| News Release |

Trustmark Corporation Announces Third Quarter 2014 Financial Results

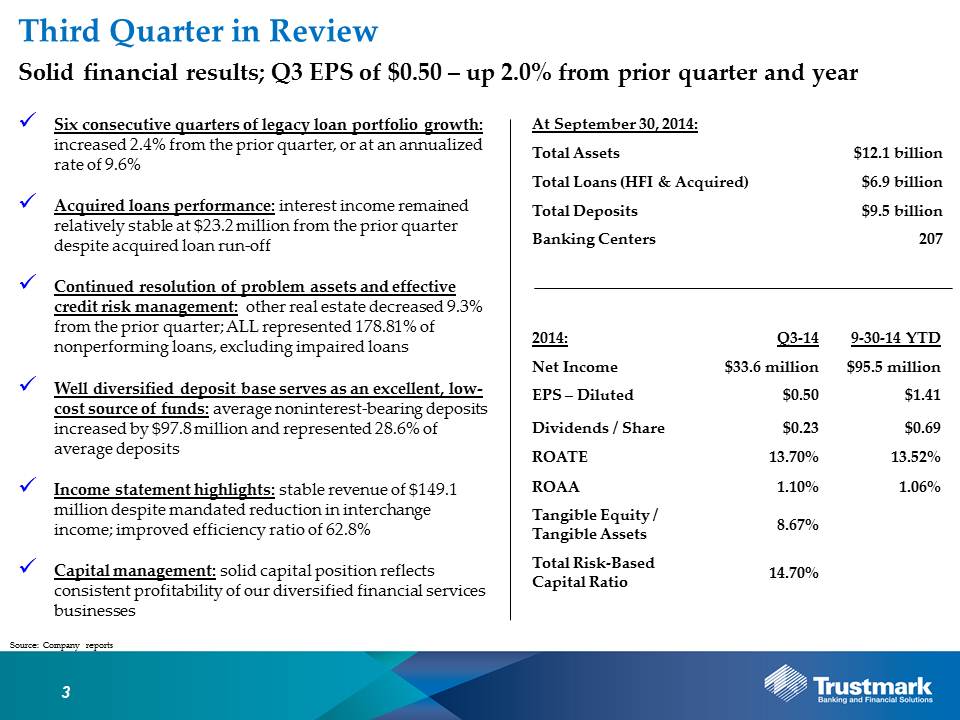

JACKSON, Miss. – October 28, 2014 – Trustmark Corporation (NASDAQ:TRMK) reported net income of $33.6 million in the third quarter of 2014, which represented diluted earnings per share of $0.50, an increase of 2.0% from both the prior quarter and third quarter of 2013. Trustmark’s performance during the third quarter of 2014 produced a return on average tangible equity of 13.70% and a return on average assets of 1.10%. During the first nine months of 2014, Trustmark’s net income totaled $95.5 million, which represented diluted earnings per share of $1.41, an increase of 6.0% from the prior year. Trustmark’s Board of Directors declared a quarterly cash dividend of $0.23 per share payable December 15, 2014, to shareholders of record on December 1, 2014.

Gerard R. Host, President and CEO, stated, “Trustmark continued to achieve solid financial results in the third quarter, including the sixth consecutive quarter of growth in our legacy loan portfolio, significant growth in our insurance and wealth management businesses, and improvement in our efficiency ratio. Thanks to our associates, solid profitability and strong capital base, Trustmark remains well-positioned to continue meeting the needs of our customers and creating value for our shareholders.”

