Fidelity® Massachusetts AMT Tax-Free Money Market Fund

Fidelity® Massachusetts AMT Tax-Free Money Market Fund

Institutional Class

Service Class

Annual Report January 31, 2016 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544, or for Institutional and Service Class, call 1-877-208-0098, to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2016 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification

| Days | % of fund's investments 1/31/16 | % of fund's investments 7/31/15 | % of fund's investments 1/31/15 |

| 1 - 7 | 79.3 | 84.1 | 75.6 |

| 8 - 30 | 3.0 | 1.8 | 1.7 |

| 31 - 60 | 2.4 | 3.4 | 2.1 |

| 61 - 90 | 4.0 | 2.6 | 3.1 |

| 91 - 180 | 7.9 | 2.9 | 13.1 |

| > 180 | 3.4 | 5.2 | 4.4 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

Weighted Average Maturity

| | 1/31/16 | 7/31/15 | 1/31/15 |

| Fidelity Massachusetts AMT Tax-Free Money Market Fund | 26 Days | 28 Days | 35 Days |

| Massachusetts Tax-Free Money Market Funds Average(a) | 26 Days | 31 Days | 38 Days |

(a) Source: iMoneyNet, Inc.

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM.

Weighted Average Life

| | 1/31/16 | 7/31/15 | 1/31/15 |

| Fidelity Massachusetts AMT Tax-Free Money Market Fund | 28 Days | 29 Days | 36 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security.

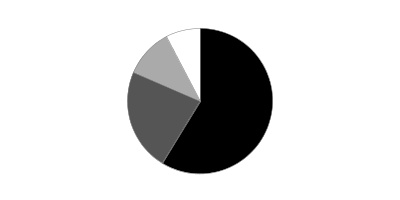

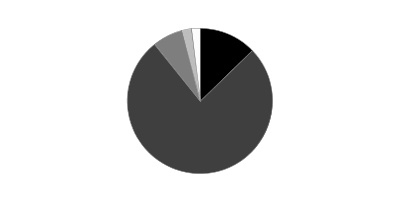

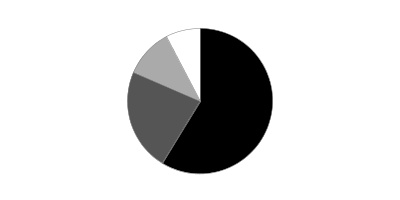

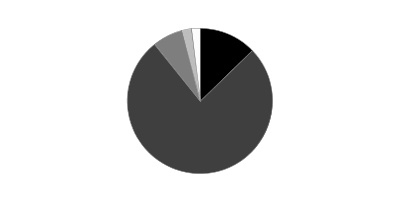

Asset Allocation (% of fund's net assets)

| As of January 31, 2016 |

| | Variable Rate Demand Notes (VRDNs) | 58.7% |

| | Other Municipal Debt | 22.8% |

| | Investment Companies | 10.8% |

| | Net Other Assets (Liabilities) | 7.7% |

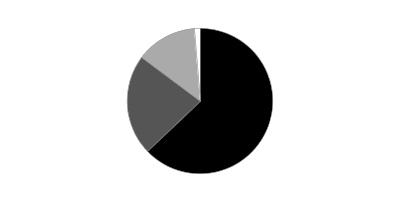

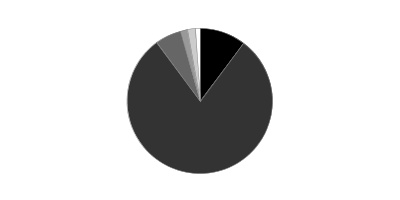

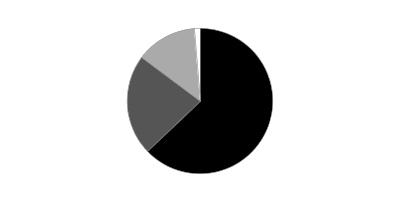

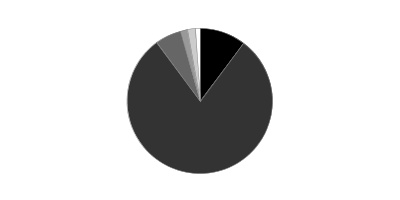

| As of July 31, 2015 |

| | Variable Rate Demand Notes (VRDNs) | 62.8% |

| | Other Municipal Debt | 22.4% |

| | Investment Companies | 13.5% |

| | Net Other Assets (Liabilities) | 1.3% |

Current And Historical 7-Day Yields

| | 1/31/2016 | 10/31/15 | 07/31/15 | 4/30/15 | 1/31/15 |

| Fidelity® Massachusetts AMT Tax-Free Money Market Fund | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Institutional Class | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Service Class | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

Yield refers to the income paid by the Fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending January 31, 2016, the most recent period shown in the table, would have been -0.24% for Massachusetts AMT Tax-Free Money Market, -0.19% for Institutional Class and -0.44% for Service Class.

Investments January 31, 2016

Showing Percentage of Net Assets

| Variable Rate Demand Note - 58.7% | | | |

| | | Principal Amount | Value |

| Delaware - 0.4% | | | |

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1999 A, 0.07% 2/5/16, VRDN (a) | | $2,300,000 | $2,300,000 |

| Georgia - 0.5% | | | |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Vogtle Proj.): | | | |

| First Series 2009, 0.19% 2/1/16, VRDN (a) | | 1,000,000 | 1,000,000 |

| Series 2013, 0.17% 2/5/16, VRDN (a) | | 600,000 | 600,000 |

| Coweta County Dev. Auth. Poll. Cont. Rev. (Georgia Pwr. Co. Plant Yates Proj.) Series 2006, 0.18% 2/1/16, VRDN (a) | | 700,000 | 700,000 |

| Monroe County Dev. Auth. Poll. Cont. Rev.: | | | |

| (Georgia Pwr. Co. Plant Scherer Proj.) Series 1997, 0.18% 2/1/16, VRDN (a) | | 300,000 | 300,000 |

| (Georgia Pwr. Plant Co. Scherer Proj.) Series 2008, 0.18% 2/1/16, VRDN (a) | | 500,000 | 500,000 |

| | | | 3,100,000 |

| Louisiana - 0.2% | | | |

| Saint James Parish Gen. Oblig. (Nucor Steel Louisiana LLC Proj.) Series 2010 A1, 0.4% 2/5/16, VRDN (a) | | 1,100,000 | 1,100,000 |

| Massachusetts - 56.7% | | | |

| JPMorgan Chase Participating VRDN: | | | |

| Series Putters 16 5004, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 1,100,000 | 1,100,000 |

| Series Putters 16 5005, 0.01% 2/1/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 1,100,000 | 1,100,000 |

