SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

TrustCo Bank Corp NY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| Michael Hall |

| | General Counsel and Corporate Secretary |

| To: | Glass Lewis Subscribers |

| Re: | Report Feedback Statement |

We appreciate the opportunity to submit this feedback statement regarding the 2022 Glass Lewis (“GL”) report on the Trustco Bank Corp NY (“TrustCo”) 2022 Proxy Statement. We disagree with the GL analysis on two points: The GL recommendation against the election of Frank B. Silverman as a director and the recommendation against the advisory resolution on the compensation of TrustCo’s named executive officers.

Election of Frank B. Silverman:

GL determined under its standard for director independence that incumbent director Frank B. Silverman is “affiliated” rather than “independent.” We wish to clarify that TrustCo’s board has determined, with the assistance of counsel and following a review of Mr. Silverman’s business arrangements, that Mr. Silverman meets the Nasdaq tests for director independence set forth in Nasdaq Listing Rule 5605. The board determined that due to the effect of partial divestments by Mr. Silverman from the entities that receive payments from TrustCo and a relinquishment of a controlling interest in those entities, the Nasdaq listing standards do not operate as a bar to Mr. Silverman being considered independent. Additionally, the board determined that Mr. Silverman does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

As justification for its position, GL states that relationships such as that between Mr. Silverman and TrustCo create a conflict of interest for the director and goes on to question whether “a company’s decision regarding where to turn for the best properties may be compromised when doing business with . . . one of the company’s directors.” While we agree that a relationship between a director and a company could be so financially significant to one or the other that the director’s independence could be compromised, we disagree that such is the case here. The leases between TrustCo and the entities affiliated with Mr. Silverman all predate Mr. Silverman’s board service by many years, and there are no plans for the bank to lease additional properties associated with Mr. Silverman in the future. We also believe that the character of the director must be weighed by the board in making an independence determination. This is why Nasdaq’s focus on relationships that “would interfere with the exercise of independent judgment in carrying out the responsibilities of a director” is so critical. Indeed, an entity controlled by Mr. Silverman sold outright one property leased by TrustCo, and Mr. Silverman divested his controlling interest in the other entities that own properties that TrustCo leases. We believe that the assessment of our board as to Mr. Silverman’s independence, with full knowledge of Mr. Silverman’s character and the value of the transactions in relation to his total business holdings (which are extensive), is correct and we urge shareholders to accept the board’s recommendation in favor of electing Mr. Silverman.

We note, in addition, that even under GL’s independence policy, and the strictly numerical analysis it requires, Mr. Silverman’s business dealings with TrustCo should not be found to impair his independence. Specifically, Mr. Silverman owns 100% of Leesburg Development 2, LLC, which sold the property TrustCo leases in May 2021, and neither Mr. Silverman nor Leesburg Development 2, LLC retained any interest in the property following the sale. The amount of rental and other payments made by TrustCo under this lease from January 1, 2021 through the date of sale was $52,576, which is below 1% of the consolidated gross revenue in 2021 of (1) TrustCo (which had consolidated interest and dividend income of $168m and noninterest income of $17.9m in 2021) and (2) entities controlled by Mr. Silverman, as found by TrustCo’s board after detailed review of Mr. Silverman’s financial statements. As to the other lessor entities, according to Glass Lewis policy, the 1% test applies to “other business relationships (e.g., where the director is an executive officer of a company that provides services or products to or receives services or products from the company).” This test does not apply to the other leases disclosed in Trustco’s Proxy Statement because Mr. Silverman does not control, manage or have policy-making functions at any of those lessors. Again, we urge shareholders to accept the recommendation in favor of electing Mr. Silverman.

Advisory Vote on Executive Compensation

GL recommends that shareholders vote against the advisory vote on executive compensation. GL cites, among other factors, that the long-term incentive plan provided for vesting below median and what it calls a significant deficit between performance ranking relative to executive pay levels among peers. We disagree with GL’s assessments and urge shareholders to support the advisory vote.

Having considered 2021 performance relative to the peer group, feedback received through the Company’s shareholder engagement program, and the anticipated analysis of GL and other analysts, the Compensation Committee determined that three changes to the compensation program for 2022 would be appropriate.

First, salaries for Mr. McCormick, Mr. Salvador and Mr. Leonard all remained level and Mr. Ozimek and Mr. Curley, the two named executive officers (“NEOs”) most recently named as Executive Vice Presidents, received modest increases.

Second, total shareholder return was added as a performance metric. The Committee’s decision in this regard was influenced by (1) its recognition that proxy advisory firms place a particular emphasis on this metric and (2) the Committee’s conclusion that this metric appropriately reflects corporate performance in a way that should be related to corporate executives’ compensation. Specifically, total shareholder return was added as a metric in the executive officer incentive plan in addition to ROAA, efficiency ratio, and Tier 1 Risk-Based Capital Ratio, with each metric being weighted evenly.

