| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 2 |

| | |

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 3 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Report of the Board of Directors

SUMMARY

In 2021, the COVID-19 pandemic continued to affect the Nordic-Baltic economies. At the same time, investment activity was low. Consequently, NIB’s lending volumes normalised after record-high activity in 2020. A total of EUR 2,440 million was disbursed (EUR 4,853 million in 2020), of which EUR 340 million was disbursed as COVID Response Loans (EUR 1,470 million in 2020).

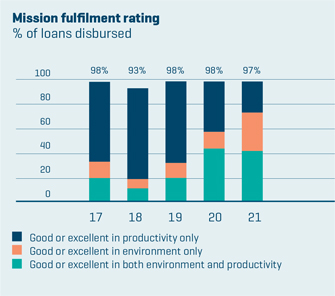

NIB continued to provide long-term financing to projects that deliver a lasting impact on the productivity and environment of the region. Loans achieving ratings of “good” or “excellent” on at least one of these mandates accounted for 97% of the total amount of disbursed funds (from the rated projects). Some 73% of the total loans disbursed and rated were channelled to projects that provide environmental benefits, which reflects both the goal set by the Board to increase environmental lending as well as the growing interest for sustainable finance. During the year, NIB disbursed its first sustainability linked loans.

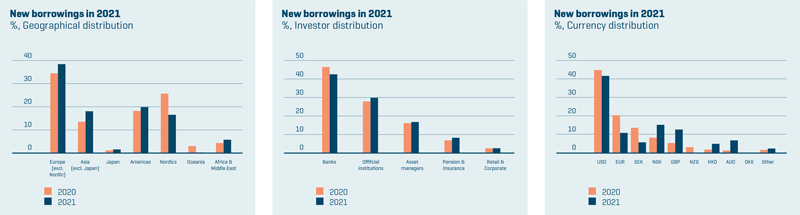

In 2021, NIB raised new funding with a nominal value of EUR 6.9 billion through 71 bond transactions. The Bank marked its 10th anniversary as an issuer of green and blue bonds by raising a total of EUR 898 million in NIB Environmental Bonds (NEBs), consisting of a six-year EUR 500 million bond, a five-year SEK 3 billion bond and an inaugural NOK 1 billion bond.

The net profit of EUR 159.2 million for the year was EUR 5.5 million lower than in 2020.

The Board of Directors proposes to the Board of Governors that a sum of EUR 40 million be distributed to the Banks’ member countries from the 2021 net profit as dividend, which equates to a pay-out ratio of 25% of net profit.

NIB launched its revised Sustainability Policy, which describes the principles and commitments the Bank follows. The policy defines a new set of ambitions for NIB and takes a decisive stance against fossil fuels. The assessment of ESG performance at counterparty level is incorporated.

NIB’s Board of Directors completed a review of the Bank’s business strategy. The mission to finance projects that improve productivity and benefit the environment was re-confirmed, as was the importance of the Bank’s triple-A credit rating. NIB will continue to develop on its product offering and increase its activity in under-served market segments to better meet the needs of its customers and owners.

The Bank’s stakeholder survey confirmed that NIB has a leading position as a provider of sustainable long-term financing in the Nordic–Baltic region.

The Board approved the new Capital and Liquidity Recovery Plan. This aligns the Bank’s risk management framework with the recent statutory changes and the requirements set out in the Board of Governor’s Principles. NIB has a strong capital and liquidity position.

| | |

On the Board’s agenda In 2021, NIB celebrated its 45th anniversary. To continue to deliver on our mission in the future, the Board reviewed NIB’s business strategy. The foundations of the Bank are solid, and NIB’s |

| | triple-A credit rating continues to be the cornerstone of the business model. The Bank is committed to playing its part as a financier of a sustainable Nordic–Baltic region in line with the climate goals of the Paris Agreement and supporting the green transition by further developing our product offering. Esther Finnbogadóttir Chair of the Board of Directors |

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 4 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

OPERATING ENVIRONMENT

The COVID-19 pandemic continued to affect both the global and the Nordic–Baltic economies in 2021. The emergence of new virus variants and uneven vaccination rates have affected economies to varying degrees. Still, the Nordic and Baltic economies were less volatile on average, experiencing lower contraction in 2020 and smaller subsequent recovery in 2021 than the rest of the world.

The majority of advanced economies posted a strong recovery, driven by private consumption growth and policy support. Central banks continued to provide abundant liquidity to the financial system. As a result, interest rates remained at historically low levels. At the same time, investment activity was low due to high levels of uncertainty. All this affected the overall demand for financing negatively.

The second half of the year was characterised by negative supply-chains effects and labour market shortages. A significant increase in energy prices slowly started to feed into producer and consumer prices, subsequently increasing the headline inflation pressure. At the end of 2021, the emergence of new virus variant, Omicron, introduced more uncertainty to the economic outlook.

STRATEGY REVIEW

NIB’s Board of Directors completed a review of the Bank’s business strategy in 2021. The Board re-confirmed NIB’s mission – to finance projects that improve productivity and benefit the environment of the Nordic and Baltic countries. The twin environment and productivity mandates remain equally relevant.

The COP26 conference further highlighted the urgency of climate action and the important role of IFIs and the private sector in mobilising climate finance. NIB will increase its climate finance activities, focusing on financing high-impact transitions in hard-to-abate sectors. Further, NIB will support the development of sustainable finance and capital markets in its member countries by broadening its product offering and promoting high quality standard.

Development of the client value proposition is central to the updated strategy. This will be achieved by broadening the Bank’s product offering, localising and digitalising services, and combining sustainability expertise with its investment products. Development of the product offering includes: (i) sustainability-linked lending, (ii) increasing activity in the sub-investment grade and mid-cap market segments, (iii) expanding bond investments, (iv) developing risk-sharing models such as InvestEU, and (v) providing MREL (minimum requirement for own funds and eligible liabilities) lending to financial institutions for SME financing. NIB will continue to focus on long-term lending and increase its activity in under-served market segments within the limits of its risk appetite.

NIB will also develop its value proposition for its member countries, with a focus on topics that are of high common interest, contributing to decarbonisation plans and sustainable finance. In addition, there is the potential for NIB to amplify its impact through partnerships with official agencies and institutions. NIB will maintain capital headroom for counter-cyclical lending and financing projects of special importance to its owners.

NIB’s triple-A credit rating continues to be the cornerstone of the Bank’s business model. The objective is to sustain profitability by broadening NIB’s engagement across client segments, reducing concentrations in low return market segments, moderately increasing risk-taking in line with its Risk Appetite Statement, managing the balance sheet actively, and improving the efficiency of its business process.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 5 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

LENDING

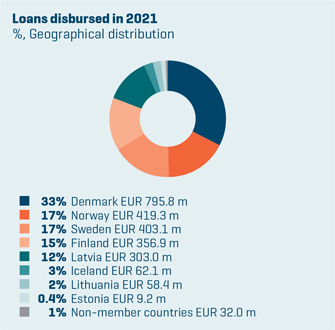

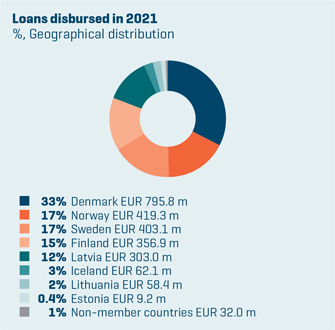

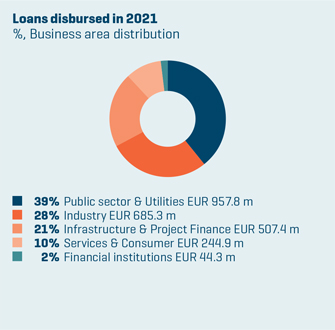

Against the backdrop of the changing operating environment, NIB’s lending volumes normalised in 2021, following the record high lending of 2020 that was driven by the Bank’s COVID response. NIB continued to provide long-term financing to projects that deliver lasting impact on the productivity and environment of the region. A total of EUR 2,440 million in loans was disbursed (EUR 4,853 million in 2020), of which EUR 340 million was disbursed as Response Loans (EUR 1,470 million in 2020). The decreased demand was reflected in the volume of agreed loans which was EUR 1,852 million (EUR 5,666 million in 2020).

