September 12, 2019 U.S. Bancorp Investor Day Exhibit 99.1

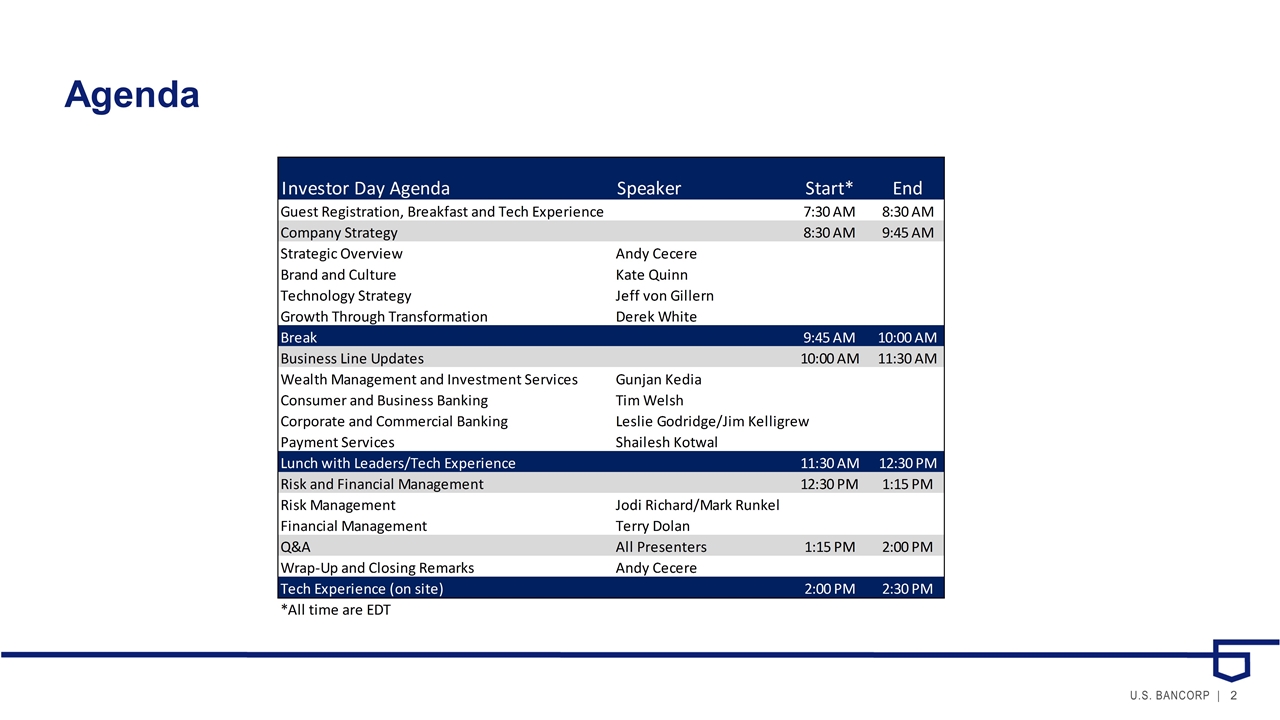

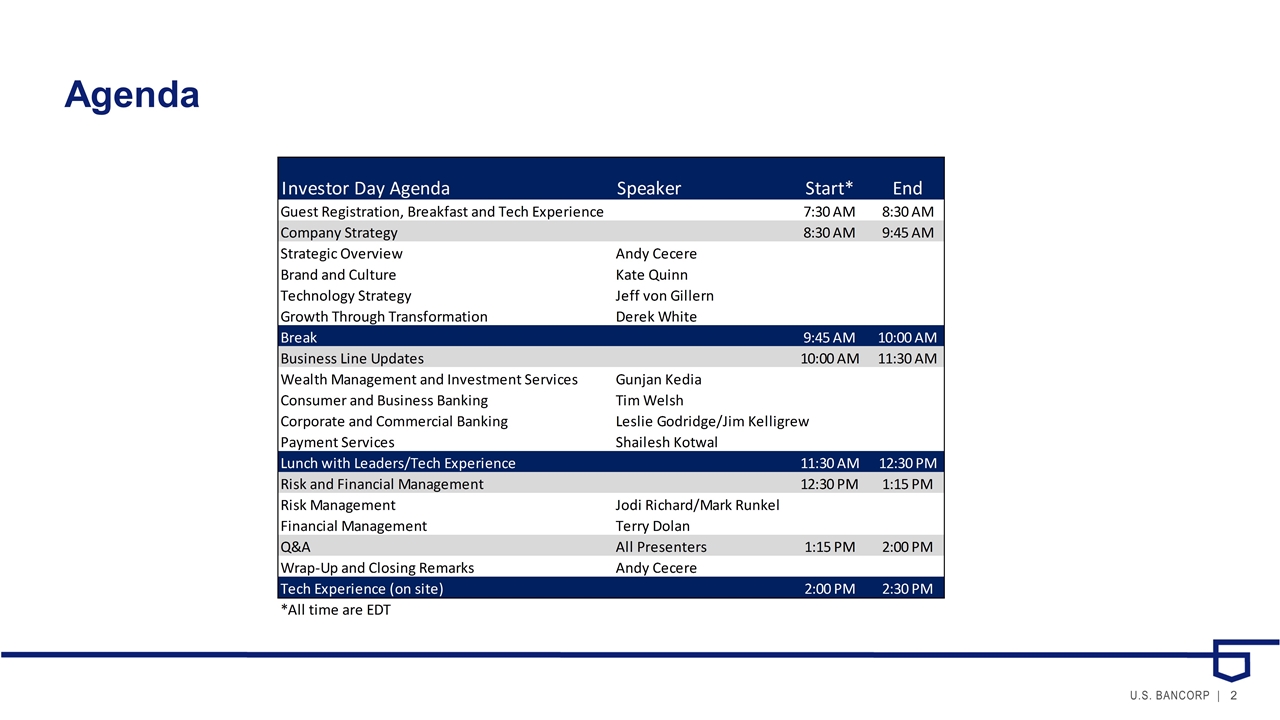

Agenda

The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. Deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs and other trade policies of the United States and its global trading partners; changes in customer behavior and preferences; breaches in data security; failures to safeguard personal information; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2018, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Forward-looking Statements and Additional Information

U.S. Bancorp Investor Day Strategic Overview September 12, 2019 Andy Cecere Chairman, President and CEO

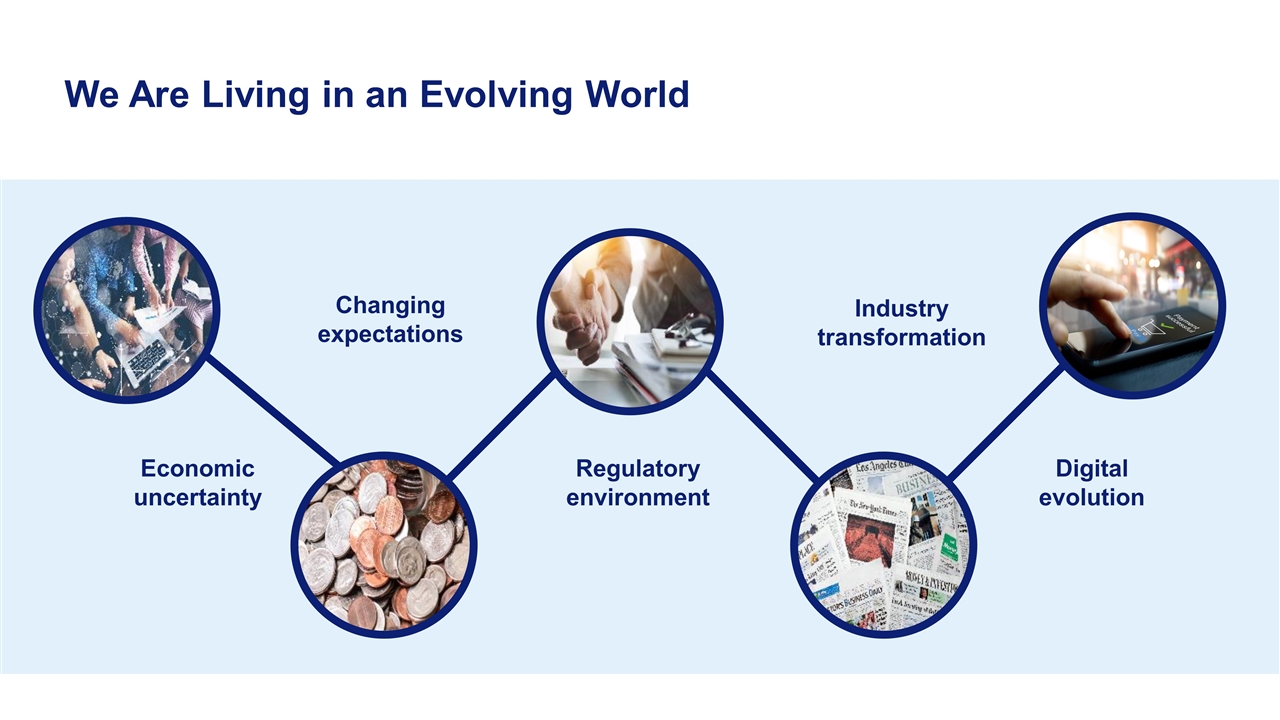

A Changing World

We Are Living in an Evolving World Changing expectations Economic uncertainty Digital evolution Industry transformation Regulatory environment

Customer Expectations and Behavior in the Digital Age Simplicity Convenience and speed Uniqueness Ubiquity Privacy From two-day shipping to Amazon Now 67% of all banking transactions occur on a mobile device

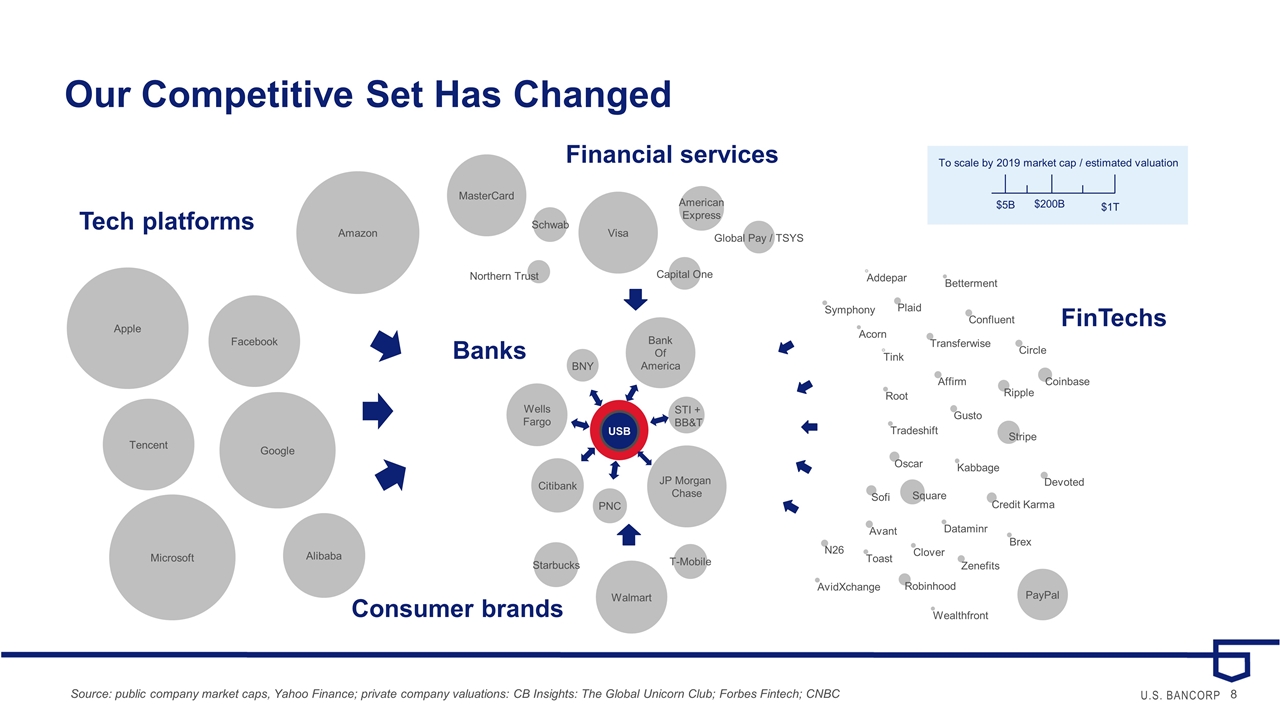

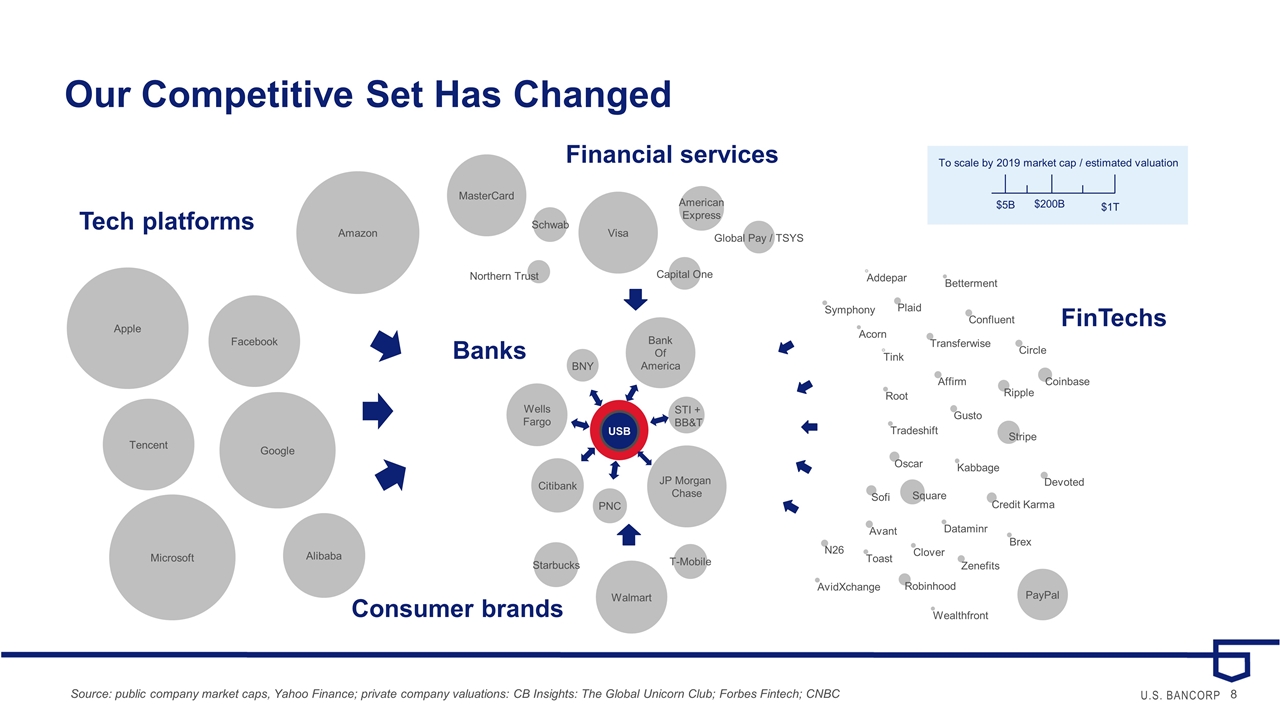

Microsoft Google Apple Amazon Facebook Walmart PayPal Square Stripe Coinbase Robinhood Ripple Sofi Plaid Brex Kabbage Root Tradeshift Circle Affirm Credit Karma Oscar Clover Devoted Dataminr Gusto Zenefits Confluent Betterment Wealthfront Tink Transferwise Starbucks T-Mobile Tencent To scale by 2019 market cap / estimated valuation $1T $200B $5B Symphony Toast Avant Acorn Addepar N26 AvidXchange JP Morgan Chase Bank Of America Wells Fargo Citibank USB STI + BB&T PNC BNY Northern Trust Schwab Visa American Express Capital One Alibaba Tech platforms Financial services FinTechs Banks Consumer brands MasterCard Global Pay / TSYS Our Competitive Set Has Changed Source: public company market caps, Yahoo Finance; private company valuations: CB Insights: The Global Unicorn Club; Forbes Fintech; CNBC

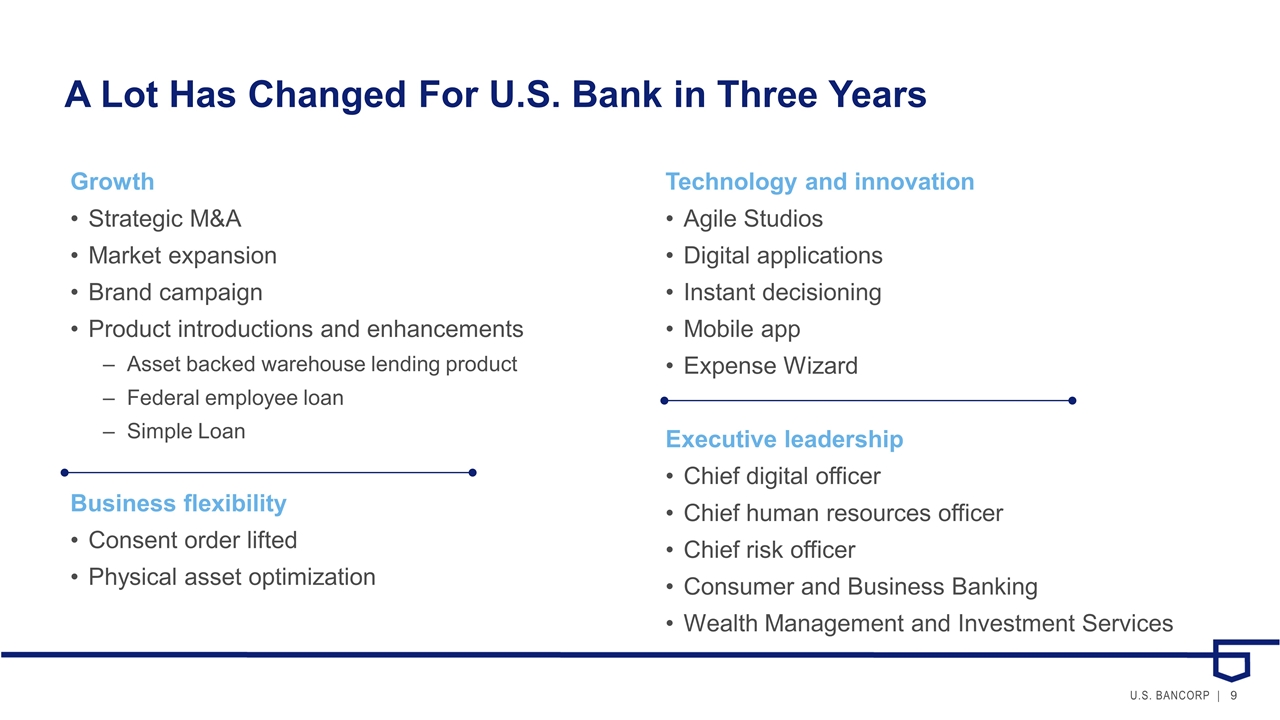

A Lot Has Changed For U.S. Bank in Three Years Growth Strategic M&A Market expansion Brand campaign Product introductions and enhancements Asset backed warehouse lending product Federal employee loan Simple Loan Business flexibility Consent order lifted Physical asset optimization Technology and innovation Agile Studios Digital applications Instant decisioning Mobile app Expense Wizard Executive leadership Chief digital officer Chief human resources officer Chief risk officer Consumer and Business Banking Wealth Management and Investment Services

Where We Are Today We are starting from a position of strength The core competencies and competitive advantages that made us great in the past remain in place The world is changing, and we are transforming how we do business and investing for the future

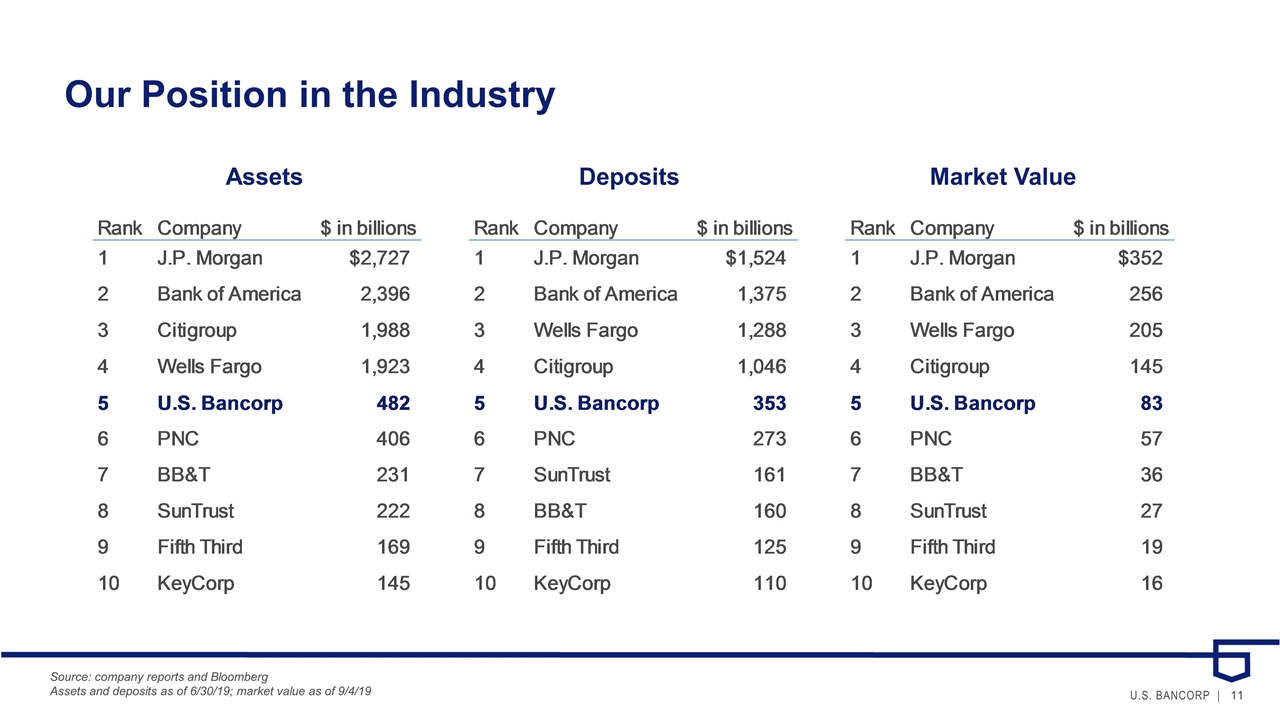

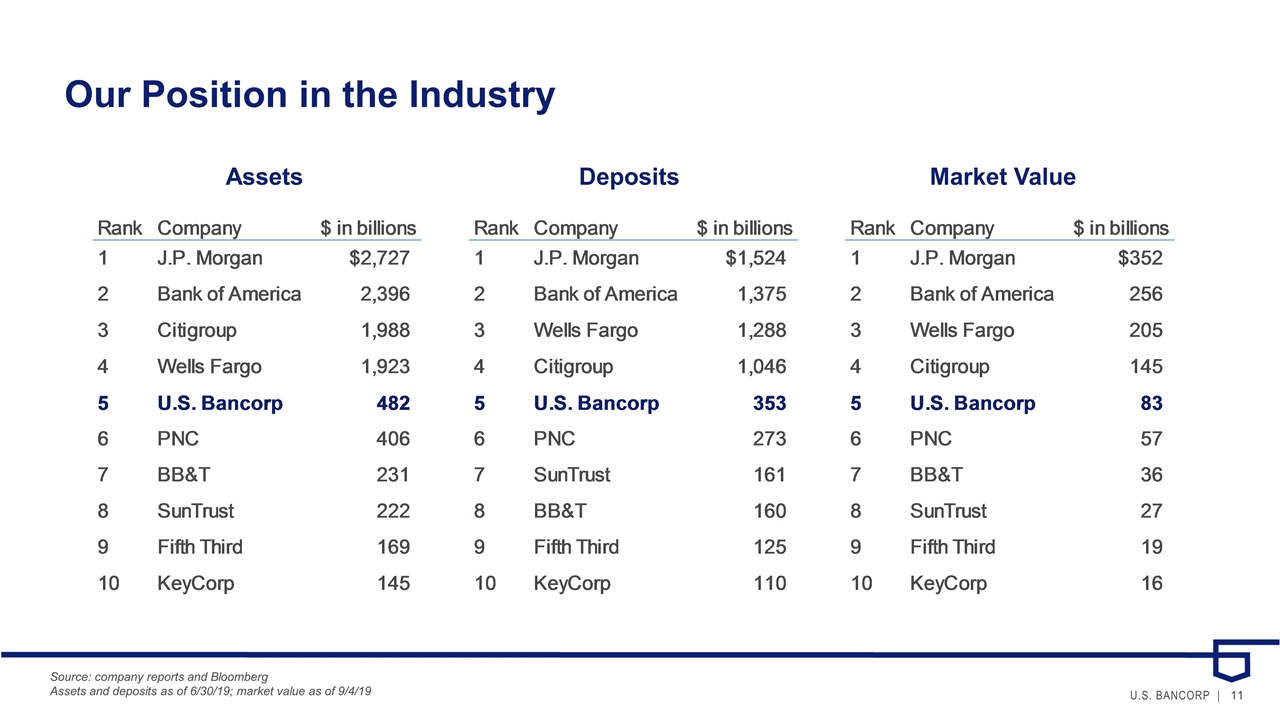

Our Position in the Industry Source: company reports and Bloomberg Assets and deposits as of 6/30/19; market value as of 9/4/19 Assets Deposits Market Value Assets Deposits Market Value U.S. U.S. U.S. Rank Company $ in billions Rank Company $ in billions Rank Company $ in billions 1 J.P. Morgan $2,727 1 J.P. Morgan $1,524 1 J.P. Morgan $352 2 Bank of America 2396 2 Bank of America 1375 2 Bank of America 256 3 Citigroup 1988 3 Wells Fargo 1288 3 Wells Fargo 205 4 Wells Fargo 1923 4 Citigroup 1046 4 Citigroup 145 5 U.S. Bancorp 482 5 U.S. Bancorp 353 5 U.S. Bancorp 83 6 PNC 406 6 PNC 273 6 PNC 57 7 BB&T 231 7 SunTrust 161 7 BB&T 36 8 SunTrust 222 8 BB&T 160 8 SunTrust 27 9 Fifth Third 169 9 Fifth Third 125 9 Fifth Third 19 10 KeyCorp 145 10 KeyCorp 110 10 KeyCorp 16 Assets and deposits as of 12/31/18 Market Value as of 10/22/18

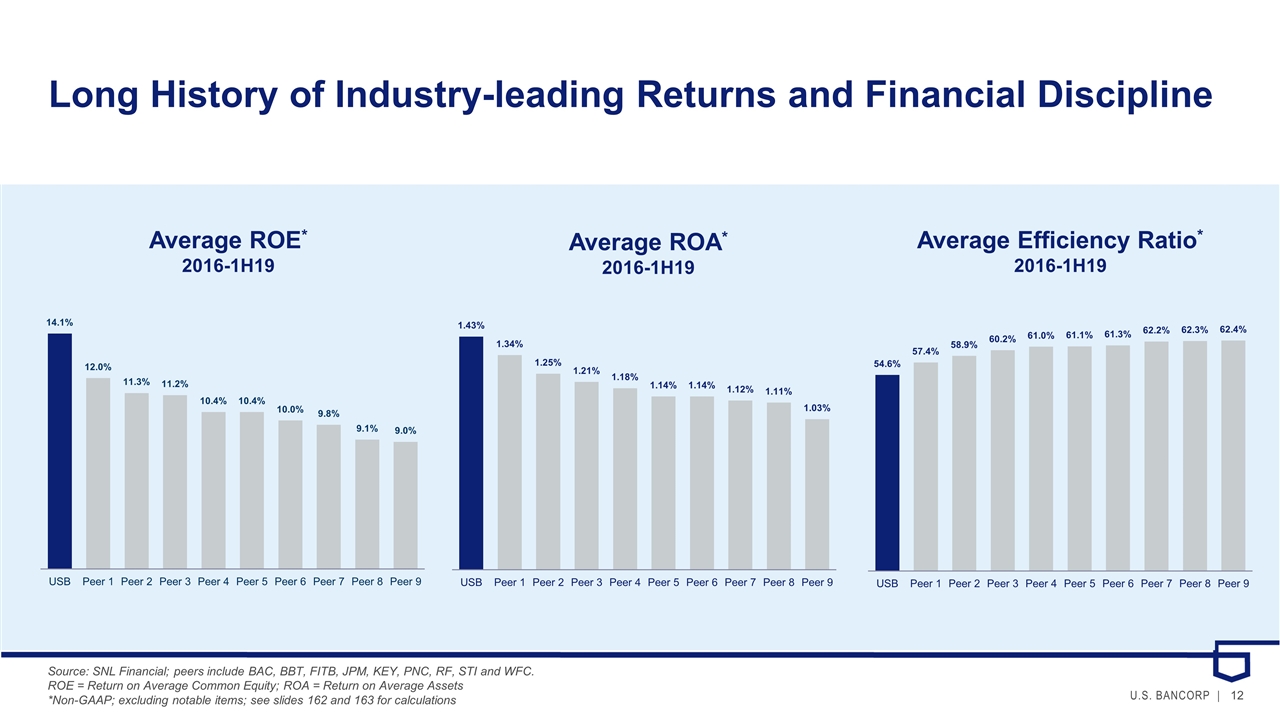

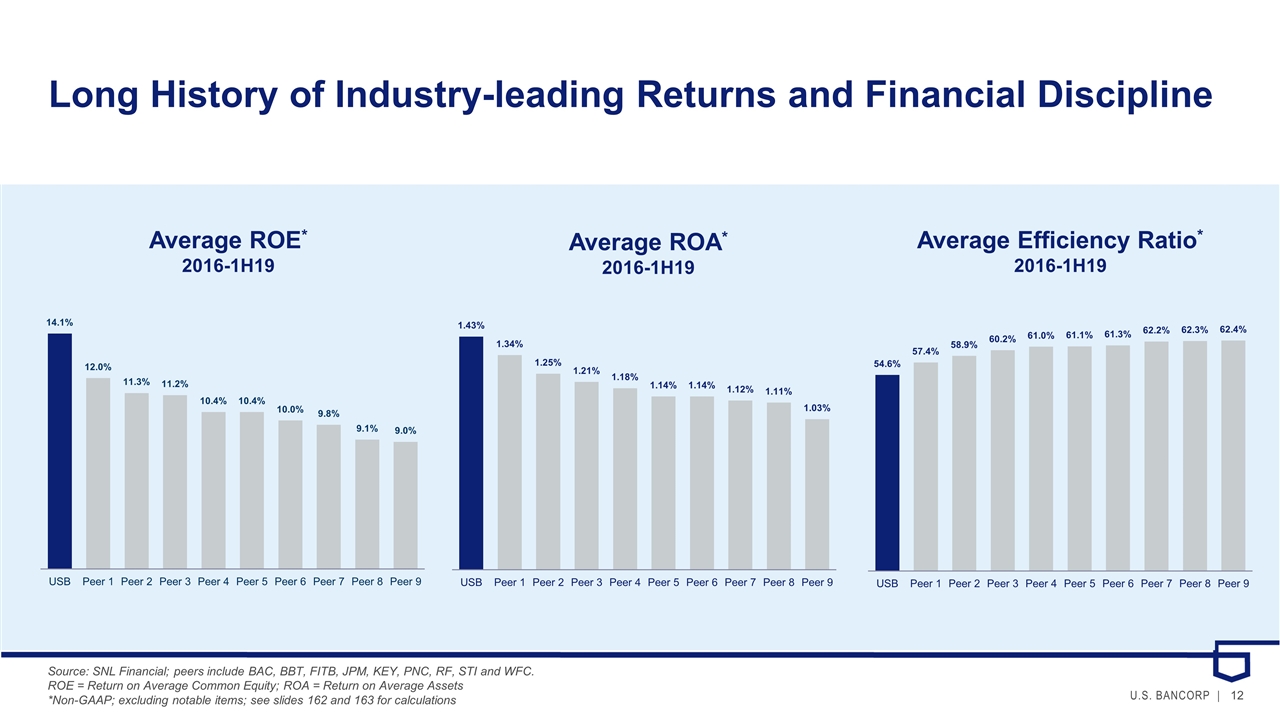

Long History of Industry-leading Returns and Financial Discipline Average ROE* 2016-1H19 Average ROA* 2016-1H19 Average Efficiency Ratio* 2016-1H19 Source: SNL Financial; peers include BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC. ROE = Return on Average Common Equity; ROA = Return on Average Assets *Non-GAAP; excluding notable items; see slides 162 and 163 for calculations

A strong reputation rooted in trust and engagement. Recognized inside and outside the bank for focus and action in areas that matter most. A clear strategy that we are executing effectively. Nimble yet clear so we can evolve in a rapidly changing environment. Best-in-class financial results and risk management. Track record of industry leading performance and the highest debt ratings in the world. A diverse mix of businesses and core financial products. Balance of customers and fee and non-fee based businesses. Our Advantages

We Need to Build on Our Past Success to Grow in the Future We will keep what made us great … … while enhancing how we do business Our business mix Our risk and financial discipline Our culture Becoming more agile Embedding innovation more broadly Driving digital experiences Customers and employees remain at the center of everything we do – past, present and future.

Investing For the Future

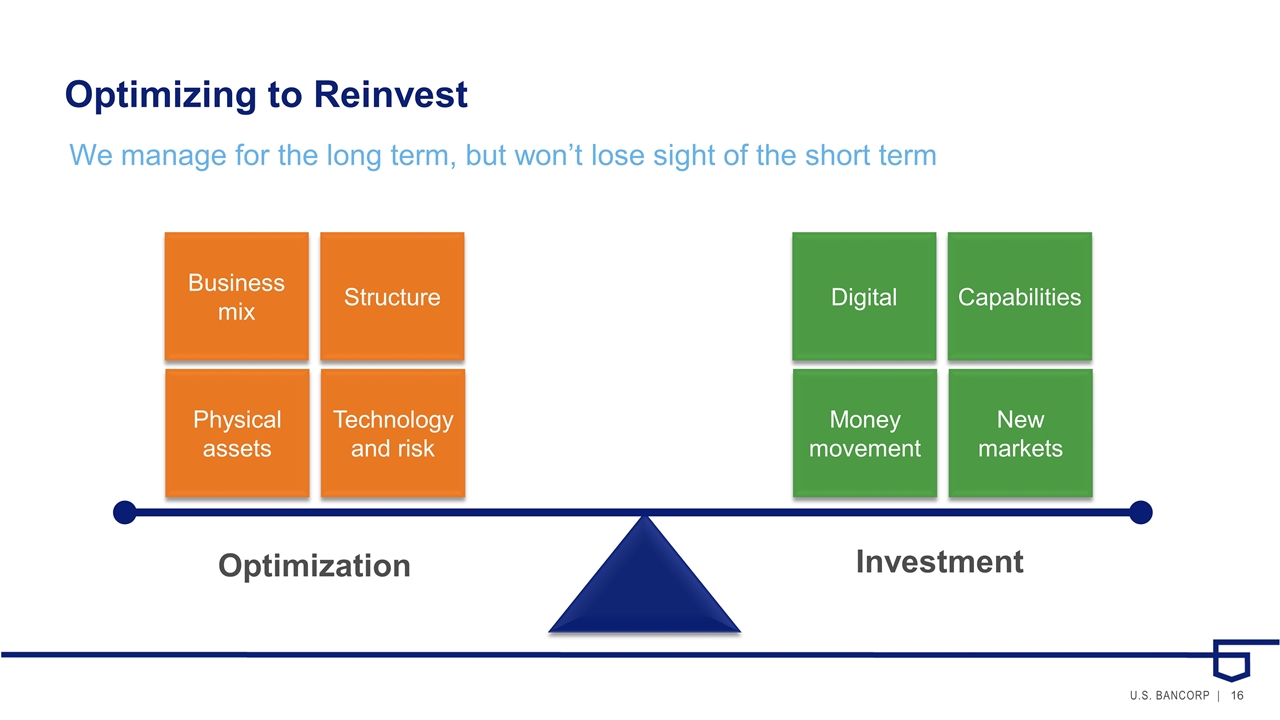

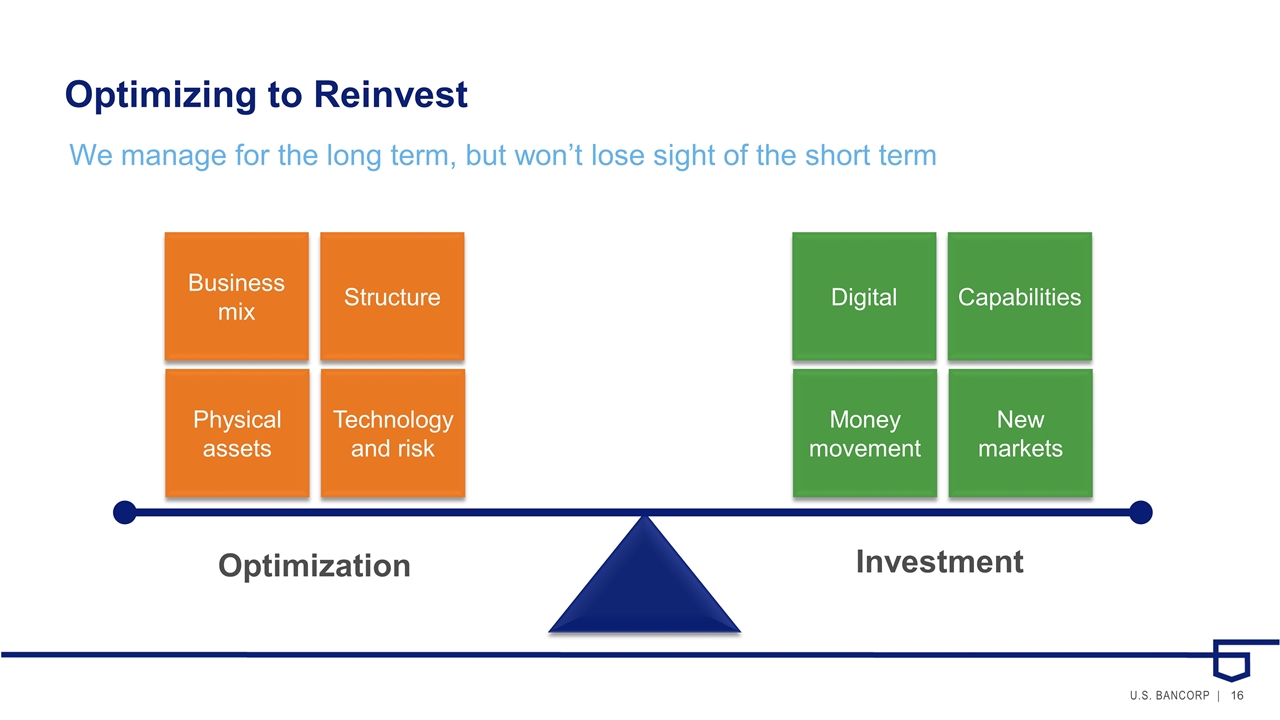

Optimizing to Reinvest We manage for the long term, but won’t lose sight of the short term Physical assets Technology and risk Business mix Structure Money movement New markets Digital Capabilities Optimization Investment

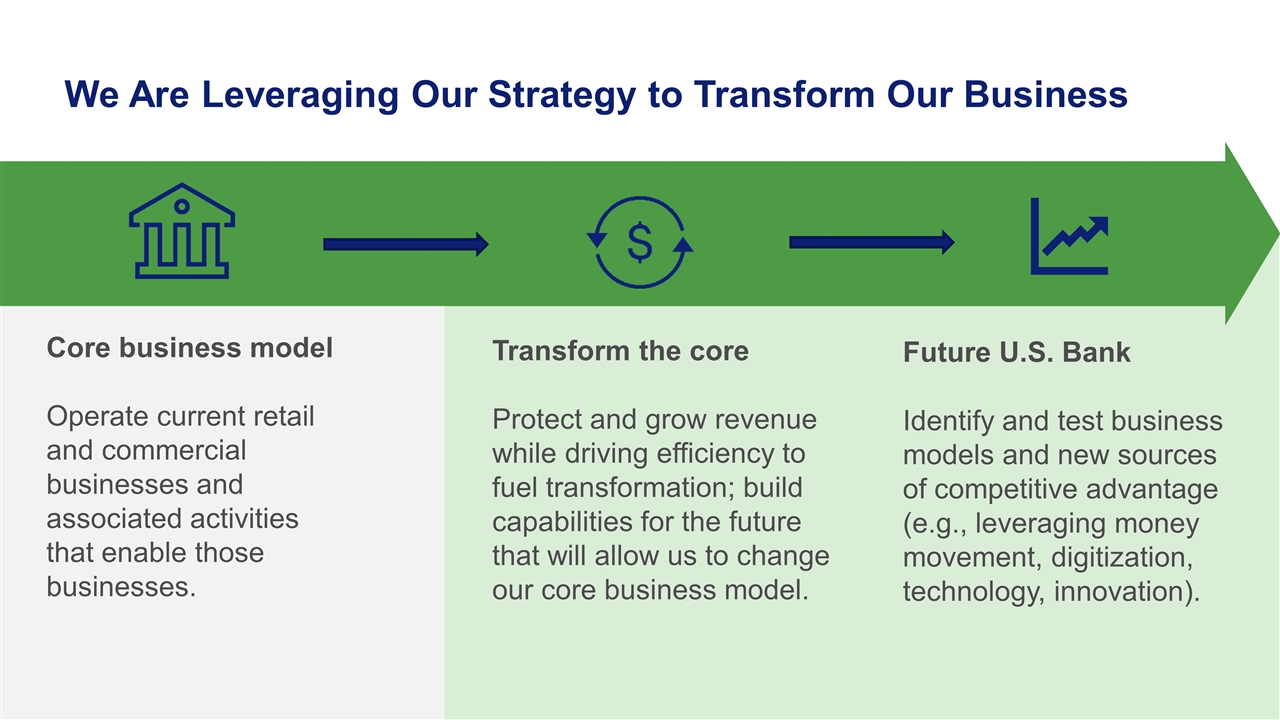

We Are Leveraging Our Strategy to Transform Our Business Core business model Operate current retail and commercial businesses and associated activities that enable those businesses. Transform the core Protect and grow revenue while driving efficiency to fuel transformation; build capabilities for the future that will allow us to change our core business model. Future U.S. Bank Identify and test business models and new sources of competitive advantage (e.g., leveraging money movement, digitization, technology, innovation).

We Are Enhancing Our Capabilities to Compete in a New World 3 2 1 Focusing relentlessly on the customer Capitalizing on digital investments to accelerate the future Leveraging data, analytics and insights 4 Facilitating the right partnerships to advance our efforts 5 Integrating solutions seamlessly across one U.S. Bank

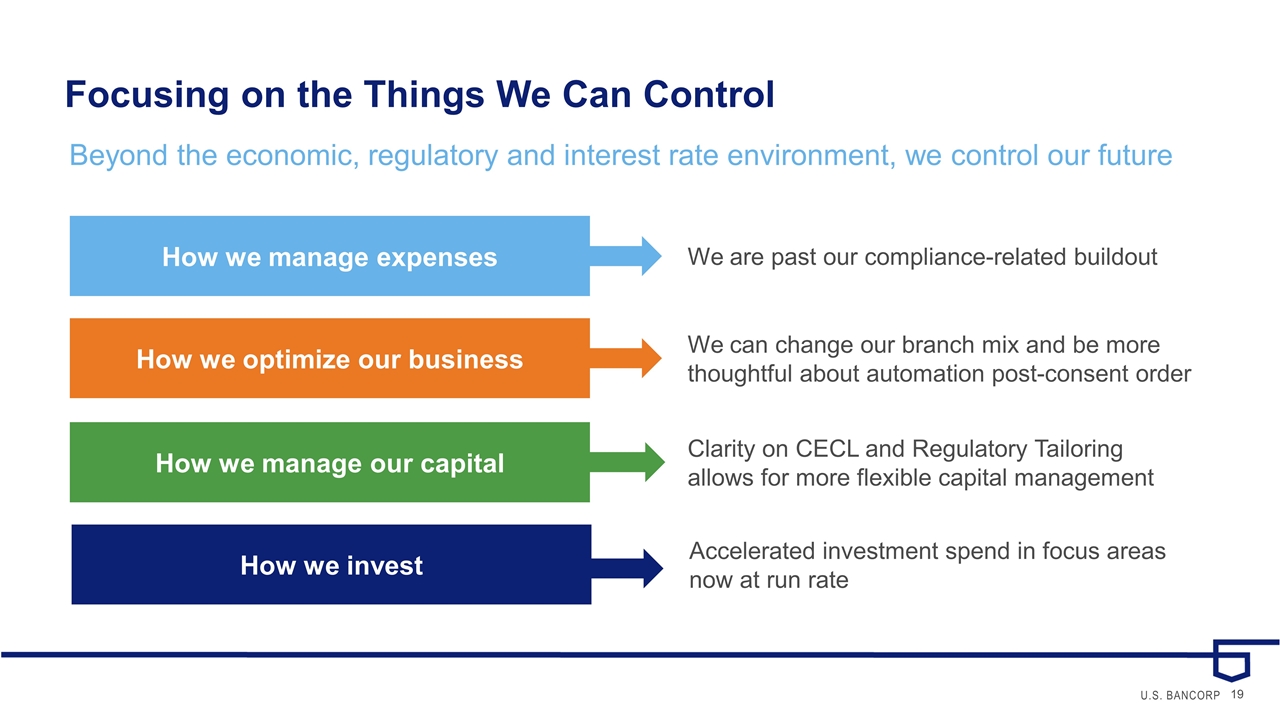

Focusing on the Things We Can Control Beyond the economic, regulatory and interest rate environment, we control our future How we invest Accelerated investment spend in focus areas now at run rate How we manage expenses We are past our compliance-related buildout How we optimize our business We can change our branch mix and be more thoughtful about automation post-consent order How we manage our capital Clarity on CECL and Regulatory Tailoring allows for more flexible capital management

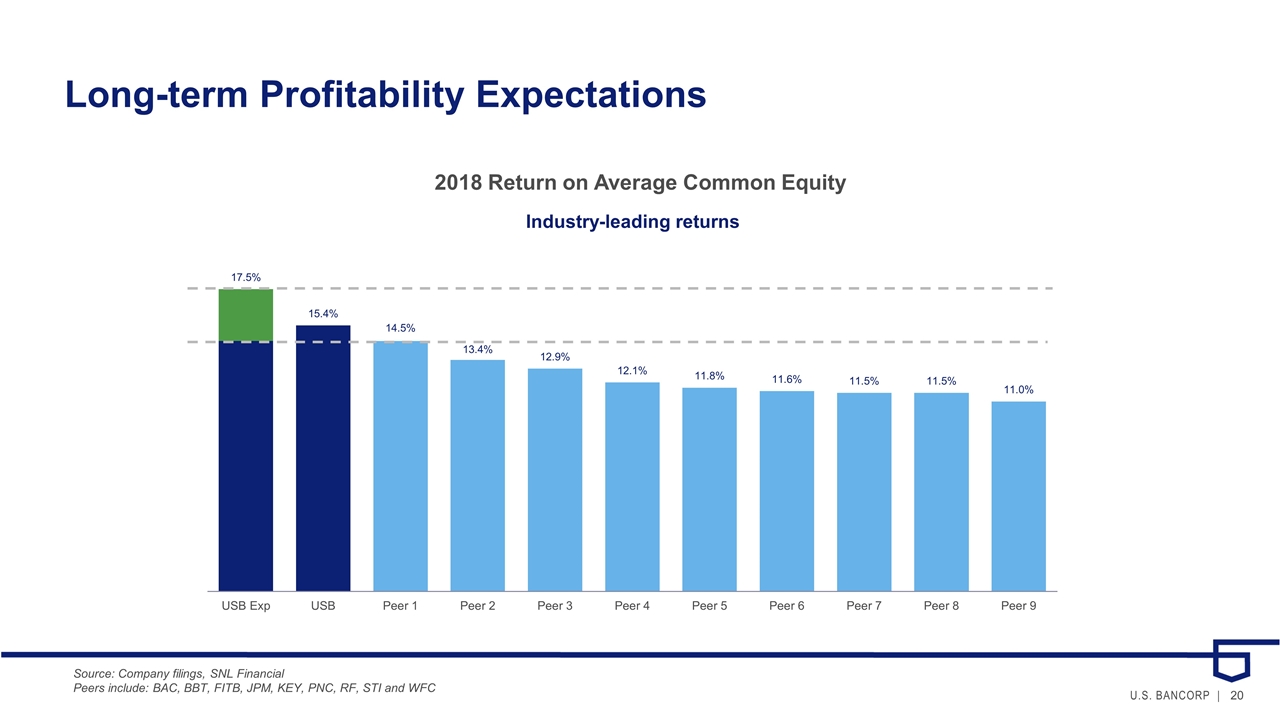

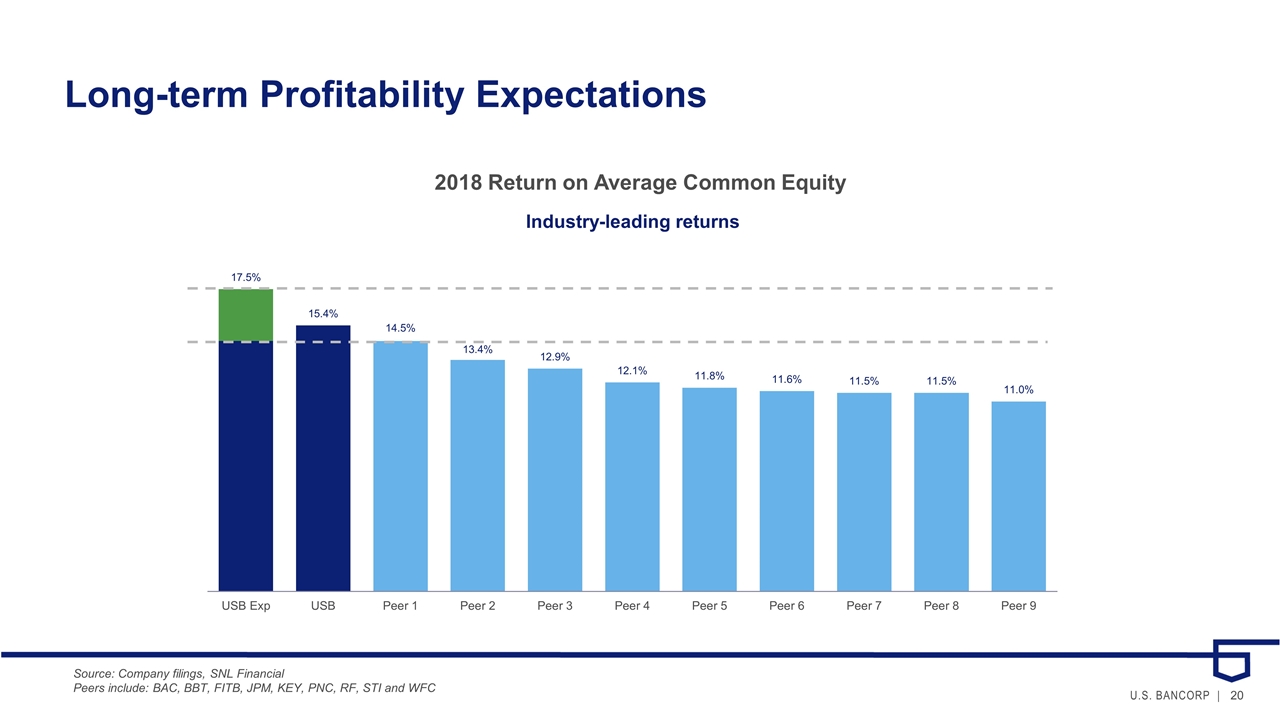

Long-term Profitability Expectations 13.5% 14.5% Source: Company filings, SNL Financial Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC

Positioned to Win Position of strength Building from success Investing for the future Our scale, reach, risk discipline, reputation and track record of execution are differentiators We choose our playing fields and operate with an agile mindset and willingness to try and fail – and try again We are taking a strategic approach to organic growth, partnerships, and M&A

What You Will Hear Today Enabling the future Brand and culture Growth through transformation Vision for digital Business line updates Size, scale Differentiation What’s next Leveraging risk and financial discipline Proven track record Our proactive and agile approach Investing in technology and innovation

U.S. Bancorp Investor Day Brand and Culture September 12, 2019 Kate Quinn Vice Chair, Chief Administrative Officer

We invest our hearts and minds to power human potential. Not buying what you do, but why

Brand and Culture: Source of Competitive Advantage BRAND CULTURE

Brand Directly Impacts Every Major Constituency We bring our story to life in relevant ways across each group Employees Customers Communities Shareholders Experience, purpose, rewards and engagement Ethics, experience, products and services, relationships Investment, partnerships, sponsorships Consistent results, best-in-class returns

Maturing Our Brand in the Face of a New Reality Stakeholders have heightened expectations for companies to address social issues of millennials believe that working for an environmentally and socially responsible company is important (Gallup) 92%

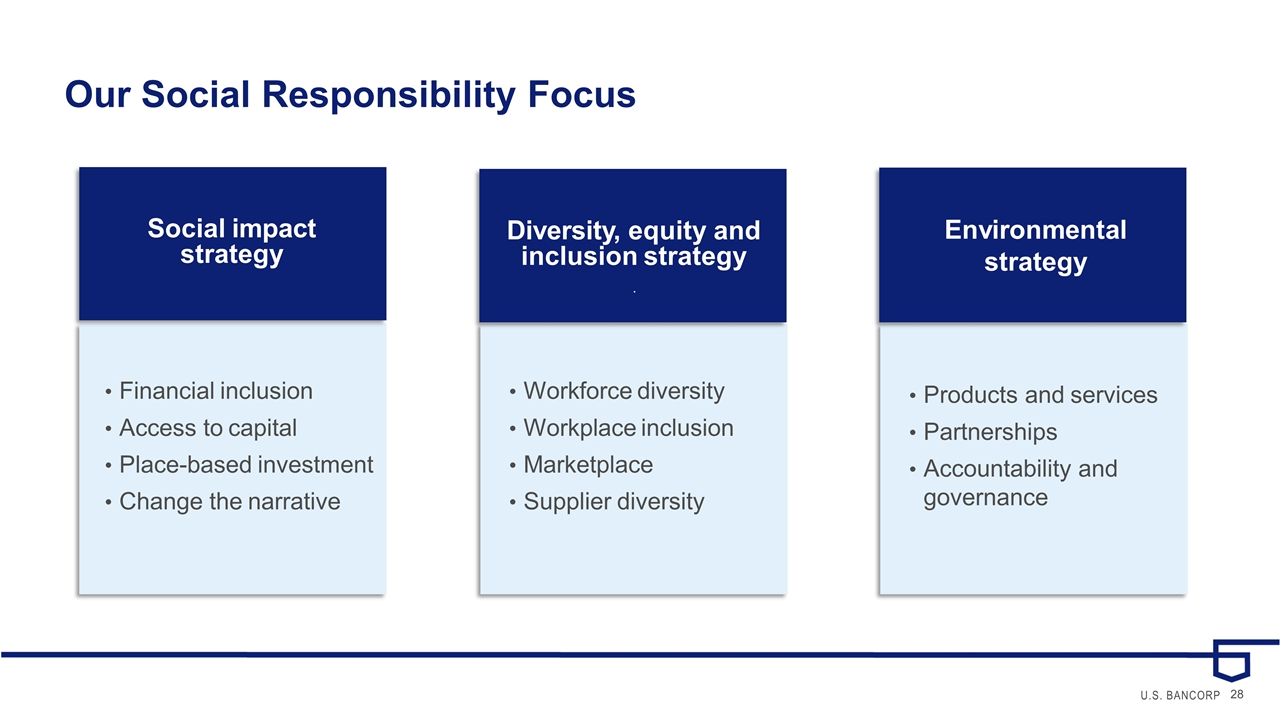

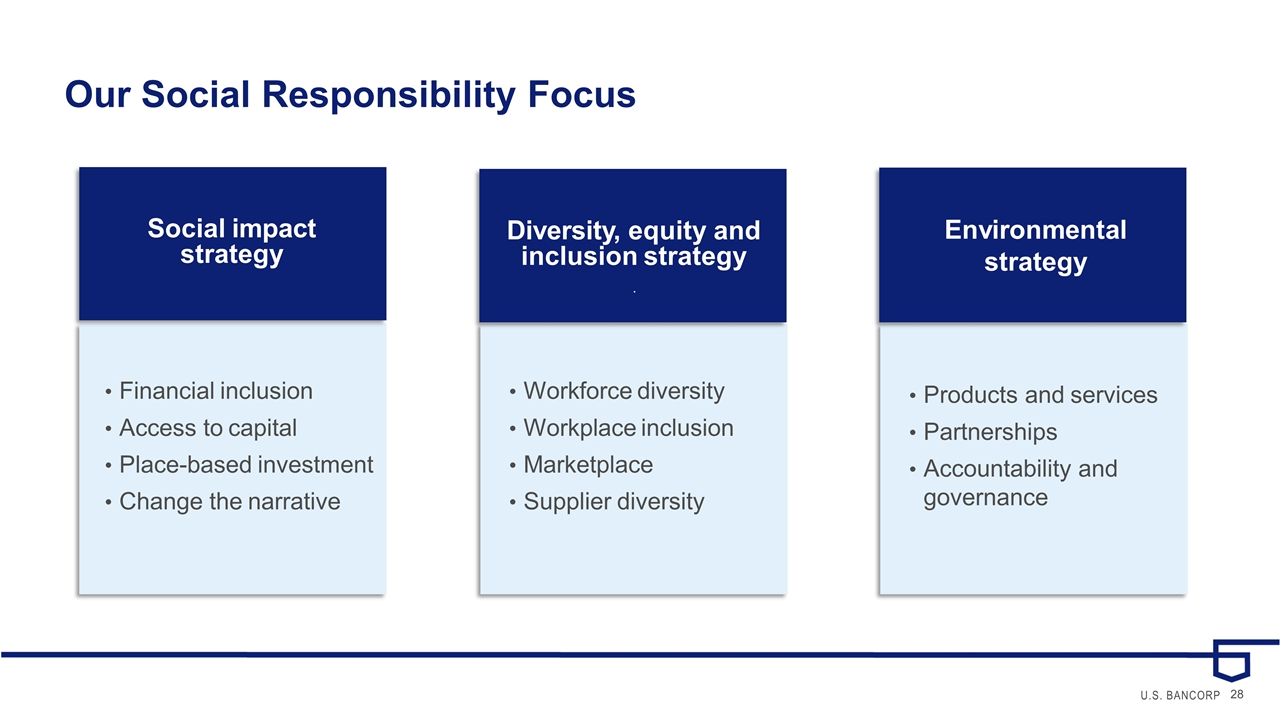

Our Social Responsibility Focus Social impact strategy Diversity, equity and inclusion strategy . Environmental strategy Financial inclusion Access to capital Place-based investment Change the narrative Workforce diversity Workplace inclusion Marketplace Supplier diversity Products and services Partnerships Accountability and governance

Early Wins From Our Brand Launch Increased awareness Strengthened Most Trusted Choice positioning Increased revenue vs. non-campaign markets Drove higher rates of new “central” customers Increased deposit share Deepened relationships with existing customers 55% Growth in brand value since 2016 (Brand Finance)

Strong Reputation, Especially Among Community Partners We maintain an “Excellent Reputation” score as defined by our community partners 91 71 72 61 70 58 48 65 61 46 Statistically Trailing Statistically Leading Source: Reputation Institute – Community Partner Reputation Study – March 2019

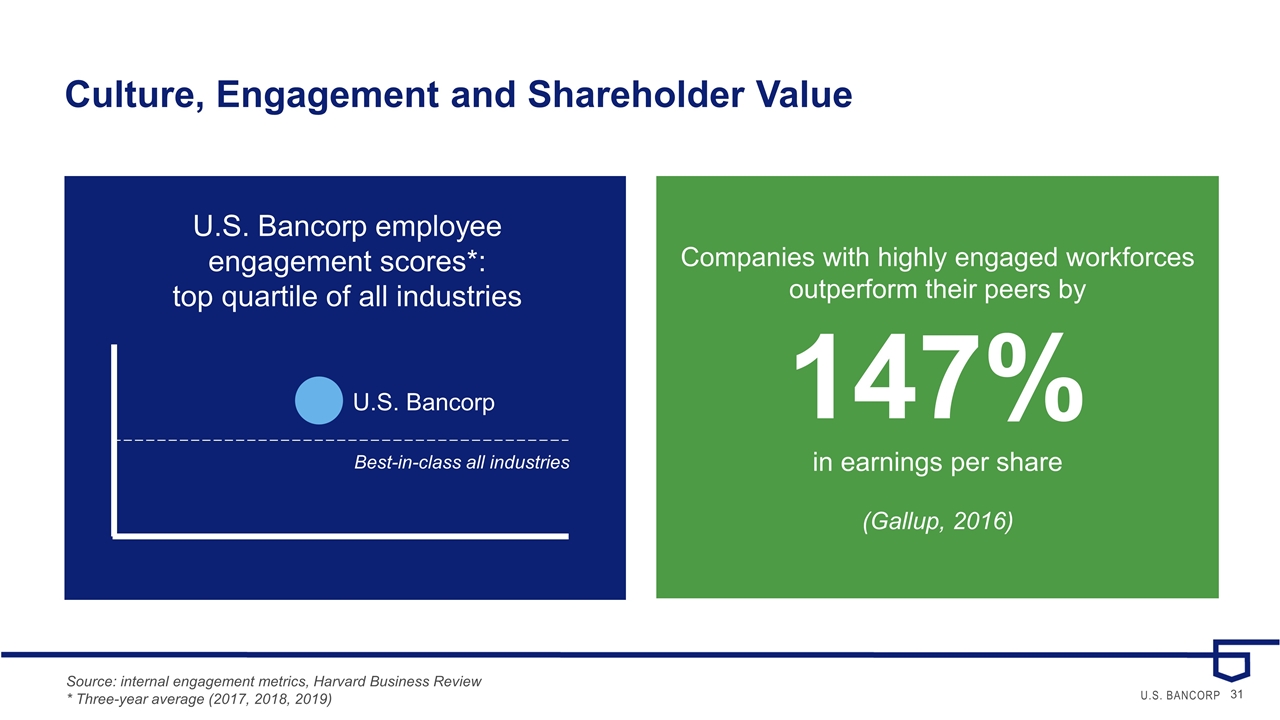

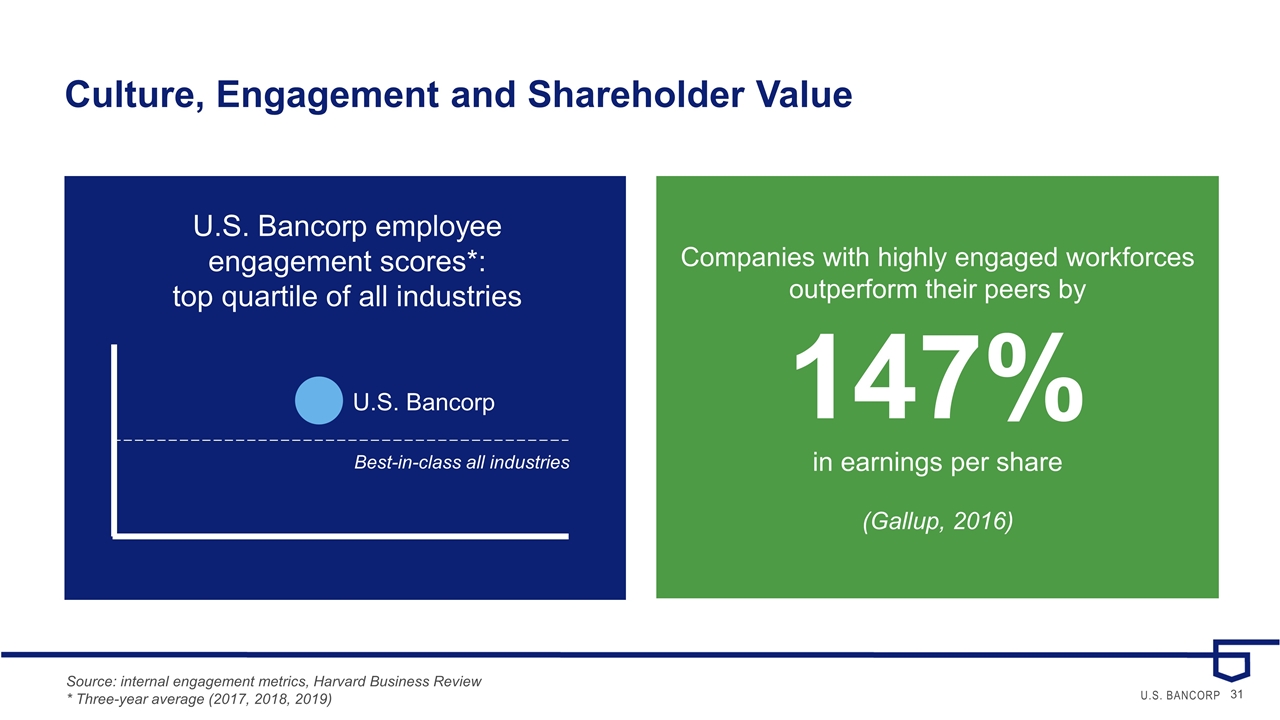

Culture, Engagement and Shareholder Value Companies with highly engaged workforces outperform their peers by 147% in earnings per share (Gallup, 2016) Source: internal engagement metrics, Harvard Business Review * Three-year average (2017, 2018, 2019) U.S. Bancorp employee engagement scores*: top quartile of all industries Best-in-class all industries U.S. Bancorp