Third, the Committee adjusted the performance goals for the Executive Officer incentive plan to eliminate any possibility of a bonus for performance below the 50th percentile compared to the peer group. This change directly addresses a concern raised by GL.

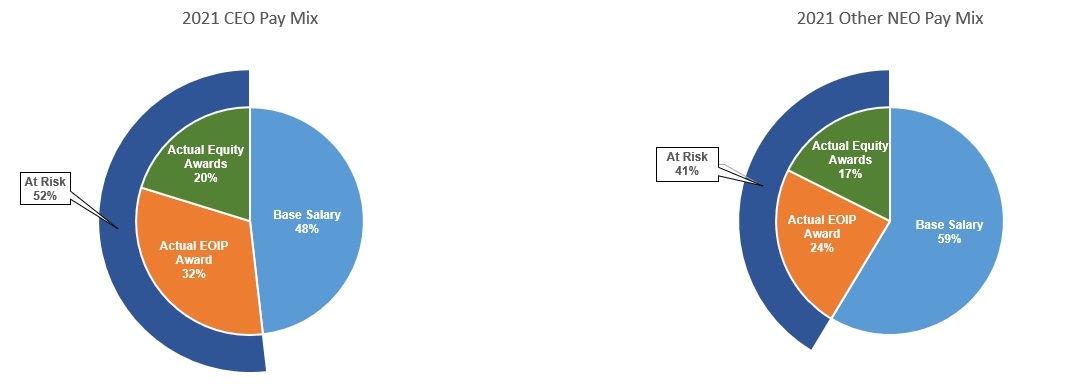

We also disagree that there is a deficit between performance and pay. For 2021 compensation, the program operated as intended with respect to relating pay and performance. The compensation program, as shown in the charts below, places 66% of the CEO’s potential compensation, and 56% of the other NEOs’ compensation, at risk. Based upon actual performance, however, the Executive Officer Incentive Plan awards did not pay out at the maximum level, and current-year payments on 2018 Performance Share Awards also did not pay out at maximum level and were further reduced by one third based upon actual performance relative to the applicable benchmark – the “second trigger” under the plan. Thus, while the CEO had the potential to earn $2,842,780 if all performance measures were achieved at the maximum level, based upon actual performance Mr. McCormick was paid $2,023,018 in connection with the bonus components of the compensation program.

2021 At Risk Compensation Components - Potential

| (1) | Base salary for Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, was $975,000, $410,000, $600,000, $600,000, and $375,000, respectively. |

| (2) | The potential EOIP award is the full amount authorized by the board of directors in December 2021. This amount is added to the deferred portion of the 2020 award that paid out based upon 2021 performance. This portion of the award is calculated by taking the 2020 deferral percentage (27% for McCormick, 12% for the other NEOs) multiplied by 125% multiplied by 2021 Base Salary. For Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, the combined total potential for these awards was equal to $1,157,813, $307,500, $450,000, $450,000, and $281,250, respectively |

| (3) | The potential equity awards are based on the RSU shares granted in November 2020, 2019 and 2018 at $31.50, $43.95 and $38.30 respectively. For Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, this was equal to $259,962, $73,379, $99,998, $130,011, and $86,696, respectively. It also includes the PSU shares granted in November 2018 at a price of $38.30 and multiplied by 150%. For Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, this was equal to $450,006, $67,504, $247,495, $247,495, and $67,504, respectively. |

2021 At Risk Compensation Components – Actual

| (1) | Base salary for Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, was $975,000, $410,000, $600,000, $600,000, and $375,000, respectively. |

| (2) | The actual EOIP award is amount received for both 2021 plan performance and the 2020 deferral portion. For Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, the combined total potential for these awards was equal to $638,625, $166,050, $243,000, $243,000, and $151,875, respectively |

| (3) | The actual equity awards are based on the vesting of the RSU shares granted in November 2020, 2019 and 2018 and the PSU shares granted in 2018. For Messrs. McCormick, Ozimek, Salvador, Leonard, and Curley, this was equal to $409,393, $93,458, $186,255, $213,266, and $103,579, respectively. |

Accordingly, we disagree that the TrustCo compensation program does not appropriately link pay and performance and urge shareholders to support the advisory resolution on executive compensation. We believe that the changes to our executive compensation program for 2022 will enhance the link between pay and performance.

Best regards,

/s/ Michael Hall

Safe Harbor Statement

All statements in this letter that are not historical are forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding our expectations for the compensation of our named executive officers and the undertaking of related-party transactions. Such forward-looking statements are subject to factors that could cause actual results to differ materially from those discussed, including other risks and uncertainties under the heading “Risk Factors” in our most recent annual report on Form 10-K and in our subsequent quarterly reports on Form 10-Q or other securities filings. TrustCo wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We do not undertake any obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise.