | 1,215,548 | |

NIKE, Inc. | | | 19,025 | | | | 1,433,914 | |

PepsiCo, Inc. | | | 21,425 | | | | 3,533,626 | |

Procter & Gamble Co. | | | 23,050 | | | | 3,801,406 | |

| | | | | | | | |

| | |

| | | | | | | 9,984,494 | |

| | | | | | | | |

| | |

Consumer Services - 2.3% | | | | | | | | |

McDonald’s Corp. | | | 10,500 | | | | 2,675,820 | |

Visa, Inc. | | | 11,085 | | | | 2,909,480 | |

| | | | | | | | |

| | |

| | | | | | | 5,585,300 | |

| | | | | | | | |

| | |

Electronic Technology - 19.8% | | | | | | | | |

Apple, Inc. | | | 63,425 | | | | 13,358,573 | |

Applied Materials, Inc. | | | 16,875 | | | | 3,982,331 | |

Broadcom, Inc. | | | 5,662 | | | | 9,090,511 | |

Cisco Systems, Inc. | | | 36,500 | | | | 1,734,115 | |

Dell Technologies, Inc. | | | 13,550 | | | | 1,868,681 | |

Garmin, Ltd. | | | 15,925 | | | | 2,594,501 | |

International Business Machines Corp. | | | 15,125 | | | | 2,615,869 | |

Micron Technology, Inc. | | | 9,950 | | | | 1,308,723 | |

NVIDIA Corp. | | | 65,300 | | | | 8,067,162 | |

TE Connectivity, Ltd. | | | 23,125 | | | | 3,478,694 | |

| | | | | | | | |

| | |

| | | | | | | 48,099,160 | |

| | | | | | | | |

| | |

Energy Minerals - 4.1% | | | | | | | | |

ConocoPhillips | | | 32,975 | | | | 3,771,680 | |

Exxon Mobil Corp. | | | 53,200 | | | | 6,124,384 | |

| | | | | | | | |

| | |

| | | | | | | 9,896,064 | |

| | | | | | | | |

| | |

Finance - 13.1% | | | | | | | | |

Air Lease Corp. | | | 31,650 | | | | 1,504,325 | |

American International Group, Inc. | | | 40,625 | | | | 3,016,000 | |

Axis Capital Holdings, Ltd. | | | 23,580 | | | | 1,665,927 | |

Bank of New York Mellon Corp. | | | 45,525 | | | | 2,726,492 | |

Carlyle Group, Inc. | | | 42,100 | | | | 1,690,315 | |

Citigroup, Inc. | | | 45,225 | | | | 2,869,979 | |

Everest Group, Ltd. | | | 4,985 | | | | 1,899,385 | |

Goldman Sachs Group, Inc. | | | 4,795 | | | | 2,168,874 | |

Intercontinental Exchange, Inc. | | | 19,135 | | | | 2,619,390 | |

Invitation Homes, Inc. | | | 35,300 | | | | 1,266,917 | |

JPMorgan Chase & Co. | | | 20,720 | | | | 4,190,827 | |

Realty Income Corp. | | | 54,900 | | | | 2,899,818 | |

Reinsurance Group of America, Inc. | | | 16,150 | | | | 3,315,110 | |

| | | | | | | | |

| | |

| | | | | | | 31,833,359 | |

| | | | | | | | |

| | |

Health Services - 4.2% | | | | | | | | |

Cardinal Health, Inc. | | | 20,550 | | | | 2,020,476 | |

Quest Diagnostics, Inc. | | | 20,625 | | | | 2,823,150 | |

UnitedHealth Group, Inc. | | | 10,740 | | | | 5,469,452 | |

| | | | | | | | |

| | |

| | | | | | | 10,313,078 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Health Technology - 10.6% | | | | | | | | |

