SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

PERMANENT PORTFOLIO FAMILY OF FUNDS

(Exact Name of Registrant as specified in charter)

600 Montgomery Street, Suite 4100, San Francisco, California 94111

(Address of Principal Executive Offices) (Zip Code)

MICHAEL J. CUGGINO, 600 Montgomery Street, Suite 4100, San Francisco, California 94111

(Name and Address of Agent For Service)

| | |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | January 31, 2024 |

| |

| Date of reporting period: | | July 31, 2024 |

Form

N-CSR

is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule

30e-1

under the Investment Company Act of 1940 (17 CFR

270.30e-1).

The Commission may use the information provided on Form

N-CSR

in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSR,

and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form

N-CSR

unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| | |

|

| |

| | The Semi-Annual Shareholder Report for each share class in each Portfolio of Permanent Portfolio Family of Funds (“Registrant”) is included herein. |

Class A — PRPDX

Class C — PRPHX

Class I — PRPFX

Short-Term Treasury Portfolio

Class I — PRTBX

Class A — PRVDX

Class C — PRVHX

Class I — PRVBX

Aggressive Growth Portfolio

Class A — PAGDX

Class C — PAGHX

Class I — PAGRX

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Permanent Portfolio

®

(“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Permanent Portfolio—Class A shares (PRPDX) | | $ | 56 | | | | .56 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 3,376,855,475 | |

| | |

| Total number of Portfolio holdings | | | 175 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 12.87% | |

What is the Portfolio invested in?

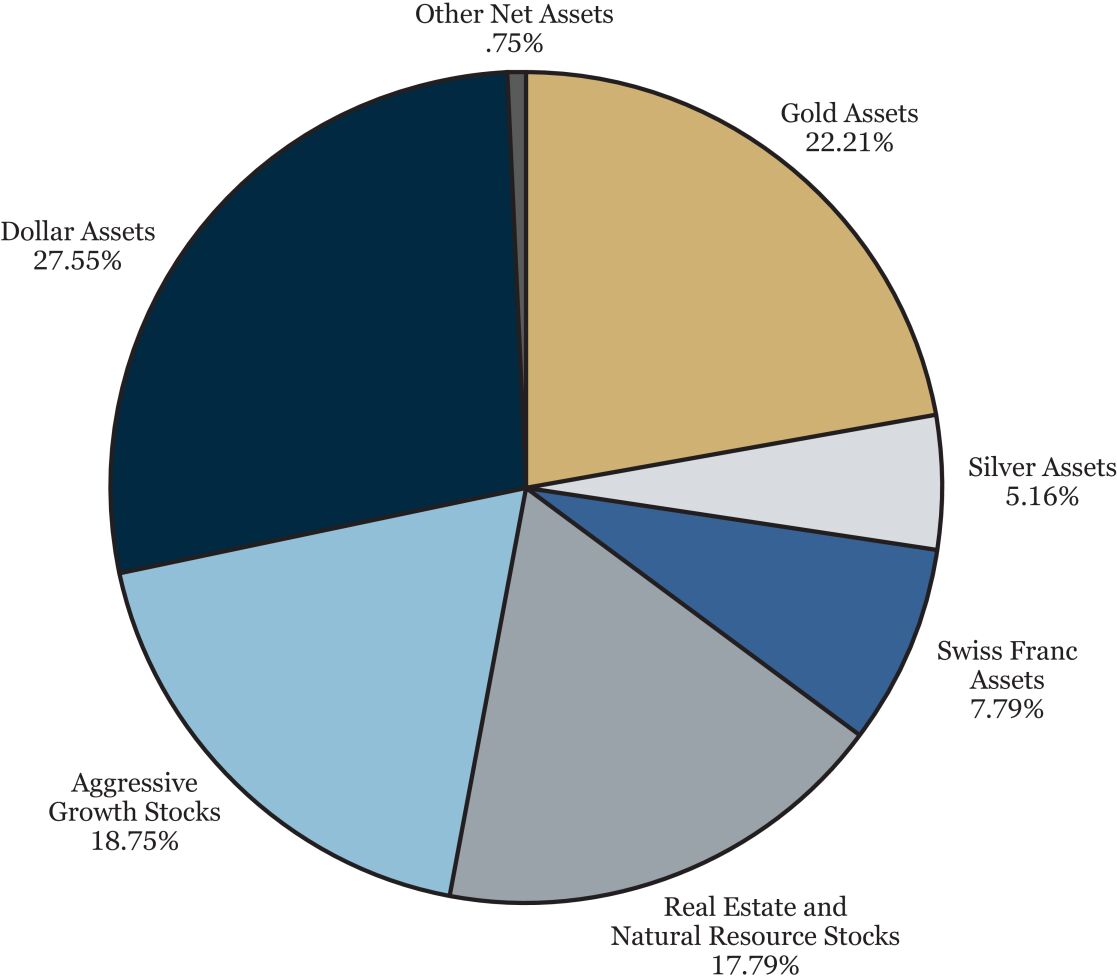

The following pie chart shows Permanent Portfolio’s investment holdings by asset class, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Permanent Portfolio

®

(“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Permanent Portfolio—Class C shares (PRPHX) | | $ | 96 | | | | .96 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 3,376,855,475 | |

| | |

| Total number of Portfolio holdings | | | 175 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 12.87% | |

What is the Portfolio invested in?

The following pie chart shows Permanent Portfolio’s investment holdings by asset class, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Permanent Portfolio

®

(“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Permanent Portfolio—Class I shares (PRPFX) | | $ | 43 | | | | .43 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 3,376,855,475 | |

| | |

| Total number of Portfolio holdings | | | 175 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 12.87% | |

What is the Portfolio invested in?

The following pie chart shows Permanent Portfolio’s investment holdings by asset class, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

| | |

SHORT-TERM TREASURY PORTFOLIO | |  |

|

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Short-Term Treasury Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Short-Term Treasury Portfolio—Class I shares (PRTBX) | | $ | 33 | | | | .33 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 11,457,469 | |

| | |

| Total number of Portfolio holdings | | | 9 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 20.64% | |

What is the Portfolio invested in?

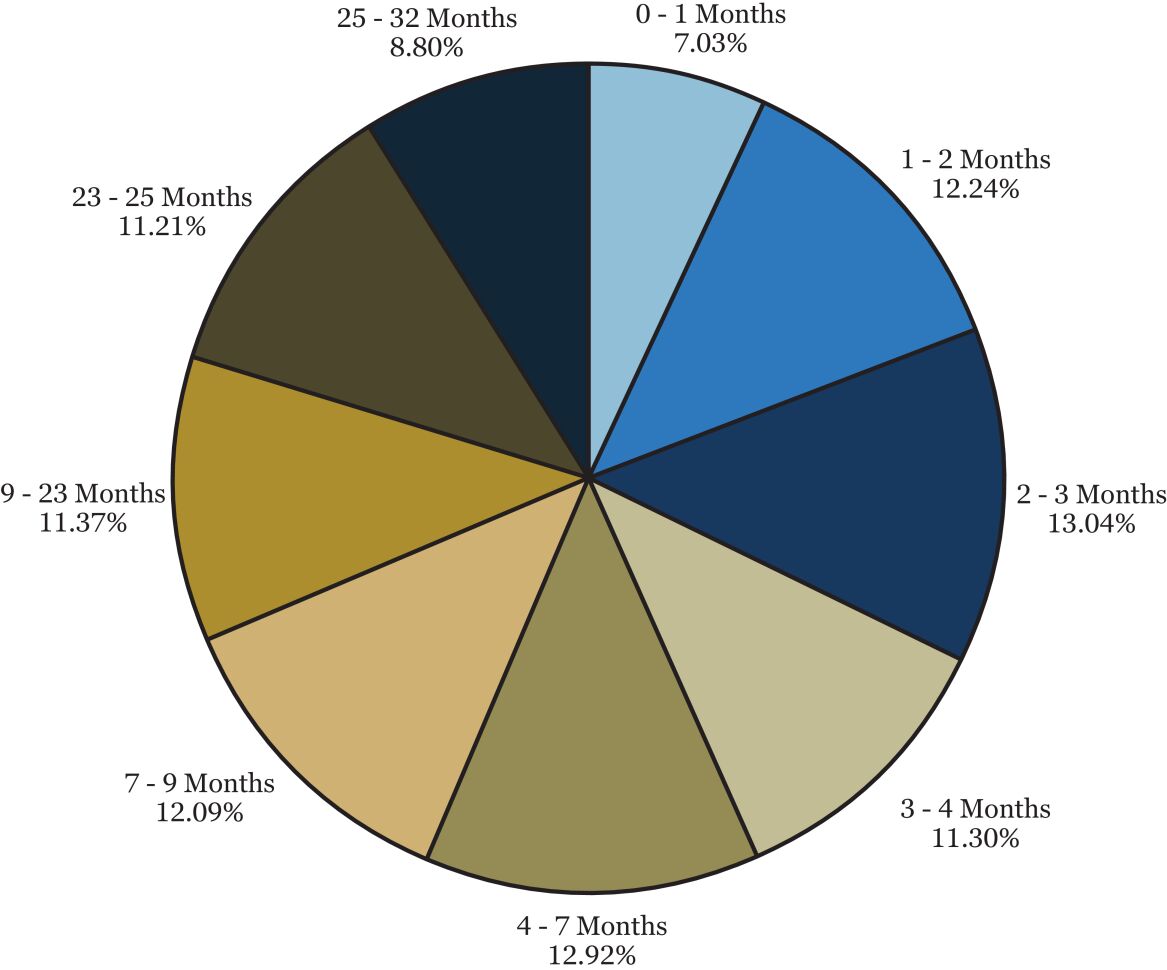

The following pie chart shows Short-Term Treasury Portfolio’s investment holdings by months to maturity, as a percentage of investments as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Versatile Bond Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Versatile Bond Portfolio—Class A shares (PRVDX) | | $ | 46 | | | | .46 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 97,110,356 | |

| | |

| Total number of Portfolio holdings | | | 80 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 17.12% | |

What is the Portfolio invested in?

