Exhibit IV 2023 Annual Report

2 ANNUAL REPORT 2023 Contents We finance projects that accelerate the climate and energy transition in the Nordic-Baltic region. Read more on p. 17 16 51 Introduction 3Governance 68 This is NIB 4 Governance Statement 69 Our year 5 Members of the governing bodies and management 73 Message from the President and CEO 7 Strategy 9 Report of the Board of Directors 78 Value creation 12 Financial Reporting 93 Impact and sustainability 13 Financial statements and notes 95 Lending impact 14 Proposal by the Board of Directors 162 Funding in 2023 23 Auditor’s report 163 NIB Environmental Bonds 24 Report of the Control Committee Chairmanship 169 Action for climate 37 Report of the Control Committee 172 Impact from our internal operations 47 Ratio definitions 173 Impactful workplace 51 Sustainability management 55 Sustainability indices 174 About this report: NIB is publishing Our commitments and partnerships 58 GRI content index 175 one combined report covering our Stakeholder engagement 60 PRB content index 181 activities, impact, sustainability, and Defining what matters 63 TCFD disclosure index 191 financial reporting. About this report 65 Independent Assurance Report 66 Glossary is available here NIB’s Integrity Report 2023 Cover images: Scania, Andris Barbans, and Teemu Kuusimurto. is available here. Photo on the right: Ignitis Group.

ANNUAL REPORT 2023 INTRODUCTION INTRODUCTION This is NIB Our year CEO message We provide Strategy Value creation long-term IMPACT & SUSTAINABILITY GOVERNANCE financing BOD REPORT FINANCIALS SUSTAINABILITY INDICES I applied for the Country Lead position in search of new challenges and a more international environment. The position offers me the opportunity to bring NIB closer to new clients in Latvia. When I applied, I already knew NIB was involved in financing green transition projects. By taking the role, I’m helping to find green financing opportunities and supporting Latvia become even more sustainable in the future. Kaspars Piladzis, Senior Banker, Country Lead Latvia

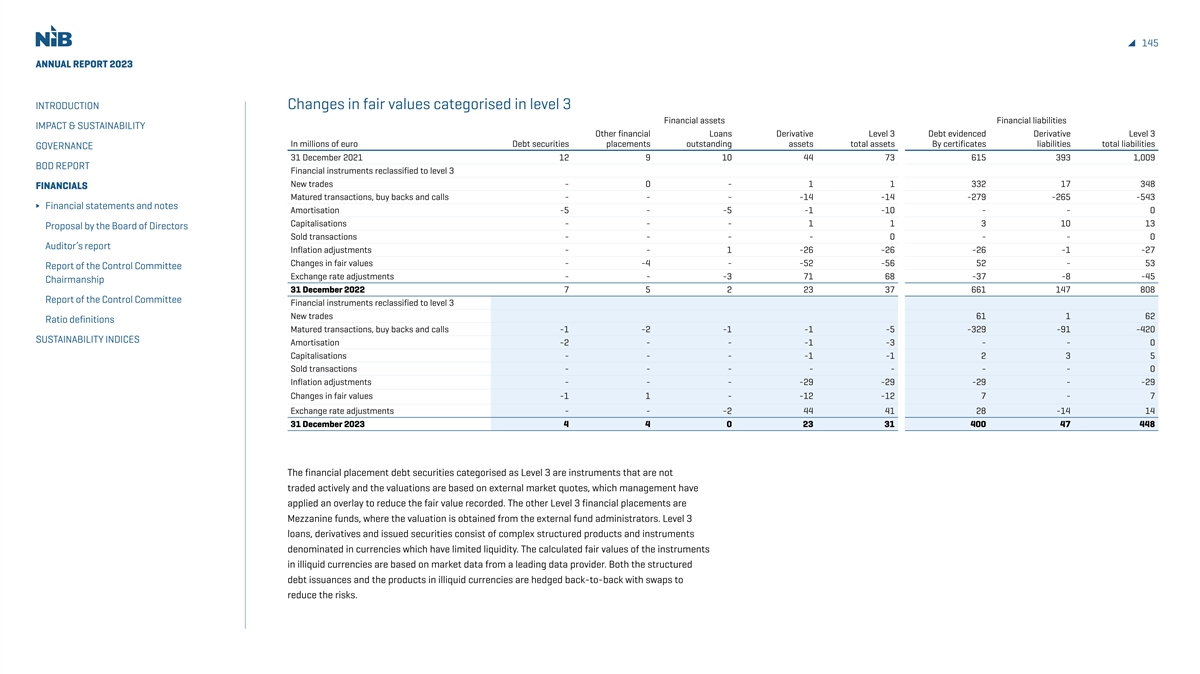

4 ANNUAL REPORT 2023 INTRODUCTION This is NIB This is NIB Our year CEO message Strategy Value creation NIB is an international financial The Bank finances private IMPACT & SUSTAINABILITY institution owned by eight and public projects inside member countries: Denmark, and outside the member GOVERNANCE Estonia, Finland, Iceland, Latvia, countries. BOD REPORT Lithuania, Norway and Sweden. FINANCIALS SUSTAINABILITY INDICES Our vision Our mission AAA/Aaa Our values 244 A prosperous Our mission is to finance NIB acquires funds employees at ∆ Competence and sustainable projects that improve on the international the end of 2023 ∆ Commitment Nordic-Baltic the productivity and capital markets ∆ Cooperation region. benefit the environment and has the highest of the Nordic and AAA/Aaa credit rating. Baltic countries.

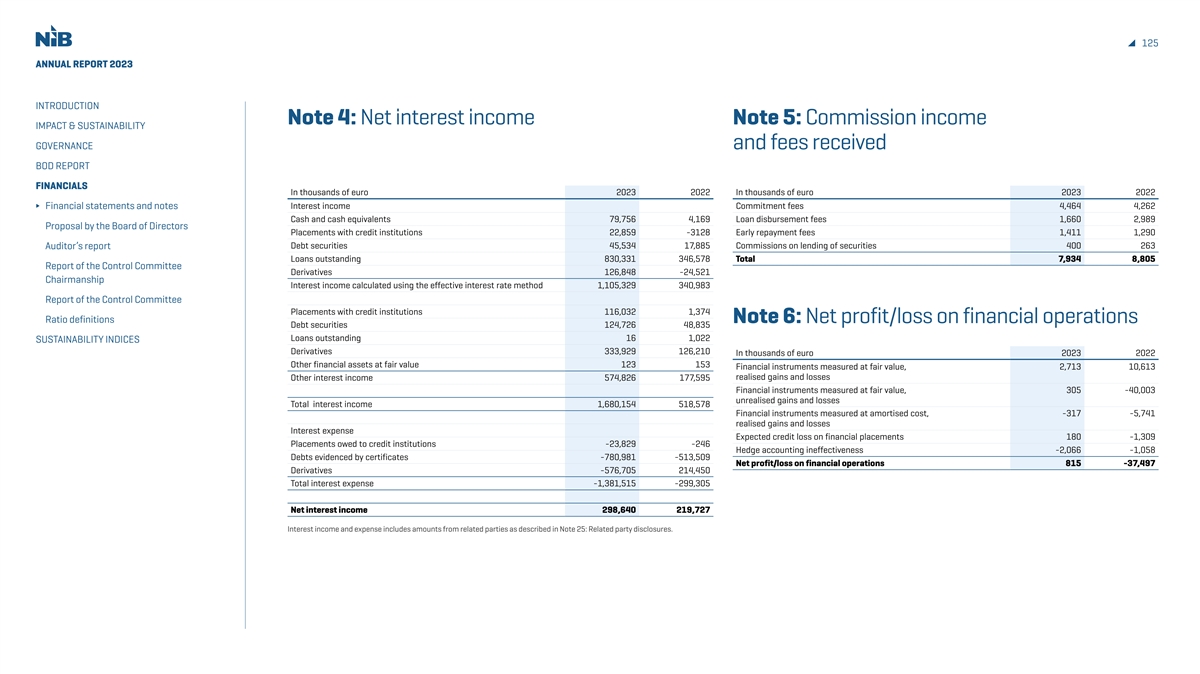

5 ANNUAL REPORT 2023 INTRODUCTION Year in brief This is NIB Our year CEO message Strategy Value creation IMPACT & SUSTAINABILITY GOVERNANCE BOD REPORT FINANCIALS Closer to member countries Net zero by 2050 Skills for the future SUSTAINABILITY INDICES In 2023, we strengthened NIB published a new We strengthened the Bank’s our presence in the Baltics. climate strategy and targets. competence with new talent. Read more Read more Read more Focus on green transition P Prot rotecting biodiv ecting biodiver ersity sity Stak Stakeholder dialogue eholder dialogue During the year, we During the year, we held 152,500 started to assess the and participated in several tonnes of net CO e emissions nature-related impacts 2 stakeholder events. reduced or avoided in 2023. of our lending portfolio. Read more Read more Read more

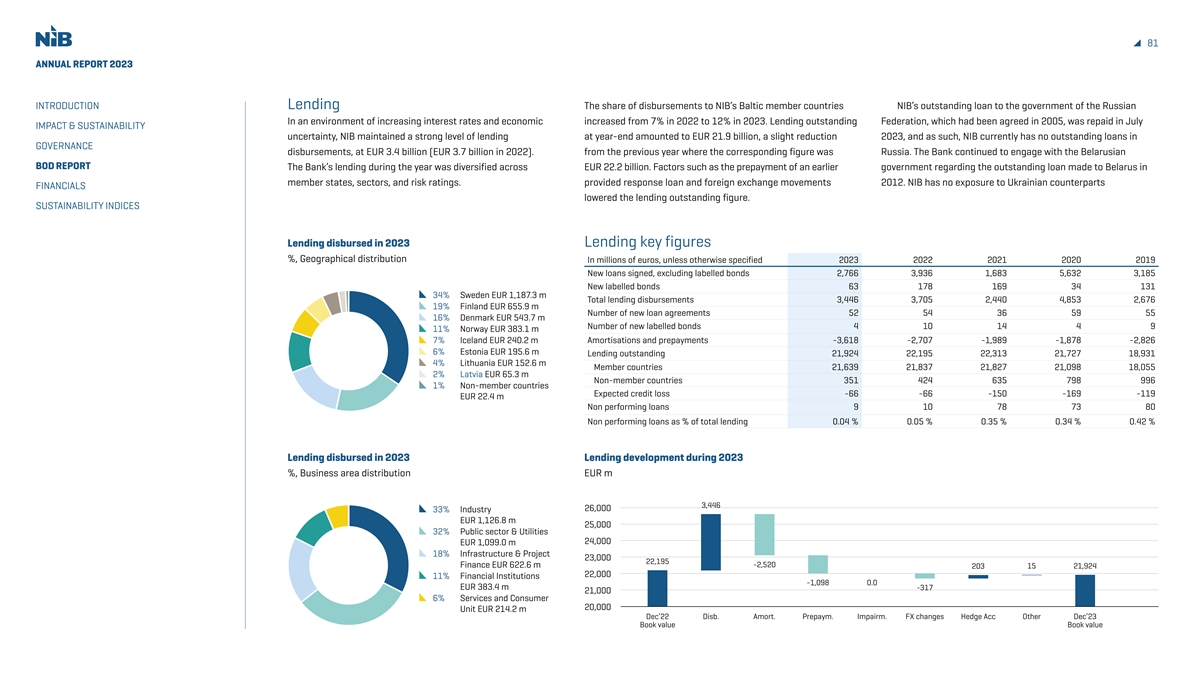

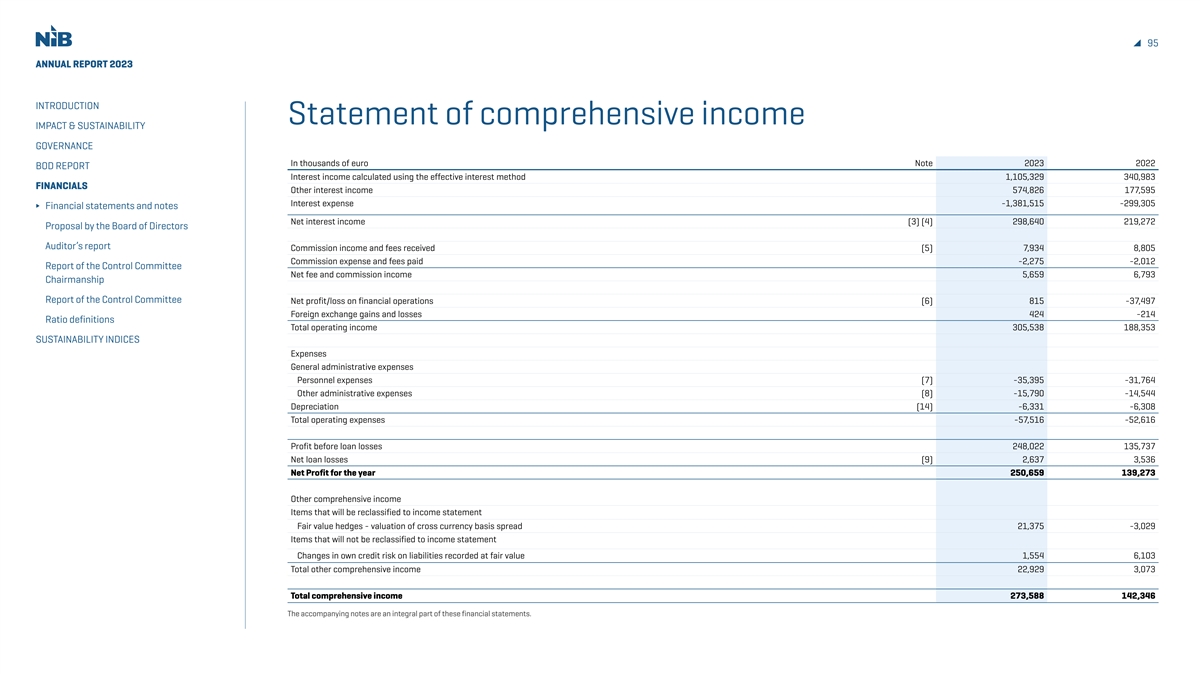

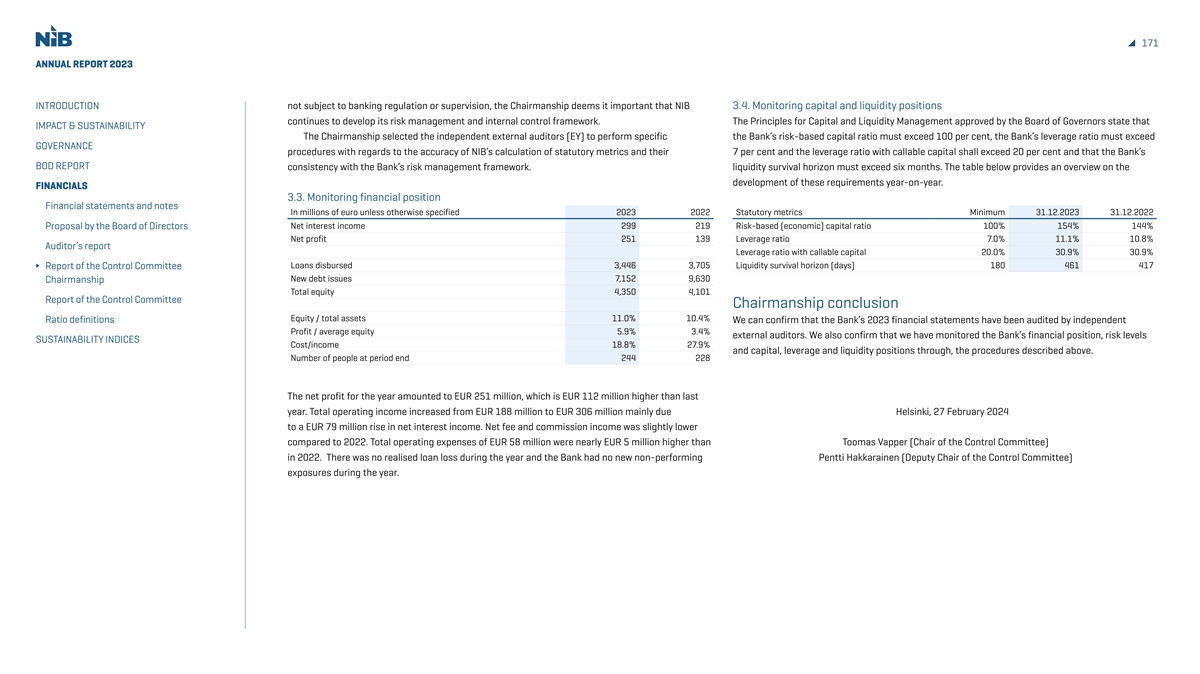

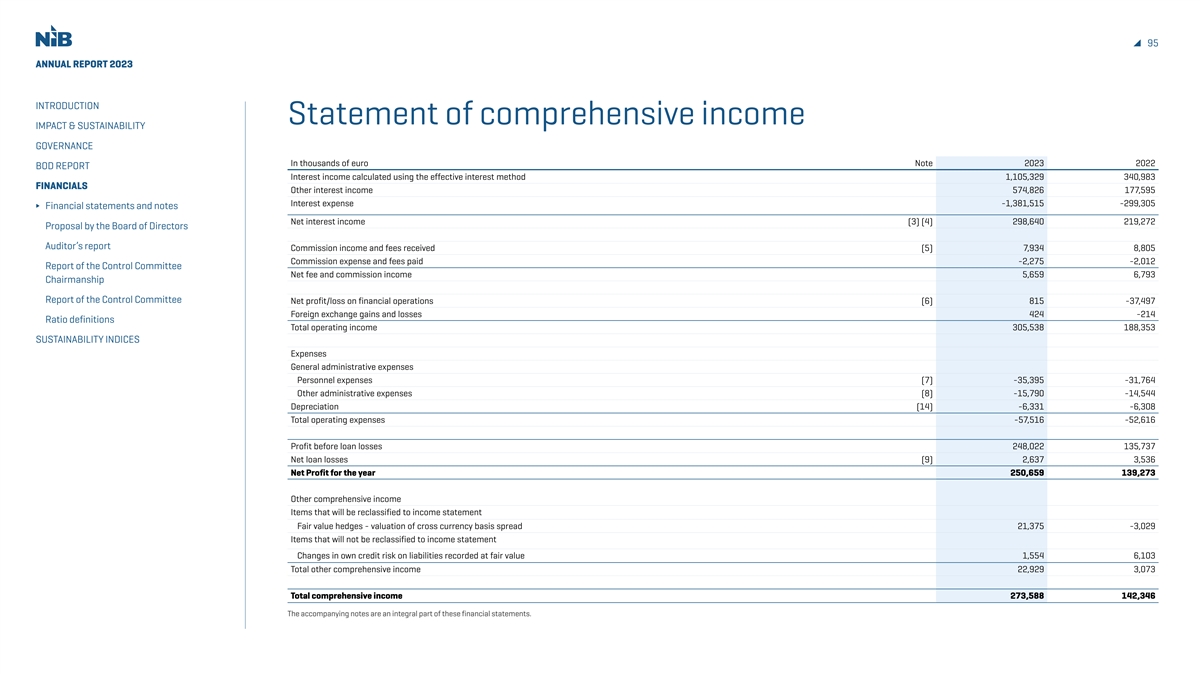

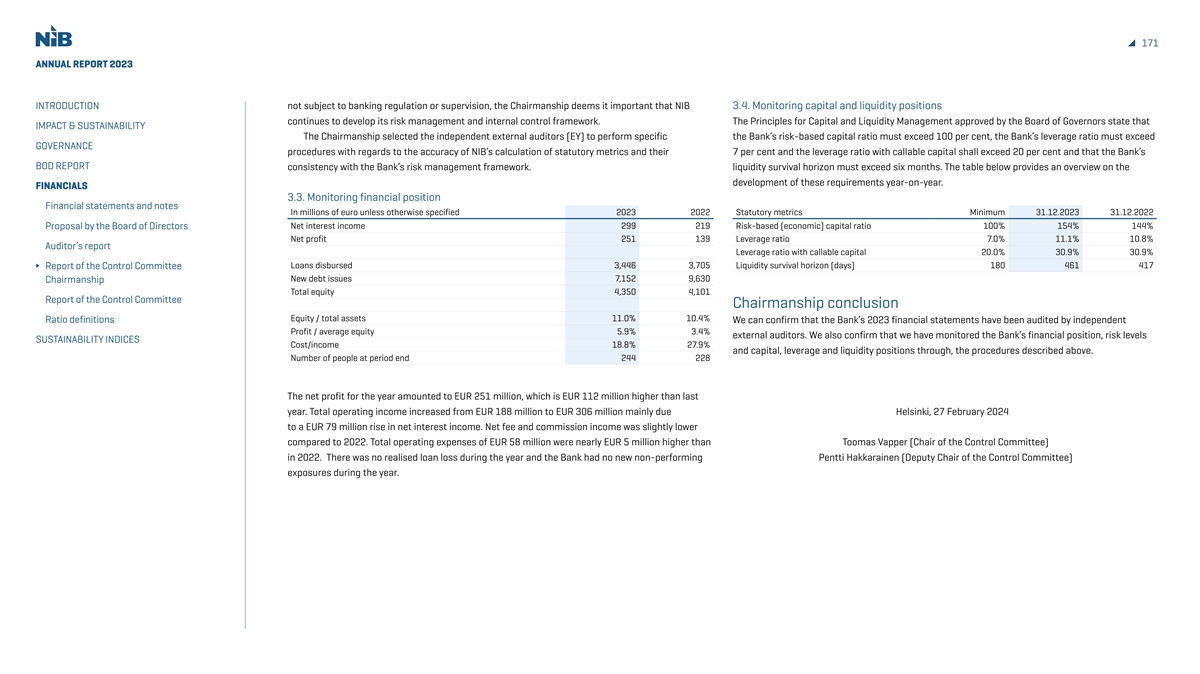

6 ANNUAL REPORT 2023 INTRODUCTION Our year in numbers This is NIB Our year CEO message Strategy Value creation IMPACT & SUSTAINABILITY GOVERNANCE BOD REPORT FINANCIALS SUSTAINABILITY INDICES EUR 7.2 billion EUR 3.4 billion raised in funding lending disbursed Key figures and ratios In millions of euro, unless otherwise stated 2023 2022 YoY change % Net interest income 299 219 36% Profit before net loan losses 248 136 83% Net Profit 251 139 80% Lending disbursed 3,446 3,705 -7% Lending signed 2,829 4,114 -31% Mandate fulfilment 99.8% 99.2% 0.6% Lending outstanding 21,924 22,195 -1% Total assets 39,593 39,280 1% New debt issues 7,152 9,630 -26% Image: Enefit Green Purtse hybrid park Debts evidenced by certificates 32,190 31,595 2% Total equity 4,350 4,101 6% Equity/total assets (%) 11.0% 10.4% 5% 99.8% Net profit increased to Net profit/average equity (%) 5.9% 3.4% 75% disbursed loans Cost/income (%) 18.8% 27.9% -33% Number of employees at year end 244 228 7% fulfil our mandate EUR 251 million Lending disbursed includes loans, labelled bonds and MREL investments.

7 ANNUAL REPORT 2023 INTRODUCTION Message from the President and CEO This is NIB Our year Strengthening our ties CEO message Strategy We opened our Value creation Riga office IMPACT & SUSTAINABILITY The Nordic-Baltic countries entered 2023 While the Bank has recently been helping to enhance our dealing with the consequences of recent our member countries tackle the short-term GOVERNANCE disruptions. Against the backdrop of new shocks, the long-term challenges we face as Baltic presence. BOD REPORT geopolitical realities and past interest rate a region have not disappeared. As the climate FINANCIALS increases, uncertainty remained around and nature crisis is worsening, we must address the future economic development as the both mitigation and adaptation strategies to SUSTAINABILITY INDICES year went on. build resilience. As our societies are ageing, For the Nordic Investment Bank (NIB), we must rejuvenate our economies by investing it was a reminder that international financial in innovation, digitalisation and human capital. institutions like ours play a key role in ensuring Despite this, I remain optimistic. During the stability. Building on NIB’s triple-A credit year, we saw our owners, customers and ratings, we can mobilise private capital investors concentrating even more efforts on and leverage public investments. With NIB’s a green and just transition. Working with you— long-term lending, we can scale up financing our stakeholders—allowed NIB to sharpen the in spite of turbulence. tools that will speed up our journey towards a sustainable future. Closer to our stakeholders As a new addition to this toolbox, we opened an office in Riga to enhance our Baltic presence. Setting up a regional hub is in line with NIB’s strategy of increasing investment in underserved market segments, such as expanding our lending to private sector NIB can mobilise private companies in the Baltics. capital and leverage At the same time, we continued to public investments. build on our partnerships through various

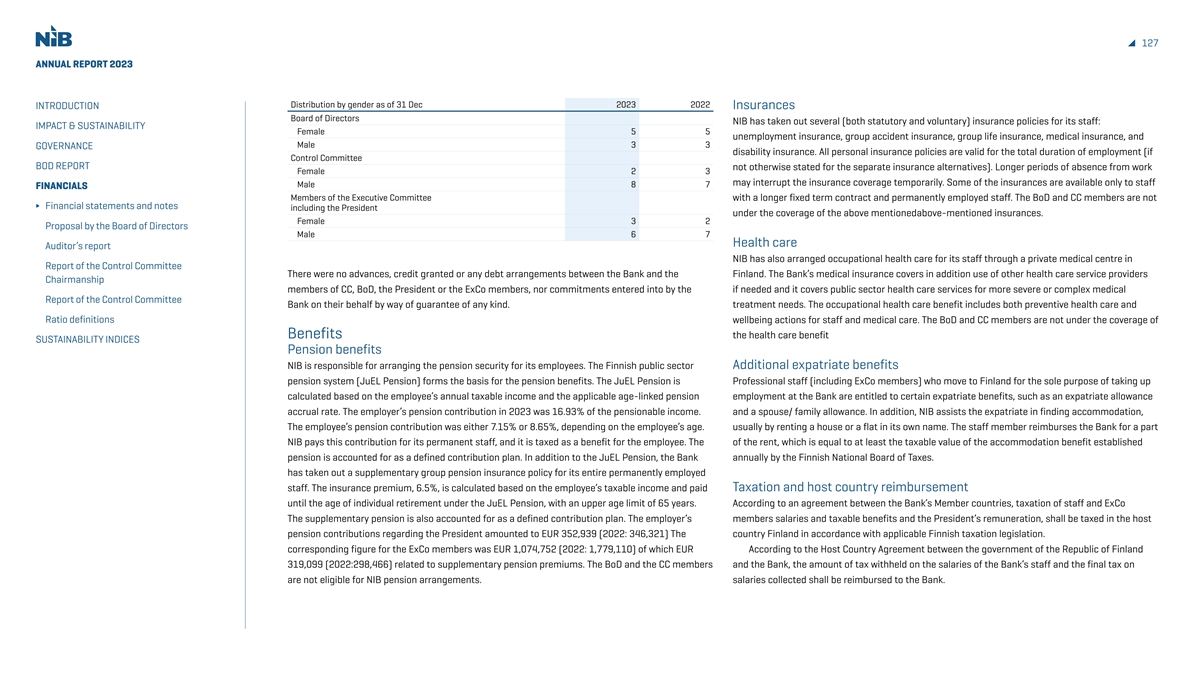

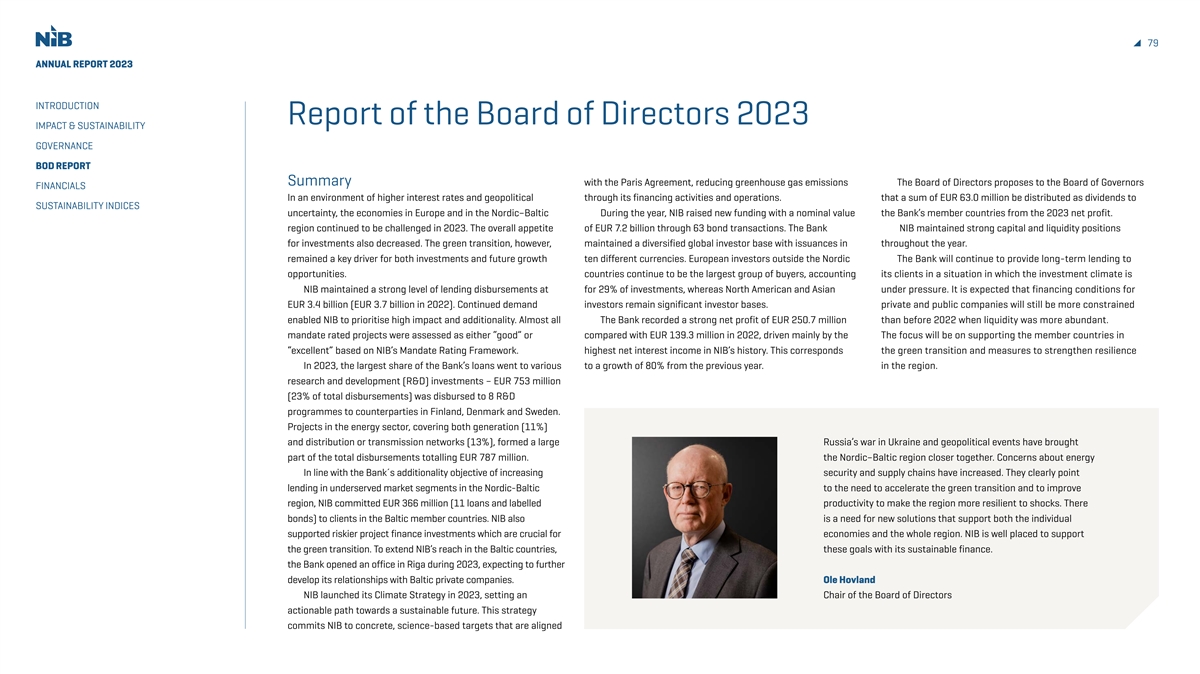

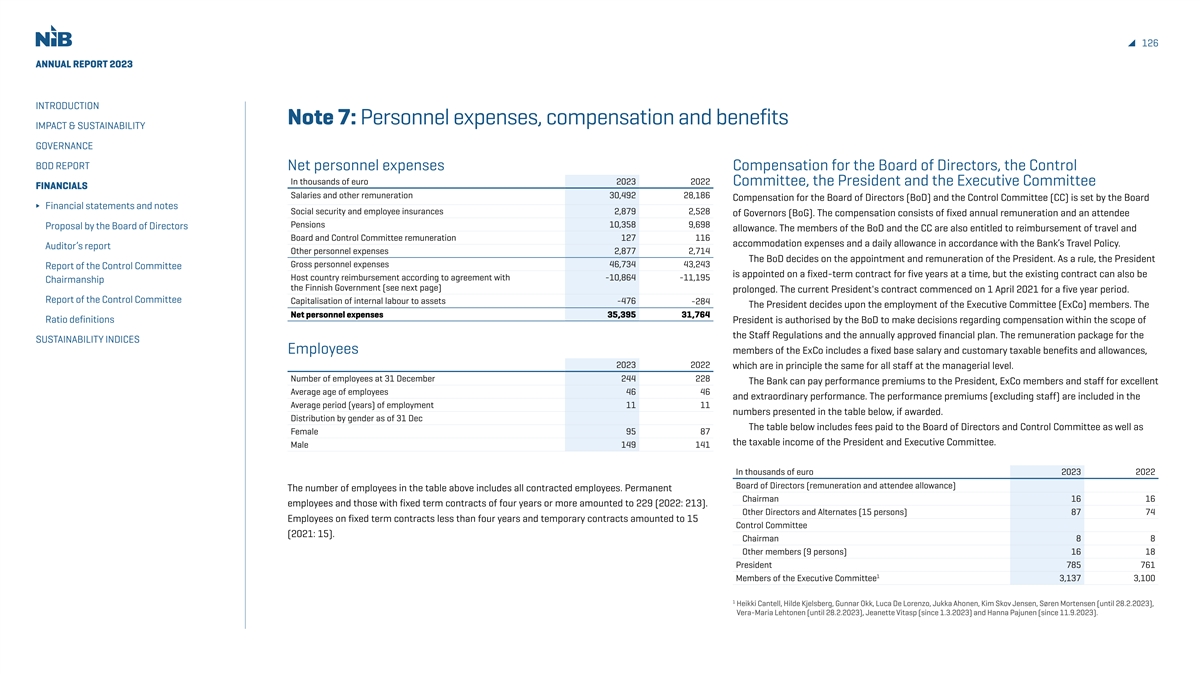

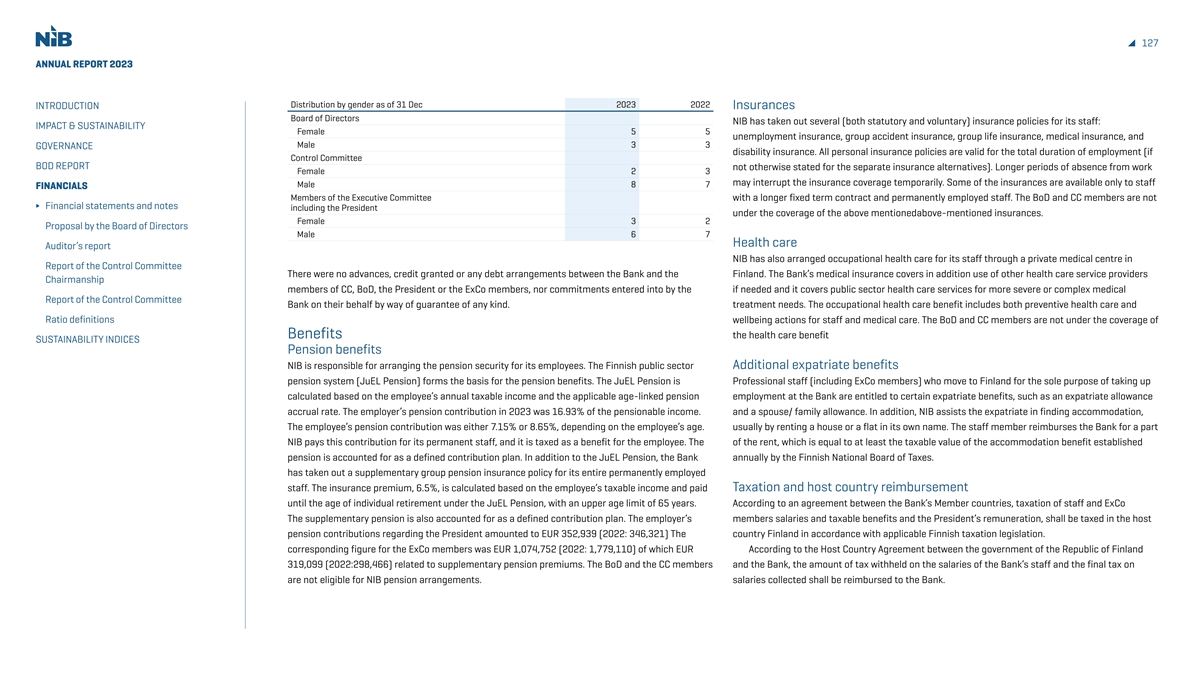

8 ANNUAL REPORT 2023 INTRODUCTION INTRODUCTION events. With NIB’s Board of Directors, environment of the Nordic-Baltic countries. Ready for a sustainable future we held external stakeholder seminars In 2023, we fortified the latter commitment NIB also reinforced its in-house expertise during This is NIB This is NIB in Riga and Stockholm focusing on the with the launch of the NIB Climate Strategy the year. We welcomed two new colleagues to Our y Our year ear green transition and the future of mobility. and targets at COP28. our Executive Committee and saw the entire NIB CEO message CEO message With NIB colleagues, we visited many This significant milestone sets an work community continue to grow, advancing the clients and projects shaping the future actionable plan for driving the sustainable Bank further. To accommodate this growth, NIB’s Strat Strategy egy of our region. transformation. The strategy commits NIB to Climate strategy Board of Directors approved the Bank’s long-term V Value creation alue creation Next year, NIB will continue bringing tangible science-based targets that are aligned targets to guide our operations in this decade and commits NIB to tangible IMP IMPA ACT & SUS CT & SUST TAINABILITY AINABILITY our stakeholders closer. These meetings are not with the Paris Agreement, reducing greenhouse beyond. science-based targets. merely a privilege that we have as a relatively gas emissions through our financing activities Yet while adding new talent and setting GO GOVERNANCE VERNANCE small regional community. They allow us to and operations. By setting NIB’s own climate the right targets are crucial for achieving our BOD REPOR BOD REPORT T identify the priorities of our member countries targets, we are even better placed to support common goals, their realisation does not rest FINANCIAL FINANCIALS S and explore how NIB can best assist them. our member countries’ decarbonisation goals. on our shoulders alone. Having a clear direction enables us to move Here, let me turn back to you. NIB’s strength SUS SUST TAINABILITY INDICES AINABILITY INDICES Ambitious climate targets forward with confidence, steering the region fulfilment also remained high, a record 99.8% lies in the dedication of our employees, the The fundamental ask from our owners towards a more resilient future. We will also of NIB’s disbursements were rated “good” or success of our customers, the trust of prevails in NIB’s mission—financing projects continue to bolster our approach to nature “excellent” in terms of environmental and our investors and the support of our owners. that improve productivity and benefit the action. During the year, we have started to productivity benefits. As the global landscape evolves, those assess nature-related impacts at the portfolio During the year, NIB raised new funding who swiftly adapt to the new conditions will level that will serve as a basis for setting with a nominal value of EUR 7.2 billion, gain an advantage. targets for nature. bringing funds to our region from international We are ready to support our stakeholders capital markets and creating a solid liquidity in this transition. We are committed to Delivering on our mission position. To fund projects accelerating the remaining your reliable partner. Together, Another reason to remain confident is the transition to low-carbon economies, the Bank we are financing the future. continued demand for our long-term lending, issued an equivalent of EUR 757 million in NIB which allowed NIB to prioritise high-impact Environmental Bonds. André Küüsvek, projects. In 2023, we disbursed EUR 3.4 billion NIB’s net profit increased by 80% from EUR President and CEO to facilitate decarbonisation, build renewable 139 million in 2022 to EUR 251 million in 2023 energy generation, upgrade electricity as the Bank recorded its highest ever net NIB’s net profit increased networks, or foster research and development, interest income from a solid loan portfolio and Read the Report of the Board of Directors by 80% to EUR 251 million for example. treasury activities. Increasing the capital NIB’s customer focus on the green accumulation from earnings has strengthened in 2023 as the Bank transition was evident in our environmental the NIB’s financial position and capital ratios, recorded its highest ever mandate result, the share of which reached which are the foundation for continuing to net interest income. historic highs. As the productivity mandate deliver on our mission.

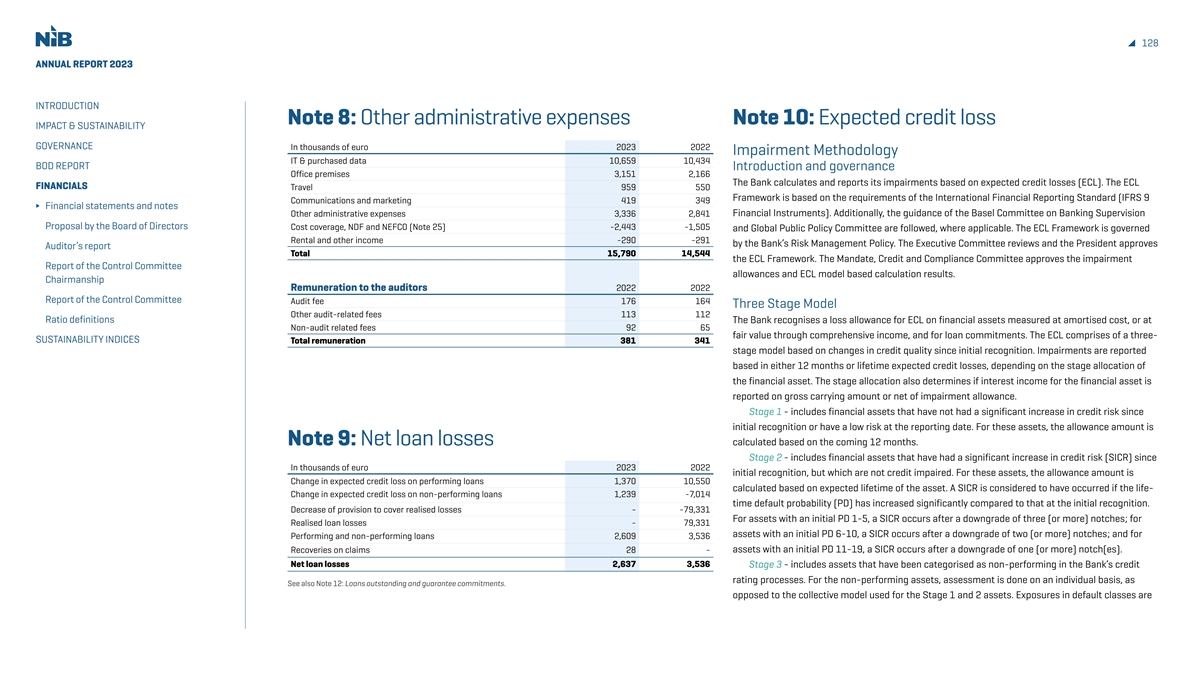

9 ANNUAL REPORT 2023 INTRODUCTION Long-term targets setting our direction This is NIB Our year CEO message In 2023, the Board of Directors approved our long-term targets that will guide the Bank’s operations by 2030 and beyond. These include maintaining a strong financial position, achieving sustainability targets for net-zero by 2050 (including interim 2030 climate targets), and fostering diversity, Strategy engagement & leadership. Each of the key topics are supported by a set of specific indicators and targets. Value creation IMPACT & SUSTAINABILITY GOVERNANCE Capital accumulation Sustainability Diversity, engagement & leadership BOD REPORT FINANCIALS • Return on equity >5% • 30-by-30 (EUR 30bn of green • Each gender to have at least 40% SUSTAINABILITY INDICES projects financed by 2030) representation at leadership roles • Maintain AAA rating • Delivering on 2030 climate targets • Share of international member country workforce at least 25% • Doubling in transition lending to hard-to-abate sectors by 2030 • Engagement score trending upwards in the employee engagement survey • Strengthened leadership capabilities to support aspired NIB culture

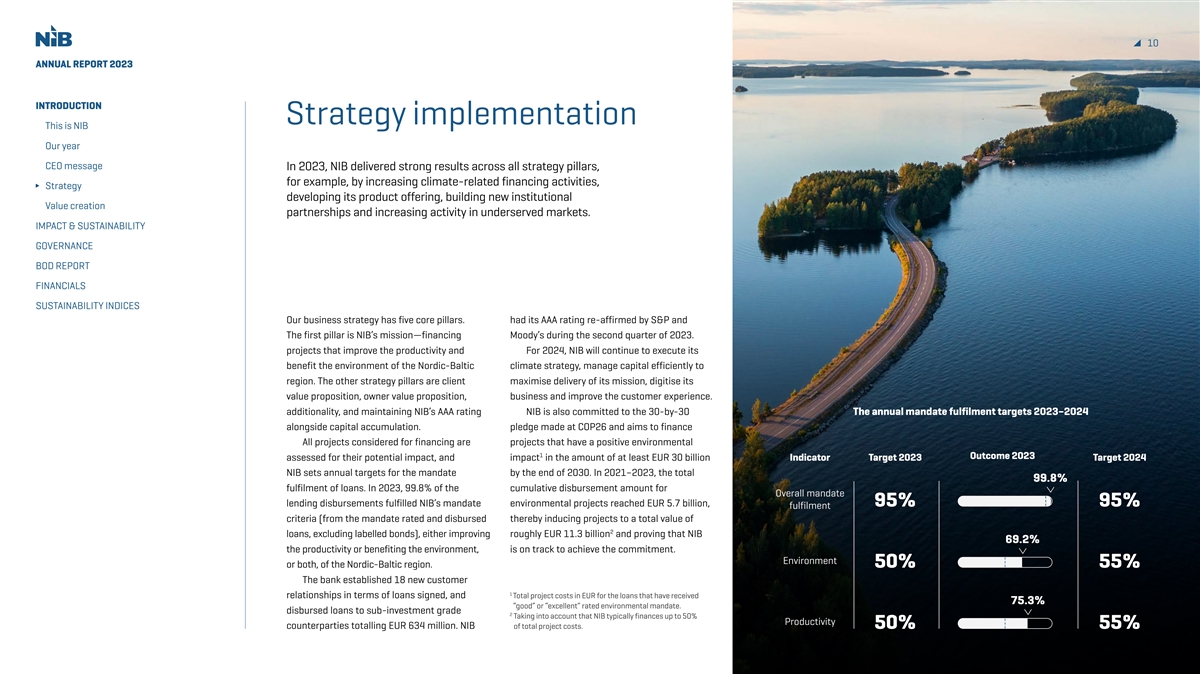

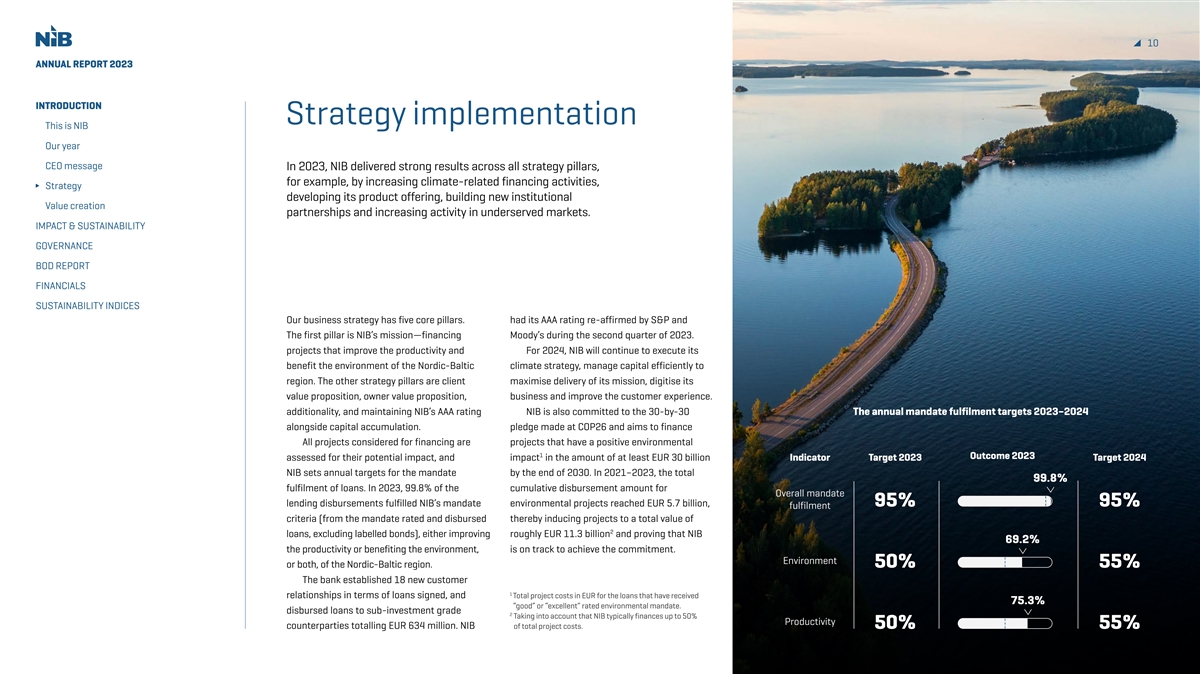

10 ANNUAL REPORT 2023 INTRODUCTION Strategy implementation This is NIB Our year CEO message In 2023, NIB delivered strong results across all strategy pillars, for example, by increasing climate-related financing activities, Strategy developing its product offering, building new institutional Value creation partnerships and increasing activity in underserved markets. IMPACT & SUSTAINABILITY GOVERNANCE BOD REPORT FINANCIALS SUSTAINABILITY INDICES Our business strategy has five core pillars. had its AAA rating re-affirmed by S&P and The first pillar is NIB’s mission—financing Moody’s during the second quarter of 2023. projects that improve the productivity and For 2024, NIB will continue to execute its benefit the environment of the Nordic-Baltic climate strategy, manage capital efficiently to region. The other strategy pillars are client maximise delivery of its mission, digitise its value proposition, owner value proposition, business and improve the customer experience. additionality, and maintaining NIB’s AAA rating NIB is also committed to the 30-by-30 The annual mandate fulfilment targets 2023–2024 alongside capital accumulation. pledge made at COP26 and aims to finance All projects considered for financing are projects that have a positive environmental 1 Outcome 2023 assessed for their potential impact, and impact in the amount of at least EUR 30 billion Indicator Target 2023 Target 2024 NIB sets annual targets for the mandate by the end of 2030. In 2021–2023, the total 99.8% fulfilment of loans. In 2023, 99.8% of the cumulative disbursement amount for Overall mandate lending disbursements fulfilled NIB’s mandate environmental projects reached EUR 5.7 billion, 95% 95% fulfilment criteria (from the mandate rated and disbursed thereby inducing projects to a total value of 2 loans, excluding labelled bonds), either improving roughly EUR 11.3 billion and proving that NIB 69.2% the productivity or benefiting the environment, is on track to achieve the commitment. Environment or both, of the Nordic-Baltic region. 50% 55% The bank established 18 new customer 1 relationships in terms of loans signed, and Total project costs in EUR for the loans that have received 75.3% “good” or “excellent” rated environmental mandate. disbursed loans to sub-investment grade 2 Taking into account that NIB typically finances up to 50% Productivity counterparties totalling EUR 634 million. NIB of total project costs. 50% 55%

11 ANNUAL REPORT 2023 INTRODUCTION Climate strategy providing lending, especially long-term lending, In 2023, the NIB Board of Directors approved that is less readily available from other market This is NIB the Bank’s climate strategy and targets. participants. Additionality can also be delivered Our year This was a significant milestone for the Bank, by providing expertise alongside financing, risk CEO message as it concretises the Bank’s ambition level within taking in projects, lending to companies that climate-related topics and ensures that the are limited in their other financing sources or Strategy Bank’s activities are steered and aligned to meet crowding in other financiers, for example. Value creation the climate commitments of its owner countries. During 2023, additionality was evaluated as IMPACT & SUSTAINABILITY As NIB has long had an environmental mission, part of the appraisal process for all new lending the carbon intensity of its lending portfolio opportunities. Broadening the risk profile of GOVERNANCE is already low compared to other financial new lending is enabled by NIB being an BOD REPORT institutions. Implementation of the strategy will implementing partner of InvestEU, a risk- FINANCIALS involve financing high-impact climate transitions sharing programme aligned with green and in hard-to-abate sectors and ensuring that these digital transition goals. In 2023, NIB agreed its SUSTAINABILITY INDICES investments are aligned with the sectoral first lending under InvestEU. As an example, the transition pathways described in the strategy. InvestEU programme supports NIB's recent Read more here. loan with Northvolt Ett AB. Underserved market segments Client value proposition In 2023, we strenghtened our Baltic presence with a new office in Riga. NIB’s business strategy highlights the During 2023, NIB reviewed its client value importance of building closer relationships proposition, with a focus on enhancing its and liquidity bond portfolio positioning in Digital transformation with owners and clients while doing more in product and services offering, the speed a manner that allowed investing at higher In the last few years, NIB has been in a transition currently underserved market segments (e.g. of loan appraisal and execution, and client rates have had a considerable impact on towards a more cloud-based IT infrastructure. mid-caps and private sector clients in the Baltic communication. The development of the Bank’s the Bank's earnings from treasury activities, During 2023, the Bank’s Enterprise Data states). NIB opened a business hub in Riga in client value proposition will continue in 2024, but the strategy from broadened risk taking Warehouse (EDW) was migrated to the cloud. Latvia, with the ambition to increase its Baltic with exploring opportunities in lending is also strengthening the Bank’s The content of the EDW will continue to be lending in the coming years, and facilitate to expand the product results. NIB is planning to utilise the newly extended in 2024 to have more business cooperation opportunities with its owners. offering, more touchpoints generated capital to further grow its lending intelligence and analytics capabilities from a During the year, NIB committed EUR 366 million with clients and better portfolio. Additional initiatives are also single source. Another use-case for better data (11 loans and labelled bonds) to clients in the ways of collecting being taken to optimise the capital use. management comes from a multiyear project Baltic member countries. client feedback. InvestEU and its related guarantee structure that is reviewing and redesigning, is one example. Furthermore, during 2023, a where necessary, our lending Additionality Capital management pilot for a credit risk insurance transaction processes for process Additionality means adding extra value in NIB’s NIB has witnessed a significant improvement was completed—an additional tool for the efficiency while also improving operating markets, filling market gaps and in its profitability. Increased interest rates Bank to release capital to do more lending. the customer experience.