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev.: | | | |

| Series 2010 A1, 0.01% 2/5/16, LOC Citibank NA, VRDN (a) | | 17,150,000 | 17,150,000 |

| Series 2010 A3, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 6,300,000 | 6,300,000 |

| Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. (Tammy Brook Apts. Proj.) Series 2009, 0.03% 2/5/16, LOC Freddie Mac, VRDN (a) | | 3,515,000 | 3,515,000 |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Babson College Proj.) Series 2008 A, 0.01% 2/5/16, LOC Fed. Home Ln. Bank of Boston, VRDN (a) | | 26,690,000 | 26,690,000 |

| (Boston Univ. Proj.) Series U3, 0.01% 2/5/16, LOC Northern Trust Co., VRDN (a) | | 5,900,000 | 5,900,000 |

| (Briarwood Retirement Cmnty. Proj.) Series 2004 A, 0.01% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 3,485,000 | 3,485,000 |

| (College of the Holy Cross Proj.) Series 2008 A, 0.01% 2/1/16, LOC JPMorgan Chase Bank, VRDN (a) | | 2,385,000 | 2,385,000 |

| (Governor Dummer Academy Issues Proj.) Series 2006, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 4,555,000 | 4,555,000 |

| (New England Deaconess Assoc. Proj.) Series 2011 B, 0.03% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 5,325,000 | 5,325,000 |

| (Olin College Proj.): | | | |

| Series 2008 C2, 0.02% 2/1/16, LOC RBS Citizens NA, VRDN (a) | | 3,700,000 | 3,700,000 |

| Series 2008 C3, 0.02% 2/1/16, LOC RBS Citizens NA, VRDN (a) | | 1,935,000 | 1,935,000 |

| (Partners HealthCare Sys. Proj.): | | | |

| Series 2011 K2, 0.01% 2/5/16 (Liquidity Facility Barclays Bank PLC), VRDN (a) | | 4,500,000 | 4,500,000 |

| Series 2014 M1, 0.01% 2/1/16, LOC U.S. Bank NA, Cincinnati, VRDN (a) | | 6,000,000 | 6,000,000 |

| (Simmons College Proj.) Series G, 0.01% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a) | | 4,755,000 | 4,755,000 |

| (Worcester Polytechnic Institute Proj.) Series 2008 A, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 22,870,000 | 22,870,000 |

| Participating VRDN: | | | |

| Series 15 XF0245, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 400,000 | 400,000 |

| Series 2016 XM0137, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 1,350,000 | 1,350,000 |

| Series MS 3373, 0.02% 2/5/16 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (a)(b) | | 900,000 | 900,000 |

| Series Putters 3840, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 400,000 | 400,000 |

| Series 2010, 0.03% 2/5/16, LOC Manufacturers & Traders Trust Co., VRDN (a) | | 980,000 | 980,000 |

| Series 2014 M2, 0.01% 2/5/16, LOC Bank of New York, New York, VRDN (a) | | 3,300,000 | 3,300,000 |

| Massachusetts Gen. Oblig.: | | | |

| (Central Artery Proj.): | | | |

| Series 2000 A, 0.01% 2/5/16 (Liquidity Facility Citibank NA), VRDN (a) | | 7,800,000 | 7,800,000 |

| Series 2000 B, 0.01% 2/1/16 (Liquidity Facility Bank of America NA), VRDN (a) | | 5,990,000 | 5,990,000 |

| Participating VRDN: | | | |

| Series Clipper 07 06, 0.04% 2/5/16 (Liquidity Facility State Street Bank & Trust Co., Boston) (a)(b) | | 17,900,000 | 17,900,000 |

| Series Clipper 07 39, 0.01% 2/5/16 (Liquidity Facility State Street Bank & Trust Co., Boston) (a)(b) | | 14,400,000 | 14,400,000 |

| Series Putters 3699, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 4,800,000 | 4,800,000 |

| Series Putters 3898, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 3,500,000 | 3,500,000 |

| Series XF 2197, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 1,350,000 | 1,350,000 |

| Series 2001 C, 0.01% 2/5/16 (Liquidity Facility State Street Bank & Trust Co., Boston), VRDN (a) | | 3,495,000 | 3,495,000 |

| Series 2006 A, 0.01% 2/1/16 (Liquidity Facility Wells Fargo Bank NA), VRDN (a) | | 8,200,000 | 8,200,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev.: | | | |

| (Amherst College Proj.): | | | |

| Series 1996 F, 0.01% 2/5/16, VRDN (a) | | 900,000 | 900,000 |

| Series 2005 I, 0.01% 2/5/16, VRDN (a) | | 1,340,000 | 1,340,000 |

| Series 2005 J2, 0.01% 2/1/16, VRDN (a) | | 2,900,000 | 2,900,000 |

| (Baystate Health Sys. Proj.): | | | |

| Series 2009 J1, 0.01% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a) | | 6,000,000 | 6,000,000 |

| Series 2009 J2, 0.01% 2/1/16, LOC JPMorgan Chase Bank, VRDN (a) | | 1,600,000 | 1,600,000 |

| (Baystate Med. Ctr. Proj.) Series 2005 G, 0.01% 2/1/16, LOC Wells Fargo Bank NA, VRDN (a) | | 1,315,000 | 1,315,000 |

| (Children's Hosp. Proj.): | | | |

| Series 2010 N3, 0.01% 2/5/16, LOC U.S. Bank NA, Cincinnati, VRDN (a) | | 2,500,000 | 2,500,000 |

| Series 2010 N4, 0.01% 2/1/16, LOC Wells Fargo Bank NA, VRDN (a) | | 20,100,000 | 20,100,000 |

| (CIL Realty of Massachusetts Proj.) Series 2007, 0.01% 2/5/16, LOC HSBC Bank U.S.A., NA, VRDN(a) | | 1,005,000 | 1,005,000 |

| (Fairview Extended Care Proj.) Series B, 0.08% 2/5/16, LOC Bank of America NA, VRDN (a) | | 2,065,000 | 2,065,000 |

| (Henry Heywood Memorial Hosp. Proj.) Series 2008 C, 0.01% 2/1/16, LOC TD Banknorth, NA, VRDN (a) | | 975,000 | 975,000 |

| (Massachusetts Institute of Technology Proj.): | | | |

| Series 2001 J1, 0.01% 2/5/16, VRDN (a) | | 13,000,000 | 13,000,000 |

| Series 2001 J2, 0.01% 2/5/16, VRDN (a) | | 13,025,000 | 13,025,000 |

| (Northeast Hosp. Corp. Proj.) Series 2004 G, 0.07% 2/5/16, LOC JPMorgan Chase Bank, VRDN (a) | | 8,985,000 | 8,985,000 |

