| | | |

| | | Delivering Sustainable Growth |

| | | 2005 Annual Report |

Business Description

As the nation’s fourth largest banking company and third largest retail brokerage firm, Wachovia (NYSE:WB) provides 13.4 million household and business clients with a full range of retail banking and brokerage, asset and wealth management, and corporate and investment banking products and services.

Wachovia Bank’s retail and commercial banking operations form a leading presence in 15 states from Connecticut to Florida and west to Texas. Wachovia Securities LLC serves retail brokerage clients through more than 700 offices in 49 states and six Latin American countries. Global services also are offered through more than 40 international banking offices. Online banking is available at wachovia.com; online brokerage products and services at wachoviasec.com; and investment products and services at evergreeninvestments.com.

At December 31, 2005:

| n | | Assets: $520.8 billion |

| |

| n | | Market capitalization: $82.3 billion |

| |

| n | | Stockholders’ equity: $47.6 billion |

| |

| n | | Common shares outstanding: 1.6 billion |

| |

| n | | Listing: NYSE |

| |

| n | | Ticker symbol: WB |

Delivering Sustainable Growth . . .

Strong financial performance and

a customer-driven product

and delivery strategy propel

Wachovia’s momentum.

Contents

| | | | | | | | | |

| Letter to Our Shareholders | | | | | | | 2 | |

| Corporate Citizenship | | | | | | | 7 | |

| Corporate Overview | | | | | | | 8 | |

| Overview of Major Businesses | | | | | | | 9 | |

| Guide to Our Financial Discussion | | | | | | | 12 | |

| Management’s Discussion and Analysis | | | | | | | 14 | |

| Management’s Report on Internal Control over Financial Reporting | | | | | | | 62 | |

| Reports of Independent Registered Public Accounting Firm | | | | | | | 63 | |

| Consolidated Financial Statements | | | | | | | 65 | |

| Glossary | | | | | | | 123 | |

| Board of Directors, Operating Committee and General Bank Branch Listing | | | | 124 | |

| Shareholder Information(Dividend and Stock Price tables on pages 1, 31, 45, 46, 47 and 49) | | Inside Back Cover

|

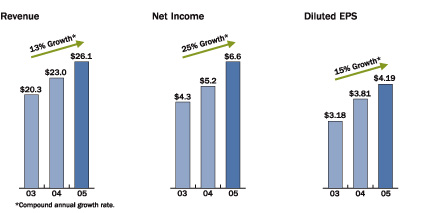

EPS up 15% on a compound annual basis since 2003

Financial Performance Highlights

| | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| (Dollars in millions, except per share data) | | 2005 | | | 2004 | | | 2003 | |

| |

Total revenue(Tax-equivalent) | | $ | 26,119 | | | | 22,990 | | | | 20,345 | |

| Income from continuing operations before cumulative effect of a change in accounting principle | | | 6,429 | | | | 5,214 | | | | 4,247 | |

| Net income available to common stockholders | | | 6,643 | | | | 5,214 | | | | 4,259 | |

| Diluted earnings per common share | | | | | | | | | | | | |

| Income from continuing operations before change in accounting principle | | | 4.05 | | | | 3.81 | | | | 3.17 | |

| Net income available to common stockholders | | $ | 4.19 | | | | 3.81 | | | | 3.18 | |

| Return on average tangible common stockholders’ equity | | | 27.85 | % | | | 24.61 | | | | 24.21 | |

| Total assets | | $ | 520,755 | | | | 493,324 | | | | 401,188 | |

| Stockholders’ equity | | $ | 47,561 | | | | 47,317 | | | | 32,428 | |

Actual common shares(In millions) | | | 1,557 | | | | 1,588 | | | | 1,312 | |

| Dividends paid per common share | | $ | 1.94 | | | | 1.66 | | | | 1.25 | |

| Book value per common share | | | 30.55 | | | | 29.79 | | | | 24.71 | |

| Common stock price | | | 52.86 | | | | 52.60 | | | | 46.59 | |

| Market capitalization | | $ | 82,291 | | | | 83,537 | | | | 61,139 | |

| Financial centers/brokerage offices | | | 3,850 | | | | 3,971 | | | | 3,328 | |

| Employees | | | 93,980 | | | | 96,030 | | | | 86,114 | |

| |

Continued momentum drives results

(In billions, except earnings per share)

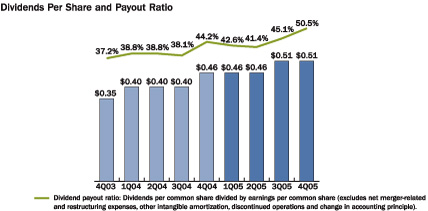

Common stock dividends up 46% since 4Q03

Including predecessor Union National Bank, dividends paid every year since 1910

For an explanation of our use of non-GAAP financial measures, please see table 1 on page 45.

Delivering Sustainable Growth

Double-digit

earnings per share

growth for four

consecutive years

113% increase in

dividend since

year-end 2001

No. 1 in customer

service among

banking peers

for five years

11th largest

banking company

globally

(market capitalization)

Strong balance

sheet— two debt

rating upgrades

Wachovia Corporation 2005 Annual Report 1

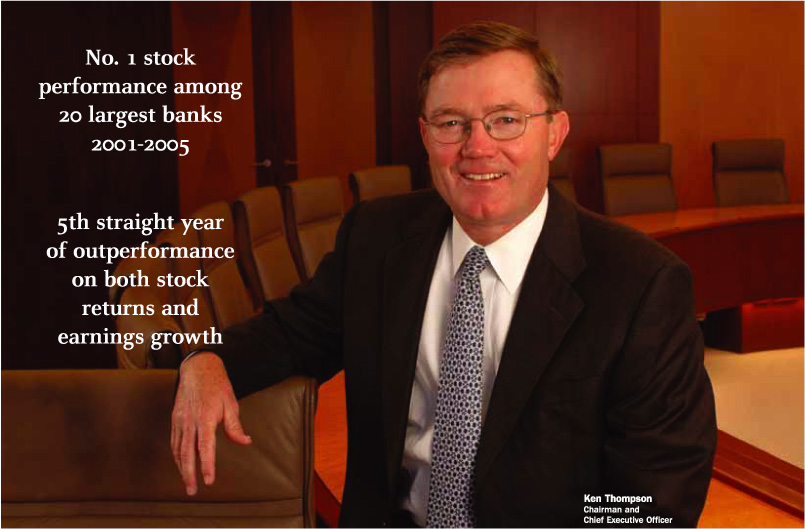

Letter to Our Shareholders

Dear Shareholders,

Wachovia generated record results in 2005 by focusing on the right things: meeting our customers’ needs, controlling costs and investing in our future.

Our employees executed extremely well on our revenue strategies and expense initiatives, including merger cost savings. This is where I believe Wachovia clearly distinguishes itself: execution — getting the job done. That’s why we’re in an excellent position to continue delivering sustainable growth for our shareholders.

We enter 2006 with great momentum, and important strengths and advantages:

| n | | A track record of superior financial performance. |

| |

| n | | Strong debt ratings. |

| |

| n | | Excellent credit quality and risk management. |

| |

| n | | Industry-leading customer service. |

| |

| n | | Solid organic growth, with market share gains. |

| |

| n | | A disciplined expense culture. |

| |

| n | | And, unlike many competitors, we’ve continued to invest heavily for future growth. |

2 Wachovia Corporation 2005 Annual Report

In addition, we hit several key quantitative milestones in 2005:

| n | | Record earnings of $6.6 billion, or $4.19 per common share — the fourth consecutive year of double-digit growth in earnings per share. |

| |

| n | | An 11 percent increase in our quarterly dividend to 51 cents per common share, or $2.04 annualized. The quarterly dividend is up 113 percent over the past five years. |

| |

| n | | $5.7 billion in capital returned to shareholders including dividends of $3.0 billion, or 46 percent of earnings excluding merger-related, restructuring and other charges, and stock repurchases of $2.7 billion. |

| |

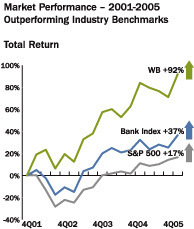

| n | | 92 percent total return to shareholders, outpacing the KBW bank index of 37 percent, and the No. 1 total return performance among the nation’s 20 largest banks since 2001 when First Union and the former Wachovia merged. |

| |

| n | | Double-digit growth in deposits to $325 billion, which ranks third largest nationally in domestic deposits. In fact, we’ve been among the leaders in growing low-cost core deposits for the past three years. |

| |

| n | | Double-digit growth in loans to $259 billion, ranking us fifth largest in the nation and No. 1 in commercial loans in our marketplace. |

Building competitive businesses

When I wrote my first letter to you six years ago, I said we were going to focus strategically on strengthening Wachovia’s four core businesses. Today, I’m proud that each one of those businesses either is or is on the verge of becoming a great franchise in its own right, and combined, they create a very appealing value proposition for our customers and our shareholders. The most important thing I can do in my job is to support the leaders in these businesses and ensure they get the resources they need.

