SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under Rule 14a-12 |

FIRST WEST VIRGINIA BANCORP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

P.O. Box 6671

Wheeling, WV 26003

NOTICE OF ANNUAL MEETING OF THE

SHAREHOLDERS OF

FIRST WEST VIRGINIA BANCORP, INC.

Wheeling, West Virginia

April 15, 2013

TO OUR SHAREHOLDERS:

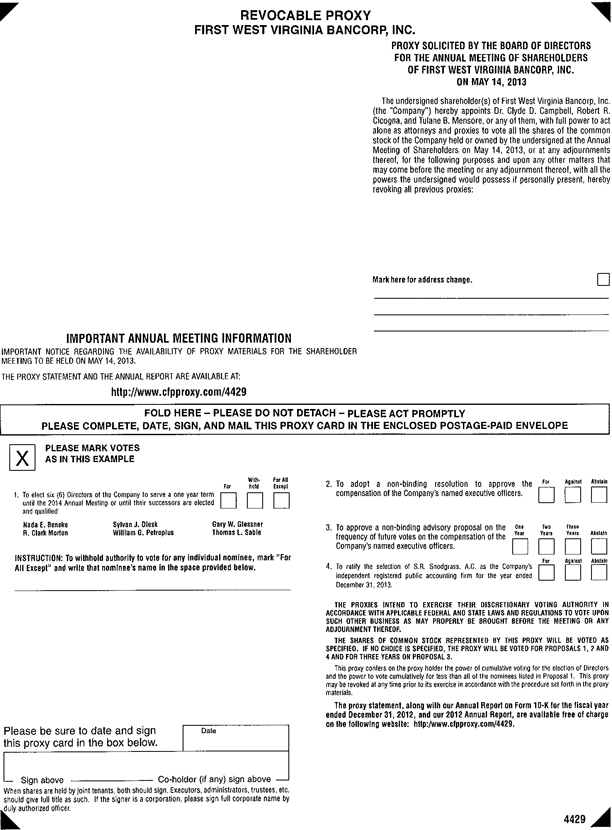

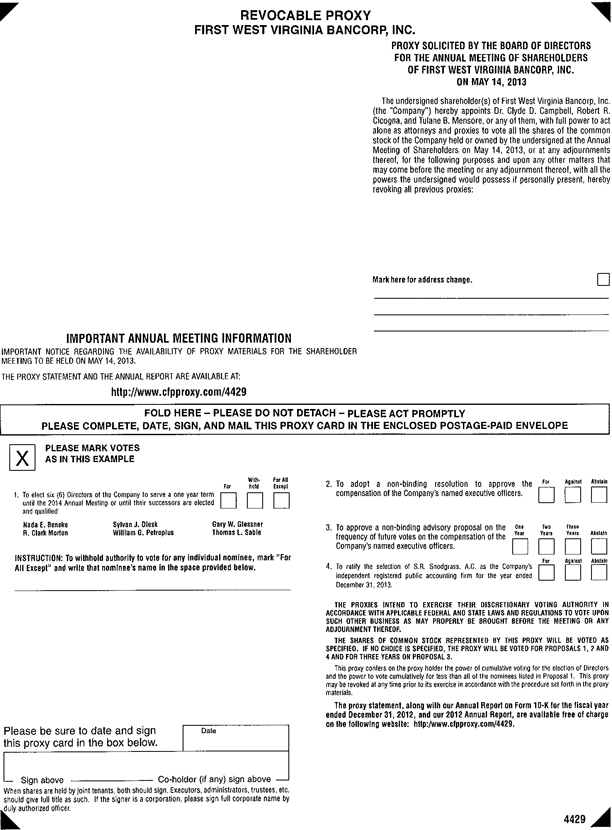

Please take notice that the Annual Meeting of Shareholders of First West Virginia Bancorp, Inc. (the “Company”), a West Virginia corporation, will be held at the Corporate Office of Progressive Bank, N.A., 590 National Road, Wheeling, West Virginia, at 4:00 p.m., on May 14, 2013. The close of business on March 25, 2013 has been fixed as the record date for the determination of shareholders entitled to vote at the Annual Meeting of Shareholders.

While the Board of Directors sincerely hopes that all of you will attend the meeting, we nevertheless urge you to COMPLETE, DATE, SIGN AND RETURN THE PROXY CARD, ENCLOSED, AS SOON AS POSSIBLE. A self-addressed stamped envelope is provided for that purpose. You should return the proxy whether or not you plan to attend the meeting in person. If you do attend the meeting, you may revoke the proxy and vote in person if you so desire.

| | The | purposes of the Annual Meeting are as follows: |

| | 1. | To elect six directors to the Company’s Board of Directors to serve until the 2014 Annual Meeting of Shareholders. |

| | 2. | To adopt a non-binding resolution to approve the compensation of the Company’s named executive officers. |

| | 3. | To approve a non-binding advisory proposal on the frequency of future votes on the compensation of the Company’s named executive officers. |

| | 4. | To ratify the selection of S. R. Snodgrass, A.C. as the Company’s independent registered public accounting firm for the year ended December 31, 2013. |

| | 5. | To transact such other business as may lawfully be brought before the meeting. |

You are urged to read the accompanying Proxy Statement carefully, as it contains detailed information regarding the nominees for directors of the Company and the independent registered public accounting firm of the Company.

|

| By order of the Board of Directors. |

|

| /s/ DEBORAH A. KLOEPPNER |

| Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 14, 2013

This proxy statement, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, and our 2012 Annual Report, are available free of charge on the following website: http:/www.cfpproxy.com/4429.

FIRST WEST VIRGINIA BANCORP, INC.

1701 Warwood Avenue, Wheeling, West Virginia 26003

PROXY STATEMENT

For Annual Meeting of Shareholders to be Held May 14, 2013

This proxy statement is furnished to the shareholders of First West Virginia Bancorp, Inc., (the “Company”), in connection with the solicitation of proxies for use at the Annual Meeting of Shareholders to be held May 14, 2013, beginning at 4:00 p.m., and at all adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The meeting will be held at the Corporate Office of Progressive Bank, N.A., 590 National Road, Wheeling, West Virginia. This proxy statement and the enclosed form of proxy are first being mailed to shareholders on or about April 15, 2013.

Whether or not you expect to be personally present at the meeting, you are requested to fill in, sign, date and return the enclosed form of proxy. A proxy may be revoked at any time before it is voted at the meeting by executing a later dated proxy or by voting in person at the meeting, or by filing a written revocation with the judges of election. All shares represented by duly executed proxies in the accompanying form will be voted unless revoked prior to the voting thereof.

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast by the shareholders entitled to vote at the Annual Meeting is necessary to constitute a quorum. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

The close of business on March 25, 2013 has been fixed as the record date for the determination of shareholders entitled to vote at the Annual Meeting of Shareholders. As of the record date, there were outstanding and entitled to be voted at such meeting 1,728,730 shares of common stock less 10,000 shares held in treasury. The holders of the common stock will be entitled to one vote for each share of common stock held of record on the record date. In the election for directors votes may be cumulated if a shareholder requests cumulative voting for directors at least 48 hours before the meeting. Please seeVoting and Election of Directors, below.

Owners of common stock in street name may receive a notice from their broker or bank stating that only one proxy statement will be delivered to multiple security holders sharing an address. This practice, known as “householding,” is designed to reduce printing and postage costs. If any shareholder residing at such an address wishes to receive a separate proxy statement, he or she may contact Deborah A. Kloeppner, Secretary, First West Virginia Bancorp, Inc., 1701 Warwood Avenue, Wheeling, West Virginia 26003, or by telephone at (304) 277-1100, or by e-mail at dkloeppner@progbank.com. In addition, shareholders who receive multiple copies of the proxy statement at the same address may also contact Deborah A. Kloeppner to request that a single copy of the proxy statement be sent in the future.

