Exhibit IX

Report of the Board of Directors 2011

At the beginning of 2011, the world economy showed some signs of picking up. However, towards the end of the year the outlook deteriorated significantly. The sovereign debt crisis deepened further, adversely affecting the confidence in the financial markets. Both the real economy and financial intermediation were negatively affected. Within this globally volatile context, the Nordic-Baltic region posted a relatively healthy economic performance.

In February 2011, the decision of the Board of Governors to increase the Bank’s capital base by EUR 2 billion came into force. After the increase, the Bank’s authorised capital totals EUR 6,142 million. With the additional capital, the 35-year-old NIB is well equipped to finance projects which contribute to enhancing the competitiveness and environment of the region.

Accordingly, NIB continued to build up the lending pipeline of projects fulfilling the Bank’s mandate. Demand for loans from IFIs such as NIB was good although increased uncertainty and worsened economic outlook had a negative effect on investments. During 2011, signings of new loan agreements reached EUR 2,608 million, compared to EUR 1,763 million in 2010. A similar upward trend was seen in loan disbursements. Of all loans NIB agreed to during this period, approximately 90% went to projects of high mandate fulfilment, mainly within the sectors of energy, environment and transport.

Turbulence in the financial markets, especially in the latter part of 2011, had only little impact on NIB’s funding programme. Investors were seeking stability and NIB raised almost EUR 3 billion at favourable costs.

The Bank’s profit for the period amounted to EUR 194 million (2010: EUR 211 million).

Strategic focus

During the financial crisis, NIB has focused on financing projects within its mandate. This was also emphasised in the context of the decision to increase the Bank’s capital, which entered into force in February 2011, after all member countries had completed their national procedures. Against the background of constrained public finances, NIB was actively encouraged to provide its financing and to complement other financing sources to support the competitiveness and environment in the Baltic Sea region.

Within the field of environment and energy, the Board took some additional steps. NIB’s Climate Change, Energy Efficiency and Renewable Energy (CLEERE) lending facility was further extended to EUR 3 billion in June 2011. The Bank launched the facility in early 2008 and had by the end of 2011 nearly committed the whole amount to projects aimed at promoting renewable energy, energy efficiency and other measures of abating and adapting to climate change. It is estimated that NIB’s share of projects agreed with customers in 2011 will reduce CO2 emissions by 933,700 tonnes per year.

In response to the effects of the financial crisis in its member countries, the Board of Directors also decided in December 2011 to step up its lending activities in 2012. A new lending facility, the NIB Refinancing Facility (NRF), of EUR 500 million, was created for this purpose. Loans, which are aimed at member country borrowers, would be granted within the mandate and risk framework of the Bank. Loans under the facility will be made on normal terms but the maturities can be shorter, starting from three years and up. Loans would be targeted at counterparties which have refinancing needs for projects that comply with NIB’s mandate.

The progress continued to be slower in the field of financing Baltic Sea projects. Less than half of the Baltic Sea Environment (BASE) lending facility of EUR 500 million was committed by the end of 2011. The BSAP fund managed by NIB and the Nordic Environment Finance Corporation (NEFCO) helped several new projects to be identified.

The environmental approach was complemented by a new product on the funding side, NIB Environmental Bond, which was launched in October. Through this new product, investors have the possibility to support NIB’s environmental lending. Projects funded through these bonds aim at either reducing emissions to the air by promoting energy efficiency, renewable energy, public transport solutions, recycling or reducing discharges to water by improving wastewater treatment and cutting down pollutant runoff from agriculture. The net proceeds of the issue are held in a separate portfolio pending disbursement to eligible projects. The first project earmarked for these funds was an offshore wind park in Denmark.

A business strategy for transport, logistics and communications was established. The new approach will help identify opportunities to finance qualified projects. In identifying eligible projects, NIB aims to support regional cooperation under the umbrella of the recently established Northern Dimension Partnership on Transport and Logistics (NDPTL) as well as the EU Strategy for the Baltic Sea region, including the development of trans-European transport.

As an important institutional step, a secretariat for the partnership was set up within NIB in Helsinki and its activities started in February 2011. The Secretariat has a staff of a director and two assistants. The Secretariat provides administrative and technical support to the Steering Committee and High Level Meetings in their task of monitoring the implementation of the partnership.

The revised Host Country Agreement (HCA) entered into force in January 2011.

Jesper Olesen acted as Chairman of the Board.

In January 2012, the Board of Directors of the Nordic Investment Bank appointed Henrik Normann (Denmark) as President and Chief Executive Officer of the Bank. Mr Normann will take up his appointment on 1 April 2012. He will succeed Mr Johnny Åkerholm (Finland), who has been President and CEO of NIB since April 2005.

Key figures

| | | | | | | | | | | | |

(in EUR million) | | 2011 | | | 2010 | | | 2009 | |

Net interest income | | | 228 | | | | 234 | | | | 219 | |

Profit/loss on financial operations | | | 8 | | | | 39 | | | | 178 | |

Loan impairments | | | 12 | | | | 38 | | | | 43 | |

Profit/loss | | | 194 | | | | 211 | | | | 324 | |

Equity | | | 2,456 | | | | 2,262 | | | | 2,050 | |

Total assets | | | 23,802 | | | | 24,898 | | | | 22,423 | |

Solvency ratio (equity/total assets %) | | | 10.3 | % | | | 9.1 | % | | | 9.1 | % |

Activities

In 2011, NIB continued to build its lending pipeline, resulting in an increase of new loan agreements. All in all, the Bank signed 47 loan agreements during 2011 for a total of EUR 2,608 million, a clear jump compared to EUR 1,763 million during the same period the previous year. The disbursement of loans rose to EUR 1,946 million, compared to EUR 1,274 million during the same period in 2010. The outcome was broadly in line with the business plan for 2011 with new loan agreements slightly exceeding the target and disbursement somewhat below the target.

Of all loan agreements, 87% went to projects of high mandate fulfilment in terms of competitiveness and environment. As in previous years, the sectors of power generation and supply, renewable energy and development of modern transport infrastructure dominated NIB’s lending. In addition, it is expected that a large portion of the still unallocated loans to financial intermediaries will eventually be allocated to high mandate projects.

NIB defines loans to projects with significant direct or indirect positive environmental impacts as environmental loans. In net terms, environment-related lending accounted for 31% of agreed loans in 2011. Key areas of operation were renewable energy (including wind energy and hydro power), combined heat and power plants, waste to energy, energy efficiency and wastewater treatment.

Energy investments accounted for 26% of the loans agreed during the year. The energy sector’s main focus is on energy efficiency, energy networks and sustainable and sufficient generation capacity. In 2011, NIB financed substantial projects in electricity transmission and distribution networks. An important milestone was the signing of a loan for construction of a 170-kilometre electricity interconnection between Estonia and Finland.

Within transport, logistics and communication, NIB targets road constructions, railways, airports, broadband and mobile phone networks. All these areas featured in new loan agreements which were 30% of the total new lending. Effective transport, logistics and communications are essential for ensuring competitiveness. Many projects also have significant environmental benefits.

In the innovation sector, NIB was active in financing research and development activities. One example in this category was the financing of the largest academic library in Finland.

NIB was also actively seeking high mandate compliance in other sectors such as manufacturing, mining or services. In addition, NIB makes loans available to financial intermediaries which in turn finance smaller projects in the SME sector.

In total, 82% of the lending was targeted inside the membership area.

NIB continued to closely monitor the Bank’s loan portfolio in order to identify and mitigate possible problems among existing borrowers.

Stable results, a strong balance sheet and high confidence in the owner countries supported NIB’s standing in the financial market in 2011. In the volatile environment, investors continued to support NIB’s funding programme, seeking a safe harbour in the Nordic countries. As a result, the Bank maintained its favourable funding costs throughout 2011. NIB borrowed a total of EUR 2.9 billion in 11 different currencies through 43 transactions which was broadly in line with the plan.The average maturity was 5.3 years. The long average maturity was achieved by issuing 15–20 year transactions in NOK and SEK and a NZD 10-year transaction. The funding cost was very favourable, and after financial swaps one of the lowest in the Bank’s history.

It is the Bank’s target to ensure a sufficient level of liquidity to be able to continue disbursing new loans and fulfil all payment obligations for one year forward, without necessitating additional funding. This target was reached in 2011.

