Exhibit 99(c)

Wachovia

Fourth Quarter 2003

Quarterly Earnings Report

January 15, 2004

Table of Contents

READERS ARE ENCOURAGED TO REFER TO WACHOVIA’S RESULTS FOR THE QUARTER ENDED SEPTEMBER 30, 2003, PRESENTED IN ACCORDANCE WITH U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”), WHICH MAY BE FOUND IN WACHOVIA’S THIRD QUARTER 2003 REPORT ON FORM 10-Q.

ALL NARRATIVE COMPARISONS ARE WITH THIRD QUARTER 2003 UNLESS OTHERWISE NOTED.

THE INFORMATION CONTAINED HEREIN INCLUDES CERTAIN NON-GAAP FINANCIAL MEASURES. PLEASE REFER TO PAGE 39 FOR AN IMPORTANT EXPLANATION OF OUR USE OF NON-GAAP MEASURES AND RECONCILIATION OF THOSE NON-GAAP MEASURES TO GAAP.

Wachovia 4Q03 Quarterly Earnings Report

Fourth Quarter 2003 Financial Highlights

Versus 3Q03

| | • | | Earnings of $1.1 billion, up 23% over 4Q02 |

| | — | | EPS of $0.83 consistent with 3Q03 and up 26% from 4Q02 |

| | • | | Excluding $0.05 per share of net merger-related and restructuring expenses and $0.06 per share of intangible amortization expense, EPS of $0.94 up $0.01 from 3Q03 and up 21% from 4Q02 |

| | • | | Segment earnings in all four businesses reflect the benefit of our balanced business model |

| | — | | General Bank full year 2003 up 10% over full year 2002; 4Q03 down 15% from record 3Q03 levels |

| | — | | Capital Management up 2%, and up 43% from 4Q02 due to the effect of the Prudential Financial retail brokerage transaction |

| | — | | Wealth Management up 7% and up 15% from 4Q02 |

| | — | | Corporate and Investment Bank earnings in line with 3Q03, up 109% from 4Q02 |

| | • | | Revenue grew 4% driven by exceptionally strong net interest income growth of 8% |

| | • | | Net interest margin rose 7 bps to 3.64 % |

| | • | | Provision expense increased 6% to $86 million; included $24 million of provision related to portfolio management activity vs. none in 3Q03 and reflects a reduction in allowance of $94 million |

| | — | | Net charge-offs were $156 million, up 18% from very low 3Q03 levels |

| | — | | Full year net charge-offs totaled 41 bps of average loans |

| | • | | NPAs declined 26%; new commercial nonaccruals down 52% |

| | • | | Release of reserves totaling $94 million more than offset by actions totaling $118 million including net securities losses and discretionary expenses |

| | • | | Total noninterest expense rose 6% reflecting higher costs associated with strategic growth initiatives as well as discretionary expenses of $94 million |

| | • | | Average diluted share count decreased 6 million shares |

| | • | | Increased dividend 14%, or $0.05 per share to $0.40 per share, up 54% since 4Q02 |

| | — | | Estimated dividend payout ratio of 43% within targeted range of 40 - 50% of earnings (this target is before merger-related and restructuring expenses and intangible amortization) |

Page-1

Wachovia 4Q03 Quarterly Earnings Report

Earnings Reconciliation

Earnings Reconciliation

| | | 2003

| | 2002

| | 4 Q 03 EPS

| |

| | | Fourth Quarter

| | Third Quarter

| | | Second Quarter

| | First Quarter

| | Fourth Quarter

| | vs 3 Q 03

| | | vs 4 Q 02

| |

(After-tax in millions, except per share data)

| | Amount

| | EPS

| | Amount

| | | EPS

| | | Amount

| | EPS

| | Amount

| | EPS

| | Amount

| | EPS

| | |

Net income available to common stockholders (GAAP) | | $ | 1,100 | | 0.83 | | 1,105 | | | 0.83 | | | 1,031 | | 0.77 | | 1,023 | | 0.76 | | 891 | | 0.66 | | — | % | | 26 | |

Dividends on preferred stock | | | — | | — | | — | | | — | | | 1 | | — | | 4 | | — | | 4 | | — | | — | | | — | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Net income | | | 1,100 | | 0.83 | | 1,105 | | | 0.83 | | | 1,032 | | 0.77 | | 1,027 | | 0.76 | | 895 | | 0.66 | | — | | | 26 | |

Cumulative effect of a change in accounting principle | | | — | | — | | (17 | ) | | (0.01 | ) | | — | | — | | — | | — | | — | | — | | — | | | — | |

Net merger-related and restructuring expenses | | | 75 | | 0.05 | | 83 | | | 0.06 | | | 60 | | 0.04 | | 40 | | 0.03 | | 92 | | 0.06 | | (17 | ) | | (17 | ) |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, and cumulative effect of a change in accounting principle | | | 1,175 | | 0.88 | | 1,171 | | | 0.88 | | | 1,092 | | 0.81 | | 1,067 | | 0.79 | | 987 | | 0.72 | | — | | | 22 | |

Deposit base and other intangible amortization | | | 74 | | 0.06 | | 79 | | | 0.05 | | | 81 | | 0.06 | | 88 | | 0.07 | | 83 | | 0.06 | | 20 | | | — | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, intangible amortization and cumulative effect of a change in accounting principle | | $ | 1,249 | | 0.94 | | 1,250 | | | 0.93 | | | 1,173 | | 0.87 | | 1,155 | | 0.86 | | 1,070 | | 0.78 | | 1 | % | | 21 | |

| | |

|

| |

| |

|

| |

|

| |

| |

| |

| |

| |

| |

| |

|

| |

|

|

| | • | | Expected amortization of existing intangibles for 2004: 1Q04 $0.05; 2Q04 $0.05; 3Q04 $0.05; 4Q04 $0.04; calculated using average diluted shares outstanding of 1,332 million |

(See Appendix, page 18 for further detail)

Page-2

Wachovia 4Q03 Quarterly Earnings Report

Summary Results

Earnings Summary

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions, except per share data)

| | Fourth Quarter

| | | Third Quarter

| | Second Quarter

| | | First Quarter

| | Fourth Quarter

| | |

Net interest income (Tax-equivalent) | | $ | 2,942 | | | 2,717 | | 2,603 | | | 2,601 | | 2,555 | | 8 | % | | 15 | |

Fee and other income | | | 2,591 | | | 2,603 | | 2,145 | | | 2,055 | | 1,952 | | — | | | 33 | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Total revenue (Tax-equivalent) | | | 5,533 | | | 5,320 | | 4,748 | | | 4,656 | | 4,507 | | 4 | | | 23 | |

Provision for loan losses | | | 86 | | | 81 | | 195 | | | 224 | | 308 | | 6 | | | (72 | ) |

Other noninterest expense | | | 3,498 | | | 3,282 | | 2,761 | | | 2,690 | | 2,745 | | 7 | | | 27 | |

Merger-related and restructuring expenses | | | 135 | | | 148 | | 96 | | | 64 | | 145 | | (9 | ) | | (7 | ) |

Other intangible amortization | | | 120 | | | 127 | | 131 | | | 140 | | 147 | | (6 | ) | | (18 | ) |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Total noninterest expense | | | 3,753 | | | 3,557 | | 2,988 | | | 2,894 | | 3,037 | | 6 | | | 24 | |

Minority interest in income of consolidated subsidiaries | | | 63 | | | 55 | | 16 | | | 9 | | 5 | | 15 | | | — | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Income before income taxes and cumulative effect of a change in accounting principle (Tax-equivalent) | | | 1,631 | | | 1,627 | | 1,549 | | | 1,529 | | 1,157 | | — | | | 41 | |

Income taxes (Tax-equivalent) | | | 531 | | | 539 | | 517 | | | 502 | | 262 | | (1 | ) | | — | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Income before cumulative effect of a change in accounting principle | | | 1,100 | | | 1,088 | | 1,032 | | | 1,027 | | 895 | | 1 | | | 23 | |

Cumulative effect of a change in accounting principle | | | — | | | 17 | | — | | | — | | — | | — | | | — | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Net income | | $ | 1,100 | | | 1,105 | | 1,032 | | | 1,027 | | 895 | | — | % | | 23 | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Diluted earnings per common share | | $ | 0.83 | | | 0.83 | | 0.77 | | | 0.76 | | 0.66 | | — | % | | 26 | |

Dividend payout ratio on common shares | | | 42.17 | % | | 42.17 | | 37.66 | | | 34.21 | | 39.39 | | — | | | — | |

Return on average common stockholders' equity | | | 13.59 | | | 13.71 | | 12.78 | | | 12.94 | | 11.07 | | — | | | — | |

Return on average assets | | | 1.12 | | | 1.16 | | 1.21 | | | 1.23 | | 1.08 | | — | | | — | |

Overhead efficiency ratio (Tax-equivalent) | | | 67.82 | % | | 66.87 | | 62.92 | | | 62.16 | | 67.40 | | — | | | — | |

