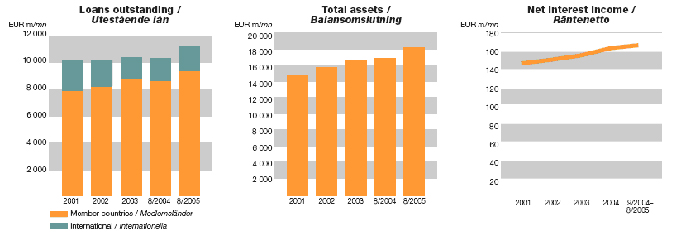

NIB shows good results for the year’s first eight months. Profits for the period increased by 5.2% from EUR 111 million in 2004 to EUR 117 million.This increase is mainly due to profits on financial transactions following the fall in long-term interest rates during 2005. Net interest income rose to EUR 110 million (August 2004: EUR 109 million).

With the membership of Estonia, Latvia and Lithuania on 1 January 2005, the Bank’s authorised and subscribed capital rose from EUR 4,000 million to EUR 4,142 million.

New loan agreements exceeded last year’s level, amounting to EUR 1,747 million (1,031) for the fi rst eight months. Loans disbursed amounted to EUR 1,378 million (779). This is the Bank’s highest ever level of disbursements. Loans outstanding were significantly higher than at end-August 2004 and amounted to EUR 11,315 million at end-August 2005. Loans outstanding amounted to EUR 10,279 million at year-end 2004.

Total assets rose from EUR 16 billion at year-end 2004 to EUR 19 billion. Net liquidity rose to EUR 3,445 million, compared with EUR 2,876 million at year-end. Equity reached EUR 1,900 million at period-end, compared with EUR 1,781 million at year-end. During the period under review, the Bank paid its owners in 2004 a dividend of EUR 55 million for that financial year.

The Bank pays special attention to further improving its existing systems and models for its risk management methods. Previously started projects on developing and improving risk management methods were continued. These methods combine a traditional system of management by limits and the use of benchmarks with a model-based follow-up of portfolio risks.

The quality of the Bank’s loan port-folio and of its financial counterparties continues to be maintained at a high level. The Bank recognised one minor credit loss. The net effect of credit losses and recoveries was positive at EUR 0.1 million.

The Bank expects to show good profits for the year 2005 as a whole.

LENDING

Member countries

The first eight months of 2005 were characterised by greater demand for NIB’s long-term loans, despite a high supply of liquidity in the market. The volume of the Bank’s new lending in the member countries reached an all-time high. NIB entered into loan agreements for EUR 1,188 million (778), and a total of EUR 1,165 million (650) was disbursed. Amortisations and prepayments amounted to EUR 467 million compared with EUR 784 million during the same period last year.

The currency distribution of new lending follows the same pattern as in previous years. The euro was the dominant lending currency, with a 58% (54) share of disbursements during the period under review. Another important lending currency was the Swedish krona, accounting for 18% (21).

The portfolio of loans outstanding and guarantees in the member countries amounted to EUR 9,384 million at the end of August 2005, compared with EUR 8,595 million at year-end 2004. In addition to the existing portfolio of loans outstanding, the Bank had, by the end of the period, concluded agreements on loans, not yet disbursed, totalling EUR 402 million, compared with EUR 430 million at year-end.

The manufacturing industry, which in recent years has been the largest sector, accounted for 41% of the amount of loans agreed during the period. Most of the loans to this sector went to cross-border corporate acquisitions, including the largest single disbursement, made to the food industry. Environmentally friendly and energy-saving investments in the pulp and paper industry in Sweden and Finland were also significant, accounting for one third of loans to the manufacturing industry.

The energy sector was the second largest, with 28% of loans agreed during the period under review. NIB’s loans went to, for example, investments in hydro power stations in Norway, a biofuelled power plant in Finland, as well as investments in environmentally friendly energy production in Sweden. In Estonia, Finland, Latvia and Norway, the Bank agreed on loans for the expansion of and improvements in electric transmission networks.

