FINANCIAL REPORT

Exhibit IX

FINANCIAL REPORT

| | |

| |

| Report of the Board of Directors | | |

| |

| Proposal by the Board of Directors to the Board of Governors | | |

| |

| Statement of comprehensive income | | |

| |

| Statement of financial position | | |

| |

| Changes in equity | | |

| |

| Cash flow statement | | |

| |

| Notes to the financial statements | | |

| |

| Auditors’ reports | | |

| |

| Statement by the Control Committee | | |

Report of the Board of Directors

Report of the Board of Directors 2012

The euro area sovereign debt and banking crisis influenced the economic landscape of 2012. Significant progress was nevertheless made amid the uncertainty, most notably as a result of actions taken by the ECB, IMF, EU and euro zone member countries. In 2013, output from the EU is expected to stagnate due to the weight of continued financial sector and household deleveraging and public sector austerity measures. However, the Nordic-Baltic region should continue to grow slowly and to outperform relative to European markets.

Under these circumstances, demand continued for NIB’s long-term loans. Lending activities developed broadly in line with the Bank’s targets, with signings of loan agreements of EUR 2,366 million. Disbursements reached EUR 2,355 million, signalling a clear increase from the previous year (EUR 1,946 million). Of all loan agreements, 96% were projects with high mandate fulfilment in terms of competitiveness and the environment.

NIB’s funding activities continued to benefit from the highest possible credit rating and the relatively stable financial environment in the Nordic countries, which have been seen as a safe haven for investors during the financial crisis. NIB raised EUR 4.4 billion in new funding during 2012.

The Bank’s profit for the period amounted to EUR 209 million (2011: EUR 194 million).

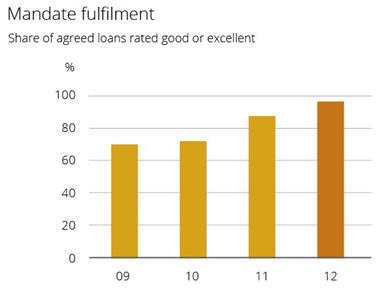

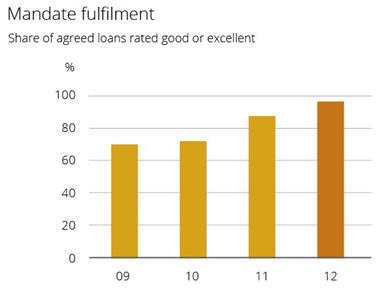

MANDATE FULFILMENT

In 2012, NIB continued to finance projects that improve the competitiveness and environment of the Nordic-Baltic region. This is measured by so called mandate fulfilment, which was emphasised in the Board of Governors’ decision to increase the Bank’s capital. The decision entered into force in February 2011.

In 2012, mandate fulfilment for agreed lending improved from the previous year. The share of loans reaching a good or excellent mandate was at an all-time high of 96%. Similarly, nearly 90% of loans were allocated to the focus sectors¹ identified as a priority in connection with the capital replenishment. It is further expected that a large portion of the still unallocated loans to financial intermediaries will reach a high mandate. This means that nearly all lending in 2012 was at the high end of NIB’s quality and impact scale.

Most projects with high competitiveness impact were infrastructure investments, productivity-enhancing corporate capital investments, new entries into—or improved access to—emerging markets and support for R&D. These are all important channels through which NIB’s lending helps strengthen member country competitiveness.

Environmental projects were mainly in the energy sector (e.g. renewable energy projects), the public transport sector (e.g. rail and public transport infrastructure projects) as well as projects focusing on sustainable buildings and energy efficiency. In addition, projects reducing nutrient discharges into the Baltic Sea continued in 2012.

The Board of Directors decided to allocate another EUR 1 billion under its Climate Change, Energy Efficiency and Renewable Energy (CLEERE) lending facility. Since the facility was launched in 2008, NIB has committed EUR 4 billion to projects aimed at promoting renewable energy, energy efficiency and other measures for abating and adapting to climate change. NIB estimates that the share of its projects agreed in 2012 could reduce CO2 emissions by 300,000 tonnes annually.

Report of the Board of Directors

In March 2012, the Bank’s revised Sustainability policy and guidelines entered into force. The policy covers the environmental and social aspects of the sustainability concept. It replaced the Environmental policy and guidelines adopted in 2008. The policy and guidelines provide criteria for assessing the environmental and social impacts of every loan application. A proposed project can be rejected due to non-compliance with the policy. The policy also specifies activities not eligible for NIB financing.

In response to the effects of the financial crisis in its member countries, the Board of Directors decided in 2011 to set up a new lending facility, the NIB Refinancing Facility (NRF), of EUR 500 million. Although there was ample demand for NIB’s long-term lending, member country companies did not see a need to draw on this temporary short-term refinancing facility.

¹ Focus sectors: Environment; energy; transport, logistics and communications; and innovation.

LENDING ACTIVITIES

In 2012, NIB’s lending activities developed well. The Bank signed 42 loan agreements for a total of EUR 2,366 million. The disbursement of loans rose to EUR 2,355 million, an increase compared to EUR 1,946 million during 2011.

The Infrastructure, transportation and telecom was the largest business area with one third of all newly agreed loans, directed towards road construction, railways, ports and broadband and mobile phone networks. This was followed by the Energy and environment sector accounting for slightly above one fifth of new lending. Projects in this sector are related to energy transmission and distribution, renewable energy, combined heat and power plants, waste to energy and wastewater treatment.

The Heavy industry and mechanical engineering sector as well as the Consumer goods and services sector each accounted for slightly less than one fifth of new lending. In the former, key focus was on research and development and energy efficiency, while in the latter food production and eco-efficient buildings were the main focus.

In addition, NIB makes loans available to financial intermediaries, which in turn finance smaller projects in the SME sector. This sector accounted for close to one tenth of new loans.

Report of the Board of Directors

NIB defines loans to projects with significant direct or indirect positive environmental impacts as environmental loans, regardless of the industrial sector in which they occur. Environment-related lending accounted for 60% of agreed loans in 2012.

In total, 79% of lending was for investments within the membership area.

NIB continued to closely monitor the Bank’s loan portfolio in order to identify and mitigate possible problems among existing borrowers. The loan book continued to show good credit quality with only a few new problem loans being encountered. The uncertainty of the economic outlook requires continued vigilance in the Bank’s credit process.

Lending

| | | | | | | | |

| (In EUR million unless otherwise specified) | | 2012 | | | 2011 | |

Energy and environment | | | 525 | | | | 868 | |

Infrastructure, transportation and telecom | | | 744 | | | | 780 | |

Heavy industry and mechanical engineering | | | 473 | | | | 199 | |

Consumer goods and services | | | 426 | | | | 312 | |

Financial institutions and SME’s | | | 198 | | | | 450 | |

Loans agreed, total | | | 2,366 | | | | 2,608 | |

Member countries | | | 1,880 | | | | 2,130 | |

Non-member countries | | | 487 | | | | 478 | |

Loans disbursed, total | | | 2,355 | | | | 1,946 | |

Member countries | | | 1,979 | | | | 1,593 | |

Non-member countries | | | 376 | | | | 353 | |

Number of loan agreements, total | | | 42 | | | | 47 | |

Member countries | | | 33 | | | | 37 | |

Non-member countries | | | 9 | | | | 10 | |

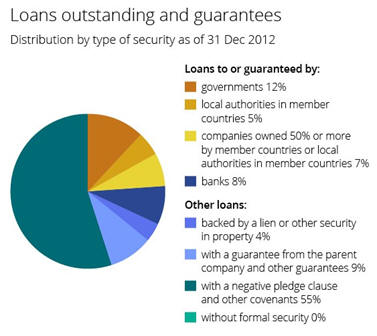

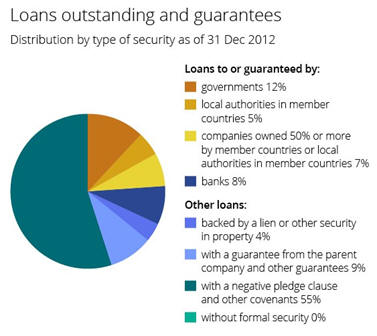

Loans outstanding and guarantees | | | 15,131 | | | | 14,157 | |

Member countries | | | 12,241 | | | | 11,268 | |

Non-member countries | | | 2,930 | | | | 2,889 | |

Collective impairment | | | -40 | | | | - | |

Repayments and prepayments | | | 1,503 | | | | 1,835 | |

TREASURY ACTIVITIES

NIB’s funding costs were stable during 2012 and again very favourable, especially after financial swaps where costs were some of the lowest in the Bank’s history. A new regulation for commercial banks to hold more capital and liquidity for entering into swap transactions did not affect NIB’s overall funding costs during 2012.