A copy of the Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2012 accompanies this proxy statement.

The solicitation of this proxy is made by the Board of Directors of the Company. The solicitation will be by mail and the expense thereof will be paid by the Company. In addition, solicitation of proxies may be made by telephone or other means by directors, officers or regular employees of the Company.

Voting

Voting at the Annual Meeting

The method by which you vote now will in no way limit your right to vote at the Annual Meeting if you later decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Meeting.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors.

Voting on Other Matters

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the enclosed form of proxy intend to exercise their discretionary authority in accordance with applicable federal and state laws and regulations to vote on those matters for you. As of the date this proxy statement went to press, we did not know of any other matter to be raised at the Annual Meeting.

Required Vote

A plurality of the votes cast is required for the election of directors. Abstentions and broker “non-votes” will be disregarded and will have no effect on the outcome of the vote for the election of directors.

Shares represented by proxies which are marked “withhold authority” with respect to the election of any one or more nominees for election as directors and proxies which are marked to deny discretionary authority on other matters will be counted for the purpose of determining the number of shares represented by proxy at the meeting. Such proxies will thus have the same effect as if the shares represented thereby were voted against such nominee or nominees or against such other matters. If a broker indicates on a proxy that the broker does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter.

2

Election of Directors—Cumulative Voting

In the election for directors every shareholder entitled to vote shall have the right to vote, in person or by proxy, the number of shares owned by him or her for as many persons as there are directors to be elected and for whose election he or she has a right to vote, or to cumulate his or her votes by giving one candidate as many votes as the number of such directors multiplied by the number of his or her shares shall equal, or by distributing such votes on the same principal among any number of such candidates. Such rights may be exercised by a clear indication of the shareholder’s intent on the form of proxy. Under applicable law, there are no dissenter’s rights of appraisal as to the election of directors.

At our 2013 Annual Meeting, the total number of directors to be elected is six (6) with terms to expire at the 2014 annual meeting. Each shareholder has the right to cast six (6) votes for each share of stock held on the record date for purposes of cumulative voting for the election of directors.

If cumulative voting is invoked by any shareholder, the vote represented by the proxies delivered pursuant to this solicitation, which do not contain contrary instructions, may be cumulated at the discretion of the Board of Directors of First West Virginia Bancorp, Inc. in order to elect to the Board of Directors the maximum nominees named in this proxy statement.

Voting on Other Business

For purposes of (i) the non-binding resolution to approve compensation of the Company’s named executive officers and (ii) ratification of S. R. Snodgrass, A. C. as the Company’s independent registered public accounting firm for the year ended December 31, 2013, an affirmative vote of a majority of the votes cast on this proposal is required. Under applicable law, there are no dissenter’s rights of appraisal as to this item. In determining whether the proposal has received the requisite number of affirmative votes, abstentions and broker “non-votes” will be disregarded and will have no effect on the outcome of the vote.

As to the frequency of the non-binding proposal to approve the compensation of the Company’s named executive officers, the greatest number of votes (either every year, every two years or every three years) will be the frequency that shareholders approve, without regard to abstentions and broker “non-votes.”

Item 1—Election of Directors

The first proposal to be voted upon is the election of the following six (6) directors, each of whom were recommended by the Nominating Committee and approved by the Board of Directors of the Company:

| | |

Nada E. Beneke | | R. Clark Morton |

Sylvan J. Dlesk | | William G. Petroplus |

Gary W. Glessner | | Thomas L. Sable |

3

All of the nominees are directors standing for re-election. Each of these nominees will be elected to serve a one-year term and will be subject to re-election at the 2014 Annual Meeting.

Should any one or more of the nominees be unable or unwilling to serve (which is not expected), the proxies (except proxies marked to the contrary) will be voted for such other person or persons as the Board of Directors of the Company may recommend.

The persons named in the enclosed proxy intend to vote the proxy for the election of each of the six nominees, unless you indicate on the proxy card that your vote should be withheld from any or all of such nominees.

THIS BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE FOLLOWING NOMINEES FOR DIRECTOR

| | |

NOMINEES FOR DIRECTOR STERMS TO EXPIRE AT THE 2014 ANNUAL MEETING | | INITIAL

ELECTION

TO BOARD |

| NADA E. BENEKE (57) - Sanitarian, Ohio County Health Department; Director of Progressive Bank, N.A. | | 2001 |

| SYLVAN J. DLESK (74) - Chairman of the Board, President and Chief Executive Officer of the Company; President and Chief Executive Officer of Progressive Bank, N.A.; Owner of Dlesk Realty and Investment Company; President of Dlesk, Inc.; President of Ohio Valley Carpeting, Inc.; Director of Progressive Bank, N.A. | | 1988 |

| GARY W. GLESSNER (46) - Certified Public Accountant; Managing member of Glessner & Associates, PLLC; Licensed representative of HD Vest Financial Services, a non-banking subsidiary owned by Wells Fargo; Managing member of Wheeling Coin, LLC; Vice President of Windmill Truckers Center, Inc.; Vice President of Glessner Enterprises, Inc.; Member of Red Stripe & Associates, LLC; Managing member of G & W Insurance Group, LLC; Managing member of GW Rentals, LLC; Director of Progressive Bank, N.A. | | 2005 |

| R. CLARK MORTON (84) - Attorney-at-Law, Retired Partner, Herndon, Morton, Herndon & Yaeger; Chairman of the Board of Progressive Bank, N.A. and Director of Progressive Bank, N.A. | | 1965 |

| WILLIAM G. PETROPLUS (65) - Attorney-at-Law, Member/Partner, Petroplus & Gaudino; Director of Progressive Bank, N.A. | | 1998 |

| THOMAS L. SABLE (55) - Managing Partner, Summit Atlantic Group, LLC; Village Clerk/Treasurer, Village of Bellaire; Director of Progressive Bank, N.A. | | 2005 |

4

Director Qualifications and Review of Director Nominees

In connection with the director nominations for the 2013 Annual Meeting, the Nominating Committee considered the nominee’s roles in identifying and understanding the Company’s risks and overseeing the Company’s compliance with its risk management program. These considerations were in addition to the qualifications, skills and attributes described below that are considered by the Nominating Committee in selecting nominees for the Board of Directors.

In addition to fulfilling the above criteria, five of the six nominees for re-election are independent under the NYSE MKT (formerly known as AMEX) standards and the SEC rules. Mr. Dlesk is not independent because he is an executive officer of the Company.

Each nominee brings a strong and unique background and set of skills to the Board providing the Board as a whole competence and experience in a wide variety of areas including, banking, finance, accounting, legal, corporate governance, and executive management. Set forth below are the specific experience, qualifications, skills, and attributes considered by the Board in concluding that the nominees are qualified to serve as directors of the Company:

Nominees:

Nada E. Beneke, age 57, has served as a member of the Board of Directors of the Company since 2001 and is currently serves as a member of the Nominating and Audit Committees. She also serves as a director of Progressive Bank, N.A., a subsidiary bank of the Company.

Ms. Beneke’s background has proven beneficial in board discussions and decisions impacting the development and implementation of our Pandemic Response Plan. She brings an inquisitive perspective to the board and injects probing questions that invoke further discussion and evaluation of our options.

Ms. Beneke is a Sanitarian Supervisor for the Ohio County Health Department in Wheeling, West Virginia. Ms. Beneke received her undergraduate and master’s degrees from West Virginia University.

Sylvan J. Dlesk, age 74, has served as a member of the Board of Directors of the Company since 1988. Mr. Dlesk presently is the Chairman of the Board and has held that position since 2004 and is also the President and Chief Executive Officer since 2006. He also serves as President and Chief Executive Officer and director of Progressive Bank. N.A., a subsidiary bank of the Company.

As our Chairman, President and Chief Executive Officer, Mr. Dlesk provides insight based on his experience as a businessman to the Board of directors. Mr. Dlesk possesses hands-on, detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its business. His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s shareowners, employees, and customers, particularly during times

5

of turbulent economic and industry conditions. Mr. Dlesk’s operation of various businesses brings a vast amount of business knowledge and experience to the Board.

Mr. Dlesk previously held the following positions with the Company: Interim President and Chief Executive Officer of the Company from April 2005 to June 2006; Vice Chairman of the Board of the Holding Company from 2000 to 2004; Interim President and Chief Executive Officer of Progressive Bank, N.A. from April 2005 to February 2006. Mr. Dlesk also operates Dlesk Realty and Investment Company as a sole proprietor, serves as President of Dlesk, Inc. and serves as President of Ohio Valley Carpeting, Inc.

Gary W. Glessner, age 46, has served as a member of the Board of Directors of the Company since 2005 and serves as Chairman of our Audit Committee and as a member of the Nominating Committee. He also serves as a director of Progressive Bank, N.A., a subsidiary bank of the Company.

Mr. Glessner has provided his various firms with corporate oversight and strategic direction of all aspects of business ownership. His expertise in financial accounting, public company governance, internal control structure, and health care structuring has proven invaluable to our board discussions and the evaluation of our options. He brings to our board a policyholder perspective, including intimate knowledge of family-run corporations and the matters that financially impact such businesses.

Mr. Glessner is the owner and managing member of Glessner & Associates, PLLC, which is a Certified Public Accounting firm in the Wheeling area that primarily focuses on financial statement and tax return preparation. He holds various positions with nine other local retail companies. Of these companies, one includes the ownership and management of commercial/residential rental properties and one includes the sale of annuities and insurance. Mr. Glessner has a degree in accounting from Wheeling College and obtained his CPA license in 1991. In addition, he also holds insurance licenses for life, health, annuity, property & casualty, as well as a Series 6 and 63 investment license as a Registered Representative with HD Vest Financial Services.

William G. Petroplus, age 65, has served as a member of the Board of Directors of the Company since 1998 and is currently serving as Chairman of the Nominating Committee and is a member of the Corporate Governance/Human Resource Compensation Committee. He also serves as a director of Progressive Bank, N.A., a subsidiary bank of the Company.

Mr. Petroplus’s expertise in laws and regulations, that pertain to, but are not limited to real estate law, commercial lending, corporate law and fiduciary matters, contribute insight to the board on such matters.

Mr. Petroplus has over 39 years’ experience as an attorney with the law firm, Petroplus & Gaudino, PLLC. He also is the sole member of GWP Realty LLC a real estate investment and rental limited liability company. Mr. Petroplus is a graduate of West Virginia University and the West Virginia University College of Law.

6

R. Clark Morton,age 84, has served as a member of the Board of Directors of the Company since 1965 and is currently serving as a member of the Audit Committee and the Corporate Governance/Human Resource Compensation Committee. He also currently serves as the Chairman of Progressive Bank, N.A., a subsidiary bank of the Company.

Mr. Morton’s long tenure with the Company provides continuity in the leadership and strategic initiatives and goals of the Company. He also assists in the compliance with corporate governance standards and regulatory issues. His expertise in taxation also provides guidance to the board.

Prior to his retirement in 1995, Mr. Morton was a partner in the law firm of Herndon Morton Herndon and Yaeger which specializes in tax law, corporate law, estate and trust planning and business law. Before private law practice, Mr. Morton was an attorney for the U.S. Treasury Department Internal Revenue Service. Mr. Morton received his undergraduate degree from West Liberty State College and his degree in law from Georgetown University. Mr. Morton’s leadership and service to the Wheeling area is reflected by his involvement in a local community board and foundation.

Thomas L. Sable, age 55, has served as a member of the Board of Directors of the Company since 2005 and serves as a member of our Audit Committee. He has also served as a director of Progressive Bank, N.A., a subsidiary bank of the Company.

Mr. Sable, as a self-employed businessman, contributes to assessments of the impacts of our board decisions on our customers, employees, and community reputation. He brings to the board an entrepreneur perspective, which joined with his banking and governmental expertise, provides ongoing insight into attracting and servicing our customer base.

Mr. Sable is the owner and managing partner of Summit Atlantic Group, LLC, which is the parent company to Myrtle Beach Tanning, a retail tanning salon service. He has held the position of the Clerk/Treasurer for the Village of Bellaire, Ohio for the past decade and also currently serves on their Public Records Commission. He previously served as their City Auditor. He was the owner/operator of Bellaire Hardware & Equipment Rentals for 23 years. In 1982, he served on the City of Bellaire Neighborhood Development Corporation as a Rehabilitation Grant Specialist for a two-year period. Mr. Sable was employed by Farmers & Merchants National Bank for six years beginning in 1976 and gained valuable experience engaged as a loan officer, security officer, and other departmental positions.

Our Board of Directors recommends a vote “FOR” each of the nominees listed above.

Governance of the Company

Independence of Directors and Nominees

The Board of Directors annually reviews the relationships of each member of the Board with the Company to determine whether each director is independent. This determination is based on both subjective and objective criteria developed by the NYSE MKT standards and the SEC rules.

7

The Corporate Governance/Human Resource and Compensation Committee met to determine the independence of the current members of the Board of Directors and the nominees for election as a director of the Company. At the meeting, the Committee reviewed the directors’ and nominees’ responses to a questionnaire asking about their relationships with the Company (and those of their immediate family members) and other potential conflicts of interest, as well as information provided by management related to transactions, relationships, or arrangements between the Company and the directors, parties related to the directors, and nominees.

Based on the subjective and objective criteria developed by the NYSE MKT standards and the SEC rules, the Corporate Governance/Human Resource and Compensation Committee determined that the following nominees and current members of the Board of Directors are independent: R. Clark Morton, William G. Petroplus, Nada E. Beneke, Gary W. Glessner, and Thomas L. Sable. The Board of Directors ratified this recommendation by the Corporate Governance/Human Resources and Compensation Committee.

Sylvan J. Dlesk is not independent because he is an executive officer of the Company. In addition, the transactions with Dlesk described below exceed five percent of the following entities’ gross revenues in 2012. In 2012, transactions with Dlesk Realty and Investment Company and Dlesk, Inc. represent approximately 6.72% and 38.22%, respectively, of each company’s gross revenue.

Dlesk Realty and Investment Company, which is owned by Mr. Dlesk and his wife Rosalie J. Dlesk, serves as a landlord to the Company’s subsidiary bank, Progressive Bank, N.A., under a lease agreement to rent property for use as a banking premises. Dlesk Realty and Investment Company also provides certain maintenance services to the banking premises. The Company also purchased six season tickets, suite access, parking permits and food service to West Virginia University football games from Dlesk, Inc.

The NYSE MKT standards contain additional requirements for members of the Nominating Committee and the Audit Committee. All of the directors serving on each of these committees is independent under the additional requirements applicable to such committees.

The Board also considered the following relationships in evaluating the independence of the Company’s independent directors and determined that none of the relationships constitute a material relationship with the Company and each of the relationships satisfied the standards for independence:

• Progressive Bank, N.A., a subsidiary of the Company, provided lending and/or other financial services to members of the Company’s Board of Directors, their immediate family members, and/or their affiliated organizations during 2012 in the ordinary course of business and on substantially the same terms as those available to unrelated parties;

• Mr. Petroplus is an attorney with Petroplus & Gaudino, attorneys-at-law, of Wheeling, WV, which firm serves as general counsel to the Company.

8

• Mr. Morton is a retired attorney with Herndon, Morton, Herndon & Yaeger, attorneys-at-law, of Wheeling, West Virginia, which firm serves as special counsel to the Company.

Management believes that these payments were made on no more favorable terms or greater rates than would have been extended for third parties not otherwise affiliated with the Company or its subsidiary bank.

Board of Director Meetings

There were twelve (12) meetings of the Board of Directors of the Company during 2012. All directors attended at least 75 percent of the meetings of the Board and the meetings held by committees of the Board on which the directors served in 2012. The standing committees of the Board include: Audit Committee, Nominating Committee and Corporate Governance/Human Resource and Compensation Committee.

Policy On Director Attendance At Shareholder Meetings

In order to fulfill their primary responsibilities, directors of the Company are expected to attend the annual meeting of shareholders and all board meetings, as well as all meetings on committees on which they serve. All of the directors of the Company attended the 2012 annual meeting of shareholders, except for Nada E. Beneke.

Audit Committee

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing: the financial reports and other financial information provided by the Company to the shareholders, any governmental body, and others; the Company’s systems of internal control regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Company’s auditing, accounting and financial reporting processes. The Audit Committee operates pursuant to a written charter, a copy of which is available on the Company’s website at www.progbank.com on the Investor Relations page. The committee met six (6) times during 2012. The independent members of the committee consist of non-salaried directors and presently include Gary W. Glessner, chairman, Nada E. Beneke, R. Clark Morton, and Thomas L. Sable.

The Company’s Board of Directors has determined that Gary W. Glessner meets the requirement of an “audit committee financial expert” as defined by the Securities and Exchange Commission. The Board of Directors believes that Mr. Glessner has the following five attributes to qualify as an “audit committee financial expert”: Mr. Glessner is a licensed Certified Public Accountant, and, through education and experience, has: an understanding of financial statements and generally accepted accounting principles; an ability to assess the general application of generally accepted accounting principles in connection with accounting for estimates, accruals and reserves; some experience in preparing, auditing, analyzing and evaluating financial statements that present a level of complexity of accounting issues comparable to the breadth of issues that could reasonably be expected to be presented by the Company’s financial statements; an understanding of internal controls; and, an understanding of

9

audit committee functions. The Company believes that each member of the audit committee has sufficient knowledge in financial and auditing matters to serve on the committee. The committee has authority to engage legal counsel, other experts or consultants as it deems appropriate to carry out its responsibilities.

Report of the Audit Committee

The charter for the Audit Committee is reviewed annually. The Audit Committee reviewed and discussed the Company’s annual audited financial statements with management. The Committee discussed with the independent registered public accounting firm, S. R. Snodgrass A.C., who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, the matters required to be discussed by SAS 61, as amended (AICPA Professional Standards, Vol. 1 AU Section 380), as adopted by the Public Company Accounting Oversight Board. The Committee also received and reviewed the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. Additionally, the Audit Committee reviewed reports of the internal audit director concerning the results of the examinations of the accounting controls and procedures reviewed. The committee also reviewed various other matters pertaining to the business and operations of the Corporation during the year, including the scope and planning of the audits and the internal control procedures. Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. The Audit Committee also recommended to the Board of Directors the appointment of S. R. Snodgrass, A.C. as the independent auditors for the Company for 2013.

| | | | |

| March 21, 2013 | | | | Audit Committee: |

| | | | Gary W. Glessner, Chairman Nada E. Beneke R. Clark Morton Thomas L. Sable |

| | | | |

This report shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, unless the Company specifically incorporates this report by reference. It will not otherwise be filed under such Acts.

Nominating Committee

The Board of Directors has established a formal nominating committee for the selection of directors of the Company, consisting of non-salaried directors and presently includes William G. Petroplus, chairman, Nada E. Beneke and Gary W. Glessner. The committee met one (1) time during 2012. Each member of the nominating committee is independent as that term is defined by the NYSE MKT. The nominating committee has a charter, a copy of which is available on

10

the Company’s website at www.progbank.com on the Investor Relations page. The Nominating committee charter requires that candidates for director should have certain minimum qualifications, including:

- Directors should be of the highest ethical character;

- Directors should have excellent personal and professional reputations in the Company’s market area;

- Directors should be accomplished in their professions or careers;

- Directors should be able to read and understand financial statements and either have knowledge of, or the ability and willingness to learn, financial institution law;

- Directors should have relevant experience and expertise to evaluate financial data and provide direction and advice to the chief executive officer and the ability to exercise sound business judgment;

- Directors must be willing and able to expend the time to attend meetings of the board of directors of the Company and the bank and to serve on board committees;

- The board of directors will consider whether a nominee is independent, as legally defined. In addition, directors should avoid the appearance of any conflict and should be independent of any particular constituency and be able to serve all shareholders of the Company;

- Because the directors of the Company also serve as directors of the bank, a majority of directors must be residents of West Virginia, as required by state banking law;

- Directors must be acceptable to the Company’s and the bank’s regulatory agencies, including the Comptroller of the Currency, Federal Reserve Board, Federal Deposit Insurance Corporation and West Virginia Division of Banking and must not be under any legal disability which prevents them from serving on the board of directors or participating in the affairs of a financial institution;

- Directors must own or acquire sufficient capital stock to satisfy the requirements of law and the bylaws of the bank; and,

- Directors must be at least 21 years of age.

The board of directors of the Company reserves the right to modify these minimum qualifications from time to time, except where the qualifications are required by the laws relating to financial institutions. The nominating committee does not consider diversity in identifying nominees for directors.

The nominating committee’s process for identifying and evaluating nominees is as follows: In the case of incumbent directors whose terms are set to expire, the nominating committee considers the directors’ overall service to the Company during their term, including such factors as the number of meetings attended, the level of participation, quality of

11

performance and any transactions between such directors of the Company and the bank. The nominating committee also reviews the payment history of loans, if any, made to such directors of the bank to ensure that the directors are not chronically delinquent and in default. The nominating committee considers whether any transactions between the directors and the bank have been criticized by any banking regulatory agency or the bank’s external auditors and whether corrective action, if required, has been taken and was sufficient. The nominating committee also confirms that such directors remain eligible to serve on the board of directors of a financial institution under federal and state law. For new director candidates, the nominating committee uses its network of contacts in the Company’s market area to compile a list of potential candidates. The nominating committee then meets to discuss each candidate and whether he or she meets the criteria set forth above. The nominating committee then discusses each candidate’s qualifications and chooses a candidate by majority vote.

The nominating committee will consider director candidates recommended by shareholders, provided that the recommendations are received at least 120 days before the next annual meeting of shareholders. In addition, the procedures set forth below must be followed by shareholders for submitting nominations. The nominating committee does not intend to alter the manner in which it evaluates candidates, regardless of whether or not the candidate was recommended or nominated by a shareholder.

The Company’s bylaws provide that nominations for election to the board of directors, other than those made by or on behalf of the Company’s existing management, must be made by a shareholder in writing delivered or mailed to the President not less than 14 days nor more than 40 days prior to the meeting called for the election of directors; provided, however, that if less than 21 days’ notice of the meeting is given to shareholders, the nominations must be mailed or delivered to the president not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. The notice of nomination must contain the following information, to the extent known:

| | - | | Name and address of proposed nominee(s); |

| | - | | Principal occupation of nominee(s); |

| | - | | Total shares to be voted for each nominee; |

| | - | | Name and address of notifying shareholder; and |

| | - | | Number of shares owned by notifying shareholder. |

Nominations not made in accordance with these requirements may be disregarded by the chairman of the meeting and in such case the votes cast for each such nominee will likewise be disregarded. No shareholder recommendations or nominations have been made in connection with the 2013 Annual Meeting of Shareholders.

