Exhibit 10.1

LICENSE AND OPTION AGREEMENT

THIS LICENSE AND OPTION AGREEMENT (the “Agreement”) is made this 22nd day of October, 2002 (the “Effective Date”) by and betweenGENESOFT PHARMACEUTICALS, INC., a Delaware corporation having its principal place of business at 7300 Shoreline Court, South San Francisco, CA, USA 94080 (“GS”) andLG LIFE SCIENCES, LTD., a corporation organized under the laws of the Republic of Korea having its principal place of business at LG Twin Tower, 20 yoido-dong, Youngdungpo-gu, Seoul, 150-721, Republic of Korea (“LGLS”). LGLS and GS are sometimes referred to herein individually as a “Party” and collectively as the “Parties”.

RECITALS

WHEREAS:

LGLS is the owner of all right, title and interest in certain patents and know-how relating to Gemifloxacin (as hereafter defined); and

LGLS is the owner or licensee of certain patent rights, know-how, trademark rights and other intellectual property related to Gemifloxacin; and

LGLS wishes to license to GS the foregoing intellectual property rights to enable GS to develop and commercialize Gemifloxacin in the Territory (as hereafter defined) and in the Field (as hereafter defined) and GS wishes to obtain such a license, all on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, the Parties hereto agree as follows:

ARTICLE 1

DEFINITIONS

When used in this Agreement, the following terms shall have the meanings indicated below.

1.1 “Active Pharmaceutical Ingredient”or “API” means Gemifloxacin in active bulk form meeting the API Specifications.

1.2 “Additional Indication” means an FDA-approved indication or formulation for Gemifloxacin within the Field other than the Initial Indication(s).

1.3 “Affiliate” means an individual, trust, business trust, joint venture, partnership, corporation, association or any other entity which (directly or indirectly) is controlled by, controls or is under common control with a Party. For the purposes of this definition, the term “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”) as used with respect to any Party, shall mean the possession (directly or indirectly)

1

of at least 50 percent of the outstanding voting securities of a corporation or comparable equity interest in any other type of entity.

1.4 “API Specifications”shall mean the specifications for Active Pharmaceutical Ingredient attached hereto as Schedule 1.4.

1.5 “Combination Product”means a product consisting of Gemifloxacin and at least one other biologically active ingredient.

1.6 “Commercialization” means all activities undertaken relating to the marketing, promotion, distribution, use, storage, sale and offer for sale of a Product in the Territory including, without limitation, advertising and any Phase IV clinical trials.

1.7 “Development” means:

(a) all activities relating to obtaining and/or maintaining Regulatory Approval of the Product in the Territory for the Initial Indication including, without limitation, clinical trials and the preparation, submission, review and development of data or other information related thereto;

(b) Phase IV clinical trials supporting pre-launch and commercialization of the Product but not contributing to obtaining and/or maintaining Marketing Authorization Applications of the Product for the Initial Indication and any Additional Indications in the Territory;

(c) all activities relating to obtaining and/or maintaining Marketing Authorization of Product for an Additional Indication in the Territory, including Phase III clinical trials and the preparation, submission, review and development of data or other information related thereto; and

(d) all formulation studies for intravenous administration and any other new formulation of the Product.

The term “Development” shall not include process development or final finish or fill of Product.

1.8“EMEA” means the European Agency for the Evaluations of Medical Products.

1.9 “FDA” means the U.S. Food and Drug Administration.

1.10 “Field” means the development, use, distribution, importation, storage, marketing, sale and offer for sale of Product for any human pharmaceutical or veterinary use.

1.11 “Final Product” means the Product in final form for commercialization and distribution, labeled in accordance with applicable regulatory requirements and custom and meeting the Final Product Specifications.

1.12 “Final Product Specifications”means the specifications for Final Product attached hereto as Schedule 1.12.

2

1.13 “Fully Burdened Cost of Manufacture” means: *****

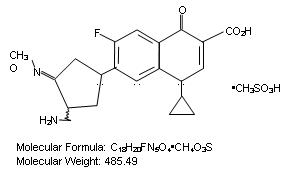

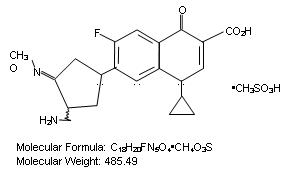

1.14 “Gemifloxacin” means the racemic compound whose mesylate is represented on Schedule 1.14 hereto as well as the pharmaceutically acceptable salts, physiologically hydolyzable esters, and solvates thereof, but excluding either enantiomer alone. The mesylate salt of Gemifloxacin is also known under the trademark Factive®.

1.15 “GLAXO” means GlaxoSmithKline plc and its Affiliates.

1.16 “GLAXO Agreement” means a certain Termination and Transfer Agreement dated on or about October 14, 2002, by and among GLAXO (including certain of its Affiliates) and LGLS (including its Affiliate LG Chem Investment, Ltd.).

1.17 “GLAXO Know-how” means that Information relating to the Product identified on Schedule 1.17 hereto.

1.18 “GLAXO Patents” means those patents and patent applications shown on Schedule 1.18 hereto and the equivalents thereof in all countries in the Territory and patents issuing from such patent applications, as well as divisionals, continuations, continuations-in-part, reissues, reexaminations, renewals, extensions, utility models, additions and supplementary protection certificates to any such patents and patent applications which are necessary or useful for the development, use, importation, manufacture, formulation, packaging, sale or offer for sale of Product in the Territory.

1.19 “GS” means Genesoft Pharmaceuticals, Inc. and its Affiliates.

1.20 “GS Know-how”means all Information relating to the Product developed by GS as a result of its activities under this Agreement and any and all patent applications and patents covering or claiming any such Information.

1.21 “Information” means, whether or not patentable: (i) techniques and data including inventions, practices, methods, know-how, data (including pharmacological, toxicological and clinical test data, regulatory submissions and data and analytical and quality control data), marketing, distribution, and sales data or descriptions, (ii) compounds, compositions of matter, assays and biological materials, and (iii) dossiers of information necessary for Regulatory Approvals.

1.22 “Initial Indication(s)” means the first indication(s) for a Product approved by Regulatory Authorities anywhere in the Territory, formulated in the manner so approved.

1.23 “Launch” means the first commercial sale of a Product in a country in the Territory by GS or any of its Affiliates or sub-licensees following receipt of Regulatory Approval in such country.

1.24 “*****” shall mean that compound represented on Schedule 1.24 hereto, as well as *****.

1.25 “LGLS” means LG Life Sciences, Ltd. and its Affiliates.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

3

1.26 “LGLS Know-How” means all Information now or hereafter within the Control of LGLS necessary or useful for the Development or Commercialization of the Product in the Territory, or for the filling, labeling and packaging of the Product anywhere in the world for use or sale in the Territory.

1.27 “LGLS Patents” means: (i) those patents and patent applications shown on Schedule 1.27 attached hereto and the equivalents thereof in all countries in the Territory, (ii) all patents issuing from such patent applications, divisionals, continuations, continuations-in-part, reissues, reexaminations, renewals, extensions, utility models, additions and supplementary protection certificates to any such patents and patent applications, and (iii) all patents and patent applications now or hereafter owned or controlled by LGLS necessary or useful for the development, use, importation, formulation, packaging, sale or offer for sale of Product in the Territory.

1.28 “Marketing Authorization Application” means an application for Regulatory Approval required before commercial sale or use of the Product in the Field in a regulatory jurisdiction in the Territory.

1.29 “Memorandum of Understanding” means an agreement between the Parties so titled and dated August 23, 2002.