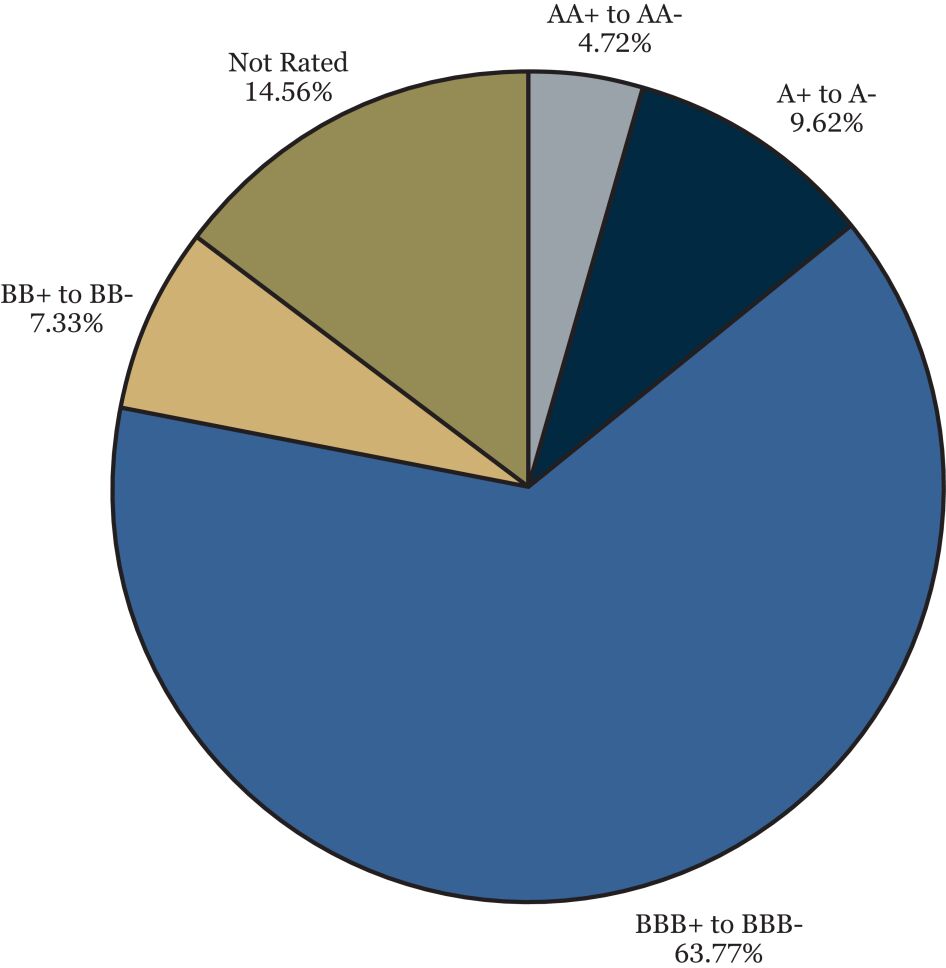

The following pie chart shows Versatile Bond Portfolio’s investment holdings by S&P credit rating, as a percentage of investments as of July 31, 2024. Credit ratings range from AAA (highest) to D (lowest) based on S&P measures. Other rating agencies may rate the same securities differently. “Not Rated” securities are not rated by S&P. Credit ratings are only the opinions of the rating agencies issuing them, do not purport to reflect the risk of fluctuations in market value, are not guarantees as to the payment of interest and repayment of principal, and are subject to change.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Versatile Bond Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | Costs of a $10,000

investment | | | Costs paid as a percentage

of a $10,000 investment | |

| Versatile Bond Portfolio—Class C shares (PRVHX) | | $ | 83 | | | | .83 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 97,110,356 | |

| | |

| Total number of Portfolio holdings | | | 80 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 17.12% | |

What is the Portfolio invested in?

The following pie chart shows Versatile Bond Portfolio’s investment holdings by S&P credit rating, as a percentage of investments as of July 31, 2024. Credit ratings range from AAA (highest) to D (lowest) based on S&P measures. Other rating agencies may rate the same securities differently. “Not Rated” securities are not rated by S&P. Credit ratings are only the opinions of the rating agencies issuing them, do not purport to reflect the risk of fluctuations in market value, are not guarantees as to the payment of interest and repayment of principal, and are subject to change.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Versatile Bond Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Versatile Bond Portfolio—Class I shares (PRVBX) | | $ | 33 | | | | .33 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 97,110,356 | |

| | |

| Total number of Portfolio holdings | | | 80 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | 17.12% | |

What is the Portfolio invested in?

The following pie chart shows Versatile Bond Portfolio’s investment holdings by S&P credit rating, as a percentage of investments as of July 31, 2024. Credit ratings range from AAA (highest) to D (lowest) based on S&P measures. Other rating agencies may rate the same securities differently. “Not Rated” securities are not rated by S&P. Credit ratings are only the opinions of the rating agencies issuing them, do not purport to reflect the risk of fluctuations in market value, are not guarantees as to the payment of interest and repayment of principal, and are subject to change.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

| | |

AGGRESSIVE GROWTH PORTFOLIO | |  |

|

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Aggressive Growth Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | Costs of a $10,000

investment | | | Costs paid as a percentage

of a $10,000 investment | |

| Aggressive Growth Portfolio—Class A shares (PAGDX) | | $ | 81 | | | | .81 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 41,465,129 | |

| | |

| Total number of Portfolio holdings | | | 36 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | —% | |

What is the Portfolio invested in?

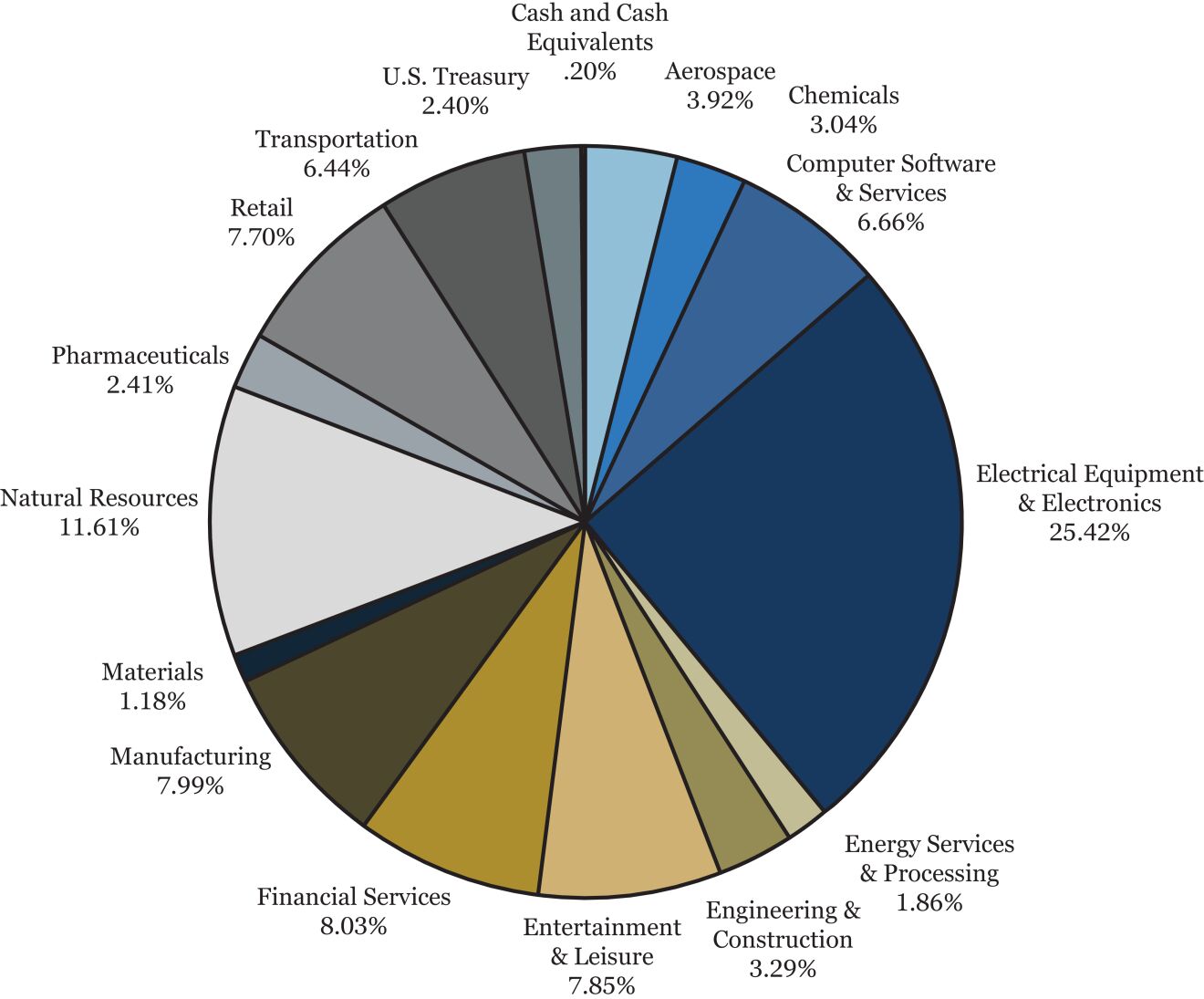

The following pie chart shows Aggressive Growth Portfolio’s investment holdings by industry sector, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

| | |

AGGRESSIVE GROWTH PORTFOLIO | |  |

|

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Aggressive Growth Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | Costs of a $10,000

investment | | | Costs paid as a percentage

of a $10,000 investment | |

| Aggressive Growth Portfolio—Class C shares (PAGHX) | | $ | 81 | | | | .81 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 41,465,129 | |

| | |

| Total number of Portfolio holdings | | | 36 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | —% | |

What is the Portfolio invested in?