Balance Sheet Management

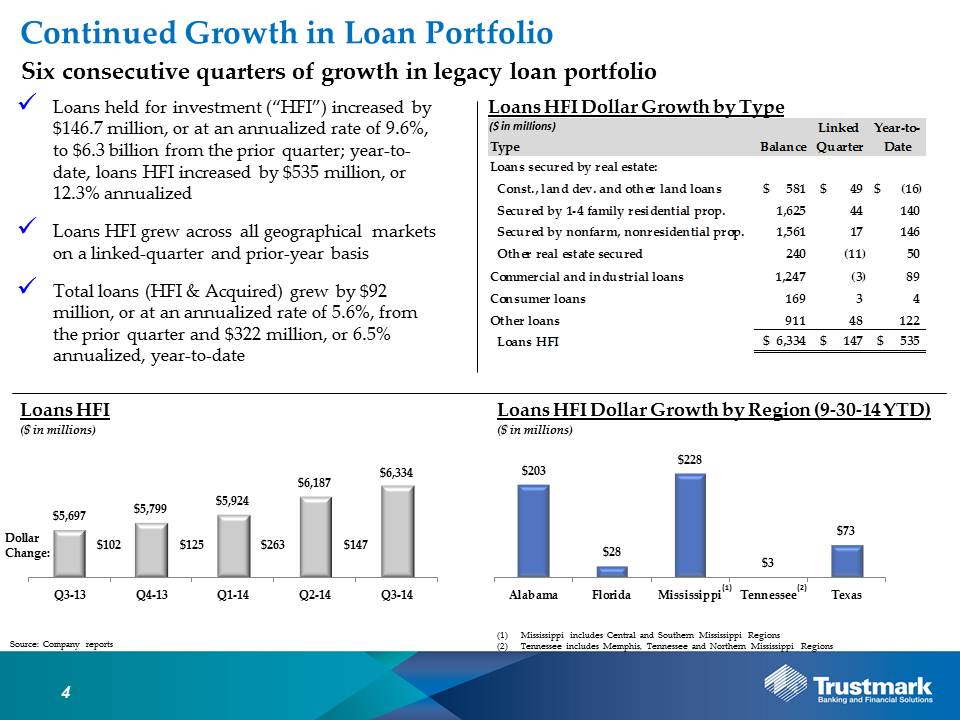

| · | Loans held for investment increased at an annualized rate of 9.6% in the third quarter |

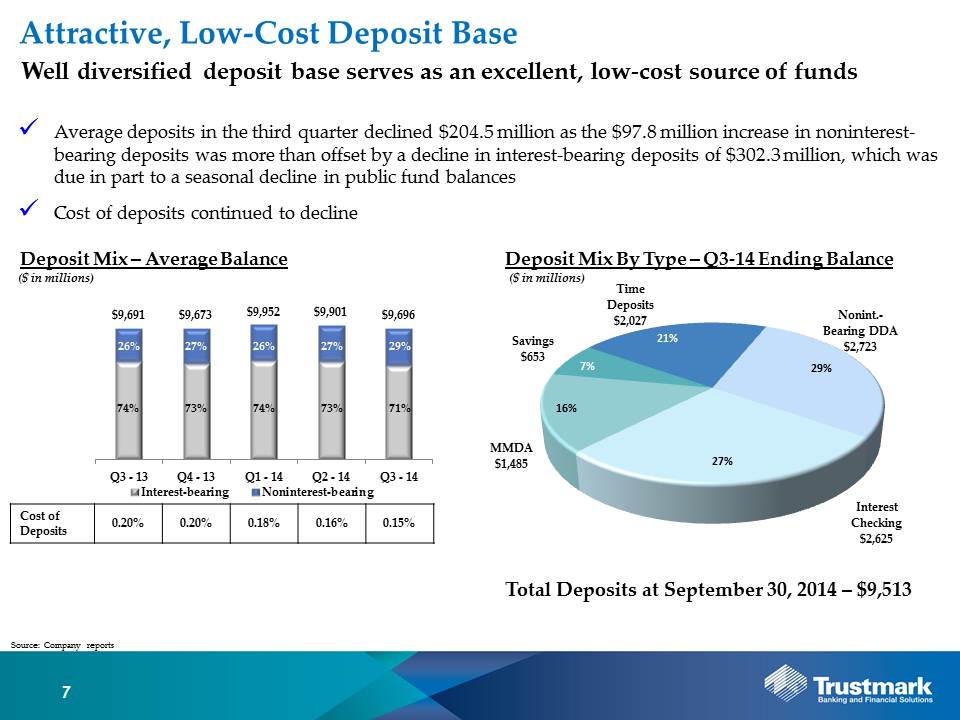

| · | Average noninterest-bearing deposits increased $97.8 million from the prior quarter to represent 28.6% of average total deposits |

