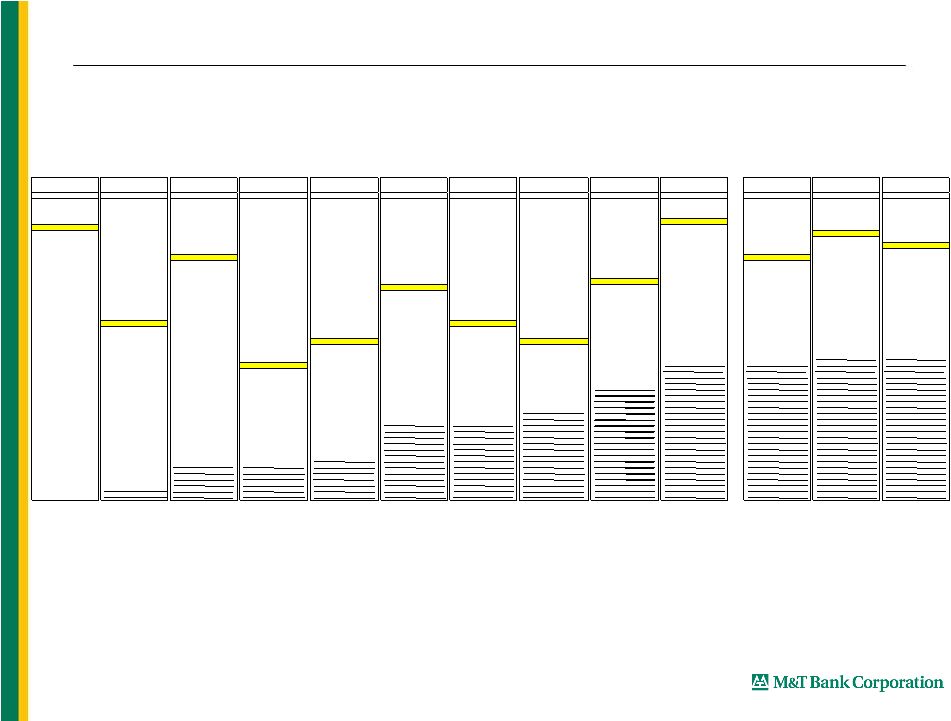

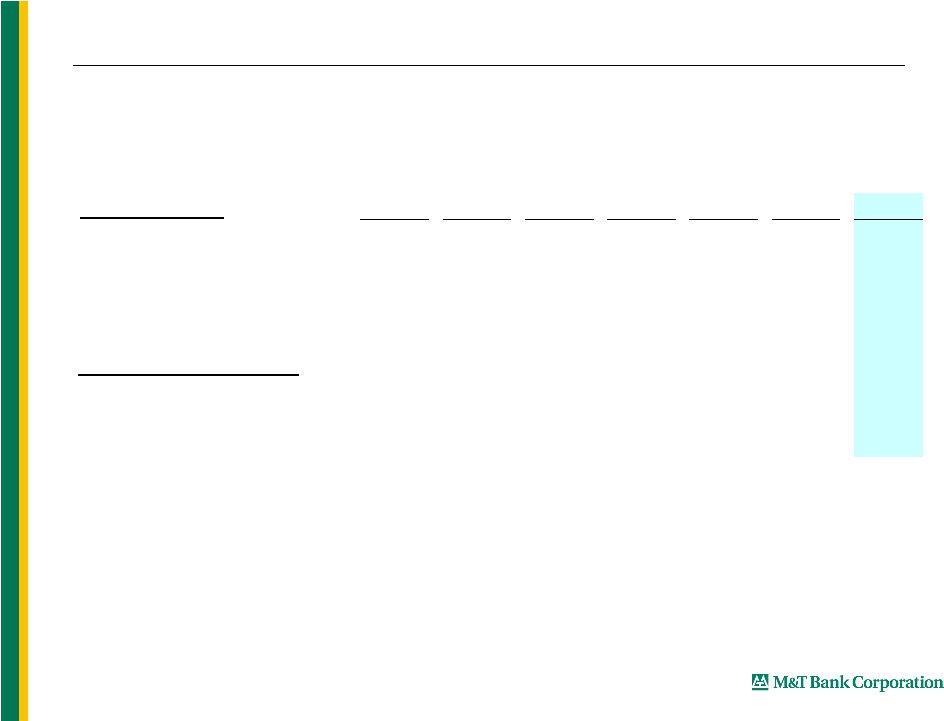

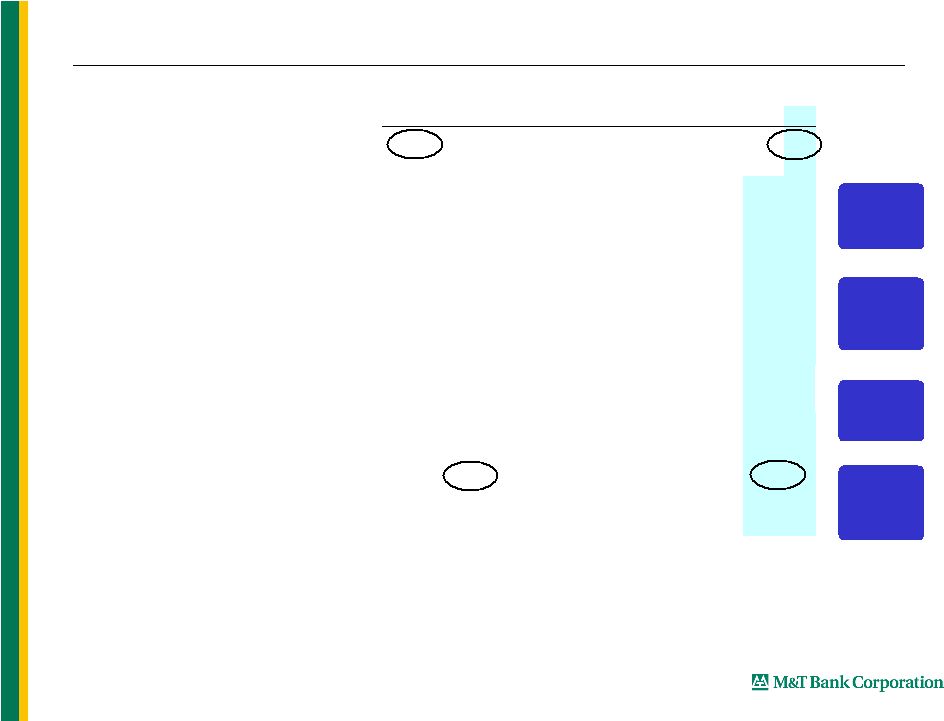

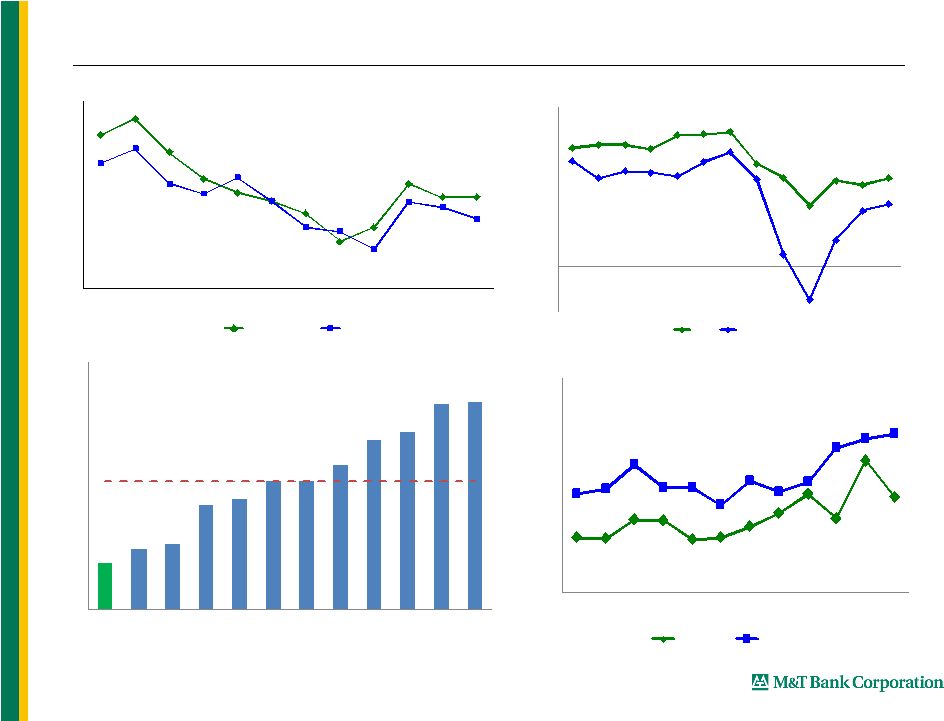

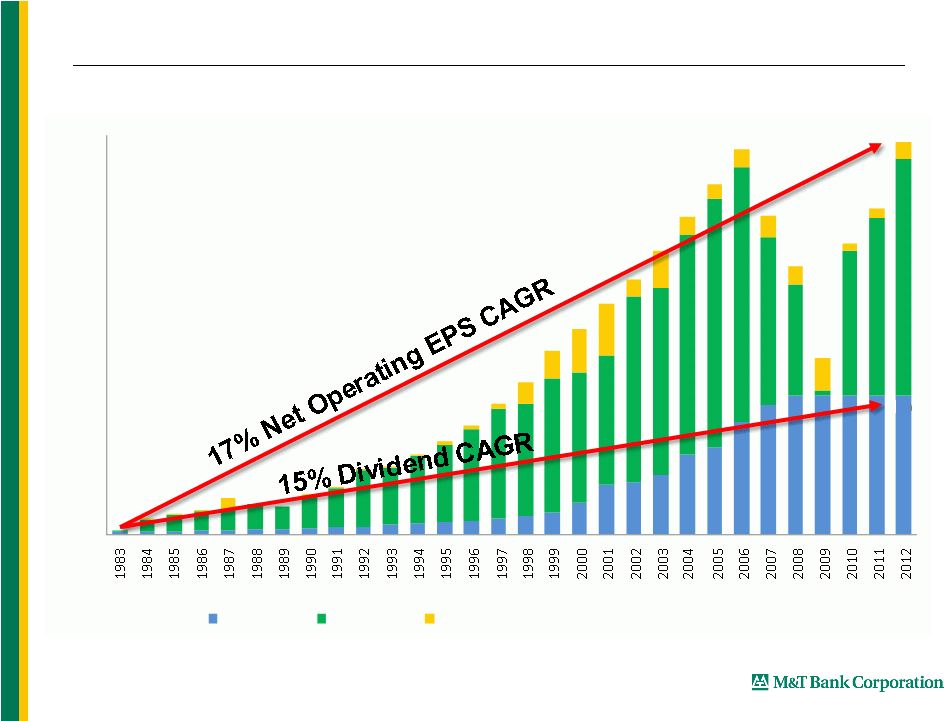

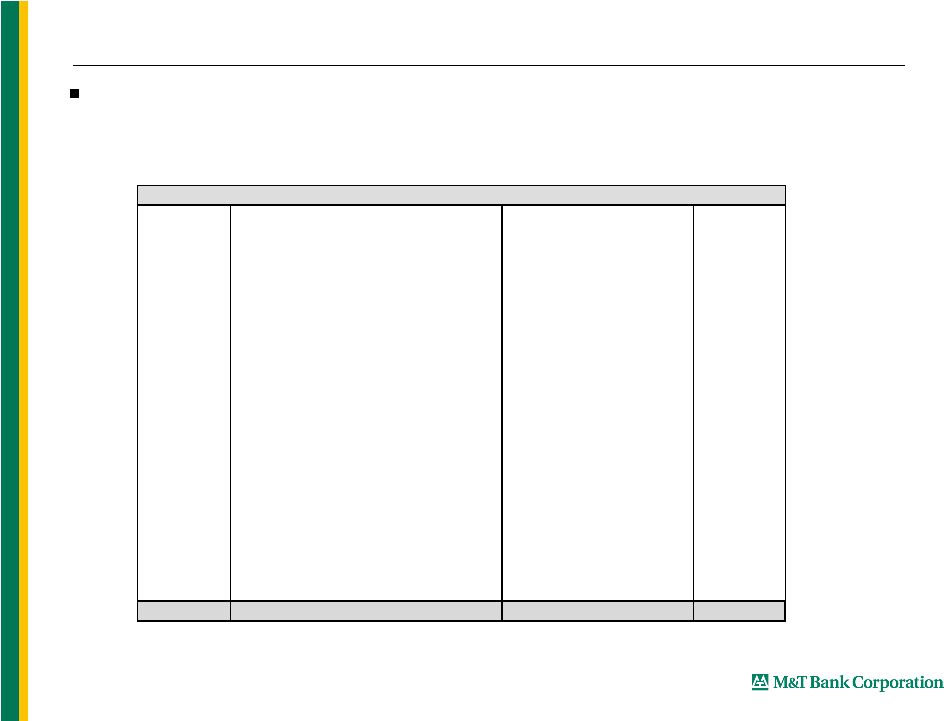

27 $'s in millions 1991Q3 1991Q4 1992Q1 1992Q2 1992Q3 1992Q4 1993Q1 1993Q2 1993Q3 1993Q4 1994Q1 1994Q2 1994Q3 1994Q4 1995Q1 1995Q2 1995Q3 1995Q4 1996Q1 1996Q2 1996Q3 Net income $17.4 $18.2 $26.9 $28.4 $21.0 $21.6 $24.3 $25.2 $25.8 $26.6 $27.6 $28.7 $29.1 $31.9 $27.2 $31.5 $35.6 $36.8 $36.1 $38.7 $35.9 less: Extraordinary items, net of tax (per FR-Y9C, Sch. HI) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 less: Realized gains (losses) on securities, net of tax (35%) 0.2 0.1 9.3 8.9 0.5 -0.5 0.5 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 3.2 -0.3 0.2 0.1 0.0 FDIC Core Earnings metric $17.2 $18.1 $17.6 $19.5 $20.5 $22.1 $23.8 $25.2 $25.8 $26.6 $27.6 $28.7 $29.0 $31.9 $27.2 $31.5 $32.4 $37.1 $35.9 $38.6 $35.9 Total Assets, end of period 8,805 9,171 9,019 8,752 10,266 9,588 10,423 10,457 10,930 10,365 10,415 10,336 10,301 10,529 11,277 11,630 11,754 11,956 12,671 12,542 12,821 Numerator for Core Earnings Ratio: 4-Qtr Core