Exhibit 99.1

2016 Annual Shareholder Meeting

Executive Management at First Financial

Years with Company Years in Industry

Scott Dueser

Chairman of the Board, President & 41 46

Chief Executive Officer

Ron Butler

Executive Vice President 24 35

Chief Administrative Officer

Troy Fore

President 1 35

First Financial Mortgage

Gary S. Gragg

Executive Vice President 26 38

Lending

J. Bruce Hildebrand, CPA

Executive Vice President 14 38

Chief Financial Officer

Monica Houston

Executive Vice President 21 21

Retail Banking & Training

1

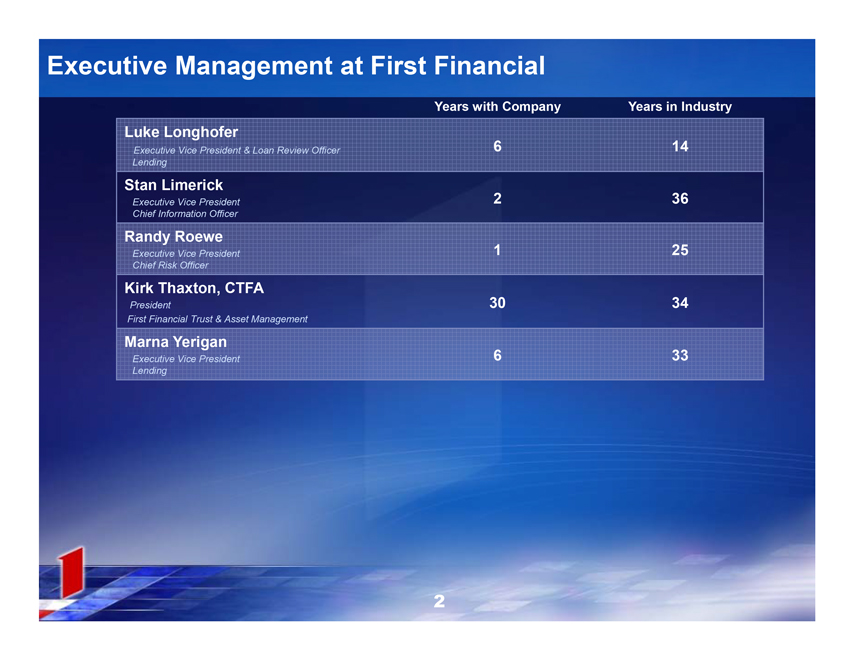

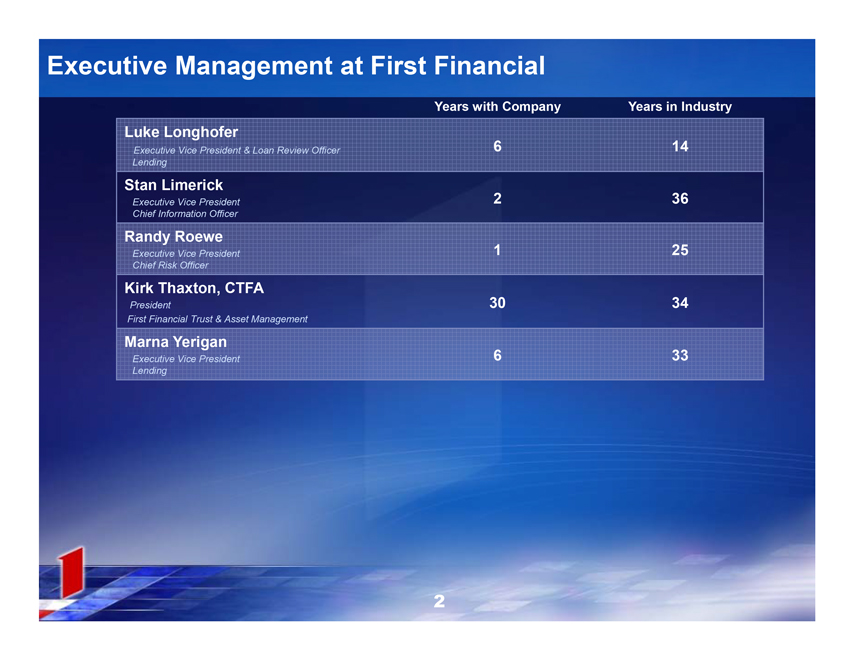

Executive Management at First Financial

Years with Company Years in Industry

Luke Longhofer

Executive Vice President & Loan Review Officer Lending 6 14

Stan Limerick

Executive Vice President 2 36

Chief Information Officer

Randy Roewe

Executive Vice President 1 25

Chief Risk Officer

Kirk Thaxton, CTFA

President 30 34

First Financial Trust & Asset Management

Marna Yerigan

Executive Vice President 6 33

Lending

2

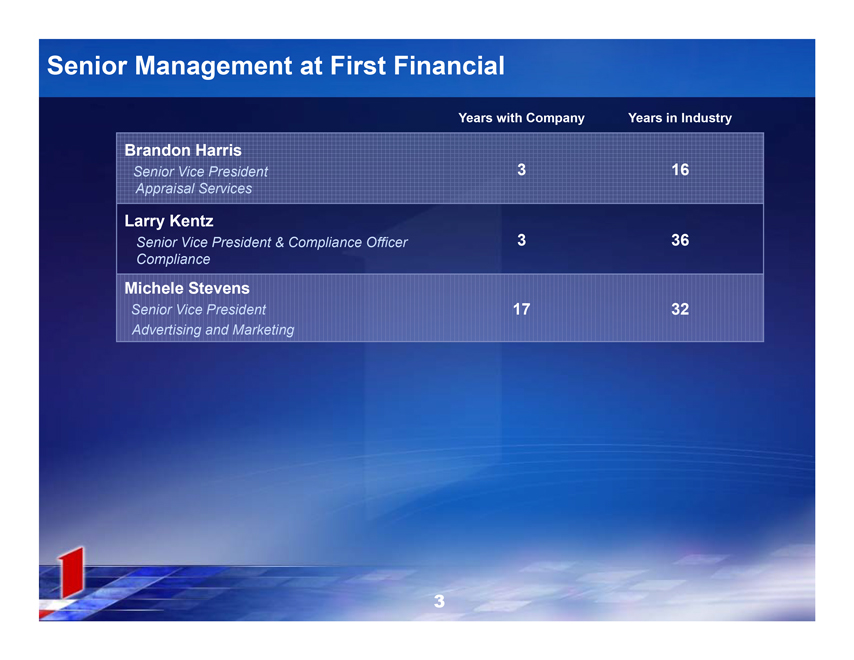

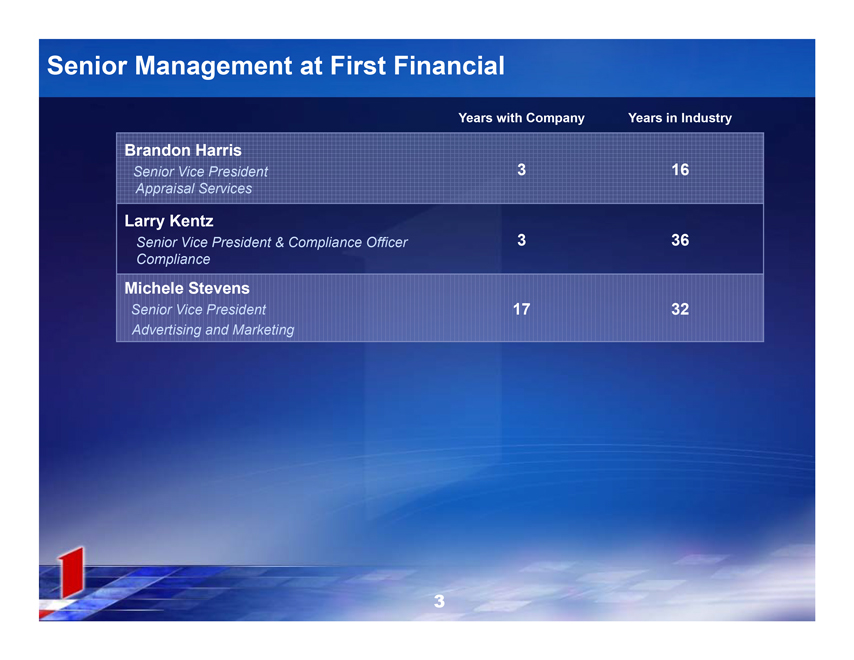

Senior Management at First Financial

Years with Company Years in Industry

Brandon Harris

Senior Vice President 3 16

Appraisal Services

Larry Kentz

Senior Vice President & Compliance Officer 3 36

Compliance

Michele Stevens

Senior Vice President 17 32

Advertising and Marketing

3

Experienced Regional CEOs & Presidents

Years with Company Years in Industry

Marelyn Shedd, Abilene 25 33

Kirby Andrews, Sweetwater 20 23

David Bailey, Eastland 14 14

Mike Mauldin, Hereford 14 39

Mike Boyd, San Angelo 41 44

Chris Evatt, San Angelo 12 12

Tom O’Neil, Cleburne 18 37

Trent Swearengin, Stephenville 17 19

Jay Gibbs, Weatherford 15 42

Justin Hooper, Weatherford 13 24

Mark Jones, Southlake 16 39

Ken Williamson, Mineral Wells 15 45

Stephen Lee, Southeast Region 4 28

Sam Baker, Conroe 2 41

Robert Pate, Conroe 20 39

Martin Noto, Fort Worth 1 33

FIRST FINANCIAL BANKSHARES

A Family of Community Banks

4

FIRST FINANCIAL BANKSHARES INC. TM

Independent Public Auditors

EY Building a better working world

6

FIRST FINANCIAL BANKSHARES INC. TM

Board of Directors

Years as Board Member

Committee Appointment

April Anthony

Chief Executive Officer

2

Audit

Encompass Home Health and Hospice & Homecare Homebase

Steven L. Beal Director and Former President and COO of Concho Resources Inc.