The following pie chart shows Aggressive Growth Portfolio’s investment holdings by industry sector, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

| | |

AGGRESSIVE GROWTH PORTFOLIO | |  |

|

Semi-Annual Shareholder Report (July 31, 2024)

This Semi-Annual Shareholder Report contains important information about the Aggressive Growth Portfolio (“Portfolio”) for the period of January 31, 2024 to July 31, 2024. You can find additional information about the Portfolio, online at

www.permanentportfoliofunds.com

. You can also get this information at no cost by calling the Portfolio’s Transfer Agent at (800) 341-8900 or the Portfolio’s Shareholder Services Office at (800) 531-5142, or by contacting your financial intermediary.

What were the Portfolio costs for the last six months?

(Based on a hypothetical $10,000 investment)

The below table explains the costs that you would have paid within the reporting period.

| | | | | | | | |

Portfolio and Share Class | | | | | Costs paid as a percentage

of a $10,000 investment | |

| Aggressive Growth Portfolio—Class I shares (PAGRX) | | $ | 67 | | | | .67 | % |

What are the Key Portfolio statistics you should know?

The following table outlines key Portfolio statistics that you should pay attention to:

| | | | |

| | |

| Portfolio’s total net assets | | $ | 41,465,129 | |

| | |

| Total number of Portfolio holdings | | | 36 | |

| | |

| Portfolio turnover rate as of end of reporting period | | | —% | |

What is the Portfolio invested in?

The following pie chart shows Aggressive Growth Portfolio’s investment holdings by industry sector, as a percentage of total net assets as of July 31, 2024.

How can you get additional information about the Portfolio?

| | |

| | Select the QR code or you can find additional information about the Portfolio such as the prospectus, financial information, Portfolio holdings and proxy voting information at www.permanentportfoliofunds.com . |

Each year, the Portfolio sends to its shareholders an updated prospectus and other similar documents (each a “Report”). The mailing of the Reports may result in multiple copies of a Report being sent by the Portfolio to the same household. In order to reduce the volume of mail that the Portfolio sends to a household, the Portfolio may, whenever possible, only send one copy of a Report to shareholders who are members of the same family and share the same address of record. Shareholders may request, however, to receive individual copies of any Report, by contacting the Transfer Agent at (800) 341-8900. Shareholders who own shares of the Portfolio through a financial intermediary may also contact their financial intermediary with such a request. All such requests shall be implemented by the Portfolio within thirty days.

Distributed by Quasar Distributors, LLC

| | |

| Item 2. Code of Ethics. |

| |

| | Not applicable to semi-annual reports. |

|

| Item 3. Audit Committee Financial Expert. |

| |

| | Not applicable to semi-annual reports. |

|

| Item 4. Principal Accountant Fees and Services. |

| |

| | Not applicable to semi-annual reports. |

|

| Item 5. Audit Committee of Listed Registrants. |

| |

| | Not applicable to the Registrant. |

|

| Item 6. Investments. |

| |

| | Included in Item 7. |

|

| Item 7. Financial Statements and Financial Highlights For Open-End Management Investment Companies. |

| |

| | The Semi-Annual Financial Statements and Other Information of the Registrant for the six months ended July 31, 2024 is included herein. |

| | |

| | Semi-Annual Financial Statements and Other Information Six Months Ended July 31, 2024 |

Permanent Portfolio®

Class A — PRPDX | Class C — PRPHX | Class I — PRPFX

Short-Term Treasury Portfolio

Class I — PRTBX

Versatile Bond Portfolio

Class A — PRVDX | Class C — PRVHX | Class I — PRVBX

Aggressive Growth Portfolio

Class A — PAGDX | Class C — PAGHX | Class I — PAGRX

Permanent Portfolio®, The Permanent Portfolio Family of Funds®, A Fund for All Seasons® and The Permanent Portfolio Family of Funds logo are registered trademarks of Pacific Heights Asset Management, LLC. This Report is Copyright© 2024 Permanent Portfolio Family of Funds. All rights reserved.

2

TABLE OF CONTENTS

3

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Quantity | | | | | Market Value | |

| | | | GOLD ASSETS — 22.21% of Total Net Assets | | | | |

| | 217,320 Troy Oz. | | | Gold bullion (a) | | $ | 527,325,791 | |

| | 90,000 Coins | | | One-ounce gold coins (a) | | | 222,553,000 | |

| | | | | | | | |

| | | | Total Gold Assets (identified cost $328,396,837) | | $ | 749,878,791 | |

| | | | | | | | |

| | |

| | | | SILVER ASSETS — 5.16% of Total Net Assets | | | | |

| | 6,058,176 Troy Oz. | | | Silver bullion (a) | | $ | 174,342,194 | |

| | | | | | | | |

| | | | Total Silver Assets (identified cost $92,215,771) | | $ | 174,342,194 | |

| | | | | | | | |

| | | | | | | | |

| Principal Amount | | | | | | |

| | | | SWISS FRANC ASSETS — 7.79% of Total Net Assets | | | | |

| CHF | 500,164 | | | Swiss franc deposits | | $ | 569,824 | |

| | | | | | | | |

| | |

| CHF | 70,000,000 | | | 1.500% Swiss Confederation Bonds, 07-24-25 | | $ | 80,231,843 | |

| CHF | 65,000,000 | | | 1.250% Swiss Confederation Bonds, 05-28-26 | | | 74,841,641 | |

| CHF | 15,000,000 | | | 3.250% Swiss Confederation Bonds, 06-27-27 | | | 18,387,924 | |

| CHF | 80,000,000 | | | .514% Swiss Confederation Bonds, 06-22-29 (b) | | | 88,879,521 | |

| | | | | | | | |

| | | | Total Swiss Confederation bonds | | $ | 262,340,929 | |

| | | | | | | | |

| | | | Total Swiss Franc Assets (identified cost $246,400,512) | | $ | 262,910,753 | |

| | | | | | | | |

| | | | | | | | |

| Number of Shares | | | | | | |

| | | | REAL ESTATE AND NATURAL RESOURCE STOCKS — 17.79% of Total Net Assets | |

| | |

| | | | NATURAL RESOURCES — 8.97% of Total Net Assets | | | | |

| | 180,000 | | | APA Corporation | | $ | 5,614,200 | |

| | 160,000 | | | BHP Group, Ltd. (c) | | | 8,884,800 | |

| | 2,000,000 | | | Birchcliff Energy, Ltd. | | | 8,660,000 | |

| | 160,000 | | | BP, p.l.c. (c) | | | 5,662,400 | |

| | 500,000 | | | Cameco Corporation | | | 22,745,000 | |

| | 320,000 | | | Canadian Natural Resources Ltd. | | | 11,353,600 | |

| | 150,000 | | | Chevron Corporation | | | 24,070,500 | |

| | 150,000 | | | ConocoPhillips | | | 16,680,000 | |

| | 350,000 | | | Devon Energy Corporation | | | 16,460,500 | |

| | 150,000 | | | Exxon Mobil Corporation | | | 17,788,500 | |

| | 2,100,000 | | | Freeport-McMoRan, Inc. | | | 95,361,000 | |

| | 350,000 | | | Murphy Oil Corporation | | | 14,483,000 | |

| | 135,000 | | | Nutrien, Ltd. | | | 6,912,000 | |

| | 180,000 | | | Occidental Petroleum Corporation | | | 10,947,600 | |

| | 100,000 | | | Occidental Petroleum Corporation warrants (a) | | | 3,895,000 | |

| | 180,000 | | | Ovintiv, Inc. | | | 8,359,200 | |

| | 160,000 | | | Rio Tinto p.l.c (c) | | | 10,425,600 | |

| | 500,000 | | | South32 Limited (c) | | | 5,030,000 | |

| | 200,000 | | | Vale S.A. (c) | | | 2,170,000 | |

| | 175,000 | | | Viper Energy Partners LP | | | 7,467,250 | |

| | | | | | | | |

| | | | | | $ | 302,970,150 | |

| | | | | | | | |

Continued on following page.

4

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Number of Shares | | | | | Market Value | |