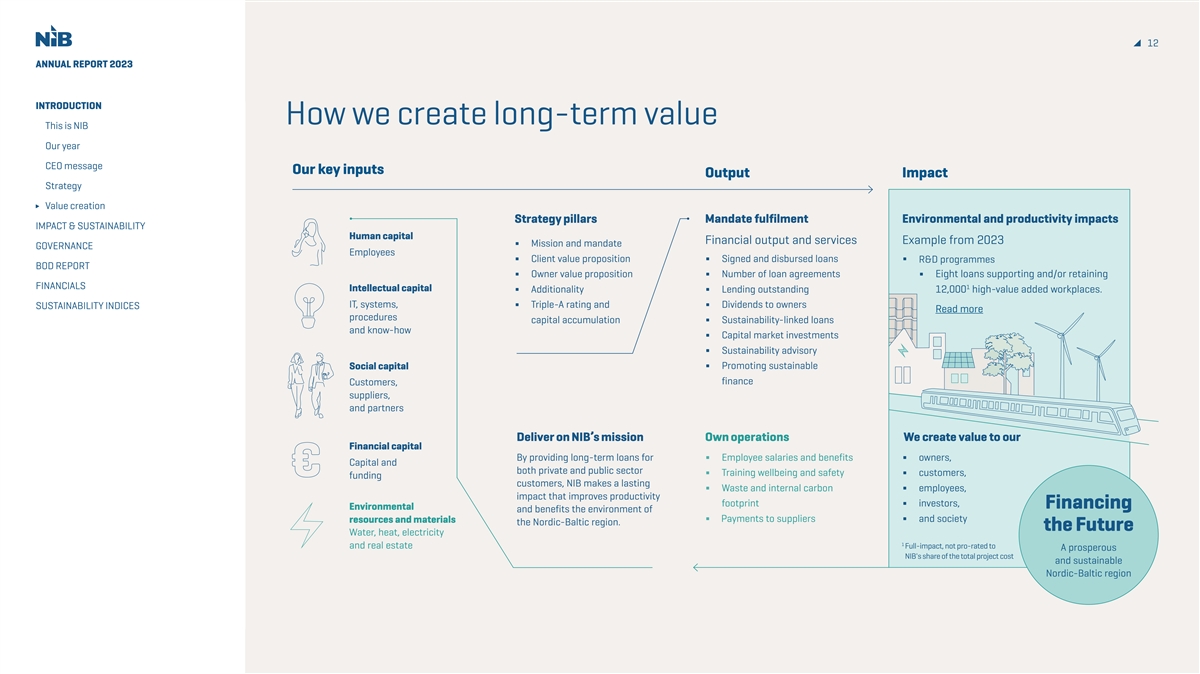

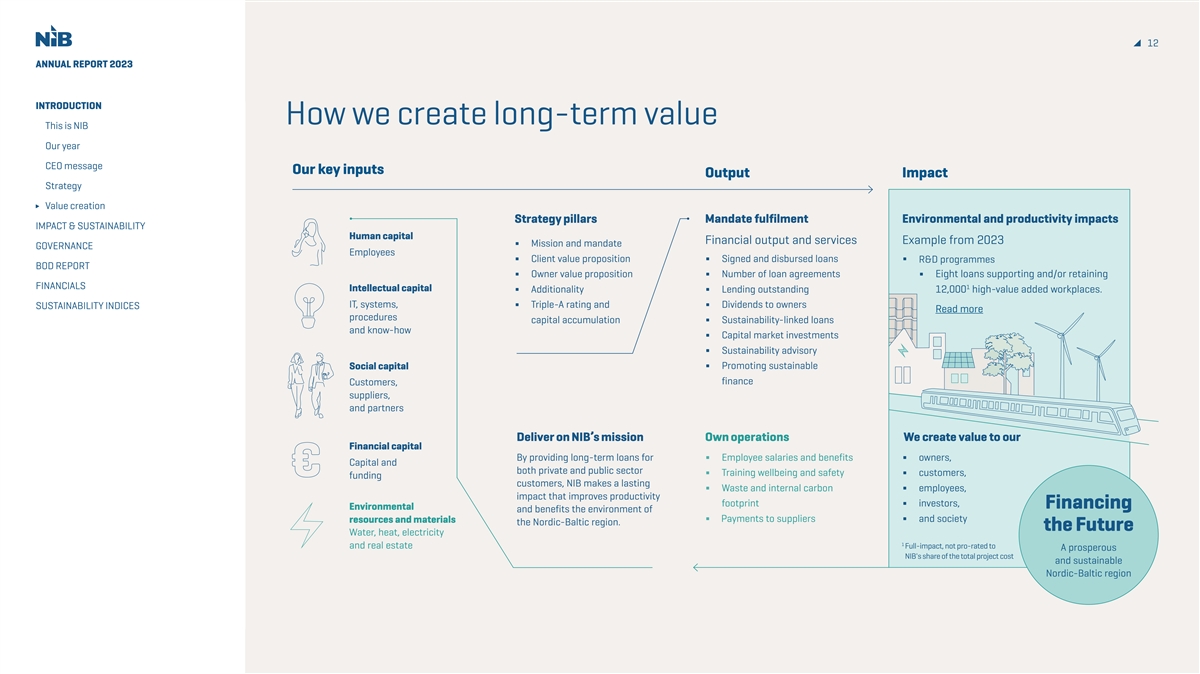

12 ANNUAL REPORT 2023 INTRODUCTION How we create long-term value This is NIB Our year CEO message Our key inputs Output Impact Strategy Value creation Strategy pillars Mandate fulfilment Environmental and productivity impacts IMPACT & SUSTAINABILITY Human capital Financial output and services Example from 2023 Mission and mandate ∆ GOVERNANCE Employees Client value proposition Signed and disbursed loans ∆ ∆ ∆ R&D programmes BOD REPORT Owner value proposition Number of loan agreements Eight loans supporting and/or retaining ∆ ∆ ∆ FINANCIALS 1 Intellectual capital Additionality Lending outstanding 12,000 high-value added workplaces. ∆ ∆ IT, systems, Triple-A rating and Dividends to owners SUSTAINABILITY INDICES ∆ ∆ Read more procedures capital accumulation Sustainability-linked loans ∆ and know-how Capital market investments ∆ Sustainability advisory ∆ Social capital Promoting sustainable ∆ finance Customers, suppliers, and partners Deliver on NIB’s mission Own operations We create value to our Financial capital By providing long-term loans for Employee salaries and benefits owners, ∆ ∆ Capital and both private and public sector Training wellbeing and safety customers, ∆ ∆ funding customers, NIB makes a lasting Waste and internal carbon employees, ∆ ∆ impact that improves productivity footprint investors, ∆ Financing Environmental and benefits the environment of Payments to suppliers and society resources and materials ∆ ∆ the Nordic-Baltic region. the Future Water, heat, electricity 1 and real estate Full-impact, not pro-rated to A prosperous NIB's share of the total project cost and sustainable Nordic-Baltic region

ANNUAL REPORT 2023 INTRODUCTION IMPACT & SUSTAINABILITY IMPACT & SUSTAINABILITY Lending impact Funding in 2023 We accelerate the transition NIB Environmental Bonds Action for climate of our societies Internal impact Impactful workplace Sustainability management Stakeholder engagement About this report Independent Assurance Report GOVERNANCE BOD REPORT FINANCIALS SUSTAINABILITY INDICES As Gothenburg’s automotive industry is shaping the vehicles of the future, we are contributing to the progress with our loans to Volvo Cars, Northvolt, SEEL, and AstaZero. SEEL, the Swedish Electric Transport Laboratory will provide a test centre for electrified transport.

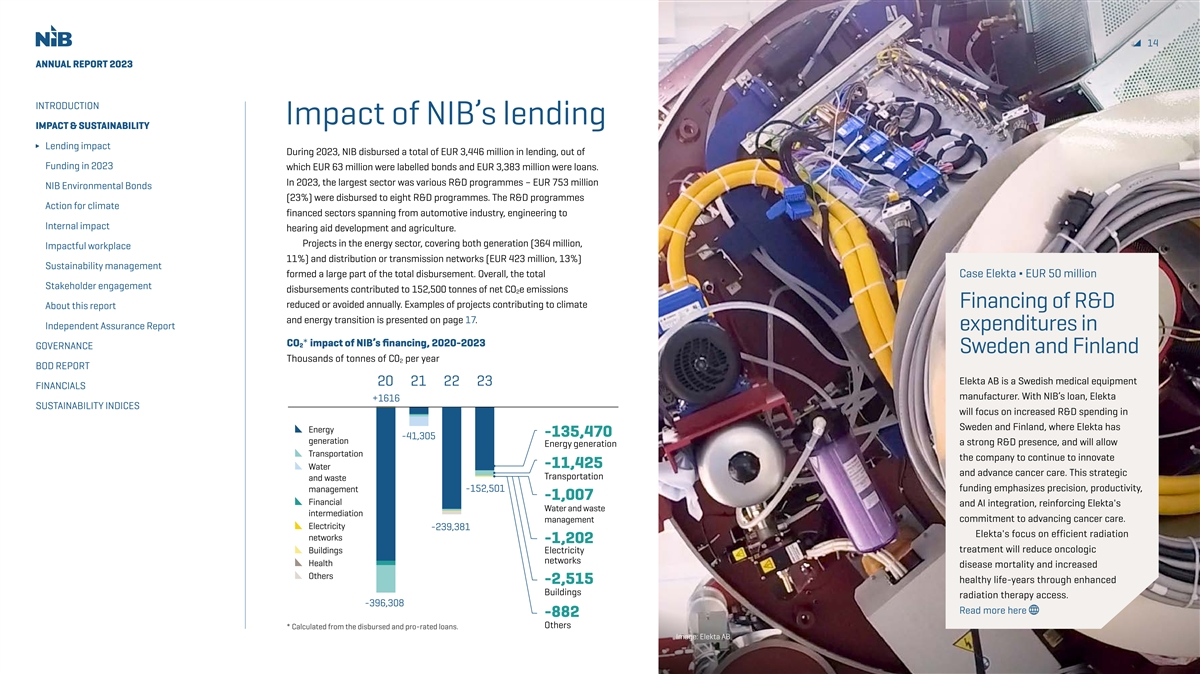

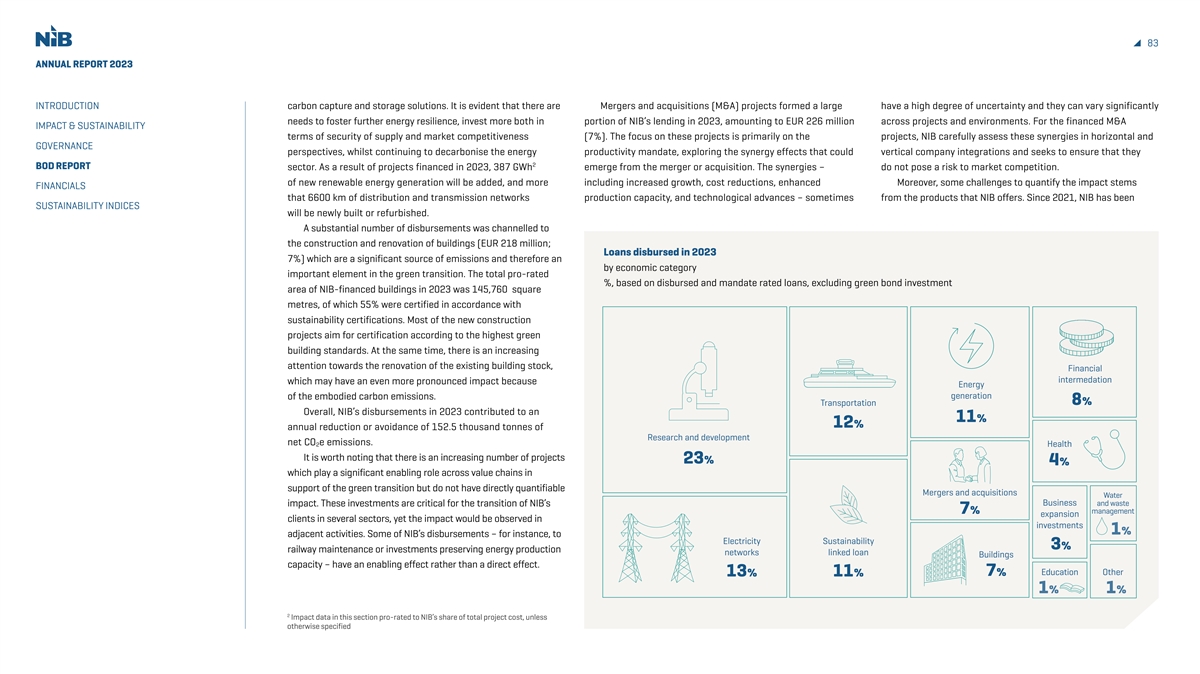

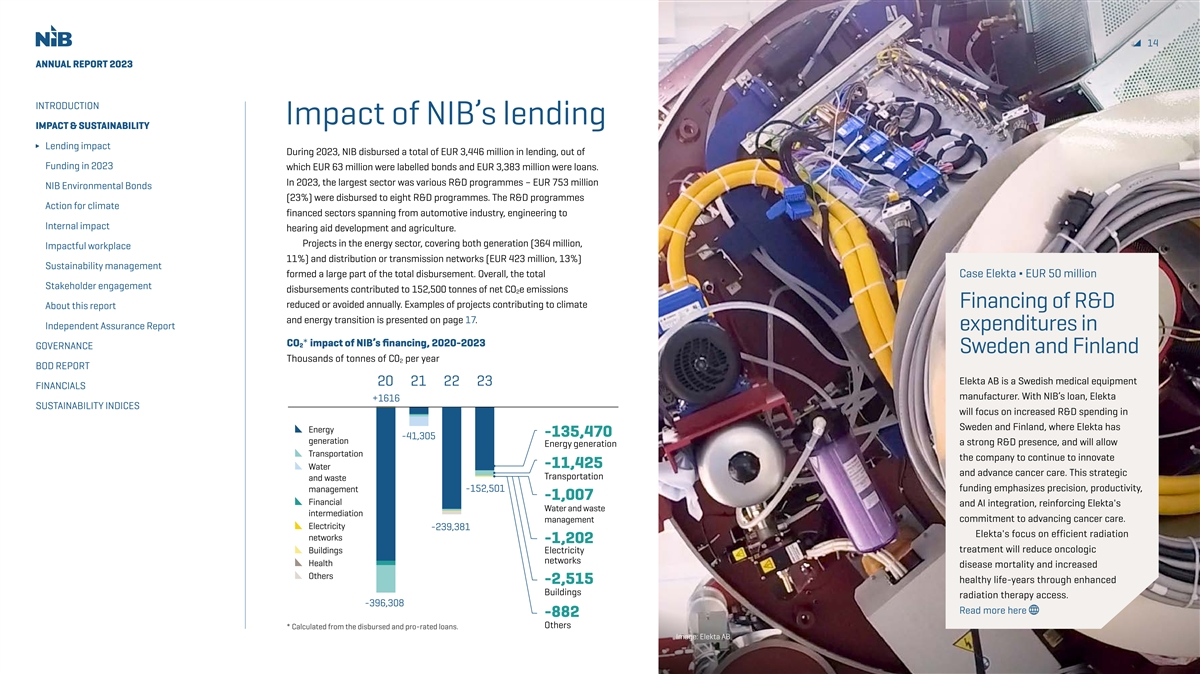

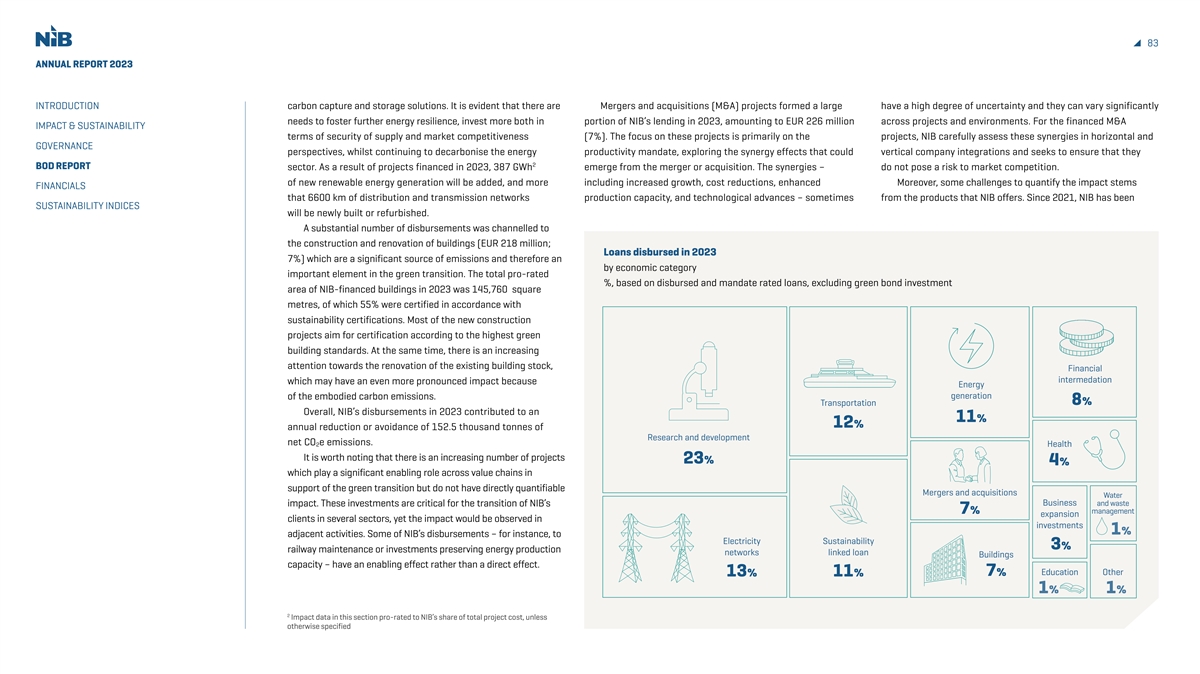

14 ANNUAL REPORT 2023 INTRODUCTION Impact of NIB’s lending IMPACT & SUSTAINABILITY Lending impact During 2023, NIB disbursed a total of EUR 3,446 million in lending, out of Funding in 2023 which EUR 63 million were labelled bonds and EUR 3,383 million were loans. In 2023, the largest sector was various R&D programmes – EUR 753 million NIB Environmental Bonds (23%) were disbursed to eight R&D programmes. The R&D programmes Action for climate financed sectors spanning from automotive industry, engineering to Internal impact hearing aid development and agriculture. Projects in the energy sector, covering both generation (364 million, Impactful workplace 11%) and distribution or transmission networks (EUR 423 million, 13%) Sustainability management formed a large part of the total disbursement. Overall, the total Case Elekta ∆ EUR 50 million Stakeholder engagement disbursements contributed to 152,500 tonnes of net CO e emissions 2 reduced or avoided annually. Examples of projects contributing to climate Financing of R&D About this report and energy transition is presented on page 17. Independent Assurance Report expenditures in CO * impact of NIB’s financing, 2020-2023 2 GOVERNANCE Sweden and Finland Thousands of tonnes of C0 per year 2 BOD REPORT Elekta AB is a Swedish medical equipment 20 21 22 23 FINANCIALS manufacturer. With NIB’s loan, Elekta +1616 SUSTAINABILITY INDICES will focus on increased R&D spending in Sweden and Finland, where Elekta has Energy -135,470 -41,305 generation a strong R&D presence, and will allow Energy generation Transportation the company to continue to innovate -11,425 Water and advance cancer care. This strategic Transportation and waste -152,501 funding emphasizes precision, productivity, management -1,007 Financial and AI integration, reinforcing Elekta's Water and waste intermediation management commitment to advancing cancer care. Electricity -239,381 Elekta's focus on efficient radiation networks -1,202 treatment will reduce oncologic Buildings Electricity networks Health disease mortality and increased Others healthy life-years through enhanced -2,515 Buildings radiation therapy access. -396,308 Read more here -882 Others * Calculated from the disbursed and pro-rated loans. Image: Elekta AB

15 ANNUAL REPORT 2023 INTRODUCTION Measuring our impact Lending disbursed in 2023 IMPACT & SUSTAINABILITY %, mandate rated and disbursed loans Lending impact Funding in 2023 NIB is an impact-oriented bank, and we measure the value created through our loans and investments. We follow up the project NIB Environmental Bonds implementation, and once completed, we evaluate the extent to Action for climate which the estimated impacts have materialised. In measuring the Internal impact impact of our financing, we apply a set of predefined principles 11% and indicators. The impact of NIB’s lending has a limited assurance Impactful workplace Sustainability-linked provided by a third party; read more here. Detailed information Sustainability management impacts about how we calculate our impact is available on our website. Stakeholder engagement Our impact can be roughly categorised in three ways: About this report ∆ Direct impact: these are the NIB financed activities Independent Assurance Report and projects that cause a direct, measurable impact. 54% GOVERNANCE This is what we report with key metrics relevant to the Direct BOD REPORT impact achieved. See page 16. 1 impacts ∆ Enabling impact: these are the NIB financed activities and FINANCIALS projects that enable an ultimate direct impact along the SUSTAINABILITY INDICES value chain. For this reason, the impact is not measurable and directly attributable to the activity itself, yet the activity is necessary for the impact to materialise. Examples of such investments are investments into the electric grid, auxiliary transport infrastructure like train maintenance facilities, and financing that is extended to financial intermediaries. ∆ Sustainability-linked impact: these are the NIB financed 35% activities and projects where the impact is linked to the Enabling achievement of counterparty level, mid-term KPIs. For this impacts reason, the impact is more scattered across value chain and is measured in terms of fulfilment of the target. The first progress follow-up is available on pages 21-22. 1 Loans that have at least one identified and reported For more detailed information about our reported impact, (under Impacts of loans disbursed on page 16) impact indicator. see the Report of the Board of Directors.

16 ANNUAL REPORT 2023 Impact of loans disbursed in 2023 INTRODUCTION IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB Environmental Bonds Action for climate CO reduction Renewable R&D On-lending Electricity Healthcare Green Energy Internal impact 2 energy programmes to SMEs and networks buildings saved Projects financed EUR 139 million Impactful workplace generation environmental contributed to disbursed to seven Eight R&D loans EUR 423 million EUR 231 million As a result of various Sustainability management annual CO reduction projects in health- 2 projects totalling EUR 753 disbursed to 12 were chanelled to energy efficiency The disbursed loans of 152,500 tonnes. care - construction/ million support and/ electricity network seven green building measures spanning Stakeholder engagement contribute to an The reduction equals 3 Seven loan refurbishement of or retain 12,000 projects building and projects in Finland, from efficiency annual increase of to an approximate programmes healthcare facilities high-value added renovating 6,600 km Sweden and Iceland. improvement in About this report 387,000 MWh annual carbon foot- with financial and purchase of workplaces in NIB’s of distribution and Combined, the green industrial processes 1 of generated print of 19,170 intermediaries medical equipment. Independent Assurance Report member countries. transmission networks building projects to energy efficiency renewable electricity people in the member totalling The healthcare 2 in Norway, Sweden, cover ~80,000 m increase for buildings and thermal heat, GOVERNANCE country region. In EUR 260 million facilities will be able Denmark, Iceland of certified floor area 51,500 MWh of which equals final addition financed for on-lending to to provide services and Finland. The (for instance by LEED, electricity and energy consumption of BOD REPORT projects contributed SMEs, mid-caps to approximately projects support BREEAM). This area thermal energy 2 approximately 20,800 4 to creation of carbon and environmental 719,000 people functioning energy corresponds to more will be saved FINANCIALS households in member capture capacity of projects in Finland, living in respective 5 markets by enabling than 11 football fields . which corresponds country region. 6,000 tonnes per year. Norway, Denmark, catchment areas in SUSTAINABILITY INDICES further connections to final energy Iceland and Sweden. Finland and Estonia. and strenghten consumption grid resilience for of about 2,700 2 increased intake of households . renewable energy generated. 1 By assuming greenhouse gases of 8.0 tonnes per capita, based on data of Eurostat for member country area in the years 2020-2022. 2 Based on total final energy consumption of households in 2021 (18.6 MWh) according to Eurostat energy balances. 3 Not pro-rated number. 4 Not pro-rated number. 5 2 Assuming that one football field is 7,140 m .

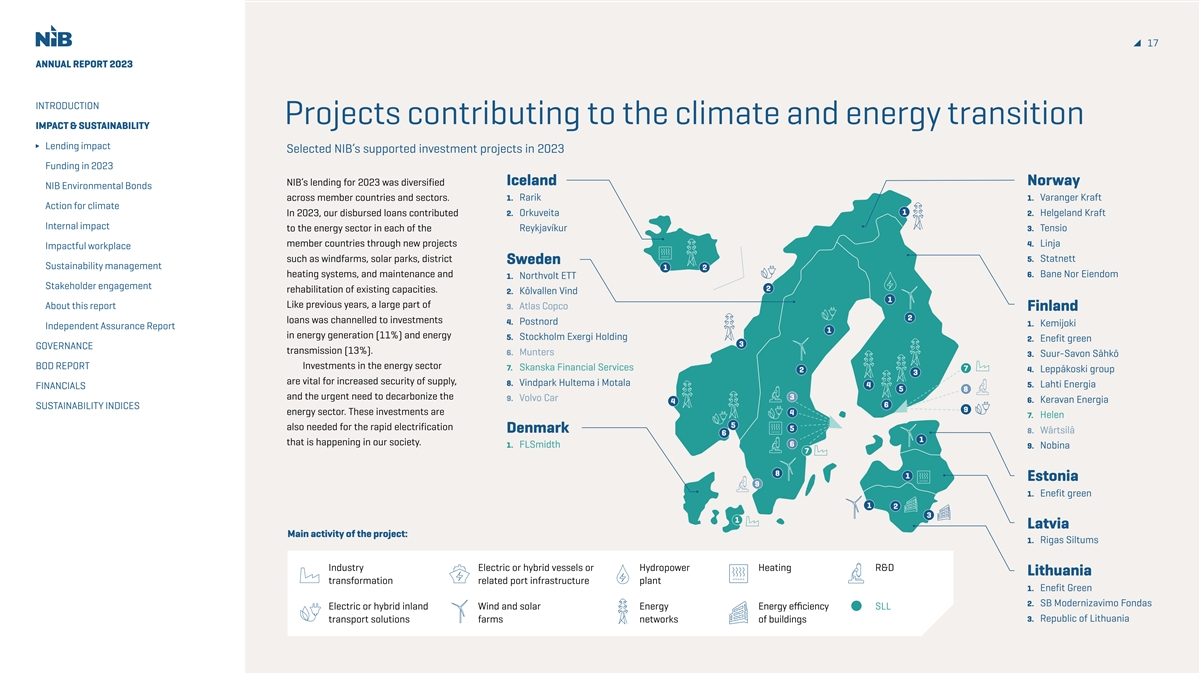

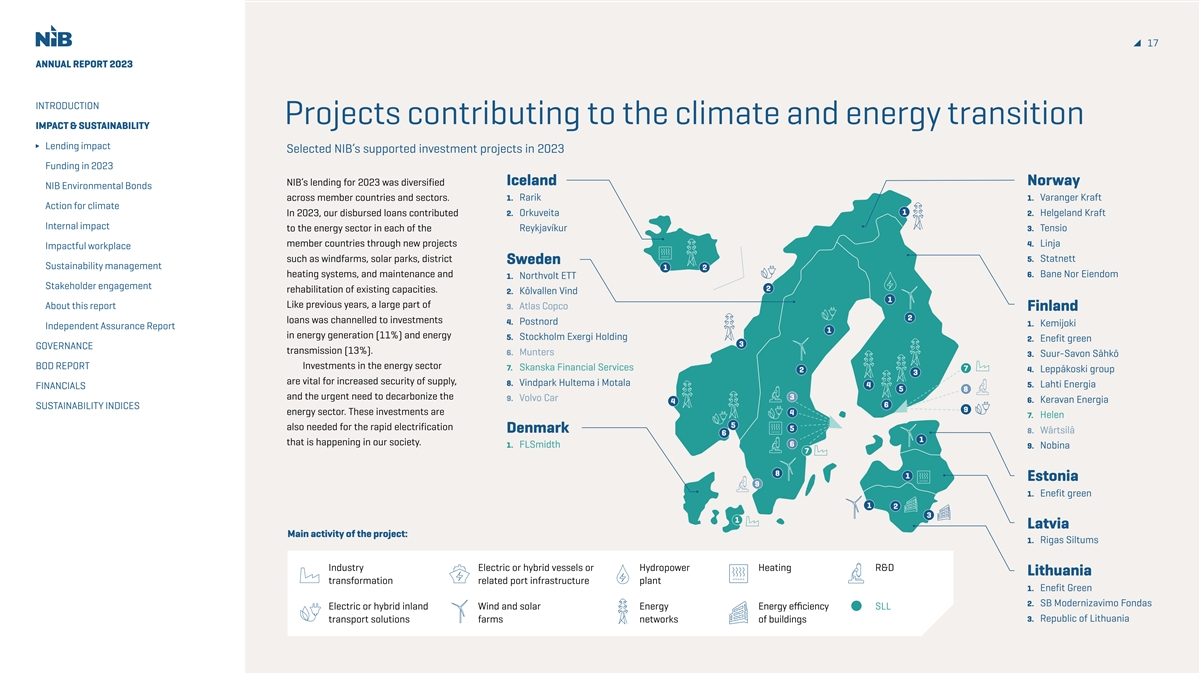

17 ANNUAL REPORT 2023 INTRODUCTION Projects contributing to the climate and energy transition IMPACT & SUSTAINABILITY Lending impact Selected NIB’s supported investment projects in 2023 Funding in 2023 Iceland Norway NIB’s lending for 2023 was diversified NIB Environmental Bonds across member countries and sectors. 1. Rarik 1. Varanger Kraft Action for climate 1 In 2023, our disbursed loans contributed 2. Orkuveita 2. Helgeland Kraft Internal impact to the energy sector in each of the Reykjavíkur 3. Tensio member countries through new projects 4. Linja Impactful workplace such as windfarms, solar parks, district 5. Statnett Sweden Sustainability management 1 2 heating systems, and maintenance and 6. Bane Nor Eiendom 1. Northvolt ETT Stakeholder engagement 2 rehabilitation of existing capacities. 2. Kölvallen Vind 1 Like previous years, a large part of About this report 3. Atlas Copco Finland 2 loans was channelled to investments 4. Postnord 1. Kemijoki Independent Assurance Report 1 in energy generation (11%) and energy 5. Stockholm Exergi Holding 2. Enefit green 3 GOVERNANCE transmission (13%). 6. Munters 3. Suur-Savon Sähkö BOD REPORT Investments in the energy sector 7. Skanska Financial Services 7 2 4. Leppäkoski group 3 are vital for increased security of supply, 8. Vindpark Hultema i Motala 4 5. Lahti Energia FINANCIALS 5 8 and the urgent need to decarbonize the 3 9. Volvo Car 6. Keravan Energia 4 6 SUSTAINABILITY INDICES 9 energy sector. These investments are 4 7. Helen 5 also needed for the rapid electrification 5 Denmark 8. Wärtsilä 6 1 that is happening in our society. 6 1. FLSmidth 9. Nobina 7 8 1 Estonia 9 1. Enefit green 1 2 3 1 Latvia Main activity of the project: 1. Rigas Siltums Industry Electric or hybrid vessels or Hydropower Heating R&D Lithuania transformation related port infrastructure plant 1. Enefit Green 2. SB Modernizavimo Fondas Electric or hybrid inland Wind and solar Energy Energy efficiency SLL 3. Republic of Lithuania transport solutions farms networks of buildings

ANNUAL REPORT 2023 INTRODUCTION From turbulence IMPACT & SUSTAINABILITY to transformation Lending impact Funding in 2023 The existing geopolitical tremors are fast-tracking the Baltics' energy transition. NIB Environmental Bonds NIB, in part owned by Baltic countries, has Action for climate always seen energy security as one of the Internal impact material topics for the further convergence path of Baltic member countries. Over the Impactful workplace last two decades NIB has been financing a list Sustainability management of impactful projects, such as the windfarms Stakeholder engagement and solar farms of Enefit Green. Also municipalities are changing their energy About this report sources of heating. For instance, NIB Independent Assurance Report financed biomass-based energy generation GOVERNANCE investments for Rigas Siltums. BOD REPORT The Baltics stand at a transformative juncture in their energy system trajectory, FINANCIALS spurred by geopolitical tensions close to their SUSTAINABILITY INDICES borders. The journey toward energy independence and sustainability is multifaceted, involving strategic decoupling from previous energy systems, investment in Case Rigas Siltums AS ∆ EUR 20 million the renewable generation, and a focus on demand-side efficiency. This transition District heating infrastructure improvements highlights how regional turbulences can forge pathways to autonomy and resilience, which In 2023, NIB and Rigas Siltums AS signed a 10-year outdated pipelines, the company will improve the shapes a stable, sustainable energy future. EUR 20 million agreement to support the 2022–2023 district heating network and reduce energy losses, Read more about the urgent shift to investment programme aimed at enhancing the thus allowing new clients to be serviced and reducing sustainable and secure energy production in district heating infrastructure in Riga, Latvia. air pollution. Moreover, incorporating renewable- the Baltic region here. The investment programme focuses on upgrading resource-based energy generation capacities will heat distribution systems and enhancing energy reduce reliance on natural gas-generated heat. generation from sustainable biomass. By replacing Read more here Image: Rigas Siltums

19 19 ANNUAL REPORT 2023 INTRODUCTION Future fuels in IMPACT & SUSTAINABILITY transportation Lending impact Funding in 2023 The transport sector accounts for a quarter of global greenhouse gas emissions. Unlike in NIB Environmental Bonds many other industries, where increasing Action for climate generation of renewable electricity is spurring Internal impact electrification in many segments, transport struggles with the dual challenges of reducing Impactful workplace greenhouse gas emissions and meeting the Sustainability management growing demand for mobility. To address these Case Wärtsilä ∆ EUR 75 million Stakeholder engagement challenges, the future of transport relies on new sustainable fuels and power sources. Decarbonisation of marine About this report Biofuels emerged as a transitional solution Independent Assurance Report and energy sectors more than 25-years ago, and since then electric GOVERNANCE vehicles have been gaining prominence as a clean Wärtsilä provides innovative technologies and lifecycle BOD REPORT and energy-efficient solution for road transport. solutions for the marine and energy markets. The NIB But this also requires the development of an loan provides long-term financing for Wärtsilä’s R&D FINANCIALS extensive charging infrastructure. Also, the investments aimed at accelerating the transition towards SUSTAINABILITY INDICES marine sector needs to transform, and solutions marine decarbonisation and renewable energy. to reduce emissions in shipping are needed. The R&D activities in the marine business mainly What alternatives are available today and focus on the development of new sustainable fuel how can we get around without fossil fuels? solutions for the marine industry. Wärtsilä’s aim is to Read the full article here. develop and provide a product portfolio which will be ready for zero carbon fuels by 2030. In addition, Wärtsilä’s R&D efforts on new fuel solutions enable the company to provide compliant technologies and solutions to customers, helping them meet evolving regulatory requirements and remain competitive on the market landscape. R&D is the main driver of productivity growth, and its impacts are widely distributed through the transfer of skills and knowledge in labour markets. Read more here Image: Wärtsilä

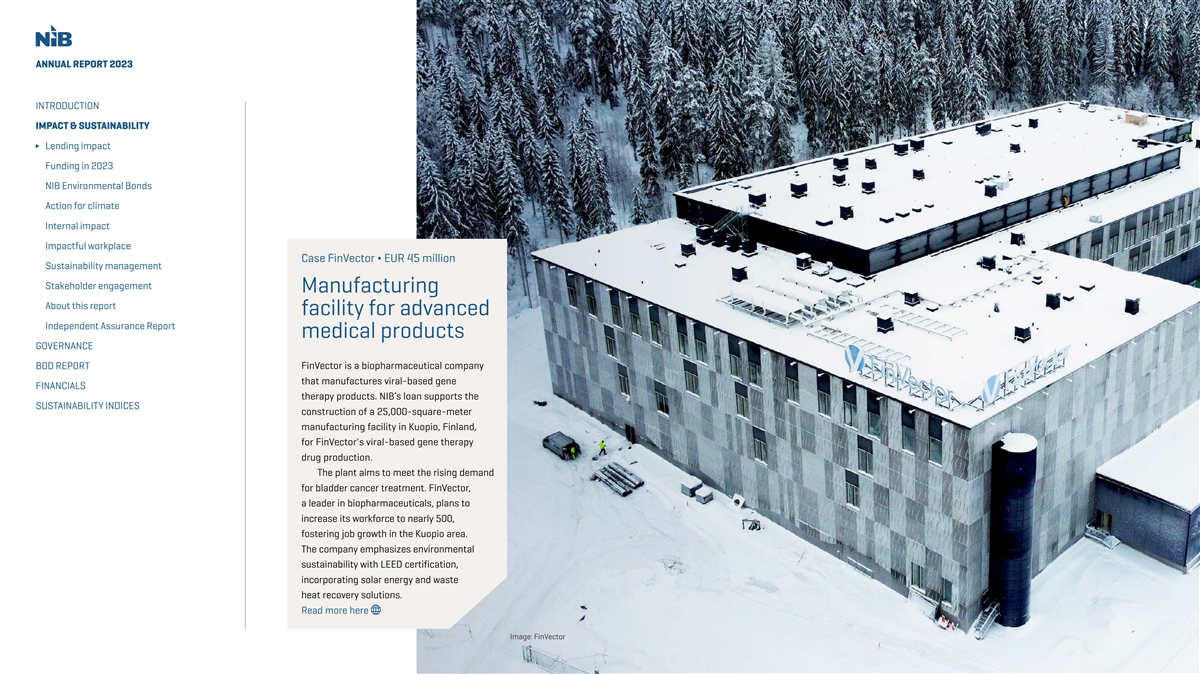

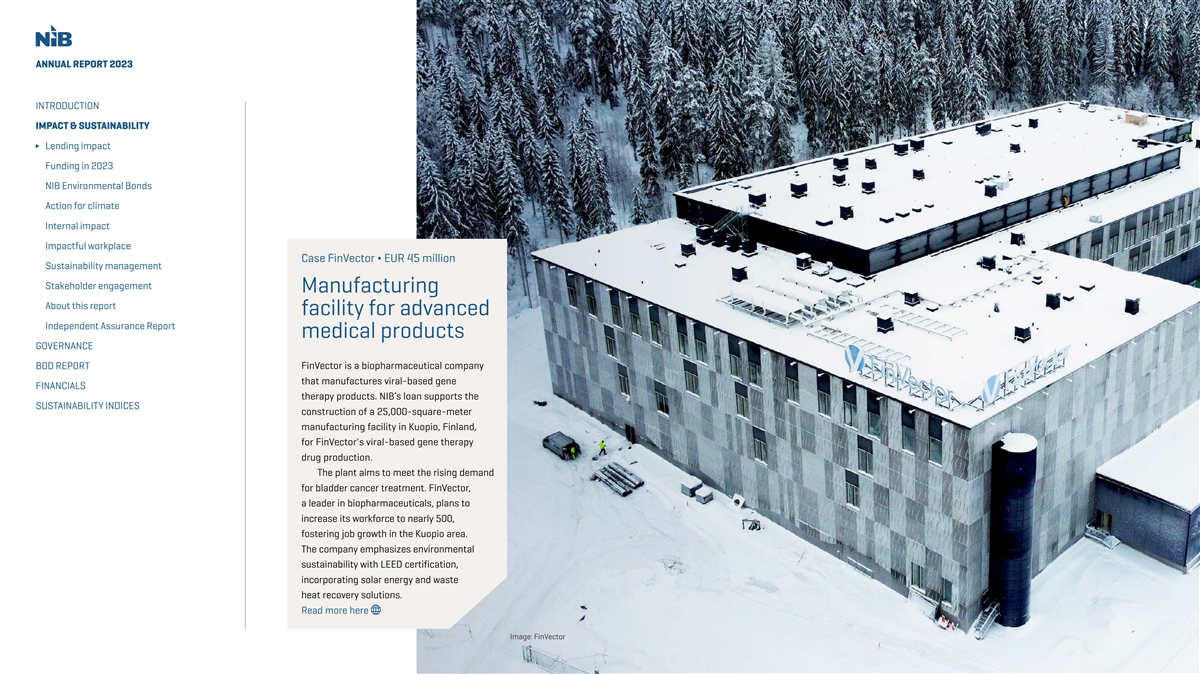

ANNUAL REPORT 2023 INTRODUCTION IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB Environmental Bonds Action for climate Internal impact Impactful workplace Case FinVector ∆ EUR 45 million Sustainability management Stakeholder engagement Manufacturing About this report facility for advanced Independent Assurance Report medical products GOVERNANCE BOD REPORT FinVector is a biopharmaceutical company that manufactures viral-based gene FINANCIALS therapy products. NIB’s loan supports the SUSTAINABILITY INDICES construction of a 25,000-square-meter manufacturing facility in Kuopio, Finland, for FinVector's viral-based gene therapy drug production. The plant aims to meet the rising demand for bladder cancer treatment. FinVector, a leader in biopharmaceuticals, plans to increase its workforce to nearly 500, fostering job growth in the Kuopio area. The company emphasizes environmental sustainability with LEED certification, incorporating solar energy and waste heat recovery solutions. Read more here Image: FinVector

