Exhibit 99.1

FOURTH QUARTER 2016

FINANCIAL SUPPLEMENT

If you need further information, please contact:

Aarti Bowman, Investor Relations

901-523-4017

aagoorha@firsthorizon.com

FHN TABLE OF CONTENTS

| Page | |

| First Horizon National Corporation Segment Structure | 3 |

| Performance Highlights | 4 |

| Consolidated Results | |

| Income Statement | |

| Income Statement | 6 |

| Other Income and Other Expense | 7 |

| Balance Sheet | |

| Period End Balance Sheet | 8 |

| Average Balance Sheet | 9 |

| Net Interest Income | 10 |

| Average Balance Sheet: Yields and Rates | 11 |

| Capital Highlights | 12 |

| Business Segment Detail | |

| Segment Highlights | 13 |

| Regional Banking | 14 |

| Fixed Income and Corporate | 15 |

| Non-Strategic | 16 |

| Asset Quality | |

| Asset Quality: Consolidated | 17 |

| Asset Quality: Regional Banking and Corporate | 19 |

| Asset Quality: Non-Strategic | 20 |

| Portfolio Metrics | 21 |

| Non-GAAP to GAAP Reconciliation | 22 |

| Glossary of Terms | 23 |

| Other Information |

This financial supplement contains forward-looking statements involving significant risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking information. Those factors include general economic and financial market conditions, including expectations of and actual timing and amount of interest rate movements including the slope of the yield curve, competition, customer and investor responses to these conditions, ability to execute business plans, geopolitical developments, recent and future legislative and regulatory developments, natural disasters, and items mentioned in this financial supplement and in First Horizon National Corporation’s (“FHN”) most recent press release, as well as critical accounting estimates and other factors described in FHN’s recent filings with the SEC. FHN disclaims any obligation to update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements to reflect future events or developments.

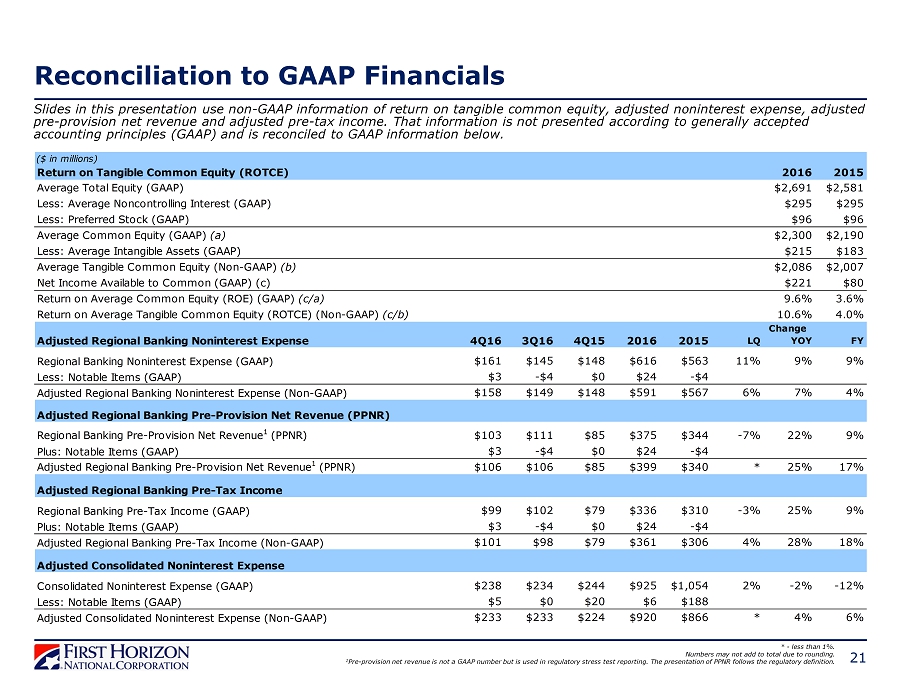

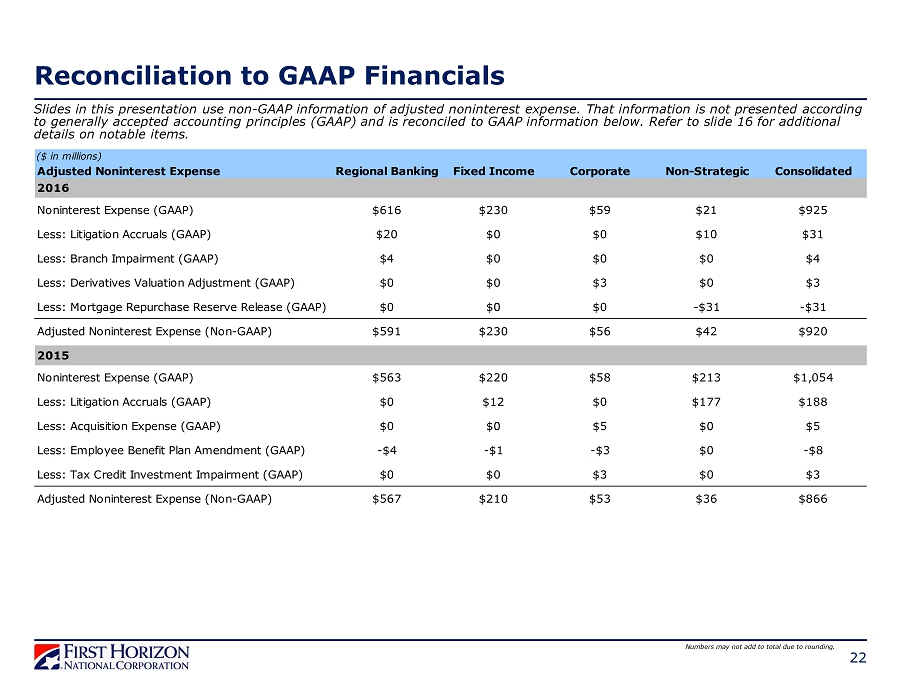

Use of Non-GAAP Measures and Regulatory Measures that are not GAAP

Certain measures are included in this financial supplement that are “non-GAAP,” meaning (under U.S. financial reporting rules) they are not presented in accordance with generally accepted accounting principles (“GAAP”) in the U.S. and also are not codified in U.S. banking regulations currently applicable to FHN. Although other entities may use calculation methods that differ from those used by FHN for non-GAAP measures, FHN’s management believes such measures are relevant to understanding the financial condition, capital position, and financial results of FHN and its business segments. Non-GAAP measures are reported to FHN’s management and Board of Directors through various internal reports.

Presentation of regulatory measures, some of which follow regulatory definitions rather than GAAP, provides a meaningful base for comparability to other financial institutions subject to the same regulations as FHN. Such measures are used by the various banking regulators in reviewing the performance, stability, and capital adequacy of financial institutions they regulate. Although not GAAP terms, these regulatory measures are not considered “non-GAAP” under U.S. financial reporting rules as long as their presentation conforms to regulatory standards. Regulatory measures used in this financial supplement include: common equity tier 1 capital, generally defined as common equity less goodwill, other intangibles, and certain other required regulatory deductions; tier 1 capital, generally defined as the sum of core capital (including common equity and instruments that cannot be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations; risk weighted assets (“RWA”), which is a measure of total on- and off-balance sheet assets adjusted for credit and market risk, used to determine regulatory capital ratios; and pre-provision net revenue (“PPNR”), calculated by adding the provision/(provision credit) for loan losses to income before income taxes.

The non-GAAP measures presented in this financial supplement are return on average tangible common equity (“ROTCE”), tangible common equity (“TCE”) to tangible assets (“TA”), and tangible book value per common share.

Refer to the tabular reconciliation of non-GAAP to GAAP measures and presentation of the most comparable GAAP items on page 22 of this financial supplement.

| 2 |

| FIRST HORIZON NATIONAL CORPORATION SEGMENT STRUCTURE |  |

| 3 |

FHN PERFORMANCE HIGHLIGHTS

Summary of Fourth Quarter 2016 Notable Items

| Segment | Item | Income Statement | Amount | Comments | ||||||

| • | Regional Banking & Non-Strategic | Litigation expense | Noninterest Expense: Litigation and regulatory matters | $4.7 million | Pre-tax loss accruals related to legal matters |

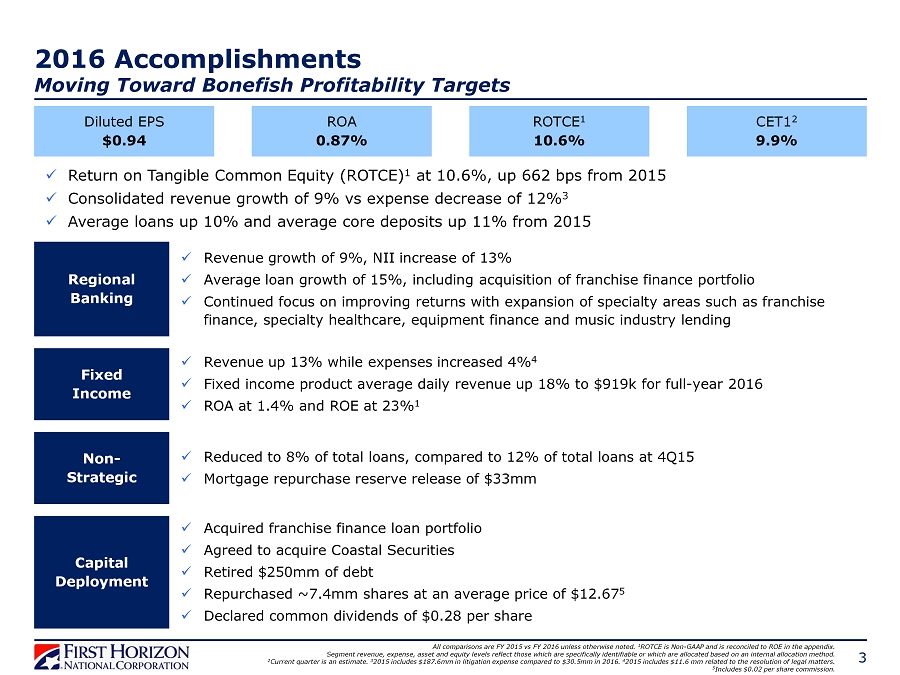

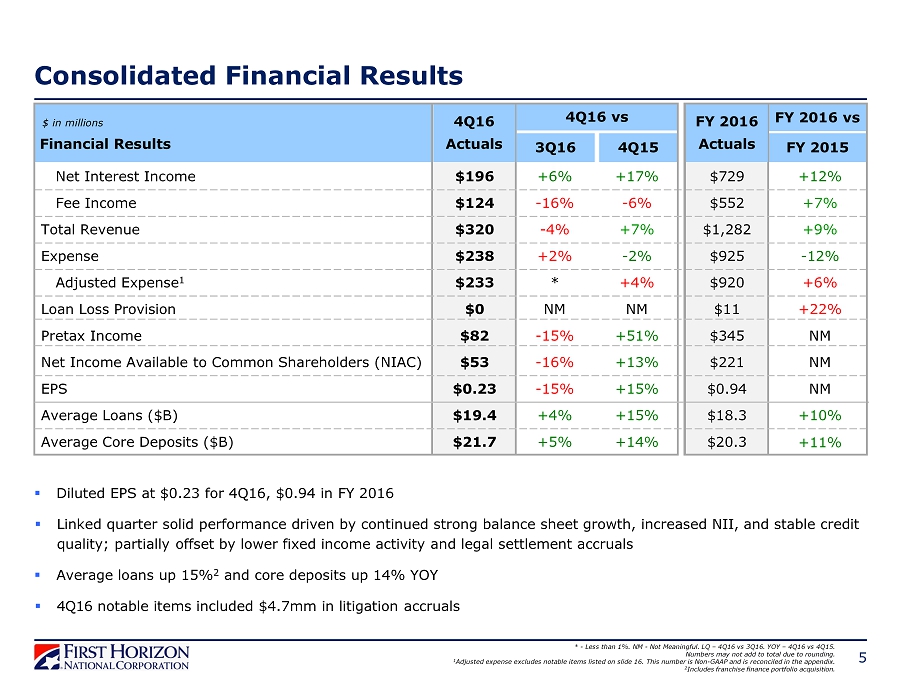

Consolidated Results for Fiscal Year 2016 vs. 2015

| • | Net income available to common shareholders was $220.8 million, or $.94 per diluted share in 2016, compared to $79.7 million, or $.34 per diluted share in 2015 |

