SEGALL BRYANT & HAMILL TRUST

1290 Broadway, Suite 1100

Denver, Colorado 80203

May 3, 2019

VIA EDGAR

Mr. Jay Williamson

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

| Re: | Segall Bryant & Hamill Trust (the “Registrant”) |

File Nos. 002-75677, 811-03373

Dear Mr. Williamson:

On behalf of the Registrant, set forth below are the Registrant’s responses to comments received from the staff of the Division of Investment Management regarding post-effective amendment No. 104 (“PEA 104”) to the Registrant’s registration statement under the Securities Act of 1933, as amended (the “Securities Act”), and Post-Effective Amendment No. PEA 105 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), filed pursuant to Rule 485(a) on February 21, 2019, with respect to the Segall Bryant & Hamill All Cap Fund (the “All Cap Fund”), Segall Bryant & Hamill Small Cap Value Fund (the “Small Cap Value Fund”), Segall Bryant & Hamill Emerging Markets Fund (the “Emerging Markets Fund”)and Segall Bryant & Hamill International Small Cap Fund (the “International Small Cap Fund,” each a “Fund” and collectively, the “Funds”).

In connection with this response letter, and on or around May 8, 2019, the Registrant anticipates filing, pursuant to Rule 485(b), post-effective amendment No. 108 to the Registrant’s registration statement under the Securities Act (“PEA 108”), which is expected to include (i) changes to PEA 104 in response to the Staff’s comments, (ii) certain other non-material information; and (ii) certain other required exhibits.

Set forth in the numbered paragraphs below are the Staff’s oral comments provided April 11, 2019 to PEA 104, accompanied by the Registrant’s responses to the comments.

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 2

| 1. | Staff Comment Please respond to comments in writing and file the Registrant’s responses as correspondence via EDGAR. Where a comment asks for revised disclosure or where revisions are contemplated by your response, please provide draft disclosures with the correspondence. Please allow sufficient time to review prior to filing the updated registration statement. Many comments may apply to multiple locations within each registration statement. For brevity we have not repeated our comments. Please consider if a comment applies to more than one fund or multiple locations within fund disclosures. |

□Registrant’s Response: Comment noted and complied with.

| 2. | Staff Comment: The cover letter indicates that each Fund will each be an acquiring fund in respective reorganizations with a corresponding series of Investment Managers Series Trust. We note the disclosure presents predecessor information and financial highlight information. Please clarify how the reorganizations will be accomplished consistent with the Securities Act and the Investment Company Act (with reference to N-14 filing timelines and shareholder votes). Please note that because the disclosure reflects completed transactions, the Registrant should confirm that it will not use the prospectus to offer or sell shares until the reorganizations have been consummated. |

□Registrant’s Response: Comment complied with. A registration statement on Form N-14 was filed by the Registrant with the Commission on April 8, 2019. The N-14 relates to the proposed reorganizations of the Segall Bryant & Hamill All Cap Fund, Segall Bryant & Hamill Small Cap Value Fund, Segall Bryant & Hamill Emerging Markets Fund and Segall Bryant & Hamill International Small Cap Fund (each, a series of Investment Managers Series Trust, or “IMST,” and each, an “Acquired Fund”)) into, respectively, identically named and newly created series of the Registrant (the “Reorganizations”).

The Registrant has received comments from the Staff on the N-14, and expects to file an amendment thereto on or about May 8, 2019, concurrently with the proposed filing of PEA 108. Following the effectiveness of the N-14, the Registrant anticipates commencing the solicitation of proxies from the shareholders of the abovementioned IMST seeking the approval of the Reorganizations. The Registrant expects that the combined proxy statement/prospectus, as reflected in the N-14, will refer to a special meeting of shareholders of the abovementioned Acquired Funds to be held on or about June 28, 2019, and closing date for the Reorganizations (assuming shareholder approval is obtained) on or about July 15, 2019.

| 3. | Staff Comment: With respect to the fees and expenses table for the All Cap Fund, we note that the format used for “Other Expenses” is confusing. Please consider whether an alternative presentation would be easier to understand. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 3

