Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: Massey Energy Company

Subject Company: Massey Energy Company

Commission File Number: 001-07775

ALPHA+MASSEY April 2011 | Issue 2 Info Express

The Ne w footprint: Central Appalachia

With so much of Alpha’s and Massey’s footprints lying within Central Appalachia, employees have many questions about the integration’s impact on the region. The new Alpha Natural Resources organization will boast the largest presence and largest reserve of metallurgical coal of any coal company in the United States. This impressive scale will allow numerous opportunities to efficiently deploy assets and facilities. For example: • Massey already washes some metallurgical coal at Alpha’s affiliate Kepler Processing Plant.

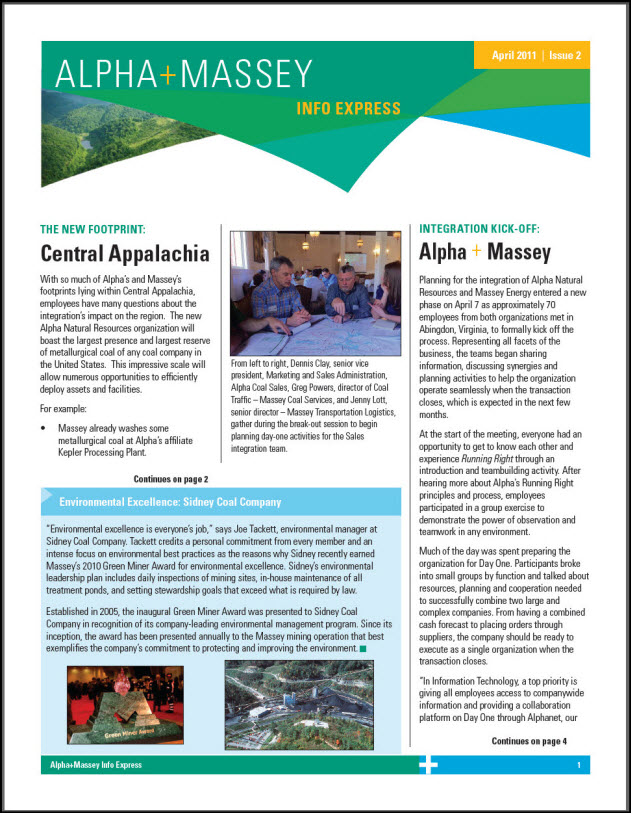

Continues on page 2 From left to right, Dennis Clay, senior vice . president, Marketing and Sales Administration, Alpha Coal Sales, Greg Powers, director of Coal Traffic – Massey Coal Services, and Jenny Lott, senior director – Massey Transportation Logistics, gather during the break-out session to begin planning day-one activities for the Sales integration team.

Integration Kick-Off: Alpha + Massey

Planning for the integration of Alpha Natural Resources and Massey Energy entered a new phase on April 7 as approximately 70 employees from both organizations met in Abingdon, Virginia, to formally kick off the process. Representing all facets of the business, the teams began sharing information, discussing synergies and planning activities to help the organization operate seamlessly when the transaction closes, which is expected in the next few months. At the start of the meeting, everyone had an opportunity to get to know each other and experience Running Right through an introduction and teambuilding activity. After hearing more about Alpha’s Running Right principles and process, employees participated in a group exercise to demonstrate the power of observation and teamwork in any environment. Much of the day was spent preparing the organization for Day One. Participants broke into small groups by function and talked about resources, planning and cooperation needed to successfully combine two large and complex companies. From having a combined cash forecast to placing orders through suppliers, the company should be ready to execute as a single organization when the transaction closes. “In Information Technology, a top priority is giving all employees access to companywide information and providing a collaboration platform on Day One through Alphanet, our

Continues on page 4 Environmental Excellence: Sidney Coal Company sue 2 “Environmental excellence is everyone’s job,” says Joe Tackett, environmental manager at Sidney Coal Company. Tackett credits a personal commitment from every member and an intense focus on environmental best practices as the reasons why Sidney recently earned Massey’s 2010 Green Miner Award for environmental excellence. Sidney’s environmental leadership plan includes daily inspections of mining sites, in-house maintenance of all treatment ponds, and setting stewardship goals that exceed what is required by law. Established in 2005, the inaugural Green Miner Award was presented to Sidney Coal Company in recognition of its company-leading environmental management program. Since its inception, the award has been presented annually to the Massey mining operation that best exemplifies the company’s commitment to protecting and improving the environment. Alpha+Massey Info Express

Did You Know?

