UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTIONS 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 |

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) of the SECURITIES EXCHANGE ACT OF 1934 |

ALLEGHENY ENERGY, INC.

(Name of Registrant)

| | |

| Maryland | | 13-5531602 |

(State of Incorporation) 800 Cabin Hill Drive, Greensburg, Pennsylvania | | (IRS Employer Identification Number) |

| |

| (Address of Principal Executive Offices) | | 15601 (Zip Code) |

(724) 837-3000

(Telephone Number)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one).

| | | | |

Large accelerated filer x | | Accelerated filer | | ¨ |

| | |

| Non-accelerated filer ¨ | | Smaller reporting company | | ¨ |

(Do not check if a smaller reporting company) | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of December 31, 2007, 167,223,576 shares of the common stock, par value of $1.25 per share, of the registrant were outstanding.

Documents Incorporated by Reference

Portions of the Allegheny Energy, Inc. definitive Proxy Statement for its 2008 Annual Meeting of Stockholders are incorporated by reference to Part III of this Annual Report on Form 10-K.

GLOSSARY

| I. | The following abbreviations and terms are used in this report to identify Allegheny Energy, Inc. and its subsidiaries: |

| | |

ACC | | Allegheny Communications Connect, Inc., a subsidiary of Allegheny Ventures |

AE | | Allegheny Energy, Inc., a diversified utility holding company |

AESC | | Allegheny Energy Service Corporation, a subsidiary of AE |

AE Solutions | | Allegheny Energy Solutions, Inc., a subsidiary of Allegheny Ventures |

AE Supply | | Allegheny Energy Supply Company, LLC, an unregulated generation subsidiary of AE |

AGC | | Allegheny Generating Company, an unregulated generation subsidiary of AE Supply and Monongahela |

Allegheny | | Allegheny Energy, Inc., together with its consolidated subsidiaries |

Allegheny Ventures | | Allegheny Ventures, Inc., a nonutility, unregulated subsidiary of AE |

Distribution Companies | | Monongahela, Potomac Edison and West Penn, which collectively do business as Allegheny Power |

Green Valley Hydro | | Green Valley Hydro, LLC, a subsidiary of AE |

Monongahela | | Monongahela Power Company, a regulated subsidiary of AE |

PATH, LLC | | Potomac-Appalachian Transmission Highline, LLC, a joint venture between Allegheny and a subsidiary of American Electric Power Company, Inc. |

Potomac Edison | | The Potomac Edison Company, a regulated subsidiary of AE |

TrAIL Company | | Trans-Allegheny Interstate Line Company |

West Penn | | West Penn Power Company, a regulated subsidiary of AE |

| II. | The following abbreviations and acronyms are used in this report to identify entities and terms relevant to Allegheny’s business and operations: |

| | |

CDD | | Cooling Degree-Days |

Clean Air Act | | Clean Air Act of 1970 |

CO2 | | Carbon dioxide |

DOE | | United States Department of Energy |

EPA | | United States Environmental Protection Agency |

Energy Policy Act | | Energy Policy Act of 2005 |

Exchange Act | | Securities Exchange Act of 1934, as amended |

FERC | | Federal Energy Regulatory Commission, an independent commission within the DOE |

FPA | | Federal Power Act |

GAAP | | Generally accepted accounting principles used in the United States of America |

HDD | | Heating Degree-Days |

kW | | Kilowatt, which is equal to 1,000 watts |

kWh | | Kilowatt-hour, which is a unit of electric energy equivalent to one kW operating for one hour |

Maryland PSC | | Maryland Public Service Commission |

MW | | Megawatt, which is equal to 1,000,000 watts |

MWh | | Megawatt-hour, which is a unit of electric energy equivalent to one MW operating for one hour |

NSR | | The New Source Performance Review Standards, or “New Source Review,” applicable to facilities deemed “new” sources of emissions by the EPA |