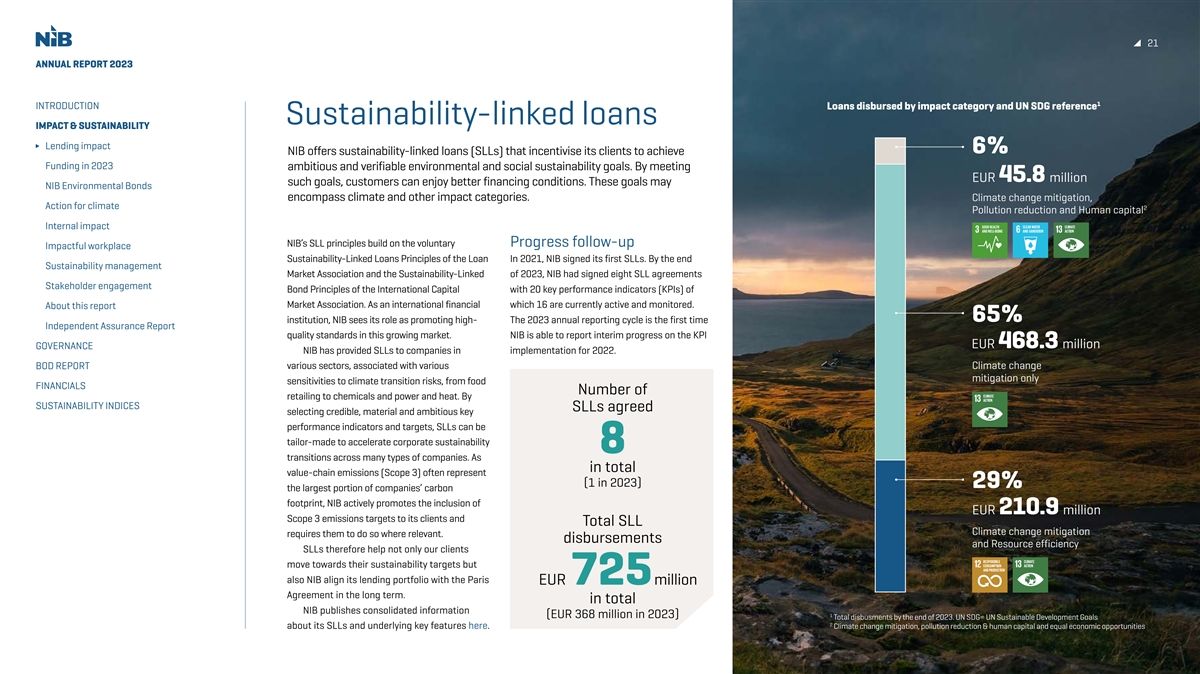

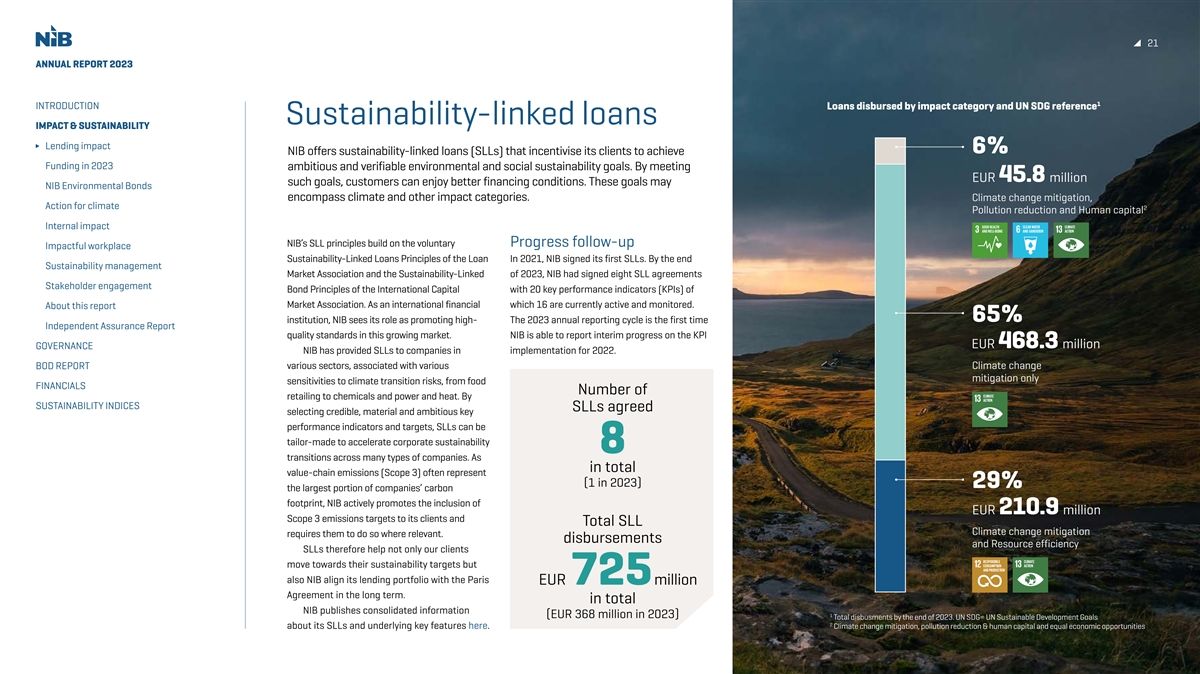

21 ANNUAL REPORT 2023 1 INTRODUCTION Loans disbursed by impact category and UN SDG reference Sustainability-linked loans IMPACT & SUSTAINABILITY Lending impact 6% NIB offers sustainability-linked loans (SLLs) that incentivise its clients to achieve Funding in 2023 ambitious and verifiable environmental and social sustainability goals. By meeting EUR 45.8 million such goals, customers can enjoy better financing conditions. These goals may NIB Environmental Bonds encompass climate and other impact categories. Climate change mitigation, Action for climate 2 Pollution reduction and Human capital Internal impact NIB’s SLL principles build on the voluntary Progress follow-up Impactful workplace Sustainability-Linked Loans Principles of the Loan In 2021, NIB signed its first SLLs. By the end Sustainability management Market Association and the Sustainability-Linked of 2023, NIB had signed eight SLL agreements Stakeholder engagement Bond Principles of the International Capital with 20 key performance indicators (KPIs) of Market Association. As an international financial which 16 are currently active and monitored. About this report 65% institution, NIB sees its role as promoting high- The 2023 annual reporting cycle is the first time Independent Assurance Report quality standards in this growing market. NIB is able to report interim progress on the KPI EUR 468.3 million GOVERNANCE NIB has provided SLLs to companies in implementation for 2022. BOD REPORT various sectors, associated with various Climate change mitigation only sensitivities to climate transition risks, from food FINANCIALS Number of retailing to chemicals and power and heat. By SUSTAINABILITY INDICES SLLs agreed selecting credible, material and ambitious key performance indicators and targets, SLLs can be tailor-made to accelerate corporate sustainability 8 transitions across many types of companies. As in total value-chain emissions (Scope 3) often represent ( ) 1 in 2023 29% the largest portion of companies’ carbon footprint, NIB actively promotes the inclusion of EUR 210.9 million Scope 3 emissions targets to its clients and Total SLL Climate change mitigation requires them to do so where relevant. disbursements and Resource efficiency SLLs therefore help not only our clients move towards their sustainability targets but also NIB align its lending portfolio with the Paris EUR 725 million Agreement in the long term. in total NIB publishes consolidated information ( ) 1 EUR 368 million in 2023 T otal disbusments by the end of 2023. UN SDG= UN Sustainable Development Goals 2 about its SLLs and underlying key features here. Climat e change mitigation, pollution reduction & human capital and equal economic opportunities

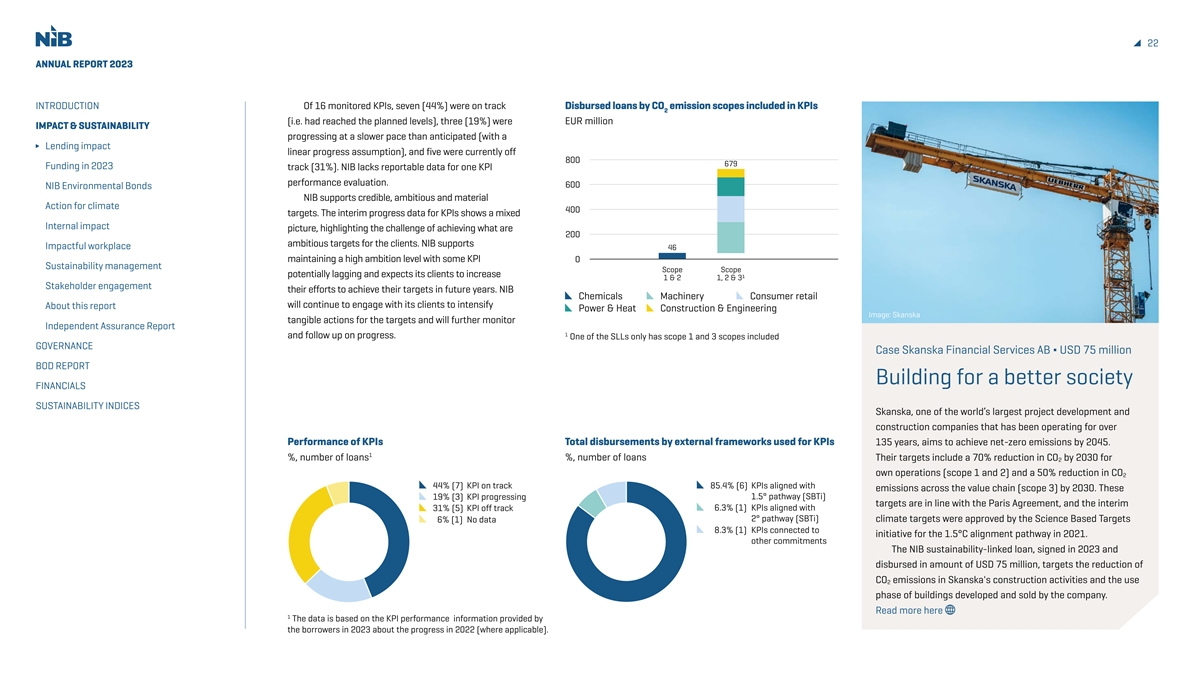

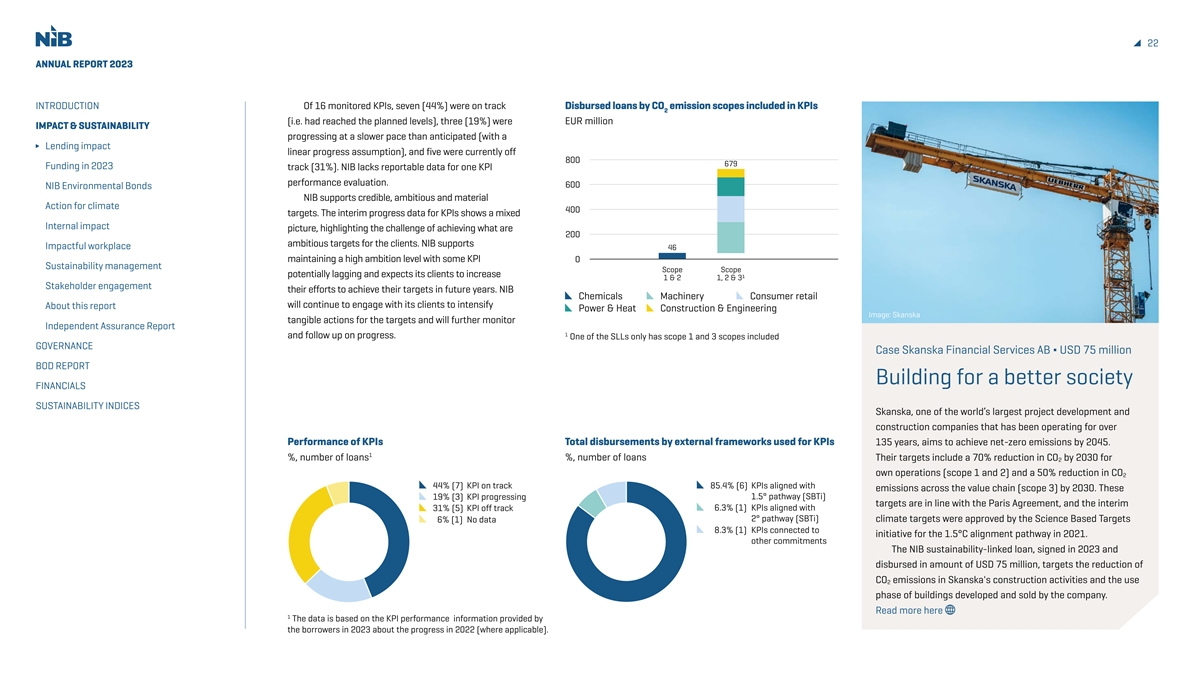

22 ANNUAL REPORT 2023 INTRODUCTION Of 16 monitored KPIs, seven (44%) were on track Disbursed loans by CO emission scopes included in KPIs 2 (i.e. had reached the planned levels), three (19%) were EUR million IMPACT & SUSTAINABILITY progressing at a slower pace than anticipated (with a Lending impact linear progress assumption), and five were currently off 800 679 Funding in 2023 track (31%). NIB lacks reportable data for one KPI performance evaluation. 600 NIB Environmental Bonds NIB supports credible, ambitious and material Action for climate 400 targets. The interim progress data for KPIs shows a mixed Internal impact picture, highlighting the challenge of achieving what are 200 ambitious targets for the clients. NIB supports Impactful workplace 46 maintaining a high ambition level with some KPI 0 Sustainability management Scope Scope potentially lagging and expects its clients to increase 1 & 2 1, 2 & 3¹ Stakeholder engagement their efforts to achieve their targets in future years. NIB Chemicals Machinery Consumer retail will continue to engage with its clients to intensify About this report P ower & Heat Construction & Engineering Image: Skanska tangible actions for the targets and will further monitor Independent Assurance Report 1 and follow up on progress. One of the SLLs only has scope 1 and 3 scopes included GOVERNANCE Case Skanska Financial Services AB ∆ USD 75 million BOD REPORT Building for a better society FINANCIALS SUSTAINABILITY INDICES Skanska, one of the world’s largest project development and construction companies that has been operating for over Performance of KPIs Total disbursements by external frameworks used for KPIs 135 years, aims to achieve net-zero emissions by 2045. 1 %, number of loans %, number of loans Their targets include a 70% reduction in CO by 2030 for 2 own operations (scope 1 and 2) and a 50% reduction in CO 2 44% (7) KPI on track 85.4% (6) KPIs aligned with emissions across the value chain (scope 3) by 2030. These 19% (3) KPI progressing 1.5° pathway (SBTi) targets are in line with the Paris Agreement, and the interim 31% (5) KPI off track 6.3% (1) KPIs aligned with 6% (1) No data 2° pathway (SBTi) climate targets were approved by the Science Based Targets 8.3% (1) KPIs connected to initiative for the 1.5°C alignment pathway in 2021. other commitments The NIB sustainability-linked loan, signed in 2023 and disbursed in amount of USD 75 million, targets the reduction of CO emissions in Skanska's construction activities and the use 2 phase of buildings developed and sold by the company. Read more here 1 The data is based on the KPI performance information provided by the borrowers in 2023 about the progress in 2022 (where applicable).

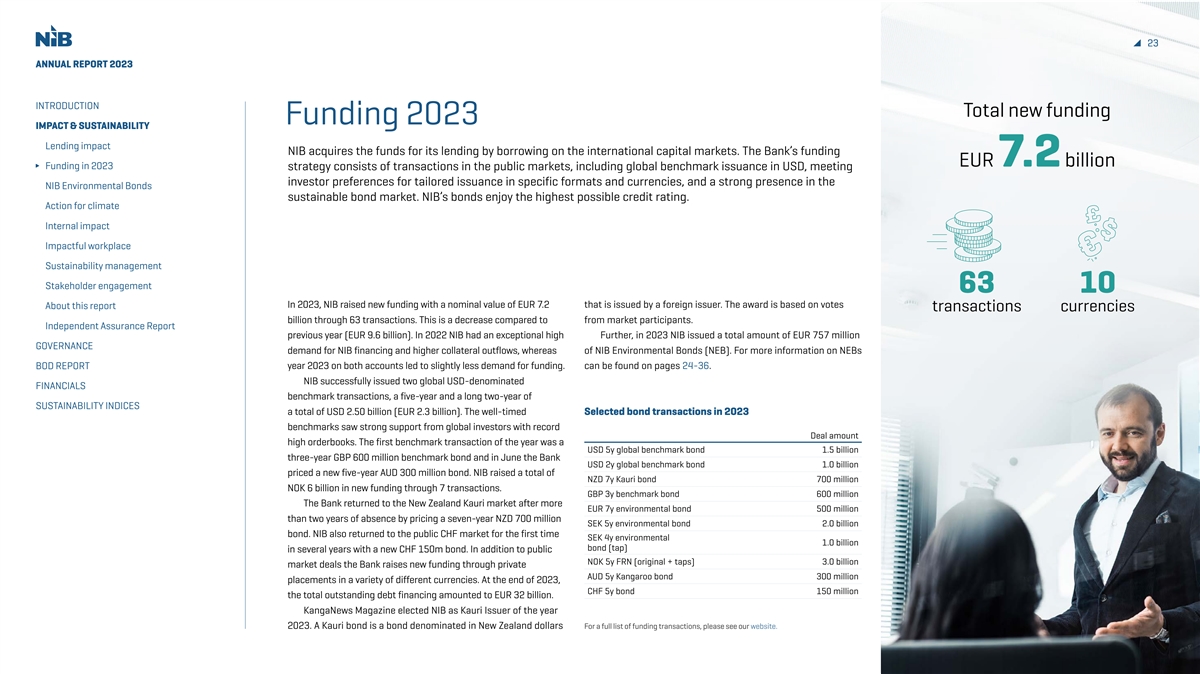

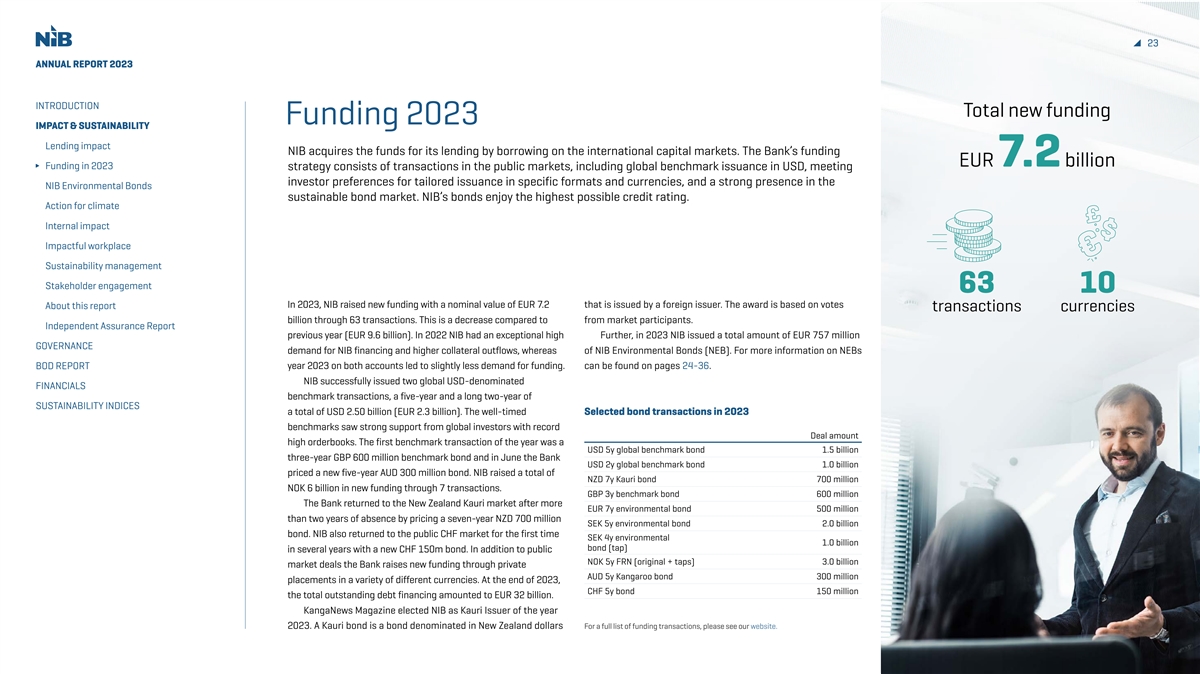

23 23 ANNUAL REPORT 2023 INTRODUCTION Total new funding Funding 2023 IMPACT & SUSTAINABILITY Lending impact NIB acquires the funds for its lending by borrowing on the international capital markets. The Bank’s funding EUR 7.2 billion Funding in 2023 strategy consists of transactions in the public markets, including global benchmark issuance in USD, meeting investor preferences for tailored issuance in specific formats and currencies, and a strong presence in the NIB Environmental Bonds sustainable bond market. NIB’s bonds enjoy the highest possible credit rating. Action for climate Internal impact Impactful workplace Sustainability management Stakeholder engagement 63 10 In 2023, NIB raised new funding with a nominal value of EUR 7.2 that is issued by a foreign issuer. The award is based on votes About this report transactions currencies billion through 63 transactions. This is a decrease compared to from market participants. Independent Assurance Report previous year (EUR 9.6 billion). In 2022 NIB had an exceptional high Further, in 2023 NIB issued a total amount of EUR 757 million GOVERNANCE demand for NIB financing and higher collateral outflows, whereas of NIB Environmental Bonds (NEB). For more information on NEBs BOD REPORT year 2023 on both accounts led to slightly less demand for funding. can be found on pages 24-36. NIB successfully issued two global USD-denominated FINANCIALS benchmark transactions, a five-year and a long two-year of SUSTAINABILITY INDICES a total of USD 2.50 billion (EUR 2.3 billion). The well-timed Selected bond transactions in 2023 benchmarks saw strong support from global investors with record Deal amount high orderbooks. The first benchmark transaction of the year was a USD 5y global benchmark bond 1.5 billion three-year GBP 600 million benchmark bond and in June the Bank USD 2y global benchmark bond 1.0 billion priced a new five-year AUD 300 million bond. NIB raised a total of NZD 7y Kauri bond 700 million NOK 6 billion in new funding through 7 transactions. GBP 3y benchmark bond 600 million The Bank returned to the New Zealand Kauri market after more EUR 7y environmental bond 500 million than two years of absence by pricing a seven-year NZD 700 million SEK 5y environmental bond 2.0 billion bond. NIB also returned to the public CHF market for the first time SEK 4y environmental 1.0 billion bond (tap) in several years with a new CHF 150m bond. In addition to public NOK 5y FRN (original + taps) 3.0 billion market deals the Bank raises new funding through private AUD 5y Kangaroo bond 300 million placements in a variety of different currencies. At the end of 2023, CHF 5y bond 150 million the total outstanding debt financing amounted to EUR 32 billion. KangaNews Magazine elected NIB as Kauri Issuer of the year 2023. A Kauri bond is a bond denominated in New Zealand dollars For a full list of funding transactions, please see our website.

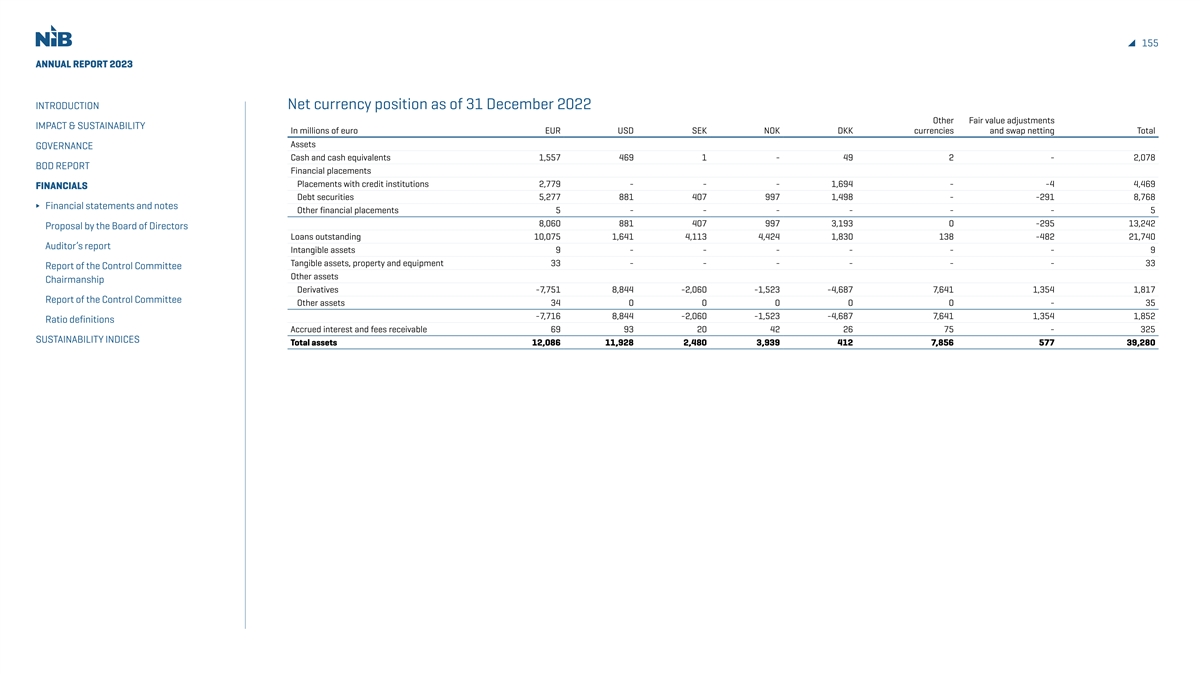

24 ANNUAL REPORT 2023 INTRODUCTION NIB Environmental Bonds 2023 IMPACT & SUSTAINABILITY Lending impact Year 2023 was the thirteenth year in a row that the bank issued NIB Funding in 2023 Environmental Bonds (NEB). The total issuance of NEB since 2011 now stands at EUR 7.6 billion. In 2023, a record amount of NEB eligible NIB Environmental Bonds projects was disbursed, EUR 1.275 billion. Action for climate Internal impact Impactful workplace The NEBs issued in 2023 were denominated in investors in Sweden. Also the third NEB Sustainability management EUR and SEK and totalled the equivalent of of the year, a four-year SEK 1 billion tap was Stakeholder engagement EUR 757 million. The first NIB Environmental placed domestically. Bond of the year was a seven-year EUR 500 By continuing issuing NEBs the Bank About this report million NEB launched in January. The second attracts sustainable bond investors, both loyal Independent Assurance Report green bond for the year, a five-year SEK 2 billion investors but also new investors. GOVERNANCE NEB was priced in September. In December NIB NIB continued the work in The Principles. BOD REPORT increased an outstanding four-year green bond The Principles are a global initiative providing with SEK 1 billion, taking the new total of the support and guidelines to the sustainable bond FINANCIALS bond to SEK 3 billion. market. The International Capital Markets SUSTAINABILITY INDICES The no-grow EUR 500 million NEB issued Association (ICMA) serves as Secretariat to the in January had a solid diversified orderbook Principles. NIB has been committed to this work of almost EUR 1 billion. This is the ninth year since its establishment in 2014 and a member Year 2023 marked a record in a row that NIB issues a EUR 500 million of the Executive Committee since. year of NEB eligible projects benchmark bond. The SEK 2 billion NEB NIB’s framework for issuance of green disbursed. This shows the issued in September had an orderbook of bonds (NEB Framework), is undergoing a review SEK 2.7 billion and was bought by domestic that is expected to be finalised during 2024. commitment from our The update will reflect current market best customers to NIB’s mandate practise and NIB’s intention to gradually align of financing projects itself with the EU taxonomy. Total NEB issuance benefitting the environment. NIB continues to report transparently on 2011-2023 Kim Skov Jensen, the allocation and impact of its environmental CFO bonds, including NIB's estimated alignment with the EU taxonomy for its green fund pool EUR 7.6 billion (see page 34).

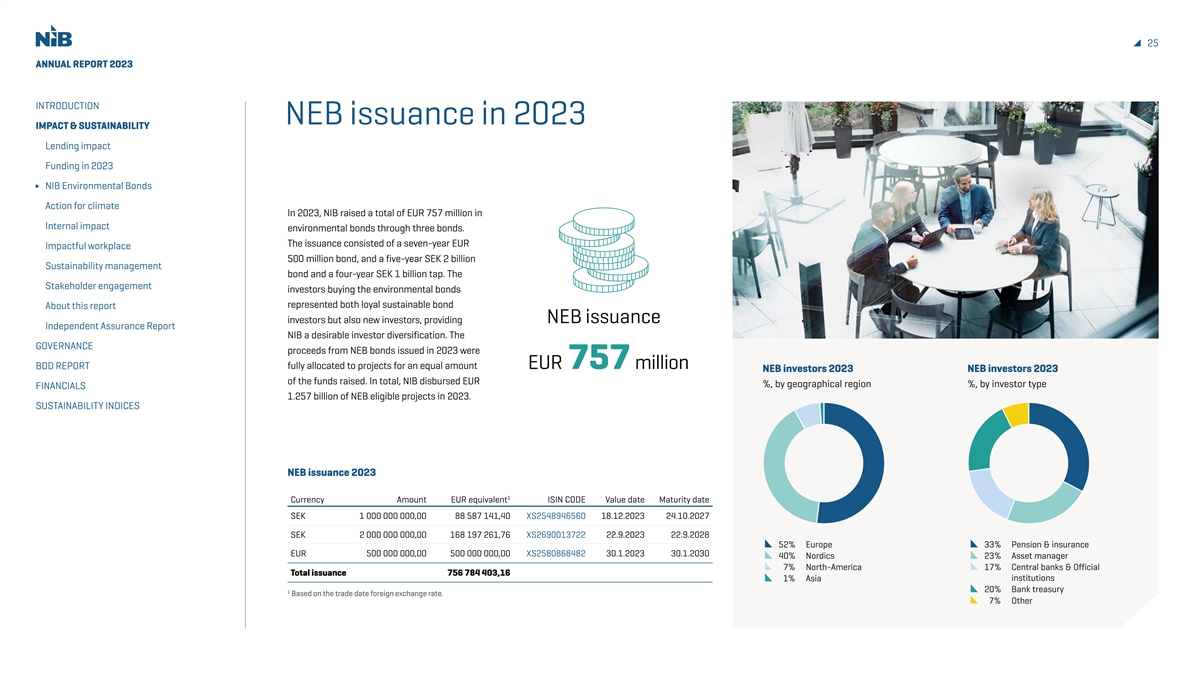

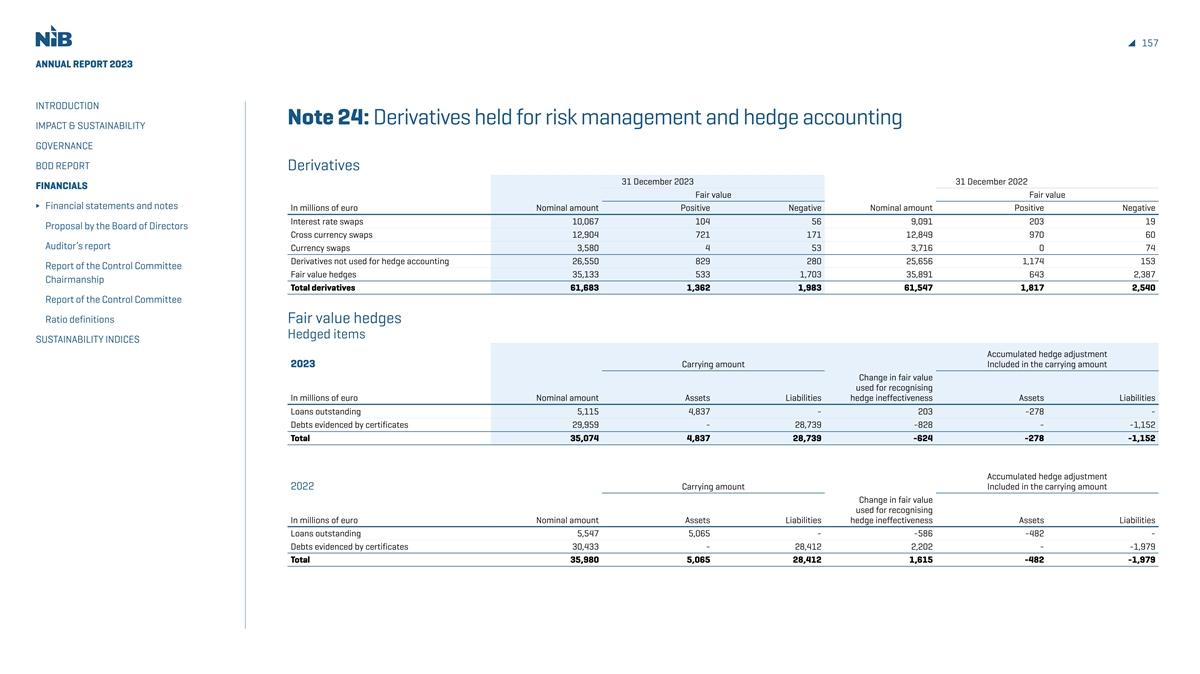

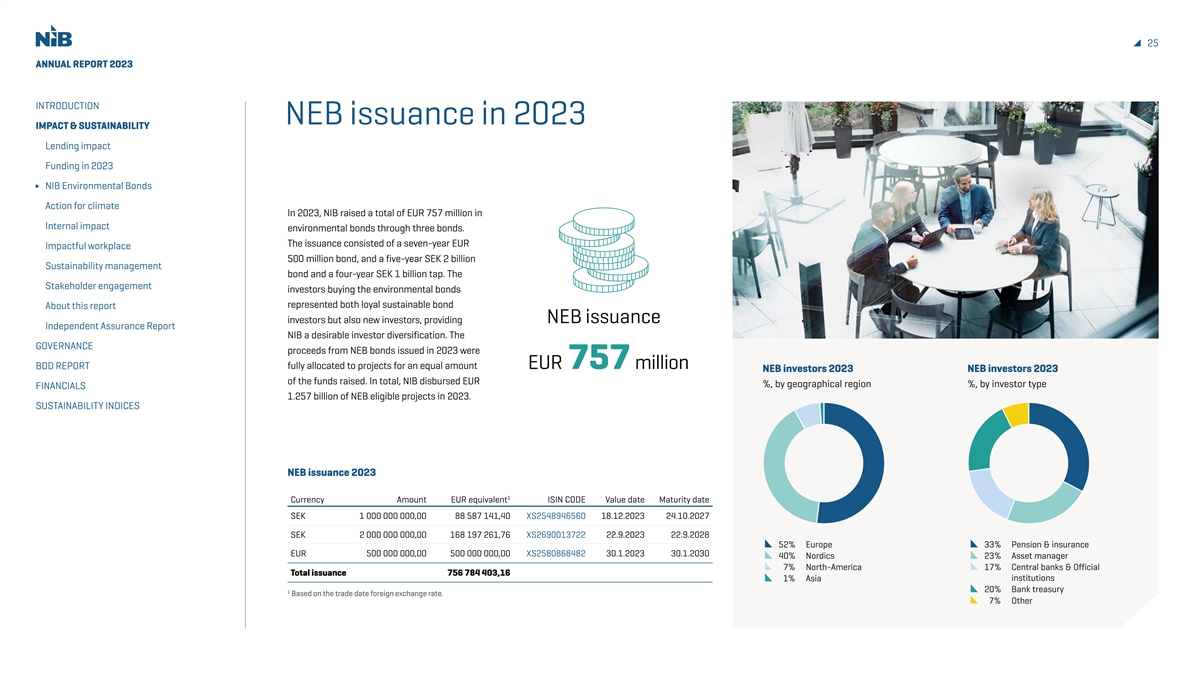

25 ANNUAL REPORT 2023 INTRODUCTION NEB issuance in 2023 IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB Environmental Bonds Action for climate In 2023, NIB raised a total of EUR 757 million in Internal impact environmental bonds through three bonds. The issuance consisted of a seven-year EUR Impactful workplace 500 million bond, and a five-year SEK 2 billion Sustainability management bond and a four-year SEK 1 billion tap. The Stakeholder engagement investors buying the environmental bonds represented both loyal sustainable bond About this report investors but also new investors, providing NEB issuance Independent Assurance Report NIB a desirable investor diversification. The GOVERNANCE proceeds from NEB bonds issued in 2023 were BOD REPORT fully allocated to projects for an equal amount EUR 757 million NEB investors 2023 NEB investors 2023 of the funds raised. In total, NIB disbursed EUR %, by geographical region %, by investor type FINANCIALS 1.257 billion of NEB eligible projects in 2023. SUSTAINABILITY INDICES NEB issuance 2023 1 Currency Amount EUR equivalent ISIN CODE Value date Maturity date SEK 1 000 000 000,00 88 587 141,40 XS2548946560 18.12.2023 24.10.2027 SEK 2 000 000 000,00 168 197 261,76 XS2690013722 22.9.2023 22.9.2028 52% Europe 33% Pension & insurance EUR 500 000 000,00 500 000 000,00 XS2580868482 30.1.2023 30.1.2030 40% Nordics 23% Asset manager 7% North-America 17% Central banks & Official Total issuance 756 784 403,16 1% Asia institutions 20% Bank treasury 1 Based on the trade date foreign exchange rate. 7% Other

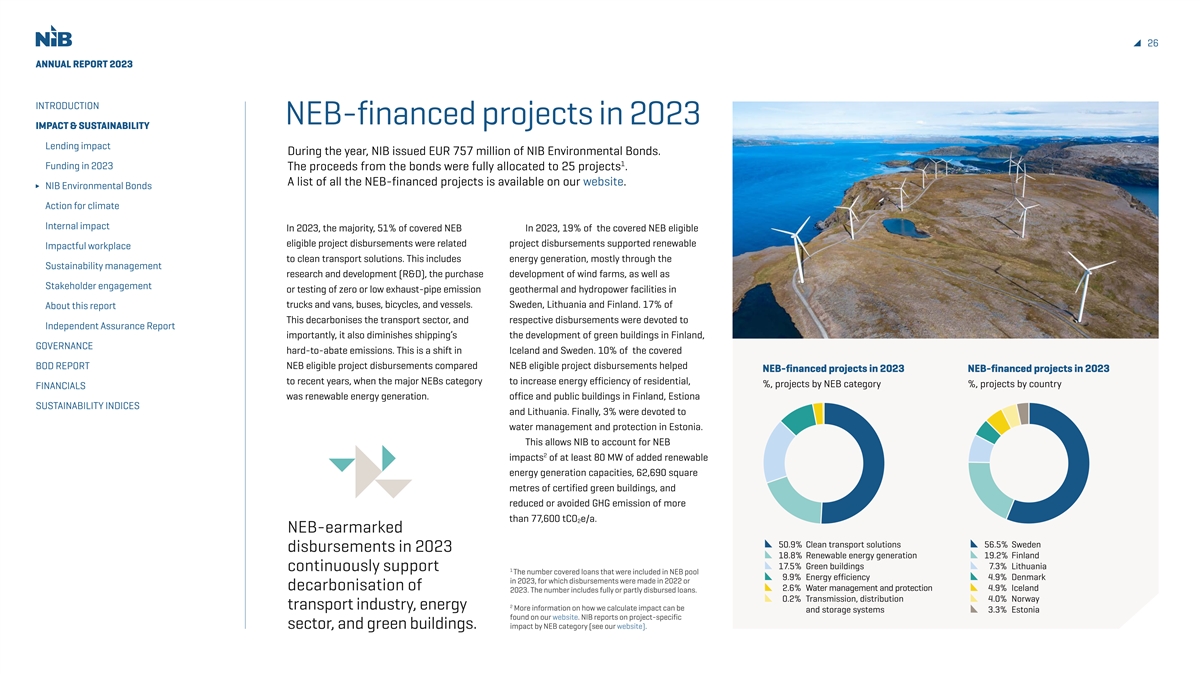

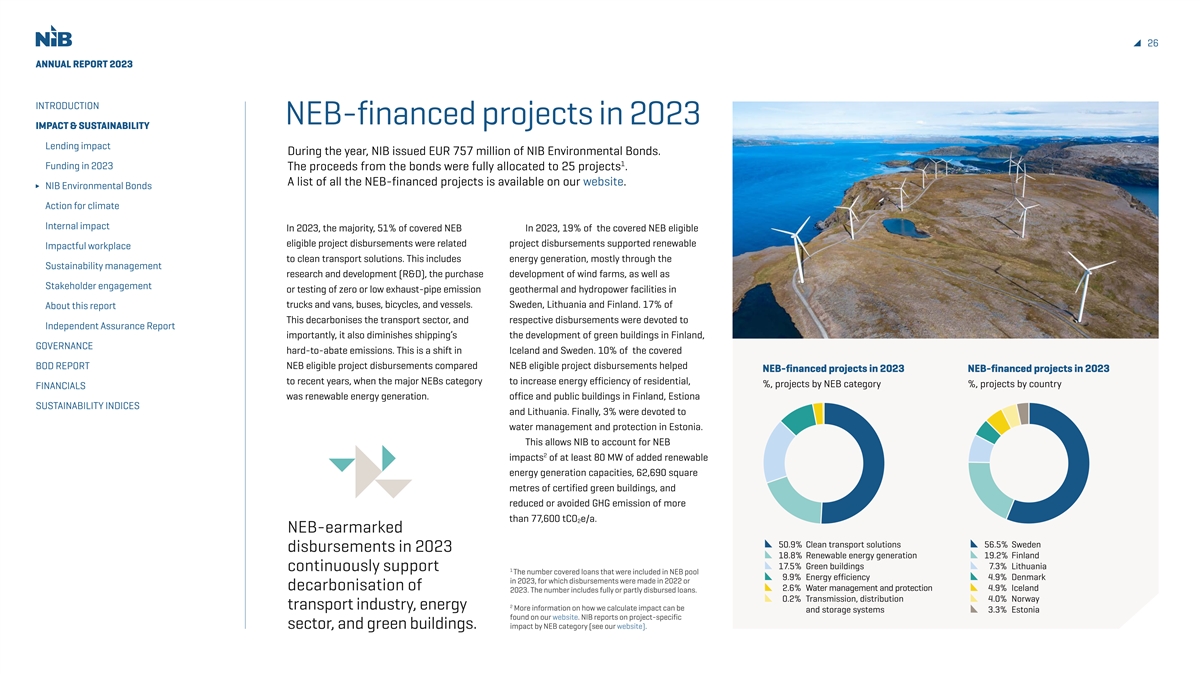

26 ANNUAL REPORT 2023 INTRODUCTION NEB-financed projects in 2023 IMPACT & SUSTAINABILITY Lending impact During the year, NIB issued EUR 757 million of NIB Environmental Bonds. 1 Funding in 2023 The proceeds from the bonds were fully allocated to 25 projects . A list of all the NEB-financed projects is available on our website. NIB Environmental Bonds Action for climate Internal impact In 2023, the majority, 51% of covered NEB In 2023, 19% of the covered NEB eligible eligible project disbursements were related project disbursements supported renewable Impactful workplace to clean transport solutions. This includes energy generation, mostly through the Sustainability management research and development (R&D), the purchase development of wind farms, as well as Stakeholder engagement or testing of zero or low exhaust-pipe emission geothermal and hydropower facilities in trucks and vans, buses, bicycles, and vessels. Sweden, Lithuania and Finland. 17% of About this report This decarbonises the transport sector, and respective disbursements were devoted to Independent Assurance Report importantly, it also diminishes shipping’s the development of green buildings in Finland, GOVERNANCE hard-to-abate emissions. This is a shift in Iceland and Sweden. 10% of the covered BOD REPORT NEB eligible project disbursements compared NEB eligible project disbursements helped NEB-financed projects in 2023 NEB-financed projects in 2023 to recent years, when the major NEBs category to increase energy efficiency of residential, %, projects by NEB category %, projects by country FINANCIALS was renewable energy generation. office and public buildings in Finland, Estiona SUSTAINABILITY INDICES and Lithuania. Finally, 3% were devoted to water management and protection in Estonia. This allows NIB to account for NEB 2 impacts of at least 80 MW of added renewable energy generation capacities, 62,690 square metres of certified green buildings, and reduced or avoided GHG emission of more than 77,600 tCO e/a. 2 NEB-earmarked 50.9% Clean transport solutions56.5% Sweden disbursements in 2023 18.8% Renewable energy generation19.2% Finland 17 .5% Green buildings 7.3% Lithuania continuously support 1 The number covered loans that were included in NEB pool 9.9% Energy efficiency 4.9% Denmark in 2023, for which disbursements were made in 2022 or decarbonisation of 2.6% Water management and protection 4.9% Iceland 2023. The number includes fully or partly disbursed loans. 0.2% Transmission, distribution 4.0% Norway 2 transport industry, energy More information on how we calculate impact can be and storage systems 3.3% Estonia found on our website. NIB reports on project-specific sector, and green buildings. impact by NEB category (see our website).

ANNUAL REPORT 2023 INTRODUCTION IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB Environmental Bonds Action for climate Internal impact Impactful workplace Sustainability management Stakeholder engagement About this report Independent Assurance Report Case Case GOVERNANCE Enefit SB Modernizavimo BOD REPORT Green AS Fondas UAB FINANCIALS Case Construction of wind power generation Financing of multi-apartment SUSTAINABILITY INDICES capacity in Lithuania and Finland, and renovation projects in Lithuania. Scania CV AB photovoltaic generation capacity in Estonia. R&D programme to develop NEB category: NEB category: battery electric vehicle. Renewable energy generation Energy efficiency NEB category: NEB-financed as of 31.12.2023: NEB-financed as of 31.12.2023: Clean transport solutions EUR 40 million EUR 33.33 million NEB-financed as of 31.12.2023: Impact: Impact: EUR 175 million The total nominal capacity of 184 MW, Decrease of energy demand by 40% increased renewableenergy generation Impact: by 468,2 GWh/a, 157 kt CO e/a Low carbon, cost efficient 2 of avoided emissions means of transportation Full impact data not pro-rated. Image credits: respective clients.

