UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.____)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to §240.14a-12

First Hartford Corporation

------------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

- -------------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

- ----------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

----------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

- ----------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

- ----------------------------------------------------------------------

(5) Total fee paid:

----------------------------------------------------------------------

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the

filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

----------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

- ----------------------------------------------------------------------

(3) Filing Party:

----------------------------------------------------------------------

(4) Date Filed:

- ----------------------------------------------------------------------

First Hartford Corporation

P.O. Box 1270

149 Colonial Road

Manchester, Connecticut 06045-1270

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 30, 2005

We will hold the annual meeting of shareholders of First Hartford Corporation, a Maine corporation, at the Holiday Inn - By The Bay, located at 88 Spring Street, Portland, Maine, on November 30, 2005 at 9:00 a.m., local time, for the following purposes:

1. To elect directors of the corporation to serve until the next annual meeting of shareholders.

2. To consider and act upon a proposal to ratify First Hartford's 2003 Stock Option Plan.

3. To consider and act on a proposal to ratify a grant of non-qualified stock options to five individuals.

4. To consider and act on a proposal to ratify a grant of put options to five individuals.

5. To act on such other matters as may be properly brought before the meeting or any adjournments, postponements or continuations of the meeting.

The Board of Directors recommends that you vote FOR the election of all of the nominees, FOR the proposal to ratify the 2003 Stock Option Plan, FOR the proposal to ratify a grant of non-qualified stock options to five individuals and FOR the proposal to ratify a grant of put options to five individuals.

The Board of Directors has fixed the close of business on October 25, 2005, as the record date for the meeting. Only shareholders of record at the close of business at this time are entitled to notice of, and to vote at, the meeting or any adjournments, postponements or continuations of the meeting.

All shareholders are invited to attend the meeting. To ensure your representation at the meeting, however, you are urged to mark, sign and return the enclosed proxy in the accompanying envelope, whether or not you expect to attend the meeting. In the event that you attend the meeting, you may vote in person even if you have returned a proxy.

Your vote is important.

To vote your shares, please sign, date and complete the enclosed proxy and mail it promptly in the enclosed return envelope.

October 26, 2005

By Order of the Board of Directors

Stuart I. Greenwald

Secretary to the Board of Directors

First Hartford Corporation

P.O. Box 1270

149 Colonial Road

Manchester, Connecticut 06045-1270

PROXY STATEMENT

This proxy statement is furnished to you in connection with the solicitation of proxies by the Board of Directors to be used at the Annual Meeting of Shareholders of First Hartford Corporation ("First Hartford"). Copies of this proxy statement are being mailed to shareholders of record on or about October 28, 2005.

First Hartford is a Maine corporation founded in 1909. First Hartford engages in the purchase, development, ownership, management and sale of real estate.

Date, Time and Place of Meeting

We will hold the annual meeting of shareholders on November 30, 2005, at 9:00 a.m., local time, at the Holiday Inn - - By The Bay, located at 88 Spring Street, Portland, Maine, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Matters to be Considered at the Meeting

At the meeting, we will ask our shareholders to consider and vote upon the election of directors to serve until our next annual meeting and to consider and vote upon proposals to:

• ratify the 2003 Stock Option Plan (the "2003 Stock Option Plan");

• ratify a grant of non-qualified stock options to five individuals (the "Stock Options"); and

• ratify a grant of put options to five individuals (the "Put Options").

The shareholders will also consider and vote upon such other matters as may properly be brought before the meeting or any adjournment, postponement or continuation thereof.

Vote Required

A plurality of the votes cast by the shareholders present in person or by proxy and entitled to vote is required to elect directors. With regard to the election of directors, you may vote in favor of, or withhold your vote from, each nominee. Votes that are withheld from a nominee will be excluded entirely from the vote and will not be counted in such nominee's favor. There is no cumulative voting with respect to the election of directors.

The affirmative vote of the holders of a majority of the shares of common stock present in person or by proxy and entitled to vote at the annual meeting is required to approve the ratification of the 2003 Stock Option Plan, the ratification of a grant of non-qualified stock options to five individuals and the ratification of a grant of put options to five individuals. Broker non-votes will be treated as shares not entitled to vote on these proposals. Abstentions will be counted as present and entitled to vote and therefore will have the effect of a negative vote.

Voting of Proxies

Shares of our common stock represented by properly executed proxies received in time for the meeting, unless previously revoked, will be voted at the meeting as specified by the shareholders on the proxies. If a proxy is returned without any voting instructions, the shares represented thereby will be voted FOR the election of directors FOR ratification of the 2003 Stock Option Plan, FOR ratification of the Stock Options and FOR ratification of the Put Options, as recommended by the Board of Directors.

Revocability of Proxies

If you give a proxy, you have the power to revoke it at any time before it is voted. You can do so in one of three ways. First, you can send a written notice to our Secretary at the address given below stating that you would like to revoke your proxy. Second, you can complete a new proxy card and send it to our Secretary at the address given below. Third, you can attend the meeting and vote in person. You should send any written notice or new proxy card to:

Stuart I. Greenwald

Secretary

First Hartford Corporation

P.O. Box 1270

149 Colonial Road

Manchester, Connecticut 06045-1270

You may request a new proxy card by calling Gini Pitruzzello at (860) 646-6555.

Record Date; Shareholders Entitled to Vote; Quorum

Only shareholders of record at the close of business on October 25, 2005 will be entitled to receive notice of and vote at the meeting. As of the record date, 3,046,279 shares of common stock were issued and outstanding. Each share of common stock is entitled to one vote on each matter which holders of common stock are entitled to vote. A majority of the outstanding shares of common stock entitled to vote must be represented in person or by proxy at the meeting in order for a quorum to be present.

Solicitation of Proxies

The Board of Directors may solicit proxies, the form of which is enclosed, for the meeting. The cost of any solicitation will be borne by us. Our officers, directors or regular employees may communicate with shareholders personally or by mail, telephone, telegram or otherwise for the purpose of soliciting proxies. We and our authorized agents will request brokers or other custodians, nominees and fiduciaries to forward proxy soliciting material to the beneficial owners of shares held of record by these persons and will reimburse their reasonable out-of-pocket expenses in forwarding the material.

Proposals of Shareholders

Shareholders who intend to present a proposal for action at next year's Annual Meeting of Shareholders must notify our management of such intention by notice received at our principal executive offices not later than July 31, 2006 for such proposal to be included in our proxy statement relating to such meeting. Shareholders who wish to present a proposal at next year's Annual Meeting of Shareholders, but do not wish to have the proposal included in the proxy statement for the meeting, must give notice of the proposal to the Secretary of First Hartford no later than September 13, 2006 in order for the notice to be considered timely under Rule 14a-4(c) of the SEC.

Information Concerning Auditors

On April 1, 2005, our auditors, Kostin Ruffkess & Company, LLC resigned, formally notifying First Hartford that they were withdrawing from audit work in the public company arena.

Kostin Ruffkess & Company, LLC's reports on our financial statements for each of the two years ended April 30, 2004 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. In connection with its audits for such two fiscal years and through March 31, 2005, there were no disagreements with Kostin Ruffkess & Company, LLC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement, if not resolved to the satisfaction of Kostin Ruffkess & Company, LLC, would have caused Kostin Ruffkess & Company, LLC to make reference to the subject matter of the disagreements in their reports on the financial statements for such years.

2

Effective April 1, 2005, the Board of Directors of First Hartford appointed Carlin, Charron & Rosen, LLP as our auditors for the year ending April 30, 2005. We had not consulted with Carlin, Charron & Rosen, LLP on any specific matters prior to their engagement.

Financial Statements

Copies of our Annual Report on Form 10-K for the fiscal year ended April 30, 2005 are being delivered to shareholders together with this proxy statement. Representatives of Carlin, Charron & Rosen LLP are not expected to be present at our Annual Meeting of Shareholders and thus, will not have an opportunity to make a statement at the meeting. However, Carlin, Charron & Rosen LLP are expected to be available to respond to appropriate questions submitted in writing to Stuart I. Greenwald, our Treasurer and Secretary, prior to or at the meeting.