OVEC | | Ohio Valley Electric Corporation |

PATH | | Potomac-Appalachian Transmission Highline |

Pennsylvania PUC | | Pennsylvania Public Utility Commission |

PJM | | PJM Interconnection, L.L.C., a regional transmission organization |

PLR | | Provider-of-last-resort |

PURPA | | Public Utility Regulatory Policies Act of 1978 |

RPM | | Reliability Pricing Model, which is PJM’s capacity market |

RTO | | Regional Transmission Organization |

Scrubbers | | Flue-gas desulfurization equipment |

SEC | | Securities and Exchange Commission |

SO2 | | Sulfur dioxide |

SOS | | Standard Offer Service |

T&D | | Transmission and distribution |

TrAIL | | Trans-Allegheny Interstate Line |

Virginia SCC | | Virginia State Corporate Commission |

West Virginia PSC | | Public Service Commission of West Virginia |

CONTENTS

PART I

ITEM 1. BUSINESS

OVERVIEW

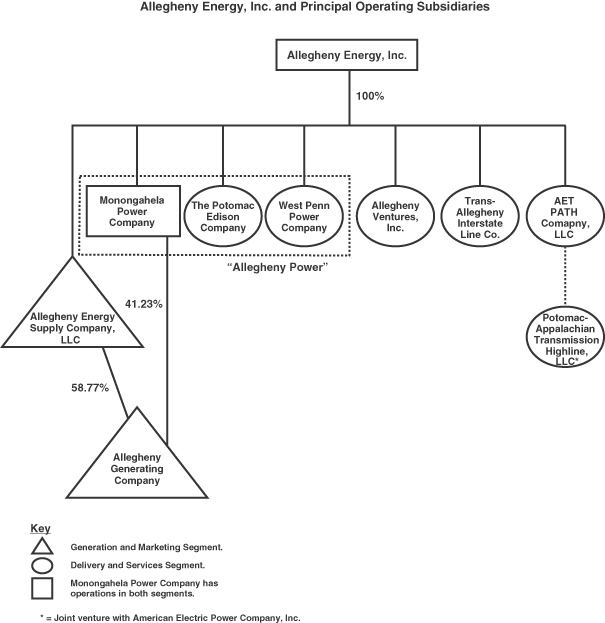

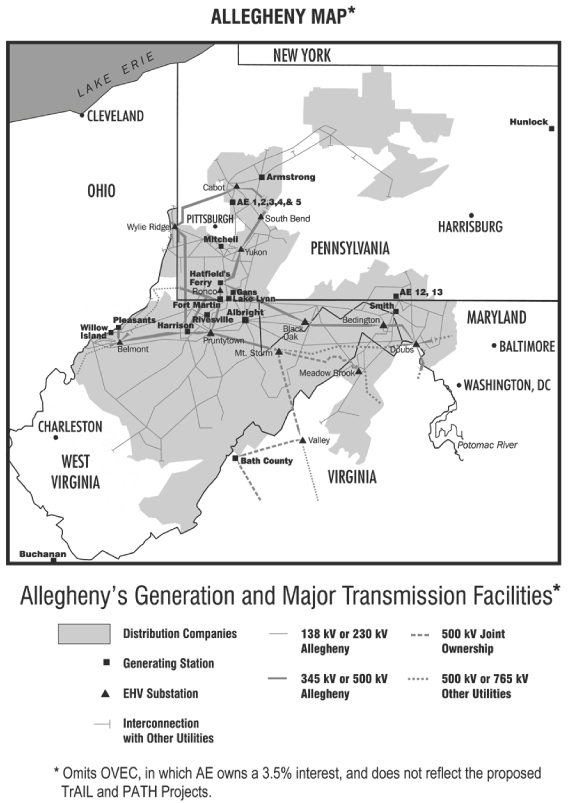

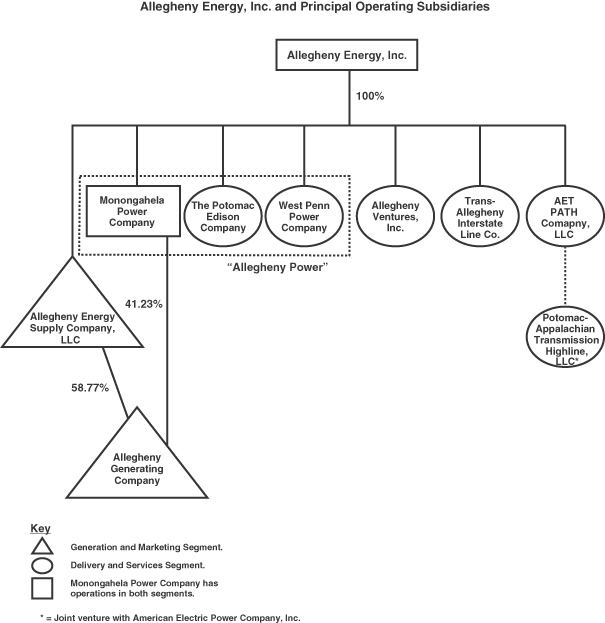

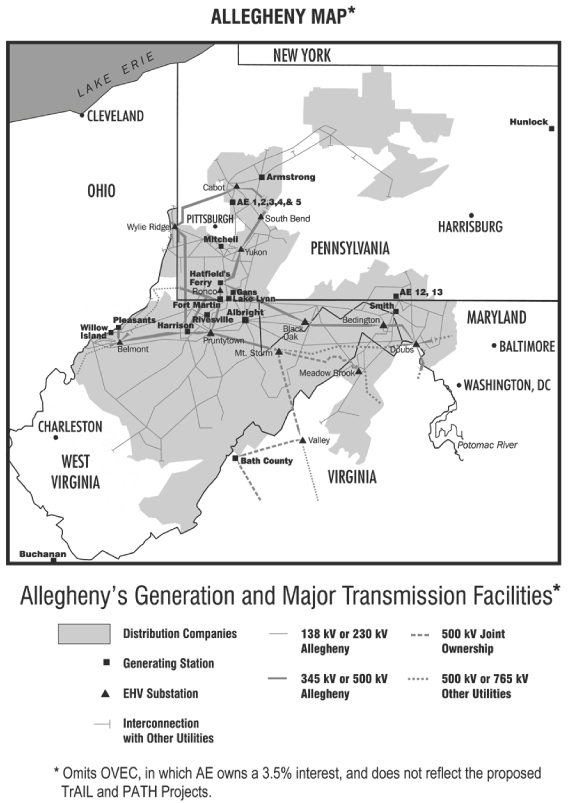

Allegheny is an integrated energy business that owns and operates electric generation facilities and delivers electric services to customers in Pennsylvania, West Virginia, Maryland and Virginia. AE, Allegheny’s parent holding company, was incorporated in Maryland in 1925. Allegheny operates its business primarily through AE’s various directly and indirectly owned subsidiaries.

Allegheny has two business segments:

| | • | | The Delivery and Services segment includes Allegheny’s electric T&D operations. |

| | • | | The Generation and Marketing segment includes Allegheny’s power generation operations. |

The Delivery and Services Segment

The principal companies and operations in AE’s Delivery and Services segment include the following:

| | • | | The Distribution Companies include Monongahela (excluding its West Virginia generation assets), Potomac Edison and West Penn. Each of the Distribution Companies is a public utility company and does business under the trade name Allegheny Power. Allegheny Power’s principal business is the operation of electric public utility systems. In April 2002, the Distribution Companies transferred functional control over their transmission systems to PJM. As a RTO, PJM coordinates the movement of electricity over the transmission grid in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. |

| | • | | Monongahela was incorporated in Ohio in 1924. It conducts an electric T&D business that serves approximately 378,600 customers in northern West Virginia in a service area of approximately 12,400 square miles with a population of approximately 783,000. Monongahela’s Delivery and Services segment had operating revenues of $650.8 million and sold 10.8 billion kWhs of electricity to retail customers in 2007. Monongahela also owns generation assets, which are included in the Generation and Marketing Segment. See “The Generation and Marketing Segment” below. |

| | • | | Potomac Edison was incorporated in Maryland in 1923 and was also incorporated in Virginia in 1974. It operates an electric T&D system in portions of West Virginia, Maryland and Virginia. Potomac Edison serves approximately 475,000 customers in a service area of about 7,300 square miles with a population of approximately 1.05 million. Potomac Edison had total operating revenues of $888.2 million and sold 13.5 billion kWhs of electricity to retail customers in 2007. |

| | • | | West Penn was incorporated in Pennsylvania in 1916. It operates an electric T&D system in southwestern, south-central and northern Pennsylvania. West Penn serves approximately 711,000 customers in a service area of about 9,900 square miles with a population of approximately 1.5 million. West Penn had total operating revenues of $1.3 billion and sold 20.5 billion kWhs of electricity to retail customers in 2007. |

| | • | | TrAIL Company was incorporated in Maryland and Virginia in 2006. In June 2006, PJM, which manages a regional planning process for transmission expansion, approved a regional transmission expansion plan designed to maintain the reliability of the transmission grid in the Mid-Atlantic region. The transmission expansion plan includes TrAIL, a new 240-mile 500 kV transmission line, 210 miles of which is to be located in the Distribution Companies’ PJM zone. PJM designated Allegheny to construct the portion of the line that will be located in the Distribution Companies’ PJM zone. TrAIL |

5

| | Company was formed in connection with the management and financing of transmission expansion projects, including this project (the “TrAIL Project”), and will own and operate the new transmission line. |

| | • | | PATH, LLC was formed in Delaware in 2007 as a joint venture between Allegheny and a subsidiary of American Electric Power Company, Inc. (“AEP”) following PJM approval of PATH, a 290-mile, high-voltage transmission line. PATH will include approximately 244 miles of 765 kV transmission line and approximately 46 miles of twin-circuit 500 kV transmission lines and will extend from AEP’s substation near St. Albans, West Virginia, to a new substation near Kemptown, Maryland. PATH, LLC, which was formed in connection with the management and financing of this project (the “PATH Project”), is a series limited liability company. The “West Virginia Series” is owned equally by Allegheny and AEP and, through an operating subsidiary, will build, own and operate the portion of the line extending from AEP’s Amos substation to Allegheny’s Bedington substation. The “Allegheny Series” is 100% owned by Allegheny and, through an operating subsidiary, will build, own and operate the portion of the line extending from Bedington to the new substation near Kemptown, Maryland. |

| | • | | Allegheny Ventures is a nonutility, unregulated subsidiary of AE that was incorporated in Delaware in 1994. Allegheny Ventures engages in telecommunications and unregulated energy-related projects. Allegheny Ventures has two principal wholly-owned subsidiaries, ACC and AE Solutions. Both ACC and AE Solutions are Delaware corporations. ACC develops fiber-optic projects, including fiber and data services. AE Solutions manages energy-related projects. Allegheny Ventures had total operating revenues of $9.1 million in 2007. |

During 2007, the Delivery and Services segment had operating revenues of $2.8 billion and net income of $117.7 million. As of December 31, 2007, the Delivery and Services segment held approximately $4.6 billion of identifiable assets. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 16, “Business Segments,” to the Consolidated Financial Statements.

The Generation and Marketing Segment

The principal companies and operations in AE’s Generation and Marketing segment include the following:

| | • | | AE Supply was formed in Delaware in 1999. AE Supply owns, operates and manages electric generation facilities. AE Supply also purchases and sells energy and energy-related commodities. As of December 31, 2007, AE Supply owned or contractually controlled approximately 6,896 MWs of generation capacity. See “Electric Facilities” below. |

AE Supply markets its electric generation capacity to various customers and markets. AE Supply currently is contractually obligated to provide Potomac Edison and West Penn with the power that they need to meet a majority of their PLR obligations, which represents a majority of AE Supply’s normal operating capacity. AE Supply had total operating revenues of $1.6 billion in 2007.

| | • | | Monongahela’s West Virginia generation assets are included in the Generation and Marketing segment. As of December 31, 2007, Monongahela owned or contractually controlled 2,806 MWs of generation capacity. See “Electric Facilities” below. |

Monongahela’s generation capacity supplies Monongahela’s Delivery and Services segment. In addition, Monongahela is contractually obligated to provide Potomac Edison with the power that it needs to meet its load obligations in West Virginia. Monongahela’s Generation and Marketing segment had operating revenues of $555.2 million in 2007.

| | • | | AGC was incorporated in Virginia in 1981. As of December 31, 2007, AGC was owned approximately 59% by AE Supply and approximately 41% by Monongahela. AGC’s sole asset is a 40% undivided interest in the Bath County, Virginia pumped-storage hydroelectric generation facility and its connecting transmission facilities. All of AGC’s revenues are derived from sales of its 1,059 MW share of generation capacity from the Bath County generation facility to AE Supply and Monongahela. AGC had total operating revenues of $67.4 million in 2007. See “Electric Facilities” below. |

6

In addition to coordinating the movement of wholesale electricity in its region and managing regional plans for generation and transmission expansion, PJM operates a competitive wholesale energy market. All of Allegheny’s generation facilities are located within the PJM market. To facilitate the economic dispatch of generation, AE Supply and Monongahela sell power into the PJM market and purchase power from the PJM market to meet their contractual obligations to supply power. See “Fuel, Power and Resource Supply” and “Regulatory Framework Affecting Allegheny” below.

During 2007, the Generation and Marketing segment had operating revenues of $2.1 billion and net income of $294.5 million. As of December 31, 2007, the Generation and Marketing segment held approximately $5.3 billion of identifiable assets. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 16, “Business Segments,” to the Consolidated Financial Statements.

Intersegment Services

AESC was incorporated in Maryland in 1963 and is a service company for Allegheny. AESC employs substantially all of the Allegheny personnel who provide services to AE, AE Supply, AGC, the Distribution Companies, Allegheny Ventures, TrAIL Company, PATH, LLC and their respective subsidiaries. These companies reimburse AESC at cost for services provided to them by AESC’s employees. AESC had 4,355 employees as of December 31, 2007.

