UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended October 31, 2010

| o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 000-25043

| FIRST REAL ESTATE INVESTMENT TRUST OF NEW JERSEY |

(Exact name of registrant as specified in its charter) |

| New Jersey | | 22-1697095 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 505 Main Street, Hackensack, New Jersey | | 07601 |

| (Address of principal executive offices) | | (Zip Code) |

201-488-6400

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | | Name of each exchange on which registered |

| None | | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

Shares of Beneficial Interest

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer o | Accelerated Filer x | Non-Accelerated Filer o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s shares of beneficial interest held by non-affiliates was approximately $79 million. Computation is based on the closing sales price of such shares as quoted on the over-the-counter-market on April 30, 2010, the last business day of the registrant’s most recently completed second quarter.

As of January 14, 2011, the number of shares of beneficial interest outstanding was 6,942,143

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the Registrant’s 2011 Annual Meeting of Shareholders to be held on April 6, 2011 are incorporated by reference in Part III of this Annual Report.

TABLE OF CONTENTS

FORM 10-K

| PART I | | | Page No. |

| | Item 1 | Business | 3 |

| | Item 1A | Risk Factors | 10 |

| | Item 1B | Unresolved Staff Comments | 13 |

| | Item 2 | Properties | 13 |

| | Item 3 | Legal Proceedings | 16 |

| | Item 4 | (Removed and Reserved) | 16 |

| | | | |

| PART II | | | |

| | Item 5 | Market for FREIT’s Common Equity, Related Security Holder Matters and Issuer Purchases of Equity Securities | 16 |

| | Item 6 | Selected Financial Data | 18 |

| | Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| | Item 7A | Quantitative and Qualitative Disclosures About Market Risk | 33 |

| | Item 8 | Financial Statements and Supplementary Data | 33 |

| | Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 33 |

| | Item 9A | Controls and Procedures | 33 |

| | Item 9B | Other Information | 33 |

| | | | |

| | | | |

PART III | Item 10 | Directors, Executive Officers and Corporate Governance | 35 |

| | Item 11 | Executive Compensation | 35 |

| | Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| | Item 13 | Certain Relationships and Related Transactions, and Director Independence | 35 |

| | Item 14 | Principal Accountant Fees and Services | 35 |

| | | | |

| | | | |

PART IV | Item 15 | Exhibits, Financial Statement Schedules | 36 |

| | | | |

| | | | |

FORWARD-LOOKING STATEMENTS

Certain information included in this Annual Report contains or may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The registrant cautions readers that forward-looking statements, including, without limitation, those relating to the registrant’s investment policies and objectives; the financial performance of the registrant; the ability of the registrant to borrow and service its debt; the economic and competitive conditions which affect the registrant’s business; the ability of the registrant to obtain the necessary governmental approvals for the development, expansion or renovation of its properties, the impact of environmental conditions affecting the registrant’s properties, and the registrant’s liquidity and capital resources, are subject to certain risks and uncertainties. Actual results or outcomes may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors, including, without limitation, the registrant’s future financial performance; the availability of capital; general market conditions; national and local economic conditions, particularly long-term interest rates; federal, state and local governmental regulations that affect the registrant; and the competitive environment in which the registrant operates, including, the availability of retail space and residential apartment units in the areas where the registrant’s properties are located. In addition, the registrant’s continued qualification as a real estate investment trust involves the application of highly technical and complex rules of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). The forward-looking statements are made as of the date of this Annual Report and the registrant assumes no obligation to update the forward-looking statements or to update the reasons actual results could differ from those projected in such forward-looking statements.

PART I

First Real Estate Investment Trust of New Jersey (“FREIT”) is an equity real estate investment trust (“REIT”) organized in New Jersey in 1961. FREIT acquires, develops, constructs and holds real estate properties for long-term investment and not for resale.

FREIT’s long-range investment policy is to review and evaluate potential real estate investment opportunities for acquisition that it believes will (i) complement its existing investment portfolio, (ii) generate increased income and distributions to its shareholders, and (iii) increase the overall value of FREIT’s portfolio. FREIT’s investments may take the form of wholly-owned fee interests, or if the circumstances warrant diversification of risk, ownership on a joint venture basis with other parties, including employees and affiliates of Hekemian & Co., Inc., FREIT’s managing agent (“Hekemian”) (See “Management Agreement”), provided FREIT is able to maintain management control over the property. While our general investment policy is to hold and maintain properties long-term, we may , from time-to-time, sell or trade certain properties in order to (i) obtain capital to be used to purchase, develop or renovate other properties which we believe will provide a higher rate of return and increase the value of our investment portfolio, and (ii) divest properties which we have determined or determine are no longer compatible with our growth strategies and investment objectives for our real estate portfolio.

FREIT Website

All of FREIT’s Securities and Exchange Commission filings for the past three years are available free of charge on FREIT’s website, which can be accessed at http://www.FREITNJ.com.

Fiscal Year 2010 Developments

| | (a) | We are in the process of expanding and rebuilding the Damascus Shopping Center, located in Damascus, Maryland (the “Damascus Center”) and owned by Damascus Centre, LLC, a 70% owned affiliate of FREIT. The total capital required for this project is estimated at $22.7 million. On February 12, 2008, Damascus Centre, LLC closed on a $27.3 million construction loan that is available to fund already expended and future construction costs. As a result of a reevaluation of the future funding needs for this project, on May 6, 2010, Damascus Centre, LLC reduced the amount of the construction loan facility to $21.3 million. As of October 31, 2010, Damascus Centre, LLC drew down $10.0 million of this loan to cover construction costs. In addition to the $21.3 million construction loan obtained by Damascus Centre, LLC, FREIT has elected to fund, on a selective basis, construction costs for the redevelopment projec t at the Damascus Center, at the prevailing interest rate for similar loans. |

| | (b) | The $22.5 million mortgage loan entered into by Grande Rotunda, LLC for the acquisition of the Rotunda was scheduled to come due on July 19, 2009, and was extended by the bank until February 1, 2010. On February 1, 2010, a principal payment of $3 million was made reducing the original loan amount of $22.5 million to $19.5 million and the due date was extended until February 1, 2013. As part of the terms of the loan extension agreement, the loan is further collateralized by a first mortgage lien and the assignment of the ground lease on FREIT’s Rochelle Park, NJ land parcel. Under the restructured terms, the interest rate is now 350 basis points above the BBA LIBOR rate with a floor of 4%, and monthly principal payments of $10,000 are required. An additional principal payment may be required on February 1, 2012 in an amount necessary to reduce the loan to achieve a stipulated debt service coverage ratio. Un der the agreement with the equity owners of Grande Rotunda, LLC, FREIT would be responsible for 60% of any cash required by Grande Rotunda, LLC, and 40% would be the responsibility of the minority interest. (See Notes 4 and 6 to FREIT’s consolidated financial statements.) |

| | (c) | FREIT has an $18 million line of credit provided by the Provident Bank. The line of credit is for a two year term ending in January 2012, but can be cancelled by the bank, at its will, within 60 days before or after each anniversary date. The credit line will automatically be extended at the termination date of the current term and each subsequent term for an additional period of 24 months, provided there is no default and the credit line has not been cancelled. Draws against the credit line can be used for general corporate purposes, for property acquisitions, construction activities, and letters of credit. Draws against the credit line are secured by mortgages on FREIT’s Franklin Crossing Shopping Center, Franklin Lakes, NJ, retail space in Glen Rock, NJ, Palisades Manor Apartments, Palisades Park, NJ, and Grandview Apartments, Hasbrouck Heights, NJ. Interest rates on draws will be set at the time of eac h draw for 30, 60, or 90-day periods, based on our choice of the prime rate or at 175 basis points over the 30, 60, or 90-day LIBOR rates at the time of the draws. The interest rate on the line of credit has a floor of 4%. As of October 31, 2010, $18 million was available under the line of credit, and no amount is outstanding. |