Translating Our Brand to Growth We believe in branding from the inside out, investing in the employee experience to drive higher engagement, which leads to better customer experiences, greater customer satisfaction and stronger retention. This all contributes to deeper relationships, more referrals, new accounts and overall growth. Employee to customer value cycle Employee experience Employee engagement Customer experience Customer satisfaction Customer retention Growth

Our Goals for Employees and Customers Are Similar ATTRACT RETAIN DEVELOP EMPLOYEES CUSTOMERS Leveraging data and insights Creating compelling journeys Enhancing their digital experiences Establishing meaningful relationships

Trust and Reputation Are Foundational to All Constituencies Earning the right to be integral to their lives Staying relevant with our brand Prioritizing and building “trust” at moments that matter most Driving social impact through our community and Diversity, Equity and Inclusion focus to create economic opportunity

U.S. Bancorp Investor Day Technology Strategy September 12, 2019 Jeff von Gillern Vice Chair, Technology and Operations Services

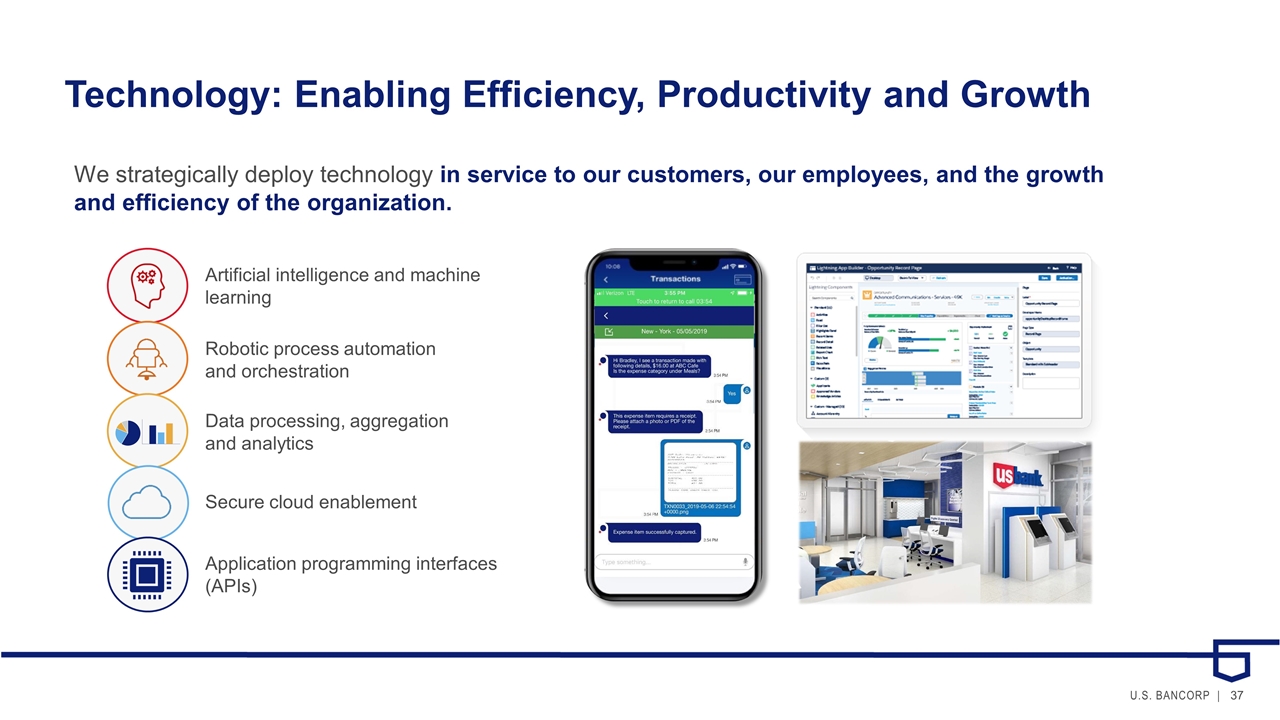

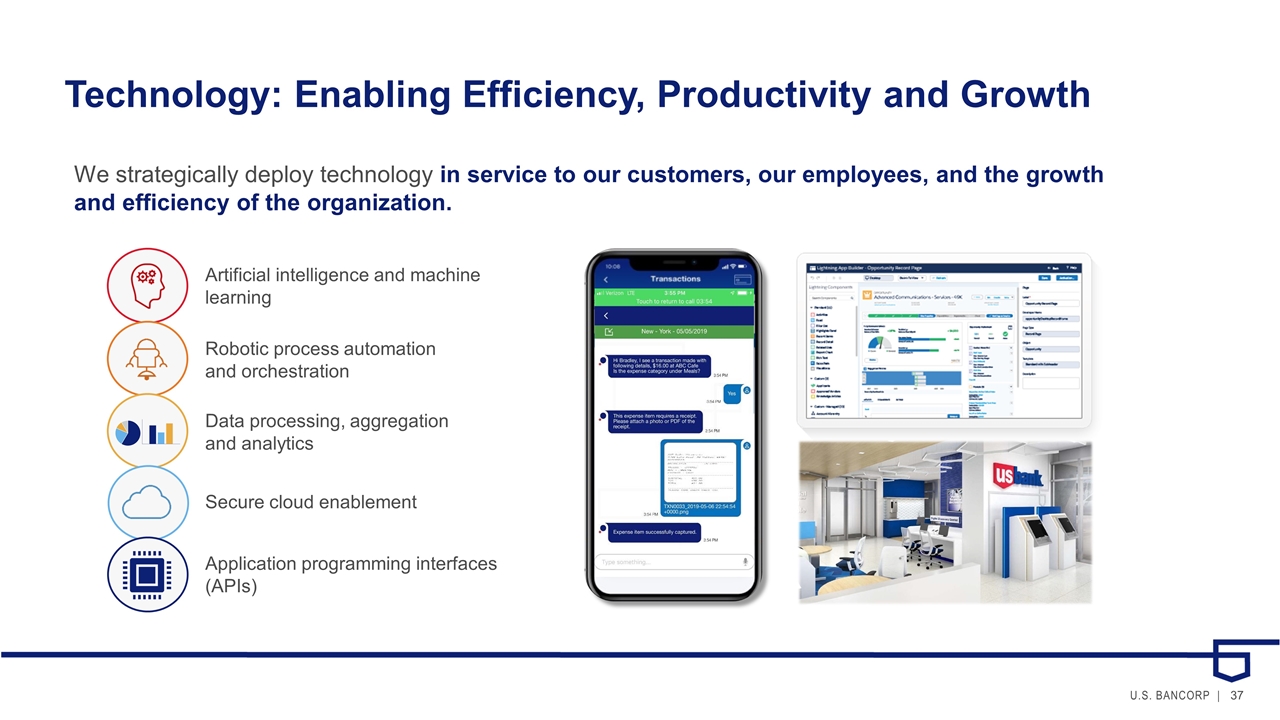

Technology: Enabling Efficiency, Productivity and Growth We strategically deploy technology in service to our customers, our employees, and the growth and efficiency of the organization. Artificial intelligence and machine learning Secure cloud enablement Robotic process automation and orchestration Application programming interfaces (APIs) Data processing, aggregation and analytics

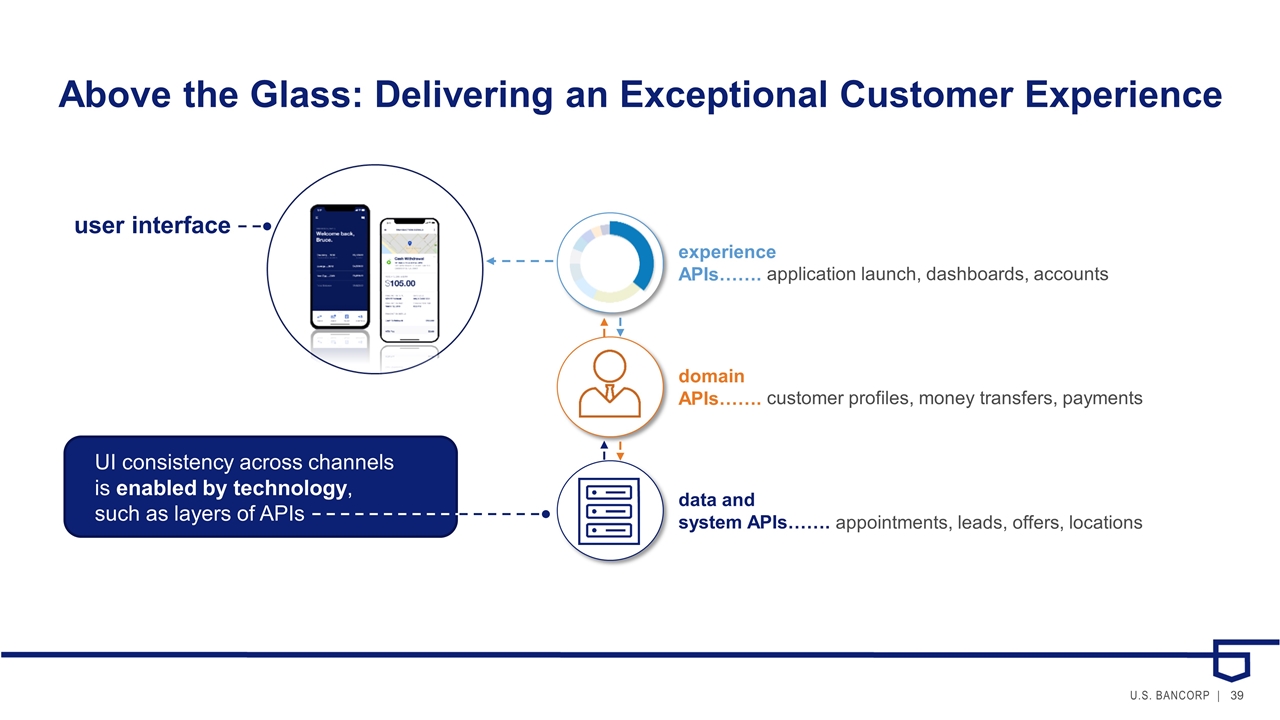

Technology at Work “Above and Below the Glass” Delivering simple-to-navigate, consistent user experiences along with information, insights and product offers that are timely and relevant Deploying resources in a highly effective and cost-efficient way for the benefit of the organization; Enabling rapid and flexible delivery of technology services, data and intelligence to ultimately be leveraged for the benefit of the customer Above the glass: seamless customer experiences Below the glass: core and enabling technology

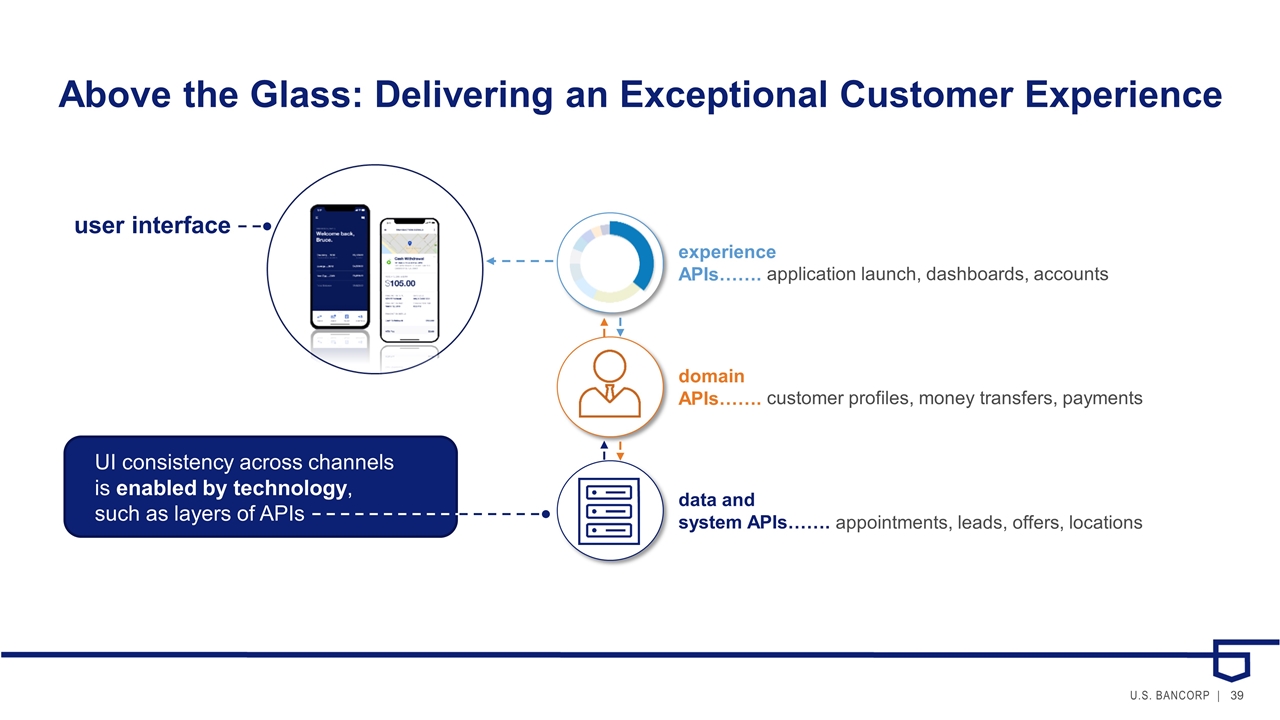

Above the Glass: Delivering an Exceptional Customer Experience appointments, leads, offers, locations data and system APIs……. customer profiles, money transfers, payments domain APIs……. application launch, dashboards, accounts experience APIs……. user interface UI consistency across channels is enabled by technology, such as layers of APIs

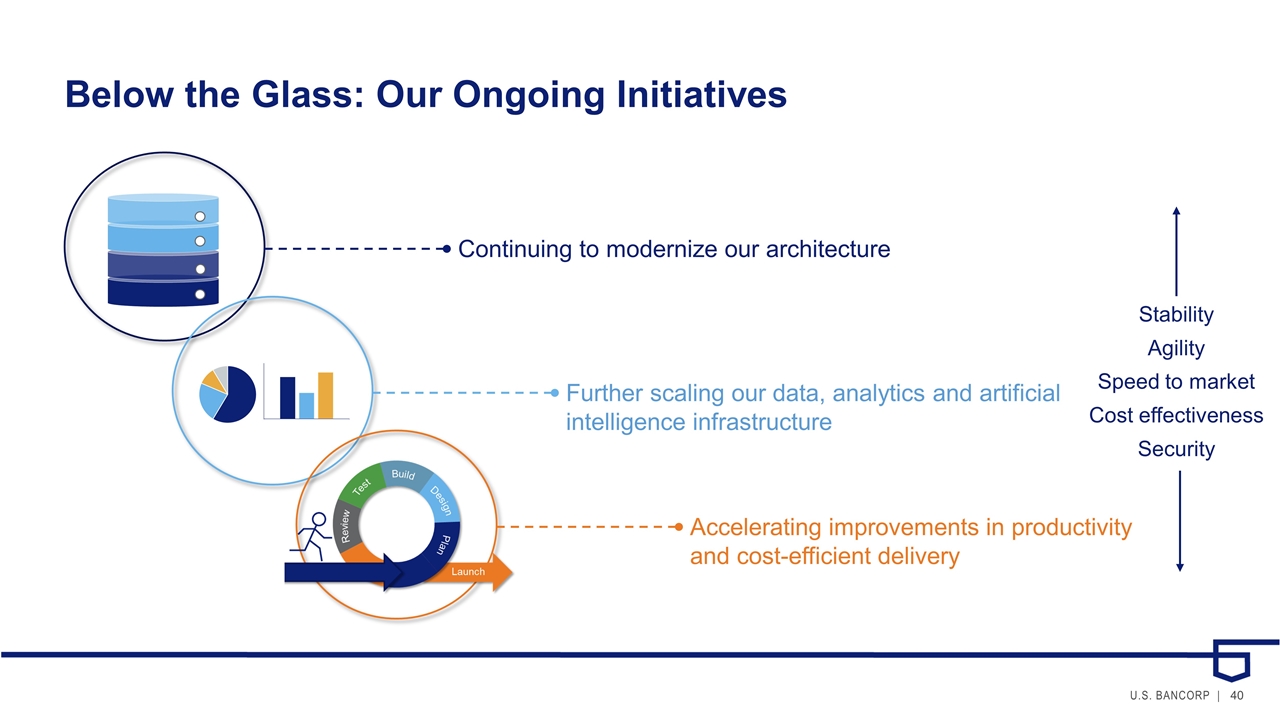

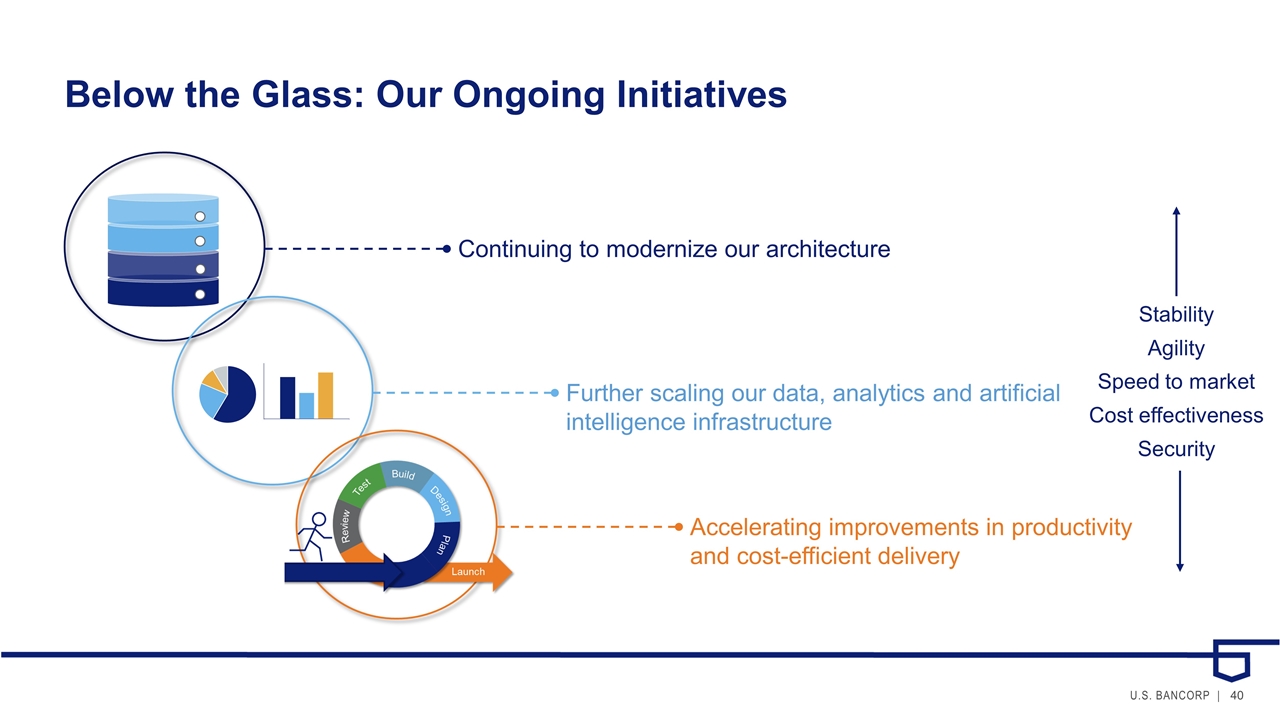

Below the Glass: Our Ongoing Initiatives Continuing to modernize our architecture Further scaling our data, analytics and artificial intelligence infrastructure Accelerating improvements in productivity and cost-efficient delivery Stability Agility Speed to market Cost effectiveness Security

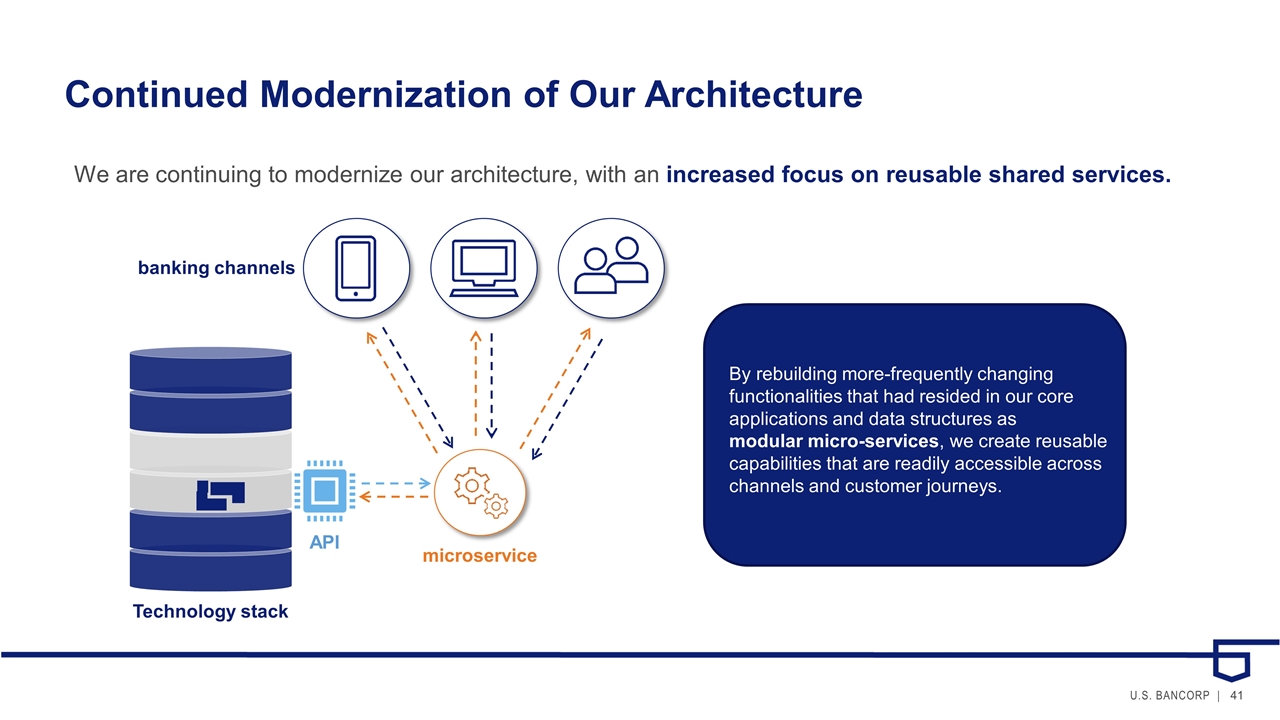

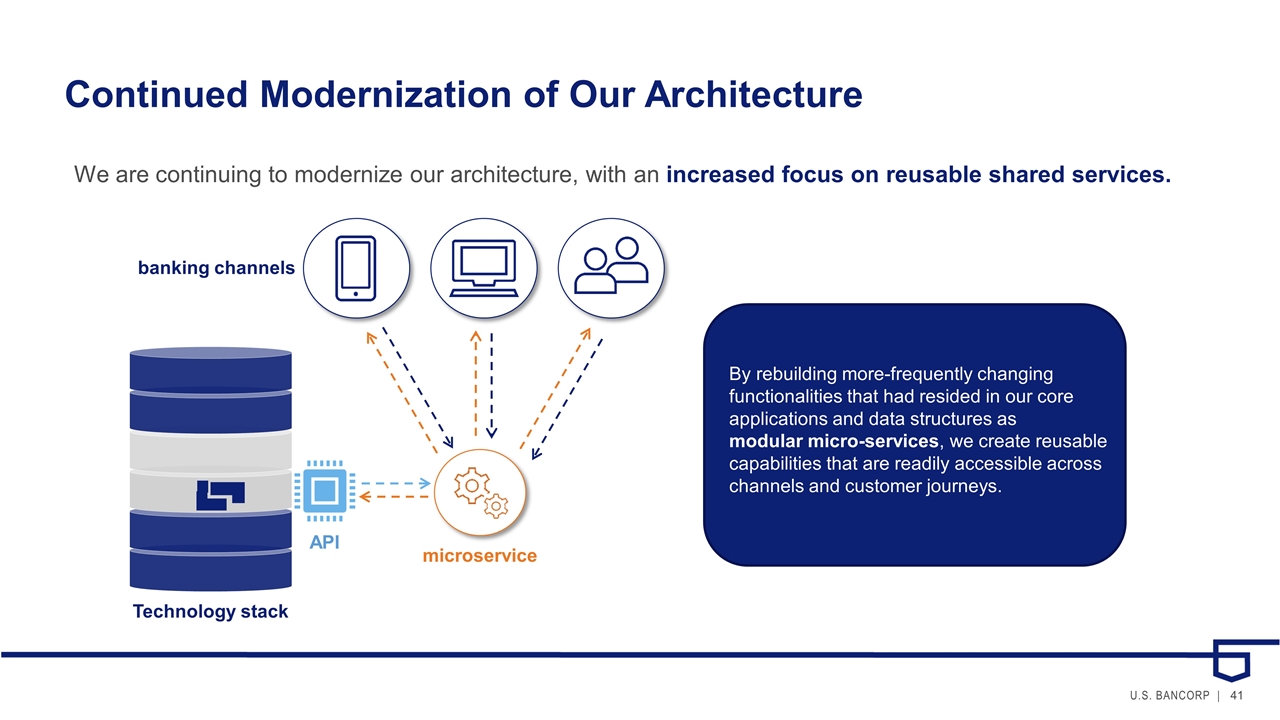

Continued Modernization of Our Architecture We are continuing to modernize our architecture, with an increased focus on reusable shared services. By rebuilding more-frequently changing functionalities that had resided in our core applications and data structures as modular micro-services, we create reusable capabilities that are readily accessible across channels and customer journeys. API microservice Technology stack banking channels

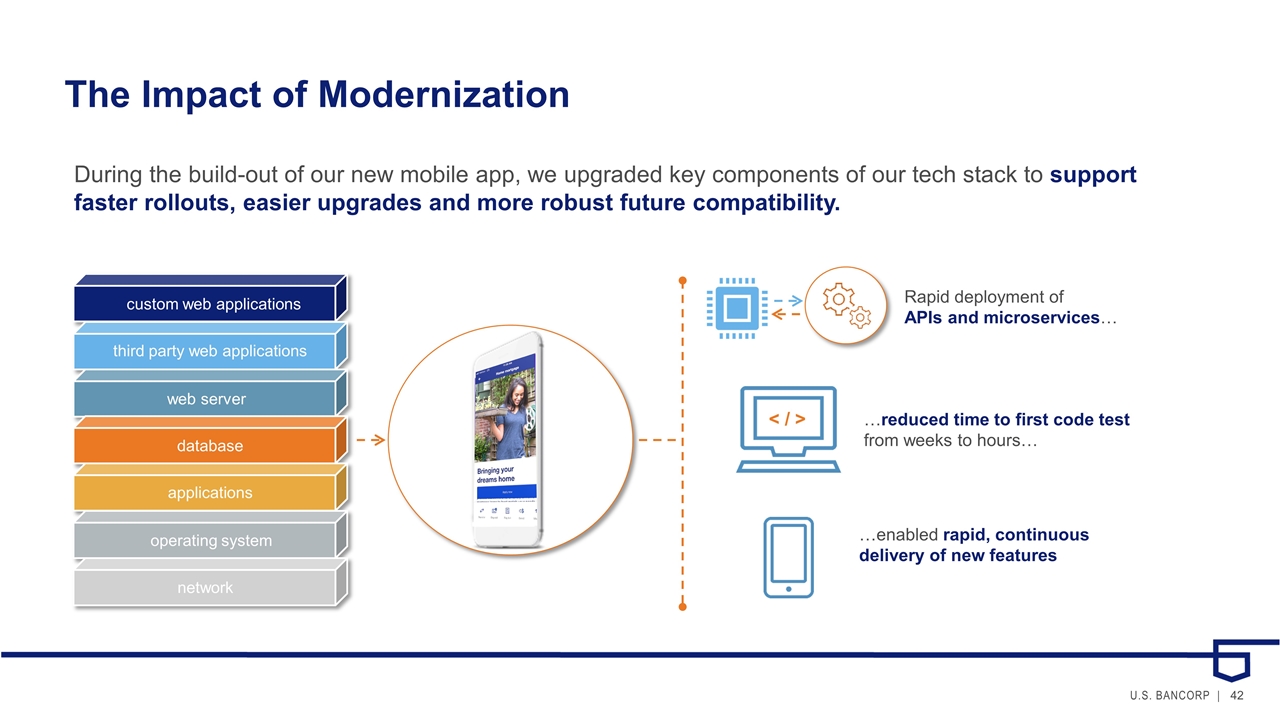

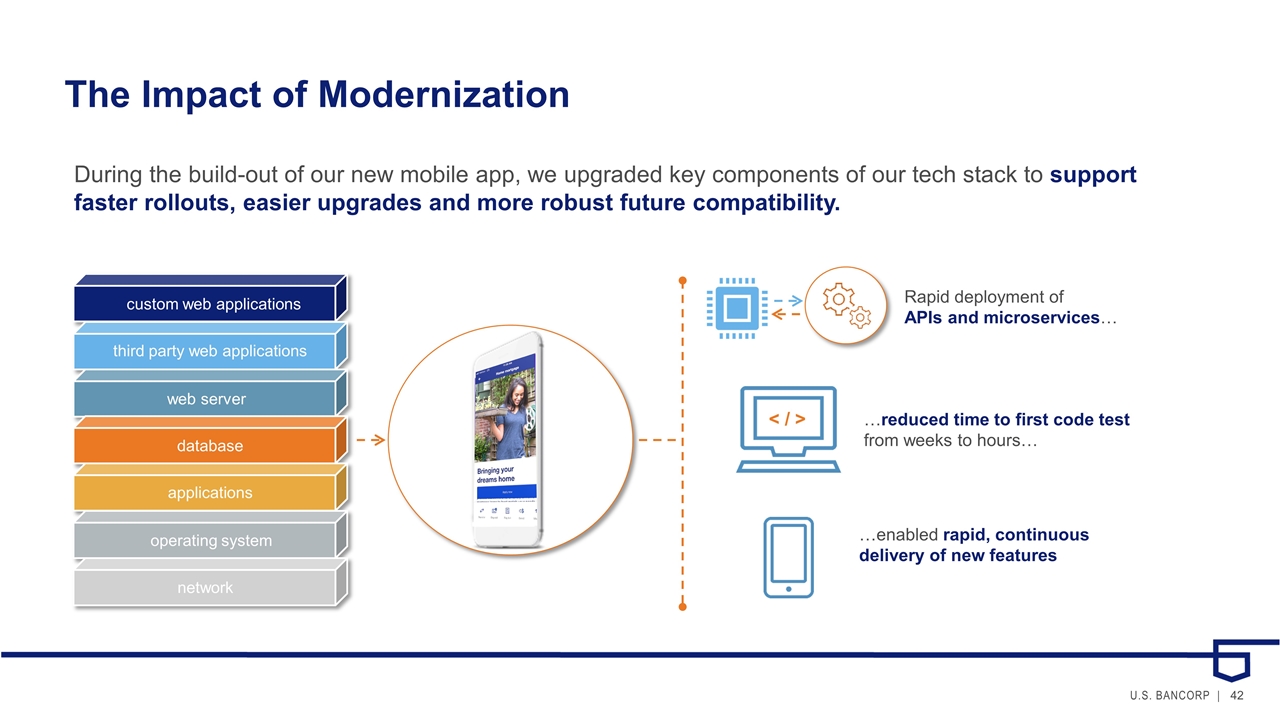

The Impact of Modernization custom web applications third party web applications web server database applications operating system network During the build-out of our new mobile app, we upgraded key components of our tech stack to support faster rollouts, easier upgrades and more robust future compatibility. < / > Rapid deployment of APIs and microservices… …reduced time to first code test from weeks to hours… …enabled rapid, continuous delivery of new features

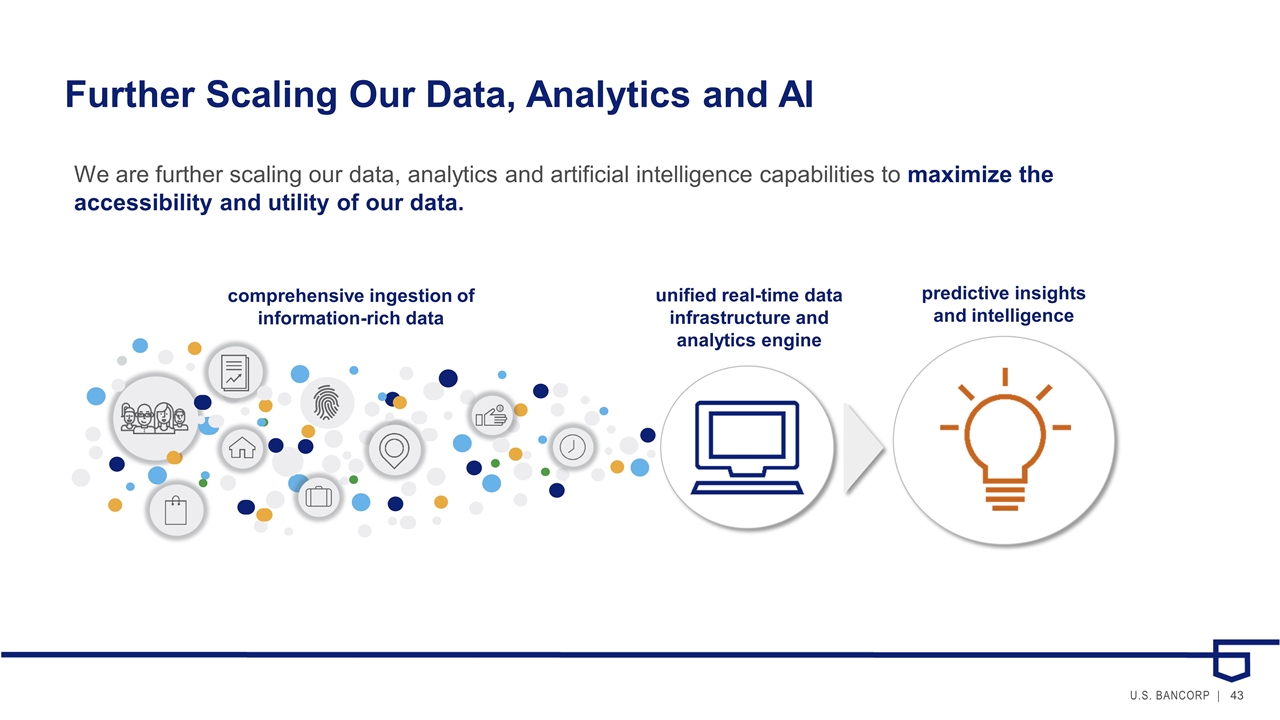

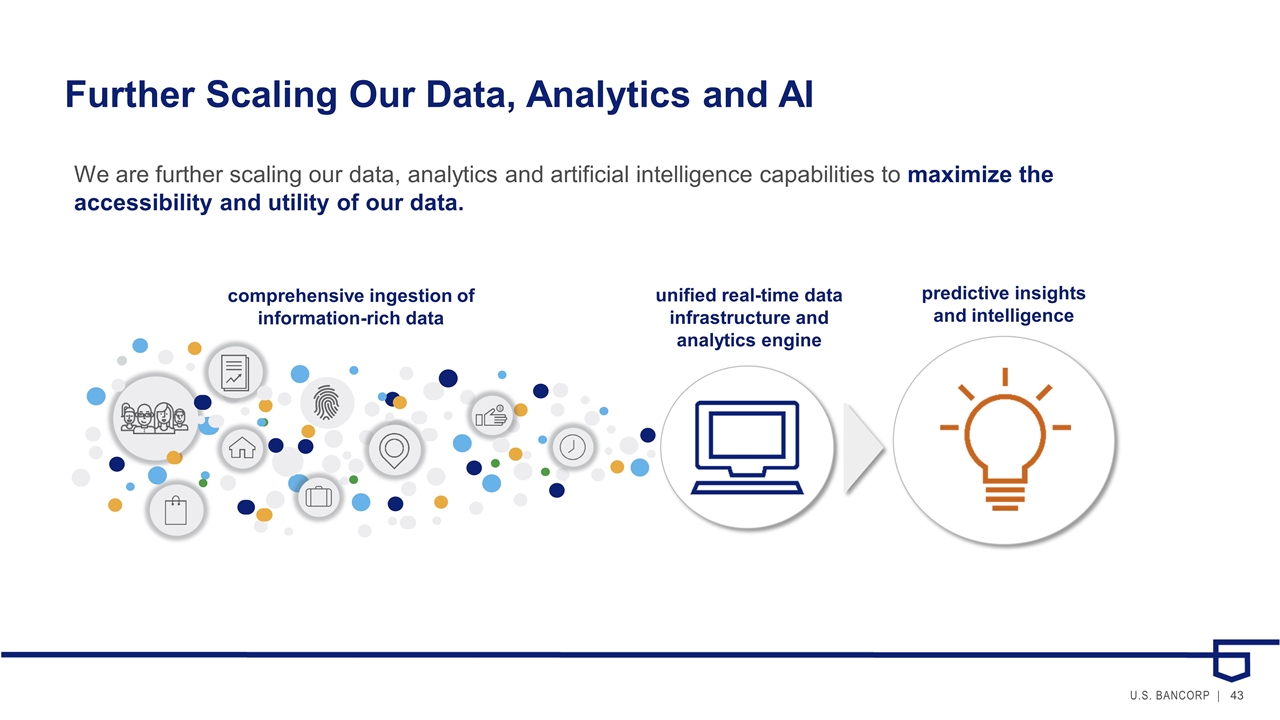

Further Scaling Our Data, Analytics and AI We are further scaling our data, analytics and artificial intelligence capabilities to maximize the accessibility and utility of our data. unified real-time data infrastructure and analytics engine predictive insights and intelligence comprehensive ingestion of information-rich data

The Impact of Robust Data, Analytics and AI We see you’ve been traveling lately. A travel rewards credit card could earn you more rewards. Your checking account balance is getting low. We can help you avoid an overdraft. Here are some tips to help you maximize your retirement savings. Responsibly leveraging data across all products and at every touchpoint allows us to build more personalized and high value relationships with our customers. Your monthly Social Security deposit will happen in two days. There is a transaction in your account that might be a duplicate. Can we help with that? Would you like to try a simpler authentication method?

Accelerating Productivity and Cost-efficient Delivery We are accelerating advancements in productivity and cost-efficient delivery via process enhancements, workforce and tools, such as the Cloud. Accelerating the pace of product and experience delivery with Agile development practices and DevOps tools Working in Experience Studios with business, technology and risk partners collaborating Using advanced development capabilities to build, deploy and automate testing of applications in the Cloud

The Role of the Cloud Why Cloud? Speed to market Development productivity Cost optimization Our approach: Build new applications in the Cloud wherever possible; deliberately migrate existing apps Leverage the public Cloud’s extensive tool set, scalable infrastructure and operating cost benefits Focus on comprehensive governance and controls to ensure security and safety

Cybersecurity We continue to innovate in the cybersecurity space, leveraging our investments in intelligence-driven, machine-speed information security techniques to securely enable our digital-first strategy. Use of deep machine learning, analytics and AI to identify event anomalies (e.g. insider threats) Enables near real-time automation and orchestration 5 billion data-level events processed daily Integrated approach with on-premise and Cloud security and compliance

The Impact of Changing the Way We Work Customer Obsession & Business Partnership Flexibility & Speed Quality & Resilience Scalability & Efficiency Increasing the pace of innovation and accelerating our response to changing customer expectations Anticipating new and emerging customer needs Improving cost efficiency using smaller teams of highly skilled engineers while optimizing expenses Remaining a bedrock of technology safety, soundness and customer confidence

U.S. Bancorp Investor Day Growth Through Transformation September 12, 2019 Derek White Chief Digital Officer

Positioning Ourselves For The Future We have aligned key functions, promoting a holistic approach to investing in and executing on our digital-first strategy. chief digital officer innovation…. agile…. omnichannel….

Building Customer Relationships in a Digital-First World In order to attract, retain, better serve and drive centrality with our customers, we must: be digital-first deliver exceptional experiences be nimble, adapting and evolving quickly

Interactions Are the New “Eyeballs” Interactions are coveted as a means to reach current and potential customers and influence behaviors Interactions are a leading indicator and an important measure of future success Traffic is moving rapidly to digital channels, and digital interactions now occur at a rate of ~30x physical means of interaction: brick glass air

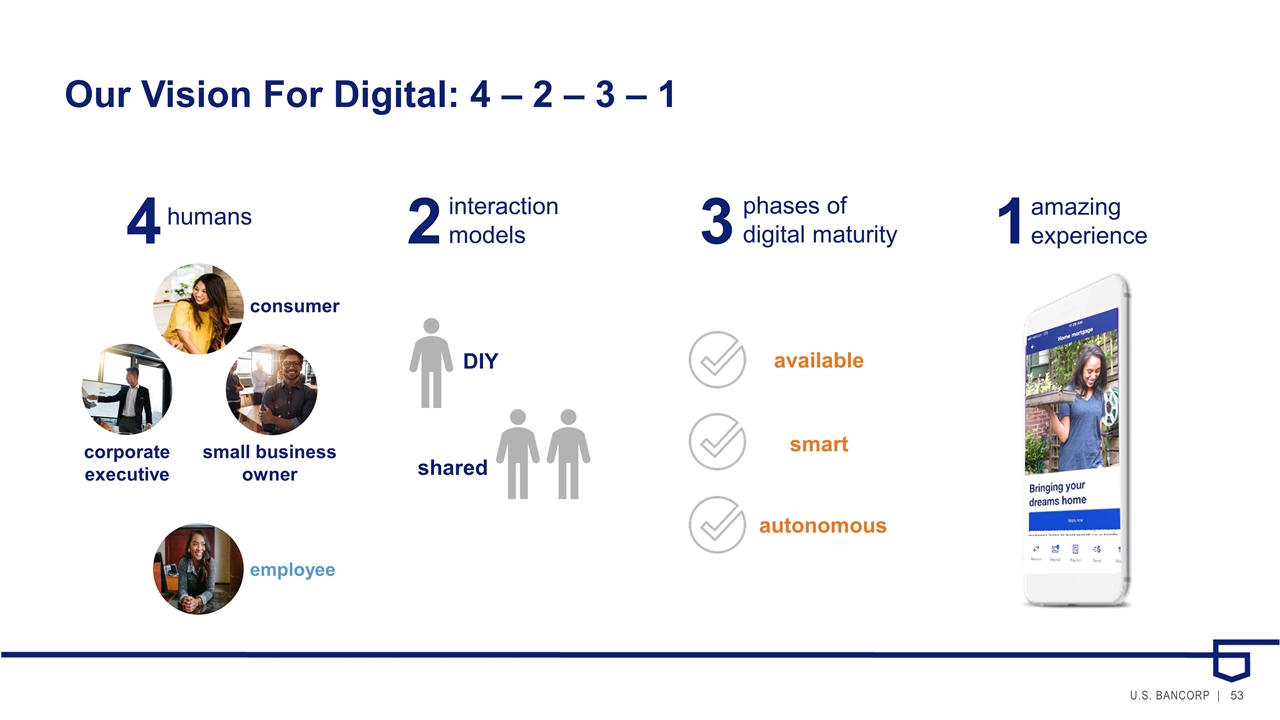

Vision for Digital: 4-2-3-1 4 Humans DIY shared Our Vision For Digital: 4 – 2 – 3 – 1 3 4 humans 2 interaction models phases of digital maturity 1 amazing experience available smart autonomous consumer corporate executive small business owner employee

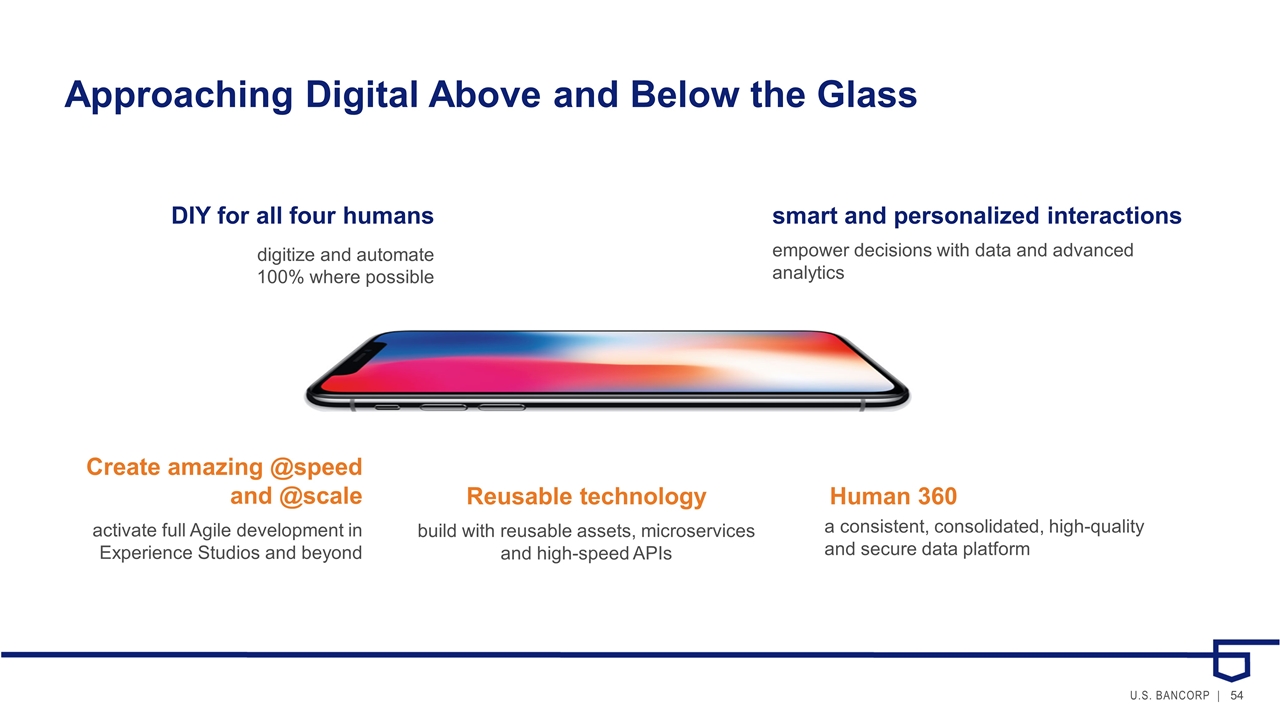

Approaching Digital Above and Below the Glass Create amazing @speed and @scale activate full Agile development in Experience Studios and beyond DIY for all four humans digitize and automate 100% where possible Reusable technology build with reusable assets, microservices and high-speed APIs smart and personalized interactions empower decisions with data and advanced analytics Human 360 a consistent, consolidated, high-quality and secure data platform

Embracing New and Better Ways of Working We’re implementing Agile product development throughout the organization to deliver better products, faster. Collaborating across studios to rapidly design, test and deliver solutions 18 months in, we are rapidly scaling our Agile practice and accelerating the pace of implementation Accelerating our creation rhythm to months vs. years to translate ideas to execution Over 6,000 agile creators across the company, in every function and business line Risk is embedded in every studio

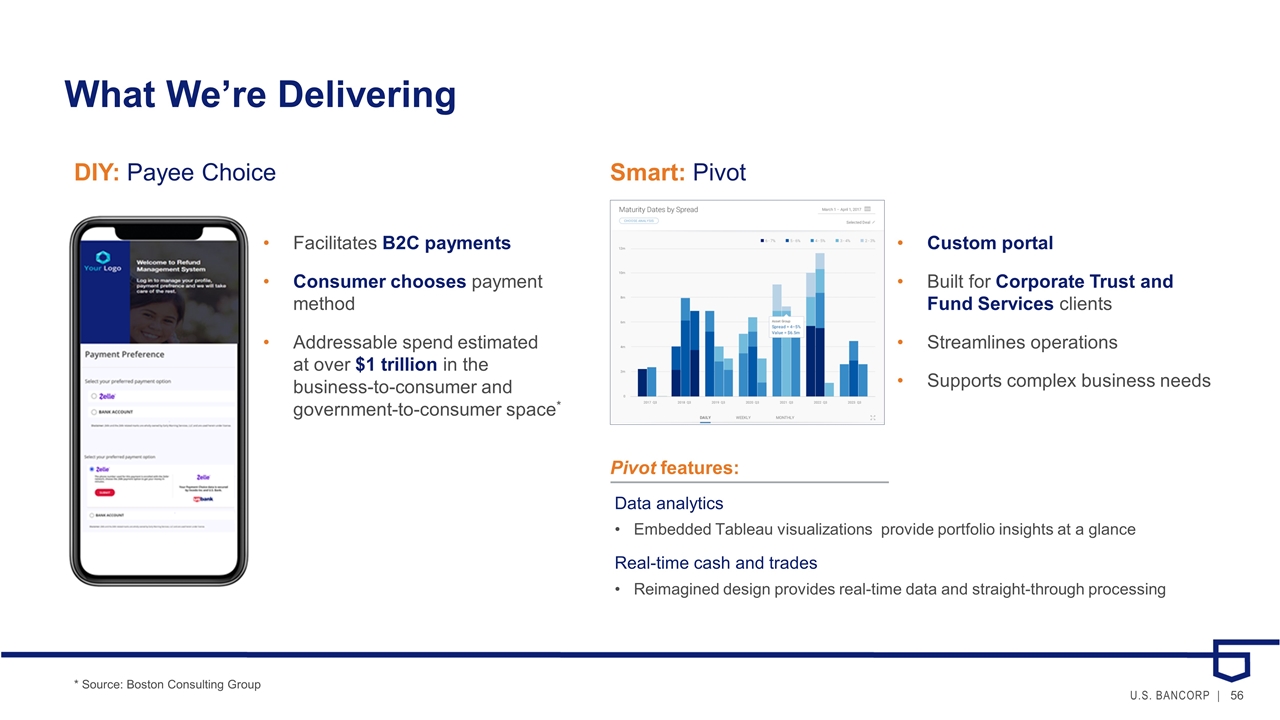

What We’re Delivering DIY: Payee Choice Facilitates B2C payments Consumer chooses payment method Addressable spend estimated at over $1 trillion in the business-to-consumer and government-to-consumer space* Smart: Pivot Custom portal Built for Corporate Trust and Fund Services clients Streamlines operations Supports complex business needs Data analytics Embedded Tableau visualizations provide portfolio insights at a glance Real-time cash and trades Reimagined design provides real-time data and straight-through processing Pivot features: * Source: Boston Consulting Group

In Summary… Our digital initiatives span across the organization, are both customer- and employee-facing, and address digital above and below the glass We’re moving @speed and @scale to become an Agile organization We’re realizing benefits in both revenue growth and expense control Digital is “table stakes” for some applications, but opportunities remain plentiful to delight customers with smart and autonomous capabilities This is a long game, and we’re in it for the long-term

U.S. Bancorp Investor Day Wealth Management and Investment Services September 12, 2019 Gunjan Kedia Vice Chair, Wealth Management and Investment Services

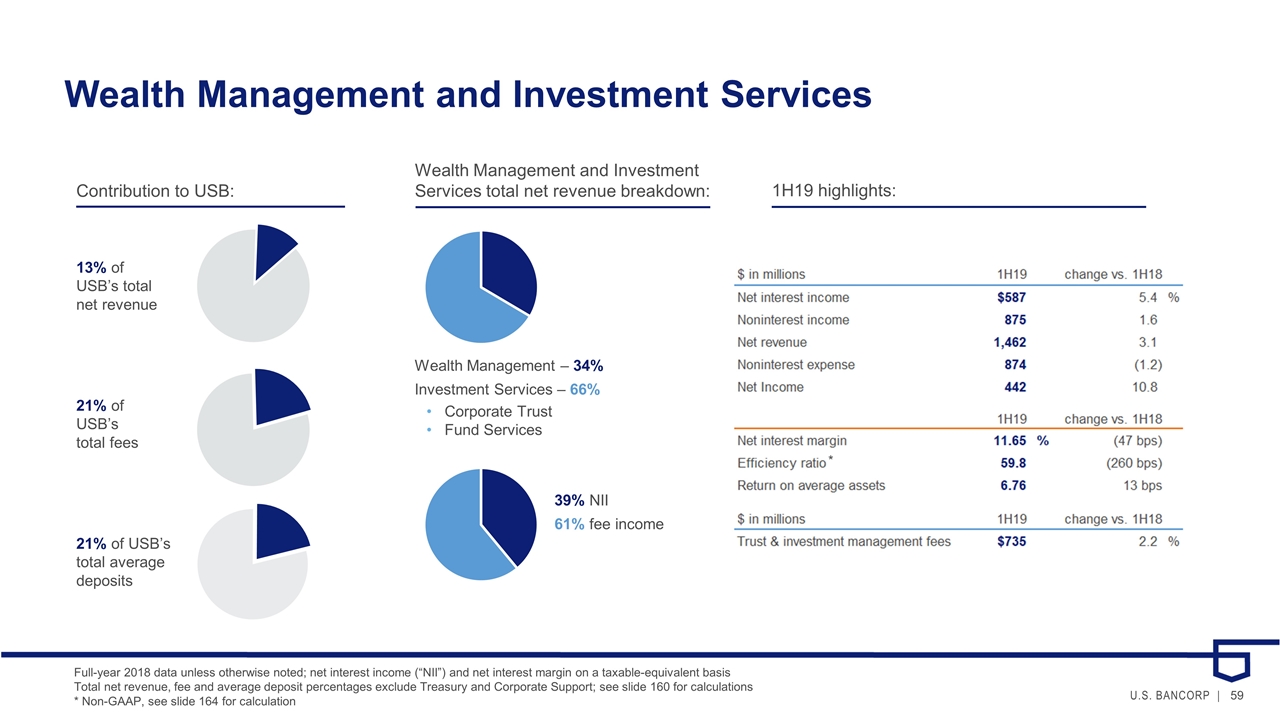

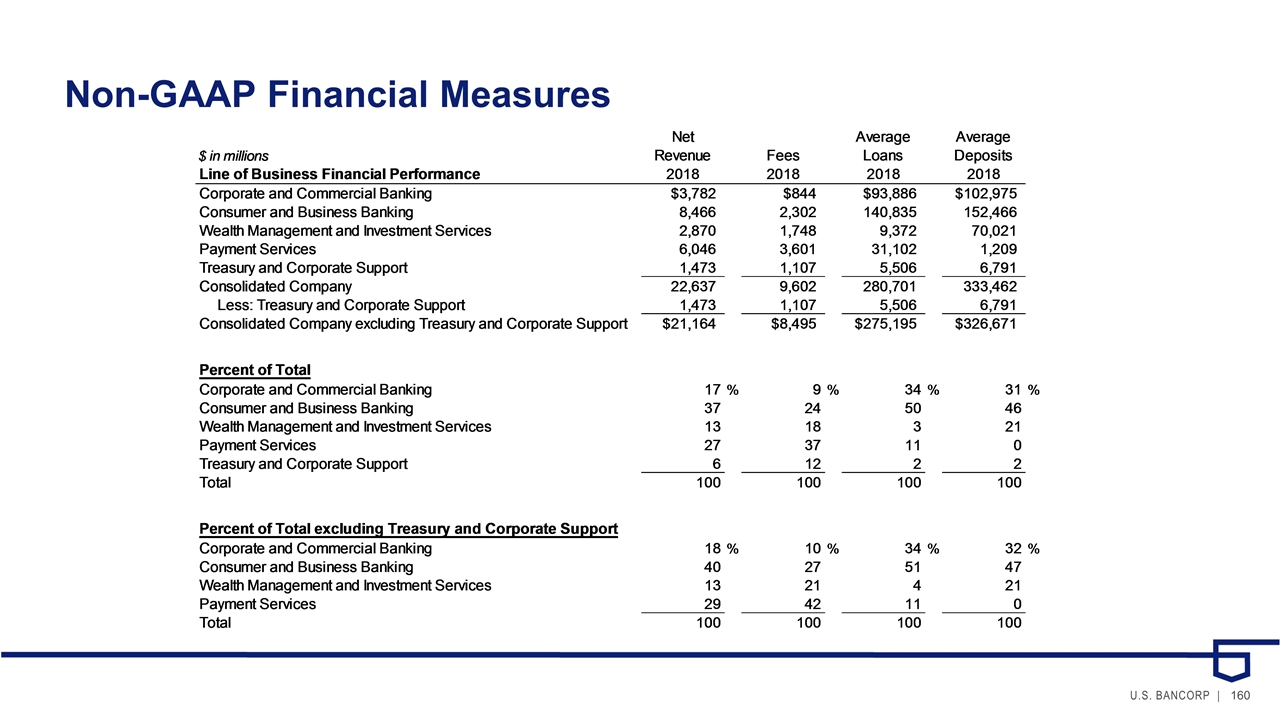

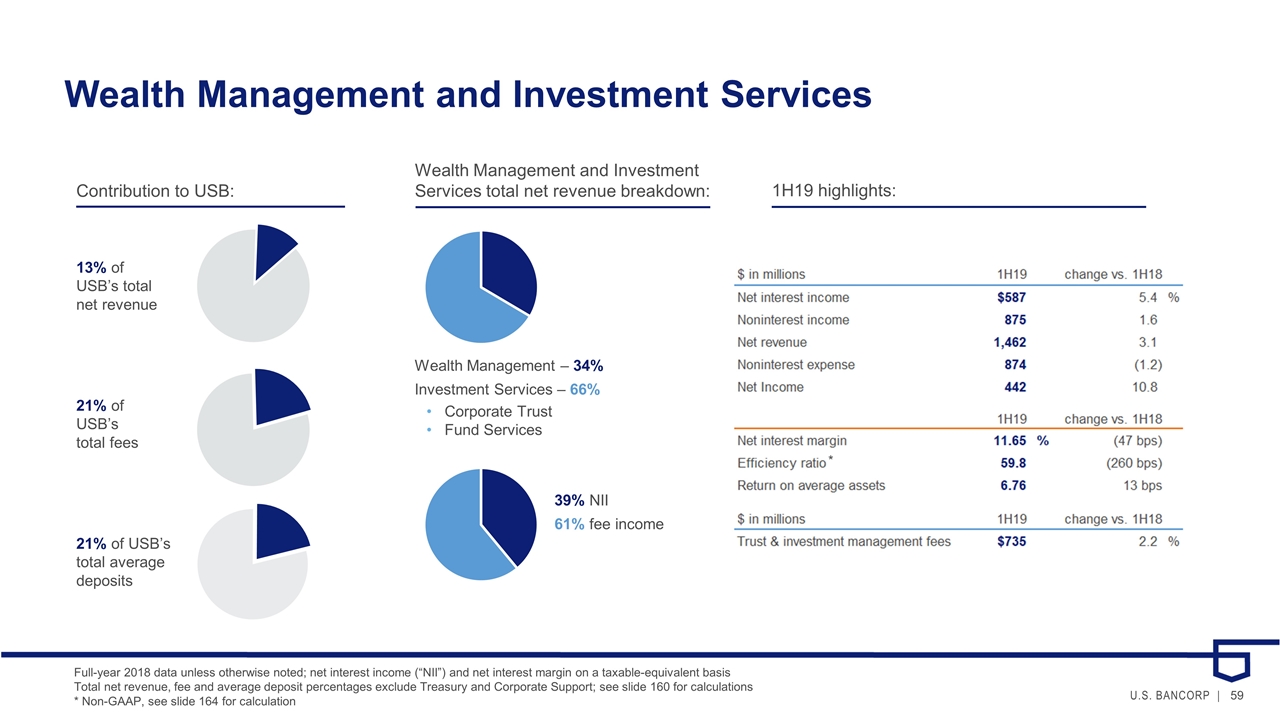

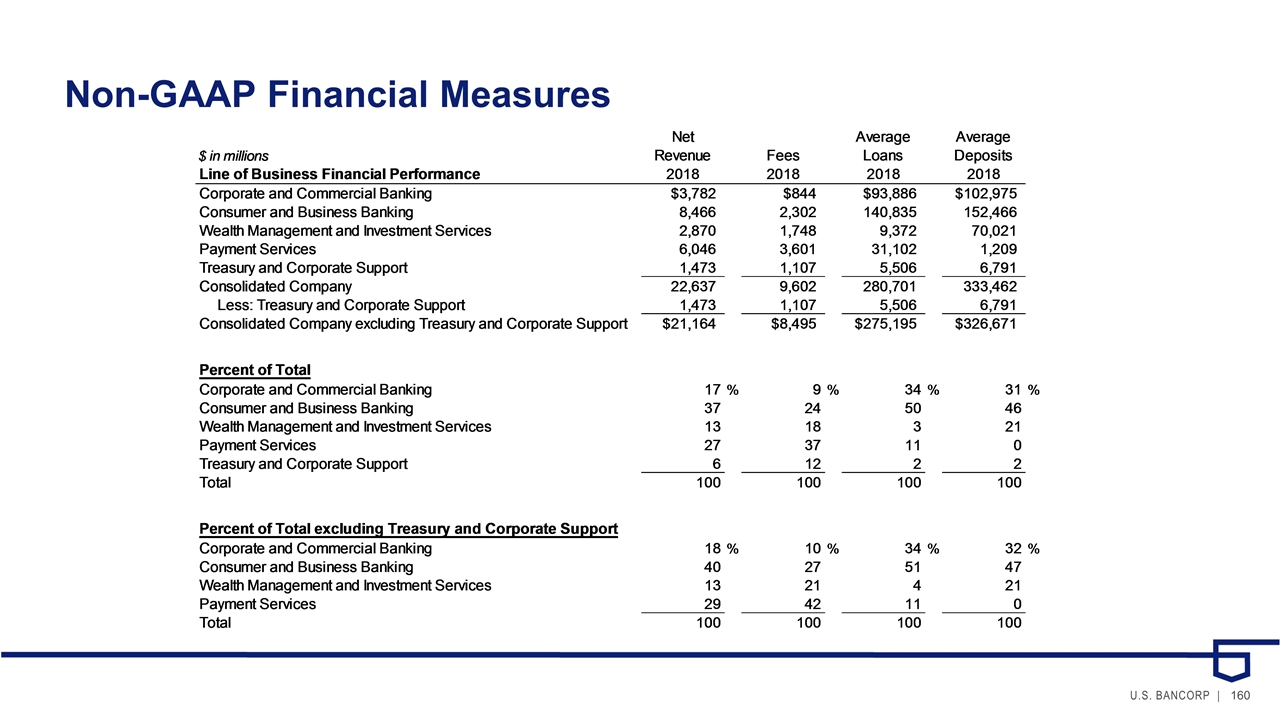

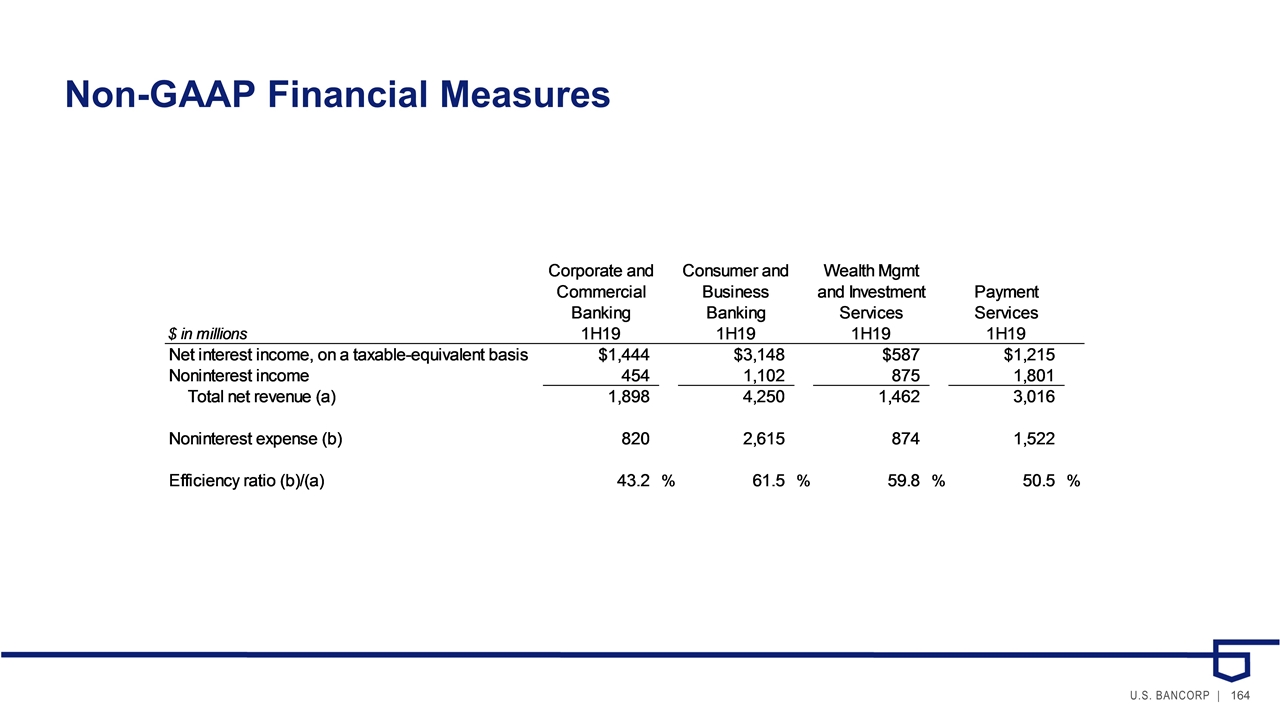

Wealth Management and Investment Services Wealth Management – 34% Investment Services – 66% Wealth Management and Investment Services total net revenue breakdown: 1H19 highlights: 39% NII 61% fee income Contribution to USB: 13% of USB’s total net revenue 21% of USB’s total fees 21% of USB’s total average deposits Full-year 2018 data unless otherwise noted; net interest income (“NII”) and net interest margin on a taxable-equivalent basis Total net revenue, fee and average deposit percentages exclude Treasury and Corporate Support; see slide 160 for calculations * Non-GAAP, see slide 164 for calculation Corporate Trust Fund Services *