| (Wellesley College Proj.): | | | |

| Series B, 0.01% 2/5/16, VRDN (a) | | 1,400,000 | 1,400,000 |

| Series I, 0.01% 2/5/16, VRDN (a) | | 4,385,000 | 4,385,000 |

| (Williams College Proj.) Series J, 0.01% 2/5/16, VRDN (a) | | 466,000 | 466,000 |

| Participating VRDN: | | | |

| Series BA 08 3503, 0.06% 2/5/16 (Liquidity Facility Bank of America NA) (a)(b) | | 5,550,000 | 5,550,000 |

| Series BC 10 20W, 0.03% 2/5/16 (Liquidity Facility Barclays Bank PLC) (a)(b) | | 2,550,000 | 2,550,000 |

| Series Putters 3163, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 5,655,000 | 5,655,000 |

| Series Putters 3529, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 10,000,000 | 10,000,000 |

| Series Putters 3530, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 4,495,000 | 4,495,000 |

| Series Putters 3650, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 3,200,000 | 3,200,000 |

| Massachusetts Indl. Fin. Agcy. Rev.: | | | |

| (Governor Dummer Academy Proj.) Series 1996, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 800,000 | 800,000 |

| (Society for the Prevention of Cruelty to Animals Proj.) Series 1997, 0.01% 2/5/16, LOC TD Banknorth, NA, VRDN (a) | | 2,815,000 | 2,815,000 |

| Massachusetts Port Auth. Rev. Series 2008 A, 0.01% 2/5/16, LOC State Street Bank & Trust Co., Boston, VRDN (a) | | 4,400,000 | 4,400,000 |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Participating VRDN: | | | |

| Series EGL 15 0004, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 5,900,000 | 5,900,000 |

| Series EGL 15 001, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 5,900,000 | 5,900,000 |

| Series EGL 15 002, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 6,600,000 | 6,600,000 |

| Series EGL 15 003, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 5,000,000 | 5,000,000 |

| Series Putters 1920, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 7,985,000 | 7,985,000 |

| Series Putters 3691, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 1,425,000 | 1,425,000 |

| Series Putters 4420, 0.02% 2/5/16 (Liquidity Facility JPMorgan Chase Bank) (a)(b) | | 600,000 | 600,000 |

| Series RBC O 72, 0.01% 2/5/16 (Liquidity Facility Royal Bank of Canada) (a)(b) | | 1,000,000 | 1,000,000 |

| Series ROC II R 14021, 0.01% 2/5/16 (Liquidity Facility Citibank NA) (a)(b) | | 1,500,000 | 1,500,000 |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev. Series 1999 B, 0.01% 2/5/16, LOC Landesbank Hessen-Thuringen, VRDN (a) | | 5,500,000 | 5,500,000 |

| | | | 358,866,000 |

| New Jersey - 0.2% | | | |

| Salem County Poll. Cont. Fin. Auth. Rev. (Pub. Svc. Elec. and Gas Co. Proj.) Series 2003 B1, 0.13% 2/5/16, VRDN (a) | | 1,400,000 | 1,400,000 |

| Pennsylvania - 0.3% | | | |

| Bucks County Indl. Dev. Auth. Rev. (Lutheran Cmnty. at Telford Healthcare Ctr., Inc. Proj.) Series 2007 B, 0.22% 2/5/16, LOC Citizens Bank of Pennsylvania, VRDN (a) | | 2,050,000 | 2,050,000 |

| Texas - 0.4% | | | |

| Port Arthur Navigation District Envir. Facilities Rev. (Motiva Enterprises LLC Proj.): | | | |

| Series 2001 A, 0.2% 2/1/16, VRDN (a) | | 200,000 | 200,000 |

| Series 2009 A, 0.2% 2/1/16, VRDN (a) | | 300,000 | 300,000 |

| Series 2010 B, 0.2% 2/1/16, VRDN (a) | | 300,000 | 300,000 |

| Series 2010 C, 0.21% 2/1/16, VRDN (a) | | 150,000 | 150,000 |

| Series 2010 D: | | | |

| 0.2% 2/1/16, VRDN (a) | | 1,100,000 | 1,100,000 |

| 0.21% 2/1/16, VRDN (a) | | 700,000 | 700,000 |

| | | | 2,750,000 |

| TOTAL VARIABLE RATE DEMAND NOTE | | | |

| (Cost $371,566,000) | | | 371,566,000 |

|

| Other Municipal Debt - 22.8% | | | |

| Kentucky - 0.1% | | | |

| Jefferson County Poll. Cont. Rev. Bonds (Louisville Gas & Elec. Co. Proj.) Series 2001 A, 0.25% tender 2/16/16, CP mode | | 300,000 | 300,000 |

| Massachusetts - 22.7% | | | |

| Arlington Gen. Oblig. BAN 2% 11/10/16 | | 1,000,000 | 1,012,474 |

| Beverly Gen. Oblig. BAN 1.25% 4/23/16 | | 1,000,000 | 1,002,346 |

| Cambridge Gen. Oblig. Bonds Series 2013, 3% 2/15/16 | | 1,900,000 | 1,902,034 |

| Concord & Carlisle Reg'l. School District BAN 1.5% 3/16/16 | | 2,000,000 | 2,003,167 |

| Danvers Gen. Oblig. BAN 2% 8/19/16 | | 1,200,000 | 1,211,242 |

| Eastham Massachusetts BAN 2% 6/30/16 | | 2,000,000 | 2,013,639 |

| Falmouth Gen. Oblig. BAN 2% 12/16/16 | | 1,400,000 | 1,418,208 |

| Gloucester Gen. Oblig. BAN: | | | |

| Series 2015, 2% 8/12/16 | | 1,900,000 | 1,917,176 |

| 2% 2/3/17 | | 1,200,000 | 1,218,168 |

| Holden Massachusetts Gen. Oblig. BAN 2% 6/17/16 | | 2,200,000 | 2,213,952 |

| Lexington Gen. Oblig. BAN Series 2015 B, 1.25% 6/10/16 | | 1,366,000 | 1,370,347 |

| Marblehead Gen. Oblig. BAN 2% 8/5/16 | | 1,200,000 | 1,210,271 |

| Marlborough Gen. Oblig. BAN 1.5% 6/17/16 | | 3,805,229 | 3,822,687 |

| Massachusetts Bay Trans. Auth. Sales Tax Rev. Bonds Series A, 5.5% 7/1/16 | | 745,000 | 761,159 |

| Massachusetts Clean Wtr. Trust Bonds: | | | |

| (Pool Prog.) Series 2004 A, 5.25% 8/1/16 | | 1,000,000 | 1,024,029 |

| Series 2010 A, 4% 8/1/16 | | 1,675,000 | 1,706,271 |

| Massachusetts Dev. Fin. Agcy. Series 5, 0.09% 2/10/16, LOC TD Banknorth, NA, CP | | 900,000 | 900,000 |

