As filed with the Securities and Exchange Commission on October 19, 2023

Registration No. 333-274559

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. 2

Post-Effective Amendment No. __

SEGALL BRYANT & HAMILL TRUST

(Exact name of Registrant as Specified in Charter)

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number: (513) 587-3400

Maggie Bull, Secretary

Segall Bryant & Hamill Trust

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(Name and Address of Agent for Service)

With copies to:

Peter H. Schwartz, Esq.

Davis Graham & Stubbs LLP

1550 17th Street, Suite 500

Denver, CO 80202

Title of Securities Being Registered: Barrett Growth Fund, a series of the Registrant.

No filing fee is required because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares.

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or days as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that the Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

COMBINED PROXY STATEMENT AND PROSPECTUS

CONTENTS OF REGISTRATION STATEMENT

Cover Sheet

Contents of Registration Statement

Part A — Proxy Statement/Prospectus

Part B — Statement of Additional Information

Part C — Other Information

Signature Page

Exhibits

Barrett Growth Fund

(Ticker Symbol: BGRWX)

a Series of Trust for Professional Managers

c/o U.S. Bank Global Fund Services

P. O. Box 701

Milwaukee, Wisconsin 53201-0701

(877) 363-6333

October 19, 2023

Dear Shareholder:

We are sending this information to you because you are a shareholder of the Barrett Growth Fund (the “Existing Fund”), a series of Trust for Professional Managers (“TPM”). At the request of Barrett Asset Management, LLC, the Existing Fund’s investment adviser (“Barrett”), and after careful consideration and analysis, the Board of Trustees of TPM approved the reorganization (the “Reorganization”) of the Existing Fund into an identically named, newly created series (the “New Fund”) of Segall Bryant & Hamill Trust (“SBHT”), subject to the approval of the shareholders of the Existing Fund.

The proposed Reorganization will not result in any material changes to the Existing Fund’s investment objective or principal investment strategies or fundamental investment restrictions. The portfolio managers will continue to be the same for the New Fund, although the investment adviser will be Segall Bryant & Hamill, LLC (the “New Adviser”), an affiliate of Barrett, which are both wholly owned subsidiaries of CI Financial Corp. through its Corient Holdings Inc entity.

A Special Meeting of Shareholders (“Special Meeting”) of the Existing Fund is to be held at 1:00 p.m. eastern standard time on November 8, 2023, at the offices of Barrett, located at 90 Park Ave., New York, NY 10016, where shareholders of the Existing Fund will be asked to vote on the Reorganization of the Existing Fund into the New Fund. A Combined Proxy Statement and Prospectus (the “Proxy Statement”) regarding the Special Meeting, a proxy card for your vote at the Special Meeting, and a postage-prepaid envelope in which to return your proxy card are enclosed.

As explained in the enclosed Proxy Statement, upon satisfaction of the conditions set forth in the Agreement and Plan of Reorganization (“Reorganization Plan”), your current shares in the Existing Fund will be exchanged for shares of the New Fund at the closing of the Reorganization. If the parties comply with the terms of the Reorganization Plan and supply appropriate representation letters, the exchange is expected to qualify as a tax-free reorganization under federal income tax laws. You may purchase and redeem shares of the Existing Fund in the ordinary course until the last business day before the closing. Purchase and redemption requests received after that time will be treated as purchase and redemption requests for shares of the New Fund received in connection with the Reorganization. No sales loads, commissions or other transactional fees will be imposed on shareholders in connection with the Reorganization. Barrett or its successor will pay all expenses related to the Reorganization.

Shareholders of the Existing Fund will vote on the Reorganization into the New Fund. If shareholders of the Existing Fund approve the Reorganization and certain other closing conditions are met, the Reorganization is expected to take effect immediately prior to the open of business (8:00 a.m. eastern standard Time) on or about November 20, 2023. At that time, the shares of the Existing Fund that you currently own will, in effect, be exchanged for shares of the New Fund. The Reorganization is expected to be a tax-free reorganization under Section 368(a)(1)(F) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, no gain or loss is expected to be recognized by the Existing Fund shareholders, the Existing Fund or the New Fund as a direct result of the Reorganization. Shares in the New Fund will have the same aggregate net asset value as that of your Existing Fund shares at the time of the Reorganization. Shares will be exchanged as follows:

| Trust for Professional Managers | | Segall Bryant & Hamill Trust |

| Barrett Growth Fund | → | Barrett Growth Fund |

| | | |

The Board of Trustees of Trust for Professional Managers has unanimously approved the proposed Reorganization and recommends that you read the enclosed materials carefully and then vote “FOR” the proposals.

More information on the New Fund, the reasons for the proposed Reorganization and projected benefits of the Reorganization are contained in the enclosed Proxy Statement. You should review the Proxy Statement carefully and retain it for future reference. Shareholder approval is required to effect the Reorganization.

If you have questions, please contact the Existing Fund at 1-877-363-6333.

Sincerely,

John Buckel

President

Trust for Professional Managers

TRUST FOR PROFESSIONAL MANAGERS

Barrett Growth Fund

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

(877) 363-6333

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 8, 2023

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (“Special Meeting”) of the Barrett Growth Fund (the “Existing Fund”) is to be held at 1:00 p.m. eastern standard time on November 8, 2023, at the offices of Barrett Asset Management (“Barrett”), located at 90 Park Ave., New York, NY 10016 for the following purposes:

At the Special Meeting, shareholders of the Existing Fund will be asked to vote on the following proposals with respect to the Existing Fund:

| | (i) | To approve an Agreement and Plan of Reorganization (“Reorganization Plan”) by and among Trust for Professional Managers (“TPM”), on behalf of its series the Barrett Growth Fund; Segall Bryant & Hamill Trust (“SBHT”), on behalf of its identically-named series (“New Fund”); Segall Bryant & Hamill, LLC (“New Adviser”); and Barrett; and |

| | | |

| | (ii) | To approve one or more adjournments of the Special Meeting to a later date to solicit additional proxies. |

| | | |

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof. Shareholders of record of the shares of beneficial interest in the Existing Fund as of the close of business on September 18, 2023, are entitled to vote on the Reorganization of the Existing Fund at the Special Meeting or any adjournments or postponements thereof. If the necessary quorum to transact business is not obtained at the Special Meeting or if a quorum is obtained, but sufficient votes required to approve the Reorganization Plan are not obtained, the persons named as proxies on the enclosed proxy card may propose one or more adjournments or postponements of the Special Meeting to permit, in accordance with applicable law, further solicitation of proxies with respect to the proposal. The Special Meeting may be held as adjourned or postponed within a reasonable time after the date set for the original meeting without further notice and in accordance with applicable law. The persons designated as proxies may use their discretionary authority to vote on questions of adjournment and on any other proposals raised at the Special Meeting to the extent permitted by the proxy rules of the SEC, including proposals for which timely notice was not received, as set forth in the SEC’s proxy rules.

By order of the Board of Trustees of TPM,

John Buckel

President

Trust for Professional Managers

October 19, 2023

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be held on November 8, 2023 or any adjournment or postponement thereof. This Notice and Combined Proxy Statement and Prospectus are available on the internet at https://www.barrettasset.com/barrettmutual. On this website, you will be able to access this Notice, the Combined Proxy Statement and Prospectus, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

IMPORTANT — We urge you to sign and date the enclosed proxy card and return it in the enclosed addressed envelope, which requires no postage and is intended for your convenience. You also may vote in person at the time and at the address indicated on your proxy card; through the internet, by visiting the website address on your proxy card; or by telephone, by using the toll-free number on your proxy card. Your prompt vote may save the Existing Fund the necessity of further solicitations to ensure a quorum at the Special Meeting.