Operating leverage (Tax-equivalent) | | $ | 18 | | | 2 | | (1 | ) | | 293 | | 3 | | — | % | | — | |

| | |

|

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Key Points

| | • | | Net interest income increased 8% to $2.9 billion, reflecting continued growth in low-cost core deposits, and earning assets as well as the funding benefit associated with the introduction of the FDIC-Insured money market sweep product |

| | • | | Fee and other income remained relatively stable as improvement in capital markets-related fees were largely offset by a $117 million decline in net securitization income and securities losses |

| | • | | Provision expense increased 6% from 3Q03 levels and included $24 million related to the sale or transfer to held for sale of loans |

| | Reflects | | a release of reserves totaling $94 million vs. $51 million in 3Q03 |

| | • | | Other noninterest expense up 7%, excluding net merger-related and restructuring expenses and intangible amortization |

| | Includes | | $23 million of non-recurring personnel costs, a $25 million increase in corporate contributions, $19 million in legal costs, a $14 million write-down of a lease on real estate, and non-merger severance costs totaling $13 million |

(See Appendix, pages 18-21 for further detail)

MINORITY INTEREST IN PRE-TAX INCOME OF CONSOLIDATED ENTITIES IS ACCOUNTED FOR AS AN EXPENSE ON OUR INCOME STATEMENT. BEGINNING IN THE THIRD QUARTER 2003, MINORITY INTEREST INCLUDES THE EXPENSE REPRESENTED BY PRUDENTIAL FINANCIAL, INC.’S 38% OWNERSHIP INTEREST IN WACHOVIA SECURITIES FINANCIAL HOLDINGS, LLC (WSFH) CREATED ON JULY 1, 2003, IN ADDITION TO THE EXPENSE ASSOCIATED WITH OTHER MINORITY INTERESTS IN OUR CONSOLIDATED SUBSIDIARIES.

IN ADDITION, THESE RESULTS FOR ALL PERIODS PRESENTED REFLECT MINORITY INTEREST EXPENSE ASSOCIATED WITH OTHER CONSOLIDATED SUBSIDIARIES INCLUDING BUT NOT LIMITED TO WACHOVIA PREFERRED FUNDING CORP., OUR REAL ESTATE INVESTMENT TRUST SUBSIDIARY.

THIS GAAP BASIS MINORITY INTEREST EXPENSE IS NOT ACCOUNTED FOR IN THE SAME MANNER IN THE FINANCIAL STATEMENTS OF PRUDENTIAL FINANCIAL, INC. UNDER PURCHASE ACCOUNTING, EACH ENTITY CONTRIBUTING BUSINESSES TO WSFH RECORDS FAIR VALUE ADJUSTMENTS TO THE ASSETS AND LIABILITIES CONTRIBUTED BY THE OTHER ENTITY. THEREFORE, THE AMOUNT REFLECTED HEREIN SHOULD NOT BE USED TO FORECAST THE IMPACT OF PRUDENTIAL FINANCIAL’S MINORITY INTEREST IN WSFH ON ITS RESULTS.

Page-3

Wachovia 4Q03 Quarterly Earnings Report

Other Financial Measures

Performance Highlights

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(Dollars in millions, except per share data)

| | Fourth Quarter

| | | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Earnings excluding merger-related and restructuring expenses, and cumulative effect of change in accounting principle(a)(b) | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,175 | | | 1,171 | | 1,092 | | 1,067 | | 987 | | — | % | | 19 | |

Return on average assets | | | 1.20 | % | | 1.23 | | 1.28 | | 1.28 | | 1.19 | | — | | | — | |

Return on average common stockholders' equity | | | 14.42 | | | 14.46 | | 13.49 | | 13.45 | | 12.13 | | — | | | — | |

Overhead efficiency ratio (Tax-equivalent) | | | 65.37 | | | 64.10 | | 60.91 | | 60.78 | | 64.19 | | — | | | — | |

Overhead efficiency ratio excluding brokerage (Tax-equivalent) | | | 59.99 | % | | 58.19 | | 57.98 | | 57.53 | | 61.43 | | — | | | — | |

Operating leverage (Tax-equivalent) | | $ | 6 | | | 54 | | 30 | | 213 | | 40 | | (89 | )% | | (85 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Earnings excluding merger-related and restructuring expenses, other intangible amortization and cumulative effect of a change in accounting principle(a)(b) | | | | | | | | | | | | | | | | | | |

Net income | | $ | 1,249 | | | 1,250 | | 1,173 | | 1,155 | | 1,070 | | — | % | | 17 | |

Dividend payout ratio on common shares | | | 37.23 | % | | 37.63 | | 33.33 | | 30.23 | | 33.33 | | — | | | — | |

Return on average tangible assets | | | 1.32 | | | 1.36 | | 1.43 | | 1.44 | | 1.34 | | — | | | — | |

Return on average tangible common stockholders' equity | | | 24.86 | | | 24.97 | | 23.32 | | 23.71 | | 21.52 | | — | | | — | |

Overhead efficiency ratio (Tax-equivalent) | | | 63.20 | | | 61.70 | | 58.15 | | 57.78 | | 60.92 | | — | | | — | |

Overhead efficiency ratio excluding brokerage (Tax-equivalent) | | | 57.29 | % | | 55.20 | | 54.85 | | 54.18 | | 57.76 | | — | | | — | |

Operating leverage (Tax-equivalent) | | $ | (1 | ) | | 50 | | 21 | | 205 | | 34 | | — | % | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Other financial data | | | | | | | | | | | | | | | | | | |

Net interest margin | | | 3.64 | % | | 3.57 | | 3.81 | | 3.90 | | 3.90 | | — | | | — | |

Fee and other income as % of total revenue | | | 46.83 | | | 48.93 | | 45.18 | | 44.14 | | 43.30 | | — | | | — | |

Effective income tax rate | | | 29.76 | | | 30.41 | | 30.54 | | 29.94 | | 18.39 | | — | | | — | |

Tax rate (Tax-equivalent) (c) | | | 32.57 | % | | 33.10 | | 33.37 | | 32.86 | | 22.50 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Asset quality | | | | | | | | | | | | | | | | | | |

Allowance as % of loans, net | | | 1.51 | % | | 1.59 | | 1.66 | | 1.67 | | 1.72 | | — | | | — | |

Allowance as % of nonperforming assets | | | 219 | | | 175 | | 166 | | 158 | | 161 | | — | | | — | |

Net charge-offs as % of average loans, net | | | 0.39 | | | 0.33 | | 0.43 | | 0.49 | | 0.52 | | — | | | — | |

Nonperforming assets as % of loans, net, foreclosed properties and loans held for sale | | | 0.69 | % | | 0.95 | | 1.04 | | 1.08 | | 1.11 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Capital adequacy | | | | | | | | | | | | | | | | | | |

Tier 1 capital ratio (d) | | | 8.52 | % | | 8.67 | | 8.33 | | 8.27 | | 8.22 | | — | | | — | |

Tangible capital ratio | | | 5.13 | | | 5.41 | | 5.75 | | 5.94 | | 5.96 | | — | | | — | |

Leverage ratio | | | 6.36 | % | | 6.56 | | 6.78 | | 6.71 | | 6.77 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Other | | | | | | | | | | | | | | | | | | |

Average diluted common shares | | | 1,332 | | | 1,338 | | 1,346 | | 1,346 | | 1,360 | | — | % | | (2 | ) |

Actual common shares | | | 1,312 | | | 1,328 | | 1,332 | | 1,345 | | 1,357 | | (1 | ) | | (3 | ) |

Dividends paid per common share | | $ | 0.35 | | | 0.35 | | 0.29 | | 0.26 | | 0.26 | | — | | | 35 | |

Dividends paid per preferred share | | | — | | | — | | 0.01 | | 0.04 | | 0.04 | | — | | | — | |

Book value per common share | | | 24.63 | | | 24.71 | | 24.37 | | 23.99 | | 23.63 | | — | | | 4 | |

Common stock price | | | 46.59 | | | 41.19 | | 39.96 | | 34.07 | | 36.44 | | 13 | | | 28 | |

Market capitalization | | $ | 61,139 | | | 54,701 | | 53,228 | | 45,828 | | 49,461 | | 12 | | | 24 | |

Common stock price to book | | | 189 | % | | 167 | | 164 | | 142 | | 154 | | — | | | — | |

FTE employees | | | 86,670 | | | 87,550 | | 81,316 | | 81,152 | | 80,778 | | (1 | ) | | 7 | |

Total financial centers/brokerage offices | | | 3,360 | | | 3,399 | | 3,176 | | 3,251 | | 3,280 | | (1 | ) | | 2 | |

ATMs | | | 4,408 | | | 4,420 | | 4,479 | | 4,539 | | 4,560 | | — | % | | (3 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | | See tables on page 2, and on pages 40 through 42 for reconciliation to earnings prepared in accordance with GAAP. |

| (b) | | See page 3 for the most directly comparable GAAP financial measure and pages 40 through 42 for reconciliation to earnings prepared in accordance with GAAP. |

| (c) | | The tax-equivalent tax rate applies to fully tax-equivalized revenues. |

| (d) | | The fourth quarter of 2003 is based on estimates. |

Key Points

| | • | | Cash overhead efficiency ratio of 63.20%; excluding our large retail brokerage operation, ratio would have been 57.29%; increase due to non-recurring expenses/discretionary spending |

| | • | | Net interest margin increased 7 bps to 3.64% reflecting reduced premium amortization on mortgage-backed securities, unusually high loan fees and the funding benefit associated with our FDIC money market sweep product |

| | • | | Tax rate lower due to 4Q effect of affordable housing tax credits |

| | • | | Allowance to NPAs of 219% at a five-year high |

| | • | | Tier 1 capital ratio declined 15 bps to 8.52%, 8 bps due to growth in the securities portfolio; leverage ratio declined 20 bps to 6.36% |

| | • | | Average diluted shares down 6 million reflecting repurchase of 14 million shares at an average cost of $45.36 per share and 4.9 million shares through settlement of equity collar contracts at an average cost of $34.95 per share |