• Alpha was founded in 2002 with the acquisition of Pittston Coal Company’s assets. Alpha has a long history of successfully integrating newly-acquired operations and companies, having completed more than 10 acquisitions. The company went public in 2005 with the stock symbol ANR. • Massey uses a mentoring program for newly-hired miners, which is designed to improve their understanding of safety guidelines. Every new miner is supported and taught by a well-trained and experienced team member. The mentoring program gives all miners another level of protection as they adapt to life in the mines. • Alpha is a leading supplier and exporter of met coal in the U.S., shipping approximately 12 million tons of met coal during 2010. • Massey is organized into 23 distinct Resource Groups, similar to Alpha’s Business Units. Currently, Massey maintains 17 in West Virginia, five in Kentucky, and one in Virginia. Massey is the largest coal producer in Central Appalachia. • Alpha’s adjusted EBITDA from continuing operations in 2010 reached a record $796.2 million, up 47 percent from 2009. • Massey’s environmental commitments involve planting more than a million new trees each year, with a particular focus on restoring the American Chestnut. Massey won six major state reforestation awards from 2005-2010.

Continued from page 1

• The combined Alpha/Massey will be able to eliminate the significant cost of operating segregated assets while creating significant blending opportunities. • Alpha’s affiliates have numerous mines that are closer to Massey’s affiliate Marianna Processing Plant than they are to Kepler. Processing at Marianna instead of Kepler will save money. • Massey’s affiliate Republic and Alpha’s affiliate PAX surface mines also are close neighbors. Operating together, they can share equipment, training resources, personnel and logistics. Combining Alpha and Massey also creates substantial opportunity to capitalize on the surging demand for metallurgical coal overseas. Alpha is a leading exporter of metallurgical coal from the U.S., and combining with Massey’s capacity will create a major player in the global seaborne market. Stay tuned for more details about how Alpha and Massey will be stronger in the CAPP region by working together.

EMPLOYEE SPOT LIGHT :

Running Right: In Their Own Words

This section will feature employees describing their own personal Running Right experiences.

Tell us about yourself? My name is Marion Deskins and I work at the Horse Creek #1 Mine in McDowell County, West Virginia. How long have you been in the mines? I started in the mines in 1974. I am currently a shuttle car operator and an employee involvement group champion. I tabulate and review all the safety observation cards and present Horse creek’s results each month at the Performance Group meeting. What are your thoughts about the Running Right process? This is the first company I’ve worked at that has this type of process, and it makes a big difference. It keeps the number of accidents down and keeps the citations down also. Can you explain how the observation card works and its real purpose? Well, it’s not a rat card! You’re not trying to tell on anyone. The good thing about the card is you don’t have to put your name on it. You’re just trying to document at-risk behaviors that we can all learn from. And, it’s not just about at-risk behaviors, you can also recognize good behaviors. We want to tell our guys when they’re doing something right! It’s the good with the bad. Have the observation cards impacted your operation and if so how? The cards keep the number of accidents and injuries down. Everyone works safe and looks out for each other and the company stresses that. This is the first company I’ve worked for that has this process, and it does work. Would you like to be featured in the next Employee Spotlight? Please send us your own experience with Running Right, and we will contact you.

Alpha+Massey Info Express

The Truth about observation cards:

