QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12 |

FIRST BANKING CENTER, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

FIRST BANKING CENTER, INC.

400 Milwaukee Avenue

Burlington, Wisconsin 53105

(262) 763-3581

Dear Shareholder:

You are cordially invited to attend a special meeting of shareholders of First Banking Center, Inc. to be held on [ ] at [ ] local time at the Masonic Temple, 325 N. Kane Street, Burlington, Wisconsin 53105, next to our main banking location at the above address.

At this important meeting, you will be asked to vote on proposed amendments to our articles of incorporation. These amendments will provide for a reverse 1-for-2,000 stock split followed immediately by a forward 2,000-for-1 stock split of our common stock. The text of the proposed amendments is attached as Appendix A to the accompanying proxy statement.

If approved at the special meeting, the transaction will affect our shareholders as follows:

If you are a record shareholder with:

| | Effect:

|

|---|

| 2,000 or more shares: | | Will continue to hold the same number of shares |

Fewer than 2,000 shares: |

|

Will be entitled to $60.00 in cash, without interest, per share |

The primary effect of this transaction will be to reduce our total number of record shareholders to below 300. As a result, we will terminate the registration of our common stock under federal securities laws and will no longer be considered a "public" company.

We are proposing this transaction because our board has concluded, after careful consideration, that the costs and other disadvantages associated with being an SEC-reporting company outweigh any of the advantages. The reasons the board considered in reaching this conclusion include:

- •

- we estimate that we will eliminate costs and avoid immediately anticipated future costs of approximately $500,000 by eliminating the requirement to make periodic reports and reducing the expenses of shareholder communications; in addition to these annual costs, we estimate saving approximately $160,000 of one time costs associated with implementing the requirements of the Sarbanes-Oxley Act of 2002;

- •

- operating as a non-SEC reporting company will reduce the burden on our management that arises from increasingly stringent SEC reporting requirements, thus allowing management to focus more of its attention on our customers and the communities in which we operate; and

- •

- management will have increased flexibility to consider and initiate actions that may produce long-term benefits and growth.

Except for the effects described in the accompanying proxy statement, we do not expect this transaction to adversely affect our operations. In addition, we have no current intentions to engage in any significant transactions following the split transaction, but instead expect to focus management's energy on our core business and our customers.

Your board of directors believes the terms of the proposed transaction are fair and are in the best interest of our unaffiliated shareholders, and unanimously recommends that you vote "FOR" the proposal to amend our articles of incorporation. The enclosed proxy statement includes a discussion of the alternatives and factors considered by the board in connection with its approval of the transaction, and we encourage you to read carefully the proxy statement and appendices.

Your vote is very important. Whether or not you plan to attend the special meeting, please complete, date, sign and return your proxy promptly in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the special meeting, you may vote in person if you wish, even if you have previously returned your proxy.

On behalf of our board of directors, I would like to express our appreciation for your continued interest in the affairs of First Banking Center, Inc.

| | | Sincerely, |

|

|

|

|

|

Brantly Chappell

President and Chief Executive Officer |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon the merits or fairness of this transaction or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This proxy statement is dated [ ], 2004, and is being mailed to shareholders on or about [ ], 2004.

FIRST BANKING CENTER, INC.

400 Milwaukee Avenue

Burlington, Wisconsin 53105

(262) 763-3581

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON [ ], 2004

A special meeting of shareholders of First Banking Center, Inc. will be held on [ ], 2004, at [ ], local time at the Masonic Temple, 325 N. Kane Street, Burlington, Wisconsin 53105, located next to our main bank location at the above address, for the following purposes:

- (1)

- To consider and vote upon a proposal to adopt two amendments to First Banking Center Inc.'s articles of incorporation. The amendments will provide for (a) a reverse 1-for-2,000 stock split, followed immediately by (b) a forward 2,000-for-1 stock split. Each record shareholder owning less than 2,000 shares of common stock immediately prior to the reverse split will, instead of participating in the forward split, receive a cash payment equal to $60.00 per share on a pre-split basis.

- (2)

- To consider and vote upon a proposal to transact any other business that properly comes before the special meeting or any adjournment or postponement of the special meeting.

The board of directors has fixed the close of business on[ ], 2004, as the record date for determining those shareholders entitled to vote at the special meeting and any adjournment or postponement of the special meeting. Only shareholders at the close of business on the record date are entitled to notice of, and to vote at, the special meeting.

| | | By order of the Board of Directors |

|

|

|

|

|

Melvin W. Wendt

Chairman of the Board |

YOUR VOTE IS VERY IMPORTANT.

Whether or not you plan to attend the special meeting in person, please take the time to vote by completing and marking the enclosed proxy card in the enclosed postage-paid envelope. If you attend the special meeting, you may still vote in person if you wish, even if you have previously returned your proxy card.

Your board of directors unanimously recommends that you vote "FOR" approval of the amendments to our articles of incorporation.

TABLE OF CONTENTS

| SUMMARY TERM SHEET | | 1 |

| | First Banking Center, Inc. and the Bank | | 1 |

| | Introduction and Overview of the Split Transaction | | 1 |

| | Background of the Split Transaction | | 1 |

| | Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation | | 2 |

| | Valuation of Financial Advisor; Fairness Opinion | | 3 |

| | Purpose and Structure of the Split Transaction | | 3 |

| | Effects of the Split Transaction | | 4 |

| | Interests of Certain Persons in the Split Transaction | | 4 |

| | Financing of the Split Transaction | | 5 |

| | Material Federal Income Tax Consequences of the Split Transaction | | 5 |

| | Appraisal Rights | | 5 |

| | Date, Time and Place of Special Meeting; Proposal to be Considered at the Special Meeting | | 6 |

| | Record Date | | 6 |

| | Vote Required for Approval | | 6 |

| | Provisions for Unaffiliated Shareholders | | 7 |

| QUESTIONS AND ANSWERS ABOUT THE SPLIT TRANSACTION | | 8 |

| SPECIAL FACTORS | | 11 |

| | Overview of the Split Transaction | | 11 |

| | Background of the Split Transaction | | 12 |

| | Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation | | 17 |

| | Valuation of Financial Advisor; Fairness Opinion | | 25 |

| | Purpose and Structure of the Split Transaction | | 34 |

| | Effects of the Split Transaction on First Banking Center; Plans or Proposals after the Split Transaction | | 36 |

| | Effects of the Split Transaction on Shareholders of First Banking Center | | 39 |

| | Interests of Certain Persons in the Split Transaction | | 42 |

| | Financing of the Split Transaction | | 44 |

| | Material Federal Income Tax Consequences of the Split Transaction | | 44 |

| | Appraisal Rights and Dissenter's Rights; Escheat Laws | | 47 |

| | Regulatory Requirements | | 48 |

| | Accounting Treatment | | 48 |

| | Fees and Expenses | | 48 |

| ABOUT THE SPECIAL MEETING | | 49 |

| | Date, Time and Place of Special Meeting; Proposal to be Considered at the Special Meeting | | 49 |

| | Record Date | | 49 |

| | Quorum; Vote Required for Approval | | 49 |

| | Voting and Revocation of Proxies | | 50 |

| | Solicitation of Proxies; Expenses of Solicitation | | 50 |

| | Authority to Adjourn Special Meeting to Solicit Additional Proxies | | 51 |

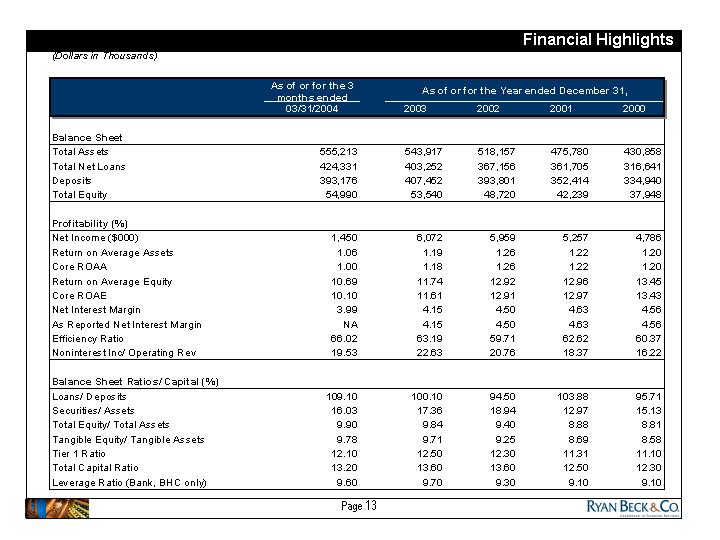

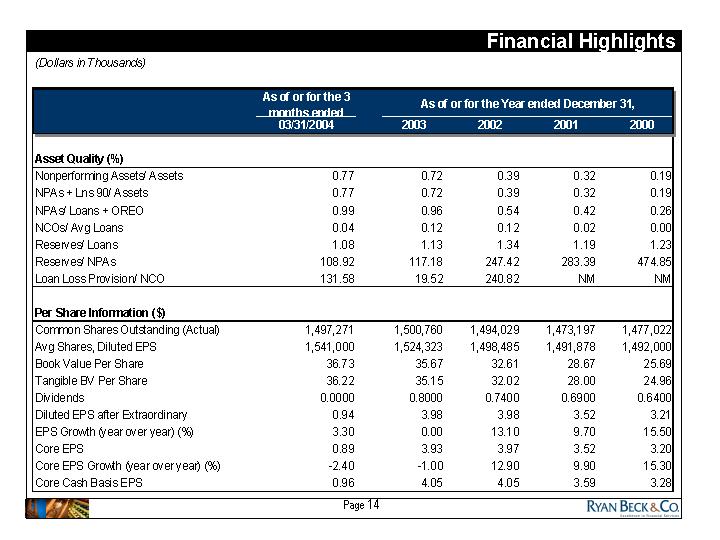

| FINANCIAL INFORMATION | | 52 |

| | Selected Historical and Pro Forma Financial Data | | 52 |

| MARKET PRICE OF FIRST BANKING CENTER, INC. COMMON STOCK AND DIVIDEND INFORMATION | | 54 |

| | MARKET PRICE OF FIRST BANKING CENTER, INC. COMMON STOCK AND DIVIDEND INFORMATON | | 54 |

| | Comparative Market Price Data | | 54 |

| | Dividends | | 54 |

| | | |

i

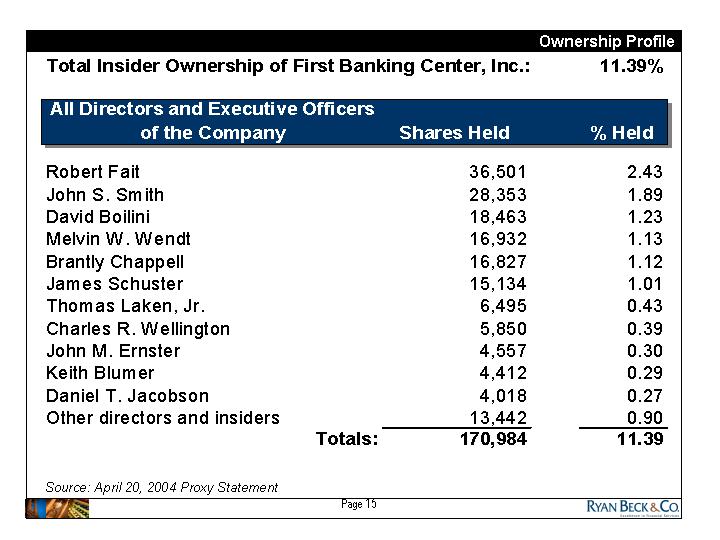

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 54 |

| COMMON STOCK PURCHASE INFORMATION | | 56 |

| | Prior Stock Purchases | | 56 |

| | Recent Transactions | | 56 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 57 |

| | Related Transactions | | 57 |

| | Agreements Involving First Banking Center's Securities | | 57 |

| OTHER MATTERS | | 57 |

| | Reports, Opinions, Appraisals and Negotiations | | 57 |

| | Persons Making the Solicitation | | 57 |

| | Shareholder Proposals for 2005 Annual Meeting | | 57 |

| | Other Matters of Special Meeting | | 57 |

| | Forward Looking Statements | | 57 |

| | Where You Can Find More Information | | 58 |

| | Information Incorporated by Reference | | 58 |

ii

SUMMARY TERM SHEET

This summary provides an overview of material information from this proxy statement about the proposed reverse stock split and forward stock split transaction. However, it is a summary only. To better understand the transaction and for a more complete description of its terms we encourage you to read carefully this entire document and the documents to which it refers before voting.