1.30 “Net Sales” means, with respect to a Product that is not a Combination Product, the gross receipts representing sales of Product to Third Parties by GS and its Affiliates and sub-licensees in the Territory, less deductions for the following items:

(i) reasonable transportation and insurance charges borne by the selling party,

(ii) sales and excise taxes or customs duties paid by the selling party and any other governmental charges imposed upon the sale of the Product,

(iii) rebates or allowances actually granted or allowed, including government and managed care rebates,

(iv) quantity discounts, cash discounts or chargebacks actually granted, allowed or incurred in the ordinary course of business in connection with the sale of the Product, and

(v) allowances or credits to customers, not in excess of the selling price of the Product, on account of governmental requirements, rejection, outdating, recalls or return of the Product.

Sales between GS and its Affiliates and sub-licensees shall be excluded from the computation of Net Sales and no royalties shall be payable on such sales. With respect to a Combination Product, the Parties shall in good faith endeavor to agree as to an equitable and commercially reasonable means of defining “Net Sales.” If they are unable to reach such agreement, the matter shall be resolved as provided in Article 15, below.

1.31 “Patent Expenses” means governmental fees and the reasonable fees and expenses of outside counsel and payments to Third Parties incurred after the Effective Date in

4

connection with the preparation, filing, prosecution and maintenance of patents or patent applications, including the costs of patent interference, opposition and revocation proceedings related thereto or to any Third Party patents containing claims which cover the manufacture, use, sale, offer for sale, importation or exportation of Product in the Territory.

1.32 “Product” means any compound including Gemifloxacin as an active ingredient.

1.33 “Regulatory Approvals” means all approvals (including pricing and reimbursement approvals) and licenses, registrations or authorizations of a Regulatory Authority, necessary for the use, import, storage, export, transport, filling, labeling, packaging (to the extent that filling, labeling or packaging are carried out by GS or its Affiliates) or sale of a Product in a regulatory jurisdiction in the Territory. “Regulatory Approval” shall not, however, include any regulatory approvals related to the manufacture of API and supply of API by LGLS to GS as contemplated herein.

1.34 “Regulatory Authority” means a governmental entity with the authority to grant Regulatory Approvals.

1.35 “Steering Committee” means the entity described in Article 3, below.

1.36 “Territory” means the United States of America, Canada, Mexico, France, Germany, the United Kingdom, Luxembourg, Ireland, Italy, Spain, Portugal, Belgium, the Netherlands, Austria, Greece, Sweden, Denmark, Finland, Norway, Iceland, Switzerland, Andorra, Monaco, San Marino and Vatican City.

1.37 “Third Party”means an entity or person other than LGLS or GS or their respective Affiliates.

1.38 “Trademarks” means those trademarks, trade names, domain names and logos identified on Schedule 1.38 hereto.

ARTICLE 2

PRODUCT DEVELOPMENT

2.1 Scope of Development. Upon the Effective Date, GS will assume lead responsibility for Development throughout the Territory for the Initial Indication(s), in consultation with LGLS. Following the Effective Date GS shall in good faith establish internal and external competence and controls appropriate for the assumption of full responsibility for Development for the Initial Indication and, on notice to LGLS not later than the date on which first Regulatory Approval is received in the Territory LGLS shall, to the extent permitted by law, transfer to GS ownership of all pending Marketing Authorization Applications and Regulatory Approvals including, without limitation, New Drug Application Nos. 21-158 and 21-376 (the “NDA”). Following the Effective Date, GS shall have sole responsibility for *****; provided, however, that GS shall notify LGLS prior to filing a Marketing Authorization Application for any *****.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

5

2.2 Development Effort.GS shall carry out its responsibilities under Section 2.1 using reasonable efforts consistent with prudent business judgment, and in accordance with all applicable legal and regulatory requirements including, without limitation, then-current Good Laboratory Practices, and Good Clinical Practices.

2.3 Ownership of Regulatory Approvals. Following the transfer of ownership provided in Section 2.1, above, all Marketing Authorization Applications shall be filed and maintained in the name of GS and GS shall be the owner of all resulting Regulatory Approvals. Through meetings of the Steering Committee, GS shall: (i) keep LGLS informed regarding the schedule and progress for the preparation and submission of Marketing Authorization Applications in the Territory, and (ii) permit LGLS a reasonable opportunity to comment on such Marketing Authorization Applications.

2.4 Communication with Regulatory Authorities. GS shall have primary responsibility for dealing with Regulatory Authorities in the Territory, including filing all supplements and other documents with such authorities with respect to obtaining Regulatory Approvals, reporting all adverse drug experiences related to the Product, and handling all Product complaints. At each meeting of the Steering Committee, GS shall provide to the Steering Committee a report describing the regulatory filing status of each Product throughout the Territory.

2.5 Costs of Development. All Development expenses shall be borne by GS. Without limiting the foregoing, within 30 days after receipt of an appropriate invoice from LGLS, GS shall reimburse LGLS for Development expenses in the Territory incurred between August 23, 2002 and the Effective Date, as contemplated by the Memorandum of Understanding; provided, however, that the amount of reimbursement due for LGLS activities during such period in the Territory but outside of the United States of America shall not exceed $***** unless GS shall have previously approved such excess.

ARTICLE 3

MANAGEMENT OF THE COLLABORATION

3.1 Steering Committee. Within 30 days after the Effective Date, LGLS and GS shall create a Steering Committee consisting of an equal number of qualified representatives of each Party. A Party may change or replace its representatives on the Steering Committee as it deems appropriate, by notice to the other Party. Each Party will designate one of its members of the Steering Committee as co-chairperson. The co-chairperson appointed by each Party shall be empowered to bind such Party to decisions of the Steering Committee to the extent contemplated herein.

3.2 Meetings of the Steering Committee. The Steering Committee shall hold meetings at such times and places as shall be determined by the co-chairpersons. The meetings shall be held no less frequently than once every ***** months in the period from the Effective Date through the ***** year after the first Launch in the United States of America, and not less than once every ***** months thereafter. Steering Committee meetings may be held in person or by telephone or video conference. The co-chairpersons shall alternate in keeping written

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

6

minutes that shall reflect the decisions taken at the meetings. Such minutes shall be circulated to the Steering Committee for review and approval within two weeks after each meeting.

3.3 Function of the Steering Committee.The Steering Committee shall coordinate the activities of the Parties under this Agreement, and perform such other functions as appropriate to further the purposes of this Agreement as determined by the Parties.

3.4 Decision Making. To the extent feasible, the Steering Committee shall make decisions and take actions by consensus after an open discussion of the matters as to which decisions are being made. If no consensus can be reached, GS shall have the right to make final determinations regarding the Development and Commercialization of the Product in the Territory to the extent not inconsistent with the express terms and provisions of this Agreement. Subject to Section 3.7, below, LGLS shall have the right to make final determinations regarding the development and commercialization of Product outside the Territory.

3.5 Limitations of Powers of the Steering Committee. The Steering Committee shall have only such powers as are expressly delegated to it in this Agreement. The Steering Committee is not a substitute for the rights or the obligations of the Parties and,inter alia, shall not have the authority to amend this Agreement.

3.6 Liaison Manager. Each Party will designate one of its members of the Steering Committee to act as its liaison manager to facilitate the performance of its rights and satisfaction of its obligations hereunder.

3.7 Development and Commercialization Outside the Territory. LGLS shall have the sole responsibility for development and commercialization of the Product outside of the Territory. LGLS shall regularly disclose to GS its plans for such development and afford GS a reasonable opportunity to comment thereon. During the term of this Agreement, LGLS shall assure that its development of Product outside of the Territory (whether directly or through one or more sub-licenses) is conducted in a manner which minimizes the risk of disruption of or other adverse effects on the development and commercialization of the Product in the Territory by GS as contemplated herein. Without limiting the foregoing: (i) following good faith consultation with GS, LGLS and its other licensees shall be free to conduct clinical, regulatory, sales and marketing activities anywhere outside the Territory so long as they are for indications and/or formulations of Product consistent with label(s) for Product approved by Regulatory Authorities in the United States or European Union, (ii) LGLS and its other licensees shall not conduct any pre-clinical activities with respect to the Product for any indication or formulation without the prior approval of GS, and (iii) LGLS and its other licensees shall not conduct clinical, regulatory, sales or marketing activities with respect to any Additional Indication or a materially increased dosage or new means of administration of the Product without the prior approval of GS. At LGLS’s request, the Parties shall in good faith discuss the matters for which GS approval or consultation is required pursuant subsections (ii) and (iii), above, at each meeting of the Steering Committee.