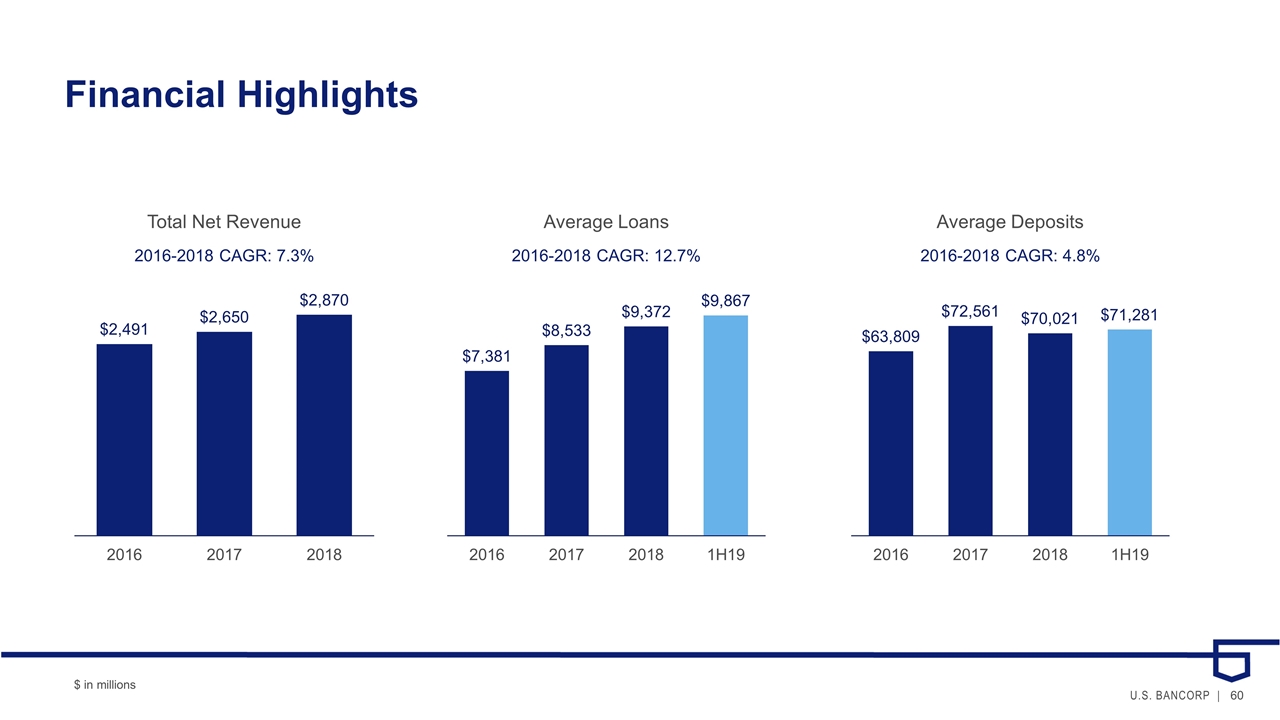

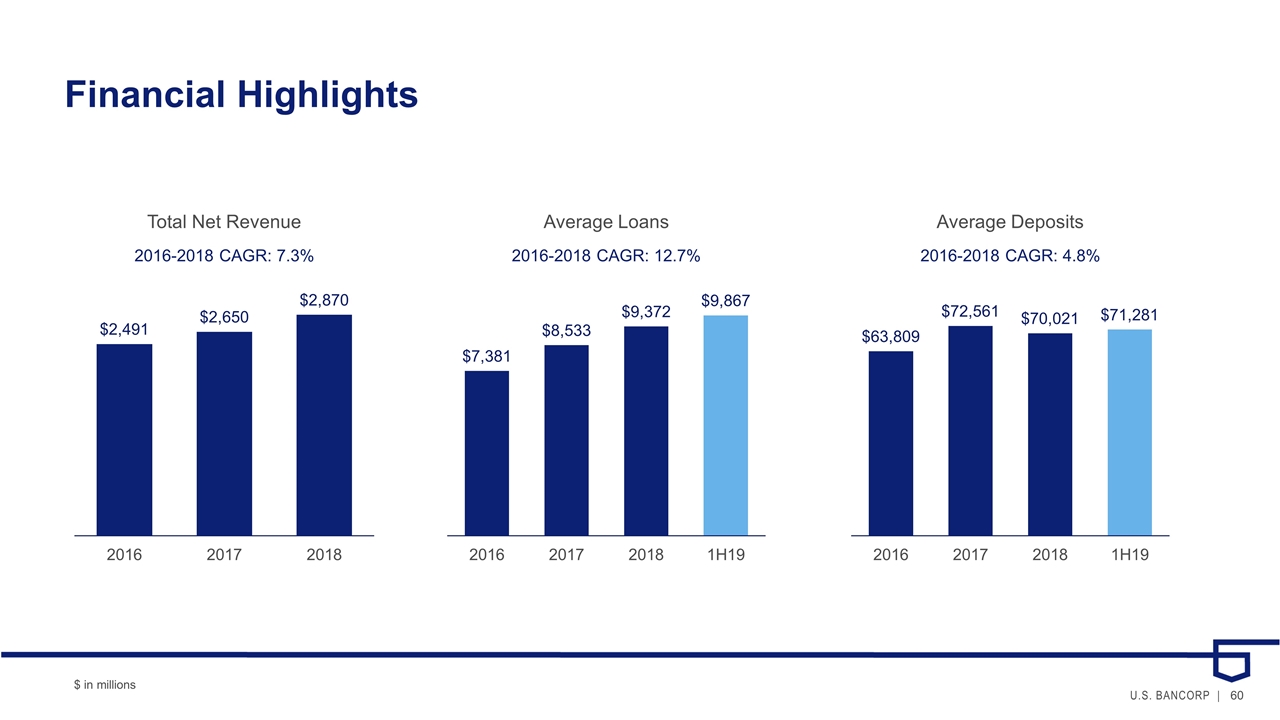

Financial Highlights $ in millions 2016-2018 CAGR: 7.3% 2016-2018 CAGR: 12.7% 2016-2018 CAGR: 4.8%

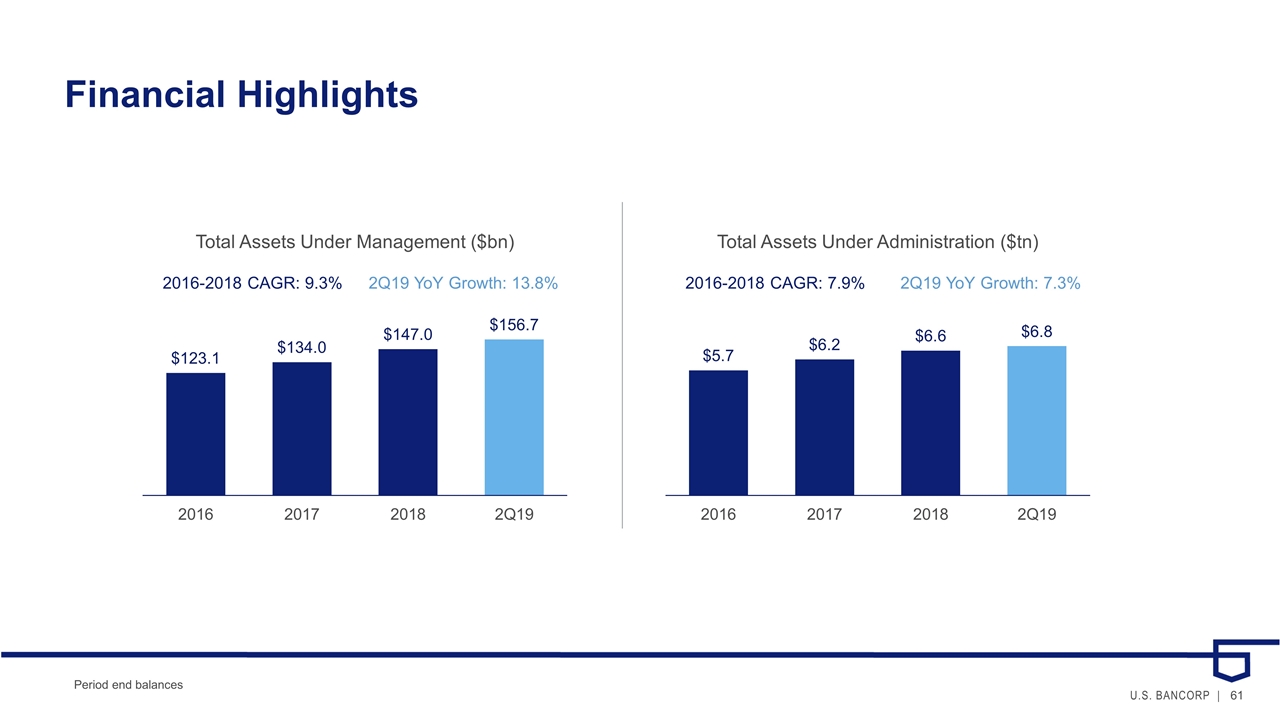

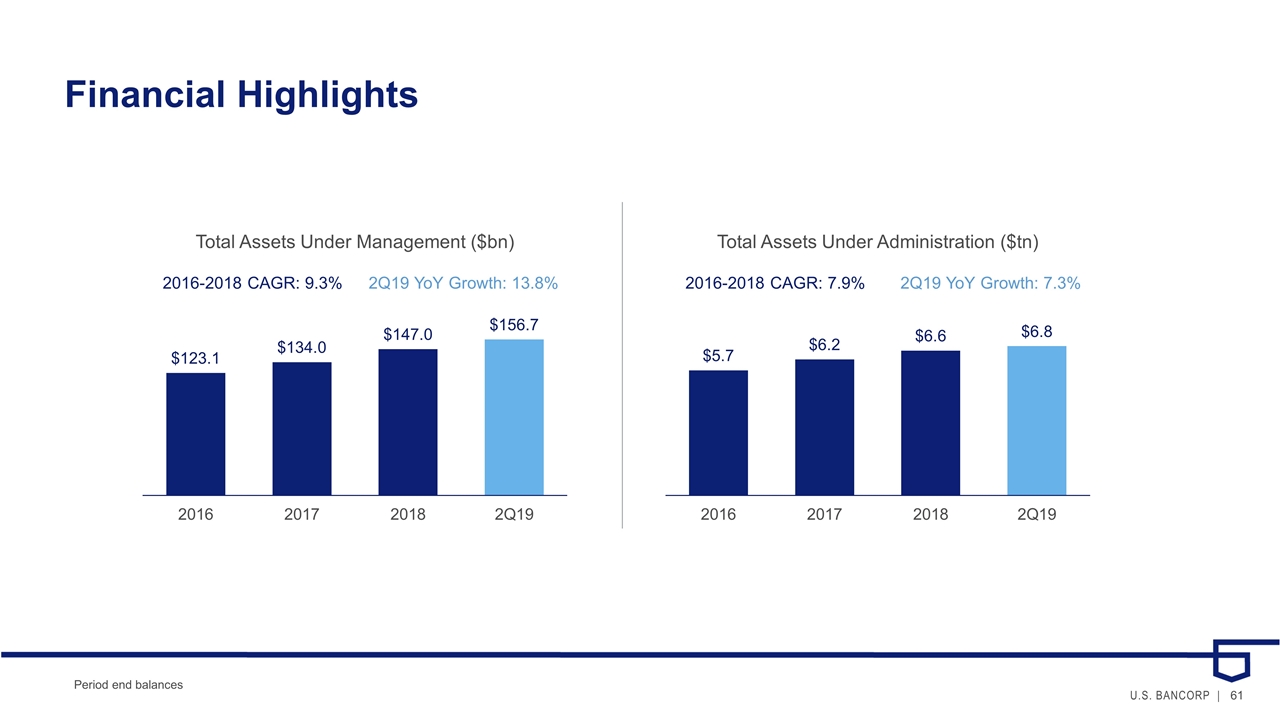

Financial Highlights Period end balances 2016-2018 CAGR: 9.3% 2Q19 YoY Growth: 13.8% 2016-2018 CAGR: 7.9% 2Q19 YoY Growth: 7.3%

Wealth Management: Tailored Services Across Segments Ultra High Net Worth >$75MM net worth Family office Multi-generational focus Planning beyond financial matters Affluent >$250K net worth Full product set Dedicated advisor-banker teams Branch-based High Net Worth >$3MM net worth Complex financial needs Dedicated team of specialists for banking, trust, investments Broadest product set 8 million 4 million 370,000 ~1,000 N/A ~1,500 30 6 USB households and offices Clients start to invest Digitally-focused Emerging Wealth <$250K net worth

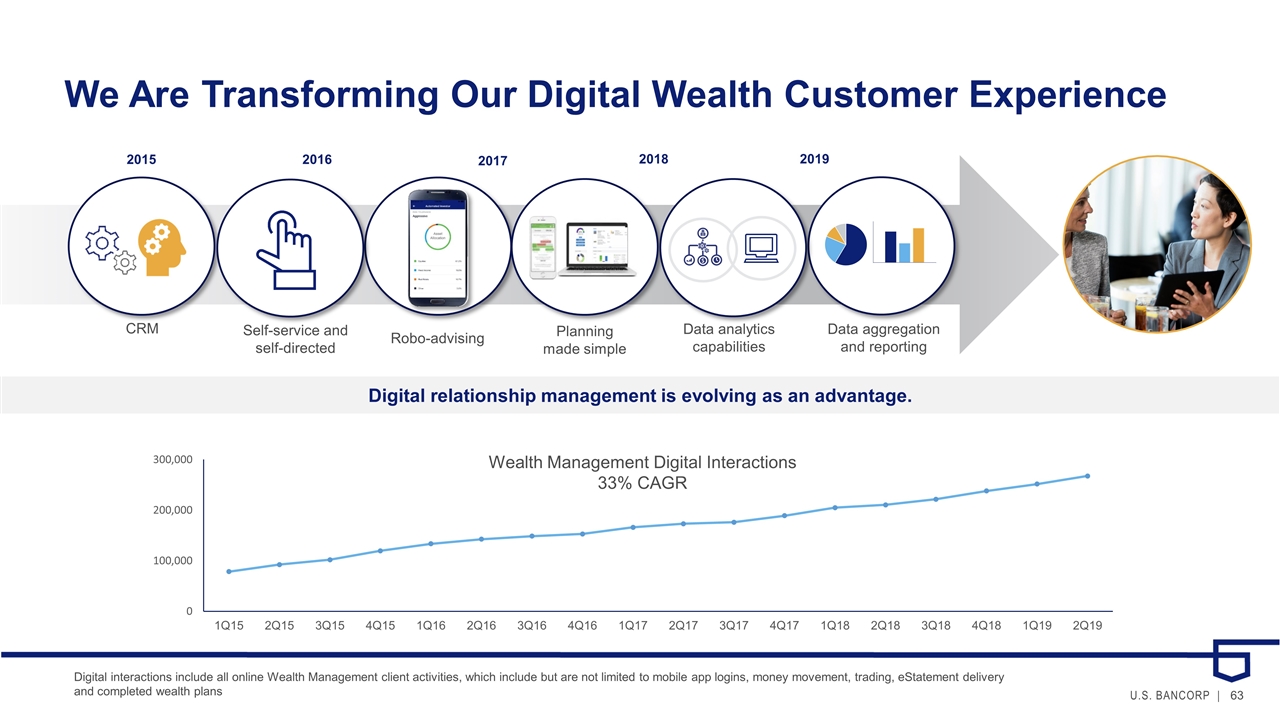

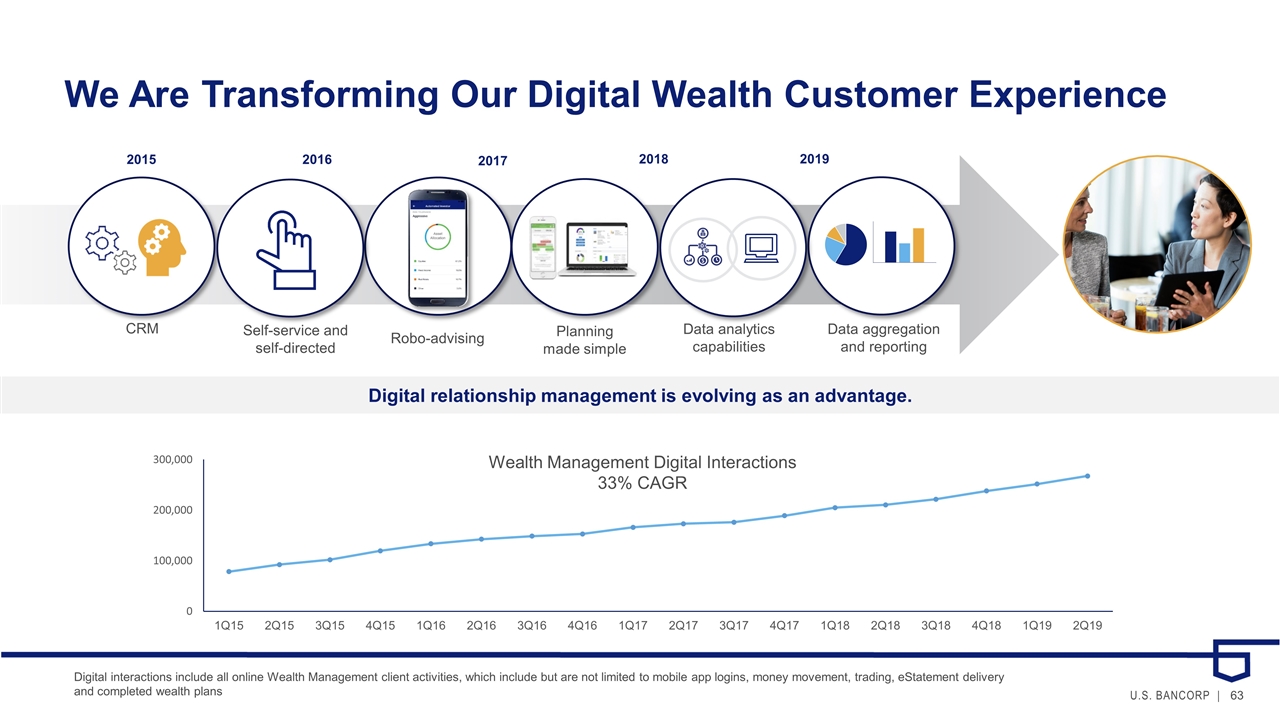

We Are Transforming Our Digital Wealth Customer Experience Digital relationship management is evolving as an advantage. Wealth Management Digital Interactions 33% CAGR 2015 2017 2018 2019 2016 Robo-advising Self-service and self-directed Data aggregation and reporting Planning made simple Data analytics capabilities CRM Digital interactions include all online Wealth Management client activities, which include but are not limited to mobile app logins, money movement, trading, eStatement delivery and completed wealth plans

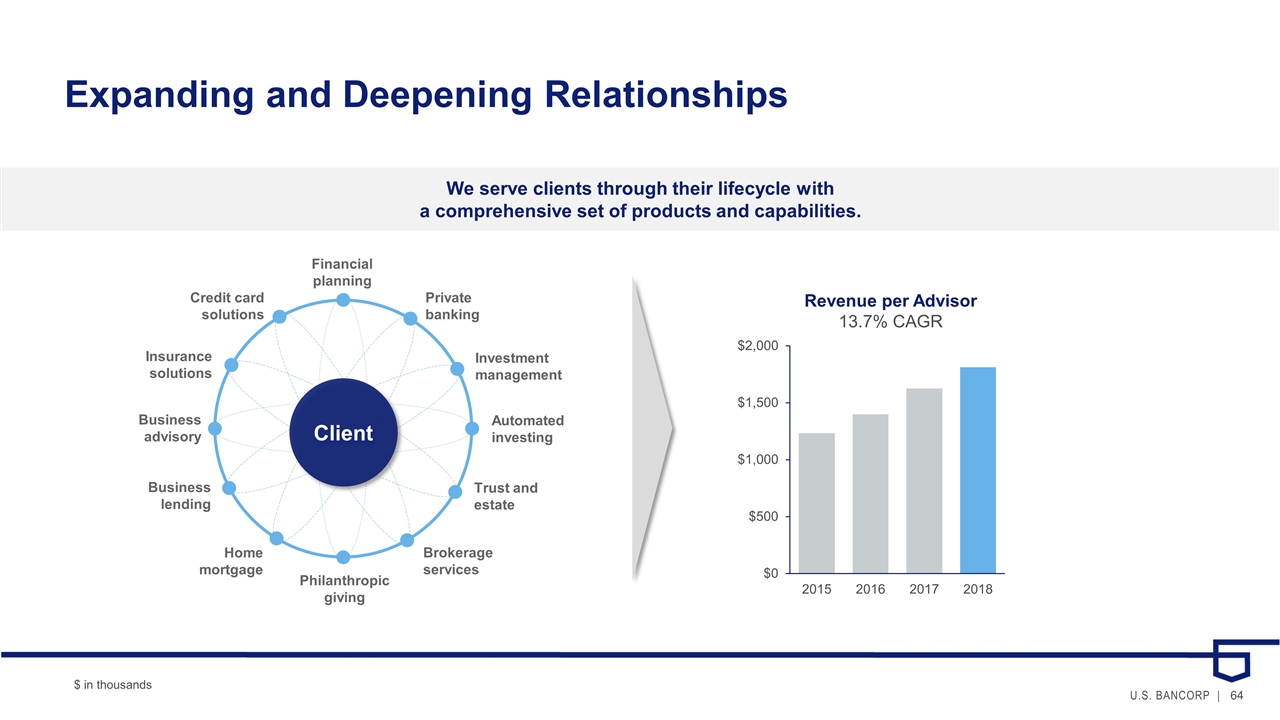

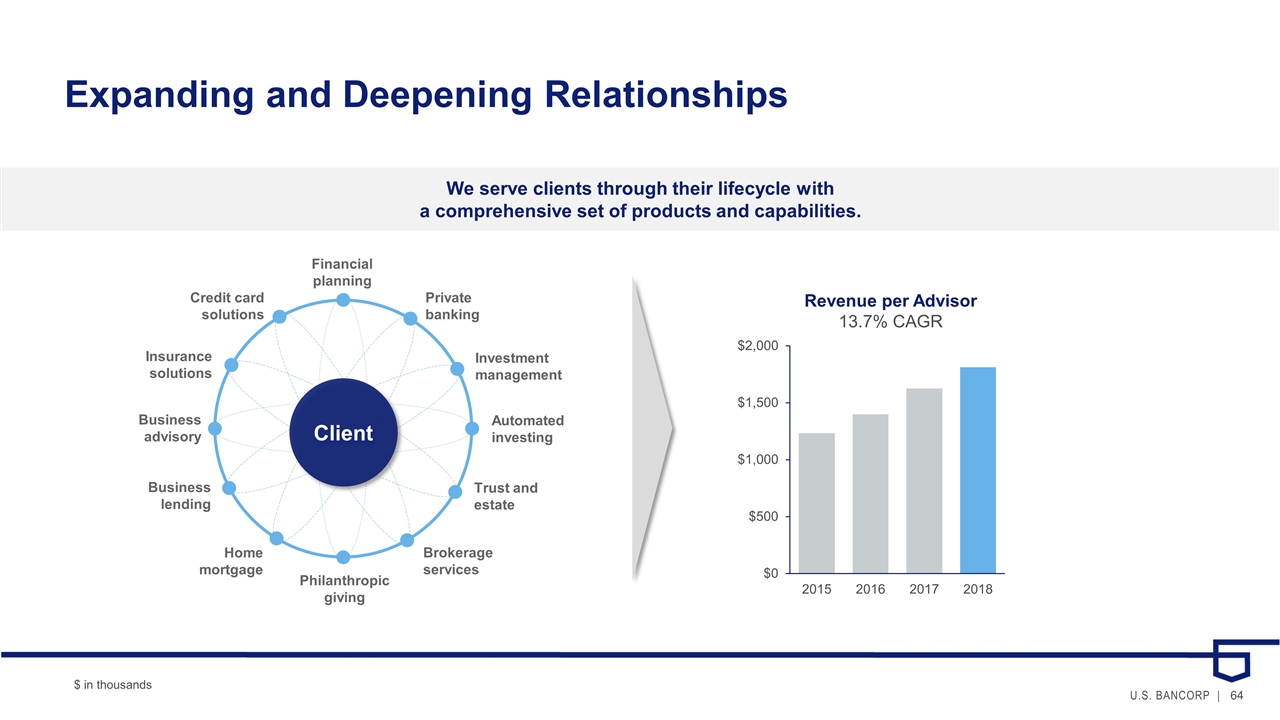

Expanding and Deepening Relationships We serve clients through their lifecycle with a comprehensive set of products and capabilities. Financial planning Private banking Investment management Automated investing Trust and estate Brokerage services Home mortgage Business lending Philanthropic giving Credit card solutions Insurance solutions Business advisory Client Revenue per Advisor 13.7% CAGR $ in thousands

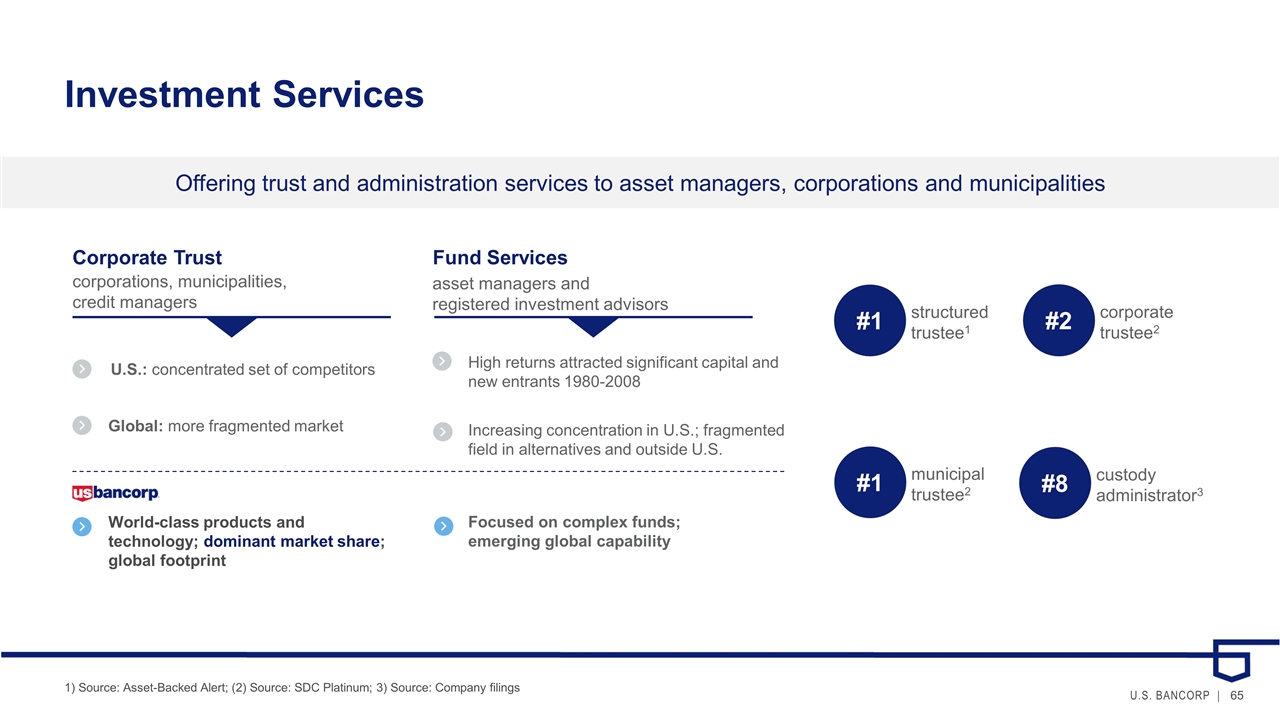

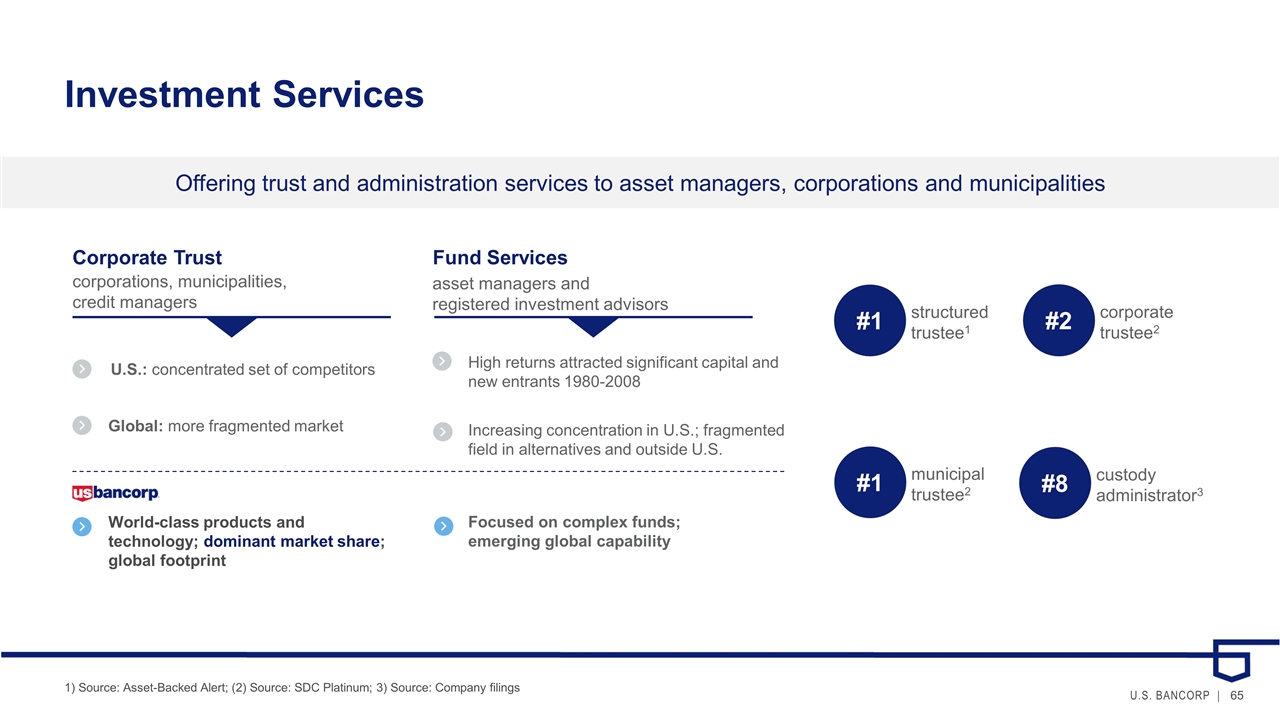

Investment Services U.S.: concentrated set of competitors Global: more fragmented market Corporate Trust corporations, municipalities, credit managers Fund Services asset managers and registered investment advisors High returns attracted significant capital and new entrants 1980-2008 Increasing concentration in U.S.; fragmented field in alternatives and outside U.S. Offering trust and administration services to asset managers, corporations and municipalities World-class products and technology; dominant market share; global footprint Focused on complex funds; emerging global capability #1 structured trustee1 #2 corporate trustee2 #1 municipal trustee2 1) Source: Asset-Backed Alert; (2) Source: SDC Platinum; 3) Source: Company filings #8 custody administrator3

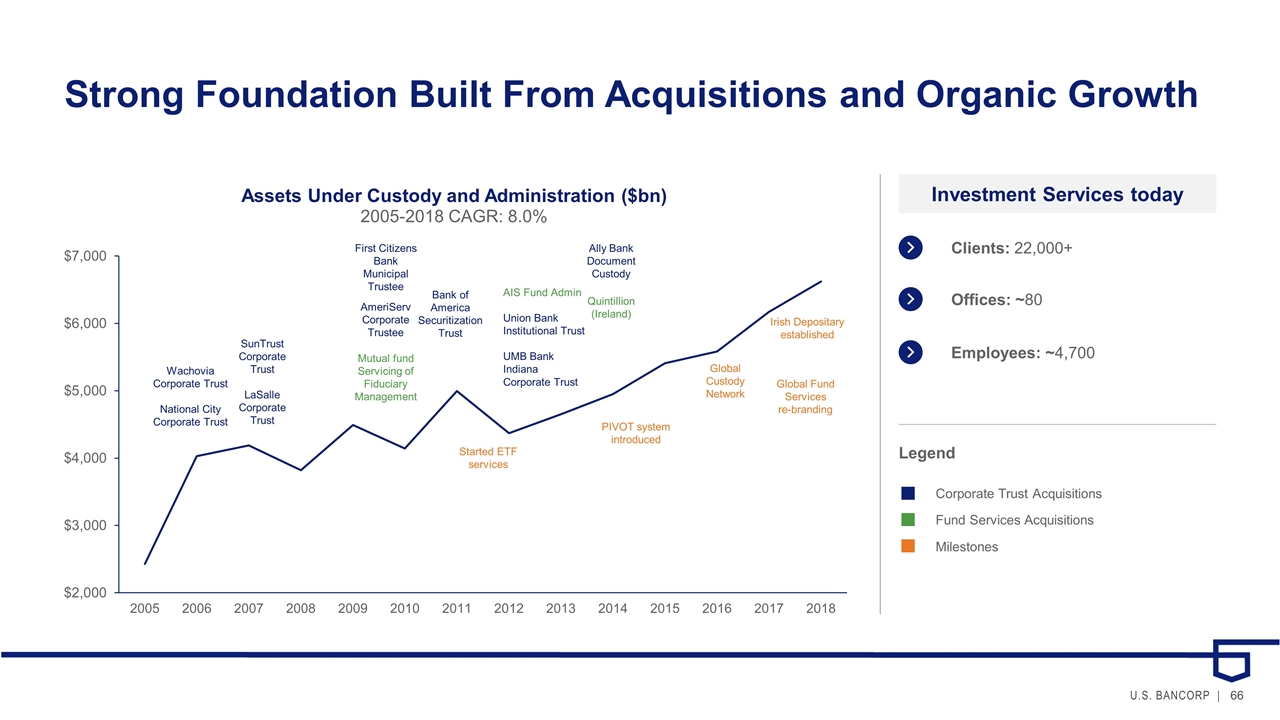

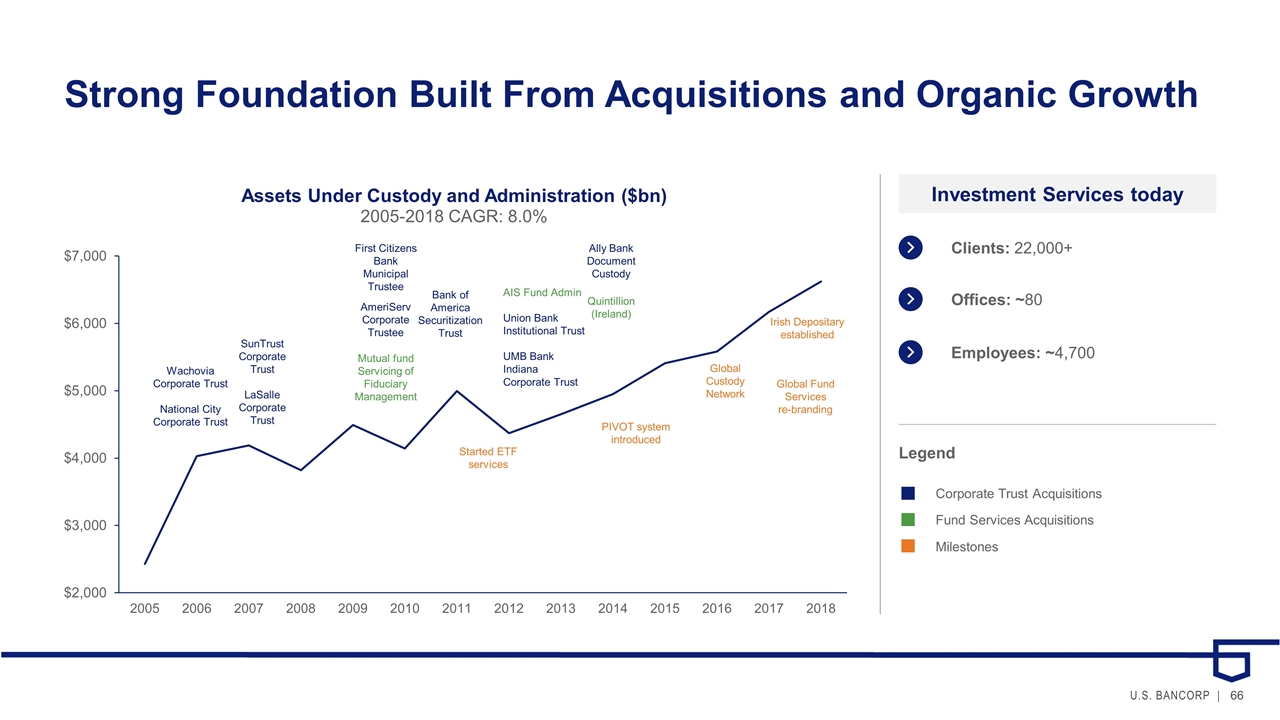

Strong Foundation Built From Acquisitions and Organic Growth Investment Services today Clients: 22,000+ Offices: ~80 Employees: ~4,700 Legend Corporate Trust Acquisitions Fund Services Acquisitions Milestones First Citizens Bank Municipal Trustee Mutual fund Servicing of Fiduciary Management Bank of America Securitization Trust AmeriServ Corporate Trustee AIS Fund Admin Union Bank Institutional Trust UMB Bank Indiana Corporate Trust Quintillion (Ireland) Wachovia Corporate Trust National City Corporate Trust PIVOT system introduced Irish Depositary established Global Fund Services re-branding Global Custody Network SunTrust Corporate Trust LaSalle Corporate Trust Ally Bank Document Custody Started ETF services

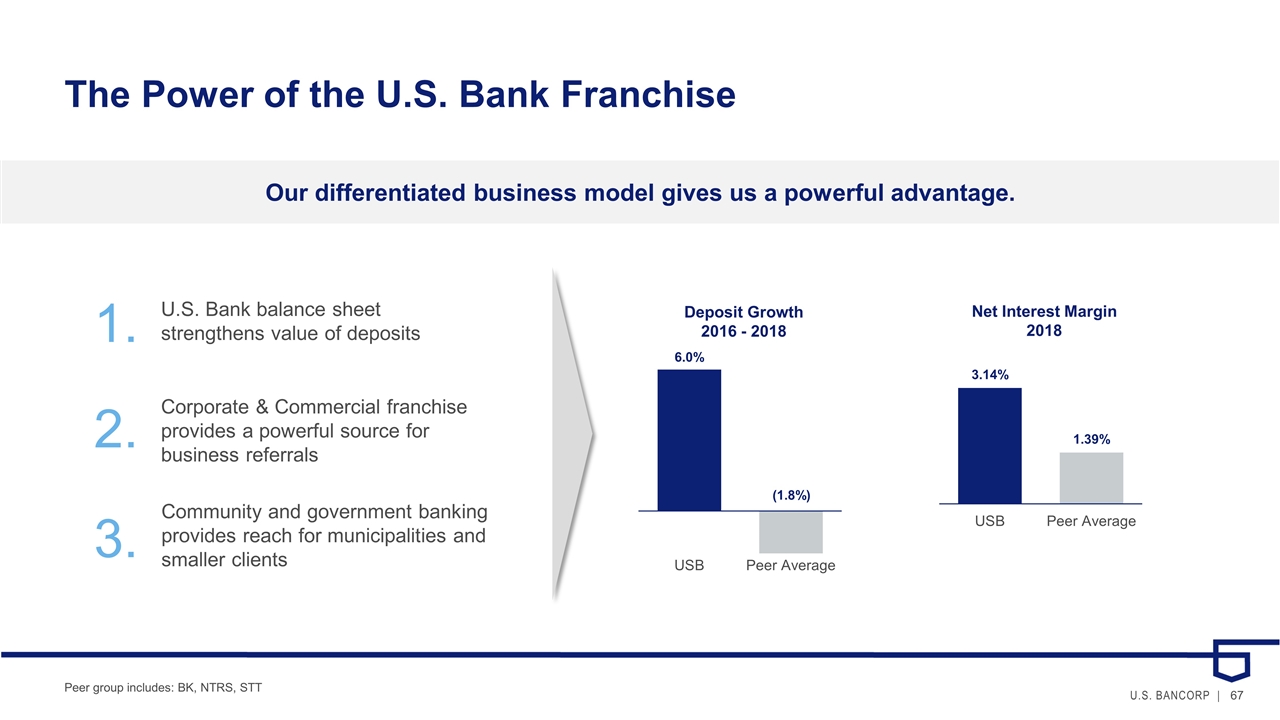

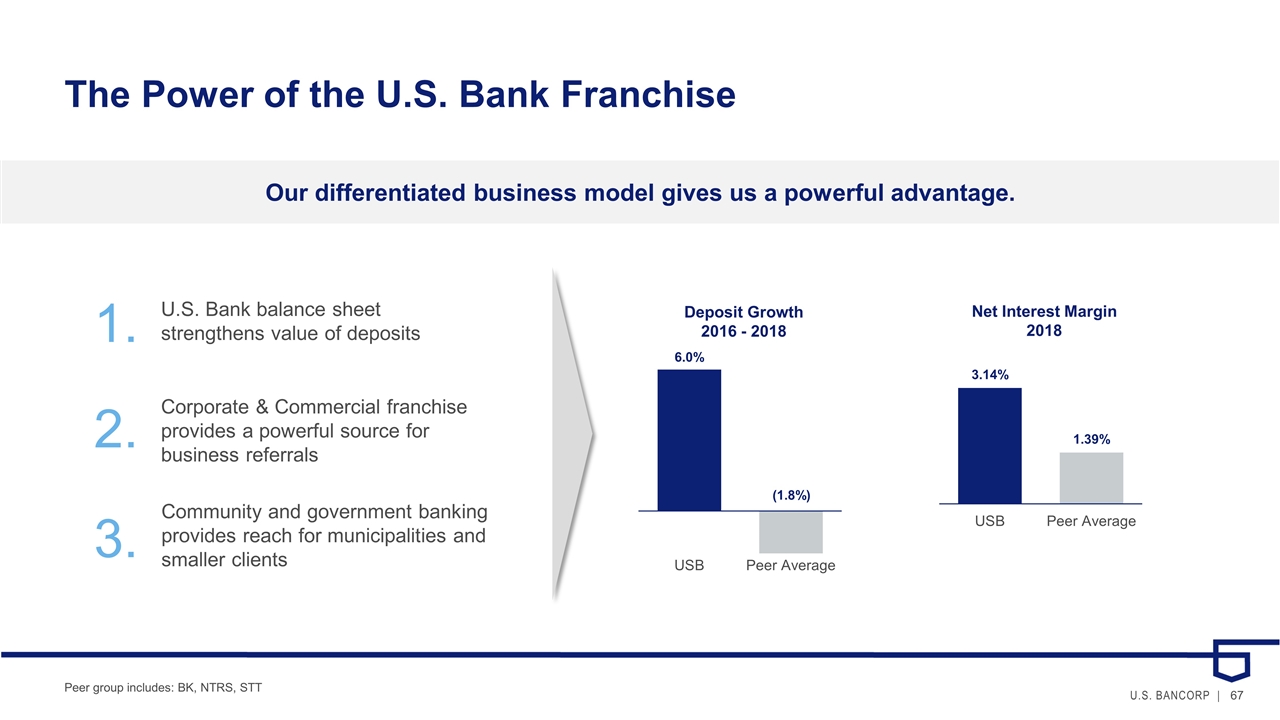

The Power of the U.S. Bank Franchise Net Interest Margin 2018 Deposit Growth 2016 - 2018 Our differentiated business model gives us a powerful advantage. 1. 2. 3. U.S. Bank balance sheet strengthens value of deposits Corporate & Commercial franchise provides a powerful source for business referrals Community and government banking provides reach for municipalities and smaller clients Peer group includes: BK, NTRS, STT

Creating Valuable Client Relationships as One U.S. Bank Client 1: Registered Investment Advisor New funds and portfolios launch USB selected to custody portfolios Fund Services administers a fund Wealth Management provides loans to private clients 13x revenue growth Custody for private funds Corporate & Commercial provides credit to parent company Corporate Trust inherits relationship via acquisition USB selected to provide trustee services in the UK 23x revenue growth Client 2: Global Asset Manager v v v v v v v v $ in millions

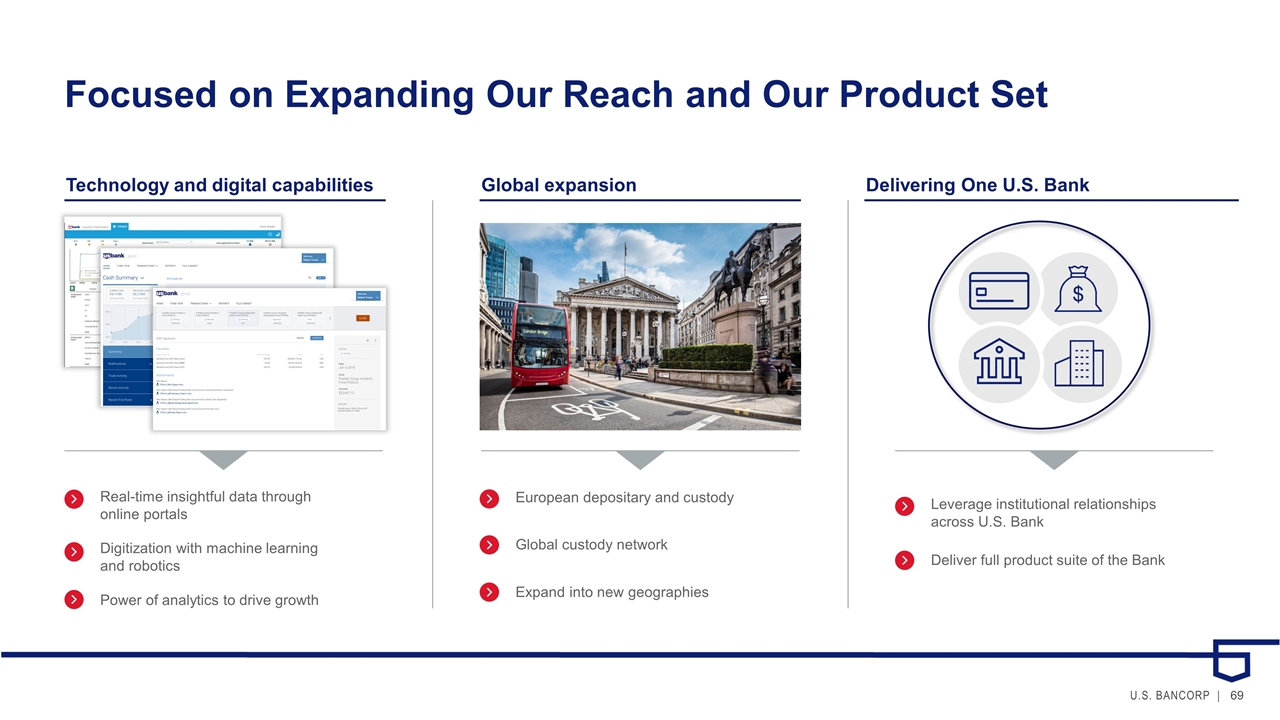

Focused on Expanding Our Reach and Our Product Set Technology and digital capabilities Delivering One U.S. Bank Global expansion Real-time insightful data through online portals Digitization with machine learning and robotics Power of analytics to drive growth European depositary and custody Global custody network Expand into new geographies Leverage institutional relationships across U.S. Bank Deliver full product suite of the Bank

In Summary… Wealth Management Strong foundation at the higher end of wealth management Successful team-based model provides significant growth in Affluent segment Strong digital capabilities to transform our service model Investment Services We are at scale in a capital intensive, efficient, fee-based deposit gathering business Our products and technology are industry leading Our growth will be fueled by market share gains, global expansion and M&A

U.S. Bancorp Investor Day Consumer and Business Banking September 12, 2019 Tim Welsh Vice Chair, Consumer and Business Banking

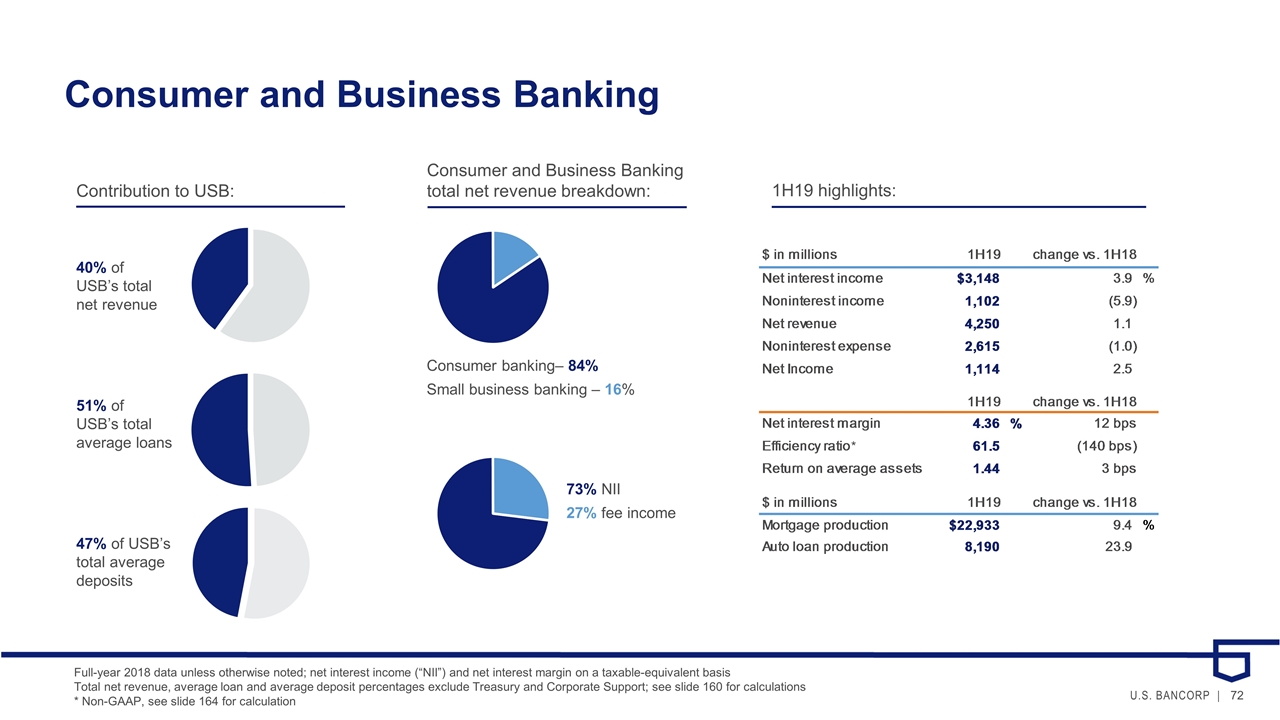

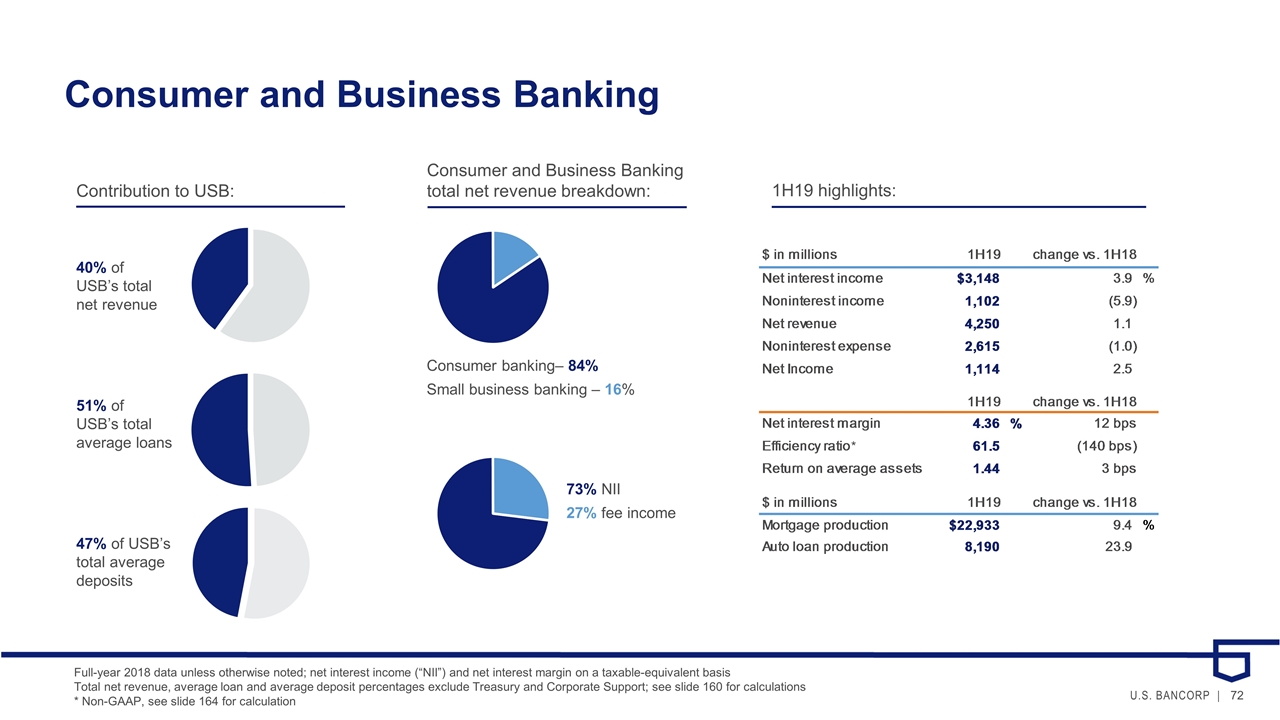

Consumer and Business Banking Consumer banking– 84% Small business banking – 16% Consumer and Business Banking total net revenue breakdown: 1H19 highlights: 73% NII 27% fee income Contribution to USB: 40% of USB’s total net revenue 51% of USB’s total average loans 47% of USB’s total average deposits Full-year 2018 data unless otherwise noted; net interest income (“NII”) and net interest margin on a taxable-equivalent basis Total net revenue, average loan and average deposit percentages exclude Treasury and Corporate Support; see slide 160 for calculations * Non-GAAP, see slide 164 for calculation *

Financial Highlights $ in millions 2016-2018 CAGR: 2.3% 2016-2018 CAGR: 3.4%

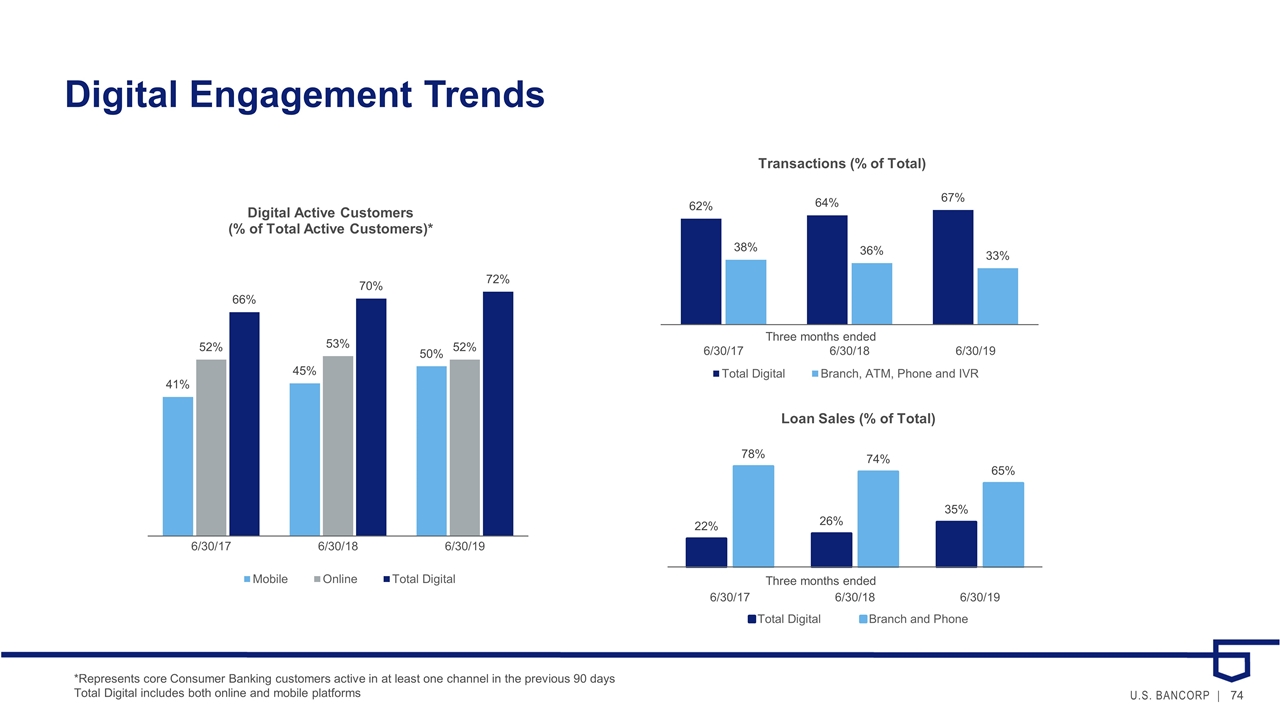

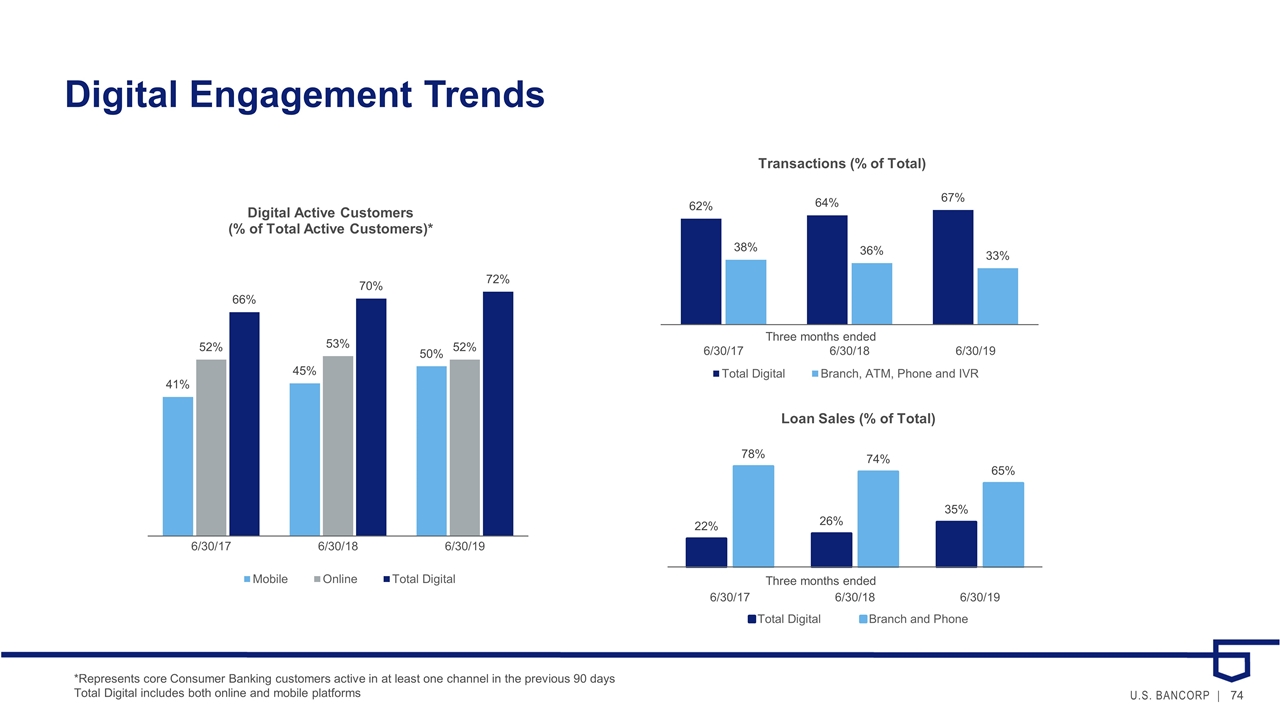

Digital Engagement Trends *Represents core Consumer Banking customers active in at least one channel in the previous 90 days Total Digital includes both online and mobile platforms Three months ended Three months ended

A Scale Player Across Our Businesses 1) Source: SNL, peer banks include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC; 2) Source: Inside Mortgage Finance, as of 12/31/18; 3) Source: SNL; 4) Source: Experian AutoCount; 5) Source: Small Business Administration; 6) represents core Consumer Banking customers deposit share among peer banks, within 25-state footprint1 # 4 bank new auto financing4 # 5 bank mortgage lender ranked by dollar volume2 # 4 in-store and on-site branch network within 25-state footprint3 #1 bank mortgage servicer2 # 4 consumer customers6 employees 30K 11.6M SBA lender ranked by unit volume5 # 4

Our Strategy and Key Initiatives We put our customers in the center of everything we do, staying ahead of their needs, desires and expectations to deliver exceptional experiences and create deeper, more valuable relationships. We are digital first, while maintaining a strong human connection. We are transforming our distribution network. Relocating and redesigning branches in our existing markets Selectively entering new markets with a branch-lite physical presence Closing branches where appropriate and optimizing square footage

Becoming Central to the Lives of Our Customers We have organized around the customer to design and deliver exceptional experiences, focusing on three key areas: mortgage, small business and mobile banking. home buyer / homeowner small business owner digitally active consumer

