U.S. Bancorp Fixed Income Investor Presentation June 2019 Exhibit 99.1

Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. Deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs and other trade policies of the United States and its global trading partners; changes in customer behavior and preferences; breaches in data security; failures to safeguard personal information; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2018, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Agenda Overview Business Lines & Financial Management Balance Sheet & Capital Management Appendix

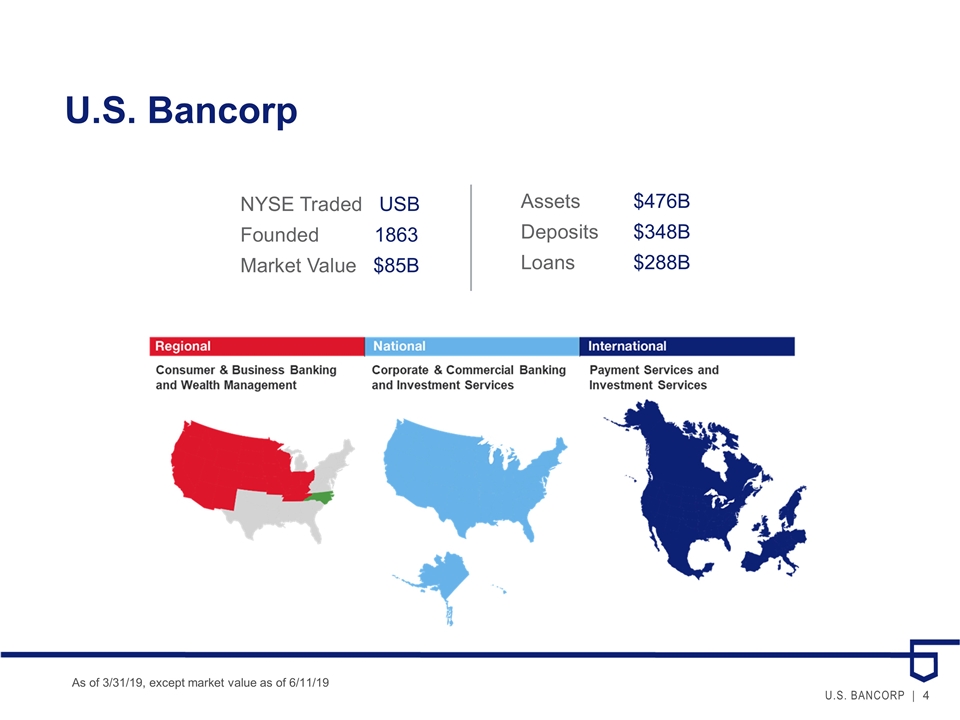

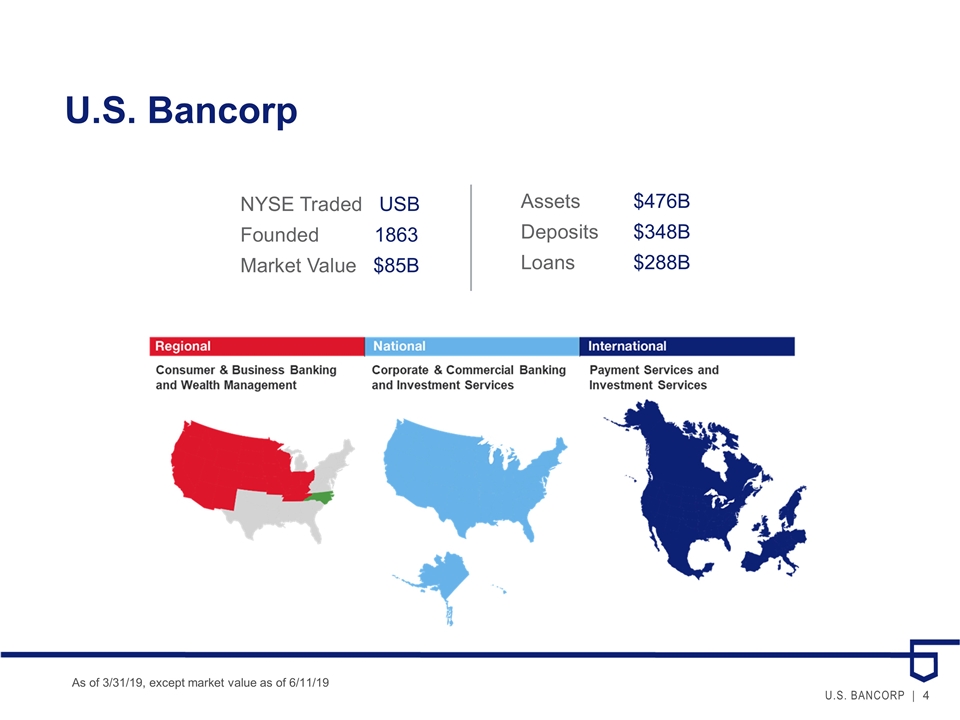

As of 3/31/19, except market value as of 6/11/19 NYSE Traded USB Founded 1863 Market Value $85B Assets $476B Deposits $348B Loans $288B U.S. Bancorp

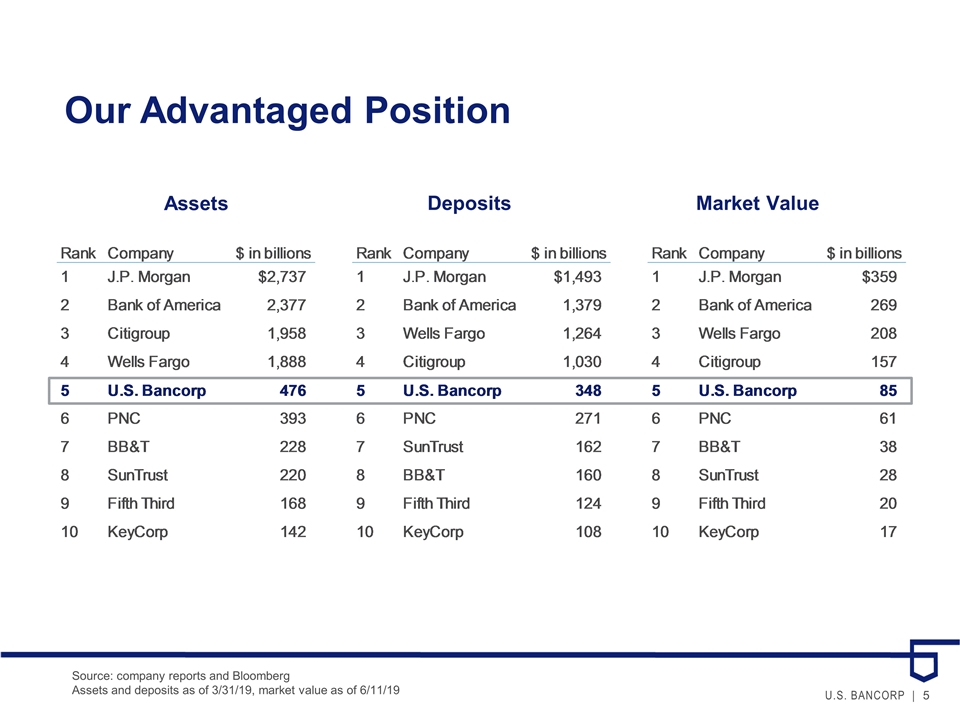

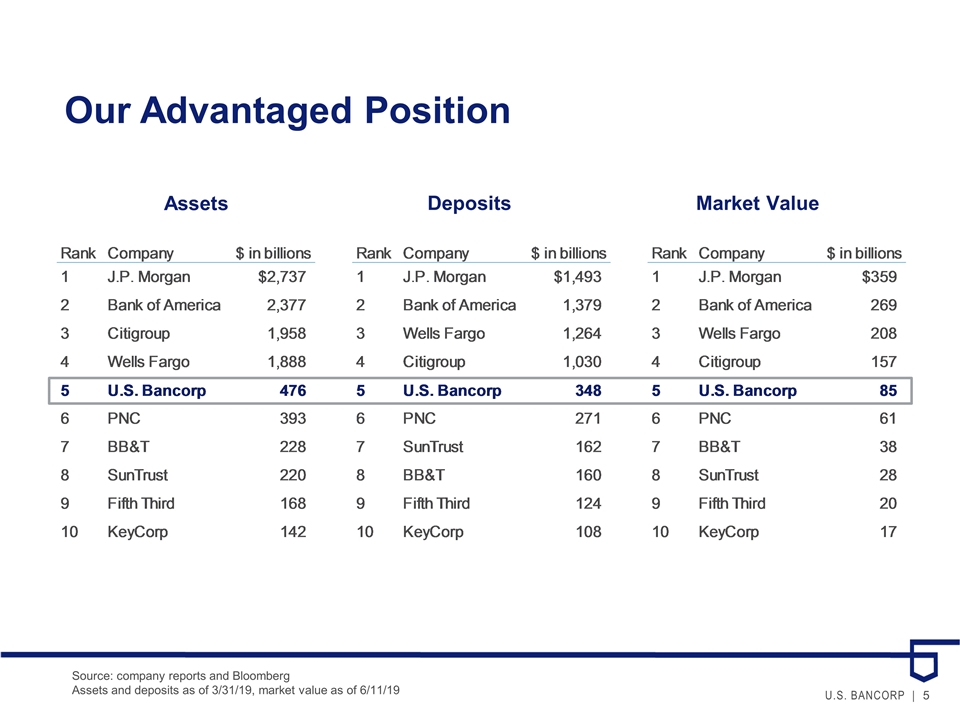

Source: company reports and Bloomberg Assets and deposits as of 3/31/19, market value as of 6/11/19 Our Advantaged Position Assets Market Value Deposits

Agenda Overview Business Lines & Financial Management Balance Sheet & Capital Management Appendix