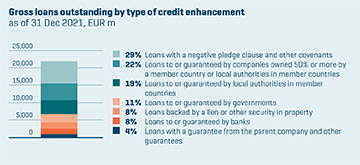

Lending outstanding at year-end amounted to EUR 22,313 million (EUR 21,727 million in 2020). Despite the business impact of the pandemic and the uncertain outlook, credit risk in the portfolio remained stable.

LENDING KEY FIGURES

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

In millions of

euros, unless

otherwise specified | | 2017 | | | 2018 | | | 2019 | | | 2020 | | | 2021 | |

| | | | | |

Loans agreed (without labelled bond and CP investments) | | | 3,665 | | | | 4,269 | | | | 3,185 | | | | 5,632 | | | | 1,683 | |

| | | | | |

Labelled bond and CP investments, total | | | 147 | | | | 61 | | | | 131 | | | | 34 | | | | 169 | |

| | | | | |

Total disbursements | | | 3,147 | | | | 4,047 | | | | 2,676 | | | | 4,853 | | | | 2,440 | |

| | | | | |

Number of loan agreements | | | 55 | | | | 58 | | | | 55 | | | | 59 | | | | 36 | |

| | | | | |

Number of labelled bond and CP investments | | | 9 | | | | 3 | | | | 9 | | | | 4 | | | | 14 | |

| | | | | |

Repayments/prepayments | | | 1,832 | | | | 577 | | | | 2,826 | | | | -1 878 | | | | -1,989 | |

| | | | | |

Lending outstanding | | | 17,232 | | | | 19,065 | | | | 18,931 | | | | 21,727 | | | | 22,313 | |

| | | | | |

Member countries | | | 15,867 | | | | 17,960 | | | | 18,055 | | | | 21,098 | | | | 21,827 | |

| | | | | |

Non-member countries | | | 1,504 | | | | 1,222 | | | | 996 | | | | 798 | | | | 635 | |

| | | | | |

Loan impairment provision | | | -139 | | | | -117 | | | | -119 | | | | -169 | | | | -150 | |

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 6 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

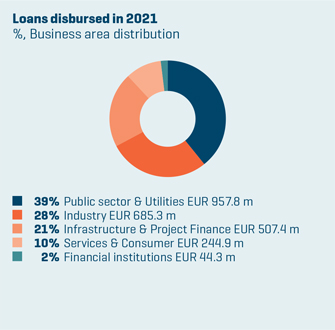

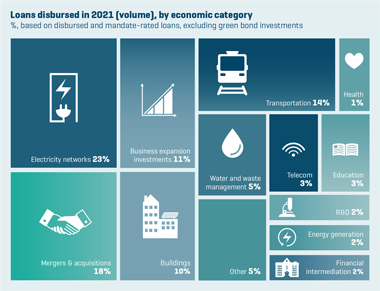

MISSION FULFILMENT

Projects considered for financing are expected to contribute to the fulfilment of NIB’s mission and are assessed and rated for their potential impacts on productivity and the environment on a scale from “negative” to “excellent”. At least 90% of loans (by disbursement) should achieve a “good” or “excellent” rating in at least one of these two mandates.

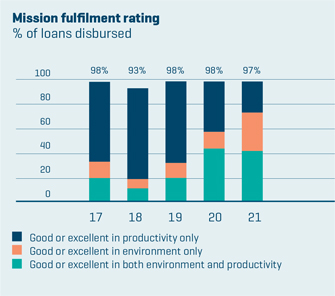

In 2021, loans achieving ratings of “good” or “excellent” on at least one of the mandates accounted for 97% of the total amount of disbursed funds (from the rated projects), and 41% of projects were rated “good” or “excellent” on both mandates. 2.7% of total disbursed and rated loans went to projects within the transport and energy sectors that received a negative environmental mandate rating. The rationale for financing such projects is the positive contribution to productivity in the region.

As shown in the graph below, 65.6% of NIB’s loans disbursed and rated were channelled to projects that significantly contribute to improvements in terms of productivity (for the member country companies and, more importantly, the wider economy). Some 72.8% of the total loans disbursed and rated were channelled to projects with “good” or “excellent” environmental benefits. This high share of

environmental mandate fulfilment reflects both the goal set by the Board to increase environmental lending as well as the growing interest for sustainable finance.

Three years after a NIB-financed project has been completed, the Bank’s analysts follow up on the actual impact the project has had, compared to the impact that was anticipated in the ex-ante analysis stage. In 2021, 15 such ex-post assessments were completed. Roughly, 90% of the ex-ante identified impacts have materialised or partly materialised. NIB uses these results to further develop its mandate rating methodology and apply the lessons learned to the assessment of future projects.

IMPACT

In 2021, the operational environment continued to be affected by the pandemic. Strong governmental policy support, various recovery instruments and accommodative monetary policy impacted the debt market. As mentioned above, the year 2020 was extraordinary in terms of NIB’s lending volumes, mainly due to the Bank’s COVID Response. Compared to 2020 levels, the lower levels of disbursements in 2021 led also to somewhat lower identifiable project-related impacts. Moreover, in 2021, the total disbursement numbers were affected by a couple of large disbursements to individual projects. Therefore, the top ten largest disbursements represent 59% of total disbursements of the year (excluding COVID Response loans).

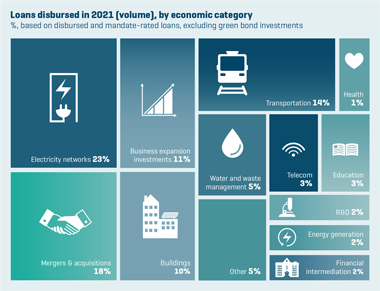

Productivity

From a sectoral perspective, 2021 has been characterised by a relatively large share of disbursements (EUR 434 million, 22.8% of total mandate rated and disbursed loans) made to projects in the sector of electricity distribution and transmission (395 km of transmission lines, including trans-border connections and connections to renewable energy generation) in Norway, Denmark, Iceland, and Finland.

Given the decarbonisation strategies of NIB’s member countries and the need for further electrification of the economies, investments in grids play a critical role, both from the economic and environmental perspectives. This became especially important in the second half of the year, when the Nordic–Baltic region, along with the rest of Europe, experienced high price volatility in both the natural gas and electricity markets. The situation clearly highlighted a need to further strengthen transmission, balancing and storage capacities in parallel to the roll-out of new generation capacities.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 7 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

The second largest group of disbursements financed mergers and acquisitions (M&A) (EUR 346 million, 18.2%) in Denmark and Norway. For NIB, it is not enough to just finance these activities. What matters are the potential synergies (financial, manufacturing, and logistical) and new possibilities (including access to new markets, suppliers, and capital injections) that are created as a result of the acquisition, as is the sharing of skills, knowledge, and know-how.

EUR 209 million (11%) were channelled to general business expansion investments in Lithuania, Finland, Sweden and Germany, mostly in the manufacturing sector. Most of the investments included expansion of business either in a new location or by expanding the existing production facilities. These types of loans are crucially important for productivity, since they are financing the creation of tangible assets, which are often more efficient than existing ones. Therefore, they enhance the competitiveness of Nordic–Baltic companies.

Loans covering transportation infrastructure and vehicles in Finland, Denmark, Lithuania and Estonia accounted for EUR 262 million (13.7%). The investments cover a wide array of projects – airports, ports, railway rolling stock, municipal light traffic road infrastructure and public transportation. These investments are necessary for the mobility of people and goods.