7

Executive Compensation Nominating / Corporate Governance

Tucker S. Bridwell

10

Lead Director / Executive

President, Mansefeldt Investment Corporation

Nominating / Corporate Governance

David Copeland

Executive / Audit

President, SIPCO, Inc. and Shelton Family Foundation

19

Nominating / Corporate Governance

F. Scott Dueser

26

Executive

Chairman of the Board, President and CEO Murray Edwards

11

Executive / Audit

Principal, The Edwards Group

Nominating / Corporate Governance

8

Board of Directors

Years as Board Member

Committee Appointment

Ron Giddiens

8

Audit

G&G Investments

Tim Lancaster

4

Audit

President and CEO Hedrick Health System

Kade L. Matthews

19

Compensation

Ranching and Investments

Ross H. Smith, Jr.

3

Compensation

Chairman and President Akrotex, Inc.

Executive

Johnny E. Trotter

14

Compensation

President and CEO Livestock Investors, Ltd.

Nominating/Corporate Governance

9

FIRST FINANCIAL BANKSHARES, INC. TM

FIRST FINANCIAL BANKSHARES, INC. TM

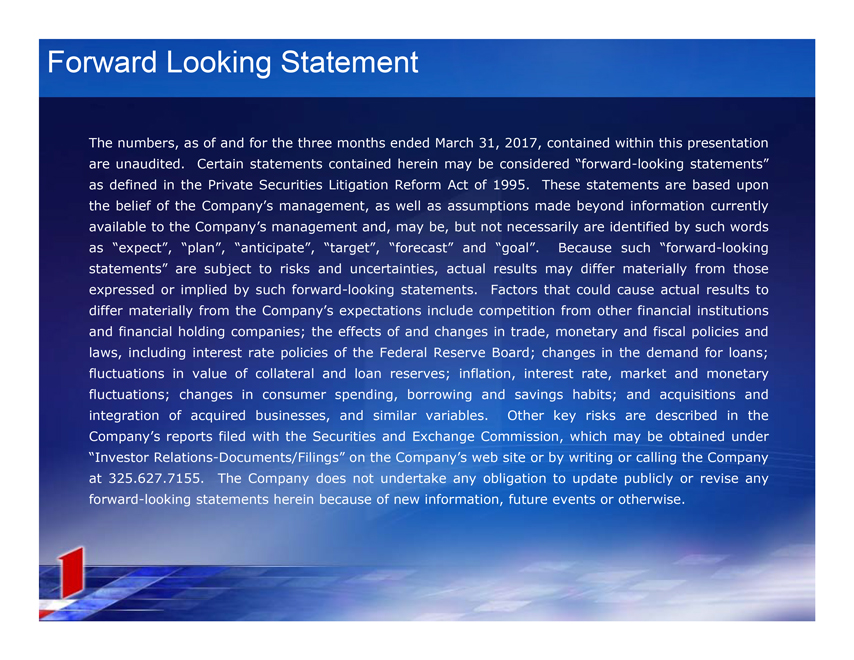

Forward Looking Statement

The numbers, as of and for the three months ended March 31, 2017, contained within this presentation are unaudited. Certain statements contained herein may be considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These statements are based upon the belief of the Company’s management, as well as assumptions made beyond information currently available to the Company’s management and, may be, but not necessarily are identified by such words as “expect”, “plan”, “anticipate”, “target”, “forecast” and “goal”. Because such “forward-looking statements” are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from the Company’s expectations include competition from other financial institutions and financial holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses, and similar variables. Other key risks are described in the Company’s reports filed with the Securities and Exchange Commission, which may be obtained under “Investor Relations-Documents/Filings” on the Company’s web site or by writing or calling the Company at 325.627.7155. The Company does not undertake any obligation to update publicly or revise any forward-looking statements herein because of new information, future events or otherwise.

2016 Financial Review

Earnings

30th Consecutive Year of Increased Earnings

FFIN Earnings (in millions)

$68.4 $74.2 $78.9 $89.6 $100.4 $104.8

2011 2012 2013 2014 2015 2016

14

Strong Shareholder Earnings

Basic Earnings Per Share

$1.09 $1.18 $1.24 $1.40 $1.55 $1.59

2011 2012 2013 2014 2015 2016

15

Working Harder and Smarter

Efficiency Ratio (FFIN vs. Peers)

2011 2012 2013 2014 2015 2016

First Financial 48.37% 48.14% 50.20% 49.24% 47.61% 49.22%

Peer Group 65.57% 65.77% 67.80% 66.94% 63.92% 62.83%

16

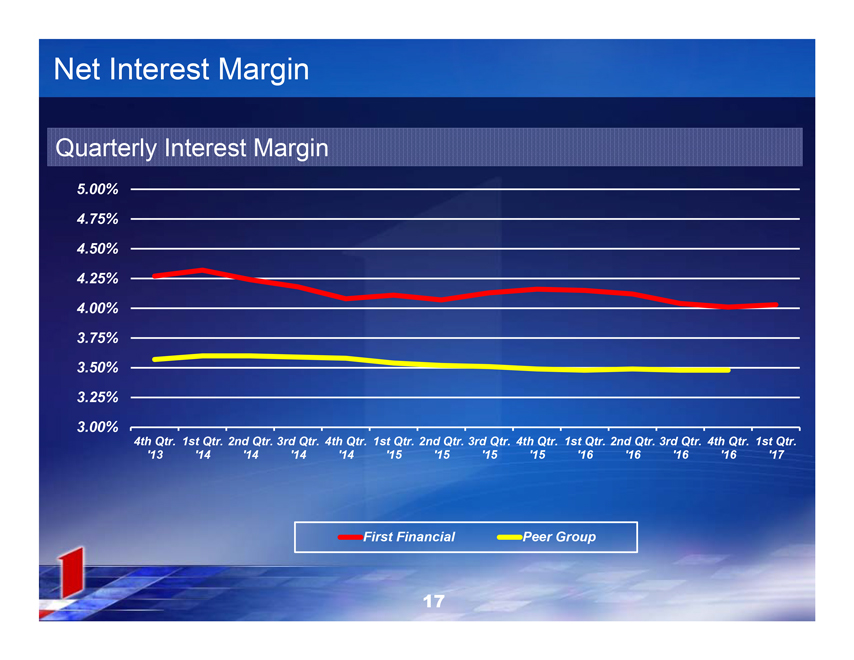

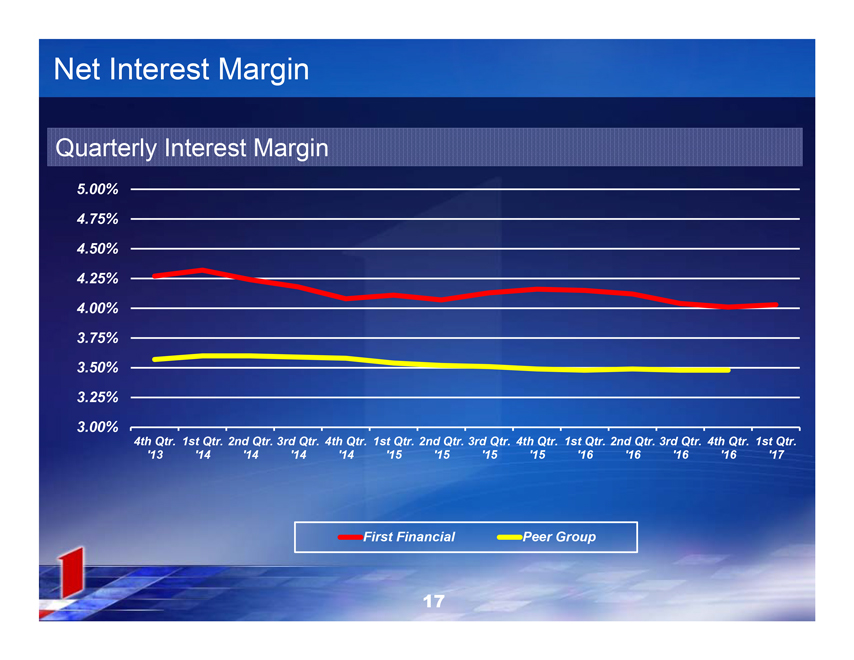

Net Interest Margin

Quarterly Interest Margin

5.00%

4.75%

4.50%

4.25%

4.00%

3.75%

3.50%

3.25%

3.00%

4th Qtr. 1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr. 1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr. 1st Qtr. 2nd Qtr. 3rd Qtr. 4th Qtr. 1st Qtr.

