- TRMK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Trustmark (TRMK) 8-KRegulation FD Disclosure

Filed: 22 Feb 05, 12:00am

| Sterne, Agee & Leach, Inc. Mississippi Banking Conference Jackson, MS February 22, 2005 |

| Forward Looking Statements This presentation may contain forward-looking statements within the meaning of and pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A forward-looking statement in this presentation encompasses any estimate, prediction, expectation, projection, opinion, anticipation, outlook or statement of belief included therein, as well as the management assumptions underlying those forward-looking statements. Factors that might cause future results to differ from such forward-looking statements are described in Trustmark Corporation's filings with the Securities and Exchange Commission. Trustmark undertakes no obligation to update or revise any of this information, whether as the result of new information, future events or developments, or otherwise. |

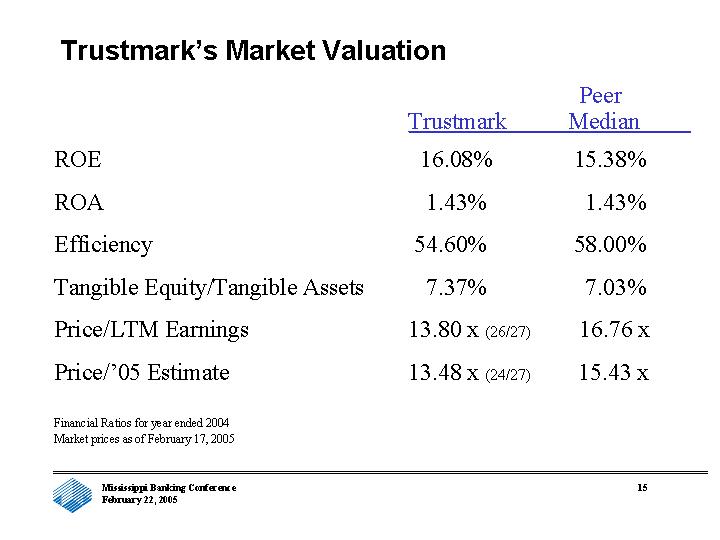

| Reasons to Invest in Trustmark Above Peer returns on equity and assets Prudent balance sheet and capital base Discounted P/E valuation relative to Peers Diversified business mix expanding into attractive growth markets |

| Corporate Profile as of December 31, 2004 Trustmark is an integrated provider of banking and financial solutions $ 8.1 billion in total assets $ 400 million in revenue $ 116.7 million in net income 16.08% ROE 1.43% ROA Investment Ratings Moody's: A3 S&P: BBB+ Corporate Infrastructure Over 145 offices and 180 ATMs Over 2,600 associates Serving Florida, Mississippi, Tennessee and Texas |

| Our vision is to be a premier financial services company in our marketplace. Our mission is to achieve outstanding customer satisfaction by providing banking, wealth management and insurance solutions through superior sales and service, utilizing excellent people, teamwork and diversity, while meeting our corporate financial goals. |

| Peer Group *Total Assets as of December 31, 2004 *Market Value as of February 17, 2005 |

| Key Ratios *before Security transactions Source: SNL Financial |

| Balance Sheet Data ($ in thousands) |

| Average Loans and Securities Average Deposits and Borrowings $ Billions $ Billions |

| 1999 2000 2001 2002 2003 2004 Loan Yield 0.0827 0.0855 0.0806 0.0685 0.0601 0.0565 Spread 0.0562 0.0523 0.0511 0.0515 0.048 0.0463 Deposit Cost 0.0265 0.0332 0.0295 0.017 0.0121 0.0102 Loan Spread Security Spread 1999 2000 2001 2002 2003 2004 Security Yields 0.0634 0.0679 0.0661 0.0627 0.0406 0.035 Spread 0.0148 0.0077 0.0236 0.0385 0.0233 0.0181 Borrowings 0.0488 0.0602 0.0422 0.0231 0.0167 0.0165 |