In this proxy statement, "First Banking Center" "we," "our," "ours," "us" and the "company" refer to First Banking Center, Inc., a Wisconsin corporation. The term "the Bank" refers to First Banking Center's wholly-owned subsidiary, also named First Banking Center, which is a Wisconsin state bank. The term "split transaction" refers to the reverse and forward stock splits, together with the related cash payments to shareholders holding fewer than 2,000 shares at the effective time of the split transaction. The term "non-continuing shareholders" of First Banking Center means all record holders of common stock of First Banking Center with less than 2,000 shares at the effective time of the reverse stock split transaction. The term "continuing shareholders" means all record holders of common stock of First Banking Center with at least 2,000 shares at the effective time of the reverse stock split transaction. References to "common stock" or "shares" refer to First Banking Center's common stock, par value $1.00 per share.

First Banking Center, Inc. and the Bank

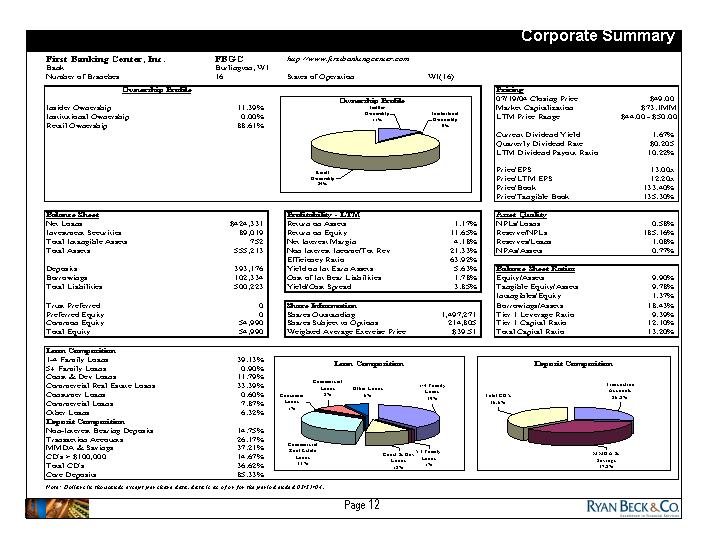

First Banking Center, Inc. is a one-bank holding company registered under the Bank Holding Company Act of 1956, as amended, with a business address of 400 Milwaukee Avenue, Burlington, Wisconsin, 53105, and a business telephone number of (262) 763-3581. We own 100% of the Bank.

First Banking Center is a Wisconsin state banking corporation. The Bank was organized in 1920 and is a full service commercial bank with a main business address of 400 Milwaukee Avenue, Burlington, Wisconsin, 53105, and a main business telephone number of (262) 763-3581. The Bank has branch offices in Albany, Burlington, Darlington, Genoa City, Kenosha, Lake Geneva, Lyons, Monroe, Pell Lake, Pleasant Prairie, Shullsburg, Union Grove, Walworth, and Wind Lake, Wisconsin. The Bank offers a wide range of services, which include loans, personal banking, trust and investment services and insurance and annuity products.

Introduction and Overview of the Split Transaction

(see pages )

We are proposing that our shareholders adopt amendments to our articles of incorporation that will result in a reverse 1-for-2,000 stock split followed immediately by a forward 2,000-for-1 stock split. If the split transaction is completed, our record shareholders who hold only fractional shares after giving effect to the reverse 2,000-for-1 stock split will receive a payment of $60.00 per share for each pre-split share. If the reverse stock split is completed, record shareholders with less than 2,000 pre-split shares will have no interest in the company and will become entitled only to a cash payment for their shares following the reverse stock split. We expect to pay a total of approximately $21,660,000 to shareholders in the reverse stock split. After we complete the reverse stock split and identify those shareholders entitled to payment for their pre-split shares, we will complete a forward stock split in which each share of common stock will be converted into 2,000 shares of common stock post-split. As a result of this subsequent forward stock split, record shareholders who hold 2,000 or more shares prior to the reverse stock split will ultimately hold the same number of shares following the forward stock split. The effect of the split transaction will be to reduce the number of shareholders of record to less than 300, which will allow us to terminate our reporting obligations under federal securities laws.

Background of the Split Transaction

(see pages )

For a description of the events leading to the approval of the split transaction by our board of directors and the reasons for its approval, you should refer to "Special Factors—Background of the Split Transaction," "Special Factors—Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation" and "Special Factors—Purpose and Structure of the Split

Transaction" on pages through and page . As we explain more fully in these sections, our board considered and rejected various alternative methods of effecting a transaction that would enable us to become a non-SEC reporting company, as well as remaining an independent, community-owned company.

Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation

(see pages )

Our reasons for the split transaction include the following:

- •

- we estimate that we will eliminate costs and avoid immediately anticipated future costs of approximately $500,000 by eliminating the requirement to make periodic reports and reducing the expenses of shareholder communications; in addition to these annual costs, we estimate saving approximately $160,000 of one time costs associated with implementing the requirements of the Sarbanes-Oxley Act of 2002;

- •

- given the low trading volume in our common stock, the fact that approximately 80.3% of our shareholders hold fewer than 2,000 shares, and that our earnings are sufficient to support growth, thereby eliminating any need to raise capital in the public market, there is little justification for remaining a reporting company;

- •

- operating as a non-SEC reporting company will reduce the burden on our management that arises from increasingly stringent SEC reporting requirements, thus allowing management to focus more of its attention on our customers and the communities in which we operate;

- •

- management will have increased flexibility to consider and initiate actions that may produce long-term benefits and growth;

- •

- the split transaction proposal allows us to discontinue our reporting obligations with the SEC, and allows the non-continuing shareholders to receive fair value and cash for their shares, in a quick and cost-effective manner;

- •

- because our common stock is not listed on any exchange or on the over-the-counter bulletin board (OTCBB), the split transaction will allow the non-continuing shareholders to receive a uniform amount of cash for their shares, even though our shares are not actively traded; and

- •

- the split transaction will allow the non-continuing shareholders to realize what our board has determined to be a fair value for their First Banking Center common stock; in reaching this conclusion, our board of directors considered the valuation report prepared by Ryan Beck & Co., Inc., and in particular, our board considered that the $60.00 price represents 14.96 times earnings for March 31, 2004, and 163.25% of book value, which values are in line with comparable SEC-reporting companies.

We considered that some of our shareholders may prefer to continue as shareholders of First Banking Center as an SEC-reporting company, which is a factor weighing against the split transaction. However, we believe that the disadvantages of continuing our reporting obligations with the SEC outweigh any advantages associated with doing so.

Based on a careful review of the facts and circumstances relating to the split transaction, our board of directors believes that the split transaction and the terms and provisions of the split transaction, including the cash to be paid to the non-continuing shareholders, are substantively and procedurally fair to our unaffiliated shareholders, including both unaffiliated shareholders that are continuing shareholders and unaffiliated shareholders that are non-continuing shareholders. Our board of directors unanimously approved the split transaction.

2

In the course of determining that the split transaction is fair to and is in the best interests of our unaffiliated shareholders, including both unaffiliated shareholders that are continuing shareholders and unaffiliated shareholders that are non-continuing shareholders, the board, after consulting with legal and financial advisors, considered a number of positive and negative factors affecting these groups of unaffiliated shareholders in making their determination. To review the reasons for the split transaction in greater detail, please see pages through .

In addition, under the federal securities laws, the Bank is required to join in the filing of this proxy statement. The Bank adopts the analyses and conclusions of the First Banking Center board of directors. Please see pages through .

Our Board of Directors unanimously recommends that you vote "FOR" the proposed amendments to our articles of incorporation that will effect the split transaction.

Valuation of Financial Advisor; Fairness Opinion

(see pages )