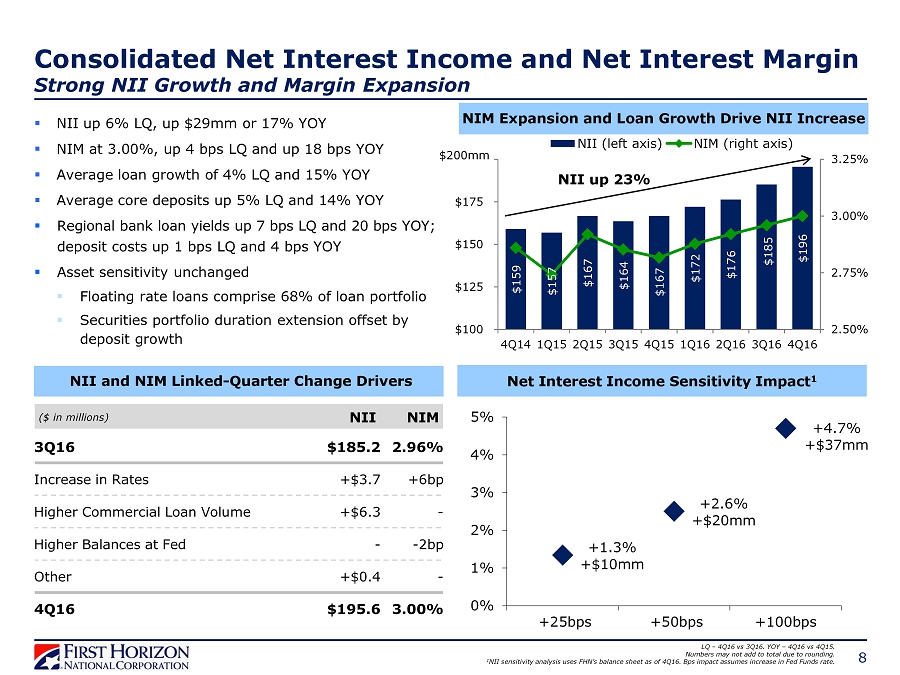

| • | Net interest income (“NII”) increased 12 percent in 2016 to $729.1 million from $653.7 million in 2015; Net interest margin (“NIM”) increased to 2.94 percent from 2.83 percent |

| • | The increase in NII was the result of loan growth within the regional bank, the positive impact of higher market rates, lower long-term funding costs, and a larger investment securities portfolio, partially offset by the continued run-off of the non-strategic loan portfolios and lower cash basis interest income in 2016 relative to the prior year | |

| • | Higher market rates, lower long-term funding costs, a decrease in average excess cash held at the Fed during the year, and higher average balances of loans to mortgage companies contributed to the increase in NIM, but were somewhat mitigated by the continued run-off of the non-strategic loan portfolios and a decrease in cash basis interest income relative to 2015 |

| • | Noninterest income (including securities gains) increased to $552.4 million in 2016 from $517.3 million in 2015 primarily driven by higher fixed income sales revenue in 2016 |

| • | Provision expense was $11.0 million in 2016 compared to $9.0 million in 2015 |

| • | Noninterest expense decreased to $.9 billion in 2016 from $1.1 billion in 2015 |

| • | The decrease in noninterest expense was primarily the result of an 84 percent decline in loss accruals related to legal matters and the favorable impact of a $32.7 million reversal of repurchase and foreclosure provision primarily as a result of settlements/recoveries of certain repurchase claims, somewhat offset by an increase in personnel expenses within the regional banking and fixed income segments |

| • | Period-end loans increased 11 percent to $19.6 billion; average loans were $18.3 billion in 2016 compared to $16.6 billion in 2015 |

| • | The increase in period-end and average loans was driven by the third quarter 2016 franchise finance loan purchase, as well as increases in loans to mortgage companies and other commercial loan portfolios within the regional bank, somewhat offset by the continued run-off of the non-strategic loan portfolios | |

| • | The positive impact of the $.5 billion third quarter 2016 franchise finance loan purchase on average loans was somewhat mitigated by the transaction’s timing |

| • | Period-end core deposits increased 13 percent to $22.0 billion; average core deposits were $20.3 billion in 2016 compared to $18.4 billion in 2015 |

| • | Increase in period-end and average core deposits was driven by an increase in insured network deposits and other customer deposits | |

| • | The fourth quarter 2015 TrustAtlantic acquisition also contributed to the increase in average core deposits in 2016 compared to the prior year |

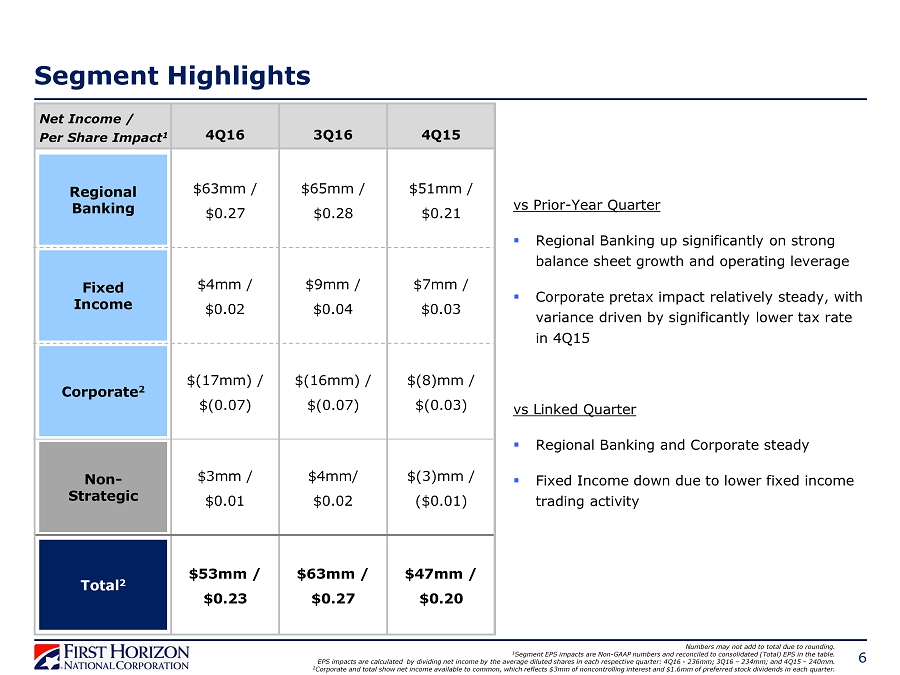

Fourth Quarter 2016 vs. Third Quarter 2016

Consolidated

| • | Net income available to common shareholders was $53.3 million, or $.23 per diluted share in fourth quarter, compared to $63.2 million, or $.27 per diluted share in third quarter |

| • | NII increased to $195.6 million in fourth quarter from $185.2 million in third quarter; NIM increased to 3.00 percent in fourth quarter from 2.96 percent in prior quarter |

| • | NII was favorably impacted by loan growth within the regional bank and the positive impact of higher market rates | |

| • | The increase in NIM was primarily due to higher market rates, somewhat offset by an increase in average excess cash held at the Fed during fourth quarter relative to third quarter |

| • | Noninterest income (including securities gains) was $124.1 million in fourth quarter compared to $148.5 million in prior quarter |

| • | The decrease was primarily driven by lower fixed income sales revenue |

| • | Noninterest expense increased to $237.9 million in fourth quarter from $233.6 million in third quarter primarily driven by a net increase in loss accruals related to legal matters |

| • | Period-end loans were $19.6 billion in fourth and third quarters; average loans increased 4 percent to $19.4 billion in fourth quarter |

| • | Period-end core deposits were $22.0 billion and $21.0 billion in fourth quarter and third quarter, respectively; average core deposits increased 5 percent linked quarter to $21.7 billion in fourth quarter |

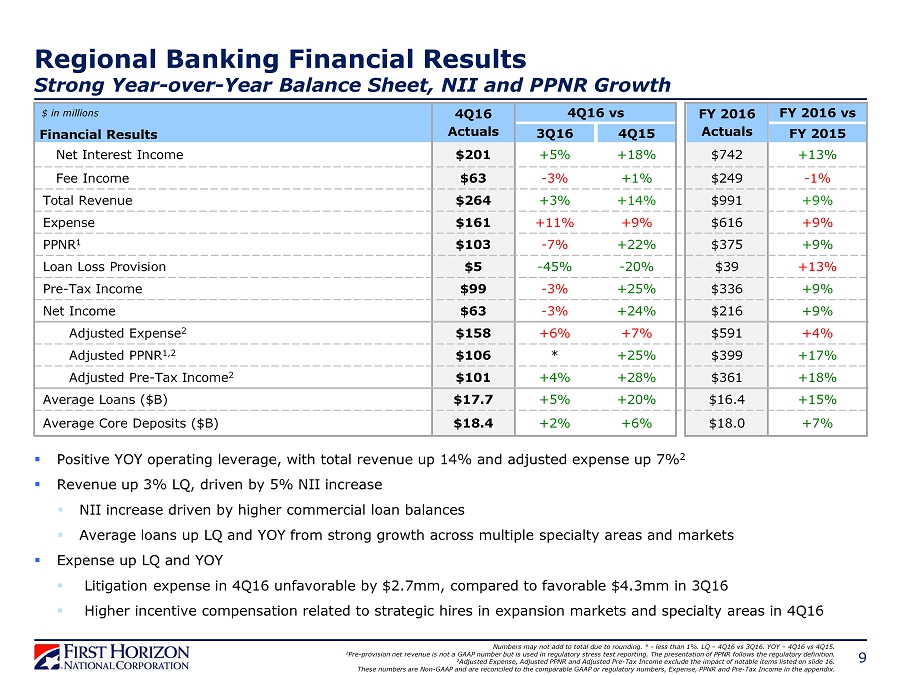

Regional Banking

| • | Pre-tax income was $98.5 million in fourth quarter compared to $102.1 million in third quarter; pre-provision net revenue was $103.2 million and $110.6 million in fourth and third quarters, respectively |

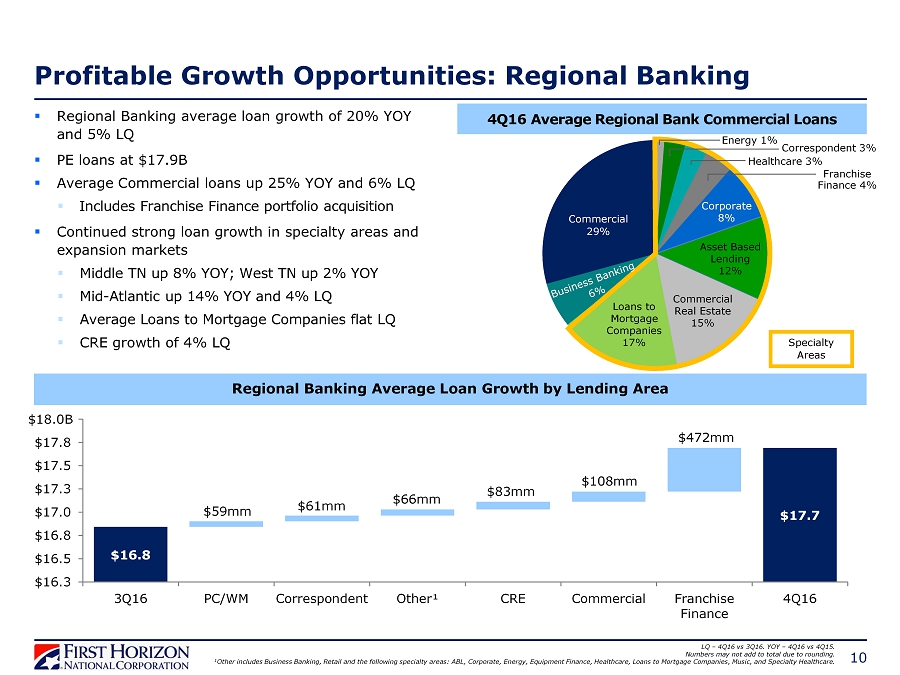

| • | Period-end loans were $17.9 billion and $17.8 billion in fourth and third quarters, respectively; average loans increased 5 percent to $17.7 billion in fourth quarter |

| • | The increase in average loans was primarily driven by the third quarter 2016 franchise finance loan purchase, as well as increases in other commercial loan portfolios |

| • | Period-end core deposits increased to $18.7 billion in fourth quarter from $18.2 billion in third quarter; average core deposits increased 2 percent to $18.4 billion |

| • | NII increased to $200.7 million in fourth quarter from $190.5 million in third quarter |

| • | The increase in NII was largely the result of higher average balances of franchise finance loans, higher average balances of other commercial loans, and a higher earnings credit on deposits |

| • | Provision expense was $4.7 million in fourth quarter compared to $8.5 million in the prior quarter |

| • | Provision in fourth quarter was primarily driven by increased reserves as a result of commercial loan growth | |

| • | Net charge-offs declined by $1.5 million in fourth quarter to $2.0 million driven by a net recovery in the C&I portfolio of $1.6 million |

| • | Noninterest income was $63.3 million in fourth quarter compared to $65.1 million in third quarter; the decrease was largely the result of the favorable impact on third quarter income of a $1.8 million gain on the sale of properties |

| • | Noninterest expense increased to $160.8 million in fourth quarter from $145.0 million in third quarter primarily driven by a $7.0 million net increase in loss accruals related to legal matters |

| • | Fourth quarter includes $2.7 million of loss accruals related to legal matters compared to a $4.3 million reversal in third quarter | |

| • | Higher personnel-related expenses associated with strategic hires in expansion markets and specialty areas and professional fees also contributed to the linked-quarter expense increase |

| 4 |

FHN PERFORMANCE HIGHLIGHTS (continued)

Fourth Quarter 2016 vs. Third Quarter 2016 (continued)

