First Quarter 2024 Earnings April 17, 2024

2 Disclaimers Non-GAAP Information Certain measures included in this document are “non-GAAP,” meaning they are not presented in accordance with generally accepted accounting principles in the U.S. and also are not codified in U.S. banking regulations currently applicable to FHN. FHN’s management believes such measures, even though not always comparable to non-GAAP measures used by other financial institutions, are relevant to understanding the financial condition, capital position, and financial results of FHN and its business segments. The non-GAAP measures presented in this document are listed, and are reconciled to the most comparable GAAP presentation, in the non-GAAP reconciliation table(s) appearing in the Appendix. In addition, presentation of regulatory measures, even those which are not GAAP, provide a meaningful base for comparability to other financial institutions subject to the same regulations as FHN. Although not GAAP terms, these regulatory measures are not considered “non-GAAP” under U.S. financial reporting rules as long as their presentation conforms to regulatory standards. Regulatory measures used in this document include: common equity tier 1 capital, generally defined as common equity less goodwill, other intangibles, and certain other required regulatory deductions; tier 1 capital, generally defined as the sum of core capital (including common equity and instruments that cannot be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations; and risk-weighted assets, which is a measure of total on- and off-balance sheet assets adjusted for credit and market risk, used to determine regulatory capital ratios. Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements pertain to FHN's beliefs, plans, goals, expectations, and estimates. Forward-looking statements are not a representation of historical information, but instead pertain to future operations, strategies, financial results, or other developments. Forward- looking statements can be identified by the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “should,” “is likely,” “will,” “going forward,” and other expressions that indicate future events and trends. Forward-looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, operational, economic, and competitive uncertainties and contingencies, many of which are beyond FHN’s control, and many of which, with respect to future business decisions and actions (including acquisitions and divestitures), are subject to change and could cause FHN’s actual future results and outcomes to differ materially from those contemplated or implied by forward-looking statements or historical performance. Examples of uncertainties and contingencies include those mentioned: in this document; in Items 2.02 and 7.01 of FHN’s Current Report on Form 8-K to which this document has been filed as an exhibit; in the forepart, and in Items 1, 1A, and 7, of FHN’s most recent Annual Report on Form 10-K; and in the forepart, and in Item 1A of Part II, of FHN’s Quarterly Report(s) on Form 10-Q filed after that Annual Report. FHN assumes no obligation to update or revise any forward-looking statements that are made in this document or in any other statement, release, report, or filing from time to time. Throughout this presentation, numbers may not foot due to rounding, references to EPS are fully diluted, and 1Q24 capital ratios are estimates.

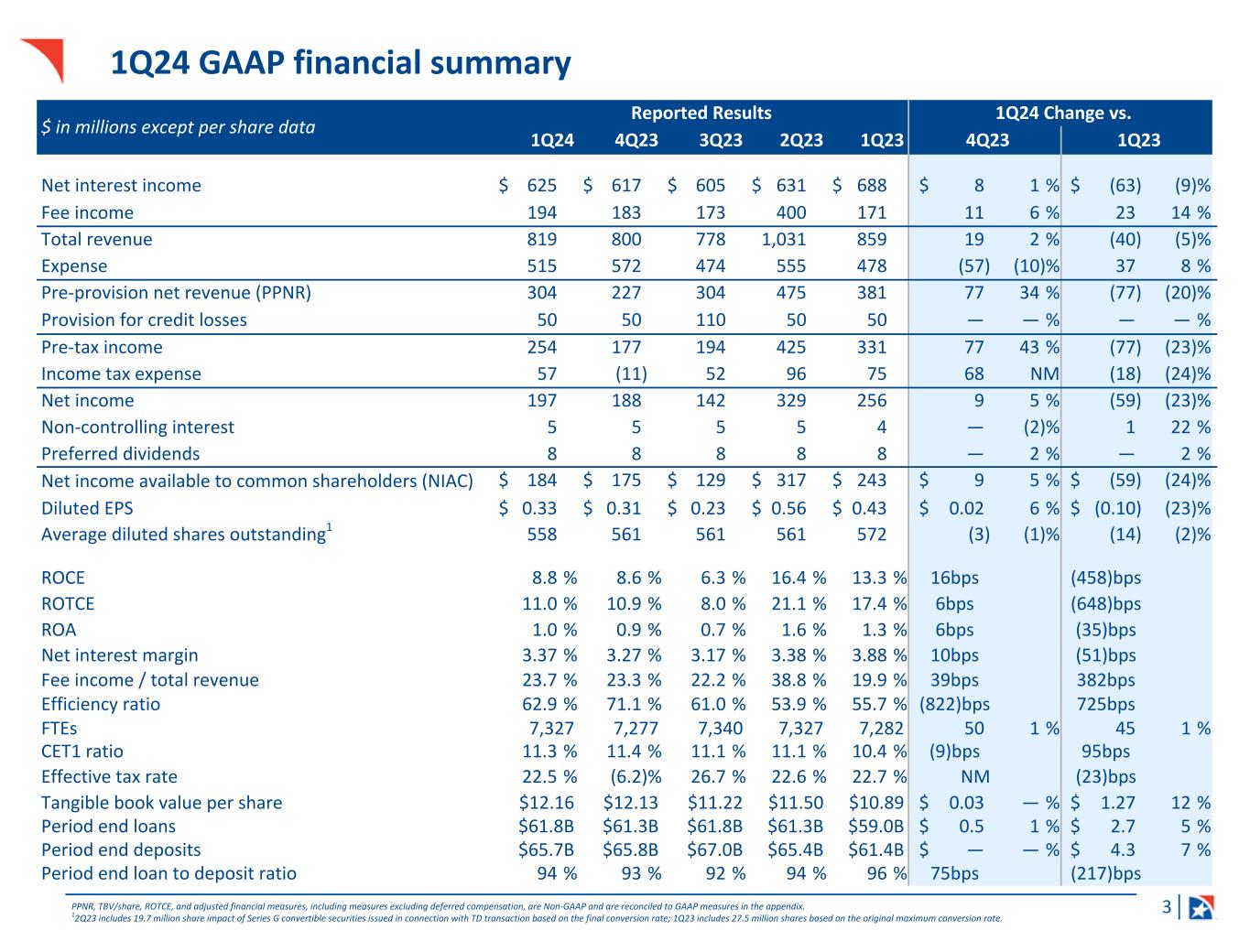

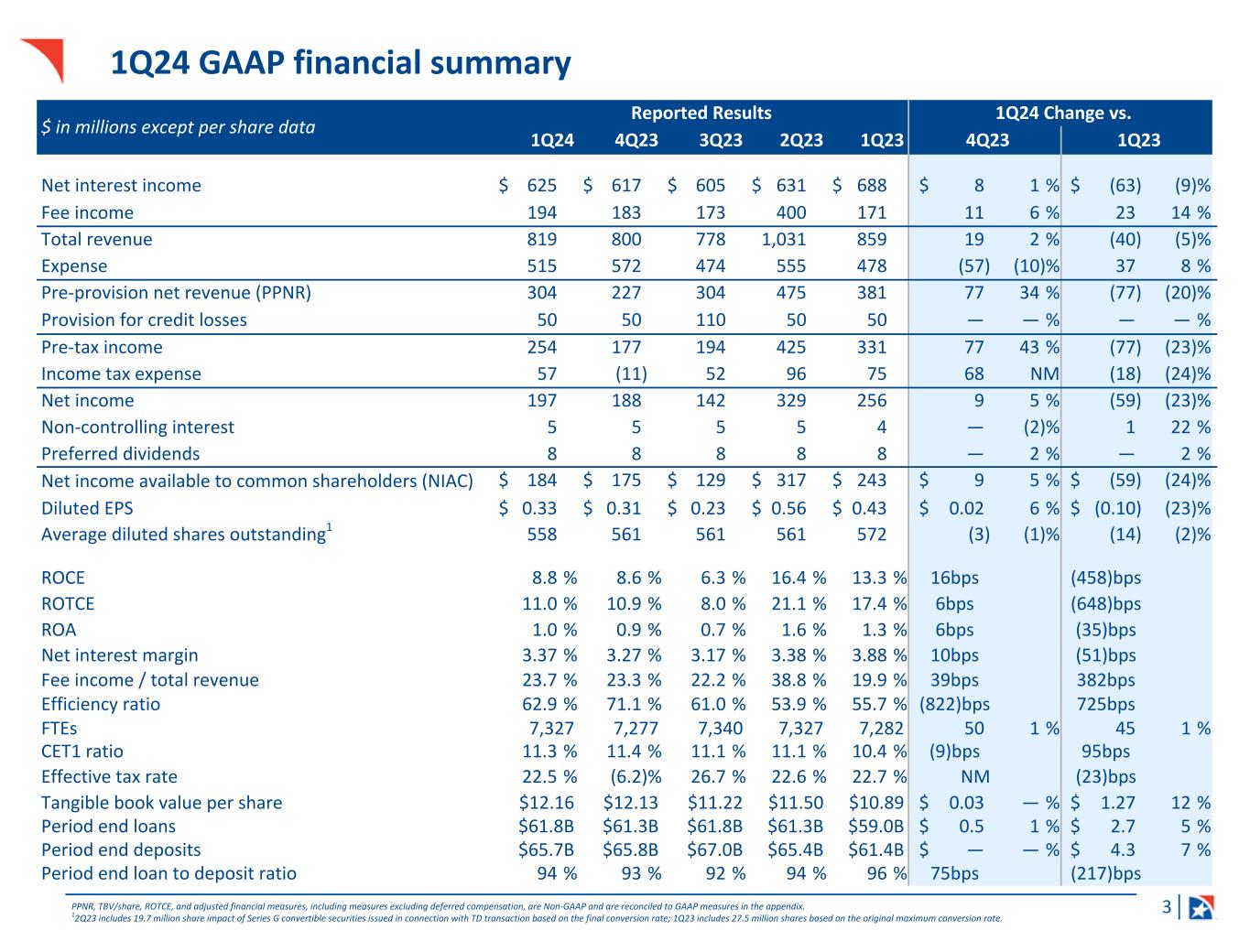

3 1Q24 GAAP financial summary PPNR, TBV/share, ROTCE, and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. 12Q23 includes 19.7 million share impact of Series G convertible securities issued in connection with TD transaction based on the final conversion rate; 1Q23 includes 27.5 million shares based on the original maximum conversion rate. $ in millions except per share data Reported Results 1Q24 Change vs. 1Q24 4Q23 3Q23 2Q23 1Q23 4Q23 1Q23 Net interest income $ 625 $ 617 $ 605 $ 631 $ 688 $ 8 1 % $ (63) (9) % Fee income 194 183 173 400 171 11 6 % 23 14 % Total revenue 819 800 778 1,031 859 19 2 % (40) (5) % Expense 515 572 474 555 478 (57) (10) % 37 8 % Pre-provision net revenue (PPNR) 304 227 304 475 381 77 34 % (77) (20) % Provision for credit losses 50 50 110 50 50 — — % — — % Pre-tax income 254 177 194 425 331 77 43 % (77) (23) % Income tax expense 57 (11) 52 96 75 68 NM (18) (24) % Net income 197 188 142 329 256 9 5 % (59) (23) % Non-controlling interest 5 5 5 5 4 — (2) % 1 22 % Preferred dividends 8 8 8 8 8 — 2 % — 2 % Net income available to common shareholders (NIAC) $ 184 $ 175 $ 129 $ 317 $ 243 $ 9 5 % $ (59) (24) % Diluted EPS $ 0.33 $ 0.31 $ 0.23 $ 0.56 $ 0.43 $ 0.02 6 % $ (0.10) (23) % Average diluted shares outstanding1 558 561 561 561 572 (3) (1) % (14) (2) % ROCE 8.8 % 8.6 % 6.3 % 16.4 % 13.3 % 16bps (458)bps ROTCE 11.0 % 10.9 % 8.0 % 21.1 % 17.4 % 6bps (648)bps ROA 1.0 % 0.9 % 0.7 % 1.6 % 1.3 % 6bps (35)bps Net interest margin 3.37 % 3.27 % 3.17 % 3.38 % 3.88 % 10bps (51)bps Fee income / total revenue 23.7 % 23.3 % 22.2 % 38.8 % 19.9 % 39bps 382bps Efficiency ratio 62.9 % 71.1 % 61.0 % 53.9 % 55.7 % (822)bps 725bps FTEs 7,327 7,277 7,340 7,327 7,282 50 1 % 45 1 % CET1 ratio 11.3 % 11.4 % 11.1 % 11.1 % 10.4 % (9)bps 95bps Effective tax rate 22.5 % (6.2) % 26.7 % 22.6 % 22.7 % NM (23)bps Tangible book value per share $12.16 $12.13 $11.22 $11.50 $10.89 $ 0.03 — % $ 1.27 12 % Period end loans $61.8B $61.3B $61.8B $61.3B $59.0B $ 0.5 1 % $ 2.7 5 % Period end deposits $65.7B $65.8B $67.0B $65.4B $61.4B $ — — % $ 4.3 7 % Period end loan to deposit ratio 94 % 93 % 92 % 94 % 96 % 75bps (217)bps

4 Table of contents 1Q24 highlights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 1Q24 adjusted financial results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 1Q24 notable items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 NII and NIM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 Deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Adjusted fee income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 Adjusted expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Asset quality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 FY24 outlook . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Strategic focus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 Appendix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

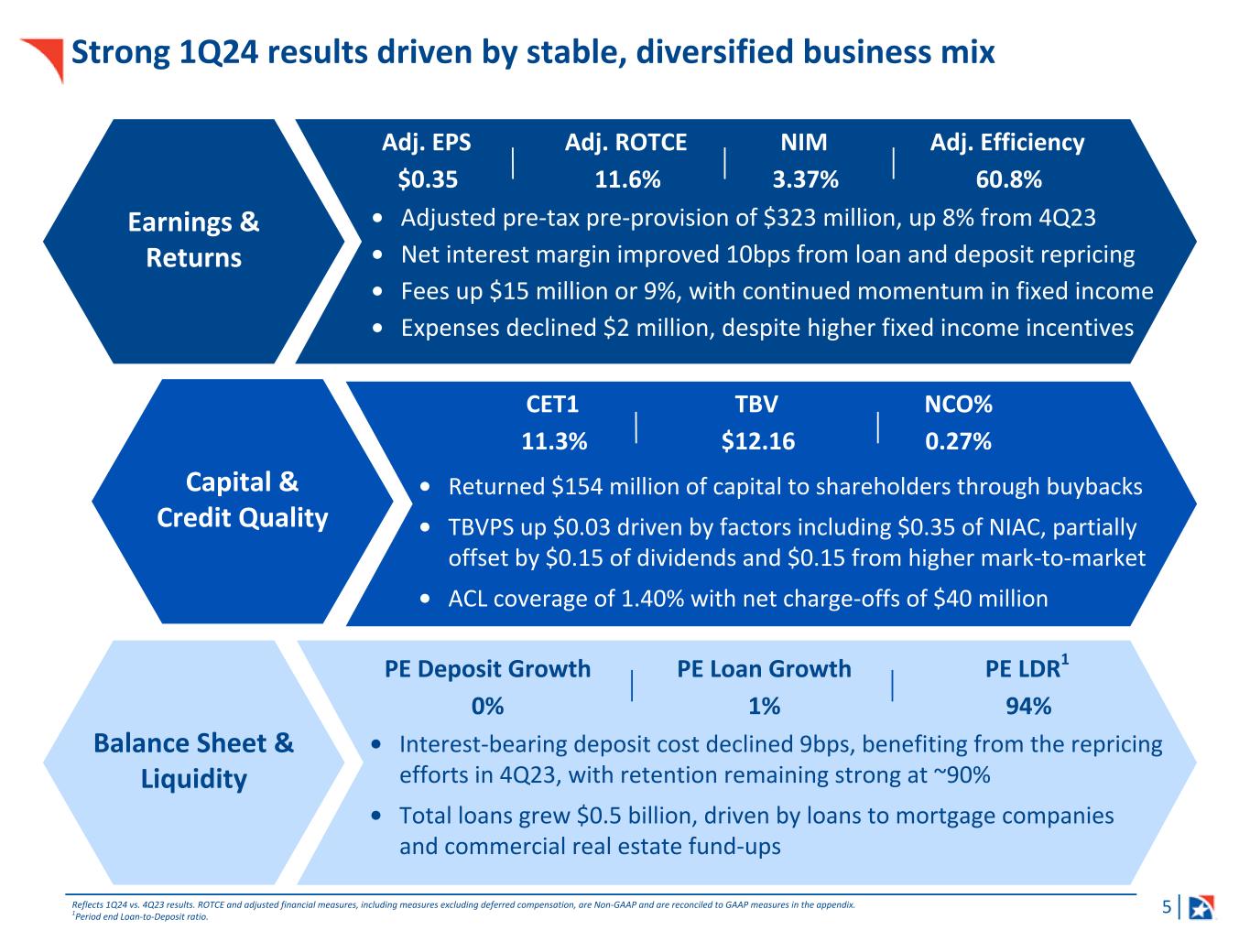

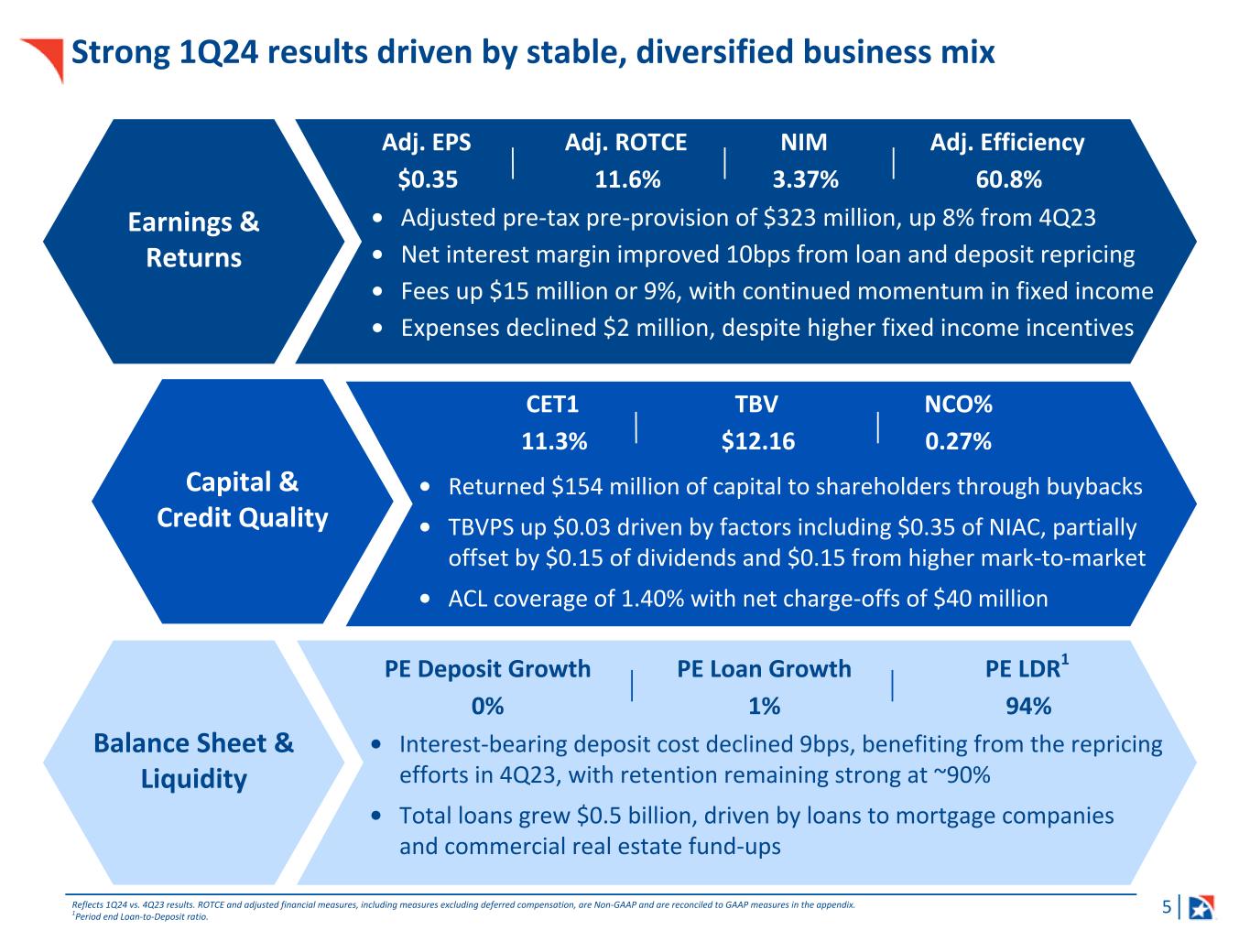

5 • Interest-bearing deposit cost declined 9bps, benefiting from the repricing efforts in 4Q23, with retention remaining strong at ~90% • Total loans grew $0.5 billion, driven by loans to mortgage companies and commercial real estate fund-ups • Returned $154 million of capital to shareholders through buybacks • TBVPS up $0.03 driven by factors including $0.35 of NIAC, partially offset by $0.15 of dividends and $0.15 from higher mark-to-market • ACL coverage of 1.40% with net charge-offs of $40 million • Adjusted pre-tax pre-provision of $323 million, up 8% from 4Q23 • Net interest margin improved 10bps from loan and deposit repricing • Fees up $15 million or 9%, with continued momentum in fixed income • Expenses declined $2 million, despite higher fixed income incentives Strong 1Q24 results driven by stable, diversified business mix Reflects 1Q24 vs. 4Q23 results. ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. 1Period end Loan-to-Deposit ratio. Earnings & Returns Capital & Credit Quality Balance Sheet & Liquidity Adj. EPS Adj. ROTCE NIM Adj. Efficiency $0.35 11.6% 3.37% 60.8% CET1 TBV NCO% 11.3% $12.16 0.27% PE Deposit Growth PE Loan Growth PE LDR1 0% 1% 94%

