SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12 | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

MASSEY ENERGY COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Massey Energy Company

4 North Fourth Street

Richmond, Virginia 23219

March 1, 2002

Dear Shareholder:

You are cordially invited to attend the 2002 Annual Meeting of Shareholders, which will be held on Tuesday, April 16, 2002, at 9:00 a.m. Eastern Daylight Time at The Jefferson Hotel, 101 West Franklin Street, Richmond, Virginia. A map showing the Annual Meeting location is included for your convenience on the back page of this booklet.

Information about the Annual Meeting and the various matters on which the shareholders will act is included in the Notice of Annual Meeting and Proxy Statement that follow. Also included is a Proxy/Voting Instruction Card and postage-paid return envelope.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend, we hope that you will complete and return your Proxy/Voting Instruction Card in the enclosed envelope as promptly as possible.

| | Ch | airman and Chief Executive Officer |

MASSEY ENERGY COMPANY

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held April 16, 2002

The Annual Meeting of Shareholders of Massey Energy Company will be held at The Jefferson Hotel, 101 West Franklin Street, Richmond, Virginia, on Tuesday, April 16, 2002, at 9:00 a.m. Eastern Daylight Time, for the following purposes:

| | 1. | | To elect two Class III directors to hold office for three years and until their respective successors are elected and qualified. The Board of Directors intends to nominate as directors the two persons identified in the attached Proxy Statement. |

| | 2. | | To consider and act upon a proposal to ratify the appointment of Ernst & Young LLP as auditors for the fiscal year ending December 31, 2002. |

| | 3. | | To consider and act upon a shareholder proposal to urge the Board of Directors of the Company to seek shareholder approval for future severance agreements with senior executives that provide benefits in an amount exceeding 2.99 times the sum of the executive’s base salary plus bonus. |

| | 4. | | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors has fixed February 25, 2002, as the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting.

SHAREHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON.

PLEASE COMPLETE, SIGN AND DATE THE ACCOMPANYING PROXY/VOTING INSTRUCTION CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

| | By | Order of the Board of Directors |

| | Vic | e President, Secretary and General Counsel |

March 1, 2002

Richmond, Virginia

MASSEY ENERGY COMPANY

PROXY STATEMENT

March 1, 2002

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Massey Energy Company, 4 North 4th Street, Richmond, Virginia 23219 (the “Company”), of your proxy for use at the annual meeting of holders of the Company’s common stock, $0.625 par value per share (the “Common Stock”), to be held April 16, 2002, or at any adjournment or postponement thereof (the “Annual Meeting”). This proxy statement and the accompanying proxy/voting instruction card are being mailed to all shareholders on or about March 5, 2002. The expense of the solicitation will be paid by the Company. Some officers and regular employees may solicit proxies personally and by telephone. Mellon Investor Services LLC has been engaged to assist in the solicitation for which it will receive a fee of $8,500 plus expenses from the Company. Your proxy is revocable by written notice to the Secretary of the Company at any time prior to exercise, and it shall be suspended if you are a shareholder of record or valid proxyholder who attends the Annual Meeting and elects to vote in person.

On February 25, 2002, the record date fixed by the Board of Directors, the Company had outstanding 74,817,646 shares of Common Stock. A majority of the outstanding shares of Common Stock will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions are counted in tabulations of the votes cast on proposals presented to shareholders, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved. Shareholders have one vote for each share on all business of the Annual Meeting, except that shareholders have cumulative voting rights with respect to the election of the two directors. Cumulative voting rights entitle a shareholder to give one nominee as many votes as is equal to the number of directors to be elected multiplied by the number of shares owned by the shareholder, or to distribute his or her votes on the same principle among two or more nominees as the shareholder sees fit. The two nominees for director receiving the highest number of votes at the Annual Meeting will be elected. With respect to the other proposals, the affirmative vote of the majority of shares represented in person or by proxy at the Annual Meeting and entitled to vote is required for approval.

Unless otherwise directed in the accompanying proxy/voting instruction card, the persons named therein will vote (i) FOR the election of the two director nominees listed below; (ii) FOR the proposal to ratify the appointment of Ernst & Young LLP as auditors for the fiscal year ending December 31, 2002; and (iii) AGAINST the proposal to urge the Board of Directors of the Company to seek shareholder approval for future severance agreements with senior executives that provide benefits in an amount exceeding 2.99 times the sum of the executive’s base salary plus bonus.

As to any other business that may properly come before the Annual Meeting, the persons named in the accompanying proxy/voting instruction card will vote in accordance with their best judgment. The Company does not presently know of any other business.

BACKGROUND INFORMATION

On November 30, 2000, the Company completed a reverse spin-off (the “Spin-Off”), which divided it into the spun-off corporation, “new” Fluor Corporation (“New Fluor”), and Fluor Corporation, subsequently renamed Massey Energy Company, which retained the Company’s coal-related businesses. Except where noted, the information reported in this proxy statement concerning the Company addresses the period following the Spin-Off.

ELECTION OF DIRECTORS

Proposal 1

In accordance with the Company’s Certificate of Incorporation and Bylaws, which provide for a “classified” Board of Directors, two Class III directors have been nominated for election at the Annual Meeting to serve a three-year term expiring at the annual meeting in 2005 and until their respective successors are elected and qualified. The Bylaws of the Company provide for eight directors, three serving as Class I directors, three serving as Class II directors and two serving as Class III directors.

Each of the two nominees listed below presently serves as a Class III director of the Company. If either of the nominees should decline or be unable to act as a director, the persons named in the proxy will vote in accordance with their best judgment. The Company knows of no reason why the nominees would not be available for election or, if elected, would not be able to serve.

Biographical

The following biographical information is furnished with respect to each of the two nominees for election at the Annual Meeting as Class III directors and each of the other Class I and Class II directors whose terms will continue after the Annual Meeting.

Class I Directors—Term expires 2003:

JAMES L. GARDNER, age 50

Mr. Gardner has been a director since November 30, 2000. He is Chairman of the Governance Committee and a member of the Executive and the Public and Environmental Policy Committees.

Mr. Gardner is an attorney in private practice. He was Senior Vice President and General Counsel of A.T. Massey Coal Company, Inc. (“A.T. Massey”) from 1994 to February 2000.

E. GORDON GEE, age 57

Mr. Gee has been a director since November 30, 2000. He is a member of the Audit, the Governance and the Public and Environmental Policy Committees.

Mr. Gee is the Chancellor of Vanderbilt University. Mr. Gee also serves as a director of Dollar General Corporation, Allmerica Financial Corp., Hasbro, Inc., Intimate Brands, Inc. and The Limited, Inc.

JAMES H. “BUCK” HARLESS, age 81

Mr. Harless has been a director since April 27, 2001. He is Chairman of the Public and Environmental Policy Committee and is a member of the Governance Committee.

2

Mr. Harless is Chairman of the Board of International Industries, Inc., with interests in coal mining, timber, manufacturing and other businesses. He currently serves as a member of the West Virginia University Foundation Board and the Marshall University Foundation Board.

Class II Directors—Term expires 2004:

WILLIAM R. GRANT, age 76

Mr. Grant has been a director since November 30, 2000. He is Chairman of the Audit Committee and a member of the Executive, the Compensation and the Governance Committees.

He is the co-founder of Galen Associates, a venture capital company. Mr. Grant also serves as a director of Allergan, Inc., Quest Diagnostics, Inc., Ocular Sciences, Inc. and Vasogen, PLC. He is a member of the General Electric Advisory Board, Trustee for the Center of Blood Research (Harvard) and Trustee, Emeritus, Mary Flager Cary Charitable Trust.

DR. MARTHA R. SEGER, age 69

Dr. Seger has been a director since 1991. She is a member of the Audit, the Compensation and the Governance Committees.

She is a Distinguished Visiting Professor of Finance, Arizona State University and a former member of the Board of Governors of the Federal Reserve System.

Dr. Seger also is a director of Fluor Corporation, Kroger Company, Tucson Electric Power/Unisource Energy and Xerox Corporation.

DAN R. MOORE, age 61

Mr. Moore has been a director since January 22, 2002. He is a member of the Governance and Public and Environmental Policy Committees.

He is the former Chairman of the Board and President of Matewan BancShares, a multi-bank holding company which was sold to BB&T Corporation in 1999. He is the Chairman of Moore Group, Inc. in Williamson, West Virginia. He is a member of the Board of Directors of Branch Bank and Trust Company, a wholly-owned subsidiary of BB&T Corporation, a publicly traded company. He is also on the West Virginia advisory board of BB&T Corporation.

Mr. Moore also is a member of the Marshall University Board of Governors and serves as a member of the West Virginia University Foundation Board.

