|

EXHIBIT 99.1

|

2015 Annual Shareholder Meeting

Thank you for 125 years of allowing us to put You First.

Years with Company Years in Industry

Scott Dueser

Chairman of the Board, President & 38 43

Chief Executive Officer

Ron Butler

Executive Vice President 22 33

Chief Administrative Officer

Gary S. Gragg

Executive Vice President 24 36

Credit Administration

J. Bruce Hildebrand, CPA

Executive Vice President 12 36

Chief Financial Officer

Stan Limerick

Executive Vice President — 35

Chief Information Officer

Kirk Thaxton, CTFA

President, First Financial Trust & Asset 28 31

Management

Gary L. Webb 12 26

Executive Vice President

Marna Yerigan

Executive Vice President 4 30

Credit Administration

1

Senior Management at First Financial

Years with Company Years in Industry

Brandon Harris

Senior Vice President 2 15

Appraisal Services

Monica Houston

Senior Vice President 20 20

Training

Larry Kentz

Senior Vice President & Compliance Officer 1 35

Compliance

Luke Longhofer

Senior Vice President & Loan Review Officer 3 10

Credit Administration

Michele Stevens

Senior Vice President 16 32

Advertising and Marketing

2

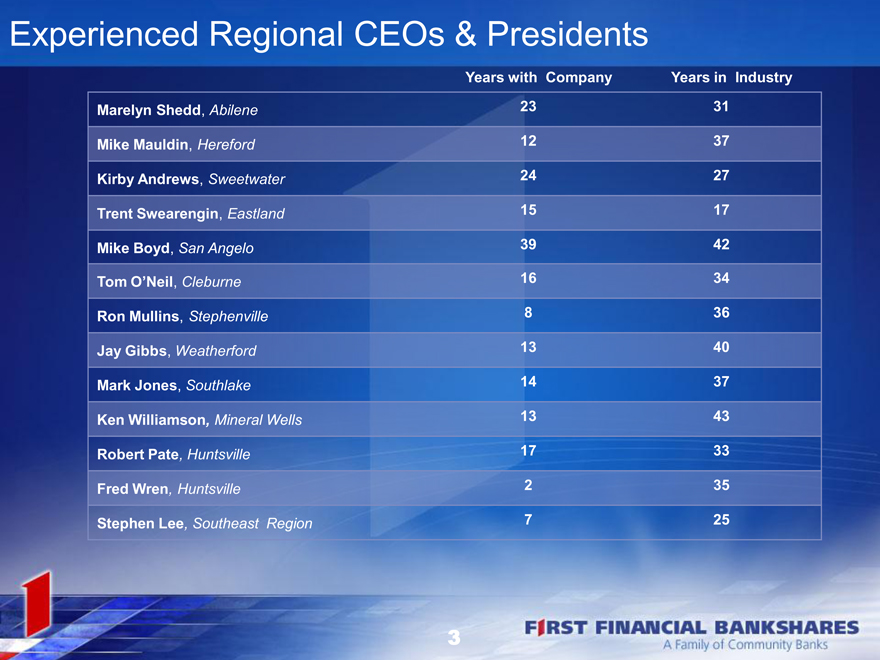

Experienced Regional CEOs & Presidents

Years with Company Years in Industry

Marelyn Shedd, Abilene 23 31

Mike Mauldin, Hereford 12 37

Kirby Andrews, Sweetwater 24 27

Trent Swearengin, Eastland 15 17

Mike Boyd, San Angelo 39 42

Tom O’Neil, Cleburne 16 34

Ron Mullins, Stephenville 8 36

Jay Gibbs, Weatherford 13 40

Mark Jones, Southlake 14 37

Ken Williamson, Mineral Wells 13 43

Robert Pate, Huntsville 17 33

Fred Wren, Huntsville 2 35

Stephen Lee, Southeast Region 7 25

3

Thank you for 125 years of allowing us to put You First.

Independent Public Auditors

Building a better working world

5

FIRST FINANCIAL BANKSHARES, INC. TM

A Family of community BanksTM

FIRST FINANCIAL BANKSHARES, INC.

Board of Directors

Years as Board Committee

Member Appointment

April Anthony

Chief Executive Officer — Nominated

Encompass Home Health and Hospice

& Homecare Homebase

Steven L. Beal Executive

Director and Former President and COO of 5 Compensation

Concho Resources Inc. Nominating / Corporate Governance

Tucker S. Bridwell Lead Director / Executive

8

President, Mansefeldt Investment Corporation Nominating / Corporate Governance

David Copeland Executive / Audit

President, SIPCO, Inc. and 17

Shelton Family Foundation Nominating / Corporate Governance

F. Scott Dueser 24 Executive

Chairman of the Board, President and CEO

Murray Edwards Executive / Audit

9

Principal, The Edwards Group Nominating / Corporate Governance

7

Board of Directors

Years as Board Committee

Member Appointment

Ron Giddiens 6 Audit

G&G Investments

Tim Lancaster 2 Audit

President and CEO Hedrick Health System

Kade L. Matthews 17 Compensation

Ranching and Investments

Ross H. Smith, Jr. 1 Compensation

Chairman and President Akrotex, Inc.

Executive

Johnny E. Trotter 12 Compensation

President and CEO Livestock Investors, Ltd.

Nominating/Corporate Governance

8

FIRST FINANCIAL BANKSHARES, INC. TM

A Family of community BanksTM

FIRST FINANCIAL BANKSHARES, INC.

Ms. April Anthony

10

Thank you for 125 years of allowing us to put You First.

Forward Looking Statement

The numbers, as of and for the three months ended March 31, 2015, contained within this presentation are unaudited. Certain statements contained herein may be considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These statements are based upon the belief of the Company’s management, as well as assumptions made beyond information currently available to the Company’s management and, may be, but not necessarily are identified by such words as “expect”, “plan”, “anticipate”, “target”, “forecast” and “goal”. Because such “forward-looking statements” are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from the Company’s expectations include competition from other financial institutions and financial holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. Other key risks are described in the Company’s reports filed with the Securities and Exchange Commission, which may be obtained under “Investor Relations-Documents/Filings” on the Company’s web site or by writing or calling the Company at 325.627.7155. The Company does not undertake any obligation to update publicly or revise any forward-looking statements herein because of new information, future events or otherwise.

|

|

2014 Financial Review

Earnings

28th Consecutive Year of Increased Earnings

FFIN Earnings (in millions)

$89.6

$78.9

$74.2

$68.4

$59.7

$53.8

2009 2010 2011 2012 2013 2014

15

Strong Shareholder Earnings

Basic Earnings Per Share

$1.40

$1.24

$1.18

$1.09

$0.95

$0.86

2009 2010 2011 2012 2013 2014

*Per share amounts reflect the 2 for 1 stock split that was effective June 2, 2014.