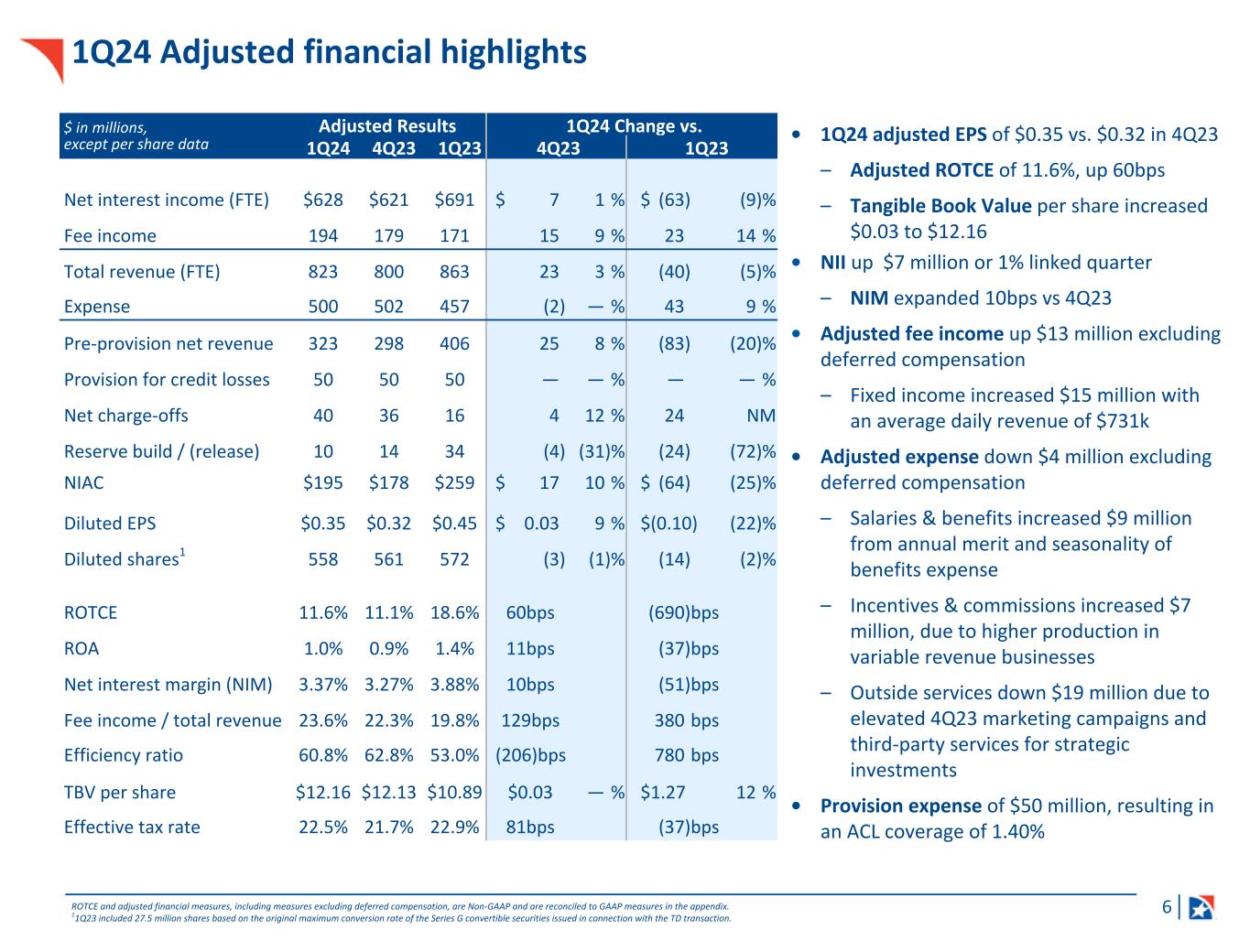

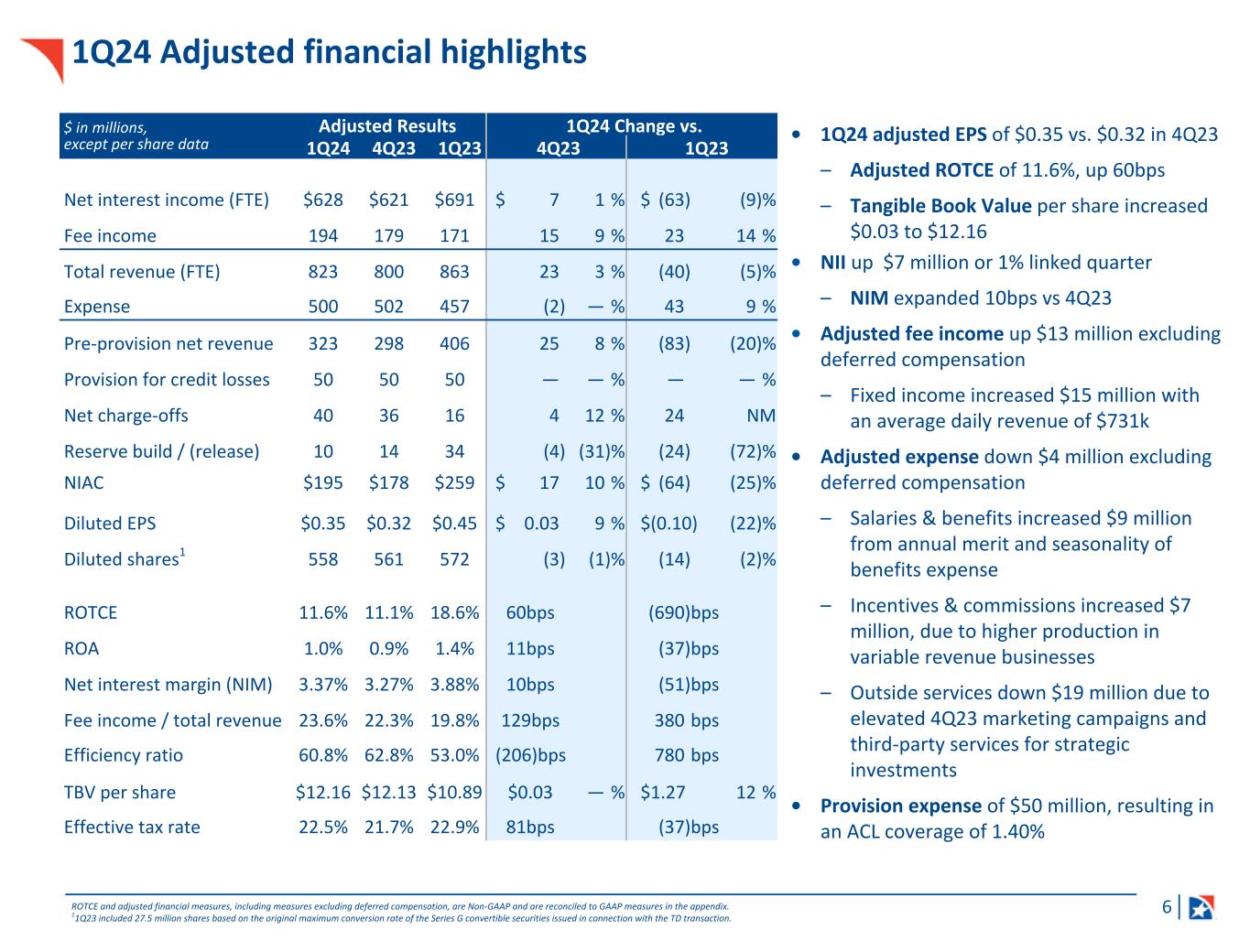

6 • 1Q24 adjusted EPS of $0.35 vs. $0.32 in 4Q23 – Adjusted ROTCE of 11.6%, up 60bps – Tangible Book Value per share increased $0.03 to $12.16 • NII up $7 million or 1% linked quarter – NIM expanded 10bps vs 4Q23 • Adjusted fee income up $13 million excluding deferred compensation – Fixed income increased $15 million with an average daily revenue of $731k • Adjusted expense down $4 million excluding deferred compensation – Salaries & benefits increased $9 million from annual merit and seasonality of benefits expense – Incentives & commissions increased $7 million, due to higher production in variable revenue businesses – Outside services down $19 million due to elevated 4Q23 marketing campaigns and third-party services for strategic investments • Provision expense of $50 million, resulting in an ACL coverage of 1.40% 1Q24 Adjusted financial highlights ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. 11Q23 included 27.5 million shares based on the original maximum conversion rate of the Series G convertible securities issued in connection with the TD transaction. $ in millions, except per share data Adjusted Results 1Q24 Change vs. 1Q24 4Q23 1Q23 4Q23 1Q23 Net interest income (FTE) $628 $621 $691 $ 7 1 % $ (63) (9) % Fee income 194 179 171 15 9 % 23 14 % Total revenue (FTE) 823 800 863 23 3 % (40) (5) % Expense 500 502 457 (2) — % 43 9 % Pre-provision net revenue 323 298 406 25 8 % (83) (20) % Provision for credit losses 50 50 50 — — % — — % Net charge-offs 40 36 16 4 12 % 24 NM Reserve build / (release) 10 14 34 (4) (31) % (24) (72) % NIAC $195 $178 $259 $ 17 10 % $ (64) (25) % Diluted EPS $0.35 $0.32 $0.45 $ 0.03 9 % $ (0.10) (22) % Diluted shares1 558 561 572 (3) (1) % (14) (2) % ROTCE 11.6% 11.1% 18.6% 60bps (690) bps ROA 1.0% 0.9% 1.4% 11bps (37) bps Net interest margin (NIM) 3.37% 3.27% 3.88% 10bps (51) bps Fee income / total revenue 23.6% 22.3% 19.8% 129bps 380 bps Efficiency ratio 60.8% 62.8% 53.0% (206)bps 780 bps TBV per share $12.16 $12.13 $10.89 $0.03 — % $ 1.27 12 % Effective tax rate 22.5% 21.7% 22.9% 81bps (37) bps

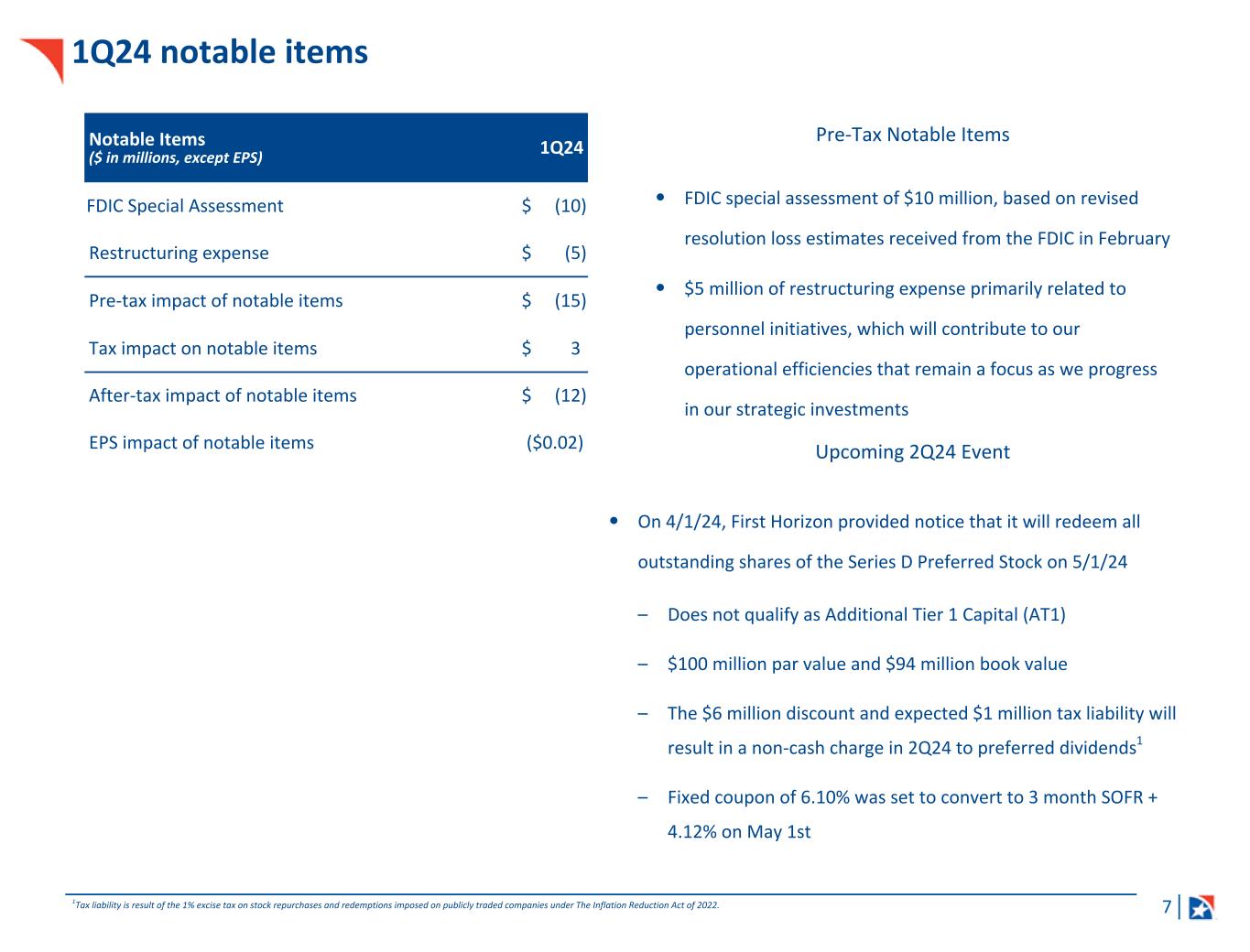

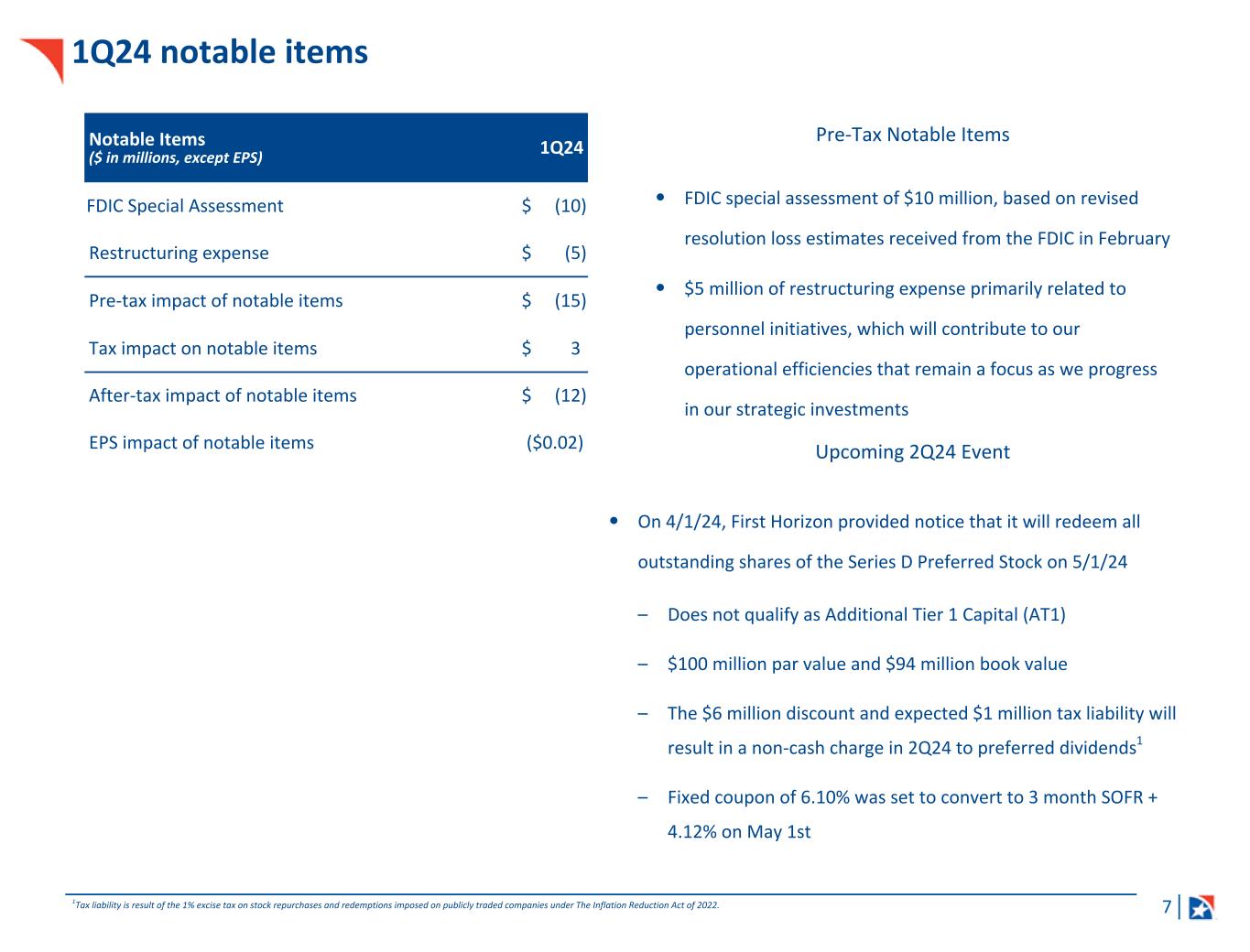

7 1Q24 notable items Notable Items ($ in millions, except EPS) 1Q24 FDIC Special Assessment $ (10) Restructuring expense $ (5) Pre-tax impact of notable items $ (15) Tax impact on notable items $ 3 After-tax impact of notable items $ (12) EPS impact of notable items ($0.02) Pre-Tax Notable Items • On 4/1/24, First Horizon provided notice that it will redeem all outstanding shares of the Series D Preferred Stock on 5/1/24 – Does not qualify as Additional Tier 1 Capital (AT1) – $100 million par value and $94 million book value – The $6 million discount and expected $1 million tax liability will result in a non-cash charge in 2Q24 to preferred dividends1 – Fixed coupon of 6.10% was set to convert to 3 month SOFR + 4.12% on May 1st Upcoming 2Q24 Event 1Tax liability is result of the 1% excise tax on stock repurchases and redemptions imposed on publicly traded companies under The Inflation Reduction Act of 2022. • FDIC special assessment of $10 million, based on revised resolution loss estimates received from the FDIC in February • $5 million of restructuring expense primarily related to personnel initiatives, which will contribute to our operational efficiencies that remain a focus as we progress in our strategic investments

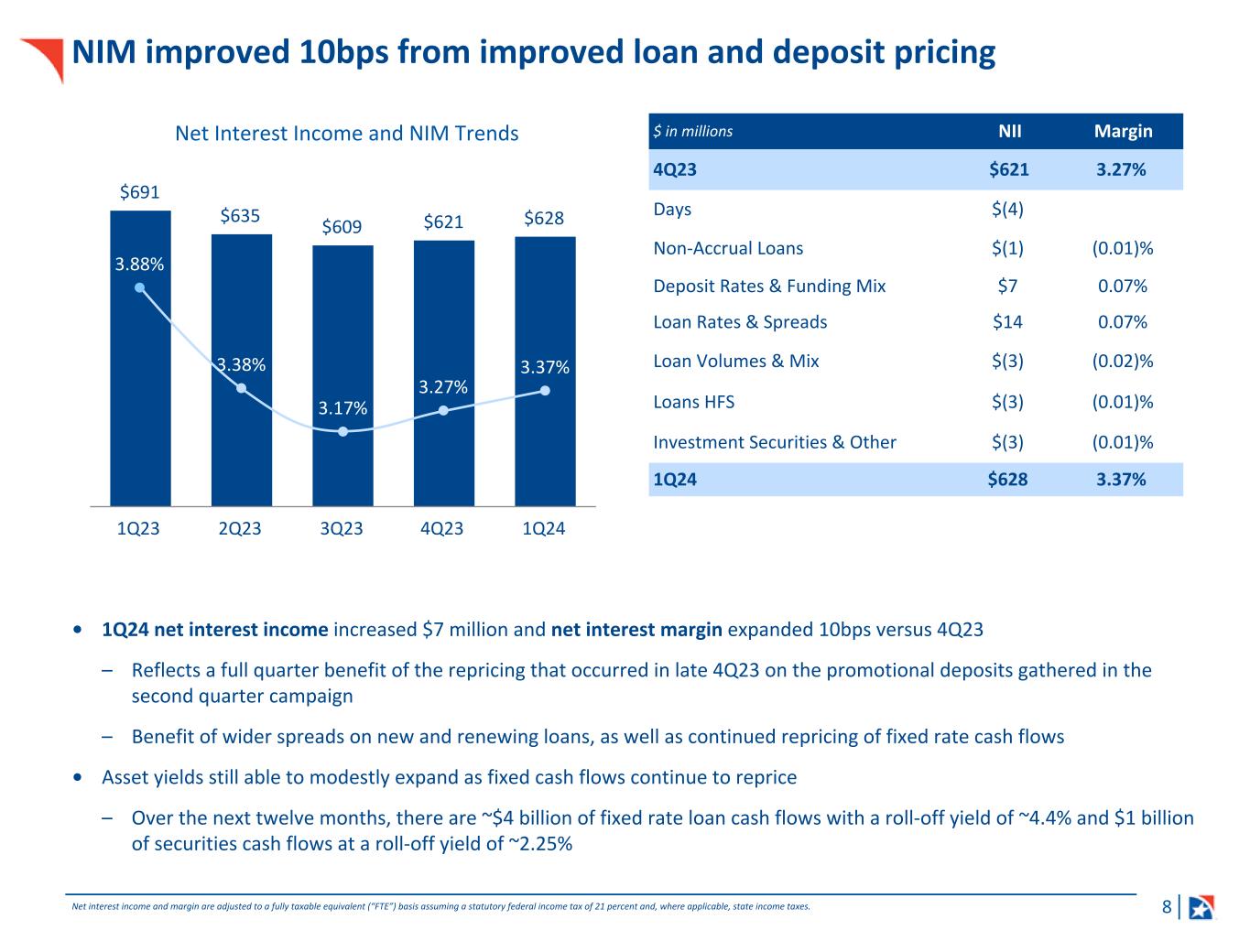

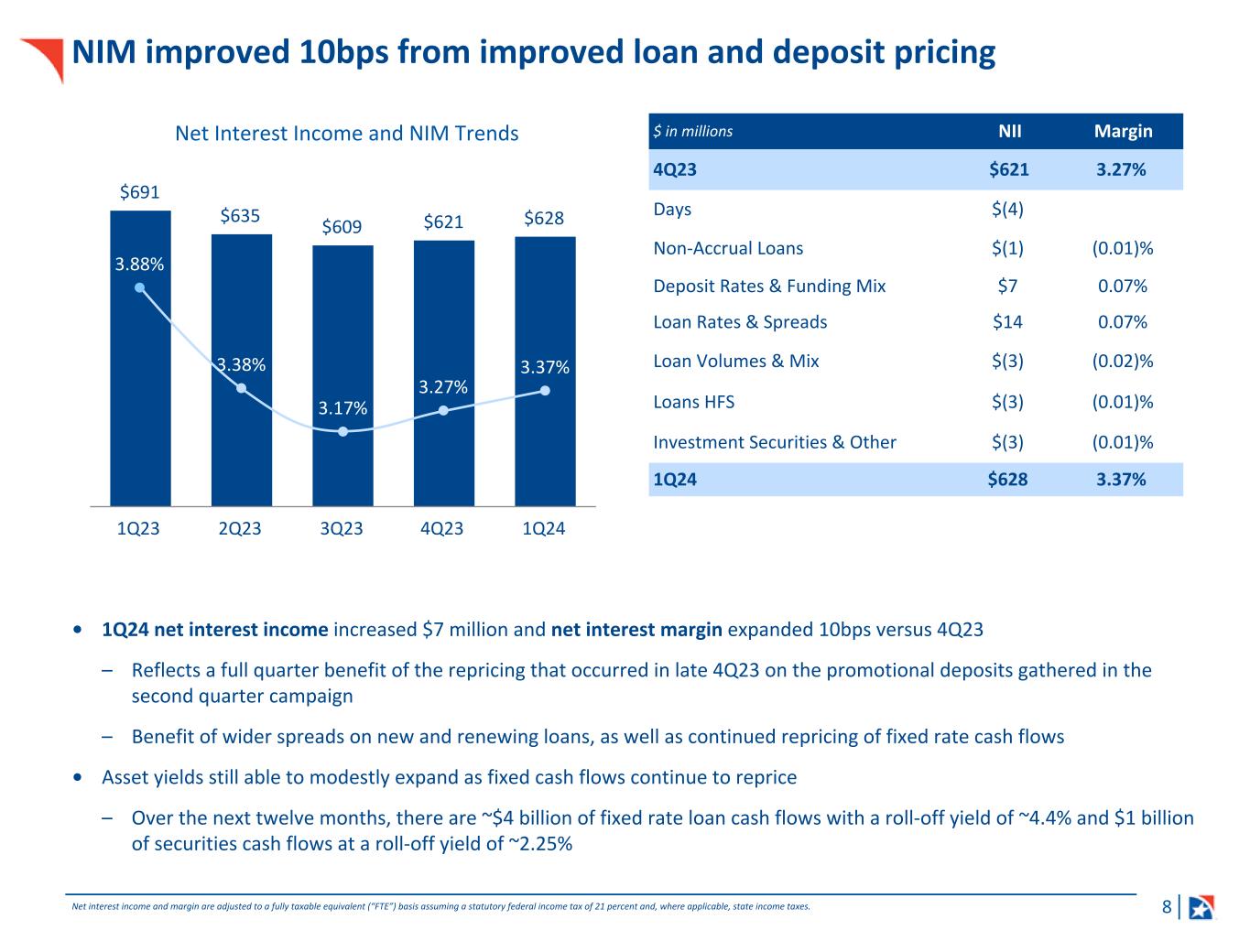

8 NIM improved 10bps from improved loan and deposit pricing $691 $635 $609 $621 $628 3.88% 3.38% 3.17% 3.27% 3.37% 1Q23 2Q23 3Q23 4Q23 1Q24 Net Interest Income and NIM Trends Net interest income and margin are adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. • 1Q24 net interest income increased $7 million and net interest margin expanded 10bps versus 4Q23 – Reflects a full quarter benefit of the repricing that occurred in late 4Q23 on the promotional deposits gathered in the second quarter campaign – Benefit of wider spreads on new and renewing loans, as well as continued repricing of fixed rate cash flows • Asset yields still able to modestly expand as fixed cash flows continue to reprice – Over the next twelve months, there are ~$4 billion of fixed rate loan cash flows with a roll-off yield of ~4.4% and $1 billion of securities cash flows at a roll-off yield of ~2.25% $ in millions NII Margin 4Q23 $621 3.27% Days $(4) Non-Accrual Loans $(1) (0.01)% Deposit Rates & Funding Mix $7 0.07% Loan Rates & Spreads $14 0.07% Loan Volumes & Mix $(3) (0.02)% Loans HFS $(3) (0.01)% Investment Securities & Other $(3) (0.01)% 1Q24 $628 3.37%

