UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03379

PERMANENT PORTFOLIO FAMILY OF FUNDS

(Exact Name of Registrant as specified in charter)

600 Montgomery Street, Suite 4100, San Francisco, California 94111

(Address of Principal Executive Offices) (Zip Code)

MICHAEL J. CUGGINO, 600 Montgomery Street, Suite 4100, San Francisco, California 94111

(Name and Address of Agent For Service)

Registrant’s telephone number, including area code: (415) 398-8000

Date of fiscal year end: January 31, 2024

Date of reporting period: January 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders. | ||||

(a) | The Annual Report to Shareholders of Permanent Portfolio Family of Funds (“Registrant”) for the fiscal year ended January 31, 2024 is attached hereto. | |||

(b) | Not applicable. | |||

| Item 2. Code of Ethics. | ||||

| (a) | As of the end of the period covered by this Form N-CSR, the Registrant has adopted a code of ethics that applies to its principal executive officer and principal financial officer (“Code of Ethics for Executive Officers”). | |||

| (b) | No response required. | |||

| (c) | The Registrant has not made amendments to its Code of Ethics for Executive Officers during the fiscal year ended January 31, 2024. | |||

| (d) | The Registrant has not granted any waivers from any provisions of its Code of Ethics for Executive Officers during the fiscal year ended January 31, 2024. | |||

| (e) | Not applicable. | |||

| (f) | A copy of the Registrant’s Code of Ethics for Executive Officers, adopted September 21, 2015, is filed as Exhibit 13(a)(1) to this Form N-CSR. The Code of Ethics for Executive Officers is available, without charge and upon request, by writing or calling the Registrant’s Shareholder Services Office at (800) 531-5142. | |||

| Item 3. Audit Committee Financial Expert. | ||||

The Registrant’s Board of Trustees (“Board”) has determined that no member of its Audit Committee qualifies as an “audit committee financial expert” (“ACFE”). After evaluating the matter, the Board concluded that it was not necessary to have a trustee on the Audit Committee who qualifies as an ACFE, given that the financial statements and accounting principles that apply to registered investment companies such as the Registrant are generally simpler and more straightforward compared to operating companies, and the financial literacy of the current Audit Committee members is adequate to discharge their duties as members of the Audit Committee. | ||||

| Item 4. Principal Accountant Fees and Services. | ||||

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years, were $132,700 and $132,700 for the fiscal years ended January 31, 2024 and January 31, 2023, respectively. | |||

| (b) | Audit-Related Fees. There were no fees billed for each of the last two fiscal years ended January 31, 2024 and January 31, 2023, respectively, for assurance and related services provided by the Registrant’s principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and were not reported under paragraph (a) of this Item. | |||

| (c) | Tax Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the Registrant’s principal accountant for tax compliance, tax advice and tax planning were $16,000 and $16,000 for the fiscal years ended January 31, 2024 and January 31, 2023, respectively. Tax fees represent tax compliance services provided in connection with the preparation of the Registrant’s tax returns. | |||

| (d) | All Other Fees. There were no fees billed for each of the last two fiscal years ended January 31, 2024 and January 31, 2023, respectively, for products and services provided by the Registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. | |||

| (e)(1) | Pursuant to Section 3(c) of the Registrant’s Audit Committee Charter, adopted September 21, 2015, the pre-approval policies and procedures of the Registrant’s Audit Committee, in accordance with paragraph (c)(7) of Rule 2-01 of Regulation S-X, are as follows:

“The Committee shall review any audit and non-audit services provided to the Trust by the Auditor and the fees charged for such services. Except as provided below, the Committee’s prior approval shall be necessary for the engagement of the Auditor to provide any audit or non-audit services on behalf of the Trust, and any non-audit services on behalf of the Trust’s investment adviser (“Adviser”) or any entity controlling, controlled by or under common control with the Adviser that provides ongoing services to the Trust, where the proposed engagement relates directly to the operations and financial reporting of the Trust. Non-audit services that would otherwise qualify under the de minimis exception described in the Securities Exchange Act of 1934, as amended, and any applicable rules thereunder, that were not pre-approved by the Committee shall be approved by the Committee prior to the completion of the engagement. Pre-approval by the Committee shall not be required for engagements entered into pursuant to: (i) pre-approval policies and procedures established by the Committee; or (ii) pre-approval granted by one or more members of the Committee to whom, or by a subcommittee to which, the Committee has delegated pre-approval authority; provided, however, in either case, that the Committee is informed of each such engagement at the earlier of its next meeting, or at the Board’s next quarterly meeting.” | |||

| (e)(2) | None of the services included in each of paragraphs (b) through (d) of this Item were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. | |||

| (f) | Not applicable to the Registrant because there were no hours expended on the principal accountant’s engagement to audit the Registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time permanent employees. | |||

| (g) | The aggregate non-audit fees billed for each of the last two fiscal years for services rendered by the Registrant’s principal accountant to the Registrant were $16,000 and $16,000 for the fiscal years ended January 31, 2024 and January 31, 2023, respectively. There were no non-audit fees billed by the Registrant’s principal accountant for services rendered to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant for each of the last two fiscal years of the Registrant. | |||

| (h) | Not applicable to the Registrant as the Registrant’s principal accountant did not render any non-audit services to the Registrant’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant for each of the last two fiscal years of the Registrant. | |||

(i) | Not applicable to the Registrant. | |||

(j) | Not applicable to the Registrant. | |||

| Item 5. Audit Committee of Listed Registrants. | ||||

Not applicable to the Registrant. | ||||

| Item 6. Investments. | ||||

Included in Item 1. | ||||

| Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies. | ||||

Not applicable to the Registrant. | ||||

| Item 8. Portfolio Managers of Closed-End Management Investment Companies. | ||||

Not applicable to the Registrant. | ||||

| Item 9. Purchases of Equity Securities By Closed-End Management Investment Company and Affiliated Purchasers. | ||||

Not applicable to the Registrant. | ||||

| Item 10. Submission of Matters to a Vote of Security Holders. | ||||

There were no changes to the procedures by which shareholders may recommend nominees to the Board of Trustees for the fiscal year ended January 31, 2024. | ||||

| Item 11. Controls and Procedures. | ||||

| (a) | Michael J. Cuggino, the Registrant’s President, and James H. Andrews, the Registrant’s Treasurer, each has concluded that, in his judgment, the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (“1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on his evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). | |||

| (b) | There was no change in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting. | |||

Item 12. Disclosure of Securities Lending Activities For Closed-End Management Investment Companies. | ||||

| Not applicable to the Registrant. | ||||

| Item 13. Exhibits. | ||||

| (a)(1) | ||||

| (a)(2) | ||||

| (a)(3) | Not applicable to the Registrant. | |||

| (a)(4) | Not applicable to the Registrant. | |||

| (b) | ||||

The certifications provided pursuant to Rule 30a-2(b) under the 1940 Act (17 CFR 270.30a-2(b)) and Section 906 of the Sarbanes-Oxley Act of 2002 are not deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. Such certifications will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Registrant specifically incorporates them by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Permanent Portfolio Family of Funds

/s/ Michael J. Cuggino

By: Michael J. Cuggino, President

Date: April 2, 2024

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

Permanent Portfolio Family of Funds

/s/ Michael J. Cuggino

By: Michael J. Cuggino, President

Date: April 2, 2024

/s/ James H. Andrews

By: James H. Andrews, Treasurer

Date: April 2, 2024

| Annual Report

Year Ended January 31, 2024 |

Permanent Portfolio®

Class A — PRPDX | Class C — PRPHX | Class I — PRPFX

Short-Term Treasury Portfolio

Class I — PRTBX

Versatile Bond Portfolio

Class A — PRVDX | Class C — PRVHX | Class I — PRVBX

Aggressive Growth Portfolio

Class A — PAGDX | Class C — PAGHX | Class I — PAGRX

The views in this Report are those of the Fund’s investment adviser, Pacific Heights Asset Management, LLC, as of January 31, 2024 and may not reflect their views on the date this Report is first published or anytime thereafter. This Report may contain discussions about certain investments both held and not held in each Fund Portfolio as of January 31, 2024. All current and future holdings are subject to risk and are subject to change. While these views are intended to assist shareholders in understanding their investment in each Portfolio, they do not constitute investment advice, are not a guarantee of future performance and are not intended as an offer or solicitation with respect to the purchase or sale of any security. Performance figures include the reinvestment of dividend and capital gain distributions.

Diversification does not assure a profit, nor does it protect against a loss.

The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is an objective, quantitative, risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. Although LSEG Lipper makes reasonable efforts to ensure the accuracy and reliability of the data used to calculate the awards, their accuracy is not guaranteed. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see www.lipperfundawards.com.

Permanent Portfolio®, The Permanent Portfolio Family of Funds®, A Fund for All Seasons® and The Permanent Portfolio Family of Funds logo are registered trademarks of Pacific Heights Asset Management, LLC. This Report is Copyright© 2024 Permanent Portfolio Family of Funds. All rights reserved.

2

LETTER FROM THE PRESIDENT

Dear Fellow Shareholder:

I am pleased to present you with this Annual Report of Permanent Portfolio Family of Funds for the year ended January 31, 2024. The Annual Report includes the audited financial statements of each of our four Portfolios, as well as additional information such as management commentary, performance data, lists of investments held and financial highlights.