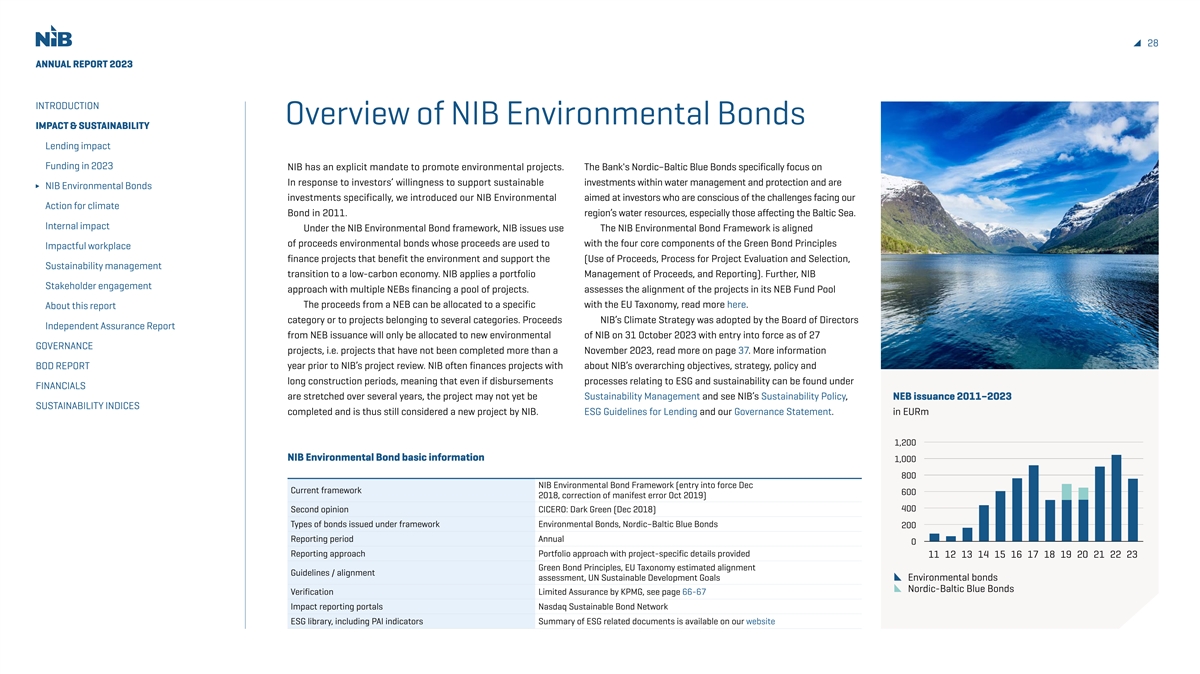

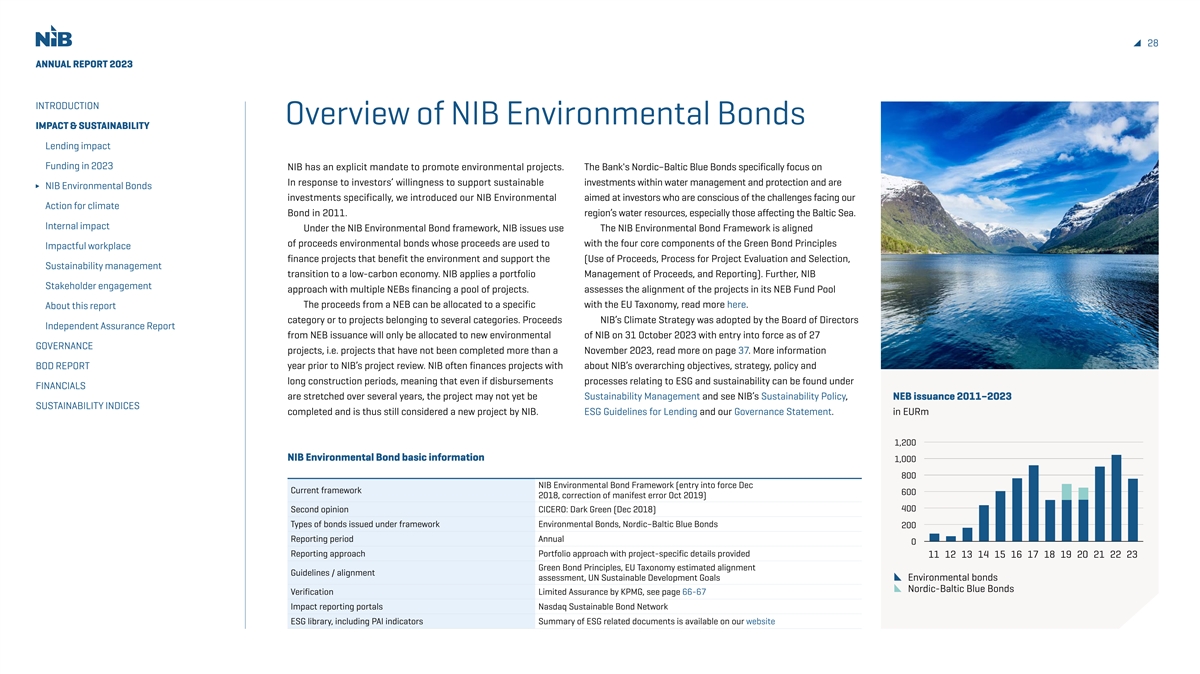

28 ANNUAL REPORT 2023 INTRODUCTION Overview of NIB Environmental Bonds IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB has an explicit mandate to promote environmental projects. The Bank's Nordic–Baltic Blue Bonds specifically focus on In response to investors’ willingness to support sustainable investments within water management and protection and are NIB Environmental Bonds investments specifically, we introduced our NIB Environmental aimed at investors who are conscious of the challenges facing our Action for climate Bond in 2011. region’s water resources, especially those affecting the Baltic Sea. Internal impact Under the NIB Environmental Bond framework, NIB issues use The NIB Environmental Bond Framework is aligned of proceeds environmental bonds whose proceeds are used to with the four core components of the Green Bond Principles Impactful workplace finance projects that benefit the environment and support the (Use of Proceeds, Process for Project Evaluation and Selection, Sustainability management transition to a low-carbon economy. NIB applies a portfolio Management of Proceeds, and Reporting). Further, NIB Stakeholder engagement approach with multiple NEBs financing a pool of projects. assesses the alignment of the projects in its NEB Fund Pool The proceeds from a NEB can be allocated to a specific with the EU Taxonomy, read more here. About this report category or to projects belonging to several categories. Proceeds NIB’s Climate Strategy was adopted by the Board of Directors Independent Assurance Report from NEB issuance will only be allocated to new environmental of NIB on 31 October 2023 with entry into force as of 27 GOVERNANCE projects, i.e. projects that have not been completed more than a November 2023, read more on page 37. More information BOD REPORT year prior to NIB’s project review. NIB often finances projects with about NIB’s overarching objectives, strategy, policy and long construction periods, meaning that even if disbursements processes relating to ESG and sustainability can be found under FINANCIALS are stretched over several years, the project may not yet be Sustainability Management and see NIB’s Sustainability Policy, NEB issuance 2011–2023 SUSTAINABILITY INDICES completed and is thus still considered a new project by NIB. ESG Guidelines for Lending and our Governance Statement. in EURm 1,200 NIB Environmental Bond basic information 1,000 800 NIB Environmental Bond Framework (entry into force Dec Current framework 600 2018, correction of manifest error Oct 2019) Second opinion CICERO: Dark Green (Dec 2018) 400 Types of bonds issued under framework Environmental Bonds, Nordic–Baltic Blue Bonds 200 Reporting period Annual 0 Reporting approach Portfolio approach with project-specific details provided 11 12 13 14 15 16 17 18 19 20 21 22 23 Green Bond Principles, EU Taxonomy estimated alignment Guidelines / alignment assessment, UN Sustainable Development Goals Environmental bonds Nordic-Baltic Blue Bonds Verification Limited Assurance by KPMG, see page 66-67 Impact reporting portals Nasdaq Sustainable Bond Network ESG library, including PAI indicators Summary of ESG related documents is available on our website

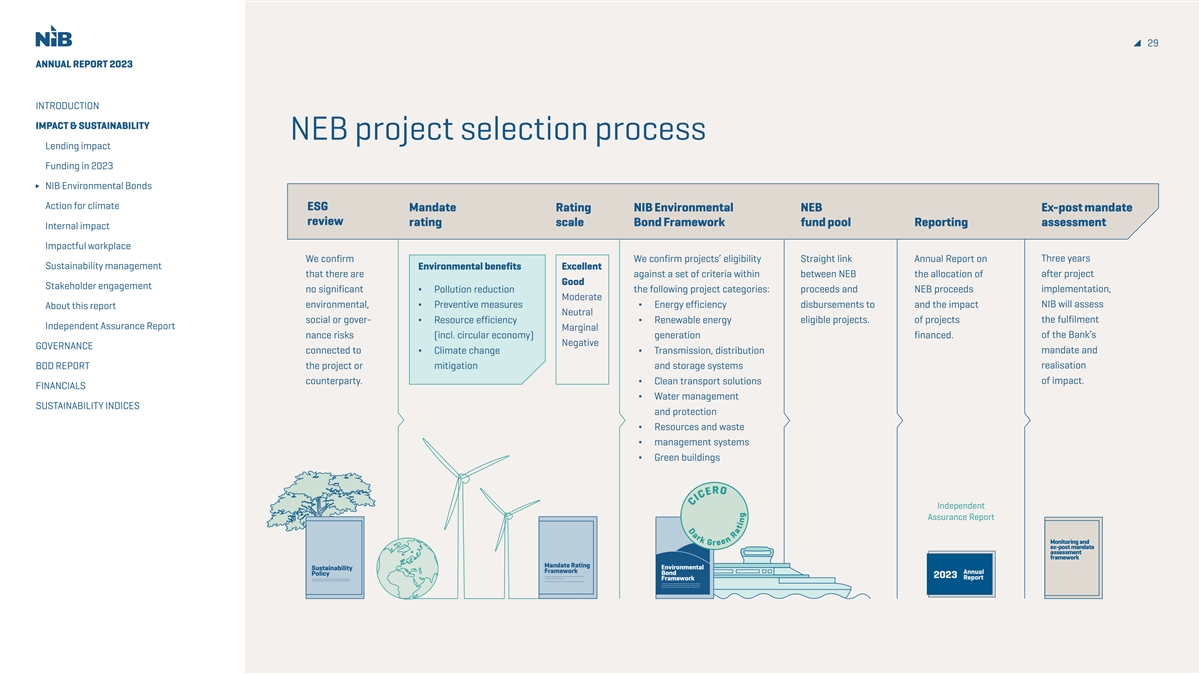

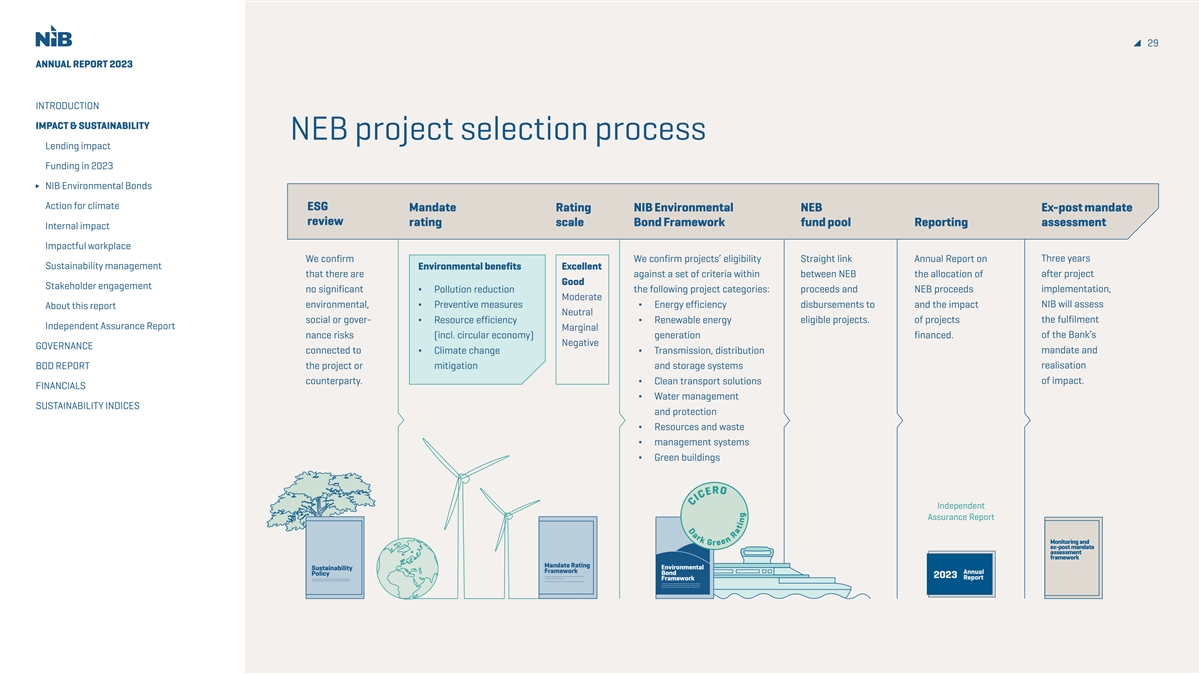

D a r k O G 29 ANNUAL REPORT 2023 INTRODUCTION IMPACT & SUSTAINABILITY NEB project selection process Lending impact Funding in 2023 NIB Environmental Bonds Action for climate ESG Mandate Rating NIB Environmental NEB Ex-post mandate review rating scale Bond Framework fund pool Reporting assessment Internal impact Impactful workplace We confirm We confirm projects’ eligibility Straight link Annual Report on Three years Sustainability management Environmental benefits Excellent after project that there are against a set of criteria within between NEB the allocation of Good Stakeholder engagement no significant ∆ Pollution reduction the following project categories: proceeds and NEB proceeds implementation, Moderate NIB will assess environmental, ∆ Preventive measures ∆ Energy efficiency disbursements to and the impact About this report Neutral social or gover- ∆ Resource efficiency ∆ R enewable energy eligible projects. of projects the fulfilment Independent Assurance Report Marginal of the Bank’s nance risks (incl. circular economy) generation financed. Negative GOVERNANCE connected to ∆ Climate change ∆ T ransmission, distribution mandate and realisation BOD REPORT the project or mitigation and storage systems counterparty. ∆ Clean transport solutions of impact. FINANCIALS ∆ Water management SUSTAINABILITY INDICES and protection ∆ Resources and waste ∆ management systems ∆ Green buildings Independent Assurance Report t NIB Mandate Rating Sustainability Environmental Framework Annual Policy Bond The Nordic Investment Bank is the international financial institution 2023 of the Nordic and Baltic countries. Adopted by the Board of Directors of the Nordic Investment Bank on Report 11 November 2021 with entry into force as of 11 November 2021 Framework We work towards a prosperous and sustainable Nordic–Baltic region. Framework for the undertaking of NIB Environmental Bond issuance – the underlying rationale and methodology for loan selection, and the governance of bond issuance, proceeds management and reporting R r e E e C n I R C a t i n g

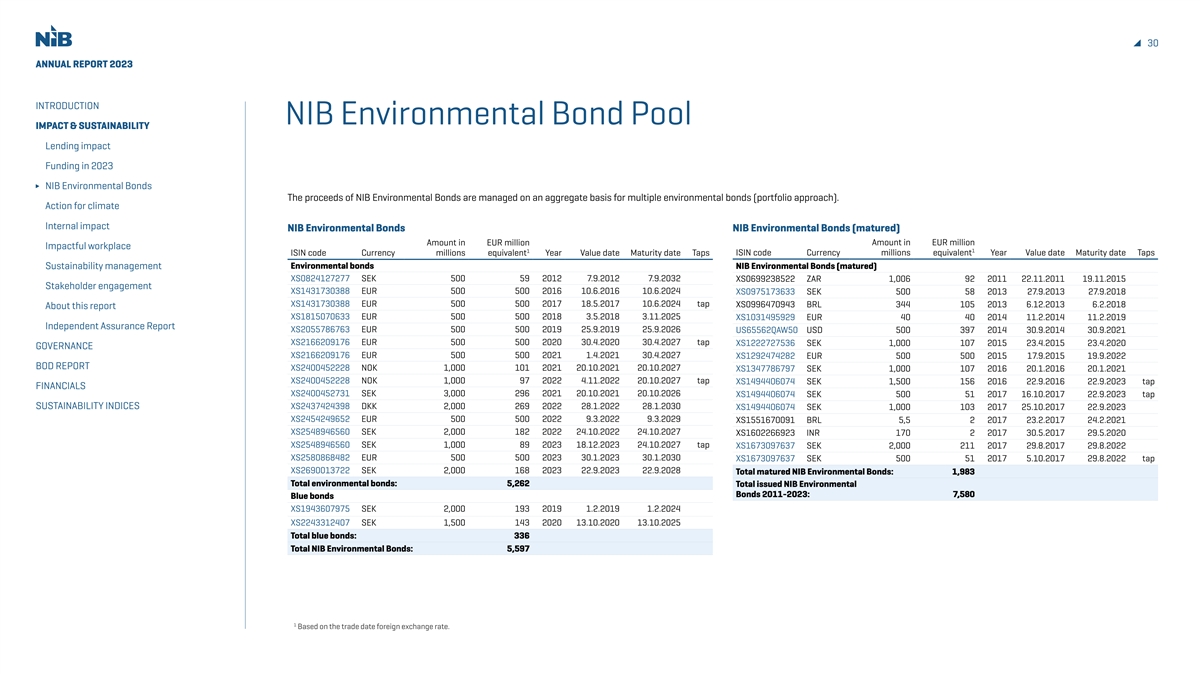

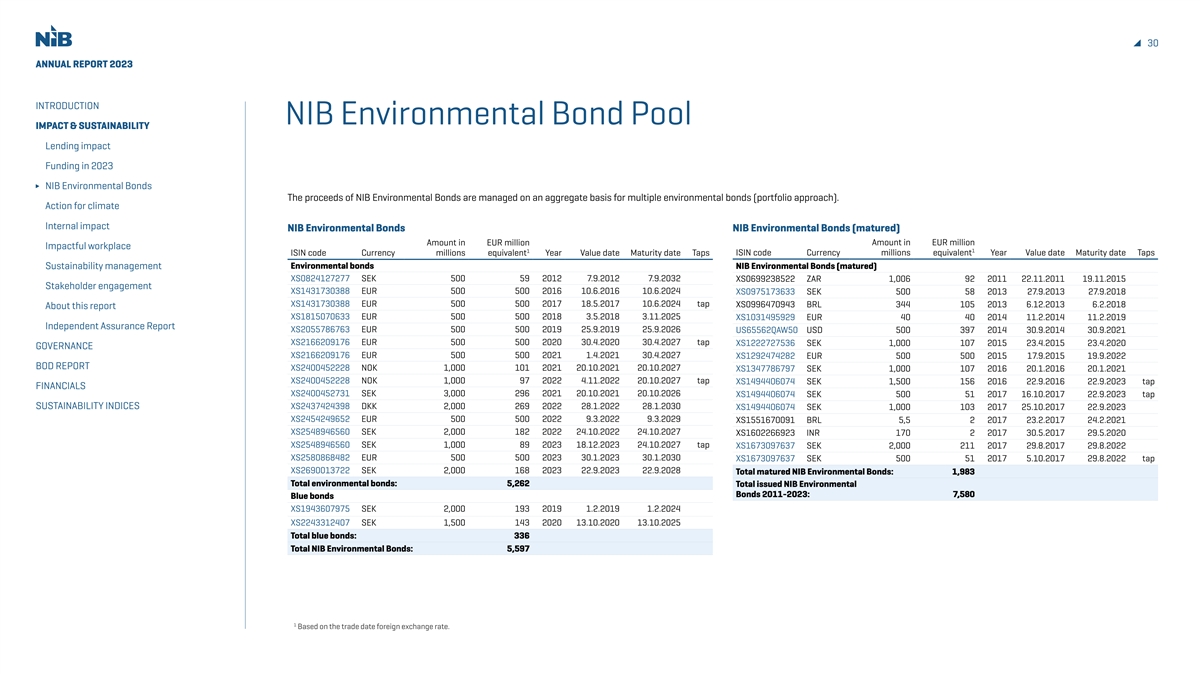

30 ANNUAL REPORT 2023 INTRODUCTION NIB Environmental Bond Pool IMPACT & SUSTAINABILITY Lending impact Funding in 2023 NIB Environmental Bonds The proceeds of NIB Environmental Bonds are managed on an aggregate basis for multiple environmental bonds (portfolio approach). Action for climate Internal impact NIB Environmental Bonds NIB Environmental Bonds (matured) Amount in EUR million Amount in EUR million Impactful workplace 1 1 ISIN code Currency millions equivalent Year Value date Maturity date Taps ISIN code Currency millions equivalent Year Value date Maturity date Taps Environmental bonds NIB Environmental Bonds (matured) Sustainability management XS0824127277 SEK 500 59 2012 7.9.2012 7.9.2032 XS0699238522 ZAR 1,006 92 2011 22.11.2011 19.11.2015 Stakeholder engagement XS1431730388 EUR 500 500 2016 10.6.2016 10.6.2024 XS0975173633 SEK 500 58 2013 27.9.2013 27.9.2018 XS1431730388 EUR 500 500 2017 18.5.2017 10.6.2024 tap XS0996470943 BRL 344 105 2013 6.12.2013 6.2.2018 About this report XS1815070633 EUR 500 500 2018 3.5.2018 3.11.2025 XS1031495929 EUR 40 40 2014 11.2.2014 11.2.2019 Independent Assurance Report XS2055786763 EUR 500 500 2019 25.9.2019 25.9.2026 US65562QAW50 USD 500 397 2014 30.9.2014 30.9.2021 XS2166209176 EUR 500 500 2020 30.4.2020 30.4.2027 tap XS1222727536 SEK 1,000 107 2015 23.4.2015 23.4.2020 GOVERNANCE XS2166209176 EUR 500 500 2021 1.4.2021 30.4.2027 XS1292474282 EUR 500 500 2015 17.9.2015 19.9.2022 BOD REPORT XS2400452228 NOK 1,000 101 2021 20.10.2021 20.10.2027 XS1347786797 SEK 1,000 107 2016 20.1.2016 20.1.2021 XS2400452228 NOK 1,000 97 2022 4.11.2022 20.10.2027 tap XS1494406074 SEK 1,500 156 2016 22.9.2016 22.9.2023 tap FINANCIALS XS2400452731 SEK 3,000 296 2021 20.10.2021 20.10.2026 XS1494406074 SEK 500 51 2017 16.10.2017 22.9.2023 tap SUSTAINABILITY INDICES XS2437424398 DKK 2,000 269 2022 28.1.2022 28.1.2030 XS1494406074 SEK 1,000 103 2017 25.10.2017 22.9.2023 XS2454249652 EUR 500 500 2022 9.3.2022 9.3.2029 XS1551670091 BRL 5,5 2 2017 23.2.2017 24.2.2021 XS2548946560 SEK 2,000 182 2022 24.10.2022 24.10.2027 XS1602266923 INR 170 2 2017 30.5.2017 29.5.2020 XS2548946560 SEK 1,000 89 2023 18.12.2023 24.10.2027 tap XS1673097637 SEK 2,000 211 2017 29.8.2017 29.8.2022 XS2580868482 EUR 500 500 2023 30.1.2023 30.1.2030 XS1673097637 SEK 500 51 2017 5.10.2017 29.8.2022 tap XS2690013722 SEK 2,000 168 2023 22.9.2023 22.9.2028 Total matured NIB Environmental Bonds: 1,983 Total environmental bonds: 5,262 Total issued NIB Environmental Bonds 2011-2023: 7,580 Blue bonds XS1943607975 SEK 2,000 193 2019 1.2.2019 1.2.2024 XS2243312407 SEK 1,500 143 2020 13.10.2020 13.10.2025 Total blue bonds: 336 Total NIB Environmental Bonds: 5,597 1 Based on the trade date foreign exchange rate.

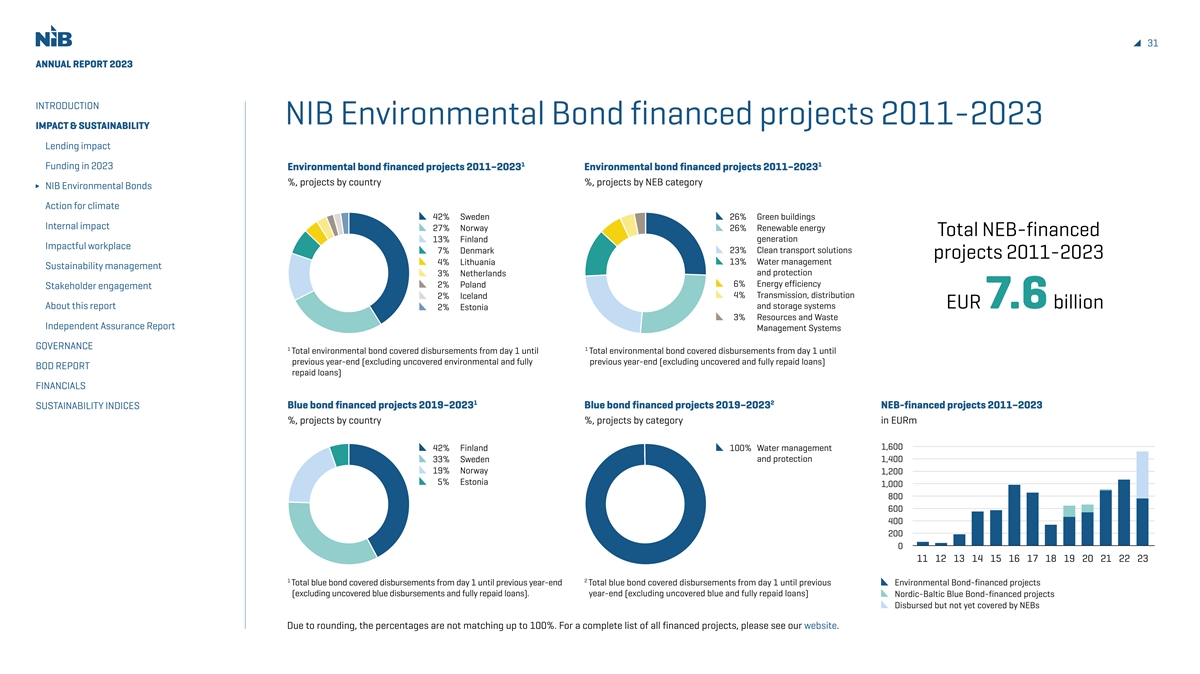

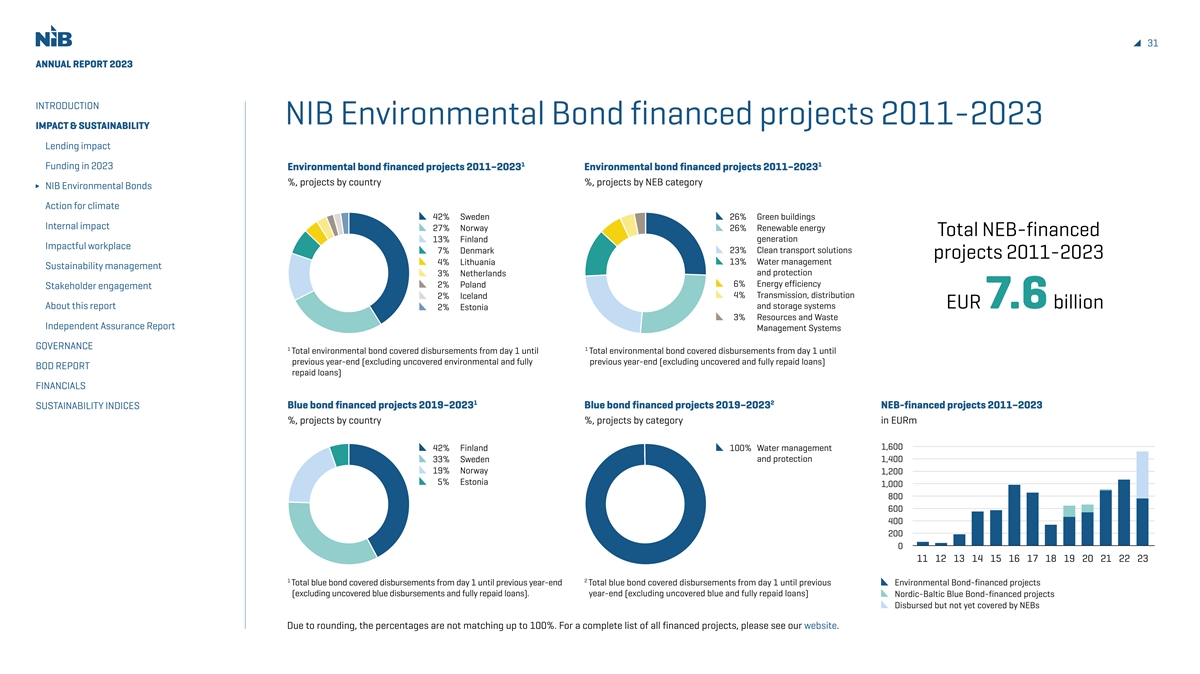

31 ANNUAL REPORT 2023 INTRODUCTION NIB Environmental Bond financed projects 2011-2023 IMPACT & SUSTAINABILITY Lending impact 1 1 Funding in 2023 Environmental bond financed projects 2011–2023 Environmental bond financed projects 2011–2023 %, projects by country %, projects by NEB category NIB Environmental Bonds Action for climate 42% Sweden 26% Green buildings Internal impact 27% Norway 26% Renewable energy Total NEB-financed 13% Finland generation Impactful workplace 7% Denmark 23% Clean transport solutions projects 2011-2023 4% Lithuania 13% Water management Sustainability management and protection 3% Netherlands 6% Energy efficiency 2% Poland Stakeholder engagement 4% Transmission, distribution 2% Iceland EUR 7.6 billion About this report and storage systems 2% Estonia 3% Resources and Waste Independent Assurance Report Management Systems GOVERNANCE 1 1 Total environmental bond covered disbursements from day 1 until Total environmental bond covered disbursements from day 1 until previous year-end (excluding uncovered environmental and fully previous year-end (excluding uncovered and fully repaid loans) BOD REPORT repaid loans) FINANCIALS 1 2 SUSTAINABILITY INDICES Blue bond financed projects 2019–2023 Blue bond financed projects 2019–2023 NEB-financed projects 2011–2023 %, projects by country %, projects by category in EURm 1,600 42% Finland 100% Water management 33% Sweden and protection 1,400 19% Norway 1,200 5% Estonia 1,000 800 600 400 200 0 11 12 13 14 15 16 17 18 19 20 21 22 23 1 2 Total blue bond covered disbursements from day 1 until previous year-end Total blue bond covered disbursements from day 1 until previous Environmental Bond-financed projects (excluding uncovered blue disbursements and fully repaid loans). year-end (excluding uncovered blue and fully repaid loans) Nordic-Baltic Blue Bond-financed projects Disbursed but not yet covered by NEBs Due to rounding, the percentages are not matching up to 100%. For a complete list of all financed projects, please see our website.

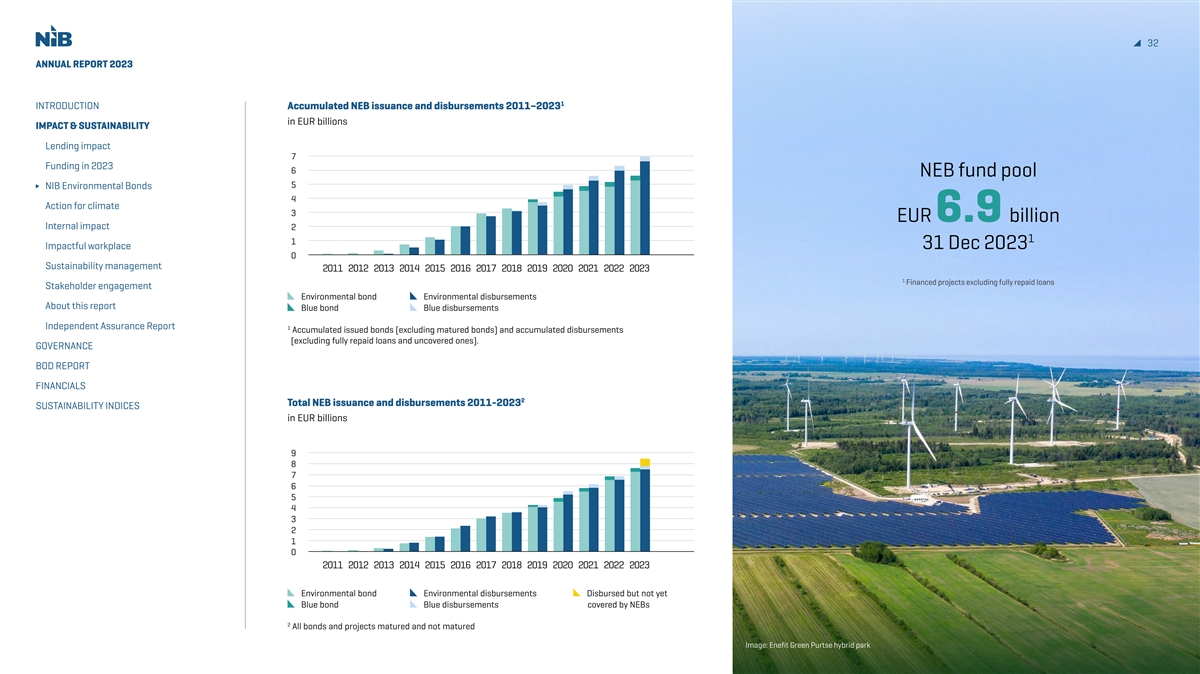

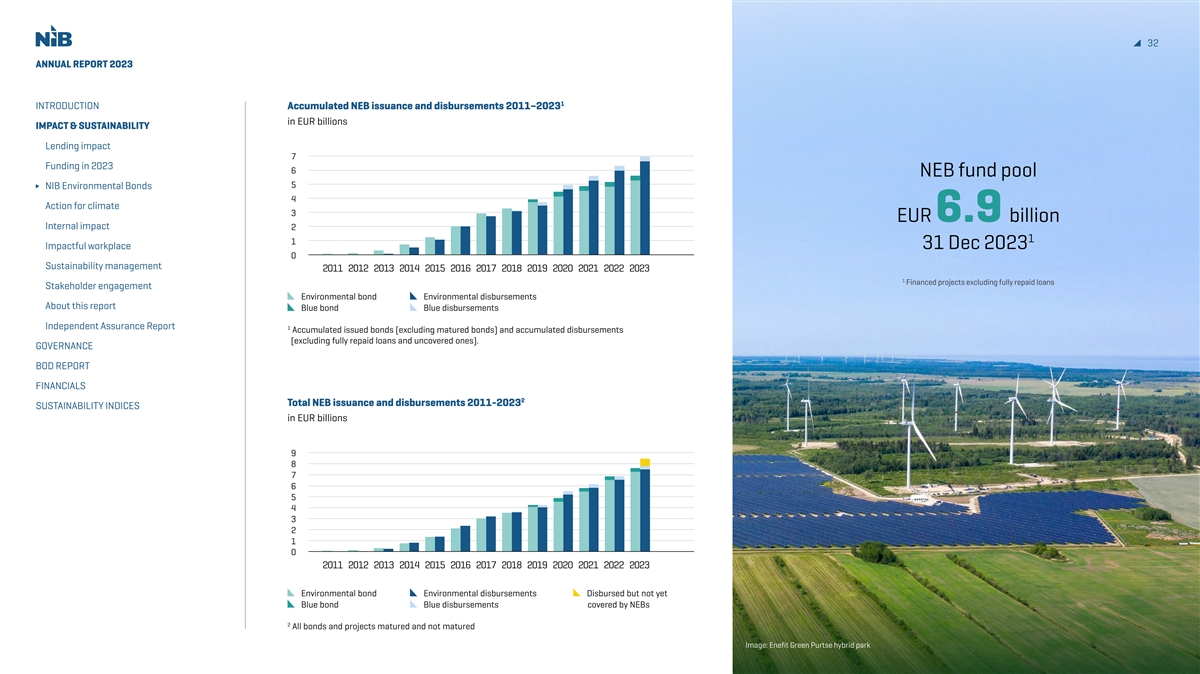

32 ANNUAL REPORT 2023 1 INTRODUCTION Accumulated NEB issuance and disbursements 2011–2023 in EUR billions IMPACT & SUSTAINABILITY Lending impact 7 Funding in 2023 6 NEB fund pool 5 NIB Environmental Bonds 4 Action for climate 3 EUR 6.9 billion Internal impact 2 1 1 Impactful workplace 31 Dec 2023 0 Sustainability management 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1 Financed projects excluding fully repaid loans Stakeholder engagement Environmental bond Environmental disbursements About this report Blue bond Blue disbursements Independent Assurance Report 1 Accumulated issued bonds (excluding matured bonds) and accumulated disbursements (excluding fully repaid loans and uncovered ones). GOVERNANCE BOD REPORT FINANCIALS 2 Total NEB issuance and disbursements 2011-2023 SUSTAINABILITY INDICES in EUR billions 9 8 7 6 5 4 3 2 1 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Environmental bond Environmental disbursements Disbursed but not yet Blue bond Blue disbursements covered by NEBs 2 All bonds and projects matured and not matured Image: Enefit Green Purtse hybrid park

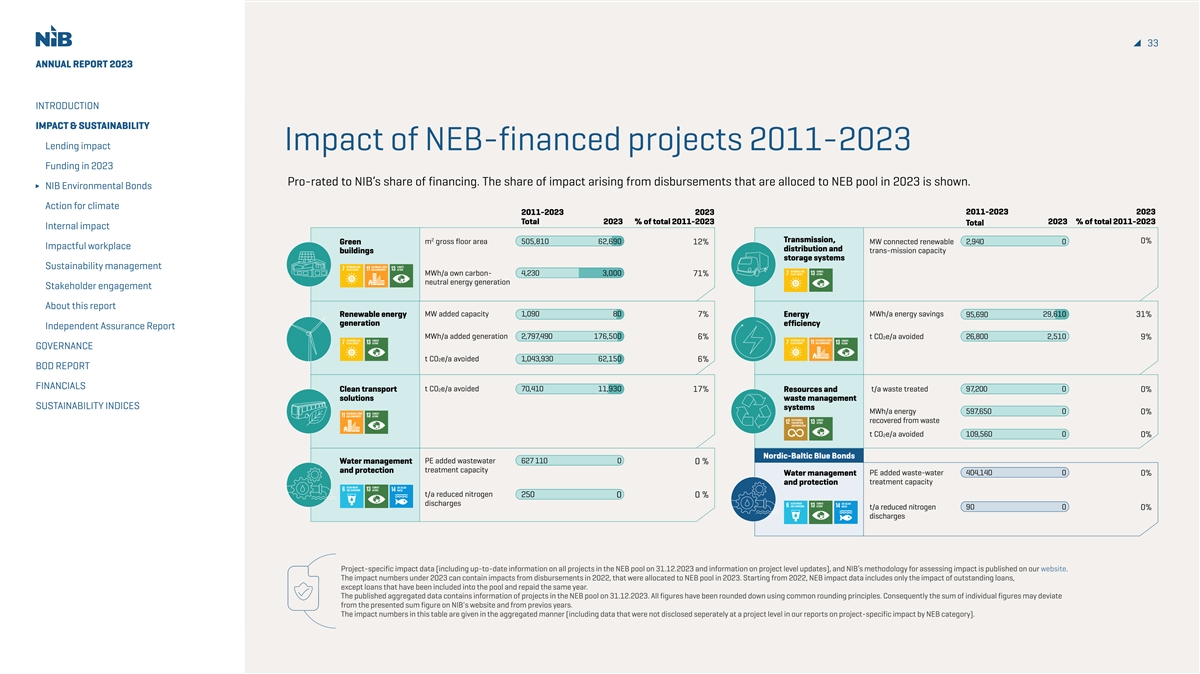

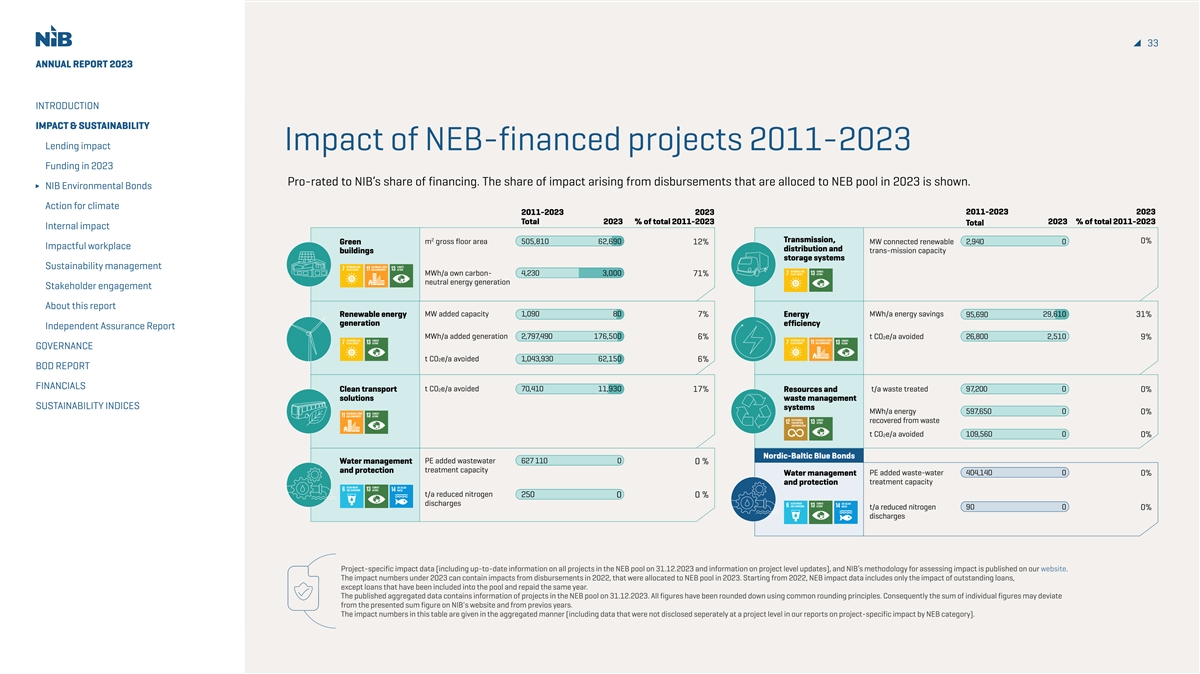

33 ANNUAL REPORT 2023 INTRODUCTION IMPACT & SUSTAINABILITY Lending impact Impact of NEB-financed projects 2011-2023 Funding in 2023 Pro-rated to NIB’s share of financing. The share of impact arising from disbursements that are alloced to NEB pool in 2023 is shown. NIB Environmental Bonds Action for climate 2011-2023 2023 2011-2023 2023 Total 2023 % of total 2011-2023 2023 % of total 2011-2023 Total Internal impact 2 Transmission, m gross floor area 505,810 62,690 0% Green 12% MW connected renewable 2,940 0 Impactful workplace distribution and buildings trans-mission capacity storage systems Sustainability management MWh/a own carbon- 4,230 3,000 71% neutral energy generation Stakeholder engagement About this report MW added capacity 1,090 80 MWh/a energy savings Renewable energy 7% Energy 95,690 29,610 31% generation efficiency Independent Assurance Report MWh/a added generation 2,797,490 176,500 t CO e/a avoided 26,800 2,510 6% 2 9% GOVERNANCE t CO2e/a avoided 1,043,930 62,150 6% BOD REPORT FINANCIALS t CO e/a avoided 70,410 11,930 Clean transport 2 17% Resources and t/a waste treated 97,200 0 0% solutions waste management SUSTAINABILITY INDICES systems MWh/a energy 597,650 0 0% recovered from waste t CO2e/a avoided 109,560 0 0% Nordic-Baltic Blue Bonds Water management PE added wastewater 627 110 0 0 % and protection treatment capacity Water management PE added waste-water 404,140 0 0% and protection treatment capacity t/a reduced nitrogen 250 0 0 % discharges t/a reduced nitrogen 90 0 0% discharges Project-specific impact data (including up-to-date information on all projects in the NEB pool on 31.12.2023 and information on project level updates), and NIB’s methodology for assessing impact is published on our website. The impact numbers under 2023 can contain impacts from disbursements in 2022, that were allocated to NEB pool in 2023. Starting from 2022, NEB impact data includes only the impact of outstanding loans, except loans that have been included into the pool and repaid the same year. The published aggregated data contains information of projects in the NEB pool on 31.12.2023. All figures have been rounded down using common rounding principles. Consequently the sum of individual figures may deviate from the presented sum figure on NIB's website and from previos years. The impact numbers in this table are given in the aggregated manner (including data that were not disclosed seperately at a project level in our reports on project-specific impact by NEB category).

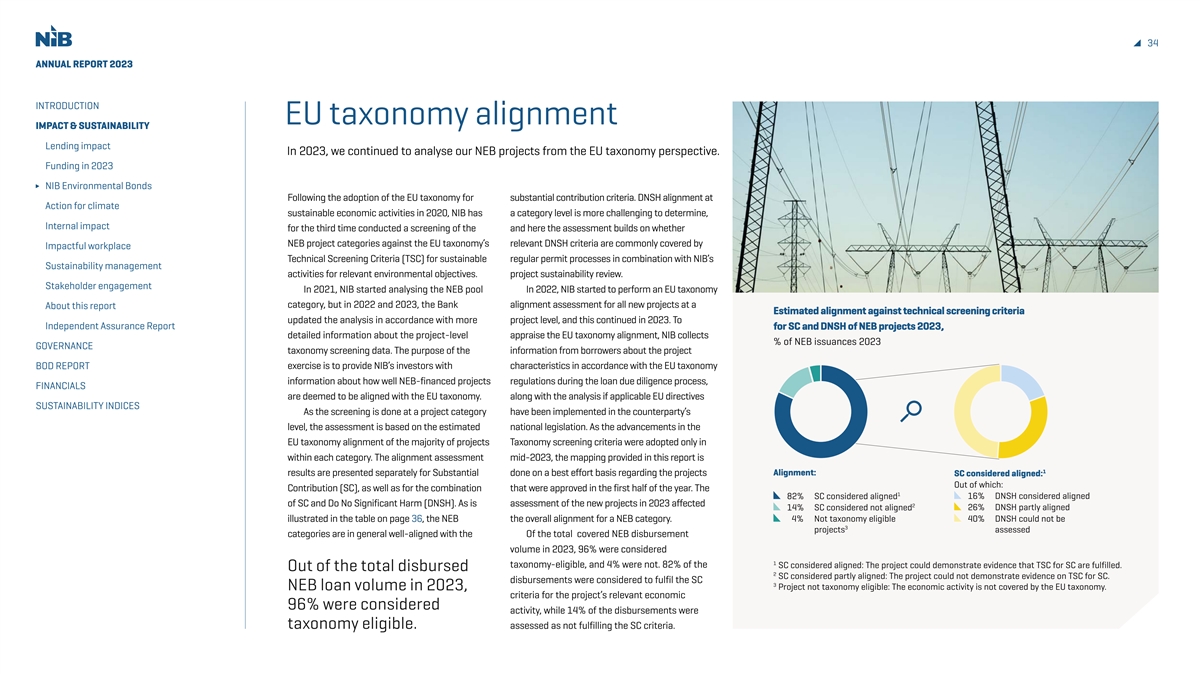

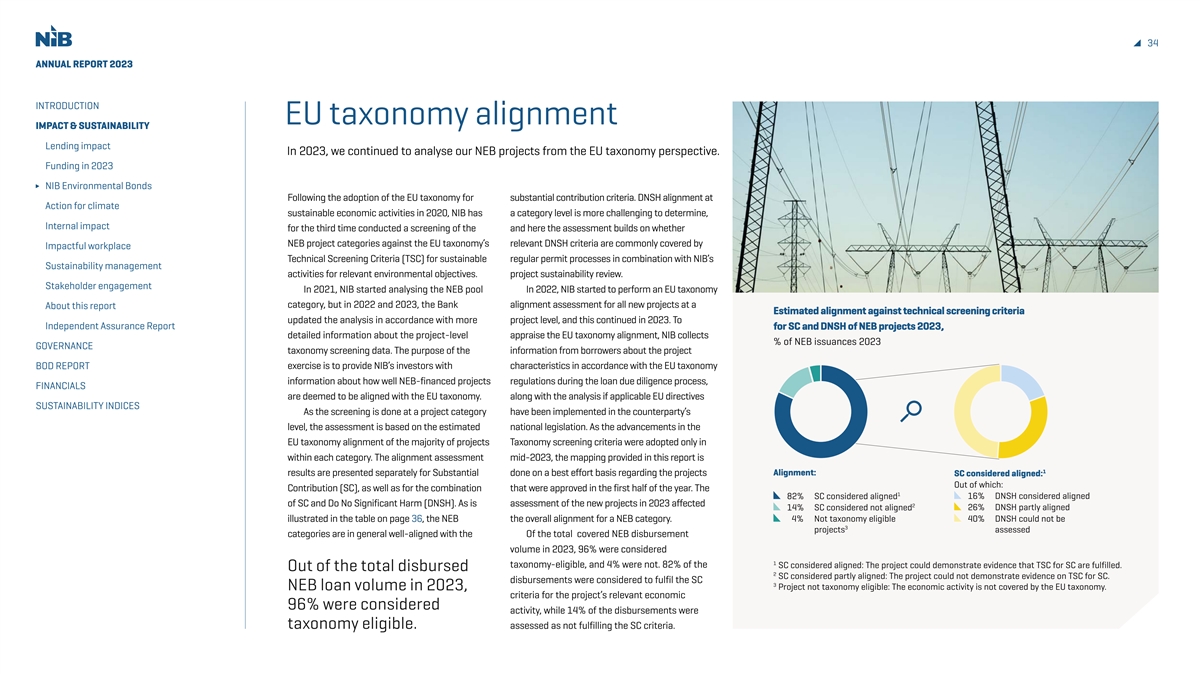

34 ANNUAL REPORT 2023 INTRODUCTION EU taxonomy alignment IMPACT & SUSTAINABILITY Lending impact In 2023, we continued to analyse our NEB projects from the EU taxonomy perspective. Funding in 2023 NIB Environmental Bonds Following the adoption of the EU taxonomy for substantial contribution criteria. DNSH alignment at Action for climate sustainable economic activities in 2020, NIB has a category level is more challenging to determine, Internal impact for the third time conducted a screening of the and here the assessment builds on whether NEB project categories against the EU taxonomy’s relevant DNSH criteria are commonly covered by Impactful workplace Technical Screening Criteria (TSC) for sustainable regular permit processes in combination with NIB’s Sustainability management activities for relevant environmental objectives. project sustainability review. Stakeholder engagement In 2021, NIB started analysing the NEB pool In 2022, NIB started to perform an EU taxonomy category, but in 2022 and 2023, the Bank alignment assessment for all new projects at a About this report Estimated alignment against technical screening criteria updated the analysis in accordance with more project level, and this continued in 2023. To Independent Assurance Report for SC and DNSH of NEB projects 2023, detailed information about the project-level appraise the EU taxonomy alignment, NIB collects % of NEB issuances 2023 GOVERNANCE taxonomy screening data. The purpose of the information from borrowers about the project BOD REPORT exercise is to provide NIB’s investors with characteristics in accordance with the EU taxonomy information about how well NEB-financed projects regulations during the loan due diligence process, FINANCIALS are deemed to be aligned with the EU taxonomy. along with the analysis if applicable EU directives SUSTAINABILITY INDICES As the screening is done at a project category have been implemented in the counterparty’s level, the assessment is based on the estimated national legislation. As the advancements in the EU taxonomy alignment of the majority of projects Taxonomy screening criteria were adopted only in within each category. The alignment assessment mid-2023, the mapping provided in this report is 1 results are presented separately for Substantial done on a best effort basis regarding the projects Alignment: SC considered aligned: Out of which: Contribution (SC), as well as for the combination that were approved in the first half of the year. The 1 82% SC considered aligned 16% DNSH considered aligned of SC and Do No Significant Harm (DNSH). As is assessment of the new projects in 2023 affected 2 14% SC considered not aligned 26% DNSH partly aligned illustrated in the table on page 36, the NEB the overall alignment for a NEB category. 4% Not taxonomy eligible 40% DNSH could not be 3 projects assessed categories are in general well-aligned with the Of the total covered NEB disbursement volume in 2023, 96% were considered 1 taxonomy-eligible, and 4% were not. 82% of the SC considered aligned: The project could demonstrate evidence that TSC for SC are fulfilled. Out of the total disbursed 2 SC considered partly aligned: The project could not demonstrate evidence on TSC for SC. disbursements were considered to fulfil the SC 3 NEB loan volume in 2023, Project not taxonomy eligible: The economic activity is not covered by the EU taxonomy. criteria for the project’s relevant economic 96% were considered activity, while 14% of the disbursements were taxonomy eligible. assessed as not fulfilling the SC criteria.