| Massachusetts Dev. Fin. Agcy. Rev. Series 1, 0.07% 2/2/16, LOC JPMorgan Chase Bank, CP | | 800,000 | 800,000 |

| Massachusetts Gen. Oblig.: | | | |

| Bonds: | | | |

| Series 2004 C, 5.5% 12/1/16 | | 325,000 | 338,454 |

| Series 2006 D, 5% 8/1/16 (Pre-Refunded to 8/1/16 @ 100) | | 1,000,000 | 1,023,082 |

| Series 2008 A, 5% 8/1/16 | | 2,530,000 | 2,589,054 |

| Series 2009 B, 5% 7/1/16 | | 2,940,000 | 2,996,994 |

| Series 2011 B, 5% 8/1/16 | | 1,300,000 | 1,330,467 |

| Series 2011 D, 5% 10/1/16 | | 500,000 | 515,230 |

| Series 2012 D, 0.35% 1/1/17 (a) | | 1,900,000 | 1,901,330 |

| Series 2013 A, 0.37% 2/1/17 (a) | | 1,300,000 | 1,301,132 |

| Series 2014 D, 0.01% 2/1/16 (a) | | 1,160,000 | 1,160,000 |

| RAN: | | | |

| Series 2015 A, 2% 4/27/16 | | 9,700,000 | 9,742,619 |

| Series 2015 B, 2% 5/25/16 | | 13,000,000 | 13,074,629 |

| Series 2015 C, 2% 6/22/16 | | 4,800,000 | 4,833,672 |

| 0.06% 4/21/16 (Liquidity Facility TD Banknorth, NA), CP | | 4,400,000 | 4,400,000 |

| Massachusetts Health & Edl. Facilities Auth. Rev.: | | | |

| Bonds (Partners HealthCare Sys., Inc. Proj.): | | | |

| Series 2008 H1: | | | |

| 0.05% tender 3/4/16, CP mode | | 1,400,000 | 1,400,000 |

| 0.07% tender 3/1/16, CP mode | | 1,700,000 | 1,700,000 |

| 0.07% tender 3/2/16, CP mode | | 1,200,000 | 1,200,000 |

| 0.08% tender 2/1/16, CP mode | | 1,900,000 | 1,900,000 |

| 0.08% tender 4/5/16, CP mode | | 1,800,000 | 1,800,000 |

| Series 2008 H2: | | | |

| 0.05% tender 2/2/16, CP mode | | 1,890,000 | 1,890,000 |

| 0.07% tender 2/4/16, CP mode | | 1,900,000 | 1,900,000 |

| 0.07% tender 2/8/16, CP mode | | 1,340,000 | 1,340,000 |

| 0.07% tender 3/3/16, CP mode | | 1,340,000 | 1,340,000 |

| Series EE, 0.02% 2/1/16, CP | | 1,500,000 | 1,500,000 |

| Massachusetts Indl. Fin. Agcy. Poll. Cont. Rev.: | | | |

| Bonds (New England Pwr. Co. Proj.) Series 1993 B: | | | |

| 0.48% tender 2/5/16, CP mode | | 1,800,000 | 1,800,000 |

| 0.48% tender 3/10/16, CP mode | | 500,000 | 500,000 |

| Series 1992, Bonds (New England Pwr. Co. Proj.) 0.4% tender 2/24/16, CP mode | | 600,000 | 600,000 |

| Massachusetts Port Auth. Rev. Series 2012 A, 0.04% 3/9/16, LOC TD Banknorth, NA, CP | | 2,400,000 | 2,400,000 |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev.: | | | |

| Series A: | | | |

| 0.02% 2/1/16, LOC Bank of America NA, CP | | 4,700,000 | 4,700,000 |

| 0.03% 3/2/16, LOC Bank of America NA, CP | | 1,700,000 | 1,700,000 |

| Series B: | | | |

| 0.03% 2/16/16, LOC Citibank NA, CP | | 4,500,000 | 4,500,000 |

| 0.03% 2/17/16, LOC Citibank NA, CP | | 2,200,000 | 2,200,000 |

| Series C: | | | |

| 0.03% 2/1/16, LOC Barclays Bank PLC, CP | | 1,800,000 | 1,800,000 |

| 0.03% 2/2/16, LOC Barclays Bank PLC, CP | | 1,800,000 | 1,800,000 |

| 0.05% 3/2/16, LOC Barclays Bank PLC, CP | | 1,800,000 | 1,800,000 |

| 0.06% 2/1/16, LOC Barclays Bank PLC, CP | | 1,100,000 | 1,100,000 |

| Massachusetts Spl. Oblig. Rev. Bonds Series 2005 A, 5.5% 6/1/16 | | 1,000,000 | 1,017,543 |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev. Series 99, 0.06% 2/10/16, LOC State Street Bank & Trust Co., Boston, CP | | 4,000,000 | 4,000,000 |

| Melrose Gen. Oblig. Bonds Series 2015 B, 2% 8/1/16 | | 1,220,000 | 1,230,300 |

| Milford Gen. Oblig. BAN 2% 7/1/16 | | 1,600,000 | 1,611,684 |

| Norwood Gen. Oblig. BAN 2% 7/29/16 | | 2,000,000 | 2,016,898 |

| Peabody Gen. Oblig. BAN 1.25% 3/24/16 | | 1,900,000 | 1,902,910 |

| Pittsfield Gen. Oblig. BAN: | | | |

| 1.25% 4/1/16 | | 1,500,000 | 1,502,601 |

| 1.5% 4/1/16 | | 2,000,000 | 2,003,981 |

| Quincy Gen. Oblig. BAN 2% 6/17/16 | | 3,121,000 | 3,140,911 |

| RBC Muni. Products, Inc. Trust Bonds Series RBC E 42, 0.1%, tender 5/2/16 (Liquidity Facility Royal Bank of Canada) (a)(b)(c) | | 2,200,000 | 2,200,000 |

| Revere Gen. Oblig. BAN 1.25% 4/15/16 | | 1,600,000 | 1,603,422 |

| Shrewsbury Gen. Oblig. BAN 2% 7/29/16 | | 1,700,000 | 1,713,831 |

| Somerville Gen. Oblig. BAN Series 2015 B, 1.5% 6/10/16 | | 3,200,000 | 3,213,939 |

| Westfield Gen. Oblig. BAN 1.25% 4/1/16 | | 1,300,000 | 1,302,297 |

| Worcester Gen. Oblig. Bonds Series 2015 C, 5% 9/15/16 | | 1,870,000 | 1,922,620 |