□Registrant’s Response: Comment complied with. The Registrant has adjusted the formatting for each of the fees and expenses tables in PEA 108 and specifically, the manner in which “Other Expenses” (and sub-line items) reflected. By way of example, the fees and expenses table for the Segall Bryant & Hamill All Cap Fund is excerpted here:

Shareholder Fees (fees paid directly from your investment) | Retail Class | Institutional Class |

| Annual Account Maintenance Fee (for Retail Class accounts under $750) | $12.00 | – |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | |

| Management Fees | 0.73% | 0.73% |

| Distribution (12b-1) Fees | None | None |

| Other Expenses | 0.46% | 0.31% |

| Shareholder service fee | 0.25% | 0.10% |

| All other expenses | 0.21% | 0.21% |

| Total Annual Fund Operating Expenses | 1.19% | 1.04% |

| Fee Waiver and Expense Reimbursement | (0.20)%(1) | (0.20)%(2) |

Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | 0.99%(1) | 0.84%(2) |

| 4. | Staff Comment: Also with respect to the fees and expenses table for the All Cap Fund, please confirm that no right of recoupment exists for either agreement referenced in footnote 1 or 2; if such a right exists, please add appropriate disclosure summarizing the material terms. |

□Registrant’s Response: Comment complied with. The Registrant confirms that no right of recoupment of waived/reimbursed amounts exists under the proposed fee/waiver letter agreements (reflected in footnotes 1 and 2) between the Adviser and the Registrant with respect to each of the Funds.

| 5. | Staff Comment: Please disclose the Fund’s turnover rate. |

□Registrant’s Response: Comment complied with. PEA 108 will state that, during the most recent fiscal year for each of the Acquired Funds, the portfolio turnover rates were 37% for the Segall Bryant & Hamill All Cap Fund, 59% for the Segall Bryant & Hamill Small Cap Value Fund, 99% for the Segall Bryant & Hamill Emerging Markets Fund, and 111% for the Segall Bryant & Hamill International Small Cap Fund.

| 6. | Staff Comment: With respect to the All Cap Fund, and bearing in mind the name of the Fund, we note that there is an 80% investment policy tied to equity securities of companies of any size. The Registrant further states that this Fund will primarily invest in companies traded on U.S. exchanges with market caps in excess of $1 billion. Similar to how the staff views “global funds,” the staff believes that an “all cap fund” should have significant exposure to issuers with a variety of different market capitalizations. Please confirm your understanding of the issue and revise the strategy disclosure as appropriate. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 4

□Registrant’s Response: As an initial matter, the Registrant notes that the All Cap Fund is already adhering to Rule 35d-1, and that the Fund has undertaken to invest at least 80% of its net assets (including borrowings for investment purposes) in equity securities of companies of any size. The Registrant does not believe that the word “All” in the Fund’s name does not itself implicate Rule 35d-1.

However, to seek to minimize the likelihood of a reasonable investor concluding, based on the All Cap Fund’s name, that the Fund invests in a manner inconsistent with the intended investments, the Registrant will enhance the All Cap Fund’s current principal investment strategy language. In doing so, the Registrant believes that the guidance provided in the Memorandum from Investment Company Institute to SEC Rules Members No. 47-12 et al. (June 4, 2012) pertaining to “global” funds should be applied to the 80% of the Fund’s portfolio subject to Rule 35d-1.

The Registrant will revise the first paragraph of the All Cap Fund’s principal investment strategy language to read as follows:

“Under normal circumstances, the Fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of companies of any size, including small- and mid-capitalization companies. The Fund will primarily invest in common stock of companies traded on US exchanges with market capitalization in excess of $1 billion. The Russell 3000 index is the Fund’s benchmark which represents a broad-based US equity index. The Russell Midcap Index and the Russell 2000 index are indices which include companies with market capitalizations within the mid-cap and small-cap universe. The Fund will, under normal circumstances, invest at least 35% of its net assets in common stock of companies with market capitalizations similar in size to companies within the Russell Midcap index and Russell 2000 index.”

