Exhibit 13.1

2008 Annual Report

Table of Contents

Letter to Stockholders | | 2-3 |

| | |

Financial Highlights | | 4 |

| | |

Management’s Discussion | | 6-19 |

| | |

Consolidated Balance Sheets | | 21 |

| | |

Consolidated Statements of Income | | 22 |

| | |

Consolidated Statements of Cash Flows | | 23-24 |

| | |

Consolidated Statements of Changes in Stockholders’ Equity | | 25 |

| | |

Notes to Consolidated Financial Statements | | 26-59 |

| | |

Report of Independent Auditors | | 60 |

| | |

Corporate Information | | 61 |

| | |

Bancorp and Subsidiaries Consolidated Balance Sheet | | 62 |

| | |

Bancorp Directors | | 63 |

| | |

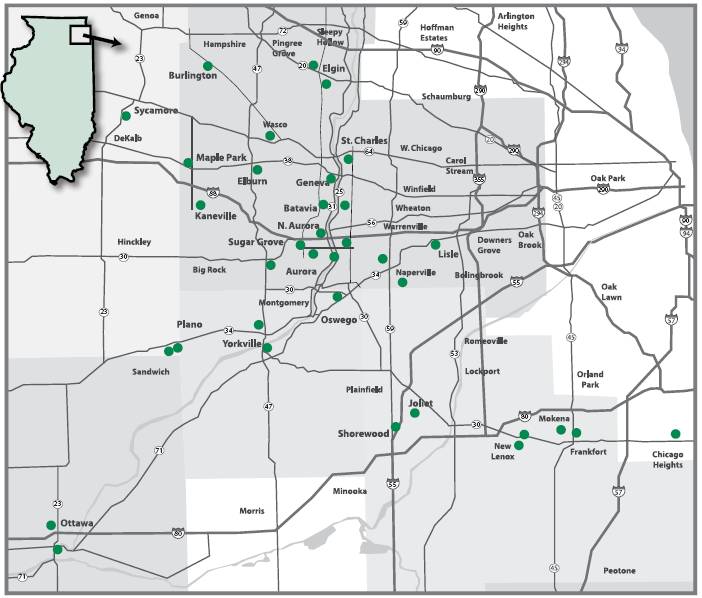

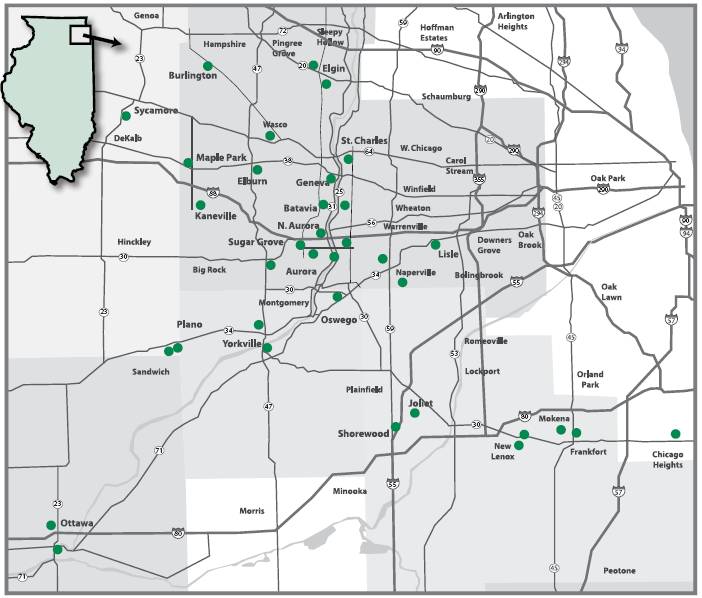

Old Second Locations Map | | 64 |

41

2008 Year End Letter to Stockholders

2008 was a very challenging year for Old Second and the entire banking industry.

In spite of these difficult times your Bank ended the year with net income of $11.8 million. Profits were down (50.7%) from 2007 and although we are disappointed with any decrease in net income, when compared to our peers we performed above most other banks.

Our past emphasis on conservative lending, ongoing cost controls, and our improvement in net interest margin, and increased fee income account for these results.

Our return on equity was 6.03% and earnings per share of $0.87 was down from $1.92 in 2007.

In 2008, we completed our purchase of the HeritageBanc, Inc., and have expanded our footprint into Will and southern Cook Counties. We now have 35 branches and continue to have a commanding #1 market share in Kane and Kendall Counties and good opportunity to grow and gain market share in Will, Dekalb, Dupage, LaSalle, and other contiguous counties.

An area of concern for banks is increasing credit problems. Our non-performing loans reached $108.6 million and other real estate owned was $15.2 million.

Net charge-offs for the year were $9.4 million (.41% of loans) and we added $30.3 million to the loan loss reserve, bringing the reserve to $44.9 million, or 1.82% of loans.

We believe this reserve is adequate to cover our problems as of 12/31/08; however, if this economy continues to deteriorate and real estate values continue to decline, more additions to the reserve are likely.

As an insurance policy against catastrophic economic events and to allow for growth, the Bancorp did participate in the United States Treasury’s TARP Capital Purchase Program (“CPP”). The Treasury implemented CPP to encourage financial institutions to increase the flow of financing to U.S. businesses and consumers to support the U.S. economy. The new capital is in the form of Preferred Stock in the amount of $73 million, on which we pay a 5% dividend and have issued warrants totaling 815,339 shares, convertible at a price of $13.43 per share.

With the CPP, we now have $336 million in regulatory capital and this moved our existing well capitalized regulatory ratio to an even stronger position that will allow us to grow and persevere even in the severe economic downturn we are now experiencing.

In fact, in 2008 our loans did increase by $380 million, $287 million of which came from the Heritage acquisition and $93 million from other growth opportunities.

Also our mortgage department experienced explosive growth in refinances and funded over $381 million in new mortgage loans.

42

Our key strategic initiatives in 2009 will be as follows:

1) Manage through this credit crisis.

2) Drive core deposit growth.

3) Grow loans strategically.

4) Focus on efficiencies and cost controls.

5) Continue double digit fee income growth.

· Ride the refinance wave.

· Expand derivative fee income.

· Maintain growth in Wealth Management.

6) Maintain net interest margin at target of the 3.50% range.

By accomplishing these goals we feel confident that we can earn our way through these difficult times and emerge as a stronger bank with the ability to take on the growth opportunities as they come back to our markets.

Many thanks to our Directors, shareholders, and our customers for the loyalty and faith in our organization and to our staff for their continued dedication and hard work.

43

Old Second Bancorp, Inc. and Subsidiaries

Financial Highlights

(In thousands, except share data)

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

Balance sheet items at year-end | | | | | | | | | | | |

Total assets | | $ | 2,984,605 | | $ | 2,658,576 | | $ | 2,459,140 | | $ | 2,367,830 | | $ | 2,105,019 | |

Loans, gross | | 2,271,114 | | 1,891,110 | | 1,763,912 | | 1,704,382 | | 1,509,076 | |

Deposits | | 2,387,128 | | 2,113,618 | | 2,062,693 | | 1,935,278 | | 1,798,849 | |

Securities sold under repurchase agreements | | 46,345 | | 53,222 | | 38,218 | | 57,625 | | 45,242 | |

Federal funds purchased | | 28,900 | | 165,100 | | 54,000 | | 170,000 | | 49,000 | |

Other short-term borrowings | | 169,383 | | 82,873 | | 73,090 | | 1,825 | | 26,786 | |

Junior subordinated debentures | | 58,378 | | 57,399 | | 31,625 | | 31,625 | | 31,625 | |

Subordinated debt | | 45,000 | | — | | — | | — | | — | |

Notes payable and other borrowings | | 23,184 | | 18,610 | | 16,425 | | 3,200 | | 2,700 | |

Stockholders’ equity | | 193,096 | | 149,889 | | 158,555 | | 152,262 | | 134,988 | |

| | | | | | | | | | | |

Results of operations for the year-ended | | | | | | | | | | | |

Net interest and dividend income | | $ | 89,514 | | $ | 68,598 | | $ | 71,199 | | $ | 73,999 | | $ | 68,359 | |

Provision for loan losses | | 30,315 | | 1,188 | | 1,244 | | 353 | | (2,900 | ) |