Corporate Governance/Human Resource and Compensation Committee

The functions of the Corporate Governance, Human Resource and Compensation Committee are to review and recommend the annual salaries and bonuses of all executive officers; recommend the annual contribution to the employees’ profit sharing plan; and monitor

12

the senior management and succession plans. The Committee reviews profitability of the Company and makes recommendations to the Board of Directors with regard to annual dividends to shareholders. The Committee also reviews director fees paid for attendance at board and committee meetings. The Board of Directors reviews the Committee recommendations for final action thereon. Company performance is considered in establishing the annual budget for salary increases and is the initial part of the review process. Company performance factors, including net income and return on equity, and individual performance are considered in setting annual bonuses. The Committee has a charter, a copy of which is available on the Company’s website at www.progbank.com on the Investor Relations page. The Committee has authority to retain consultants and delegate authority if deemed necessary. The Committee met three (3) times during 2012. The members of the Committee consist of non-salaried directors. The Committee members presently include R. Clark Morton, chairman, William G. Petroplus, and Thomas L. Sable.

Board Leadership Structure

The Board of Directors of the Company is led by Sylvan J. Dlesk, who serves as both the Chairman and President and Chief Executive Officer. The Board of Directors believes that Mr. Dlesk’s service as both Chairman of the Board and President and CEO is in the best interest of the Company and its shareholders. Mr. Dlesk possesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its businesses and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters.

His combined role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s shareholders, employees, and customers, particularly during times of turbulent economic and industry conditions.

The majority of the Board is independent and the Board believes that the independent directors provide effective oversight of management. Moreover, in addition to feedback provided during the course of Board meetings, each of the Board’s standing committees, the Audit Committee, the Nominating Committee and the Corporate Governance/Human Resource and Compensation Committee, are composed solely of independent directors. The Board believes that this structure appropriately and effectively complements the combined CEO/Chairman structure.

Board’s Role in Risk Oversight

The Board’s role in the Company’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, market, credit, financial, legal and regulatory risks. The full Board (or the appropriate Committee in the case of risks that are under the purview of a particular Committee such as the Asset/Liability Management Committee) receives these reports from the appropriate “risk owner” within the organization to enable it to understand our risk identification, risk management and risk mitigation strategies. When a Committee receives the report, the Chairman of the relevant Committee reports on the discussion to the full Board during the

13

Committee reports portion of the next Board meeting. This enables the Board and its Committees to coordinate the risk oversight role, particularly with respect to risk interrelationships. As part of its charter, the Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities to ensure the quality and integrity of the Company’s financial reports.

Item 2—Adoption of Non-Binding Resolution to Approve the Compensation of the Company’s Named Executive Officers

The Dodd-Frank Wall Street Reform and Consumer Protection Act added Section 14C of the Exchange Act, which requires that we provide our shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission.

The executive officers named in the summary compensation table set forth in this proxy statement and deemed to be the Company’s “named executive officers” are Sylvan J. Dlesk, Francie P. Reppy and Brad D. Winwood.

Shareholders are urged to read the compensation information on the following pages of this proxy statement which discusses the compensation policies and procedures with respect to the Company’s named executive officers and vote on the following advisory, non-binding resolution:

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation paid to Company’s named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table and the narrative discussion.”

As described in detail under the heading “Executive Officer Compensation” beginning on page 16, we seek to closely align the interests of our named executive officers with the interests of our shareholders. Our compensation programs are designed to reward our named executive officers for the achievement of the Company’s financial goals, while at the same time avoiding the encouragement of unnecessary or excessive risk taking.

This advisory vote, commonly referred to as a “say-on-pay” advisory vote, is non-binding on the Board of Directors. Although non-binding, the Board of Directors and the Corporate Governance, Human Resource and Compensation Committee (the “Committee”) value constructive dialogue on executive compensation and other important governance topics with shareholders and encourages all shareholders to vote their shares on this matter. The Board of Directors and the Committee will review the voting results and take them into consideration when making future decisions regarding the Company’s executive compensation programs.

The Board of Directors and the Committee recommends a vote FOR the nonbinding resolution to approve the compensation of the Company’s named executive officers.

14

Item 3—Non-Binding Advisory Vote on the Frequency of Future Votes on the Compensation of the Company’s Named Executive Officers

The Dodd-Frank Wall Street Reform and Consumer Protection Act also provides that shareholders must be given the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently the Company should seek future advisory votes on the compensation of the Company’s named executive officers as disclosed in accordance with the compensation disclosure rules of the Securities and Exchange Commission (the “say-on-pay” advisory vote in Item 2 above). By voting on this Item 3, shareholders may indicate whether they would prefer that the Company conduct future “say-on-pay” advisory votes on executive compensation every year, every two years or every three years. Shareholders also may abstain from casting a vote on this item.

The Board of Directors has determined that an advisory vote on executive compensation that occurs once every three years is the most appropriate alternative for the Company and therefore our Board recommends that you vote for a three-year interval for the advisory vote on executive compensation. In determining to recommend that shareholders vote for a frequency of once every three years, the Board considered how an advisory vote at this frequency will provide our shareholders with sufficient time to evaluate the effectiveness of our overall compensation philosophy, policies and practices in the context of our long-term business results for the corresponding period, while avoiding over-emphasis on short term variations in compensation and business results. An advisory vote occurring once every three years will also permit our shareholders to observe and evaluate the impact of any changes to our executive compensation policies and practices which have occurred since the last advisory vote on executive compensation, including changes made in response to the outcome of a prior advisory vote on executive compensation.

Although the Board of Directors recommends a “say-on-pay” vote every three years, shareholders will be able to specify one of four choices for this proposal on the proxy card: one year, two years, three years or abstain. Shareholders are not voting to approve or disapprove the recommendation of the Board of Directors.

This vote is advisory and not binding on the Company or the Board of Directors in any way. The Board of Directors and the Committee will take into account the outcome of the vote, however, when considering the frequency of future advisory votes on executive compensation. The Board may decide that it is in the best interests of our shareholders and the Company to hold an advisory vote on executive compensation more or less frequently than the frequency receiving the most votes cast by our shareholders.

The Board of Directors recommends a vote “FOR” the option of once every THREE YEARS as the preferred frequency for an advisory vote to approve named executive officer compensation.

15

Executive Officer Compensation

Executive Officers

The Executive Officers of First West Virginia Bancorp, Inc., as of March 1, 2013, are as follows:

| | | | |

| Name | | Age | | Position and Background |

| | |

Sylvan J. Dlesk | | 74 | | Chairman of the Board, President and Chief Executive Officer of the Company since 2005. |

| | |

Francie P. Reppy | | 52 | | Executive Vice President, Chief Administrative Officer, Chief Financial Officer and Treasurer of the Company since 2005. |

| | |

Brad D. Winwood | | 56 | | Vice President, Chief Operating Officer and Investment Officer of the Company since April, 2010. Previously served as Vice President and Senior Operations Officer of the Company from 2008-2009. |

Overview of Compensation Program

The Corporate Governance, Human Resource and Compensation Committee (the “Committee”) of the Board is responsible for the establishment and review of the Company’s executive compensation program. The Committee endeavors to determine executive compensation in a manner designed to provide a competitive compensation package that will be attractive to potential new executives and which will also provide incentives for existing executives to stay with the Company and contribute toward the success of the Company. Ultimately, compensation is based on the overall performance of the Company.

The Committee conducts an annual base salary and bonus review of its executive officers and develops incentive compensation programs where appropriate. The Committee also reviews and develops recommendations for director compensation, including committee fees.