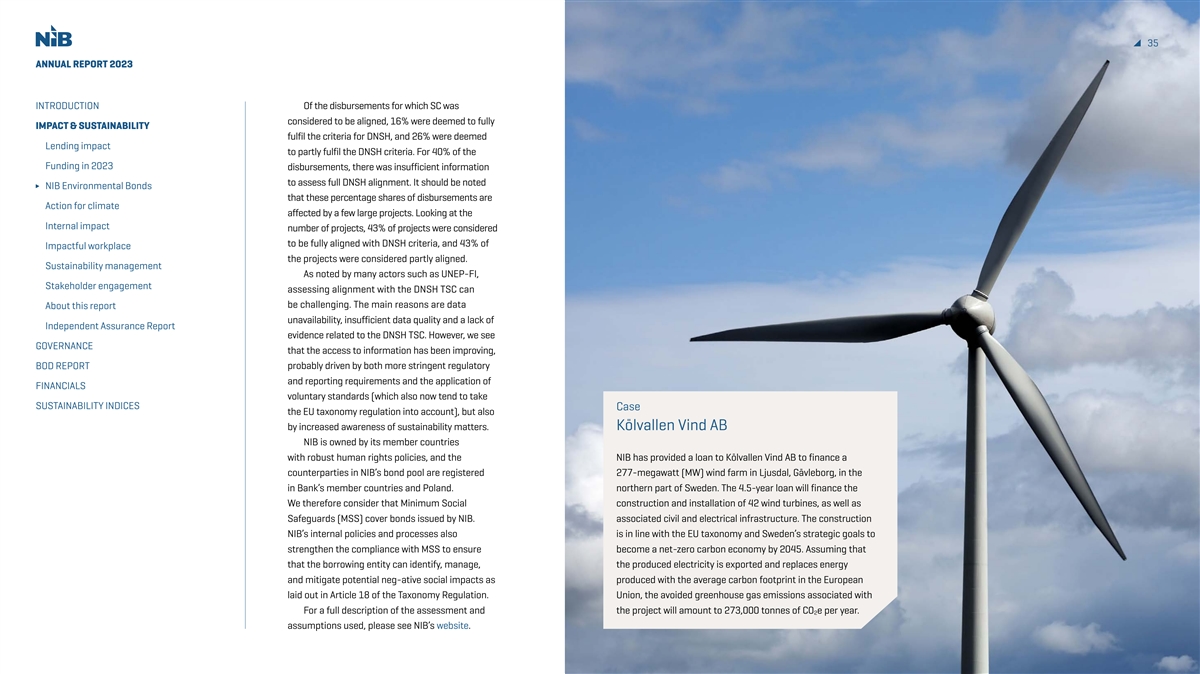

35 ANNUAL REPORT 2023 INTRODUCTION Of the disbursements for which SC was considered to be aligned, 16% were deemed to fully IMPACT & SUSTAINABILITY fulfil the criteria for DNSH, and 26% were deemed Lending impact to partly fulfil the DNSH criteria. For 40% of the Funding in 2023 disbursements, there was insufficient information to assess full DNSH alignment. It should be noted NIB Environmental Bonds that these percentage shares of disbursements are Action for climate affected by a few large projects. Looking at the Internal impact number of projects, 43% of projects were considered to be fully aligned with DNSH criteria, and 43% of Impactful workplace the projects were considered partly aligned. Sustainability management As noted by many actors such as UNEP-FI, Stakeholder engagement assessing alignment with the DNSH TSC can be challenging. The main reasons are data About this report unavailability, insufficient data quality and a lack of Independent Assurance Report evidence related to the DNSH TSC. However, we see GOVERNANCE that the access to information has been improving, BOD REPORT probably driven by both more stringent regulatory and reporting requirements and the application of FINANCIALS voluntary standards (which also now tend to take SUSTAINABILITY INDICES Case the EU taxonomy regulation into account), but also by increased awareness of sustainability matters. Kölvallen Vind AB NIB is owned by its member countries with robust human rights policies, and the NIB has provided a loan to Kölvallen Vind AB to finance a counterparties in NIB’s bond pool are registered 277-megawatt (MW) wind farm in Ljusdal, Gävleborg, in the in Bank’s member countries and Poland. northern part of Sweden. The 4.5-year loan will finance the We therefore consider that Minimum Social construction and installation of 42 wind turbines, as well as Safeguards (MSS) cover bonds issued by NIB. associated civil and electrical infrastructure. The construction NIB’s internal policies and processes also is in line with the EU taxonomy and Sweden’s strategic goals to strengthen the compliance with MSS to ensure become a net-zero carbon economy by 2045. Assuming that that the borrowing entity can identify, manage, the produced electricity is exported and replaces energy and mitigate potential neg-ative social impacts as produced with the average carbon footprint in the European laid out in Article 18 of the Taxonomy Regulation. Union, the avoided greenhouse gas emissions associated with For a full description of the assessment and the project will amount to 273,000 tonnes of CO e per year. 2 assumptions used, please see NIB’s website.

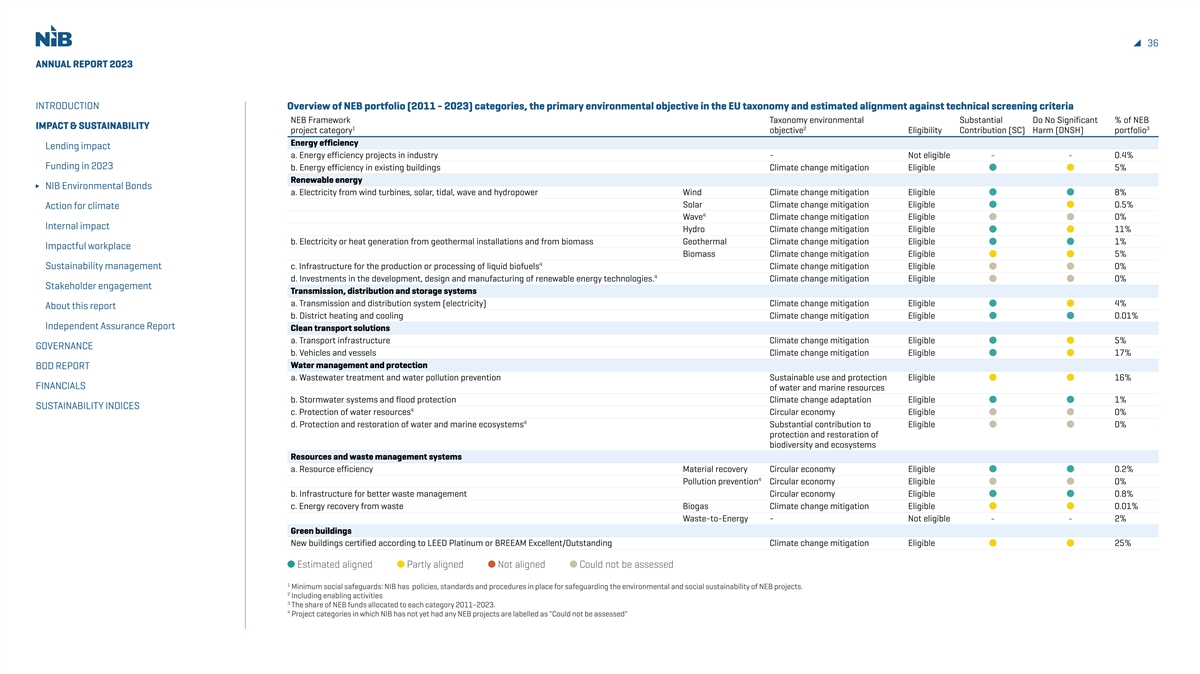

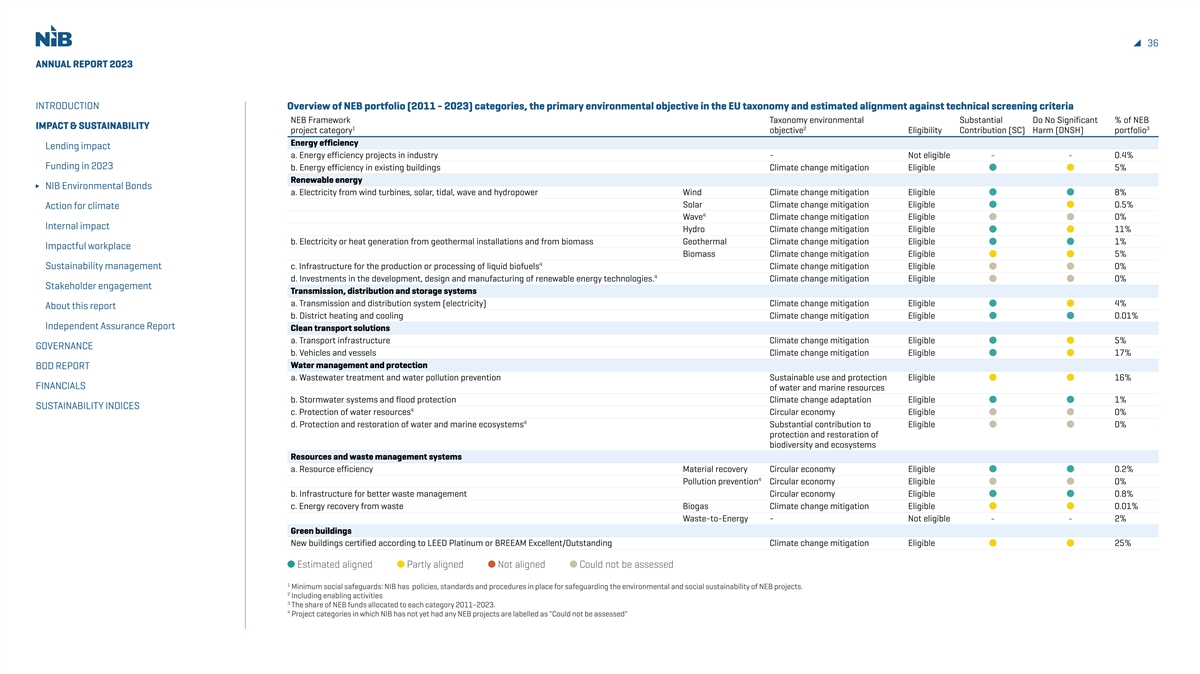

36 ANNUAL REPORT 2023 INTRODUCTION Overview of NEB portfolio (2011 - 2023) categories, the primary environmental objective in the EU taxonomy and estimated alignment against technical screening criteria NEB Framework Taxonomy environmental Substantial Do No Significant % of NEB IMPACT & SUSTAINABILITY 1 2 3 project category objective Eligibility Contribution (SC) Harm (DNSH)portf olio Energy efficiency Lending impact a. Energy efficiency projects in industry - Not eligible 0.4% - - Funding in 2023 b. Energy efficiency in existing buildings Climate change mitigation Eligible 5% Renewable energy NIB Environmental Bonds a. Electricity from wind turbines, solar, tidal, wave and hydropower Wind Climate change mitigation Eligible 8% Solar Climate change mitigation Eligible 0.5% Action for climate 4 Wave Climate change mitigation Eligible 0% Internal impact Hydro Climate change mitigation Eligible 11% b. Electricity or heat generation from geothermal installations and from biomass Geothermal Climate change mitigation Eligible 1% Impactful workplace Biomass Climate change mitigation Eligible 5% 4 Sustainability management c. Infrastructure for the production or processing of liquid biofuels Climate change mitigation Eligible 0% 4 d. Investments in the development, design and manufacturing of renewable energy technologies. Climate change mitigation Eligible 0% Stakeholder engagement Transmission, distribution and storage systems a. Transmission and distribution system (electricity) Climate change mitigation Eligible 4% About this report b. District heating and cooling Climate change mitigation Eligible 0.01% Independent Assurance Report Clean transport solutions a. Transport infrastructure Climate change mitigation Eligible 5% GOVERNANCE b. Vehicles and vessels Climate change mitigation Eligible 17% Water management and protection BOD REPORT a. Wastewater treatment and water pollution prevention Sustainable use and protection Eligible 16% FINANCIALS of water and marine resources b. Stormwater systems and flood protection Climate change adaptation Eligible 1% SUSTAINABILITY INDICES 4 c. Protection of water resources Circular economy Eligible 0% 4 d. Protection and restoration of water and marine ecosystems Substantial contribution to Eligible 0% protection and restoration of biodiversity and ecosystems Resources and waste management systems a. Resource efficiency Material recovery Circular economy Eligible 0.2% 4 Pollution prevention Circular economy Eligible 0% b. Infrastructure for better waste management Circular economy Eligible 0.8% c. Energy recovery from waste Biogas Climate change mitigation Eligible 0.01% Waste-to-Energy - Not eligible 2% - - Green buildings New buildings certified according to LEED Platinum or BREEAM Excellent/Outstanding Climate change mitigation Eligible 25% Estimated aligned Partly aligned Not aligned Could not be assessed 1 Minimum social safeguards: NIB has policies, standards and procedures in place for safeguarding the environmental and social sustainability of NEB projects. 2 Including enabling activities 3 The share of NEB funds allocated to each category 2011-2023. 4 Project categories in which NIB has not yet had any NEB projects are labelled as Could not be assessed

