Exhibit XII

| | |

| | Financial Report 2015 |

Contents

| | | | |

Report of the Board of Directors | | | 1 | |

| Proposal by the Board of Directors to the Board of Governors | | | 8 | |

Statement of comprehensive income | | | 9 | |

Statement of financial position | | | 10 | |

Changes in equity | | | 11 | |

Cash flow statement | | | 12 | |

| Notes to the financial statements | | | 14 | |

Note 1: Segment information | | | 33 | |

Note 2: Interest income and interest expense | | | 35 | |

Note 3: Commission income and fees received | | | 36 | |

Note 4: Net profit/loss on financial operations | | | 37 | |

Note 5: General administrative expenses | | | 38 | |

Note 6: Impairment of loans | | | 42 | |

Note 7: Financial placements | | | 43 | |

Note 8: Loans outstanding and guarantee commitments | | | 45 | |

Note 9: Intangible assets, tangible assets (property and equipment) | | | 50 | |

Note 10: Depreciation | | | 52 | |

| | | | |

Note 11: Other assets | | | 53 | |

Note 12: Debts evidenced by certificates and swaps | | | 54 | |

Note 13: Other liabilities | | | 55 | |

Note 14: Authorised capital – paid-in capital | | | 56 | |

Note 15: Statutory reserve and credit risk funds | | | 57 | |

Note 16: Collateral and commitments | | | 58 | |

Note 17: Fair value of financial instruments | | | 59 | |

Note 18: Maturity profile of financial assets and liabilities | | | 62 | |

Note 19: Interest rate risk | | | 64 | |

Note 20: Currency risk | | | 66 | |

Note 21: Related party disclosures | | | 68 | |

Note 22: Cash flow statement | | | 69 | |

Note 23: Exchange rates | | | 70 | |

Note 24: Post balance sheet events | | | 71 | |

Auditor´s report | | | 72 | |

Statement by the Control Committee | | | 74 | |

Report of the Board of Directors

Summary

| ● | | The Board concluded NIB’s strategy review in 2015. There will be no change to the core business model. The Bank will continue with the mission of financing investments that improve competitiveness and the environment in the region. The Board sees both pillars as being of equal importance. It put emphasis on identifying bankable environmental projects and cross-border investments that support member country integration. |

| ● | | Furthermore, it was decided that NIB will develop lending activities in two ways. The first route is to better serve SMEs and mid-sized corporates, which are important for growth and jobs in the region. The other initiative is to increase flexibility in non-member-country lending. The new lending initiatives to be implemented in 2016 are expected to promote the favourable development of lending volumes and support sustainable growth in the region. |

| ● | | NIB’s lending activities continued to develop very positively in 2015, with disbursements of loans reaching an all-time high of EUR 2,716 million. |

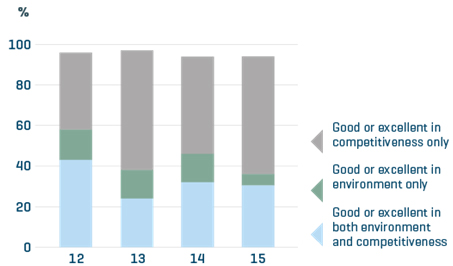

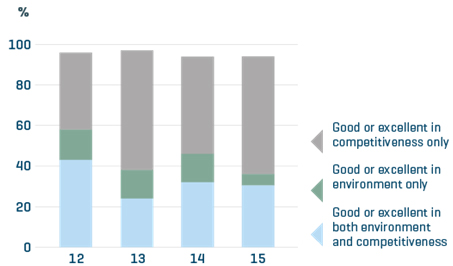

| ● | | Loans achieving a “good” or “excellent” mandate rating accounted for 94% of the total amount of lending. The majority of the environmental loans were for projects aimed at climate change mitigation in the member countries. Loans promoting competitiveness mainly supported investments in R&D, infrastructure and energy. |

| ● | | The profit was EUR 215 million (2014: EUR 210 million). |

| ● | | NIB raised EUR 4.3 billion in new funding and continued to issue NIB Environmental Bonds. |

| ● | | The Bank’s overall risk position remained strong in 2015, the main drivers being high asset quality, solid liquidity, and strong capitalisation. |

| ● | | During 2015, the Bank strengthened its risk management practice in line with evolving market standards. The Bank implemented, amongst other things, an improved framework for estimating loss given default and started developing an internal capital adequacy assessment process. |

Operating environment

Global growth weakened somewhat in 2015, reflecting uneven developments in the major regions. The recovery in advanced economies was not enough to fully offset the slowdown in emerging markets.

The Nordic–Baltic region experienced modest growth, but developments in the world economy affected the member countries in different ways. As a result of the low oil price, growth in oil-exporting Norway slowed down, whereas the rest of the region benefited from lower commodity prices. Some countries felt the effect of Russia’s weakened economy. On the positive side, Denmark, and particularly Sweden and Iceland, fared relatively well, and the Baltic countries showed resilience.

As a result of these developments, underlying demand for corporate investment-related credit remained subdued. The public sector’s demand for credit, however, was supported by large-scale investment needs. Against the background of a competitive Nordic banking sector and active bond markets, spreads remained compressed in most markets.

Strategy conclusions and implementation

In 2015, the Board of Directors concluded the Bank’s strategy review, which had been initiated one year before. During the process, the Board covered all relevant aspects of the Bank, such as its mission and success factors, lending operations, capital and liquidity, and the implications of possible changes in the strategy.

The key conclusion was that the present business model remains the foundation of NIB’s operations. The Bank will continue with the mission of financing investments that improve competitiveness and the environment in the region. The Board sees both pillars as being of equal importance. It put emphasis on identifying bankable environmental projects and cross-border investments.

NIB adopted a framework for monitoring and ex-post mandate assessment in order to evaluate the results of projects financed by the Bank.

Despite the unchanged focus, the Board saw it as important for the Bank to develop its lending activities in order to stay flexible and relevant for the future. The Board decided that during the coming years, NIB will seek to increase lending to SMEs in cooperation with financial intermediaries and to mid-sized corporates, which are important for growth and job creation in the region.

1

NIB will also put more emphasis on non-member-country lending. The Bank will cease to limit its non-member-country lending activities only to focus countries, with the aim of increasing non-member-country lending in the longer term, up to approximately one fifth of the annual new lending. By doing so, NIB is responding to its customers’ wishes for the Bank to become more involved in financing their investments outside the Nordic–Baltic region.

In addition, the Bank will increasingly focus on member country integration, investments in the Baltic countries and projects in the Arctic region.

The Board took its first decisions on how to implement the strategy conclusions for broadened lending activities. An Arctic Financing Facility with a framework of up to EUR 500 million in loans for projects in the Arctic region was set up.

The Board also adopted new financial policies for lending to SMEs and mid-sized corporates.

With the purpose of “keeping the house in order” and supporting the new lending initiatives, the Board stressed the importance of further advancement of compliance, governance and enterprise architecture, development of human resources, and improvement in the working environment. As a result, a number of projects were initiated, for instance an enhanced staff training programme.

Lending activities

NIB’s lending activities were better than anticipated in 2015. The Bank signed 45 loan agreements with an aggregate value of EUR 2,830 million. More than half of these loans were to new borrowers, which was in line with the Bank’s aim of broadening its client base. Lending volumes by business sector are displayed in the table below.

Disbursements of loans increased to an all-time high of EUR 2,716 million, compared to EUR 2,274 million in 2014. The largest sector was industries and services, with a substantial part of NIB’s financing provided for research and development. The public sector in the member countries was also a major recipient of loans.