16

Working Harder and Smarter

Efficiency Ratio (FFIN vs. Peers)

2009 2010 2011 2012 2013 2014

First

Financial 50.11% 49.49% 48.37% 48.14% 50.20% 49.24%

Peer Group 69.53% 67.33% 65.57% 65.77% 67.79% 66.77%

17

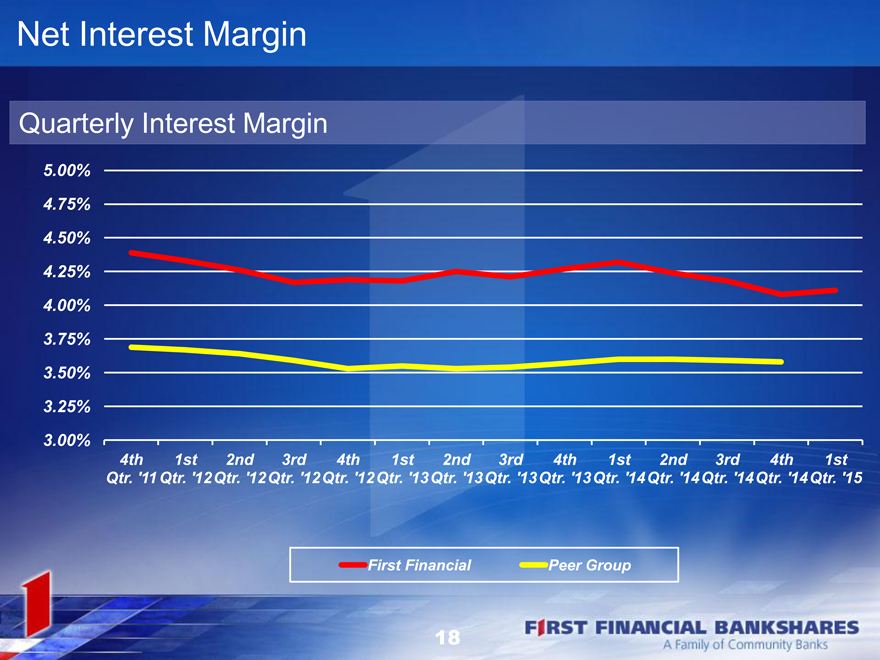

Net Interest Margin

Quarterly Interest Margin

5.00%

4.75%

4.50%

4.25%

4.00%

3.75%

3.50%

3.25%

3.00%

4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st

Qtr. ‘11 Qtr. ‘12 Qtr. ‘12 Qtr. ‘12 Qtr. ‘12 Qtr. ‘13 Qtr. ‘13 Qtr. ‘13 Qtr. ‘13 Qtr. ‘14 Qtr. ‘14 Qtr. ‘14 Qtr. ‘14 Qtr. ‘15

First Financial Peer Group

18

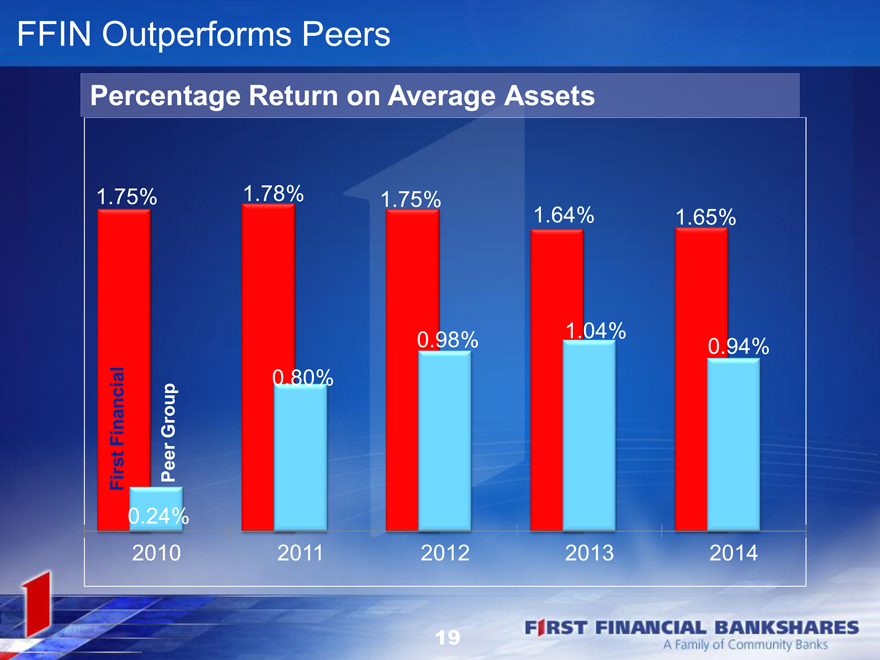

FFIN Outperforms Peers

Percentage Return on Average Assets

1.75% 1.78% 1.75%

1.64% 1.65%

0.98% 1.04% 0.94%

0.80%

Financial Group

First Peer

0.24%

2010 2011 2012 2013 2014

19

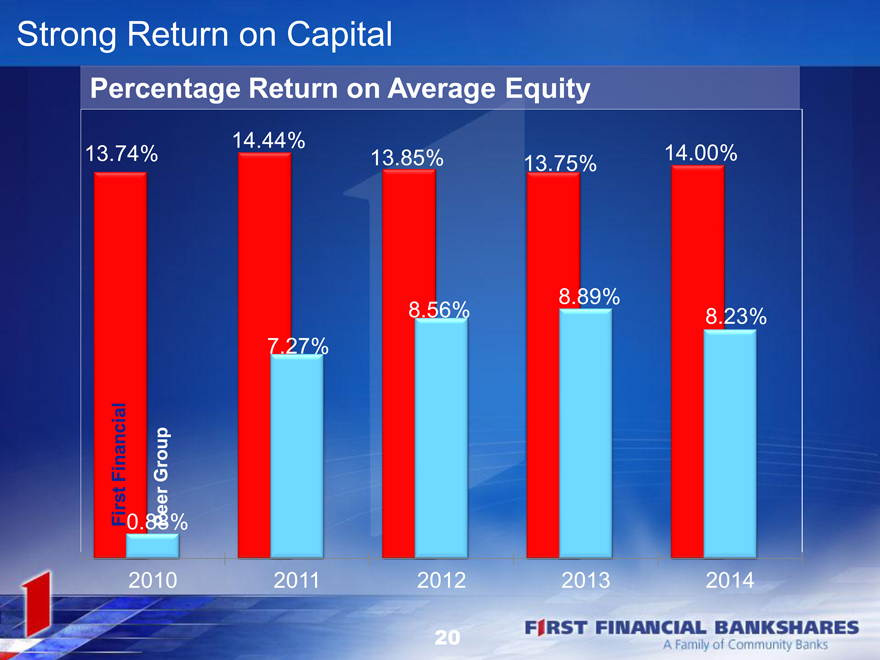

Strong Return on Capital

Percentage Return on Average Equity

14.44%

13.74% 13.85% 13.75% 14.00%

8.89%

8.56% 8.23%

7.27%

Financial Group

First 0.88%Peer

2010 2011 2012 2013 2014

20

Capital Ratios

To be considered

12-31-14 03-31-15

well Capitalized

Tier 1

9.89 9.85 > 5.00

Leverage Ratio

Tier 1 Risk

16.05 16.23 > 6.00

Based Capital Ratio

Risk Based

17.16 17.35 > 10.00

Capital Ratio

21

Asset Performance

Growth in Total Assets (in millions)

