SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, For Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

LTX Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

50 ROSEMONT ROAD

WESTWOOD, MASSACHUSETTS 02090

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 10, 2005

The Annual Meeting of Stockholders of LTX Corporation will be held at the offices of LTX Corporation at 50 Rosemont Road, Westwood, Massachusetts 02090 on November 10, 2005, beginning at 10:00 a.m. local time, for the following purposes:

| | 1. | | To elect two members of the Board of Directors to serve for three-year terms as Class I Directors. |

| | 2. | | To consider and act upon a proposal to amend the Articles of Organization of the Company, as amended to date, to increase the number of authorized shares of common stock, par value $.05 per share, from 100,000,000 shares to 200,000,000 shares. |

| | 3. | | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for its 2006 fiscal year. |

| | 4. | | To transact such other business as may properly come before the meeting and any adjournments thereof. |

The Board of Directors has fixed the close of business on September 29, 2005 as the record date for the Annual Meeting. All holders of common stock of record at that time are entitled to vote at the meeting.

By Order of the Board

JOSEPH A. HEDAL,Secretary

October 14, 2005

Whether or not you expect to attend the meeting, please complete, date and sign the enclosed proxy and mail it promptly in the enclosed envelope to assure representation of your shares, unless you are voting by internet or telephone. No postage need be affixed if mailed in the United States.

LTX CORPORATION

PROXY STATEMENT

October 14, 2005

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of LTX Corporation (“LTX” or the “Company”) of proxies for use at the Annual Meeting of Stockholders to be held on November 10, 2005, and any adjournments thereof (the “2005 Annual Meeting”). Shares as to which a proxy has been executed will be voted as specified in the proxy.

A majority of the votes entitled to be cast on a matter, represented at the meeting in person or by proxy, shall constitute a quorum for the transaction of business on any particular matter to be voted on at the Annual Meeting. Votes withheld from any nominee, abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for such matter.

A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Brokers have the discretion to vote shares on routine matters, but not on non-routine matters. All of the Company’s proposals for the 2005 Annual Meeting are considered routine. Shares which abstain from voting on a particular matter and broker non-votes will not be counted as votes in favor of such matter and will also not be counted as votes cast or shares voting on such matter. As a result, abstentions and broker non-votes will have no effect on Proposals 1 and 3. However, because the proposed amendment to the Company’s Articles of Organization requires approval by a majority of the issued and outstanding shares of common stock entitled to vote, abstentions and broker non-votes will have the same effect as a vote against Proposal 2.

A proxy may be revoked at any time by notice in writing received by the Secretary of the Company before it is voted, by executing a proxy with a later date or by attending and voting at the 2005 Annual Meeting.

Solicitation of proxies by mail is expected to commence on October 14, 2005, and the cost thereof will be borne by the Company. The Company has engaged The Proxy Advisory Group of Strategic Stock Surveillance, LLC to assist in the solicitation of proxies and provide related informational support for a service fee of $9,000. The Company has also agreed to reimburse customary out-of-pocket expenses associated with the solicitation. Copies of solicitation material will also be furnished to brokerage firms, fiduciaries and custodians to forward to their principals, and the Company will reimburse them for their reasonable expenses.

Any stockholder who owns shares of common stock of record may authorize the voting of its shares over the internet athttp://www.eproxyvote.com/ltxx or by telephone by calling 1-877-779-8683, 24 hours a day, 7 days a week, and by following the instructions on the enclosed proxy card. Authorizations submitted over the internet or by telephone must be received by 11:59 p.m. EST on November 9, 2005.

VOTING SECURITIES

The Company’s only issued and outstanding class of voting securities is its common stock, par value $0.05 per share. Each stockholder of record on September 29, 2005 is entitled to one vote for each share registered in such stockholder’s name. As of that date, there were 61,536,392 shares of common stock issued and outstanding.

1

CERTAIN STOCKHOLDERS

The following table sets forth, as of September 21, 2005 (unless otherwise noted), the amount and percentage of outstanding common stock of the Company beneficially owned by (i) each person known by the Company to beneficially own 5% of the Company’s outstanding common stock, (ii) each executive officer named in the Summary Compensation Table under the heading “Compensation of Executive Officers” on page 9, (iii) each director and (iv) all directors and executive officers of the Company as a group, on the basis of information supplied to the Company.

| | | | | |

Name and Address

| | Number of Shares of

Common Stock Beneficially Owned(5)

| | Percent of

Common Stock

| |

FMR Corp.(1) | | 4,879,803 | | 7.9 | % |

Mellon Financial Corporation(2) | | 3,793,685 | | 6.2 | |

Deephaven Capital Management LLC(3) | | 3,695,942 | | 6.0 | |

Capital Group International, Inc.(4) | | 3,633,060 | | 5.9 | |

Roger W. Blethen | | 1,748,211 | | 2.8 | |

David G. Tacelli | | 735,734 | | * | |

Mark J. Gallenberger | | 530,770 | | * | |

David Brown | | 134,321 | | * | |

Peter S. Rood | | 116,313 | | * | |

Robert J. Boehlke | | 156,700 | | * | |

Roger J. Maggs | | 148,375 | | * | |

Samuel Rubinovitz | | 131,700 | | * | |

Robert E. Moore | | 100,375 | | * | |

Stephen M. Jennings | | 93,050 | | * | |

Mark S. Ain | | 69,475 | | * | |

Richard S. Hill | | 64,375 | | * | |

All directors and executive officers as a group (12 persons) | | 4,026,787 | | 6.2 | % |

* Less than 1%

| (1) | | The address for FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109. Beneficial ownership is derived from a Schedule 13G/A filed on August 10, 2005. |

| (2) | | The address for Mellon Financial Corporation is One Mellon Center, Pittsburgh, Pennsylvania 15258. Beneficial ownership is derived from a Schedule 13G/A filed on February 15, 2005. |

| (3) | | The address for Deephaven Capital Management is 130 Cheshire Lane, Suite 102, Minnetonka, Minnesota. Beneficial ownership is derived from a Schedule 13G filed on April 4, 2005. |

| (4) | | The address for Capital Group International, Inc. is 1110 Santa Monica Boulevard, Los Angeles, California 90025. Beneficial ownership is derived from a Schedule 13G/A filed on August 10, 2005. Includes 3,435,260 shares deemed to be beneficially owned by Capital Guardian Trust Company. |

| (5) | | Shares owned by Messrs. Blethen, Tacelli, Gallenberger, Brown, Rood, Boehlke, Maggs, Rubinovitz, Moore, Jennings, Ain, Hill and by all executive officers and directors as a group include 1,669,256 shares, 729,551 shares, 497,750 shares, 133,188 shares, 114,094 shares, 126,700 shares, 140,375 shares, 109,700 shares, 80,375 shares, 86,300 shares, 65,875 shares, 64,375 shares, and 3,817,539 shares, respectively, under options which are presently exercisable or become so within sixty days of September 21, 2005. |

2

ITEM 1. ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three classes. Each class serves three years, with the terms of office of the respective classes expiring in successive years. The current Class I Directors are Messrs. Richard S. Hill, Stephen M. Jennings and Robert E. Moore. The present term of office for the Class I Directors expires at the 2005 Annual Meeting. The nominees for election as Class I Director are Messrs. Jennings and Moore. If re-elected, the Class I nominees will hold office until the Annual Meeting of Stockholders to be held in the year 2008. Mr. Hill will not be standing for election as a Class I Director and this decision was not a result of any disagreement with the Company or any matter relating to the Company’s operations, policies or practices.