Class III Director Nominees:

DON L. BLANKENSHIP, age 51

Mr. Blankenship has been a director since 1996. He is Chairman of the Executive Committee.

Mr. Blankenship has been President, Chief Executive Officer and Chairman of the Board of the Company since November 30, 2000, and has been President, Chief Executive Officer and Chairman of the Board of A. T. Massey since 1992.

Mr. Blankenship is also a director of the National Mining Association, and a member of the Governor’s Mission of West Virginia and the Norfolk Southern Advisory Board.

3

BOBBY R. INMAN, age 70

Admiral Inman, U. S. Navy (retired), has been a director since 1985. He is Chairman of the Compensation Committee and a member of the Executive and the Governance Committees.

Admiral Inman served as Director of the National Security Agency and Deputy Director of the Central Intelligence Agency.

Admiral Inman also is a director of Fluor Corporation, Science Applications International Corporation, SBC Communications Inc. and Temple-Inland Inc.

Stock Ownership of Directors and Executive Officers

The following information is furnished with respect to each director and nominee for director, each person who served as Chief Executive Officer of the Company for any portion of the last fiscal year and each of the four other most highly compensated executive officers of the Company for the last completed fiscal year (the “Named Executive Officers”), and all current directors and executive officers of the Company as a group, as to ownership of shares of Common Stock of the Company as of December 31, 2001. Except as otherwise noted, the individual or his or her family members had sole voting and investment power with respect to such shares.

Security Ownership of Directors and Executive Officers

| | | | | Amount and Nature of Beneficial Ownership

| | | |

Title of Class

| | Name of Beneficial Owner

| | Shares Beneficially Owned

| | Shares for which Beneficial Ownership can be Acquired within 60 Days (Note 2)

| | Total Beneficial Ownership

| | Percent of Class (Note 3)

| |

| Massey Energy | | Class I Directors | | | | | | | | | |

| Company Common | | James L. Gardner | | 10,112 | | 0 | | 10,112 | | * | |

| Stock $0.625 Par Value | | E. Gordon Gee | | 8,112 | | 0 | | 8,112 | | * | |

| | | James H. Harless | | 7,084 | | 0 | | 7,084 | | * | |

|

| | | Class II Director Nominees | | | | | | | | | |

| | | William R. Grant | | 49,060

(Note 4) | | 0 | | 49,060 | | * | |

| | | Dan R. Moore | | 0

(Note 5) | | 0 | | 0 | | * | |

| | | Dr. Martha R. Seger | | 7,198 | | 0 | | 7,198 | | * | |

|

| | | Class III Directors | | | | | | | | | |

| | | Don L. Blankenship (Note 1) | | 109,470 | | 296,399 | | 405,869 | | * | |

| | | Bobby R. Inman | | 8,970 | | 0 | | 8,970 | | * | |

|

| | | Other Named Executive Officers | | | | | | | | | |

| | | B. K. Hatfield (Note 6) | | 216 | | 0 | | 216 | | * | |

| | | H. D. Short | | 22,300 | | 88,203 | | 110,503 | | * | |

| | | J. M. Jarosinski | | 14,089 | | 45,846 | | 59,935 | | * | |

| | | B. F. Phillips, Jr. | | 10,807 | | 67,469 | | 78,276 | | * | |

| | | R. L. Nicholson | | 10,612 | | 25,632 | | 36,244 | | * | |

| | | Directors (including nominees) and executive officers as a group (13 persons) | | 274,830 | | 559,159 | | 833,989 | | 0.90 | % |

| (1) | | This individual is also a Named Executive Officer. |

| (2) | | Represents shares under options exercisable within 60 days of December 31, 2001. |

| (3) | | Based on 74,773,920 shares outstanding on December 31, 2001, plus shares deemed outstanding for which beneficial ownership can be acquired within 60 days by that individual or group. An asterisk (*) indicates that ownership is less than one percent of class. |

| (4) | | Mr. Grant owns 25,443 shares directly and 23,617 shares indirectly through his proportionate ownership interest in Contrarian Trends, L.P. |

| (5) | | Mr. Moore was elected a director by the other directors on January 22, 2002. As of December 31, 2001, Mr. Moore beneficially held 0 shares. |

| (6) | | Mr. Hatfield resigned as an officer of the Company effective December 15, 2001. |

4

Stock Ownership Of Certain Beneficial Owners

Management of the Company knows of no person, except as set forth below, who is the beneficial owner of more than 5% of the voting shares of the Company. The table sets forth information known to the Company as of February 14, 2002, with percentage of ownership calculated using the number of outstanding shares on December 31, 2001.

Name and Address of Beneficial Owners

| | Shares Beneficially Owned

| | | Percent of Class

|

| FMR Corp. and related entities | | 8,519,628 | (1) | | 11.45 |

| Mellon Financial Corporation and related entities | | 7,477,845 | (2) | | 10.05 |

| Merrill Lynch & Co., Inc. | | 4,609,102 | (3) | | 6.13 |

| (1) | | Based on information provided by FMR Corp. (“FMR”), Edward C. Johnson 3d (“Mr. Johnson”) and Abigail P. Johnson (“Ms. Johnson”) included in their joint Schedule 13G Amendment filed on February 14, 2002 with the Securities and Exchange Commission wherein they reported the beneficial ownership of 8,519,628 shares at December 31, 2001. They state that: Fidelity Management & Research Company (“Fidelity”) is the beneficial owner of 7,830,128 shares as the result of acting as investment advisor to various investment companies; Mr. Johnson and FMR and the funds each has sole power to dispose of the 7,830,128 shares but neither FMR nor Mr. Johnson has the sole power to vote or direct the voting of the shares owned directly by the Fidelity funds, which power resides with the funds’ boards of trustees; Fidelity Management Trust Company (“FMTC”) is the beneficial owner of 197,500 shares as a result of its serving as investment manager of institutional accounts; Mr. Johnson and FMR each has sole dispositive power over 197,500 shares, sole power to vote 197,500 shares owned by institutional accounts; and Fidelity International Limited (“FIL”) is the beneficial owner of 492,000 shares. The address of FMR, Mr. Johnson, Ms. Johnson, Fidelity and FMTC is 82 Devonshire Street, Boston, Massachusetts 02109. The address of FIL is Pembroke Hall, 42 Crowlane, Hamilton, Bermuda. |

| (2) | | Based on the Schedule 13G Amendment filed by Mellon Financial Corporation on January 23, 2002 that indicates that Mellon Financial Corporation. is the beneficial owner of 7,477,845 shares at December 31, 2001 and has sole voting power over 6,118,450 shares, shared voting power over 314,275 shares, sole dispositive power over 7,390,327 shares and shared dispositive power over 44,975 shares. The amount beneficially held by Mellon Financial Corporation includes amounts held by direct and indirect subsidiaries (several of which act as investment advisors) and intermediate parent holding companies (which filed on a joint reporting person page of this 13G filing). Mellon Financial Corporation has offices at One Mellon Center, Pittsburgh, Pennsylvania 15258. |

| (3) | | Based on the Schedule 13G filed by Merrill Lynch & Co., Inc. (on behalf of Merrill Lynch Investment Managers, an operating division of Merrill Lynch & Co., Inc.’s indirectly owned asset management subsidiaries) on February 5, 2002, with the Securities and Exchange Commission that indicates that Merrill Lynch & Co., Inc. is the beneficial owner of 4,609,102 shares at December 31, 2001, and has shared voting power and shared dispositive power over all such shares. Merrill Lynch Investment Managers holds such beneficial interest as the result of acting as investment advisor to various investment companies. Merrill Lynch & Co., Inc. has offices at World Financial Center, North Tower, 250 Vesey Street, New York, New York 10381. |

Committees of the Board

The standing committees of the Board consist of an Audit Committee, Executive Committee, Governance Committee, Compensation Committee and Public and Environmental Policy Committee. All of the information regarding the meetings of these committees refers to meetings that took place in fiscal year 2001.

Audit Committee

The principal duties of the Audit Committee are to nominate the firm of independent auditors for appointment by the Board; to meet with the independent auditors to review and approve the scope of their audit

5

engagement and the fees related to such work; to meet with the Company’s financial management, internal audit management and independent auditors to review matters relating to internal accounting controls, the internal audit program, the Company’s accounting practices and procedures and other matters relating to the financial condition of the Company and its subsidiaries; to review the work of the independent auditors that falls outside the scope of their audit engagement for the purpose of determining the independence of the independent auditors; and to report to the Board periodically any conclusions or recommendations the Audit Committee may have with respect to such matters. The members of the Audit Committee are William R. Grant (Chairman), Dr. Martha R. Seger and E. Gordon Gee, each of whom is an “independent director” under the rules of The New York Stock Exchange, the exchange on which the Company’s Common Stock is traded. The Audit Committee held four regular meetings and three telephonic meetings during fiscal year 2001, one of which was to review and approve the Company’s Annual Report, Form 10-K and proxy materials.