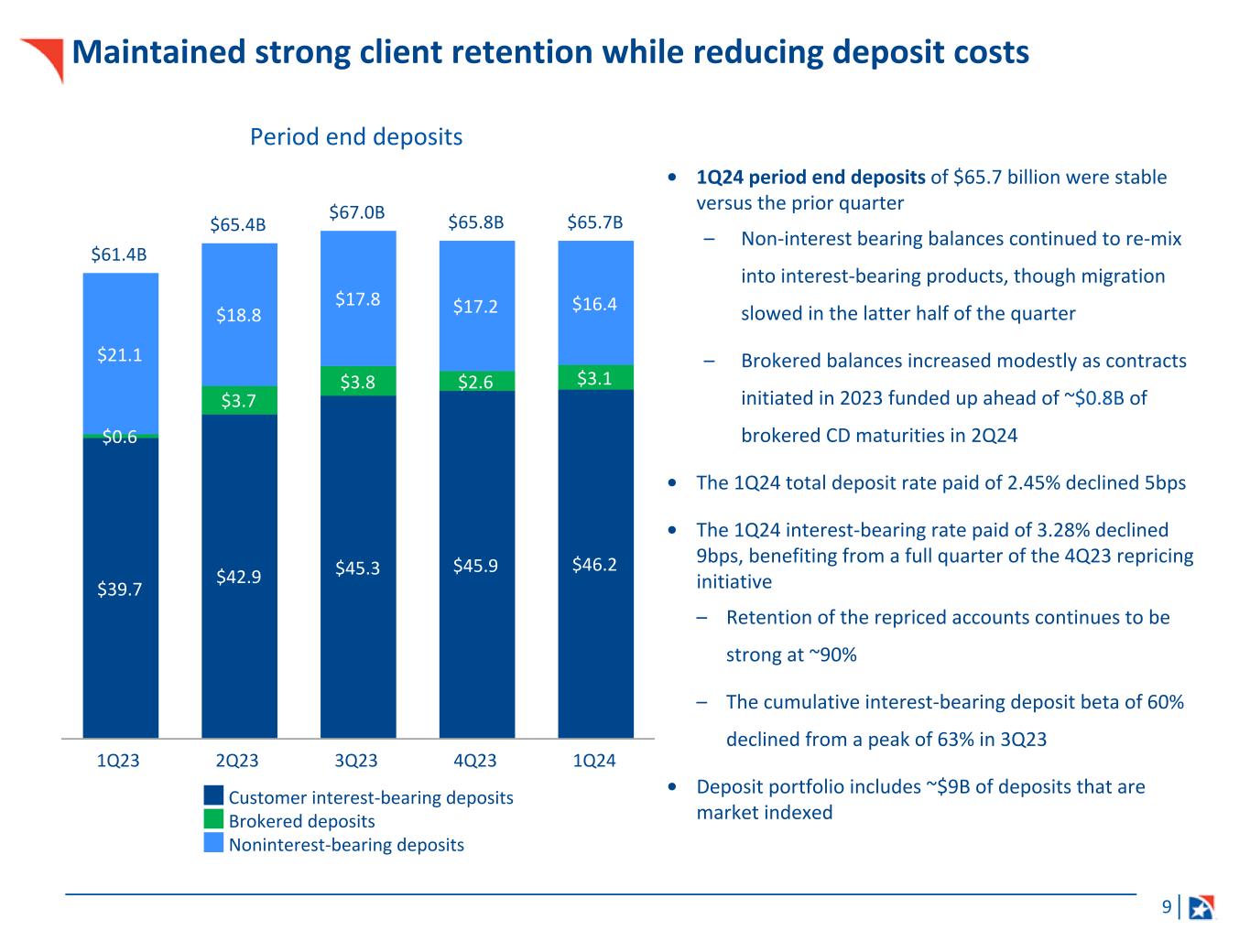

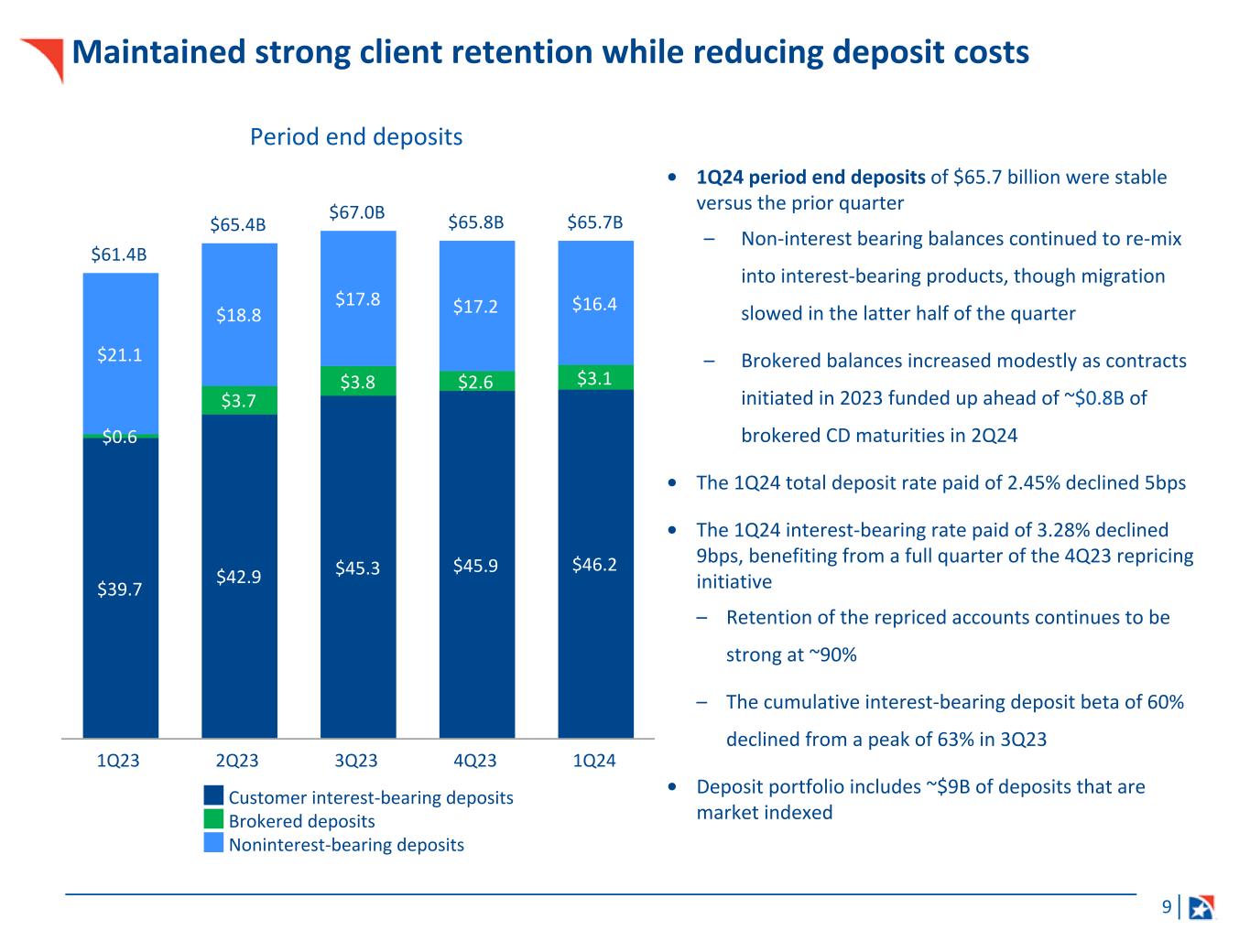

9 $61.4B $65.4B $67.0B $65.8B $65.7B $39.7 $42.9 $45.3 $45.9 $46.2 $0.6 $3.7 $3.8 $2.6 $3.1 $21.1 $18.8 $17.8 $17.2 $16.4 Customer interest-bearing deposits Brokered deposits Noninterest-bearing deposits 1Q23 2Q23 3Q23 4Q23 1Q24 Maintained strong client retention while reducing deposit costs Period end deposits • 1Q24 period end deposits of $65.7 billion were stable versus the prior quarter – Non-interest bearing balances continued to re-mix into interest-bearing products, though migration slowed in the latter half of the quarter – Brokered balances increased modestly as contracts initiated in 2023 funded up ahead of ~$0.8B of brokered CD maturities in 2Q24 • The 1Q24 total deposit rate paid of 2.45% declined 5bps • The 1Q24 interest-bearing rate paid of 3.28% declined 9bps, benefiting from a full quarter of the 4Q23 repricing initiative – Retention of the repriced accounts continues to be strong at ~90% – The cumulative interest-bearing deposit beta of 60% declined from a peak of 63% in 3Q23 • Deposit portfolio includes ~$9B of deposits that are market indexed

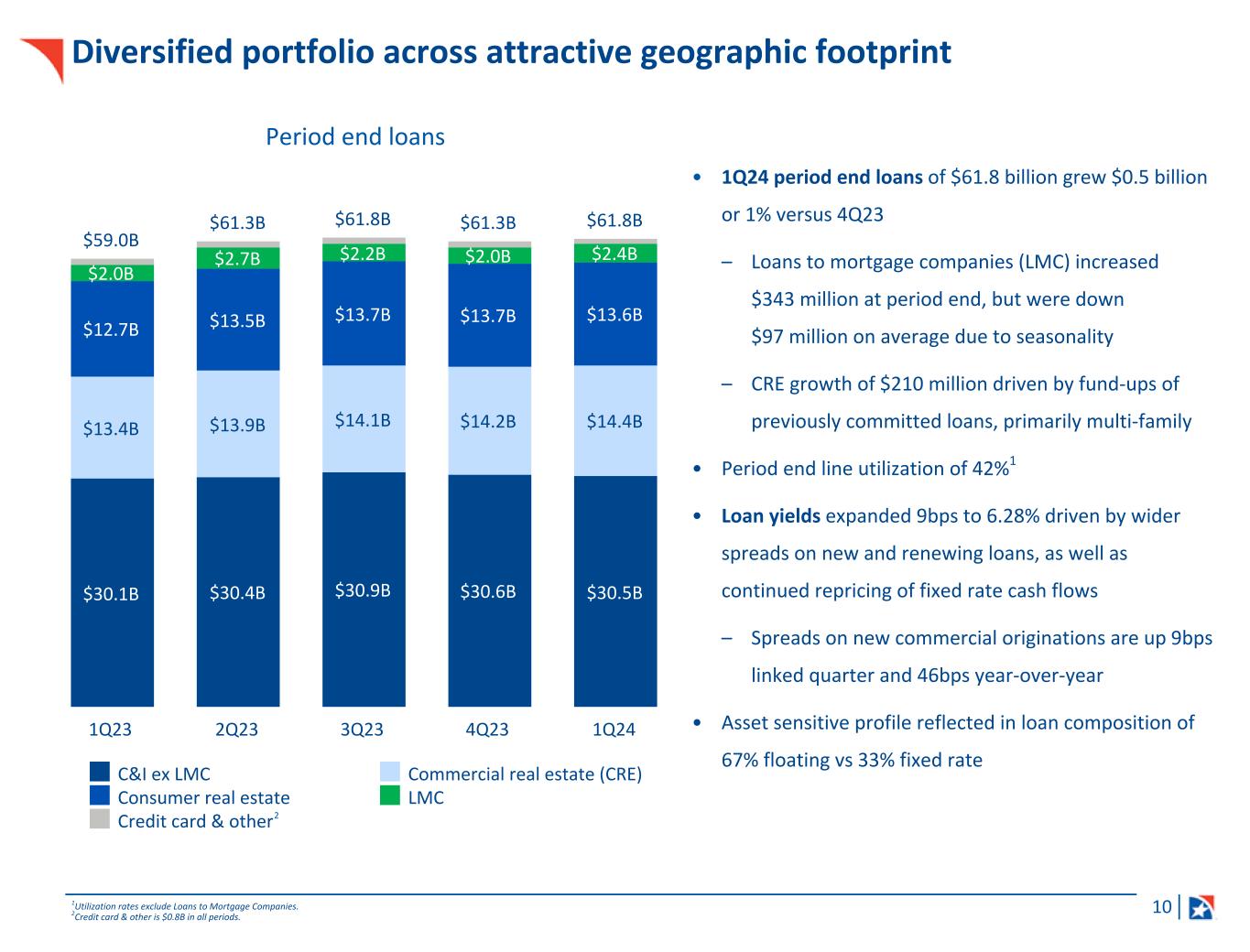

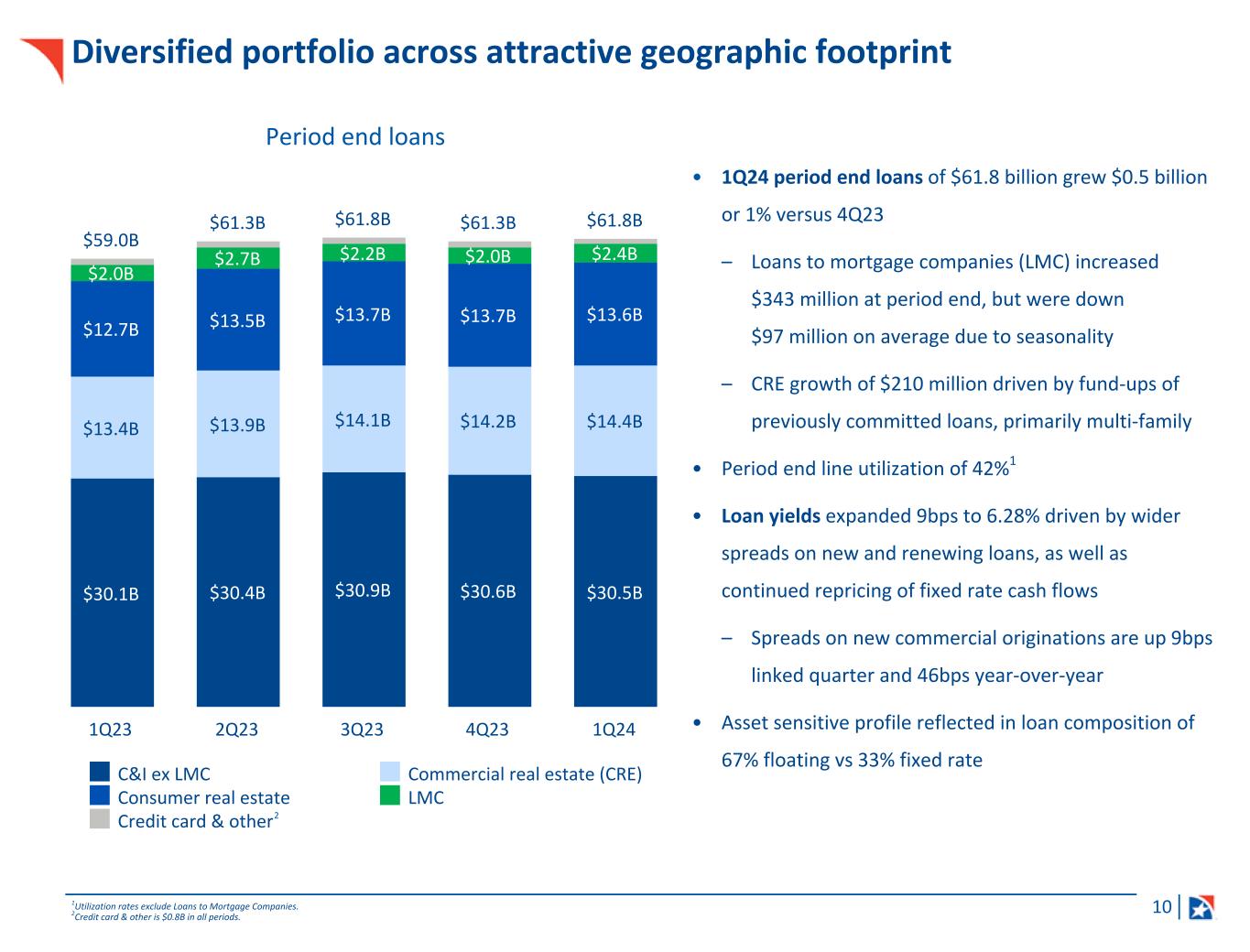

10 • 1Q24 period end loans of $61.8 billion grew $0.5 billion or 1% versus 4Q23 – Loans to mortgage companies (LMC) increased $343 million at period end, but were down $97 million on average due to seasonality – CRE growth of $210 million driven by fund-ups of previously committed loans, primarily multi-family • Period end line utilization of 42%1 • Loan yields expanded 9bps to 6.28% driven by wider spreads on new and renewing loans, as well as continued repricing of fixed rate cash flows – Spreads on new commercial originations are up 9bps linked quarter and 46bps year-over-year • Asset sensitive profile reflected in loan composition of 67% floating vs 33% fixed rate 1Utilization rates exclude Loans to Mortgage Companies. 2Credit card & other is $0.8B in all periods. Period end loans Diversified portfolio across attractive geographic footprint $59.0B $61.3B $61.8B $61.3B $61.8B $30.1B $30.4B $30.9B $30.6B $30.5B $13.4B $13.9B $14.1B $14.2B $14.4B $12.7B $13.5B $13.7B $13.7B $13.6B $2.0B $2.7B $2.2B $2.0B $2.4B C&I ex LMC Commercial real estate (CRE) Consumer real estate LMC Credit card & other 1Q23 2Q23 3Q23 4Q23 1Q24 2

11 • 1Q24 adjusted fee income excluding deferred compensation increased $13 million from 4Q23 – Fixed income increased $15 million as average daily revenue (ADR) rebounded to $731k from $463k, driven by the market's expectation that short-term rates have peaked and improved liquidity conditions in the banking sector – Mortgage banking income increased $4 million as both volume and gain-on-sale spreads increased – Service Charges and fees decreased $2 million primarily due to seasonality of overdraft fees – Card and digital banking fees increased $3 million, primarily due to a methodology adjustment on cardholder rebates, resulting in an isolated impact in the prior quarter – Other noninterest income declined by $6 million, from $3 million of lower FHLB dividends, as well as slightly lower letter of credit fees and swap fees Strong fee income driven by higher fixed income production ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. $ in millions Adjusted Results 1Q24 Change vs. 1Q24 4Q23 3Q23 2Q23 1Q23 4Q23 1Q23 Fixed income $52 $37 $28 $30 $39 $15 40 % $13 33 % Mortgage banking $9 $5 $7 $6 $5 $4 71 % $4 71 % Service charges and fees $57 $59 $60 $59 $55 $(2) (3) % $2 4 % Brokerage, trust, and insurance $36 $36 $34 $35 $34 $0 (1) % $2 5 % Card and digital banking fees $19 $16 $20 $21 $19 $3 16 % $0 (2) % Deferred compensation income $9 $6 $0 $8 $3 $3 42 % $6 NM Other noninterest income $14 $20 $25 $17 $15 $(6) (29) % $(1) (6) % Total fee income $194 $179 $173 $175 $171 $15 9 % $23 14 % Fee income ex deferred comp $186 $173 $173 $167 $168 $13 7 % $18 11 % Fixed income ADR $731k $463k $301k $348k $437k $268k 58 % $294k 67 %

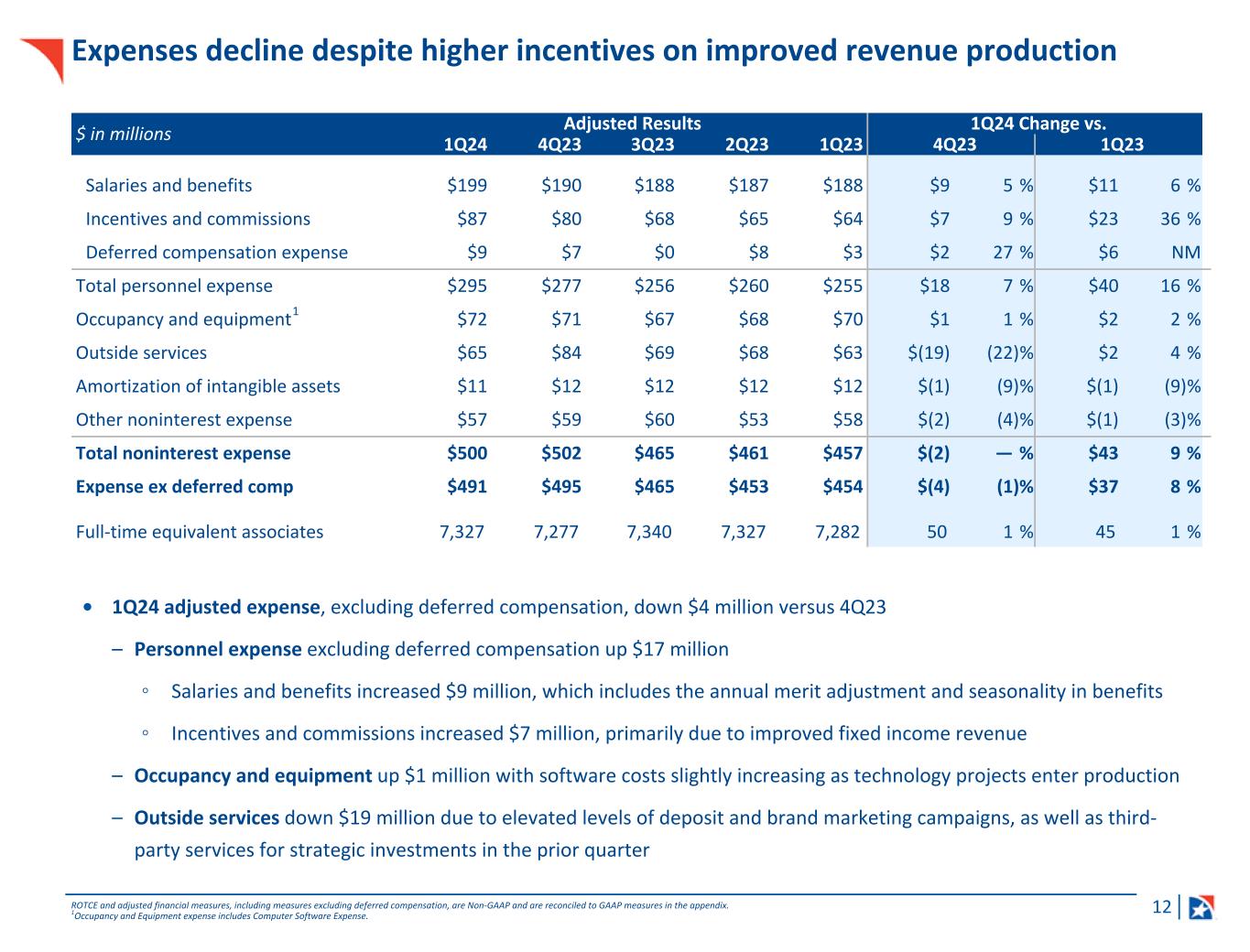

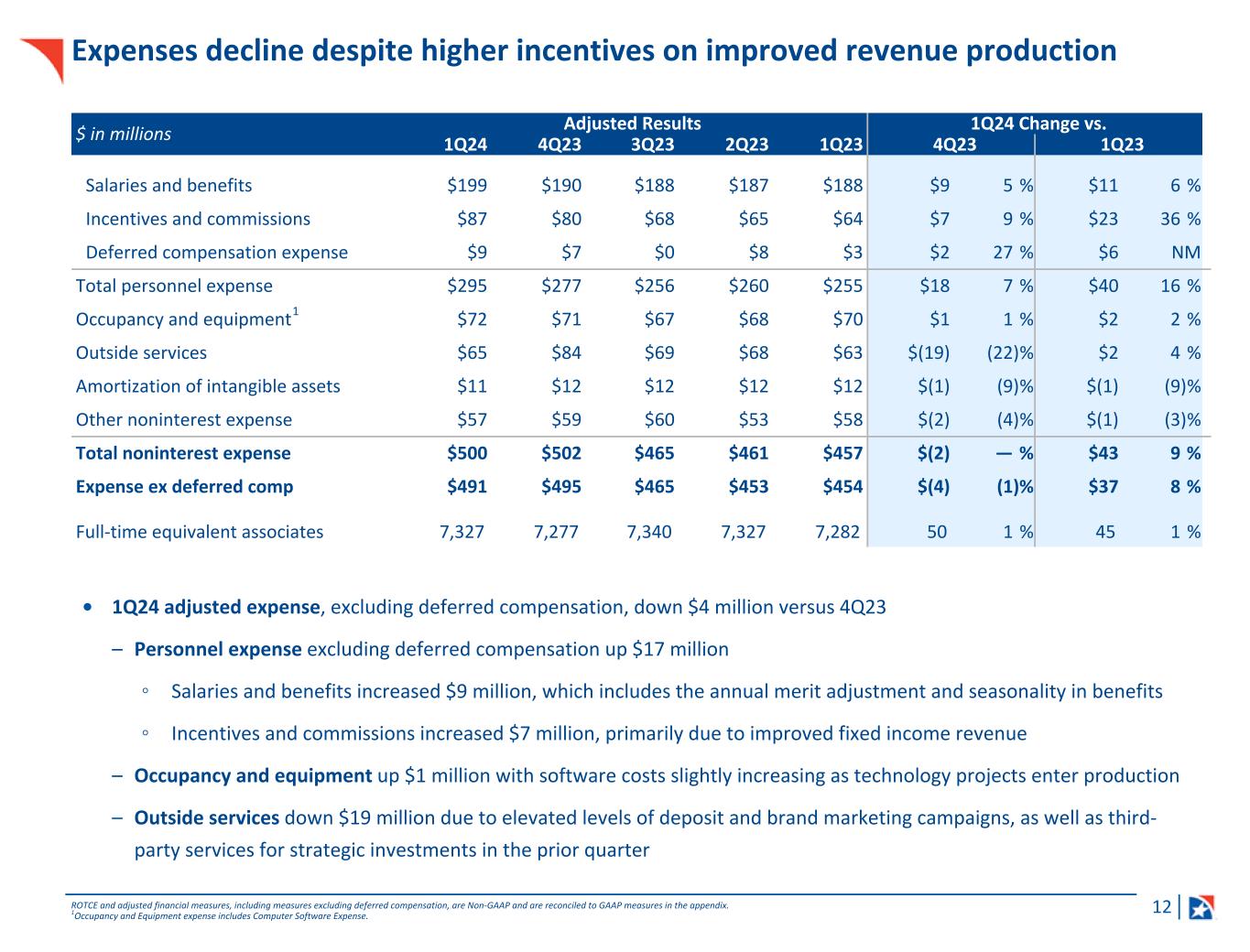

12 Expenses decline despite higher incentives on improved revenue production • 1Q24 adjusted expense, excluding deferred compensation, down $4 million versus 4Q23 – Personnel expense excluding deferred compensation up $17 million ◦ Salaries and benefits increased $9 million, which includes the annual merit adjustment and seasonality in benefits ◦ Incentives and commissions increased $7 million, primarily due to improved fixed income revenue – Occupancy and equipment up $1 million with software costs slightly increasing as technology projects enter production – Outside services down $19 million due to elevated levels of deposit and brand marketing campaigns, as well as third- party services for strategic investments in the prior quarter $ in millions Adjusted Results 1Q24 Change vs. 1Q24 4Q23 3Q23 2Q23 1Q23 4Q23 1Q23 Salaries and benefits $199 $190 $188 $187 $188 $9 5 % $11 6 % Incentives and commissions $87 $80 $68 $65 $64 $7 9 % $23 36 % Deferred compensation expense $9 $7 $0 $8 $3 $2 27 % $6 NM Total personnel expense $295 $277 $256 $260 $255 $18 7 % $40 16 % Occupancy and equipment $72 $71 $67 $68 $70 $1 1 % $2 2 % Outside services $65 $84 $69 $68 $63 $(19) (22) % $2 4 % Amortization of intangible assets $11 $12 $12 $12 $12 $(1) (9) % $(1) (9) % Other noninterest expense $57 $59 $60 $53 $58 $(2) (4) % $(1) (3) % Total noninterest expense $500 $502 $465 $461 $457 $(2) — % $43 9 % Expense ex deferred comp $491 $495 $465 $453 $454 $(4) (1) % $37 8 % Full-time equivalent associates 7,327 7,277 7,340 7,327 7,282 50 1 % 45 1 % ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. 1Occupancy and Equipment expense includes Computer Software Expense. 1