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 5

| 7. | Staff Comment: In the Item 4 and Item 9 disclosure, explain what the Registrant means by “the adviser invests assets opportunistically based on market information and is not constrained by investment style parameters.” |

□Registrant’s Response: “Comment complied with. The Registrant has revised the disclosure in question to state that the “Adviser invests assets opportunistically based on market information, and does not limit its investment analysis approach to value, growth, or core investment styles.”

| 8. | Staff Comment: With respect to the performance tables, please provide a copy of the performance information prior to the effective 485(b) filing. |

□Registrant’s Response: Comment complied with. The excerpted performance information sections from each Fund’s summary prospectus appear inExhibit A hereto.

| 9. | Staff Comment: Briefly explain the difference between the Russell 2000 and the Russell 2000 Value Index from an average market cap and market cap range perspective. |

□Registrant’s Response: The benchmark index for the Small Cap Value Fund is the Russell 2000 Value Index, for which there currently is market capitalization range data in the principal investment strategy disclosure for this Fund. The Registrant does not believe that similar data for the Russell 2000 Index, which is not a primary nor secondary benchmark for the Small Cap Value Fund, would be helpful information for investors.

| 10. | Staff Comment: Please consider adding a reference to market liquidity to your small-cap risk disclosure if appropriate. |

□Registrant’s Response: Comment complied with. In the principal risk disclosure for “Small-Cap Company Risk,” immediately following the sentence stating that “[t]he securities of small-capitalization companies . . . may have lower trading volumes or more erratic trading than securities of larger, more established companies,” the Registrant will add that “[a]s a consequence, such securities may be less liquid than those of larger companies, and the Fund may not always be able to sell such securities at the desired price or time.”

| 11. | Staff Comment: With respect to the All Cap Fund, please revise the disclosure to indicate whether the 80% investment policy is fundamental or may be changed on 60 days’ notice. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 6

□Registrant’s Response: Comment complied with. The Registrant has added the following to the Funds’ Item 9 disclosures (with the Fund-specific disclosures to appear in the respective prospectuses):

“Pursuant to Rule 35d-1 of the Investment Company Act of 1940, certain Segall Bryant & Hamill Funds must notify shareholders with written notice sixty (60) days prior to any change in its investment policy. The following are those Segall Bryant & Hamill Funds and each respective principal investment policy:

Segall Bryant & Hamill All Cap Fund: Under normal circumstances, the Fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of companies of any size, including small- and mid-capitalization companies.

Segall Bryant & Hamill Small Cap Value Fund: Under normal circumstances, the Fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities of small-capitalization companies.

Segall Bryant & Hamill Emerging Markets Fund: Under normal circumstances, the Fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities, primarily common stock, of companies tied economically to emerging markets countries.

Segall Bryant & Hamill International Small Cap Fund:Under normal circumstances, the Fund will invest at least 80% of its net assets (including amounts borrowed for investment purposes) in equity securities, primarily common stock, of small capitalization companies located outside of the United States, including those in emerging markets.”

| 12. | Staff Comment: Please clarify the difference between quantitative analysis and fundamental analysis for investors. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 7

□Registrant’s Response: Comment complied with. The Adviser has revised the sentences in question referring to quantitative analysis and fundamental analysis, with respect to each Fund, such that the sentence now reads as follows:

“Through a combination of quantitative analysis (which may encompass techniques such as evaluation of financial data or statistical/mathematical modeling), fundamental analysis (which may include assessments of a company’s holdings or key characteristics, as well as broader economic factors) and experienced judgment, the Adviser seeks to identify companies that have historically generated, or are positioned to generate, superior returns on investments.”

| 13. | Staff Comment: Likewise in the investment strategy section, please revise the disclosure to address any portfolio construction parameters the adviser follows. It is unclear, for example, how many positions the adviser typically intends to hold and whether it will employ any sort of risk limits with respect to holding size, industries and similar; please revise or advise as appropriate. |

□Registrant’s Response: Except to the extent already described in the principal investment strategy disclosures for each Fund (as modified to reflect the comments herein), the Adviser does not intend to adhere strictly to any predefined limits on the number of holdings or on holdings size.

