| | | | |

| | | | |

| (Second Quarter 2008 vs. First Quarter 2008) |

| | | | |

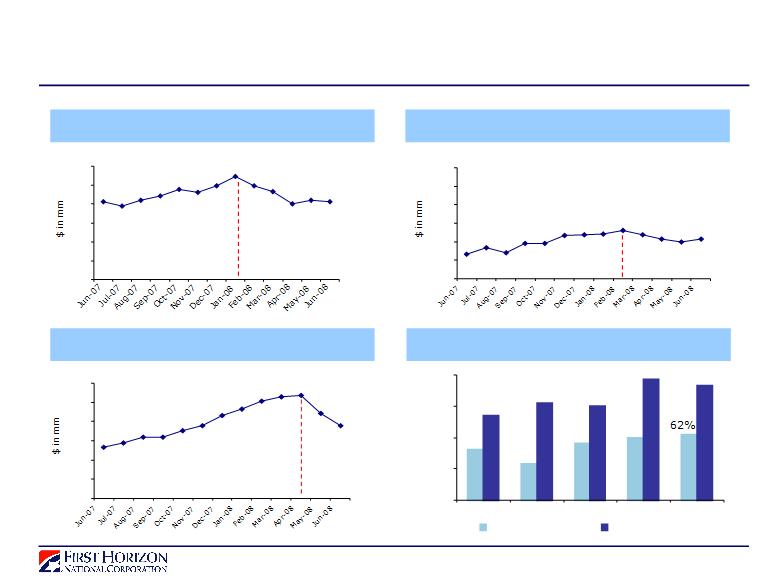

| Regional Banking |

| - Net interest margin remained stable at 4.38% compared to 4.39% in first quarter |

| | - Reflects improved ability to pass through effects Federal Reserve rate cuts to deposit customers |

| - Noninterest income increased to $92.5 million from $87.1 million |

| | - Seasonal increase in fee income, primarily from deposit accounts |

- Provision expense in current quarter primarily reflects grade migration in commercial loans and remodeled home equity expectations |

| - Noninterest expense remained flat at $150.3 million compared to $150.5 million in prior quarter |

| | - Effects of efficiency initiatives and seasonal decreases in personnel costs offset by increase in unfunded commitment reserve |

| - Completed disposition of final 9 First Horizon Bank branches in Atlanta |

| | | | |

| Capital Markets |

| - Fixed income revenues were $105.0 million in current quarter compared to $152.2 million in prior quarter |

| | - Continuing strength due to Federal Reserve's rate reductions resulting in a steeper yield curve |

| | - Decline from prior quarter's record levels was anticipated as Federal Reserve slowed the pace of rate decreases |

| - Other product revenues increased to $19.6 million from $(18.3) million |

| | - $36.2 million LOCOM adjustment on trust preferred warehouse recognized in prior quarter |

| | - Net trust preferred warehouse of $345.3 million transferred to portfolio during current quarter |

| - Provision increased to $18.5 million from $15.0 million to reflect deterioration of correspondent banking loans |

| - Decrease in noninterest expense resulted from lower production levels |

| | | | |

| National Specialty Lending |

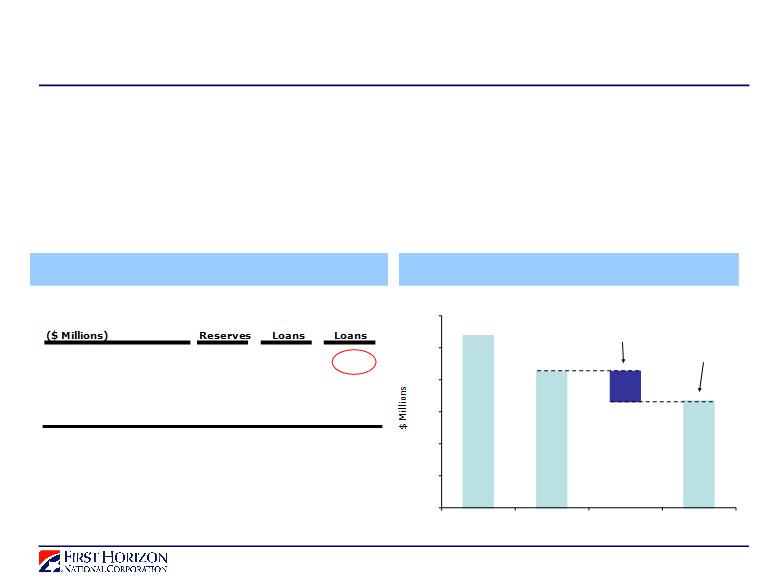

- Total loans declined to $8.6 billion from $9.1 billion reflecting continuing wind down |