| (ii) | CONSTRUCTION A modernization and expansion is underway at the Damascus Center. Total construction costs, inclusive of tenant improvement costs, are expected to approximate $22.7 million. The building plans incorporate an expansion of retail space from its current configuration of approximately 140,000 sq. ft. to approximately 150,000 sq. ft., anchored by a modern 58,000 sq. ft. Safeway supermarket. Construction on Phase I began in June 2007, and was completed in June 2008. Phase I construction costs were approximately $6.2 million, of which $1.1 million related to tenant improvements. Phase II, which comprises a new 58,000 sq. ft. Safeway supermarket, was started in December 2008. The new Safeway supermarket was completed and the tenant opened for business in September 2009. Construction and other costs for Phase II approximated $9.8 million. The Phase III construction is expected to begin during the second quarter of 2011, with total construction costs for Phase III expected to approximate $6.7 million. Total construction costs were to be funded from a $27.3 million construction loan entered into by Damascus Centre, LLC on February 12, 2008. As a result of a reevaluation of the future funding needs for this project, on May 6, 2010, Damascus Centre, LLC reduced the amount of the construction loan facility to $21.3 million. The construction loan is secured by the Damascus Center. This loan will be drawn upon as needed to fund already expended and future construction costs at the Damascus Center. Because of this expansion, leases for certain tenants have been allowed to expire and have not been renewed. This has caused occupancy to decline, on a temporary basis, during the construction phase. However, with the completion of the Phase I and Phase II (Safeway) construction, certain tenant leases have been renewed and occupancy is beginning to increase. Redevelopment plans and studies for the phased expansion and renovation of the Rotunda, have been prepared. The Rotunda, on an 11.5-acre site, currently consists of an office building containing 138,000 sq. ft. of office space and 78,000 sq. ft. of retail space on the lower floor of the main building. The building plans incorporate an expansion of approximately 180,500 sq. ft. of retail space, approximately 302 residential rental apartments, 56 condominium units and 120 hotel rooms, and structured parking. Development costs for this project are expected to approximate $200 million. As of October 31, 2010, the Company has incurred approximately $7.5 million of such costs, which are included in Construction in Progress (“CIP”) on the Consolidated Balance Sheet. City Planning Board approval has been received. & #160;Due to the difficult economic environment, that redevelopment activity was placed on hold by FREIT during the fourth quarter of Fiscal 2008. The delay notwithstanding, at this time, FREIT currently intends, upon improvement in the economic and financing climate, to resume the redevelopment of the Rotunda as planned. To that end, FREIT has had, from time to time, ongoing discussions with potential sources of financing and potential major national and local tenants. |

(iii) PLANNED DISPOSITION

| | On July 7, 2010, FREIT’s Board of Trustees (the “Board”) authorized management to pursue a sale of the Westridge Square Shopping Center located in Frederick, Maryland. The decision to sell the property (acquired in 1992) was based on the Board’s desire to re-deploy the net proceeds or other consideration arising from the sale to real estate assets in other areas of FREIT’s operations. It is the intention of the Board to structure the sale as a like-kind exchange (Code Sec.1031), in order to defer the income taxes on the expected gain. The property is being actively marketed for sale, however, due to current conditions in the commercial real estate market, it is not possible for management to estimate when a sale of the property will occur. |

(b) | Financial Information about Segments |

FREIT has two reportable segments: Commercial Properties and Residential Properties. These reportable segments have different types of tenants and are managed separately because each requires different operating strategies and management expertise. Segment information for the three years ended October 31, 2010 is included in Note 11, “Segment Information” to FREIT’s consolidated financial statements.

(c) | Narrative Description of Business |

FREIT was founded and organized for the principal purpose of acquiring, developing, and owning a portfolio of diverse income producing real estate properties. FREIT’s developed properties include residential apartment communities and commercial properties that consist of multi and single tenanted properties. Our properties are located in New Jersey, Maryland and on Long Island, NY. We also currently own approximately 40.37 acres of unimproved land in New Jersey. See “Item 2 Properties - Portfolio of Investments.”

FREIT elected to be taxed as a REIT under the Internal Revenue Code. FREIT operates in such a manner as to qualify for taxation as a REIT in order to take advantage of certain favorable tax aspects of the REIT structure. Generally, a REIT will not be subject to federal income taxes on that portion of its ordinary income or capital gain that is currently distributed to its equity holders.

As an equity REIT, we generally acquire interests in income producing properties to be held as long-term investments. FREIT’s return on such investments is based on the income generated by such properties mainly in the form of rents.

From time to time, FREIT has sold, and may sell again in the future, certain of its properties in order to (i) obtain capital used or to be used to purchase, develop or renovate other properties which we believe will provide a higher rate of return and increase the value of our investment portfolio, and (ii) divest properties which FREIT has determined or determines are no longer compatible with our growth strategies and investment objectives for our real estate portfolio.

We do not hold any patents, trademarks, or licenses.

Portfolio of Real Estate Investments

At October 31, 2010, FREIT’s real estate holdings included (i) nine (9) apartment buildings or complexes containing 1,075 rentable units, (ii) ten (10) commercial properties (retail and office) containing approximately 1,265,000 square feet of leasable space, including one (1) single tenant store, two (2) separate one acre parcels subject to ground leases, and (iii) four (4) parcels of undeveloped land consisting of approximately 40.37 acres. FREIT and its subsidiaries own all such properties in fee simple. See “Item 2 Properties - Portfolio of Investments” of this Annual Report for a description of FREIT’s separate investment properties and certain other pertinent information with respect to such properties that is relevant to FREIT’s business.

Investment in Subsidiaries

The consolidated financial statements (See Note 1 to the Consolidated Financial Statements included in this Form 10-K) include the accounts of the following subsidiaries of FREIT:

Westwood Hills, LLC (“Westwood Hills”): FREIT owns a 40% membership interest in Westwood Hills, which owns and operates a 210-unit residential apartment complex in Westwood, NJ.

Wayne PSC, LLC (“WaynePSC”): FREIT owns a 40% membership interest in Wayne PSC, which owns a 322,000 sq. ft. community center in Wayne, NJ.

S And A Commercial Associates Limited Partnership (“S And A”): S And A owns a 100% interest in Pierre Towers, LLC, which owns a 269-unit residential apartment complex in Hackensack, NJ. FREIT owns a 65% partnership interest in S And A.

Grande Rotunda, LLC: FREIT owns a 60% membership interest in Grande Rotunda, which owns a 217,000 square foot mixed use property in Baltimore, MD.

Damascus Centre, LLC: FREIT owns a 70% membership interest in Damascus Centre, which owns the Damascus Center that is currently being renovated and expanded. (See Item 1-a(ii) Construction.)

Damascus Second, LLC: FREIT owns a 70% interest in Damascus Second, LLC, which assumed a $21.3 million (originally $27.3 million) construction loan from Bank of America for the purpose of assisting Damascus Centre, LLC in owning, operating, managing and, as required, repairing the land and premises of the Damascus Center.

WestFREIT Corp: FREIT owns a 100% membership interest in WestFREIT, which owns the Westridge Square Shopping Center, a 257,000 square foot shopping center in Frederick, MD.

WestFredic LLC: FREIT owns a 100% membership interest in WestFredic, which assumed a $22 million mortgage loan that is secured by the Westridge Square Shopping Center in Frederick, MD.

On October 31, 2010 FREIT and its subsidiaries had twenty-two (22) full-time employees and seven (7) part-time employees who work solely at the properties owned by FREIT or its subsidiaries. The number of part-time employees varies seasonally.

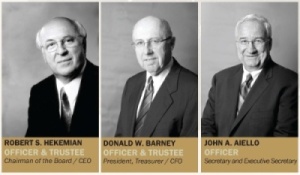

Mr. Robert S. Hekemian, Chairman of the Board and Chief Executive Officer, Mr. Donald W. Barney, President, Treasurer and Chief Financial Officer, and Mr. John A. Aiello, Esq., Secretary and Executive Secretary, are the executive officers of FREIT. Mr. Hekemian devotes approximately seventy percent (70%) of his business activities to FREIT, Mr. Barney devotes approximately fifteen percent (15%) of his business activities to FREIT, and Mr. Aiello devotes approximately six percent (6%) of his business activities to FREIT. Refer to “Item 10 – Directors, Executive Officers and Corporate Governance.” Hekemian has been retained by FREIT to manage FREIT’s properties and is responsible for recruiting, on behalf of FREIT, the personnel required to perform all services related to the operation of FREIT’s properties. See “Management Agreement.”

