| | |

| | |

| | |

ANNUAL REPORT 2022 | |  2 2 |

|

About this report: For 2022, NIB is publishing one combined report covering our activities, impact, sustainability, and financial reporting. NIB’s Intergity Report 2022 is available here. |

Cover images: Ville Maali and Boliden AB.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  4 4 |

| | |

|

| |

| INTRODUCTION |

| |

u This is NIB |

| |

Our year |

| |

CEO message |

| |

Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

This is NIB

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  5 5 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

u Our year |

| |

CEO message |

| |

Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

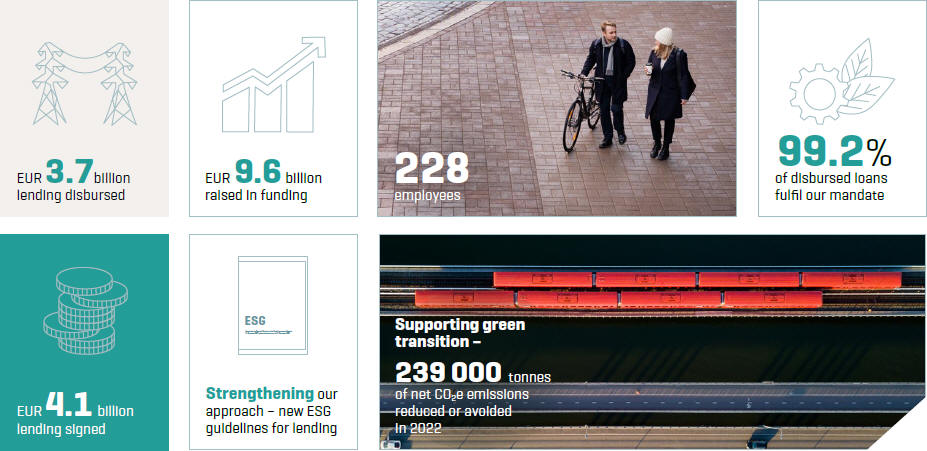

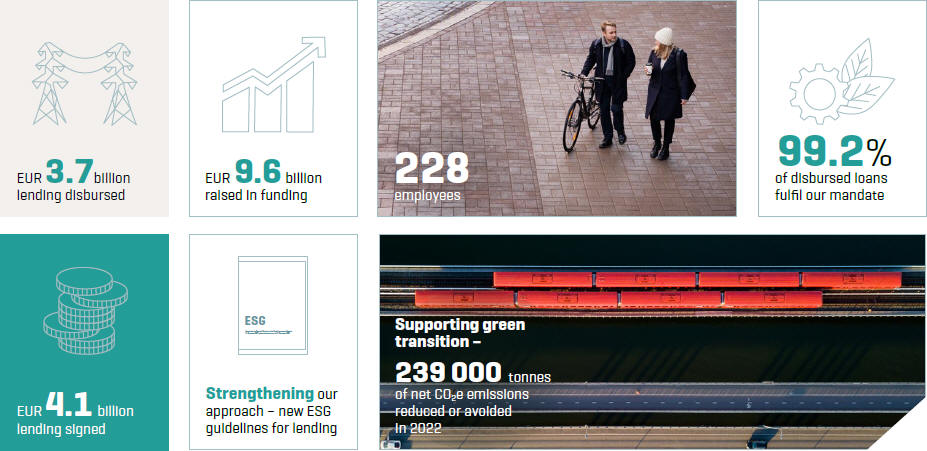

Our year

Lending disbursed includes loans, labelled bonds and MREL investments.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  6 6 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

Our year |

| |

u CEO message |

| |

Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Message from the President and CEO

Navigating the storm together

| | |

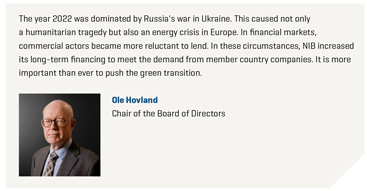

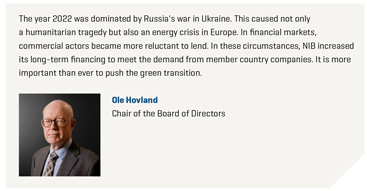

It was yet another stormy year, with Russia’s war in Ukraine bringing dark clouds over the free world. The aggression keeps causing terrible suffering to the Ukrainian people, whilst also leaving its footprints well beyond the country’s borders. For our member countries, it has not only changed the security landscape but also brought new societal challenges that have thundered all across Europe. On the heels of what seemed a strong post COVID-19 recovery, the war carried new supply-demand imbalances and record-high energy costs that led to inflation, higher interest rates and financial market volatility. Yet, this storm has also cleared the skies for new opportunities. It has underlined the need to end the dependence on malicious fossil fuels and secure cleaner energy supply for generations to come. It has made it ever more evident that we need to push even harder to accelerate the transition to low-carbon economies. Here, NIB has a key part to play. Our mandate to finance projects that improve productivity and benefit the environment is more important than ever. So is our stabilising role: as the increased uncertainty makes other financiers more reluctant to lend, we continue to support our clients. With our long-term lending, NIB’s customers can tackle the issues of today while keeping their sights on a sustainable future. In for the long journey The increased demand for NIB’s financing shows that Nordic-Baltic borrowers are committed to this journey. During the year, | |

|

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  7 7 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

Our year |

| |

u CEO message |

| |

Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

we disbursed EUR 3.7 billion to our clients and signed EUR 4.1 billion in new lending. These agreements include renewable energy generation, transmission networks and energy efficiency improvements – all to make our region more resilient.

To meet these needs, we raised a record-high EUR 9.6 billion in new funding. For the first time since we started offering NIB Environmental Bonds (NEB), our environmental issuance for the year surpassed EUR 1 billion. NEB transactions in EUR, DKK, NOK and SEK enabled our investors to directly channel funds to the most environmentally sound projects close to their homes.

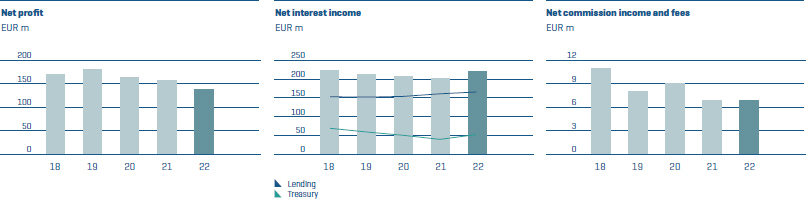

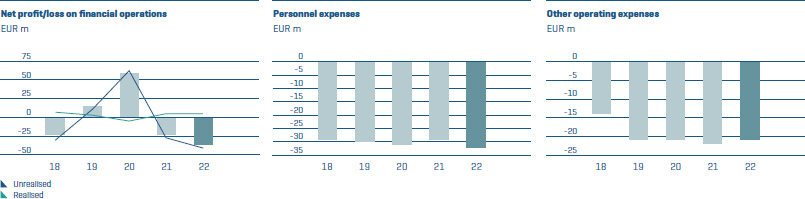

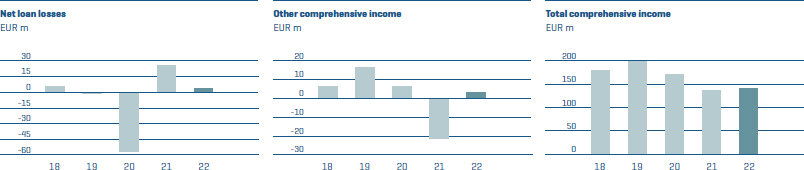

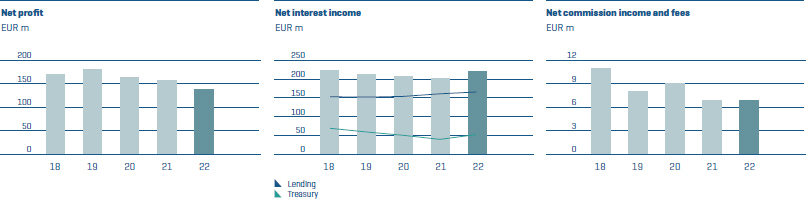

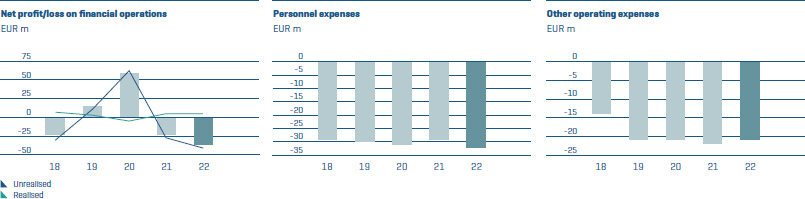

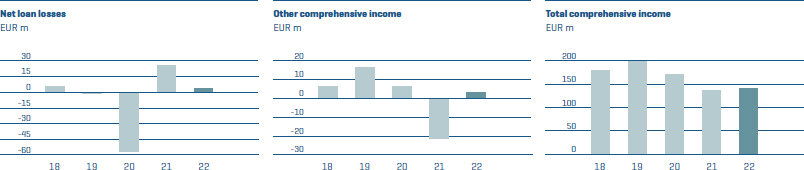

During 2022, we saw a significant increase in interest rates as central banks started to address high inflation levels. Combined with higher credit spreads and increasing lending volumes, this resulted in a net interest income of EUR 219 million compared to EUR 201 million in 2021. Our loan portfolio remains solid.

While the turmoil in the financial markets temporarily affected unrealised valuations in financial operations and other comprehensive income negatively, some of these reversed in the later part of the year. Our total net profit for 2022 amounted to EUR 139 million compared to EUR 159 million in the previous year.

Staying on course

Despite the turbulence, we remain on course in implementing NIB’s business strategy, which aims to sharpen our capabilities to support the green transition and mobilise climate finance.