You will find a series of tables to follow under the headingExecutive Compensation that contain specific information about compensation earned or paid in 2012 to the Company’s Chief Executive Officer, Chief Financial Officer and Chief Operating Officer serving as of December 31, 2012, and 2011, who are sometimes referred to as “named executive officers” or “NEOs”. The Company or its subsidiary did not have any other executive officers whose compensation was in excess of $100,000. The Committee strives to ensure that the total compensation paid to the NEO’s is fair, reasonable and competitive, and does not result in excessive risk taking. Following an assessment of the compensation paid to the NEO’s, the Board has concluded that the compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

16

Role of Executive Officers in Compensation Decisions

While the Committee makes all decisions related to executive compensation, the Chief Executive Officer will provide input regarding the annual performance of each executive officer of the Company and will make recommendations for proposed salary adjustments. The Chief Executive Officer is not involved in determining his own compensation. The Committee then is responsible for recommending to the Board of Directors of the Company, and subject to final approval of such recommendations by the Board of Directors of the Company, the annual salary, raise and bonus determinations for the executive officers of the Company.

Executive Compensation Components

The Company’s compensation package as of December 31, 2012 and 2011 consisted of the following components: base salary, bonus, and retirement benefits. Each element is described below.

Base Salary

The NEO’s and other employees are provided with a base salary to compensate them for services rendered during the year. Base salary ranges were established for NEO’s and were determined based on their position and responsibility within the organization by using available market data for similarly configured positions which may be adjusted to reflect other duties and responsibilities. In determining the base salaries of the NEO’s, the Committee primarily gave consideration to the West Virginia Bankers Association salary survey, the NEO’s base salary on an individual basis and in relation to the other officers in the Company and the NEO’s performance of his/her duties and responsibilities.

Annually, the Committee reviews the base salary levels as part of the Company’s performance review process. Base salary levels for NEO’s may also be adjusted for promotions or upon a change in their duties and responsibilities.

Bonus

The determination of bonuses, as detailed below, is predicated on the Company’s earnings in the previous year, the increase in corporate net worth and individual executive officer performance. The Committee also is acutely aware that the purpose of our NEO’s is to generate earnings for the shareholders of the Company. Therefore, the Committee’s philosophy for its Executive Compensation Incentive Plan does not deviate from that avowed purpose. The plan consists of two basic steps. The first step is an earnings plateau which establishes the annual percentage return to the Company (based on corporate net worth) which was expected to be reached. The amount of return in excess of that expected percentage forms the basis for the bonus pool. The philosophy underlying this first earnings plateau is as follows.

Earnings to the extent of the determined percentage of corporate net worth are intended to provide for the following purposes:

| | (a) | Payment of income taxes thereon; |

17

| | (b) | Payment of regularly established quarterly dividends; |

| | (c) | Provide for increases in executive salaries attributable to inflation; |

| | (d) | Provide for an increase to the regularly established quarterly dividend for the next year in the same percentage as the percentage of salary raises granted executives to compensate for inflation; and, |

| | (e) | Provide for growth of corporate net worth. |

Earnings in excess of that percentage of corporate net worth are available for distributions for bonuses to NEO’s excepting any extraordinary profits received from the sale of assets owned by the Company and its subsidiary, with the exception of the subsidiary’s ordinary investment portfolio. The second basic step of the plan apportions earnings in excess of the first plateau. The Committee has divided those excess earnings into five incremental categories. Beginning with the first $400,000.00 of such excess and for each increment thereafter, the Committee has determined what percentage will be paid as executive bonuses. In addition to bonus payments, from each such increment comes a percentage for payment of income taxes thereon, and a payment for dividends to shareholders and to provide for growth of corporate net worth. After the first $400,000.00 increment has been exhausted, the second category consists of the next $300,000.00 of such excess earnings. After that has been exhausted, the third category consists of the next $200,000.00 of such excess earnings. After that has been exhausted, the fourth category consists of the next $100,000.00 of such excess earnings. Finally, after that has been exhausted, the fifth category consists of all excess earnings over $1,000,000.00.

The underlying goal of the Committee’s determinations is to provide a strong incentive for all NEO’s to strive to increase the annual earnings of the Company for the benefit of its shareholders.

Bonuses are paid to NEO’s by the Company’s subsidiary bank, Progressive Bank, N.A. Decisions as to the issuance of a bonus and the amount paid in each year is determined by the Committee and is recommended to the Company’s Board of Directors. The Committee determined that bonuses would not be calculated under the Plan in 2012 and 2011, however that merit increases would be accrued in 2012 and 2011 and paid in 2013 and 2012, to its NEO’s.

Retirement Benefits

Retirement benefits represent an important component of the Company’s compensation package as it provides financial security which promotes retention for its NEO’s. The Committee believes that its retirement program is comparable to other similarly situated banking institutions.

The Company maintains a noncontributory profit-sharing plan for all employees of its existing subsidiary bank who are 21 years of age or older, have worked for the bank in excess of one year, are not parties to a collective bargaining agreement and have completed a minimum of 1000 hours of service. This plan has received a favorable determination letter from the Internal Revenue Service. The Company makes contributions to this profit-sharing plan based upon a

18

discretionary contribution ranging from zero percent to 15 percent of total compensation as fixed by appropriate action of the bank before the close of the year. Once determined, this discretionary contribution is distributed according to a four-tiered integrated allocation formula. In the first tier, the allocation is made by taking three percent of each participant’s compensation. This amount is then distributed to the employee’s separate retirement accounts. In the second tier, any amount of the total contribution remaining undistributed by the first tier is then allocated and distributed by taking each participant’s compensation in excess of $22,500.00 and multiplying that amount by three percent. If Company contributions are insufficient to fund to this level, the Company will determine the uniform allocation percentage to allocate to those participants who have compensation in excess of the integration level of $22,500.00. The uniform allocation percentage is determined by taking the remaining contribution and dividing this amount by the total excess compensation of participants. In the third tier, any amount of the total contribution remaining undistributed by the first and second tier is allocated and distributed by taking each participant’s compensation plus the excess compensation and multiplying that amount by 1.3%. If Company contributions are insufficient to fund to this level, the Company will determine the uniform allocation percentage to allocate to those participants who have compensation in excess of the integration level and excess compensation. The uniform allocation percentage is determined by taking the remaining contribution and dividing this amount by the total compensation including excess compensation of participants. Any amount of the total contribution remaining undistributed by the first, second and third tier is then allocated and distributed to the employee’s retirement accounts on a pro rata basis based upon the percentage of each employee’s compensation compared to total compensation. Employees are entitled to the balances in their separate retirement accounts at either normal retirement age, disability or death, but the amount of such benefits cannot accurately be predicted due to the discretionary nature of the contributions. During 2012, contributions amounted to $109,686, of which $24,614 accrued to the benefit of the NEO’s. In 2011, contributions amounted to $115,000, of which $25,272 accrued to the benefit of the NEO’s.

The Company’s profit sharing plan also includes a 401(k) feature. That feature qualifies as a tax-deferred savings plan under Section 401(k) of the Internal Revenue Code (The “401(k) Plan”) for all Company employees who are at least 21 years old, have completed a minimum of 1000 hours of service, and who have completed one year of service with the bank. Under the 401(k) Plan, eligible employees may contribute up to 50% of their gross salary to the 401(k) Plan or $17,000, whichever is less ($17,000 as of January 1, 2012). If an employee is age 50 or older and makes the maximum allowable deferral to the Plan, they are entitled to contribute an additional “catch-up contribution.” The catch-up contribution is intended to help eligible employees make up for smaller contributions made earlier in their careers. The maximum catch-up contribution for 2012 was $5,500. Each participating employee is fully vested in contributions made by such employee. The bank has elected to provide a matching contribution for participants which elect to make employee 401(k) contributions. The Company’s share of the contribution during 2012 was $23,009, of which $975 was for the benefit of the NEO’s. During 2011 the Company’s share of the contribution was $22,547, none of which was for the benefit of the NEO’s.