Net income | | 11,824 | | 23,972 | | 23,656 | | 27,683 | | 26,287 | |

| | | | | | | | | | | |

Per share data | | | | | | | | | | | |

Basic earnings | | $ | 0.87 | | $ | 1.92 | | $ | 1.77 | | $ | 2.05 | | $ | 1.96 | |

Diluted earnings | | 0.86 | | 1.89 | | 1.75 | | 2.03 | | 1.94 | |

Dividends declared | | 0.63 | | 0.59 | | 0.55 | | 0.51 | | 0.46 | |

Stockholders’ equity as of December 31 | | 14.04 | | 12.34 | | 12.08 | | 11.26 | | 10.06 | |

| | | | | | | | | | | |

Weighted average diluted shares outstanding | | 13,689,214 | | 12,655,306 | | 13,526,603 | | 13,661,024 | | 13,535,881 | |

Weighted average basic shares outstanding | | 13,584,381 | | 12,508,551 | | 13,367,062 | | 13,486,598 | | 13,413,263 | |

Shares outstanding at year-end | | 13,755,884 | | 12,149,296 | | 13,127,292 | | 13,520,073 | | 13,424,346 | |

44

Old Second Bancorp, Inc.

and Subsidiaries

Management’s Discussion

and Analysis of Financial Condition

and Results of Operations

45

Old Second Bancorp, Inc. and Subsidiaries

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Overview

The following discussion provides additional information regarding the Company’s operations for the twelve-month periods ending December 31, 2008, 2007, and 2006, and financial condition at December 31, 2008 and 2007. This discussion should be read in conjunction with “Selected Consolidated Financial Data” and the Company’s consolidated financial statements and the accompanying notes thereto included or incorporated by reference elsewhere in this document.

Old Second Bancorp, Inc. is a financial services company with its main headquarters located in Aurora, Illinois. The consolidated financial statements include Old Second Bancorp, Inc. and its wholly-owned subsidiaries, which are together referred to as the “Company”:

· Old Second National Bank (“the Bank”).

· Old Second Financial, Inc., which provides insurance agency services.

· Old Second Capital Trust I, which was formed for the exclusive purpose of issuing trust preferred securities in an offering that was completed in July 2003. Old Second Capital Trust I is an unconsolidated subsidiary of the Company. See Notes A and K of the consolidated financial statements included in this annual report for further discussion.

· Old Second Capital Trust II, which was formed for the exclusive purpose of issuing trust preferred securities in an offering that was completed in April 2007. Old Second Capital Trust II is also an unconsolidated subsidiary of the Company and additional information is available in the notes cited above.

· Old Second Affordable Housing Fund, L.L.C., which was formed for the purpose of providing down payment assistance for home ownership to qualified individuals.

· Old Second Management, LLC (“OSM”), which was formed for the purpose of providing a possible future source of capital as well as providing certain tax advantages. Old Second Bank owns 100% of the common stock of OSM. Old Second Realty, LLC (“OSR”) is a Delaware real estate investment trust and 100% of the common stock of OSR is owned by OSM. As of January 2, 2007, there were various minority holders of preferred stock in OSR.

· Old Second Acquisition, Inc., which was formed as part of the November 5, 2007 Agreement and Plan of Merger between the Company, Old Second Acquisition, Inc., a wholly-owned subsidiary of the Company, and HeritageBanc, Inc. (“Heritage”). The parties consummated the merger on February 8, 2008, at which time, Old Second Acquisition, Inc. was merged with and into Heritage with Heritage as the surviving corporation as a wholly-owned subsidiary of the Company. Additionally, the parties merged Heritage Bank, a wholly-owned subsidiary of Heritage, with and into Old Second National Bank, with Old Second National Bank as the surviving bank. After the completion of the merger transaction, Heritage was dissolved and is no longer an existing subsidiary.

· Station I, LLC, a wholly owned subsidiary of Old Second National Bank, which was formed in August 2008 to hold property acquired by the Bank through foreclosure or in the ordinary course of collecting a debt previously contracted with a borrower.

Inter-company transactions and balances are eliminated in consolidation.

The Company provides financial services through its thirty-five banking locations located in Cook, Kane, Kendall, DeKalb, DuPage, LaSalle and Will counties in Illinois. As a result of the February 2008 merger, the franchise expanded into the southwestern section of Cook County, which includes the higher growth markets of the south Chicago suburbs. This acquisition provided additional market penetration by adding five retail-banking locations and allowed the Company to fill in its footprint surrounding the Chicago metropolitan area. The Company also offers insurance products in this new market area through Old Second Financial, Inc.

The Company began to realize the economic benefits of the transaction in the second quarter of 2008 as all of the major integration initiatives were completed. The acquired client base provided revenue opportunities for the corporate business unit as well as the Company’s retail and mortgage services operations. Likewise, wealth management and employee benefit services offerings were more expansive than the previous products and services offered. Access to remote capture services and other treasury management products also became available and complemented the traditional commercial deposit and loan products previously offered. The Company paid consideration of $43.0 million in cash and 1,563,636 shares of the Company’s common stock valued at $27.50 per share to consummate the Heritage acquisition. Details related to the allocation of the purchase price for this business combination are discussed in Note B of the financial statements included in this annual report. The terms of the credit facilities that were established to complete the acquisition are detailed in Note K of the financial statements included in this annual report. Additional organizational

46

Management’s Discussion – continued

changes that occurred during 2008 are also detailed in Note A of the financial statements included in this annual report.

Our primary deposit products are checking, NOW, money market, savings, and certificate of deposit accounts, and the Company’s primary lending products are commercial mortgages, construction lending, commercial and industrial loans, residential mortgages and installment loans. Major portions of the Company’s loans are secured by various forms of collateral including real estate, business assets, and consumer property while borrower cash flow is the primary source of repayment. The Bank also engages in trust operations.

The Company recorded net income of $11.8 million or $.86 diluted earnings per share in 2008, which compares with earnings of $24.0 million or $1.89 per diluted share in 2007, and $23.7 million, or $1.75 per diluted share in 2006. Basic earnings per share were $.87 in 2008, $1.92 in 2007, and $1.77 in 2006. In 2008, balance sheet growth in earning assets, including increases in net interest margin and increases in noninterest income were more than offset by increases in the provision for loan losses combined with increases in other expenses. The Company recorded an $30.3 million provision for loan losses in 2008, which included an addition of $21.2 million in the fourth quarter. The provision for loan losses for 2007 approximately equaled the 2006 expense of $1.2 million with no fourth quarter addition recorded in either period.

Net interest income increased $20.9 million (30.5%) to $89.5 million in 2008, compared to a decrease of $2.6 million (3.7%) to $68.6 million in 2007. The 2008 increase resulted from both an increase in assets as well as a general decrease in interest rates in 2008, which lowered the Company’s cost of funds. In addition to organic growth, the Company acquired $329.0 million in earning assets through the February acquisition, which included $283.6 million in loans and $45.4 million in investments. Average earning assets grew $337.0 million, or 14.3%, from December 31, 2007 to December 31, 2008. The net interest margin (tax-equivalent basis), expressed as a percentage of average earning assets, increased from 3.05% in the year ended December 31, 2007 to 3.45% in the year ended December 31, 2008. The net interest margin (tax equivalent basis) was 3.34% in 2006. Year-end total assets were $2.99 billion as of December 31, 2008, an increase of $326.0 million (12.3%) from $2.66 billion as of December 31, 2007. Average assets were $2.92 billion, $2.52 billion, and $2.38 billion in 2008, 2007, and 2006, respectively.

Application of critical accounting policies

The Company’s consolidated financial statements are prepared in accordance with United States generally accepted accounting principles and follow general practices within the banking industry. Application of these principles requires management to make estimates, assumptions, and judgments that affect the amounts reported in the consolidated financial statements and accompanying notes. These estimates, assumptions, and judgments are based on information available as of the date of the consolidated financial statements.

Future changes in information may affect these estimates, assumptions, and judgments; which, in turn, may affect amounts reported in the consolidated financial statements.

All significant accounting policies are presented in Note A of the financial statements included in this annual report. These policies, along with the disclosures presented in the other financial statement notes and in this discussion, provide information on how significant assets and liabilities are valued in the financial statements and on how those values are determined.