‘13 ’14 ‘14’14’14’15’15’15’15’16’16’16’16’17

First Financial Peer Group

17

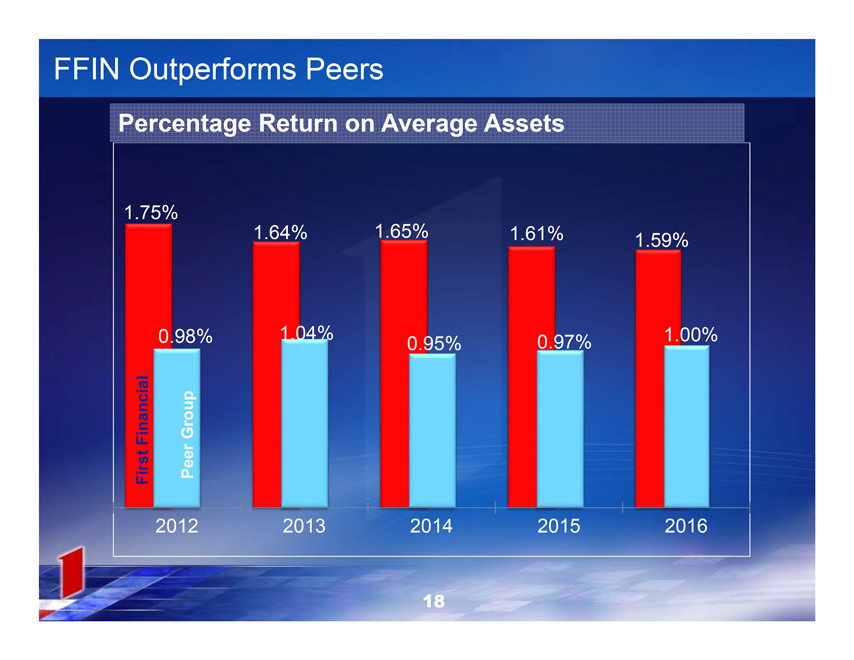

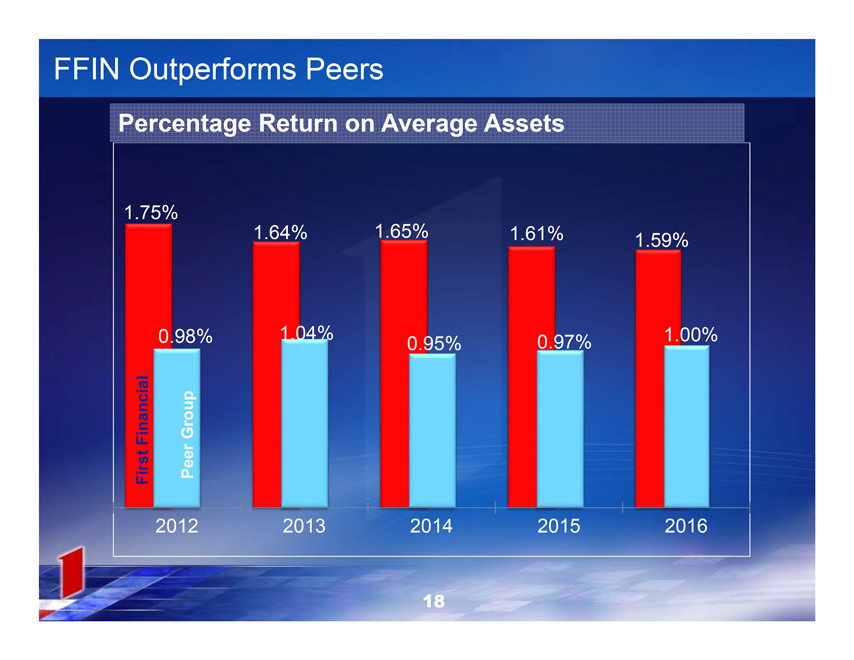

FFIN Outperforms Peers

Percentage Return on Average Assets

1.75% 1.64% 1.65% 1.61% 1.59%

0.98% 1.04% 0.95% 0.97% 1.00%

First Financial Peer Group

2012 2013 2014 2015 2016

18

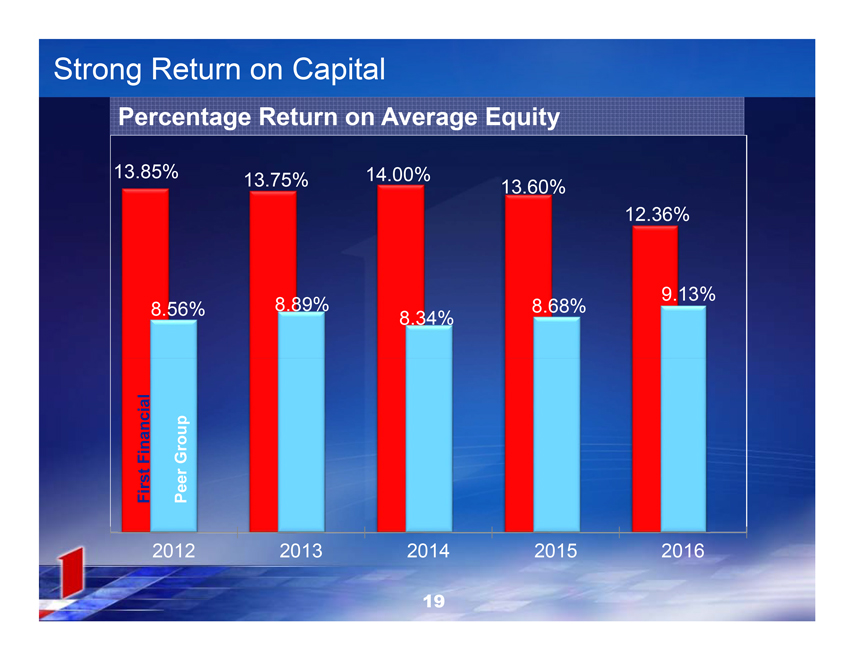

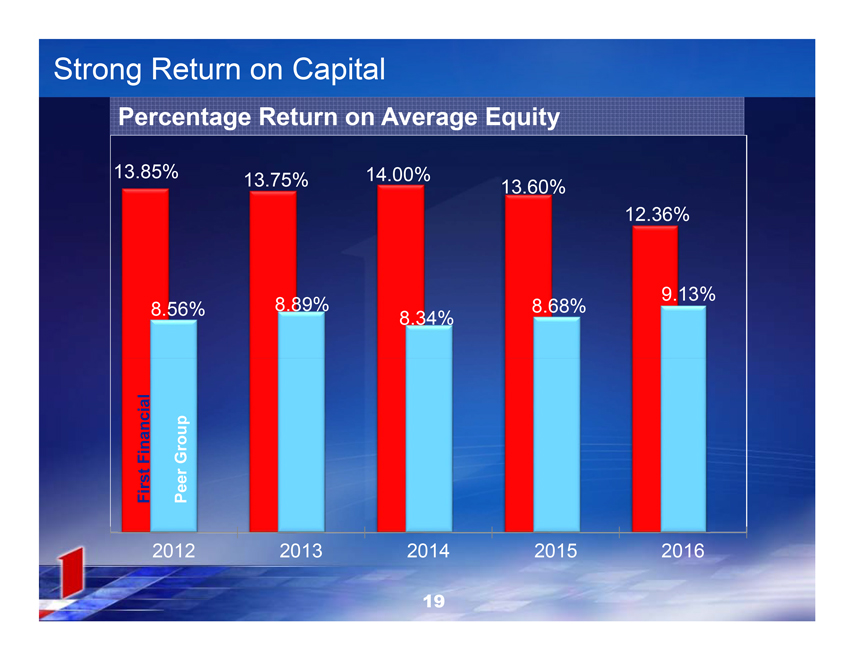

Strong Return on Capital

Percentage Return on Average Equity

13.85%

13.75%

14.00%

13.60%

12.36%

8.56%

8.89%

8.68%

9.13%

8.34%

First Financial

Peer Group

2012

2013

2014

2015

2016

19

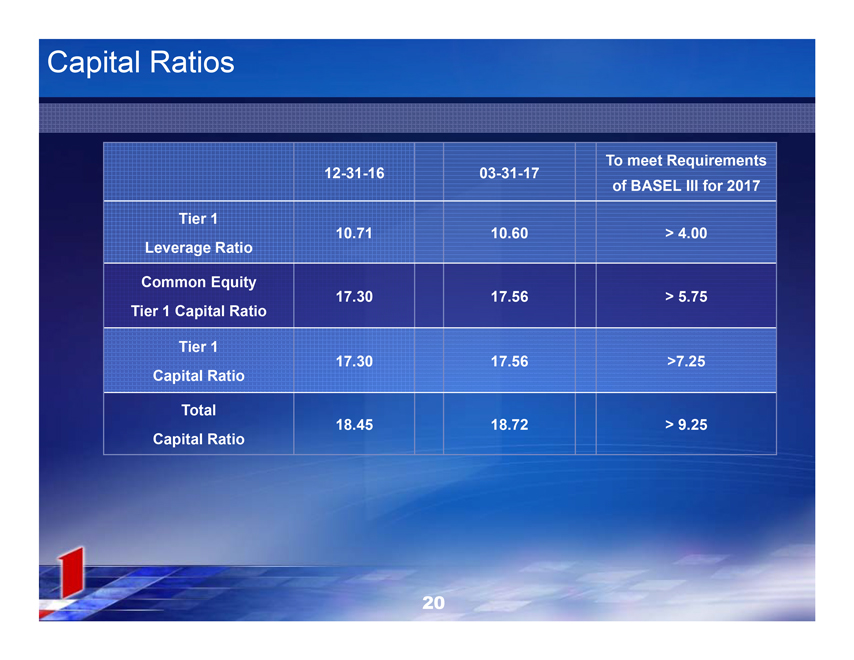

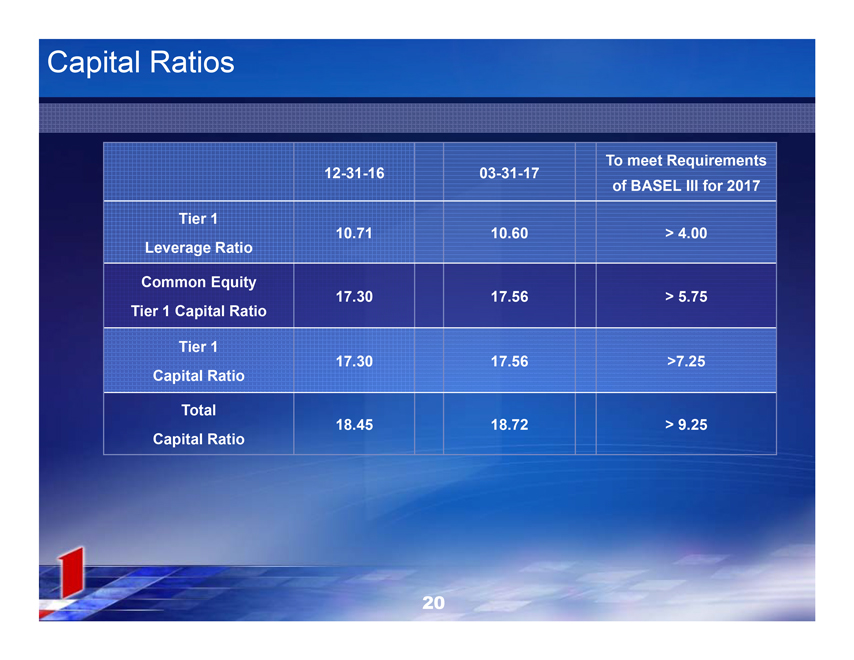

Capital Ratios

To meet Requirements

12-31-16

03-31-17

of BASEL III for 2017

Tier 1

10.71

10.60

> 4.00

Leverage Ratio

Common Equity

17.30

17.56

> 5.75

Tier 1 Capital Ratio

Tier 1

17.30

17.56

>7.25

Capital Ratio

Total

18.45

18.72

> 9.25

Capital Ratio

20

Asset Performance

Growth in Total Assets

(in millions)

$4,121

2011

$4,502

2012

$5,222

2013