Effective December 31, 2004, the Company froze its non-qualified deferred compensation plan arrangement with its executive officers and no further contributions are

19

permitted to the plan. This plan was frozen as a result of tax law changes by the Internal Revenue Service and limited usage by its executive officers. Under the original plan arrangement, each executive officer was permitted to elect to defer up to 50 percent of their bonus. The executive officers in the plan are generally entitled to the balances in their separate deferred compensation accounts at either normal retirement age, disability or death, or other termination of employment.

Executive Compensation

The following table shows all compensation awarded to, earned by or paid to the Company’s President and Chief Executive Officer, Sylvan J. Dlesk, to its Executive Vice President, Chief Administrative Officer, Chief Financial Officer and Treasurer, Francie P. Reppy and to its Vice President, Chief Operating Officer and Investment Officer, Brad D. Winwood, for all services rendered by them in all capacities to the Company and/or its subsidiary bank as of December 31, 2012 and 2011. No other NEO had compensation in excess of $100,000 as of December 31, 2012 and 2011.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY COMPENSATION TABLE | |

| Name and Principal Position | | | | Annual Compensation | |

| | | | | Year | | | | Salary | | | | | Bonus | | | | | All Other

Compensation | | | | Total | |

| Sylvan J. Dlesk, (74) Chairman of the Board and President and Chief Executive Officer of the Company; President and Chief Executive Officer of Progressive Bank, N.A. | | | | 2012

2011 | | | |

| $180,000

$180,000 |

| | | |

| $9,000

$9,000 |

| | | | $11,021(2)

$11,322(2) | | | |

| $200,021

$200,322 |

|

| Francie P. Reppy, (52) Executive Vice President, Chief Administrative Officer, Chief Financial Officer and Treasurer of the Company, Executive Vice President, Chief Administrative Officer and Chief Financial Officer of Progressive Bank, N.A. | | | | 2012

2011 | | | |

| $130,000

$130,000 | (1)

| | | |

| $6,500

$6,500 |

| | | | $ 7,780(2)

$ 7,978(2) | | | |

| $144,280

$144,478 |

|

| Brad D. Winwood, (56) Vice President, Chief Operating Officer and Investment Officer of the Company; Senior Vice President, Chief Operating Officer and Investment Officer of Progressive Bank, N.A. | | | | 2012

2011 | | | |

| $100,000

$100,000 |

| | | |

| $5,000

$5,000 |

| | | | $ 5,813(2)

$ 5,972(2) | | | |

| $110,813

$110,972 |

|

Notes: (1) Includes amounts deferred at the officer’s election pursuant to the Company’s 401(k) Plan.

(2) Includes contributions to the Profit Sharing and 401(k) Plan.

20

Director Compensation

Each director of the Company was compensated at the rate of $750 per regular meeting. Audit Committee members were compensated at the rate of $450 for regular meetings. Additionally, each Audit Committee member was compensated at the rate of $300 for any meetings held in addition to the regular meetings. The Chairman of the Audit Committee received additional compensation of $100 for each regular meeting for services in that capacity. The Corporate Governance/Human Resource and Compensation and Nominating Committee members were compensated at the rate of $300 for attendance at each committee meeting, unless a special meeting is held following a regular meeting in which event there is no additional compensation at the special meeting.

The Company’s directors, who are also directors of its subsidiary bank, Progressive Bank, N.A., were paid $300 for attendance at each regular bank board or committee meeting.

The following table shows all compensation paid by the Company to directors for the year ended December 31, 2012.

| | | | | | | | | | |

| Director Compensation Disclosure |

| Name | | Fees Earned

or Paid in Cash ($) | | | All Other

Compensation

($) | | | Total |

Nada E. Beneke(1) | | | $16,050 | | | | $ — | | | $16,050 |

Sylvan J. Dlesk(2) | | | $ — | | | | $ — | | | $ — |

Gary W. Glessner(3) | | | $16,550 | | | | $ — | | | $16,550 |

Elizabeth Hestick(4) | | | $4,950 | | | | $ — | | | $4,950 |

R. Clark Morton(5) | | | $16,650 | | | | $ — | | | $16,650 |

William G. Petroplus(6) | | | $13,200 | | | | $ — | | | $13,200 |

Thomas L. Sable(7) | | | $16,950 | | | | $ — | | | $16,950 |

| Notes: (1) | Nada E. Beneke was compensated $11,850 and $4,200 for serving as director of the Company and Progressive Bank, N.A., respectively. |

| | (2) | Sylvan J. Dlesk was not compensated for serving as director of the Company and Progressive Bank, N.A., respectively, in 2012. |

| | (3) | Gary W. Glessner was compensated $12,350 and $4,200 for serving as director of the Company and Progressive Bank, N.A., respectively. |

| | (4) | Elizabeth H. Hestick was compensated $1,950 and $3,000 for serving as director of the Company and Progressive Bank, N.A., respectively. |

21

| | (5) | R. Clark Morton was compensated $12,450 and $4,200 for serving as director of the Company and Progressive Bank, N.A., respectively. |

| | (6) | William G. Petroplus was compensated $10,200 and $3,000 for serving as director of the Company and Progressive Bank, N.A., respectively. |

| | (7) | Thomas L. Sable was compensated $12,450 and $4,500 for serving as director of the Company and Progressive Bank, N.A., respectively. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers, and beneficial owners of more than 10 percent of the common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission (SEC). Reporting persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms filed by them. Based on a review of the copies of Section 16(a) forms received by the Company, and on written representations from reporting persons concerning the necessity of filing a Form 5—Annual Statement of Changes in Beneficial Ownership, the Company believes that all filing requirements applicable to reporting persons were met for the fiscal year ending December 31, 2012, except for Sylvan J. Dlesk who had one (1) late filing relating to one (1) transaction.

Security Ownership of Management

The following table sets forth, as of March 1, 2013, the name and address of each director, nominee for director, and NEO’s, the number of shares of the Company’s common stock beneficially owned, the percentage of stock so owned, and the percent of stock beneficially owned by all directors and NEO’s as a group. The “beneficial ownership” of a security by an individual is determined in accordance with the rules of the Securities and Exchange Commission. Unless otherwise noted, sole voting power and sole investment power with respect to the shares shown in the table below are held either by each individual listed or by such individual together with their spouse.

| | | | | | |

| Title of Class | | Name & Address | | Amount and Nature of

Beneficial Ownership | | Percent of Class(1) |

Common | | Nada E. Beneke P.O. Box 4075 Wheeling, WV 26003 | | 38,019 | | 2.21% |

Common | | Sylvan J. Dlesk Highland Park Wheeling, WV 26003 | | 200,229(2) | | 11.65% |

Common | | Gary W. Glessner 2084 National Road Wheeling, WV 26003 | | 13,569 | | * |

22

| | | | | | |

| Title of Class | | Name & Address | | Amount and Nature of Beneficial Ownership | | Percent of Class(1) |

Common | | R. Clark Morton 129 Elm Street Wheeling, WV 26003 | | 61,876(3) | | 3.60% |

Common | | William G. Petroplus 69-15th Street Wheeling, WV 26003 | | 7,435(4) | | * |

Common | | Francie P. Reppy 1701 Warwood Avenue Wheeling, WV 26003 | | 391 | | * |

Common | | Thomas L. Sable 1333 Elm Street Bellaire, OH 43906 | | 11,248(5) | | * |