PLEASE VOTE THE ENCLOSED PROXY BALLOT CARD.

YOUR VOTE IS VERY IMPORTANT!

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and will avoid the time and expense in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Each party must sign the proxy card. Each party should sign exactly as shown in the registration on the proxy card. |

| 3. | All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

Registration Valid Signature

| | Corporate Accounts | |

| | | |

| (1) | ABC Corp. | ABC Corp. |

| | | |

| (2) | ABC Corp. | John Doe, Treasurer |

| | | |

| (3) | ABC Corp.

c/o John Doe, Treasurer | John Doe |

| | | |

| (4) | ABC Corp. Profit Sharing Plan John Doe, Trustee |

| | |

| | Trust Accounts | |

| | | |

| (1) | ABC Trust | Jane B. Doe, Trustee |

| | | |

| (2) | Jane B. Doe, Trustee

u/t/d 12/28/78 | Jane B. Doe |

| | | |

| | Custodial or Estate Accounts | |

| | | |

| (1) | John B. Smith, Cust.

f/b/o John B. Smith, Jr. UGMA John B. Smith |

| | | |

| (2) | Estate of John B. Smith | John B. Smith, Jr., Executor |

| | | |

Trust for Professional Managers

Barrett Growth Fund

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

(877) 363-6333

QUESTIONS & ANSWERS

YOUR VOTE IS VERY IMPORTANT!

Dated: October 18, 2023

Question: What is this document and why did you send it to me?

Answer: The attached document is a proxy statement for the Barrett Growth Fund (the “Existing Fund”), and a prospectus for shares of the identically named, newly-created series (the “New Fund”) of Segall Bryant & Hamill Trust (“SBHT”). The purpose of this Combined Proxy Statement and Prospectus (“Proxy Statement”) is to solicit votes from shareholders of the Existing Fund to approve the proposed reorganization of the Existing Fund into the New Fund (the “Reorganization”) as described in the Agreement and Plan of Reorganization (the “Reorganization Plan”) by and among Trust for Professional Managers (“TPM”), on behalf of the Existing Fund; SBHT, on behalf of the New Fund; Segall Bryant & Hamill, LLC, the investment adviser for the New Fund (the “New Adviser”); and Barrett Asset Management, LLC (“Barrett”).

The Proxy Statement contains information that shareholders of the Existing Fund should know before voting on the Reorganization. The Proxy Statement should be reviewed and retained for future reference.

Question: What is the purpose of the Reorganization?

Answer: The primary purpose of the Reorganization is to move your Existing Fund from its existing trust to another trust – SBHT – which the New Adviser, an affiliate of Barrett, the investment adviser to the Existing Fund, believes will allow the New Fund to lower total net annual fund operating expenses (after fee waivers and reimbursements) as compared to the Existing Fund. Following the Reorganization, the portfolio managers of the Existing Fund, who are currently employed by both Barrett and Corient Holdings Inc which are both wholly owned affiliates of CI Financial Corp. (“CI Financial”), will become employees of the New Adviser while remaining employees of Corient Holdings Inc and they will continue to manage the New Fund.

CI Financial, the parent company of both Barrett and the New Adviser, is in the process of restructuring its U.S. affiliated investment advisory businesses. As part of that process, CI Financial is seeking to consolidate the mutual fund businesses of its affiliated advisers to the New Adviser to ease the burden of many smaller advisers having to comply with the enhanced compliance and other regulatory requirements specific to investment advisers to registered investment companies. CI Financial and Barrett also believe that the proposed Reorganization would provide the Existing Fund with the ability to experience economies of scale by being included in a suite of funds with the same service providers. In light of CI Financial’s restructuring and the possible economies of scale that could be realized by the Existing Fund if the Reorganization was approved, CI Financial and Barrett proposed the Reorganization to the Board of Directors of the Existing Fund.

Following the Reorganization, third-party service providers for the New Funds will be: Ultimus Fund Solutions, LLC (accounting, co-administrative, transfer agency, dividend disbursing agency, and shareholder servicing agency) (“Ultimus”); Ultimus Fund Distributors, LLC (“Distributor”); Brown Brothers Harriman, will serve as the New Fund’s custodian (“Custodian”); Cohen & Company Ltd., (independent registered public accounting firm) (“Cohen”); and Davis Graham & Stubbs LLP (counsel to SBHT and the independent trustees of SBHT). In addition,

the New Fund will be overseen by a different Board of Trustees and will have different officers, including a new President, Secretary, Treasurer, Assistant Treasurer, and Chief Compliance Officer.

The New Adviser believes that, following the Reorganization, the New Fund’s net total annual expense ratio (after fee waivers and expense reimbursements) will be lower than the Existing Fund’s current net total annual expense ratio (after fee waivers and expense reimbursements). In addition, the New Adviser believes that the net total operating expenses of the New Fund (before fee waivers and expense reimbursements) will be lower than those of the Existing Fund. As a result, the amount that the New Adviser will be required to waive and/or reimburse would be reduced.

Barrett, the New Adviser, and the Board of Trustees of TPM each recommends that the Existing Fund be reorganized as a series of SBHT.

Question: How will the Reorganization work?

Answer: To reorganize the Existing Fund into SBHT, a new fund with substantially the same investment objective and investment strategies as the Existing Fund has been created as a new series of SBHT. If shareholders of the Existing Fund approve the Reorganization Plan, the Existing Fund will transfer all of its assets to the New Fund in exchange for shares of the New Fund and the New Fund’s assumption of all of the Existing Fund’s liabilities. The New Fund will issue to the Existing Fund shares of the New Fund with an aggregate net asset value (“NAV”) equal to the aggregate value of the assets that it receives from the Existing Fund, less the liabilities it assumes from the Existing Fund (the “Reorganization Shares”). The Reorganization Shares will be distributed to the shareholders of the Existing Fund (in liquidation of such Existing Fund). After the Reorganization is complete, shareholders of the Existing Fund will be shareholders of the New Fund, and the Existing Fund will wind down its business and affairs and will be dissolved.

Please refer to the Proxy Statement for a detailed explanation of the proposal. If the Reorganization Plan is approved by shareholders of the Existing Fund at the Special Meeting of Shareholders to be held at 1:00 pm eastern time on November 8, 2023, at the offices of Barrett Asset Management, located at 90 Park Avenue, New York, NY 10016 (“Special Meeting”), the Reorganization presently is expected to be effective immediately prior to the open of business (8:00 a.m. eastern standard time) on or about November 20, 2023 (“Effective Time”).

Question: How will the Reorganization affect me as a shareholder?

Answer: If you are a shareholder of the Existing Fund, you will become a shareholder of the New Fund. The New Fund shares that you receive immediately following the Reorganization will have a total NAV equal to the total NAV of the shares you held in the Existing Fund as of the Effective Time. The Reorganization will not affect the value of your investment at the time of the Reorganization. The Reorganization is expected to be tax-free to the Existing Fund and its shareholders. It is expected that your aggregate tax basis in the Existing Fund shares will carry over to your New Fund shares, and the holding period for such New Fund shares will include the holding period for the shareholder’s Existing Fund shares provided that you held such Existing Fund shares as capital assets. It is expected that the taxable year of the Existing Fund will not end on the date of the Reorganization merely because of the closing of the Reorganization.

The New Fund’s investment adviser will be a different investment adviser from that of the Existing Fund, however the portfolio managers responsible for managing the Existing Fund will continue to manage the New Fund following the Reorganization. The investment objective and principal investment strategies of the New Fund will be substantially the same as the investment objective and principal investment strategies of the Existing Fund.