$5,522

2014

$6,665

2015

$6,810

2016

21

Loan Performance

Growth in FFIN Total Loans

(in millions)

Real Estate Commercial Consumer Agricultural

$1,691

$1,076

$427 $218 $66 2011

$1,787

$1,238

$510

$273 $68 2012

$2,089

$1,689

$590

$334 $76 2013

$2,689

$1,831

$640

$361 $106 2014

$2,938

$2,178

$685

$386 $102 2015

$3,384

$2,220

$671

$409 $84 2016

22

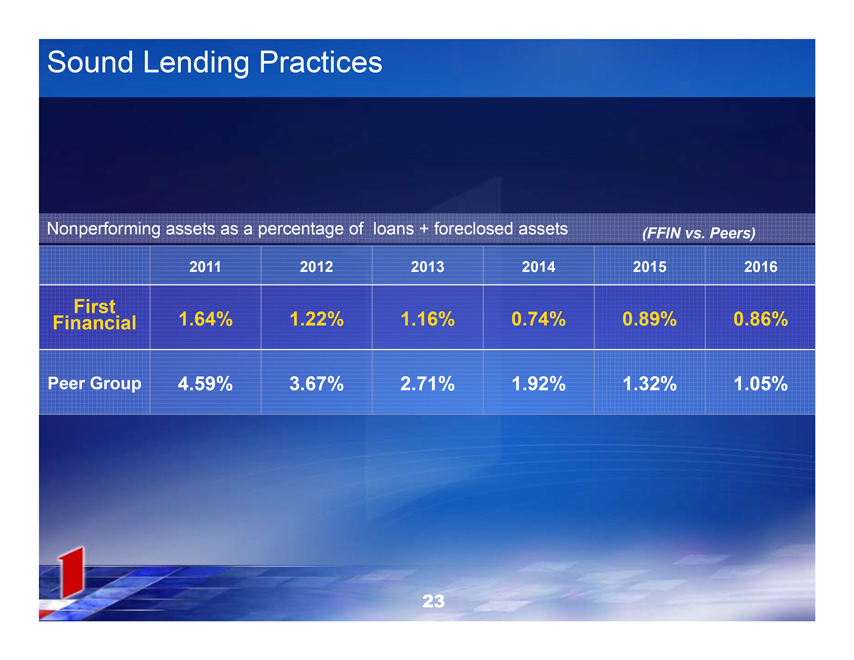

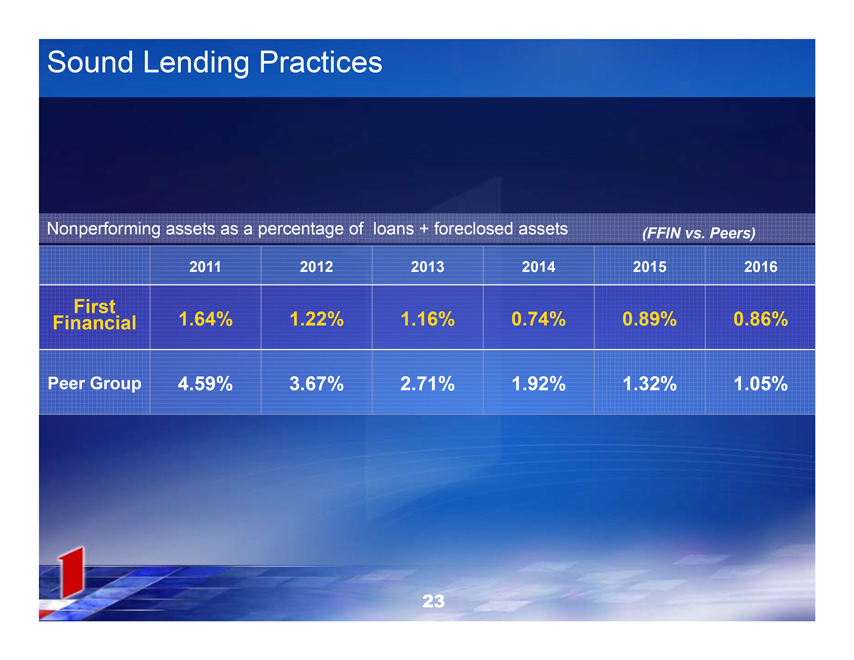

Sound Lending Practices

Nonperforming assets as a percentage of

loans + foreclosed assets

(FFIN vs. Peers)

2011

2012

2013

2014

2015

2016

First

Financial

1.64%

1.22%

1.16%

0.74%

0.89%

0.86%

Peer Group

4.59%

3.67%

2.71%

1.92%

1.32%

1.05%

23

Deposit Growth

Growth in FFIN Total Deposits

(in millions)

$3,113

$2,233

$1,102

2011

$3,335

$2,321

$1,312

2012

$3,633

$2,773

$1,362

2013

$4,135

$3,180

$1,570

2014

$4,750

$3,444

$1,746

2015

$5,479

$3,761

1,718

2016

Non Interest Bearing Interest Bearing

24

1st Quarter 2017 Summary

1st Quarter Earnings

FFIN Earnings

(in millions)

