Year 2023 started with the expectations of central banks raising interest rates due to stubbornly high inflation. In March, the collapse of regional banks in the US sparked concerns about the stability of the banking system. This caused volatility in the financial markets. However, the determined actions by the public authorities on both sides of the Atlantic seem to have calmed the situation, at least temporarily.

The demand for NIB’s long-term lending increased significantly in 2022, driven by a lower supply of long-term credit in the commercial bank and bond markets, the accelerated green transition and NIB’s wider sustainable finance offering. In the current circumstances, we continue to see this strong demand in 2023 and our disbursements are in line with our plans.

On 31 March, the annual meeting of the Board of Governors of NIB approved the Bank’s audited financial statements for 2022 and a dividend payment of EUR 25 million to the Nordic and Baltic member countries. Annika Saarikko, Finland’s Minister of Finance and Chair of the Bank’s Board of Governors, gave guidance to NIB: “NIB should continue focusing on the green transition and energy independence in the region. NIB should also strengthen its additionality, further engage with market segments where the biggest financing needs exist.” We at the Bank will endeavour to ensure this guidance is fulfilled through the implementation of our strategy in accordance with our mandate.

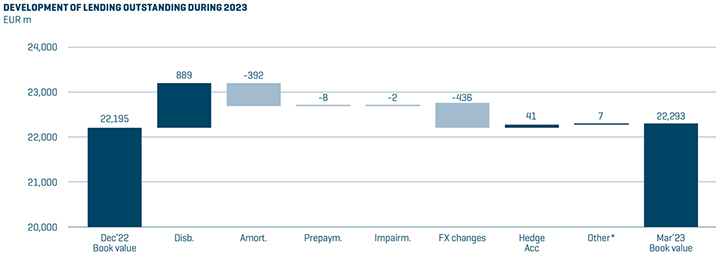

In the first quarter, a total of EUR 432 million in new lending was signed and EUR 889 million were disbursed. The lending signed was distributed across various sectors and countries, more details of which can be found here. Total assets at the quarter end amounted to EUR 42 billion compared to EUR 40 billion at 31 March 2022. The total lending outstanding amounted to EUR 22.3 billion at 31 March 2023 compared to EUR 22.9 billion at 31 March 2022. The decrease was mainly attributable to significant foreign exchange and hedge accounting impacts.

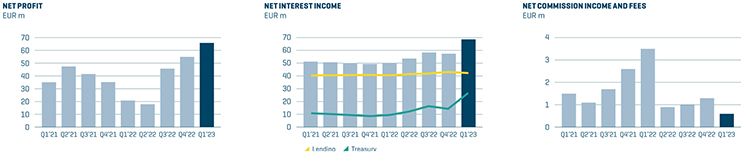

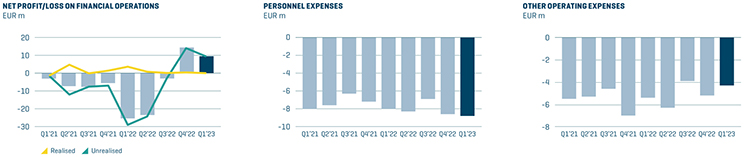

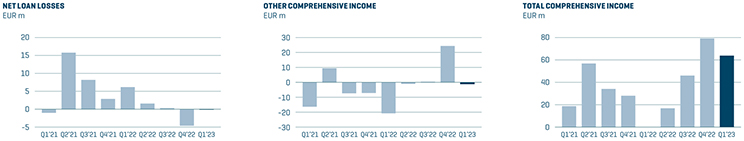

The net profit for the period January to March amounted to EUR 65 million compared to EUR 21 million in 2021. The increase in net profit is mainly due to higher net interest income and an unrealised profit on financial operations. The underlying trend in core earnings is improving and dominates the volatile result on financial operations from the increased uncertainty in the financial markets.

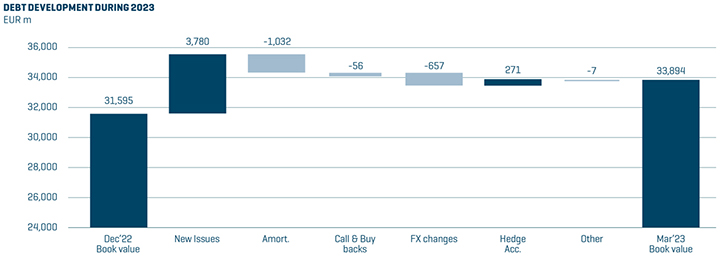

To meet the demand for our financing, the Bank has raised EUR 3.8 billion in new funding so far in 2023. On 7 March, NIB priced a five-year USD 1.5 billion global benchmark bond, its first USD benchmark of the year. The issue had a final orderbook of more than USD 4 billion, the largest ever for NIB.

The Bank is in a strong financial position as confirmed by our triple-A rating which was reaffirmed by Standard & Poor’s in April. NIB’s credit rating reflects its high asset quality, solid liquidity and capital adequacy, strong balance sheet and ownership.

Finally, I would like to welcome our new Head of Lending, Jeanette Vitasp to NIB. She brings a wealth of experience from a longstanding career in corporate banking, treasury and capital markets. I would also like to thank Søren Kjær Mortensen, who is retiring from the Bank in 2023 for his successful leadership of the Lending department and years of dedicated service.

André Küüsvek, President & CEO