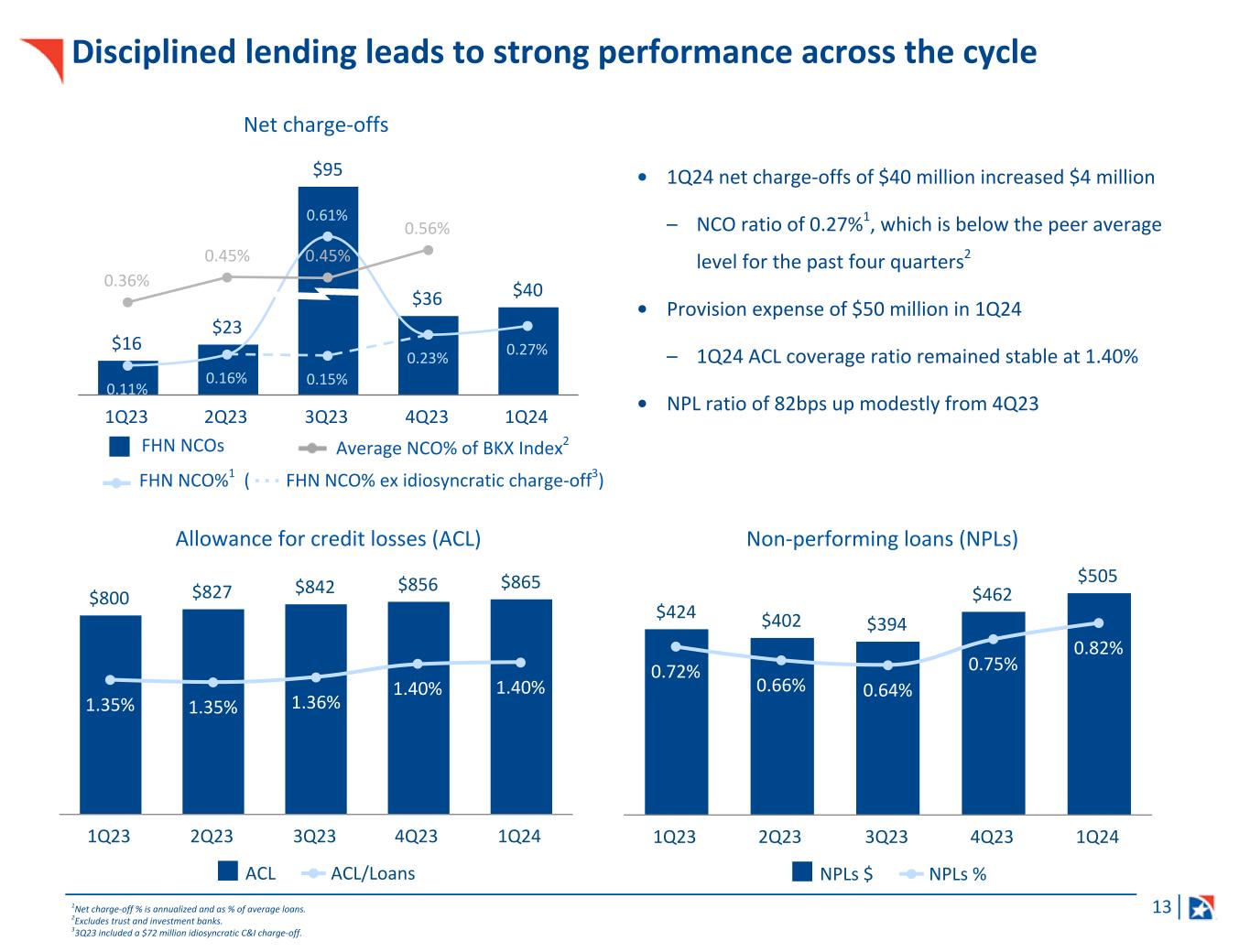

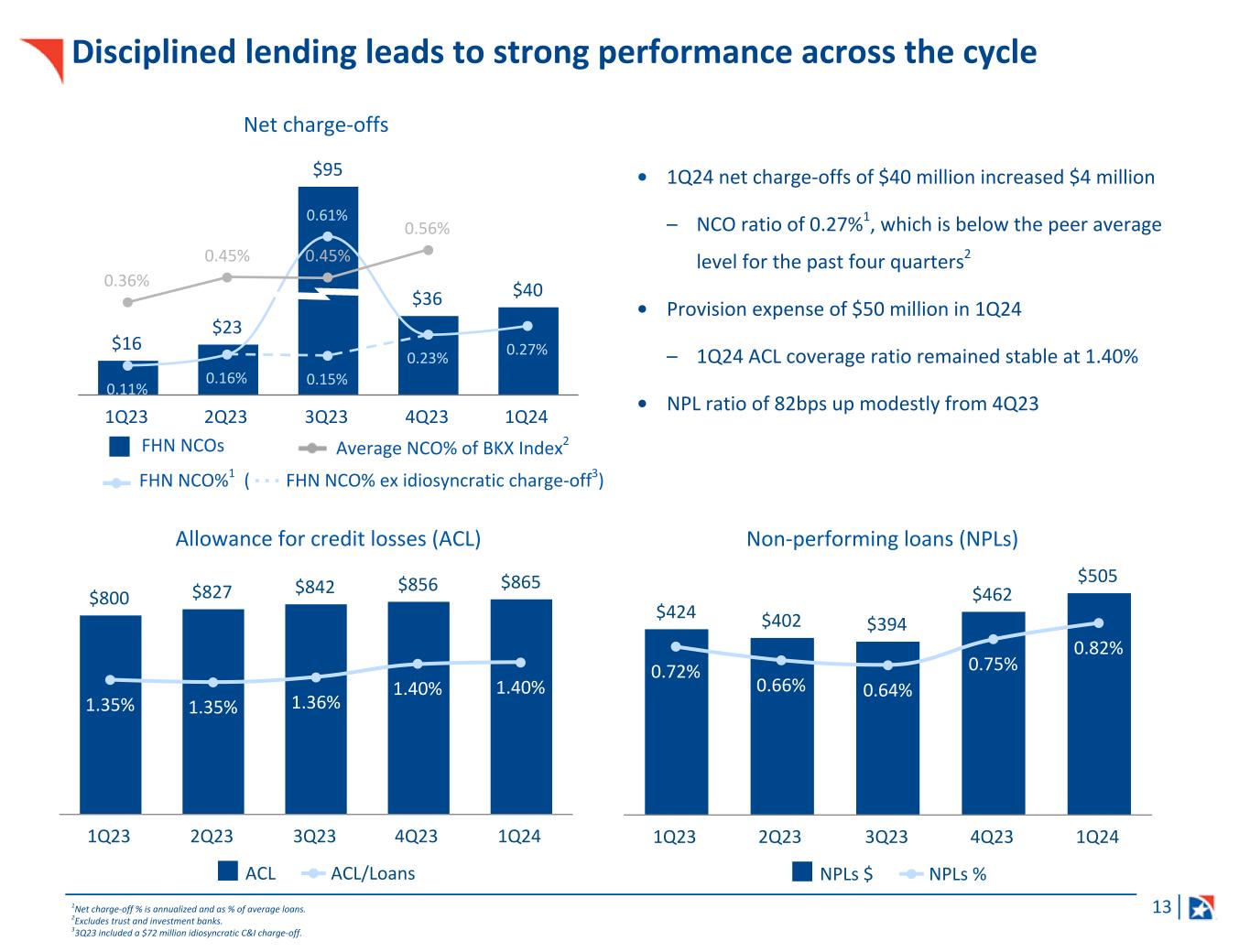

13 FHN NCO%1 ( FHN NCO% ex idiosyncratic charge-off3) Average NCO% of BKX Index2 $16 $23 $95 $36 $40 0.11% 0.16% 0.61% 0.23% 0.27% 0.15% 0.36% 0.45% 0.45% 0.56% 1Q23 2Q23 3Q23 4Q23 1Q24 FHN NCOs Disciplined lending leads to strong performance across the cycle 1Net charge-off % is annualized and as % of average loans. 2Excludes trust and investment banks. 33Q23 included a $72 million idiosyncratic C&I charge-off. $800 $827 $842 $856 $865 1.35% 1.35% 1.36% 1.40% 1.40% ACL ACL/Loans 1Q23 2Q23 3Q23 4Q23 1Q24 Allowance for credit losses (ACL) Non-performing loans (NPLs) $424 $402 $394 $462 $505 0.72% 0.66% 0.64% 0.75% 0.82% NPLs $ NPLs % 1Q23 2Q23 3Q23 4Q23 1Q24 • 1Q24 net charge-offs of $40 million increased $4 million – NCO ratio of 0.27%1, which is below the peer average level for the past four quarters2 • Provision expense of $50 million in 1Q24 – 1Q24 ACL coverage ratio remained stable at 1.40% • NPL ratio of 82bps up modestly from 4Q23 Net charge-offs