2024 has been an exciting year for us so far. All four of our Portfolios delivered profitable results last year, and we are off to a strong start in the new year. We often speak about the benefits of our philosophy of wealth creation—investing over the long term, beating the effects of inflation, tax efficiency, avoiding unnecessary risks, etc.—and as prudent investors do, it is appropriate to periodically assess how a plan is working out. “Trust but verify” one might say. We are pleased to report that our Family of Funds recently received four LSEG Lipper Fund Awards, recognizing outstanding performance for consistently strong risk-adjusted returns. Our flagship fund—Permanent Portfolio—won best fund over three and five years in the Alternative Global Macro Funds category (out of 36 funds), and our flexible bond fund—Versatile Bond Portfolio—won best fund over three and five years in the Corporate Debt Funds BBB-Rated category (out of 55 and 52 funds, respectively). We are honored to receive these awards and view them as a confirmation of our core beliefs. We are proud to have provided such strong results for our shareholders, particularly given the challenging market environment of the past few years.

As we look further into 2024, we continue to believe in our diversified strategy given the current market environment of stubborn inflation, an exuberant stock market, higher for longer interest rates and uncertain geopolitical issues. With so many options of how and where to invest, we believe a comprehensive asset allocation strategy like our Permanent Portfolio minimizes downside risk, reduces broader volatility, and provides a return over time that will potentially exceed the rate of inflation. We look forward to continuing to help you achieve long-term success in building your nest egg in all types of markets, as we’ve been doing since 1982.

I encourage you to visit our website—permanentportfoliofunds.com—which offers a wide range of information on each of our Portfolios, including our current prospectus, statement of additional information, fact sheets, investor guides, performance data, and recent market insights and perspectives. In addition, if you have questions or would like more information on any of our strategies, including, for income investors, Versatile Bond Portfolio or our Short-Term Treasury Portfolio, or for longer term equity investors, our multi-cap core Aggressive Growth Portfolio, please contact your investment professional, one of our Institutional Sales representatives at (866) 792-6547, or our Shareholder Services Office at (800) 531-5142.

As always, thank you for your continued trust and confidence in our Family of Funds. We continue to look forward to helping you achieve long-term success in reaching your financial goals now and for many years to come.

Sincerely,

Michael J. Cuggino

Chairman and President

3

4

Management’s Discussion and Analysis

Year Ended January 31, 2024 (Unaudited)

Permanent Portfolio’s investment objective is to preserve and increase the purchasing power value of its shares over the long term. The Portfolio’s strategy is to invest a fixed “Target Percentage” of its net assets in gold, silver, Swiss franc assets, real estate and natural resource stocks, aggressive growth stocks and dollar assets, such as U.S. Treasury securities and corporate bonds. During the year ended January 31, 2024, the Portfolio’s Class I shares achieved a total return of 6.61%, net of expenses to average net assets of .82%, as compared to 5.36% for the FTSE 3-Month U.S. Treasury Bill Index and 20.82% for the S&P 500, and as compared to a 3.09% inflation rate over the same period as measured by the change in the Consumer Price Index (“CPI-U”), a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services as compiled by the U.S. Bureau of Labor Statistics. The Portfolio’s return during the year then ended reflected positive returns on its aggressive growth stocks, and to a lesser degree its gold, Swiss franc assets, real estate stocks, and holdings of U.S. Treasury securities and corporate bonds, which more than offset negative returns on its silver and natural resource stocks. Neither the FTSE 3-Month U.S. Treasury Bill Index return, the S&P 500 return nor the change in CPI-U reflect deductions for fees, expenses or taxes. Returns for the Portfolio’s Class A and Class C shares are provided on pages 7, 39 and 40.

Mutual fund investing involves risk; loss of principal is possible. Permanent Portfolio invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. The Portfolio will be affected by changes in the prices of gold, silver, U.S. and foreign real estate and natural resource company stocks and aggressive growth stocks. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in debt securities are also subject to credit risk, which is the risk that an issuer of debt securities may be unable or unwilling to pay principal and interest when due. Although the Portfolio invests in multiple and diverse asset classes, diversification across asset classes does not assure a profit, nor does it protect against a loss. The Portfolio is non-diversified, meaning that it may invest a larger percentage of its assets in a smaller number of issuers and kinds of assets.

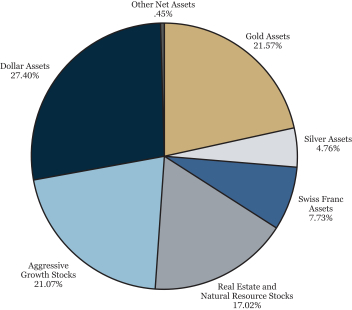

The following pie chart shows Permanent Portfolio’s investment holdings by asset class, as a percentage of total net assets as of January 31, 2024.

Allocations are subject to change and should not be considered a recommendation to buy or sell any security within an asset class.

5

PERMANENT PORTFOLIO®

Ten Years Ended January 31, 2024 (Unaudited)

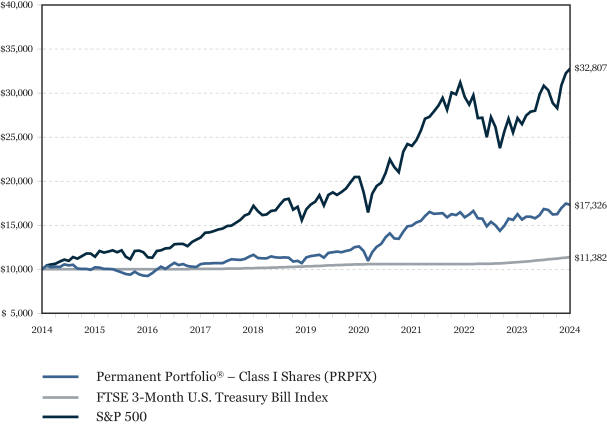

The chart above compares the initial account values and subsequent account values over the past ten years, assuming a hypothetical $10,000 investment in the Portfolio’s Class I shares at the beginning of the first period indicated and reinvestment of all dividends and other distributions, without the deduction of taxes, to a $10,000 investment over the same periods in comparable broad-based securities market indices. The performance of the Portfolio’s Class A and Class C shares will differ due to different sales charge structures and share class expenses.

The FTSE 3-Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury. The S&P 500, an equity index provided by S&P Dow Jones Indices, a Division of S&P Global, Inc. (“S&P”), is a market-capitalization weighted index of common stocks and represents an unmanaged portfolio. You cannot invest directly in an index. Returns shown for the FTSE 3-Month U.S. Treasury Bill Index and the S&P 500 reflect reinvested interest, dividends and other distributions as applicable, but do not reflect a deduction for fees, expenses or taxes.

Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

6

PERMANENT PORTFOLIO®

Periods Ended January 31, 2024 (Unaudited)

| One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||

At Net Asset Value | ||||||||||||||||||||

Class I Shares (PRPFX) (1) | 6.61% | 8.81% | 5.65% | 6.28% | 12/01/1982 | |||||||||||||||

Class A Shares (PRPDX) | 6.33% | 8.53% | — | 7.12% | 5/31/2016 | |||||||||||||||

Class C Shares (PRPHX) | 5.55% | 7.73% | — | 6.32% | 5/31/2016 | |||||||||||||||

With Sales Charge | ||||||||||||||||||||

Class A Shares (PRPDX) (2) | 1.00% | 7.43% | — | 6.41% | ||||||||||||||||

Class C Shares (PRPHX) (2) | 4.55% | 7.73% | — | 6.32% | ||||||||||||||||

FTSE 3-Month U.S.Treasury Bill Index (3) | 5.36% | 1.97% | 1.30% | 3.55% | ||||||||||||||||

S&P 500 (3) | 20.82% | 14.30% | 12.62% | 11.63% | ||||||||||||||||

| (1) | Returns for the ten-year and since inception periods reflect the impact of fee waivers then in effect. In the absence of such fee waivers, total returns would be reduced. |

| (2) | Returns with sales charge reflect the deduction of the maximum front end sales charge of 5.00% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is imposed on Class C shares that are redeemed within one year of purchase. |

| (3) | The date used to calculate performance since inception for the Indices is the inception date of the Class I shares. |

The table above shows Permanent Portfolio’s average annual total returns for the periods indicated, assuming reinvestment of all dividends and other distributions, and deduction of all applicable fees and expenses (except the $35 one-time account start-up fee which was eliminated in January 2016). All share classes of the Portfolio are invested in the same securities and returns only differ to the extent that the fees and expenses of the share classes are different. Performance does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

As stated in the Portfolio’s Prospectus dated May 31, 2023, the total annual operating expenses (“expense ratios”) for the year ended January 31, 2023 were .82%, 1.07% and 1.82% for the Portfolio’s Class I, Class A and Class C shares, respectively. The expense ratios for the year ended January 31, 2024 may be found in the Financial Highlights section of this Report.

Performance data shown above for Permanent Portfolio represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Investment performance, current to the most recent month-end, may be lower or higher than the performance shown above, and can be obtained by calling the Fund’s Shareholder Services Office at (800) 531-5142.

Investments in the Portfolio are not insured or guaranteed by the Federal Deposit Insurance Corporation or other government agency. It is therefore possible to lose money by investing in Permanent Portfolio.