Management Agreement

On April 10, 2002, FREIT and Hekemian executed a Management Agreement whereby Hekemian would continue as Managing Agent for FREIT. The term of the Management Agreement currently runs until October 31, 2011 and shall be automatically renewed for periods of two years unless either party gives not less than six (6) months prior notice to the other of non-renewal. The salient provisions of the Management Agreement are as follows: FREIT retains Hekemian as the exclusive management and leasing agent for properties which FREIT owned as of April 2002 and for the Preakness Shopping Center acquired on November 1, 2002 by WaynePSC. However, FREIT may retain other managing agents to manage certain other properties acquired after April 10, 2002 and to perform various other duties such as sales, acquisitions, and development with respect to any or a ll properties. Hekemian does not serve as the exclusive advisor for FREIT to locate and recommend to FREIT investments, which Hekemian deems suitable for FREIT, and is not required to offer potential acquisition properties exclusively to FREIT before acquiring those properties for its own account. The Management Agreement includes a detailed schedule of fees for those services, which Hekemian may be called upon to perform. The Management Agreement provides for a termination fee in the event of a termination or non-renewal of the Management Agreement under certain circumstances.

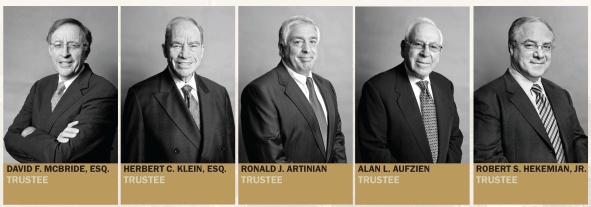

Pursuant to the terms of the Management Agreement, FREIT pays Hekemian certain fees and commissions as compensation for its services. From time to time, FREIT engages Hekemian to provide certain additional services, such as consulting services related to development and financing activities of FREIT. Separate fee arrangements are negotiated between Hekemian and FREIT or its affiliates, with respect to such additional services. During the 4th quarter of Fiscal 2007, FREIT’s Board of Trustees approved, in general, development fee arrangements for the development services to be performed at the Rotunda (owned by Grande Rotunda, LLC), the Damascus Center (owned by Damascus Centre, LLC), and the South Brunswick project. These fees will be payable to Hekemian Development Resources LLC (“Resources”), a wholly owned affiliate of Hekemian. Definitive agreements for the development services to be performed at the Rotunda and the Damascus Center have been executed. The development fee arrangement for the Rotunda provides for Resources to receive a fee equal to 6.375% of the total development costs of up to $136 million (as may be modified), and the fee for the redevelopment of the Damascus Center to be equal to 7% of the redevelopment costs of up to approximately $17.3 million (as may be modified). The minority ownership interests of Grande Rotunda, LLC and Damascus Centre, LLC are owned by Rotunda 100, LLC and Damascus 100, LLC, which are principally owned by employees of Hekemian, including certain members of the immediate family of Robert S. Hekemian, FREIT’s CEO and Chairman, and Robert S. Hekemian, Jr., a trustee of FREIT, and the members of the Hekemian family have majority management control of these entities. In connection with t he development activities at South Brunswick, the fees with respect to this project are 7% of development costs of up to $21,000,000 (as may be modified). A definitive contract regarding the specific services to be provided at the South Brunswick project has not yet been finalized and approved. See Note 6 to FREIT’s consolidated financial statements.

Mr. Robert S. Hekemian, Chairman of the Board, Chief Executive Officer and a Trustee of FREIT, is the Chairman of the Board and Chief Executive Officer of Hekemian. Mr. Hekemian owns approximately 0.2% of all of the issued and outstanding shares of Hekemian. Mr. Robert S. Hekemian, Jr, a Trustee of FREIT, is the President of Hekemian, and owns approximately 33.3% of all of the issued and outstanding shares of Hekemian.

Real Estate Financing

FREIT funds acquisition opportunities and the development of its real estate properties largely through debt financing, including mortgage loans against certain of its properties. At October 31, 2010, FREIT’s aggregate outstanding mortgage debt was $204.6 million with an average interest cost on a weighted average basis of 5.38%. FREIT has mortgage loans against certain properties, which serve as collateral for such loans. See the tables in “Item 2 Properties - Portfolio of Investments” for the outstanding mortgage balances at October 31, 2010 with respect to each of these properties.

FREIT is currently highly leveraged and will continue to be for the foreseeable future. This increased level of indebtedness also presents an increased risk of default on the obligations of FREIT and an increase in debt service requirements that could adversely affect the financial condition and results of operations of FREIT. A number of FREIT’s mortgage loans are being amortized over a period that is longer than the terms of such loans; thereby requiring balloon payments at the expiration of the terms of such loans. FREIT has not established a cash reserve sinking fund with respect to such obligations and at this time does not expect to have sufficient funds from operations to make such balloon payments when due under the terms of such loans. See “Liquidity and Capital Resources” under Item 7.

FREIT is subject to the normal risks associated with debt financing, including the risk that FREIT’s cash flow will be insufficient to meet required payments of principal and interest; the risk that indebtedness on its properties will not be able to be renewed, repaid or refinanced when due; or that the terms of any renewal or refinancing will not be as favorable as the terms of the indebtedness being replaced. If FREIT were unable to refinance its indebtedness on acceptable terms, or at all, FREIT might be forced to dispose of one or more of its properties on disadvantageous terms which might result in losses to FREIT. These losses could have a material adverse effect on FREIT and its ability to make distributions to shareholders and to pay amounts due on its debt. If a property is mortgaged to secure payment of indebtednes s and FREIT is unable to meet mortgage payments, the mortgagee could foreclose upon the property, appoint a receiver and receive an assignment of rents and leases or pursue other remedies, all with a consequent loss of revenues and asset value to FREIT. Further, payment obligations on FREIT’s mortgage loans will not be reduced if there is a decline in the economic performance of any of FREIT’s properties. If any such decline in economic performance occurs, FREIT’s revenues, earnings, and funds available for distribution to shareholders would be adversely affected.

Neither FREIT’s Declaration of Trust nor any policy statement formally adopted by FREIT’s Board of Trustees limits either the total amount of indebtedness or the specified percentage of indebtedness (based on the total capitalization of FREIT), which may be incurred by FREIT. Accordingly, FREIT may incur in the future additional secured or unsecured indebtedness in furtherance of its business activities, including, if or when necessary, to refinance its existing debt. Future debt incurred by FREIT could bear interest at rates, which are higher than the rates on FREIT’s existing debt. Future debt incurred by FREIT could also bear interest at a variable rate. Increases in interest rates would increase FREIT’s variable interest costs (to the extent that the related indebtedness was not protected by interest rate pr otection arrangements), which could have a material adverse effect on FREIT and its ability to make distributions to shareholders and to pay amounts due on its debt or cause FREIT to be in default under its debt. Further, in the future, FREIT may not be able to, or may determine that it is not able to, obtain financing for property acquisitions or for capital expenditures to develop or improve its properties on terms, which are acceptable to FREIT. In such event, FREIT might elect to defer certain projects unless alternative sources of capital were available, such as through an equity or debt offering by FREIT.

Competitive Conditions

FREIT is subject to normal competition with other investors to acquire real property and to profitably manage such property. Numerous other REITs, banks, insurance companies and pension funds, as well as corporate and individual developers and owners of real estate, compete with FREIT in seeking properties for acquisition and for tenants. Many of these competitors have significantly greater financial resources than FREIT.

In addition, retailers at FREIT's commercial properties face increasing competition from discount shopping centers, outlet malls, sales through catalogue offerings, discount shopping clubs, marketing and shopping through cable and computer sources, particularly over the internet, and telemarketing. In many markets, the trade areas of FREIT's commercial properties overlap with the trade areas of other shopping centers. Renovations and expansions at those competing shopping centers and malls could negatively affect FREIT's commercial properties by encouraging shoppers to make their purchases at such new, expanded or renovated shopping centers and malls. Increased competition through these various sources could adversely affect the viability of FREIT's tenants, and any new commercial real estate competition developed in the future could p otentially have an adverse effect on the revenues of and earnings from FREIT's commercial properties.

| | (A) | General Factors Affecting Investment in Commercial and Apartment Properties; Effect of Economic and Real Estate Conditions |

The revenues and value of FREIT’s commercial and residential apartment properties may be adversely affected by a number of factors, including, without limitation, the national economic climate; the regional economic climate (which may be adversely affected by plant closings, industry slow downs and other local business factors); local real estate conditions (such as an oversupply of retail space or apartment units); perceptions by retailers or shoppers of the security, safety, convenience and attractiveness of a shopping center; perception by residential tenants of the safety, convenience and attractiveness of an apartment building or complex; the proximity and the number of competing shopping centers and apartment complexes; the availability of recreational and other amenities and the willingness and ability of the owner to provide capable management and adequate maintenance. In addition, other factors may adversely affect the fair market value of a commercial property or apartment building or complex without necessarily affecting the revenues, including changes in government regulations (such as limitations on development or on hours of operation) changes in tax laws or rates, and potential environmental or other legal liabilities.

| | (B) | Commercial Shopping Center Properties' Dependence on Anchor Stores and Satellite Tenants |

FREIT believes that its revenues and earnings; its ability to meet its debt obligations; and its funds available for distribution to shareholders would be adversely affected if space in FREIT's multi-store shopping center properties could not be leased or if anchor store tenants or satellite tenants failed to meet their lease obligations.