Abbott Laboratories | | | 27,050 | | | | 2,810,766 | |

AbbVie, Inc. | | | 20,300 | | | | 3,481,856 | |

Agilent Technologies, Inc. | | | 14,575 | | | | 1,889,357 | |

AstraZeneca, PLC, ADR | | | 45,275 | | | | 3,530,997 | |

Eli Lilly & Co. | | | 2,240 | | | | 2,028,051 | |

Johnson & Johnson | | | 16,675 | | | | 2,437,218 | |

Medtronic, PLC | | | 22,890 | | | | 1,801,672 | |

Merck & Co., Inc. | | | 23,775 | | | | 2,943,345 | |

Novo Nordisk A/S, ADR | | | 14,075 | | | | 2,009,066 | |

Zimmer Biomet Holdings, Inc. | | | 26,150 | | | | 2,838,059 | |

| | | | | | | | |

| | |

| | | | | | | 25,770,387 | |

| | | | | | | | |

| | |

Industrial Services - 2.1% | | | | | | | | |

Waste Management, Inc. | | | 11,575 | | | | 2,469,410 | |

Williams Cos., Inc. | | | 64,365 | | | | 2,735,513 | |

| | | | | | | | |

| | |

| | | | | | | 5,204,923 | |

| | | | | | | | |

| | |

Process Industries - 1.0% | | | | | | | | |

PPG Industries, Inc. | | | 18,550 | | | | 2,335,260 | |

| | | | | | | | |

| | |

Producer Manufacturing - 7.0% | | | | | | | | |

Eaton Corp., PLC | | | 8,775 | | | | 2,751,401 | |

Emerson Electric Co. | | | 26,900 | | | | 2,963,304 | |

General Dynamics Corp. | | | 11,330 | | | | 3,287,286 | |

Honeywell International, Inc. | | | 11,905 | | | | 2,542,194 | |

L3Harris Technologies, Inc. | | | 9,655 | | | | 2,168,320 | |

Parker-Hannifin Corp. | | | 3,635 | | | | 1,838,620 | |

Siemens AG, ADR | | | 16,425 | | | | 1,531,631 | |

| | | | | | | | |

| | |

| | | | | | | 17,082,756 | |

| | | | | | | | |

| | |

Retail Trade - 5.0% | | | | | | | | |

Amazon.com, Inc. * | | | 18,100 | | | | 3,497,825 | |

eBay, Inc. | | | 28,100 | | | | 1,509,532 | |

Home Depot, Inc. | | | 9,070 | | | | 3,122,257 | |

Target Corp. | | | 7,350 | | | | 1,088,094 | |

TJX Cos., Inc. | | | 27,000 | | | | 2,972,700 | |

| | | | | | | | |

| | |

| | | | | | | 12,190,408 | |

| | | | | | | | |

| | |

Technology Services - 15.4% | | | | | | | | |

Accenture, PLC | | | 10,450 | | | | 3,170,635 | |

Adobe, Inc. * | | | 4,350 | | | | 2,416,599 | |

Alphabet, Inc. - Class A | | | 23,075 | | | | 4,203,111 | |

Intuit, Inc. | | | 4,035 | | | | 2,651,842 | |

Meta Platforms, Inc. | | | 6,300 | | | | 3,176,586 | |

Microsoft Corp. | | | 42,180 | | | | 18,852,351 | |

Oracle Corp. | | | 21,700 | | | | 3,064,040 | |

| | | | | | | | |

| | |

| | | | | | | 37,535,164 | |

| | | | | | | | |

| | |

Transportation - 3.0% | | | | | | | | |

FedEx Corp. | | | 9,385 | | | | 2,813,998 | |

TFI International, Inc. | | | 9,500 | | | | 1,379,020 | |

Union Pacific Corp. | | | 13,400 | | | | 3,031,884 | |

| | | | | | | | |

| | |

| | | | | | | 7,224,902 | |

| | | | | | | | |

| | |

Utilities - 4.4% | | | | | | | | |

DTE Energy Co. | | | 22,825 | | | | 2,533,803 | |

NextEra Energy, Inc. | | | 30,750 | | | | 2,177,407 | |

NiSource, Inc. | | | 108,650 | | | | 3,130,207 | |

See accompanying notes to financial statements.

| | |

| | |

| 6 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

PPL Corp. | | | 108,800 | | | | 3,008,320 | |

| | | | | | | | |

| | |

| | | | | | | 10,849,737 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $172,950,228) | | | | | | | 241,772,868 | |

| | | | | | | | |

| | |

Short-Term Securities - 0.7% | | | | | | | | |

| | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $1,623,333) | | | 1,623,333 | | | | 1,623,333 | |

| | | | | | | | |

| | |

Total Investments in Securities - 100.0%

(cost $174,573,561) | | | | | | | 243,396,201 | |

| | |

Other Assets and Liabilities, net - (0.0)% | | | | | | | (119,073 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $243,277,128 | |

| | | | | | | | |

| * | Non-income producing security. |

ADR — American Depositary Receipt

PLC — Public Limited Company

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | | |

| | | Level 1 Quoted Prices ($) | | | Level 2

Other significant

observable inputs ($) | | Level 3 Significant

unobservable inputs ($) | | Total ($) | |

| | | | |

Common Stocks** | | | 241,772,868 | | | | — | | | | — | | | | 241,772,868 | |

Short-Term Securities | | | 1,623,333 | | | | — | | | | — | | | | 1,623,333 | |

| | | | |

Total: | | | 243,396,201 | | | | — | | | | — | | | | 243,396,201 | |

| | | | |

| ** | For equity securities categorized in a single level, refer to the detail above for further breakdown. |

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Global Dividend Growth Fund

Investments are grouped by geographic region

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Common Stocks - 98.4% | | | | | | | | |