Our largest business, the General Bank, gained market share and generated $3.9 billion in earnings on record revenue in 2005. I believe it is the best in the industry. While all banks benefited from customer preferences for deposits over the past few years, our General Bank is among the industry’s leaders because of its best-in-class customer care philosophy and sales management practices.

Ben Jenkins, head of our General Bank, whom our board recently named vice chairman, is the catalyst. He is simply a great leader who has built a culture of excellence in our General Bank.

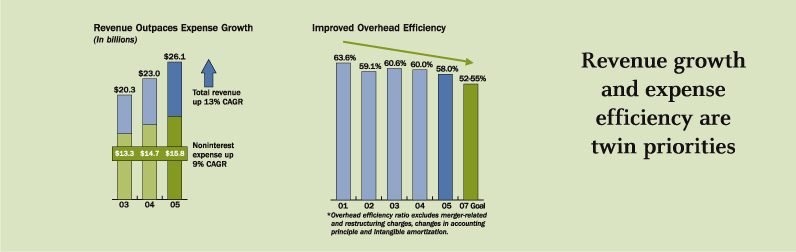

Ben’s team in the General Bank continued to maintain strong earnings momentum by growing top line revenues at twice the rate of expense growth, including the impact of the SouthTrust acquisition. Not only has his team been a market leader in deposit growth, but they’ve also increased overall financial center sales production throughout the course of the year.

Looking forward, the General Bank has an ample opportunity to continue its revenue growth trajectory. We are currently rebuilding our mortgage origination capability and we have reentered the credit card business. Both of these businesses will focus on Wachovia’s distribution channels and customer base.

Also contributing to bottom line growth has been the General Bank’s focus on disciplined expense management. We enter 2006 fully enjoying savings from our SouthTrust acquisition as we met all timelines we set for ourselves and spent less than planned to complete the integration.

In our Corporate and Investment Bank, we continue to gain market share and add lead bank relationships. In the key product areas in investment banking that serve our corporate clients, we have gained more domestic market share than any other firm on Wall Street since the beginning of 2001. We have also built one of the top structured products businesses in the industry. But as can be expected in a diversified global markets business, not all product groups hit on all cylinders at the same time. Our equities business is one that had a challenging year, but we made a number of key additions to the equities team and evidence of a turnaround came at year end. Our momentum remains strong and we expect these trends to continue.

Steve Cummings, who heads this business, has set the bar very high in creating a Corporate and Investment Bank where teamwork and integrity are valued as much as winning new business. We’ve built this business organically, rather than through acquisition, and along the way we’ve deliberately sought out talented professionals who will thrive following our business model and value proposition.

I once ran our Corporate and Investment Bank in its early years, so I feel great pride when I consider what it has become. In 2005, it generated record revenue growth and record earnings of $1.7 billion.

We have ambitious growth plans for our Corporate and Investment Bank, which will require significant investment in systems and technology and in intellectual capital. The good news is that our Corporate and Investment Bank has become a magnet for talent because we are winning in key markets and we are focused on organic growth. We also understand bottom line results must be achieved even with continued heavy investment in talent and technology, and we look for this group to self fund its growth plans.

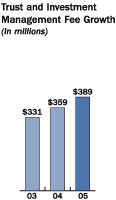

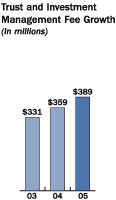

Wealth Management focuses on the high net worth client segment. Although it is our smallest business, it ranks as the fourth largest wealth manager in the nation, according to Barron’s magazine. In 2005, Wealth Management experienced high double-digit growth with record earnings of $256 million on record revenues. The Wealth Management team accomplished this while narrowing their target market and enhancing their sales force.

Stan Kelly, who heads our Wealth Management business, has led his team superbly through this transformational process. Wealth is focused on winning additional clients on top of the 3, 900 new relationships added in 2005, and on broadening and deepening our relationships with affluent customers. Another priority in Wealth is to ensure that our commercial insurance brokerage business is working to cross-sell its products to our commercial customers in the General Bank.

Wachovia Corporation 2005 Annual Report 3

Letter to Our Shareholders

That’s a significant revenue opportunity for us, enhanced by the May 2005 acquisition of a commercial insurance brokerage firm, which doubled our size and moved us into the Top 10 rankings in this business.

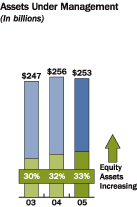

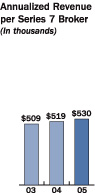

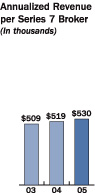

Our fourth business line is Capital Management. This business includes our Wachovia Securities retail brokerage firm and our asset management practice. This business has the necessary scale to succeed after years of piecing the platform together through acquisitions. We have 10, 500 registered representatives whose clients have more than $680 billion of assets with us. That makes Wachovia Securities the third largest brokerage firm in the United States. In addition, our asset management firm, Evergreen Investments, manages more than $250 billion in assets.

Now the opportunity is to achieve our earnings potential in these businesses. David Carroll is the right leader to make that happen. He assumed responsibility for the Capital Management business last year, and I am pleased with the progress after a year of restructuring that positions this division for better earnings growth in the future. We completed the integration of the Prudential retail brokerage joint venture; consolidated two internal insurance divisions; restructured our Evergreen Investments business for improved performance; hired more than 900 new financial advisors; and divested our corporate trust, custody and stock transfer businesses. Already we are seeing improved financial specialist results; we’re selling considerably more bank products through our brokerage channel and increasing the focus of brokerage in our bank branches, and we’re capitalizing on the distribution advantages that retail brokerage provides for products originated in our Corporate and Investment Bank.

Capital Management increased earnings 20 percent in 2005 to $579 million as they controlled costs and achieved all our planned efficiencies from the Prudential retail brokerage integration. Our margins and our income are positioned to improve substantially when retail volume increases and equity

markets strengthen. In addition, CMG surpassed a milestone $100 billion in brokerage managed account assets, which is significant because managed accounts generate longer-term recurring income.

Leveraging our businesses

As the performance of our four businesses attests, our diversified business model provides great balance and serves our shareholders very well. We have created a full-service financial firm with complementary products and cross-business partnerships, and we’re seeing increasing synergies among our teams. For example:

| n | | Our Wachovia Client Partnership strategy has deepened relationships with customers and driven product referrals among our businesses, and in the process, added nearly $190 million in additional revenue in 2005 from cross-sales of mortgages, loans, deposits and other products. |

| |

| n | | Our retirement and investment products strategy, which also crosses all of our business lines, helped increase individual retirement account sales nearly 150 percent and the number of participants in retirement plans 19 percent from 2004. |

| |

| n | | Cross-sales of capital markets products to our commercial customers were up over 50 percent in 2005 from 2004. |

| |

| n | | Cross-sales between Capital Management and the Corporate and Investment Bank increased and jointly originated revenue was up 16 percent. |

These strategies contributed meaningfully to our success in delivering strong earnings growth in 2005 despite industry pressures on funding costs and profit margins.

Strengthening our core

In an environment of narrow profit margins and stiff business competition, one of the most important steps we can take to remain strong and competitive is to control expense growth. We intend to be a revenue-driven company, but you can’t consistently grow the bottom line without keeping a watchful eye

4 Wachovia Corporation 2005 Annual Report

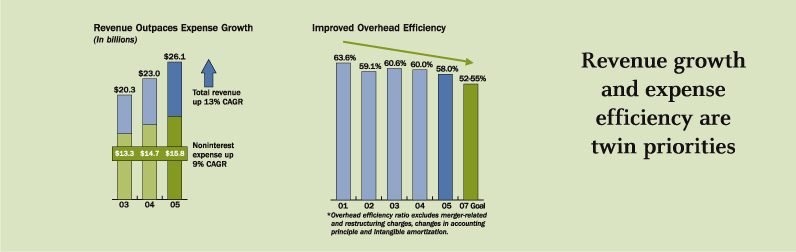

on expenses. As I wrote last year, we’re in the middle of a very methodical, three-year initiative designed to ensure — business-by-business and process-by-process — that we are continuously becoming more effective and efficient. Our goal is to reduce our overhead efficiency ratio (the amount we spend to generate each dollar of revenue) to 52 to 55 percent, which would place us in the middle of the pack of our peer group. That positioning is right for us because we want to continue investing in such things as upgrading and expanding our retail branch network, in technology improvements company-wide and in attracting top talent.

In addition, after many months of research and deliberation, we chose to outsource some functions that could be performed remotely without negatively affecting customer service. We’ve selected highly skilled domestic and global partners who can do the job more efficiently and at lower cost. This enables us to use our technology dollars to invest in more sophisticated technology that supports our growth businesses.