(See Appendix, pages 19-21 for further detail)

Page-4

Wachovia 4Q03 Quarterly Earnings Report

Loan and Deposit Growth

Average Balance Sheet Data

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Assets | | | | | | | | | | | | | | | | | |

Trading assets | | $ | 20,038 | | 18,941 | | 18,254 | | 16,298 | | 14,683 | | 6 | % | | 36 | |

Securities | | | 94,584 | | 78,436 | | 68,994 | | 72,116 | | 71,249 | | 21 | | | 33 | |

Commercial loans, net | | | | | | | | | | | | | | | | | |

General Bank | | | 50,095 | | 49,722 | | 49,793 | | 49,088 | | 48,870 | | 1 | | | 3 | |

Corporate and Investment Bank | | | 31,142 | | 32,138 | | 34,601 | | 36,096 | | 38,664 | | (3 | ) | | (19 | ) |

Other | | | 9,391 | | 9,052 | | 8,070 | | 7,855 | | 7,530 | | 4 | | | 25 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total commercial loans, net | | | 90,628 | | 90,912 | | 92,464 | | 93,039 | | 95,064 | | — | | | (5 | ) |

Consumer loans, net | | | 68,972 | | 67,082 | | 65,271 | | 64,925 | | 58,215 | | 3 | | | 18 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total loans, net | | | 159,600 | | 157,994 | | 157,735 | | 157,964 | | 153,279 | | 1 | | | 4 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Other earning assets (a) | | | 48,052 | | 48,132 | | 28,892 | | 22,217 | | 21,892 | | — | | | — | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total earning assets | | | 322,274 | | 303,503 | | 273,875 | | 268,595 | | 261,103 | | 6 | | | 23 | |

Cash | | | 10,728 | | 11,092 | | 10,845 | | 10,887 | | 10,636 | | (3 | ) | | 1 | |

Other assets | | | 55,810 | | 62,111 | | 56,998 | | 57,799 | | 58,221 | | (10 | ) | | (4 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total assets | | $ | 388,812 | | 376,706 | | 341,718 | | 337,281 | | 329,960 | | 3 | % | | 18 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Liabilities and Stockholders' Equity | | | | | | | | | | | | | | | | | |

Core interest-bearing deposits | | | 148,413 | | 140,960 | | 136,828 | | 131,545 | | 130,220 | | 5 | | | 14 | |

Foreign and other time deposits | | | 18,168 | | 14,680 | | 14,383 | | 15,960 | | 16,704 | | 24 | | | 9 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total interest-bearing deposits | | | 166,581 | | 155,640 | | 151,211 | | 147,505 | | 146,924 | | 7 | | | 13 | |

Short-term borrowings | | | 81,569 | | 74,323 | | 52,049 | | 50,055 | | 43,921 | | 10 | | | 86 | |

Long-term debt | | | 35,855 | | 36,388 | | 35,751 | | 38,744 | | 38,758 | | (1 | ) | | (7 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total interest-bearing liabilities | | | 284,005 | | 266,351 | | 239,011 | | 236,304 | | 229,603 | | 7 | | | 24 | |

Noninterest-bearing deposits | | | 45,696 | | 44,755 | | 42,589 | | 41,443 | | 40,518 | | 2 | | | 13 | |

Other liabilities | | | 26,988 | | 33,615 | | 27,756 | | 27,482 | | 27,893 | | (20 | ) | | (3 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total liabilities | | | 356,689 | | 344,721 | | 309,356 | | 305,229 | | 298,014 | | 3 | | | 20 | |

Stockholders' equity | | | 32,123 | | 31,985 | | 32,362 | | 32,052 | | 31,946 | | — | | | 1 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total liabilities and stockholders' equity | | $ | 388,812 | | 376,706 | | 341,718 | | 337,281 | | 329,960 | | 3 | % | | 18 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

(a) Includes loans held for sale, interest-bearing bank balances, federal funds sold and securities purchased under resale agreements. |

| | | | | | | |

Memoranda | | | | | | | | | | | | | | | | | |

Low-cost core deposits | | $ | 154,176 | | 145,558 | | 137,366 | | 128,936 | | 124,269 | | 6 | % | | 24 | |

Other core deposits | | | 39,933 | | 40,157 | | 42,051 | | 44,052 | | 46,469 | | (1 | ) | | (14 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total core deposits | | $ | 194,109 | | 185,715 | | 179,417 | | 172,988 | | 170,738 | | 5 | % | | 14 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Key Points

| | • | | Average securities increased substantially, as planned, up 21% or $16.1 billion largely associated with our FDIC-Insured money market sweep product for brokerage customers |

| | — | | Since June 30, period end securities have increased by $26.5 billion: $6 billion related to FIN 46 and the Prudential Financial retail brokerage transaction and $18 billion from investment of deposit growth, including $11.8 billion from our FDIC-Insured sweep product for brokerage customers |

| | • | | Consumer loans grew 3% reflecting continued growth in home equity balances and student loans |

| | • | | Low-cost core deposits up 6% linked-quarter and 24% from 4Q02 levels, including an average $5.4 billion associated with the FDIC-Insured money market sweep product; total core deposits increased 5% from 3Q03 and 14% from 4Q02 levels |

(See Appendix, pages 18-19 for further detail)

Page-5

Wachovia 4Q03 Quarterly Earnings Report

Fee and Other Income

Fee and Other Income

| | | 2003

| | | 2002

| | | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | | Second Quarter

| | | First Quarter

| | | Fourth Quarter

| | | |

Service charges | | $ | 436 | | | 439 | | | 426 | | | 430 | | | 421 | | | (1 | )% | | 4 | |

Other banking fees | | | 241 | | | 257 | | | 248 | | | 233 | | | 236 | | | (6 | ) | | 2 | |

Commissions | | | 752 | | | 732 | | | 459 | | | 412 | | | 454 | | | 3 | | | 66 | |

Fiduciary and asset management fees | | | 667 | | | 657 | | | 470 | | | 464 | | | 447 | | | 2 | | | 49 | |

Advisory, underwriting and other investment banking fees | | | 231 | | | 216 | | | 220 | | | 145 | | | 190 | | | 7 | | | 22 | |

Trading account profits (losses) | | | 5 | | | (46 | ) | | 49 | | | 77 | | | (69 | ) | | — | | | — | |

Principal investing | | | (13 | ) | | (25 | ) | | (57 | ) | | (44 | ) | | (105 | ) | | 48 | | | 88 | |

Securities gains (losses) | | | (24 | ) | | 22 | | | 10 | | | 37 | | | 46 | | | — | | | — | |

Other income | | | 296 | | | 351 | | | 320 | | | 301 | | | 332 | | | (16 | ) | | (11 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total fee and other income | | $ | 2,591 | | | 2,603 | | | 2,145 | | | 2,055 | | | 1,952 | | | — | % | | 33 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Key Points

| | • | | Fee and other income was relatively flat, largely reflecting a $117 million decline in net securitization revenue and securities gains/losses |

| | • | | Other banking fees were down $16 million driven by lower mortgage origination income and seasonally lower international trade finance revenue |

| | • | | Commissions increased 3% on continued growth in both insurance and retail brokerage commissions |

| | • | | Fiduciary and asset management fees up $10 million or 2% due to improvement in the equity markets |

| | • | | Advisory, underwriting and other investment banking fees grew 7% driven by strong M&A, loan syndications and structured products results |

| | • | | Trading account results improved $51 million linked quarter to $5 million driven by equity-linked and fixed income results |

| | — | | Trading results reclassified in prior quarters, reflecting a change in our presentation of certain trading derivatives, which had the effect of shifting expense from net interest income to trading |

| | • | | Other income declined 16% reflecting a $71 million decline in securitization income |

(See Appendix, pages 20-21 for further detail)

Page-6

Wachovia 4Q03 Quarterly Earnings Report

Noninterest Expense

Noninterest Expense

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

| | | | | | | |

Salaries and employee benefits | | $ | 2,152 | | 2,109 | | 1,748 | | 1,699 | | 1,681 | | 2 | % | | 28 | |

Occupancy | | | 244 | | 220 | | 190 | | 197 | | 202 | | 11 | | | 21 | |

Equipment | | | 285 | | 264 | | 238 | | 234 | | 255 | | 8 | | | 12 | |

Advertising | | | 56 | | 38 | | 34 | | 32 | | 16 | | 47 | | | — | |

Communications and supplies | | | 153 | | 156 | | 136 | | 141 | | 143 | | (2 | ) | | 7 | |