The success of FREIT's investment in its shopping center properties is largely dependent upon the success of its tenants. Unfavorable economic, demographic, or competitive conditions may adversely affect the financial condition of tenants and consequently the lease revenues from and the value of FREIT's investments in its shopping center properties. If the sales of stores operating in FREIT's shopping center properties were to decline due to deteriorating economic conditions, the tenants may be unable to pay their base rents or meet other lease charges and fees due to FREIT. In addition, any lease provisions providing for additional rent based on a percentage of sales would not be operative in this economic environment. In the event of default by a tenant, FREIT could suffer a loss of rent and experience extraordinary delays while incu rring additional costs in enforcing its rights under the lease, which may or may not be recaptured by FREIT. As at October 31, 2010 the following table lists the ten (10) largest commercial tenants, which account for approximately 53.1% of FREIT’s leased commercial rental space and 36.0% of fixed commercial rents.

| Tenant | Center | Sq. Ft. |

| Burlington Coat Factory | Westridge Square | 85,992 |

| Kmart Corporation | Westwood Plaza | 84,254 |

| Macy's Federated Department Stores, Inc. | Preakness | 81,160 |

| Pathmark Stores Inc. | Patchoque | 63,932 |

| Stop & Shop Supermarket Co. | Preakness | 61,020 |

| Safeway Stores Inc. | Damascus Center | 58,358 |

| Giant Of Maryland Inc. | Westridge Square | 55,330 |

| Stop & Shop Supermarket Co. | Franklin Crossing | 48,673 |

| Giant Food of Maryland | The Rotunda | 35,994 |

| TJ MAXX | Westwood Plaza | 28,480 |

| | (C) | Renewal of Leases and Reletting of Space |

There is no assurance that we will be able to retain tenants at our commercial properties upon expiration of their leases. Upon expiration or termination of leases for space located in FREIT's commercial properties, the premises may not be relet or the terms of reletting (including the cost of concessions to tenants) may not be as favorable as lease terms for the terminated lease. If FREIT were unable to promptly relet all or a substantial portion of this space or if the rental rates upon such reletting were significantly lower than current or expected rates, FREIT's revenues and earnings, FREIT’s ability to service its debt, and FREIT’s ability to make expected distributions to its shareholders, could be adversely affected. During Fiscal 2010 and Fiscal 2009 there were no material lease expirations, and there are no materi al lease expirations expected during Fiscal 2011.

| | (D) | Illiquidity of Real Estate Investments; Possibility that Value of FREIT's Interests may be less than its Investment |

Equity real estate investments are relatively illiquid. Accordingly, the ability of FREIT to vary its portfolio in response to changing economic, market or other conditions is limited. Also, FREIT's interests in its partially owned subsidiaries are subject to transfer constraints imposed by the operating agreements which govern FREIT’s investment in these partially owned subsidiaries. Even without such restrictions on the transfer of its interests, FREIT believes that there would be a limited market for its interests in these partially owned subsidiaries.

If FREIT had to liquidate all or substantially all of its real estate holdings, the value of such assets would likely be diminished if a sale was required to be completed in a limited time frame. The proceeds to FREIT from any such sale of the assets in FREIT’s real estate portfolio might be less than the fair market value of those assets.

Impact of Governmental Laws and Regulations on Registrant's Business

FREIT’s properties are subject to various federal, state and local laws, ordinances and regulations, including those relating to the environment and local rent control and zoning ordinances.

Both federal and state governments are concerned with the impact of real estate construction and development programs upon the environment. Environmental legislation affects the cost of selling real estate, the cost to develop real estate, and the risks associated with purchasing real estate.

Under various federal, state and local environmental laws, statutes, ordinances, rules and regulations, an owner of real property may be liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, in or under such property, as well as certain other potential costs relating to hazardous or toxic substances (including government fines and penalties and damages for injuries to persons and adjacent property). Such laws often impose such liability without regard to whether the owners knew of, or were responsible for, the presence or disposal of such substances. Such liability may be imposed on the owner in connection with the activities of any operator of, or tenant at the property. The cost of any required remediation, removal, fines or personal or property damages and the owner's liability therefore cou ld exceed the value of the property and/or the aggregate assets of the owner. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner's ability to sell or rent such property or to borrow using such property as collateral. If FREIT incurred any such liability, it could reduce FREIT's revenues and ability to make distributions to its shareholders.

A property can also be negatively impacted by either physical contamination or by virtue of an adverse effect upon value attributable to the migration of hazardous or toxic substances, or other contaminants that have or may have emanated from other properties.

At this time, FREIT is aware of the following environmental matters affecting its properties:

| | (i) | Westwood Plaza Shopping Center, Westwood, NJ |

This property is in a HUD Flood Hazard Zone and serves as a local flood retention basin for part of Westwood, New Jersey. FREIT maintains flood insurance in the amount of $500,000 for the subject property, which is the maximum available under the HUD Flood Program for the property. Any reconstruction of that portion of the property situated in the flood hazard zone is subject to regulations promulgated by the New Jersey Department of Environmental Protection ("NJDEP"), which could require extraordinary construction methods.

| | (ii) | Franklin Crossing, Franklin Lakes, NJ |

The redeveloped Franklin Crossing shopping center was completed during the summer of 1997. Also in 1997, a historical discharge of hazardous materials was discovered at Franklin Crossing. The discharge was reported to the NJDEP in accordance with applicable regulations. FREIT completed the remediation required by the NJDEP.

In November 1999, FREIT received a No Further Action Letter from the NJDEP concerning the contaminated soil at Franklin Crossing. Monitoring of the groundwater will continue pursuant to a memorandum of agreement filed with the NJDEP.

| | (iii) | Preakness Shopping Center, Wayne, NJ |

Prior to its purchase by WaynePSC, a Phase I and Phase II Environmental Assessment of the Preakness shopping center revealed soil and ground water contamination with Percloroethylene (Dry Cleaning Fluid) caused by the mishandling of this chemical by a former Dry Cleaner tenant.

The seller of the center to WaynePSC is in the process of performing the remedial work in accordance with the requirements of the NJDEP. Additionally, the seller has escrowed the estimated cost of the remediation and has purchased a cap-cost insurance policy covering any expenses over and above the estimated cost.

In performing the remedial work, possible contamination of this property by groundwater migrating from an offsite source was discovered. The NJDEP has not made any determination with respect to responsibility for remediation of this possible condition, and it is not possible to determine whether or to what extent Wayne PSC will have potential liability with respect to this condition or whether or to what extent insurance coverage may be available.

a) The State of New Jersey has adopted an underground fuel storage tank law and various regulations with respect to underground storage tanks.

FREIT no longer has underground storage tanks on any of its properties.

In prior years, FREIT conducted environmental audits for all of its properties except for its undeveloped land; retail properties in Franklin Lakes (Franklin Crossing) and Glen Rock, New Jersey; and residential apartment properties located in Palisades Park and Hasbrouck Heights, New Jersey. Except as noted in subparagraph (iii) above, the environmental reports secured by FREIT have not revealed any environmental conditions on its properties, which require remediation pursuant to any applicable Federal or state law or regulation.

b) FREIT has determined that several of its properties contain lead based paint (“LBP”). FREIT believes that it complies with all federal, state and local requirements as they pertain to LBP.

FREIT does not believe that the environmental conditions described in subparagraphs (i) - (iv) above will have a material adverse effect upon the capital expenditures, revenues, earnings, financial condition or competitive position of FREIT.

| | (B) | Rent Control Ordinances |

Each of the apartment buildings or complexes owned by FREIT is subject to some form of rent control ordinance which limits the amount by which FREIT can increase the rent for renewed leases, and in some cases, limits the amount of rent which FREIT can charge for vacated units, except for Westwood Hills and The Boulders at Rockaway which are not subject to any rent control law or regulation.

