- TRMK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Trustmark (TRMK) 8-KOther events

Filed: 26 Apr 04, 12:00am

EXHIBIT 99.1

| Gulf South Bank Conference April 26, 2004 |

| Forward Looking Statements This presentation may contain forward-looking statements within the meaning of and pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A forward-looking statement in this presentation encompasses any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of belief included therein, as well as the management assumptions underlying those forward-looking statements. Factors that might cause future results to differ from such forward-looking statements are described in Trustmark's filings with the Securities and Exchange Commission. Trustmark undertakes no obligation to update or revise any of this information, whether as the result of new information, future events or developments, or otherwise. |

| 2003 Corporate Profile Trustmark is an integrated provider of banking and financial solutions: $ 7.9 billion in total assets $ 427 million in revenue $ 118.5 million in net income 17.56% ROE 8.71% Equity to Assets 1.60% ROA Investment Ratings Moody's: A3 S&P: BBB+ Corporate Infrastructure: Over 145 branches and 175 ATMs Over 2,400 associates Serving Mississippi, Florida, Tennessee and Texas |

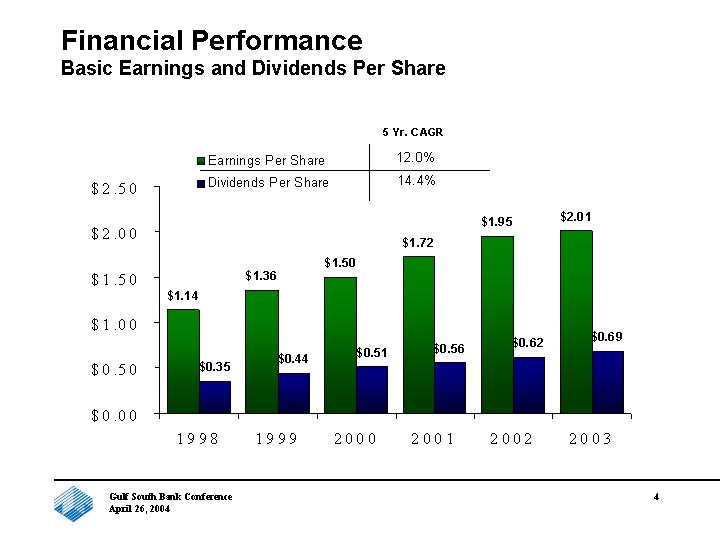

| Financial Performance Basic Earnings and Dividends Per Share |

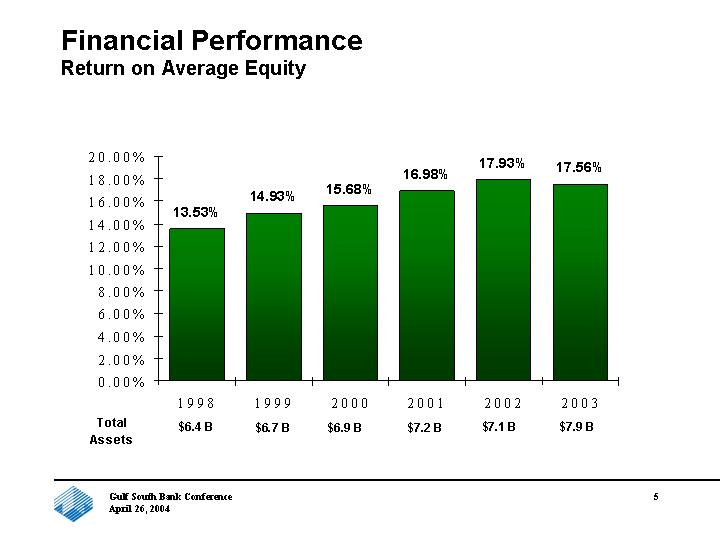

| Financial Performance Return on Average Equity |

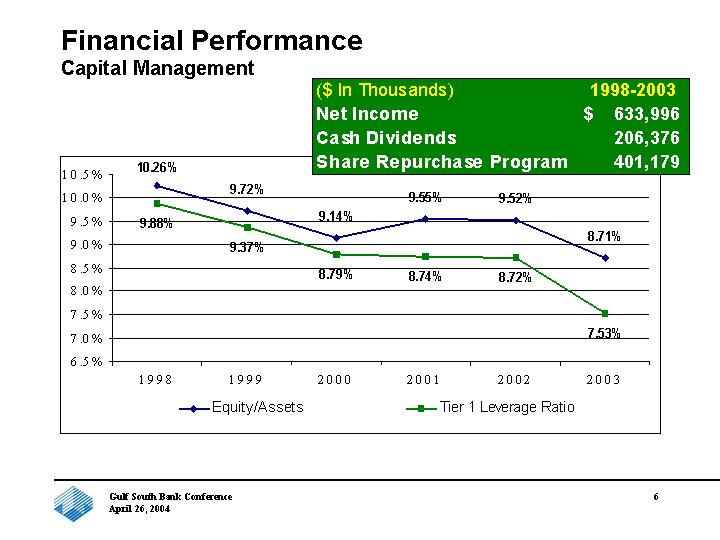

| Financial Performance Capital Management |

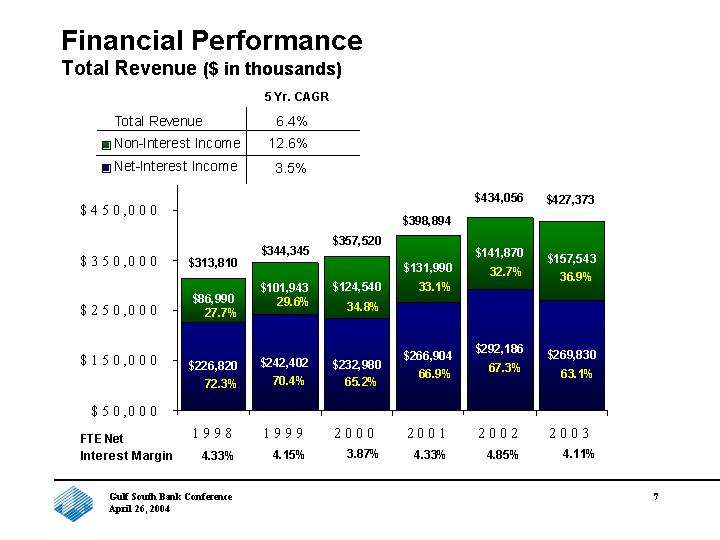

| Financial Performance Total Revenue ($ in thousands) |

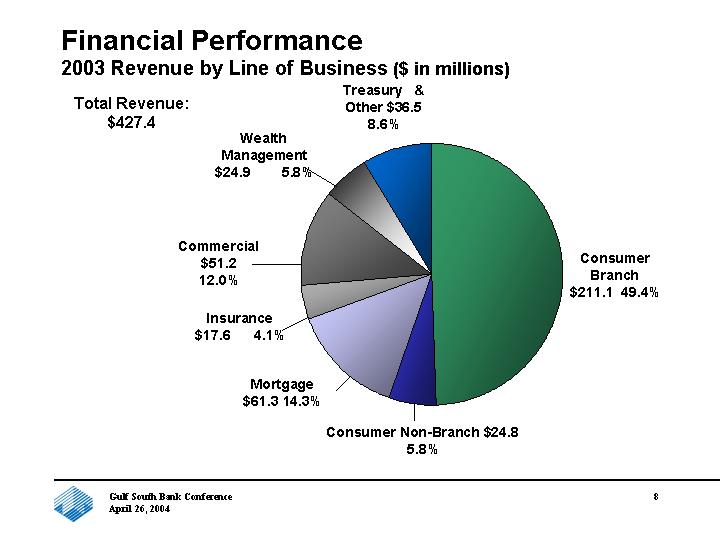