$5,848

$5,222

$4,502

$4,121

$3,776

$3,279

2009 2010 2011 2012 2013 2014

22

Loan Performance

Growth in FFIN Total Loans (in millions)

$2,938

$2,689

Real Estate

$2,089

Commercial $1,831

$1,690 $1,787 $1,689

$1,514

Consumer $1,238

$990 $1,076

$860

Agricultural $590 $640

$510

$406 $429 $427

$175 $191 $218 $273 $334 $361

$73 $81 $66 $68 $76 $106

2009 2010 2011 2012 2013 2014

23

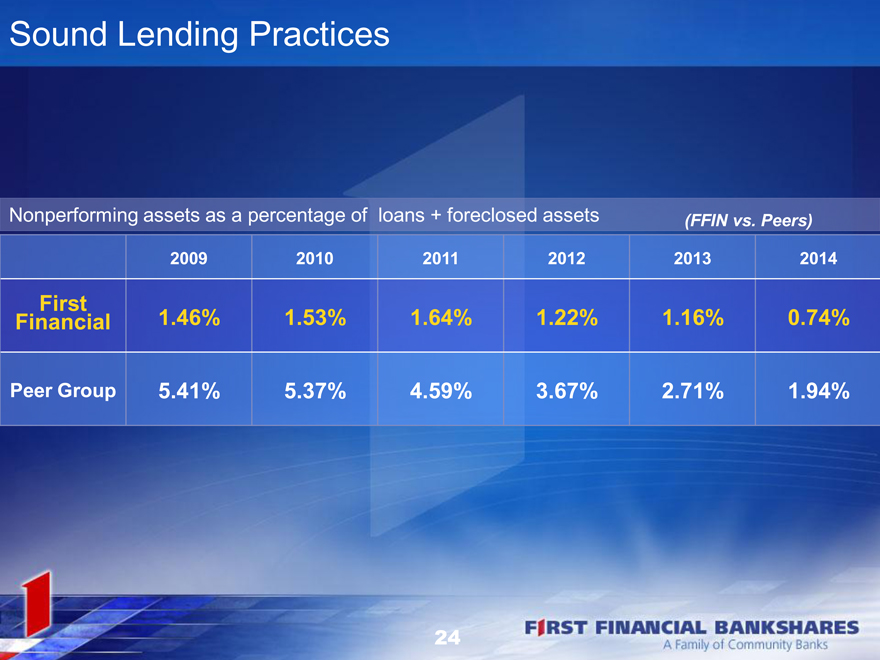

Sound Lending Practices

Nonperforming assets as a percentage of loans + foreclosed assets (FFIN vs. Peers)

2009 2010 2011 2012 2013 2014

First

Financial 1.46% 1.53% 1.64% 1.22% 1.16% 0.74%

Peer Group 5.41% 5.37% 4.59% 3.67% 2.71% 1.94%

24

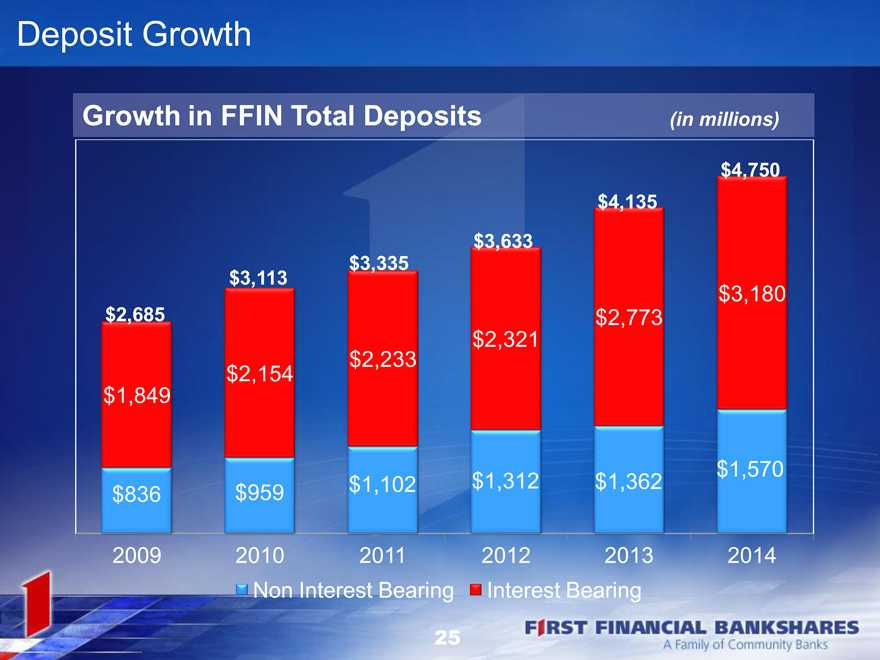

Deposit Growth

Growth in FFIN Total Deposits (in millions)