NIB borrowed a total of EUR 4.4 billion in eight different currencies through 28 transactions. In line with previous years, NIB issued USD benchmarks, totalling EUR 1.7 billion. The average maturity of the new funding was 5.5 years.

During the year Standard & Poor’s rating services revised their methodology for multilateral lending institutions. NIB’s long- and short-term issuer credit ratings were confirmed at ‘AAA/A-1+’ with a stable outlook.

Despite the very low yield environment in the Nordic area the Bank managed to increase its net interest income compared to the same period last year. Management of liquidity benefitted from the improved money market conditions and the general credit spread tightening.

Report of the Board of Directors

Financial activities

| | | | | | | | | | | | |

| (In EUR million) | | 2012 | | | 2011 | | | 2010 | |

New debt issues | | | 4,355 | | | | 2,887 | | | | 4,120 | |

Debts evidenced by certificates at year-end | | | 20,332 | | | | 18,433 | | | | 19,944 | |

Number of borrowing transactions | | | 28 | | | | 43 | | | | 65 | |

Number of borrowing currencies | | | 8 | | | | 11 | | | | 11 | |

RISK MANAGEMENT

Overall, the credit quality of the Bank’s lending and treasury exposure remained sound in 2012, despite continued weakness in the economic environment and some counterparties facing difficulties. The credit exposure in the best risk classes (1-2) increased, mainly driven by the treasury portfolio. The exposure in the weakest risk classes (14-20) was almost unchanged compared to the previous year and remained on a low level in relation to the total portfolio.

There was no material deviation in the geographical and sectoral distribution compared to the previous year. At year-end 2012, the member countries accounted for 77% of the total lending exposure and 39% of the treasury exposure. The quality of loans in the member countries remained sound and stable with 85% in the investment grade category (risk classes 1-10). Of the lending in non-member countries, 70% was in the investment grade category.

In the treasury portfolio there was a shift into the top two risk classes, which accounted for 64% of the total exposure compared to 50% at year-end 2011. The duration in the portfolio was lowered. The Bank’s exposure to Southern Europe was reduced and mainly comprises debt secured by mortgages. As in recent years, a major part of the Bank’s total credit exposure was to the financial sector, the public sector and to utilities. The concentration in terms of exposure to individual counterparties was fairly unchanged with the twenty largest exposures accounting for 31% of the total credit exposure.

In 2012, the Bank continued to put emphasis on the follow-up of its customers and counterparties.

FINANCIAL RESULTS

NIB recorded a profit of EUR 209 million, compared with a profit of EUR 194 million in 2011. The change in profit mainly reflects higher net interest income and positive valuations on financial instruments in the Treasury portfolios. Net interest income improved by 10.2% to EUR 252 million. Operating income was up 24.5%.

The Bank increased the loan impairment charge due to its revised method for collective impairments. The new method is based on historical loss experience and is commonly used in the banking sector for estimating collective impairment. The new collective impairments were EUR 40 million. Individually assessed loan loss provisions were EUR 16 million.

Costs are in line with 2011, and total expenses amounted to EUR 38 million (2011: EUR 37 million. The average number of employees was 180 (2011: 175).

The Bank’s total assets reached EUR 26 billion at 31 December 2012 (2011: EUR 24 billion). Lending volumes increased. The total amount of loans outstanding increased to EUR 15.1 billion (2011: EUR 14.2 billion). The amount of loans disbursed increased to EUR 2.4 billion (2011: EUR 1.9 billion). Loans were provided for projects within the sectors of power generation and supply, renewable energy, sustainable transport infrastructure, research and development and in other sectors.

Report of the Board of Directors

Return on equity 2012 was 8.1%.

Key figures

| | | | | | | | | | | | |

| (in EUR million) | | 2012 | | | 2011 | | | 2010 | |

Net interest income | | | 252 | | | | 228 | | | | 234 | |

Profit/loss on financial operations | | | 43 | | | | 8 | | | | 39 | |

Loan impairments | | | 56 | | | | 12 | | | | 38 | |

Profit/loss | | | 209 | | | | 194 | | | | 211 | |

Equity | | | 2,666 | | | | 2,456 | | | | 2,262 | |

Total assets | | | 25,983 | | | | 23,802 | | | | 24,898 | |

Solvency ratio (equity/total assets %) | | | 10.3% | | | | 10.3% | | | | 9.1% | |

Cost/income ratio | | | 13.1% | | | | 13.6% | | | | 12.2% | |

DIVIDEND

The Board of Directors proposes to the Board of Governors to resume dividend payments and that EUR 52 million be paid as dividends to the Bank’s member countries for the year 2012.

GOVERNANCE AND ORGANISATION

The year 2012 marked a change in the presidency of the Nordic Investment Bank. The Board of Directors appointed Henrik Normann as President and Chief Executive Officer of the Bank. Mr Normann took up his position on 1 April 2012 when Johnny Åkerholm retired.

In 2012, NIB made some organisational adjustments. NIB’s office premises in Copenhagen, Stockholm and Oslo were closed. NIB will continue with its local representatives in China and Russia. The re-organised lending function is managed by First Vice-President and Head of Lending Thomas Wrangdahl, who took up his position on 1 September 2012. The origination of loans and client relationships are now managed on a sectoral basis in a single Origination unit.

In 2012, NIB also established a new Asset and Liability Committee with the objective of assessing all risks and overall capital adequacy.

The Board of Directors approved amendments to the Code of Conduct for the staff. The main changes related to additional restrictions in trading with financial instruments.

Rolandas Kriščiūnas was the Chairman of the Board.

OUTLOOK

NIB assumes that demand for financing will be led by refinancing needs. New investment demand will likely remain weak due to lingering uncertainties regarding the economic outlook. On the supply side, long-term financing is expected to remain limited. As such, NIB’s long-term lending should take on increased relevance as a complement to other funding sources, while helping to improve the sustainability and competitiveness of its customers and member countries.

Proposal by the Board of Directors to the Board of Governors

Proposal by the Board of Directors to the

Board of Governors

The Board of Directors’ proposal with regard to the financial results for the year 2012 takes into account the need to keep the Bank’s ratio of equity to risk weighted assets at a secure level, which is a prerequisite for maintaining the Bank’s high creditworthiness.

In accordance with section 11 of the Statutes of the Bank, the profit for 2012 of EUR 209,205,181.00 is to be allocated as follows:

- EUR 157,205,181.00 is transferred to the General Credit Risk Fund as a part of equity;

- no transfer is made to the Special Credit Risk Fund for Project Investment Loans;

- no transfer is made to the Statutory Reserve - the Statutory Reserve amounts to EUR 686,325,305.70 or 11.2% of the Bank’s authorised capital stock as of 31 December 2012; and

- EUR 52,000,000.00 is made available for distribution as dividends to the Bank’s member countries.

More information can be found in the statement of comprehensive income, statement of financial position, changes in equity and cash flow statement, as well as in the notes to the financial statements.