7

PERMANENT PORTFOLIO®

January 31, 2024

| Quantity | Market Value | |||||||

| GOLD ASSETS — 21.57% of Total Net Assets | ||||||||

| 217,320 Troy Oz. | Gold bullion (a) | $ | 445,157,284 | |||||

| 90,000 Coins | One-ounce gold coins (a) | 188,001,500 | ||||||

|

| |||||||

Total Gold Assets (identified cost $328,396,837) | $ | 633,158,784 | ||||||

|

| |||||||

| SILVER ASSETS — 4.76% of Total Net Assets | ||||||||

| 6,058,176 Troy Oz. | Silver bullion (a) | $ | 139,647,019 | |||||

|

| |||||||

Total Silver Assets (identified cost $92,215,771) | $ | 139,647,019 | ||||||

|

| |||||||

| Principal Amount | ||||||||

| SWISS FRANC ASSETS — 7.73% of Total Net Assets | ||||||||

| CHF | 60,000,000 | 1.250% Swiss Confederation Bonds, 06-11-24 | $ | 69,480,384 | ||||

| CHF | 70,000,000 | 1.500% Swiss Confederation Bonds, 07-24-25 | 81,624,080 | |||||

| CHF | 65,000,000 | 1.250% Swiss Confederation Bonds, 05-28-26 | 75,936,903 | |||||

|

| |||||||

Total Swiss Franc Assets (identified cost $210,371,429) | $ | 227,041,367 | ||||||

|

| |||||||

| Number of Shares | ||||||||

REAL ESTATE AND NATURAL RESOURCE STOCKS — 17.02% of Total Net Assets |

| |||||||

| NATURAL RESOURCES — 9.59% of Total Net Assets | ||||||||

| 180,000 | APA Corporation | $ | 5,639,400 | |||||

| 160,000 | BHP Group, Ltd. (b) | 9,795,200 | ||||||

| 2,000,000 | Birchcliff Energy, Ltd. | 7,520,000 | ||||||

| 160,000 | BP, p.l.c. (b) | 5,616,000 | ||||||

| 500,000 | Cameco Corporation | 23,875,000 | ||||||

| 160,000 | Canadian Natural Resources Ltd. | 10,238,400 | ||||||

| 150,000 | Chevron Corporation | 22,114,500 | ||||||

| 150,000 | ConocoPhillips | 16,780,500 | ||||||

| 350,000 | Devon Energy Corporation | 14,707,000 | ||||||

| 150,000 | Exxon Mobil Corporation | 15,421,500 | ||||||

| 2,100,000 | Freeport-McMoRan, Inc. | 83,349,000 | ||||||

| 350,000 | Murphy Oil Corporation | 13,545,000 | ||||||

| 135,000 | Nutrien, Ltd. | 6,732,450 | ||||||

| 180,000 | Occidental Petroleum Corporation | 10,362,600 | ||||||

| 100,000 | Occidental Petroleum Corporation warrants (a) | 3,568,000 | ||||||

| 180,000 | Ovintiv, Inc. | 7,635,600 | ||||||

| 160,000 | Rio Tinto p.l.c (b) | 11,083,200 | ||||||

| 500,000 | South32 Limited (b) | 5,420,000 | ||||||

| 200,000 | Vale S.A. (b) | 2,738,000 | ||||||

| 175,000 | Viper Energy Partners LP | 5,463,500 | ||||||

|

| |||||||

| $ | 281,604,850 | |||||||

Continued on following page.

8

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Number of Shares | Market Value | |||||||

| REAL ESTATE — 7.43% of Total Net Assets | ||||||||

| 125,000 | Alexander & Baldwin, Inc. | $ | 2,165,000 | |||||

| 20,000 | American Tower Corporation | 3,913,000 | ||||||

| 60,000 | AvalonBay Communities, Inc. | 10,740,600 | ||||||

| 60,000 | Boston Properties, Inc. | 3,990,000 | ||||||

| 200,000 | Centerspace | 10,952,000 | ||||||

| 75,000 | Digital Realty Trust, Inc. | 10,534,500 | ||||||

| 60,000 | Essex Property Trust, Inc. | 13,996,200 | ||||||

| 100,000 | Federal Realty Investment Trust | 10,173,000 | ||||||

| 150,000 | Highwoods Properties, Inc. | 3,445,500 | ||||||

| 300,000 | Kimco Realty Corporation | 6,060,000 | ||||||

| 400,000 | Outfront Media, Inc. | 5,208,000 | ||||||

| 150,000 | Prologis, Inc. | 19,003,500 | ||||||

| 125,000 | Regency Centers Corporation | 7,833,750 | ||||||

| 100,000 | Simon Property Group, Inc. | 13,861,000 | ||||||

| 55,000 | Texas Pacific Land Corporation | 80,373,150 | ||||||

| 125,000 | UDR, Inc. | 4,502,500 | ||||||

| 250,000 | UMH Properties, Inc. | 3,777,500 | ||||||

| 100,000 | Vornado Realty Trust | 2,719,000 | ||||||

| 150,000 | Weyerhaeuser Company | 4,915,500 | ||||||

|

| |||||||

| $ | 218,163,700 | |||||||

|

| |||||||

Total Real Estate and Natural Resource Stocks | $ | 499,768,550 | ||||||

|

| |||||||

| AGGRESSIVE GROWTH STOCKS — 21.07% of Total Net Assets |

| |||||||

| AEROSPACE — .95% of Total Net Assets |

| |||||||

| 65,000 | Lockheed Martin Corporation | $ | 27,911,650 | |||||

|

| |||||||

| $ | 27,911,650 | |||||||

| CHEMICALS — .82% of Total Net Assets |

| |||||||

| 65,000 | Air Products & Chemicals, Inc. | $ | 16,621,150 | |||||

| 65,000 | Albemarle Corporation | 7,458,100 | ||||||

|

| |||||||

| $ | 24,079,250 | |||||||

| COMPUTER SOFTWARE & SERVICES — 1.84% of Total Net Assets |

| |||||||

| 65,000 | Autodesk, Inc. (a) | $ | 16,497,650 | |||||

| 1,500,000 | Palantir Technologies, Inc. Class A (a) | 24,135,000 | ||||||

| 190,000 | Twilio, Inc. Class A (a) | 13,362,700 | ||||||

|

| |||||||

| $ | 53,995,350 | |||||||

| ELECTRICAL EQUIPMENT & ELECTRONICS — 4.02% of Total Net Assets |

| |||||||

| 30,000 | Broadcom, Inc. | $ | 35,400,000 | |||||

| 200,000 | Intel Corporation | 8,616,000 | ||||||

| 120,000 | NVIDIA Corporation | 73,832,400 | ||||||

|

| |||||||

| $ | 117,848,400 | |||||||

| ENERGY SERVICES & PROCESSING — .75% of Total Net Assets |

| |||||||

| 200,000 | HF Sinclair Corporation | $ | 11,298,000 | |||||

| 75,000 | Phillips 66 | 10,823,250 | ||||||

|

| |||||||

| $ | 22,121,250 | |||||||

| ENGINEERING & CONSTRUCTION — .86% of Total Net Assets |

| |||||||

| 175,000 | Fluor Corporation (a) | $ | 6,599,250 | |||||

| 125,000 | Lennar Corporation Class A | 18,731,250 | ||||||

|

| |||||||

| $ | 25,330,500 | |||||||

Continued on following page.

9

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Number of Shares | Market Value | |||||||

| ENTERTAINMENT & LEISURE — 2.75% of Total Net Assets | ||||||||

| 65,000 | Disney (Walt) Company | $ | 6,243,250 | |||||

| 175,000 | Meta Platforms, Inc. Class A | 68,274,500 | ||||||

| 65,000 | Wynn Resorts, Ltd. (a) | 6,137,950 | ||||||

|

| |||||||

| $ | 80,655,700 | |||||||

| FINANCIAL SERVICES — 1.90% of Total Net Assets | ||||||||

| 300,000 | Affirm Holdings, Inc. Class A (a) | $ | 12,153,000 | |||||

| 175,000 | Morgan Stanley | 15,267,000 | ||||||

| 175,000 | Schwab (Charles) Corporation | 11,011,000 | ||||||

| 50,000 | State Street Corporation | 3,693,500 | ||||||

| 50,000 | Visa, Inc. Class A | 13,663,000 | ||||||

|

| |||||||

| $ | 55,787,500 | |||||||

| MANUFACTURING — 2.27% of Total Net Assets | ||||||||

| 70,000 | Agilent Technologies, Inc. | $ | 9,107,000 | |||||

| 70,000 | Illinois Tool Works, Inc. | 18,263,000 | ||||||

| 70,000 | IPG Photonics Corporation (a) | 6,852,300 | ||||||

| 70,000 | Parker-Hannifin Corporation | 32,515,000 | ||||||

|

| |||||||

| $ | 66,737,300 | |||||||

| MATERIALS — .80% of Total Net Assets | ||||||||

| 125,000 | Nucor Corporation | $ | 23,366,250 | |||||

|

| |||||||

| $ | 23,366,250 | |||||||

| PHARMACEUTICALS — .70% of Total Net Assets | ||||||||

| 65,000 | Amgen, Inc. | $ | 20,426,900 | |||||

|

| |||||||

| $ | 20,426,900 | |||||||

| RETAIL — 1.66% of Total Net Assets | ||||||||

| 55,000 | Costco Wholesale Corporation | $ | 38,218,400 | |||||

| 55,000 | Williams-Sonoma, Inc. | 10,636,450 | ||||||

|

| |||||||

| $ | 48,854,850 | |||||||

| TRANSPORTATION — 1.75% of Total Net Assets | ||||||||

| 175,000 | Canadian Pacific Kansas City Limited | $ | 14,082,250 | |||||

| 65,000 | FedEx Corporation | 15,683,850 | ||||||

| 75,000 | Ryder System, Inc. | 8,517,750 | ||||||

| 200,000 | Uber Technologies, Inc. (a) | 13,054,000 | ||||||

|

| |||||||

| $ | 51,337,850 | |||||||

|

| |||||||

Total Aggressive Growth Stocks (identified cost $240,526,255) | $ | 618,452,750 | ||||||

|

| |||||||

Continued on following page.