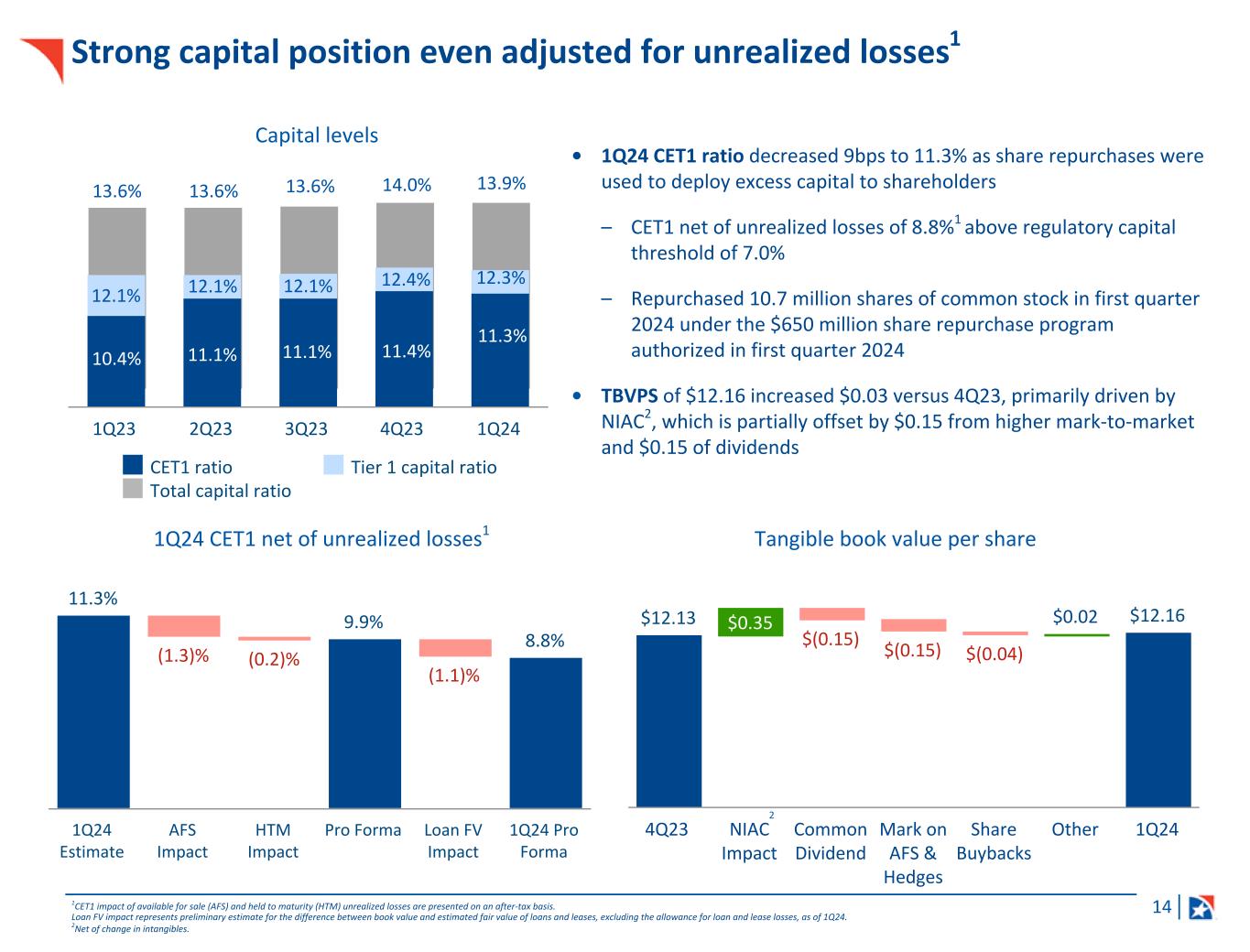

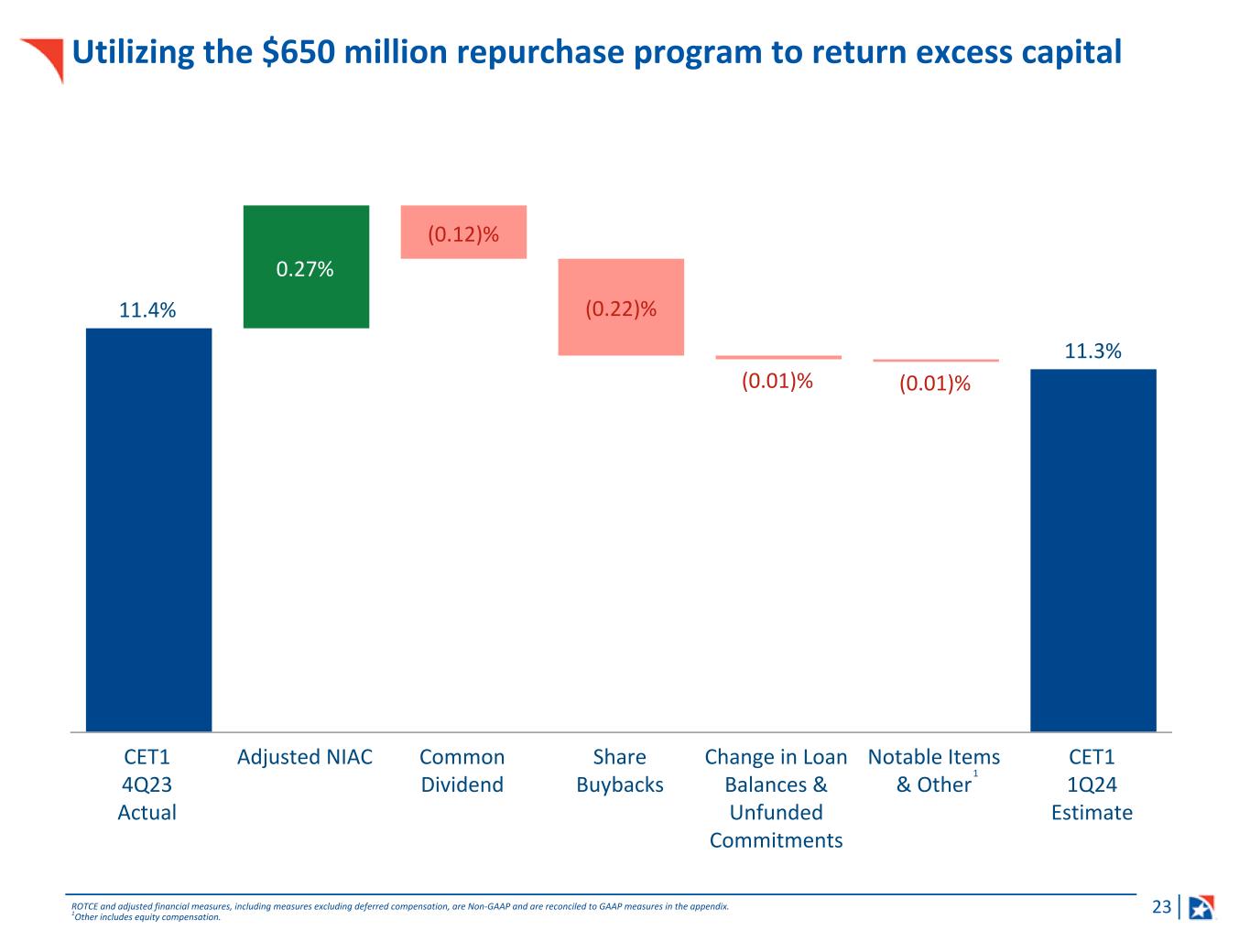

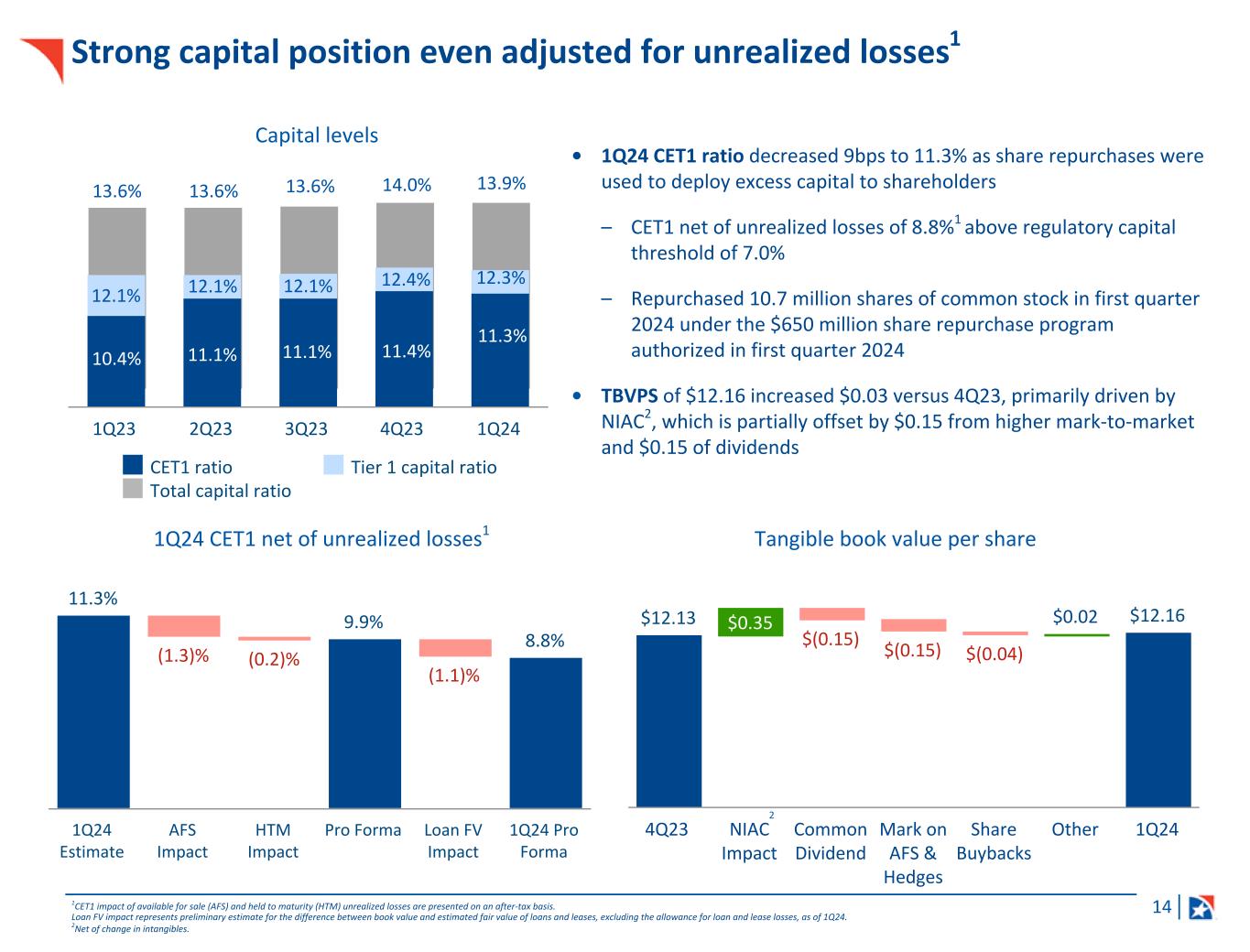

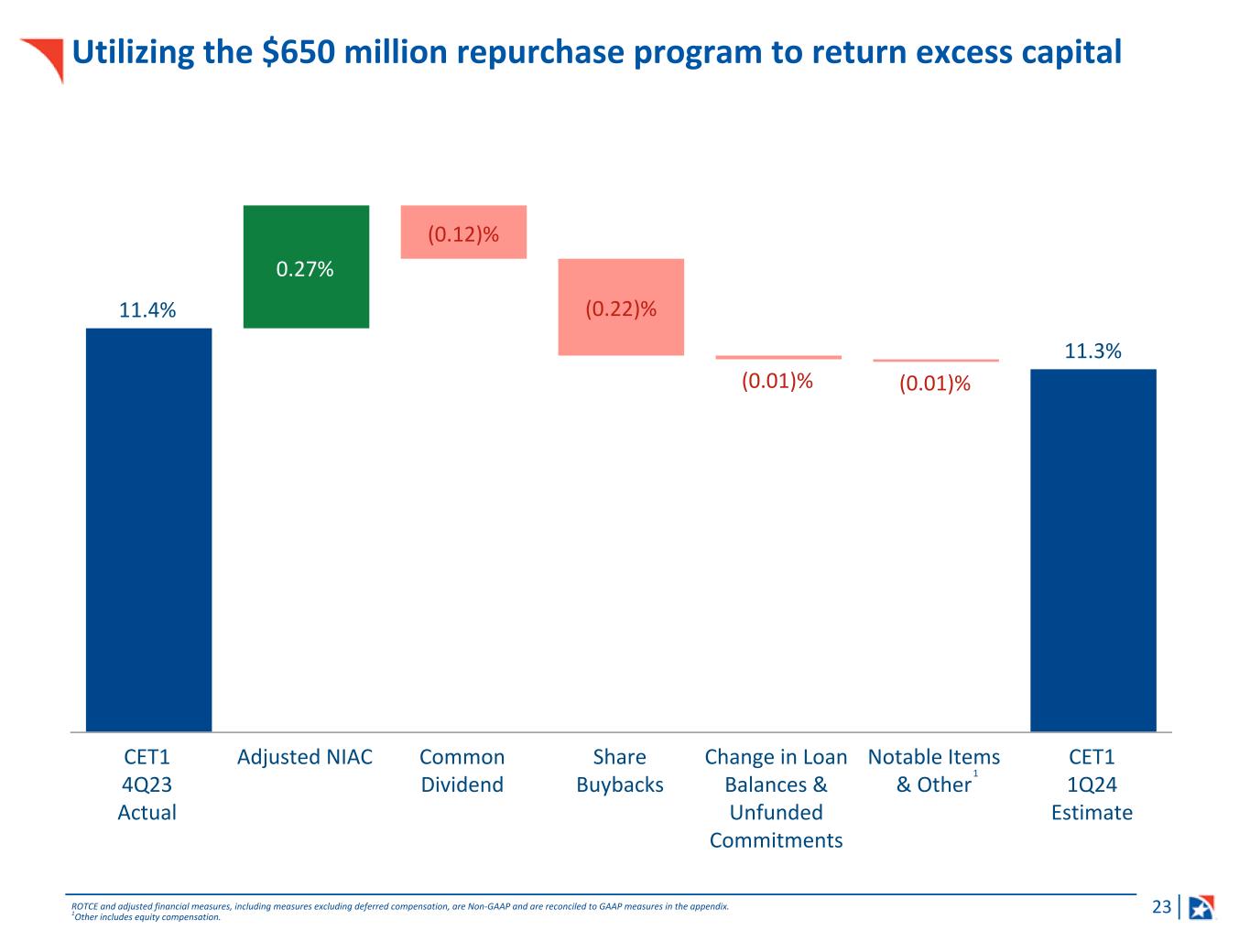

14 1Q23 2Q23 3Q23 4Q23 1Q24 CET1 ratio Tier 1 capital ratio Total capital ratio 1Q23 2Q23 3Q23 4Q23 1Q24 Strong capital position even adjusted for unrealized losses1 Capital levels 12.1% 13.6% 13.6% 12.1% 13.6% 12.1% 14.0% 12.4% 13.9% 12.3% $12.13 $0.35 $(0.15) $(0.15) $(0.04) $0.02 $12.16 4Q23 NIAC Impact Common Dividend Mark on AFS & Hedges Share Buybacks Other 1Q24 • 1Q24 CET1 ratio decreased 9bps to 11.3% as share repurchases were used to deploy excess capital to shareholders – CET1 net of unrealized losses of 8.8%1 above regulatory capital threshold of 7.0% – Repurchased 10.7 million shares of common stock in first quarter 2024 under the $650 million share repurchase program authorized in first quarter 2024 • TBVPS of $12.16 increased $0.03 versus 4Q23, primarily driven by NIAC2, which is partially offset by $0.15 from higher mark-to-market and $0.15 of dividends 1CET1 impact of available for sale (AFS) and held to maturity (HTM) unrealized losses are presented on an after-tax basis. Loan FV impact represents preliminary estimate for the difference between book value and estimated fair value of loans and leases, excluding the allowance for loan and lease losses, as of 1Q24. 2Net of change in intangibles. Tangible book value per share 10.4% 11.1% 11.1% 11.4% 11.3% 11.3% (1.3)% (0.2)% 9.9% (1.1)% 8.8% 1Q24 Estimate AFS Impact HTM Impact Pro Forma Loan FV Impact 1Q24 Pro Forma 1Q24 CET1 net of unrealized losses1 2

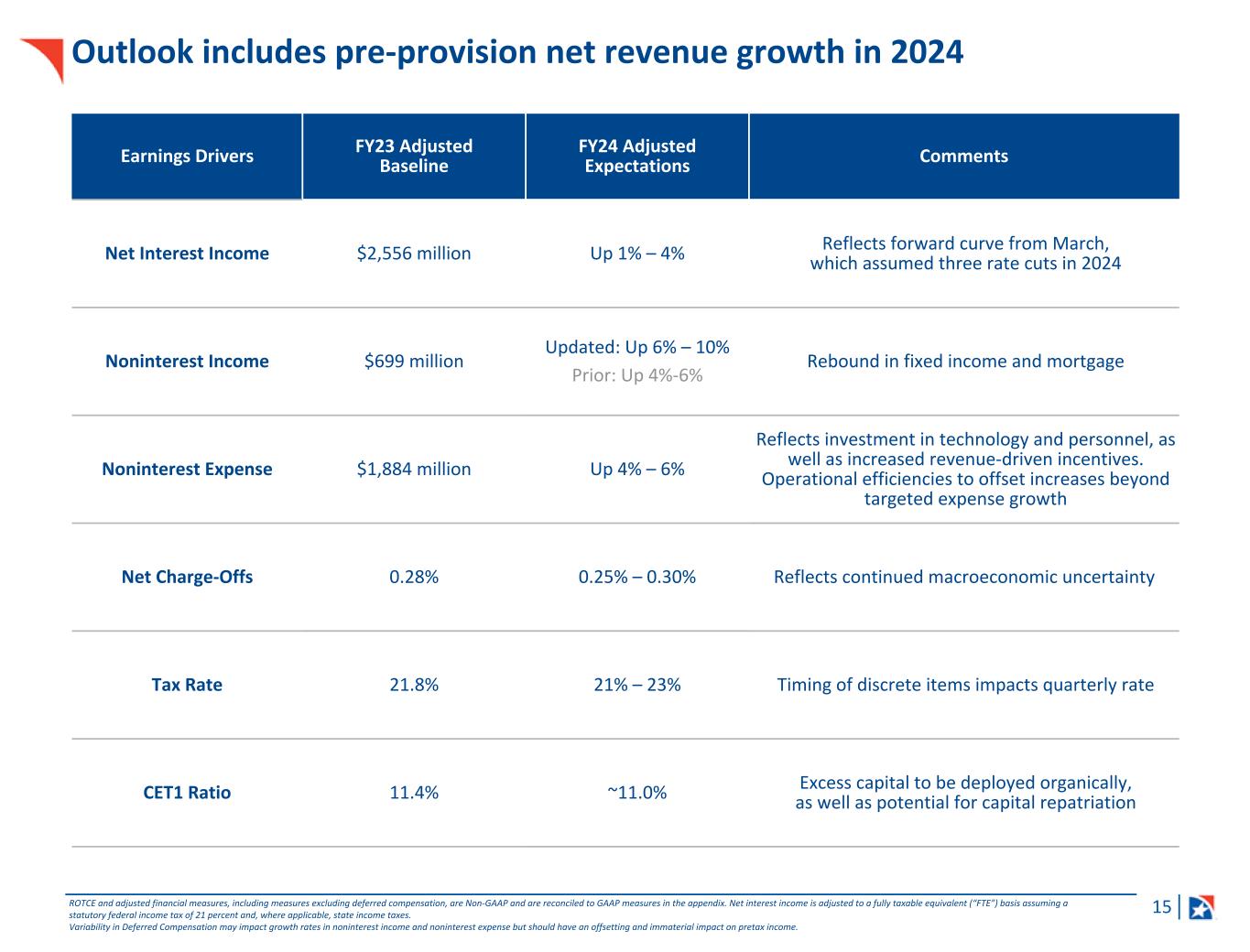

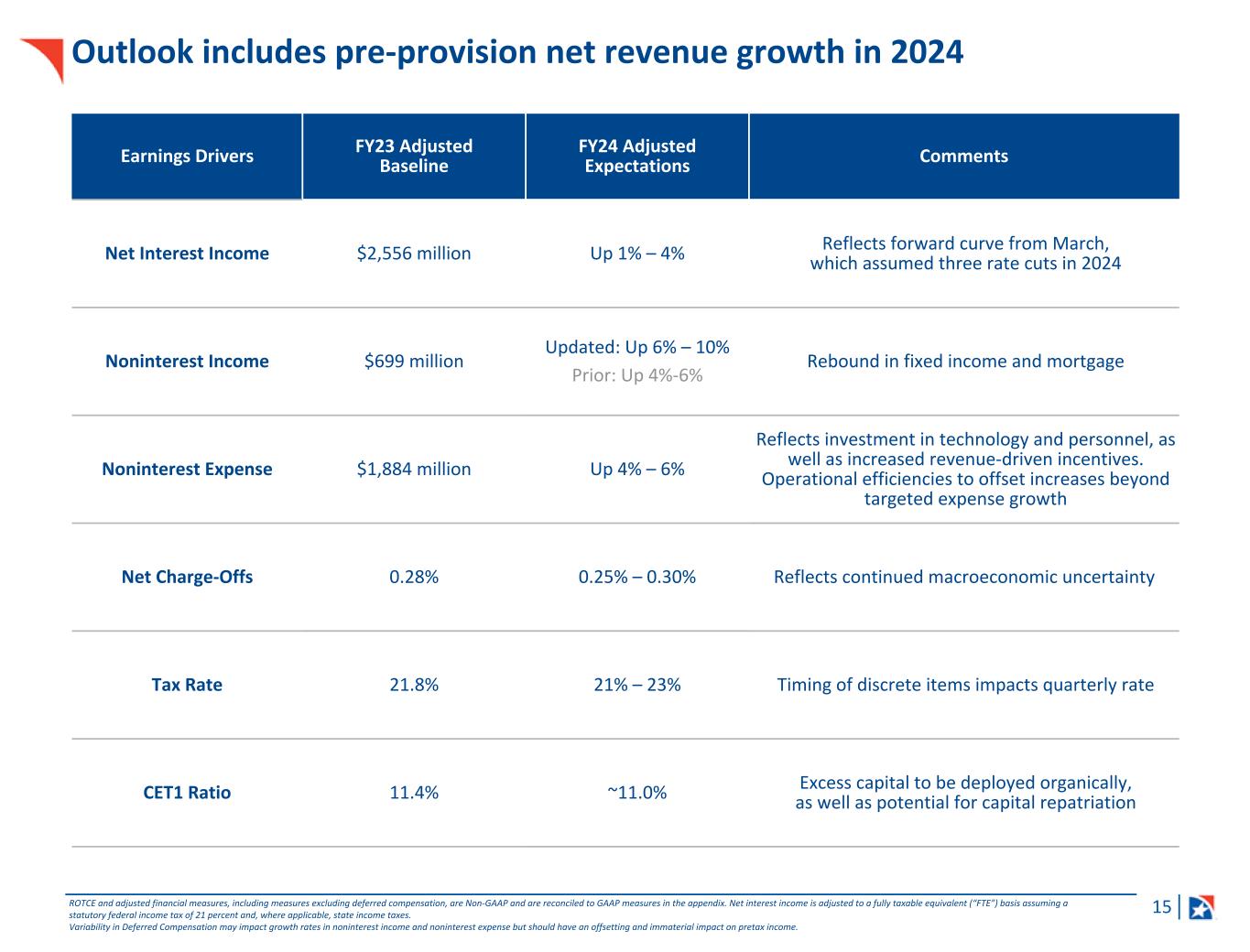

15 Outlook includes pre-provision net revenue growth in 2024 Earnings Drivers FY23 Adjusted Baseline FY24 Adjusted Expectations Comments Net Interest Income $2,556 million Up 1% – 4% Reflects forward curve from March, which assumed three rate cuts in 2024 Noninterest Income $699 million Updated: Up 6% – 10% Prior: Up 4%-6% Rebound in fixed income and mortgage Noninterest Expense $1,884 million Up 4% – 6% Reflects investment in technology and personnel, as well as increased revenue-driven incentives. Operational efficiencies to offset increases beyond targeted expense growth Net Charge-Offs 0.28% 0.25% – 0.30% Reflects continued macroeconomic uncertainty Tax Rate 21.8% 21% – 23% Timing of discrete items impacts quarterly rate CET1 Ratio 11.4% ~11.0% Excess capital to be deployed organically, as well as potential for capital repatriation ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. Net interest income is adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 21 percent and, where applicable, state income taxes. Variability in Deferred Compensation may impact growth rates in noninterest income and noninterest expense but should have an offsetting and immaterial impact on pretax income.

16 Diversified business model with highly attractive geographic footprint provides opportunity to deliver outperformance through a variety of economic cycles Strategic focus on delivering enhanced shareholder value 1 Strong balance sheet and prudent risk management to drive increased capital efficiency and returns 2 Client-centric model committed to serving as trusted advisor through Capital + Counsel as a core differentiator3 Disciplined execution of strategy and continuous improvement mindset to further enhance efficiency and productivity 4 Investing in the well-being of associates and communities is central to our purpose5

APPENDIX 17

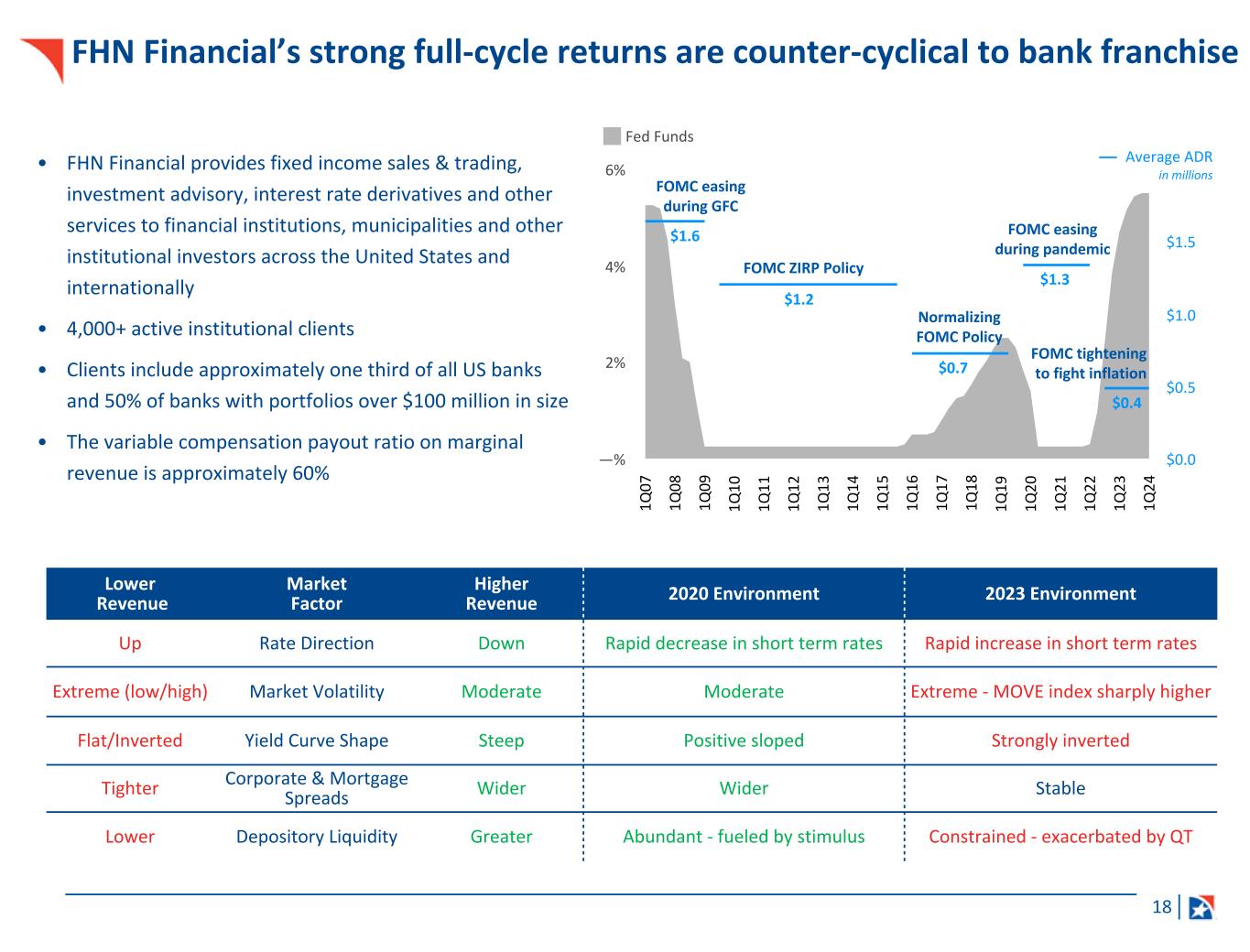

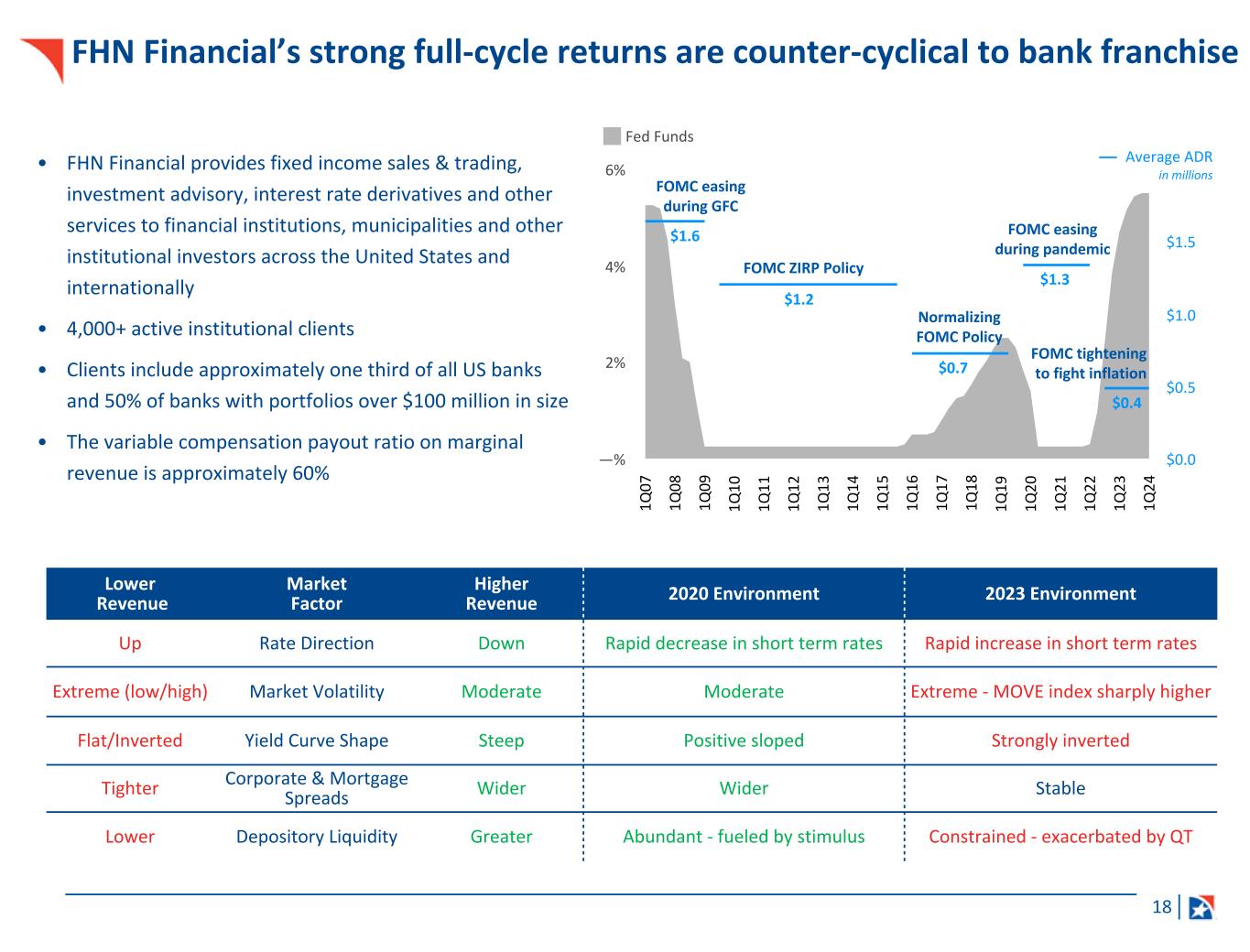

18 1Q 07 1Q 08 1Q 09 1Q 10 1Q 11 1Q 12 1Q 13 1Q 14 1Q 15 1Q 16 1Q 17 1Q 18 1Q 19 1Q 20 1Q 21 1Q 22 1Q 23 1Q 24 —% 2% 4% 6% $0.0 $0.5 $1.0 $1.5 $2.0 FHN Financial’s strong full-cycle returns are counter-cyclical to bank franchise Lower Revenue Market Factor Higher Revenue 2020 Environment 2023 Environment Up Rate Direction Down Rapid decrease in short term rates Rapid increase in short term rates Extreme (low/high) Market Volatility Moderate Moderate Extreme - MOVE index sharply higher Flat/Inverted Yield Curve Shape Steep Positive sloped Strongly inverted Tighter Corporate & Mortgage Spreads Wider Wider Stable Lower Depository Liquidity Greater Abundant - fueled by stimulus Constrained - exacerbated by QT • FHN Financial provides fixed income sales & trading, investment advisory, interest rate derivatives and other services to financial institutions, municipalities and other institutional investors across the United States and internationally • 4,000+ active institutional clients • Clients include approximately one third of all US banks and 50% of banks with portfolios over $100 million in size • The variable compensation payout ratio on marginal revenue is approximately 60% FOMC easing during GFC FOMC ZIRP Policy Normalizing FOMC Policy FOMC easing during pandemic FOMC tightening to fight inflation Fed Funds Average ADR in millions $1.6 $1.2 $0.7 $1.3 $0.4

19 TN, 38% FL, 18% NC, 13% LA, 12% AL, 3% TX, 2% GA, 2% AR, 2% All other states, 3% Specialty Bank, 6% Attractive portfolio diversified by customer type, product, and geography • Stable, cost-effective deposits from a diverse commercial and consumer client base across 12-state footprint and specialty lines of business • Commercial deposits of $36.2 billion or 55% and consumer of $29.5 billion or 45% • Attractive lower-cost deposit base with 25% DDA • Contingency funding plan equates to ~161% of uninsured or uncollateralized deposits 67% of 1Q24 deposits insured or collateralized 1Q24 diversified deposit mix by product 25% 39% 10% 26% Demand deposit accounts Savings Time deposits Other interest-bearing deposits 1Q24 deposits by state $38.4 58% $21.9 33% $5.5 8% Insured Uninsured & uncollateralized Collateralized