Earnings 75.7 79.7 85.9 91.6 96.8 101.4 105.2 108.7 112.0 117.2 116.8 119.6 123.0 128.1 136.8 144.0 147.4 Denominator for Core Earnings Ratio: 5-Qtr Avg. Assets 9,203 9,359 9,609 9,897 10,333 10,353 10,518 10,501 10,469 10,389 10,571 10,814 11,098 11,429 11,857 12,111 12,349 FDIC Core Earnings Ratio 0.82% 0.85% 0.89% 0.93% 0.94% 0.98% 1.00% 1.04% 1.07% 1.13% 1.10% 1.11% 1.11% 1.12% 1.15% 1.19% 1.19% 1996Q4 1997Q1 1997Q2 1997Q3 1997Q4 1998Q1 1998Q2 1998Q3 1998Q4 1999Q1 1999Q2 1999Q3 1999Q4 2000Q1 2000Q2 2000Q3 2000Q4 2001Q1 2001Q2 2001Q3 2001Q4 Net income $40.4 $41.3 $42.8 $45.9 $46.3 $49.0 $44.7 $56.5 $57.9 $66.9 $65.0 $67.6 $66.1 $68.2 $71.5 $74.4 $72.0 $83.7 $94.8 $97.9 $101.7 less: Extraordinary items, net of tax (per FR-Y9C, Sch. HI) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 less: Realized gains (losses) on securities, net of tax (35%) -0.3 0.0 -0.1 0.0 0.0 0.0 0.2 0.2 0.7 0.1 0.0 0.9 0.0 0.0 0.0 0.0 -2.0 0.1 1.0 0.2 0.0 FDIC Core Earnings metric $40.7 $41.3 $42.9 $45.9 $46.3 $49.0 $44.5 $56.2 $57.2 $66.8 $65.0 $66.7 $66.1 $68.2 $71.5 $74.4 $74.0 $83.6 $93.8 $97.7 $101.7 Total Assets, end of period 12,944 13,122 13,441 13,675 14,003 14,570 20,138 19,478 20,584 20,285 