The Reorganization will affect certain service providers to the Existing Fund as follows:

| Service Providers | | Existing Fund | | New Fund |

| Investment Adviser | | Barrett Asset Management, LLC | | Segall Bryant & Hamill, LLC |

| Distributor & Principal Underwriter | | Quasar Distributors, LLC | | Ultimus Fund Distributors, LLC |

| Custodian | | U.S. Bank n.a. | | Brown Brothers Harriman |

| Transfer Agent, Fund Accountant & Fund Administrator | | U.S. Bancorp Fund Services, LLC | | Ultimus Fund Solutions, LLC |

| Co-Administrator | | N/A | | Segall Bryant & Hamill, LLC |

| Independent Registered Public Accounting Firm | | Cohen & Company, Ltd. | | Cohen & Company, Ltd. |

The Reorganization will move the assets of the Existing Fund from TPM, a Delaware statutory trust, to the New Fund, a series of SBHT, a Massachusetts business trust. Following the Reorganization, the New Fund will operate under the supervision of a different Board of Trustees. TPM is governed by a declaration of trust and by-laws. SBHT is governed by a declaration of trust and code of regulations. The differences between the organizational documents of each of TPM and SBHT are immaterial with respect to operation of the Funds. The most significant difference between the two Trusts is that each is overseen by a different Board and will have different officers, including a new President, Secretary, Treasurer, Assistant Treasurer, and Chief Compliance Officer. More discussion on Delaware statutory trusts and Massachusetts business trusts is below under “Form of Organization” in the Proxy Statement.

Question: Who will manage the New Fund?

Answer: Segall Bryant & Hamill, LLC will be the investment adviser and responsible for overseeing the management of the New Fund. The New Adviser is an affiliate of Barrett Asset Management, LLC, the investment adviser to the Existing Fund, both of which are wholly owned subsidiaries of CI Financial. As a result of a corporate restructuring by CI Financial, Barrett Asset Management will be dissolved following the Reorganization and the portfolio managers of the Existing Fund will become employees of the New Adviser and CI Financial.

Question: How will the Reorganization affect the fees and expenses I pay as a shareholder of the Existing Fund?

Answer: The Existing Fund’s advisory fee is 1.00% of the Existing Fund’s average daily net assets. The New Fund’s advisory fee is 0.65% of the New Fund’s average daily net assets. While the Existing Fund has a 0.25% Rule 12b-1 Plan fee, the New Fund does not have a Rule 12b-1 Plan; however, the New Fund has a Shareholder Services Plan pursuant to which the New Fund pays a 0.25% fee for shareholder services. The New Fund pays its proportionate share (based on the New Fund’s average daily net assets) of an annual fee of 0.01% of SBHT’s average daily net assets, payable to the New Adviser for co-administration services the New Adviser provides to SBHT. It is anticipated that following the Reorganization, the New Fund’s other expenses (including the co-administration fee but excluding the shareholder servicing fee) will be lower than the Existing Fund’s other expenses. It is anticipated that the total annual operating expenses of the New Fund (before fee waivers and expense reimbursements) will be lower than those of the Existing Fund. It is anticipated that, following the Reorganization, the New Fund’s net total annual operating expense ratio (after fee waivers and expense reimbursements) will also be lower than the Existing Fund’s current net total annual operating expense ratio (after fee waivers and expense reimbursements) as a result of the New Adviser’s contractual obligation to cap the New Fund’s expenses at a lower ratio. As a result, the amount that the New Adviser will be required to waive and/or reimburse would be reduced. No sales loads, commissions or other transactional fees will be imposed on shareholders in connection with the Reorganization. Barrett or its successor will pay all expenses related to the Reorganization.

The New Adviser has contractually agreed, pursuant to an Expense Limitation Agreement, to reduce its fees and/or absorb expenses of the New Fund through at least November 30, 2025 to ensure that the total net annual fund operating expenses after fee waiver and/or reimbursement (exclusive of acquired fund fees and expenses, taxes, brokerage expenses, class action claim fees, tax reclaim fees, and extraordinary expenses) do not exceed 0.99% of the New Fund’s average daily net assets. Following the Reorganization, the New Adviser will not be able to recoup expenses waived by Barrett prior to the date of the Reorganization. After the expiration of the Expense Limitation Agreement, the New Fund’s total annual fund operating expenses paid by the shareholders may increase.

Question: Will the Reorganization result in any federal income taxes?

Answer: Neither the Existing Fund nor its shareholders are expected to recognize any gain or loss for federal income tax purposes as a direct result of the Reorganization. If the parties comply with the terms of each applicable Reorganization Plan and supply appropriate representation letters, TPM and SBHT will receive an opinion, based upon, and subject to, the accuracy of the representation letters and based upon certain assumptions and subject to certain qualifications, that the Reorganization is a tax-free reorganization under federal income tax laws. Shareholders should consult their tax advisors about the effect of the Reorganization on their federal income taxes in light of their individual circumstances and the possible state and local tax consequences of the Reorganization, if any, because the information about tax consequences in this document relates to the federal income tax consequences of the Reorganization only.

Question: Will I be charged a sales charge or contingent deferred sales charge (CDSC) as a result of the Reorganization?

Answer: No sales loads, commissions or other transactional fees will be imposed on shareholders in connection with the Reorganization.

Question: Why do I need to vote?

Answer: Your vote is needed to ensure that a quorum and sufficient votes are present at the Special Meeting so that the proposal to approve the Reorganization Plan can be acted upon. Your immediate response on the enclosed Proxy Card will help prevent the need for any further solicitations for a shareholder vote. Your vote is very important to us regardless of the number of shares you own.

Question: Who is paying for expenses related to the Reorganization?

Answer: Barrett or its successor will pay all expenses related to the Reorganization.

Question: What will happen if the Reorganization Plan is not approved by shareholders?

Answer: If shareholders of the Existing Fund do not approve the Reorganization Plan, the Reorganization of such Fund will not take effect and the Board of Trustees of TPM will consider what action it deems would be in the best interests of the Existing Fund and its shareholders, including the possibility of liquidating the Existing Fund.

Question: How do I vote my shares?

Answer: You can vote your shares by mail, telephone or internet by following the instructions on the enclosed proxy card. You may also vote your shares in person by personally attending the Special Meeting at 1:00 pm eastern time on November 8, 2023 at the offices of Barrett Asset Management, located at 90 Park Avenue, New York, NY 10016.

Question: Who do I call if I have questions?

Answer: If you have any questions about the Reorganization, Reorganization Plan, this Proxy Statement or the proxy card, please do not hesitate to call the Existing Fund at 1-877-363-6333 or Broadridge at 1-833-501-4708. Broadridge representatives are available to answer your call Monday through Friday, 9:00 a.m. to 10:00 p.m. eastern time.

COMBINED PROXY STATEMENT/PROSPECTUS

October 19, 2023

FOR THE REORGANIZATION OF

Barrett Growth Fund

(a series of Trust for Professional Managers)

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

(877) 363-6333

IN EXCHANGE FOR SHARES OF

Barrett Growth Fund

(a series of Segall Bryant & Hamill Trust)

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(800) 392-2673

This Combined Proxy Statement and Prospectus (“Proxy Statement”) is a proxy statement for the Existing Fund (as defined below) and a prospectus for the New Fund (as defined below). This Proxy Statement contains information you should know before voting on the following proposals with respect to the Existing Fund, as indicated below. Please read this Proxy Statement and keep it for future reference.

| | Proposal 1 | To approve an Agreement and Plan of Reorganization (“Reorganization Plan”) by and among Trust for Professional Managers (“TPM”), on behalf of its series the Barrett Growth Fund (“Existing Fund”); Segall Bryant & Hamill Trust (“SBHT”), on behalf of its identically-named series (“New Fund”); Segall Bryant & Hamill, LLC (“New Adviser”); and Barrett Asset Management, LLC (“Barrett”); and |

| | | |

| | Proposal 2 | To approve any adjournments of the Special Meeting from time to time to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to constitute a quorum or to approve Proposal 1. |

| | | |

Those present and the appointed proxies also will transact such other business, if any, as may properly come before the Special Meeting or any adjournments or postponements thereof.