At the end of each of the regular meetings, the members met privately with the Company’s independent auditors without any Company officers or other personnel present.

Executive Committee

The Executive Committee has all of the power and authority of the Board to the extent permitted by Delaware law. The members of the Executive Committee are Don L. Blankenship (Chairman), James L. Gardner, William R. Grant and Admiral Bobby R. Inman. The Executive Committee held no meetings but held several telephonic discussions and took action by unanimous written consent on one occasion during fiscal year 2001.

Governance Committee

The function of the Governance Committee is to seek out, evaluate and recommend to the Board qualified nominees for election as directors of the Company; to recommend directors of the Company for election as members of Committees of the Board; to recommend new Committees to the Board; and to consider other matters including the size and composition of the Board and Committees and other issues of corporate governance. The members of the Governance Committee are James L. Gardner (Chairman), E. Gordon Gee, William R. Grant, James H. Harless, Admiral Bobby R. Inman and Dr. Martha R. Seger. During fiscal year 2001, the Governance Committee held four meetings. The Governance Committee will give appropriate consideration to qualified persons recommended by shareholders for nomination as directors of the Company provided that such recommendations are accompanied by information sufficient to enable the Governance Committee to evaluate the qualifications of the nominee.

The Company’s Bylaws require that the Secretary of the Company must receive written notice of all persons to be nominated as a director at an annual meeting, other than nominations made at the direction of the Board of Directors, not less than 60 nor more than 90 days prior to the annual meeting at which the election will take place (or not later than 10 days after public disclosure of such meeting if such disclosure occurs less than 40 days prior to the date of such meeting). The notice must set forth (i) the shareholder’s name and address, and the number of shares of Common Stock beneficially owned by such shareholder, (ii) such information with respect to the nominee as would have to be included in the proxy statement if such person were a nominee included in that proxy statement and (iii) a consent to serve as director signed by such nominee.

Compensation Committee

The principal duties of the Compensation Committee are to review corporate organizational structures; to review key employee compensation policies, plans and programs; to monitor performance and compensation of employee-directors and officers of the Company and other key employees; to prepare recommendations and periodic reports to the Board concerning such matters; and to function as the Committee which administers the long-term incentive programs referred to in the Executive Compensation section hereof. The members of the Compensation Committee are Admiral Bobby R. Inman (Chairman), William R. Grant and Dr. Martha R. Seger,

6

none of whom is a current or former officer or employee of the Company or any subsidiary. The Compensation Committee held four meetings during fiscal year 2001.

Public and Environmental Policy Committee

The principal duties of the Public and Environmental Policy Committee are to review and make recommendations regarding the policies, programs, position and strategies of the Company in relation to public and environmental issues deemed significant by the Committee or which may be referred to the Committee by the Board or by management; review and make recommendations regarding political, social and environmental trends and issues as they may affect the operations of the Company and its subsidiaries; review and make recommendations in respect of the Company’s general policy regarding support of business, charitable, educational and political organizations; and review and make recommendations in respect of the Company’s environmental policies and practices. The members of the Public and Environmental Policy Committee are James H. Harless (Chairman), James L. Gardner, E. Gordon Gee and Dan R. Moore. The Public and Environmental Policy Committee held one meeting during fiscal year 2001.

Board and Committee Attendance

During fiscal year 2001, the Board held four regular meetings and five special telephonic meetings, two of which occurred prior to the Spin-Off, and took action by unanimous written consent on three occasions, one of which occurred prior to the Spin-Off. Each of the directors attended at least 75% of the aggregate number of meetings of the Board and of the Board Committees on which he or she served.

Certain Relationships and Related Transactions

James L. Gardner, a director of the Company, is an attorney in the private practice of law. The Company’s wholly-owned subsidiary, A. T. Massey, retains Mr. Gardner as an independent contractor to assist it in certain legal matters. Mr. Gardner’s consulting contract with A. T. Massey commenced March 1, 2000, extends through December 31, 2002 and provides, among other things, (i) that Mr. Gardner generally is expected to work at least one week per month, (ii) for payment to Mr. Gardner of $5,250 per month, plus $175 per hour for each hour worked in excess of 30 hours during any calendar month, (iii) that A. T. Massey will provide family medical and dental insurance coverage to Mr. Gardner for a period of 60 calendar months (whether or not the contract is terminated) on the same terms and conditions as such medical and dental coverage is provided to A. T. Massey’s employees in return for payment by Mr. Gardner of a monthly fee calculated for extended coverage under COBRA. The amount of fees (exclusive of reimbursed costs) paid to Mr. Gardner in fiscal 2001 was $114,494. Mr. Gardner serves on neither the Audit Committee nor the Compensation Committee.

James H. Harless, a director of the Company, is Chairman of the Board of International Industries, Inc. which owns interests in, or guarantees the loans of, several companies that have outstanding loans with several capital company subsidiaries of the Company. As of December 31, 2001, such loans had an aggregate outstanding balance of $2,129,596. In addition, Mr. Harless guaranteed an aggregate of $500,000 of the loans made by capital company subsidiaries of the Company to an entity owned by members of Mr. Harless’s immediate family. These loans were made according to customary credit practices used for comparable loans made by the Company’s capital company subsidiaries to other companies.

Dan R. Moore, a director of the Company, is a member of the Board of Directors of Branch Bank and Trust Company, a wholly-owned subsidiary of BB&T Corporation, a publicly traded company. He is also on the West Virginia advisory board of BB&T Corporation. Branch Bank and Trust Company is a participant in the Company’s 3-year and 364-day credit facilities with a commitment level of $20 million.

Don L. Blankenship, Chairman and Chief Executive Officer, has a brother, George Blankenship, who is a certified public accountant who, since 1977, has performed accounting services for several of the Company’s vendors and independent contractors. George Blankenship does not perform any services on behalf of the Company, and Don L. Blankenship receives no financial or other benefit from George Blankenship’s activities.

7

Don L. Blankenship, Chairman and Chief Executive Officer, has a nephew, Keith Blankenship, who owns A-A Tire and Parts, Inc. (“A-A”). Various Company subsidiaries purchase automobile and light truck parts from A-A. In calendar year 2001, the Company’s subsidiaries expended an aggregate of $34,123 for goods and services provided by A-A. Other than payments by the Company’s subsidiaries for goods and services of A-A (which are guaranteed by A-A to be the lowest prices for comparable goods and services), the Company and the Company’s subsidiaries make no other payments to A-A or its shareholders or officers. Don L. Blankenship receives no financial or other interest in the activities of A-A.

Section 16(a) Beneficial Ownership Reporting Compliance

The Legal Department of the Company has ongoing responsibility for filing reports required by Section 16(b) of the Securities Exchange Act of 1934 (“Section 16”) on behalf of executive officers and directors. Based upon a review of forms received by the Company during and with respect to the Company’s most recent fiscal year, the Company is not aware of any executive officer, director or beneficial owner of more than 10% of the Company’s stock that failed to file on a timely basis any Forms 3, 4 or 5, except that three Forms 4 for William R. Grant, a director of the Company, were filed late due to the inadvertent failure to report indirect beneficial ownership of Company securities by a partnership in which Mr. Grant holds an ownership interest.

COMPENSATION COMMITTEE

REPORT ON EXECUTIVE COMPENSATION

The Company has established challenging objectives for earnings growth and shareholder returns for the Company. To support the alignment of management’s interests with those of the shareholders, the Compensation Committee conducts on a regular basis a thorough review of the Company’s compensation programs and, as a result, has approved the following executive compensation philosophy.

Executive Compensation Philosophy

The Company’s basic strategy is to establish executive compensation programs that will attract, retain, develop and motivate the highly qualified executive team that is needed to achieve challenging performance objectives and build shareholder value. The Company expects superior performance, both collectively and individually, and its compensation programs are designed to provide superior rewards when expectations are achieved. The competitiveness of the programs is evaluated against a mining industry peer group of companies comparable to the Company selected by the Compensation Committee based on advice by a compensation consulting firm. This compensation peer group includes some but not all of the companies included in the indices as presented in the stock performance graph found on page 19. The compensation peer group was selected on the basis of industry, size, complexity, financial performance history, growth and other relevant factors including executive talent resources.

The intent of the Company’s compensation philosophy is to provide the participating executives a clear and common understanding of Company objectives (financial and non-financial), how objectives are established and the reward for the achievement of objectives. Individual accountability for the achievement of pre-established personal and Company performance objectives are reflected in the achievement of the targeted level of compensation. The programs will provide the flexibility to meet the compensation needs of the Company. The programs maintain an appropriate compensation mix for executives between fixed, annual incentive and long-term incentive compensation.