| | |

Asia - 4.3% | | | | | | | | |

| | |

Australia - 2.2% | | | | | | | | |

Atlassian Corp. * | | | 3,445 | | | | 609,352 | |

Macquarie Group, Ltd. | | | 3,810 | | | | 520,250 | |

| | | | | | | | |

| | |

| | | | | | | 1,129,602 | |

| | | | | | | | |

| | |

Japan - 1.1% | | | | | | | | |

Recruit Holdings Co., Ltd. | | | 10,600 | | | | 567,060 | |

| | | | | | | | |

| | |

Singapore - 1.0% | | | | | | | | |

Singapore Technologies Engineering, Ltd. | | | 155,000 | | | | 494,948 | |

| | | | | | | | |

| | |

Europe - 31.5% | | | | | | | | |

| | |

Denmark - 0.5% | | | | | | | | |

Novo Nordisk A/S, ADR | | | 1,925 | | | | 274,774 | |

| | | | | | | | |

| | |

France - 0.8% | | | | | | | | |

Safran SA, ADR | | | 7,520 | | | | 400,440 | |

| | | | | | | | |

| | |

Germany - 5.3% | | | | | | | | |

Allianz SE, ADR | | | 34,190 | | | | 947,747 | |

Infineon Technologies AG | | | 6,275 | | | | 230,537 | |

Muenchener Rueckversicherungs AG | | | 1,470 | | | | 735,196 | |

Siemens AG | | | 4,250 | | | | 790,693 | |

| | | | | | | | |

| | |

| | | | | | | 2,704,173 | |

| | | | | | | | |

| | |

Ireland - 4.6% | | | | | | | | |

Accenture, PLC | | | 3,285 | | | | 996,702 | |

Linde, PLC | | | 1,445 | | | | 634,081 | |

Trane Technologies, PLC | | | 2,125 | | | | 698,976 | |

| | | | | | | | |

| | |

| | | | | | | 2,329,759 | |

| | | | | | | | |

| | |

Spain - 1.5% | | | | | | | | |

Iberdrola SA | | | 59,010 | | | | 765,629 | |

| | | | | | | | |

| | |

Switzerland - 5.7% | | | | | | | | |

Chubb, Ltd. | | | 2,590 | | | | 660,657 | |

Logitech International SA | | | 2,650 | | | | 256,732 | |

Lonza Group AG | | | 930 | | | | 507,621 | |

Nestle SA | | | 5,935 | | | | 605,886 | |

Partners Group Holding AG | | | 705 | | | | 905,526 | |

| | | | | | | | |

| | |

| | | | | | | 2,936,422 | |

| | | | | | | | |

| | |

United Kingdom - 13.1% | | | | | | | | |

AstraZeneca, PLC, ADR | | | 15,040 | | | | 1,172,970 | |

BAE Systems, PLC | | | 63,905 | | | | 1,066,326 | |

Compass Group, PLC | | | 14,170 | | | | 386,906 | |

Diageo, PLC, ADR | | | 4,125 | | | | 520,080 | |

London Stock Exchange Group, PLC | | | 6,715 | | | | 797,913 | |

Man Group, PLC | | | 216,290 | | | | 662,204 | |

RELX, PLC | | | 14,120 | | | | 649,633 | |

Shell, PLC, ADR | | | 20,055 | | | | 1,447,570 | |

| | | | | | | | |

| | |

| | | | | | | 6,703,602 | |

| | | | | | | | |

| | |

North America - 62.6% | | | | | | | | |

| | |

United States - 62.6% | | | | | | | | |

Abbott Laboratories | | | 7,230 | | | | 751,269 | |

AbbVie, Inc. | | | 750 | | | | 128,640 | |

Alphabet, Inc. - Class A | | | 8,790 | | | | 1,601,099 | |

Apple, Inc. | | | 18,220 | | | | 3,837,496 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Applied Materials, Inc. | | | 7,985 | | | | 1,884,380 | |

Arthur J Gallagher & Co. | | | 3,685 | | | | 955,557 | |

Broadcom, Inc. | | | 1,785 | | | | 2,865,871 | |

Cheniere Energy, Inc. | | | 2,830 | | | | 494,769 | |

ConocoPhillips | | | 4,025 | | | | 460,380 | |

Constellation Brands, Inc. | | | 2,690 | | | | 692,083 | |

FedEx Corp. | | | 1,900 | | | | 569,696 | |

Goldman Sachs Group, Inc. | | | 1,370 | | | | 619,678 | |

Home Depot, Inc. | | | 2,490 | | | | 857,158 | |

Honeywell International, Inc. | | | 3,130 | | | | 668,380 | |

Johnson & Johnson | | | 5,865 | | | | 857,228 | |

JPMorgan Chase & Co. | | | 7,180 | | | | 1,452,227 | |

Lockheed Martin Corp. | | | 1,525 | | | | 712,327 | |

McDonald’s Corp. | | | 1,820 | | | | 463,809 | |

Microsoft Corp. | | | 10,475 | | | | 4,681,801 | |

Mondelez International, Inc. | | | 6,940 | | | | 454,154 | |

NVIDIA Corp. | | | 11,500 | | | | 1,420,710 | |

Otis Worldwide Corp. | | | 3,785 | | | | 364,344 | |

PepsiCo, Inc. | | | 4,765 | | | | 785,891 | |

Salesforce, Inc. | | | 705 | | | | 181,256 | |

Sherwin-Williams Co. | | | 1,835 | | | | 547,619 | |

Thermo Fisher Scientific, Inc. | | | 1,145 | | | | 633,185 | |

Union Pacific Corp. | | | 3,960 | | | | 895,990 | |

UnitedHealth Group, Inc. | | | 1,930 | | | | 982,872 | |

Waste Management, Inc. | | | 2,880 | | | | 614,419 | |

WEC Energy Group, Inc. | | | 3,010 | | | | 236,165 | |

Williams Cos., Inc. | | | 8,500 | | | | 361,250 | |

| | | | | | | | |

| | |

| | | | | | | 32,031,703 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $22,385,080) | | | | | | | 50,338,112 | |

| | | | | | | | |

| | |

Short-Term Securities - 1.4% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $698,629) | | | 698,629 | | | | 698,629 | |

| | | | | | | | |

| | |

Total Investments in Securities - 99.8%

(cost $23,083,709) | | | | | | | 51,036,741 | |

| | |

Other Assets and Liabilities, net - 0.2% | | | | | | | 77,794 | |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $51,114,535 | |

| | | | | | | | |

| * | Non-income producing security. |

| | ADR — American Depositary Receipt |

| | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

See accompanying notes to financial statements.

| | |

| | |

| 8 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | | |

| | | Level 1 Quoted Prices ($) | | | Level 2 Other significant observable inputs ($) | | | Level 3 Significant unobservable inputs ($) | | | Total ($) | |

Common Stocks | | | | | | | | | | | | | | | | |

Australia | | | 1,129,602 | | | | — | | | | — | | | | 1,129,602 | |

Denmark | | | 274,774 | | | | — | | | | — | | | | 274,774 | |

France | | | 400,440 | | | | — | | | | — | | | | 400,440 | |

Germany | | | 2,704,173 | | | | — | | | | — | | | | 2,704,173 | |

Ireland | | | 2,329,759 | | | | — | | | | — | | | | 2,329,759 | |

Japan | | | 567,060 | | | | — | | | | — | | | | 567,060 | |

Singapore | | | 494,948 | | | | — | | | | — | | | | 494,948 | |

Spain | | | 765,629 | | | | — | | | | — | | | | 765,629 | |

Switzerland | | | 2,936,422 | | | | — | | | | — | | | | 2,936,422 | |

United Kingdom | | | 6,703,602 | | | | — | | | | — | | | | 6,703,602 | |

United States | | | 32,031,703 | | | | — | | | | — | | | | 32,031,703 | |

Short-Term Securities | | | 698,629 | | | | — | | | | — | | | | 698,629 | |

Total: | | | 51,036,741 | | | | — | | | | — | | | | 51,036,741 | |

Level 1 securities of foreign issuers are primarily American Depositary Receipts (ADRs), Public Limited Companies (PLCs) or Global Depositary Receipts (GDRs).