Unless a proxy is marked to withhold authority for the election of either or both of the nominees for Class I Directors, then the persons named in the proxy will vote the shares represented by the proxy for the election of both of the nominees for Class I Directors. If the proxy indicates that the stockholder wishes to withhold a vote from a Class I Director nominee, such instructions will be followed by the persons named in the proxy. Management has no reason to believe that either of the nominees will be unable to serve. In the event that a nominee should not be available, the persons named in the proxies will vote for the other nominee and may vote for a substitute for such nominee.

Set forth below is information for each of the nominees for Class I Directors to be elected at the 2005 Annual Meeting, and for each of the Class II Directors and Class III Directors who will continue to serve until the Annual Meetings of the Stockholders to be held in 2006 and 2007, respectively.

Nominees to Serve a Three-Year Term Expiring at the 2008 Annual Meeting (Class I Directors)

| | |

Name

| | Business Affiliations

|

Stephen M. Jennings | | Mr. Jennings, age 44, was elected a Director of the Company in 1997. Mr. Jennings has been a Director of Monitor Company, a strategy consulting firm, since 1996. From 1988 to 1996, he was a consultant to that company. Mr. Jennings is a director of Aspen Technology, Inc. |

| |

Robert E. Moore | | Mr. Moore, age 67, has been a Director of the Company since 1989. Mr. Moore was Chief Executive Officer and Chairman of Reliable Power Meters, Inc., a company that manufactures and sells power measurement instruments, from the time he founded it in 1992 until April 2002 when it was purchased by Fluke Corporation. From April 2002 until September 2003, he was acting President of that company. He also was a founder of Basic Measuring Instruments, Inc., which manufactures and sells power measurement instruments. He served as a director of that company from 1982 until 1990 and as a Senior Vice President responsible for marketing and sales from 1985 until 1990. |

Directors Serving a Three-Year Term Expiring at the 2006 Annual Meeting (Class II Directors)

| | |

Name

| | Business Affiliations

|

Roger W. Blethen | | Mr. Blethen, age 54, has been a Director since 1980 and was appointed Chairman of the Board in December 2001. He has been Chief Executive Officer of the Company since September 1996. Effective November 1, 2005, Mr. Blethen will no longer serve as Chief Executive Officer but will continue as Chairman of the Board. Mr. Blethen was a President of the Company from 1994 to 1996 and a Senior Vice President of the Company from 1985 until 1994. Mr. Blethen was a founder of the Company and served in a number of senior management positions with the Company since its formation in 1976. |

3

| | |

Name

| | Business Affiliations

|

Robert J. Boehlke | | Mr. Boehlke, age 64, was elected a Director of the Company in 1997. Mr. Boehlke was Executive Vice President and Chief Financial Officer of KLA-Tencor Corporation, a position he held from 1990 until his retirement in 2000. Between 1983 and 1990, he held a variety of management positions with that company. Prior to his employment by KLA-Tencor, Mr. Boehlke was a partner at the investment banking firm of Kidder, Peabody & Company, Inc. from 1971 until 1983. Mr. Boehlke is a director of MEMC Electronic Materials, Inc. and Tessara Technologies, Inc. |

| |

Roger J. Maggs | | Mr. Maggs, age 59, was elected a Director of the Company in 1994. Mr. Maggs is currently a partner at Celtic House Investment Partners, a private investment firm. Mr. Maggs was a Vice President of Alcan Aluminum Limited from 1986 until 1994. |

Directors Serving a Three-Year Term Expiring at the 2007 Annual Meeting (Class III Directors)

| | |

Name

| | Business Affiliations

|

Mark S. Ain | | Mr. Ain, age 62, was elected a Director of the Company in September 2001. Since founding Kronos Incorporated in 1977, Mr. Ain has held the position of Chairman and Chief Executive Officer. From 1974 to 1977, Mr. Ain was a consultant, specifically in strategic planning, product development, market research and organizational development. Prior to that, he was employed by Digital Equipment Corporation both in product development and as Sales Training Director. Mr. Ain serves as a director of Kronos Incorporated, American Electronics Association (AeA) and KVH Industries, Inc. |

| |

Samuel Rubinovitz | | Mr. Rubinovitz, age 75, was elected a Director of the Company in 1994 and served as Chairman of the Board from December 1997 to 2001. He was Executive Vice President of EG&G, Inc., responsible for the aerospace, optoelectronics and instrument product groups from 1989 until his retirement in 1994. He is a director of Richardson Electronics, Ltd. and Kronos Incorporated. |

| |

David G. Tacelli | | Mr. Tacelli, age 46, was elected a Director of the Company, effective November 1, 2005. He will also assume the position of Chief Executive Officer of the Company effective November 1, 2005. Mr. Tacelli has been with the Company for 17 years and has been President and Chief Operating Officer since 2002. Prior to his promotion to President and Chief Operating Officer, Mr. Tacelli served as Executive Vice President from 1999 to 2002. He was also Chief Financial Officer and Treasurer from 1998 to 2000 and Vice President of Operations from 1996 to 1998. He has held other leadership positions at the Company in sales management, manufacturing and customer service. Mr. Tacelli joined LTX in 1988 after seven years at Texas Instruments in various management positions. |

4

Retiring Director

| | |

Name

| | Business Affiliations

|

Richard S. Hill | | Mr. Hill, age 53, was elected a Director of the Company in October 2001. Mr. Hill is currently Chief Executive Officer of Novellus Systems, Inc., a position he has held since 1993. He has also been Chairman of the Board of Directors of Novellus since 1996. Between 1981 and 1993, Mr. Hill was employed by Tektronix, Inc., an electronics company, where he held a variety of management positions. Prior to joining Tektronix, Mr. Hill held engineering management positions at General Electric, Motorola and Hughes Aircraft Company. Mr. Hill serves as a director of Novellus Systems, Inc. and Agere Systems Inc. |

Required Vote; Board Recommendation

The affirmative vote of the holders of a plurality of the Company’s outstanding common stock present in person or by proxy and voting at the 2005 Annual Meeting is required to elect the Class I Directors. The Board of Directors recommends you vote “FOR” the election of its nominees for Class I Directors.

Compensation of Directors

Directors who are not employees of the Company receive a retainer of $20,000 per year, payable on a quarterly basis, a fee of $3,000 for each directors’ meeting attended and a fee of $1,000 for attendance at each meeting of a committee approved by the Board of Directors. The Audit Committee chairman and the Compensation Committee chairman, however, receive $3,000 and $2,000, respectively, for their services as chairman at each such committee meeting attended. Directors are also reimbursed for travel expenses for attending meetings. In addition, directors who are not employees of the Company receive an option to purchase 20,000 shares on the date first elected to the Board, 9,500 additional shares in each year served as a member of the Board, 3,000 additional shares in each year served as chairman of a committee of the Board and 1,500 additional shares in each year served as a member of a committee of the Board. Mr. Maggs also received an option to purchase 20,000 shares during the fiscal year for services as a director. All of such options have an exercise price equal to the fair market value of the Company’s common stock on the date of grant and vest over a period of three years as follows: (i) 20% one year from grant date; (ii) 35% two years from grant date; and, (iii) 45% three years from grant date. As a result of the requirement for the Company to expense stock option grants in its 2006 fiscal year, in the future it is expected that directors who are not employees of the Company will receive stock settled stock appreciation rights in lieu of stock options. Employee directors receive no separate, additional compensation or options for their services as directors.

