| | |

| Nordic Investment Bank | | Interim Management Statement January–March 2019 |

Operating and financial review

January–March 2019 compared to January–March 2018

Comprehensive Income

Net Profit

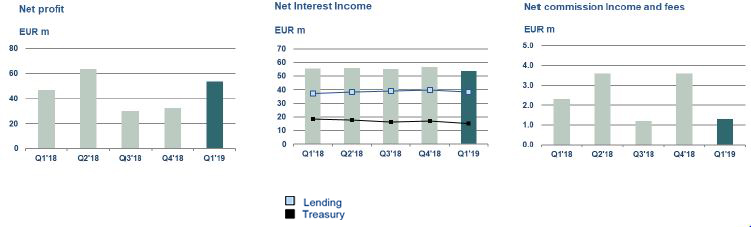

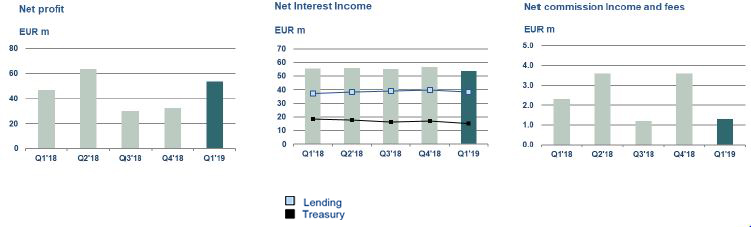

The net profit for the period January–March 2019 amounted to EUR 53.6 million, up from EUR 49.0 million in the same period last year. Total operating income increased from EUR 59.1 million to EUR 61.7 million. Total operating expenses decreased by EUR 0.4 million to EUR 10.7 million, resulting in profit before net loan losses increasing to EUR 51.0 million (January–March 2018: EUR 48.7 million).

Net interest income

Net interest income for the period amounted to EUR 53.6 million (January–March 2018: EUR 55.6 million). Net interest income on lending activities increased by EUR 1.0 million, due to higher loans outstanding. Interest income on treasury activities decreased by EUR 3.0 million due to the low yield environment.

Net commission income and fees

Net fee and commission income for the period January–March 2019 was EUR 1.3 million, compared to EUR 2.3 million in 2018, due to the lower volume of loans agreed and disbursed.

Net profit on financial operations

The net profit on financial operations for the period January–March 2019 totalled EUR 6.7 million, which was EUR 5.5 million higher than the same period in 2018. The result comprises realised losses of EUR 0.7 million and unrealised profits of EUR 7.4 million. The unrealised results are expected to reverse when the underlying transactions reach maturity.

Total operating expenses

Total operating expenses were EUR 0.4 million lower than in 2018. The Bank continues to focus on costs to ensure an efficient ratio of operating cost to income.

Net loan losses

The total provision for expected credit losses on assets held at amortised cost amounted to EUR 119.2 million, which is similar to the position at 31 December 2018. This provision covers both loans outstanding and treasury assets held at amortised cost. There were no new non-performing loans during the period and no realised losses. The gain recognised in the income statement for net loan losses of EUR 2.6 million relates to recoveries on non-performing loans of EUR 1.2 million and EUR 1.4 million related to the improved credit quality of performing loans.

4 (14)