| | | | | | | |

| Kassaflödesanalys / Cash flow statement | | | | | | |

| (EUR 1 000) | Jan.-Aug. 2004 | | Jan.-Aug. 2003 | | Jan.-Dec. 2003 | |

|

|

|

|

|

| |

| Kassaflöde från rörelsen / Cash flows from operating activities | 119 180 | | 104 549 | | 152 211 | |

| Investeringar / Investing activities | 119 371 | | -402 477 | | -698 328 | |

| Finansiering / Financing activities | 206 475 | | 1 153 183 | | 343 855 | |

|

|

|

|

|

| |

| Förändring i nettolikviditet / Change in net liquidity | 445 027 | | 855 255 | | -202 262 | |

| | | | | | | |

| Nettolikviditet vid periodens början / | | | | | | |

| Net liquidity at beginning of period | 2 744 295 | | 2 946 558 | | 2 946 558 | |

| Nettolikviditet vid periodens slut / | | | | | | |

| Net liquidity at end of period | 3 189 322 | | 3 801 812 | | 2 744 295 | |

| | | | | | | |

| | | | | | |

| Förändringar i eget kapital / Changes in equity | | | | | |

| (miljoner EUR / EUR million) | Jan.-Aug. 2004 | | Jan.-Aug. 2003 | | Jan.-Dec. 2003 | |

|

|

|

|

|

| |

| Eget kapital per 1 jan. / Equity at 1 Jan. | 1 650 | | 1 540 | | 1 540 | |

| | | | | | | |

| Utdelning / Dividend payment | -41 | | -40 | | -40 | |

| Available-for-sale-portföljen / Available-for-sale portfolio | - | | 1 | | 2 | |

| Säkringsredovisning / Hedge accounting | - | | -2 | | -3 | |

| Periodens resultat / Profit for the period | 111 | | 100 | | 151 | |

|

|

|

|

|

| |

| Summa förändringar i eget kapital / Changes in equity, total | 70 | | 59 | | 110 | |

| | | | | | | |

| Eget kapital vid periodens slut / Equity at end of period | 1 719 | | 1 599 | | 1 650 | |

| | | | | | | |

| | | | | | | |

| Nyckeltal / Key figures | | | | | | |

| (miljoner EUR / EUR million) | Jan.-Aug. 2004 | | Jan.-Aug. 2003 | | Jan.-Dec. 2003 | |

|

|

|

|

|

| |

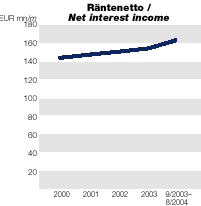

| Räntenetto / Net interest income | 109 | | 102 | | 155 | |

| Överskott / Profit | 111 | | 100 | | 151 | |

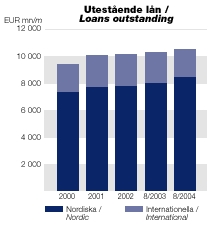

| Utbetalade lån / Loans disbursed | 779 | | 910 | | 1 841 | |

| Avtalade lån / New loan agreements | 1 031 | | 1 029 | | 1 859 | |

| Nyupplåning / New debt issues | 1 545 | | 2 759 | | 3 258 | |

| Överskott/genomsnittligt eget kapital / | | | | | | |

| Profit/average equity (%) | 9,9 | | 9,5 | | 9,5 | |

| | | | | | | |

| | 31 Aug. 2004 | | 31 Aug. 2003 | | 31 Dec. 2003 | |

|

|

|

|

|

| |

| Eget kapital / Equity | 1 719 | | 1 599 | | 1 650 | |

| Eget kapital/balansomslutning / Equity/total assets (%) | 10,2 | | 9,2 | | 9,9 | |

| (Eget kapital+garantikapital)/balansomslutning / | | | | | | |

| (Equity+callable capital)/total assets (%) | 31,4 | | 30,0 | | 31,5 | |

RECENT DEVELOPMENTS

By the resolution by the Board of Directors of the Bank dated October 13, 2004, all PIL loans (outstanding and agreed but non-disbursed) to Estonia, Latvia and Lithuania (totaling EUR 380.3 million as of August 31, 2004) were transferred to the ordinary lending facility of the Bank, as of November 1, 2004. The rationale for the transfer was improved creditworthiness of Estonia, Latvia and Lithuania and the entry of these countries as members of NIB on January 1, 2005.

Since August 31, 2004, NIB has carried out 8 borrowing transactions in 4 different currencies, in an amount corresponding to EUR 295 million*. Repayment of borrowings previously entered into corresponded to EUR 379 million. The maturity profile for new borrowings during this period is set forth in the table below.

| Maturity profile for new borrowing | |

| | | | | | | | | | | |

| | | | Number of

transactions | | | Amount in

EUR million | | | Percentage | |

| | | |

| | |

| | |

| |

| 1-3 years | | | 1 | | | 29 | | | 9.8 | |

| 3-5 years | | | 4 | | | 65 | | | 22.1 | |

| 5-7 years | | | 1 | | | 51 | | | 17.3 | |

| 7-10 years | | | 1 | | | 75 | | | 25.4 | |

| 10 years and longer | | | 1 | | | 75 | | | 25.4 | |

|

| Total | | | 8 | | | 295 | | | 100.0 | |

* During the period NIB has entered into additional new borrowing transactions that have not yet settled corresponding to EUR 29 million.

Provisions for loan losses

There has been no increase in non-performing loans during 2004, on the contrary, a few loans that were not fully serviced in 2003 are now being served. Reversals of earlier loan-loss provisions are expected to outweigh the possible new provisions for the fiscal year 2004.