Loans held for investment totaled $6.3 billion at September 30, 2014, an increase of $146.7 million, or 2.4%, from the prior quarter and $637.0 million, or 11.2%, from one year earlier. Construction, land development and other land loans increased $49.1 million during the quarter; this growth was driven entirely by commercial and residential construction primarily in Trustmark’s Texas, Mississippi and Alabama markets. The single-family mortgage portfolio increased $43.6 million primarily as a result of growth in Trustmark’s Mississippi and Alabama markets. Loans secured by nonfarm and nonresidential real estate increased $16.4 million as growth in owner occupied real estate in Trustmark’s Mississippi and Alabama markets was offset in part by declines in Texas, Florida and Tennessee. Other real estate secured loans, which include multifamily projects, declined $10.6 million reflecting reductions primarily in Trustmark’s Mississippi and Tennessee markets. Commercial and industrial loans remained relatively stable as growth in Alabama and Tennessee was offset by reductions in Texas and Mississippi. Consumer loans expanded $3.4 million due principally to growth in Trustmark’s Mississippi market. Other loans, which include lending to states and municipalities, nonprofits and REITS, increased $48.0 million during the third quarter due to growth in Trustmark’s Mississippi, Alabama and Tennessee markets.

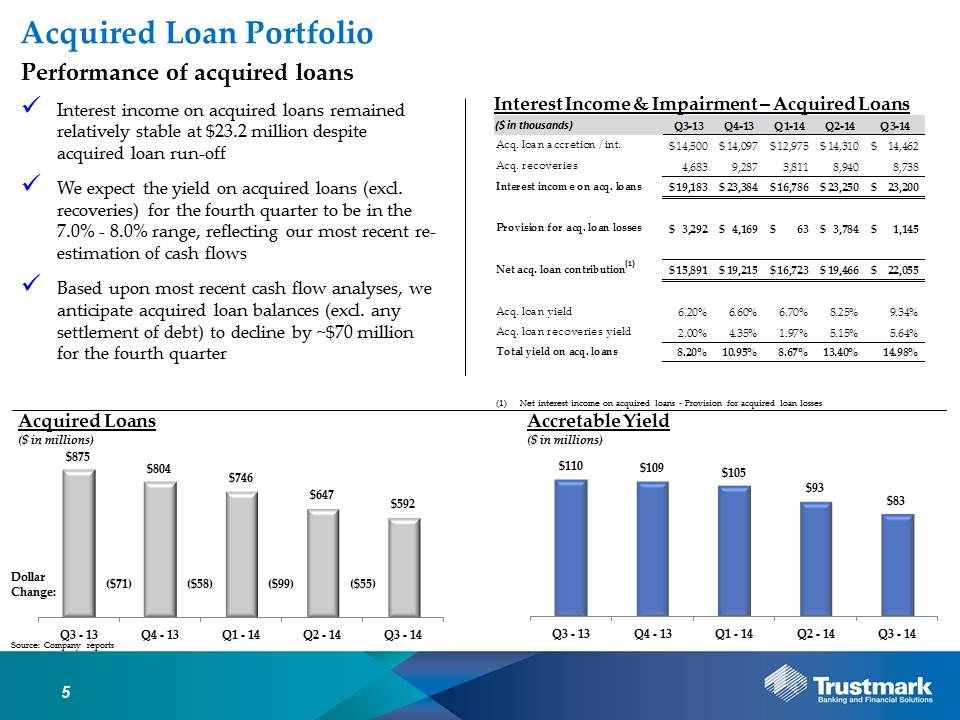

Acquired loans totaled $592.1 million at September 30, 2014, down $54.4 million from the prior quarter. Collectively, loans held for investment and acquired loans totaled $6.9 billion at September 30, 2014, up $92.3 million, or 5.6% annualized, from the prior quarter.

Average earning assets during the third quarter increased $149.9 million relative to the prior quarter principally due to increased balances of loans held for investment. Average deposits in the third quarter declined $204.5 million as the $97.8 million increase in average noninterest-bearing deposits was more than offset by a decline in average interest-bearing deposits of $302.3 million.