Lending

| | | | | | | | | | | | |

(In EUR million unless otherwise specified) | | 2011 | | | 2010 | | | 2009 | |

Energy | | | 691 | | | | 383 | | | | 253 | |

Environment | | | 810 | | | | 498 | | | | 415 | |

Transport, logistics and communication | | | 770 | | | | 216 | | | | 327 | |

Innovation | | | 33 | | | | 102 | | | | 139 | |

Financial intermediaries | | | 211 | | | | 308 | | | | 144 | |

Others | | | 93 | | | | 257 | | | | 140 | |

Loans agreed, total | | | 2,608 | | | | 1,763 | | | | 1,417 | |

Member countries | | | 2,130 | | | | 1,284 | | | | 1,201 | |

Non-member countries | | | 478 | | | | 479 | | | | 216 | |

Number of loan agreements, total | | | 47 | | | | 39 | | | | 40 | |

Member countries | | | 37 | | | | 28 | | | | 33 | |

Non-member countries | | | 10 | | | | 11 | | | | 7 | |

Loans outstanding and guarantees | | | 14,157 | | | | 13,780 | | | | 13,775 | |

Member countries | | | 11,268 | | | | 11,019 | | | | 10,901 | |

Non-member countries | | | 2,889 | | | | 2,761 | | | | 2,874 | |

Repayments and prepayments | | | 1,835 | | | | 1,807 | | | | 1,343 | |

The statistics based on agreed loans includes loan programs which will be allocated to focus sectors only after the amounts have been disbursed.

Financial activities

| | | | | | | | | | | | |

(In EUR million) | | 2011 | | | 2010 | | | 2009 | |

New debt issues | | | 2,887 | | | | 4,120 | | | | 4,137 | |

Debts evidenced by certificates at year-end | | | 18,433 | | | | 19,944 | | | | 17,998 | |

Number of borrowing transactions | | | 43 | | | | 65 | | | | 71 | |

Number of borrowing currencies | | | 11 | | | | 11 | | | | 10 | |

Financial results

NIB’s net interest income amounted to EUR 228 million, which is broadly in line with the outcome of EUR 234 million in 2010.

The profit for the period amounted to EUR 194 million (2010: 211 million), of which net profit on financial operations accounted for EUR 8 million (2010: 39 million).

The administrative expenses for the period amounted to EUR 33 million. Loan impairment charges (net impairment charges) made during the period amounted to EUR 12 million (2010: 38 million).

The Bank’s statement of financial position total at the end of the period was EUR 24 billion (EUR 25 billion 2010). Loans outstanding increased to slightly more than EUR 14 billion.

Risk management

Overall, the quality of the Bank’s portfolios remained high in 2011, despite the continued weakness of the economic environment and the problems encountered by some counterparties. The share of the weakest risk classes remained stable during the year. The quality of loans in member countries remained sound. The quality of the loan portfolio in non-member countries was also largely unchanged in 2011. The credit quality of the treasury portfolio improved during the year. As regards both the geographical and sectoral distribution, as well as the degree of concentration in terms of exposure to individual counterparties, the portfolio distribution is fairly unchanged compared to the previous years. At year-end 2011, the member countries accounted for 76% of the lending exposure and 39% of the treasury exposure.

The Bank continued to emphasise follow-up measures on its customers and counterparties during 2011.

Outlook

NIB assumes that the supply of long-term financing will remain constrained due to increased uncertainty in the financial markets. Investment activity will be weak but NIB’s customers will face significant refinancing needs. NIB will look at possibilities to support borrowers in the Nordic–Baltic area within its mandate and risk framework. This activity will be facilitated by continued good access to funding.

Proposal by the Board of Directors to the Board of Governors

The Board of Directors’ proposal with regard to the financial results for the year 2011 takes into account the need to keep the Bank’s ratio of equity to total assets at a secure level, which is a prerequisite for maintaining the Bank’s high creditworthiness.

In accordance with section 11 of the Statutes of the Bank, the profit for 2011 of EUR 194,036,624.80 is to be allocated as follows:

- EUR 194,036,624.80 is transferred to the General Credit Risk Fund as a part of equity;

- no transfer is made to the Special Credit Risk Fund for Project Investment Loans;

- no transfer is made to the Statutory Reserve. The Statutory Reserve amounts to EUR 683,685,337.72 or 11.1% of the Bank’s authorised capital stock as of 31 December 2011; and

- no dividends be made available to the Bank’s member countries.

Read more in the statement of comprehensive income, statement of financial position, changes in equity and cash flow statement, as well as in the notes to the financial statements.

Helsinki, 1 March 2012

Jesper Olesen

Rolandas Kriščiūnas

Madis Üürike

Kristina Sarjo

Þorsteinn Þorsteinsson

Kaspars Āboliņš

Heidi Heggenes

Erik Åsbrink

Johnny Åkerholm

President and CEO

Statement of comprehensive income 1 January–31 December

| | | | | | | | | | | | |

EUR 1,000 | | Note | | | 2011 | | | 2010 | |

Interest income | | | | | | | 499,642 | | | | 429,649 | |

Interest expense | | | | | | | –271,189 | | | | –195,999 | |

Net interest income | | | (1),(2),(22) | | | | 228,452 | | | | 233,650 | |

| | | |

Commission income and fees received | | | (3) | | | | 10,310 | | | | 12,070 | |

Commission expense and fees paid | | | | | | | –2,203 | | | | –2,423 | |

Net profit/loss on financial operations | | | (4) | | | | 7,575 | | | | 39,317 | |

Foreign exchange gains and losses | | | | | | | –653 | | | | 2,822 | |

Operating income | | | | | | | 243,483 | | | | 285,436 | |

| | | |

Expenses | | | | | | | | | | | | |

General administrative expenses | | | (5),(22) | | | | 32,955 | | | | 31,381 | |

Depreciation | | | (9),(10) | | | | 4,048 | | | | 4,735 | |

Impairment of loans | | | (6),(8) | | | | 12,442 | | | | 38,489 | |

| | | | | | | | | | | | |

Total expenses | | | | | | | 49,446 | | | | 74,604 | |

| | | | | | | | | | | | |

| | | |

PROFIT/LOSS FOR THE YEAR | | | | | | | 194,037 | | | | 210,832 | |

| | | |

Value adjustments on the available-for-sale portfolio | | | | | | | — | | | | 514 | |

| | | | | | | | | | | | |

Total comprehensive income | | | | | | | 194,037 | | | | 211,346 | |

| | | | | | | | | | | | |

The Nordic Investment Bank’s accounts are kept in euro.

Statement of financial position at 31 December

| | | | | | | | | | | | | | |

EUR 1,000 | | | | Note | | | 2011 | | | 2010 | |

ASSETS | | | | | (1),(18),(19),(20),(21) | | | | | | | | | |

Cash and cash equivalents | | | | | (17),(23) | | | | 2,414,954 | | | | 2,725,570 | |

| | | | |

Financial placements | | | | | (17) | | | | | | | | | |

Placements with credit institutions | | | | | | | | | 3,517 | | | | 130,262 | |

Debt securities | | | | | (7 | ) | | | 4,343,767 | | | | 5,074,778 | |

Other | | | | | | | | | 25,508 | | | | 26,238 | |

| | | | | | | | | 4,372,792 | | | | 5,231,278 | |

| | | | |

Loans outstanding | | | | | (8),(17) | | | | 14,152,905 | | | | 13,771,286 | |

Intangible assets | | | | | (9) | | | | 4,560 | | | | 5,158 | |

Tangible assets, property and equipment | | | | | (9) | | | | 30,806 | | | | 31,888 | |

| | | | |

Other assets | | | | | (11),(17) | | | | | | | | | |

Derivatives | | | | | | | | | 2,420,570 | | | | 2,717,942 | |

Other assets | | | | | (22 | ) | | | 38,625 | | | | 37,357 | |

| | | | | | | | | 2,459,195 | | | | 2,755,299 | |

| | | | |

Payments to the Bank’s reserves, receivable | | | | | | | | | 2,640 | | | | 5,280 | |

Accrued interest and fees receivable | | | | | | | | | 363,687 | | | | 372,071 | |

| | | | | | | | | | | | | | |

TOTAL ASSETS | | | | | | | | | 23,801,539 | | | | 24,897,830 | |

| | | | | | | | | | | | | | |

| | | | |

LIABILITIES AND EQUITY | | | | | (1),(18),(19),(20),(21) | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | |

Amounts owed to credit institutions | | | | | (17),(22) | | | | | | | | | |

Short-term amounts owed to credit institutions | | | | | (16),(23) | | | | 1,495,517 | | | | 1,131,200 | |