Professional and consulting fees | | | 145 | | 109 | | 104 | | 99 | | 126 | | 33 | | | 15 | |

Sundry expense | | | 463 | | 386 | | 311 | | 288 | | 322 | | 20 | | | 44 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Other noninterest expense | | | 3,498 | | 3,282 | | 2,761 | | 2,690 | | 2,745 | | 7 | | | 27 | |

Merger-related and restructuring expenses | | | 135 | | 148 | | 96 | | 64 | | 145 | | (9 | ) | | (7 | ) |

Other intangible amortization | | | 120 | | 127 | | 131 | | 140 | | 147 | | (6 | ) | | (18 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total noninterest expense | | $ | 3,753 | | 3,557 | | 2,988 | | 2,894 | | 3,037 | | 6 | % | | 24 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Key Points

| | • | | Other noninterest expense increased 7% from 3Q03 levels driven by several discretionary items described below |

| | • | | Salaries and employee benefits increased 2%; reflects $23 million of non-recurring costs to restructure an employee benefit program due to a tax law change, $13 million of non-merger severance costs, and continued strategic hiring initiatives |

| | • | | Occupancy grew 11% largely reflecting a $14 million non-recurring expense associated with a write-off of a lease |

| | • | | Advertising costs rose 47% to $56 million reflecting continued investment in our brand; included $13 million increase relating to our retail brokerage operations |

| | • | | Professional and consulting fees rose $36 million reflecting higher seasonal billings |

| | • | | Sundry expense increased due largely to increased corporate contributions, travel expenses, loan costs and legal costs |

(See Appendix, page 21 for further detail)

Page-7

Wachovia 4Q03 Quarterly Earnings Report

Consolidated Results—Segment Summary

Wachovia Corporation

Performance Summary

| | | Three Months Ended December 31, 2003

|

(In millions)

| | General

Bank

| | | Capital

Management

| | Wealth

Management

| | Corporate and

Investment Bank

| | | Parent

| | Merger-Related

and Restructuring

Expenses

| | | Total

Corporation

|

Income statement data | | | | | | | | | | | | | | | | | | |

Total revenue (Tax-equivalent) | | $ | 2,441 | | | 1,392 | | 255 | | 1,184 | | | 261 | | — | | | 5,533 |

Noninterest expense | | | 1,409 | | | 1,180 | | 184 | | 648 | | | 197 | | 135 | | | 3,753 |

Minority interest | | | — | | | — | | — | | — | | | 78 | | (15 | ) | | 63 |

Segment earnings | | $ | 564 | | | 136 | | 45 | | 314 | | �� | 116 | | (75 | ) | | 1,100 |

| | |

|

|

| |

| |

| |

|

| |

| |

|

| |

|

Performance and other data | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 424 | | | 100 | | 28 | | 161 | | | 65 | | — | | | 778 |

Risk adjusted return on capital (RAROC) | | | 41.63 | % | | 41.61 | | 39.17 | | 23.18 | | | 23.57 | | — | | | 32.30 |

Economic capital, average | | $ | 5,482 | | | 1,295 | | 403 | | 5,243 | | | 2,079 | | — | | | 14,502 |

Cash overhead efficiency | | | | | | | | | | | | | | | | | | |

ratio (Tax-equivalent) | | | 57.70 | % | | 84.65 | | 72.21 | | 54.76 | | | 29.35 | | — | | | 63.20 |

FTE employees | | | 34,896 | | | 19,769 | | 3,815 | | 4,319 | | | 23,871 | | — | | | 86,670 |

| | |

|

|

| |

| |

| |

|

| |

| |

|

| |

|

Business mix/Economic capital | | | | | | | | | | | | | | | | | | |

Based on total revenue | | | 44.12 | % | | 25.16 | | 4.61 | | 21.40 | | | | | | | | |

Based on segment earnings | | | 48.00 | | | 11.57 | | 3.83 | | 26.72 | | | | | | | | |

Average economic capital change (4q03 vs. 4q02) | | | (3.00 | )% | | 94.00 | | 7.00 | | (21.00 | ) | | | | | | | |

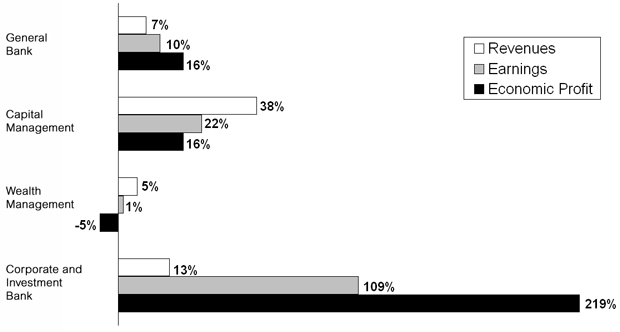

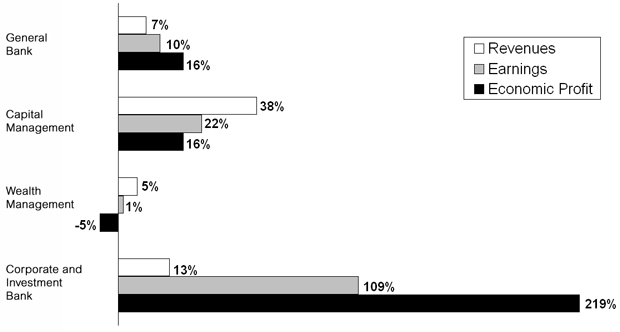

Full Year 2003 vs. 2002 Growth

Page-8

Wachovia 4Q03 Quarterly Earnings Report

General Bank

This segment includes Retail and Small Business and Commercial.

General Bank

Performance Summary

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Income statement data | | | | | | | | | | | | | | | | | | |

Net interest income (Tax-equivalent) | | $ | 1,881 | | | 1,886 | | 1,811 | | 1,741 | | 1,764 | | — | % | | 7 | |

Fee and other income | | | 509 | | | 568 | | 581 | | 562 | | 569 | | (10 | ) | | (11 | ) |

Intersegment revenue | | | 51 | | | 48 | | 45 | | 43 | | 42 | | 6 | | | 21 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Total revenue (Tax-equivalent) | | | 2,441 | | | 2,502 | | 2,437 | | 2,346 | | 2,375 | | (2 | ) | | 3 | |

Provision for loan losses | | | 144 | | | 121 | | 99 | | 105 | | 144 | | 19 | | | — | |

Noninterest expense | | | 1,409 | | | 1,340 | | 1,324 | | 1,297 | | 1,341 | | 5 | | | 5 | |

Income taxes (Tax-equivalent) | | | 324 | | | 379 | | 371 | | 344 | | 324 | | (15 | ) | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Segment earnings | | $ | 564 | | | 662 | | 643 | | 600 | | 566 | | (15 | )% | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 424 | | | 495 | | 463 | | 429 | | 411 | | (14 | )% | | 3 | |

Risk adjusted return on capital (RAROC) | | | 41.63 | % | | 45.84 | | 43.75 | | 42.25 | | 39.89 | | — | | | — | |

Economic capital, average | | $ | 5,482 | | | 5,639 | | 5,668 | | 5,571 | | 5,641 | | (3 | ) | | (3 | ) |

Cash overhead efficiency ratio (Tax-equivalent) | | | 57.70 | % | | 53.55 | | 54.35 | | 55.28 | | 56.45 | | — | | | — | |

Lending commitments | | $ | 65,457 | | | 63,509 | | 63,712 | | 59,557 | | 57,358 | | 3 | | | 14 | |

Average loans, net | | | 115,949 | | | 114,226 | | 112,941 | | 110,798 | | 106,080 | | 2 | | | 9 | |

Average core deposits | | $ | 157,977 | | | 155,098 | | 151,166 | | 145,496 | | 144,252 | | 2 | | | 10 | |

FTE employees | | | 34,896 | | | 35,451 | | 36,933 | | 36,634 | | 36,503 | | (2 | )% | | (4 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| | | | | | | |

| General Bank Key Metrics | | | | | | | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 4 Q 03

vs 3 Q 03

| | | 4 Q 03

vs 4 Q 02

| |

| | | Fourth

Quarter

| | | Third

Quarter

| | Second

Quarter

| | First

Quarter

| | Fourth

Quarter

| | |

Customer overall satisfaction score (a) | | | 6.57 | | | 6.55 | | 6.54 | | 6.55 | | 6.49 | | — | % | | 1 | |

New/Lost ratio | | | 1.28 | | | 1.17 | | 1.11 | | 1.02 | | 1.08 | | 9 | | | 19 | |

Online product and service enrollments (In thousands) (b) | | | 6,239 | | | 5,915 | | 5,609 | | 5,220 | | 4,841 | | 5 | | | 29 | |

Online active customers (In thousands) (b) | | | 2,144 | | | 1,991 | | 1,884 | | 1,672 | | 1,614 | | 8 | | | 33 | |

Financial centers | | | 2,565 | | | 2,580 | | 2,619 | | 2,692 | | 2,717 | | (1 | ) | | (6 | ) |

ATMs | | | 4,408 | | | 4,420 | | 4,479 | | 4,539 | | 4,560 | | — | % | | (3 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | | Gallup survey measured on a 1-7 scale; 6.4 = “best in class”. |

| (b) | | Retail and small business. |

Key Points

| | • | | Total revenue declined 2% from 3Q03 largely due to a $51 million reduction in mortgage-related revenue; revenue remained relatively stable in all businesses other than mortgage banking |

| | • | | Provision expense increased 19% |

| | — | | $21 million relating to a change in accounting methodology for charge-offs on residential real-estate secured loans which resulted in the acceleration of charge-offs |

| | — | | $15 million due to the sale/transfer to held for sale of $305 million of loans out of the portfolio |

| | • | | Expenses rose 5% largely driven by investments in advertising and branch technology |

| | • | | Average loans up 2% on growth in home equity, student loan, and commercial outstandings |

| | • | | Low-cost core deposit momentum continued with growth of 4% linked-quarter and 22% over 4Q02; core deposits grew 2% over 3Q03 |

| | • | | Customer satisfaction scores and new/lost ratio at an all-time high |

(See Appendix, pages 22-24 for further discussion of business unit results)

Page-9

Wachovia 4Q03 Quarterly Earnings Report

Capital Management

This segment includes Asset Management and Retail Brokerage Services.