Base Salary

The Company’s base salary philosophy is to provide a basic level of financial security to executives targeting the 50th percentile of competitive pay within the compensation peer group as selected by the

8

Compensation Committee. The Compensation Committee will review base salaries for executives and those of the compensation peer group on a regular basis to ensure that the Company pays within the target.

Annual Incentive Program

Annual incentive bonuses provide an opportunity to earn significant additional compensation for attainment of Company and individual performance objectives. Over time, performance objectives are expected to represent above-average performance compared to peers within the Company.

The annual incentive plan covers most salaried employees, including all the Named Executive Officers. The target amount payable to each executive is based on the Company’s and the executive’s actual performance. Performance criteria for the annual incentive award for the CEO included the Company’s operating profit growth, return on assets, gross margin per ton, produced coal revenue growth, strategic member development and strategic diversity planning. The award of each other Named Executive Officer is reviewed and approved by the Compensation Committee. Based upon performance in relation to earnings targets and other strategic objectives, incentive awards, when taken together with salary, were established at levels that put each of the Named Executive Officers, other than Mr. Blankenship, in the 65th percentile of competitive pay within the compensation peer group.

Long Term Incentive Program

Approximately 105 management employees, including all of the Named Executive Officers, participate in the Company’s long-term incentive program. This program’s primary purposes are to offer an incentive for the achievement of superior operating results, to align executive officer and shareholder interests and to foster the retention of key management personnel. It is the Compensation Committee’s intent that all amounts to be awarded under this program qualify as performance-based compensation under Internal Revenue Service definitions.

Under the long-term incentive program, the Compensation Committee may make grants of the following: (i) cash incentive awards, which are based upon meeting earnings or other financial targets established by the Compensation Committee; (ii) stock options, which become exercisable on terms established by the Compensation Committee and which have value only if shareholder value is increased; and (iii) restricted stock awards.

The focus of the program is regularly reviewed and, if necessary, changed so that the Company will remain competitive in the markets in which it competes. The program presently emphasizes the use of cash and stock based awards aligned to building shareholder value. Vesting of the stock based awards is contingent upon an executive’s continued employment.

Discussion of 2001 Compensation for the Chief Executive Officer

Since Mr. Blankenship became the Chief Executive Officer of A.T. Massey Coal Company, Inc. in 1992, the Company’s coal business has prospered, not only in earnings performance but also in accumulation of reserves. These accomplishments have occurred during challenging times in the coal industry with fierce price competition and consolidation. In 1998, another coal industry competitor made a lucrative employment offer to Mr. Blankenship. As a result, Fluor Corporation (the then parent company of A. T. Massey) and Mr. Blankenship negotiated and entered into a contract that was competitive with other coal producers in the central Appalachian area to retain Mr. Blankenship’s services at A. T. Massey. After the Spin-Off, the Compensation Committee negotiated a similar contract to encourage Mr. Blankenship to continue leading the Company through April 2005. During 2001, challenging times continued in the coal industry generally, and with the Company, specifically. Mr. Blankenship continued his strong leadership of the Company by, among other things, leading it through the Spin-Off to become a publicly traded company, effectively handling the partial failure and clean up of Martin County

9

Coal Corporation’s coal refuse impoundment (see the Company’s annual report on Form 10-K for the fiscal year ended October 31, 2001 for further details), and directing the expansion of the Company’s production capacity in a very tight labor market to favorably position the Company for the future. As a result, even though not all of the performance criteria (which were set pre-Spin-Off by Fluor Corporation and related to Mr. Blankenship’s former employment agreement that expired October 31, 2001) were met, the Compensation Committee awarded Mr. Blankenship his target bonus. His compensation package, which is reflected in the employment agreement that is effective November 1, 2001, and that is summarized following this report, is designed to provide significant incentives for Mr. Blankenship to continue his strong leadership.

Conclusion

All amounts paid or accrued during fiscal year 2001 under the above-described plans and programs are included in the tables which follow. No member of the Compensation Committee is a former or current officer or employee of the Company or any of its subsidiaries.

Section 162(m) of the Internal Revenue Code generally limits the corporate tax deduction for compensation paid to executive officers named in the Summary Compensation Table in the proxy statement to $1 million, unless certain requirements are met. The Company intends to maximize the corporate tax deduction. However, while the Company’s incentive compensation programs are designed to facilitate compliance with Section 162(m), the Compensation Committee believes that the Company must attract and retain qualified executives to manage the Company and that, in some instances, the Compensation Committee may need the flexibility to offer compensation that exceeds the Section 162(m) threshold for deductibility. The Compensation Committee has approved the Chief Executive Officer’s compensation recognizing that a portion of it will not be deductible.

Compensation Committee

Bobby R. Inman William R. Grant Martha R. Seger

February 11, 2002

Employment Contract with Don L. Blankenship

The Company entered into an employment agreement with Mr. Blankenship, the Company’s Chairman and Chief Executive Officer, effective November 1, 2001 and ending April 30, 2005. Mr. Blankenship will receive a base salary of $1,000,000 per year.

Mr. Blankenship’s agreement provides for annual bonuses in 2002, 2003, 2004 and 2005 with target amounts of not less than $700,000, $800,000, $900,000 and $450,000, respectively, which will be based on meeting predetermined performance goals and objectives established and mutually agreed to by the Compensation Committee and Mr. Blankenship.

Mr. Blankenship will also be eligible for a long-term incentive award under the Company’s Long-Term Incentive Program (the “Long-Term Incentive Program”). Mr. Blankenship will participate in the annual 2002, 2003, 2004 and 2005 performance cycles. The Long Term Incentive Program for each cycle shall consist of a target cash award of $300,000, annual grants of 50,000 non–qualified stock options, 12,700 shares of restricted stock, and a cash bonus equal to the fair market value of 7,300 shares of Company stock (except for the four month fiscal 2005 performance cycle the Long Term Incentive Program which will consist of a target cash award of $150,000, 25,000 non-qualified stock options, 6,350 shares of restricted stock and a cash bonus equal to the fair market value of 3,650 shares of Company stock).

Mr. Blankenship was granted 1,050,000 shadow stock units on November 1, 2001 under his employment agreement that will vest 300,000 units each on October 31, 2002, 2003 and 2004 with the remaining 150,000

10

units vesting on April 30, 2005. The units become vested if Mr. Blankenship remains continuously employed by the Company through the expiration of the term, or his employment terminates due to termination by the Company without “cause”, or terminates following a “change of control” (as such terms are defined in the employment agreement). Upon vesting, the value of these units will be credited to Mr. Blankenship’s account under the Company’s Executive Deferred Compensation Program (the “Deferred Compensation Program”). In the event Mr. Blankenship’s employment terminates prior to the expiration of the term due to death or disability, then any previously granted units will become vested and the units not yet granted would be forfeited. In the event Mr. Blankenship’s employment terminates prior to the expiration of the term for any reason other than the foregoing, then all of the units which have not previously vested terminate and are forfeited.

Mr. Blankenship was also granted 787,500 stock appreciation rights (“SARs”) on November 1, 2001 under his employment agreement if he remains continuously employed by the Company until the applicable vesting dates as follows: 225,000 SARs each will vest on October 31 2002, 2003 and 2004 with the remaining 112,500 SARs vesting on April 30, 2005. In addition, all of the restrictions on the SARs will expire if Mr. Blankenship’s employment with the Company terminates either due to termination by the Company without “cause” or following a “change of control”. In each of these cases, the value of the SARs upon exercise after vesting will be credited to Mr. Blankenship’s account in the Deferred Compensation Program. In the event Mr. Blankenship’s employment terminates prior to the expiration of the term for any reason other than the foregoing, then all of the unvested SARs terminate and are forfeited.

On November 1, 2001, a retention stock account (the “Retention Stock Account”) in favor of Mr. Blankenship was established under the Deferred Compensation Program and credited with the then value of 350,000 shares of Company stock. Mr. Blankenship’s interest in the Retention Stock Account will vest on April 30, 2005 if he remains continuously employed by the Company until April 30, 2005. In addition, Mr. Blankenship’s interest in the Retention Stock Account will vest if Mr. Blankenship’s employment with the Company terminates either due to termination by the Company without “cause” or following a “change of control”. In the event Mr. Blankenship’s employment terminates prior to the expiration of the term due to death or disability, then the Retention Stock Account will vest in accordance with the following table and the portion of the Retention Stock Account which does not vest shall terminate and be forfeited:

Date of Death or Disability

| | Pro rata Portion to be Vested

|

| November 1, 2001 through October 31, 2002 | | 2/7 |

| November 1, 2002 through October 31, 2003 | | 4/7 |

| November 1, 2003 through October 31, 2004 | | 6/7 |

| On or after November 1, 2004 | | 7/7 |

In the event Mr. Blankenship’s employment terminates prior to the expiration of the term for any reason other than the foregoing, then all of his interest in the Retention Stock Account shall terminate and is forfeited.