High liquidity and subdued investment in the Nordic–Baltic region affected NIB’s loan portfolio through larger-than-average early redemptions of loans.

| | | | | | | | |

LENDING (IN EUR MILLION, UNLESS OTHERWISE SPECIFIED) | | 2015 | | | 2014 | |

Loans agreed according to areas: | | | | | | | | |

Energy and environment | | | 710 | | | | 630 | |

Infrastructure and telecom | | | 823 | | | | 557 | |

Industries and services | | | 996 | | | | 926 | |

Financial institutions and SMEs | | | 301 | | | | 277 | |

Loans agreed, total | | | 2,830 | | | | 2,389 | |

Member countries | | | 2,740 | | | | 2,327 | |

Non-member countries | | | 90 | | | | 62 | |

Loans disbursed, total | | | 2,716 | | | | 2,274 | |

Member countries | | | 2,546 | | | | 2,181 | |

Non-member countries | | | 170 | | | | 93 | |

Number of loan agreements, total | | | 45 | | | | 45 | |

Member countries | | | 44 | | | | 43 | |

Non-member countries | | | 1 | | | | 2 | |

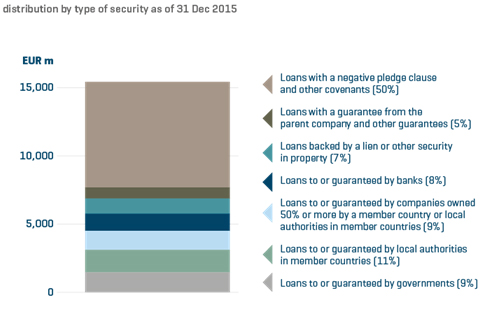

Loans outstanding and guarantees | | | 15,627 | | | | 15,156 | |

Member countries | | | 13,347 | | | | 12,705 | |

Non-member countries | | | 2,341 | | | | 2,506 | |

Collective impairments | | | -61 | | | | -55 | |

Repayments/prepayments | | | 2,351 | | | | 2,005 | |

2

Mission fulfilment

Each NIB-financed project is rated regarding how well it fulfils the Bank’s mission to improve competitiveness and the environment of the Nordic–Baltic countries. In 2015, the loans achieving a “good” or “excellent” mandate rating accounted for 94% of the total amount of loans agreed.

Besides fulfilling its mission, NIB’s lending operations are expected to add value to what the market provides. This is achieved by offering flexible long-term loans, providing diversification of financing sources and sharing expertise. NIB does not compete with commercial or other financiers; it complements them, especially through longer maturities.

Mandate rating

Competitiveness impact

In 2015, the largest part (36%) of NIB’s lending in the membership area was extended to industrial and service companies. NIB supported technological innovation in the member countries by providing financing to customers’ R&D programmes and investments in new production facilities. Moreover, a significant share of NIB’s lending to corporate clients was used to finance acquisitions of member and non-member area companies. Companies add value to their product offerings by developing and adopting new technology and skills through R&D and acquisitions. All agreed loans for corporates’ R&D activities received a “good” or “excellent” competitiveness rating. The share of acquisition projects rated at “good” and “excellent” was 44%. In total, lending to finance R&D projects and acquisitions accounted for 23% and 8%, respectively, of NIB’s loans agreed.

Infrastructure investments have a long-term impact on the region’s ability to maintain its attractiveness as a place to do business. As most of NIB’s member countries are sparsely populated, the quality of transport infrastructure and services is of utmost importance for creating a productive business environment. In 2015, NIB contributed 22% of its total loans agreed to transport infrastructure projects. All these loans received a “good” or “excellent” competitiveness rating.

The key focus of investments in the energy sector was on fuel diversification in order to reduce the region’s dependence on imported fuels. This trend also involved the upgrade of production technologies to increase the efficiency of energy assets. A significant share of NIB’s lending in the energy sector was provided for investments in new production facilities fuelled by local biomass resources.

Member area utilities continued to modernise and expand energy transmission and distribution networks. These investments help remove transmission bottlenecks and secure energy supply in all demand and weather conditions. NIB’s lending to the energy sector accounted for 25% of total loans agreed. The share of investments in new heat and power production facilities was 12%. All loans in this sector received a “good” or “excellent” competitiveness and/or environmental mandate rating.

In order to support small companies in better access to finance in member countries, NIB reached out to smaller counterparties by providing financing through financial intermediaries. Excluding unallocated credit lines, these loan programmes accounted for 7% of NIB’s total lending. This is considered an important method for NIB to strengthen the capacity of such companies to invest, grow and create jobs. Also, these loans were rated “good” or “excellent” for mandate impact.

3

Environmental impact

NIB defines loans to projects with significant direct or indirect positive environmental impacts as environmental loans, regardless of the sector in which they occur. In 2015, a total volume of EUR 1,019 million was agreed for projects with an environmental mandate rating of “good” or “excellent”, which is equivalent to 36% of the total agreed volume.

The majority of the environmental loans were related to projects aimed at climate change mitigation in the member countries. These were investments in energy efficiency improvements in public and commercial buildings, as well as investments in public rail transport infrastructure. Financing was also provided for renewable energy projects in the hydropower and waste-to-energy sectors.

When implemented, the NIB-financed energy projects will add 0.52 TWh annually to renewable energy generation. The Bank estimates that the loans agreed in 2015 are helping to reduce CO2 emissions by 50,100 tonnes annually, prorated to NIB’s share of the financing. Loans allocated for climate change mitigation projects accounted for 33% of NIB’s total lending volume.

Financing was also provided for two new wastewater treatment plants in Finland and for the technical improvement of industrial plants in Norway to reduce nitrogen oxide emissions into the air by 40%. Furthermore, an environmental loan was provided for an R&D programme with a focus on improving energy and resource efficiency in industrial production.

NIB’s Sustainability Policy and Guidelines cover the environmental, social and ethical aspects of the Bank’s operations. More detailed information on NIB’s corporate responsibility matters are described in the Annual Report 2015, specifically under GRI reporting, available online.

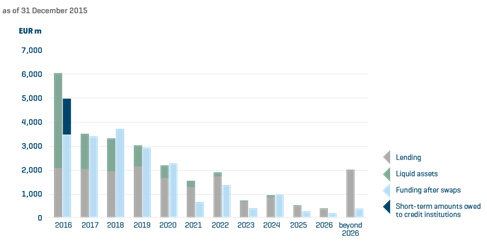

Treasury activities

NIB acquires funds for its lending by borrowing on the international capital markets. During 2015, NIB raised EUR 4.3 billion in new funding through 25 funding transactions. At year-end, outstanding debt totalled EUR 20.9 billion in 18 currencies. The largest transaction in 2015 was a three-year, USD 1.25 billion global benchmark transaction, which was issued in March. In September, NIB launched its second US dollar- denominated benchmark transaction, a five-year, USD 1 billion transaction.

Of the new funding issued in 2015, over EUR 2 billion was issued in US dollars, 13% directly in euros and 12% in Nordic currencies.

NIB continued to issue NIB Environmental Bonds (NEBs) and launched its first EUR benchmark bond under the NEB programme. A seven-year, EUR 500 million Environmental Bond benchmark was issued in September. NEBs are mainly sold to investors following socially responsible investment principles. The proceeds from the bonds are used to finance eligible projects with a positive impact on the environment. In 2015, the Bank enhanced the information and reporting towards investors regarding NIB Environmental Bonds on its website.

Of the total NIB investor base in 2015, Europe (including the Nordics) accounted for 42% and the Americas for 21%, while investors based in Asia bought 18% of NIB’s new issuance, and investors from the Australia/New Zealand region contributed a share of 12%.

| | | | | | | | | | | | |

FINANCIAL ACTIVITIES (IN EUR MILLION) | | 2015 | | | 2014 | | | 2013 | |

New debt issues | | | 4,276 | | | | 3,361 | | | | 4,080 | |

Debts evidenced by certificates at year-end | | | 20,862 | | | | 19,446 | | | | 18,421 | |

Number of borrowing transactions | | | 25 | | | | 35 | | | | 42 | |

Number of borrowing currencies | | | 11 | | | | 10 | | | | 12 | |

4

Risk management

The Bank’s overall risk position remained strong in 2015, with high asset quality, a solid liquidity and strong capitalisation being the main drivers.

The credit quality of the lending exposure was stable in 2015: 83% of the exposure was in investment-grade categories (risk classes 1–10), which was the same level as at year-end 2014. The exposure in the weakest risk classes (17–20), declined slightly to 0.4% (2014: 1%). The loan portfolio remained well balanced. There were no material changes in the geographical and sectoral distribution of the loan portfolio. At year-end, the member countries accounted for 84% (2014: 82%) of the total lending exposure, followed by 6% for Central and Eastern Europe, and 5% for Asia.

As in the previous year, the credit quality of the Treasury portfolio was strong, with close to 100% of the exposure in the investment-grade categories (risk classes 1–10). Of the Treasury exposure, 39% was within the member countries, compared to 35% the year before. The geographical distribution of the Treasury portfolio continued to be weighted towards Germany, Finland, the Netherlands and Sweden, accounting for 53% of the total exposure (2014: 57%).