Much has been made of this decision. The truth is, we’re adding more jobs domestically today than we’re losing. As noted earlier, we’ve added substantial depth in our Corporate and Investment Bank, we’ve doubled the hiring of commercial relationship managers, and we’ve continued to bring in talent in many other areas that are essential to serving our customers and ensuring revenue growth.

You may also recall in the letter I wrote at the beginning of this decade, we announced we were restructuring our company and selling some businesses to rebuild capital strength. Since that time, we’ve built a strong balance sheet, placed our company firmly on a growth path, and added millions of new customers.

Today, our most-pressing strategic need is to be able to offer our existing customers the full suite of products and services they’ll need throughout their lifetime. As I mentioned earlier, in 2005 we announced our intention to reenter the credit card business as a direct issuer and to expand our existing mortgage business. These products can produce strong profit

margins by leveraging the customer base and distribution infrastructure that we have already built.

We also plan to expand our auto dealer financial services business with a pending acquisition that brings an industry-leading management team to our consumer loan business. It gives our commercial bank access to a larger base of nationwide automotive dealers and provides attractive opportunities for additional commercial loan growth. It also gives us a toehold in the attractive California banking market with 19 financial centers in the Orange County, Los Angeles and San Diego metro areas.

As for 2006, we believe this could be a year in which our financial performance significantly outpaces our industry. We feel uncommonly prepared to deliver sustainable growth:

| n | | We’re in great financial shape. |

| |

| n | | We’re executing very well. |

| |

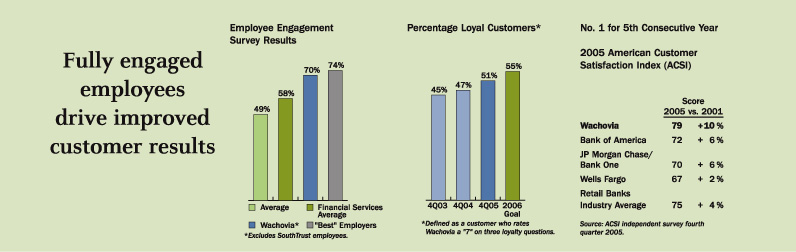

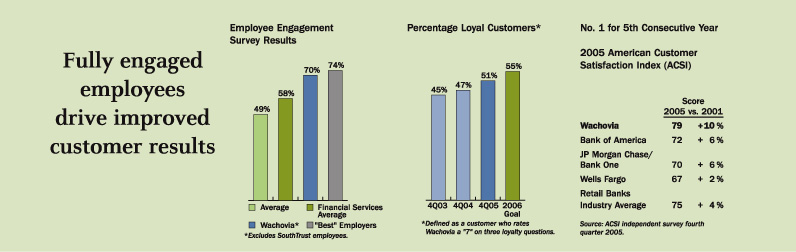

| n | | Employee engagement and performance is industry leading. |

| |

| n | | We’re in an enviable position in relation to our competitors. |

| |

| n | | We remain a market leader in some of the nation’s most attractive markets. |

With all of these advantages, we have no intention of taking our eyes off the ball. We’ll continue to focus on being the best at providing excellent service to our customers, at being the employer of choice, and in making a real and lasting contribution to the communities we serve.

So, as proud as we are of our financial performance, we’re equally proud of the recognition Wachovia has received as we work toward our goal of being the best, most trusted and admired financial services company. In 2005, among other honors, we were named “Banker of the Year” by American Banker magazine and among 2005’s “Best Business Leaders” by BusinessWeek magazine. Working Mother, Training, Latina Style, Essence and other magazines regularly cite Wachovia as an employer of choice. And we were honored to receive the

Wachovia Corporation 2005 Annual Report 5

Letter to Our Shareholders

2005 Secretary of Defense Freedom Award for our support of employees who are serving our country in the military.

As I’ve told employees in Town Hall meetings this past year, these accolades belong to them. We’re extremely proud of the way they have maintained their focus on our No. 1 priority: serving our customers — even while successfully integrating the former SouthTrust branches, moving into new territories in Texas and New York, and seeking out efficiencies.

We were inspired and heartened by our employees’ efforts to help their customers and their colleagues in the wake of the hurricanes of 2005 — from making sure each employee was located and safe, to giving up vacation time to volunteer for relief work, to stepping up with cash donations.

Their spirit and dedication give me great confidence in our ability to achieve Wachovia’s goals for delivering sustainable growth, and I sincerely appreciate all their efforts.

I’d especially like to express my appreciation to Wallace Malone, our vice chairman and the former chief executive officer at SouthTrust. I’ve had the privilege for the past year to have a true partner in Wallace as we integrated our two companies. With that mission complete, Wallace has decided to retire from our company after a long and distinguished career in banking. I know shareholders will join with me in thanking Wallace for his service and for creating tremendous shareholder value in his years at the helm.

I would like to wish good fortune to Bob Kelly, our chief financial officer since mid-2000, who has taken the leadership of another major U.S. financial institution. We are fortunate to have another talented individual ready to immediately assume the responsibilities of CFO: Tom Wurtz, who has been our treasurer for the past seven years. In working closely with Tom, I have been impressed with his financial management abilities, his deep understanding of our businesses and his judgment. Tom’s dedication, commitment and vision will provide us with a seamless transition and consistency in our strategy, which is serving us so well.

In addition, I’d also like to thank our dedicated board of directors for their wise counsel and guidance throughout the year. And we are especially grateful for the support of our customers and communities. We continue to be dedicated to bringing them enduring value.

As always, we especially thank our shareholders for your interest and support of Wachovia.

Sincerely,

G. Kennedy Thompson

Chairman and Chief Executive Officer

February 24, 2006

6 Wachovia Corporation 2005 Annual Report

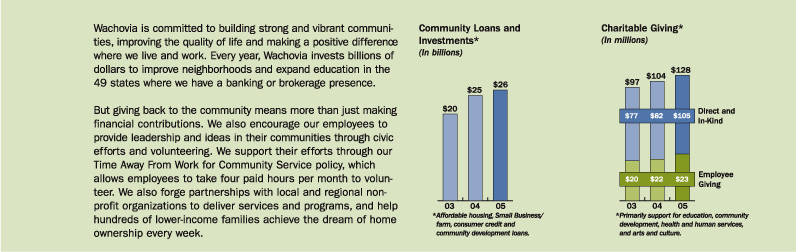

Corporate Citizenship

One of the nation’s leading community development lenders

| n | | Rated “outstanding” by the Office of the Comptroller of the Currency for Community Reinvestment Act Compliance |

| |

| n | | $25.6 billion in community loans and investments |

| |

| n | | $283 million in equity to create over 4,500 affordable rental housing units |

| |

| n | | $12 million in community development grants and in-kind donations |

| |

| n | | Helped 450 low- to moderate-income families buy homes each week |

| n | | Created more than 1,400 jobs in lower-income communities through $114.6 million in lending through New Markets Tax Credits projects |

| |

| n | | Trained 22,000 families and individuals in personal computer, Internet and money management skills through our financial literacy programs led by employee volunteers in conjunction with community groups; offered in English and Spanish |

One of the nation’s leaders in corporate philanthropy and community involvement

| n | | One of the nation’s Top 10 corporate donors (BusinessWeekmagazine) |

| |

| n | | Recognized as the “Outstanding Corporation” for philanthropy and community involvement (Association of Fundraising Professionals) |

| |

| n | | $128 million to charitable organizations through employee, company and foundation giving |

| |

| n | | $15 million in grants to 23 organizations in 11 states through the Wachovia Teachers and Teaching Initiative designed to help teachers develop skills to advance student achievement in under-resourced schools |

| |

| n | | Reading First, our literacy education program, involved employees in nearly 4,900 partnerships with local classrooms, with 98,000 books donated to classroom libraries |

| n | | Wachovia employees logged more than 650,000 hours volunteering in their communities by building homes, mentoring children, reading in schools, tutoring adults in financial literacy, and more |

| |

| n | | Over 1,500 grants amounting to more than $210,000 made to the charity of choice for employees who volunteered at least 24 hours |

| |

| n | | Wachovia and its employees contributed more than $4 million to relief efforts after hurricanes Katrina, Rita and Wilma |

| |

| n | | Donated $1 million in proceeds from Wachovia Championship PGA TOUR golf tournament to Teach For America |

Providing corporate leadership in environmental stewardship

Funding and Investing Policies

| n | | Cognizant that our funding and investment decisions play an important role in protecting the environment, combating poverty and fostering economic development |

| |

| n | | Adhere to all environmental laws and regulations in jurisdictions where we operate and expect customers to do the same |

Energy Efficiency

| n | | Encouraged homeowner energy savings through Energy Efficient Mortgage Program in partnership with Fannie Mae |

| |

| n | | Incorporated energy-efficient lighting systems and energy consumption control features in our recently constructed facilities |