| | | | REAL ESTATE — 8.82% of Total Net Assets | | | | |

| | 125,000 | | | Alexander & Baldwin, Inc. | | $ | 2,463,750 | |

| | 40,000 | | | American Tower Corporation | | | 8,816,000 | |

| | 60,000 | | | AvalonBay Communities, Inc. | | | 12,295,200 | |

| | 60,000 | | | Boston Properties, Inc. | | | 4,278,600 | |

| | 200,000 | | | Centerspace | | | 13,966,000 | |

| | 75,000 | | | Digital Realty Trust, Inc. | | | 11,211,750 | |

| | 60,000 | | | Essex Property Trust, Inc. | | | 16,701,600 | |

| | 100,000 | | | Federal Realty Investment Trust | | | 11,165,000 | |

| | 150,000 | | | Highwoods Properties, Inc. | | | 4,645,500 | |

| | 300,000 | | | Kimco Realty Corporation | | | 6,519,000 | |

| | 400,000 | | | Outfront Media, Inc. | | | 6,488,000 | |

| | 150,000 | | | Prologis, Inc. | | | 18,907,500 | |

| | 125,000 | | | Regency Centers Corporation | | | 8,417,500 | |

| | 100,000 | | | Simon Property Group, Inc. | | | 15,344,000 | |

| | 165,000 | | | Texas Pacific Land Corporation | | | 139,408,500 | |

| | 125,000 | | | UDR, Inc. | | | 5,008,750 | |

| | 250,000 | | | UMH Properties, Inc. | | | 4,440,000 | |

| | 100,000 | | | Vornado Realty Trust | | | 2,999,000 | |

| | 150,000 | | | Weyerhaeuser Company | | | 4,764,000 | |

| | | | | | | | |

| | | | | | $ | 297,839,650 | |

| | | | | | | | |

| | | | Total Real Estate and Natural Resource Stocks

(identified cost $310,539,817) | | $ | 600,809,800 | |

| | | | | | | | |

| |

| | | | AGGRESSIVE GROWTH STOCKS — 18.75% of Total Net Assets | |

| |

| | | | AEROSPACE — .88% of Total Net Assets | |

| | 55,000 | | | Lockheed Martin Corporation | | $ | 29,805,600 | |

| | | | | | | | |

| | | | | | $ | 29,805,600 | |

| | | | | | | | |

| | | | CHEMICALS — .58% of Total Net Assets | |

| | 55,000 | | | Air Products & Chemicals, Inc. | | $ | 14,511,750 | |

| | 55,000 | | | Albemarle Corporation | | | 5,151,850 | |

| | | | | | | | |

| | | | | | $ | 19,663,600 | |

| | | | COMPUTER SOFTWARE & SERVICES — 1.60% of Total Net Assets | |

| | 55,000 | | | Autodesk, Inc. (a) | | $ | 13,613,600 | |

| | 1,500,000 | | | Palantir Technologies, Inc. Class A (a) | | | 40,335,000 | |

| | | | | | | | |

| | | | | | $ | 53,948,600 | |

| | | | ELECTRICAL EQUIPMENT & ELECTRONICS — 3.91% of Total Net Assets | |

| | 200,000 | | | Broadcom, Inc. | | $ | 32,136,000 | |

| | 200,000 | | | Intel Corporation | | | 6,148,000 | |

| | 800,000 | | | NVIDIA Corporation | | | 93,616,000 | |

| | | | | | | | |

| | | | | | $ | 131,900,000 | |

| | | | ENERGY SERVICES & PROCESSING — .63% of Total Net Assets | |

| | 200,000 | | | HF Sinclair Corporation | | $ | 10,294,000 | |

| | 75,000 | | | Phillips 66 | | | 10,911,000 | |

| | | | | | | | |

| | | | | | $ | 21,205,000 | |

| | | | ENGINEERING & CONSTRUCTION — .90% of Total Net Assets | |

| | 175,000 | | | Fluor Corporation (a) | | $ | 8,417,500 | |

| | 125,000 | | | Lennar Corporation Class A | | | 22,116,250 | |

| | | | | | | | |

| | | | | | $ | 30,533,750 | |

Continued on following page.

5

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Number of Shares | | | | | Market Value | |

| | | | ENTERTAINMENT & LEISURE — 2.45% of Total Net Assets | | | | |

| | 65,000 | | | Disney (Walt) Company | | $ | 6,089,850 | |

| | 150,000 | | | Meta Platforms, Inc. Class A | | | 71,224,500 | |

| | 65,000 | | | Wynn Resorts, Ltd. (a) | | | 5,383,300 | |

| | | | | | | | |

| | | | | | $ | 82,697,650 | |

| | | | FINANCIAL SERVICES — 1.64% of Total Net Assets | | | | |

| | 300,000 | | | Affirm Holdings, Inc. Class A (a) | | $ | 8,487,000 | |

| | 175,000 | | | Morgan Stanley | | | 18,061,750 | |

| | 175,000 | | | Schwab (Charles) Corporation | | | 11,408,250 | |

| | 50,000 | | | State Street Corporation | | | 4,248,500 | |

| | 50,000 | | | Visa, Inc. Class A | | | 13,283,500 | |

| | | | | | | | |

| | | | | | $ | 55,489,000 | |

| | | | MANUFACTURING — 1.83% of Total Net Assets | | | | |

| | 60,000 | | | Agilent Technologies, Inc. | | $ | 8,484,000 | |

| | 60,000 | | | Illinois Tool Works, Inc. | | | 14,836,800 | |

| | 60,000 | | | IPG Photonics Corporation (a) | | | 4,824,000 | |

| | 60,000 | | | Parker-Hannifin Corporation | | | 33,669,600 | |

| | | | | | | | |

| | | | | | $ | 61,814,400 | |

| | | | MATERIALS — .48% of Total Net Assets | | | | |

| | 100,000 | | | Nucor Corporation | | $ | 16,294,000 | |

| | | | | | | | |

| | | | | | $ | 16,294,000 | |

| | | | PHARMACEUTICALS — .54% of Total Net Assets | | | | |

| | 55,000 | | | Amgen, Inc. | | $ | 18,285,850 | |

| | | | | | | | |

| | | | | | $ | 18,285,850 | |

| | | | RETAIL — 1.80% of Total Net Assets | | | | |

| | 55,000 | | | Costco Wholesale Corporation | | $ | 45,210,000 | |

| | 100,000 | | | Williams-Sonoma, Inc. | | | 15,468,000 | |

| | | | | | | | |

| | | | | | $ | 60,678,000 | |

| | | | TRANSPORTATION — 1.51% of Total Net Assets | | | | |

| | 150,000 | | | Canadian Pacific Kansas City Limited | | $ | 12,573,000 | |

| | 55,000 | | | FedEx Corporation | | | 16,623,750 | |

| | 75,000 | | | Ryder System, Inc. | | | 10,512,000 | |

| | 175,000 | | | Uber Technologies, Inc. (a) | | | 11,282,250 | |

| | | | | | | | |

| | | | | | $ | 50,991,000 | |

| | | | | | | | |

| | | | Total Aggressive Growth Stocks (identified cost $192,173,060) | | $ | 633,306,450 | |

| | | | | | | | |

Continued on following page.

6

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | DOLLAR ASSETS — 27.55% of Total Net Assets | | | | |

| | |

| | | | CORPORATE BONDS — 25.72% of Total Net Assets | | | | |

| | |

| | | | AEROSPACE — .22% of Total Net Assets | | | | |

| $ | 7,500,000 | | | 2.930% Northrop Grumman Corporation, 01-15-25 | | $ | 7,414,043 | |

| | | | | | | | |

| | | | | | $ | 7,414,043 | |

| | | | CHEMICALS — 1.02% of Total Net Assets | | | | |

| | 10,000,000 | | | 4.650% Albemarle Corporation, 06-01-27 | | $ | 9,924,235 | |

| | 10,000,000 | | | 5.150% FMC Corporation, 05-18-26 | | | 10,015,205 | |

| | 7,500,000 | | | 3.750% RPM International, Inc., 03-15-27 | | | 7,283,411 | |

| | 7,500,000 | | | 3.600% Westlake Corporation, 08-15-26 | | | 7,319,269 | |

| | | | | | | | |

| | | | | | $ | 34,542,120 | |

| | | | COMPUTER SOFTWARE & SERVICES — .99% of Total Net Assets | | | | |

| | 33,500,000 | | | 4.750% Trimble, Inc., 12-01-24 | | $ | 33,321,948 | |

| | | | | | | | |

| | | | | | $ | 33,321,948 | |

| | | | CONSUMER PRODUCTS — 4.18% of Total Net Assets | | | | |

| | 25,000,000 | | | 3.222% B.A.T. Capital Corporation, 08-15-24 | | $ | 24,977,762 | |

| | 15,000,000 | | | 4.600% Conagra Brands, Inc., 11-01-25 | | | 14,902,965 | |

| | 10,000,000 | | | 7.125% Conagra Brands, Inc., 10-01-26 | | | 10,469,005 | |

| | 20,000,000 | | | 3.500% Imperial Brands, p.l.c., 07-26-26 (d) | | | 19,353,850 | |

| | 11,070,000 | | | 2.250% Mondelez International Holdings Netherlands B.V., 09-19-24 (d) | | | 11,010,167 | |

| | 2,810,000 | | | .750% Mondelez International Holdings Netherlands B.V., 09-24-24 (d) | | | 2,787,691 | |

| | 30,000,000 | | | 1.250% Pernod Ricard International Finance, LLC, 04-01-28 (d) | | | 26,557,305 | |

| | 15,000,000 | | | 3.500% Smucker (J. M.) Company, 03-15-25 | | | 14,805,023 | |

| | 5,000,000 | | | 3.375% Smucker (J. M.) Company, 12-15-27 | | | 4,809,265 | |

| | 11,500,000 | | | 2.250% Suntory Holdings, Ltd., 10-16-24 (d) | | | 11,416,964 | |

| | | | | | | | |

| | | | | | $ | 141,089,997 | |

| | | | ELECTRICAL EQUIPMENT & ELECTRONICS — .37% of Total Net Assets | |

| | 12,500,000 | | | 4.625% Avnet, Inc., 04-15-26 | | $ | 12,386,219 | |

| | | | | | | | |

| | | | | | $ | 12,386,219 | |

| | | | ENGINEERING & CONSTRUCTION — 1.01% of Total Net Assets | | | | |

| | 17,500,000 | | | 2.500% D.R. Horton, Inc., 10-15-24 | | $ | 17,383,739 | |

| | 9,313,000 | | | 4.750% Lennar Corporation, 11-29-27 | | | 9,316,059 | |

| | 7,500,000 | | | 5.500% PulteGroup, Inc., 03-01-26 | | | 7,540,793 | |

| | | | | | | | |

| | | | | | $ | 34,240,591 | |

| | | | ENTERTAINMENT & LEISURE — .07% of Total Net Assets | | | | |

| | 2,035,000 | | | 7.625% Disney (Walt) Company, 11-30-28 | | $ | 2,260,215 | |

| | | | | | | | |

| | | | | | $ | 2,260,215 | |

| | | | FINANCIAL SERVICES — 3.32% of Total Net Assets | | | | |

| | 7,500,000 | | | 3.500% Affiliated Managers Group, Inc., 08-01-25 | | $ | 7,365,555 | |

| | 7,500,000 | | | 6.750% AmSouth Bancorporation, 11-01-25 | | | 7,562,989 | |

| | 7,500,000 | | | 4.250% Associated Banc-Corp, 01-15-25 | | | 7,486,237 | |

| | 7,500,000 | | | 3.375% Citadel Finance, LLC, 03-09-26 (d) | | | 7,217,115 | |

| | 10,000,000 | | | 3.750% Intercontinental Exchange, Inc., 12-01-25 | | | 9,855,145 | |

| | 15,000,000 | | | 4.875% Janus Henderson Holdings, Inc., 08-01-25 | | | 14,922,892 | |

| | 15,000,000 | | | 4.700% Key Bank, N.A., 01-26-26 | | | 14,818,320 | |

| | 15,000,000 | | | 5.400% Manufacturers & Traders Trust Company, 11-21-25 | | | 15,041,273 | |

| | 5,000,000 | | | 4.875% Mastercard, Inc., 05-09-34 | | | 5,068,367 | |

| | 8,090,000 | | | 2.250% Regions Financial Corporation, 05-18-25 | | | 7,884,660 | |

| | 15,000,000 | | | .700% UBS Group, AG, 08-09-24 (d) | | | 14,981,460 | |

| | | | | | | | |

| | | | | | $ | 112,204,013 | |

Continued on following page.