| | | | 143,966,770 |

| TOTAL OTHER MUNICIPAL DEBT | | | |

| (Cost $144,266,770) | | | 144,266,770 |

| | | Shares | Value |

|

| Investment Company - 10.8% | | | |

| Fidelity Tax-Free Cash Central Fund, 0.01% (d)(e) | | | |

| (Cost $68,628,689) | | 68,628,689 | 68,628,689 |

| TOTAL INVESTMENT PORTFOLIO - 92.3% | | | |

| (Cost $584,461,459) | | | 584,461,459 |

| NET OTHER ASSETS (LIABILITIES) - 7.7% | | | 48,764,217 |

| NET ASSETS - 100% | | | $633,225,676 |

Security Type Abbreviations

BAN – BOND ANTICIPATION NOTE

CP – COMMERCIAL PAPER

RAN – REVENUE ANTICIPATION NOTE

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Provides evidence of ownership in one or more underlying municipal bonds.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $2,200,000 or 0.3% of net assets.

(d) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Tax-Free Cash Central Fund.

(e) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Cost |

| RBC Muni. Products, Inc. Trust Bonds Series RBC E 42, 0.1%, tender 5/2/16 (Liquidity Facility Royal Bank of Canada) | 11/5/15 | $2,200,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Tax-Free Cash Central Fund | $22,929 |

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | January 31, 2016 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $515,832,770) | $515,832,770 | |

| Fidelity Central Funds (cost $68,628,689) | 68,628,689 | |

| Total Investments (cost $584,461,459) | | $584,461,459 |

| Cash | | 50,985,598 |

| Receivable for fund shares sold | | 93,531 |

| Interest receivable | | 837,858 |

| Distributions receivable from Fidelity Central Funds | | 638 |

| Receivable from investment adviser for expense reductions | | 16,916 |

| Other receivables | | 1,195 |

| Total assets | | 636,397,195 |

| Liabilities | | |

| Payable for investments purchased | $1,733,398 | |

| Payable for fund shares redeemed | 1,396,327 | |

| Distributions payable | 546 | |

| Accrued management fee | 41,062 | |

| Other affiliated payables | 186 | |

| Total liabilities | | 3,171,519 |

| Net Assets | | $633,225,676 |

| Net Assets consist of: | | |

| Paid in capital | | $633,212,468 |

| Accumulated undistributed net realized gain (loss) on investments | | 13,208 |

| Net Assets | | $633,225,676 |

| Massachusetts AMT Tax-Free Money Market: | | |

| Net Asset Value, offering price and redemption price per share ($200,616,383 ÷ 200,342,037 shares) | | $1.00 |

| Institutional Class: | | |

| Net Asset Value, offering price and redemption price per share ($432,509,027 ÷ 432,085,415 shares) | | $1.00 |

| Service Class: | | |

| Net Asset Value, offering price and redemption price per share ($100,266 ÷ 100,167 shares) | | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Year ended January 31, 2016 |

| Investment Income | | |

| Interest | | $404,758 |

| Income from Fidelity Central Funds | | 22,929 |

| Total income | | 427,687 |

| Expenses | | |

| Management fee | $1,372,133 | |

| Transfer agent fees | 453,257 | |

| Distribution and service plan fees | 250 | |

| Independent trustees' compensation | 2,928 | |

| Total expenses before reductions | 1,828,568 | |

| Expense reductions | (1,469,453) | 359,115 |

| Net investment income (loss) | | 68,572 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 414,710 | |

| Total net realized gain (loss) | | 414,710 |

| Net increase in net assets resulting from operations | | $483,282 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Year ended January 31, 2016 | Year ended January 31, 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $68,572 | $77,348 |

| Net realized gain (loss) | 414,710 | 223,411 |

| Net increase in net assets resulting from operations | 483,282 | 300,759 |

| Distributions to shareholders from net investment income | (68,563) | (77,313) |

| Distributions to shareholders from net realized gain | (657,144) | (191,037) |

| Total distributions | (725,707) | (268,350) |

| Share transactions - net increase (decrease) | (86,757,068) | (97,697,929) |

| Total increase (decrease) in net assets | (86,999,493) | (97,665,520) |

| Net Assets | | |

| Beginning of period | 720,225,169 | 817,890,689 |

| End of period | $633,225,676 | $720,225,169 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Massachusetts AMT Tax-Free Money Market Fund

| | | January 31, | | | |

| Years ended January 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | – | – | – | – | – |

| Net realized and unrealized gain (loss) | .001 | –A | –A | –A | –A |

| Total from investment operations | .001 | –A | –A | –A | –A |

| Distributions from net investment incomeA | – | – | – | – | – |

| Distributions from net realized gain | (.001) | –A | –A | –A | –A |

| Total distributions | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB | .11% | .04% | .02% | .02% | .01% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .30% | .30% | .30% | .30% | .30% |

| Expenses net of fee waivers, if any | .05% | .07% | .10% | .17% | .17% |

| Expenses net of all reductions | .05% | .06% | .10% | .17% | .17% |

| Net investment income (loss) | .01% | .01% | .01% | .01% | .01% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $200,616 | $235,903 | $250,871 | $272,374 | $290,104 |

A Amount represents less than $.005 per share.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Massachusetts AMT Tax-Free Money Market Fund Institutional Class

| | | January 31, | | | |

| Years ended January 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | – | – | – | – | – |

| Net realized and unrealized gain (loss) | .001 | –A | –A | –A | –A |

| Total from investment operations | .001 | –A | –A | –A | –A |

| Distributions from net investment incomeA | – | – | – | – | – |

| Distributions from net realized gain | (.001) | –A | –A | –A | –A |

| Total distributions | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB | .11% | .04% | .02% | .02% | .02% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .25% | .25% | .25% | .25% | .25% |

| Expenses net of fee waivers, if any | .05% | .07% | .10% | .17% | .15% |

| Expenses net of all reductions | .05% | .06% | .10% | .17% | .15% |

| Net investment income (loss) | .01% | .01% | .01% | .01% | .03% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $432,509 | $484,222 | $566,873 | $660,561 | $982,481 |

A Amount represents less than $.005 per share.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Massachusetts AMT Tax-Free Money Market Fund Service Class

| | | January 31, | | | |

| Years ended January 31, | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | – | – | – | – | – |

| Net realized and unrealized gain (loss) | .001 | –A | –A | –A | –A |

| Total from investment operations | .001 | –A | –A | –A | –A |

| Distributions from net investment incomeA | – | – | – | – | – |

| Distributions from net realized gain | (.001) | –A | –A | –A | –A |

| Total distributions | (.001) | –A | –A | –A | –A |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB | .11% | .04% | .02% | .02% | .01% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .50% | .50% | .50% | .50% | .50% |

| Expenses net of fee waivers, if any | .05% | .06% | .10% | .18% | .17% |

| Expenses net of all reductions | .05% | .06% | .10% | .18% | .16% |

| Net investment income (loss) | .01% | .01% | .01% | .01% | .01% |

| Supplemental Data | | | | | |

| Net assets, end of period (000 omitted) | $100 | $100 | $146 | $94 | $534 |

A Amount represents less than $.005 per share.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended January 31, 2016

1. Organization.

Fidelity Massachusetts AMT Tax-Free Money Market Fund (the Fund) is a fund of Fidelity Massachusetts Municipal Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Massachusetts AMT Tax-Free Money Market, Institutional Class and Service Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Effective January 1, 2016 shares of the Fund are only available for purchase by retail shareholders. The Fund may be affected by economic and political developments in the state of Massachusetts.