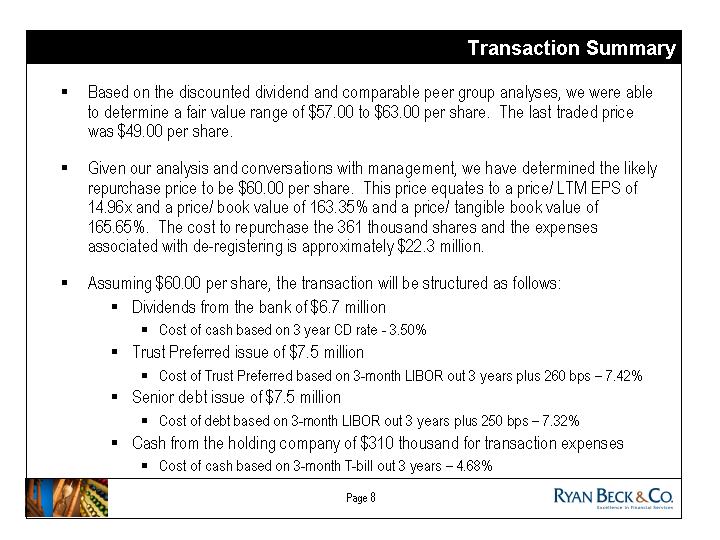

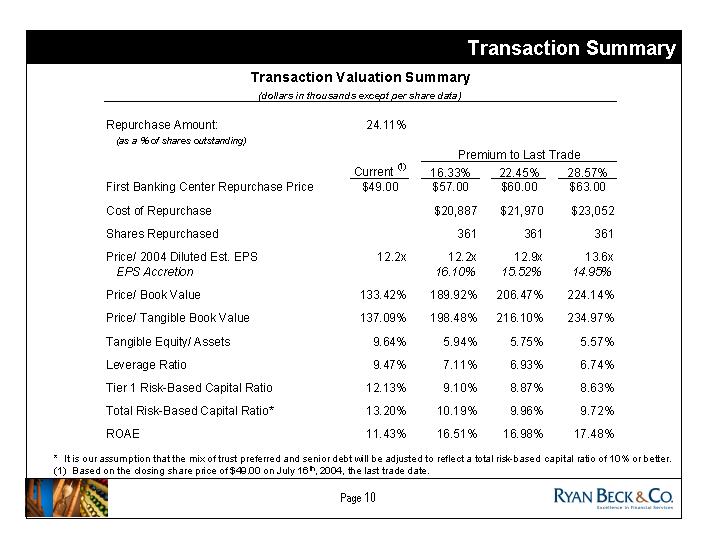

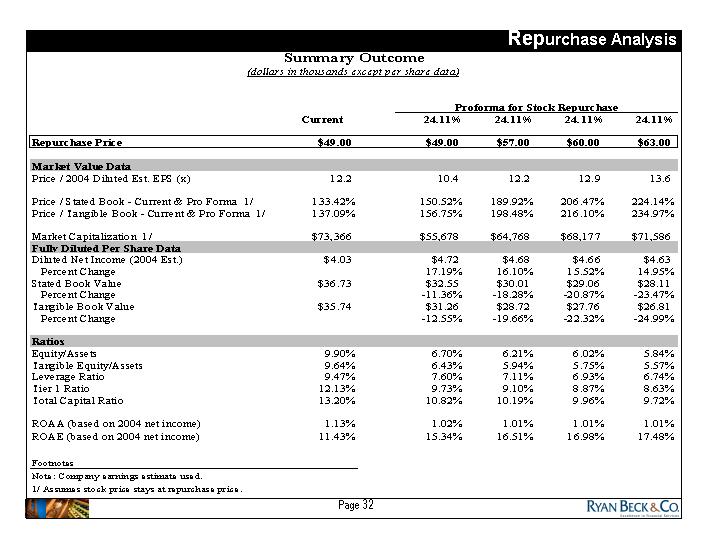

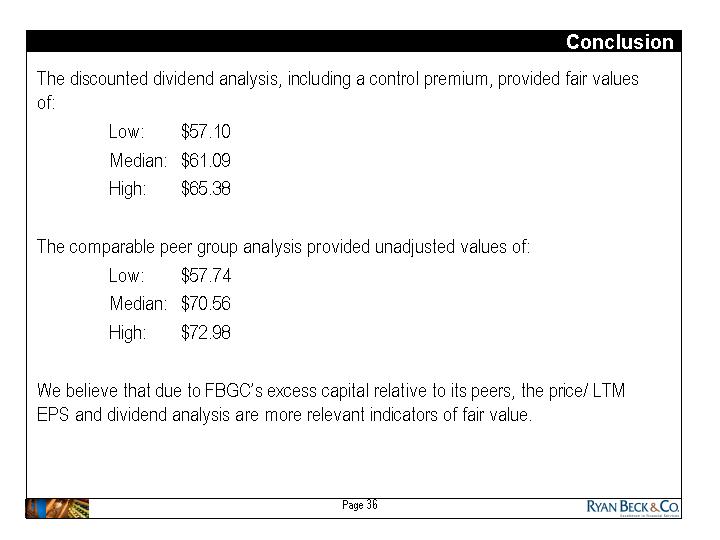

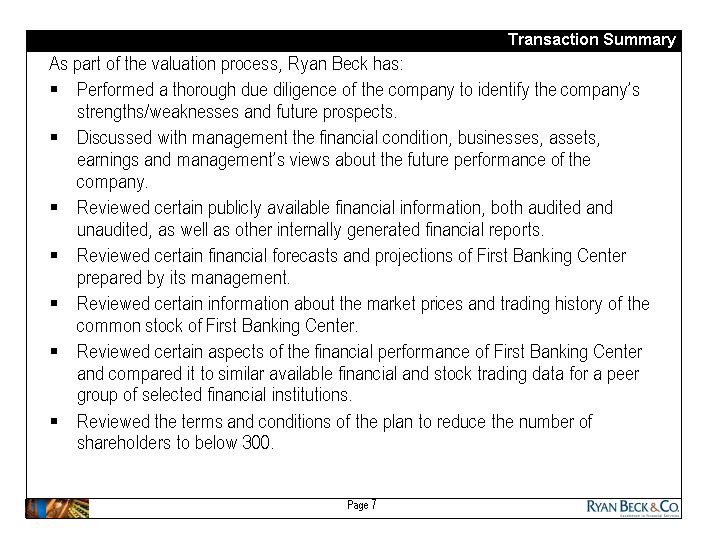

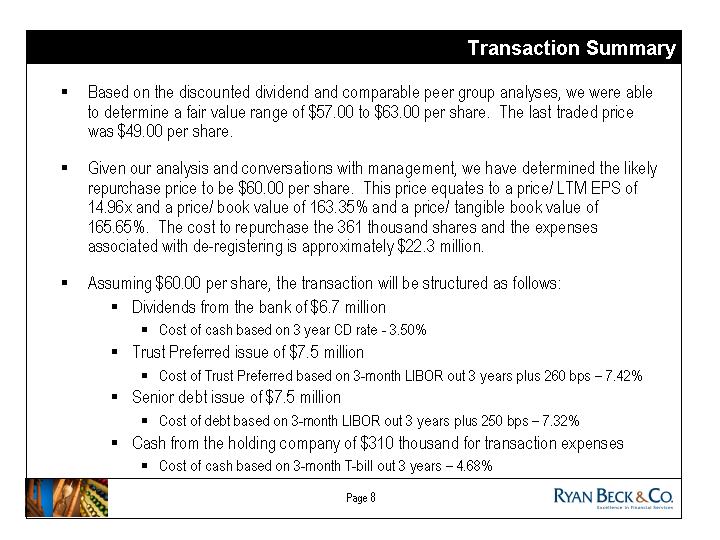

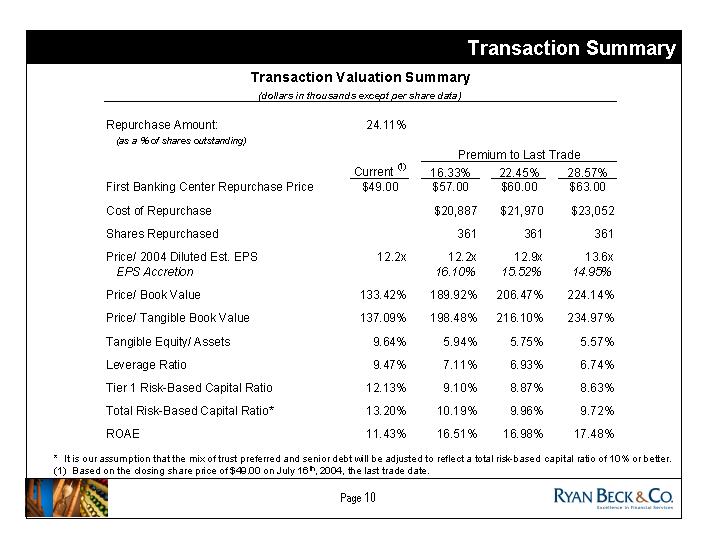

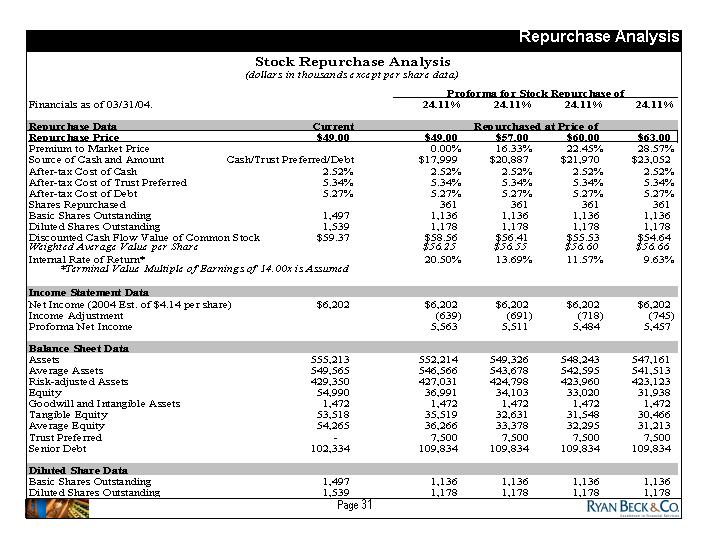

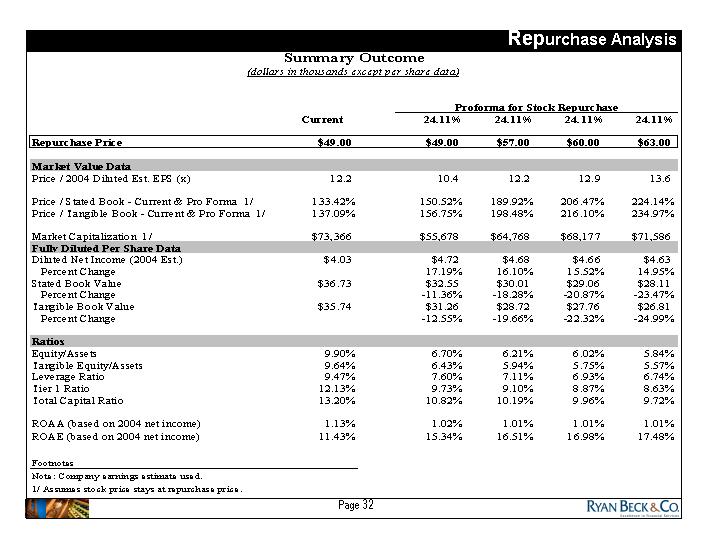

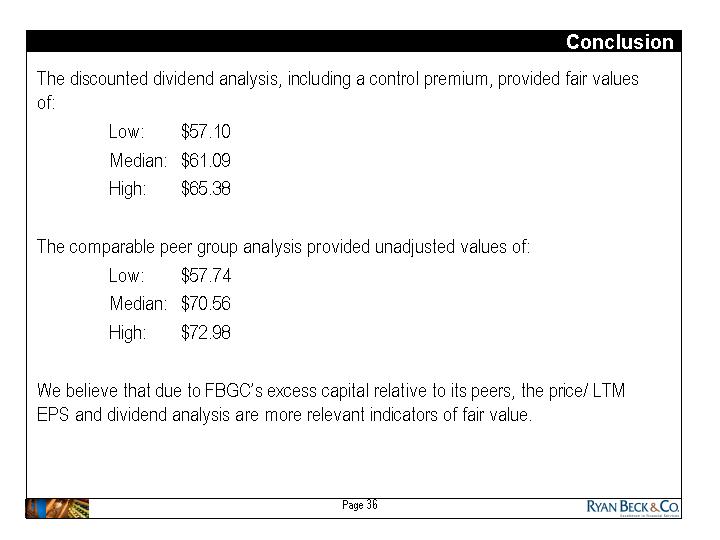

We retained Ryan Beck & Co., Inc. to perform an independent valuation of the fair value of our common stock as of July 19, 2004. In that report, Ryan Beck determined that the fair value of our common stock was between $57.00 and $63.00 per share as of July 19, 2004. Taking this valuation into consideration, in addition to other factors discussed in this proxy statement, the board determined the fair value of our common stock for purpose of the split transaction to be $60.00.

In deciding to approve the split transaction and recommend it to our shareholders, our board of directors considered the opinion of Ryan Beck that the $60.00 consideration proposed to be paid to the non-continuing shareholders is fair from a financial point of view. The full text of the valuation report and opinion are attached to this proxy statement asAppendix B andAppendix C, and you are encouraged to read them carefully.

Purpose and Structure of the Split Transaction

(see pages )

The purpose of the split transaction is to consolidate ownership of our common stock and reduce the number of our record shareholders to less than 300. If successful, we will be able to discontinue our SEC reporting requirements and allow our management to refocus time spent on complying with SEC-reporting obligations on operational and business goals.

The transaction has been structured as a two-step stock split transaction because the reverse stock split will enable us to reduce the number of our record shareholders to fewer than 300, while the forward stock reverse stock split will avoid disruption to the shareholders that own 2,000 or more shares of common stock prior to the split transaction. Because shareholders owning 2,000 or more shares of common stock are not affected by the two-step structure, this structure minimizes the costs of our becoming a non-SEC reporting company while achieving the goals outlined in this proxy statement.See "Special Factors—Background of the Split Transaction" beginning on page .

The split transaction is being effected at the record shareholder level. This means that we will look at the number of shares registered in the name of a single holder to determine if that holder's shares will be cashed out. It is important that our shareholders understand how shares that are held by them in "street name" will be treated for purposes of the split transaction described in this proxy statement. Shareholders who have transferred their shares of First Banking Center stock into a brokerage or custodial account are no longer shown on our shareholder records as the record holder of these shares. Instead, the brokerage firms or custodians typically hold all shares of First Banking Center stock that its clients have deposited with it through a single nominee; this is what is meant by "street name." If that single nominee is the record shareholder for 2,000 or more shares, then the stock registered in

3

that nominee's name will be completely unaffected by the split transaction. Because the split transaction only affects record shareholders, it does not matter whether any of the underlying beneficial owners for whom that nominee acts own less than 2,000 shares. At the end of this transaction, these beneficial owners will continue to beneficially own the same number of shares of our stock as they did at the start of this transaction, even if the number of shares they own is less than 2,000.

If you hold your shares in "street name," you should talk to your broker, nominee or agent to determine how they expect the split transaction to affect you. Because other "street name" holders who hold through your broker, agent or nominee may adjust their holdings prior to the split transaction, you may have no way of knowing whether you will be cashed out in the transaction until it is completed. However, because we think it is likely that any brokerage firm or other nominee will hold more than 2,000 shares in any one account, we think it is likely that all "street name" holders will remain continuing shareholders.

Effects of the Split Transaction

(see pages )

The split transaction is a going private transaction for First Banking Center, meaning it will allow us to deregister with the SEC and we will no longer be subject to reporting obligations under federal securities laws. As a result of the split transaction, among other things:

- •

- The number of our record shareholders will be reduced from approximately 814 to approximately 160, and the number of outstanding shares of our common stock will decrease approximately 24.2%, from 1,493,683 shares to approximately 1,132,807 shares;

- •

- the non-continuing shareholders will receive $60.00 in cash per share of our common stock owned by them;

- •

- because of the reduction of our total number of record shareholders to less than 300, we will be allowed to terminate our status as a reporting company with the SEC;

- •

- the non-continuing shareholders will no longer have an interest in, or be record shareholders of, First Banking Center, and therefore, will not be able to participate in our future earnings and growth, if any; and

- •

- our regulatory and Tier 1 capital will each be reduced approximately $14,470,000, from approximately $54,479,000 and $52,723,000, respectively, as of June 30, 2004, on a historical basis to approximately $40,009,000 and $38,253,000, respectively, on a pro forma basis.

For a further description of how the split transaction will affect our unaffiliated shareholders, including the different effects on the continuing and non-continuing shareholders, pleasesee "Special Factors—Effects of the Split Transaction on Shareholders of First Banking Center" on pages through .

Interests of Certain Persons in the Split Transaction

(see pages )

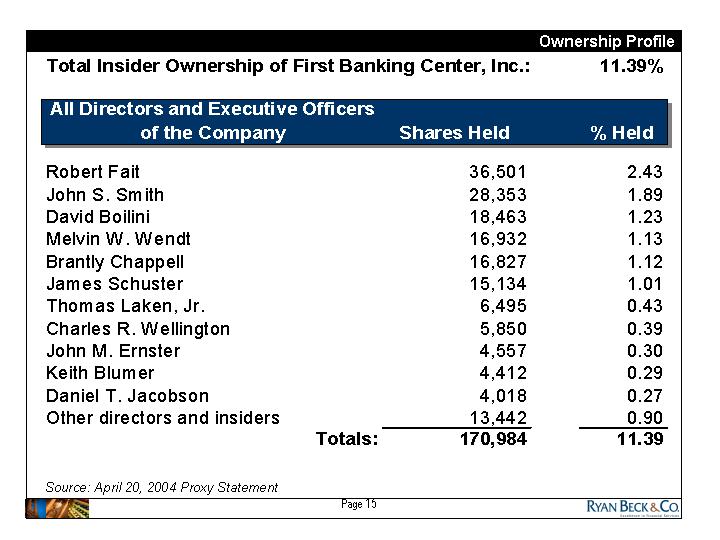

You should be aware that the directors and executive officers of First Banking Center and the Bank have interests in the split transaction that may present actual or potential, or the appearance of actual or potential, conflicts of interest in connection with the split transaction.