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Large Cap Growth Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) |

| | |

Common Stocks - 97.5% | | | | | | | | |

| | |

Consumer Durables - 0.5% | | | | | | | | |

Sony Group Corp., ADR | | | 13,200 | | | | 1,121,340 | |

| | | | | | | | |

| | |

Consumer Non-Durables - 2.4% | | | | | | | | |

Constellation Brands, Inc. | | | 7,425 | | | | 1,910,304 | |

Mondelez International, Inc. | | | 12,850 | | | | 840,904 | |

NIKE, Inc. | | | 9,050 | | | | 682,099 | |

PepsiCo, Inc. | | | 10,000 | | | | 1,649,300 | |

| | | | | | | | |

| | |

| | | | | | | 5,082,607 | |

| | | | | | | | |

| | |

Consumer Services - 2.5% | | | | | | | | |

McDonald’s Corp. | | | 6,650 | | | | 1,694,686 | |

Visa, Inc. | | | 13,650 | | | | 3,582,715 | |

| | | | | | | | |

| | |

| | | | | | | 5,277,401 | |

| | | | | | | | |

| | |

Electronic Technology - 29.1% | | | | | | | | |

Apple, Inc. | | | 107,900 | | | | 22,725,898 | |

Applied Materials, Inc. | | | 22,175 | | | | 5,233,078 | |

Arista Networks, Inc. * | | | 3,750 | | | | 1,314,300 | |

Broadcom, Inc. | | | 5,250 | | | | 8,429,033 | |

NVIDIA Corp. | | | 173,100 | | | | 21,384,774 | |

Palo Alto Networks, Inc. * | | | 9,225 | | | | 3,127,367 | |

| | | | | | | | |

| | |

| | | | | | | 62,214,450 | |

| | | | | | | | |

| | |

Energy Minerals - 1.5% | | | | | | | | |

Chevron Corp. | | | 2,100 | | | | 328,482 | |

ConocoPhillips | | | 24,600 | | | | 2,813,748 | |

| | | | | | | | |

| | |

| | | | | | | 3,142,230 | |

| | | | | | | | |

| | |

Finance - 2.1% | | | | | | | | |

Chubb, Ltd. | | | 5,050 | | | | 1,288,154 | |

Goldman Sachs Group, Inc. | | | 5,150 | | | | 2,329,448 | |

JPMorgan Chase & Co. | | | 4,900 | | | | 991,074 | |

| | | | | | | | |

| | |

| | | | | | | 4,608,676 | |

| | | | | | | | |

| | |

Health Services - 2.9% | | | | | | | | |

Centene Corp. * | | | 16,425 | | | | 1,088,978 | |

UnitedHealth Group, Inc. | | | 10,125 | | | | 5,156,257 | |

| | | | | | | | |

| | |

| | | | | | | 6,245,235 | |

| | | | | | | | |

| | |

Health Technology - 6.4% | | | | | | | | |

Abbott Laboratories | | | 15,500 | | | | 1,610,605 | |

AbbVie, Inc. | | | 2,975 | | | | 510,272 | |

Dexcom, Inc. * | | | 22,000 | | | | 2,494,360 | |

Eli Lilly & Co. | | | 2,400 | | | | 2,172,912 | |

Intuitive Surgical, Inc. * | | | 3,800 | | | | 1,690,430 | |

Johnson & Johnson | | | 6,150 | | | | 898,884 | |

Novo Nordisk A/S, ADR | | | 7,600 | | | | 1,084,824 | |

Thermo Fisher Scientific, Inc. | | | 5,250 | | | | 2,903,250 | |

Zimmer Biomet Holdings, Inc. | | | 3,075 | | | | 333,730 | |

| | | | | | | | |

| | |

| | | | | | | 13,699,267 | |

| | | | | | | | |

| | |

Industrial Services - 1.1% | | | | | | | | |

Cheniere Energy, Inc. | | | 13,675 | | | | 2,390,800 | |

| | | | | | | | |

| | |

Non-Energy Minerals - 0.5% | | | | | | | | |

Trex Co., Inc. * | | | 13,800 | | | | 1,022,856 | |

| | | | | | | | |

| | |

Process Industries - 1.3% | | | | | | | | |

Linde, PLC | | | 2,650 | | | | 1,162,846 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) |