In acknowledgement of the Staff’s comment, however, and based on information from the Adviser, the Registrant will add the following disclosure to the Small Cap Value Fund’s principal investment strategy language:

“With respect to portfolio structure, the Adviser maintains exposure to most sectors within the benchmark; however, with an active management process, there will be variances in sector exposure relative to the benchmark index. The Adviser maintains guidelines to monitor this variance. The portfolio typically holds between 70 to 85 stocks.”

| 14. | Staff Comment: With respect to the presentation of prior performance, please confirm supplementally that the Fund has the records necessary to support the performance calculations as required by Rule 204-2(a)(16) under the Advisers Act. |

□Registrant’s Response: Comment complied with. Based on information provided by the Adviser, the Registrant confirms that the Funds have the records required by Rule 204-2(a)(16) under the Advisers Act with respect to their predecessor funds’ performance.

| 15. | Staff Comment: With respect to the investment strategy discussion for the Emerging Markets Fund, please disclose how the Registrant intends to value derivatives for purposes of Rule 35d-1 under the Investment Company Act. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 8

□Registrant’s Response: Comment complied with. The Registrant will add the following disclosure to the Funds’ statement of additional information:

“For purposes of assessing compliance with an 80% investment policy (where applicable), the Fund will count certain derivative instruments, such as interest rate swaps, credit default swaps in which the Fund is buying protection, options on swaps, and Eurodollar futures, at market value in aggregating each Fund’s relevant investments providing exposure to the type of investments, industries, countries or geographic regions suggested by the Fund’s name because the exposure provided by these instruments is not equal to the full notional value of the derivative. With regard to other derivatives, such as futures, forwards, total return swaps, and credit default swaps in which the Fund is selling protection, the Fund counts the full notional value of the derivative in aggregating each Fund’s relevant investments providing exposure to the type of investments, industries, countries or geographic regions suggested by the Fund’s name because the Fund’s exposure to the underlying asset is equal to the notional value.”

| 16. | Staff Comment: Please explain why the Registrant includes ETF risk in the Item 4 disclosure; in this respect we note that the Registrant does not include Acquired Fund Fees and Expenses in the fee table nor does the Registrant discuss it in the Fund’s strategy; please revise or advise as appropriate. |

□Registrant’s Response: The Registrant notes that the summary section principal investment strategy disclosures for the Emerging Markets Fund and the International Small Cap Fund do refer to the potential use of ETFs. The Registrant will conform the Item 9 principal investment strategy disclosures of the two Funds to also include such references. Based on information from the Adviser, the Registrant understands that any potential use of ETFs is unlikely to rise to a level that would necessitate an Acquired Fund Fees and Expenses item in the fee table.

| 17. | Staff Comment: With respect to the International Small Cap Fund’s principal risk disclosure, we note that the Fund has an 80% investment policy tied to foreign small-cap companies. As the Fund and the adviser are in the best position to evaluate what risks are material to investors, please consider whether risks associated with small-cap companies should be one of the first risks presented in the disclosure as opposed to one of the last ones. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 9

□Registrant’s Response: The Registrant notes that the principal risk disclosure for the International Small Cap Fund currently appears in alphabetical order in its summary section, and that this is true for the other Funds as well. The Registrant believes this is appropriate, to avoid any potential misunderstanding that the order in which the principal risk items appear are indicative of the magnitude of such risks. The Registrant believes that each of the listed disclosures is a “principal risk” of the respective Fund, and that the relative magnitude of such risks may vary over time and under different circumstances. As a consequence, the Registrant believes that the current presentation of risk disclosures remains appropriate.

| 18. | Staff Comment: With respect to the International Small Cap Fund’s investments, and to the extent those investments will be exposed to Japan’s domestic economy, please consider the need to reference demographic trends there related to aging. |

□Registrant’s Response: Based on information provided by the Adviser, the Registrant will add the following disclosure to the disclosure currently appearing under the heading “Japan Risk”:

“Japan's aging and shrinking population increases the cost of the country's pension and public welfare system and lowers domestic demand, making Japan more dependent on exports to sustain its economy. Therefore, any developments that negatively affect Japan's exports could present risks to a fund's investments in Japan.”

| 19. | Staff Comment: In the Statement of Additional Information (page 4), briefly explain the Funds’ borrowing-related policies. In this respect the reference to 10% is unclear; please revise or advise. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 10