Waste Reduction

| n | | Recycled more than 20,000 tons of paper in 2005 |

| |

| n | | Introduced a company-wide recycling program for office supplies |

Industry Leadership

| n | | Founder and sponsor of The Forum for Corporation Conscience |

| |

| n | | Founding member of the Environmental Bankers Association |

| |

| n | | Included in the FTSE4Good Global Index, a leading socially responsible investment index |

Wachovia Corporation 2005 Annual Report 7

Driving our growth is

an uncommon partnership

of banking and brokerage

businesses that

leverage

the collective wisdom

of our skilled relationship

managers and financial

advisors to

bridge a lifetime

of customer needs

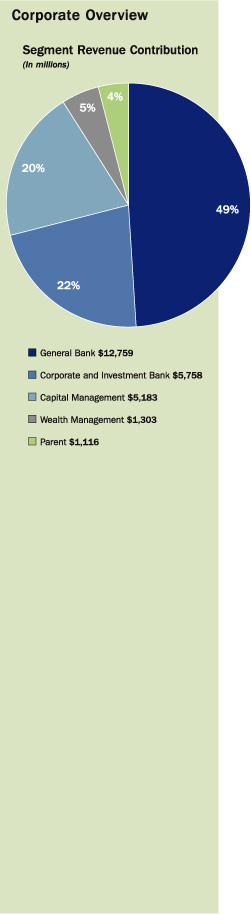

Diversified Business Mix

| n | | Steady revenue stream in a challenging environment and upside potential in an improving economy |

| |

| n | | Relatively stable mix of interest income and fee income |

| |

| n | | About half of Wachovia’s 2005 revenue came from banking operations and half from a broad array of brokerage, asset management, wealth management, and corporate and investment banking businesses |

Broad Distribution Network

| n | | 3,900 financial centers and brokerage offices, 5,100 ATMs, telephone and Internet |

| |

| n | | Sales force of 37,700 bank sales and service associates; 10,500 registered representatives, including 2,500 licensed financial specialists and 8,000 full-service brokers, of which 1,300 are in financial centers; 980 wealth management advisors; 500 insurance brokers in 46 insurance brokerage offices; 1,300 commercial and small business relationship managers; and 1,100 corporate and institutional coverage officers |

Preferred by Customers

| n | | Customer satisfaction and loyalty rankings among industry best in class |

| |

| n | | Wachovia ranks No. 1 among all retail banks in ability to attract and retain customers (A.T. Kearny Organic Growth Index) |

Growth Potential

| n | | Core relationship products average core deposits up 20% and average loans up 32% |

| |

| n | | Broad product array with expanded branch network, credit card and mortgage offerings, and auto dealer services |

| |

| n | | Positioned for growth in global payments industry |

8 Wachovia Corporation 2005 Annual Report

Overview of Major Businesses

General Bank

Description

Our General Bank provides a broad range of banking products and services to individuals, small businesses, commercial enterprises and governmental institutions in 15 states and Washington, D.C. We focus on small business customers with annual revenues up to $3 million; business banking customers with annual revenues between $3 million and $15 million; and commercial customers with revenues between $15 million and $250 million.

2005 Business Fundamentals

| n | | $12.8 billion total revenue |

| |

| n | | $163.5 billion average loans |

| |

| n | | $207.3 billion average core deposits |

| |

| n | | $4.1 billion investment sales |

| |

| n | | 11 million retail and small business households |

| |

| n | | 42,200 employees |

| |

| n | | 2,500 licensed financial specialists |

| |

| n | | 10.5 million online product and service enrollments and 3.2 million active online customers |

Capital Management

Description

Capital Management leverages its multi-channel distribution to provide a full line of proprietary and nonproprietary investment and retirement products and services to retail and institutional clients. Retail brokerage services are offered through the 2,700 offices of Wachovia Securities in 49 states and Washington, D.C., and in Latin America. Evergreen Investments, a large and diversified asset management company, manages investments for a broad range of retail and institutional investors.

2005 Business Fundamentals

| n | | $5.2 billion total revenue |

| |

| n | | $683.6 billion broker client assets |

| |

| n | | $311.1 billion assets under management and securities lending |

| |

| n | | $103.9 billion mutual fund assets |

| |

| n | | $149.6 billion separate account assets |

| |

| n | | $68.9 billion retirement plan assets |

| |

| n | | 10,500 registered representatives |

Wealth Management

Description

With nearly 200 years of experience in managing wealth, Wealth Management provides a comprehensive suite of private banking, trust and investment management and financial planning services to high net worth individuals, their families and businesses. More than 50 teams of relationship managers and specialty advisors focus on serving clients with $2 million or more in investable assets, while four family offices focus on families with $25 million or more in investable assets. Wachovia Insurance Services provides commercial insurance brokerage and risk management services, employee benefits, life insurance, executive benefits and personal insurance services to businesses and individuals.

2005 Business Fundamentals

| n | | $1.3 billion total revenue |

| |

| n | | $13.9 billion average loans |

| |

| n | | $65.6 billion assets under management |

| |

| n | | $130.4 billion assets under administration |

| |

| n | | 44,500 client relationships |

| |

| n | | 980 wealth management advisors |

| |

| n | | 500 insurance brokers |

Corporate and Investment Bank

Description

Our Corporate and Investment Bank serves domestic and global corporate and institutional clients typically with revenues in excess of $250 million, and primarily in these key industry sectors: healthcare; media and communications; technology and services; financial institutions; real estate; consumer and retail; industrial growth; defense and aerospace; and energy and power. The Corporate and Investment Bank includes Corporate Lending, Investment Banking, and Treasury and International Trade Finance lines of business. The Corporate and Investment Bank also serves an institutional client base of money managers, hedge funds, insurance companies, pension funds, banks and broker dealers.

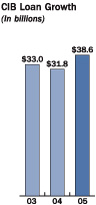

2005 Business Fundamentals

| n | | $5.8 billion total revenue |

| |

| n | | $102.7 billion lending commitments |

| |

| n | | $38.6 billion average loans |

| |

| n | | $23.5 billion average core deposits |

| |

| n | | 3,800 corporate client relationships |

| |

| n | | 2,400 institutional investor relationships |

Wachovia Corporation 2005 Annual Report 9

General Bank

| | | |

| | Market Position |

| |

| | n | Dominant East Coast presence |

| |

| | n | No. 1 in Southeast |

| |

| | n | No. 3 nationwide deposit share |

| |

| | n | No. 1 middle-market lender in footprint |

| |

| | n | No. 4 bank-owned ATM network |

| |

| | n | No. 4 domestic online bank |

| |

| | n | Top 12 nationwide mortgage lender |

| |

| | n | No. 3 primary mortgage lending satisfaction (J.D. Power and Associates) |

| |

| | n | Top 3 nationwide real estate financial services |

Value Proposition

The General Bank provides deposit, lending and investment products and services for customers at every stage of life, whether they are saving for a home, for a child’s education or for a business ... whether they are building wealth or building a business ... or planning for retirement. The General Bank’s 37,700 sales and service associates and 1,300 commercial and small business relationship managers provide knowledgeable and reliable guidance, whether customers choose to meet with them personally, visit one of our 3,100 financial centers or 5,100 automated teller machines, call our telephone banking center or visit online at wachovia.com.

The General Bank also serves the specialized financial needs of businesses of all sizes with a variety of business checking and savings products, treasury services, global trade services, loans, leases and capital markets products and services.

Capital Management

| | | |

| | Market Position |

| |

| | n | 3rd largest full-service retail brokerage firm |

| |

| | n | 4.4 million broker client accounts |

| |

| | n | 1.3 million participants in retirement plans |

| |

| | n | Top 20 largest mutual fund company (FRC) |

| |

| | n | 2nd largest bank annuity provider based on Kehrer-LIMRA survey |

| |

| | n | Best in Class for retirement services to small businesses (PlanSponsormagazine) and client satisfaction (Boston Research Group) |

| |

| | n | 2005 Dalbar Customer Service Award to Evergreen Investments |

Value Proposition

Capital Management is focused on helping clients achieve a lifetime of financial goals with many choices and resources structured around their individual needs.

Our 8,000 financial advisors and 2,500 financial specialists help clients make educated decisions regarding their investments and help them plan their financial future using our proprietary Envision product, with an emphasis on disciplined investing and unbiased advice. Evergreen Investments provides comprehensive investment solutions to individuals, institutions and endowments. Securities lending services are offered through Metropolitan West Securities, LLC. The Retirement and Investment Products Group is a leading provider of retirement services for individual investors, corporations and plan participants, offering individual retirement accounts, variable and fixed annuities, full-service defined contributions, defined benefit and nonqualified plan administration, and reinsurance services.