$17.8

2012

$18.6

2013

$22.3

2014

$24.0

2015

$25.7

2016

$26.6

2017

26

Shareholder Earnings – 1st Quarter

Basic Earnings Per Share

$0.28

2012

$0.30

2013

$0.35

2014

$0.37

2015

$0.39

2016

$0.40

2017

27

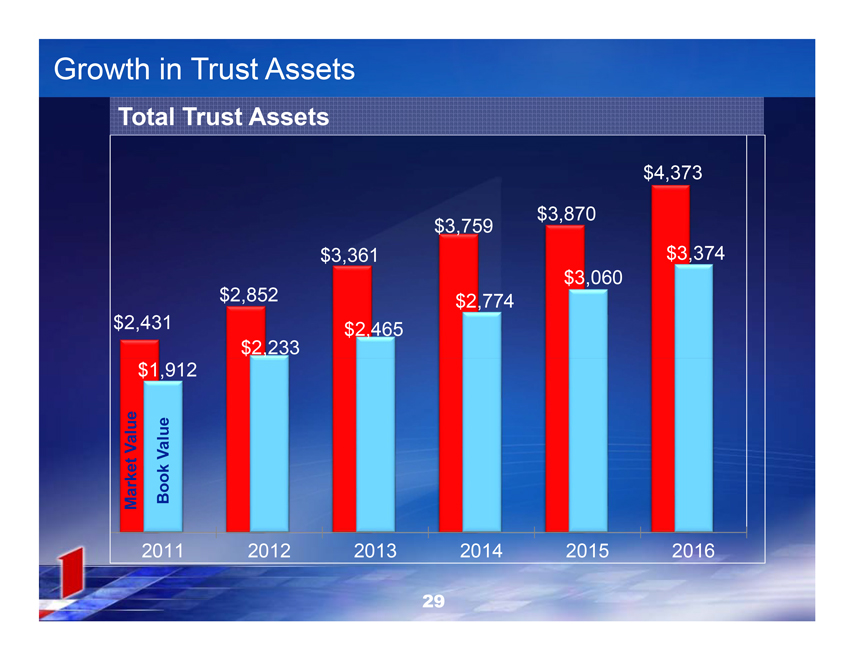

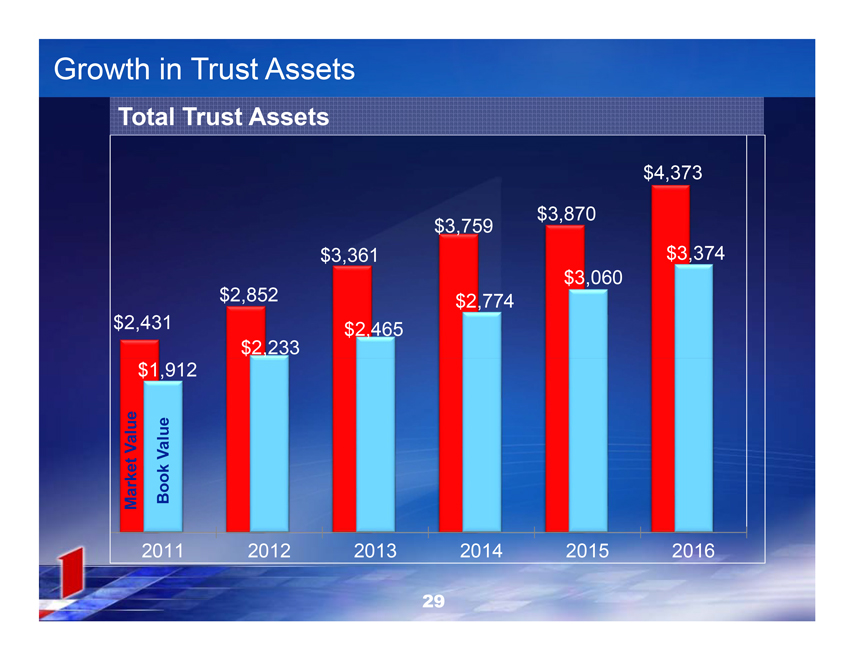

FIRST FINANCIAL TRUST&ASSET MANAGEMENT COMPANY NA

Growth in Trust Assets

Total Trust Assets

Market Value

2011 Book Value $1,912 $2,431

$2,852

$2,233

2012

$3,361

$2,465

2013

$3,759

$2,774

2014

$3,870

$3,060

2015

$4,373 $3,374 2016

29

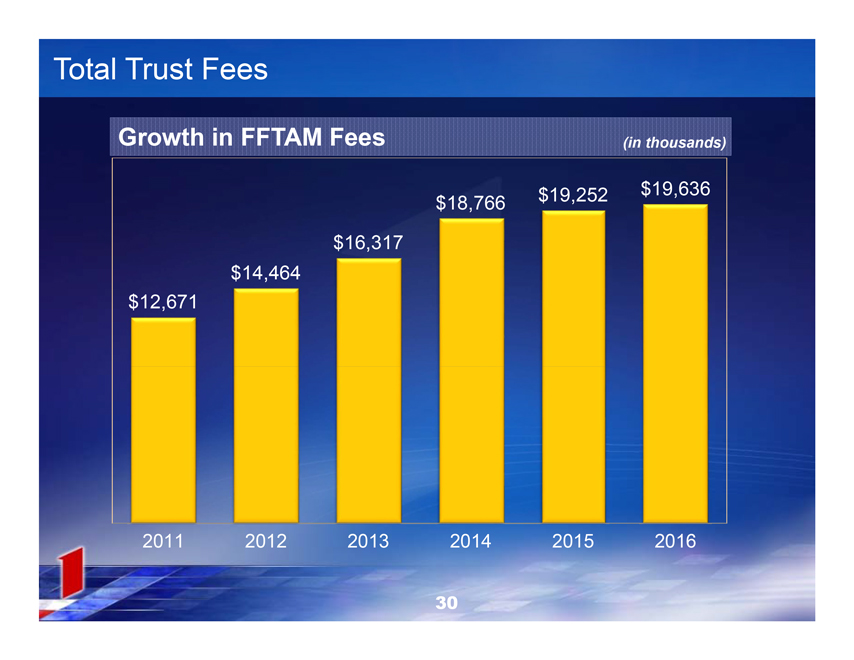

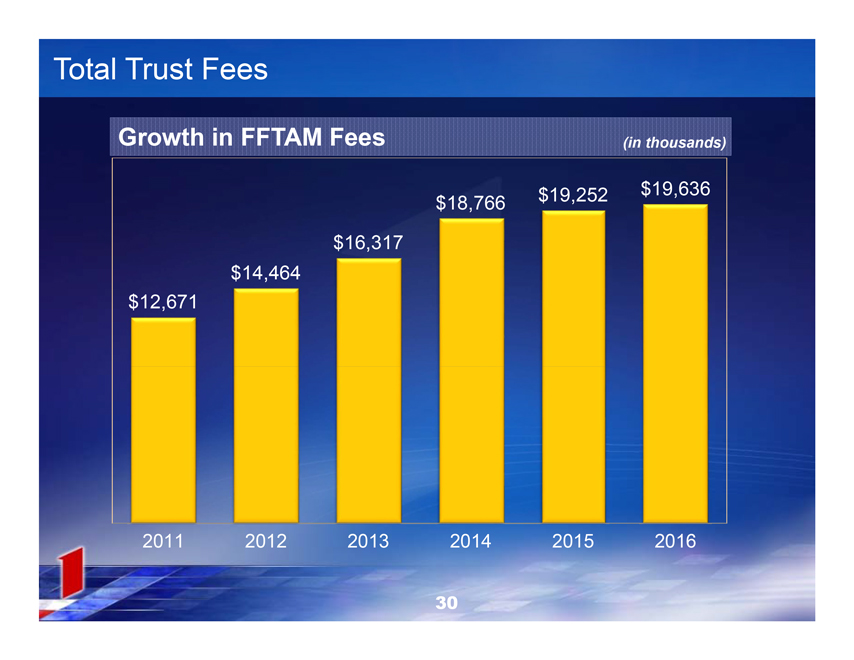

Total Trust Fees

Growth in FFTAM Fees

(in thousands)

$12,671

2011

$14,464

2012

$16,317

2013

$18,766

2014

$19,252

2015

$19,636

2016

30

Revenue from Mineral Management

Growth in Mineral Management

(in thousands)