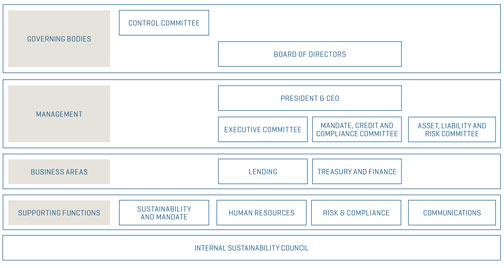

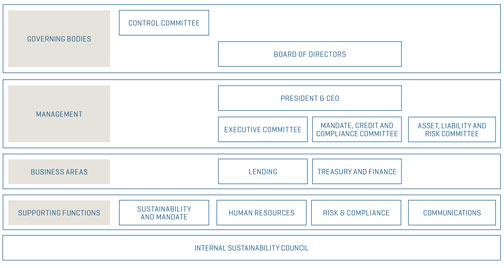

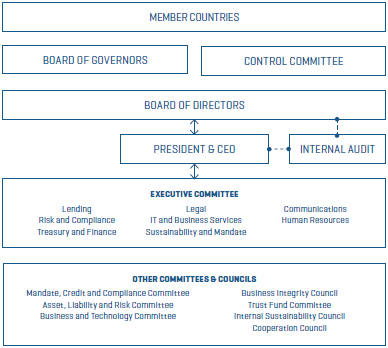

During the year, we further strengthened our organisation and focused on promoting an inclusive workplace and leadership development. We restructured our internal committees to bring experts and middle management closer to the decision-making, as well as to streamline the way we work.

With our long- term lending, NIB’s customers can tackle the issues of today while keeping their sights on a sustainable future.

Together with our clients, we continued to mainstream sustainability-linked lending by connecting financing to their ambitious climate targets and corporate strategies. In 2022, we signed four sustainability-linked loans, including sustainable transitions of the energy sector and sectors supporting hard-to-abate cement and mining industry.

In December, we joined the InvestEU programme to further mobilise investment for sustainable energy infrastructure as well as for research, innovation and digitalisation. As an implementing partner of the European Commission guarantee programme, we will be able to take more risk in these areas and enhance our lending to small and medium-sized and mid-cap companies.

As for the way ahead, NIB will proceed with developing the toolbox that supports its clients and owners in achieving their energy independence and climate resilience goals. In 2023, we will finalise NIB’s climate strategy and continue integrating ESG factors in our loan assessment. These developments

will consolidate sustainability as the cornerstone of NIB’s operations.

In light of this, we will also be more ambitious in the fulfilment of our mandate. NIB’s Board of Directors approved our target of 95% of loan disbursements to achieve a “good” or “excellent” rating on its impact on either environment or productivity in 2023.

Guided by the green light

Although the direction is clear, the road remains winding. The ongoing war, inflationary pressures and the volatility in the energy and financial markets have made predictions of the economic environment even foggier.

Contrary to some of Russia’s war objectives, however, the challenges that sought to divide us have brought us ever closer together. We shall keep building on this cooperation further.

During the year, I met with various NIB stakeholders and counterparties – from Nordic-Baltic ministers and ambassadors, public servants or non-governmental institutions to our investors and existing or potential borrowers. They all shared a common goal to come out of this crisis stronger.

To all of them, I also had a common message: we are your Bank – use us.

The storm is likely far from over. Yet even after the darkest of times, the light always comes. By working together, we can let it shine greener than ever before.

André Küüsvek, President and CEO

| | |

| | |

| Read the Report of the Board of Directors | | |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  8 8 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

Our year |

| |

CEO message |

| |

u Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

NIB’s business strategy and implementation

| | | | | | |

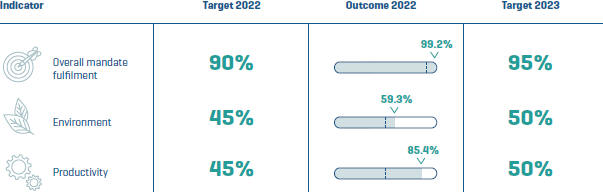

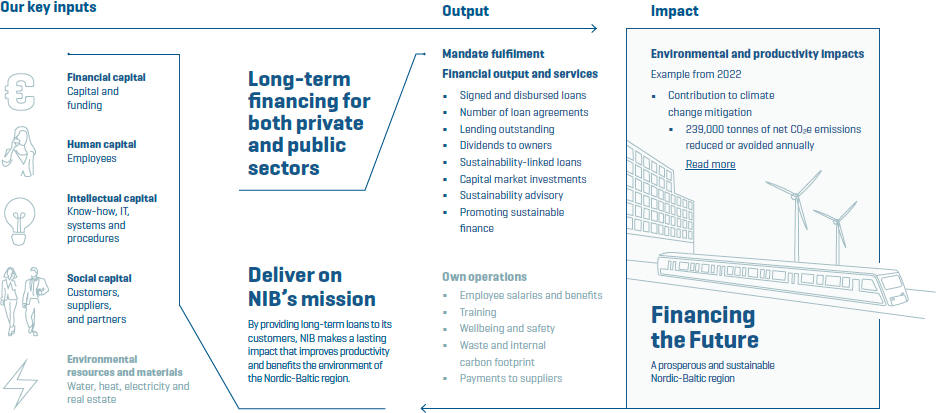

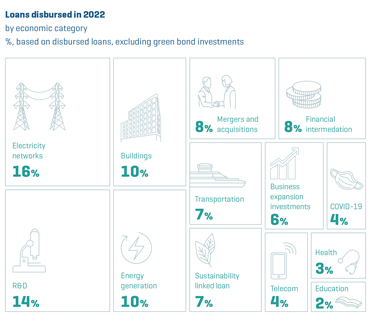

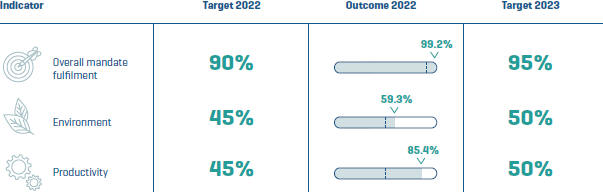

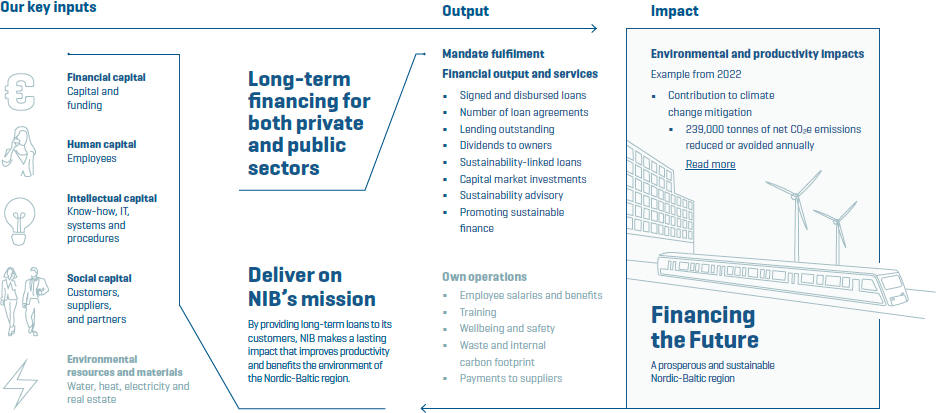

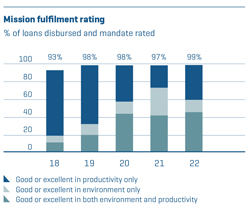

NIB supports the Nordic and Baltic member countries in their decarbonisation plans to achieve climate neutrality by 2050. The Bank complements its financial and investment product offering with sustainability expertise for its clients and investors. NIB is committed to further developing its value proposition based on active dialogue with all its stakeholders on sustainability matters and market needs. In addition to the twin mandates of environment and productivity, the key objectives of NIB’s business strategy are to develop the client and owner value proposition, enhance additionality, and improve capital accumulation while maintaining the Bank’s AAA rating. The drivers of our environmental mandate comprise climate change mitigation, preventive measures (including climate change adaptation), circular economy and pollution reduction. The productivity growth drivers include technical progress and innovation, infrastructure improvements, human capital and equal economic opportunities, and development and improvements in market effciency and the business environment. All projects considered for financing are assessed for their potential impact on the environment and productivity and NIB sets annual targets for the mandate fulfilment of loans. | | | | NIB offers environmental and productivity loans based on its mandate and funds the green loans by issuing NIB Environmental Bonds (NEBs). Since 2021, NIB also provides sustainability-linked loans for financing the sustainability transformation of companies and their value chains to ambitious and credible sustainability targets, expanding the Bank’s product range and impact. During 2022 99.2% of new disbursements received a good or excellent mandate rating (from the mandate rated projects1). EUR 561 million were committed to borrowers operating in hard-to-abate sectors such as chemicals, metals and mining, and transportation and logistics. NIB is also committed to the 30-by-30 pledge made at COP26 and aims to finance projects that | | have a positive environmental impact2 in the amount of at least EUR 30 billion, by the end of 2030. In 2021 and 2022 together, the total cumulative disbursement amount to environmental projects reached EUR 3.37 billion, therefore inducing projects in total of roughly EUR 7.5 billion3 and proving that NIB is on track to achieve the commitment. 1 No mandate rating is performed for response loans. These loans are issued on a specific mandate given by the Bank’s owners. 2 Total project costs in EUR for the loans that have received “good” or “excellent” rated environmental mandate. 3 Taking into account that NIB typically finances up to 50% of a total project costs. |

| | The annual mandate fulfilment targets 2022–2023

|

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  9 9 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