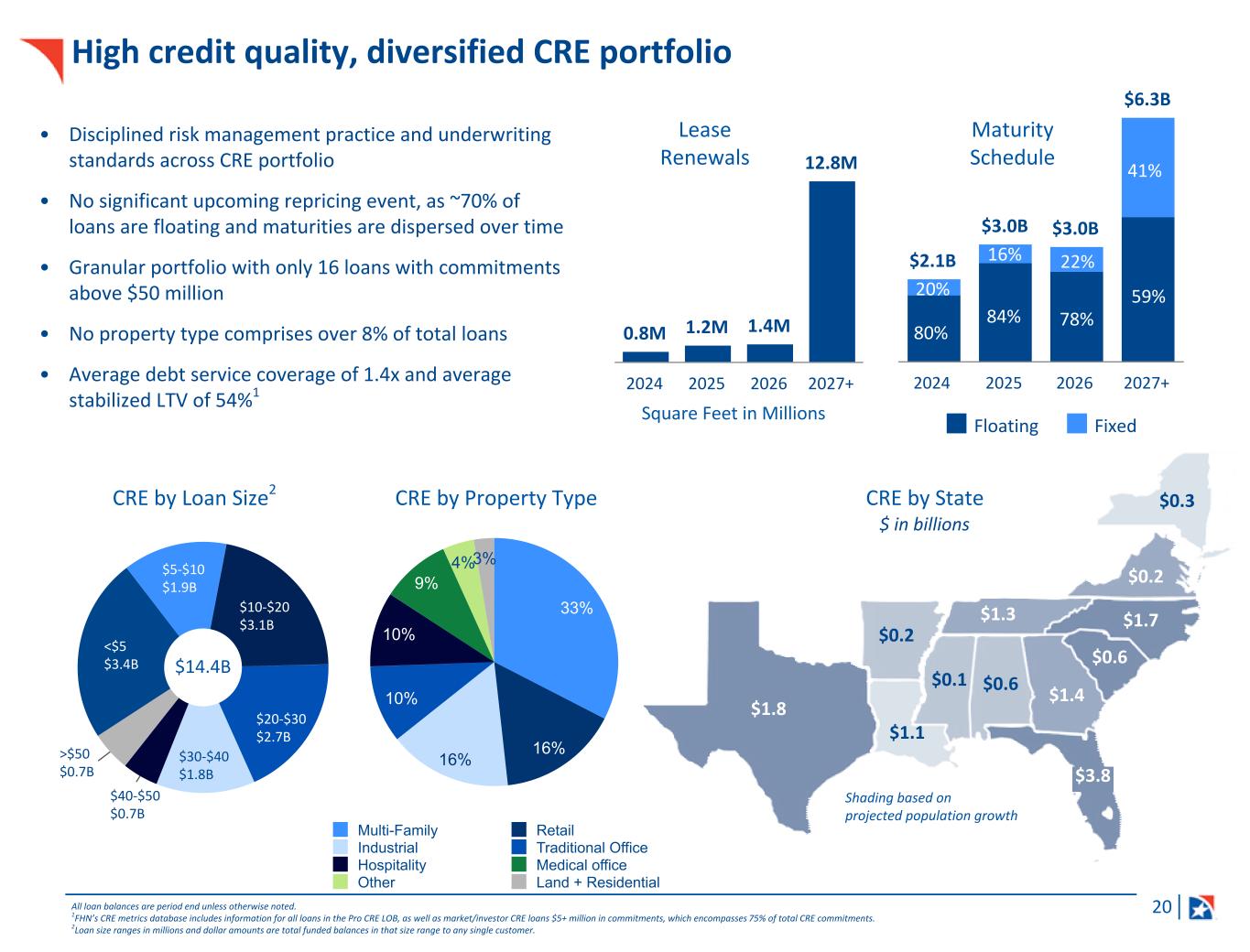

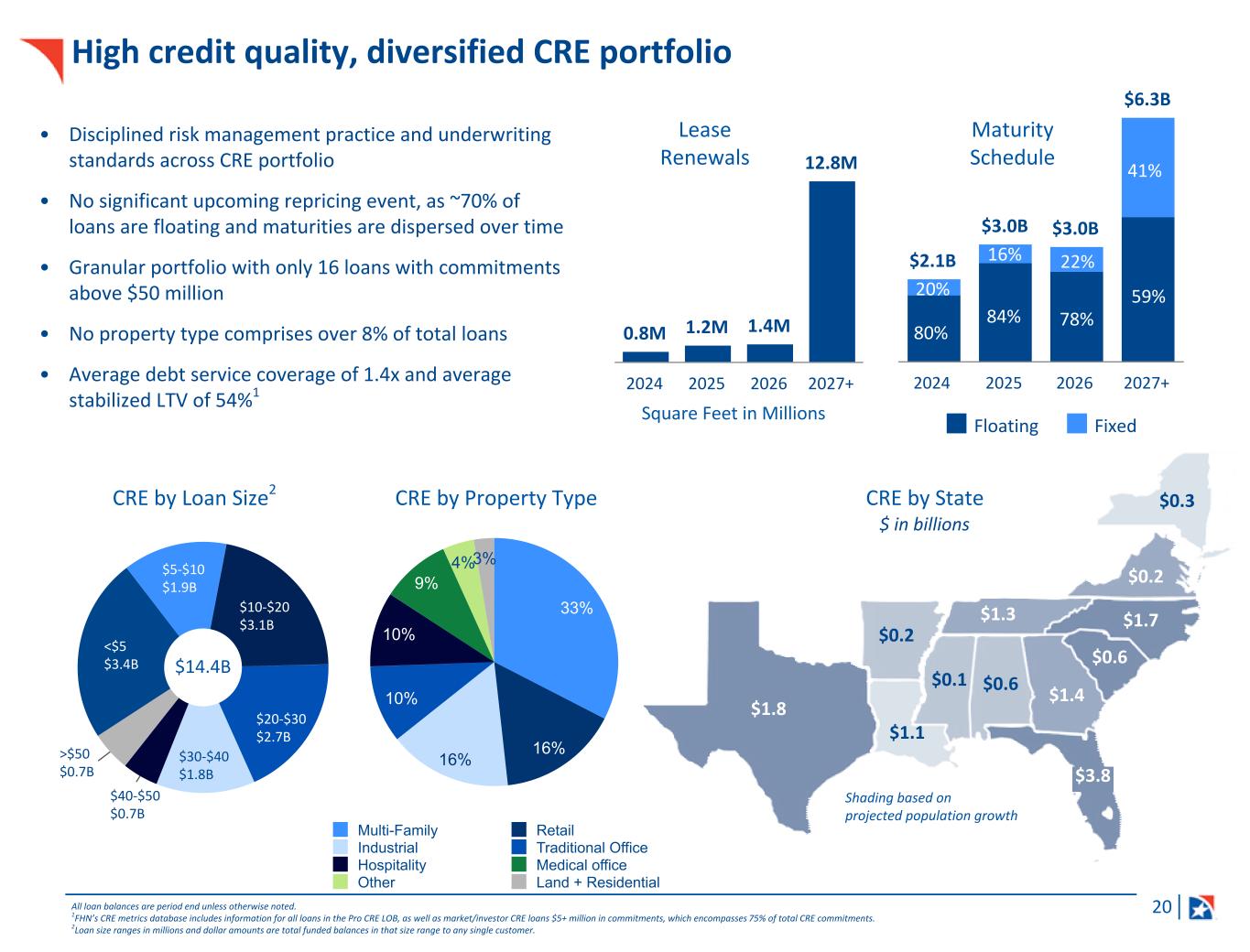

20 $2.1B $3.0B $3.0B $6.3B Floating Fixed 2024 2025 2026 2027+ 33% 16% 16% 10% 10% 9% 4%3% Multi-Family Retail Industrial Traditional Office Hospitality Medical office Other Land + Residential 80% 84% 78% 59% CRE by Loan Size2 CRE by State Maturity Schedule CRE by Property Type High credit quality, diversified CRE portfolio All loan balances are period end unless otherwise noted. 1FHN’s CRE metrics database includes information for all loans in the Pro CRE LOB, as well as market/investor CRE loans $5+ million in commitments, which encompasses 75% of total CRE commitments. 2Loan size ranges in millions and dollar amounts are total funded balances in that size range to any single customer. • Disciplined risk management practice and underwriting standards across CRE portfolio • No significant upcoming repricing event, as ~70% of loans are floating and maturities are dispersed over time • Granular portfolio with only 16 loans with commitments above $50 million • No property type comprises over 8% of total loans • Average debt service coverage of 1.4x and average stabilized LTV of 54%1 $3.8 $1.8 $1.7 $1.4 $1.3 $1.1 $0.6 $0.6 $0.2 $0.2 $0.1 $0.3 $ in billions $14.4B 20% 16% 22% 41% Shading based on projected population growth 0.8M 1.2M 1.4M 12.8M 2024 2025 2026 2027+ Lease Renewals Square Feet in Millions <$5 $3.4B $5-$10 $1.9B $10-$20 $3.1B $20-$30 $2.7B $30-$40 $1.8B $40-$50 $0.7B >$50 $0.7B

21 Multi-Family $ in millions Multi-Family CRE1 Strong underwriting in the office and multi-family portfolios All loan balances are period end unless otherwise noted. 1FHN’s CRE metrics database includes information for all loans in the Pro CRE LOB, as well as market/investor CRE loans $5+ million in commitments, which encompasses 69% of traditional office CRE commitments and 87% of multi-family CRE commitments. Traditional Office $ in millions • Average debt service coverage of 1.2x • Average stabilized LTV of 52% • Average property has 250 units • Low exposure to rent control, which is mostly related to low and moderate income housing focused on serving the communities in our footprint Office CRE $1.4B $870 $350 $702 $363 $150 $173 $203 $40 $90 $6 • Medical office comprises 47% of office exposure • Only 12 buildings are 10 stories or taller • Within the traditional office portfolio1: – Average debt service coverage of 1.6x – Average stabilized LTV of 59% – Vacancy rate of 19% $261 $164 $284 $230 $179 $118 $55 $50 $37 $23 $0.4 $24 $254

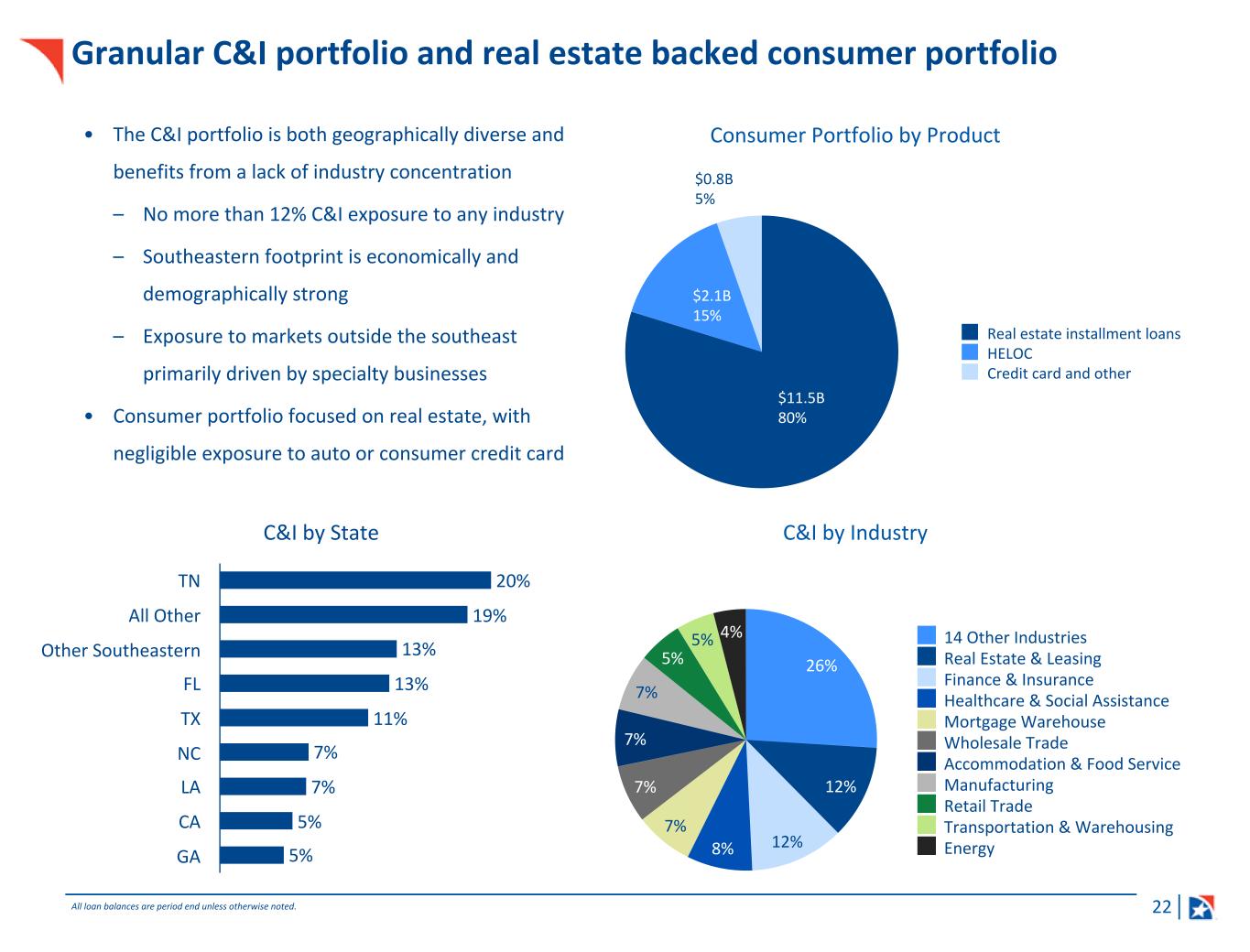

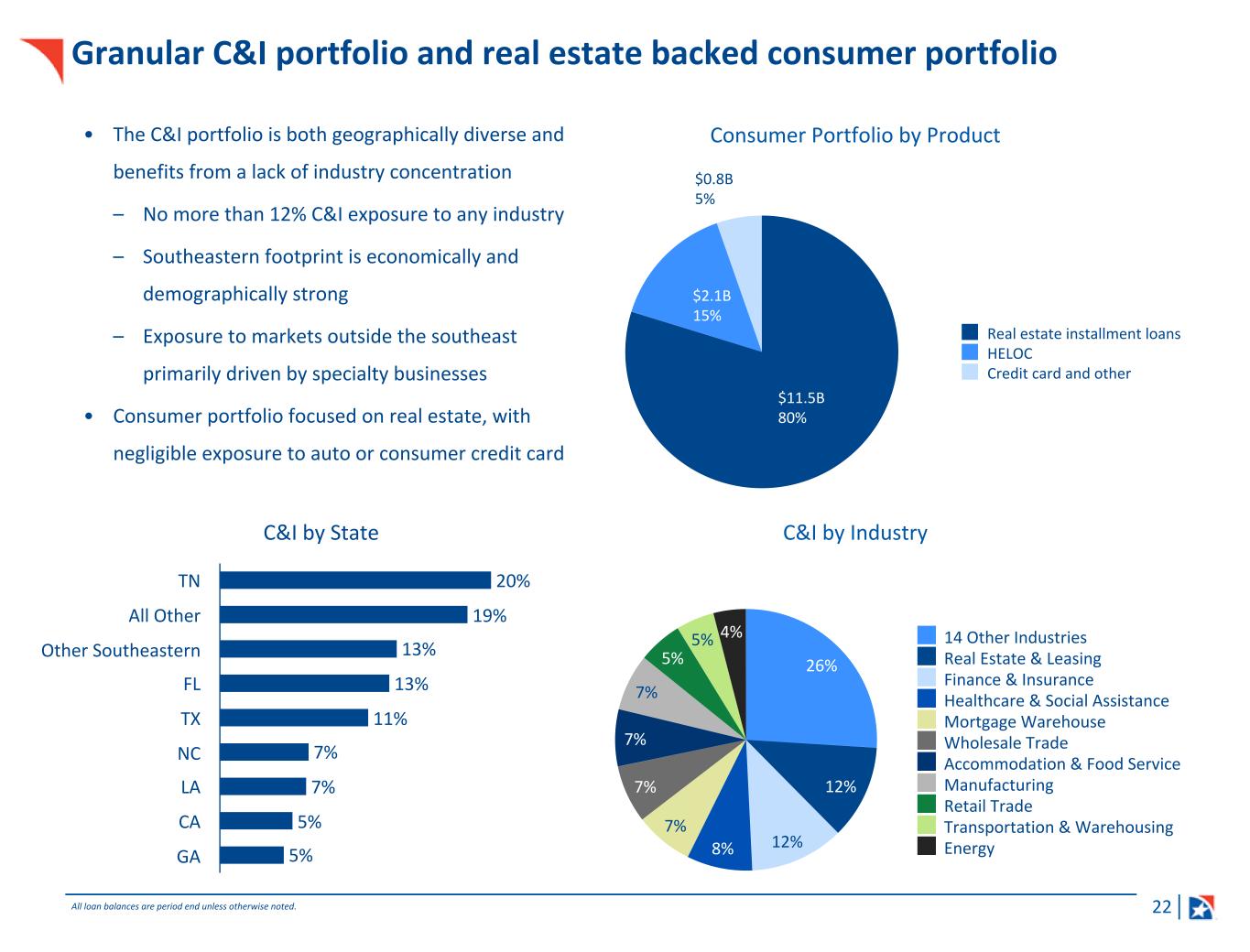

22 $11.5B 80% $2.1B 15% $0.8B 5% Real estate installment loans HELOC Credit card and other Granular C&I portfolio and real estate backed consumer portfolio C&I by Industry 20% 19% 13% 13% 11% 7% 7% 5% 5% TN All Other Other Southeastern FL TX NC LA CA GA C&I by State Consumer Portfolio by Product 26% 12% 12%8% 7% 7% 7% 7% 5% 5% 4% 14 Other Industries Real Estate & Leasing Finance & Insurance Healthcare & Social Assistance Mortgage Warehouse Wholesale Trade Accommodation & Food Service Manufacturing Retail Trade Transportation & Warehousing Energy • The C&I portfolio is both geographically diverse and benefits from a lack of industry concentration – No more than 12% C&I exposure to any industry – Southeastern footprint is economically and demographically strong – Exposure to markets outside the southeast primarily driven by specialty businesses • Consumer portfolio focused on real estate, with negligible exposure to auto or consumer credit card All loan balances are period end unless otherwise noted.

23ROTCE and adjusted financial measures, including measures excluding deferred compensation, are Non-GAAP and are reconciled to GAAP measures in the appendix. 1Other includes equity compensation. Utilizing the $650 million repurchase program to return excess capital 11.4% 0.27% (0.12)% (0.22)% (0.01)% (0.01)% 11.3% CET1 4Q23 Actual Adjusted NIAC Common Dividend Share Buybacks Change in Loan Balances & Unfunded Commitments Notable Items & Other CET1 1Q24 Estimate 1

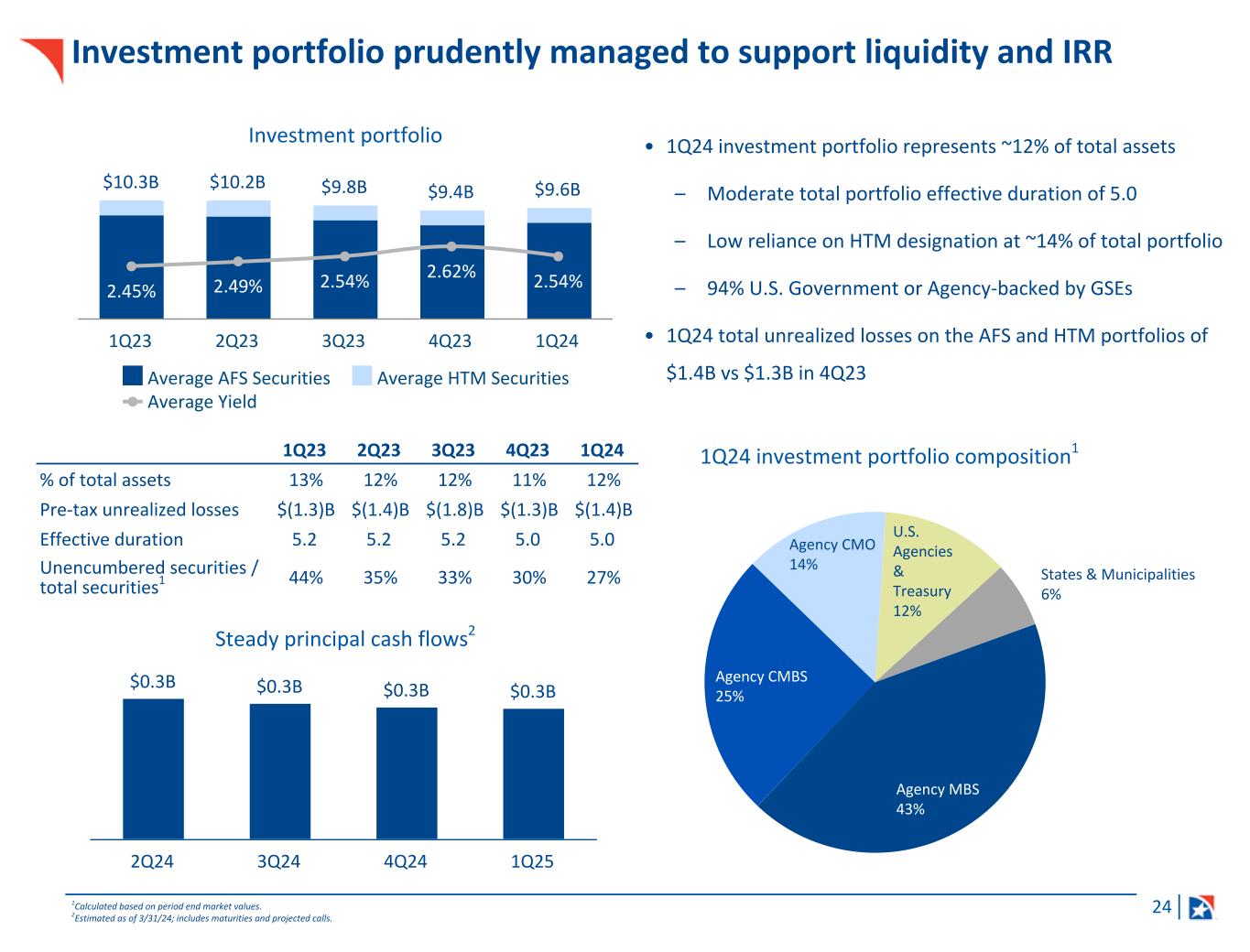

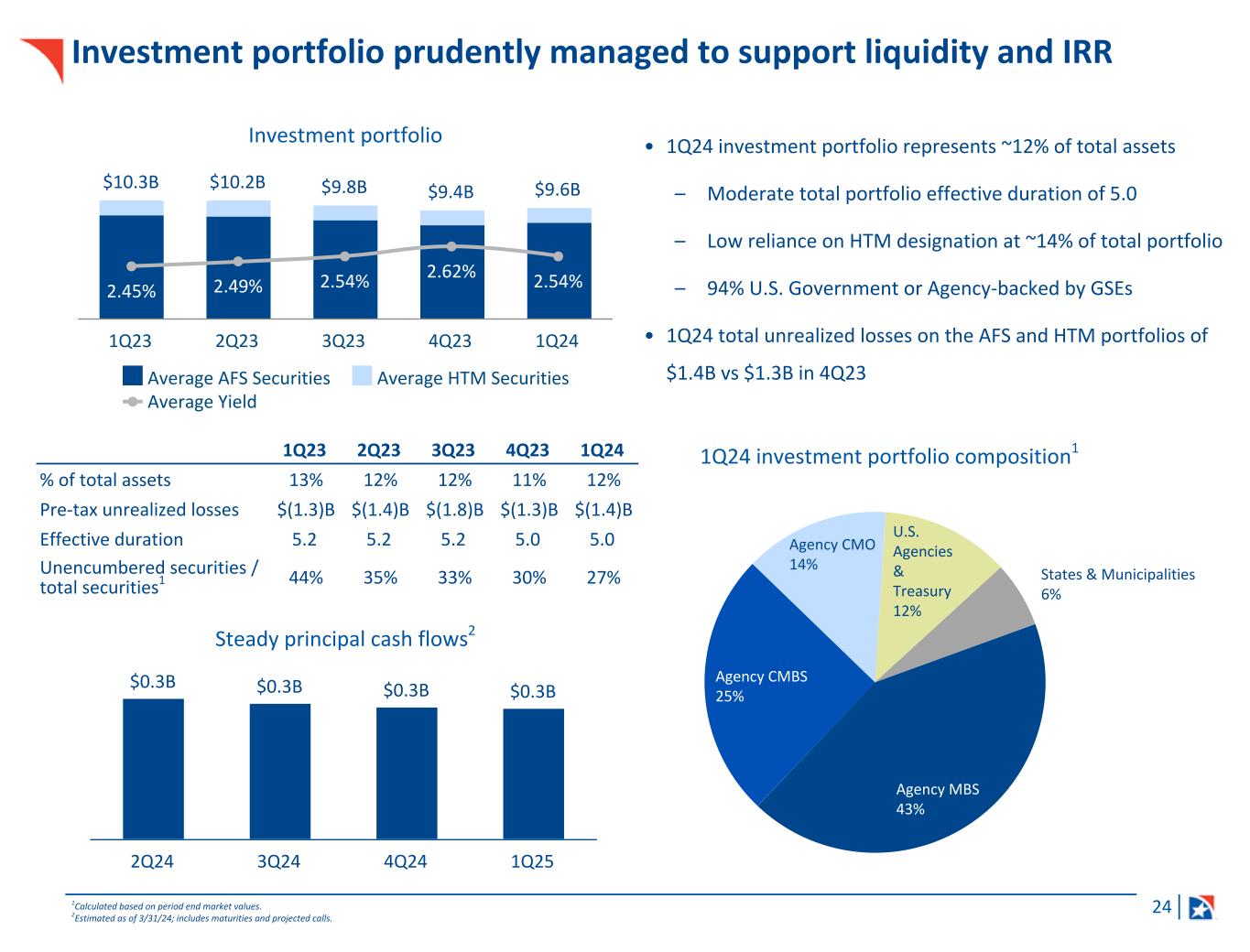

24 $0.3B $0.3B $0.3B $0.3B 2Q24 3Q24 4Q24 1Q25 Agency MBS 43% Agency CMBS 25% Agency CMO 14% U.S. Agencies & Treasury 12% States & Municipalities 6% $10.3B $10.2B $9.8B $9.4B $9.6B 2.45% 2.49% 2.54% 2.62% 2.54% Average AFS Securities Average HTM Securities Average Yield 1Q23 2Q23 3Q23 4Q23 1Q24 Investment portfolio prudently managed to support liquidity and IRR • 1Q24 investment portfolio represents ~12% of total assets – Moderate total portfolio effective duration of 5.0 – Low reliance on HTM designation at ~14% of total portfolio – 94% U.S. Government or Agency-backed by GSEs • 1Q24 total unrealized losses on the AFS and HTM portfolios of $1.4B vs $1.3B in 4Q23 1Calculated based on period end market values. 2Estimated as of 3/31/24; includes maturities and projected calls. Steady principal cash flows2 Investment portfolio 1Q23 2Q23 3Q23 4Q23 1Q24 % of total assets 13% 12% 12% 11% 12% Pre-tax unrealized losses $(1.3)B $(1.4)B $(1.8)B $(1.3)B $(1.4)B Effective duration 5.2 5.2 5.2 5.0 5.0 Unencumbered securities / total securities1 44% 35% 33% 30% 27% 1Q24 investment portfolio composition1