Part of the Bank’s lending to small and medium-sized enterprises is channelled through financial intermediaries. This efficient way for NIB to participate in the financing of small, mainly energy-and environment-related investments, was during the period especially used in Denmark.

International lending

Demand for the Bank’s loans outside the member countries was strong during the first eight months of 2005. New international loans were granted in the amount of EUR 760 million (310):EUR 614 million to 13 individual projects and EUR 147 million to six loan programmes in cooperation with financial and other intermediaries.

The Bank entered into 17 agreements corresponding to EUR 559 million (253) in the first eight months of 2005. Loan disbursements for the period were, however, lower than expected and amounted to EUR 213 million, even if they were higher compared to the total of EUR 129 million during the same period last year. The largest borrower regions were Asia and Central and Eastern Europe.

Loans outstanding amounted to EUR 1,956 million, compared with EUR 1,709 million at year-end 2004. Loans agreed but not yet disbursed rose to EUR 1,122 million, compared with EUR 717 million at year-end.

At present, NIB has loans outstanding in 32 countries outside the membership area. The cooperation with these countries is long-term and based on agreements made with the countries’ governments. As a rule, these agreements enable NIB to participate in the financing of projects in both the public and private sectors.

3

Loans outside the member countries are usually granted to governments or with government guarantees for important public projects. An increasing share of loans is now also granted for projects in the private sector, mostly concerning privatised infrastructure—telecommunications or energy, for example.

In addition, the Bank continues to increase the cooperation with its intermediaries in most of the countries with which it has framework agreements. At present, the number of intermediaries outside the membership area is 24. Of that number, 18 are financial intermediaries—mainly state-owned development banks or local commercial banks. By channelling part of the lending operations through financial intermediaries, NIB can participate efficiently in the financing of small and medium-sized enterprises’ investments in particular. Ministries or large companies in the infrastructure sector also act as intermediaries. Loans with the character of lending programmes or credit lines to these borrowers, which have recurrent investment needs in their respective areas of concentration, have proven to be a quick, effective way for NIB to participate in the financing of new projects.

International lending continues to be dominated by loans to infrastructure investments, especially in the energy, transportation, and telecommunications sectors. Among other projects, NIB has during the period agreed on loans for the financing of a motorway in Poland, a flood protection barrier as well as a modernisation project of a paper and pulp plant in Russia, the expansion of mobile telephone networks in the Philippines and Thailand, development of ports in India, Brazilian oil drilling-platforms, and a hydropower plant in Laos. Through loans to intermediaries, NIB also participates in the financing of projects in, for example, the industrial and service sector, as well as in the environmental, health and health-care sectors.

ENVIRONMENTAL FINANCING

Financing environmental investments is one of the cornerstones of NIB’s lending operations. NIB actively promotes investments that directly or indirectly reduce harmful emissions or other environmental hazards. Priority is given to environmental investments that are of importance for the member countries and their neighbouring areas. During the period under review, the Bank granted 16 new environmental loans, totalling EUR 232 million. Of the total loans disbursed during the period, almost 21% comprised environmental loans.

Important environmental projects in the member countries during the period concerned energy efficiency and wind power plants, as well as emission reduction investments in pulp and paper mills. All these projects have a significant positive environmental impact.

In the period July 2004 to July 2005 NIB chaired the Steering Group for the Northern Dimension Environmental Partnership (NDEP). The aim of the NDEP is to coordinate and stream-line the financing of environmental projects with cross-border effects in the Northern Dimension Area. Fifteen large environmental projects are either in the preparation or implementation stage. NIB is responsible for preparing and coordinating seven of these projects. Some of the feasibility studies of the NDEP projects are cofinanced with the Finnish Ministry of the Environment and the Swedish International Development Cooperation Agency Sida.

The first NDEP project to be completed was the Southwest Waste-water Treatment Plant in St. Petersburg, which was inaugurated in September 2005.The new plant will make a major contribution to improving the quality of water in the Baltic Sea as the effluent load of untreated and contaminated wastewater will be reduced significantly. Since 2000, NIB has been coordinating the financial structuring of the project and has acted as lead bank for the project financing.