The market risk remained largely unchanged. The Bank is mainly exposed to interest rate risk, credit spread risk in treasury operations and cross-currency basis risk. The market value sensitivities towards a one-basis-point shift in the specific yield curves were EUR 0.95 million, EUR 1.6 million and EUR 2 million, respectively.

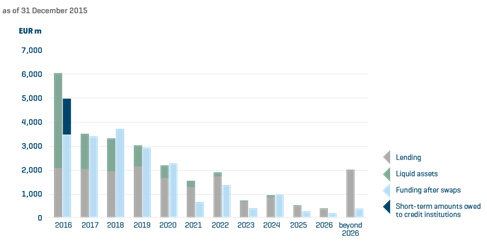

The Bank’s liquidity position remained strong during 2015. At the end of the year, the liquidity buffer amounted to EUR 9,077 million, of which 29%, or EUR 2,653 million, was held as cash and short-term money market instruments, and 71%, or EUR 6,424 million, in securities with longer maturities.

The survival horizon, net stable funding ratio (NSFR) and liquidity coverage ratio[1] (LCR) are the measurements used for the purpose of assessing the liquidity risk. At year-end, the survival horizon measured according to the Bank’s liquidity policy was 431 days. The NFSR was approximately 150% and the LCR approximately 1,200%. The minimum NSFR and LCR requirements for commercial banks are 100% following the implementation of Basel III.

The Bank’s ordinary lending ceiling corresponds to 250% of the authorised capital and accumulated general reserves. At the end of 2015, the ordinary lending ceiling amounted to EUR 20,922 million, while the ordinary lending portfolio amounted to EUR 13,956 million.

The Bank strengthened its risk management in line with evolving market standards. During 2015, the Bank improved and implemented a framework for estimating loss given default and further developed risk management reporting to the decision-making bodies. Furthermore, the Bank started the work of developing an internal capital adequacy assessment process.

It was decided that the Bank should move from one-way to two-way credit support agreements. This is now the market standard and is expected to decrease the cost of derivative contracts for the Bank. It also requires a higher liquidity buffer to mitigate the need for the Bank to post collateral with swap counterparties.

Compliance

There were no allegations of corruption involving members of the Bank’s personnel. The Board of Directors was informed that three new external allegations of corruption were registered during 2015 and that the cases are currently under investigation by the Bank’s Committee on Fighting Corruption, in consultation with national enforcement agencies and co-financing partners. The Compliance Unit followed up with national enforcement agencies on other fraud and corruption cases for which investigations were concluded in 2013 and 2014.

During 2015, a major review of the Bank’s compliance and anti-corruption framework was undertaken. With the assistance of external consultants, the Bank also undertook a review of its current procedures and processes relating to anti-money laundering and counteracting terrorist financing. Proposed changes resulting from the reviews will be implemented in 2016.

[1] Liquidity coverage ratio is a measure banks need to report and adhere to. Given NIB’s business model based on long-term lending matched with long-term funding, LCR is less relevant for NIB than it is for commercial banks.

5

Financial results

NIB’s performance during the year demonstrates the underlying strength of its business model. Despite low interest rates, the Bank managed to improve its financial results. Profit totalled EUR 215 million, up from EUR 210 million in 2014.

The profit reflected growth in net interest income and lower loan impairment charges. This was partially offset by lower profits from financial operations.

The net interest income amounted to EUR 247 million, up 3% from the previous year. Both lending and treasury operations posted a net interest income higher than in 2014. Particularly encouraging was the net interest income growth from lending, mainly driven by a larger loan book. Commission income rose by EUR 3 million, to EUR 12 million.

The financial markets were volatile during the year, which resulted in greater uncertainty and wider spreads. In 2015, NIB updated its valuation model for derivative instruments in order to better align the valuation methods with the current market practice. A EUR 12 million net return on financial operations was recorded, which reflected the volatility of the markets and the fair value movements.

Administrative expenses and depreciation increased compared to 2014, mainly due to the changed depreciation methodology on intangible assets with a once-for-all effect of EUR 4.5 million. Further, the Bank made an extra provision of EUR 2 million for the purpose of planning, training and adapting to the changing banking industry requirements. As a consequence, the cost/income ratio based on underlying costs deteriorated from 15.1% in 2014 to 18.8% in 2015.

The quality of the loan portfolio remained high. Loan impairment charges were down, and in 2015 loan impairment charges amounted to EUR 3 million. New collective impairment charges amounted to EUR 6 million and the reversals of previously recorded impairments to EUR 3 million. The Bank continued to adopt a conservative approach in relation to impairments.

Since year-end 2014, the Bank’s total assets have increased by EUR 2 billion to EUR 27.3 billion.

| | | | | | | | | | | | |

KEY FIGURES (IN EUR MILLION) | | 2015 | | | 2014 | | | 2013 | |

Net interest income | | | 247 | | | | 239 | | | | 244 | |

Profit/loss on financial operations | | | 12 | | | | 26 | | | | 20 | |

Administrative expenses and depreciation | | | 50* | | | | 41 | | | | 39 | |

Loan impairments | | | 3 | | | | 21 | | | | 15 | |

Profit/loss | | | 215 | | | | 210 | | | | 217 | |

Equity | | | 3,146 | | | | 2,986 | | | | 2,831 | |

Total assets | | | 27,311 | | | | 24,870 | | | | 23,490 | |

Solvency ratio (equity/total assets, %) | | | 11.5% | | | | 12.0% | | | | 12.1% | |

Cost/income ratio | | | 18.8%* | | | | 15.1% | | | | 14.3% | |

* Including the effects from changed depreciation methodology and the extra provision as mentioned above.

Dividend

The Board of Directors proposes to the Board of Governors that EUR 55 million be paid as dividends to the Bank’s member countries for the year 2015.

6

Chairmanship and meetings

During the year, the Board had eight meetings and one online meeting, all chaired by Pentti Pikkarainen (Finland). As well as formal agenda items, the meetings included seminars (four during the year) with the Bank’s customers, investors and other invited experts. In connection with the Board meetings in Lithuania and Norway, the members visited the LNG terminal in Klaipeda, the Lysebotn 2 hydropower plant and the Ryfast road tunnel in Stavanger, which are financed by NIB loans. In London, the Board met with the rating agency Standard & Poor’s, the Financial Conduct Authority (FCA), HSBC and the EBRD. The Board continued its efforts to further improve the efficiency of the decision-making process on the basis of a self-evaluation process that had been finalised. The Board also discussed the possibility of undergoing a “fit and proper” test.

Outlook

Going into 2016, prospects across the main regions remain uneven. Although global growth is projected to gather pace somewhat, uncertainties remain, caused by declining commodity prices, weaker emerging market economies and financial market volatility. Forecasts for the Nordic–Baltic countries vary from a slight pick-up in activity in Finland to continued robust growth in Sweden.

As Nordic banks continue to supply credit and corporate investment remains modest despite accommodative central bank policies, volumes and margins are unlikely to pick up in the near term. Meanwhile, the rise in short-term financing rates in the US dollar could further increase spreads in the euro corporate bond market.

In 2016, the Bank expects somewhat lower results compared to the previous year. This is due to lower income from treasury operations in the prevailing market conditions. NIB expects that the new lending initiatives, which will be gradually implemented in 2016, will further support the favourable development of lending volumes and sustainable growth in the region.

7

Proposal by the Board of Directors to the Board of Governors

The Board of Directors’ proposal with regard to the financial results for the year 2015 takes into account the need to maintain the Bank’s ratio of equity to total risk-weighted assets at a secure level, which is a prerequisite for maintaining the Bank’s high creditworthiness.