10

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| DOLLAR ASSETS — 27.40% of Total Net Assets | ||||||||

| CORPORATE BONDS — 26.40% of Total Net Assets | ||||||||

| ADVERTISING & MARKETING — .25% of Total Net Assets | ||||||||

| $ | 7,500,000 | 4.200% The Interpublic Group of Companies, Inc., 04-15-24 | $ | 7,466,329 | ||||

|

| |||||||

| $ | 7,466,329 | |||||||

| AEROSPACE — .35% of Total Net Assets | ||||||||

| 3,000,000 | 8.375% Lockheed Martin Corporation, 06-15-24 | $ | 3,029,052 | |||||

| 7,500,000 | 2.930% Northrop Grumman Corporation, 01-15-25 | 7,352,168 | ||||||

|

| |||||||

| $ | 10,381,220 | |||||||

| CHEMICALS — .51% of Total Net Assets | ||||||||

| 10,000,000 | 4.650% Albemarle Corporation, 06-01-27 | $ | 9,885,855 | |||||

| 5,000,000 | 5.150% FMC Corporation, 05-18-26 | 5,007,170 | ||||||

|

| |||||||

| $ | 14,893,025 | |||||||

| COMMUNICATIONS SERVICES — .12% of Total Net Assets | ||||||||

| 3,500,000 | .750% Bell Canada, 03-17-24 | $ | 3,478,167 | |||||

|

| |||||||

| $ | 3,478,167 | |||||||

| COMPUTER SOFTWARE & SERVICES — 1.13% of Total Net Assets | ||||||||

| 33,500,000 | 4.750% Trimble, Inc., 12-01-24 | $ | 33,144,733 | |||||

|

| |||||||

| $ | 33,144,733 | |||||||

| CONSUMER PRODUCTS — 4.90% of Total Net Assets | ||||||||

| 25,000,000 | 3.222% B.A.T. Capital Corporation, 08-15-24 | $ | 24,684,887 | |||||

| 15,000,000 | 4.600% Conagra Brands, Inc., 11-01-25 | 14,876,603 | ||||||

| 10,000,000 | 7.125% Conagra Brands, Inc., 10-01-26 | 10,458,430 | ||||||

| 5,000,000 | 3.650% General Mills, Inc., 02-15-24 | 4,997,083 | ||||||

| 20,000,000 | 3.500% Imperial Brands, p.l.c., 07-26-26 (c) | 19,129,410 | ||||||

| 11,070,000 | 2.250% Mondelez International Holdings Netherlands B.V., 09-19-24 (c) | 10,835,094 | ||||||

| 30,000,000 | 1.250% Pernod Ricard International Finance, LLC, 04-01-28 (c) | 26,239,890 | ||||||

| 7,500,000 | 2.750% Reckitt Benckiser Treasury Services PLC, 06-26-24 (c) | 7,413,641 | ||||||

| 15,000,000 | 3.500% Smucker (J. M.) Company, 03-15-25 | 14,739,413 | ||||||

| 10,900,000 | 2.250% Suntory Holdings, Ltd., 10-16-24 (c) | 10,645,283 | ||||||

|

| |||||||

| $ | 144,019,734 | |||||||

ELECTRICAL EQUIPMENT & ELECTRONICS — .25% of Total Net Assets |

| |||||||

| 7,500,000 | 4.625% Avnet, Inc., 04-15-26 | $ | 7,397,621 | |||||

|

| |||||||

| $ | 7,397,621 | |||||||

| ENGINEERING & CONSTRUCTION — .93% of Total Net Assets | ||||||||

| 15,000,000 | 2.500% D.R. Horton, Inc., 10-15-24 | $ | 14,690,002 | |||||

| 5,000,000 | 4.750% Lennar Corporation, 11-29-27 | 4,987,610 | ||||||

| 7,500,000 | 5.500% PulteGroup, Inc., 03-01-26 | 7,562,764 | ||||||

|

| |||||||

| $ | 27,240,376 | |||||||

| ENTERTAINMENT & LEISURE — .10% of Total Net Assets | ||||||||

| 2,500,000 | 7.625% Disney (Walt) Company, 11-30-28 | $ | 2,803,745 | |||||

|

| |||||||

| $ | 2,803,745 | |||||||

Continued on following page.

11

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| FINANCIAL SERVICES — 4.40% of Total Net Assets | ||||||||

| $ | 13,500,000 | 4.250% Affiliated Managers Group, Inc., 02-15-24 | $ | 13,483,186 | ||||

| 7,500,000 | 3.500% Affiliated Managers Group, Inc., 08-01-25 | 7,299,323 | ||||||

| 7,500,000 | 6.750% AmSouth Bancorporation, 11-01-25 | 7,601,520 | ||||||

| 15,000,000 | 4.000% Apollo Management Holdings, LLC, 05-30-24 (c) | 14,919,956 | ||||||

| 7,500,000 | 4.250% Associated Banc-Corp, 01-15-25 | 7,426,350 | ||||||

| 7,500,000 | 3.375% Citadel Finance, LLC, 03-09-26 (c) | 7,070,700 | ||||||

| 7,500,000 | 3.750% Intercontinental Exchange, Inc., 12-01-25 | 7,353,348 | ||||||

| 15,000,000 | 4.875% Janus Henderson Holdings, Inc., 08-01-25 | 14,884,140 | ||||||

| 7,500,000 | 4.700% Key Bank, N.A., 01-26-26 | 7,346,760 | ||||||

| 17,500,000 | 3.750% Lazard Group, LLC, 02-13-25 | 17,182,427 | ||||||

| 10,000,000 | 5.400% Manufacturers & Traders Trust Company, 11-21-25 | 9,971,590 | ||||||

| 15,000,000 | .700% UBS Group, AG, 08-09-24 (c) | 14,628,810 | ||||||

|

| |||||||

| $ | 129,168,110 | |||||||

| INFORMATION SERVICES — .17% of Total Net Assets | ||||||||

| 5,000,000 | 2.750% Fiserv, Inc., 07-01-24 | $ | 4,941,340 | |||||

|

| |||||||

| $ | 4,941,340 | |||||||

| INSURANCE — 1.53% of Total Net Assets | ||||||||

| 15,000,000 | 3.625% Alleghany Corporation, 05-15-30 | $ | 14,309,947 | |||||

| 5,500,000 | 4.500% Horace Mann Educators Corporation, 12-01-25 | 5,411,483 | ||||||

| 15,000,000 | 4.350% Kemper Corporation, 02-15-25 | 14,765,430 | ||||||

| 7,500,000 | 4.400% Mercury General Corporation, 03-15-27 | 7,198,466 | ||||||

| 3,500,000 | 5.125% SBL Holdings, Inc., 11-13-26 (c) | 3,322,064 | ||||||

|

| |||||||

| $ | 45,007,390 | |||||||

| MANUFACTURING — 1.32% of Total Net Assets | ||||||||

| 15,000,000 | 2.750% Alcon Finance Corporation, 09-23-26 (c) | $ | 14,169,998 | |||||

| 10,000,000 | 4.625% Kennametal, Inc., 06-15-28 | 9,789,860 | ||||||

| 10,000,000 | 4.550% Keysight Technologies, Inc., 10-30-24 | 9,916,650 | ||||||

| 5,000,000 | 2.700% Parker-Hannifin Corporation, 06-14-24 | 4,946,382 | ||||||

|

| |||||||

| $ | 38,822,890 | |||||||

| MATERIALS — 1.04% of Total Net Assets | ||||||||

| 7,500,000 | 2.400% Steel Dynamics, Inc., 06-15-25 | $ | 7,209,375 | |||||

| 7,250,000 | 4.500% Vulcan Materials Company, 04-01-25 | 7,166,338 | ||||||

| 6,195,000 | 5.800% Vulcan Materials Company, 03-01-26 | 6,197,410 | ||||||

| 10,000,000 | 3.000% WRKCO, Inc., 09-15-24 | 9,828,515 | ||||||

|

| |||||||

| $ | 30,401,638 | |||||||

| NATURAL RESOURCES — 2.07% of Total Net Assets | ||||||||

| 7,500,000 | 4.875% BHP Billiton Finance (USA) Limited, 02-27-26 | $ | 7,545,154 | |||||

| 5,250,000 | 3.900% Cimarex Energy Company, 05-15-27 | 4,666,347 | ||||||

| 4,500,000 | 3.900% Coterra Energy, Inc., 05-15-27 | 4,354,466 | ||||||

| 5,000,000 | 3.000% Nutrien, Ltd., 04-01-25 | 4,870,185 | ||||||

| 5,000,000 | 4.000% Nutrien, Ltd., 12-15-26 | 4,899,022 | ||||||

| 9,940,000 | 5.650% Ovintiv, Inc., 05-15-25 | 9,977,533 | ||||||

| 15,000,000 | 5.375% Ovintiv, Inc., 01-01-26 | 15,009,375 | ||||||

| 4,779,000 | 4.125% Parsley Energy, LLC, 02-15-28 (c) | 4,567,639 | ||||||

| 5,000,000 | 3.800% Yara International ASA, 06-06-26 (c) | 4,856,250 | ||||||

|

| |||||||

| $ | 60,745,971 | |||||||

| PHARMACEUTICALS — .40% of Total Net Assets | ||||||||

| 5,000,000 | 6.800% Bristol-Myers Squibb Company, 11-15-26 | $ | 5,299,173 | |||||

| 6,500,000 | 3.250% EMD Finance, LLC, 03-15-25 (c) | 6,354,663 | ||||||

|

| |||||||

| $ | 11,653,836 | |||||||

Continued on following page.