Helsinki, 7 March 2013

| | | | |

Rolandas Kriščiūnas | | Kaspars Āboliņš | | Pentti Pikkarainen |

| | |

Gisle Glück Evensen | | Jesper Olesen | | Sven Hegelund |

| | |

on behalf of Silje Gamstøbakk | | | | |

| | |

Þorsteinn Þorsteinsson | | Henrik Normann President and CEO | | Madis Üürike |

Statement of comprehensive income

Statement of comprehensive income

1 January – 31 December

| | | | | | | | | | | | |

| EUR 1,000 | | Note | | | 2012 | | | 2011 | |

| Interest income | | | | | | | 494,064 | | | | 499,642 | |

Interest expense | | | | | | | -242,370 | | | | -271,189 | |

| Net interest income | | | (1), (2), (22) | | | | 251,693 | | | | 228,452 | |

| | | |

Commission income and fees received | | | (3) | | | | 10,620 | | | | 10,310 | |

| Commission expense and fees paid | | | | | | | -2,223 | | | | -2,203 | |

| Net profit/loss on financial operations | | | (4) | | | | 43,288 | | | | 7,575 | |

| Foreign exchange gains and losses | | | | | | | -221 | | | | -653 | |

| Operating income | | | | | | | 303,157 | | | | 243,483 | |

| | | |

Expenses General administrative expenses | | | (5), (22) | | | | 34,291 | | | | 32,955 | |

| Depreciation | | | (9), (10) | | | | 3,611 | | | | 4,048 | |

| Impairment of loans | | | (6), (8) | | | | 56,050 | | | | 12,442 | |

| Total expenses | | | | | | | 93,951 | | | | 49,446 | |

| | | | | | | | | | | | | |

| PROFIT/LOSS FOR THE YEAR | | | | | 209,205 | | | 194,037 | |

| | | |

Total comprehensive income | | | | | | | 209,205 | | | | 194,037 | |

The Nordic Investment Bank’s accounts are kept in euro.

Statement of financial position

Statement of financial position

at 31 December

| | | | | | | | | | | | |

| EUR 1,000 | | Note | | | 2012 | | | 2011 | |

ASSETS | | | (1), (18), (19), (20), (21) | | | | | | | | | |

Cash and cash equivalents | | | (17), (23) | | | | 2,817,189 | | | | 2,414,954 | |

| | | |

Financial placements | | | (17) | | | | | | | | | |

Placements with credit institutions | | | | | | | 4,191 | | | | 3,517 | |

Debt securities | | | (7) | | | | 5,248,858 | | | | 4,343,767 | |

Other | | | | | | | 22,059 | | | | 25,508 | |

| | | | | | | | 5,275,108 | | | | 4,372,792 | |

| | | |

Loans outstanding | | | (8), (17) | | | | 15,130,669 | | | | 14,152,905 | |

| Intangible assets | | | (9) | | | | 4,446 | | | | 4,560 | |

| Tangible assets, property and equipment | | | (9) | | | | 29,856 | | | | 30,806 | |

| | | |

Other assets | | | (11), (17) | | | | | | | | | |

Derivatives | | | | | | | 2,347,873 | | | | 2,420,570 | |

Other assets | | | (22) | | | | 25,895 | | | | 38,625 | |

| | | | | | | | 2,373,768 | | | | 2,459,195 | |

| | | |

Payments to the Bank’s reserves, receivable | | | | | | | - | | | | 2,640 | |

| Accrued interest and fees receivable | | | | | | | 351,875 | | | | 363,687 | |

| TOTAL ASSETS | | | | | | | 25,982,911 | | | | 23,801,539 | |

Statement of financial position

| | | | | | | | | | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | (1), (18), (19), (20), (21) | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Amounts owed to credit institutions | | | | | | | (17), (22) | | | | | | | | | |

Short-term amounts owed to credit institutions | | | | | | | (16), (23) | | | | 1,593,338 | | | | 1,495,517 | |

Long-term amounts owed to credit institutions | | | | | | | | | | | 15,222 | | | | 101,666 | |

| | | | | | | | | | | | 1,608,560 | | | | 1,597,183 | |

| | | | |

Debts evidenced by certificates | | | | | | | (12), (17) | | | | | | | | | |

Debt securities issued | | | | | | | | | | | 20,254,987 | | | | 18,359,521 | |

Other debt | | | | | | | | | | | 77,144 | | | | 73,200 | |

| | | | | | | | | | | | 20,332,131 | | | | 18,432,721 | |

| Other liabilities | | | | | | | (13), (17) | | | | | | | | | |

Derivatives | | | | | | | | | | | 1,102,707 | | | | 1,025,842 | |

Other liabilities | | | | | | | | | | | 9,397 | | | | 9,942 | |

| | | | | | | | | | | | 1,112,104 | | | | 1,035,785 | |

| | | | |

Accrued interest and fees payable | | | | | | | | | | | 264,439 | | | | 279,378 | |

| Total liabilities | | | | | | | | | | | 23,317,234 | | | | 21,345,067 | |

| | | | |

Equity | | | | | | | | | | | | | | | | |

Authorised and subscribed capital | | | 6,141,903 | | | | | | | | | | | | | |

of which callable capital | | | -5,723,302 | | | | | | | | | | | | | |

Paid-in capital | | | 418,602 | | | | (14) | | | | 418,602 | | | | 418,602 | |

| Reserve funds | | | | | | | (15) | | | | | | | | | |

Statutory Reserve | | | | | | | | | | | 686,325 | | | | 683,685 | |

General Credit Risk Fund | | | | | | | | | | | 955,626 | | | | 761,589 | |

Special Credit Risk Fund PIL | | | | | | | | | | | 395,919 | | | | 395,919 | |

Payments to the Bank’s reserves, receivable | | | | | | | | | | | - | | | | 2,640 | |

| Profit/loss for the year | | | | | | | | | | | 209,205 | | | | 194,037 | |

| Total equity | | | | | | | | | | | 2,665,677 | | | | 2,456,472 | |

| | | | |

TOTAL LIABILITIES AND EQUITY | | | | | | | | | | | 25,982,911 | | | | 23,801,539 | |

| | | | |

Collateral and commitments | | | | | | | (16) | | | | | | | | | |

The Nordic Investment Bank’s accounts are kept in euro.

Changes in equity

Changes in equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EUR 1,000 | | Paid-in

capital | | | Statutory

Reserve* | | | General Credit

Risk Fund | | | Special

Credit Risk

Fund

PIL | | | Payments to the Bank’s Statutory Reserve and

credit risk

funds | | | Appropriation to dividend payment | | | Other value

adjustments* | | | Profit/Loss for the year | | | Total | |

| EQUITY AT 31 DECEMBER 2010 | | | 418,602 | | | | 683,046 | | | | 550,756 | | | | 395,919 | | | | 5,280 | | | | 0 | | | | -2,780 | | | | 210,832 | | | | 2,261,656 | |

Appropriations between reserve funds * | | | | | | | -2,000 | | | | 210,832 | | | | | | | | | | | | | | | | 2,000 | | | | -210,832 | | | | 0 | |

| Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

| Called in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | 2,640 | | | | | | | | | | | | -2,640 | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

| Comprehensive income for the year * | | | | | | | | | | | | | | | | | | | | | | | | | | | 779 | | | | 194,037 | | | | 194,816 | |

| EQUITY AT 31 DECEMBER 2011 | | 418,602 | | | 683,685 | | | 761,589 | | | 395,919 | | | 2,640 | | | 0 | | | 0 | | | 194,037 | | | 2,456,472 | |

| | | | | | | | | |

| Appropriations between reserve funds | | | | | | | | | | | 194,037 | | | | | | | | | | | | | | | | | | | | -194,037 | | | | 0 | |

| Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

| Called in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | 2,640 | | | | | | | | | | | | -2,640 | | | | | | | | | | | | | | | | 0 | |

| | | | | | | | | |

| Comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 209,205 | | | | 209,205 | |

| EQUITY AT 31 DECEMBER 2012 | | | 418,602 | | | | 686,325 | | | | 955,625 | | | | 395,919 | | | | 0 | | | | 0 | | | | 0 | | | | 209,205 | | | | 2,665,677 | |

| | | | | | | | |

| Proposed appropriation of the year’s profit/loss | | 2012 | | | 2011 | |

Appropriation to Statutory Reserve | | | - | | | | - | |

Appropriations to credit risk reserve funds | | | | | | | | |

General Credit Risk Fund | | | 157,205 | | | | 194,037 | |

Special Credit Risk Fund PIL | | | - | | | | - | |

Appropriation to dividend payment | | | 52,000 | | | | - | |

Profit/loss for the year | | | 209,205 | | | | 194,037 | |

* Other value adjustments have been moved from the available for sale portfolio to the statutory reserve on 1/5/2011 when IFRS 9 was implemented regarding the classification of financial assets.

The Nordic Investment Bank’s accounts are kept in euro.