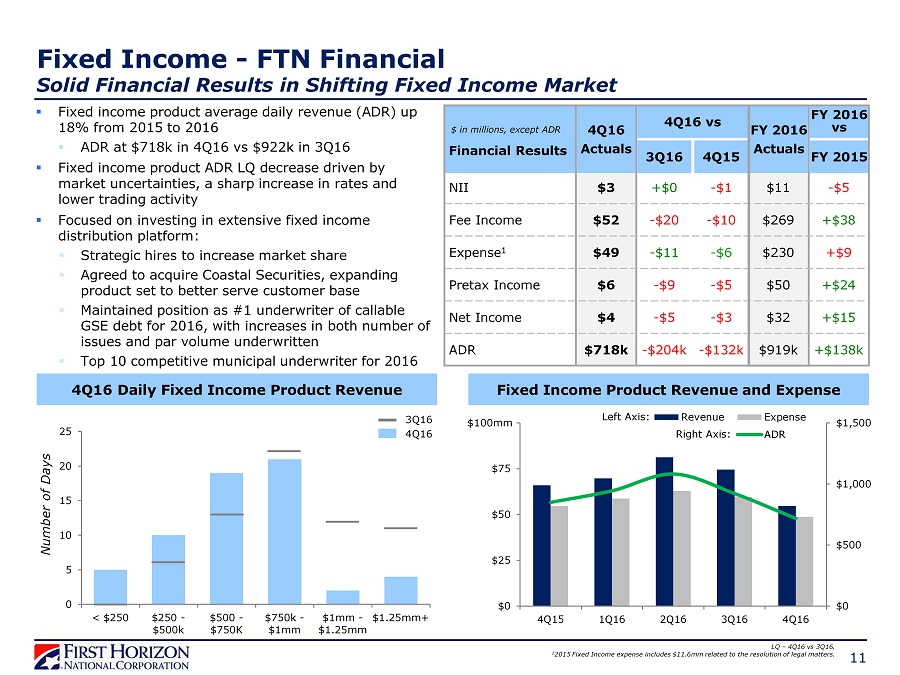

Fixed Income

| • | Pre-tax income was $5.9 million in fourth quarter compared to $14.9 million in third quarter |

| • | Noninterest income decreased to $52.1 million in fourth quarter from $72.1 million in the prior quarter |

| • | Fixed income product revenue was $43.8 million in fourth quarter compared to $59.0 million in third quarter |

| • | Fixed income product average daily revenue (“ADR”) was $718 thousand and $922 thousand in fourth and third quarters, respectively, the decrease was driven by market uncertainties, a sharp increase in rates and lower trading activity |

| • | Other product revenue decreased $4.8 million to $8.3 million in fourth quarter driven by a decrease in fees from loan and derivative sales |

| • | Noninterest expense decreased to $48.7 million in fourth quarter from $59.6 million in the prior quarter primarily due to lower variable compensation costs |

Corporate

| • | Pre-tax loss was $27.5 million in fourth quarter compared to pre-tax loss of $27.9 million in prior quarter |

| • | NII was negative $17.5 million and negative $18.2 million in fourth and third quarter, respectively |

| • | Estimated effective duration of the securities portfolio was 4.8 years in fourth quarter compared to 2.5 years in third quarter |

| • | Higher interest rates in fourth quarter provided an attractive entry point for further moderation of the balance sheet’s asset sensitivity. Part of this initiative included bond swaps executed in the fourth quarter to extend the duration of the investment portfolio. Higher interest rates also extended the duration of existing holdings in the investment portfolio |

| • | Noninterest income (including net securities gains) was $4.7 million in fourth quarter compared to $5.1 million in third quarter |

| • | Noninterest expense decreased to $14.6 million in fourth quarter from $14.8 million in prior quarter |

Non-Strategic

| • | Pre-tax income was $4.8 million in fourth quarter compared to $7.0 million in third quarter |

| • | NII was $9.8 million and $10.5 million in fourth and third quarter, respectively |

| • | The provision credit was $4.7 million in fourth quarter compared to a provision credit of $4.5 million in third quarter |

| • | The level of provision continues to reflect declining balances combined with stable performance within the legacy portfolio |

| • | Noninterest income was $4.0 million in fourth quarter compared to $6.2 million in prior quarter |

| • | Fourth quarter included a $1.5 million gain related to the reversal of a contingency accrual associated with prior sales of MSR, while third quarter included $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales |

| • | Noninterest expense decreased to $13.7 million in fourth quarter from $14.2 million in third quarter driven by a $2.5 million net decline in loss accruals related to legal matters somewhat offset by an increase in legal fees |

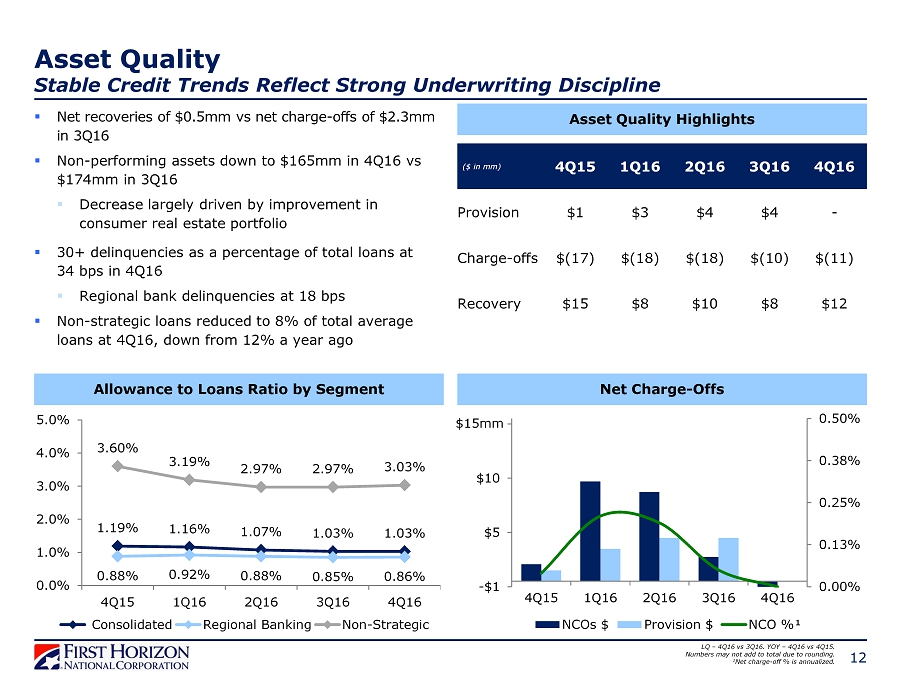

Asset Quality

| • | Allowance for loan losses increased to $202.1 million in fourth quarter from $201.6 million in third quarter; the allowance to loans ratio remained flat at 103 basis points in fourth quarter |

| • | Reserves for the commercial portfolio increased $4.0 million which was partially offset by a $3.5 million decline in consumer portfolio reserves |

| • | The increase in regional bank commercial reserves was primarily due to increased balances compared to third quarter |

| • | Net recoveries were $.5 million in fourth quarter compared to net charge-offs (“NCOs”) of $2.3 million in third quarter |

| • | Regional bank net charge-offs decreased $1.5 million to $2.0 million in fourth quarter due to a net recovery in C&I of $1.6 million; the net recovery was primarily driven by one credit | |

| • | Non-strategic net recoveries increased $1.3 million to $2.5 million in fourth quarter; the increase was driven by the consumer real estate portfolio |

| • | Nonperforming loans (“NPLs”), excluding loans held-for-sale, decreased to $145.6 million in fourth quarter from $152.1 million in third quarter; the decrease was largely driven by the consumer real estate portfolio |

| • | Nonperforming assets (“NPAs”), excluding loans held-for-sale, were $156.9 million compared to $165.7 million |

| • | 30+ delinquencies as a percentage of total loans increased to 34 basis points in fourth quarter compared to 32 basis points in third quarter; the increase was primarily driven by the consumer portfolio |

| • | TDRs decreased to $354.5 million in fourth quarter from $360.8 million in prior quarter |

Taxes

| • | The effective tax rates for fourth and third quarters were 29.37 percent and 29.68 percent, respectively. |

| • | The rates reflect the favorable effect from permanent benefits. Permanent benefits primarily consist of tax credit investments, life insurance, and tax-exempt interest |

Capital and Liquidity

| • | Declared $.07 per common share quarterly dividend in fourth quarter, aggregating $16.3 million, which was paid on January 3, 2017 |

| • | Declared aggregate preferred quarterly dividend of $1.6 million in fourth quarter which was paid on January 10, 2017 |

| • | There were no repurchases of shares under the current share repurchase program in fourth quarter; $189.7 million remains in the stock purchase authorization first announced in 2014, currently scheduled to expire January 31, 2018 |

| • | Capital ratios (regulatory capital ratios calculated under the Basel III risk-based capital rules as phased-in; current quarter is an estimate) |

| • | Total equity to total assets (GAAP) of 9.47 percent in fourth quarter compared to 9.65 percent in prior quarter | |

| • | Tangible common equity to tangible assets (Non-GAAP) of 7.42 percent in fourth quarter compared to 7.58 percent in prior quarter | |

| • | Common Equity Tier 1 of 9.94 percent in fourth quarter compared to 9.81 percent in prior quarter | |

| • | Tier 1 of 11.17 percent in fourth quarter compared to 11.03 percent in prior quarter | |

| • | Total Capital of 12.23 percent in fourth quarter compared to 12.09 percent in prior quarter | |

| • | Leverage of 9.35 percent in fourth quarter compared to 9.52 percent in prior quarter |

| 5 |

FHN CONSOLIDATED INCOME STATEMENT

Quarterly/Annually, Unaudited

| 4Q16 Changes vs. | Twelve months ended | 2016 vs. | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | 2016 | 2015 | 2015 | ||||||||||||||||||||||||||||||

| Interest income | $ | 219,897 | $ | 206,972 | $ | 197,376 | $ | 193,664 | $ | 187,620 | 6 | % | 17 | % | $ | 817,909 | $ | 736,405 | 11 | % | ||||||||||||||||||||

| Less: interest expense | 24,346 | 21,777 | 21,112 | 21,590 | 20,968 | 12 | % | 16 | % | 88,825 | 82,685 | 7 | % | |||||||||||||||||||||||||||

| Net interest income | 195,551 | 185,195 | 176,264 | 172,074 | 166,652 | 6 | % | 17 | % | 729,084 | 653,720 | 12 | % | |||||||||||||||||||||||||||

| Provision for loan losses | — | 4,000 | 4,000 | 3,000 | 1,000 | NM | NM | 11,000 | 9,000 | 22 | % | |||||||||||||||||||||||||||||

| Net interest income after provision for loan losses | 195,551 | 181,195 | 172,264 | 169,074 | 165,652 | 8 | % | 18 | % | 718,084 | 644,720 | 11 | % | |||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||||||||||

| Fixed income | 51,923 | 71,748 | 77,913 | 66,977 | 61,673 | (28 | )% | (16 | )% | 268,561 | 231,337 | 16 | % | |||||||||||||||||||||||||||

| Deposit transactions and cash management | 27,504 | 27,221 | 26,991 | 26,837 | 28,951 | 1 | % | (5 | )% | 108,553 | 112,843 | (4 | )% | |||||||||||||||||||||||||||

| Brokerage, management fees and commissions | 11,003 | 10,828 | 10,665 | 10,415 | 11,021 | 2 | % | * | 42,911 | 46,496 | (8 | )% | ||||||||||||||||||||||||||||

| Trust services and investment management | 7,053 | 6,885 | 7,224 | 6,565 | 6,873 | 2 | % | 3 | % | 27,727 | 27,577 | 1 | % | |||||||||||||||||||||||||||

| Bankcard income (a) | 6,353 | 6,260 | 6,558 | 5,259 | 5,607 | 1 | % | 13 | % | 24,430 | 22,238 | 10 | % | |||||||||||||||||||||||||||

| Bank-owned life insurance | 3,558 | 3,997 | 3,743 | 3,389 | 3,738 | (11 | )% | (5 | )% | 14,687 | 14,726 | * | ||||||||||||||||||||||||||||

| Securities gains/(losses), net | (132 | ) | (200 | ) | 99 | 1,574 | 1,439 | 34 | % | NM | 1,341 | 1,378 | (3 | )% | ||||||||||||||||||||||||||

| Other (b) | 16,815 | 21,806 | 12,321 | 13,289 | 12,930 | (23 | )% | 30 | % | 64,231 | 60,730 | 6 | % | |||||||||||||||||||||||||||

| Total noninterest income | 124,077 | 148,545 | 145,514 | 134,305 | 132,232 | (16 | )% | (6 | )% | 552,441 | 517,325 | 7 | % | |||||||||||||||||||||||||||

| Adjusted gross income after provision for loan losses | 319,628 | 329,740 | 317,778 | 303,379 | 297,884 | (3 | )% | 7 | % | 1,270,525 | 1,162,045 | 9 | % | |||||||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits | 137,324 | 145,103 | 143,370 | 137,151 | 136,000 | (5 | )% | 1 | % | 562,948 | 511,633 | 10 | % | |||||||||||||||||||||||||||

| Repurchase and foreclosure provision (c) | (1,104 | ) | (218 | ) | (31,400 | ) | — | — | NM | NM | (32,722 | ) | — | NM | ||||||||||||||||||||||||||

| Legal fees | 6,038 | 4,750 | 5,891 | 4,879 | 4,601 | 27 | % | 31 | % | 21,558 | 16,287 | 32 | % | |||||||||||||||||||||||||||

| Professional fees | 4,827 | 4,859 | 4,284 | 5,199 | 4,859 | (1 | )% | (1 | )% | 19,169 | 18,922 | 1 | % | |||||||||||||||||||||||||||

| Occupancy | 12,818 | 12,722 | 12,736 | 12,604 | 13,853 | 1 | % | (7 | )% | 50,880 | 51,117 | * | ||||||||||||||||||||||||||||

| Computer software (d) | 11,909 | 10,400 | 11,226 | 11,587 | 11,432 | 15 | % | 4 | % | 45,122 | 44,724 | 1 | % | |||||||||||||||||||||||||||

| Contract employment and outsourcing | 2,696 | 2,443 | 2,497 | 2,425 | 3,159 | 10 | % | (15 | )% | 10,061 | 14,494 | (31 | )% | |||||||||||||||||||||||||||