□Registrant’s Response: Comment complied with. The Registrant will revise the disclosure in the statement of additional information pertaining to borrowings to read as follows:

“Each Fund may borrow money from banks to the extent permitted by the Investment Company Act of 1940, as amended (the “1940 Act”), only for short term cash flow purposes, not for investment purposes. Such borrowings may be on a secured or unsecured basis at fixed or variable rates of interest, though each Fund will borrow no more than 10% of net assets. Under Section 18(f) of the 1940 Act, any borrowing exceeding 5% of a Fund’s total assets at the time the evidence of indebtedness is issued will be regarded as a “senior security.” The 1940 Act requires each Fund to maintain continuous asset coverage of not less than 300% with respect to all borrowings that are considered “senior securities” (generally borrowings other than for temporary or emergency purposes). If such asset coverage should decline to less than 300% due to market fluctuations or other reasons, that Fund may be required to dispose of some of its portfolio holdings within three days in order to reduce that Fund’s debt and restore the 300% asset coverage, even though it may be disadvantageous from an investment standpoint to dispose of assets at that time.”

* * * * *

If you have any questions or further comments, please contact Peter Schwartz, counsel to the Registrant, at (303) 892-7381.

| | Very truly yours, |

| | /s/ Derek W. Smith |

| | Derek W. Smith |

| | Secretary |

| | Segall Bryant & Hamill Trust |

| cc: | Peter H. Schwartz, Esq., Davis Graham & Stubbs LLP |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 11

EXHIBIT A

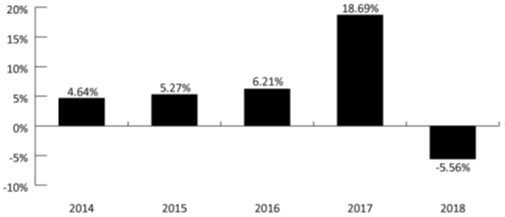

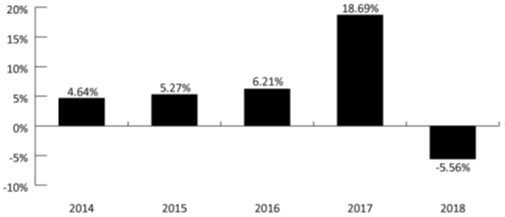

Segall Bryant & Hamill All Cap Fund

Bar Chart and Performance Tables

The IMST Predecessor Fund was also advised by Segall Bryant & Hamill, LLC. Performance results shown for the Institutional Class in the bar chart and the performance table below reflect the performance of the IMST Predecessor Fund. Institutional Class shares’ returns of the Fund will be different from the IMST Predecessor Fund as they have different expenses. The IMST Predecessor’s Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following bar chart and table provide an indication of the risk of investing in the Fund by showing changes in the Predecessor Fund’s performance from year to year, and by showing how the IMST Predecessor Fund’s average annual returns for one year, five years, and since inception for the IMST Predecessor Fund, compared with those of an unmanaged index of securities.

The Retail Class shares of the Fund is anticipated to commence operations on or about July 15, 2019. The Retail Class would have substantially similar annual returns to the Institutional Class because the classes are invested in the same portfolio securities. The Institutional Class’ returns will be higher over the long-term when compared to the Retail Class’ returns to the extent that the Retail Class has higher expenses.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information is available on www.sbhfunds.com or call toll-free (800) 392-2673.

Institutional Class - Calendar Year Total Returns as of December 31 (%)

| Highest Quarterly Return:Quarter Ended 9/30/2018 7.99% | Lowest Quarterly Return:Quarter Ended 12/31/2018 (14.68)% |

The year-to-date return for the Fund as of March 31, 2019, was 13.78%.