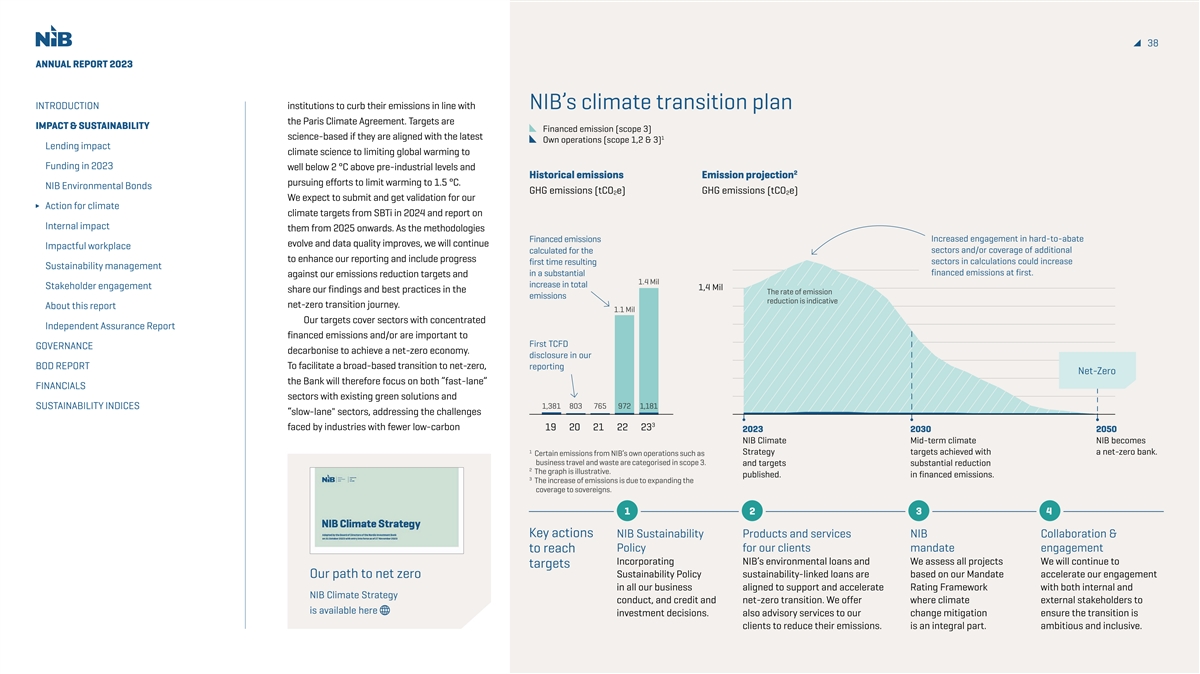

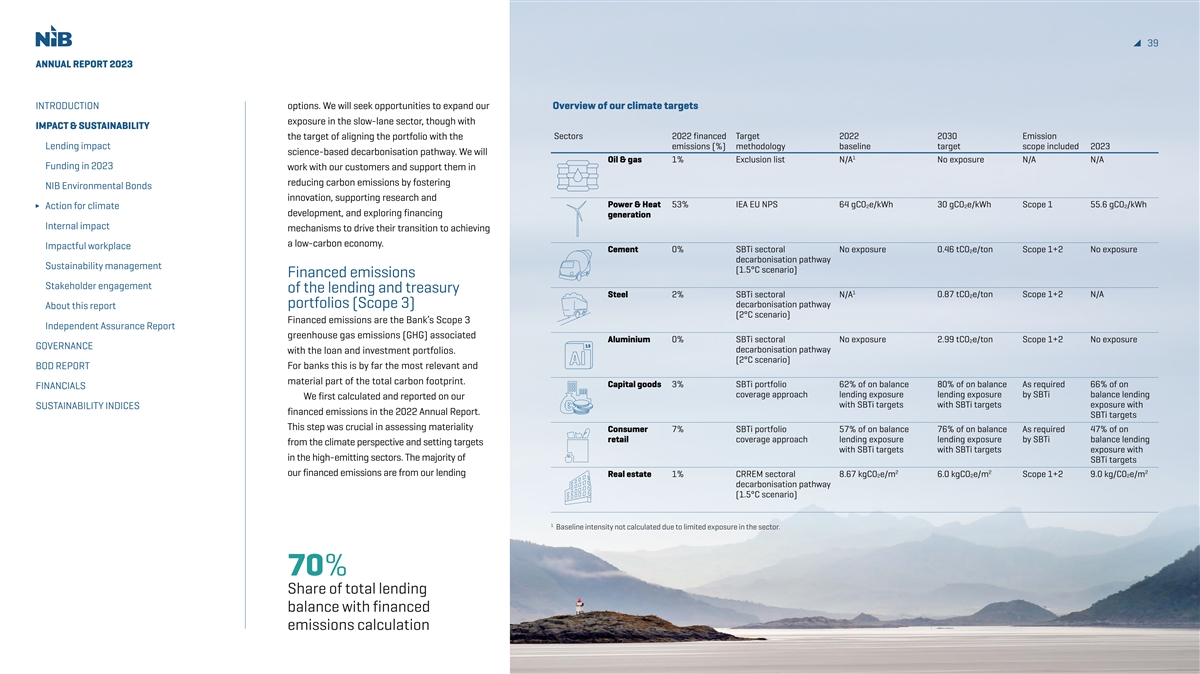

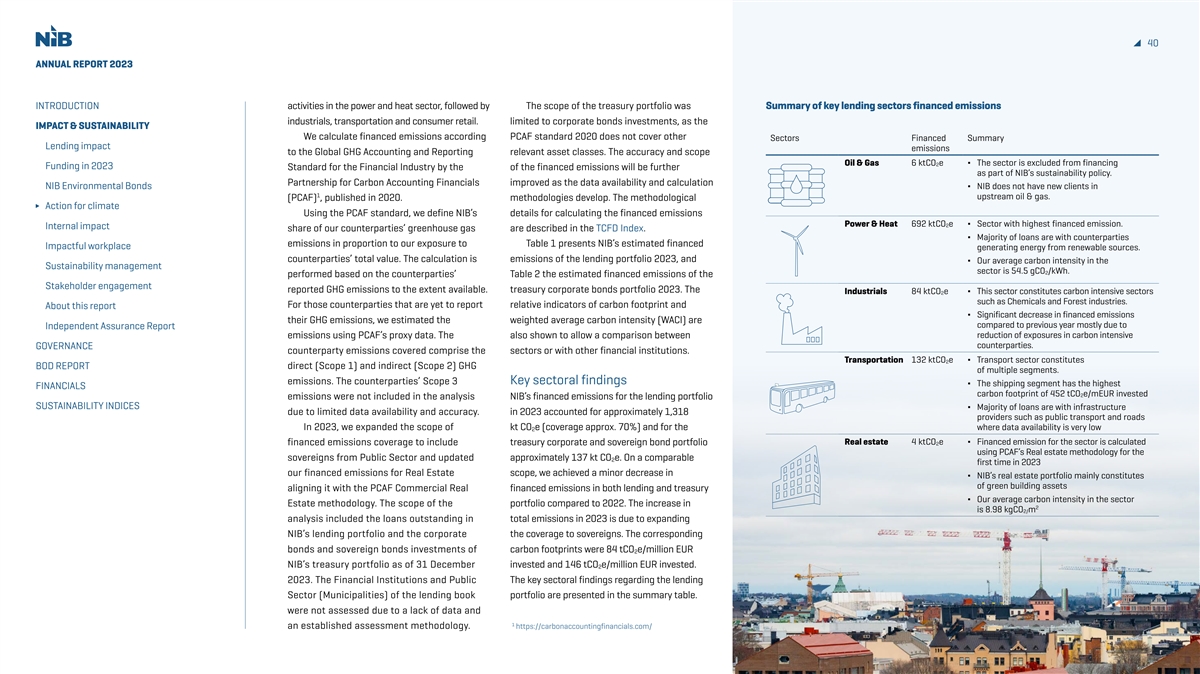

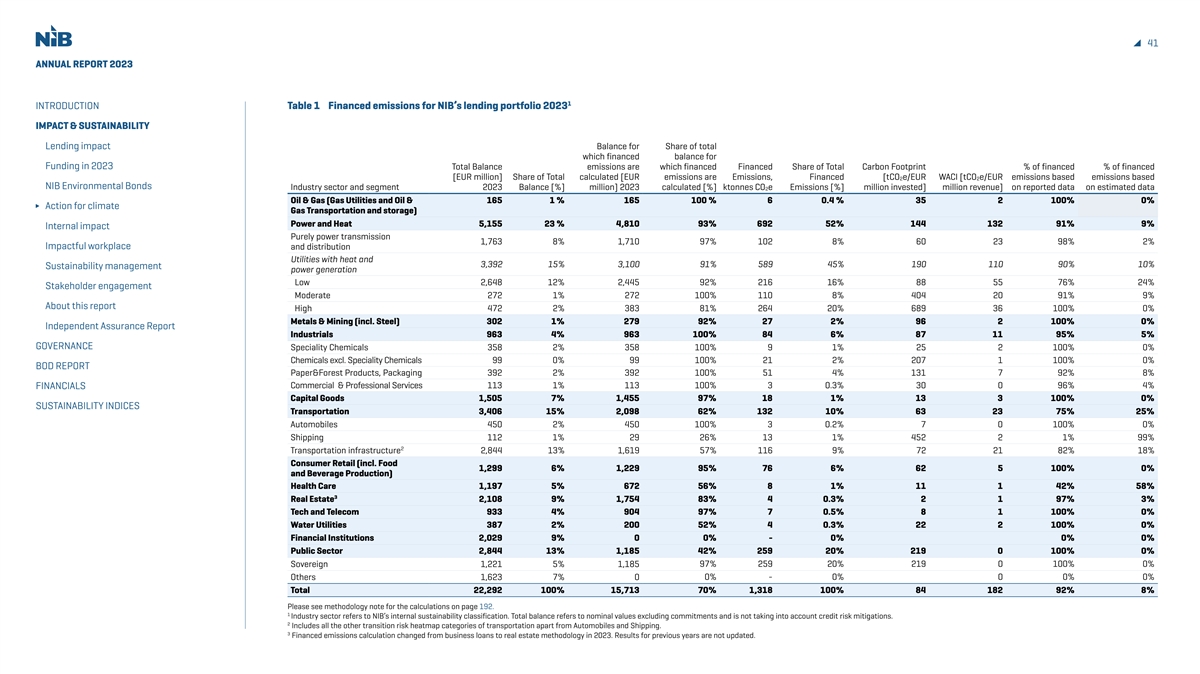

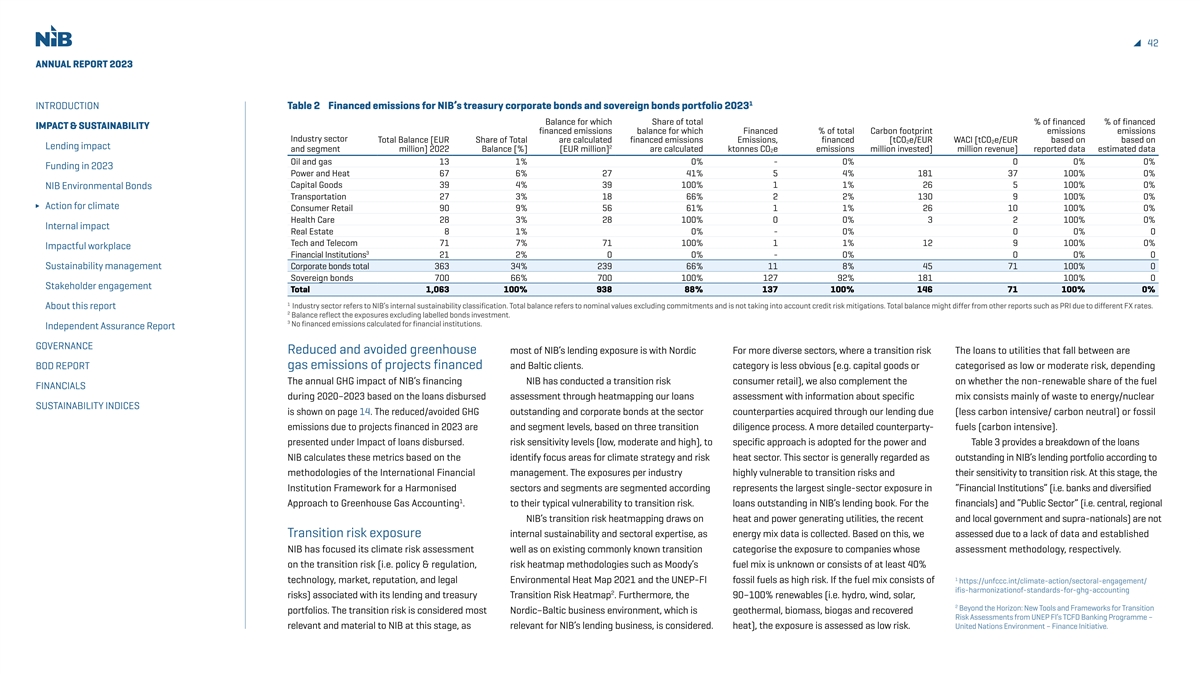

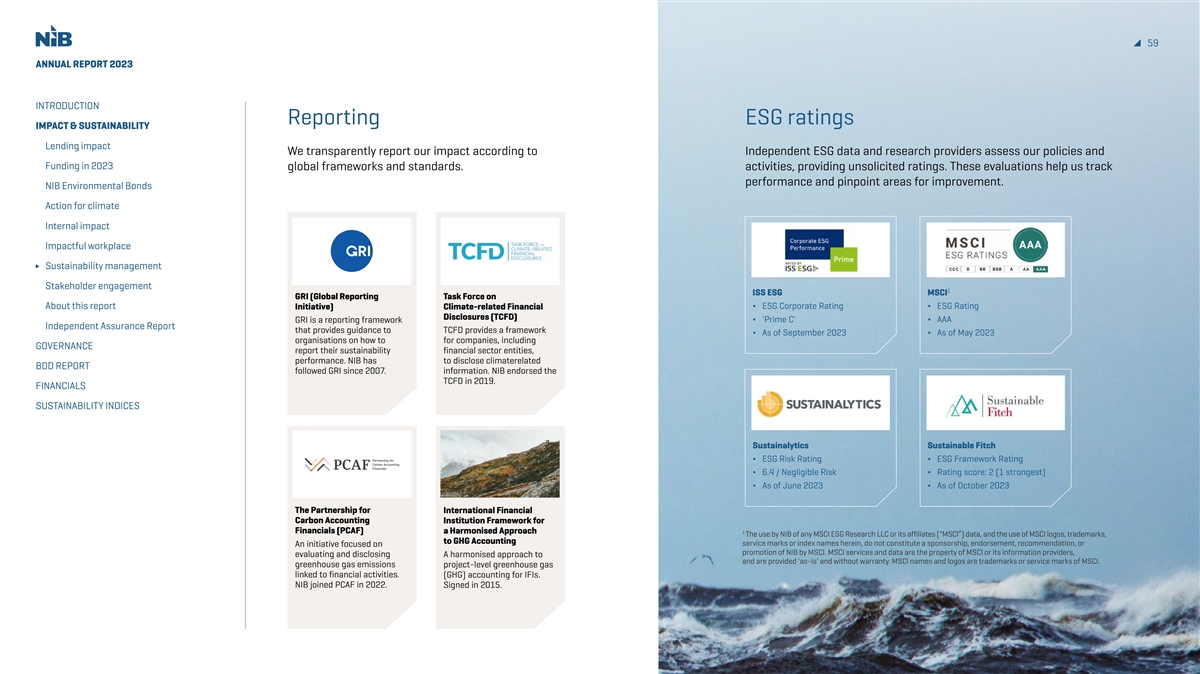

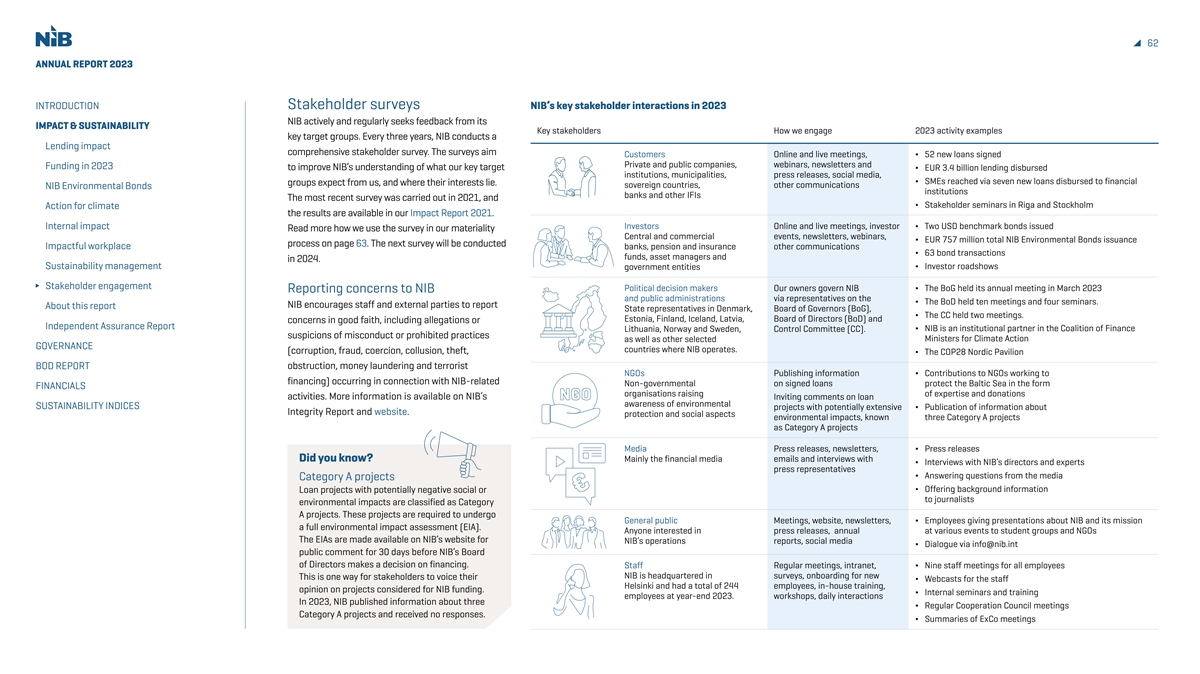

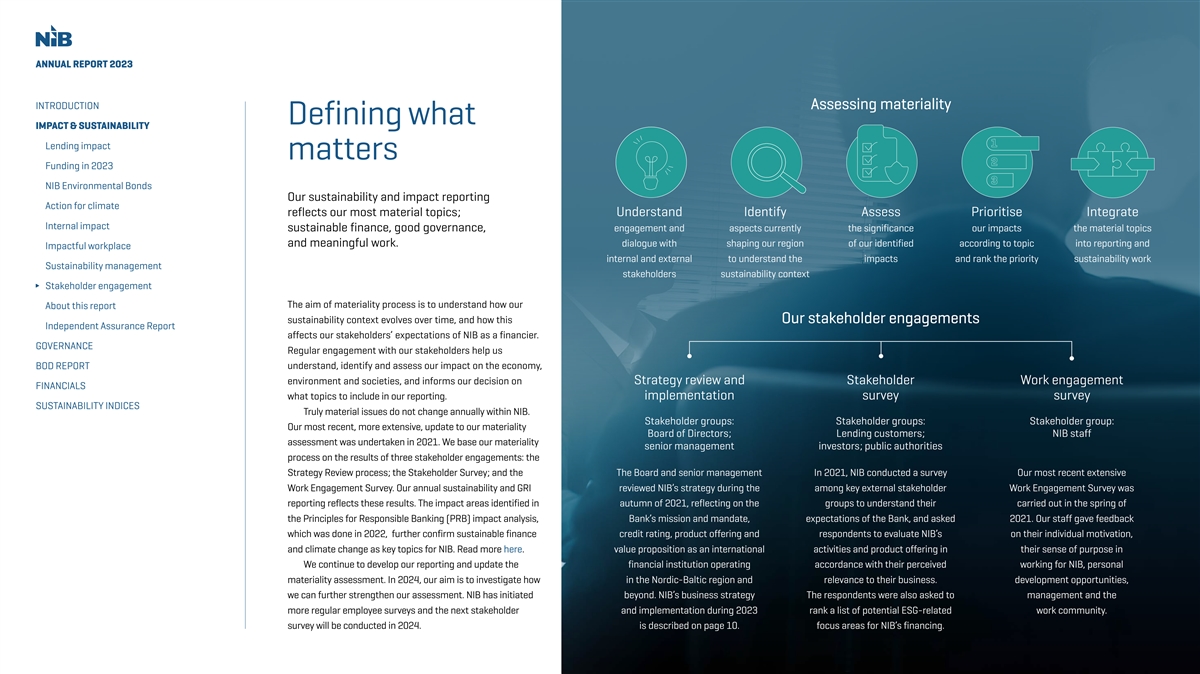

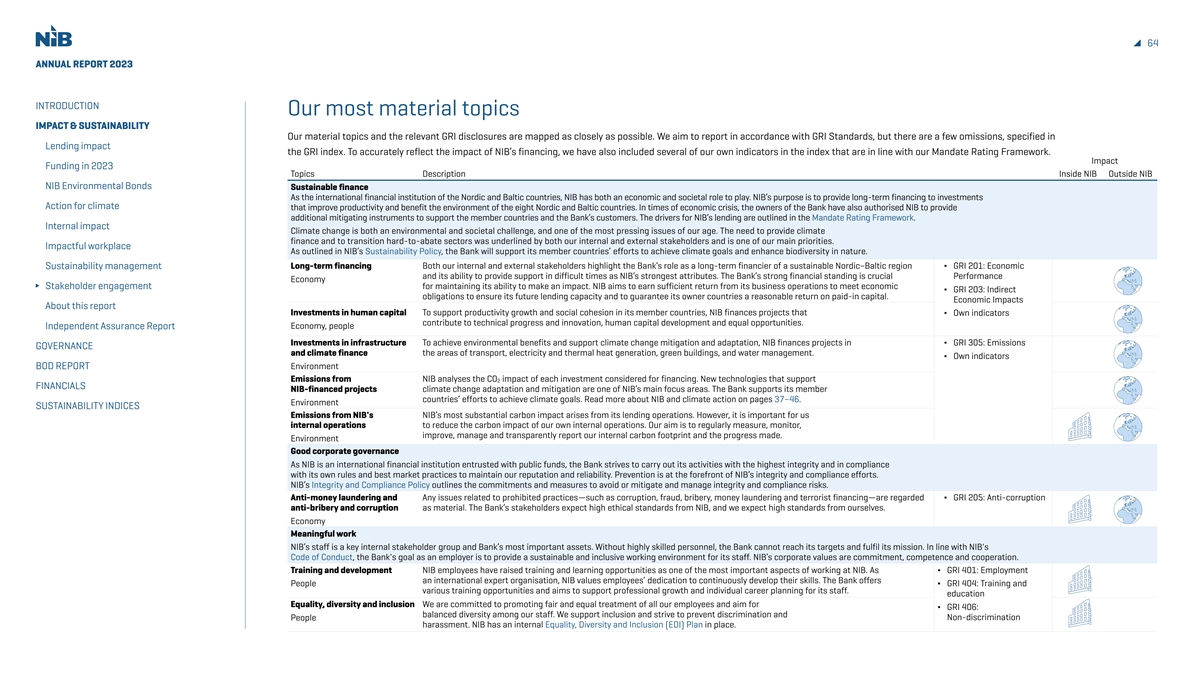

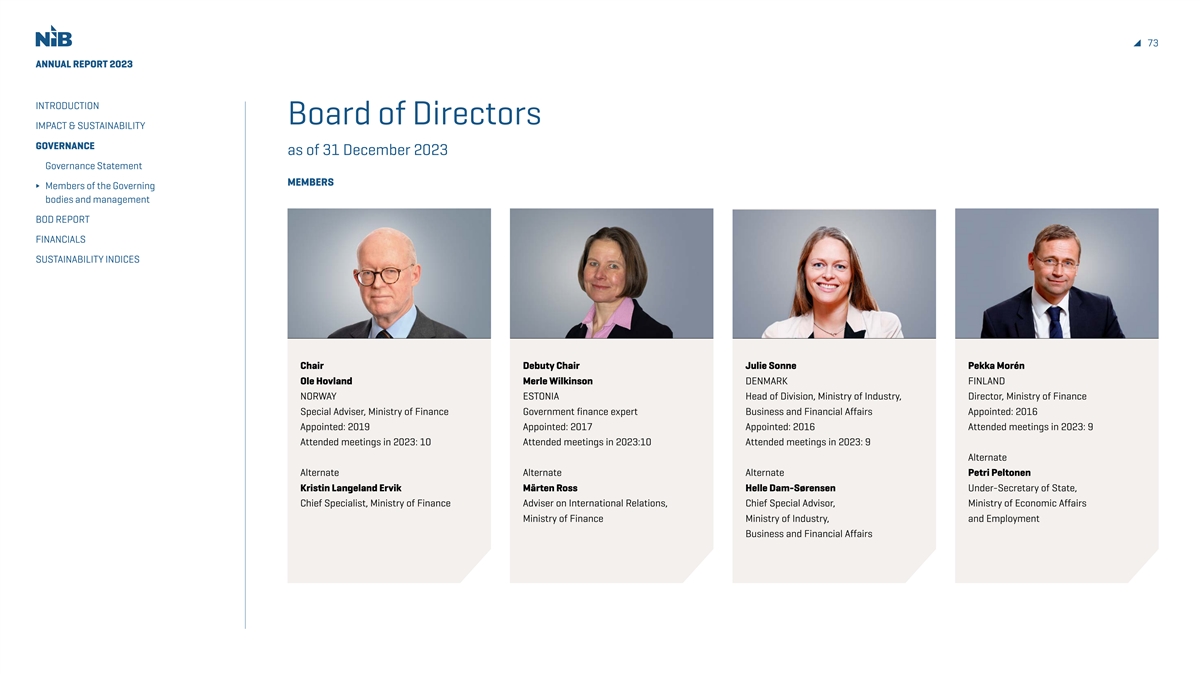

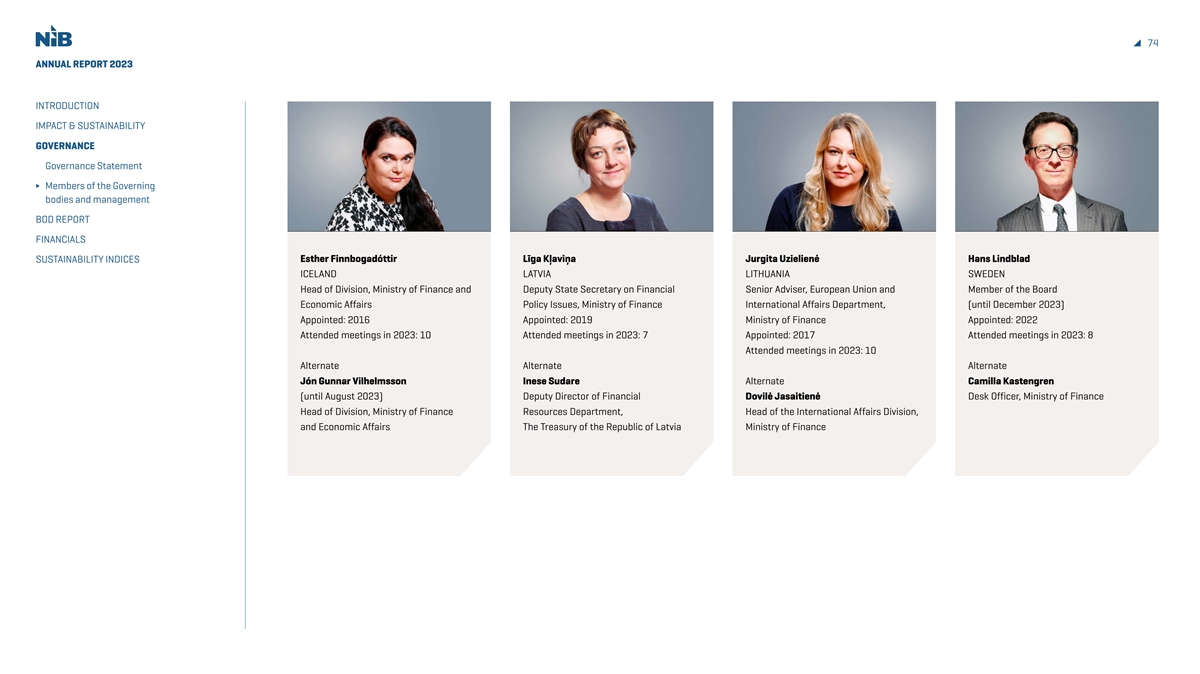

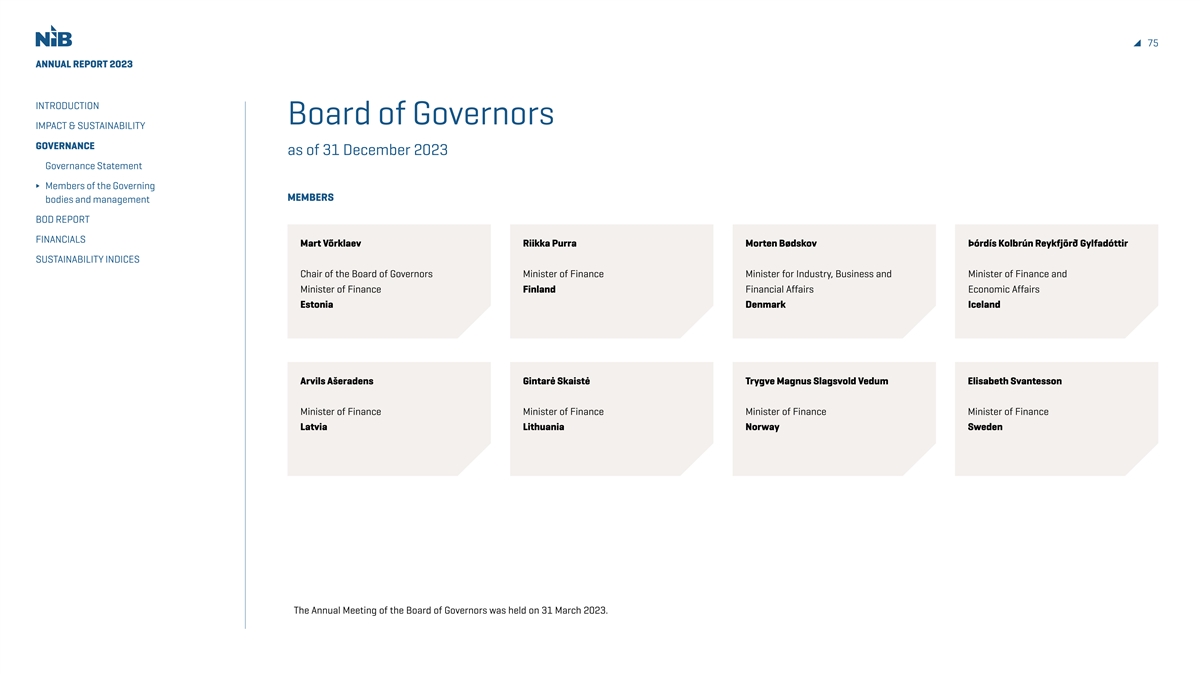

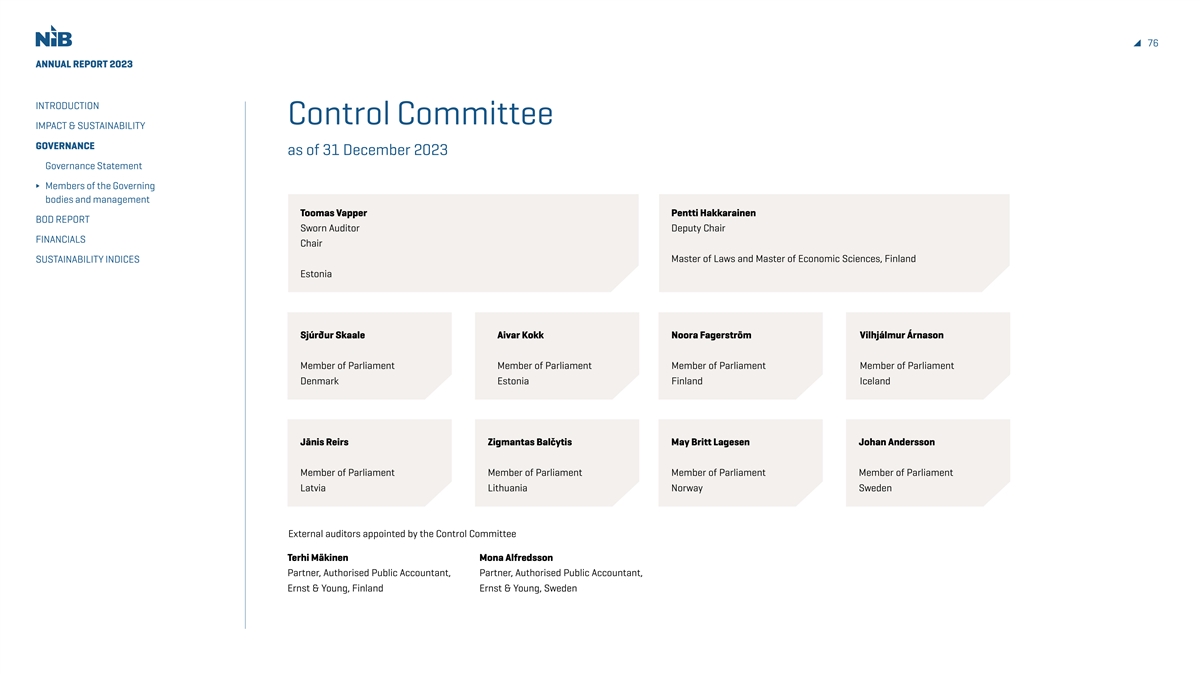

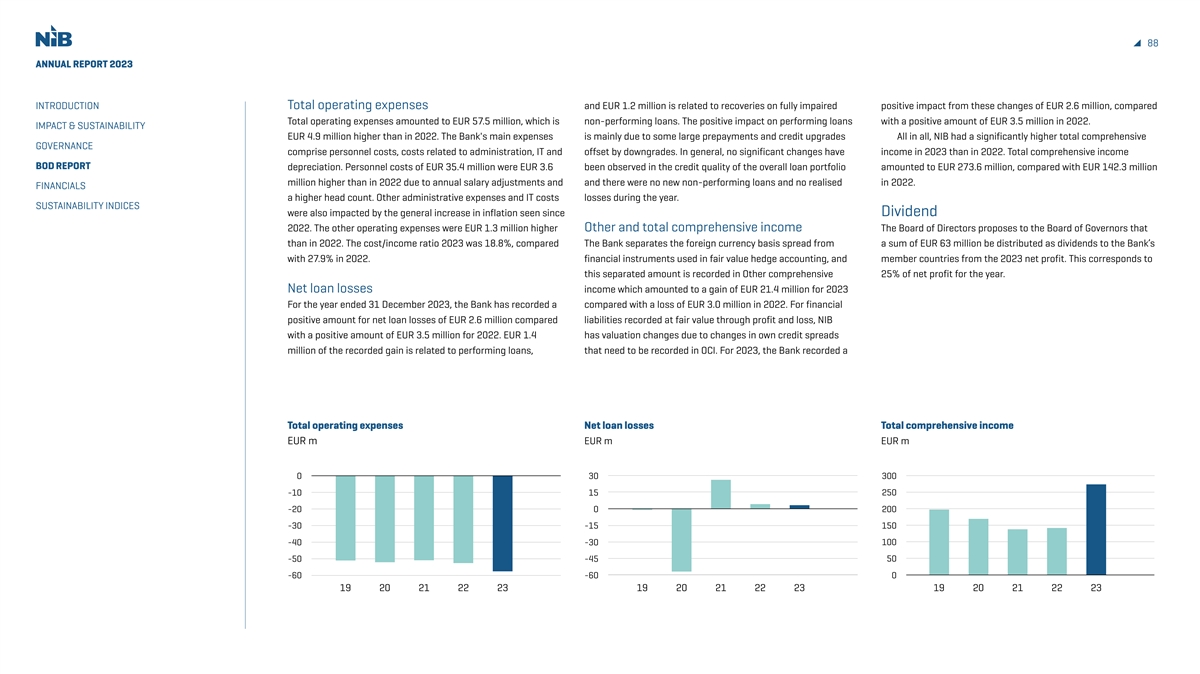

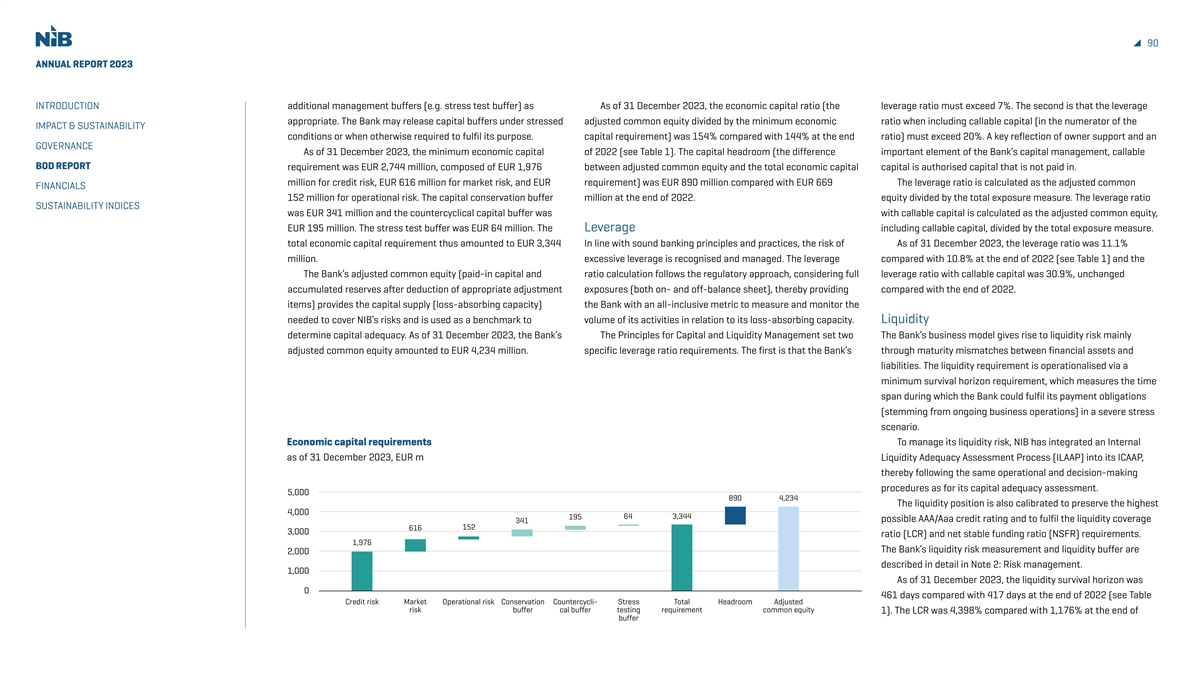

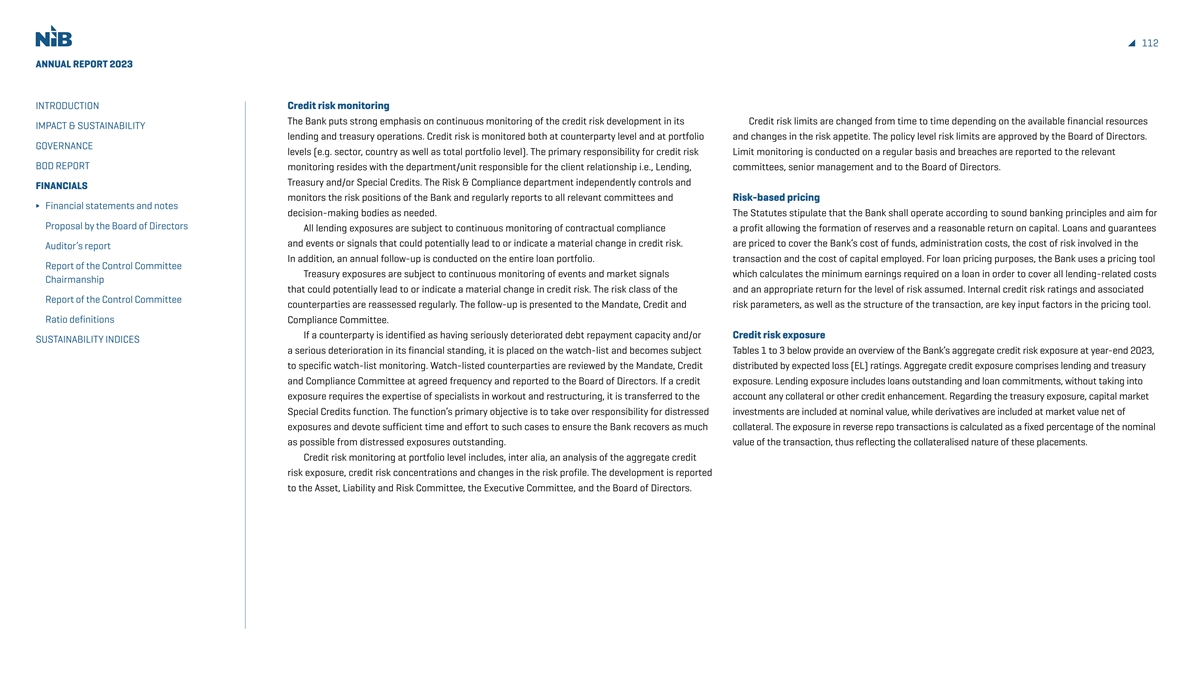

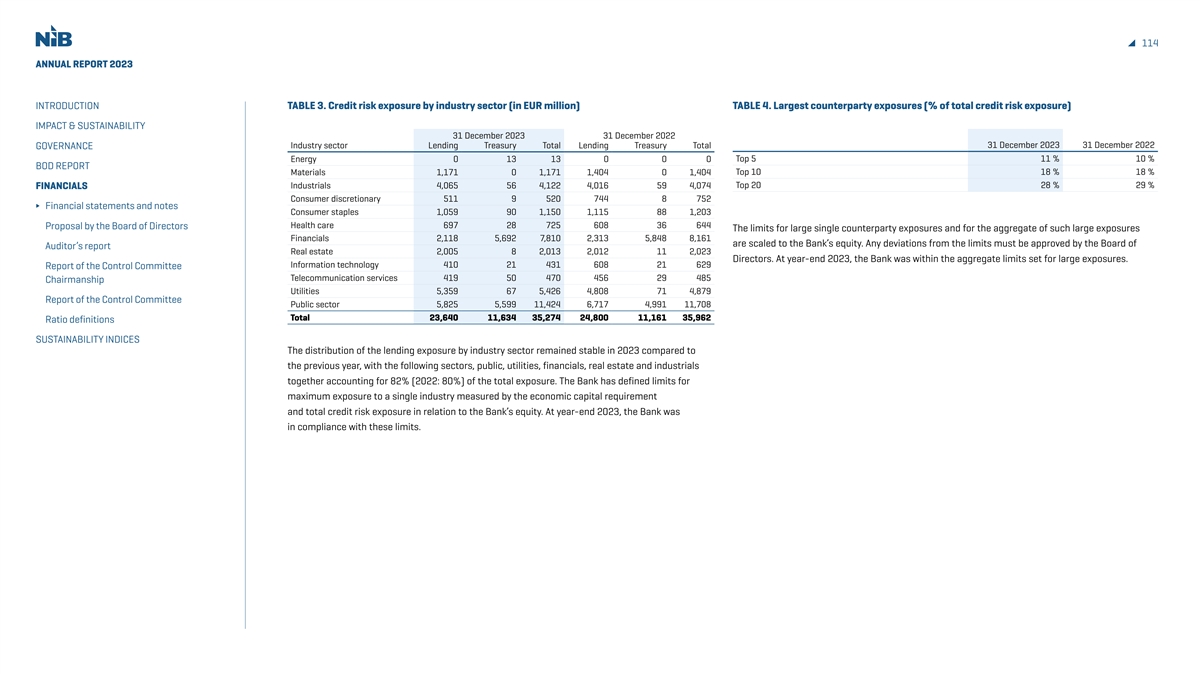

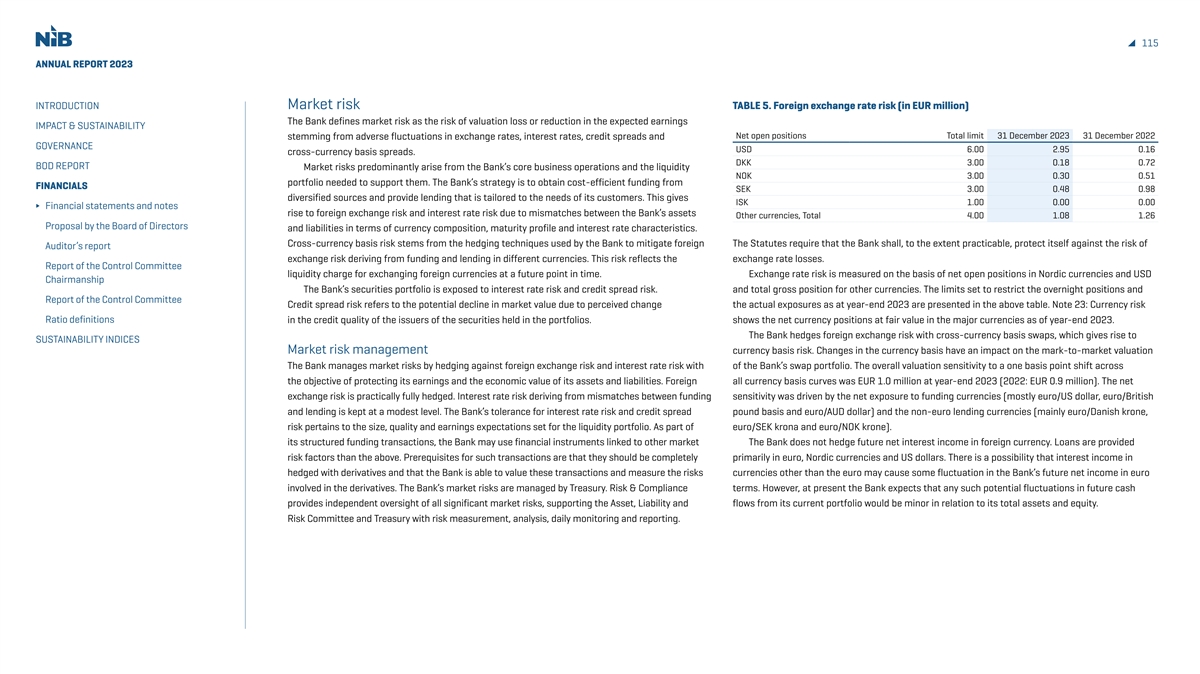

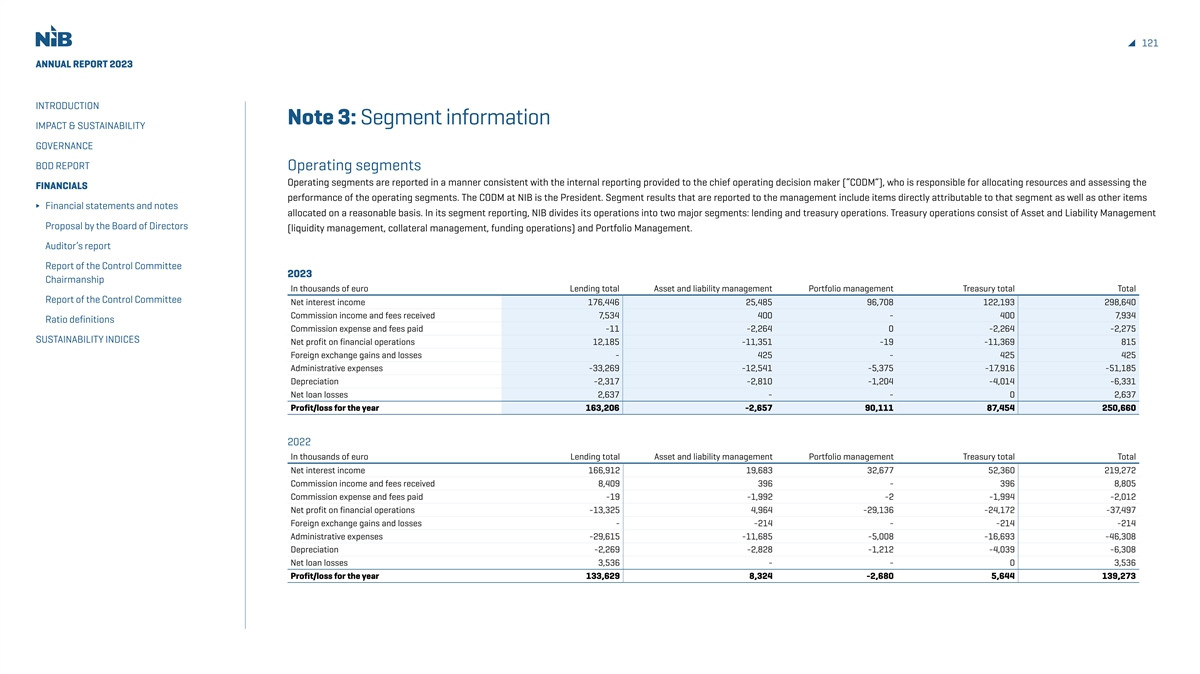

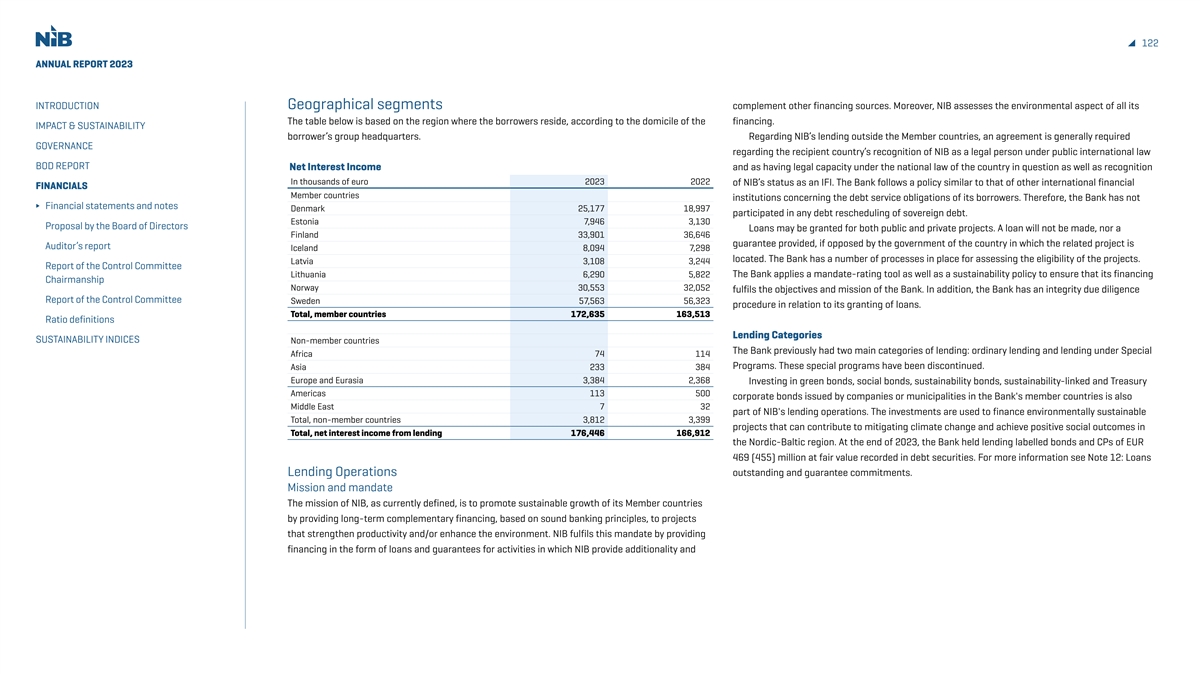

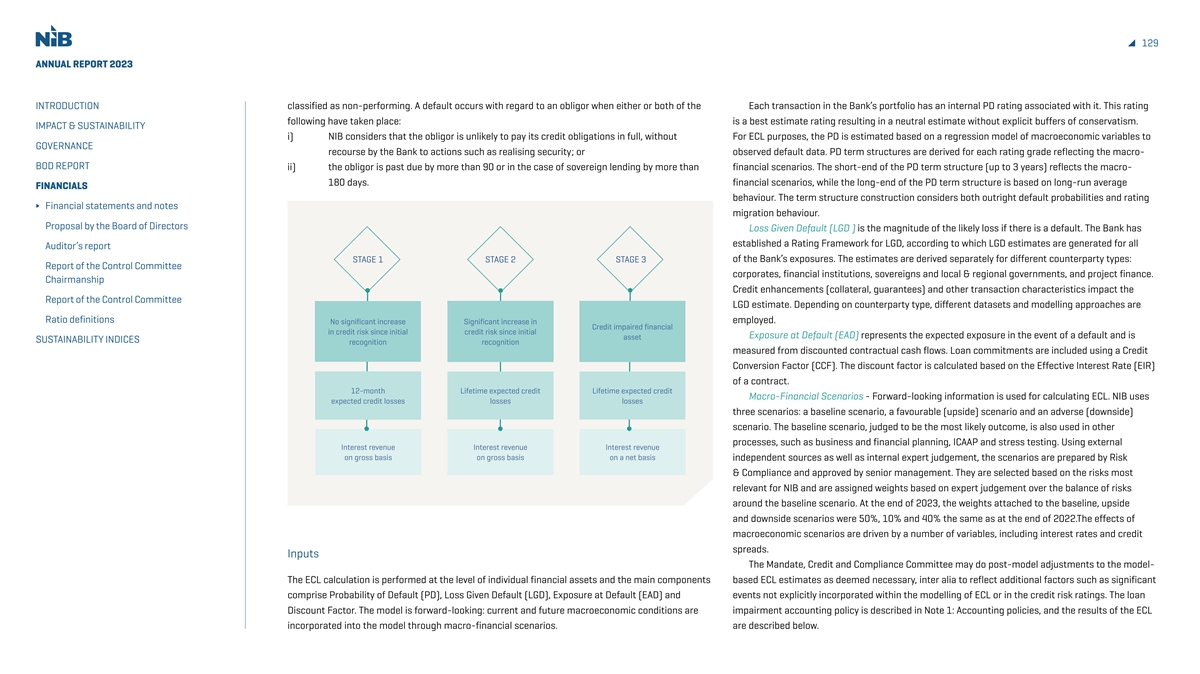

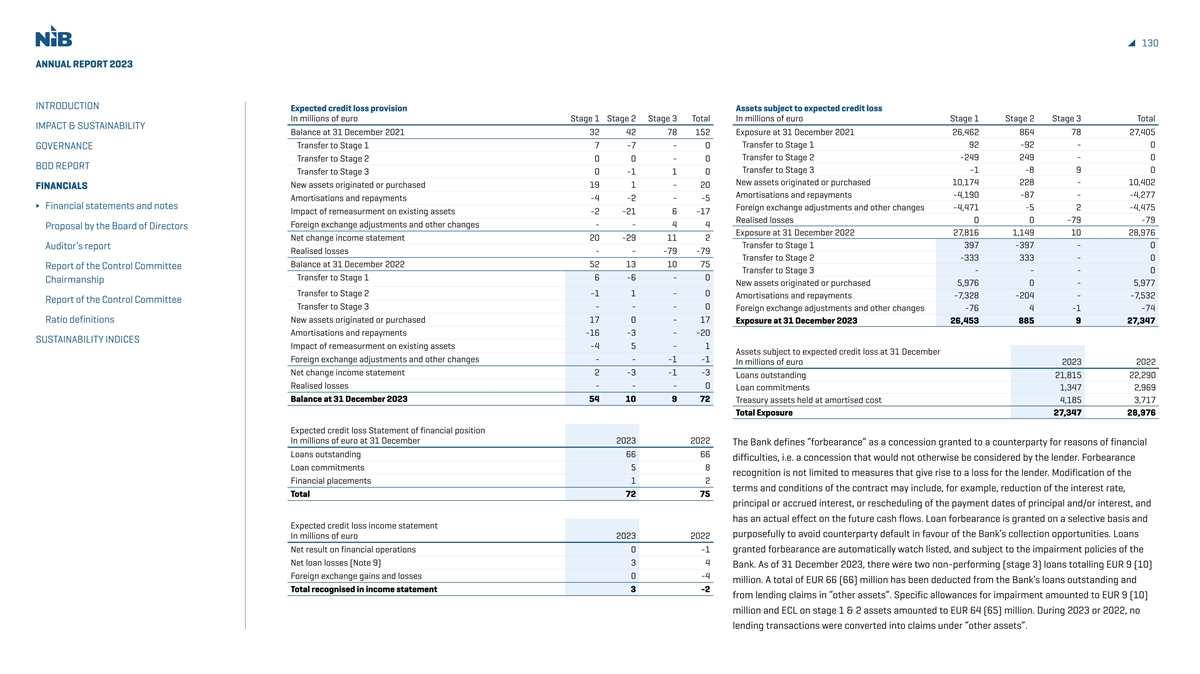

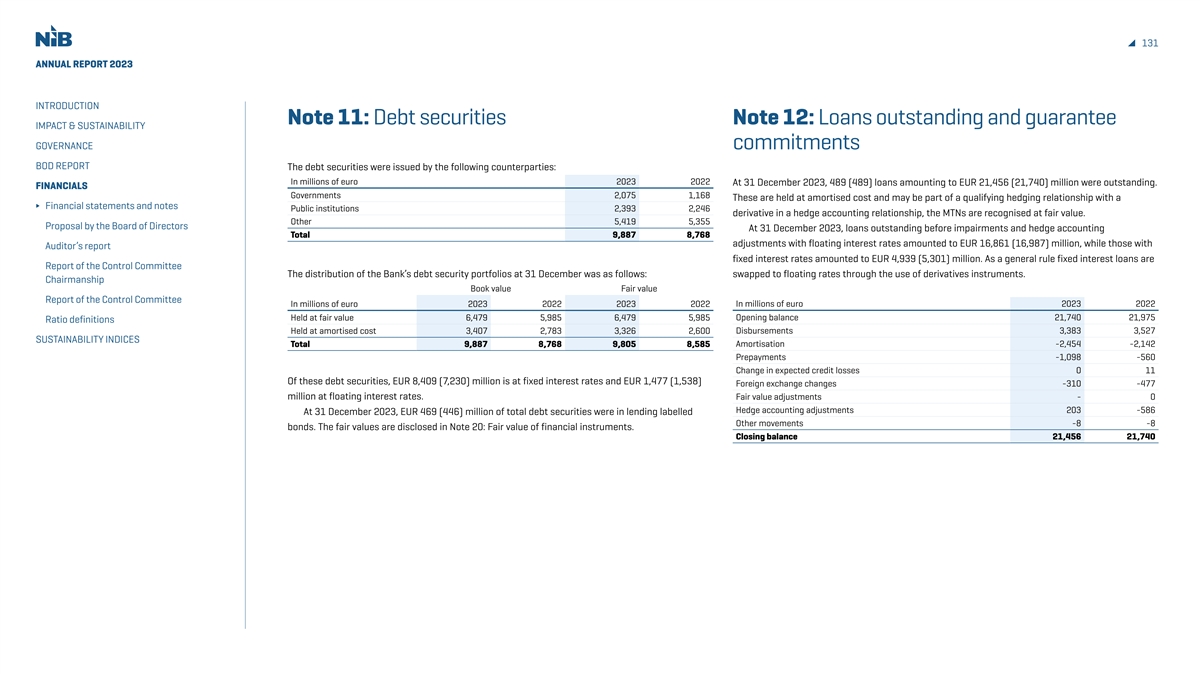

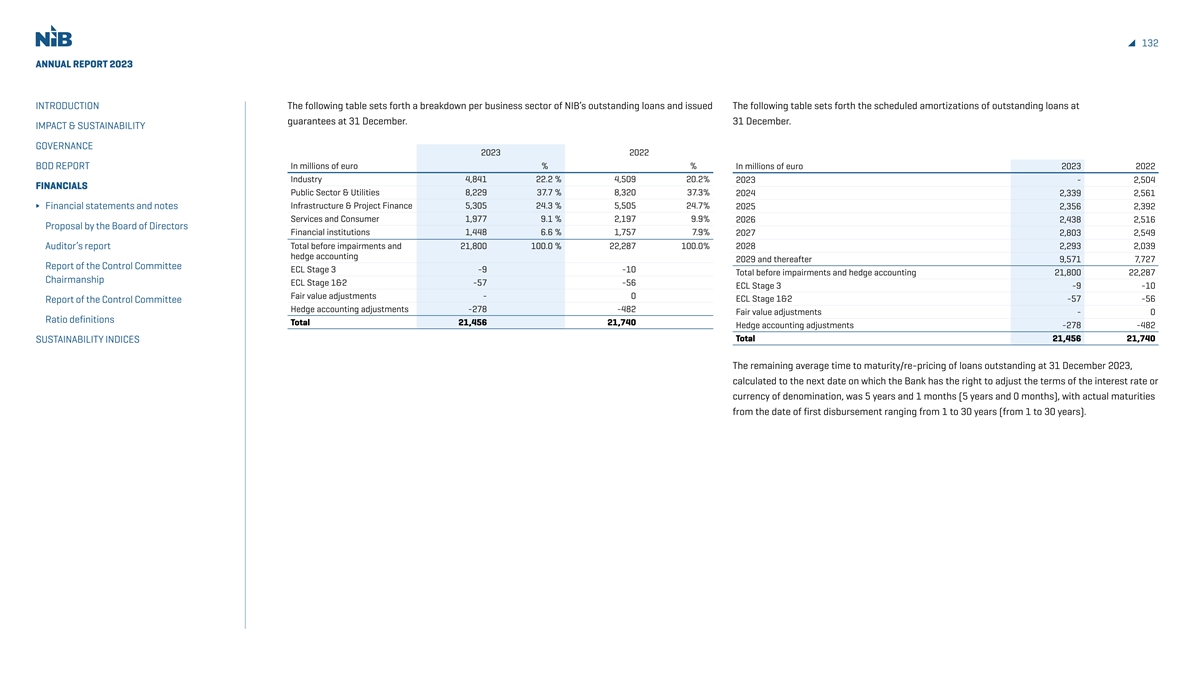

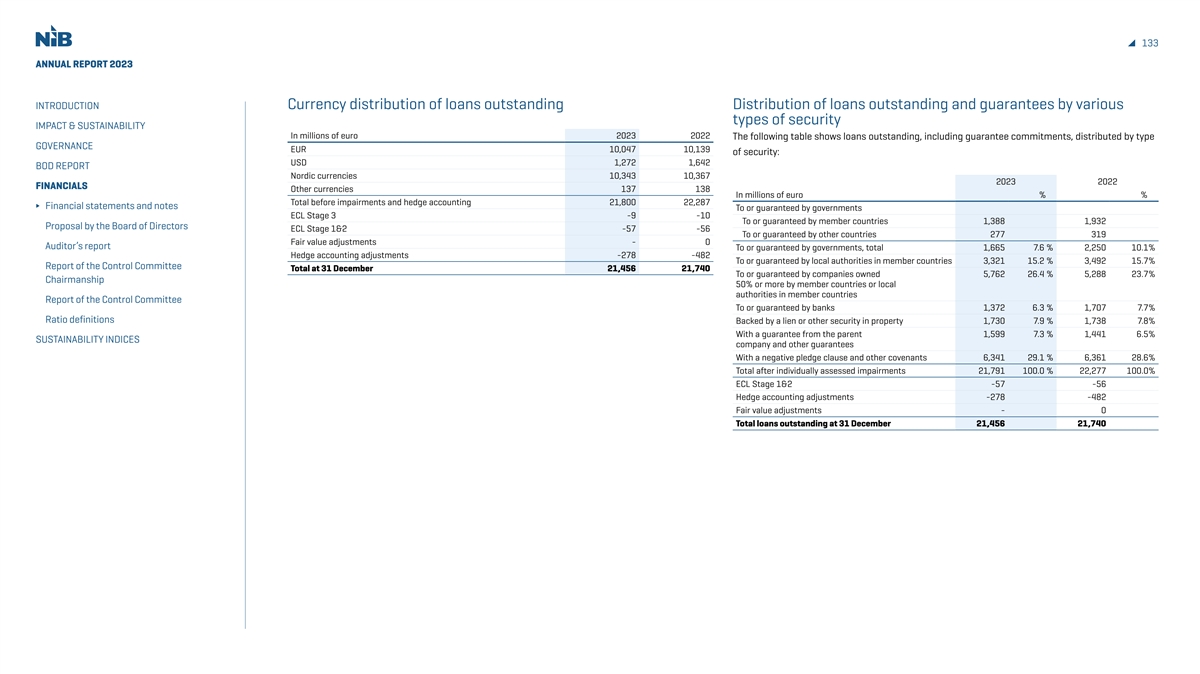

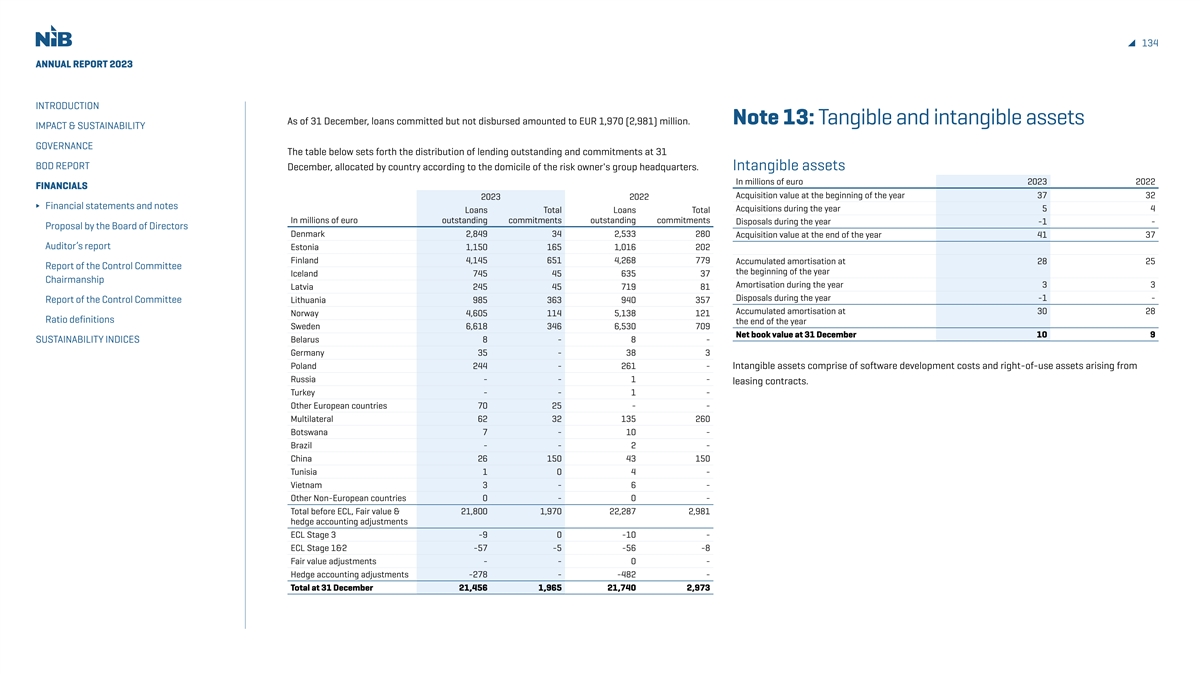

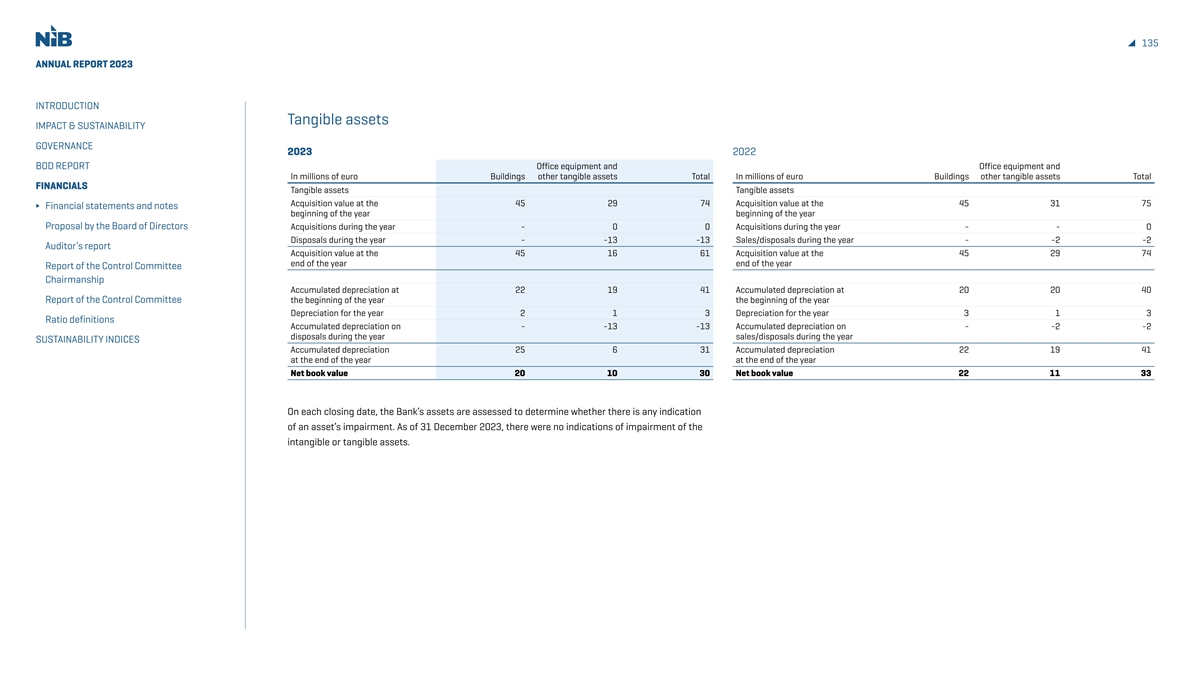

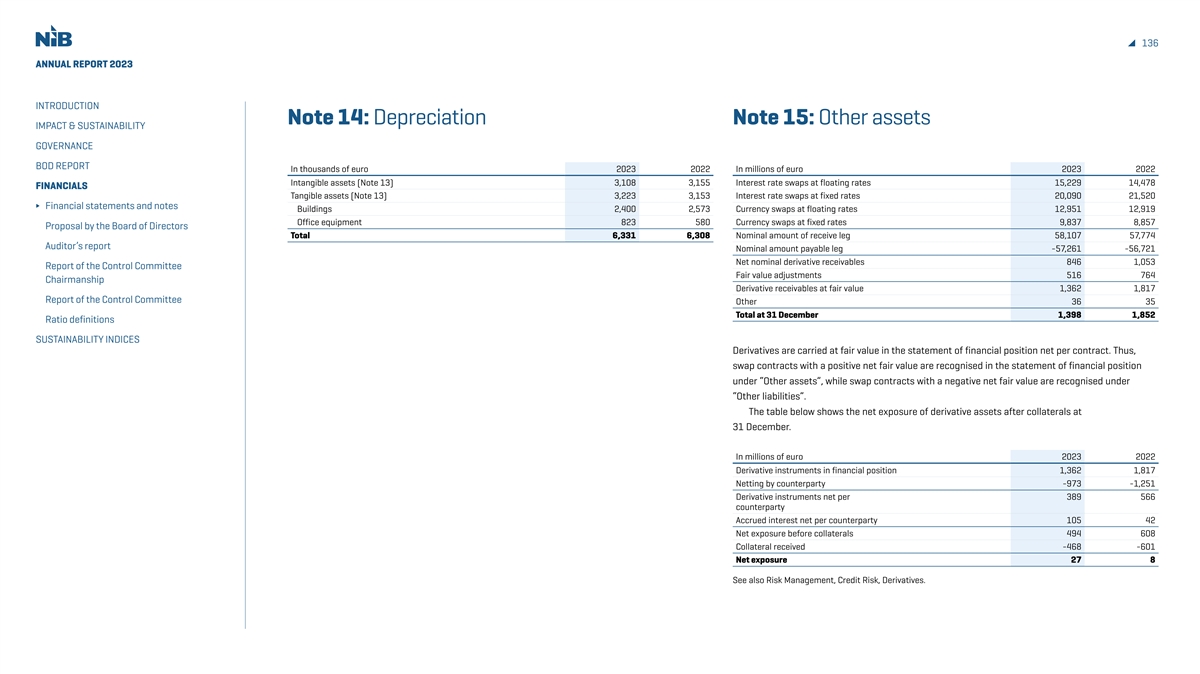

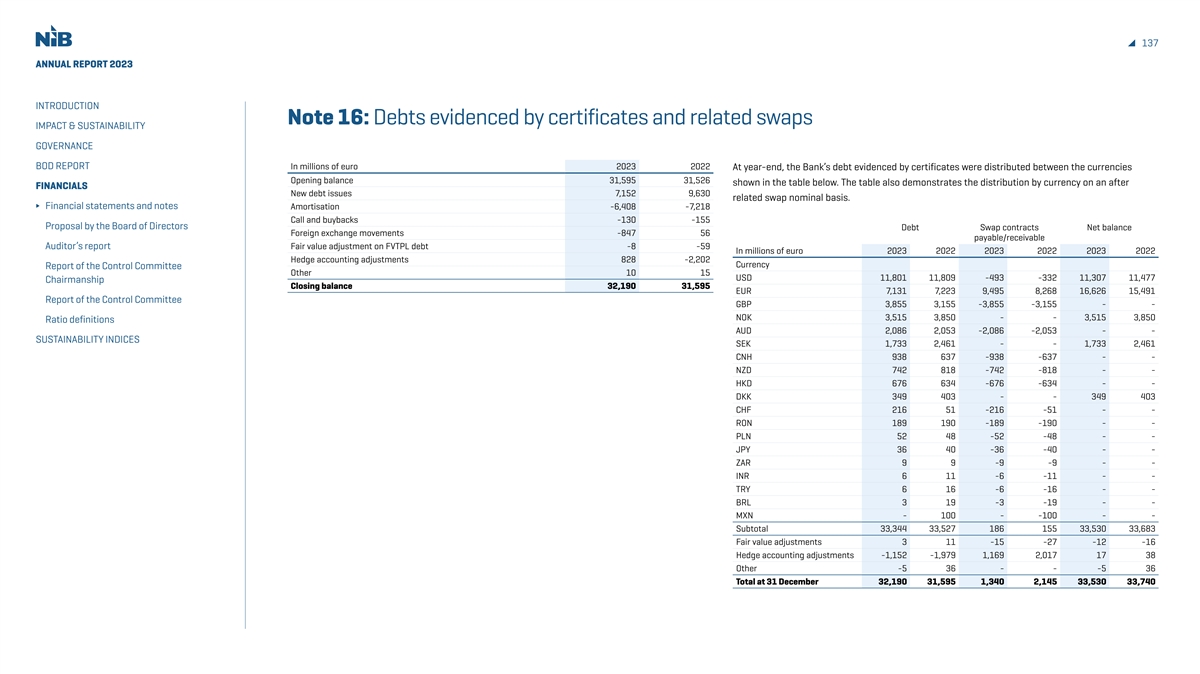

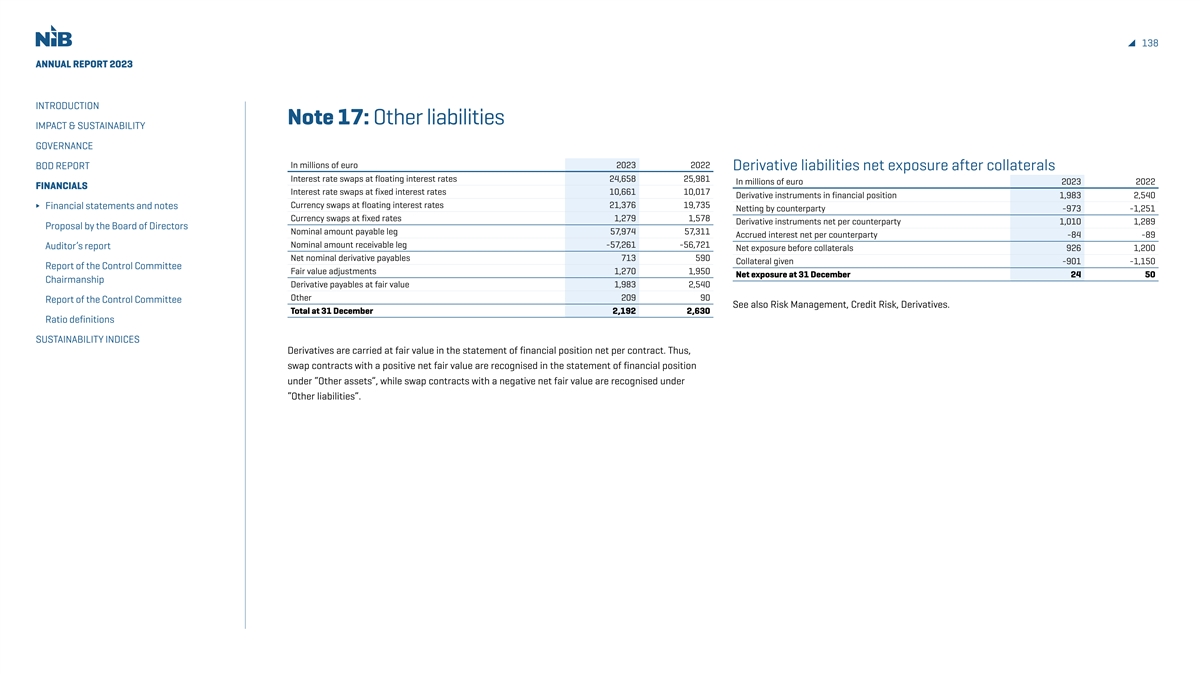

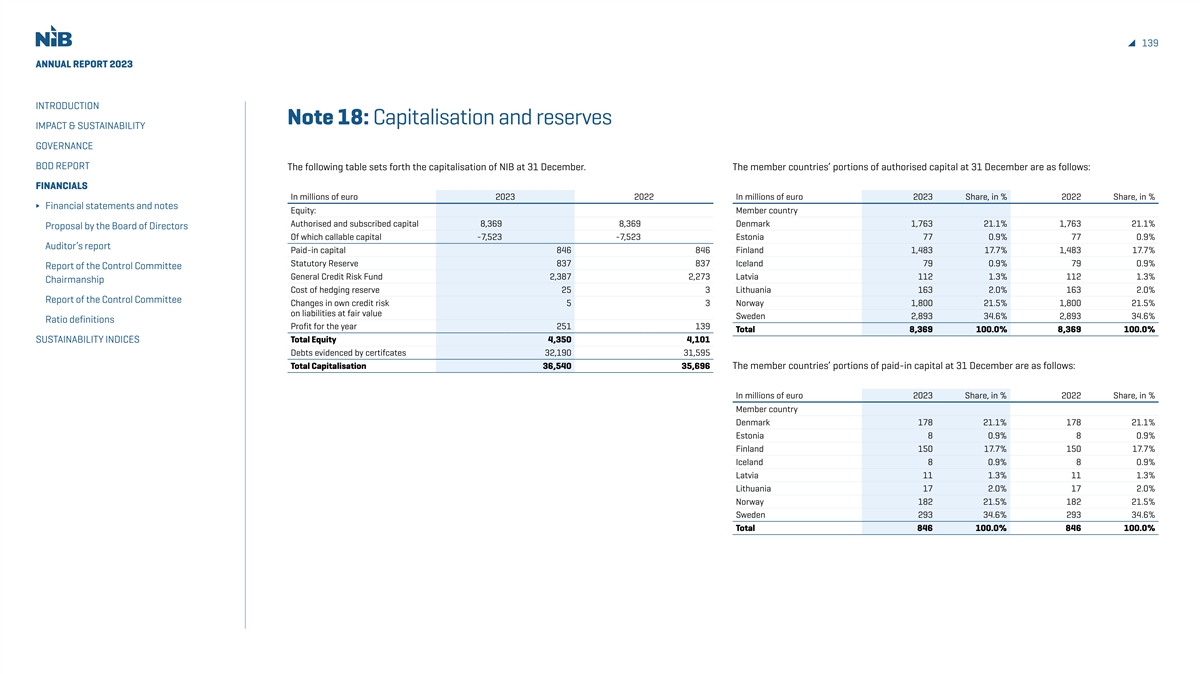

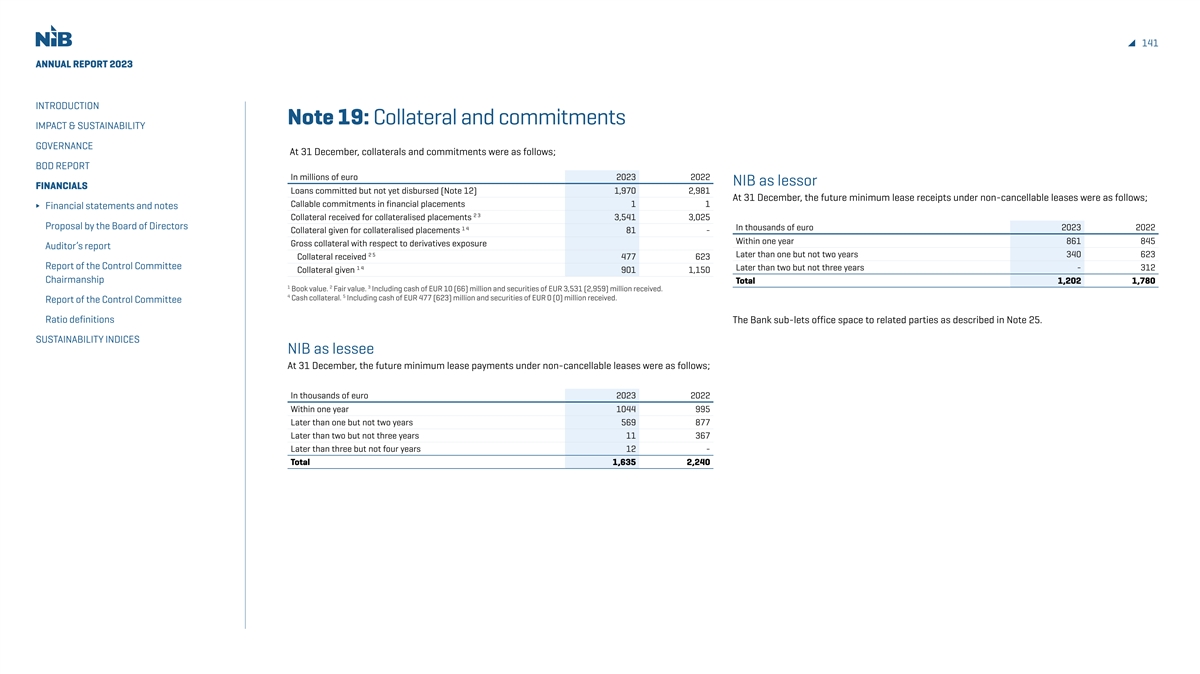

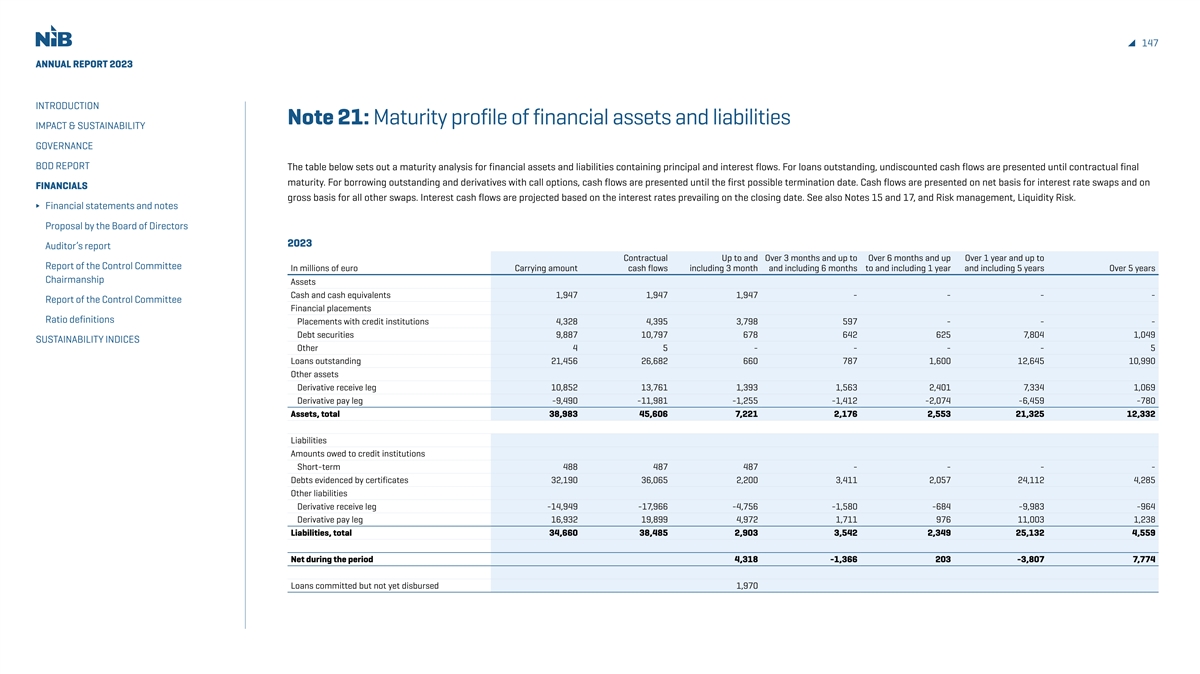

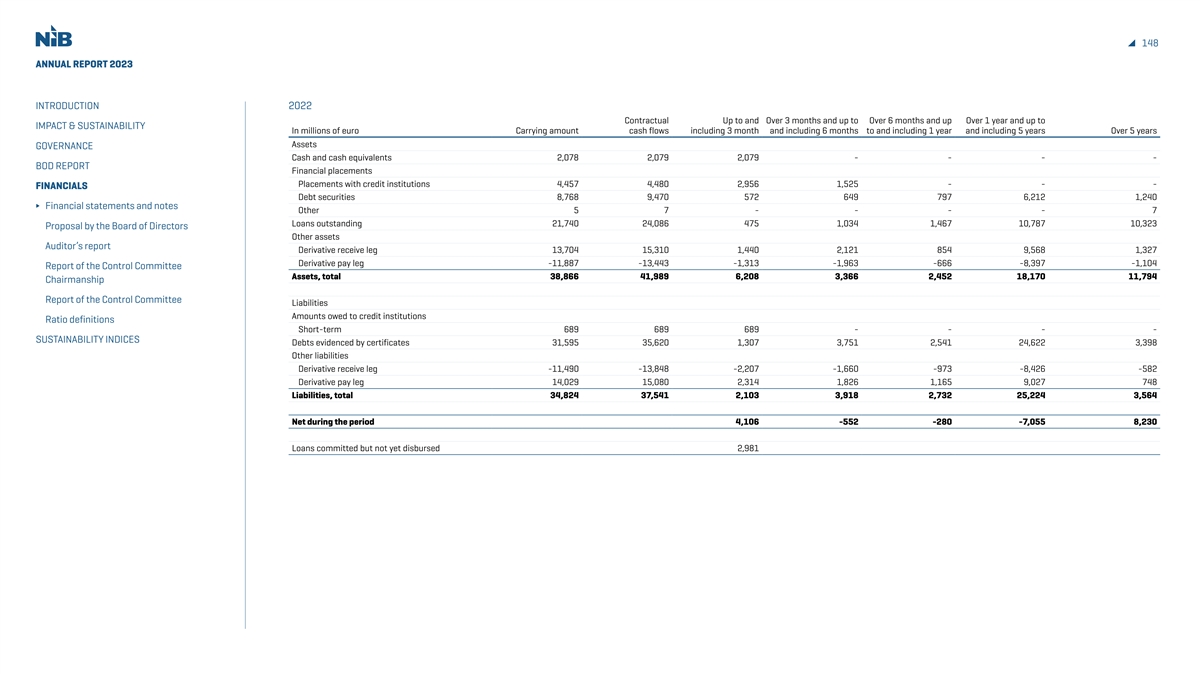

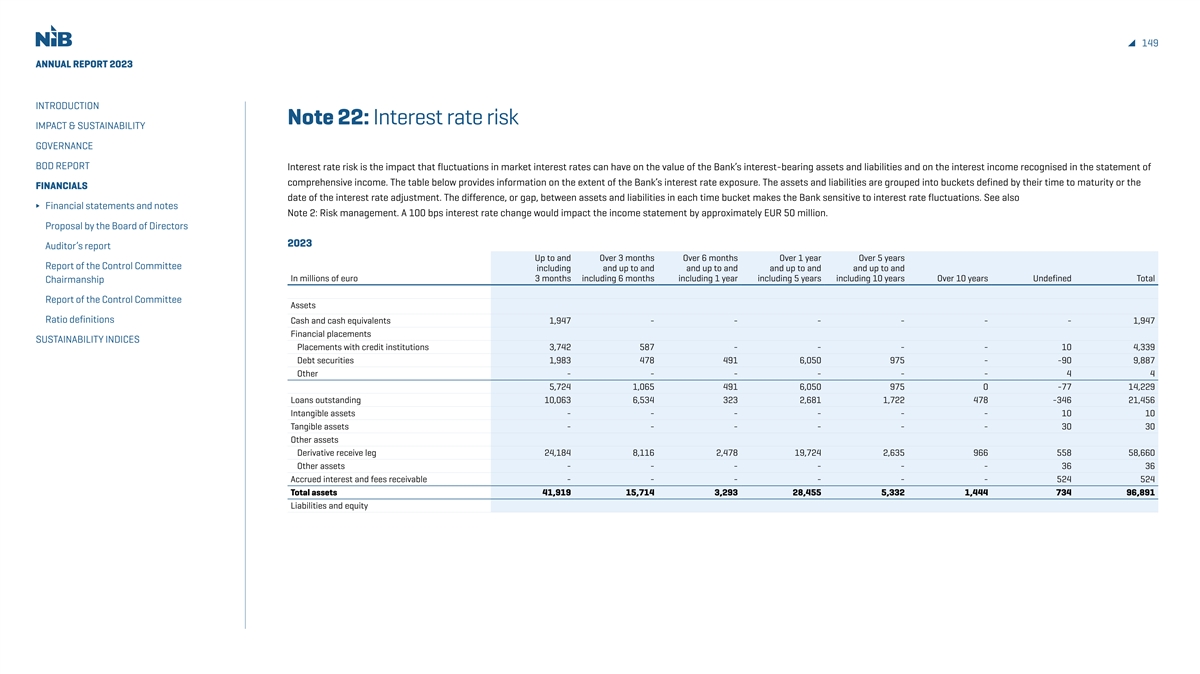

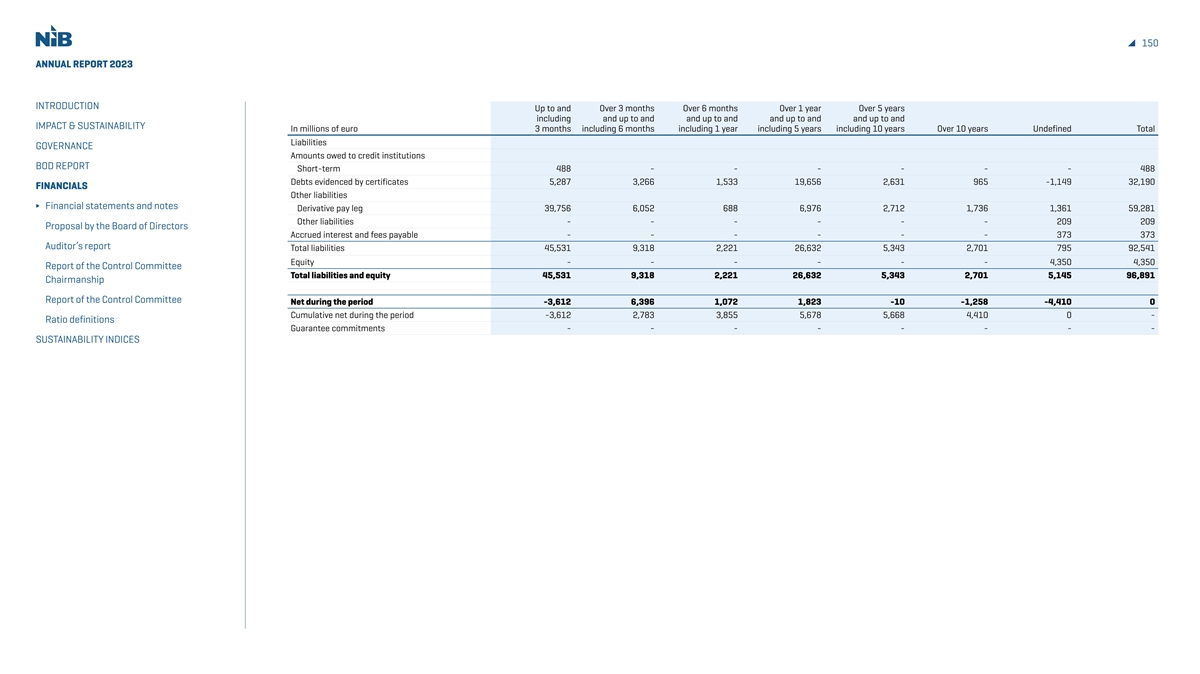

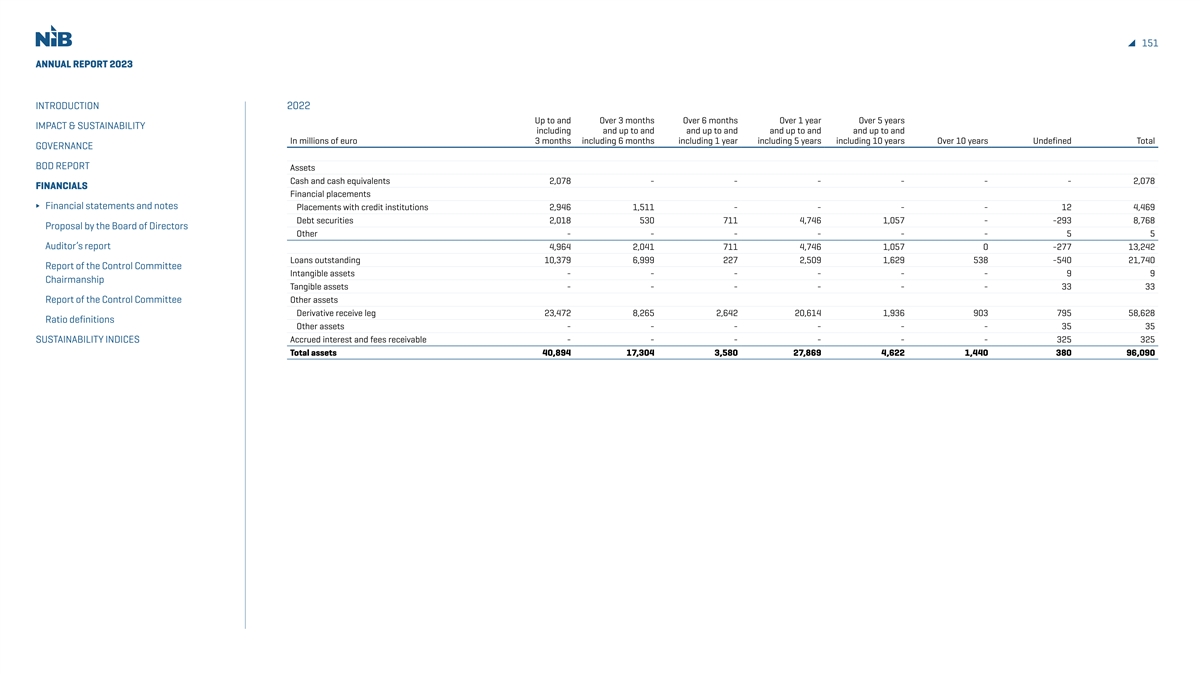

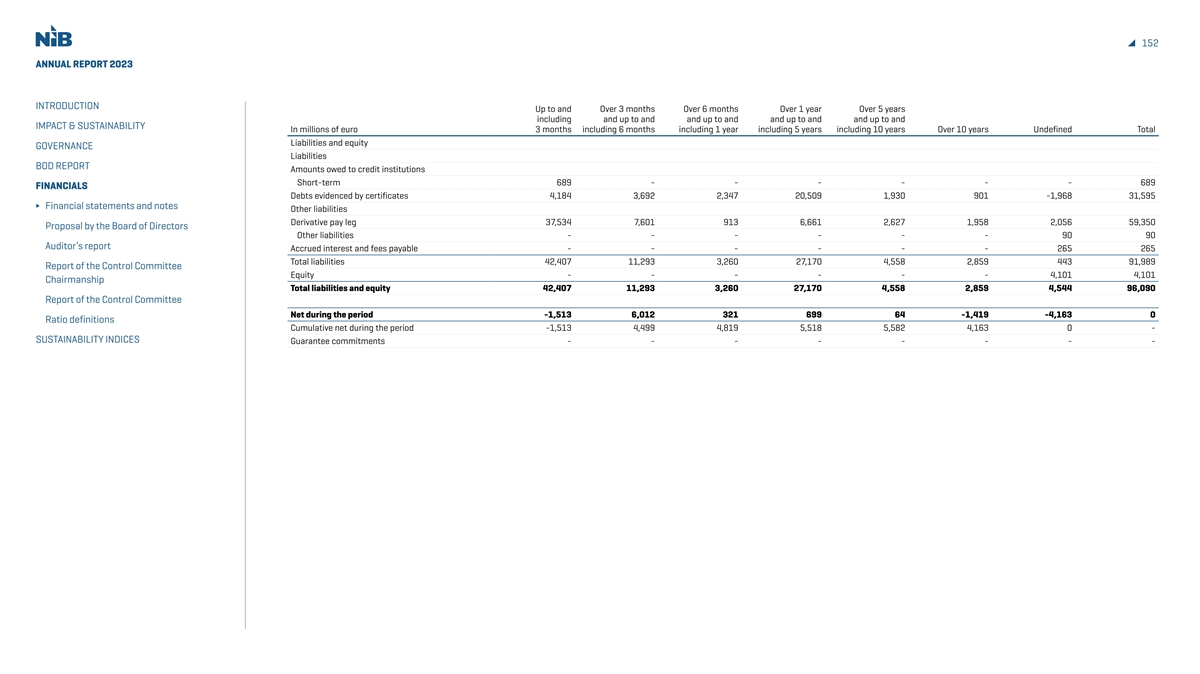

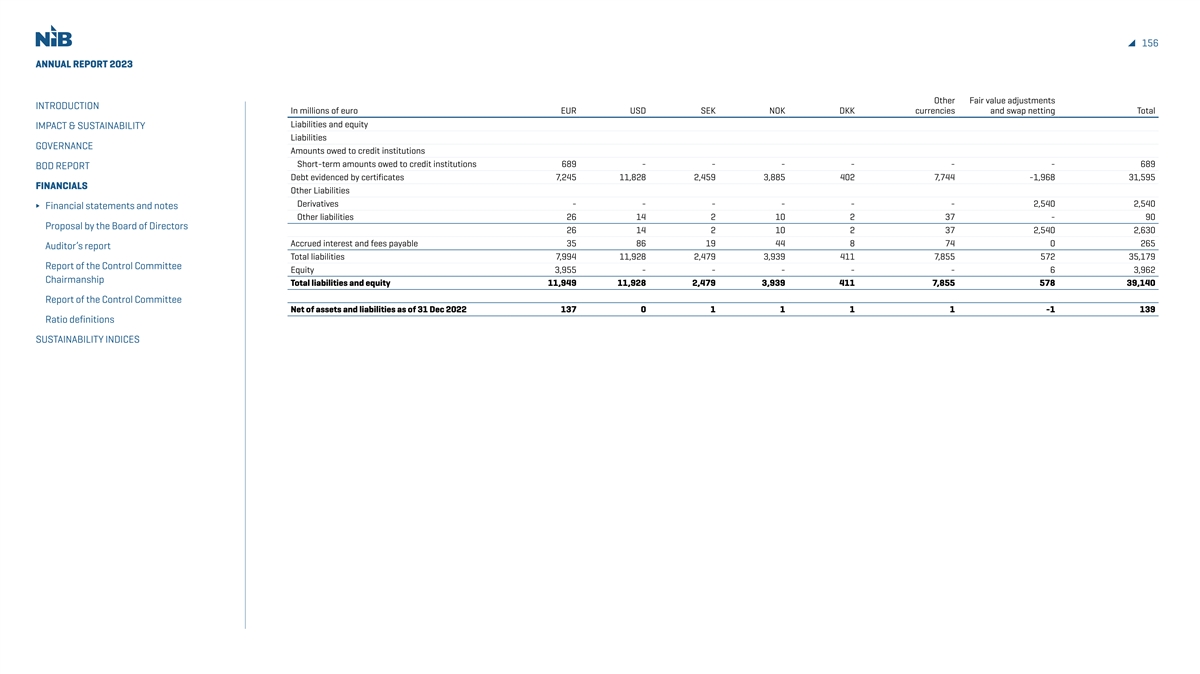

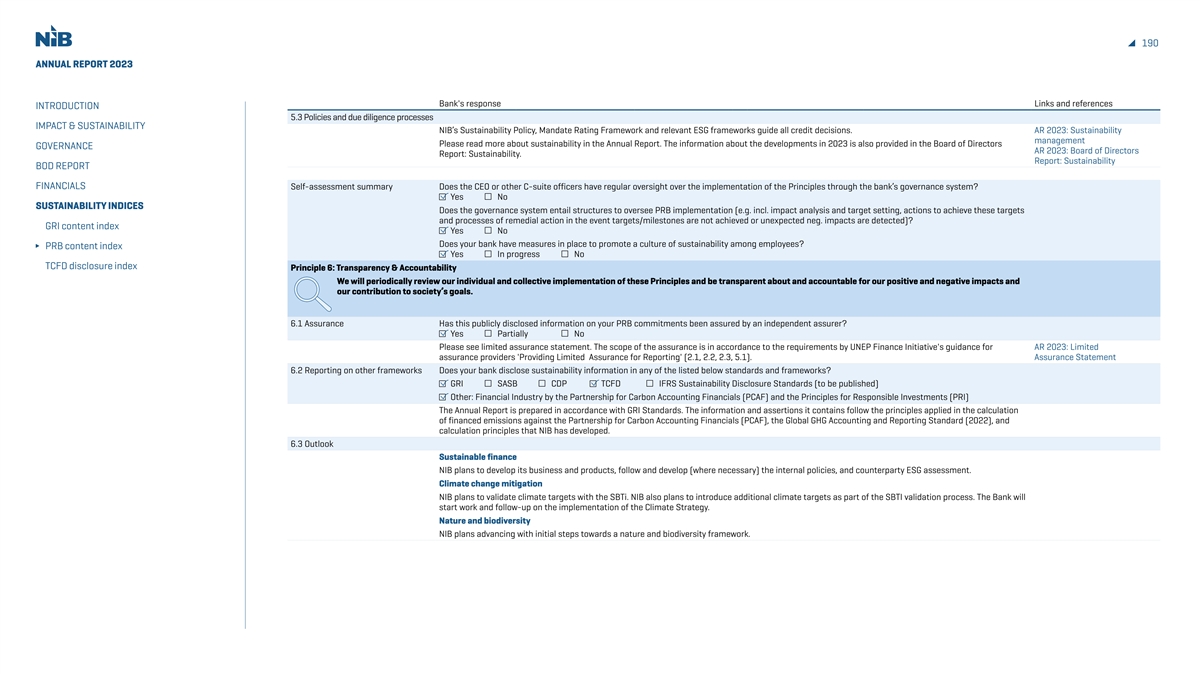

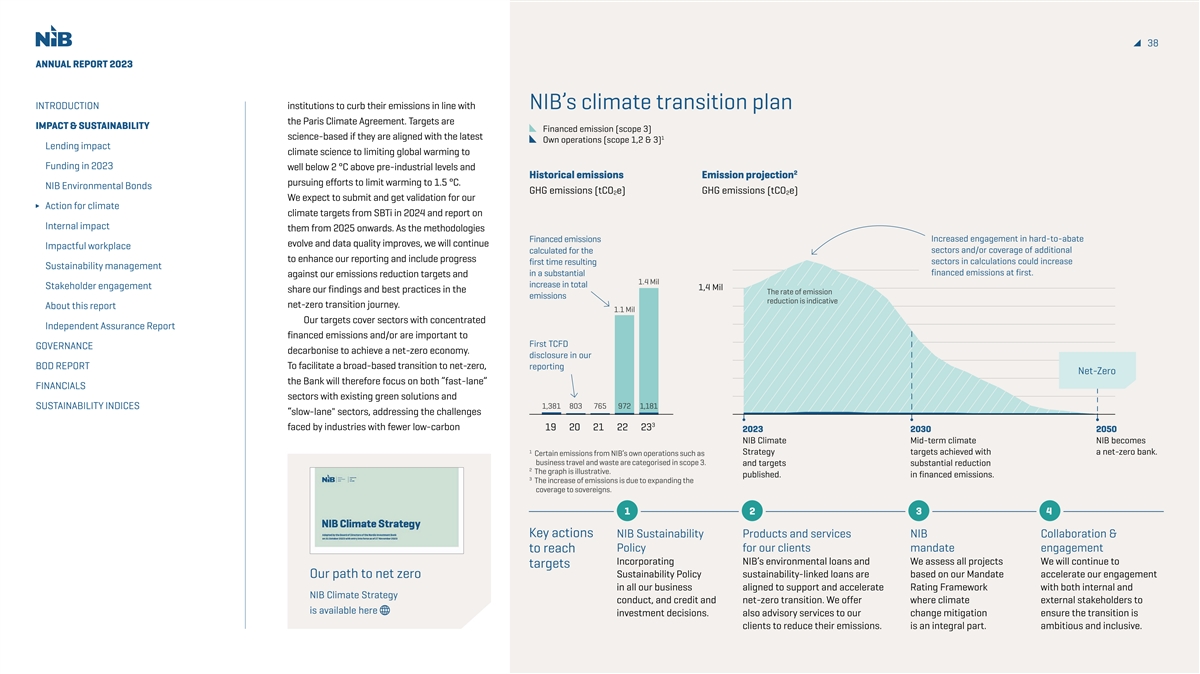

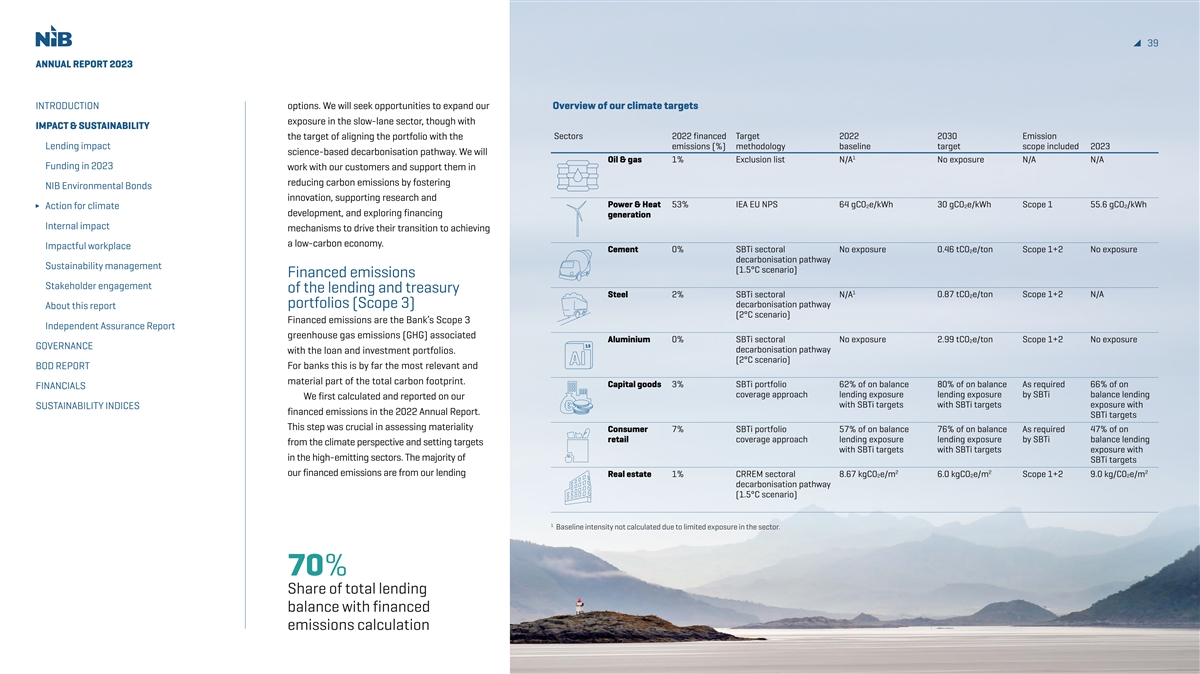

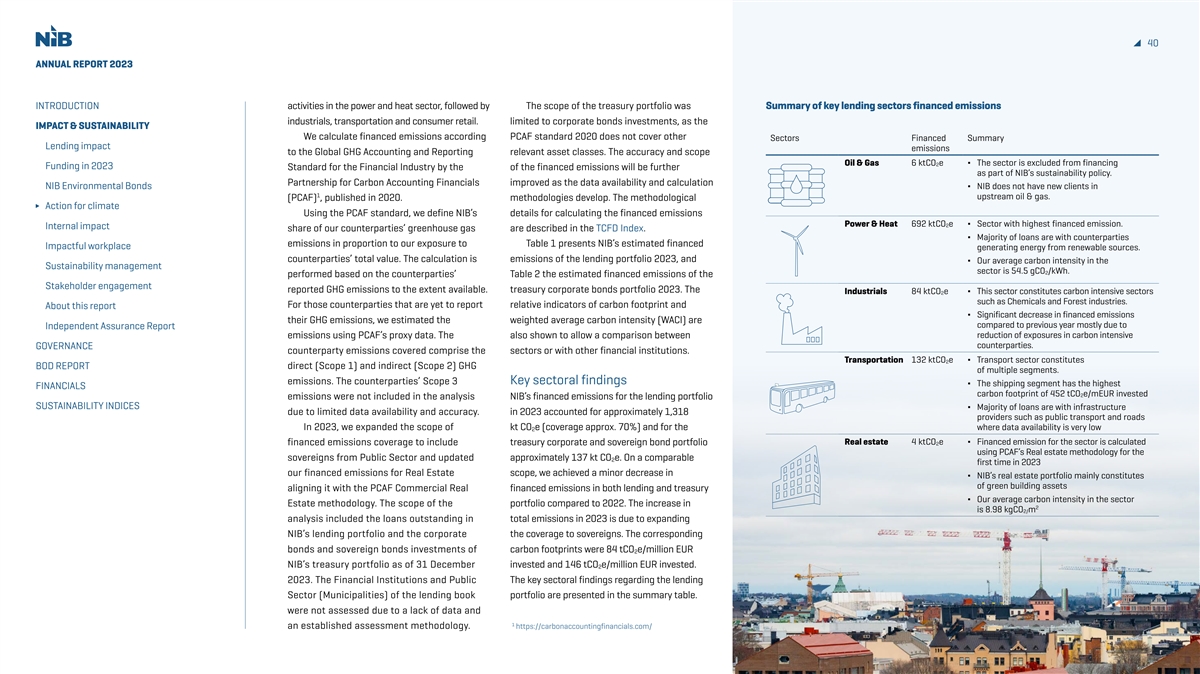

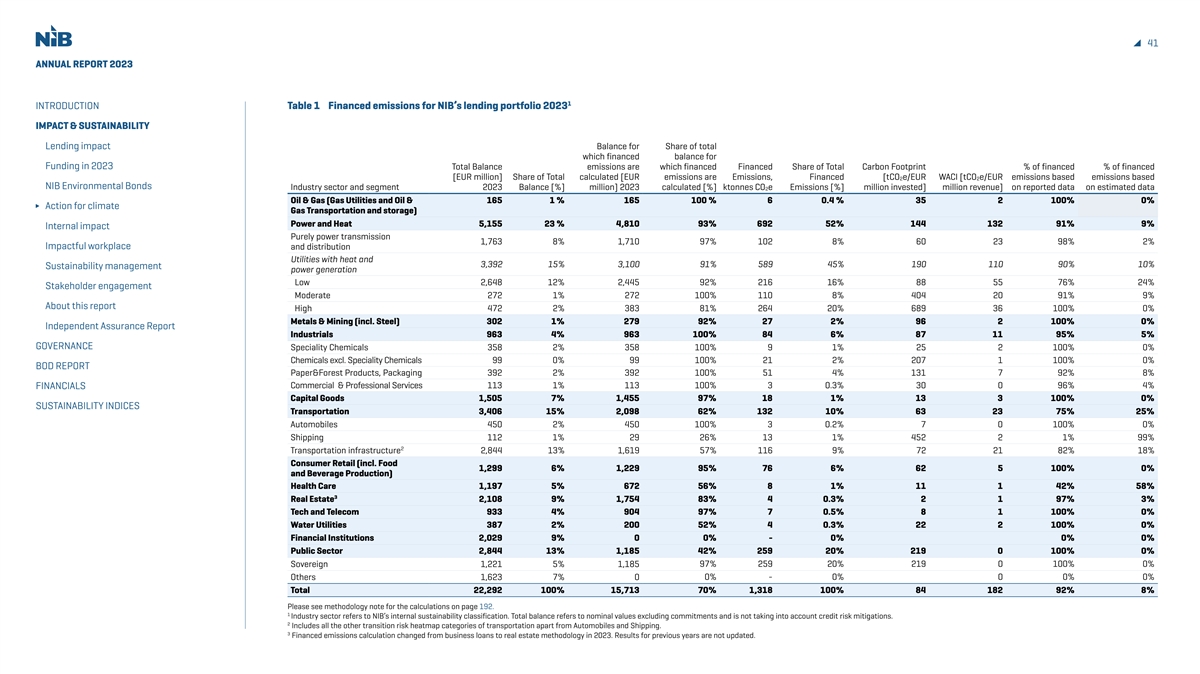

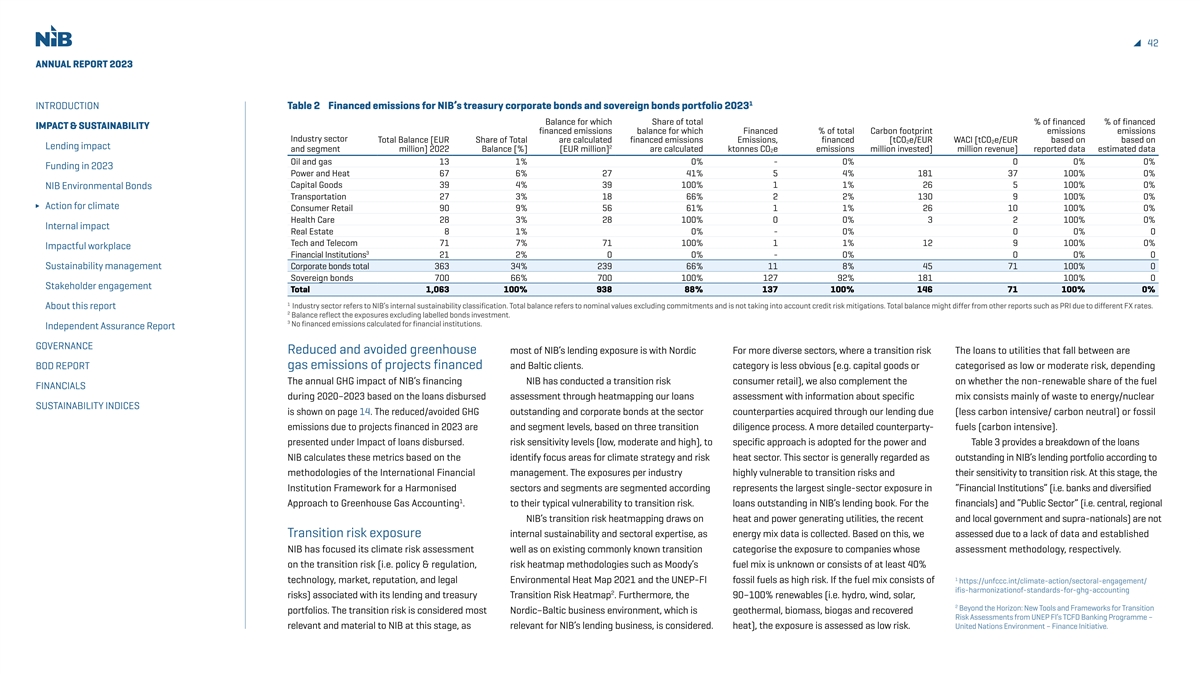

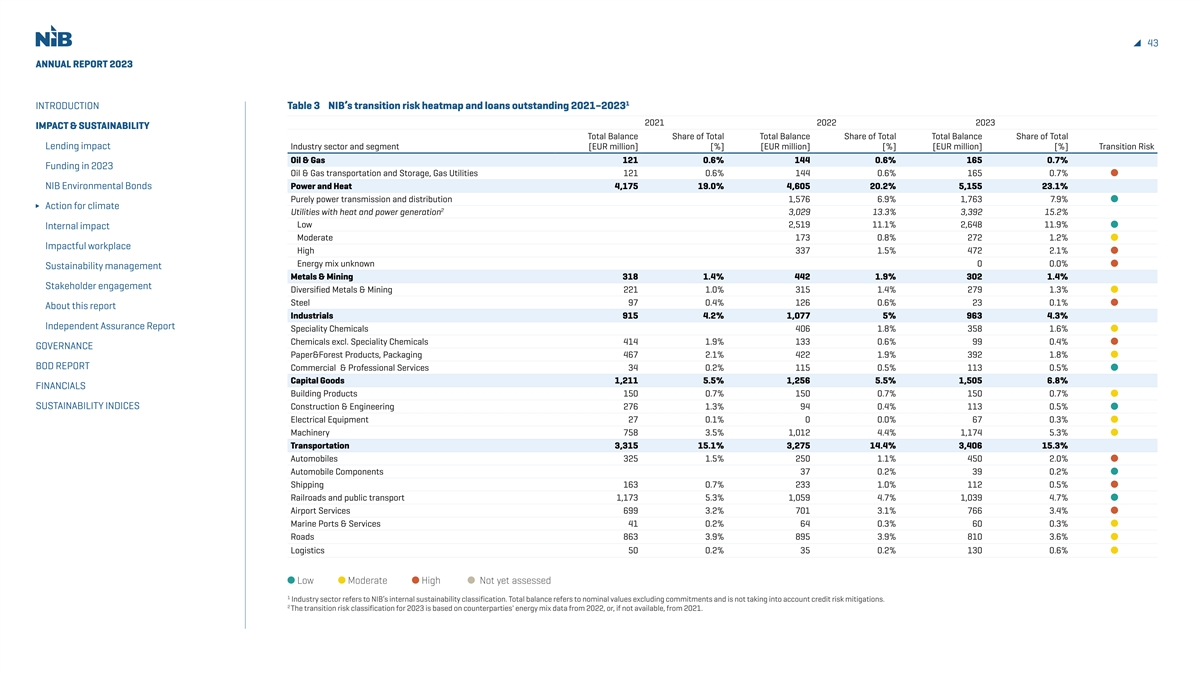