The rest of disbursements are spread out roughly evenly over the other sectors, among which the largest were waste and water management projects (EUR 100 million, 5.3%) and educational and healthcare infrastructure (EUR 78 million, 4.1%). Compared to previous years, less than usual has been disbursed to financial institutions (EUR 44 million, 2.3%).

Environment

The total environmental impact figures also decreased in 2021. This is partly due to lower disbursements, partly due to fewer energy generation investments and more enabling projects (M&As, electricity networks, municipality investment programmes) being financed. Enabling projects typically have less quantifiable impacts.

However, the importance of financing enabling activities should not be underestimated. The above-mentioned expansion and strengthening of electricity grids in four member countries enabled the connection of additional renewable energy to the network (1,072 MW) and increased electricity transmission. Electrification is seen as a key pillar in building a sustainable society and requires significant investments into transmission and distribution systems. Transport is a sector where electrification plays a crucial role in phasing out fossil fuels and where absolute impacts are challenging to quantify. NIB has not only financed

electrification of rail transport, but also the development and manufacturing of batteries for electrified road transports.

Overall, the total disbursements contributed to quantifiable impacts of 41,000 tonnes of net CO2 emissions reduced or avoided annually (396,000 tonnes in 2020), and total expected renewable energy generation annually of 39 GWh (738 GWh in 2020).

NIB’s first sustainability-linked loans were disbursed in 2021. These loans are connected to a few key performance indicators (KPI’s) in a company’s overall sustainability strategy. The intention is to support the achievement of company-level sustainability targets. Thus, the impact reporting for sustainability-linked loans differs from project-specific financing. M&A are another example where environmental benefits are assessed at company level and for which quantifying impact is difficult. Most M&A’s are considered neutral in terms of environmental impact, however, in 2021, one project was identified to bring significant environmental benefits within material recycling contributing to the development of a circular economy.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 8 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

FUNDING AND OTHER TREASURY ACTIVITIES

NIB acquires the funds for lending by borrowing on the international capital markets. NIB’s funding strategy rests on four pillars: global benchmark issuance in USD, a strong presence in the sustainable bond market, public bonds in other major currencies and meeting investors’ demand for tailored issuance in specific formats and currencies.

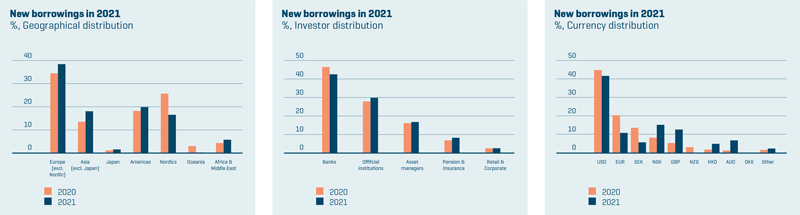

In 2021, NIB raised new funding with a nominal value of EUR 6.9 billion through 71 bond transactions. The Bank maintained a diversified global investor base. European investors outside the Nordic countries continue to be the largest group of buyers, accounting for 35% of investments. NIB issued two global USD-denominated benchmark transactions this year, totalling USD 2.25 billion (EUR 1.9 billion). In January, the Bank issued a five-year USD 1.25 billion global benchmark and another USD 1.0 billion bond with a three-year maturity followed in September. Both attracted strong support from global investors. Central banks and bank treasuries remain the main investor base in NIB’s USD benchmark transactions. In May, the Bank issued its inaugural USD 700 million five-year benchmark bond linked to the SOFR (Secured Overnight Financing Rate) index.

Since 2011, the Bank has been issuing NIB Environmental Bonds (NEBs), the proceeds of which are used to finance projects that benefit the environment and support the transition to a low carbon economy. In 2021, NIB celebrated its 10th anniversary as an issuer of green and blue bonds by raising a total of EUR 898 million in NEBs, consisting of a six-year EUR 500 million bond, a five-year SEK 3 billion bond, and an inaugural NOK 1 billion bond. The Bank has now issued EUR 5.8 billion in NEBs and financed some 130 sustainable projects with the proceeds.

In order to manage the liquidity risk, NIB maintains a significant liquidity buffer, which amounted to EUR 11.3 billion at year-end. Its size is determined by the Bank’s twelve-month target for the survival horizon, which is the duration for which NIB can continue to fulfil all its payment obligations and continue normal business operations without obtaining any new funding, even under severely stressed market conditions. The Bank has a strong liquidity position and the survival horizon at the end of 2021 was 450 days. The liquidity bond portfolio, which currently forms EUR 7.6 billion of the liquidity buffer, generated a positive return of 0.8%. The return is considered satisfactory, even though the negative yield environment is putting continued pressure on profitability.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 9 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

SUSTAINABILITY AGENDA

As highlighted at the COP26 meeting in Glasgow, this decade will be decisive for collective efforts to decouple economic activity from fossil fuel use. The financial sector is ready to step up its efforts. Investors and asset owners are demanding more impact, transparency and are supporting initiatives towards net zero emissions by 2050. Banks and financial intermediaries are responding by developing further sustainable financial products. Regulatory bodies are increasingly paying attention to ESG matters and rating agencies are broadening their ESG evaluation offering. The EU taxonomy is close to ratification. All in all, the sustainable finance market continues to grow rapidly.

In 2021, NIB launched its revised Sustainability Policy. In the new policy, the Bank takes a stronger stance against fossil fuels, effectively banning any direct financing of fossil fuel-based energy generation. It also describes a new set of ambitions and a clear assessment

of ESG performance at counterparty level. The policy is designed to send a strong signal of “transition”, whereby NIB will work and engage with clients who agree on a robust and credible transition pathway in accordance with the Paris Agreement. The Bank will particularly target “hard-to-abate” sectors that might not be green today but are quickly required to become part of the solution.

As mentioned above, NIB disbursed its first Sustainability-Linked Loans (SLL), which further support the Bank’s efforts to finance clients’ transition strategies. The SLL market has grown rapidly in recent months. NIB intends to support the development of the market with high integrity and standards.

During the year, NIB expanded its fixed-income investments to support the development of sustainable capital markets in its member region. The scope has broadened from green bonds to all types of labelled bonds, including social, sustainability and sustainability-linked bonds.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 10 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

In the Bank’s treasury operations, NIB adopted a Responsible Investment Framework, which introduces sustainability and ESG considerations as additional criteria for its liquidity portfolio investments.

As a signatory to Task Force on Climate-Related Financial Disclosures (TCFD), NIB continues to work towards fully integrating climate risks and opportunities in its core operations. More broadly, NIB has also started to look beyond counterparty-level ESG assessments to explore how best to evaluate ESG factors at the portfolio level.

In 2021, NIB joined the Coalition of Finance Ministers for Climate Action as an institutional partner. The Coalition brings together fiscal and economic policymakers from over 60 countries in leading the global climate response and in securing a just transition towards low-carbon resilient development.

A limited assurance was conducted for the first time on NIB’s Impact Report for 2020. The scope of this valuable assurance work is being expanded for the Impact Report 2021 to include further lending impact indicators, which demonstrates NIB’s commitment to increased transparency through reliable disclosures across the financial sector.

RISK MANAGEMENT

NIB monitors international risk management regulations and standards and takes them into account where relevant. The Bank has strengthened its risk, capital and liquidity management framework in recent years. In 2020, the amended Statutes and the Principles for Capital and Liquidity Management (‘Principles’) introduced high-level statutory requirements for capital, leverage, and liquidity. These are supported by a Risk Appetite Statement (RAS) and an Internal Capital Adequacy Assessment Process (ICAAP), and are operationalised via risk management policies, guidelines, and procedures.