The value of the Retention Stock Account shall be determined based on the value of Company stock as if the amount credited thereto was invested in Company stock and received dividends and other distributions thereon to the same extent as if it was invested in Company stock.

Mr. Blankenship’s account in the Deferred Compensation Plan will be credited with $400,000 on each of October 31, 2002, October 31, 2003 and October 31, 2004 and an additional $200,000 on April 30, 2005. All restrictions on such amounts and the bookkeeping earnings thereon shall lapse on April 30, 2005 if Mr. Blankenship remains continuously employed by the Company until April 30, 2005. In addition, if Mr. Blankenship’s employment with the Company terminates either due to termination by the Company without “cause” or following a “change of control” then the date for the addition of any credits to the Deferred Compensation Plan shall be accelerated and all restrictions on all such amounts (including amounts credited before the termination date) and the bookkeeping earnings thereon shall lapse as of such termination date. In the

11

event that Mr. Blankenship’s employment with the Company and Massey terminates prior to the expiration of the term due to death or permanent and total disability, all restrictions shall lapse on amounts scheduled to be credited to Mr. Blankenship’s account in the Deferred Compensation Plan on or before Mr. Blankenship’s termination date and the bookkeeping earnings thereon. In the event that Mr. Blankenship’s employment with the Company terminates prior to April 30, 2005 for any reason other than the foregoing, then all of his rights with respect to amounts credited or to be credited to his account in the Deferred Compensation Plan shall terminate as of the date of such termination of employment.

Mr. Blankenship’s rights under the $4,000,000 split dollar life insurance policies or program owned by the Company shall be vested if Mr. Blankenship remains continuously employed by the Company until April 30, 2005 or, if earlier, the termination of Mr. Blankenship’s employment following a “change in control”, for reasons which do not constitute “cause” or due to death or permanent and total disability. Mr. Blankenship’s rights under the $4,000,000 split dollar life insurance policies or program is determined without regard to this paragraph if Mr. Blankenship’s employment with the Company and Massey terminates before April 30, 2005 for any reason other than the foregoing.

The agreement also provides for certain payments in connection with the termination of Mr. Blankenship’s employment. Upon termination, the Company will be obligated to pay Mr. Blankenship as a minimum amount all accrued and unpaid base salary, any unpaid bonus and any benefits to which he is entitled under the Deferred Compensation Program and Long-Term Incentive Program. Under the Long-Term Incentive Program, if Mr. Blankenship’s employment with the Company is terminated due to death or disability, or within two years following a “change of control” (as defined in the program), the stock options, restricted stock and restricted units will become fully vested, and a pro-rata portion of the cash component will become payable. In the event Mr. Blankenship’s employment terminates for any reason other than the foregoing, then such stock-based awards will be forfeited to the extent they are unvested and the cash component will be forfeited entirely.

If Mr. Blankenship’s employment is terminated by the Company without cause, the Company will be obligated to pay Mr. Blankenship, in addition to the minimum amount, base salary for the remaining term of the agreement, annual bonuses for the remaining term (including a pro-rata bonus for any partial year), and the shadow stock units, the SARs, Retention Stock Account, Mr. Blankenship’s account under the Deferred Compensation Plan and his split dollar life insurance policy, will become fully vested.

Also, the Company is obligated upon Mr. Blankenship’s retirement to provide Mr. Blankenship title to a company-owned residence and associated property in Sprigg, West Virginia, and to pay an amount to reimburse him for any income taxes owed by him as a result of such title transfer. The residence is currently valued at approximately $250,000. The Compensation Committee may authorize such transfer before retirement. Also under the Successor and Retention Program, the Compensation Committee agreed to approve Mr. Blankenship’s early retirement at age 55 for the purposes of the Company’s Executive Supplemental Benefit Plan.

12

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Other Compensation

The following table shows for the fiscal years ended October 31, 1999, 2000 and 2001, the cash compensation paid by the Company and its subsidiaries, as well as certain other compensation paid or accrued for those years, to the Named Executive Officers in all capacities in which they served.

SUMMARY COMPENSATION TABLE (A)

| | | | | Long Term Compensation

| | |

| | | | | Annual Compensation

| | Awards(D)

| | Payouts

| | |

Name and Principal Position

| | Fiscal Year

| | Salary ($)(B)

| | Bonus ($)(B)

| | Other Annual Compensation ($)(C)

| | Restricted Stock Awards ($)(D)

| | Securities Underlying Options/ SARs (#)

| | LTIP Payouts ($)

| | All Other Compensation ($)(E)

|

| D. L. Blankenship | | 2001 | | $ | 881,000 | | $ | 700,000 | | $ | 584,986 | | $ | 1,336,388 | | 115,943 | | $ | 13,480 | | $ | 31,414 |

| Chairman, Chief Executive | | 2000 | | | 769,334 | | | 650,000 | | | 302,725 | | | 1,941,341 | | 55,284 | | | 49,098 | | | 29,981 |

| Officer and President | | 1999 | | | 697,908 | | | 625,000 | | | 149,494 | | | 3,404,729 | | 55,284 | | | 134,700 | | | 51,835 |

|

| B. K. Hatfield (F) | | 2001 | | | 279,888 | | | 552,500 | | | 54,848 | | | 181,502 | | 39,222 | | | 16,000 | | | 19,476 |

| Executive Vice President | | 2000 | | | 274,400 | | | 272,500 | | | 200,447 | | | 40,620 | | 47,329 | | | 45,893 | | | 13,051 |

| and Chief Operating Officer | | 1999 | | | 275,000 | | | 270,000 | | | 39,808 | | | 22,724 | | 11,356 | | | 126,000 | | | 24,640 |

|

| H. D. Short | | 2001 | | | 239,700 | | | 460,000 | | | 35,483 | | | 106,754 | | 23,072 | | | 16,000 | | | 16,876 |

| Senior Vice President | | 2000 | | | 230,079 | | | 257,000 | | | 14,347 | | | 40,620 | | 47,329 | | | 45,893 | | | 11,645 |

| Group Operations | | 1999 | | | 205,920 | | | 192,300 | | | 20,217 | | | 22,724 | | 11,356 | | | 126,000 | | | 20,408 |

|

| J. M. Jarosinski | | 2001 | | | 144,942 | | | 212,000 | | | 18,143 | | | 85,403 | | 18,457 | | | 16,000 | | | 8,601 |

| Vice President—Finance | | 2000 | | | 142,100 | | | 105,000 | | | 12,256 | | | 40,620 | | 47,329 | | | 41,522 | | | 6,300 |

| and Chief Financial Officer | | 1999 | | | 141,667 | | | 93,000 | | | 13,388 | | | 22,724 | | 11,356 | | | 67,500 | | | 9,878 |

|

| B. F. Phillips, Jr. | | 2001 | | | 134,946 | | | 212,000 | | | 23,099 | | | 85,403 | | 18,457 | | | 13,000 | | | 9,435 |

| Vice President | | 2000 | | | 132,300 | | | 85,000 | | | 11,608 | | | 22,003 | | 25,632 | | | 41,522 | | | 6,611 |

| and Treasurer | | 1999 | | | 134,167 | | | 92,000 | | | 16,380 | | | 20,151 | | 10,140 | | | 114,000 | | | 11,200 |

|

| R. L. Nicholson | | 2001 | | | 142,800 | | | 215,000 | | | 11,939 | | | 85,403 | | 18,457 | | | 10,000 | | | 9,059 |

| Vice President, Secretary | | 2000 | | | 130,612 | | | 58,000 | | | 6,936 | | | 22,003 | | 25,632 | | | 33,509 | | | 3,044 |

| and General Counsel | | 1999 | | | 112,501 | | | 47,600 | | | 8,908 | | | 13,035 | | 8,112 | | | 92,000 | | | 6,200 |

| (A) | | With respect to restricted shares, restricted stock units, shadow stock units, SARs and stock options (collectively, “Grants”), as a result of the Spin-Off from Fluor Corporation effective November 1, 2000, and following the Spin-Off, all Grants awarded to employees and directors of Old Fluor were retained by the Company. In addition, in order to preserve the intrinsic value of the Grants, adjustments were made to the number of Grants and, as applicable, the ratio of the exercise price to the market price of the Grants. In that regard, the outstanding number of Grants was increased by multiplying the applicable amount by 4.056 (the “Conversion Ratio”). Similarly, where applicable, the exercise price was reduced by dividing the exercise price prior to the Spin-Off by the Conversion Ratio. The Conversion Ratio was determined in accordance with accounting rules by taking the closing price of Old Fluor’s stock on the date of the Spin-Off ($36.50) and dividing it by the opening price for the Company’s Common Stock the first stock trading day after the Spin-Off ($9.00). The exception to the aforementioned Conversion Ratio is Mr. Blankenship as follows: (i) the outstanding number of Option Grants for Mr. Blankenship was increased by multiplying the applicable amount by 3.4 with no change in the aggregate exercise price of the options, (ii) the SARs continued to represent an equivalent number of SARs on Company shares with the strike price reduced by the Conversation Ratio, (iii) the shadow stock units, restricted stock and restricted units continued to represent an equivalent number of shadow stock units, restricted stock and restricted units on Company shares. All stock-based award amounts in the table and accompanying footnotes have been converted to Massey common stock. |

| (B) | | Amounts shown include cash compensation earned and received by Named Executive Officers as well as amounts earned but deferred at the election of those officers. A large portion of the bonuses for fiscal year 2001 represents |