Management has determined that the Company’s accounting policies with respect to the allowance for loan losses is the accounting area requiring subjective or complex judgments that is most important to the Company’s financial position and results of operations, and therefore, is one of the Company’s most critical accounting policies. The allowance for loan losses represents management’s estimate of probable credit losses inherent in the loan portfolio. Determining the amount of the allowance for loan losses is considered a critical accounting estimate because it requires significant judgment and the amount of estimated losses on pools of homogeneous loans based on historical loss experience, and consideration of current economic trends and conditions, as well as estimated collateral valuations, all of which may be susceptible to significant change. The loan portfolio also represents the largest asset type on the consolidated balance sheet. The allowance for loan losses is a valuation allowance for credit losses, increased by the provision for loan losses and decreased by charge-offs less recoveries. Management estimates the allowance balance required using an assessment of various risk factors including, but not limited to, past loan loss experience, known and inherent risks in the portfolio, information about specific borrower situations and estimated collateral values, volume trends in delinquencies and nonaccruals, economic conditions, and other factors. Allocations of the allowance may be made for specific loans, but the entire allowance is available for losses inherent in the loan portfolio. A loan is considered impaired when it is probable that not all contractual principal or interest due will be received according to the original terms of the loan agreement. Management defines the measured value of an impaired loan based upon the present value of the future cash flows, discounted at the loan’s original effective interest rate, or the fair value of underlying collateral, if the loan is collateral dependent. Impaired loans at December 31, 2008 and 2007 were $108.6 million and $30.0 million, respectively. In addition, a discussion of the factors driving changes in the amount of the allowance for loan losses is included in the Provision for Loan Losses section that follows.

Another of the Company’s critical accounting policies relates to the fair value of various financial instruments including investment securities, derivative instruments and the expanded fair value measurement disclosures related to the recently adopted FAS 157 and the subsequent associated FASB issued Staff Positions (“FSP”) discussed in Note A.

47

Management’s Discussion – continued

Recent Developments

On January 16, 2009, the Company announced that the United States Department of the Treasury (“Treasury”) completed its investment of $73 million in Series B Fixed Rate Cumulative Perpetual Preferred Stock and warrants to purchase common stock of Old Second National Bank (“Bank”) as part of Treasury’s Troubled Asset Relief Program (“TARP”) Capital Purchase Program (“CPP”).

The Series B preferred shares issued to Treasury pay a dividend of 5% per year for the first five years and will reset to 9% per year thereafter. The Series B preferred shares are callable at their liquidation value of $1,000 per share and can be redeemed prior to then only with the approval of the Federal Reserve. Old Second also issued to Treasury a ten-year warrant to purchase 815,339 shares of common stock at an exercise price of $13.43 per share. The warrant is immediately exercisable.

Results of operations

Net interest income

Net interest income is the difference between interest income earned on earning assets and interest expense paid on interest bearing liabilities. As such, net interest income is affected by changes in the volume and yields on earning assets and the volume and rates paid on interest bearing liabilities. Net interest margin is the ratio of tax-equivalent net interest income to average earning assets. As discussed in the overview section, increases in net interest income during this period were primarily the result of growth in earning assets as well as the general decrease in rates in 2008. The average tax-equivalent yield on earning assets decreased 76 basis points from 6.67% in 2007, to 5.91% in 2008. However, the cost of funds on interest bearing liabilities decreased 131 basis points from 4.16%, to 2.85% in the same period. The average net interest margin (tax equivalent) was 3.45%, 3.05%, and 3.34% in 2008, 2007, and 2006, respectively.

Net interest income was $89.5 million in 2008, $68.6 million in 2007, and $71.2 million in 2006. Average earning assets were $2.69 billion in 2008, an increase of $337.0 million, or 14.3%, from $2.36 billion in 2007. Average earning assets were $2.22 billion in 2006. Average portfolio loans increased $356.5 million, or 19.5%, from $1.83 billion in 2007 to $2.18 billion in 2008. During 2007, average portfolio loans increased $76.9 million, or 4.4%, from $1.75 billion in 2006, to $1.83 billion in 2007. Average interest bearing liabilities were $2.39 billion in 2008, an increase of $300.0 million, or 14.3%, from 2007. Average interest bearing liabilities were $2.09 billion in 2007, an increase of $140.7 million, or 7.2%, from 1.95 billion in 2006. In 2006, management recorded an adjustment to interest expense on other short-term borrowings of $961,000 due to a reduction in estimate for accrued interest payable. Approximately $528,000 of this reduction related to 2006.

The major factor that reduced interest expense was the decline in rates that occurred throughout 2008. Changes in deposit funding composition did occur as account holders reacted to the change in rates, but had a lesser effect. The average balances of lower-cost sources of funds such as interest-bearing transaction accounts and savings accounts increased $40.3 million, or 16.1%, and $7.8 million, or 7.6%, respectively, from December 31, 2007 to December 31, 2008. At the same time, average non-interest-bearing deposits increased by $55.9 million, or 21.7% while higher-cost sources of funds such as money market and time deposits increased $54.7 million, or 11.0% and $100.1 million, or 10.2%, respectively. Non-deposit funding costs also decreased significantly in 2008 as lower interest rates more than offset higher borrowing levels.

Given the Company’s mix of negatively gapped interest earning assets and interest bearing liabilities at December 31, 2007, the net interest margin was generally positioned to increase during a declining rate environment, which occurred throughout 2008. The Federal Open Market Committee (“FOMC”) decreased the target for the Federal Funds rate by announcing a series of interest rate cuts in 2008. These decreases lowered the target rate from 4.25% at January 1, 2008 to 0.25% at December 31, 2008. The Bank’s prime rate decreased in correlation with the Federal Funds rate, moving from 7.25% on January 1, 2008 to 3.25% as of December 31, 2008. While interest costs associated with generating deposit growth and other sources of funds in 2008 generally increased funding costs through increased volume, these increases were more than offset by the amount of liabilities that repriced with the general decreases in market rates. The Company was asset sensitive at December 31, 2008, and this change was due in large part to the first quarter acquisition of Heritage as well as a general extension of many of the Company’s liabilities particularly with the large growth in certificates of deposit.

Provision for loan losses

In 2008, the Company recorded a $30.3 million provision for loan losses, which included an addition of $21.2 million in the fourth quarter. In both 2007 and 2006, the provision for loan losses was $1.2 million. Nonperforming loans increased to $108.6 million at December 31, 2008 from $6.0 million at December 31, 2007, and $2.2 million at December 31, 2006. Nonperforming loans are defined as non-accrual loans, restructured loans, and loans past due ninety days or more and still accruing interest. Net charge-offs in 2008, 2007 and 2006 were $8.9 million, $546,000, and $380,000 respectively. When compared with total loans, net charge-offs as a percentage of total average loans were 0.41%, 0.03%, and 0.02% in 2008, 2007 and 2006, respectively. Provisions for loan losses are made to provide for probable and estimable losses inherent in the loan portfolio. Approximately $53.6 million of the December 31, 2008 problem loan total was acquired through the Heritage Bank acquisition and these loans had a total specific allocation estimate of $2.9 million at December 31, 2008. Management believed that the $3.0 million allowance for loan losses assumed in the Heritage transaction in the first quarter was adequate to address the risks specific to the loan portfolio purchased.

48

Management’s Discussion – continued

Nonperforming loans increased in 2008 despite a fourth quarter conversion of $14.3 million to other real estate, which included $12.6 million from a single relationship. The remaining nonperforming loans at December 31, 2008 were concentrated in a small number of credit relationships. Six relationships make up 53.3% of the total, and ten relationships make up 61.7% of total nonperforming loans. Management reviewed the status of each of these relationships and made an estimated loss allocation for each relationship as disclosed below. The following narrative provides detail relative to each of the largest six nonperforming relationships.

· The first nonperforming relationship is with a residential investor in multi-family and 1-4 unit properties with a total exposure outstanding of $15.8 million, and an allocation for loss of $1.3 million. The various credits comprising this relationship are secured by two apartment buildings, and an assortment of approximately seventy one-to-four family investment properties, and two small commercial buildings. These credits were underwritten at 75-80% of the estimated collateral value at inception and were also supported by cash flow analysis. Management believes that the estimated value of these properties are sufficient to support the current exposure.