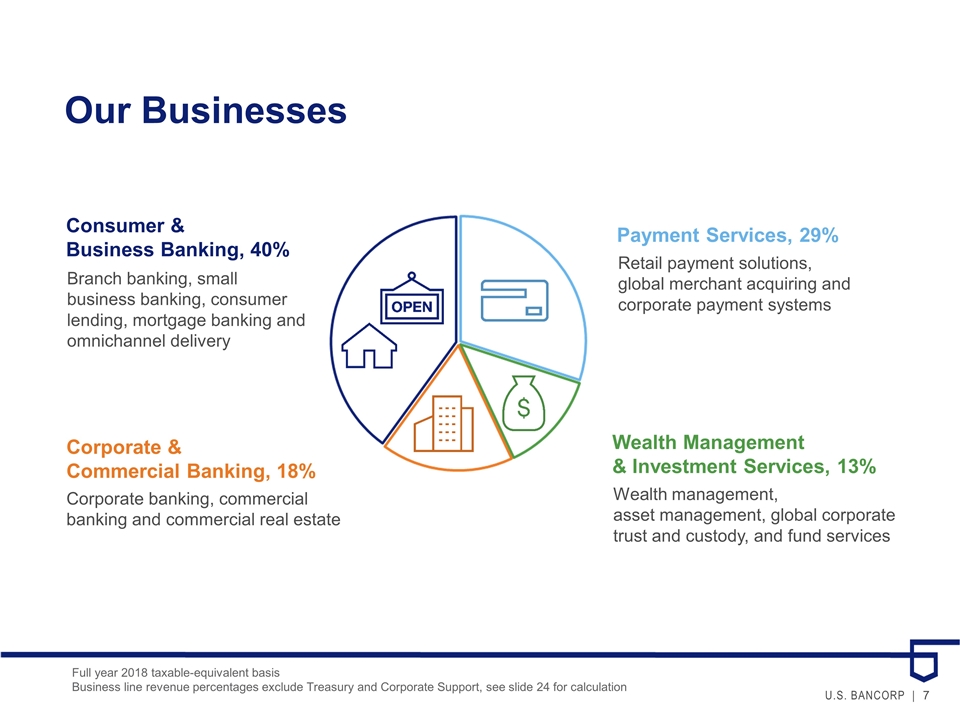

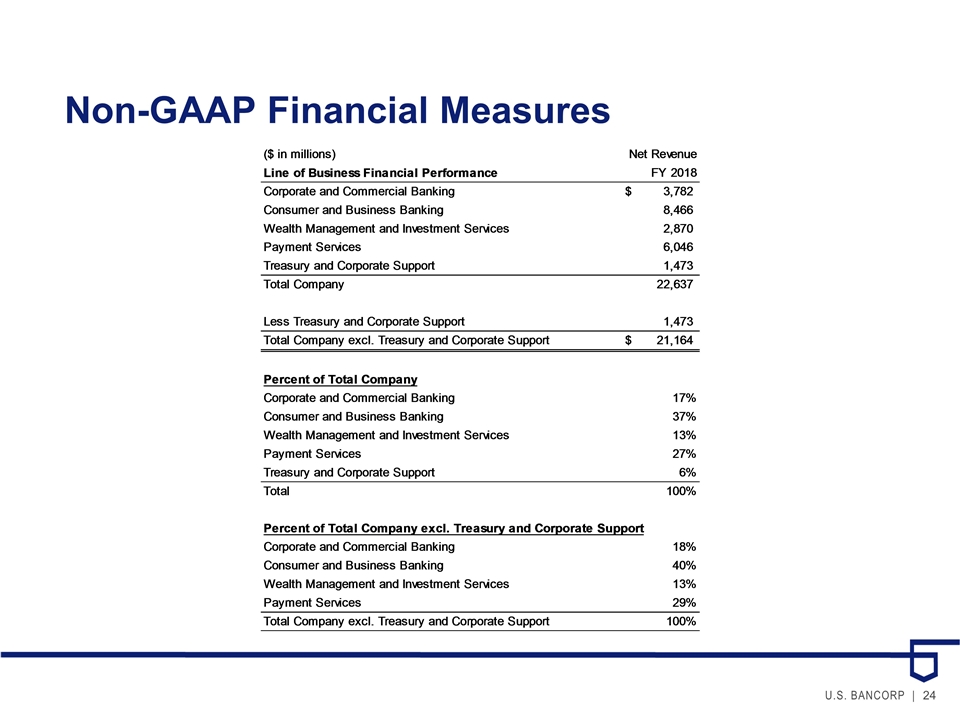

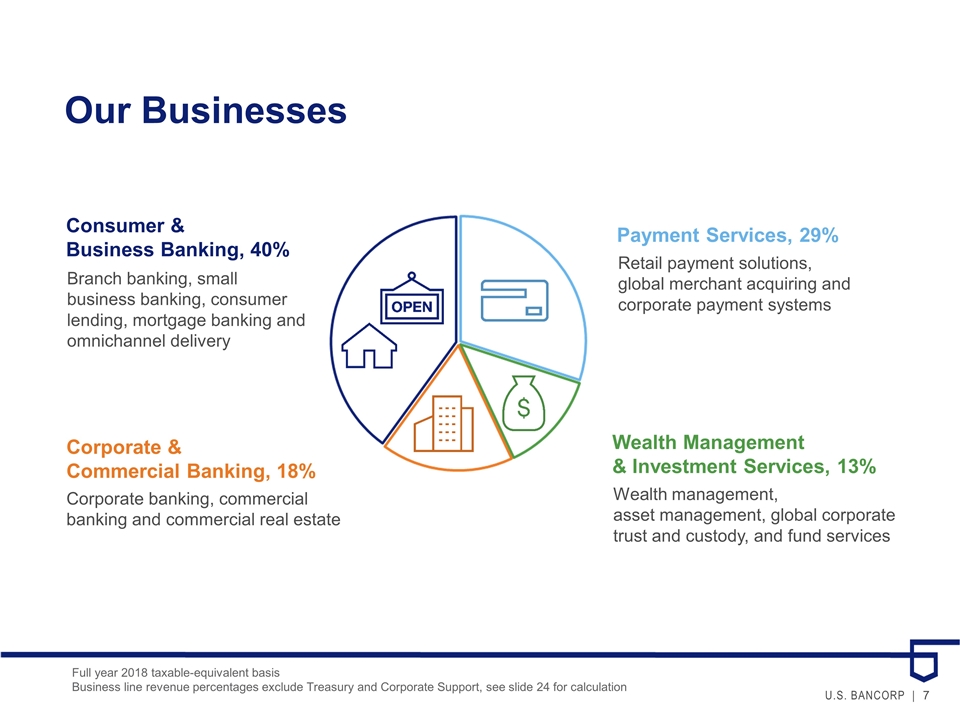

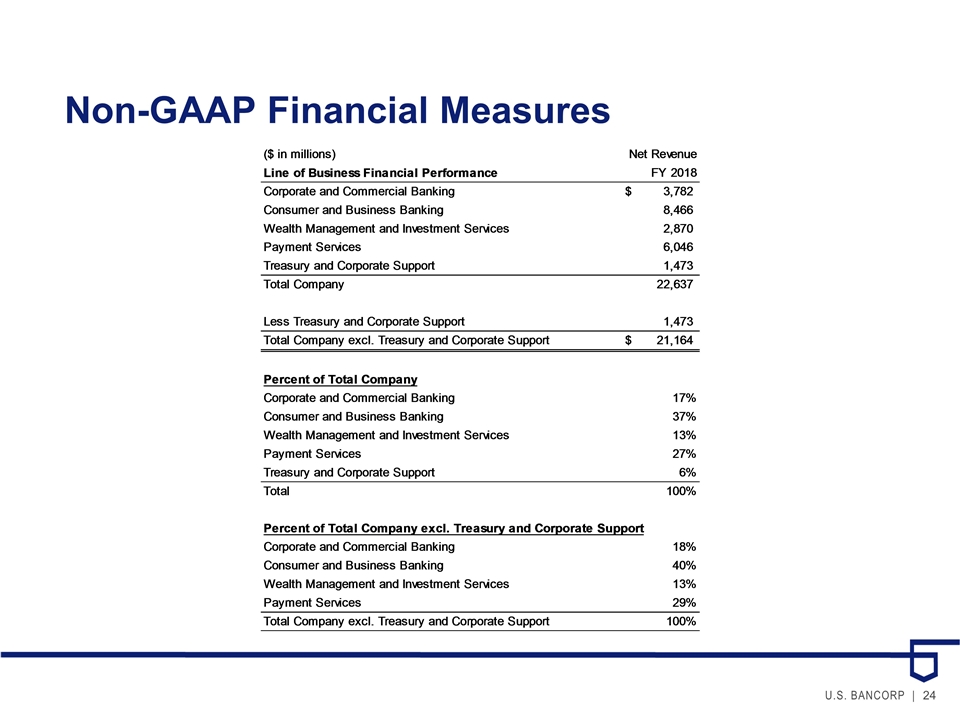

Consumer & Business Banking, 40% Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Payment Services, 29% Retail payment solutions, global merchant acquiring and corporate payment systems Corporate & Commercial Banking, 18% Corporate banking, commercial banking and commercial real estate Wealth Management & Investment Services, 13% Wealth management, asset management, global corporate trust and custody, and fund services Full year 2018 taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support, see slide 24 for calculation Our Businesses

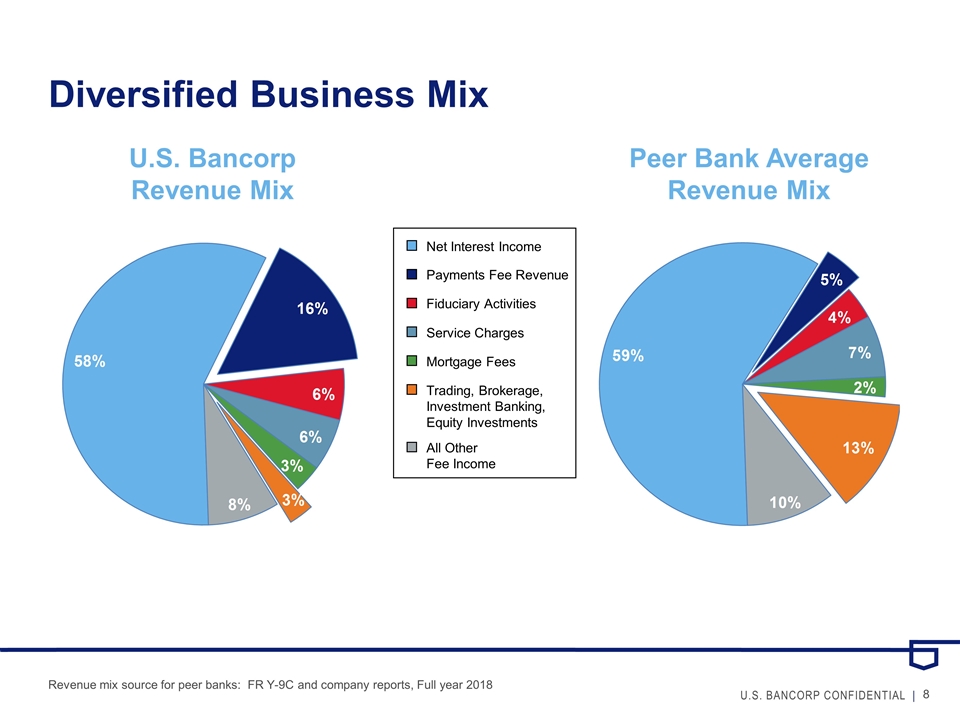

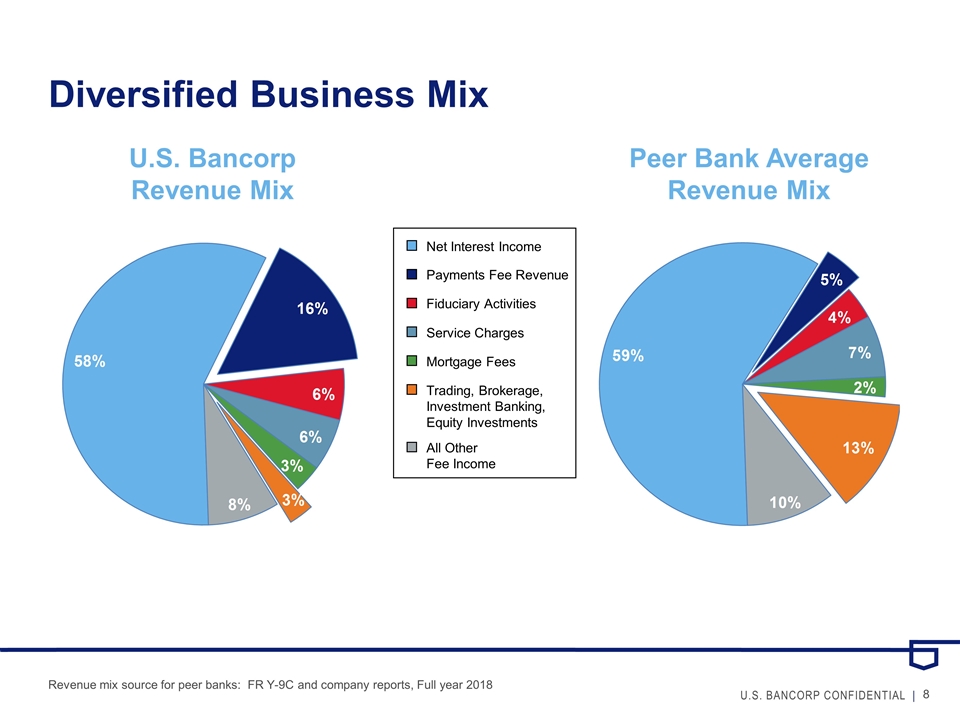

Diversified Business Mix Revenue mix source for peer banks: FR Y-9C and company reports, Full year 2018 U.S. Bancorp Revenue Mix Peer Bank Average Revenue Mix Net Interest Income Payments Fee Revenue Fiduciary Activities Service Charges Mortgage Fees Trading, Brokerage, Investment Banking, Equity Investments All Other Fee Income