Board of Directors’ Meetings and Committees

The Board of Directors of the Company held ten meetings during the fiscal year ended July 31, 2005, and took other actions by unanimous consent of the Board of Directors. All directors attended at least 75% of the meetings of the Board and of the committees of the Board on which they respectively served. During the fiscal year, the Board appointed Mr. Maggs as lead director to preside over meetings of the non-employee directors and perform such other duties as may be designated by the Board of Directors.

The Board has a standing Compensation Committee which meets periodically and met five times during the fiscal year ended July 31, 2005. The Compensation Committee determines the compensation of all executive officers of the Company and recommends the compensation policies for other officers and employees. The members of the Compensation Committee are Messrs. Ain, Jennings and Moore. Mr. Jennings serves as chairman of the Compensation Committee. The Board has a standing Audit Committee which meets periodically and met nine times during the fiscal year ended July 31, 2005. The Audit Committee assists the Board of Directors’ oversight of the integrity of the Company’s financial statements and compliance with legal and

5

regulatory requirements, the independent registered public accounting firm’s qualifications and independence and the performance of the Company’s independent registered public accounting firm. The members of the Audit Committee are Messrs. Boehlke, Hill and Maggs. Mr. Boehlke serves as the chairman of the Audit Committee and is an “audit committee financial expert” as defined by the SEC’s rules. The Board has a standing Corporate Governance and Nominating Committee which meets periodically and met two times during the fiscal year ended July 31, 2005. The Corporate Governance and Nominating Committee is responsible for overseeing corporate governance principles applicable to the Company, recommending to the Board of Directors the persons to be nominated for election as directors and determining the membership of Board committees. The members of the Corporate Governance and Nominating Committee are Messrs. Ain, Boehlke, Hill, Jennings, Maggs, Moore and Rubinovitz. Mr. Ain serves as chairman of the Corporate Governance and Nominating Committee. A copy of the Corporate Governance and Nominating Committee Charter is included as Appendix A to this Proxy Statement. The Strategic Planning Committee, comprised of all members of the Board of Directors, was not reconstituted following the 2004 Annual Meeting of Stockholders. All matters previously considered by the Strategic Planning Committee are now considered by the Board of Directors.

The Board of Directors has determined that each member of the Audit, Compensation and Corporate Governance and Nominating Committees is independent as defined under the new rules of the Nasdaq Stock Market including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 of the Securities Exchange Act of 1934. In addition, all of the members of the Audit Committee otherwise satisfy NASDAQ’s eligibility requirements for Audit Committee membership.

Under NASDAQ rules, a director of the Company will only qualify as an “independent director” if, in the opinion of the Company’s Board of Directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Company’s Board of Directors has determined that none of Mark S. Ain, Robert J. Boehlke, Richard S. Hill, Stephen M. Jennings, Roger J. Maggs, Robert E. Moore or Samuel Rubinovitz has a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 4200(a)(15) of the rules of the Nasdaq Stock Market.

Director Candidates

The process followed by the Corporate Governance and Nominating Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and the Board.

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Corporate Governance and Nominating Committee applies criteria it deems appropriate for the Board. These criteria may include the candidate’s integrity, business acumen, knowledge of the Company’s business and industry, experience, diligence, conflicts of interest and the ability to act in the interest of all stockholders. The Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The Company believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities.

Stockholders may recommend individuals to the Corporate Governance and Nominating Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials to: Corporate Governance and Nominating Committee, c/o Secretary, LTX Corporation, 50 Rosemont Road, Westwood, Massachusetts 02090. Assuming that appropriate biographical and background material has been provided on a timely basis, the Committee will evaluate stockholder recommended candidates by following substantially the same process and applying substantially the same criteria as it follows for candidates submitted by others.

6

Stockholders also have the right to directly nominate director candidates, without any action by the Corporate Governance and Nominating Committee or the Board by submitting a written notice to the Secretary of LTX at the same address in accordance with the procedures set forth in the Company’s By-laws. These procedures are described in the section of this Proxy Statement entitled “Stockholder Proposals”.

Director Attendance at Annual Meetings

The Company’s policy is to encourage the Board of Directors to attend annual meetings. Seven directors attended the 2004 Annual Meeting.

Communicating with the Independent Directors

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. The Chairman of the Corporate Governance and Nominating Committee, with the assistance of the Company’s Secretary, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the Corporate Governance and Nominating Committee considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which the Company tends to receive repetitive or duplicative communications.

Stockholders who wish to send communications on any topic to the Board should address such communications to Board of Directors, c/o Secretary, LTX Corporation, 50 Rosemont Road, Westwood, Massachusetts 02090.

Executive Officers of the Company

The executive officers of the Company, as of September 21, 2005, are as follows:

| | | | |

Executive Officer

| | Age

| | Position

|

Roger W. Blethen | | 54 | | Chairman of the Board and Chief Executive Officer |

David G. Tacelli | | 46 | | President and Chief Operating Officer |

Mark J. Gallenberger | | 41 | | Vice President, Chief Financial Officer and Treasurer |

David Brown | | 47 | | Vice President, Worldwide Sales |

Peter S. Rood | | 50 | | Vice President, Product Development and Operations |

Executive officers are appointed by and serve at the discretion of the Board of Directors of the Company.

Roger W. Blethen was appointed Chief Executive Officer of the Company in September 1996 and Chairman of the Board in December 2001. Effective November 1, 2005, Mr. Blethen will no longer serve as Chief Executive Officer but will continue as Chairman of the Board of the Company. Mr. Blethen was a President of the Company from 1994 to 1996 and a Senior Vice President of the Company from 1985 until 1994. Mr. Blethen was a founder of LTX and has served in a number of senior management positions with the Company since its formation in 1976.

David G. Tacelli will assume the position of Chief Executive Officer of the Company, effective November 1, 2005. He has served as President and Chief Operating Officer since May 2002 and will remain President of the Company. Prior to that, he was Executive Vice President from December 1999 to May 2002. He was Chief Financial Officer and Treasurer from December 1998 to October 2000. Prior to that, Mr. Tacelli was Vice President, Operations from 1996 to 1998. Mr. Tacelli’s previous responsibilities at LTX included Director of Manufacturing of the Mixed Signal Division, a position he held from 1994 to 1996. From 1992 to 1994, he was

7

Director of Customer Service. He served as Controller and Business Manager for Operations from 1990 to 1992 and was Controller for Sales and Support from 1988 to 1990. Prior to joining LTX, Mr. Tacelli was employed by Texas Instruments for seven years in various management positions.

Mark J. Gallenberger was appointed Vice President, Chief Financial Officer and Treasurer in October 2000. Prior to joining LTX, Mr. Gallenberger was a Vice President with Ernst & Young’s consulting practice. During his six years with Ernst & Young, Mr. Gallenberger established the Deals & Acquisitions Group, where he was involved in numerous domestic and international strategic acquisitions, joint ventures, alliances and equity investments. Mr. Gallenberger holds an MBA from Northwestern University’s Kellogg Graduate School of Management and a Bachelor of Science degree in electrical engineering from Rochester Institute of Technology. Prior to joining Ernst & Young, Mr. Gallenberger served in several technical and management positions within Digital Equipment Corporation’s semiconductor products group.