Long-term amounts owed to credit institutions | | | | | | | | | 101,666 | | | | 144,130 | |

| | | | | | | | | 1,597,183 | | | | 1,275,330 | |

| | | | |

Debts evidenced by certificates | | | | | (12),(17) | | | | | | | | | |

Debt securities issued | | | | | | | | | 18,359,521 | | | | 19,709,566 | |

Other debt | | | | | | | | | 73,200 | | | | 234,476 | |

| | | | | | | | | 18,432,721 | | | | 19,944,042 | |

Other liabilities | | | | | (13),(17) | | | | | | | | | |

Derivatives | | | | | | | | | 1,025,842 | | | | 1,116,684 | |

Other liabilities | | | | | | | | | 9,942 | | | | 5,816 | |

| | | | | | | | | 1,035,785 | | | | 1,122,500 | |

| | | | |

Accrued interest and fees payable | | | | | | | | | 279,378 | | | | 294,303 | |

| | | | | | | | | | | | | | |

Total liabilities | | | | | | | | | 21,345,067 | | | | 22,636,174 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

EUR 1,000 | | | | | Note | | | 2011 | | | 2010 | |

Equity | | | | | | | | | | | | | | | | |

Authorised and subscribed capital | | | 6,141,903 | | | | | | | | | | | | | |

of which callable capital | | | –5,723,302 | | | | | | | | | | | | | |

Paid-in capital | | | 418,602 | | | | (14) | | | | 418,602 | | | | 418,602 | |

Reserve funds | | | | | | | (15) | | | | | | | | | |

Statutory Reserve | | | | | | | | | | | 683,685 | | | | 683,046 | |

General Credit Risk Fund | | | | | | | | | | | 761,589 | | | | 550,757 | |

Special Credit Risk Fund PIL | | | | | | | | | | | 395,919 | | | | 395,919 | |

Payments to the Bank’s reserves, receivable | | | | | | | | | | | 2,640 | | | | 5,280 | |

Other value adjustments | | | | | | | | | | | — | | | | –2,780 | |

Profit/loss for the year | | | | | | | | | | | 194,037 | | | | 210,832 | |

| | | | | | | | | | | | | | | | |

Total equity | | | | | | | | | | | 2,456,472 | | | | 2,261,656 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL LIABILITIES AND EQUITY | | | | | | | | | | | 23,801,539 | | | | 24,897,830 | |

| | | | | | | | | | | | | | | | |

| | | | |

Collateral and commitments | | | | | | | (16) | | | | | | | | | |

The Nordic Investment Bank’s accounts are kept in euro.

Changes in equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EUR 1,000 | | Paid-in

capital | | | Statutory

Reserve* | | | General

Credit

Risk

Fund | | | Special

Credit

Risk

Fund

PIL | | | Payments

to the

Bank’s

Statutory

Reserve

and credit

risk funds | | | Appropriation

to dividend

payment | | | Other value

adjustments* | | | Profit/Loss

for the year | | | Total | |

EQUITY AT 31 DECEMBER 2009 | | | 418,602 | | | | 670,568 | | | | 340,857 | | | | 281,919 | | | | 17,758 | | | | 0 | | | | –3,294 | | | | 323,900 | | | | 2,050,310 | |

Appropriations between reserve funds | | | | | | | | | | | 209,900 | | | | 114,000 | | | | | | | | | | | | | | | | –323,900 | | | | 0 | |

Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

Called in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | 12,478 | | | | | | | | | | | | –12,478 | | | | | | | | | | | | | | | | 0 | |

Comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | 514 | | | | 210,832 | | | | 211,346 | |

EQUITY AT 31 DECEMBER 2010 | | | 418,602 | | | | 683,046 | | | | 550,756 | | | | 395,919 | | | | 5,280 | | | | 0 | | | | –2,780 | | | | 210,832 | | | | 2,261,656 | |

Appropriations between reserve funds * | | | | | | | –2,000 | | | | 210,832 | | | | | | | | | | | | | | | | 2,000 | | | | -210,832 | | | | 0 | |

Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

Called in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | 2,640 | | | | | | | | | | | | –2,640 | | | | | | | | | | | | | | | | 0 | |

Comprehensive income for the year * | | | | | | | | | | | | | | | | | | | | | | | | | | | 779 | | | | 194,037 | | | | 194,816 | |

EQUITY AT 31 DECEMBER 2011 | | | 418,602 | | | | 683,685 | | | | 761,589 | | | | 395,919 | | | | 2,640 | | | | 0 | | | | 0 | | | | 194,037 | | | | 2,456,472 | |

| | | | | | | | |

Proposed appropriation of the year’s profit/loss | | 2011 | | | 2010 | |

Appropriation to Statutory Reserve | | | — | | | | — | |

Appropriations to credit risk reserve funds | | | | | | | | |

General Credit Risk Fund | | | 194,037 | | | | 210,832 | |

Special Credit Risk Fund PIL | | | — | | | | — | |

Appropriation to dividend payment | | | — | | | | — | |

Profit/loss for the year | | | 194,037 | | | | 210,832 | |

* Other value adjustments have been moved from the available for sale portfolio to the statutory reserve on 1/5/2011 when IFRS 9 was implemented regarding the classification of financial assets.

The Nordic Investment Bank’s accounts are kept in euro.

Cash flow statement 1 January–31 December

| | | | | | | | | | |

EUR 1,000 | | Note | | Jan–Dec 2011 | | | Jan–Dec 2010 | |

Cash flows from operating activities | | | | | | | | | | |

Profit/loss from operating activities | | | | | 194,037 | | | | 210,832 | |

| | | |

Adjustments: | | | | | | | | | | |

Unrealised gains/losses of financial assets held at fair value | | | | | –11,223 | | | | –26,871 | |

Impairment of bonds held at amortised cost | | | | | 11,819 | | | | — | |

Depreciation and write-down in value of tangible and intangible assets | | | | | 4,048 | | | | 4,735 | |

Change in accrued interest and fees (assets) | | | | | 8,427 | | | | 212 | |

Change in accrued interest and fees (liabilities) | | | | | –14,925 | | | | 3,759 | |

Impairment of loans | | | | | 12,442 | | | | 38,489 | |

Adjustment to hedge accounting | | | | | 1,574 | | | | –5,029 | |

Other adjustments to the year’s profit | | | | | –37 | | | | –39 | |

| | | | | | | | | | |

Adjustments, total | | | | | 12,126 | | | | 15,257 | |

| | | | | | | | | | |

| | | |

Lending | | | | | | | | | | |

Disbursements of loans | | | | | –1,946,500 | | | | –1,274,234 | |

Repayments of loans | | | | | 1,835,279 | | | | 1,806,725 | |

Capitalisations, redenominations, index adjustments, etc. | | | | �� | –846 | | | | –237 | |

Transfer of loans to claims in other assets | | | | | 7,972 | | | | — | |

Exchange rate adjustments | | | | | –100,179 | | | | –533,249 | |

| | | | | | | | | | |

Lending, total | | | | | –204,274 | | | | –996 | |

| | | | | | | | | | |

| | | |

Cash flows from operating activities, total | | | | | 1,889 | | | | 225,093 | |

| | | |

Cash flows from investing activities | | | | | | | | | | |

Placements and debt securities | | | | | | | | | | |

Purchase of debt securities | | | | | –2,082,224 | | | | –3,253,162 | |

Sold and matured debt securities | | | | | 2,830,234 | | | | 3,898,729 | |

Placements with credit institutions | | | | | 126,745 | | | | –45,227 | |

Other financial placements | | | | | –751 | | | | –5,355 | |

Exchange rate adjustments, etc. | | | | | –2,575 | | | | –46,940 | |

| | | | | | | | | | |

Placements and debt securities, total | | | | | 871,430 | | | | 548,045 | |

| | | | | | | | | | |

| | | |

Other items | | | | | | | | | | |

Acquisition of intangible assets | | | | | –1,655 | | | | –1,197 | |

Acquisition of tangible assets | | | | | –712 | | | | –424 | |

Change in other assets | | | | | –4,979 | | | | 1,774 | |

| | | | | | | | | | |

Other items, total | | | | | –7,346 | | | | 154 | |

| | | | | | | | | | |

| | | |

Cash flows from investing activities, total | | | | | 864,084 | | | | 548,199 | |

| | | | | | | | | | | | |

EUR 1,000 | | Note | | | Jan–Dec 2011 | | | Jan–Dec 2010 | |

| | | |

Cash flows from financing activities | | | | | | | | | | | | |

Debts evidenced by certificates | | | | | | | | | | | | |

Issues of new debt | | | | | | | 2,886,621 | | | | 4,120,271 | |

Redemptions | | | | | | | –4,632,648 | | | | –4,444,943 | |

Exchange rate adjustments | | | | | | | 416,864 | | | | 1,785,787 | |

| | | | | | | | | | | | |

Debts evidenced by certificates, total | | | | | | | –1,329,163 | | | | 1,461,116 | |

| | | | | | | | | | | | |

| | | |

Other items | | | | | | | | | | | | |

Long-term placements from credit institutions | | | | | | | –42,464 | | | | –56,922 | |