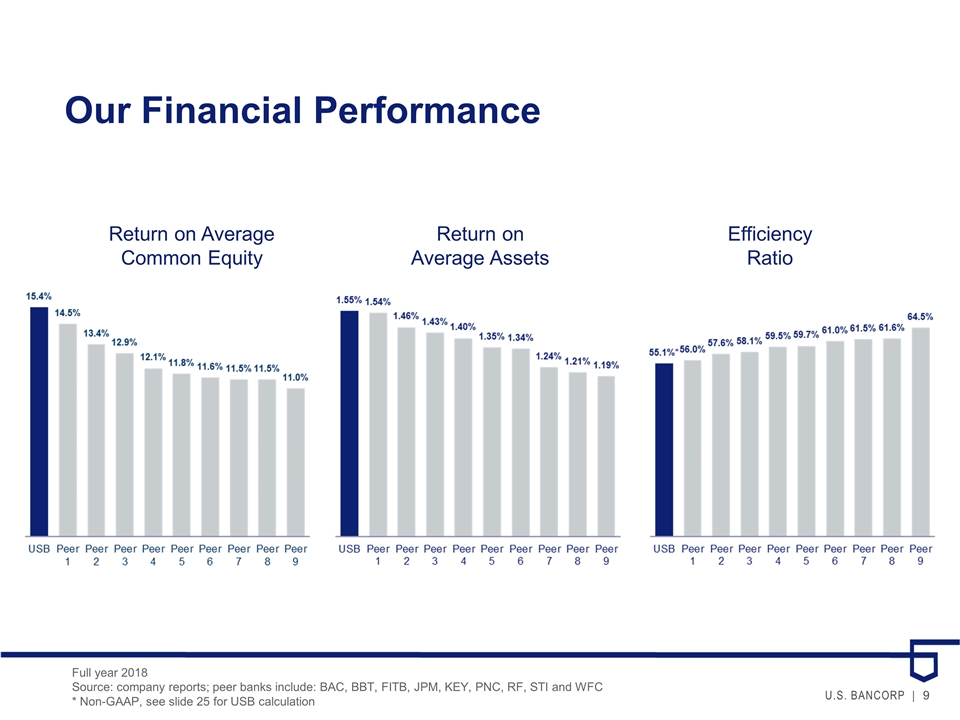

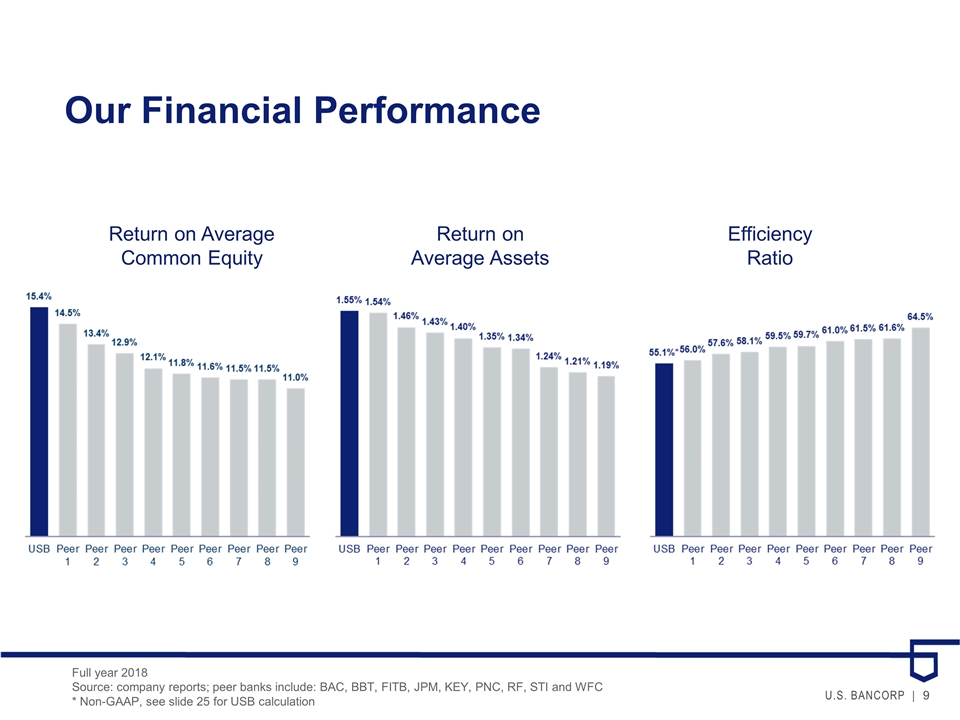

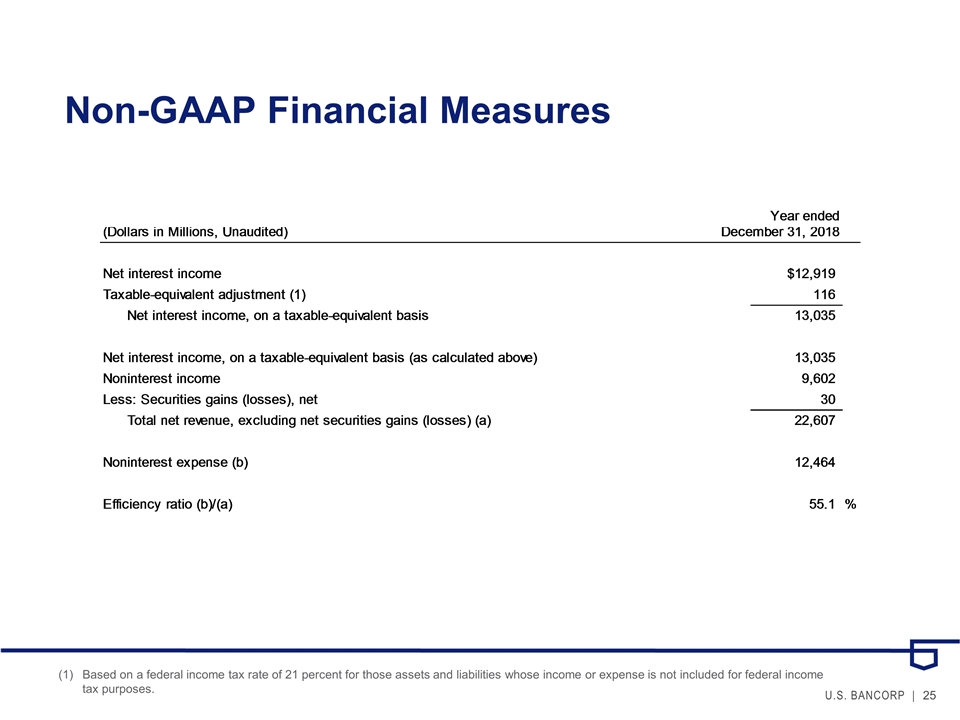

Full year 2018 Source: company reports; peer banks include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC * Non-GAAP, see slide 25 for USB calculation Our Financial Performance Return on Average Common Equity Return on Average Assets Efficiency Ratio