David Brown was appointed Vice President, Worldwide Sales in March 2002. From March 2000 to March 2002, he served as Vice President, Europe and Asia Sales based in Singapore and from June 1998 to March 2000, he was General Manager, LTX Europe. Prior to that, Mr. Brown was responsible for European sales from 1995 to 1998 and marketing in Europe and Asia from 1990 to 1995. From 1983 to 1990, Mr. Brown served in various sales, marketing and engineering positions with LTX.

Peter S. Rood was appointed Vice President, Product Development and Operations in November 2004. He rejoined the Company in June 2004 as Vice President of Engineering and Product Development. From May 2003 to June 2004, he was President and Chief Executive Officer of PSR Associates, a management consulting firm. From October 1999 to May 2003, he was Chief Operating Officer of InfoLibria Inc. and from November 1996 to October 1999, he was Vice President of Operations of Rascom Corporation. Prior to that, he was Vice President of Operations for ASECO Corporation from December 1993 to November 1996 and from June 1986 to December 1993 he worked in a number of different management positions with the Company, including Vice President of Operations.

8

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth certain information with respect to the annual and long term compensation of the Company’s Chief Executive Officer and the other executive officers of the Company who were serving as executive officers at the end of fiscal 2005 (such executive officers are sometimes collectively referred to herein as the “named executive officers”):

| | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term

Compensation

| | |

Name and Principal Position

| | Year

| | Salary

| | | Bonus

| | | Other Annual Compensation(5)

| | Options

Granted(#)

| | All Other

Compensation(6)

|

Roger W. Blethen | | 2005 | | $ | 450,000 | | | $ | 135,000 | | | | | 225,000 | | $ | 1,609 |

Chairman of the Board | | 2004 | | | 450,000 | | | | 474,000 | | | — | | 200,000 | | | 1,609 |

and Chief Executive | | 2003 | | | 450,000 | (2) | | | 0 | | | — | | 243,500 | | | 1,344 |

Officer(1) | | | | | | | | | | | | | | | | | |

| | | | | | |

David G. Tacelli | | 2005 | | | 330,000 | | | | 66,000 | | | | | 150,000 | | | 403 |

President and Chief | | 2004 | | | 300,000 | (2) | | | 226,000 | | | — | | 135,000 | | | 403 |

Operating Officer(1) | | 2003 | | | 300,000 | (2) | | | 0 | | | — | | 159,150 | | | 363 |

| | | | | | |

Mark J. Gallenberger | | 2005 | | | 300,000 | | | | 37,500 | | | | | 100,000 | | | 300 |

Vice President, Chief | | 2004 | | | 300,000 | (2) | | | 130,000 | | | — | | 90,000 | | | 311 |

Financial Officer and | | 2003 | | | 300,000 | (2) | | | 0 | | | — | | 106,500 | | | 311 |

Treasurer | | | | | | | | | | | | | | | | | |

| | | | | | |

David Brown | | 2005 | | | 170,300 | | | | 72,339 | (3) | | | | 34,000 | | | — |

Vice President, | | 2004 | | | 170,300 | | | | 207,808 | (3) | | — | | 25,000 | | | — |

Worldwide Sales(3) | | 2003 | | | 170,300 | | | | 171,569 | (3) | | — | | 25,000 | | | — |

| | | | | | |

Peter Rood(4) | | 2005 | | | 235,000 | | | | 40,000 | | | | | 20,000 | | | — |

Vice President, Product | | | | | | | | | | | | | | | | | |

Development and | | | | | | | | | | | | | | | | | |

Operations | | | | | | | | | | | | | | | | | |

| (1) | | Effective November 1, 2005, Mr. Blethen will no longer serve as Chief Executive Officer, with Mr. Tacelli assuming that position as of that date. Mr. Tacelli will remain President of the Company. |

| (2) | | Of the amounts reported above for salary, Mr. Tacelli and Mr. Gallenberger deferred salary of $43,725 and $184,945 for fiscal year 2005, respectively, and $38,750 and $138,170 for fiscal year 2004, respectively, pursuant to a deferred compensation plan. For fiscal year 2003, of the amounts above reported for salary, Mr. Blethen, Mr. Tacelli and Mr. Gallenberger deferred salary of $150,000, $42,500 and $90,000, respectively, pursuant to a deferred compensation plan. |

| (3) | | Mr. Brown’s bonus for each of fiscal years 2005, 2004, and 2003 consisted of incentive compensation under the Company’s sales commission plan. |

| (4) | | Mr. Rood became an executive officer in November 2004. |

| (5) | | Amounts shown under “Other Annual Compensation” column exclude perquisites if the aggregate amount of the named executive officer’s perquisites was less than the lesser of $50,000 or 10% of such officer’s salary plus bonus. |

| (6) | | Amounts shown under “All Other Compensation” column represent taxable amounts in respect of split dollar life insurance. |

9

Option Grants in Last Fiscal Year

The following table sets forth certain information regarding options granted during the fiscal year ended July 31, 2005 by the Company to each of the named executive officers:

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | |

| | | Options

Granted(A)

| | % of Total

Options

Granted

to Employees

in Fiscal Year

| | | Exercise

Price

Per Share

| | Potential Realizable

Value at Assumed Annual

Rates of Stock Price

Appreciation for Option Term(B)

|

Name

| | | | | Expiration

Date

| | 5%

| | 10%

|

Roger W. Blethen | | 146,250 | | 6.71 | % | | $ | 5.42 | | 09/23/14 | | $ | 498,508 | | $ | 1,263,308 |

| | | 78,750 | | 3.61 | | | | 7.80 | | 12/08/14 | | | 386,292 | | | 978,956 |

David G. Tacelli | | 97,500 | | 4.47 | | | | 5.42 | | 09/23/14 | | | 332,339 | | | 842,205 |

| | | 52,500 | | 2.41 | | | | 7.80 | | 12/08/14 | | | 257,528 | | | 652,637 |

Mark J. Gallenberger | | 65,000 | | 2.98 | | | | 5.42 | | 09/23/14 | | | 221,559 | | | 561,470 |

| | | 35,000 | | 1.61 | | | | 7.80 | | 12/08/14 | | | 171,686 | | | 435,092 |

David Brown | | 26,000 | | 1.19 | | | | 5.42 | | 09/23/14 | | | 88,624 | | | 224,588 |

| | | 14,000 | | 0.64 | | | | 7.80 | | 12/08/14 | | | 68,674 | | | 174,037 |

Peter S. Rood | | 13,000 | | 0.60 | | | | 5.42 | | 09/23/14 | | | 44,312 | | | 112,294 |

| | | 7,000 | | 0.32 | | | | 7.80 | | 12/08/14 | | | 34,337 | | | 87,018 |

| (A) | | These options become exercisable in four installments of twenty-five percent commencing one year from the grant date. |

| (B) | | Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% to 10% compounded annually from the date the respective options were granted to their expiration date. Actual gains, if any, on stock appreciation exercises will depend on the future performance of the common stock and the date on which the options are exercised. |

On June 7, 2005, the Board of Directors, upon recommendation of the Board’s Compensation Committee, approved the accelerated vesting of certain unvested and “out-of-the-money” stock options held by employees, executive officers and non-employee directors with exercise prices greater than $7.50 per share. The closing sale price of LTXX’s common stock on the Nasdaq National Market on June 7, 2005 was $5.20. As a result of this vesting acceleration, which became effective on June 7, 2005, options to purchase approximately 2.3 million shares of LTX’s common stock, including shares held by the named executive officers, that would otherwise have vested at various times within the next four years became fully vested.

Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth the aggregate dollar value of all options exercised during the fiscal year ended July 31, 2005 and the total number of unexercised options held on July 31, 2005 by each of the named executive officers:

| | | | | | | | | | | | | | |

| | | Shares

Acquired

on Exercise

| | Value

Realized

| | Number of Unexercised

Options at Fiscal Year End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year End(A)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Roger W. Blethen | | — | | — | | 1,500,131 | | 317,500 | | $ | 67,865 | | $ | 390,988 |

David G. Tacelli | | — | | — | | 667,676 | | 172,500 | | | 28,395 | | | 152,025 |

Mark J. Gallenberger | | — | | — | | 456,500 | | 115,000 | | | 27,120 | | | 101,350 |

David Brown | | — | | — | | 120,438 | | 38,500 | | | 20,955 | | | 36,940 |

Peter S. Rood | | — | | — | | 110,844 | | 13,000 | | | 76,142 | | | 15,470 |

| (A) | | The closing price for the Company’s common stock as reported by the Nasdaq National Market on July 29, 2005, the last business day of fiscal 2005, was $6.61. Value is calculated on the basis of the difference between the option exercise price and $6.61 multiplied by the number of shares of common stock underlying the option. |

10

Defined Benefit Plan

One named executive officer, David Brown, participates in the LTX Europe Limited Life Assurance and Pension Plan, a United Kingdom deferred benefit plan (the “UK Plan”). The UK Plan was established for the purpose of providing a lifetime annual income upon retirement to substantially all employees in the United Kingdom, although the ability to participate in the plan was terminated in December 2001. As of July 31, 2005, a total of 11 employees participated in the UK Plan. The UK Plan provides for the payment of a pension at age 65 calculated by using a formula equal to the number of years of service divided by 60, multiplied by the greater of final pensionable earnings, or an average of the highest three consecutive years of pensionable earnings in the last 10 years. The benefits since December 1999 have been subject to an annual cap published by the UK Inland Revenue. Under the UK Plan, pension benefits become fully vested after two full years of pensionable service. Benefits are payable in the form of an annuity either at normal retirement age or at a reduced rate upon early retirement. The UK Plan also provides for the payment of certain benefits to a surviving spouse provided that death occurs in service. Amounts payable under the UK Plan are taxable as ordinary income and are subject to other applicable deductions. Mr. Brown is credited with 21 years of service under the UK Plan. Accordingly, if Mr. Brown had elected to retire this year, having reached the defined plan retirement age, and applying the currently published cap, he would be eligible to receive a maximum benefit under the plan equal to approximately £33,333 annually.

Employment Contracts and Change in Control Arrangements

The Company has entered into change of control employment agreements with each of the named executive officers and with six other officers. The change of control employment agreements have three year terms, which terms extend for one year upon each anniversary unless a notice not to extend is given by the Company. If a Change of Control (as defined in the agreements) occurs during the term of an agreement, then the agreements become operative for a fixed three year period. The agreements provide generally that the executive’s terms and conditions of employment (including position, location, compensation and benefits) will not be adversely changed during the three year period after a Change of Control of the Company. If the Company terminates the executive’s employment (other than for cause, death or disability) or if the executive terminates for good reason during such three year period or for any reason during the 30 day period following the first anniversary of the Change of Control (or upon certain terminations prior to a Change of Control or in connection with or in anticipation of a Change of Control), the executive is generally entitled to receive (i) three times in the case of the Chief Executive Officer, and two times in the case of the other officers (a) the executive’s annual base salary plus (b) the executive’s annual bonus amount (as defined in the agreement), (ii) accrued but unpaid compensation for the period before the date of termination, (iii) continued welfare benefits for three years in the case of the Chief Executive Officer and for two years in the case of the other officers, and (iv) outplacement services. In addition, the executive is entitled to receive an additional payment, if any, in an amount sufficient to make the executive whole for any excise tax on excess parachute payments imposed under Section 4999 of the Internal Revenue Code of 1986, as amended.

Options granted to the named executive officers contain provisions pursuant to which, under certain circumstances, they become fully vested and immediately exercisable upon a “change of control event” as defined in such options.

Code of Ethics

The Company has adopted a code of ethics that applies to all directors and employees, including its principal executive officer, principal financial officer, principal accounting officer, or persons performing similar functions. The text of the code of ethics is posted on the Company’s website atwww.ltx.com. The Company intends to post on its website all disclosures that are required by law or Nasdaq Stock Market listing standards concerning any amendments to, or waivers from, any provision of the code.

11

EQUITY COMPENSATION PLANS

The following table shows information relating to the Company’s equity compensation plans as of July 31, 2005:

| | | | | | | | | | |

| | | Equity Compensation Plan Information

| | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities in

first column)

| |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | | Weighted average

exercise Price of

outstanding options,

warrants and rights

| | |

| | | |

Equity compensation plans approved by security holders | | 10,657,434 | * | | $ | 10.46 | * | | 3,968,086 | ** |

| | | |

Equity compensation plans not approved by security holders | | 0 | | | | 0 | | | 0 | |

| | |

|

| |

|

|

| |

|

|

| | | |

Total | | 10,657,434 | * | | $ | 10.46 | * | | 3,968,086 | ** |

* Excludes an aggregate of 65,571 shares issuable upon exercise of outstanding options assumed by the Company in connection with an acquisition. The weighted average exercise price of the excluded options is $0.8730.

** Includes 761,654 shares available for issuance under an employee stock purchase plan which is intended to qualify as such under Section 423 of the Internal Revenue Code.

12

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors consists of three directors who are not employees of the Company. The Committee met five times during the fiscal year ended July 31, 2005. The Compensation Committee is responsible for establishing compensation policies with respect to all executive officers of the Company and determining on an annual basis the compensation of these individuals.

The Compensation Committee has identified three principal goals for its work on behalf of the Company:

| | 1. | | Insure appropriate linkage between executive compensation and creation of stockholder value. |

| | 2. | | Insure that the total compensation program can attract, motivate and retain executives with outstanding abilities. |

| | 3. | | Determine the competitiveness of current cash and equity incentive opportunities. |

In order to fulfill these goals, the Committee has reviewed various salary surveys conducted by consultants as well as proxy statements from a peer group identified by the Committee consisting of more than twenty other public semiconductor equipment companies that have annual revenues of between $200 and $800 million. The Committee believes that setting base salaries at the 50th percentile and incentive cash compensation at the 70th percentile of compensation paid at the peer group is appropriate to advance the goals identified by the Committee.

Executive Bonus Plan

The Compensation Committee has continued the prior year’s Executive Bonus Plan for fiscal 2005 after reviewing the Company’s business and financial position entering the year and the business plan for the year. The Executive Bonus Plan provides for an annual cash bonus based upon net income goals set at the beginning of the year, as well as upon the achievement of individual goals. Specific participation percentages for each executive officer were established with reference to the officer’s area and scope of responsibility within the Company.

The cash bonus payable to executive officers under the Plan is calculated based on a formula. The formula provides that 40% of the assigned target incentive compensation amount can be earned through performance of individual goals and that the remaining portion of the cash bonus is calculated as a percentage of net income based on each officer’s specific participation percentage. In addition, the total cash bonus payable based on net income achieved is subject to a maximum amount not to exceed 3.5 times 60% of the target incentive compensation amount. The Compensation Committee has the discretion to make equitable adjustments to any amounts payable under the Executive Bonus Plan. The Vice President of Worldwide Sales receives incentive compensation under the Company’s sales commission plan and does not participate in the Executive Bonus Plan.