In accordance with section 11 of the Statutes of the Bank, the profit for 2015 of EUR 215,398,492.93 is to be allocated as follows:

| ● | | EUR 110,398,492.93 will be transferred to the General Credit Risk Fund as a part of equity; |

| ● | | EUR 50,000,000.00 will be transferred to the Special Credit Risk Fund for Project Investment Loans; |

| ● | | no transfer is made to the Statutory Reserve. The Statutory Reserve amounts to EUR 686,325,305.70 or 11.2 % of the Bank’s authorized capital stock; and |

| ● | | EUR 55,000,000.00 will be made available for distribution as dividends to the Bank’s member countries. |

More information can be found in the statement of comprehensive income, the statement of financial position, the changes in equity and cash flow statement, as well as the notes to the financial statements.

| | | | |

| | Helsinki, 3 March 2016 | | |

Pentti Pikkarainen Sven Hegelund Þorsteinn Þorsteinsson | | Trond Eklund Julie Sonne Henrik Normann President & CEO | | Kaspars Āboliņš Algimantas Rimkūnas Madis Üürike |

8

Statement of comprehensive income 1 January – 31 December

| | | | | | | | | | | | |

| EUR 1,000 | | NOTE | | 2015 | | 2014 |

Interest income | | | | | | | 338,781 | | | | 382,760 | |

Interest expense | | | | | | | -92,005 | | | | -143,652 | |

Net interest income | | | (1), (2), (21) | | | | 246,776 | | | | 239,108 | |

| | | |

Commission income and fees received | | | (3) | | | | 12,218 | | | | 9,326 | |

Commission expense and fees paid | | | | | | | -2,212 | | | | -2,092 | |

Net profit/loss on financial operations | | | (4) | | | | 11,521 | | | | 25,684 | |

Foreign exchange gains and losses | | | | | | | 82 | | | | 187 | |

Operating income | | | | | | | 268,385 | | | | 272,211 | |

| | | |

Expenses | | | | | | | | | | | | |

General administrative expenses | | | (5), (21) | | | | 41,740 | | | | 37,386 | |

Depreciation | | | (9), (10) | | | | 8,737 | | | | 3,709 | |

Impairment of loans | | | (6), (8) | | | | 2,509 | | | | 20,905 | |

Total expenses | | | | | | | 52,987 | | | | 62,000 | |

| | | | | | | | | | | | | |

PROFIT/LOSS FOR THE YEAR | | | | | | | 215,398 | | | | 210,211 | |

| | | |

| | | | | | | | | | | | | |

Total comprehensive income | | | | | | | 215,398 | | | | 210,211 | |

The Nordic Investment Bank’s accounts are kept in euro.

9

Statement of financial position at 31 December

| | | | | | | | | | | | | | | | |

EUR 1,000 | | | | NOTE | | 2015 | | 2014 |

ASSETS | | | | | | | (1), (18), (19), (20) | | | | | | | | | |

Cash and cash equivalents | | | | | | | (17), (22) | | | | 2,666,070 | | | | 1,639,139 | |

Financial placements | | | | | | | (17) | | | | | | | | | |

Placements with credit institutions | | | | | | | | | | | 7,921 | | | | 6,571 | |

Debt securities | | | | | | | (7) | | | | 6,080,069 | | | | 5,489,623 | |

Other | | | | | | | | | | | 22,023 | | | | 22,190 | |

| | | | | | | | | | | | 6,110,012 | | | | 5,518,384 | |

Loans outstanding | | | | | | | (8), (17) | | | | 15,626,946 | | | | 15,156,486 | |

Intangible assets | | | | | | | (9) | | | | – | | | | 5,217 | |

Tangible assets, property and equipment | | | | | | | (9) | | | | 28,360 | | | | 28,324 | |

Other assets | | | | | | | (11), (17) | | | | | | | | | |

Derivatives | | | | | | | | | | | 2,557,979 | | | | 2,198,003 | |

Other assets | | | | | | | (21) | | | | 23,103 | | | | 19,259 | |

| | | | | | | | | | | | 2,581,083 | | | | 2,217,262 | |

Accrued interest and fees receivable | | | | | | | | | | | 298,977 | | | | 305,590 | |

TOTAL ASSETS | | | | | | | | | | | 27,311,447 | | | | 24,870,400 | |

| | | | |

LIABILITIES AND EQUITY | | | | | | | (1), (18), (19), (20) | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | |

Amounts owed to credit institutions | | | | | | | (17), (21) | | | | | | | | | |

Short-term amounts owed to credit institutions | | | | | | | (16), (22) | | | | 1,448,888 | | | | 872,010 | |

Long-term amounts owed to credit institutions | | | | | | | | | | | 18,000 | | | | – | |

| | | | | | | | | | | | 1,466,888 | | | | 872,010 | |

Repurchase agreements | | | | | | | | | | | 122,556 | | | | – | |

Debts evidenced by certificates | | | | | | | (12), (17) | | | | | | | | | |

Debt securities issued | | | | | | | | | | | 20,802,164 | | | | 19,369,052 | |

Other debt | | | | | | | | | | | 59,860 | | | | 76,597 | |

| | | | | | | | | | | | 20,862,024 | | | | 19,445,649 | |

Other liabilities | | | | | | | (13), (17) | | | | | | | | | |

Derivatives | | | | | | | | | | | 1,480,736 | | | | 1,329,097 | |

Other liabilities | | | | | | | | | | | 9,946 | | | | 6,760 | |

| | | | | | | | | | | | 1,490,682 | | | | 1,335,857 | |

Accrued interest and fees payable | | | | | | | | | | | 222,800 | | | | 230,786 | |

Total liabilities | | | | | | | | | | | 24,164,950 | | | | 21,884,302 | |

Equity | | | | | | | | | | | | | | | | |

Authorised and subscribed capital | | | 6,141,903 | | | | | | | | | | | | | |

of which callable capital | | | -5,723,302 | | | | | | | | | | | | | |

Paid-in capital | | | 418,602 | | | | (14) | | | | 418,602 | | | | 418,602 | |

Reserve funds | | | | | | | (15) | | | | | | | | | |

Statutory Reserve | | | | | | | | | | | 686,325 | | | | 686,325 | |

General Credit Risk Fund | | | | | | | | | | | 1,430,252 | | | | 1,275,041 | |

Special Credit Risk Fund PIL | | | | | | | | | | | 395,919 | | | | 395,919 | |

Profit/loss for the year | | | | | | | | | | | 215,398 | | | | 210,211 | |

Total equity | | | | | | | | | | | 3,146,497 | | | | 2,986,099 | |

TOTAL LIABILITIES AND EQUITY | | | | | | | | | | | 27,311,447 | | | | 24,870,400 | |

Collateral and commitments | | | | | | | (16) | | | | | | | | | |

The Nordic Investment Bank’s accounts are kept in euro.

10

Changes in equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EUR 1,000 | | PAID-IN

CAPITAL | | | STATUTORY

RESERVE | | | GENERAL

CREDIT RISK

FUND | | | SPECIAL

CREDIT RISK

FUND PIL | | | PAYMENTS TO THE

BANK’S STATUTORY

RESERVE AND CREDIT

RISK FUNDS | | | APPROPRIATION TO

DIVIDEND PAYMENT | | | OTHER VALUE

ADJUSTMENTS | | | PROFIT/LOSS

FOR THE YEAR | | | TOTAL | | | |

| | | |

| EQUITY AT 31 DECEMBER 2013 | | | 418,602 | | | | 686,325 | | | | 1,112,831 | | | | 395,919 | | | | 0 | | | | 0 | | | | 0 | | | | 217,210 | | | | 2,830,887 | | | |

| | | |

| Appropriations between reserve funds | | | | | | | | | | | 162,210 | | | | | | | | | | | | 55,000 | | | | | | | | -217,210 | | | | 0 | | | |

| | | |

| Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Called-in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Dividend payment | | | | | | | | | | | | | | | | | | | | | | | -55,000 | | | | | | | | | | | | -55,000 | | | |

| | | |

| Comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 210,211 | | | | 210,211 | | | |

| | | |

| EQUITY AT 31 DECEMBER 2014 | | | 418,602 | | | | 686,325 | | | | 1,275,041 | | | | 395,919 | | | | 0 | | | | 0 | | | | 0 | | | | 210,211 | | | | 2,986,099 | | | |

| | | |

| Appropriations between reserve funds | | | | | | | | | | | 155,211 | | | | | | | | | | | | 55,000 | | | | | | | | -210,211 | | | | 0 | | | |

| | | |

| Paid-in capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Called-in authorised and subscribed capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Payments to the Bank’s Statutory Reserve and credit risk funds, receivable | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | | | |

| | | |

| Dividend payment | | | | | | | | | | | | | | | | | | | | | | | -55,000 | | | | | | | | | | | | -55,000 | | | |

| | | |

| Comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 215,398 | | | | 215,398 | | | |

EQUITY AT 31 DECEMBER 2015 | | | 418,602 | | | | 686,325 | | | | 1,430,252 | | | | 395,919 | | | | 0 | | | | 0 | | | | 0 | | | | 215,398 | | | | 3,146,497 | | | |

| | | | | | | | |

PROPOSED APPROPRIATION OF THE YEAR’S PROFIT/LOSS | | 2015 | | | 2014 | |

Appropriation to Statutory Reserve | | | – | | | | – | |

Appropriations to credit risk reserve funds | | | | | | | | |

General Credit Risk Fund | | | 110,398 | | | | 155,211 | |

Special Credit Risk Fund PIL | | | 50,000 | | | | – | |

Appropriation to dividend payment | | | 55,000 | | | | 55,000 | |

Profit/loss for the year | | | 215,398 | | | | 210,211 | |

The Nordic Investment Bank’s accounts are kept in euro.