Initiatives and Achievements

Allegheny’s long-term strategy is to focus on its core generation and T&D businesses. Allegheny’s management believes that this emphasis is enabling Allegheny to take advantage of its regional presence, operational expertise and knowledge of its markets to grow earnings and add shareholder value.

Significant initiatives and recent achievements include:

| | • | | Transmission Expansion. In June 2006, PJM approved a regional transmission expansion plan designed to maintain the reliability of the transmission grid in the Mid-Atlantic region that includes TrAIL, and in June 2007, PJM authorized the construction of PATH. These new lines are designed to alleviate future reliability concerns and increase the west to east transmission capability of the PJM transmission system. PJM designated Allegheny to construct the portion of TrAIL that will be located in the Distribution Companies’ PJM zone, and Allegheny and AEP have formed a joint venture to construct PATH. FERC approved four incentive rate treatments, which are intended to promote the construction of transmission facilities, for TrAIL. PATH, LLC has applied for incentive rate treatment for PATH. Additionally, the DOE designated the region in which both projects are proposed to be located as a National Interest Electric Transmission Corridor. Allegheny currently is in the process of seeking requisite permits and regulatory approvals. |

Allegheny also is taking additional steps to enhance the performance and reliability of its transmission system. For example, in December 2007, Allegheny completed the installation and start-up of the world’s largest Static VAR Compensator, or “SVC,” located at its Black Oak transmission substation, near Rawlings, Maryland. The new SVC is expected to enhance the reliability of Allegheny’s high-voltage Black Oak-Bedington transmission line, which is one of the most congested transmission lines in the PJM region, and increase transmission capacity across the PJM region.

| | • | | Environmental Compliance and Risk Management. Allegheny is working to effectively manage its environmental compliance efforts to ensure continuing compliance with applicable federal and state regulations while controlling its compliance costs, reducing emissions levels and minimizing its risk exposure. |

Among other initiatives, AE Supply and Monongahela completed the elimination of a partial Scrubber bypass at the Pleasants generation facility in 2007, are constructing Scrubbers at the Hatfield’s Ferry generation facility in Pennsylvania and the Fort Martin generation facility in West Virginia, and are also

7

evaluating other pollution control projects at other facilities. Additionally, AE Supply and Monongahela are currently blending lower-sulfur Powder River Basin (“PRB”) coal at several generation facilities. See “Environmental Matters” below.

| | • | | Energy Efficiency and Conservation. Through its Watt Watchers program introduced in 2007, Allegheny has implemented a number of programs to encourage energy efficiency and conservation among its customers, in addition to its long-standing portfolio of existing energy conservation programs. In August 2007, for example, Allegheny announced its partnership with ENERGY STAR®, the EPA’s voluntary, market-based program to reduce greenhouse gasses through energy efficiency. As part of this initiative, Allegheny joined the “Change a Light, Change the World” campaign, a national program to encourage consumers to replace at least one standard light bulb with a longer-lasting, more efficient bulb that has earned the ENERGY STAR® label. Customers can pledge to replace the lights in their homes and can purchase compact fluorescent light bulbs and other energy-efficient products through Allegheny’s website. Also as part of its Watt Watchers program, Allegheny has worked to educate students in its region about energy conservation by, among other things, providing free educational materials on energy conservation and safety. |

Allegheny also is pursuing options for “green” energy sourcing for its customers. In November, 2007, Allegheny filed an application with the Pennsylvania PUC to offer a voluntary wind energy program to customers in Pennsylvania, and Allegheny continues to explore other programs through which customers can purchase electricity from renewable sources.

Allegheny is developing a number of other new programs for customers that it believes can help drive energy efficiency and conservation, such as: helping customers conduct home energy audits; conducting workshops for business customers to encourage participation in utility demand reduction programs; and launching an automated metering pilot program to help customers better understand and manage their energy usage.

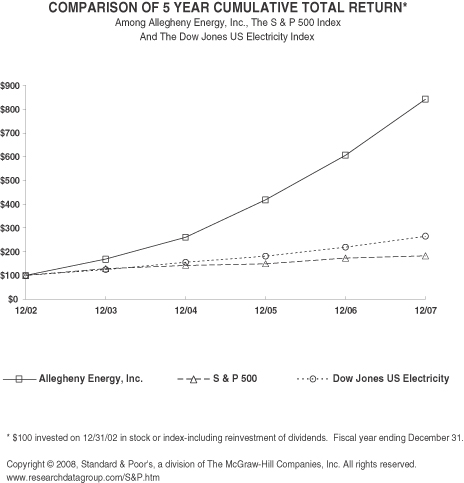

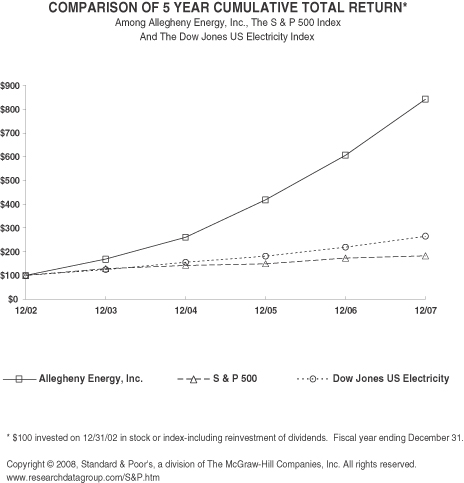

| | • | | Investment Grade Status and Common Stock Dividend. Allegheny’s extensive efforts since 2003 to improve its credit profile by repaying debt and improving liquidity, along with the overall improvements in Allegheny’s financial condition, led to the achievement of a significant milestone in 2007 with the upgrade to investment grade of Allegheny’s corporate credit ratings by all three major credit rating agencies. In May 2007, Standard & Poor’s upgraded AE’s corporate credit rating from BB+ to BBB-, marking Allegheny’s return to investment grade status, and in September 2007, Moody’s Investor Services upgraded AE’s corporate family rating from Ba2 to Baa3. In December 2007, Fitch Ratings upgraded AE’s issuer default rating and unsecured debt rating from BB+ to BBB-. |

With Allegheny’s return to investment grade status, AE reinstated its common stock dividend, ending a suspension that began in 2002, when Allegheny was in financial distress. In October 2007, AE’s Board of Directors declared a cash dividend on AE’s common stock of $0.15 per share, and in February 2008, the Board declared a dividend of $0.15 per share. See Note 8, “Dividend Restrictions” to the Consolidated Financial Statements.

| | • | | Transition to Market-based Rates. Each of the states in Allegheny’s service territory other than West Virginia has, to some extent, deregulated its electric utility industry. Pennsylvania and Maryland have instituted customer choice and are transitioning to market-based, rather than cost-based pricing for generation. Virginia undertook to deregulate the provision of generation services beginning in 1999, but recent legislation in Virginia will result in re-regulation of these services as of January 1, 2009 for most customers. In West Virginia, the rates charged to retail customers are regulated by the West Virginia PSC and are determined through traditional, cost-based, regulated utility rate making. |

In March 2007, the Maryland PSC approved a rate stabilization and transition plan proposed by Potomac Edison for its residential customers in Maryland that is intended to gradually transition residential customers from capped generation rates to generation rates based on market prices beginning in 2007 and ending in 2010. Under the plan, residential customers who did not opt out of the plan began

8

paying a distribution surcharge beginning in June 2007, which will result in an overall rate increase of approximately 15% annually from 2007 to 2010. With the expiration of the residential generation rate caps and the move to generation rates based on market prices on January 1, 2009, the surcharge will convert to a credit on customers’ bills. Funds collected through the surcharge during 2007 and 2008, plus interest, will be returned to customers as a credit on these customers’ electric bills, thereby reducing the effect of the rate cap expiration. The credit will continue, with adjustments, to maintain rate stability until December 31, 2010. See “Regulatory Framework Affecting Allegheny” and “Fuel, Power and Resource Supply” below.

In 2005, Allegheny successfully implemented a plan to transition Pennsylvania customers to generation rates based on market prices through increases in applicable rate caps in 2007, 2009 and 2010 and a two-year extension of the applicable transition period. Together with previously approved rate cap increases for 2006 and 2008, these increases are intended to gradually move generation rates in Pennsylvania closer to market prices. See “Risk Factors” below.

| | • | | Generation Value. Allegheny is working to maximize the value of the power that it generates by achieving full recovery of its costs and a reasonable return through the traditional rate-making process for its regulated utilities and by effectively managing the transition to market prices for AE Supply and its subsidiaries. |

While its recent requests for rate increases in West Virginia and Virginia have for the most part been denied by the relevant state regulatory commissions, Allegheny was able to obtain approval from the West Virginia PSC for the reinstatement of a fuel and purchased power cost recovery clause in West Virginia and from the Virginia SCC for partial recovery of purchased power costs. Allegheny continues to appeal the decisions of the West Virginia PSC and Virginia SCC with respect to its rates in those jurisdictions. See “Regulatory Framework Affecting Allegheny” and “Risk Factors—Risks Relating to Regulation” below and Note 4, “Rates and Regulation” to the Consolidated Financial Statements.