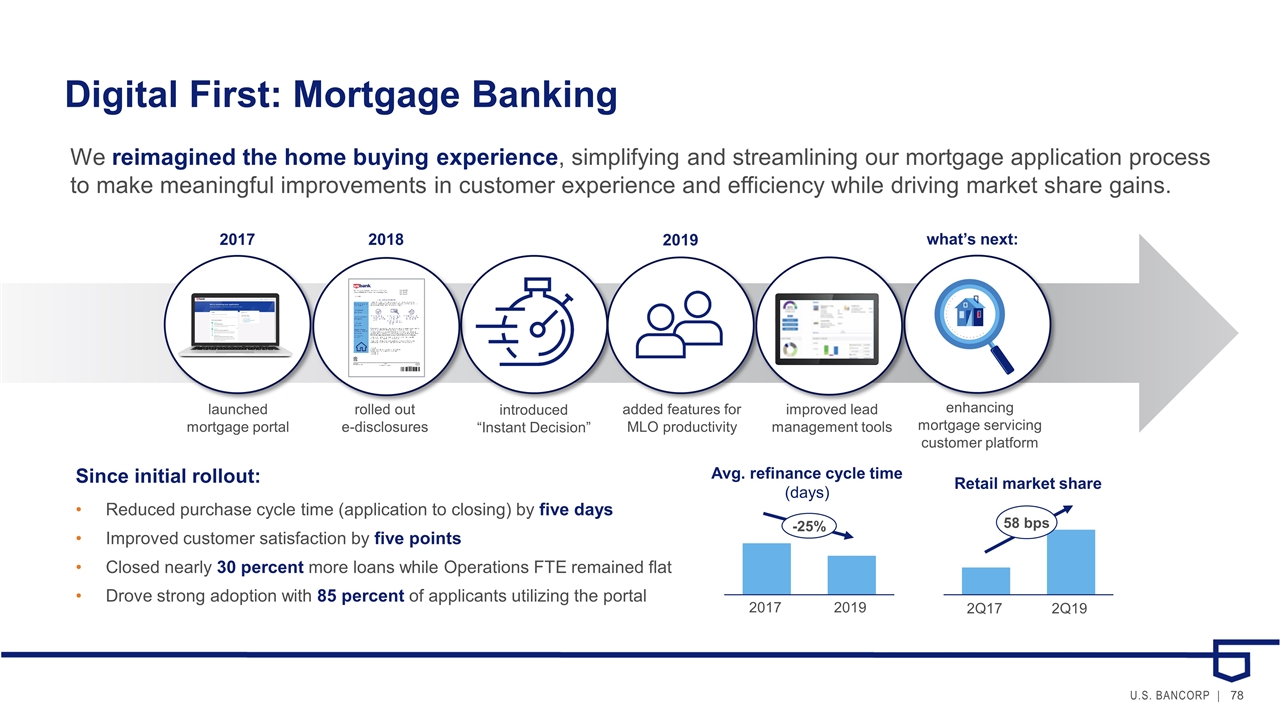

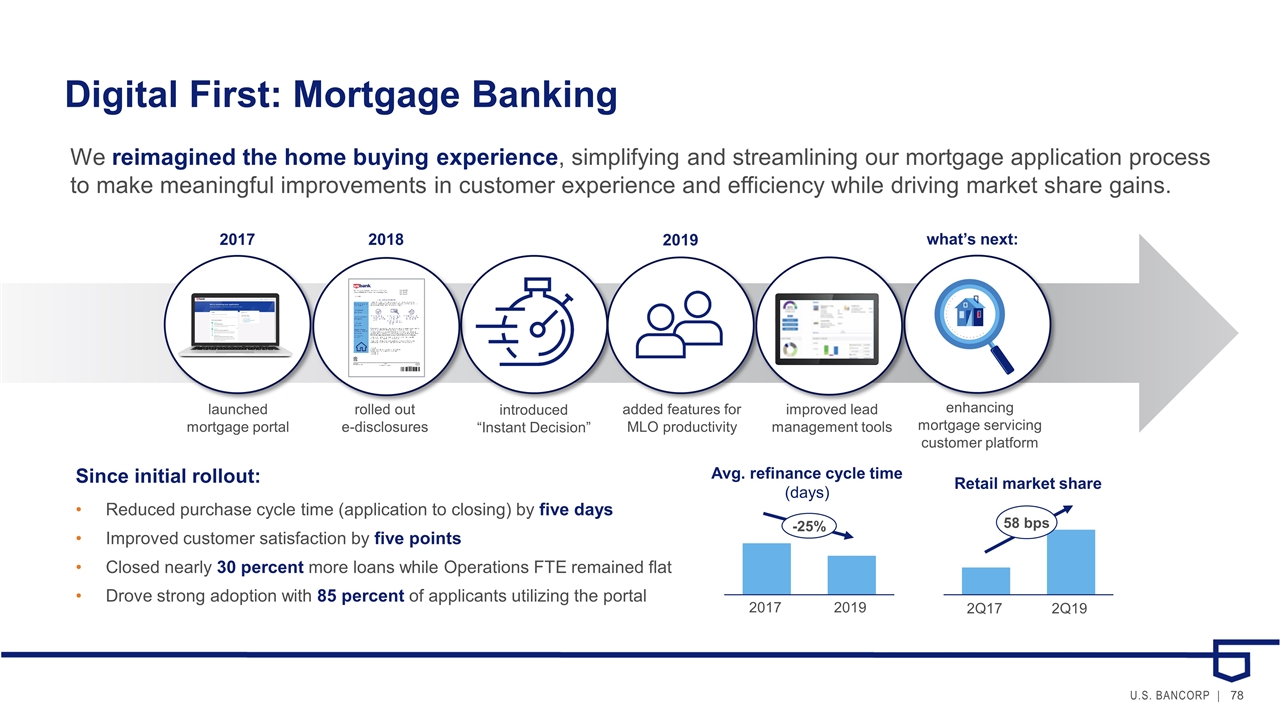

Digital First: Mortgage Banking We reimagined the home buying experience, simplifying and streamlining our mortgage application process to make meaningful improvements in customer experience and efficiency while driving market share gains. launched mortgage portal 2017 2019 what’s next: 2018 introduced “Instant Decision” rolled out e-disclosures enhancing mortgage servicing customer platform added features for MLO productivity improved lead management tools Since initial rollout: Reduced purchase cycle time (application to closing) by five days Improved customer satisfaction by five points Closed nearly 30 percent more loans while Operations FTE remained flat Drove strong adoption with 85 percent of applicants utilizing the portal Avg. refinance cycle time (days) 2017 -25% Retail market share 2Q17 2Q19 58 bps

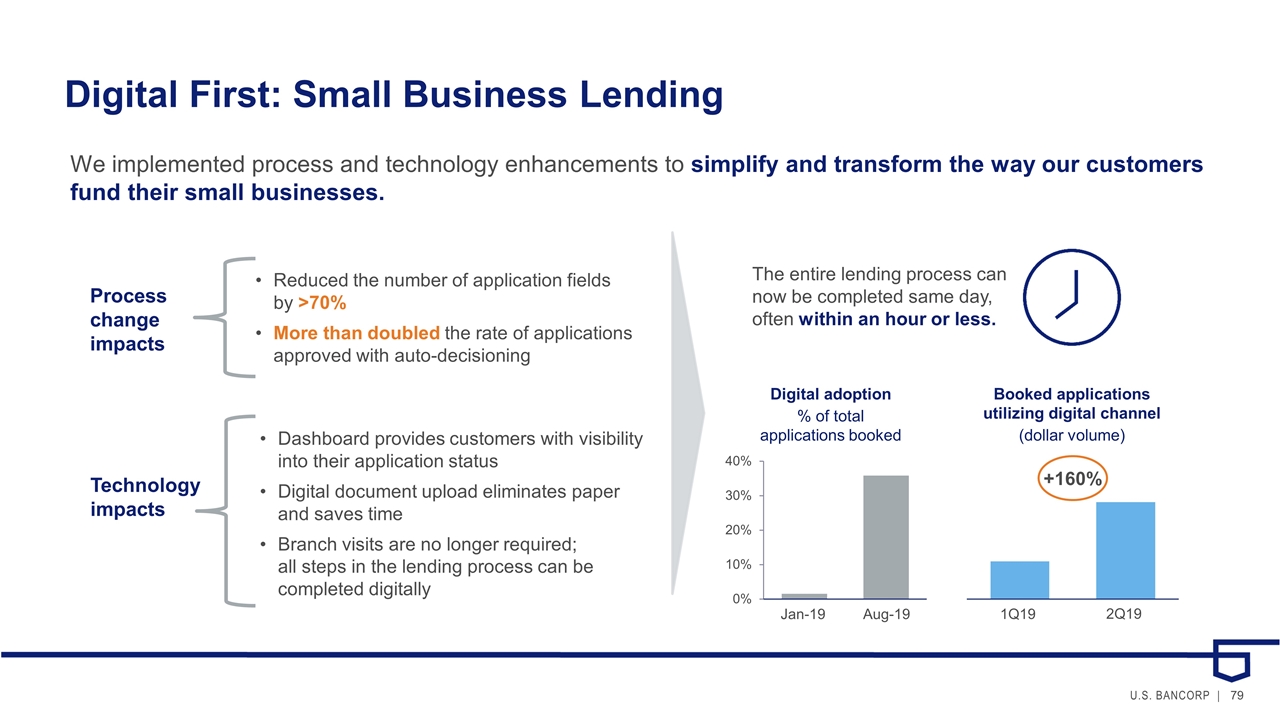

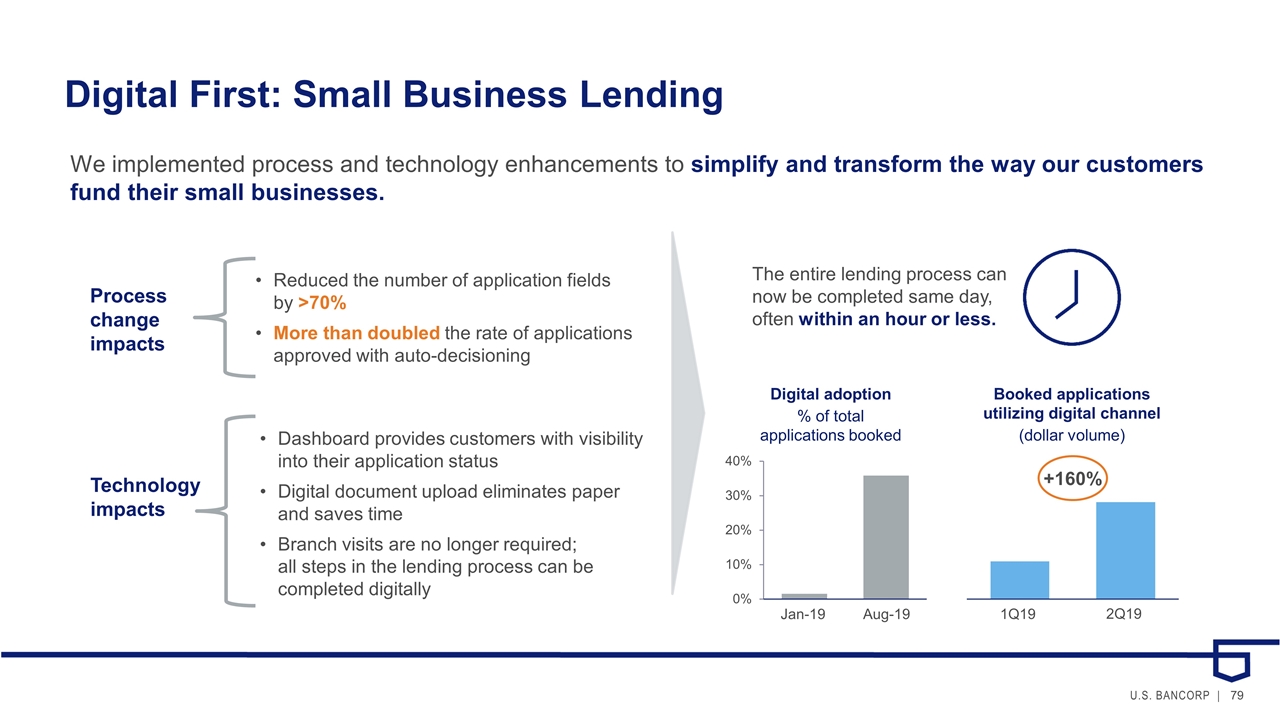

Digital First: Small Business Lending We implemented process and technology enhancements to simplify and transform the way our customers fund their small businesses. Process change impacts Technology impacts Reduced the number of application fields by >70% More than doubled the rate of applications approved with auto-decisioning Dashboard provides customers with visibility into their application status Digital document upload eliminates paper and saves time Branch visits are no longer required; all steps in the lending process can be completed digitally The entire lending process can now be completed same day, often within an hour or less. Jan-19 Aug-19 Digital adoption % of total applications booked 1Q19 2Q19 +160% Booked applications utilizing digital channel (dollar volume)

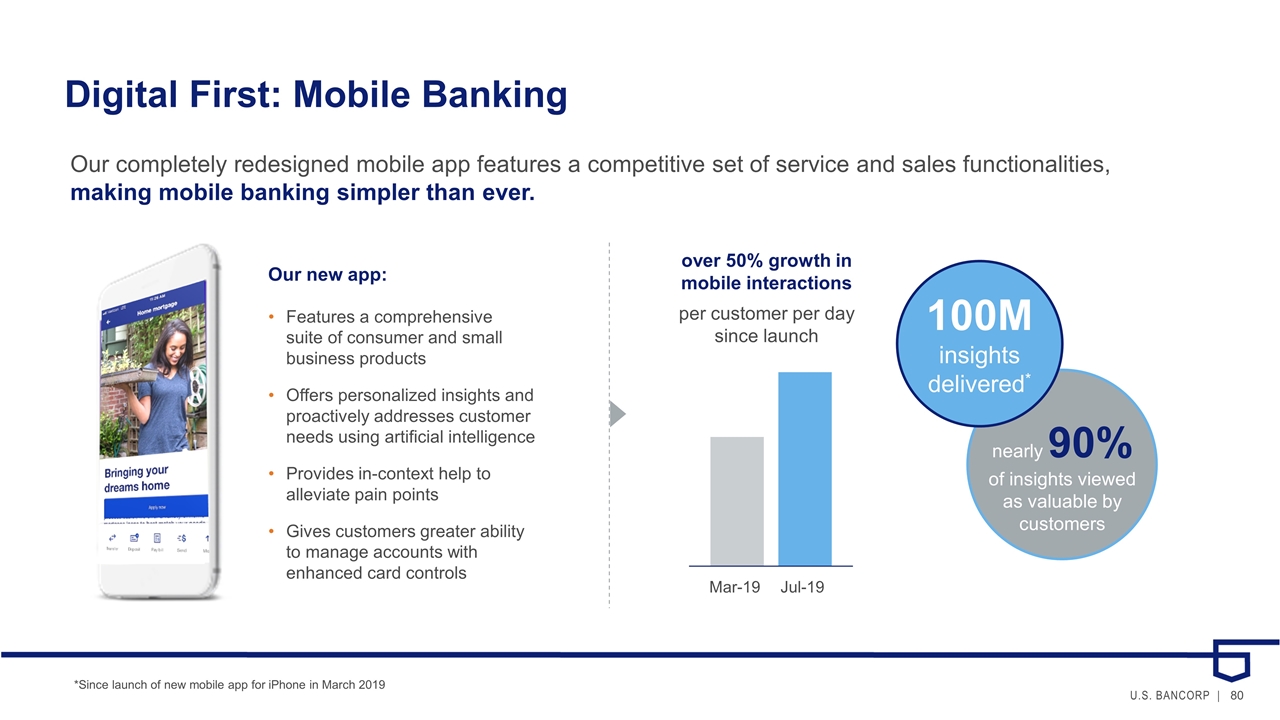

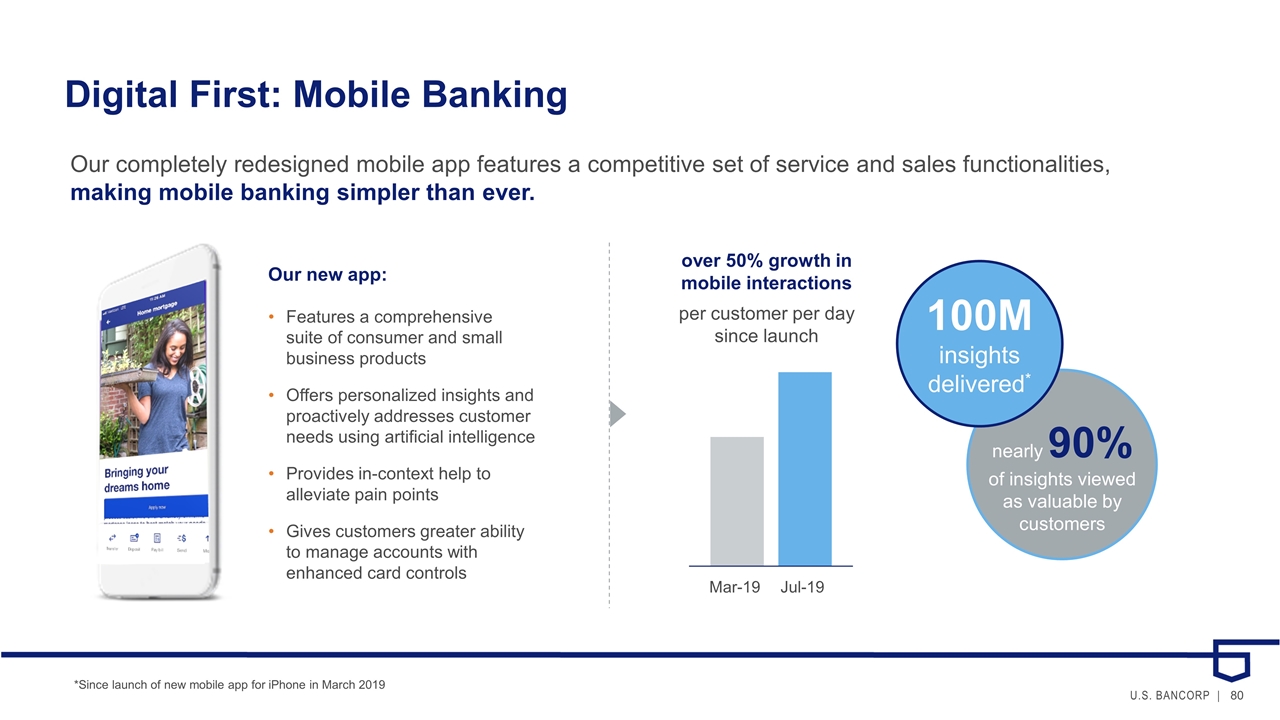

Digital First: Mobile Banking Features a comprehensive suite of consumer and small business products Offers personalized insights and proactively addresses customer needs using artificial intelligence Provides in-context help to alleviate pain points Gives customers greater ability to manage accounts with enhanced card controls Our new app: Our completely redesigned mobile app features a competitive set of service and sales functionalities, making mobile banking simpler than ever. *Since launch of new mobile app for iPhone in March 2019 nearly 90% of insights viewed as valuable by customers 100M insights delivered* over 50% growth in mobile interactions per customer per day since launch Mar-19 Jul-19

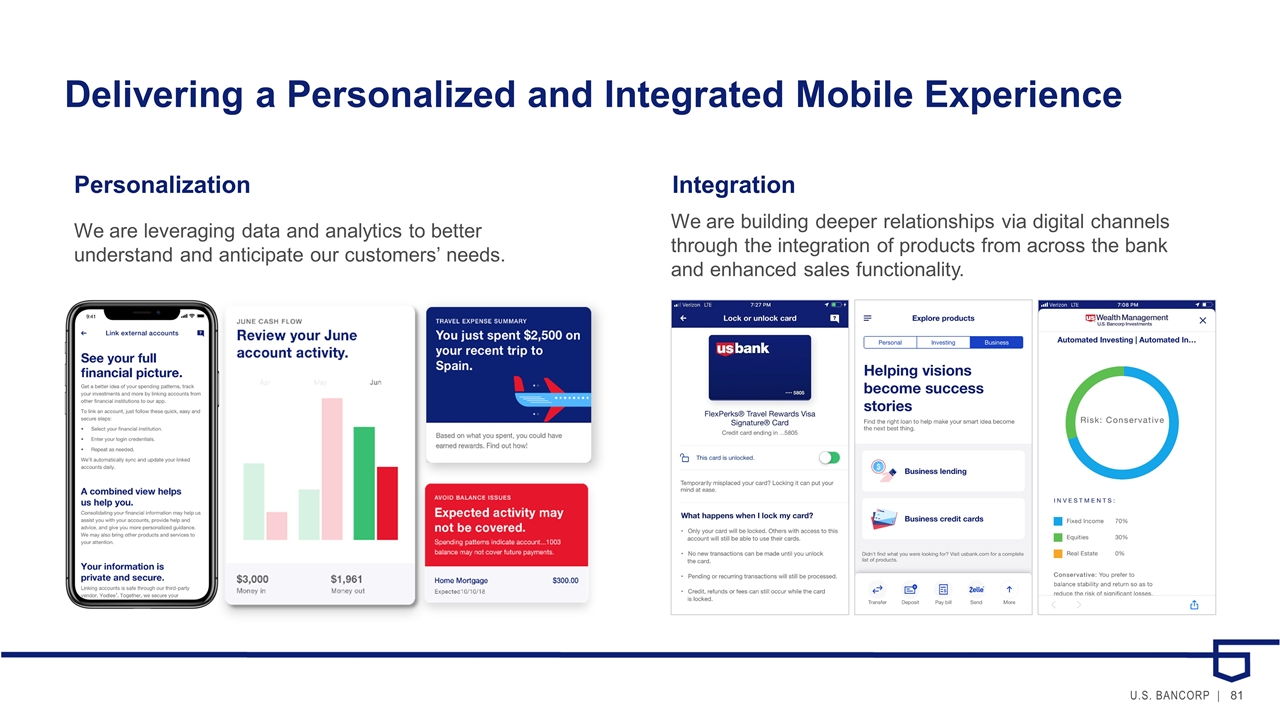

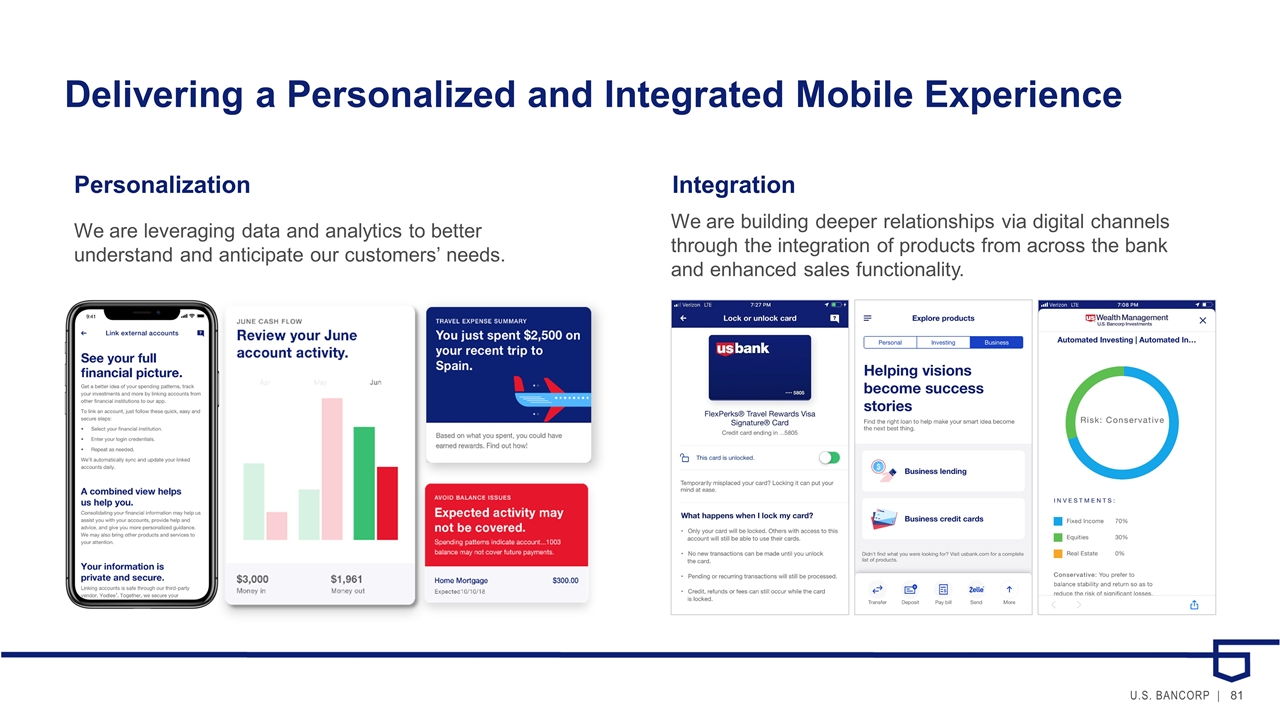

Delivering a Personalized and Integrated Mobile Experience We are leveraging data and analytics to better understand and anticipate our customers’ needs. Personalization We are building deeper relationships via digital channels through the integration of products from across the bank and enhanced sales functionality. Integration

As we accelerate the transformation of our distribution network, we are delivering the branch model that best serves our customers’ evolving preferences. Optimizing Our Existing Branch Network near-term expectation: approximately 10-15 percent net branch closures completed by end of Q1 2021 2019 branch closures to date*: 140 * As of 8/31/19

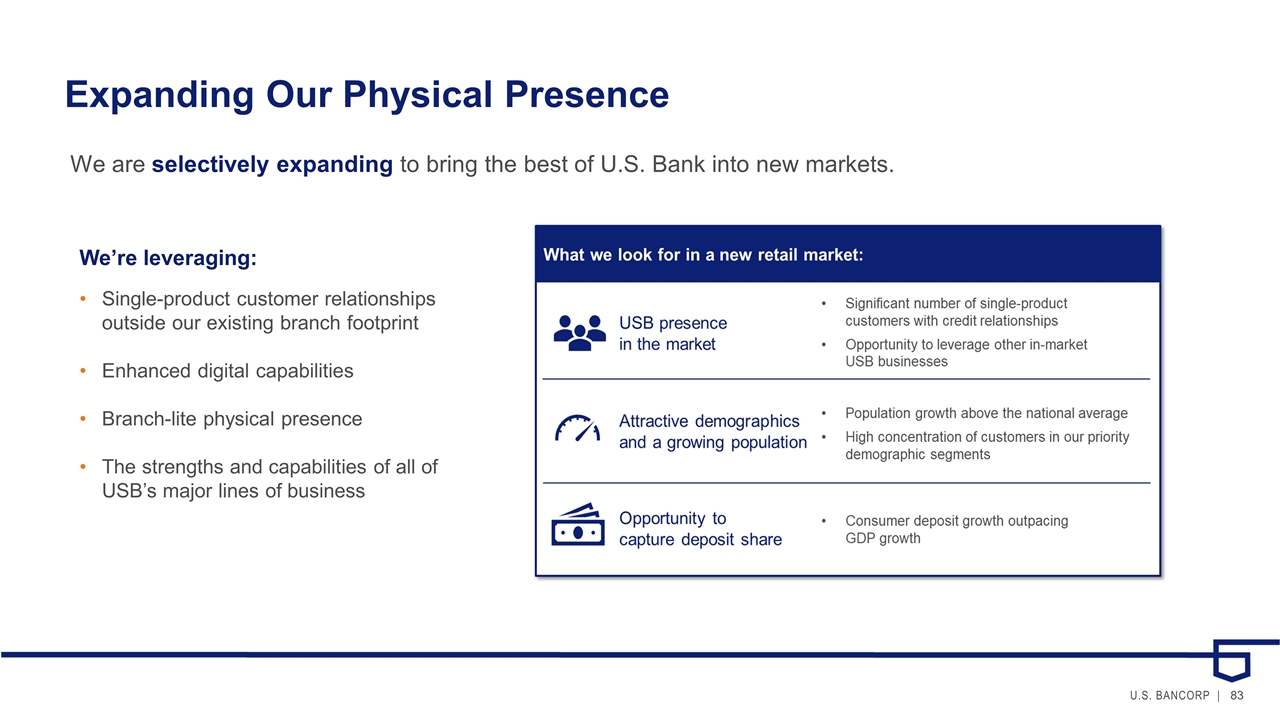

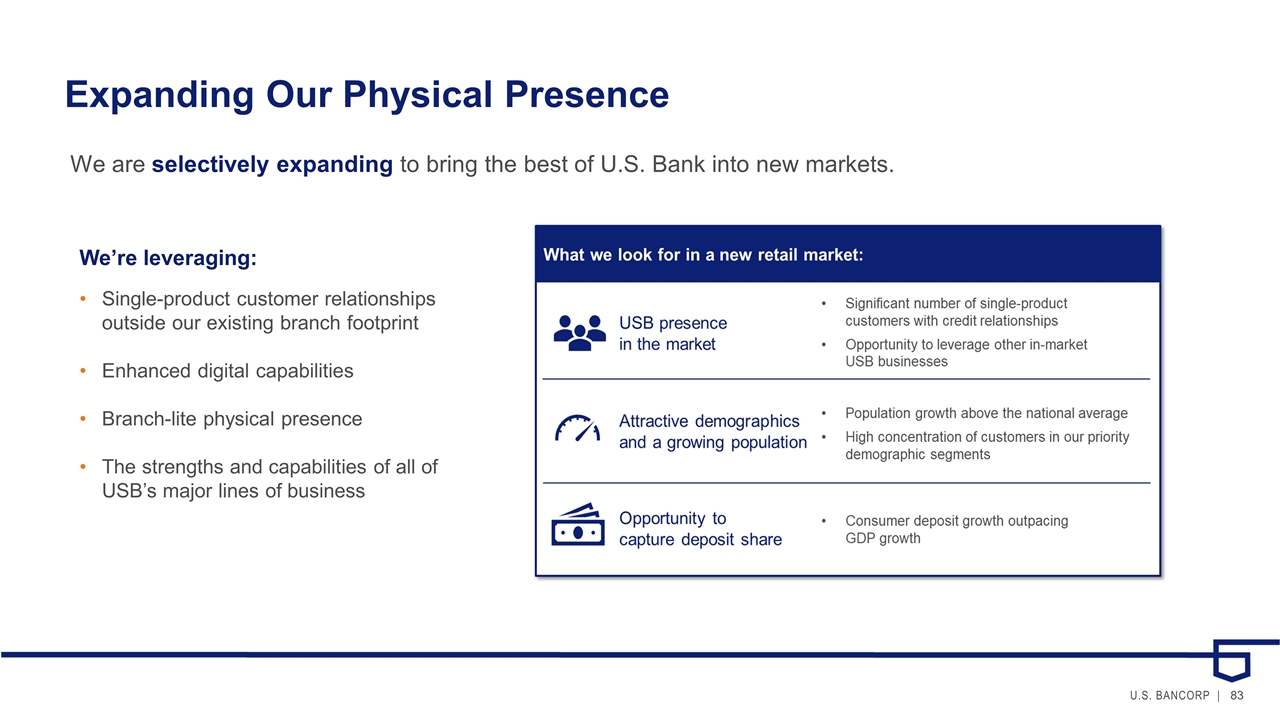

We’re leveraging: Single-product customer relationships outside our existing branch footprint Enhanced digital capabilities Branch-lite physical presence The strengths and capabilities of all of USB’s major lines of business Expanding Our Physical Presence We are selectively expanding to bring the best of U.S. Bank into new markets.

Optimizing to Reinvest Remodels and de novo branches built in 2019 Potential expansion states 2019 expansion market in Charlotte: more than 800 employees ~40k customers

In Summary… We are transforming Consumer and Business Banking to be: More agile and digital and able to serve customers better, faster and where and how they choose More personal, with the advice and information customers want More available, in new markets More optimized and efficient We expect to realize: Stronger growth Deeper relationships Greater efficiency

U.S. Bancorp Investor Day Corporate and Commercial Banking September 12, 2019 Leslie Godridge & Jim Kelligrew Vice Chairs and Co-Heads, Corporate and Commercial Banking

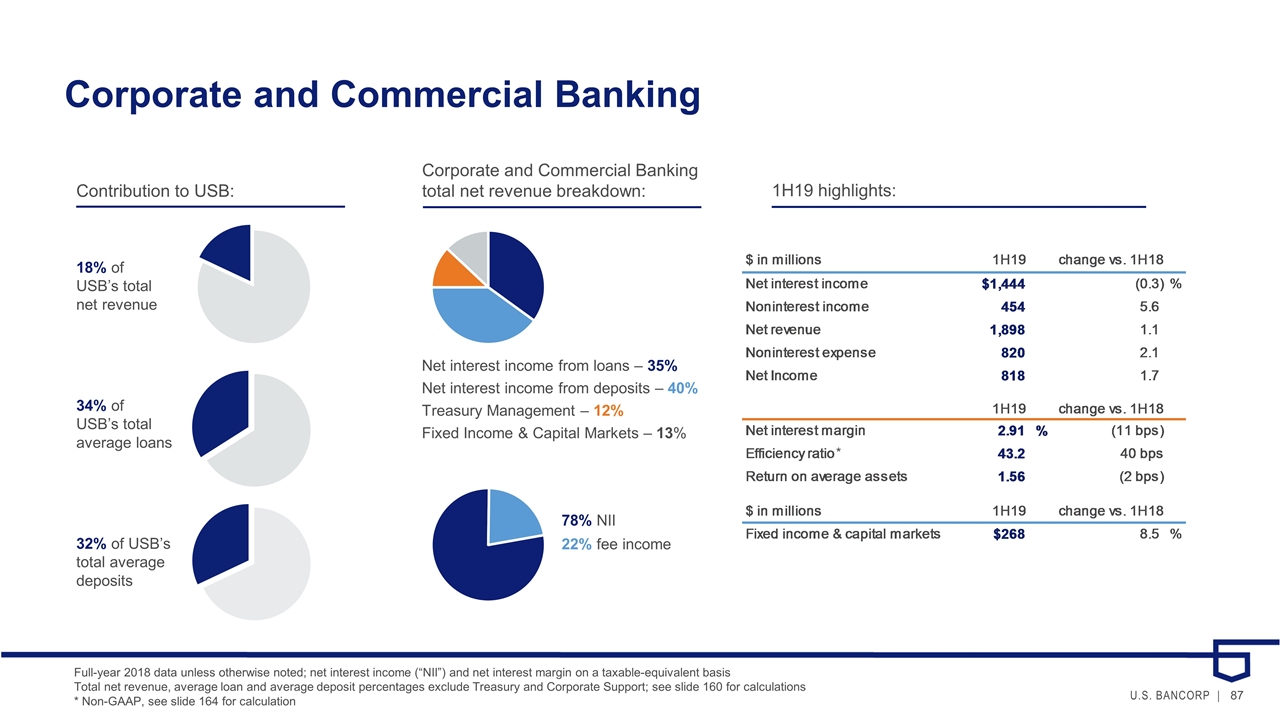

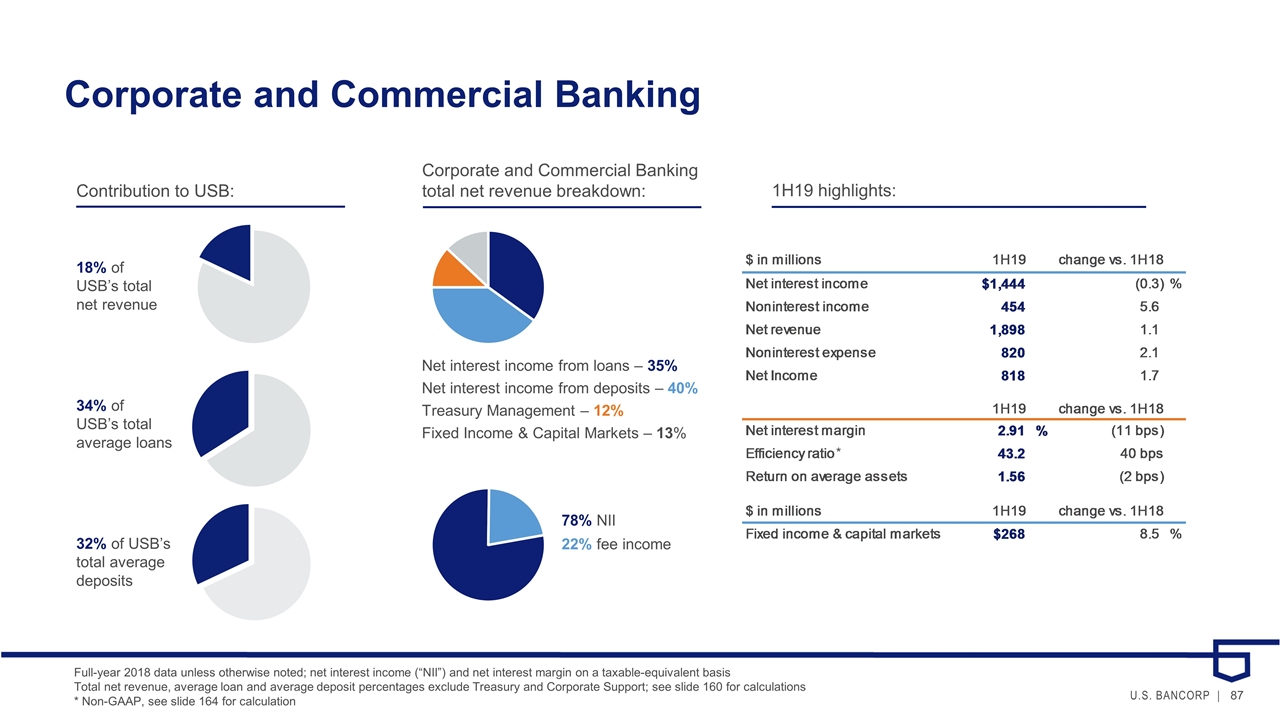

Corporate and Commercial Banking Net interest income from loans – 35% Net interest income from deposits – 40% Treasury Management – 12% Fixed Income & Capital Markets – 13% Corporate and Commercial Banking total net revenue breakdown: 1H19 highlights: 78% NII 22% fee income Contribution to USB: 18% of USB’s total net revenue 34% of USB’s total average loans 32% of USB’s total average deposits Full-year 2018 data unless otherwise noted; net interest income (“NII”) and net interest margin on a taxable-equivalent basis Total net revenue, average loan and average deposit percentages exclude Treasury and Corporate Support; see slide 160 for calculations * Non-GAAP, see slide 164 for calculation *

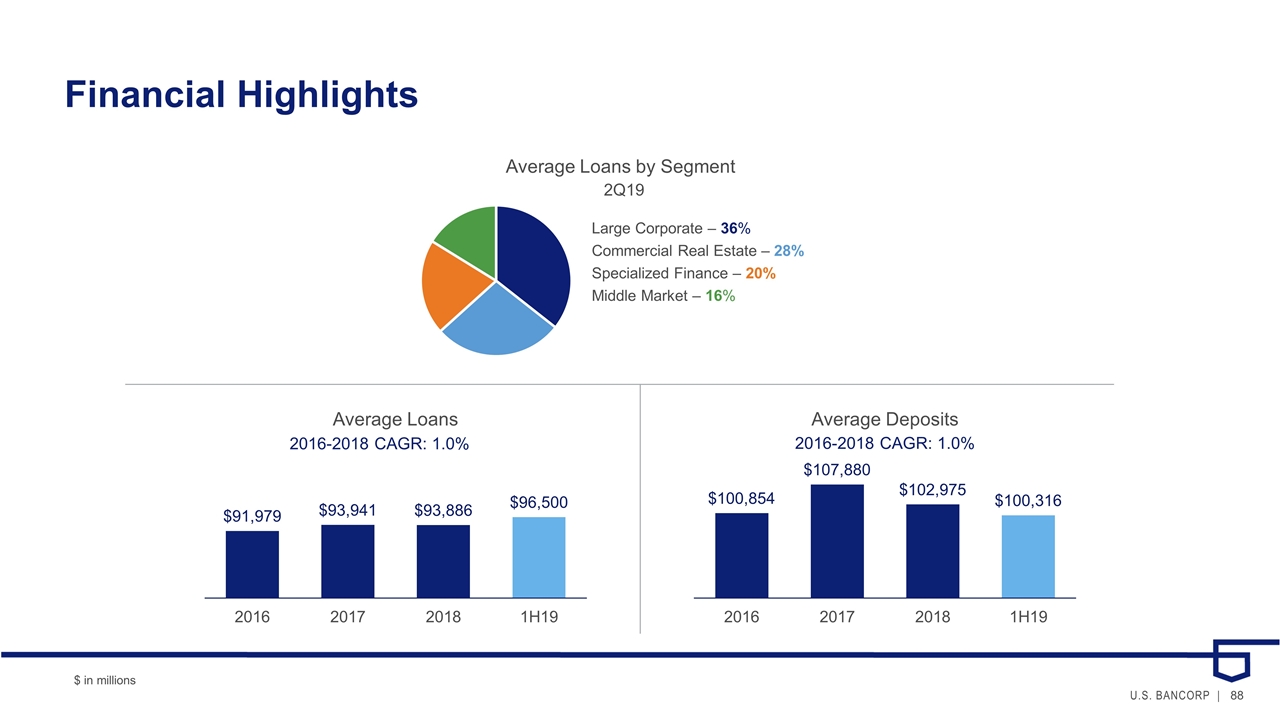

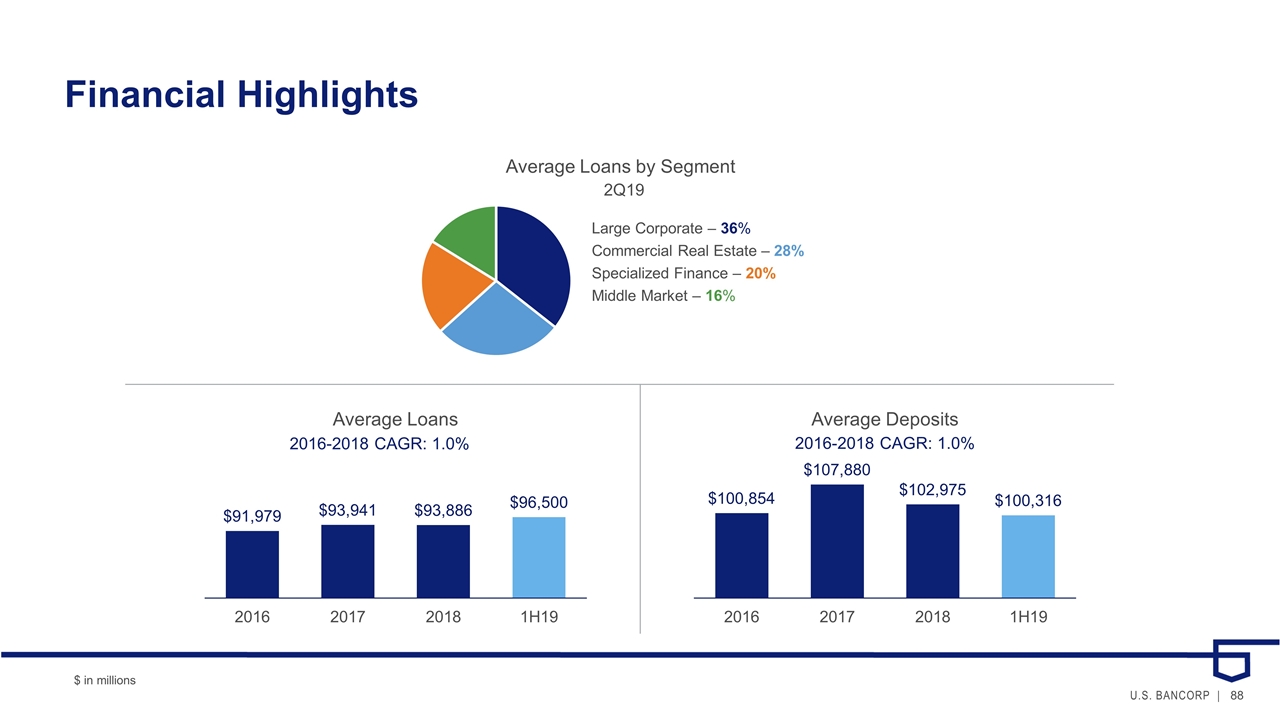

Financial Highlights Large Corporate – 36% Commercial Real Estate – 28% Specialized Finance – 20% Middle Market – 16% Average Loans by Segment 2Q19 2016-2018 CAGR: 1.0% 2016-2018 CAGR: 1.0% $ in millions

Best-in-class risk discipline Culture of innovation underpinning B2B opportunities Differentiated payments and trust solutions, with a One U.S. Bank approach to creating value Highest debt ratings Our Competitive Advantages counterparty of choice safety and dependability holistic set of products and solutions value-add and digitally-enabled solutions

Our Strategy and Key Initiatives Expanding Reach We are investing in our payments and digital capabilities to help our clients simplify, optimize and grow their businesses. Deepening Relationships We are selectively entering new markets, expanding our presence in current markets and enhancing our product offerings. Digitization of Business Payments We are growing our lead relationships in our lending and capital markets businesses and providing a holistic offering to our clients by leveraging One U.S. Bank.

Expanding Our Reach Selectively expanding our middle market presence Driving deeper penetration in the mid-corporate segment Expanding capital markets coverage in key industries Charlotte New York Dallas Houston Orlando We are extending our distribution. We are enhancing and deepening our product set with new and complementary solutions as well as digital and tech-driven improvements to our existing solutions. Asset-backed warehouse lending Modernized treasury management platform Targeted money movement solutions with a focus on key industry verticals Retail branch footprint CCB office est. pre-2007 CCB office est. since 2007 Middle market footprint expansion

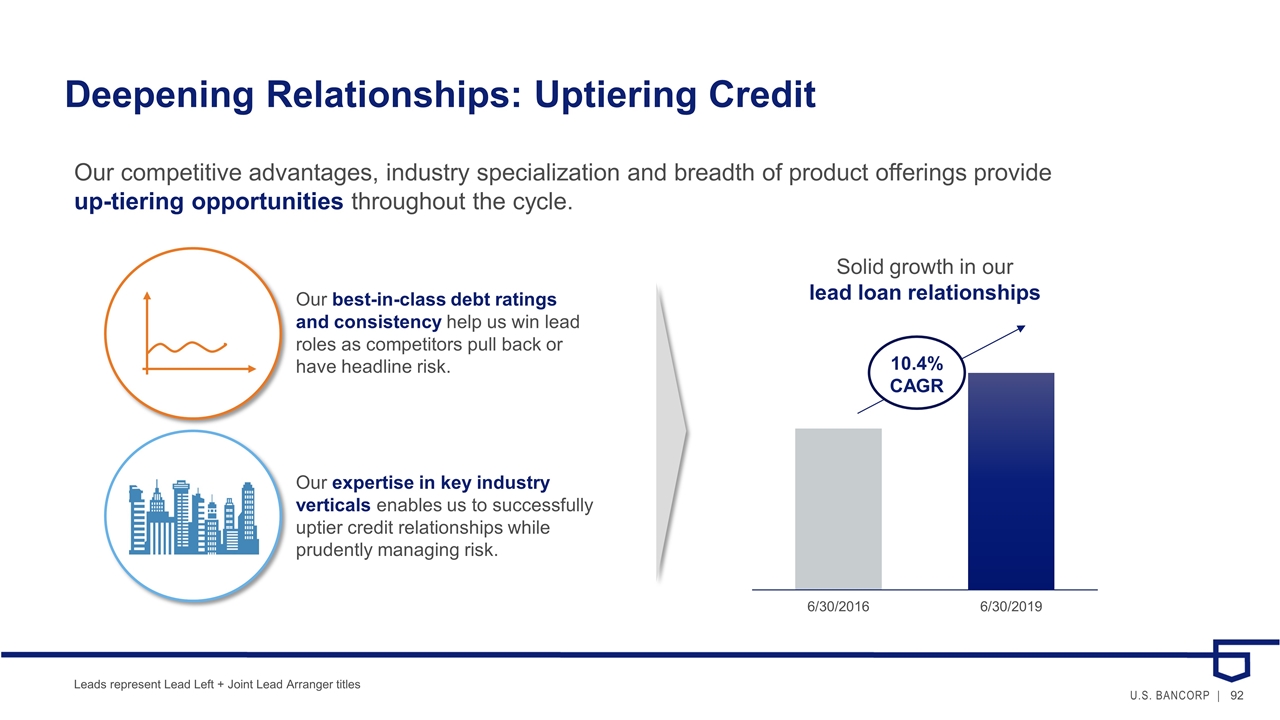

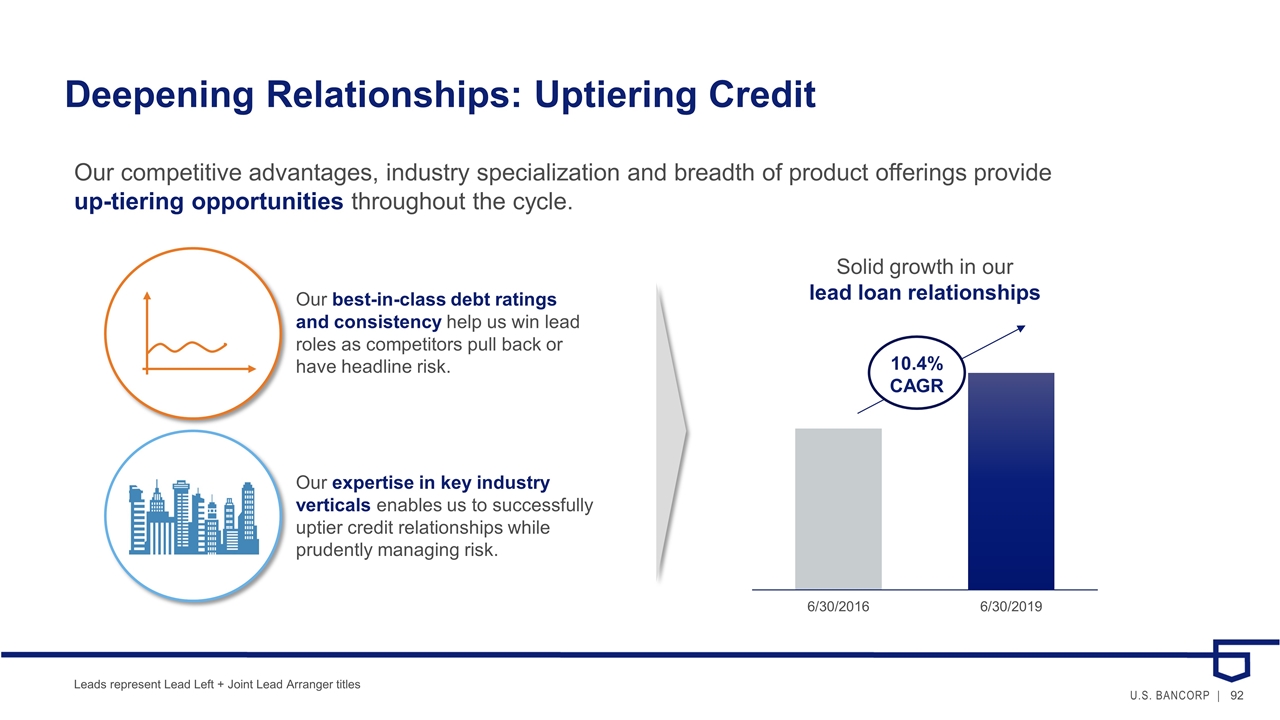

Deepening Relationships: Uptiering Credit Solid growth in our lead loan relationships Leads represent Lead Left + Joint Lead Arranger titles Our competitive advantages, industry specialization and breadth of product offerings provide up-tiering opportunities throughout the cycle. 10.4% CAGR Our best-in-class debt ratings and consistency help us win lead roles as competitors pull back or have headline risk. Our expertise in key industry verticals enables us to successfully uptier credit relationships while prudently managing risk.

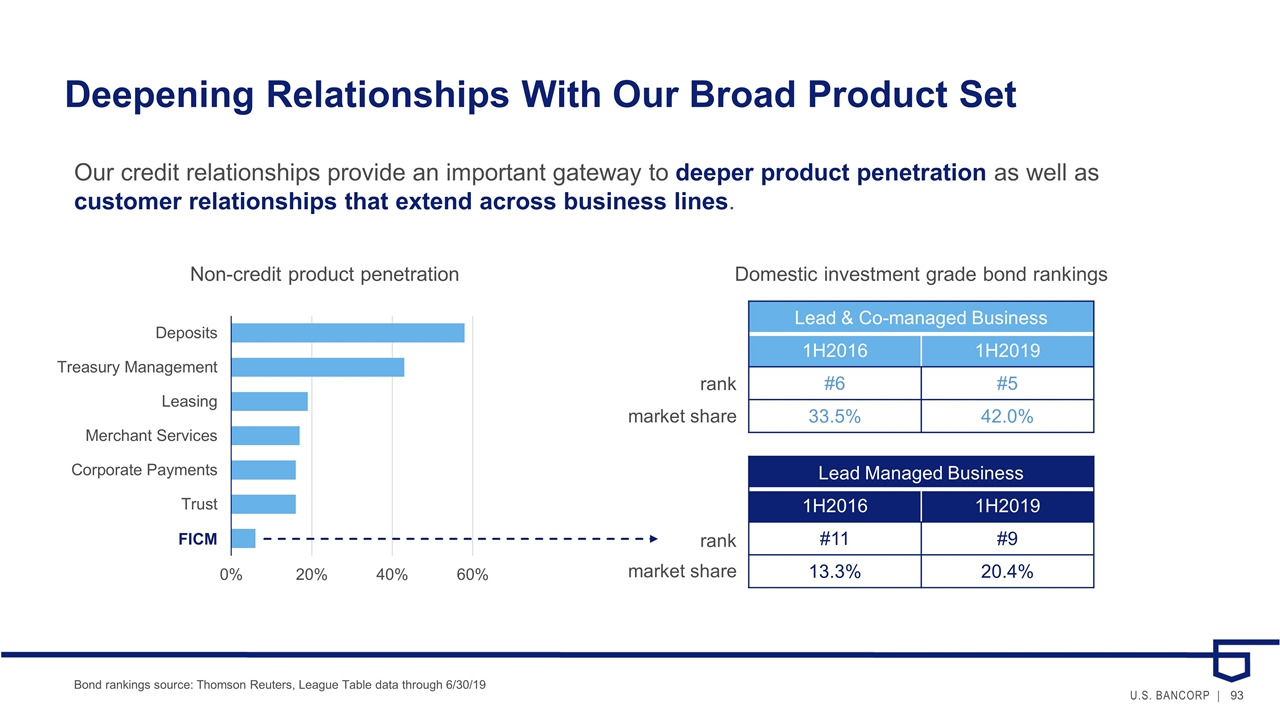

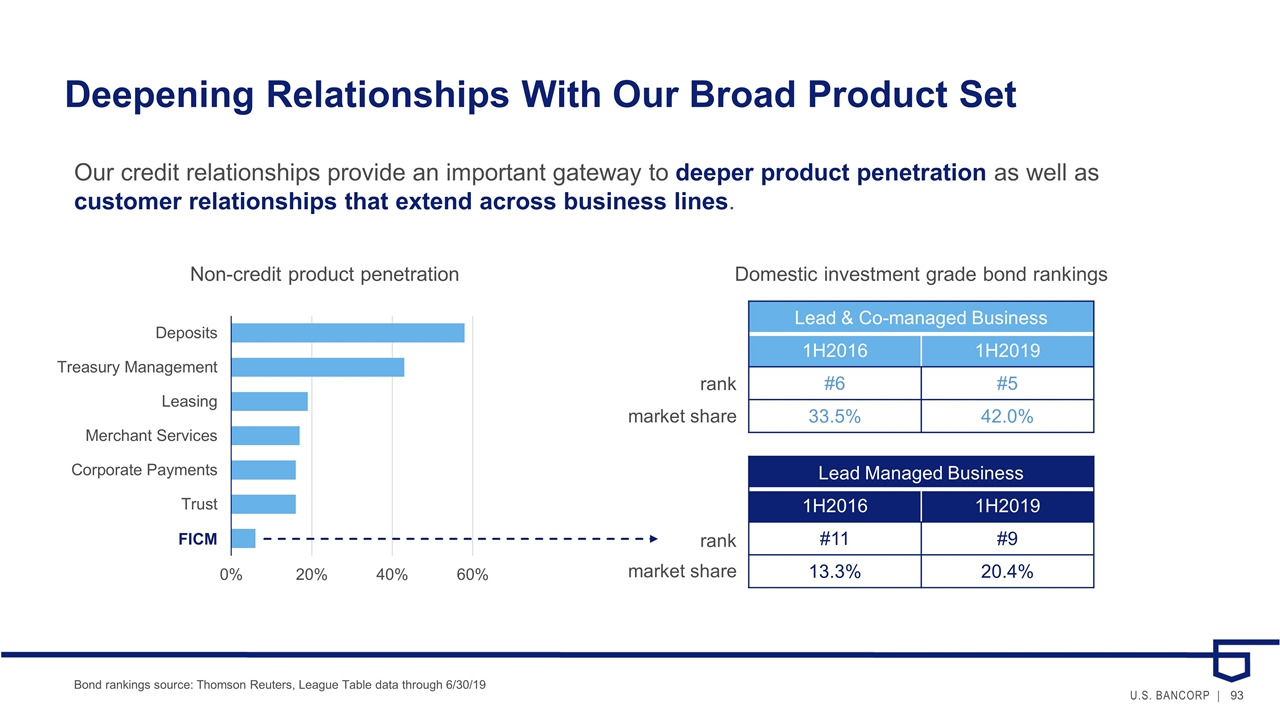

Deepening Relationships With Our Broad Product Set Bond rankings source: Thomson Reuters, League Table data through 6/30/19 Non-credit product penetration Our credit relationships provide an important gateway to deeper product penetration as well as customer relationships that extend across business lines. rank market share Lead & Co-managed Business 1H2016 1H2019 #6 #5 33.5% 42.0% rank market share Lead Managed Business 1H2016 1H2019 #11 #9 13.3% 20.4% Domestic investment grade bond rankings FICM

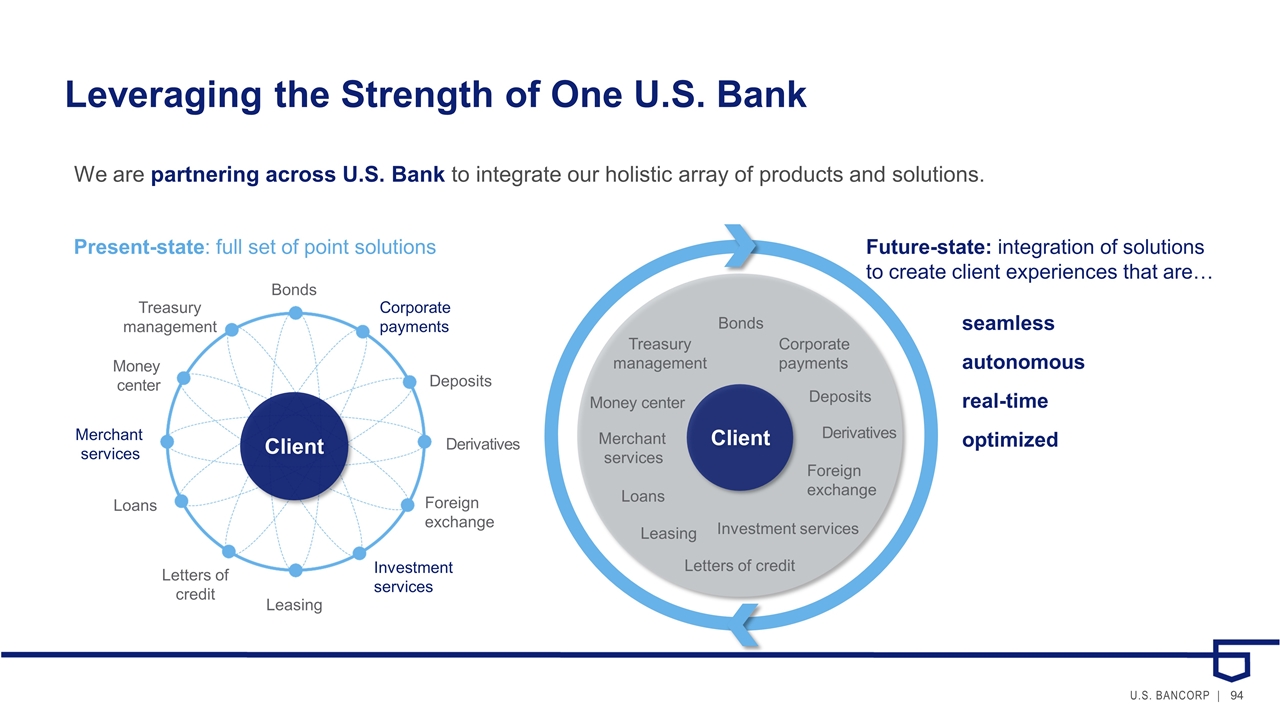

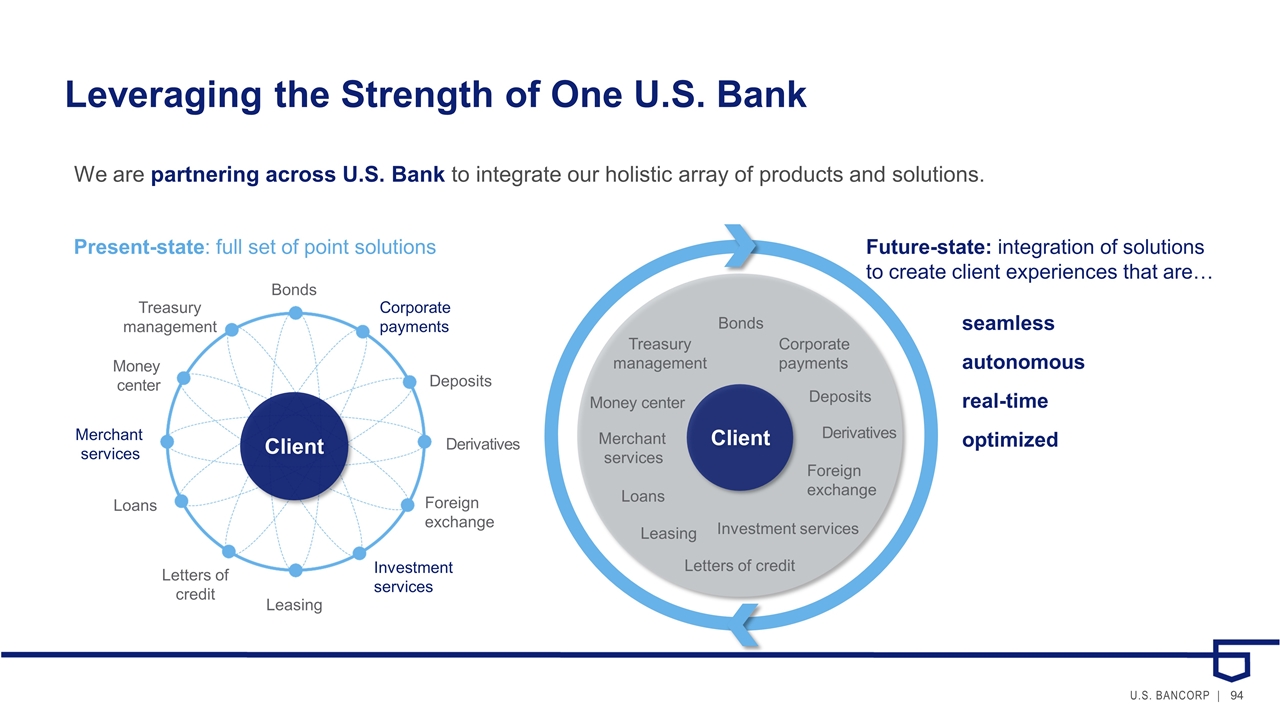

Leveraging the Strength of One U.S. Bank We are partnering across U.S. Bank to integrate our holistic array of products and solutions. Corporate payments Deposits Derivatives Foreign exchange Investment services Letters of credit Loans Treasury management Money center Merchant services Client Bonds Leasing seamless autonomous real-time optimized Corporate payments Deposits Derivatives Foreign exchange Investment services Letters of credit Loans Treasury management Money center Merchant services Client Bonds Leasing Future-state: integration of solutions to create client experiences that are… Present-state: full set of point solutions