Under the Reorganization Plan, the Existing Fund will transfer all of its assets to the New Fund in exchange for shares of the New Fund and the assumption by the New Fund of all of the liabilities of the Existing Fund. Shares of the New Fund will be distributed proportionately to shareholders of the Existing Fund (“Reorganization”).

The Proposals will be considered at a special meeting of shareholders (“Special Meeting”) to be held at the offices of Barrett Asset Management, located at 90 Park Avenue, New York, NY 10016 on November 8, 2023 at 1:00 p.m. eastern standard time.

TPM is an open-end management investment company organized as a Delaware statutory trust. Segall Bryant & Hamill Trust is an open-end management investment company organized as a Massachusetts business trust. Segall Bryant & Hamill, LLC is the investment adviser for the New Fund and will be responsible for providing investment advisory and portfolio management services to the New Fund following the completion of the Reorganization.

If you need additional free copies of this Proxy Statement, please contact the Existing Fund at 877-363-6333 or in writing at 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202. Additional copies of this Proxy Statement will be delivered to you promptly upon request. For a free copy of the Existing Fund’s annual report for the fiscal

year ended May 31, 2023 please contact the Existing Fund at 877-363-6333 or in writing at 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202.

How the Reorganization Will Work:

| | ● | The Existing Fund will transfer all of its assets to the New Fund in exchange for shares of the New Fund (“Reorganization Shares”) and the assumption by the New Fund of all of the Existing Fund’s liabilities. |

| | | |

| | ● | The New Fund will issue Reorganization Shares with an aggregate net asset value (“NAV”) equal to the aggregate value of the assets that it receives from the Existing Fund, less the liabilities it assumes from the Existing Fund. The Reorganization Shares will be distributed to the shareholders of the Existing Fund (in liquidation of such Existing Fund). |

| | | |

| | ● | After the Reorganization is complete, shareholders of the Existing Fund will be shareholders of the New Fund, and the Existing Fund will wind down its business and affairs and will be dissolved. |

| | | |

The Board of Trustees of TPM (the “TPM Board” or “Board”) considered the proposed Reorganization, and, after careful consideration, the Board approved the Reorganization. A copy of the form of the Reorganization Plan is attached to this Proxy Statement as Appendix A. As further described later in this Proxy Statement, the Reorganization Plan is required to be approved by a majority of the shares (as defined under the Investment Company Act of 1940 (the “1940 Act”)) represented at the Special Meeting, either in person or by proxy. Accordingly, shareholders of the Existing Fund are being asked to vote on and approve the Reorganization Plan.

The Existing Fund’s Prospectus dated September 28, 2023 and Annual Report to Shareholders for the fiscal year ended May 31, 2023 containing audited financial statements, have been previously delivered to shareholders. Copies of these documents are available upon request and without charge by writing to TPM at 615 East Michigan Street, 3rd Floor, Milwaukee, WI 53202, through the Internet at www.barrettasset.com/barrettmutual or by calling 877-363-6333.

The following documents have been filed with the U.S. Securities and Exchange Commission (the “SEC”) and are incorporated by reference in this Proxy Statement:

| | ● | The Prospectus and Statement of Additional Information for the Existing Fund dated September 28, 2023 are incorporated by reference to Post-Effective Amendment No. 841 to TPM’s Registration Statement on Form N-1A (File No. 811-10401), filed with the SEC on September 22, 2023. |

| | | |

| | ● | The Report of the Independent Registered Public Accounting Firm for and audited financial statements of the Existing Fund is incorporated by reference to the Annual Report of the Existing Fund for the fiscal year ended May 31, 2023, filed on Form N-CSR (File No. 811-10401) with the SEC on August 3, 2023. |

| | | |

| | ● | The Prospectus and Statement of Additional Information for the New Fund dated October 19, 2023 , are incorporated by reference to Post-Effective Amendment No. 145 to SBHT’s Registration Statement on Form N-1A (File No. 811-03373), filed with the SEC on October 19, 2023. |

| | | |

This Proxy Statement will be mailed on or about October 20, 2023 to shareholders of record of the Existing Fund as of September 18, 2023 (“Record Date”).

Copies of these materials and other information about SBHT, the Existing Fund and the New Fund are available upon request and without charge by writing to the appropriate address below or by calling the telephone numbers listed as follows:

| For inquiries regarding the Existing Fund: | For inquiries regarding the New Fund: |

| | |

| Barrett Growth Fund | Barrett Growth Fund |

| | |

c/o

U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

(877) 363-6333

www.barretasset.com/barrettmutual | c/o

Ultimus Fund Solutions

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(800) 392-2673

www.sbhfunds.com |

| | |

Shareholder approval is required to effect the Reorganization. The Special Meeting is scheduled for November 8, 2023. If you are unable to attend the Special Meeting, please complete and return the enclosed Proxy Card by November 1, 2023.

The Board of Trustees of TPM has unanimously approved the Proposals and recommends shareholders of the Existing Fund approve the Proposals.

The SEC has not approved or disapproved the New Fund’s shares to be issued in the Reorganization nor has it passed on the accuracy or adequacy of this Proxy Statement. Any representation to the contrary is a criminal offense.

_____________________________________

Table of Contents

| SUMMARY | | 1 |

| REORGANIZATION PROPOSAL | | 1 |

| INFORMATION ABOUT THE REORGANIZATION | | 8 |

| Reasons for the Reorganization | | 8 |

| Board Considerations | | 8 |

| Reorganization Plan | | 9 |

| Costs and Expenses of the Reorganization | | 10 |

| Federal Income Tax Consequences | | 10 |

| ADDITIONAL INFORMATION ABOUT THE REORGANIZATION | | 12 |

| Investment Advisers | | 12 |

| Investment Advisory Agreement | | 12 |

| Fund Management | | 13 |

| ADJOURNMENT PROPOSAL | | 14 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | | 14 |

| Shareholder Information | | 14 |

| Description of the Securities to be Issued; Rights of Shareholders | | 14 |

| Trustees and Officers | | 15 |

| Other Fund Service Providers | | 18 |

| VOTING INFORMATION | | 18 |

| OTHER MATTERS | | 20 |

| LEGAL MATTERS | | 21 |

| EXPERTS | | 21 |

| | | |

| Appendix A | | A-1 |

| Appendix B | | B-1 |

| Appendix C | | C-1 |

SUMMARY

This Proxy Statement is being used by the Existing Fund to solicit proxies to vote at the Special Meeting and any adjournments or postponements thereof. The following is a summary of more complete information appearing later in this Proxy Statement or incorporated herein. You should read carefully the entire Proxy Statement, including the Reorganization Plan for the Existing Fund, the form of which is attached as Appendix A, because it contains details that are not in the summary.

Under the Reorganization Plan, the Existing Fund would be reorganized into a newly created series of SBHT. The New Fund was created solely for the purpose of acquiring and carrying on the business of the Existing Fund and will not engage in any operations prior to the Reorganization other than in connection with organizational activities. If shareholders of the Existing Fund approve the Reorganization Plan, the Existing Fund will transfer all of its assets to the New Fund in exchange for shares of such New Fund and such New Fund’s assumption of the Existing Fund’s liabilities. The Reorganization Plan further provides that shares of the New Fund will then be distributed to the shareholders of the Existing Fund. The Reorganization, if approved by shareholders, is expected to take place immediately prior to the open of business (8:00 a.m. eastern standard time) on or about November 20, 2023, although that date may be adjusted in accordance with the terms of the Reorganization Plan.