During the period under review a loan was granted to a solid waste management project in Kaliningrad. The investment will substantially reduce the negative environmental impact of poor waste management practices. There is an urgent need to provide new landfill sites in Kaliningrad where waste disposal can be undertaken in a controlled way with appropriate pollution control procedures to en-sure environmental protection. The proposed investments comprise waste transport infrastructure and new landfill disposal, as well as necessary measures for the closure of existing dumpsites and landfills.

NIB has granted the first loans of the Ladoga programme to some paper and pulp manufacturers. The programme is an environmental investment initiative for the private sector in Northwest Russia aimed at decreasing environmental degradation in the area of the lakes Ladoga and Onega, headwaters for the river Neva that discharge into the Gulf of Finland. The programme is mainly geared towards large private companies in the paper, pulp and metal industries in the area. The investments are expected to lead to a reduction of harmful emissions from industrial processes in the region, and will lead to positive environmental effects for the Baltic Sea as well.

4

BORROWING

In the first eight months of the year, 21 (13) borrowing transactions were carried out in 7 (6) different currencies, in an amount corresponding to EUR 1,923 million (1,545).

The US dollar was NIB’s most important borrowing currency during the period. The Bank carried out seven transactions in US dollars for a total of EUR 1,259 million, which corresponds to 67% of the borrowing during the period. In spring 2005, the Bank launched its fourth global benchmark transaction of USD 1 billion in the form of five-year bonds. The bonds were sold to investors round the world on the basis of their global format and liquidity. Sales were distributed as follows: Asia/ Japan 44%, North America 34%, and Europe, Africa and the Middle East together 22%. Another transaction was a USD 500 million issue with a four-year maturity. The strategic objective of this issue was to broaden the Bank’s investor base by targeting retail and smaller institutional investors. The issue attracted many new investors, especially in Europe, where more than 50% of the bonds were sold.

The euro, the new Turkish lira, the Hong Kong dollar, the Australian dollar, the Japanese yen and the Slovak koruna were the other borrowing currencies during the period.

Total debts evidenced by certificates constituted EUR 14,466 million at period-end, compared with EUR 12,355 million at year-end 2004.

Helsinki, October 2005

Johnny Åkerholm

President and CEO

| Cash flow statement / Kassaflödesanalys | | | | | | | |

| (EUR 1,000) | | Jan.-Aug. 2005 | | Jan.-Aug. 2004 | | Jan.-Dec. 2004 | |

|

|

|

|

|

|

| |

| Cash flows from operating activities / Kassaflö från rörelsen | | 119,227 | | 119,180 | | 177,841 | |

| Investing activities / Investeringar 1) | | –1,080,636 | | 119,371 | | 287,722 | |

| Financing activities / Finansiering 1) | | 1,530,251 | | 206,475 | | –333,885 | |

|

|

|

|

|

|

| |

| Change in net liquidity / Förändring i nettolikviditet | | 568,842 | | 445,027 | | 131,678 | |

| Net liquidity at beginning of period / Nettolikviditet vid periodens början | | 2,875,973 | | 2,744,295 | | 2,744,295 | |

| Net liquidity at end of period / Nettolikviditet vid periodens slut | | 3,444,815 | | 3,189,322 | | 2,875,973 | |

5

| | | | | | |

| Changes in equity / Förändringar i eget kapital | | | | | |

| (EUR m / mn EUR) | | Jan.-Aug. 2005 | | Jan.-Aug. 2004 | | Jan.-Dec. 2004 | |

|

|

|

|

|

|

| |

| Equity at 1 Jan. / Eget kapital per 1 januari | | 1,781 | | 1,650 | | 1,650 | |

| Paid-in capital / Inbetalat grundkapital | | 5 | | — | | — | |

| Paid-in capital, receivable / Inbetalat grundkapital, fordringar | | 10 | | — | | — | |

| Payments to the Bank’s reserves, receivable / Inbetalningar till bankens reserver, fordringar | | 43 | | — | | — | |

| Dividend payment / Utdelning | | –55 | | –41 | | –41 | |

| Available-for-sale portfolio / Available-for-sale-portföljen | | — | | — | | — | |

| Hedge accounting / Säkringsredovisning | | — | | — | | — | |

| Profit for the period / Periodens resultat | | 117 | | 111 | | 172 | |

|

|

|

|

|

|

| |

| Changes in equity, total / Summa förändringar i eget kapital | | 119 | | 70 | | 131 | |

| Equity at end of period / Eget kapital vid periodens slut | | 1,900 | | 1,719 | | 1,781 | |