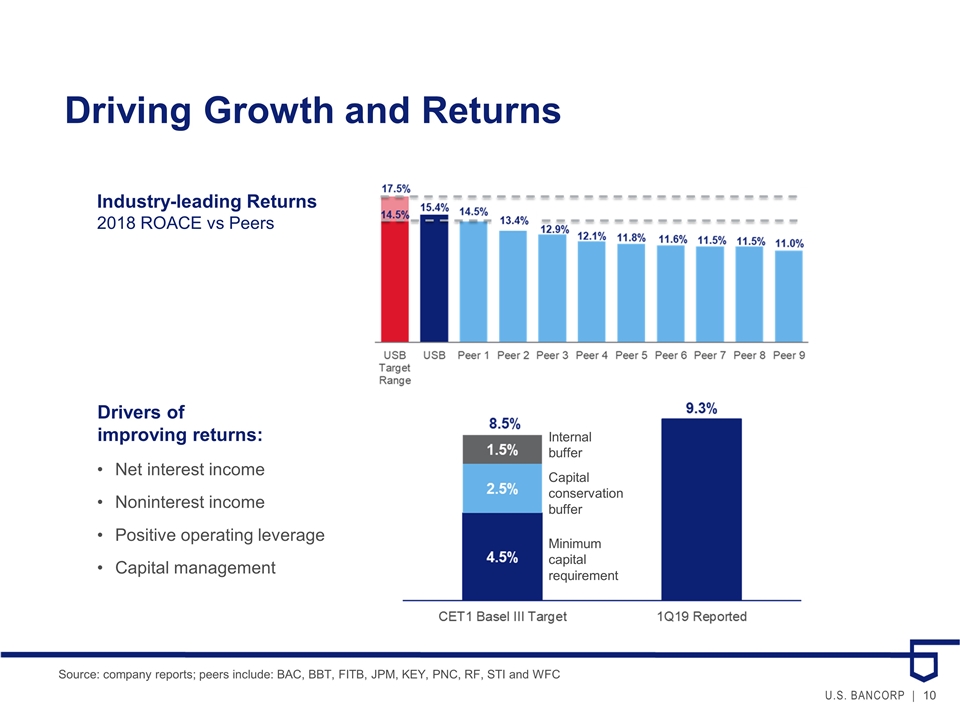

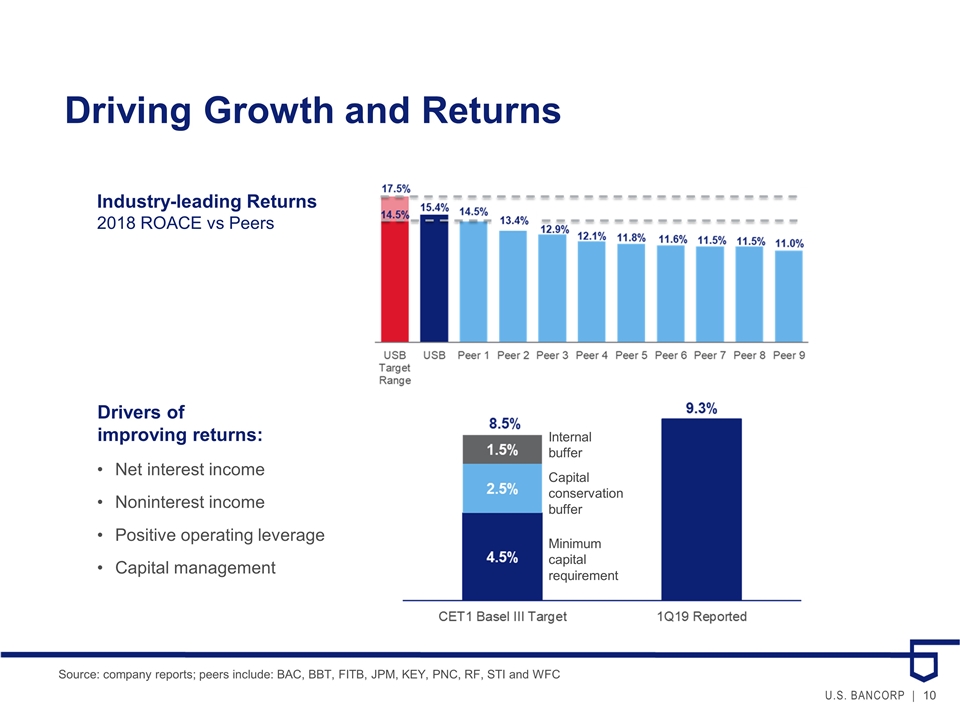

Drivers of improving returns: Net interest income Noninterest income Positive operating leverage Capital management Driving Growth and Returns Industry-leading Returns 2018 ROACE vs Peers Source: company reports; peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC Capital conservation buffer Minimum capital requirement Internal buffer

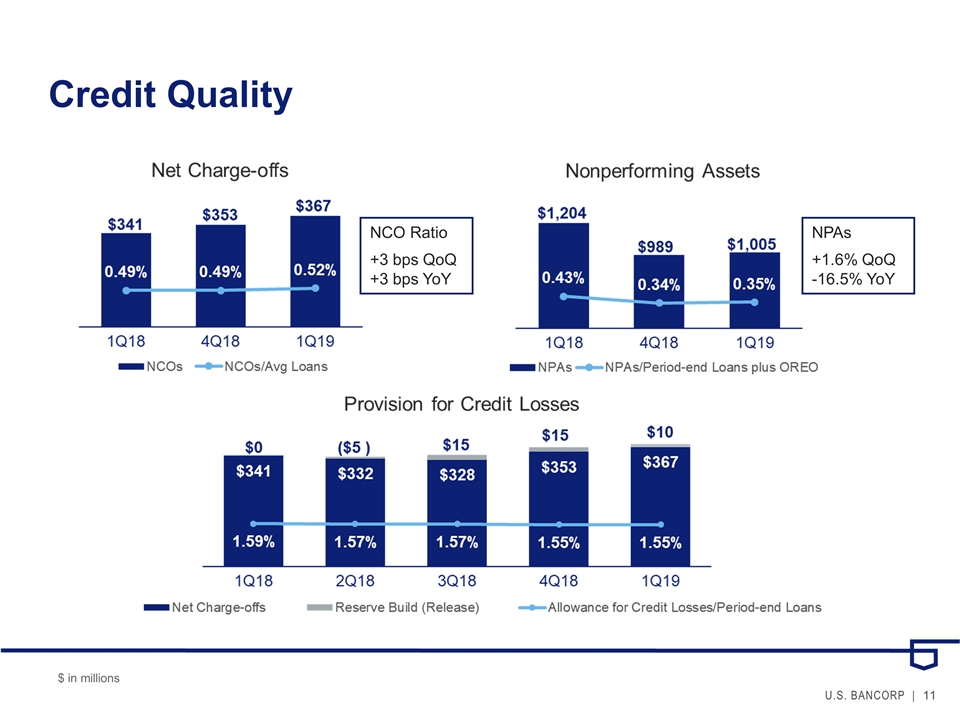

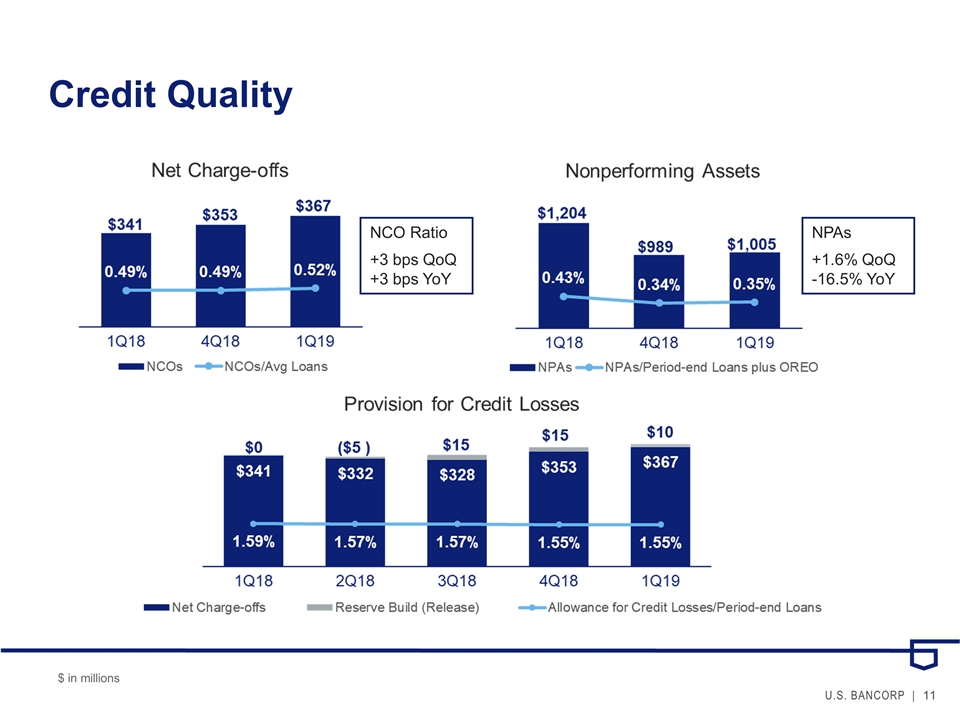

Credit Quality $ in millions NCO Ratio +3 bps QoQ +3 bps YoY NPAs +1.6% QoQ -16.5% YoY

Agenda Overview Business Lines & Financial Management Balance Sheet & Capital Management Appendix

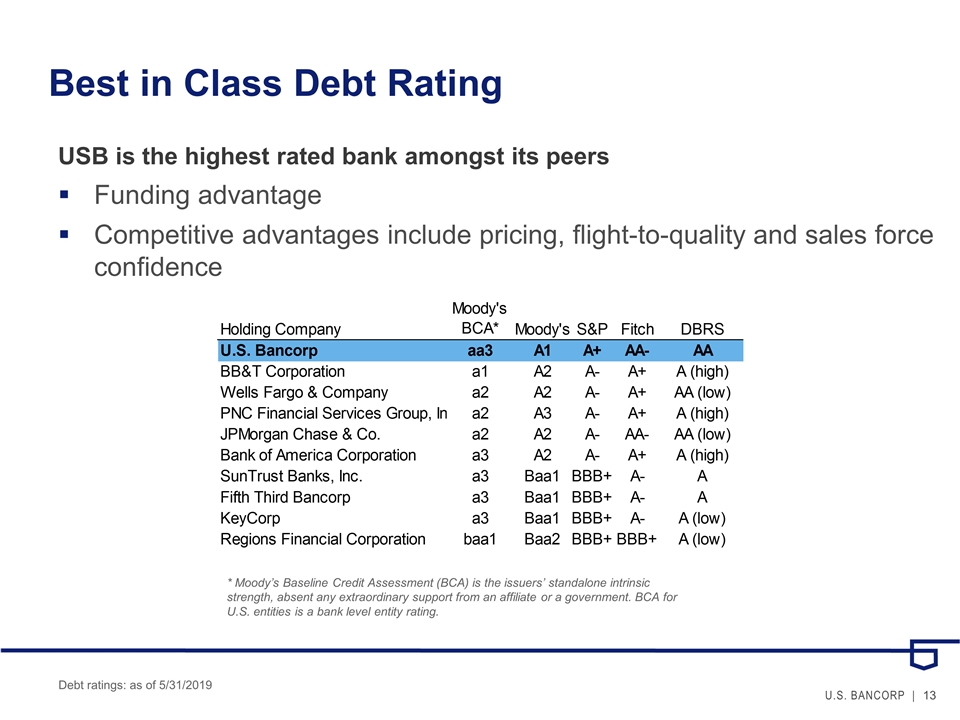

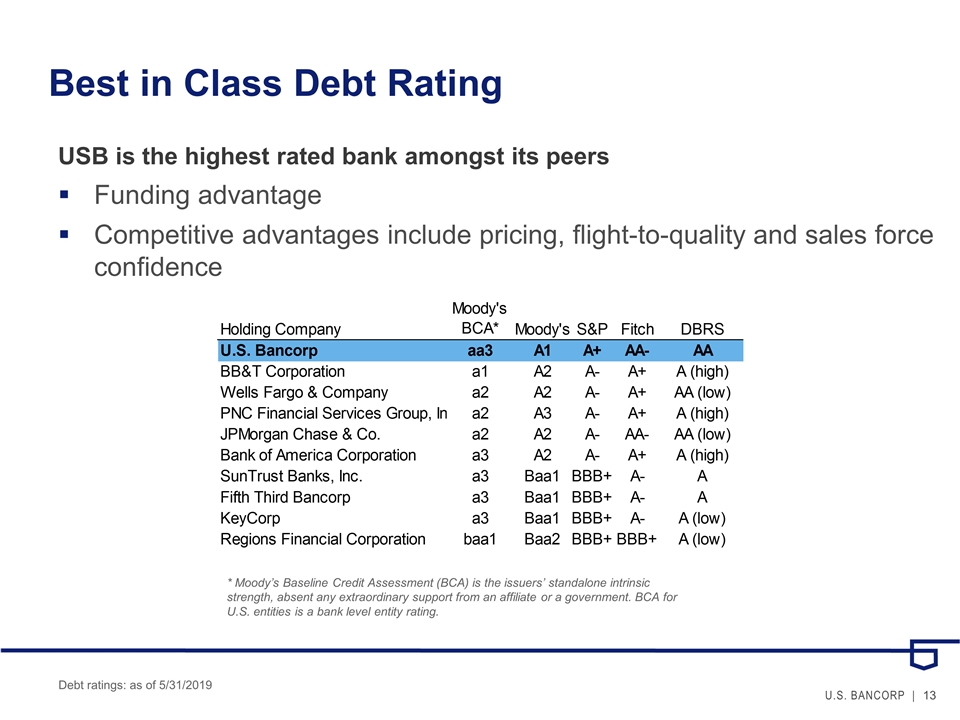

Best in Class Debt Rating Debt ratings: as of 5/31/2019 USB is the highest rated bank amongst its peers Funding advantage Competitive advantages include pricing, flight-to-quality and sales force confidence * Moody’s Baseline Credit Assessment (BCA) is the issuers’ standalone intrinsic strength, absent any extraordinary support from an affiliate or a government. BCA for U.S. entities is a bank level entity rating.