Running Right Process

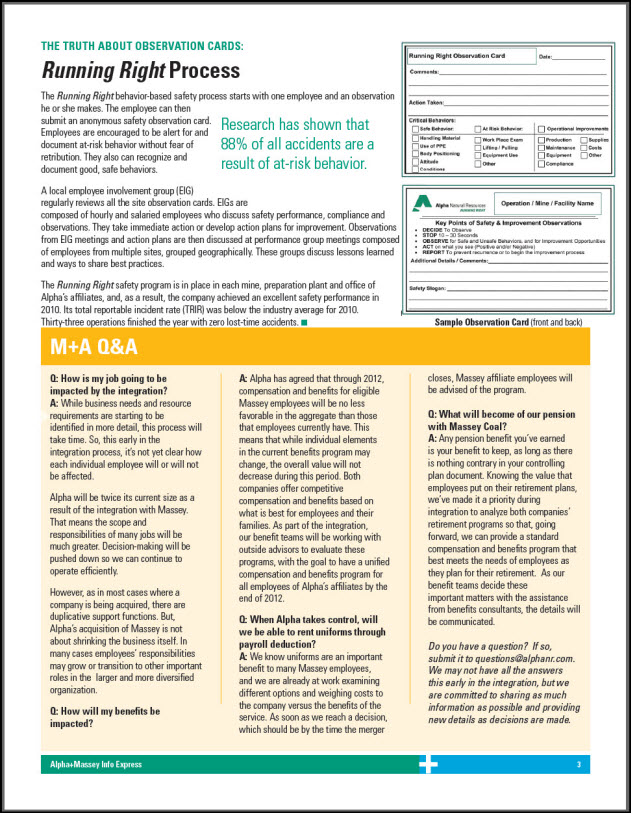

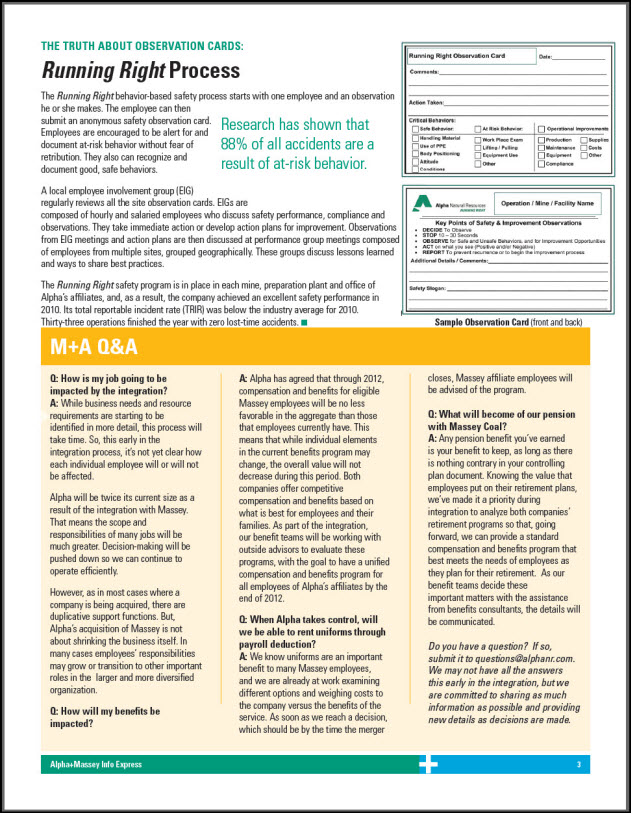

The Running Right behavior-based safety process starts with one employee and an observation he or she makes. The employee can then submit an anonymous safety observation card. Employees are encouraged to be alert for and document at-risk behavior without fear of retribution. They also can recognize and document good, safe behaviors.

A local employee involvement group (EIG) regularly reviews all the site observation cards. EIGs are composed of hourly and salaried employees who discuss safety performance, compliance and observations. They take immediate action or develop action plans for improvement. Observations from EIG meetings and action plans are then discussed at performance group meetings composed of employees from multiple sites, grouped geographically. These groups discuss lessons learned and ways to share best practices. The Running Right safety program is in place in each mine, preparation plant and office of Alpha’s affiliates, and, as a result, the company achieved an excellent safety performance in 2010. Its total reportable incident rate (TRIR) was below the industry average for 2010. Thirty-three operations finished the year with zero lost-time accidents.

Research has shown that 88% of all accidents are a result of at-risk behavior.

Sample Observation Card (front and back)

M+A Q&A

Q: How is my job going to be impacted by the integration? A: While business needs and resource requirements are starting to be identified in more detail, this process will take time. So, this early in the integration process, it’s not yet clear how each individual employee will or will not be affected. Alpha will be twice its current size as a result of the integration with Massey. That means the scope and responsibilities of many jobs will be much greater. Decision-making will be pushed down so we can continue to operate efficiently. However, as in most cases where a company is being acquired, there are duplicative support functions. But, Alpha’s acquisition of Massey is not about shrinking the business itself. In many cases employees’ responsibilities may grow or transition to other important roles in the larger and more diversified organization. Q: How will my benefits be impacted?

