of-the-art technology were made in Trustmark’s insurance, wealth management and mortgage banking areas, as well as in human resources and accounting systems. We also made significant upgrades to our mobile banking platform, ITM network and digital marketing platform. In 2021, we introduced redesigned digital channels to enhance the customer experience and provide expanded sales capabilities, including online account openings. Customers have embraced these offerings, and we look forward to leveraging these new tools to expand relationships and profitably generate additional revenue. We are progressing toward the implementation of a new core banking system for consumer and commercial loans, deposits and customer information. This implementation, which we have named Core Optimization for Relationship

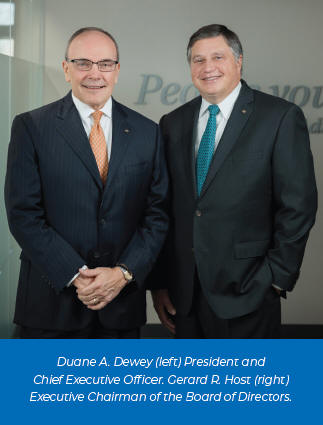

Enhancement (CORE), is a multi-year project, the next phase of which will occur in 2022. These investments will better position Trustmark for continued growth and improved efficiency. During 2021, Trustmark continued to realign delivery channels and consolidated 15 offices, reflecting changing customer preferences and the continued migration to mobile and digital banking channels. Additionally, Trustmark opened five new offices: one each in the Birmingham, AL, Jackson, MS, and Memphis, TN MSAs as well as in the Oxford and Greenville, MS markets. Each of these offices features a design that integrates myTeller® interactive teller machine (ITM) technology that provides enhanced areas for customer interaction. In addition to branch realignment initiatives, we announced a voluntary early retirement program in 2021 which was accepted by 98 associates, or 3.6% | | | | of our workforce. As you may recall, we also had a voluntary early retirement program in the first quarter of 2020 in which 107 associates, or 3.8% of the workforce at that time, elected to participate. Collectively, these programs have provided additional opportunities to redesign workflows and restructure the organization to leverage investments in technology and improve efficiency. Leadership We greatly value the leadership, counsel, and guidance of our Board. Trustmark’s Directors are engaged in our governance and strategic direction and work with management to enhance the value of our franchise. During the year, Harry M. Walker retired from the Board after many years of distinguished service as a Director. Harry was a Trustmark associate for 44 years, having served in many capacities in the organization, including as an executive officer. We appreciate his immeasurable contributions and wish him all the best in retirement. Strategic Focus Looking forward, Trustmark will focus on efficiency, growth, and innovation initiatives. We continue to pursue opportunities to redesign workflows and restructure the organization to further leverage investments in technology that will broaden our reach, enhance the customer experience, and improve efficiency. We remain focused on providing the financial services and advice our customers have come to expect while building long-term value for our shareholders. We remain grateful to our associates for their commitment, perseverance, and dedication to our customers and communities. We also appreciate our shareholders for their investment in Trustmark and its future. Finally, we are honored to serve our customers, who have chosen us as their financial partner. Trustmark is “People you trust. Advice that works.” Sincerely, |