The Reorganization is expected to qualify as a tax-free reorganization for federal income tax purposes under Section 368(a)(1)(F) of the Code. For information on the tax consequences of the Reorganization, see the section titled “Information about the Reorganization – Federal Income Tax Consequences” in this Proxy Statement.

The TPM Board has fixed the close of business on September 18, 2023 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Special Meeting and any adjournments and postponements thereof. In considering whether to approve the Reorganization, you should review the information in this Proxy Statement.

PROPOSAL 1: REORGANIZATION PROPOSAL

Comparison of the Existing Fund’s and the New Fund’s Principal Risks, Investment Objectives and Principal Investment Strategies.

The Existing Fund and the New Fund have identical investment objectives and principal investment risks and substantially the same principal investment strategies, which are presented below. The New Fund has been created as a new series of SBHT solely for the purpose of acquiring the Existing Fund’s assets and continuing its investment business and will not conduct any investment operations until after the closing of the Reorganization. For a comparison of the Existing Fund’s and the New Fund’s fundamental investment limitations, please see the section “Additional Information about the Existing Fund and the New Fund—Comparison of Investment Limitations,” below.

Principal Risks

A discussion regarding the principal risks of investing in the Existing Fund and the New Fund is set forth below. The Existing Fund’s and New Fund’s principal risks are identical.

| Existing Fund | | New Fund |

| Management Risk. Investment strategies employed by the Adviser in selecting investments for the Fund may not result in an increase in the value of your investment or in overall performance equal to other investments. | | Identical. |

| General Market Risk. Certain securities selected for the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time. | | Identical. |

| Recent Market Events Risk. U.S. and international markets have experienced significant periods of volatility in recent months and years due to a number of economic, political and global macro factors including rising inflation, uncertainty regarding central banks’ interest rate increases, the possibility of a national or global recession, trade tensions, political events, the war between Russia and Ukraine, and the impact of COVID-19. The recovery from COVID-19 is proceeding at slower than expected rates and may last for a prolonged period of time. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so. Continuing market volatility as a result of recent market conditions or other events may have an adverse effect on the performance of the Fund. | | Identical. |

| Equity Market Risk. The equity securities held in a Fund’s portfolio may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors or companies in which a Fund invests. Common stocks are generally exposed to greater risk than other types of securities, such as preferred stock and debt obligations, because common stockholders generally have inferior rights to receive payment from issuers. | | Identical. |

| Foreign Securities Risk. The risks of investments in securities of foreign companies involve risks not generally associated with investments in the securities of U.S. companies, including risks relating to political, social and economic developments abroad and between U.S. and foreign regulatory requirements and market practices, including fluctuations in foreign currencies. Income earned on foreign stocks and securities may be subject to foreign withholding taxes. | | Identical. |

| Growth Stock Risk. The prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks and may be out of favor with investors at different periods of time. Compared to value stocks, growth stocks may experience larger price swings. | | Identical. |

| Large-Capitalization Company Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. Also, large-capitalization companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. | | Identical. |

| Mid-Capitalization Company Risk. The mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, these mid-sized companies may pose additional risks, including liquidity risk, because these companies may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, mid-cap stocks may be more volatile than those of larger companies. | | Identical. |

| Options and Futures Risk. Options and futures may be more volatile than investments in securities, involve additional costs and may involve a small initial investment relative to the risk assumed. In addition, the value of an option or future may not correlate perfectly to the underlying securities index or overall securities markets. | | Identical. |

| Cybersecurity Risk. With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security, and related risks. Cyber incidents affecting the Fund or its service providers have the ability to cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its NAV, impediments to trading, the inability of shareholders to transact business, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, or additional compliance costs. | | Identical. |

An investment in the Fund is subject to investment risks, including the possible loss of some or all of the principal amount invested. There can be no assurance that the Fund will be successful in meeting its investment objective.

Investment Objective

The Existing Fund and the New Fund share the same investment objective:

| Existing Fund | | New Fund |

| To seek to achieve long term capital appreciation and to maximize after-tax returns. | | Identical |

Principal Investment Strategies

A discussion regarding certain principal investment strategies of the Existing Fund and the New Fund is set forth below. Please note that the references to “the Adviser” in the Existing Fund disclosure refers to Barrett, while the New Fund’s disclosure will refer to the New Adviser. The principal investment strategies of the Existing Fund are substantially similar to the New Fund.

| Existing Fund | | New Fund |

The Fund invests primarily in a diversified portfolio of common stocks of large- and mid-cap U.S. companies, as well as global companies traded on a U.S. exchange, selected by the Adviser. The Fund considers mid-cap companies to be companies with market capitalizations of approximately $2 billion to $15 billion and large-cap companies to be companies with market capitalizations greater than $15 billion. The Fund may also purchase securities with an equity component, such as preferred stock, warrants, rights or other securities that are convertible into or exchangeable for shares of common stock. The Fund may invest up to 25% of its net assets in foreign securities, and will normally make such investments through the purchase of American Depositary Receipts (“ADRs”). The Fund takes a conservative approach to growth stock investing that emphasizes “Growth at a Reasonable Price.” The Fund invests in common stocks of high-quality companies that the Adviser believes have superior growth potential and stocks that can be purchased at reasonable prices. The Fund makes investments in companies that have solid long-term earnings prospects and the Fund expects to hold these investments for prolonged periods of time, thereby avoiding short-term capital gains, which are taxable to shareholders at higher rates than long-term capital gains. The Adviser focuses on identifying companies that will produce earnings and cash flow growth in excess of companies in the Standard & Poor’s 500 Composite Stock Price Index (“S&P 500® Index”). The Adviser makes investments in companies that it believes produce superior earnings at reasonable valuations. Superior relative earnings growth is usually driven by new products and services, niche products in growth sectors and industries, open-ended global growth opportunities, and cyclical companies whose margins are benefiting from a recovery in their respective industries. Stocks are sold when there is likely to be deterioration in earnings growth or other financial metrics, including balance sheet items. Maintaining a competitive industry position and management stability are also important factors in retaining a company position. Unusually weak relative stock market performance is another signal that prompts the Adviser to reevaluate a holding. The Adviser mitigates risk in several ways. In order to invest in a specific company, the Adviser carefully analyzes the company’s balance sheet and overall ability to withstand adverse economic conditions. More broadly, the Adviser diversifies the portfolio across multiple industries, economic sectors and geographic regions to reduce the risk of a particular industry’s or region’s weakness adversely affecting the Fund’s performance. Since the Adviser focuses on buying companies at reasonable valuations, the risk of overpaying for companies with strong earnings growth is also reduced. The Fund invests in companies across the large- and mid-capitalization spectrum which provides the Fund with exposure to companies of different revenue and earnings levels. Finally, the Fund emphasizes objectivity in evaluating existing holdings and sells holdings when the fundamental outlook for a company is expected to deteriorate. From time to time, the Fund may purchase options, futures contracts or other instruments, such as depositary receipts, that relate to a particular stock index, to allow the Fund to quickly invest excess cash in order to gain exposure to the markets until the Fund can purchase individual stocks. | | Identical, except that the disclosure for the New Fund indicates that short-term capital gains are taxable at rates “applicable to ordinary income,” rather than “higher rates than long-term capital gains.” |