The RAS sets the principles for risk taking, risk mitigation and risk avoidance. In 2021, the RAS was updated as a part of the annual review cycle, with a refinement of key risk indicators and the introduction of a statement on climate risk – ensuring coverage of emerging risks and highlighting the risk management side of our commitment to, inter alia, the TCFD.

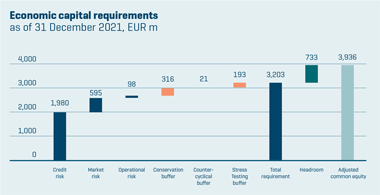

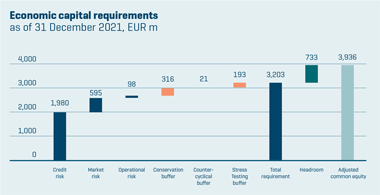

The ICAAP, which is conducted annually, is one of the main tools used by the Board of Directors to ensure that the Bank operates within the established risk appetite as well as capital and liquidity adequacy targets. In 2021, NIB maintained adequate capital and liquidity buffers throughout the year, despite the continued challenges stemming from the COVID-19 pandemic. An increase in equity (through net profit)

combined with a modest increase of the risk-based (economic) capital requirement enabled the Bank to maintain its strong capital position, with a capital headroom1 of EUR 733 million (19% of adjusted common equity).

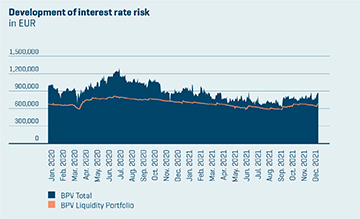

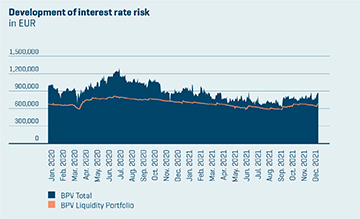

Asset quality remained solid. As of end-2021, 94% of the lending exposure was within the investment-grade category, and the public sector accounted for 32% of total lending exposure. In terms of geographical distribution, 96% of the lending exposure was to counterparties located in the Bank’s member countries. As for the treasury portfolio, all exposure was well within the investment-grade category, with 90% within the best risk classes (equivalent to ratings of AAA to AA-). In terms of market risk, the Bank is mainly exposed to interest rate risk, credit spread risk, and cross-currency basis risk via its treasury operations. While the valuations of mark-to-market financial instruments varied throughout the year, the Bank’s overall market risk remained modest. As of end-2021, it was essentially unchanged compared to the previous year.

NIB continued to improve its risk management framework during 2021. Several policies and procedures were reviewed and updated to reflect the implementation of the three lines of defence model as well as to keep up with best practices. High-level principles and requirements for managing market risks were formalised at the Policy (Board) level, and a number of policies and guidelines related to operational risks were clarified and adopted. The framework for managing model risks became operational. The Board approved the new Capital and Liquidity Recovery Plan, while management adopted its own set of financial risk limits. Combined, these milestones completed the Bank’s ‘waterfall’ risk management system, which cascades from Statutes and Principles to the RAS and to the Risk Management Policy (and downstream to specific policies for each core risk category) down to management limits and operations.

In the aftermath of the COVID-19 pandemic, an extensive overhaul and validation of the model used to estimate expected credit loss (ECL) was initiated. The work will be completed in 2022. Lastly, work continued towards a more systematic integration of sustainability / ESG (including climate risk) factors into the Bank’s core processes (lending and treasury).

1 “Capital headroom” is defined as the capital supply (adjusted common equity) minus capital demand, i.e., the internally assessed risk-based (economic) capital requirement for the current operations covering all identified risks the Bank is exposed to (i.e., credit, market and operational risk, and buffers for macroprudential risks and stress testing).

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 11 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

FINANCIAL RESULTS

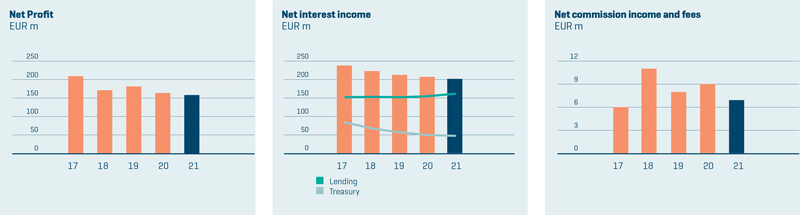

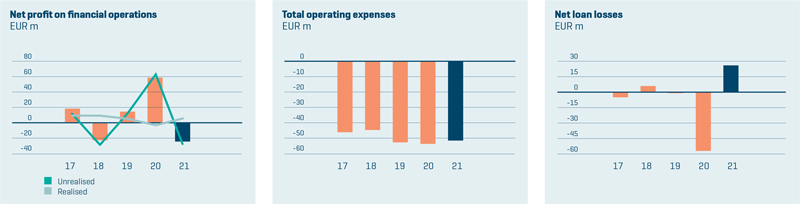

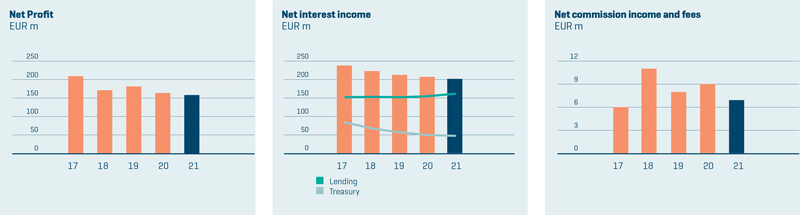

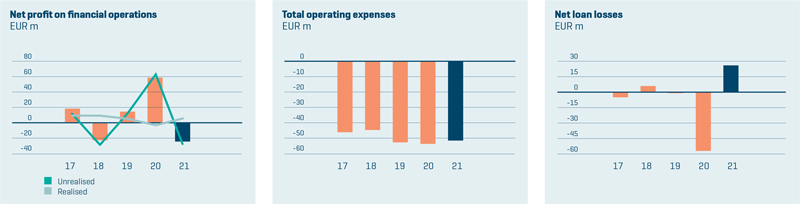

The net profit for the year of EUR 159.2 million was EUR 5.5 million lower than in 2020. Total operating income decreased from EUR 273.9 million to EUR 184.8 million, mainly due to a decrease in net profit on financial operations of EUR 82.5 million. Net interest income decreased by EUR 4.1 million and net fees and commission decreased by EUR 2.3 million. Total operating expenses of EUR 51.5 million were EUR 0.9 million lower than in 2020.

Following the outbreak of COVID-19 in 2020, the global operating environment rapidly deteriorated. As a result, the Bank adjusted the macro-financial scenarios used to calculate the expected credit loss (“ECL”) provision resulting in net loan losses of EUR 57 million. During 2021, the macro-financial scenarios improved, resulting in a decrease of the ECL and the Bank recorded a reversal of EUR 25.9 million in net loan losses. The Bank did not record any realised loan losses nor any new non-performing loans during 2021.

Net interest income for the year amounted to EUR 201.4 million, compared to EUR 205.5 million in 2020. Net interest income from lending activities of EUR 162.4 million was EUR 7.1 million higher than in previous years due to a larger loan balance. Net interest income from treasury activities decreased by EUR 11.2 million to EUR 39.0 million due to the low yield environment. A more detailed commentary on the Bank’s financial results can be found in the Operating and Financial Review in the Financial Report.

The Bank is in a strong financial position with solid capital and liquidity ratios, well above the minimum requirements stipulated in the Statutes and compliant with the limits and monitoring thresholds defined in the Risk Appetite Statement. Total assets increased from EUR 35,422 million to EUR 37,553 million and total equity increased from EUR 3,861 million to EUR 3,999 million. A more detailed commentary on the Bank’s statutory metrics can be found in the Capital and Liquidity Management section in the Financial Report.

