The COVID-19 pandemic has caused a sharp decline in global economic activity, threatening growth and employment also in the Nordic and Baltic countries. The Nordic-Baltic ministers, who are the Governors of NIB, invited the Bank already at the end of March to take swift action to help alleviate the effects of the COVID-19 crisis, thus our mission is more relevant than ever.

As an immediate response to the crisis we have substantially increased our lending. Loans have been made available to member countries and sustainable businesses that are facing short-term liquidity problems due to the crisis. We finance larger businesses directly. Small and medium-sized companies have access to our lending via financial intermediaries.

At the same time, it is of utmost importance that long-term challenges, such as climate change, shall not be forgotten during this crisis. NIB’s mission is to provide long-term financing to projects that ensure sustainable growth and lasting impact on the productivity and environment of the Nordic-Baltic region.

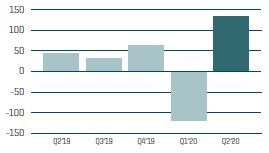

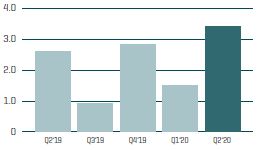

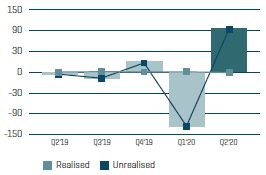

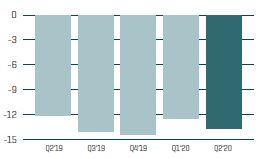

Disbursements in the first half of the year of EUR 2.8 billion were higher than anticipated and at a historically high level due to the Bank’s response to COVID-19. During the six-month period ending 30 June 2020, a total of EUR 3.4 billion in new loans were agreed. Due to the uncertain economic outlook, NIB has increased its provision for loan losses; however, no realised losses were recorded during the first six months of the year.

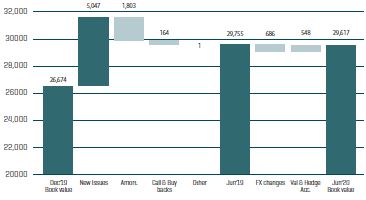

During the first six months of 2020, the Bank raised EUR 5.0 billion in new funding. Amongst other transactions, NIB issued its first EUR 1 billion NIB Response Bond. The proceeds of the bond will be used to finance projects that alleviate the social and economic consequences of the COVID-19 pandemic in our member countries.