12

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| REAL ESTATE — 3.92% of Total Net Assets | ||||||||

| $ | 7,500,000 | 4.100% Brandywine Operating Partnership, L.P., 10-01-24 | $ | 7,406,250 | ||||

| 5,000,000 | 3.950% Brandywine Operating Partnership, L.P., 11-15-27 | 4,531,418 | ||||||

| 5,000,000 | 3.500% Camden Property Trust, 09-15-24 | 4,929,963 | ||||||

| 11,000,000 | 2.000% Corporate Office Properties, L.P., 01-15-29 | 9,262,368 | ||||||

| 4,740,000 | 3.125% Cubesmart, L.P., 09-01-26 | 4,514,549 | ||||||

| 5,000,000 | 2.625% Equinix, Inc., 11-18-24 | 4,884,895 | ||||||

| 5,000,000 | 1.250% Federal Realty Investment Trust, 02-15-26 | 4,627,097 | ||||||

| 7,500,000 | 4.125% Highwoods Realty, L.P., 03-15-28 | 7,012,635 | ||||||

| 8,725,000 | 3.850% Kimco Realty Corporation, 06-01-25 | 8,524,207 | ||||||

| 4,537,000 | 4.400% LXP Industrial Trust, 06-15-24 | 4,498,451 | ||||||

| 5,000,000 | 4.600% Realty Income Corporation, 02-06-24 | 4,999,142 | ||||||

| 15,000,000 | 4.000% Retail Opportunity Investments Corporation, 12-15-24 | 14,769,143 | ||||||

| 12,500,000 | 3.625% Site Centers Corporation, 02-01-25 | 12,284,150 | ||||||

| 15,000,000 | 2.300% Sun Communities Operating Limited Partnership, 11-01-28 | 13,230,488 | ||||||

| 10,000,000 | 2.950% UDR, Inc., 09-01-26 | 9,512,700 | ||||||

|

| |||||||

| $ | 114,987,456 | |||||||

| RETAIL — .88% of Total Net Assets | ||||||||

| 7,500,000 | 1.750% Advance Auto Parts, Inc., 10-01-27 | $ | 6,478,339 | |||||

| 14,500,000 | 3.500% AutoNation, Inc., 11-15-24 | 14,209,065 | ||||||

| 5,000,000 | 4.750% Starbucks Corporation, 02-15-26 | 5,020,072 | ||||||

|

| |||||||

| $ | 25,707,476 | |||||||

| TRANSPORTATION — 1.46% of Total Net Assets | ||||||||

| 7,500,000 | 2.875% Canadian Pacific Kansas City Limited, 11-15-29 | $ | 6,748,433 | |||||

| 5,000,000 | 3.350% CSX Corporation, 11-01-25 | 4,884,710 | ||||||

| 5,000,000 | 4.250% CSX Corporation, 03-15-29 | 4,964,415 | ||||||

| 7,500,000 | 3.875% Hunt (J.B.) Transport Services, Inc., 03-01-26 | 7,348,136 | ||||||

| 11,750,000 | 4.450% Penske Truck Leasing Company, L.P., 01-29-26 (c) | 11,505,982 | ||||||

| 7,500,000 | 2.500% Ryder System, Inc., 09-01-24 | 7,370,756 | ||||||

|

| |||||||

| $ | 42,822,432 | |||||||

| UTILITIES — .67% of Total Net Assets | ||||||||

| 7,500,000 | 5.200% National Fuel Gas Company, 07-15-25 | $ | 7,470,296 | |||||

| 5,000,000 | .800% WEC Energy Group, Inc., 03-15-24 | 4,970,555 | ||||||

| 7,500,000 | 3.300% Xcel Energy, Inc., 06-01-25 | 7,321,973 | ||||||

|

| |||||||

| $ | 19,762,824 | |||||||

|

| |||||||

| $ | 774,846,313 | |||||||

|

| |||||||

Continued on following page.

13

PERMANENT PORTFOLIO®

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| UNITED STATES TREASURY SECURITIES — 1.00% of Total Net Assets | ||||||||

| $ | 10,000,000 | United States Treasury bills 5.144%, 03-12-24 (d) | $ | 9,941,496 | ||||

| 10,000,000 | United States Treasury bonds 2.250%, 03-31-24 | 9,950,236 | ||||||

| 10,000,000 | United States Treasury bonds 1.125%, 01-15-25 | 9,664,744 | ||||||

|

| |||||||

| $ | 29,556,476 | |||||||

|

| |||||||

Total Dollar Assets (identified cost $823,168,322) | $ | 804,402,789 | ||||||

|

| |||||||

Total Portfolio — 99.55% of total net assets | $ | 2,922,471,259 | ||||||

Other assets, less liabilities (.45% of total net assets) | 13,158,343 | |||||||

|

| |||||||

Net assets applicable to outstanding shares | $ | 2,935,629,602 | ||||||

|

| |||||||

Notes: | ||||||||

(a) Non-income producing. | ||||||||

(b) Sponsored American Depositary Receipt (ADR). | ||||||||

(c) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration to qualified institutional investors. As of January 31, 2024, these securities amounted to $155,659,380, or 5.30% of Permanent Portfolio’s total net assets, and have been determined by the Portfolio’s investment adviser to be liquid. | ||||||||

(d) Interest rate represents yield to maturity. | ||||||||

(e) Aggregate cost for book and federal income tax purposes are the same. | ||||||||

See accompanying notes to financial statements.

14

Management’s Discussion and Analysis

Year Ended January 31, 2024 (Unaudited)

Short-Term Treasury Portfolio’s investment objective is to earn high current income, consistent with safety and liquidity of principal. Under normal market conditions, the Portfolio invests at least 80% of its assets in direct debt obligations of the United States Treasury, including U.S. Treasury bills, notes and bonds, and other securities issued by the U.S. Treasury. The remainder of the Portfolio’s assets may be invested in U.S. government agency securities, which include debt obligations issued and/or guaranteed as to principal and interest by the U.S. government or its agencies, sponsored enterprises or instrumentalities. The Portfolio expects to maintain a dollar-weighted average portfolio maturity and duration of zero to three years. During the year ended January 31, 2024, the Portfolio’s Class I shares achieved a total return of 3.62%, net of expenses to average net assets of .65%, as compared to 5.36% for the FTSE 3-Month U.S. Treasury Bill Index over the same period. The Portfolio’s return during the year then ended was primarily due to increasing net investment returns available on short-term U.S. Treasury and Agency securities being only partially offset by decreases in value of Portfolio securities caused by the continued rise in short term interest rates. The FTSE 3-Month U.S. Treasury Bill Index does not reflect a deduction for fees, expenses or taxes.

Mutual fund investing involves risk; loss of principal is possible. The Portfolio’s yield and share price will fluctuate in response to changes in interest rates. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

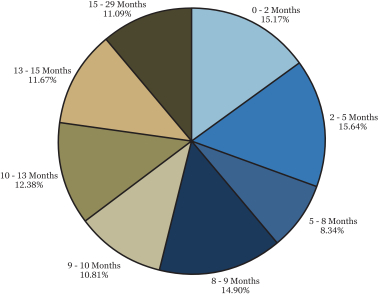

The following pie chart shows Short-Term Treasury Portfolio’s investment holdings by months to maturity, as a percentage of investments as of January 31, 2024.

Allocations are subject to change and should not be considered a recommendation to buy or sell any security.

15

SHORT-TERM TREASURY PORTFOLIO

Ten Years Ended January 31, 2024 (Unaudited)

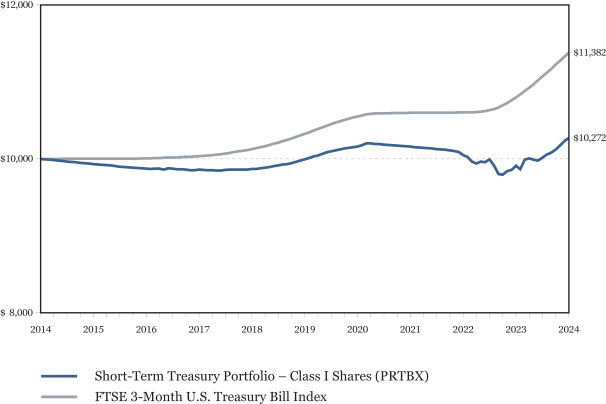

The chart above compares the initial account values and subsequent account values over the past ten years, assuming a hypothetical $10,000 investment in the Portfolio at the beginning of the first period indicated and reinvestment of all dividends and other distributions, without the deduction of taxes, to a $10,000 investment over the same periods in a comparable broad-based securities market index.

The FTSE 3-Month U.S. Treasury Bill Index tracks the performance of U.S. Treasury bills with a remaining maturity of three months. U.S. Treasury bills, which are short-term loans to the U.S. government, are full-faith-and-credit obligations of the U.S. Treasury. You cannot invest directly in an index. Returns shown for the FTSE 3-Month U.S. Treasury Bill Index reflect reinvested interest as applicable, but do not reflect a deduction for fees, expenses or taxes.

Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

16

SHORT-TERM TREASURY PORTFOLIO

Periods Ended January 31, 2024 (Unaudited)

| One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||

At Net Asset Value | ||||||||||||||||||||

Class I Shares (PRTBX) (1) | 3.62% | .55% | .27% | 2.11% | 5/26/1987 | |||||||||||||||

FTSE 3-Month U.S. Treasury Bill Index (2) | 5.36% | 1.97% | 1.30% | 3.01% | ||||||||||||||||

| (1) | Returns reflect the impact of fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. See the Notes to Financial Statements for specific information regarding fee waivers. |

| (2) | The date used to calculate performance since inception for the Index is the inception date of the Class I shares. |

The table above shows Short-Term Treasury Portfolio’s average annual total returns for the periods indicated, assuming reinvestment of all dividends and other distributions, and deduction of all applicable fees and expenses (except the $35 one-time account start-up fee which was eliminated in January 2016). Performance does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

As stated in the Portfolio’s Prospectus dated May 31, 2023, the total annual operating expenses before and after fee waivers (“expense ratios”) for the year ended January 31, 2023 were 1.21% and .65%, respectively. The expense ratios for the year ended January 31, 2024 may be found in the Financial Highlights section of this Report.