| | |

Sherwin-Williams Co. | | | 5,225 | | | | 1,559,297 | |

| | | | | | | | |

| | |

| | | | | | | 2,722,143 | |

| | | | | | | | |

| | |

Producer Manufacturing - 5.0% | | | | | | | | |

BAE Systems, PLC, ADR | | | 15,500 | | | | 1,036,175 | |

Eaton Corp., PLC | | | 3,300 | | | | 1,034,715 | |

Emerson Electric Co. | | | 9,800 | | | | 1,079,568 | |

General Dynamics Corp. | | | 3,550 | | | | 1,029,997 | |

Honeywell International, Inc. | | | 8,425 | | | | 1,799,075 | |

Northrop Grumman Corp. | | | 1,875 | | | | 817,406 | |

Parker-Hannifin Corp. | | | 3,950 | | | | 1,997,949 | |

Siemens AG, ADR | | | 21,675 | | | | 2,021,194 | |

| | | | | | | | |

| | |

| | | | | | | 10,816,079 | |

| | | | | | | | |

| | |

Retail Trade - 9.8% | | | | | | | | |

Amazon.com, Inc. * | | | 63,000 | | | | 12,174,750 | |

Home Depot, Inc. | | | 8,425 | | | | 2,900,222 | |

Lululemon Athletica, Inc. * | | | 4,425 | | | | 1,321,747 | |

Netflix, Inc. * | | | 2,300 | | | | 1,552,224 | |

TJX Cos., Inc. | | | 18,075 | | | | 1,990,058 | |

Ulta Beauty, Inc. * | | | 2,800 | | | | 1,080,436 | |

| | | | | | | | |

| | |

| | | | | | | 21,019,437 | |

| | | | | | | | |

| | |

Technology Services - 30.0% | | | | | | | | |

Accenture, PLC | | | 10,200 | | | | 3,094,782 | |

Adobe, Inc. * | | | 6,250 | | | | 3,472,125 | |

Alphabet, Inc. - Class A | | | 12,500 | | | | 2,276,875 | |

Alphabet, Inc. - Class C | | | 73,500 | | | | 13,481,370 | |

Atlassian Corp. * | | | 7,675 | | | | 1,357,554 | |

Autodesk, Inc. * | | | 6,300 | | | | 1,558,935 | |

Intuit, Inc. | | | 5,200 | | | | 3,417,492 | |

Meta Platforms, Inc. | | | 9,725 | | | | 4,903,539 | |

Microsoft Corp. | | | 55,000 | | | | 24,582,250 | |

Paycom Software, Inc. | | | 2,500 | | | | 357,600 | |

salesforce.com, Inc. | | | 15,225 | | | | 3,914,348 | |

ServiceNow, Inc. * | | | 2,275 | | | | 1,789,674 | |

| | | | | | | | |

| | |

| | | | | | | 64,206,544 | |

| | | | | | | | |

| | |

Transportation - 2.0% | | | | | | | | |

FedEx Corp. | | | 7,575 | | | | 2,271,288 | |

Union Pacific Corp. | | | 9,200 | | | | 2,081,592 | |

| | | | | | | | |

| | |

| | | | | | | 4,352,880 | |

| | | | | | | | |

| | |

Utilities - 0.4% | | | | | | | | |

NextEra Energy, Inc. | | | 13,100 | | | | 927,611 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $65,630,670) | | | | | | | 208,849,556 | |

| | | | | | | | |

| | |

Short-Term Securities - 2.5% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $5,360,832) | | | 5,360,832 | | | | 5,360,832 | |

| | | | | | | | |

| | |

Total Investments in Securities - 100.0%

(cost $70,991,502) | | | | | | | 214,210,388 | |

| |

Other Assets and Liabilities, net - (0.0)% | | | | (97,971 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | $ | 214,112,417 | |

| | | | | | | | |

| * | Non-income producing security. |

See accompanying notes to financial statements.

| | |

| | |

| 10 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

| | | ADR — American Depositary Receipt |

| | | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | |

| | | Quoted | | | Other significant | | | Significant | | | |

| | | Prices ($) | | | observable inputs ($) | | | unobservable inputs ($) | | Total ($) | |

Common Stocks** | | | 208,849,556 | | | | — | | | — | | | 208,849,556 | |

Short-Term Securities | | | 5,360,832 | | | | — | | | — | | | 5,360,832 | |

Total: | | | 214,210,388 | | | | — | | | — | | | 214,210,388 | |

| ** | For equity securities categorized in a single level, refer to the detail above for further breakdown. |

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit ESG Growth Fund

Investments are grouped by geographic region.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| | |