Change in swap receivables | | | | | | | 33,463 | | | | –764,456 | |

Change in swap payables | | | | | | | –209,510 | | | | –350,647 | |

Change in other liabilities | | | | | | | 4,127 | | | | –1,931 | |

Paid-in capital and reserves | | | | | | | 2,640 | | | | 12,478 | |

| | | | | | | | | | | | |

Other items, total | | | | | | | –211,744 | | | | –1,161,479 | |

| | | | | | | | | | | | |

| | | |

Cash flows from financing activities, total | | | | | | | –1,540,907 | | | | 299,636 | |

| | | | | | | | | | | | |

| | | |

CHANGE IN NET LIQUIDITY | | | (23 | ) | | | –674,934 | | | | 1,072,929 | |

| | | |

Opening balance for net liquidity | | | | | | | 1,594,370 | | | | 521,442 | |

Closing balance for net liquidity | | | | | | | 919,437 | | | | 1,594,370 | |

| | | |

Additional information to the statement of cash flows | | | | | | | | | | | | |

Interest income received | | | | | | | 508,025 | | | | 429,867 | |

Interest expense paid | | | | | | | –286,114 | | | | –192,240 | |

The cash flow statement has been prepared using the indirect method and cash flow items cannot be directly concluded from the statements of financial positions.

The Nordic Investment Bank’s accounts are kept in euro.

Notes to the financial statements

ACCOUNTING POLICIES

General operating principles

The operations of the Nordic Investment Bank (hereinafter called the Bank or NIB) are governed by an agreement among the governments of Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden (hereinafter called the member countries), and the Statutes adopted in conjunction with that agreement. NIB is an international financial institution that operates in accordance with sound banking principles. NIB finances private and public projects which have high priority with the member countries and the borrowers. NIB finances projects both in and outside the member countries, and offers its clients long-term loans and guarantees on competitive market terms.

NIB acquires the funds to finance its lending by borrowing on international capital markets.

The authorised capital stock of the Bank is subscribed by the member countries. Any increase or decrease in the authorised capital stock shall be decided by the Board of Governors, upon a proposal of the Board of Directors of the Bank.

In the member countries, the Bank is exempt from payment restrictions and credit policy measures, and has the legal status of an international legal person, with full legal capacity. The Agreement concerning NIB contains provisions regarding immunity and privileges accorded to the Bank, e.g. the exemption of the Bank’s assets and income from taxation.

The headquarters of the Bank are located at Fabianinkatu 34 in Helsinki, Finland.

Significant accounting policies

Basis for preparing the financial statements

The Bank’s financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB). The Bank’s accounts are kept in euro. With the exceptions noted below, they are based on historical cost.

New and amended standard adopted by the Bank from 1 May 2011

IFRS 9, Financial Instruments: Classification and Measurement, was issued in November 2009 with mandatory application from annual periods beginning on or after 1 January 2015 with early adoption permitted. The Bank decided to adopt IFRS 9 from 1 May 2011, because the new accounting standard better reflects the Bank’s business model. Early adopters with an initial application date before 1 January 2012 need not restate comparative information for prior periods.

IFRS 9 replaces the parts of IAS 39 that relate to the classification and measurement of financial assets (Phase 1). The Board’s work on the other phases is ongoing and includes impairment of financial instruments and hedge accounting, with a view to replacing IAS 39 Financial Instruments in its entirety. Phase 1 of IFRS 9 applies to all financial instruments within the scope of IAS 39.

Financial assets

IFRS 9 requires financial assets to be classified, at the point of initial recognition, into two measurement categories: those measured at fair value and those measured at amortised cost. The classification depends on both the Bank’s business model for managing the assets and their contractual cash flow characteristics.

Impact

IFRS 9 had no significant impact on the classification and measurement of financial assets.

Financial assets categorised as available for sale, a portfolio of EUR 29 million, was reclassified as part of the fair value portfolio.

Held for trading assets were retained as financial assets at fair value.

All financial placements classified as held-to-maturity financial investments were retained in the amortised cost category.

Loans met the requirements for amortised cost and were classified as such.

Significant accounting judgements and estimates

As part of the process of preparing the financial statements in conformity with IFRS, the Bank’s management is required to make certain judgements,estimates and assumptions that have an effect on the Bank’s profits, its financial position and other information presented in the Annual Report. These estimates are based on available information and the judgements made by the Bank’s management. Actual outcomes may deviate from the assessments made, and such deviations may at times be substantial.

The Bank uses various valuation models and techniques to estimate fair values of assets and liabilities. There are significant uncertainties related to these estimates in particular when they involve modelling complex financial instruments, such as derivative instruments used for hedging activities related to both borrowing and lending. The estimates are highly dependent on market data, such as the level of interest rates, currency rates and other factors. The uncertainties related to these estimates are reflected mainly in the statement of financial position. NIB undertakes continuous development in order to improve the basis for the fair value estimates, both with regard to modelling and market data. Changes in estimates resulting from refinements in assumptions and methodologies are reflected in the period in which the enhancements are first applied.

Judgements and estimates are also associated with impairment testing of loans and claims.

Recognition and derecognition of financial instruments

Financial instruments are recognised in the statement of financial position on a settlement date basis.

A financial asset is derecognised when the contractual rights to the cash flows from the financial asset expire.

A financial liability is removed from the statement of financial position when the obligation specified in the contract is discharged, cancelled or expires.

Foreign currency translation

Monetary assets and liabilities denominated in foreign currencies are recognised in the accounts at the exchange rate prevailing on the closing date. Non-monetary assets and liabilities are recognised in the accounts at the euro rate prevailing on the transaction date. Income and expenses recognised in currencies other than the euro are converted on a daily basis to the euro, in accordance with the euro exchange rate prevailing each day.

Realised and unrealised exchange rate gains and losses are recognised in the statement of comprehensive income.

The Bank uses the official exchange rates published for the euro by the European Central Bank. See Note 24.

Basis for measurement

The financial statements have been prepared on the historical cost basis except for the following material items in the statement of financial position.

From 1 May 2011, the Bank classifies its financial assets in the following categories: those measured at amortised cost, and those measured at fair value. This classification depends on both the contractual characteristics of the assets and the business model adopted for their management.

Financial assets at amortised cost

An investment is classified at “amortised cost” only if both of the following criteria are met: the objective of the Bank’s business model is to hold the assets in order to collect the contractual cash flows and the contractual terms of the financial assets must give rise on specified dates to cash flows that are only payments of principal and interest on the principal amount outstanding.

Financial assets at fair value

If either of the two criteria above is not met, the asset cannot be classified in the amortised cost category and must be classified at fair value.

Recognised financial assets and financial liabilities designated as hedged items in qualifying fair value hedge relationships are adjusted for changes in fair value attributable to the risk being hedged.

Cash and cash equivalents, net liquidity

Cash and cash equivalents comprise monetary assets and placements with original maturities of six months or less, calculated from the date the acquisition and placements were made.

Net liquidity in the cash flow statement refers to the net amount of monetary assets, placements and liabilities with original maturities of six months or less calculated from the time the transaction was entered into.

Financial placements

Items recognised as financial placements in the statement of financial position include placements with credit institutions and in debt securities, for example, bonds and other debt certificates, as well as certain placements in instruments with equity features. The placements are initially recognised on the settlement date. Their subsequent accounting treatment depends on both the Bank’s business model for managing the placements and their contractual cash flow characteristics.

Lending

The Bank may grant loans and provide guarantees under its Ordinary Lending or under special lending facilities. The special lending facilities, which carry member country guarantees, consist of Project Investment Loans (PIL) and Environmental Investment Loans (MIL).

Ordinary Lending includes loans and guarantees within and outside the member countries. The Bank’s Ordinary Lending ceiling corresponds to 250% of its authorised capital and accumulated general reserves and amounts to EUR 19,460 million following the allocations of the year’s profit in accordance with the Board of Directors’ proposal.