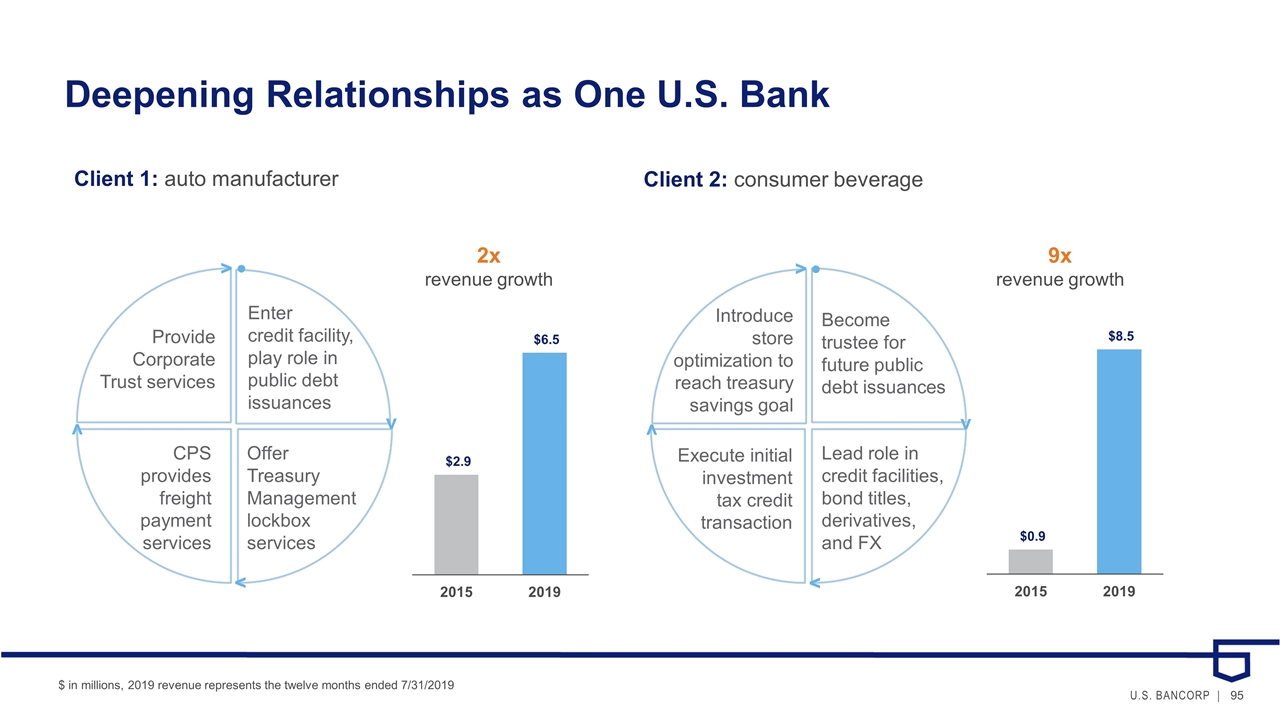

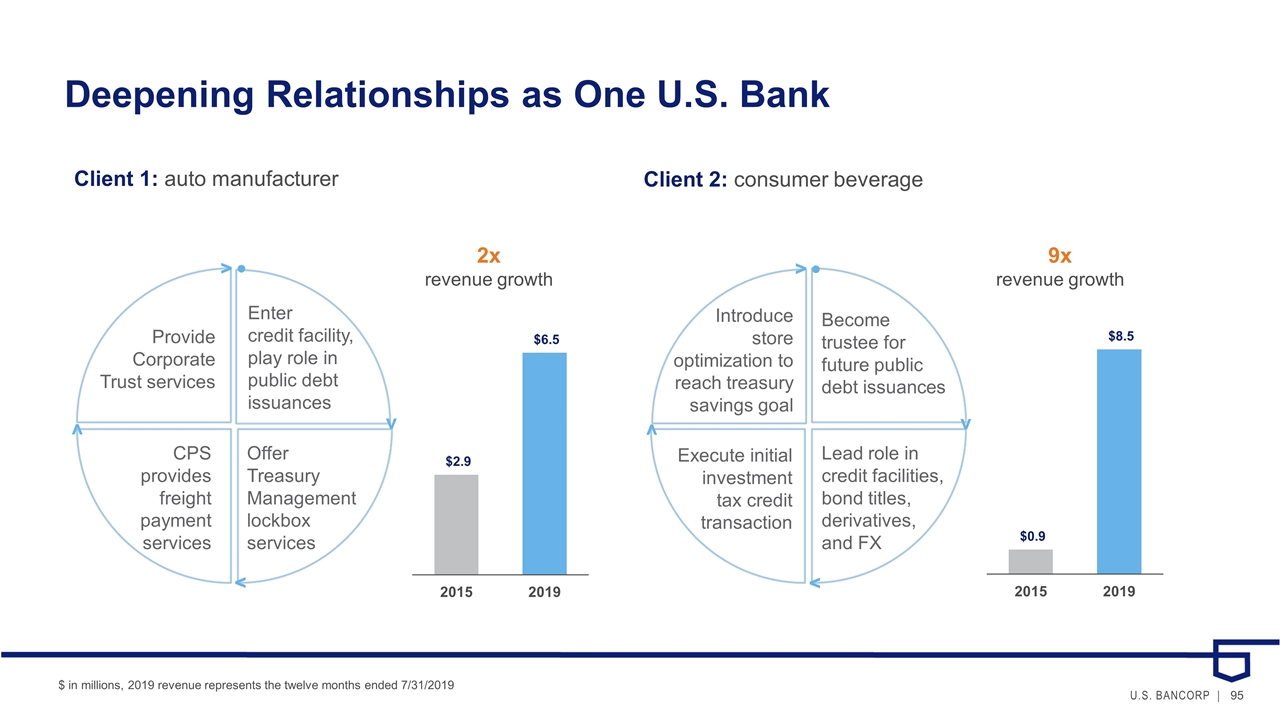

Deepening Relationships as One U.S. Bank $ in millions, 2019 revenue represents the twelve months ended 7/31/2019 Client 1: auto manufacturer CPS provides freight payment services Offer Treasury Management lockbox services Provide Corporate Trust services 2x revenue growth Execute initial investment tax credit transaction Lead role in credit facilities, bond titles, derivatives, and FX Become trustee for future public debt issuances Introduce store optimization to reach treasury savings goal 9x revenue growth Client 2: consumer beverage v v v v v v v v Enter credit facility, play role in public debt issuances

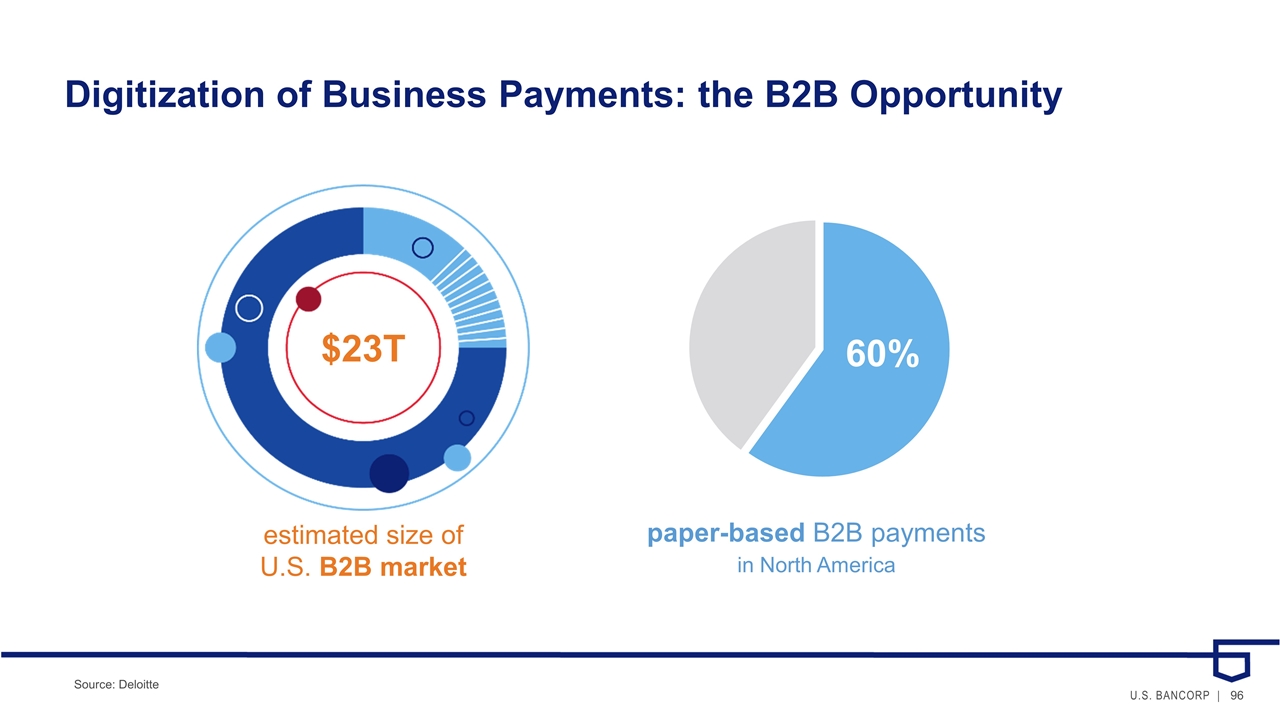

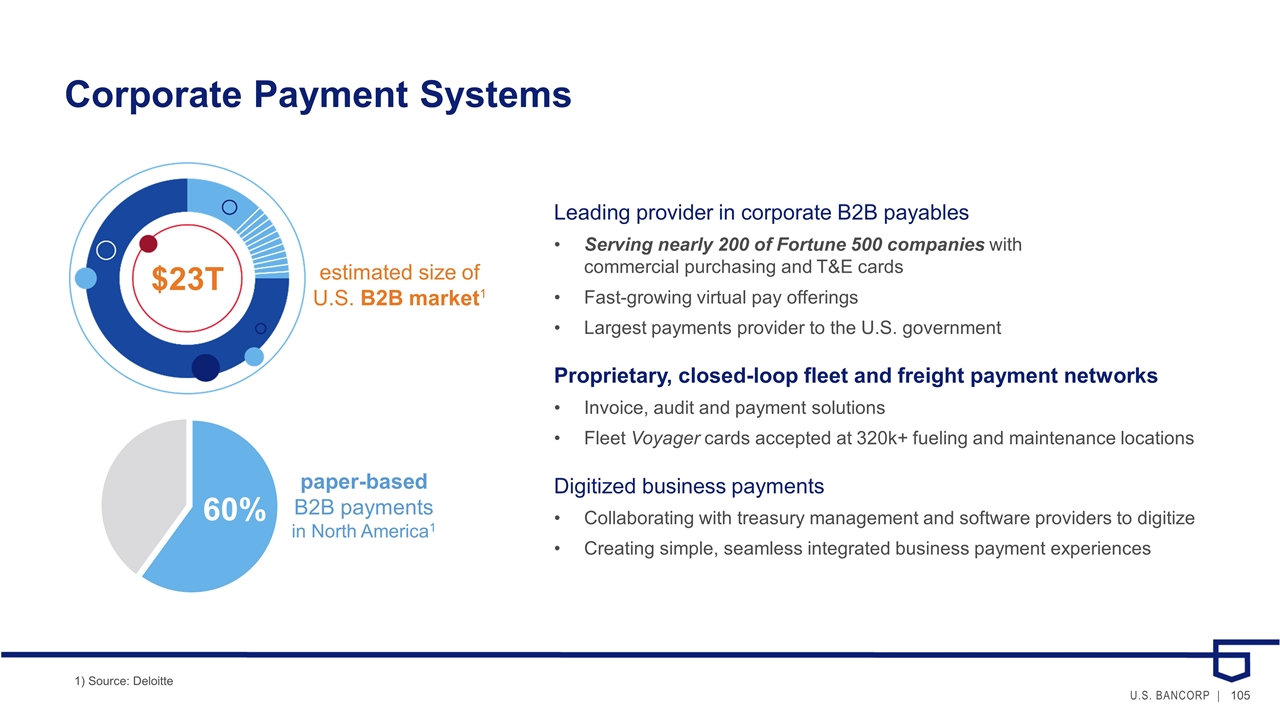

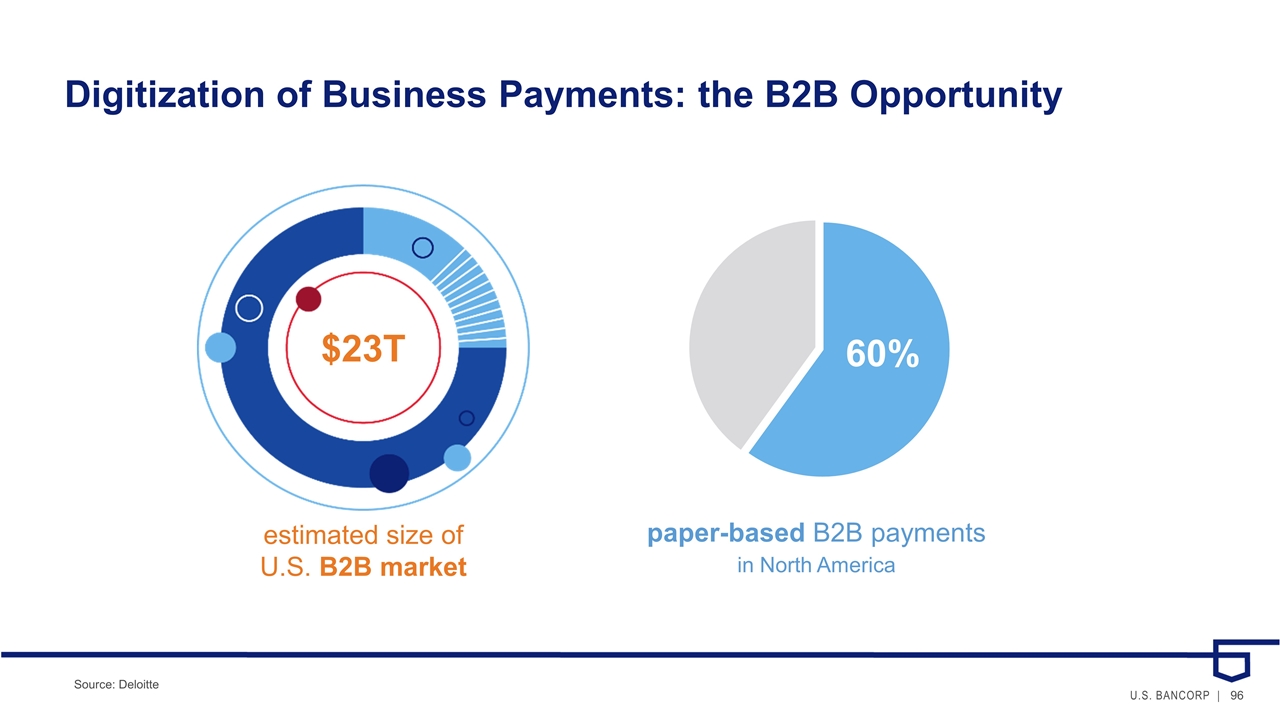

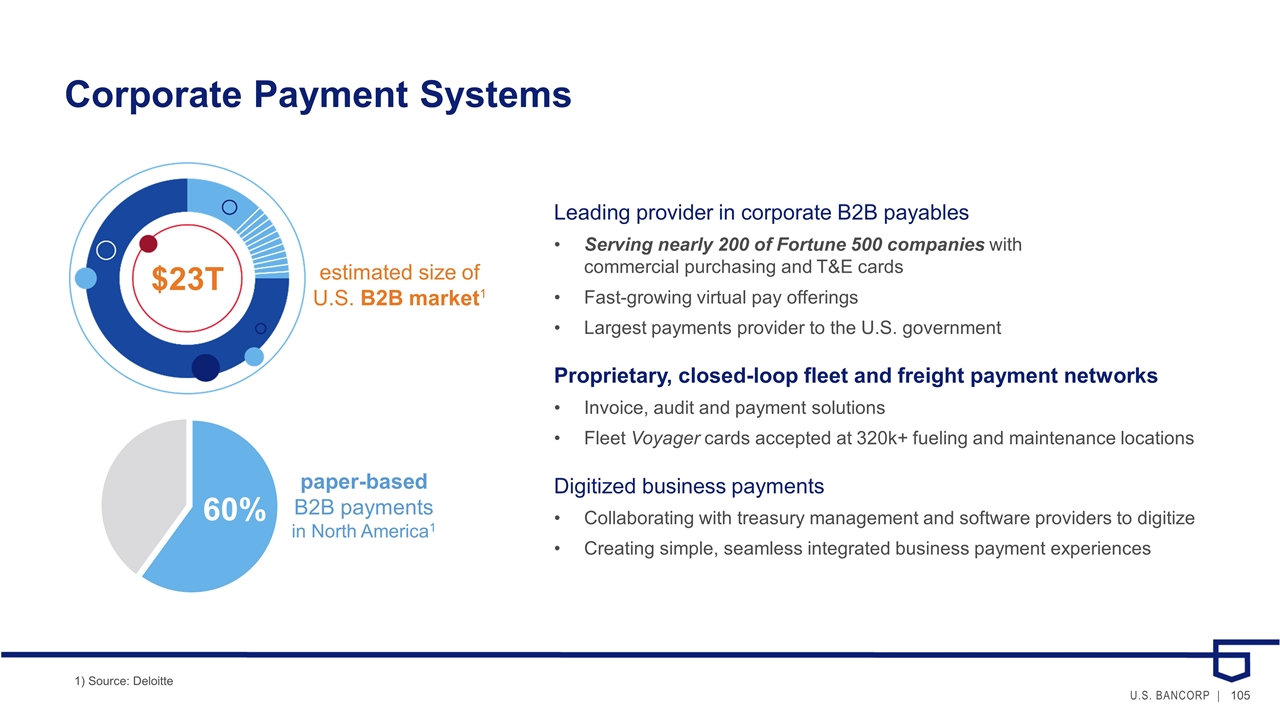

Digitization of Business Payments: the B2B Opportunity estimated size of U.S. B2B market paper-based B2B payments in North America $23T 60% Source: Deloitte

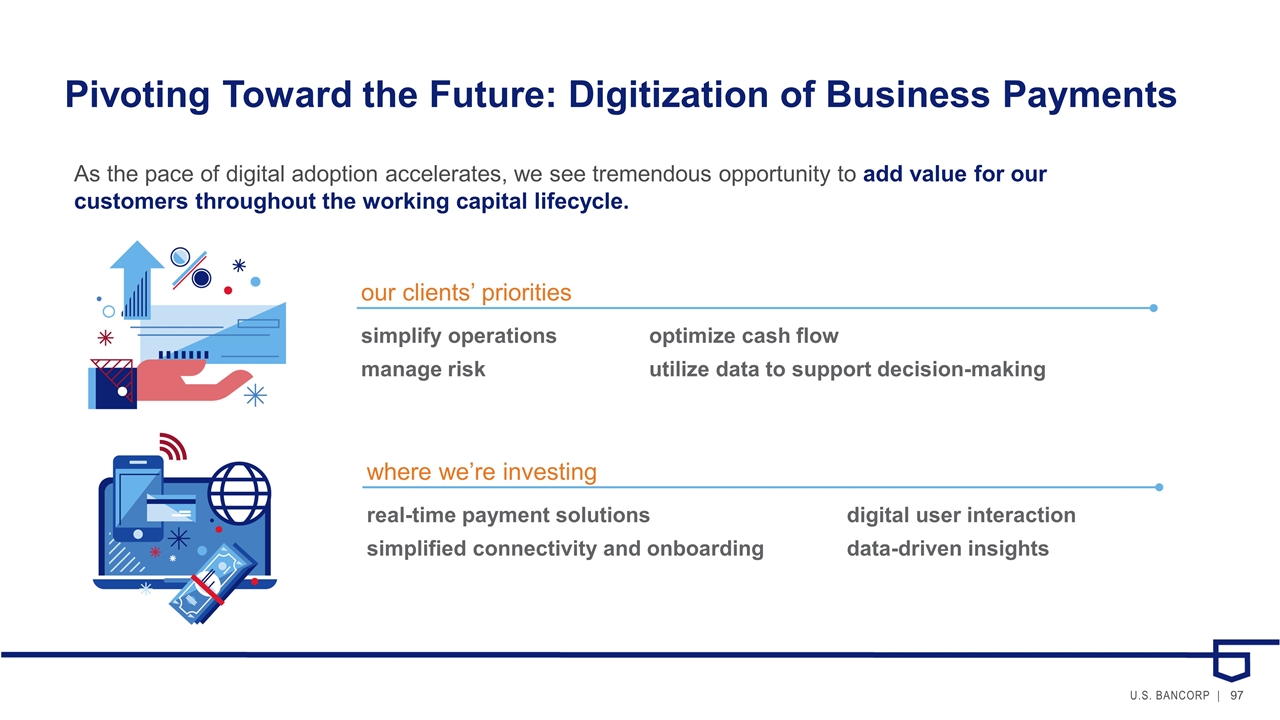

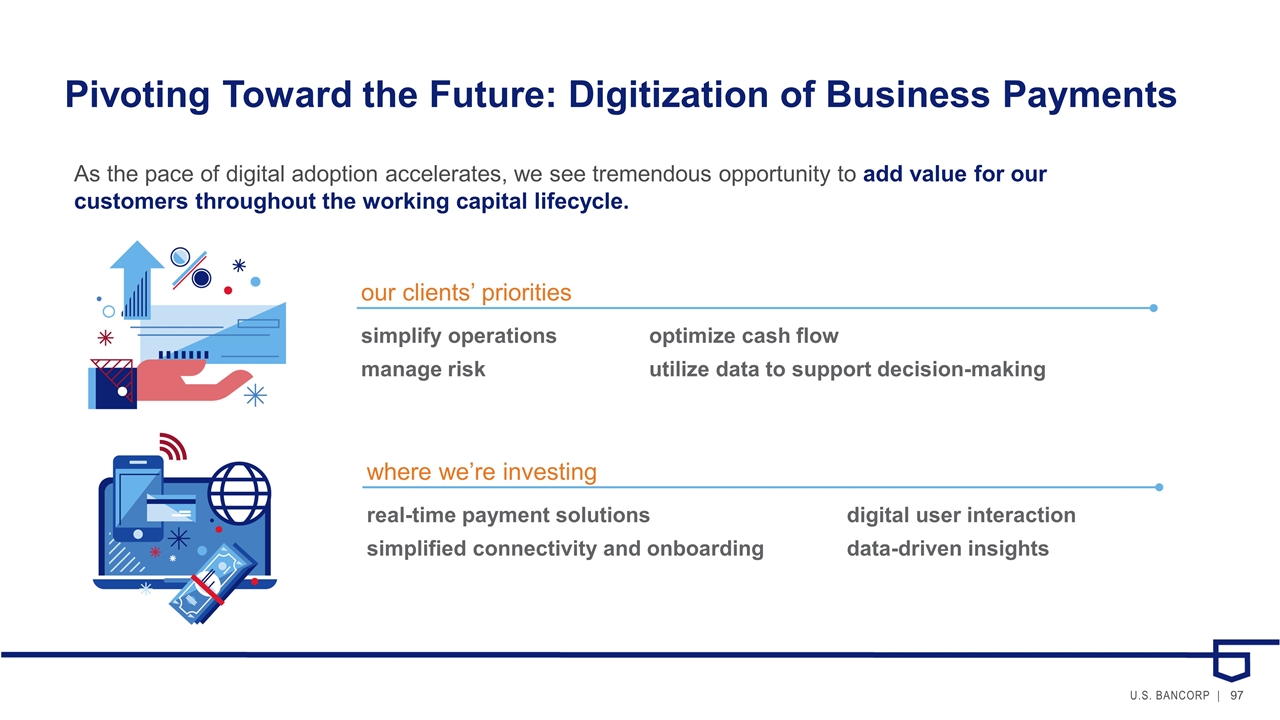

Pivoting Toward the Future: Digitization of Business Payments our clients’ priorities simplify operationsoptimize cash flow manage riskutilize data to support decision-making As the pace of digital adoption accelerates, we see tremendous opportunity to add value for our customers throughout the working capital lifecycle. where we’re investing real-time payment solutionsdigital user interaction simplified connectivity and onboardingdata-driven insights

In Summary… We are: Leveraging our competitive advantages Building on the success of past investments Expanding our reach through increased distribution and enhanced product capabilities Investing in the digitization of business payments We expect to: Deepen client relationships Continue to gain share via opportunities in lending and capital markets Capture market share in the emerging business payments space as the shift toward digital accelerates

U.S. Bancorp Investor Day Payment Services September 12, 2019 Shailesh Kotwal Vice Chair, Payment Services

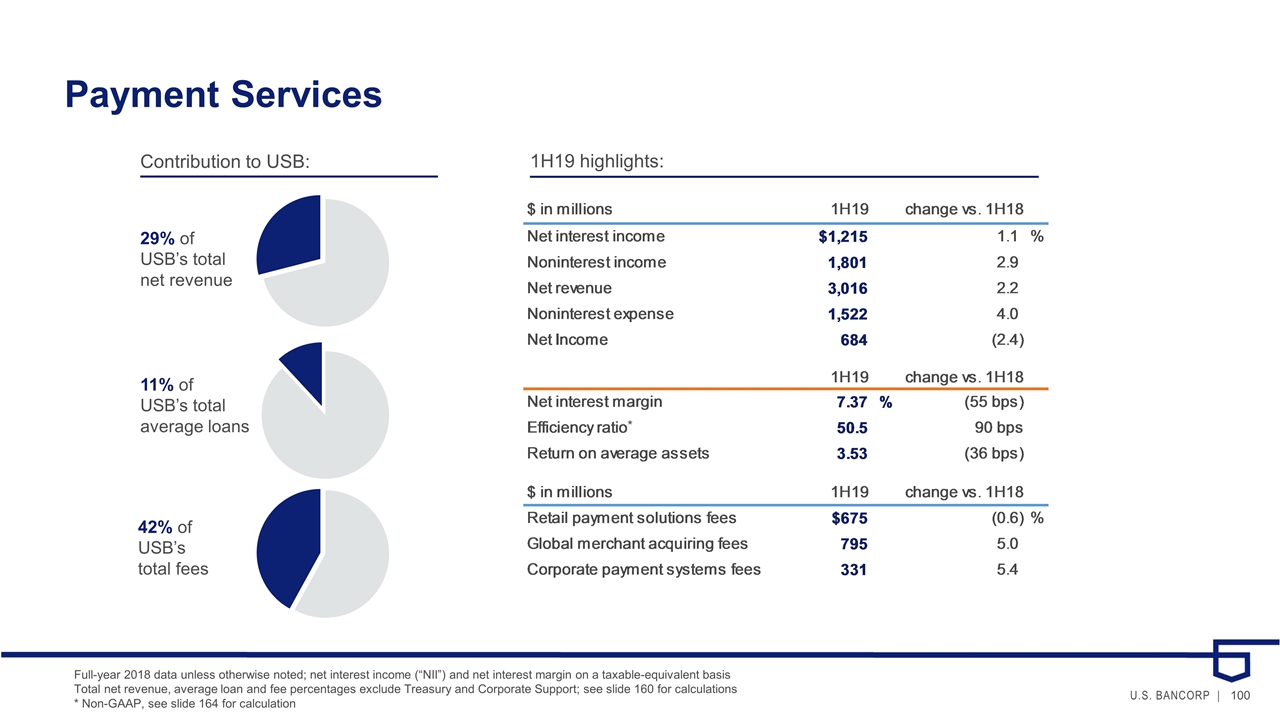

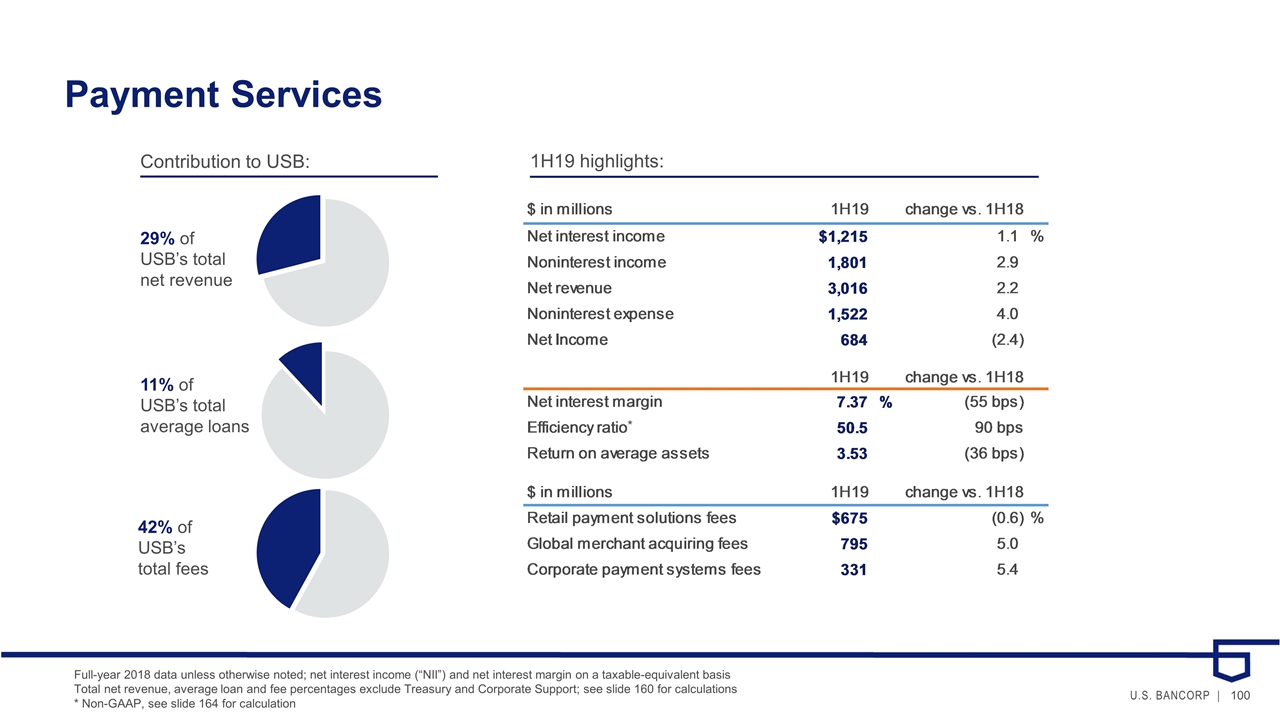

Payment Services 1H19 highlights: Contribution to USB: 29% of USB’s total net revenue 11% of USB’s total average loans 42% of USB’s total fees Full-year 2018 data unless otherwise noted; net interest income (“NII”) and net interest margin on a taxable-equivalent basis Total net revenue, average loan and fee percentages exclude Treasury and Corporate Support; see slide 160 for calculations * Non-GAAP, see slide 164 for calculation *

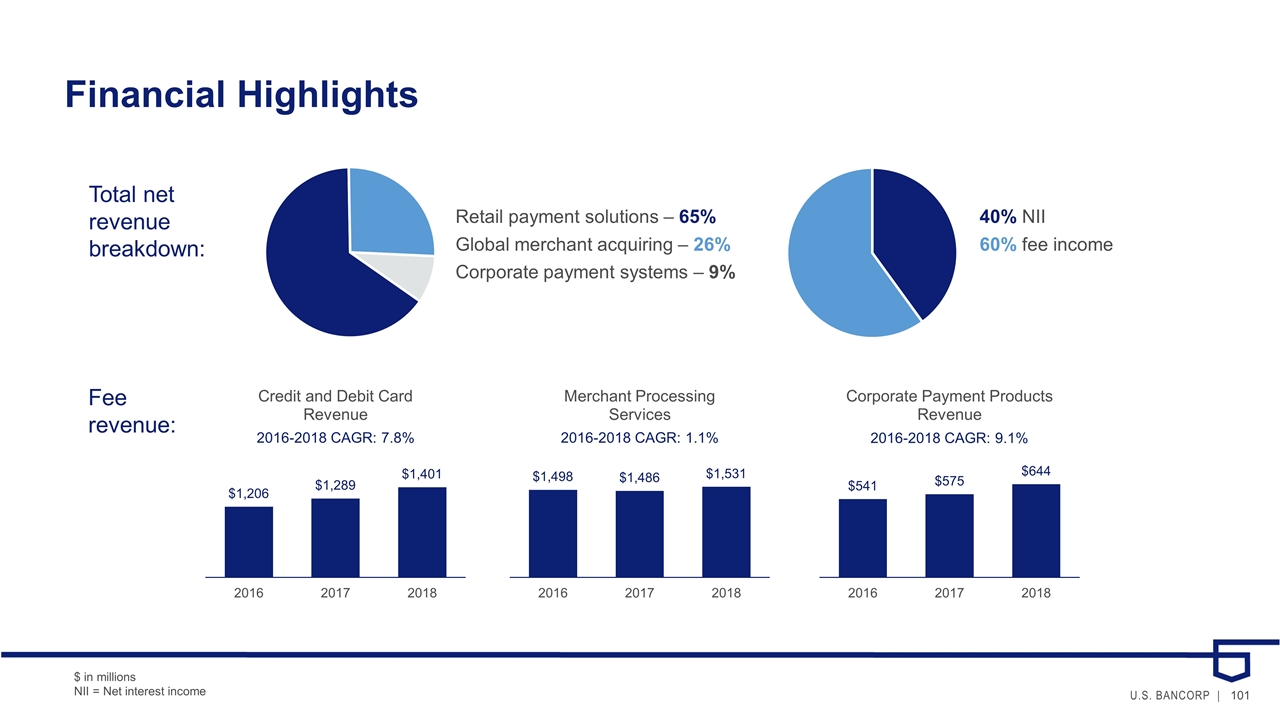

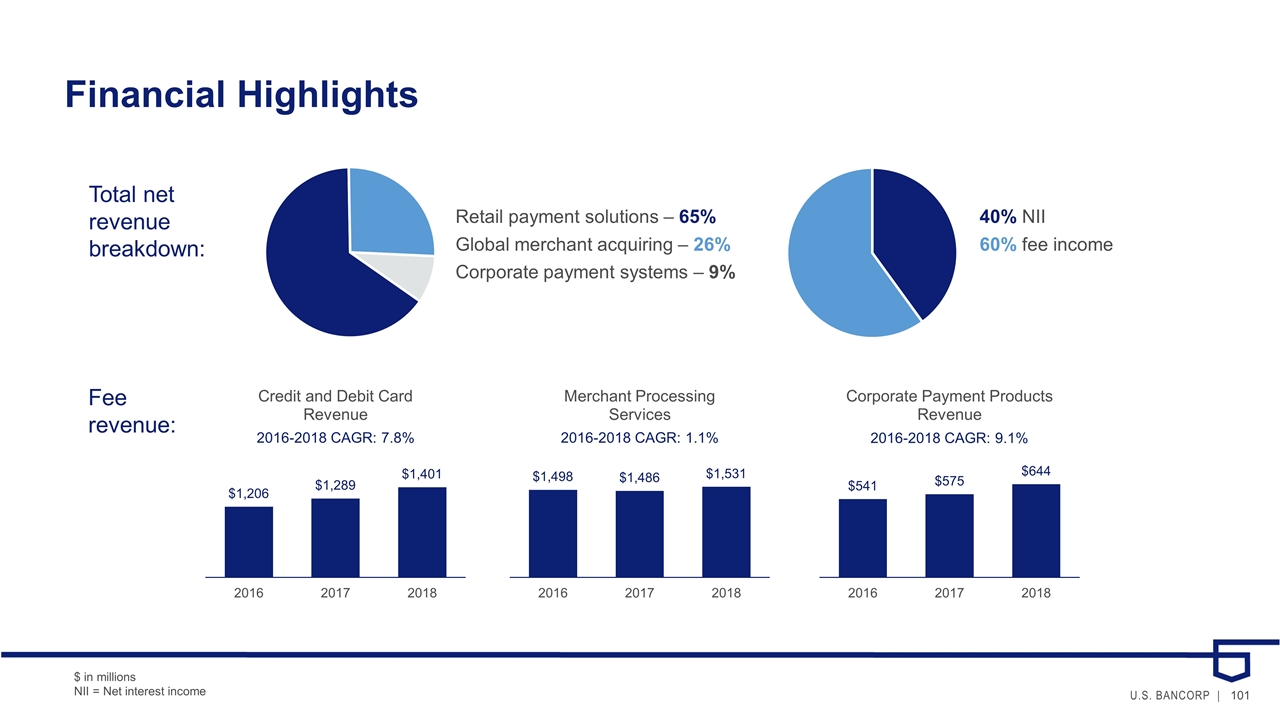

Financial Highlights Retail payment solutions – 65% Global merchant acquiring – 26% Corporate payment systems – 9% Total net revenue breakdown: 40% NII 60% fee income 2016-2018 CAGR: 7.8% 2016-2018 CAGR: 1.1% 2016-2018 CAGR: 9.1% $ in millions NII = Net interest income Fee revenue:

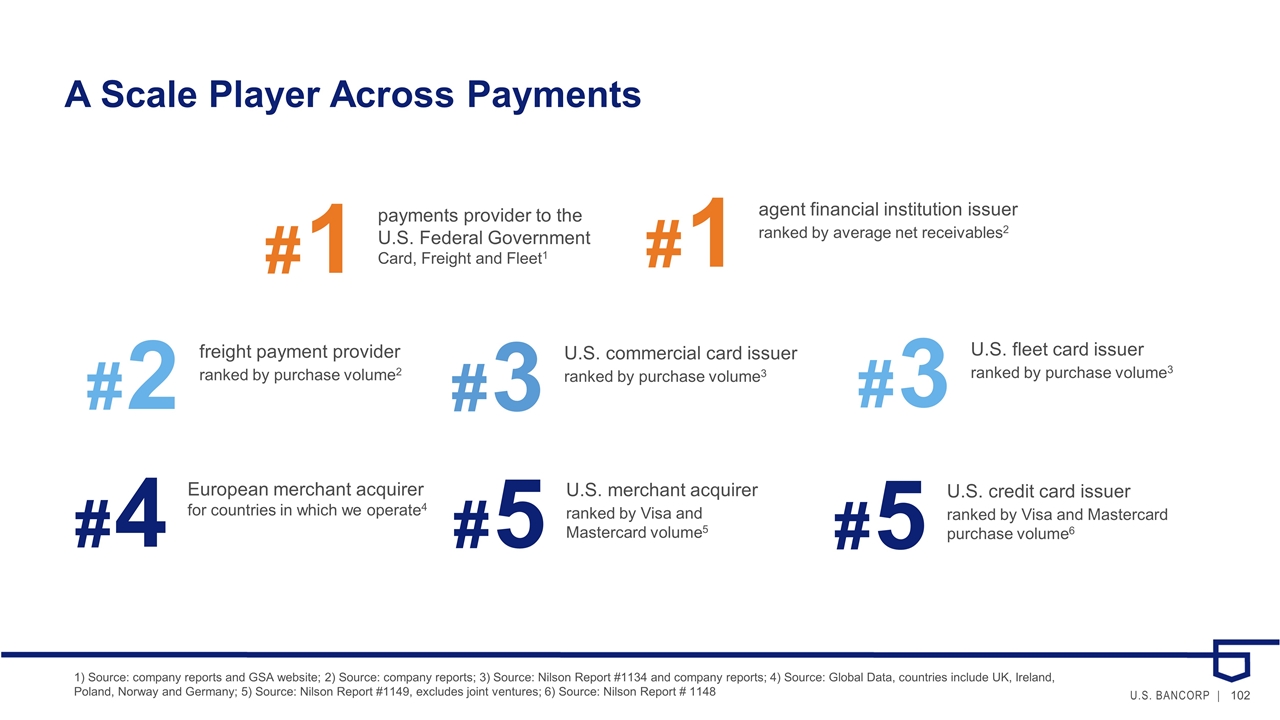

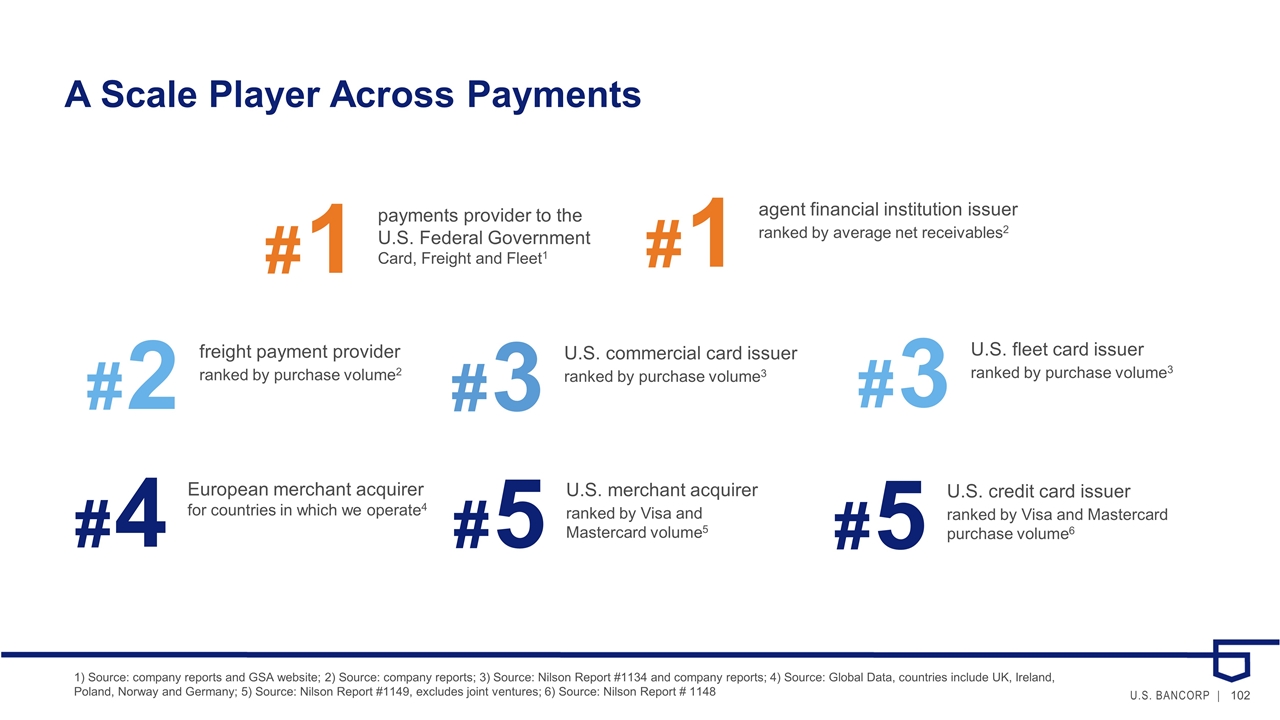

A Scale Player Across Payments 1) Source: company reports and GSA website; 2) Source: company reports; 3) Source: Nilson Report #1134 and company reports; 4) Source: Global Data, countries include UK, Ireland, Poland, Norway and Germany; 5) Source: Nilson Report #1149, excludes joint ventures; 6) Source: Nilson Report # 1148 U.S. credit card issuer ranked by Visa and Mastercard purchase volume6 # 5 U.S. merchant acquirer ranked by Visa and Mastercard volume5 # 5 agent financial institution issuer ranked by average net receivables2 # 1 payments provider to the U.S. Federal Government Card, Freight and Fleet1 # 1 U.S. commercial card issuer ranked by purchase volume3 # 3 freight payment provider ranked by purchase volume2 # 2 U.S. fleet card issuer ranked by purchase volume3 # 3 European merchant acquirer for countries in which we operate4 # 4

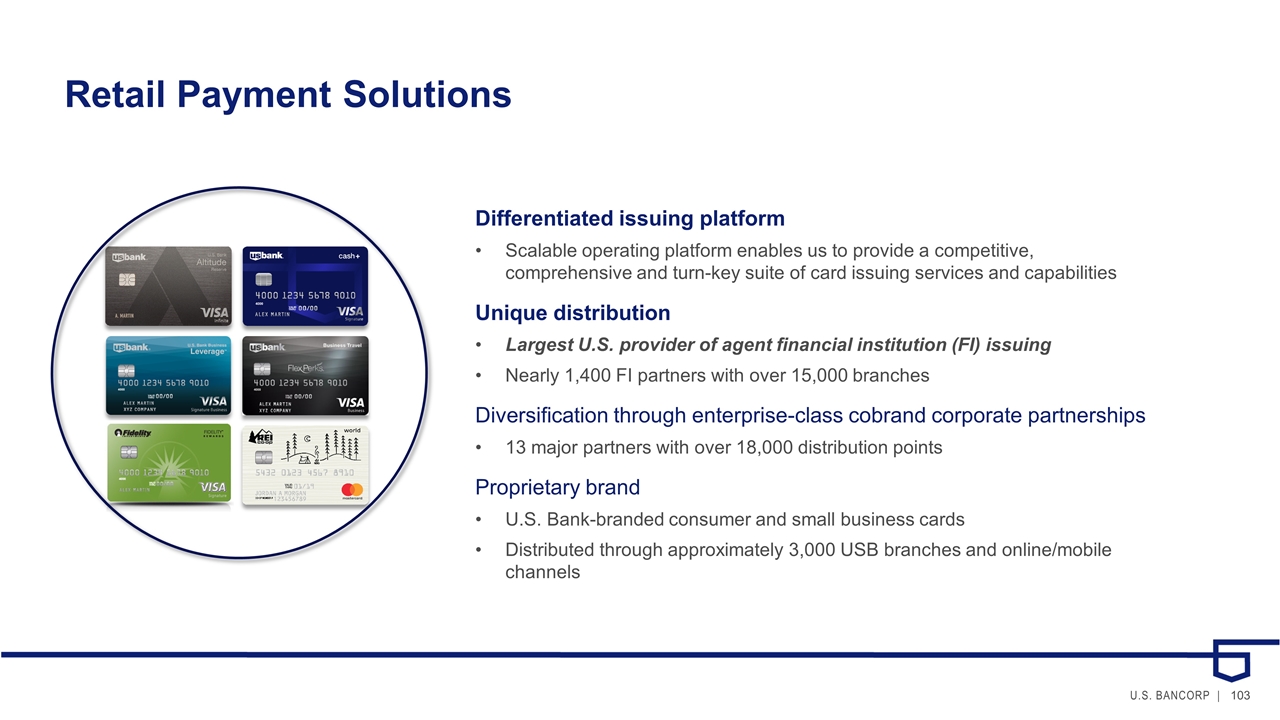

Retail Payment Solutions Differentiated issuing platform Scalable operating platform enables us to provide a competitive, comprehensive and turn-key suite of card issuing services and capabilities Unique distribution Largest U.S. provider of agent financial institution (FI) issuing Nearly 1,400 FI partners with over 15,000 branches Diversification through enterprise-class cobrand corporate partnerships 13 major partners with over 18,000 distribution points Proprietary brand U.S. Bank-branded consumer and small business cards Distributed through approximately 3,000 USB branches and online/mobile channels

Global Merchant Acquiring International processing platform Pan-European acquirer processing 100+ currencies in 25+ countries Integration with software vendors Continuing to build, buy and collaborate on solutions that drive growth in our ISV distribution channel and enhance our offerings in select vertical markets ISV partnerships up more than 40% YoY Industry vertical specialization Key verticals include airline, hospitality, healthcare, and small- and medium-sized businesses (SMBs) Added capabilities serving state and local governments Delivering comprehensive and seamless banking solutions Integrating banking products with merchant processing capabilities

Corporate Payment Systems Leading provider in corporate B2B payables Serving nearly 200 of Fortune 500 companies with commercial purchasing and T&E cards Fast-growing virtual pay offerings Largest payments provider to the U.S. government Proprietary, closed-loop fleet and freight payment networks Invoice, audit and payment solutions Fleet Voyager cards accepted at 320k+ fueling and maintenance locations Digitized business payments Collaborating with treasury management and software providers to digitize Creating simple, seamless integrated business payment experiences paper-based B2B payments in North America1 estimated size of U.S. B2B market1 1) Source: Deloitte 60% $23T

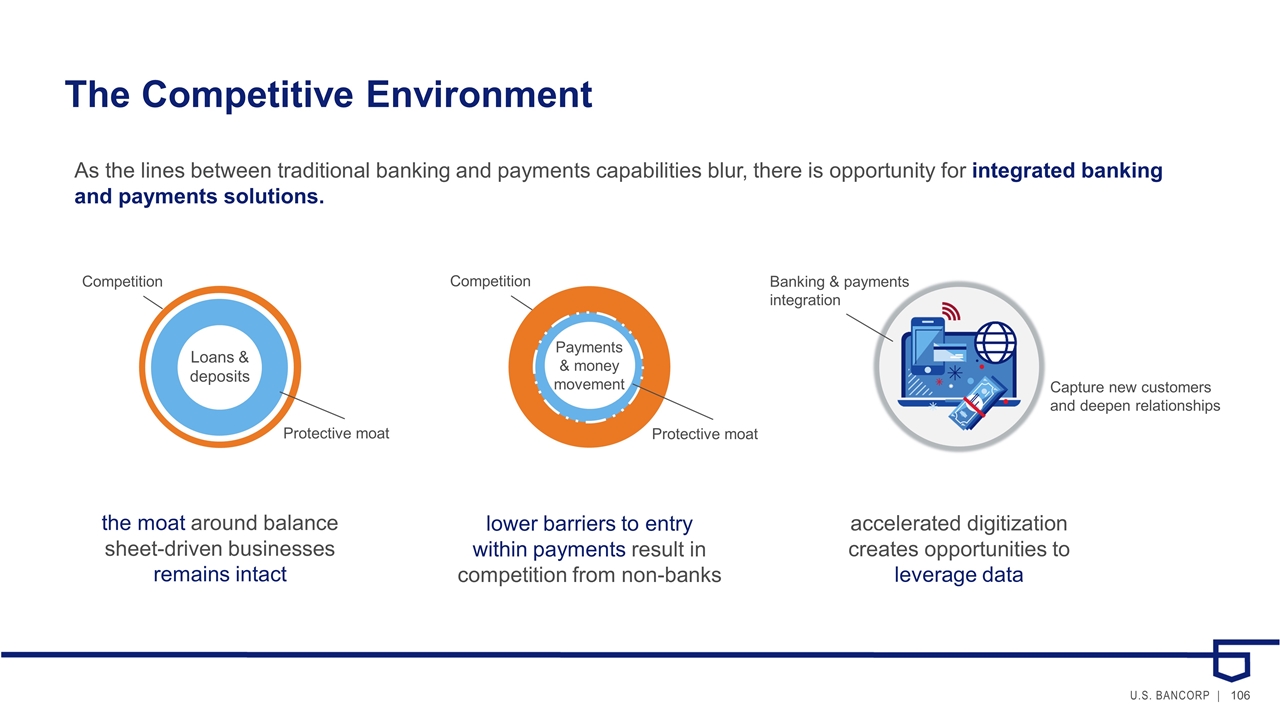

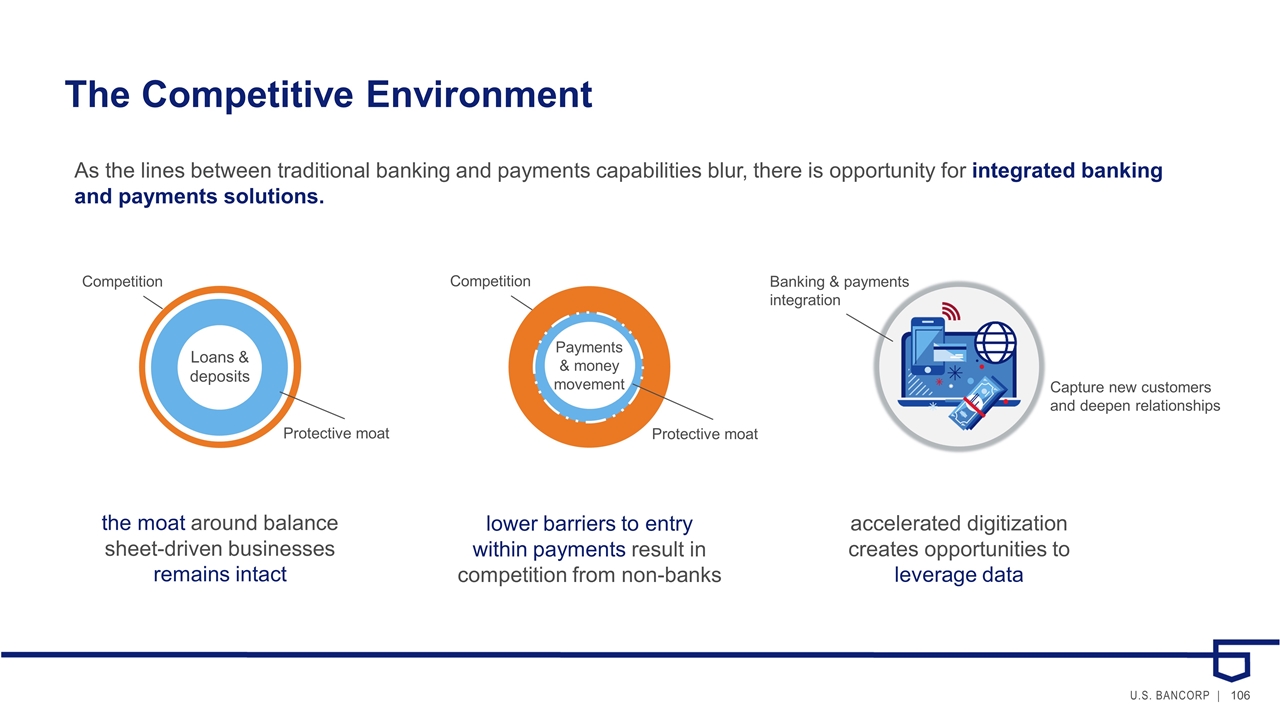

The Competitive Environment As the lines between traditional banking and payments capabilities blur, there is opportunity for integrated banking and payments solutions. the moat around balance sheet-driven businesses remains intact lower barriers to entry within payments result in competition from non-banks accelerated digitization creates opportunities to leverage data Loans & deposits Competition Protective moat Payments & money movement Competition Protective moat Banking & payments integration Capture new customers and deepen relationships

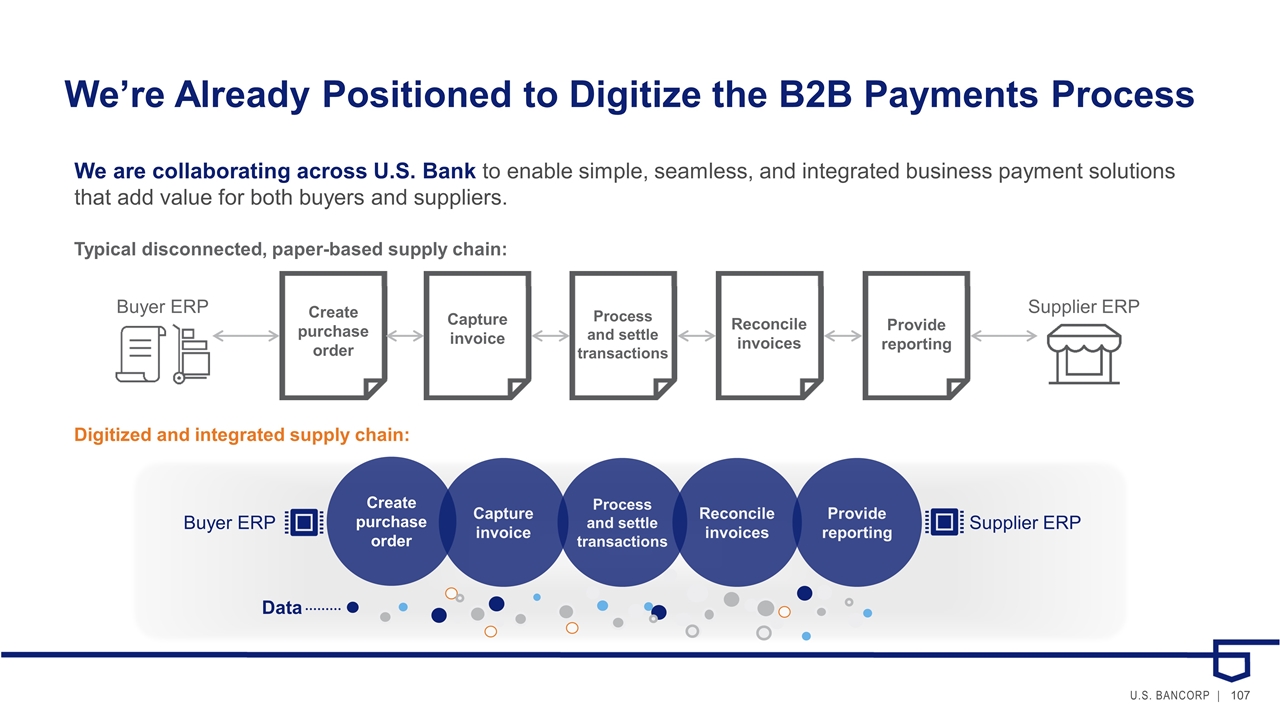

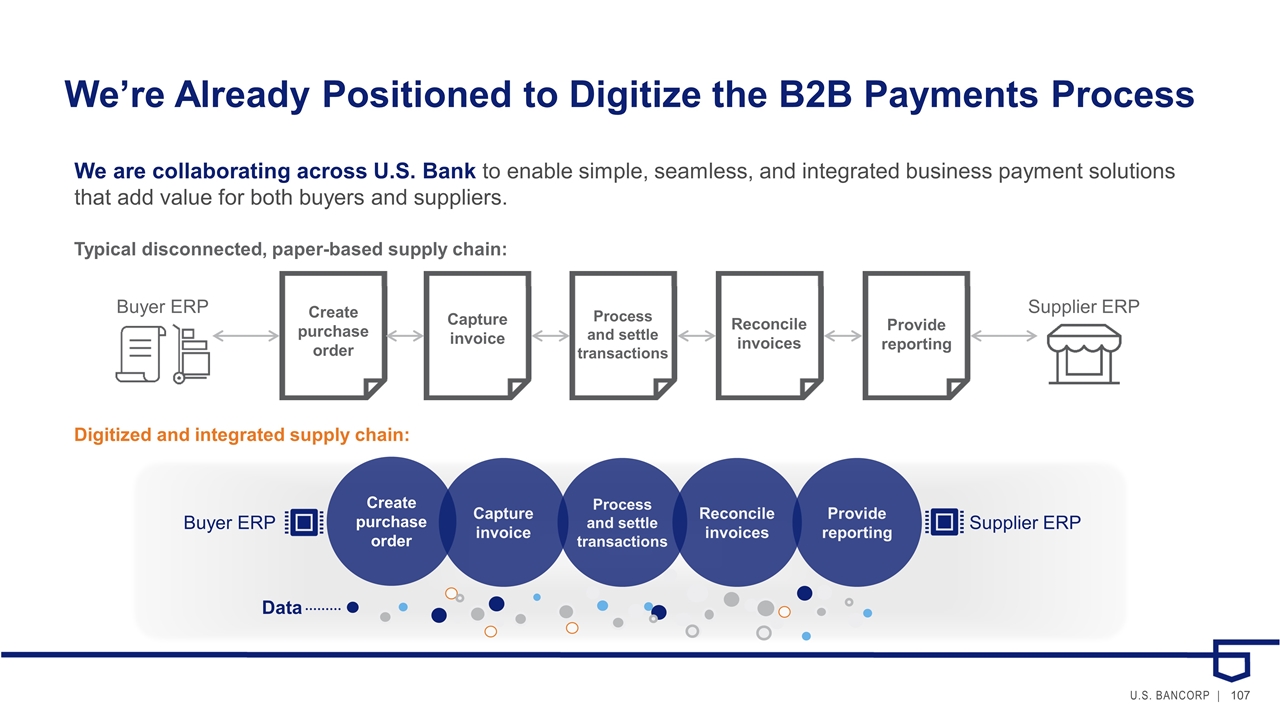

We’re Already Positioned to Digitize the B2B Payments Process Typical disconnected, paper-based supply chain: We are collaborating across U.S. Bank to enable simple, seamless, and integrated business payment solutions that add value for both buyers and suppliers. Digitized and integrated supply chain: Buyer ERP Create purchase order Capture invoice Process and settle transactions Reconcile invoices Provide reporting Supplier ERP Data Buyer ERP Supplier ERP Process and settle transactions Capture invoice Create purchase order Reconcile invoices Provide reporting

Our Strategy and Key Initiatives Ubiquity Driving digitization and leveraging data across both consumer and business payments Expanding our reach via added and enhanced capabilities and distribution Integrating business payments with a broader set of banking solutions to serve our customers’ needs holistically

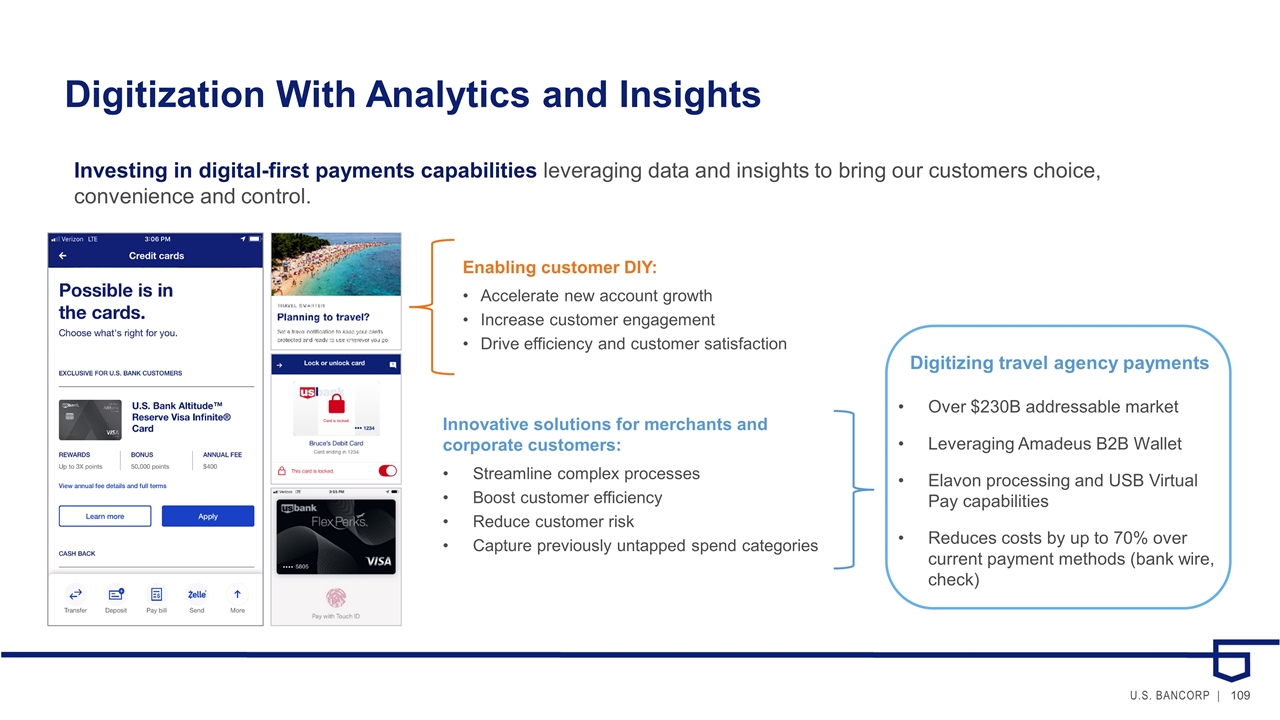

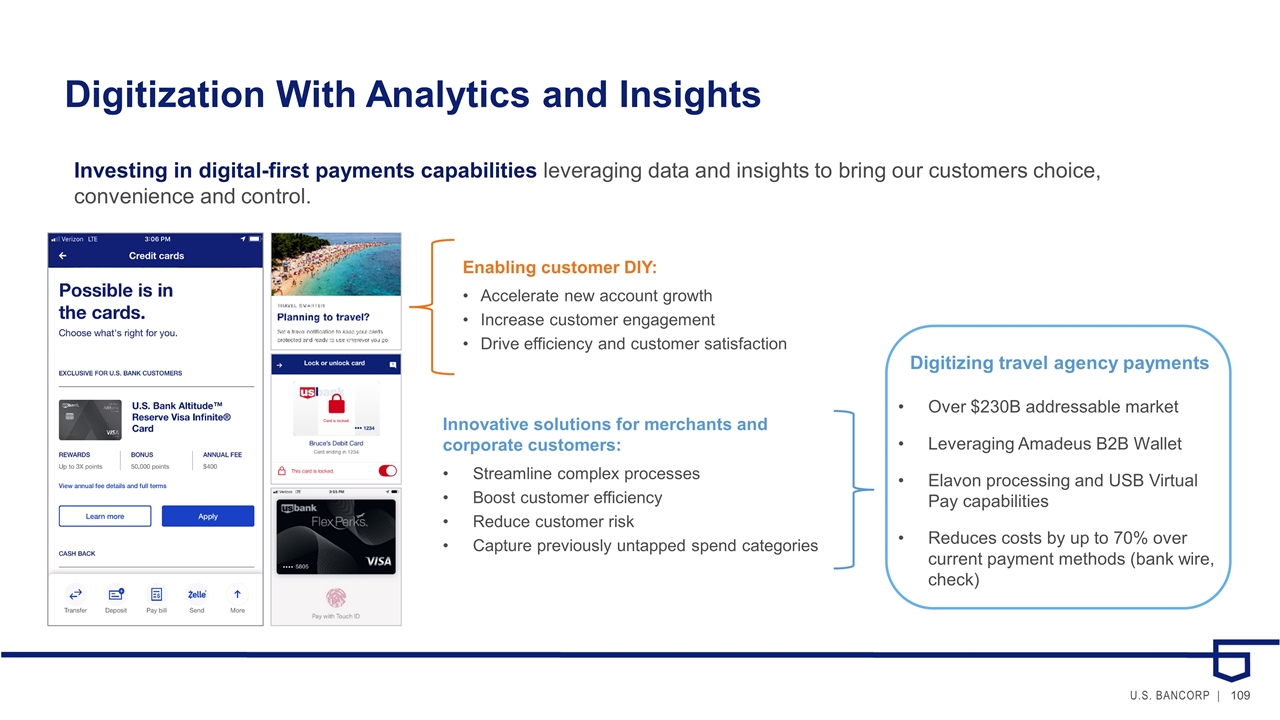

Digitization With Analytics and Insights Enabling customer DIY: Accelerate new account growth Increase customer engagement Drive efficiency and customer satisfaction Innovative solutions for merchants and corporate customers: Streamline complex processes Boost customer efficiency Reduce customer risk Capture previously untapped spend categories Investing in digital-first payments capabilities leveraging data and insights to bring our customers choice, convenience and control. Digitizing travel agency payments Over $230B addressable market Leveraging Amadeus B2B Wallet Elavon processing and USB Virtual Pay capabilities Reduces costs by up to 70% over current payment methods (bank wire, check)

Expanding Our Distribution and Capabilities Expanding our distribution Innovative products capturing new spend Buying Over $3B in card portfolio acquisitions 60+ deals in the financial services sector via Elan Six merchant and B2B capability acquisitions Collaborating: Expense Wizard Digitizing infrequent traveler expense management AI-driven digital tools and customer control Building: integrated payments partner tools Developer portal enhancements APIs and software development kits ISV partnerships up more than 40% year-over-year Artificial intelligence-driven Chrome River collaboration Leveraging virtual cards in mobile wallets Addressable market spend of $150 billion

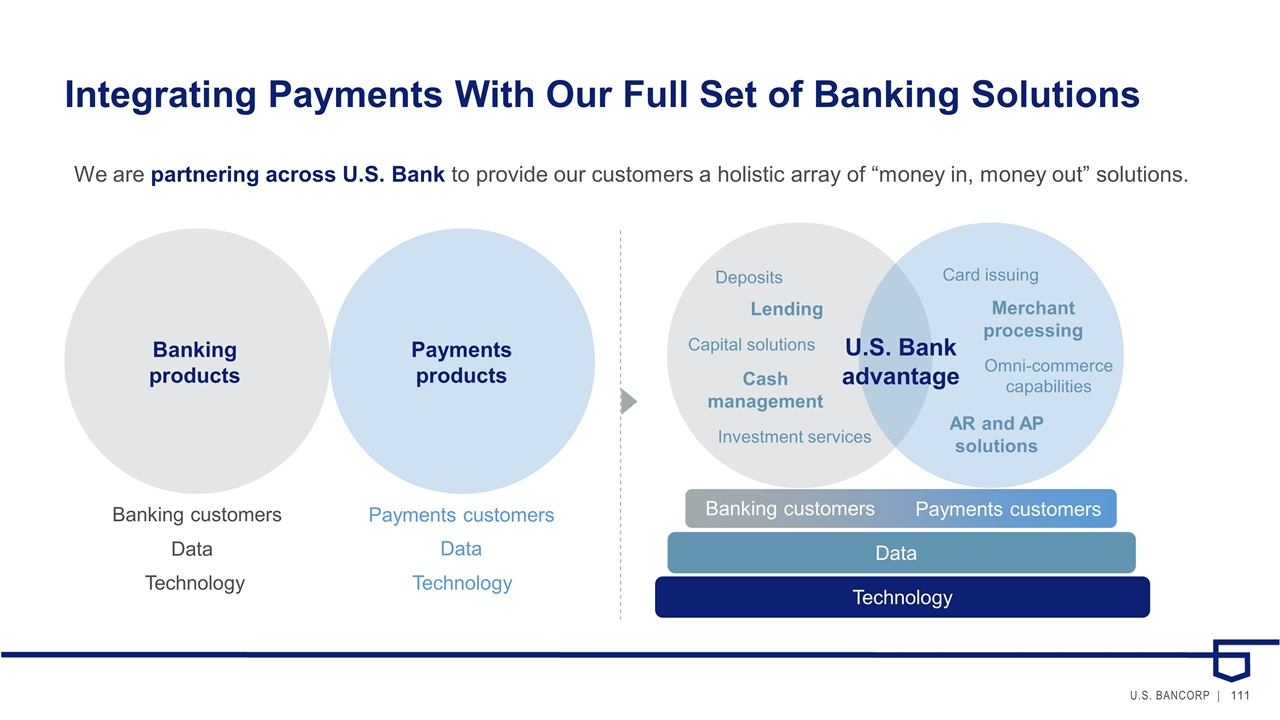

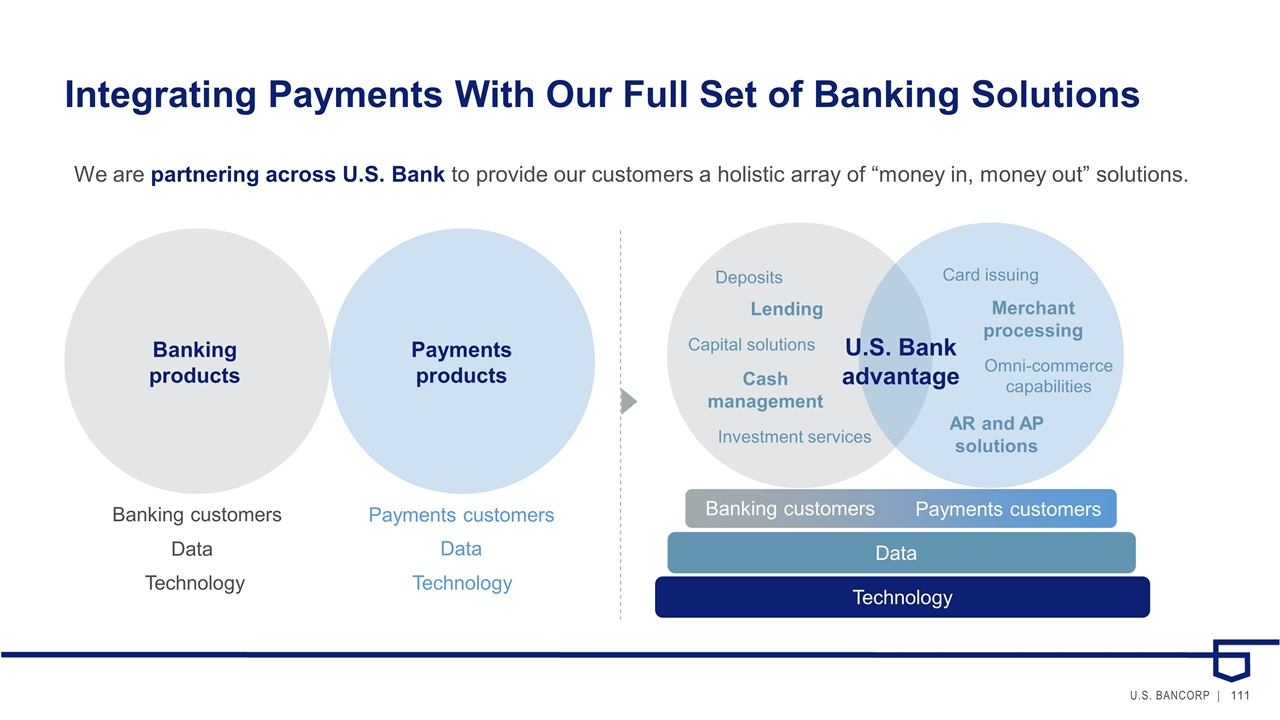

Integrating Payments With Our Full Set of Banking Solutions Technology Data U.S. Bank advantage Card issuing Merchant processing AR and AP solutions Omni-commerce capabilities Lending Deposits Capital solutions Cash management Investment services Banking customers Technology Data Banking products Banking customers Payments customers Data Technology Payments products Payments customers We are partnering across U.S. Bank to provide our customers a holistic array of “money in, money out” solutions.