10 Wachovia Corporation 2005 Annual Report

Wealth Management

| | | |

| | Market Position |

| |

| | n | 4th largest in wealth market based on Wachovia Securities and Wealth Management assets under management for clients with $1 million or more (Barron’s 2005 survey) |

| |

| | n | High net worth leader of the year (Private Asset Management 2005) |

| |

| | n | Top 3 personal trust provider |

| |

| | n | Top 10 commercial insurance brokerage firm |

| |

| | n | Top 3 multifamily office practice (assets under advisement of $10 billion) (Bloomberg report) |

Value Proposition

Wealth Management offers a fully integrated and objective approach that incorporates all the disciplines related to managing our clients’ wealth — from creation and growth to preservation and transfer to future generations. A dedicated relationship manager coordinates a team of financial advisors to meet each client’s individual needs. Through a separate, independent practice called Calibre, we also provide sophisticated family office solutions to ultra high net worth families that go beyond meeting financial needs by ensuring each future generation is prepared to be effective stewards of the family’s legacy.

Wachovia Insurance Services provides commercial property casualty insurance brokerage, risk management services, employee benefits, life insurance, executive benefits and personal insurance nationwide through 46 offices in 23 states and Washington, D.C.

Corporate and Investment Bank

| | | |

| | Market Position |

| |

| | n | Strong industry position across a full capital markets product set |

| |

| | n | Top 3 leveraged loan syndications and U.S. collateralized debt obligations |

| |

| | n | Top 10 issuer of domestic high yield, high grade, preferred stock and equity |

| |

| | n | No. 1 U.S. CMB Sloan contributor and master servicer |

| |

| | n | Top 3 U.S. asset-based lending lead arranger |

| |

| | n | Top 3 provider of large corporate cash management |

| |

| | n | No. 1 customer service global financial institutions in Western Europe, Asia and the Americas |

Value Proposition

The Corporate and Investment Bank has become a premier partner to corporations and institutional investors through an intense focus on client needs, combined with significant capital-raising capability and a leading treasury services platform. The Corporate and Investment Bank has an integrated team approach, a breadth of products and services and deep industry expertise to help grow and sustain corporate clients in any economic environment. The clients in this arm of Wachovia Securities are primarily CEOs, CFOs and treasurers of companies with annual revenues above $250 million, as well as managing partners of private equity firms, institutional investors, financial institutions and corporations with import/export needs.

The Corporate and Investment Bank’s 5,800 employees provide Wachovia with a deep pool of relationship coverage officers, product specialists, portfolio managers, and fixed income and equity sales, trading and research professionals.

Wachovia Corporation 2005 Annual Report 11

Guide to Our Financial Discussion

We value our relationship with our investors and pledge to keep you informed about our company.

On the following pages, we strive to help you understand more about our financial results, our sources of earnings and our financial condition.

Management’s Discussion and Analysis

| | | | | | | |

Executive Summary | | | 14 | | | We begin with an executive summary of our company and our |

| Tables on pages 14 and 47 | | | | | | strategy of balance and diversity in our lines of business. We also |

| | | | | | | summarize our financial results and the underlying trends and |

| | | | | | | factors that affected these results. |

| | | | | | | |

| |

Outlook | | | 15 | | | We discuss our expectations for the future and provide a financial |

| | | | | | | outlook for the upcoming year. |

| | | | | | | |

| |

Critical Accounting Policies | | | 17 | | | We describe the more significant accounting policies that affect our |

| | | | | | | results, and the extent to which we use judgment and estimates in |

| | | | | | | applying those policies. |

| | | | | | | |

| |

Corporate Results of Operations | | | 20, 42 | | | We describe in more detail the topics highlighted in the |

| Net interest income and margin (tables on pages 20, 45-47, 49, 60, 66 and 96) | | | | | | Executive Summary. |

| Fee and other income (tables on pages 20, 46-47, 49, 66 and 96) | | | | | | |

| Noninterest expense (tables on pages 21, 47, 49, 66 and 96) | | | | | | |

| Merger-related and restructuring expenses (tables on pages 21, 47, 49, 66, 96 and 102) | | | | | | |

| Income taxes (tables on pages 14, 21, 23-26, 47, 49, 66, 68, 76, 96 and 104) | | | | | | |

| | | | | | | |

| |

Business Segments | | | 21, 43 | | | Then we review results from our business segments in depth, |

| Key performance metrics (tables on pages 23-26 and 96-97) | | | | | | including the metrics we used to evaluate segment results. |

| General Bank (tables on pages 23 and 96-97) | | | | | | |

| Capital Management (tables on pages 24 and 96-97) | | | | | | |

| Wealth Management (tables on pages 25 and 96-97) | | | | | | |

| Corporate and Investment Bank (tables on pages 25 and 96-97) | | | | | | |

| Parent (tables on pages 26 and 96-97) | | | | | | |

| | | | | | | |

| |

Balance Sheet Analysis | | | 27, 44 | | | The two primary groups of assets that we hold on our balance |

| Earning assets (tables on pages 20 and 59-60) | | | | | | sheet are securities and loans, which we call earning assets. We |

| Securities (tables on pages 20, 27, 59, 65, 78 and 81) | | | | | | discuss these earning assets and related topics such as the mix |

| Loans (tables on pages 20, 27-28, 50-52, 59-60, 65 and 85) | | | | | | of our loan portfolio and asset quality here. |

| Asset quality (tables on pages 29, 46 and 53-55) | | | | | | |

| Charge-offs (tables on pages 29, 46, 53 and 55) | | | | | | |

| Commercial real estate (tables on pages 27-28 and 52-53) | | | | | | |

| Commitments (tables on pages 23-26 and 96) | | | | | | |

| Industry concentrations (table on page 28) | | | | | | |

| Loans held for sale (table on page 51) | | | | | | |

| Goodwill (tables on pages 56, 65 and 87) | | | | | | |

| | | | | | | |

| |

Liquidity and Capital Adequacy | | | 30, 44 | | | Here we describe our funding strategies and our management |

| Core deposits (other deposit tables on pages 20, 57 and 65) | | | | | | of liquidity - or the ease with which an asset may be converted |

| Purchased funds (tables on pages 20, 59, 60, 65 and 88) | | | | | | into cash at no or little risk, or how funds may be raised in |

| Long-term debt (tables on pages 20, 47, 59, 60, 65 and 89) | | | | | | various markets. |

| Stockholders’ equity (tables on pages 1, 31, 65 and 67) | | | | | | |

| Subsidiary dividends (table on page 121) | | | | | | |

| Regulatory capital (tables on pages 46, 58 and 93) | | | | | | |

| Debt ratings | Inside Back Cover | | | |

| | | | | | | |

| |

Off-Balance Sheet Transactions | | | 31 | | | We also provide information about our "off-balance sheet" activities |

| Off-balance sheet summary tables on pages 31, 114 and 119 | | | | | | such as guarantees and retained interests from securitizations. |

| | | | | | | |

| |

Risk Management | | | 33 | | | This section discusses the types of risk to which our business is |

| Allowance for loan losses and reserve for unfunded | | | | | | exposed in the ordinary course of business and our strategies for |

| lending commitments (tables on pages 29, 46, 53-54 and 86) | | | | | | mitigating that risk. |

| Credit risk management | | | | | | |

| Derivatives (tables on pages 108-112) | | | | | | |

| Earnings sensitivity (table on page 39) | | | | | | |

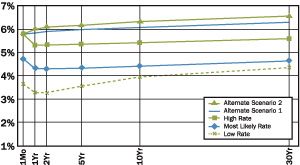

| Interest rate risk management (graph on page 38) | | | | | | |

| Liquidity risk management (table on page 36) | | | | | | |

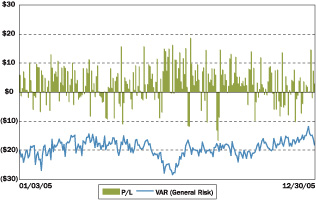

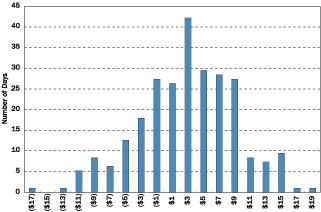

| Market risk management (table and graphs on page 35) | | | | | | |

| Operational risk management | | | | | | |

| Trading activities (tables on pages 48, 59-60, 65-66, 68 and 77) | | | | | | |

12 Wachovia Corporation 2005 Annual Report

| | | | | | | |

Selected Financial Data | | | 45-49 | | | These tables provide often-requested information, including |

| Explanation of our use of non-GAAP financial measures | | | | | | multi-year and quarterly comparisons of our results. |

| Selected statistical data | | | | | | |

| Five-year summaries of income | | | | | | |

| Selected quarterly data | | | | | | |

| |

| |

Management’s Report on Internal Control over Financial Reporting | | | 62 | | | In this letter, we affirm our responsibilities related to the reliability of |

| | | | | | | our financial reporting. We continue to be committed to presenting |

| | | | | | | financial results that are complete, transparent and understandable. |