Other Matters

The Board of Directors knows of no matters that are expected to be presented for consideration at the meeting that are not described herein. However, if other matters properly come before the meeting, it is intended that the persons named in the accompanying proxy will vote thereon in accordance with their best judgment.

3

ELECTION OF DIRECTORS

It is the intention of the persons named in the enclosed form of proxy, unless such proxy specifies otherwise, to nominate and to vote the shares represented by such proxy for the election of all of the nominees listed below to hold office until the next annual meeting of shareholders or until their respective successors have been duly elected and qualified. First Hartford has no reason to believe that any of the nominees will become unavailable to serve as directors for any reason before this year's annual meeting. However, in the event that any of them shall become unavailable, the persons designated as proxies reserve the right to substitute another person of their choice when voting at the annual meeting. Certain information regarding each nominee is set forth in the table and text below. The number of shares, if any, beneficially owned by each nominee is listed below under "Security Ownership of Certain Beneficial Owners and Management."

Nominees for the Board of Directors

All our directors serve for a term of one year or until their successors are elected and qualified. All of the nominees are currently serving as directors. The name, age and term of office as director of each nominee for election as director and his present position with First Hartford are:

Name | Age | | Position | Period of Service |

Neil H. Ellis | 77 | | Director and President | 1966 - Present |

Stuart I. Greenwald | 63 | | Director, Treasurer and Secretary | 1980 - Present |

David B. Harding | 61 | | Director and Vice President | 1998 - Present |

Neil H. Ellis has been President of First Hartford for more than five years. He is also President and director of Green Manor Corporation, a holding company owned by Mr. Ellis and his wife, and a Vice President of Journal Publishing Company, Inc., a corporation that publishes a newspaper in New England, which is owned by Green Manor Corporation. Mr. Ellis also serves as director of the Gerald P. Murphy Cancer Foundation and trustee of the Jonathan G. Ellis Leukemia Foundation. He has been a member of the Board of Directors since 1966.

Stuart I. Greenwald has been Treasurer of First Hartford for more than five years and also holds the position of Secretary. He has been a member of the Board of Directors since 1980.

David B. Harding has been a Vice President of First Hartford since 1992. He was the President of Richmond Realty, LLC, a real estate management company, from January 1996 to January 2003. In the past, Richmond Realty managed certain properties of First Hartford, but currently it only manages property of others. He has been a member of the Board of Directors since 1998.

Executive Officers

The name, age, title and period of service of each of our executive officers are set forth below. All executive officers are elected by the Board of Directors and serve until their successors are duly elected by the Board of Directors.

Name | Age | | Position | Period of Service |

Neil H. Ellis | 77 | | President | 1966 - Present |

Stuart I. Greenwald | 63 | | Treasurer and Secretary | 1978 - Present |

David B. Harding | 61 | | Vice President | 1992 - Present |

Meetings of the Board of Directors

Our Board of Directors convened four times in the fiscal year ended April 30, 2005. No director attended fewer than 100 percent of the meetings of the Board. Directors are generally expected to attend our annual meeting of shareholders. All of our directors attended last year's Annual Meeting of Shareholders.

4

The Board does not currently have a standing audit, nominating or compensation committee, or committees performing similar functions. The Board of Directors does not believe a standing nominating committee is necessary since the full Board of Directors currently participates in the consideration of director nominees. The Board of Directors does not have a charter with respect to the duties it fulfills in its nominating capacity. Mr. Ellis, Mr. Greenwald and Mr. Harding are members of our management and Mr. Ellis has various business relationships with First Hartford described under "Certain Relationships and Related Transactions," beginning on page 10. The Board of Directors gives consideration to director candidates recommended by shareholders in accordance with the procedures described under "Proposals of Shareholders" on page 2. The Board of Directors does not have a specific process for identifying and evaluating nominees for director, but when considering nominations for membership on the Board, the Board of Directors seeks to identify persons who have the highest capabilities, judgment and ethical standards and who have an understanding of our business.

Shareholder Communications with our Board of Directors

The Board of Directors has implemented a process by which shareholders may communicate with our Board of Directors. Shareholders may communicate with any of our directors by writing to them c/o First Hartford Corporation, P.O. Box 1270, 149 Colonial Road, Manchester, CT 06045-1270.

Director Compensation

At the present time, there are no separate fees for membership on the Board of Directors. Each director is also an officer of First Hartford.

Audit Committee Report

First Hartford does not have a separately designated audit committee and accordingly the entire Board of Directors performs the functions described in the report set forth below. Mr. Ellis, Mr. Greenwald and Mr. Harding are members of our management, and Mr. Ellis has various business relationships with First Hartford described under "Certain Relationships and Related Transactions," beginning on page 10. Thus, none of the members of the Board of Directors meet the criteria for independence established by the New York Stock Exchange or other self-regulatory organizations. First Hartford does not otherwise meet the eligibility requirements for listing on the NYSE or with such other self-regulatory organizations.

The Board of Directors has:

(a) reviewed and discussed our audited financial statements;

(b) discussed with our independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU §380); and

(c) received the written disclosures and the letter from our auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed the independence of our auditors with our independent auditors.

Based on the review and discussions described above, the Board of Directors approved the inclusion of our audited financial statements in our Annual Report on Form 10-K for the fiscal year ended April 30, 2005.

Neil H. Ellis

Stuart I. Greenwald

David B. Harding

Principal Accounting Firm Fees

Set forth below is a summary of the audit fees paid for the fiscal year ended April 30, 2005 to First Hartford's current principal accounting firm, Carlin, Charron & Rosen LLP, and audit-related fees paid for the fiscal year ended April 30, 2005 to First Hartford's prior principal accounting firm, Kostin, Ruffkess & Company, LLC. Also set forth below is a summary of the fees paid for the fiscal year ended April 30, 2004 to Kostin, Ruffkess & Company, LLC.

5

| 2004 | 2005 |

Audit Fees | $30,500 | $52,000 |

Audit-Related Fees1 | $5,750 | $6,625 |

Tax Fees | $0 | $0 |

All Other Fees | $0 | $0 |

1Audit-related fees paid to Kostin, Ruffkess & Company, LLC for 2005 related to the review of First Hartford's quarterly financial statements and for consultations with our new principal accounting firm, Carlin, Charron & Rosen LLP. Audit-related fees paid to Kostin, Ruffkess & Company, LLC for 2004 related to the review of First Hartford's quarterly financial statements and miscellaneous internal control testing.

Compensation Committee Report

First Hartford does not have a separately designated compensation committee, but its entire Board of Directors fulfills some of the functions of a compensation committee. Executive compensation is determined solely by Mr. Ellis, Director and President of First Hartford. Mr. Ellis in his sole discretion may approve or disapprove an increase in compensation of an employee if such increase is recommended to Mr. Ellis by the head of such employee's department. First Hartford has engaged CFS Consulting, Inc., a consulting firm that specializes in the development and implementation of total compensation systems, to provide advice with respect to executive compensation issues during the current fiscal year.

Compensation Committee Interlocks and Insider Participation

Mr. Ellis has various business relationships with First Hartford described under "Certain Relationships and Related Transactions," beginning on page 10.