· The second nonperforming relationship is with a commercial and residential land developer with a total exposure outstanding of $14.6 million. This relationship consists of a $4.7 million loan on a retail building that is partially leased, a $5.7 million loan on retail-zoned land within the same project as the retail building, and a $4.2 million loan on a retail-zoned parcel in a separate project. In addition to placing the loans on nonaccrual status, management has estimated a loss allocation amount of $2.3 million based upon a review of the appraisals and the current legal status of these properties. Additionally, on the land financed by the $5.7 million loan, a retail building was constructed by the owner and was financed by his general contractor. Mechanic’s lien claims have been filed against that property. For the retail building, contractor financed building, and retail zoned lots in the first project, the Company is negotiating with the borrower and the general contractor to obtain deed to the property while simultaneously pursuing a foreclosure action. The outcome of these negotiations is not certain, but the Company believes this portion of the debt will be resolved through a negotiated plan. The remaining retail-zoned parcel is under a pending sale contract awaiting completion of due diligence and management believes such proceeds would be more than sufficient to satisfy the $4.2 million debt. Since culmination of that sale is not certain, the Company is also negotiating a possible deedin-lieu-of-foreclosure arrangement on this property while simultaneously pursuing a foreclosure action.

· The third largest nonperforming relationship is to a residential homebuilder with a total credit exposure of $8.5 million. This townhome project recently experienced a sales decline consistent with other such projects operating in the current economic environment. $6.1 million of this credit is secured by lots zoned for townhome construction. The remainder of the credit is secured by various completed and partially-completed townhome units within the same project. Despite continuing negotiations with the owners and guarantors to continue their support on this project, no agreement has been reached. As a result, this credit has been placed on nonaccrual with a specific allocation of approximately $1.5 million based upon the appraisals in file, which were adjusted downwards by management to be consistent with the estimated decline in value that has been observed in other, recently obtained appraisals for similar projects.

· The fourth largest nonperforming relationship is to a residential builder and developer with a total exposure of $7.5 million. This credit is on nonaccrual and has a specific allocation of $400,000. The relationship is comprised of debts that are secured by residential-zoned farmland, and a combination of completed residential lots and phased land slated for development in two other projects. One of these projects started approximately three years ago and experienced good sales volume until late 2007. Recent sales have been slow and management’s review of values obtained in recent appraisals indicated that the likely liquidation value required the specific allocation amount cited above. A second project opened in 2007 and sales activity has been stagnant. The borrower is working with the Company to provide additional collateral in exchange for extension/forbearance terms while the various properties continue to be marketed for sale. Management continues to pursue a variety of workout remedies with the borrower.

· The fifth largest nonperforming loan relationship is to a residential developer with a total exposure of $6.3 million. This loan is on nonaccrual and the amount outstanding is net of a $2.8 million charge-off that was taken in September 2008, and an additional $700,000 charge-off recorded in December 2008. A parcel of residential-zoned farmland secures this loan. The developer has ceased supporting the credit relationship. The amount charged-off in the third quarter reduced the exposure to approximately 65% of original land-only costs as supported by a current appraisal. In the fourth quarter review, management estimated that the value of this property had further weakened and reduced the exposure with a specific allocation of $1.4 million.

· The sixth largest nonperforming loan relationship is to a commercial and residential land developer with total exposure of $5.2 million. This loan is on nonaccrual and matured late in the fourth quarter. This project consists of land zoned for residential and commercial development. The land was appraised in the third quarter of 2008 at $9.5 million, but management now believes that valuation was overstated as it was based on comparables from a stronger economic period. The preliminary results of a new appraisal valuation in process indicate the value is closer to $3.7 million and as a result, management increased the estimate for the specific allocation amount to $1.8 million. Management continues to negotiate with the borrower but was informed in the first quarter of 2009 that an end buyer/option holder on the project has decided to abandon the zoning process that was in process for this property.

49

Management’s Discussion – continued

The next four largest nonperforming credits range in size from $2.0 million to $2.6 million and are comprised of one credit on income-producing residential real estate, one credit on income-producing commercial real estate, and two credits to small builders and developers. All of the properties are located in the greater Chicago area. All of these credits are on nonaccrual, and the total specific allocation is approximately $730,000 for these four relationships. In December, approximately $200,000 was charged-off for the residential real estate credit. These amounts were based upon the receipt of updated appraisals and/or management evaluations of the properties, and are believed to be adequate to cover the probable loss amounts inherent in these loans.

The remaining nonperforming loans consist of various small builder commercial real estate, residential real estate and small business credits. The Bank is pursuing foreclosure remedies in many of these cases. A total of $5.9 million of specific allocation has been recorded as the probable loss amount inherent in these credits.

The Company’s market areas have not experienced some of the more dramatic downturns in housing prices as reported in other areas of the country, but significant price declines have occurred throughout the Chicago area. As of the December 31, 2008 loan portfolio total, the Company had 16.5% invested in real estate construction and development loans and 40.9% invested in commercial real estate. The Company has generally limited its lending activity to locally known markets and construction lending is typically based upon cost instead of appraisal values. In addition to encouraging local real estate lending activities within nearby markets, versus purchased or out of territory loans, the Company has maintained its focus upon providing traditional loan products to residential borrowers.

The ratio of the allowance for loan losses to nonperforming loans was 37.99% as of December 31, 2008, compared with 281.95% as of December 31, 2007 and 731.06% as of December 31, 2006. While this ratio decreased at December 31, 2008, management believed the allowance coverage was sufficient due to the estimated loss potential. In addition to specific allocations on loans, management determines the amount to provide in the allowance for loan losses based upon a number of qualitative and other factors, including, but not limited to, loan growth, the quality and composition of the loan portfolio, and loan loss experience. Prior to 2008, the Company has had minimal credit losses. The current allowance is weighted heavily toward the real estate portfolio due to its size in relation to the other portions of our portfolio. With the continued increase in the amount of nonperforming loans in 2008, and the prolonged deceleration in real estate building and development activity as compared to prior years, management increased the factors for residential, development and commercial real estate loans. As the slowdown in the development and construction sector was observed, combined with the Company’s concentration in these types of loans, management concluded that it represented increased risk that warranted higher provisioning, particularly as it related to specific construction and development activities. These environmental factors are evaluated on an ongoing basis and are included in the assessment of the adequacy of the allowance for loan losses. When measured as a percentage of loans outstanding, the allowance for loan losses increased to 1.82% at December 31, 2008, as compared to 0.89% at December 31, 2007. In management’s judgment, an adequate allowance for estimated losses has been established; however, there can be no assurance that actual losses will not exceed the estimated amounts in the future.

The allowance for loan losses consists of three components: (i) specific allocations established for losses resulting from an analysis developed through reviews of individual loans for which the recorded investment in the loan exceeds the measured value of the loan; (ii) reserves based on historical loss experience for each loan category; and (iii) reserves based on general current economic conditions as well as specific economic and other factors believed to be relevant to the Company’s loan portfolio. Management evaluates the sufficiency of the allowance for loan losses based on the combined total of each of these components. The components of the allowance for loan losses represent an estimation performed pursuant to Statement of Financial Accounting Standard (“SFAS”) 5, Accounting for Contingencies, and SFAS 114, Accounting by Creditors for Impairment of a Loan, and SFAS 118 “Accounting by Creditors for Impairment of a Loan — Income Recognition and Disclosures,” which amended several provisions of SFAS 114.

Specific allocations

Management reviews on at least a quarterly basis certain loans on nonaccrual, loans over 90 days past due, troubled debt restructurings or any loans considered doubtful or loss. The individual loan officers analyze these loans with the results reported to the Loan Review Committee on a Credit Management Report. From that report, management determines the amount of specific allocations by reviewing, on a credit-by-credit basis, all loans considered impaired under SFAS 114 as amended by SFAS 118 as well as all problem and watch loans. SFAS 114 defines impaired loans as loans where, based on current information and events, it is probable that a creditor may be unable to collect all amounts due according to the original contractual terms of the loan agreement.

A problem loan is defined by the Company’s loan policy as “A credit that is inadequately protected by the current sound worth and paying capacity of the borrower or of the collateral pledged, if any. Loans so classified have a well-defined weakness that jeopardizes the liquidation of the debt. These loans are characterized by the distinct possibility that the Bank will sustain some loss if the deficiencies are not corrected. Loss potential, while existing in the aggregate amount of substandard loans, does not have to exist in individual loans classified”.