Cash flow statement

Cash flow statement

1 January – 31 December

| | | | | | | | | | |

| EUR 1,000 | | Note | | Jan–Dec

2012 | | | Jan–Dec

2011 | |

Cash flows from operating activities | | | | | | | | | | |

Profit/loss from operating activities | | | | | 209,205 | | | | 194,037 | |

| | | |

Adjustments: | | | | | | | | | | |

Unrealised gains/losses of financial assets held at fair value | | | | | -44,717 | | | | -11,223 | |

Impairment of bonds held at amortised cost | | | | | | | | | 11,819 | |

Depreciation and write-down in value of tangible and intangible assets | | | | | 3,611 | | | | 4,048 | |

Change in accrued interest and fees (assets) | | | | | 11,812 | | | | 8,427 | |

Change in accrued interest and fees (liabilities) | | | | | -14,939 | | | | -14,925 | |

Impairment of loans | | | | | 56,050 | | | | 12,442 | |

Adjustment to hedge accounting | | | | | 1,381 | | | | 1,574 | |

Other adjustments to the year’s profit | | | | | -2,523 | | | | -37 | |

Adjustments, total | | | | | 10,675 | | | | 12,126 | |

| | | |

Lending | | | | | | | | | | |

Disbursements of loans | | | | | -2,354,787 | | | | -1,946,500 | |

Repayments of loans | | | | | 1,502,789 | | | | 1,835,279 | |

Capitalisations, redenominations, index adjustments, etc. | | | | | 245 | | | | -846 | |

Transfer of loans to claims in other assets | | | | | 2,854 | | | | 7,972 | |

Exchange rate adjustments | | | | | -85,199 | | | | -100,179 | |

Lending, total | | | | | -934,098 | | | | -204,274 | |

| | | |

Cash flows from operating activities, total | | | | | -714,218 | | | | 1,889 | |

| | | |

Cash flows from investing activities | | | | | | | | | | |

Placements and debt securities | | | | | | | | | | |

Purchase of debt securities | | | | | -2,893,778 | | | | -2,082,224 | |

Sold and matured debt securities | | | | | 2,046,894 | | | | 2,830,234 | |

Placements with credit institutions | | | | | -674 | | | | 126,745 | |

Other financial placements | | | | | -3,463 | | | | -751 | |

Exchange rate adjustments, etc. | | | | | 4,074 | | | | -2,575 | |

Placements and debt securities, total | | | | | -846,947 | | | | 871,430 | |

| | | | | | | | | | | | |

Other items | | | | | | | | | | | | |

Acquisition of intangible assets | | | | | | | -1,727 | | | | -1,655 | |

Acquisition of tangible assets | | | | | | | -820 | | | | -712 | |

Change in other assets | | | | | | | 13,587 | | | | -4,979 | |

Other items, total | | | | | | | 11,040 | | | | -7,346 | |

| | | |

Cash flows from investing activities, total | | | | | | | -835,907 | | | | 864,084 | |

| | | |

Cash flows from financing activities | | | | | | | | | | | | |

Debts evidenced by certificates | | | | | | | | | | | | |

Issues of new debt | | | | | | | 4,355,019 | | | | 2,886,621 | |

Redemptions | | | | | | | -2,435,918 | | | | -4,632,648 | |

Exchange rate adjustments | | | | | | | -312,663 | | | | 416,864 | |

Debts evidenced by certificates, total | | | | | | | 1,606,438 | | | | -1,329,163 | |

| | | |

Other items | | | | | | | | | | | | |

Long-term placements from credit institutions | | | | | | | -86,444 | | | | -42,464 | |

Change in swap receivables | | | | | | | 262,337 | | | | 33,463 | |

Change in swap payables | | | | | | | 70,114 | | | | -209,510 | |

Change in other liabilities | | | | | | | -545 | | | | 4,127 | |

Paid-in capital and reserves | | | | | | | 2,640 | | | | 2,640 | |

Other items, total | | | | | | | 248,102 | | | | -211,744 | |

| | | |

Cash flows from financing activities, total | | | | | | | 1,854,540 | | | | -1,540,907 | |

| | | |

CHANGE IN CASH AND CASH EQUIVALENTS, NET | | | (23) | | | | 304,414 | | | | -674,934 | |

| | | |

Opening balance for cash and cash equivalents, net | | | | | | | 919,437 | | | | 1,594,370 | |

Closing balance for cash and cash equivalents, net | | | | | | | 1,223,851 | | | | 919,437 | |

| | | |

Additional information to the statement of cash flows | | | | | | | | | | | | |

Interest income received | | | | | | | 505,876 | | | | 508,025 | |

Interest expense paid | | | | | | | -257,309 | | | | -286,114 | |

The cash flow statement has been prepared using the indirect method and cash flow items cannot be directly concluded from the statements of financial positions.

Accounting policies

Notes to the financial statements

ACCOUNTING POLICIES

General operating principles

The operations of the Nordic Investment Bank (hereinafter called the Bank or NIB) are governed by an agreement (hereinafter called Agreement) among the governments of Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden (hereinafter called the member countries), and the Statutes adopted in conjunction with that agreement. NIB is an international financial institution that operates in accordance with sound banking principles. NIB finances private and public projects which have high priority with the member countries and the borrowers. NIB finances projects both in and outside the member countries, and offers its clients long-term loans and guarantees on competitive market terms.

NIB acquires the funds to finance its lending by borrowing on international capital markets.

The authorised capital stock of the Bank is subscribed by the member countries. Any increase or decrease in the authorised capital stock shall be decided by the Board of Governors, upon a proposal of the Board of Directors of the Bank.

In the member countries, the Bank is exempt from payment restrictions and credit policy measures, and has the legal status of an international legal person, with full legal capacity. The Agreement concerning NIB contains provisions regarding immunity and privileges accorded to the Bank, e.g. the exemption of the Bank’s assets and income from taxation.

The headquarters of the Bank are located at Fabianinkatu 34 in Helsinki, Finland.

Significant accounting policies

Basis for preparing the financial statements

The Bank’s financial statements have been prepared in accordance with the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB). The Bank’s accounts are kept in euro. With the exceptions noted below, they are based on historical cost.

Significant accounting judgements and estimates

As part of the process of preparing the financial statements in conformity with IFRS, the Bank’s management is required to make certain judgements, estimates and assumptions that have an effect on the Bank’s profits, its financial position and other information presented in the Annual Report. These estimates are based on available information and the judgements made by the Bank’s management. Actual outcomes may deviate from the assessments made, and such deviations may at times be substantial.

The Bank uses various valuation models and techniques to estimate fair values of assets and liabilities. There are significant uncertainties related to these estimates in particular when they involve modelling complex financial instruments, such as derivative instruments used for hedging activities related to both borrowing and lending. The estimates are highly dependent on market data, such as the level of interest rates, currency rates and other factors. The uncertainties related to these estimates are reflected mainly in the statement of financial position. NIB undertakes continuous development in order to improve the basis for the fair value estimates, both with regard to modelling and market data. Changes in estimates resulting from refinements in assumptions and methodologies are reflected in the period in which the enhancements are first applied.

Accounting policies

Judgements and estimates are also associated with impairment testing of loans and claims.

Recognition and derecognition of financial instruments

Financial instruments are recognised in the statement of financial position on a settlement date basis.

A financial asset is derecognised when the contractual rights to the cash flows from the financial asset expire.

A financial liability is removed from the statement of financial position when the obligation specified in the contract is discharged, cancelled or expires.

Foreign currency translation

Monetary assets and liabilities denominated in foreign currencies are recognised in the accounts at the exchange rate prevailing on the closing date. Non-monetary assets and liabilities are recognised in the accounts at the euro rate prevailing on the transaction date. Income and expenses recognised in currencies other than the euro are converted on a daily basis to the euro, in accordance with the euro exchange rate prevailing each day.

Realised and unrealised exchange rate gains and losses are recognised in the statement of comprehensive income.

The Bank uses the official exchange rates published for the euro by the European Central Bank. See Note 24.

Basis for measurement

The financial statements have been prepared on the historical cost basis except for the following material items in the statement of financial position.

Financial Instruments: Classification and Measurement. The Bank has adopted IFRS 9 from 1 May 2011, because the new accounting standard better reflects the Bank’s business model.

From 1 May 2011, the Bank classifies its financial assets into the following categories: those measured at amortised cost, and those measured at fair value. This classification depends on both the contractual characteristics of the assets and the business model adopted for their management.