Local zoning ordinances may prevent FREIT from renovating, expanding or converting its existing properties, for their highest and best use as determined by FREIT’s Board of Trustees. The Board of Trustees is not aware of any such zoning impediments to the development of the South Brunswick property described herein.

| | (D) | Financial Information about Foreign and Domestic Operations and Export Sale |

FREIT does not engage in operations in foreign countries and it does not derive any portion of its revenues from customers in foreign countries.

Almost all of FREIT’s income and cash flow is derived from the net rental income (revenues after expenses) from our properties. FREIT’s business and financial results are affected by the following fundamental factors:

| | · | the national and regional economic climate; |

| | · | occupancy rates at the properties; |

| | · | tenant improvement and leasing costs; |

| | · | cost of and availability of capital; |

| | · | failure of banking institutions; |

| | · | failure of insurance carriers; |

| | · | new acquisitions and development projects; and |

| | · | changes in governmental regulations, real estate tax rates and similar matters. |

A negative or adverse quality change in the above factors could potentially cause a detrimental effect on FREIT’s revenue, earnings and cash flow. If rental revenues decline, we would expect to have less cash available to pay our indebtedness and distribute to our shareholders.

Adverse Changes in General Economic Climate: FREIT derives the majority of its revenues from renting apartments to individuals or families, and from retailers renting space at its shopping centers. Despite the fact that the U. S. economy has recovered from the recent recession, the recovery rate has been much slower than anticipated. In addition, job growth remains sluggish, and sustained high unemployment can hinder economic growth even further. While bank earnings and liquidity are on the rebound, the potential of significant future credit losses clouds the lending outlook. Credit availability has improved, but still lags pre-recession levels hampering business expansion and new development activities. The higher level of unemployment in o ur areas of operation, coupled with the sluggish rate of economic recovery, may continue to adversely impact the level of consumer spending at some of our retail tenants, resulting in their inability to pay rent and/or expense recovery, as well as adversely impact occupancy levels at our residential properties. Some retail tenants have vacated, and others may continue to vacate or fail to exercise renewal options for their space.

We receive a substantial portion of our operating income as rent under long-term leases with commercial tenants. At any time, any of our commercial tenants could experience a downturn in its business that might weaken its financial condition. These tenants might defer or fail to make rental payments when due, delay lease commencement, voluntarily vacate the premises or declare bankruptcy, which could result in the termination of the tenant’s lease, and could result in material losses to us and harm to our results of operations. Also, it might take time to terminate leases of underperforming or nonperforming tenants and we might incur costs to remove such tenants. Given current conditions in the capital markets, retailers that have sought protection from creditors under bankruptcy law have had difficulty in some instances in obtai ning debtor-in-possession financing, which has decreased the likelihood that such retailers will emerge from bankruptcy protection and has limited their alternatives. Also, if tenants are unable to comply with the terms of our leases, we might modify lease terms in ways that are less favorable to us.

Tenants unable to pay rent: Financially distressed tenants may be unable to pay rents and expense recovery charges, where applicable, and may default on their leases. Enforcing our rights as landlord could result in substantial costs and may not result in a full recovery of unpaid rent. If a tenant files for bankruptcy, the tenant’s lease may be terminated. In each such instance FREIT’s income and cash flow would be negatively impacted.

Costs of re-renting space: If tenants fail to renew leases, fail to exercise renewal options, or terminate their leases early, the lost rents due to vacancy and the costs of re-renting the space could prove costly to FREIT. In addition to cleaning and renovating the vacated space, we may be required to grant concessions to a new tenant, and may incur leasing brokerage commissions. The lease terms to a new tenant may be less favorable than the prior tenant’s lease terms, and will negatively impact FREIT’s income and cash flow and adversely affect our ability to pay mortgage debt and interest or make distributions to our shareholders.

Inflation may adversely affect our financial condition and results of operations: Increased inflation could have a pronounced negative impact on our operating and administrative expenses, as these costs may increase at a higher rate than our rents. While increases in most operating expenses at our commercial properties can be passed on to retail tenants, increases in expenses at our residential properties cannot be passed on to residential tenants. Unreimbursed increased operating expenses may reduce cash flow available for payment of mortgage debt and interest, and for distributions to shareholders.

Development and construction risks: As part of its investment strategy, FREIT seeks to acquire property for development and construction, as well as to develop and build on land already in its portfolio. FREIT is currently renovating the Damascus Center and is planning a major redevelopment at the Rotunda property in Baltimore, Maryland. In addition it is contemplating the construction of an industrial building on its South Brunswick, New Jersey property. Development and construction activities are challenged with the following risks, which may adversely affect our cash flow:

| | · | financing may not be available in the amounts we seek, or may not be on favorable terms; |

| | · | long-term financing may not be available upon completion of the construction; |

| | · | failure to complete construction on schedule or within budget may increase debt service costs and construction costs; and |

| | · | abandoned project costs could result in an impairment loss. |

Debt financing could adversely affect income and cash flow: FREIT relies on debt financing to fund its growth through acquisitions and development activities. To the extent third party debt financing is not available, or not available on favorable terms, acquisitions and development activities will be curtailed.

FREIT currently has approximately $175.2 million of non-recourse mortgage debt subject to fixed interest rates, and $29.4 million of partial recourse mortgage debt subject to variable interest rates ($19.4 million relates to the acquisition of the Rotunda property, and $10.0 million relates to the Damascus Center redevelopment project). These mortgages are being repaid over periods (amortization schedules) that are longer than the terms of the mortgages. Accordingly, when the mortgages become due (at various times) significant balloon payments (the unpaid principal amounts) will be required. FREIT expects to refinance the individual mortgages with new mortgages when their terms expire. To this extent we have exposure to capital availability and interest rate risk. If interest rates, at the time any individual mortgage note is due, are higher than the current fixed interest rate, higher debt service may be required and/or refinancing proceeds may be less than the amount of the mortgage debt being retired. The $22.5 million mortgage loan entered into by Grande Rotunda, LLC for the acquisition of the Rotunda was scheduled to come due on July 19, 2009, and was extended by the bank until February 1, 2010. On February 1, 2010, a principal payment of $3 million was made reducing the original loan amount of $22.5 million to $19.5 million and the due date was extended until February 1, 2013. As part of the terms of the loan extension agreement, the loan is further collateralized by a first mortgage lien and the assignment of the ground lease on FREIT’s Rochelle Park, NJ land parcel. Under the restructured terms, the interest rate is now 350 basis points above the BBA LIBOR rate with a floor of 4%, and monthly principal payments of $10,000 are required. An additional principal payment may be required on February 1, 2012 in an amount necessary to reduce the loan to achieve a stipulated debt service coverage ratio. Under the agreement with the equity owners of Grande Rotunda, LLC, FREIT would be responsible for 60% of any cash required by Grande Rotunda, LLC, and 40% would be the responsibility of the minority interest. To the extent we are unable to refinance our indebtedness on acceptable terms, we may need to dispose of one or more of our properties upon disadvantageous terms.

Our revolving $18 million credit line (of which $18 million was available as of October 31, 2010), our Grande Rotunda acquisition mortgage loan, and our Damascus Center construction loan contain financial covenants that could restrict our acquisition activities and result in a default on these loans if we fail to satisfy these covenants.

Failure of banking and financing institutions: Banking and financing institutions such as insurance companies provide FREIT with credit lines and construction financing. The credit lines available to FREIT may be used for a variety of business purposes, including general corporate purposes, acquisitions, construction, letters of credit, etc. Construction financing enables FREIT to develop new properties, or renovate or expand existing properties. A failure of the banking institution making credit lines available may render the line unavailable and adversely affect FREIT’s liquidity, and negatively impact our operations in a number of ways. A failure of a financial institution unable to fund its construction financing obligations to FREIT may caus e the construction to halt or be delayed. Substitute financing may be significantly more expensive, and construction delays may subject FREIT to delivery penalties.

Failure of insurance carriers: FREIT’s properties are insured against unforeseen liability claims, property damages, and other hazards. The insurance companies FREIT uses have good ratings at the time the policies are put into effect. Financial failure of our carriers may result in their inability to pay current and future claims. This inability to pay claims may have an adverse impact on FREIT’s financial condition. In addition, a failure of FREIT’s insurance carrier may cause FREIT’s insurance renewal or replacement policy costs to increase.