| Financial Performance 2003 Revenue by Line of Business ($ in millions) Branch Non-Branch Mortgage Insurance Commercial Investment Treasury 12/31/2003 211.1 24.8 61.3 17.6 51.2 24.9 36.4 Consumer Branch $211.1 49.4% Mortgage $61.3 14.3% Insurance $17.6 4.1% Commercial $51.2 12.0% Wealth Management $24.9 5.8% Treasury & Other $36.5 8.6% Consumer Non-Branch $24.8 5.8% Total Revenue: $427.4 |

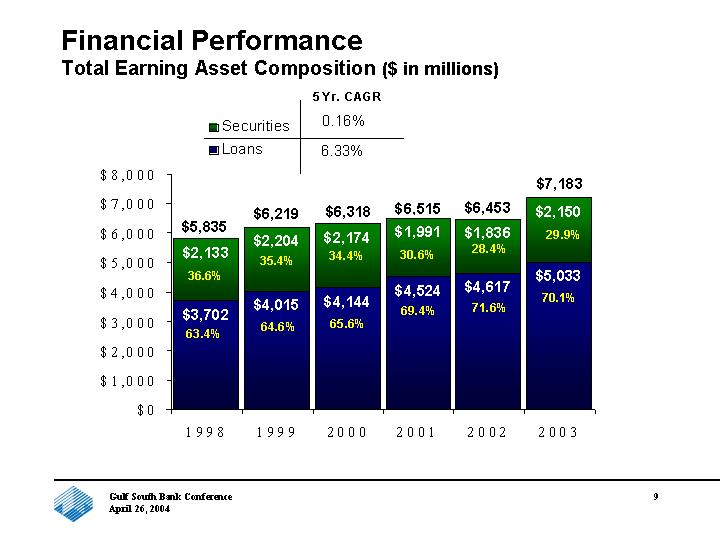

| Financial Performance Total Earning Asset Composition ($ in millions) |

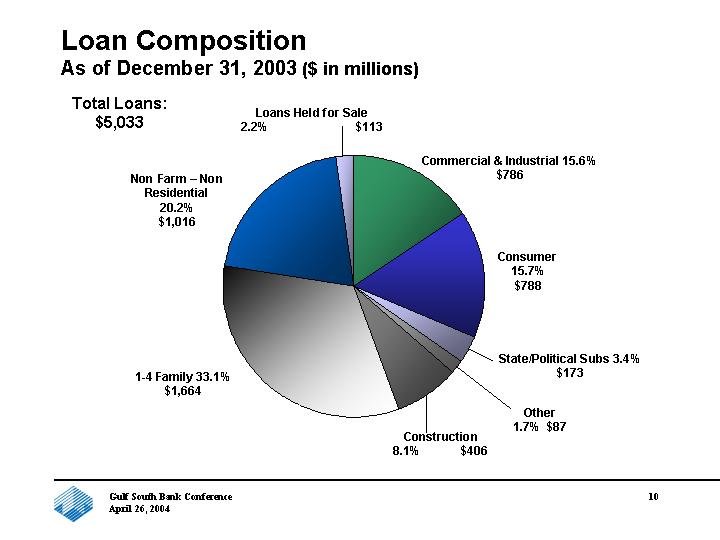

| Loan Composition As of December 31, 2003 ($ in millions) Commercial & Industrial Consumer State/Political Subs Other Construction 1-4 Family Non Farm-Non Residential Loans Held for Sale 12/31/2003 787 787 173 87 406 1664 1016 113 Consumer 15.7% $788 Other 1.7% $87 Construction 8.1% $406 Non Farm - Non Residential 20.2% $1,016 Loans Held for Sale 2.2% $113 Commercial & Industrial 15.6% $786 State/Political Subs 3.4% $173 1-4 Family 33.1% $1,664 Total Loans: $5,033 |

| Deposit Market Share Source: SNL Financial Trustmark ranked #1 in Deposit Market Share in Jackson MSA Deposits 2003 2002 06/30/03 Market Share Market Share Trustmark $2,583 million 40.66% 37.90% AmSouth 1,399 million 22.02% 22.55% BancorpSouth 667 million 10.49% 10.90% BancPlus 434 million 6.84% 6.64% Union Planters 400 million 6.29% 6.55% Trustmark regained #1 ranking in Deposit Market Share in Mississippi Deposits 2003 2002 06/30/03 Market Share Market Share Trustmark $4.5 billion 13.73% 13.15% BancorpSouth 4.4 billion 13.43% 13.29% AmSouth 3.1 billion 9.29% 9.63% Union Planters 2.5 billion 7.49% 7.88% Hancock 2.1 billion 6.41% 6.43% |

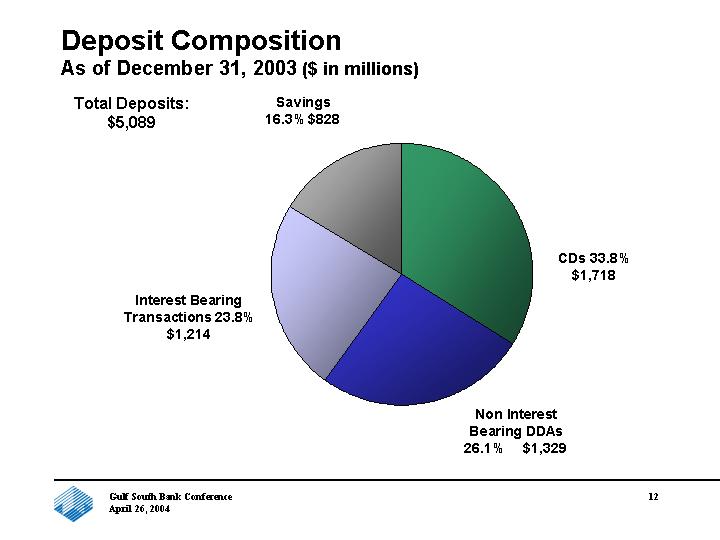

| Deposit Composition As of December 31, 2003 ($ in millions) CDs Non Interest Bearing DDAs Interest Bearing Transactions Savings 9/30/2003 1718 1329 1214 828 CDs 33.8% $1,718 Interest Bearing Transactions 23.8% $1,214 Savings 16.3% $828 Non Interest Bearing DDAs 26.1% $1,329 Total Deposits: $5,089 |

| Strategic Accomplishments Corporate Governance Corporate Governance Quotient ranks in 99th percentile according to Institutional Shareholder Services (ISS) Ranked 5th in the Russell 3000 as rated by ISS for Corporate Governance Compliance with Sarbanes-Oxley Act Successful re-audit by KPMG Selected to be on Jim Jubak's list of "Clean Stocks" |

| Strategic Accomplishments Technology Credit Process Redesign Right sized loan operations staffing Implemented B2B for business loan originations and APPRO for consumer loan originations throughout Mississippi community banks Reaffirmed loan officer lending authority systemwide Transaction Image Archive Prime pass capture of all transaction documents On-line access of all transaction images Intranet S1 consumer and business internet banking systems Decreased reliance on paper and microfilm in back office operations Improved Electronic Delivery Channels Converted to premier internet banking provider - S1 Provides expanded features: image viewing, account alerts, and inter-day reports |

| Strategic Accomplishments Mergers and Acquisitions Entered Florida market with purchase of 7 Emerald Coast Bank offices serving markets from Destin to Panama City Purchased 5 Allied Houston Bank offices in Houston Positioned for potential significant transactions Revised charter and bylaws to provide additional financial management flexibility Received investment grade ratings from Moody's and Standard and Poors' Filed $200 million shelf registration |