6

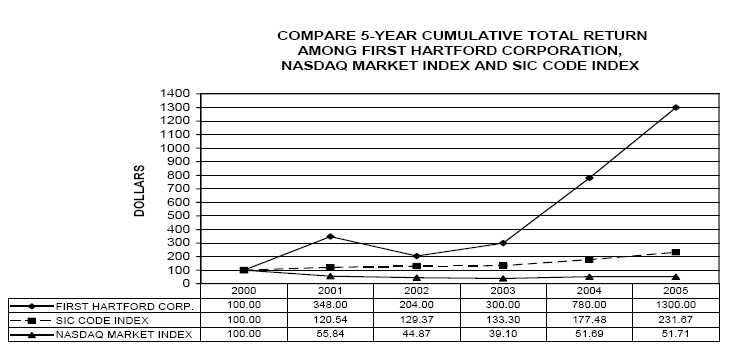

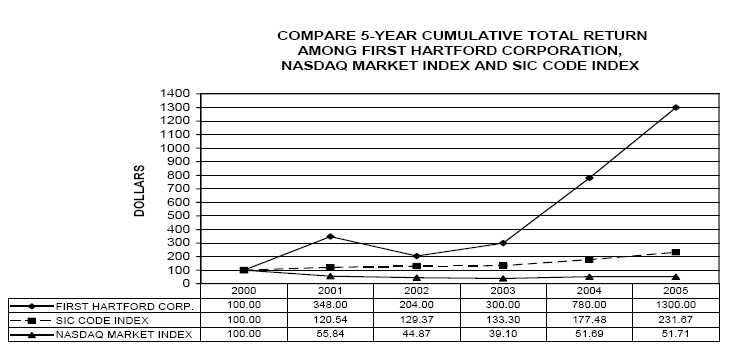

FIVE-YEAR PERFORMANCE GRAPH: 2000 - 2005

Comparison of Five-Year Cumulative Total Return Among First Hartford, NASDAQ Index and SIC Code Index

The annual changes for the five-year period shown in the graph on this page are based on the assumption that $100 had been invested in First Hartford stock, the NASDAQ Index and the SIC Code Index on May 1, 2000, as required by SEC rules, and that all quarterly dividends were reinvested at the average of the closing stock prices at the beginning and end of the quarter. The total cumulative dollar returns shown on the graph represent the value that such investments would have had on April 30, 2005.

7

EXECUTIVE COMPENSATION

The following summary compensation table sets forth the total compensation for the fiscal years ended April 30, 2005, April 30, 2004 and April 30, 2003 for our Chief Executive Officer and our other executive officers.

Summary Compensation Table

| | | | | Long-Term

Compensation Awards |

| | | | | Securities |

| | Annual Compensation | | All Other | Underlying |

Name and Principal Position | Year | Salary | Bonus | Compensation(1) | Options/SARs (#) |

| | | | | | |

Neil H. Ellis, Director and President | 2005 | $200,000 | $10,000 | $1,515(2) | -- |

(CEO) | 2004 | $200,000 | -- | $1,515 | -- |

| | 2003 | $135,408 | -- | $ 967 | -- |

| | | | | | |

Stuart I. Greenwald, Director, Treasurer | 2005 | $120,016 | $10,000 | $5,376(3) | -- |

and Secretary | 2004 | $103,333 | -- | $4,576 | 50,000(4) |

| | 2003 | $100,918 | -- | $4,421 | -- |

| | | | | | |

David B. Harding, Director and Vice | 2005 | $152,459 | $10,000 | $6,991(5) | -- |

President | 2004 | $142,272 | -- | $6,386 | 50,000(4) |

| | 2003(6) | $ 45,000 | -- | $1,966 | -- |

(1) First Hartford provides each of its executive officers with an automobile or an automobile allowance in the amount of the approximate automobile lease cost. The amount of this personal benefit does not exceed $10,000 annually for any executive officer and is not quantified in this table.

(2) Represents the amount of life and disability insurance premiums paid by First Harford with respect to Mr. Ellis.

(3) $3,900 represents the matching contribution to First Hartford's IRA and $1,476 represents the amount of life and disability insurance premiums paid by First Harford with respect to Mr. Greenwald.

(4) Non-qualified stock options to purchase 50,000 shares of common stock were granted to Mr. Greenwald and Mr. Harding on February 11, 2004. The options become exercisable on February 11, 2006. Messrs. Greenwald and Harding were also granted a "put option" that requires First Hartford to purchase the exercised shares for $1.30 in excess of the grant price. The put option expires five years after the stock options are fully exercisable. For a further description of these stock options and put options, see the discussion below under the captions "Proposal to Ratify a Grant of Non-Qualified Stock Options" and "Proposal to Ratify a Grant of Put Options."

(5) $4,873 represents the matching contribution to First Hartford's IRA and $2,118 represents the amount of life and disability insurance premiums paid by First Harford with respect to Mr. Harding.

(6) For the period from January 18, 2003 to April 30, 2003.

8

Life Insurance

Each employee of First Hartford is eligible to receive life insurance that, in the event of such employee's death, will provide proceeds of two times the annual salary of each employee until such employee reaches the age of 65. At the age of 65, the amount of life insurance proceeds each employee is entitled to receive upon his or her death is equal to one times such employee's annual salary.

Pension and Retirement Plans

First Hartford previously maintained a defined benefit pension plan. The pension plan was frozen in January 1986 and was taken over by the Pension Benefit Guaranty Corporation in January 1994. In January 1997, First Hartford had come to settlement terms with the PBGC and the Department of Labor concerning the pension plan. Pursuant to the settlement, First Hartford gave the PBGC a 10-year note of approximately $670,000 (6% interest payable quarterly) which was guaranteed by a bond of an insurance company. Mr. Ellis waived any and all benefits under the pension plan in the settlement with the PBGC and personally guaranteed the bond. Subsequent to April 30, 2005, First Hartford paid its note to the PBGC. Mr. Greenwald will receive approximately $6,000 per year under the pension plan when he reaches age 65.

Each employee of First Hartford may participate in the First Hartford IRA pursuant to which First Hartford will match up to 3% of each employee's annual salary.

Employment, Severance and Change in Control Agreements

None.

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

Name | Shares Acquired

on Exercise

(#) | Value

Realized | Number of Securities Underlying Options/SARs at Fiscal Year-End (#) | Value of Unexercised In-the-Money Options(1) at

April 30, 2005 |

| | | Exercisable | Unexercisable | Exercisable | Unexercisable |

Stuart I. Greenwald | -- | -- | -- | 50,000 | -- | $142,500 |

David B. Harding | -- | -- | -- | 50,000 | -- | $142,500 |

(1) "In-the-Money Options" are defined as options with an exercise price that is less than the fair market value (defined as the last sales price) of First Hartford's common stock at April 30, 2005, which was $3.95 per share.

9

CERTAIN RELATIONSHIPS

AND RELATED TRANSACTIONS

Transactions with Management and Others

Since the filing of First Hartford's Petition for Reorganization in February of 1981, and owing to the uncertainty as to the financial stability of First Hartford, lenders that we use to finance our purchase and development of real estate have required the personal guaranty of Neil H. Ellis, our President and a member of the Board of Directors, on certain loans to First Hartford and its subsidiaries. To meet this requirement, First Hartford's real estate development has followed a standard procedure. Money is borrowed directly by a subsidiary of First Hartford which develops the property. Neil Ellis guarantees the loan and in return receives a pledge of all of the stock of the borrowing subsidiary until such time as the loan guaranty is released. On December 27, 1999, 100 percent of the outstanding stock of Brewery Parkade, Inc. was pledged to Mr. Ellis as security for his guaranty of a construction loan in Cranston, Rhode Island. The Ellis guaranty was subsequently reduced to 5% of the outstanding principle of a mortgage which was $11,337,866 at October 26, 2005. In December, 2004 Bangor Parkade, Inc., a wholly owned indirect subsidiary of First Hartford, closed a $19,350,000 construction loan with Sovereign Bank for our shopping center (under construction) in Bangor, Maine. This loan also required the guarantee of Mr. Ellis, and he received a pledge of the stock of Bangor Parkade.

In past years, Mr. Ellis has guaranteed millions of dollars of letters of credit and bonds issued for the benefit of First Hartford. Currently, all such letters of credit and bonds have been satisfied.

As of October 26, 2005, the following guarantees by Neil Ellis, for which Mr. Ellis received a pledge of the stock of the borrowing subsidiary, were still in effect:

• Personal guarantee of 5% of the outstanding principal amount of the $11,700,000 mortgage loan for construction of an office building in Cranston, Rhode Island.