11

Cash flow statement 1 January – 31 December

| | | | | | | | | | |

EUR 1,000 | | NOTE | | JAN–DEC 2015 | | | JAN–DEC 2014 | |

Cash flows from operating activities | | | | | | | | | | |

Profit/loss from operating activities | | | | | 215,398 | | | | 210,211 | |

| | | |

Adjustments: | | | | | | | | | | |

Unrealised gains/losses of financial assets held at fair value | | | | | 13,865 | | | | -27,631 | |

Depreciation and write-down in value of tangible and intangible assets | | | | | 8,737 | | | | 3,709 | |

Change in accrued interest and fees (assets) | | | | | 6,613 | | | | 12,491 | |

Change in accrued interest and fees (liabilities) | | | | | -7,986 | | | | -12,069 | |

Impairment of loans | | | | | 2,509 | | | | 20,905 | |

Adjustment to hedge accounting | | | | | -20,667 | | | | 1,019 | |

Other adjustments to the year’s profit | | | | | 376 | | | | -641 | |

Adjustments, total | | | | | 3,447 | | | | -2,217 | |

| | | |

Lending | | | | | | | | | | |

Disbursements of loans | | | | | -2,715,757 | | | | -2,273,619 | |

Repayments of loans | | | | | 2,350,532 | | | | 2,005,001 | |

Capitalisations, redenominations, index adjustments, etc. | | | | | -51 | | | | -69 | |

Exchange rate adjustments | | | | | -247,764 | | | | -84,071 | |

Lending, total | | | | | -613,039 | | | | -352,758 | |

| | | | | | | | | | | |

Cash flows from operating activities, total | | | | | -394,193 | | | | -144,763 | |

| | | |

Cash flows from investing activities | | | | | | | | | | |

Placements and debt securities | | | | | | | | | | |

Purchase of debt securities | | | | | -2,168,290 | | | | -2,555,763 | |

Sold and matured debt securities | | | | | 1,614,972 | | | | 2,489,721 | |

Placements with credit institutions | | | | | -1,350 | | | | -830 | |

Other financial placements | | | | | 2,699 | | | | 1,663 | |

Exchange rate adjustments, etc. | | | | | -59,523 | | | | -36,599 | |

Placements and debt securities, total | | | | | -611,491 | | | | -101,808 | |

| | | |

Other items | | | | | | | | | | |

Acquisition of intangible assets | | | | | -1,005 | | | | -1,637 | |

Acquisition of tangible assets | | | | | -2,551 | | | | -861 | |

Change in other assets | | | | | 5,676 | | | | 16,570 | |

Other items, total | | | | | 2,120 | | | | 14,072 | |

| | | | | | | | | | | |

Cash flows from investing activities, total | | | | | -609,372 | | | | -87,736 | |

12

| | | | | | | | | | | | |

EUR 1,000 | | NOTE | | | JAN–DEC 2015 | | | JAN–DEC 2014 | |

| | | | | | | | | | | | |

Cash flows from financing activities | | | | | | | | | | | | |

Debts evidenced by certificates | | | | | | | | | | | | |

Issues of new debt | | | | | | | 4,276,138 | | | | 3,360,777 | |

Redemptions | | | | | | | -3,636,669 | | | | -4,031,164 | |

Exchange rate adjustments | | | | | | | 884,174 | | | | 1,272,741 | |

Debts evidenced by certificates, total | | | | | | | 1,523,643 | | | | 602,354 | |

| | | |

Other items | | | | | | | | | | | | |

Long-term placements from credit institutions | | | | | | | 18,000 | | | | – | |

Change in swap receivables | | | | | | | -441,813 | | | | -653,925 | |

Change in swap payables | | | | | | | 218,769 | | | | -277,680 | |

Change in other liabilities | | | | | | | 3,186 | | | | -1,334 | |

Dividend paid | | | | | | | -55,000 | | | | -55,000 | |

Paid-in capital and reserves | | | | | | | – | | | | – | |

Other items, total | | | | | | | -256,858 | | | | -987,939 | |

| | | | | | | | | | | | |

Cash flows from financing activities, total | | | | | | | 1,266,784 | | | | -385,585 | |

| | | | | | | | | | | | |

CHANGE IN CASH AND CASH EQUIVALENTS, NET | | | (22) | | | | 263,219 | | | | -618,084 | |

| | | |

Opening balance for cash and cash equivalents, net | | | | | | | 767,129 | | | | 1,385,213 | |

Closing balance for cash and cash equivalents, net | | | | | | | 1,030,348 | | | | 767,129 | |

| | | |

Additional information to the statement of cash flows | | | | | | | | | | | | |

Interest income received | | | | | | | 345,394 | | | | 395,321 | |

Interest expense paid | | | | | | | -99,991 | | | | -155,722 | |

The cash flow statement has been prepared using the indirect method and cash flow items cannot be directly concluded from the statements of financial positions.

13

Notes to the financial statements

Accounting policies

General operating principles

The operations of the Nordic Investment Bank (hereinafter called “the Bank” or “NIB”) are governed by an agreement (hereinafter called “the Agreement”) between the governments of Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway and Sweden (hereinafter called “the member countries”), and the Statutes adopted in conjunction with the Agreement. NIB is an international financial institution that operates in accordance with sound banking principles. NIB finances private and public projects that have high priority for the member countries and borrowers. NIB finances projects both within and outside the member countries, and offers its clients long-term loans and guarantees on competitive market terms.

NIB acquires the funds to finance its lending by borrowing on international capital markets.

The authorised capital stock of the Bank is subscribed by the member countries. Any increase or decrease in the authorised capital stock shall be decided by the Board of Governors, upon a proposal of the Board of Directors of the Bank.

In the member countries, the Bank has the legal status of an international legal person, with full legal capacity, and is exempt from payment restrictions and credit policy measures. The Agreement concerning NIB contains provisions regarding immunities and privileges accorded to the Bank, e.g. the exemption of the Bank’s assets and income from taxation.

The headquarters of the Bank are located at Fabianinkatu 34 in Helsinki, Finland.

Significant accounting policies

Basis for preparing the financial statements

The Bank’s financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). The Bank’s accounts are kept in euro. With the exceptions noted below, they are based on historical cost.

Significant accounting judgements and estimates

As part of the process of preparing the financial statements in conformity with IFRS, the Bank’s management is required to make certain judgements, estimates and assumptions that may affect the Bank’s profits, its financial position and other information presented in the Annual Report. These estimates are based on available information and the judgements made by the Bank’s management. Actual outcomes may deviate from the assessments made, and such deviations may at times be substantial.

The Bank uses various valuation models and techniques to estimate the fair values of assets and liabilities. There are significant uncertainties related to these estimates, in particular when they involve modelling complex financial instruments, such as derivative instruments used for hedging activities related to both borrowing and lending. The estimates are highly dependent on market data, such as the level of interest rates, currency rates and other factors. The uncertainties related to these estimates are reflected mainly in the statement of financial position. NIB undertakes continuous development in order to improve the basis for fair value estimates, with regard to both modelling and market data. Changes in estimates resulting from refinements in assumptions and methodologies are reflected in the period in which the enhancements are first applied.

Judgements and estimates are also associated with impairment testing of loans and claims.

14

Foreign currency translation

Monetary assets and liabilities denominated in foreign currencies are recognised in the accounts at the exchange rate prevailing on the closing date. Non-monetary assets and liabilities are recognised in the accounts at the euro rate prevailing on the transaction date. Income and expenses recognised in currencies other than the euro are converted on a daily basis to the euro, in accordance with the euro exchange rate prevailing on that day.