| Operations services | 10,913 | 10,518 | 10,521 | 9,900 | 9,761 | 4 | % | 12 | % | 41,852 | 39,261 | 7 | % | |||||||||||||||||||||||||||

| Equipment rentals, depreciation, and maintenance | 7,959 | 6,085 | 7,182 | 6,159 | 8,568 | 31 | % | (7 | )% | 27,385 | 30,864 | (11 | )% | |||||||||||||||||||||||||||

| FDIC premium expense | 6,095 | 5,721 | 4,848 | 4,921 | 5,098 | 7 | % | 20 | % | 21,585 | 18,027 | 20 | % | |||||||||||||||||||||||||||

| Advertising and public relations (e) | 6,093 | 6,065 | 4,481 | 4,973 | 5,273 | * | 16 | % | 21,612 | 19,187 | 13 | % | ||||||||||||||||||||||||||||

| Communications and courier | 3,593 | 3,883 | 3,039 | 3,750 | 4,089 | (7 | )% | (12 | )% | 14,265 | 15,820 | (10 | )% | |||||||||||||||||||||||||||

| Amortization of intangible assets | 1,300 | 1,299 | 1,299 | 1,300 | 1,359 | * | (4 | )% | 5,198 | 5,253 | (1 | )% | ||||||||||||||||||||||||||||

| Other (b) | 27,436 | 19,928 | 46,848 | 22,079 | 35,688 | 38 | % | (23 | )% | 116,291 | 268,202 | (57 | )% | |||||||||||||||||||||||||||

| Total noninterest expense | 237,897 | 233,558 | 226,822 | 226,927 | 243,740 | 2 | % | (2 | )% | 925,204 | 1,053,791 | (12 | )% | |||||||||||||||||||||||||||

| Income before income taxes | 81,731 | 96,182 | 90,956 | 76,452 | 54,144 | (15 | )% | 51 | % | 345,321 | 108,254 | NM | ||||||||||||||||||||||||||||

| Provision for income taxes | 24,008 | 28,547 | 30,016 | 24,239 | 2,715 | (16 | )% | NM | 106,810 | 10,941 | NM | |||||||||||||||||||||||||||||

| Net income | 57,723 | 67,635 | 60,940 | 52,213 | 51,429 | (15 | )% | 12 | % | 238,511 | 97,313 | NM | ||||||||||||||||||||||||||||

| Net income attributable to noncontrolling interest | 2,879 | 2,883 | 2,852 | 2,851 | 2,848 | * | 1 | % | 11,465 | 11,434 | * | |||||||||||||||||||||||||||||

| Net income attributable to controlling interest | 54,844 | 64,752 | 58,088 | 49,362 | 48,581 | (15 | )% | 13 | % | 227,046 | 85,879 | NM | ||||||||||||||||||||||||||||

| Preferred stock dividends | 1,550 | 1,550 | 1,550 | 1,550 | 1,550 | * | * | 6,200 | 6,200 | * | ||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 53,294 | $ | 63,202 | $ | 56,538 | $ | 47,812 | $ | 47,031 | (16 | )% | 13 | % | $ | 220,846 | $ | 79,679 | NM | |||||||||||||||||||||

| Common Stock Data | ||||||||||||||||||||||||||||||||||||||||

| EPS | $ | 0.23 | $ | 0.27 | $ | 0.24 | $ | 0.20 | $ | 0.20 | (15 | )% | 15 | % | $ | 0.95 | $ | 0.34 | NM | |||||||||||||||||||||

| Basic shares (thousands) | 232,731 | 231,856 | 231,573 | 234,651 | 237,983 | * | (2 | )% | 232,700 | 234,189 | (1 | )% | ||||||||||||||||||||||||||||

| Diluted EPS | $ | 0.23 | $ | 0.27 | $ | 0.24 | $ | 0.20 | $ | 0.20 | (15 | )% | 15 | % | $ | 0.94 | $ | 0.34 | NM | |||||||||||||||||||||

| Diluted shares (thousands) | 235,590 | 234,092 | 233,576 | 236,666 | 240,072 | 1 | % | (2 | )% | 235,292 | 236,266 | * | ||||||||||||||||||||||||||||

| Key Ratios & Other | ||||||||||||||||||||||||||||||||||||||||

| Return on average assets (annualized) (f) | 0.80 | % | 0.97 | % | 0.91 | % | 0.79 | % | 0.78 | % | 0.87 | % | 0.38 | % | ||||||||||||||||||||||||||

| Return on average common equity (“ROE”) (annualized) (f) | 9.00 | % | 10.80 | % | 10.04 | % | 8.53 | % | 8.23 | % | 9.60 | % | 3.64 | % | ||||||||||||||||||||||||||

| Return on average tangible common equity (“ROTCE”) (annualized) (f) (g) | 9.89 | % | 11.90 | % | 11.10 | % | 9.44 | % | 9.07 | % | 10.59 | % | 3.97 | % | ||||||||||||||||||||||||||

| Fee income to total revenue (f) | 38.84 | % | 44.54 | % | 45.21 | % | 43.55 | % | 43.97 | % | 43.05 | % | 44.11 | % | ||||||||||||||||||||||||||

| Efficiency ratio (f) | 74.40 | % | 69.94 | % | 70.51 | % | 74.45 | % | 81.94 | % | 72.27 | % | 90.09 | % | ||||||||||||||||||||||||||

| Full time equivalent employees | 4,248 | 4,246 | 4,228 | 4,241 | 4,260 | |||||||||||||||||||||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

NM - Not meaningful

* Amount is less than one percent.

| (a) | 2Q16 increase driven by a significant new relationship. |

| (b) | Refer to the Other Income and Other Expense table on page 7 for additional information. |

| (c) | Expense reversals driven by the settlements/recoveries of certain repurchase claims. |

| (d) | 4Q16 expense increase largely driven by investments in the new digital banking platform. |

| (e) | 4Q16 includes $1.1 million related to CRA initiatives; 3Q16 increase related to a promotional branding campaign. |

| (f) | See Glossary of Terms for definitions of Key Ratios. |

| (g) | This non-GAAP measure is reconciled to ROE (GAAP) in the Non-GAAP to GAAP reconciliation on page 22 of this financial supplement. |

| 6 |

FHN OTHER INCOME AND OTHER EXPENSE

Quarterly/Annually, Unaudited

| 4Q16 Changes vs. | Twelve months ended | 2016 vs. | ||||||||||||||||||||||||||||||||||||||

| (Thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | 2016 | 2015 | 2015 | ||||||||||||||||||||||||||||||

| Other Income | ||||||||||||||||||||||||||||||||||||||||

| ATM and interchange fees | $ | 3,047 | $ | 3,081 | $ | 2,879 | $ | 2,958 | $ | 3,133 | (1 | )% | (3 | )% | $ | 11,965 | $ | 11,917 | * | |||||||||||||||||||||

| Electronic banking fees | 1,301 | 1,398 | 1,381 | 1,397 | 1,474 | (7 | )% | (12 | )% | 5,477 | 5,840 | (6 | )% | |||||||||||||||||||||||||||

| Letter of credit fees | 946 | 981 | 1,115 | 1,061 | 988 | (4 | )% | (4 | )% | 4,103 | 4,621 | (11 | )% | |||||||||||||||||||||||||||

| Mortgage banking (a) | 2,820 | 5,524 | 598 | 1,273 | 1,149 | (49 | )% | NM | 10,215 | 3,870 | NM | |||||||||||||||||||||||||||||

| Deferred compensation (b) | 863 | 1,038 | 795 | 329 | (58 | ) | (17 | )% | NM | 3,025 | (1,369 | ) | NM | |||||||||||||||||||||||||||

| Gain/(loss) on extinguishment of debt (c) | — | — | — | — | (1 | ) | NM | NM | — | 5,793 | NM | |||||||||||||||||||||||||||||

| Insurance commissions | 680 | 1,262 | 552 | 487 | 769 | (46 | )% | (12 | ) | 2,981 | 2,627 | 13 | % | |||||||||||||||||||||||||||

| Other service charges | 3,018 | 3,004 | 2,996 | 2,713 | 2,751 | * | 10 | % | 11,731 | 11,610 | 1 | % | ||||||||||||||||||||||||||||

| Other (d) | 4,140 | 5,518 | 2,005 | 3,071 | 2,725 | (25 | )% | 52 | % | 14,734 | 15,821 | (7 | )% | |||||||||||||||||||||||||||

| Total | $ | 16,815 | $ | 21,806 | $ | 12,321 | $ | 13,289 | $ | 12,930 | (23 | )% | 30 | % | $ | 64,231 | $ | 60,730 | 6 | % | ||||||||||||||||||||

| Other Expense | ||||||||||||||||||||||||||||||||||||||||

| Litigation and regulatory matters (e) | $ | 4,684 | $ | 260 | $ | 26,000 | $ | (475 | ) | $ | 14,185 | NM | (67 | )% | $ | 30,469 | $ | 187,607 | (84 | )% | ||||||||||||||||||||

| Tax credit investments (f) | 1,024 | 788 | 831 | 706 | 3,199 | 30 | % | (68 | )% | 3,349 | 4,582 | (27 | )% | |||||||||||||||||||||||||||

| Travel and entertainment | 3,240 | 2,478 | 2,495 | 2,062 | 2,893 | 31 | % | 12 | % | 10,275 | 9,590 | 7 | % | |||||||||||||||||||||||||||

| Employee training and dues | 1,603 | 1,360 | 1,338 | 1,390 | 1,537 | 18 | % | 4 | % | 5,691 | 5,390 | 6 | % | |||||||||||||||||||||||||||

| Customer relations | 1,451 | 1,442 | 1,483 | 1,879 | 1,086 | 1 | % | 34 | % | 6,255 | 5,382 | 16 | % | |||||||||||||||||||||||||||

| Miscellaneous loan costs | 628 | 676 | 565 | 717 | 835 | (7 | )% | (25 | )% | 2,586 | 2,656 | (3 | )% | |||||||||||||||||||||||||||

| Supplies | 1,320 | 1,158 | 930 | 1,026 | 1,046 | 14 | % | 26 | % | 4,434 | 3,827 | 16 | % | |||||||||||||||||||||||||||

| Foreclosed real estate | 648 | 815 | (432 | ) | (258 | ) | 475 | (20 | )% | 36 | % | 773 | 2,104 | (63 | )% | |||||||||||||||||||||||||

| Other insurance and taxes | 1,939 | 2,625 | 3,014 | 3,313 | 2,874 | (26 | )% | (33 | )% | 10,891 | 12,941 | (16 | )% | |||||||||||||||||||||||||||

| Other (g) | 10,899 | 8,326 | 10,624 | 11,719 | 7,558 | 31 | % | 44 | % | 41,568 | 34,123 | 22 | % | |||||||||||||||||||||||||||

| Total | $ | 27,436 | $ | 19,928 | $ | 46,848 | $ | 22,079 | $ | 35,688 | 38 | % | (23 | )% | $ | 116,291 | $ | 268,202 | (57 | )% | ||||||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

NM-Not meaningful

* Amount is less than one percent.

| (a) | 4Q16 includes a $1.5 million gain related to the reversal of a contingency accrual associated with prior sales of MSR; 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales |

| (b) | Amounts driven by market conditions and are mirrored by changes in deferred compensation expense which is included in employee compensation expense. |

| (c) | 2015 gain related to the extinguishment of $206 million of junior subordinated notes underlying $200 million of trust preferred debt. |

| (d) | 3Q16 includes a $1.8 million gain on the sales of properties; 2015 includes $3.7 million gain on the sale of properties. |

| (e) | 2015 includes $162.5 million related to the settlement of potential claims related to FHN’s underwriting and origination of FHA-insured mortgage loans. |

| (f) | 4Q15 includes $2.8 million of impairment related to a tax credit investment accounted for under the equity method. |

| (g) | 2Q16 includes $2.5 million of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares; 1Q16 includes $3.7 million of impairment related to branch closures. |

| 7 |

FHN CONSOLIDATED PERIOD-END BALANCE SHEET

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | |||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||

| Investment securities | $ | 3,957,846 | $ | 4,041,934 | $ | 4,023,576 | $ | 4,028,731 | $ | 3,944,166 | (2 | )% | * | |||||||||||||||

| Loans held-for-sale | 111,248 | 155,215 | 117,976 | 116,270 | 126,342 | (28 | )% | (12 | )% | |||||||||||||||||||

| Loans, net of unearned income | 19,589,520 | 19,555,787 | 18,589,337 | 17,574,994 | 17,686,502 | * | 11 | % | ||||||||||||||||||||

| Federal funds sold | 50,838 | 27,097 | 40,570 | 34,061 | 114,479 | 88 | % | (56 | )% | |||||||||||||||||||

| Securities purchased under agreements to resell | 613,682 | 802,815 | 881,732 | 767,483 | 615,773 | (24 | )% | * | ||||||||||||||||||||

| Interest-bearing cash (a) | 1,060,034 | 219,834 | 321,743 | 951,920 | 602,836 | NM | 76 | % | ||||||||||||||||||||

| Trading securities | 897,071 | 1,320,535 | 1,162,959 | 1,226,521 | 881,450 | (32 | )% | 2 | % | |||||||||||||||||||

| Total earning assets | 26,280,239 | 26,123,217 | 25,137,893 | 24,699,980 | 23,971,548 | 1 | % | 10 | % | |||||||||||||||||||

| Cash and due from banks | 373,274 | 327,639 | 283,648 | 280,625 | 300,811 | 14 | % | 24 | % | |||||||||||||||||||