21,205 21,759 22,409 22,762 21,746 22,009 28,949 30,925 31,202 31,139 31,450 Numerator for Core Earnings Ratio: 4-Qtr Core Earnings 151.1 156.5 160.8 170.8 176.4 184.1 185.7 196.0 206.9 224.7 245.2 255.7 264.6 266.1 272.6 280.3 288.2 303.5 325.8 349.1 376.9 Denominator for Core Earnings Ratio: 5-Qtr Avg. Assets 12,587 12,820 12,974 13,201 13,437 13,762 15,165 16,373 17,755 19,011 20,338 20,662 21,249 21,684 21,976 22,137 23,575 25,278 26,966 28,845 30,733 FDIC Core Earnings Ratio 1.20% 1.22% 1.24% 1.29% 1.31% 1.34% 1.22% 1.20% 1.17% 1.18% 1.21% 1.24% 1.25% 1.23% 1.24% 1.27% 1.22% 1.20% 1.21% 1.21% 1.23% 2002Q1 2002Q2 2002Q3 2002Q4 2003Q1 2003Q2 2003Q3 2003Q4 2004Q1 2004Q2 2004Q3 2004Q4 2005Q1 2005Q2 2005Q3 2005Q4 2006Q1 2006Q2 2006Q3 2006Q4 2007Q1 Net income $120.6 $121.5 $117.2 $125.8 $116.6 $134.1 $156.4 $166.9 $159.5 $184.4 $186.4 $192.2 $189.2 $196.8 $191.1 $205.0 $202.9 $212.6 $210.3 $213.3 $176.0 less: Extraordinary items, net of tax (per FR-Y9C, Sch. HI) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 less: Realized gains (losses) on securities, net of tax (35%) 0.1 -0.1 -0.4 0.0 0.2 0.2 0.0 1.3 1.6 0.0 0.0 0.2 0.1 0.0 -18.2 -0.2 0.0 0.2 0.7 0.7 0.7 FDIC Core Earnings