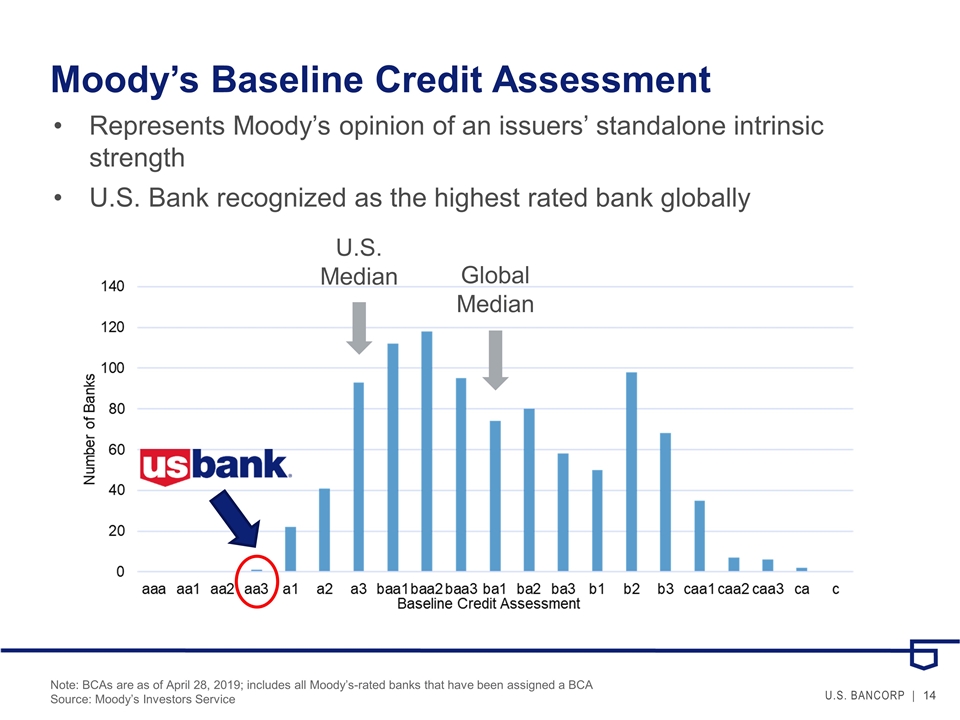

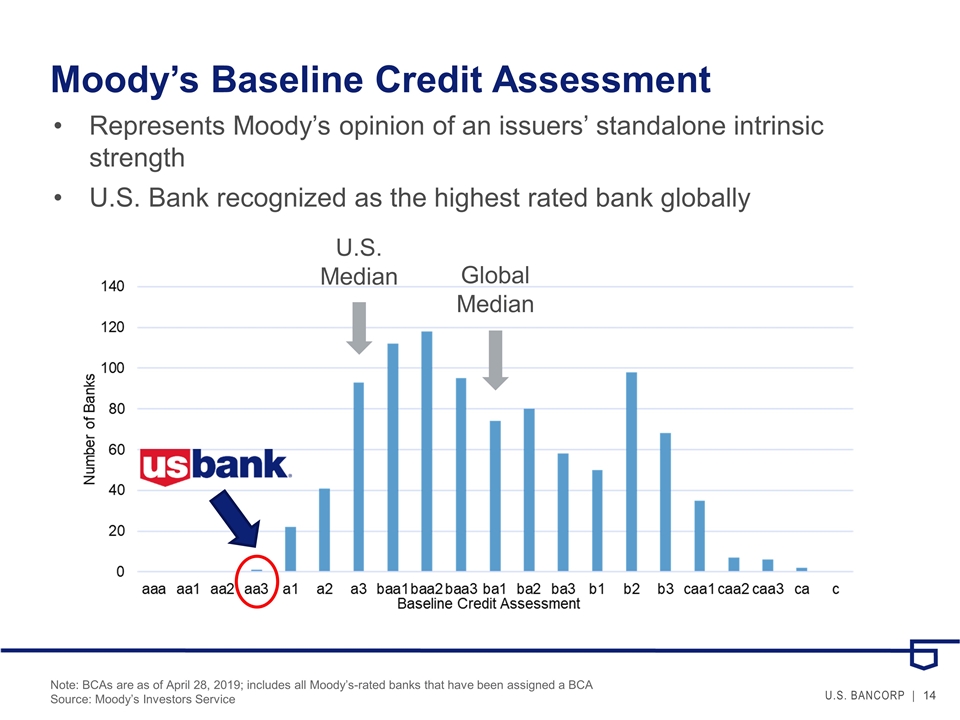

Moody’s Baseline Credit Assessment Represents Moody’s opinion of an issuers’ standalone intrinsic strength U.S. Bank recognized as the highest rated bank globally Note: BCAs are as of April 28, 2019; includes all Moody’s-rated banks that have been assigned a BCA Source: Moody’s Investors Service U.S. Median Global Median

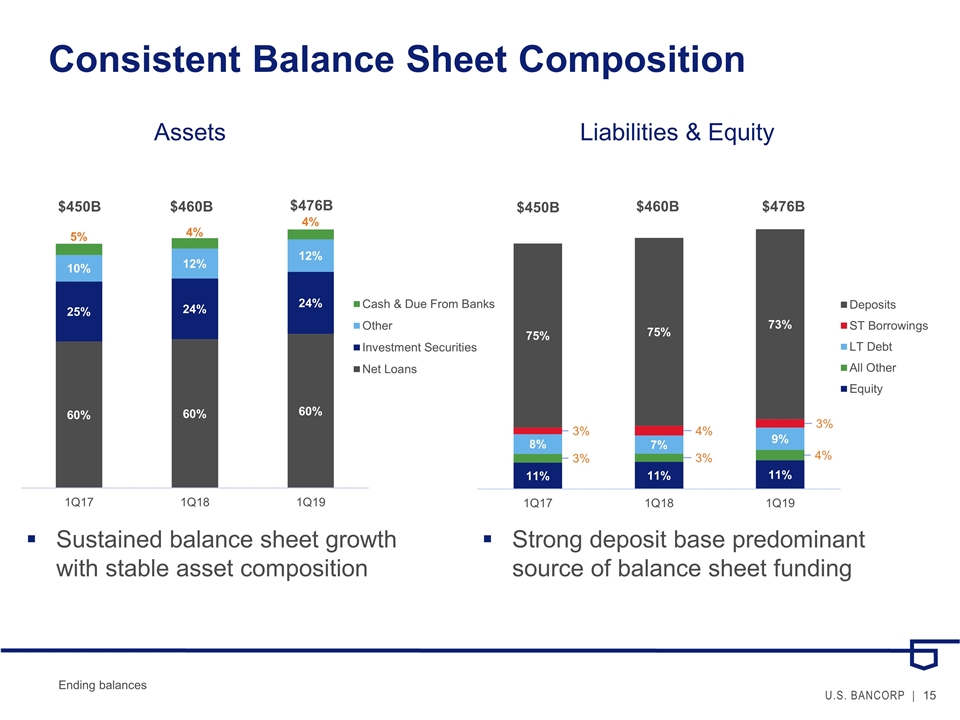

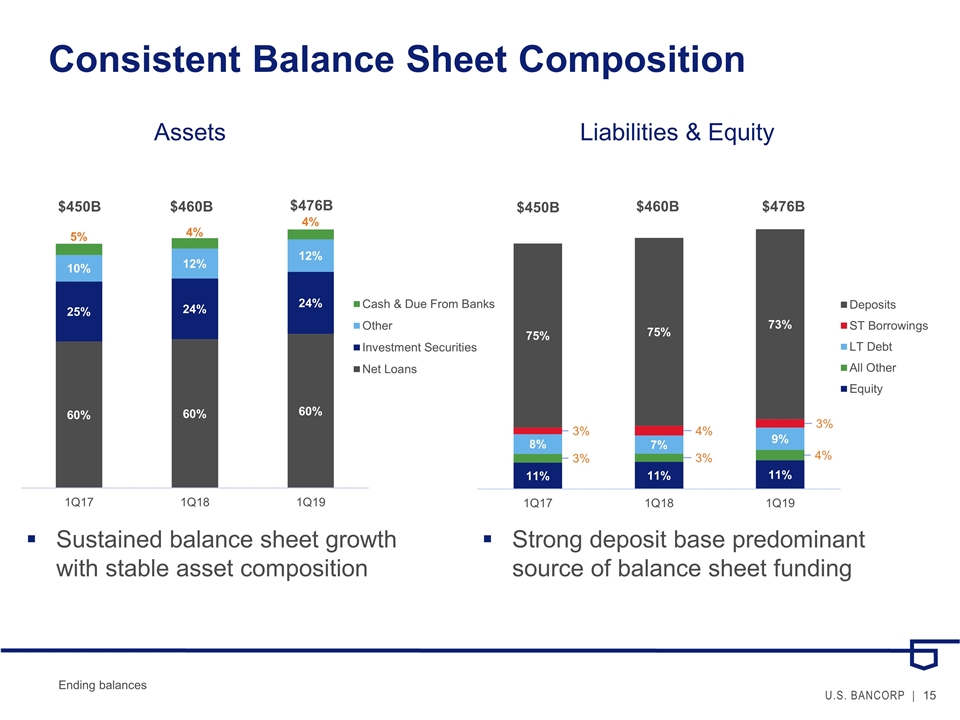

Consistent Balance Sheet Composition Assets Liabilities & Equity Sustained balance sheet growth with stable asset composition Strong deposit base predominant source of balance sheet funding Ending balances