As discussed above, in April 2005, Allegheny obtained approval from the Pennsylvania PUC for increases in applicable rate caps in 2007, 2009 and 2010 in connection with a two-year extension of the period during which Pennsylvania customers will transition to market prices. In addition, AE Supply won the contracts to serve the PLR customer load in Pennsylvania in 2009 and 2010 and entered into contracts to provide power to Potomac Edison to serve commercial, industrial and outdoor lighting customer loads in Maryland and customer load for all classes in Virginia.

| | • | | Plant Availability and Operational Efficiency. Allegheny is working to maximize the availability and operational efficiency of its physical assets, particularly its supercritical generation facilities (those that utilize steam pressure in excess of 3,200 pounds per square inch). In 2007, Allegheny completed an extensive special maintenance program, which it began in 2005, at each of its 10 supercritical generating units, targeted at improving the availability of those units. |

Allegheny is continuously working to identify and develop opportunities to optimize operating processes, increase productivity and reduce or contain operation and maintenance expenses where appropriate.

For example, in January 2007, Allegheny successfully implemented an enterprise resource planning system as part of its program to improve its processes and technology. As part of the same initiative, Allegheny entered into an agreement in 2005 to outsource many of its information technology functions.

Additionally, Allegheny has entered into various coal supply contracts in an effort to ensure a consistent supply of coal at predictable prices, and currently has commitments in place for the delivery of approximately 95% of its expected coal needs for 2008. See “Fuel, Power and Resource Supply” below.

| | • | | High Customer Satisfaction. Allegheny continues to see high levels of satisfaction among its customers. For example, in 2007, a leading independent survey firm ranked Allegheny second in customer satisfaction for residential customers and business customers in the eastern United States and fourth in residential customer satisfaction nationwide, while another leading independent survey firm |

9

| | ranked Allegheny first in customer satisfaction among commercial and industrial customers in the northeast. Allegheny remains focused on maintaining or improving customer satisfaction levels. |

Management’s priorities for 2008 include continued focus on improving operations, environmental stewardship, managing the transition to market-based rates, maintaining high levels of customer satisfaction and expanding Allegheny’s transmission system.

10

Where You Can Find More Information

AE files or furnishes Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other information with or to the SEC. You may read and copy any document that AE files with the SEC at the SEC’s public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. These SEC filings are also available to the public from the SEC’s website athttp://www.sec.gov.

The Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, statements of changes in beneficial ownership and other SEC filings, and any amendments to those reports, that AE files with or furnishes to the SEC under the Exchange Act are made available free of charge on AE’s website athttp://www.alleghenyenergy.com as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Audited annual financial statements for AE Supply also are available on AE’s website. AE’s website and the information contained therein are not incorporated into this report.

11

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical information, this report contains a number of forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. These include statements with respect to:

| | • | | regulatory matters, including but not limited to environmental regulation, state rate regulation, and the status of retail generation service supply competition in states served by the Distribution Companies; |

| | • | | market demand and prices for energy and capacity; |

| | • | | the cost and availability of raw materials, including coal, and Allegheny’s ability to enter into long-term fuel purchase agreements; |

| | • | | PLR and power supply contracts; |

| | • | | internal controls and procedures; |

| | • | | status and condition of plants and equipment; |

| | • | | changes in technology and their effects on the competitiveness of Allegheny’s generation facilities; |

| | • | | work stoppages by Allegheny’s unionized employees; and |

| | • | | capacity purchase commitments. |

Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not differ materially from expectations. Actual results have varied materially and unpredictably from past expectations. Factors that could cause actual results to differ materially include, among others, the following:

| | • | | the results of regulatory proceedings, including proceedings related to rates; |

| | • | | plant performance and unplanned outages; |

| | • | | volatility and changes in the price and demand for energy and capacity; |

| | • | | volatility and changes in the price of coal, natural gas and other energy-related commodities and Allegheny’s ability to enter into long term fuel purchase agreements; |

| | • | | changes in the weather and other natural phenomena; |

| | • | | changes in industry capacity, development and other activities by Allegheny’s competitors; |

| | • | | changes in market rules, including changes to PJM’s participant rules and tariffs; |

| | • | | the loss of any significant customers or suppliers; |

| | • | | changes in customer switching behavior and their resulting effects on existing and future PLR load requirements; |

| | • | | dependence on other electric transmission and gas transportation systems and their constraints on availability; |

| | • | | environmental regulations; |

| | • | | changes in other laws and regulations applicable to Allegheny, its markets or its activities; |

12

| | • | | changes in the underlying inputs and assumptions, including market conditions, used to estimate the fair values of commodity contracts; |

| | • | | complications or other factors that make it difficult or impossible to obtain necessary lender consents or regulatory authorizations on a timely basis; |

| | • | | changes in access to capital markets, the availability of credit and actions of rating agencies; |

| | • | | inflationary and interest rate trends; |

| | • | | the effect of accounting pronouncements issued periodically by accounting standard-setting bodies and accounting issues facing Allegheny; |

| | • | | general economic and business conditions; and |

| | • | | other risks, including the effects of global instability, terrorism and war. |

13

ALLEGHENY’S SALES AND REVENUES

Generation and Marketing

The Generation and Marketing segment had operating revenues of $2.1 billion and $1.8 billion in 2007 and 2006, respectively. For more information regarding the Generation and Marketing segment’s operating revenues, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below and Note 16, “Business Segments,” to the Consolidated Financial Statements.

Delivery and Services

The Delivery and Services segment sold 44.9 billion and 43.2 billion kWhs of electricity to retail customers in 2007 and 2006, respectively. The Delivery and Services segment had operating revenues of $2.8 billion and $2.7 billion in 2007 and 2006, respectively. These revenues included revenue from electric sales and unregulated services. There were $1.7 billion and $1.4 billion of intersegment sales and revenues between the Generation and Marketing segment and the Delivery and Services segment in 2007 and 2006, respectively, which have been eliminated in Allegheny’s statement of income. The following table describes the segment’s revenues from electric sales:

| | | | | | |

Revenues (in millions): | | 2007 | | 2006 |

Retail electric: | | | | | | |

Generation | | $ | 1,813.2 | | $ | 1,688.0 |

Transmission | | | 166.0 | | | 160.3 |

Distribution | | | 698.9 | | | 682.8 |

| | | | | | |

Subtotal retail | | $ | 2,678.1 | | $ | 2,531.1 |

| | | | | | |

Transmission services and bulk power | | | 110.1 | | | 150.7 |

Other affiliated and nonaffiliated energy services | | | 41.0 | | | 35.9 |

| | | | | | |

Total Delivery and Services revenues | | $ | 2,829.2 | | $ | 2,717.7 |

| | | | | | |

For more information regarding the Delivery and Services segment’s revenues, see “Management’s Discussion and Analysis of Financial Condition and Operating Results” below and Note 16, “Business Segments,” to the Consolidated Financial Statements.

14

CAPITAL EXPENDITURES

Actual capital expenditures for 2007 and estimated capital expenditures for 2008 and 2009 are shown on a cash basis in the following table. The amounts and timing of capital expenditures are subject to continuing review and adjustment, and actual capital expenditures may vary from these estimates.

| | | | | | | | | |

| | | Actual | | Projected |

(In millions) | | 2007 | | 2008 | | 2009 |

Transmission and distribution facilities: | | | | | | | | | |

TrAIL and related transmission expansion (a) | | $ | 65 | | $ | 255 | | $ | 360 |

PATH Project (b) | | | 0 | | | 45 | | | 165 |

Other transmission and distribution facilities | | | 209 | | | 265 | | | 285 |

Environmental: | | | | | | | | | |

Fort Martin Scrubbers (c) | | | 96 | | | 295 | | | 140 |

Hatfield Scrubbers (d) | | | 288 | | | 340 | | | 80 |

Other | | | 69 | | | 80 | | | 60 |

Other generation facilities | | | 91 | | | 60 | | | 70 |

Other capital expenditures | | | 30 | | | 10 | | | 15 |

| | | | | | | | | |

Total capital expenditures | | $ | 848 | | $ | 1,350 | | $ | 1,175 |

| | | | | | | | | |

AFUDC and capitalized interest included above | | $ | 24 | | $ | 40 | | $ | 15 |

| | | | | | | | | |

| (a) | Includes expenditures for the TrAIL Project, which has a target completion date of 2011 and an estimated cost, excluding AFUDC, of approximately $820 million, as well as expenditures for other related transmission projects requested by PJM. |

| (b) | Reflects total expenditures for the PATH Project to be paid by PATH, LLC, a joint venture with AEP, in the years shown. The PATH Project has a target completion date of 2012. Excluding AFUDC, total project costs of the West Virginia Series, which is owned equally by Allegheny and AEP, are expected to be approximately $1.2 billion, and total project costs of the Allegheny Series, which is owned by Allegheny, are expected to be approximately $0.6 billion. |

| (c) | Construction of the Scrubbers at Allegheny’s Fort Martin generation facility is expected to be completed in 2009 at an estimated cost, excluding AFUDC, of approximately $550 million. |

| (d) | Construction of the Scrubbers at Allegheny’s Hatfield’s Ferry generation facility is expected to be completed in 2009 at an estimated cost, excluding capitalized interest, of approximately $725 million. |

15

ELECTRIC FACILITIES

Generation Capacity

All of Allegheny’s owned or controlled generation capacity is part of the Generation and Marketing segment. In addition, the Distribution Companies are obligated to purchase 479 MWs of power through state utility commission-approved arrangements pursuant to PURPA. This PURPA capacity is part of the Delivery and Services segment, except that, effective January 1, 2007, the PURPA capacity for which Monongahela contracts is part of the Generation and Marketing segment. Allegheny’s generation capacity is more fully described in the tables titled “Nominal Maximum Operational Generation Capacity” and “PURPA Capacity” below.