DIVIDEND

For 2020, the Board of Directors proposed that no dividend be paid to NIB’s member countries, with approval by the Board of Governors. This decision was part of the owners’ will to maximise the Bank’s response to the COVID-19 pandemic and to show strong support for NIB’s activities, while preserving its solid capitalisation. Although there are still significant uncertainties that may impact the economy in the future, the macroeconomic outlook has improved. As stated, NIB is in a strong financial position with solid capital and liquidity ratios, therefore the Board of Directors proposes to the Board of Governors that the payment of dividends be reinstated, and that a sum of EUR 40 million be distributed to the Banks’ member countries from the 2021 net profit, which equates to a pay-out ratio of 25% of net profit.

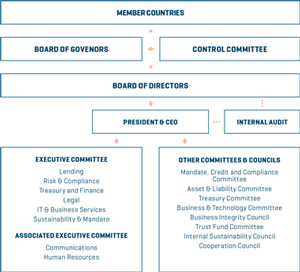

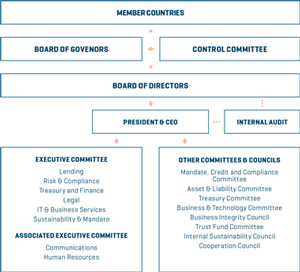

GOVERNANCE

NIB’s Board of Directors held eleven meetings in 2021. Due to the ongoing pandemic, meetings were held fully online until July, and after that in hybrid mode (i.e., some members attended in person, while others attended remotely via secure video call). Ms Esther Finnbogadóttir (Iceland) chaired all Board meetings. A hybrid meeting was held in Reykjavík on 26 August (meeting 8/2021) and three hybrid meetings took place in Helsinki. Four separate Board seminars were held.

The Control Committee (the Bank’s supervisory body responsible for appointing the Bank’s external auditors) had two ordinary meetings during the year. The first ordinary meeting was held online and the second was held in hybrid mode in Oslo. The Control Committee Chairmanship is reinforced by an independent expert, the re-appointment of whom was approved by the Control Committee on 12 February 2021 for a two-year period. The Control Committee Chairmanship held seven meetings (either online or in hybrid mode because of the pandemic situation).

From 1 April 2021, the Board of Directors appointed Mr André Küüsvek (Estonia) to serve as President and Chief Executive Officer (CEO) of the Bank. The President of NIB is appointed by the Board of Directors for a term of five years at a time. Mr Küüsvek succeeded Mr Henrik Normann (Denmark), who had occupied the position from April 2012. Mr Küüsvek is the first NIB President from a Baltic country.

The Board of Directors also approved to include the Head of Sustainability and Mandate as an ordinary member to the Executive Committee and the Mandate, Credit and Compliance Committee.

COMPLIANCE

Efforts to further strengthen NIB’s integrity and compliance framework continued this year. The Integrity & Compliance Office (ICO) reviewed three of the Bank’s policies to improve their accessibility and align them with current best practices. In addition, a new e-learning course targeting all staff members was launched.

In accordance with best market practice, ICO conducted a money laundering and terrorism financing risk assessment of NIB’s lending operations. The assessment concluded that, considering both the inherent risk associated with our customers and the control measures the Bank has in place, NIB’s residual money laundering and terrorism financing risk is low. To further enhance controls, relevant policy reviews and further staff trainings will be arranged in 2022. More information about ICO’s activities can be found in NIB’s annual Integrity Report, which will be published in March 2022.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 12 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Most Board meetings were held in hybrid mode in 2021. Photo: Ville Maali.

BUSINESS CONTINUITY AND HYBRID WORKING

Based in Helsinki, NIB takes into account the advice and guidelines of the Finnish government and health care authorities regarding the developments of the COVID-19 epidemic. Following the improved epidemic situation and vaccination coverage in Finland, most of the Bank’s staff returned to the office during autumn, and the Bank implemented a hybrid work model. Since then, the epidemic situation deteriorated again, resulting in most of the staff reverting to a remote work mode by year-end.

OTHER DEVELOPMENT PROJECTS

Stakeholder survey

NIB actively seeks feedback from its key target groups by conducting a comprehensive stakeholder survey every three years, most recently in autumn 2021. A total of 139 interviews were conducted with lending customers, investors, and public authorities. The results confirmed that NIB’s reputation continues to be very strong among all of these stakeholders. The Bank is seen as a leading provider of long-term financing in the region. Climate change adaptation and mitigation as well as the green transition are on top of the agenda. The results support the conclusions of the strategy review.

Work Engagement Survey

NIB also conducts regular work engagement surveys among its staff to collect feedback on NIB as an employer, the work environment, the management, individual motivation, and wellbeing. The most recent survey was conducted in 2021, where a total of 192 answers were received. The survey results were very positive, especially with regards to individual work engagement and motivational drivers, supervisory work and teamwork, reflecting strong levels of commitment overall. The Bank’s handling of health and safety during the pandemic received an excellent score. Compared to our previous survey (2018), results have improved across all areas. Further, Bank-wide development needs were identified in relation to digitalisation and the implementation of new initiatives.

Digitalisation

Several initiatives were implemented to adapt the Bank’s IT to a digitalised operating environment and to ensure more stable and secure remote working solutions. Digitalisation of workplace services continued, with the installation of Office 365, the provision of new workstations, and an updated security solution. The first steps to further digitalise the lending process were taken.

From a governance perspective, two primary focus areas are IT process management and IT security improvement. Several enhancements of the IT security domain have been implemented and the three-line-defence model for IT security is now fully operational.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 13 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

In order to meet growing capacity demands and to better manage related operational risks, NIB has decided to outsource its data centre infrastructure. The outsourcing process was initiated during 2021 and will continue into 2022. Further, the Enterprise Data Warehouse (EDW) project has delivered important results on data modelling and key business applications. Work on the future operating model and roles and responsibilities is ongoing, aiming for NIB to become a data driven Bank.

Internal sustainability management

NIB’s newly renovated office building received certification under the Excellent level of the BREEAM rating system for green buildings in spring of this year. The certification assures that the facilities meet the highest standards in several sustainability dimensions, including energy efficiency and building materials. When financing real estate projects, NIB requires its customers to obtain a high level of external certification. Therefore, it was important to apply the same requirements to NIB’s own premises. An overview of how NIB manages its internal footprint is available in the Impact Report 2021.

OUTLOOK

Although vaccination efforts have somewhat mitigated the negative effects of the COVID-19 pandemic on the real economy, the epidemiological situation remains a major cause for concern, not least due to new virus variants. The overall level of uncertainty regarding the economic outlook is still elevated. The consensus is that the global economy will continue a broad recovery in 2022, mainly spurred by hopes that the vaccination efforts will prove to be successful in reducing the spread of the disease.

The monetary policy stance in advanced economies is expected to remain accommodative in 2022, with interest rates remaining at historically low levels. However, given the inflationary pressures, the likelihood of a somewhat less accommodative monetary policy is increasing. The possible change of monetary stance will largely depend on the policymaker’s view on whether the price shocks are temporary or not.

The overall demand for financing is still affected by the sizable fiscal support from governments, including various recovery funds, which has led to a steep increase in public debt. Due to high levels of uncertainty, corporate investments will potentially remain subdued. At the same time, the growing momentum behind the development of a sustainable finance universe will create new opportunities.

Going forward, NIB has a role to play in the green recovery of the Nordic-Baltic region. In this context, the Bank will particularly support the decarbonisation plans of its member countries.