| |

| |

Reports of Independent Registered Public Accounting Firm | | | 63-64 | | | In these reports, our auditor, KPMG, expresses their independent |

| | | | | | | opinions on our consolidated financial statements and internal |

| | | | | | | controls over financial reporting. |

| |

| |

Consolidated Financial Statements | | | 65-68 | | | These four statements, and theNotes to Consolidated Financial |

| Consolidated balance sheets | | | | | | Statementsthat accompany them, have been prepared by manage- |

| Consolidated statements of income | | | | | | ment and are audited by KPMG, our independent registered public |

| Consolidated statements of changes in stockholders’ equity | | | | | | accounting firm. |

| Consolidated statements of cash flows | | | | | | |

| |

| |

Notes to Consolidated Financial Statements | | | 69-122 | | | In these notes, we describe the policies we use in accounting for |

| Summary of significant accounting policies | | | | | | our assets, liabilities and operating activities. We also discuss our |

| Business combinations and dispositions | | | | | | significant acquisitions and divestitures and provide additional |

| Trading account assets and liabilities | | | | | | information about our primary assets, including securities and |

| Securities | | | | | | loans, and funding sources, such as short-term borrowings and |

| Variable interest entities, securitizations and retained | | | | | | long-term debt, along with our off-balance sheet commitments. |

| beneficial interests, and servicing assets | | | | | | Specific details are included for our stock-based compensation, |

| Loans, net of unearned income | | | | | | income taxes and business segments. We believe you will find |

| Allowance for loan losses and reserve for unfunded lending commitments | | | | | | useful information to help you more fully understand our financial |

| Goodwill and other intangible assets | | | | | | statements in these disclosures, which are provided to meet |

| Other assets | | | | | | accounting and reporting requirements and are presented in |

| Short-term borrowings | | | | | | stipulated formats. |

| Long-term debt | | | | | | |

| Common and preferred stock and capital ratios | | | | | | |

| Accumulated other comprehensive income, net | | | | | | |

| Business segments | | | | | | |

| Personnel expense and retirement benefits | | | | | | |

| Merger-related and restructuring expenses | | | | | | |

| Income taxes | | | | | | |

| Basic and diluted earnings per common share | | | | | | |

| Derivatives | | | | | | |

| Commitments, guarantees and contingencies | | | | | | |

| Fair value of financial instruments | | | | | | |

| Wachovia Corporation (parent company) | | | | | | |

| |

| |

Ratios | | | 46-48 | | | Throughout this document, we provide information about the key |

| Capital and leverage (tables on pages 46 and 58) | | | 31 | | | performance indicators by which we measure our success in |

| Common stockholders’ equity to assets (table on page 49) | | | | | | driving shareholder value, including measures that serve as |

| Dividend payout ratio (graph on page 1 and tables on pages 45 and 48) | | | 15 | | | benchmarks for our management team's compensation. |

| Economic profit (tables on pages 23-26) | | | 22 | | | |

| Efficiency ratio (tables on pages 23-26 and 96-97) | | | 15 | | | |

| Net interest margin (table on page 60) | | | 20 | | | |

| Profitability (ROA and ROE) (tables on pages 46, 48 and 49) | | | | | | |

| Risk-adjusted return on capital (tables on pages 23-26 and 96-97) | | | 22 | | | |

| |

| |

Glossary of Financial Terms | | | 123 | | | More definitions to help you understand our businesses. |

| |

| |

Board of Directors and Operating Committee | | | 124 | | | These are the people who lead our company. |

| |

| |

Stockholder Information | Inside Back Cover | | | We end with information about our Annual Meeting, how to contact |

| | | | | | | us, and for our fixed income investors, we provide a summary |

| | | | | | | table of our debt ratings. |

Wachovia Corporation 2005 Annual Report 13

Management’s Discussion and Analysis

The following discussion and analysis is based primarily on amounts presented in our consolidated financial statements, which are prepared in accordance with accounting principles generally accepted in the United States, or GAAP. This discussion contains forward-looking statements. Please refer to our 2005 Form 10-K for a discussion of various factors that could cause our actual results to differ materially from those expressed in such forward-looking statements.

Summary of Results of Operations

| | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| (In millions, except per share data) | | 2005 | | | 2004 | | | 2003 | |

| |

Net interest income(GAAP) | | $ | 13,681 | | | | 11,961 | | | | 10,607 | |

| Tax-equivalent adjustment | | | 219 | | | | 250 | | | | 256 | |

| |

Net interest income(a) | | | 13,900 | | | | 12,211 | | | | 10,863 | |

| Fee and other income | | | 12,219 | | | | 10,779 | | | | 9,482 | |

| |

Total revenue(a) | | | 26,119 | | | | 22,990 | | | | 20,345 | |

| Provision for credit losses | | | 249 | | | | 257 | | | | 586 | |

| Other noninterest expense | | | 15,139 | | | | 13,791 | | | | 12,319 | |

| Merger-related and restructuring expenses | | | 292 | | | | 444 | | | | 443 | |

| Other intangible amortization | | | 416 | | | | 431 | | | | 518 | |

| |

| Total noninterest expense | | | 15,847 | | | | 14,666 | | | | 13,280 | |

| Minority interest in income of consolidated subsidiaries | | | 342 | | | | 184 | | | | 143 | |

| Income taxes | | | 3,033 | | | | 2,419 | | | | 1,833 | |

| Tax-equivalent adjustment | | | 219 | | | | 250 | | | | 256 | |

| |

| Income from continuing operations before cumulative effect of a change in accounting principle | | | 6,429 | | | | 5,214 | | | | 4,247 | |

| Discontinued operations, net of income taxes | | | 214 | | | | — | | | | — | |

| |

| Income before cumulative effect of a change in accounting principle | | | 6,643 | | | | 5,214 | | | | 4,247 | |

| Cumulative effect of a change in accounting principle, net of income taxes | | | — | | | | — | | | | 17 | |

| |

| Net income | | | 6,643 | | | | 5,214 | | | | 4,264 | |

| Dividends on preferred stock | | | — | | | | — | | | | 5 | |

| |

| Net income available to common stockholders | | $ | 6,643 | | | | 5,214 | | | | 4,259 | |

| |

| Diluted earnings per common share from continuing operations | | $ | 4.05 | | | | 3.81 | | | | 3.18 | |

| |

| Diluted earnings per common share available to common stockholders | | $ | 4.19 | | | | 3.81 | | | | 3.18 | |

| |

Executive Summary

Our earnings are primarily generated through four core businesses: the General Bank, the Corporate and Investment Bank, Capital Management and Wealth Management. In the following discussion, we explain this diverse group of businesses and why we believe our shareholders and customers benefit from this balance and diversity. In addition, through out this document, we address key performance indicators of our financial position and results of operations that drive shareholder value and serve as benchmarks to compensate management. We discuss trends and uncertainties affecting our businesses, and analyze liquidity and capital resources.

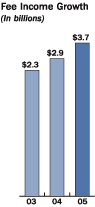

Our business model is based on a mix of businesses that provide a broad range of financial products and services, delivered through multiple distribution channels. This means that in addition to the typical lending and deposit-taking activities of traditional banking companies, we also offer investment products and services for retail customers, and capital markets financing alternatives for institutional and corporate clients. This business mix produces revenue from the interest income earned on loans and securities, as well as fee income from faster-growth but less predictable asset management, retail brokerage and investment banking businesses. Fee income represented 47 percent of our total revenue in both 2005 and 2004.

Our businesses generated strong sales by serving a broad range of customers, which drove record net income available to common stockholders in 2005 of $6.6 billion, up 27 percent from 2004, and record earnings per common share of $4.19, up 10 percent from 2004. Results in 2004 included the former SouthTrust Corporation for only two months following the November 1, 2004, consummation of this merger. In accordance with the purchase method of accounting, prior periods were not restated. Results in 2005 included a $214 million after-tax gain on the sale of most of our corporate and institutional trust (CIT) businesses, which is reflected as a gain on sale of discontinued operations as discussed further in theOutlooksection. In addition, results include after-tax net merger-related and restructuring expenses of 11 cents per share in 2005 and 14 cents per share in 2004.

In 2005 compared with 2004, revenue rose 14 percent to $26.1 billion, with strong balance sheet growth overcoming margin compression resulting from the addition of lower-yielding trading assets and the effects of a flattening yield curve. Net interest income growth of 14 percent reflected 20 percent growth in average earnings assets due both to the SouthTrust acquisition and to organic growth. Fee and other income growth of 13 percent included, in addition to SouthTrust, increased debit card interchange fees, capital markets fees and trading revenues, as well as, in 2005, gains on the sale of equity securities received in settlement of problem loans. Lower market activity dampened retail brokerage commissions, while growth in managed account assets contributed to higher fiduciary and asset management fees.