Average Annual Total Returns (for the Periods Ended December 31, 2018)

After-tax returns for the Institutional Class are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown only for the Institutional Class, after-tax returns for the Retail Class will be different. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 12

Segall Bryant & Hamill All Cap Fund | 1 Year | 5 Years | Since Inception July 31, 2013 |

| Institutional Class | | | |

| Return Before Taxes | (5.56)% | 5.57% | 6.89% |

| Return After Taxes on Distributions | (6.45)% | 5.10% | 6.44% |

| Return After Taxes on Distributions and Sale of Fund Shares | (2.66)% | 4.31% | 5.38% |

| Russell 3000® Index (reflects no deduction for fees, expenses or taxes) | (5.24)% | 7.91% | 9.37% |

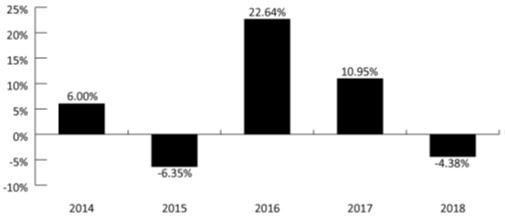

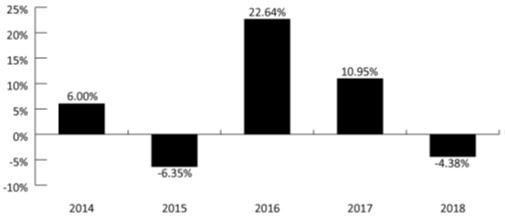

Segall Bryant & Hamill Small Cap Value Fund

Bar Chart and Performance Tables

The Predecessor Fund was also advised by Segall Bryant & Hamill, LLC. Performance results shown for the Institutional Class in the bar chart and the performance table below reflect the performance of the Predecessor Fund. Institutional Class shares’ returns of the Fund will be different from the Predecessor Fund as they have different expenses. The Predecessor’s Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following bar chart and table provide an indication of the risk of investing in the Fund by showing changes in the Predecessor Fund’s performance from year to year, and by showing how the Predecessor Fund’s average annual returns for one year, five years, and since inception for the Predecessor Fund, compared with those of an unmanaged index of securities.

The Retail Class shares of the Fund is anticipated to commence operations on or about July 15, 2019. The Retail Class would have substantially similar annual returns to the Institutional Class because the classes are invested in the same portfolio securities. The Institutional Class’ returns will be higher over the long-term when compared to the Retail Class’ returns to the extent that the Retail Class has higher expenses.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information is available on www.sbhfunds.com or call toll-free (800) 392-2673.

Institutional Class - Calendar Year Total Returns as of December 31 (%)

| Highest Quarterly Return:Quarter Ended 12/31/2016 9.00% | Lowest Quarterly Return:Quarter Ended 12/31/2018 (13.32)% |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 13

The year-to-date return for the Fund as of March 31, 2019 was 14.11%.

Average Annual Total Returns (for the Periods Ended December 31, 2018)

After-tax returns for the Institutional Class are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown only for the Institutional Class, after-tax returns for the Retail Class will be different. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

Segall Bryant & Hamill Small Cap Value Fund | 1 Year | 5 Years | Since Inception (July 31, 2013) |

| Institutional Class | | | |

| Return Before Taxes | (4.38)% | 5.25% | 6.77% |

| Return After Taxes on Distributions | (6.97)% | 3.58% | 5.16% |

| Return After Taxes on Distributions and Sale of Fund Shares | (1.55)% | 3.64% | 4.87% |

| Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | (12.86)% | 3.61% | 5.24% |