6

| | | | | | | | |

| Key figures / Nyckeltal | | | | | | | |

| (EUR m / mn EUR) | | Jan.-Aug. 2005 | | Jan.-Aug. 2004 | | Jan.-Dec. 2004 | |

|

|

|

|

|

|

| |

| Net interest income / Räntenetto | | 110 | | 109 | | 163 | |

| Profit / Överskott | | 117 | | 111 | | 172 | |

| Loans disbursed and guarantees issued / Utbetalade lån och ställda garantier | | 1,378 | | 779 | | 1,348 | |

| New loan agreements / Avtalade lån | | 1,747 | | 1,031 | | 1,657 | |

| New debt issues / Nyupplåning | | 1,923 | | 1,545 | | 1,808 | |

| Profi t/average equity / Överskott/genomsnittligt eget kapital (%) | | 9.6 | | 9.9 | | 10.1 | |

| | | 31 Aug. 2005 | | 31 Aug. 2004 | | 31 Dec. 2004 | |

|

|

|

|

|

|

| |

| Equity / Eget kapital | | 1,900 | | 1,719 | | 1,781 | |

| Equity/total assets / Eget kapital/balansomslutning (%) | | 10.3 | | 10.2 | | 10.9 | |

| Equity+callable capital/total assets / Eget Kapital+garantikapital/balansomslutning (%) | | 30.4 | | 31.4 | | 32.9 | |

1) In 2005 the Cash Flow Statement has been changed by handling the change in swap receivables and swap payables gross per swap contract. This is done in order to improve the transparency of the Cash Flow Statement and to facilitate the reconciliation of the cash flows to the Balance Sheet. / År 2005 har kassaflödesanalysen ändrats så att förändringen i swapfordringar och swapskulder har behandlats brutto per swapkontrakt. Detta har gjorts för att förbättra transparensen i kassaflödesanalysen och underlätta avstämmandet av kassaflödena mot balansräkningen.

Nordic Investment Bank

Fabianinkatu 34, P.O. Box 249, FI-00171 Helsinki, Finland

Telephone +358 9 18001, fax +358 9 180 0210, www.nib.int

Nordiska Investeringsbanken

Fabiansgatan 34, PB 249, FI-00171 Helsingfors, Finland

Telefon +358 9 18001, fax +358 9 180 0210, www.nib.int

7

RECENT DEVELOPMENTS

Since August 31, 2005 NIB has carried out 14 borrowing transactions in 7 different currencies, in an amount corresponding to Euro 493 million*. Repayment of borrowings previously entered into corresponded to Euro 1,078 million. The maturity profile for new borrowings during this period is set forth in the table below.

Maturity profile for new borrowing (as of February 13, 2006)

| | Number of | | Amount in | | | |

| | transactions | | EUR million | | Percentage | |

| |

|

|

|

|

| |

| 1-3 years | 6 | | 146 | | 30 | |

| 3-5 years | 4 | | 89 | | 18 | |

| 5-7 years | 2 | | 193 | | 39 | |

| 7-10 years | 1 | | 15 | | 3 | |

| 10 years and longer | 1 | | 50 | | 10 | |

|

|

|

|

|

| |

| Total | 14 | | 493 | | 100 | |

* During the period NIB has entered into additional new borrowing transactions that have not yet settled corresponding to Euro 88 million.

Provisions for loan losses

As of December 31, 2005 all NIB’s loans were performing. It is expected that no new allowances will be made for fiscal year 2005.

8