Our year |

| |

CEO message |

| |

u Strategy |

| |

Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | |

| | Developing the climate strategy Work on climate strategy and integrating climate risk into the Bank’s activities continued in 2022. The Bank identified the focus areas and the most carbon intensive exposures and sectors in its lending portfolio. In 2023, NIB will finalise its climate strategy and set targets. NIB intends to follow the market guidance on net zero transition plans for the financial institutions published by the Glasgow Financial Alliance for Net Zero. The Bank will continue to support the build-out of renewable capacities to further advance the transition of the power and heat sector and to enhance the electrification of the Nordic and Baltic economies. NIB also aims to focus more on financing the high-impact transitions in the hard-to-abate sectors, such as heavy industry and heavy-duty transport and in sectors, where the Bank’s clients face the challenge of improving the climate performance of their value chains. | | | | this guarantee to mobilise investments of up to EUR 480 million in clean energy, the modernisation and decarbonisation of industry, critical raw materials supply, sustainable transport, environmental protection, bioeconomy, digital connectivity, and sustainable data infrastructure. The initiative thus supports NIB’s objective of delivering higher additionality and client value by enhancing the access of long-term financing to the under-served market segments. |

| |

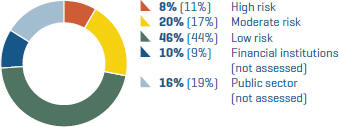

| | Developing capital markets NIB also continued supporting the development of debt capital markets in the member country region by investing in sustainability and sustainability-linked bonds as well as Baltic commercial paper, with the focus on first time issuers. In addition, NIB invested EUR 94.8 million into Nordic-Baltic MREL issuances, with the Bank’s product focus being on smaller financial institutions with lower access to the capital markets. With MREL investments, the Bank supports the financial institutions in the member countries fulfil their regulatory requirements whilst utilising the financing vehicle for SME on-lending. Enhancing additionality Broadening the risk profile of new lending was identified as an important step in enhancing our additionality and being more accessible to borrowers with a less diverse funding base. In 2022, the share of lending to sub-investment grade counterparties was 19% (EUR 707 million), compared to an average of 12% of all disbursements over the preceding 5 years. This step also contributes to greater profitability, enabling the accumulation of capital for the future fulfilment of NIB’s mission – to finance projects that improve productivity and benefit the environment of the Nordic and Baltic countries. |

| | Closer to our owners and clients Enhancing our additionality and delivering a higher value proposition to our clients and owners are cornerstones of NIB’s business strategy. In order to develop, coordinate and maintain key stakeholder relationships and networks within a member country, the Bank appointed Country Leads for each of the Nordic-Baltic countries, with the responsibility of liaising with governments, public agencies and regulators, business associations, corporates and financial institutions – bringing NIB closer to its clients and owners. | |

|

| | Mobilising green investments In 2022, NIB became one of the first implementation partners under the InvestEU programme, which provides an EU budgetary guarantee to implementing partners to increase their risk-taking capacity and therefore contributes to mobilising public and private investment for the EU’s policy priorities. NIB will use |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  10 10 |

| | |

|

| |

| INTRODUCTION |

| |

This is NIB |

| |

Our year |

| |

CEO message |

| |

Strategy |

| |

u Value creation |

| |

| IMPACT |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

How we create long-term value

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  12 12 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

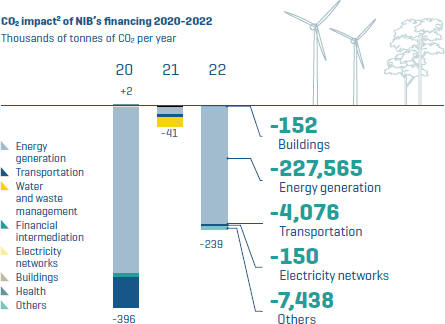

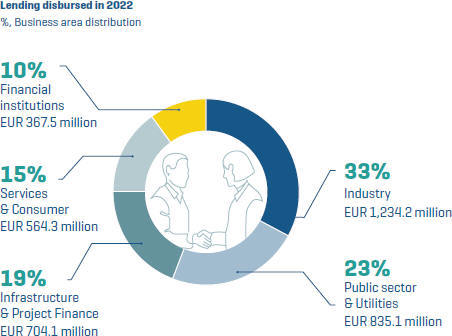

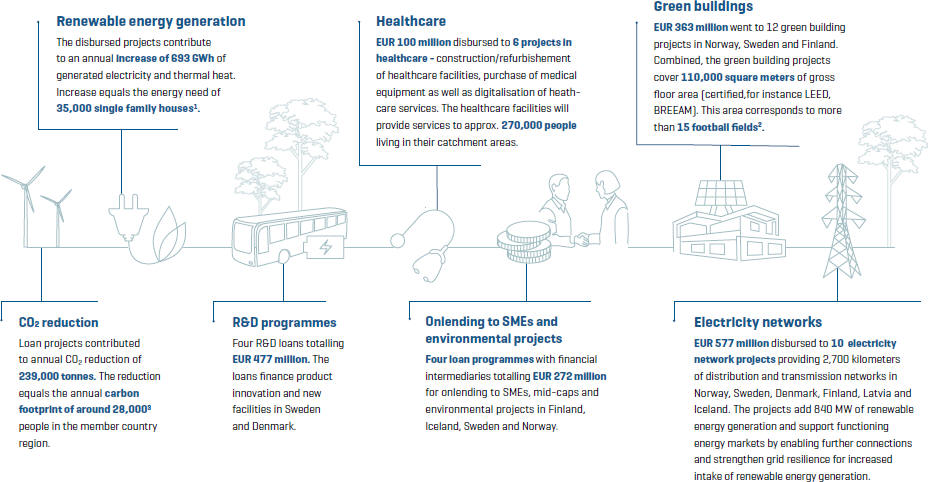

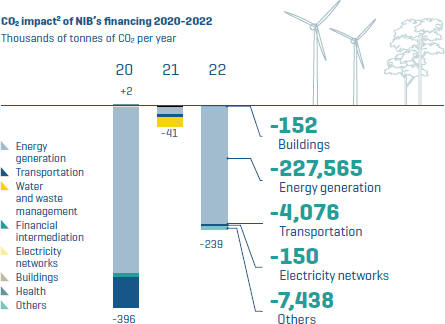

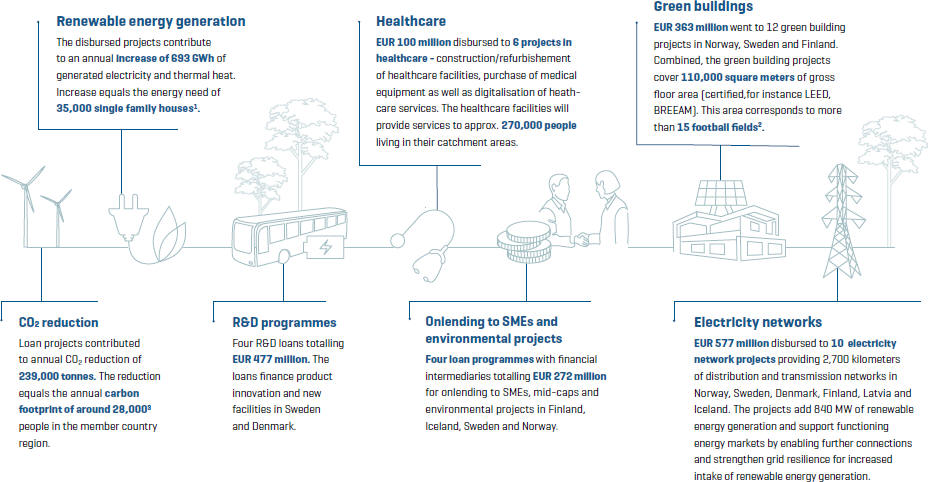

Impact of NIB’s lending

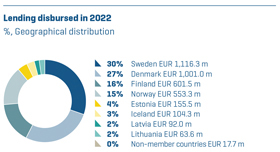

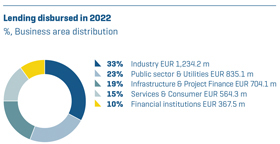

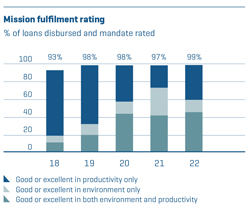

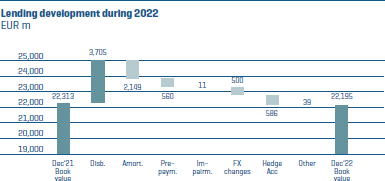

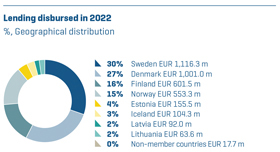

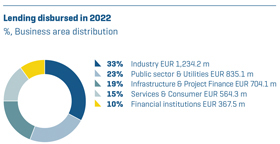

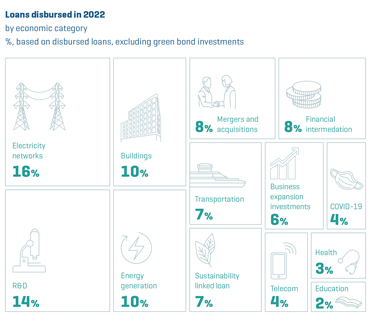

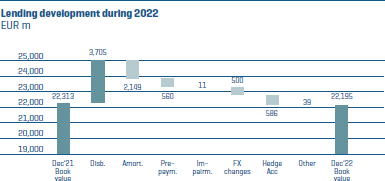

In 2022, a total of EUR 3,527 million in loans1 was disbursed. The increased demand was reflected in the volume of signed loans which was EUR 3,936 million. Lending outstanding at year-end amounted to EUR 22,195 million.

The largest share of disbursements were channelled to the sectors of transmission/ distribution of energy (EUR 577 million, 16% of disbursed loans),

R&D investments (EUR 477 million, 14%) , green buildings (EUR 363 million, 10%), and energy generation (EUR 357 million, 10%).

Overall, the total disbursements contributed to quantifiable impacts of 239,000 tonnes of net CO2 emissions reduced or avoided annually and total expected renewable energy generation annually of 693.2 GWh.

1 Excluding labelled bonds and MREL investments.

2 Calculated from the disbursed and pro-rated loans.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  13 13 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Impact of loans disbursed in 2022

NIB’s share

More information on how we calculate impact can be found on our website.

1 Assuming that one single family house in the member country area consumes around 20 MWh per year.

2 Assuming that one football field is 7140 m2. 3 By assuming greenhouse gases of 8.6 tonnes per capita, based on data of Eurostat for member country area in the years 2018-2020.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  14 14 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

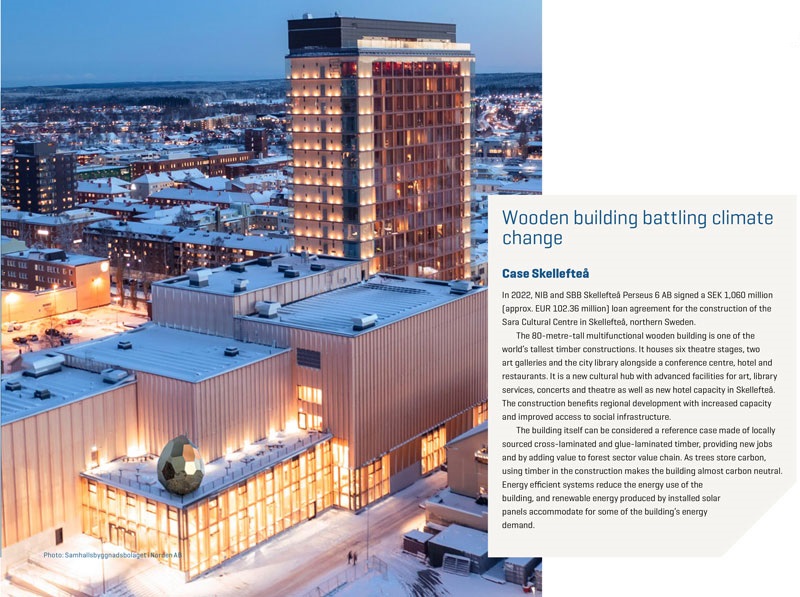

Supporting the

green transition

During its nearly half-a-century long experience, NIB has proven its strengths not only in financing well planned sustainable developments but also in swiftly reacting to extraordinary situations. Last year was no exception.