• Personal guarantee of $19,350,000 construction loan for construction of a shopping center in Bangor, Maine.

As of October 26, 2005, the following additional guarantees by Mr. Ellis were still in effect, for which Mr. Ellis received no security from First Hartford:

• Personal guarantee of $311,225 mortgage loan on our headquarters building in Manchester, CT.

• Personal guarantee of $750,000 revolving line of credit from Citizens Bank to First Hartford.

• Limited guarantee related to a refinance of a mortgage loan in the amount of $36,000,000 to Cranston BVT Limited Liability Partnership, of which First Hartford owns a 50% partnership interest.

• Limited guarantee related to a refinancing of a mortgage in the amount of $20,500,000 to Dover Parkade, LLC, of which First Hartford owns a 50% membership interest.

• Limited guarantee related to a $5,300,000 refinancing of a mortgage for Plainfield Parkade, Inc., a wholly owned indirect subsidiary of First Hartford.

• Limited guarantee on borrowings by Putnam Parkade, Inc. of $5,600,000 and 1150 Union Street Corporation of $9,250,000, each of which is a wholly owned indirect subsidiary of First Hartford.

• Limited guarantee related to $10,581,000 financing of shopping center in North Adams, MA owned by Main Street NA Parkade, LLC, a wholly owned indirect subsidiary of First Hartford.

10

In July 2002, Mr. Ellis obtained an $850,000 loan from M&T Bank and loaned the proceeds to First Hartford. Mr. Ellis received a pledge of all of the stock of First Hartford Realty Corp., our subsidiary that holds the stock of each of our indirect real estate subsidiaries, as security for this loan. The other financial terms of the loan from Mr. Ellis to First Hartford were the same as the terms of the loan from M&T Bank to Mr. Ellis. A minimum of $10,000 was required to be paid monthly, plus interest at the prime rate plus 1.5%. As of April 30, 2005, $510,000 remained outstanding. As of September 28, 2005, this loan had been paid in full by First Hartford and Mr. Ellis released the pledged stock of First Hartford Reality Corp.

On October 25, 2004, Putnam Parkade, Inc., a wholly owned indirect subsidiary of First Hartford, completed a refinancing of its indebtedness whereby it received a new mortgage loan in the principal amount of $5,600,000 and repaid an existing first mortgage loan in the principal amount of $3,860,939 and a second mortgage loan in the principal amount of $1,235,000. The holder of the second mortgage loan was Journal Publishing Company, Inc., a subsidiary of Green Manor Corporation, which is owned by Mr. Ellis and his wife. In connection with this repayment, a pledge of the stock of Putnam Parkade was released.

As of April 30, 2004, in addition to the indebtedness described in the two preceding paragraphs, First Hartford had net indebtedness to Mr. Ellis and entities owned or controlled by Mr. Ellis and his wife in the aggregate amount of $277,944. The background of this indebtedness, which was incurred in prior fiscal years, was described in our proxy statement for our annual meeting of shareholders held on February 24, 2005. As of October 26, 2005, this indebtedness had been paid in full by First Hartford, without interest.

On or about April 7, 2005, Mr. Ellis advanced $180,000 to Bear Stearns for the benefit of Cranston Parkade, LLC, a 50% owned indirect subsidiary of First Hartford, to facilitate the refinancing of a shopping center in Cranston, RI. Mr. Ellis was repaid those funds without interest on April 27, 2005 in connection with the closing of the refinancing.

Certain Business Relationships

Hartford Lubbock L.P., a limited partnership of which Journal Publishing Company, Inc. owns a 99% limited partnership interest and First Hartford owns a 1% general partnership interest, paid management fees to First Hartford in the fiscal year ended April 30, 2005 in the amount of $46,862 for managing a shopping center owned by Hartford Lubbock L.P. in Lubbock, Texas. Mr. Ellis' wife is the President of Journal Publishing Company, a subsidiary of Green Manor Corporation, which is wholly owned by Mr. Ellis and his wife.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the "beneficial ownership" (as that term is defined in the rules of the Securities and Exchange Commission) of the common stock as of October 25, 2005, except as otherwise noted, by each executive officer and member of the Board of Directors and each person who is known by us to beneficially own more than 5% of our common stock.

Name & Address | Number of Shares

of Common Stock | Percent of Outstanding

Shares of Common Stock |

| | | |

Neil H. Ellis

43 Butternut Road

Manchester, CT 06040 | 1,327,587 (l) | 43.6% |

| | | |

Stuart I. Greenwald

149 Colonial Road

P.O. Box 1270

Manchester, CT 06045-1270 | 0 | 0% |

| | | |

David B. Harding

149 Colonial Road

P.O. Box 1270

Manchester, CT 06045-1270 | 0 | 0% |

| | | |

John Filipelli

85 Pawling Lake

Pawling, New York 12564 | 197,476 (2) | 6.5% |

| | | |

Richard E. Kaplan

2345 Washington Street

Newton, MA 02462 | 591,254 (3) | 19.4% |

| | | |

David Kaplan

257 East Center Street

Manchester, CT 06040 | 501,686 (4) | 16.5% |

| | | |

Joel Lehrer

P.O. Box 825

Keyport, NJ 07735 | 174,137 (5) | 5.7% |

| | | |

All Directors and Officers as a Group (3 in number) | 1,327,587 (l) | 43.6% |

| | | |

(l) Includes 417,183 shares owned by a corporation which is wholly owned by Mr. and Mrs. Ellis; 17,543 shares owned beneficially and of record by Mr. Ellis' wife; and 53,412 shares held as Trustee for his daughters in which he disclaims beneficial ownership. Excludes 14,250 shares held as Trustee for the Jonathan G. Ellis Leukemia Foundation (a charitable foundation).

(2) This information is as of October 23, 2003, as set forth in a Schedule 13D filed by Mr. Filipelli with the Securities and Exchange Commission on December 11, 2003. Includes 16,600 shares owned by Mr. Filippelli's wife and 84,326 shares as to which Mr. and Mrs. Filippelli share voting and dispositive power.

(3) Included in Richard Kaplan's shares are 445,535 shares for which both he and David Kaplan share voting and dispositive power. This information is as of September 26, 2005, as set forth in Amendment No. 1 to Schedule 13D filed by Mr. Kaplan with the Securities and Exchange Commission on that date.

(4) Included in David Kaplan's shares are 445,535 shares for which both he and Richard E. Kaplan share voting and dispositive power. This information is as of September 26, 2005, as set forth in Amendment No. 1 to Schedule 13D filed by Mr. Kaplan with the Securities and Exchange Commission on that date.

12

(5) This information is as of November 5, 2003, as set forth in a Schedule 13D filed by Mr. Lehrer with the Securities and Exchange Commission on December 8, 2003.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires First Hartford's directors and executive officers, and persons who own more than 10% of a registered class of First Hartford's equity securities, to file with the Securities and Exchange Commission initial reports of beneficial ownership on Form 3 and reports of changes in beneficial ownership of First Hartford's equity securities on Forms 4 or 5. The rules promulgated by the Commission under Section 16(a) of the Exchange Act require those persons to furnish First Hartford with copies of all reports filed with the Commission pursuant to Section 16(a). Based solely upon written representations of First Hartford's directors and executive officers that no forms were required to be filed, First Hartford believes that during fiscal year 2005, all directors, executive officers and 10% of shareholders of First Hartford have filed with the Commission on a timely basis all reports required to be filed under Section 16(a) of the Exchange Act.