Capital Management

Performance Summary

| | | 2003

| | | 2002

| | | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

|

(In millions)

| | Fourth

Quarter

| | | Third

Quarter

| | | Second

Quarter

| | | First

Quarter

| | | Fourth

Quarter

| | | |

Income statement data | | | | | | | | | | | | | | | | | | | | | |

Net interest income (Tax-equivalent) | | $ | 95 | | | 79 | | | 38 | | | 39 | | | 39 | | | 20 | % | | — |

Fee and other income | | | 1,314 | | | 1,292 | | | 800 | | | 735 | | | 751 | | | 2 | | | 75 |

Intersegment revenue | | | (17 | ) | | (17 | ) | | (16 | ) | | (19 | ) | | (18 | ) | | — | | | 6 |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Total revenue (Tax-equivalent) | | | 1,392 | | | 1,354 | | | 822 | | | 755 | | | 772 | | | 3 | | | 80 |

Provision for loan losses | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Noninterest expense | | | 1,180 | | | 1,144 | | | 662 | | | 625 | | | 622 | | | 3 | | | 90 |

Income taxes (Tax-equivalent) | | | 76 | | | 77 | | | 59 | | | 47 | | | 55 | | | (1 | ) | | 38 |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Segment earnings | | $ | 136 | | | 133 | | | 101 | | | 83 | | | 95 | | | 2 | % | | 43 |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Performance and other data | | | | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 100 | | | 97 | | | 81 | | | 65 | | | 76 | | | 3 | % | | 32 |

Risk adjusted return on capital (RAROC) | | | 41.61 | % | | 40.30 | | | 56.90 | | | 49.76 | | | 56.64 | | | — | | | — |

Economic capital, average | | $ | 1,295 | | | 1,309 | | | 710 | | | 678 | | | 667 | | | (1 | ) | | 94 |

Cash overhead efficiency ratio (Tax-equivalent) | | | 84.65 | % | | 84.53 | | | 80.69 | | | 82.67 | | | 80.54 | | | — | | | — |

Average loans, net | | $ | 162 | | | 135 | | | 140 | | | 134 | | | 131 | | | 20 | | | 24 |

Average core deposits | | $ | 7,115 | | | 1,754 | | | 1,338 | | | 1,367 | | | 1,487 | | | — | | | — |

FTE employees | | | 19,769 | | | 19,911 | | | 12,428 | | | 12,528 | | | 12,682 | | | (1 | )% | | 56 |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Capital Management Key Metrics

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

| (In millions) | | Fourth Quarter

| | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Separate account assets | | $ | 138,867 | | 127,860 | | 124,423 | | 120,331 | | 119,337 | | 9 | % | | 16 | |

Mutual fund assets | | | 109,359 | | 113,700 | | 115,414 | | 112,803 | | 113,093 | | (4 | ) | | (3 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Total assets under management (a) | | $ | 248,226 | | 241,560 | | 239,837 | | 233,134 | | 232,430 | | 3 | | | 7 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Gross fluctuating mutual fund sales | | $ | 3,892 | | 4,802 | | 6,645 | | 6,342 | | 5,479 | | (19 | ) | | (29 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Full-service financial advisors series 7 | | | 8,192 | | 8,309 | | 4,613 | | 4,714 | | 4,777 | | (1 | ) | | 71 | |

Financial center advisors series 6 | | | 3,270 | | 3,316 | | 3,331 | | 3,340 | | 3,332 | | (1 | ) | | (2 | ) |

Broker client assets | | $ | 603,100 | | 568,500 | | 282,200 | | 265,100 | | 264,800 | | 6 | | | — | |

Margin loans | | $ | 6,097 | | 5,832 | | 2,436 | | 2,394 | | 2,489 | | 5 | | | — | |

Brokerage offices (Actual) | | | 3,328 | | 3,367 | | 3,146 | | 3,221 | | 3,250 | | (1 | )% | | 2 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

(a) Includes $65 billion in assets managed for Wealth Management which are also reported in that segment.

Retail Brokerage Integration

| | | | | | |

| | | 2003

| | | | | | | | | | | |

| | | Fourth

Quarter

| | | Third

Quarter

| | | | | | | | Goal

| | | |

Merger costs (Dollars in millions) | | $ | 67 | | | 136 | | | | | | | | 1,128 | | | |

Position reductions | | | 68 | | | 12 | | | | | | | | 1,750 | | | |

Real estate square footage reduction (In millions) | | | 0.5 | | | | | | | | | | | 2.7 | | | |

Branches consolidated | | | 22 | | | | | | | | | | | 157 | | | |

Percent of system conversions completed | | | 62 | % | | | | | | | | | | 100 | % | | |

| | |

|

|

| |

| | | | | | | |

|

| | |

Key Points

| | • | | Revenue was up 3% or $38 million from 3Q03 reflecting stronger commissions and advisory-related fees |

| | • | | Expenses rose $36 million as reductions in personnel costs were more than offset by higher distribution and brand advertising costs |

| | • | | AUM rose 3% due to increase in equity assets and solid institutional sales, despite approximately $7 billion in money market outflows relating to our FDIC-Insured money market sweep product |

| | — | | Deposits up an average $5.4 billion tied to this FDIC-Insured money market sweep product |

| | • | | Broker client assets up 6% and margin loans up 5% |

| | • | | Merger integration proceeding as planned; 22 branches consolidated and rebranding completed |

(See Appendix, pages 25-27 for further discussion of business unit results)

Beginning in 3Q03, Capital Management’s Segment results include 100% of the Wachovia Securities retail brokerage transaction

Page-10

Wachovia 4Q03 Quarterly Earnings Report

Wealth Management

This segment includes Private Banking, Personal Trust, Investment Advisory Services, Charitable Services, Financial Planning, and Insurance Brokerage (property and casualty, high net worth life).

Wealth Management

Performance Summary

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Income statement data | | | | | | | | | | | | | | | | | | |

Net interest income (Tax-equivalent) | | $ | 116 | | | 114 | | 107 | | 103 | | 103 | | 2 | % | | 13 | |

Fee and other income | | | 138 | | | 132 | | 133 | | 133 | | 135 | | 5 | | | 2 | |

Intersegment revenue | | | 1 | | | 1 | | 2 | | 1 | | 1 | | — | | | — | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Total revenue (Tax-equivalent) | | | 255 | | | 247 | | 242 | | 237 | | 239 | | 3 | | | 7 | |

Provision for loan losses | | | 1 | | | 2 | | 5 | | 4 | | 6 | | (50 | ) | | (83 | ) |

Noninterest expense | | | 184 | | | 180 | | 175 | | 170 | | 172 | | 2 | | | 7 | |

Income taxes (Tax-equivalent) | | | 25 | | | 23 | | 24 | | 23 | | 22 | | 9 | | | 14 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Segment earnings | | $ | 45 | | | 42 | | 38 | | 40 | | 39 | | 7 | % | | 15 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

| | | | | | | |

Performance and other data | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 28 | | | 27 | | 25 | | 28 | | 27 | | 4 | % | | 4 | |

Risk adjusted return on capital (RAROC) | | | 39.17 | % | | 37.10 | | 37.18 | | 40.73 | | 39.82 | | — | | | — | |

Economic capital, average | | $ | 403 | | | 402 | | 391 | | 376 | | 375 | | — | | | 7 | |

Cash overhead efficiency ratio (Tax-equivalent) | | | 72.21 | % | | 72.45 | | 72.80 | | 71.62 | | 71.62 | | — | | | — | |

Lending commitments | | $ | 4,012 | | | 3,843 | | 3,678 | | 3,343 | | 3,288 | | 4 | | | 22 | |

Average loans, net | | | 10,033 | | | 9,824 | | 9,672 | | 9,422 | | 9,029 | | 2 | | | 11 | |

Average core deposits | | $ | 11,320 | | | 11,083 | | 10,817 | | 10,662 | | 10,339 | | 2 | | | 9 | |

FTE employees | | | 3,815 | | | 3,839 | | 3,921 | | 3,881 | | 3,726 | | (1 | )% | | 2 | |