2. Investments in Fidelity Central Funds.

The Fund may invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

As permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

Investment Transactions and Income. The net asset value per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Security transactions, including the Fund's investment activity in the Fidelity Central Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of January 31, 2016, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustees compensation.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $– |

| Gross unrealized depreciation | – |

| Net unrealized appreciation (depreciation) on securities | $– |

| Tax Cost | $584,461,459 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed tax-exempt income | $13,402 |

The tax character of distributions paid was as follows:

| | January 31, 2016 | January 31, 2015 |

| Tax-exempt Income | $68,563 | $77,313 |

| Long-term Capital Gains | 657,144 | 191,037 |

| Total | $725,707 | $ 268,350 |

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee that is based on an annual rate of .20% of the Fund's average net assets. Under the management contract, the investment adviser pays all other fund-level expenses, except the compensation of the independent Trustees and certain other expenses such as interest expense. The management fee is reduced by an amount equal to the fees and expenses paid by the Fund to the independent Trustees.

In addition, under the expense contract, the investment adviser pays class-level expenses for Massachusetts AMT Tax-Free Money Market so that the total expenses do not exceed .35%, expressed as a percentage of class average net assets, with certain exceptions such as interest expense.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Service Class pays Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, a Service Fee based on an annual percentage of Service Class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Service Fee rate, total service fees and amounts retained by FDC were as follows:

| | Service

Fee | Total Fees | Retained

by FDC |

| Service Class | .25% | $250 | $– |

During the period, the investment adviser or its affiliates waived a portion of these fees.

Transfer Agent Fees. Pursuant to the transfer agent contract approved by the Board of Trustees effective May 1, 2015, Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for the Fund. FIIOC receives asset-based fees with respect to each account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. Each class, with the exception of Massachusetts AMT Tax-Free Money Market, pays a transfer agent fee equal to an annual rate of .05% of class-level average net assets. Massachusetts AMT Tax-Free Money Market pays a transfer agent fee equal to an annual rate of .10% of class-level average net assets. For the period, transfer agent fees for each class were as follows:

| | Amount |

| Massachusetts AMT Tax-Free Money Market | $218,858 |

| Institutional Class | 234,350 |

| Service Class | 49 |

| | $453,257 |

During the period, the investment adviser or its affiliates waived a portion of these fees.

Prior to May 1, 2015, Citibank, N.A. was the transfer, dividend disbursing and shareholder servicing agent for the Fund. Prior to May 8, 2015, Citibank, N.A. was the custodian for the Fund.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act.

5. Expense Reductions.

The investment adviser contractually agreed to reimburse Institutional Class and Service Class to the extent annual operating expenses, expressed as a percentage of each class' average net assets, exceed .20% and .45%, respectively. Some expenses, for example interest expense, are excluded from this reimbursement. During the period, this reimbursement reduced Institutional Class and Service Class expenses by $234,629 and $49, respectively.

Additionally, the investment adviser or its affiliates voluntarily agreed to waive certain fees in order to maintain a minimum annualized yield of .01%. Such arrangements may be discontinued by the investment adviser at any time. For the period, the amount of the waiver for each class was as follows:

| | Amount |

| Massachusetts AMT Tax-Free Money Market | $540,502 |

| Institutional Class | 687,752 |

| Service Class | 399 |

In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's expenses by $6,122.

6. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Years ended January 31, | 2016 | 2015 |

| From net investment income | | |

| Massachusetts AMT Tax-Free Money Market | $21,765 | $24,529 |

| Institutional Class | 46,787 | 52,770 |

| Service Class | 11 | 14 |

| Total | $68,563 | $77,313 |

| From net realized gain | | |

| Massachusetts AMT Tax-Free Money Market | $207,228 | $61,845 |

| Institutional Class | 449,816 | 129,158 |

| Service Class | 100 | 34 |

| Total | $657,144 | $191,037 |

7. Share Transactions.

Share transactions for each class of shares at a $1.00 per share were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| Years ended January 31, | 2016 | 2015 |

| Massachusetts AMT Tax-Free Money Market | | |

| Shares sold | 56,824,175 | 68,833,614 |

| Reinvestment of distributions | 211,201 | 81,141 |

| Shares redeemed | (92,226,287) | (83,905,639) |

| Net increase (decrease) | (35,190,911) | (14,990,884) |

| Institutional Class | | |

| Shares sold | 108,908,865 | 106,197,119 |

| Reinvestment of distributions | 416,350 | 156,392 |

| Shares redeemed | (160,891,482) | (189,014,381) |

| Net increase (decrease) | (51,566,267) | (82,660,870) |

| Service Class | | |

| Reinvestment of distributions | 110 | 48 |

| Shares redeemed | – | (46,223) |

| Net increase (decrease) | 110 | (46,175) |

8. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Massachusetts Municipal Trust and Shareholders of Fidelity Massachusetts AMT Tax-Free Money Market Fund:

We have audited the accompanying statement of assets and liabilities of Fidelity® Massachusetts AMT Tax-Free Money Market Fund (the Fund), a fund of Fidelity Massachusetts Municipal Trust, including the schedule of investments, as of January 31, 2016, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of January 31, 2016, by correspondence with the custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Fidelity Massachusetts AMT Tax-Free Money Market Fund as of January 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

March 16, 2016

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Elizabeth S. Acton, John Engler, and Geoffrey A. von Kuhn, each of the Trustees oversees 239 funds. Ms. Acton and Mr. Engler each oversees 234 funds. Mr. von Kuhn oversees 163 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-544-8544 for Fidelity® Massachusetts AMT Tax-Free Money Market Fund or at 1-877-208-0098 for Institutional Class and Service Class.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. Abigail P. Johnson is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Marie L. Knowles serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's investment-grade bond, money market, asset allocation and certain equity funds, and other Boards oversee Fidelity's high income, sector and other equity funds. The asset allocation funds may invest in Fidelity® funds that are overseen by such other Boards. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations and Audit Committees. In addition, an ad hoc Board committee of Independent Trustees has worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. The Operations Committee also worked and continues to work with FMR to enhance the stress tests required under SEC regulations for money market funds. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Abigail P. Johnson (1961)