Specific allocations are discussed at the quarterly watch list meeting. The First Vice President of Loan Review chairs this meeting. The committee consists of the Company’s President, the Bank’s President and Chief Operating Officer, Regional

50

Management’s Discussion – continued

Senior Vice Presidents, the Company’s Executive Vice President of Credit & Chief Risk Officer, the Executive Vice President of Strategic Development and other senior lenders who serve as members of the loan committee.

As of December 31, 2008, the Company had a total of $106.5 million in nonaccrual loans, of which fifty seven nonaccrual loans totaling $75.6 million had a specific allocation of $15.2 million. The Company has no specific allocations for restructured loans, but did have two past due loans totaling approximately $2.0 million, which had a specific allocation estimate of $140,000 included in the allowance. As of December 31, 2007, the Company had eighteen nonaccrual loans totaling $5.3 million with a specific allocation of $136,000 for those loans. As of December 31, 2006, the Company had fourteen nonaccrual loans totaling $1.6 million with an allocation of $133,000 for those loans. Impaired loans at December 31, 2008, 2007, and 2006 were $108.6 million, $30.0 million, and $10.3 million respectively.

Historical reserves and management allocations

The component of the allowance for loan losses based on historical loan loss experience is determined using historical charge-off data for the last five years, with more weight placed on the most recent years. This calculation is done monthly and refined quarterly. Management considers a variety of factors to determine the appropriate level of allowance for inherent loan losses including but not limited to, past loan loss experience, known and inherent risks in the portfolio, information about specific borrower situations and estimated collateral values, volume trends in delinquencies and nonaccruals, economic conditions, and other factors. Allocations of the allowance may be made for specific loans, but the entire allowance is available for losses inherent in the loan portfolio. All factors are considered on a quarterly basis and are adjusted when appropriate. In addition, various regulatory agencies, as an integral part of their examination process, periodically review the Company’s allowance for loan losses. Such agencies may require the Company to make additional provisions to the allowance based on their judgments about information available to them at the time of their examination.

The general component of the allowance recognizes probable inherent, but undetected, losses in the loan portfolio. Regardless of how management analyzes customer performance, ratings migration, economic conditions and interest rate risk, management believes there are additional potential risks that are unaccounted for in the process of making loans. This is due to several factors including, but not limited to:

· Timing delays in receiving information regarding a customer’s financial condition;

· Changes in individual business climates;

· The judgmental nature of individual loan evaluations and collateral assessments; and

· The open interpretation of economic trends.

The analysis of these factors involves a high degree of judgment by management. Because of the imprecision surrounding these factors, the bank estimates a range of inherent losses and maintains a general allowance that is not allocated to a specific category.

Non-interest income

Non-interest income was $35.3 million for the year 2008, an increase of $3.4 million, or 10.7%, as compared to 2007. The increase in non-interest income in 2008 was primarily the result of increased income from mortgage banking operations and realized gains on sales of securities. Non-interest income was $31.9 million for 2007, an increase of $3.1 million, or 11.0%, as compared to 2006.

Trust income was $8.1 million in 2008, a decrease of $605,000, or 7.0%, from 2007 due principally to decreased volume in estate administration activity coupled with a decrease in assets under management as a result of the general decline in asset values in the second half of 2008. Assets under management were $924.8 million, $1.1 billion, and $1.0 billion at December 31, 2008, 2007, and 2006, respectively. Trust income increased to $8.7 million in 2007, an increase of $1.1 million, or 14.1%, from $7.6 million in 2006. Trust income increased generally in 2007 due to greater volumes in both assets under management and estate administration activities.

Service charges on deposits were $9.3 million in 2008, an increase of $758,000, or 8.9%, from $8.6 million in 2007, primarily due to increased volumes from commercial overdraft and account service charges. The latter item also increased in part due to the reduced commercial earnings credits that resulted from a lower interest rate environment, although fee structures were also changed in 2008.

Mortgage banking income, including net gain on sales of mortgage loans, secondary market fees, and servicing income was $7.3 million in 2008, an increase of $1.7 million, or 30.4%, from $5.6 million in 2007. Mortgage banking income was $4.9 million in 2006. The largest increase in income from mortgage operations was in net gain on sales of mortgage loans, which resulted largely from a significant revision to secondary market execution processes. Mortgage banking income is largely volume-driven and mortgage activity is susceptible to changes in interest rates and general economic conditions. Loans sold, including gains on sale totaled $318.7 million in 2008, $232.4 million in 2007, and $288.8 million in 2006. Originations in 2008 increased as mortgage rates decreased, which spurred an increase in refinancing activity. The decrease in 2007 mortgage originations was due largely to the fact that interest rates did not begin to decline until September of that year. The Company reengineered its secondary mortgage lending operations and system tools in the first half of 2007 including its approach to pricing, compensation and geographic distribution of lenders. This effort, in addition to an increase in cross sell opportunities from other business units in 2008, increased mortgage-banking income despite the ongoing market turbulence experienced in that sector.

51

Management’s Discussion – continued

Realized gains on sales of securities in 2008 were $1.9 million, an increase of $1.2 million, or 179.2%, as compared with $674,000 for 2007. Gains on sales of securities in 2006 totaled $418,000. In 2008, Bank-owned life insurance (“BOLI”) income decreased $1.4 million, or 69.5%, from 2007 levels. This performance decline was due in part to the continued decrease in interest rates available as well as losses recorded on the underlying insurance investments in both the quarter and year. The increase in cash surrender value of BOLI was $2.1 million in 2006. Interchange income from debit card usage continued to increase in 2008 as customers continued to respond favorably to rewards programs and generally showed a preference for this payment method. Interchange income from debit card usage was $2.4 million, $2.0 million and $1.8 million respectively in 2008, 2007 and 2006.

Other non-interest income in 2008 was $5.7 million, an increase of $1.4 million, or 32.5%, from $4.3 million in 2007. Some of the larger sources of increase in the other income category were credit card processing fees, automatic teller machine surcharge and interchange fees and letter of credit fees. Other income increased $661,000, or 18.1%, to $4.3 million in 2007, from $3.7 million in 2006. The comparative improvement in 2007 performance was primarily due to increased levels of fee income from processing of merchant credit card sales combined with annuity sales, mutual fund and letter of credit fees.

Non-interest expense

Non-interest expense was $80.3 million during 2008, an increase of $13.9 million, or 20.8%, from $66.5 million in the prior year. Approximately $881,000 of the aggregate non-interest expense increase was related to one-time merger costs and $492,000 of that amount was related to personnel costs. Non-interest expense totaled $65.1 million in 2006. The efficiency ratio, which is a non-GAAP measure, was 62.0%, 64.5%, and 63.3%, for December 31, 2008, 2007, and 2006, respectively. This ratio measures non-interest expense as a percentage of the sum of net tax-equivalent interest income plus non-interest income. Because a financial institution’s largest non-interest expense is generally the cost of salary and benefits, management of this cost has a significant impact on efficiency. Salaries and benefits expense was $44.5 million during the twelve months ended December 31, 2008, an increase of $6.4 million, or 16.8%, from $38.1 million for 2007. The 2008 increase in personnel expenses related to normal annual increases in compensation rates and increased staffing levels that included the addition of 57 full time equivalent (“FTE”) employees from Heritage. Accordingly, the FTE count rose from 541 in the fourth quarter of 2007 to 615 in the fourth quarter of 2008. The 2008 expense for the discretionary profit sharing, stock compensation and management bonus plans also increased in part due to the FTE increase from the acquisition. The 2008 commission expense related to mortgage loan sales activity increased substantially with the increased income from that line of business. In 2007, salaries and benefits were $38.1 million compared to $35.9 million in 2006, an increase of $2.2 million or 6.2%. The increase in expense in 2007 was primarily due to increases in bonus expense and profit sharing accruals as well as increases in mortgage and brokerage commissions coupled with increases in stock compensation and health insurance costs. The FTE count in the fourth quarter of 2006 was 582 and the decrease in employee count to 541 in the fourth quarter of 2007 was primarily due to the 8.5% reduction in available positions that was announced in April of 2007. The Company moved away from the defined benefit pension plan that was settled with the $1.5 million loss that was recorded in 2006 to the 401K and profit sharing structure adopted in 2007, which continued in 2008. Even though the profit sharing percentage decreased in 2008 as compared to 2007, the cost of that plan increased due in part to the increased number of employees discussed above.