13

| | amounts paid in December 2000 based on performance for the previous six months and special one-time bonuses to the Named Executive Officers except Mr. Blankenship for additional work related to the Spin-Off. |

| (C) | | The perquisites or other personal benefits exceeding $50,000 or 10 percent of the total annual salary and bonus were for the years and in the cases of individuals as follows: (i) during fiscal year 2001, for Mr. Blankenship, $479,778 for restricted unit payments to compensate for federal and state withholding taxes arising from the lapse of restrictions on restricted stock held; (ii) during fiscal year 2000, (a) for Mr. Blankenship, $221,035 for restricted unit payments to compensate for federal and state withholding taxes as stated in (C)(i) above and $9,437 for life insurance premiums; and (b) for Mr. Hatfield, $172,239 representing forgiveness and gross-up of a bridge loan from A. T. Massey; and (iii) during fiscal year 1999, for Mr. Blankenship, $58,060 for restricted unit payments to compensate for federal and state withholding taxes as stated in (C)(i) above. |

| (D) | | The amount reported in the table includes restricted stock and shadow stock, and represents the market value at the date of grant, without giving effect to the diminution in value attributable to the restrictions on such stock. In fiscal years 1999, 2000, and 2001 the Company or its predecessor awarded 35,972, 21,179, and 60,641 respectively, shares of restricted stock to all Named Executive Officers as a group. With respect to shares granted in fiscal year 1999, 21,367 shares of restricted stock awarded vest at 33 1/3% per year and 14,605 shares vest at the rate of 10% per year. With respect to shares granted in fiscal year 2000, 18,009 shares of restricted stock awarded will vest after five years and 3,170 shares vest at 10% per year. With respect to all shares granted in fiscal year 2001, shares of restricted stock awarded will vest at 25% per year. In each of fiscal years 1998, 1999, 2000, and 2001, the Company awarded 60,000 shares of shadow stock to Mr. Blankenship. The total 240,000 shares of shadow stock granted to Mr. Blankenship will vest upon completion of the term of his employment agreement or sooner in certain events related to termination of his employment. As of the end of fiscal year 2001, the aggregate restricted stock holdings for each of the above Named Executive Officers consisted of the following: (i) Mr. Blankenship: 43,798 shares with a value of $897,859; (ii) Mr. Hatfield: 22,990 shares with a value of $471,295; (iii) Mr. Short: 18,566 with a value of $380,603; (iv) Mr. Jarosinski: 12,756 shares with a value of $261,498; (v) Mr. Phillips: 12,670 shares with a value of $259,735; and (vi) Mr. Nicholson: 9,805 shares with a value of $201,003. As of the end of fiscal year 2001, aggregate restricted stock holdings for the Company consisted of 457,822 shares with a value of $9,385,351 at the then current market value, without giving effect to the diminution of value attributable to the restrictions on such stock. Holders of restricted stock are entitled to receive dividends paid on Common Stock. As of the end of fiscal year 2001, the aggregate shadow stock holdings for each of the above Named Executive Officers consisted of 240,000 shares with a value of $4,920,000. Mr. Blankenship currently is the sole holder of the Company’s shadow stock. |

| (E) | | Amounts shown in this column include Company contributions to the Coal Company Salary Deferral and Profit Sharing Plan. The amounts contributed for fiscal years 1999, 2000 and 2001 are as follows: (i) for Mr. Blankenship: $3,000; $1,500; and $1,575 respectively; (ii) for Mr. Hatfield: $3,000; $1,500; and $1,575 respectively; (iii) for Mr. Short: $3,000; $1,500; and $1,575 respectively; (iv) for Mr. Jarosinski: $3,000; $1,500; and $1,575 respectively; (v) for Mr. Phillips: $3,000; $1,500; and $1,575 respectively; and (vi) for Mr. Nicholson: $3,000, $1,500; and $1,575 respectively. Amounts shown also include contributions to the A.T. Massey Coal Company, Inc. Executive Deferred Compensation Plan. The amounts contributed for fiscal years 1999, 2000 and 2001 are as follows: (i) for Mr. Blankenship: $48,835; $28,481; and $29,839 respectively; (ii) for Mr. Hatfield: $21,640; 11,551; and $17,901 respectively; (iii) for Mr. Short: $17,408; $10,145; and $15,301 respectively; (iv) for Mr. Jarosinski: $6,878; $4,800; and $7,026 respectively; (v) for Mr. Phillips: $8,200; $5,111; and $7,860 respectively; and (vi) for Mr. Nicholson: $3,200; $1,544; and $7,484 respectively. |

| (F) | | Mr. Hatfield resigned as an officer of the Company effective December 15, 2001. Upon such resignation, Mr. Hatfield forfeited all of his unvested restricted stock holdings and all of his unexercisable stock options. |

14

Stock Options

The following table contains information concerning the grant of stock options and SARs made during fiscal year 2001 under the Long-Term Incentive Program to the Named Executive Officers:

OPTION/SAR GRANTS IN LAST FISCAL YEAR (A)

| | | Individual Grants(A)

| | |

Name

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price(s) ($/Sh) (B)

| | Expiration Date

| | Grant Date Present Value ($) (C)

|

| D. L. Blankenship | | 65,943 | | 13.2 | % | | $ | 19.420 | | 07/09/11 | | $ | 476,748 |

| | | 50,000 | | | | | | 20.105 | | 10/29/11 | | | 360,900 |

|

| B. K. Hatfield (D) | | 19,595 | | 4.5 | % | | | 19.420 | | 07/09/11 | | | 141,666 |

| | | 19,627 | | | | | | 20.105 | | 10/29/11 | | | 141,668 |

|

| H. D. Short | | 11,527 | | 2.6 | % | | | 19.420 | | 07/09/11 | | | 83,337 |

| | | 11,545 | | | | | | 20.105 | | 10/29/11 | | | 83,332 |

|

| J. M. Jarosinski | | 9,221 | | 2.1 | % | | | 19.420 | | 07/09/11 | | | 66,665 |

| | | 9,236 | | | | | | 20.105 | | 10/29/11 | | | 66,665 |

|

| B. F. Phillips, Jr. | | 9,221 | | 2.1 | % | | | 19.420 | | 07/09/11 | | | 66,665 |

| | | 9,236 | | | | | | 20.105 | | 10/29/11 | | | 66,665 |

|

| R. L. Nicholson | | 9,221 | | 2.1 | % | | | 19.420 | | 07/09/11 | | | 66,665 |

| | | 9,236 | | | | | | 20.105 | | 10/29/11 | | | 66,665 |

| (A) | | The Named Executive Officers received only grants of options in fiscal year 2001; no SARs were granted in fiscal year 2001 to the Company’s management. There were two option grants during fiscal year 2001 due to the timing of the Spin-Off (November 30, 2000) and the approval of a new fiscal year end by the Board of Directors on October 29, 2001. The Board of Directors did not consider granting long term incentive awards for the fiscal year 2001 cycle until the meeting of the Board of Directors on January 16, 2001. Restricted stock and long term cash incentives (covering fiscal years 2001-2003) were awarded on January 16, 2001. Stock options were granted as part of the fiscal year 2001 long term incentive package on July 9, 2001 due to accounting rules surrounding the Spin-Off. The fiscal year 2002 long term incentive plan awards consisting of restricted stock, long term cash incentive (covering fiscal years 2002-2004), and stock options were considered and approved at the Board of Directors meeting on October 29, 2001. At this meeting, the fiscal year change to the the calendar year was also approved. It is anticipated that future annual grants, if any, will be awarded in the fourth quarter of the fiscal year. |

| (B) | | Options were granted with an exercise price equal to the fair market value of the underlying Common Stock of the Company on the date of grant. All options were granted for a term of ten years, subject to earlier termination in certain events related to termination of employment, and vest at 25% per year so that they are fully vested by the end of four years. The exercise price and tax withholding obligations related to exercise may be paid by delivery of already owned shares or by offset of the underlying shares, subject to certain conditions. |

| (C) | | The Grant Date Present Value for the option with the 7/9/11 expiration date is computed using the Black-Scholes option pricing model based on the following general assumptions: (i) an Expected Option Term of five years for options which expire ten years from the date of grant which reflects a reduction of the actual 10-year life of the option based on historical data regarding the average length of time an executive holds an option before exercising; (ii) a Risk-Free Interest Rate that represents the interest rate on a U.S. Treasury Strip with a maturity date corresponding to that of the Expected Option Term; (iii) Stock Price Volatility is calculated using a combination of Massey and Fluor Corporation (predecessor company) stock price |