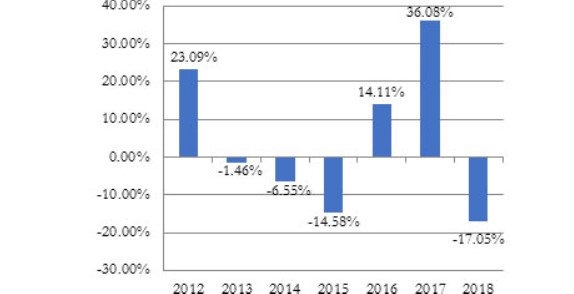

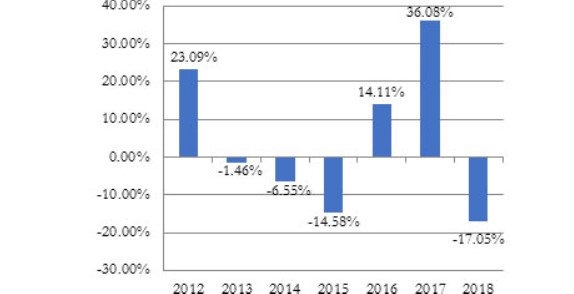

Segall Bryant & Hamill Emerging Markets Fund

Bar Chart and Performance Tables

The IMST Predecessor Fund also advised by Segall Bryant & Hamill, LLC. On October 30, 2015, the IMST Predecessor Fund acquired the assets and liabilities of the Philadelphia Emerging Markets Fund (the “Philadelphia Predecessor Fund”) (together, with the IMST Predecessor Fund, the “Predecessor Funds”).

For periods October 31, 2015 to December 31, 2018, performance results shown in the bar chart and the performance table below for the Fund’s Retail Class shares and Institutional Class shares reflect the performance of the IMST Predecessor Fund. For periods prior to October 30, 2015, performance results shown in the bar chart and the performance table below for the Fund’s Class I shares and Class A shares reflect the performance of the Philadelphia Predecessor Fund’s Class IV shares and Class I shares, respectively.

Performance results shown in the bar chart and the performance table below reflect the performance of the Predecessor Funds. Performance returns of the Fund will be different from the Predecessor Funds as they have different expenses. The Predecessor Funds’ past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following bar chart and table provide an indication of the risk of investing in the Fund by showing changes in the Predecessor Funds’ performance from year to year, and by showing how the Predecessor Funds’ average annual returns for one year, five years, and since inception for the Predecessor Funds, compared with those of an unmanaged index of securities.

The Predecessor Funds’ past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information is available on www.sbhfunds.com or call toll-free (800) 392-2673.

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 14

Institutional Class - Calendar Year Total Returns as of December 31 (%)

| Highest Quarterly Return:Quarter Ended 3/31/2012 16.71% | Lowest Quarterly Return:Quarter Ended 9/30/2015 (17.40)% |

The year-to-date return for the Fund as of March 31, 2019, was 10.90%.

Average Annual Total Returns (for the Periods Ended December 31, 2018)

After-tax returns for the Institutional Class are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown only for the Institutional Class, after-tax returns for the Retail Class will be different. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

SEGALL BRYANT & HAMILL EMERGING MARKETS FUND | 1 Year | 5 Years | Since Inception | Inception Date |

| Institutional Class | | | | |

Return Before Taxes | (17.05)% | 0.56% | (0.12)% | 6/30/11 |

| Return After Taxes on Distributions | (17.42)% | (0.31)% | (0.89)% | 6/30/11 |

| Return After Taxes on Distributions and Sale of Fund Shares | (9.37)% | 0.45% | (0.02)% | 6/30/11 |

Retail Class | (21.94)% | (0.78)% | (1.09)% | 6/30/14* |

| Return Before Taxes | | | | |

| MSCI Emerging Markets Index (reflects no deduction for fees, expenses or taxes) | (14.58)% | 1.65% | 0.14% | 6/30/11 |

| * | Institutional Class (previously known as Class I of the Predecessor Funds) started on June 30, 2011. Retail Class (previously known as Class A of the Predecessor Funds) started on June 30, 2014. The performance figures for Retail Class include the performance for Institutional Class for the periods prior to the start date of Retail Class, adjusted for the difference in Retail Class and Institutional Class expenses. Retail Class imposes higher expenses than Institutional Class. |