| Fixed income receivables (b) | 57,411 | 91,997 | 219,939 | 114,854 | 63,660 | (38 | )% | (10 | )% | |||||||||||||||||||

| Goodwill | 191,371 | 191,371 | 191,307 | 191,307 | 191,307 | * | * | |||||||||||||||||||||

| Other intangible assets, net | 21,017 | 22,317 | 23,616 | 24,915 | 26,215 | (6 | )% | (20 | )% | |||||||||||||||||||

| Premises and equipment, net | 289,385 | 279,178 | 279,676 | 274,347 | 275,619 | 4 | % | 5 | % | |||||||||||||||||||

| Real estate acquired by foreclosure | 16,237 | 18,945 | 20,053 | 24,521 | 33,063 | (14 | )% | (51 | )% | |||||||||||||||||||

| Allowance for loan losses | (202,068 | ) | (201,557 | ) | (199,807 | ) | (204,034 | ) | (210,242 | ) | * | (4 | )% | |||||||||||||||

| Derivative assets | 121,654 | 160,736 | 196,989 | 165,007 | 104,365 | (24 | )% | 17 | % | |||||||||||||||||||

| Other assets | 1,406,711 | 1,435,379 | 1,387,756 | 1,392,160 | 1,436,291 | (2 | )% | (2 | )% | |||||||||||||||||||

| Total assets | $ | 28,555,231 | $ | 28,449,222 | $ | 27,541,070 | $ | 26,963,682 | $ | 26,192,637 | * | 9 | % | |||||||||||||||

| Liabilities and Equity: | ||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||

| Savings | $ | 9,428,197 | $ | 8,753,115 | $ | 7,960,182 | $ | 7,921,344 | $ | 7,811,191 | 8 | % | 21 | % | ||||||||||||||

| Other interest-bearing deposits | 5,948,439 | 5,605,734 | 5,720,628 | 5,371,864 | 5,388,526 | 6 | % | 10 | % | |||||||||||||||||||

| Time deposits | 706,700 | 732,561 | 741,992 | 763,897 | 788,487 | (4 | )% | (10 | )% | |||||||||||||||||||

| Total interest-bearing core deposits | 16,083,336 | 15,091,410 | 14,422,802 | 14,057,105 | 13,988,204 | 7 | % | 15 | % | |||||||||||||||||||

| Noninterest-bearing deposits | 5,940,594 | 5,890,252 | 5,684,732 | 5,717,195 | 5,535,885 | 1 | % | 7 | % | |||||||||||||||||||

| Total core deposits (c) | 22,023,930 | 20,981,662 | 20,107,534 | 19,774,300 | 19,524,089 | 5 | % | 13 | % | |||||||||||||||||||

| Certificates of deposit $100,000 and more | 648,433 | 592,518 | 522,643 | 553,534 | 443,389 | 9 | % | 46 | % | |||||||||||||||||||

| Total deposits | 22,672,363 | 21,574,180 | 20,630,177 | 20,327,834 | 19,967,478 | 5 | % | 14 | % | |||||||||||||||||||

| Federal funds purchased | 414,207 | 538,284 | 508,669 | 588,413 | 464,166 | (23 | )% | (11 | )% | |||||||||||||||||||

| Securities sold under agreements to repurchase | 453,053 | 341,998 | 451,129 | 425,217 | 338,133 | 32 | % | 34 | % | |||||||||||||||||||

| Trading liabilities | 561,848 | 702,226 | 789,540 | 738,653 | 566,019 | (20 | )% | (1 | )% | |||||||||||||||||||

| Other short-term borrowings (d) | 83,177 | 792,736 | 543,033 | 96,723 | 137,861 | (90 | )% | (40 | )% | |||||||||||||||||||

| Term borrowings (e) | 1,040,656 | 1,065,651 | 1,076,943 | 1,323,749 | 1,312,677 | (2 | )% | (21 | )% | |||||||||||||||||||

| Fixed income payables (b) | 21,002 | 68,897 | 90,400 | 56,399 | 23,072 | (70 | )% | (9 | )% | |||||||||||||||||||

| Derivative liabilities | 135,897 | 144,829 | 170,619 | 146,297 | 108,339 | (6 | )% | 25 | % | |||||||||||||||||||

| Other liabilities | 467,944 | 475,839 | 588,636 | 617,449 | 635,306 | (2 | )% | (26 | )% | |||||||||||||||||||

| Total liabilities | 25,850,147 | 25,704,640 | 24,849,146 | 24,320,734 | 23,553,051 | 1 | % | 10 | % | |||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||

| Common stock | 146,015 | 145,772 | 145,012 | 145,342 | 149,117 | * | (2 | )% | ||||||||||||||||||||

| Capital surplus | 1,386,636 | 1,376,319 | 1,362,528 | 1,371,397 | 1,439,303 | 1 | % | (4 | )% | |||||||||||||||||||

| Undivided profits | 1,029,032 | 992,264 | 945,663 | 905,595 | 874,303 | 4 | % | 18 | % | |||||||||||||||||||

| Accumulated other comprehensive loss, net | (247,654 | ) | (160,828 | ) | (152,334 | ) | (170,441 | ) | (214,192 | ) | 54 | % | 16 | % | ||||||||||||||

| Preferred stock | 95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | |||||||||||||||||||||

| Noncontrolling interest (f) | 295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | |||||||||||||||||||||

| Total equity | 2,705,084 | 2,744,582 | 2,691,924 | 2,642,948 | 2,639,586 | (1 | )% | 2 | % | |||||||||||||||||||

| Total liabilities and equity | $ | 28,555,231 | $ | 28,449,222 | $ | 27,541,070 | $ | 26,963,682 | $ | 26,192,637 | * | 9 | % | |||||||||||||||

| NM - Not meaningful | |

| *Amount is less than one percent. | |

| (a) | Includes excess balances held at Fed. |

| (b) | Period-end balances fluctuate based on the level of pending unsettled trades. |

| (c) | 4Q16 average core deposits were $21.7 billion. |

| (d) | 4Q16 decrease due to repayment of FHLB borrowings as a result of an inflow of deposits; 3Q16 and 2Q16 increase related to higher FHLB borrowings as a result of increased loan demand. |

| (e) | In 2Q16 $250 million of FTBNA subordinated notes matured. |

| (f) | Consists of preferred stock of subsidiaries. |

| 8 |

| FHN CONSOLIDATED AVERAGE BALANCE SHEET | ||||||||||||||||||||||||||||||||||||||||

| Quarterly/Annually, Unaudited | ||||||||||||||||||||||||||||||||||||||||

| 4Q16 Changes vs. | Twelve months ended | 2016 vs | ||||||||||||||||||||||||||||||||||||||

| (Thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | 2016 | 2015 | 2015 | ||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||||||||||

| Earning assets: | ||||||||||||||||||||||||||||||||||||||||

| Loans, net of unearned income: | ||||||||||||||||||||||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $ | 11,987,562 | $ | 11,281,691 | $ | 10,451,954 | $ | 9,994,084 | $ | 9,720,115 | 6 | % | 23 | % | $ | 10,932,679 | $ | 9,477,376 | 15 | % | ||||||||||||||||||||

| Commercial real estate | 2,089,314 | 1,997,121 | 1,901,592 | 1,765,435 | 1,612,730 | 5 | % | 30 | % | 1,938,939 | 1,425,813 | 36 | % | |||||||||||||||||||||||||||

| Consumer real estate | 4,545,646 | 4,601,420 | 4,662,172 | 4,732,968 | 4,798,067 | (1 | )% | (5 | )% | 4,635,213 | 4,879,083 | (5 | )% | |||||||||||||||||||||||||||

| Permanent mortgage | 429,914 | 436,952 | 435,521 | 447,800 | 455,299 | (2 | )% | (6 | )% | 437,524 | 489,190 | (11 | )% | |||||||||||||||||||||||||||

| Credit card and other | 361,311 | 362,166 | 360,874 | 353,661 | 356,948 | * | 1 | % | 359,515 | 352,977 | 2 | % | ||||||||||||||||||||||||||||

| Total loans, net of unearned income (a) | 19,413,747 | 18,679,350 | 17,812,113 | 17,293,948 | 16,943,159 | 4 | % | 15 | % | 18,303,870 | 16,624,439 | 10 | % | |||||||||||||||||||||||||||

| Loans held-for-sale | 127,484 | 132,434 | 114,859 | 122,146 | 122,046 | (4 | )% | 4 | % | 124,262 | 128,950 | (4 | )% | |||||||||||||||||||||||||||

| Investment securities: | ||||||||||||||||||||||||||||||||||||||||

| U.S. treasuries | 100 | 100 | 100 | 100 | 100 | * | * | 100 | 100 | * | ||||||||||||||||||||||||||||||

| U.S. government agencies | 3,810,207 | 3,844,103 | 3,814,059 | 3,790,568 | 3,619,334 | (1 | )% | 5 | % | 3,814,802 | 3,500,159 | 9 | % | |||||||||||||||||||||||||||

| States and municipalities | 4,344 | 4,516 | 5,830 | 5,823 | 8,881 | (4 | )% | (51 | )% | 5,124 | 12,747 | (60 | )% | |||||||||||||||||||||||||||

| Corporate bonds | 10,000 | 10,000 | 10,000 | 10,000 | 1,522 | * | NM | 10,000 | 384 | NM | ||||||||||||||||||||||||||||||

| Other | 186,452 | 186,632 | 186,812 | 185,638 | 188,813 | * | (1 | )% | 186,385 | 183,573 | 2 | % | ||||||||||||||||||||||||||||

| Total investment securities | 4,011,103 | 4,045,351 | 4,016,801 | 3,992,129 | 3,818,650 | (1 | )% | 5 | % | 4,016,411 | 3,696,963 | 9 | % | |||||||||||||||||||||||||||

| Trading securities | 1,283,407 | 1,155,776 | 1,269,909 | 1,142,215 | 1,307,102 | 11 | % | (2 | )% | 1,212,864 | 1,294,308 | (6 | )% | |||||||||||||||||||||||||||

| Other earning assets: | ||||||||||||||||||||||||||||||||||||||||

| Federal funds sold | 19,323 | 28,049 | 20,825 | 25,454 | 19,832 | (31 | )% | (3 | )% | 23,414 | 27,635 | (15 | )% | |||||||||||||||||||||||||||

| Securities purchased under agreements to resell | 792,156 | 808,861 | 891,973 | 817,963 | 804,000 | (2 | )% | (1 | )% | 827,590 | 776,302 | 7 | % | |||||||||||||||||||||||||||

| Interest-bearing cash (b) | 711,485 | 491,164 | 475,881 | 1,009,739 | 913,432 | 45 | % | (22 | )% | 671,681 | 907,619 | (26 | )% | |||||||||||||||||||||||||||

| Total other earning assets | 1,522,964 | 1,328,074 | 1,388,679 | 1,853,156 | 1,737,264 | 15 | % | (12 | )% | 1,522,685 | 1,711,556 | (11 | )% | |||||||||||||||||||||||||||

| Total earning assets | 26,358,705 | 25,340,985 | 24,602,361 | 24,403,594 | 23,928,221 | 4 | % | 10 | % | 25,180,092 | 23,456,216 | 7 | % | |||||||||||||||||||||||||||

| Allowance for loan losses | (201,306 | ) | (200,654 | ) | (201,622 | ) | (208,884 | ) | (208,804 | ) | * | (4 | )% | (203,105 | ) | (221,436 | ) | (8 | )% | |||||||||||||||||||||

| Cash and due from banks | 334,168 | 320,549 | 310,691 | 316,467 | 320,147 | 4 | % | 4 | % | 320,506 | 321,602 | * | ||||||||||||||||||||||||||||

| Fixed income receivables | 83,019 | 75,255 | 73,029 | 74,495 | 91,510 | 10 | % | (9 | )% | 76,464 | 63,064 | 21 | % | |||||||||||||||||||||||||||

| Premises and equipment, net | 282,849 | 278,042 | 275,206 | 275,764 | 273,365 | 2 | % | 3 | % | 277,979 | 283,950 | (2 | )% | |||||||||||||||||||||||||||

| Derivative assets | 138,451 | 170,546 | 147,561 | 117,815 | 131,479 | (19 | )% | 5 | % | 143,653 | 130,790 | 10 | % | |||||||||||||||||||||||||||

| Other assets | 1,640,781 | 1,624,979 | 1,621,322 | 1,639,443 | 1,639,256 | 1 | % | * | 1,631,638 | 1,601,789 | 2 | % | ||||||||||||||||||||||||||||

| Total assets | $ | 28,636,667 | $ | 27,609,702 | $ | 26,828,548 | $ | 26,618,694 | $ | 26,175,174 | 4 | % | 9 | % | $ | 27,427,227 | $ | 25,635,975 | 7 | % | ||||||||||||||||||||

| Liabilities and equity: | ||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 9,202,101 | $ | 8,507,474 | $ | 7,865,977 | $ | 7,898,580 | $ | 7,589,314 | 8 | % | 21 | % | $ | 8,371,190 | $ | 7,496,225 | 12 | % | ||||||||||||||||||||

| Other interest-bearing deposits | 5,706,246 | 5,450,401 | 5,431,736 | 5,281,059 | 4,956,451 | 5 | % | 15 | % | 5,467,967 | 4,748,731 | 15 | % | |||||||||||||||||||||||||||

| Time deposits | 717,748 | 748,135 | 755,273 | 774,345 | 798,661 | (4 | )% | (10 | )% | 748,788 | 786,918 | (5 | )% | |||||||||||||||||||||||||||