metric $120.5 $121.6 $117.6 $125.8 $116.4 $133.9 $156.4 $165.6 $157.9 $184.4 $186.4 $192.0 $189.1 $196.8 $209.3 $205.2 $202.9 $212.4 $209.6 $212.6 $175.3 Total Assets, end of period 31,296 31,686 34,148 33,175 33,444 50,399 50,259 49,826 50,832 52,094 52,887 52,939 53,887 54,482 54,841 55,146 55,420 56,507 56,373 57,065 57,842 Numerator for Core Earnings Ratio: 4-Qtr Core Earnings 413.7 441.5 461.4 485.5 481.5 493.8 532.5 572.4 613.8 664.2 694.3 720.7 751.9 764.3 787.1 800.4 814.2 829.8 830.1 837.5 809.9 Denominator for Core Earnings Ratio: 5-Qtr Avg. Assets 31,202 31,355 31,944 32,351 32,750 36,570 40,285 43,420 46,952 50,682 51,180 51,716 52,528 53,258 53,807 54,259 54,755 55,279 55,658 56,102 56,642 FDIC Core Earnings Ratio 1.33% 1.41% 1.44% 1.50% 1.47% 1.35% 1.32% 1.32% 1.31% 1.31% 1.36% 1.39% 1.43% 1.44% 1.46% 1.48% 1.49% 1.50% 1.49% 1.49% 1.43% 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 2010Q2 2010Q3 2010Q4 2011Q1 2011Q2 2011Q3 2011Q4 2012Q1 2012Q2 2012Q3 Net income $214.2 $199.2 $65.0 $202.2 $160.3 $91.2 $102.2 $64.2 $51.2 $127.7 $136.8 $151.0 $188.8 $192.0 $204.4 $206.3 $322.3 $183.1 $147.8 $206.5 $233.4 $293.5 less: Extraordinary items, net of tax (per