In Summary… Strong, at-scale franchises in issuing, acquiring and corporate B2B payments Extensive network of distribution points, innovative products and capabilities Unique, proprietary platforms at scale Expanding reach with integrated software vendors delivering omni-commerce solutions Leveraging data and digitization Integrating an extensive set of payments and banking solutions

U.S. Bancorp Investor Day Risk Management September 12, 2019 Jodi Richard Vice Chair, Chief Risk Officer Mark Runkel Executive Vice President, Chief Credit Officer

Key Risk Management Strategies Our focus: Ensuring sustainability of programs Staying ahead of emerging risks Simplifying processes Remaining agile Leveraging data and analytics Undertaking risk prudently Avoiding undue concentrations of risk Avoiding activities that may damage our reputation Avoiding unnecessary complexity Maintaining sufficient capital and liquidity A strong risk culture is embedded in our corporate strategy and will continue to be foundational to our long-term success. Aligned with our risk appetite:

Ensuring Sustainability of Risk and Compliance Programs We invest in people, processes and technology to mature our risk programs. Experienced staff and sufficient resources Consistent tone and messaging throughout every layer of the organization Speak up culture and rapid escalation of issues Continued investment in automation and new technologies Collaboration with participants across the industry Keys to success

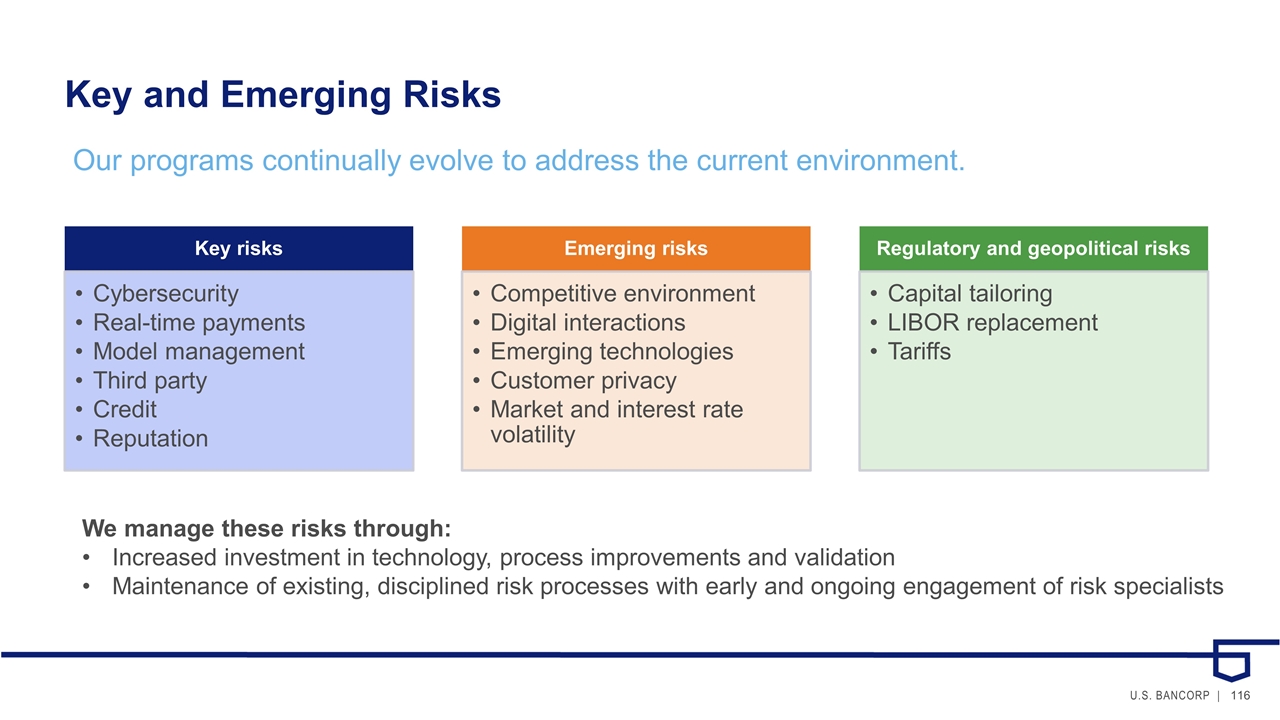

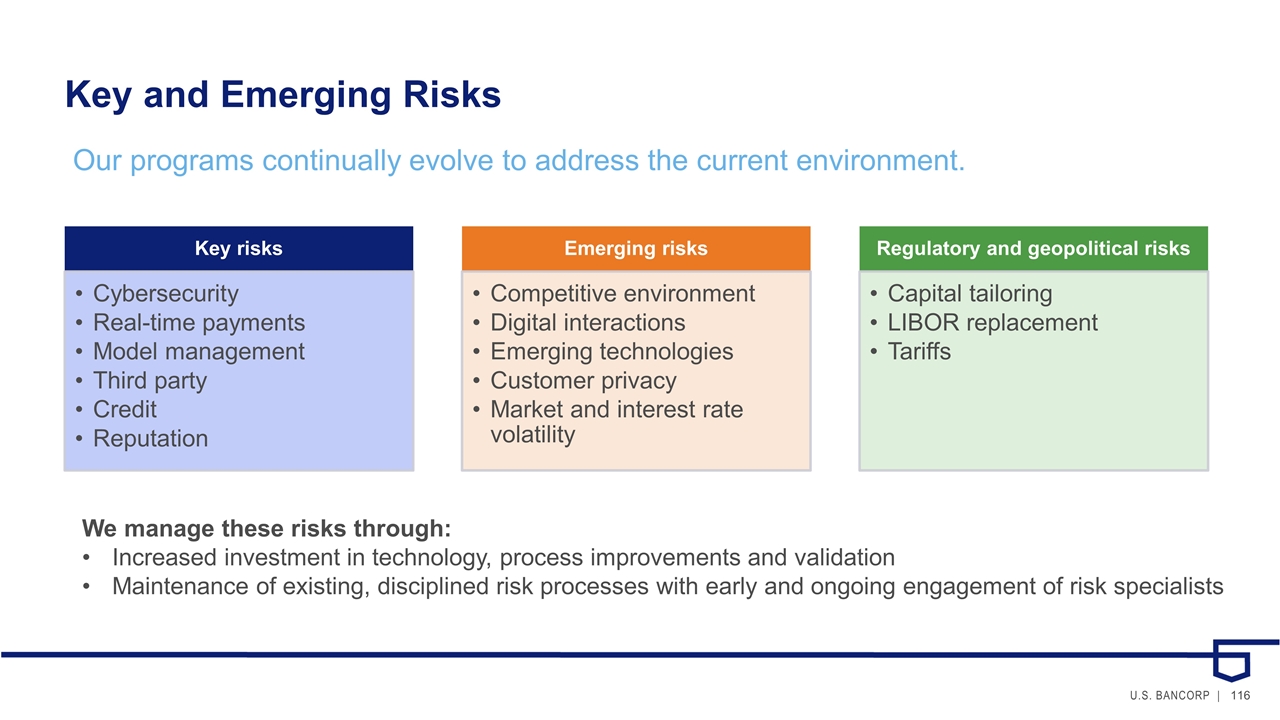

Key and Emerging Risks Our programs continually evolve to address the current environment. We manage these risks through: Increased investment in technology, process improvements and validation Maintenance of existing, disciplined risk processes with early and ongoing engagement of risk specialists Key risks Cybersecurity Emerging risks Competitive environment Regulatory and geopolitical risks Capital tailoring Real-time payments Model management Third party Credit Digital interactions Emerging technologies Customer privacy LIBOR replacement Tariffs Market and interest rate volatility Reputation

Key Risk: Cybersecurity Cyber adversaries are becoming more sophisticated all the time, but we are evolving. We continue to invest in and enhance our Cybersecurity program: Executive Cyber Dashboard monitors current threats, defense effectiveness and status of our overall Cyber program 3rd Party Independent Assessments enable us to identify and implement program enhancements in a rapidly changing environment Scenario Planning involves continually exercising scenarios and applying lessons learned from others and updating playbooks Board Subcommittee adds focus to Cybersecurity risks facing the industry

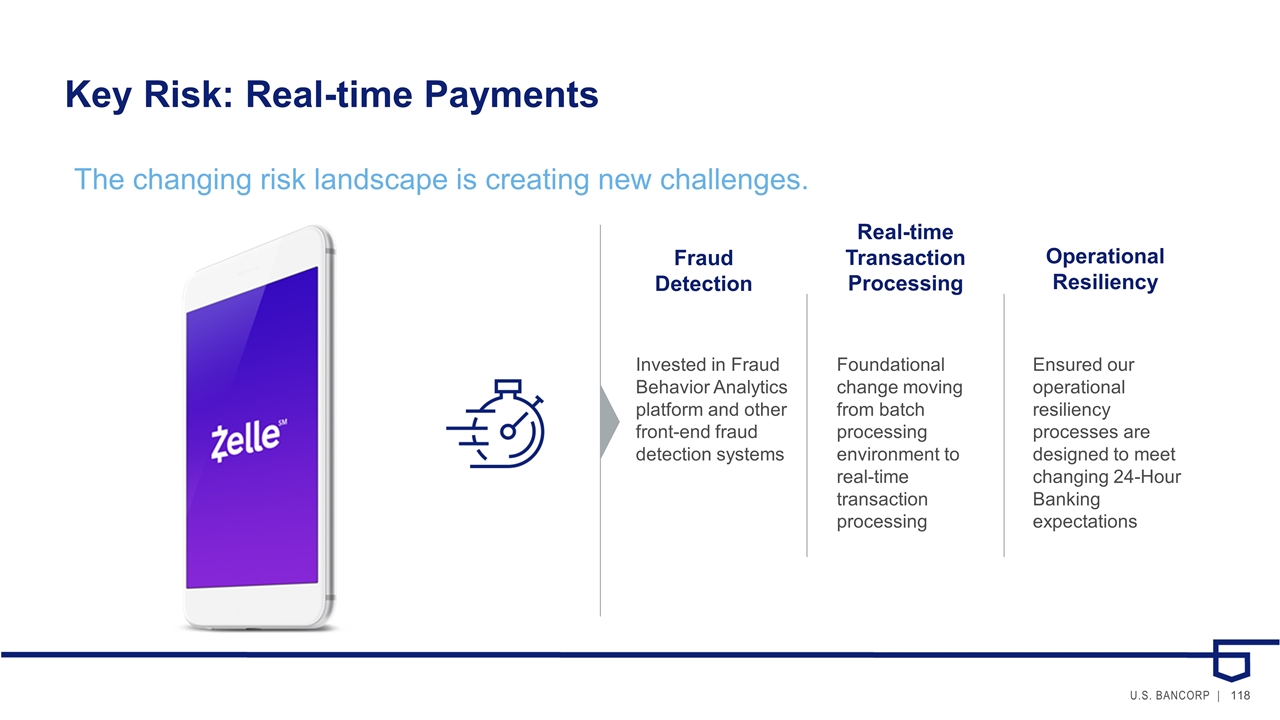

Key Risk: Real-time Payments The changing risk landscape is creating new challenges. Fraud Detection Real-time Transaction Processing Operational Resiliency Invested in Fraud Behavior Analytics platform and other front-end fraud detection systems Foundational change moving from batch processing environment to real-time transaction processing Ensured our operational resiliency processes are designed to meet changing 24-Hour Banking expectations

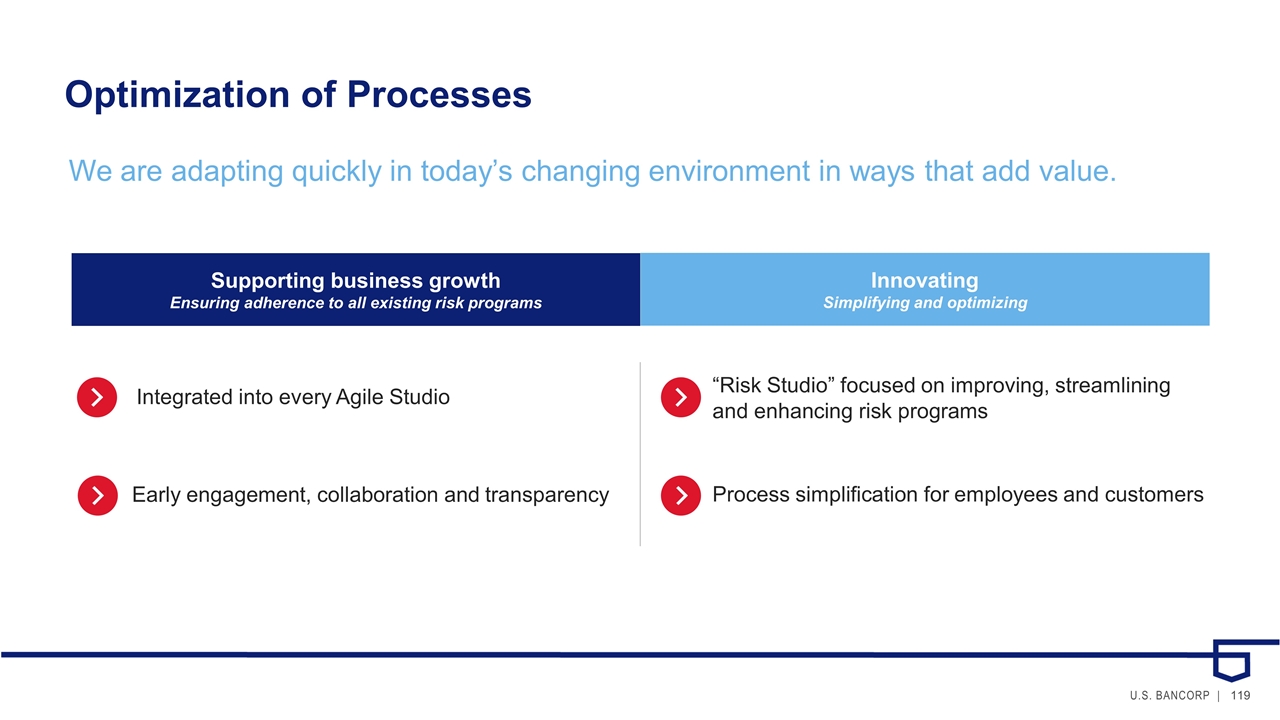

Optimization of Processes We are adapting quickly in today’s changing environment in ways that add value. “Risk Studio” focused on improving, streamlining and enhancing risk programs Innovating Simplifying and optimizing Integrated into every Agile Studio Early engagement, collaboration and transparency Process simplification for employees and customers Supporting business growth Ensuring adherence to all existing risk programs

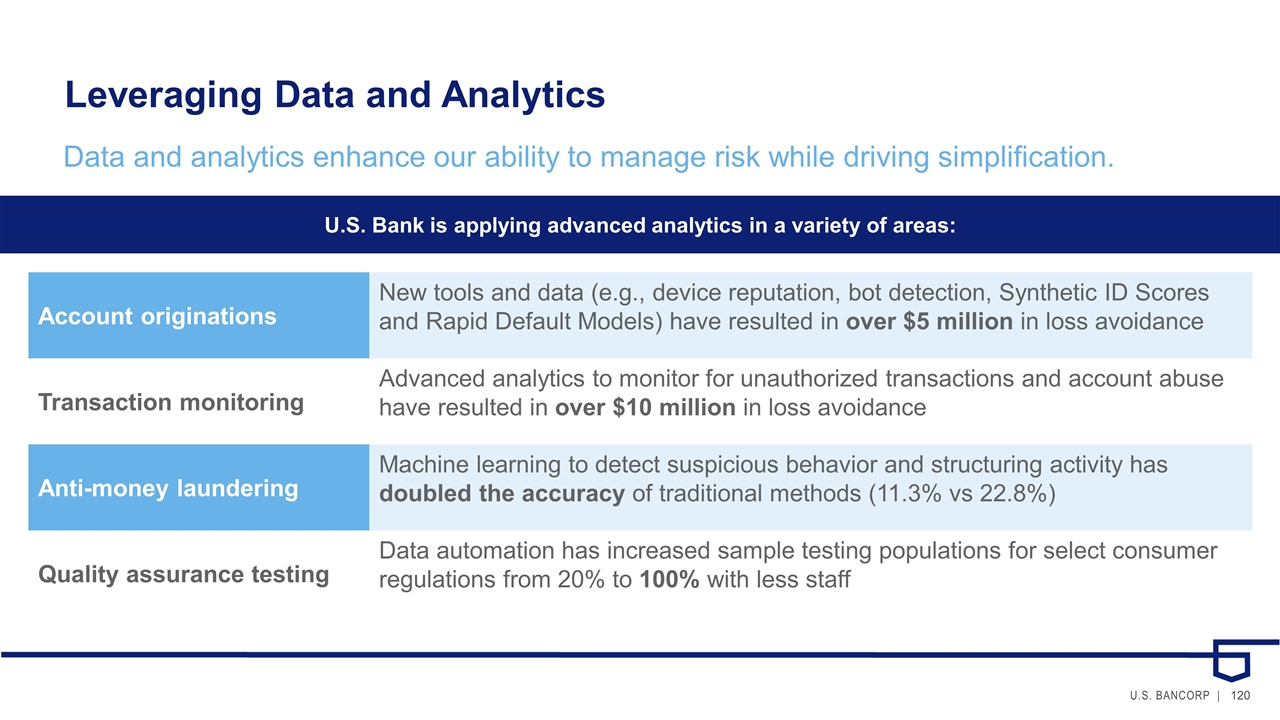

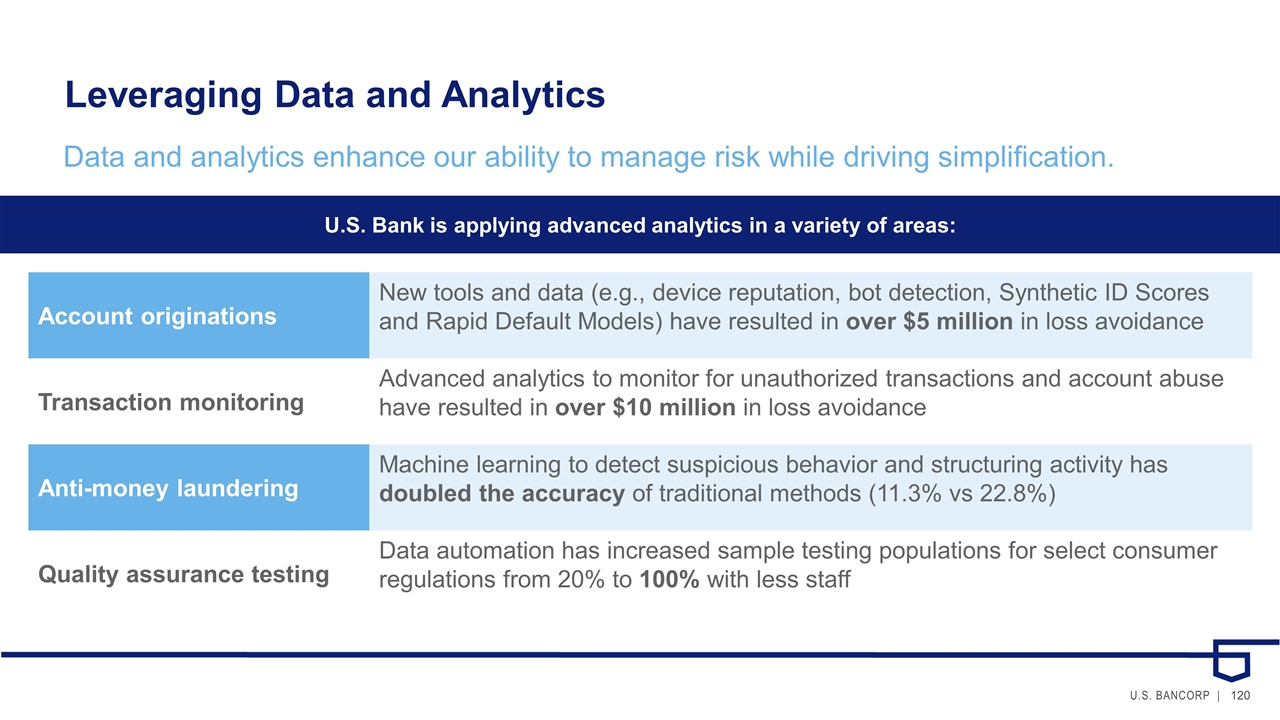

Leveraging Data and Analytics Data and analytics enhance our ability to manage risk while driving simplification. U.S. Bank is applying advanced analytics in a variety of areas: Account originations New tools and data (e.g., device reputation, bot detection, Synthetic ID Scores and Rapid Default Models) have resulted in over $5 million in loss avoidance Transaction monitoring Advanced analytics to monitor for unauthorized transactions and account abuse have resulted in over $10 million in loss avoidance Anti-money laundering Machine learning to detect suspicious behavior and structuring activity has doubled the accuracy of traditional methods (11.3% vs 22.8%) Quality assurance testing Data automation has increased sample testing populations for select consumer regulations from 20% to 100% with less staff

Credit Risk Management

Credit Risk Management is a Core Competency A strong credit culture is key to our long-term, consistent performance. Continuous improvement Portfolio diversification Relationship based Cash flow lender Consistent underwriting Proactive portfolio management Supports and enables prudent long-term growth Enhances our position as the most trusted choice Produces consistent results

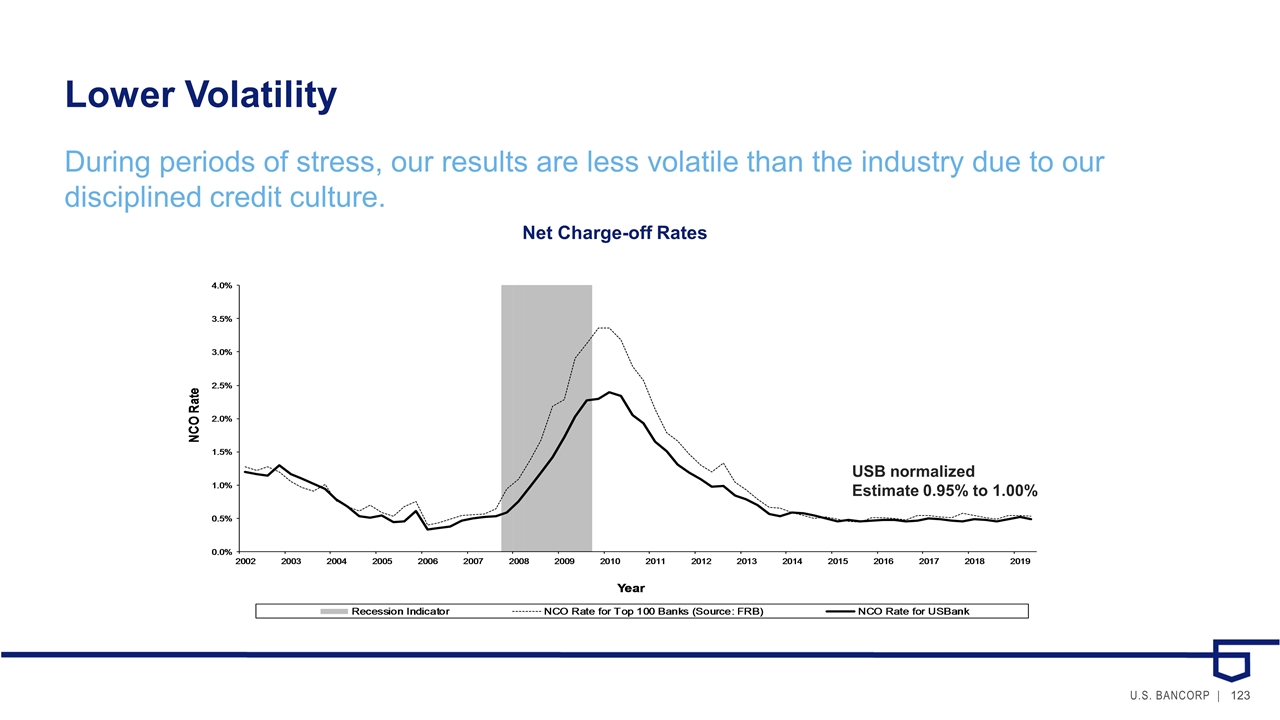

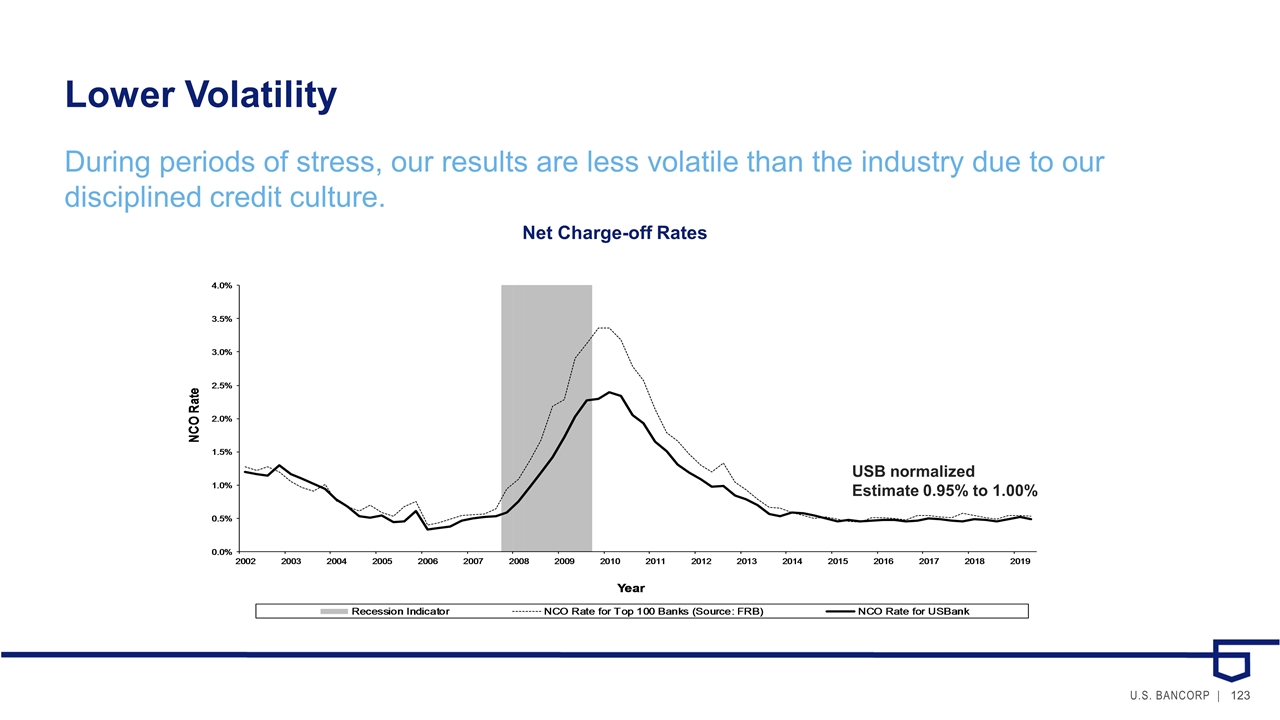

Lower Volatility During periods of stress, our results are less volatile than the industry due to our disciplined credit culture. Net Charge-off Rates USB normalized Estimate 0.95% to 1.00%

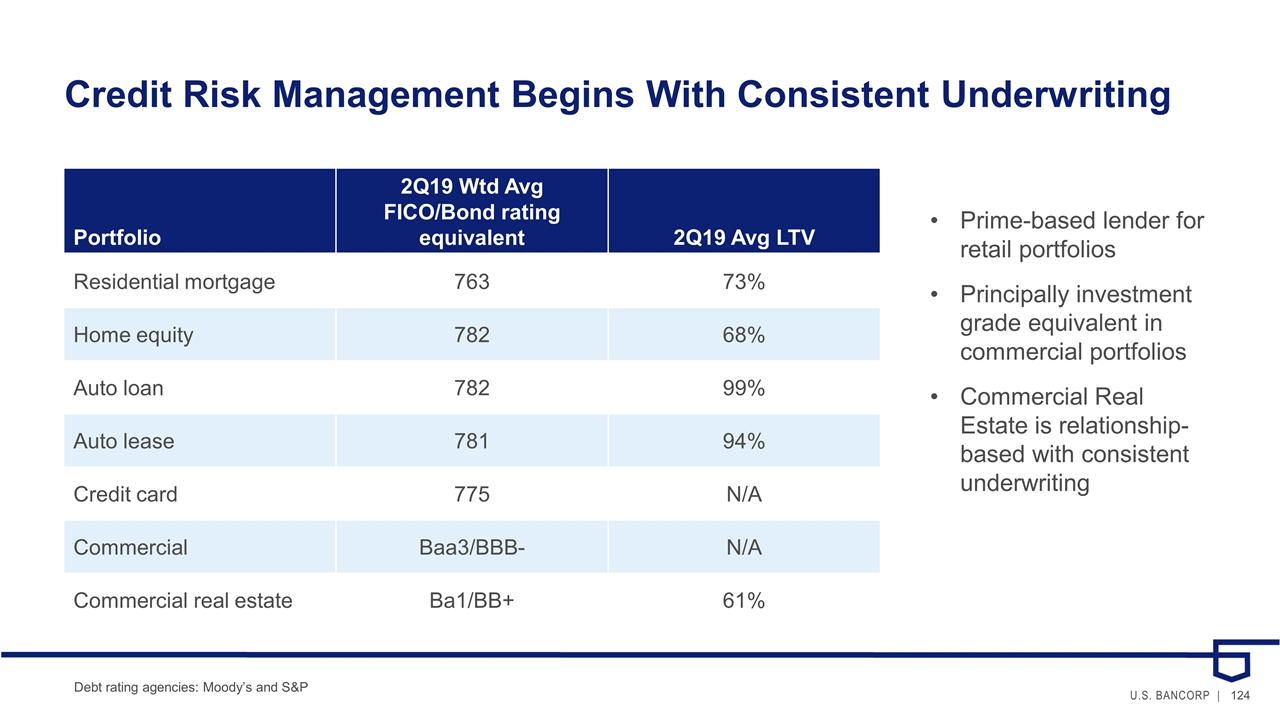

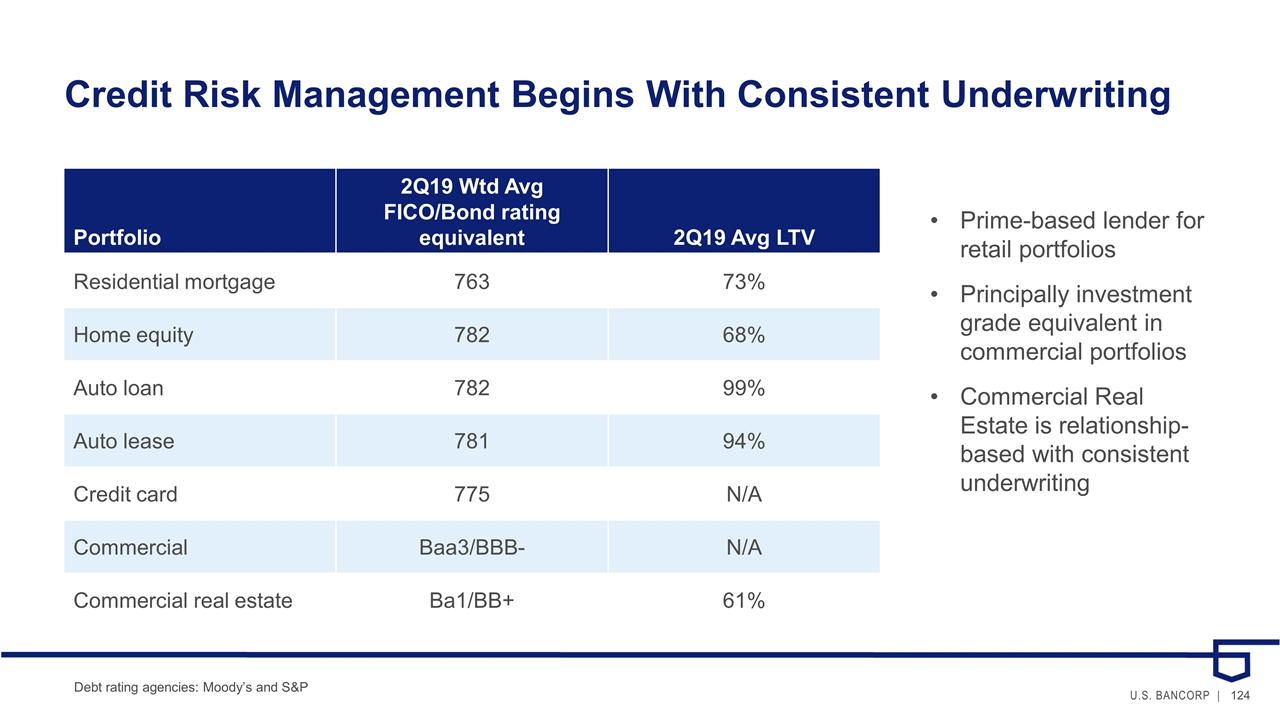

Credit Risk Management Begins With Consistent Underwriting Prime-based lender for retail portfolios Principally investment grade equivalent in commercial portfolios Commercial Real Estate is relationship- based with consistent underwriting Portfolio 2Q19 Wtd Avg FICO/Bond rating equivalent 2Q19 Avg LTV Residential mortgage 763 73% Home equity 782 68% Auto loan 782 99% Auto lease 781 94% Credit card 775 N/A Commercial Baa3/BBB- N/A Commercial real estate Ba1/BB+ 61% Debt rating agencies: Moody’s and S&P

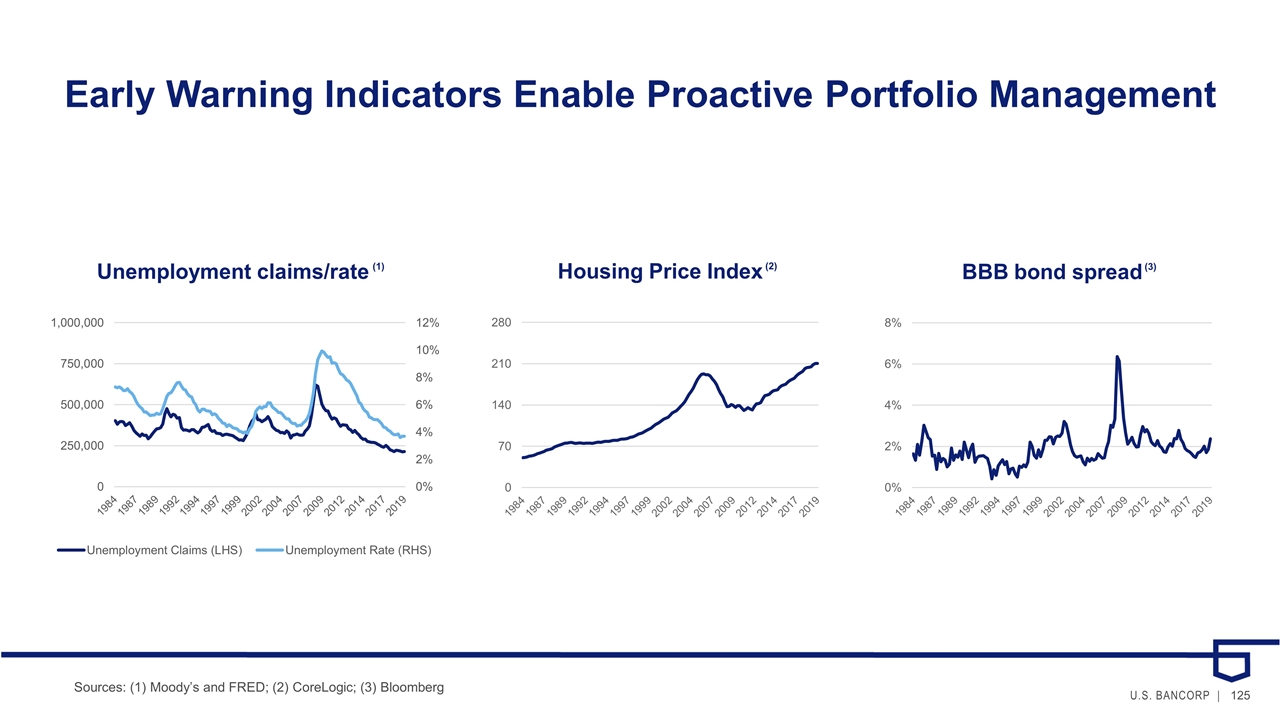

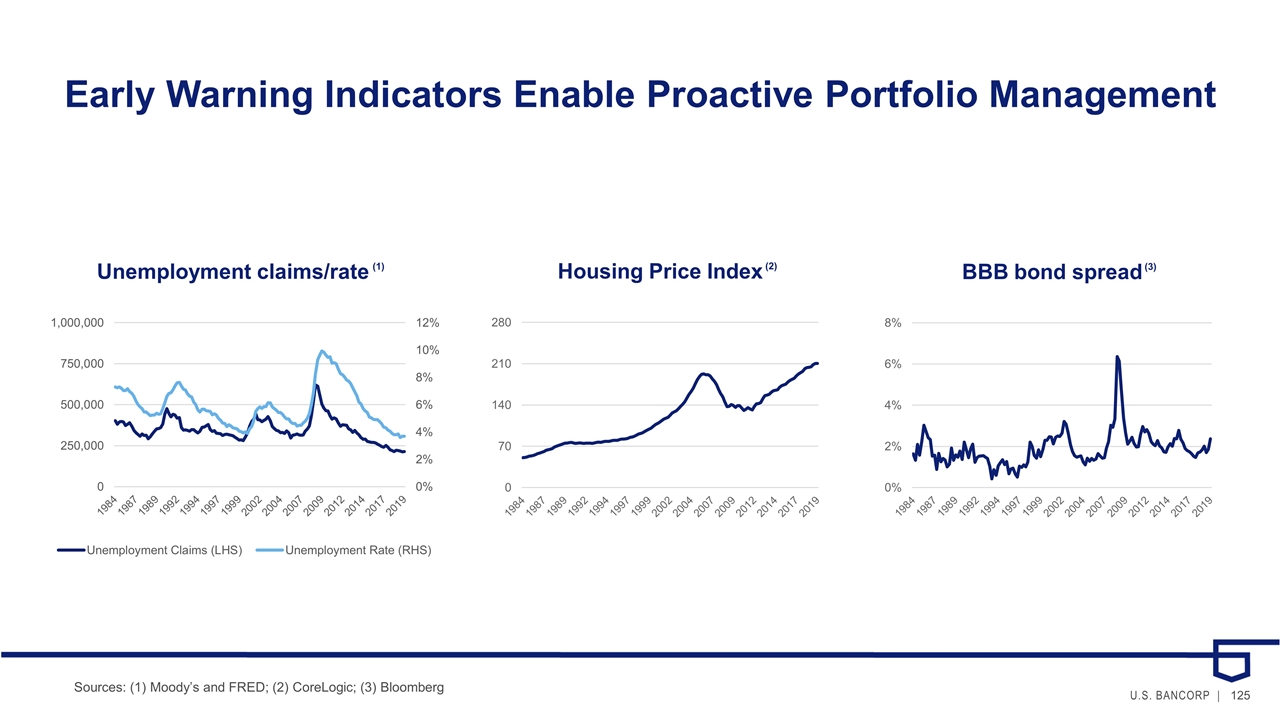

Early Warning Indicators Enable Proactive Portfolio Management Unemployment claims/rate (1) BBB bond spread (3) Housing Price Index (2) Sources: (1) Moody’s and FRED; (2) CoreLogic; (3) Bloomberg

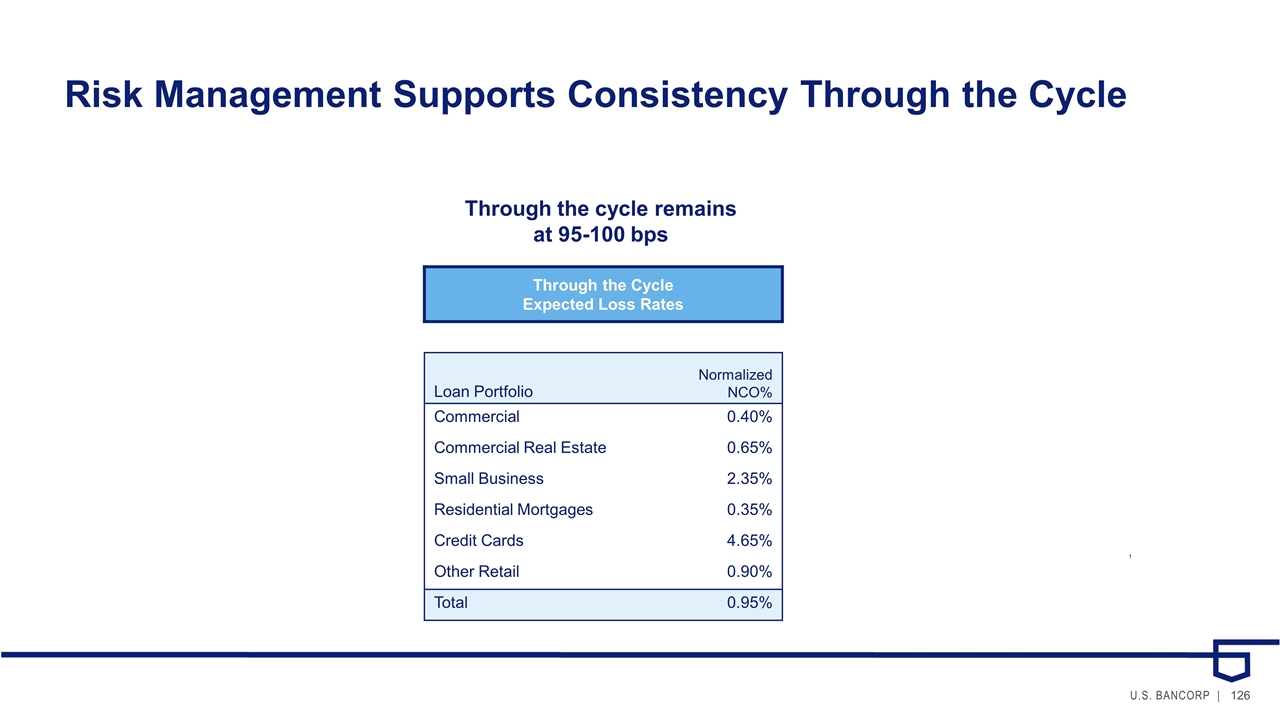

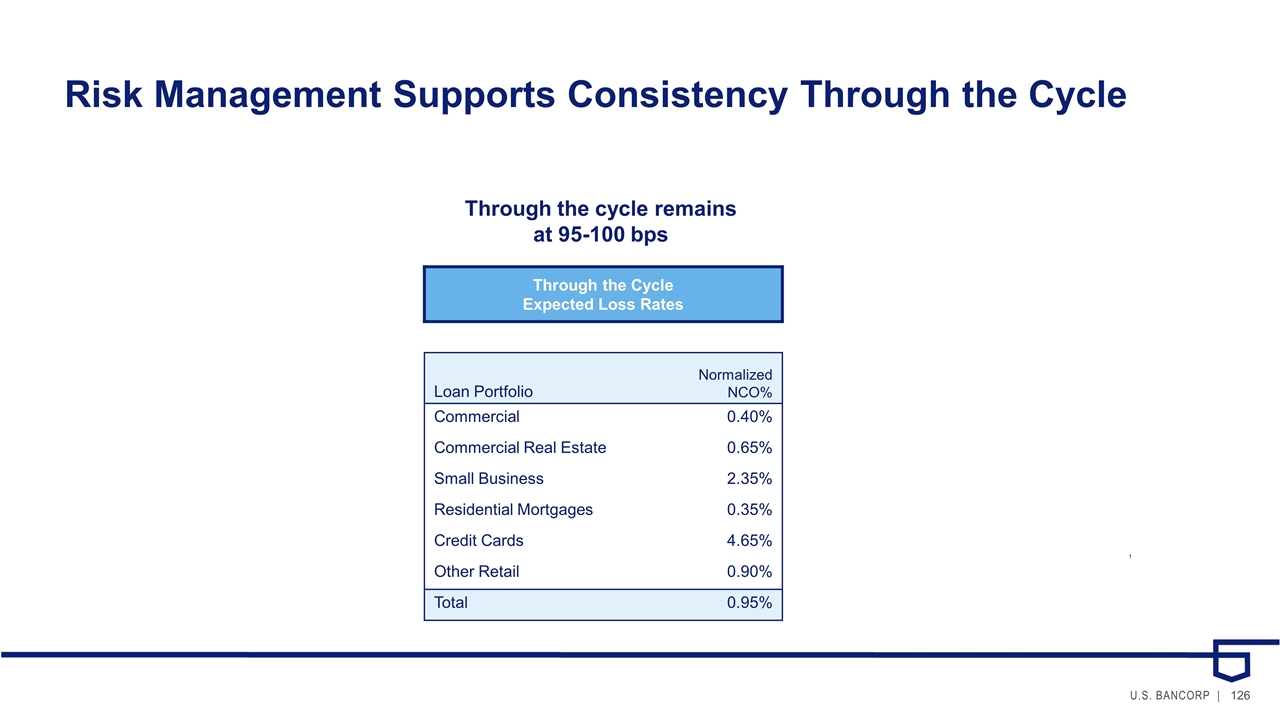

Risk Management Supports Consistency Through the Cycle Through the cycle remains at 95-100 bps 1 Through the Cycle Expected Loss Rates Loan Portfolio Normalized NCO% Commercial 0.40% Commercial Real Estate 0.65% Small Business 2.35% Residential Mortgages 0.35% Credit Cards 4.65% Other Retail 0.90% Total 0.95%

In Summary: Prudent Risk Management is a Core Competency Proven track record Strong governance and culture Agile risk mindset Proactively addressing emerging risks Focus on through-the-cycle performance Strong risk management supports best-in-class growth and returns through the cycle.