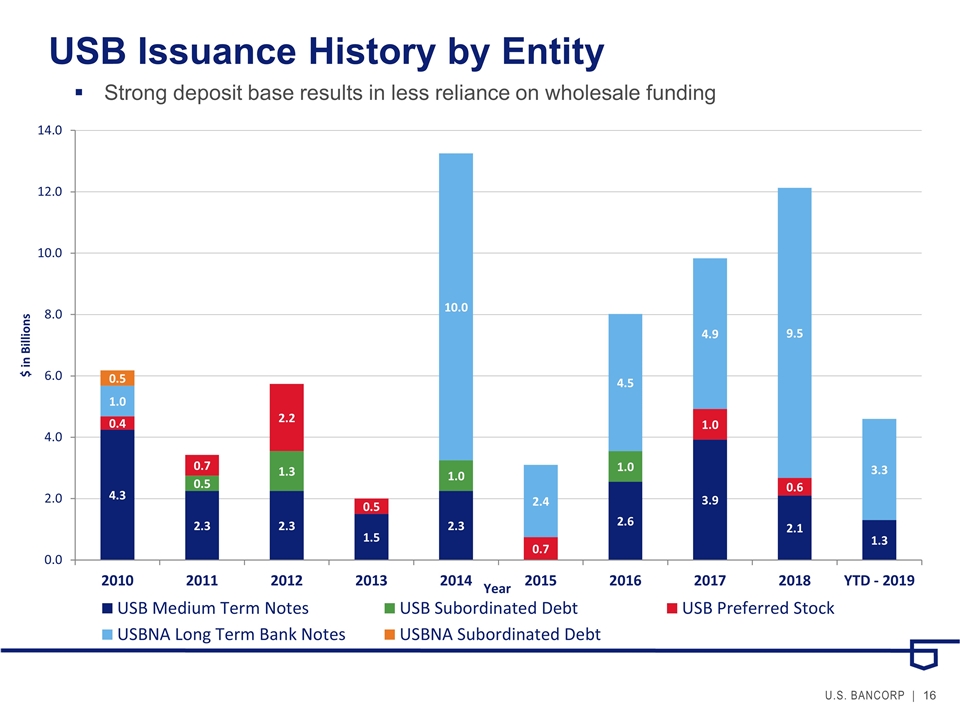

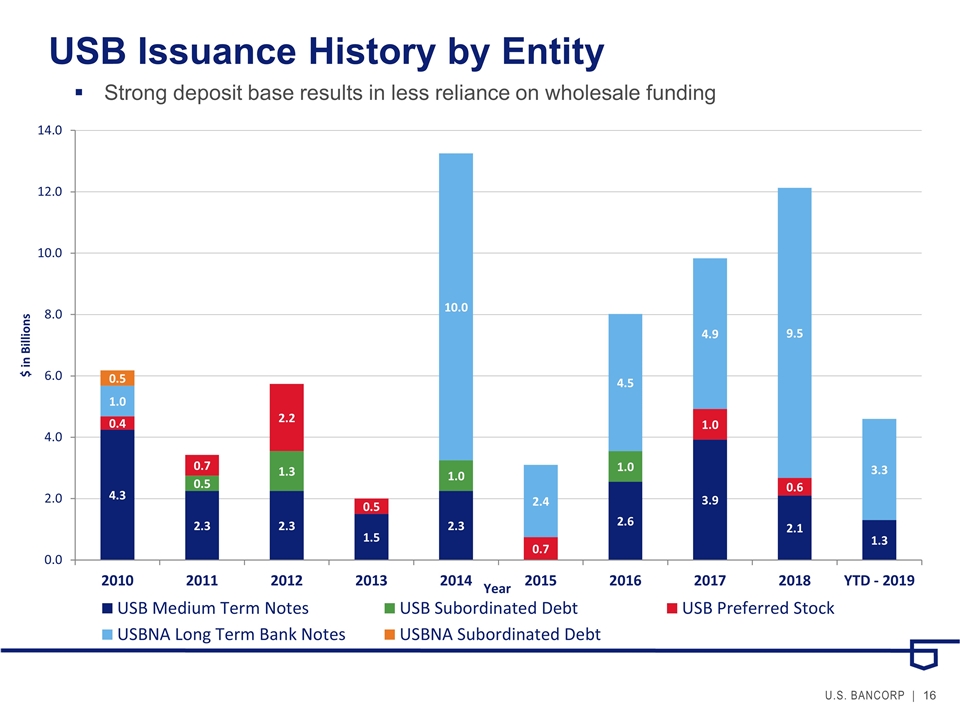

USB Issuance History by Entity Strong deposit base results in less reliance on wholesale funding

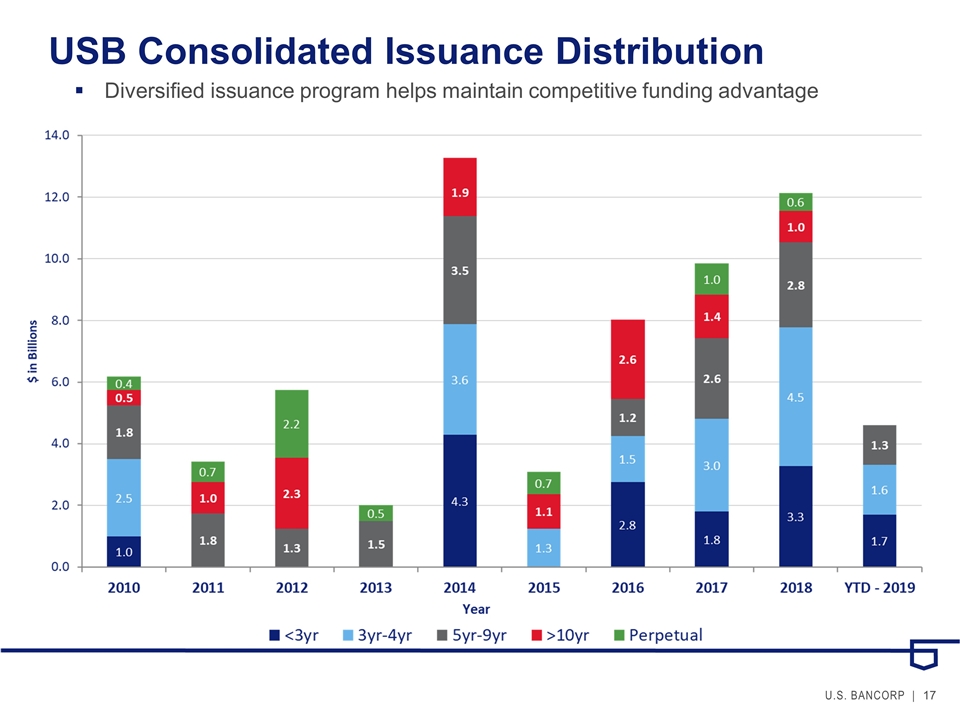

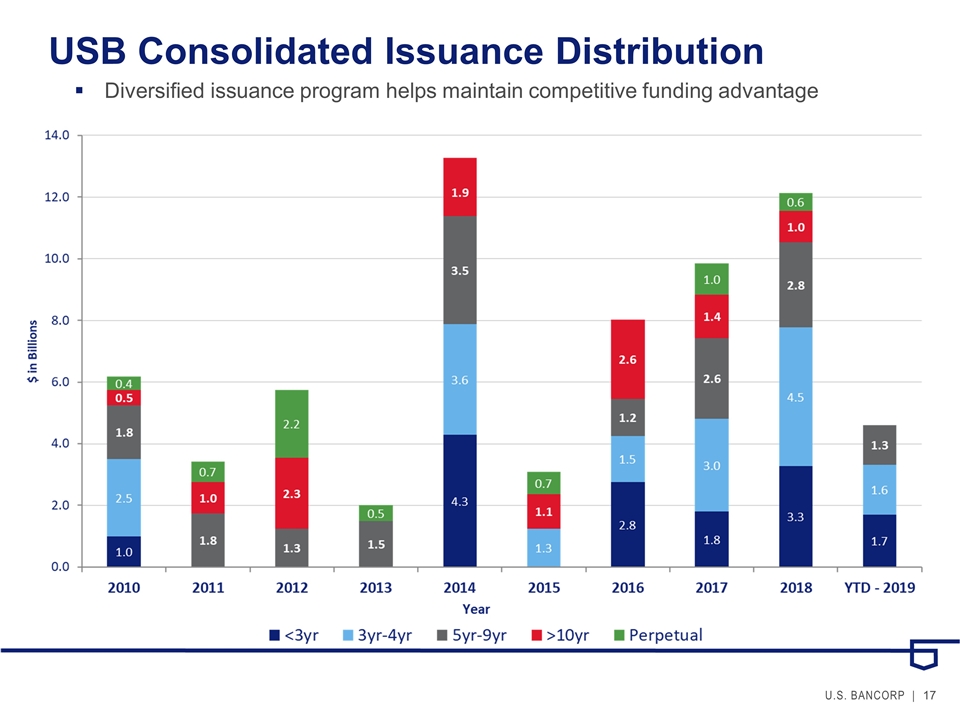

USB Consolidated Issuance Distribution Diversified issuance program helps maintain competitive funding advantage

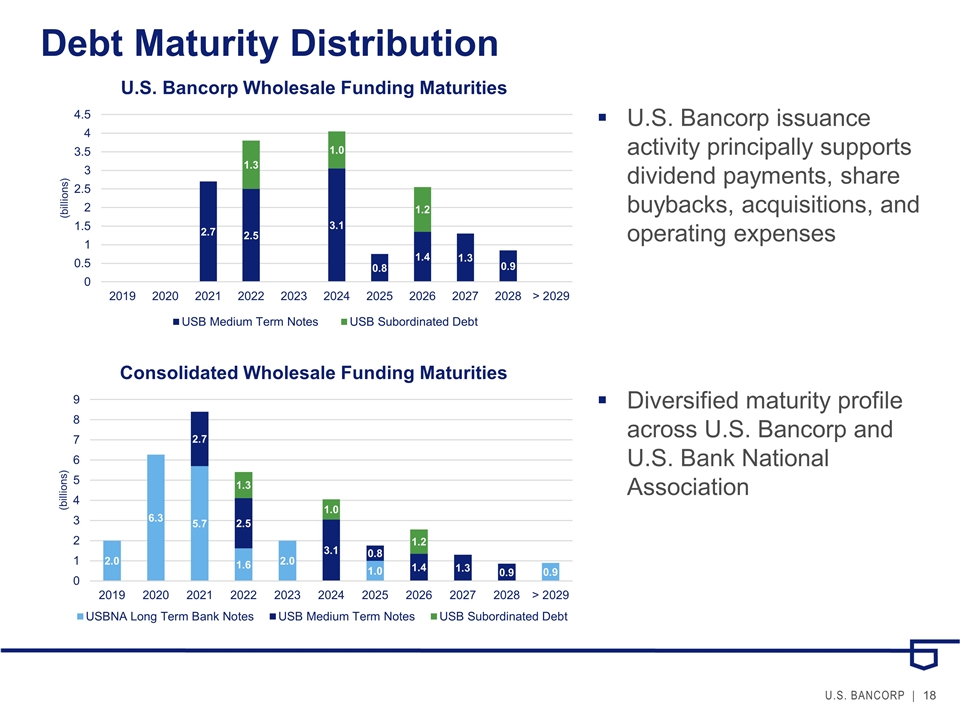

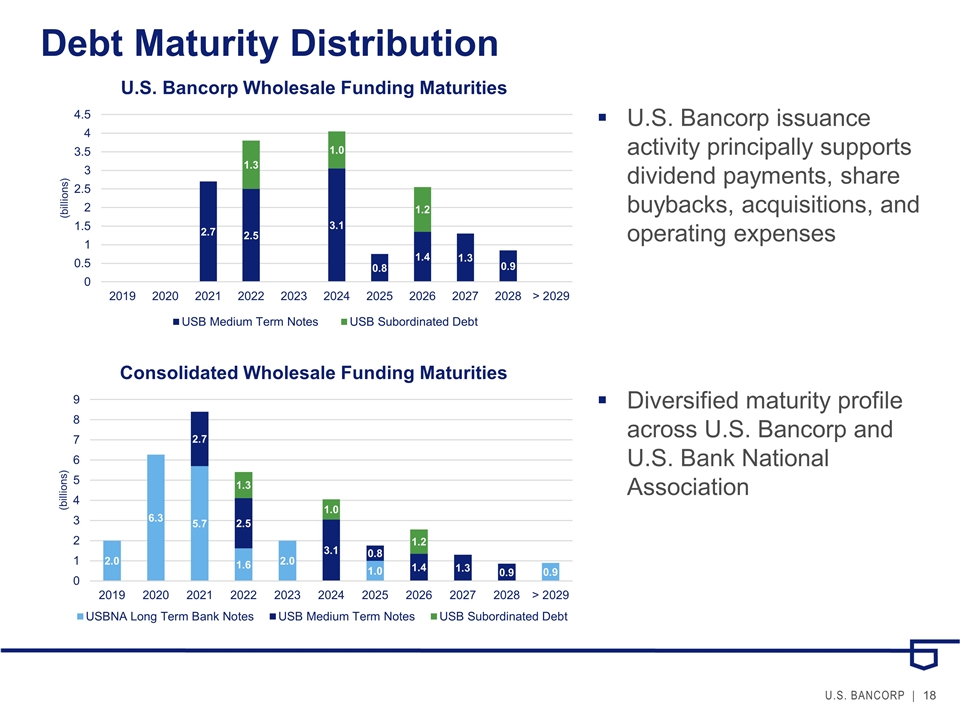

Debt Maturity Distribution U.S. Bancorp issuance activity principally supports dividend payments, share buybacks, acquisitions, and operating expenses Diversified maturity profile across U.S. Bancorp and U.S. Bank National Association