$1,835

2011

$2,167

2012

$2,648

2013

$3,150

2014

$2,000

2015

$1,605

2016

30

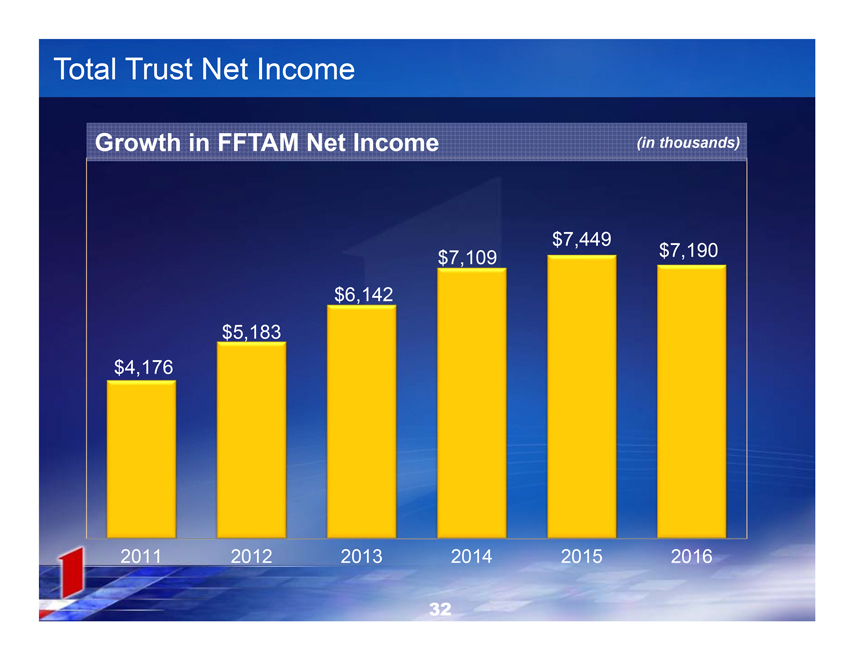

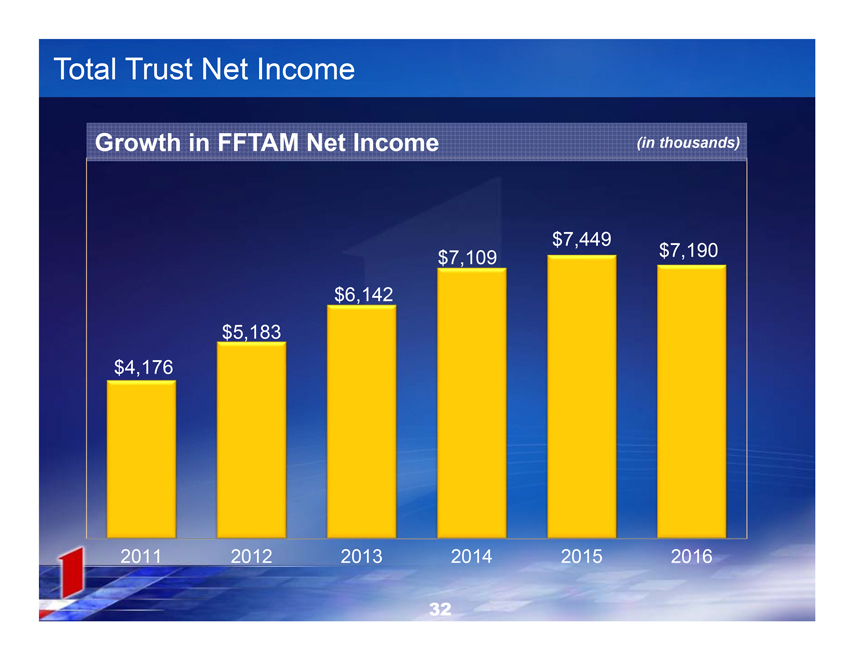

Total Trust Net Income

Growth in FFTAM Net Income

(in thousands)

$4,176

2011

$5,183

2012

$6,142

2013

$7,109

2014

$7,449

2015

$7,190

2016

32

Managed Equity Styles

Equity Income

Core Domestic

Core Diversified

Core World

Strategic Growth

33

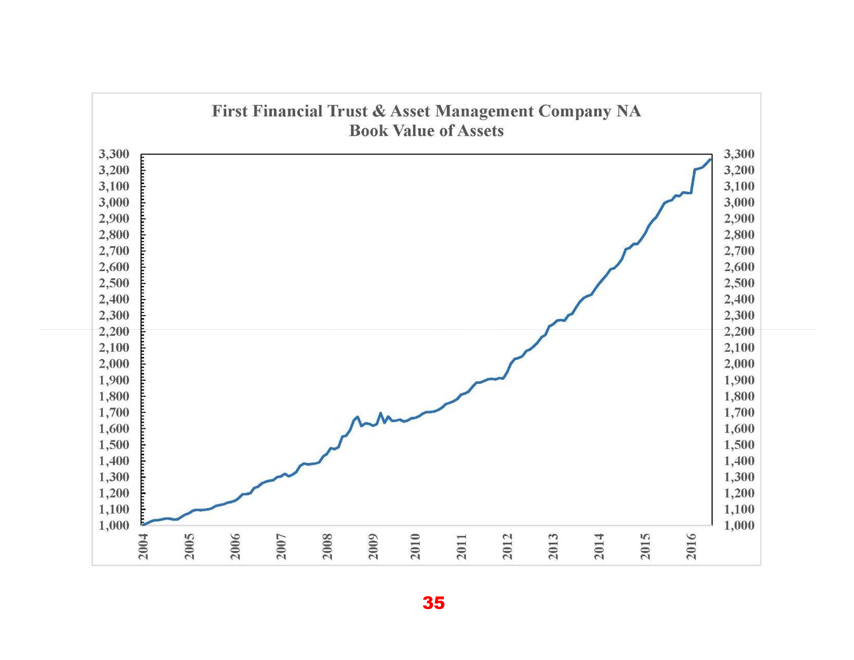

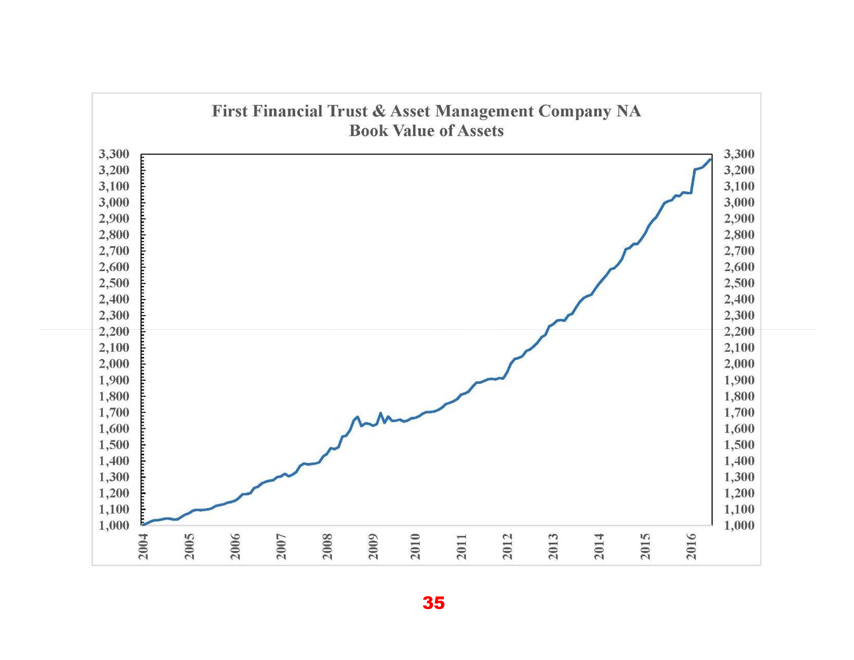

FIRST FINANCIAL TRUST&ASSET MANAGEMENT COMPANYNA

First Financial Trust&Asset Management Company NA

Book Value of Assets

3,300

3,200

3,100

3,000

2,900

2,800

2,700

2,600

2,500

2,400

2,300

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

1,100

1,000

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

3,300

3,200

3,100

3,000

2,900

2,800

2,700

2,600

2,500

2,400

2,300

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

1,100

1,000

35

FIRST FINANCIAL TRUST&ASSET MANAGEMENT COMPANYNA

FIRST FINANCIAL BANKSHARES,INC.TM

30th Consecutive Year of Increased Earnings

FFIN Earnings

(in millions)