NIB will continue to focus on long-term lending and increase its activities in under-served segments of the market. Overall, the Bank expects new lending volumes to be moderately higher in 2022 compared to 2021. In line with its updated business strategy, NIB will broaden its product offering and participate in developing sustainable finance and capital markets in the Nordic–Baltic region, with a focus on setting high quality standards in the market and supporting high impact transitions.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 14 |

| | |

|

|

REPORT OF THE BOARD OF DIRECTORS |

| |

PRESIDENT AND CEO’S COMMENTS |

|

OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

President & CEO’s comments January–December 2021

This is the first annual financial report for which I am President, and it is therefore an opportune time to reflect on my first months at the Bank. Prior to joining NIB, my impression of the Bank was that of a professional institution with a strong financial position anchored to a clear mandate. I am pleased to report that my expectations have been met and my first impressions have been very positive indeed. I would like to take this opportunity to thank everyone at NIB and the Board of Directors for making me feel very welcome and I look forward to our future cooperation together.

What has really impressed me to date, is the engagement of the Bank’s owners through the active participation of the Board in the governance of the Bank. During the autumn, the Board reviewed the Bank’s business strategy, the objective of which was to adapt to the changing operating environment and to accelerate the delivery of our mission. Our new strategy continues to focus on our key strengths but will also explore new products to enhance our client and owner value propositions, further details of which can be found here. The Board also approved NIB’s updated Sustainability Policy, details of which can be found here. These are two very significant milestones in setting the course for the Bank to follow during these increasingly complex and challenging times.

The Bank’s net profit for the year amounted to EUR 159 million, total assets increased from EUR 35,422 million to EUR 37,553 million and our total equity increased from EUR 3,861 million to EUR 3,999 million. The Bank is in a strong financial position with solid capital and liquidity ratios, and on this basis, management supports the Board decision to reinstate dividends after last year’s suspension.

I look forward to implementing the new strategy and I am confident that NIB will play an important role in the post-COVID recovery in the member countries, by providing sustainable finance solutions and facilitating positive change.

André Küüsvek, President & CEO

Executive Committee

MEMBERS

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 15 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

| |

| |

| HIGHLIGHTS |

| |

| |

| KEY FIGURES AND RATIOS |

|

| TOTAL COMPREHENSIVE INCOME |

|

| FINANCIAL POSITION |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Operating and financial review

Highlights

During 2021, the Bank disbursed EUR 2,440 million in loans compared to EUR 4,853 million in 2020 when the Bank disbursed a historically high amount in response to the COVID-19 crisis.

The Bank is in a strong financial position with solid capital and liquidity ratios. Total assets increased from EUR 35,422 million in 2020 to EUR 37,553 million at 31 December 2021 and total equity increased from EUR 3,861 million to EUR 3,999 million. The net profit for the year amounted to EUR 159 million compared to EUR 165 million in 2020 due to an increase in unrealised losses on financial instruments offset by a decrease in net loan loss provisions.

Key figures and ratios

| | | | | | | | |

| | | |

In millions of euro, unless otherwise

stated | | 2021 | | | 2020 | |

| | |

Net interest income | | | 201 | | | | 206 | |

| | |

Profit before net loan losses | | | 133 | | | | 221 | |

| | |

Net Profit | | | 159 | | | | 165 | |

| | |

| | | | | | | | |

| | |

Loans disbursed | | | 2,440 | | | | 4,853 | |

| | |

Loans agreed | | | 1,852 | | | | 5,666 | |

| | |

% of loans achieving good or above mandate | | | 97% | | | | 98% | |

| | |

| | | | | | | | |

| | |

Lending outstanding | | | 22,313 | | | | 21,727 | |

| | |

Total assets | | | 37,553 | | | | 35,422 | |

| | |

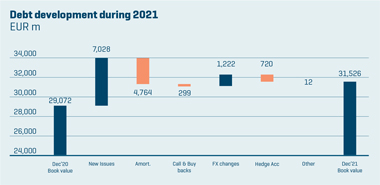

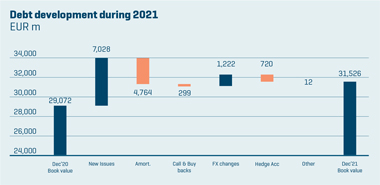

New debt issues | | | 7,028 | | | | 7,540 | |

| | |

Debts evidenced by certificates | | | 31,526 | | | | 29,072 | |

| | |

Total equity | | | 3,999 | | | | 3,861 | |

| | |

| | | | | | | | |

| | |

Equity/total assets (%) | | | 10.6% | | | | 10.9% | |

| | |

Net profit/average equity (%) | | | 4.1% | | | | 4.4% | |

| | |

Cost/income (%) | | | 27.9% | | | | 19.1% | |

| | |

Number of employees at year end | | | 221 | | | | 222 | |

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 16 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

|

| HIGHLIGHTS |

|

KEY FIGURES AND RATIOS |

| |

| TOTAL COMPREHENSIVE INCOME |

|

FINANCIAL POSITION |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Total comprehensive income

NET PROFIT

The net profit for the year amounted to EUR 159.2 million, which is EUR 5.5 million lower than last year. Total operating income decreased from EUR 273.9 million to EUR 184.8 million mainly due to a decrease in net profit on financial operations of EUR 82.5 million. Net interest income decreased by EUR 4.1 million and net fee and commission income decreased by EUR 2.3 million. Total operating expenses of EUR 51.5 million were EUR 0.9 million lower than in 2020. The Bank has decreased the expected credit loss provision resulting in positive net loan losses of EUR 25.9 million. There have been no realised loan losses during the year.

NET INTEREST INCOME

Net interest income for the year amounted to EUR 201.4 million which is 4.1 million lower than in 2020. Net interest income on lending activities was EUR 7.1 million higher than in 2020, due to a higher volume of loans outstanding. The interest income on treasury activities decreased by EUR 11.2 million due to the ongoing low yield environment.

NET FEE AND COMMISSION INCOME

Net fee and commission income amounted to EUR 7.0 million, compared to EUR9.3 million in 2020, due to the higher volume of loans agreed and disbursed last year.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 17 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

|

| HIGHLIGHTS |

|

KEY FIGURES AND RATIOS |

| |

| TOTAL COMPREHENSIVE INCOME |

|

FINANCIAL POSITION |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

NET PROFIT/LOSS ON FINANCIAL OPERATIONS

The loss on financial operations amounted to EUR 23.7 million compared to a gain of EUR 58.8 million in 2020. This result includes realised net gains of EUR 4.8 million and unrealised net losses of EUR 28.5 million compared to realised net losses of EUR 5.0 million and unrealised net profits of EUR 63.8 million in 2020. During 2020 and 2021, the financial markets experienced large market movements because of the COVID-19 outbreak. This has significantly increased the volatility of unrealised gains and losses recorded on financial instruments that NIB holds to hedge its interest rate risks and in its liquidity portfolio.

The unrealised valuation gains and losses on interest rate hedges mainly arise from the change of the interest rate spreads that are embedded in the Bank’s funding and lending transactions. When the Bank raises funds with fixed rates or offers borrowers fixed rate loans, it hedges the resulting interest rate risk using swaps, in which the fixed rate is swapped to the short-term money market floating rates referred to as the IBORS (e.g., LIBOR, EURIBOR, STIBOR, NIBOR etc.). In keeping with what NIB believes is industry best practice, the valuation of these swaps is based on a risk-free discounting rate called OIS (Overnight Interest rate Swap). The changes in spread between the risk-free rates (the OIS rates) and the relevant IBORs applicable to each such swap creates unrealised valuation gains and losses. It should be noted that as the Bank intends to hold these transactions to maturity, so that they are not sold for a price based on their exit market value,

these valuation gains and losses will not be realised as the transactions will settle at par.

The unrealised valuation gains and losses on assets in the Bank’s liquidity portfolio arise from changes in credit spreads. The Bank maintains a large liquidity portfolio, which it invests in high quality bonds. The interest rate risk may be hedged using swaps but when credit spreads widen, this results in negative valuations on the bonds. In periods of financial turbulence credit spreads tend to rise, which also affects NIB’s high quality bonds. As the Bank intends to hold the bonds to maturity, so that they are not sold based on the current exit market value, the valuation gains and losses will reverse, as the bonds will settle at par.