Performance

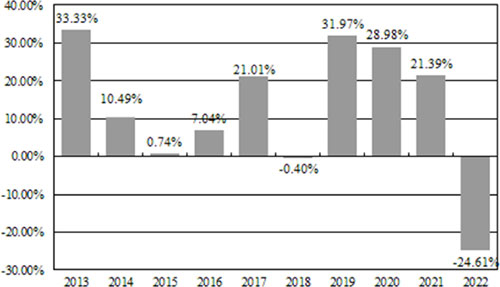

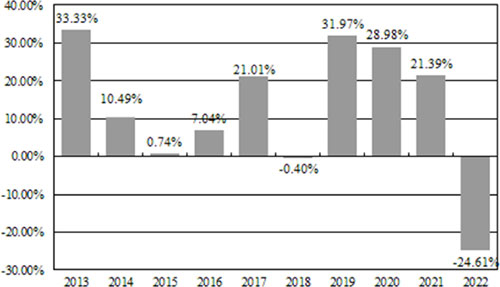

The performance information demonstrates the risks of investing in the Existing Fund by showing changes in the Existing Fund’s performance from year to year. The Average Annual Total Returns table also demonstrates these risks by showing how the Existing Fund’s average annual returns for one, five and ten years compare with those of a broad measure of market performance and the returns of a Lipper peer group (a group of mutual funds with characteristics similar to those of the Existing Fund). Past performance of the Existing Fund is not necessarily an indication of how the Existing Fund or the New Fund will perform in the future. The New Fund has no performance history, as it will not commence investment operations until after the Reorganization is completed. Following the Reorganization, the New Fund will assume the performance information of the Existing Fund and will be subject to identical risks, as described above.

Existing Fund

During the period shown in the bar chart, the best performance for a quarter was 22.72% (for the quarter ended June 30, 2020) and the worst performance was -17.54% (for the quarter ended March 31, 2020). The Fund’s calendar year-to-date return as of September 30, 2023 was 18.14%.

AVERAGE ANNUAL TOTAL RETURNS

For the Period Ended December 31, 2022

| | | 1 Year | | 5 Years | | 10 Years |

| Return Before Taxes | | -24.61% | | 9.18% | | 11.55% |

| Return After Taxes on Distributions* | | -27.87% | | 7.02% | | 10.29% |

| Return After Taxes on Distributions and sale of shares | | -12.28% | | 7.35% | | 9.63% |

| S&P 500 Total Return Index (reflects no deduction for fees, expenses, or taxes) | | -18.11% | | 9.42% | | 12.56% |

| Lipper Large-Cap Growth Funds Index (reflects no deduction for fees, expenses, or taxes) | | -32.03% | | 8.91% | | 12.35% |

| | | | | | | |

| | * | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold Fund shares through tax-advantaged arrangements such as 401(k) plans or individual retirement accounts. |

| | | |

In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax benefit to the investor.

Comparison of Shareholder Fees and Annual Fund Operating Expenses

The following table describes the expenses that you may pay if you buy, hold, and sell shares of the Existing Fund compared to the New Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and the Example below. These fees and expenses are based on expenses incurred by the Existing Fund during its most recently completed fiscal year.

The Existing Fund and the New Fund each offer one share class.

| | | Existing

Fund | | | New Fund

(and Combined

Pro Forma) | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

| Management Fees | | | 1.00 | % | | | 0.65 | % |

| Distribution (12b-1) Fees1 | | | 0.25 | % | | | None | |

| Other Expenses | | | 0.98 | % | | | 0.67 | % |

| Shareholder service fee | | | None | | | | 0.25 | % |

| All other expenses | | | 0.98 | % | | | 0.42 | % |

| Total Annual Fund Operating Expenses | | | 2.23 | % | | | 1.32 | % |

| Fee Waiver and Expense Reimbursement | | | (0.98 | )%(2) | | | (0.33 | )%(3) |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | | | 1.25 | % | | | 0.99 | % |

| | 1 | The Existing Fund accrued 12b-1 fees in the amount of 0.17% during the prior fiscal year. |

| | 2 | Pursuant to an operating expense limitation agreement between Barrett Asset Management, LLC, the Fund’s existing investment adviser (“Barrett,”) and TPM, on behalf of the Existing Fund, Barrett has agreed to waive its management fees and/or reimburse Fund expenses to ensure that Total Annual Fund Operating Expenses (exclusive of front-end or contingent deferred loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage (i.e., any expenses incurred in connection with borrowings made by the Existing Fund), interest (including interest incurred in connection with bank and custody overdrafts), brokerage commissions and other transactional expenses, expenses incurred in connection with any merger or reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses such as litigation (collectively, “Excluded Expenses”)) do not exceed 1.00% of the Existing Fund’s average daily net assets through September 30, 2024. Under the former operating expense limitation agreement, Barrett agreed to waive its |

| | | management fees and/or reimburse Existing Fund expenses to ensure Total Annual Fund Operating Expenses (exclusive of Excluded Expenses), did not exceed 1.25% of the Existing Fund’s daily net assets. The current operating expense limitation agreement became effective on August 12, 2021. The current operating expense limitation agreement can be terminated only by, or with the consent of, the TPM Board. To the extent the Existing Fund incurs Excluded Expenses, Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement, may be greater than 1.00%. Barrett may request recoupment of previously waived fees and paid expenses from the Existing Fund for up to three years from the date such fees and expenses were waived or paid, subject to the operating expense limitation agreement, if such reimbursement will not cause the Existing Fund’s expense ratio, after recoupment has been taken into account, to exceed the lesser of: (1) the expense limitation in place at the time of the waiver and/or expense payment; or (2) the expense limitation in place at the time of the recoupment. |

| | 3 | Segall Bryant & Hamill, LLC has contractually agreed until at least November 30, 2025 to waive the investment advisory and/or administration fees and/or to reimburse other expenses (not including acquired fund fees and expenses, taxes, brokerage expenses, class action claim fees, tax reclaim fees, and extraordinary expenses), so that the ratio of expenses to average net assets as reported in the New Fund’s Financial Highlights will be no more than 0.99% for such period. This agreement may not be terminated or modified by the New Adviser prior to November 30, 2025 without the approval of the SBHT Board of Trustees. Following the Reorganization, the New Adviser will not be able to recoup expenses waived by Barrett prior to the date of the Reorganization. |

Example

The Example below is intended to help you compare the costs of investing in the Existing Fund and the New Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. With respect to the New Fund, the Example assumes that the Reorganization has been completed. The Example also assumes that your investment has a 5% return each year and that each Fund’s operating expenses remain the same (taking into account the expense cap in year one). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | 1 year | | 3 years | | 5 years | | 10 years |

| Existing Fund | | $127 | | $465 | | $895 | | $2,095 |

| New Fund (Pro Forma) | | $101 | | $386 | | $692 | | $1,561 |

Portfolio Turnover

The Existing Fund pays, and the New Fund will pay, transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Fee Table Example above, affect the Fund’s performance. During the most recent fiscal year ended May 31, 2023 the portfolio turnover rate for the Existing Fund was 4% of the average value of its portfolio. Because the New Fund is newly organized, no portfolio data is available.

Comparison of Fundamental Investment Limitations

This section will help you contrast the fundamental and non-fundamental investment policies and restrictions of the Existing Fund and the New Fund.

Fundamental Investment Limitations

The fundamental investment limitations of the Existing Fund and the New Fund are identical. These limitations cannot be changed without the consent of the holders of a majority of each Fund’s outstanding shares. The term “majority of the outstanding shares” means the vote of (i) 67% or more of the Fund’s shares present at a meeting, if more than 50% of the outstanding shares of the Fund are present or represented by proxy; or (ii) more than 50% of the Fund’s outstanding shares, whichever is less.

Form of Organization

The Existing Fund is organized as a diversified series of TPM, an open-end management investment company organized as a Delaware statutory trust. The New Fund is organized as a diversified series of SBHT, an open-end management investment company organized as a Massachusetts business trust. There is no material difference between the governing documents for each of TPM and SBHT. The most significant difference between the two Trusts is that each is overseen by a completely different Board of Trustees. For a comparison of certain differences in shareholder rights, please see “Additional Information about the Reorganization—Description of the Securities to be Issued; Rights of Shareholders,” below.