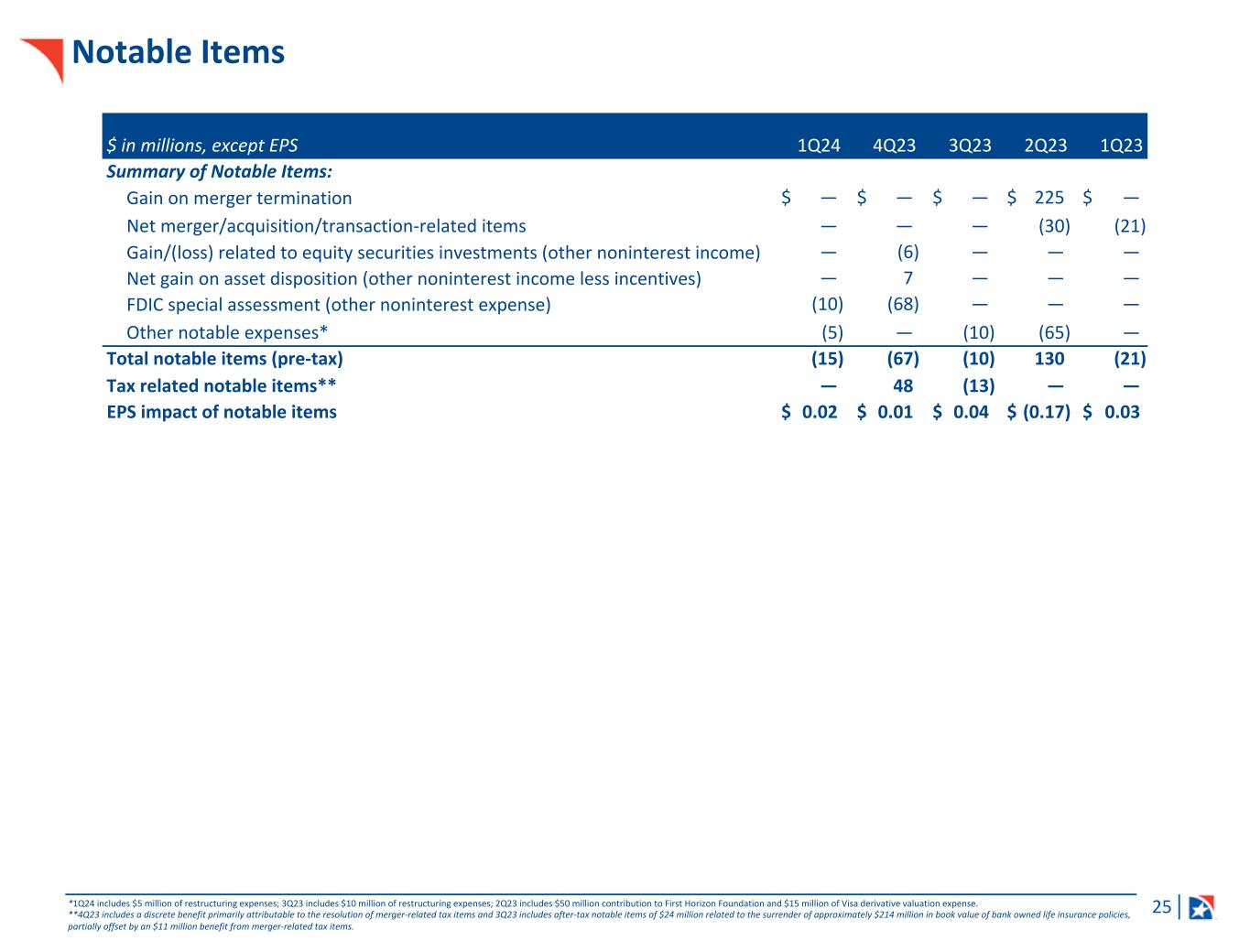

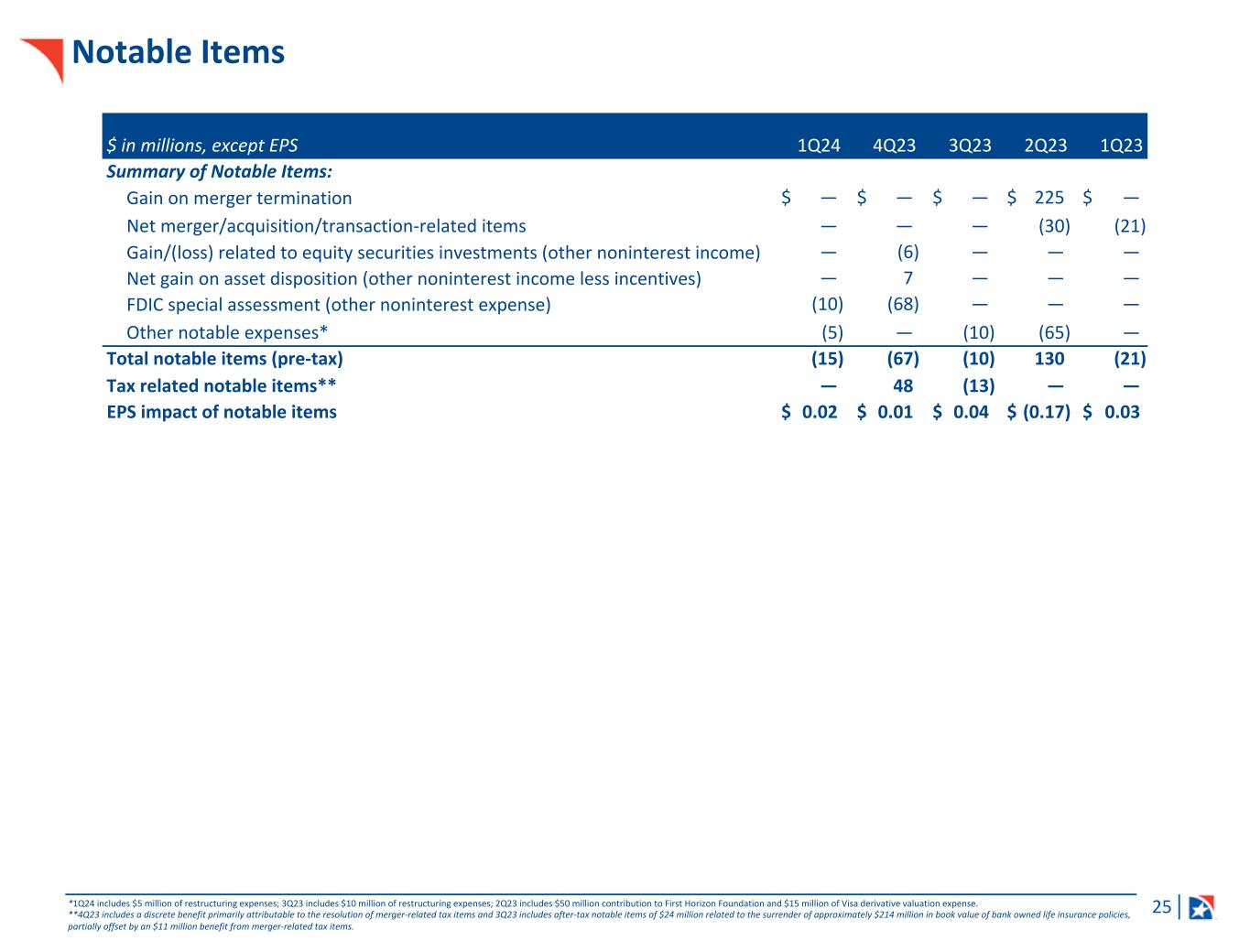

25 Notable Items *1Q24 includes $5 million of restructuring expenses; 3Q23 includes $10 million of restructuring expenses; 2Q23 includes $50 million contribution to First Horizon Foundation and $15 million of Visa derivative valuation expense. **4Q23 includes a discrete benefit primarily attributable to the resolution of merger-related tax items and 3Q23 includes after-tax notable items of $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies, partially offset by an $11 million benefit from merger-related tax items. $ in millions, except EPS 1Q24 4Q23 3Q23 2Q23 1Q23 Summary of Notable Items: Gain on merger termination $ — $ — $ — $ 225 $ — Net merger/acquisition/transaction-related items — — — (30) (21) Gain/(loss) related to equity securities investments (other noninterest income) — (6) — — — Net gain on asset disposition (other noninterest income less incentives) — 7 — — — FDIC special assessment (other noninterest expense) (10) (68) — — — Other notable expenses* (5) — (10) (65) — Total notable items (pre-tax) (15) (67) (10) 130 (21) Tax related notable items** — 48 (13) — — EPS impact of notable items $ 0.02 $ 0.01 $ 0.04 $ (0.17) $ 0.03

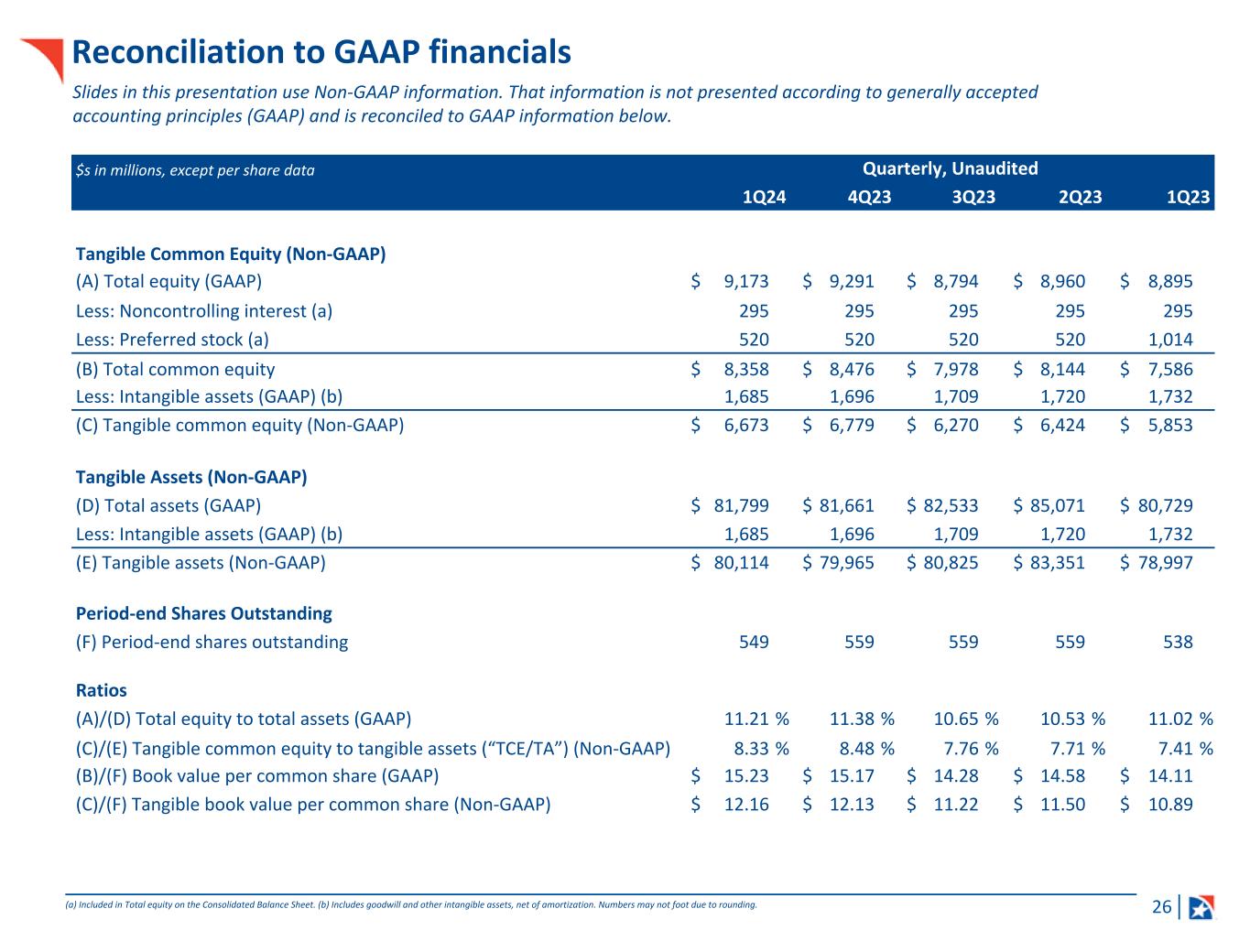

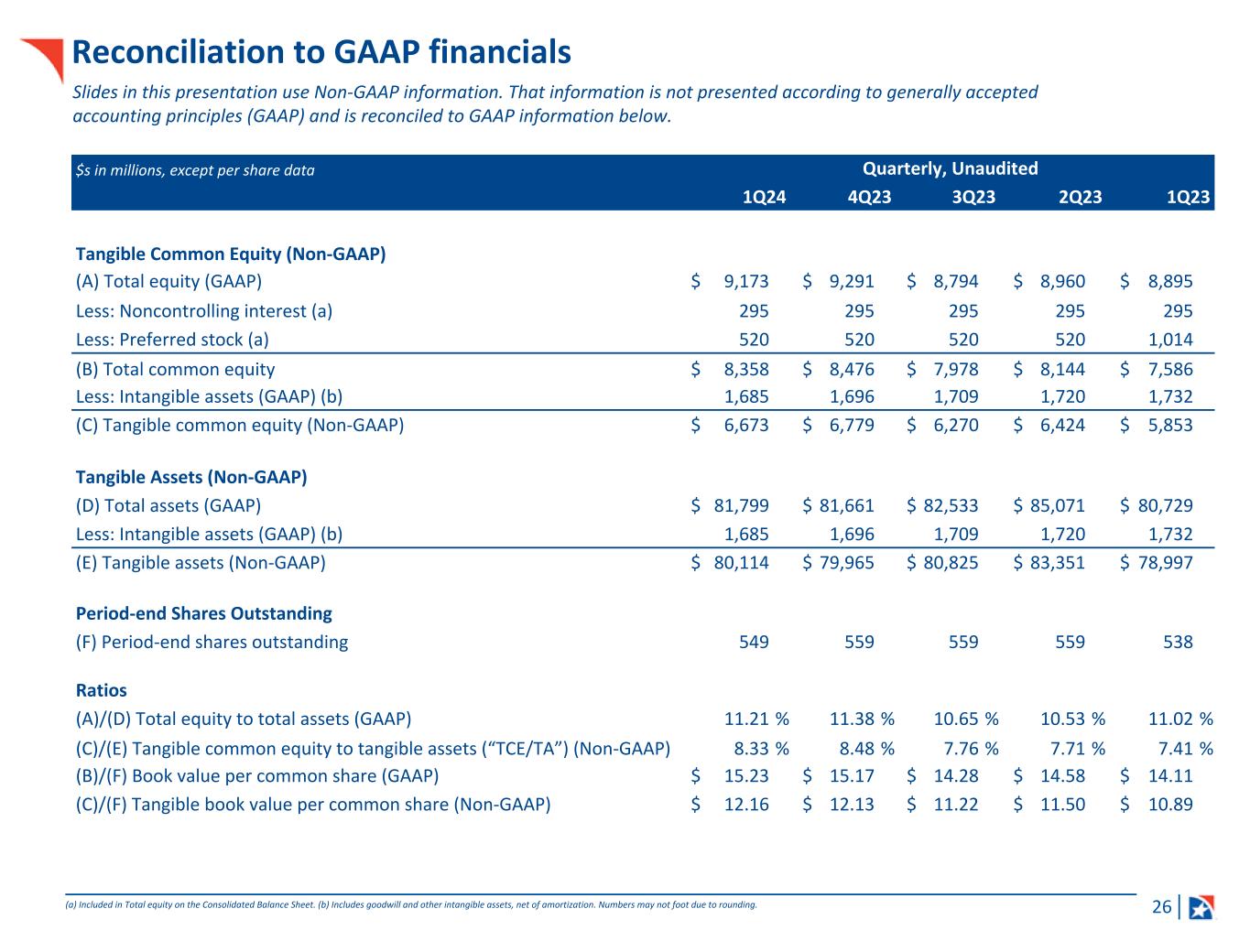

26 Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. (a) Included in Total equity on the Consolidated Balance Sheet. (b) Includes goodwill and other intangible assets, net of amortization. Numbers may not foot due to rounding. $s in millions, except per share data Quarterly, Unaudited 1Q24 4Q23 3Q23 2Q23 1Q23 Tangible Common Equity (Non-GAAP) (A) Total equity (GAAP) $ 9,173 $ 9,291 $ 8,794 $ 8,960 $ 8,895 Less: Noncontrolling interest (a) 295 295 295 295 295 Less: Preferred stock (a) 520 520 520 520 1,014 (B) Total common equity $ 8,358 $ 8,476 $ 7,978 $ 8,144 $ 7,586 Less: Intangible assets (GAAP) (b) 1,685 1,696 1,709 1,720 1,732 (C) Tangible common equity (Non-GAAP) $ 6,673 $ 6,779 $ 6,270 $ 6,424 $ 5,853 Tangible Assets (Non-GAAP) (D) Total assets (GAAP) $ 81,799 $ 81,661 $ 82,533 $ 85,071 $ 80,729 Less: Intangible assets (GAAP) (b) 1,685 1,696 1,709 1,720 1,732 (E) Tangible assets (Non-GAAP) $ 80,114 $ 79,965 $ 80,825 $ 83,351 $ 78,997 Period-end Shares Outstanding (F) Period-end shares outstanding 549 559 559 559 538 Ratios (A)/(D) Total equity to total assets (GAAP) 11.21 % 11.38 % 10.65 % 10.53 % 11.02 % (C)/(E) Tangible common equity to tangible assets (“TCE/TA”) (Non-GAAP) 8.33 % 8.48 % 7.76 % 7.71 % 7.41 % (B)/(F) Book value per common share (GAAP) $ 15.23 $ 15.17 $ 14.28 $ 14.58 $ 14.11 (C)/(F) Tangible book value per common share (Non-GAAP) $ 12.16 $ 12.13 $ 11.22 $ 11.50 $ 10.89