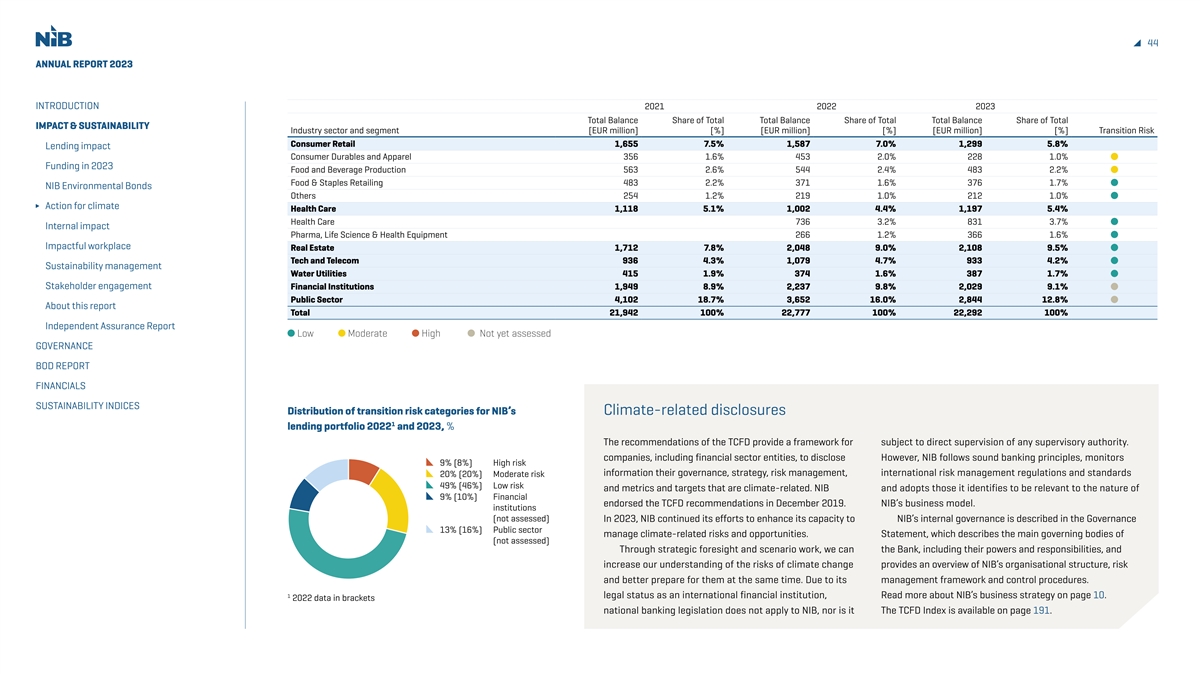

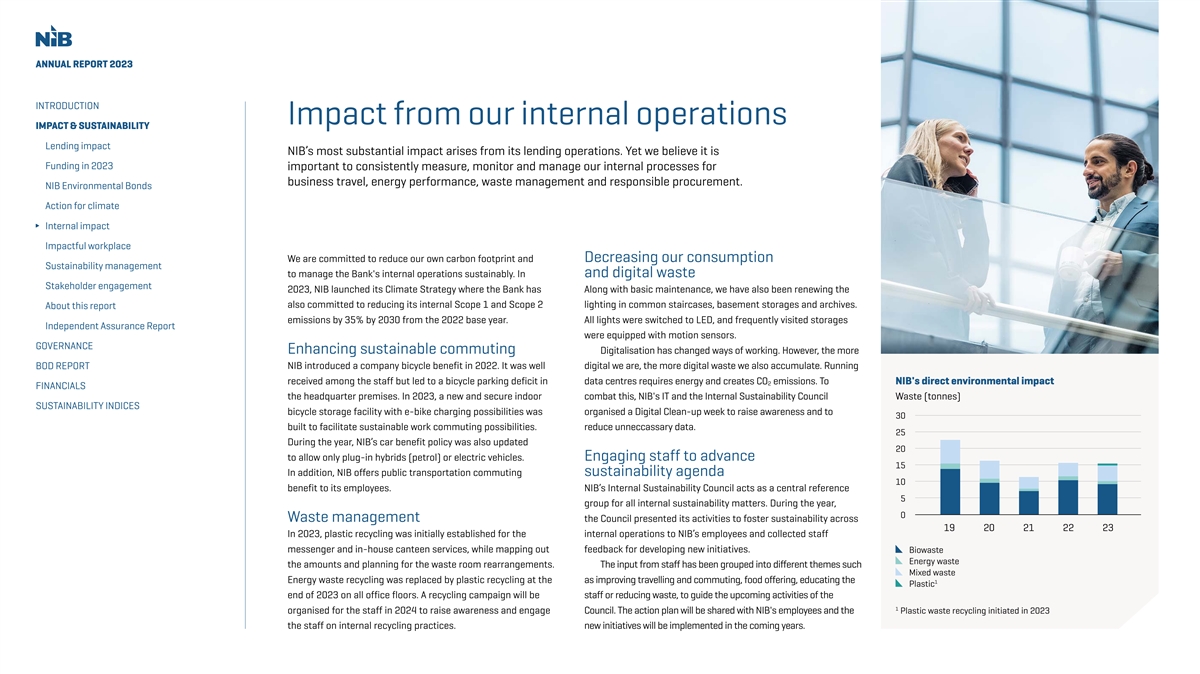

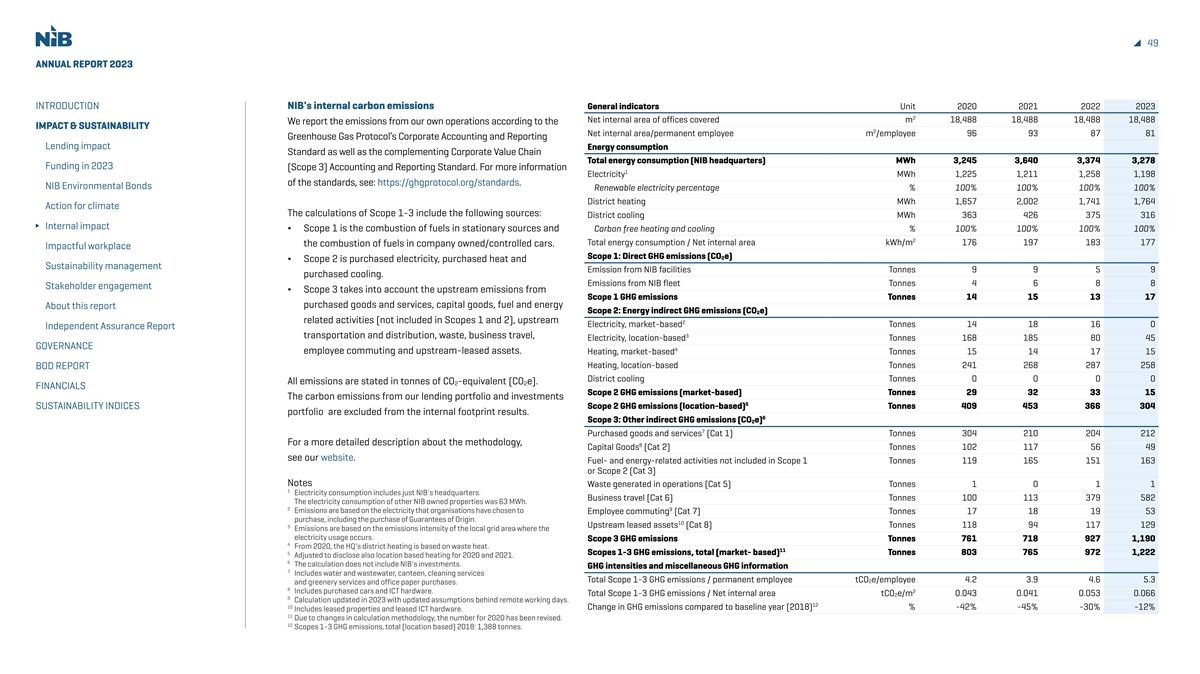

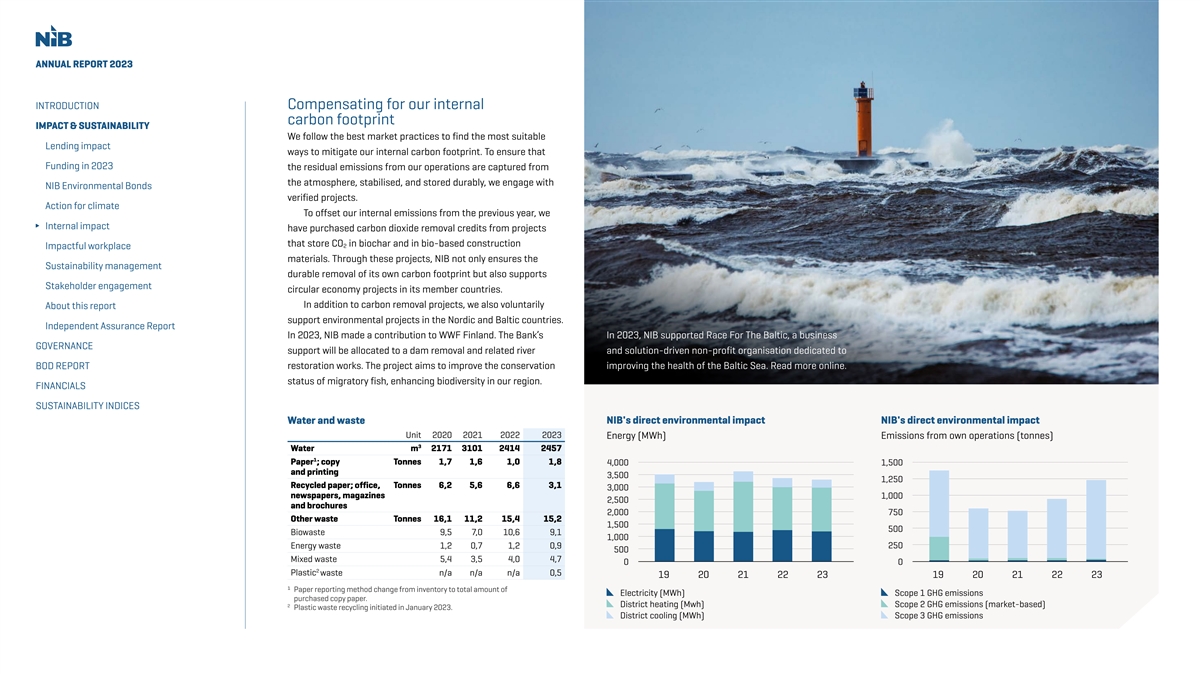

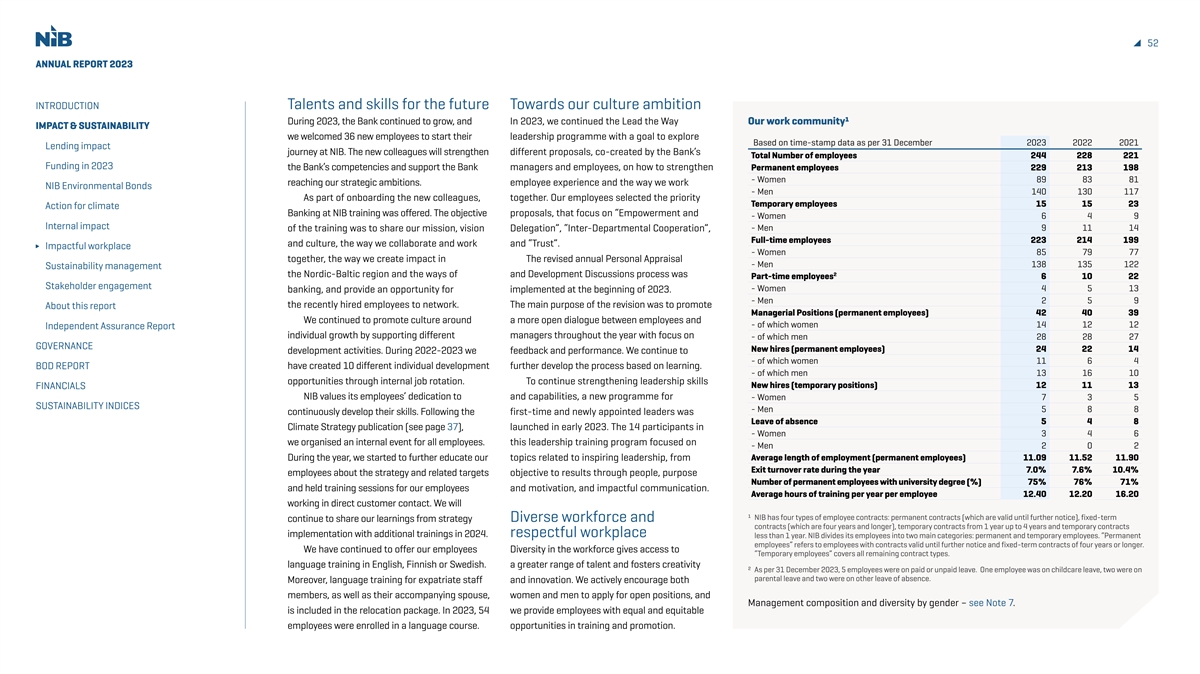

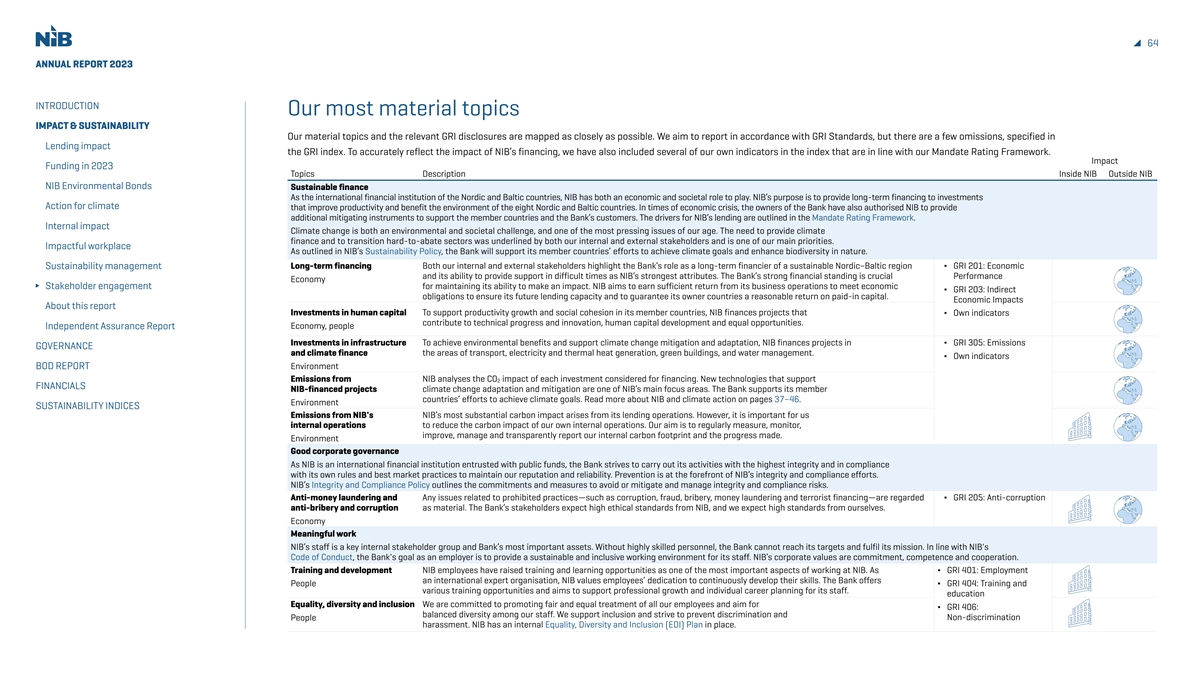

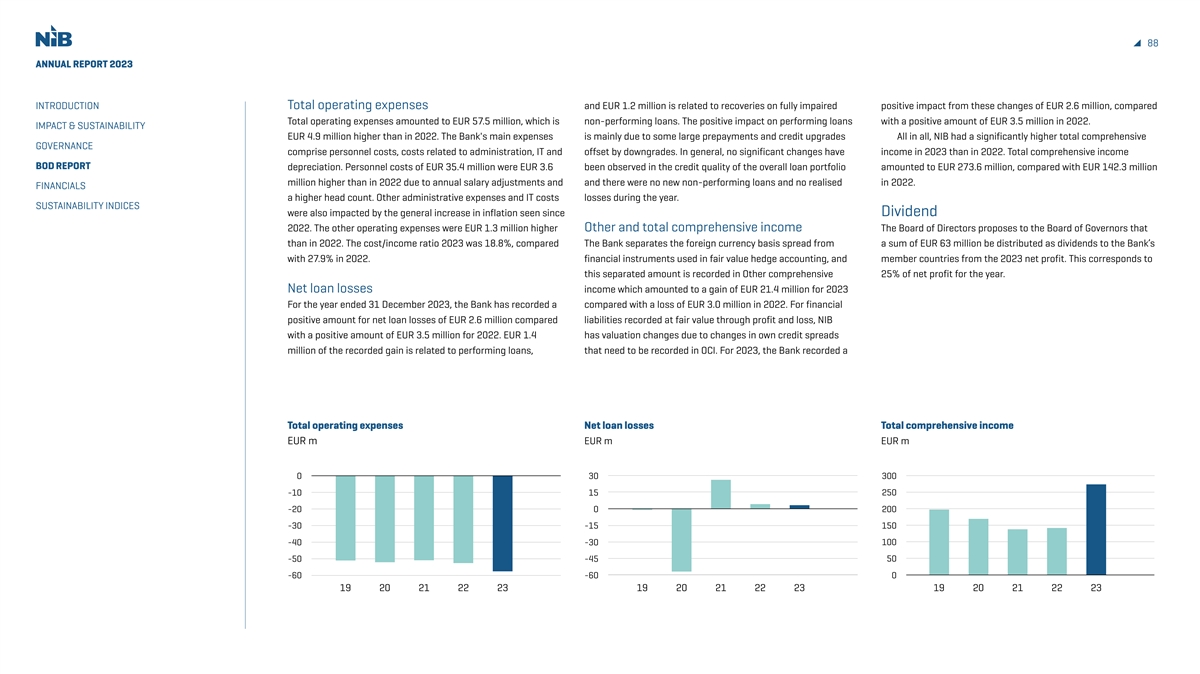

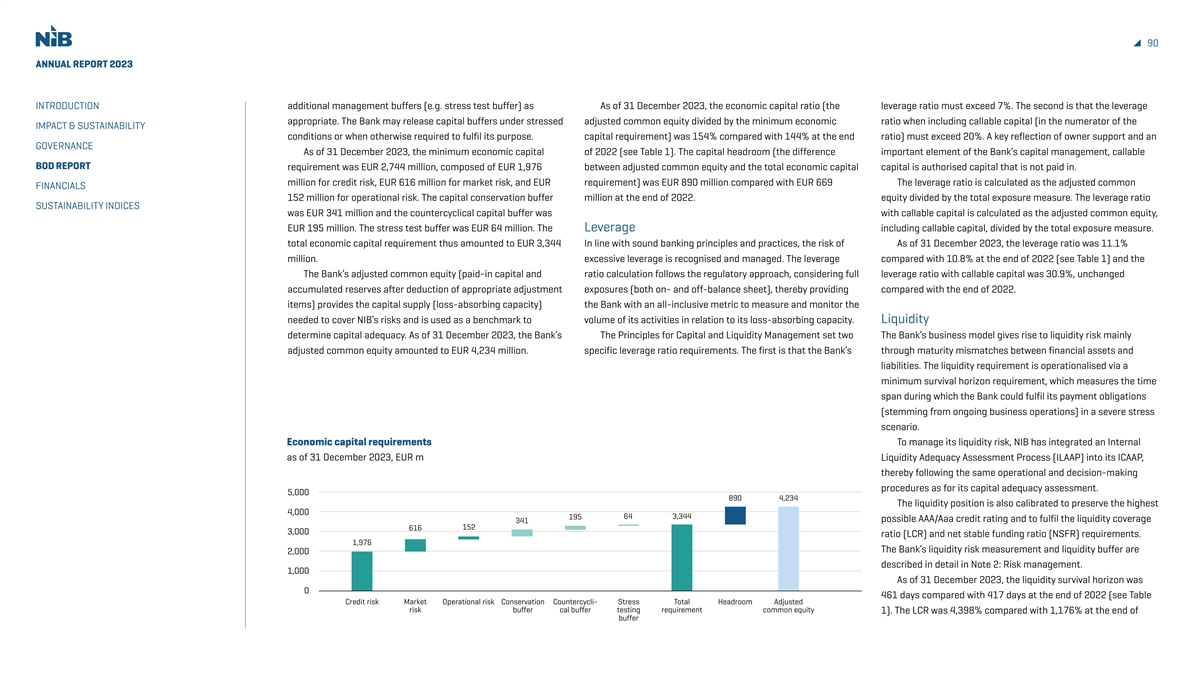

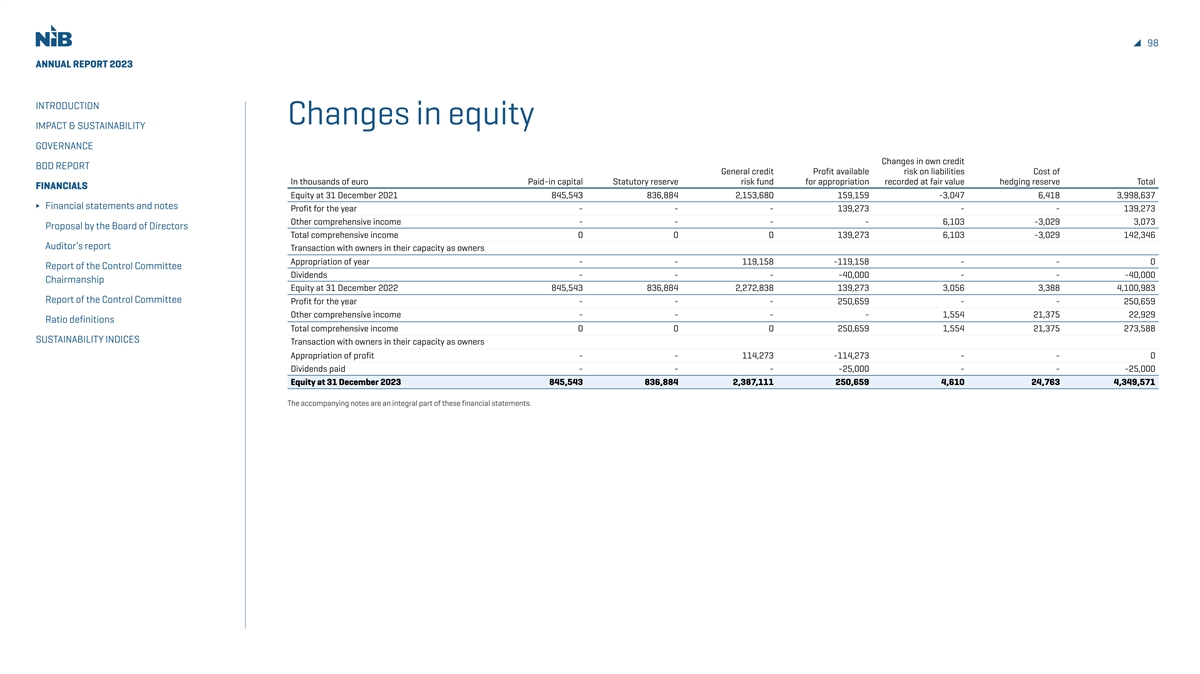

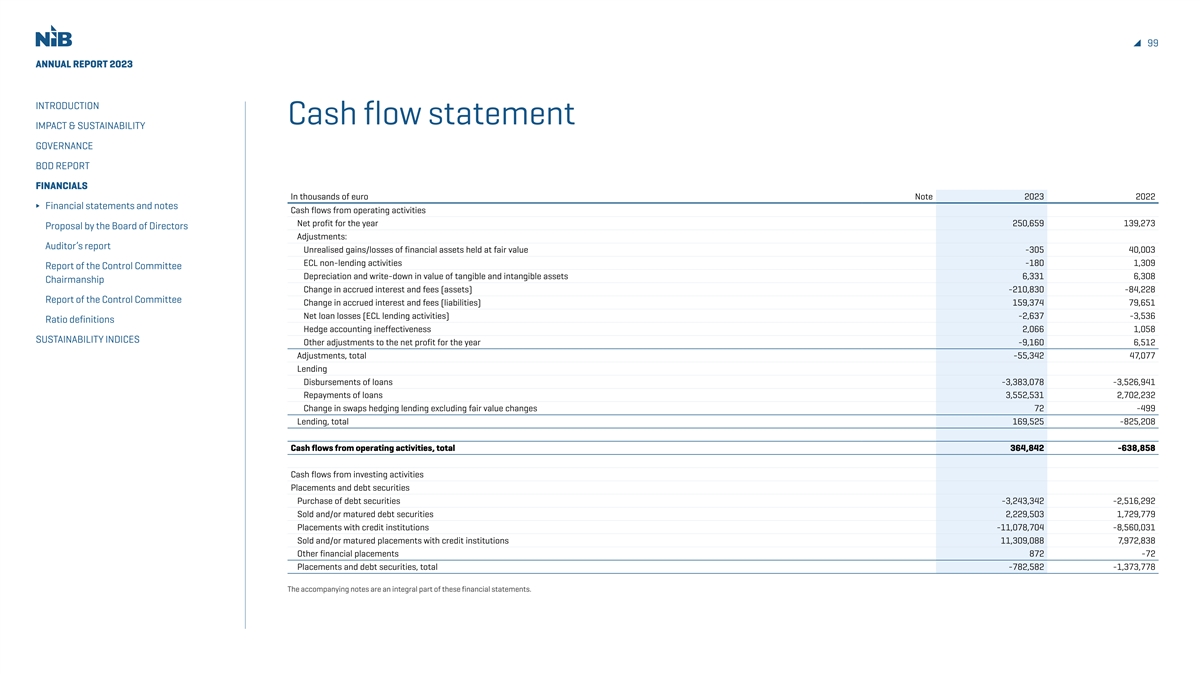

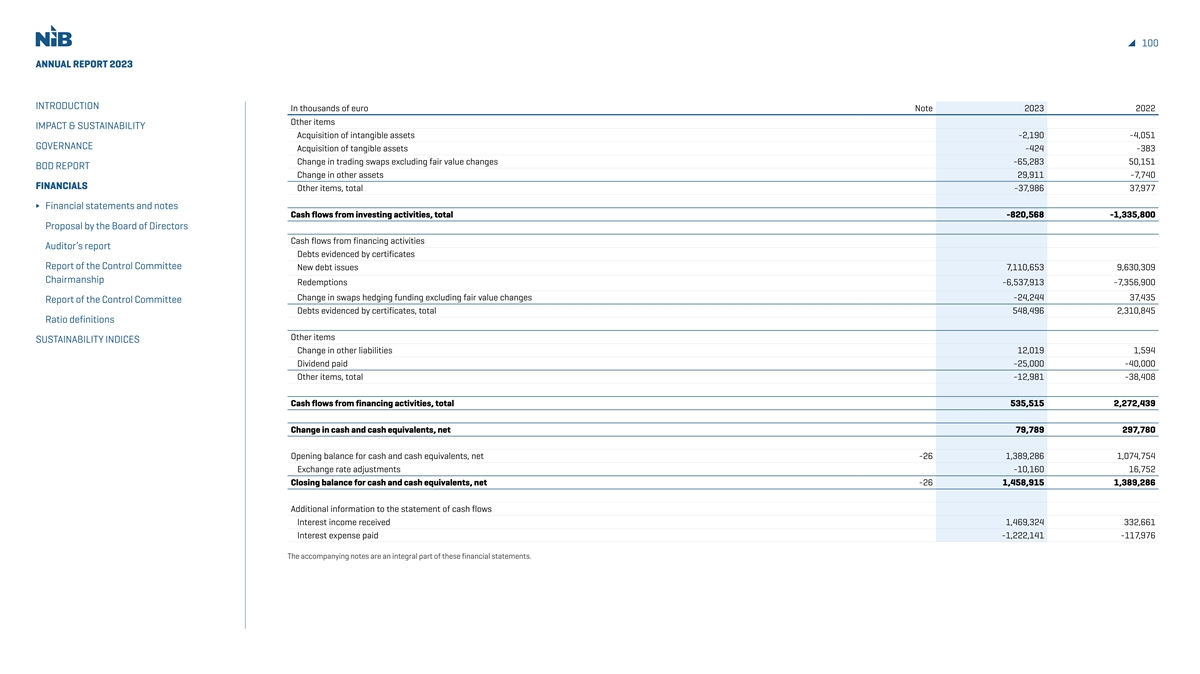

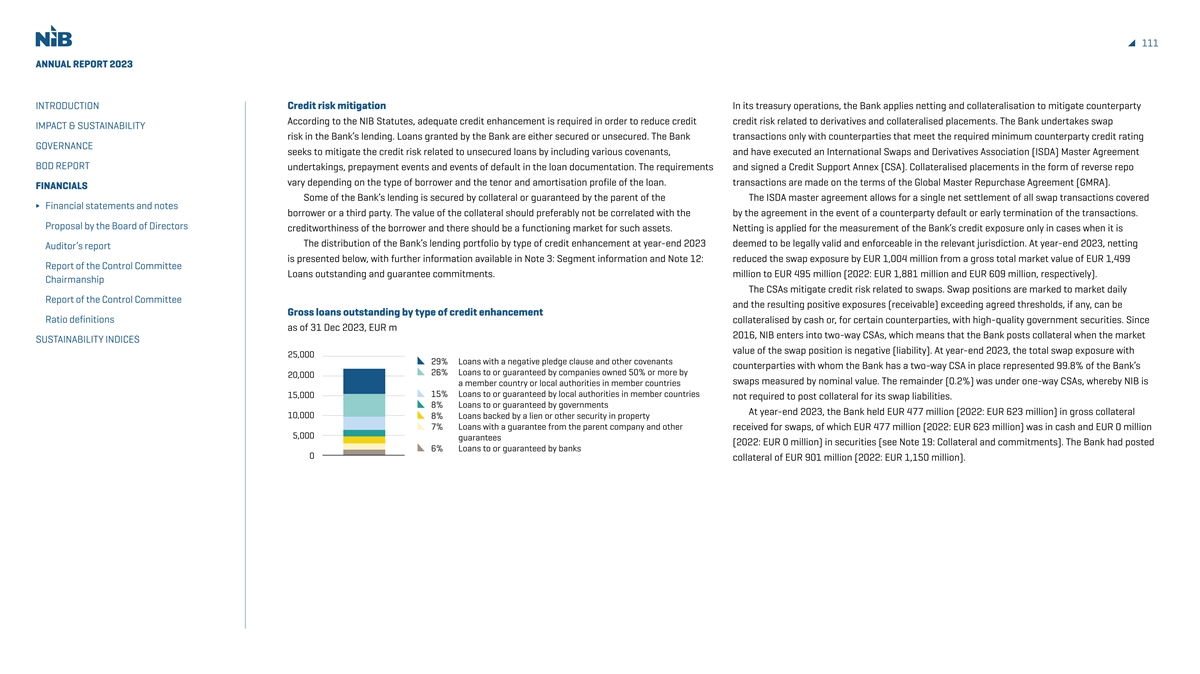

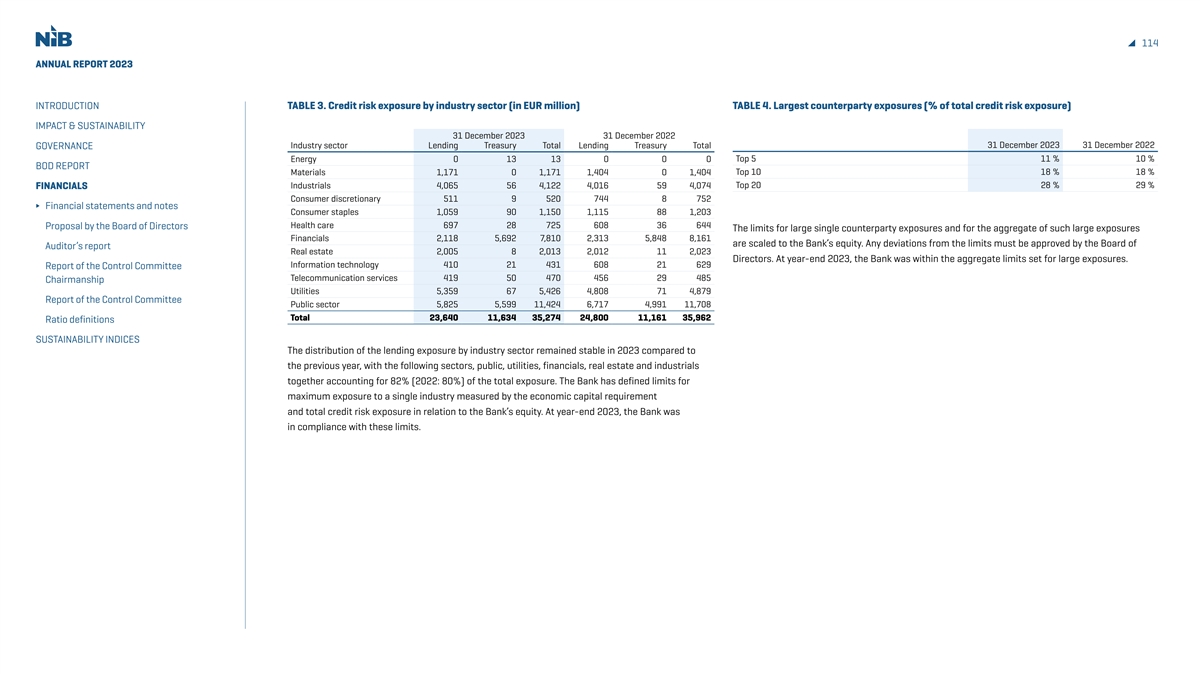

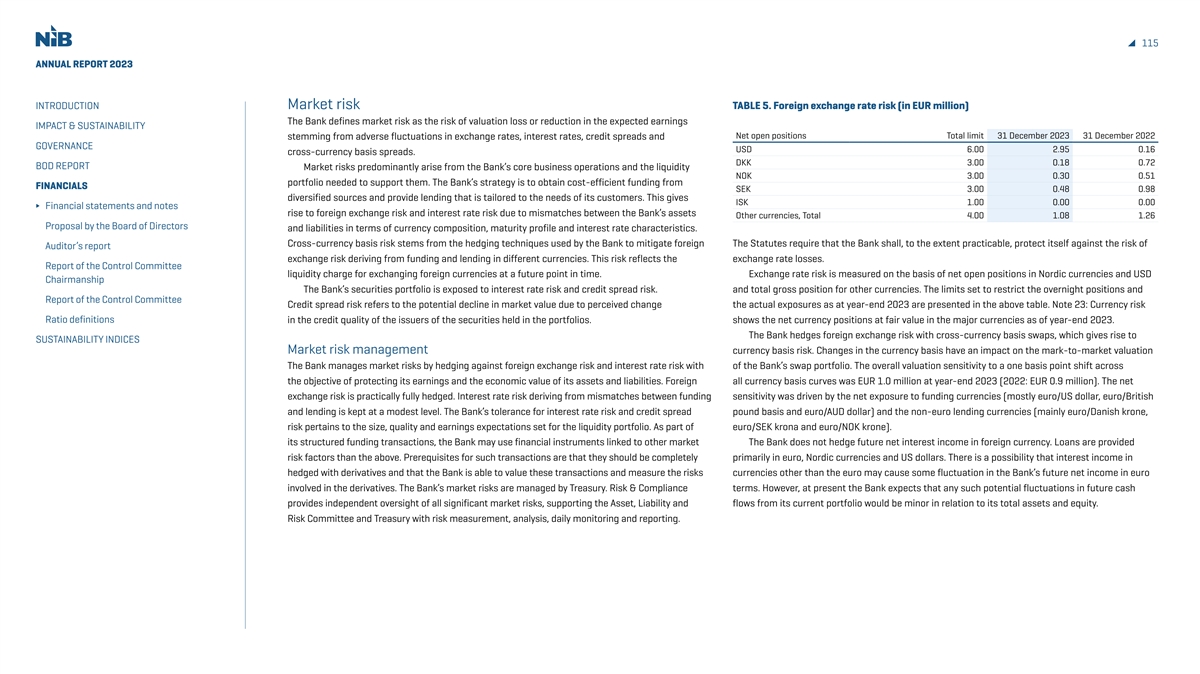

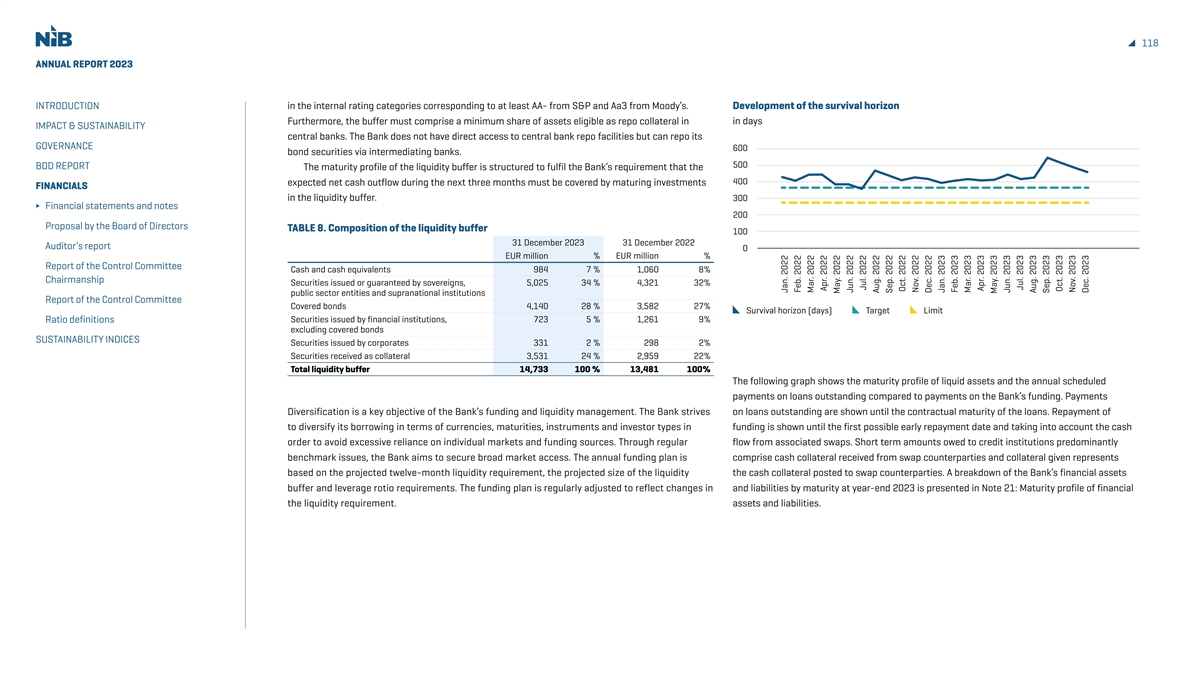

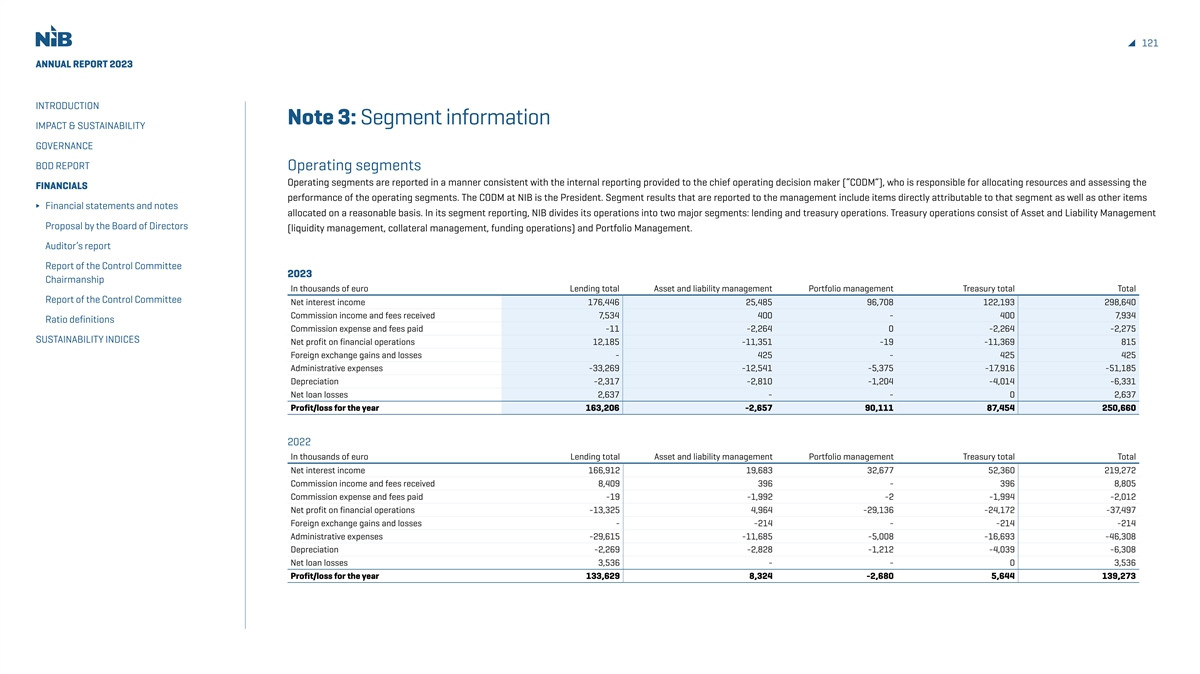

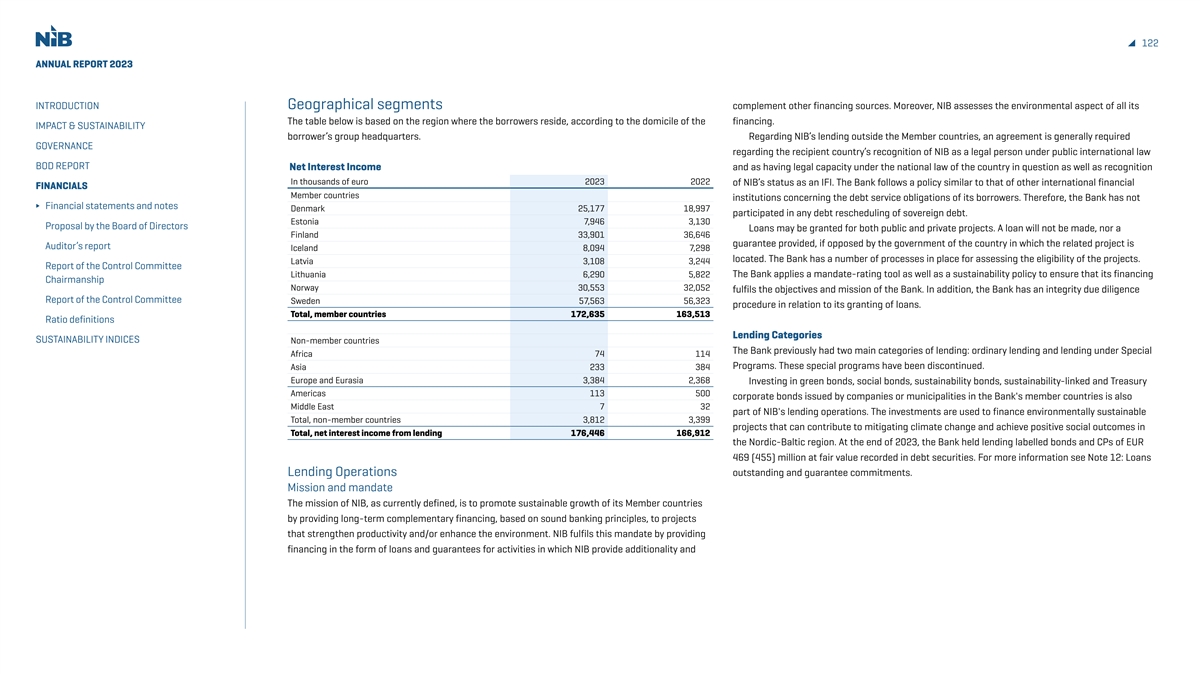

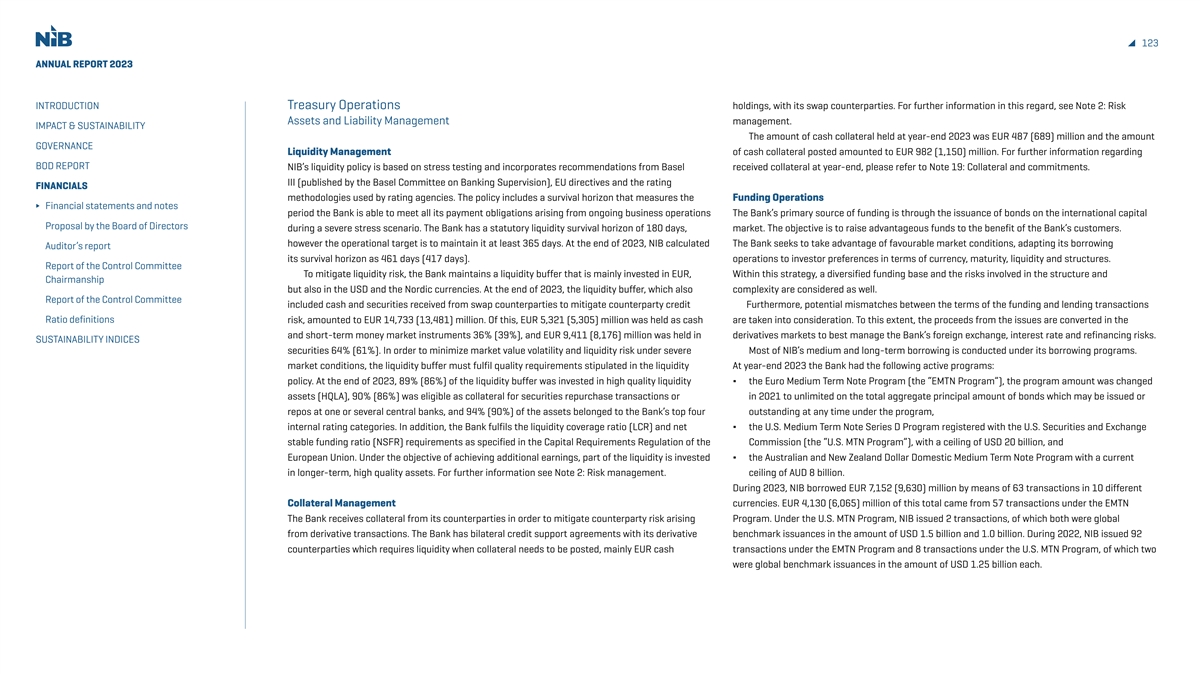

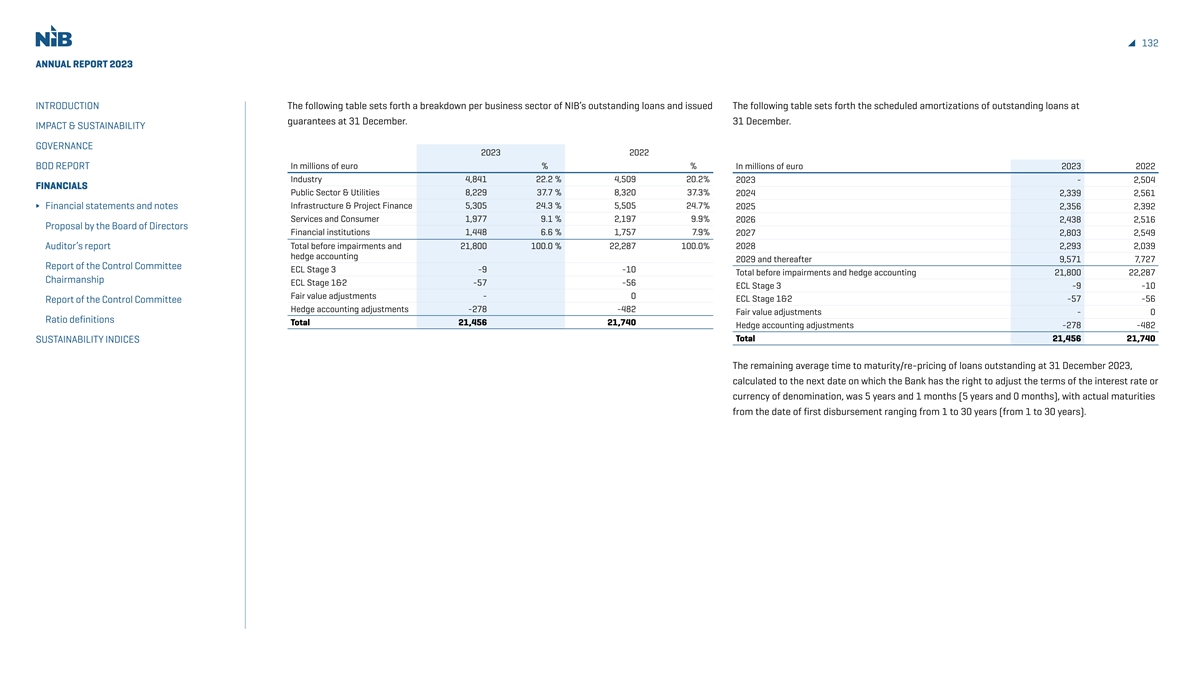

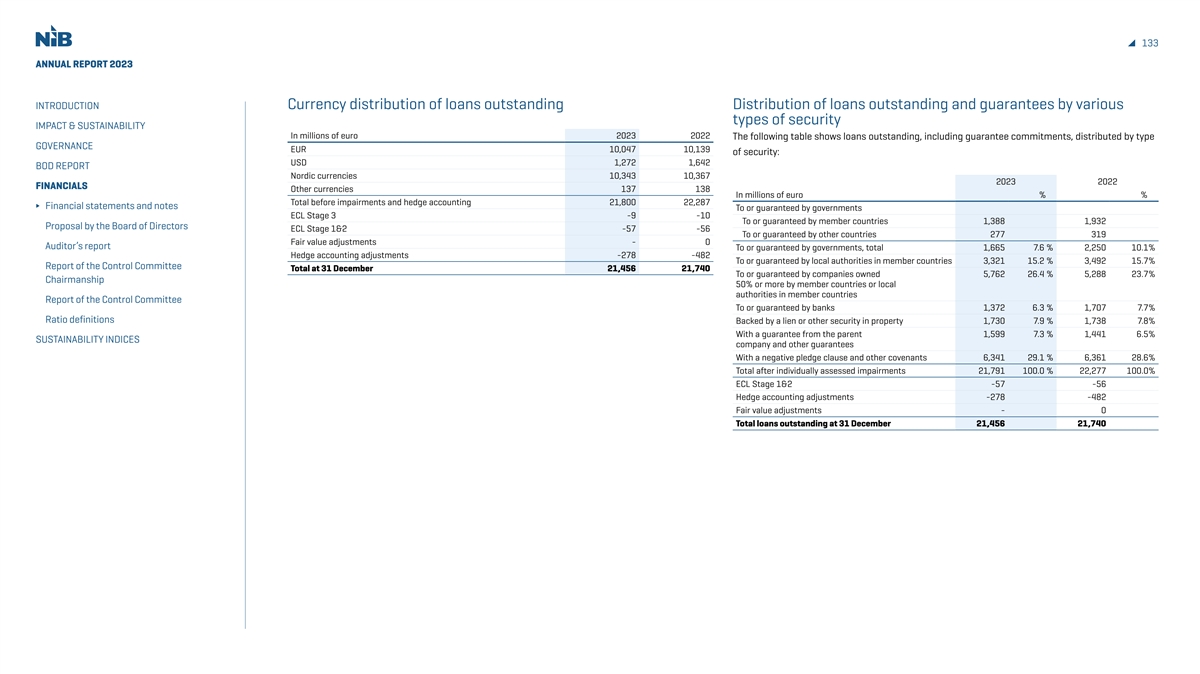

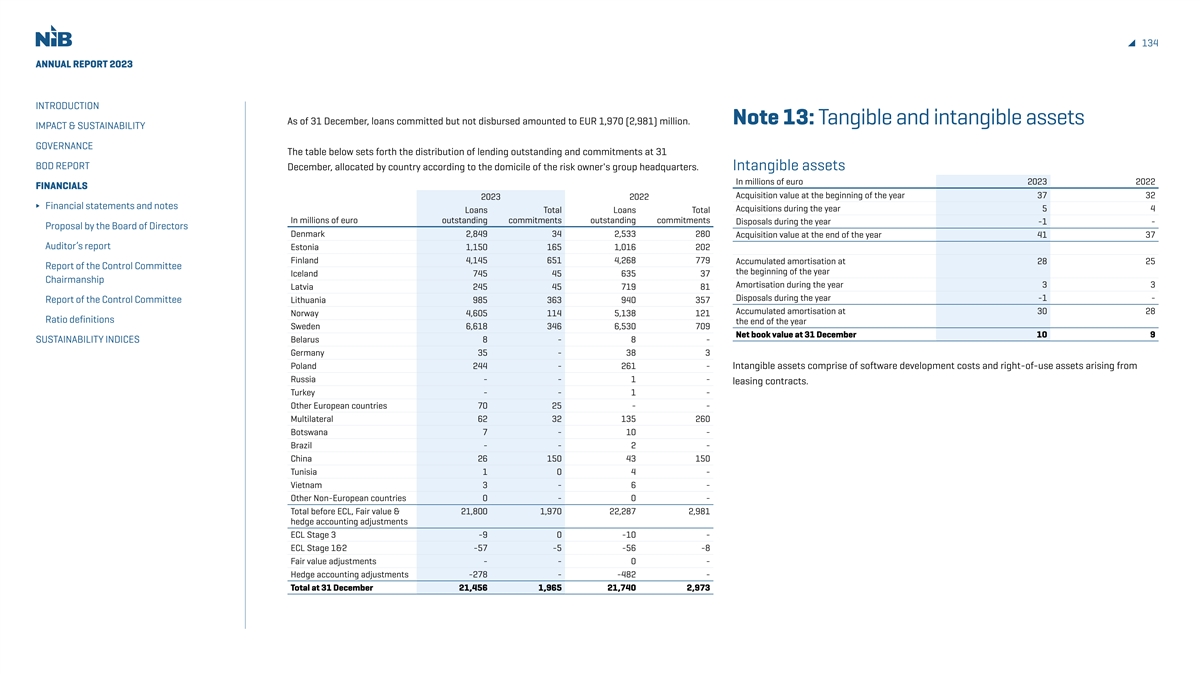

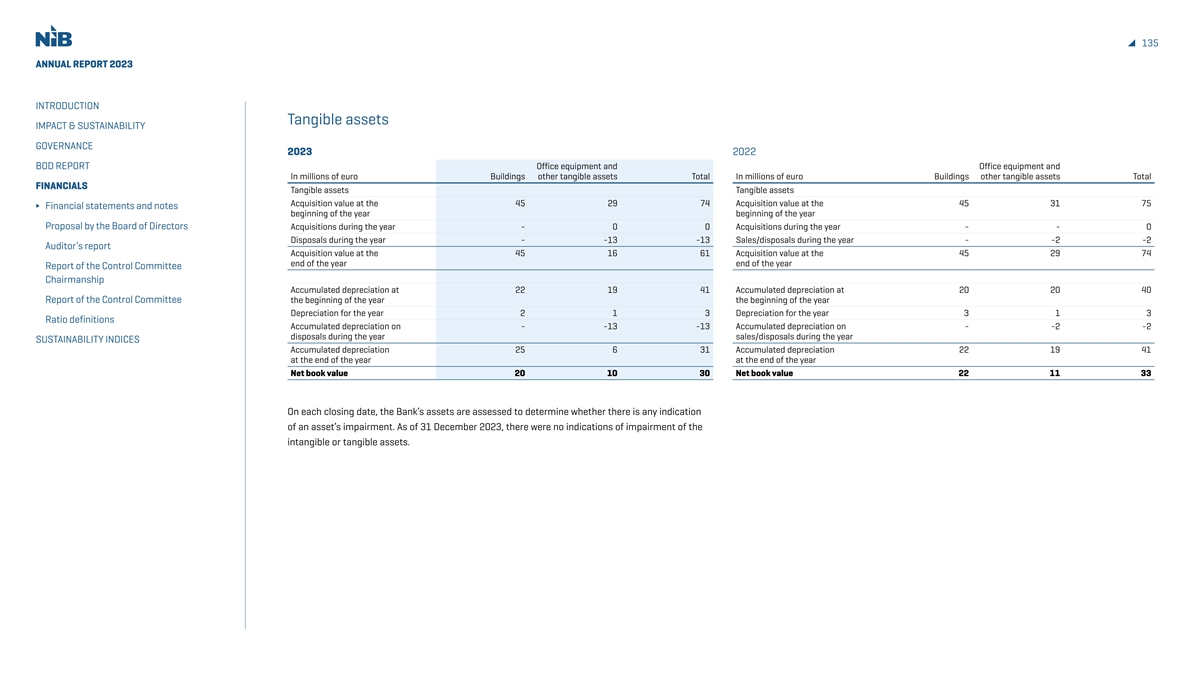

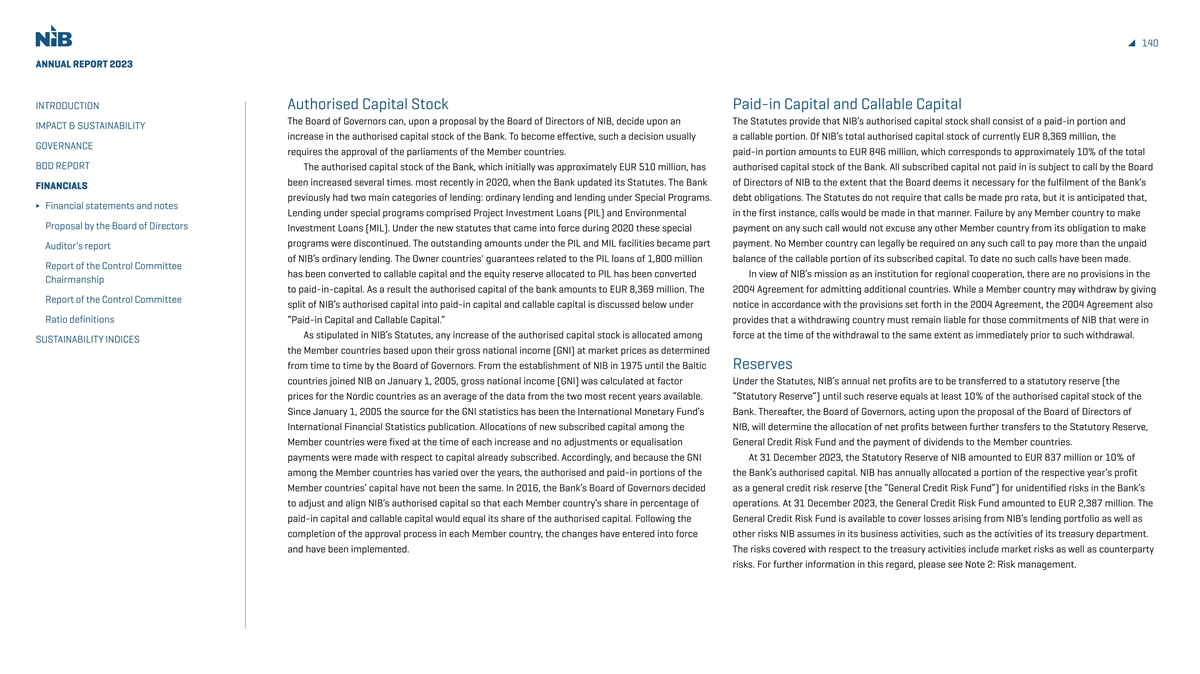

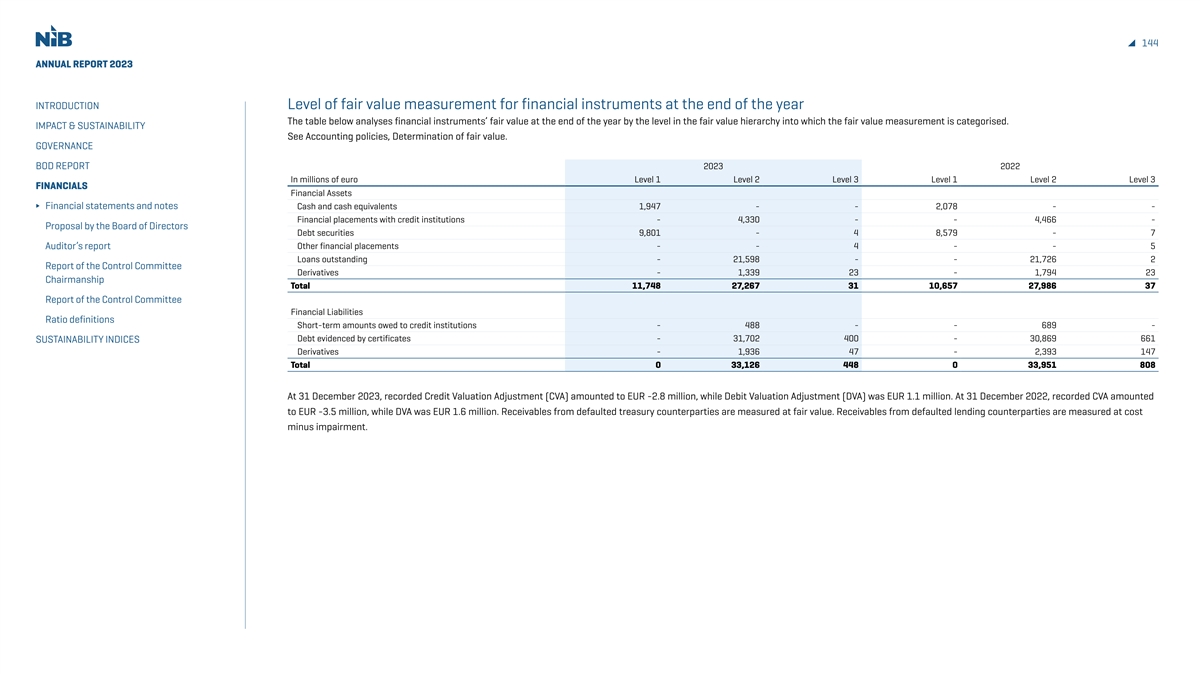

37 ANNUAL REPORT 2023 INTRODUCTION Action for climate IMPACT & SUSTAINABILITY Lending impact In 2023, we published our Climate Strategy and targets, Funding in 2023 and continued climate risk management integration. NIB Environmental Bonds Action for climate Internal impact Net-zero bank by 2050 of its 2022 financed emissions. Sectors that Impactful workplace As the impact of climate change continues are high-emitting and hold significant Sustainability management to intensify, achieving net-zero emissions importance in terms of decarbonisation to Stakeholder engagement is imperative from both environmental and limit the global temperature rise to below financial perspectives. 