| Total interest-bearing core deposits | 15,626,095 | 14,706,010 | 14,052,986 | 13,953,984 | 13,344,426 | 6 | % | 17 | % | 14,587,945 | 13,031,874 | 12 | % | |||||||||||||||||||||||||||

| Certificates of deposit $100,000 and more | 623,304 | 518,630 | 545,436 | 511,975 | 389,682 | 20 | % | 60 | % | 549,952 | 393,109 | 40 | % | |||||||||||||||||||||||||||

| Federal funds purchased | 528,266 | 598,666 | 600,381 | 630,143 | 569,603 | (12 | )% | (7 | )% | 589,223 | 705,054 | (16 | )% | |||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 378,837 | 387,486 | 490,449 | 445,964 | 337,893 | (2 | )% | 12 | % | 425,452 | 370,097 | 15 | % | |||||||||||||||||||||||||||

| Trading liabilities | 745,011 | 752,270 | 828,629 | 758,739 | 768,721 | (1 | )% | (3 | )% | 771,039 | 733,189 | 5 | % | |||||||||||||||||||||||||||

| Other short-term borrowings (c) | 243,527 | 252,048 | 184,602 | 112,498 | 128,740 | (3 | )% | 89 | % | 198,440 | 164,951 | 20 | % | |||||||||||||||||||||||||||

| Term borrowings (d) | 1,064,206 | 1,075,039 | 1,072,393 | 1,310,370 | 1,583,213 | (1 | )% | (33 | )% | 1,130,169 | 1,557,213 | (27 | )% | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 19,209,246 | 18,290,149 | 17,774,876 | 17,723,673 | 17,122,278 | 5 | % | 12 | % | 18,252,220 | 16,955,487 | 8 | % | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 6,039,025 | 5,874,857 | 5,654,446 | 5,470,855 | 5,627,935 | 3 | % | 7 | % | 5,760,873 | 5,328,762 | 8 | % | |||||||||||||||||||||||||||

| Fixed income payables | 63,745 | 44,600 | 30,872 | 53,004 | 52,034 | 43 | % | 23 | % | 48,089 | 35,188 | 37 | % | |||||||||||||||||||||||||||

| Derivative liabilities | 123,460 | 146,063 | 129,260 | 122,378 | 120,728 | (15 | )% | 2 | % | 130,315 | 118,473 | 10 | % | |||||||||||||||||||||||||||

| Other liabilities | 454,363 | 535,714 | 583,606 | 604,410 | 592,624 | (15 | )% | (23 | )% | 544,252 | 616,878 | (12 | )% | |||||||||||||||||||||||||||

| Total liabilities | 25,889,839 | 24,891,383 | 24,173,060 | 23,974,320 | 23,515,599 | 4 | % | 10 | % | 24,735,749 | 23,054,788 | 7 | % | |||||||||||||||||||||||||||

| Equity: | ||||||||||||||||||||||||||||||||||||||||

| Common stock | 145,902 | 145,362 | 145,226 | 147,287 | 149,401 | * | (2 | )% | 145,943 | 147,031 | (1 | )% | ||||||||||||||||||||||||||||

| Capital surplus | 1,380,843 | 1,369,708 | 1,367,468 | 1,405,996 | 1,443,988 | 1 | % | (4 | )% | 1,380,972 | 1,391,639 | (1 | )% | |||||||||||||||||||||||||||

| Undivided profits | 1,015,742 | 967,872 | 924,822 | 889,209 | 860,778 | 5 | % | 18 | % | 949,642 | 830,989 | 14 | % | |||||||||||||||||||||||||||

| Accumulated other comprehensive loss, net | (186,714 | ) | (155,678 | ) | (173,083 | ) | (189,173 | ) | (185,647 | ) | 20 | % | 1 | % | (176,134 | ) | (179,527 | ) | (2 | )% | ||||||||||||||||||||

| Preferred stock | 95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | 95,624 | 95,624 | * | ||||||||||||||||||||||||||||||

| Noncontrolling interest (e) | 295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | 295,431 | 295,431 | * | ||||||||||||||||||||||||||||||

| Total equity | 2,746,828 | 2,718,319 | 2,655,488 | 2,644,374 | 2,659,575 | 1 | % | 3 | % | 2,691,478 | 2,581,187 | 4 | % | |||||||||||||||||||||||||||

| Total liabilities and equity | $ | 28,636,667 | $ | 27,609,702 | $ | 26,828,548 | $ | 26,618,694 | $ | 26,175,174 | 4 | % | 9 | % | $ | 27,427,227 | $ | 25,635,975 | 7 | % | ||||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| NM-Not meaningful | |

| * Amount is less than one percent. | |

| (a) | Includes loans on nonaccrual status. |

| (b) | Includes excess balances held at Fed. |

| (c) | 4Q16, 3Q16 and 2Q16 include higher FHLB borrowings as a result of increased loan demand. |

| (d) | In 2Q16 $250 million of FTBNA subordinated notes matured. |

| (e) | Consists of preferred stock of subsidiaries. |

| 9 |

FHN CONSOLIDATED NET INTEREST INCOME (a)

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| (Thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | |||||||||||||||||||||

| Interest Income: | ||||||||||||||||||||||||||||

| Loans, net of unearned income (b) | $ | 187,158 | $ | 176,511 | $ | 165,550 | $ | 160,687 | $ | 154,959 | 6 | % | 21 | % | ||||||||||||||

| Loans held-for-sale | 1,602 | 1,445 | 1,198 | 1,261 | 1,305 | 11 | % | 23 | % | |||||||||||||||||||

| Investment securities: | ||||||||||||||||||||||||||||

| U.S. government agencies | 23,110 | 22,517 | 22,801 | 23,273 | 22,349 | 3 | % | 3 | % | |||||||||||||||||||

| States and municipalities | 102 | 102 | 106 | 97 | 129 | * | (21 | )% | ||||||||||||||||||||

| Corporate bonds | 131 | 131 | 132 | 131 | 19 | * | NM | |||||||||||||||||||||

| Other | 1,479 | 1,138 | 1,152 | 1,201 | 1,906 | 30 | % | (22 | )% | |||||||||||||||||||

| Total investment securities | 24,822 | 23,888 | 24,191 | 24,702 | 24,403 | 4 | % | 2 | % | |||||||||||||||||||

| Trading securities | 8,616 | 7,110 | 8,374 | 8,185 | 9,360 | 21 | % | (8 | )% | |||||||||||||||||||

| Other earning assets: | ||||||||||||||||||||||||||||

| Federal funds sold | 52 | 70 | 57 | 80 | 56 | (26 | )% | (7 | )% | |||||||||||||||||||

| Securities purchased under agreements to resell (c) | (186 | ) | 169 | 322 | 226 | (277 | ) | NM | 33 | % | ||||||||||||||||||

| Interest-bearing cash | 1,027 | 604 | 574 | 1,252 | 636 | 70 | % | 61 | % | |||||||||||||||||||

| Total other earning assets | 893 | 843 | 953 | 1,558 | 415 | 6 | % | NM | ||||||||||||||||||||

| Interest income | $ | 223,091 | $ | 209,797 | $ | 200,266 | $ | 196,393 | $ | 190,442 | 6 | % | 17 | % | ||||||||||||||

| Interest Expense: | ||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||

| Savings | $ | 6,333 | $ | 4,939 | $ | 4,146 | $ | 4,190 | $ | 2,930 | 28 | % | NM | |||||||||||||||

| Other interest-bearing deposits | 2,935 | 2,592 | 2,526 | 2,304 | 1,312 | 13 | % | NM | ||||||||||||||||||||

| Time deposits | 1,033 | 1,117 | 1,148 | 1,112 | 1,200 | (8 | )% | (14 | )% | |||||||||||||||||||

| Total interest-bearing core deposits | 10,301 | 8,648 | 7,820 | 7,606 | 5,442 | 19 | % | 89 | % | |||||||||||||||||||

| Certificates of deposit $100,000 and more | 1,695 | 1,379 | 1,326 | 1,211 | 1,013 | 23 | % | 67 | % | |||||||||||||||||||

| Federal funds purchased | 731 | 779 | 762 | 797 | 428 | (6 | )% | 71 | % | |||||||||||||||||||

| Securities sold under agreements to repurchase | 47 | 90 | 138 | 59 | 46 | (48 | )% | 2 | % | |||||||||||||||||||

| Trading liabilities | 3,848 | 3,331 | 3,782 | 4,039 | 4,034 | 16 | % | (5 | )% | |||||||||||||||||||

| Other short-term borrowings | 373 | 385 | 303 | 272 | 262 | (3 | )% | 42 | % | |||||||||||||||||||

| Term borrowings | 7,351 | 7,165 | 6,981 | 7,606 | 9,743 | 3 | % | (25 | )% | |||||||||||||||||||

| Interest expense | 24,346 | 21,777 | 21,112 | 21,590 | 20,968 | 12 | % | 16 | % | |||||||||||||||||||

| Net interest income - tax equivalent basis | 198,745 | 188,020 | 179,154 | 174,803 | 169,474 | 6 | % | 17 | % | |||||||||||||||||||

| Fully taxable equivalent adjustment | (3,194 | ) | (2,825 | ) | (2,890 | ) | (2,729 | ) | (2,822 | ) | (13 | )% | (13 | )% | ||||||||||||||

| Net interest income | $ | 195,551 | $ | 185,195 | $ | 176,264 | $ | 172,074 | $ | 166,652 | 6 | % | 17 | % | ||||||||||||||

| NM - Not meaningful | |

| * Amount is less than one percent. | |

| (a) | Net interest income adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 35 percent and, where applicable, state income taxes. |

| (b) | Includes interest on loans in nonaccrual status. |

| (c) | 4Q16 and 4Q15 driven by negative market rates on reverse repurchase agreements. |

| 10 |

FHN CONSOLIDATED AVERAGE BALANCE SHEET: YIELDS AND RATES

Quarterly, Unaudited

| 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | ||||||||||||||||

| Assets: | ||||||||||||||||||||

| Earning assets (a): | ||||||||||||||||||||

| Loans, net of unearned income (b): | ||||||||||||||||||||

| Commercial loans | 3.75 | % | 3.63 | % | 3.58 | % | 3.58 | % | 3.46 | % | ||||||||||

| Consumer loans | 4.06 | 4.08 | 4.08 | 4.07 | 3.98 | |||||||||||||||

| Total loans, net of unearned income (c) | 3.84 | 3.76 | 3.74 | 3.73 | 3.63 | |||||||||||||||

| Loans held-for-sale | 5.03 | 4.36 | 4.17 | 4.13 | 4.28 | |||||||||||||||

| Investment securities: | ||||||||||||||||||||

| U.S. government agencies | 2.43 | 2.34 | 2.39 | 2.46 | 2.47 | |||||||||||||||

| States and municipalities | 9.39 | 9.01 | 7.27 | 6.70 | 5.81 | |||||||||||||||

| Corporate bonds | 5.25 | 5.25 | 5.25 | 5.25 | 4.98 | |||||||||||||||

| Other | 3.17 | 2.44 | 2.47 | 2.59 | 4.04 | |||||||||||||||

| Total investment securities | 2.48 | 2.36 | 2.41 | 2.48 | 2.56 | |||||||||||||||

| Trading securities | 2.69 | 2.46 | 2.64 | 2.87 | 2.86 | |||||||||||||||

| Other earning assets: | ||||||||||||||||||||

| Federal funds sold | 1.07 | 0.99 | 1.11 | 1.26 | 1.12 | |||||||||||||||

| Securities purchased under agreements to resell (d) | (0.09 | ) | 0.08 | 0.15 | 0.11 | (0.14 | ) | |||||||||||||

| Interest-bearing cash | 0.57 | 0.49 | 0.48 | 0.50 | 0.28 | |||||||||||||||

| Total other earning assets | 0.23 | 0.25 | 0.28 | 0.34 | 0.09 | |||||||||||||||

| Interest income/total earning assets | 3.37 | % | 3.30 | % | 3.27 | % | 3.23 | % | 3.17 | % | ||||||||||

| Liabilities: | ||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||

| Savings | 0.27 | % | 0.23 | % | 0.21 | % | 0.21 | % | 0.15 | % | ||||||||||

| Other interest-bearing deposits | 0.20 | 0.19 | 0.19 | 0.18 | 0.10 | |||||||||||||||

| Time deposits | 0.57 | 0.59 | 0.61 | 0.58 | 0.60 | |||||||||||||||

| Total interest-bearing core deposits | 0.26 | 0.23 | 0.22 | 0.22 | 0.16 | |||||||||||||||

| Certificates of deposit $100,000 and more | 1.08 | 1.06 | 0.98 | 0.95 | 1.03 | |||||||||||||||

| Federal funds purchased | 0.55 | 0.52 | 0.51 | 0.51 | 0.30 | |||||||||||||||

| Securities sold under agreements to repurchase | 0.05 | 0.09 | 0.11 | 0.05 | 0.05 | |||||||||||||||

| Trading liabilities | 2.06 | 1.76 | 1.84 | 2.14 | 2.08 | |||||||||||||||

| Other short-term borrowings (e) | 0.61 | 0.61 | 0.66 | 0.97 | 0.81 | |||||||||||||||

| Term borrowings (f) | 2.76 | 2.67 | 2.60 | 2.32 | 2.46 | |||||||||||||||

| Interest expense/total interest-bearing liabilities | 0.51 | 0.47 | 0.48 | 0.49 | 0.49 | |||||||||||||||

| Net interest spread | 2.86 | % | 2.83 | % | 2.79 | % | 2.74 | % | 2.68 | % | ||||||||||

| Effect of interest-free sources used to fund earning assets | 0.14 | 0.13 | 0.13 | 0.14 | 0.14 | |||||||||||||||