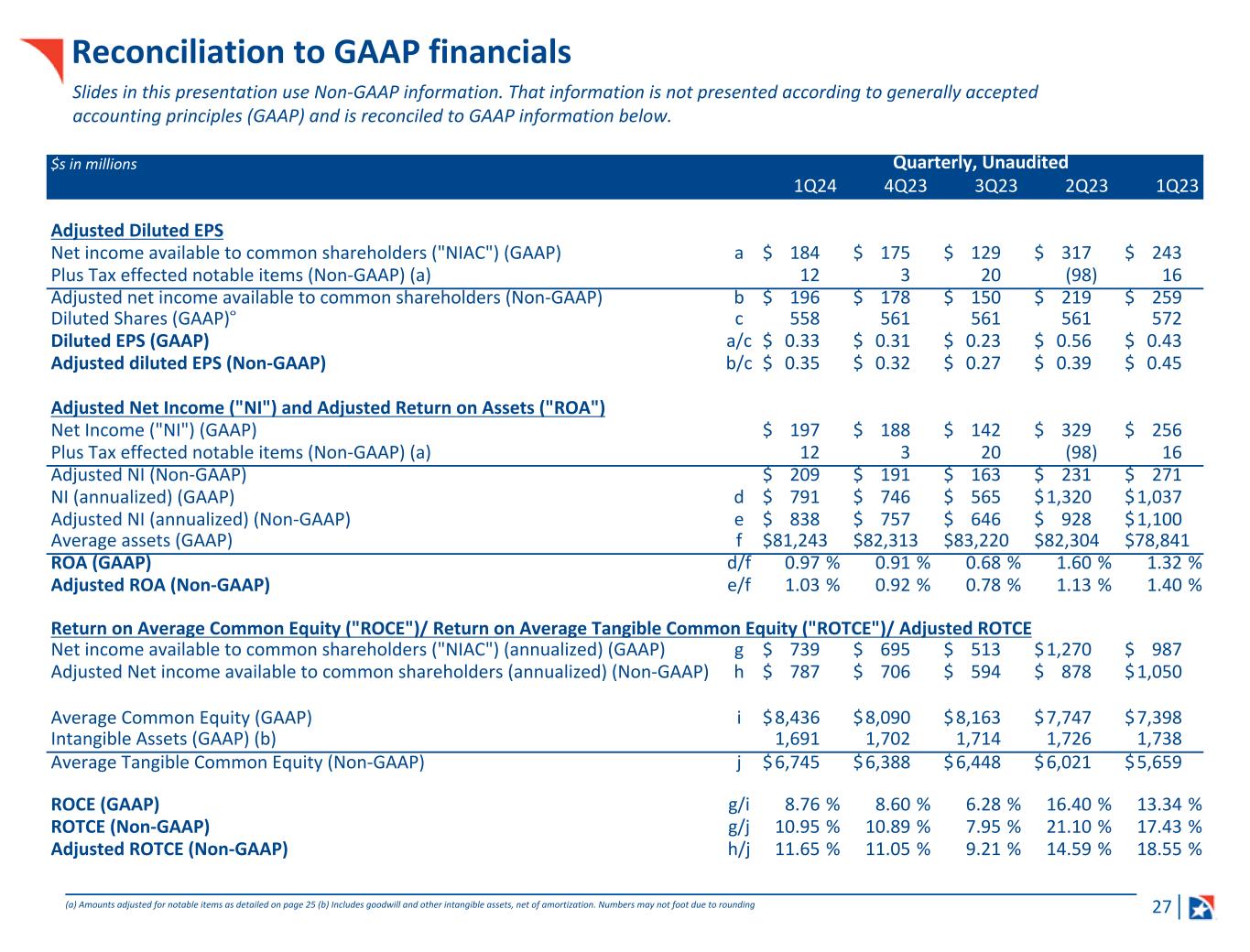

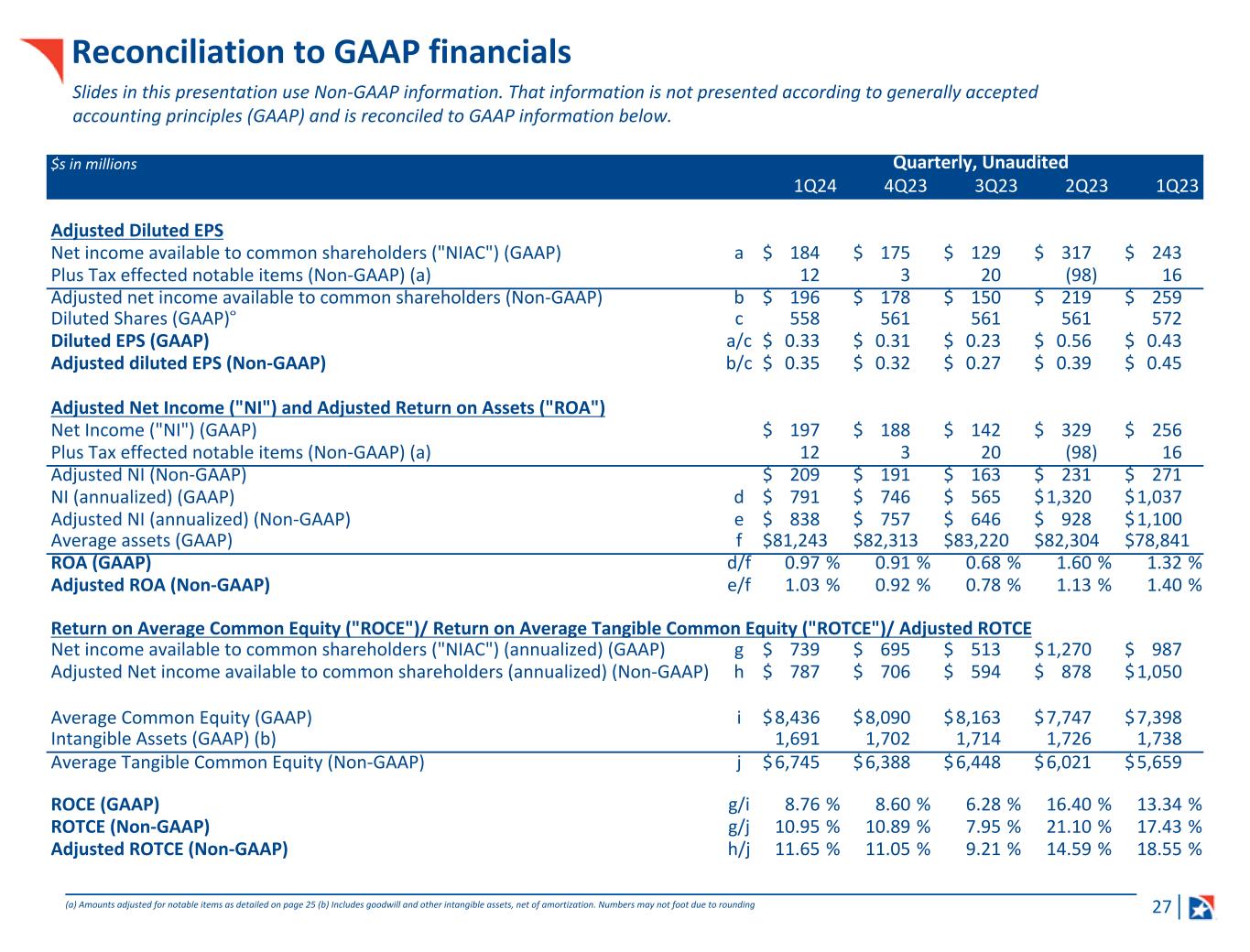

27 Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. $s in millions Quarterly, Unaudited 1Q24 4Q23 3Q23 2Q23 1Q23 Adjusted Diluted EPS Net income available to common shareholders ("NIAC") (GAAP) a $ 184 $ 175 $ 129 $ 317 $ 243 Plus Tax effected notable items (Non-GAAP) (a) 12 3 20 (98) 16 Adjusted net income available to common shareholders (Non-GAAP) b $ 196 $ 178 $ 150 $ 219 $ 259 Diluted Shares (GAAP)8 c 558 561 561 561 572 Diluted EPS (GAAP) a/c $ 0.33 $ 0.31 $ 0.23 $ 0.56 $ 0.43 Adjusted diluted EPS (Non-GAAP) b/c $ 0.35 $ 0.32 $ 0.27 $ 0.39 $ 0.45 Adjusted Net Income ("NI") and Adjusted Return on Assets ("ROA") Net Income ("NI") (GAAP) $ 197 $ 188 $ 142 $ 329 $ 256 Plus Tax effected notable items (Non-GAAP) (a) 12 3 20 (98) 16 Adjusted NI (Non-GAAP) $ 209 $ 191 $ 163 $ 231 $ 271 NI (annualized) (GAAP) d $ 791 $ 746 $ 565 $ 1,320 $ 1,037 Adjusted NI (annualized) (Non-GAAP) e $ 838 $ 757 $ 646 $ 928 $ 1,100 Average assets (GAAP) f $ 81,243 $ 82,313 $ 83,220 $ 82,304 $ 78,841 ROA (GAAP) d/f 0.97 % 0.91 % 0.68 % 1.60 % 1.32 % Adjusted ROA (Non-GAAP) e/f 1.03 % 0.92 % 0.78 % 1.13 % 1.40 % Return on Average Common Equity ("ROCE")/ Return on Average Tangible Common Equity ("ROTCE")/ Adjusted ROTCE Net income available to common shareholders ("NIAC") (annualized) (GAAP) g $ 739 $ 695 $ 513 $ 1,270 $ 987 Adjusted Net income available to common shareholders (annualized) (Non-GAAP) h $ 787 $ 706 $ 594 $ 878 $ 1,050 Average Common Equity (GAAP) i $ 8,436 $ 8,090 $ 8,163 $ 7,747 $ 7,398 Intangible Assets (GAAP) (b) 1,691 1,702 1,714 1,726 1,738 Average Tangible Common Equity (Non-GAAP) j $ 6,745 $ 6,388 $ 6,448 $ 6,021 $ 5,659 ROCE (GAAP) g/i 8.76 % 8.60 % 6.28 % 16.40 % 13.34 % ROTCE (Non-GAAP) g/j 10.95 % 10.89 % 7.95 % 21.10 % 17.43 % Adjusted ROTCE (Non-GAAP) h/j 11.65 % 11.05 % 9.21 % 14.59 % 18.55 % (a) Amounts adjusted for notable items as detailed on page 25 (b) Includes goodwill and other intangible assets, net of amortization. Numbers may not foot due to rounding

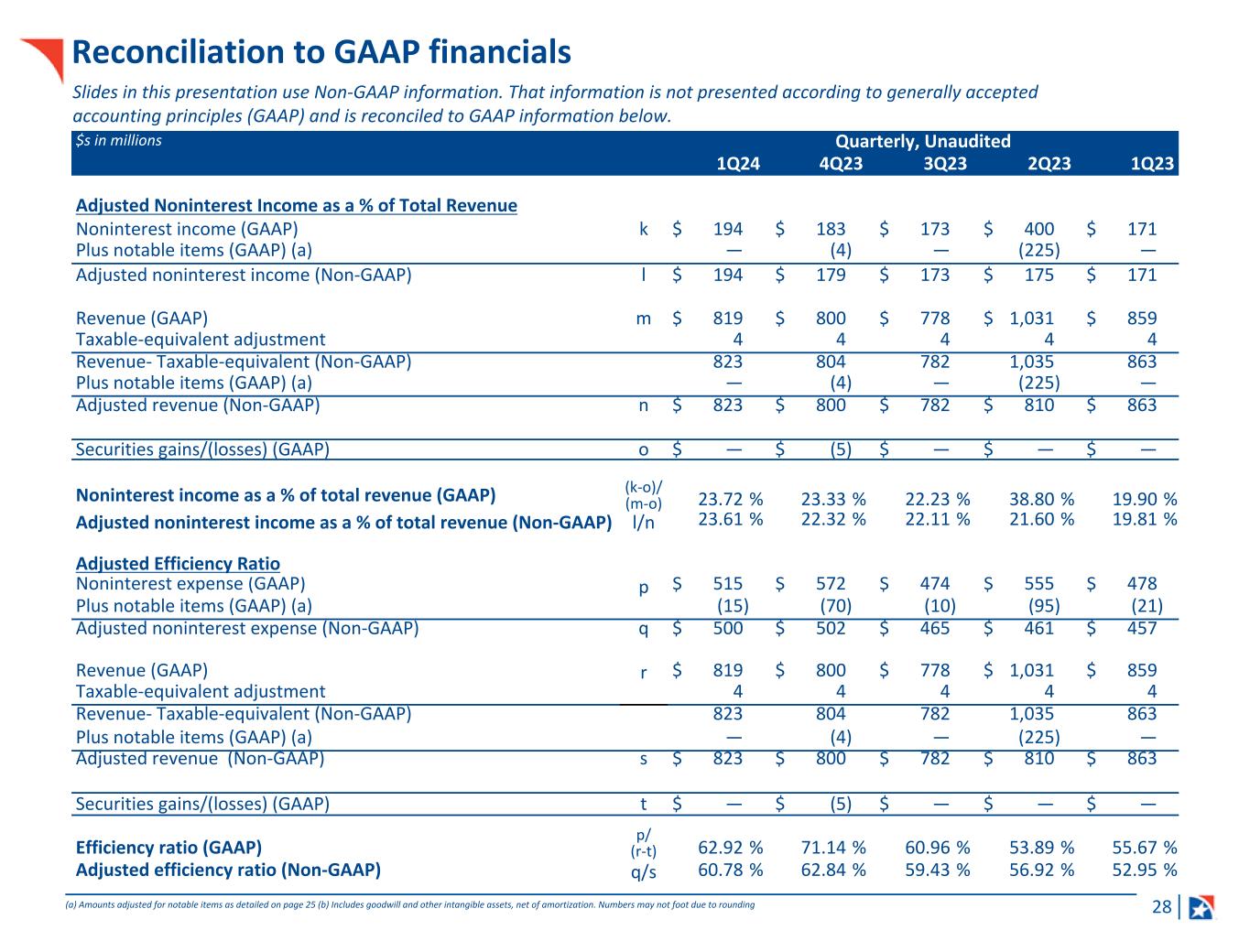

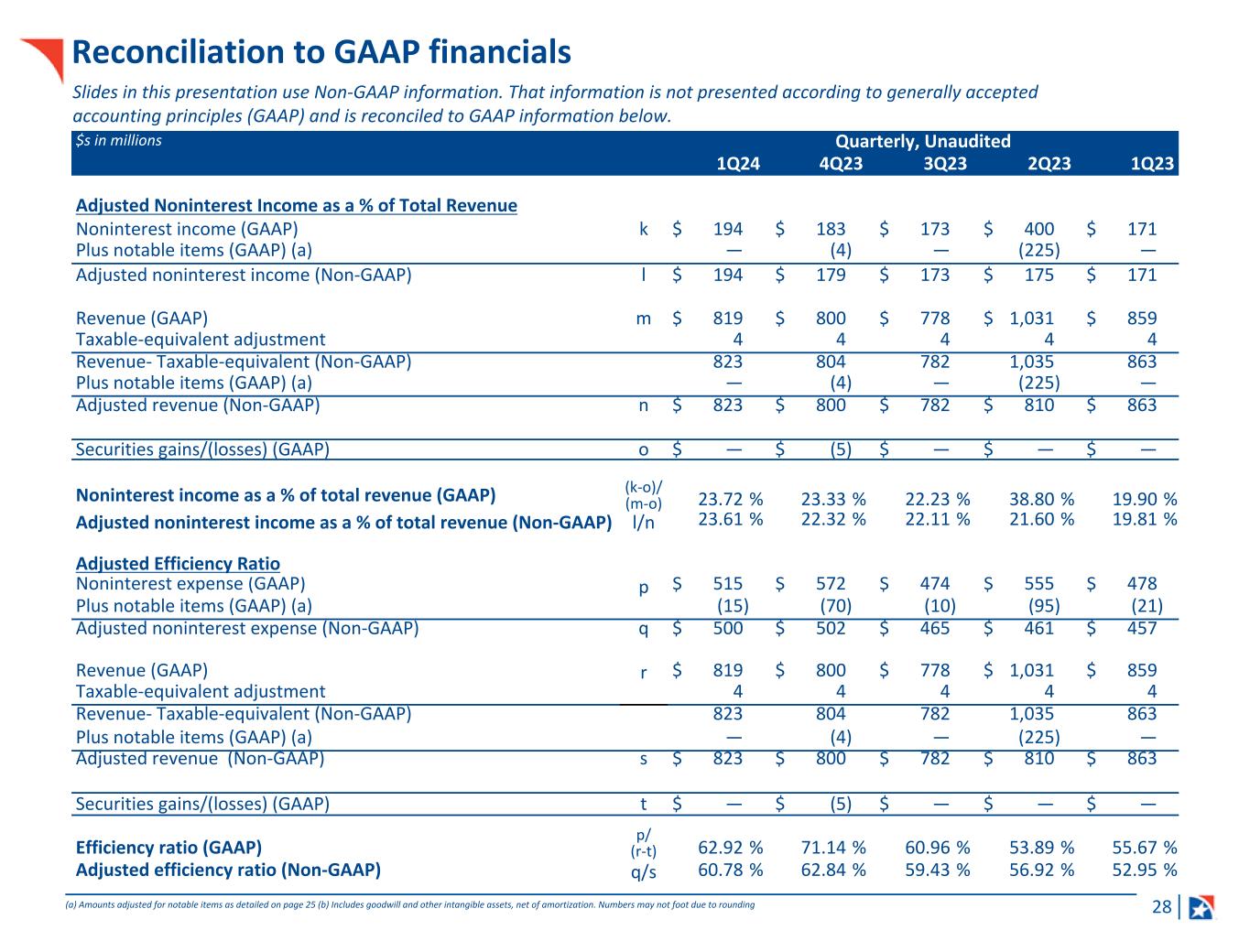

28 Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. $s in millions Quarterly, Unaudited 1Q24 4Q23 3Q23 2Q23 1Q23 Adjusted Noninterest Income as a % of Total Revenue Noninterest income (GAAP) k $ 194 $ 183 $ 173 $ 400 $ 171 Plus notable items (GAAP) (a) — (4) — (225) — Adjusted noninterest income (Non-GAAP) l $ 194 $ 179 $ 173 $ 175 $ 171 Revenue (GAAP) m $ 819 $ 800 $ 778 $ 1,031 $ 859 Taxable-equivalent adjustment 4 4 4 4 4 Revenue- Taxable-equivalent (Non-GAAP) 823 804 782 1,035 863 Plus notable items (GAAP) (a) — (4) — (225) — Adjusted revenue (Non-GAAP) n $ 823 $ 800 $ 782 $ 810 $ 863 Securities gains/(losses) (GAAP) o $ — $ (5) $ — $ — $ — Noninterest income as a % of total revenue (GAAP) (k-o)/ (m-o) 23.72 % 23.33 % 22.23 % 38.80 % 19.90 % Adjusted noninterest income as a % of total revenue (Non-GAAP) l/n 23.61 % 22.32 % 22.11 % 21.60 % 19.81 % Adjusted Efficiency Ratio Noninterest expense (GAAP) p $ 515 $ 572 $ 474 $ 555 $ 478 Plus notable items (GAAP) (a) (15) (70) (10) (95) (21) Adjusted noninterest expense (Non-GAAP) q $ 500 $ 502 $ 465 $ 461 $ 457 Revenue (GAAP) r $ 819 $ 800 $ 778 $ 1,031 $ 859 Taxable-equivalent adjustment 4 4 4 4 4 Revenue- Taxable-equivalent (Non-GAAP) 823 804 782 1,035 863 Plus notable items (GAAP) (a) — (4) — (225) — Adjusted revenue (Non-GAAP) s $ 823 $ 800 $ 782 $ 810 $ 863 Securities gains/(losses) (GAAP) t $ — $ (5) $ — $ — $ — Efficiency ratio (GAAP) p/ (r-t) 62.92 % 71.14 % 60.96 % 53.89 % 55.67 % Adjusted efficiency ratio (Non-GAAP) q/s 60.78 % 62.84 % 59.43 % 56.92 % 52.95 % (a) Amounts adjusted for notable items as detailed on page 25 (b) Includes goodwill and other intangible assets, net of amortization. Numbers may not foot due to rounding

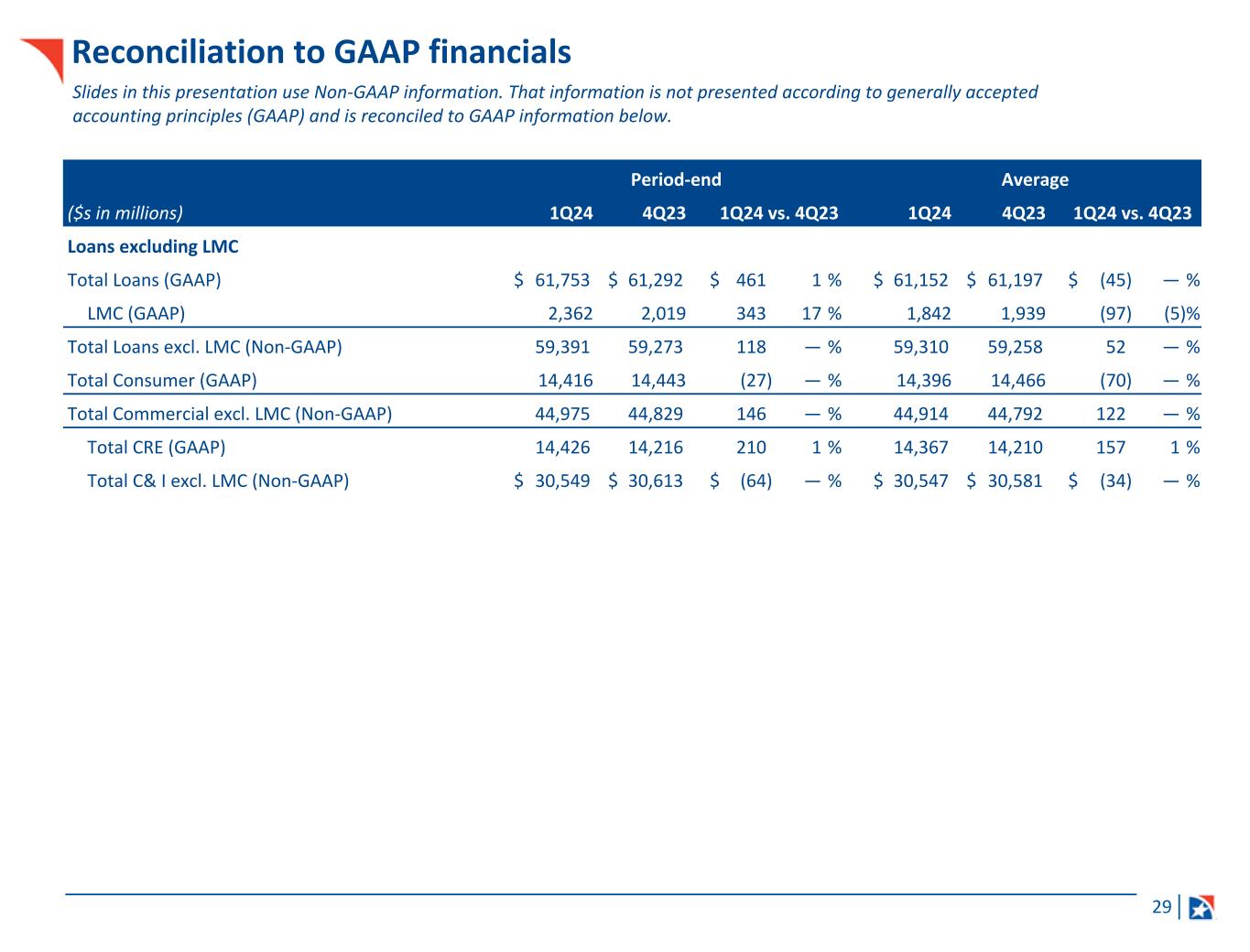

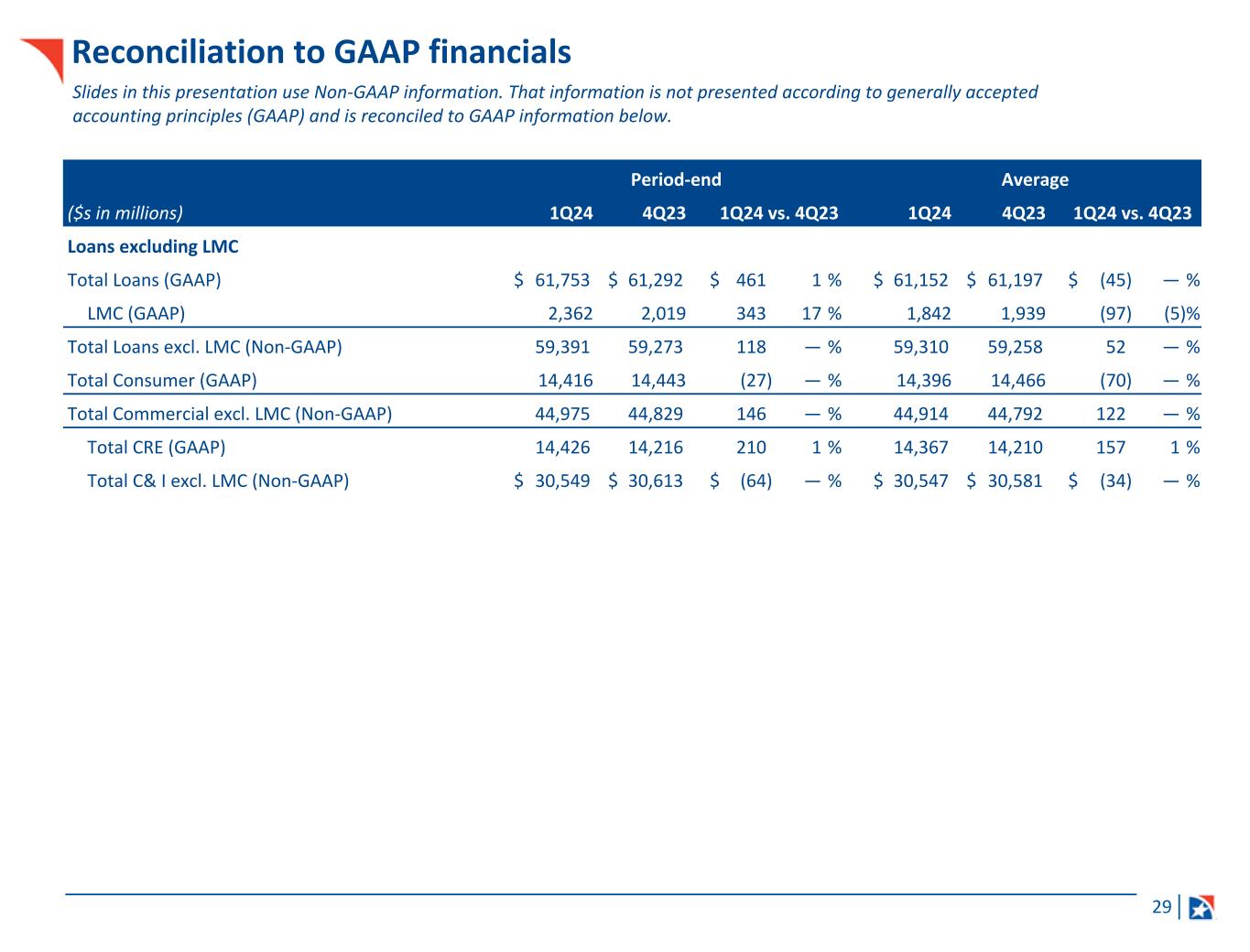

29 Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. Period-end Average ($s in millions) 1Q24 4Q23 1Q24 vs. 4Q23 1Q24 4Q23 1Q24 vs. 4Q23 Loans excluding LMC Total Loans (GAAP) $ 61,753 $ 61,292 $ 461 1 % $ 61,152 $ 61,197 $ (45) — % LMC (GAAP) 2,362 2,019 343 17 % 1,842 1,939 (97) (5) % Total Loans excl. LMC (Non-GAAP) 59,391 59,273 118 — % 59,310 59,258 52 — % Total Consumer (GAAP) 14,416 14,443 (27) — % 14,396 14,466 (70) — % Total Commercial excl. LMC (Non-GAAP) 44,975 44,829 146 — % 44,914 44,792 122 — % Total CRE (GAAP) 14,426 14,216 210 1 % 14,367 14,210 157 1 % Total C& I excl. LMC (Non-GAAP) $ 30,549 $ 30,613 $ (64) — % $ 30,547 $ 30,581 $ (34) — %

30 Reconciliation to GAAP financials Slides in this presentation use Non-GAAP information. That information is not presented according to generally accepted accounting principles (GAAP) and is reconciled to GAAP information below. (a) Amounts adjusted for notable items as detailed on page 25. Numbers may not foot due to rounding $s in millions Quarterly, Unaudited 1Q24 4Q23 Adjusted noninterest income excluding deferred compensation income Noninterest income (GAAP) $ 194 $ 183 Plus notable items (GAAP) — (4) Adjusted noninterest income (Non-GAAP) $ 194 $ 179 Less deferred compensation income (GAAP) 9 6 Adjusted noninterest income excluding deferred compensation income (Non-GAAP) $ 186 $ 173 Adjusted noninterest expense excluding deferred compensation expense Noninterest expense (GAAP) $ 515 $ 572 Plus notable items (GAAP) (15) (70) Adjusted noninterest expense (Non-GAAP) $ 500 $ 502 Less deferred compensation expense (GAAP) 9 7 Adjusted noninterest expense excluding deferred compensation expense (Non-GAAP) $ 491 $ 495 Adjusted personnel expense excluding deferred compensation expense Personnel expense (GAAP) $ 301 $ 279 Plus notable items (GAAP) (5) (2) Adjusted personnel expense (Non-GAAP) $ 295 $ 277 Less deferred compensation expense (GAAP) 9 7 Adjusted personnel expense excluding deferred compensation expense (Non-GAAP) $ 286 $ 270