1.5-degree pre-industrial levels are About this report Supporting the decarbonisation of our prioritised in target setting. Independent Assurance Report economies and societies has long been Although the Bank’s own operations GOVERNANCE integrated in NIB’s business strategy. (Scopes 1 and 2) account for a very limited BOD REPORT Our impact primarily stems from lending share of our emissions, we recognise the and investment activities. Financed emissions importance of minimising our impact, however FINANCIALS NIB is committed to account for more than 99% of our total small, to lead and truly achieve the net-zero SUSTAINABILITY INDICES accelerate climate action. greenhouse gas (GHG) emissions. These transition. We have thus also set the climate By setting 2030 targets emissions are the indirect emissions that result targets for our own operations. The strategy for ourselves, we will work from our lending and investment activities announced in December 2023 at COP28 also together with our clients and fall under Scope 3 in the Greenhouse Gas outlines how we will reach our targets and Protocol. More details about our financed achieve net zero emissions by 2050. across sectors to support emissions can be found on pages 39-42. the Nordic-Baltic region's NIB has committed to being a net-zero bank Setting science-based targets climate neutrality goals. by 2050. This means our activities across our In 2023, NIB also committed to setting science- Luca De Lorenzo, value chain will result in no net GHG emissions. based targets and will thus expand the coverage Head of Sustainability and Mandate For a financial institution achieving net zero will of its 2030 climate targets to additional sectors, mostly require working with our clients and including in our treasury assets, as required by Science-based targets helping them in their own low-carbon transition. the Science Based Targets initiative (SBTi) before In 2023, the Bank published its Climate Strategy commencing the validation process. pushing decarbonisation and committed to intermediate 2030 climate Science-based targets provide emission Read the article targets for key lending sectors covering 67% reduction pathways for businesses and financial