U.S. Bancorp Investor Day Financial Management Terry Dolan Vice Chair, Chief Financial Officer September 12, 2019

Agenda What we have achieved Review of U.S. Bank’s performance and positioning Long-term strategic expectations Growth Returns Efficiency Sustainability

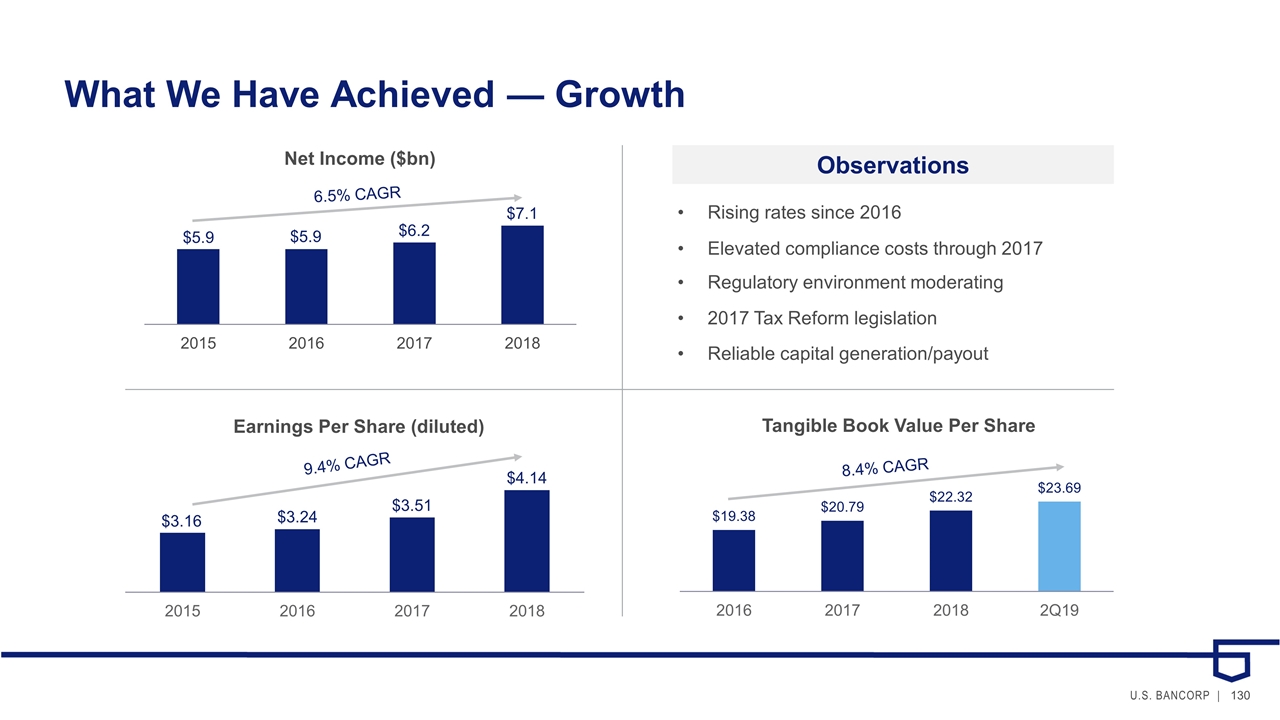

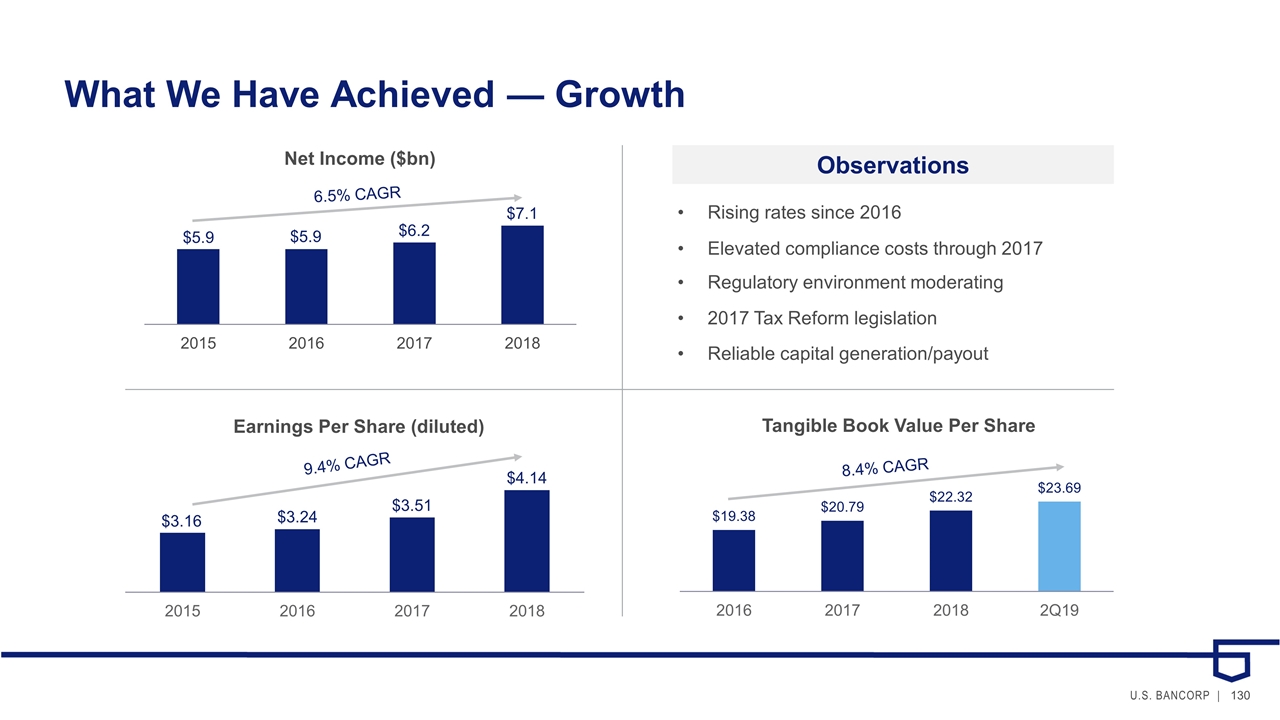

What We Have Achieved — Growth 6.5% CAGR 9.4% CAGR 8.4% CAGR Observations Elevated compliance costs through 2017 2017 Tax Reform legislation Rising rates since 2016 Regulatory environment moderating Reliable capital generation/payout

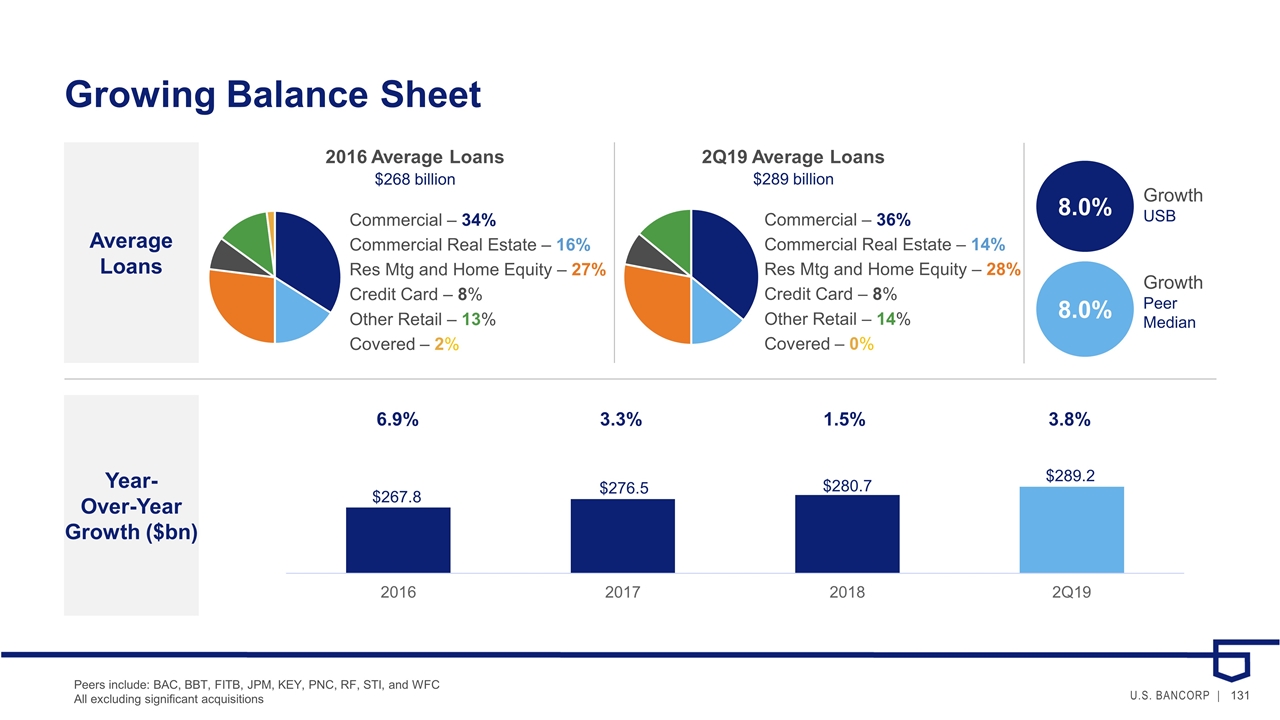

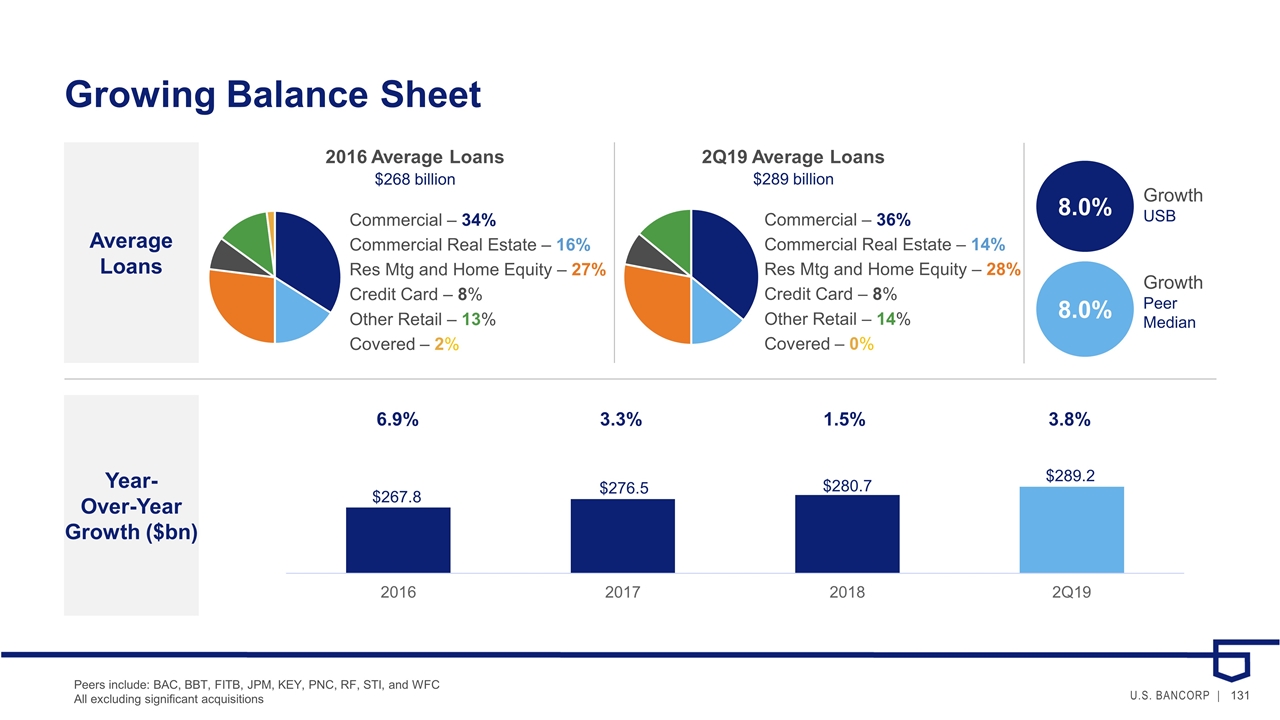

Growing Balance Sheet Average Loans Commercial – 34% Commercial Real Estate – 16% Res Mtg and Home Equity – 27% Credit Card – 8% Other Retail – 13% Covered – 2% Commercial – 36% Commercial Real Estate – 14% Res Mtg and Home Equity – 28% Credit Card – 8% Other Retail – 14% Covered – 0% 2016 Average Loans $268 billion Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC All excluding significant acquisitions 2Q19 Average Loans $289 billion 8.0% Growth USB 8.0% Growth Peer Median 6.9% 3.3% 1.5% 3.8% Year- Over-Year Growth ($bn)

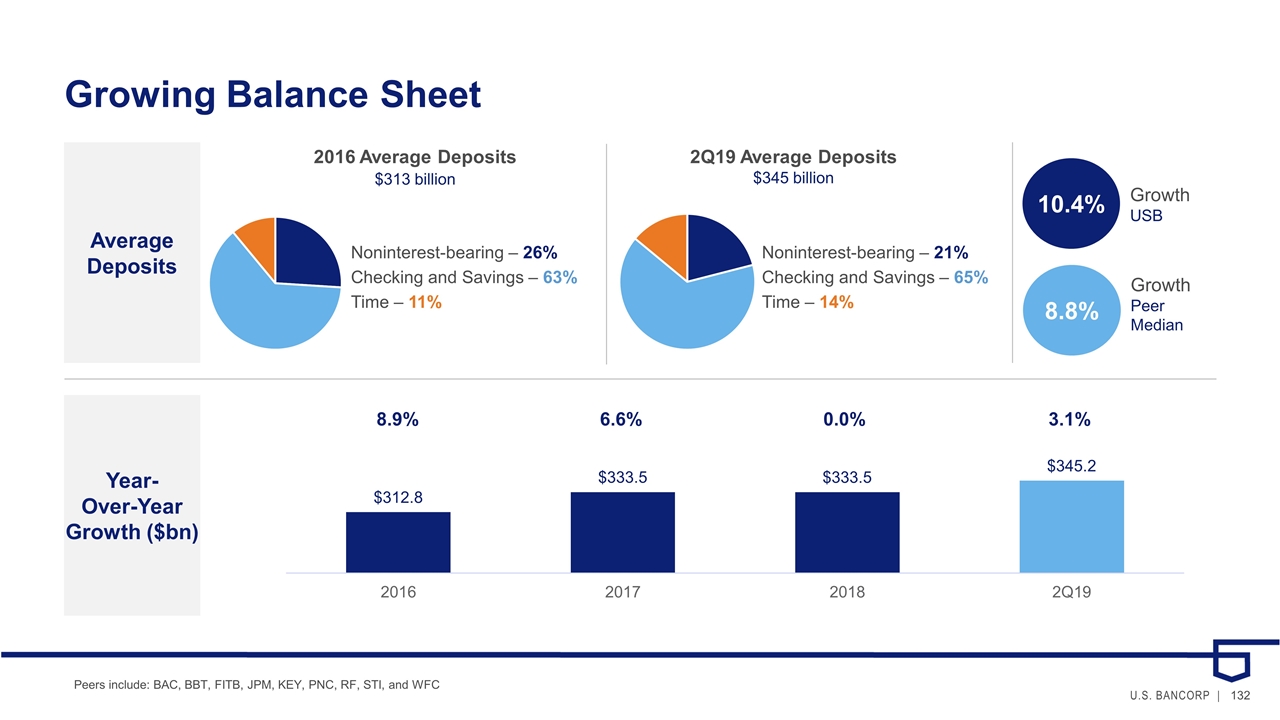

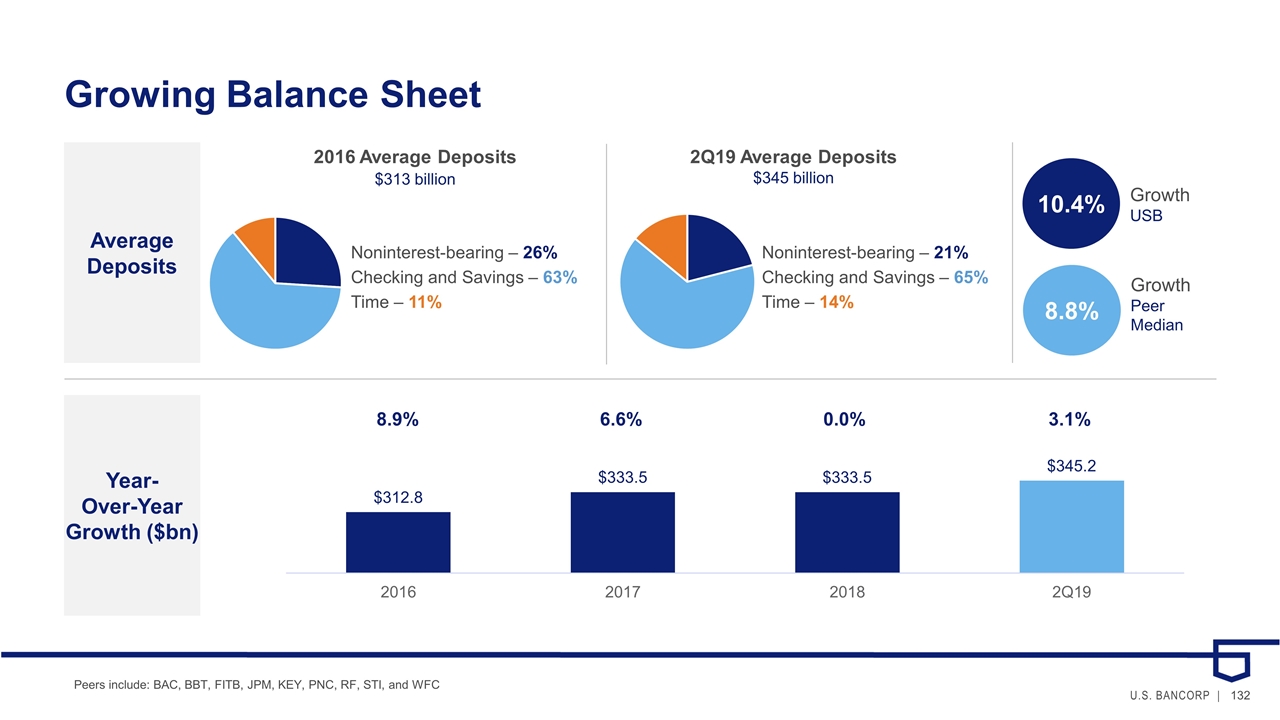

Growing Balance Sheet Average Deposits Noninterest-bearing – 26% Checking and Savings – 63% Time – 11% Noninterest-bearing – 21% Checking and Savings – 65% Time – 14% 2016 Average Deposits $313 billion Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC 2Q19 Average Deposits $345 billion 10.4% Growth USB 8.8% Growth Peer Median Year- Over-Year Growth ($bn) 8.9% 6.6% 0.0% 3.1%

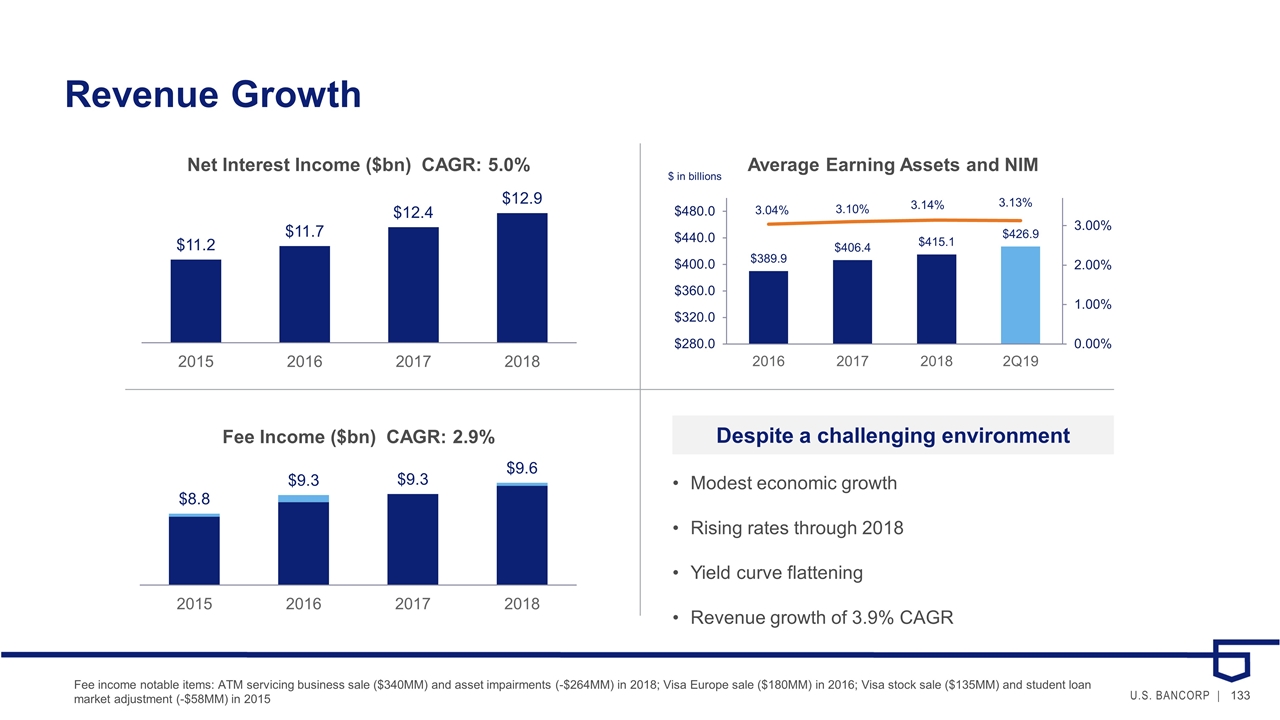

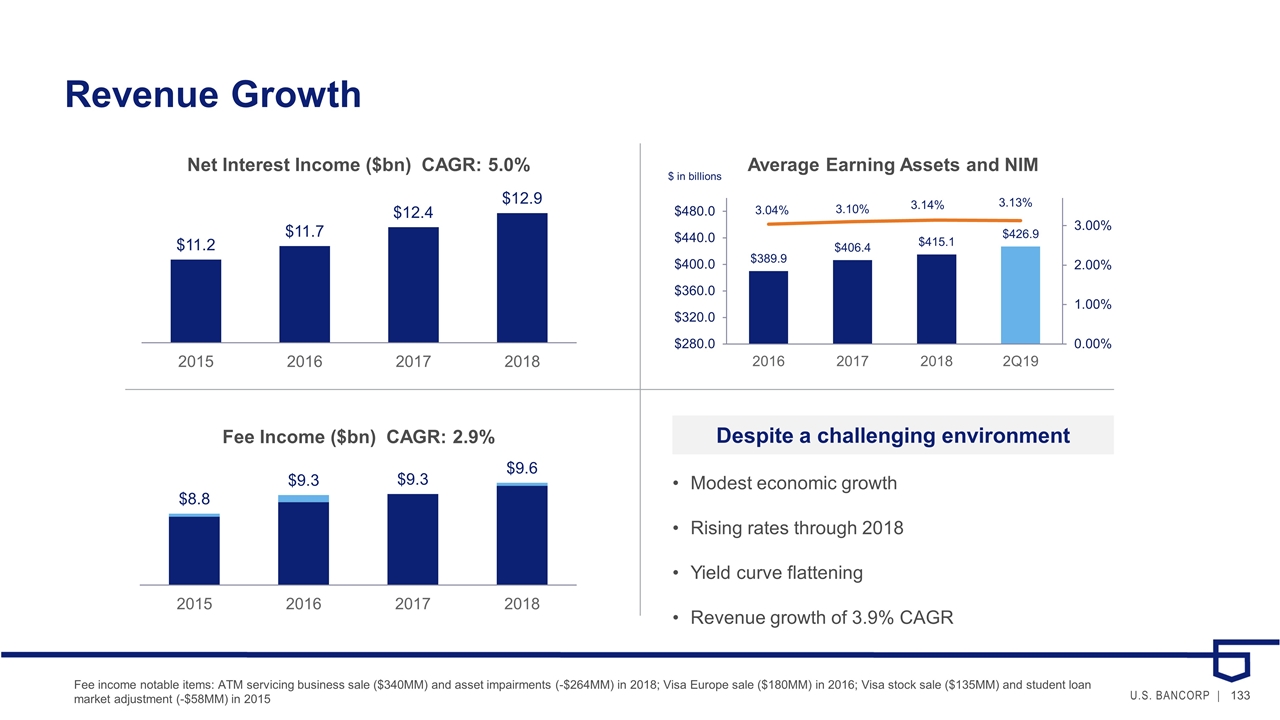

Revenue Growth Fee income notable items: ATM servicing business sale ($340MM) and asset impairments (-$264MM) in 2018; Visa Europe sale ($180MM) in 2016; Visa stock sale ($135MM) and student loan market adjustment (-$58MM) in 2015 Despite a challenging environment Modest economic growth Rising rates through 2018 Yield curve flattening Revenue growth of 3.9% CAGR $ in billions

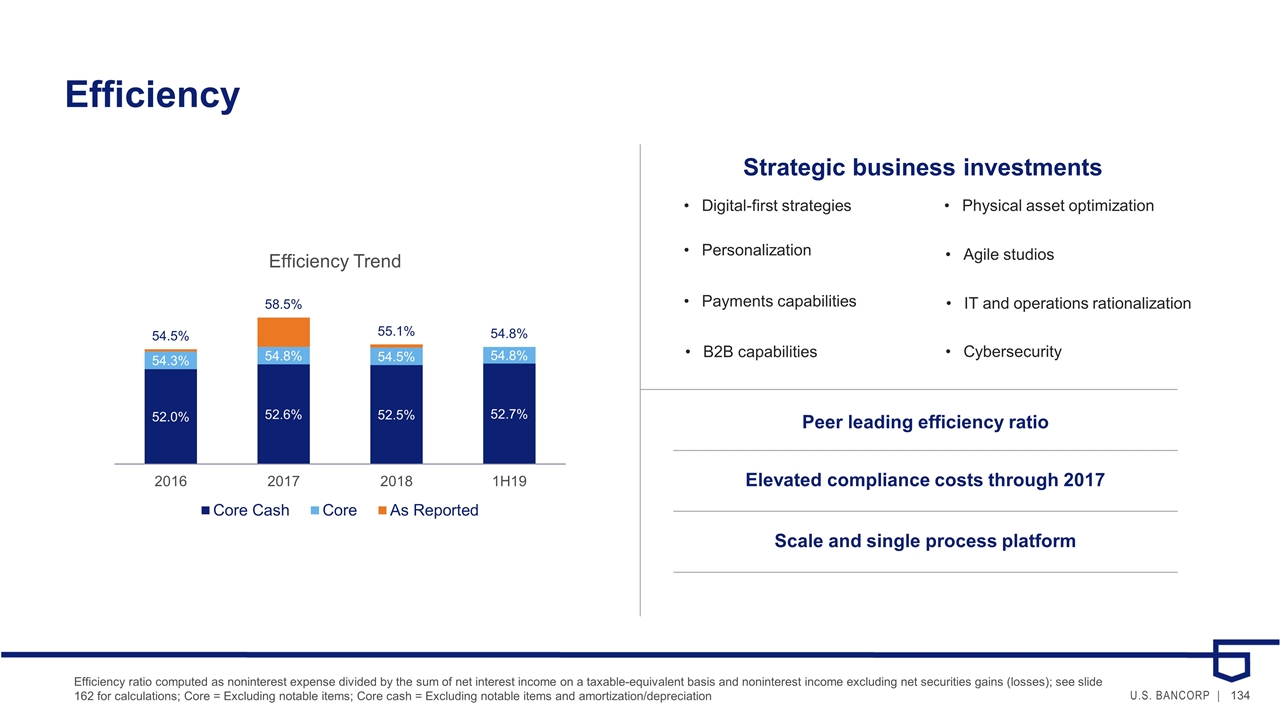

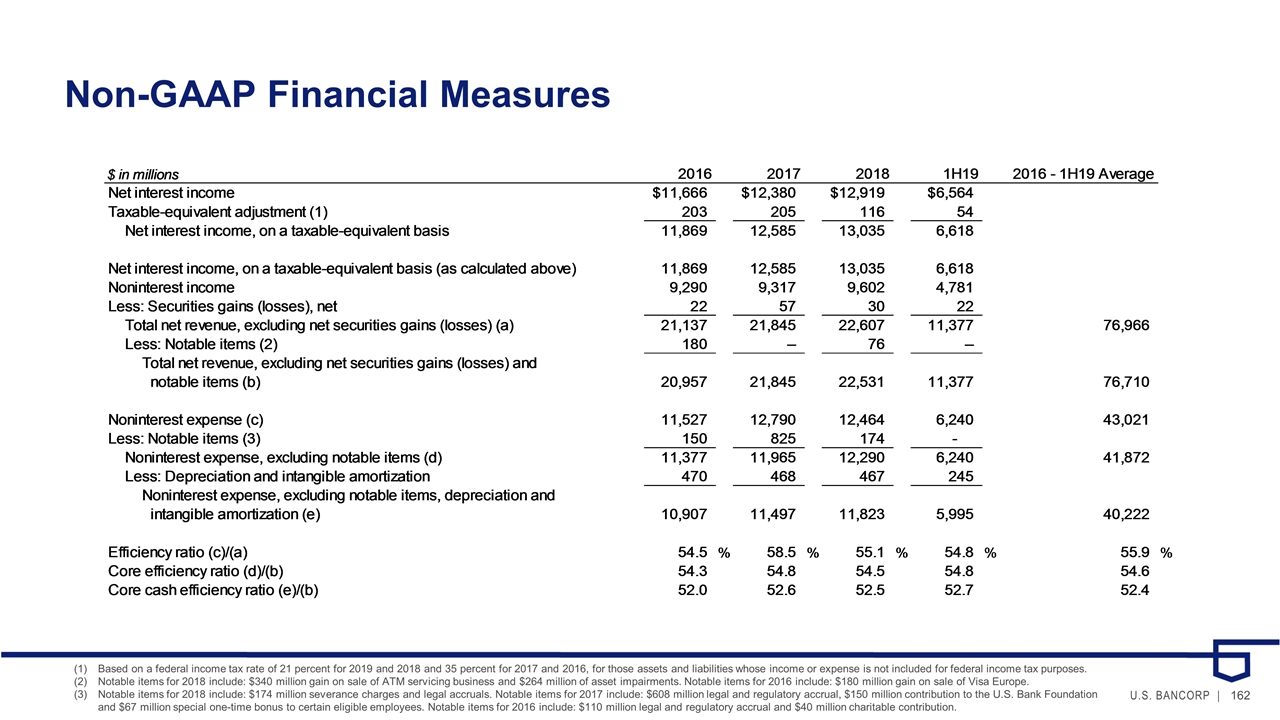

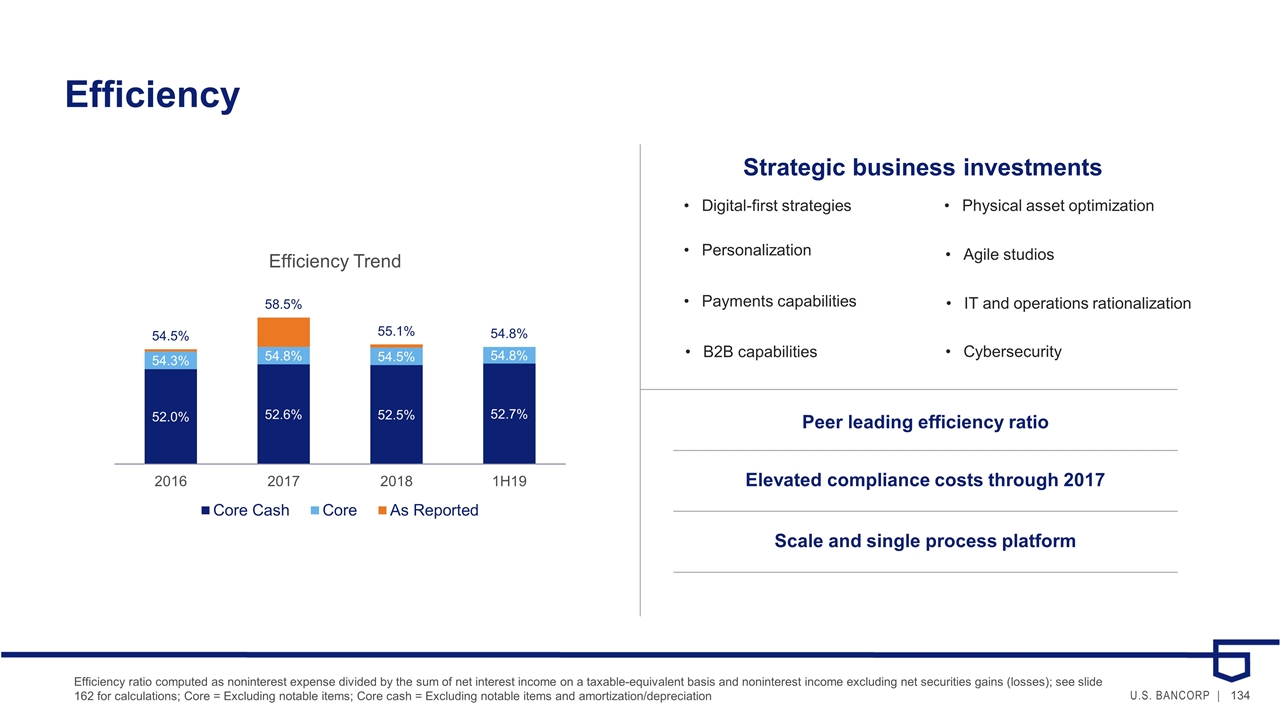

Efficiency Efficiency ratio computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and noninterest income excluding net securities gains (losses); see slide 162 for calculations; Core = Excluding notable items; Core cash = Excluding notable items and amortization/depreciation Strategic business investments Digital-first strategies Physical asset optimization Personalization Payments capabilities Agile studios Elevated compliance costs through 2017 Peer leading efficiency ratio Scale and single process platform IT and operations rationalization B2B capabilities Cybersecurity

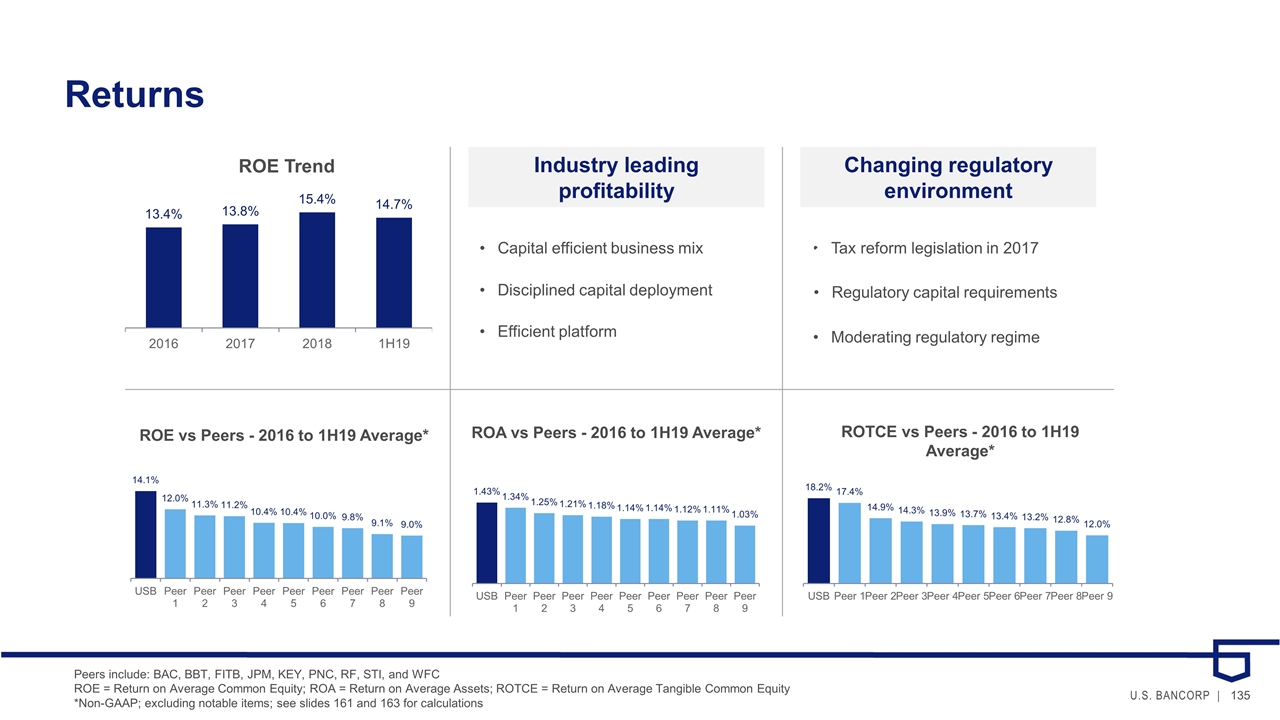

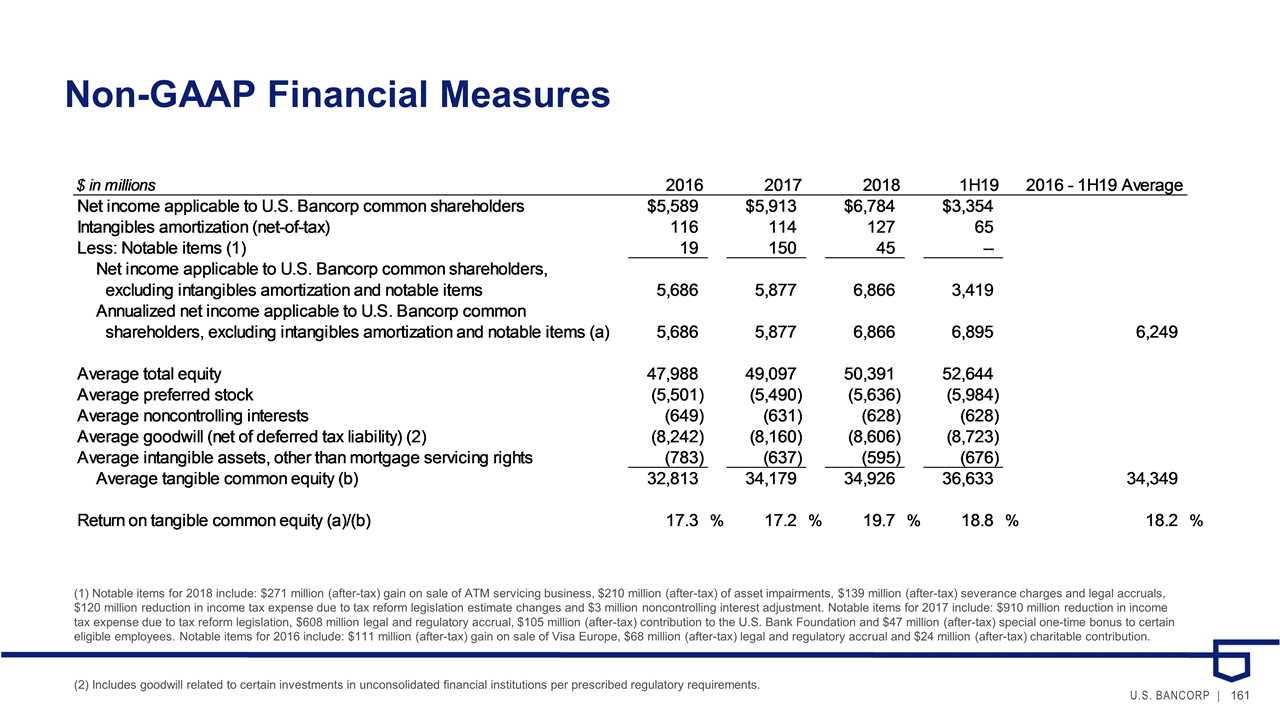

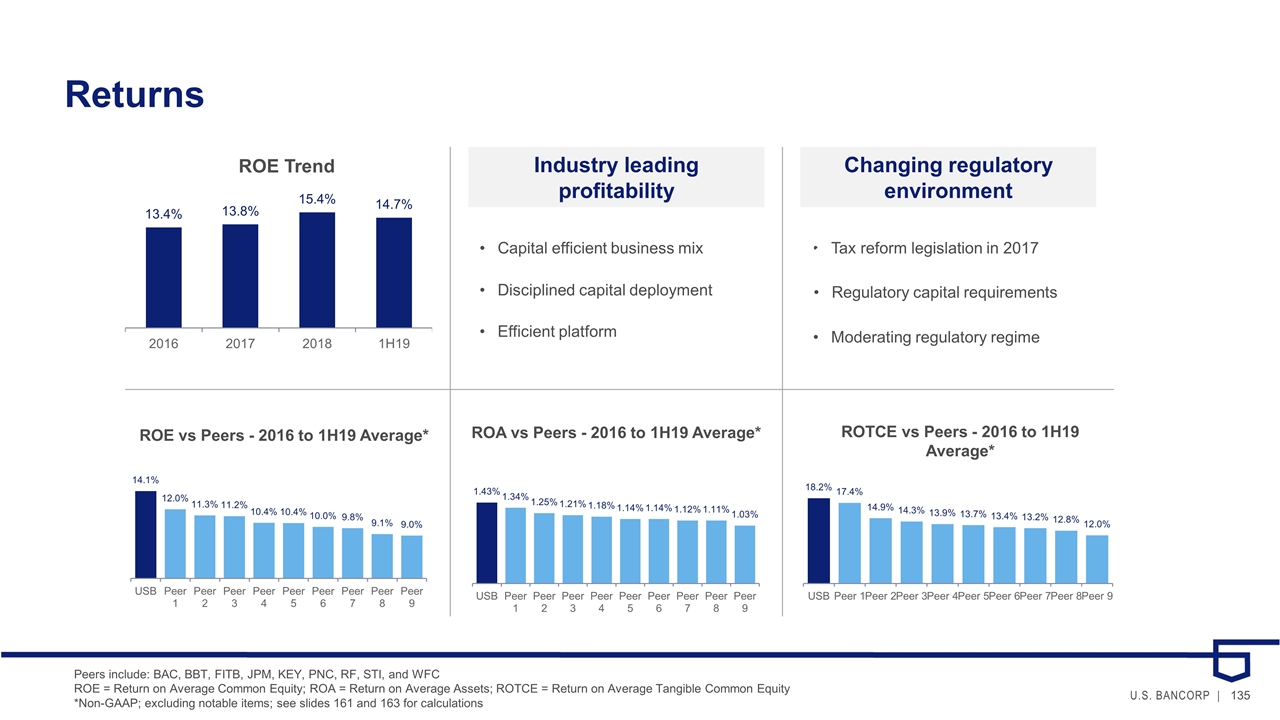

Returns Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC ROE = Return on Average Common Equity; ROA = Return on Average Assets; ROTCE = Return on Average Tangible Common Equity *Non-GAAP; excluding notable items; see slides 161 and 163 for calculations ROE vs Peers - 2016 to 1H19 Average* Industry leading profitability Changing regulatory environment Capital efficient business mix Tax reform legislation in 2017 Disciplined capital deployment Regulatory capital requirements Efficient platform Moderating regulatory regime

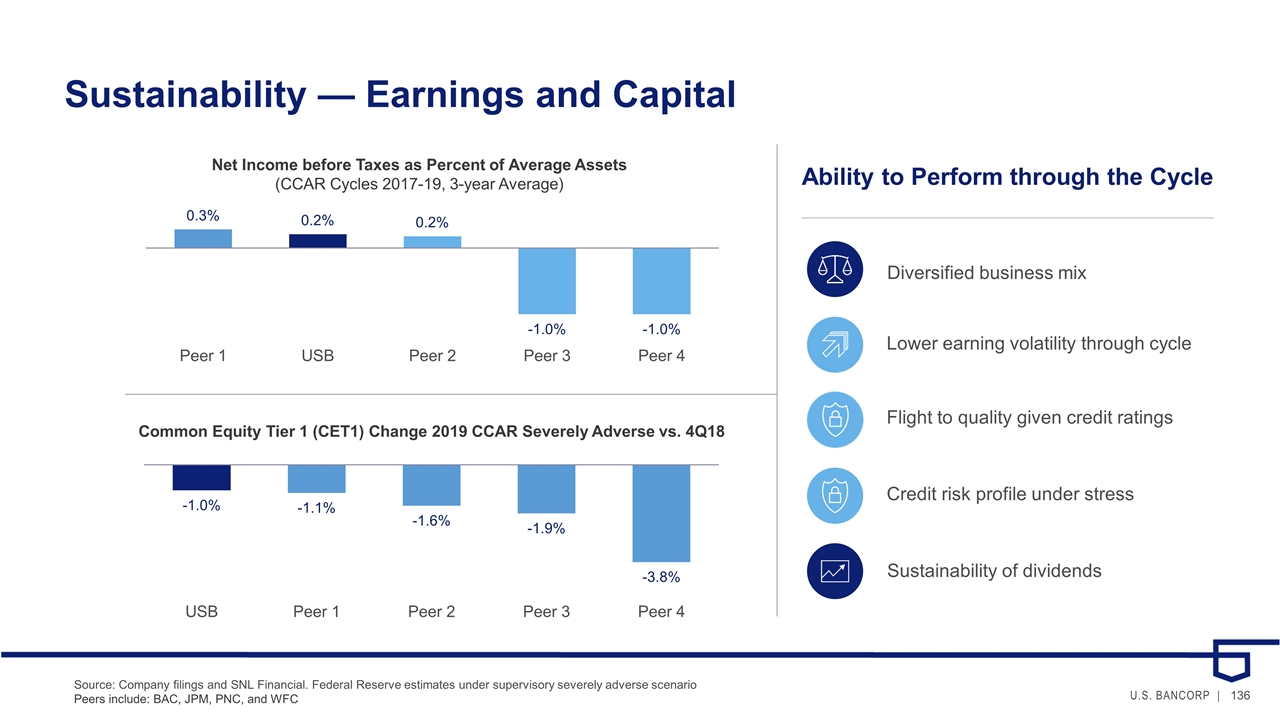

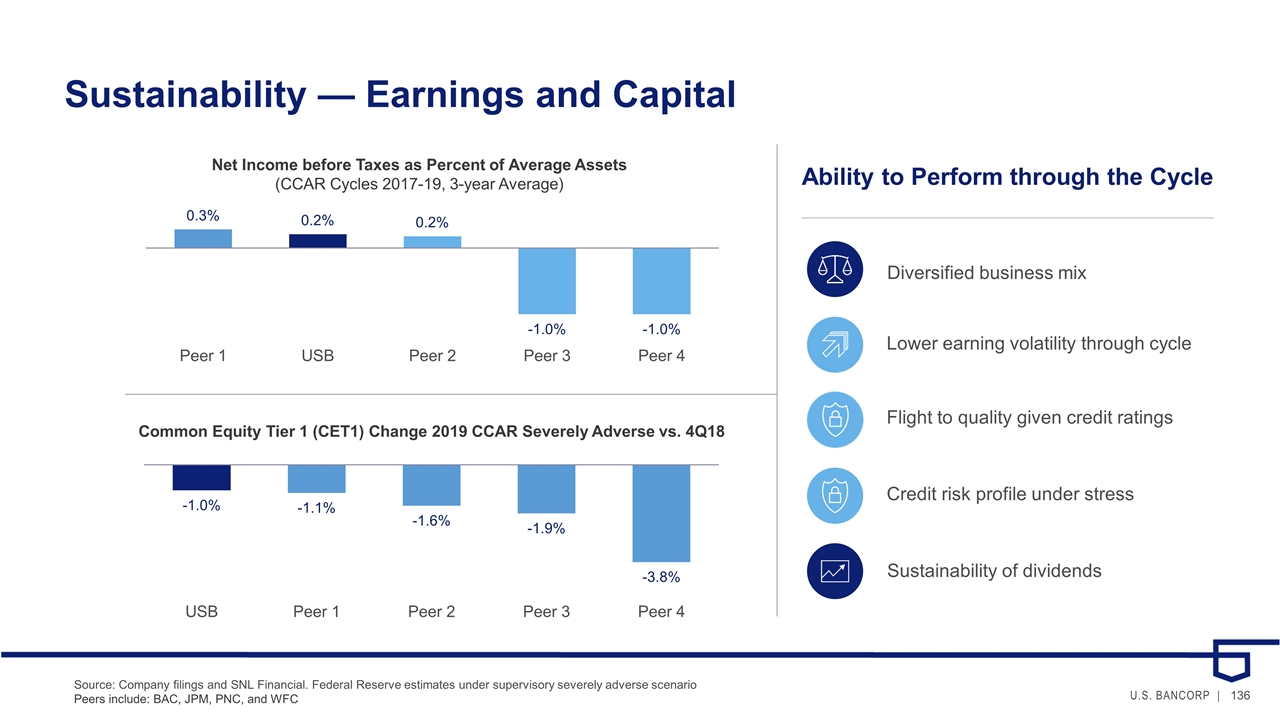

Sustainability — Earnings and Capital Source: Company filings and SNL Financial. Federal Reserve estimates under supervisory severely adverse scenario Peers include: BAC, JPM, PNC, and WFC Net Income before Taxes as Percent of Average Assets (CCAR Cycles 2017-19, 3-year Average) Common Equity Tier 1 (CET1) Change 2019 CCAR Severely Adverse vs. 4Q18 Ability to Perform through the Cycle Sustainability of dividends Diversified business mix Flight to quality given credit ratings Credit risk profile under stress Lower earning volatility through cycle

Growth in Dividends Dividend Growth Capacity for dividend growth 13.5% increase in 2019 Quarterly dividend raised to $0.42 per share in 3Q19 11.84% CAGR *2019 dividend based on CCAR planned distributions

Agenda What we have achieved Long-term strategic expectations Review of U.S. Bank’s performance and positioning Efficiency as a competitive advantage Preferred mix of businesses Diversified revenues Funding as a competitive advantage Capital flexibility Asset sensitivity and liquidity

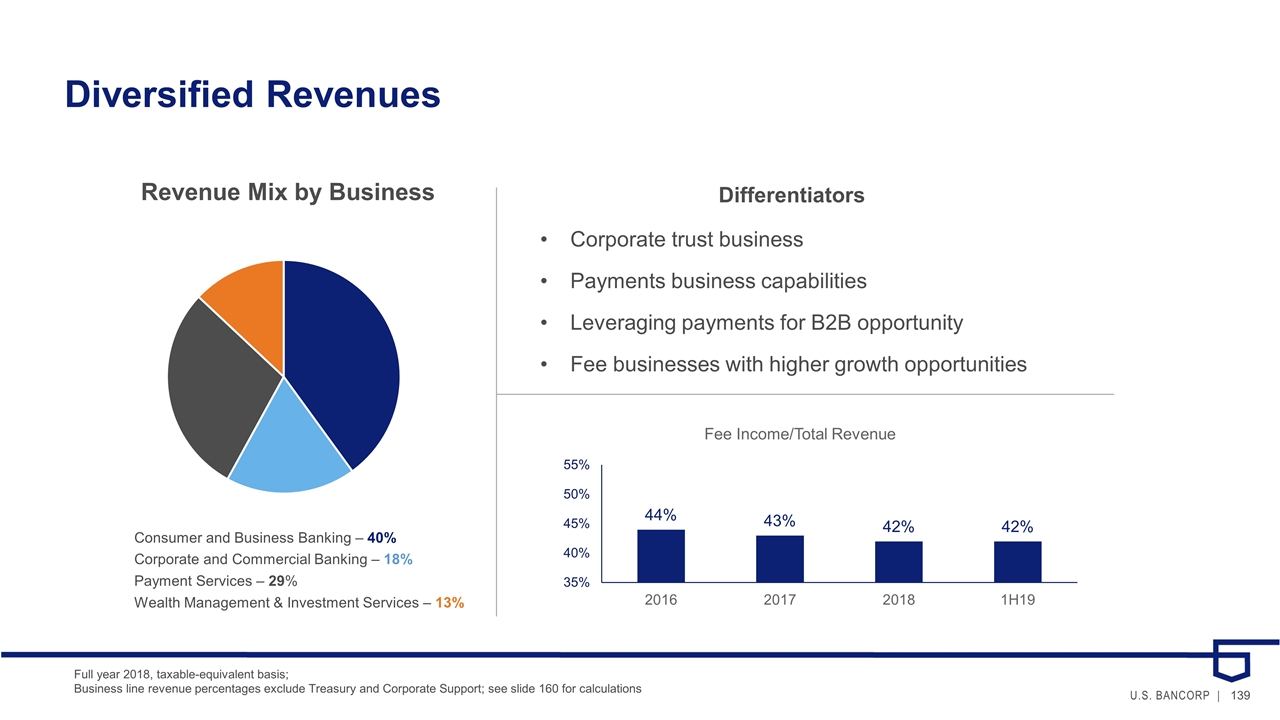

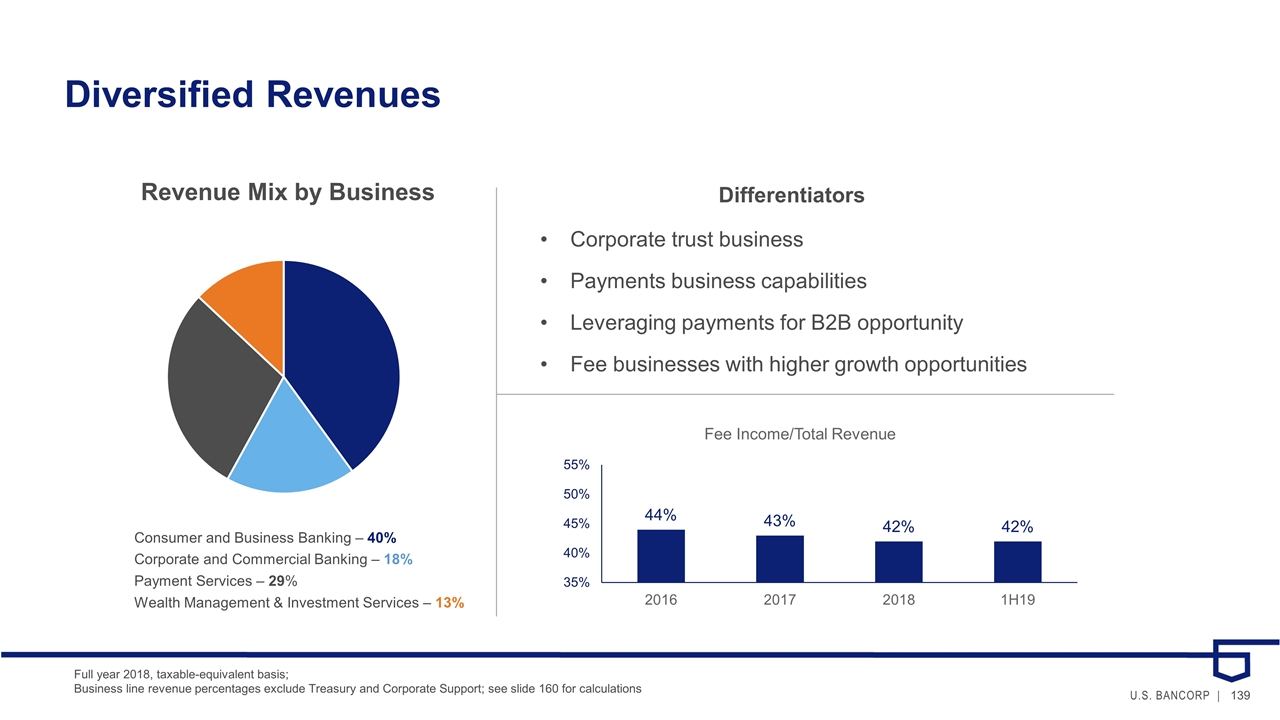

Diversified Revenues Consumer and Business Banking – 40% Corporate and Commercial Banking – 18% Payment Services – 29% Wealth Management & Investment Services – 13% Revenue Mix by Business Fee Income/Total Revenue Full year 2018, taxable-equivalent basis; Business line revenue percentages exclude Treasury and Corporate Support; see slide 160 for calculations Differentiators Corporate trust business Payments business capabilities Leveraging payments for B2B opportunity Fee businesses with higher growth opportunities

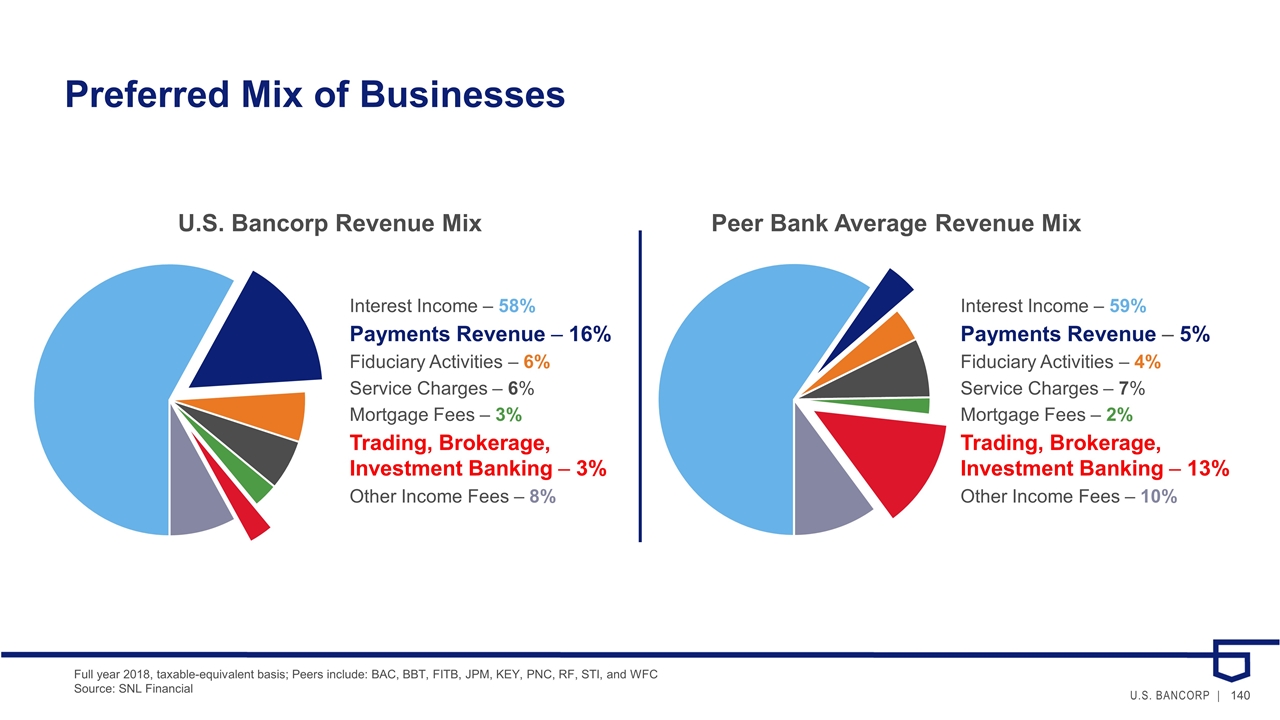

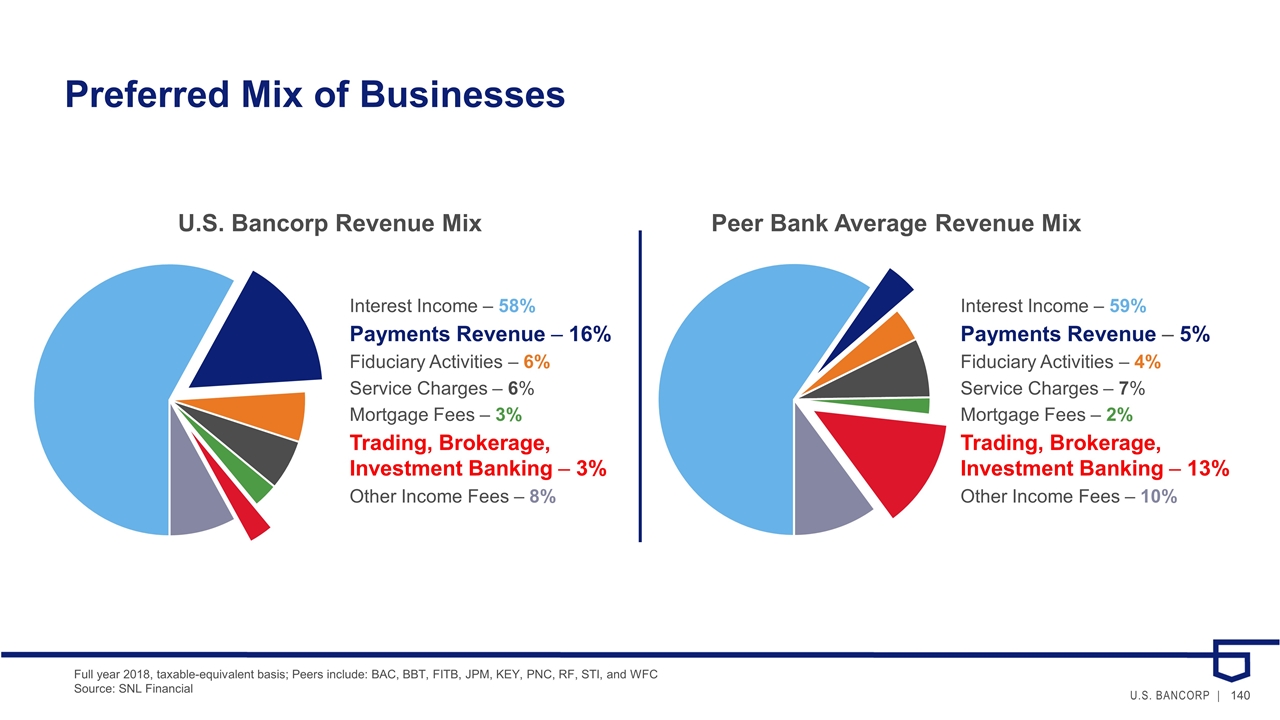

Preferred Mix of Businesses U.S. Bancorp Revenue Mix Peer Bank Average Revenue Mix Interest Income – 58% Payments Revenue – 16% Fiduciary Activities – 6% Service Charges – 6% Mortgage Fees – 3% Trading, Brokerage, Investment Banking – 3% Other Income Fees – 8% Interest Income – 59% Payments Revenue – 5% Fiduciary Activities – 4% Service Charges – 7% Mortgage Fees – 2% Trading, Brokerage, Investment Banking – 13% Other Income Fees – 10% Full year 2018, taxable-equivalent basis; Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC Source: SNL Financial

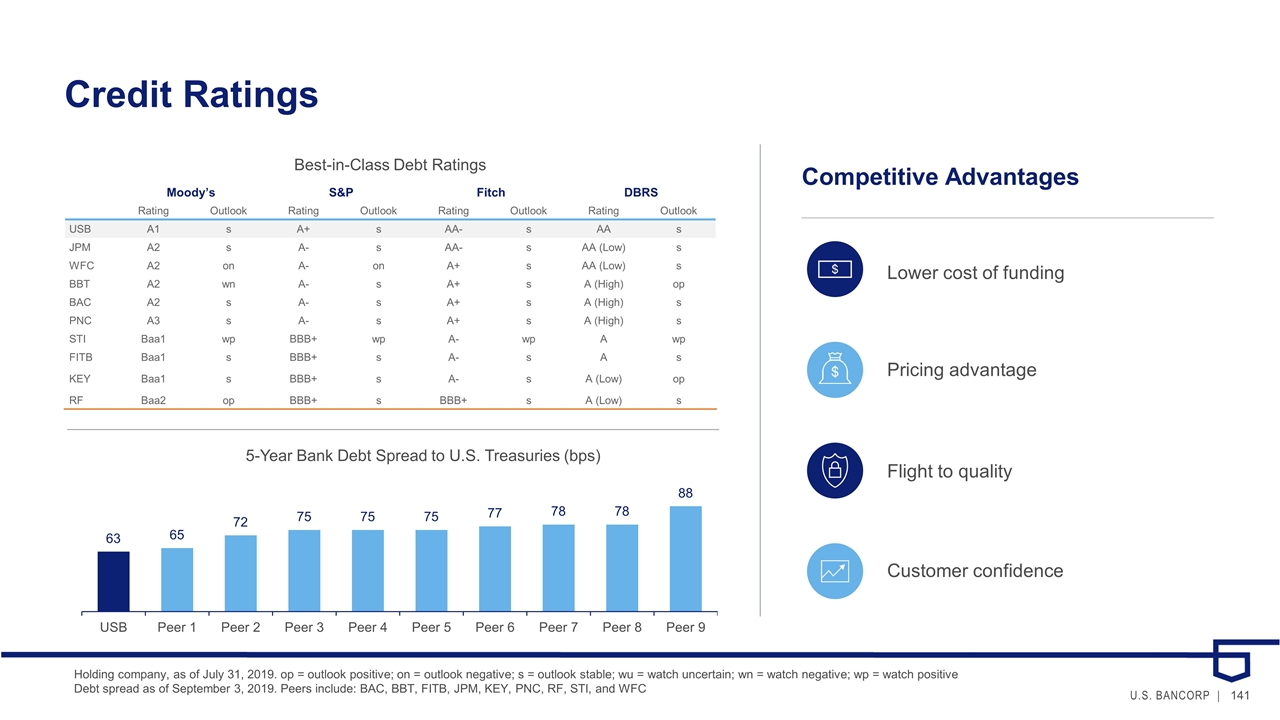

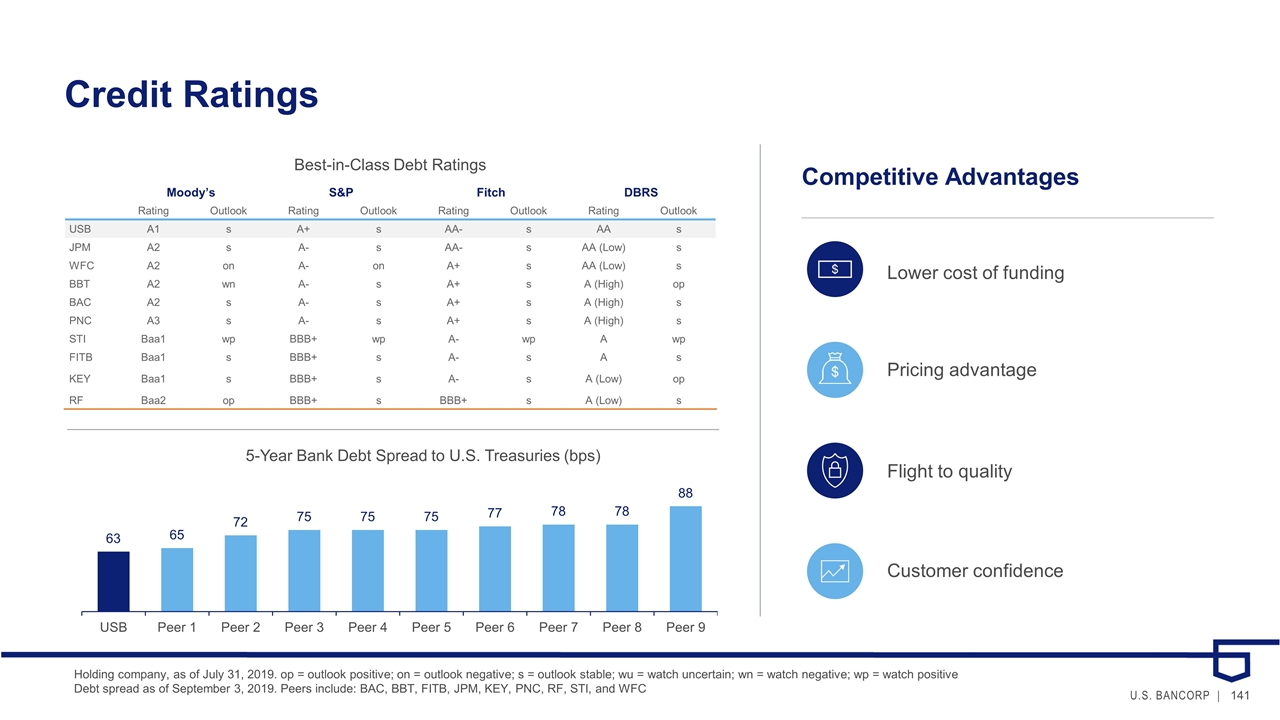

Credit Ratings Competitive Advantages Flight to quality Customer confidence Lower cost of funding Pricing advantage Best-in-Class Debt Ratings 5-Year Bank Debt Spread to U.S. Treasuries (bps) Moody’s S&P Fitch DBRS Rating Outlook Rating Outlook Rating Outlook Rating Outlook USB A1 s A+ s AA- s AA s JPM A2 s A- s AA- s AA (Low) s WFC A2 on A- on A+ s AA (Low) s BBT A2 wn A- s A+ s A (High) op BAC A2 s A- s A+ s A (High) s PNC A3 s A- s A+ s A (High) s STI Baa1 wp BBB+ wp A- wp A wp FITB Baa1 s BBB+ s A- s A s KEY Baa1 s BBB+ s A- s A (Low) op RF Baa2 op BBB+ s BBB+ s A (Low) s Holding company, as of July 31, 2019. op = outlook positive; on = outlook negative; s = outlook stable; wu = watch uncertain; wn = watch negative; wp = watch positive Debt spread as of September 3, 2019. Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC

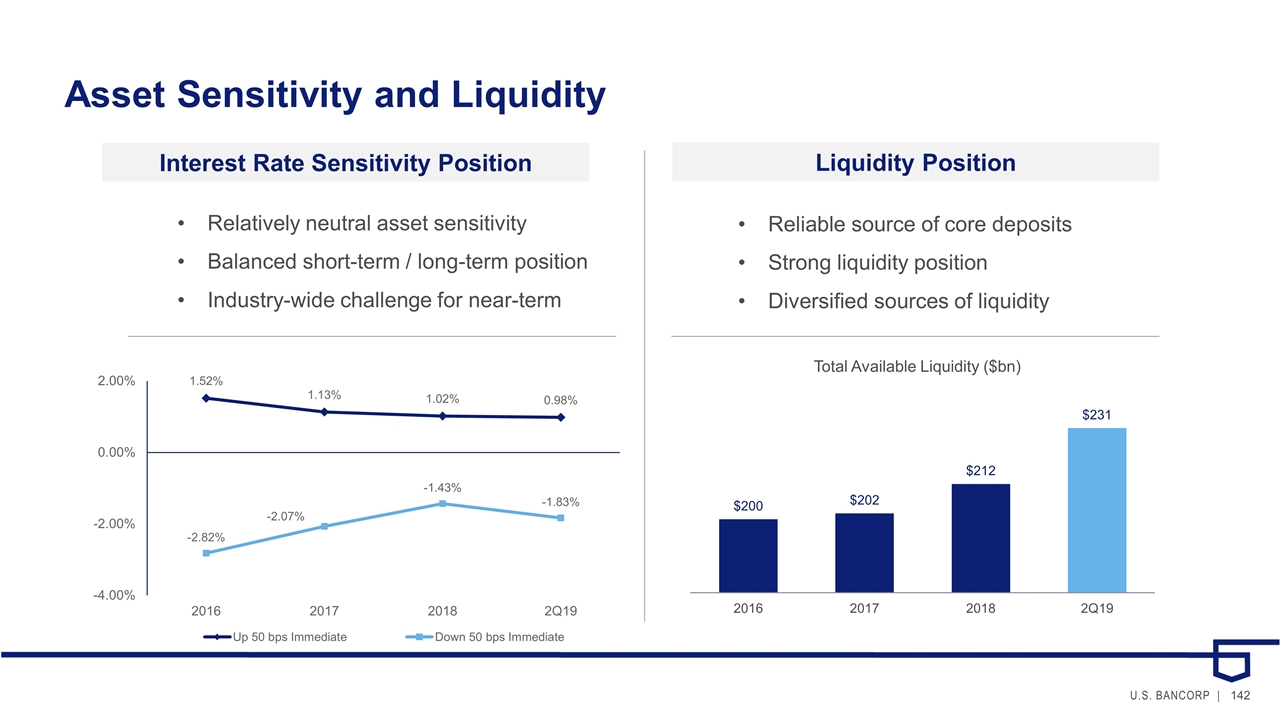

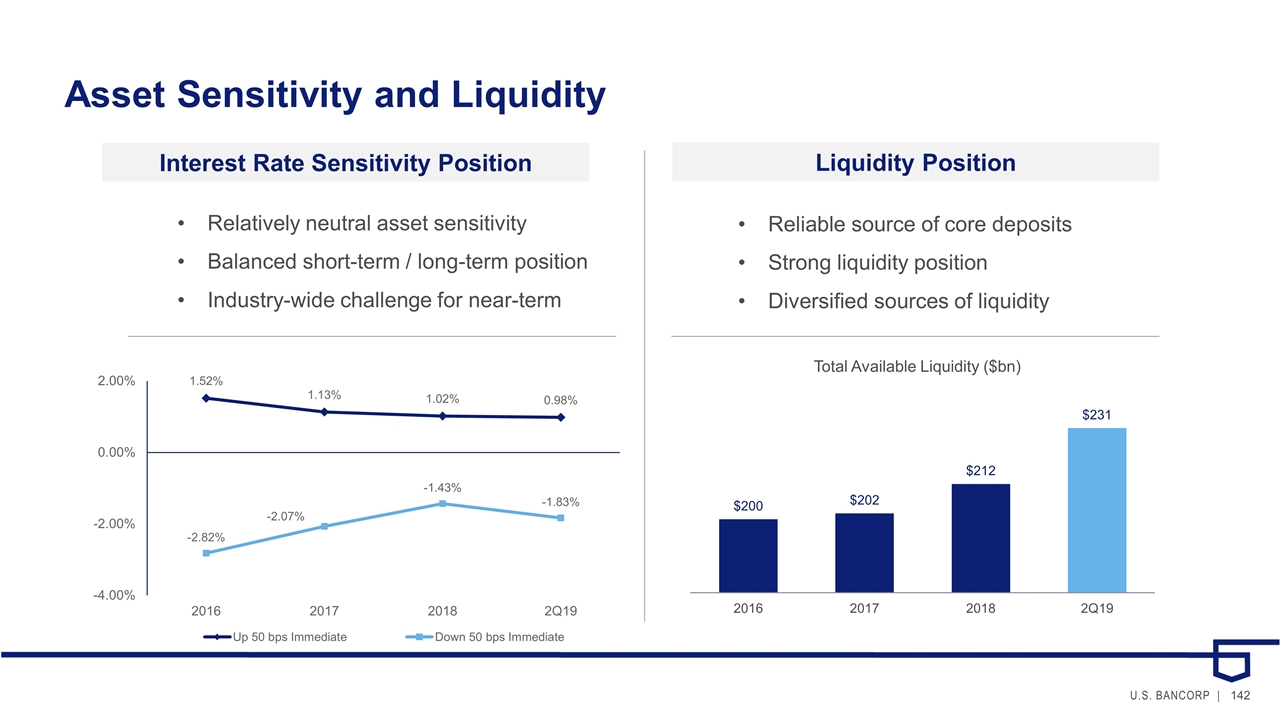

Asset Sensitivity and Liquidity Liquidity Position Interest Rate Sensitivity Position Reliable source of core deposits Strong liquidity position Diversified sources of liquidity Relatively neutral asset sensitivity Balanced short-term / long-term position Industry-wide challenge for near-term