| Net interest margin | 3.00 | % | 2.96 | % | 2.92 | % | 2.88 | % | 2.82 | % | ||||||||||

| Yields are adjusted to a FTE basis assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. | |

| (a) | Earning assets yields are expressed net of unearned income. |

| (b) | Includes loan fees and cash basis interest income. |

| (c) | Includes loans on nonaccrual status. |

| (d) | 4Q16 and 4Q15 driven by negative market rates on reverse repurchase agreements. |

| (e) | 4Q16, 3Q16 and 2Q16 rates driven by higher FHLB borrowings at a rate lower than other short-term borrowings. |

| (f) | Rates are expressed net of unamortized debenture cost for term borrowings. |

| 11 |

FHN CAPITAL HIGHLIGHTS

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| (Dollars and shares in thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | |||||||||||||||||||||

| Common equity tier 1 capital (a) (b) | $ | 2,377,986 | $ | 2,326,207 | $ | 2,260,722 | $ | 2,226,621 | $ | 2,278,580 | 2 | % | 4 | % | ||||||||||||||

| Tier 1 capital (a) (b) | 2,672,332 | 2,615,449 | 2,538,876 | 2,493,080 | 2,572,141 | 2 | % | 4 | % | |||||||||||||||||||

| Total capital (a) | 2,926,631 | 2,868,437 | 2,788,558 | 2,744,189 | 2,836,715 | 2 | % | 3 | % | |||||||||||||||||||

| Risk-weighted assets (“RWA”) (a) (b) | 23,931,220 | 23,716,102 | 22,503,305 | 21,559,035 | 21,812,015 | 1 | % | 10 | % | |||||||||||||||||||

| Average assets for leverage (a) (b) | 28,581,554 | 27,481,309 | 26,715,209 | 26,519,986 | 26,109,449 | 4 | % | 9 | % | |||||||||||||||||||

| Common equity tier 1 ratio (a) (b) | 9.94 | % | 9.81 | % | 10.05 | % | 10.33 | % | 10.45 | % | ||||||||||||||||||

| Tier 1 ratio (a) (b) | 11.17 | 11.03 | 11.28 | 11.56 | 11.79 | |||||||||||||||||||||||

| Total capital ratio (a) | 12.23 | 12.09 | 12.39 | 12.73 | 13.01 | |||||||||||||||||||||||

| Leverage ratio (a) (b) | 9.35 | 9.52 | 9.50 | 9.40 | 9.85 | |||||||||||||||||||||||

| Total equity to total assets | 9.47 | % | 9.65 | % | 9.77 | % | 9.80 | % | 10.08 | % | ||||||||||||||||||

| Tangible common equity/tangible assets (“TCE/TA”) (c) | 7.42 | % | 7.58 | % | 7.63 | % | 7.61 | % | 7.82 | % | ||||||||||||||||||

| Period-end shares outstanding | 233,624 | 233,235 | 232,019 | 232,547 | 238,587 | * | (2 | )% | ||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.07 | $ | 0.07 | $ | 0.07 | $ | 0.07 | $ | 0.06 | * | 17 | % | |||||||||||||||

| Book value per common share | $ | 9.90 | $ | 10.09 | $ | 9.92 | $ | 9.68 | $ | 9.42 | ||||||||||||||||||

| Tangible book value per common share (c) | $ | 9.00 | $ | 9.17 | $ | 8.99 | $ | 8.75 | $ | 8.51 | ||||||||||||||||||

| Market capitalization (millions) | $ | 4,674.8 | $ | 3,552.2 | $ | 3,197.2 | $ | 3,046.4 | $ | 3,464.3 | ||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| * Amount is less than one percent. | |

| (a) | Current quarter is an estimate. |

| (b) | See Glossary of Terms for definition. |

| (c) | TCE/TA and Tangible book value per common share are non-GAAP measures and are reconciled to Total equity to total assets (GAAP) and to Book value per common share (GAAP), respectively, in the Non-GAAP to GAAP reconciliation on page 22 of this financial supplement. |

| 12 |

FHN BUSINESS SEGMENT HIGHLIGHTS

Quarterly/Annually, Unaudited

| 4Q16 Changes vs. | Twelve Months Ended | 2016 vs. | ||||||||||||||||||||||||||||||||||||||

| (Thousands) | 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | 2016 | 2015 | 2015 | ||||||||||||||||||||||||||||||

| Regional Banking | ||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 200,719 | $ | 190,510 | $ | 178,321 | $ | 172,313 | $ | 169,600 | 5 | % | 18 | % | $ | 741,863 | $ | 655,164 | 13 | % | ||||||||||||||||||||

| Noninterest income | 63,324 | 65,128 | 61,275 | 59,276 | 62,644 | (3 | )% | 1 | % | 249,003 | 251,586 | (1 | )% | |||||||||||||||||||||||||||

| Total revenues | 264,043 | 255,638 | 239,596 | 231,589 | 232,244 | 3 | % | 14 | % | 990,866 | 906,750 | 9 | % | |||||||||||||||||||||||||||

| Provision for loan losses | 4,692 | 8,544 | 10,883 | 14,767 | 5,856 | (45 | )% | (20 | )% | 38,886 | 34,545 | 13 | % | |||||||||||||||||||||||||||

| Noninterest expense (a) | 160,815 | 144,992 | 164,342 | 145,381 | 147,546 | 11 | % | 9 | % | 615,530 | 562,572 | 9 | % | |||||||||||||||||||||||||||

| Income before income taxes | 98,536 | 102,102 | 64,371 | 71,441 | 78,842 | (3 | )% | 25 | % | 336,450 | 309,633 | 9 | % | |||||||||||||||||||||||||||

| Provision for income taxes | 35,415 | 37,086 | 22,444 | 25,415 | 28,131 | (5 | )% | 26 | % | 120,360 | 110,589 | 9 | % | |||||||||||||||||||||||||||

| Net income | $ | 63,121 | $ | 65,016 | $ | 41,927 | $ | 46,026 | $ | 50,711 | (3 | )% | 24 | % | $ | 216,090 | $ | 199,044 | 9 | % | ||||||||||||||||||||

| Fixed Income | ||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 2,541 | $ | 2,412 | $ | 3,147 | $ | 2,666 | $ | 3,901 | 5 | % | (35 | )% | $ | 10,766 | $ | 15,517 | (31 | )% | ||||||||||||||||||||

| Noninterest income | 52,061 | 72,073 | 78,083 | 67,122 | 61,991 | (28 | )% | (16 | )% | 269,339 | 231,314 | 16 | % | |||||||||||||||||||||||||||

| Total revenues | 54,602 | 74,485 | 81,230 | 69,788 | 65,892 | (27 | )% | (17 | )% | 280,105 | 246,831 | 13 | % | |||||||||||||||||||||||||||

| Noninterest expense (b) | 48,732 | 59,578 | 62,883 | 58,670 | 54,605 | (18 | )% | (11 | )% | 229,863 | 220,441 | 4 | % | |||||||||||||||||||||||||||

| Income before income taxes | 5,870 | 14,907 | 18,347 | 11,118 | 11,287 | (61 | )% | (48 | )% | 50,242 | 26,390 | 90 | % | |||||||||||||||||||||||||||

| Provision for income taxes | 1,873 | 5,458 | 6,754 | 3,874 | 3,971 | (66 | )% | (53 | )% | 17,959 | 8,885 | NM | ||||||||||||||||||||||||||||

| Net income | $ | 3,997 | $ | 9,449 | $ | 11,593 | $ | 7,244 | $ | 7,316 | (58 | )% | (45 | )% | $ | 32,283 | $ | 17,505 | 84 | % | ||||||||||||||||||||

| Corporate | ||||||||||||||||||||||||||||||||||||||||

| Net interest income/(expense) | $ | (17,503 | ) | $ | (18,195 | ) | $ | (15,850 | ) | $ | (14,364 | ) | $ | (19,221 | ) | 4 | % | 9 | % | $ | (65,912 | ) | $ | (71,688 | ) | 8 | % | |||||||||||||

| Noninterest income | 4,670 | 5,134 | 4,909 | 5,723 | 5,486 | (9 | )% | (15 | )% | 20,436 | 23,331 | (12 | )% | |||||||||||||||||||||||||||

| Total revenues | (12,833 | ) | (13,061 | ) | (10,941 | ) | (8,641 | ) | (13,735 | ) | 2 | % | 7 | % | (45,476 | ) | (48,357 | ) | 6 | % | ||||||||||||||||||||

| Noninterest expense | 14,622 | 14,812 | 16,038 | 13,442 | 17,736 | (1 | )% | (18 | )% | 58,914 | 57,943 | 2 | % | |||||||||||||||||||||||||||

| Loss before income taxes | (27,455 | ) | (27,873 | ) | (26,979 | ) | (22,083 | ) | (31,471 | ) | 1 | % | 13 | % | (104,390 | ) | (106,300 | ) | 2 | % | ||||||||||||||||||||

| Benefit for income taxes | (15,130 | ) | (16,727 | ) | (12,827 | ) | (11,240 | ) | (27,636 | ) | 10 | % | 45 | % | (55,924 | ) | (80,276 | ) | 30 | % | ||||||||||||||||||||

| Net income/(loss) | $ | (12,325 | ) | $ | (11,146 | ) | $ | (14,152 | ) | $ | (10,843 | ) | $ | (3,835 | ) | (11 | )% | NM | $ | (48,466 | ) | $ | (26,024 | ) | (86 | )% | ||||||||||||||

| Non-Strategic | ||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 9,794 | $ | 10,468 | $ | 10,646 | $ | 11,459 | $ | 12,372 | (6 | )% | (21 | )% | $ | 42,367 | $ | 54,727 | (23 | )% | ||||||||||||||||||||

| Noninterest income (c) | 4,022 | 6,210 | 1,247 | 2,184 | 2,111 | (35 | )% | 91 | % | 13,663 | 11,094 | 23 | % | |||||||||||||||||||||||||||

| Total revenues | 13,816 | 16,678 | 11,893 | 13,643 | 14,483 | (17 | )% | (5 | )% | 56,030 | 65,821 | (15 | )% | |||||||||||||||||||||||||||

| Provision/(provision credit) for loan losses | (4,692 | ) | (4,544 | ) | (6,883 | ) | (11,767 | ) | (4,856 | ) | (3 | )% | 3 | % | (27,886 | ) | (25,545 | ) | (9 | )% | ||||||||||||||||||||

| Noninterest expense (d) | 13,728 | 14,176 | (16,441 | ) | 9,434 | 23,853 | (3 | )% | (42 | )% | 20,897 | 212,835 | (90 | )% | ||||||||||||||||||||||||||

| Income/(loss) before income taxes | 4,780 | 7,046 | 35,217 | 15,976 | (4,514 | ) | (32 | )% | NM | 63,019 | (121,469 | ) | NM | |||||||||||||||||||||||||||

| Provision/(benefit) for income taxes | 1,850 | 2,730 | 13,645 | 6,190 | (1,751 | ) | (32 | )% | NM | 24,415 | (28,257 | ) | NM | |||||||||||||||||||||||||||

| Net income/(loss) | $ | 2,930 | $ | 4,316 | $ | 21,572 | $ | 9,786 | $ | (2,763 | ) | (32 | )% | NM | $ | 38,604 | $ | (93,212 | ) | NM | ||||||||||||||||||||

| Total Consolidated | ||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 195,551 | $ | 185,195 | $ | 176,264 | $ | 172,074 | $ | 166,652 | 6 | % | 17 | % | $ | 729,084 | $ | 653,720 | 12 | % | ||||||||||||||||||||

| Noninterest income | 124,077 | 148,545 | 145,514 | 134,305 | 132,232 | (16 | )% | (6 | )% | 552,441 | 517,325 | 7 | % | |||||||||||||||||||||||||||

| Total revenues | 319,628 | 333,740 | 321,778 | 306,379 | 298,884 | (4 | )% | 7 | % | 1,281,525 | 1,171,045 | 9 | % | |||||||||||||||||||||||||||

| Provision for loan losses | — | 4,000 | 4,000 | 3,000 | 1,000 | NM | NM | 11,000 | 9,000 | 22 | % | |||||||||||||||||||||||||||||

| Noninterest expense | 237,897 | 233,558 | 226,822 | 226,927 | 243,740 | 2 | % | (2 | )% | 925,204 | 1,053,791 | (12 | )% | |||||||||||||||||||||||||||

| Income before income taxes | 81,731 | 96,182 | 90,956 | 76,452 | 54,144 | (15 | )% | 51 | % | 345,321 | 108,254 | NM | ||||||||||||||||||||||||||||

| Provision for income taxes | 24,008 | 28,547 | 30,016 | 24,239 | 2,715 | (16 | )% | NM | 106,810 | 10,941 | NM | |||||||||||||||||||||||||||||

| Net income | $ | 57,723 | $ | 67,635 | $ | 60,940 | $ | 52,213 | $ | 51,429 | (15 | )% | 12 | % | $ | 238,511 | $ | 97,313 | NM | |||||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| NM - Not meaningful | |

| (a) | 4Q16 includes $2.7 million of loss accruals related to legal matters; 3Q16 includes a $4.3 million reversal of loss accruals related to legal matters; 2Q16 includes $22.0 million of loss accruals related to legal matters. |

| (b) | 2015 includes an $11.6 million charge to litigation and regulatory matters related to the resolution of a legal matter. |

| (c) | 4Q16 includes a $1.5 million gain related to the reversal of a contingency accrual associated with prior sales of MSR; 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales. |