Chief Executive Officer’s Compensation

The Compensation Committee subjectively determined that it was appropriate to maintain Mr. Blethen’s base salary at the level set by the Committee since fiscal year 1998, and that any additional increase in total compensation should be derived from Mr. Blethen’s participation in the Executive Bonus Plan and from stock options. The decisions made with respect to the fiscal 2005 compensation of the Chief Executive Officer were intended to continue the Company’s philosophy of aligning the interests of the Chief Executive Officer with the interests of the Company and its stockholders. The fiscal 2005 cash bonus paid to the Chief Executive Officer was earned based upon the Company’s achievement of individual goals achieved during the year.

The cash bonus payable to the Chief Executive Officer under the Company’s Executive Bonus Plan is calculated based on the formula described above. Individual goals for the Chief Executive Officer are determined by the Compensation Committee early in fiscal year and generally relate to specific strategic customer, market and product development initiatives.

13

Compensation of Other Executive Officers

The Committee set base salaries of each of the executive officers with reference to both the base salary of the Chief Executive Officer and the salaries of officers with comparable responsibilities in comparable companies. The Committee determined the appropriate portion of each other executive officer’s total potential cash compensation to be contingent upon performance and payable under the Executive Bonus Plan which was in effect for fiscal 2005. The fiscal 2005 cash bonus paid to the President, Chief Financial Officer and Vice President of Product Development and Operations was earned based upon the Company’s achievement of individual goals achieved during the year. The Vice President of Worldwide Sales was paid commissions for sales made in fiscal 2005.

Equity Arrangements

The Company maintains several stock option plans and an employee stock purchase plan. Each executive officer is eligible for stock option grants under one of the stock option plans. In determining the size of grants to be made to executive officers, the Committee seeks to implement its stated goal that there be appropriate linkage between executive compensation and the creation of stockholder value. If executive officers are able to increase the market capitalization of the Company, their stock options will achieve significant value and the stockholders will benefit generally. There is no fixed ratio between Company performance and size of grants or between base salary and size of grants.

In determining the size of the option grant to the Chief Executive Officer and other executive officers, the Compensation Committee reviewed the Company’s strategic performance relative to its competitors and equity awards made in the peer group review, including competitors.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to publicly held companies for compensation exceeding $1 million paid to certain of the corporation’s executive officers. The Committee believes that any compensation deemed paid to an executive officer when he or she exercises an outstanding option granted under the stock option plans with an exercise price equal to the fair market value of the option share on the grant date will qualify as performance-based compensation which will not be subject to the $1 million limitation. Otherwise, it is not expected that the compensation to be paid to the Company’s executive officers for fiscal 2006 will exceed the $1 million limit per officer.

Stephen M. Jennings

Mark S. Ain

Robert E. Moore

14

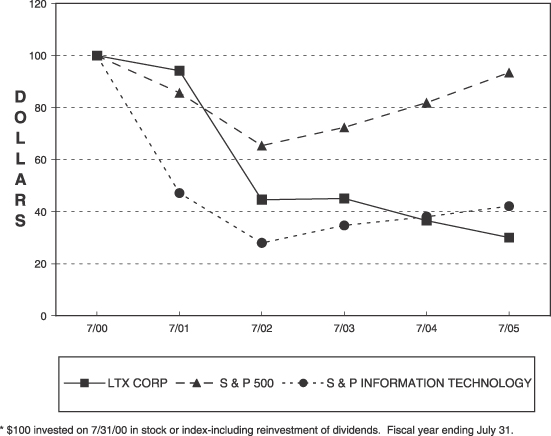

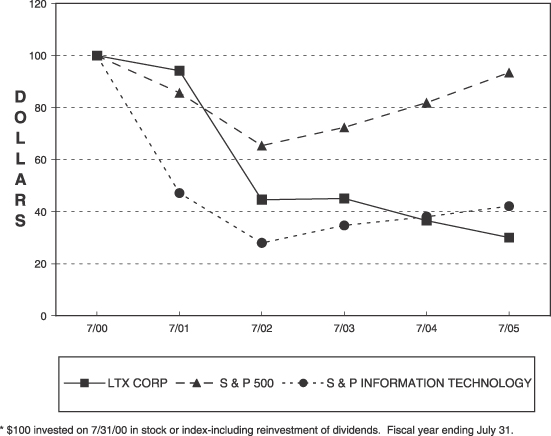

Stock Performance Chart

The following chart compares the yearly percentage change in the cumulative total stockholder return on the Company’s common stock during the five years ended July 31, 2005 with the total return on the Standard & Poor’s 500 Composite Index and the Standard & Poor’s High Technology Composite Index. The comparison assumes $100 was invested on July 31, 2000 in the Company’s common stock and in each of the foregoing indices and assumes reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG LTX CORPORATION, THE S & P 500 INDEX

AND THE S & P INFORMATION TECHNOLOGY INDEX

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, as amended, the Company’s directors and certain of its officers and persons holding more than ten percent of the Company’s common stock are required to report their ownership of the common stock and any changes in such ownership to the Securities and Exchange Commission and the Company. Based on the Company’s review of copies of such reports, no untimely reports were made during the fiscal year ended July 31, 2005.

15

ITEM 2. PROPOSAL TO APPROVE THE AMENDMENT TO ARTICLES OF ORGANIZATION

TO INCREASE NUMBER OF SHARES OF AUTHORIZED SHARES

OF COMMON STOCK FROM 100,000,000 TO 200,000,000

On September 21, 2005, the Board of Directors adopted, subject to stockholder approval, an amendment to the Company’s Articles of Organization (as amended to date, the “Articles”) providing for an increase in the number of authorized shares of common stock from 100,000,000 to 200,000,000 shares (the “Common Stock Amendment”).

If the Common Stock Amendment is approved by stockholders, it will become effective upon filing the Articles of Amendment to the Articles with the Secretary of State of the Commonwealth of Massachusetts. Specifically, the Articles of Amendment would amend Article III of the Company’s Articles to provide that 200,000,000 shares of common stock, par value $.05 per the share, are authorized for issuance by the Company.

As of July 31, 2005, the Company had a total of 61,531,881 shares of common stock outstanding and an aggregate of 37,731,277 shares of common stock were reserved for issuance, consisting of: 10,723,005 shares of common stock reserved for issuance upon exercise of outstanding options under its equity plans, 761,654 shares of common stock available for purchase by employees under its employee stock purchase plan, 3,206,432 shares of common stock reserved for grants of future equity awards under various stockholder approved plans, 3,040,186 shares of common reserved for issuance upon conversion of the Company’s convertible subordinated notes and 20,000,000 shares of common stock reserved for issuance under the Company’s Rights Agreement. Based on the number of outstanding and reserved shares of common stock as described above, as of July 31, 2005, the Company has 736,842 shares of common stock available for issuance.

Upon approval, the additional authorized shares of common stock would be available for issuance for any corporate purpose, including, without limitation, financings, acquisitions, strategic business partnerships and joint ventures, stock splits and stock dividends, and management incentive and employee benefit plans, all as the Board of Directors many deem advisable, without the necessity of further stockholder action except as may be required by law, Securities and Exchange Commission rules or NASDAQ listing requirements. Except for the shares reserved for issuance as described above, the Company has no present intention or plans to issue any shares of common stock.