7

ARTICLE 4

COMMERCIALIZATION

4.1 Commercialization Efforts.Commencing on the Effective Date, and subject to Section 4.3, below, GS shall be responsible for carrying out Commercialization, at its sole expense, using reasonable efforts consistent with prudent business judgment. GS, directly or through one or more Affiliates or sub-licensees, shall launch in each country in the Territory using the same level of diligence as GS would use with respect to a GS product with substantially the same market potential within in such country.

4.2 Pricing in the Territory. GS shall diligently obtain such Product pricing approvals as may be required in each country of the Territory. GS shall be free to set the sale price of the Product in the Territory as it deems appropriate.

4.3 Co-Promotion. (a) LGLS shall have the option, exercisable on notice to GS prior to *****, to co-promote Product in the Territory commencing on January 1, 2008. If LGLS timely exercises this option, the Parties shall promptly and in good faith negotiate a co-promotion agreement which establishes their respective rights and obligations, which agreement shall become effective on January 1, 2008. Such co-promotion agreement shall provide,inter alia, that *****.

(b) If LGLS exercises its option pursuant to subsection (a), above, all GS royalty obligations under Section 10.4, below, shall terminate with respect to Product sales occurring on or after January 1, 2008, but GS’s obligations under Section 10.2 shall remain in full force and effect.

ARTICLE 5

MANUFACTURE AND SUPPLY

5.1 General. (a) The intent of the Parties is that: (i) between the Effective Date and July 1, 2004, LGLS shall supply to GS, and GS shall exclusively purchase from LGLS all of GS’s requirements of Product in final form according to the Final Product Specifications, and (ii) following July 1, 2004 LGLS shall supply to GS, and GS shall purchase from LGLS all of GS’s requirements of Product in bulk form according to the API Specifications, with final finish and fill to be provided either by LGLS or a Third Party, as provided in Section 5.1(b). The terms and conditions of LGLS supply pursuant to subsection (i) are as set forth in this Article 5. The terms and conditions of LGLS supply pursuant to subsection (ii) shall be set forth in a supply agreement to be entered into as provided in Section 5.2.

(b) The Parties acknowledge that secure long-term supply of Product for GS is essential to the success of the relationship reflected herein. No later than December 31, 2002 that Parties shall identify and, to the extent practicable, contractually commit to a long-term final finish and fill facility for the Product. Either the Parties will jointly agree on a Third Party or LGLS shall commit to provide these services, either directly through the acquisition of a U.S.-based facility or by contract with a mutually acceptable third party. If LGLS elects to provide these services, it shall notify GS to that effect no later than December 31, 2002. Regardless of whether final finish and fill is provided by LGLS or through a Third Party, GS shall have the right to approve the site selected for final finish and fill, which approval shall not be unreasonably withheld.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

8

5.2 Supply Agreement. Not later than December 31, 2002, the Parties shall complete and enter into a supply agreement covering the supply of API by LGLS for the remainder of the term of this Agreement. Such supply agreement shall be consistent with the terms and conditions of this Agreement with respect to supply of Final Product and shall include such other terms and conditions as the Parties may mutually agree including, without limitation, adequate provision for API shortages and supply interruption events to assure GS a secure long-term source of supply of API as well as license to GS or its designee of the right to manufacture API in the event that LGLS fails to supply. The supply price for API provided under the Supply Agreement shall be equal to ***** percent of LGLS’s Fully Burdened Cost of Manufacturing for API supplied thereunder, which shall in no event be ***** $***** per kg ***** $***** per kg. In addition, the supply agreement shall provide that: (i) if GS purchases more than ***** kg of API in any calendar year, the $***** supply price shall be reduced by $***** for each ***** kg of API purchased in such year in excess of ***** kg, and (ii) the bulk supply price (including the ***** price) shall be renegotiated in good faith in the event that GS purchases more than ***** kg of API in any 12 month period.

5.3 Manufacturing Approvals. GS shall be promptly notified of any proposed change in the process for the manufacture of Product pursuant to this Article 5 which potentially impacts the Marketing Authorization Applications or Regulatory Approval in the Territory including, without limitation, any proposed change as to the site at which such manufacture is to occur. No Product incorporating any such proposed change and no Product manufactured at any proposed new facility shall be supplied by LGLS to GS hereunder without such changes having first been approved by the appropriate Regulatory Authorities or by mutual agreement by the Parties, which regulatory approvals the Parties agree to pursue diligently following notice from LGLS of such proposed changes.

5.4 Specifications. LGLS warrants that the Product it supplies hereunder shall meet the Final Product Specifications, and shall have been manufactured in accordance with all applicable laws and regulations including, without limitation, then-current Good Manufacturing Practice (“GMP”) compliance standards.

5.5 Purchase Order and Forecasting. On or before the later of: (i) December 31, 2002, or (ii) three business day after the date on which the NDA is accepted by the FDA, GS shall place a firm order for the amount of Product produced to Final Product Specifications which incorporates ***** metric tons of API. On or before January 1, 2003, GS shall provide to LGLS a non-binding forecast of the quantities of API to be manufactured during the forthcoming ***** period. As shall be provided in the supply agreement, this forecast shall be updated by GS on or before ***** of each calendar year for the following *****. Within 45 days after receipt of each such forecast, LGLS shall provide to GS a good faith non-binding forecast of the Fully Burdened Cost of Manufacturing of the supply forecast by GS.

Without limiting the foregoing, GS shall use its best efforts to provide LGLS with supply orders for the delivery of Final Product or API within the following dates:

| | (i) | In ***** of each year, GS shall provide its supply orders for delivery during the ***** calendar quarter of such year; |

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

9

| | (ii) | In ***** of each year, GS shall provide its supply orders for delivery during the ***** calendar quarter of such year; |

| | (iii) | In ***** of each year, GS shall provide its supply orders for delivery during the ***** calendar quarter of such year; and |

| | (iv) | In ***** of each year, GS shall provide its supply orders for delivery during the ***** calendar quarter of the next year. |

5.6Delivery. The first order of ***** metric tons placed by GS pursuant to Section 5.5 shall be delivered to GS no more than 30 days prior to the date on which the Parties in good faith anticipate receipt of final FDA approval of the Product for the Initial Indication(s). All deliveries of Product shall be made ***** as such term is defined in the INCOTERMS 2000. Title to the Product and all risks of loss or damage to Product shall remain with LGLS until Product is delivered to the carrier for shipment at the ***** point, at which time title and all risks of loss or damage shall transfer to GS. LGLS agrees, in accordance with GS’s reasonable written instructions, to arrange for shipping and insurance, to be paid by GS from the ***** point to such locations as are requested by GS.

5.7 Inspection and Rejection.

5.7.1 GS shall, promptly upon receipt of a shipment of Product from LGLS, inspect such shipment for defects that cause the Product to deviate from the Final Product Specifications (other than those resulting subsequent to delivery of Product to GS). If GS discovers such a defect, GS may reject such defective Product, and shall promptly notify LGLS in writing of the rejection and the reason therefor.

5.7.2 Any rejection of defective or non-conforming Product by GS must occur within 40 days from delivery, failing which GS shall be deemed to have accepted such shipment and to have irrevocably waived any claims it may have with respect to such shipment failing to meet the Final Product Specifications.