Russia’s aggression in Ukraine pushed Europe into an energy crisis and the need for action is urgent. Europe must build up its energy resilience and accelerate its transition to a low-carbon economy. Energy efficiency – in industry and homes – as well as renewable energy generation need to be scaled up now.

In 2022, 26% of disbursements were channelled to the energy-related investments which also reflects the largest challenges and need for financing the member countries have been facing lately.

For instance, along with 2,700 km of transmission and distribution infrastructure, we supported six wind parks in Sweden and Baltics with the capacity of 192.4 GW and new hydro-energy capacities in Norway. This equals the annual carbon footprint of 209,000 tonnes of CO2 equivalent, which corresponds to yearly emission of approximately 24,000 people in our region.

In addition, NIB financed R&D

efforts in the transportation

sector to develop of next-

generation vehicles.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  15 15 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | |

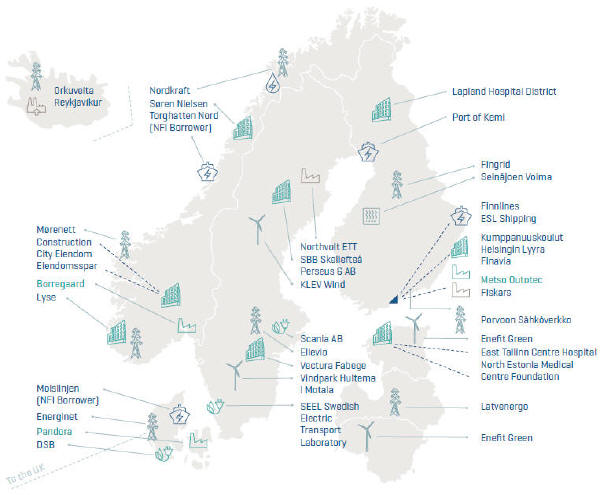

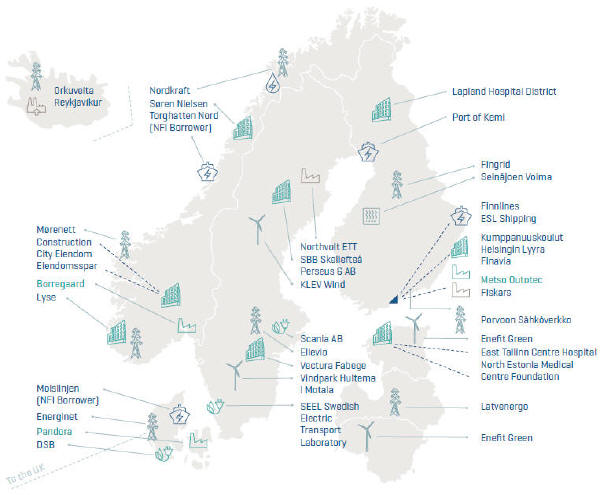

Projects contributing to the climate and energy transition

| | In 2022, our disbursed loans contributed to the energy sector in each of the member countries through new renewable energy capacities, upgrades and expansion of transmission and distribution networks that allow connecting more of green energy to the grid, increasing energy efficiency, and implementation of industry transformation measures. These projects are not only in line with the climate targets of our member countries and the Paris Agreement, but also help to increase energy independence of the Nordic-Baltic region. |

| |  | | Industry transformation Industry transformation (SLL1) Electric or hybrid inland transport solutions Electric or hybrid vessels or related port infrastructure Green buildings or energy saving measures Wind energy generation Hydro energy generation Geothermal energy generation District heating Energy networks Interconnector |

| | | | 1 Sustainability-linked loan |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  16 16 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  17 17 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  18 18 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

Advancing digital transformation journeys In 2022, NIB has signed and disbursed loans to a number of companies that are on their digital transformation journey transforming their own internal operations, and more importantly how they reach and communicate with their customers. The digitalisation theme spanned across the sectors. There have been elements of digitalisation financed in business expansion projects in manufacturing and in M&A projects where the company has acquired another smaller company with the necessary digital capabilities. Digitalisation has also been visible in the service sector, in healthcare, and in energy distribution, to mention a few. In addition to the actual digitalisation projects, in 2022, NIB also financed IT infrastructure projects in Denmark and Finland – roll out of fibre networks, which help the member countries to reach their digitalisation targets and support the digital agendas of the companies. We saw our clients increase their focus on digital agendas. | |  |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  19 19 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | |

| Sustainability-linked loans | | |

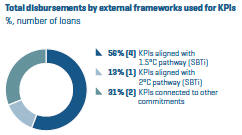

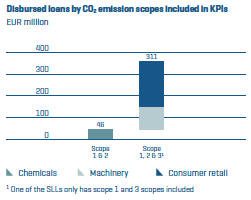

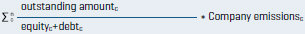

NIB offers sustainability-linked loans (SLLs) that incentivise its clients to reach ambitious and verifiable environmental and social sustainability goals. By meeting such goals, customers can enjoy better financing conditions. These goals may encompass climate and other impact categories. NIB’s SLL principles build upon the voluntary Sustainability-Linked Loans Principles of the Loan Market Association and the Sustainability-Linked Bond Principles of the International Capital Market Association. As an international financial institution, we also see as our role to promote the high-quality standards in this growing market. Value-chain emissions (scope 3) often represent the largest portion of companies’ carbon footprint. Therefore NIB actively promotes and requires its clients to include targets for scope 3 emissions, where relevant. NIB publishes consolidated information on its SLLs and underlying key features here.

| |

| |  |

| | | | |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  20 20 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

u Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

NIB has provided SLLs to companies in various sectors, associated with different sensitivities to climate transition risks, from food retailing to chemicals and power and heat. By selecting the key performance indicators and targets carefully, SLLs can be tailor-made to support the sustainability transition across many types of companies. SLLs help therefore not only our clients to move toward their sustainability targets, but also NIB to align its lending portfolio with the Paris Agreement in the long term. |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  21 21 |

| | |

|

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

u Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

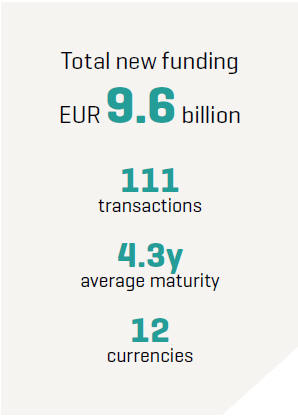

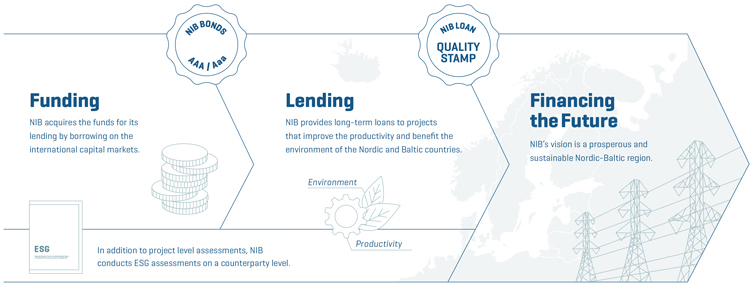

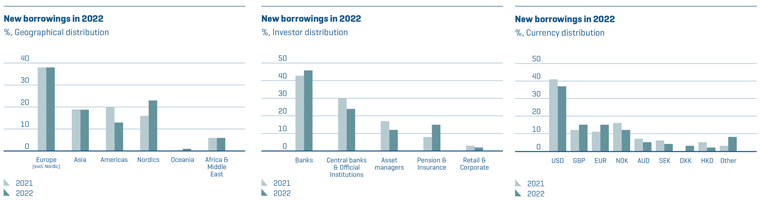

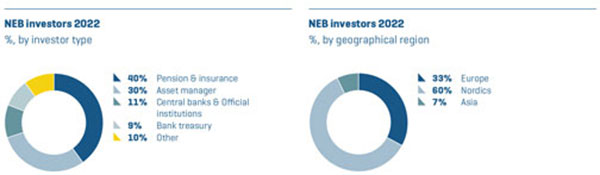

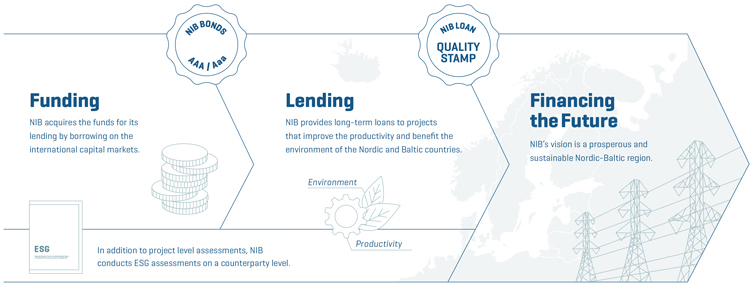

Funding in 2022

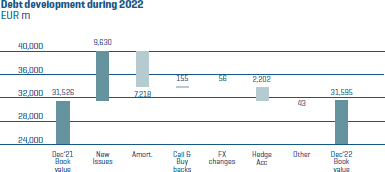

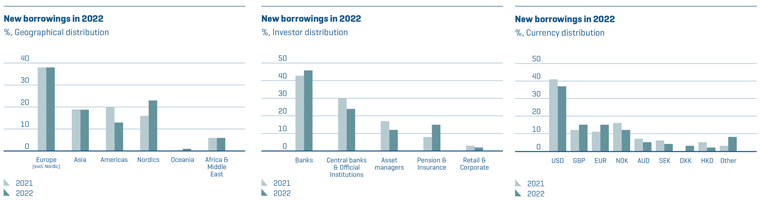

NIB acquires the funds for its lending by borrowing on the international capital markets. The Bank’s funding strategy consists of transactions in the public markets, including global benchmark issuance in USD, meeting investor preferences for tailored issuance in specific formats and currencies, and a strong presence in the sustainable bond market. NIB’s bonds enjoy the highest possible credit rating.