While the Company has no immediate plans to effect any acquisition or financing transactions, its ability to do so could be constrained by the limited number of shares of common stock currently available. The requirement to obtain stockholder approval for an increase in the authorized shares of capital stock could create additional costs or delays in connection with such transactions, and could also impact the Company’s ability to effect acquisitions in competition with others or financings that are predicated upon immediate access to capital markets. The Company’s Board believes that the Company’s ability to act in a timely and flexible manner is important to its competitive position and urges its stockholders to vote in favor of the Common Stock Amendment.

Upon approval, the additional shares of common stock would also be available for issuance under the Company’s Rights Agreement, which provides that each common stockholder has one common share purchase right for each share of common stock held. As previously disclosed in a Form 8-K filed on January 28, 2004, if the rights became exercisable, the Company would not currently have available shares of common stock sufficient to issue one share of common stock for each outstanding right. The Company’s Board does not have any current intention of reserving additional shares of common stock under the Rights Agreement, which expires on April 30, 2009, but reserves the right to do so in the future. The Company is subject to other provisions that could have an anti-takeover effect including a classified Board of Directors, By-laws requirements that requests for stockholders meetings may be made only during limited periods of time and must be made by a group of stockholders holding at least 40% of the outstanding capital stock entitled to vote and certain supermajority voting requirements.

Shares of common stock, including the shares proposed for authorization, do not have pre-emptive or similar rights; this means that current stockholders do not have the right to purchase any new shares in order to maintain

16

their proportionate ownership in the Company. Holders of shares of common stock are not entitled to dividends except as and when declared by the Board. The Company has not paid cash dividends on its common stock in the past. The Company has no plans to pay such dividends in the foreseeable future, and is prohibited from declaring such dividends by its current commercial lender.

Under Massachusetts law, the stockholders are not entitled to dissenter’s rights with respect to the Common Stock Amendment.

Required Vote; Board Recommendation

The affirmative vote of the holders of a majority of the issued and outstanding shares of common stock entitled to vote at the Meeting is required in order to approve the proposed Common Stock Amendment. The Board of Directors recommends that you vote “FOR” this proposal.

ITEM. 3 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP as the Company’s independent registered public accounting firm to audit the Company’s financial statements for the fiscal year ending July 31, 2006. We are asking stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm. Although ratification is not required by our By-laws or otherwise, the Board is submitting the selection of Ernst & Young LLP to our stockholders for ratification as a matter of good corporate practice. If the stockholders do not ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm, the Audit Committee will reconsider its selection. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’ best interest. Representatives of Ernst & Young LLP are expected to be present at the Meeting and will have the opportunity to make a statement if they desire to do so. Such representatives are also expected to be available to respond to appropriate questions from stockholders.

Board Recommendation

The Board of Directors recommends that you vote “FOR” this proposal.

Fiscal 2005 Audit Firm Fee Summary

During fiscal 2005, the Company retained Ernst & Young LLP to provide services in the following categories and amounts:

Audit Fees

The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audits of LTX’s annual financial statements for the fiscal years ended July 31, 2005 and 2004, the audit of LTX’s internal control over financial reporting as of July 31, 2005 and for the review of the financial statements included in LTX’s Quarterly Reports on Form 10-Q for those fiscal years, and registration statements and new accounting regulations, stock option expensing and acquisition accounting consultations, were $472,625 and $308,925, respectively.

Audit Related Fees

The aggregate fees billed by Ernst & Young LLP for audit related services in the fiscal year ended July 31, 2005 and 2004 was $0 and $39,620, respectively. The audit related fees were for internal controls compliance under the Sarbanes-Oxley Act.

17

Tax Fees

The aggregate fees billed by Ernst & Young LLP for tax services in the fiscal years ended July 31, 2005 and 2004 were $73,700 and $89,300, respectively, consisting of tax planning consultations and tax return compliance and preparation.

All Other Fees

There were no fees billed by Ernst & Young LLP for services other than those described above for the fiscal years ended July 31, 2005 and 2004.

All of the above services provided by Ernst & Young were approved by the Audit Committee. All of the work performed by Ernst & Young was performed by Ernst & Young’s full-time, permanent employees.

LTX’s Audit Committee has determined that the services provided by Ernst & Young LLP as set forth herein are compatible with maintaining Ernst & Young’s independence.

AUDIT COMMITTEE POLICIES AND PROCEDURES AND REPORT

Pre-Approval Policies and Procedures

The Audit Committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by the Company’s independent registered public accounting firm. This policy generally provides that the Company will not engage its independent registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to the Company by its independent registered public accounting firm during the next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

The Audit Committee has also delegated to the Chairman of the Audit Committee the authority to approve any audit or non-audit services to be provided to the Company by its independent registered public accounting firm. Any approval of services pursuant to this delegated authority is reported on at the next meeting of the Audit Committee.

Audit Committee Report

The Audit Committee of the Board of Directors consists of Robert J. Boehlke, Richard S. Hill and Roger J. Maggs. The Board has determined that at least one if its members, Mr. Boehlke, is an “audit committee financial expert” as defined by the SEC’s rules. The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. All members of the Audit Committee are “independent” under Rule 4200(a)(15) of the NASD listing standards.

The Audit Committee reviewed and discussed the audited financial statements for the fiscal year ended July 31, 2005 with the Company’s management and Ernst & Young LLP. The Audit Committee also discussed with Ernst & Young LLP matters required to be discussed by AICPA SAS 61 and SEC regulations.

In addition, the Audit Committee discussed with the independent registered public accounting firm the firm’s independence from management and the Company, including the matters in the written disclosures required by the Independent Standards Board, and considered the compatibility of non-audit services with the firm’s independence. The Audit Committee believes that the non-audit services are compatible with such independence.

The Audit Committee also discussed with the independent registered public accounting firm the overall quality of the Company’s financial reporting and their evaluation of the Company’s internal control systems.

18

Based on the review and discussions referred to above, the Audit Committee has recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended July 31, 2005 for filing with the Securities and Exchange Commission.

Robert J. Boehlke

Richard S. Hill

Roger J. Maggs

STOCKHOLDER PROPOSALS

Stockholder proposals to be submitted for vote at the 2006 Annual Meeting pursuant to Rule 14a-8 promulgated under the Exchange Act must be delivered to the Company on or before July 8, 2006. In order to minimize controversy as to the date on which a proposal was received by the Company, it is suggested that proponents submit their proposals by Certified Mail—Return Receipt Requested. If a proponent fails to notify the Company by September 21, 2006 of a non-Rule 14a-8 shareholder proposal which such proponent intends to submit at the Company’s 2006 Annual Meeting, the proxy solicited by the Board of Directors with respect to such meeting may grant discretionary authority to the proxies named therein to vote on such matter.

The Company’s By-laws set forth the procedures a stockholder must follow to nominate a director or to bring other business before a stockholder meeting. Stockholders who wish to nominate a candidate for director at the 2006 Annual Meeting must provide at least sixty days’ advance written notice to the Secretary of the Company, together with such information concerning the identity, background and experience of the nominee as the Board of Directors may require, along with any other information that may be required in a proxy statement soliciting proxies for the election of the nominee as a director of the Company.

OTHER MATTERS

As of this date, management knows of no business which may properly come before the 2005 Annual Meeting other than that stated in the Notice of Meeting accompanying this Proxy Statement. Under the Company’s By-laws, the deadline for stockholders to notify the Company of any proposals or director nominations to be presented at the 2005 Annual Meeting has passed. Should any other business arise, proxies given in the accompanying form will be voted in accordance with the discretion of the person or persons voting them.