5.7.3 At the request of LGLS, GS shall either allow a representative of LGLS to inspect the rejected Product and to make a determination as to the cause of the defect, or return a sample of the defective Product to LGLS for such inspection. If LGLS disagrees with GS’s determination, it shall notify GS within 30 days after inspection by LGLS as provided in this Section 5.7.3, whereupon the Parties shall select an independent laboratory to draw a sample and determine whether such Product in fact conformed to the Final Product Specifications at the time of delivery to GS. The determination of such independent laboratory shall be final. The Party whose determination was not accurate shall bear the cost of the independent analysis.

5.7.4 At the request and expense of LGLS, Product under the control of GS found to be defective shall be returned to LGLS (if by permitted by law) or disposed of in accordance with LGLS’s lawful instructions. With respect to payments previously made by GS with respect to defective Product, GS shall be entitled, at its discretion, either to a refund or a credit against amounts otherwise due to LGLS for supply hereunder.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

10

5.8 Remedies.

5.8.1 If GS asserts that a shipment of Product was defective or non-conforming at the time of delivery to GS, LGLS shall as soon as practical replace the rejected or disputed Product, pending resolution of the question of whether such original shipment was or was not defective.

5.8.2 The remedies set forth in this Article 5 are GS’s sole and exclusive remedies for claims by GS against LGLS based on Product supplied by LGLS pursuant to this Agreement not conforming to the Final Product Specifications.

5.9 Supply Price and Payment Mechanism.

5.9.1Product for use by GS non-commercial purposes (including, without limitation, clinical trials and for pre-Launch compassionate use) shall be supplied by LGLS at its Fully Burdened Cost of Manufacturing.

5.9.2Product for commercial use shall be supplied by LGLS at a supply price of ***** percent of its Fully Burdened Cost of Manufacturing; provided, however that the price shall in no event be ***** $***** per finished tablet ***** $***** per finished tablet.

5.9.3Payment for API and Final Product supplied by LGLS hereunder shall be due 30 days after delivery to GS’s premises pursuant to Section 5.6, above; provided, however, that payment for the ***** metric tons of material ordered by GS pursuant to Section 5.5, above, shall be due in two equal installments. The first such installment shall be due 30 days after delivery to GS’s premises pursuant to Section 5.6, above, and the second such installment shall be due 90 days after the first installment is due.

5.9.4 Notwithstanding the foregoing, in the event that any of the Product ordered by and delivered to GS pursuant to this Article 5 is unused by GS because of: (i) the expiration of FDA- or EMEA- approved Product dating, or (ii) commercial considerations which make such Product unusable (including, without limitation, because the Product is not approved by the FDA or the EMEA), GS shall return such unused Product to LGLS (or at LGLS’s request and expense lawfully dispose of such Product). LGLS shall be responsible for the Fully Burdened Cost of Manufacture of the API component of such returned Product and, if GS has previously paid for such Product, shall give GS a credit or prompt reimbursement for such amount. GS shall be responsible for the final finish and fill costs costs associated with such returned Product.

5.10 Release Certificate. LGLS shall provide to GS with each delivery of Final Product a Release Certificate, a Certificate of Analysis and a Certificate of Compliance signed by a responsible person duly authorized by LGLS to certify the quality of the API delivered, each in a form reasonably acceptable to GS. The Release Certificate shall, inter alia, state that the results of the agreed upon testing procedures are in compliance with the Final Product Specifications as well as any additional applicable requirements of Regulatory Authorities. Without limiting the foregoing, unless expressly agreed by the Parties all Final Products supplied hereunder shall meet all release criteria established by the FDA or EMEA with respect to such Final Product.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

11

5.11 Production Records. LGLS shall maintain records related to its manufacture and handling of Final Product in accordance with the applicable rules and regulations and conditions of its licensure (including applicable rules of the FDA and EMEA and any other applicable regulatory requirements for record retention), for the longer of: (i) five years after the date of manufacture of each batch of API, and (ii) the period required by applicable law. LGLS shall notify GS of any intent to destroy or dispose of records related to the manufacture or handling of API and allow GS an opportunity to secure said records for additional storage periods in accordance with the written procedures of GS or its designee. Upon GS’s request with no fewer than five days’ prior notice, and at GS’s sole expense, LGLS shall send to GS copies of the relevant documents or permit GS or an independent auditor selected by GS to have access to such records from time to time during ordinary business hours to verify compliance by LGLS with such rules and regulations. The provisions set forth in this section shall survive termination of the Agreement for a period of 10 years.

5.12 Post Expiration Supply. The Parties recognize that following the expiration of the term of this Agreement GS may (or may not) continue to sell Product under the Trademark as contemplated by Sections 10.4 and 11.4. In the event that GS does so and in the further event that LGLS or any Affiliate of LGLS is at such time producing API in commercial quantities, LGLS shall offer to supply API to GS on a non-exclusive basis (i.e. GS shall be free to purchase from Third Parties and LGLS shall be free to supply Third Parties) on commercially reasonable terms and conditions.

ARTICLE 6

CONFIDENTIALITY

6.1 Confidentiality; Exceptions. The receiving Party shall keep confidential and shall not publish or otherwise disclose or use for any purpose other than as provided for in this Agreement any Information and other information and materials furnished to it by the other Party pursuant to this Agreement, or any provision of this Agreement that is the subject of an effective order of the Securities Exchange Commission granting confidential treatment pursuant to the Securities Act of 1934, as amended (collectively, “Confidential Information”), except to the extent that it can be established by the receiving Party that such Confidential Information:

| | (i) | was already known to the receiving Party at the time of disclosure by the other Party; |

12

| | (ii) | was generally available to the public or otherwise part of the public domain at the time of its disclosure to the receiving Party; |

| | (iii) | became generally available to the public or otherwise part of the public domain after its disclosure by the disclosing Party and other than through any act or omission of the receiving Party in breach of this Agreement; |

| | (iv) | was disclosed to the receiving Party, other than under an obligation of confidentiality, by a Third Party who had no obligation to the disclosing Party not to disclose such information to others; or |

| | (v) | was developed by the receiving Party’s employees without the use of or access to confidential information of the disclosing Party, as demonstrated by contemporaneous written records of the receiving Party. |

6.2 Authorized Disclosure. A Party may disclose Confidential Information of the other Party to the extent such disclosure is reasonably necessary in filing or prosecuting patent applications, prosecuting or defending litigation, complying with applicable governmental regulations or conducting pre-clinical or clinical trials, provided that if a Party is required by law to make any such disclosure it will, to the extent practicable, give reasonable advance notice to the other Party of such disclosure requirement and, except to the extent inappropriate in the case of patent applications, use reasonable efforts to secure confidential treatment of such Confidential Information required to be disclosed. In addition, each Party shall be entitled to disclose Confidential Information, under a binder of confidentiality containing provisions as protective as those of this Article 6, to a Third Party for the purpose of carrying out activities authorized under this Agreement, including disclosures to authorized or potential sub-licensees. Nothing in this Article 6 shall restrict any Party from using for any purpose outside the Field any Information developed by it during the course of the collaboration hereunder.

6.3 Survival. This Article 6 shall survive the expiration or termination of this Agreement for a period of five years; provided, however, that Confidential Information regarding LGLS’s manufacturing process for API shall be kept confidential by GS during the term of this Agreement and for a further period of 10 years after the expiration or termination of this Agreement, subject to the exceptions in Section 6.1, above.

ARTICLE 7

INFORMATION AND REPORTS

7.1 Information and Reports During Development and Commercialization.

7.1.1 To the extent permitted by law, GS and LGLS will each regularly disclose and make available to the other without charge all Information (including, without limitation, copies of all pre-clinical and clinical reports and training, marketing and promotional materials) known to them. Without limiting the foregoing, promptly following the Effective Date, and at

13

reasonable intervals thereafter, LGLS shall disclose and transfer to GS all LGLS Know-how and GLAXO Know-how and GS shall disclose and transfer to LGLS all GS Know-how.