Project Investment Loans are granted for financing creditworthy projects in the emerging markets of Africa, Asia, Europe and Eurasia, Latin America and the Middle East. The Bank’s Statutes permit loans to be granted and guarantees to be issued under the PIL facility up to an amount corresponding to EUR 4,000 million. The member countries guarantee the PIL loans up to a total amount of EUR 1,800 million. The Bank, however, will assume 100% of any losses incurred under an individual PIL loan, up to the amount available at any given time in the Special Credit Risk Fund for PIL. Only thereafter would the Bank be able to call the member countries’ guarantees according to the following principle: the member countries guarantee 90% of each loan under the PIL facility up to a total amount of EUR 1,800 million. Payment under the member countries’ guarantees would take place at the request of the Board of Directors, as provided for under an agreement between the Bank and each individual member country.

The Bank is authorised to grant special Environmental Investment Loans up to the amount of EUR 300 million, for the financing of environmental projects in the areas adjacent to the member countries. The Bank’s member countries guarantee 100% of the MIL facility.

The Bank’s lending transactions are recognised in the statement of financial position at the time the funds are transferred to the borrower. Loans are recognised initially at historical cost, which corresponds to the fair value of the transferred funds including transaction costs. Loans outstanding are carried at amortised cost. If the loans are hedged against changes in fair value by using derivative instruments, they are recognised in the statement of financial position at fair value, with value changes recognised in the statement of comprehensive income. Changes in fair value are mainly caused by changes in market interest rates.

Impairment of loans and receivables

The Bank reviews its problem loans and receivables at each reporting date to assess whether an allowance for impairment should be recorded in the statement of comprehensive income. In particular, judgement by management is required in the estimation of the amount and timing of future cash flows when determining the level of allowance required. Such estimates are based on assumptions about a number of factors and actual results may differ, resulting in future changes to the allowance.

Receivables are carried at their estimated recoverable amount. Where the collectability of identified loans is in doubt, specific impairment losses are recognised in the statement of comprehensive income. Impairment is defined as the difference between the carrying value of the asset and the net present value of expected future cash flows, determined using the instrument’s original effective interest rate where applicable.

In addition to specific allowances against individual loans, the Bank assesses the need to make a collective impairment test on exposures which, although not specifically identified as requiring a specific allowance, have a

greater risk of default than when originally granted. This collective impairment test is based on any deterioration in the internal rating of the groups of loans or investments from the time they were granted or acquired. These internal ratings take into consideration factors such as any deterioration in counterparty risk, value of collaterals or securities received, and sectoral outlook, as well as identified structural weaknesses or deterioration in cash flows.

On the liabilities side, impairment is recognised in respect of the guarantees NIB has issued. The impairment is recognised when it is both probable that the guarantee will need to be settled and the settlement amount can be reliably estimated.

In the event that payments in respect of an ordinary loan are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing and consequently the need for impairment is assessed and recognised.

In the event that payments in respect of a PIL loan to a government or guaranteed by a government are more than 180 days overdue, all of the borrower’s loans are deemed to be non-performing.

Whenever payments in respect of a PIL loan that is not to a government or guaranteed by a government are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing. Impairment losses are then recognised in respect of the part of the outstanding loan principal, interest, and fees that correspond to the Bank’s own risk for this loan facility at any given point in time.

Intangible assets

Intangible assets mainly consist of investments in software, software licences and ongoing investments in new ICT systems. The investments are carried at historical cost, and are amortised over the assessed useful life of the assets, which is estimated to be between three and five years. The amortisations are made on a straight-line basis.

Tangible assets

Tangible assets in the statement of financial position include land, buildings, office equipment, and other tangible assets owned by the Bank. The assets are recognised at historical cost, less any accumulated depreciation based on their assessed useful life. No depreciations are made for land. The Bank’s office building in Helsinki is depreciated on a straight-line basis over a 40-year period. The Bank’s other buildings are depreciated over a 30-year period. The depreciation period for office equipment and other tangible assets is determined by assessing the individual item. The depreciation period is usually three to five years. The depreciations are calculated on a straight-line basis.

Write-downs and impairment of intangible and tangible assets

The Bank’s assets are reviewed annually for impairment. If there is any objective evidence of impairment, the impairment loss is determined based on the recoverable amount of the assets.

Borrowing

The Bank’s borrowing transactions are recognised in the statement of financial position at the time the funds are transferred to the Bank. The borrowing transactions are recognised initially at a cost that comprises the fair value of the funds transferred, less transaction costs. The Bank uses derivative instruments to hedge the fair value of virtually all its borrowing transactions. In these instances, the borrowing transaction is subsequently recognised in the statement of financial position at fair value, with any changes in value recognised in the statement of comprehensive income.

Securities delivered under repurchase agreements are not derecognised from the statement of financial position. Cash received under repurchase agreements are recognised in the statement of financial position as “Repurchase agreements”.

Derivative instruments and hedge accounting

The Bank’s derivative instruments are initially recognised on a trade-date basis at fair value in the statement of financial position as “Other assets” or “Other liabilities”.

During the time the Bank holds a derivative instrument, any changes in the fair value of such an instrument are recognised in the statement of comprehensive income, or directly in “Equity” as part of the item “Other value adjustments”, depending on the purpose for which the instruments were acquired. The value changes of derivative instruments that were not acquired for hedging purposes are recognised in the statement of comprehensive income. The accounting treatment for derivative instruments that were acquired for hedging purposes depends on whether the hedging operation was in respect of cash flow or fair value.

At the time the IAS 39 standard concerning hedge accounting was adopted, the Bank had a portfolio of floating rate assets, which had been converted to fixed rates using derivative contracts (swaps). This portfolio was designated as a

cash flow hedge, but this specific type of hedging is no longer used for new transactions. In general, the Bank does not have an ongoing programme for entering into cash flow hedging, although it may choose to do so at any given point in time.

When hedging future cash flows, the change in fair value of the effective portion of the hedging instrument is recognised directly in “Equity” as part of the item “Other value adjustments” until the maturity of the instrument. At maturity, the amount accumulated in “Equity” is included in the statement of comprehensive income in the same period or periods during which the hedged item affects the statement of comprehensive income.

In order to protect NIB from market risks that arise as an inherent part of its borrowing and lending activities, the Bank enters into swap transactions. The net effect of the swap hedging is to convert the borrowing and lending transactions to floating rates. This hedging activity is an integral part of the Bank’s business process and is a fair value hedge.

When hedging the fair value of a financial asset or liability, the derivative instrument’s change in fair value is recognised in the statement of comprehensive income together with the hedged item’s change in fair value in “Net profit on financial operations”.

Sometimes a derivative may be a component of a hybrid financial instrument that includes both the derivative and a host contract. Such embedded derivative instruments are part of a structured financing transaction that is hedged against changes in fair value by means of matching swap contracts. In such cases, both the hedged borrowing transaction and the hedging derivative instrument are recognised at fair value with changes in fair value in the statement of comprehensive income.

The hedge accounting is based on a clearly documented relationship between the item hedged and the hedging instrument. When there is a high (negative) correlation between the hedging instrument on the one hand and the value change of the hedged item or the cash flows generated by the hedged item on the other, the hedge is regarded as effective. The hedging relationship is documented at the time the hedge transaction is entered into, and the effectiveness of the hedge is assessed continuously.

Determination of fair value

The fair value of financial instruments, including derivative instruments that are traded in a liquid market, is the bid or offered closing price at balance sheet date. Many of NIB’s financial instruments are not traded in a liquid market, like the Bank’s borrowing transactions with embedded derivative instruments. These are measured at fair value using different valuation models and techniques. This process involves determining future expected cash flows, which can then be discounted to the balance sheet date. The estimation of future cash flows for these instruments is subject to assumptions on market data and in some cases, in particular where options are involved, even on the behaviour of the Bank’s counterparties. The fair value estimate may therefore be subject to large variations and may not be realisable in the market. Under different market assumptions the values could also differ substantially.

The Bank measures fair values using the following fair value hierarchy that reflects the significance of the inputs used in making the measurements:

Level 1: Quoted market prices (unadjusted) in an active market for identical instruments.

Level 2: Valuation techniques based on observable inputs, either directly (i.e. as prices) or indirectly (i.e. derived from prices). This category includes instruments valued using: quoted market prices in active markets for similar instruments; quoted prices for identical or similar instruments in markets that are considered less than active; or other valuation techniques where all significant inputs are directly or indirectly observable from market data.