$68.4

2011

$74.2

2012

$78.9

2013

$89.6

2014

$100.4

2015

$104.8

2016

38

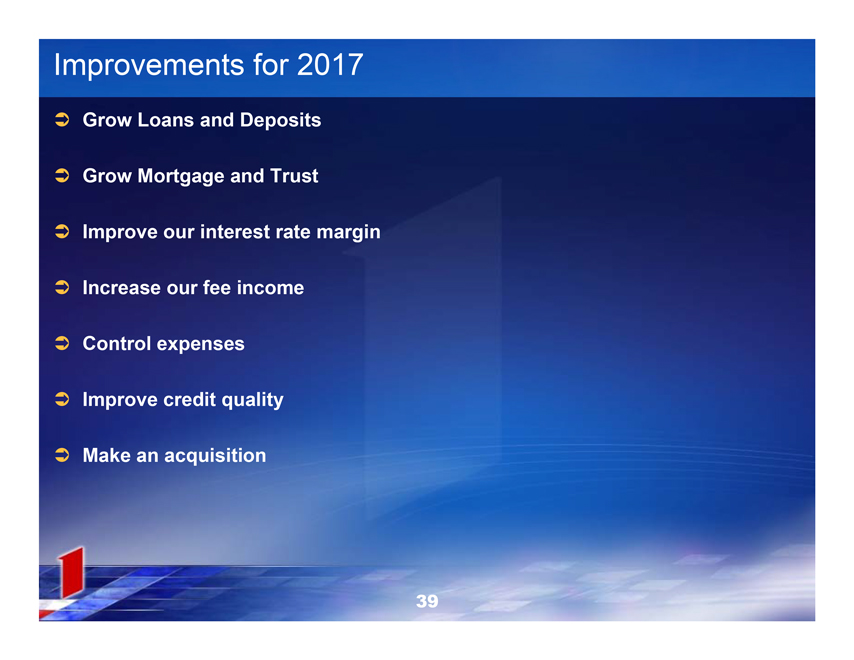

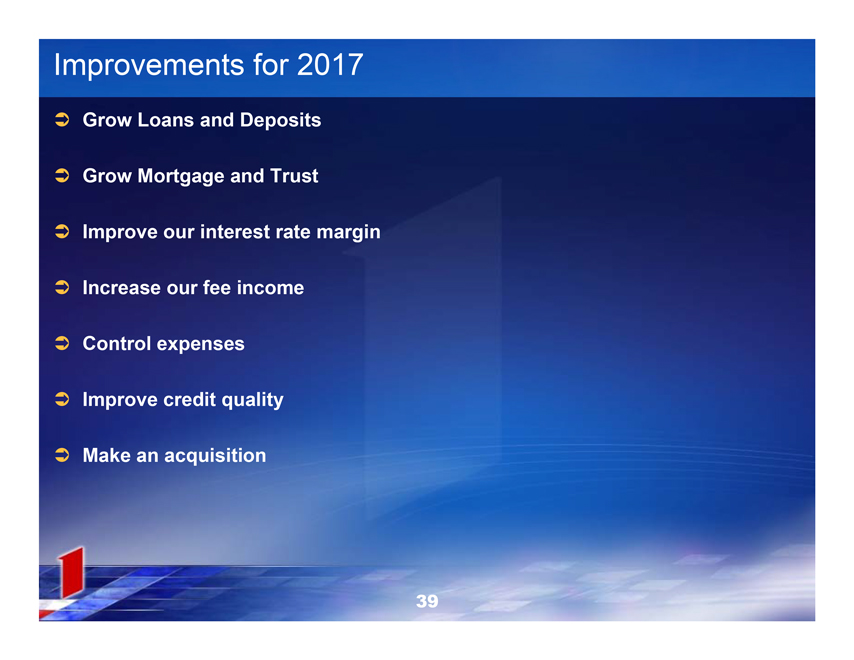

Improvements for 2017

Grow Loans and Deposits

Grow Mortgage and Trust

Improve our interest rate margin

Increase our fee income

Control expenses

Improve credit quality

Make an acquisition

39

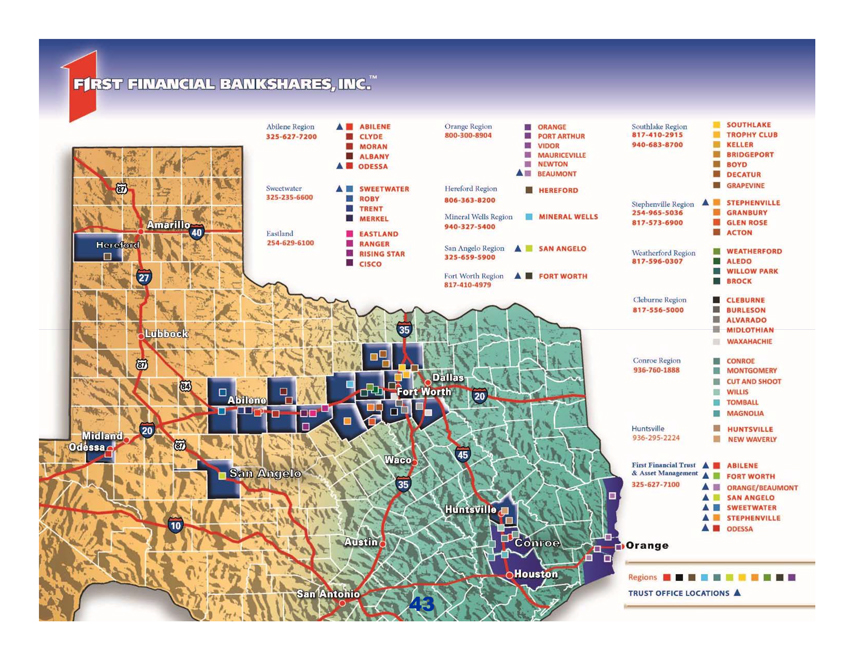

FIRST FINANCIAL BANKSHARES, INC. TM

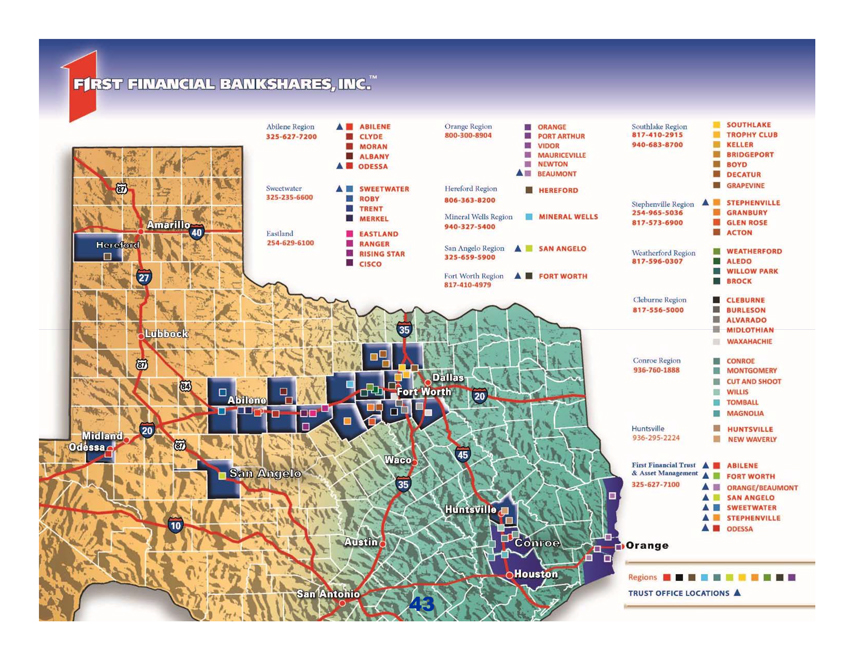

Abilene Region 325-627-7200 ABILENE CLYDE MORAN ALBANY ODESSA

Sweetwater 325-235-6600 SWEETWATER ROBY TRENT MERKEL

Eastland 254-629-6100 EASTLAND RANGER RISING STAR CISCO

Orange Region 800-300-8904 ORANGE PORT ARTHUR VIDOR MAURICEVILLE NEWTON BEAUMONT

Hereford Region 806-363-8200 HEREFORD

Mineral Wells Region 940-327-5400 MINERAL WELLS

San Angelo Region 325-659-5900 SAN ANGELO

Fort Worth Region 817-410-4979 FORTH WORTH

Southlake Region 817-410-2915 940-683-8700 SOUTHLAKE TROPHY CLUB KELLER BRIDGEPORT BOYD DECATUR GRAPEVINE

Stephenville Region 254-965-5036 817-573-6900 STEPHENVILLE GRANBURY GLEN ROSE ACTON

Weatherford Region 817-596-0307 WEATHERFORD ALEDO WILLOW PARK BROCK

Cleburne Region 817-556-5000 CLEBURNE BURLESON ALVARADO MIDLOTHIAN WAXAHACHIE

Conroe Region 936-760-1888 CONROE MONTGOMERY CUT AND SHOOT WILLIS TOMBALL MAGNOLIA

Huntsville 936-295-2224 HUNTSVILLE NEW WAVERLY

First Financial Trust & Asset Management 325-627-7100 ABILENE FORT WORTH ORANGE/BEAUMONT SAN ANGELO SWEETWATER STEPHENVILLE ODESSA