Realised and unrealised exchange rate gains and losses are recognised in the statement of comprehensive income.

The Bank uses the official exchange rates published for the euro by the European Central Bank. See Note 23.

Recognition and derecognition of financial instruments

Financial instruments are recognised in the statement of financial position on a settlement date basis, except for derivative instruments, which are recognized on a trade date basis.

A financial asset is derecognised when the contractual rights to the cash flows from the financial asset expire.

A financial liability is removed from the statement of financial position when the obligation specified in the contract is discharged, cancelled or expires.

Basis for classification and measurement

The financial statements have been prepared on the historical cost basis, except for the following material items in the statement of financial position.

Following the early adoption of IFRS 9 in 2011, the Bank classifies its financial assets into the following categories: those measured at amortised cost, and those measured at fair value. This classification depends on both the contractual characteristics of the assets and the business model adopted for their management.

Financial assets at amortised cost

An investment is classified at “amortised cost” only if both of the following criteria are met: the objective of the Bank’s business model is to hold the assets in order to collect the contractual cash flows, and the contractual terms of the financial assets must give rise on specified dates to cash flows that are only payments of principal and interest on the principal amount outstanding.

Financial assets at fair value

If either of the two criteria above is not met, the asset cannot be classified in the amortised cost category and must be classified at fair value.

Recognised financial assets and financial liabilities designated as hedged items in qualifying fair value hedge relationships are adjusted for changes in fair value attributable to the risk being hedged.

Determination of fair value

The fair value of financial instruments, including derivative instruments that are traded in a liquid market, is the bid or offered closing price on the balance sheet date. Where the fair values cannot be derived from active markets, they are determined using a variety of valuation techniques that include the use of mathematical models. The input to these models is taken from observable market data where possible. Many of NIB’s financial instruments are not traded in a liquid market, such as the Bank’s borrowing transactions with embedded derivative instruments. These are measured at fair value using different valuation models and techniques. This process involves determining future expected cash flows, which can then be discounted to the balance sheet date. The estimation of future cash flows for these instruments is subject to assumptions on market data, and in some cases, in particular where options are involved, even on the behaviour of the Bank’s counterparties. The fair value estimate may therefore be subject to variations and may not be realisable in the market. Under different market assumptions, the values could also differ substantially.

15

The Bank measures fair values using the following fair value hierarchy, which reflects the significance of the inputs used in making the measurements:

Level 1: Quoted market prices (unadjusted) in an active market for identical instruments.

Level 2: Valuation techniques based on observable inputs, either directly (i.e. as prices) or indirectly (i.e. derived from prices). This category includes instruments valued using: quoted market prices in active markets for similar instruments, quoted prices for identical or similar instruments in markets that are considered less than active, or other valuation techniques where all significant inputs are directly or indirectly observable from market data.

Level 3: Valuation techniques using significant unobservable inputs. This category includes all instruments where the valuation technique includes inputs not based on observable data and where the unobservable inputs have a significant effect on the instrument’s valuation. This category includes instruments that are valued based on quoted prices for similar instruments where significant unobservable adjustments or assumptions are required to reflect differences between the instruments.

See Note 17 for further details.

Cash and cash equivalents

Cash and cash equivalents comprise monetary assets and placements with original maturities of six months or less, calculated from the date the acquisition and placements were made.

Cash and cash equivalents in the cash flow statement refers to the net amount of monetary assets, placements and liabilities with original maturities of six months or less, calculated from the time the transaction was entered into.

Financial placements

Items recognised as financial placements in the statement of financial position include placements with credit institutions and placements in debt securities, for example, bonds and other debt certificates, as well as certain placements in instruments with equity features. The placements are initially recognised on the settlement date. Their subsequent accounting treatment depends on both the Bank’s business model for managing the placements and their contractual cash flow characteristics.

Reclassifications

Following the amendment to IAS 39 issued in October 2008, permitting the reclassification of financial assets in certain restricted circumstances, the Bank decided to reclassify EUR 715 million of its trading portfolio assets into the held-to-maturity portfolio. This amendment has been applied retrospectively to commence on 1 September 2008. The reclassification has resulted in the cessation of fair value accounting for those assets previously designated as held for trading. The fair values of the assets at the date of reclassification became their new amortised cost, and those assets will subsequently be accounted for on that measurement basis. The reclassified cost will be amortised over the instrument’s expected remaining lifetime through interest income using the effective interest method. See Note 7.

Lending

The Bank may grant loans and provide guarantees under its Ordinary Lending or under special lending facilities. The special lending facilities, which carry member country guarantees, consist of Project Investment Loans (PIL) and Environmental Investment Loans (MIL).

Ordinary Lending includes loans and guarantees within and outside the member countries. The Bank’s Ordinary Lending ceiling corresponds to 250% of its authorised capital and accumulated general reserves and amounts to EUR 20,922 million following the allocations of the year’s profit in accordance with the Board of Directors’ proposal.

16

Project Investment Loans are granted for financing creditworthy projects in the emerging markets of Africa, Asia, Europe and Eurasia, Latin America and the Middle East. The Bank’s Statutes permit loans to be granted and guarantees to be issued under the PIL facility up to an amount corresponding to EUR 4,000 million. The member countries guarantee the PIL loans up to a total amount of EUR 1,800 million. The Bank, however, will assume 100% of any losses incurred under an individual PIL loan, up to the amount available at any given time in the Special Credit Risk Fund for PIL. Only thereafter would the Bank be able to call on the member countries’ guarantees according to the following principle: the member countries guarantee 90% of each loan under the PIL facility up to a total amount of EUR 1,800 million. Payment under the member countries’ guarantees would take place at the request of the Board of Directors, as provided for under an agreement between the Bank and each individual member country.

The Bank is authorised to grant special Environmental Investment Loans, originally up to the amount of EUR 300 million, for the financing of environmental projects in the areas adjacent to the member countries. The Bank’s member countries guarantee 100% of the MIL facility. For further information about the MIL facility as of 31 December 2015, see “Distribution of loans outstanding and guarantees by various types of security” in Note 8.

The Bank’s lending transactions are recognised in the statement of financial position at the time the funds are transferred to the borrower. Loans are recognised initially at historical cost, which corresponds to the fair value of the transferred funds, including transaction costs. Loans outstanding are carried at amortised cost. If the loans are hedged against changes in fair value caused by changes in market interest rates by using derivative instruments, they are recognised in the statement of financial position at fair value, with value changes recognised in the statement of comprehensive income.

Impairment of loans and receivables

Impairment of individually assessed loans

The Bank reviews its problem loans and receivables on each reporting date to assess whether an allowance for impairment should be recorded in the statement of comprehensive income. In particular, the judgement of the management is required in estimating the amount and timing of future cash flows when determining the level of allowance required. Such estimates are based on assumptions about a number of factors, and actual results may differ, resulting in future changes to the allowance.

Receivables are carried at their estimated recoverable amount. Where the collectability of identified loans is in doubt, specific impairment losses are recognised in the statement of comprehensive income. Impairment is defined as the difference between the carrying value of the asset and the net present value of expected future cash flows, determined using the instrument’s original effective interest rate, where applicable. If the carrying amount of the loan is higher than the net present value of the estimated future cash flows, including the fair value of the collaterals, the loan is impaired.

For issued guarantees, the impairment is recognised when it is both probable that the guarantee will need to be settled and the settlement amount can be reliably estimated.

In the event that payments in respect of an ordinary loan are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing, and consequently the need for impairment is assessed and recognised.

In the event that payments in respect of a PIL loan to a government or guaranteed by a government are more than 180 days overdue, all of the borrower’s loans are deemed to be non-performing.

Whenever payments in respect of a PIL loan that is not to a government or guaranteed by a government are more than 90 days overdue, all of the borrower’s loans are deemed to be non-performing. Impairment losses are then recognised in respect of the part of the outstanding loan principal, interest, and fees that correspond to the Bank’s own risk for this loan facility at any given point in time.

Whenever payments in respect of a MIL loan that is not to a government or guaranteed by a government are more than 90 days overdue, or payments in respect of a MIL loan to a government or guaranteed by a government are more than 180 days overdue, all of the borrower’s loans are deemed to be non-performing. Due to the Bank’s member countries’ guarantees, no impairment losses are recognised for MIL loans.

Impairment of collectively assessed loans

Loans that are not individually impaired will be transferred to a group of loans with similar risk characteristics for a collective impairment test.