Level 3: Valuation techniques using significant unobservable inputs. This category includes all instruments where the valuation technique includes inputs not based on observable data and the unobservable inputs have a significant effect on the instrument’s valuation. This category includes instruments that are valued based on quoted prices for similar instruments where significant unobservable adjustments or assumptions are required to reflect differences between the instruments.

See Note 17 for further details.

Equity

As of 31 December 2011, the Bank’s authorised and subscribed capital is EUR 6,141.9 million, of which the paid-in portion is EUR 418.6 million. Payment of the subscribed, non-paid-in portion of the authorised capital, that is, the callable capital, will take place at the request of the Bank’s Board of Directors to the extent that the Board deems it necessary for the fulfilment of the Bank’s debt obligations.

In June 2010, the Board of Governors decided to increase the Bank’s authorised capital by EUR 2 billion to EUR 6,141.9 million. The capital increase came into force on 16 February 2011 after all member countries had confirmed the increase.

The increase was allocated to the callable portion of the authorised capital stock.

The Bank’s reserves have been built up by means of appropriations from the profits of previous accounting periods, and consist of the Statutory Reserve, as well as the General Credit Risk Fund and the Special Credit Risk Fund for PIL.

The Bank’s profits, after allocation to appropriate credit risk funds, are transferred to the Statutory Reserve until it amounts to 10% of NIB’s subscribed authorised capital. Thereafter, the Board of Governors, upon a proposal by the Bank’s Board of Directors, shall decide upon the allocation of the profits between the reserve fund and dividends on the subscribed capital.

The General Credit Risk Fund is designed to cover unidentified exceptional risks in the Bank’s operations. Allocations to the Special Credit Risk Fund for PIL are made primarily to cover the Bank’s own risk in respect of credit losses on PIL loans.

Interest

The Bank’s net interest income includes accrued interest on loans, debt securities, placements and accruals of the premium or discount value of financial instruments. Net interest income also includes interest expenses on debts, swap fees and borrowing costs.

Fees and commissions

Fees collected when disbursing loans are recognised as income at the time of the disbursement, which means that fees and commissions are recognised as income at the same time as the costs are incurred. Commitment fees are charged on loans that are agreed but not yet disbursed, and are accrued in the statement of comprehensive income over the commitment period.

Annually recurrent costs arising as a result of the Bank’s borrowing, investment and payment transactions are recognised under the item “Commission expense and fees paid”.

Financial transactions

The Bank recognises in “Net profit on financial operations” both realised and unrealised gains and losses on debt securities and other financial instruments. Adjustments for hedge accounting are included.

Administrative expenses

The Bank provides services to its related parties, the Nordic Development Fund (NDF) and the Nordic Environment Finance Corporation (NEFCO). Payments received by the Bank for providing services at cost to these organisations are recognised as a reduction in the Bank’s administrative expenses. NIB receives a host country reimbursement from the Finnish Government equal to the tax withheld from the salaries of NIB’s employees. This payment reduces the Bank’s administrative expenses, as shown in Note 5.

Leasing agreements

Leasing agreements are classified as operating leases if the rewards and risks incident to ownership of the leased asset, in all major respects, lie with the lessor. Lease payments under operating leases are recognised on a straight-line basis over the lease term. The Bank’s rental agreements are classified as operating leases.

Employee pensions and insurance

The Bank is responsible for arranging pension security for its employees. In accordance with the Host Country Agreement between the Bank and the Finnish Government and as part of the Bank’s pension arrangements, the Bank has decided to apply the Finnish state pension system. Contributions to this pension system, which are paid to the Finnish State Pension Fund, are calculated as a percentage of salaries. The Finnish Government determines the basis for the contributions, and the Finnish State Treasury establishes the actual percentage of the contributions. See Note 5.

NIB has also provided its permanent employees with a supplementary pension insurance scheme arranged by a private pension insurance company. This is group pension insurance based on a defined contribution plan. The Bank’s pension liability is completely covered.

In addition to the applicable local social security systems, NIB has taken out, for example, comprehensive accident, life and medical insurance policies for its employees in the form of group insurance.

Segment information

Segment information and currency distribution in the notes are presented in nominal amounts. The adjustment to hedge accounting is presented as a separate item (except for Note 1, the primary reporting segment).

Reclassifications

Following the amendment to IAS 39 issued in October 2008, permitting the reclassification of financial assets in certain restricted circumstances, the Bank decided to reclassify EUR 715 million of its trading portfolio assets into the held-to-maturity portfolio. This amendment has been applied retrospectively to commence on 1 September 2008. The reclassification has resulted in the cessation of fair value accounting for those assets previously designated as held for trading. The fair values of the assets at the date of reclassification became their new amortised cost and those assets will subsequently be accounted for on that measurement basis. The reclassified cost will be amortised over the instrument’s expected remaining lifetime through interest income using the effective interest method. See Note 7.

Some other minor reclassifications have been made. The comparative figures have been adjusted accordingly.

INTERNATIONAL FINANCIAL REPORTING STANDARDS AND INTERPRETATIONS

Standards, amendments and interpretations effective in 2011

Changes in standards revised by the IASB, effective for accounting periods on or after 1 January 2011, did not have a significant impact on the Bank’s financial statements.

Standards, amendments to published standards and interpretations that are not yet effective and have not been adopted early by the Bank

New pronouncements applicable to December 2012 year-ends

IFRS 7 Financial Instruments: Disclosures (Amendment)

New and amended pronouncements effective subsequent to December 2012 year-ends

IFRS 13 Fair Value Measurement

IAS 19 Employee Benefits (Revised)

These pronouncements do not have a significant impact on the Bank’s financial statements.

FINANCIAL GUIDELINES AND RISK MANAGEMENT

NIB assumes a conservative approach to risk-taking. The Bank’s constituent documents require that loans be made in accordance with sound banking principles, that adequate security be obtained for the loans and that the Bank protect itself against the risk of exchange rate losses. The main risks—credit risk, market risk, liquidity risk and operational risk— are managed carefully with risk management closely integrated into the Bank’s business processes. As an international financial institution, NIB is not subject to any national or international banking regulations. However, the Bank’s risk management procedures are reviewed and refined on an ongoing basis in order to comply in substance with what the Bank identifies as the relevant market standards, recommendations and best practices. The Bank has chosen the Advanced Internal Ratings Based Approach as a benchmark, although the Bank is not subject to regulations based on the Basel Capital Accords.

Key risk responsibilities

The Board of Directors defines the overall risk profile of the Bank and the general framework for risk management by approving its financial policies and guidelines, including maximum limits for exposure to various types of risk. Credit

approval is primarily the responsibility of the Board of Directors with some delegation of approval to the President for execution in the Credit Committee. The President is responsible for managing the risk profile of the Bank as a whole within the framework set by the Board of Directors, and for ensuring that the Bank’s aggregate risk is consistent with its financial resources. The Management Committee, Credit Committee and Finance Committee assist the President in carrying out risk management duties. The Management Committee has the overall responsibility for risk management. The risk management duties of the Credit Committee are focused on credit risk in the Bank’s lending operations. The Finance Committee deals with market risk and liquidity risk, as well as credit risk related to the Bank’s treasury operations.

The business functions, Lending and Treasury, are responsible for the day-to-day management of all risks assumed through their operations and for ensuring that an adequate return for the risks taken is achieved. Risk Management, Credit and Analysis, Compliance and Internal Audit are independent of the departments carrying out the Bank’s business activities. Risk Management has the overall responsibility for identifying, measuring, monitoring and reporting all types of risk inherent in the Bank’s operations. Credit and Analysis is responsible for assessing and monitoring credit risk in the Bank’s lending operations and it oversees that credit proposals are in compliance with established limits and policies. Internal Audit provides an independent evaluation of the controls, risk management and governance processes. The Compliance function assists the Bank in identifying, assessing, monitoring and reporting on compliance risk in matters relating to the institution, its operations and to personal conduct.

Credit risk

Credit risk is NIB’s main financial risk. Credit risk is the risk that the Bank’s borrowers and other counterparties fail to fulfil their contractual obligations and that any collateral provided does not cover the Bank’s claims. Following from NIB’s mandate and financial structure, most of the credit risk arises in the lending operations. The Bank’s credit policy forms the basis for all its lending operations. The credit policy aims at maintaining the Bank’s high quality loan portfolio and ensuring proper risk diversification as well as the enhancement of the Bank’s mission and strategy. The credit policy sets the basic criteria for acceptable risks and identifies risk areas that require special attention.

The Bank is also exposed to credit risk in its treasury activities, where credit risk derives from the financial assets and derivative instruments that the Bank uses for investing its liquidity and managing currency and interest rate risks as well as other market risks related to structured funding transactions.