Financial assets at amortised cost

An investment is classified at “amortised cost” only if both of the following criteria are met: the objective of the Bank’s business model is to hold the assets in order to collect the contractual cash flows and the contractual terms of the financial assets must give rise on specified dates to cash flows that are only payments of principal and interest on the principal amount outstanding.

Financial assets at fair value

If either of the two criteria above is not met, the asset cannot be classified in the amortised cost category and must be classified at fair value.

Recognised financial assets and financial liabilities designated as hedged items in qualifying fair value hedge relationships are adjusted for changes in fair value attributable to the risk being hedged.

Accounting policies

Cash and cash equivalents

Cash and cash equivalents comprise monetary assets and placements with original maturities of six months or less, calculated from the date the acquisition and placements were made.

Cash and cash equivalents in the cash flow statement refers to the net amount of monetary assets, placements and liabilities with original maturities of six months or less calculated from the time the transaction was entered into.

Financial placements

Items recognised as financial placements in the statement of financial position include placements with credit institutions and placements in debt securities, for example, bonds and other debt certificates, as well as certain placements in instruments with equity features. The placements are initially recognised on the settlement date. Their subsequent accounting treatment depends on both the Bank’s business model for managing the placements and their contractual cash flow characteristics.

Lending

The Bank may grant loans and provide guarantees under its Ordinary Lending or under special lending facilities. The special lending facilities, which carry member country guarantees, consist of Project Investment Loans (PIL) and Environmental Investment Loans (MIL).

Ordinary Lending includes loans and guarantees within and outside the member countries. The Bank’s Ordinary Lending ceiling corresponds to 250% of its authorised capital and accumulated general reserves and amounts to EUR 19,853 million following the allocations of the year’s profit in accordance with the Board of Directors’ proposal.

Project Investment Loans are granted for financing creditworthy projects in the emerging markets of Africa, Asia, Europe and Eurasia, Latin America and the Middle East. The Bank’s Statutes permit loans to be granted and guarantees to be issued under the PIL facility up to an amount corresponding to EUR 4,000 million. The member countries guarantee the PIL loans up to a total amount of EUR 1,800 million. The Bank, however, will assume 100% of any losses incurred under an individual PIL loan, up to the amount available at any given time in the Special Credit Risk Fund for PIL. Only thereafter would the Bank be able to call the member countries’ guarantees according to the following principle: the member countries guarantee 90% of each loan under the PIL facility up to a total amount of EUR 1,800 million. Payment under the member countries’ guarantees would take place at the request of the Board of Directors, as provided for under an agreement between the Bank and each individual member country.

The Bank is authorised to grant special Environmental Investment Loans up to the amount of EUR 300 million, for the financing of environmental projects in the areas adjacent to the member countries. The Bank’s member countries guarantee 100% of the MIL facility.

The Bank’s lending transactions are recognised in the statement of financial position at the time the funds are transferred to the borrower. Loans are recognised initially at historical cost, which corresponds to the fair value of the transferred funds, including transaction costs. Loans outstanding are carried at amortised cost. If the loans are hedged against changes in fair value by using derivative instruments, they are recognised in the statement of financial position at fair value, with value changes recognised in the statement of comprehensive income. Changes in fair value are mainly caused by changes in market interest rates.

Accounting policies

Impairment of loans and receivables

Impairment of individually assessed loans

The Bank reviews its problem loans and receivables on each reporting date to assess whether an allowance for impairment should be recorded in the statement of comprehensive income. In particular, judgement by management is required in the estimation of the amount and timing of future cash flows when determining the level of allowance required. Such estimates are based on assumptions about a number of factors and actual results may differ, resulting in future changes to the allowance.

Receivables are carried at their estimated recoverable amount. Where the collectability of identified loans is in doubt, specific impairment losses are recognised in the statement of comprehensive income. Impairment is defined as the difference between the carrying value of the asset and the net present value of expected future cash flows, determined using the instrument’s original effective interest rate where applicable. If the carrying amount of the loan is higher than the net present value of the estimated future cash flows, including the fair value of the collaterals, the loan is impaired.

Impairment of collectively assessed loans

Loans that are not individually impaired will be transferred to a group of loans with similar risk characteristics for a collective impairment test.

The Bank assesses the need to make a collective impairment test on exposures which, although not specifically identified as requiring a specific allowance, have a greater risk of default than when originally granted. This collective impairment test is based on any deterioration in the internal rating of the groups of loans or investments from the time they were granted or acquired. These internal ratings take into consideration factors such as any deterioration in counterparty risk, value of collaterals or securities received, and sectoral outlook, as well as identified structural weaknesses or deterioration in cash flows.

The process includes management’s judgement based on the current macroeconomic environment and the current view of the expected economic outlook. In the Bank’s view the assumptions and estimates made represent an appropriate level of conservatism and are reflective of the predicted economic conditions, the Bank’s portfolio characteristics and their correlation with losses incurred based on historical loss experience. The impairment remains related to the group of loans until the losses have been identified on an individual basis.

For issued guarantees, the impairment is recognised when it is both probable that the guarantee will need to be settled and the settlement amount can be reliably estimated.

In the event that payments in respect of an ordinary loan are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing and consequently the need for impairment is assessed and recognised.

In the event that payments in respect of a PIL loan to a government or guaranteed by a government are more than 180 days overdue, all of the borrower’s loans are deemed to be non-performing.

Whenever payments in respect of a PIL loan that is not to a government or guaranteed by a government are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing. Impairment losses are then recognised in respect of the part of the outstanding loan principal, interest, and fees that correspond to the Bank’s own risk for this loan facility at any given point in time.

Accounting policies

Intangible assets

Intangible assets mainly consist of investments in software, software licences and ongoing investments in new ICT systems. The investments are carried at historical cost, and are amortised over the assessed useful life of the assets, which is estimated to be between three and five years. The amortisations are made on a straight-line basis.

Tangible assets

Tangible assets in the statement of financial position include land, buildings, office equipment, and other tangible assets owned by the Bank. The assets are recognised at historical cost, less any accumulated depreciation based on their assessed useful life. No depreciations are made for land. The Bank’s office building in Helsinki is depreciated on a straight-line basis over a 40-year period. The Bank’s other buildings are depreciated over a 30-year period. The depreciation period for office equipment and other tangible assets is determined by assessing the individual item. The depreciation period is usually three to five years. The depreciations are calculated on a straight-line basis.

Write-downs and impairment of intangible and tangible assets

The Bank’s assets are reviewed annually for impairment. If there is any objective evidence of impairment, the impairment loss is determined based on the recoverable amount of the assets.

Borrowing

The Bank’s borrowing transactions are recognised in the statement of financial position at the time the funds are transferred to the Bank. The borrowing transactions are recognised initially at a cost that comprises the fair value of the funds transferred, less transaction costs. The Bank uses derivative instruments to hedge the fair value of virtually all its borrowing transactions. In these instances, the borrowing transaction is subsequently recognised in the statement of financial position at fair value, with any changes in value recognised in the statement of comprehensive income.

Securities delivered under repurchase agreements are not derecognised from the statement of financial position. Cash received under repurchase agreements is recognised in the statement of financial position as “Repurchase agreements”.

Derivative instruments and hedge accounting

The Bank’s derivative instruments are initially recognised on a trade-date basis at fair value in the statement of financial position as “Other assets” or “Other liabilities”.

During the time the Bank holds a derivative instrument, any changes in the fair value of such an instrument are recognised in the statement of comprehensive income, or directly in “Equity” as part of the item “Other value adjustments”, depending on the purpose for which the instruments were acquired. The value changes of derivative instruments that were not acquired for hedging purposes are recognised in the statement of comprehensive income. The accounting treatment for derivative instruments that were acquired for hedging purposes depends on whether the hedging operation was in respect of cash flow or fair value.

At the time the IAS 39 standard concerning hedge accounting was adopted, the Bank had a portfolio of floating rate assets, which had been converted to fixed rates using derivative contracts (swaps). This portfolio was designated as a cash flow hedge, but this specific type of hedging is no longer used for new transactions. In general, the Bank does not have an ongoing programme for entering into cash flow hedging, although it may choose to do so at any given point in time.

Accounting policies

When hedging future cash flows, the change in fair value of the effective portion of the hedging instrument is recognised directly in “Equity” as part of the item “Other value adjustments” until the maturity of the instrument. At maturity, the amount accumulated in “Equity” is included in the statement of comprehensive income in the same period or periods during which the hedged item affects the statement of comprehensive income.