$4,750

$4,135

$3,633

$3,335

$3,113

$3,180

$2,685 $2,773

$2,321

$2,233

$2,154

$1,849

$1,570

$836 $959 $1,102 $ 1,312 $1,362

2009 2010 2011 2012 2013 2014

Non Interest Bearing Interest Bearing

25

1st Quarter 2015 Summary

1st Quarter Earnings

FFIN Earnings

$24.0

$22.3

$17.8 $18.6

$16.3

$13.7

2010 2011 2012 2013 2014 2015

27

Shareholder Earnings – 1st Quarter

Basic Earnings Per Share

$0.37

$0.35

$0.28 $0.30

$0.26

$0.22

2010 2011 2012 2013 2014 2015

28

FIRST FINANCIAL TRUST & ASSET MANAGEMENT COMPANY NA

A Family of Community Banks

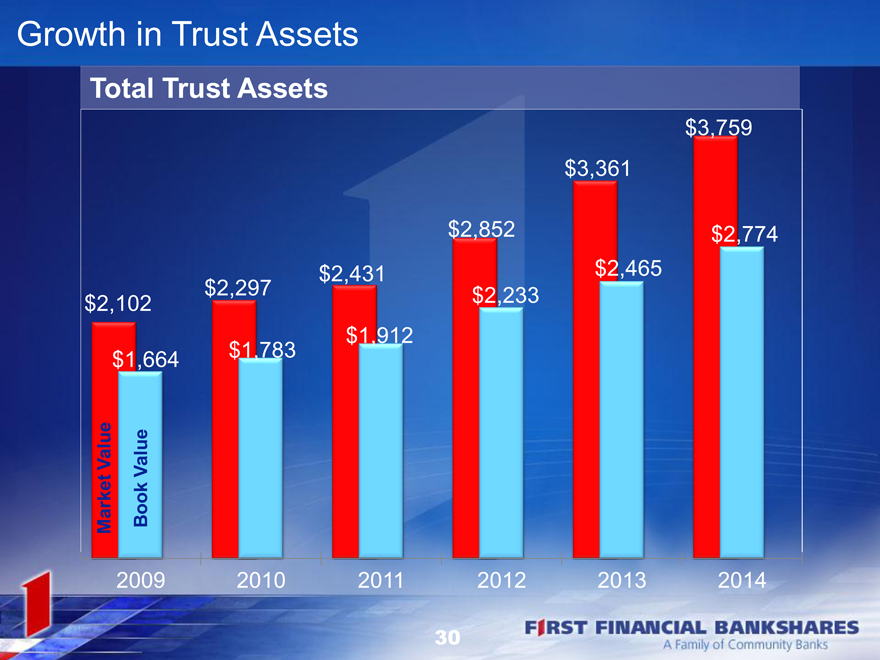

Growth in Trust Assets

Total Trust Assets

$3,759

$3,361

$2,852 $2,774

$2,431 $2,465

$2,102 $2,297 $2,233

$1,912

$1,664 $1,783

Value Value

ket Mar Book

2009 2010 2011 2012 2013 2014

30

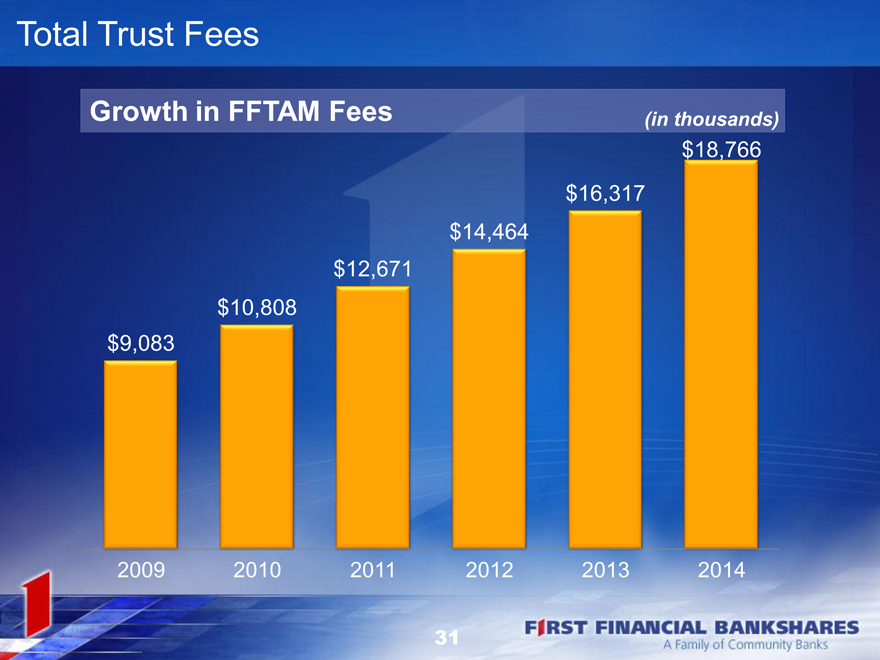

Total Trust Fees

Growth in FFTAM Fees (in thousands)

$18,766

$16,317

$14,464

$12,671

$10,808

$9,083

2009 2010 2011 2012 2013 2014

31

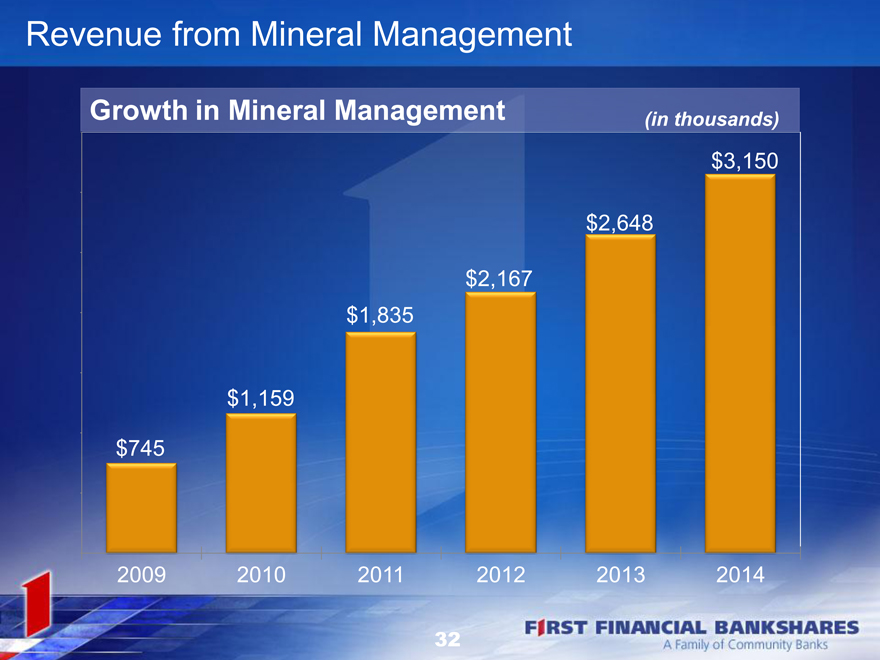

Revenue from Mineral Management

Growth in Mineral Management (in thousands)

$3,150

$2,648

$2,167

$1,835

$1,159

$745

2009 2010 2011 2012 2013 2014

32

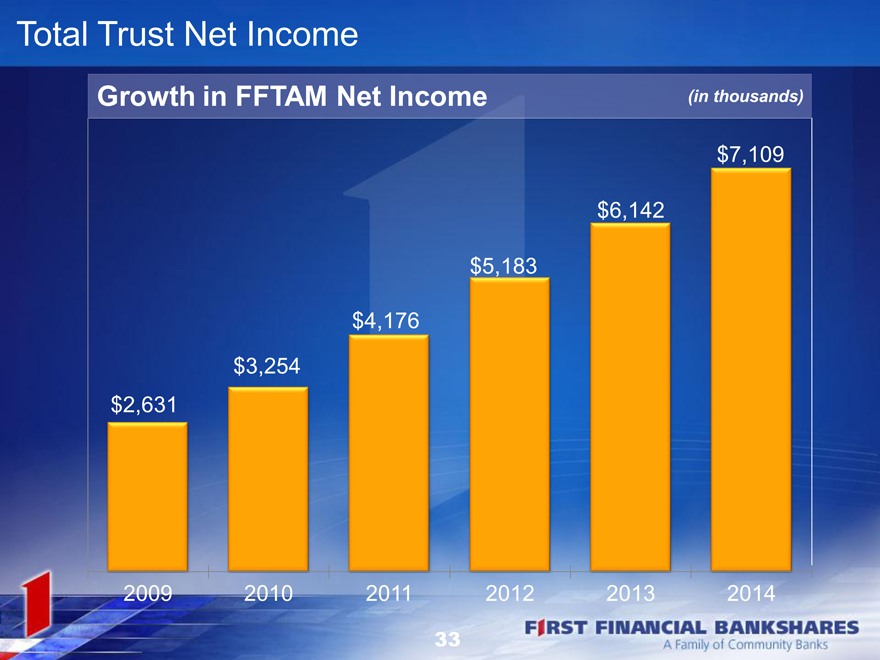

Total Trust Net Income

Growth in FFTAM Net Income (in thousands)