| Loan Composition Commercial & Industrial Consumer Other Construction 1-4 Family Non Farm-Non Residential 12/31/2004 865.4 812.1 359.6 526.3 1849.3 1018.4 1999 2000 2001 2002 2003 2004 Loans 4014000 4144000 4524000 4617000 5033000 5431000 Loans by Type Total Loans 1-4 Family 34% $1.8 Construction 10% $0.5 Real Estate 18% $1.0 Commercial 16% $0.9 Consumer 15% $0.8 Other 7% $0.4 6.2% CAGR $ Billions |

| Financial Performance Credit Quality ($ in millions) |

| Deposit Composition CDs Non Interest Bearing Transaction Interest Bearing Transaction Savings 12/31/2004 1840.2 1360 1362.4 892.6 1999 2000 2001 2002 2003 2004 Deposits 3925000 4058000 4613000 4686000 5089000 5450000 Total Deposits Deposits by Type 6.8% CAGR $ Billions |

| Capital Management Dividends Per Share 11.84% CAGR |

| Strategic Focus Jackson, MS Maintain market position and profitability Harry Walker, President of Jackson Metro, 3 Market Presidents and 42 Commercial Relationship Managers Integrate Wealth Management Selective branching in higher growth areas Continue Mortgage Banking dominance County 2004 Population 04-09 Growth 2004 Median HHI 04-09 Growth 6/04 Market Deposits ($Thousands) 6/04 TRMK Deposits ($Thousands) Market Share TRMK Stores Hinds 249,021 -0.86% $35,840 9.41% $4,249,408 $1,751,326 41.21% 22 Madison 80,100 8.49% $53,543 14.98% $1,265,482 $308,745 24.40% 8 Rankin 125,777 10.41% $48,476 8.97% $1,216,118 $463,749 38.13% 10 Total 454,898 3.90% $42,487 11.53% $6,731,008 $2,523,820 37.50% 40 |

| Strategic Focus Memphis, TN Demographics Population - 1.2 million 3.6% growth from 2004-09 Median HHI - $45,054 17.6% growth from 2004-09 Deposits - $25.9 billion Trustmark has 22 stores, $456 million in loans, $609 million in deposits, #5 deposit market share of 2.4% Strategic Focus Enhance commercial banking utilizing 25 Relationship Managers Selective branching in growth areas Integrate Wealth Management Continue Mortgage Banking expansion Chris Holmes - North Region President |

| Strategic Focus Florida's Emerald Coast Demographics Population- 379 thousand 8.8% growth from 2004-09 Median HHI - $42,539 13.5% growth from 2004-09 Deposits - $5.7 billion Trustmark has 8 stores, $343 million in loans, $249 million in deposits and 4.4% deposit market share Strategic Focus Continue commercial loan growth Integrate and cross-sell with Fisher-Brown Insurance Expand Wealth Management Selective branching in growth areas Continue Mortgage Banking expansion John Sumrall - Florida CEO, 12 Commercial Relationship Managers |

| Strategic Focus Houston, TX Demographics Population - 5.0 million 9.8% growth from 2004-09 Median HHI - $50,343 14.9% growth from 2004-09 Deposits - $73.5 billion Trustmark has 6 stores, $108 million in loans, $143 million in deposits Strategic Focus Branding Middle market commercial lending with 15 Relationship Managers Build Retail Banking Implement Mortgage Banking Expand Wealth Management Lee Cutrone - Texas CEO John Rossitto - Regional Retail Executive |

| Wealth Management Comprehensive, fully integrated services to accumulate, preserve and transfer wealth $24.8 million in revenue in 2004 Outstanding Investment Results All bond and equity funds of the Performance Fund Family outperformed peer benchmarks in 2004 Leaders' Equity Fund was highlighted by Lipper Trustmark Investment Advisors President Doug Ralston manages a team of investment professionals including 7 Chartered Financial Analysts Assets under management and administration of $6.2 billion Enhanced product capabilities through Financial Planning & Risk Management services Creation of Wealth Management Center in Jackson Expansion in Florida's Emerald Coast, Houston and Memphis |

| Insurance The Bottrell Agency Major Mississippi commercial property and casualty agency 23 producers in Jackson $17 million in annual revenue Fisher-Brown, Inc. Leading agency in Northwest Florida providing broad spectrum of risk management products to businesses and individuals 22 producers in Pensacola, Destin, Milton, Mary Esther and Panama City $16 million in annual revenue |