FR-Y9C, Sch. HI) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 less: Realized gains (losses) on securities, net of tax (35%) 0.2 -0.1 -82.7 21.7 -3.5 -99.0 -15.3 -20.6 -15.9 -30.6 -22.1 -17.1 -14.5 -5.3 -17.4 15.2 54.7 -6.2 -16.1 -7.4 -10.8 -3.4 FDIC Core Earnings metric $214.0 $199.3 $147.7 $180.5 $163.8 $190.2 $117.5 $84.8 $67.1 $158.3 $158.9 $168.1 $203.3 $197.3 $221.8 $191.1 $267.6 $189.3 $163.9 $213.9 $244.2 $296.9 Total Assets, end of period 57,869 60,008 64,876 66,086 65,893 65,247 65,816 64,883 69,913 68,997 68,880 68,439 68,154 68,247 68,021 67,881 77,727 77,864 77,924 79,187 80,808 81,085 Numerator for Core Earnings Ratio: 4-Qtr Core Earnings 811.4 801.1 736.3 741.5 691.3 682.1 651.9 556.2 459.6 427.7 469.0 552.3 688.6 727.6 790.5 813.5 877.8 869.8 811.9 834.7 811.3 918.9 Denominator for Core Earnings Ratio: 5-Qtr Avg. Assets 57,131 57,832 59,532 61,336 62,946 64,422 65,584 65,585 66,351 66,971 67,698 68,223 68,877 68,544 68,348 68,148 70,006 71,948 73,884 76,117 78,702 79,374 FDIC Core Earnings Ratio 1.42% 1.39% 1.24% 1.21% 1.10% 1.06% 0.99% 0.85% 0.69% 0.64% 0.69% 0.81% 1.00% 1.06% 1.16% 1.19% 1.25% 1.21% 1.10% 1.10% 1.03% 1.16% Reconciliation of GAAP to Non-GAAP measures |