$7,109

$6,142

$5,183

$4,176

$3,254

$2,631

2009 2010 2011 2012 2013 2014

33

Managed Equity Styles

Equity Income

Core Domestic

Core Diversified

Core World

Strategic Growth

34

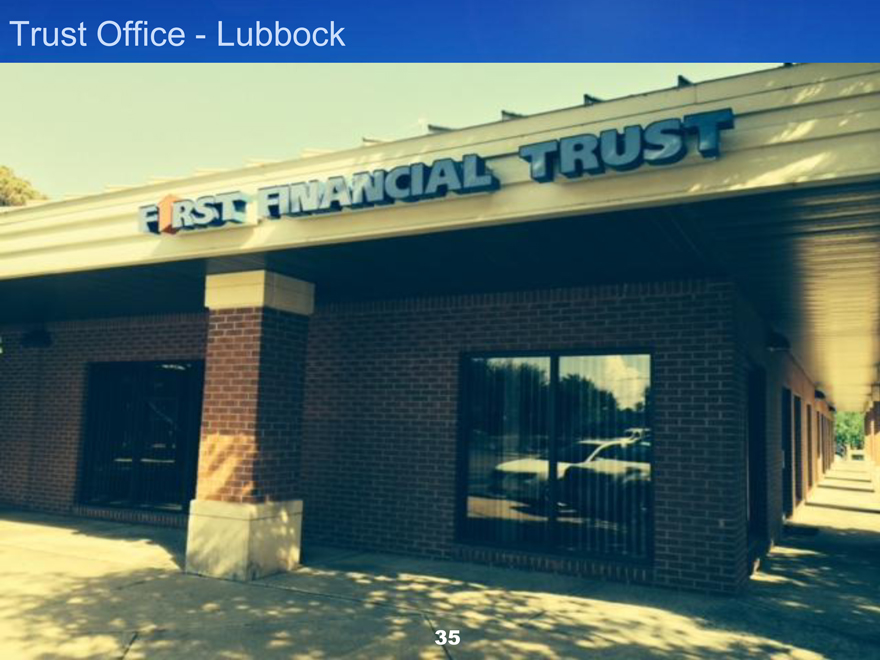

Trust Office—Lubbock

35

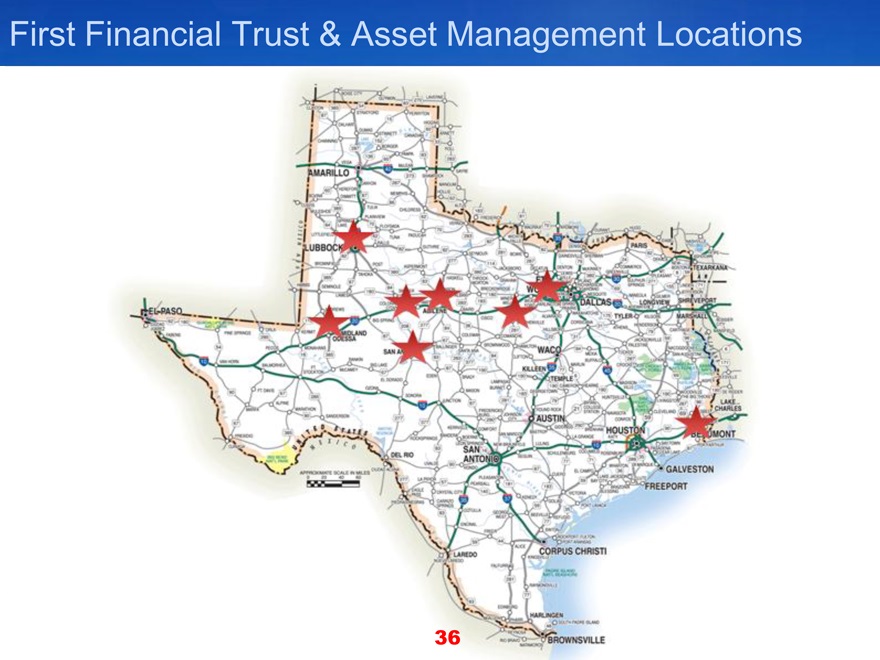

First Financial Trust & Asset Management Locations

36

FIRST FINANCIAL TRUST & ASSET MANAGEMENT COMPANY NA

A Family of Community Banks

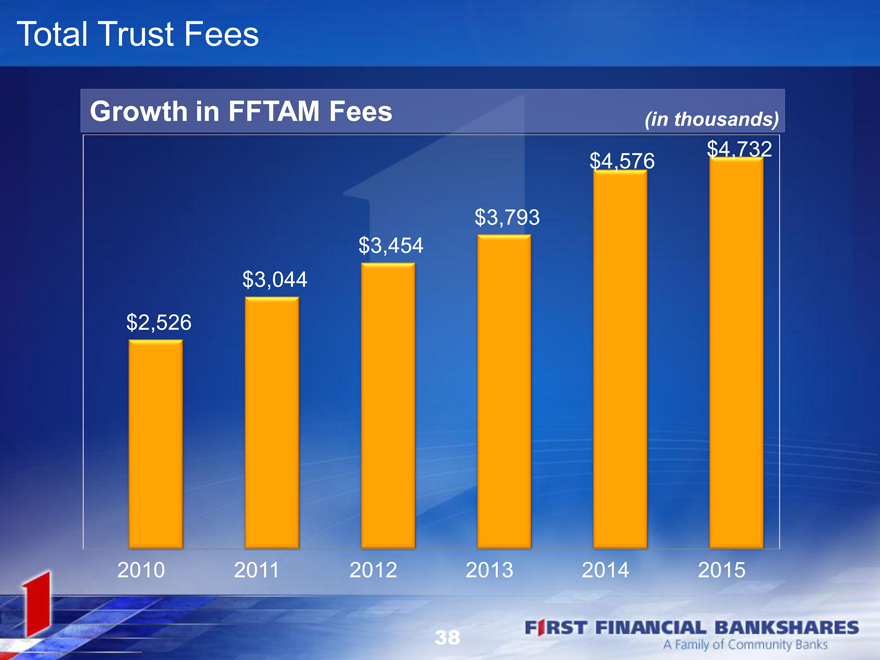

Total Trust Fees

Growth in FFTAM Fees (in thousands)