Regions TRUST OFFICE LOCATIONS

43

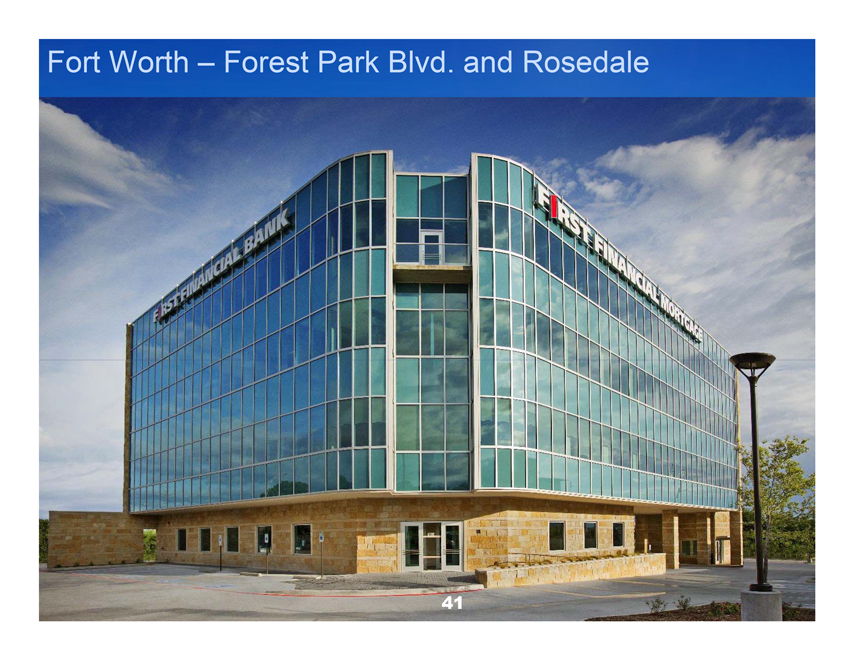

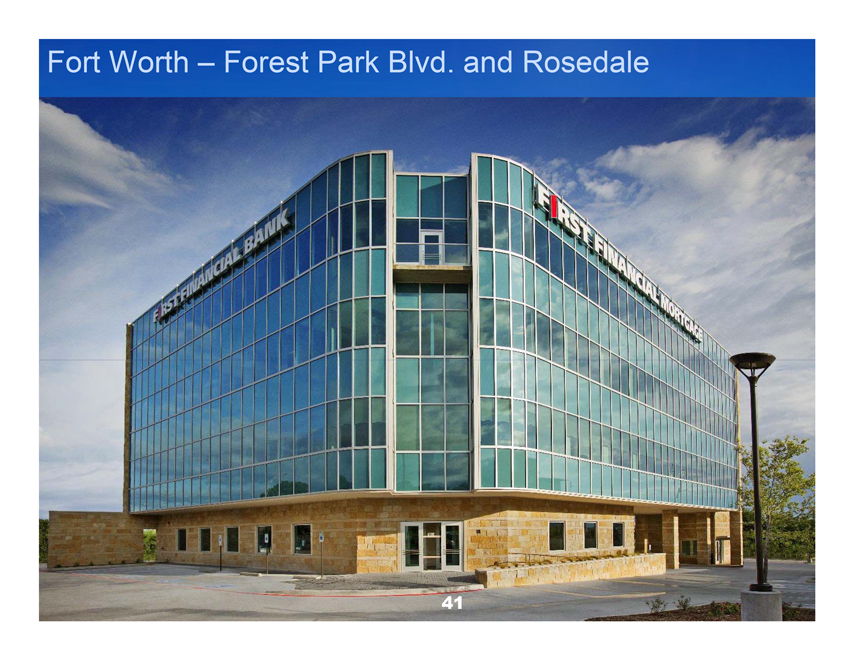

Forth Worth – Forest Park Blvd. and Rosedale

41

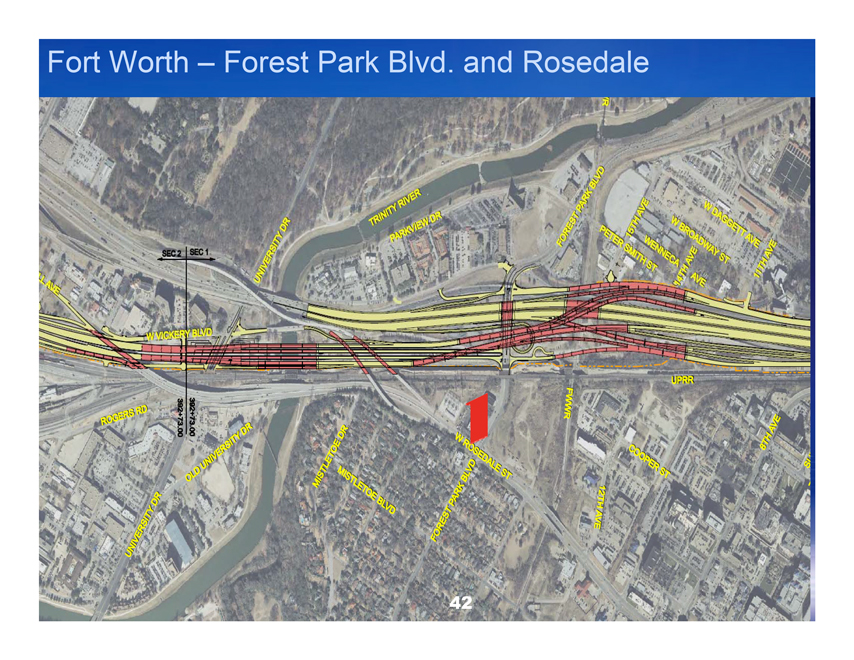

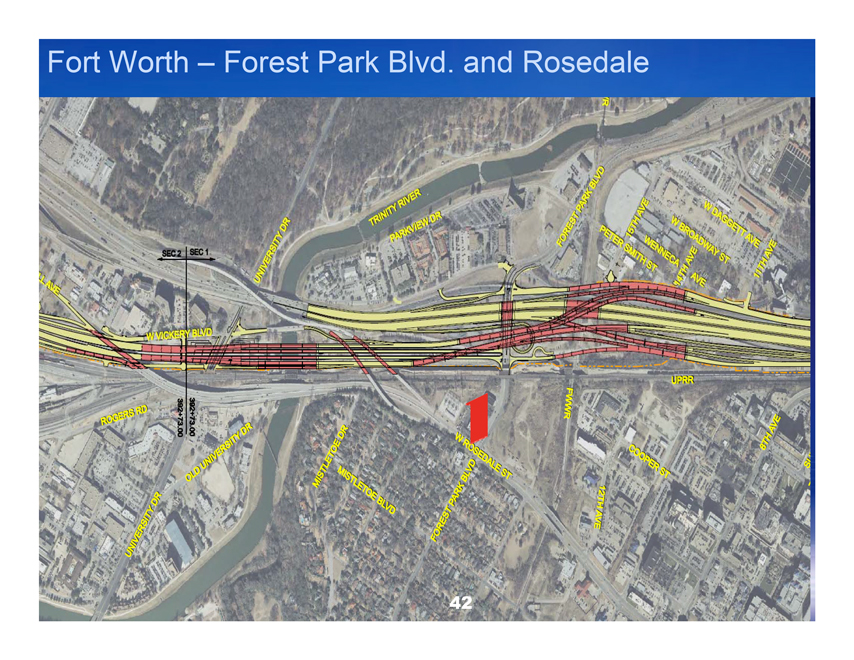

Fort Worth – Forest Park Blvd. and Rosedale

42

Cisco – 2006 Conrad Hilton Blvd. - August 2016

43

Odessa – 3555 Billy Hext Rd. - September 2016

44

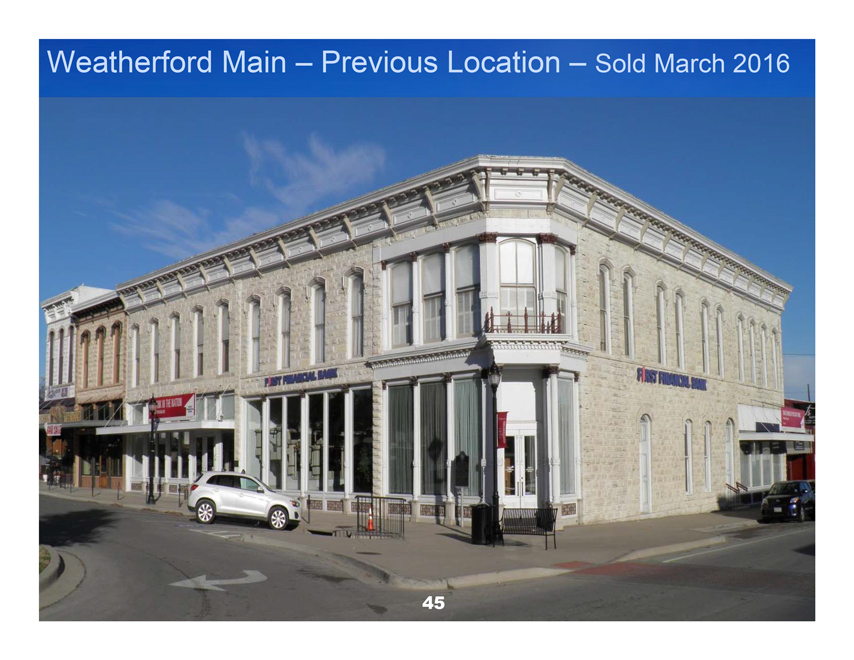

Weatherford Main – Previous Location – Sold March 2016

45

Weatherford – Remodeled College Park

46

San Angelo Main – Current Downtown Location

47

San Angelo – New Downtown Location to open June 2017

48

Orange Main – Current Main Office Location

49

Orange – New Location to open in 2018

50

Abilene – New Buffalo Gap Location opening May 2017

51

Management Enhancements

February 2016 – Trent Swearengin, President – Stephenville Region

February 2016 – David Bailey, President – Eastland Division

September 2016 – Jeff Casey, Executive Vice President and Chief Digital Officer, First Technology Services

September 2016 – Chris Evatt, President – San Angelo Region

December 2016 – Monica Houston, Executive Vice President of Retail Banking and Training

January 2017 – Justin Hooper, President – Weatherford Region

52

Total Return on Investment

Assume you owned 1,000 shares of FFIN stock on January 1, 2016…

Stock cost in January 2016 $30,170

Dividend declared ($0.70 x 1,000 shares) $700

Increase in stock price during 2016

($30.17 to $45.20 X 1,000 shares) $15,030

2016 return on investment 52.14%

2015 return on investment 3.05%

2014 return on investment -7.96%

2013 return on investment 72.11%

2012 return on investment 19.65%

5 year compound average return 21.94%

53

Strong Stock Performance

250.00% 200.00% 150.00% 100.00%

50.00% 0.00%-50.00%-100.00%

Jan . ‘07 Dec ‘07 Dec ‘08 Dec . ‘09 Dec. ‘10 Dec. ’11 Dec. ’12 Dec. ’13 Dec. ’14 Dec. ’15 Dec. ’16 Mar. ’17

FFIN S&P 500 NASDAQ Dow Jones

54

Dividends Per Share

Annual Dividends Declared Per Share

$0.50

2012

$0.52

2013

$0.55

2014

$0.62

2015

$0.70

2016

55

Increased Cash Dividend

Increase cash Dividend by $0.01 to $0.19 per quarter – 5.6% increase

2017 Dividend will be $0.75

Shareholders of record as of June 16, 2017

Dividend payable July 3, 2017

56

FIRST FINANCIAL BANKSHARES INC.TM