Wealth Management Key Metrics(a)

| | | 2003

| | 2002

| | 4 Q 03

vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Assets under management (b) | | $ | 64,800 | | 61,700 | | 61,900 | | 59,800 | | 61,100 | | 5 | % | | 6 | |

Assets under care | | $ | 29,100 | | 26,300 | | 27,000 | | 26,000 | | 28,600 | | 11 | | | 2 | |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

Client relationships (Actual) | | | 85,264 | | 82,300 | | 78,825 | | 77,650 | | 77,200 | | 4 | | | 10 | |

Wealth Management advisors (Actual) | | | 960 | | 993 | | 1,027 | | 1,068 | | 1,056 | | (3 | )% | | (9 | ) |

| | |

|

| |

| |

| |

| |

| |

|

| |

|

|

| (a) | | Historical periods restated to reflect subsequent consolidations of client accounts of both legacy companies, as well as transfers of assets to other business units. |

Future restatements may occur as relationships are moved to channels that best meet client needs.

| (b) | | These assets are managed by and reported in Capital Management. |

Key Points

| | • | | Total revenue increased 3% from 3Q03 and 7% from 4Q02 driven by strength in private banking and improving asset values |

| | • | | Fee and other income rose 5% from 3Q03 and 2% from 4Q02 driven by growth in insurance commissions as well as trust and investment management fees |

| | • | | Average loans up 2% and average core deposits up 2%, reflecting continued private banking momentum |

| | • | | AUM increased 5% from 3Q03 and 6% from 4Q02 largely attributable to higher market valuations and continued sales momentum |

(See Appendix, page 28 for further discussion of business unit results)

Page-11

Wachovia 4Q03 Quarterly Earnings Report

Corporate and Investment Bank

This segment includes Corporate Lending, Investment Banking, Global Treasury and Trade Finance, and Principal Investing.

Corporate and Investment Bank

Performance Summary

| | | 2003

| | | 2002

| | | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | | Second Quarter

| | | First Quarter

| | | Fourth Quarter

| | | |

Income statement data | | | | | | | | | | | | | | | | | | | | | | |

Net interest income (Tax-equivalent) | | $ | 598 | | | 578 | | | 572 | | | 588 | | | 616 | | | 3 | % | | (3 | ) |

Fee and other income | | | 622 | | | 541 | | | 557 | | | 548 | | | 348 | | | 15 | | | 79 | |

Intersegment revenue | | | (36 | ) | | (31 | ) | | (29 | ) | | (26 | ) | | (25 | ) | | (16 | ) | | (44 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total revenue (Tax-equivalent) | | | 1,184 | | | 1,088 | | | 1,100 | | | 1,110 | | | 939 | | | 9 | | | 26 | |

Provision for loan losses | | | 35 | | | 10 | | | 95 | | | 110 | | | 161 | | | — | | | (78 | ) |

Noninterest expense | | | 648 | | | 578 | | | 566 | | | 556 | | | 537 | | | 12 | | | 21 | |

Income taxes (Tax-equivalent) | | | 187 | | | 186 | | | 163 | | | 165 | | | 91 | | | 1 | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Segment earnings | | $ | 314 | | | 314 | | | 276 | | | 279 | | | 150 | | | — | % | | 109 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Performance and other data | | | | | | | | | | | | | | | | | | | | | | |

Economic profit | | $ | 161 | | | 140 | | | 128 | | | 126 | | | 14 | | | 15 | % | | — | |

Risk adjusted return on capital (RAROC) | | | 23.18 | % | | 21.19 | | | 19.50 | | | 19.04 | | | 11.80 | | | — | | | — | |

Economic capital, average | | $ | 5,243 | | | 5,437 | | | 6,039 | | | 6,367 | | | 6,602 | | | (4 | ) | | (21 | ) |

Cash overhead efficiency ratio (Tax-equivalent) | | | 54.76 | % | | 53.18 | | | 51.41 | | | 50.12 | | | 57.18 | | | — | | | — | |

Lending commitments | | $ | 69,745 | | | 69,481 | | | 72,275 | | | 75,278 | | | 78,332 | | | — | | | (11 | ) |

Average loans, net | | | 31,149 | | | 32,145 | | | 34,608 | | | 36,104 | | | 38,673 | | | (3 | ) | | (19 | ) |

Average core deposits | | $ | 16,485 | | | 16,472 | | | 14,815 | | | 14,120 | | | 13,491 | | | — | | | 22 | |

FTE employees | | | 4,319 | | | 4,305 | | | 4,309 | | | 4,157 | | | 4,203 | | | — | % | | 3 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Key Points

| | • | | Record revenue of $1.2 billion increased 9% on improved equity-linked products and fixed income trading results, M&A deal flow, and growth in Loan Syndications and Real Estate Capital Markets revenue |

| | • | | Provision expense of $35 million increased $25 million on increased net charge-offs and lower recoveries; included $9 million related to the sale/transfer to held for sale of $420 million of exposure |

| | • | | Expenses rose 12% on higher personnel costs, primarily increased incentive expense, and transaction costs; included $21 million of costs associated with the write-off of a lease on real estate and severance |

| | • | | Average loans decreased 3% on continued reductions in credit facility usage and $247 million of loans outstanding that were sold or transferred to held for sale ($158 million sold and $89 million transferred) |

| | • | | Total capital declined 4% on continued strength in credit quality and lower loan outstandings |

(See Appendix, pages 29-32 for further discussion of business unit results)

Page-12

Wachovia 4Q03 Quarterly Earnings Report

Asset Quality

Asset Quality

| | | 2003

| | | 2002

| | | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | | Second

Quarter

| | | First Quarter

| | | Fourth

Quarter

| | | |

Nonperforming assets | | | | | | | | | | | | | | | | | | | | | | |

Nonaccrual loans | | $ | 1,035 | | | 1,391 | | | 1,501 | | | 1,622 | | | 1,585 | | | (26 | )% | | (35 | ) |

Foreclosed properties | | | 111 | | | 116 | | | 130 | | | 118 | | | 150 | | | (4 | ) | | (26 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total nonperforming assets | | $ | 1,146 | | | 1,507 | | | 1,631 | | | 1,740 | | | 1,735 | | | (24 | )% | | (34 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

as % of loans, net and foreclosed properties | | | 0.69 | % | | 0.91 | | | 1.00 | | | 1.06 | | | 1.06 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Nonperforming assets in loans held for sale | | $ | 82 | | | 160 | | | 167 | | | 114 | | | 138 | | | (49 | )% | | (41 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Total nonperforming assets in loans and in loans held for sale | | $ | 1,228 | | | 1,667 | | | 1,798 | | | 1,854 | | | 1,873 | | | (26 | )% | | (34 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

as % of loans, net, foreclosed properties and loans in other assets as held for sale | | | 0.69 | % | | 0.95 | | | 1.04 | | | 1.08 | | | 1.11 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Allowance for loan losses | | | | | | | | | | | | | | | | | | | | | | |

Balance, beginning of period | | $ | 2,631 | | | 2,704 | | | 2,747 | | | 2,798 | | | 2,847 | | | (3 | )% | | (8 | ) |

Net charge-offs | | | (156 | ) | | (132 | ) | | (169 | ) | | (195 | ) | | (199 | ) | | 18 | | | (22 | ) |

Allowance relating to loans transferred or sold | | | (57 | ) | | (22 | ) | | (69 | ) | | (80 | ) | | (158 | ) | | — | | | (64 | ) |

Provision for loan losses related to loans transferred or sold | | | 24 | | | — | | | 26 | | | 25 | | | 109 | | | — | | | — | |

Provision for loan losses | | | 62 | | | 81 | | | 169 | | | 199 | | | 199 | | | (23 | ) | | (69 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Balance, end of period | | $ | 2,504 | | | 2,631 | | | 2,704 | | | 2,747 | | | 2,798 | | | (5 | )% | | (11 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

as % of loans, net | | | 1.51 | % | | 1.59 | | | 1.66 | | | 1.67 | | | 1.72 | | | — | | | — | |

as % of nonaccrual and restructured loans (a) | | | 242 | | | 189 | | | 180 | | | 169 | | | 177 | | | — | | | — | |

as % of nonperforming assets (a) | | | 219 | % | | 175 | | | 166 | | | 158 | | | 161 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net charge-offs | | $ | 156 | | | 132 | | | 169 | | | 195 | | | 199 | | | 18 | % | | (22 | ) |

Commercial, as % of average commercial loans | | | 0.31 | % | | 0.21 | | | 0.42 | | | 0.53 | | | 0.53 | | | — | | | — | |

Consumer, as % of average consumer loans | | | 0.50 | % | | 0.51 | | | 0.44 | | | 0.44 | | | 0.52 | | | — | | | — | |

Total, as % of average loans, net | | | 0.39 | % | | 0.33 | | | 0.43 | | | 0.49 | | | 0.52 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Past due loans, 90 days and over, and nonaccrual loans (a) | | | | | | | | | | | | | | | | | | | | | | |

Commercial, as a % of loans, net | | | 0.87 | % | | 1.20 | | | 1.30 | | | 1.41 | | | 1.42 | | | — | | | — | |