In order to protect NIB from market risks that arise as an inherent part of its borrowing and lending activities, the Bank enters into swap transactions. The net effect of the swap hedging is to convert the borrowing and lending transactions to floating rates. This hedging activity is an integral part of the Bank’s business process and is a fair value hedge.

When hedging the fair value of a financial asset or liability, the derivative instrument’s change in fair value is recognised in the statement of comprehensive income together with the hedged item’s change in fair value in “Net profit on financial operations”.

Sometimes a derivative may be a component of a hybrid financial instrument that includes both the derivative and a host contract. Such embedded derivative instruments are part of a structured financing transaction that is hedged against changes in fair value by means of matching swap contracts. In such cases, both the hedged borrowing transaction and the hedging derivative instrument are recognised at fair value with changes in fair value in the statement of comprehensive income.

The hedge accounting is based on a clearly documented relationship between the item hedged and the hedging instrument. When there is a high (negative) correlation between the hedging instrument on the one hand and the value change of the hedged item or the cash flows generated by the hedged item on the other, the hedge is regarded as effective. The hedging relationship is documented at the time the hedge transaction is entered into, and the effectiveness of the hedge is assessed continuously.

Determination of fair value

The fair value of financial instruments, including derivative instruments that are traded in a liquid market, is the bid or offered closing price at balance sheet date. Many of NIB’s financial instruments are not traded in a liquid market, like the Bank’s borrowing transactions with embedded derivative instruments. These are measured at fair value using different valuation models and techniques. This process involves determining future expected cash flows, which can then be discounted to the balance sheet date. The estimation of future cash flows for these instruments is subject to assumptions on market data and in some cases, in particular where options are involved, even on the behaviour of the Bank’s counterparties. The fair value estimate may therefore be subject to variations and may not be realisable in the market. Under different market assumptions, the values could also differ substantially.

The Bank measures fair values using the following fair value hierarchy that reflects the significance of the inputs used in making the measurements:

Level 1: Quoted market prices (unadjusted) in an active market for identical instruments.

Level 2: Valuation techniques based on observable inputs, either directly (i.e. as prices) or indirectly (i.e. derived from prices). This category includes instruments valued using: quoted market prices in active markets for similar instruments; quoted prices for identical or similar instruments in markets that are considered less than active; or other valuation techniques where all significant inputs are directly or indirectly observable from market data.

Accounting policies

Level 3: Valuation techniques using significant unobservable inputs. This category includes all instruments where the valuation technique includes inputs not based on observable data and where the unobservable inputs have a significant effect on the instrument’s valuation. This category includes instruments that are valued based on quoted prices for similar instruments where significant unobservable adjustments or assumptions are required to reflect differences between the instruments.

See Note 17 for further details.

Equity

As of 31 December 2012, the Bank’s authorised and subscribed capital is EUR 6,141.9 million, of which the paid-in portion is EUR 418.6 million. Payment of the subscribed, non-paid-in portion of the authorised capital, that is, the callable capital, will take place at the request of the Bank’s Board of Directors to the extent that the Board deems it necessary for the fulfilment of the Bank’s debt obligations.

The Bank’s reserves have been built up by means of appropriations from the profits of previous accounting periods, and consist of the Statutory Reserve, as well as the General Credit Risk Fund and the Special Credit Risk Fund for PIL.

The Bank’s profits, after allocation to appropriate credit risk funds, are transferred to the Statutory Reserve until it amounts to 10% of NIB’s subscribed authorised capital. Thereafter, the Board of Governors, upon a proposal by the Bank’s Board of Directors, shall decide upon the allocation of the profits between the reserve fund and dividends on the subscribed capital.

The General Credit Risk Fund is designed to cover unidentified exceptional risks in the Bank’s operations. Allocations to the Special Credit Risk Fund for PIL are made primarily to cover the Bank’s own risk in respect of credit losses on PIL loans.

Interest

The Bank’s net interest income includes accrued interest on loans, debt securities, placements and accruals of the premium or discount value of financial instruments. Net interest income also includes interest expenses on debts, swap fees and borrowing costs.

Fees and commissions

Fees collected when disbursing loans are recognised as income at the time of the disbursement, which means that fees and commissions are recognised as income at the same time as the costs are incurred. Commitment fees are charged on loans that are agreed but not yet disbursed, and are accrued in the statement of comprehensive income over the commitment period.

Annually recurrent costs arising as a result of the Bank’s borrowing, investment and payment transactions are recognised under the item “Commission expense and fees paid”.

Financial transactions

The Bank recognises in “Net profit on financial operations” both realised and unrealised gains and losses on debt securities and other financial instruments. Adjustments for hedge accounting are included.

Administrative expenses

The Bank provides services to its related parties, the Nordic Development Fund (NDF) and the Nordic Environment Finance Corporation (NEFCO). Payments received by the Bank for providing services at cost

Accounting policies

to these organisations are recognised as a reduction in the Bank’s administrative expenses. NIB receives a host country reimbursement from the Finnish Government equal to the tax withheld from the salaries of NIB’s employees. This payment reduces the Bank’s administrative expenses, as shown in Note 5.

Leasing agreements

Leasing agreements are classified as operating leases if the rewards and risks incident to ownership of the leased asset, in all major respects, lie with the lessor. Lease payments under operating leases are recognised on a straight-line basis over the lease term. The Bank’s rental agreements are classified as operating leases.

Employee pensions and insurance

The Bank is responsible for arranging pension security for its employees. In accordance with the Host Country Agreement between the Bank and the Finnish Government and as part of the Bank’s pension arrangements, the Bank has decided to apply the Finnish state pension system. Contributions to this pension system, which are paid to the Finnish State Pension Fund, are calculated as a percentage of salaries. The Finnish Government determines the basis for the contributions, and the Finnish State Treasury establishes the actual percentage of the contributions. See Note 5.

NIB also provides its permanent employees with a supplementary pension insurance scheme arranged by a private pension insurance company. This is group pension insurance based on a defined contribution plan. The Bank’s pension liability is completely covered.

In addition to the applicable local social security systems, NIB has taken out, for example, comprehensive accident, life, medical and disability insurance policies for its employees in the form of group insurance.

Segment information

Segment information and currency distribution in the notes are presented in nominal amounts. The adjustment to hedge accounting is presented as a separate item (except for Note 1, the primary reporting segment).

Reclassifications

Following the amendment to IAS 39 issued in October 2008, permitting the reclassification of financial assets in certain restricted circumstances, the Bank decided to reclassify EUR 715 million of its trading portfolio assets into the held-to-maturity portfolio. This amendment has been applied retrospectively to commence on 1 September 2008. The reclassification has resulted in the cessation of fair value accounting for those assets previously designated as held for trading. The fair values of the assets at the date of reclassification became their new amortised cost and those assets will subsequently be accounted for on that measurement basis. The reclassified cost will be amortised over the instrument’s expected remaining lifetime through interest income using the effective interest method. See Note 7.

Some other minor reclassifications have been made. The comparative figures have been adjusted accordingly.

INTERNATIONAL FINANCIAL REPORTING STANDARDS AND INTERPRETATIONS

New and amended standards applied in the financial year 2012

NIB has applied as from 1 January 2012 the following amended standard that has come into effect. The standard had no significant impact on the financial statements for the financial year 2012.

Accounting policies

Amendments to IFRS 7 Financial Instruments: Disclosures (effective for financial years beginning on or after 1 July 2011).

Adoption of new and amended standards and interpretations applicable in future financial years

NIB has not yet adopted the following new and amended standards and interpretations already issued by the IASB. NIB will adopt them as of the effective date or, if the date is other than the first day of the financial year, from the beginning of the subsequent financial year.

• Amendments to IAS 1 Presentation of Financial Statements (effective for financial years beginning on or after 1 July 2012)

• IFRS 13 Fair Value Measurement (effective for financial years beginning on or after 1 January 2013): IFRS 13 establishes a single source for all fair value measurements and disclosure requirements for use across IFRSs. The new standard also provides a precise definition of fair value. IFRS 13 does not extend the use of fair value accounting, but it provides guidance on how to measure fair value under IFRSs when fair value is required or permitted. IFRS 13 will expand the disclosures to be provided for non-financial assets measured at fair value. The new standard is not assessed to have a material impact on NIB’s financial statements.