Furniture and equipment expenses were $6.9 million in 2008, $6.4 million in 2007, and $5.3 million in 2006. In 2008, net occupancy and furniture and equipment expenses increased $1.1 million, or 9.0%, from 2007, whereas in 2007 it increased $1.9 million, or 19.7%, from 2006. On a comparative basis, facility expense in 2008 incorporated a full year of expense for one new retail branch that opened in May 2007, the relocation of a leasehold facility to an owned location in the third quarter of 2008, as well as the addition of five Heritage retail locations in February 2008. An additional $55,000 was due to a one-time settlement charge to close a leased mortgage origination office that was vacated in the first quarter of 2008. The largest category increases in occupancy expense for the year to date period, however, were for real estate taxes and maintenance expenses. Furniture and fixture costs increased $294,000 due to one-time conversion costs related to the acquisition. This category also increased due to systems enhancements, including expanded off site systems recovery infrastructure. In 2007, the increases from 2006 were primarily attributable to the combined effect of the Company’s expansion and development into new markets, network and system integration costs from a July bank charter consolidation, and third and fourth quarter 2007 recognition of accelerated leasehold depreciation and other associated impaired asset expense. The latter expense resulted primarily from the July 2007 closing of three leased branches that had market overlap with existing locations. The Company opened five new retail locations in 2006 and a new location on the western edge of Elgin in May 2007, which also increased the related 2007 facility expenses as compared to 2006.

Amortization of core deposit and other intangible assets totaled $1.1 million in 2008 and $355,000 in 2006. The 2008 resumption in amortization resulted from the February 2008 acquisition of Heritage, whereas the intangible asset amortization from prior acquisitions had been fully recognized as of December 31, 2006. Advertising expenses were $2.0 million in 2008, $1.6 million in 2007, and $2.1 million in 2006. There was an increase in marketing initiatives in 2008, which included $29,000 in one time acquisition costs as well increased direct mail costs, a grand opening celebration for a new location as well as a general increase in sponsorship of local community events.

52

Management’s Discussion – continued

Other expenses were $19.8 million in 2008, $15.0 million in 2007, and $15.5 million in 2006. A major factor in the 2008 increase was the resumption of Federal Deposit Insurance Corporation (“FDIC”) insurance premiums as available credits expired in 2007. Additionally, in response to the crisis affecting the U.S. banking system and financial markets, the U.S. Congress passed, and the President signed into law, the Emergency Economic Stabilization Act of 2008 (the “Stabilization Act”). This Act authorized the Secretary of the U.S. Treasury and the FDIC to implement various temporary emergency programs to improve confidence in the financial system. As a result of all the above events, including the Company’s decision to opt into the extended deposit insurance programs developed under the Stabilization Act, the FDIC deposit insurance premium was $1.5 million in 2008 as compared to nothing in 2007. This premium amount also included the estimated cost to increase the amount of insurance coverage on deposit accounts held at Old Second National Bank generally, from $100,000 to $250,000 as well as providing unlimited coverage on certain no and low interest transaction accounts. Expanded disclosures related to deposit insurance coverage are available at the FDIC website as well as the retail offices of the Bank. The increased coverage is effective during the period from October 3, 2008 until December 31, 2009.

In addition to the FDIC related expenses described above, other expense increased $512,000 due to a mortgage servicing rights net impairment that was recognized in 2008 as compared to a $63,000 net recovery that was recorded in 2007. The net impairment amount recognized in 2006 was $150,000. Annual expenses related to telephone, loan valuation and collection related activity and debit card processing costs also increased in 2008 as compared to prior years. Correspondent bank fees also increased through much of 2008 as the earnings credits declined with the general decline in market interest rates. Other expenses decreased generally in 2007 as compared to 2006 due in large part to reductions in other employee related expenditures such as recruitment and travel as well as decreased audit fees.

Income taxes

The Company’s provisions for Federal and State of Illinois income taxes were $2.3 million, $8.8 million, and $9.9 million during the years ended December 31, 2008, 2007, and 2006, respectively. The effective income tax rates for these years were 16.4%, 26.9%, and 29.4%, respectively. With the lower level of earnings in 2008, the portion of earnings that was taxable declined significantly in comparison to 2007 and 2006. There were also changes in the state tax structure in 2008 as compared to 2007. Under the revised tax law, OSM, an investment subsidiary of the Bank, no longer qualifies as an excluded company and its receipts now require inclusion in the unitary tax return. This change was offset somewhat by a decline in the apportionment factor in 2008 as compared to 2007. The reduction in effective tax rate in 2007 as compared to 2006 was due in large part to the formation of OSM in the fourth quarter of 2006.

The above Illinois tax law revision also changed the deductibility of real estate investment trust (“REIT”) dividends beginning January 1, 2009, which will eliminate the recognition of a substantial portion of the tax benefits related to this ownership structure. OSM owns 100% of the common stock of a REIT, which holds fixed and variable rate real estate loans that were previously held by the Bank subsidiary. The general decrease in market and loan portfolio interest rates lowered the amount of interest income generated by the REIT in 2008, as did a decrease in the loan balances and an increase in provision expense recognized by that subsidiary. In addition to providing income tax benefits, which lowered the effective tax rate, the REIT ownership structure also provides the Company with a vehicle for raising future capital as desired.

Financial condition

Total assets were $2.98 billion as of December 31, 2008, an increase of $326.0 million, or 12.3%, from $2.66 billion as of December 31, 2007. The most significant growth in assets was in loans, which were $2.27 billion as of December 31, 2008, an increase of $380.0 million, or 20.1%, from $1.89 billion as of December 31, 2007. Heritage contributed $286.6 million of that increase at the February acquisition date. Securities available for sale decreased $154.5 million during 2008 and served to provide funding for loan growth. Total deposits were $2.39 billion as of December 31, 2008 an increase of $273.5 million, or 12.9%, from $2.11 billion as of December 31, 2007, also due in large part to the acquisition. The largest change in funding, however, was a decrease in federal funds purchased of $136.2 million, or 82.5%, during 2008. In addition to the $45.0 million in subordinated debt obtained in conjunction with the acquisition, other short-term debt, primarily Federal Home Loan Bank advances, also increased to $169.4 million at December 31, 2008, an increase of $86.5 million, or 104.4%, from $82.9 million at December 31, 2007.

Investments

Securities available-for-sale decreased $154.5 million during 2008, from $560.9 million as of December 31, 2007, to $406.4 million as of December 31, 2008. At December 31, 2008, U.S. government agency securities and mortgage-backed agency securities were $96.4 million and $87.3 million, respectively. The Company decreased its position in agency securities by $114.2 million, or 54.2%, as of December 31, 2008 while it simultaneously decreased mortgage-backed agency securities by $9.6 million, or 9.9%. U.S. government agency securities comprised 23.7% of the portfolio as of December 31, 2008, and 37.5% of the portfolio as of December 31, 2007 whereas the mortgage-backed agency securities represented 21.5% and 17.3% of the investment portfolio as of the same dates. As of December 31, 2008, the Company held $59.3 million in collateralized mortgage obligations versus $73.9 million at December 31, 2007. The largest dollar investment category decreases were in United States government agency and United States government agency mortgage-backed as well as collateralized mortgage-backed securities. All of the decreases were largely due to the increased volume of called securities and mortgage pass-

53

Management’s Discussion – continued

through payments received in a declining rate environment. At December 31, 2008, state and political subdivision securities totaled $151.6 million, a decrease of $8.2 million, or 5.1%, from $159.8 million at December 31, 2007. State and political subdivision securities comprised 37.3% of the portfolio as of December 31, 2008, compared to 28.5% of the portfolio as of December 31, 2007. At December 31, 2008, U.S. Treasury Securities were $1.6 million, a decrease of $8.6 million, or 84.6%, from $10.2 million at December 31, 2007, primarily due to security sales. Collateralized debt obligations increased slightly in 2008 to $10.3 at December 31, 2008 from $9.5 million at December 31, 2007 despite a sale in the second quarter of 2008. As mentioned above, the cash flows from the security calls, prepayments, maturities and sales were generally used to fund loan growth. The net unrealized losses in the portfolio were $3.4 million at December 31, 2008 as compared to net unrealized gains of $3.3 million as of December 31, 2007, primarily due to changes in interest rates although there was a decline in the value of the collateralized debt obligations due to declines in market liquidity despite no deterioration in credit quality at December 31, 2008.