Wachovia is one of the nation’s largest lenders, and the credit quality of our loan portfolio can have a significant impact on earnings. Our credit quality remained among the best in the banking industry in 2005. Our net charge-off ratio of 0.09 percent was down from 0.17 percent in 2004. Total nonperforming assets, including loans held for sale, declined 40 percent from 2004. Provision expense declined 3 percent from 2004, reflecting sustained improvement in credit quality. We continue to mitigate risk and volatility on our balance sheet by actively monitoring

14 Wachovia Corporation 2005 Annual Report

and reducing potential problem loans, including their sale when prudent. We continue to foresee positive trends in the economy and solid asset quality over the next few quarters.

Average net loans in 2005 increased 32 percent from 2004 to $227.9 billion, primarily due to the SouthTrust impact. Average consumer loan growth of 31 percent was led by real estate-secured loans, including the effect of a net $9.3 billion of primarily home equity lines transferred from loans held for sale to the loan portfolio in the fourth quarter of 2004. Average commercial loan growth of 34 percent reflected strength in middle-market commercial and large corporate lending. Average core deposits increased 20 percent from 2004 to $278.7 billion and average low-cost core deposits increased 18 percent from year-end 2004 to $239.0 billion at December 31, 2005.

Controlling expense growth and improving revenue growth continued to be a strategic focus in 2005, with our business units and the corporation making progress toward overhead efficiency targets for 2007. Overall, we are targeting an overhead efficiency ratio in the range of 52 percent to 55 percent by 2007. Further information about our goals for improving efficiency is in theLetter to Our Shareholdersand theOutlooksections.

Total noninterest expense rose 8 percent from 2004, primarily reflecting, in addition to SouthTrust, increased variable pay linked to higher revenues, as well as continued investments that better position us for future earnings growth. Expense growth was offset in part by merger and other expense efficiencies.

As we manage interest rate risk, we believe our investment and hedging strategies are designed to achieve our goal of stable and growing net interest income in a variety of rate environments. We believe we are well positioned with our current, slightly liability sensitive stance, given market expectations for modest continued increases in short-term rates and likely alternatives to the current market forward rate projections.

Our diversified business model and strategic focus on efficiency helped drive solid performance by our four major businesses amid industry challenges such as a flattening yield curve and a weak retail brokerage environment. All four of our major businesses generated record earnings and three of the four generated record revenue for the second consecutive year.

The General Bank’s earnings rose 28 percent from 2004 on record revenue largely due to increased earning assets related to the SouthTrust acquisition and other loan growth as well as continuing strong deposit growth. The General Bank’s overhead efficiency ratio was 49.49 percent.

Capital Management grew earnings 20 percent from 2004 despite a modest decline in revenues as expense savings from the now-completed retail brokerage integration offset

lower brokerage transaction activity. The results of Capital Management for each year exclude the CIT businesses that were sold in December 2005.

Wealth Management generated a 24 percent increase in earnings on record revenue, up 19 percent. These results reflected strong growth in loans and deposits, improved trust and investment management fees, and the May 2005 acquisition of an insurance brokerage firm.

Our Corporate and Investment Bank generated 3 percent earnings growth on record revenue, up 11 percent, with record results in advisory, underwriting and other investment banking fees, gains on the sale of equity securities received in settlement of loans, and higher trading and principal investing results. Net interest income declined due to higher funding costs associated with our commercial leasing portfolio, and a change in the mix of trading assets, which lowered the overall spread in the trading portfolio. Expenses rose due to higher variable compensation and strategic hiring in key positions.

In 2005, Wachovia’s board of directors increased the quarterly dividend paid to common stockholders by 11 percent to 51 cents per share, or $2.04 annualized. We paid common stockholders total dividends of $3.0 billion, or $1.94 per common share, up 17 percent from 2004. Our goal is to return 40 percent to 50 percent of our earnings to shareholders as dividends, and in 2005 our dividend payout ratio was 46.30 percent, or 44.80 percent excluding merger-related and restructuring expenses, other intangible amortization and discontinued operations, which is the basis we use in measuring our goal.

Additionally, two leading debt rating agencies, citing the benefits of Wachovia’s business model and disciplined risk management, upgraded their ratings of our corporate and subsidiary debt in 2005. Fitch Ratings long-term and short-term ratings for Wachovia Corporation and for Wachovia Bank, National Association, improved to AA-/ F1+ from A+/F1. Standard & Poor’s raised its counterparty credit ratings on Wachovia Corporation to A+/A-1 from A/A-1 and its counterparty ratings on Wachovia Bank, National Association, to AA-/A-1+ from A+/A-1. Our balance sheet is strong and “well capitalized” under regulatory guidelines with a tier 1 capital ratio of 7.50 percent and a leverage ratio of 6.12 percent at December 31, 2005.

Outlook

Our diversified business model and strong execution in our four major businesses on their efficiency initiatives and revenue growth strategies give us confidence Wachovia will be one of the leading growth companies in our industry. We continue to make excellent progress in meeting our corporate objectives of revenue growth and disciplined expense control, increased distribution of products and services, hallmark customer service and balance sheet strength.

Wachovia Corporation 2005 Annual Report 15

Based on our consistent performance, confidence in our business model, capital strength and improving market conditions, we have updated our financial outlook for 2006. Economic assumptions used to formulate the 2006 outlook include growth in the real gross domestic product (GDP) of 3.40 percent; inflation (based on the Consumer Price Index) of 2.90 percent; a federal funds rate of 4.75 percent by December 2006; a 10-year Treasury bond rate of 4.40 percent by December 2006; and growth in the S&P 500 index of 7.00 percent.

The following outlook is for the full year 2006 compared with an “adjusted” 2005 amount, which includes our reported results and the reported results for the nine months ended September 30, 2005, for Westcorp, an auto dealer financial services business that we expect to acquire in the latter part of the first quarter of 2006. Amounts discussed below exclude merger-related and restructuring expenses and the effect, if any, of accounting proposals.

| n | | Net interest income growth in the low single-digit percentage range on a tax-equivalent basis from an adjusted $14.6 billion. |

| |

| n | | Fee income growth in the low double-digit percentage range from an adjusted $12.3 billion. |

| |

| n | | Noninterest expense growth in the low single digits from an adjusted $15.8 billion. |

| |

| n | | Minority interest expense increase in the mid-teens percentage range from an adjusted $367 million. |

| |

| n | | Loan growth in the mid-teens percentage range from an adjusted $240.6 billion, including consumer loan growth in the high teens from an adjusted $107.9 billion, and commercial loan growth in the low double-digit range from an adjusted $132.7 billion. |

| |

| n | | Net charge-offs in the 15 basis point to 25 basis point range, up from an adjusted 15 basis points, with provision expense also expected to be in the 15 basis point to 25 basis point range. |

| |

| n | | An effective income tax rate of approximately 34 percent to 35 percent on a tax-equivalent basis. |

| |

| n | | A tier 1 capital ratio above 7.5 percent, a leverage ratio above 6.0 percent, and a tangible capital to tangible asset ratio above 4.7 percent. |

| |

| n | | A dividend payout ratio of 40 percent to 50 percent of earnings excluding merger-related and restructuring expenses, and other intangible amortization. |

| |

| n | | Use of excess capital to opportunistically repurchase shares, to reinvest in our businesses and to undertake financially attractive, shareholder friendly acquisitions. |

Recent proposals on leveraged lease accounting and uncertain tax positions by the Financial Accounting Standards Board (FASB), if adopted as currently proposed, may have an impact on our financial results in future periods. The impact, if adopted as currently proposed, would include (i) a one-time noncash charge to the results of operations recorded as a cumulative effect of a change in accounting principle, and (ii) in the leveraged lease proposal, the recognition as income in future periods of amounts in the aggregate approximating the amount of the one-time charge. TheAccounting and Regulatory Matterssection has additional information about these FASB proposals along with the impact of the change in treatment of stock awards to retirement-eligible employees.

We have successfully completed the integration of SouthTrust systems, products and signs to the Wachovia platform. Deposit and branch conversions in overlapping states were completed in June 2005 and in the states in our extended footprint in October 2005. We expect 2006 to reflect our original expectation for annual after-tax savings of $255 million.

In addition, we announced agreements in 2005 to acquire or invest in opportunities we believe will augment the diversity of our business model and deepen our customer relationships. For example, through selective acquisitions, we doubled the size of our insurance brokerage operation; we acquired a nationwide residential mortgage broker; we expanded our international correspondent banking business; and we enhanced the high net worth division of Evergreen Investments. We also announced the pending acquisition of a nationally known auto dealer financial services business in a transaction that is expected to close in the latter part of the first quarter of 2006. And we re-entered the credit card market as a direct issuer in January 2006. Proceeds of a $100 million termination fee paid by MBNA Corporation in 2006 as a result of the Bank of America/MBNA merger will primarily be invested in systems and personnel to build our credit card business as well as other initiatives to support earnings growth.