7

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | INSURANCE — 1.52% of Total Net Assets | | | | |

| $ | 15,000,000 | | | 3.625% Alleghany Corporation, 05-15-30 | | $ | 14,250,172 | |

| | 5,000,000 | | | 4.500% Brown & Brown, Inc., 03-15-29 | | | 4,917,090 | |

| | 6,785,000 | | | 4.500% Horace Mann Educators Corporation, 12-01-25 | | | 6,687,751 | |

| | 15,000,000 | | | 4.350% Kemper Corporation, 02-15-25 | | | 14,895,000 | |

| | 7,500,000 | | | 4.400% Mercury General Corporation, 03-15-27 | | | 7,323,683 | |

| | 3,500,000 | | | 5.125% SBL Holdings, Inc., 11-13-26 (d) | | | 3,418,329 | |

| | | | | | | | |

| | | | | | $ | 51,492,025 | |

| | | | MANUFACTURING — 1.31% of Total Net Assets | | | | |

| | 15,000,000 | | | 2.750% Alcon Finance Corporation, 09-23-26 (d) | | $ | 14,377,200 | |

| | 10,000,000 | | | 4.625% Kennametal, Inc., 06-15-28 | | | 9,912,170 | |

| | 10,000,000 | | | 4.550% Keysight Technologies, Inc., 10-30-24 | | | 9,961,950 | |

| | 10,000,000 | | | 4.600% Keysight Technologies, Inc., 04-06-27 | | | 9,943,700 | |

| | | | | | | | |

| | | | | | $ | 44,195,020 | |

| | | | MATERIALS— .95% of Total Net Assets | | | | |

| | 8,702,000 | | | 2.500% Martin Marietta Materials, Inc., 03-15-30 | | $ | 7,725,744 | |

| | 7,500,000 | | | 2.400% Steel Dynamics, Inc., 06-15-25 | | | 7,303,125 | |

| | 7,250,000 | | | 4.500% Vulcan Materials Company, 04-01-25 | | | 7,199,943 | |

| | 10,000,000 | | | 3.000% WRKCO, Inc., 09-15-24 | | | 9,960,925 | |

| | | | | | | | |

| | | | | | $ | 32,189,737 | |

| | | | NATURAL RESOURCES — 2.94% of Total Net Assets | | | | |

| | 7,500,000 | | | 4.875% BHP Billiton Finance (USA) Limited, 02-27-26 | | $ | 7,502,047 | |

| | 5,250,000 | | | 3.900% Cimarex Energy Company, 05-15-27 | | | 4,823,081 | |

| | 5,000,000 | | | 4.375% Cimarex Energy Company, 03-15-29 | | | 4,559,297 | |

| | 4,500,000 | | | 3.900% Coterra Energy, Inc., 05-15-27 | | | 4,387,714 | |

| | 10,000,000 | | | 5.875% Devon Energy Corporation, 06-15-28 | | | 10,130,480 | |

| | 10,000,000 | | | 4.050% Mosaic (The) Company, 11-15-27 | | | 9,784,170 | |

| | 7,500,000 | | | 3.000% Nutrien, Ltd., 04-01-25 | | | 7,381,725 | |

| | 7,500,000 | | | 4.000% Nutrien, Ltd., 12-15-26 | | | 7,343,269 | |

| | 17,500,000 | | | 5.650% Ovintiv, Inc., 05-15-25 | | | 17,510,063 | |

| | 15,000,000 | | | 5.375% Ovintiv, Inc., 01-01-26 | | | 15,027,525 | |

| | 6,000,000 | | | 4.125% Parsley Energy, LLC, 02-15-28 (d) | | | 5,808,294 | |

| | 5,000,000 | | | 3.800% Yara International ASA, 06-06-26 (d) | | | 4,893,750 | |

| | | | | | | | |

| | | | | | $ | 99,151,415 | |

| | | | PHARMACEUTICALS — .34% of Total Net Assets | | | | |

| | 5,000,000 | | | 6.800% Bristol-Myers Squibb Company, 11-15-26 | | $ | 5,223,579 | |

| | 6,500,000 | | | 3.250% EMD Finance, LLC, 03-15-25 (d) | | | 6,409,553 | |

| | | | | | | | |

| | | | | | $ | 11,633,132 | |

Continued on following page.

8

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | REAL ESTATE — 4.29% of Total Net Assets | | | | |

| $ | 5,000,000 | | | 3.950% Brandywine Operating Partnership, L.P., 11-15-27 | | $ | 4,622,630 | |

| | 5,000,000 | | | 3.500% Camden Property Trust, 09-15-24 | | | 4,984,065 | |

| | 7,500,000 | | | 5.850% Camden Property Trust, 11-03-26 | | | 7,673,647 | |

| | 7,500,000 | | | 4.100% Camden Property Trust, 10-15-28 | | | 7,317,855 | |

| | 11,000,000 | | | 2.000% COPT Defense Properties, 01-15-29 | | | 9,569,895 | |

| | 15,000,000 | | | 3.125% Cubesmart, L.P., 09-01-26 | | | 14,446,260 | |

| | 5,000,000 | | | 2.625% Equinix, Inc., 11-18-24 | | | 4,956,883 | |

| | 5,000,000 | | | 1.250% Federal Realty Investment Trust, 02-15-26 | | | 4,718,533 | |

| | 7,500,000 | | | 4.125% Highwoods Realty, L.P., 03-15-28 | | | 7,159,830 | |

| | 10,000,000 | | | 3.850% Kimco Realty Corporation, 06-01-25 | | | 9,841,415 | |

| | 5,000,000 | | | 3.600% Regency Centers, L.P., 02-01-27 | | | 4,865,075 | |

| | 5,145,000 | | | 4.125% Regency Centers, L.P., 03-15-28 | | | 5,029,127 | |

| | 7,500,000 | | | 3.700% Regency Centers, L.P., 6-15-30 | | | 7,040,374 | |

| | 15,000,000 | | | 4.000% Retail Opportunity Investments Corporation, 12-15-24 | | | 14,898,870 | |

| | 12,500,000 | | | 3.625% Site Centers Corporation, 02-01-25 | | | 12,406,212 | |

| | 17,500,000 | | | 2.300% Sun Communities Operating Limited Partnership, 11-01-28 | | | 15,586,690 | |

| | 10,000,000 | | | 2.950% UDR, Inc., 09-01-26 | | | 9,587,125 | |

| | | | | | | | |

| | | | | | $ | 144,704,486 | |

| | | | RETAIL — 1.01% of Total Net Assets | | | | |

| | 7,500,000 | | | 1.750% Advance Auto Parts, Inc., 10-01-27 | | $ | 6,641,820 | |

| | 15,000,000 | | | 3.500% AutoNation, Inc., 11-15-24 | | | 14,896,012 | |

| | 5,000,000 | | | 4.500% AutoNation, Inc., 10-01-25 | | | 4,944,190 | |

| | 7,500,000 | | | 4.750% Starbucks Corporation, 02-15-26 | | | 7,492,410 | |

| | | | | | | | |

| | | | | | $ | 33,974,432 | |

| | | | TRANSPORTATION — 1.67% of Total Net Assets | | | | |

| | 7,500,000 | | | 2.875% Canadian Pacific Kansas City Limited, 11-15-29 | | $ | 6,862,462 | |

| | 5,000,000 | | | 3.350% CSX Corporation, 11-01-25 | | | 4,903,753 | |

| | 10,000,000 | | | 4.250% CSX Corporation, 03-15-29 | | | 9,892,960 | |

| | 7,500,000 | | | 3.875% Hunt (J.B.) Transport Services, Inc., 03-01-26 | | | 7,380,019 | |

| | 14,500,000 | | | 4.450% Penske Truck Leasing Company, L.P., 01-29-26 (d) | | | 14,344,132 | |

| | 7,500,000 | | | 2.500% Ryder System, Inc., 09-01-24 | | | 7,474,969 | |

| | 6,000,000 | | | 1.750% Ryder System, Inc., 09-01-26 | | | 5,628,663 | |

| | | | | | | | |

| | | | | | $ | 56,486,958 | |

| | | | UTILITIES — .51% of Total Net Assets | | | | |

| | 10,000,000 | | | 5.200% National Fuel Gas Company, 07-15-25 | | $ | 9,989,650 | |

| | 7,500,000 | | | 3.300% Xcel Energy, Inc., 06-01-25 | | | 7,370,602 | |

| | | | | | | | |

| | | | | | $ | 17,360,252 | |

| | | | | | | | |

| | | | | | $ | 868,646,603 | |

| | | | | | | | |

Continued on following page.