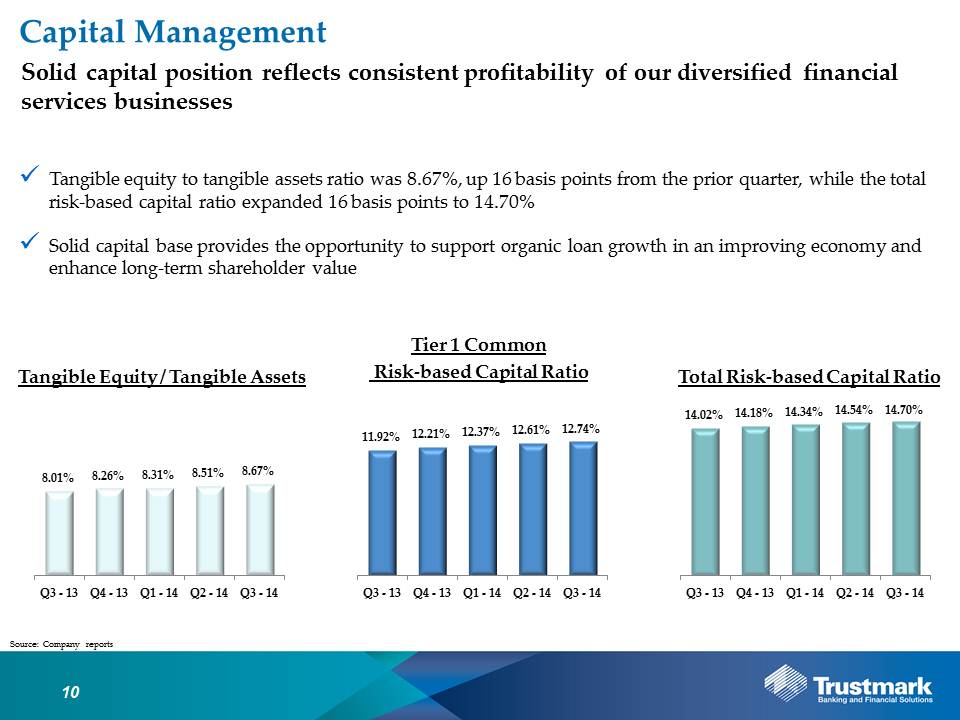

Trustmark’s capital position remained solid, reflecting the consistent profitability of its diversified financial services businesses. At September 30, 2014, Trustmark’s tangible equity to tangible assets ratio was 8.67%, up 16 basis points from the prior quarter, while the total risk-based capital ratio expanded 16 basis points to 14.70%. Trustmark’s solid capital base provides the opportunity to support organic loan growth in an improving economy and enhance long-term shareholder value.

Credit Quality

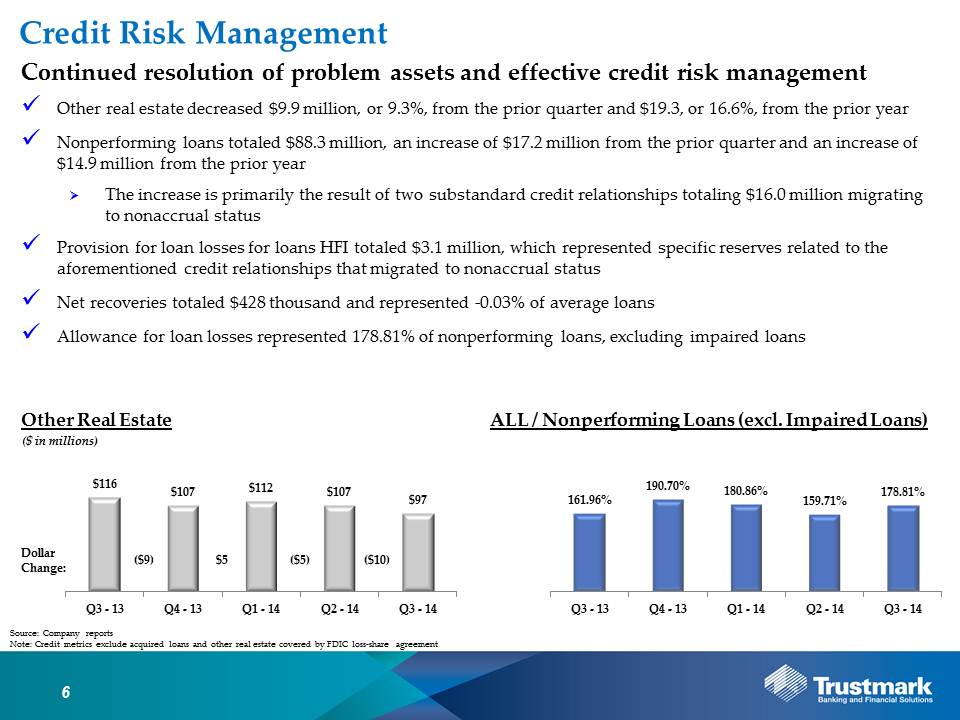

| · | Other real estate declined 9.3% and 16.6% from the prior quarter and year, respectively |

| · | Allowance for loan losses represented 178.81% of nonperforming loans, excluding impaired loans |