Common Stocks - 96.9% | | | | | | | | |

| | |

Asia - 5.7% | | | | | | | | |

| | |

Japan - 4.6% | | | | | | | | |

Keyence Corp. | | | 200 | | | | 87,700 | |

Recruit Holdings Co., Ltd. | | | 3,100 | | | | 165,838 | |

Sony Group Corp., ADR | | | 2,175 | | | | 184,766 | |

Terumo Corp. | | | 5,200 | | | | 85,746 | |

| | | | | | | | |

| | |

| | | | | | | 524,050 | |

| | | | | | | | |

| | |

Singapore - 1.1% | | | | | | | | |

Singapore Technologies Engineering, Ltd. | | | 37,400 | | | | 119,426 | |

| | | | | | | | |

| | |

Europe - 32.8% | | | | | | | | |

| | |

Denmark - 1.0% | | | | | | | | |

Novo Nordisk A/S, ADR | | | 800 | | | | 114,192 | |

| | | | | | | | |

| | |

France - 1.5% | | | | | | | | |

Forvia SE | | | 2,358 | | | | 27,917 | |

Safran SA, ADR | | | 2,750 | | | | 146,438 | |

| | | | | | | | |

| | |

| | | | | | | 174,355 | |

| | | | | | | | |

| | |

Germany - 5.8% | | | | | | | | |

Allianz SE, ADR | | | 8,800 | | | | 243,936 | |

Deutsche Post AG | | | 1,550 | | | | 62,730 | |

Infineon Technologies AG | | | 1,225 | | | | 45,005 | |

Muenchener Rueckversicherungs AG | | | 275 | | | | 137,537 | |

Siemens AG, ADR | | | 1,775 | | | | 165,519 | |

| | | | | | | | |

| | |

| | | | | | | 654,727 | |

| | | | | | | | |

| | |

Ireland - 5.9% | | | | | | | | |

Accenture, PLC | | | 750 | | | | 227,557 | |

CRH, PLC | | | 1,200 | | | | 89,976 | |

Medtronic, PLC | | | 725 | | | | 57,065 | |

Trane Technologies, PLC | | | 875 | | | | 287,814 | |

| | | | | | | | |

| | |

| | | | | | | 662,412 | |

| | | | | | | | |

| | |

Netherlands - 0.6% | | | | | | | | |

ASML Holding NV | | | 65 | | | | 66,477 | |

| | | | | | | | |

| | |

Spain - 1.9% | | | | | | | | |

Iberdrola SA, ADR | | | 4,050 | | | | 211,896 | |

| | | | | | | | |

| | |

Switzerland - 3.0% | | | | | | | | |

Chubb, Ltd. | | | 250 | | | | 63,770 | |

Logitech International SA | | | 590 | | | | 57,159 | |

Lonza Group AG | | | 185 | | | | 100,979 | |

Nestle SA, ADR | | | 1,200 | | | | 122,940 | |

| | | | | | | | |

| | |

| | | | | | | 344,848 | |

| | | | | | | | |

| | |

United Kingdom - 13.1% | | | | | | | | |

AstraZeneca, PLC, ADR | | | 3,625 | | | | 282,714 | |

BAE Systems, PLC, ADR | | | 3,200 | | | | 213,920 | |

Coca-Cola Europacific Partners, PLC | | | 2,100 | | | | 153,027 | |

Compass Group, PLC | | | 3,600 | | | | 98,296 | |

Diageo, PLC, ADR | | | 785 | | | | 98,973 | |

Entain, PLC | | | 10,225 | | | | 81,430 | |

Man Group, PLC | | | 55,725 | | | | 170,610 | |

RELX, PLC, ADR | | | 4,700 | | | | 215,636 | |

Rentokil Initial, PLC, ADR | | | 2,375 | | | | 70,419 | |

Smith & Nephew, PLC | | | 8,050 | | | | 99,786 | |

| | | | | | | | |

| | |

| | | | | | | 1,484,811 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | | Fair Value ($) | |

| | |

North America - 58.4% | | | | | | | | |

| | |

United States - 58.4% | | | | | | | | |

AbbVie, Inc. | | | 160 | | | | 27,443 | |

Adobe, Inc. * | | | 450 | | | | 249,993 | |

AES Corp. | | | 3,025 | | | | 53,149 | |

Alphabet, Inc. - Class A | | | 2,500 | | | | 455,375 | |

Apple, Inc. | | | 3,600 | | | | 758,232 | |

Broadcom, Inc. | | | 125 | | | | 200,691 | |

Cheniere Energy, Inc. | | | 775 | | | | 135,493 | |

Dexcom, Inc. * | | | 1,080 | | | | 122,450 | |

Ecolab, Inc. | | | 325 | | | | 77,350 | |

FedEx Corp. | | | 375 | | | | 112,440 | |

Gilead Sciences, Inc. | | | 1,190 | | | | 81,646 | |

Goldman Sachs Group, Inc. | | | 600 | | | | 271,392 | |

Home Depot, Inc. | | | 745 | | | | 256,459 | |

Johnson & Johnson | | | 1,175 | | | | 171,738 | |

JPMorgan Chase & Co. | | | 1,075 | | | | 217,430 | |

Lockheed Martin Corp. | | | 275 | | | | 128,453 | |

Microsoft Corp. | | | 2,000 | | | | 893,900 | |

NIKE, Inc. | | | 850 | | | | 64,065 | |

NVIDIA Corp. | | | 10,000 | | | | 1,235,400 | |

PepsiCo, Inc. | | | 875 | | | | 144,314 | |

salesforce.com, Inc. | | | 850 | | | | 218,535 | |

Starbucks Corp. | | | 1,000 | | | | 77,850 | |

T Rowe Price Group, Inc. | | | 475 | | | | 54,772 | |

TJX Cos., Inc. | | | 1,380 | | | | 151,938 | |

UnitedHealth Group, Inc. | | | 500 | | | | 254,630 | |

Visa, Inc. | | | 475 | | | | 124,673 | |

Williams Cos., Inc. | | | 1,800 | | | | 76,500 | |

| | | | | | | | |

| | |

| | | | | | | 6,616,311 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $5,540,410) | | | | | | | 10,973,505 | |

| | | | | | | | |

| | |

Short-Term Securities - 3.0% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $341,750) | | | 341,750 | | | | 341,750 | |

| | | | | | | | |

| | |

Total Investments in Securities - 99.9%

(cost $5,882,160) | | | | | | | 11,315,255 | |

| | |

Other Assets and Liabilities, net - 0.1% | | | | | | | 9,713 | |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $11,324,968 | |

| | | | | | | | |

| * | Non-income producing security. |

ADR — American Depositary Receipt

PLC — Public Limited Company

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

See accompanying notes to financial statements.

| | |

| | |

| 12 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1 | | | Level 2 | | Level 3 | | | | |

| | | Quoted | | | Other significant | | Significant | | | | |

| | | Prices ($) | | | observable inputs ($) | | unobservable inputs ($) | | | Total ($) | |