Common | | Brad D. Winwood 1701 Warwood Avenue Wheeling, WV 26003 | | 141(6) | | * |

| | | Officers and Directors as a Group (8 persons) | | 333,812 | | 19.4% |

| * | Beneficial ownership does not exceed 1%. |

| Notes: (1) | Beneficial ownership of First West Virginia common stock is stated as of March 1, 2013. Under rules of the Securities and Exchange Commission, persons who have power to vote or dispose of securities, either alone or jointly with others, are deemed to be the beneficial owners of such securities. Shares owned separately by spouses are included in the column totals but are identified in the footnotes which follow. Each person reflected in the table has both sole voting power and sole investment power with respect to the shares included in the table, except as described in the footnotes. |

| | (2) | Includes 2,042 shares owned by Rosalie J. Dlesk, his wife, and 196,648 shares owned jointly by Sylvan J. Dlesk and Rosalie J. Dlesk. 62,000 shares are pledged as collateral. |

| | (3) | Includes 30,668 shares owned by Patricia H. Morton, his wife, and 12,425 shares owned jointly by R. Clark Morton and Patricia H. Morton. |

| | (4) | Includes 907 shares owned jointly by William G. Petroplus and Sheree A. Petroplus and 452 shares owned by Sheree A. Petroplus, his wife. Mr. Petroplus disclaims beneficial ownership of 452 shares owned by Kristen G. Petroplus, his daughter, for which William G. Petroplus acts as custodian and 452 shares owned jointly by Alyssa R. Petroplus, his daughter, for which William G. Petroplus acts as custodian. |

| | (5) | Includes 11,248 shares owned jointly by Thomas L. Sable and Janice M. Sable, his wife. |

| | (6) | Includes 141 shares owned jointly by Brad D. Winwood and Douglas E. Winwood. |

The subsidiary of the Company is: Progressive Bank, N.A., Wheeling, WV.

23

Principal Shareholders

The following table sets forth, as of March 1, 2013, the name and address of each person or entity that owns of record or is the beneficial owner of more than five percent (5%) of the Company’s common stock.

| | | | | | |

| Title of Class | | Name & Address | | Amount and Nature of

Beneficial Ownership | | Percent of Class |

Common Stock | | Cede & Co. P.O. Box 20 Bowling Green Station New York, NY 10274 | | 1,190,939(1) | | 67.02% |

Common Stock | | Sylvan J. Dlesk Highland Park Wheeling, WV 26003 | | 200,229(2) | | 11.65% |

Common Stock | | James C. Inman and Laura G. Inman R.D. 1 Wellsburg, WV 26070 | | 135,199(3) | | 7.87% |

Common Stock | | Wellington Management Company, LLP | | 170,173(4) | | 9.90% |

| Notes: (1) | Depository trust company that holds company shares in street name for brokerage firms and other financial institutions. |

| | (2) | Includes 2,042 shares owned by Rosalie J. Dlesk, his wife, and 196,648 shares owned jointly by Sylvan J. Dlesk and Rosalie J. Dlesk |

| | (3) | Includes 112,486 shares owned by Laura G. Inman and 22,713 shares owned by James C. Inman. |

| | (4) | Includes shares held for clients as an investment advisor. |

Other than those individuals and entities listed above, as of March 1, 2013, no person was known by the Company to be the beneficial owner of more than 5 percent of the Company’s stock.

Transactions with Management and Others

Management personnel of the Company and its subsidiary bank have had and expect to continue to have banking transactions with the bank in the ordinary course of business. Extensions of credit to such persons are made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons. Management believes that these transactions do not involve more than a normal risk of collectability or present other unfavorable features.

24

The Company does maintain certain related party transaction and conflict of interest policies that require the disclosure by management, including directors and NEO’s of any business or financial interest or relationship that may pose a potential conflict of interest or which might otherwise interfere with the best interests of the Company. The Company also maintains a Code of Conduct & Ethics under the supervision of the Audit Committee.

The Board of Directors met on March 12, 2013, and reviewed all transactions with related parties since January 1, 2011, to determine if such transactions were required to be reported in this Proxy Statement. The Company has not entered into any transactions with related persons since January 1, 2011, that met the threshold for disclosure in this Proxy Statement under the relevant SEC rules, nor has the Company entered into a current transaction, in which the amount of the transaction exceeds $120,000 or 1% of the average assets of the Company at December 31, 2011, and December 31, 2012, and in which a related person had or will have a direct or indirect material interest.

Item 4—Ratification of Independent Registered Public Accounting Firm

The Board of Directors has appointed S.R. Snodgrass, A.C. to serve as our independent registered public accounting firm for 2013 subject to the ratification of our shareholders.

S.R. Snodgrass, A.C. advised the Company that no member of that accounting firm has any direct or indirect material interest in the Company or its subsidiary. The table below presents the fees that were paid by the Company and the bank to S.R. Snodgrass, A.C. during the years ended December 31, 2012 and 2011, respectively.

| | | | | | | | |

| | | | | 2011 | | | | 2012 |

| | | | | |

Audit Fees(1) | | | | $92,750 | | | | $86,500 |

| | | | | |

Audit Related Fees | | | | $ — | | | | $ — |

| | | | | |

Tax Fees(2) | | | | $9,500 | | | | $9,800 |

| | | | | |

All Other Fees(3) | | | | $1,200 | | | | $1,350 |

| | (1) | Audit fees consist of fees for professional service rendered for the audit of the consolidated financial statements and the review of financial statements included in the Company’s quarterly reports. |

| | (2) | Tax fees consist of fees for the preparation of original and amended federal and state income tax returns and franchise tax returns. |

| | (3) | Other service consist of fees for consulting on various accounting matters. |

The audit committee has considered whether S.R. Snodgrass, A.C., has maintained its independence during the fiscal year ended December 31, 2012. The audit committee charter requires that the audit committee pre-approve all audit and non-audit services to be provided to the Company by the independent accountants; provided, however, that the audit committee may

25

specifically authorize its chairman to pre-approve the provision of any non-audit service to the Company. Further, the foregoing pre-approval policies may be waived, with respect to the provision of any non-audit services consistent with the exceptions for federal securities law. All of the services described above for which S.R. Snodgrass, A.C. billed the Company for the fiscal year ended December 31, 2012, were pre-approved by the Company’s audit committee. For the fiscal year ended December 31, 2012, the Company’s audit committee did not waive the pre-approval requirement of any non-audit services to be provided to the Company by S.R. Snodgrass, A.C.

Representatives of S.R. Snodgrass, A.C. will be present at the Annual Meeting to answer questions. They will also have the opportunity to make a statement if they desire to do so.

Shareholder ratification of the selection of S.R. Snodgrass, A.C. as our independent registered public accounting firm is not required by our Bylaws or otherwise. However, the Board of Directors is submitting the selection of S.R. Snodgrass, A.C. to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit and Compliance Committee and the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit and Compliance Committee and the Board of Directors in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of us and our shareholders.

The Board of Directors recommends a vote FOR the ratification of S.R. Snodgrass, A.C. as our independent registered public accounting firm for the year 2013.

Deadline for Submission of Proxy Proposals, Nomination of Directors

and Other Business of Shareholders

Under the rules of the SEC, proposals of shareholders intended to be presented at the 2014 Annual Meeting scheduled to be held on May 13, 2014, must be received by the Company by December 16, 2013, for inclusion in the Company’s proxy statement and proxy relating to that meeting. Upon receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and proxy in accordance with regulations governing the solicitation of proxies. We strongly encourage any shareholder interested in submitting a proposal to consult knowledgeable counsel with regard to the detailed requirements of applicable securities laws.