Comparison of Distribution, Purchase & Redemption Procedures

Distribution. Quasar Distributors, LLC, 111 East Kilbourn Avenue, Suite 2200, Milwaukee, Wisconsin 53202, serves as distributor to the Existing Fund. Ultimus Fund Distributors, LLC., 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, serves as the New Fund’s exclusive agent for the distribution of the New Fund’s shares. Ultimus Fund Distributors, LLC, Inc. may sell the New Fund’s shares to or through qualified securities dealers or others.

Minimum Initial and Subsequent Investment Amounts. The New Fund will offer the same initial and subsequent investment minimums as the Existing Fund, which are as follows:

| Initial Purchase (regular account) | | $ | 2,500 | |

| Subsequent Purchases (regular account only) | | $ | 50 | |

| Initial Purchase (retirement account) | | $ | 1,000 | |

| Initial Purchase (education account) | | $ | 500 | |

| | | | | |

Shares for both the Existing Fund and the New Fund may be purchased by mail, by phone, by wire, or from your dealer, financial advisor or other financial intermediary. Please see the Existing Fund’s prospectus, incorporated by reference into this Proxy Statement, for additional information about purchasing of shares of the Existing Fund. Please see the New Fund’s Prospectus dated October 19, 2023, which is incorporated herein by reference for additional information about purchasing shares of the New Fund.

Redemptions. The Existing Fund and the New Fund both allow for redemption payments in the form of check or federal wire transfer. For both the Existing Fund and the New Fund, redemption requests may be made by mail or telephone. Please see the Existing Fund’s prospectus, incorporated by reference into this Proxy Statement, for additional information about redeeming Existing Fund shares. Please see the New Fund’s Prospectus dated October 19, 2023, which is incorporated herein by reference for additional information about redeeming shares of the New Fund.

Capitalization

The following table sets forth, as of August 31, 2023, the capitalization of the Existing Fund and the hypothetical unaudited pro forma capitalization of the New Fund assuming the proposed Reorganization had taken place as of that date. While the New Fund will not have any assets until after the Reorganization is complete, the table reflects the amount it would have if the Reorganization was completed as of August 31, 2023.

| Barrett Growth Fund |

| Name | Net

Assets | Net Assets

per Share | Shares

Outstanding |

| Existing Fund | $25,581,470 | $23.58 | 1,084,738 |

| New Fund (pro forma) | $25,581,470 | $23.58 | 1,084,738 |

* * * * * * * * * * * * *

The preceding is only a summary of certain information contained in this Proxy Statement relating to the Reorganization. This summary is qualified by reference to the more complete information contained elsewhere in this Proxy Statement, the New Fund’s Prospectus and Statement of Additional Information, and the Reorganization Plan. Shareholders should read this entire Proxy Statement carefully.

Board’s Approval

At the request of Barrett, and after careful consideration, the Board of Trustees of TPM approved the Reorganization of each Existing Fund into the corresponding New Fund, subject to the approval of the shareholders of each Existing Fund.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization.

CI Financial Corp (“CI Financial”), the parent company of both Barrett and the New Adviser, is in the process of restructuring its U.S. affiliated investment advisory businesses. As part of that process, CI Financial is seeking to consolidate the mutual fund businesses of its affiliated advisers to the New Adviser to ease the burden of many smaller advisers having to comply with the enhanced compliance and other requirements specific to investment advisers to registered investment companies. In light of this restructuring, CI Financial and Barrett, the Existing Fund’s investment adviser, proposed to the Board of Trustees of the Existing Fund the Reorganization of the Existing Fund into a newly created series of SBHT that would have the same portfolio managers, investment objective, investment strategies and risks of the Existing Fund. In addition, CI Financial and Barrett believe that the proposed Reorganization would also provide the Existing Fund with the ability to experience economies of scale by being included in a suite of funds with the same service providers.

Board Considerations.

The TPM Board considered the Reorganization at a meeting held on August 17, 2023. At the meeting, the TPM Board reviewed and considered various information provided by the New Adviser relating to the Reorganization, and considered, among other things, the factors discussed below, in light of their fiduciary duties under federal and state law. After careful consideration, the TPM Board, including all trustees who are not “interested persons” under the 1940 Act of TPM, the New Adviser, Barrett or their affiliates, with the advice and assistance of counsel, determined that the Reorganization Plan would be in the best interests of the Existing Fund and its shareholders, and that such shareholders’ interests would not be diluted as a result of the Reorganization. The TPM Board approved the Reorganization Plan and recommends that the shareholders of the Existing Fund vote in favor of the Reorganization Plan relating to the Reorganization of the Existing Fund. As part of its consideration, the TPM Board considered various factors, including among other items:

| | (1) | the terms and conditions of the Reorganization; |

| | (2) | the compatibility of the investment objectives, strategies and restrictions of the Existing Fund and the New Fund, including that the New Fund will have the same investment objective and investment restrictions and substantially similar investment strategies as the Existing Fund; |

| | (3) | the continuity of the same portfolio management team as a result of the Reorganization; |

| | (4) | the relative size of the Existing Fund and the New Fund; |

| | (5) | possible benefits to the shareholders of the Existing Fund, including potential cost savings, greater economies of scale and increased marketing and distribution efforts; |

| | (6) | how the Existing Fund’s share class will be mapped to the New Fund and the impact of the Reorganization on the rights and privileges of the shareholders of the Existing Fund as compared to those they will be subject to as shareholders of the New Fund; |

| | (7) | the expense ratios and information regarding the fees and expenses of the Existing Fund and the New Fund and the New Adviser’s commitment to waive its investment advisory and/or administration fees and/or reimburse other expenses, so that the ratio of expenses to average net assets will be no more than 0.99% through November 30, 2025; |

| | (8) | the expected federal tax consequences of the Reorganization, including the anticipated tax-free nature of the Reorganization for the Existing Fund and its shareholders; |

| | (9) | the costs to be incurred in connection with the Reorganization and the fact that the Existing Fund and New Fund will not bear them; |

| | (10) | the interests of the shareholders of the Existing Fund will not be diluted as a result of the Reorganization; and |

| | (11) | the possible alternatives to the Reorganization. |

Based on the foregoing, the TPM Board approved the Reorganization Plan and recommends that the shareholders of the Existing Fund vote “FOR” the approval of the Reorganization Plan relating to the Reorganization of the Existing Fund.

Reorganization Plan. The Reorganization Plan sets forth the terms by which the Existing Fund will be reorganized into the New Fund. A form of the Reorganization Plan is attached as Appendix A. Shareholders are encouraged to read the entire Reorganization Plan. The following sections summarize the material terms of the Reorganization Plan and the anticipated federal income tax treatment of the Reorganization.

The Reorganization Plan provides that upon the transfer of all of the assets and all of the liabilities of the Existing Fund to the New Fund, such New Fund will issue to the Existing Fund that number of full and fractional shares, having an aggregate net asset value equal in value to the aggregate net asset value of the Existing Fund’s shares, calculated as of the close of business (4:00 p.m. eastern standard time) on November 17, 2023 or such other date as is agreed to by the parties (the “Valuation Date”). The Existing Fund will redeem its shares in exchange for the Reorganization Shares received by it. The Existing Fund will distribute such shares to the shareholders of the Existing Fund in complete liquidation of the Existing Fund. Shareholders of the Existing Fund will receive Reorganization Shares based on their respective holdings in the Existing Fund as of the Valuation Date.