• Annual Improvements to IFRSs 2009-2011 (May 2012) (effective for financial years beginning on or after 1 January 2013): The annual improvements process provides a mechanism for minor and non- urgent amendments to IFRSs to be grouped together and issued in one package annually. The amendments cover in total five standards. Their impacts vary standard by standard but are not significant.

• Amendments to IFRS 7 Financial Instruments: Disclosures (effective for financial years beginning on or after 1 January 2013): The amendments clarify disclosure requirements for financial assets and liabilities that are offset in the statement of financial position or subject to master netting arrangements or similar agreements. The disclosures required by those amendments are to be provided retrospectively. The amendments are not assessed to have a significant impact on NIB’s financial statements.

• Amendments to IAS 32 Financial Instruments: Presentation (effective for financial years beginning on or after 1 January 2014): The amendments provide clarifications on the application of presentation requirements for offsetting financial assets and financial liabilities on the statement of financial position and give more related application guidance. The amended standard is to be applied retrospectively. The amendments are not assessed to have a significant impact on NIB’s financial statements.

The unfinished parts of IFRS 9, i.e. the impairment of financial assets and general hedge accounting phases are still a work in progress. Furthermore, the IASB is also considering limited amendments regarding the classification and measurement of financial assets. The macro hedge accounting phase has been taken apart from the IFRS 9 project as a separate project. As the IFRS 9 project is incomplete, the impacts of the standard on the financial statements cannot yet be assessed.

Accounting policies

RISK MANAGEMENT

The Bank assumes a conservative approach to risk-taking. Its constituent documents require that loans be made in accordance with sound banking principles, that adequate security be obtained for the loans, and that the Bank protect itself against the risk of exchange rate losses. The Bank’s risk tolerance is defined by a set of policies, guidelines and limits taking into account the objective of maintaining strong credit quality, stable earnings and a level of capital required to maintain the AAA/Aaa rating.

The main risks—credit risk, market risk, liquidity risk and operational risk— are managed carefully with risk management closely integrated into the Bank’s business processes. As an international financial institution, the Bank is not subject to national or international banking regulations. However, the Bank’s risk management systems and processes are reviewed on an ongoing basis and adapted to changing conditions with the aim to comply in substance with what the Bank identifies as the relevant market standards and best practices including the recommendations of the Basel Committee on Banking Supervision.

Key risk responsibilities

The Board of Directors lays down the general framework for the Bank’s risk management by approving its financial policies and guidelines, including maximum limits for exposure to the main types of risk. Credit approval is primarily the responsibility of the Board of Directors. The Board annually grants authorisation to the Bank to raise funds in the capital markets based on its estimated funding requirements.

The President is responsible for managing the risk profile of the Bank within the framework set by the Board of Directors, and for ensuring that the Bank’s aggregate risk is consistent with its financial resources. The Board of Directors has delegated some credit approval authority to the President for execution in the Credit Committee.

To assist and advise the President, the following committees have been established:

The Executive Committee consists of the President and senior officers, whose appointment to the committee has been confirmed by the Board of Directors. The committee is the forum for addressing policy and management issues. The committee meets approximately twice a month.

The Credit Committee consists of the President and senior officers appointed by the Board of Directors. The committee is responsible for the preparation of and decision-making on matters related to lending operations including, among others, review of all credit proposals before submission to the Board of Directors for approval. The committee meets weekly.

The Finance Committee consists of the President, the Head of Treasury and the Head of Risk and Finance. The committee is responsible for preparation of and decision-making on matters related to the treasury operations. The committee makes recommendations, and where appropriate, decisions in the area of market, counterparty and liquidity risk exposure, monitors the Bank’s borrowing activities and has oversight of treasury risk reporting to the Board of Directors. The committee meets monthly.

The Asset and Liability Committee (ALCO) is a newly established body for strategic balance sheet planning. Together with the Executive Committee it has the overall responsibility for the Bank’s risk management. The committee consists of the members of the Executive Committee and is chaired by the President. The responsibilities of ALCO include, i.a., monitoring performance against the agreed risk appetite, preparation of recommendations to the Board of Directors concerning i.a. changes to the capital structure and limits and targets for key risk factors. The committee meets at least quarterly.

Accounting policies

In the day-to-day management of risks, the Bank has established a segregation of duties between units that enter into business transactions with customers or otherwise expose the Bank to risk on the one hand, and units in charge of risk assessment, risk measurement and control on the other hand. The business units, Lending and Treasury, are responsible for the day-to-day management of all risks assumed through their operations and for ensuring that an adequate return for the risks taken is achieved. These duties are carried out in accordance with guidelines, instructions and limits set for their respective activities.

Risk and Finance, Credit and Analysis, Internal Audit and Compliance are independent from the departments carrying out the Bank’s business activities.

Risk and Finance has the overall responsibility for measuring, monitoring and reporting on risks across risk types and organisational units. The unit is responsible for the Bank’s risk models and tools, the day- to-day monitoring of market and operational risks and the assessment of risk related to new instruments. The Head of Risk and Finance reports to the President.

Credit and Analysis is responsible for assessing and monitoring credit risk in the Bank’s lending and treasury operations and for overseeing that credit proposals are in compliance with established limits and policies. The unit also manages transactions requiring particular attention due to restructuring work- out and recovery processing. The Head of Credit and Analysis reports to the President.

The Legal department carries the responsibility for minimising and mitigating the legal risks in the Bank’s activities. The General Counsel reports to the President.

The Compliance function assists the Bank in identifying, assessing, monitoring and reporting on compliance risk in matters relating to the institution, its operations and to the personal conduct of staff members. The Chief Compliance Officer reports to the President with full and unlimited access to the Chairman of the Board of Directors and to the Chairman of the Control Committee.

Internal Audit provides an independent evaluation of the controls, risk management and governance processes. The Head of Internal Audit reports to the Board of Directors and the Control Committee.

The Control Committee is the Bank’s supervisory body. It ensures that the operations of the Bank are conducted in accordance with the Statutes. The committee is responsible for the audit of the Bank and submits its annual audit report to the Board of Governors.

Credit risk

Credit risk is the Bank’s main financial risk. Credit risk is the risk that the Bank’s borrowers and other counterparties fail to fulfil their contractual obligations and that any collateral held does not cover the Bank’s claims. Following from NIB’s mandate and financial structure, most of the credit risk stems from lending operations. The Bank is also exposed to credit risk in its treasury activities, where credit risk derives from the financial assets such as fixed-income securities and interbank deposits that the Bank uses for investing its liquidity, and from derivative instruments used for managing currency and interest rate risks and other market risks related to structured funding transactions.

Accounting policies

Credit risk management

Credit risk policies and guidelines

The Bank’s credit policy sets the basic criteria for acceptable credit risks, including the minimum credit quality levels for borrowers and guarantors in lending operations, and identifies risk areas that require special attention. The credit enhancement policy requires that the Bank’s position in a transaction should rank at least equal to that of other senior lenders. The credit enhancement guidelines specify the types of security and contractual undertakings that the Bank deems acceptable to mitigate credit risk. Through a set of key clauses for the loan documentation, the Bank strives to ensure that it will receive early warning if the credit quality of the borrower deteriorates or if an event occurs that could have an adverse effect on the borrower’s ability to repay the loan. The portfolio policy aims to ensure an adequate diversification of credit risk across counterparties, countries and industry sectors. Based on the policies set by the Board of Directors, specific guidelines and instructions have been implemented as a basis for the business and control processes and procedures.

Credit risk assessment

Credit risk assessment is an important part of the credit process. Credit and Analysis independently assesses the creditworthiness of borrowers and treasury counterparties. The assessment is qualitative and quantitative and based on internal rating methodologies supported by scoring templates. The assessment results in a risk rating denoting the probability of default of the counterparty.

The credit enhancement in a transaction is assessed separately and a loss given default (LGD) is determined for the transaction as an estimate of the portion of the Bank’s claim that would not be recoverable if the counterparty defaults. The combination of the probability of default of the counterparty and the LGD quantifies the expected loss for the transaction. The Bank applies a rating scale ranging from 1 to 20, with class 1 representing the lowest probability of default and expected loss. In addition, the rating scale includes a class D for non-performing transactions or transactions for which specific impairment provisions have been made. The rating scale is mapped to the ratings of Standard & Poor’s and Moody’s such that the classes 1 to 10 correspond to the external rating equivalent of investment grade (AAA to BBB- and Aaa to Baa3, respectively).