Nominal Maximum Operational Generation Capacity (MW)

| | | | | | | | | | |

Stations | | Units | | Project

Total | | Regulated | | Unregulated | | Service

Commencement

Dates (b) |

| | | | Monongahela (a) | | AE Supply and Other (a) | |

Coal Fired-Supercritical (Steam): | | | | | | | | | | |

Harrison (Haywood, WV) | | 3 | | 1,983 | | 407 | | 1,576 | | 1972-74 |

Hatfield’s Ferry (Masontown, PA) | | 3 | | 1,710 | | | | 1,710 | | 1969-71 |

Pleasants (Willow Island, WV) | | 2 | | 1,300 | | 100 | | 1,200 | | 1979-80 |

Fort Martin (Maidsville, WV) | | 2 | | 1,107 | | 1,107 | | | | 1967-68 |

| | | | | |

Coal Fired-Other (Steam): | | | | | | | | | | |

Armstrong (Adrian, PA) | | 2 | | 356 | | | | 356 | | 1958-59 |

Albright (Albright, WV) | | 3 | | 292 | | 292 | | | | 1952-54 |

Mitchell (Courtney, PA) | | 1 | | 288 | | | | 288 | | 1963 |

Ohio Valley Electric Corp. (Chelsea, OH) (Madison, IN) (c) | | 11 | | 78 | | 78 | | | | |

Willow Island (Willow Island, WV) | | 2 | | 243 | | 243 | | | | 1949-60 |

Rivesville (Rivesville, WV) | | 2 | | 142 | | 142 | | | | 1943-51 |

R. Paul Smith (Williamsport, MD) | | 2 | | 116 | | | | 116 | | 1947-58 |

| | | | | |

Pumped-Storage and Hydro: | | | | | | | | | | |

Bath County (Warm Springs, VA) (d) | | 6 | | 1,059 | | 437 | | 622 | | 1985; 2001 |

Lake Lynn (Lake Lynn, PA) (e) | | 4 | | 52 | | | | 52 | | 1926 |

Green Valley Hydro (f) | | 21 | | 6 | | | | 6 | | Various |

| | | | | |

Gas-Fired: | | | | | | | | | | |

AE Nos. 3, 4 & 5 (Springdale, PA) | | 3 | | 540 | | | | 540 | | 2003 |

AE Nos. 1 & 2 (Springdale, PA) | | 2 | | 88 | | | | 88 | | 1999 |

AE Nos. 8 & 9 (Gans, PA) | | 2 | | 88 | | | | 88 | | 2000 |

AE Nos. 12 & 13 (Chambersburg, PA) | | 2 | | 88 | | | | 88 | | 2001 |

Buchanan (Oakwood, VA) (g) | | 2 | | 43 | | | | 43 | | 2002 |

Hunlock CT (Hunlock Creek, PA) | | 1 | | 44 | | | | 44 | | 2000 |

| | | | | |

Oil-Fired (Steam): | | | | | | | | | | |

Mitchell (Courtney, PA) | | 1 | | 82 | | | | 82 | | 1949 |

| | | | | | | | | | |

| | | | | |

Total Capacity | | | | 9,705 | | 2,806 | | 6,899 | | |

| | | | | | | | | | |

| (a) | Effective January 1, 2007, Monongahela and AE Supply completed an intra-company transfer of assets (the “Asset Swap”) that realigned generation ownership and contractual obligations within the Allegheny system. See Note 7, “Asset Swap,” to the Consolidated Financial Statements. |

| (b) | When more than one year is listed as a commencement date for a particular generation facility, the dates refer to the years in which operations commenced for the different units at that generation facility. |

16

| (c) | The amount attributed to OVEC represents capacity entitlement through AE’s ownership of OVEC shares. AE holds a 3.5% equity stake in, and is a sponsoring company of, OVEC. OVEC supplies power to its sponsoring companies under an intercompany power agreement. Currently, as a result of AE’s equity interest, Monongahela is entitled to 3.5% of OVEC generation, a portion (66 MWs) of which it has agreed to sell to AE Supply at cost in connection with the Asset Swap. Monongahela will transfer to AE Supply its rights to OVEC generation at such time as AE Supply’s long-term unsecured non-credit enhanced indebtedness has a Standard & Poor’s credit rating of at least BBB- and a Moody’s Investor Services, Inc. credit rating of at least Baa3. |

| (d) | This figure represents capacity entitlement through ownership of AGC. A modernization project has been completed on four of the six generating units at the Bath County facility, and work on the remaining two units is expected to be completed in 2008 and 2009, respectively. Each upgrade results in an increase of approximately 25 MWs to AGC’s capacity entitlement. |

| (e) | AE Supply has a license for Lake Lynn through 2024. |

| (f) | The licenses for hydroelectric facilities Dam No. 4 and Dam No. 5, located in West Virginia and Maryland, will expire in November 2024. The licenses for the Shenandoah, Warren, Luray and Newport projects located in Virginia run through 2024. |

| (g) | Buchanan Energy Company of Virginia, LLC (“Buchanan”) is a subsidiary of AE Supply. CNX Gas Corporation and Buchanan have equal ownership interests in Buchanan Generation LLC (“Buchanan Generation”). AE Supply operates and dispatches 100% of Buchanan Generation’s 86 MWs. |

PURPA Capacity

The following table shows additional generation capacity available to the Distribution Companies through state utility commission-approved arrangements pursuant to PURPA. PURPA requires electric utility companies, such as the Distribution Companies, to interconnect with, provide back-up electric service to and purchase electric capacity and energy from qualifying small power production and cogeneration facilities. The capacity purchases reflected in this table are reflected in the results of the Delivery and Services segment, except that the PURPA generation for which Monongahela contracts is reflected in the results of the Generation and Marketing segment.

| | | | | | | | | | |

| | | PURPA Capacity (MW) | | |

PURPA Stations | | Project

Total | | Monongahela | | Potomac

Edison | | West

Penn | | Contract

Termination

Date |

Coal-Fired: Steam | | | | | | | | | | |

AES Warrior Run (Cumberland, MD) (a) | | 180 | | | | 180 | | | | 2030 |

AES Beaver Valley (Monaca, PA) | | 125 | | | | | | 125 | | 2016 |

Grant Town (Grant Town, WV) | | 80 | | 80 | | | | | | 2036 |

West Virginia University (Morgantown, WV) | | 50 | | 50 | | | | | | 2027 |

| | | | | |

Hydro: | | | | | | | | | | |

Hannibal Lock and Dam (New Martinsville, WV) | | 31 | | 31 | | | | | | 2034 |

Allegheny Lock and Dam 6 (Freeport, PA) | | 7 | | | | | | 7 | | 2034 |

Allegheny Lock and Dam 5 (Freeport, PA) | | 6 | | | | | | 6 | | 2034 |

| | | | | | | | | | |

Total PURPA Capacity | | 479 | | 161 | | 180 | | 138 | | |

| | | | | | | | | | |

| (a) | As required under the terms of a Maryland restructuring settlement, Potomac Edison offers the 180 MW output of the AES Warrior Run project to the wholesale market and will continue to do so for the term of the AES Warrior Run contract, which ends on February 10, 2030. Revenue received from the sale reduces the AES Warrior Run surcharge paid by Maryland customers. |

The Energy Policy Act amended PURPA. Among other things, the amendments provide that electric utilities are no longer required to enter into any new contractual obligation to purchase energy from a qualifying facility if FERC finds that the facility has non-discriminatory access to a functioning wholesale market and open-access transmission. See “Regulatory Framework Affecting Allegheny” below.