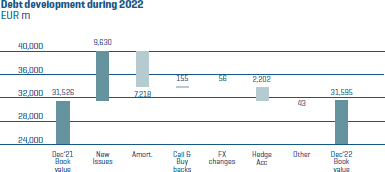

In 2022, NIB raised new funding with a nominal value of EUR 9.6 billion through 111 transactions. This is an increase compared to previous year (EUR 6.9 billion). The reason is mainly due to increased demand for NIB financing and higher collateral outflows.

NIB issued two global USD-denominated benchmark transactions with a three-year and five-year maturity of a total of USD 2.50 billion (EUR 2.4 billion). The Bank priced two GBP-denominated benchmark transactions with three-year and four-year maturity of a total of GBP 1.15 billion (EUR 1.4 billion). In addition to public market deals the Bank raised new funding in a record amount of private placements. At the end of 2022, the outstanding debt amounted to EUR 31.6 billion.

NIB’s total Environmental Bond issuance surpassed EUR 1 billion – a record-high amount over a course of one year since NIB started issuing environmental bonds in 2011. The

issuance consisted of a seven-year EUR 500 million bond, an inaugural eight-year DKK 2 billion bond, a five-year SEK 2 billion bond, and an increase of NOK 1 billion to a five-year bond. By the end of 2022, the Bank had issued a total of EUR 6.8 billion in NIB Environmental Bonds. More information on NIB’s Environmental Bonds can be found on pages 23-33.

Selected bond transactions in 2022

| | | | |

| Deal amount | |

| |

| USD 5y global benchmark | | | 1.25 billion | |

| |

| USD 3y global benchmark | | | 1.25 billion | |

| |

| GBP 3y benchmark | | | 800 million | |

| |

| EUR 7y environmental bond | | | 500 million | |

| |

| GBP 4y benchmark | | | 350 million | |

| |

| USD 4y FRN (tap) | | | 350 million | |

| |

| AUD 3y benchmark bond | | | 500 million | |

| |

| DKK 8y environmental bond | | | 2 billion | |

| |

| NOK 4y FRN (tap) | | | 2 billion | |

| |

| SEK 5y environmental bond | | | 2 billion | |

For a full list of funding transactions, please see our website.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  22 22 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

u Funding in 2022 |

| |

NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

NIB Response Bonds

In the spring of 2020, NIB issued two Response Bonds of EUR 1 billion and SEK 4 billion (EUR 1.37 billion1 in total), to finance projects that alleviate the socioeconomic impacts of the COVID-19 pandemic in NIB’s member countries.

These Bonds were globally among the first bond offerings dedicated to finance measures that mitigate the negative socioeconomic impacts of the pandemic. NIB devoted the

proceeds from the bonds to finance three response loans to Baltic states in 2020 and 2021.

The Baltic countries used the proceeds from the response loans in line with NIB’s Response Bond Framework. A bulk of the proceeds covered support measures for smaller companies in Latvia and Lithuania that struggled with disruptions in their operations. As pressures to healthcare systems rose significantly, Estonia and Lithuania used the response loans to finance temporary increases in service capacity and in procurement of personal protection and laboratory testing

equipment. While all Baltic countries introduced expansions in social security, only Estonia utilised funding from NIB in programmes aimed at preserving jobs and expansion of sickness allowances. Government-related entities, such as educational facilities and infrastructure service providers, received a total of EUR 165 million from governments of Estonia and Latvia. In terms of UN Sustainable Development Goals (SDGs), the Response Bonds contributed to SDG 1, SDG 3, SDG 8 and SDG 9.

Read more about the NIB response bonds on our website.

Companies and people affected by NIB response loans

| 1 | The total amount disbursed to the Baltic states was higher than the bond issuance. To match the impacts with the amount issued in response bonds, this report considers impacts from expenditures totalling EUR 1.37 billion. The remaining credit of EUR 380 million extended to the Baltic states mostly fulfil the eligibility criteria of the response bond framework as well. These loans were financed out of NIB’s general liquidity pool. |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  23 23 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  24 24 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | |

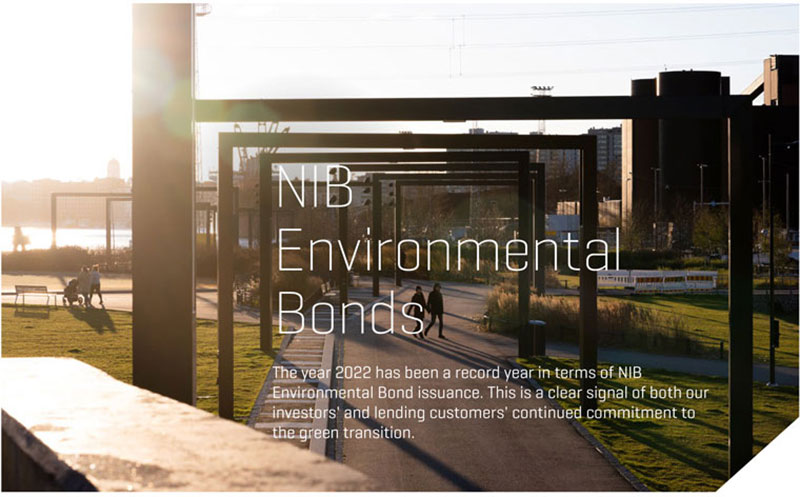

| | “In 2022, we issued a record high amount of environmental bonds showing our commitment to sustainable bond markets.” CFO, Kim Skov Jensen |

|

| | | | support and guidelines to the sustainable bond market. NIB has been committed to this work since its establishment in 2014 and a member of the Executive committee since. The sustainable bond market continuous to evolve. NIB aims to stay at the forefront and adapt to any changes and new requirements, whilst maintaining high integrity around sustainable objectives. One prominent initiative in the market has been the introduction of the EU taxonomy. NIB reports its estimated alignment with the taxonomy for its green fund pool, please see page 34. |

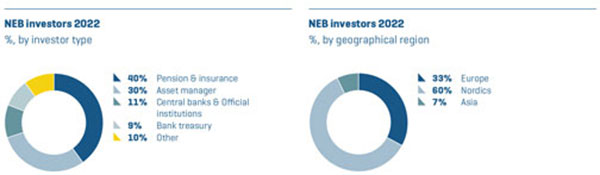

At the beginning of 2022, we set the ambitious target of issuing more than EUR 1 billion of environmental bonds. With the four environmental bonds issued, NIB did indeed surpass the EUR 1 billion mark during the year. This is the highest amount ever issued over the course of one year since the Bank started issuing environmental bonds in 2011. The environmental bonds issued in 2022 were denominated in four different currencies: EUR, DKK, NOK and SEK. The first environmental bond for the year, an eight-year DKK 2 billion bond was the Bank’s inaugural NIB Environmental Bond (NEB) denominated in Danish kroner. This transaction was followed by a seven-year EUR 500 million, a five-year SEK 2 billion and a five-year tap bond of NOK 1 billion. | | The EUR 500 million NEB was issued in early March. The bond had the highest subscription rates of any NEB issued. This shows the continued commitment of our green bond investors. Through the NEB issuance in 2022 the Bank drew the attention of new investors, which brings a desirable diversification. In total, NIB has now issued EUR 6.8 billion in environmental bonds under its NEB framework. This record year for NEB issuance was enabled by a robust pipeline of loans with high environmental impact. The urge for energy security and independence has pushed the green transition forward amongst the Bank’s lending clients. In June, NIB was re-elected to the Executive committee of the Principles. The Principles are a global initiative providing |

| |

| | Jens Hellerup Senior Director, Head of Funding & Investor Relations |

| | | | | | |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  25 25 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

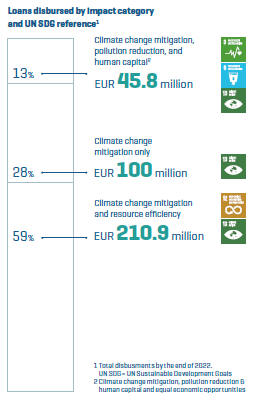

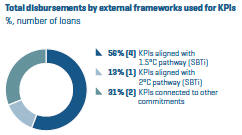

NIB Environmental Bond issuance in 2022

In 2022, NIB raised a total of EUR 1,048 million in Environmental bonds through four bonds. The issuance consisted of a seven-year EUR 500 million bond, an inaugural eight-year DKK 2 billion bond, a five-year SEK 2 billion bond and a five-year NOK 1 billion bond.

With the four environmental bonds issued, the Bank surpassed the EUR 1 billion mark of NEB issuance during the year. The bonds were sold to a wide-ranging investor base.

NEB issuance 2022

| | | | | | | | | | |

| | | | | | |

| Currency | | Amount in millions | | EUR million equivalent1 | | ISIN | | Value date | | Maturity date |

NOK | | 1,000 | | 97 | | XS2400452228 | | 4.11.2022 | | 20.10.2027 |

SEK | | 2,000 | | 182 | | XS2548946560 | | 24.10.2022 | | 24.10.2027 |

EUR | | 500 | | 500 | | XS2454249652 | | 9.3.2022 | | 9.3.2029 |

DKK | | 2,000 | | 269 | | XS2437424398 | | 28.1.2022 | | 28.1.2030 |

Total, EUR | | | | 1,048 | | | | | | |

1 Based on the trade date foreign exchange rate.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  26 26 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