| | - Produced a sequential decline in net interest income |

| - Net interest margin increased to 2.40% compared to 2.31% in first quarter |

| | - Primarily results from wider spreads on consumer loans |

| - Provision for loan losses continues to reflect deterioration within national construction and home equity portfolios |

| - Contraction of portfolios will continue since origination activity has been significantly curtailed |

| - Noninterest income declined sequentially |

| | - Expense of $8.7 million recognized in current quarter as repurchase reserves were increased |

| | - Value of residual interests in prior securitizations declined by $7.2 million primarily due to credit risk adjustments |

| | | - Remaining value of $3.8 million |

| | - Partially offset by first quarter decline in valuation of servicing rights due to interest rate changes |

| - Noninterest expense increased primarily due to the higher foreclosure losses |

| | | | |

| Mortgage Banking |

| - Net effect of adopting new accounting standards negatively affected pre-tax earnings by $7.2 million |

| | - $42.4 million positive effect on first quarter 2008 |

| - Increased origination income |

| | - 2% decrease in deliveries and 9% decrease in originations |

| | - Originations remain strong as lower rates are driving refinance activity |

| | - Gain (loss) on sale margin improved to 118 basis points from (20) basis points |

| | | - Significantly higher percentage of government loans in current quarter |

| | | - Gains from favorable rate moves at the end of the current quarter |

| | | - LOCOM adjustments of $8.3 million in current quarter compared to $17.0 million in prior quarter |

| - Hedging results positively impacted earnings by $16.5 million vs. $32.7 million in first quarter |

| | - Resulted from yield curve steepening at a slower rate in current quarter in comparison to prior quarter |

| | - Foreclosure reserves expense of $15.9 million in current quarter related to increased repurchase activity |

| - Net interest income increased in line with increase in warehouse spread |

| - Servicing runoff stable at $37.1 million for current quarter from $37.4 million in prior quarter |

| - Noninterest expense remained relatively flat at $149.1 million in current quarter compared to $147.5 million in prior quarter |

| | - Declines in personnel costs from lower production volumes and seasonality were offset by increase in foreclosure losses |

| - Provision of $4.0 million in current quarter due to deterioration of loans previously moved to portfolio |

| - Approximately $330 million of jumbo loans were transferred to the loan portfolio in second quarter |

| | - Future jumbo originations, represented in current lending commitments only, will also be for the portfolio |

| | | - $7.6 million reserve for unfunded commitments represents prior value of associated derivative interest rate locks |

| | | | |

| Taxes | | |

| - Approximate $8 million positive quarterly effect from permanent tax credits |

| - $3.1 million positive pre-tax impact in current quarter from resolution of state tax audits |

| | | | |

| Corporate Segment |

| - $12.6 million of gains recognized in current quarter related to repurchases of debt |

| | - $152.1 million of debt repurchased with maturity dates ranging from January 2009 to February 2011 |

| - Net charges of $26.0 million recognized for restructuring, repositioning and efficiency initiatives (detail on next page) |

| | - Current quarter included $16.2 million of expenses, including $5.8 million of asset impairments |

| | - $9.3 million of transaction costs from sale of mortgage servicing rights presented as reduction of Mortgage Banking income |

| | - $0.4 million of losses related to First Horizon bank branch sales presented in (Losses)/Gains on Divestitures |

| | - Prior quarter included $21.3 million of net charges for these initiatives |

| - Prior quarter included $95.9 million improvement in pre-tax earnings from Visa IPO |

| | - Equity securities gains of $65.9 million for shares redeemed in conjunction with IPO |

| | - $30.0 million of expense reversals associated with Visa's funding of escrow account for certain Visa litigation matters |