Loans

Total loans were $2.27 billion as of December 31, 2008, an increase of $380.0 million, or 20.1%, from $1.89 billion as of December 31, 2007. The loan portfolio increase included organic portfolio growth as well as the $286.6 million in loans that were acquired in the Heritage acquisition. Heritage had a portfolio distribution similar to the Company and the types of loans held in the portfolio did not change dramatically in 2008. The following comparisons are based upon revised 2007 classification totals whereby construction balances were decreased $27.3 million and commercial real estate was increased by a like amount. The largest category increase was in commercial real estate loans, which rose $268.4 million, or 40.6%, since December 31, 2007. Residential real estate and commercial and industrial loan sector increased $67.0 million and $46.9 million, respectively, since December 31, 2007.

The loan portfolio generally reflects the profile of the communities in which the Company operates, and the local economy has been affected by the overall decline in economic conditions including real estate related activity and valuations. Because the Company is located in growth areas with significant open space, real estate lending (including commercial, residential, and construction) has been and continues to be a sizeable portion of the portfolio. As noted previously, a substantial portion of the loan growth in 2008 was acquired in the Heritage transaction and its loan portfolio mix also had a substantial real estate component. These categories comprised 88.3% of the portfolio as of December 31, 2008 compared to 88.2% of the portfolio as of December 31, 2007. The construction and development loan sector also increased $1.9 million, or 0.52%, to $373.7 million at December 31, 2008, from $371.8 million at December 31, 2007. At the same time, installment loans and lease financing receivables decreased $4.1 million, or 14.4%, to $24.3 million from $28.4 million at December 31, 2007. The 2008 loan growth was substantially from within the Company’s market area including a nominal amount of participations purchased.

The provision for loan losses was $30.3 million and $1.2 million in 2008 and 2007, respectively. As discussed in the Provision for Loan Losses section above, management concluded that the increase in the amount of nonperforming loans and net charge-offs in 2008, combined with the prolonged deceleration in real estate building and development activity as compared to prior years represented increased risk that warranted higher provisioning. Accordingly, management increased the qualitative loan factors related to estimating the provision for loan losses. These factors along with increased specific allocations contributed to the increase in the provision for 2008 compared to 2007.

One measure of the adequacy of the allowance for loan losses is the ratio of the allowance to total loans. The allowance for loan losses as a percentage of total loans was 1.82% as of December 31, 2008, compared to 0.89% as of December 31, 2007. In management’s judgment, an adequate allowance for estimated losses has been established; however, there can be no assurance that losses will not exceed the estimated amounts in the future.

Management, along with many other financial institutions, remains cautious about the current economic environment and outlook. Furthermore, the sustained slowdown in the real estate market could continue to adversely affect consumer confidence and collateral values. These events adversely affect cash flows generally for both commercial and individual borrowers, and as a result, the Company could continue to experience increases in problem assets, delinquencies, and losses on loans in future periods.

Other Assets

Other real estate owned (“OREO”) totaled $15.2 million at December 31, 2008. Of this amount, $12.6 million is attributable to one project that was acquired in December 2008 in satisfaction of the outstanding debt. That project is comprised of residential townhomes, residential townhome lots, lots zoned for condominiums, and lots zoned for retail. Management based the estimated value of these assets primarily upon recent appraisals. The remaining OREO consists of $1.3 million in residential lots located in four different communities, $360,000 in a single commercial building, and $1.0 million in five single-family residences.

Goodwill and other intangible assets are reviewed for potential impairment on an annual basis, or more often if events or circumstances indicate that there may be impairment, in accordance with SFAS No. 142, “Goodwill and Other Intangible Assets and SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” Goodwill is tested for impairment at the reporting unit level and an impairment loss is recorded to the extent that the carrying amount of goodwill exceeds its implied fair value. The Company employs general industry practices in evaluating the impairment of its goodwill and

54

Management’s Discussion – continued

other intangible assets. The Company calculates the value of goodwill using a combination of the following valuation methods: dividend discount analysis under the income approach, which calculates the present value of all excess cash flows plus the present value of a terminal value, the price/earnings multiple under the market approach and the change in control premium to market price approach. Management performed its annual review of goodwill at September 30, 2008 and updated that review at December 31, 2008, as the stock prices in the financial services sector generally remained out of favor. Based upon these reviews, management determined there was no impairment of goodwill as of December 31, 2008. No assurance can be given that future impairment tests will not result in a charge to earnings. Goodwill and core deposit and other intangible assets related to Heritage were $56.9 million and $8.9 million at acquisition. Additional information related to goodwill and other intangible assets is found in Note H of the financial statements included in this annual report.

Liquidity

Total deposits increased $273.5 million, or 12.9%, during 2008 to $2.39 billion as of December 31, 2008. In February 2008, the Company acquired $294.4 million of deposit growth through the acquisition of Heritage. Non-interest-bearing deposits increased $46.5 million, or 17.1%, while lower cost sources of funds such as NOW and savings deposits increased $27.6 million, or 11.2%, and $13.6 million, or 14.1%, respectively. At the same time, money market accounts increased $37.6 million, or 7.4%. In 2008, time deposits increased $148.1 million, or 14.9% in part, from the certificates of deposit acquired from Heritage, as well as customers moving to lock in interest rates in a declining interest rate environment. To enhance future deposit growth and retention, the Company also opted to participate in the enhanced FDIC insurance coverage that became available in November 2008 and is set to expire in December 2009.

The most significant borrowing in 2008 occurred on January 31, 2008, when the Company entered into a $75.5 million credit facility with LaSalle Bank National Association (now Bank of America). Part of this new credit facility replaced a $30.0 million revolving line of credit facility previously held between the Company and Marshall & Ilsley Bank and was not a significant source of new funds. The $75.5 million credit facility was comprised of a $30.5 million senior debt facility and $45.0 million of new subordinated debt. The proceeds of the $45.0 million of subordinated debt issuance were used to finance the Heritage acquisition costs and qualify as Tier 2 regulatory capital. Additional terms related to the Bank of America credit facility are discussed in Note K of the financial statements included in this annual report. Other major borrowing category changes from December 31, 2007 included a decrease of $136.2 million, or 82.5%, in overnight federal funds purchased and an $87.0 million increase in short term Federal Home Loan Bank of Chicago (“FHLBC”) advances, which was included in other short-term borrowings. The cost of interest-bearing liabilities decreased substantially in 2008, from 4.16% to 2.85%, or 131 basis points, which significantly improved the net interest margin.

Capital

Total stockholders’ equity increased $43.2 million, or 28.8%, to $193.1 million during 2008, from $149.9 million as of December 31, 2007. Net income of $11.8 million, reduced by dividends of $8.7 million, increased retained earnings to $213.0 million as of December 31, 2008. In the same year, a $4.0 million change to a $2.0 million net unrealized securities loss position from a $2.0 million net unrealized securities gain position at December 31, 2007, combined with the 2008 incurrence of a $95,000 net unrealized loss on a cash flow hedge decreased stockholders’ equity. In 2007 retained earnings increased by net income of $24.0 million, less dividends of $7.3 million. During 2007, a $4.5 million change to a $2.0 million net unrealized securities gain position from a $2.5 million net unrealized securities loss position at December 31, 2006 also increased stockholders’ equity.

Treasury repurchase activity in 2008 decreased significantly from 2007. The Company is limited in its ability to repurchased shares in the future because of restrictions imposed by the United States Department of Treasury as a result of the Company’s participation in the Capital Purchase Program. The Company repurchased 2,968 shares in 2008, resulting in an increase in treasury stock to 4,548,447 shares as of December 31, 2008. The repurchase of these shares increased treasury stock by $41,000 or less than 0.1% at December 31, 2008. The Company had repurchased 1,038,251 shares in 2007, resulting in an increase in treasury stock to 4,545,479 shares as of December 31, 2007. The repurchase of these shares increased treasury stock by $31.2 million, or 49.2%, to $94.8 million at December 31, 2007. Treasury stock repurchased decreases stockholders’ equity, but also increases earnings per share by reducing the number of shares outstanding. Return on average equity was 6.03%, 16.13%, and 15.29% in 2008, 2007, and 2006, respectively.