17

Transmission and Distribution Facilities

The following table sets forth the existing miles of T&D lines and the number of substations of the Distribution Companies and AGC as of December 31, 2007:

| | | | | | | | | | |

| | | Underground | | Above-

Ground | | Total

Miles | | Total Miles

Consisting of

500-Kilovolt

(kV) Lines | | Number of

Transmission and

Distribution

Substations |

Monongahela | | 835 | | 22,387 | | 23,222 | | 250 | | 276 |

Potomac Edison | | 5,196 | | 18,116 | | 23,312 | | 175 | | 259 |

West Penn | | 2,898 | | 24,236 | | 27,134 | | 277 | | 597 |

AGC (a) | | 0 | | 87 | | 87 | | 87 | | 1 |

| | | | | | | | | | |

Total | | 8,929 | | 64,826 | | 73,755 | | 789 | | 1,133 |

| | | | | | | | | | |

| (a) | Total Bath County transmission lines, of which AGC owns an undivided 40% interest and Virginia Electric and Power Company owns the remainder. |

The Distribution Companies’ transmission network has 12 extra-high-voltage (345 kV and above) and 36 lower-voltage interconnections with neighboring utility systems.

18

19

FUEL, POWER AND RESOURCE SUPPLY

Generation and Marketing Segment

Coal Supply

Allegheny consumed approximately 19 million tons of coal and synthetic fuel in 2007 at an average price of $40.64 per ton delivered. Allegheny purchased these fuels primarily from mines in Pennsylvania, West Virginia and Ohio. However, Allegheny also purchases coal from other regions, and blends coal from the Powder River Basin with eastern bituminous coal at several generation facilities.

Historically, Allegheny has purchased a majority of its coal from a limited number of suppliers. Of Allegheny’s coal purchases in 2007, 65% came from subsidiaries of three companies, the largest of which represented 35% of the total tons purchased.

As of February 27, 2008, Allegheny had commitments for the delivery of more than 95% of the coal that Allegheny expects to consume in 2008. Allegheny also had commitments for the delivery of approximately 60% of its anticipated coal needs for 2009 and 2010 and for approximately 50% of its anticipated coal needs for 2011 and 2012.

Most of Allegheny’s coal purchase agreements contain specified prices and include price adjustment provisions related to changes in specified cost indices, as well as to specific events, such as changes in regulations that affect the coal industry.

Developments and operational factors affecting our coal suppliers, including increased costs, transportation constraints, safety issues and operational difficulties, may have negative effects on coal supplier performance. See “Risk Factors” below.

Natural Gas Supply

AE Supply purchases natural gas to supply its natural gas-fired generation facilities. In 2007, AE Supply purchased its natural gas requirements principally in the spot market.

The Delivery and Services Segment

Electric Power

Allegheny reorganized its corporate structure in response to electric utility deregulation within its service area between 1999 and 2001. The Distribution Companies, with the exception of Monongahela and its West Virginia generation assets, do not produce their own power. Potomac Edison transferred all of its generation assets to AE Supply in 2000. West Penn transferred all of its generation assets to AE Supply in 1999. Monongahela transferred the portion of its generation assets dedicated to its previously-owned Ohio service territory to AE Supply in 2001. The Asset Swap realigned ownership of certain generation facilities between Monongahela and AE Supply, effective as of January 1, 2007. See “Regulatory Framework Affecting Allegheny” below and Note 7, “Asset Swap,” to the Consolidated Financial Statements.

Each of the states in Allegheny’s service territory other than West Virginia has, to some extent, deregulated its electric utility industry. Pennsylvania and Maryland have instituted retail customer choice and are transitioning to market-based, rather than cost-based pricing for generation. Virginia undertook to deregulate the provision of generation services beginning in 1999, but recent legislation in Virginia will result in re-regulation of such services as of January 1, 2009 for all but large customers with load in excess of 5 MW or for any customer wishing to purchase renewable energy. In West Virginia, the rates charged to retail customers are regulated by the West Virginia PSC and are determined through traditional, cost-based, regulated utility rate-making.

20

West Penn has PLR obligations to its customers in Pennsylvania. Potomac Edison has PLR obligations to its customers in Virginia and its residential customers in Maryland. As “providers of last resort,” West Penn and Potomac Edison must supply power to certain retail customers who have not chosen alternative suppliers (or have chosen to return to Allegheny service) at rates that are capped at various levels during the applicable transition period. The transition periods vary across Allegheny’s service area and across customer class. These transition periods could be altered by legislative, judicial or, in some cases, regulatory actions. See “Regulatory Framework Affecting Allegheny” below.

A significant portion of the power necessary to meet the PLR obligations of West Penn and Potomac Edison is purchased from AE Supply. AE Supply is contractually obligated to provide power to West Penn and Potomac Edison during the relevant state deregulation transition periods under the terms of power sales agreements. These power sales agreements include both fixed price and market-based pricing components. These pricing components may not fully reflect the cost of supplying this power. As a result, AE Supply currently absorbs a portion of the risk of fuel price increases and increased costs of environmental compliance. Prior to January 1, 2007, AE Supply also sold power to Potomac Edison to serve customers in Potomac Edison’s West Virginia service territory. In connection with the Asset Swap, Monongahela assumed the obligation to supply power to Potomac Edison to meet its West Virginia load obligations. A portion of Allegheny’s PLR obligations is satisfied by PURPA contract purchases.

When the initial power sales agreements with AE Supply for service to PLR customers during the rate cap periods terminate, Potomac Edison and West Penn will be unable to rely on the previously dedicated supply of power at specified contract prices to meet their respective power supply requirements. The arrangements to serve the applicable PLR obligations following the expiration of these agreements have been partially determined in Maryland but are still under development in Pennsylvania and Virginia for all load, and in Maryland with respect to residential customers. AE Supply’s existing power sales agreements with West Penn and Potomac Edison will expire or have expired as set forth in the chart below.

| | | | | | |

Distribution Company | | Load Type | | State | | Expiration Date of

Power Sale Agreement |

Potomac Edison | | Commercial and Industrial | | Maryland | | December 31, 2004 |

Potomac Edison | | Residential | | Maryland | | December 31, 2008 |

Potomac Edison | | All load | | Virginia | | June 30, 2007 (a) |

West Penn | | All load (b) | | Pennsylvania | | December 31, 2010 |

| (a) | Potomac Edison has procured market based agreements for this load through May 31, 2008. Additional procurements are occurring in the spring of 2008 for service beginning June 1, 2008. |

| (b) | Load served under Tariff 37 was not included in the rate cap extension plan approved by the Pennsylvania PUC in 2005 for service years 2009 and 2010. Consequently, the expiration date of the power sales agreement for that load is December 31, 2008, and a PLR II procurement plan has been filed with the Pennsylvania PUC to procure power supply of service beginning January 1, 2009. |

Monongahela’s Generation and Marketing segment provides the power necessary to meet the obligations of its Delivery and Services segment. Additionally, Monongahela is contractually obligated to provide Potomac Edison with the power necessary to serve its West Virginia load through 2027. To facilitate the economic dispatch of its generation, Monongahela sells the power that it generates from its West Virginia jurisdictional assets into the PJM market and purchases from the PJM market the power necessary to meet its West Virginia jurisdictional customer load and contractual obligations to provide power.

21

REGULATORY FRAMEWORK AFFECTING ALLEGHENY

The interstate transmission services and wholesale power sales of the Distribution Companies, AE Supply and AGC are regulated by FERC under the FPA. The Distribution Companies’ local distribution service and sales at the retail level are subject to state regulation. The statutory and regulatory framework affecting these companies has evolved significantly over the past decade, and these changes have exposed the Distribution Companies to significant new risks and opportunities. In addition, Allegheny’s communications subsidiary, ACC, is subject, to a limited extent, to the jurisdiction of the Federal Communications Commission and state regulatory commissions. Allegheny is subject to numerous other local, state and federal laws, regulations and rules. See “Risk Factors” below.

Federal Regulation and Rate Matters

FERC, Competition and RTOs

FERC is an independent agency within the DOE that regulates the U.S. electric utility industry.

FERC Authority Under the Federal Power Act

FERC regulates the transmission and wholesale sales of electricity under the authority of the FPA. Under the FPA, as amended by the Energy Policy Act, FERC regulates:

| | • | | the rates, terms and conditions of wholesale power sales and transmission services offered by public utilities; |

| | • | | the development, operation and maintenance of hydroelectricity projects; |

| | • | | the interconnection of transmission systems with other electric systems, including generation facilities; |

| | • | | the disposition of public utility property and the merger, acquisition and consolidation of public utility systems; |

| | • | | the issuance of certain securities and assumption of certain liabilities by public utilities; |

| | • | | the system of accounts and methods of depreciation used by public utilities; |

| | • | | the reliability of the transmission grid; |

| | • | | the siting of certain transmission facilities; |

| | • | | the allocation of transmission rights; |

| | • | | the types of incentives available to encourage new transmission investment; |

| | • | | the transparency of power sales prices and market manipulation; |

| | • | | the relationship between holding companies and their public utility affiliates, including cost allocations, affiliate transactions and communications, and the availability of books and records; and |

| | • | | the holding of a director or officer position at more than one public utility or specified company. |

In addition, FERC has the authority under the FPA to resolve complaints initiated on its own motion or by others as well as to conduct investigations. FERC also has the authority to enforce the FPA through the imposition of penalties.

