Highlights

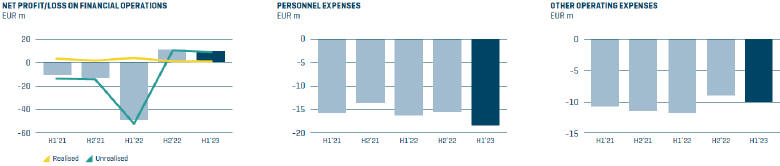

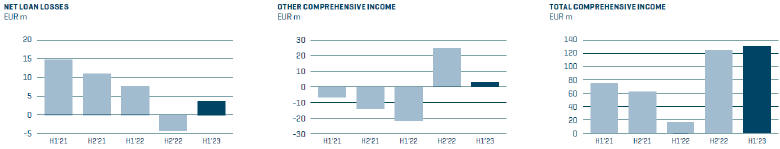

The net profit for the period January to June 2023 of EUR 127 million is significantly higher than the EUR 39 million recorded in 2022. The net interest income, the Bank’s core earnings, for the first six months increased from EUR 104 million in 2022 to EUR 139 million in 2023. The outlook for the second half of the year is for this trend to continue. During the first quarter, the Bank experienced some volatility in gains and losses related to its financial operations due to the increased uncertainty in the financial markets. However, the markets stabilised in the second quarter which resulted in a better net profit on financial operations. As expenses were kept under control, the cost/income ratio fell below 20% to 18.5%.

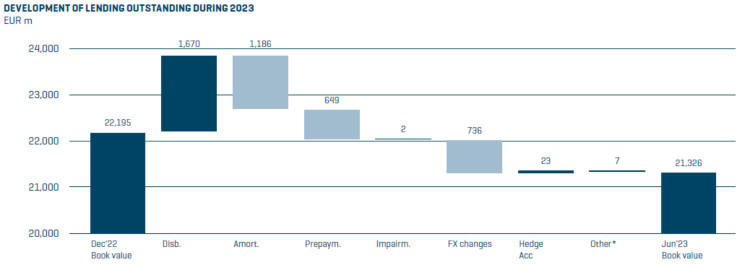

During the first half of 2023, lending disbursements amounted to EUR 1,670 million and lending signed was EUR 1,242 million, compared to EUR 2,142 million and EUR 2,203 million respectively, in the same period in 2022. The focus on the green transition is evident in the environmental mandate result, which is at historical highs for NIB. The productivity mandate also remains above target.

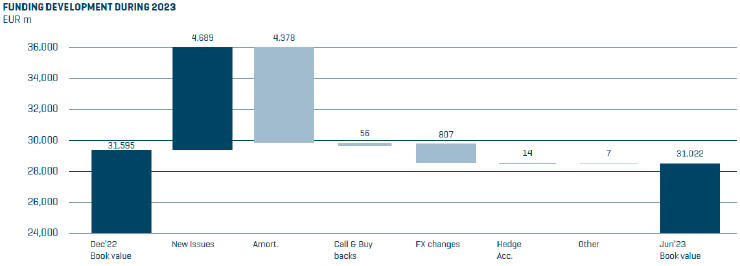

The Bank has raised EUR 4.7 billion in new funding so far in 2023. In March, NIB priced a five-year USD 1.5 billion global benchmark bond, which attracted high quality demand and had one hundred participating accounts, resulting in a final orderbook of more than USD 4 billion, the largest ever for NIB.

The Bank is in a strong financial position with solid capital and liquidity ratios as evidenced by the Bank’s triple-A rating, reaffirmed by Standard and Poor’s and Moody’s during the second quarter. The credit quality remains strong and net loan losses was a positive amount due to decreasing impairment provisions.

On 31 March, the annual meeting of the Board of Governors of NIB approved the Bank’s audited financial statements for 2022 and a dividend payment of EUR 25 million to the Nordic and Baltic member countries.

During the first half of 2023, the InvestEU Investment Committee approved a framework agreement in the area of clean energy transition. The guarantee provided under the agreement will enable NIB to increase its risk-bearing capacity, enabling it to provide financing up to an amount of EUR 300 million to projects promoting a more sustainable energy system in the Nordic and Baltic region.