A: Alpha has agreed that through 2012, compensation and benefits for eligible Massey employees will be no less favorable in the aggregate than those that employees currently have. This means that while individual elements in the current benefits program may change, the overall value will not decrease during this period. Both companies offer competitive compensation and benefits based on what is best for employees and their families. As part of the integration, our benefit teams will be working with outside advisors to evaluate these programs, with the goal to have a unified compensation and benefits program for all employees of Alpha’s affiliates by the end of 2012. Q: When Alpha takes control, will we be able to rent uniforms through payroll deduction? A: We know uniforms are an important benefit to many Massey employees, and we are already at work examining different options and weighing costs to the company versus the benefits of the service. As soon as we reach a decision, which should be by the time the merger closes, Massey affiliate employees will be advised of the program. Q: What will become of our pension with Massey Coal? A: Any pension benefit you’ve earned is your benefit to keep, as long as there is nothing contrary in your controlling plan document. Knowing the value that employees put on their retirement plans, we’ve made it a priority during integration to analyze both companies’ retirement programs so that, going forward, we can provide a standard compensation and benefits program that best meets the needs of employees as they plan for their retirement. As our benefit teams decide these important matters with the assistance from benefits consultants, the details will be communicated. Do you have a question? If so, submit it to questions@alphanr.com. We may not have all the answers this early in the integration, but we are committed to sharing as much information as possible and providing new details as decisions are made.

Continued from page 1

senior vice president, Information Systems and Technology. “To help ensure business continuity, Alpha and Massey employees who currently use systems for sales, production and inventory will also be able to access and share data on a single, trusted network.” “For the Sales Team, we want to be ready to ship coal on Day One,” said Jill Harrison, vice president and general counsel, Alpha Coal Sales. “This means we need coordinated shipping logistics and invoicing procedures across the new Alpha.” The day’s session ended with Kevin Crutchfield, Alpha’s CEO, encouraging teams to continue working together. “Integration is hard work,” he said. “We know that from doing about a dozen deals in the last eight years. While we have an approach, I want to get this exactly right. Getting it exactly right takes more time, more thinking, more teamwork, and more anticipating what’s around the corner that we cannot see.”

This newsletter is being distributed to both Alpha and Massey employees to provide updated news, announcements, and information about the integration. Info Express will be published twice monthly until the deal is closed.

Forward Looking Statements Information set forth herein contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties. Alpha and Massey caution readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Alpha and Massey, including future financial and operating results, the combined company’s plans, objectives, expectations (financial or otherwise) and intentions and other statements that are not historical facts.The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain regulatory approvals of the transaction on the proposed terms and schedule; the failure of Alpha or Massey stockholders to approve the transaction; the outcome of pending or potential litigation or governmental investigations; the risk that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; uncertainty of the expected financial performance of Alpha following completion of the proposed transaction; Alpha’s ability to achieve the cost savings and synergies contemplated by the proposed transaction within the expected time frame; disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees or suppliers; the calculations of, and factors that may impact the calculations of, the acquisition price in connection with the proposed merger and the allocation of such acquisition price to the net assets acquired in accordance with applicable accounting rules and methodologies; general economic conditions that are less favorable than expected; changes in, renewal of and acquiring new long term coal supply arrangements; and competition in coal markets. Additional information and other factors are contained in Alpha’s and Massey’s filings with the Securities and Exchange Commission (the “SEC”), including Alpha’s and Massey’s Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s web site http://www.sec.gov. Alpha and Massey disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise. Important Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, on March 17, 2011 Alpha filed with the SEC a registration statement on Form S-4 (commission file number 333-172888) that includes a preliminary joint proxy statement/prospectus regarding the proposed merger. After the registration statement has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to Alpha and Massey stockholders in connection with the proposed merger. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. You may obtain a copy of the joint proxy statement/prospectus and other related documents filed by Alpha and Massey with the SEC regarding the proposed merger as well as other filings containing information, free of charge, through the web site maintained by the SEC at www.sec.gov, by directing a request to Alpha’s Investor Relations department at Alpha Natural Resources, Inc., One Alpha Place, P.O. Box 2345, Abingdon, Virginia 24212, Attn: Investor Relations, to D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, New York 10005 or to Massey’s Investor Relations department at, (804) 788 - 1824 or by email to Investor@masseyenergyco.com. Copies of the joint proxy statement/ prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, from Alpha’s website at www. alphanr.com under the heading “Investor Relations” and then under the heading “SEC Filings” and Massey’s website at www.masseyenergyco.com under the heading “Investors” and then under the heading “SEC Filings”.Participants in Solicitation Alpha, Massey and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of proxies in favor of the proposed merger is set forth in the preliminary joint proxy statement/prospectus filed with the SEC. You can find information about Alpha’s and Massey’s directors and executive officers in their respective definitive proxy statements filed with the SEC on April 1, 2011 and April 16, 2010, respectively. You can obtain free copies of these documents from Alpha or Massey using the contact information above.