9

PERMANENT PORTFOLIO®

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | UNITED STATES TREASURY SECURITIES — 1.83% of Total Net Assets | | | | |

| $ | 12,500,000 | | | United States Treasury bills 5.356%, 09-10-24 (b) | | $ | 12,427,075 | |

| | 15,000,000 | | | United States Treasury bills 5.300%, 11-05-24 (b) | | | 14,795,959 | |

| | 15,000,000 | | | United States Treasury bills 5.125%, 01-23-25 (b) | | | 14,644,417 | |

| | 10,000,000 | | | United States Treasury bonds 1.125%, 01-15-25 | | | 9,822,962 | |

| | 10,000,000 | | | United States Treasury bonds 4.875%, 04-30-26 | | | 10,085,423 | |

| | | | | | | | |

| | | | | | $ | 61,775,836 | |

| | | | | | | | |

| | | | Total Dollar Assets (identified cost $940,397,045) | | $ | 930,422,439 | |

| | | | | | | | |

| | | | Total Portfolio — 99.25% of total net assets (identified cost $2,110,123,042) (e) | | $ | 3,351,670,427 | |

| | | | Other assets, less liabilities (.75% of total net assets) | | | 25,185,048 | |

| | | | | | | | |

| | | | Net assets applicable to outstanding shares | | $ | 3,376,855,475 | |

| | | | | | | | |

| | |

| | | | Notes: | | | | |

| | | | (a) Non-income producing. | | | | |

| | | | (b) Interest rate represents yield to maturity. | | | | |

| | | | (c) Sponsored American Depositary Receipt (ADR). | | | | |

| | | | (d) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration to qualified institutional investors. As of July 31, 2024, these securities amounted to $142,575,810, or 4.22% of Permanent Portfolio’s total net assets, and have been determined by the Portfolio’s investment adviser to be liquid. | | | | |

| | | | (e) Aggregate cost for book and federal income tax purposes are the same. | | | | |

See accompanying notes to financial statements.

10

SHORT-TERM TREASURY PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | UNITED STATES TREASURY SECURITIES — 99.02% of Total Net Assets | | | | |

| $ | 750,000 | | | United States Treasury bills 4.964%, 08-15-24 (a) | | $ | 748,473 | |

| | 1,400,000 | | | United States Treasury notes 1.250%, 08-31-24 | | | 1,394,997 | |

| | 1,500,000 | | | United States Treasury notes .625%, 10-15-24 | | | 1,486,012 | |

| | 1,300,000 | | | United States Treasury notes 1.500%, 10-31-24 | | | 1,287,890 | |

| | 1,500,000 | | | United States Treasury notes 1.375%, 01-31-25 | | | 1,472,955 | |

| | 1,400,000 | | | United States Treasury notes 2.625%, 04-15-25 | | | 1,378,096 | |

| | 1,300,000 | | | United States Treasury notes 4.125%, 06-15-26 | | | 1,295,676 | |

| | 1,350,000 | | | United States Treasury notes 1.500%, 08-15-26 | | | 1,277,774 | |

| | 1,000,000 | | | United States Treasury notes 4.250%, 03-15-27 | | | 1,003,405 | |

| | | | | | | | |

| | | | Total Portfolio — 99.02% of total net assets

(identified cost $11,371,880)(b) | | $ | 11,345,278 | |

| | | | Other assets, less liabilities (.98% of total net assets) | | | 112,191 | |

| | | | | | | | |

| | | | Net assets applicable to outstanding shares | | $ | 11,457,469 | |

| | | | | | | | |

| | |

| | | | Notes: | | | | |

| | | | (a) Interest rate represents yield to maturity. | | | | |

| | | | (b) Aggregate cost for book and federal income tax purposes are the same. | | | | |

See accompanying notes to financial statements.

11

VERSATILE BOND PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | CORPORATE BONDS — 88.49% of Total Net Assets | | | | |

| | |

| | | | AEROSPACE— 1.00% of Total Net Assets | | | | |

| $ | 1,000,000 | | | 4.200% Hexcel Corporation, 02-15-27 | | $ | 974,572 | |

| | | | | | | | |

| | | | | | $ | 974,572 | |

| | | | CHEMICALS — 2.02% of Total Net Assets | | | | |

| | 1,000,000 | | | 3.200% FMC Corporation, 10-01-26 | | $ | 960,264 | |

| | 1,000,000 | | | .875% Westlake Corporation, 08-15-24 | | | 997,981 | |

| | | | | | | | |

| | | | | | $ | 1,958,245 | |

| | | | COMPUTER SOFTWARE & SERVICES — 3.56% of Total Net Assets | | | | |

| | 500,000 | | | 1.000% Fortinent, Inc., 03-15-26 | | $ | 469,392 | |

| | 3,000,000 | | | 4.750% Trimble, Inc., 12-01-24 | | | 2,984,055 | |

| | | | | | | | |

| | | | | | $ | 3,453,447 | |

| | | | CONSUMER PRODUCTS — 12.28% of Total Net Assets | | | | |

| | 2,500,000 | | | 3.222% B.A.T. Capital Corporation, 08-15-24 | | $ | 2,497,776 | |

| | 1,000,000 | | | 7.125% Conagra Brands, Inc., 10-01-26 | | | 1,046,901 | |

| | 4,750,000 | | | 3.500% Imperial Brands, p.l.c., 07-26-26 (a) | | | 4,596,539 | |

| | 500,000 | | | 3.350% Johnson (S.C.) & Son, Inc., 09-30-24 (a) | | | 497,840 | |

| | 370,000 | | | .875% Mars, Inc., 07-16-26 (a) | | | 343,792 | |

| | 1,000,000 | | | 3.500% Smucker (J. M.) Company, 03-15-25 | | | 987,002 | |

| | 1,000,000 | | | 3.375% Smucker (J. M.) Company, 12-15-27 | | | 961,853 | |

| | 1,000,000 | | | 2.250% Suntory Holdings, Ltd., 10-16-24 (a) | | | 992,779 | |

| | | | | | | | |

| | | | | | $ | 11,924,482 | |

| | | | ELECTRICAL EQUIPMENT & ELECTRONICS — 1.28% of Total Net Assets | |

| | 1,250,000 | | | 4.625% Avnet, Inc., 04-15-26 | | $ | 1,238,622 | |

| | | | | | | | |

| | | | | | $ | 1,238,622 | |

| | | | ENERGY SERVICES & PROCESSING — 8.10% of Total Net Assets | | | | |

| | 5,543,600 | | | 4.750% El Paso Energy Capital Trust I, 03-31-28 (b) | | $ | 5,233,159 | |

| | 820,000 | | | 5.625% Hess Midstream Operations, LP, 02-15-26 (a) | | | 814,875 | |

| | 564,000 | | | 5.875% HF Sinclair Corporation, 04-01-26 | | | 568,615 | |

| | 1,250,000 | | | 5.000% Oneok, Inc., 03-01-26 | | | 1,249,239 | |

| | | | | | | | |

| | | | | | $ | 7,865,888 | |

| | | | ENGINEERING & CONSTRUCTION — 1.04% of Total Net Assets | | | | |

| | 1,000,000 | | | 5.500% PulteGroup, Inc., 03-01-26 | | $ | 1,005,439 | |

| | | | | | | | |

| | | | | | $ | 1,005,439 | |

| | | | FINANCIAL SERVICES — 8.19% of Total Net Assets | | | | |

| | 1,000,000 | | | 3.500% Affiliated Managers Group, Inc., 08-01-25 | | $ | 982,074 | |

| | 997,500 | | | 6.500% B. Riley Financial, Inc., 09-30-26 | | | 762,090 | |

| | 2,500,000 | | | 4.700% Key Bank, N.A., 01-26-26 | | | 2,469,720 | |

| | 375,000 | | | 4.625% KKR Group Finance Company IX, LLC, 04-01-61 | | | 288,750 | |

| | 3,000,000 | | | 2.900% Manufactuers & Traders Trust Company, 02-06-25 | | | 2,952,377 | |

| | 500,000 | | | 5.900% PNC Bank, N.A., 04-01-26 | | | 500,628 | |

| | | | | | | | |

| | | | | | $ | 7,955,639 | |

Continued on following page.

12

VERSATILE BOND PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | INSURANCE — 13.21% of Total Net Assets | | | | |

| $ | 500,000 | | | 4.200% Brown & Brown, Inc., 09-15-24 | | $ | 498,960 | |

| | 1,500,000 | | | 4.500% Brown & Brown, Inc., 03-15-29 | | | 1,475,127 | |

| | 2,000,000 | | | 4.550% Globe Life, Inc., 09-15-28 | | | 1,940,095 | |

| | 2,750,000 | | | 4.500% Horace Mann Educators Corporation, 12-01-25 | | | 2,710,584 | |

| | 3,000,000 | | | 4.350% Kemper Corporation, 02-15-25 | | | 2,979,000 | |

| | 1,000,000 | | | 3.750% Loews Corporation, 04-01-26 | | | 982,323 | |

| | 1,750,000 | | | 4.400% Mercury General Corporation, 03-15-27 | | | 1,708,860 | |

| | 750,000 | | | 7.450% Phoenix Companies, Inc., 01-15-32 | | | 532,500 | |

| | | | | | | | |

| | | | | | $ | 12,827,449 | |

| | | | MANUFACTURING — 7.27% of Total Net Assets | | | | |

| | 375,000 | | | 8.125% Babcock & Wilcox Enterprises, Inc., 02-28-26 | | $ | 332,100 | |

| | 3,000,000 | | | 4.625% Kennametal, Inc., 06-15-28 | | | 2,973,651 | |

| | 1,000,000 | | | 4.550% Keysight Technologies, Inc., 10-30-24 | | | 996,195 | |

| | 2,000,000 | | | 4.600% Keysight Technologies, Inc., 04-06-27 | | | 1,988,740 | |