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 15

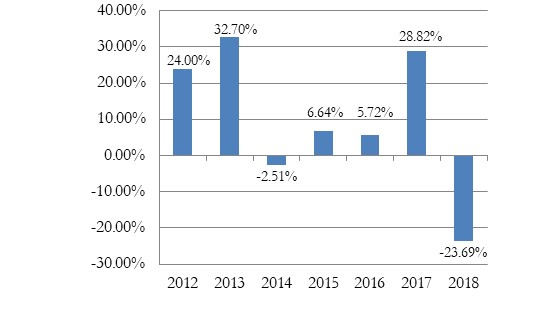

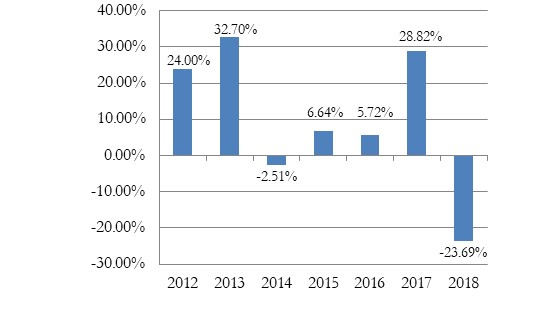

Segall Bryant & Hamill International Small Cap Fund

Bar Chart and Performance Tables

The IMST International Small Cap Predecessor Fund was also advised by Segall Bryant & Hamill, LLC. On October 30, 2015, the IMST International Small Cap Predecessor Fund acquired the assets and liabilities of the Philadelphia International Small Cap Fund (the “Philadelphia International Small Cap Predecessor Fund”) (together, with the IMST International Small Cap Predecessor Fund, the “Predecessor Funds”).

For periods October 31, 2015 to December 31, 2018, performance results shown in the bar chart and the performance table below for the Fund’s Retail Class shares and Institutional Class shares reflect the performance of the IMST International Small Cap Predecessor Fund. For periods prior to October 30, 2015, performance results shown in the bar chart and the performance table below for the Fund’s Class I shares and Class A shares reflect the performance of the Philadelphia International Small Cap Predecessor Fund’s Class IV shares and Class I shares, respectively.

Performance results shown in the bar chart and the performance table below reflect the performance of the Predecessor Funds. Performance returns of the Fund will be different from the Predecessor Funds as they have different expenses. The Predecessor Funds’ past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

The following bar chart and table provide an indication of the risk of investing in the Fund by showing changes in the Predecessor Funds’ performance from year to year, and by showing how the Predecessor Funds’ average annual returns for one year, five years, and since inception for the Predecessor Funds, compared with those of an unmanaged index of securities.

The following bar chart and table provide an indication of the risk of investing in the Fund by showing changes in the Fund’s Retail Class performance from year to year, and by showing how the Fund’s average annual returns for one year, five years, and ten years for the Retail Class and one year, five years, and ten years for the Institutional Class, compared with those of an unmanaged index of securities. The Predecessor Funds’ past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information is available on www.sbhfunds.com or call toll-free (800) 392-2673.

Institutional Class - Calendar Year Total Returns as of December 31 (%)

| Highest Quarterly Return:Quarter Ended 3/31/2012 16.13% | Lowest Quarterly Return:Quarter Ended 12/31/2018 (17.35)% |

The year-to-date return for the Fund as of March 31, 2019, was 8.24%.

Average Annual Total Returns (for the Periods Ended December 31, 2018)

U.S. Securities and Exchange Commission

Division of Investment Management

May 3, 2019

Page 16

After-tax returns for the Institutional Class are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are shown only for the Institutional Class, after-tax returns for the Retail Class will be different. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

SEGALL BRYANT & HAMILL INTERNATIONAL SMALL CAP FUND | 1 Year | 5 Years | Since Inception | Inception Date |

Institutional Class | (23.69)% | 1.56% | 4.71% | 5/31/11 |

| Return Before Taxes | | | | |

| Return After Taxes on Distributions | (23.91)% | 0.64% | 3.76% | 5/31/11 |

| Return After Taxes on Distributions and Sale of Fund Shares | (13.41)% | 1.23% | 3.69% | 5/31/11 |

Retail Class | (28.34)% | 0.12% | 3.64% | 6/30/14* |

| Return Before Taxes | | | | |

| MSCI EAFE Small Cap Index (reflects no deduction for fees, expenses or taxes) | (17.89)% | 3.06% | 4.88% | 5/31/11 |

| * | Institutional Class (previously known as Class I of the Predecessor Funds) started on June 30, 2011. Retail Class (previously known as Class A of the Predecessor Funds) started on May 31, 2011. The performance figures for Retail Class include the performance for Institutional Class for the periods prior to the start date of Retail Class, adjusted for the difference in Retail Class and Institutional Class expenses. Retail Class imposes higher expenses than Institutional Class. |