$4,576 $4,732

$3,793

$3,454

$3,044

$2,526

2010 2011 2012 2013 2014 2015

38

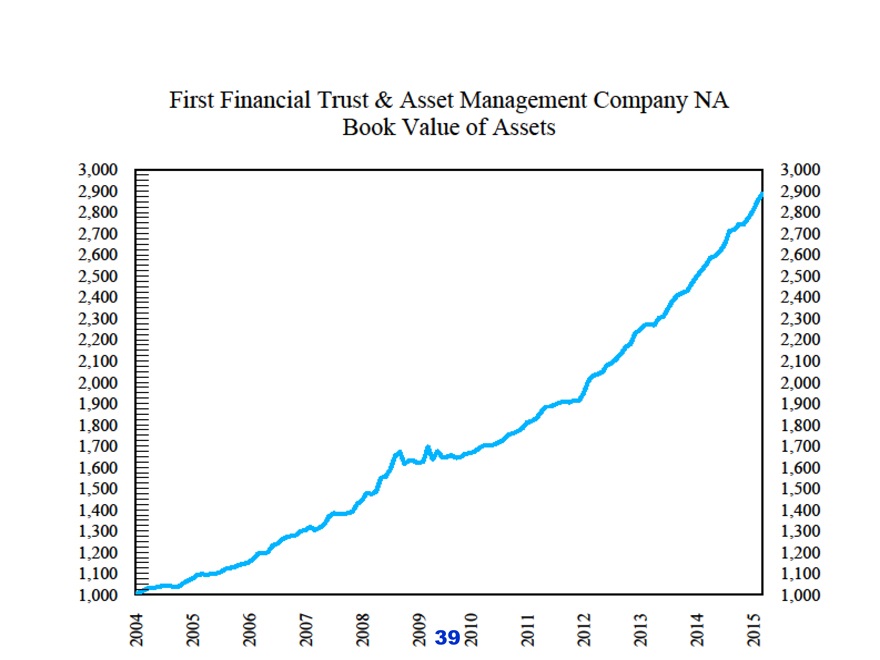

First financial Trust & Asset Management Company NA

Book Value of Assets

3,000

2,900

2,800

2,700

2,600

2,500

2,400

2,300

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

3,000

2,900

2,800

2,700

2,600

2,500

2,400

2,300

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

39

FIRST FINANCIAL TRUST & ASSET MANAGEMENT COMPANY NA

A Family of Community Banks

Thank you for 125 years of allowing us to put You First.

# 2 in 2012

# 2 in 2013

#1 in the Nation by Bank Director Magazine

2014

# 2 in 2009

# 2 in 2010

# 2 in 2011

42

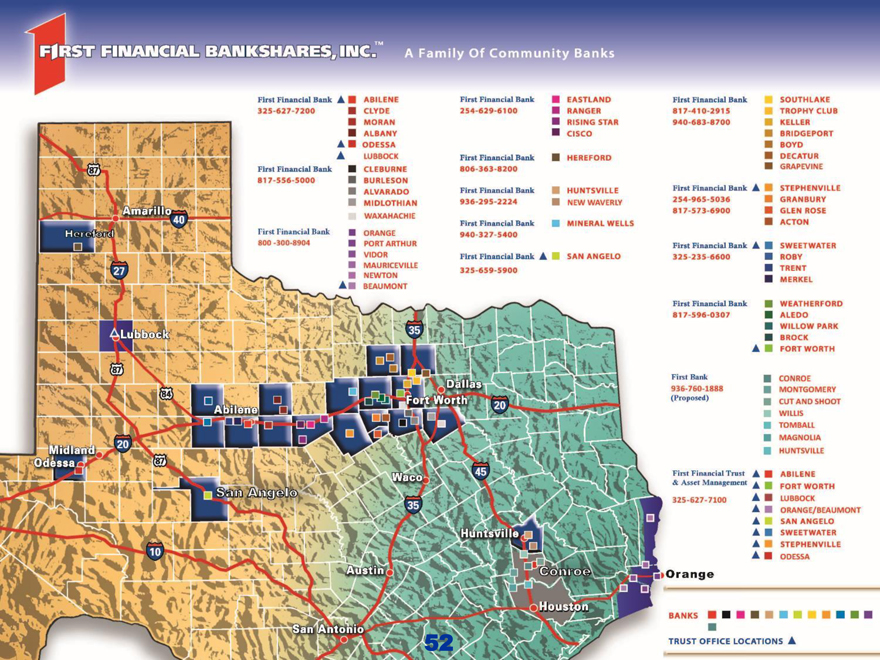

First Bank, N.A.—Conroe Proposed Acquisition

Definitive Agreement Signed— April 2015

Montgomery, Walker, & Harris Counties (On I-45 North of Houston)

Exxon Mobil Headquarters in the Woodlands

Montgomery County – Approximately 500,000 residents, 55% growth from 2000 to 2010, 24th fastest growing county in the United States ? #4 Market Share in Conroe – 10.6%

8 Branches in Conroe, Magnolia, Tomball, Cut and Shoot, Montgomery, and Huntsville; additional site on Grand Parkway in Spring, Texas to expand $378.1 million in Assets*

$342.4 million in deposits ? $259.5 million in loans

1.06% Return on Assets in 2014 16x last twelve months earnings

Conroe acquisition is consistent with our acquisition model of high growth areas, strong management and excellent earnings opportunity Provides diversification and fits well into our footprint Management and Board share same values to outstanding customer service