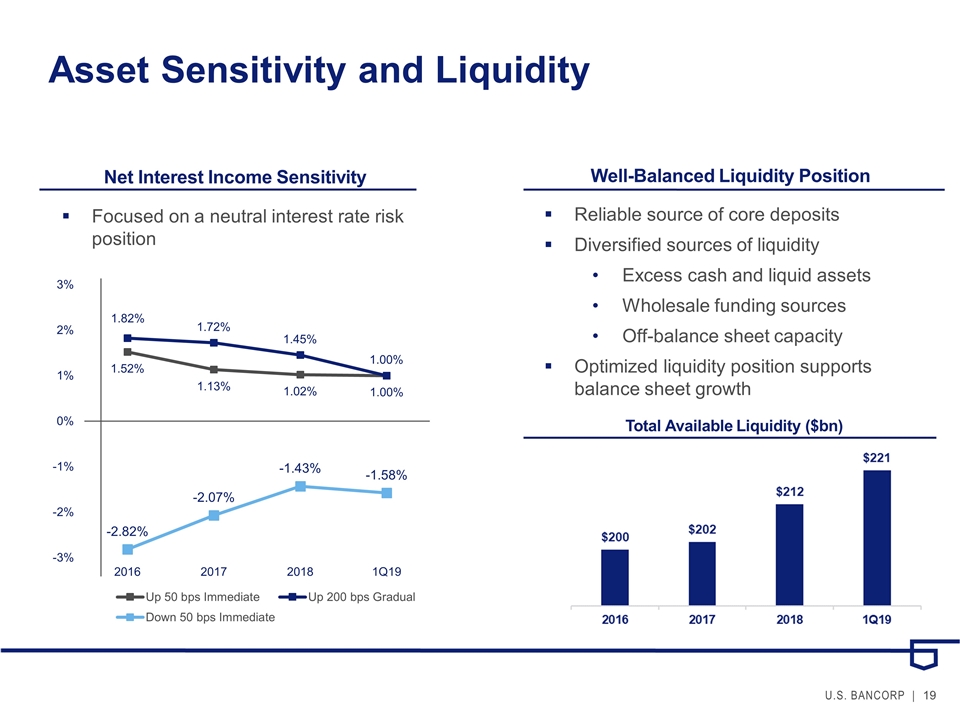

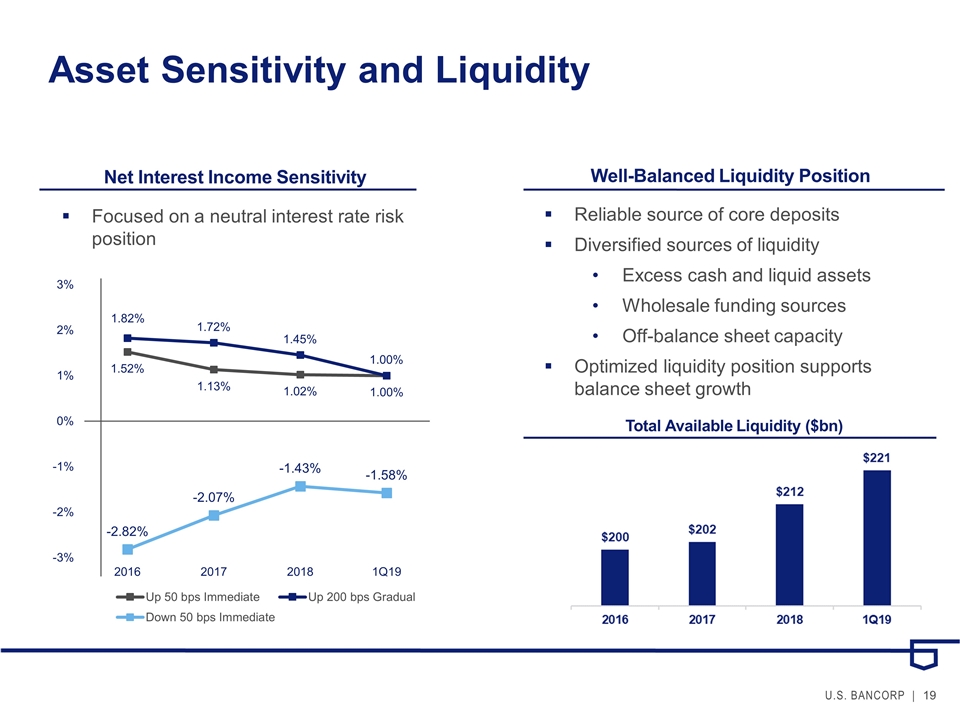

Asset Sensitivity and Liquidity Net Interest Income Sensitivity Reliable source of core deposits Diversified sources of liquidity Excess cash and liquid assets Wholesale funding sources Off-balance sheet capacity Optimized liquidity position supports balance sheet growth Total Available Liquidity ($bn) Well-Balanced Liquidity Position Focused on a neutral interest rate risk position

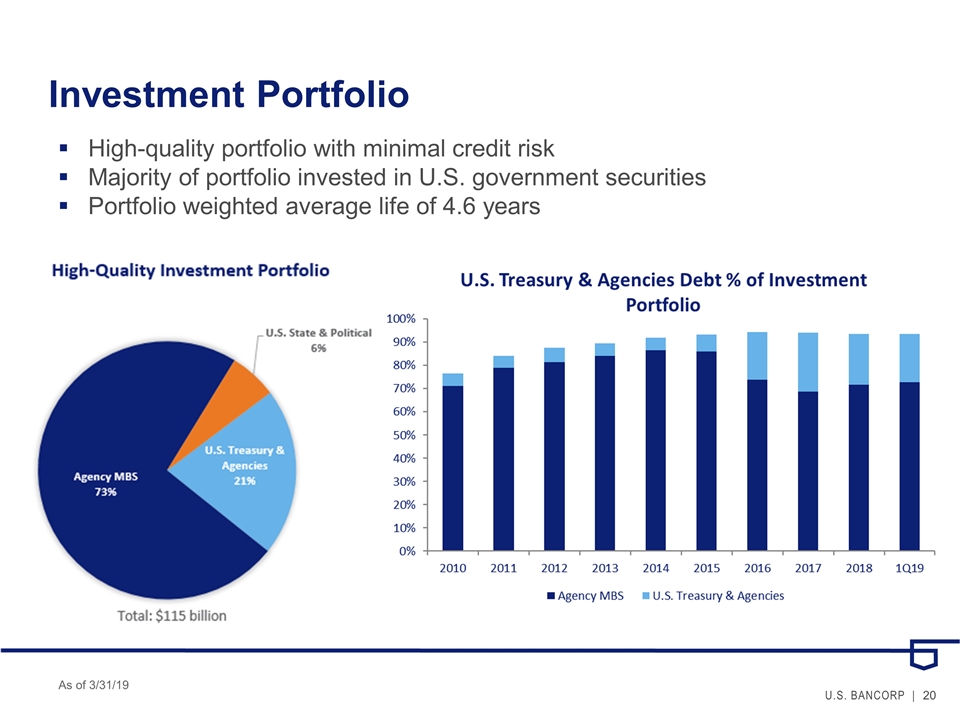

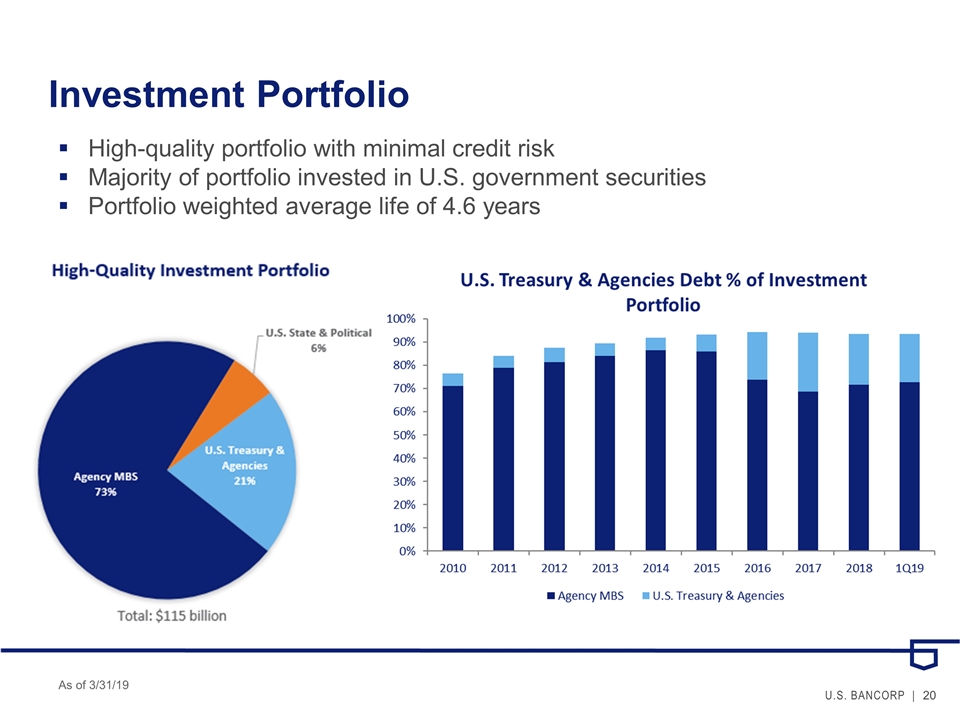

Investment Portfolio High-quality portfolio with minimal credit risk Majority of portfolio invested in U.S. government securities Portfolio weighted average life of 4.6 years As of 3/31/19