Performance data shown above for Short-Term Treasury Portfolio represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Investment performance, current to the most recent month-end, may be lower or higher than the performance shown above, and can be obtained by calling the Fund’s Shareholder Services Office at (800) 531-5142.

Investments in the Portfolio are not insured or guaranteed by the Federal Deposit Insurance Corporation or other government agency. It is therefore possible to lose money by investing in Short-Term Treasury Portfolio.

17

SHORT-TERM TREASURY PORTFOLIO

January 31, 2024

| Principal Amount | Market Value | |||||||

| UNITED STATES TREASURY SECURITIES — 99.95% of Total Net Assets | ||||||||

| $ | 1,800,000 | United States Treasury bills 5.155%, 03-19-24 (a) | $ | 1,787,626 | ||||

| 1,850,000 | United States Treasury notes 2.500%, 05-31-24 | 1,833,034 | ||||||

| 1,000,000 | United States Treasury notes 1.250%, 08-31-24 | 977,950 | ||||||

| 1,800,000 | United States Treasury notes .625%, 10-15-24 | 1,746,580 | ||||||

| 1,300,000 | United States Treasury notes 1.500%, 10-31-24 | 1,267,730 | ||||||

| 1,500,000 | United States Treasury notes 1.375%, 01-31-25 | 1,451,227 | ||||||

| 1,400,000 | United States Treasury notes 2.625%, 04-15-25 | 1,367,864 | ||||||

| 1,300,000 | United States Treasury notes 4.125%, 06-15-26 | 1,300,385 | ||||||

|

| |||||||

Total Portfolio — 99.95% of total net assets | $ | 11,732,396 | ||||||

Other assets, less liabilities (.05% of total net assets) | 5,655 | |||||||

|

| |||||||

Net assets applicable to outstanding shares | $ | 11,738,051 | ||||||

|

| |||||||

Notes: | ||||||||

(a) Interest rate represents yield to maturity. | ||||||||

(b) Aggregate cost for book and federal income tax purposes are the same. | ||||||||

See accompanying notes to financial statements.

18

Management’s Discussion and Analysis

Year Ended January 31, 2024 (Unaudited)

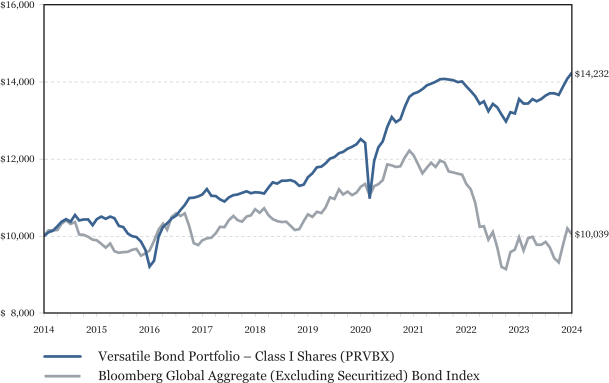

Versatile Bond Portfolio’s investment objective is to earn high current income. Under normal market conditions, the Portfolio invests at least 80% of its assets in bonds, which may include debt securities of all types and of any maturity, and may invest up to 20% of its assets in other securities, including preferred stocks. During the year ended January 31, 2024, the Portfolio’s Class I shares achieved a total return of 5.00%, net of expenses to average net assets of .66%, as compared to .78% for the Bloomberg Global Aggregate (Excluding Securitized) Bond Index over the same period. The Portfolio’s return during the year then ended exceeded the performance of the index, primarily due to its investment selection, the timing of purchases and sales of those investments in relation to fluctuating market values relative to the aforementioned index, and its investments in U.S. dollar denominated corporate securities having greater credit risk, lower duration and less currency risk than the index. The returns of the index do not reflect a deduction for fees, expenses or taxes. Returns for the Portfolio’s Class A and Class C shares are provided on pages 21, 43 and 44.

Mutual fund investing involves risk; loss of principal is possible. The Portfolio’s yield and share price will fluctuate in response to changes in interest rates. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in debt securities are also subject to credit risk, which is the risk that an issuer of debt securities may be unable or unwilling to pay principal and interest when due. Below investment grade bonds involve greater risk of loss because they are subject to greater levels of credit risk.

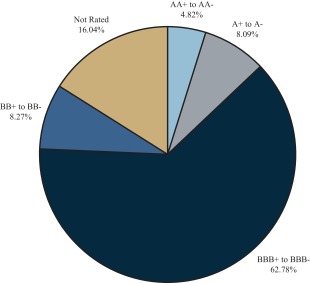

The following pie chart shows Versatile Bond Portfolio’s investment holdings by S&P credit rating, as a percentage of investments as of January 31, 2024. Credit ratings range from AAA (highest) to D (lowest) based on S&P measures. Other rating agencies may rate the same securities differently. “Not Rated” securities are not rated by S&P. Credit ratings are only the opinions of the rating agencies issuing them, do not purport to reflect the risk of fluctuations in market value, are not guarantees as to the payment of interest and repayment of principal, and are subject to change.

Allocations are subject to change and should not be considered a recommendation to buy or sell any security.

19

VERSATILE BOND PORTFOLIO

Ten Years Ended January 31, 2024 (Unaudited)

The chart above compares the initial account values and subsequent account values over the past ten years, assuming a hypothetical $10,000 investment in the Portfolio’s Class I shares at the beginning of the first period indicated and reinvestment of all dividends and other distributions, without the deduction of taxes, to a $10,000 investment over the same periods in a comparable broad-based securities market index. The performance of the Portfolio’s Class A and Class C shares will differ due to different sales charge structures and share class expenses.

The Bloomberg Global Aggregate Bond Index is a market-capitalization weighted, broad-based measure of global, government-related, treasury, corporate and securitized fixed income investments. The Bloomberg Global Aggregate (Excluding Securitized) Bond Index, which excludes securitized fixed income investments, is a sub-index of the Bloomberg Global Aggregate Bond Index. You cannot invest directly in an index. Returns shown for the Bloomberg Global Aggregate (Excluding Securitized) Bond Index reflect reinvested interest, dividends and other distributions as applicable, but do not reflect a deduction for fees, expenses or taxes.

Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

20

VERSATILE BOND PORTFOLIO

Periods Ended January 31, 2024 (Unaudited)

| One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||

At Net Asset Value | ||||||||||||||||||||

Class I Shares (PRVBX) (1)(2) | 5.00% | 4.32% | 3.59% | 3.57% | 9/27/1991 | |||||||||||||||

Class A Shares (PRVDX) (1) | 4.74% | 4.06% | — | 4.01% | 5/31/2016 | |||||||||||||||

Class C Shares (PRVHX) (1) | 3.97% | 3.28% | — | 3.23% | 5/31/2016 | |||||||||||||||

With Sales Charge | ||||||||||||||||||||

Class A Shares (PRVDX) (1)(3) | .56% | 3.21% | — | 3.46% | ||||||||||||||||

Class C Shares (PRVHX) (1)(3) | 2.97% | 3.28% | — | 3.23% | ||||||||||||||||

Bloomberg Global Aggregate (Excluding Securitized) Bond Index (4)(5) | .78% | -1.01% | .04% | 4.27% | ||||||||||||||||

| (1) | Returns reflect the impact of fee waivers in effect. In the absence of such fee waivers, total returns would be reduced. See the Notes to Financial Statements for specific information regarding fee waivers. |

| (2) | Returns for periods prior to May 30, 2012 reflect the Portfolio’s results under its prior investment strategies. Such returns should not be considered predictive or representative of results the Portfolio may experience under its current investment strategies. |

| (3) | Returns with sales charge reflect the deduction of the maximum front end sales charge of 4.00% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is imposed on Class C shares that are redeemed within one year of purchase. |

| (4) | The Bloomberg Global Aggregate (Excluding Securitized) Bond Index commenced on September 30, 2002. Performance of the Index for periods prior to September 30, 2002, is calculated using the return data of the Bloomberg Global Aggregate Bond Index through September 29, 2002 and the return data of the Bloomberg Global Aggregate (Excluding Securitized) Bond Index since September 30, 2002. |

| (5) | The date used to calculate performance since inception for the Index is the inception date of the Class I shares. |

The table above shows Versatile Bond Portfolio’s average annual total returns for the periods indicated, assuming reinvestment of all dividends and other distributions, and deduction of all applicable fees and expenses (except the $35 one-time account start-up fee which was eliminated in January 2016). All share classes of the Portfolio are invested in the same securities and returns only differ to the extent that the fees and expenses of the share classes are different. Performance does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

As stated in the Portfolio’s Prospectus dated May 31, 2023, as amended July 26, 2023, the total annual operating expenses (“expense ratios”) for the year ended January 31, 2023, before fee waivers, were 1.21%, 1.46% and 2.21% for the Portfolio’s Class I, Class A and Class C shares, respectively. The expense ratios for the same period, after fee waivers, were .65%, .90% and 1.65% for the Portfolio’s Class I, Class A and Class C shares, respectively. The expense ratios for the year ended January 31, 2024 may be found in the Financial Highlights section of this Report.

Performance data shown above for Versatile Bond Portfolio represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Investment performance, current to the most recent month-end, may be lower or higher than the performance shown above, and can be obtained by calling the Fund’s Shareholder Services Office at (800) 531-5142.

Investments in the Portfolio are not insured or guaranteed by the Federal Deposit Insurance Corporation or other government agency. It is therefore possible to lose money by investing in Versatile Bond Portfolio.