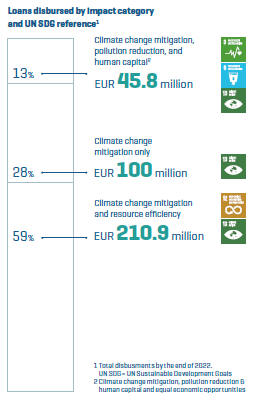

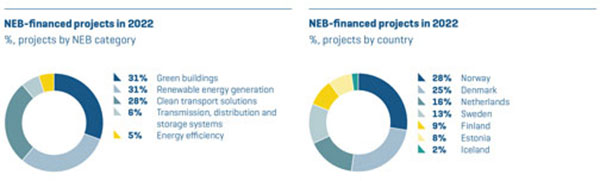

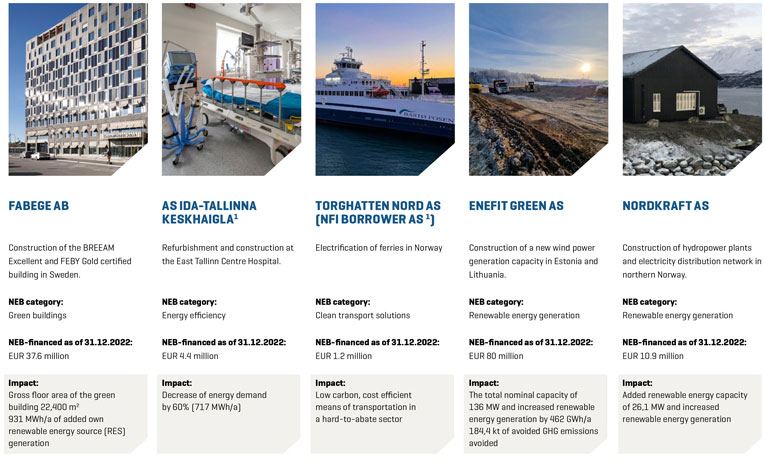

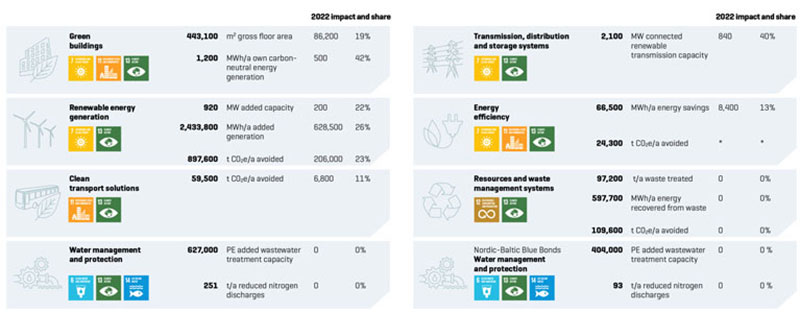

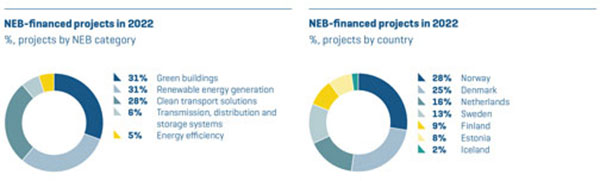

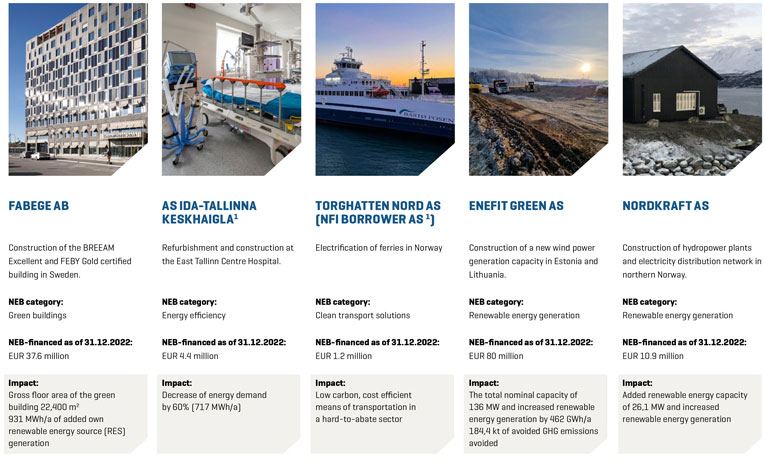

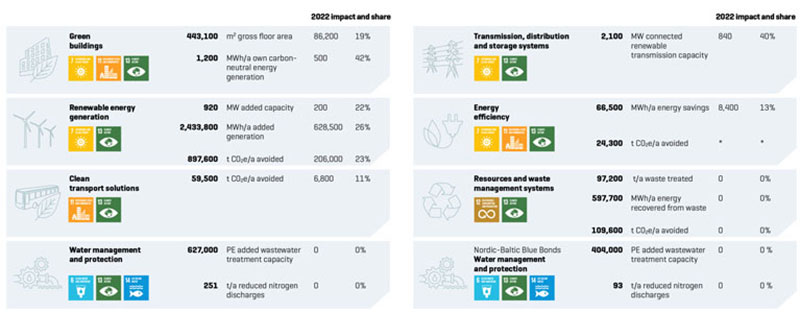

NEB-financed projects in 2022

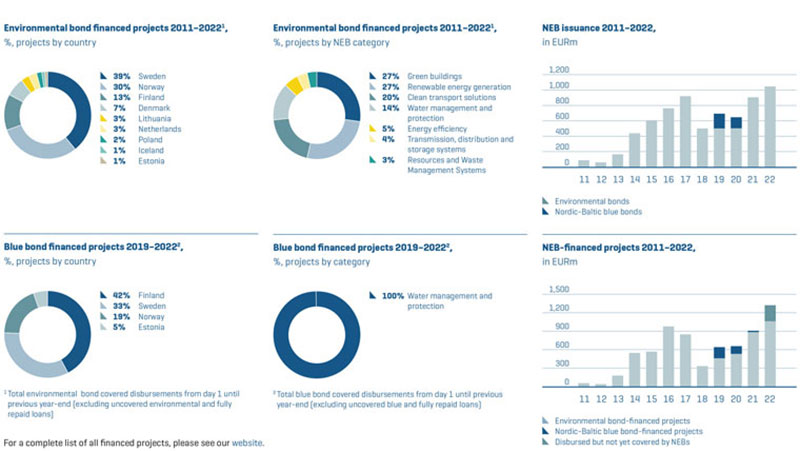

During the year, NIB financed projects with NEB proceeds over EUR 1 billion, consisting of 24 projects1. A list of all the NEB-financed projects is available on our website.

In 2022, 31% of the NEB disbursements were related to the renewable energy generation, mostly supporting the development of wind parks, but also that of geothermal and hydropower facilities. 31% of disbursements were related to development of new green buildings, and 28% for clean transport solutions, especially regarding the electrification of the sector. 6% of the total disbursements dealt with energy transmission and distribution infrastructure. 5% of the disbursements increased energy efficiency through

refurbishment of buildings and replacement of industrial equipment, resulting in energy savings of over 30%. To summarise, a substantial share of NEB-earmarked disbursements in 2022 were channelled towards green transition in the energy sector, allowing NIB to account for impacts of at least 200 MW of added renewable energy generation capacity, 86 200 square meters of certified green buildings, as well as reduction or avoidance of GHG emissions of 207 ktCO2e/a.

From a regional perspective, NIB’s disbursements for the projects in Denmark mainly concerned clean transport solutions (82%). Most of the disbursements for the Norwegian projects (87%) were related to investments in green buildings certified, or to be certified as LEED Platinum or BREEAM Excellent.

NEB-earmarked transactions for projects in Finland were predominantly connected with the development of energy transmission and distribution networks (55%), which are essential for the uptake of renewable energy and electrification processes. Disbursements for projects implemented in Sweden covered diverse needs in all the above-mentioned NEB categories dealing with energy and climate, while almost all financing for Icelandic and Estonian projects helped to increase renewable energy generation capacities (100% and 97% respectively).

1 The number includes fully or partly disbursed loans.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  27 27 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

1 Partially covered.

Image credits: respective clients.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  28 28 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

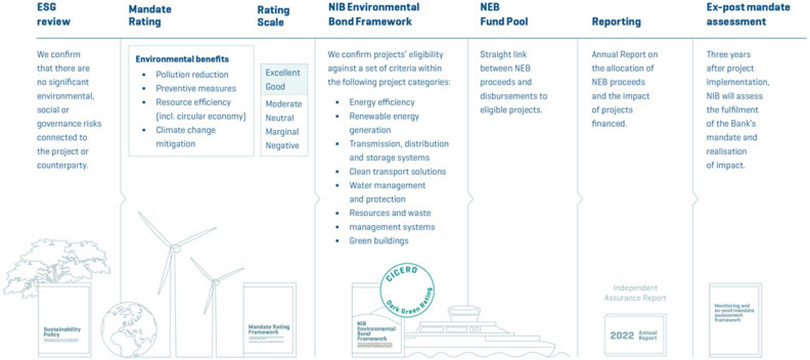

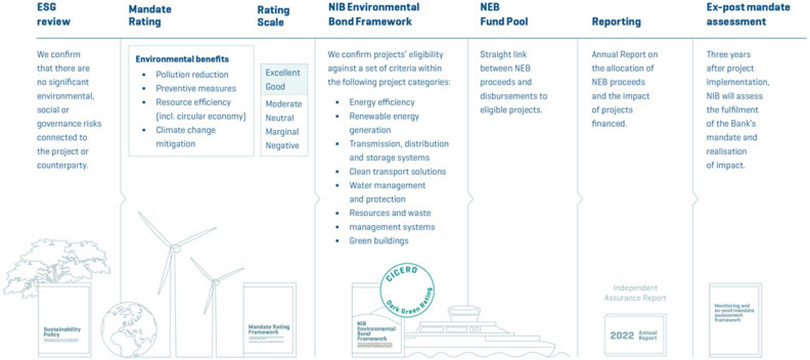

Overview of NIB Environmental Bonds

NIB has an explicit mandate to promote environmental projects. In response to investors’ willingness to support sustainable investments specifically, we introduced our NIB Environmental Bond Framework in 2011. Under the framework, NIB issues use of proceeds environmental bonds whose proceeds are used to finance projects that benefit the environment and support the transition to a low-carbon economy. NIB applies a portfolio approach with multiple NEBs financing a pool of projects. The proceeds from a NEB can be allocated to a specific category or to projects belonging to several categories. Proceeds from NEB issuance will only be allocated to new environmental projects,

i.e. projects that have not been completed more than a year prior to NIB’s project review. NIB often finances projects with long construction periods, meaning that even if disbursements are stretched over several years, the project may not yet be completed and is thus still considered a new project by NIB. NIB’s Nordic–Baltic Blue Bonds specifically focus on investments within water management and protection and are aimed at investors who are conscious of the challenges facing our region’s water resources, especially those affecting the Baltic Sea.

The NIB Environmental Bond Framework is aligned with the four core components of the Green Bond Principles (Use

of Proceeds, Process for Project Evaluation and Selection, Management of Proceeds, and Reporting). Further, NIB assesses the alignment of the projects in its NEB Fund Pool with the EU Taxonomy, read more here.