17

The Bank assesses the need to make a collective impairment test on exposures which, although not specifically identified as requiring a specific allowance, have a greater risk of default than when originally granted. This collective impairment test is based on any deterioration in the internal rating of the groups of loans or investments from the time they were granted or acquired. These internal ratings take into consideration factors such as any deterioration in counterparty risk, the value of collaterals or securities received, and the outlook for the sector, as well as identified structural weaknesses or deterioration in cash flows.

The process includes the management’s judgement based on the current macroeconomic environment and the current view of the expected economic outlook. In the Bank’s view, the assumptions and estimates made are appropriately conservative and are reflective of the predicted economic conditions, the Bank’s portfolio characteristics and their correlation with losses incurred based on historical loss experience. The impairment remains related to the group of loans until the losses have been identified on an individual basis.

Intangible assets

Intangible assets mainly consist of investments in software, software licences and ongoing investments in new ICT systems. Acquisitions that generate economic benefits exceeding costs beyond one year are recognised as intangible assets. The investments are carried at historical cost, and are amortised over the assessed useful life of the assets, which is estimated to be between three and five years. The amortisations are made on a straight-line basis.

Tangible assets

Tangible assets in the statement of financial position include land, buildings, office equipment and other tangible assets owned by the Bank. The assets are recognised at historical cost, less any accumulated depreciation based on their assessed useful life. No depreciations are made for land. The Bank’s office building in Helsinki is depreciated on a straight-line basis over a 40-year period. The Bank’s other buildings are depreciated over a 30-year period. The depreciation period for office equipment and other tangible assets is determined by assessing the individual item. The depreciation period is usually three to five years. The depreciations are calculated on a straight-line basis.

Write-downs and impairment of intangible and tangible assets

The Bank’s assets are reviewed annually for impairment. If there is any objective evidence of impairment, the impairment loss is determined based on the recoverable amount of the assets.

Derivative instruments and hedge accounting

The Bank’s derivative instruments are recognised on a trade-date basis at fair value in the statement of financial position as “Other assets” or “Other liabilities”.

During the time the Bank holds a derivative instrument, any changes in the fair value of such an instrument are recognised in the statement of comprehensive income, or directly in “Equity” as part of the item “Other value adjustments”, depending on the purpose for which the instruments were acquired. The value changes of derivative instruments that were not acquired for hedging purposes are recognised in the statement of comprehensive income. The accounting treatment for derivative instruments that were acquired for hedging purposes depends on whether the hedging operation was in respect of cash flow or fair value.

When hedging future cash flows, the change in fair value of the effective portion of the hedging instrument is recognised directly in “Equity” as part of the item “Other value adjustments” until the maturity of the instrument. At maturity, the amount accumulated in “Equity” is included in the statement of comprehensive income in the same period or periods during which the hedged item affects the statement of comprehensive income. Currently, the Bank does not have cash flow hedging, although it may choose to do so at any time.

In order to protect NIB from market risks that arise as an inherent part of its borrowing and lending activities, the Bank enters into swap transactions. The net effect of the swap hedging is to convert the borrowing and lending transactions to floating rates. This hedging activity is an integral part of the Bank’s business process and is a fair value hedge.

When hedging the fair value of a financial asset or liability, the derivative instrument’s change in fair value is recognised in the statement of comprehensive income together with the hedged item’s change in fair value in “Net profit on financial operations”.

18

Sometimes a derivative may be a component of a hybrid financial instrument that includes both the derivative and a host contract. Such embedded derivative instruments are part of a structured financing transaction that is hedged against changes in fair value by means of matching swap contracts. In such cases, both the hedged borrowing transaction and the hedging derivative instrument are recognised at fair value with changes in fair value in the statement of comprehensive income.

The hedge accounting is based on a clearly documented relationship between the item hedged and the hedging instrument. When there is a high (negative) correlation between the hedging instrument on the one hand and the value change of the hedged item or the cash flows generated by the hedged item on the other, the hedge is regarded as effective. The hedging relationship is documented at the time the hedge transaction is entered into, and the effectiveness of the hedge is continually assessed.

Borrowing

The Bank’s borrowing transactions are recognised in the statement of financial position at the time the funds are transferred to the Bank. The borrowing transactions are recognised initially at a cost that comprises the fair value of the funds transferred, less transaction costs. The Bank uses derivative instruments to hedge the fair value of virtually all its borrowing transactions. In these instances, the borrowing transaction is subsequently recognised in the statement of financial position at fair value, with any changes in value recognised in the statement of comprehensive income.

Securities delivered under repurchase agreements are not derecognised from the statement of financial position. Cash received under repurchase agreements is recognised in the statement of financial position as “Amounts owed to credit institutions”.

Equity

As of 31 December 2015, the Bank’s authorised and subscribed capital is EUR 6,141.9 million, of which the paid-in portion is EUR 418.6 million. Payment of the subscribed, non-paid-in portion of the authorised capital, i.e. the callable capital, will take place at the request of the Bank’s Board of Directors to the extent that the Board deems it necessary for the fulfilment of the Bank’s debt obligations.

The Bank’s reserves have been built up by means of appropriations from the profits of previous accounting periods, and consist of the Statutory Reserve, as well as the General Credit Risk Fund and the Special Credit Risk Fund for PIL.

The Bank’s profits, after allocation to appropriate credit risk funds, are transferred to the Statutory Reserve until it amounts to 10% of NIB’s subscribed authorised capital. Thereafter, the Board of Governors, upon a proposal by the Bank’s Board of Directors, decides upon the allocation of the profits between the reserve fund and dividends on the subscribed capital.

The General Credit Risk Fund is designed to cover unidentified exceptional risks in the Bank’s operations. Allocations to the Special Credit Risk Fund for PIL are made primarily to cover the Bank’s own risk in respect of credit losses on PIL loans.

Interest

The Bank’s net interest income includes accrued interest on loans, debt securities, placements and accruals of the premium or discount value of financial instruments. Net interest income also includes interest expenses on debts, swap fees and borrowing costs.

Fees and commissions

Fees collected when disbursing loans are recognised as income at the time of the disbursement, which means that fees and commissions are recognised as income at the same time as the costs are incurred. Commitment fees are charged on loans that are agreed but not yet disbursed and are accrued in the statement of comprehensive income over the commitment period.

Annually recurrent costs arising as a result of the Bank’s borrowing, investment and payment transactions are recognised under the item “Commission expense and fees paid”.

Financial transactions

The Bank recognises in “Net profit on financial operations” both realised and unrealised gains and losses on debt securities and other financial instruments. Adjustments for hedge accounting are included.

19

Administrative expenses

The Bank provides services to its related parties, the Nordic Development Fund (NDF) and the Nordic Environment Finance Corporation (NEFCO). Payments received by the Bank for providing services at cost to these organisations are recognised as a reduction in the Bank’s administrative expenses. NIB receives a host country reimbursement from the Finnish Government equal to the tax withheld from the salaries of NIB’s employees. This payment reduces the Bank’s administrative expenses, as shown in Note 5.

Leasing agreements

Leasing agreements are classified as operating leases if the rewards and risks incident to ownership of the leased asset, in all major respects, lie with the lessor. Lease payments under operating leases are recognised on a straight-line basis over the lease term. The Bank’s rental agreements are classified as operating leases.

Employee pensions and insurance

The Bank is responsible for arranging pension security for its employees. In accordance with the Host Country Agreement between the Bank and the Finnish Government and as part of the Bank’s pension arrangements, the Bank has decided to apply the Finnish state pension system. Contributions to this pension system, which are paid into the Finnish State Pension Fund, are calculated as a percentage of salaries. The Finnish Ministry of Finance determines the basis for the contributions and establishes the actual percentage of the contributions according to a proposal from the local government pensions institution Keva. See Note 5.

NIB also provides its permanent employees with a supplementary pension insurance scheme arranged by a private pension insurance company. This is group pension insurance based on a defined contribution plan. The Bank’s pension liability is completely covered.

In addition to the applicable local social security systems, NIB has taken out, for example, comprehensive accident, life, medical and disability insurance policies for its employees in the form of group insurance.

Segment information

Segment information and currency distribution in the notes are presented in nominal amounts. The adjustment to hedge accounting is presented as a separate item (except for Note 1, the primary reporting segment).