| | 750,000 | | | 5.600% Nordson Corporation, 09-15-28 | | | 771,925 | |

| | | | | | | | |

| | | | | | $ | 7,062,611 | |

| | | | MATERIALS — 1.02% of Total Net Assets | | | | |

| | 1,000,000 | | | 2.800% Steel Dynamics, Inc., 12-15-24 | | $ | 989,375 | |

| | | | | | | | |

| | | | | | $ | 989,375 | |

| | | | NATURAL RESOURCES — 8.05% of Total Net Assets | | | | |

| | 1,000,000 | | | 3.900% Cimarex Energy Company, 05-15-27 | | $ | 918,682 | |

| | 500,000 | | | 1.625% Glencore Funding, LLC, 09-01-25 (a) | | | 480,243 | |

| | 3,000,000 | | | 5.650% Ovintiv, Inc., 05-15-25 | | | 3,001,725 | |

| | 1,000,000 | | | 5.375% Ovintiv, Inc., 01-01-26 | | | 1,001,835 | |

| | 2,500,000 | | | 4.125% Parsley Energy, LLC, 02-15-28 (a) | | | 2,420,122 | |

| | | | | | | | |

| | | | | | $ | 7,822,607 | |

| | | | REAL ESTATE— 13.41% of Total Net Assets | | | | |

| | 1,250,000 | | | 4.100% Camden Property Trust, 10-15-28 | | $ | 1,219,643 | |

| | 1,100,000 | | | 2.000% COPT Defense Properties, 01-15-29 | | | 956,990 | |

| | 1,250,000 | | | 3.125% Cubesmart, L.P., 09-01-26 | | | 1,203,855 | |

| | 750,000 | | | 2.250% Cubesmart, L.P., 12-15-28 | | | 674,775 | |

| | 538,000 | | | 3.375% Duke Realty, L.P., 12-15-27 | | | 503,706 | |

| | 500,000 | | | 7.600% First Industrial, L.P., 07-15-28 | | | 534,503 | |

| | 1,250,000 | | | 3.850% Kimco Realty Corporation, 06-01-25 | | | 1,230,177 | |

| | 1,250,000 | | | 3.250% Kimco Realty Corporation, 08-15-26 | | | 1,204,337 | |

| | 500,000 | | | 1.900% Kimco Realty Corporation, 03-01-28 | | | 453,932 | |

| | 1,000,000 | | | 3.600% Regency Centers, L.P., 02-01-27 | | | 973,015 | |

| | 1,000,000 | | | 3.700% Regency Centers, L.P., 06-15-30 | | | 938,716 | |

| | 2,250,000 | | | 4.000% Retail Opportunity Investments Corporation, 12-15-24 | | | 2,234,831 | |

| | 1,000,000 | | | 2.300% Sun Communities Operating Limited Partnership, 11-01-28 | | | 890,668 | |

| | | | | | | | |

| | | | | | $ | 13,019,148 | |

| | | | RETAIL — 2.56% of Total Net Assets | | | | |

| | 2,500,000 | | | 3.500% AutoNation, Inc., 11-15-24 | | $ | 2,482,669 | |

| | | | | | | | |

| | | | | | $ | 2,482,669 | |

| | | | TRANSPORTATION — 2.23% of Total Net Assets | | | | |

| | 1,083,000 | | | 6.700% Burlington Northern Santa Fe, LLC, 08-01-28 | | $ | 1,169,770 | |

| | 500,000 | | | 4.250% CSX Corporation, 03-15-29 | | | 494,648 | |

| | 500,000 | | | 2.500% Ryder System, Inc., 09-01-24 | | | 498,331 | |

| | | | | | | | |

| | | | | | $ | 2,162,749 | |

Continued on following page.

13

VERSATILE BOND PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Principal Amount | | | | | Market Value | |

| | | | UTILITIES — 1.45% of Total Net Assets | | | | |

| $ | 498,000 | | | 3.600% Eastern Gas Transmission & Storage, Inc., 12-15-24 | | $ | 492,903 | |

| | 500,000 | | | 7.375% National Fuel Gas Company, 06-13-25 | | | 506,447 | |

| | 415,000 | | | 3.508% Niagara Mohawk Power Corporation, 10-01-24 (a) | | | 413,006 | |

| | | | | | | | |

| | | | | | $ | 1,412,356 | |

| | | | WASTE & ENVIRONMENTAL SERVICES — 1.82% of Total Net Assets | | | | |

| | 1,750,000 | | | 4.875% Republic Services, Inc., 04-01-29 | | $ | 1,768,372 | |

| | | | | | | | |

| | | | | | $ | 1,768,372 | |

| | | | | | | | |

| | | | Total Corporate Bonds (identified cost $87,677,552) | | $ | 85,923,670 | |

| | | | | | | | |

| | | | | | | | |

| Number of Shares | | | | | | |

| | | | PREFERRED STOCKS — 10.02% of Total Net Assets | | | | |

| |

| | | | COMMUNICATIONS SERVICES — 2.47% of Total Net Assets | |

| | 45,000 | | | 7.125% DigitalBridge Group, Inc., Preferred Class H (c) | | $ | 1,014,750 | |

| | 45,000 | | | 7.125% DigitalBridge Group, Inc., Preferred Class J (c) | | | 1,036,800 | |

| | 20,000 | | | 6.000% Telephone & Data Systems, Inc., Preferred Class VV (c) | | | 345,200 | |

| | | | | | | | |

| | | | | | $ | 2,396,750 | |

| | | | FINANCIAL SERVICES — 3.91% of Total Net Assets | | | | |

| | 15,000 | | | 5.625% Associated Banc-Corp, Preferred Class F (d) | | $ | 304,800 | |

| | 50,000 | | | 5.000% Capital One Financial Corporation, Preferred Class I (d) | | | 976,500 | |

| | 40,721 | | | 7.875% Compass Diversified Holdings, Preferred Class C (c) | | | 1,014,360 | |

| | 10,000 | | | 2.900% Manufacturers & Traders Trust Company, Preferred Class J (d) | | | 263,100 | |

| | 15,000 | | | 6.000% Merchants Bancorp, Preferred Class C (d) | | | 320,550 | |

| | 15,000 | | | 4.450% Schwab (Charles) Corporation, Preferred Class J (d) | | | 302,700 | |

| | 37,500 | | | 4.875% WaFD, Inc., Preferred Class A (d) | | | 618,750 | |

| | | | | | | | |

| | | | | | $ | 3,800,760 | |

| | | | INSURANCE — .43% of Total Net Assets | | | | |

| | 500,000 | | | 6.500% SBL Holdings, Inc., Perpetual Hybrid Subordinated (a)(c)(e) | | $ | 417,500 | |

| | | | | | | | |

| | | | | | $ | 417,500 | |

| | | | REAL ESTATE — 3.21% of Total Net Assets | | | | |

| | 45,000 | | | 6.375% CTO Realty Growth, Inc., Preferred Class A (c) | | $ | 983,700 | |

| | 65,000 | | | 6.250% Regency Centers Corporation, Preferred Class A (c) | | | 1,436,500 | |

| | 30,000 | | | 5.875% Regency Centers Corporation, Preferred Class B (c) | | | 697,500 | |

| | | | | | | | |

| | | | | | $ | 3,117,700 | |

| | | | | | | | |

| | | | Total Preferred Stocks (identified cost $10,963,526) | | $ | 9,732,710 | |

| | | | | | | | |

| | | | | | | | |

| Principal Amount | | | | | | |

| | | | UNITED STATES TREASURY SECURITIES — .51% of Total Net Assets | | | | |

| | 500,000 | | | United States Treasury bills 4.964%, 08-15-24 (f) | | $ | 498,982 | |

| | | | | | | | |

| | | | Total United States Treasury Securities (identified cost $498,972) | | $ | 498,982 | |

| | | | | | | | |

| | | | Total Portfolio — 99.02% of total net assets

(identified cost $99,140,050) (g) | | $ | 96,155,362 | |

| | | | Other assets, less liabilities (.98% of total net assets) | | | 954,994 | |

| | | | | | | | |

| | | | Net assets applicable to outstanding shares | | $ | 97,110,356 | |

| | | | | | | | |

Continued on following page.

14

VERSATILE BOND PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| | | | Notes: | | | | |

| | | | (a) Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration to qualified institutional investors. As of July 31, 2024, these securities amounted to $10,976,696, or 11.30% of Versatile Bond Portfolio’s total net assets, and have been determined by the Portfolio’s investment adviser to be liquid. | | | | |

| | | | (b) Convertible security. | | | | |

| | | | (c) Cumulative, perpetual preferred stock. | | | | |

| | | | (d) Non-cumulative, perpetual preferred stock. | | | | |

| | | | (e) Variable or floating rate security whereby the interest rate is periodically reset. The interest rate shown reflects the rate in effect as of July 31, 2024. | | | | |

| | | | (f) Interest rate represents yield to maturity. | | | | |

| | | | (g) Aggregate cost for book and federal income tax purposes are the same. | | | | |

See accompanying notes to financial statements.