21

VERSATILE BOND PORTFOLIO

January 31, 2024

| Principal Amount | Market Value | |||||||

| CORPORATE BONDS — 85.50% of Total Net Assets | ||||||||

| ADVERTISING & MARKETING — 1.04% of Total Net Assets | ||||||||

| $ | 1,000,000 | 4.200% The Interpublic Group of Companies, Inc., 04-15-24 | $ | 995,511 | ||||

|

| |||||||

| $ | 995,511 | |||||||

| AEROSPACE — .83% of Total Net Assets | ||||||||

| 834,000 | 4.200% Hexcel Corporation, 02-15-27 | $ | 800,679 | |||||

|

| |||||||

| $ | 800,679 | |||||||

| CHEMICALS — 2.00% of Total Net Assets | ||||||||

| 1,000,000 | 3.200% FMC Corporation, 10-01-26 | $ | 950,057 | |||||

| 1,000,000 | .875% Westlake Corporation, 08-15-24 | 973,004 | ||||||

|

| |||||||

| $ | 1,923,061 | |||||||

| COMPUTER SOFTWARE & SERVICES — 3.57% of Total Net Assets | ||||||||

| 500,000 | 1.000% Fortinent, Inc., 03-15-26 | $ | 460,024 | |||||

| 3,000,000 | 4.750% Trimble, Inc., 12-01-24 | 2,968,185 | ||||||

|

| |||||||

| $ | 3,428,209 | |||||||

| CONSUMER PRODUCTS — 11.43% of Total Net Assets | ||||||||

| 3,500,000 | 3.222% B.A.T. Capital Corporation, 08-15-24 | $ | 3,455,884 | |||||

| 1,000,000 | 7.125% Conagra Brands, Inc., 10-01-26 | 1,045,843 | ||||||

| 4,750,000 | 3.500% Imperial Brands, p.l.c., 07-26-26 (a) | 4,543,235 | ||||||

| 229,000 | 3.350% Johnson (S.C.) & Son, Inc., 09-30-24 (a) | 226,462 | ||||||

| 1,000,000 | 3.500% Smucker (J. M.) Company, 03-15-25 | 982,627 | ||||||

| 750,000 | 2.250% Suntory Holdings, Ltd., 10-16-24 (a) | 732,474 | ||||||

|

| |||||||

| $ | 10,986,525 | |||||||

| ELECTRICAL EQUIPMENT & ELECTRONICS — 1.03% of Total Net Assets | ||||||||

| 1,000,000 | 4.625% Avnet, Inc., 04-15-26 | $ | 986,350 | |||||

|

| |||||||

| $ | 986,350 | |||||||

| ENERGY SERVICES & PROCESSING — 7.22% of Total Net Assets | ||||||||

| 5,543,600 | 4.750% El Paso Energy Capital Trust I, 03-31-28 (b) | $ | 5,214,310 | |||||

| 460,000 | 5.875% HF Sinclair Corporation, 04-01-26 | 465,688 | ||||||

| 1,250,000 | 5.000% Magellan Midstream Partners, L.P., 03-01-26 | 1,255,294 | ||||||

|

| |||||||

| $ | 6,935,292 | |||||||

| ENGINEERING & CONSTRUCTION — 1.05% of Total Net Assets | ||||||||

| 1,000,000 | 5.500% PulteGroup, Inc., 03-01-26 | $ | 1,008,368 | |||||

|

| |||||||

| $ | 1,008,368 | |||||||

| FINANCIAL SERVICES — 15.35% of Total Net Assets | ||||||||

| 3,000,000 | 4.250% Affiliated Managers Group, Inc., 02-15-24 | $ | 2,996,264 | |||||

| 1,000,000 | 3.500% Affiliated Managers Group, Inc., 08-01-25 | 973,243 | ||||||

| 997,500 | 6.500% B. Riley Financial, Inc., 09-30-26 | 697,452 | ||||||

| 2,500,000 | 4.700% Key Bank, N.A., 01-26-26 | 2,448,920 | ||||||

| 375,000 | 4.625% KKR Group Finance Company IX, LLC, 04-01-61 | 297,000 | ||||||

| 4,500,000 | 3.750% Lazard Group, LLC, 02-13-25 | 4,418,338 | ||||||

| 3,000,000 | 2.900% Manufactuers & Traders Trust Company, 02-06-25 | 2,920,631 | ||||||

|

| |||||||

| $ | 14,751,848 | |||||||

Continued on following page.

22

VERSATILE BOND PORTFOLIO

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| INSURANCE — 12.03% of Total Net Assets | ||||||||

| $ | 500,000 | 4.200% Brown & Brown, Inc., 09-15-24 | $ | 495,225 | ||||

| 1,500,000 | 4.500% Brown & Brown, Inc., 03-15-29 | 1,460,879 | ||||||

| 2,000,000 | 4.550% Globe Life, Inc., 09-15-28 | 1,981,893 | ||||||

| 2,485,000 | 4.500% Horace Mann Educators Corporation, 12-01-25 | 2,445,006 | ||||||

| 3,000,000 | 4.350% Kemper Corporation, 02-15-25 | 2,953,086 | ||||||

| 1,750,000 | 4.400% Mercury General Corporation, 03-15-27 | 1,679,642 | ||||||

| 750,000 | 7.450% Phoenix Companies, Inc., 01-15-32 | 543,750 | ||||||

|

| |||||||

| $ | 11,559,481 | |||||||

| MANUFACTURING — 4.91% of Total Net Assets | ||||||||

| 375,000 | 8.125% Babcock & Wilcox Enterprises, Inc., 02-28-26 | $ | 299,250 | |||||

| 3,000,000 | 4.625% Kennametal, Inc., 06-15-28 | 2,936,958 | ||||||

| 1,000,000 | 4.550% Keysight Technologies, Inc., 10-30-24 | 991,665 | ||||||

| 500,000 | 4.600% Keysight Technologies Inc., 04-06-27 | 496,037 | ||||||

|

| |||||||

| $ | 4,723,910 | |||||||

| MATERIALS — 1.02% of Total Net Assets | ||||||||

| 1,000,000 | 2.800% Steel Dynamics, Inc., 12-15-24 | $ | 977,500 | |||||

|

| |||||||

| $ | 977,500 | |||||||

| NATURAL RESOURCES — 4.75% of Total Net Assets | ||||||||

| 1,000,000 | 3.900% Cimarex Energy Company, 05-15-27 | $ | 888,828 | |||||

| 500,000 | 1.625% Glencore Funding, LLC, 09-01-25 (a) | 473,958 | ||||||

| 1,000,000 | 5.375% Ovintiv, Inc., 01-01-26 | 1,000,625 | ||||||

| 2,300,000 | 4.125% Parsley Energy, LLC, 02-15-28 (a) | 2,198,277 | ||||||

|

| |||||||

| $ | 4,561,688 | |||||||

| PHARMACEUTICALS — .38% of Total Net Assets | ||||||||

| 370,000 | 2.900% Bristol-Myers Squibb Company, 07-26-24 (a) | $ | 365,339 | |||||

|

| |||||||

| $ | 365,339 | |||||||

| REAL ESTATE — 12.15% of Total Net Assets | ||||||||

| 2,000,000 | 4.100% Brandywine Operating Partnership, L.P., 10-01-24 | $ | 1,975,000 | |||||

| 1,250,000 | 4.100% Camden Property Trust, 10-15-28 | 1,219,975 | ||||||

| 1,100,000 | 2.000% Corporate Office Properties, L.P., 01-15-29 | 926,237 | ||||||

| 865,000 | 3.125% Cubesmart, L.P., 09-01-26 | 823,858 | ||||||

| 408,000 | 3.375% Duke Realty, L.P., 12-15-27 | 377,033 | ||||||

| 500,000 | 7.600% First Industrial, L.P., 07-15-28 | 529,374 | ||||||

| 1,250,000 | 3.850% Kimco Realty Corporation, 06-01-25 | 1,221,233 | ||||||

| 481,000 | 1.900% Kimco Realty Corporation, 03-01-28 | 426,611 | ||||||

| 620,000 | 4.600% Realty Income Corporation, 02-06-24 | 619,893 | ||||||

| 470,000 | 3.750% Regency Centers, L.P., 06-15-24 | 465,691 | ||||||

| 2,250,000 | 4.000% Retail Opportunity Investments Corporation, 12-15-24 | 2,215,371 | ||||||

| 1,000,000 | 2.300% Sun Communities Operating Limited Partnership, 11-01-28 | 882,033 | ||||||

|

| |||||||

| $ | 11,682,309 | |||||||

| RETAIL — 2.55% of Total Net Assets | ||||||||

| 2,500,000 | 3.500% AutoNation, Inc., 11-15-24 | $ | 2,449,839 | |||||

|

| |||||||

| $ | 2,449,839 | |||||||

| TRANSPORTATION — 1.73% of Total Net Assets | ||||||||

| 1,083,000 | 6.700% Burlington Northern Santa Fe, LLC, 08-01-28 | $ | 1,171,404 | |||||

| 500,000 | 2.500% Ryder System, Inc., 09-01-24 | 491,384 | ||||||

|

| |||||||

| $ | 1,662,788 | |||||||

Continued on following page.