Real estate is a competitive business: FREIT is subject to normal competition with other investors to acquire real property and to profitably manage such property. Numerous other REITs, banks, insurance companies and pension funds, as well as corporate and individual developers and owners of real estate, compete with FREIT in seeking properties for acquisition and for tenants. Many of these competitors have significantly greater financial resources than FREIT. In addition, retailers at FREIT's commercial properties face increasing competition from discount shopping centers, outlet malls, sales through catalogue offerings, discount shopping clubs, marketing and shopping through cable and comp uter sources, particularly over the internet, and telemarketing. In many markets, the trade areas of FREIT's commercial properties overlap with the trade areas of other shopping centers. Renovations and expansions at those competing shopping centers and malls could negatively affect FREIT's commercial properties by encouraging shoppers to make their purchases at such new, expanded or renovated shopping centers and malls. Increased competition through these various sources could adversely affect the viability of FREIT's tenants, and any new commercial real estate competition developed in the future could potentially have an adverse effect on the revenues of and earnings from FREIT's commercial properties.

Illiquidity of real estate investment: Real estate investments are relatively difficult to buy and sell quickly. Accordingly, the ability of FREIT to vary its portfolio in response to changing economic, market or other conditions is limited. Also, FREIT’s interests in its partially owned subsidiaries are subject to transfer constraints by the operating agreements, which govern FREIT’s investment in these partially owned subsidiaries.

Environmental problems may be costly: Both federal and state governments are concerned with the impact of real estate construction and development programs upon the environment. Environmental legislation affects the cost of selling real estate, the cost to develop real estate, and the risks associated with purchasing real estate.

Under various federal, state and local environmental laws, statutes, ordinances, rules and regulations, an owner of real property may be liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, in or under such property, as well as certain other potential costs relating to hazardous or toxic substances (including government fines and penalties and damages for injuries to persons and adjacent property). Such laws often impose such liability without regard to whether the owners knew of, or were responsible for, the presence or disposal of such substances. Such liability may be imposed on the owner in connection with the activities of any operator of, or tenant at the property. The cost of any required remediation, re moval, fines or personal or property damages and the owner's liability therefore could exceed the value of the property and/or the aggregate assets of the owner. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner's ability to sell or rent such property or to borrow using such property as collateral. If FREIT incurred any such liability, it could reduce FREIT's revenues and ability to make distributions to its shareholders.

A property can also be negatively impacted by either physical contamination or by virtue of an adverse effect upon value attributable to the migration of hazardous or toxic substances, or other contaminants that have or may have emanated from other properties.

Qualification as a REIT: Since its inception in 1961, FREIT has elected, and will continue to operate so as to qualify as a REIT for federal income tax purposes. In order to qualify as a REIT, we must satisfy a number of highly technical and complex provisions of the Internal Revenue Code. Governmental legislation, new regulations, and administrative interpretations may significantly change the tax laws with respect to the requirements for qualification as a REIT, or the federal income tax consequences of qualifying as a REIT. Although FREIT intends to continue to operate in a manner to allow it to qualify as a REIT, future economic, market, legal, tax or other considerations may cause it to revoke the REIT election or fail to qualify as a REIT. Such a revocation would subject FREIT’s income to federal income tax at regular corporate rates, and failure to qualify as a REIT would also eliminate the requirement that we pay dividends to our shareholders.

Change of investment and operating policies: FREIT’s investment and operating policies, including indebtedness and dividends, are exclusively determined by FREIT’s Board of Trustees, and not subject to shareholder approval.

| ITEM 1 B | UNRESOLVED STAFF COMMENTS |

None.

Portfolio of Investments: The following tables set forth certain information relating to each of FREIT's real estate investments in addition to the specific mortgages encumbering the properties.

| Residential Apartment Properties as of October 31, 2010: |

| Property & Location | Year Acquired | No. of Units | Average Annual Occupancy Rate for the Year Ended 10/31/10 | Average Monthly Rent per Unit @ 10/31/10 | Average Monthly Rent per Unit @ 10/31/09 | Mortgage Balance ($000) | Depreciated Cost of Land, Buildings & Equipment ($000) |

| | | | | | | | |

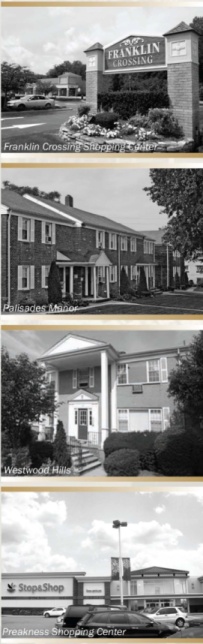

| Palisades Manor | 1962 | 12 | 92.3% | $1,080 | $1,107 | None (1) | $41 |

| Palisades Park, NJ | | | | | | | |

| | | | | | | | |

| Grandview Apts. | 1964 | 20 | 86.9% | $1,135 | $1,166 | None (1) | $128 |

| Hasbrouck Heights, NJ | | | | | | | |

| | | | | | | | |

| Berdan Court | 1965 | 176 | 96.2% | $1,409 | $1,441 | $19,739 (2) | $1,315 |

| Wayne, NJ | | | | | | | |

| | | | | | | | |

| Heights Manor | 1971 | 79 | 89.6% | $1,086 | $1,143 | $2,999 | $422 |

| Spring Lake Heights, NJ | | | | | | | |

| | | | | | | | |

| Hammel Gardens | 1972 | 80 | 94.6% | $1,229 | $1,220 | $4,352 | $685 |

| Maywood, NJ | | | | | | | |

| | | | | | | | |

| Steuben Arms | 1975 | 100 | 97.0% | $1,262 | $1,263 | $6,037 | $1,173 |

| River Edge, NJ | | | | | | | |

| | | | | | | | |

| Westwood Hills (3) | 1994 | 210 | 95.8% | $1,440 | $1,448 | $23,500 (6) | $11,350 |

| Westwood Hills, NJ | | | | | | | |

| | | | | | | | |

| Pierre Towers (4) | 2004 | 269 | 92.6% | $1,818 | $1,813 | $33,410 | $42,791 |

| Hackensack, NJ | | | | | | | |

| | | | | | | | |

| Boulders (5) | 2006 | 129 | 94.5% | $1,679 | $1,753 | $19,546 | $18,967 |

| Rockaway, NJ | | | | | | | |

| (1) Security for draws against FREIT's Credit Line. | | | | |

| (2) On August 6, 2009, FREIT refinanced the mortgage loans secured by its Berdan Court apartment property in Wayne, NJ, with a new mortgage for approximately $20 million, due in 2019. The refinanced mortgages had outstanding principal balances that aggregated approximately $12.3 million at a weighted average interest rate of 6.7%, and were due January 1, 2010. |

| (3) FREIT owns a 40% equity interest in Westwood Hills. See "Investment in Subsidiaries". | | |

| (4) Pierre Towers is 100% owned by S And A Commercial Associates LP, which is 65% owned by FREIT. | |

| (5) Construction completed in August 2006 on land acquired in 1963 / 1964. | | | |

| (6) On October 20, 2010, Westwood Hills, LLC refinanced the mortgage loans secured by its Westwood Hills apartment property in Westwood, NJ, with a new mortgage for $23.5 million. The refinanced mortgages had outstanding principal balances that aggregated approximately $15.4 million at a weighted average interest rate of 6.6%, and were due December 31, 2013. The new mortgage is payable in monthly installments of $120,752 including interest of 4.62%, and is due November 1, 2020. |

| Commercial Properties as of October 31, 2010: |

| Property & Location | Year Acquired | Leasable Space- Approximate Sq.Ft. | Average Annual Occupancy Rate for the Year Ended 10/31/10 | Average Annualized Rent per Sq. Ft. @ 10/31/10 | Average Annualized Rent per Sq. Ft. @ 10/31/09 | Mortgage Balance ($000) | Depreciated Cost of Land, Buildings & Equipment ($000) |

| | | | | | | | |

| Glen Rock, NJ | 1962 | 4,800 | 100.0% | $23.20 | $22.73 | None (1) | $102 |

| | | | | | | | |

| | | | | | | | |

| Franklin Crossing | 1966 (2) | 87,041 | 93.4% | $23.86 | $24.03 | None (1) | $8,333 |