We expect that all of the directors and executive officers of First Banking Center and the Bank will own more than 2,000 shares of common stock at the effective time of the split transaction, and will therefore continue as shareholders if the split transaction is approved. In addition, because there will be fewer outstanding shares, these directors and executive officers will own a larger relative percentage of the company on a post-split basis. This represents a potential conflict of interest because the

4

directors of First Banking Center approved the split transaction and are recommending that you approve it. Despite this potential conflict of interest, the board believes the proposed split transaction is fair to our unaffiliated shareholders for the reasons discussed in the proxy statement.

In addition, the board of directors of First Banking Center, throughout its consideration of the transaction, recognized that the interests of the non-continuing shareholders and the continuing shareholders are different and possibly in conflict. The non-continuing shareholders may wish to remain shareholders of an SEC-reporting company to share in future growth and, in the split transaction, may have the goal of obtaining the highest value for their shares. On the other hand, the continuing shareholders may have the goal of retaining cash for our future operations.See "Special Factors—Background of the Split Transaction" and "Special Factors—Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation" for a discussion of how the board of directors addressed this situation.

Financing of the Split Transaction

(see pages )

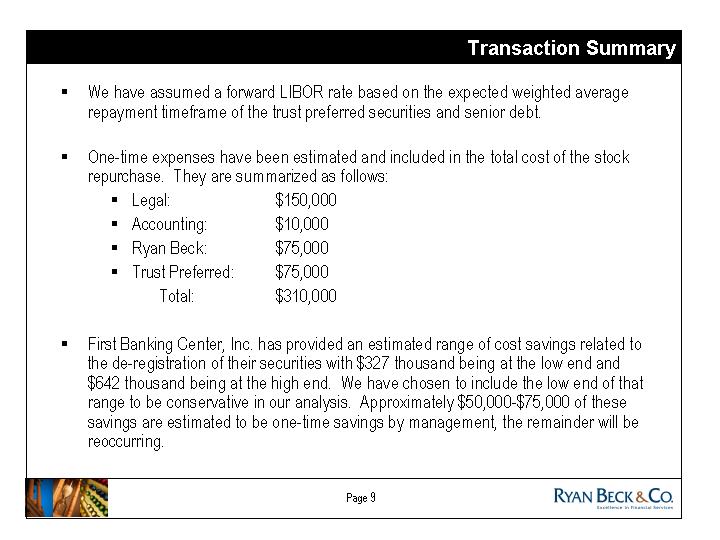

We estimate that the total funds required to fund the payment of the split transaction consideration to the non-continuing shareholders and to pay fees and expenses relating to the split transaction will be approximately $21,970,000.

We intend to finance the split transaction through a mixture of dividends paid to us by the Bank, funds available under our line of credit, and funds received through the proceeds of the sale by us of trust preferred securities.

Material Federal Income Tax Consequences of the Split Transaction

(see pages )

We believe that the split transaction, if approved and completed, will have the following federal income tax consequences:

- •

- the split transaction should result in no material federal income tax consequences to us or the Bank;

- •

- the receipt of cash in the split transaction by the non-continuing shareholders will be taxable to those shareholders, who will generally recognize gain or loss in the split transaction in an amount determined by the difference between the cash they receive and their adjusted tax basis in their common stock surrendered; and

- •

- the continuing shareholders will not recognize any gain or loss or dividend income in connection with the transaction.

The split transaction will be a taxable transaction to the non-continuing shareholders. For United States federal income tax purposes, you will generally recognize gain or loss in the split transaction in an amount determined by the difference between the cash you receive and your tax basis in your common stock surrendered.

Because determining the tax consequences of the split transaction can be complicated, you should consult your own tax advisor to understand fully how the split transaction will affect you.

Appraisal Rights

(see pages )

Under Wisconsin law, you do not have appraisal rights in connection with the split transaction. For a description of Wisconsin law governing this transaction, see page . Although you will not have

5

appraisal rights in connection with the split transaction, you may pursue all available remedies under applicable law.

Date, Time and Place of Special Meeting; Proposal to be Considered at the Special Meeting

(see pages )

Our board of directors is asking for your proxy for use at a special meeting of shareholders to be held on [ ], 2004, at [ ] local time at the Masonic Temple, 325 N. Kane Street, Burlington, Wisconsin 53105, which is next to our main bank location, and at any adjournments or postponements of that meeting. At the special meeting, shareholders will be asked:

- •

- to consider and vote upon a proposal to adopt amendments to our articles of incorporation that will result in a 1-for-2,000 reverse stock split followed immediately by a 2,000-for-1 forward stock split; and

- •

- to consider and vote upon any other matters that may properly be submitted to a vote at the meeting or any adjournment or postponement of the special meeting.

Record Date

(see pages )

You may vote at the special meeting if you owned First Banking Center common stock at the close of business on [ ], 2004, which has been set as the record date. At the close of business on the record date, there were 1,493,683 shares of our common stock outstanding held by approximately 814 record shareholders. You are entitled to one vote on each matter considered and voted upon at the special meeting for each share of common stock you held of record at the close of business on the record date.

Vote Required for Approval

(see pages )

Approval of the split transaction requires the affirmative vote of the holders of a majority in voting power of all outstanding shares of our common stock entitled to vote at the special meeting, or 746,842 of the 1,493,683 outstanding shares. Because the executive officers and directors of First Banking Center and the Bank have the power to vote a total of 138,812 shares, and because we believe that all of them will vote in favor of the transaction, this means a total of 608,030 shares held by shareholders who are not executive officers or directors of the company or the Bank will be required to vote in favor of the transaction for it to be approved. Because the executive officers and directors of First Banking Center and the Bank own only 9.29% of the voting power of our outstanding common stock, there is no assurance that the split transaction will be approved.

Abstentions and broker non-votes will have the effect of a vote "AGAINST" the split transaction. Approval of the split transaction does not require the separate vote of a majority of our unaffiliated shareholders, and no separate vote will be conducted.

You may vote your shares in person by attending the special meeting, or by mailing us your completed proxy if you are unable or do not wish to attend. You can revoke your proxy at any time before we take a vote at the meeting by submitting either a written notice revoking the proxy or a later-dated proxy to our secretary. You may also revoke your proxy by attending the meeting and voting in person.

6

Provisions for Unaffiliated Shareholders

(see pages )

First Banking Center has not made any provisions in connection with the split transaction to grant unaffiliated shareholders access to our corporate files or the files of the continuing shareholders, or to obtain counsel or appraisal services for unaffiliated shareholders at our expense or at the expense of the continuing shareholders.

7

QUESTIONS AND ANSWERS ABOUT THE SPLIT TRANSACTION

- Q:

- What is the date, time and place of the special meeting?

- A:

- The special meeting of our shareholders will be held on [ ], 2004, at [ ] local time at the Masonic Temple, 325 N. Kane Street, Burlington, Wisconsin 53105, which is next to our main bank location, to consider and vote upon the split transaction proposal.

- Q:

- What is the proposed split transaction?

- A:

- We are proposing that our shareholders approve a reverse 1-for-2,000 stock split followed immediately by a forward 2,000-for-1 stock split of our outstanding common stock.

The purpose of the split transaction is to allow us to terminate our SEC-reporting obligations (referred to as "going private") by reducing the number of our record shareholders to less than 300. This will allow us to terminate our registration under the Securities Exchange Act of 1934, as amended, and relieve us of the costs typically associated with the preparation and filing of public reports and other documents.

- Q:

- What will I receive in the split transaction?

- A:

- If you own in record name fewer than 2,000 shares of our common stock on the date of the reverse stock split, you will receive $60.00 in cash from us for each pre-split share you own. If you own in record name 2,000 or more shares of our common stock on the date of the reverse stock split, you will not receive any cash payment for your shares in connection with the split transaction and will continue to hold the same number of shares of our common stock as you did before the split transaction.

- Q:

- Why is 2,000 shares the "cutoff" number for determining which shareholders will be cashed out and which shareholders will remain as shareholders of First Banking Center?

- A:

- The purpose of the split transaction is to reduce the number of our record shareholders to fewer than 300, which will allow us to de-register as an SEC-reporting company. Our board selected 2,000 shares as the "cutoff" number in order to enhance the probability that after the split transaction, if approved, we will have fewer than 300 record shareholders.

- Q:

- May I buy additional shares in order to remain a shareholder of First Banking Center?

- A:

- Yes. The key date for acquiring additional shares is [ ], 2004. So long as you are able to acquire a sufficient number of shares so that you are the record owner of 2,000 or more shares by [ ], 2004, your shares of common stock will not be cashed out by the split transaction.

- Q:

- What if I hold my shares in "street name"?

- A:

- The split transaction will be effected at the record shareholder level. This means that we will look at the number of shares registered in the name of a single holder to determine if that holder's shares will be cashed out. So for shares held in "street name," because it is likely that your brokerage firm holds 2,000 or more shares total, you will not be cashed out, even if fewer than 2,000 shares are held on your behalf. If you hold shares in "street name," you should talk to your broker, nominee or agent to determine how the split transaction will affect you.

- Q:

- What is the recommendation of our board of directors regarding the proposal?

- A:

- Our board of directors has determined that the split transaction is advisable and in the best interests of First Banking Center's unaffiliated shareholders. Our board of directors has unanimously approved the split transaction and recommends that you vote "FOR" approval of this matter at the special meeting.

8

- Q:

- When is the split transaction expected to be completed?

- A:

- If the proposed amendments to our articles of incorporation and split transaction are approved at the special meeting, we expect the split transaction to be completed on the date of the special meeting.

- Q:

- Who is entitled to vote at the special meeting?

- A:

- Holders of record of our common stock as of the close of business on [ ], 2004, are entitled to vote at the special meeting. Each of our shareholders is entitled to one vote for each share of our common stock owned at the record date.

- Q:

- What vote is required for our shareholders to approve the split transaction?

- A:

- For the amendments to our articles of incorporation to be adopted and the split transaction to be approved, holders of a majority of the outstanding voting power represented by shares entitled to vote at the special meeting must vote "FOR" the split transaction.

- Q:

- What if the proposed split transaction is not completed?

- A:

- It is possible that the proposed split transaction will not be completed. The proposed split transaction will not be completed if, for example, the holders of a majority of our common stock do not vote to adopt the proposed amendments to our articles of incorporation and approve the proposed split transaction. If the split transaction is not completed, we will continue our current operations, and we will continue to be subject to the reporting requirements of the SEC.

- Q:

- What happens if I do not return my proxy card?

- A:

- Because the affirmative vote of the holders of a majority of the shares of our common stock outstanding on the record date is required to approve the split transaction, unless you vote in person, a failure to return your proxy card will have the same effect as voting against the split transaction proposal.

- Q:

- What do I need to do now?

- A:

- After carefully reading and considering the information contained in this proxy statement, please vote your shares of common stock as soon as possible. You may vote your shares by returning the enclosed proxy or by voting in person at the special meeting of shareholders. This proxy statement includes detailed information on how to cast your vote.

- Q:

- If my shares are held for me by my broker, will my broker vote those shares for me?

- A:

- Your broker will vote your shares only if you provide instructions to your broker on how to vote. You should instruct your broker on how to vote your shares using the voting instruction card provided by your broker.

- Q:

- Can I change my vote after I have mailed my proxy card?

- A:

- Yes. You can change your vote at any time before your proxy is voted at the special meeting by following the procedures outlined in this proxy statement.

- Q:

- Do I need to attend the special meeting in person?

- A:

- No. You do not have to attend the special meeting to vote your First Banking Center shares.

- Q:

- Will I have appraisal or dissenter's rights in connection with the split transaction?

- A:

- No. Under Wisconsin law, which governs the split transaction, you do not have the right to demand the appraised value of your shares or any other dissenter's rights if you vote against the

9

proposed split transaction. Your rights are described in more detail under "Special Factors—Appraisal Rights and Dissenter's Rights; Escheat Laws" at page .

- Q:

- Should I send in my stock certificates now?

- A:

- No. If you own in record name fewer than 2,000 shares of common stock of record after the split transaction is completed, our transfer agent will send you written instructions for exchanging your stock certificates for cash. If you own in record name 2,000 or more shares of our common stock, you will continue to hold the same shares after the split transaction as you did before.

- Q.

- Where can I find more information about First Banking Center?

- A.