Nonperforming loans totaled $88.3 million at September 30, 2014, an increase of $17.2 million from the prior quarter and $14.9 million from one year earlier. The increase in nonperforming loans was primarily the result of two substandard credit relationships totaling $16.0 million migrating to nonaccrual status. Other real estate totaled $97.0 million, a decrease of $9.9 million, or 9.3%, from the prior quarter. Relative to levels one year earlier, other real estate decreased $19.3 million, or 16.6%. Collectively, nonperforming assets totaled $185.4 million, an increase of $7.3 million from the prior quarter and a decrease of $4.4 million from one year earlier.

Trustmark’s net recovery position during the third quarter of 2014 totaled $428 thousand and represented -0.03% of average loans. This compares favorably to net charge-offs in the prior quarter of $1.2 million, or 0.08% of average loans, and to net charge-offs in the third quarter of the prior year of $569 thousand, or 0.04% of average loans. During the third quarter of 2014, the provision for loan losses for loans held for investment totaled $3.1 million, which represented specific reserves related to the aforementioned credit relationships that migrated to nonaccrual status.

Allocation of Trustmark’s $70.1 million allowance for loan losses represented 1.26% of commercial loans and 0.69% of consumer and home mortgage loans, resulting in an allowance to total loans held for investment of 1.11% at September 30, 2014, which represents a level management considers commensurate with the inherent risk in the loan portfolio. The allowance for loan losses represented 178.81% of nonperforming loans, excluding impaired loans.

All of the above credit quality metrics exclude acquired loans and other real estate covered by FDIC loss-share agreement.

Revenue Generation

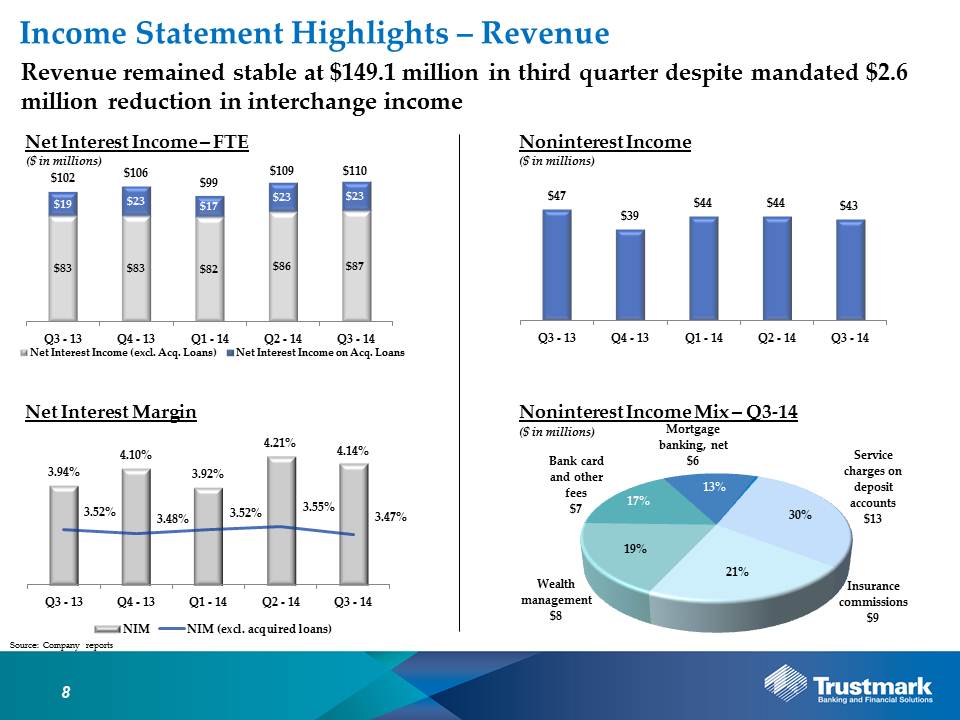

| · | Total revenue remained stable at $149.1 million despite the mandated reduction in interchange income |

| · | Insurance and wealth management revenue expanded 11.3% and 4.3%, respectively, from the prior quarter |

Net interest income (FTE) in the third quarter totaled $110.1 million, resulting in a net interest margin of 4.14%. Relative to the prior quarter, interest income (FTE) increased $662 thousand due principally to additional interest and fees on loans held for investment. The yield on acquired loans totaled 14.98% and included recoveries from settlement of debt of $8.7 million, which represented approximately 5.64% of the total acquired annualized loan yield in the third quarter. Excluding acquired loans, the net interest margin in the third quarter totaled 3.47%, down eight basis points from the prior quarter, reflecting declining yields on loans held for investment and loans held for sale.