TOTAL OPERATING EXPENSES

Total operating expenses amounted to EUR 51.5 million comprising personnel expenses of EUR 29.2 million, administrative expenses of EUR 12.8 million and depreciation of EUR 9.5 million. The main administrative expenses are IT, office premises, travel and project consultancy cost, however due to COVID-19, the travel and project consultancy costs were lower than usual. Personnel costs decreased by EUR 2.1 million which was mainly due to staff turnover and reduced activities due to COVID-19.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 18 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

|

| HIGHLIGHTS |

|

KEY FIGURES AND RATIOS |

| |

| TOTAL COMPREHENSIVE INCOME |

|

FINANCIAL POSITION |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

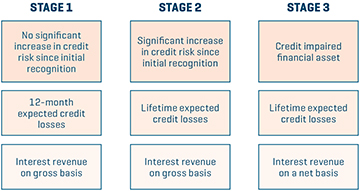

NET LOAN LOSSES

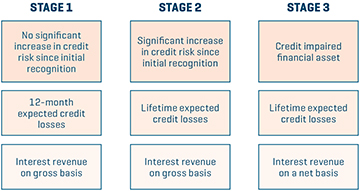

Following the outbreak of COVID-19 in 2020, the global operating environment rapidly deteriorated and as a result, the Bank adjusted the macro-financial scenarios used to calculate the expected credit loss (“ECL”) provision. In 2020, there was an increase in the ECL provision from EUR 122.3 million at 31 December 2019 to EUR 172.6 million at 31 December 2020. During 2021, the macro-financial scenarios improved, resulting in a decrease of the ECL provision to EUR 152.4 million at 31 December 2021.

There have been no significant observed changes in the credit quality of the overall loan portfolio and there were no new non-performing loans during the period and no realised losses. The gain recognised in the income statement for net loan losses of EUR 25.9 million relates to recoveries on non-performing loans of EUR 0.5 million and EUR 25.4 million related to the change in ECL on performing loans.

OTHER COMPREHENSIVE INCOME

The Bank separates the foreign currency basis spread from financial instruments used in fair value hedge accounting and this separated amount is recorded in “Other comprehensive income” (OCI) which amounted to a loss of EUR 21.6 million for the year compared to a gain of EUR 9.1 million in 2020.

This recorded loss is due to the widening of the Cross Currency Basis spreads, which negatively affect the valuation of basis swaps used to convert funding currencies into lending currencies.

For financial liabilities recorded at fair value through profit or loss, valuation changes due to changes in own credit spreads need to be recorded in OCI. In 2021, the impact was insignificant. The resulting total comprehensive profit for the year amounted to EUR 137.9 million, compared to EUR 170.4 million in 2020.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 19 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

|

| HIGHLIGHTS |

|

| KEY FIGURES AND RATIOS |

|

TOTAL COMPREHENSIVE INCOME |

| |

| FINANCIAL POSITION |

| |

CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Financial position

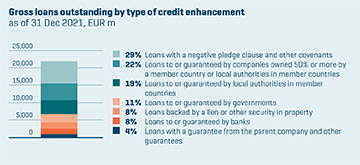

LENDING OUTSTANDING

Total lending outstanding amounted to EUR 22,313 million, comprising loans outstanding of EUR 21,975 million and investments of EUR 338 million in labelled bonds and CPs. The total disbursements in 2021 amounted to EUR 2,440 million. More information regarding loans agreed can be found on our website at Agreed Loans.

Total lending outstanding, excluding exchange rate and valuation effects, increased from EUR 21,727 million at 31 December 2020 to EUR 22,215 million. The book value amounted to EUR 22,313 million due to foreign exchange movements and fair valuations/hedge accounting effects of EUR 249 million and EUR -151 million, respectively.

MISSION FULFILMENT

NIB’s vision is a prosperous and sustainable Nordic-Baltic region. All projects proposed for financing undergo an assessment of their potential impact on productivity and the environment of the member country area. This mission fulfilment is rated on a five-grade scale from “negative” to “excellent”. In response to the COVID-19 pandemic, NIB provided “response loans” to alleviate the economic and social consequences of the crisis. These response loans are tracked separately and are not included in the standard mandate rating. During 2021, projects achieving a “good” or “excellent” mandate rating accounted for 97% of the total amount of loans agreed excluding response loans which exceeded the target of 90%.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 20 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

| OPERATING AND FINANCIAL REVIEW |

|

| HIGHLIGHTS |

|

| KEY FIGURES AND RATIOS |

|

TOTAL COMPREHENSIVE INCOME |

| |

| FINANCIAL POSITION |

| |

CAPITAL AND LIQUIDITY MANAGEMENT |

| |

| FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| �� |

| |

| |

| |

| |

| |

| |

| |

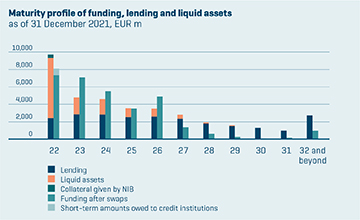

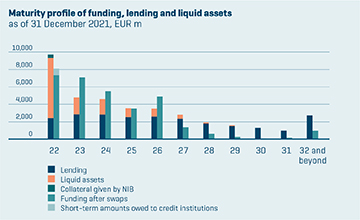

FUNDING

During 2021, NIB raised new funding with a nominal value of EUR 6.9 billion through 71 issues in eleven currencies with an average maturity of 4.4 years.

The Bank completed two global USD benchmarks during the year and complemented the issuance by other public and private transactions, hence maintaining a global investor base and a diversified portfolio of currencies. NIB continued its strong presence in the sustainable bond market by issuing NIB Environmental Bonds (NEB). This year the Bank celebrated its 10th anniversary as a green and blue bond issuer.

On 7 January, NIB priced a five-year GBP 600 million issue. The transaction was NIB’s largest ever new sterling benchmark, with the final order-book reaching over GBP 800 million.

On 13 January, the Bank issued its first global USD benchmark issue for the year. The five-year USD 1.25 billion benchmark transaction has a final maturity on 21 January 2026 and was met with strong support from investors.

On 25 March, NIB issued its first NEB for the year. The EUR 500 million transaction was an increase of a NEB due April 2027, bringing the new total outstanding to EUR 1 billion. With this re-opening, NIB’s total environmental bond issuance surpassed EUR 5 billion.

On 6 May, NIB issued its inaugural USD 700 million five-year benchmark bond linked to the SOFR (Secured Overnight Financing Rate) index.

On 14 September, NIB priced a 3-year USD 1 billion benchmark, the second USD benchmark of the year. The transaction attracted strong support from over 50 global investors, with the order-book closing in excess of USD 1.9 billion.

On 13 October, NIB issued two Environmental Bonds (NEBs): a 5-year SEK 3 billion NEB, and a 6-year NOK 1 billion NEB – the Bank’s inaugural green bond issued in Norwegian kroner. With these two bonds, NIB marked its 10th anniversary as a green bond issuer. The Bank has now issued EUR 5.8 billion in environmental bonds and financed over 130 sustainable projects with the proceeds.

A full list of funding transactions can be found on our website at Funding Transactions.