Credit risk limits

The primary source of credit risk is the individual counterparty and the secondary source is the potential default correlation of groups of counterparties and sectors. Exposure limits are set at both counterparty level and portfolio level. Counterparty limits are determined based on the probability of default and expected loss. To reduce risk concentrations, the Bank applies portfolio-level limits for large counterparty exposure as well as for sector and country exposures. The limits are scaled to the Bank’s equity, the counterparty’s equity, the size of the total credit exposure and the Bank’s economic capital. As a general principle, the Bank limits the maximum amount granted as loan or guarantee for a single project to 50% of the total project cost.

Credit risk monitoring

The Bank works continuously to review the quality of its credit exposures. Strong emphasis is put on regular monitoring of the creditworthiness of the counterparties in the Bank’s lending and treasury operations. The monitoring frequency is determined based on, among other things, the ratings and the size and type of exposure. Generally, intensified follow-up applies to counterparties with internal ratings below the level eligible for new exposure or other defined levels. When serious deterioration of a counterparty’s debt repayment capacity and/or financial standing is identified, the counterparty is transferred to the watch list and placed under close monitoring with regular reporting to the Board of Directors.

Accounting policies

Compliance with existing limits is monitored regularly. For treasury counterparties limit compliance is monitored on a daily basis.

Portfolio level measurement and monitoring of credit risk is carried out within the Bank’s economic capital framework. Economic capital is the Bank’s estimate of the capital required to cover unexpected losses deriving from credit risk, market risk and operational risk. As the Bank is not subject to regulatory capital requirements, the economic capital is used for internal monitoring to ensure that the Bank has sufficient capital to fulfil its commitments. The portfolio approach provides a more comprehensive assessment of the Bank’s aggregate credit risk as it captures the impact of concentration and diversification in the Bank’s operations. A report on the Bank’s economic capital and risk profile is submitted to the Board of Directors every four months. The report includes an analysis of the capital required, the aggregate credit risk exposure, credit risk concentrations, changes in the risk profile and exposure against portfolio risk limits with any breaches of limits explained.

Derivatives

The Bank uses derivatives as part of its funding strategy in order to match the interest rate and currency characteristics of the funds raised with those of loans granted and also to reduce funding costs. Derivatives are transacted under normal counterparty limits.

As a rule, NIB enters into International Swaps and Derivatives Association (ISDA) contracts with swap counterparties. This allows the netting of the obligations arising under all of the derivative contracts covered by the ISDA agreement in case of insolvency and, thus, results in one single net claim on, or payable to, the counterparty. Netting is applied for the measurement of the Bank’s credit exposure only in cases when it is deemed to be legally enforceable in the relevant jurisdiction and against a counterparty. The gross total fair value of swaps at year-end 2012 amounted to EUR 2,568 million, compared to a value of EUR 1,951 million after applying netting (year-end 2011: EUR 2,623 million and EUR 1,999 million, respectively).

The credit risk on swaps is further mitigated through credit support agreements with the Bank’s major swap counterparties. Under these agreements swap exposures exceeding agreed thresholds are collateralised by cash or high-quality government securities. Both the swap portfolio with individual counterparties and the collateral received are regularly monitored and valued, with a subsequent call for additional collateral or release. The Bank strives to use unilateral credit support agreements under which the Bank does not have to post collateral. At year-end 2012, the Bank held EUR 1,783 million (2011: EUR 1,558 million) in collateral received, of which EUR 1,464 million (2011: EUR 1,223 million) was in cash and EUR 319 million (2011: EUR 335 million) in securities (Note 16, Collateral and Commitments).

Credit risk reserves, impairment methodology

The Bank maintains two credit risk funds within its equity, in addition to the Statutory Reserve. The General Credit Risk Fund is available to cover unexpected losses arising from the Bank’s lending and other business activities. At year-end 2012 the fund amounted to EUR 956 million. The Statutes require that the Bank maintains the Special Credit Risk Fund for the Project Investment Loan (PIL) facility to cover the Bank’s own risk on such loans before resorting to the member countries’ guarantees that support the facility. At year-end 2012, the fund amounted to EUR 396 million.

The Bank reviews at least every four months the possible need for impairment provisions on weak

Accounting policies

exposures. The assessment is carried out both at an individual counterparty level and collectively for groups of counterparties. At the counterparty level specific impairment provision is recognised if there is objective evidence that the counterparty’s capacity to fulfil its obligations has deteriorated to the extent that full repayment is unlikely when taking into consideration any collateral received. The Bank’s method for collective impairments was revised during 2012. Collective impairment provisions are determined on a portfolio basis for exposures with similar credit risk characteristics, as reflected in their risk ratings. The process includes management’s judgement based on the current macroeconomic environment and the current view of the expected economic outlook. In the Bank’s view, the assumptions and estimates made represent an appropriate level of conservatism and are reflective of the predicted economic conditions, the Bank’s portfolio characteristics and their correlation with losses incurred based on historical loss experience. In the assessment of sovereign exposures, the Bank takes into account its preferred creditor status. The Bank’s principles for impairment provisioning are described in more detail in the section “Significant accounting policies”.

Credit risk exposure

Tables 1 to 3 below provide an overview of the Bank’s aggregate credit risk exposure as at year-end 2012 before collective impairment. Aggregate credit exposure comprises lending and treasury exposure. Lending exposure includes loans outstanding and loans agreed but not yet disbursed without taking into account any collateral or other credit enhancement. Regarding the treasury exposure, capital market investments are included at nominal value, while derivatives are included at fair value net of collateral held when credit support agreements are in place and at fair value with an add-on for potential future exposure when not under credit support agreement.

TABLE 1. Credit risk exposure by internal rating (in EUR million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Risk class | | S&P

equivalent | | | Lending | | | 31.12.2012 Treasury | | | Total | | | Lending | | | 31.12.2011 Treasury | | | Total | |

1–2 | | | AAA/AA+ | | | | 2,277 | | | | 4,966 | | | | 7,243 | | | | 1,890 | | | | 3,945 | | | | 5,835 | |

3–4 | | | AA/AA- | | | | 1,014 | | | | 1,455 | | | | 2,469 | | | | 803 | | | | 1,711 | | | | 2,514 | |

5–6 | | | A+/A | | | | 1,147 | | | | 1,044 | | | | 2,191 | | | | 1,351 | | | | 1,834 | | | | 3,184 | |

7–8 | | | A-/BBB+ | | | | 5,112 | | | | 207 | | | | 5,319 | | | | 4,616 | | | | 135 | | | | 4,751 | |

9–10 | | | BBB/BBB- | | | | 3,912 | | | | 85 | | | | 3,997 | | | | 3,997 | | | | 169 | | | | 4,165 | |

11–12 | | | BB+/BB | | | | 2,045 | | | | 10 | | | | 2,055 | | | | 2,148 | | | | 8 | | | | 2,156 | |

13–14 | | | BB/BB- | | | | 507 | | | | 0 | | | | 507 | | | | 436 | | | | 0 | | | | 436 | |

15–16 | | | BB-/B+ | | | | 272 | | | | 20 | | | | 292 | | | | 192 | | | | 0 | | | | 192 | |

17–18 | | | B/B- | | | | 76 | | | | 0 | | | | 76 | | | | 122 | | | | 0 | | | | 122 | |

19–20 | | | B-/CCC | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

D | | | | | | | 80 | | | | 10 | | | | 89 | | | | 77 | | | | 28 | | | | 105 | |

TOTAL | | | | | | | 16,442 | | | | 7,797 | | | | 24,239 | | | | 15,633 | | | | 7,829 | | | | 23,462 | |

| | | | | | | |

Class D | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross | | | | | | | 198 | | | | 90 | | | | 288 | | | | 204 | | | | 167 | | | | 371 | |

| Impairment | | | | | | | 118 | | | | 80 | | | | 198 | | | | 127 | | | | 139 | | | | 266 | |

Net | | | | | | | 80 | | | | 10 | | | | 89 | | | | 77 | | | | 28 | | | | 105 | |