7.1.2 Upon reasonable prior notice, each Party shall have the right to: (i) review the raw data generated in any clinical trial conducted by the other Party with respect to Product, (ii) visit clinical investigators and centers involved in performance of such clinical trials, and (iii) discuss any such clinical trial and its results in detail with such clinical investigators.

7.2 Publicity Review.

7.2.1 Neither Party shall originate any publicity, news release, or other announcement disclosing any non-public terms of this Agreement (collectively, “Disclosure”), without the prior prompt review and written approval of the other, which approval shall not be unreasonably withheld. Once specific information has been approved for disclosure, that information may be reiterated in any subsequent Disclosure without further approval; provided, however, that the Parties shall, to the extent lawful, maintain the confidentiality of financial information contained in this Agreement and resulting from the activities contemplated hereunder.

7.2.2 Notwithstanding Section 7.2.1, a Party may make any Disclosure it believes in good faith based upon the advice of its counsel or its auditors is required by applicable law and without the prior approval of the other Party may make such disclosures as are required by the rules or regulations of the U.S. Securities and Exchange Commission or its relevant foreign counterpart.With respect to disclosures other than those required under such rules or regulations, prior to making such Disclosure, the disclosing Party shall provide the other Party with a written copy or rendition of the materials proposed to be disclosed and provide the receiving Party with an opportunity to promptly review the proposed Disclosure.

7.3 Use of Names. Except as required by law or in furtherance of the exercise of its rights hereunder, neither Party shall use the name of the other in any public announcement, press release or other public document related to this Agreement or the understanding reflected herein without the written consent of such other Party, which consent shall not be unreasonably withheld or delayed. No such approval shall be required to republish a disclosure previously made or otherwise in the public domain.

7.4 Adverse Drug Events. Each Party shall promptly report to the other Party any adverse event observed during any use of a Product. Prior to the first commercial sale of a Product in the Territory, the Parties shall in good faith enter into a data safety exchange agreement consistent with applicable law and regulatory requirements and practices in the United States and European Union.

7.5 Recall

7.5.1 Any necessary recall of Product or any batch of Product from the market in the Territory shall be effected by GS at GS’s reasonable discretion following, to the extent practicable, consultation with LGLS. Upon any Product recall, any then-pending orders of Product pursuant to Article 5, above, shall be suspended until the reinstatement of the Product or revocation of the recall.

14

7.5.2 If any Product is recalled either: (i) as a result of an act or omission of GS or its Third Party contractors or sub-licensees, or (ii) for any other reason not resulting in whole or part from an act or omission of LGLS or GLAXO, then GS shall bear all costs and expenses of such recall including, without limitation, expenses or obligations to Third Parties, the cost of notifying end users and costs associated with shipment of any recalled Products from end users and destruction of such Products.

7.5.3If any Product is recalled as a result of an act or omission of LGLS or its Third Party contractors or sub-licensees, then LGLS shall bear all costs and expenses of such recall including, without limitation, refund of the supply price of the recalled Products, expenses or obligations to Third Parties, the cost of notifying end users and costs associated with shipment of any recalled Products from end users and destruction of such Products.

7.5.4If a recall of Products is necessary for reasons attributable in part to each of the Parties, then LGLS and GS shall be responsible for a proportionate share of such recall costs on the basis of their respective responsibilities with respect to the event justifying the recall.

7.5.5In the event of a recall of Products, each Party shall immediately notify the other Party and cooperate in a manner which is appropriate and reasonable under the circumstances.

7.6 Except as may be expressly provided herein and without prejudice to either Party’s responsibility for Third Party damages as provided for in Article 14, below, no claim for compensation, losses or damages (including, without limitation, punitive, exemplary, incidental or consequential damages) may be made by one Party against the other as a result of any Product recall or any other act or omission of a Party pursuant to this Agreement (including, without limitation, the termination of this Agreement by either Party).

ARTICLE 8

PATENT RIGHTS

8.1 LGLS Patents and GLAXO Patents. (a) During the term of this Agreement, LGLS shall diligently maintain the LGLS Patents and the GLAXO Patents in the Territory and shall use reasonable efforts to convert any currently pending or future filed patent applications into granted patents without undue delay. LGLS shall use patent counsel selected by LGLS and reasonably approved by GS for such prosecution and maintenance and LGLS shall bear all related Patent Expenses. GS shall cooperate fully with LGLS in all such matters, at GS’s expense.

(b) LGLS shall promptly disclose to GS the text of all LGLS Patents filed after the Effective Date as well as all information received after the Effective Date concerning the institution or possible institution of any interference, opposition, re-examination, reissue, revocation, nullification or any official proceeding involving an LGLS Patent or GLAXO Patent any where in the Territory. GS shall have the right to review all such pending applications and other proceedings and make recommendations to LGLS with respect thereto. LGLS shall keep

15

GS promptly and fully informed of the course of patent prosecution and other proceedings and shall provide GS with copies of all substantive communications, search reports and Third Party observations submitted to or received from patent offices throughout the Territory. All such disclosures shall be considered “Confidential Information” subject to Article 6, above.

8.2 Abandonment.LGLS shall be free, on at least 30 days’ prior notice to GS, to abandon and stop funding Patent Expenses related to any of the LGLS Patents in any country in the Territory. In such event, GS may, at its sole option, assume and continue prosecution or maintenance of the LGLS Patents and GLAXO Patents in question, and shall thereafter bear all related Patent Expenses. Following such abandonment of a LGLS Patent by LGLS, LGLS shall have no further rights hereunder with respect to the LGLS Patent in question to the extent of such abandonment, and the term “LGLS Patents” shall be deemed to have been modified accordingly. LGLS shall not abandon any GLAXO Patent nor stop funding Patent Expenses related thereto without the prior consent of GS, which consent shall not be unreasonably withheld.

8.3 Infringement. If either Party learns of an infringement or threatened infringement of the LGLS Patents or GLAXO Patents in the Territory in the Field it shall promptly notify the other Party and shall provide the latter Party with all information reasonably available to the notifying Party evidencing such infringement or threatened infringement. Thereafter, the Parties shall in good faith consult and cooperate in abating such infringement or threatened infringement.

GS shall have the right, but not the obligation, to bring, defend and maintain any appropriate suit or action for abatement of the infringement or threatened infringement of the LGLS or GLAXO Patents in the Territory and in the Field, at GS’s sole expense. If GS requests LGLS to join GS as a party in such suit or action, LGLS shall execute all papers and perform such other acts as may be reasonably requested by GS, at GS’s expense. LGLS shall have the right to participate in any such suit or action using independent counsel, at its sole expense. Any amount recovered by GS as a result of such suit or action shall first be applied to reimburse each of the Parties, pro rata, for any costs or expenses incurred in bringing, defending and maintaining any such action. The balance (the “Net Recovery”) shall be for the sole benefit of GS. The Net Recovery shall be considered “Net Sales” with respect to the calendar quarter in which payment to GS was received, and royalties shall accordingly be paid on the amount of the Net Recovery exclusively at the rate(s) specified in Section 10.3, below. The Net Recovery shall be considered “Net Sales” for purposes of calculating annual Net Sales in accordance with Milestone 3 and in Section 10.2, below.