*As of Dec. 31, 2014

43

Conroe – Main Facility

44

Conroe— Westview Branch

45

Cut and Shoot Branch

46

Huntsville Branch

47

Willis Branch

48

Montgomery Branch

49

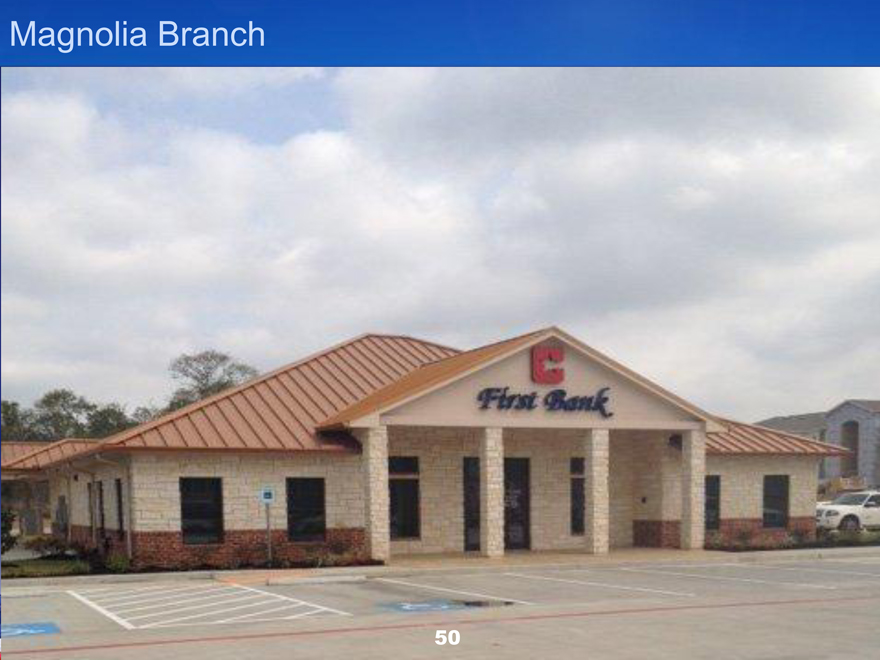

Magnolia Branch

50

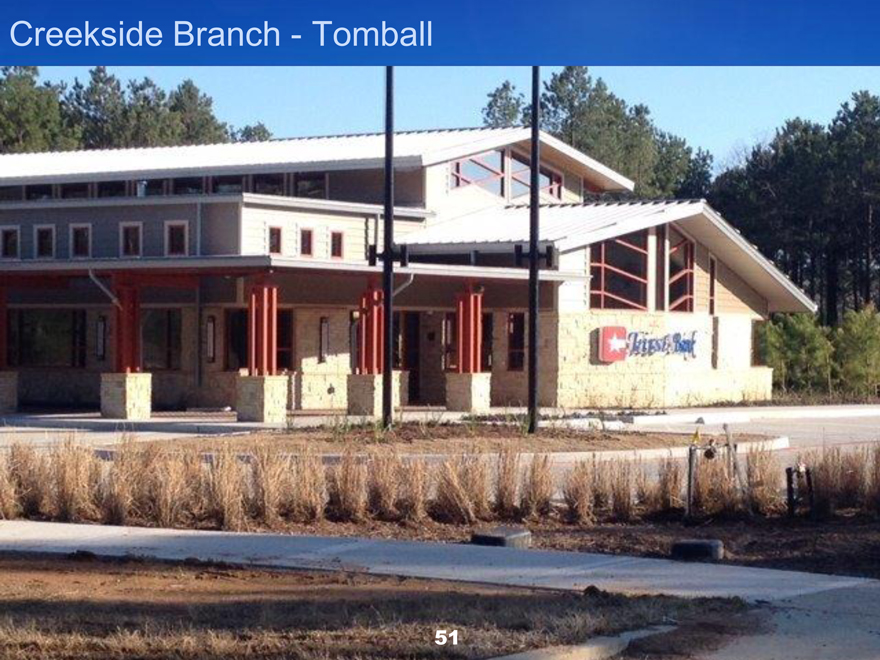

Creekside Branch—Tomball

51

FIRST FINANCIAL BANKSHARES, INC. TM

A Family of community Banks

52

Sam Baker, President & CEO – First Bank Conroe

53

First Bank, Conroe

Jay Shands, Chairman of the Board Trey Denman, Director Sam Baker, President & CEO Bart Griffith, EVP & Chief Lending Officer Jed Crow, EVP Lending Lee Warren, SVP & Chief Operations Officer

54

4Trust Mortgage Proposed Acquisition Announced

Asset Purchase Agreement Signed— April 2015

Anticipated effective date – May 31, 2015

Originated $175 million in mortgage loans in 2014 – Compared to $225 million that First Financial Bank originated in 2014

15 year old Company with offices in Fort Worth, Dallas and North Richland Hills $1.9 million purchase price Considered one of the top mortgage companies in Fort Worth Will be able to offer expanded mortgage products and services to their customers

Troy Fore will be President of Mortgage Division of First Financial Bank; other owners joining First Financial as EVP’s – Tammie Harding, Kami Graves, and Ryan