Year of Election or Appointment: 2009

Trustee

Chairman of the Board of Trustees

Ms. Johnson also serves as Trustee of other Fidelity® funds. Ms. Johnson serves as President (2013-present) and Chief Executive Officer (2014-present) of FMR LLC (diversified financial services company), President of Fidelity Financial Services (2012-present) and President of Personal, Workplace and Institutional Services (2005-present). Ms. Johnson is Chairman and Director of FMR Co., Inc. (investment adviser firm, 2011-present), Chairman and Director of FMR (investment adviser firm, 2011-present), and the Vice Chairman and Director (2007-present) of FMR LLC. Previously, Ms. Johnson served as President and a Director of FMR (2001-2005), a Trustee of other investment companies advised by FMR, Fidelity Investments Money Management, Inc. (investment adviser firm), and FMR Co., Inc. (2001-2005), Senior Vice President of the Fidelity® funds (2001-2005), and managed a number of Fidelity® funds. Ms. Abigail P. Johnson and Mr. Arthur E. Johnson are not related.

Geoffrey A. von Kuhn (1951)

Year of Election or Appointment: 2016

Trustee

Mr. von Kuhn also serves as Trustee or Member of the Advisory Board of other Fidelity funds. Mr. von Kuhn is Chief Administrative Officer for FMR LLC (diversified financial services company, 2013-present), a Director of Pembroke Real Estate, Inc. (2009-present), and a Director of Discovery Natural Resources LLC (2012-present). Previously, Mr. von Kuhn was a managing director of Crosby Group (private wealth management company, 2007-2013), a member of the management committee and senior executive in the Wealth Management Group of AmSouth Bank (2001-2006), and head of the U.S. private bank at Citigroup (2000-2001).

* Determined to be an “Interested Trustee” by virtue of, among other things, his or her affiliation with the trust or various entities under common control with FMR.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Elizabeth S. Acton (1951)

Year of Election or Appointment: 2013

Trustee

Ms. Acton also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. Prior to her retirement in April 2012, Ms. Acton was Executive Vice President, Finance (2011-2012), Executive Vice President, Chief Financial Officer (2002-2011), and Treasurer (2004-2005) of Comerica Incorporated (financial services). Prior to joining Comerica, Ms. Acton held a variety of positions at Ford Motor Company (1983-2002), including Vice President and Treasurer (2000-2002) and Executive Vice President and Chief Financial Officer of Ford Motor Credit Company (1998-2000). Ms. Acton currently serves as a member of the Board of Directors and Audit and Finance Committees of Beazer Homes USA, Inc. (homebuilding, 2012-present).

John Engler (1948)

Year of Election or Appointment: 2014

Trustee

Mr. Engler also serves as Trustee or Member of the Advisory Board of other Fidelity® funds. He serves as president of the Business Roundtable (2011-present), and on the board of directors for Universal Forest Products (manufacturer and distributor of wood and wood-alternative products, 2003-present) and K12 Inc. (technology-based education company, 2012-present). Previously, Mr. Engler served as a trustee of The Munder Funds (2003-2014), president and CEO of the National Association of Manufacturers (2004-2011), member of the Board of Trustees of the Annie E. Casey Foundation (2004-2015), and as governor of Michigan (1991-2003). He is a past chairman of the National Governors Association.

Albert R. Gamper, Jr. (1942)

Year of Election or Appointment: 2006

Trustee

Mr. Gamper also serves as Trustee of other Fidelity® funds. Prior to his retirement in December 2004, Mr. Gamper served as Chairman of the Board of CIT Group Inc. (commercial finance). During his tenure with CIT Group Inc. Mr. Gamper served in numerous senior management positions, including Chairman (1987-1989; 1999-2001; 2002-2004), Chief Executive Officer (1987-2004), and President (2002-2003). Mr. Gamper currently serves as a member of the Board of Directors of Public Service Enterprise Group (utilities, 2000-present), and Member of the Board of Trustees of Barnabas Health Care System (1997-present). Previously, Mr. Gamper served as Chairman (2012-2015) and Vice Chairman (2011-2012) of the Independent Trustees of certain Fidelity® funds and as Chairman of the Board of Governors, Rutgers University (2004-2007).

Robert F. Gartland (1951)

Year of Election or Appointment: 2010

Trustee

Mr. Gartland also serves as Trustee of other Fidelity® funds. Mr. Gartland is Chairman and an investor in Gartland and Mellina Group Corp. (consulting, 2009-present). Previously, Mr. Gartland served as a partner and investor of Vietnam Partners LLC (investments and consulting, 2008-2011). Prior to his retirement, Mr. Gartland held a variety of positions at Morgan Stanley (financial services, 1979-2007) including Managing Director (1987-2007).

Arthur E. Johnson (1947)

Year of Election or Appointment: 2008

Trustee

Vice Chairman of the Independent Trustees

Mr. Johnson also serves as Trustee of other Fidelity® funds. Mr. Johnson serves as a member of the Board of Directors of Eaton Corporation plc (diversified power management, 2009-present), AGL Resources, Inc. (holding company, 2002-present) and Booz Allen Hamilton (management consulting, 2011-present). Prior to his retirement, Mr. Johnson served as Senior Vice President of Corporate Strategic Development of Lockheed Martin Corporation (defense contractor, 1999-2009). He previously served on the Board of Directors of IKON Office Solutions, Inc. (1999-2008) and Delta Airlines (2005-2007). Mr. Arthur E. Johnson is not related to Ms. Abigail P. Johnson.

Michael E. Kenneally (1954)

Year of Election or Appointment: 2009

Trustee

Mr. Kenneally also serves as Trustee of other Fidelity® funds. Prior to his retirement, Mr. Kenneally served as Chairman and Global Chief Executive Officer of Credit Suisse Asset Management. Before joining Credit Suisse, he was an Executive Vice President and Chief Investment Officer for Bank of America Corporation. Earlier roles at Bank of America included Director of Research, Senior Portfolio Manager and Research Analyst, and Mr. Kenneally was awarded the Chartered Financial Analyst (CFA) designation in 1991.