Noninterest income totaled $42.9 million in the third quarter, down $1.2 million from the prior quarter. Bank card and other fees totaled $7.3 million, a decline of $2.6 million, or 26.4%, from the prior quarter, which reflected the impact of decreased interchange income as a result of Trustmark becoming subject to debit card interchange fee standards effective July 1, 2014. Service charges on deposit accounts totaled $12.7 million in the third quarter, an increase of $897 thousand, or 7.6%, from the prior quarter driven principally by seasonal factors.

As a result of increased property and casualty business, insurance revenue in the third quarter totaled $9.2 million, an increase of 11.3% from the prior quarter. Wealth management revenue totaled $8.0 million, up 4.3% from the prior quarter, due principally to increased brokerage activity.

Mortgage loan production in the third quarter totaled $345.4 million, an increase of 7.2% from the prior quarter, due in part to seasonal factors as well as lower mortgage rates and expanded originations in Trustmark’s Alabama markets. During the third quarter, mortgage banking revenue totaled $5.8 million, reflecting increased mortgage servicing income, expanded secondary marketing gains, and stable mortgage servicing hedge ineffectiveness, which was offset in part by a decline in the fair value of mortgage loans held for sale.

Noninterest Expense

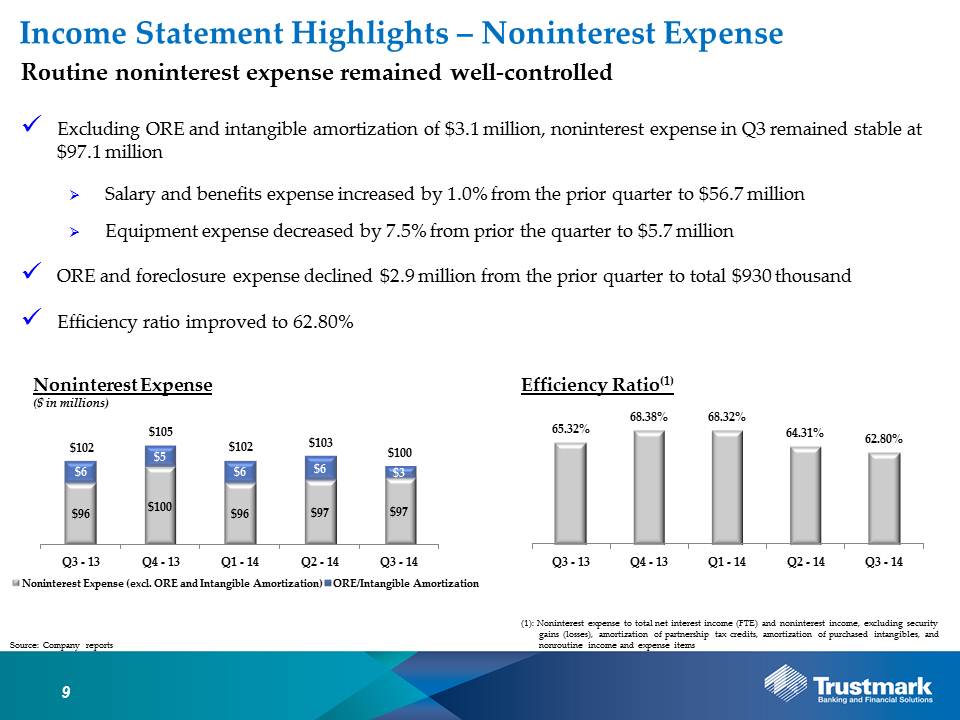

| · | Routine noninterest expense remained well-controlled |

| · | Efficiency ratio improved to 62.80% |

Noninterest expense in the third quarter declined $2.6 million, or 2.5%, from the prior quarter to total $100.2 million. Excluding ORE and intangible amortization of $3.1 million, noninterest expense during the third quarter remained stable at $97.1 million. Salaries and benefits expense remained well-controlled and totaled $56.7 million in the third quarter, up $541 thousand, or 1.0%, from the prior quarter. Services and fees remained stable at $14.5 million while ORE and foreclosure expense declined $2.9 million from the prior quarter to total $930 thousand. Equipment expense declined $461 thousand, or 7.5%, from the prior quarter to $5.7 million. Net occupancy expense increased $404 thousand to $6.8 million during the quarter while other expense declined $267 thousand to $13.0 million.