Credit risk management

The Bank’s credit risk management is based on an internal credit risk rating system, a limit system based on the credit risk ratings and on a model for the calculation of economic capital for the management of portfolio-level credit risk. A primary element of the credit approval process is a detailed risk assessment, which also involves a risk-versus-return analysis. The risk assessment concludes with a classification of the risk of the counterparty and the transaction, expressed in terms of a counterparty risk rating and a transaction risk class.

Credit risk rating. The Bank assesses the creditworthiness of all counterparties that create credit risk exposure. Based on the assessment, a credit risk rating is assigned to each counterparty and a risk class to each transaction. The rating process is carried out through functions independent of the business-originating departments.

The Bank’s rating system is based on estimating the probability of default (PD) of a counterparty and the loss given default (LGD) on a transaction. The PD for the various counterparty types is derived from a combination of in-house expert judgement, scenario analyses, peer group comparisons and output from the Bank’s quantitative and qualitative rating models. For financial market counterparties the ratings assigned by the major international rating agencies are used as an additional reference. The counterparty is assigned a rating class on a scale of 1 to 20, with class 1 referring to the lowest probability of default and class 20 to the highest probability of default. In addition, two classes of default are applied. The first one indicates impairment and the second a non-performing status. Each transaction is also assigned a risk class reflecting the expected loss. The expected loss is the combined effect of the PD of the counterparty and the Bank’s estimate of the portion of the Bank’s claim that would not be recoverable if the counterparty defaults. The non-recoverable portion, that is, the loss given default (LGD), is determined on the basis of benchmark values for unsecured transactions and by using a security rating tool for secured loans. The risk classes range from 1 to 20, so that risk class 1 refers to the lowest expected loss and class 20 to the highest expected loss. The counterparty ratings and the transaction risk classes form the basis for setting exposure limits, for the risk-based pricing of loans as well as for monitoring and reporting the Bank’s credit quality.

Limits on credit risk exposure. NIB applies a limit system in which maximum exposure to a counterparty is determined on the basis of the probability of default and the expected loss. The limits are scaled to the Bank’s equity

and to the counterparty’s equity. To reduce large risk concentrations, the Bank applies portfolio-level limits for large counterparty exposure as well as sector and country limits. The Board of Directors sets the limits for maximum exposure.

Measurement of credit risk exposure. For loans and capital market investments, credit exposure is measured in terms of gross nominal amounts, without recognising the availability of collateral or other credit enhancement. Exposure to each counterparty is measured on a consolidated group level, i.e. individual counterparties that are linked to one another by ownership or other group affiliation are considered as one counterparty.

The credit risk exposure of swaps is measured as the current market value plus an allowance for potential increases in exposure over the transaction’s lifetime (often referred to as potential exposure). The add-on for potential exposure reflects the fact that significant fluctuations in the swap’s value may occur over time. As a rule, NIB enters into the International Swaps and Derivatives Association (ISDA) contract with swap counterparties. This allows the netting of the obligations arising under all of the derivative contracts covered by the ISDA agreement in case of insolvency and, thus, results in one single net claim on, or payable to, the counterparty. Netting is applied for the measurement of the Bank’s credit exposure only in cases when it is deemed to be legally enforceable in the relevant jurisdiction and against a counterparty. The gross total market value of swaps at year-end 2011 amounted to EUR 2,623 million, compared to a value of EUR 1,999 million after applying netting (year-end 2010: EUR 2,394 million and EUR 1,604 million, respectively).

To further reduce the credit risk in derivatives, NIB enters into credit support agreements with its major swap counterparties. This provides risk mitigation, as the swap transactions are regularly marked-to-market and the party being the net obligor is requested to post collateral. The Bank strives to use unilateral credit support agreements under which the Bank does not have to post collateral. When credit support agreements are in place, NIB does not apply add-ons in the exposure calculation. As of year-end 2011, the Bank held EUR 1,558 million in collateral received, of which EUR 1,223 million was in cash and EUR 335 million in securities (Note 16 Collateral and Commitments).

Economic capital. Economic capital is the amount of capital that the Bank needs in order to be able to absorb severe unexpected losses, with a defined level of certainty. As an international financial institution, the Bank is not subject to regulatory capital requirements. However, the Bank uses standards proposed by the Basel Capital Accords as a benchmark for its risk management and economic capital framework. The Bank’s policy is to hold a level of capital required to maintain the AAA/Aaa rating.

The overall purpose of the Bank’s economic capital framework is to incorporate risk awareness throughout the business decision process. The economic capital model provides an aggregated view of the Bank’s risk position at a certain point in time, it allows capital to be allocated for the purpose of the risk-based pricing of loans and it is used for measuring the Bank’s risk-adjusted performance.

The Bank estimates its economic capital requirement for each of the main risks: credit risk, market risk and operational risk. When allocating economic capital for credit risk, the model uses the PD and LGD values arrived at in the internal rating process. The model recognises correlations between assets in various sectors and geographical regions, which enable it to take into account the positive impact of diversification and the negative impact of concentrations in the Bank’s portfolios. When estimating the total economic capital requirement, the model recognises correlations between the different types of risk (credit risk, market risk and operational risk).

Credit quality

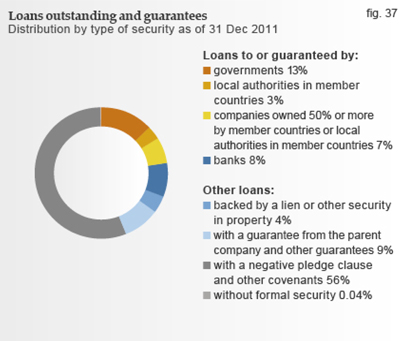

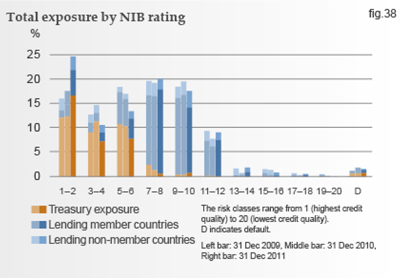

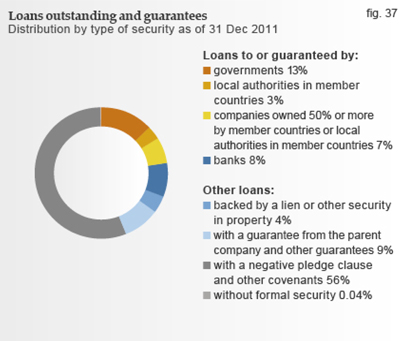

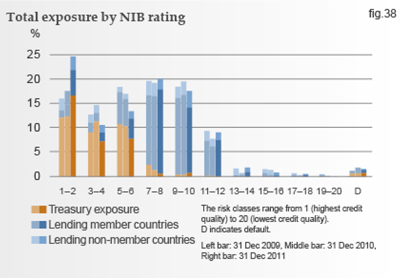

Overall, the quality of the Bank’s aggregate credit exposure remained at a high level in 2011. Figure 37, “Loans outstanding and guarantees”, shows the distribution of the Bank’s lending exposure by type of security as of year-end 2011. The distribution of loans by security type is also presented in a table in Note 8. Figure 38, “Total exposure by NIB rating”, compares the quality of the Bank’s credit risks based on the credit risk classification system at year-end 2009, 2010 and 2011. Aggregate credit exposure includes lending and treasury exposure. Lending exposure refers to loans outstanding and loans agreed but not yet disbursed.

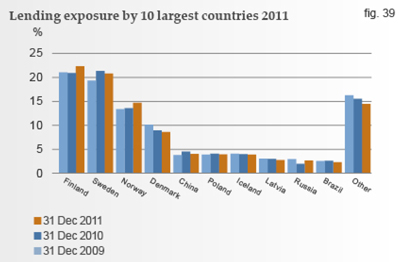

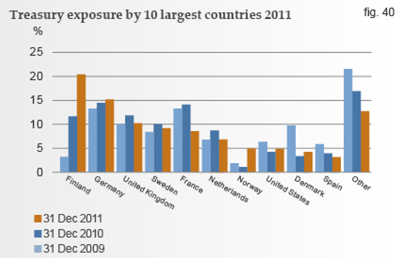

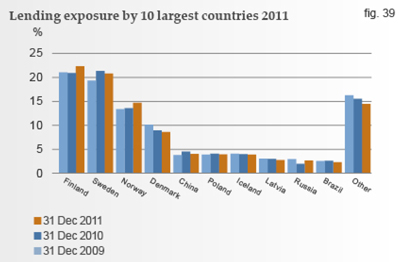

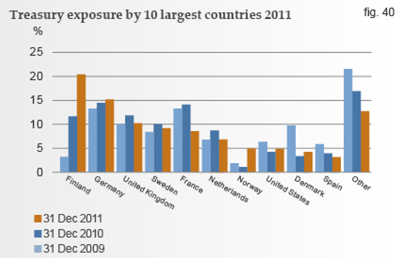

A geographical distribution of the lending and treasury exposure is shown in figures 39–40. Furthermore, a geographical and sectoral distribution of the Bank’s loans outstanding and guarantees is shown in Note 8. In the context of the Bank’s mission and mandate, the credit exposure continued to be fairly well balanced in terms of geographical and industrial sector distribution as well as regarding the distribution of the exposure by size.