CERTAIN LEGAL PROCEEDINGS

On February 27, 2004, Richard E. Kaplan ("Kaplan") filed suit against First Hartford in U.S. District Court in Boston alleging, among other things, that the proxy materials disseminated by First Hartford in advance of a January 2004 shareholders meeting contained false or misleading statements of material fact ("Kaplan I"). Kaplan seeks an order (i) voiding the shareholder votes taken at the January 22, 2004 meeting, (ii) requiring First Hartford to issue new proxy materials, and (iii) requiring a new shareholders' vote to be held. The case was initially assigned to Judge Reginald Lindsay and was subsequently reassigned to Judge Nathaniel Gorton. On March 29, 2004, First Hartford answered Kaplan's complaint and denied its substantive allegations. The parties have engaged in written discovery and have taken numerous depositions in connection with this action.

On February 17, 2005, Kaplan filed a second complaint against First Hartford in U.S. District Court in Boston alleging, among other things, that the proxy materials disseminated by First Hartford in advance of the February 2005 shareholders meeting contained false and misleading statements of material fact ("Kaplan II"). Like in Kaplan I, in Kaplan II, Kaplan seeks an order (i) voiding the shareholder votes taken at the February 2005 meeting, (ii) requiring First Hartford to issue new proxy materials, and (iii) requiring a new shareholders' vote to be held. On February 28, 2005, Kaplan filed an amended complaint. On April 4, 2005, First Hartford answered Kaplan's amended complaint and denied its substantive allegations.

On May 27, 2005, First Hartford filed a motion with the U.S. District Court in Boston to consolidate Kaplan I with Kaplan II. On July 12, 2005, the Court granted First Hartford's motion and consolidated the two cases. The parties have exchanged limited written discovery in the consolidated action. No depositions have been taken. The discovery deadline is November 30, 2005. The Court has scheduled trial to commence on May 1, 2006.

On September 15, 2005, Kaplan filed a complaint against First Hartford and Neil Ellis ("Ellis"), its President, in the U.S. District Court for the District of Maine alleging that First Hartford and Ellis have engaged in illegal, oppressive, and fraudulent conduct. Kaplan seeks (i) an order dissolving First Hartford and appointing a receiver for various purposes, or, alternatively (ii) an order requiring Ellis and/or First Hartford to purchase Kaplan's shares (and the shares of others interested in selling) at fair value or appointing one or more independent receivers or directors to make recommendations concerning the preservation of First Hartford's value. On October 11, 2005, First Hartford answered Kaplan's complaint and denied its substantive allegations.

13

PROPOSAL TO RATIFY THE 2003 STOCK OPTION PLAN

On December 19, 2003, the Board of Directors approved the First Hartford Corporation 2003 Stock Option Plan (the "2003 Plan" or the "Plan"), subject to shareholder approval at First Hartford's annual meeting held on January 22, 2004. The Plan was approved by shareholders at the annual meeting and became effective as of December 19, 2003. As described above under the caption "Certain Legal Proceedings," on February 27, 2004, Richard E. Kaplan, a shareholder of First Hartford, filed suit against First Hartford in U.S. District Court in Boston alleging, among other things, that the proxy materials disseminated by First Hartford in advance of the January 2004 shareholders meeting contained false or misleading statements of material fact, and seeking, among other things, an order voiding the shareholder votes taken at the meeting. While First Hartford is vigorously contesting this litigation, to remove any doubt as to the validity of the approval of the 2003 Stock Plan, First Hartford is seeking shareholder approval to ratify the Plan. In the event the shareholders do not approve the ratification, First Hartford will not grant any further options under the Plan.

The Board believes that the 2003 Plan will enable us to motivate and reward superior performance on the part of employees and thereby attract and retain employees of superior ability. The Board believes that the ratification of the approval of the Plan is in the best interests of First Hartford and its shareholders.

The Plan does not permit the repricing of options or the grant of discounted options. Provisions have been included to meet the requirements for deductibility of executive compensation for the purposes of Section 162(m) of the Internal Revenue Code with respect to options and other awards by qualifying grants and payments under the 2003 Plan as performance-based compensation.

The following is a brief description of the 2003 Plan. The full text of the Plan is attached as Appendix A hereto and the following description is qualified in its entirety by reference to this Appendix.

Administration of the Plan

The selection of key employees who may participate in the Plan, and the terms and conditions of each award, will be determined by the Board of Directors. The Board will have full power, discretion and authority to interpret, construe and administer the Plan, and all decisions, determinations or actions of the Board pursuant to the Plan will be final and binding on all persons for all purposes.

Eligibility

All employees, officers and directors of First Hartford and its subsidiaries are eligible to receive awards under the Plan. As of October 25, 2005, First Hartford had 33 employees. Because future awards under the 2003 Plan will be granted at the discretion of the Board of Directors, the type, number, recipients, and other terms of such awards cannot be determined at this time. Information regarding options previously granted by the Board of Directors under the 2003 Plan is set forth below under the caption "Proposal to Ratify a Grant of Non-Qualified Stock Options." If stockholders decline to ratify the 2003 Plan, future awards will not be granted under the 2003 Plan.

Types of Awards that May Be Made under the Plan

Stock options granted under the Plan may be of two types: (i) incentive stock options and (ii) nonqualified stock options.

Shares Covered by the 2003 Plan; Limit on Awards

The Plan permits the granting of awards covering 1,000,000 shares of common stock. As of October 25, 2005, there were 3,046,279 shares of common stock outstanding. The last reported sale price per common share on October 17, 2005 was $3.00 and there has been no reported trades since such date. The common stock may be either authorized but unissued shares of common stock or shares of common stock purchased on the open market.

14

Any shares that are reserved for options that lapse, expire or are forfeited, and any shares that are exchanged (actually or constructively) by optionees as full or partial payment to First Hartford for shares acquired on the exercise of an option may be available for subsequent awards to persons other than directors or executive officers of First Hartford.

No more than 1,000,000 shares of the total number of the shares of common stock on a cumulative basis are available for awards of incentive stock options. In the case of an incentive stock option, the aggregate fair market value of such option on the date of grant by the Board with respect to which the option becomes exercisable for the first time by an optionee during any calendar year shall not exceed $100,000.

Stock Options

Options granted under the 2003 Plan may be either non-qualified stock options or incentive stock options qualifying for special tax treatment under Section 422 of the Internal Revenue Code. The exercise price of any stock option may not be less than the fair market value of the common shares on the date of grant. The exercise price is payable in cash or certain cash equivalents, shares of common stock previously owned by the optionee or a combination of cash and shares of common stock previously owned by the optionee. Non-qualified stock options will generally expire ten years and two days following the date of grant, and incentive stock will generally expire on the tenth anniversary of the date of grant.

Federal Income Tax Treatment of Options

Non-Qualified Stock Options. No tax consequences result from the grant of a non-qualified stock option. On the exercise of a non-qualified stock option, the optionee will recognize ordinary income for federal income tax purposes on the amount by which the fair market value of the stock on the date of exercise exceeds the exercise price of the option. The optionee will be taxed on this amount in the year of exercise, and First Hartford will generally be allowed a deduction in this amount for federal income tax purposes in the same year. When the optionee disposes of shares acquired on the exercise of a non-qualified stock option, any amount received in excess of the fair market value of the shares on the date of exercise will be treated as long- or short-term capital gain to the optionee, depending on the holding period for the shares. If the amount received is less than the market value of the shares on the date of exercise, the loss will be treated as long- or short-term capital loss, depending upon the holding period of the shares.

Incentive Stock Options. No tax consequences result from the grant of an incentive stock option. On the exercise of an incentive stock option, no ordinary income will be recognized by the optionee. If the optionee holds the shares for over one year after the date of exercise, then if the date of sale of the shares is at least two years from the date of grant of the incentive stock option (i) the excess of the sale proceeds over the aggregate exercise price of the option (the "option spread") will be long-term capital gain to the optionee, and (ii) First Hartford will not be entitled to a tax deduction for any amount in respect of such option. Generally, if the optionee sells or otherwise disposes of the shares within one year after the date of exercise or two years from the date of grant, the excess of the fair market value of such shares at the time of exercise over the aggregate exercise price (but generally not more than the amount of gain realized on the disposition) will be ordinary income to the optionee at the time of such disposition. This is sometimes referred to as a "disqualifying disposition." The option spread on the exercise of an incentive stock option is an adjustment in computing the alternative minimum taxable income of the optionee where there has not been a taxable disqualifying disposition. First Hartford generally will be entitled to a federal tax deduction equal to the amount of ordinary income recognized by the optionee upon a disqualifying disposition.