Craig

55

4Trust Management – Kami, Ryan, Troy & Tammie

56

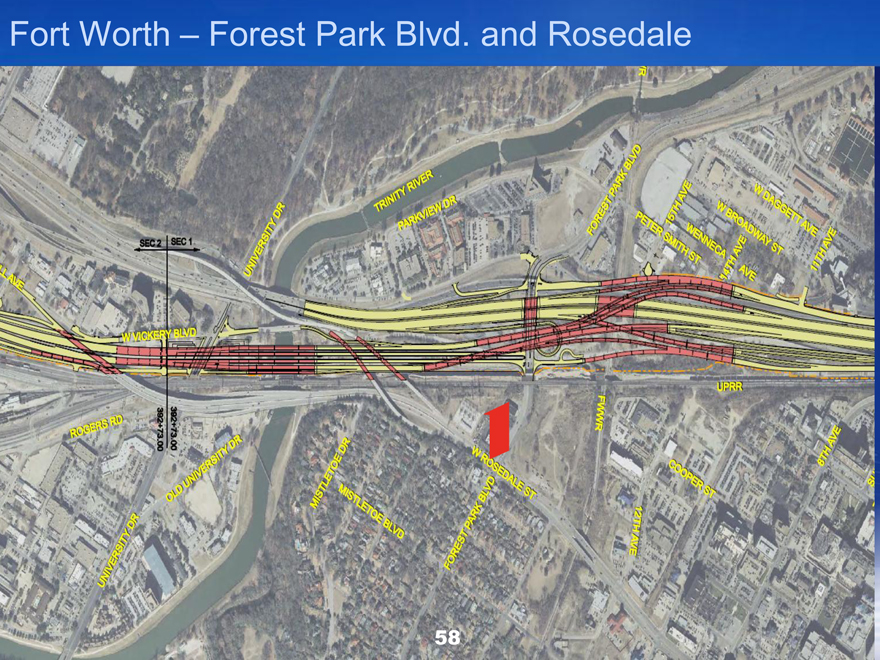

Fort Worth – Forest Park Blvd. and Rosedale

57

Fort Worth – Forest Park Blvd. and Rosedale

58

Keller – 1491 Keller Parkway – February 2014

59

Beaumont – 61st Branch – 3515 Dowlen Rd. – Aug. 2014

60

New Waverly – 62nd Branch – 125 SH 75 North – Aug. 2014

61

Trust Office – Lubbock – 4903 82nd St. Suite 30 – Oct. 2014

62

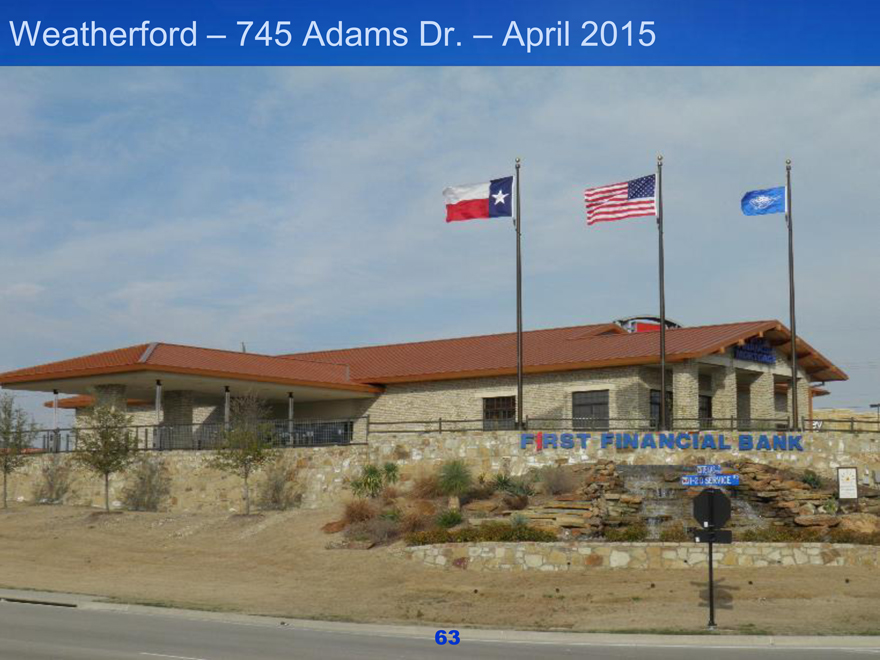

Weatherford – 745 Adams Dr. – April 2015

63

Odessa – Billy Hext Road & Eastridge

64

Cisco – Conrad Hilton & West 20th St.

65

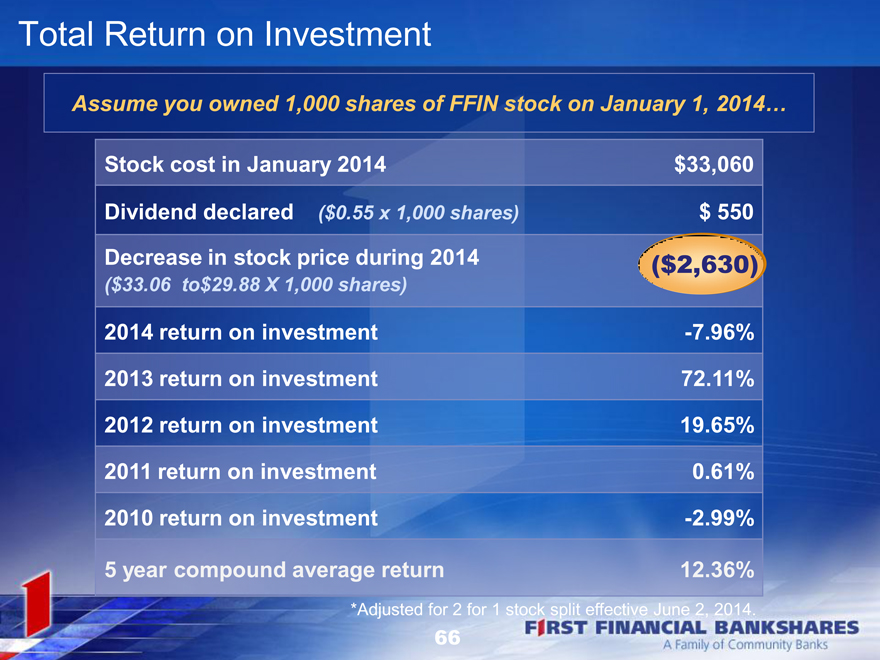

Total Return on Investment

Assume you owned 1,000 shares of FFIN stock on January 1, 2014…

Stock cost in January 2014 $33,060

Dividend declared ($0.55 x 1,000 shares) $ 550

Decrease in stock price during 2014 $ ($ 2210,720 2,630)

($33.06 to$29.88 X 1,000 shares)

2014 return on investment -7.96%

2013 return on investment 72.11%

2012 return on investment 19.65%

2011 return on investment 0.61%

2010 return on investment -2.99%

5 year compound average return 12.36%

*Adjusted for 2 for 1 stock split effective June 2, 2014.

66

Strong Stock Performance

150.00%

100.00%

50.00%

0.00%

-50.00%

-100.00% Jan . ‘07 Dec ‘07 Dec ‘08 Dec . ‘09 Dec. ‘10 Dec. ’11 Dec. ’12 Dec. ’13 Dec. ’14 Mar. ’15

FFIN S&P 500 NASDAQ Dow Jones

67

Dividends Per Share

Annual Dividends Declared Per Share*

$0.55

$0.50 $0.52

$0.46 $0.48

2010 2011 2012 2013 2014

*Per share amounts reflect the 2 for 1 stock split that was effective June 2, 2014.

68

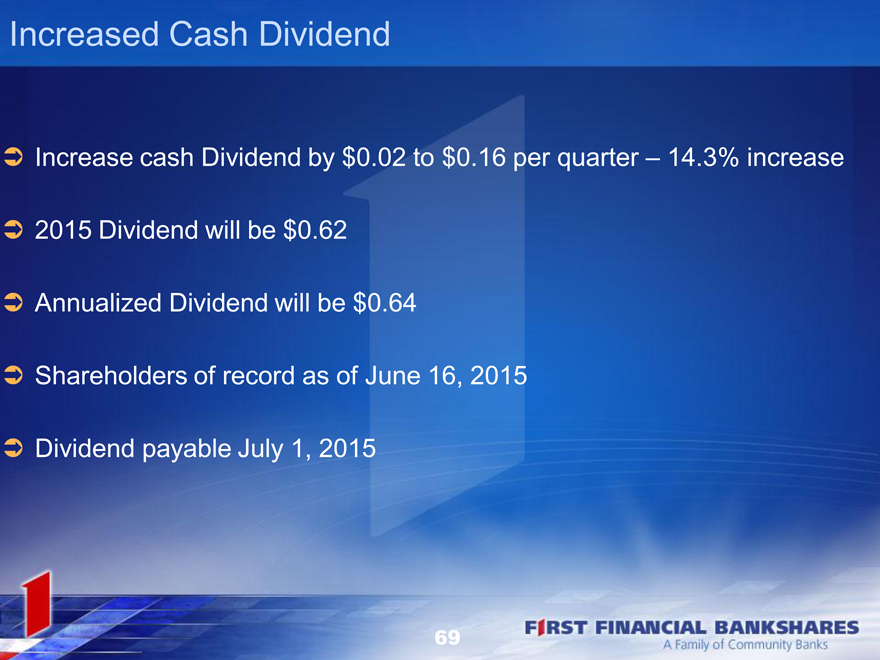

Increased Cash Dividend

Increase cash Dividend by $0.02 to $0.16 per quarter – 14.3% increase 2015 Dividend will be $0.62 Annualized Dividend will be $0.64 Shareholders of record as of June 16, 2015 Dividend payable July 1, 2015

69

Thank you for 125 years of allowing us to put You First.