- We file periodic reports and other information with the SEC. You may read and copy this information at the SEC's public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at the Internet site maintained by the SEC athttp://www.sec.gov. General information about us is available at our Internet site athttp://www.firstbankingcenter.com; the information on our Internet site isnot incorporated by reference into this proxy statement and doesnot form a part of this proxy statement. For a more detailed description of the information available, please see page .

- Q.

- Who can help answer my questions?

- A.

- If you have questions about the split transaction after reading this proxy statement or need assistance in voting your shares, you should contact [ ],[ ], at (800) [ ] (toll-free) or [( ) ] (call collect).

10

SPECIAL FACTORS

Overview of the Split Transaction

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors of First Banking Center, Inc., a Wisconsin corporation, and is to be used at a special meeting at which our shareholders will be asked to consider and vote upon a proposal to amend our articles of incorporation. If approved, the amendments will result in a 1-for-2,000 reverse split of our common stock, followed immediately by a 2,000-for-1 forward split of our common stock.

If the reverse and forward stock splits are approved as described below, record holders of less than 2,000 shares of our common stock prior to the reverse split will no longer be shareholders of the company. Instead, those shareholders will be entitled only to receive payment of $60.00 per share of common stock held prior to the reverse split. Record shareholders holding 2,000 or more pre-split shares will remain shareholders. We intend, immediately following the split transaction, to terminate the registration of our shares under the Securities Act of 1933, as amended, and our registration and further reporting under the Securities Exchange Act of 1934, as amended.

If approved by our shareholders at the special meeting and implemented by our board of directors, the split transaction will generally affect our shareholders as follows:

SHAREHOLDER POSITION PRIOR

TO SPLIT TRANSACTION

| | EFFECT OF SPLIT TRANSACTION

|

|---|

| Shareholders holding in record name 2,000 or more shares of common stock | | Shares will no longer be eligible for public trading; although our shares are not actively traded currently, this means that brokers will no longer actively make a market in our common stock. Sales may continue to be made in privately negotiated transactions. |

|

Shareholders holding in record name fewer than 2,000 of shares of common stock |

|

Shares will be converted into $60.00 per share of common stock outstanding immediately prior to the reverse split for those shareholders holding in record name less than 2,000 pre-split shares of common stock. |

|

Shareholders holding common stock in "street name" through a nominee (such as a bank or broker) |

|

The split transaction will be effected at the record shareholder level. Therefore, regardless of the number of beneficial holders or the number of shares held by each beneficial holder, shares held in "street name" will be subject to the forward split, and the beneficial holders who hold their shares in "street name" will be continuing shareholders with the same number of shares as before the split transaction. |

The effects of the split transaction on each group of unaffiliated shareholders are described more fully below under "—Effects of the Split Transaction on Shareholders of First Banking Center," and the effects on the company are described more fully below under "—Effects of the Split Transaction on First Banking Center; Plans or Proposals after the Split Transaction."

11

Background of the Split Transaction

As an SEC reporting company, we are required to prepare and file with the SEC, among other items, the following:

- •

- Annual Reports on Form 10-K;

- •

- Quarterly Reports on Form 10-Q;

- •

- Proxy Statements and related materials as required by Regulation 14A under the Securities Exchange Act; and

- •

- Current Reports on Form 8-K.

In addition to the burden on management, the costs associated with these reports and other filing obligations comprise a significant corporate overhead expense. These costs include securities counsel fees, auditor fees, special board meeting fees, costs of printing and mailing shareholder documents, and word processing, specialized software and filing costs. These registration and reporting related costs have been increasing over the years, and we believe they will continue to increase, particularly as a result of the additional reporting and disclosure obligations imposed on SEC-reporting companies by the recently enacted Sarbanes-Oxley Act of 2002.

As of[ ], 2004, there were 1,493,683 shares of our common stock issued and outstanding, held by approximately 814 current record shareholders and, to our knowledge, approximately 193 persons who hold their shares in "street name" through brokers or other intermediaries. Of our approximately 814 shareholders, we believe approximately 80.3% hold fewer than 2,000 shares. Our board of directors and management believe that the recurring expense and burden of our SEC-reporting requirements described above, coupled with the time and expense of maintaining so many shareholder accounts, are not cost efficient for First Banking Center. Becoming a non-SEC reporting company will allow us to avoid these costs and expenses.

There can be many advantages to being a public company, possibly including a higher stock value, a more active trading market and the enhanced ability to use company stock to raise capital or make acquisitions. However, there is a limited market for our common stock, and we have therefore not been able to effectively take advantage of these benefits. For example, we believe that in recent years the public marketplace has had less interest in public companies with a small market capitalization and a limited amount of securities available for trading. We believe it is highly speculative whether our common stock would ever achieve significant market value with an active and liquid market comprised of many buyers and sellers. In addition, as a result of our limited trading market, we are unlikely to be well-positioned to use our public company status to raise capital in the future through sales of our common stock in a public offering or to acquire other business entities using our stock as consideration. Moreover, our limited trading market and the fact that our common stock is not listed on any exchange or on the OTCBB could make it difficult for our shareholders to liquidate a large number of shares of our stock without negatively affecting the per share sale price. The split transaction will allow our small shareholders to sell their shares at a fixed price that will not decline based upon the number of shares sold, and allow them to do so without incurring typical transaction costs. Therefore, our board of directors and management have concluded that the benefits of being an SEC-reporting company are substantially outweighed by the burden on management and the expense related to the SEC reporting obligations. The board considered that many of the factors arguing in favor of de-registration, including eliminating costs associated with registration and allowing management to focus on customers, community and core business initiatives, had been in existence for some time, and felt that the increasingly stringent regulation brought on by the Sarbanes-Oxley Act would only make these factors more compelling as time went on. In addition, as the board evaluated the company's overall strategic planning process, they determined that there was excess capital available, which could best be put to use to begin to undertake a deregistration transaction. As a result

12

of the confluence of these factors in the second quarter of this year, the board determined at that time that it would be beneficial to consider the pursuit of such a transaction. Please refer to "—Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation" for a further discussion of the reasons supporting the split transaction.

As a result of the board's conclusions, our management began to explore the possibility of reducing our number of record shareholders to below 300 in order to terminate our periodic reporting obligations to the SEC.

In May of 2003, our board initially began to evaluate generally the advantages and disadvantages of repurchasing shares from shareholders. At this time, an investment banker from Howe Barnes Investments, Inc. spoke informally to the board regarding the possible methods of repurchasing shares, including an open market repurchase plan, a fixed price tender offer and a dutch auction tender offer. Although the board discussed these options at its regularly-scheduled May and June meetings in 2003, no formal action was taken, and the board did not focus on terminating our reporting obligations. In April 2004, the board renewed discussions of repurchasing shares, with a focus on becoming a non-SEC reporting company, because of the increasingly high costs. At this time, the board discussed the general steps involved, and determined to meet with counsel to discuss its options in further detail.

On May 6, 2004, Brantly Chappell, our President and Chief Executive Officer, and James Schuster, our Chief Financial Officer, met with representatives of Barack Ferrazzano Kirschbaum Perlman & Nagelberg LLP, prospective legal counsel; Ryan Beck & Co., prospective financial advisors; and McGladrey and Pullen, LLP, our independent accountants, to discuss alternatives to better manage our large shareholder base and thinly-traded common stock. The alternatives considered included a possible going private transaction, various structures of which were discussed, as well as alternatives to a going private transaction, such as a tender offer, stock repurchases on the open market and other methods of reducing the number of outstanding shares of our common stock (although not necessarily the number of our record shareholders), as well as continuing operations as a public company. Subsequent to this meeting, Messrs. Chappell and Schuster considered these discussions and evaluated the costs associated with a potential going private transaction and the ongoing costs of remaining an SEC-reporting company.

At a regular meeting of the board of directors held on June 14, 2004, management made a presentation to the board concerning our strategic alternatives, including the potential advantages and disadvantages of a going private transaction and continuing operations as an SEC-reporting company. At this meeting, after substantial discussion of the alternatives, the board of directors directed management to further analyze the costs and benefits of a going private transaction. The board further authorized management to retain Barack Ferrazzano as our legal counsel and Ryan Beck as our financial advisor for this purpose. Our board's determination to evaluate a going private transaction was based, among other things, on:

- •

- the administrative burden and expense of making our periodic filings with the SEC;

- •

- the increased flexibility, as a non-SEC reporting company, that management might have to consider and initiate actions that may produce long-term benefits and growth;

- •

- the administrative burden and expense of maintaining numerous shareholder accounts;

- •

- the low trading volume of our common stock and the resulting lack of an active market for our shareholders; and

- •

- the estimated expense of a going private transaction.

On June 28, 2004, Messrs. Chappell and Schuster and John S. Smith, our Secretary and the President and Trust Officer of the Bank, met with representatives of Barack Ferrazzano and Ryan Beck to further discuss a potential going private transaction, the benefits of effecting a reverse stock split and

13

the steps involved, including the valuation report and fairness opinion to be obtained from Ryan Beck and financing alternatives. We retained Barack Ferrazzano as our legal counsel on that date.

At a regular meeting of the board held on July 12, 2004, management presented its report on the further exploration of a going private transaction. At the meeting, representatives of Barack Ferrazzano advised the board on the methods for proceeding with a going private transaction. Barack Ferrazzano reviewed with the board alternative methods of effecting the transaction and the potential advantages to the use of a stock split transaction as a preferred method to achieve this result. For a discussion of the alternatives considered,see "—Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation" below. Representatives of Barack Ferrazzano also discussed with the board various other corporate and securities law matters applicable to the transaction, including the possible creation of an independent special committee of the board of directors comprised of independent members of the board to review and evaluate the proposed transaction on behalf of our shareholders, as well as possibly structuring the transaction to include "neutralized voting," whereby separate approval by a majority of those shareholders who are not our executive officers or directors would be required in order to consummate the transaction.

Following discussion, the board unanimously determined not to form an independent special committee to evaluate the proposed split transaction. In making this determination, the board took into consideration the fact that our board members would be treated the same as other shareholders in the transaction, that it was expected that all of our board members would be continuing shareholders following the split transaction, and that the 2,000 share cutoff number had been proposed, and ultimately was selected as described below, solely because the board felt that it was the most efficient and effective means to assure reduction in our shareholders to fewer than 300, with no consideration in this selection being given to the level of board share ownership. As a result, the board felt that consideration of the transaction by the full board was a sufficient procedural safeguard that made it unnecessary to form a special committee.

The board also unanimously determined not to offer neutralized voting, or approval of the transaction by a majority of unaffiliated shareholders. Because affiliated and unaffiliated shareholders would be treated identically under the terms of the split transaction as proposed, the board did not believe that this procedural safeguard was a necessary measure. Although the board of directors believes that the procedural safeguards of a special committee and neutralized voting were not necessary, in rendering its determination, the board did consider that the members of the board and the executive officers of the company control approximately 8.81% of the voting power of our outstanding common stock and would control an increased percentage following the proposed transaction.See "—Effects of the Split Transaction on First Banking Center; Plans or Proposals After the Split Transaction—Effect on our Directors and Executive Officers" for a further discussion of the effect on director and executive officer share ownership.

Barack Ferrazzano also discussed with the board the application to the transaction of the going private statute adopted by the Wisconsin Department of Financial Institutions, Division of Securities, and the fact that obtaining recommendations from two independent appraisers with respect to the consideration to be paid in the transaction may result in a presumption that the consideration was fair under Wisconsin law. The board considered that obtaining an additional valuation or appraisal would likely result in a material additional cost to us, and that the presumption created by the second valuation would still be rebuttable by any shareholder who presented contrary evidence. Because our board felt that the valuation coupled with the fairness opinion would provide sufficient procedural safeguards with respect to the cash to be paid to the non-continuing shareholders, the board determined that it would be unnecessary to incur the additional cost associated with obtaining a second recommendation from a second independent appraiser, notwithstanding the possible presumption of fairness under Wisconsin law.

14

Also at the July 12 meeting of the board of directors, representatives of Ryan Beck explained to the board the methodologies that would be used in its valuation of the value of our common stock. Ryan Beck also presented alternatives for the financing of the reverse stock split, including a dividend from the Bank, the issuance of trust preferred securities and obtaining senior debt from a financial institution. Following a lengthy discussion and consideration of the matters discussed, the board authorized management to continue pursuing a going private transaction structured as a reverse stock split followed by a forward stock split and authorized management to enter into an engagement letter with Ryan Beck which provided for the preparation by Ryan Beck of a valuation of our common stock, and the issuance of a fairness opinion regarding the consideration to be paid by us in the reverse stock split to non-continuing shareholders. The board also authorized management and Ryan Beck to continue to explore the three methods of financing discussed by Ryan Beck.