In December 2005, we sold most of our CIT businesses, including our (i) corporate trust, institutional custody, document custody and structured finance trust services units, and (ii) stock transfer units, in two separate transactions for an aggregate initial sale price of $740 million. These transactions generated a fourth quarter 2005 net pre-tax gain of $447 million, or $214 million after tax, and reduced goodwill and other intangibles by $210 million. We may realize an additional gain of up to $80 million pre-tax or $50 million after tax related to the corporate trust and institutional custody transaction, depending upon the level of business retained by the purchaser during the 12-month period following the completion of that transaction. The gain on sale has been presented, net of applicable income taxes, as discontinued operations in the consolidated statements of income. Financial results of the CIT businesses have

16 Wachovia Corporation 2005 Annual Report

not been presented as discontinued operations based on materiality, but have been excluded from results presented for our Capital Management business segment and included in the Parent for all periods presented. Not included in this transaction was our securities lending unit, a business we entered two years ago with the acquisition of Metropolitan West Securities, and our institutional retirement plan business, Wachovia Retirement Services. We are firmly committed to and will continue to operate and grow the securities lending and retirement plan businesses.

We continue to evaluate our operations and organizational structures to ensure they are closely aligned with our goal of maximizing performance through increased efficiency and competitiveness in our four core businesses. We are striving to make Wachovia a more efficient company, but it is not our intention to have the lowest overhead efficiency ratio in our peer group because we expect to continue to invest in higher growth businesses. We believe we will slow annual expense growth by $600 million to $1.0 billion by 2007. We believe this will result in position reductions in the range of 3, 500 to 4, 000, approximately 20 percent of which will result from normal attrition, although we also expect to add positions in higher growth businesses. To date, we have identified initial expense reduction opportunities in the range of $650 million to $750 million annually and work continues.

In conjunction with these efforts, we have established overhead efficiency targets, excluding merger-related and restructuring expenses, other intangible amortization, discontinued operations and changes in accounting principle, for each of our four businesses and for the overall company to achieve by 2007. These 2007 targets are as follows:

| n | | General Bank | 45 percent to 47 percent |

| |

| n | | Capital Management | 75 percent to 77 percent |

| |

| n | | Wealth Management | 60 percent to 62 percent |

| |

| n | | Corporate and Investment Bank | 49 percent to 51 percent |

| |

| n | | Wachovia Corporation | 52 percent to 55 percent |

Segment tables in theBusiness Segmentssection have additional information.

When consistent with our overall business strategy, we may consider disposing of certain assets, branches, subsidiaries or lines of business. We continue to routinely explore acquisition opportunities in areas that would complement our core businesses, and frequently conduct due diligence activities in connection with possible acquisitions. As a result, acquisition discussions and, in some cases, negotiations frequently take place and future acquisitions involving cash, debt or equity securities could occur.

Critical Accounting Policies

Our accounting and reporting policies are in accordance with U.S. generally accepted accounting principles (GAAP) and they conform to general practices within the applicable industries. We use a significant amount of judgment and estimates based on assumptions for which the actual results are uncertain when we make the estimations. We have identified five policies as being particularly sensitive in terms of judgments and the extent to which significant estimates are used: allowance for loan losses and the reserve for unfunded lending commitments (which is recorded in other liabilities); fair value of certain financial instruments; consolidation; goodwill impairment; and contingent liabilities. Other accounting policies, such as pension liability measurement and stock option fair value determination, also involve a significant amount of judgment and estimates, but the impact of the estimates involved is not significant to our consolidated results of operations. Periodically, the Audit Committee of our board of directors reviews these policies, the judgment and estimation processes involved, and related disclosures.

Our policy on the allowance for loan losses applies to all loans, but is different from the methodology used to allocate the provision for credit losses for segment reporting purposes, which is discussed inNote 14: Business Segmentsin theNotes to Consolidated Financial Statements. The policy on fair value of certain financial instruments applies largely to the Corporate and Investment Bank and the Parent, both of which hold large portfolios of securities and derivatives. The policy on consolidation also affects the Corporate and Investment Bank and the Parent, both of which are involved in structuring securitization transactions. The policies on goodwill impairment and contingent liabilities affect all segments.

Allowance for Loan Losses and Reserve for Unfunded Lending CommitmentsThe allowance for loan losses and reserve for unfunded lending commitments, which we refer to collectively as the allowance for credit losses, are maintained at levels we believe are adequate to absorb probable losses inherent in the loan portfolio and unfunded lending commitments as of the date of the consolidated financial statements. We monitor qualitative and quantitative trends, including changes in the levels of past due, criticized and nonperforming loans. In addition, we rely on estimates and exercise judgment in assessing credit risk.

We employ a variety of modeling and estimation tools for measuring credit risk. These tools are periodically reevaluated and refined as appropriate. The following provides a description of each component of our allowance for credit losses, the techniques we currently use and the estimates and judgments inherent to each.

Our model for the allowance for loan losses has four components: formula-based components for both the commercial and consumer portfolios, each including an

Wachovia Corporation 2005 Annual Report 17

adjustment for historical loss variability; a reserve for impaired commercial loans; and an unallocated component.

For commercial loans, the formula-based component of the allowance for loan losses is based on statistical estimates of the average losses observed for commercial loans classified by credit grade. Average losses for each credit grade are computed using the annualized historical rate at which loans in each credit grade have defaulted and the historical average losses realized for defaulted loans.

For consumer loans, the formula-based component of the allowance for loan losses is based on historical loss data, historical delinquency patterns, vintage analyses, credit score-based forecasting methods and stress tests for each product classification.

For both commercial and consumer loans, the formula-based loss components include additional amounts to establish reasonable ranges that consider observed historical variability in losses. Factors we may consider in setting these amounts include, but are not limited to, industry-specific data, portfolio-specific risks or concentrations, and macroeconomic conditions. At December 31, 2005, the formula-based components of the allowance were $1.9 billion for commercial loans and $730 million for consumer loans, compared with $1.9 billion and $759 million, respectively, at December 31, 2004.

We have established a specific reserve within the allowance for loan losses for impaired loans. We define impaired loans as commercial loans on nonaccrual status. We individually review any impaired loans with a minimum total exposure of $10 million in the Corporate and Investment Bank and $5 million in other segments. The reserve for each individually reviewed loan is based on the difference between the loan’s carrying amount and the loan’s estimated fair value. No other reserve is provided on impaired loans that are individually reviewed. At December 31, 2005, the allowance for loan losses included $10 million and the reserve for unfunded lending commitments included $7 million for individually reviewed impaired loans and facilities. At December 31, 2004, these amounts were $31 million and $16 million, respectively.

The allowance for loan losses is supplemented with an unallocated component. This component reflects in part the inherent uncertainty of estimates and is designed as the final tool to fully capture probable incurred losses in the loan portfolio. The amount of this component and its relationship to the total allowance for loan losses may change from one period to another. We anticipate that the unallocated component of the allowance will generally not exceed 5 percent of the total allowance for loan losses. At December 31, 2005, the unallocated component of the allowance for loan losses was $135 million, or 5 percent of the allowance for loan losses, compared with $90 million, or 3 percent, at December 31, 2004. The increase in the unallocated component reflects the impact of recent hurricanes.

The reserve for unfunded lending commitments, which relates only to commercial business, is based on the modeling process that is consistent with the methodology described above for the commercial portion of the allowance for loan losses. In addition, this model includes as a key factor the historical average rate at which unfunded commercial exposures have been funded at the time of default. At December 31, 2005 and 2004, the reserve for unfunded lending commitments was $158 million and $154 million, respectively.

The factors supporting the allowance for loan losses and the reserve for unfunded lending commitments as described above do not diminish the fact that the entire allowance for loan losses and reserve for unfunded lending commitments are available to absorb losses in the loan portfolio and related commitment portfolio, respectively. Our principal focus, therefore, is on the adequacy of the total allowance for loan losses and reserve for unfunded lending commitments. Additionally, our primary bank regulators regularly conduct examinations of the allowance for credit losses and make assessments regarding its adequacy and the methodology employed in its determination.

Fair Value of Certain Financial InstrumentsFair value is defined as the amount at which a financial instrument could be exchanged in a transaction between willing, unrelated parties in a normal business transaction. Financial instruments recorded at fair value include:

| n | | Instruments held for trading, including debt and equity securities and derivatives, with unrealized gains and losses recorded in earnings. |

| |

| n | | Debt and equity securities and retained interests in securitizations classified as available for sale, with unrealized gains and losses recorded in stockholders’ equity. |

| |

| n | | Derivatives designated as fair value or cash flow accounting hedges, with unrealized gains and losses recorded in earnings for fair value hedges and stockholders’ equity for cash flow hedges. |

| |

| n | | Principal investments, which are classified in other assets and which include public equity and private investments, with realized and unrealized gains and losses recorded in earnings. |