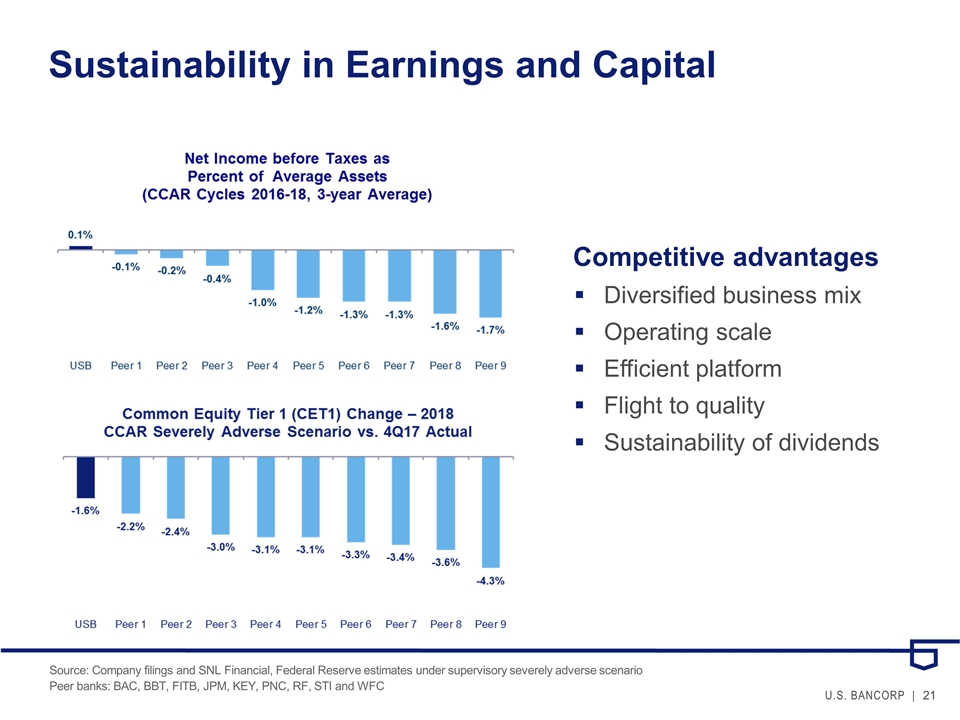

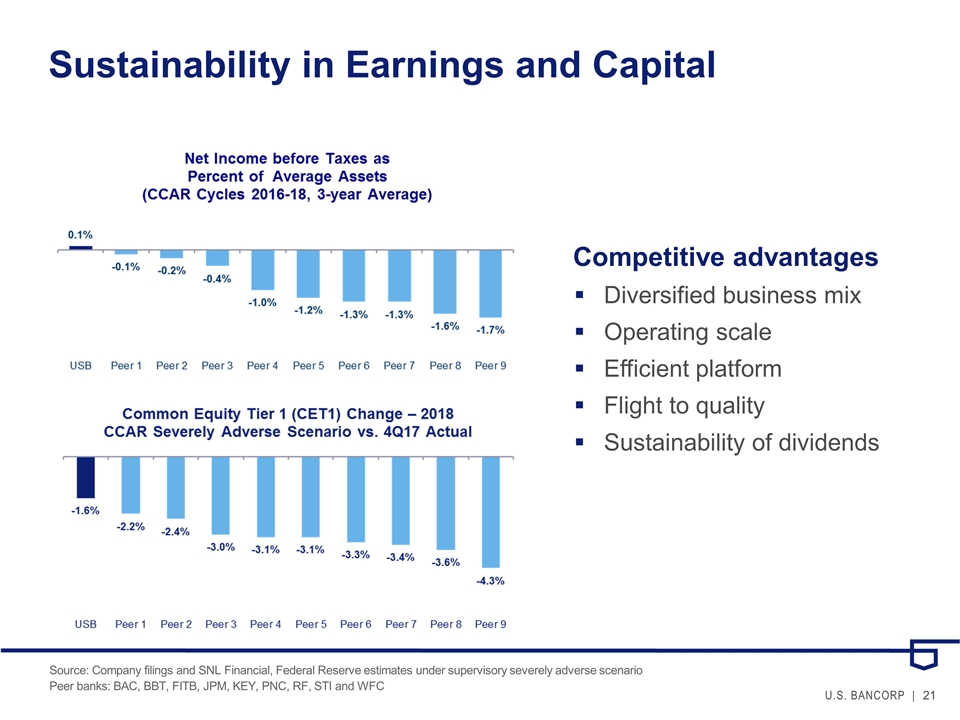

Competitive advantages Diversified business mix Operating scale Efficient platform Flight to quality Sustainability of dividends Sustainability in Earnings and Capital Source: Company filings and SNL Financial, Federal Reserve estimates under supervisory severely adverse scenario Peer banks: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC

Agenda Overview Business Lines & Financial Management Balance Sheet & Capital Management Appendix

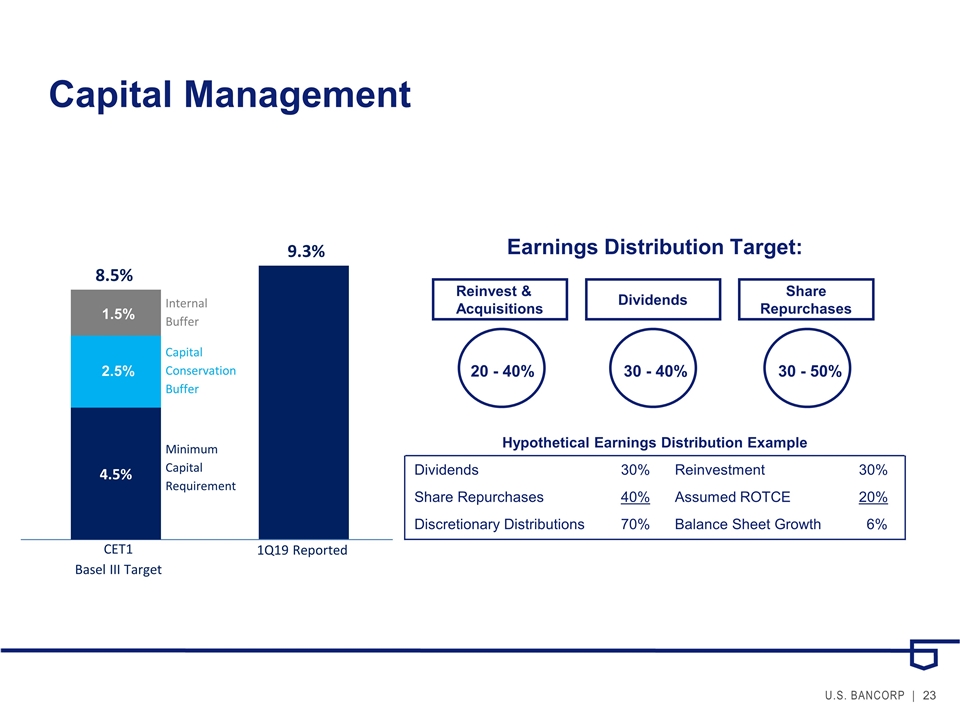

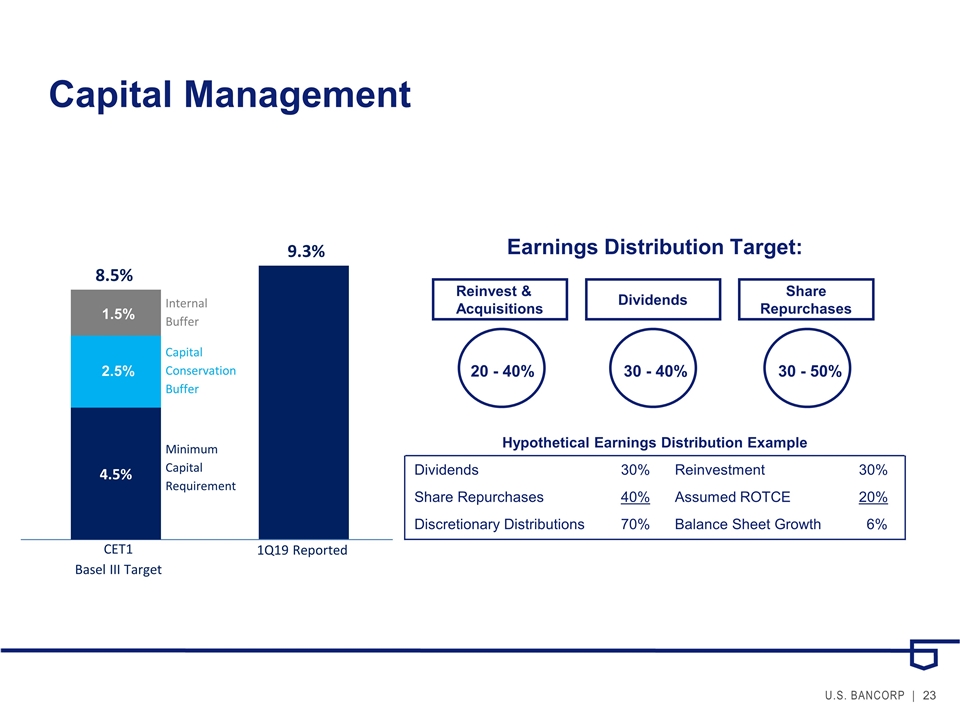

Earnings Distribution Target: Reinvest & Acquisitions Dividends Share Repurchases 20 - 40% 30 - 50% 30 - 40% Hypothetical Earnings Distribution Example Dividends 30% Reinvestment 30% Share Repurchases 40% Assumed ROTCE 20% Discretionary Distributions 70% Balance Sheet Growth 6% 2.5% 1.5% 9.3% 8.5% Internal Buffer CET1 Basel III Target 4.5% Capital Conservation Buffer Minimum Capital Requirement 1Q19 Reported 2.5% 1.5% Capital Management

Non-GAAP Financial Measures

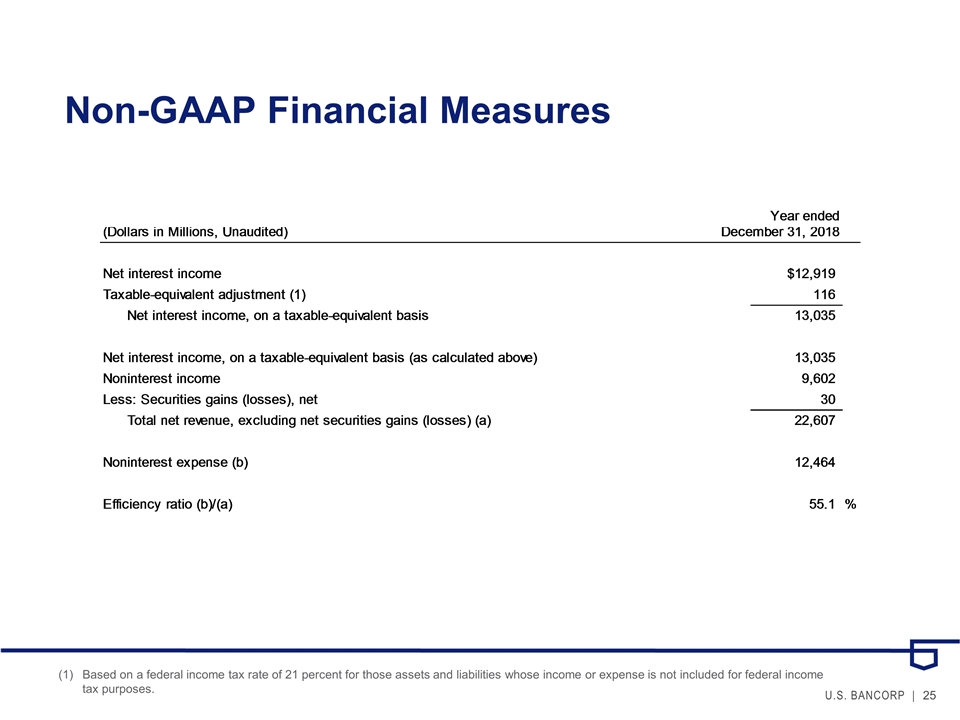

Based on a federal income tax rate of 21 percent for those assets and liabilities whose income or expense is not included for federal income tax purposes. Non-GAAP Financial Measures

June 2019 U.S. Bancorp Fixed Income Investor Presentation