Consumer, as a % of loans, net | | | 0.77 | % | | 0.76 | | | 0.80 | | | 0.79 | | | 0.75 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| (a) | | These ratios do not include nonperforming assets included in other assets as held for sale. |

Key Points

| | • | | Net charge-offs at 39 bps of average loans increased 18% to $156 million (3Q03 included higher than anticipated recoveries); gross charge-offs up $16 million |

| | • | | Provision expense of $86 million increased $5 million and included $24 million associated with loan sales/transfers to held for sale |

| | • | | Allowance totaled $2.5 billion, declining $127 million reflecting continued improvement in credit quality; included a $57 million reduction relating to the sale of loans or the transfer of loans to held for sale |

| | — | | Allowance to loans declined slightly to 1.51% reflecting continued overall improvement in credit quality |

| | — | | Allowance to nonperforming loans improved to 242% from 189% in 3Q03 |

| | • | | Continued proactive portfolio management actions by selling $610 million of exposure out of the loan portfolio, including $448 million of outstandings |

| | — | | Included in the sales was $583 million of commercial exposure, with $421 million outstanding ($101 million nonperforming), and $27 million of nonperforming consumer loans |

| | — | | Also transferred $100 million of commercial performing exposure, including $89 million outstanding, to held for sale |

(See Appendix, pages 34-35 for further detail)

Page-13

Wachovia 4Q03 Quarterly Earnings Report

Nonperforming Loans

Nonperforming Loans (a)

| | | 2003

| | | 2002

| | | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | | Second

Quarter

| | | First Quarter

| | | Fourth

Quarter

| | | |

Balance, beginning of period | | $ | 1,391 | | | 1,501 | | | 1,622 | | | 1,585 | | | 1,751 | | | (7 | )% | | (21 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Commercial nonaccrual loan activity | | | | | | | | | | | | | | | | | | | | | | |

Commercial nonaccrual loans, beginning of period | | | 1,148 | | | 1,249 | | | 1,371 | | | 1,374 | | | 1,577 | | | (8 | ) | | (27 | ) |

New nonaccrual loans and advances | | | 122 | | | 252 | | | 291 | | | 386 | | | 485 | | | (52 | ) | | (75 | ) |

Charge-offs | | | (109 | ) | | (93 | ) | | (135 | ) | | (152 | ) | | (148 | ) | | 17 | | | (26 | ) |

Transfers (to) from loans held for sale | | | — | | | (37 | ) | | (44 | ) | | 12 | | | (105 | ) | | — | | | — | |

Transfers (to) from other real estate owned | | | (5 | ) | | — | | | (6 | ) | | (1 | ) | | (4 | ) | | — | | | 25 | |

Sales | | | (101 | ) | | (56 | ) | | (29 | ) | | (70 | ) | | (49 | ) | | 80 | | | — | |

Other, principally payments | | | (236 | ) | | (167 | ) | | (199 | ) | | (178 | ) | | (382 | ) | | 41 | | | (38 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net commercial nonaccrual loan activity | | | (329 | ) | | (101 | ) | | (122 | ) | | (3 | ) | | (203 | ) | | — | | | 62 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Commercial nonaccrual loans, end of period | | | 819 | | | 1,148 | | | 1,249 | | | 1,371 | | | 1,374 | | | (29 | ) | | (40 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Consumer nonaccrual loan activity | | | | | | | | | | | | | | | | | | | | | | |

Consumer nonaccrual loans, beginning of period | | | 243 | | | 252 | | | 251 | | | 211 | | | 174 | | | (4 | ) | | 40 | |

New nonaccrual loans and advances | | | 13 | | | 15 | | | 22 | | | 56 | | | 55 | | | (13 | ) | | (76 | ) |

Transfers (to) from loans held for sale | | | (13 | ) | | (24 | ) | | (21 | ) | | — | | | — | | | (46 | ) | | — | |

Sales and securitizations | | | (27 | ) | | — | | | — | | | (16 | ) | | (18 | ) | | — | | | 50 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net consumer nonaccrual loan activity | | | (27 | ) | | (9 | ) | | 1 | | | 40 | | | 37 | | | — | | | — | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Consumer nonaccrual loans, end of period | | | 216 | | | 243 | | | 252 | | | 251 | | | 211 | | | (11 | ) | | 2 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Balance, end of period | | $ | 1,035 | | | 1,391 | | | 1,501 | | | 1,622 | | | 1,585 | | | (26 | )% | | (35 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| (a) | | Excludes nonperforming loans included in loans held for sale, which at December 31, September 30, June 30, and March 31, 2003, and at December 31, 2002, were $82 million, $160 million, $167 million, $108 million and $138 million, respectively. |

Key Points

| | • | | New commercial nonaccruals declined to $122 million, down 52% from 3Q03 and down 75% from 4Q02; largest inflow was $17 million |

| | • | | Sold $101 million of commercial nonperforming loans and $27 million of consumer nonperforming loans out of the loan portfolio and transferred $15 million of nonperforming consumer loans to held for sale |

| | • | | Payments and other resolutions represented approximately 21% of 4Q03 beginning commercial nonperforming loans |

(See Appendix, pages 34-35 for further detail)

Page-14

Wachovia 4Q03 Quarterly Earnings Report

Loans Held For Sale

Loans Held for Sale

| | | 2003

| | | 2002

| |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | | Second

Quarter

| | | First Quarter

| | | Fourth

Quarter

| |

Balance, beginning of period | | $ | 10,173 | | | 10,088 | | | 7,461 | | | 6,012 | | | 6,257 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

Core business activity | | | | | | | | | | | | | | | | |

Core business activity, beginning of period | | | 9,897 | | | 9,762 | | | 6,937 | | | 5,488 | | | 4,562 | |

Originations/purchases | | | 8,343 | | | 9,271 | | | 9,729 | | | 8,488 | | | 8,692 | |

Transfers to (from) loans held for sale, net | | | 8 | | | (783 | ) | | 18 | | | (49 | ) | | (52 | ) |

Lower of cost or market value adjustments | | | (8 | ) | | (7 | ) | | (6 | ) | | (46 | ) | | (13 | ) |

Performing loans sold or securitized | | | (4,484 | ) | | (7,253 | ) | | (6,171 | ) | | (6,491 | ) | | (7,419 | ) |

Nonperforming loans sold | | | (36 | ) | | (11 | ) | | — | | | — | | | — | |

Other, principally payments | | | (1,216 | ) | | (1,082 | ) | | (745 | ) | | (453 | ) | | (282 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

Core business activity, end of period | | | 12,504 | | | 9,897 | | | 9,762 | | | 6,937 | | | 5,488 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

Portfolio management activity | | | | | | | | | | | | | | | | |

Portfolio management activity, beginning of period | | | 276 | | | 326 | | | 524 | | | 524 | | | 1,695 | |

Transfers to (from) loans held for sale, net | | | | | | | | | | | | | | | | |

Performing loans | | | 29 | | | 81 | | | 83 | | | 244 | | | 245 | |

Nonperforming loans | | | 13 | | | 61 | | | 59 | | | (12 | ) | | 105 | |

Lower of cost or market value adjustments | | | 5 | | | — | | | — | | | 40 | | | (1 | ) |

Performing loans sold | | | (108 | ) | | (102 | ) | | (220 | ) | | (147 | ) | | (1,357 | ) |

Nonperforming loans sold | | | (63 | ) | | (64 | ) | | (2 | ) | | (51 | ) | | (12 | ) |

Allowance for loan losses related to loans transferred to loans held for sale | | | (17 | ) | | (18 | ) | | (44 | ) | | (55 | ) | | (122 | ) |

Other, principally payments | | | (14 | ) | | (8 | ) | | (74 | ) | | (19 | ) | | (29 | ) |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

Portfolio management activity, end of period | | | 121 | | | 276 | | | 326 | | | 524 | | | 524 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

Balance, end of period (a) | | $ | 12,625 | | | 10,173 | | | 10,088 | | | 7,461 | | | 6,012 | |

| | |

|

|

| |

|

| |

|

| |

|

| |

|

|

| (a) | | Nonperforming assets included in loans held for sale at December 31, September 30, June 30, and March 31, 2003, and at December 31, 2002, were $82 million, $160 million, $167 million, $114 million and $138 million, respectively. |

Key Points

| | • | | Core business loan origination/purchases of $8.3 billion and sales of $4.5 billion |

| | • | | Portfolio management activity included gross transfers to held for sale of $100 million of performing large corporate exposure (including $89 million of outstandings) marked to an average carrying value of 92% of par |

| | • | | Sold $108 million of performing loans and $63 million of nonperforming loans relating to portfolio management activity out of held for sale |

| | • | | 96% of the $4.2 billion of portfolio management large corporate exposure moved to held for sale since 3Q01 has been paid down or sold |

(See Appendix, pages 34-35 for further detail)