Common Stocks | | | | | | | | | | | | | | | | |

Denmark | | | 114,192 | | | | — | | | | — | | | | 114,192 | |

France | | | 174,355 | | | | — | | | | — | | | | 174,355 | |

Germany | | | 654,727 | | | | — | | | | — | | | | 654,727 | |

Ireland | | | 662,412 | | | | — | | | | — | | | | 662,412 | |

Japan | | | 524,050 | | | | — | | | | — | | | | 524,050 | |

Netherlands | | | 66,477 | | | | — | | | | — | | | | 66,477 | |

Singapore | | | 119,426 | | | | — | | | | — | | | | 119,426 | |

Spain | | | 211,896 | | | | — | | | | — | | | | 211,896 | |

Switzerland | | | 344,848 | | | | — | | | | — | | | | 344,848 | |

United Kingdom | | | 1,484,811 | | | | — | | | | — | | | | 1,484,811 | |

United States | | | 6,616,311 | | | | — | | | | — | | | | 6,616,311 | |

Short-Term Securities | | | 341,750 | | | | — | | | | — | | | | 341,750 | |

Total: | | | 11,315,255 | | | | — | | | | — | | | | 11,315,255 | |

Level 1 securities of foreign issuers are primarily American Depositary Receipts (ADRs), Public Limited Companies (PLCs) or Global Depositary Receipts (GDRs).

There were no transfers into or out of level 3 during the reporting period.

See accompanying notes to financial statements.

SCHEDULE OF INVESTMENTS

June 30, 2024

Sit Mid Cap Growth Fund

Investments are grouped by economic sectors.

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Common Stocks - 97.9% | | | | | | | | |

| | |

Commercial Services - 3.5% | | | | | | | | |

ASGN, Inc. * | | | 13,525 | | | | 1,192,499 | |

Booz Allen Hamilton Holding Corp. | | | 27,550 | | | | 4,239,945 | |

Copart, Inc. * | | | 32,000 | | | | 1,733,120 | |

| | | | | | | | |

| | |

| | | | | | | 7,165,564 | |

| | | | | | | | |

| | |

Communications - 0.6% | | | | | | | | |

Iridium Communications, Inc. | | | 47,300 | | | | 1,259,126 | |

| | | | | | | | |

| | |

Consumer Durables - 0.9% | | | | | | | | |

Take-Two Interactive Software, Inc. * | | | 4,892 | | | | 760,657 | |

YETI Holdings, Inc. * | | | 28,100 | | | | 1,072,015 | |

| | | | | | | | |

| | |

| | | | | | | 1,832,672 | |

| | | | | | | | |

| | |

Consumer Non-Durables - 1.5% | | | | | | | | |

Coca-Cola Europacific Partners, PLC | | | 40,700 | | | | 2,965,809 | |

| | | | | | | | |

| | |

Consumer Services - 2.2% | | | | | | | | |

Nexstar Media Group, Inc. | | | 18,250 | | | | 3,029,683 | |

Vail Resorts, Inc. | | | 7,700 | | | | 1,387,001 | |

| | | | | | | | |

| | |

| | | | | | | 4,416,684 | |

| | | | | | | | |

| | |

Electronic Technology - 18.8% | | | | | | | | |

Applied Materials, Inc. | | | 24,350 | | | | 5,746,356 | |

Arista Networks, Inc. * | | | 35,075 | | | | 12,293,086 | |

Broadcom, Inc. | | | 8,085 | | | | 12,980,710 | |

Ciena Corp. * | | | 16,525 | | | | 796,175 | |

MKS Instruments, Inc. | | | 15,100 | | | | 1,971,758 | |

Monolithic Power Systems, Inc. | | | 5,400 | | | | 4,437,072 | |

| | | | | | | | |

| | |

| | | | | | | 38,225,157 | |

| | | | | | | | |

| | |

Energy Minerals - 3.7% | | | | | | | | |

Chord Energy Corp. | | | 18,850 | | | | 3,160,768 | |

Northern Oil & Gas, Inc. | | | 73,100 | | | | 2,717,127 | |

Texas Pacific Land Corp. | | | 2,295 | | | | 1,685,150 | |

| | | | | | | | |

| | |

| | | | | | | 7,563,045 | |

| | | | | | | | |

| | |

Finance - 8.8% | | | | | | | | |

Air Lease Corp. | | | 32,900 | | | | 1,563,737 | |

Ameriprise Financial, Inc. | | | 10,000 | | | | 4,271,900 | |

Arthur J Gallagher & Co. | | | 11,600 | | | | 3,007,996 | |

Carlyle Group, Inc. | | | 85,700 | | | | 3,440,855 | |

Intercontinental Exchange, Inc. | | | 25,300 | | | | 3,463,317 | |

Reinsurance Group of America, Inc. | | | 10,300 | | | | 2,114,281 | |

| | | | | | | | |

| | |

| | | | | | | 17,862,086 | |

| | | | | | | | |

| | |

Health Services - 4.0% | | | | | | | | |

Encompass Health Corp. | | | 41,200 | | | | 3,534,548 | |

Molina Healthcare, Inc. * | | | 6,250 | | | | 1,858,125 | |

Tenet Healthcare Corp. * | | | 20,225 | | | | 2,690,532 | |

| | | | | | | | |

| | |

| | | | | | | 8,083,205 | |

| | | | | | | | |

| | |

Health Technology - 12.8% | | | | | | | | |

Align Technology, Inc. * | | | 6,025 | | | | 1,454,616 | |

Ascendis Pharma A/S, ADR * | | | 7,375 | | | | 1,005,803 | |

BioMarin Pharmaceutical, Inc. * | | | 23,500 | | | | 1,934,755 | |

Bio-Techne Corp. | | | 32,900 | | | | 2,357,285 | |

Dexcom, Inc. * | | | 48,040 | | | | 5,446,775 | |

Exact Sciences Corp. * | | | 40,850 | | | | 1,725,912 | |

Glaukos Corp. * | | | 4,525 | | | | 535,534 | |

Inspire Medical Systems, Inc. * | | | 4,075 | | | | 545,357 | |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