The FPA gives FERC exclusive rate-making jurisdiction over wholesale sales and transmission of electricity in interstate commerce. Entities, such as the Distribution Companies, AE Supply and AGC, that sell electricity at wholesale or own transmission facilities are considered “public utilities” subject to FERC jurisdiction. Public

22

utilities must obtain FERC acceptance for filing of their wholesale rate schedules. Rates for wholesale sales of electricity are determined on a cost-basis, or, if the seller demonstrates that it does not have market power, FERC may grant market-based rate authority, which allows transactions to be priced based on prevailing market conditions. Rates for transmission facilities are determined on a cost basis.

Competition and RTOs

Over the past decade, FERC has taken a number of steps to foster increased competition within the electric industry. Among other things, FERC requires public utilities that own transmission facilities to offer non-discriminatory, open-access transmission services. FERC also has taken steps to encourage utilities to participate in RTOs, such as PJM, by transferring functional control over their transmission assets to RTOs.

In addition, FERC has imposed standards of conduct governing communications between employees conducting transmission functions and employees engaged in wholesale power sale activities. These standards of conduct are intended to prevent transmission-owning utilities from giving their power marketing businesses preferential access to the transmission system and transmission information.

Following FERC’s initiative to promote competition, a number of states, including Pennsylvania, Maryland and Virginia, adopted retail access legislation, which permitted utilities to transfer their generation assets to affiliated companies or third parties. Similar to many other utilities, the Distribution Companies restructured their businesses in Pennsylvania, Maryland and Virginia between 1996 and 2001 to comply with retail restructuring requirements in those states by, among other things, transferring generation assets serving customers in those states to AE Supply.

However, this trend toward restructuring and increased competition for retail markets has slowed in response to events over the past several years. Market-based competition within the wholesale markets is now continuing with greater FERC oversight, and some states have moved away from electricity choice at the retail level by delaying and/or reversing the implementation of retail competition (as in Virginia) or rejecting it outright (as in West Virginia). Further delays, discontinuations or reversals of electricity marketing restructurings in states in which Allegheny operates could have a material adverse effect on its results of operation and financial condition.

All of Allegheny’s generation assets and power supply obligations are located within the PJM market, and PJM maintains functional control over the Distribution Companies’ transmission facilities. PJM operates a competitive wholesale electricity market and coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia. PJM also manages a regional planning process for transmission expansion in an effort to ensure reliability of the electric grid in its region. Changes in the PJM tariff, operating agreement, policies and/or market rules could adversely affect Allegheny’s financial results. These matters include changes involving: the terms, conditions and pricing of transmission services; construction of transmission enhancements; auction of long-term financial transmission rights and the allocation mechanism for the auction revenues; changes in PJM’s Reliability Pricing Model, or “RPM”; changes in the locational marginal pricing mechanism; changes in transmission congestion patterns due to the implementation of PJM’s regional transmission expansion planning protocol or other required transmission system upgrades; generation retirement rules and reliability pricing issues.

Transmission Rate Design. FERC actions with respect to the transmission rate design within PJM may impact the Distribution Companies. Beginning in July 2003, FERC issued a series of orders related to transmission rate design for the PJM and Midwest Independent Transmission System Operator (“MISO”) regions. Specifically, FERC ordered the elimination of multiple and additive (i.e., “pancaked”) rates and called for the implementation of a long-term rate design for these regions. In November 2004, FERC rejected long-term regional rate proposals from the Distribution Companies and others. FERC concluded that neither the rate design

23

proposals nor the existing PJM rate design had been shown to be just and reasonable. However, FERC ordered the continuation of the existing PJM rate design and the implementation of a transition charge for these regions through March 31, 2006 through filings made by transmission owners in both regions. In February 2005, FERC accepted these transition charges, effective December 1, 2004, subject to an evidentiary hearing. FERC’s February 2005 order remains subject to multiple rehearing requests and, potentially, appellate review. Allegheny cannot predict the outcome of these proceedings or whether they will have a material impact on its business or financial position.

During the now-expired transition period, the Distribution Companies were both payers and payees of transition charges. These charges resulted in the payment by the Distribution Companies of $13.7 million, and payments to the Distribution Companies of $3.5 million, for the 16-month period ended March 31, 2006. Following the evidentiary hearing, on August 10, 2006, an administrative law judge issued an initial decision that generally found fault with the methodologies used to develop the transition charges. That decision is now subject to review by FERC. The order that will be issued by FERC on review of the initial decision may require the Distribution Companies to refund some portion of the amounts received from these transition charges or entitle the Distribution Companies to receive additional revenue from these charges. In addition, the Distribution Companies may be required to pay additional amounts as a result of increases in the transition charges previously billed to them, or they may receive refunds of transition charges previously billed. Allegheny cannot predict the outcome of these proceedings. The Distribution Companies have entered into nine partial settlements with regard to the transition charges, and may enter into additional settlements in the future. FERC has approved four of these settlements, and approval is pending for the remaining partial settlements.

In a May 2005 order, FERC again determined that the existing PJM rate design may not be just and reasonable. On September 30, 2005, the Distribution Companies, together with another PJM transmission owner, filed a proposed rate design with FERC to replace the existing rate design within PJM, effective April 1, 2006. Two other PJM transmission owners also filed a separate proposed rate design. A hearing was held in April 2006 to determine whether the rate design is unjust and unreasonable and whether it should be replaced by either of the proposed rate designs. On July 13, 2006, the administrative law judge issued an initial decision, finding that the existing PJM rate design for existing transmission facilities is not just and reasonable. The administrative law judge found that the rate design for existing transmission facilities proposed by the Distribution Companies is just and reasonable, but ruled that the rate design proposed by FERC staff is also just and reasonable, is superior and should be made effective as of April 1, 2006. The initial decision also found that the Distribution Companies’ proposal for rate recovery for new transmission facilities had not demonstrated that the existing rate recovery mechanism for such facilities is unjust and unreasonable but adopted the Distribution Companies’ position that the implementation of a new rate design does not necessitate a change in the allocation of auction revenue rights and financial transmission rights. On April 19, 2007, FERC issued an order on the initial decision that (a) retained the current license plate rate design for existing facilities, (b) requires that the parties develop a detailed “beneficiary pays” methodology for new facilities below 500 kV that would be set forth in the PJM tariff, and (c) allocates on a region-wide basis the costs of new, centrally-planned facilities that operate at or above 500 kV. The Distribution Companies participated as settling parties in a settlement currently pending before FERC with regard to the “beneficiary pays” methodology. If approved, the settlement will continue the application of intra-zonal netting and distribution factors for the determination of cost allocations for new facilities below 500 kV. On January 31, 2008, FERC denied requests for rehearing of its April 19, 2007 order on the initial decision.

On August 1, 2007, the Distribution Companies joined in a filing with other PJM and MISO transmission owners proposing a rate design for transmission transactions crossing the border between PJM and MISO. The proposal provides that customers will pay the rates applicable in the transmission zone where such transmission transactions end. Several parties filed protests of the proposal. On January 31, 2008, FERC rejected the protests and accepted the proposal as filed. FERC’s January 2008 decision is currently pending on appeal to the U.S. Court of Appeals.

24

On September 17, 2007, AEP filed a complaint with FERC against MISO and PJM alleging that the rate designs underlying the MISO and PJM open access transmission tariffs are unjust, unreasonable and unduly discriminatory and, therefore, must be revised. AEP requested that FERC establish a refund-effective date of October 1, 2007 with respect to any such revisions. The Distribution Companies intervened in this proceeding, and on January 31, 2008, FERC denied AEP’s request.

Wholesale Markets.In August 2005, PJM filed at FERC to replace its capacity market with a new Reliability Pricing Model , or “RPM,” to address reliability concerns. On April 20, 2006, FERC issued an initial order that found PJM’s capacity market to be unjust and unreasonable and set a process to resolve features of the RPM that needed to be analyzed further before it could determine whether the RPM is a just and reasonable capacity market process. FERC ordered the implementation of settlement procedures in this proceeding, and AE Supply and the Distribution Companies participated in a settlement agreement that was filed with the FERC on September 29, 2006. The settlement agreement created a locational capacity market in PJM, in which PJM procures needed capacity resources through auctions held three years in advance at prices and in quantities determined by an administratively established demand curve. Under the settlement agreement, capacity needs in PJM are met either through purchases made in the proposed auctions or though commitments by load serving entities (“LSEs”) to self-supply their capacity needs. On December 22, 2006, FERC conditionally approved the settlement agreement, the implementation of which began with the 2007-2008 PJM planning year. Capacity auctions were held in April, July and October of 2007 and in January 2008, and an additional auction is expected to be conducted in May 2008. On June 25, 2007 and again on November 11, 2007, FERC issued orders denying pending requests for rehearing of the December 22, 2006 order and affirming its acceptance of the RPM settlement agreement. Several parties have appealed FERC’s orders approving the RPM settlement, and those appeals are currently pending at the United States Court of Appeals for the District of Columbia Circuit and the United States Court of Appeals for the Third Circuit.