Read more about NIB’s overarching objectives, strategy, policy and processes relating to ESG and sustainability under Sustainability Management and see NIB’s Sustainability Policy and our Governance Statement.

| | | | |

| |

NIB Environmental Bond basic information | |  |

| | | |

Current framework | | NIB Environmental Bond Framework (last updated Oct 2019) |

Second opinion | | CICERO: Dark Green (Oct 2018) |

Types of bonds issued under framework | | Environmental Bonds, Nordic–Baltic Blue Bonds |

Reporting period | | Annual |

Reporting approach | | Portfolio approach with project-specific details provided |

Guidelines / alignment | | Green Bond Principles, EU Taxonomy estimated alignment assessment, UN Sustainable Development Goals |

Verification | | Limited Assurance by KPMG, see page 66-67 |

Impact reporting portals | | Nasdaq Sustainable Bond Network |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  29 29 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

NEB selection process

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  30 30 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

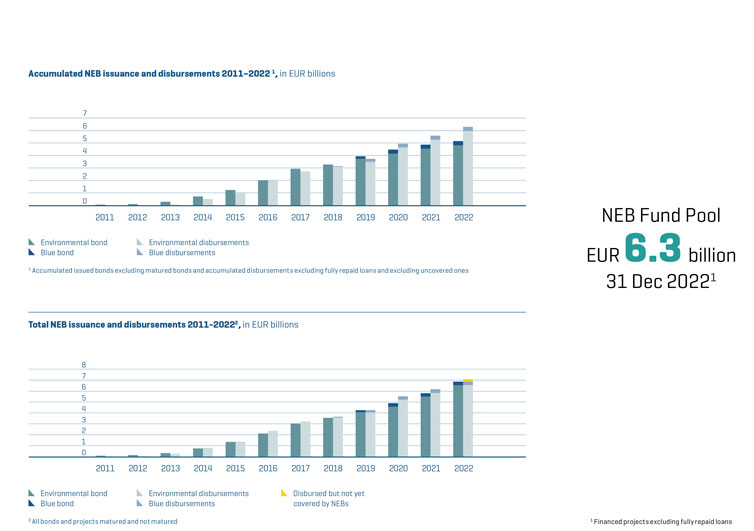

NIB Environmental Bond Pool

The proceeds of NIB Environmental Bonds are managed on an aggregate basis for multiple environmental bonds (portfolio approach).

| | | | | | | | | | | | | | | | | | | | | | | | |

| NIB Environmental Bonds (not matured) |

| | | | | | | | |

| ISIN code | | Curr | | Amount in

millions | | | EUR million

equivalent1 | | | Year | | | Value date | | | Maturity date | | | Taps |

Environmental bonds | | | | | | | | | | | | | | | | | | | |

XS2400452228 | | NOK | | | 1,000 | | | | 97 | | | | 2022 | | | | 4.11.2022 | | | | 20.10.2027 | | | tap |

XS2548946560 | | SEK | | | 2,000 | | | | 182 | | | | 2022 | | | | 24.10.2022 | | | | 24.10.2027 | | | |

XS2454249652 | | EUR | | | 500 | | | | 500 | | | | 2022 | | | | 9.3.2022 | | | | 9.3.2029 | | | |

XS2437424398 | | DKK | | | 2,000 | | | | 269 | | | | 2022 | | | | 28.1.2022 | | | | 28.1.2030 | | | |

XS2400452731 | | SEK | | | 3,000 | | | | 296 | | | | 2021 | | | | 20.10.2021 | | | | 20.10.2026 | | | |

XS2400452228 | | NOK | | | 1,000 | | | | 101 | | | | 2021 | | | | 20.10.2021 | | | | 20.10.2027 | | | |

XS2166209176 | | EUR | | | 500 | | | | 500 | | | | 2021 | | | | 1.4.2021 | | | | 30.4.2027 | | | tap |

XS2166209176 | | EUR | | | 500 | | | | 500 | | | | 2020 | | | | 30.4.2020 | | | | 30.4.2027 | | | |

XS2055786763 | | EUR | | | 500 | | | | 500 | | | | 2019 | | | | 25.9.2019 | | | | 25.9.2026 | | | |

XS1815070633 | | EUR | | | 500 | | | | 500 | | | | 2018 | | | | 3.5.2018 | | | | 3.11.2025 | | | |

XS1494406074 | | SEK | | | 1,000 | | | | 103 | | | | 2017 | | | | 25.10.2017 | | | | 22.9.2023 | | | tap |

XS1494406074 | | SEK | | | 500 | | | | 51 | | | | 2017 | | | | 16.10.2017 | | | | 22.9.2023 | | | tap |

XS1431730388 | | EUR | | | 500 | | | | 500 | | | | 2017 | | | | 18.5.2017 | | | | 10.6.2024 | | | tap |

XS1494406074 | | SEK | | | 1,500 | | | | 156 | | | | 2016 | | | | 22.9.2016 | | | | 22.9.2023 | | | |

XS1431730388 | | EUR | | | 500 | | | | 500 | | | | 2016 | | | | 10.6.2016 | | | | 10.6.2024 | | | |

XS0824127277 | | SEK | | | 500 | | | | 59 | | | | 2012 | | | | 7.9.2012 | | | | 7.9.2032 | | | |

| Total environmental bonds: | | | | 4,814 | | | | | | | | | | | | | | | |

Blue bonds | | | | | | | | | | | | | | | | | | | | | | | | |

XS2243312407 | | SEK | | | 1,500 | | | | 143 | | | | 2020 | | | | 13.10.2020 | | | | 13.10.2025 | | | |

XS1943607975 | | SEK | | | 2,000 | | | | 193 | | | | 2019 | | | | 1.2.2019 | | | | 1.2.2024 | | | |

| Total blue bonds: | | | | 336 | | | | | | | | | | | | | | | |

| Total NIB Environmental Bonds: | | | | 5,150 | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| NIB Environmental Bonds (matured) |

| | | | | | | | |

| ISIN code | | Curr | | Amount in

millions | | | EUR million

equivalent1 | | | Year | | | Value date | | | Maturity date | | | Taps |

NIB Environmental bonds (matured) | | | | | | | |

XS1673097637 | | SEK | | | 500 | | | | 51 | | | | 2017 | | | | 5.10.2017 | | | | 29.8.2022 | | | tap |

XS1673097637 | | SEK | | | 2,000 | | | | 211 | | | | 2017 | | | | 29.8.2017 | | | | 29.8.2022 | | | |

XS1602266923 | | INR | | | 170 | | | | 2 | | | | 2017 | | | | 30.5.2017 | | | | 29.5.2020 | | | |

XS1551670091 | | BRL | | | 5,5 | | | | 2 | | | | 2017 | | | | 23.2.2017 | | | | 24.2.2021 | | | |

XS1347786797 | | SEK | | | 1,000 | | | | 107 | | | | 2016 | | | | 20.1.2016 | | | | 20.1.2021 | | | |

XS1292474282 | | EUR | | | 500 | | | | 500 | | | | 2015 | | | | 17.9.2015 | | | | 19.9.2022 | | | |

XS1222727536 | | SEK | | | 1,000 | | | | 107 | | | | 2015 | | | | 23.4.2015 | | | | 23.4.2020 | | | |

US65562QAW50 | | USD | | | 500 | | | | 397 | | | | 2014 | | | | 30.9.2014 | | | | 30.9.2021 | | | |

XS1031495929 | | EUR | | | 40 | | | | 40 | | | | 2014 | | | | 11.2.2014 | | | | 11.2.2019 | | | |

XS0996470943 | | BRL | | | 343,5 | | | | 105 | | | | 2013 | | | | 6.12.2013 | | | | 6.2.2018 | | | |

XS0975173633 | | SEK | | | 500 | | | | 58 | | | | 2013 | | | | 27.9.2013 | | | | 27.9.2018 | | | |

XS0699238522 | | ZAR | | | 1,006,4 | | | | 92 | | | | 2011 | | | | 22.11.2011 | | | | 19.11.2015 | | | |

| Total matured NIB Environmental Bonds: | | | | 1,673 | | | | | | | | | | | | | | | |

Total issued NIB Environmental Bonds 2011-2022: | | | | 6,823 | | | | | | | | | | | | | | | |

1 Based on the trade date foreign exchange rate.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  31 31 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

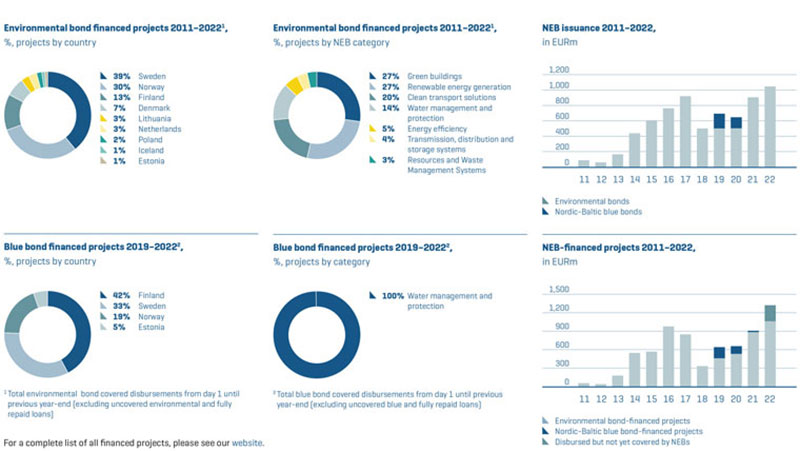

NIB Environmental Bond financed projects 2011-2022

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  32 32 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  33 33 |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Impact of NEB-financed projects 2011-2022

Pro-rated to NIB’s share of financing. The share of impact for each category arising from disbursements that were allocated to the NEB pool during 2022 is shown.

* Not disclosed

Project-specific impact data and NIB’s methodology for assessing impact is published on our website.

The impact numbers under 2022 can contain impacts from disbursements in 2021, that were disbursed but not allocated to NEB pool.

Starting from 2022, NEB impact data includes only the impact of not matured loans.