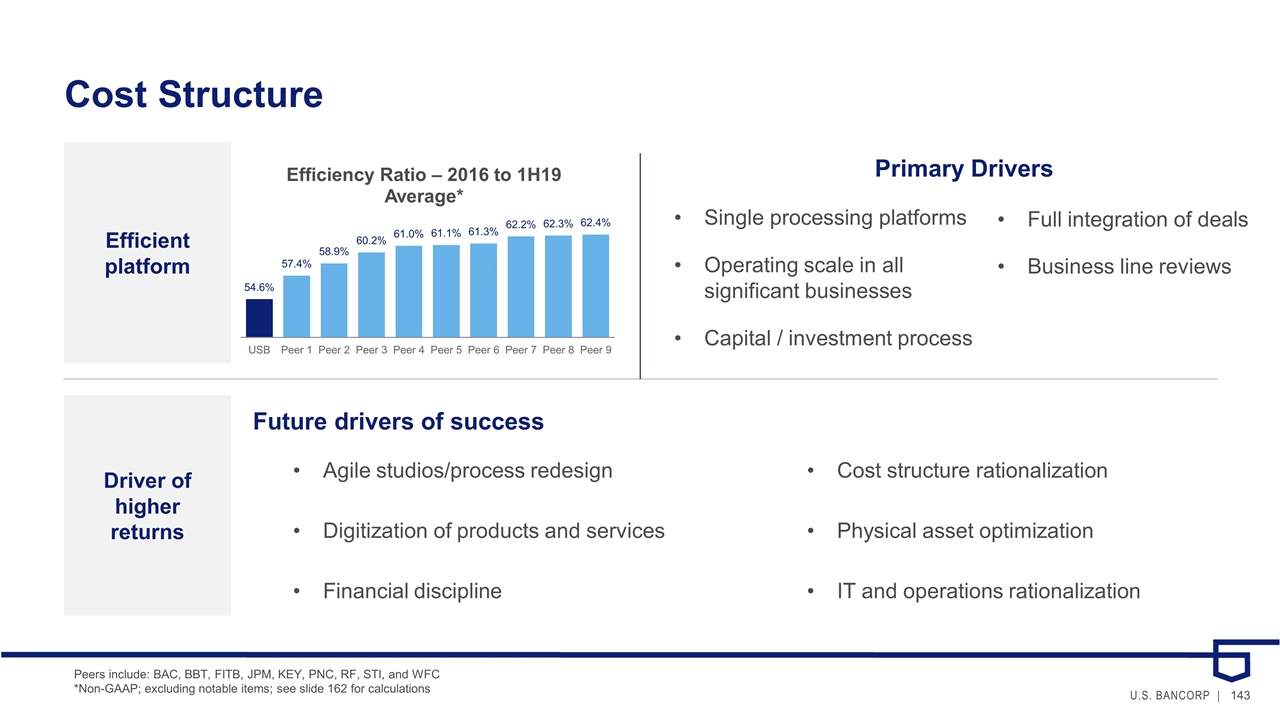

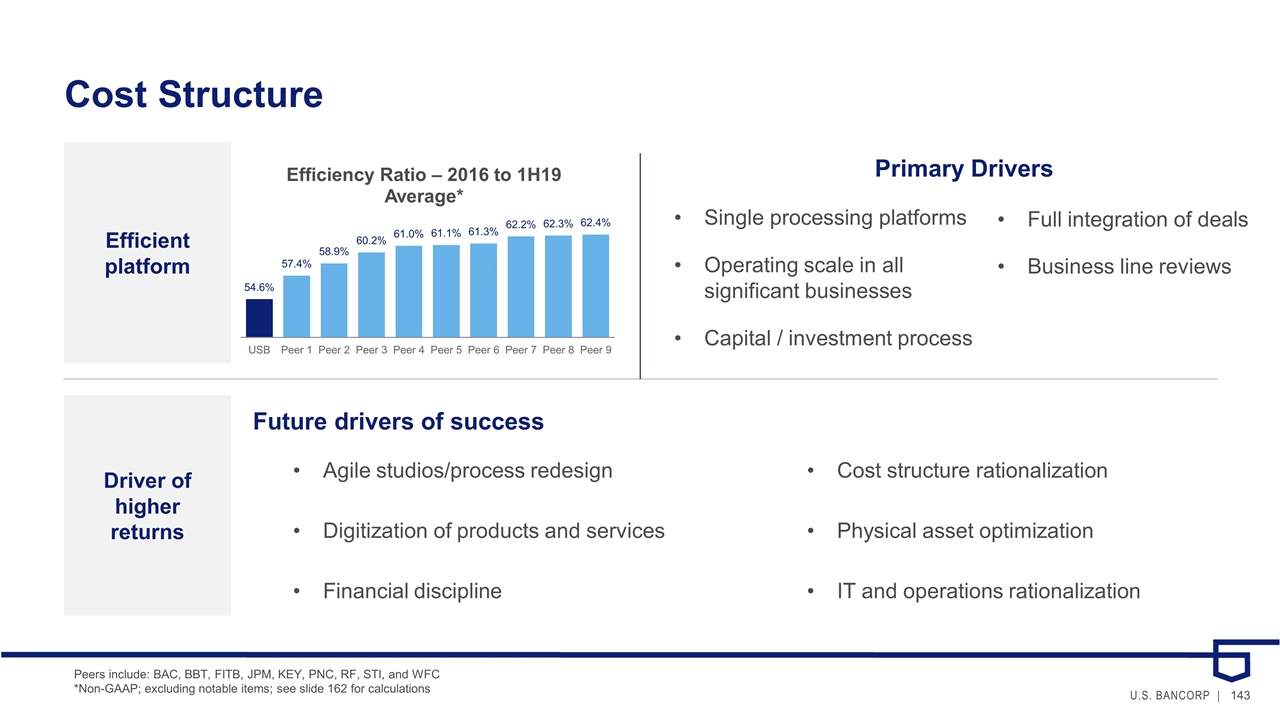

Cost Structure Efficient platform Driver of higher returns Primary Drivers Single processing platforms Full integration of deals Operating scale in all significant businesses Business line reviews Capital / investment process Future drivers of success Agile studios/process redesign Cost structure rationalization Digitization of products and services Physical asset optimization Financial discipline IT and operations rationalization Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC *Non-GAAP; excluding notable items; see slide 162 for calculations

Agenda What we have achieved Review of U.S. Bank’s performance and positioning Long-term strategic expectations

Our Changing Environment Advantages will drive strong relative performance Recent competitive challenges Become opportunities Lower asset sensitivity Stronger relative NIM as rates decline Elevated risk and compliance costs Risk and compliance costs have moderated AML / BSA restrict branch optimization Optimization of physical assets and distribution channels can accelerate Credit profile moderates growth Credit portfolio that performs well in recessionary business cycle Significant capital payouts by peers Capital levels normalizing / “tailoring rules”

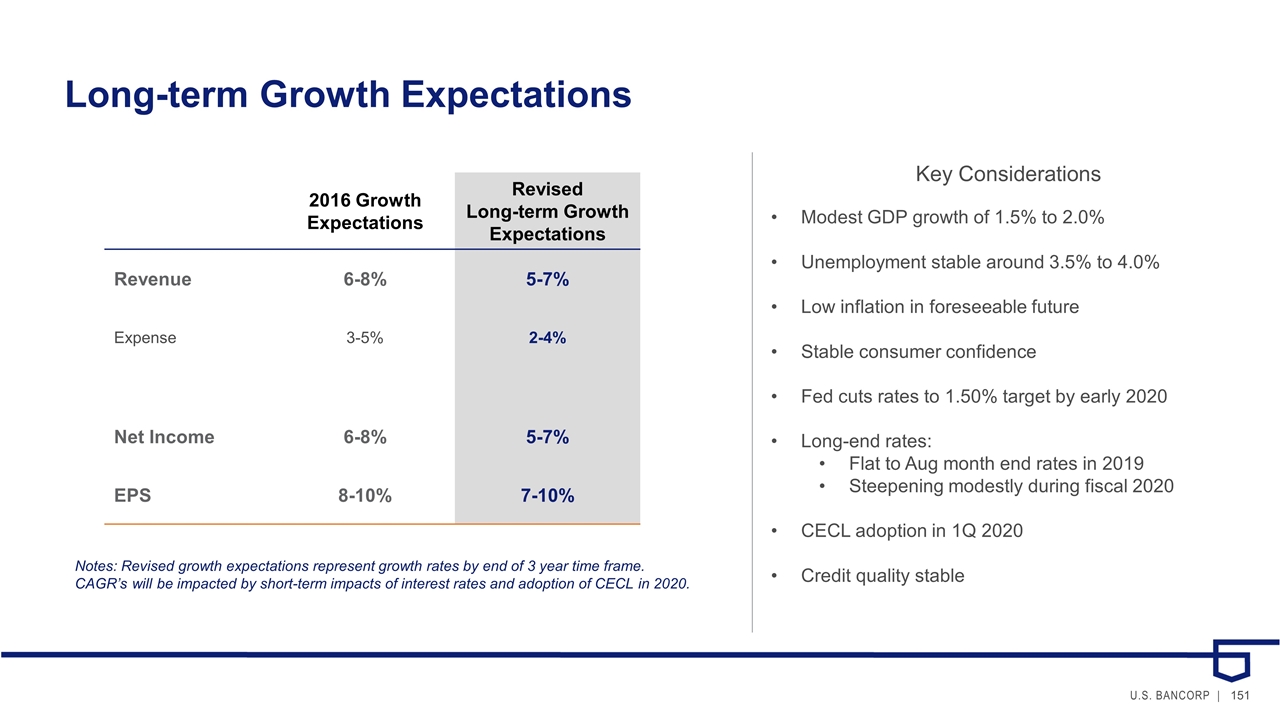

Key Considerations Modest GDP growth of 1.5% to 2.0% Unemployment stable around 3.5% to 4.0% Low inflation in foreseeable future Stable consumer confidence Fed cuts rates to 1.50% target by early 2020 Long-end rates: Flat to Aug month end rates in 2019 Steepening modestly during fiscal 2020 Credit quality stable Macro-economic factors

Optimization and Business Investment Portfolio management of businesses Holistic business review Market attractiveness Business performance Growth opportunity/returns Capital required Physical asset optimization accelerating Recent actions Elan ATM processing Gaming Retail lockbox Student lending FDIC covered loans Digital focus Redesigning employee roles Rethinking branch format Reinvesting in higher growth locations Enhancing the branch experience Why the change? Opportunity to accelerate changes Enabling branch redesign/investment Digital-first market expansion strategies

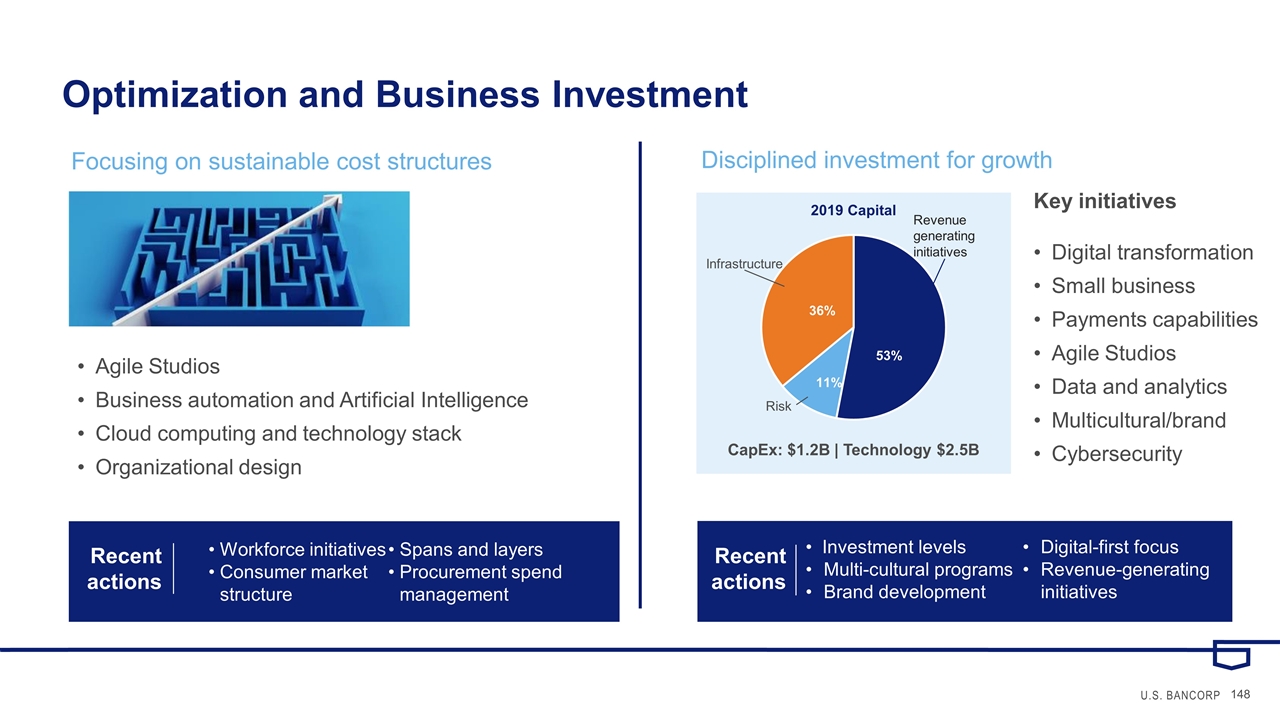

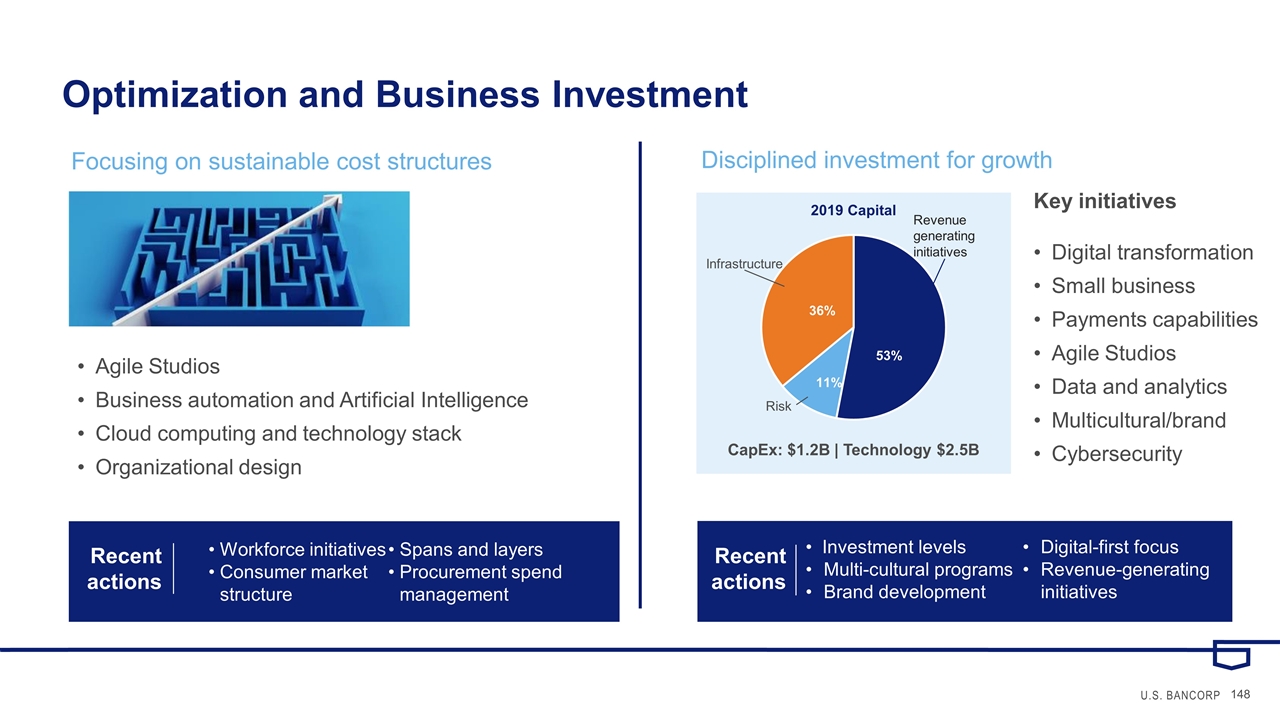

Optimization and Business Investment Disciplined investment for growth Key initiatives Digital transformation Small business Payments capabilities Agile Studios Data and analytics Multicultural/brand Cybersecurity Focusing on sustainable cost structures Agile Studios Business automation and Artificial Intelligence Cloud computing and technology stack Organizational design Recent actions Workforce initiatives Consumer market structure Spans and layers Procurement spend management Business growth 36% 11% 53% CapEx: $1.2B | Technology $2.5B Risk Infrastructure Recent actions Investment levels Multi-cultural programs Brand development Digital-first focus Revenue-generating initiatives

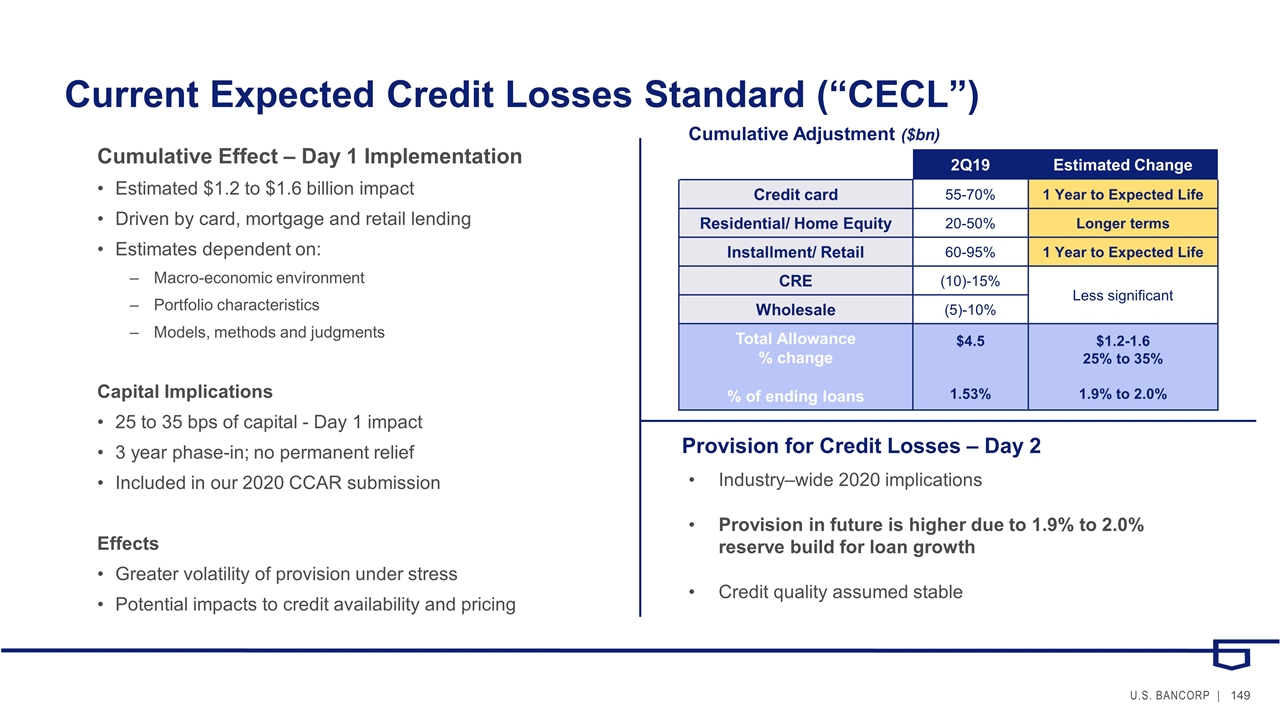

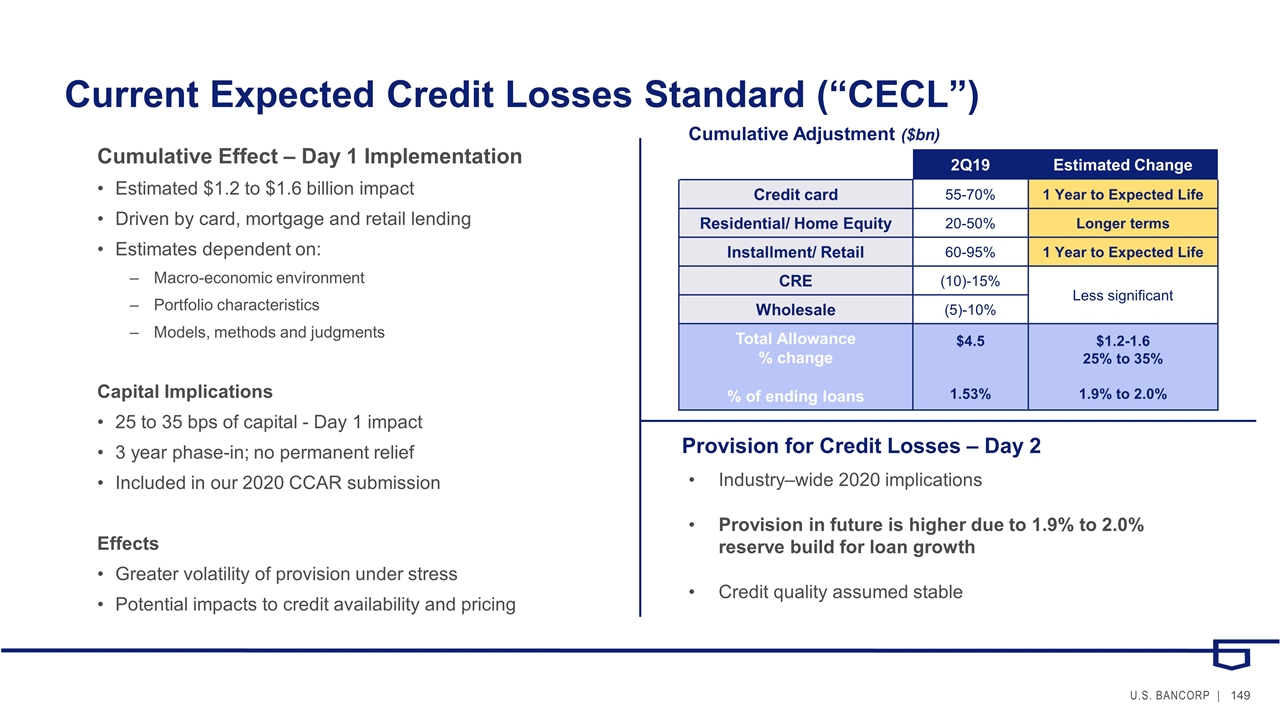

Current Expected Credit Losses Standard (“CECL”) Cumulative Effect – Day 1 Implementation Estimated $1.2 to $1.6 billion impact Driven by card, mortgage and retail lending Estimates dependent on: Macro-economic environment Portfolio characteristics Models, methods and judgments Capital Implications 25 to 35 bps of capital - Day 1 impact 3 year phase-in; no permanent relief Included in our 2020 CCAR submission Effects Greater volatility of provision under stress Potential impacts to credit availability and pricing Cumulative Adjustment ($bn) 2Q19 Estimated Change Credit card 55-70% 1 Year to Expected Life Residential/ Home Equity 20-50% Longer terms Installment/ Retail 60-95% 1 Year to Expected Life CRE (10)-15% Less significant Wholesale (5)-10% Total Allowance % change % of ending loans $4.5 1.53% $1.2-1.6 25% to 35% 1.9% to 2.0% Industry–wide 2020 implications Provision in future is higher due to 1.9% to 2.0% reserve build for loan growth Credit quality assumed stable Provision for Credit Losses – Day 2

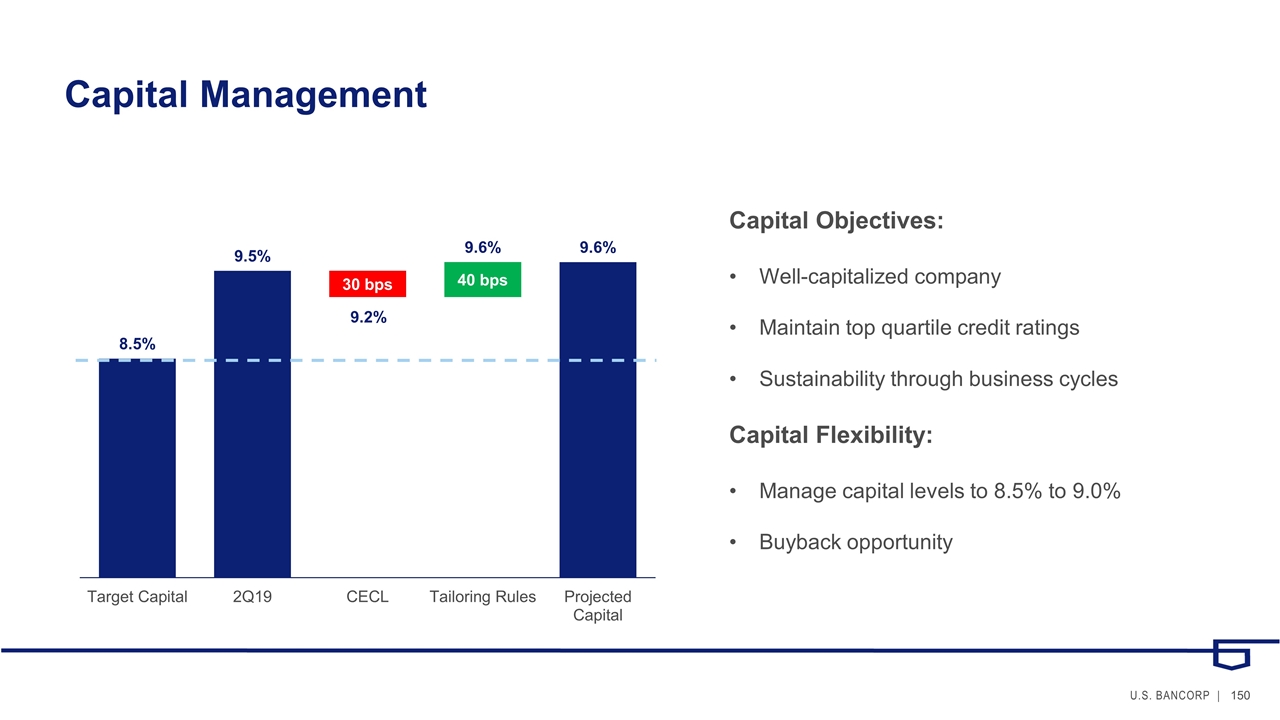

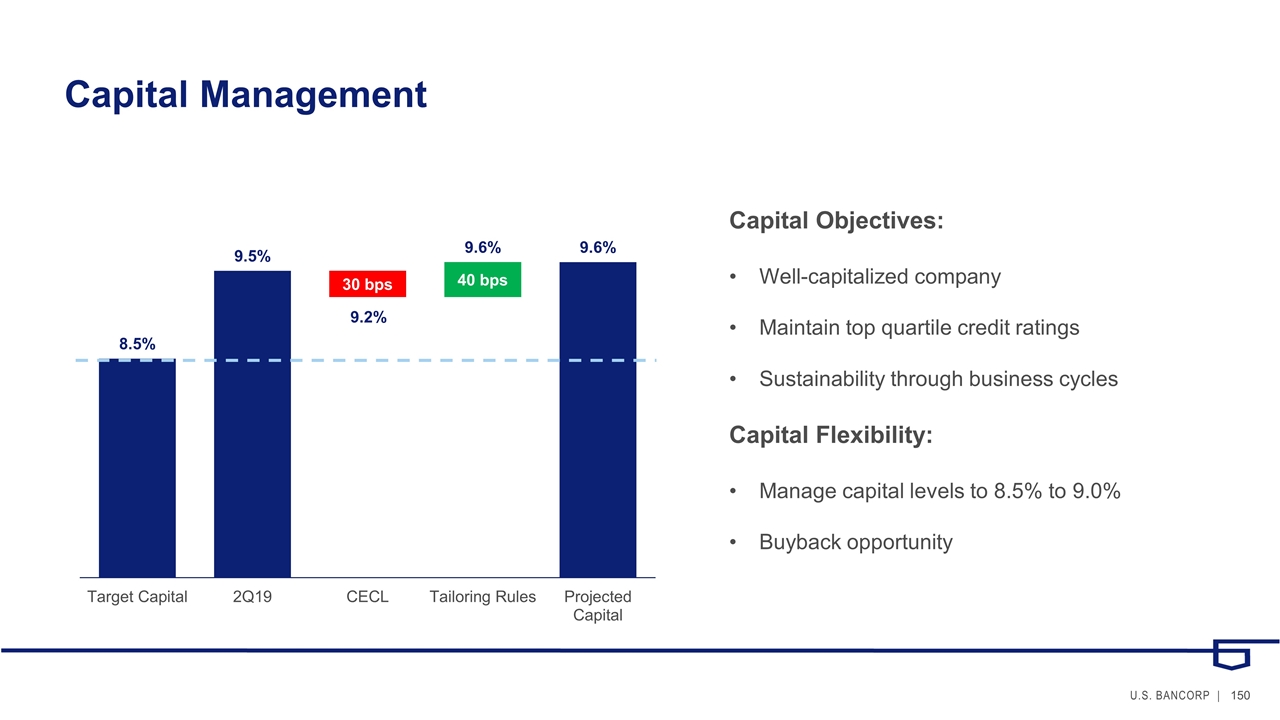

Capital Management Capital Objectives: Well-capitalized company Maintain top quartile credit ratings Sustainability through business cycles Capital Flexibility: Manage capital levels to 8.5% to 9.0% Buyback opportunity 40bps

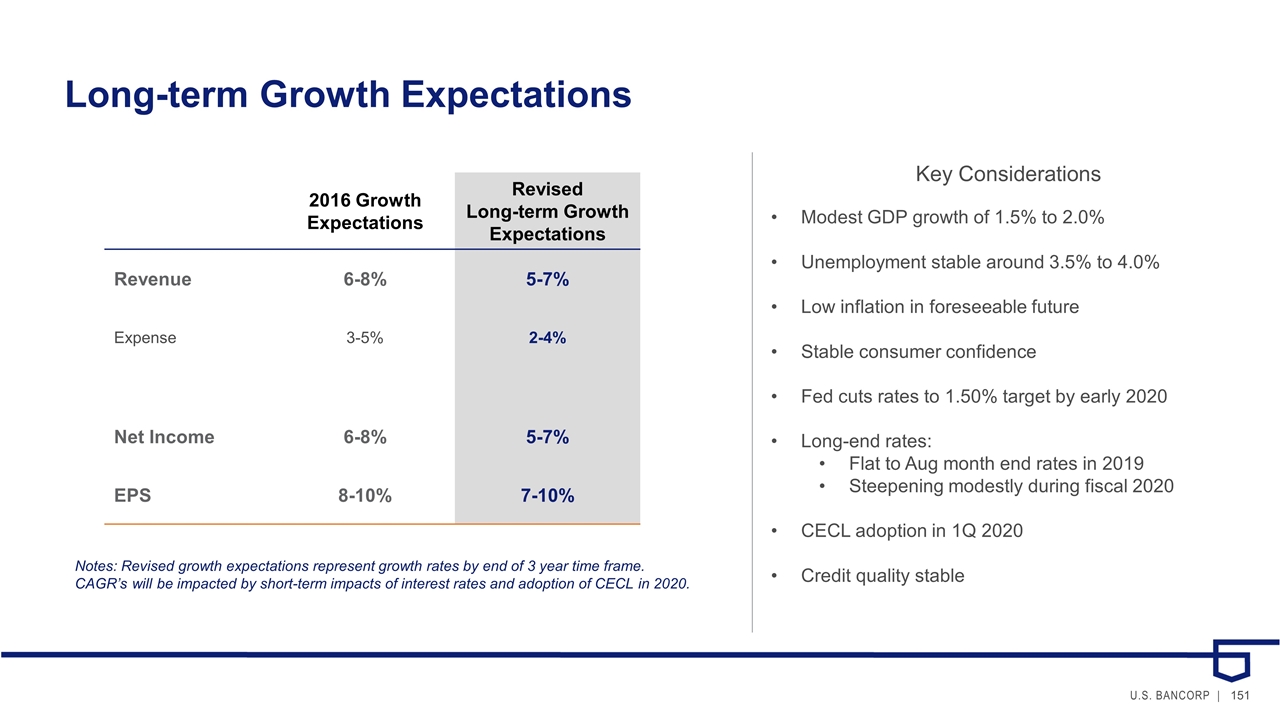

Long-term Growth Expectations Key Considerations Modest GDP growth of 1.5% to 2.0% Unemployment stable around 3.5% to 4.0% Low inflation in foreseeable future Stable consumer confidence Fed cuts rates to 1.50% target by early 2020 Long-end rates: Flat to Aug month end rates in 2019 Steepening modestly during fiscal 2020 CECL adoption in 1Q 2020 Credit quality stable 2016 Growth Expectations Revised Long-term Growth Expectations Revenue 6-8% 5-7% Expense 3-5% 2-4% Net Income 6-8% 5-7% EPS 8-10% 7-10% Notes: Revised growth expectations represent growth rates by end of 3 year time frame. CAGR’s will be impacted by short-term impacts of interest rates and adoption of CECL in 2020.

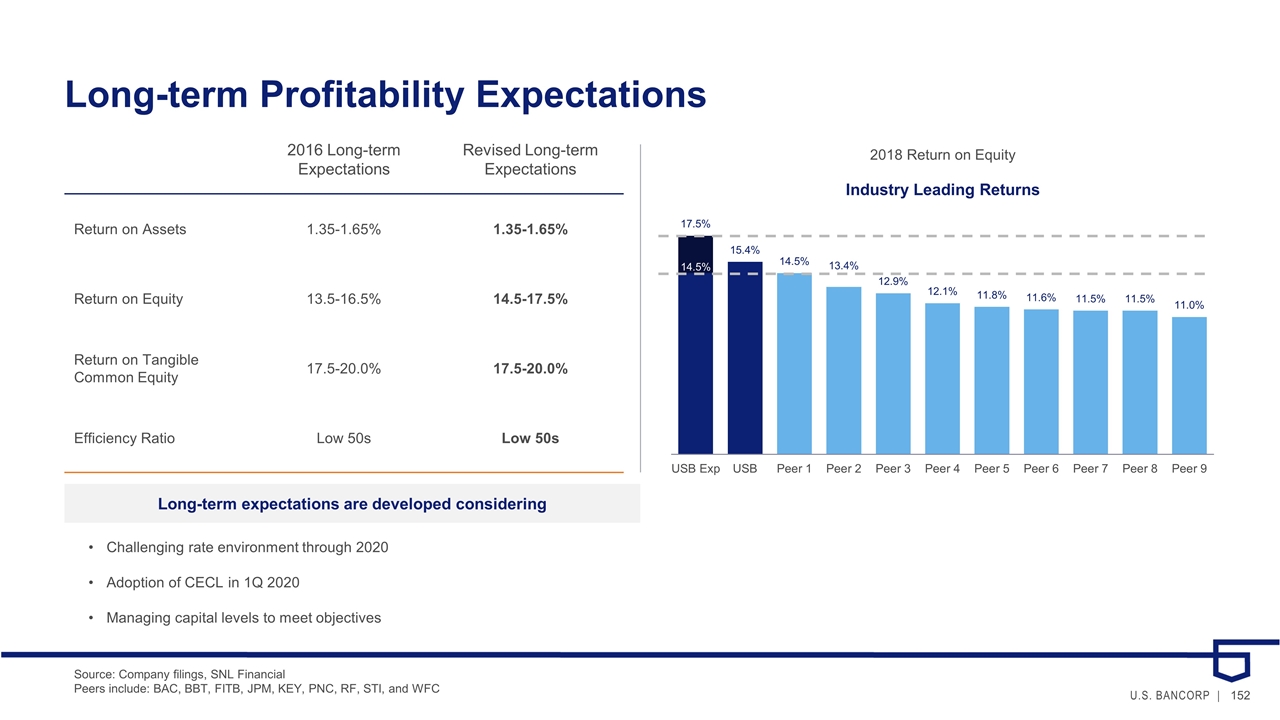

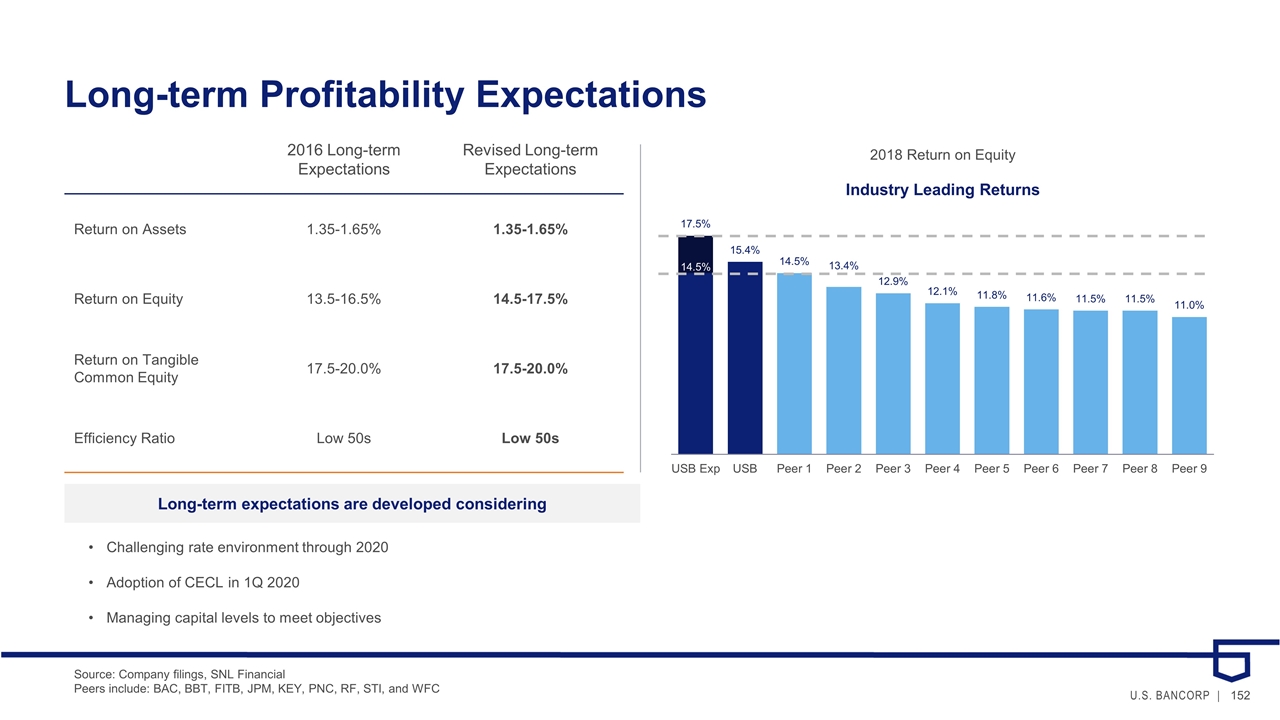

Long-term Profitability Expectations 2016 Long-term Expectations Revised Long-term Expectations Return on Assets 1.35-1.65% 1.35-1.65% Return on Equity 13.5-16.5% 14.5-17.5% Return on Tangible Common Equity 17.5-20.0% 17.5-20.0% Efficiency Ratio Low 50s Low 50s Long-term expectations are developed considering Challenging rate environment through 2020 Adoption of CECL in 1Q 2020 Managing capital levels to meet objectives 13.5% 14.5% Source: Company filings, SNL Financial Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC

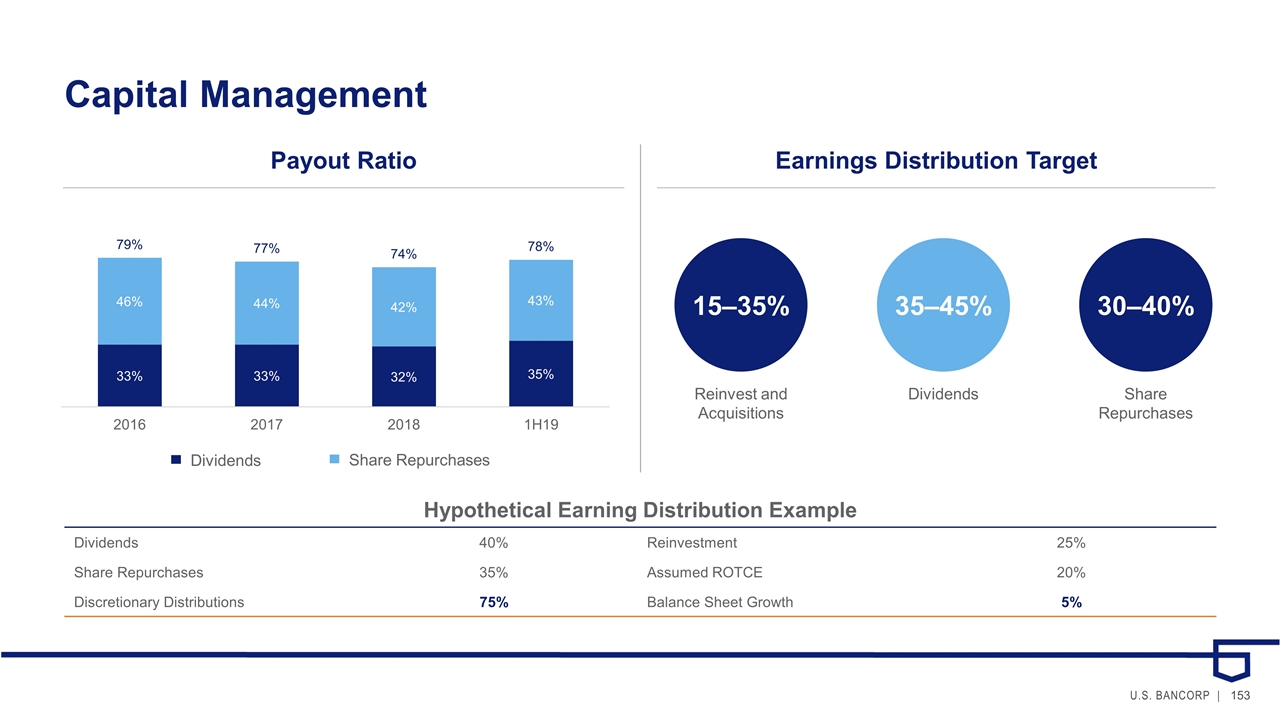

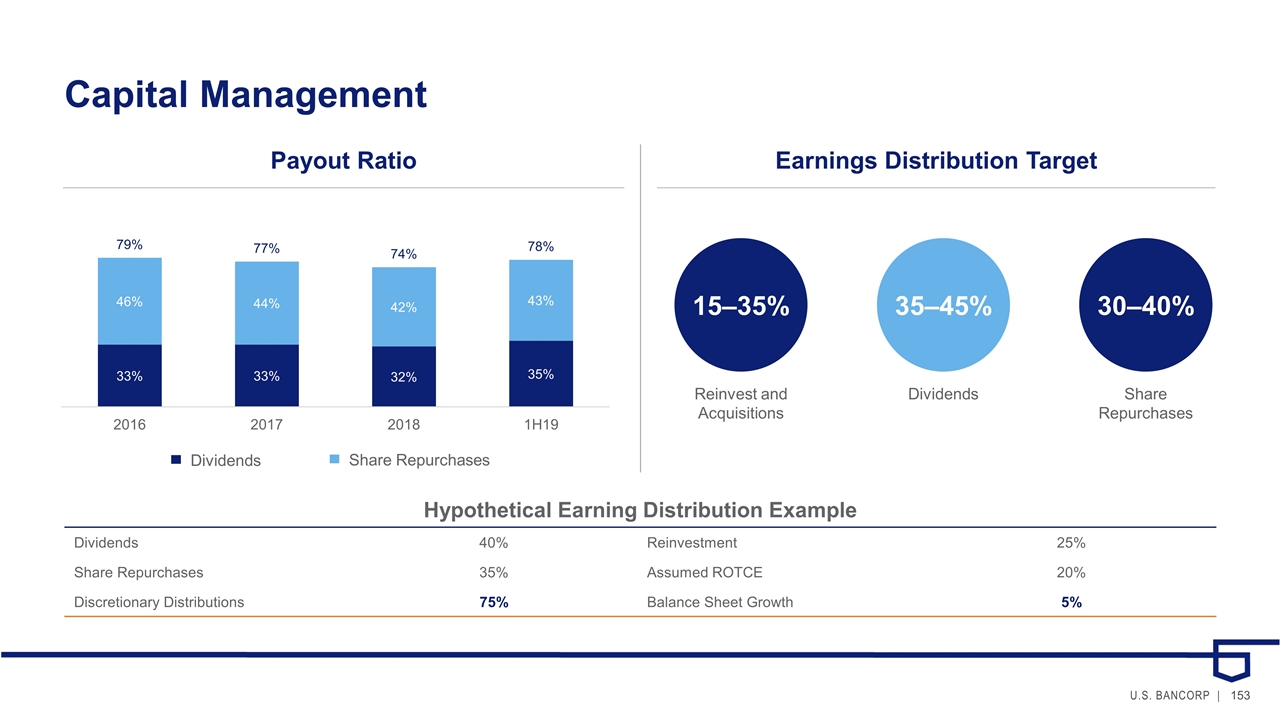

Capital Management Dividends Share Repurchases Payout Ratio Earnings Distribution Target 15–35% Reinvest and Acquisitions 35–45% Dividends 30–40% Share Repurchases Hypothetical Earning Distribution Example Dividends 40% Reinvestment 25% Share Repurchases 35% Assumed ROTCE 20% Discretionary Distributions 75% Balance Sheet Growth 5%

Source: Company filings, SNL Financial Peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI, and WFC Long History of Industry-leading Returns and Financial Discipline

3Q19 Guidance Update Net interest income Noninterest income Operating leverage Tax rate Credit Quality

U.S. Bancorp Investor Day Closing Remarks September 12, 2019 Andy Cecere Chairman, President and CEO

U.S. Bancorp Investor Day 2019 – Summary Starting from a position of strength Leveraging competitive advantages Investing for the future Enabling the future, transforming for growth Consumer & Business Banking Wealth Management & Investment Services Corporate & Commercial Banking Payment Services Executing on our strategy

We are managing for the long-term while delivering near-term results that support a pathway to the future.

Appendix

Non-GAAP Financial Measures

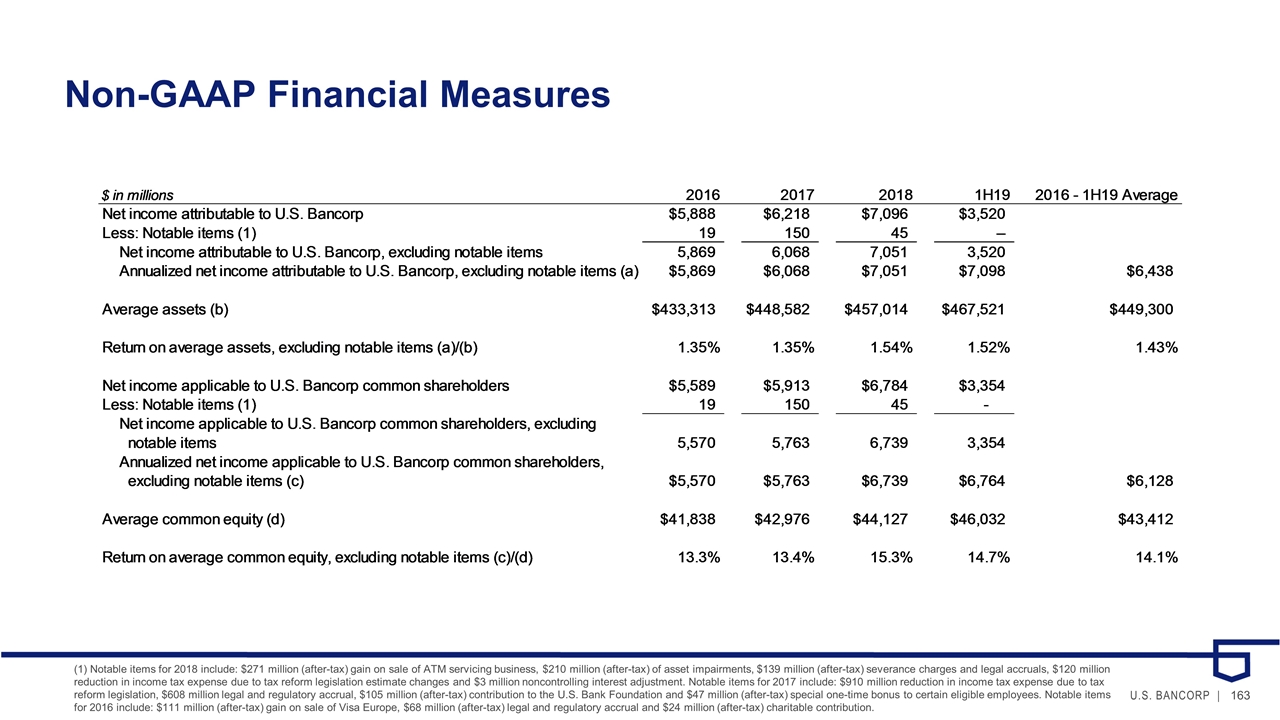

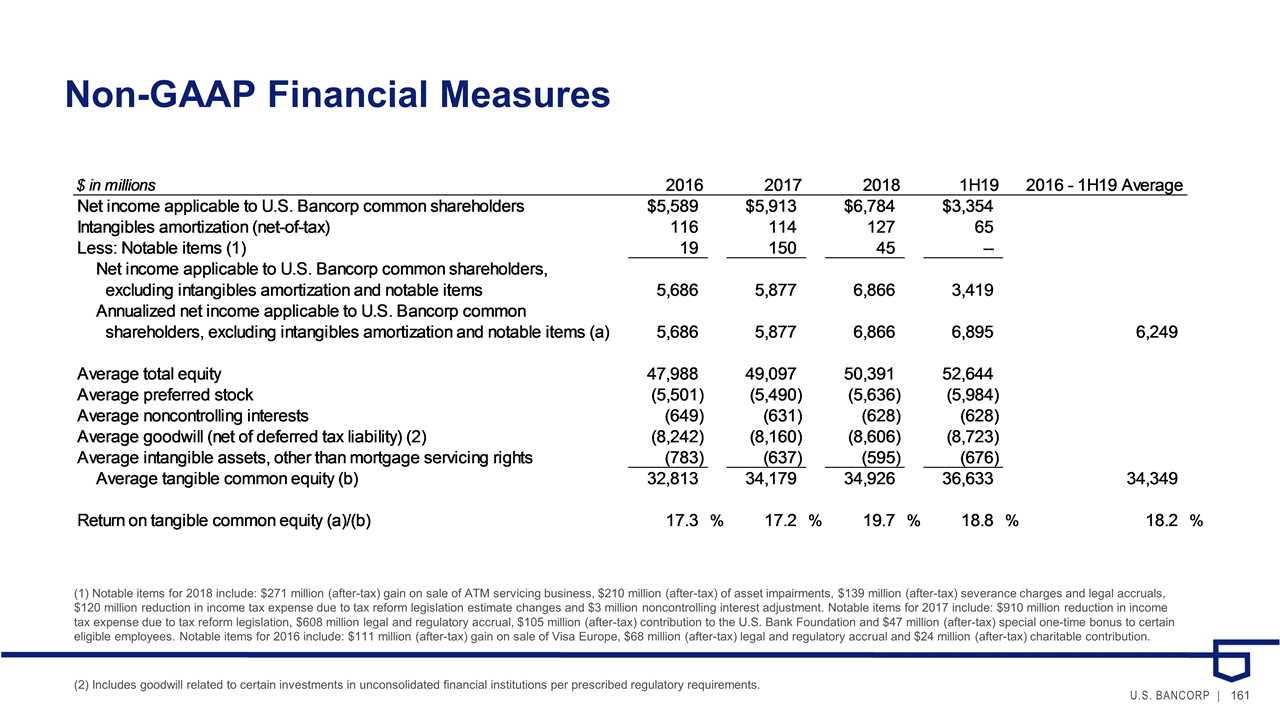

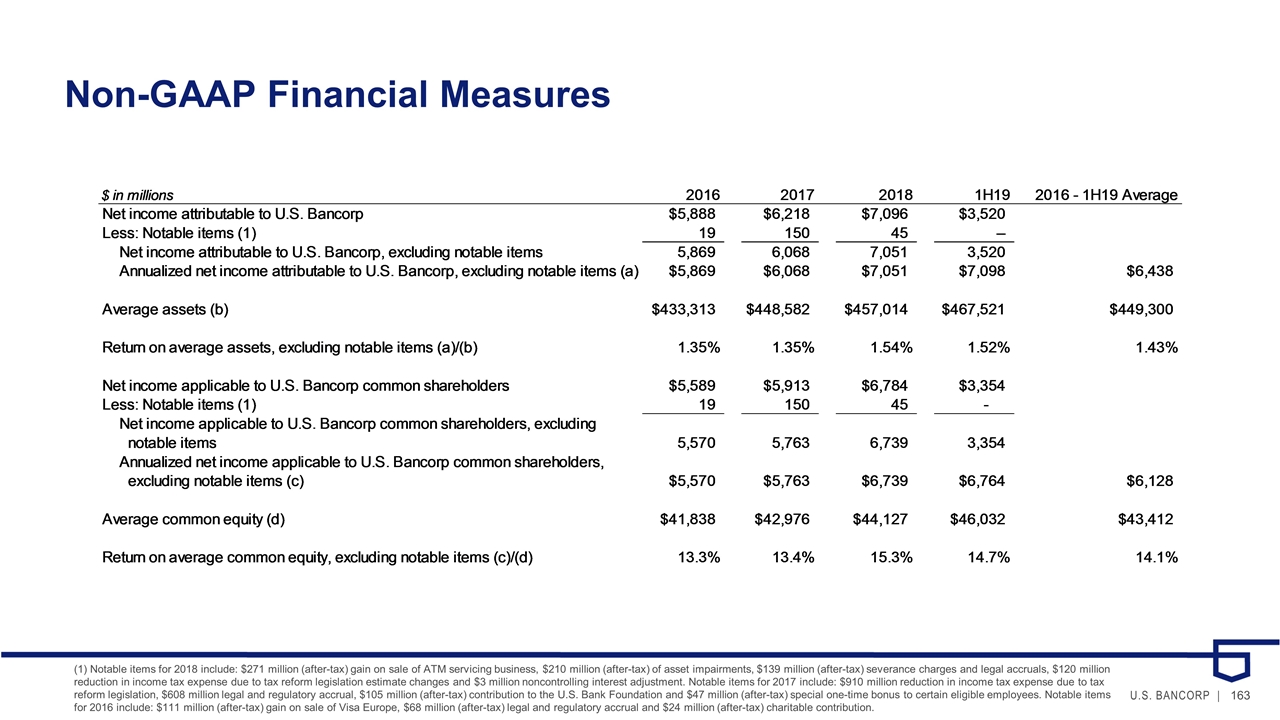

Non-GAAP Financial Measures (1) Notable items for 2018 include: $271 million (after-tax) gain on sale of ATM servicing business, $210 million (after-tax) of asset impairments, $139 million (after-tax) severance charges and legal accruals, $120 million reduction in income tax expense due to tax reform legislation estimate changes and $3 million noncontrolling interest adjustment. Notable items for 2017 include: $910 million reduction in income tax expense due to tax reform legislation, $608 million legal and regulatory accrual, $105 million (after-tax) contribution to the U.S. Bank Foundation and $47 million (after-tax) special one-time bonus to certain eligible employees. Notable items for 2016 include: $111 million (after-tax) gain on sale of Visa Europe, $68 million (after-tax) legal and regulatory accrual and $24 million (after-tax) charitable contribution. (2) Includes goodwill related to certain investments in unconsolidated financial institutions per prescribed regulatory requirements.

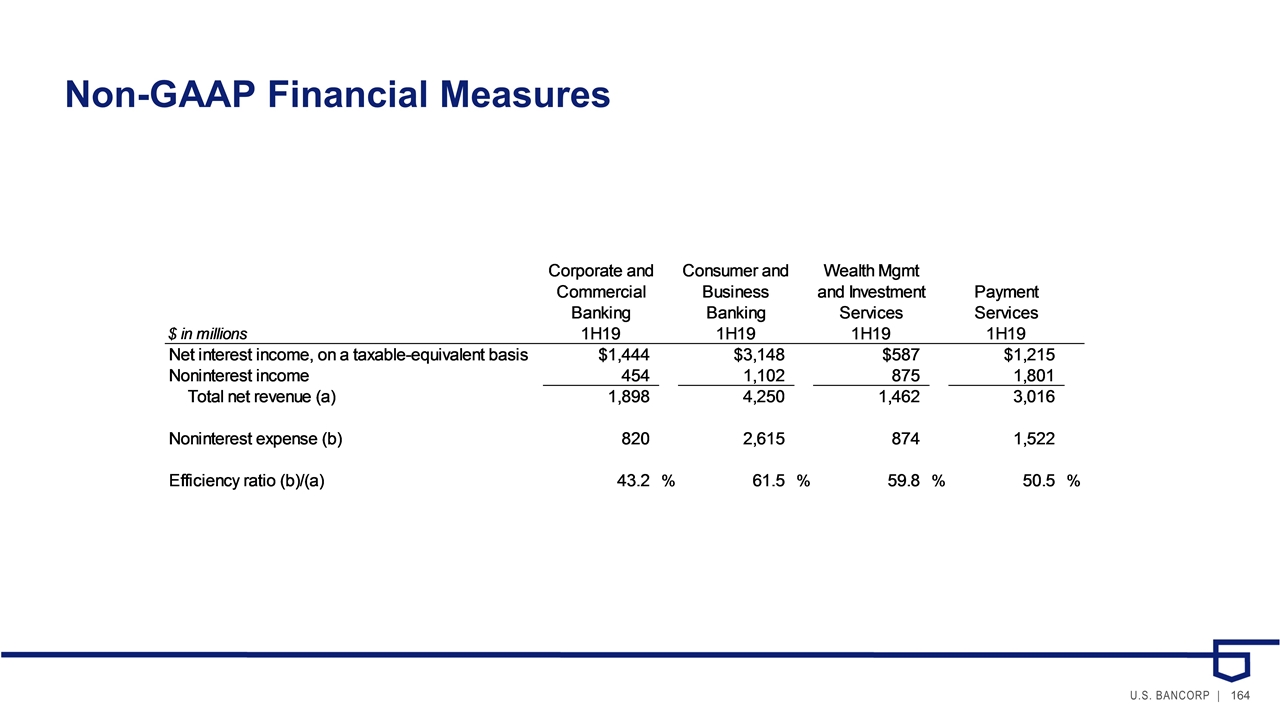

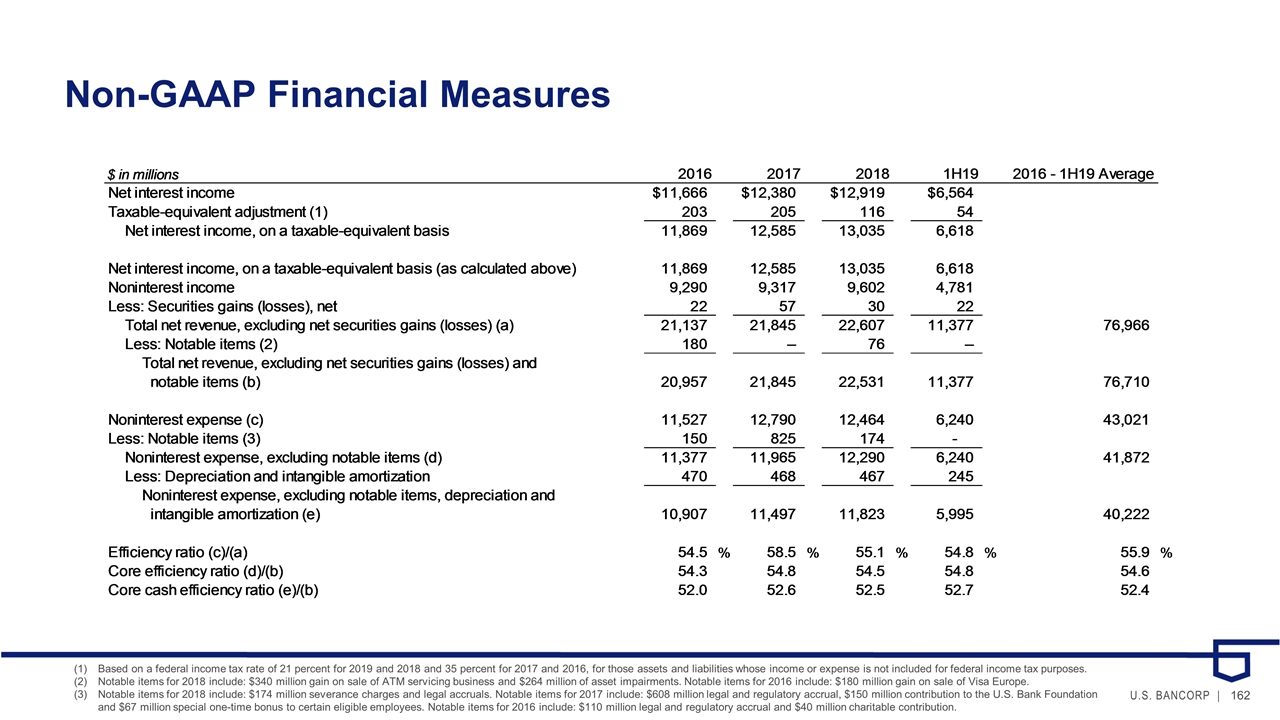

Non-GAAP Financial Measures Based on a federal income tax rate of 21 percent for 2019 and 2018 and 35 percent for 2017 and 2016, for those assets and liabilities whose income or expense is not included for federal income tax purposes. Notable items for 2018 include: $340 million gain on sale of ATM servicing business and $264 million of asset impairments. Notable items for 2016 include: $180 million gain on sale of Visa Europe. Notable items for 2018 include: $174 million severance charges and legal accruals. Notable items for 2017 include: $608 million legal and regulatory accrual, $150 million contribution to the U.S. Bank Foundation and $67 million special one-time bonus to certain eligible employees. Notable items for 2016 include: $110 million legal and regulatory accrual and $40 million charitable contribution.

Non-GAAP Financial Measures (1) Notable items for 2018 include: $271 million (after-tax) gain on sale of ATM servicing business, $210 million (after-tax) of asset impairments, $139 million (after-tax) severance charges and legal accruals, $120 million reduction in income tax expense due to tax reform legislation estimate changes and $3 million noncontrolling interest adjustment. Notable items for 2017 include: $910 million reduction in income tax expense due to tax reform legislation, $608 million legal and regulatory accrual, $105 million (after-tax) contribution to the U.S. Bank Foundation and $47 million (after-tax) special one-time bonus to certain eligible employees. Notable items for 2016 include: $111 million (after-tax) gain on sale of Visa Europe, $68 million (after-tax) legal and regulatory accrual and $24 million (after-tax) charitable contribution.

Non-GAAP Financial Measures

September 12, 2019 U.S. Bancorp Investor Day