| Franklin Lakes, NJ | | | | | | | |

| | | | | | | | |

| Westwood Plaza | 1988 | 173,854 | 98.1% | $12.84 | $12.95 | $8,563 | $9,532 |

| Westwood, NJ | | | | | | | |

| | | | | | | | |

| Westridge Square (3) | 1992 | 256,620 | 93.0% | $12.78 | $12.94 | $22,000 | $18,982 |

| Frederick, MD | | | | | | | |

| | | | | | | | |

| Pathmark Super Store | 1997 | 63,962 | 100.0% | $19.99 | $19.99 | $5,798 (7) | $8,047 |

| Patchogue, NY | | | | | | | |

| | | | | | | | |

| Preakness Center (4) | 2002 | 322,136 | 96.9% | $13.09 | $13.01 | $29,220 | $29,587 |

| Wayne, NJ | | | | | | | |

| | | | | | | | |

| Damascus Center (5) | 2003 | 150,000 | 55.2% | $19.96 | $14.62 | $10,020 (8) | $25,301 |

| Damascus, MD | | | | | | | |

| | | | | . | . | | |

| The Rotunda (6) | 2005 | 216,645 | 88.0% | $17.64 | $18.16 | $19,420 | $39,943 |

| Baltimore, MD | | | | | | | |

| | | | | | | | |

| Rockaway, NJ | 1964/1963 | 1 Acre | 100.0% | N/A | N/A | None | $165 |

| | | Landlease | | | | | |

| | | | | | | | |

| Rochelle Park, NJ | 2007 | 1 Acre | N/A | N/A | N/A | None (9) | $2,442 |

| | | Landlease | | | | | |

| (1) Security for draws against FREIT's Credit Line. | | | | | |

| (2) The original 33,000 sq. ft. shopping center was replaced with a new 87,041 sq. ft. center that opened in October 1997. | |

| (3) FREIT owns a 100% interest in WestFREIT Corp, that owns the center. | | | | |

| (4) FREIT owns a 40% equity interest in WaynePSC, that owns the center. | | | | |

| (5) FREIT owns a 70% equity interest in Damascus Centre, LLC, that owns the center. Undergoing a renovation and expansion project. | |

| (6) FREIT owns a 60% equity interest in Grande Rotunda, LLC, that owns the center. | | | |

| (7) On February 29, 2008, unpaid principal amount of $5.9 million was refinanced with a $6 million mortgage loan bearing fixed interest rate of 6.125%, with a 10 year term. |

| (8) On February 12, 2008, Damascus Centre, LLC closed on a $27.3 million construction loan, of which $10.0 million was drawn down at 10/31/10. As a result of a reevaluation of the future funding needs for this project, on May 6, 2010, Damascus Centre, LLC reduced the amount of the construction loan facility to $21.3 million. |

| (9) Security for Rotunda $19.5 million acquisition loan. | | | | |

Supplemental Segment Information:

| Commercial lease expirations at October 31, 2010 assuming none of the tenants exercise renewal options: |

| | | | | Annual Rent of Expiring Leases |

| Year Ending | Number of | Expiring Leases | Percent of | | |

| October 31, | Expiring Leases | Sq. Ft. | Commercial Sq. Ft. | Total | Per Sq. Ft. |

| | | | | | |

| Month to month | 13 | 67,441 | 5.9% | $ 1,286,704 | $ 19.08 |

| 2011 | 18 | 57,409 | 5.1% | $ 1,111,589 | $ 19.36 |

| 2012 | 23 | 156,348 | 13.8% | $ 1,746,719 | $ 11.17 |

| 2013 | 20 | 87,883 | 7.7% | $ 1,653,712 | $ 18.82 |

| 2014 | 16 | 49,082 | 4.3% | $ 830,101 | $ 16.91 |

| 2015 | 19 | 77,187 | 6.8% | $ 1,121,429 | $ 14.53 |

| 2016 | 12 | 93,251 | 8.2% | $ 1,369,766 | $ 14.69 |

| 2017 | 8 | 35,868 | 3.2% | $ 603,646 | $ 16.83 |

| 2018 | 15 | 42,819 | 3.8% | $ 886,277 | $ 20.70 |

| 2019 | 4 | 86,709 | 7.6% | $ 357,040 | $ 4.12 |

| 2020 | 2 | 7,400 | 0.7% | $ 189,225 | $ 25.57 |

Land Under Development and Vacant Land as of October 31, 2010:

| | | | | |

| Vacant Land | | | Permitted Use Per | Acreage Per |

| Location (1) | Acquired | Current Use | Local Zoning Laws | Parcel |

| Franklin Lakes, NJ | 1966 | None | Residential | 4.27 |

| | | | | |

| Wayne, NJ | 2002 | None | Commercial | 2.1 |

| | | | | |

| Rockaway, NJ | 1964 | None | Residential | 1.0 |

| | | | | |

| So. Brunswick, NJ (2) | 1964 | Principally leased | Industrial | 33.0 |

| | | as farmland qualifying | | |

| | | for state farmland assessment | | |

| | | tax treatment | | |

| | | | | |

| (1) All of the above land is unencumbered, except as noted. |

| (2) Site plan approval received for the construction of a 563,000 square foot industrial building. |

FREIT believes that it has a diversified portfolio of residential and commercial properties. FREIT’s business is not materially dependent upon any single tenant or any one of its properties.

FREIT has no properties that have contributed 15% or more of FREIT’s total revenue in one (1) or more of the last three (3) fiscal years.

Although FREIT’s general investment policy is to hold properties as long-term investments, FREIT could selectively sell certain properties if it determines that any such sale is in FREIT’s and its shareholders’ best interests. With respect to FREIT’s future acquisition and development activities, FREIT will evaluate various real estate opportunities, which FREIT believes would increase FREIT’s revenues and earnings, as well as complement and increase the overall value of FREIT’s existing investment portfolio.

Except for the Pathmark supermarket super store located in Patchogue, Long Island, the TD Bank branch located in Rockaway, NJ and the Pascack Community Bank branch located on our land in Rochelle Park, NJ, all of FREIT’s and its subsidiaries’ commercial properties have multiple tenants.

FREIT and its subsidiaries’ commercial properties have eighteen (18) anchor / major tenants, that account for approximately 54% of the space leased. The balance of the space is leased to one hundred and sixty six (166) satellite and office tenants. The following table lists the anchor / major tenants at each center and the number of satellite tenants:

| Commercial Property | | | | No. of |

| Shopping Center (SC) | | Net Leaseable | | Additional/Satellite |

| Office Building (O) | | Space | Anchor/Major Tenants | Tenants |

| | | | | |

| Westridge Square | (SC) | 256,620 | Burlington Coat Factory | 25 |

| Frederick, MD | | | Giant Supermarket | |

| Franklin Crossing | (SC) | 87,041 | Stop & Shop | 18 |

| Franklin, Lakes, NJ | | | | |

| Westwood Plaza | (SC) | 173,854 | Kmart Corp | 19 |

| Westwood, NJ | | | TJMaxx | |

| Preakness Center (1) | (SC) | 322,136 | Stop & Shop | 38 |

| Wayne, NJ | | | Macy's | |

| | | | CVS | |

| | | | Annie Sez | |

| | | | Clearview Theaters | |

| Damascus Center (2) | (SC) | 150,000 | Safeway Stores | 11 |

| Damascus, MD | | | | |

| The Rotunda (3) | (O) | 138,276 | Clear Channel Broadcasting | 46 |

| Baltimore, MD | | | US Social Security Office | |

| | | | Janus Associates | |

| | | | | |

| | (SC) | 78,369 | Giant Food of Maryland | 8 |

| | | | Rite Aid Corporation | |

| Patchogue, NY | (SC) | 63,962 | Pathmark | - |

| Glen Rock, NJ | (SC) | 4,800 | Chase Bank | 1 |

| (1) FREIT has a 40% interest in this property. | (2) FREIT has a 70% interest in this property. |

| (3) FREIT has a 60% interest in this property. | | |

With respect to most of FREIT’s commercial properties, lease terms range from five (5) years to twenty-five (25) years with options, which if exercised would extend the terms of such leases. The lease agreements generally provide for reimbursement of real estate taxes, maintenance, insurance and certain other operating expenses of the properties. During the last three (3) completed fiscal years, FREIT’s commercial properties averaged an 89.63% occupancy rate with respect to FREIT’s available leasable space.