| (d) | 4Q16 includes $2.0 million of loss accruals related to legal matters; 3Q16 includes $4.5 million of loss accruals related to legal matters; 2Q16 includes a $31.4 million reversal of repurchase and foreclosure provision as a result of the settlements/recoveries of certain repurchase claims, somewhat offset by $4.0 million of loss accruals related to legal matters; 4Q15 includes $14.2 million of loss accruals related to legal matters; 2015 includes $175.8 million of loss accruals related to legal matters, including $162.5 million associated with the settlement of potential claims related to FHN’s underwriting and origination of FHA-insured mortgage loans. |

| 13 |

FHN REGIONAL BANKING

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | ||||||||||||||||||||||

| Income Statement (thousands) | ||||||||||||||||||||||||||||

| Net interest income | $ | 200,719 | $ | 190,510 | $ | 178,321 | $ | 172,313 | $ | 169,600 | 5 | % | 18 | % | ||||||||||||||

| Provision for loan losses | 4,692 | 8,544 | 10,883 | 14,767 | 5,856 | (45 | )% | (20 | )% | |||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||

| NSF / Overdraft fees (a) | 9,707 | 10,076 | 8,905 | 9,576 | 11,630 | (4 | )% | (17 | )% | |||||||||||||||||||

| Cash management fees | 8,659 | 7,947 | 8,612 | 8,760 | 8,637 | 9 | % | * | ||||||||||||||||||||

| Debit card income | 3,516 | 3,496 | 3,464 | 3,221 | 3,302 | 1 | % | 6 | % | |||||||||||||||||||

| Other | 4,291 | 4,215 | 4,466 | 4,288 | 4,382 | 2 | % | (2 | )% | |||||||||||||||||||

| Total deposit transactions and cash management | 26,173 | 25,734 | 25,447 | 25,845 | 27,951 | 2 | % | (6 | )% | |||||||||||||||||||

| Brokerage, management fees and commissions | 11,003 | 10,828 | 10,665 | 10,415 | 11,021 | 2 | % | * | ||||||||||||||||||||

| Trust services and investment management | 7,056 | 6,900 | 7,239 | 6,569 | 6,889 | 2 | % | 2 | % | |||||||||||||||||||

| Bankcard income (b) | 6,230 | 6,151 | 6,432 | 5,132 | 5,423 | 1 | % | 15 | % | |||||||||||||||||||

| Other service charges | 2,596 | 2,591 | 2,579 | 2,318 | 2,358 | * | 10 | % | ||||||||||||||||||||

| Miscellaneous revenue (c) | 10,266 | 12,924 | 8,913 | 8,997 | 9,002 | (21 | )% | 14 | % | |||||||||||||||||||

| Total noninterest income | 63,324 | 65,128 | 61,275 | 59,276 | 62,644 | (3 | )% | 1 | % | |||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||

| Employee compensation, incentives, and benefits | 58,627 | 56,440 | 53,413 | 52,173 | 51,507 | 4 | % | 14 | % | |||||||||||||||||||

| Other (d) | 102,188 | 88,552 | 110,929 | 93,208 | 96,039 | 15 | % | 6 | % | |||||||||||||||||||

| Total noninterest expense | 160,815 | 144,992 | 164,342 | 145,381 | 147,546 | 11 | % | 9 | % | |||||||||||||||||||

| Income before income taxes | $ | 98,536 | $ | 102,102 | $ | 64,371 | $ | 71,441 | $ | 78,842 | (3 | )% | 25 | % | ||||||||||||||

| PPNR (e) | 103,228 | 110,646 | 75,254 | 86,208 | 84,698 | (7 | )% | 22 | % | |||||||||||||||||||

| Efficiency ratio (f) | 60.90 | % | 56.72 | % | 68.59 | % | 62.78 | % | 63.53 | % | ||||||||||||||||||

| Balance Sheet (millions) | ||||||||||||||||||||||||||||

| Average loans | $ | 17,692 | $ | 16,844 | $ | 15,859 | $ | 15,224 | $ | 14,760 | 5 | % | 20 | % | ||||||||||||||

| Average other earning assets | 37 | 46 | 42 | 47 | 42 | (20 | )% | (12 | )% | |||||||||||||||||||

| Total average earning assets | 17,729 | 16,890 | 15,901 | 15,271 | 14,802 | 5 | % | 20 | % | |||||||||||||||||||

| Average core deposits | 18,444 | 18,132 | 17,869 | 17,592 | 17,351 | 2 | % | 6 | % | |||||||||||||||||||

| Average other deposits | 578 | 472 | 498 | 461 | 338 | 22 | % | 71 | % | |||||||||||||||||||

| Total average deposits | 19,022 | 18,604 | 18,367 | 18,053 | 17,689 | 2 | % | 8 | % | |||||||||||||||||||

| Total period-end deposits | 19,348 | 18,742 | 18,674 | 18,534 | 18,077 | 3 | % | 7 | % | |||||||||||||||||||

| Total period-end assets | 18,772 | 18,562 | 17,434 | 16,280 | 16,394 | 1 | % | 15 | % | |||||||||||||||||||

| Net interest margin (g) | 4.57 | % | 4.55 | % | 4.57 | % | 4.60 | % | 4.61 | % | ||||||||||||||||||

| Net interest spread | 3.52 | 3.46 | 3.44 | 3.42 | 3.36 | |||||||||||||||||||||||

| Loan yield | 3.68 | 3.61 | 3.59 | 3.57 | 3.48 | |||||||||||||||||||||||

| Deposit average rate | 0.16 | 0.15 | 0.15 | 0.15 | 0.12 | |||||||||||||||||||||||

| Key Statistics | ||||||||||||||||||||||||||||

| Financial center locations | 162 | 162 | 162 | 174 | 177 | * | (8 | )% | ||||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| * Amount is less than one percent. | |

| (a) | Variability is driven by changes in consumer behavior. |

| (b) | 2Q16 increase driven by a significant new relationship. |

| (c) | 3Q16 includes a $1.8 million gain on the sales of properties. |

| (d) | 4Q16 includes $2.7 million of loss accruals related to legal matters; 3Q16 includes a reversal of loss accruals related to legal matters of $4.3 million; 2Q16 includes $22.0 million of loss accruals related to legal matters; 1Q16 includes $3.7 million of impairment related to branch closures. |

| (e) | Pre-provision net revenue is not a GAAP number but is used in regulatory stress test reporting. The presentation of PPNR in this Financial Supplement follows the regulatory definition. |

| (f) | Noninterest expense divided by total revenue. |

| (g) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

| 14 |

FHN FIXED INCOME

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | ||||||||||||||||||||||

| Income Statement (thousands) | ||||||||||||||||||||||||||||

| Net interest income | $ | 2,541 | $ | 2,412 | $ | 3,147 | $ | 2,666 | $ | 3,901 | 5 | % | (35 | )% | ||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||

| Fixed income product revenue | 43,794 | 59,003 | 69,279 | 57,583 | 52,713 | (26 | )% | (17 | )% | |||||||||||||||||||

| Other (a) | 8,267 | 13,070 | 8,804 | 9,539 | 9,278 | (37 | )% | (11 | )% | |||||||||||||||||||

| Total noninterest income | 52,061 | 72,073 | 78,083 | 67,122 | 61,991 | (28 | )% | (16 | )% | |||||||||||||||||||

| Noninterest expense | 48,732 | 59,578 | 62,883 | 58,670 | 54,605 | (18 | )% | (11 | )% | |||||||||||||||||||

| Income before income taxes | $ | 5,870 | $ | 14,907 | $ | 18,347 | $ | 11,118 | $ | 11,287 | (61 | )% | (48 | )% | ||||||||||||||

| Efficiency ratio (b) | 89.25 | % | 79.99 | % | 77.41 | % | 84.07 | % | 82.87 | % | ||||||||||||||||||

| Fixed income product average daily revenue | $ | 718 | $ | 922 | $ | 1,082 | $ | 944 | $ | 850 | (22 | )% | (16 | )% | ||||||||||||||

| Balance Sheet (millions) | ||||||||||||||||||||||||||||

| Average trading inventory | $ | 1,281 | $ | 1,153 | $ | 1,267 | $ | 1,138 | $ | 1,303 | 11 | % | (2 | )% | ||||||||||||||

| Average other earning assets | 818 | 831 | 893 | 822 | 805 | (2 | )% | 2 | % | |||||||||||||||||||

| Total average earning assets | 2,099 | 1,984 | 2,160 | 1,960 | 2,108 | 6 | % | * | ||||||||||||||||||||

| Total period-end assets | 1,817 | 2,516 | 2,540 | 2,361 | 1,779 | (28 | )% | 2 | % | |||||||||||||||||||

| Net interest margin (c) | 0.57 | % | 0.55 | % | 0.64 | % | 0.63 | % | 0.82 | % | ||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| * Amount is less than one percent. | |

| (a) | 3Q16 increase driven by higher fees from loan and derivative sales. |

| (b) | Noninterest expense divided by total revenue. |

| (c) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

FHN CORPORATE

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | ||||||||||||||||||||||

| Income Statement (thousands) | ||||||||||||||||||||||||||||

| Net interest income/(expense) | $ | (17,503 | ) | $ | (18,195 | ) | $ | (15,850 | ) | $ | (14,364 | ) | $ | (19,221 | ) | 4 | % | 9 | % | |||||||||

| Noninterest income excluding securities gains/(losses) | 4,802 | 5,335 | 4,810 | 4,149 | 4,047 | (10 | )% | 19 | % | |||||||||||||||||||

| Securities gains/(losses), net | (132 | ) | (201 | ) | 99 | 1,574 | 1,439 | 34 | % | NM | ||||||||||||||||||

| Noninterest expense (a) | 14,622 | 14,812 | 16,038 | 13,442 | 17,736 | (1 | )% | (18 | )% | |||||||||||||||||||

| Loss before income taxes | $ | (27,455 | ) | $ | (27,873 | ) | $ | (26,979 | ) | $ | (22,083 | ) | $ | (31,471 | ) | 1 | % | 13 | % | |||||||||

| Average Balance Sheet (millions) | ||||||||||||||||||||||||||||

| Average loans | $ | 86 | $ | 91 | $ | 96 | $ | 103 | $ | 110 | (5 | )% | (22 | )% | ||||||||||||||

| Total earning assets | $ | 4,795 | $ | 4,617 | $ | 4,576 | $ | 5,093 | $ | 4,830 | 4 | % | (1 | )% | ||||||||||||||

| Net interest margin (b) | (1.44 | )% | (1.55 | )% | (1.40 | )% | (1.14 | )% | (1.56 | )% | ||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| NM - Not meaningful | |

| (a) | 2Q16 includes $2.5 million of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares; 4Q15 includes $2.8 million of impairment related to a tax credit investment accounted for under the equity method and $2.7 million of costs related to the TrustAtlantic acquisition. |

| (b) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

| 15 |

FHN NON-STRATEGIC

Quarterly, Unaudited

| 4Q16 Changes vs. | ||||||||||||||||||||||||||||

| 4Q16 | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q16 | 4Q15 | ||||||||||||||||||||||

| Income Statement (thousands) | ||||||||||||||||||||||||||||

| Net interest income | $ | 9,794 | $ | 10,468 | $ | 10,646 | $ | 11,459 | $ | 12,372 | (6 | )% | (21 | )% | ||||||||||||||

| Provision/(provision credit) for loan losses | (4,692 | ) | (4,544 | ) | (6,883 | ) | (11,767 | ) | (4,856 | ) | (3 | )% | 3 | % | ||||||||||||||

| Noninterest income (a) | 4,022 | 6,210 | 1,247 | 2,184 | 2,111 | (35 | )% | 91 | % | |||||||||||||||||||

| Noninterest expense (b) | 13,728 | 14,176 | (16,441 | ) | 9,434 | 23,853 | (3 | )% | (42 | )% | ||||||||||||||||||

| Income/(loss) before income taxes | $ | 4,780 | $ | 7,046 | $ | 35,217 | $ | 15,976 | $ | (4,514 | ) | (32 | )% | NM | ||||||||||||||

| Average Balance Sheet (millions) | ||||||||||||||||||||||||||||

| Loans | $ | 1,636 | $ | 1,744 | $ | 1,856 | $ | 1,967 | $ | 2,073 | (6 | )% | (21 | )% | ||||||||||||||

| Loans held-for-sale | 96 | 100 | 103 | 106 | 109 | (4 | )% | (12 | )% | |||||||||||||||||||

| Trading securities | 3 | 3 | 3 | 4 | 5 | * | (40 | )% | ||||||||||||||||||||

| Allowance for loan losses | (50 | ) | (53 | ) | (59 | ) | (69 | ) | (76 | ) | (6 | )% | (34 | )% | ||||||||||||||

| Other assets | 38 | 47 | 46 | 34 | 13 | (19 | )% | NM | ||||||||||||||||||||

| Total assets | 1,723 | 1,841 | 1,949 | 2,042 | 2,124 | (6 | )% | (19 | )% | |||||||||||||||||||

| Net interest margin (c) | 2.25 | % | 2.26 | % | 2.17 | % | 2.21 | % | 2.25 | % | ||||||||||||||||||

| Efficiency ratio (d) | 99.36 | % | 85.00 | % | NM | 69.15 | % | NM | ||||||||||||||||||||

| Certain previously reported amounts have been reclassified to agree with current presentation. | |

| NM - Not meaningful | |

| * Amount is less than one percent. | |

| (a) | 4Q16 includes a $1.5 million gain related to the reversal of a contingency accrual associated with prior sales of MSR; 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales. |