If GS fails to initiate suit or action within 90 days after first notice of infringement or threatened infringement of the LGLS Patents or the GLAXO Patents, or if having initiated such suit or action it thereafter diligently fails to prosecute such suit or action, LGLS shall have the right, but not the obligation, to bring, defend and maintain any appropriate suit or action for abatement of the infringement or threatened infringement, at LGLS’s sole expense. If LGLS requests GS to join LGLS as a party in such suit or action, GS shall execute all papers and perform such other acts as may be reasonably requested by LGLS, at LGLS’s expense. GS shall

16

have the right to participate in any such suit or action using independent counsel, at its sole expense. Any amount recovered by LGLS as a result of such suit or action shall first be applied to reimburse each of the Parties, pro rata, for any costs or expenses incurred in bringing, defending and maintaining any such action. The balance shall be divided equally between the Parties. The amount of any recovery, net of the amounts necessary to reimburse the Parties as provided above shall be considered “Net Sales” for purposes of calculating annual Net Sales in accordance with Milestones 3 and in Section 10.2, below. If such recovery is apportioned by the court such that portions thereof are attributed to infringing activity in different calendar years, or if such apportionment of the recovery can otherwise be readily ascertained, then such apportionment shall govern as to the calendar year(s) in which Net Sales shall be deemed to have occurred for purposes of such Milestones. Otherwise, the amount of such recovery shall be apportioned equally over the number of calendar years in which infringement was found to have occurred (or in the event of a settlement, over the number of calendar years in which it was alleged to have occurred).

8.4 Third Party Claims. If a Third Party asserts that a patent or other right owned by it is infringed by the development, manufacture, import, use, sale or offer for sale of a Product by GS or its Affiliates or sub-licensees in the Territory in the Field, the Party first obtaining knowledge of such claim shall immediately provide the other Party notice of such claim and the related facts in reasonable detail. In such event, the Parties shall determine how best to control the defense of any such claim. In the event the Parties cannot agree on the defense of such claim, such defense shall be controlled by GS with respect to sales of Product in the Territory and by LGLS with respect to Product sales outside of the Territory. In each such case, the other Party shall have the right, at its own expense, to participate in such defense and to be represented in any such action by counsel of its choice at its sole discretion. With respect to any such claim, the Party entitled to control defense shall also have the right to control settlement of such claim; provided, however, that no settlement shall be entered into without the written consent of the other Party, which consent shall not be withheld unreasonably.

8.5 Ownership. Subject to Section 9.2, below, each Party shall have and retain sole and exclusive title to all inventions, discoveries and know-how which are made, conceived, reduced to practice or generated solely by its employees or agents in the course of or as a result of this Agreement. Each Party shall own an equal undivided interest in all such inventions, discoveries and know-how made, conceived, reduced to practice or generated jointly by the employees or agents of one Party and the employees or agents of the other Party.

ARTICLE 9

LICENSES and OPTIONS

9.1 License Grant by LGLS. Subject to the terms and conditions of this Agreement, LGLS hereby grants to GS and GS hereby accepts from LGLS a sole and exclusive license under the LGLS Patents, LGLS Know-How, GLAXO Patents, GLAXO Know-how to use, import, package, sell and offer for sale Products within the Field in the Territory, as well as the exclusive right to use the Trademarks in the Territory in conjunction with the use or sale of Products.

9.2 License Grant by GS. Subject to the terms and conditions of this Agreement, GS hereby grants to LGLS and LGLS hereby accepts from GS a non-exclusive royalty-free

17

license under the GS Know-How to develop, use, import, formulate, package, sell and offer for sale Products outside of the Territory. Without limiting the foregoing, the Parties agree that any patent application filed by or on behalf of GS prior to January 1, 2010 which covers or claims any novel use or formulation or means of administration of Product shall be jointly owned by the Parties regardless of inventorship, and to the extent of LGLS’s ownership interest shall be considered an “LGLS Patent” for purposes of this Agreement. At LGLS’s request GS shall take all steps reasonably required to assign to LGLS its joint ownership interest.

9.3 Sub-licensing. GS may sub-license the license granted to it hereunder on prior notice to LGLS. LGLS may sub-license the license granted to it with respect to GS Know-how only upon prior agreement of GS, which may be withheld or granted in GS’s sole discretion.

9.4 Use of Licenses. Neither Party shall use or disseminate the Know-how of the other Party other than as expressly provided under this Agreement. In addition, GS warrants that it shall not adapt the GLAXO databases included in the GLAXO Knowhow or software operating on such databases for uses unrelated to the uses of Product authorized herein.

9.5*****.During the period commencing on the Effective Date and ending on December 31, 2002 (the “Negotiating Period”), the Parties shall in good faith negotiate the terms and conditions on which LGLS would grant to GS the exclusive right to develop and commercialize ***** in the Territory. During the Negotiating Period LGLS shall not solicit or otherwise participate in any communications with any Third Party regarding the commercialization of ***** in the Territory.

9.6 DNA Nanobinder Compounds.Schedule 9.6 hereto describes GS’s DNA nanobinder compounds being developed for use in the fields of ***** (each, a “GS Option Field”). Promptly following the completion of the first Phase II clinical trial for a DNA nanobinder compound in each of the GS Option Fields, GS shall notify LGLS and disclose to LGLS all available preclinical and clinical data regarding the use of such DNA nanobinder compound in the GS Option Field in question. During the ***** day period following such closure the Parties shall in good faith negotiate the terms and conditions on which GS would grant to LGLS the exclusive right to develop and commercialize such DNA nanobinder compound in the GS Option Field in question in East Asia, including Japan. If the Parties are unable to reach agreement by the end of such ***** day period, GS shall be free to develop and commercialize such DNA nanobinder compound in the GS Option Field in question as it sees fit.

9.7*****. In the event that LGLS proposes to grant commercial rights in the Territory with respect to ***** to a Third Party, it shall first offer such rights to GS on definitive terms. GS shall have 30 days after receipt of such offer to accept, failing which LGLS shall be free to offer such rights to a Third Party on overall terms and conditions no more favorable to such Third Party than those offered to GS. In the event that LGLS proposes to develop and commercialize ***** in the Territory directly or in a collaboration with a Third Party, it shall notify GS. Upon request by GS within 30 days following such notice, the Parties shall in good faith negotiate commercially reasonable terms and conditions on which GS would receive from LGLS an exclusive license with respect to such proposed development and commercialization. If the Parties are unable to reach such agreement within 90 days after GS’s notice, at GS’s

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

18

request the terms of such an exclusive license shall be set by arbitration as provided in Article 15, below, and the Parties shall promptly execute a license agreement consistent with the findings of the arbitration panel.

ARTICLE 10

PAYMENTS TO LGLS

10.1 License Fee. Within 45 days following the Effective Date GS shall: (i) pay to LGLS a non-refundable license fee of $5.5 million, and (ii) deliver to LGLS 4,749,659 fully-paid up and non-assessable shares of GS common stock (the “Shares”). GS represents and warrants that the Shares represent 14.0 percent of the total equity of GS on October 22, 2002, calculated on a fully diluted basis. The rights and further characteristics of the Shares (including, without limitation, certain anti-dilution rights) are as set forth in the Stock Purchase Agreement and related documents attached hereto as Schedule 10.1.

10.2 Milestone Payments. Within 30 days after the achievement of each milestone set forth below, GS shall owe to LGLS a non-refundable milestone payment to LGLS in the amount set forth below. Each milestone payment shall be due only once, notwithstanding the number of Products actually developed or commercialized by GS hereunder. Milestone payments 3 and 4, when earned by LGLS, shall be payable in two installments, the first of which shall be payable on the first day of July or the first day of January (which comes first following the date on which the milestone was earned) and the second installment due six months thereafter. All other milestone payments shall be due 30 days after the relevant milestone event.

| | | |

Milestone Event

| | Payment

|

1. Upon FDA approval of the Product for the Initial Indication. If at the time of such approval GS has not received and accepted the first shipment of Product required pursuant to Section 5.8, one half of this milestone shall be deemed to have been earned, with the second half earned upon receipt and acceptance by GS of such shipment | | $ | 5.0 million |

2. Upon an initial public offering (“IPO”) by GS of its shares or a sale of GS if, at the time of such IPO or sale, Product has been approved for an Initial Indication | | $ | 8.0 million |

3. Upon both: (i) approval for the first Additional Indication or approval of an IV formulation of the Product, and (ii) annual Net Sales in the Territory reaching $***** | | $ | ***** |

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

19

| | | |

4. Upon both: (i) approval for a second Additional Indication or approval of an IV formulation of the Product, and (ii) annual Net Sales in the Territory reaching $***** | | $ | ***** |

5. Upon approval of the Product for an Initial Indication in the United Kingdom | | $ | ***** |

6. Upon approval of the Product for an Initial Indication in the first of Italy, Germany, France or Spain | | $ | ***** |

As used in this Section 10.2, “IV formulation” shall mean a formulation of Product for intravenous administration.