HOUSEHOLDING OF ANNUAL MEETING MATERIALS

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Company’s proxy statement or annual report may have been sent to multiple stockholders in a household. The Company will promptly deliver a separate copy of either document to a stockholder if such stockholder calls or writes the Company at the following address or phone number: Investor Relations, LTX Corporation, 50 Rosemont Road, Westwood, Massachusetts 02090; or 781-461-1000.

ANNUAL REPORT ON FORM 10-K

Copies of the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2005 as filed with the Securities and Exchange Commission are available to stockholders without charge upon written request addressed to Investor Relations, LTX Corporation, 50 Rosemont Road, Westwood, Massachusetts 02090.

JOSEPH A. HEDAL,Secretary

19

Appendix A

LTX CORPORATION

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

CHARTER

1. Purpose

The purpose of the Corporate Governance and Nominating Committee is to:

| | • | | Oversee corporate governance principles applicable to the Company; and |

| | • | | Recommend to the Board the persons to be nominated for election as directors at any meeting of stockholders and the membership of Board Committees. |

2. Structure and Membership

| | 1. | | Number. The Corporate Governance and Nominating Committee shall consist of such number of directors as the Board shall from time to time determine. |

(a)Independence. Except as otherwise permitted by the applicable rules of Nasdaq, each member of the Corporate Governance and Nominating Committee shall be an “independent director” as defined by such rules.

(b)Chair. Unless the Board elects a Chair of the Corporate Governance and Nominating Committee, the Committee shall elect a Chair by majority vote.

(c)Compensation. The compensation of Corporate Governance and Nominating Committee members shall be as determined by the Board.

(d)Selection and Removal. Members of the Corporate Governance and Nominating Committee shall be appointed by the Board, upon the recommendation of the Committee. The Board may remove members of the Corporate Governance and Nominating Committee from such Committee, with or without cause.

3. Authority and Responsibilities

General

The Corporate Governance and Nominating Committee shall discharge its responsibilities, and shall assess the information provided by the Company’s management, in accordance with its business judgment.

Corporate Governance

(a)Corporate Governance Review. The Corporate Governance and Nominating Committee shall monitor corporate governance principles applicable to the Company. The Committee shall, from time to time as it deems appropriate, review and reassess the adequacy of the Company’s corporate governance and recommend any proposed changes to the Board for approval.

Board and Committee Membership

| | 2. | | Selection of Director Nominees. Except where the Company is legally required by contract, bylaws or otherwise to provide third parties with the ability to nominate directors, the Corporate Governance and Nominating Committee shall have responsibility for recommending to the Board the persons to be nominated for election as directors at any meeting of stockholders and the persons to be elected by the Board to fill any vacancies on the Board. |

(b)Criteria for Selecting Directors. The Committee shall be responsible for reviewing with the Board, from time to time as it deems appropriate, the requisite skills and criteria for new Board members as well as the composition of the Board as a whole.

A-1

(c)Search Firms. The Corporate Governance and Nominating Committee shall have the authority to retain and terminate any search firm to be used to identify director nominees, including authority to approve the search firm’s fees and other retention terms. The Committee is empowered, without further action by the Board, to cause the Company to pay the compensation of any search firm engaged by the Committee.

(d)Selection of Committee Members. The Corporate Governance and Nominating Committee shall be responsible for recommending to the Board the directors to be appointed to each committee of the Board.

(e)Additional Powers. The Corporate Governance and Nominating Committee shall have such other duties as may be delegated from time to time by the Board.

4. Procedures and Administration

(a)Meetings. The Corporate Governance and Nominating Committee shall meet as often as it deems necessary in order to perform its responsibilities. The Committee shall keep such records of its meetings as it shall deem appropriate.

(b)Subcommittees. The Corporate Governance and Nominating Committee may form and delegate authority to one or more subcommittees (including a subcommittee consisting of a single member), as it deems appropriate from time to time under the circumstances.

(c)Reports to the Board. The Corporate Governance and Nominating Committee shall report regularly to the Board.

(d)Charter. The Corporate Governance and Nominating Committee shall, from time to time as it deems appropriate, review and reassess the adequacy of this Charter and recommend any proposed changes to the Board for approval.

(e)Independent Advisors. The Corporate Governance and Nominating Committee shall have the authority to engage such independent legal and other advisors as it deems necessary or appropriate to carry out its responsibilities. Such independent advisors may be the regular advisors to the Company. The Committee is empowered, without further action by the Board, to cause the Company to pay the compensation of such advisors as established by the Committee.

(f)Investigations. The Corporate Governance and Nominating Committee shall have the authority to conduct or authorize investigations into any matters within the scope of its responsibilities as it shall deem appropriate, including the authority to request any officer, employee or advisor of the Company to meet with the Committee or any advisors engaged by the Committee.

December 10, 2003

A-2

PROXY

LTX CORPORATION

50 ROSEMONT ROAD

WESTWOOD, MASSACHUSETTS 02090

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

This Proxy is solicited on behalf of the Board of Directors

The undersigned hereby appoints David G. Tacelli and Mark J. Gallenberger or either of them as Proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote as designated below, all of the shares of common stock of LTX Corporation held of record by the undersigned on September 29, 2005, at the annual meeting of stockholders to be held on November 10, 2005, and any adjournments thereof.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR PROPOSALS 1, 2 and 3. In their discretion, the proxies are authorized to vote upon such other matters as may properly come before the meeting or any adjournment thereof.

SEE REVERSE SIDE. If you wish to vote in accordance with the Board of Directors’ recommendations, just sign on the reverse side. You need not mark any boxes.However, you must sign and return this card to assure representation of your shares.

| | | | |

SEE REVERSE

SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE

SIDE |

LTX CORPORATION

C/O EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

Your vote is important. Please vote immediately.

If you vote over the Internet or by telephone, please do not mail your card.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL | | ZLTXC1 | | | | |

| | | | | | | | | | | |

| x | | Please mark votes as inthis example. | | | | | | | | | | | | | | | | #LTX | | | | |

| | |

| PLEASE MARK, SIGN, DATE AND RETURN THIS FORM OF PROXY PROMPTLY, USING THE ENCLOSED ENVELOPE. The Board of Directors recommends that stockholders vote for Proposals No. 1, 2 and 3. | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1. | | To elect two members to the Board of Directors to serve for three-year terms as Class I Directors. Nominees: (01) Stephen M. Jennings and (02) Robert E. Moore | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | FOR BOTH NOMINEES | | ¨ | | ¨ | | WITHHELD FROM BOTH NOMINEES | | | | | | | | | | | | | | | | |

| | | | | | | | | |

¨ | |

| | | | | | | | | | | | | | | | |

| | | For both nominee(s) except as written above | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | FOR | | AGAINST | | ABSTAIN | | | | | | | | | | | | |

| 2. | | To approve the amendment to the Articles of Organization to increase the authorized number of shares of common stock, par value $.05 per share, from 100,000,000 to 200,000,000 shares. | | ¨ | | ¨ | | ¨ | | | | | | | | | | | | |

| | | | | | | | | | |

| 3. | | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for its 2006 fiscal year. | | ¨ | | ¨ | | ¨ | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT ¨ | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign.PLEASE MARK, SIGN, DATE AND RETURNTHE PROXY PROMPTLY, USING THE ENCLOSED ENVELOPE. |

| | | | | | | | | | | | | | |

| | | | | | | |

Signature: | | | | Date: | | | | Signature: | | | | Date: | | |