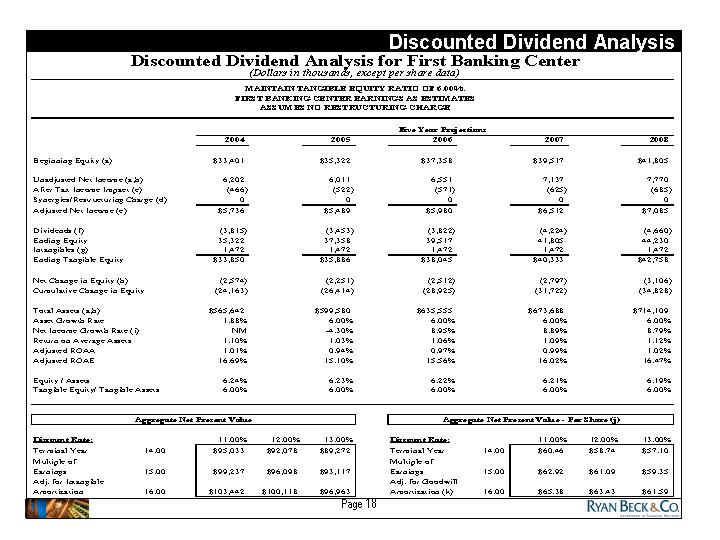

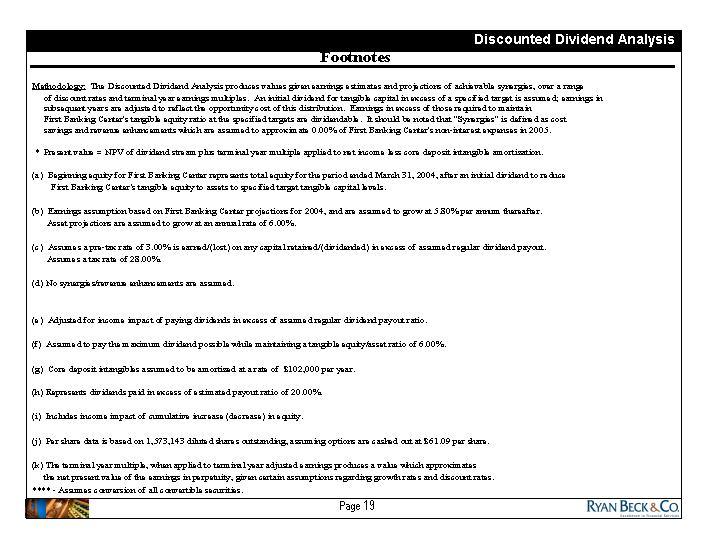

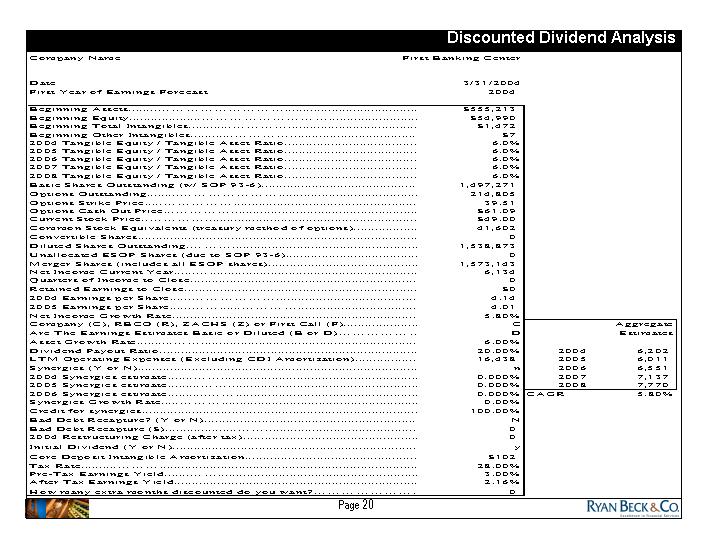

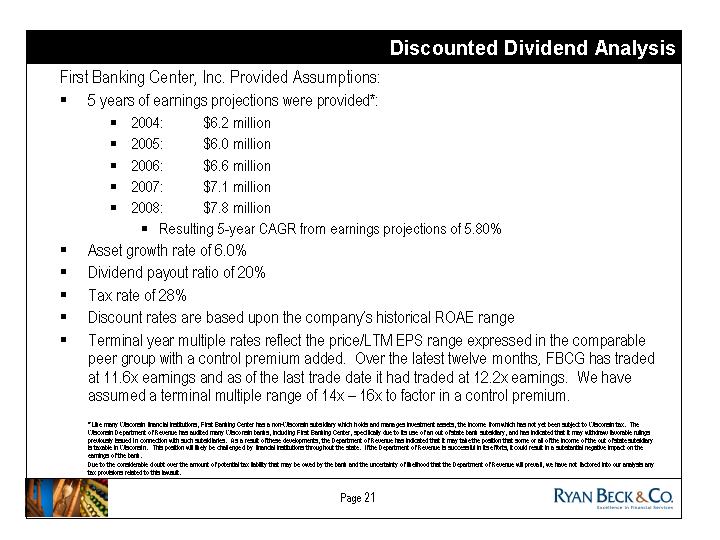

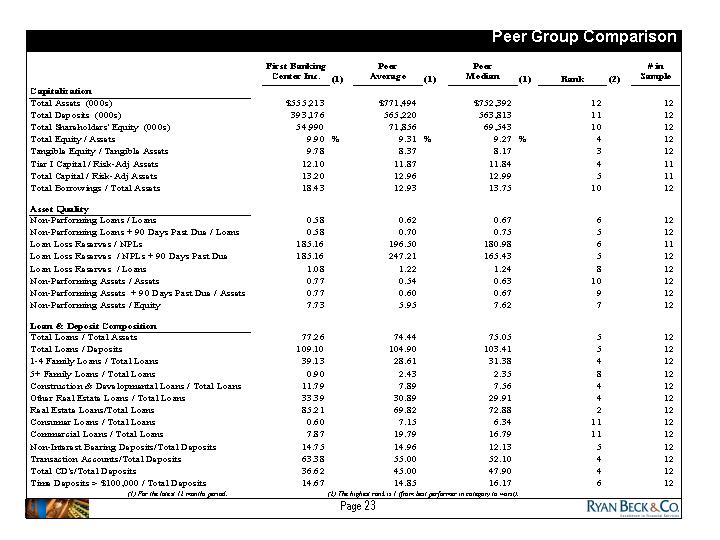

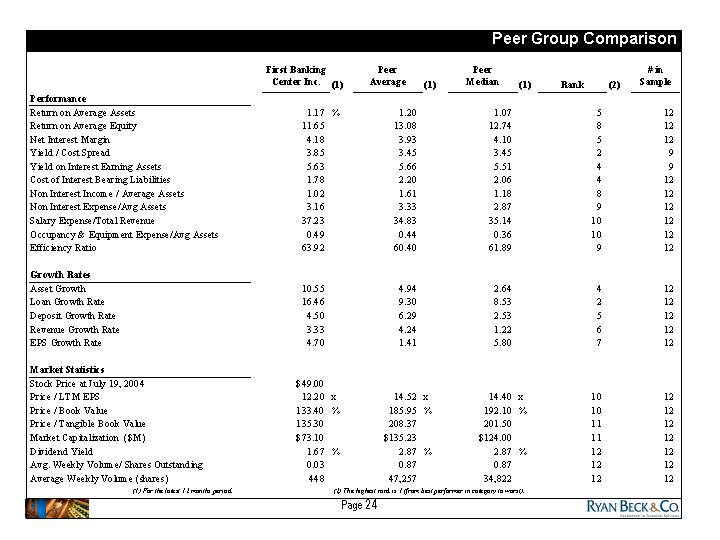

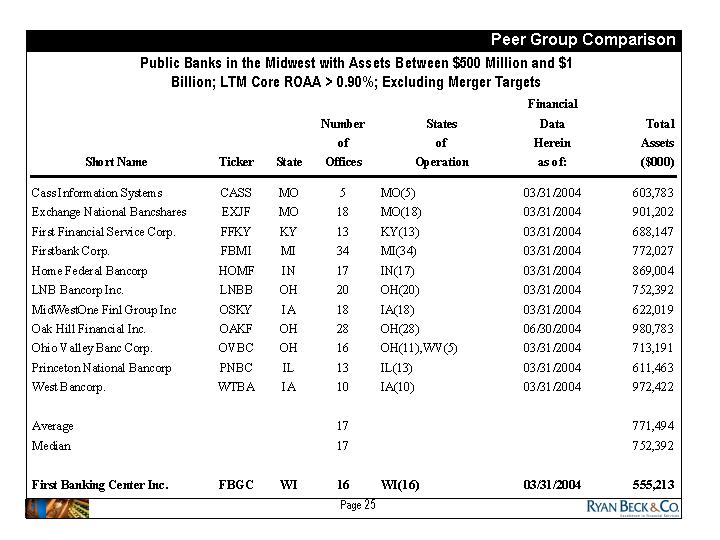

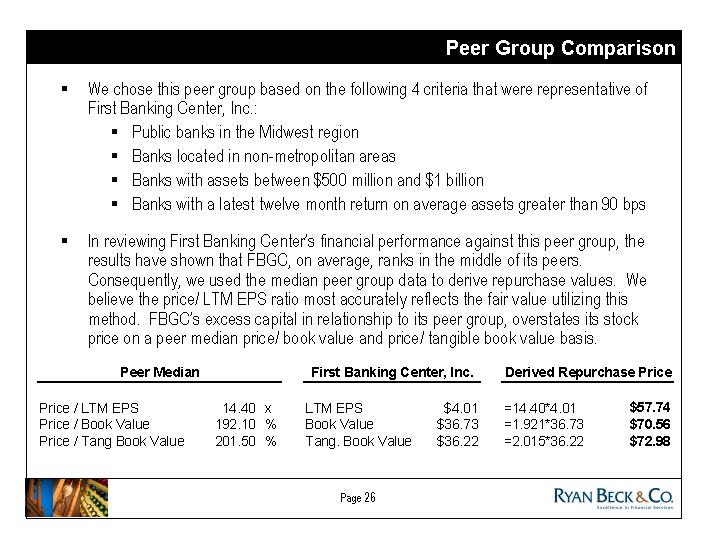

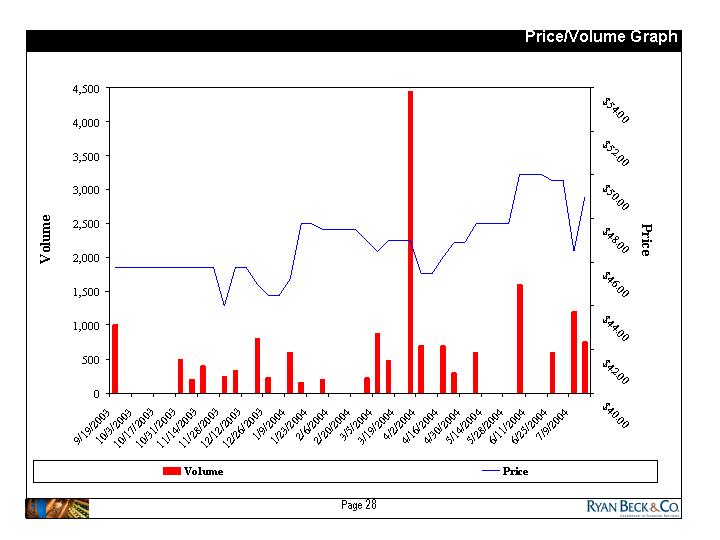

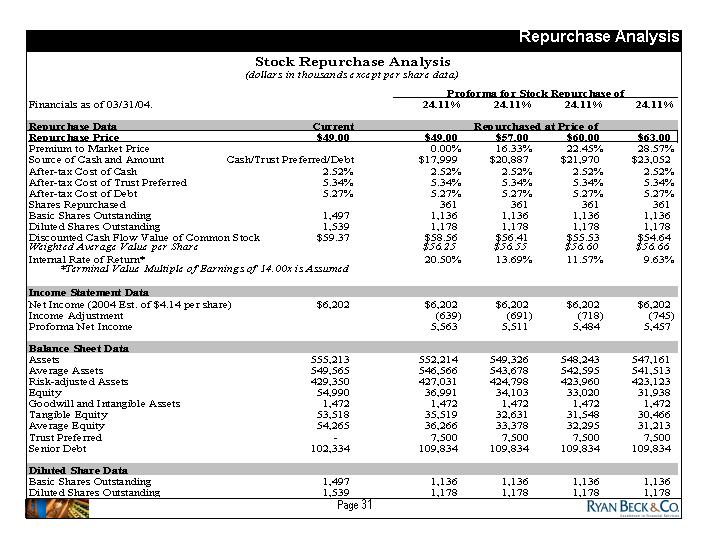

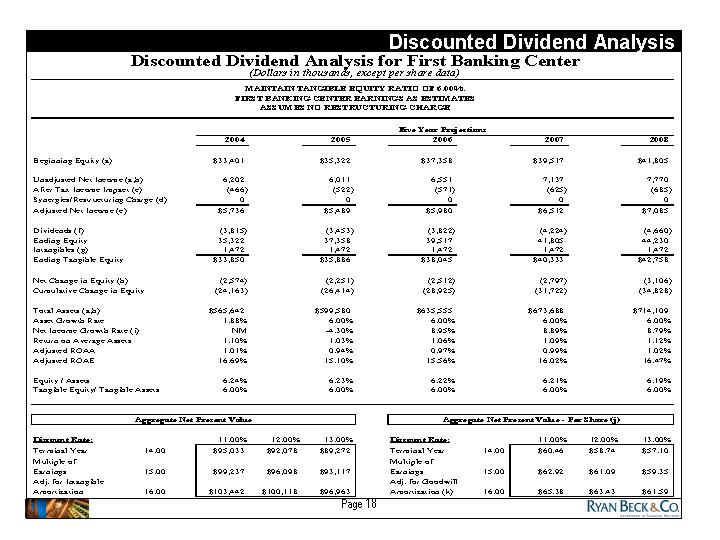

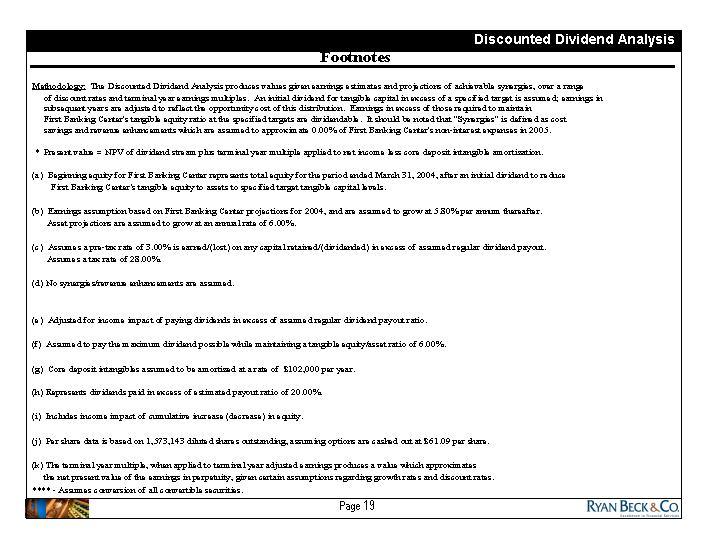

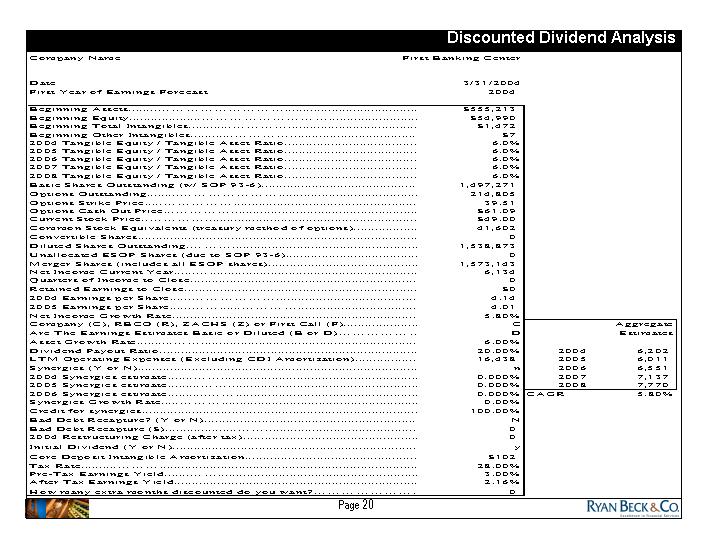

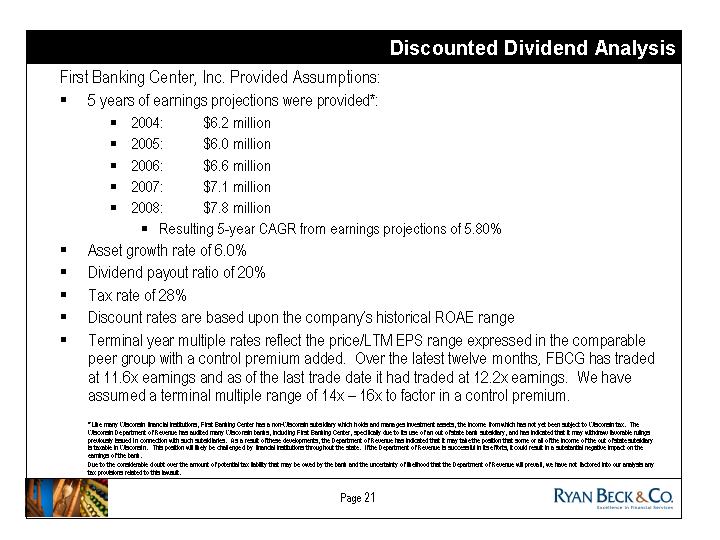

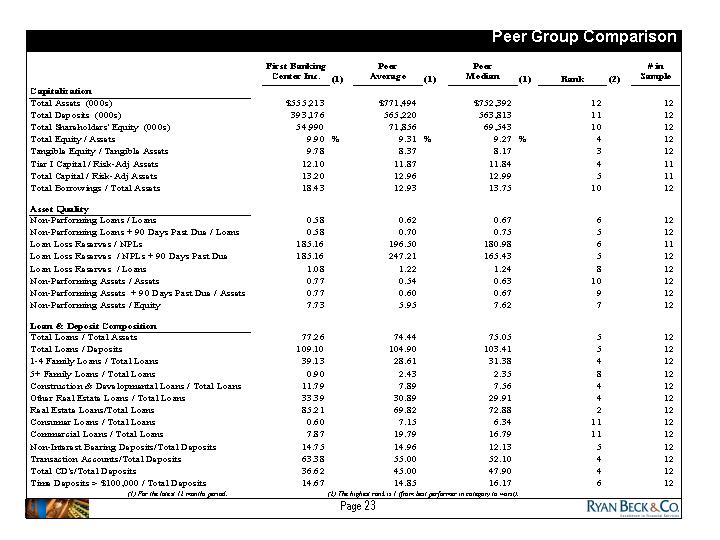

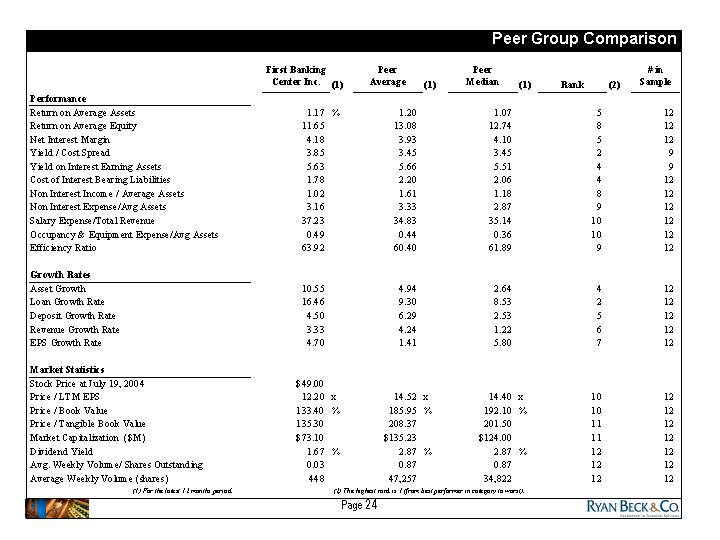

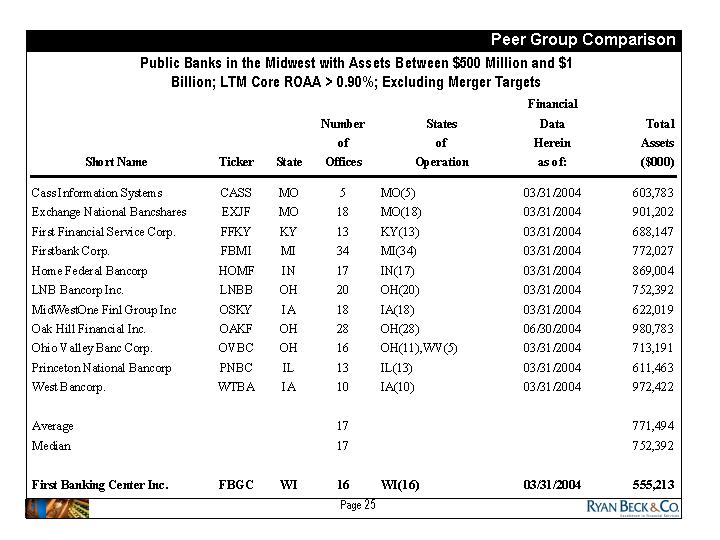

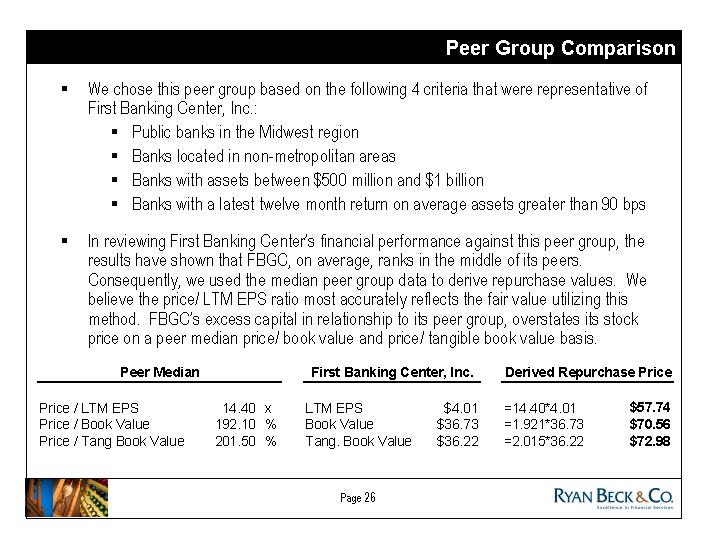

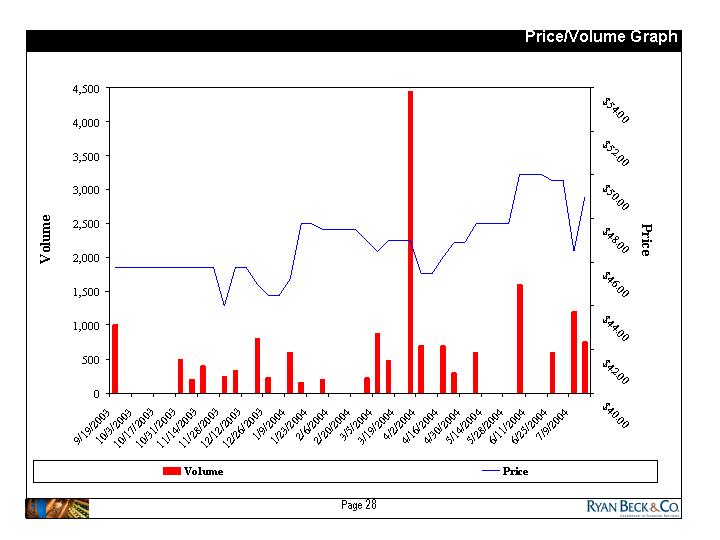

At a special meeting of the board of directors held on July 26, 2004, a representative of Barack Ferrazzano reviewed with the board the presentation made by Barack Ferrazzano at the July 12, 2004 meeting. In particular, counsel reviewed with the board the various corporate and securities laws that would need to be taken into consideration, the alternative methods of completing a transaction that would allow us to deregister our shares, and the legal effects of each, the regulatory processes involved, and procedural matters. Following the legal presentation, Ryan Beck delivered to the board of directors its report, dated July 26, 2004, on the valuation of our common stock. The Ryan Beck valuation report indicated that the fair value of our common stock, as of July 19, 2004, ranged from $57.00 to $63.00 per share. Ryan Beck's report and its presentation to the board provided the board with a detailed explanation of the financial analyses supporting the range of values and the methods utilized in preparing its valuation report. The valuation report also included a general discussion of approaches to valuation, and an analysis of our financial condition. Additionally, the valuation report included a discounted dividend analysis of First Banking Center, historical trading information for a "peer" group of publicly traded bank holding companies of comparable size to us ($500 million—$1 billion in assets) located in the Midwest, and information on our historical stock price performance on a stand-alone and relative basis. The valuation report also included a discussion of the assumptions made by Ryan Beck in preparing the report as well as certain other limiting conditions.See "—Valuation of Financial Advisor; Fairness Opinion."