23

VERSATILE BOND PORTFOLIO

Schedule of Investments

January 31, 2024

| Principal Amount | Market Value | |||||||

| UTILITIES — 1.47% of Total Net Assets | ||||||||

| $ | 498,000 | 3.600% Eastern Gas Transmission & Storage, Inc., 12-15-24 | $ | 490,299 | ||||

| 500,000 | 7.375% National Fuel Gas Company, 06-13-25 | 510,985 | ||||||

| 415,000 | 3.508% Niagara Mohawk Power Corporation, 10-01-24 (a) | 408,539 | ||||||

|

| |||||||

| $ | 1,409,823 | |||||||

| WASTE & ENVIRONMENTAL SERVICES — .99% of Total Net Assets | ||||||||

| 940,000 | 4.875% Republic Services, Inc., 04-01-29 | $ | 950,633 | |||||

|

| |||||||

| $ | 950,633 | |||||||

|

| |||||||

Total Corporate Bonds (identified cost $84,982,925) | $ | 82,159,153 | ||||||

|

| |||||||

| UNITED STATES TREASURY SECURITIES — 3.63% of Total Net Assets | ||||||||

| 2,500,000 | United States Treasury bills 5.231%, 02-01-24 (c) | $ | 2,499,637 | |||||

| 1,000,000 | United States Treasury bills 5.114%, 03-12-24 (c) | 994,149 | ||||||

|

| |||||||

Total United States Treasury Securities (identified cost $3,494,166) | $ | 3,493,786 | ||||||

|

| |||||||

| Number of Shares | ||||||||

| PREFERRED STOCKS — 11.46% of Total Net Assets | ||||||||

| COMMUNICATIONS SERVICES — 2.32% of Total Net Assets | ||||||||

| 45,000 | 7.125% DigitalBridge Group, Inc., Preferred Class H (d) | $ | 1,036,350 | |||||

| 45,000 | 7.125% DigitalBridge Group, Inc., Preferred Class J (d) | 1,032,750 | ||||||

| 10,000 | 6.000% Telephone & Data Systems, Inc., Preferred Class VV (d) | 164,900 | ||||||

|

| |||||||

| $ | 2,234,000 | |||||||

| FINANCIAL SERVICES — 4.53% of Total Net Assets | ||||||||

| 15,000 | 5.625% Associated Banc-Corp, Preferred Class F (e) | $ | 302,550 | |||||

| 50,000 | 5.000% Capital One Financial Corporation, Preferred Class I (e) | 1,016,000 | ||||||

| 42,500 | 7.875% Compass Diversified Holdings, Preferred Class C (d) | 1,066,750 | ||||||

| 10,000 | 6.000% Merchants Bancorp, Preferred Class C (e) | 216,500 | ||||||

| 15,000 | 4.450% Schwab (Charles) Corporation, Preferred Class J (e) | 312,000 | ||||||

| 35,000 | 6.000% Steel Partners Holdings, L.P., Cumulative Preferred Class C, 02-07-26 | 833,000 | ||||||

| 35,000 | 4.875% WaFD, Inc., Preferred Class A (e) | 603,400 | ||||||

|

| |||||||

| $ | 4,350,200 | |||||||

| INSURANCE — .33% of Total Net Assets | ||||||||

| 500,000 | 6.500% SBL Holdings, Inc., Perpetual Hybrid Subordinated (a)(d)(f) | $ | 319,778 | |||||

|

| |||||||

| $ | 319,778 | |||||||

| MANUFACTURING — 1.12% of Total Net Assets | ||||||||

| 40,000 | 10.625% Wesco International, Inc., Preferred Class A (d)(f) | $ | 1,072,400 | |||||

|

| |||||||

| $ | 1,072,400 | |||||||

| REAL ESTATE — 3.16% of Total Net Assets | ||||||||

| 45,000 | 6.375% CTO Realty Growth, Inc., Preferred Class A (d) | $ | 936,900 | |||||

| 20,000 | 6.250% Regency Centers Corporation, Preferred Class A (d) | 490,000 | ||||||

| 65,000 | 5.875% Regency Centers Corporation, Preferred Class B (d) | 1,612,000 | ||||||

|

| |||||||

| $ | 3,038,900 | |||||||

|

| |||||||

Total Preferred Stocks (identified cost $12,208,536) | $ | 11,015,278 | ||||||

|

| |||||||

Total Portfolio — 100.59% of total net assets | $ | 96,668,217 | ||||||

Liabilities, less other assets (.59% of total net assets) | (571,527 | ) | ||||||

|

| |||||||

Net assets applicable to outstanding shares | $ | 96,096,690 | ||||||

|

| |||||||

Continued on following page.

24

VERSATILE BOND PORTFOLIO

Schedule of Investments

January 31, 2024

Notes: | ||||||||

(a) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration to qualified institutional investors. As of January 31, 2024, these securities amounted to $9,268,062, or 9.64% of Versatile Bond Portfolio’s total net assets, and have been determined by the Portfolio’s investment adviser to be liquid. | ||||||||

(b) Convertible security. | ||||||||

(c) Interest rate represents yield to maturity. | ||||||||

(d) Cumulative, perpetual preferred stock. | ||||||||

(e) Non-cumulative, perpetual preferred stock. | ||||||||

(f) Variable or floating rate security whereby the interest rate is periodically reset. The interest rate shown reflects the rate in effect as of January 31, 2024. | ||||||||

(g) Aggregate cost for book and federal income tax purposes are the same. |

See accompanying notes to financial statements.

25

[THIS PAGE INTENTIONALLY LEFT BLANK]

26

Management’s Discussion and Analysis

Year Ended January 31, 2024 (Unaudited)

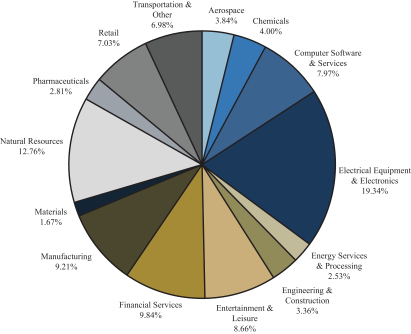

Aggressive Growth Portfolio’s investment objective is to achieve high (greater than for the stock market as a whole), long-term appreciation in the value of its shares. Under normal market conditions, the Portfolio invests in stocks and stock warrants of U.S. and foreign companies that are expected to have a higher profit potential than the stock market as a whole. During the year ended January 31, 2024, the Portfolio’s Class I shares achieved a total return of 24.28%, net of expenses to average net assets of 1.21%, as compared to 14.36% for the Dow Jones Industrial Average and 20.82% for the S&P 500 over the same period. The Portfolio’s return during the year then ended was primarily due to the Portfolio’s investment selection and the timing of purchases and sales of those investments in relation to fluctuating market values relative to the aforementioned indices. Industry sectors contributing the most appreciation to the Portfolio during the year ended January 31, 2024 included electrical equipment and electronics, entertainment and leisure, retail, computer software and services, transportation, and engineering and construction, while chemicals, natural resources, financial services, and aerospace provided the most depreciation over the same period. Neither the Dow Jones Industrial Average nor the S&P 500 reflect deductions for fees, expenses or taxes. Returns for the Portfolio’s Class A and Class C shares are provided on pages 29, 46 and 47.

Mutual fund investing involves risk; loss of principal is possible. Aggressive Growth Portfolio’s stock market investments will fluctuate, sometimes rapidly and unexpectedly. Aggressive growth stock investments are subject to greater market risk of price declines, especially during periods when the prices of U.S. stock market investments in general are declining. The Portfolio may also invest in smaller and medium capitalization companies which will involve additional risks, such as limited liquidity and greater volatility.

The following pie chart shows Aggressive Growth Portfolio’s investment holdings by industry sector, as a percentage of total net assets as of January 31, 2024.

Allocations are subject to change and should not be considered a recommendation to buy or sell any security within a sector.

27

AGGRESSIVE GROWTH PORTFOLIO

Ten Years Ended January 31, 2024 (Unaudited)

The chart above compares the initial account values and subsequent account values over the past ten years, assuming a hypothetical $10,000 investment in the Portfolio’s Class I shares at the beginning of the first period indicated and reinvestment of all dividends and other distributions, without the deduction of taxes, to a $10,000 investment over the same periods in comparable broad-based securities market indices. The performance of the Portfolio’s Class A and Class C shares will differ due to different sales charge structures and share class expenses.

The Dow Jones Industrial Average — Total Return is an average of the stock prices of thirty large companies and represents a widely recognized unmanaged portfolio of common stocks. The S&P 500 is a market-capitalization weighted index of common stocks and also represents an unmanaged portfolio. You cannot invest directly in an index. Returns shown for the Dow Jones Industrial Average and the S&P 500 reflect reinvested dividends and other distributions as applicable, but do not reflect a deduction for fees, expenses or taxes.

Past performance does not guarantee future results. The chart does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.

28

AGGRESSIVE GROWTH PORTFOLIO

Periods Ended January 31, 2024 (Unaudited)

| One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||

At Net Asset Value | ||||||||||||||||||||

Class I Shares (PAGRX) | 24.28% | 14.88% | 10.39% | 10.59% | 1/02/1990 | |||||||||||||||

Class A Shares (PAGDX) | 23.96% | 14.60% | — | 13.15% | 5/31/2016 | |||||||||||||||

Class C Shares (PAGHX) | 23.03% | 13.74% | — | 12.31% | 5/31/2016 | |||||||||||||||

With Sales Charge | ||||||||||||||||||||

Class A Shares (PAGDX) (1) | 17.76% | 13.43% | — | 12.40% | ||||||||||||||||

Class C Shares (PAGHX) (1) | 22.03% | 13.74% | — | 12.31% | ||||||||||||||||

Dow Jones Industrial Average-Total Return (2) | 14.36% | 11.19% | 11.82% | 10.57% | ||||||||||||||||

S&P 500 (2) | 20.82% | 14.30% | 12.62% | 10.18% | ||||||||||||||||

| (1) | Returns with sales charge reflect the deduction of the maximum front end sales charge of 5.00% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is imposed on Class C shares that are redeemed within one year of purchase. |

| (2) | The date used to calculate performance since inception for the Indices is the inception date of the Class I shares. |

The table above shows Aggressive Growth Portfolio’s average annual total returns for the periods indicated, assuming reinvestment of all dividends and other distributions, and deduction of all applicable fees and expenses (except the $35 one-time account start-up fee which was eliminated in January 2016). All share classes of the Portfolio are invested in the same securities and returns only differ to the extent that the fees and expenses of the share classes are different. Performance does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or on the redemption of Portfolio shares.