Page-15

Wachovia 4Q03 Quarterly Earnings Report

2003 in Review

2003 – Exceeded Expectations Again

| | • | | 2003 results exceeded outlook given in January 2003 |

— Revenue | | Exceeded expectations |

— Credit costs | | Exceeded expectations |

— Expenses | | In line with expectations |

| | • | | EPS up 22% from 4Q02 (before merger-related and restructuring expenses) |

| | • | | Increased dividend 54% from 4Q02 |

| | • | | Merger integration completed on time and on budget |

| | • | | Total return for 2003 of 32% ranked 10th among top 20 U.S. banks |

| | — | | Three-year total return of 83% ranked 3rd among top 20 U.S. banks |

Additional Milestones

| | • | | Customer service scores continued to improve to an all-time high |

| | — | | Recognized as a leader among our peers in customer service excellence by Gallup and Michigan Customer Satisfaction Survey |

| | • | | Employee engagement at an all-time high |

| | • | | Expanded retail brokerage platform through financially disciplined transaction |

| | • | | Net new money flows of $20.1 billion |

| | — | | Core deposit inflows of $23.4 billion |

| | — | | Annuity sales of $6.4 billion |

| | — | | Net mutual fund outflows of $9.7 billion |

| | Ÿ | | Including $7 billion moved to FDIC-insured money market sweep product |

| | • | | Tier 1 Capital grew 30 bps to 8.52% |

| | — | | Settled all forward purchase contracts and collars involving 30.9 million shares |

| | — | | Bought back 27.7 million shares in the open market |

| | — | | Reduced shares outstanding by 45 million |

| | • | | S&P and Fitch ratings outlook upgraded to positive |

Page-16

Wachovia 4Q03 Quarterly Earnings Report

2004 Full Year Outlook

(Versus Full-Year 2003 Unless Otherwise Noted and Reflects Full -Year Effect of Larger Retail Brokerage

Operation vs. 6 months in 2003)

| | | | | Economic Assumptions for Full-Year 2004 |

| | | | | Real GDP Growth | | 4.5% | | | | |

| | | | | Inflation (CPI) | | 2.0% | | | | |

| | | | | Fed Funds (DEC 2004) | | 1.91% | | | | |

| | | | | S&P 500 | | 5% | | | | |

| Total Revenue | | Expected % growth in high single-digit range | | |

| | |

Net Interest Income* | | Expected % growth in low-to- mid-single digit range | | |

| |

Net Interest Margin | | Expected to remain relatively flat excluding the impact of the following items totaling -30 BPS |

| | |

| | | Full-year effect of larger brokerage operation | | -9 bps |

| | | Securities growth—FDIC-Insured money market sweep | | -15 bps |

| | | Full year effect of FIN 46 consolidation | | | | -6 bps |

| | | |

Fee Income | | Anticipate % growth in upper teens range | | | | |

| |

| Noninterest Expense | | Expected % growth in high single-digit range; Marginally lower than % revenue growth |

| |

| Expected Loan Growth | | Expect mid- to high-single digit % growth from 4Q03 (excluding securitizations) |

| | |

| | | Consumer | | High-single digit % growth |

| | | Commercial and Industrial | | Mid-single digit % growth |

| | | Small Business | | Over 20% growth |

| | | Commercial | | Mid- single digit % growth |

| | | Large Corporate | | Flat-to-Low single digit % growth |

| | | Commercial real estate | | Low single digit % growth |

| | | |

| Charge-offs | | 30 – 40 bps of average net loans range | | | | |

| | |

| Effective Tax Rate | | Approximately 33 – 34% (tax-equivalent) | | |

| | | |

| Capital Ratios | | | | | | |

| | | |

Leverage Ratio | | Target > 6.00% | | | | |

| | | |

Tier 1 Capital | | Target > 8.30% | | | | |

| |

| Dividend Payout Ratio | | 40% – 50% of earnings (before merger-related and restructuring expenses and other intangible amortization) |

| |

| Excess Capital | | Opportunistically repurchase shares in open market; authorization for 123.4 million shares remaining |

| |

| | | Financially attractive shareholder friendly acquisitions |

* 1Q04 Net interest income anticipated to be down $50-60 million from 4Q03 levels due to the cost of interest rate hedges beginning in January 2004 (related to FDIC-Insured money market sweep balances), lower expected income from called securitizations and lower expected levels of commercial loan prepayment fees

Page-17

Wachovia 4Q03 Quarterly Earnings Report

Appendix

Table of Contents

Wachovia 4Q03 Quarterly Earnings Report

Summary Operating Results

Business segment results are presented excluding (i) net merger-related and restructuring expenses, (ii) deposit base intangible and other intangible amortization expense, and (iii) the cumulative effect of a change in accounting principle. This is the basis on which we manage and allocate capital to our business segments. We continuously assess assumptions, methodologies and reporting classifications to better reflect the true economics of our business segments. Several significant refinements have been incorporated for 2003. Business segment results have been restated for 2002 to reflect these changes. In addition, lending commitments have been restated to exclude liquidity facilities that were previously presented as lending commitments. In addition, lending commitments have been restated to exclude liquidity facilities that were previously presented as lending commitments.

In 4Q03, we reclassified interest and dividend income and expense relating to certain trading derivatives from net interest income to trading account profits (losses) for all periods presented. We did this to be consistent in our income statement presentation for all trading derivatives. This reclassification did not have an effect on our consolidated results of operations. The net effect of the reclassification was an increase in net interest income of $58 million ($32 million in the Corporate and Investment Bank and $26 in the Parent) in 4Q03 and $40 million ($19 million in CIB and $21 million in Parent) in 3Q03, with a corresponding reduction in trading account profits (losses).

In January 2003, the Financial Accounting Standards Board issued FASB Interpretation No. 46 (“FIN 46”),Consolidation of Variable Interest Entities, which addresses consolidation of variable interest entities, certain of which are also referred to as special purpose entities. In connection with the adoption of this standard, on July 1, 2003, we consolidated the multi-seller commercial paper conduits that we administer. On December 31, 2003, these conduits had $9.1 billion of assets, including $5.0 billion of securities and $4.0 billion of other earning assets, and $9.2 billion of short-term borrowings. Regulators have recently approved an interim rule stipulating that the capital requirements related to assets of conduits consolidated under FIN 46 remain unchanged until April 1, 2004. Therefore, we have not experienced a change in tier 1 capital due to the adoption of FIN 46, nor do we expect such a change prior to April 1, 2004, when the capital requirements will change.

We did not consolidate or de-consolidate any other significant variable interest entities in connection with the adoption of FIN 46; thus, the implementation did not have a material effect on our consolidated financial position or results of operations, other than as indicated above.

In December 2003, the FASB issued a revision to FIN 46 referred to as “FIN 46R”, which is effective no later than March 31, 2004. FIN 46R requires the de-consolidation of trusts associated with our trust preferred securities. Accordingly, at March 31, 2004, when we implement the provisions of FIN 46R, we will de-consolidate these trusts. This de-consolidation will not have a material effect on our consolidated financial position. Other than the de-consolidation of these trusts, we do not anticipate that the implementation of FIN 46R will have a material effect on our consolidated financial position or results of operations.

Banking regulators have indicated that the capital requirements related to trust preferred securities, if de-consolidated under FIN 46R, will remain unchanged until further notice. If the banking regulators change the capital treatment for trust preferred securities, our tier 1 capital would be reduced by the amount of outstanding trust preferred securities, but we believe regulatory capital would remain at the well-capitalized level.

On July 1, 2003, we adopted Statement of Financial Accounting Standards No. 150 (FAS 150),Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity, and recorded a $17 million after-tax gain ($25 million pre-tax) as the cumulative effect of an accounting change in 3Q03. This amount represented the fair value of our equity collar contracts at July 1, 2003. Under FAS 150, these contracts are recorded at fair value with changes in value recorded in earnings. Prior to the adoption of FAS 150, these contracts were recorded in equity upon settlement.

The equity collars are a combination of written puts and purchased calls and involved 4.9 million shares of our common stock. The change in value in 3Q03 resulted in a $5.8 million gain and $18.8 million in 4Q03. In 4Q03, we settled these contracts by purchasing 4.9 million shares of our common stock at an average price of $34.95 per share.

Page-18

Wachovia 4Q03 Quarterly Earnings Report

Net Interest Income

(See Table on Page 5)

Net Interest Income Summary

| | | 2003

| | 2002

| | 4 Q 03 vs 3 Q 03

| | | 4 Q 03 vs 4 Q 02

| |

| | | | | |

(In millions)

| | Fourth Quarter

| | | Third Quarter

| | Second Quarter

| | First Quarter

| | Fourth Quarter

| | |

Average earning assets | | $ | 322,274 | | | 303,503 | | 273,875 | | 268,595 | | 261,103 | | 6 | % | | 23 | |

Average interest-bearing liabilities | | | 284,005 | | | 266,351 | | 239,011 | | 236,304 | | 229,603 | | 7 | | | 24 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Interest income (Tax-equivalent) | | | 4,016 | | | 3,776 | | 3,759 | | 3,785 | | 3,942 | | 6 | | | 2 | |

Interest expense | | | 1,074 | | | 1,059 | | 1,156 | | 1,184 | | 1,387 | | 1 | | | (23 | ) |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|

Net interest income (Tax-equivalent) | | $ | 2,942 | | | 2,717 | | 2,603 | | 2,601 | | 2,555 | | 8 | % | | 15 | |

| | |

|

|

| |

| |

| |

| |

| |

|

| |

|

|