On July 3, 2006, PJM filed at FERC a proposal to implement a process for allocating long-term transmission rights (“LTTRs”). The PJM proposal would allocate a ten-year financial transmission right to PJM LSEs based on each LSE’s zonal base load. The PJM proposal created a link between PJM’s long-term transmission planning process and the LTTR allocation process to ensure that the transmission system is being upgraded as necessary to maintain the availability of the LTTRs that PJM will allocate. On November 22, 2006, FERC issued an order accepting PJM’s proposal, subject to modifications. On January 22, 2007, PJM filed a related settlement agreement, as well as a proposal to allocate any costs to fund LTTRs fully to holders of financial transmission rights on a pro-rata basis. FERC accepted this settlement agreement and related cost allocation proposal in an order issued on May 17, 2007. On October 22, 2007, FERC denied requests for rehearing of the May 17, 2007 order. FERC has also ordered the creation of a stakeholder process to determine whether the PJM proposed full funding mechanism that was accepted by FERC should be changed subsequent to the 2007-2008 PJM planning year. AE Supply and the Distribution Companies are participating in this stakeholder process.

Transmission Expansion

TrAIL Project.In June 2006, the PJM Board of Managers approved a Regional Transmission Expansion Plan (“RTEP”) that directed the Distribution Companies and Virginia Electric and Power Company to cause the construction of a 240-mile 500 kV transmission line project from southwestern Pennsylvania through northern West Virginia and into northern Virginia to address potential electric reliability issues caused by increased customer load in the mid-Atlantic area that could have adverse effects within the service territories of the Distribution Companies. Approximately 210 miles of the project are located in the Distribution Companies’ PJM zone. In October 2006, Allegheny formed TrAIL Company as the entity responsible for financing, constructing, owning, operating and maintaining this project, which has been named “Trans-Allegheny Interstate Line” and is referred to as “TrAIL.” The project includes the construction of approximately 51 miles of 500 kV and 138 kV lines in southwestern Pennsylvania to address electric reliability issues in that area. Total project costs are expected to be approximately $820 million.

25

On July 20, 2006, FERC approved incentive rate treatments for TrAIL. On February 21, 2007, TrAIL Company submitted to FERC a filing under Section 205 of the FPA to implement a formula tariff rate, with a proposed effective date of June 1, 2007, that includes the incentive rate treatments approved by FERC. On May 31, 2007, FERC issued an order permitting the formula tariff rate to become effective on June 1, 2007, subject to refund and hearing on specifically identified issues. One of the issues set for hearing is the level of the incentive return on equity for TrAIL. On January 24, 2008, TrAIL Company filed a motion to suspend the procedural schedule in this case and indicated that a settlement in principle had been reached.

PATH Project.On June 22, 2007, the PJM Board of Managers authorized the construction of a 290-mile, high-voltage transmission line, named the Potomac-Appalachian Transmission Highline, or “PATH.” The project will include approximately 244 miles of 765 kV transmission line from AEP’s substation near St. Albans, West Virginia to Allegheny’s Bedington substation near Martinsburg, West Virginia, and will also include approximately 46 miles of twin-circuit 500 kV lines from Bedington to a new substation to be built and owned by Allegheny near Kemptown, Maryland. On September 1, 2007, Allegheny entered into a joint venture agreement with a subsidiary of AEP to build PATH. Total project costs are expected to be approximately $1.8 billion, of which Allegheny’s share is expected to be approximately $1.2 billion.

On December 28, 2007, PATH, LLC submitted a filing to FERC under Section 205 of the FPA to implement a formula tariff rate to be effective March 1, 2008. The filing also included a request for certain incentive rate treatments.

National Interest Electric Transmission Corridor.The Energy Policy Act amended the FPA to, among other things, direct the Secretary of Energy to conduct a nationwide study of electric transmission congestion by August 2006 and to update the study every three years thereafter. Based on its congestion study and other relevant factors, the Secretary may designate any geographic area experiencing electric energy transmission capacity constraints or congestion that adversely affects customers a national interest transmission corridor (“NIETC”). Within a NIETC, transmission proposals could potentially be reviewed by FERC, which would have siting authority supplementing existing state authority and may consider whether to issue a permit and authorize construction of a proposed transmission project within the NIETC in the event that the relevant state authorities do not approve siting of the project within the NIETC. Under certain circumstances, a federal permit could empower the permit holder to exercise the right of eminent domain to acquire necessary property rights to construct the proposed transmission project.

On August 8, 2006, the DOE published its initial congestion study in which a portion of the Mid-Atlantic region was classified as a “critical congestion area” meriting further federal attention. On October 2, 2007, the DOE issued a NIETC designation for the Mid-Atlantic corridor that includes the areas where TrAIL and PATH are proposed to be sited. Several requests for rehearing of the DOE’s October 2, 2007 NIETC designation have been filed and are pending before the DOE. In addition, several entities, including the Pennsylvania PUC, have initiated various proceedings in the federal courts challenging the NIETC designations and the FERC rules promulgated for siting transmission lines within a NIETC. The Distribution Companies and TrAIL Company have intervened in the proceeding that challenges the FERC rules.

PURPA

The Energy Policy Act amended PURPA significantly. Most notably, electric utilities are no longer required to enter into new contract obligations to purchase energy from a qualifying facility if FERC finds that the facility has non-discriminatory access to a functioning wholesale market and open access transmission. In February 2006, FERC finalized regulations that eliminate ownership restrictions for both new and existing facilities. A qualifying facility may now be owned by a traditional utility. This rule also seeks to ensure that the thermal output of cogeneration facilities is used in a productive and beneficial manner.

The Distribution Companies have committed to purchase 479 MWs of qualifying PURPA capacity. In 2007, PURPA capacity and energy purchases pursuant to these contracts totaled approximately $224.5 million. The

26

average cost to the Distribution Companies of these power purchases was 5.9 cents/kWh. The Distribution Companies are currently authorized to recover substantially all of these costs in their retail rates. The Distribution Companies’ obligations to purchase power from qualified PURPA projects in the future may exceed amounts they are authorized to recover from their customers, which could result in losses related to the PURPA contracts.

State Rate Regulation

Allegheny’s business has been significantly influenced by state and federal deregulation initiatives, including the implementation of retail choice and plans to transition from cost-based to market-based rates, as well as by the development of wholesale electricity markets and RTOs, particularly PJM.

Each of the states in Allegheny’s service territory other than West Virginia has, to some extent, deregulated its electric utility industry. Pennsylvania and Maryland have instituted retail customer choice and are transitioning to market-based, rather than cost-based pricing for generation. Virginia undertook to deregulate the provision of generation services beginning in 1999, but recent legislation in Virginia will result in re-regulation of such services as of January 1, 2009 for all but large customers with load in excess of 5 MW or for any customer wishing to purchase renewable energy. In West Virginia, the rates charged to retail customers are regulated by the West Virginia PSC and are determined through traditional, cost-based, regulated utility rate-making.

West Penn has PLR obligations to its customers in Pennsylvania. Potomac Edison has PLR obligations to its customers in Virginia and its residential customers in Maryland. As “providers of last resort,” West Penn and Potomac Edison must supply power to certain retail customers who have not chosen alternative suppliers (or have chosen to return to Allegheny service) at rates that are capped at various levels during the applicable transition period. The transition periods vary across Allegheny’s service area and across customer class. These transition periods could be altered by legislative, judicial or, in some cases, regulatory actions.

Pennsylvania

Pennsylvania’s Electricity Generation Customer Choice and Competition Act (the “Customer Choice Act”), which was enacted in 1996, gave all retail electricity customers in Pennsylvania the right to choose their electricity generation supplier as of January 2, 2000. Under the Customer Choice Act and a subsequent restructuring settlement approved by the Pennsylvania PUC (the “1998 Restructuring Settlement”), West Penn transferred its generation assets to AE Supply. West Penn retained its T&D assets. Under the 1998 Restructuring Settlement, West Penn is the PLR for those customers who do not choose an alternate supplier, whose alternate supplier does not deliver, or who have chosen to return to West Penn service, in each case at rates that are capped at various levels during the applicable transition period, which under the original 1998 Restructuring Settlement extended through December 31, 2008. West Penn’s T&D assets are subject to traditional regulated utility ratemaking (i.e., cost-based rates).

Joint Petition and Extension of Generation Rate Caps