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  34 34 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

EU taxonomy alignment

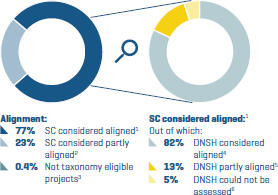

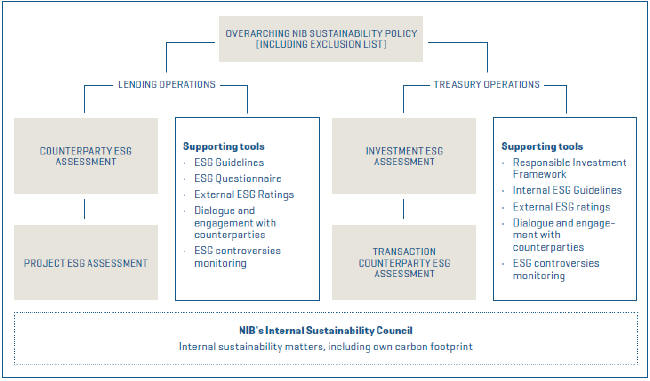

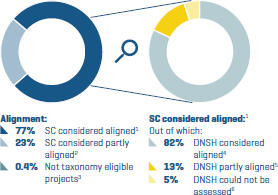

In 2022, we continued to analyse our NEB projects from the EU taxonomy perspective.

Following the adoption of the EU taxonomy for sustainable economic activities in 2020, NIB has now for the second time conducted a screening of the NEB project categories against the EU taxonomy’s Technical Screening Criteria (TSC) for sustainable activities for all six environmental objectives. The purpose of the exercise is to provide NIB’s investors with information on how well NEB-financed projects are deemed to be aligned with the taxonomy. As the screening is done on a project category level, the assessment is based on the estimated taxonomy alignment of the majority of projects within each category. The alignment assessment results are presented separately for Substantial Contribution (SC), as well as for the combination of SC and Do No Significant Harm (DNSH). As is illustrated in the table on page 36, the NEB categories are in general well-aligned to the substantial contribution criteria. DNSH alignment on a category level is more challenging to determine and here the assessment builds on whether relevant DNSH criteria are commonly covered by regular permit processes in combination with NIB’s project sustainability review.

In 2022, NIB started to perform an EU taxonomy alignment assessment for all new projects on a project level. In addition to the regular sustainability due diligence, further information has been requested in order to to assess if the SC and the DNSH criteria can be deemed to be fulfilled. As it was not feasible to

collect granular project data retroactively for already financed projects the project level assessment is currently not extended to previously financed projects. The assessment of the new projects in 2022 can however affect the overall alignment for a project category. The mapping is done on a best effort basis and the EU taxonomy is not yet adopted in its final form. Hence, the results should be seen as preliminary.

Out of the total disbursed NEB loan volume in 2022, 99.6% were considered taxonomy eligible and 0.4% were not. 77% of the disbursements were considered to fulfil the Substantial Contribution Criteria for the project’s relevant economic activity, while 23% of the disbursements were assessed to fulfil the Substantial Contribution criteria only partly. All projects which were deemed to be only partly aligned with the SC criteria were in the NEB category Green buildings, where NIB applies a certification level approach which is not directly comparable to the taxonomy criteria.

Out of the disbursements for which SC was considered to be aligned, 82% were deemed to fully fulfil the criteria for DNSH and 13% were deemed to be partly fulfil the DNSH criteria. For 5% of the disbursements there was not enough information to assess DNSH alignment. It should be noted that these percentage shares of disbursements are affected by a few large projects. Looking at the number of projects 50% of projects were considered to be fully aligned with DNSH criteria and 43% of the projects were considered partly aligned. Out of the disbursements for which SC was considered to be partly aligned,

Estimated alignment against technical screening criteria for SC and DNSH of NEB projects 2022, % of NEB issuances 2022

| | 1 | SC considered aligned: the project could demonstrate evidence that TSC for SC are fulfilled |

| | 2 | SC considered partly aligned: the project could demonstrate evidence that the TSC for SC were to a large extent fulfilled |

| | 3 | Project not taxonomy eligible: the economic activity is not covered by the EU taxonomy |

| | 4 | DNSH considered aligned: the project could demonstrate evidence that all TSC for DNSH criteria were fulfilled |

| | 5 | DNSH partly aligned: the project could present partial evidence of TSC for all or certain DNSH criteria fulfilment and/or the DNSH criteria includes what normally would be covered by typical permitting process |

| | 6 | DNSH Could not be assessed: the project was not able to present evidence of any DNSH criteria fulfilment and the DNSH criteria are not covered by the typical permit processes. |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  35 35 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

all were deemed to also just partly fulfil the DNSH criteria. As noted by many actors, such as UNEP-FI, assessing alignment with the DNSH TSC can be challenging. The main reasons are data unavailability, insufficient data quality as well as a lack of evidence related to the DNSH TSC. We see, however, that the access to information has been improving, likely driven by both more stringent regulatory requirements, but also by the general increased awareness of sustainability matters. Typically, NIB’s assessment is that for projects that have successfully undergone a full Environmental Impact Assessment in an EU member state, relevant DNSH criteria can be judged to be fulfilled if the applicable EU directives have been implemented into national legislation. The compliance with Minimum Social Safeguards (MSS) is considered to be to a large extent ensured by NIB’s policies and processes to identify, manage, and mitigate potential negative environmental and social impacts. NIB is currently assessing the need to implement further processes to ensure MSS fulfilment, also in relation to the first draft report on minimum safeguards published in July 2022 by the EU Platform on Sustainable Finance. For a full description of the assessment and assumptions used, please see NIB’s website. During 2022, NIB co-financed the construction of four small-scale (less than 10 MW) run-of-the river hydropower plants. All four plants fulfil the SC criteria for hydropower in the EU taxonomy: two plants are run-of-river plants with no artificial reservoir. The other two have small reservoirs but have a power density exceeding 5 watt/m2. Based on information from Environmental Impact Assessments and dialogue with the client, also the DNSH criteria are deemed to be fulfilled. | |  |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  36 36 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

u NIB Environmental Bonds |

| |

NIB and climate change |

| |

Internal Impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Overview of NEB categories, the primary environmental objective in the EU taxonomy and estimated alignment against technical screening criteria for SC and DNSH

| | | | | | | | | | | | | | |

NEB Framework Project category1 | | | | Taxonomy environmental

objective2 | | Eligibility | | Substantial Contribution (SC) | | SC + Do No Significant Harm (DNSH) | |

| % of NEB

portfolio3 |

|

| | | | | | |

| Energy efficiency | | | | | | | | | | | | | | |

a. Energy efficiency projects in industry | | | | - | | Not eligible | | - | | - | | | 0.4% | |

b. Energy efficiency in existing buildings | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 5% | |

| | | | | | |

| Renewable energy | | | | | | | | | | | | | | |

a. Electricity from wind turbines, solar, tidal, wave and hydropower | | Wind | | Climate change mitigation | | Eligible | | ● | | ● | | | 8% | |

| | | Solar4 | | Climate change mitigation | | Eligible | | ● | | ● | | | 0% | |

| | | Tidal and wave4 | | Climate change mitigation | | Eligible | | ● | | ● | | | 0% | |

| | | Hydro | | Climate change mitigation | | Eligible | | ● | | ● | | | 11% | |

b. Electricity or heat generation from geothermal installations and from biomass | | Geothermal | | Climate change mitigation | | Eligible | | ● | | ● | | | 1% | |

| | | Biomass | | Climate change mitigation | | Eligible | | ● | | ● | | | 6% | |

c. Infrastructure for the production or processing of liquid biofuels4 | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 0% | |

d. Investments in the development, design and manufacturing of renewable energy technologies.4 | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 0% | |

| | | | | | |

| Transmission, distribution and storage systems | | | | | | | | | | | | | | |

| a. Transmission and distribution system (electricity) | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 4% | |

b. District heating and cooling | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 0.01% | |

| | | | | | |

| Clean transport solutions | | | | | | | | | | | | | | |

a. Transport infrastructure | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 4% | |

b. Vehicles and vessels | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 15% | |

| | | | | | |

| Water management and protection | | | | | | | | | | | | | | |

a. Wastewater treatment and water pollution prevention | | | | Sustainable use and protection of water and marine resources | | Eligible | | ● | | ● | | | 18% | |

b. Stormwater systems and flood protection | | | | Climate change adaptation | | Eligible | | ● | | ● | | | 1% | |

c. Protection of water resources4 | | | | Circular economy | | Eligible | | ● | | ● | | | 0% | |

d. Protection and restoration of water and marine ecosystems4 | | | | Substantial contribution to protection and restoration of biodiversity and ecosystems | | Eligible | | ● | | ● | | | 0% | |

| | | | | | |

| Resources and waste management systems | | | | | | | | | | | | | | |

a. Resource efficiency | | Material recovery | | Circular economy | | Eligible | | ● | | ● | | | 1% | |

| | | Pollution prevention4 | | - | | Not eligible | | ● | | ● | | | 0% | |

b. Infrastructure for better waste management | | | | Circular economy | | Eligible | | ● | | ● | | | 0.2% | |

c. Energy recovery from waste | | Biogas | | Climate change mitigation | | Eligible | | ● | | ● | | | 0.01% | |

| | | Waste-to-Energy | | - | | Not eligible | | - | | - | | | 2% | |

| | | | | | |

| Green buildings | | | | | | | | | | | | | | |

| New buildings certified according to LEED Platinum or BREEAM Excellent/Outstanding | | | | Climate change mitigation | | Eligible | | ● | | ● | | | 26% | |

● Estimated aligned ● Partly aligned ● Not aligned ● Could not be assessed

| 1 | Minimum social safeguards: NIB has policies, standards and procedures in place for safeguarding the environmental and social sustainability of NEB projects. |

| 2 | Including enabling activities |

| 3 | The share of NEB funds allocated to each category 2011-2022. |

| 4 | Project categories in which NIB has not yet had any NEB projects are labelled as “Could not be assessed” |

| | |

| | |

| | |

ANNUAL REPORT 2022 | |  37 37 |

| | |

|

| |

| INTRODUCTION |

| |

| IMPACT |

| |

Lending impact |

| |

Funding in 2022 |

| |

NIB Environmental Bonds |

| |

u NIB and climate change |

| |

Internal impact |

| |

Impactful workplace |

| |

Sustainability management |

| |

About this report |

| |

Independent Assurance Report |

| |

| GOVERNANCE |

| |

| BOD REPORT |

| |

| FINANCIALS |

| |

| SUSTAINABILITY INDICES |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | |

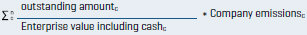

NIB and climate change | |

|