15

| | volatility over a five year period preceding the grant date (due to Massey’s short tenure); and (iv) Dividend Yield is calculated using the current dividend yield as of the grant date. The specific option pricing model assumptions for the grants were as follows: $19.42 Exercise Price; 4.75% Risk Free Interest Rate; 37.1% Stock Price Volatility; and .824% Dividend Yield. The Grant Date Present Value for the option with the 10/29/11 expiration date is computed using the Black-Scholes option pricing model based on the following general assumptions: (i) an Expected Option Term of five years for options which expire ten years from the date of grant which reflects a reduction of the actual 10-year life of the option based on historical data regarding the average length of time an executive holds an option before exercising; (ii) a Risk-Free Interest Rate that represents the interest rate on a U.S. Treasury Strip with a maturity date corresponding to that of the Expected Option Term; (iii) Stock Price Volatility is calculated using a combination of Massey and Fluor Corporation (predecessor company) stock price volatility over a five year period preceding the grant date (due to Massey’s short tenure); and (iv) Dividend Yield is calculated using the current dividend yield as of the grant date. The specific option pricing model assumptions for the grants were as follows: $20.105 Exercise Price; 3.87% Risk Free Interest Rate; 37.1% Stock Price Volatility; and .796% Dividend Yield. Notwithstanding the fact that these options are non-transferable, no discount for lack of marketability was taken. The option value was discounted by approximately 3% for risk of forfeiture during the vesting period. The actual value, if any, a Named Executive Officer may realize will depend upon the excess of the stock price on the date the option is exercised, so there is no assurance that the value realized by the Named Executive Officer will be at or near the amount shown. |

| (D) | | Mr. Hatfield resigned as an officer of the Company effective December 15, 2001. Upon such resignation, Mr. Hatfield forfeited all of his unexercisable stock options. |

Option/SAR Exercises and Holdings

The following table sets forth information with respect to the Named Executive Officers, concerning the exercise of options during the last fiscal year and unexercised options and SARs held as of October 31, 2001:

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION/SAR VALUE

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End (#)

| | Value of Unexercised In-the-Money Options/SARs at Fiscal Year End ($)(A)

|

| | | | Exercisable(A)

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| D. L. Blankenship. | | 160,000 | | $ | 1,790,487 | | 268,757 | | 485,048 | | 1,741,614 | | 3,765,836 |

| B. K. Hatfield (B) | | 0 | | | 0 | | 111,856 | | 44,900 | | 990,040 | | 85,287 |

| H. D. Short | | 0 | | | 0 | | 85,364 | | 28,750 | | 740,777 | | 68,821 |

| J. M. Jarosinski | | 20,028 | | | 164,234 | | 53,007 | | 24,135 | | 509,483 | | 69,979 |

| B. F. Phillips, Jr. | | 0 | | | 0 | | 64,934 | | 23,527 | | 554,529 | | 63,942 |

| R. L. Nicholson | | 11,924 | | | 98,966 | | 29,688 | | 22,513 | | 285,660 | | 53,875 |

| (A) | | Market value of underlying securities at fiscal year-end, minus the exercise price. |

| (B) | | Mr. Hatfield resigned as an officer of the Company effective December 15, 2001. Upon such resignation, Mr. Hatfield forfeited all of his unvested restricted stock holdings and all of his unexercisable stock options. |

16

LONG-TERM INCENTIVE PROGRAM—AWARDS IN LAST FISCAL YEAR

The following table provides information concerning cash incentive awards made to Massey’s Named Executive Officers during fiscal year 2001 under the Company’s Long-Term Incentive Award Program. Each award under the Long-Term Incentive Award Program represents the right to receive an amount in cash if earnings targets for a specified period, as established by the Company’s Compensation Committee, are achieved. If earnings fall below the threshold amount, no award is payable. If earnings fall between the threshold amount and the target amount or between the target amount and the maximum amount then the amount of the award is prorated accordingly. Payments made under the Long-Term Incentive Program are reported in the Summary Compensation Table in the year of payout, if any.

2001-2004 Award Cycle

| | | | | | |

Name

| | Performance or Other Period Until Maturation or Payment

| | Estimated Future Payouts Under Non-Stock Price Based Plans ($)

|

| | | Low Target

| | Middle Target

| | High Target

|

| D. L. Blankenship. | | 3 years | | 33,675 | | 67,350 | | 134,700 |

| B. K. Hatfield(A) | | 3 years | | 70,833 | | 141,667 | | 283,333 |

| H. D. Short | | 3 years | | 41,667 | | 83,333 | | 166,667 |

| J. M. Jarosinski | | 3 years | | 33,333 | | 66,667 | | 133,333 |

| B. F. Phillips, Jr. | | 3 years | | 33,333 | | 66,667 | | 133,333 |

| R. L. Nicholson | | 3 years | | 33,333 | | 66,667 | | 133,333 |

| (A) | | Mr. Hatfield resigned as an officer of the Company effective December 15, 2001. Upon such resignation, Mr. Hatfield forfeited all right to future payouts under the Long Term Incentive Award Program. |

2002-2005 Award Cycle

| | | | | | |

| | | Performance or Other Period Until Maturation or Payment

| | Estimated Future Payouts Under Non-Stock Price Based Plans ($)

|

Name

| | | Low Target

| | Middle Target

| | High Target

|

| D. L. Blankenship. | | 3 years | | 150,000 | | 300,000 | | 600,000 |

| H. D. Short | | 3 years | | 41,667 | | 83,333 | | 166,667 |

| J. M. Jarosinski | | 3 years | | 33,333 | | 66,667 | | 133,333 |

| B. F. Phillips, Jr. | | 3 years | | 33,333 | | 66,667 | | 133,333 |

| R. L. Nicholson | | 3 years | | 33,333 | | 66,667 | | 133,333 |

Pension Plans

The following table shows the estimated annual pension benefits payable to a covered participant at normal retirement age under the A.T. Massey Coal Company, Inc. defined benefit pension plans (the “A.T. Massey Pension Plan”), as well as a non-qualified supplemental pension that provides benefits that would otherwise be denied participants by reason of certain Internal Revenue Code limitations on qualified plan benefits, based on remuneration that is covered under the plans and years of service with A.T. Massey and its subsidiaries.

A participant’s remuneration covered by the A.T. Massey Pension Plans is his average salary and a portion of the bonus (as reported in the Summary Compensation Table) for the highest 60 consecutive months prior to the determination date. As of the end of the last calendar year, Mr. Blankenship’s covered compensation under the A.T. Massey Pension Plan was $170,000, his covered compensation under the non-qualified supplemental pension was $1,266,000 for a combined covered compensation amount of $1,436,000; he had been credited with nineteen years of service. As of the end of the last calendar year, Mr. Hatfield’s covered compensation under the A.T. Massey Pension Plan was $170,000, his covered compensation under the non-qualified supplemental pension was $367,815 for a combined covered compensation amount of $537,815; he had been credited with

17

twenty-two years of service. As of the end of the last calendar year, Mr. Short’s covered compensation under the A.T. Massey Pension Plan was $170,000 and his covered compensation under the non-qualified supplemental pension was $297,783 for a combined covered compensation amount of $467,783; he had been credited with twenty years of service. As of the end of the last calendar year, Mr. Jarosinski’s covered compensation under the A.T. Massey Pension Plan was $170,000, his covered compensation under the non-qualified supplemental pension was $92,574 for a combined covered compensation amount of $262,574; he had been credited with thirteen years of service. As of the end of the last calendar year, Mr. Phillip’s covered compensation under the A.T. Massey Pension Plan was $170,000, his covered compensation under the non-qualified supplemental pension was $77,741 for a combined covered compensation amount of $247,741; he had been credited with twenty years of service. As of the end of the last calendar year, Mr. Nicholson’s covered compensation under the A.T. Massey Pension Plan was $170,000, his covered compensation under the non-qualified supplemental pension was $90,956 for a combined covered compensation amount of $260,956; he had been credited with seven years of service. Benefits shown are computed as a ten year certain and life annuity beginning at age 65 with no deduction for Social Security or other offset amounts.