Amendment and Termination of the 2003 Plan

The Board may at any time, and from time to time, alter, amend, suspend or discontinue the Plan or any provision of the Plan; provided, however, that (a) no alteration, amendment, suspension or discontinuance that would impair the rights of an optionee under any then-existing option agreement shall be made without such optionee's consent, and (b) no alteration or amendment may be made without the approval of First Hartford's shareholders if such alteration or amendment would (i) increase the over-all number of shares of common stock reserved and available for issuance under the Plan, or (ii) decrease the minimum exercise price of stock options.

15

Our Right of First Refusal

Transfers of common stock acquired pursuant to an option under the Plan are restricted. Before selling, assigning, transferring or otherwise disposing, whether voluntarily or by operation of law, all or any portion of the shares of common stock acquired pursuant to the exercise of an option under the Plan, an optionee must first give the Board written notice by certified or registered mail of his or her receipt of an offer from a prospective purchaser. The notice must be in writing, giving the name and address of the prospective purchaser, the number of shares involved, and the terms of such purchase. Within ten days after receipt of the written notice, First Hartford may elect to purchase all, but not less than all, of such shares offered for disposition, or may elect to designate a person, including an officer, director or employee of First Hartford, to purchase all, but not less than all, of such shares. The purchase price of any shares purchased shall be on the same terms and conditions as that offered by the prospective purchaser.

If all of the shares are not purchased by First Hartford or its designee in accordance with the Plan, then the optionee shall be free to sell the unsold shares to the prospective purchaser at the price and terms set forth in the original offer, within twenty days thereafter; provided, however, that at the end of such twenty day period, First Hartford's right of first refusal shall again be applicable.

Buyout and Settlement Provisions

The Plan provides that the Board may, in its sole discretion, offer to repurchase an option previously granted, in circumstances such as a change in control or in a termination of employment where the Board believes the circumstances merit special treatment, and not in the ordinary course of business, based upon such terms and conditions as the Board shall establish and communicate to the optionee at the time that such offer is made.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE PROPOSAL TO RATIFY THE FIRST HARTFORD CORPORATION 2003 STOCK OPTION PLAN

16

PROPOSAL TO RATIFY A GRANT OF NON-QUALIFIED STOCK OPTIONS

On February 11, 2004 (the "Option Grant Date"), the Board of Directors approved the grant of non-qualified options to purchase an aggregate of 250,000 shares of First Hartford's common stock to five employees pursuant and subject to the terms of the 2003 Plan. The options were granted to the following employees, two of whom are also directors and executive officers of First Hartford:

Name

|

Position

| Number of Shares

Underlying the Options |

| | | |

Stuart I. Greenwald | Director, Treasurer and Secretary | 50,000 |

David B. Harding | Director and Vice President | 50,000 |

Herbert Byk | Vice President, First Hartford Realty Corp. | 50,000 |

Jeffrey M. Carlson | General Counsel | 50,000 |

Michael Sweeney | Director of Purchasing, First Hartford Realty Corp. | 50,000 |

As described above under the caption "Certain Legal Proceedings", on February 27, 2004, Richard E. Kaplan, a shareholder of First Hartford, filed suit against First Hartford in U.S. District Court in Boston alleging, among other things, that the proxy materials disseminated by First Hartford in advance of the January 2004 shareholders meeting contained false or misleading statements of material fact, and seeking, among other things, an order voiding the shareholder votes taken at the meeting. While First Hartford is vigorously contesting this litigation, to remove any doubt as to the appropriateness of the grant of these options to five employees, First Hartford is seeking shareholder approval to ratify these grants. In the absence of a court order, First Hartford cannot unilaterally rescind stock options that it has previously granted, and if the shareholders fail to ratify the option grants described above, these stock options will remain outstanding. However, if the shareholders do not ratify these grants, First Hartford will make no future grants under the 2003 Plan absent shareholder approval.

The options have a two year vesting period and were granted at a purchase price of $1.10 per share, representing the fair market value of the stock based on the highest bid price of the stock on the Option Grant Date. Provided the options have not expired or otherwise terminated in accorance with the provisions of the Plan, at any time commencing two years after the Option Grant Date (the "Vesting Date" and the two year period, the "Vesting Period"), the applicable employee shall have right to exercise some or all of his stock option in lots of at least 1,000 shares.

Those eligible for these stock option grants were the officers and directors of First Hartford and full time key salaried employees (as identified by First Hartford's Board of Directors) who have worked for First Hartford for at least ten consecutive years as of the Option Grant Date and voluntarily remain full time employees of First Hartford during the Vesting Period. These options become exercisable on February 11, 2006, and thereafter may be exercised at any time during the period ending February 11, 2014, subject to earlier termination if the employee's employment by First Hartford or any of its subsidiaries terminates. So long as the rights of the employee are not adversely affected, First Hartford reserves the right to modify the manner or procedure by which the stock options are granted or otherwise administered if First Hartford reasonably deems it necessary to comply with applicable laws and if such modification(s) would be permitted under applicable laws.

An optionee will not recognize income for Federal tax purposes upon the grant of a non-qualified stock option. However, upon the exercise of a non-qualified stock option an optionee will recognize ordinary compensation income in an amount equal to the excess of the fair market value of the common stock on the date of the exercise over the option price. Any gain or loss recognized by the optionee on the subsequent disposition of the stock will be capital gain or loss and will be long-term capital gain or loss if the optionee held the shares for more than one year. First Hartford will be entitled to a deduction for Federal income tax purposes at the same time and in the same amount as an optionee is required to recognize ordinary compensation income.

17

The ratification of the grant of non-qualified stock options may benefit Stuart I. Greenwald and David B. Harding, directors and executive officers of First Hartford, because both of them were recipients of a grant.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE PROPOSAL TO RATIFY A GRANT OF NON-QUALIFIED STOCK OPTIONS

18

PROPOSAL TO RATIFY A GRANT OF PUT OPTIONS

One February 11, 2004 (the "Put Grant Date"), the Board of Directors approved the grant of certain put options to each of the employees who received the grant of a non-qualified stock option, as described above under the caption "Proposal to Ratify a Grant of Non-Qualified Stock Options." These put options were granted outside, and are not a part of, the 2003 Plan. As described above under the caption "Certain Legal Proceedings", on February 27, 2004, Richard E. Kaplan, a shareholder of First Hartford, filed suit against first Hartford in U.S. District Court in Boston alleging, among other things, that the proxy materials disseminated by First Hartford in advance of the January 2004 shareholders meeting contained false or misleading statements of material fact, and seeking, among other things, an order voiding the shareholder votes taken at the meeting. While First Hartford is vigorously contesting this litigation, to remove any doubt as to the appropriateness of the grant of these put options to five employees in connection with the stock option grants discussed above, First Hartford seeks shareholder approval to ratify the grant of these put options. In the absence of a court order, First Hartford cannot unilaterally rescind the put options that it has previously granted, and if the shareholders fail to ratify the put options described herein, these put options will remain as contractual rights of the holders. However, if the shareholders do not ratify these put options, First Hartford will not subsequently grant put options in connection with any stock options it may grant in the future without shareholder approval.

Provided the stock options have not expired or otherwise terminated in accordance with the provisions of the Plan, at any time within five years after the Vesting Date, the employee may, (i) in lieu of acquiring ownership of any or all of the shares subject to the stock options, or (ii) after exercising the stock options and acquiring the shares, elect to have First Hartford buy such shares from the employee for a price of $1.30 per share in excess of the price paid by the employee for the shares (the "Put Price"). This election may be made simultaneously with providing notice of exercise to First Hartford or by the issuance of a separate "Put Option Notice" by the employee made within five years after the Vesting Date but prior to the employee having otherwise sold the shares. If the employee exercised the put option as to all of the shares subject to his stock option (50,000 shares), he would realize an aggregate gain of $65,000.