The Company issued 1,563,636 shares of Company stock valued at $27.50 per share to consummate the acquisition of Heritage on February 8, 2008 and this issuance contributed $43.0 million to stockholders’ equity in 2008. Additionally, the exercise of stock options, related tax benefit, and stock-based compensation expense contributed $1.2 million and $1.4 million to stockholders’ equity in 2008 and 2007, respectively.

The Company completed a sale of $31.6 million of cumulative trust preferred securities by its subsidiary, Old Second Capital Trust I (Nasdaq: OSBCP), in July 2003. The trust preferred securities remain outstanding for a 30-year term but, subject to regulatory approval, they can be called in whole or in part at the Company’s discretion after an initial five-year period, which has since passed. The Company does not currently intend on seeking regulatory approval to call these securities. Dividends are payable quarterly at an annual rate of 7.80% and are included in interest expense in

55

Management’s Discussion – continued

the consolidated financial statements. The Company issued an additional $25.0 million of cumulative trust preferred securities through a private placement completed by its new unconsolidated subsidiary, Old Second Capital Trust II (“the Trust”) in April 2007. These trust preferred securities also mature in 30 years, but subject to the aforementioned regulatory approval, can be called in whole or in part in 2017. The quarterly cash distributions on the securities are fixed at 6.766% through June 15, 2017 and float at 150 basis points over the British Bankers Association three-month LIBOR rate thereafter. Trust preferred proceeds of $56.6 million are held by outside investors and qualified as Tier 1 regulatory capital as of December 31, 2008. Additionally, the $45.0 million in subordinated debt that was obtained to finance the February acquisition qualified as Tier 2 regulatory capital as of December 31, 2008. At December 31, 2007, trust preferred proceeds of $49.3 million qualified as Tier 1 regulatory capital and $6.5 million qualified as Tier 2 regulatory capital.

Bank regulatory agencies have adopted capital standards by which all banks and bank holding companies are evaluated. The Company and Old Second National Bank were each categorized as “well capitalized” as of both December 31, 2008 and 2007. Additional information regarding capital levels and minimum required levels can be found in Note S of the financial statements included in this annual report. Additional information related to the amount and form of consideration paid to consummate the February 8, 2008 acquisition of Heritage is outlined in Note B of the financial statements included in this annual report, whereas information on borrowing related to that transaction is outlined in Note K of the financial statements included in this annual report.

As discussed in the recent developments section of this document, the Company announced on January 16, 2009 that the Treasury had completed its investment of $73 million in Series B fixed rate cumulative perpetual preferred stock and warrants to purchase common stock of the Company as part of Treasury’s TARP CPP. The $73.0 million received by the Company in connection with this investment qualifies as Tier 1 regulatory capital.

Quantitative and qualitative disclosure about market risk

Liquidity and market risk

Liquidity is the Company’s ability to fund operations, to meet depositor withdrawals, to provide for customer’s credit needs, and to meet maturing obligations and existing commitments. The liquidity of the Company principally depends on cash flows from operating activities, investment in and maturity of assets, changes in balances of deposits and borrowings, and its ability to borrow funds. The Company monitors and tests borrowing capacity at correspondent banks as well as the Federal Home Loan Bank and Federal Reserve Banks of Chicago as part of its liquidity management process.

Additionally, the $73.0 million cash proceeds from the Treasury discussed immediately above is a new source of liquidity that became available to the Company in January 2009.

Net cash inflows from operating activities were $41.7 million during 2008, compared with $13.9 million in 2007. Proceeds from sale of loans held-for-sale, net of funds used to originate loans held-for-sale, were a source of inflow for 2007 and outflow for 2008. Interest received, net of interest paid, combined with changes in other assets and liabilities were a source of outflow for 2007 and inflow for 2008. Management of investing and financing activities, as well as market conditions, determines the level and the stability of net interest cash flows. Management’s policy is to mitigate the impact of changes in market interest rates to the extent possible, so that balance sheet growth is a principal determinant of growth in net interest cash flows.

Net cash inflows from investing activities, which included cash paid for the net assets acquired from Heritage as detailed in the supplemental cash flow information, were $28.1 million in 2008, compared to net cash outflows of $214.6 million in 2007. The cash paid for the acquisition, net of cash and cash equivalents retained, was $38.9 million. In 2008, securities transactions accounted for a net inflow of $190.1 million, and net principal disbursed on loans accounted for net outflows of $117.4 million. In 2007, securities transactions accounted for a net outflow of $79.5 million, and net principal disbursed on loans accounted for net outflows of $127.7 million. Additionally, while not large in amount, the purchase of FHLBC stock increased the Company’s borrowing privileges as outlined in Note K of the financial statements included in this annual report. Cash outflows for property and equipment were $6.1 million in 2008 compared to $6.5 million in 2007.

Net cash outflows from financing activities in 2008, were $61.3 million, and the deposit, borrowing and other liabilities that were assumed in the Heritage acquisition are enumerated in the supplemental cash flow information provided. Significant cash outflows from financing activities in 2008 included reductions of $153.3 million and $20.8 million in federal funds purchased and net decreases in customer deposits, respectively. The largest financing cash inflows in 2008 were $82.4 million in other short-term borrowings, which consists primarily of Federal Home Loan Bank advances. Additionally, $45.0 million in subordinated debt proceeds were used to finance the Heritage acquisition. Details related to the financing of the Heritage transaction and other borrowings are provided in Note K of the financial statements included in this annual report. Cash inflows from financing activities in 2007 were $176.9 million, which included net increases in customer deposits and federal funds purchased of $50.9 million and $111.1 million, respectively. Proceeds from the issuance of junior subordinated debentures also increased funding $25.8 million in 2007. The largest financing outflow in 2007 was the $31.2 million paid to purchase treasury stock.

56

Management’s Discussion – continued

Net cash inflows from operations were $38.2 million during 2006. Net cash outflows from investing activities were $71.8 million in 2006, primarily as a result of $59.9 million in net principal disbursed on loans. Net cash outflows relating to securities available-for-sale were $1.6 million. Net cash inflows from financing activities were $57.0 million in 2006, which included a net increase in deposits of $127.4 million and other short-term borrowings of $71.3 million. The largest financing decrease in 2006 was the net change in federal funds purchased. The proceeds of $13.2 million from the note payable were used primarily to repurchase the Company’s treasury shares.

Interest rate risk

As part of its normal operations, the Company is subject to interest-rate risk on the assets it invests in (primarily loans and securities) and the liabilities it funds with (primarily customer deposits and borrowed funds), as well as its ability to manage such risk. Fluctuations in interest rates may result in changes in the fair market values of the Company’s financial instruments, cash flows, and net interest income. Like most financial institutions, the Company has an exposure to changes in both short-term and long-term interest rates.

The Company manages various market risks in its normal course of operations, including credit, liquidity and interest-rate risk. Other types of market risk, such as foreign currency exchange risk and commodity price risk, do not arise in the normal course of the Company’s business activities and operations. In addition, since the Company does not hold a trading portfolio, it is not exposed to significant market risk from trading activities. The changes in the Company’s interest rate risk exposures from December 31, 2007 are outlined in the table below.

Like most financial institutions, the Company’s net income can be significantly influenced by a variety of external factors, including: overall economic conditions, policies and actions of regulatory authorities, the amounts of and rates at which assets and liabilities reprice, variances in prepayment of loans and securities other than those that are assumed, early withdrawal of deposits, exercise of call options on borrowings or securities, competition, a general rise or decline in interest rates, changes in the slope of the yield-curve, changes in historical relationships between indices (such as LIBOR and prime), and balance sheet growth or contraction. The Company’s asset and liability committee seeks to manage interest rate risk under a variety of rate environments by structuring the Company’s balance sheet and off-balance sheet positions, which includes interest rate swap derivatives as discussed in Note W of the financial statements included in this annual report. The risk is monitored and managed within approved policy limits.