Leases for FREIT’s apartment buildings and complexes are usually one (1) year in duration. Even though the residential units are leased on a short-term basis, FREIT has averaged, during the last three (3) completed fiscal years, a 93.97% occupancy rate with respect to FREIT’s available apartment units.

FREIT does not believe that any seasonal factors materially affect FREIT’s business operations and the leasing of its commercial and apartment properties.

FREIT believes that its properties are covered by adequate fire and property insurance provided by reputable companies and with commercially reasonable deductibles and limits.

Other than the recently terminated legal proceeding related to the Damascus Center, as described below, there are no other material pending legal proceedings to which FREIT is a party, or of which any of its properties is the subject. There is, however, ordinary and routine litigation involving FREIT's business including various tenancy and related matters. Notwithstanding the environmental conditions disclosed in “Item 1(c) Narrative Description of Business - Impact of Governmental Laws and Regulations on Registrant’s Business; Environmental Matters,” there are no legal proceedings concerning environmental issues with respect to any property owned by FREIT.

On August 6, 2009, a complaint was filed against Damascus Centre, LLC, a 70% owned affiliate of FREIT, Hekemian, and others (the “Defendants”) in the Circuit Court of Montgomery County, Maryland (the “Court”). The plaintiffs leased commercial office space at the Damascus Shopping Center located in Damascus, Maryland and owned by Damascus Centre, LLC. The complaint alleged a number of causes of action in connection with alleged interference with plaintiffs’ business allegedly caused by Damascus Centre, LLC’s development activities at the Damascus Center. The complaint sought compensatory damages of $500,000 for the alleged interference with the plaintiffs’ business and $5,000,000 in punitive damages. In addition, the plaintiffs sought to enjoin the demolition of the shoppin g center. FREIT received notice of the lawsuit on September 2, 2009. On February 19, 2010, a voluntary stipulation of dismissal of the complaint, with prejudice, was filed with the Court. This stipulation with prejudice has the same effect as a final adjudication on the merits of the complaint favorable to the Defendants, and relieves the Defendants of any liability to the plaintiffs based on the relevant facts set forth in the complaint. The stipulation also bars the plaintiffs from pursuing any subsequent action based on any relevant facts in the complaint.

ITEM 4 | (REMOVED AND RESERVED) |

PART II

| | |

| ITEM 5 | MARKET FOR FREIT'S COMMON EQUITY, RELATED SECURITY HOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Shares of Beneficial Interest

Beneficial interests in FREIT are represented by shares without par value (the “Shares”). The Shares represent FREIT’s only authorized, issued and outstanding class of equity. As of January 14, 2011, there were approximately 500 holders of record of the Shares.

The Shares are traded in the over-the-counter market through use of the OTC Bulletin Board Service (the “OTC Bulletin Board”) provided by FINRA, Inc. FREIT does not believe that an active United States public trading market exists for the Shares since historically only small volumes of the Shares are traded on a sporadic basis. The following table sets forth, at the end of the periods indicated, the Bid and Asked quotations for the Shares on the OTC Bulletin Board.

| | | Bid | | Asked | |

| Fiscal Year Ended October 31, 2010 | | | | | |

| First Quarter | | $ | 18.00 | | $ | 20.25 | |

| Second Quarter | | $ | 18.00 | | $ | 19.00 | |

| Third Quarter | | $ | 16.50 | | $ | 18.00 | |

| Fourth Quarter | | $ | 17.00 | | $ | 17.00 | |

| | | Bid | | Asked | |

| Fiscal Year Ended October 31, 2009 | | | | | |

| First Quarter | | $ | 15.00 | | $ | 15.80 | |

| Second Quarter | | $ | 15.25 | | $ | 15.25 | |

| Third Quarter | | $ | 16.00 | | $ | 16.00 | |

| Fourth Quarter | | $ | 17.20 | | $ | 17.20 | |

The bid quotations set forth above for the Shares reflect inter-dealer prices, without retail mark-up, markdown or commission and may not necessarily represent actual transactions. The source of the bid and asked quotations is Janney Montgomery Scott, LLC., members of the New York Stock Exchange and other national securities exchanges.

Share Repurchase Program

FREIT’s Board of Trustees authorized the following share repurchase plans:

| | | Shares Repurchased | |

| Date Plan Authorized | Amounts Authorized | # | Cost | Date Plan Expired |

| | | | | |

| April 9, 2008 | $2,000,000 | 50,920 | $1,133,545 | March 31, 2009 |

| | | | | |

| April 14, 2009 | $1,000,000 | 89 | $1,481 | June 30, 2009 |

| | Total | 51,009 | $1,135,026 | |

The repurchase plans complied with Rules 10b5-1 and 10b-18 of the Securities Exchange Act of 1934 and provided for the repurchase of FREIT’s shares subject to certain price limitations and other conditions established under the Plans. Share repurchases under the plans could have been made, from time to time, through privately negotiated transactions or in the open market. The repurchase plans could have been terminated at any time and without prior notice. Rule 10b5-1 permits the implementation of a written plan for repurchasing shares of company stock through a repurchasing agent at times when the issuer is not in possession of material, nonpublic information and allows issuers adopting such plans to repurchase shares on a regular basis, regardless of any subsequent material, nonpublic information it receives.

Through June 30, 2009, FREIT repurchased a total of 51,009 shares of common stock under both repurchase plans at a cost of $1,135,026, which is reflected in the Equity section of FREIT’s consolidated balance sheets.

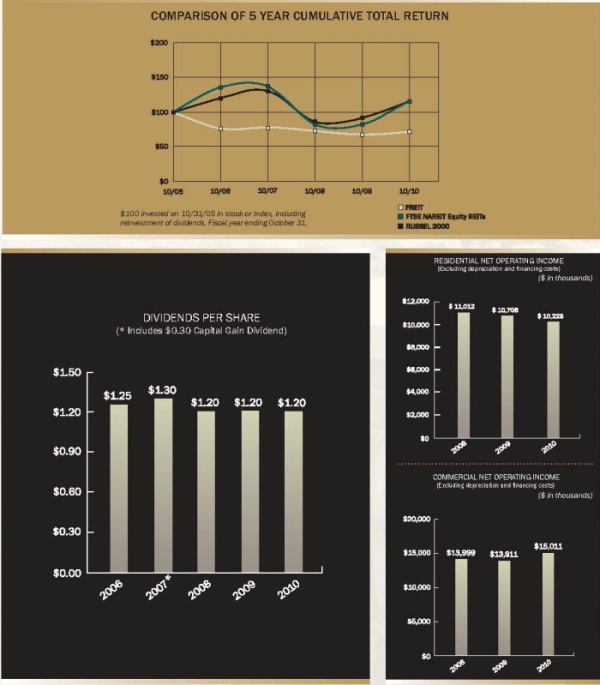

Dividends

The holders of Shares are entitled to receive distributions as may be declared by FREIT’s Board of Trustees. Dividends may be declared from time to time by the Board of Trustees and may be paid in cash, property, or Shares. The Board of Trustees’ present policy is to distribute annually at least ninety percent (90%) of FREIT’s REIT taxable income as dividends to the holders of Shares in order to qualify as a REIT for Federal income tax purposes. Distributions are made on a quarterly basis. In Fiscal 2010 and Fiscal 2009, FREIT paid or declared aggregate total dividends of $1.20 and $1.20 per share, respectively, to the holders of Shares. See “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations - Distributions to Sh areholders.”

Securities Authorized for Issuance Under Equity Compensation Plans

See Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

ITEM 6 | SELECTED FINANCIAL DATA |

The selected consolidated financial data for FREIT for each of the five (5) fiscal years in the period ended October 31, 2010 are derived from financial statements herein or previously filed financial statements. This data should be read in conjunction with “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report and with FREIT’s consolidated financial statements and related notes included in this Annual Report.

| BALANCE SHEET DATA: | | | | | | | | | | | | | | | |

| As At October 31, | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (In thousands of dollars) | |

| Total Assets | | $ | 245,128 | | | $ | 251,851 | | | $ | 241,756 | | | $ | 242,755 | | | $ | 234,786 | |

| Mortgage Loans | | $ | 204,604 | | | $ | 202,260 | | | $ | 192,352 | | | $ | 189,389 | | | $ | 180,679 | |

| Shareholders' Equity | | $ | 16,802 | | | $ | 20,722 | | | $ | 23,561 | | | $ | 25,130 | | | $ | 24,972 | |