The employee is responsible for any taxes due as a result of the exercise of the put option and First Hartford may, at its option, withhold sufficient sums from the Put Price to cover the tax incurred by the employee from this transaction.

Upon exercise of the put option, First Hartford believes that the payment to the employee would under current tax laws be treated as compensation income and that First Hartford would be entitled to a tax deduction at the same time and to the same extent as the optionee recognizes compensation income.

With respect to the stock options and put options described herein, which were granted prior to December 31, 2004, First Hartford believes that Section 409A of the Internal Revenue Code, which relates to nonqualified deferred compensation plans, does not apply under the guidelines set forth in IRS Notice 2005-1. Under recently proposed regulations under Section 409A, stock options and put options granted on or after January 1, 2007 may have to comply with different rules.

The ratification of the grant of the put options may benefit Stuart I. Greenwald and David B. Harding, directors and executive officers of First Hartford, because both of them are recipients of a put option.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE PROPOSAL TO RATIFY A GRANT OF PUT OPTIONS

| | BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| | |

| | Stuart I. Greenwald

Secretary to the Board of Directors |

Dated: October 26, 200519

19

APPENDIX A

FIRST HARTFORD CORPORATION

2003 STOCK OPTION PLAN

ARTICLE 1

PURPOSE

Purpose. The purpose of this First Hartford Corporation Stock Option Plan (the "Plan") is to enable the Company to offer to its employees, officers and directors whose past, present or potential contributions to the Company and its Subsidiaries have been, are or are expected to be important to the success of the Company, an opportunity to acquire a proprietary interest in the Company.

ARTICLE II

ADMINISTRATION

2.1 Administration. The Plan shall be administered by the full Board of Directors of the Company, or a committee established by the Board of Directors, the members of which shall be "Non-Employee Directors" as defined in Rule 16b-3 promulgated under the Exchange Act. References to the "Committee" shall mean the full Board or any such Committee.

2.2 Powers of the Committee. The Committee shall have full authority to grant Stock Options pursuant to the terms of the Plan. For purposes of illustration and not of limitation, the Committee shall have the authority (subject to the express provisions of this Plan):

(a) to select the employees, officers and directors of the Company, or any Subsidiary, to whom Stock Options may from time to time be awarded hereunder;

(b) to determine the terms and conditions, not inconsistent with the terms of the Plan, of any award granted hereunder (including, but not limited to, the number of shares, exercise price or types of consideration to be paid upon exercise of a Stock Option, any restrictions or limitations on an award, and any vesting, exchange, surrender, cancellation, acceleration, termination, exercise or forfeiture provisions, as the Committee shall determine); and

(c) to alter or amend the terms and conditions, not inconsistent with the terms of the Plan, of any award granted hereunder (including, but not limited to, any such alteration or amendment that would alter the terms and conditions of an Incentive Stock Option so as to convert it into a Nonqualified Stock Option); provided, however, that no such alteration or amendment that would impair the rights of an Optionee under any Agreement theretofore entered into hereunder may be made by the Committee without the Optionee's consent.

2.3 Interpretation of Plan.

(a) Committee Authority. Subject to Article VI below, the Committee shall have the authority to adopt, alter and repeal such administrative rules, guidelines and practices governing the Plan as it shall, from time to time, deem advisable, to interpret the terms and provisions of the Plan and any award issued under the Plan (and to determine the form and substance of all Agreements relating thereto), and to otherwise supervise the administration of the Plan.

(b) Incentive Stock Options. No term or provision of the Plan relating to Incentive Stock Options shall be interpreted, amended or altered, nor shall any discretion or authority granted under the Plan be so exercised, so as to disqualify the Plan under Section 422 of the Code.

2.4 Delegation by Committee. Except to the extent prohibited by applicable law or the applicable rules of any stock exchange on which the Common Stock is listed, the Committee may allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers to any person or persons selected by it. Any allocation or delegation of responsibilities or powers may be revoked by the Committee at any time.

ARTICLE III

STOCK SUBJECT TO PLAN

3.1 Number of Shares. The total number of shares of Common Stock reserved and available for issuance under the Plan shall be 1,000,000 shares of Common Stock, subject to adjustment as provided in Section 3.2 below. Shares of Common Stock under the Plan may consist, in whole or in part, of authorized and unissued shares or treasury shares. If any shares of Common Stock that have been granted pursuant to a Stock Option cease to be subject to a Stock Option, or if any award otherwise terminates without a payment being made to the Optionee in the form of Common Stock, such shares shall again be available for distribution in connection with future grants and awards under the Plan. If an Optionee pays the exercise price of a Stock Option by surrendering any previously owned shares or arranges to have the appropriate number of shares otherwise issuable upon exercise withheld to cover the withholding tax liability associated with the Stock Option exercise, then the number of shares available under the Plan shall be increased by the number of such surrendered shares and shares used to pay such taxes.

3.2 Adjustment Upon Changes in Capitalization, Etc. In the event of any dividend payable in shares of Common Stock, or any stock split or reverse stock split of the Common Stock, any then outstanding awards granted under the Plan shall be appropriately adjusted in such a manner as to preserve the economic benefits or potential economic benefits of such awards and the aggregate number of shares of Common Stock then reserved for issuance under the Plan, or permitted to be issued under various types of awards as provided in Section 3.1 hereof, shall be similarly adjusted. In the event of any merger, reorganization, consolidation, dividend (other than a cash dividend or a stock dividend covered by the preceding sentence) payable on shares of Common Stock, any combination or exchange of shares, or any other extraordinary or unusual event that results in a change in the shares of Common Stock of the Company as a whole, the Committee shall determine, in its sole discretion, whether such change equitably requires an adjustment in the terms of any award or the aggregate number of shares of Common Stock then reserved for issuance under the Plan. Any such adjustments shall be made by the Committee, whose determination shall be final, binding and conclusive.

ARTICLE IV

ELIGIBILITY

4.1 General. Awards may be made or granted to employees, officers or directors whose past, present or potential contributions to the Company and its Subsidiaries have been, are or are expected to be important to the success of the Company.

4.2 Incentive Stock Options. No Incentive Stock Option shall be granted to any person who is not an employee of the Company or a Subsidiary at the time of grant.

ARTICLE V

STOCK OPTIONS

5.1 Grant and Exercise. Stock Options granted under the Plan may be of two types: (i) Incentive Stock Options and (ii) Nonqualified Stock Options. Any Stock Option granted under the Plan shall contain such terms, not inconsistent with this Plan, or with respect to Incentive Stock Options, not inconsistent with the Plan and the Code, as the Committee may from time to time approve. The Committee shall have the authority to grant Incentive Stock Options or Nonqualified Stock Options, or both types of Stock Options, which may be granted alone or in addition to other awards granted under the Plan. To the extent that any Stock Option intended to qualify as an Incentive Stock Option does not so qualify, it shall constitute a separate Nonqualified Stock Option.

2

5.2 Terms and Conditions. Stock Options granted under the Plan shall be subject to the following terms and conditions:

(a) Option Term. The term of each Stock Option shall be fixed by the Committee; provided, however, that a Stock Option may be granted only within the ten-year period commencing from the Effective Date and may only be exercised within ten years of the date of grant (or five years in the case of an Incentive Stock Option granted to an Optionee who, at the time of grant, owns Common Stock possessing more than 10 percent of the total combined voting power of all classes of stock of the Company (a "10% Stockholder")).

(b) Exercise Price. The exercise price per share of Common Stock purchasable under a Stock Option shall be determined by the Committee at the time of grant and may not be less than 100% of the Fair Market Value on the day of grant; provided, however, that the exercise price of an Incentive Stock Option granted to a 10% Stockholder shall not be less than 110% of the Fair Market Value on the date of grant.