| | |

Insulet Corp. * | | | 18,000 | | | | 3,632,400 | |

Natera, Inc. * | | | 9,500 | | | | 1,028,755 | |

Sarepta Therapeutics, Inc. * | | | 19,225 | | | | 3,037,550 | |

Thermo Fisher Scientific, Inc. | | | 6,100 | | | | 3,373,300 | |

| | | | | | | | |

| | |

| | | | | | | 26,078,042 | |

| | | | | | | | |

| | |

Industrial Services - 5.5% | | | | | | | | |

Cheniere Energy, Inc. | | | 20,000 | | | | 3,496,600 | |

Jacobs Solutions, Inc. | | | 24,700 | | | | 3,450,837 | |

Waste Connections, Inc. | | | 23,400 | | | | 4,103,424 | |

| | | | | | | | |

| | |

| | | | | | | 11,050,861 | |

| | | | | | | | |

| | |

Non-Energy Minerals - 1.4% | | | | | | | | |

Trex Co., Inc. * | | | 38,625 | | | | 2,862,885 | |

| | | | | | | | |

| | |

Producer Manufacturing - 8.9% | | | | | | | | |

AGCO Corp. | | | 12,700 | | | | 1,243,076 | |

AMETEK, Inc. | | | 14,675 | | | | 2,446,469 | |

Axon Enterprise, Inc. * | | | 6,800 | | | | 2,000,832 | |

Carlisle Cos., Inc. | | | 10,075 | | | | 4,082,491 | |

Donaldson Co., Inc. | | | 22,950 | | | | 1,642,302 | |

Dover Corp. | | | 21,875 | | | | 3,947,344 | |

Hubbell, Inc. | | | 7,500 | | | | 2,741,100 | |

| | | | | | | | |

| | |

| | | | | | | 18,103,614 | |

| | | | | | | | |

| | |

Retail Trade - 5.3% | | | | | | | | |

Lululemon Athletica, Inc. * | | | 4,700 | | | | 1,403,890 | |

TJX Cos., Inc. | | | 55,175 | | | | 6,074,767 | |

Ulta Beauty, Inc. * | | | 8,600 | | | | 3,318,482 | |

| | | | | | | | |

| | |

| | | | | | | 10,797,139 | |

| | | | | | | | |

| | |

Technology Services - 18.4% | | | | | | | | |

Altair Engineering, Inc. * | | | 24,800 | | | | 2,432,384 | |

ANSYS, Inc. * | | | 10,750 | | | | 3,456,125 | |

Aspen Technology, Inc. * | | | 8,358 | | | | 1,660,150 | |

Atlassian Corp. * | | | 16,950 | | | | 2,998,116 | |

Autodesk, Inc. * | | | 14,800 | | | | 3,662,260 | |

Booking Holdings, Inc. | | | 450 | | | | 1,782,675 | |

Crowdstrike Holdings, Inc. * | | | 6,500 | | | | 2,490,735 | |

Dynatrace, Inc. * | | | 65,375 | | | | 2,924,878 | |

Euronet Worldwide, Inc. * | | | 16,075 | | | | 1,663,762 | |

Globant SA * | | | 13,000 | | | | 2,317,380 | |

HubSpot, Inc. * | | | 6,825 | | | | 4,025,317 | |

Paycom Software, Inc. | | | 7,600 | | | | 1,087,104 | |

PTC, Inc. * | | | 32,550 | | | | 5,913,358 | |

Spotify Technology SA * | | | 3,250 | | | | 1,019,817 | |

| | | | | | | | |

| | |

| | | | | | | 37,434,061 | |

| | | | | | | | |

| | |

Transportation - 1.1% | | | | | | | | |

Alaska Air Group, Inc. * | | | 17,300 | | | | 698,920 | |

Knight-Swift Transportation Holdings, Inc. | | | 28,500 | | | | 1,422,720 | |

| | | | | | | | |

| | |

| | | | | | | 2,121,640 | |

| | | | | | | | |

| | |

Utilities - 0.5% | | | | | | | | |

WEC Energy Group, Inc. | | | 12,800 | | | | 1,004,288 | |

| | | | | | | | |

| | |

Total Common Stocks

(cost: $88,684,822) | | | | | | | 198,825,878 | |

| | | | | | | | |

See accompanying notes to financial statements.

| | |

| | |

| 14 | | FINANCIAL STATEMENTS AND OTHER INFORMATION |

| | | | | | | | |

| | | |

| Name of Issuer | | Quantity | | Fair Value ($) | |

Short-Term Securities - 2.2% | | | | | | | | |

Fidelity Inst. Money Mkt. Gvt. Fund, 5.25%

(cost $4,486,737) | | | 4,486,737 | | | | 4,486,737 | |

| | | | | | | | |

| |

Total Investments in Securities - 100.1%

(cost $93,171,559) | | | | 203,312,615 | |

| |

Other Assets and Liabilities, net - (0.1)% | | | | (128,406) | |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $203,184,209 | |

| | | | | | | | |

| * | Non-income producing security. |

| | ADR — American Depositary Receipt |

| | PLC — Public Limited Company |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

A summary of the levels for the Fund’s investments as of June 30, 2024 is as follows (see Note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | | |

| | | Quoted | | | Other significant | | | Significant | | | | |

| | | Prices ($) | | | observable inputs ($) | | | unobservable inputs ($) | | | Total ($) | |

Common Stocks** | | | 198,825,878 | | | | — | | | | — | | | | 198,825,878 | |