15

AGGRESSIVE GROWTH PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Number of Shares | | | | | Market Value | |

| | | | AGGRESSIVE GROWTH STOCKS — 97.40% of Total Net Assets | | | | |

| | |

| | | | AEROSPACE — 3.92% of Total Net Assets | | | | |

| | 3,000 | | | Lockheed Martin Corporation | | $ | 1,625,760 | |

| | | | | | | | |

| | | | | | $ | 1,625,760 | |

| | | | CHEMICALS — 3.04% of Total Net Assets | | | | |

| | 3,000 | | | Air Products & Chemicals, Inc. | | $ | 791,550 | |

| | 5,000 | | | Albemarle Corporation | | | 468,350 | |

| | | | | | | | |

| | | | | | $ | 1,259,900 | |

| | | | COMPUTER SOFTWARE & SERVICES — 6.66% of Total Net Assets | | | | |

| | 3,000 | | | Autodesk, Inc. (a) | | $ | 742,560 | |

| | 75,000 | | | Palantir Technologies, Inc. Class A (a) | | | 2,016,750 | |

| | | | | | | | |

| | | | | | $ | 2,759,310 | |

| | | | ELECTRICAL EQUIPMENT & ELECTRONICS — 25.42% of Total Net Assets | |

| | 20,000 | | | Broadcom, Inc. | | $ | 3,213,600 | |

| | 10,000 | | | Intel Corporation | | | 307,400 | |

| | 60,000 | | | NVIDIA Corporation | | | 7,021,200 | |

| | | | | | | | |

| | | | | | $ | 10,542,200 | |

| | | | ENERGY SERVICES & PROCESSING — 1.86% of Total Net Assets | | | | |

| | 15,000 | | | HF Sinclair Corporation | | $ | 772,050 | |

| | | | | | | | |

| | | | | | $ | 772,050 | |

| | | | ENGINEERING & CONSTRUCTION — 3.29% of Total Net Assets | | | | |

| | 10,000 | | | Fluor Corporation (a) | | $ | 481,000 | |

| | 5,000 | | | Lennar Corporation Class A | | | 884,650 | |

| | | | | | | | |

| | | | | | $ | 1,365,650 | |

| | | | ENTERTAINMENT & LEISURE — 7.85% of Total Net Assets | | | | |

| | 5,000 | | | Disney (Walt) Company | | $ | 468,450 | |

| | 5,000 | | | Meta Platforms, Inc. Class A | | | 2,374,150 | |

| | 5,000 | | | Wynn Resorts, Ltd. (a) | | | 414,100 | |

| | | | | | | | |

| | | | | | $ | 3,256,700 | |

| | | | FINANCIAL SERVICES — 8.03% of Total Net Assets | | | | |

| | 15,000 | | | Affirm Holdings, Inc. Class A (a) | | $ | 424,350 | |

| | 10,000 | | | Morgan Stanley | | | 1,032,100 | |

| | 10,000 | | | Schwab (Charles) Corporation | | | 651,900 | |

| | 5,000 | | | State Street Corporation | | | 424,850 | |

| | 3,000 | | | Visa, Inc. Class A | | | 797,010 | |

| | | | | | | | |

| | | | | | $ | 3,330,210 | |

| | | | MANUFACTURING — 7.99% of Total Net Assets | | | | |

| | 4,000 | | | Agilent Technologies, Inc. | | $ | 565,600 | |

| | 3,000 | | | Illinois Tool Works, Inc. | | | 741,840 | |

| | 4,000 | | | IPG Photonics Corporation (a) | | | 321,600 | |

| | 3,000 | | | Parker-Hannifin Corporation | | | 1,683,480 | |

| | | | | | | | |

| | | | | | $ | 3,312,520 | |

| | | | MATERIALS — 1.18% of Total Net Assets | | | | |

| | 3,000 | | | Nucor Corporation | | $ | 488,820 | |

| | | | | | | | |

| | | | | | $ | 488,820 | |

Continued on following page.

16

AGGRESSIVE GROWTH PORTFOLIO

Schedule of Investments

July 31, 2024 (Unaudited)

| | | | | | | | |

| Number of Shares | | | | | Market Value | |

| | | | NATURAL RESOURCES — 11.61% of Total Net Assets | | | | |

| | 100,000 | | | Birchcliff Energy, Ltd. | | $ | 433,000 | |

| | 75,000 | | | Freeport-McMoRan, Inc. | | | 3,405,750 | |

| | 10,000 | | | Nutrien, Ltd. | | | 512,000 | |

| | 10,000 | | | Ovintiv, Inc. | | | 464,400 | |

| | | | | | | | |

| | | | | | $ | 4,815,150 | |

| | | | PHARMACEUTICALS — 2.41% of Total Net Assets | | | | |

| | 3,000 | | | Amgen, Inc. | | $ | 997,410 | |

| | | | | | | | |

| | | | | | $ | 997,410 | |

| | | | RETAIL — 7.70% of Total Net Assets | | | | |

| | 2,000 | | | Costco Wholesale Corporation | | $ | 1,644,000 | |

| | 10,000 | | | Williams-Sonoma, Inc. | | | 1,546,800 | |

| | | | | | | | |

| | | | | | $ | 3,190,800 | |

| | | | TRANSPORTATION — 6.44% of Total Net Assets | | | | |

| | 5,000 | | | Canadian Pacific Kansas City Limited | | $ | 419,100 | |

| | 3,000 | | | FedEx Corporation | | | 906,750 | |

| | 5,000 | | | Ryder System, Inc. | | | 700,800 | |

| | 10,000 | | | Uber Technologies, Inc. (a) | | | 644,700 | |

| | | | | | | | |

| | | | | | $ | 2,671,350 | |

| | | | | | | | |

| | | | Total Aggressive Growth Stocks (identified cost $11,000,585) | | $ | 40,387,830 | |

| | | | | | | | |

| Principal Amount | | | | | | |

| | | | UNITED STATES TREASURY SECURITIES — 2.40% of Total Net Assets | | | | |

| $ | 1,000,000 | | | United States Treasury bills 5.151%, 08-29-24 (b) | | $ | 995,924 | |

| | | | | | | | |

| | | | Total United States Treasury Securities (identified cost $995,924) | | $ | 995,924 | |

| | | | | | | | |

| | | | Total Portfolio — 99.80% of total net assets

(identified cost $11,996,509) (c) | | $ | 41,383,754 | |

| | | | Other assets, less liabilities (.20% of total net assets) | | | 81,375 | |

| | | | | | | | |

| | | | Net assets applicable to outstanding shares | | $ | 41,465,129 | |

| | | | | | | | |

| | |

| | | | Notes: | | | | |

| | | | (a) Non-income producing. | | | | |

| | | | (b) Interest rate represents yield to maturity. | | | | |

| | | | (c) Aggregate cost for book and federal income tax purposes are the same. | | | | |

See accompanying notes to financial statements.

17

STATEMENTS OF ASSETS AND LIABILITIES

July 31, 2024 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Permanent

Portfolio® | | | Short-Term

Treasury

Portfolio | | | Versatile

Bond

Portfolio | | | Aggressive

Growth

Portfolio | |

ASSETS | | | | | | | | | | | | | | | | |

Investments at market value (Notes 1, 5 & 6): | | | | | | | | | | | | | | | | |

Investments other than securities: | | | | | | | | | | | | | | | | |

Gold assets (identified cost $328,396,837; $—; $— and $—, respectively) | | $ | 749,878,791 | | | $ | — | | | $ | — | | | $ | — | |

Silver assets (identified cost $92,215,771; $—; $— and $—, respectively) | | | 174,342,194 | | | | — | | | | — | | | | — | |

Swiss franc deposits (identified cost $566,052; $—; $— and $—, respectively) | | | 569,824 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

| | | 924,790,809 | | | | — | | | | — | | | | — | |

Swiss franc bonds | | | 262,340,929 | | | | — | | | | — | | | | — | |

Real estate and natural resource stocks | | | 600,809,800 | | | | — | | | | — | | | | — | |

Aggressive growth stocks | | | 633,306,450 | | | | — | | | | — | | | | 40,387,830 | |

Corporate bonds | | | 868,646,603 | | | | — | | | | 85,923,670 | | | | — | |

Preferred stocks | | | — | | | | — | | | | 9,732,710 | | | | — | |

United States Treasury securities | | | 61,775,836 | | | | 11,345,278 | | | | 498,982 | | | | 995,924 | |

| | | | | | | | | | | | | | | | |

Total investments (identified cost $2,110,123,042; $11,371,880; $99,140,050 and $11,996,509, respectively) | | | 3,351,670,427 | | | | 11,345,278 | | | | 96,155,362 | | | | 41,383,754 | |

Cash | | | 8,366,039 | | | | 53,082 | | | | 4,994 | | | | — | |

Accounts receivable for shares of the portfolio sold | | | 3,709,394 | | | | 6,211 | | | | 109,469 | | | | 175,343 | |

Accrued dividends receivable | | | 799,725 | | | | — | | | | — | | | | 35,450 | |

Accrued interest receivable | | | 9,065,396 | | | | 58,203 | | | | 928,267 | | | | — | |

Accrued foreign taxes receivable | | | 6,784,718 | | | | — | | | | — | | | | — | |

Prepaid expenses | | | 194,334 | | | | 729 | | | | 4,053 | | | | 2,991 | |

| | | | | | | | | | | | | | | | |

Total assets | | | 3,380,590,033 | | | | 11,463,503 | | | | 97,202,145 | | | | 41,597,538 | |

| | | | |

LIABILITIES | | | | | | | | | | | | | | | | |

Bank overdraft | | | — | | | | — | | | | — | | | | 87,813 | |

Accounts payable for shares of the portfolio redeemed | | | 1,082,342 | | | | — | | | | 29,820 | | | | — | |

Accrued investment advisory fees | | | 2,230,601 | | | | 6,034 | | | | 51,291 | | | | 41,715 | |

Accrued distribution and service fees | | | 421,615 | | | | — | | | | 10,678 | | | | 2,881 | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 3,734,558 | | | | 6,034 | | | | 91,789 | | | | 132,409 | |

| | | | | | | | | | | | | | | | |

NET ASSETS | | $ | 3,376,855,475 | | | $ | 11,457,469 | | | $ | 97,110,356 | | | $ | 41,465,129 | |

| | | | | | | | | | | | | | | | |

Continued on following page.

18

STATEMENTS OF ASSETS AND LIABILITIES

July 31, 2024 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Permanent

Portfolio® | | | Short-Term

Treasury

Portfolio | | | Versatile

Bond

Portfolio | | | Aggressive

Growth

Portfolio | |

COMPONENTS OF NET ASSETS | | | | | | | | | | | | | | | | |

Capital stock | | $ | 58,615 | | | $ | 174 | | | $ | 1,495 | | | $ | 446 | |