The sum of the percentage shares may not total 100% due to rounding.

Lending in member countries. The quality of the loans granted in the member countries remained sound. Most of the portfolio—close to 82%—was located in the risk classes 1 to 10, compared to 84% the year before. Lending in the four weakest risk classes increased marginally to 0.5% of the portfolio from 0.2% in 2010. At year-end 2011, loans in the default category accounted for 1.3% of total lending in the member countries (2010: 2.3%). The default category contained seven exposures to Denmark, Finland and Iceland.

Lending in non-member countries. The quality of the portfolio of loans in non-member countries was largely unchanged in 2011. Loans in the risk classes 1 to10 accounted for 76% of the portfolio (2010: 77%). The exposure to the four weakest credit risk classes amounted to 1.7% at year-end 2011 compared to 2.5% the year before. Loans in the default category accounted for 1.2% of the non-member country lending (2010: 0.4%).

The geographical distribution of the Bank’s lending has been fairly unchanged over the past few years. At year-end 2011, the member countries accounted for 76% of the lending exposure. The exposure in the category Other comprised supranationals and 33 countries.

Treasury counterparties. The credit quality of the treasury portfolio improved in 2011. The exposure to the top four classes accounted for 71% of the total exposure (2010: 65%). The exposure in the default category increased marginally to 2.1% (2010: 1.8%), comprising primarily Lehman Brothers Inc and the defaulted Icelandic banks. At year-end 2011, around 39% of the treasury exposure was to counterparties domiciled in the member countries. The exposure in the category Other was distributed across supranationals and 17 countries.

Bank level. On an aggregate level, the Bank’s credit quality was maintained at a strong level. At year-end 2011, around 35% (2010: 32%) of the credit exposure was in the lowest risk classes (1 to 4) and 51% (2010: 56%) was in the risk classes 5 to 10. The exposure to the highest risk classes (17 to 20) was 0.5% compared to 0.4% at year-end 2010. At year-end 2011, exposures in the default category accounted for 1.6% of the aggregate credit exposure (2010: 1.8%).

Market risk

Market risk includes, inter alia, the risk that losses are incurred as a result of fluctuations in exchange rates and interest rates. NIB’s exposure to exchange rate risk occurs when translating assets and liabilities denominated in foreign currencies into the functional currency, the euro. The Bank funds its operations by borrowing in the international capital markets and often provides loans in currencies other than those borrowed, which unhedged would create currency mismatches in assets and liabilities. Furthermore, the funds borrowed often have interest rate structures other than those applied in the loans provided to the Bank’s customers. By using derivative instruments, NIB seeks to reduce its exposure to exchange rate risk and interest rate risk created in the normal course of business. The residual risk must be within the limits approved by the Board of Directors. Such limits are kept very narrow to accommodate the Statutes, which stipulate that the Bank shall, to the extent practicable, protect itself against the risk of exchange rate losses.

Exchange rate risk

Exchange rate risk is the impact of unanticipated changes in foreign exchange rates on the Bank’s assets and liabilities and on net interest income. The Bank measures and manages exchange rate risk in terms of the net nominal value of all assets and liabilities per currency on a daily basis (translation risk). The Board of Directors approves the limits for acceptable currency positions, i.e. the difference between assets and liabilities in a specific currency. The overnight exposure to any one currency may not exceed the equivalent of EUR 4 million. The currency positions are monitored against the established limits on a daily basis and reported regularly to the Finance Committee. NIB has filed proof of claims against the defaulted Icelandic banks. As a result of the filing, the claims were converted into ISK, which has caused a position in ISK exceeding the defined limit.

The Bank does not hedge future net interest income in foreign currency. Loans are provided primarily in euro, US dollars and Nordic currencies. Thus, there is a possibility that interest income in currencies other than euro may cause some fluctuation in the Bank’s future net income in euro terms. However, at present the Bank expects that any such potential fluctuations in the future cash flows from its current portfolio would be minor in relation to the Bank’s total assets and equity.

Interest rate risk

Interest rate risk is the impact that fluctuations in market interest rates can have on the value of the Bank’s interest-bearing assets and liabilities and on its net interest income. The Bank applies a set of limits and various tools to measure and manage interest rate risk. Maximum exposure limits are set by the Board of Directors. Compliance with these limits is monitored on a daily basis and reported regularly to the Finance Committee.

The Bank measures interest rate risk as the sensitivity of its interest income to a 1% change in interest rates. The Bank has defined both net and gross limits for the acceptable interest rate risk, with separate sub-limits for each individual currency. The limits are set in relation to the Bank’s equity and they are adjusted annually. In 2011, the net limit was EUR 15 million, corresponding to approximately 0.75% of NIB’s equity. At year-end 2011, the net interest rate risk was approximately EUR 9.7 million, or 65% of the limit (2010: EUR 7.6 million).

The Bank manages the interest rate risk in its own capital portfolio by means of modified duration. Modified duration measures how much the price of a security or portfolio of securities will change for a given change in interest rates. Generally, the shorter the duration, the less sensitive to interest rate changes the security is. The current limit for the maximum modified duration of the Bank’s own capital portfolio is set at 5.5 years.

Credit spread risk

The Bank is exposed to credit spread risk relating to the bonds held in its marked-to-market portfolios. Credit spread risk arises from changes in the value of debt instruments due to a perceived change in the credit quality of the issuers or underlying assets. The Bank manages the exposure to credit spread movements by calculating the sensitivity of the bonds in the marked-to-market portfolios to a 0.01% change in credit spreads. The Board of Directors sets the limit for maximum credit spread risk exposure. The limit, which is reviewed annually, is currently EUR 0.9 million. At year-end 2011, the exposure was EUR 0.34 million (year-end 2010: 0.39 million).

Value-at-Risk

The Bank monitors exchange rate risk and interest rate risk by calculating Value-at-Risk (VaR) for its investment portfolios, i.e. the Bank’s own capital portfolio and the rate portfolio, as well as for the whole balance sheet. VaR estimates the potential future loss (in terms of market value) that will not be exceeded in a defined period of time and with a defined confidence level. For measuring VaR, the Bank applies both a parametric method and the Monte Carlo method. Under the Monte Carlo method, simulations are made to estimate the sensitivity of the portfolios and the individual transactions to changes in the yield curve and exchange rates. The model is based on a 95% confidence level and a holding period of one day. At year-end 2011, the VaR of the Bank’s own capital portfolio was EUR 5.0 million (2010: EUR 6.1 million).

Refinancing and reinvestment risk

Risk emanating from differences in the maturity profile of assets and liabilities is managed by monitoring against limits established for refinancing and reinvestment risk. Refinancing risk arises when long-term assets are financed with short-term liabilities. Reinvestment risk occurs when short-term assets are financed with long-term liabilities. Refinancing and reinvestment risk are measured by means of a sensitivity analysis. The analysis captures the impact on the Bank’s net interest income over time of a 0.1% change in the margin on an asset or liability. The limits for refinancing and reinvestment risk are set by the Board of Directors in relation to the Bank’s equity. The limits are reviewed annually. In 2011, the maximum limit for refinancing and reinvestment risk was EUR 34 million, approximately 1.5% of NIB’s equity. At year-end 2011, the refinancing and reinvestment risk was calculated to EUR 23.9 million (year-end 2010: EUR 20.6 million).

Liquidity risk

Liquidity risk is defined as the risk of losing earnings and capital due to an inability to meet obligations in a timely manner when they become due. Liquidity risk is categorised into two risk types:

| | • | | Funding liquidity risk occurs when the Bank cannot fulfil its obligations because of an inability to obtain new funding. |

| | • | | Market liquidity risk occurs when the Bank is unable to sell or realise specific assets without significant losses in price. |