Reclassifications

In addition to the reclassifications under financial placements, some other minor reclassifications have been made. The comparative figures have been adjusted accordingly.

International financial reporting standards and interpretations

New and amended standards applied in the financial year 2015

NIB has no transactions that have been affected by new amendments or standards during 2015.

Adoption of new and amended standards and interpretations applicable in future financial years

NIB has not yet adopted the following new and amended standards and interpretations already issued by the IASB. NIB will adopt them as of the effective date or, if the date is other than the first day of the financial year, from the beginning of the subsequent financial year.

| ● | | Amendment to IAS 1 Presentation of Financial Statements: Disclosure Initiative (effective for financial years beginning on or after 1 January 2016). The amendments are designed to encourage companies to apply judgement in determining what information to disclose in the financial statements. For example, the amendments clarify the application of the materiality concept and judgement when determining where and in what order information is presented in the financial disclosures. The interpretation has no significant impact on NIB’s financial statements. |

20

| ● | | New IFRS 9 Financial Instruments (effective for financial years beginning on or after 1 January 2018): IFRS 9 replaces the existing guidance in IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 includes revised guidance on the classification and measurement of financial instruments, including a new expected credit loss model for calculating impairment on financial assets, and the new general hedge accounting requirements. It also carries forward the guidance on recognition and derecognition of financial instruments from IAS 39. NIB is assessing the impact of IFRS 9. |

| ● | | Amendments to IAS 16 Property, Plant and Equipment and IAS 38 Intangible Assets — Clarification of Acceptable Methods of Depreciation and Amortisation (effective for financial years beginning on or after 1 January 2016): The amendments clarify IAS 16 and IAS 38 in that the revenue-based method cannot be used to depreciate property, plant and equipment and may only be used in limited circumstances to amortise intangible assets. The amendments will have no impact on NIB’s financial statements. |

| ● | | Annual Improvements to IFRSs, (2012-2014 cycle) (effective for financial years beginning on or after 1 January 2016): The annual improvements process provides a mechanism for minor and non-urgent amendments to IFRSs to be grouped together and issued in one package annually. These amendments cover four standards. Their impacts vary standard by standard but are not significant. |

RISK MANAGEMENT

The Bank assumes a conservative approach to risk-taking. Careful balancing of mission fulfilment, revenue generation and risk mitigation is a key consideration in the Bank’s risk-taking. The constituent documents require that loans be granted in accordance with sound banking principles, that adequate security be obtained for the loans, unless sufficient security is considered to exist under the circumstances, and that the Bank protect itself against the risk of exchange rate losses to the extent practicable. The Bank’s risk tolerance is defined with the objective of maintaining strong credit quality, stable earnings and a level of capital and liquidity required to maintain the Bank’s AAA/Aaa rating.

The main risks — credit risk, market risk, liquidity risk, operational risk and compliance risk — are managed carefully with the overall objective of maintaining financial soundness and avoiding activities that could threaten the Bank’s reputation. As an international financial institution, the Bank is not subject to national or international banking regulations. However, the Bank’s risk management framework is regularly reviewed and adapted to changing conditions with the aim of complying in substance with what the Bank identifies as the relevant market standards and best practices, including the recommendations of the Basel Committee on Banking Supervision.

The Bank’s risk management framework comprises risk policies and procedures formulated for the assessment, measurement, monitoring and reporting of risks including several layers of limits set to manage the exposure to quantifiable risks. The Bank recognises that effective risk management is based on a sound risk culture, which is characterised, among other things, by a high level of awareness concerning risk and risk management in the organisation. Regular training of staff in risk-related matters is part of the Bank’s risk management practice.

Key risk responsibilities

The Board of Directors lays down the general framework for the Bank’s risk management by approving its risk policies, including maximum limits for exposure to the main types of risk. The Board approves credits and grants authorisation to the Bank to raise funds in the capital markets based on its estimated funding requirements.

The President is responsible for managing the risk profile of the Bank within the framework set by the Board of Directors and for ensuring that the Bank’s aggregate risk is consistent with its financial resources and willingness to take risk. The Board of Directors has delegated some credit approval authority to the President for execution in the Credit Committee.

The following committees assist and advise the President:

The Executive Committee consists of the President and senior officers, whose appointment to the committee has been confirmed by the Board of Directors. The committee is the forum for addressing policy and management issues, including following up the financial results, business plan and strategy of the Bank. The committee meets approximately twice a month.

The Credit Committee consists of the President and senior officers appointed by the Board of Directors. The committee is responsible for preparing and making decisions on credit matters related to lending operations and for decisions on treasury counterparties. Among other things, the committee reviews all credit proposals before they are submitted to the Board of Directors for approval. The committee usually meets weekly.

The Finance Committee consists of the President, the Head of Treasury and the Head of Risk and Finance. The committee is responsible for preparing and making decisions on matters related to treasury operations. The committee makes recommendations and, where appropriate, decisions in the area of market, counterparty and liquidity risk exposure. It also monitors the Bank’s borrowing activities and has oversight of treasury risk reporting to the Board of Directors. The committee usually meets monthly.

21

The Asset and Liability Committee (ALCO) consists of the members of the Executive Committee and the Chief Risk Officer. Together with the Executive Committee, it has overall responsibility for the Bank’s risk management. ALCO’s duties include monitoring the Bank’s balance sheet development and capital adequacy, setting targets and limits for risk to be managed at the bank level, reviewing liquidity risk management and funding structure, as well as monitoring performance against the agreed risk appetite. The committee meets approximately six times a year.

The ICT Council assists and advises the President in information and communications technology matters, and functions as a steering committee for ICT development projects. The President, however, makes his decisions on ICT matters in the Executive Committee. The ICT Council consists of the Head of ICT and of other senior staff members.

The Bank has established a segregation of duties between units that enter into business transactions with customers or otherwise expose the Bank to risk, and units in charge of risk assessment, risk measurement, monitoring and control.

The business units, Lending and Treasury, are responsible for implementing the Bank’s business strategy. Lending is responsible for loan origination and mandate fulfilment in accordance with the Bank’s willingness to take risk. Treasury provides support by executing the funding strategy and managing the liquidity as well as balance sheet risks (Asset and Liability Management). The business units carry out the day-to-day management of all risks assumed in their operations and ensure that an adequate return is achieved for the risks taken. The Head of Lending and the Head of Treasury report to the President.

The Risk Management unit within Risk and Finance carries out independent measuring, controlling, monitoring and reporting of the Bank’s credit risk, liquidity risk, market risk and operational risk exposures. The assessment of risk related to new instruments is carried out in the New Product and Structure Committee chaired by a representative of Risk and Finance. The Head of Risk and Finance reports to the President.

Credit and Analysis is responsible for assessing and monitoring counterparty credit risk in the Bank’s lending and treasury operations. The Credit unit oversees that credit proposals are in compliance with established limits and policies. The Special Credits unit manages transactions requiring particular attention due to restructuring work-out and recovery processing. The Head of Credit and Analysis reports to the President.

The Legal department supports all units of the Bank carrying the responsibility for minimising and mitigating legal risks in the Bank’s operational and administrative activities. The General Counsel reports to the President.

The Compliance function assists the Bank in identifying, assessing, monitoring and reporting on compliance risks in matters relating to the institution, its operations and the personal conduct of staff members. The Chief Compliance Officer reports to the President, with unrestricted access to the Chairman of the Board of Directors and the Chairman of the Control Committee.

Internal Audit provides an independent evaluation of the controls, risk management and governance processes. The Head of Internal Audit reports to the Board of Directors and the Control Committee.

The Control Committee is the Bank’s supervisory body. It ensures that the operations of the Bank are conducted in accordance with the Statutes. The committee is responsible for the audit of the Bank and submits its annual audit report to the Board of Governors. The committee also monitors the anti-corruption and compliance practices of the Bank.

Credit risk

Credit risk is the Bank’s main financial risk. Credit risk is defined as the risk of loss resulting from the failure of the Bank’s borrowers and other counterparties to fulfil their contractual obligations and that collateral provided does not cover the Bank’s claims. Following from NIB’s mission, most of the credit risk stems from the Bank’s lending operations. The Bank is also exposed to credit risk in its treasury activities, where credit risk derives from the financial assets that the Bank uses for investing its liquidity, such as fixed-income securities and interbank deposits, and from derivative instruments used for managing currency and interest rate risks and other market risks related to structured funding transactions.

Credit risk management