Nordic Investment Bank – Governance

Under the Agreement on the Nordic Investment Bank (the “Bank”) concluded among Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden (the ”Member Countries”) on February 11, 2004 (the “2004 Agreement”) and the Statues annexed thereto, the Bank shall have a Board of Governors, a Board of Directors, a President, and such other personnel as is necessary to carry out its operations.

The Board of Governors is composed of eight Governors. Each Member Country is represented by the Minister it designates as its Governor. The Board of Governors is responsible for matters specified in the 2004 Agreement and the Statutes.

The following individuals are the Governors of the Bank:

| Denmark | | Bendt Bendtsen | | Minister for Economic and Business Affairs |

| Estonia | | Taavi Veskimägi | | Minister of Finance |

| Finland | | Ulla-Maj Wideroos | | Coordinate Minister of Finance |

| Iceland | | Geir H. Haarde | | Minister of Finance |

| Latvia | | Oskars Spurdzins | | Minister of Finance |

| Lithuania | | Algirdas Butkevicius | | Minister of Finance |

| Norway | | Per-Kristian Foss | | Minister of Finance |

| Sweden | | Pär Nuder | | Minister of Finance |

With the exception of matters that fallwithin the authority of the Board of Governors, all of the powers of the Bank are vested in the Board of Directors. The Board of Directors is composed of eight Directors, one being appointed by each Member Country, who serve for renewable terms of up to four years and each of whom has a one vote. Each Member Country also appoints one alternate according to the same principles. The chairmanship and the deputy chairmanship shall rotate among the Member Countries every two years.

The following individuals are the Directors and Alternate Directors of the Bank:

| Directors | | | | |

| Denmark | | Lars Kolte | | Managing Director, Danish Export Credit Agency |

| Estonia | | Madis Üürike | | Advisor, Ministry of Finance |

| Finland | | Kristina Sarjo | | Financial Counsellor, Ministry of Finance |

| Iceland | | Mr. Bolli Thór Bollason | | Permanent Secretary, Prime Minister´s Office |

| (As of June 1, 2005) | | Baldur Gudlaugsson | | Permanent Secretary, Ministry of Finance |

| Latvia | | Edmunds Krastiņš | | Advisor, Ministry of Finance |

| Lithuania | | Rolandas Kriščiūnas | | Under Secretary, Ministry of Finance |

| Norway | | Arild Sundberg | | Director General, National Insurance Administration |

| Sweden | | Erik Åsbrink | | Former Minister of Finance |

| Alternate Directors | | | | |

| Denmark | | Kåre Klein Emtoft | | Chief of Division, Ministry of Economic and Business Affairs |

| Estonia | | Ülle Mathiesen | | Head of State Treasury Department, Ministry of Finance |

| Finland | | Bo Göran Eriksson | | Director General, Ministry of Trade and Industry |

| Iceland | | Baldur Gudlaugsson | | Permanent Secretary, Ministry of Finance |

| (As of June 1, 2005) | | Ragnheidur Elín Árnadóttir | | Political Adviser, Ministry of Finance |

| Latvia | | Nikolajs Sigurds Bulmanis | | Member of the Supervisory Council JSC Māras Banka |

| Lithuania | | Vilma Mačerauskiene | | Head of Financial Institutions Division, Ministry of Finance |

| Norway | | Eli Telhaug | | Director General, Ministry of Finance |

| Sweden | | Ulrika Barklund Larsson | | Director, Ministry of Finance |

The business address for each of the Directors and Alternate Directors mentioned above is Fabianinkatu 34, P.O. Box 249, FIN-00171 Helsinki, Finland.

Under the Statues, the Board of Directors may delegate its powers to the President, who is appointed by the Board and who participates in its meetings. The Statues provide, however, that the President may not be a member or an alternate of the Board. The President may be appointed by the Board of Directors for renewable terms of not more than five years each.

The current senior management of the Bank and their positions are:

| Name | | Position |

| Jón Sigurðsson | | President. Johnny Åkerholm has been appointed new President of the Bank from April 1, 2005 |

| Carl Löwenhielm | | Executive Vice President, Head of the Nordic Lending Department |

| Erkki Karmila | | Executive Vice President, Head of the International Lending Department |

| Torben Nielsen | | Senior Vice President, Head of the Financial Department |

| Siv Hellén | | Senior Vice President and General Counsel |

| Oddvar Sten Rønsen | | Senior Vice President, Head of the Appraisal Department |

| Juha Kotajoki | | Senior Vice President, Head of the Risk Management Department |

A Control Committee has the responsibility for ensuring that the operations of the Bank are conducted in accordance with its Statutes. The Control Committee is also responsible for conducting an audit of the Bank’s financial statements to be delivered to the Board of Governors. The Control Committee is composed of ten members, serving renewable terms of up to two years. The Nordic Council and the Parliaments of Estonia, Latvia and Lithuania appoint one member from each Member Country. The Board of Governors appoints two members, who serve as Chairman and Deputy Chairman. The chairmanship and the deputy chairmanship rotate among the Member Countries.

The current members of the Control Committee of the Bank are:

| Denmark | | Per Kaalund | | Member of Parliament |

| Estonia | | Anders Lipstok | | Member of Parliament |

| Finland | | Arja Alho | | Member of Parliament |

| Iceland | | Steingrímur J. Sigfússon | | Member of Parliament |

| Latvia | | Nominated Vice Chairman | | |

| | | Dace Nulle | | Director of Internal Audit Department, Ministry of Finance |

| | | Member: | | |

| | | To be appointed later | | |

| Lithuania | | Sigita Burbiene | | Former Member of Parliament |

| Norway | | Trond Helleland | | Member of Parliament |

| Sweden | | Nominated Chairman | | |

| | | Bill Fransson | | |

| | | Member: | | |

| | | Tuve Skånberg | | Member of Parliament |

At December 31, 2004, the Bank had 147employees.