Upon completion of the Reorganization, shareholders of the Existing Fund will own that number of full and fractional shares of the New Fund having an aggregate net asset value equal to the aggregate net asset value of such shareholder’s shares held in the Existing Fund as of the Valuation Date. Such shares will be held in an account with the New Fund identical in all material respects to the account currently maintained by the Existing Fund for such shareholder.

Until the Valuation Date, shareholders of the Existing Fund will continue to be able to redeem their shares at the net asset value next determined after receipt by the Existing Fund’s transfer agent of a redemption request in proper form. Redemption and purchase requests received by the transfer agent after the Valuation Date will be treated as requests received for the redemption or purchase of shares of the New Fund received from the shareholder in connection with the Reorganization. After the Reorganization, all of the issued and outstanding shares of the Existing Fund will be canceled on the books of the Existing Fund and the transfer agent’s books of the Existing Fund will be permanently closed.

The Reorganization is subject to a number of conditions, including, without limitation, the receipt of a legal opinion from counsel of the New Fund addressed to the Existing Fund and the New Fund with respect to certain tax issues, as more fully described in “Federal Income Tax Consequences” below, and the parties’ performance in all material respects of their respective agreements and undertakings in the Reorganization Plan. Assuming satisfaction of the conditions in the Reorganization Plan, the Effective Time of the Reorganization will be immediately prior to the open of business (8:00 a.m. eastern standard time) on or about November 20, 2023, or such other date as is agreed to by the parties.

The Reorganization Plan may be changed by an agreement signed by each party to the agreement.

Costs and Expenses of the Reorganization. The Reorganization Plan provides that Barrett or its successor will pay all expenses related to the Reorganization.

Federal Income Tax Consequences.

Note: Shareholders of the Existing Fund are urged to consult their own tax advisors to determine the particular U.S. federal income tax or other tax consequences to them of the Reorganization and the other transactions contemplated herein in light of their particular tax circumstances.

As a non-waivable condition to the consummation of the Reorganization, the New Fund and the Existing Fund will receive an opinion from the law firm of Davis Graham & Stubbs LLP, substantially to the effect that, based on certain facts, assumptions and representations and covenants made by the New Fund, on the basis of existing provisions of the Code, current administrative rules and court decisions, for federal income tax purposes:

| | (a) | The transfer of all the Existing Fund’s assets to the New Fund in exchange solely for New Fund shares and the assumption by the New Fund of all the liabilities of the Existing Fund followed by the pro rata distribution, by the Existing Fund of all the New Fund shares to the Existing Fund shareholders in complete liquidation of the Existing Fund will constitute a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code and the New Fund and the Existing Fund will each be a “party to a reorganization,” within the meaning of Section 368(b) of the Code, with respect to the Reorganization. |

| | (b) | No gain or loss will be recognized by the New Fund upon the receipt of all the assets of the Existing Fund solely in exchange for the New Fund shares and the assumption by the New Fund of all the liabilities of the Existing Fund. |

| | I | No gain or loss will be recognized by the Existing Fund upon the transfer of all the Existing Fund’s assets to the New Fund solely in exchange for the New Fund shares and the assumption by the New Fund of all the liabilities of the Existing Fund or upon the distribution (whether actual or constructive) of the New Fund shares to the Existing Fund shareholders solely in exchange for such shareholders’ shares of the Existing Fund in complete liquidation of the Existing Fund. |

| | (d) | No gain or loss will be recognized by the Existing Fund shareholders upon the exchange of their Existing Fund shares solely for New Fund shares in the Reorganization. |

| | (e) | The aggregate basis of the New Fund shares received by each Existing Fund shareholder pursuant to the Reorganization will be the same as the aggregate basis of the Existing Fund shares exchanged therefor by such shareholder. The holding period of New Fund shares received by each Existing |

| | | Fund shareholder will include the period during which the Existing Fund shares exchanged therefor were held by such shareholder, provided such Existing Fund shares are held as capital assets at the time of the Reorganization. |

| | (f) | The basis of the Existing Fund’s assets transferred to the New Fund will be the same as the adjusted basis of such assets to the Existing Fund immediately before the Reorganization. The holding period of the assets of the Existing Fund in the hands of the New Fund will include the period during which those assets were held by the Existing Fund (except where the New Fund’s investment activities have the effect of reducing or eliminating an asset’s holding period). |

| | (g) | The taxable year of the Existing Fund will not end merely as a result of the Reorganization. |

| | | |

| | (h) | Under Treasury Regulations Section 1.381(b)-1(a)(2), the New Fund will be treated for purposes of section 381 of the Code just as the Existing Fund would have been treated if there had been no Reorganization, and the Tax attributes of the Existing Fund enumerated in Section 381(c) of the Code will be taken into account by the New Fund as if there had been no Reorganization, subject to the conditions and limitations specified in Sections 381, 382, 383 and 384 of the Code and the Treasury Regulations thereunder. |

| | | |

No opinion will be expressed as to (1) the effect of the Reorganization on the Existing Fund or the New Fund with respect to any stock held in a passive foreign investment company as defined in Section 1297(a) of the Code, (2) the effect of the Reorganization on any transferred asset as to which any unrealized gain or loss is required to be recognized under U.S. federal income tax principles (i) at the end of a taxable year or upon the termination thereof, or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction, (3) the effect of the Reorganization on the Existing Fund with respect to any transferred asset as to which unrealized gain or loss is required to be recognized for federal income tax purposes under a mark-to-market system of accounting (including under Section 1256 of the Code), or (4) any other U.S. federal tax issues (except those set forth above) and all state, local or foreign tax issues of any kind.

Such opinion shall be based on customary assumptions and such representations as tax counsel may reasonably request of the Existing Fund and the New Fund, and the Existing Fund and the New Fund will cooperate to make and certify the accuracy of such representations.

A successful challenge to the tax-free status of the Reorganization by the Internal Revenue Service (the “IRS”) would result in the Existing Fund’s shareholder recognizing gain or loss with respect to the New Fund’s share equal to the difference between that shareholder’s basis in the share and the fair market value, as of the time of the Reorganization, of the Existing Fund’s shares received in exchange therefor. In such event, a shareholder’s aggregate basis in the shares of the Existing Fund received in the exchange would equal such fair market value, and the shareholder’s holding period for the shares would not include the period during which such shareholder held shares of the New Fund.

If any of the representations or covenants of the parties as described herein is inaccurate, the tax consequences of the transaction could differ materially from those summarized above. Furthermore, the description of the tax consequences set forth herein will neither bind the IRS, nor preclude the IRS or the courts from adopting a contrary position. No assurance can be given that contrary positions will not be asserted by the IRS or adopted by a court if the issues are litigated. No ruling has been or will be requested from the IRS in connection with this transaction. No assurance can be given that future legislative, judicial or administrative changes, on either a prospective or retroactive basis, or future factual developments, would not adversely affect the accuracy of the conclusions stated herein. Therefore, shareholders are urged to consult their tax advisers as to the specific tax consequences to them under the federal income tax laws given each shareholder’s own particular tax circumstances, as well as any consequences under other applicable state or local or foreign tax laws.

ADDITIONAL INFORMATION ABOUT THE REORGANIZATION

Investment Advisers.

Barrett Asset Management, LLC, a Delaware limited liability company, located at 90 Park Avenue, New York, New York 10016, has served as the adviser to the Existing Fund since its inception. As of June 30, 2023, Barrett managed over $2.65 billion of client assets under management, of which approximately $2.415 billion is invested in equity securities. Barrett has approximately 998 client accounts, including families, individuals, foundations and other organizations or entities. Many of the client relationships are in their third generation. The Fund was organized in order to provide investors with a cost-efficient opportunity to invest according to Barrett’s long-term equity investing philosophy of “Growth at a Reasonable Price,” without being required to maintain a large account balance.