10.3 Royalty Payments. In addition to the foregoing license fee and milestone payments, GS shall, subject to Sections 4.3 and 10.4, pay to LGLS royalties on Net Sales in each calendar year at the following rates:

| | |

Annual Net Sales

| | Royalty Rate

|

on the first $***** | | ***** |

over $***** to $***** | | ***** |

over $***** to $***** | | ***** |

over $***** | | ***** |

The Parties acknowledge that LGLS has incurred a royalty obligation to GLAXO at a rate of ***** percent of Net Sales for the use of the GLAXO Patents, the GLAXO Know-how and the Trademarks (the “GLAXO Royalty”). During the first two years following first commercial sale of a Product in the Territory, GS shall be solely responsible for payment of the GLAXO Royalty and shall pay all amounts so due to LGLS in accordance with Sections 10.7 through 10.11, below. Thereafter, LGLS shall be responsible for payment of the GLAXO Royalty and shall indemnify GS and hold GS harmless from and against any claims by GLAXO as a result of such use.

10.4 Term of Royalty Obligations. GS’s obligation to make royalty payments pursuant to Section 10.3 with respect to a Product shall commence on the date of the first commercial sale of such Product in a given country in the Territory and shall continue until the later of: (i) the expiration of the last to expire of the LGLS Patents and GLAXO Patents claiming or covering such Product in such country, and (ii) 10 years after first commercial sale of such Product in such country. Following the expiration of GS’s royalty obligations, GS shall retain a non-exclusive, royalty-free right to use, sell and offer for sale Product in the Territory, using LGLS Know-how and GLAXO Know-how licensed to GS as of the Effective Date and the exclusive right to use the Trademarks for such purposes. GS shall continue to pay to LGLS a royalty in return for such right to use the Trademark, as provided in Section 11.4, below.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

20

10.5 Royalty Reductions.If GS is required to pay royalties to Third Parties in order to exercise the license granted to GS in Section 9.1, above, with respect to any Product in any country in the Territory, GS will be entitled to deduct ***** percent of the amount due to such Third Parties from the amounts due to LGLS pursuant to Section 10.3, above, with respect to Net Sales of such Product in such country. In no event shall any such royalty reductions in any calendar quarter be more than ***** percent of the royalty payment due to LGLS with respect to such calendar quarter in a given country. Any royalty reduction to which GS would otherwise be entitled may be carried forward by GS and used by GS in a future period (subject to the maximum reductions specified in this Section 10.5).

10.6 Royalties Payable Only Once; Sales to Affiliates and Sub-Licensees. The obligation to pay royalties is imposed only once with respect to the same unit of each Product. Sales of Products between GS and its Affiliates or sub-licensees, or among such Affiliates and sub-licensees, shall not be subject to royalties under Sections 10.3 but in such cases the royalties shall be calculated on the Net Sales by such Affiliates or sub-licensees to Third Parties.

10.7 Reports. GS shall deliver to LGLS, within 60 days after the end of each calendar quarter, reasonably detailed written accountings of Net Sales that are subject to royalty payments due to LGLS for such calendar quarter. Such quarterly reports shall indicate gross sales on a country-by-country and Product-by-Product basis. When GS delivers such reports to LGLS, GS shall also deliver all royalty payments due to LGLS hereunder for such calendar quarter.

10.8 Accounting and Audits.

(a) GS shall keep, and shall require its Affiliates and sub-licensees to keep, complete and accurate records of the latest five years of sales of Products on which royalties are due hereunder. For the purpose of verifying royalties due to LGLS hereunder, LGLS shall have the right annually, at LGLS’s expense, to retain an independent certified public accountant selected by LGLS and reasonably acceptable to GS, to review such records in the location(s) where such records are maintained by GS, its Affiliates or its sub-licensees upon reasonable notice and during regular business hours and under obligations of confidence. Results of such review shall be made available to both LGLS and GS. If the review reflects an underpayment of royalties to LGLS such underpayment shall be promptly remitted to LGLS, together with interest at LIBOR plus ***** percent. If the underpayment of royalties is equal to or greater than ***** percent, then GS pay all of the costs of such review.

(b) LGLS shall keep complete and accurate records of the latest five years of supply hereunder sufficient to enable GS to confirm LGLS’s cost of goods. For the purpose of verifying cost of goods, GS shall have the right annually, at GS’s expense, to retain an independent certified public accountant selected by GS and reasonably acceptable to LGLS, to review such records in the location(s) where such records are maintained, upon reasonable notice and during regular business hours and under obligations of confidentiality. Results of such review shall be made available to both LGLS and GS. If the review reflects an overcharge by LGLS, such overcharge shall be promptly remitted to GS, together with interest calculated in the manner provided in Section 10.9, below. If the amount of such overcharge is equal to or greater than ***** percent, then LGLS pay all of the costs of such review. If the review reflects an

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

21

undercharge by LGLS, GS shall promptly refund the amount of the overpayment to LGLS, together with interest calculated at LIBOR plus ***** percent.

10.9 Currency and Method of Payment. All payments due or payable hereunder shall be made in US Dollars, delivered by wire transfer to such account as LGLS may identify from time to time on notice to GS. Royalty payments due hereunder with respect to sales not denominated in US Dollars shall be converted using the applicable conversion rates quoted in the Wall Street Journalfor buying US Dollars in accordance with U.S. generally accepted accounting principles, consistently applied. GS shall pay interest to LGLS on the amount of any payments that are not paid on or before the date such payments are due under this Agreement at a rate of LIBOR plus ***** percent for the applicable period, calculated on the number of days such payment is delinquent.

10.10 Tax Withholding. The Parties shall use all reasonable and legal efforts to reduce tax withholding on payments made to LGLS hereunder. Notwithstanding such efforts, if GS concludes that tax withholdings under the laws of any country are required with respect to payments due to LGLS, GS shall withhold the required amount and pay it to the appropriate governmental authority. In such a case, GS will promptly provide LGLS with original receipts or other evidence reasonably desirable and sufficient to allow LGLS to document such tax withholdings adequately for purposes of claiming foreign tax credits and similar benefits. No withholding deduction shall be made if LGLS furnishes lawful documentation demonstrating that the payment due is exempt from withholding according to the applicable convention for the avoidance of double taxation between the United States and the Republic of Korea or other applicable law or treaty.

10.11 Blocked Payments. If, by reason of applicable laws or regulations in any country, it becomes impossible or illegal for GS or its Affiliates or sub-licensees to transfer, or have transferred on its behalf, royalties or other payments due hereunder to LGLS, such royalties or other payments shall be deposited in local currency in the relevant country to the credit of LGLS in a recognized banking institution designated by LGLS or, if none is designated by LGLS within a period of 30 days after inquiry from GS, in a recognized banking institution selected by GS and identified by notice to LGLS.

ARTICLE 11

TRADEMARKS

11.1 Responsible Party. GS, in consultation with LGLS, shall be responsible for maintaining the trademark Factive® in all countries in the Territory in which such mark is registered as of the Effective Date and for establishing and maintaining such trademark in other countries in the Territory in which GS intends to Commercialize the Products, all at GS’s expense.