PENSION PLAN TABLE

Years of Service

Remuneration

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35 or More

|

| $ | 400,000 | | $ | 60,000 | | $ | 90,000 | | $ | 120,000 | | $ | 150,000 | | $ | 180,000 | | $ | 210,000 |

| $ | 450,000 | | $ | 67,500 | | $ | 101,250 | | $ | 135,000 | | $ | 168,750 | | $ | 202,500 | | $ | 236,250 |

| $ | 500,000 | | $ | 75,000 | | $ | 112,500 | | $ | 150,000 | | $ | 187,500 | | $ | 225,000 | | $ | 262,500 |

| $ | 550,000 | | $ | 82,500 | | $ | 123,750 | | $ | 165,000 | | $ | 206,250 | | $ | 247,500 | | $ | 288,750 |

| $ | 600,000 | | $ | 90,000 | | $ | 135,000 | | $ | 180,000 | | $ | 225,000 | | $ | 270,000 | | $ | 315,000 |

| $ | 650,000 | | $ | 97,500 | | $ | 146,250 | | $ | 195,000 | | $ | 243,750 | | $ | 292,500 | | $ | 341,250 |

| $ | 700,000 | | $ | 105,000 | | $ | 157,500 | | $ | 210,000 | | $ | 262,500 | | $ | 315,000 | | $ | 367,500 |

| $ | 750,000 | | $ | 112,500 | | $ | 168,750 | | $ | 225,000 | | $ | 281,250 | | $ | 337,500 | | $ | 393,750 |

| $ | 800,000 | | $ | 120,000 | | $ | 180,000 | | $ | 240,000 | | $ | 300,000 | | $ | 360,000 | | $ | 420,000 |

| $ | 850,000 | | $ | 127,500 | | $ | 191,250 | | $ | 255,000 | | $ | 318,750 | | $ | 382,500 | | $ | 446,250 |

| $ | 900,000 | | $ | 135,000 | | $ | 202,500 | | $ | 270,000 | | $ | 337,500 | | $ | 405,000 | | $ | 472,500 |

| $ | 950,000 | | $ | 142,500 | | $ | 213,750 | | $ | 285,000 | | $ | 356,250 | | $ | 427,500 | | $ | 498,750 |

| $ | 1,000,000 | | $ | 150,000 | | $ | 225,000 | | $ | 300,000 | | $ | 375,000 | | $ | 450,000 | | $ | 525,000 |

| $ | 1,050,000 | | $ | 157,500 | | $ | 236,250 | | $ | 315,000 | | $ | 393,750 | | $ | 472,500 | | $ | 551,250 |

| $ | 1,100,000 | | $ | 165,000 | | $ | 247,500 | | $ | 330,000 | | $ | 412,500 | | $ | 495,000 | | $ | 577,500 |

| $ | 1,150,000 | | $ | 172,500 | | $ | 258,750 | | $ | 345,000 | | $ | 431,250 | | $ | 517,500 | | $ | 603,750 |

| $ | 1,200,000 | | $ | 180,000 | | $ | 270,000 | | $ | 360,000 | | $ | 450,000 | | $ | 540,000 | | $ | 630,000 |

| $ | 1,250,000 | | $ | 187,500 | | $ | 281,250 | | $ | 375,000 | | $ | 468,750 | | $ | 562,500 | | $ | 656,250 |

| $ | 1,300,000 | | $ | 195,000 | | $ | 292,500 | | $ | 390,000 | | $ | 487,500 | | $ | 585,000 | | $ | 682,500 |

| $ | 1,350,000 | | $ | 202,500 | | $ | 303,750 | | $ | 405,000 | | $ | 506,250 | | $ | 607,500 | | $ | 708,750 |

| $ | 1,400,000 | | $ | 210,000 | | $ | 315,000 | | $ | 420,000 | | $ | 525,000 | | $ | 630,000 | | $ | 735,000 |

| $ | 1,450,000 | | $ | 217,500 | | $ | 326,250 | | $ | 435,000 | | $ | 543,750 | | $ | 652,500 | | $ | 761,250 |

| $ | 1,500,000 | | $ | 225,000 | | $ | 337,500 | | $ | 450,000 | | $ | 562,500 | | $ | 675,000 | | $ | 787,500 |

18

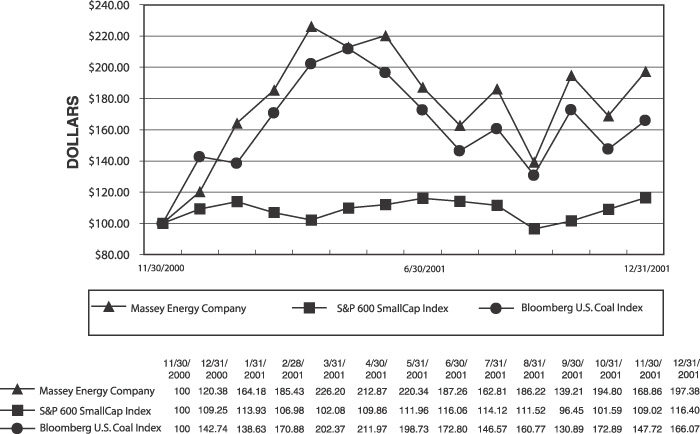

Performance Graph

COMPARISON OF CUMULATIVE TOTAL RETURN

FOR THE PERIOD DECEMBER 1, 2000 TO DECEMBER 31, 2001

Among Massey Energy Company, S&P 600 SmallCap Index and Bloomberg U.S. Coal Index

| | | 12/1/2000

| | 12/31/2000

| | 12/31/2001

|

| Massey Energy Company | | 100 | | 120.38 | | 197.38 |

| S&P 600 SmallCap Index | | 100 | | 109.25 | | 116.40 |

| Bloomberg U.S. Coal Index | | 100 | | 142.74 | | 166.07 |

The graph above compares the performance of the Company’s stock with that of the S&P SmallCap 600 Index and the Bloomberg U.S. Coal Index, a published industry index. The Company is included as a composite member of the S&P 600 SmallCap Index. The graph reflects only the performance of the Company’s stock during the period following the Spin-Off, and does not show any historic performance for the stock of Fluor Corporation prior to the Spin-Off and the subsequent name change to Massey Energy Company on November 30, 2000. The 5-year historic performance of Fluor Corporation’s stock prior to the Spin-Off can be found in the proxy statement of New Fluor for the 2002 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission.

The comparison of cumulative total return on investment (change in period-end stock price plus reinvested dividends) for each of the periods assumes that $100 was invested on December 1, 2000 in each of the Company, the S&P 600 SmallCap Index composite group and the Bloomberg U.S. Coal Index composite group, with investment weighted on the basis of market capitalization.

Change of Control Provisions in Certain Plans

Under the Company’s stock plans, including the Massey Energy Company 1999 Executive Performance Incentive Plan, Massey Energy Company 1996 Executive Stock Plan and Massey Energy Company 1988 Executive Stock Plan, which provide for stock options, restricted stock and SARs, restrictions on exercisability and transferability which are premised on continued service with the Company or its subsidiaries lapse if the

19

holder’s employment is terminated for any reason within two years following a change of control of the Company. A change of control of the Company shall be deemed to have occurred if (i) a third person, including a “group,” as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, acquires shares of the Company having 25% or more of the total number of votes that may be cast for the election of directors of the Company or (ii) as a result of any cash tender or exchange offer, merger or other business combination, or any combination of the foregoing transactions (a “Transaction”), the persons who were directors of the Company before the Transaction shall cease to constitute a majority of the Board of Directors of the Company or any successor to the Company.

DIRECTORS’ FEES

Seven of the eight present directors are not salaried employees of the Company or its subsidiaries. For their services, those directors are paid an annual retainer of $30,000 or, in the case of Chairmen of Board Committees, $34,000, plus a fee of $2,000 for each day upon which one or more Board or Board Committee meetings are attended. Salaried employees receive no additional compensation for their services as directors. Directors are permitted to defer receipt of directors’ fees until their retirement or other termination of status as a director. Deferred amounts (at the election of the director) either accrue interest at rates fixed from time to time by the Executive Committee or are valued as if having been invested in Common Stock of the Company. In calendar year 2001, two directors chose to defer all or a portion of their directors’ fees.