Appointment of Chief Administrative Officer

During the third quarter, James M. Outlaw was named Executive Vice President and Chief Administrative Officer of Trustmark National Bank. In this newly created position, Outlaw is responsible for coordinating resources within the organization that support the revenue generating activities of various lines of business and overseeing the Risk Management, Technology, Operations, Human Resources and Corporate Facilities areas of the organization. In his 18-year tenure with Trustmark, Outlaw served as Chief Information Officer prior to serving as President and Chief Operating Officer of Trustmark’s banking operations in Texas. Host commented, “I am delighted that Jim has returned to Jackson as Chief Administrative Officer, overseeing all operational and administrative functions across our organization. His proven leadership and broad experience, both on the front line and in the back room, will support our efforts to streamline processes to improve efficiency and profitability across the organization.”

Additional Information

As previously announced, Trustmark will conduct a conference call with analysts on Wednesday, October 29, 2014, at 10:00 a.m. Central Time to discuss the Corporation’s financial results. Interested parties may listen to the conference call by dialing (877) 317-3051 or by clicking on the link provided under the Investor Relations section of our website at www.trustmark.com, which will also include a slide presentation Management will review during the conference call. A replay of the conference call will also be available through Wednesday, November 12, 2014, in archived format at the same web address or by calling (877) 344-7529, passcode 10008303.

Trustmark Corporation is a financial services company providing banking and financial solutions through 207 offices in Alabama, Florida, Mississippi, Tennessee and Texas.

Forward-Looking Statements

Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements include, but are not limited to, statements relating to anticipated future operating and financial performance measures, including net interest margin, credit quality, business initiatives, growth opportunities and growth rates, among other things, and encompass any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of belief included therein as well as the management assumptions underlying these forward-looking statements. You should be aware that the occurrence of the events described under the caption “Risk Factors” in Trustmark’s filings with the Securities and Exchange Commission could have an adverse effect on our business, results of operations and financial condition. Should one or more of these risks materialize, or should any such underlying assumptions prove to be significantly different, actual results may vary significantly from those anticipated, estimated, projected or expected.

Risks that could cause actual results to differ materially from current expectations of Management include, but are not limited to, changes in the level of nonperforming assets and charge-offs, local, state and national economic and market conditions, including the extent and duration of the current volatility in the credit and financial markets, changes in our ability to measure the fair value of assets in our portfolio, material changes in the level and/or volatility of market interest rates, the performance and demand for the products and services we offer, including the level and timing of withdrawals from our deposit accounts, the costs and effects of litigation and of unexpected or adverse outcomes in such litigation, our ability to attract noninterest-bearing deposits and other low-cost funds, competition in loan and deposit pricing, as well as the entry of new competitors into our markets through de novo expansion and acquisitions, economic conditions, and monetary and other governmental actions designed to address the level and volatility of interest rates and the volatility of securities, currency and other markets, the enactment of legislation and changes in existing regulations, or enforcement practices, or the adoption of new regulations, changes in accounting standards and practices, including changes in the interpretation of existing standards, that affect our consolidated financial statements, changes in consumer spending, borrowings and savings habits, technological changes, changes in the financial performance or condition of our borrowers, changes in our ability to control expenses, changes in our compensation and benefit plans, greater than expected costs or difficulties related to the integration of acquisitions or new products and lines of business, natural disasters, environmental disasters, acts of war or terrorism, and other risks described in our filings with the Securities and Exchange Commission.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Except as required by law, we undertake no obligation to update or revise any of this information, whether as the result of new information, future events or developments or otherwise.

Trustmark Investor Contacts:

Louis E. Greer

Treasurer and

Principal Financial Officer

601-208-2310

F. Joseph Rein, Jr.

Senior Vice President

601-208-6898

Trustmark Media Contact:

Melanie A. Morgan

Senior Vice President

601-208-2979