(c) Method of Exercise. Options shall be exercised by the delivery of written notice to the Committee (or such officer of the Company as may be designated by the Committee) setting forth the number of shares with respect to which the Option is to be exercised, and specifying the address to which the certificates for such shares are to be mailed. The Option price shall be paid in full at the time of exercise in cash by United States currency, certified check, bank check, personal check or money order or by tendering to the Company (i) shares of Common Stock having a Fair Market Value on the date of exercise equal to the Option price (including shares that would otherwise be issued pursuant to such exercise), or (ii) a combination of cash and shares of Common Stock valued at such Fair Market Value.

As promptly as practicable after receipt of such written notification of the exercise of an Option and payment, the Company shall deliver to the Optionee certificates for the number of shares with respect to which such Option has been so exercised issued in the Optionee's name.

(d) Transferability. Except as may be set forth in any Agreement relating to a Nonqualified Stock Option, no Stock Option shall be transferable by the Optionee other than by will or by the laws of descent and distribution, and all Stock Options shall be exercisable, during the Optionee's lifetime, only by the Optionee (or, to the extent of legal incapacity or incompetency, the Optionee's guardian or legal representative).

(e) Termination by Reason of Death. Unless otherwise determined by the Committee and set forth in the Agreement, if an Optionee is an employee of the Company or a Subsidiary at the time of grant and if an Optionee's employment by the Company or a Subsidiary terminates by reason of death, any Stock Option held by such Optionee shall thereupon automatically terminate, except that the portion of such Stock Option that has vested on or prior to the date of death may thereafter be exercised by the legal representative of the estate or by the legatee of the Optionee under the will of the Optionee, for a period of one year (or such other greater or lesser period as the Committee may specify at grant) from the date of such death or until the expiration of the stated term of such Stock Option, whichever period is the shorter.

(f) Termination by Reason of Disability. Unless otherwise determined by the Committee and set forth in the Agreement, if an Optionee is an employee of the Company or a Subsidiary at the time of grant and if an Optionee's employment by the Company or any Subsidiary terminates by reason of Disability, any Stock Option held by such Optionee shall thereupon automatically terminate, except that the portion of such Stock Option that has vested on or prior to the date of termination may thereafter be exercised by the Optionee for a period of one year (or such other greater or lesser period as the Committee may specify at the time of grant) from the date of such termination of employment or until the expiration of the stated term of such Stock Option, whichever period is the shorter.

3

(g) Other Termination. Unless otherwise determined by the Committee and set forth in the Agreement, if an Optionee is an employee of the Company or a Subsidiary at the time of grant and if such Optionee's employment by the Company or any Subsidiary terminates for any reason other than death or Disability, the Stock Option shall thereupon automatically terminate, except that if the Optionee's employment is terminated by the Company or a Subsidiary without cause or due to Normal Retirement, then the portion of such Stock Option that has vested on or prior to the date of termination of employment may be exercised for the lesser of three months (or, in the case of a Nonqualified Stock Option, one year) after termination of employment or until the expiration of the stated term of such Stock Option, whichever period is shorter.

(h) Additional Incentive Stock Option Limitation. In the case of an Incentive Stock Option, the aggregate Fair Market Value (on the date of grant of the Option) of the shares of Common Stock with respect to which Incentive Stock Options become exercisable for the first time by an Optionee during any calendar year (under all plans of the Company and its Parent and Subsidiaries) shall not exceed $100,000.

(i) Buyout and Settlement Provisions. The Committee may, in its sole discretion, offer to repurchase a Stock Option previously granted, in circumstances such as a change in control or in a termination of employment where the Committee believes the circumstances merit special treatment, and not in the ordinary course of business, based upon such terms and conditions as the Committee shall establish and communicate to the Optionee at the time that such offer is made.

5.3 Right of First Refusal. An Optionee who acquires shares of Common Stock pursuant to the terms of this Plan shall not sell, assign, transfer, or give, or in any manner, dispose of all or any part of such shares, or any right or interest therein, whether voluntarily or by operation of law, without first giving to the Committee written notice by certified or registered mail of his or her receipt of an offer from a prospective purchaser. The notice must be in writing, giving the name and address of the prospective purchaser, the number of shares involved, and the terms of such purchase. Within ten days after receipt of the written notice, the Committee may elect to purchase all, but not less than all, of such shares offered for disposition, or may elect to designate a person, including an officer, director or employee of the Company, to purchase all, but not less than all, of such shares. The purchase price of any shares purchased shall be on the same terms and conditions as that offered by the prospective purchaser.

If all of the shares are not purchased by the Committee or its designee in accordance with the provisions of this Section 5.3, then the Optionee shall be free to sell the unsold shares to the prospective purchaser at the price and terms set forth in the original offer, at any time within twenty days thereafter; provided, however, that at the end of the twenty day period, the Committee's right of first refusal shall again be applicable.

ARTICLE VI

AMENDMENT AND TERMINATION

The Board may at any time, and from time to time, alter, amend, suspend or discontinue the Plan or any provision of the Plan; provided, however, that (a) no alteration, amendment, suspension or discontinuance that would impair the rights of an Optionee under any Agreement theretofore entered into hereunder shall be made without the Optionee's consent, and (b) no alteration or amendment may be made without the approval of the Company's stockholders if such alteration or amendment would (i) increase the over-all number of shares reserved and available for issuance under the Plan set forth in Section 3.1, or (ii) decrease the minimum exercise price of Stock Options set forth in Section 5.2(b).

ARTICLE VII

TERM OF PLAN

7.1 Effective Date. The Plan shall be effective as of December 19, 2003 (the "Effective Date"), subject to the approval of the Plan by the Company's stockholders within one year after the Effective Date. Any Stock Options granted under the Plan prior to such approval shall be effective when made (unless otherwise specified by the Committee at the time of grant), but shall be conditioned upon, and subject to, such approval of the Plan by the Company's stockholders, and no awards shall vest or otherwise become free of restrictions prior to such approval.

7.2 Termination Date. Unless earlier terminated by the Board, this Plan shall continue to remain in effect for a period of ten (10) years from the Effective Date; provided that the Plan shall continue to govern all outstanding awards until the awards themselves terminate in accordance with their terms.

4

ARTICLE VIII

GENERAL PROVISIONS

8.1 Written Agreements. Each Stock Option granted under the Plan shall be confirmed by, and shall be subject to the terms, of the Agreement executed by the Company and the Optionee. The Committee may terminate any award made under the Plan if the Agreement relating thereto is not executed and returned to the Company within 10 days after the Agreement has been delivered to the Optionee for his or her execution.

8.2 Unfunded Status of Plan. The Plan is intended to constitute an "unfunded" plan for incentive and deferred compensation. With respect to any payments not yet made to an Optionee by the Company, nothing contained herein shall give any such Optionee any rights that are greater than those of a general creditor of the Company.

8.3 No Right of Employment. Nothing contained in the Plan or in any award hereunder shall be deemed to confer upon any Optionee who is an employee of the Company or any Subsidiary any right to continued employment with the Company or any Subsidiary, nor shall it interfere in any way with the right of the Company or any Subsidiary to terminate the employment of any Optionee who is an employee at any time.

8.4 Investment Representations; Company Policy. The Committee may require each person acquiring shares of Common Stock pursuant to a Stock Option to represent to and agree with the Company in writing that the Optionee is acquiring the shares for investment without a view to distribution thereof. Each person acquiring shares of Common Stock pursuant to a Stock Option shall be required to abide by all policies of the Company in effect at the time of such acquisition and thereafter with respect to the ownership and trading of the Company's securities.

8.5 Additional Incentive Arrangements. Nothing contained in the Plan shall prevent the Board from adopting such other or additional incentive arrangements as it may deem desirable, including, but not limited to, the granting of Stock Options and the awarding of Common Stock and cash otherwise than under the Plan; and such arrangements may be either generally applicable or applicable only in specific cases.