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 21 |

| | |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| Capital and liquidity management |

The Statutes require NIB to have adequate capital and liquidity management in accordance with sound banking principles. The Bank shall have in place sound and effective strategies for risk, capital and liquidity assessments, which shall be conducted at least annually and reviewed regularly. The Bank’s capital and liquidity management shall be based on assessed risks in its operations, supplemented by stress testing. The Principles for Capital and Liquidity Management set by the Board of Governors further specify requirements as follows:

TABLE 1. Statutory ratio requirements and year-end values

| | | | | | | | | | | | |

| | | | |

| Statutory metrics | | Minimum | | | 2021 | | | 2020 | |

| | | |

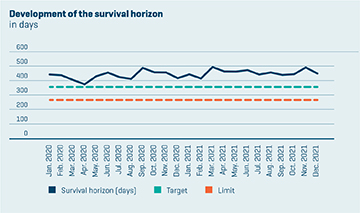

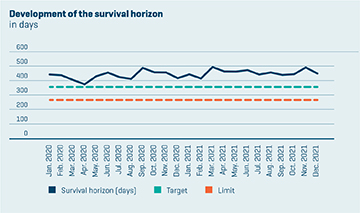

Risk-based (economic) capital ratio | | | 100% | | | | 147% | | | | 142% | |

| | | |

Leverage ratio | | | 7.0% | | | | 10.6% | | | | 11.1% | |

| | | |

Leverage ratio with callable capital | | | 20.0% | | | | 30.9% | | | | 32.9% | |

| | | |

Liquidity survival horizon (days) | | | 180 | | | | 450 | | | | 418 | |

Key components of the NIB risk, capital and liquidity management framework are the Risk Appetite Statement (RAS) and the Internal Capital Adequacy Assessment Process (ICAAP). To monitor and manage compliance with statutory requirements, the Board of Directors sets limits and monitoring thresholds in the RAS securely above the minima set by the Principles for Capital and Liquidity Management as well as those set out in the Bank’s Capital and Liquidity Recovery Plan. The Bank uses its ICAAP to evaluate the amount of capital and liquidity needed to cover the risks it is or might be exposed to. The ICAAP is conducted on an annual basis. The Bank maintains a sufficient amount of capital and liquidity to cover all material risks and to ensure that operations can be continued without disruptions even in extremely adverse situations. Moreover, in accordance with Principle 3 of the Principles for Capital and Liquidity Management, NIB has put in place contingency measures and procedures for capital, leverage and liquidity adequacy to safeguard its viability.

RISK-BASED (ECONOMIC) CAPITAL

The Statutes require that the Bank’s paid-in capital and accumulated reserves exceed its internally assessed capital requirement covering the nature and level of the risks to which the Bank is or might be exposed. The Principles for Capital and Liquidity Management further establish a risk-based capital adequacy requirement to ensure that the Bank maintains an appropriate level of capital. This is operationalised via a risk-based capital ratio minimum requirement of 100 per cent.

NIB uses an internal economic capital approach to estimate and set the risk-based capital requirements for credit risk, market risk, operational risk, and other business risks. The amount of economic capital reserved to cover these risks, also calibrated to preserve the highest possible (AAA/Aaa) credit rating, is defined as the minimum economic capital requirement. Potential diversification benefits across the main risk categories (credit, market, liquidity, and operational) are not applied. In addition to the minimum economic capital requirement, the Bank maintains macroprudential capital buffers and additional management buffers (e.g. stress test buffer) as appropriate. The Bank may release capital buffers under stressed conditions or when otherwise required to fulfil its purpose.

The credit risk economic capital model is an application of the so-called structural model broadly adopted in the industry. In technical terms, the simulation model is based on a multivariate-threshold t-copula approach. The key idea behind the model is that an individual obligor enters into default when the value of its assets crosses a threshold determined by the counterparty’s creditworthiness. The model for asset values is estimated based on historical equity data incorporating geographical, industrial, and firm-size dimensions. The likelihood that a counterparty’s assets drop below the default threshold depends on the probability of default (PD) estimates and rating scale. Finally, the actual size of default loss depends on two elements: the counterparty exposure at default (EAD) and the loss given default (LGD). The actual loss, as a proportion of the current exposures, is assumed to be random and is informed from the internal LGD methodology. The credit risk migration element is also a function of credit transition probabilities, credit spread values for each rating category, and the sensitivity of loans to spread movements. The transition probabilities are sourced from external credit rating agency data and split between corporate and sovereign lending

| | |

| | |

FINANCIAL REPORT 2021 | | NIB FINANCIAL REPORT 2021 / 22 |

|

| |

| REPORT OF THE BOARD OF DIRECTORS |

| |

| PRESIDENT AND CEO’S COMMENTS |

| |

OPERATING AND FINANCIAL REVIEW |

| |

| CAPITAL AND LIQUIDITY MANAGEMENT |

| |

FINANCIAL STATEMENTS |

| |

| PROPOSAL BY THE BOARD OF DIRECTORS |

| |

| AUDITOR’S REPORT |

| |

| GOVERNANCE STATEMENT |

| |

| REPORT OF THE CONTROL COMMITTEE CHAIRMANSHIP |

| |

| REPORT OF THE CONTROL COMMITTEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

categories. Credit spreads are estimated from internal historical lending experience, while the spread sensitivities are determined by the cash-flow structure of each individual loan.

The market risk economic capital model captures the following sub-categories: interest rate risk (covering both the economic value and net interest income risk perspectives), credit spread risk, currency basis risk, and foreign exchange risk. The Bank applies various stress testing approaches for the calculation of market risk economic capital requirements across these market risk sub-categories, and recognises diversification benefits between them in the calculation of the overall economic capital requirement for market risk.

For operational risk, the economic capital requirement is obtained by first calculating the regulatory capital requirement using the standardised approach and then scaling that requirement up to arrive at a conservative estimate.

The regulatory macroprudential tools have been designed to mitigate potential systemic risks, help counter procyclicality in the financial system, and to reserve additional capital above regulatory minimum requirements so that banks have better tools to react and operate under stressed conditions. Due to its legal status, national banking legislation does not apply to NIB, nor it is subject to direct supervision from any supervisory authority. NIB nevertheless monitors international regulations and standards on capital and liquidity management and takes them into account to the extent deemed relevant and/or feasible. Therefore, NIB includes in its ICAAP the relevant macroprudential buffers (namely for capital conservation and countercyclicality) as well as a stress test buffer.

The capital conservation buffer is a fixed percentage (2.5 per cent as of 31 December 2021) of the Bank’s risk-weighted assets (RWA). The countercyclical buffer is calculated as the weighted-average of the private sector exposures and respective countercyclical buffer rates in those countries where the risk exposures are located. The stress test buffer is normally derived from macroeconomic stress testing, based on severely adverse scenarios which build in severe yet plausible shocks to the real economy and financial markets. Scenarios are usually benchmarked to those from supervisory macroeconomic stress tests, but also incorporate expert judgment and/or specific elements to better test sensitivities to relevant factors such as the impact of particular shocks (like the COVID-19 pandemic) on sectors and/ or regions.

As of 31 December 2021, the minimum economic capital requirement was EUR 2,673 million, composed of EUR 1,980 million for credit risk, EUR 595 million for market risk, and EUR 98 million for operational risk. The capital conservation buffer was EUR 316 million and the countercyclical capital buffer was EUR 21 million. The stress test

buffer was EUR 193 million. The total economic capital requirement thus amounted to EUR 3,203 million.

Adjusted common equity (paid-in capital and accumulated reserves after deduction of appropriate adjustment items) provides the risk coverage (loss-absorbing capacity) and is used as a benchmark to determine capital adequacy. As of 31 December 2021, the Bank’s adjusted common equity amounted to EUR 3,936 million.

As of 31 December 2021, the economic capital ratio (adjusted common equity divided by the minimum economic capital requirement) was 147 per cent (2020: 142 per cent, see Table 1 above). The capital headroom (difference between adjusted common equity and the total economic capital requirement) was EUR 733 million (2020: EUR 697 million).

LEVERAGE

In line with sound banking principles and practices, the risk of excessive leverage is recognised and managed. The leverage ratio calculation follows the regulatory approach, considering full exposures (both on- and off-balance sheet) and thereby provides the Bank with an all-inclusive metric to measure and monitor the volume of its activities in relation to its loss-absorbing capacity.