James H. Keyes (1940)

Year of Election or Appointment: 2007

Trustee

Mr. Keyes also serves as Trustee of other Fidelity® funds. Mr. Keyes serves as a member of the Board and Non-Executive Chairman of Navistar International Corporation (manufacture and sale of trucks, buses, and diesel engines, since 2002). Previously, Mr. Keyes served as a member of the Board of Pitney Bowes, Inc. (integrated mail, messaging, and document management solutions, 1998-2013). Prior to his retirement, Mr. Keyes served as Chairman (1993-2002) and Chief Executive Officer (1988-2002) of Johnson Controls (automotive, building, and energy) and as a member of the Board of LSI Logic Corporation (semiconductor technologies, 1984-2008).

Marie L. Knowles (1946)

Year of Election or Appointment: 2001

Trustee

Chairman of the Independent Trustees

Ms. Knowles also serves as Trustee of other Fidelity® funds. Prior to Ms. Knowles' retirement in June 2000, she served as Executive Vice President and Chief Financial Officer of Atlantic Richfield Company (ARCO) (diversified energy, 1996-2000). From 1993 to 1996, she was a Senior Vice President of ARCO and President of ARCO Transportation Company (pipeline and tanker operations). Ms. Knowles currently serves as a Director and Chairman of the Audit Committee of McKesson Corporation (healthcare service, since 2002). Ms. Knowles is a member of the Board of the Santa Catalina Island Company (real estate, 2009-present). Ms. Knowles is a Member of the Investment Company Institute Board of Governors and a Member of the Governing Council of the Independent Directors Council (2014-present). She also serves as a member of the Advisory Board for the School of Engineering of the University of Southern California. Previously, Ms. Knowles served as a Director of Phelps Dodge Corporation (copper mining and manufacturing, 1994-2007), URS Corporation (engineering and construction, 2000-2003) and America West (airline, 1999-2002). Ms. Knowles previously served as Vice Chairman of the Independent Trustees of certain Fidelity® funds (2012-2015).

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Advisory Board Members and Officers:

Correspondence intended for an officer may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210. Officers appear below in alphabetical order.

Name, Year of Birth; Principal Occupation

Marc R. Bryant (1966)

Year of Election or Appointment: 2015

Secretary and Chief Legal Officer (CLO)

Mr. Bryant also serves as Secretary and CLO of other funds. Mr. Bryant serves as CLO, Secretary, and Senior Vice President of Fidelity Management & Research Company (investment adviser firm, 2015-present) and FMR Co., Inc. (investment adviser firm, 2015-present); Secretary of Fidelity SelectCo, LLC (investment adviser firm, 2015-present) and Fidelity Investments Money Management, Inc. (investment adviser firm, 2015-present); and CLO of Fidelity Management & Research (Hong Kong) Limited (investment adviser firm, 2015-present). He is Senior Vice President and Deputy General Counsel of FMR LLC (diversified financial services company). Previously, Mr. Bryant served as Secretary and CLO of Fidelity Rutland Square Trust II (2010-2014) and Assistant Secretary of Fidelity's Fixed Income and Asset Allocation Funds (2013-2015). Prior to joining Fidelity Investments, Mr. Bryant served as a Senior Vice President and the Head of Global Retail Legal for AllianceBernstein L.P. (2006-2010), and as the General Counsel for ProFund Advisors LLC (2001-2006).

Jonathan Davis (1968)

Year of Election or Appointment: 2010

Assistant Treasurer

Mr. Davis also serves as Assistant Treasurer of other funds, and is an employee of Fidelity Investments. Previously, Mr. Davis served as Vice President and Associate General Counsel of FMR LLC (diversified financial services company, 2003-2010).

Adrien E. Deberghes (1967)

Year of Election or Appointment: 2010

Assistant Treasurer

Mr. Deberghes also serves as an officer of other funds. He is an employee of Fidelity Investments (2008-present). Prior to joining Fidelity Investments, Mr. Deberghes was Senior Vice President of Mutual Fund Administration at State Street Corporation (2007-2008), Senior Director of Mutual Fund Administration at Investors Bank & Trust (2005-2007), and Director of Finance for Dunkin' Brands (2000-2005).

Stephanie J. Dorsey (1969)

Year of Election or Appointment: 2013

President and Treasurer

Ms. Dorsey also serves as an officer of other funds. She is an employee of Fidelity Investments (2008-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Dorsey served as Treasurer (2004-2008) of the JPMorgan Mutual Funds and Vice President (2004-2008) of JPMorgan Chase Bank.

Howard J. Galligan III (1966)

Year of Election or Appointment: 2014

Chief Financial Officer

Mr. Galligan also serves as Chief Financial Officer of other funds. Mr. Galligan serves as President of Fidelity Pricing and Cash Management Services (FPCMS) (2014-present) and as a Director of Strategic Advisers, Inc. (investment adviser firm, 2008-present). Previously, Mr. Galligan served as Chief Administrative Officer of Asset Management (2011-2014) and Chief Operating Officer and Senior Vice President of Investment Support for Strategic Advisers, Inc. (2003-2011).

Scott C. Goebel (1968)

Year of Election or Appointment: 2015

Vice President

Mr. Goebel serves as Vice President of other funds and is an employee of Fidelity Investments (2001-present). Previously, Mr. Goebel served as Secretary of Fidelity SelectCo, LLC (investment adviser firm, 2013-2015), Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2010-2015), and Fidelity Research and Analysis Company (FRAC) (investment adviser firm, 2010-2015); General Counsel, Secretary, and Senior Vice President of Fidelity Management & Research Company (investment adviser firm, 2008-2015) and FMR Co., Inc. (investment adviser firm, 2008-2015); Assistant Secretary of Fidelity Management & Research (Japan) Limited (investment adviser firm, 2008-2015) and FMR Investment Management (U.K.) Limited (investment adviser firm, 2008-2015); Chief Legal Officer (CLO) of Fidelity Management & Research (Hong Kong) Limited (investment adviser firm, 2008-2015); Secretary and CLO of certain Fidelity® funds (2008-2015); Assistant Secretary of FIMM (2008-2010), FRAC (2008-2010), and certain funds (2007-2008); and as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (2005-2007).

Timothy Huyck (1964)

Year of Election or Appointment: 2015

Vice President of Fidelity's Money Market Funds

Mr. Huyck also serves as Vice President of other funds. Mr. Huyck serves as Chief Investment Officer of Fidelity's Money Market Funds (2015-present) and is an employee of Fidelity Investments (1990-present).

Chris Maher (1972)

Year of Election or Appointment: 2013

Assistant Treasurer

Mr. Maher serves as Assistant Treasurer of other funds. Mr. Maher is Vice President of Valuation Oversight and is an employee of Fidelity Investments. Previously, Mr. Maher served as Vice President of Asset Management Compliance (2013), Vice President of the Program Management Group of FMR (investment adviser firm, 2010-2013), and Vice President of Valuation Oversight (2008-2010).

John F. Papandrea (1972)

Year of Election or Appointment: 2016