After reviewing the valuation report of Ryan Beck and considering the review by Barack Ferrazzano, the board renewed its discussions as to whether it was in our best interests and our shareholders to engage in the proposed transaction. After thorough discussion of the proposed transaction and the Ryan Beck valuation report, which discussion was held both with and without Ryan Beck representatives present, the board determined that it would make its decision as to whether to proceed with a split transaction and, if so, at what value, at a board meeting to be held on August 9, 2004.

On August 2, 2004, members of our management met with the Wisconsin Department of Financial Institutions to discuss the terms and potential effects of the proposed split transaction.

On August 9, 2004, at its regular board meeting, the board once again considered the proposed split transaction. After additional lengthy discussion both with and without Ryan Beck representatives present, the board unanimously approved the split transaction by means of a 1 for 2,000 reverse stock split followed by a 2,000 for 1 forward stock split, pursuant to which shareholders owning less than 2,000 shares would receive $60.00 in cash for their pre-split shares of our common stock. The board arrived at the $60.00 per share price by taking the average of the values determined by Ryan Beck to represent fair values for the common stock. In its judgment, the board felt that taking the average of these values was an appropriate method of arriving at a final per share price because, based on the Ryan Beck valuation, any of the prices, from the low of $57.00 to the high of $63.00, would provide fair value to the shareholders. Following the board's determination of the $60.00 per share price, Ryan Beck delivered its oral opinion that, subject to various assumptions and matters considered by Ryan

15

Beck, the $60.00 per share cash consideration to be paid to shareholders holding less than 2,000 shares of our common stock prior to the reverse stock split was fair from a financial point of view to our shareholders who will be cashed out in the transaction.

In approving the split transaction, the board took into consideration the fact that, because shareholders would be aware of the 2,000 share cutoff for participating in the forward split, small shareholders who would still prefer to remain as shareholders of First Banking Center, despite the board's recommendation, could elect to do so by acquiring sufficient shares so that they would hold at least 2,000 shares in their own name immediately prior to the split transaction. This would allow a small shareholder to have some control over the decision as to whether to remain a continuing shareholder after the split transaction is effected, or to be a non-continuing shareholder and receive a cash payment for their shares. In addition, beneficial owners who would be cashed out if they were record owners instead of beneficial owners, and who wish to receive a cash payment from First Banking Center as a part of the split transaction, would have the ability to inquire of their broker or nominee as to the procedure and cost, if any, to transfer their shares into a record account into their own name. The board felt that this flexibility helped to balance the interests of the continuing and non-continuing shareholders.

In determining the number of shares a shareholder needed to own in order to remain a shareholder after the split transaction, the board's primary consideration was how best to achieve the goal of becoming a non-SEC reporting company while cashing out the fewest number of record shareholders. The board considered a variety of cutoff numbers including using 1,000 shares as the minimum number of shares a shareholder needed to own in order to continue as a shareholder after the split transaction. The board determined, however, that 1,000 shares was too low of a threshold because, although there would be fewer than 300 record shareholders if a transaction were completed at that level, the number of continuing shareholders would be reduced to 277, a level that the board felt was too high and would not allow enough room for growth going forward. In addition, the board considered that a higher ratio would also sufficiently reduce the shares outstanding so that re-registration of the common stock would not be required in the near future, even if continuing shareholders who hold their shares in street name transfer ownership of their shares into their record names. Therefore, although more expensive, the board selected 2,000 shares as the minimum number of shares required to remain as a record shareholder. This number was chosen because it represented a cut-off among shareholders that would likely result, after completion of the split transaction, in the number of record shareholders being less than the 300 record shareholder limit necessary to terminate our reporting requirements with the SEC. At the same time, this would result in a relatively moderate number of shares (estimated at approximately 360,876, or 24.2%, of our outstanding shares at the time of the meeting) being cashed-out in the proposed split transaction.

The board determined that the proposed transaction was fair to our unaffiliated shareholders, and specifically with respect to the unaffiliated, non-continuing shareholders receiving cash in the split transaction. In making this determination, the board did not utilize the following procedural safeguards:

- •

- the split transaction was not structured to require separate approval by a majority of those shareholders who are not our executive officers or directors of First Banking Center or the Bank; and

- •

- the board of directors did not retain any unaffiliated representative to act solely on behalf of shareholders who are not officers or directors of First Banking Center or the Bank for purposes of negotiating the terms of the split transaction or to prepare a report regarding the fairness of the transaction.

We have not sought, and have not received, any proposals from third parties for any business combination transactions, such as a merger, consolidation or sale of all or substantially all of our assets. Our board did not seek any such proposals because these types of transactions are inconsistent with the narrower purpose of the proposed transaction, which is to discontinue our SEC reporting obligations.

16

Reasons for the Split Transaction; Fairness of the Split Transaction; Board Recommendation

First Banking Center's Reasons for the Split Transaction

First Banking Center is undertaking the split transaction at this time to end our SEC reporting obligations, which will enable us to save the company and our shareholder the substantial costs associated with being a reporting company, and these costs are only expected to increase over time. The specific factors considered in electing at this time to undertake the split transaction and become a non-SEC reporting company are as follows:

- •

- We estimate that we will eliminate costs and avoid immediately anticipated future costs of approximately $500,000 by eliminating the requirement to make periodic reports and reducing the expenses of shareholder communications. These expenses include legal expenses ($10,000), accounting expenses ($120,000), printing and postage ($2,000), transfer agent fees ($1,000), software and data processing ($15,000), necessitated by a large group of shareholders that hold a small interest in the outstanding shares of common stock. We will also realize cost savings by avoiding the need to add additional staff and from reduced staff and management time ($350,000) spent on reporting and securities law compliance matters and reduced directors' fees relating to additional meetings of the audit committee and meetings related to compliance issues ($2,000). In addition to these annual costs, which we expect to increase over time, we estimate saving approximately $160,000 of one time costs associated with implementing the requirements of the Sarbanes-Oxley Act of 2002;

- •

- We believe that, as a result of the recent disclosure and procedural requirements resulting from the Sarbanes Oxley Act of 2002, the legal, accounting and administrative expense, and diversion of our board of directors, management and staff effort necessary to continue as an SEC-reporting company will continue to increase as regulations implementing the act continue to be issued, without a commensurate benefit to our shareholders. We expect to continue to provide our shareholders with company financial information by disseminating our annual reports, but the costs associated with these reports are substantially less than those we incur currently;

- •

- In the board of directors' judgment, little or no justification exists for the continuing direct and indirect costs of registration with the SEC, which costs have recently increased as a result of heightened government oversight, given the low trading volume in our common stock and the fact that approximately 80.3% of our shareholders hold fewer than 2,000 shares, and given that our earnings are sufficient to support growth and we therefore do not depend on raising capital in the public market, and do not expect to do so in the near future. If it becomes necessary to raise additional capital, we believe that there are adequate sources of additional capital available, whether through borrowing at the holding company level or through private or institutional sales of equity or debt securities, although we recognize that there can be no assurance that we will be able to raise additional capital when required, or that the cost of additional capital will be attractive;

- •

- Operating as a non-SEC reporting company will reduce the burden on our management that arises from the increasingly stringent SEC reporting requirements, thus allowing management to focus more of its attention on our customers and the communities in which we operate;

- •

- Operating as a non-SEC reporting company will increase management's flexibility to consider and initiate actions that may produce long-term benefits and growth;

- •

- The split transaction proposal allows us to discontinue our reporting obligations with the SEC, and allows the non-continuing shareholders to receive fair value and cash for their shares, in a quick and cost-effective manner, particularly given the possible ineffectiveness and inefficiencies of a tender offer, an open market share repurchase or a cash-out merger;

17

- •

- The split transaction will allow the non-continuing shareholders to receive a uniform amount of cash for their shares, even though our shares are not listed on any exchange or the OTCBB and are not actively traded. The split transaction will enable small shareholders to divest themselves of their positions without the expenditure of efforts disproportionate to the value of their holdings and without transaction expenses;

- •

- The split transaction will allow the non-continuing shareholders to realize what our board has determined to be fair value for their First Banking Center common stock. In reaching this conclusion, our board considered, among other factors, the valuation report prepared by Ryan Beck. In particular, our board considered that the $60.00 price represents 14.96 times earnings for March 31, 2004, and 163.25% of book value, which values are in line with comparable SEC-reporting companies;

- •

- At this point in time, First Banking Center had sufficient excess capital available that it could put to use in strategic planning, and in determining how to best manage and utilize this excess capital, the board determined that the most beneficial use of the funds would be to undertake a de-registration transaction that would allow us to eliminate the costs and realize the other benefits outlined above;

- •

- Because, after evaluating First Banking Center's recent performance and management's expectations as to future performance, the board considered it likely that a transaction could be completed at a lower cost now than if we were to wait, and that therefore a transaction conducted at this time had the greatest likelihood of being completed; and

- •

- Completing the split transaction at this time will allow us to begin to realize the cost savings, will allow our management to redirect its focus to our customers and communities, and will allow the non-continuing shareholders to receive cash for their shares, all at the earliest possible date.

We considered that some shareholders may prefer to continue as shareholders of First Banking Center as an SEC-reporting company, which is a factor weighing against the split transaction. However, we believe that the disadvantages of remaining a public company subject to the registration and reporting requirements of the SEC outweigh any advantages. We have no present intention to raise capital through sales of securities in a public offering in the future or to acquire other business entities using stock as the consideration for such acquisition. Accordingly, we are not likely to make use of any advantage that our status as an SEC-reporting company may offer.

The board realized that many of the benefits of a deregistration transaction, such as eliminating costs associated with registration and allowing management to focus on customers, community and core business initiatives, have been in existence for some time. However, it was not until the board felt the impact over time of the increasingly stringent regulation brought on by the Sarbanes-Oxley Act that it began seriously to consider a strategic transaction that would result in the deregistration of our common stock. Moreover, it was not until the board and management, in connection with the company's overall strategic planning process, determined that we had excess capital available that the board felt the company was in a position to begin to undertake such a transaction. As a result of the confluence of these factors in the second quarter of this year, the board determined that it should undertake the transaction at this time.See "—Background of the Split Transaction."

Other than the cost savings and other benefits associated with becoming a non-SEC reporting company, as outlined above, First Banking Center does not have any other purpose for engaging in the split transaction at this particular time.

In view of the wide variety of factors considered in connection with its evaluation of the split transaction, our board of directors did not find it practicable to, and did not, quantify or otherwise attempt to assign relative weights to the specific factors it considered in reaching its determinations.

18

The split transaction, if completed, will have different effects on the non-continuing shareholders and the continuing shareholders. You should read the discussions under "—First Banking Center's Position as to the Fairness of the Split Transaction" and "—Effects of the Split Transaction on Shareholders of First Banking Center" for more information regarding these effects of the split transaction.

We considered various alternative transactions to accomplish the proposed transaction, but ultimately elected to proceed with the split transaction. The following were the alternative transactions considered, but rejected:

- •

- Odd-lot Tender Offer. The board believed that this alternative might not result in shares being tendered by a sufficient number of record shareholders to reduce the number of shareholders below 300. The board found it unlikely that many holders of small numbers of shares would make the effort to tender their shares given the limited value of the shares and the relative inconvenience associated with a tender.

- •

- Tender Offer to all Unaffiliated Shareholders. Our board of directors determined that we do not have the funds to effect a tender offer and would have to incur an unacceptably high amount of additional debt, if available, in order to effect this transaction. In addition, there might not be a sufficient number of record shareholders tendering their shares to reduce the number of record shareholders below 300, resulting in the requirement of a second-step merger.

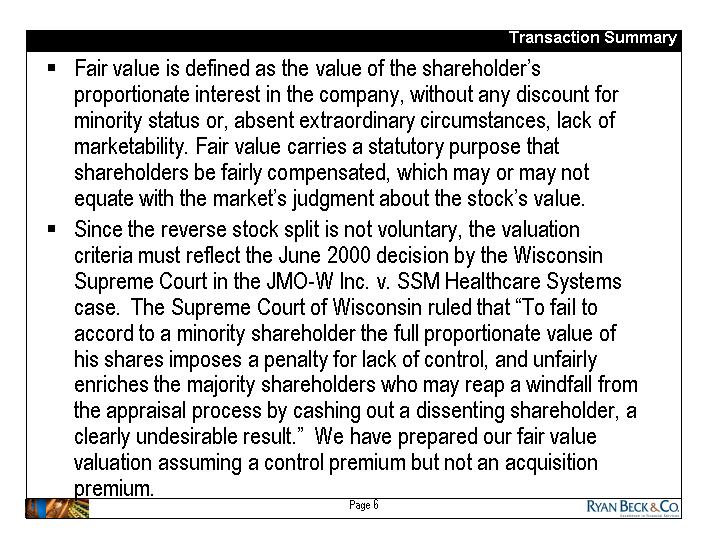

- •