11.2 Infringement and Third Party Claims. Each party shall afford the other full cooperation in the defense and assertion of the Trademarks against Third Parties. Absent agreement by the Parties, the provisions of Sections 8.2 and 8.3 shall apply by analogy with respect to infringement of or Third Party challenges to the Trademarks.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

22

11.3 Termination of the Agreement. Following termination of this Agreement for any reason (but not expiration of its term) GS will refrain from all further use of the Trademarks in the Territory.

11.4 Expiration of the Agreement. Following expiration of GS’s royalty obligations as provided in Section 10.4, above, and for so long as GS continues to use the Trademark in the use or sale of Product, GS shall pay to LGLS a royalty equal to ***** percent of Net Sales. Such royalty shall be calculated and payable as provided in Sections 10.7 through 10.11, above.

ARTICLE 12

REPRESENTATIONS, WARRANTIES AND COVENANTS

12.1 Joint Representations and Warranties. Each of the Parties hereby represents and warrants to the other Party that this Agreement is a legal and valid obligation binding upon such Party and enforceable in accordance with its terms. The execution, delivery and performance of the Agreement by such Party does not conflict with any agreement, instrument or understanding, oral or written, to which it is a Party or by which it is bound, nor violate any law or regulation of any court, governmental body or administrative or other agency having jurisdiction over it.

12.2 Representations and Warranties by LGLS.LGLS represents and warrants to GS that, as of the Effective Date, to the actual knowledge of the executive officers and directors of LGLS:

(a) The information disclosed to GS during the course of its “due diligence” review of materials related to the Product was true and correct and, through the Effective Date, no material information has been omitted from the “due diligence” disclosures made to GS by LGLS.

(b) No litigation exists or is threatened which would, if successful, adversely affect the rights granted to GS hereunder.

(c) All material safety issues related to the Product and to its manufacture have been disclosed to GS.

(d) All renewal fees related to the LGLS Patents, the GLAXO Patents and the Trademarks have been paid in full.

(e) LGLS has good title to the LGLS Patents, the GLAXO Patents, the LGLS Know-how and the GLAXO Know-how and to the Trademarks (to the extent that filings thereof exist as of the Effective Date), free and clear of any liens or encumbrances.

(f) As of the Effective Date LGLS has not been served with notice of any interference proceedings with respect to the LGLS Patents or the GLAXO Patents and to the actual knowledge of LGLS, no such proceedings have been instituted. To the actual knowledge

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

23

of LGLS, as of the Effective Date there is no existing Third Party infringement of the LGLS Patents, the GLAXO Patents or the Trademarks.

(g) The information submitted to the Regulatory Authorities with respect to the Product is true and correct.

(h) It has disclosed to GS the complete texts of all of the LGLS Patents and the GLAXO Patents existing as of the Effective Date as well as all information known to LGLS as of the Effective Date concerning the institution or possible institution of any interference, opposition, re-examination, reissue, revocation, nullification or any official proceeding involving any of the LGLS Patents or GLAXO Patents any where in the Territory.

12.3 Covenants by LGLS. LGLS hereby covenants that: (i) the Transition Plan contemplated by Section 2.1 of the GLAXO Agreement shall be completed in full not later than December 31, 2002, (ii) LGLS shall use its best efforts to finalize the Technology Transfer Agreement contemplated by Section 3.4 of the GLAXO Agreement not later than January 31, 2003, and (iii) LGLS shall use its best efforts to finalize the Supply Agreement contemplated by Section 8.1 of the GLAXO Agreement, on terms and conditions consistent with this Agreement, not later than January 31, 2003. LGLS shall indemnify GS and hold GS harmless from and against any and all losses resulting from the failure by LGLS to complete the Transition Plan or to finalize the Technology Transfer Agreement or the Supply Agreement by the dates specified in this Section 12.3.

24

In addition, the Parties recognize that Section 5.1 of the GLAXO Agreement purports to grant to LGLS only non-exclusive rights with respect to certain GLAXO Knowhow, which if so construed would be inconsistent with Section 9.1 of this Agreement. LGLS shall indemnify GS and hold GS harmless from and against any and all losses and other direct consequences of GLAXO (or its agent or licensee) exercising its rights reserved under Section 5.1 of the GLAXO Agreement in a manner inconsistent with GS’ rights under Section 9.1 of this Agreement; provided, however, that before making any claim to such indemnification GS shall provide to LGLS with such evidence as is reasonably available to GS that the GLAXO Knowhow alleged by GS to have been used to GS’ detriment was in fact proprietary and not in the public domain.

Finally, the Parties recognize that Sections 7.1 and 7.2 of the GLAXO Agreement require that unless certain events occur by June 30, 2004, GLAXO shall have the right to regain the Trademarks and the domain names listed in Appendix “G” to the GLAXO Agreement. If GLAXO shall hereafter assert that such events have not occurred and seek the reconveyance of the Trademarks and domain names, LGLS covenants that it shall take all lawful steps to oppose such efforts by GLAXO for the benefit of GS and, if unsuccessful, shall indemnify GS and hold GS harmless from and against any and all losses and other direct consequences resulting from the reconveyance to GLAXO of the Trademarks and domain names and the loss by GS of it rights hereunder with respect thereto.

12.4 Performance by Affiliates and Sub-licensees. The Parties recognize that each may perform some or all of its obligations under this Agreement through Affiliates or, to the extent permitted, by sub-licensees. Nonetheless, each Party shall remain responsible and shall be the guarantor of the performance by its Affiliates and sub-licensees and shall cause its Affiliates and sub-licensees to comply with the provisions of this Agreement in connection with such performance. In the event of a dispute arising out of the actions of an Affiliate or sub-licensee under this Agreement, each of GS and LGLS may proceed directly against the other Party, without any obligation to first proceed against the Affiliate or sub-licensee.

ARTICLE 13

TERM AND TERMINATION

13.1 Term. The term of this Agreement shall commence on the Effective Date and shall expire upon the termination or expiration in all of the countries of the Territory of the royalty obligations as set forth in Section 10.4, above.

13.2 Termination for Material Breach. If either Party materially breaches this Agreement at any time, which breach is not cured within ***** days of notice thereof from the non-breaching Party, the non-breaching Party shall have the right to terminate this Agreement on notice to the Party in breach following the expiration of such cure period; provided, however, that if the Party alleged to be in breach shall have invoked the dispute resolution mechanism of Article 15 prior to the expiration of such cure period then termination shall not be effective until the sooner of abandonment of such proceedings by the Party alleged to be in breach or completion of the dispute resolution proceedings and a non-appealable finding in arbitration in favor of the non-breaching Party.

| * | Confidential information has been omitted and filed separately with the Securities and Exchange Commission pursuant to a confidential treatment request. |

25

13.3 Termination for Challenge to Patent Rights. If either Party challenges the validity and/or enforceability of any of the other Party’s patent rights to which a license is granted hereunder, the latter Party shall have the right, to the extent lawful, to terminate the license granted pursuant to this Agreement with respect to the challenged patents.

13.4 Unilateral Termination by GS. GS may, at any time by delivery of 30 days’ prior notice to LGLS, elect to abandon its rights and obligations with respect to any country in the Territory, or to terminate this Agreement in its entirety. GS shall be entitled to suspend or discontinue its Development, distribution and/or sale of any Product immediately upon notice to LGLS if new toxicity, safety findings or side effects shall occur that are so severe as to justify such discontinuation. Upon notice by GS pursuant to this Section 13.4, this Agreement and all obligations of LGLS and GS hereunder with respect to the country or countries in question shall terminate and GS shall promptly transfer to LGLS all Marketing Authorization Applications and Regulatory Approvals and the Trademarks with respect to the country or countries in question, as well as all other Information and know-how related to such country or countries. In the event that GS terminates its rights with respect to one or more countries but not the entire Territory, then this Agreement shall remain in effect with respect to the countries not subject to such termination which countries shall, thereafter, be considered the “Territory.”